UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08314

Schwab Annuity Portfolios

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Schwab Annuity Portfolios

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Item 1: Report(s) to Shareholders.

Annual Report | December 31, 2021

Schwab Government Money Market Portfolio

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available without charge, upon request, by visiting the Schwab Fund’s website at www.schwabassetmanagement.com/schwabfunds_prospectus, the SEC’s website at www.sec.gov, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available, without charge, by visiting Schwab’s website at www.schwabassetmanagement.com/schwabfunds_prospectus or the SEC’s website at www.sec.gov.

Investment Adviser: Charles Schwab Investment Management, Inc., dba Schwab Asset ManagementTM

Schwab Government Money Market Portfolio

| Linda Klingman, Managing Director and Head of Money Market Strategies for Schwab Asset Management, leads the portfolio management teams for taxable and tax-exempt Schwab Money Funds, and has overall responsibility for all aspects of the management of the fund. Prior to joining Schwab in 1990, she was a senior money market trader with AIM Management, Inc. for five years. She has managed money market funds since 1988. |

| Lynn Paschen, Senior Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining Schwab in 2011, Ms. Paschen held a number of positions at American Century Investments. She was most recently a portfolio manager and, from 2000 to 2003, worked as a fixed-income trader. She has managed money market funds since 2003. |

| Nicole Perret-Gentil, Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining Schwab in 2016, Ms. Perret-Gentil worked at Freddie Mac for 15 years, most recently as a senior portfolio manager where she managed and executed trades for a fixed-income strategy. Prior to that role, she served as a portfolio manager performing fixed-income analysis, a senior research analyst for investor and dealer relations, a senior securities operations analyst in loan and securities operations, and a lead mortgage securities operations specialist. She also worked at Merrill Lynch for a year as a senior specialist in fixed-income global banking and investments. |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

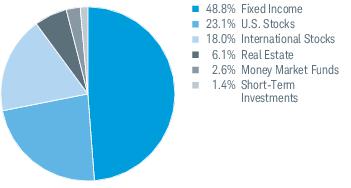

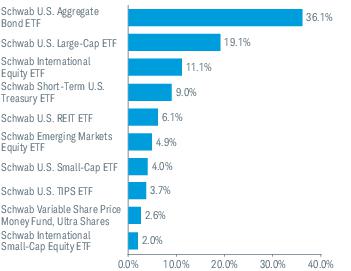

The Schwab Government Money Market Portfolio’s (the fund) goal is to seek the highest current income consistent with stability of capital and liquidity. To pursue its goal, the fund invests in U.S. government securities such as U.S. Treasury bills and notes, other obligations that are issued by the U.S. government, its agencies, or instrumentalities, repurchase agreements that are collateralized fully by cash and/or U.S. government securities, and obligations that are issued by private issuers that are guaranteed as to principal or interest by the U.S. government, its agencies, or instrumentalities. The fund will invest at least 99.5% of its total assets in cash, U.S. government securities and/or repurchase agreements that are collateralized fully by cash and/or U.S. government securities; under normal circumstances, at least 80% of the fund’s net assets (including, for this purpose, any borrowings for investment purposes) will be invested in U.S. government securities, including repurchase agreements that are collateralized fully by U.S. government securities. For more information concerning the fund’s investment objective, strategy, and risks, please see the fund’s prospectus.

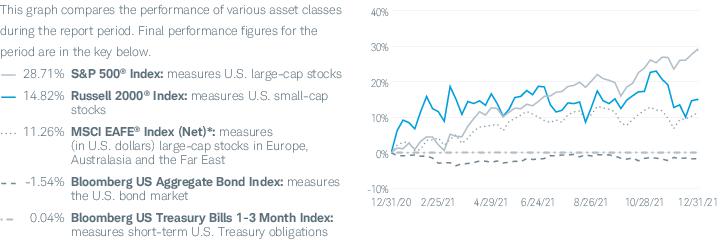

Market Highlights. The 12-month reporting period was marked by an imbalance in supply and demand of short-term U.S. Treasuries, with demand remaining high and supply declining as the U.S. Treasury’s borrowing needs decreased. Interest rates remained low, with the U.S. Federal Reserve (Fed) holding the federal funds target rate in a range of 0.00% to 0.25% throughout the reporting period. However, as inflation continued to rise and indicators of economic activity and employment continued to strengthen, the Fed began scaling back its bond-buying program beginning in November 2021. The Fed subsequently accelerated its wind-down in December 2021 to end it altogether by March 2022. The Fed also signaled that interest rates could begin to rise sooner in 2022 than previously anticipated.

To support effective monetary policy implementation and smooth market functioning by helping maintain the federal funds rate within the Fed’s target range, the Fed conducts repurchase agreement and reverse repurchase agreement transactions. Demand for the Fed’s Overnight Reverse Repurchase Agreement Facility drove its usage to an all-time high in December 2021 as a result of significant cash in the market, limited investment options, and the ongoing supply and demand imbalances for U.S. Treasuries.

Outside the U.S., most central banks were similarly accommodative while acknowledging economic improvements and, in some cases, changes in monetary policy. The European Central Bank held its policy rate at 0.00%, unchanged since March 2016. However, in December 2021, it announced that in the first quarter of 2022 it would reduce the pace of its asset purchase program it had instituted to help counter the serious risks posed by the COVID-19 pandemic. The Bank of Japan upheld its short-term interest rate target of -0.1%, also unchanged since 2016, and also announced its plans to taper its corporate debt buying to pre-pandemic levels. In December 2021, the Bank of England raised its key official bank rate from 0.1% to 0.25%, its first rate hike since the onset of the COVID-19 pandemic, citing inflation pressures.

Performance, Positioning, and Strategies. Throughout the reporting period, the fund’s investment adviser remained focused on ensuring liquidity and stability of capital as market conditions evolved, and on continuing a rigorous credit review process and ongoing monitoring for all issuers and regions in which the fund invests. The fund’s weighted average maturity (WAM) was reduced toward the end of the reporting period as the likelihood of imminent interest rate increases rose, beginning the reporting period at 44 days and ending it at 37 days.

Portfolio Composition By Effective Maturity % of Investments1

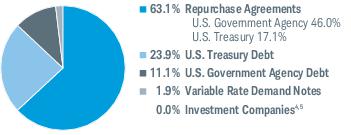

Portfolio Composition by Security Type % of Investments3

| Weighted Average Maturity2 | 37 Days |

Management views and portfolio holdings may have changed since the report date.

| 1 | Maturity shown is the date the interest rate on those securities is reset, or the date those securities can be redeemed through demand. |

| 2 | Money funds must maintain a dollar-weighted average maturity of no longer than 60 days and cannot invest in any security whose effective maturity is longer than 397 days (approximately 13 months). |

| 3 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 4 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 5 | Less than 0.05% |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Performance and Fund Facts as of December 31, 2021

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than performance data quoted. To obtain more current performance information, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

Seven-Day Average Yield Trend for Previous 12 Months1

The seven-day yield is the income generated by the fund’s holdings minus the fund’s operating expenses. The seven-day yields are calculated using standard SEC formulas. The effective yield includes the effect of reinvesting daily dividends. Please remember that money market fund yields fluctuate.

| | Schwab Government Money Market Portfolio |

| Ticker Symbol | SWPXX |

| Seven-Day Yield (with waivers)3 | 0.01% |

| Seven-Day Yield (without waivers)3 | -0.18% |

| Seven-Day Effective Yield (with waivers)3 | 0.01% |

You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

| 1 | Due to a special distribution of ordinary income to shareholders of Schwab Money Funds, the fund’s stated yields temporarily increased. Because this increase was temporary, investors should not rely on these yields for making investment decisions. |

| 2 | Fund yields do not reflect the additional fees and expenses imposed by the insurance company under the variable insurance product contract. If those contract fees and expenses were included, the yields would be less than those shown. Please refer to the variable insurance product prospectus for a complete listing of these expenses. |

| 3 | The Seven-Day Yield (with waivers) is the average income paid out over the previous seven days assuming interest income is not reinvested and it reflects the effect of any applicable waivers. Absent such waivers, the fund’s yield would have been lower. The Seven-Day Yield (without waivers) is the yield without the effect of any applicable waivers. The Seven-Day Effective Yield is the yield with waivers assuming that all interest income is reinvested in additional shares of the fund. For additional details, see financial note 4. |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Fund Expenses (Unaudited)

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, transfer agent fees, and other fund expenses.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in the fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for six months beginning July 1, 2021 and held through December 31, 2021.

The Actual Return line in the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for the fund under the heading entitled “Expenses Paid During Period.”

The Hypothetical Return line in the table below provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore, the hypothetical return lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | EXPENSE RATIO

(ANNUALIZED) 1,2 | BEGINNING

ACCOUNT VALUE

AT 7/1/21 | ENDING

ACCOUNT VALUE

(NET OF EXPENSES)

AT 12/31/21 | EXPENSES PAID

DURING PERIOD

7/1/21-12/31/213 |

| Schwab Government Money Market Portfolio | | | | |

| Actual Return | 0.06% | $1,000.00 | $1,000.50 | $0.30 |

| Hypothetical 5% Return | 0.06% | $1,000.00 | $1,024.90 | $0.31 |

| 1 | Based on the most recent six-month expense ratio; may differ from the expense ratio provided in the Financial Highlights. |

| 2 | Expense ratio (annualized) reflects the effect of a voluntary yield waiver in excess of the contractual expense limitation. (See financial note 4) |

| 3 | Expenses for each fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by the 184 days of the period, and divided by the 365 days of the fiscal year. |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Financial Statements

FINANCIAL HIGHLIGHTS

| | 1/1/21–

12/31/21 | 1/1/20–

12/31/20 | 1/1/19–

12/31/19 | 1/1/18–

12/31/18 | 1/1/17–

12/31/17 | |

| Per-Share Data |

| Net asset value at beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)1 | 0.00 2 | 0.00 2 | 0.02 | 0.02 | 0.00 2 | |

| Net realized and unrealized gains (losses) | 0.00 2 | 0.00 2 | 0.00 2 | (0.00) 2 | 0.00 2 | |

| Total from investment operations | 0.00 2 | 0.00 2 | 0.02 | 0.02 | 0.00 2 | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.00) 2,3 | (0.00) 2 | (0.02) | (0.02) | (0.00) 2 | |

| Net asset value at end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | |

| Total return | 0.06% 3 | 0.28% | 1.91% | 1.52% | 0.45% | |

| Ratios/Supplemental Data |

| Ratios to average net assets: | | | | | | |

| Net operating expenses | 0.06% 4 | 0.26% 5,6 | 0.35% | 0.35% | 0.46% 7 | |

| Gross operating expenses | 0.27% | 0.41% | 0.47% | 0.48% | 0.50% | |

| Net investment income (loss) | 0.06% | 0.25% | 1.88% | 1.55% | 0.44% | |

| Net assets, end of period (x 1,000,000) | $185 | $185 | $149 | $138 | $95 | |

| 1 | Calculated based on the average shares outstanding during the period. |

| 2 | Per-share amount was less than $0.005. |

| 3 | These amounts include a non-recurring special distribution. The effect on the distributions from net investment income was less than $0.005 and the effect on the total return was 0.05%. |

| 4 | Reflects the effect of a voluntary yield waiver. (See financial note 4) |

| 5 | Effective September 24, 2020, the contractual expense limitation changed. The ratio presented for period ended December 31, 2020 is a blended ratio. |

| 6 | Reflects the effect of a voluntary yield waiver in excess of the contractual expense limitation. (See financial note 4) |

| 7 | Effective October 3, 2017, the contractual expense limitation changed. The ratio presented for period ended December 31, 2017 is a blended ratio. |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Portfolio Holdings as of December 31, 2021

This section shows all the securities in the fund’s portfolio and their values as of the report date.

The fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (SEC) monthly on Form N-MFP, which is available immediately upon filing. The fund’s Form N-MFP is available on the SEC’s website at www.sec.gov. The fund also makes available its complete schedule of portfolio holdings 5 business days after month end on the fund’s website at www.schwabassetmanagement.com/schwabfunds_prospectus.

For fixed-rate obligations and repurchase agreements, the rate shown is the coupon rate (the rate established when the obligation was issued) and if the coupon rate is not available, the effective yield at the time of purchase is shown. For variable-rate obligations, the rate shown is the interest rate as of the report date based on each security’s rate reset date. The reference rate and spread used is shown parenthetically in the security description, if available; if not, the reference rate is described in a footnote. The date shown in the maturity date column below is either the date on which the principal amount must be paid or the date payment must be made pursuant to a demand feature. If the security’s structure includes one of a number of maturity-shortening provisions set forth in Rule 2a-7, such as an interest rate reset, demand feature or put feature, the effective maturity date is also disclosed. If the effective maturity and maturity date are the same, the date will only appear in the maturity date column.

| Issuer | Footnotes | Rate | Effective

Maturity | Maturity

Date | Face

Amount ($) | Value ($) |

| U.S. GOVERNMENT AGENCY DEBT 11.2% OF NET ASSETS |

| FEDERAL FARM CREDIT BANKS FUNDING CORP | | | | | | |

| (SOFR + 0.08%) | (a) | 0.13% | 01/03/22 | 03/10/22 | 400,000 | 400,000 |

| | | 0.25% | | 05/06/22 | 100,000 | 100,057 |

| | | 0.08% | | 05/09/22 | 100,000 | 99,997 |

| | | 0.06% | | 05/17/22 | 700,000 | 699,993 |

| | | 0.25% | | 06/02/22 | 300,000 | 300,195 |

| | | 0.08% | | 06/03/22 | 100,000 | 99,966 |

| | | 2.20% | | 06/03/22 | 100,000 | 100,880 |

| | | 0.07% | | 07/06/22 | 100,000 | 99,964 |

| (SOFR + 0.04%) | (a) | 0.09% | 01/03/22 | 07/08/22 | 500,000 | 499,987 |

| | | 0.20% | | 07/13/22 | 900,000 | 900,559 |

| | | 0.07% | | 07/19/22 | 300,000 | 299,885 |

| (SOFR + 0.09%) | (a) | 0.14% | 01/03/22 | 07/25/22 | 300,000 | 299,992 |

| | | 0.10% | | 08/02/22 | 400,000 | 400,032 |

| | | 0.09% | | 08/18/22 | 200,000 | 199,887 |

| | | 0.11% | | 08/31/22 | 200,000 | 199,853 |

| (EFFR - 0.02%) | (a) | 0.06% | 01/03/22 | 09/08/22 | 1,100,000 | 1,100,000 |

| | | 1.70% | | 09/19/22 | 100,000 | 101,113 |

| | | 0.19% | | 10/13/22 | 100,000 | 100,000 |

| (SOFR + 0.06%) | (a) | 0.11% | 01/03/22 | 10/21/22 | 600,000 | 600,000 |

| | | 0.15% | | 11/16/22 | 500,000 | 499,903 |

| (3 mo. US TBILL + 0.02%) | (a) | 0.11% | 01/03/22 | 05/01/23 | 700,000 | 700,000 |

| (3 mo. US TBILL + 0.03%) | (a) | 0.11% | 01/04/22 | 07/13/23 | 300,000 | 300,000 |

| (EFFR - 0.01%) | (a) | 0.07% | 01/03/22 | 07/21/23 | 900,000 | 900,000 |

| (SOFR + 0.06%) | (a) | 0.11% | 01/03/22 | 11/07/23 | 200,000 | 200,000 |

| (EFFR + 0.03%) | (a) | 0.11% | 01/03/22 | 12/08/23 | 100,000 | 100,000 |

| (SOFR + 0.12%) | (a) | 0.17% | 01/03/22 | 12/08/23 | 300,000 | 300,351 |

| (SOFR + 0.06%) | (a) | 0.11% | 01/03/22 | 12/13/23 | 200,000 | 200,000 |

| FEDERAL HOME LOAN BANKS | | | | | | |

| (SOFR + 0.12%) | (a) | 0.17% | 01/03/22 | 02/28/22 | 700,000 | 700,000 |

| | | 0.13% | | 08/12/22 | 200,000 | 200,035 |

| | | 3.13% | | 09/09/22 | 100,000 | 102,067 |

| | | 0.21% | | 12/02/22 | 700,000 | 700,000 |

| FEDERAL HOME LOAN MORTGAGE CORPORATION | | 2.38% | | 01/13/22 | 1,000,000 | 1,000,632 |

| (SOFR + 0.15%) | (a) | 0.20% | 01/03/22 | 03/04/22 | 900,000 | 900,000 |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Portfolio Holdings as of December 31, 2021 (continued)

| Issuer | Footnotes | Rate | Effective

Maturity | Maturity

Date | Face

Amount ($) | Value ($) |

| (SOFR + 0.20%) | (a) | 0.25% | 01/03/22 | 03/11/22 | 200,000 | 200,000 |

| (SOFR + 0.19%) | (a) | 0.24% | 01/03/22 | 06/02/22 | 500,000 | 500,000 |

| (SOFR + 0.10%) | (a) | 0.15% | 01/03/22 | 08/19/22 | 1,300,000 | 1,300,000 |

| (SOFR + 0.10%) | (a) | 0.15% | 01/03/22 | 09/09/22 | 800,000 | 800,000 |

| FEDERAL NATIONAL MORTGAGE ASSOCIATION | | | | | | |

| (SOFR + 0.35%) | (a) | 0.40% | 01/03/22 | 04/07/22 | 700,000 | 700,039 |

| | | 2.25% | | 04/12/22 | 100,000 | 100,588 |

| (SOFR + 0.39%) | (a) | 0.44% | 01/03/22 | 04/15/22 | 700,000 | 700,000 |

| (SOFR + 0.24%) | (a) | 0.29% | 01/03/22 | 04/29/22 | 500,000 | 500,000 |

| (SOFR + 0.20%) | (a) | 0.25% | 01/03/22 | 05/09/22 | 800,000 | 800,000 |

| (SOFR + 0.19%) | (a) | 0.24% | 01/03/22 | 05/19/22 | 1,200,000 | 1,200,000 |

| (SOFR + 0.19%) | (a) | 0.24% | 01/03/22 | 05/27/22 | 250,000 | 250,000 |

| | | 2.00% | | 08/26/22 | 100,000 | 101,229 |

| | | 1.38% | | 09/06/22 | 100,000 | 100,857 |

Total U.S. Government Agency Debt

(Cost $20,658,061) | 20,658,061 |

|

| U.S. TREASURY DEBT 23.8% OF NET ASSETS |

| UNITED STATES TREASURY | | | | | | |

| (3 mo. US TBILL + 0.15%) | (a) | 0.24% | 01/03/22 | 01/31/22 | 1,250,000 | 1,250,033 |

| | | 1.38% | | 01/31/22 | 1,700,000 | 1,701,701 |

| | | 1.50% | | 01/31/22 | 2,100,000 | 2,102,258 |

| | | 2.50% | | 02/15/22 | 800,000 | 802,278 |

| | | 1.88% | | 02/28/22 | 2,700,000 | 2,707,495 |

| | | 2.38% | | 03/15/22 | 1,900,000 | 1,908,511 |

| | | 1.75% | | 03/31/22 | 1,800,000 | 1,807,099 |

| | | 1.88% | | 03/31/22 | 800,000 | 803,442 |

| | | 2.25% | | 04/15/22 | 900,000 | 905,453 |

| | | 0.11% | | 04/26/22 | 1,400,000 | 1,399,539 |

| (3 mo. US TBILL + 0.11%) | (a) | 0.20% | 01/03/22 | 04/30/22 | 1,400,000 | 1,400,363 |

| | | 1.88% | | 04/30/22 | 800,000 | 804,568 |

| | | 0.13% | | 05/03/22 | 1,600,000 | 1,599,334 |

| | | 0.13% | | 05/31/22 | 700,000 | 700,076 |

| | | 1.75% | | 05/31/22 | 500,000 | 503,371 |

| | | 1.88% | | 05/31/22 | 1,300,000 | 1,309,237 |

| | | 0.11% | | 06/09/22 | 200,000 | 199,908 |

| | | 0.13% | | 06/30/22 | 200,000 | 199,979 |

| | | 1.75% | | 06/30/22 | 200,000 | 201,639 |

| | | 0.09% | | 07/14/22 | 1,000,000 | 999,520 |

| | | 0.13% | | 07/31/22 | 500,000 | 500,140 |

| (3 mo. US TBILL + 0.06%) | (a) | 0.14% | 01/03/22 | 07/31/22 | 2,800,000 | 2,799,961 |

| | | 1.88% | | 07/31/22 | 700,000 | 707,227 |

| | | 2.00% | | 07/31/22 | 500,000 | 505,520 |

| | | 0.11% | | 08/11/22 | 600,000 | 599,615 |

| | | 1.50% | | 08/15/22 | 2,500,000 | 2,521,882 |

| | | 0.13% | | 08/31/22 | 1,400,000 | 1,400,450 |

| | | 1.63% | | 08/31/22 | 1,200,000 | 1,211,622 |

| | | 1.88% | | 08/31/22 | 600,000 | 607,091 |

| | | 1.50% | | 09/15/22 | 2,300,000 | 2,322,729 |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Portfolio Holdings as of December 31, 2021 (continued)

| Issuer | Footnotes | Rate | Effective

Maturity | Maturity

Date | Face

Amount ($) | Value ($) |

| | | 0.13% | | 09/30/22 | 1,500,000 | 1,500,412 |

| | | 1.75% | | 09/30/22 | 900,000 | 911,053 |

| | | 1.88% | | 09/30/22 | 600,000 | 607,684 |

| (3 mo. US TBILL + 0.06%) | (a) | 0.14% | 01/03/22 | 10/31/22 | 500,000 | 499,979 |

| (3 mo. US TBILL + 0.05%) | (a) | 0.13% | 01/03/22 | 01/31/23 | 2,500,000 | 2,500,739 |

| (3 mo. US TBILL + 0.03%) | (a) | 0.12% | 01/03/22 | 04/30/23 | 700,000 | 700,084 |

| (3 mo. US TBILL + 0.03%) | (a) | 0.11% | 01/03/22 | 07/31/23 | 500,000 | 500,012 |

| (3 mo. US TBILL + 0.04%) | (a) | 0.12% | 01/03/22 | 10/31/23 | 400,000 | 399,993 |

Total U.S. Treasury Debt

(Cost $44,101,997) | 44,101,997 |

|

| VARIABLE RATE DEMAND NOTES 1.9% OF NET ASSETS |

| ABAG FINANCE AUTH |

| M/F HOUSING RB (CROSSING APTS) SERIES 2002A (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a)(b) | 0.07% | | 01/07/22 | 300,000 | 300,000 |

| ALABAMA HFA |

| M/F HOUSING RB (CHAPEL RIDGE APTS) SERIES 2005E (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a)(b) | 0.20% | | 01/07/22 | 100,000 | 100,000 |

| CALIFORNIA STATEWIDE COMMUNITIES DEVELOPMENT AUTH | | | | | | |

| M/F HOUSING RB (BAY VISTA AT MEADOW PARK APTS) SERIES 2003NN-1 (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a)(b) | 0.07% | | 01/07/22 | 200,000 | 200,000 |

| M/F HOUSING RB (CROSSINGS WEST APTS) SERIES 2009E (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a)(b) | 0.13% | | 01/07/22 | 100,000 | 100,000 |

| M/F HOUSING RB (VARENNA ASSISTED LIVING APTS) SERIES 2006F (LOC: FEDERAL HOME LOAN BANKS) | (a)(b) | 0.13% | | 01/07/22 | 100,000 | 100,000 |

| M/F HOUSING RB (WILSHIRE COURT APTS) SERIES 2003M (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a)(b) | 0.07% | | 01/07/22 | 100,000 | 100,000 |

| EMERYVILLE SUCCESSOR REDEVELOPMENT AGENCY |

| M/F HOUSING RB (BAY ST APTS) SERIES 2002A (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a)(b) | 0.13% | | 01/07/22 | 300,000 | 300,000 |

| HARRIS CNTY HOUSING FINANCE CORP |

| M/F HOUSING RB (LAFAYETTE VILLAGE APTS) SERIES 2006 (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a)(b) | 0.07% | | 01/07/22 | 100,000 | 100,000 |

| JACKSONVILLE HFA |

| M/F HOUSING RB (HARTWOOD APTS) SERIES 2006 (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a)(b) | 0.13% | | 01/07/22 | 505,000 | 505,000 |

| LOUISIANA LOCAL GOVERNMENT ENVIRONMENTAL FACILITIES & COMMUNITY DEVELOPMENT AUTH |

| RB (LOUISE S. MCGEHEE SCHOOL) SERIES 2010 (LOC: FEDERAL HOME LOAN BANKS) | (a)(b) | 0.15% | | 01/07/22 | 270,000 | 270,000 |

| NEW YORK STATE HFA | | | | | | |

| HOUSING RB (THEATRE ROW TOWER) SERIES 2000A (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a)(b) | 0.10% | | 01/07/22 | 100,000 | 100,000 |

| HOUSING RB SERIES 2005A (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a)(b) | 0.10% | | 01/07/22 | 200,000 | 200,000 |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Portfolio Holdings as of December 31, 2021 (continued)

| Issuer | Footnotes | Rate | Effective

Maturity | Maturity

Date | Face

Amount ($) | Value ($) |

| ORANGE CNTY HFA | | | | | | |

| M/F HOUSING RB (LANDINGS ON MILLENIA BLVD APTS) SERIES 2002A (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a)(b) | 0.15% | | 01/07/22 | 100,000 | 100,000 |

| M/F HOUSING RB (LEE VISTA CLUB APTS) SERIES 2004A (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a)(b) | 0.15% | | 01/07/22 | 100,000 | 100,000 |

| SACRAMENTO CNTY HOUSING AUTH |

| M/F HOUSING RB (LOGAN PARK APTS) SERIES 2007E (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a)(b) | 0.14% | | 01/07/22 | 300,000 | 300,000 |

| SAN JOSE |

| M/F HOUSING RB (CINNABAR COMMONS) SERIES 2003C (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a)(b) | 0.07% | | 01/07/22 | 100,000 | 100,000 |

| ST. TAMMANY PARISH DEVELOPMENT DISTRICT |

| RB (BCS DEVELOPMENT) SERIES 2008 (LOC: FEDERAL HOME LOAN BANKS) | (a)(b) | 0.15% | | 01/07/22 | 190,000 | 190,000 |

| TEXAS DEPT OF HOUSING & COMMUNITY AFFAIRS | | | | | | |

| M/F HOUSING RB (COSTA IBIZA APTS) SERIES 2008 (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a)(b) | 0.16% | | 01/07/22 | 100,000 | 100,000 |

| M/F HOUSING RB (TOWER RIDGE APTS) SERIES 2005 (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a)(b) | 0.20% | | 01/07/22 | 100,000 | 100,000 |

| M/F HOUSING REFUNDING RB (ALTA CULLEN APTS) SERIES 2008 (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a)(b) | 0.16% | | 01/07/22 | 100,000 | 100,000 |

Total Variable Rate Demand Notes

(Cost $3,465,000) | 3,465,000 |

|

| INVESTMENT COMPANIES 0.0% OF NET ASSETS |

| MONEY MARKET FUNDS 0.0% | |

| STATE STREET INSTITUTIONAL U.S. GOVERNMENT MONEY MARKET FUND, PREMIER CLASS | (c) | 0.03% | | | 45,600 | 45,600 |

Total Investment Companies

(Cost $45,600) | 45,600 |

| ISSUER | FOOTNOTES | RATE | EFFECTIVE

MATURITY | MATURITY

DATE | MATURITY

AMOUNT ($) | VALUE ($) |

| REPURCHASE AGREEMENTS 63.0% OF NET ASSETS |

| U.S. GOVERNMENT AGENCY REPURCHASE AGREEMENTS* 46.0% |

| BANK OF MONTREAL | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.05% | | 01/03/22 | 4,000,017 | 4,000,000 |

| (Collateralized by U.S. Government Agency Securities valued at $4,120,018, 1.38% - 3.20%, due 02/01/31 - 01/15/62) | | | | | | |

| BOFA SECURITIES INC | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.05% | | 01/03/22 | 20,000,083 | 20,000,000 |

| (Collateralized by U.S. Government Agency Securities valued at $20,600,001, 2.00%, due 01/01/37) | | | | | | |

| CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK SA | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.05% | | 01/03/22 | 15,000,063 | 15,000,000 |

| (Collateralized by U.S. Government Agency Securities valued at $15,450,065, 2.00%, due 01/20/51) | | | | | | |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Portfolio Holdings as of December 31, 2021 (continued)

| ISSUER | FOOTNOTES | RATE | EFFECTIVE

MATURITY | MATURITY

DATE | MATURITY

AMOUNT ($) | VALUE ($) |

| DAIWA CAPITAL MARKETS AMERICA INC | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.05% | | 01/03/22 | 8,000,033 | 8,000,000 |

| (Collateralized by U.S. Treasury and U.S. Government Agency Securities valued at $8,180,865, 0.13% - 5.00%, due 09/30/22 - 12/20/51) | | | | | | |

| DEUTSCHE BANK AG (NEW YORK BRANCH) | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.05% | | 01/03/22 | 8,000,033 | 8,000,000 |

| (Collateralized by U.S. Treasury Securities valued at $8,160,139, 2.88%, due 05/15/28) | | | | | | |

| GOLDMAN SACHS & CO LLC | | | | | | |

| Issued 12/28/21, repurchase date 01/04/22 | | 0.06% | | 01/04/22 | 3,000,035 | 3,000,000 |

| (Collateralized by U.S. Government Agency Securities valued at $3,060,000, 3.00% - 5.50%, due 12/01/30 - 12/20/51) | | | | | | |

| Issued 12/29/21, repurchase date 01/05/22 | | 0.06% | | 01/05/22 | 2,000,023 | 2,000,000 |

| (Collateralized by U.S. Government Agency Securities valued at $2,040,000, 2.50% - 7.50%, due 03/01/23 - 05/01/49) | | | | | | |

| JP MORGAN SECURITIES LLC | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.05% | | 01/03/22 | 10,000,042 | 10,000,000 |

| (Collateralized by U.S. Government Agency Securities valued at $10,300,002, 3.00%, due 07/15/48 - 11/01/51) | | | | | | |

| MIZUHO SECURITIES USA LLC | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.05% | | 01/03/22 | 5,000,021 | 5,000,000 |

| (Collateralized by U.S. Treasury Securities valued at $5,100,026, 1.25%, due 12/31/26) | | | | | | |

| RBC DOMINION SECURITIES INC | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.05% | | 01/03/22 | 2,000,008 | 2,000,000 |

| (Collateralized by U.S. Treasury and U.S. Government Agency Securities valued at $2,048,699, 0.25% - 4.50%, due 08/31/23 - 03/20/51) | | | | | | |

| ROYAL BANK OF CANADA | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.05% | | 01/03/22 | 8,000,033 | 8,000,000 |

| (Collateralized by U.S. Government Agency Securities valued at $8,240,035, 1.31% - 4.50%, due 02/01/31 - 12/20/51) | | | | | | |

| | | | | | | 85,000,000 |

| U.S. TREASURY REPURCHASE AGREEMENTS 17.0% |

| BARCLAYS BANK PLC | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.05% | | 01/03/22 | 2,506,525 | 2,506,515 |

| (Collateralized by U.S. Treasury Securities valued at $2,556,658, 2.75%, due 08/31/25) | | | | | | |

| CREDIT SUISSE AG (NEW YORK BRANCH) | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.05% | | 01/03/22 | 20,000,083 | 20,000,000 |

| (Collateralized by U.S. Treasury Securities valued at $20,400,101, 0.12% - 1.25%, due 10/31/23 - 12/31/26) | | | | | | |

| FICC - BANK OF NEW YORK | | | | | | |

| Issued 12/31/21, repurchase date 01/03/22 | | 0.06% | | 01/03/22 | 4,000,020 | 4,000,000 |

| (Collateralized by U.S. Treasury Securities valued at $4,080,026, 0.13%, due 05/31/22) | | | | | | |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Portfolio Holdings as of December 31, 2021 (continued)

| ISSUER | FOOTNOTES | RATE | EFFECTIVE

MATURITY | MATURITY

DATE | MATURITY

AMOUNT ($) | VALUE ($) |

| Issued 12/30/21, repurchase date 01/06/22 | | 0.06% | | 01/06/22 | 2,000,023 | 2,000,000 |

| (Collateralized by U.S. Treasury Securities valued at $2,636,732, 1.00%, due 12/15/24) | | | | | | |

| JP MORGAN SECURITIES LLC | | | | | | |

| Issued 12/30/21, repurchase date 01/06/22 | | 0.05% | | 01/06/22 | 3,000,029 | 3,000,000 |

| (Collateralized by U.S. Treasury Securities valued at $3,060,008, 0.13% - 7.25%, due 01/15/22 - 08/15/22) | | | | | | |

| | | | | | | 31,506,515 |

Total Repurchase Agreements

(Cost $116,506,515) | 116,506,515 |

Total Investments in Securities

(Cost $184,777,173) | 184,777,173 |

| * | Collateralized via U.S. Government Agency Securities or less frequently by higher rated U.S. Treasury Securities. |

| (a) | Variable rate security; rate shown is effective rate at period end. |

| (b) | VRDN is a municipal security which allows holders to sell their security through a put or tender feature, at par value plus accrued interest. The interest rate resets on a periodic basis, the majority of which are weekly but may be daily or monthly. Unless a reference rate and spread is shown parenthetically, the Remarketing Agent, generally a dealer, determines the interest rate for the security at each interest rate reset date. The rate is typically based on the SIFMA Municipal Swap Index. |

| (c) | The rate shown is the 7-day yield. |

| EFFR — | Effective Federal Funds Rate is published daily by the Federal Reserve Bank of New York and is based on the interest rate financial institutions charge each other for overnight funds. |

| FICC — | Fixed Income Clearing Corp |

| HFA — | Housing finance agency/authority |

| LOC — | Letter of credit |

| M/F — | Multi-family |

| RB — | Revenue bond |

| SIFMA — | Securities Industry and Financial Markets Association. The SIFMA Municipal Swap Index is a market index comprised of high-grade 7-day tax-exempt Variable Rate Demand Obligations with certain characteristics. |

| SOFR — | Secured Overnight Financing Rate is published daily by the Federal Reserve Bank of New York and is based on the cost of borrowing cash overnight collateralized by U.S. Treasury securities. |

| US TBILL — | The reference rate is the weekly auction stop for the U.S. Treasury Bill. |

| VRDN — | Variable rate demand note |

The following is a summary of the inputs used to value the fund’s investments as of December 31, 2021 (see financial note 2(a) for additional information):

| DESCRIPTION | QUOTED PRICES IN

ACTIVE MARKETS FOR

IDENTICAL ASSETS

(LEVEL 1) | OTHER SIGNIFICANT

OBSERVABLE INPUTS

(LEVEL 2) | SIGNIFICANT

UNOBSERVABLE INPUTS

(LEVEL 3) | TOTAL |

| Assets | | | | |

| U.S. Government Agency Debt1 | $— | $20,658,061 | $— | $20,658,061 |

| U.S. Treasury Debt1 | — | 44,101,997 | — | 44,101,997 |

| Variable Rate Demand Notes1 | — | 3,465,000 | — | 3,465,000 |

| Investment Companies1 | 45,600 | — | — | 45,600 |

| Repurchase Agreements1 | — | 116,506,515 | — | 116,506,515 |

| Total | $45,600 | $184,731,573 | $— | $184,777,173 |

| 1 | As categorized in the Portfolio Holdings. |

Fund investments in mutual funds are classified as Level 1, without consideration to the classification level of the underlying securities held by the mutual funds, which could be Level 1, Level 2 or Level 3.

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Statement of Assets and Liabilities

As of December 31, 2021

| Assets |

| Investments in securities, at cost and value - unaffiliated (Note 2a) | | $68,270,658 |

| Repurchase agreements, at cost and value — unaffiliated (Note 2a) | | 116,506,515 |

| Receivables: | | |

| Fund shares sold | | 1,798,543 |

| Interest | | 161,407 |

| Prepaid expenses | + | 426 |

| Total assets | | 186,737,549 |

| Liabilities |

| Payables: | | |

| Investments bought | | 1,599,334 |

| Fund shares redeemed | | 122,977 |

| Independent trustees’ fees | | 73 |

| Accrued expenses | + | 99,100 |

| Total liabilities | | 1,821,484 |

| Net assets | | $184,916,065 |

| Net Assets by Source |

| Capital received from investors | | $184,869,469 |

| Total distributable earnings | + | 46,596 |

| Net assets | | $184,916,065 |

| Net Asset Value (NAV) |

| Net Assets | ÷ | Shares

Outstanding | = | NAV |

| $184,916,065 | | 184,916,294 | | $1.00 |

| | | | | |

| | | | | |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Statement of Operations

| For the period January 1, 2021 through December 31, 2021 |

| Investment Income |

| Interest received from securities - unaffiliated | | $220,024 |

| Expenses |

| Investment adviser and administrator fees | | 351,411 |

| Portfolio accounting fees | | 38,543 |

| Custodian fees | | 35,646 |

| Professional fees | | 34,586 |

| Shareholder reports | | 24,159 |

| Independent trustees’ fees | | 15,643 |

| Transfer agent fees | | 1,949 |

| Other expenses | + | 4,831 |

| Total expenses | | 506,768 |

| Expense reduction by investment adviser and its affiliates | – | 398,609 |

| Net expenses | – | 108,159 |

| Net investment income | | 111,865 |

| REALIZED GAINS (LOSSES) |

| Net realized gains on sales of securities - unaffiliated | | 880 |

| Increase in net assets resulting from operations | | $112,745 |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Statement of Changes in Net Assets

For the current and prior report periods

| OPERATIONS |

| | 1/1/21-12/31/21 | 1/1/20-12/31/20 |

| Net investment income | | $111,865 | $458,260 |

| Net realized gains | + | 880 | 13 |

| Increase in net assets from operations | | $112,745 | $458,273 |

| DISTRIBUTIONS TO SHAREHOLDERS |

| Total distributions | | ($111,865) | ($458,260) |

| TRANSACTIONS IN FUND SHARES* |

| Shares sold | | 151,802,828 | 219,731,996 |

| Shares reinvested | | 111,865 | 458,260 |

| Shares redeemed | + | (152,073,454) | (183,969,281) |

| Net transactions in fund shares | | (158,761) | 36,220,975 |

| NET ASSETS |

| Beginning of period | | $185,073,946 | $148,852,958 |

| Total increase (decrease) | + | (157,881) | 36,220,988 |

| End of period | | $184,916,065 | $185,073,946 |

| * | Transactions took place at $1.00 per share; figures for share quantities are the same as for dollars. |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

1. Business Structure of the Fund:

Schwab Government Money Market Portfolio (the fund) is a series of Schwab Annuity Portfolios (the trust), a no-load, open-end management investment company. The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the 1940 Act). The list below shows all the funds in the trust as of the end of the period, including the fund discussed in this report, which is highlighted:

| SCHWAB ANNUITY PORTFOLIOS (ORGANIZED JANUARY 21, 1994) |

| Schwab Government Money Market Portfolio | |

| Schwab S&P 500 Index Portfolio | |

| Schwab VIT Balanced Portfolio | |

| Schwab VIT Balanced with Growth Portfolio | |

| Schwab VIT Growth Portfolio | |

The fund in this report offers one share class. Shares are bought and sold at closing net asset value per share (NAV), which is the price for all outstanding shares of a fund. Each share has a par value of 1/1,000 of a cent, and the fund’s Board of Trustees (the Board) may authorize the issuance of as many shares as necessary.

The fund is available exclusively as an investment vehicle for variable annuity and variable life insurance contracts offered by separate accounts of participating life insurance companies, and in the future may be offered to pension and retirement plans qualified under the Internal Revenue Code of 1986, as amended. At December 31, 2021, 100% of the fund’s shares were held through separate accounts of seven insurance companies. Subscriptions and redemptions of these insurance separate accounts could have a material impact on the fund.

The fund maintains its own account for purposes of holding assets and accounting, and is considered a separate entity for tax purposes. Within its account, the fund may also keep certain assets in segregated accounts, as required by securities law.

2. Significant Accounting Policies:

The following is a summary of the significant accounting policies the fund uses in its preparation of financial statements. The fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 Financial Services — Investment Companies. The accounting policies are in conformity with accounting principles generally accepted in the United States of America (GAAP).

(a) Security Valuation:

Under procedures approved by the Board, the investment adviser has formed a Pricing Committee to administer the pricing and valuation of portfolio securities and other assets and to ensure that prices used for internal purposes or provided by third parties reasonably reflect fair value. Among other things, these procedures allow the fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities in the fund are valued at amortized cost (which approximates fair value) as permitted in accordance with Rule 2a-7 of the 1940 Act. In the event that security valuations do not approximate fair value, securities may be fair valued as determined in accordance with procedures adopted by the Board. The Pricing Committee considers a number of factors, including unobservable market inputs when arriving at fair value. The Pricing Committee may employ techniques such as the review of related or comparable assets or liabilities, related market activities, recent transactions, market multiples, book values, transactional back-testing, disposition analysis and other relevant information. The Pricing Committee regularly reviews these inputs and assumptions to calibrate the valuations. Due to the subjective and variable nature of fair value pricing, there can be no assurance that a fund could obtain the fair value assigned to the security upon the sale of such security. The Board convenes on a regular basis to review fair value determinations made by the fund pursuant to the valuation procedures.

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the fund discloses the fair value of its investments in a hierarchy that prioritizes the significant inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurements). If inputs used to measure the financial instruments fall within different levels of the hierarchy, the categorization is based on the lowest level input that is significant to the valuation. If the fund determines that either the volume and/or level of activity for an asset or liability has significantly decreased (from normal conditions for that asset or liability) or price quotations or observable inputs are not associated with orderly transactions, increased analysis and management judgment will be required to estimate fair value.

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Financial Notes (continued)

2. Significant Accounting Policies (continued):

• Mutual funds: Mutual funds are valued at their respective NAVs.

The three levels of the fair value hierarchy are as follows:

• Level 1 — quoted prices in active markets for identical securities — Investments whose values are based on quoted market prices in active markets, and whose values are therefore classified as Level 1 prices, include active listed equities. Investments in mutual funds are valued daily at their NAVs, which are classified as Level 1 prices, without consideration to the classification level of the underlying securities held by an underlying fund.

• Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) — Investments that trade in markets that are not considered to be active, but whose values are based on quoted market prices, dealer quotations or valuations provided by alternative pricing sources supported by observable inputs are classified as Level 2 prices. These generally include U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, less liquid listed equities, and state, municipal and provincial obligations. Securities held by stable NAV money funds operating pursuant to Rule 2a-7 under the 1940 Act are valued at amortized cost which approximates current fair value and are considered to be valued using Level 2 inputs.

• Level 3 — significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments) — Investments whose values are classified as Level 3 prices have significant unobservable inputs, as they may trade infrequently or not at all. When observable prices are not available for these securities, the fund uses one or more valuation techniques for which sufficient and reliable data is available. The inputs used by the fund in estimating the value of Level 3 prices may include the original transaction price, quoted prices for similar securities or assets in active markets, completed or pending third-party transactions in the underlying investment or comparable issuers, and changes in financial ratios or cash flows. Level 3 prices may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the fund in the absence of market information. Assumptions used by the fund due to the lack of observable inputs may significantly impact the resulting fair value and therefore the fund’s results of operations.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The levels associated with valuing the fund’s investments as of December 31, 2021 are disclosed in the Portfolio Holdings.

(b) Accounting Policies for certain Portfolio Investments (if held):

Repurchase Agreements: In a repurchase agreement, a fund buys a security from another party (the counterparty), usually a financial institution, with the agreement that it be sold back in the future. Repurchase agreements subject a fund to counterparty risk, meaning that the fund could lose money if the other party fails to perform under the terms of the agreement. The fund mitigates this risk by ensuring that a fund’s repurchase agreements are collateralized by cash and/or U.S. government securities. All collateral is held by the fund’s custodian (or, with multi-party agreements, the agent’s bank) and is monitored daily to ensure that its fair value is at least equal to the maturity amount under the agreement. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed or limited and the value of the collateral may decline. Investments in repurchase agreements are also based on a review of the credit quality of the repurchase agreement counterparty.

As of December 31, 2021, the fund had investments in repurchase agreements with a gross value of $116,506,515 as disclosed in the Portfolio Holdings and the Statement of Assets and Liabilities. The value of the related collateral disclosed in the Portfolio Holdings exceeded the value of the repurchase agreements at period end.

Delayed-Delivery Transactions: The fund may buy securities at a predetermined price or yield, with payment and delivery taking place after the customary settlement period for that type of security. The fund will assume the rights and risks of ownership at the time of purchase, including the risk of price and yield fluctuations. Typically, no interest will accrue to the fund until the security is delivered. The fund will earmark or segregate appropriate liquid assets to cover its delayed-delivery purchase obligations, if any.

(c) Security Transactions:

Security transactions are recorded as of the date the order to buy or sell the security is executed. Realized gains and losses from security transactions are based on the identified costs of the securities involved.

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Financial Notes (continued)

2. Significant Accounting Policies (continued):

(d) Investment Income:

Interest income is recorded as it accrues. If the fund buys a debt security at a discount (less than face value) or a premium (more than face value), it amortizes premiums and accretes discounts from the purchase settlement date up to maturity. The fund then increases (in the case of discounts) or reduces (in the case of premiums) the income it records from the security. Certain securities may be callable (meaning that the issuer has the option to pay it off before its maturity date). The fund amortizes the premium and accretes the discount on each callable security to the security’s maturity date, except when the purchase price is higher than the call price at the security’s call date (in which case the premium is amortized to the call date). Dividends and distributions from underlying funds are recorded on the date they are effective (the ex-dividend date). Any distributions from underlying funds are recorded in accordance with the character of the distributions as designated by the underlying funds.

(e) Expenses:

Expenses that are specific to the fund are charged directly to the fund. Expenses that are common to more than one fund in the trusts generally are allocated among those funds in proportion to their average daily net assets.

(f) Distributions to Shareholders:

The fund declares distributions from net investment income, if any, every day it is open for business. The fund makes distributions from net realized capital gains, if any, once a year.

(g) Accounting Estimates:

The accounting policies described in this report conform to GAAP. Notwithstanding this, shareholders should understand that in order to follow these principles, fund management has to make estimates and assumptions that affect the information reported in the financial statements. It’s possible that once the results are known, they may turn out to be different from these estimates and these differences may be material.

(h) Federal Income Taxes:

The fund intends to meet federal income and excise tax requirements for regulated investment companies under subchapter M of the Internal Revenue Code, as amended. Accordingly, the fund distributes substantially all of its net investment income and net realized capital gains, if any, to the participating insurance company’s (shareholders) separate accounts each year. As long as the fund meets the tax requirements, it is not required to pay federal income tax.

(i) Indemnification:

Under the fund’s organizational documents, the officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business the fund enters into contracts with its vendors and others that provide general indemnifications. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the fund. However, based on experience, the fund expects the risk of loss attributable to these arrangements to be remote.

(j) Recent Accounting Standards:

In March 2020, the FASB issued Accounting Standards Update “Facilitation of the Effects of Reference Rate Reform on Financial Reporting (Topic 848)” (ASU 2020-04), which provides optional temporary financial reporting relief from the effect of certain types of contract modifications due to the planned discontinuation of the London Interbank Offered Rate (LIBOR) and other interbank offered based reference rates at the end of 2021. The temporary relief provided is effective for certain reference rate-related contract modifications that occur during the period March 12, 2020 through December 31, 2022. At this time, management believes the adoption of ASU 2020-04 will not have a material impact to the financial statements.

3. Risk Factors:

Market Risk. Financial markets rise and fall in response to a variety of factors, sometimes rapidly and unpredictably. Markets may be impacted by economic, political, regulatory and other conditions, including economic sanctions and other government actions. In addition, the occurrence of global events, such as war, terrorism, environmental disasters, natural disasters and epidemics may also negatively affect the financial markets. These events could reduce consumer demand or economic output; result in market closures, low or negative interest rates, travel restrictions or quarantines; and significantly adversely impact the economy. Governmental and quasi-governmental authorities and regulators throughout the world have in the past often responded to serious economic

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Financial Notes (continued)

3. Risk Factors (continued):

disruptions with a variety of significant fiscal and monetary policy changes which could have an unexpected impact on financial markets and the fund’s investments. As with any investment whose performance is tied to these markets, the value of an investment in the fund will fluctuate, which means that an investor could lose money over short or long periods.

Investment Risk. You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

Interest Rate Risk. Interest rates rise and fall over time. As with any investment whose yield reflects current interest rates, the fund’s yield will change over time. During periods when interest rates are low or there are negative interest rates, the fund’s yield (and total return) also could be low or even negative. In addition, the fund may be unable to pay expenses out of fund assets or maintain a stable $1.00 share price. Also, a change in a central bank’s monetary policy or economic conditions may result in a change in interest rates, which could have sudden and unpredictable effects on the markets. A sudden or unpredictable rise or decline in interest rates may cause volatility. Volatility in the market may decrease liquidity in the money market securities markets, making it more difficult for the fund to sell its money market investments at a time when the investment adviser might wish to sell such investments. Decreased market liquidity also may make it more difficult to value some or all of the fund’s money market securities holdings.

Stable Net Asset Value Risk. If the fund or another money market fund fails to maintain a stable net asset value (or such perception exists in the market place), the fund could experience increased redemptions, which may adversely impact the fund’s share price. The fund is permitted, among other things, to reduce or withhold any income and/or gains generated by the fund to maintain a stable $1.00 share price.

Repurchase Agreements Risk. When the fund enters into a repurchase agreement, the fund is exposed to the risk that the other party (i.e. the counterparty) will not fulfill its contractual obligation. In a repurchase agreement, there exists the risk that, when the fund buys a security from a counterparty that agrees to repurchase the security at an agreed upon price (usually higher) and time, the counterparty will not repurchase the security.

Credit Risk. A decline in the credit quality of an issuer, guarantor or liquidity provider of a portfolio investment or a counterparty could cause the fund to lose money or underperform. The fund could lose money if, due to a decline in credit quality, the issuer, guarantor or liquidity provider of a portfolio investment or a counterparty fails to make, or is perceived as being unable or unwilling to make, timely principal or interest payments or otherwise honor its obligations. Even though the fund’s investments in repurchase agreements are collateralized at all times, there is some risk to the fund if the other party should default on its obligations and the fund is delayed or prevented from recovering or disposing of the collateral. The credit quality of the fund’s portfolio holdings can change rapidly in certain market environments and any downgrade or default on the part of a single portfolio investment could cause the fund’s share price or yield to fall.

Certain U.S. government securities that the fund invests in are not backed by the full faith and credit of the U.S. government, which means they are neither issued nor guaranteed by the U.S. Treasury. Although maintained in conservatorship by the Federal Housing Finance Agency (FHFA) since September 2008, the Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac) maintain only lines of credit with the U.S. Treasury. The Federal Home Loan Banks maintain limited access to credit lines from the U.S. Treasury. Other securities, such as obligations issued by the Federal Farm Credit Banks Funding Corporation, are supported solely by the credit of the issuer. There can be no assurance that the U.S. government will provide financial support to securities of its agencies and instrumentalities if it is not obligated to do so under law. Also, any government guarantees on securities the fund owns do not extend to the shares of the fund itself.

Management Risk. Any actively managed mutual fund is subject to the risk that its investment adviser will select investments or allocate assets in a manner that could cause the fund to underperform or otherwise not meet its investment objective. The fund’s investment adviser applies its own investment techniques and risk analyses in making investment decisions for the fund, but there can be no guarantee that they will produce the desired results. The investment adviser’s maturity decisions will also affect the fund’s yield, and potentially could affect its share price. To the extent that the investment adviser anticipates interest rate trends imprecisely, the fund’s yield at times could lag the yields of other money market funds.

Redemption Risk. The fund may experience periods of heavy redemptions that could cause the fund to liquidate its assets at inopportune times or at a loss or depressed value, particularly during periods of declining or illiquid markets. Redemptions by a few large investors in the fund may have a significant adverse effect on the fund’s ability to maintain a stable $1.00 share price. In the event any money market fund fails to maintain a stable net asset value, other money market funds, including the fund, could face a market-wide risk of increased redemption pressures, potentially jeopardizing the stability of their $1.00 share prices.

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Financial Notes (continued)

3. Risk Factors (continued):

Money Market Fund Risk. The fund is not designed to offer capital appreciation. In exchange for their emphasis on stability and liquidity, money market investments may offer lower long-term performance than stock or bond investments.

Tax Diversification Risk. As described above, the fund intends to operate as a government money market fund under the regulations governing money market funds. Additionally, the fund intends to meet the diversification requirements that are applicable to insurance company separate accounts under Subchapter L of the Internal Revenue Code of 1986, as amended (the Diversification Requirements). To satisfy the Diversification Requirements applicable to variable annuity contracts, the value of the assets of the fund invested in securities issued by the U.S. government, its agencies or instrumentalities must remain below specified thresholds. For these purposes, each U.S. government agency or instrumentality is treated as a separate issuer.

Operating as a government money market fund may make it difficult for the fund to meet the Diversification Requirements. This difficulty may be exacerbated by the potential increase in demand for the types of securities in which the fund invests as a result of changes to the rules that govern SEC registered money market funds. A failure to satisfy the Diversification Requirements could have significant adverse tax consequences for variable life insurance and variable annuity contract owners whose contract values are determined by investment in the fund.

Please refer to the fund’s prospectus for a more complete description of the principal risks of investing in the fund.

4. Affiliates and Affiliated Transactions:

Investment Adviser

Charles Schwab Investment Management, Inc., dba Schwab Asset Management, a wholly owned subsidiary of The Charles Schwab Corporation, serves as the fund’s investment adviser and administrator pursuant to an Investment Advisory and Administration Agreement between the investment adviser and the trust.

For its advisory and administrative services to the fund, the investment adviser is entitled to receive an annual fee, payable monthly, equal to 0.19% of the fund’s average daily net assets.

Contractual Expense Limitation

The investment adviser and its affiliates have made an additional agreement with the fund, for so long as the investment adviser serves as the investment adviser to the fund, which may only be amended or terminated with the approval of the Board, to limit the total annual fund operating expenses charged, excluding interest, taxes, and certain non-routine expenses (expense limitation) to 0.34%.

During the year ended December 31, 2021, the fund waived a total of $398,609 in expenses, all of which was waived voluntarily.

Voluntary Yield Waiver/Reimbursement

The investment adviser and its affiliates may waive and/or reimburse expenses to the extent necessary to maintain a positive net yield for the fund.

Interfund Transactions

The fund may engage in transactions with certain other funds in the Fund Complex (for definition refer to the Trustees and Officers section)in accordance with procedures adopted by the Board pursuant to Rule 17a-7 under the 1940 Act. When one fund is seeking to sell a security that another is seeking to buy, an interfund transaction can allow both funds to benefit by reducing transaction costs. This practice is limited to funds that share the same investment adviser, trustees and/or officers. For the period ended December 31, 2021, the fund’s total aggregate security transactions with other funds in the Fund Complex was $1,505,036 and includes realized gains (losses) of $0.

Interfund Borrowing and Lending

Pursuant to an exemptive order issued by the U.S. Securities and Exchange Commission (SEC), the fund may enter into interfund borrowing and lending transactions with other funds in the Fund Complex. All loans are for temporary or emergency purposes and the interest rate to be charged will be the average of the overnight repurchase agreement rate and the short-term bank loan rate. All loans are subject to numerous conditions designed to ensure fair and equitable treatment of all participating funds. The interfund lending facility is subject to the oversight and periodic review by the Board. The fund had no interfund borrowing or lending activity during the period.

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Financial Notes (continued)

The Board may include people who are officers and/or directors of the investment adviser or its affiliates. Federal securities law limits the percentage of such “interested persons” who may serve on a trust’s board, and the trust was in compliance with these limitations throughout the report period. The trust did not pay any of these interested persons for their services as trustees, but it did pay non-interested persons (independent trustees), as noted on the fund’s Statement of Operations. For information regarding the trustees, please refer to the Trustees and Officers table at the end of this report.

6. Borrowing from Banks

During the period, the fund was a participant with other funds in the Fund Complex in a joint, syndicated, committed $850 million line of credit (the Syndicated Credit Facility), which matured on September 30, 2021. On September 30, 2021, the Syndicated Credit Facility was amended to run for a new 364 day period with the line of credit amount remaining unchanged, maturing on September 29, 2022. Under the terms of the Syndicated Credit Facility, in addition to the interest charged on any borrowings by the fund, the fund paid a commitment fee of 0.15% per annum on the fund’s proportionate share of the unused portion of the Syndicated Credit Facility.

During the period, the fund was a participant with other funds in the Fund Complex in a joint, unsecured, uncommitted $400 million line of credit (the Uncommitted Credit Facility), with State Street Bank and Trust Company, which matured on September 30, 2021. On September 30, 2021, the Uncommitted Credit Facility was amended to run for a new 364 day period with the line of credit remaining unchanged, maturing on September 29, 2022. Under the terms of the Uncommitted Credit Facility, the fund pays interest on the amount it borrows. There were no borrowings from either line of credit during the period.

The fund also has access to custodian overdraft facilities. The fund may have utilized the overdraft facility and incurred an interest expense, which is disclosed on the fund’s Statement of Operations, if any. The interest expense is determined based on a negotiated rate above the current Federal Funds Rate.

7. Federal Income Taxes:

At December 31, 2021, the tax basis cost of the fund’s investments was $184,731,573 and the unrealized appreciation and depreciation were $45,600 and ($0), respectively, with a net unrealized appreciation of $45,600.

As of December 31, 2021, the components of distributable earnings on a tax basis were as follows:

UNDISTRIBUTED

ORDINARY

INCOME | UNDISTRIBUTED

LONG-TERM

CAPITAL GAINS | NET UNREALIZED

APPRECIATION

(DEPRECIATION)

ON INVESTMENTS | TOTAL |

| $896 | $100 | $45,600 | $46,596 |

The tax basis components of distributions paid during the current and prior fiscal years were:

| CURRENT FISCAL YEAR END DISTRIBUTIONS | PRIOR FISCAL YEAR END DISTRIBUTIONS |

ORDINARY

INCOME | ORDINARY

INCOME |

| $111,865 | $458,260 |

Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements. The fund may also designate a portion of the amount paid to redeeming shareholders as a distribution for tax purposes.

Permanent book and tax basis differences may result in reclassifications between components of net assets as required. The adjustments will have no impact on net assets or the results of operations.

As of December 31, 2021, management has reviewed the tax positions for open periods (for federal purposes, three years from the date of filing and for state purposes, four years from the date of filing) as applicable to the fund, and has determined that no provision for income tax is required in the fund’s financial statements. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the fiscal year ended December 31, 2021, the fund did not incur any interest or penalties.

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Financial Notes (continued)

Management has determined there are no subsequent events or transactions through the date the financial statements were issued that would have materially impacted the financial statements as presented.

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Schwab Annuity Portfolios and Shareholders of Schwab Government Money Market Portfolio

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities, including the portfolio holdings, of Schwab Government Money Market Portfolio (the “Fund”), one of the funds constituting Schwab Annuity Portfolios, as of December 31, 2021, the related statement of operations for the year then ended, the statement of changes in net assets and the financial highlights for each of the two years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2021, the results of its operations for the year then ended, and the changes in its net assets and the financial highlights for each of the two years in the period then ended in conformity with accounting principles generally accepted in the United States of America. The financial highlights for each of the three years in the period ended December 31, 2019 were audited by other auditors, whose report, dated February 18, 2020, expressed an unqualified opinion on such financial highlights.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2021, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

Deloitte & Touche LLP

Denver, Colorado

February 17, 2022

We have served as the auditor of one or more investment companies in the Schwab Funds Complex since 2020.

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Other Federal Tax Information (unaudited)

For the fiscal year ended December 31, 2021, the fund designates 99.93% of dividend income as business interest income under section 163(j) of the Internal Revenue Code.

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

Trustees and Officers

The tables below give information about the trustees and officers of Schwab Annuity Portfolios, which includes the fund covered in this report. The “Fund Complex” includes The Charles Schwab Family of Funds, Schwab Capital Trust, Schwab Investments, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust. The Fund Complex includes 103 funds.

The address for all trustees and officers is 211 Main Street, San Francisco, CA 94105. You can find more information about the trustees and officers in the fund’s Statement of Additional Information, which is available free by calling 1-877-824-5615.

| Independent Trustees |

Name, Year of Birth, and

Position(s) with the trust

(Terms of office, and

length of Time Served1) | Principal Occupations

During the Past Five Years | Number of

Portfolios in

Fund Complex

Overseen by

the Trustee | Other Directorships |

Robert W. Burns

1959

Trustee

(Trustee of Schwab Strategic Trust since 2009; The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2016) | Retired/Private Investor (Jan. 2009 – present). Formerly, Managing Director, Pacific Investment Management Company, LLC (PIMCO) (investment management firm) and President, PIMCO Funds. | 103 | None |

Nancy F. Heller

1956

Trustee

(Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2018) | Retired. President and Chairman (2014 – 2016), TIAA Charitable (financial services); Senior Managing Director (2003 – 2016), TIAA (financial services). | 103 | None |

David L. Mahoney

1954

Trustee

(Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2011; Schwab Strategic Trust since 2016) | Private Investor. | 103 | Director (2004 – present), Corcept Therapeutics Incorporated

Director (2009 – 2021), Adamas Pharmaceuticals, Inc.

Director (2003 – 2019), Symantec Corporation |

Jane P. Moncreiff

1961

Trustee

(Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2019) | Consultant (2018 – present), Fulham Advisers LLC (management consulting); Chief Investment Officer (2009 – 2017), CareGroup Healthcare System, Inc. (healthcare). | 103 | None |

Kiran M. Patel

1948

Trustee

(Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2011; Schwab Strategic Trust since 2016) | Retired. Executive Vice President and General Manager of Small Business Group (Dec. 2008 – Sept. 2013), Intuit, Inc. (financial software and services firm for consumers and small businesses). | 103 | Director (2008 – present), KLA-Tencor Corporation |

Schwab Government Money Market Portfolio | Annual Report

Schwab Government Money Market Portfolio

| Independent Trustees (continued) |

Name, Year of Birth, and

Position(s) with the trust

(Terms of office, and

length of Time Served1) | Principal Occupations