UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07143

| T. Rowe Price Equity Series, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1.

Equity Income Portfolio | June 30, 2022 |

| T. ROWE PRICE Equity Income Portfolio |

|

HIGHLIGHTS

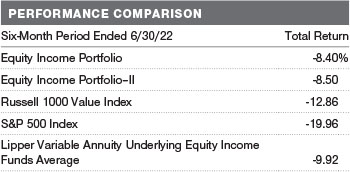

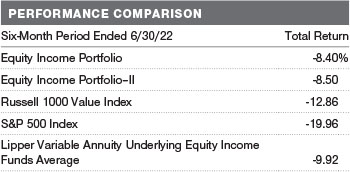

| ■ | The Equity Income Portfolio outperformed both the Russell 1000 Value Index and the Lipper Variable Annuity Underlying Equity Income Funds Average for the six months ended June 30, 2022. |

| | |

| ■ | Within the portfolio, absolute contributors were concentrated within sectors that benefited from rising commodity and energy costs and the flight to more defensive stocks against a background of geopolitical turmoil. Top detractors were focused in sectors that struggled amid the uncertainty associated with an inflationary environment. |

| | |

| ■ | Changes in sector allocation were the result of our bottom-up stock selection. During the first half of the year, we focused on fading cyclicality within the portfolio and invested in names with idiosyncratic returns drivers and companies we liked long term that faced near-term stress. |

| | |

| ■ | Going forward, our aim is to create a portfolio that is balanced for a variety of market settings, investing in ideas where the risk/reward ratio is particularly attractive while being cognizant of our beta. As always, our focus remains on investing in higher-quality companies where there is a confluence of compelling valuations, attractive long-term fundamentals, and strong dividend yields. |

Log in to your account at troweprice.com for more information.

*Certain mutual fund accounts that are assessed an annual account service fee can also save money by switching to e-delivery.

Market Commentary

Dear Investor

Major stock and bond indexes produced sharply negative results during the first half of 2022 as investors contended with persistently high inflation, tightening financial conditions, and slowing growth.

After reaching an all-time high on January 3, the S&P 500 Index finished the period down about 20%, the worst first half of a calendar year for the index since 1970. Double-digit losses were common in equity markets around the globe, and bond investors also faced a historically tough environment amid a sharp rise in interest rates.

Value shares outperformed growth stocks as equity investors turned risk averse and rising rates put downward pressure on growth stock valuations. Emerging markets stocks held up somewhat better than shares in developed markets due to the strong performance of some oil-exporting countries. Meanwhile, the U.S. dollar strengthened during the period, which weighed on returns for U.S. investors in international securities.

Within the S&P 500, energy was the only bright spot, gaining more than 30% as oil prices jumped in response to Russia’s invasion of Ukraine and the ensuing commodity supply crunch. Typically defensive shares, such as utilities, consumer staples, and health care, finished in negative territory but held up relatively well. The consumer discretionary, communication services, and information technology sectors were the weakest performers. Shares of some major retailers fell sharply following earnings misses driven in part by overstocked inventories.

Inflation remained the leading concern for investors throughout the period. Despite hopes in 2021 that the problem was transitory, and later expectations that inflation would peak in the spring, headline consumer prices continued to grind higher throughout the first half of 2022. The war in Ukraine exacerbated already existing supply chain problems, and other factors, such as the impact of the fiscal and monetary stimulus enacted during the pandemic and strong consumer demand, also pushed prices higher. The May consumer price index report (the last to be issued during our reporting period) showed prices increasing 8.6% over the 12-month period, the largest jump since late 1981.

In response, the Federal Reserve, which at the end of 2021 had forecast that only three 25-basis-point (0.25 percentage point) rate hikes would be necessary in all of 2022, rapidly shifted in a hawkish direction and executed three rate increases in the first six months of the year. The policy moves included hikes of 25, 50, and 75 basis points—the largest single increase since 1994—increasing the central bank’s short-term lending benchmark from near zero to a target range of 1.50% to 1.75% by the end of June. In addition, the Fed ended the purchases of Treasuries and agency mortgage-backed securities that it had begun to support the economy early in the pandemic and started reducing its balance sheet in June.

Longer-term bond yields also increased considerably as the Fed tightened monetary policy, with the yield on the benchmark 10-year U.S. Treasury note reaching 3.49% on June 14, its highest level in more than a decade. (Bond prices and yields move in opposite directions.) Higher mortgage rates led to signs of cooling in the housing market.

The economy continued to add jobs during the period, and other indicators pointed to a slowing but still expanding economy. However, the University of Michigan consumer sentiment index dropped in June to its lowest level since records began in 1978 as higher inflation expectations undermined confidence.

Looking ahead, investors are likely to remain focused on whether the Fed can tame inflation without sending the economy into recession, a backdrop that could produce continued volatility. We believe this environment makes skilled active management a critical tool for identifying risks and opportunities, and our investment teams will continue to use fundamental research to identify companies that can add value to your portfolio over the long term.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

CEO and President

Management’s Discussion of Fund Performance

INVESTMENT OBJECTIVE

The fund seeks a high level of dividend income and long-term capital growth primarily through investments in stocks.

FUND COMMENTARY

How did the fund perform in the past six months?

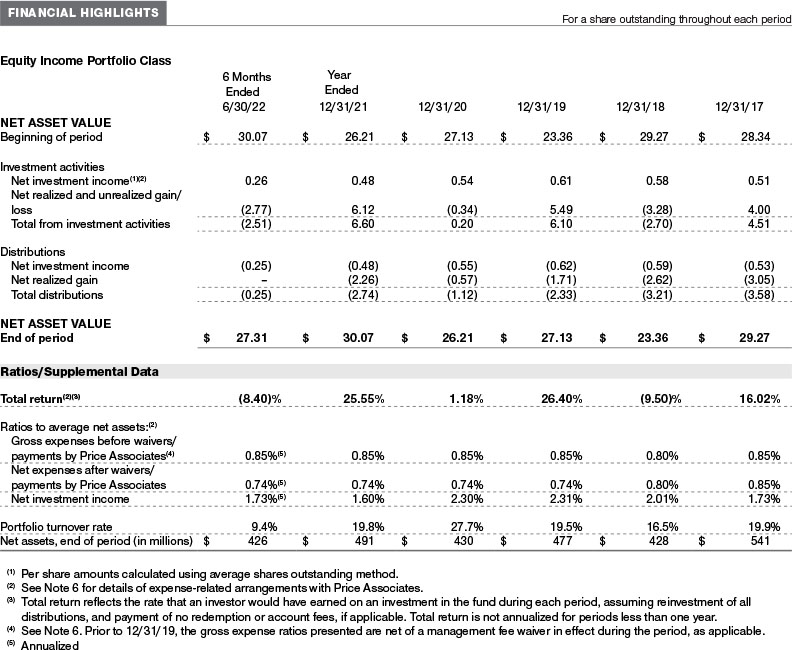

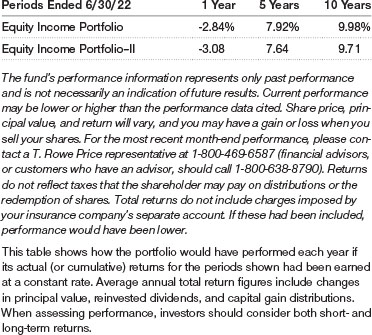

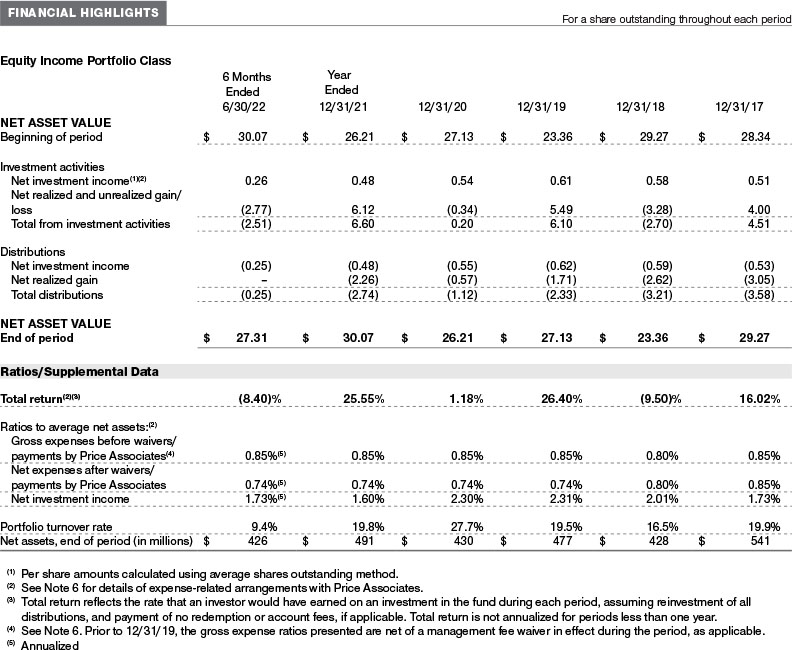

The Equity Income Portfolio returned -8.40% for the six-month period ended June 30, 2022. The fund outperformed the Russell 1000 Value Index as well as its peer group, the Lipper Variable Annuity Underlying Equity Income Funds Average. (Returns for the II Class shares varied slightly, reflecting their different fee structure. Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

In the worst first half of a calendar year for the S&P 500 Index since 1970, investors shunned riskier assets in response to Russia’s invasion of Ukraine, elevated inflation exacerbated by rising commodity prices, and Federal Reserve interest rate increases. Investors were also concerned about inflation’s impact on consumer spending and corporate profits, particularly as some high-profile companies and major retailers disappointed with their financial results or projections.

The Equity Income Portfolio outpaced its benchmark, with relative outperformance driven by both stock selection and sector allocation. Given steps taken during the worst portions of the pandemic, the portfolio was well positioned for an environment of higher interest rates and commodity prices. This positioning, combined with our valuation discipline, was a large tailwind to performance during the first half of 2022, as most of the pain in the equity market came from companies in the higher end of the valuation distribution.

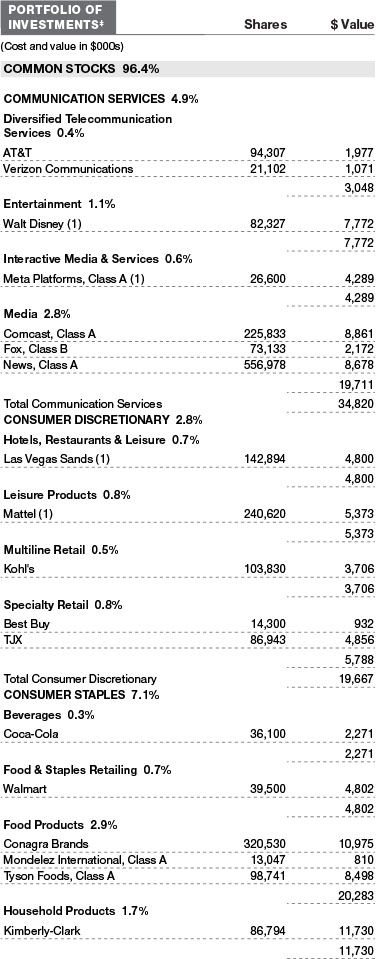

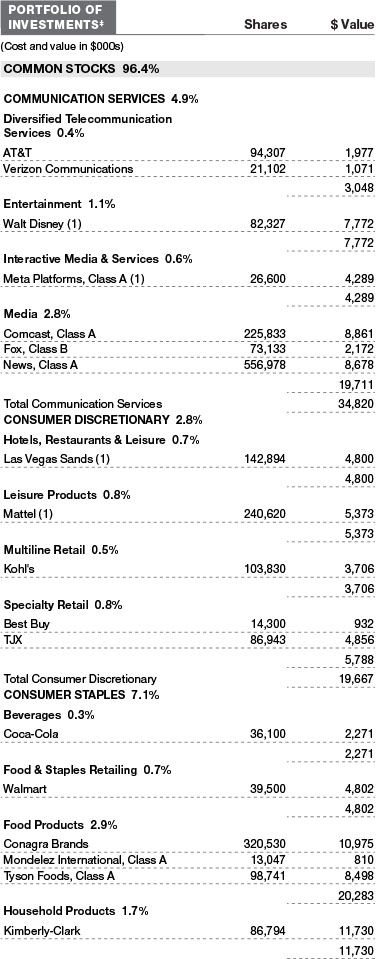

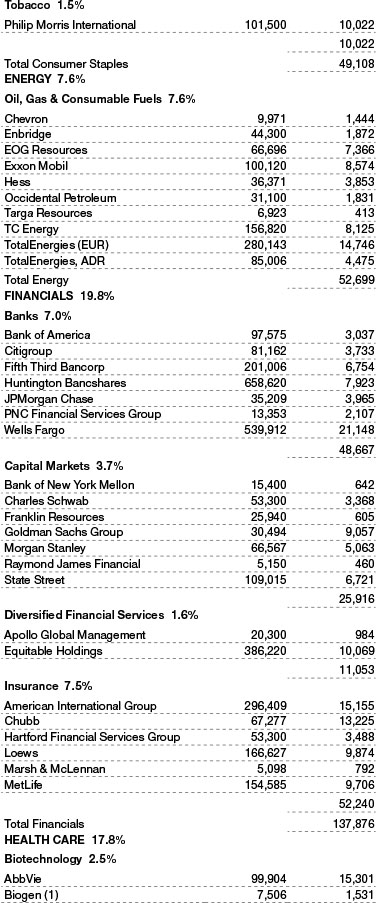

Within the portfolio, health care sector names contributed to gains, particularly AbbVie in pharmaceuticals as well as managed care companies Elevance Health (formerly Anthem) and Cigna. Overall, the sector benefited from the appeal of its defensive nature due to comparatively reduced sensitivity to macroeconomic pressures. AbbVie performed particularly well following the Food and Drug Administration approval of its drugs Rinvoq and Skyrizi, which should help balance sales deficits from Humira’s loss of exclusivity in 2023. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

Certain financial names, notably in the insurance industry, also added value over the period. Conglomerate Loews outperformed the sector for the first half. The company’s value is largely attributable to its majority ownership in U.S. commercial property and casualty (P&C) insurance company CNA Financial, which has continued to benefit from a strong pricing environment for P&C insurers. CNA Financial also reported strong earnings in both quarters, which contributed to higher underwriting income. MetLife’s recent operational results boosted positive sentiment toward the stock, and Chubb also benefited from the ongoing P&C upcycle.

Elsewhere in the portfolio, shares of low-cost nitrogen producer CF Industries profited from surging natural gas prices and fertilizer prices, which proved to be tailwinds for most of the period. Russia’s invasion of Ukraine caused natural gas prices to rise even further and created a disruption to global fertilizer supplies, which further propelled the stock. Defense contractor L3Harris Technologies, generally hedged against inflation and recession, benefited from improved Department of Defense budgets and increased international defense spending.

The portfolio’s greatest absolute detractors hailed from a variety of sectors. Global multi-industrial company GE underperformed as its renewables segment and aviation segment contended with inflationary pressures and supply chain pressures, respectively. These temporary concerns have depressed valuation, thereby creating an attractive risk/reward ratio. We believe plans to begin to separate the conglomerate next year will highlight the value of the businesses within GE. Walt Disney shares suffered from investor concerns about the ability of the company to meet the aggressive growth targets of its Disney+ streaming platform.

Compared with the benchmark, stock selection in health care contributed the most value to relative performance. Conversely, stock selection in communication services detracted the most from relative results, although our underweight position to the sector moderated losses.

How is the fund positioned?

The Equity Income Portfolio seeks to buy well-established, large-cap companies that have a strong record of paying dividends and appear to be undervalued by the market. The fund’s holdings tend to be solid, higher-quality companies going through a period of controversy or stress, reflecting our dual focus on valuation and dividend yield. Each position is the product of careful stock picking based on the fundamental research generated by T. Rowe Price’s team of equity analysts, as opposed to selection based on broader market or macroeconomic trends.

Our top purchases over the six-month period were from varied sectors. In communication services, we initiated a position in Meta Platforms late in the period following a significant correction in the stock. While questions remain about the company’s core business and its plans to invest significantly in research and development over the next few years, the sizable correction has created an attractive valuation and a reasonably good risk/reward profile from current levels. We also added to our position in News Corp. While we remain cognizant of the headwinds that the company faces, we appreciate its collection of high-quality assets with durable growth profiles. Further, we believe that shares are trading at a considerable discount to a sum-of-the-parts valuation. In financials, we added to our position in life insurance company Equitable Holdings due to its compelling valuation. In our view, the company’s earnings are poised to benefit from operational earnings growth, share buybacks, and dividends. We also purchased shares of consumer staples name Conagra Brands, as we value the stock’s defensive nature and its growth potential within the frozen foods space.

Notable sales were also spread out among several areas of the market. Our largest equity sale was chicken, beef, and pork producer and processor Tyson Foods. We continue to appreciate the name but are concerned that increased feed costs will impact margins, particularly in chicken and beef. In financials, we moderated our positions in MetLife, Wells Fargo, and Fifth Third Bancorp, all of which have been strong contributors in recent periods. Elsewhere in the portfolio, we exited our position in UnitedHealth Group given its premium valuation and took profit from Elevance Health and Cigna by paring shares.

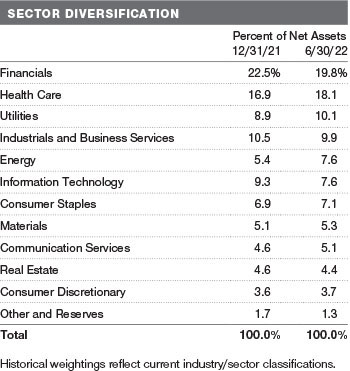

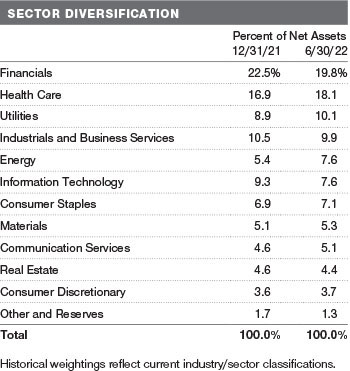

The portfolio’s largest sector allocation is in financials. We remain overweight relative to the benchmark, but we decreased our absolute exposure during the period. The portfolio’s second-largest sector allocation is in health care, where our absolute exposure increased. Utilities, our third-largest sector allocation, is significantly overweight the benchmark, and this overweight increased on an absolute and relative basis over the period. Please note that weighting versus the benchmark also changed as a result of the reconstitution of the benchmark index that took place in June.

What is portfolio management’s outlook?

We believe the cone of uncertainty is abnormally wide now, with potential outcomes dependent on events outside of our control. Additionally, the Russian invasion of Ukraine has structurally increased geopolitical risk while exacerbating already high inflationary pressures, contributing to the market pricing in higher odds of a recession.

Given this view, we have been focusing on creating a portfolio that is balanced for a variety of market settings. We used weakness in select names to take advantage of opportunities in the market where the risk/reward ratio was particularly attractive while being cognizant of our beta. Our focus remains on investing in higher-quality companies where there is a confluence of compelling valuations, attractive long-term fundamentals, and strong dividend yields.

The views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

RISKS OF INVESTING IN THE FUND

Dividend-paying stocks

The fund’s emphasis on dividend-paying stocks could cause the fund to underperform similar funds that invest without consideration of a company’s track record of paying dividends. There is no guarantee that the issuers of the stocks held by the fund will declare dividends in the future or that, if dividends are declared, they will remain at their current levels or increase over time. For example, a sharp rise in interest rates or an economic downturn could cause a company to unexpectedly reduce or eliminate its dividend. In addition, stocks of companies with a history of paying dividends may not benefit from a broad market advance to the same degree as the overall stock market.

Stock investing

The fund’s share price can fall because of weakness in the overall stock markets, a particular industry, or specific holdings. Stock markets as a whole can be volatile and decline for many reasons, such as adverse local, political, regulatory, or economic developments; changes in investor psychology; or heavy institutional selling at the same time by major institutional investors in the market, such as mutual funds, pension funds, and banks. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the adviser’s assessment of companies whose stocks are held by the fund may prove incorrect, resulting in losses or poor performance, even in rising markets. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer’s bonds and preferred stock take precedence over the claims of those who own common stock.

For a more thorough discussion of risks, please see the fund’s prospectus.

BENCHMARK INFORMATION

Note: Portions of the mutual fund information contained in this report was supplied by Lipper, a Refinitiv Company, subject to the following: Copyright 2022 © Refinitiv. All rights reserved. Any copying, republication or redistribution of Lipper content is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

Note: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® is/are a trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price’s presentation thereof.

Note: The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

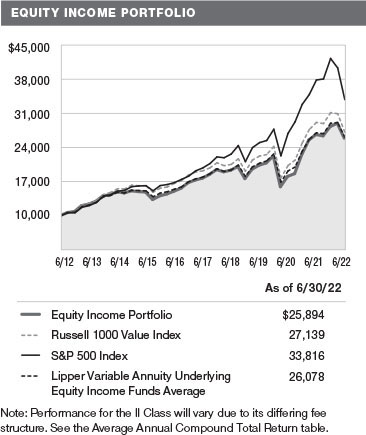

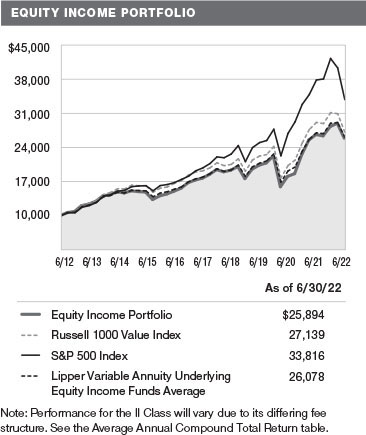

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the portfolio over the past 10 fiscal year periods or since inception (for portfolios lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from portfolio returns as well as mutual fund averages and indexes.

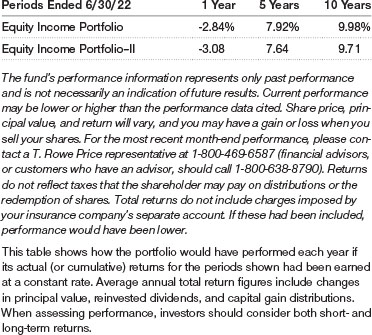

AVERAGE ANNUAL COMPOUND TOTAL RETURN

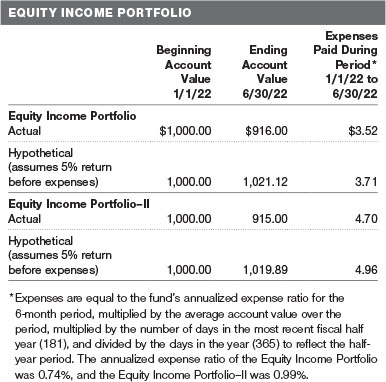

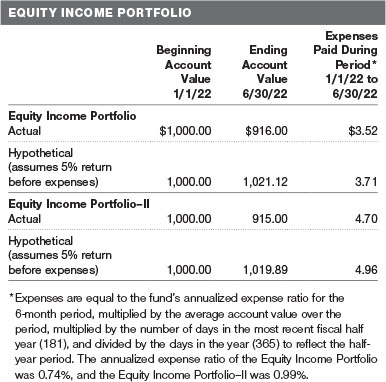

FUND EXPENSE EXAMPLE

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Shares of the fund are currently offered only through certain insurance companies as an investment medium for both variable annuity contracts and variable life insurance policies. Please note that the fund has two classes of shares: the original share class and II Class. II Class shares are sold through financial intermediaries, which are compensated for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and actual expenses. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

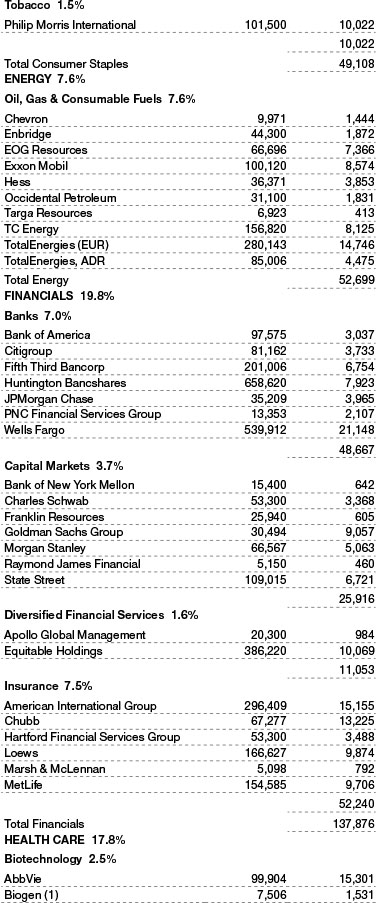

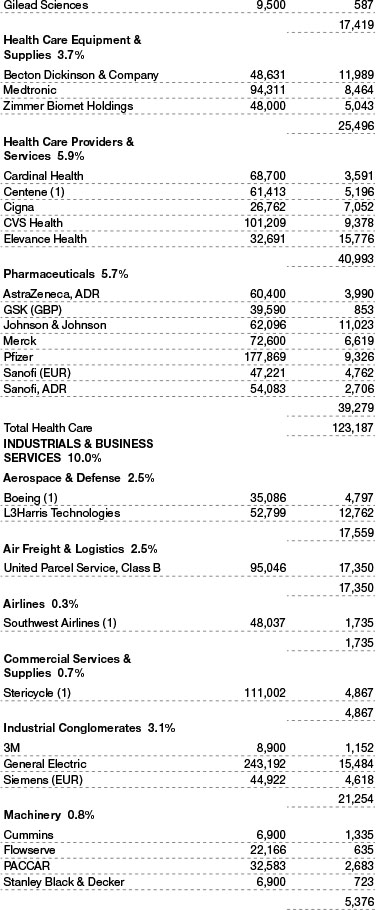

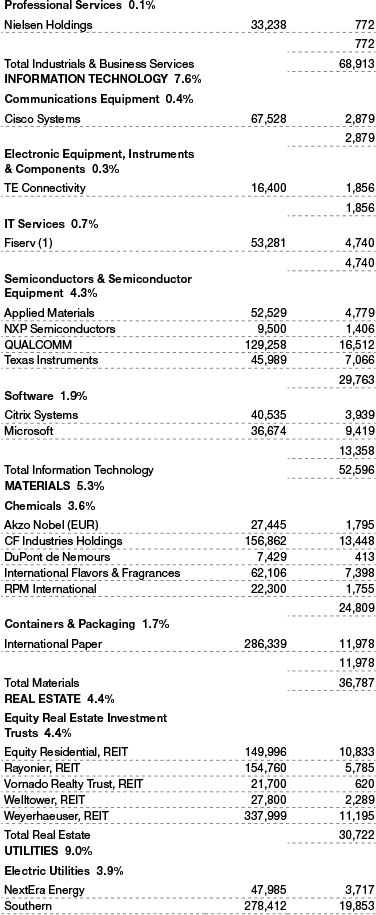

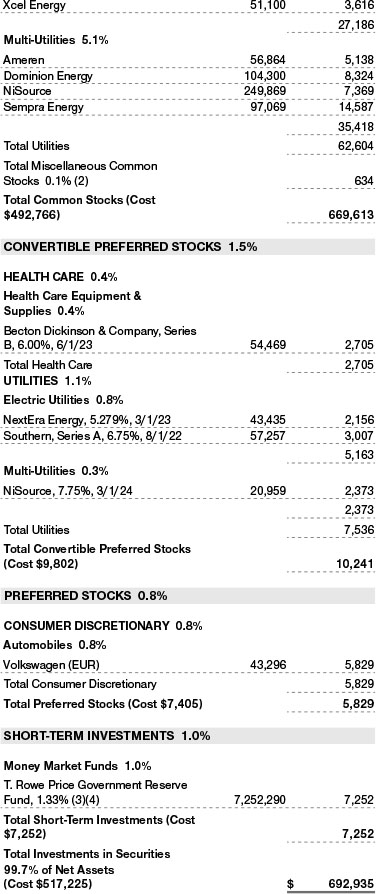

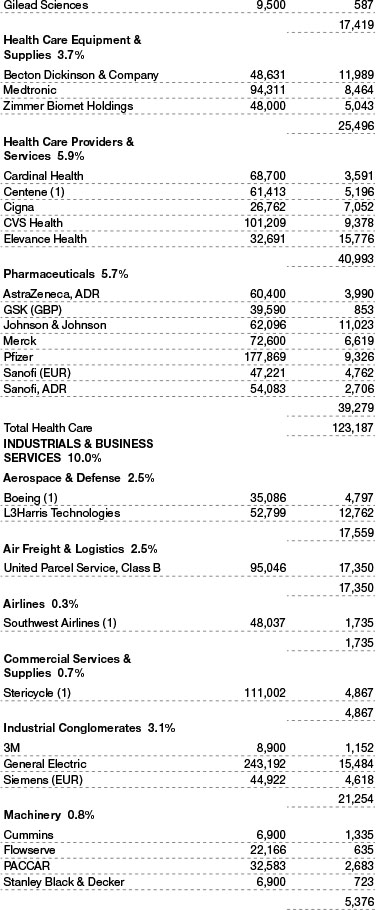

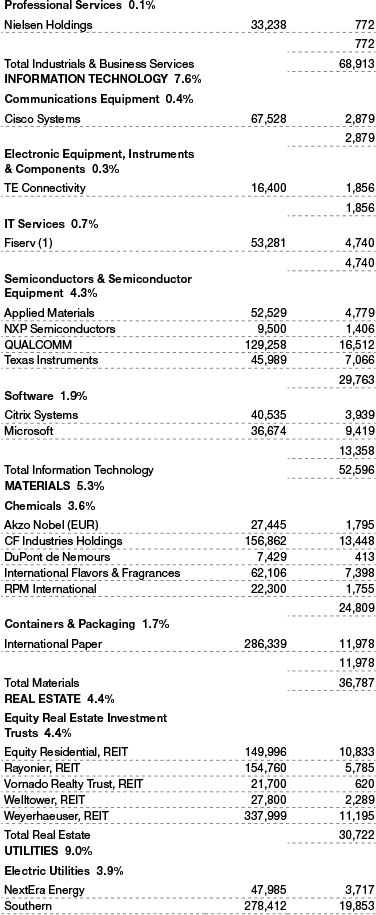

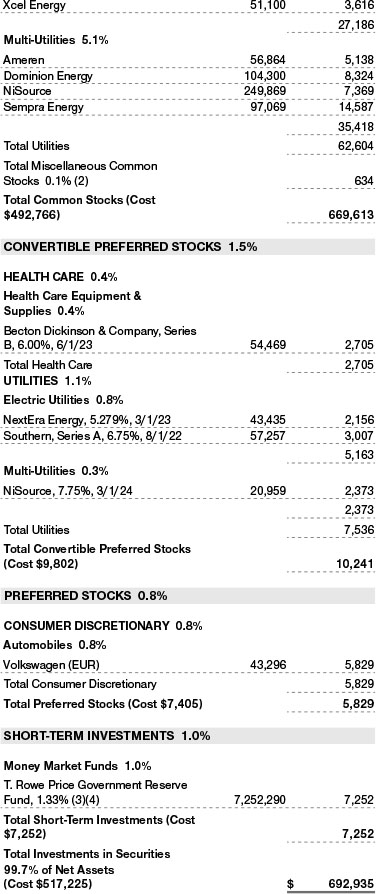

June 30, 2022 (Unaudited)

The accompanying notes are an integral part of these financial statements.

June 30, 2022 (Unaudited)

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

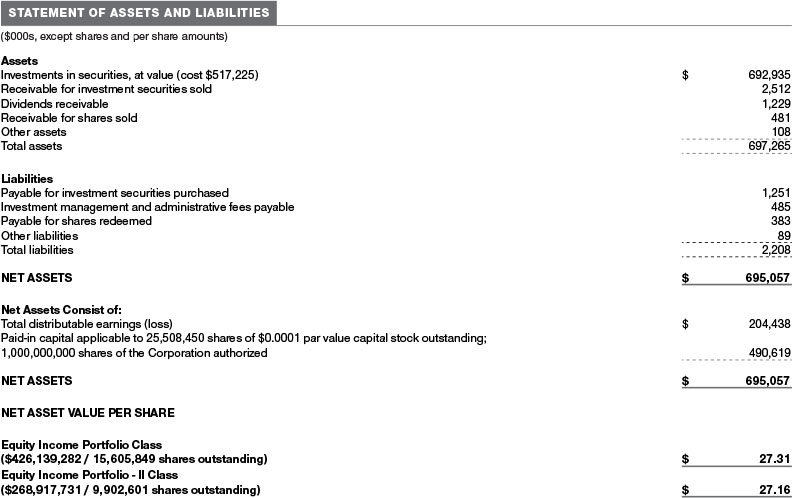

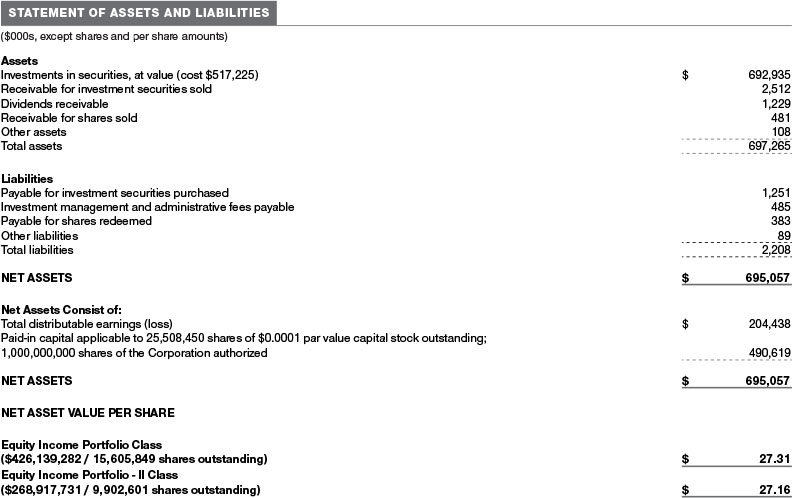

T. Rowe Price Equity Series, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The Equity Income Portfolio (the fund) is a diversified, open-end management investment company established by the corporation. The fund seeks a high level of dividend income and long-term capital growth primarily through investments in stocks. Shares of the fund currently are offered only to insurance company separate accounts established for the purpose of funding variable annuity contracts and variable life insurance policies. The fund has two classes of shares: the Equity Income Portfolio (Equity Income Portfolio Class) and the Equity Income Portfolio–II (Equity Income Portfolio–II Class). Equity Income Portfolio–II Class shares are sold through financial intermediaries, which it compensates for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to both classes; and, in all other respects, the same rights and obligations as the other class.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Investment transactions are accounted for on the trade date basis. Income and expenses are recorded on the accrual basis. Realized gains and losses are reported on the identified cost basis. Income tax-related interest and penalties, if incurred, are recorded as income tax expense. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Distributions from REITs are initially recorded as dividend income and, to the extent such represent a return of capital or capital gain for tax purposes, are reclassified when such information becomes available. Non-cash dividends, if any, are recorded at the fair market value of the asset received. Distributions to shareholders are recorded on the ex-dividend date. Income distributions, if any, are declared and paid by each class quarterly. A capital gain distribution may also be declared and paid by the fund annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as provided by an outside pricing service. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the respective date of such transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is not bifurcated from the portion attributable to changes in market prices.

Class Accounting Investment income, investment management and administrative expense, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class. Equity Income Portfolio–II Class pays Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets.

Capital Transactions Each investor’s interest in the net assets of the fund is represented by fund shares. The fund’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. Purchases and redemptions of fund shares are transacted at the next-computed NAV per share, after receipt of the transaction order by T. Rowe Price Associates, Inc., or its agents.

Indemnification In the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’s maximum exposure under these arrangements is unknown; however, the risk of material loss is currently considered to be remote.

NOTE 2 - VALUATION

Fair Value The fund’s financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) is an internal committee that has been delegated certain responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes policies and procedures used in valuing financial instruments, including those which cannot be valued in accordance with normal procedures or using pricing vendors; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; evaluates the services and performance of the pricing vendors; oversees the pricing process to ensure policies and procedures are being followed; and provides guidance on internal controls and valuation-related matters. The Valuation Committee provides periodic reporting to the Board on valuation matters.

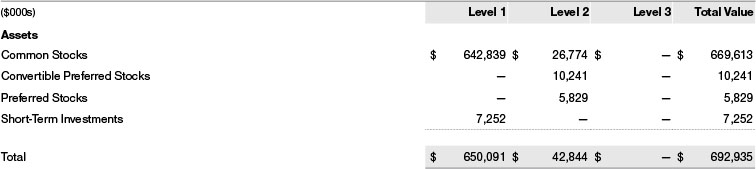

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs (including the fund’s own assumptions in determining fair value)

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Equity securities, including exchange-traded funds, listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices for domestic securities and the last quoted sale or closing price for international securities.

The last quoted prices of non-U.S. equity securities may be adjusted to reflect the fair value of such securities at the close of the NYSE, if the fund determines that developments between the close of a foreign market and the close of the NYSE will affect the value of some or all of its portfolio securities. Each business day, the fund uses information from outside pricing services to evaluate and, if appropriate, decide whether it is necessary to adjust quoted prices to reflect fair value by reviewing a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The fund uses outside pricing services to provide it with quoted prices and information to evaluate or adjust those prices. The fund cannot predict how often it will use quoted prices and how often it will determine it necessary to adjust those prices to reflect fair value.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Investments for which market quotations or market-based valuations are not readily available or deemed unreliable are valued at fair value as determined in good faith by the Valuation Committee, in accordance with fair valuation policies and procedures. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded. Factors used in determining fair value vary by type of investment and may include market or investment specific considerations. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; discounted cash flows; yield to maturity; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the investment. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants.

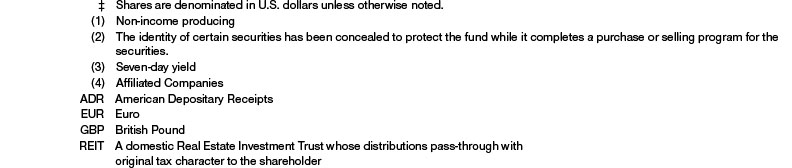

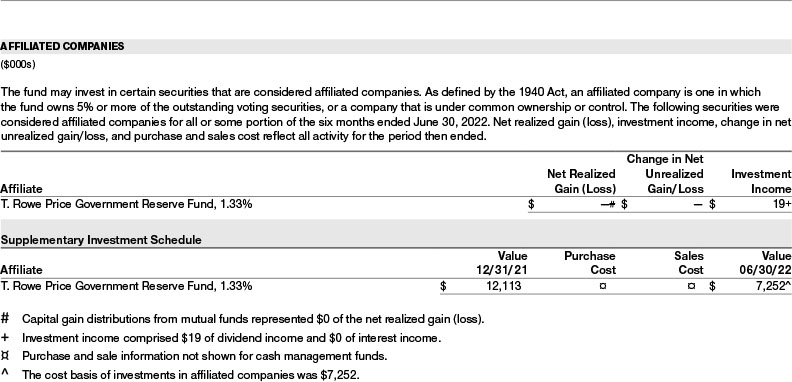

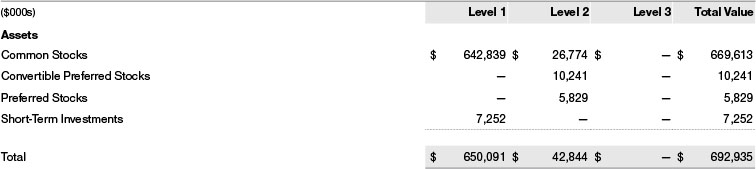

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on June 30, 2022 (for further detail by category, please refer to the accompanying Portfolio of Investments):

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Purchases and sales of portfolio securities other than short-term securities aggregated $70,867,000 and $86,435,000, respectively, for the six months ended June 30, 2022.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

At June 30, 2022, the cost of investments for federal income tax purposes was $520,413,000. Net unrealized gain aggregated $172,515,000 at period-end, of which $201,279,000 related to appreciated investments and $28,764,000 related to depreciated investments.

NOTE 5 - FOREIGN TAXES

The fund is subject to foreign income taxes imposed by certain countries in which it invests. Additionally, capital gains realized upon disposition of securities issued in or by certain foreign countries are subject to capital gains tax imposed by those countries. All taxes are computed in accordance with the applicable foreign tax law, and, to the extent permitted, capital losses are used to offset capital gains. Taxes attributable to income are accrued by the fund as a reduction of income. Current and deferred tax expense attributable to capital gains is reflected as a component of realized or change in unrealized gain/loss on securities in the accompanying financial statements. To the extent that the fund has country specific capital loss carryforwards, such carryforwards are applied against net unrealized gains when determining the deferred tax liability. Any deferred tax liability incurred by the fund is included in either Other liabilities or Deferred tax liability on the accompanying Statement of Assets and Liabilities.

NOTE 6 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management and administrative agreement between the fund and Price Associates provides for an all-inclusive annual fee equal to 0.85% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The all-inclusive fee covers investment management services and ordinary, recurring operating expenses but does not cover interest expense; expenses related to borrowing, taxes, and brokerage; or nonrecurring expenses. Effective July 1, 2018, Price Associates has contractually agreed, at least through April 30, 2023 to waive a portion of its management fee in order to limit the fund’s management fee to 0.74% of the fund’s average daily net assets. Thereafter, this agreement automatically renews for one-year terms unless terminated or modified by the fund’s Board. Fees waived and expenses paid under this agreement are not subject to reimbursement to Price Associates by the fund. The total management fees waived were $421,000 and allocated ratably in the amounts of $260,000 and $161,000 for the Equity Income Portfolio Class and Equity Income Portfolio-II Class, respectively, for the six months ended June 30, 2022.

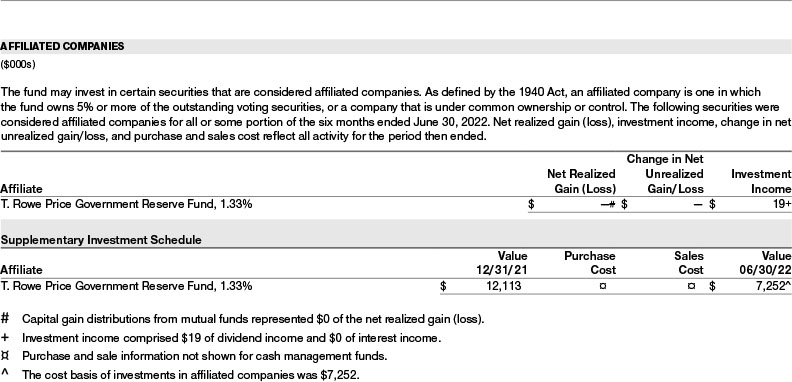

The fund may invest its cash reserves in certain open-end management investment companies managed by Price Associates and considered affiliates of the fund: the T. Rowe Price Government Reserve Fund or the T. Rowe Price Treasury Reserve Fund, organized as money market funds, or the T. Rowe Price Short-Term Fund, a short-term bond fund (collectively, the Price Reserve Funds). The Price Reserve Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. Cash collateral from securities lending, if any, is invested in the T. Rowe Price Government Reserve Fund; prior to December 13, 2021, the cash collateral from securities lending was invested in the T. Rowe Price Short-Term Fund. The Price Reserve Funds pay no investment management fees.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the six months ended June 30, 2022, the fund had no purchases or sales cross trades with other funds or accounts advised by Price Associates.

Price Associates has voluntarily agreed to reimburse the fund from its own resources on a monthly basis for the cost of investment research embedded in the cost of the fund’s securities trades. This agreement may be rescinded at any time. For the six months ended June 30, 2022, this reimbursement amounted to $7,000, which is included in Net realized gain (loss) on Securities in the Statement of Operations.

NOTE 7 - OTHER MATTERS

Unpredictable events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases, and similar public health threats may significantly affect the economy and the markets and issuers in which a fund invests. Certain events may cause instability across global markets, including reduced liquidity and disruptions in trading markets, while some events may affect certain geographic regions, countries, sectors, and industries more significantly than others, and exacerbate other pre-existing political, social, and economic risks. Since 2020, a novel strain of coronavirus (COVID-19) has resulted in disruptions to global business activity and caused significant volatility and declines in global financial markets. In February 2022, Russian forces entered Ukraine and commenced an armed conflict leading to economic sanctions being imposed on Russia and certain of its citizens, creating impacts on Russian-related stocks and debt and greater volatility in global markets. These are recent examples of global events which may have an impact on the fund’s performance, which could be negatively impacted if the value of a portfolio holding were harmed by these and such other events. Management is actively monitoring the risks and financial impacts arising from these events.

INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS

A description of the policies and procedures used by T. Rowe Price funds to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www.troweprice.com/corporate/us/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Guidelines.” Click on the links in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s reports on Form N-PORT are available electronically on the SEC’s website (sec.gov). In addition, most T. Rowe Price funds disclose their first and third fiscal quarter-end holdings on troweprice.com.

APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT

Each year, the fund’s Board of Directors (Board) considers the continuation of the investment management agreement (Advisory Contract) between the fund and its investment adviser, T. Rowe Price Associates, Inc. (Adviser). In that regard, at a meeting held on March 7–8, 2022 (Meeting), the Board, including all of the fund’s independent directors, approved the continuation of the fund’s Advisory Contract. At the Meeting, the Board considered the factors and reached the conclusions described below relating to the selection of the Adviser and the approval of the Advisory Contract. The independent directors were assisted in their evaluation of the Advisory Contract by independent legal counsel from whom they received separate legal advice and with whom they met separately.

In providing information to the Board, the Adviser was guided by a detailed set of requests for information submitted by independent legal counsel on behalf of the independent directors. In considering and approving the Advisory Contract, the Board considered the information it believed was relevant, including, but not limited to, the information discussed below. The Board considered not only the specific information presented in connection with the Meeting but also the knowledge gained over time through interaction with the Adviser about various topics. The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the T. Rowe Price funds’ advisory contracts, including performance and the services and support provided to the funds and their shareholders.

Services Provided by the Adviser

The Board considered the nature, quality, and extent of the services provided to the fund by the Adviser. These services included, but were not limited to, directing the fund’s investments in accordance with its investment program and the overall management of the fund’s portfolio, as well as a variety of related activities such as financial, investment operations, and administrative services; compliance; maintaining the fund’s records and registrations; and shareholder communications. The Board also reviewed the background and experience of the Adviser’s senior management team and investment personnel involved in the management of the fund, as well as the Adviser’s compliance record. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Adviser.

Investment Performance of the Fund

The Board took into account discussions with the Adviser and reports that it receives throughout the year relating to fund performance. In connection with the Meeting, the Board reviewed the fund’s total returns for various periods through December 31, 2021, and compared these returns with the performance of a peer group of funds with similar investment programs and a wide variety of other previously agreed-upon comparable performance measures and market data, including relative performance information as of September 30, 2021, supplied by Broadridge, which is an independent provider of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Adviser under the Advisory Contract and other direct and indirect benefits that the Adviser (and its affiliates) may have realized from its relationship with the fund. In considering soft-dollar arrangements pursuant to which research may be received from broker-dealers that execute the fund’s portfolio transactions, the Board noted that the Adviser bears the cost of research services for all client accounts that it advises, including the T. Rowe Price funds. The Board received information on the estimated costs incurred and profits realized by the Adviser from managing the T. Rowe Price funds. The Board also reviewed estimates of the profits realized from managing the fund in particular, and the Board concluded that the Adviser’s profits were reasonable in light of the services provided to the fund.

The Board also considered whether the fund benefits under the fee levels set forth in the Advisory Contract or otherwise from any economies of scale realized by the Adviser. Under the Advisory Contract, the fund pays the Adviser a single fee, or an all-inclusive management fee, which is based on the fund’s average daily net assets. The all-inclusive management fee includes investment management services and provides for the Adviser to pay all of the fund’s ordinary, recurring operating expenses except for interest, taxes, portfolio transaction fees, and any nonrecurring extraordinary expenses that may arise. However, the fund has a contractual limitation in place whereby the Adviser has agreed to waive a portion of the management fee it is entitled to receive from the fund in order to limit the fund’s overall management fee rate to 0.74% of the fund’s average daily net assets. Any fees waived under this management fee waiver agreement are not subject to reimbursement to the Adviser by the fund. The Adviser has generally implemented an all-inclusive management fee structure in situations where a fixed total expense ratio is useful for purposes of providing certainty of fees and expenses for the investors in these funds and has historically sought to set the initial all-inclusive management fee rate at levels below the expense ratios of comparable funds to take into account potential future economies of scale. Because the fund serves as an underlying option to variable annuity products, the all-inclusive fee structure is utilized to create certainty for the annuity providers’ overall pricing decisions and disclosures. Assets of the fund are included in the calculation of the group fee rate, which serves as a component of the management fee for many T. Rowe Price funds and declines at certain asset levels based on the combined average net assets of most of the T. Rowe Price funds (including the fund). Although the fund does not have a group fee component to its management fee, its assets are included in the calculation because certain resources utilized to operate the fund are shared with other T. Rowe Price funds. The Board concluded that, based on the profitability data it reviewed and consistent with this all-inclusive management fee structure, the advisory fee structure for the fund continued to be appropriate.

Fees and Expenses

The Board was provided with information regarding industry trends in management fees and expenses. Among other things, the Board reviewed data for peer groups that were compiled by Broadridge, which compared: (i) contractual management fees, actual management fees, nonmanagement expenses, and total expenses of the fund with a group of competitor funds selected by Broadridge (Expense Group) and (ii) actual management fees, nonmanagement expenses, and total expenses of the fund with a broader set of funds within the Lipper investment classification (Expense Universe). The Board considered the fund’s contractual management fee rate, actual management fee rate, and total expenses (all of which generally reflect the all-inclusive management fee rate and do not deduct the operating expenses paid by the Adviser as part of the overall management fee) in comparison with the information for the Broadridge peer groups. Broadridge generally constructed the peer groups by seeking the most comparable funds based on similar investment classifications and objectives, expense structure, asset size, and operating components and attributes and ranked funds into quintiles, with the first quintile representing the funds with the lowest relative expenses and the fifth quintile representing the funds with the highest relative expenses. The information provided to the Board indicated that the fund’s contractual management fee ranked in the fifth quintile (Expense Group), the fund’s actual management fee rate ranked in the fifth quintile (Expense Group and Expense Universe), and the fund’s total expenses ranked in the fourth quintile (Expense Group and Expense Universe).

Management provided the Board with additional information with respect to the fund’s relative management fees and total expenses ranking in the fourth and fifth quintiles and reviewed and considered the information provided relating to the fund, other funds in the peer groups, and other factors that the Board determined to be relevant.

The Board also reviewed the fee schedules for other investment portfolios with similar mandates that are advised or subadvised by the Adviser and its affiliates, including separately managed accounts for institutional and individual investors; subadvised funds; and other sponsored investment portfolios, including collective investment trusts and pooled vehicles organized and offered to investors outside the United States. Management provided the Board with information about the Adviser’s responsibilities and services provided to subadvisory and other institutional account clients, including information about how the requirements and economics of the institutional business are fundamentally different from those of the proprietary mutual fund business. The Board considered information showing that the Adviser’s mutual fund business is generally more complex from a business and compliance perspective than its institutional account business and considered various relevant factors, such as the broader scope of operations and oversight, more extensive shareholder communication infrastructure, greater asset flows, heightened business risks, and differences in applicable laws and regulations associated with the Adviser’s proprietary mutual fund business. In assessing the reasonableness of the fund’s management fee rate, the Board considered the differences in the nature of the services required for the Adviser to manage its mutual fund business versus managing a discrete pool of assets as a subadviser to another institution’s mutual fund or for an institutional account and that the Adviser generally performs significant additional services and assumes greater risk in managing the fund and other T. Rowe Price funds than it does for institutional account clients, including subadvised funds.

On the basis of the information provided and the factors considered, the Board concluded that the fees paid by the fund under the Advisory Contract are reasonable.

Approval of the Advisory Contract

As noted, the Board approved the continuation of the Advisory Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund and its shareholders for the Board to approve the continuation of the Advisory Contract (including the fees to be charged for services thereunder).

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

There has been no change to the procedures by which shareholders may recommend nominees to the registrant’s board of directors.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant’s principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant’s principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Equity Series, Inc.

| | By | /s/ David Oestreicher |

| | | David Oestreicher |

| | | Principal Executive Officer |

| | | |

| Date | | August 17, 2022 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By | /s/ David Oestreicher |

| | | David Oestreicher |

| | | Principal Executive Officer |

| | | |

| Date | | August 17, 2022 | | |

| | | | | |

| | | |

| | By | /s/ Alan S. Dupski |

| | | Alan S. Dupski |

| | | Principal Financial Officer |

| | | |

| Date | | August 17, 2022 | | |