UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08282

Loomis Sayles Funds I

(Exact name of Registrant as specified in charter)

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Address of principal executive offices) (Zip code)

Russell L. Kane, Esq.

Natixis Distribution, L.P.

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2822

Date of fiscal year end: September 30

Date of reporting period: September 30, 2020

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Loomis Sayles Small Cap Growth Fund

Loomis Sayles Small Cap Value Fund

Loomis Sayles Small/Mid Cap Growth Fund

Annual Report

September 30, 2020

IMPORTANT NOTICE TO SHAREHOLDERS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you wish to continue receiving paper copies of your shareholder reports after January 1, 2021, you can inform the Fund at any time by calling 1-800-633-3330. If you hold your account with a financial intermediary and you wish to continue receiving paper copies after January 1, 2021, you should call your financial intermediary directly. Paper copies are provided free of charge, and your election to receive reports in paper will apply to all funds held with the Natixis Funds complex. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You currently may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically at www.icsdelivery.com/loomissayles.

LOOMIS SAYLES SMALL CAP GROWTH FUND

| | | | |

| Managers | | Symbols | | |

| Mark F. Burns, CFA® | | Institutional Class | | LSSIX |

| John J. Slavik, CFA® | | Retail Class | | LCGRX |

| | Class N | | LSSNX |

Investment Objective

The Fund’s investment objective is long-term capital growth from investments in common stocks or other equity securities.

Market Conditions

The one-year period ending September 30, 2020 was positive for most domestic equity markets, although those positive returns were hard-fought. The robust positive returns in some ways masked the full extent of the challenges that investors faced over the course of this time period. After starting the period strongly, the Russell 2000® Growth Index declined in historic fashion during the first quarter of 2020 but then saw an equally sharp rebound in the second quarter. Further gains in the third quarter of 2020 added to the period’s total return.

Growth, as measured by the Russell 2000® Growth Index, significantly outperformed value, as measured by the Russell 2000® Value Index, over this time period.

Performance Results

For the 12 months ended September 30, 2020, Institutional Class shares of the Loomis Sayles Small Cap Growth Fund returned 17.98% at net asset value. The Fund outperformed its benchmark, the Russell 2000® Growth Index, which returned 15.71%.

Explanation of Fund Performance

Among contributors to overall return, stock selection in the healthcare, financials, and information technology sectors, along with an underweight position in the real estate sector, drove the Fund’s outperformance. By contrast, stock selection in the consumer discretionary sector hurt relative performance.

Among individual stocks, the Fund’s top contributors to performance were medical equipment manufacturer Quidel Corp., contact center software provider Five9 Inc. and pet food maker Freshpet Inc. Quidel performed very well during the period, as its diagnostic tests were among those used for Covid-19 testing, boosting sales. Secular growth trends toward migrating contact-center solutions to the cloud and virtualizing workforces remained in place and supported Five9’s growth. Freshpet issued robust guidance in the belief that it has ample room to grow and to continue to penetrate the dog food market. Sales rose significantly as people began to shelter in place and bought supplies in bulk, and pet adoptions were also up during the pandemic, raising investor sentiment around the stock.

1 |

Conversely, specialty food distributor The Chefs’ Warehouse Inc., industrial manufacturer Hexcel Corp. and online education provider Laureate Education Inc. were the largest detractors from the Fund’s performance. Chefs’ Warehouse saw its end markets significantly impacted by the Covid-19 crisis, especially among caterers and restaurants. Hexcel encountered disruptions in the Boeing supply chain that weighed on the stock, and the effect of the Covid-19 crisis on the airline industry only exacerbated that impact. Laureate Education reported lackluster results during the period, and guidance was below expectations. Investor concerns about slowing growth in the US market and the ability to continue making divestitures in the current industry environment appeared to weigh on the stock. The Fund sold its positions in all three of these stocks.

Outlook

Despite the pause in September, the markets have been able to deliver spectacular returns, particularly when measured from the market bottom in March of this year. Despite strong returns, however, small-cap stocks underperformed their large-cap peers. The underperformance of small-caps during the third quarter put the rolling three-year differential between large-cap and small-cap performance at its widest level since 1999. The last time large-caps outperformed small-caps by such a wide margin, small-caps subsequently enjoyed a prolonged period of outperformance.

Volatility is likely to increase as we approach the election, and regardless of the outcome, it may continue to be an uncertain time for the markets. However, increasing visibility surrounding a potential vaccine for Covid-19 may provide some stability.

While there is so much that is not known about the pandemic and the continued economic impact, we remain focused on the underlying fundamentals of our companies. These stock-specific fundamentals should have a more significant effect on investment returns as uncertainty surrounding the virus and its economic ramifications fade. We certainly take into account how the world may change as a result of what we are going through and the impact those changes may have on individual companies, but we continue to seek out long-term secular winners that can grow into larger entities and create value for stakeholders.

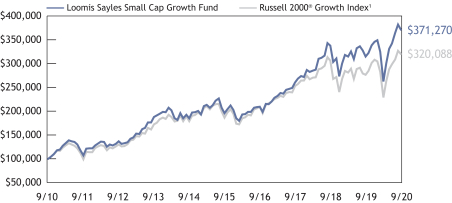

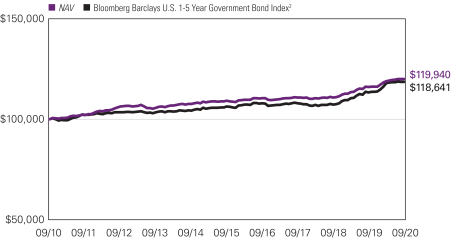

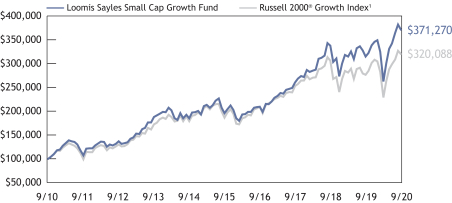

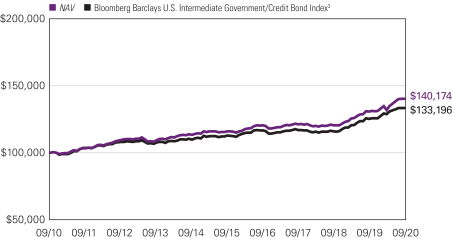

LOOMIS SAYLES SMALL CAP GROWTH FUND

Hypothetical Growth of $100,000 Investment in Institutional Class Shares

September 30, 2010 through September 30, 20202

See notes to chart on page 4.

Top Ten Holdings as of September 30, 2020

| | | | | | |

| Security name | | % of

assets | |

| 1 | | Freshpet, Inc. | | | 2.07 | % |

| 2 | | Five9, Inc. | | | 1.92 | |

| 3 | | LHC Group, Inc. | | | 1.87 | |

| 4 | | SiteOne Landscape Supply, Inc. | | | 1.85 | |

| 5 | | Generac Holdings, Inc. | | | 1.74 | |

| 6 | | Kinsale Capital Group, Inc. | | | 1.68 | |

| 7 | | Palomar Holdings, Inc. | | | 1.63 | |

| 8 | | Inovalon Holdings, Inc., Class A | | | 1.57 | |

| 9 | | Globant S.A. | | | 1.54 | |

| 10 | | Goosehead Insurance, Inc., Series A | | | 1.52 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

Average Annual Total Returns — September 30, 20202

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Expense Ratios3 | |

| | | 1 year | | | 5 years | | | 10 years | | | Life of

Class N | | | Gross | | | Net | |

| | | | | | | |

Institutional Class

(Inception 12/31/96) | | | 17.98 | % | | | 13.62 | % | | | 14.02 | % | | | — | % | | | 0.95 | % | | | 0.95 | % |

| | | | | | | |

Retail Class

(Inception 12/31/96) | | | 17.67 | | | | 13.33 | | | | 13.72 | | | | — | | | | 1.20 | | | | 1.20 | |

| | | | | | | |

Class N

(Inception 2/1/13) | | | 18.09 | | | | 13.76 | | | | — | | | | 13.27 | | | | 0.82 | | | | 0.82 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 2000® Growth Index1 | | | 15.71 | | | | 11.42 | | | | 12.34 | | | | 11.34 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | | Russell 2000® Growth Index is an unmanaged index that measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. |

| 2 | | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 3 | | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 1/31/21. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| 4

LOOMIS SAYLES SMALL CAP VALUE FUND

| | | | |

| Managers | | Symbols | | |

| Joseph R. Gatz, CFA® | | Institutional Class | | LSSCX |

| Jeffrey Schwartz, CFA® | | Retail Class | | LSCRX |

| | Admin Class | | LSVAX |

| | Class N | | LSCNX |

Investment Objective

The Fund’s investment objective is long-term capital growth from investments in common stocks or other equity securities.

Market Conditions

The one-year period ending September 30, 2020 included several distinct market phases. The first brought a cyclical-led rally that took domestic equity markets to new all-time highs by early 2020, based on improving leading economic indicators, renewed optimism over a trade deal with China and a supportive US Federal Reserve (the “Fed”) that provided an additional interest rate cut in the fourth quarter of 2019. In late February and March, the equity markets entered a swift and steep correction period as the Covid-19 emerged, causing resulting economic activity and corporate earnings projections to fall sharply. However, with a supportive Fed and many governmental stimulus programs, the market rebounded from its lows in record time as investors began to look beyond the impact of the virus with few attractive investment alternatives to stocks.

Small-cap stocks participated in the equity market recovery, matching the very healthy rebound of larger-cap stocks. The net result for the Russell 2000® Index was a slightly positive total return for the period. However, small-cap value stocks dramatically underperformed small-cap growth stocks by a margin of over 30 percentage points, with the Russell 2000® Growth Index returning +15.7% compared to the Russell 2000® Value Index return of -14.9%.

One of the driving forces behind growth stocks’ domination of market return was an investor preference for higher-visibility sales and earnings that certain sectors and industries provided during a period of increased global economic uncertainty. Record-low interest rates also had an impact on separating leading and lagging economic sectors over the course of the year. With optimism over Covid-19 vaccine development and future production volumes, the healthcare sector was the top performer. Lagging sectors included energy due to falling oil prices and demand, financials on concerns over lending credit problems and defensive sectors such as real estate and utilities.

Performance Review

For the 12 months ended September 30, 2020, Institutional Class shares of the Loomis Sayles Small Cap Value Fund returned -15.31% at net asset value. The Fund underperformed its benchmark, the Russell 2000® Value Index, which returned -14.88%.

5 |

Explanation of Performance

Global event services provider Viad Corp., hotel meeting and conference company Ryman Hospitality Properties, Inc. and oilfield services company ChampionX Corp. detracted the most from relative performance. Viad’s operations include corporate gatherings, conventions, conferences, trade shows and exhibitions as well as a travel and tourism business that serves destinations in the US, Canada and Iceland. Both business lines were significantly impacted by Covid-19 and the near elimination of large group gatherings and tourism-related travel. Similarly, Ryman Hospitality is a REIT that specializes in group-oriented hotels used for large-scale meetings and conferences. The outbreak of Covid-19 created an immediate and severe disruption to the business that extended throughout the period. ChampionX, formerly known as Apergy Corp., struggled as energy stocks significantly underperformed the market. Investors also had concerns that the announced merger with the oilfield service division of Ecolabs might not close, and even once it did in June, the subsequent rally in the stock failed to offset declines from earlier in the period. The Fund sold its positions in Viad and Ryman Hospitality.

Looking at drivers of the Fund’s performance, very positive sector allocation was offset by lagging stock selection. The Fund started the fiscal year positioned fairly conservatively, residing in the upper portion of the market capitalization range and emphasizing companies with highly durable business models. This served the Fund well throughout the market correction and shortly thereafter, but caused it to lag the benchmark during the cyclical rally of lower quality stocks over the last few months of the fiscal period.

From a sector standpoint, the Fund’s fairly significant underweight positions in energy and financials contributed to performance, as these were the two worst performing sectors of the small-cap value market. An overweight to the industrials and information technology was also a positive to relative performance. Stock selection was favorable in the financials, communication services and healthcare sectors. By contrast, the Fund was negatively affected by its overweight position in the communication services sector and by stock selection particularly within the information technology, consumer discretionary and materials sectors.

Among individual stocks, medical diagnostic test manufacturer Quidel Corp., drug compound contract manufacturer Catalent Inc. and biopharmaceutical vaccine specialist Emergent BioSolutions Inc. had the largest positive contributions to performance for the period. During the last six months of the period, Quidel received emergency use authorization from the FDA to provide Covid-19 tests both to clinical labs and for point of care testing. The company ramped up manufacturing to produce nearly 7 million Covid-19 tests quarterly for healthcare workers, schools, and businesses as the economy reopened. Catalent’s expanding presence in biologics improved top line growth, expanding operating margins, and generating stronger free cash flow, which attracted new investors to the stock. During 2020, Catalent made numerous announcements regarding partnerships to manufacture potential Covid-19 vaccines on behalf of several well-known pharmaceutical

LOOMIS SAYLES SMALL CAP VALUE FUND

developers. Emergent BioSolutions is a specialty biopharmaceutical company providing vaccines and medical countermeasures for biological and chemical threats as well as infectious disease. Given the company’s area of expertise, as well as an established contract manufacturing operation, it recently announced several large contracts providing development and manufacturing services to a number of Covid-19 vaccine organizations. In addition, the company leveraged its own proprietary platform technology to develop Covid-19 therapeutic products.

Outlook

We remain committed to identifying inefficiencies in the small-cap market that result in stock prices and valuations that do not accurately reflect our assessment of the underlying value of the corporate enterprise.

While many forms of inefficiency may exist, we focus on companies that are misunderstood, underfollowed or in the midst of a “special situation” where we believe we can use our strengths in the form of our time horizon, resource deployment or a willingness to solve complex situations. We require fundamentally sound business models, capable management teams and financial stability.

Key to our process are distinct, company-specific catalysts on the horizon to sustain, enhance, or highlight the fundamental outlook. These principles are applied consistently over time, regardless of the current market environment. With a margin of safety and a proper time horizon, our goal is to achieve an attractive total return for our investors, while managing to an appropriate level of risk.

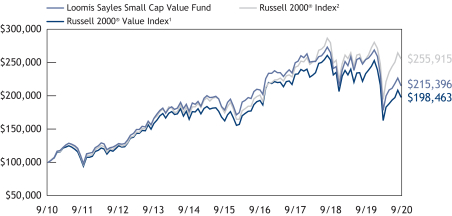

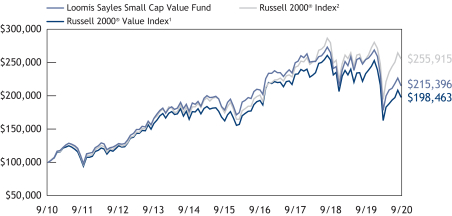

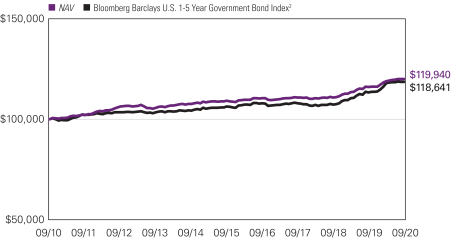

Hypothetical Growth of $100,000 Investment in Institutional Class Shares

September 30, 2010 through September 30, 20203

See notes to chart on page 9.

Top Ten Holdings as of September 30, 2020

| | | | | | |

| Security name | | % of

assets | |

| 1 | | Nomad Foods Ltd. | | | 1.75 | % |

| 2 | | GCI Liberty, Inc., Class A | | | 1.66 | |

| 3 | | NextEra Energy Partners LP | | | 1.49 | |

| 4 | | Arcosa, Inc. | | | 1.33 | |

| 5 | | Churchill Downs, Inc. | | | 1.29 | |

| 6 | | Darling Ingredients, Inc. | | | 1.28 | |

| 7 | | IAA, Inc. | | | 1.27 | |

| 8 | | Rexford Industrial Realty, Inc. | | | 1.25 | |

| 9 | | Vertiv Holdings Co. | | | 1.23 | |

| 10 | | Alamo Group, Inc. | | | 1.17 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

LOOMIS SAYLES SMALL CAP VALUE FUND

Average Annual Total Returns — September 30, 20203

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Expense Ratios4 | |

| | | 1 year | | | 5 years | | | 10 years | | | Life of Class N | | | Gross | | | Net | |

| | | | | | | |

Institutional Class

(Inception 5/13/91) | | | -15.31 | % | | | 3.80 | % | | | 7.98 | % | | | — | % | | | 0.95 | % | | | 0.92 | % |

| | | | | | | |

Retail Class

(Inception 12/31/96) | | | -15.56 | | | | 3.54 | | | | 7.70 | | | | — | | | | 1.20 | | | | 1.17 | |

| | | | | | | |

Admin Class

(Inception 1/2/98) | | | -15.74 | | | | 3.29 | | | | 7.43 | | | | — | | | | 1.45 | | | | 1.42 | |

| | | | | | | |

Class N

(Inception 2/1/13) | | | -15.28 | | | | 3.87 | | | | — | | | | 5.60 | | | | 0.85 | | | | 0.85 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 2000® Value Index1 | | | -14.88 | | | | 4.11 | | | | 7.09 | | | | 4.86 | | | | | | | | | |

| Russell 2000® Index2 | | | 0.39 | | | | 8.00 | | | | 9.85 | | | | 8.25 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | | Russell 2000® Value Index is an unmanaged index that measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. |

| 2 | | Russell 2000® Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe. |

| 3 | | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 1/31/21. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

LOOMIS SAYLES SMALL/MID CAP GROWTH FUND

| | | | |

| Managers | | Symbols | | |

| Mark F. Burns, CFA® | | Institutional Class | | LSMIX |

| John J. Slavik, CFA® | | Class N | | LSMNX |

Investment Objective

The Fund’s investment objective is long-term capital growth from investments in common stocks or other equity securities.

Market Conditions

The one-year period ending September 30, 2020 was positive for most domestic equity markets, although those positive returns were hard-fought. The robust positive returns in some ways masked the full extent of the challenges that investors faced over the course of this time period. After starting the period strongly, the Russell 2500™ Growth Index declined in historic fashion during the first quarter of 2020 but then saw an equally sharp rebound in the second quarter. Further gains in the third quarter of 2020 added to the period’s total return.

Growth, as measured by the Russell 2500™ Growth Index, significantly outperformed value, as measured by the Russell 2500™ Value Index, over this time period.

Performance Results

For the 12 months ended September 30, 2020, Institutional Class shares of the Loomis Sayles Small/Mid Cap Growth Fund returned 20.38% at net asset value. The Fund underperformed its benchmark, the Russell 2500™ Growth Index, which returned 23.37% during the one-year period.

Explanation of Fund Performance

The bulk of the Fund’s underperformance was concentrated in the second quarter of 2020. Stock selection in the information technology and consumer discretionary sectors drove the Fund’s underperformance. An underweight position in the real estate sector, along with stock selection in the consumer staples and financials sectors, contributed positively to relative returns.

Industrial manufacturer Hexcel Corp., online education provider Laureate Education Inc. and payment processing company WEX Inc. were the largest detractors from the Fund’s performance. Hexcel encountered disruptions in the Boeing supply chain that weighed on the stock, and the effect of the Covid-19 crisis on the airline industry only exacerbated that impact. Laureate Education reported lackluster results during the period, and guidance was below expectations. Investor concerns about slowing growth in the US market and the ability to continue making divestitures in the current industry environment appeared to weigh on the stock. Finally, the Covid-19 pandemic had a significant negative impact on WEX’s closed loop fuel card business for fleets of commercial vehicles, given the economic shutdown. The Fund sold its positions in all three of these stocks.

LOOMIS SAYLES SMALL/MID CAP GROWTH FUND

Among individual stocks, the Fund’s top contributors to performance were biotech company Immunomedics Inc., pet food maker Freshpet Inc. and electrical generator specialist Generac Holdings Inc. Immunomedics reported positive phase 3 drug testing data during the year, with the company stopping the trial early and the treatment receiving accelerated approval. Subsequently, industry peer Gilead Sciences announced it would acquire the company, and investors reacted positively. Freshpet issued robust guidance in the belief that it has ample room to grow and to continue to penetrate the dog food market. Sales rose significantly as people began to shelter in place and bought supplies in bulk, and pet adoptions were also up during the pandemic, raising investor sentiment around the stock. Generac benefited from continued national adoption of its home standby generators and continued to see new market development.

Outlook

Despite the pause in September, the markets have been able to deliver spectacular returns, particularly when measured from the market bottom in March of this year. Despite strong returns, however, small-cap stocks underperformed their large-cap peers. The underperformance of small-caps during the third quarter put the rolling three-year differential between large-cap and small-cap performance at its widest level since 1999. The last time large-caps outperformed small-caps by such a wide margin, small-caps subsequently enjoyed a prolonged period of outperformance.

Volatility is likely to increase as we approach the election, and regardless of the outcome, it may continue to be an uncertain time for the markets. However, increasing visibility surrounding a potential vaccine for Covid-19 may provide some stability.

While there is so much that is not known about the pandemic and the continued economic impact, we remain focused on the underlying fundamentals of our companies. These stock-specific fundamentals should have a more significant effect on investment returns as uncertainty surrounding the virus and its economic ramifications fades. We certainly take into account how the world may change as a result of what we are going through and the impact those changes may have on individual companies, but we continue to seek out long-term secular winners that can grow into larger entities and create value for stakeholders.

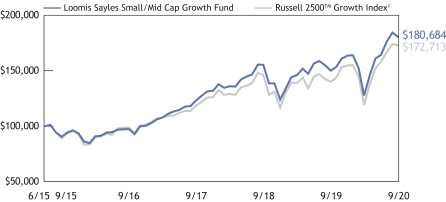

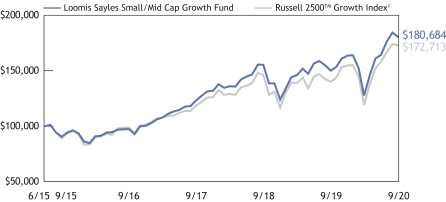

Hypothetical Growth of $100,000 Investment in Institutional Class Shares2

June 30, 2015 (inception) through September 30, 2020

See notes to chart on page 13.

Top Ten Holdings as of September 30, 2020

| | | | | | |

| Security name | | % of

assets | |

| 1 | | Freshpet, Inc. | | | 2.35 | % |

| 2 | | EPAM Systems, Inc. | | | 2.15 | |

| 3 | | SiteOne Landscape Supply, Inc. | | | 2.08 | |

| 4 | | Insulet Corp. | | | 2.07 | |

| 5 | | Black Knight, Inc. | | | 1.84 | |

| 6 | | Catalent, Inc. | | | 1.81 | |

| 7 | | LHC Group, Inc. | | | 1.71 | |

| 8 | | Ares Management Corp., Class A | | | 1.70 | |

| 9 | | Generac Holdings, Inc. | | | 1.67 | |

| 10 | | Monolithic Power Systems, Inc. | | | 1.66 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

LOOMIS SAYLES SMALL/MID CAP GROWTH FUND

Average Annual Total Returns — September 30, 20202

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Expense Ratios3 | |

| | | 1 year | | | 5 years | | | Life of

Class I | | | Life of

Class N | | | Gross | | | Net | |

| | | | | | | |

Institutional Class

(Inception 6/30/15) | | | 20.38 | % | | | 14.83 | % | | | 11.92 | % | | | — | % | | | 1.30 | % | | | 0.85 | % |

| | | | | | | |

Class N

(Inception 10/1/19) | | | — | | | | — | | | | — | | | | 22.08 | | | | 1.29 | | | | 0.83 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 2500TM Growth Index1 | | | 23.37 | | | | 14.19 | | | | 10.92 | | | | 25.41 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | | The Russell 2500™ Growth Index measures the performance of the small-to-mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500TM Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2500TM Growth Index is constructed to provide a comprehensive and unbiased barometer of the small-to-mid-cap growth market. The Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-to-mid-cap opportunity set and that the represented companies continue to reflect growth characteristics. Indices are unmanaged. |

| 2 | | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 3 | | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 1/31/21. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

ADDITIONAL INFORMATION

The views expressed in this report reflects those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

All investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

Additional Index Information

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis Affiliates”) and does not sponsor, endorse or participate in the provision of any Natixis Affiliates services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

Proxy Voting Information

A description of the Funds’ proxy voting policies and procedures is available without charge upon request, by calling Loomis Sayles at 800-633-3330; on the Funds’ website, at www.loomissayles.com, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov. Information about how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Funds’ website and the SEC’s website.

Quarterly Portfolio Schedules

The Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Funds’ Forms N-PORT are available on the SEC’s website at www.sec.gov.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

UNDERSTANDING YOUR FUND’S EXPENSES

As a mutual fund shareholder you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each Fund shows the actual amount of Fund expenses you would have paid on a $1,000 investment in the Fund from April 1, 2020 through September 30, 2020. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table of each Fund provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

Loomis Sayles Small Cap Growth Fund

| | | | | | | | | | | | |

Institutional Class | | Beginning

Account Value

4/1/2020 | | | Ending

Account Value

9/30/2020 | | | Expenses Paid

During Period*

4/1/2020 – 9/30/2020 | |

Actual | | | $1,000.00 | | | | $1,415.60 | | | | $5.62 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.35 | | | | $4.70 | |

| | |

Retail Class | | | | | | | |

Actual | | | $1,000.00 | | | | $1,413.50 | | | | $7.12 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.10 | | | | $5.96 | |

| | |

Class N | | | | | | | |

Actual | | | $1,000.00 | | | | $1,415.70 | | | | $4.95 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.90 | | | | $4.14 | |

|

* Expenses are equal to the Fund’s annualized expense ratio: 0.93%, 1.18% and 0.82% for Institutional Class, Retail Class and Class N, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). | |

Loomis Sayles Small Cap Value Fund

| | | | | | | | | | |

Institutional Class | | Beginning

Account Value

4/1/2020 | | | Ending

Account Value

9/30/2020 | | | Expenses Paid

During Period*

4/1/2020 – 9/30/2020 |

Actual | | $ | 1,000.00 | | | $ | 1,210.20 | | | $4.97 |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.50 | | | $4.55 |

| | | |

Retail Class | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,208.30 | | | $6.35 |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.25 | | | $5.81 |

| | | |

Admin Class | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,206.90 | | | $7.72 |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.00 | | | $7.06 |

| | | |

Class N | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,210.10 | | | $4.70 |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.75 | | | $4.29 |

| | | | | | |

|

* Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 0.90%, 1.15%, 1.40% and 0.85% for Institutional Class, Retail Class, Admin Class and Class N, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). |

Loomis Sayles Small/Mid Cap Growth Fund

| | | | | | | | | | |

Institutional Class | | Beginning

Account Value

4/1/2020 | | | Ending

Account Value

9/30/2020 | | | Expenses Paid

During Period*

4/1/2020 – 9/30/2020 |

Actual | | $ | 1,000.00 | | | $ | 1,414.40 | | | $5.07 |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.80 | | | $4.24 |

| | |

Class N | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,412.70 | | | $5.01 |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.85 | | | $4.19 |

| | | | | | |

* Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement) 0.84% and 0.83% for Institutional Class and Class N, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). |

BOARD APPROVAL OF THE EXISTING ADVISORY AGREEMENTS

The Board of Trustees of the Trusts (the “Board”), including the Independent Trustees, considers matters bearing on each Fund’s advisory agreement (collectively, the “Agreements”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review Committee of the Board meets to review the Agreements to determine whether to recommend that the full Board approve the continuation of the Agreements, typically for an additional one-year period. After the Contract Review Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreements.

In connection with these meetings, the Trustees receive materials that the Funds’ investment adviser (the “Adviser”) believes to be reasonably necessary for the Trustees to evaluate the Agreements. These materials generally include, among other items, (i) information on the investment performance of the Funds and the performance of peer groups of funds and the Funds’ performance benchmarks, (ii) information on the Funds’ advisory fees and other expenses, including information comparing the Funds’ advisory fees to the fees charged to institutional accounts with similar strategies managed by the Adviser, if any, and to those of peer groups of funds and information about any applicable expense caps and/or fee “breakpoints,” (iii) sales and redemption data in respect of the Funds, (iv) information about the profitability of the Agreements to the Adviser and (v) information obtained through the completion by the Adviser of a questionnaire distributed on behalf of the Trustees. The Board, including the Independent Trustees, also considers other matters such as (i) each Fund’s investment objective and strategies and the size, education and experience of the Adviser’s investment staff and its use of technology, external research and trading cost measurement tools, (ii) arrangements in respect of the distribution of the Funds’ shares and the related costs, (iii) the allocation of the Funds’ brokerage, if any, including, to the extent applicable, the use of “soft” commission dollars to pay for research and other similar services, (iv) each Adviser’s policies and procedures relating to, among other things, compliance, trading and best execution, proxy voting and valuation, (v) information about amounts invested by the Funds’ portfolio managers in the Funds or in similar accounts that they manage and (vi) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Adviser.

In addition to the materials requested by the Trustees in connection with their annual consideration of the continuation of the Agreements, the Trustees receive materials in advance of each regular quarterly meeting of the Board that provide detailed information about the Funds’ investment performance and the fees charged to the Funds for advisory and other services. This information generally includes, among other things, an internal performance rating for each Fund based on agreed-upon criteria, graphs showing each Fund’s performance and expense differentials against each Fund’s peer group/category, performance ratings provided by a third-party, total return information for various periods, and third-party performance rankings for various periods comparing a Fund against similarly categorized funds. The portfolio management team for each Fund or

other representatives of the Adviser make periodic presentations to the Contract Review Committee and/or the full Board, and Funds identified as presenting possible performance concerns may be subject to more frequent Board or Committee presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about each Fund’s portfolio. The Trustees also receive periodic updates between meetings. These updates have increased in frequency during the Covid-19 crisis.

The Board most recently approved the continuation of the Agreements for a one-year period at its meeting held in June 2020. In considering whether to approve the continuation of the Agreements, the Board, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included, but were not limited to, the factors listed below.

The nature, extent and quality of the services provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services provided by the Adviser and its affiliates to the Funds and the resources dedicated to the Funds by the Adviser and its affiliates.

The Trustees considered not only the advisory services provided by the Adviser to the Funds, but also the monitoring and oversight services provided by Natixis Advisors, L.P. (“Natixis Advisors”). They also considered the administrative and shareholder services provided by Natixis Advisors and its affiliates to the Funds. They also took into consideration increases in the services provided resulting from new regulatory requirements.

For each Fund, the Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the nature, extent and quality of services provided supported the renewal of the Agreements.

Investment performance of the Funds and the Adviser. As noted above, the Trustees received information about the performance of the Funds over various time periods, including information that compared the performance of the Funds to the performance of peer groups and categories of funds and the Funds’ respective performance benchmarks. In addition, the Trustees reviewed data prepared by an independent third party that analyzed the performance of the Funds using a variety of performance metrics, including metrics that measured the performance of the Funds on a risk adjusted basis.

The Board noted that, through December 31, 2019, each Fund’s one-, three- and five-year performance, as applicable, stated as percentile rankings within categories selected by the

independent third-party data provider was as follows (where the best performance would be in the first percentile of its category):

| | | | | | | | | | | | |

| | | One-Year | | | Three-Year | | | Five-Year | |

Loomis Sayles Small Cap Growth Fund | | | 55% | | | | 29% | | | | 30% | |

Loomis Sayles Small Cap Value Fund | | | 42% | | | | 80% | | | | 57% | |

Loomis Sayles Small/Mid Cap Growth Fund | | | 62% | | | | 36% | | | | N/A | |

In the case of each Fund that had performance that lagged that of a relevant category median as determined by the independent third party for certain (although not necessarily all) periods, the Board concluded that other factors relevant to performance supported renewal of the Agreements. These factors included one or more of the following: (1) that the underperformance was attributable, to a significant extent, to investment decisions (such as security selection or sector allocation) by the Adviser that were reasonable and consistent with the Fund’s investment objective and policies; (2) that the Loomis Sayles Small Cap Growth Fund’s performance, although lagging in certain periods, was competitive over the long term relative to its category; (3) that the Loomis Sayles Small Cap Growth Fund’s more recent performance had been stronger relative to its category; (4) that the Loomis Sayles Small/Mid Cap Growth Fund’s mid-term performance has been strong relative to its category; and (5) that the Loomis Sayles Small Cap Value Fund’s shorter-term performance has been strong relative to its category. The Board also considered information about the Funds’ more recent performance, including how that performance had been impacted by the Covid-19 crisis.

The Trustees also considered the Adviser’s performance and reputation generally, the performance of the fund family generally, and the historical responsiveness of the Adviser to Trustee concerns about performance and the willingness of the Adviser to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the performance of the Funds and the Adviser and/or other relevant factors supported the renewal of the Agreements.

The costs of the services to be provided and profits to be realized by the Adviser and its affiliates from their respective relationships with the Funds. The Trustees considered the fees charged to the Funds for advisory and administrative services as well as the total expense levels of the Funds. This information included comparisons (provided both by management and by an independent third party) of the Funds’ advisory fees and total expense levels to those of their peer groups and information about the advisory fees charged by the Adviser to comparable accounts (such as institutional separate accounts), as well as information about differences in such fees and the reasons for any such differences. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage mutual fund assets, the greater regulatory costs associated with the management of such assets, and the entrepreneurial, regulatory and other risks associated with sponsoring and managing mutual funds. In evaluating each Fund’s advisory fee, the

Trustees also took into account the demands, complexity and quality of the investment management of such Fund and the need for the Adviser to offer competitive compensation and the potential need to expend additional resources to the extent the Fund grows in size. The Trustees considered that over the past several years, management had made recommendations regarding reductions in advisory fee rates, implementation of advisory fee breakpoints and the institution of advisory fee waivers and expense caps for various funds in the fund family. They noted that the Loomis Sayles Small Cap Value Fund and Loomis Sayles Small/Mid Cap Growth Fund have expense caps in place, and they considered the amounts waived or reimbursed by the Adviser for certain Funds under their respective expense cap agreements. The Trustees also considered that Loomis Sayles Small Cap Growth Fund’s current expenses are below its cap. The Trustees noted that the Funds had total advisory fee rates that were below the medians of their respective peer groups of funds.

The Trustees also considered the compensation directly or indirectly received by the Adviser and its affiliates from their relationships with the Funds. The Trustees reviewed information provided by management as to the profitability of the Adviser’s and its affiliates’ relationships with the Funds, and information about how expenses are determined and allocated for purposes of profitability calculations. They also reviewed information provided by management about the effect of distribution costs and changes in asset levels on Adviser profitability, including information regarding resources spent on distribution activities. When reviewing profitability, the Trustees also considered information about court cases in which adviser compensation or profitability were issues, the performance of the Funds, the expense levels of the Funds, whether the Adviser had implemented breakpoints and/or expense caps with respect to such Funds and the overall profit margin of Natixis Investment Managers compared to that of certain other investment managers for which such data was available.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the advisory fee charged to each of the Funds was fair and reasonable, and that the costs of these services generally and the related profitability of the Adviser and its affiliates in respect of their relationships with the Funds supported the renewal of the Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Adviser and whether those economies are shared with the Funds through breakpoints in their investment advisory fees or other means, such as expense caps. The Trustees also considered management’s explanation of the factors that are taken into account with respect to the implementation of breakpoints in investment advisory fees or expense caps. With respect to economies of scale, the Trustees noted that although none of the Funds’ management fees were subject to breakpoints, each of the Funds was subject to an expense cap. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and on a relative basis) and the profitability to the Adviser and its affiliates of their relationships with the Funds, as discussed above. The Trustees also considered that the Funds have benefitted from the substantial reinvestment the Adviser has made into its business.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the extent to which economies of scale were shared with the Funds supported the renewal of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following:

| • | | The effect of recent market and economic events, including but not limited to the Covid-19 crisis, on the performance, asset levels and expense ratios of each Fund. |

| • | | Whether each Fund has operated in accordance with its investment objective and the Fund’s record of compliance with its investment restrictions, and the compliance programs of the Funds and the Adviser. They also considered the compliance-related resources the Adviser and its affiliates were providing to the Funds. |

| • | | So-called “fallout benefits” to the Adviser, such as the engagement of affiliates of the Adviser to provide distribution and administrative services to the Funds, and the benefits of research made available to the Adviser by reason of brokerage commissions (if any) generated by the Funds’ securities transactions. The Trustees also considered the benefits to the parent company of Natixis Advisors from the retention of the Adviser. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

| • | | The Trustees’ review and discussion of the Funds’ advisory arrangements in prior years, and management’s record of responding to Trustee concerns raised during the year and in prior years. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that each of the existing Agreements should be continued through June 30, 2021.

LIQUIDITY RISK MANAGEMENT PROGRAM

Annual Report for the Period Commencing on December 1, 2018 and ending December 31, 2019 (including updates through September 30, 2020)

Effective December 1, 2018, the Funds adopted a liquidity risk management program (the “Program”) pursuant to the requirements of Rule 22e-4 under the Investment Company Act of 1940, as amended (the “Rule”). The Rule requires registered open-end funds, including mutual funds and exchange-traded funds to establish liquidity risk management programs in order to effectively manage fund liquidity and mitigate the risk that a fund could not meet redemption requests without significantly diluting the interests of remaining investors.

The rule requires the Funds to assess, manage and review their liquidity risk considering applicable factors during normal and foreseeable stressed conditions. In fulfilling this requirement, each Fund assesses and reviews (where applicable and amongst other matters) its investment strategy, portfolio holdings, possible investment concentrations, use of derivatives, short-term and long-term cash flow projections, use of cash and cash equivalents, as well as borrowing arrangements and other funding sources. Each Program has established a Program Administrator which is the adviser of the Fund.

In accordance with the Program, each of the Fund’s portfolio investments is classified into one of four liquidity categories based on a determination of a reasonable expectation for how long it would take to convert the investment to cash (or sell or dispose of the investment) without significantly changing its market value.

Each Fund is prohibited from acquiring an investment if, after the acquisition, its holdings of illiquid assets will exceed 15% of its net assets. If a Fund does not hold a majority of highly liquid investments in its portfolio, then the Fund is required to establish a highly liquid investment minimum (“HLIM”). None of the Funds has established an HLIM.

During the period from December 1, 2018 to December 31, 2019, there were no material changes to the Program and no material events that impacted the operation of the Funds’ Programs. During the period, the Funds held sufficient liquid assets to meet redemptions on a timely basis and did not have any illiquid security violations during the period.

During the period January 1, 2020 through September 30, 2020, the Funds held sufficient liquid assets to meet redemptions on a timely basis and did not have any illiquid security violations.

Annual Program Assessment and Conclusion

In the opinion of the Program Administrator, the Program of each Fund approved by the Funds’ Board has been implemented effectively. The Program Administrator have also monitored, assessed and managed each Fund’s liquidity risk regularly and has determined that the Programs are operating effectively.

Pursuant to the Rule’s requirements, the Board has received and reviewed a written report prepared by each Fund’s Program Administrator that addressed the operation of the Program, assessed its adequacy and effectiveness and described any material changes made to the Program.

Portfolio of Investments – as of September 30, 2020

Loomis Sayles Small Cap Growth Fund

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| |

| Common Stocks – 95.4% of Net Assets | | | |

| | |

| | | | Aerospace & Defense – 2.3% | | | |

| | 1,155,064 | | | Kratos Defense & Security Solutions, Inc.(a) | | $ | 22,269,634 | |

| | 372,156 | | | Mercury Systems, Inc.(a) | | | 28,827,204 | |

| | | | | | | | |

| | | | | | | 51,096,838 | |

| | | | | | | | |

| | |

| | | | Air Freight & Logistics – 1.0% | | | |

| | 874,105 | | | Air Transport Services Group, Inc.(a) | | | 21,905,071 | |

| | | | | | | | |

| | |

| | | | Auto Components – 1.7% | | | |

| | 83,566 | | | Dorman Products, Inc.(a) | | | 7,552,695 | |

| | 291,701 | | | Fox Factory Holding Corp.(a) | | | 21,682,135 | |

| | 488,815 | | | Stoneridge, Inc.(a) | | | 8,979,532 | |

| | | | | | | | |

| | | | | | | 38,214,362 | |

| | | | | | | | |

| | |

| | | | Beverages – 0.5% | | | |

| | 780,861 | | | Primo Water Corp. | | | 11,088,226 | |

| | | | | | | | |

| | |

| | | | Biotechnology – 9.4% | | | |

| | 199,179 | | | Blueprint Medicines Corp.(a) | | | 18,463,893 | |

| | 266,067 | | | ChemoCentryx, Inc.(a) | | | 14,580,472 | |

| | 589,709 | | | Dicerna Pharmaceuticals, Inc.(a) | | | 10,608,865 | |

| | 152,537 | | | Emergent BioSolutions, Inc.(a) | | | 15,761,648 | |

| | 805,957 | | | Halozyme Therapeutics, Inc.(a) | | | 21,180,550 | |

| | 405,099 | | | Natera, Inc.(a) | | | 29,264,352 | |

| | 323,557 | | | PTC Therapeutics, Inc.(a) | | | 15,126,290 | |

| | 599,929 | | | Rocket Pharmaceuticals, Inc.(a) | | | 13,714,377 | |

| | 324,427 | | | SpringWorks Therapeutics, Inc.(a) | | | 15,465,435 | |

| | 597,319 | | | Veracyte, Inc.(a) | | | 19,406,894 | |

| | 426,408 | | | Xencor, Inc.(a) | | | 16,540,366 | |

| | 439,455 | | | Y-mAbs Therapeutics, Inc.(a) | | | 16,870,678 | |

| | | | | | | | |

| | | | | | | 206,983,820 | |

| | | | | | | | |

| | |

| | | | Building Products – 5.6% | | | |

| | 428,365 | | | AAON, Inc. | | | 25,808,991 | |

| | 491,098 | | | Advanced Drainage Systems, Inc. | | | 30,664,159 | |

| | 327,400 | | | Patrick Industries, Inc. | | | 18,832,048 | |

| | 418,580 | | | Trex Co., Inc.(a) | | | 29,970,328 | |

| | 301,378 | | | UFP Industries, Inc. | | | 17,030,871 | |

| | | | | | | | |

| | | | | | | 122,306,397 | |

| | | | | | | | |

| | |

| | | | Capital Markets – 3.4% | | | |

| | 822,483 | | | AssetMark Financial Holdings, Inc.(a) | | | 17,880,780 | |

| | 465,405 | | | Focus Financial Partners, Inc., Class A(a) | | | 15,260,630 | |

| | 273,871 | | | Hamilton Lane, Inc., Class A | | | 17,689,328 | |

| | 411,731 | | | PJT Partners, Inc., Class A | | | 24,955,016 | |

| | | | | | | | |

| | | | | | | 75,785,754 | |

| | | | | | | | |

See accompanying notes to financial statements.

Portfolio of Investments – as of September 30, 2020

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| |

| Common Stocks – continued | | | |

| | |

| | | | Commercial Services & Supplies – 2.3% | | | |

| | 516,104 | | | Casella Waste Systems, Inc., Class A(a) | | $ | 28,824,408 | |

| | 348,672 | | | McGrath RentCorp | | | 20,777,365 | |

| | | | | | | | |

| | | | | | | 49,601,773 | |

| | | | | | | | |

| | |

| | | | Construction & Engineering – 0.9% | | | |

| | 1,127,993 | | | WillScot Mobile Mini Holdings Corp.(a) | | | 18,814,923 | |

| | | | | | | | |

| | |

| | | | Diversified Consumer Services – 1.6% | | | |

| | 307,575 | | | Arco Platform Ltd., Class A(a) | | | 12,561,363 | |

| | 566,986 | | | frontdoor, Inc.(a) | | | 22,061,425 | |

| | | | | | | | |

| | | | | | | 34,622,788 | |

| | | | | | | | |

| | |

| | | | Electrical Equipment – 1.7% | | | |

| | 197,874 | | | Generac Holdings, Inc.(a) | | | 38,316,321 | |

| | | | | | | | |

| | |

| | | | Electronic Equipment, Instruments & Components – 2.6% | | | |

| | 251,691 | | | Itron, Inc.(a) | | | 15,287,711 | |

| | 532,978 | | | nLight, Inc.(a) | | | 12,514,324 | |

| | 271,044 | | | Novanta, Inc.(a) | | | 28,551,775 | |

| | | | | | | | |

| | | | | | | 56,353,810 | |

| | | | | | | | |

| | |

| | | | Food Products – 2.8% | | | |

| | 408,360 | | | Freshpet, Inc.(a) | | | 45,593,394 | |

| | 766,817 | | | Simply Good Foods Co. (The)(a) | | | 16,908,315 | |

| | | | | | | | |

| | | | | | | 62,501,709 | |

| | | | | | | | |

| | |

| | | | Health Care Equipment & Supplies – 5.5% | | | |

| | 407,490 | | | AtriCure, Inc.(a) | | | 16,258,851 | |

| | 430,322 | | | CryoPort, Inc.(a) | | | 20,397,263 | |

| | 136,120 | | | iRhythm Technologies, Inc.(a) | | | 32,411,533 | |

| | 236,470 | | | NuVasive, Inc.(a) | | | 11,485,348 | |

| | 105,678 | | | Penumbra, Inc.(a) | | | 20,541,690 | |

| | 350,629 | | | STAAR Surgical Co.(a) | | | 19,831,576 | |

| | | | | | | | |

| | | | | | | 120,926,261 | |

| | | | | | | | |

| | |

| | | | Health Care Providers & Services – 4.8% | | | |

| | 138,729 | | | Amedisys, Inc.(a) | | | 32,799,697 | |

| | 415,753 | | | BioTelemetry, Inc.(a) | | | 18,950,022 | |

| | 255,497 | | | HealthEquity, Inc.(a) | | | 13,124,881 | |

| | 193,634 | | | LHC Group, Inc.(a) | | | 41,158,843 | |

| | | | | | | | |

| | | | | | | 106,033,443 | |

| | | | | | | | |

| | |

| | | | Health Care Technology – 3.7% | | | |

| | 1,304,123 | | | Inovalon Holdings, Inc., Class A(a) | | | 34,494,053 | |

| | 220,379 | | | Inspire Medical Systems, Inc.(a) | | | 28,439,910 | |

| | 546,780 | | | Phreesia, Inc.(a) | | | 17,568,042 | |

| | | | | | | | |

| | | | | | | 80,502,005 | |

| | | | | | | | |

See accompanying notes to financial statements.

Portfolio of Investments – as of September 30, 2020

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| |

| Common Stocks – continued | | | |

| | |

| | | | Hotels, Restaurants & Leisure – 2.2% | | | |

| | 275,570 | | | Texas Roadhouse, Inc. | | $ | 16,751,900 | |

| | 224,946 | | | Wingstop, Inc. | | | 30,738,871 | |

| | | | | | | | |

| | | | | | | 47,490,771 | |

| | | | | | | | |

| | |

| | | | Insurance – 4.8% | | | |

| | 387,703 | | | Goosehead Insurance, Inc., Series A | | | 33,571,203 | |

| | 193,960 | | | Kinsale Capital Group, Inc. | | | 36,887,313 | |

| | 343,888 | | | Palomar Holdings, Inc.(a) | | | 35,846,885 | |

| | | | | | | | |

| | | | | | | 106,305,401 | |

| | | | | | | | |

| | |

| | | | Internet & Direct Marketing Retail – 0.6% | | | |

| | 266,400 | | | Shutterstock, Inc. | | | 13,863,456 | |

| | | | | | | | |

| | |

| | | | IT Services – 4.0% | | | |

| | 535,314 | | | EVERTEC, Inc. | | | 18,580,749 | |

| | 466,095 | | | KBR, Inc. | | | 10,421,884 | |

| | 186,676 | | | ManTech International Corp., Class A | | | 12,858,243 | |

| | 863,471 | | | NIC, Inc. | | | 17,010,379 | |

| | 443,586 | | | WNS Holdings Ltd., ADR(a) | | | 28,371,760 | |

| | | | | | | | |

| | | | | | | 87,243,015 | |

| | | | | | | | |

| | |

| | | | Leisure Products – 0.7% | | | |

| | 309,510 | | | Malibu Boats, Inc., Class A(a) | | | 15,339,316 | |

| | | | | | | | |

| | |

| | | | Life Sciences Tools & Services – 3.7% | | | |

| | 697,887 | | | NeoGenomics, Inc.(a) | | | 25,745,051 | |

| | 279,851 | | | PRA Health Sciences, Inc.(a) | | | 28,388,086 | |

| | 190,481 | | | Repligen Corp.(a) | | | 28,103,567 | |

| | | | | | | | |

| | | | | | | 82,236,704 | |

| | | | | | | | |

| | |

| | | | Machinery – 2.9% | | | |

| | 434,127 | | | Kornit Digital Ltd.(a) | | | 28,161,818 | |

| | 146,873 | | | Proto Labs, Inc.(a) | | | 19,020,054 | |

| | 136,663 | | | RBC Bearings, Inc.(a) | | | 16,564,922 | |

| | | | | | | | |

| | | | | | | 63,746,794 | |

| | | | | | | | |

| | |

| | | | Media – 0.7% | | | |

| | 333,885 | | | TechTarget, Inc.(a) | | | 14,677,585 | |

| | | | | | | | |

| | |

| | | | Pharmaceuticals – 3.4% | | | |

| | 1,073,759 | | | Aerie Pharmaceuticals, Inc.(a) | | | 12,638,144 | |

| | 118,398 | | | GW Pharmaceuticals PLC, Sponsored ADR(a) | | | 11,526,045 | |

| | 170,802 | | | MyoKardia, Inc.(a) | | | 23,285,437 | |

| | 469,027 | | | Pacira BioSciences, Inc.(a) | | | 28,197,903 | |

| | | | | | | | |

| | | | | | | 75,647,529 | |

| | | | | | | | |

See accompanying notes to financial statements.

Portfolio of Investments – as of September 30, 2020

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| |

| Common Stocks – continued | | | |

| | |

| | | | Professional Services – 0.6% | | | |

| | 343,344 | | | Huron Consulting Group, Inc.(a) | | $ | 13,503,719 | |

| | | | | | | | |

| | |

| | | | Semiconductors & Semiconductor Equipment – 5.0% | | | |

| | 270,609 | | | Advanced Energy Industries, Inc.(a) | | | 17,032,131 | |

| | 822,809 | | | FormFactor, Inc.(a) | | | 20,512,628 | |

| | 674,621 | | | MACOM Technology Solutions Holdings, Inc.(a) | | | 22,943,860 | |

| | 1,217,036 | | | Rambus, Inc.(a) | | | 16,661,223 | |

| | 207,007 | | | Silicon Laboratories, Inc.(a) | | | 20,255,635 | |

| | 360,522 | | | Silicon Motion Technology Corp., ADR | | | 13,620,521 | |

| | | | | | | | |

| | | | | | | 111,025,998 | |

| | | | | | | | |

| | |

| | | | Software – 12.6% | | | |

| | 219,184 | | | Blackline, Inc.(a) | | | 19,645,462 | |

| | 376,911 | | | Envestnet, Inc.(a) | | | 29,082,453 | |

| | 326,057 | | | Five9, Inc.(a) | | | 42,283,072 | |

| | 189,176 | | | Globant S.A.(a) | | | 33,904,123 | |

| | 484,140 | | | Mimecast Ltd.(a) | | | 22,715,849 | |

| | 336,712 | | | Q2 Holdings, Inc.(a) | | | 30,728,337 | |

| | 446,739 | | | Rapid7, Inc.(a) | | | 27,358,296 | |

| | 356,174 | | | RealPage, Inc.(a) | | | 20,529,869 | |

| | 685,058 | | | Tenable Holdings, Inc.(a) | | | 25,860,939 | |

| | 226,364 | | | Varonis Systems, Inc.(a) | | | 26,126,933 | |

| | | | | | | | |

| | | | | | | 278,235,333 | |

| | | | | | | | |

| | |

| | | | Specialty Retail – 1.2% | | | |

| | 705,389 | | | National Vision Holdings, Inc.(a) | | | 26,974,075 | |

| | | | | | | | |

| | |

| | | | Textiles, Apparel & Luxury Goods – 1.3% | | | |

| | 245,712 | | | Columbia Sportswear Co. | | | 21,372,030 | |

| | 414,340 | | | Steven Madden Ltd. | | | 8,079,630 | |

| | | | | | | | |

| | | | | | | 29,451,660 | |

| | | | | | | | |

| | |

| | | | Trading Companies & Distributors – 1.9% | | | |

| | 334,212 | | | SiteOne Landscape Supply, Inc.(a) | | | 40,757,153 | |

| | | | | | | | |

| | |

| | | | Total Common Stocks

(Identified Cost $1,517,178,654) | | 2,101,552,010 | |

| | | | | | | | |

See accompanying notes to financial statements.

Portfolio of Investments – as of September 30, 2020

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| |

| | Short-Term Investments – 4.1% | | | | |

| | |

| $ | 89,820,709 | | | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 9/30/2020 at 0.000% to be repurchased at $89,820,709 on 10/01/2020 collateralized by $91,624,300 U.S. Treasury Note, 0.250% due 9/30/2025 valued at $91,617,154 including accrued interest (Note 2 of Notes to Financial Statements)

(Identified Cost $89,820,709) | | $ | 89,820,709 | |

| | | | | | | | |

| | |

| | | | Total Investments – 99.5%

(Identified Cost $1,606,999,363) | | 2,191,372,719 | |

| | |

| | | | Other assets less liabilities – 0.5% | | | 10,523,805 | |

| | | | | | | | |

| | |

| | | | Net Assets – 100.0% | | $ | 2,201,896,524 | |

| | | | | | | | |

| |

| | (†) | | | See Note 2 of Notes to Financial Statements. | |

| | |

| | (a) | | | Non-income producing security. | | | | |

| |

| | ADR | | | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. The values of ADRs may be significantly influenced by trading on exchanges not located in the United States. | |

Industry Summary at September 30, 2020

| | | | |

Software | | | 12.6 | % |

Biotechnology | | | 9.4 | |

Building Products | | | 5.6 | |

Health Care Equipment & Supplies | | | 5.5 | |

Semiconductors & Semiconductor Equipment | | | 5.0 | |

Insurance | | | 4.8 | |

Health Care Providers & Services | | | 4.8 | |

IT Services | | | 4.0 | |

Life Sciences Tools & Services | | | 3.7 | |

Health Care Technology | | | 3.7 | |

Capital Markets | | | 3.4 | |

Pharmaceuticals | | | 3.4 | |

Machinery | | | 2.9 | |

Food Products | | | 2.8 | |

Electronic Equipment, Instruments & Components | | | 2.6 | |

Aerospace & Defense | | | 2.3 | |

Commercial Services & Supplies | | | 2.3 | |

Hotels, Restaurants & Leisure | | | 2.2 | |

Other Investments, less than 2% each | | | 14.4 | |

Short-Term Investments | | | 4.1 | |

| | | | |

Total Investments | | | 99.5 | |

Other assets less liabilities | | | 0.5 | |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

See accompanying notes to financial statements.

Portfolio of Investments – as of September 30, 2020

Loomis Sayles Small Cap Value Fund

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| |

| Common Stocks – 98.9% of Net Assets | | | |

| | |

| | | | Aerospace & Defense – 1.5% | | | |

| | 123,384 | | | Aerojet Rocketdyne Holdings, Inc.(a) | | $ | 4,921,788 | |

| | 36,809 | | | BWX Technologies, Inc. | | | 2,072,715 | |

| | | | | | | | |

| | | | | | | 6,994,503 | |

| | | | | | | | |

| | |

| | | | Auto Components – 2.8% | | | |

| | 134,171 | | | Cooper Tire & Rubber Co. | | | 4,253,221 | |

| | 288,336 | | | Dana, Inc. | | | 3,552,299 | |

| | 20,928 | | | Fox Factory Holding Corp.(a) | | | 1,555,578 | |

| | 38,655 | | | LCI Industries | | | 4,108,640 | |

| | | | | | | | |

| | | | | | | 13,469,738 | |

| | | | | | | | |

| | |

| | | | Banks – 11.7% | | | |

| | 158,448 | | | Ameris Bancorp | | | 3,609,445 | |

| | 178,809 | | | Atlantic Union Bankshares Corp. | | | 3,821,148 | |

| | 183,909 | | | BancorpSouth Bank | | | 3,564,156 | |

| | 143,342 | | | Bryn Mawr Bank Corp. | | | 3,564,916 | |

| | 129,117 | | | Cathay General Bancorp | | | 2,799,257 | |

| | 205,315 | | | CVB Financial Corp. | | | 3,414,388 | |

| | 264,872 | | | Home BancShares, Inc. | | | 4,015,460 | |

| | 214,326 | | | OceanFirst Financial Corp. | | | 2,934,123 | |

| | 89,424 | | | Pinnacle Financial Partners, Inc. | | | 3,182,600 | |

| | 132,588 | | | Popular, Inc. | | | 4,808,967 | |

| | 86,403 | | | Prosperity Bancshares, Inc. | | | 4,478,267 | |

| | 62,945 | | | South State Corp. | | | 3,030,802 | |

| | 146,038 | | | TCF Financial Corp. | | | 3,411,448 | |

| | 152,089 | | | Triumph Bancorp, Inc.(a) | | | 4,736,051 | |

| | 118,577 | | | Wintrust Financial Corp. | | | 4,749,009 | |

| | | | | | | | |

| | | | | | | 56,120,037 | |

| | | | | | | | |

| | |

| | | | Beverages – 1.1% | | | |

| | 384,847 | | | Primo Water Corp. | | | 5,464,827 | |

| | | | | | | | |

| | |

| | | | Biotechnology – 1.9% | | | |

| | 49,164 | | | Emergent BioSolutions, Inc.(a) | | | 5,080,116 | |

| | 41,704 | | | United Therapeutics Corp.(a) | | | 4,212,104 | |

| | | | | | | | |

| | | | | | | 9,292,220 | |

| | | | | | | | |

| | |

| | | | Building Products – 2.4% | | | |

| | 41,253 | | | American Woodmark Corp.(a) | | | 3,240,011 | |

| | 52,093 | | | Armstrong World Industries, Inc. | | | 3,584,519 | |

| | 85,538 | | | UFP Industries, Inc. | | | 4,833,752 | |

| | | | | | | | |

| | | | | | | 11,658,282 | |

| | | | | | | | |

| | |

| | | | Capital Markets – 1.8% | | | |

| | 322,542 | | | Donnelley Financial Solutions, Inc.(a) | | | 4,309,161 | |

| | 85,801 | | | Stifel Financial Corp. | | | 4,338,099 | |

| | | | | | | | |

| | | | | | | 8,647,260 | |

| | | | | | | | |

See accompanying notes to financial statements.

Portfolio of Investments – as of September 30, 2020

Loomis Sayles Small Cap Value Fund – continued

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| |

| Common Stocks – continued | | | |

| | |

| | | | Chemicals – 3.4% | | | |

| | 46,766 | | | Ashland Global Holdings, Inc. | | $ | 3,316,645 | |

| | 86,315 | | | Cabot Corp. | | | 3,109,929 | |

| | 48,315 | | | Ingevity Corp.(a) | | | 2,388,694 | |

| | 220,616 | | | Valvoline, Inc. | | | 4,200,529 | |

| | 75,242 | | | WR Grace & Co. | | | 3,031,500 | |

| | | | | | | | |

| | | | | | | 16,047,297 | |

| | | | | | | | |

| | |

| | | | Commercial Services & Supplies – 4.5% | | | |

| | 55,355 | | | Clean Harbors, Inc.(a) | | | 3,101,541 | |

| | 270,322 | | | Harsco Corp.(a) | | | 3,760,179 | |

| | 116,763 | | | IAA, Inc.(a) | | | 6,079,849 | |

| | 137,373 | | | KAR Auction Services, Inc. | | | 1,978,171 | |

| | 220,407 | | | Kimball International, Inc., Class B | | | 2,323,090 | |

| | 68,491 | | | McGrath RentCorp | | | 4,081,379 | |

| | | | | | | | |

| | | | | | | 21,324,209 | |

| | | | | | | | |

| | |

| | | | Communications Equipment – 0.7% | | | |

| | 300,248 | | | Viavi Solutions, Inc.(a) | | | 3,521,909 | |

| | | | | | | | |

| | |

| | | | Construction & Engineering – 2.4% | | | |

| | 116,522 | | | AECOM(a) | | | 4,875,281 | |

| | 144,312 | | | Arcosa, Inc. | | | 6,362,716 | |

| | | | | | | | |

| | | | | | | 11,237,997 | |

| | | | | | | | |

| | |

| | | | Distributors – 0.8% | | | |

| | 132,357 | | | Core-Mark Holding Co., Inc. | | | 3,829,088 | |

| | | | | | | | |

| | |

| | | | Diversified Consumer Services – 0.7% | | | |

| | 83,035 | | | frontdoor, Inc.(a) | | | 3,230,892 | |

| | | | | | | | |

| | |

| | | | Diversified Financial Services – 0.9% | | | |

| | 110,496 | | | Cannae Holdings, Inc.(a) | | | 4,117,081 | |

| | | | | | | | |

| | |

| | | | Diversified Telecommunication Services – 2.0% | | | |

| | 96,973 | | | GCI Liberty, Inc., Class A(a) | | | 7,947,907 | |

| | 204,894 | | | Liberty Latin America Ltd., Class C(a) | | | 1,667,837 | |

| | | | | | | | |

| | | | | | | 9,615,744 | |

| | | | | | | | |

| | |

| | | | Electric Utilities – 2.1% | | | |

| | 93,264 | | | ALLETE, Inc. | | | 4,825,479 | |