LKCM FUNDS

LKCM Small Cap Equity Fund (Institutional Class)

LKCM Small-Mid Cap Equity Fund (Institutional Class)

LKCM Equity Fund (Institutional Class)

LKCM Balanced Fund

LKCM Fixed Income Fund

(each a “Fund” and collectively, the “Funds”)

Supplement dated November 30, 2012

to the Prospectus dated May 1, 2012

IMPORTANT INFORMATION REGARDING

CHANGE TO REDEMPTION FEE POLICY

The fourth sentence in the second paragraph under “Market Timing Policy” on page 22 is hereby changed to read as follows: “To discourage market timing, each Fund charges a 1.00% redemption fee on shares exchanged or redeemed within 30 days of purchase, except on shares held in separately managed accounts of the Adviser or as otherwise determined by a Fund in its discretion.”

The fifth sentence under “Exchanging Shares” on page 22 is hereby changed to read as follows: “In addition, exchanges of shares held for less than 30 days will be subject to a 1.00% redemption fee, except on shares held in separately managed accounts of the Adviser or as otherwise determined by a Fund in its discretion.”

The second sentence under “Redemption of Shares” on page 23 is hereby changed to read as follows: “The Funds do not charge a fee for making redemptions, except that each Fund charges a 1.00% redemption fee on shares exchanged or redeemed within 30 days of purchase unless such shares are held in separately managed accounts of the Adviser or as otherwise determined by a Fund in its discretion.”

The section entitled “30-Day Redemption Fee” on page 24 is changed to read as follows:

30-Day Redemption Fee. If you redeem or exchange shares held for less than 30 days after the date of purchase, you will be subject to a 1.00% redemption fee. This fee will be deducted from the proceeds of your redemption. For purposes of applying the fee, the first day of the holding period is trade date plus one. The holding period will be determined on a “first-in, first-out” basis, meaning the Fund shares purchased first will be redeemed first. The redemption fee will not apply to shares of the Funds held in accounts separately managed by the Adviser or as otherwise determined by the Funds in their discretion. Transactions in shares of the Funds by financial intermediaries with whom the Funds do not have information sharing agreements in place may be subject to the redemption fee. The redemption fee will be retained by a Fund for the benefit of its shareholders. Redemption fees will not apply to shares acquired through reinvestment of dividends, or to shares purchased through the Automatic Investment Program.

* * *

INVESTORS SHOULD RETAIN THIS SUPPLEMENT WITH

THE PROSPECTUSES FOR FUTURE REFERENCE

1-800-688-LKCM

LKCM SMALL CAP EQUITY FUND

(Institutional Class) (LKSCX)

LKCM SMALL-MID CAP EQUITY FUND

(Institutional Class) (LKSMX)

LKCM EQUITY FUND

(Institutional Class) (LKEQX)

LKCM BALANCED FUND (LKBAX)

LKCM FIXED INCOME FUND (LKFIX)

This Prospectus contains information you should consider before you invest in the LKCM Funds. Please read it carefully and keep it for future reference.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities offered by this Prospectus, nor has the SEC or any state securities commission passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

(i)

SUMMARY SECTION

LKCM SMALL CAP EQUITY FUND

(Institutional Class)

Investment Objective: The Fund seeks to maximize long-term capital appreciation.

Fees and Expenses of the Fund: The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

| | | | |

Shareholder Fees

(fees paid directly from your investment) | | | | |

Redemption Fee (as a percentage of the amount redeemed on shares held for less than 30 days) | | | 1.00 | % |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment) | | | | |

Management Fees | | | 0.75 | % |

Distribution and Service (12b-1) Fees | | | 0.00 | % |

Other Expenses | | | 0.20 | % |

Acquired Fund Fees and Expenses(1) | | | 0.01 | % |

| | | | |

Total Annual Fund Operating Expenses | | | 0.96 | % |

| | | | |

| (1) | Acquired Fund Fees and Expenses are indirect fees and expenses that funds incur from investing in the shares of other mutual funds, including money market funds (“Acquired Fund(s)”). The Total Annual Fund Operating Expenses for the Fund differs from the Ratio of Expenses to Average Net Assets found within the “Financial Highlights” section of the prospectus because the audited information in the “Financial Highlights” reflects the operating expenses of the Fund and does not include indirect expenses such as Acquired Fund Fees and Expenses. |

Example

The following example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be as follows:

| | | | | | |

1 Year | | 3 Years | | 5 Years | | 10 Years |

| $98 | | $306 | | $531 | | $1,177 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 50% of the average value of its portfolio.

Principal Investment Strategies: The Fund seeks to achieve its investment objective by investing under normal circumstances at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of smaller companies. The Fund primarily chooses investments that the Adviser believes are likely to have above-average growth in revenue and/or earnings and potential for above-average capital appreciation. Smaller companies are those with market capitalizations at the time of investment between $400 million and $2.5 billion. The Fund is not required to sell equity securities whose market values appreciate or depreciate outside this market capitalization range.

The Fund seeks to invest in the equity securities of high quality companies that exhibit certain qualities, including profitability levels, balance sheet quality, competitive advantages, ability to generate excess cash flows, meaningful management ownership stakes, reinvestment opportunities, market share positions, and relative valuation. These equity securities may include common stocks, preferred stocks, securities convertible into common stock, American Depositary Receipts, rights and warrants.

Principal Risks: The greatest risk of investing in the Fund is that you could lose money. Investments in the Fund also are subject to the following principal risks:

| | • | | General Market Risk – Factors that affect the stock market in general, such as economic production, interest rate levels, geopolitical events or volatility may negatively affect secondary markets and cause them to experience lower valuations, reduced liquidity, price volatility, credit downgrades, increased likelihood of default and valuation difficulties. Such factors likely would lead to a decline in the value of your investment in the Fund. |

| | • | | Inflation Risk – Higher actual or anticipated inflation may have an adverse effect on corporate profits or consumer spending and result in lower values for securities held by the Fund. |

1

| | • | | Stock Market Risk – The Fund invests in equity securities and therefore is subject to stock market risks and significant fluctuations in value. The Fund’s investments in equity securities may include common stocks, preferred stocks, securities convertible into common stock, American Depositary Receipts, rights and warrants. ADRs are receipts issued by domestic banks or trust companies that represent the deposit of a security of a foreign issuer and are publicly traded in the United States. Investments in ADRs are subject to certain of the risks associated with investing directly in foreign securities, such as currency fluctuations, political and economic instability, less government regulation, less publicly available information, and differences in financial reporting standards. Investing in such securities may expose the Fund to additional risk. Common stock generally is subordinate to preferred stock upon the liquidation or bankruptcy of the issuing company. Preferred stocks and convertible securities are sensitive to movements in interest rates. In addition, convertible securities are subject to the risk that the credit standing of the issuer may have an effect on the convertible securities’ investment value. Investments in rights and warrants may be more speculative than certain other types of investments because rights and warrants do not carry with them dividend or voting rights with respect to the underlying securities, or any rights in the assets of the issuer. In addition, the value of a right or a warrant does not necessarily change with the value of the underlying securities, and a right or a warrant ceases to have value if it is not exercised prior to its expiration date. |

| | • | | Stock Selection Risk – Equity securities held by the Fund may not perform as anticipated due to a number of factors impacting the company that issued the securities, such as poor management, weak demand for the company’s products, or the company’s failure to meet earnings expectations. |

| | • | | Small-Cap Risk – The Fund invests in small capitalization companies that may not have the size, resources and other assets of mid or large capitalization companies. As a result, the securities of small capitalization companies held by the Fund may be subject to greater market risks and fluctuations in value than mid or large capitalization companies or may not correspond to changes in the stock market in general. |

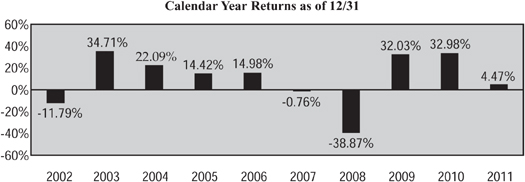

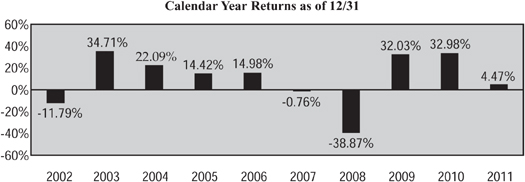

Performance: The bar chart and table that follow illustrate annual Fund returns for periods ended December 31. This information is intended to give you some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and how the Fund’s average annual returns over time compare with those of a broad measure of market performance, including an additional index that shows how the Fund’s performance compares with the returns of an index of funds with similar investment objectives. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.lkcmfunds.com or by calling the Fund toll-free at 1-800-688-LKCM.

During the period shown on the bar chart, the Fund’s best and worst quarters are shown below:

Best and Worst Quarterly Returns

| | | | |

18.90% | | | 2nd quarter, 2009 | |

-27.54% | | | 4th quarter, 2008 | |

Average Annual Total Returns for Periods Ended December 31, 2011

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Return Before Taxes | | | 4.47 | % | | | 2.16 | % | | | 7.82 | % |

Return After Taxes on Distributions | | | 4.47 | % | | | 1.91 | % | | | 7.05 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | | 2.90 | % | | | 1.82 | % | | | 6.78 | % |

| | | | | | | | | | | | |

Russell 2000 Index (reflects no deduction for fees, expenses or taxes) | | | -4.18 | % | | | 0.15 | % | | | 5.62 | % |

Lipper Small-Cap Core Funds Index (reflects no deduction for taxes) | | | -3.81 | % | | | 1.32 | % | | | 5.81 | % |

| | | | | | | | | | | | |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans and individual retirement accounts because such accounts are only subject to taxes upon redemption.

Investment Adviser: Luther King Capital Management Corporation.

2

Portfolio Managers:

| | | | |

Name | | Title | | Experience with the Fund |

Steven R. Purvis, CFA | | Principal, Vice President and Portfolio Manager | | Since 1996 |

J. Luther King, Jr., CFA | | Principal, President and Portfolio Manager | | Since Inception in 1994 |

Jonathan B. Deweese, CFA | | Analyst | | Since 2010 |

Benjamin M. Cowan, CFA | | Analyst | | Since 2010 |

Purchase and Sale of Fund Shares: Investors may purchase, exchange or redeem Fund shares by mail (LKCM Funds, c/o U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, 3rd Floor, Milwaukee, WI 53201-0701), or by telephone at 1-800-688-LKCM. Redemptions by telephone are only permitted upon previously receiving appropriate authorization. Transactions will only occur on days the New York Stock Exchange is open. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the financial intermediary directly for information relative to the purchase or sale of Fund shares. The minimum initial amount of investment in the Fund and exchanges into the Fund from another fund in the LKCM Funds is $2,000. Subsequent investments in the Fund for all types of accounts may be made with a minimum investment of $1,000.

Tax Information: The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

Payments to Broker-Dealers and Other Financial Intermediaries: If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a financial adviser), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. If made, these payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

3

LKCM SMALL-MID CAP EQUITY FUND

(Institutional Class)

Investment Objective: The Fund seeks to maximize long-term capital appreciation.

Fees and Expenses of the Fund: The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

| | | | |

Shareholder Fees | | | | |

(fees paid directly from your investment) | | | | |

Redemption Fee (as a percentage of the amount redeemed on shares held for less than 30 days) | | | 1.00 | % |

Annual Fund Operating Expenses | | | | |

(expenses that you pay each year as a percentage of the value of your investment) | | | | |

Management Fees | | | 0.75 | % |

Distribution and Service (12b-1) Fees | | | 0.00 | % |

Other Expenses | | | 1.39 | % |

Acquired Fund Fees and Expenses(1) | | | 0.01 | % |

| | | | |

Total Annual Fund Operating Expenses | | | 2.15 | % |

Fee Cap and/or Expense Reimbursement(2) | | | -1.14 | % |

| | | | |

Total Annual Fund Operating Expenses After Fee Cap and/or Expense Reimbursement(1)(2) | | | 1.01 | % |

| | | | |

| (1) | Acquired Fund Fees and Expenses are indirect fees and expenses that funds incur from investing in the shares of other mutual funds, including money market funds (“Acquired Fund(s)”). The Total Annual Fund Operating Expenses After Fee Cap and/or Expense Reimbursement for the Fund differs from the Ratio of Expenses to Average Net Assets found within the “Financial Highlights” section of the prospectus because the audited information in the “Financial Highlights” reflects the operating expenses of the Fund and does not include indirect expenses such as Acquired Fund Fees and Expenses. |

| (2) | Luther King Capital Management Corporation, the Fund’s investment adviser, has contractually agreed to cap all or a portion of its management fee and/or reimburse the Fund through April 30, 2013 in order to limit the Fund’s Total Annual Fund Operating Expenses After Fee Cap and/or Expense Reimbursement to 1.00%. This expense limitation excludes interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses. The fee reduction and expense reimbursement agreement may be terminated or changed at any time only with the consent of the Board of Trustees. |

Example

The following example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be as follows:

| | | | | | |

1 Year | | 3 Years | | 5 Years | | 10 Years |

| $103 | | $563 | | $1,050 | | $2,393 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the period from the inception of the Fund on May 2, 2011 to December 31, 2011, the Fund’s portfolio turnover rate was 36% of the average value of its portfolio.

Principal Investment Strategies: The Fund seeks to achieve its investment objective by investing under normal circumstances at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of small-mid capitalization companies. The Fund primarily chooses investments that the Adviser believes are likely to have above-average growth in revenue and/or earnings and potential for above-average capital appreciation. Small-mid capitalization companies are those with market capitalizations at the time of investment between $1 billion and $7 billion. The Fund is not required to sell equity securities whose market values appreciate or depreciate outside this market capitalization range.

The Fund seeks to invest in the equity securities of high quality companies that exhibit certain qualities, including profitability levels, balance sheet quality, competitive advantages, ability to generate excess cash flows, meaningful management ownership stakes, reinvestment opportunities, market share positions, and relative valuation. These equity securities may include common stocks, preferred stocks, securities convertible into common stock, American Depositary Receipts, rights and warrants.

Principal Risks: The greatest risk of investing in the Fund is that you could lose money. Investments in the Fund also are subject to the following principal risks:

| | • | | General Market Risk – Factors that affect the stock market in general, such as economic production, interest rate levels, geopolitical events or volatility may negatively affect secondary markets and cause them to experience lower valuations, reduced liquidity, price volatility, credit downgrades, increased likelihood of default and valuation difficulties. Such factors likely would lead to a decline in the value of your investment in the Fund. |

4

| | • | | Inflation Risk – Higher actual or anticipated inflation may have an adverse effect on corporate profits or consumer spending and result in lower values for securities held by the Fund. |

| | • | | Stock Market Risk – The Fund invests in equity securities and therefore is subject to stock market risks and significant fluctuations in value. The Fund’s investments in equity securities may include common stocks, preferred stocks, securities convertible into common stock, American Depositary Receipts, rights and warrants. ADRs are receipts issued by domestic banks or trust companies that represent the deposit of a security of a foreign issuer and are publicly traded in the United States. Investments in ADRs are subject to certain of the risks associated with investing directly in foreign securities, such as currency fluctuations, political and economic instability, less government regulation, less publicly available information, and differences in financial reporting standards. Investing in such securities may expose the Fund to additional risk. Common stock generally is subordinate to preferred stock upon the liquidation or bankruptcy of the issuing company. Preferred stocks and convertible securities are sensitive to movements in interest rates. In addition, convertible securities are subject to the risk that the credit standing of the issuer may have an effect on the convertible securities’ investment value. Investments in rights and warrants may be more speculative than certain other types of investments because rights and warrants do not carry with them dividend or voting rights with respect to the underlying securities, or any rights in the assets of the issuer. In addition, the value of a right or a warrant does not necessarily change with the value of the underlying securities, and a right or a warrant ceases to have value if it is not exercised prior to its expiration date. |

| | • | | Stock Selection Risk – Equity securities held by the Fund may not perform as anticipated due to a number of factors impacting the company that issued the securities, such as poor management, weak demand for the company’s products, or the company’s failure to meet earnings expectations. |

| | • | | Small and Mid Cap Risk – The Fund may invest in small and mid capitalization companies that may not have the size, resources and other assets of large capitalization companies. As a result, the securities of small and mid capitalization companies held by the Fund may be subject to greater market risks and fluctuations in value than large capitalization companies or may not correspond to changes in the stock market in general. |

Performance: Performance information for the Fund is not included because the Fund did not have one full calendar year of performance prior to the date of this prospectus. Performance information will be available once the Fund has at least one calendar year of performance. Updated performance information is available on the Fund’s website at www.lkcmfunds.com or by calling the Fund toll-free at 1-800-688-LKCM.

Investment Adviser: Luther King Capital Management Corporation.

Portfolio Managers:

| | | | |

Name | | Title | | Experience with the Fund |

Steven R. Purvis, CFA | | Principal, Vice President and Portfolio Manager | | Since Inception in 2011 |

J. Luther King, Jr., CFA | | Principal, President and Portfolio Manager | | Since Inception in 2011 |

Jonathan B. Deweese, CFA | | Analyst | | Since Inception in 2011 |

Benjamin M. Cowan, CFA | | Analyst | | Since Inception in 2011 |

Purchase and Sale of Fund Shares: Investors may purchase, exchange or redeem Fund shares by mail (LKCM Funds, c/o U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, 3rd Floor, Milwaukee, WI 53201-0701), or by telephone at 1-800-688-LKCM. Redemptions by telephone are only permitted upon previously receiving appropriate authorization. Transactions will only occur on days the New York Stock Exchange is open. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the financial intermediary directly for information relative to the purchase or sale of Fund shares. The minimum initial amount of investment in the Fund and exchanges into the Fund from another fund in the LKCM Funds is $2,000. Subsequent investments in the Fund for all types of accounts may be made with a minimum investment of $1,000.

Tax Information: The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

Payments to Broker-Dealers and Other Financial Intermediaries: If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a financial adviser), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. If made, these payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5

LKCM EQUITY FUND

(Institutional Class)

Investment Objective: The Fund seeks to maximize long-term capital appreciation.

Fees and Expenses of the Fund: The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

| | | | |

Shareholder Fees | | | | |

(fees paid directly from your investment) | | | | |

Redemption Fee (as a percentage of the amount redeemed on shares held for less than 30 days) | | | 1.00 | % |

Annual Fund Operating Expenses | | | | |

(expenses that you pay each year as a percentage of the value of your investment) | | | | |

Management Fees | | | 0.70 | % |

Distribution and Service (12b-1) Fees | | | 0.00 | % |

Other Expenses | | | 0.29 | % |

Acquired Fund Fees and Expenses(1) | | | 0.01 | % |

| | | | |

Total Annual Fund Operating Expenses | | | 1.00 | % |

Fee Cap and/or Expense Reimbursement(2) | | | -0.19 | % |

| | | | |

Total Annual Fund Operating Expenses After Fee Cap and/or Expense Reimbursement(1)(2) | | | 0.81 | % |

| | | | |

| (1) | Acquired Fund Fees and Expenses are indirect fees and expenses that funds incur from investing in the shares of other mutual funds, including money market funds (“Acquired Fund(s)”). The Total Annual Fund Operating Expenses After Fee Cap and/or Expense Reimbursement for the Fund differs from the Ratio of Expenses to Average Net Assets found within the “Financial Highlights” section of the prospectus because the audited information in the “Financial Highlights” reflects the operating expenses of the Fund and does not include indirect expenses such as Acquired Fund Fees and Expenses. |

| (2) | Luther King Capital Management Corporation, the Fund’s investment adviser, has contractually agreed to cap all or a portion of its management fee and/or reimburse the Fund through April 30, 2013 in order to limit the Fund’s Total Annual Fund Operating Expenses After Fee Cap and/or Expense Reimbursement to 0.80%. This expense limitation excludes interest, taxes, brokerage commissions, costs relating to investment in Acquired Funds and extraordinary expenses. The fee reduction and expense reimbursement agreement may be terminated or changed at any time only with the consent of the Board of Trustees. |

Example

The following example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be as follows:

| | | | | | |

1 Year | | 3 Years | | 5 Years | | 10 Years |

| $83 | | $299 | | $534 | | $1,207 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 20% of the average value of its portfolio.

Principal Investment Strategies: The Fund seeks to achieve its investment objective by investing under normal circumstances at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities. The Fund primarily invests in companies that the Adviser believes are likely to have above-average growth in revenue and/or earnings, above-average returns on shareholders’ equity and under-leveraged balance sheets, and potential for above-average capital appreciation. The Fund may invest in equity securities of small, mid and large capitalization companies. It seeks to invest in the equity securities of high quality companies that exhibit certain qualities, including profitability levels, balance sheet quality, competitive advantages, ability to generate excess cash flows, meaningful management ownership stakes, reinvestment opportunities, market share positions, and relative valuation. These equity securities may include common stocks, preferred stocks, securities convertible into common stock, American Depositary Receipts, rights and warrants.

Principal Risks: The greatest risk of investing in the Fund is that you could lose money. Investments in the Fund also are subject to the following principal risks:

| | • | | General Market Risk – Factors that affect the stock market in general, such as economic production, interest rate levels, geopolitical events or volatility may negatively affect secondary markets and cause them to experience lower valuations, reduced liquidity, price volatility, credit downgrades, increased likelihood of default and valuation difficulties. Such factors likely would lead to a decline in the value of your investment in the Fund. |

| | • | | Inflation Risk – Higher actual or anticipated inflation may have an adverse effect on corporate profits or consumer spending and result in lower values for securities held by the Fund. |

6

| | • | | Stock Market Risk – The Fund invests in equity securities and therefore is subject to stock market risks and significant fluctuations in value. The Fund’s investments in equity securities may include common stocks, preferred stocks, securities convertible into common stock, American Depositary Receipts, rights and warrants. ADRs are receipts issued by domestic banks or trust companies that represent the deposit of a security of a foreign issuer and are publicly traded in the United States. Investments in ADRs are subject to certain of the risks associated with investing directly in foreign securities, such as currency fluctuations, political and economic instability, less government regulation, less publicly available information, and differences in financial reporting standards. Investing in such securities may expose the Fund to additional risk. Common stock generally is subordinate to preferred stock upon the liquidation or bankruptcy of the issuing company. Preferred stocks and convertible securities are sensitive to movements in interest rates. In addition, convertible securities are subject to the risk that the credit standing of the issuer may have an effect on the convertible securities’ investment value. Investments in rights and warrants may be more speculative than certain other types of investments because rights and warrants do not carry with them dividend or voting rights with respect to the underlying securities, or any rights in the assets of the issuer. In addition, the value of a right or a warrant does not necessarily change with the value of the underlying securities, and a right or a warrant ceases to have value if it is not exercised prior to its expiration date. |

| | • | | Stock Selection Risk – Equity securities held by the Fund may not perform as anticipated due to a number of factors impacting the company that issued the securities, such as poor management, weak demand for the company’s products, or the company’s failure to meet earnings expectations. |

| | • | | Small and Mid Cap Risk – The Fund may invest in small and mid capitalization companies that may not have the size, resources and other assets of large capitalization companies. As a result, the securities of small and mid capitalization companies held by the Fund may be subject to greater market risks and fluctuations in value than large capitalization companies or may not correspond to changes in the stock market in general. |

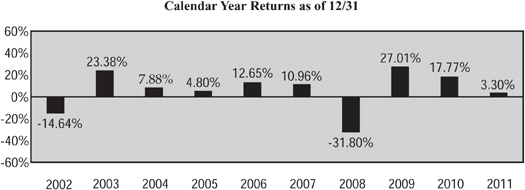

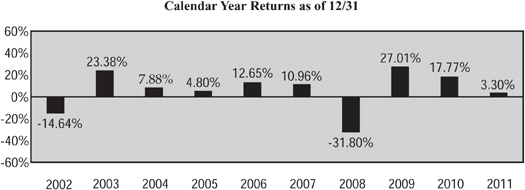

Performance: The bar chart and table that follow illustrate annual Fund returns for periods ended December 31. This information is intended to give you some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and how the Fund’s average annual returns over time compare with those of a broad measure of market performance, including an additional index that shows how the Fund’s performance compares with the returns of an index of funds with similar investment objectives. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.lkcmfunds.com or by calling the Fund toll-free at 1-800-688-LKCM.

During the period shown on the bar chart, the Fund’s best and worst quarters are shown below:

Best and Worst Quarterly Returns

| | | | |

15.36% | | | 2nd quarter, 2009 | |

-20.72% | | | 4th quarter, 2008 | |

Average Annual Total Returns for Periods Ended December 31, 2011

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Return Before Taxes | | | 3.30 | % | | | 3.18 | % | | | 4.60 | % |

Return After Taxes on Distributions | | | 2.96 | % | | | 2.89 | % | | | 4.30 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | | 2.60 | % | | | 2.70 | % | | | 3.96 | % |

| | | | | | | | | | | | |

S&P 500 Index (reflects no deduction for fees, expenses or taxes) | | | 2.11 | % | | | -0.25 | % | | | 2.92 | % |

Lipper Large-Cap Core Funds Index (reflects no deduction for taxes) | | | 0.09 | % | | | -0.60 | % | | | 2.16 | % |

| | | | | | | | | | | | |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans and individual retirement accounts because such accounts are only subject to taxes upon redemption.

7

Investment Adviser: Luther King Capital Management Corporation.

Portfolio Managers:

| | | | |

Name | | Title | | Experience with the Fund |

J. Luther King, Jr., CFA | | Principal, President and Portfolio Manager | | Since Inception in 1996 |

Scot C. Hollmann, CFA | | Principal, Vice President and Portfolio Manager | | Since 2010 |

Steven R. Purvis, CFA | | Principal, Vice President and Portfolio Manager | | Since 2010 |

Mason D. King, CFA | | Analyst | | Since 2010 |

Purchase and Sale of Fund Shares: Investors may purchase, exchange or redeem Fund shares by mail (LKCM Funds, c/o U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, 3rd Floor, Milwaukee, WI 53201-0701), or by telephone at 1-800-688-LKCM. Redemptions by telephone are only permitted upon previously receiving appropriate authorization. Transactions will only occur on days the New York Stock Exchange is open. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the financial intermediary directly for information relative to the purchase or sale of Fund shares. The minimum initial amount of investment in the Fund and exchanges into the Fund from another fund in the LKCM Funds is $2,000. Subsequent investments in the Fund for all types of accounts may be made with a minimum investment of $1,000.

Tax Information: The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

Payments to Broker-Dealers and Other Financial Intermediaries: If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a financial adviser), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. If made, these payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

8

LKCM BALANCED FUND

Investment Objective: The Fund seeks current income and long-term capital appreciation.

Fees and Expenses of the Fund: The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

| | | | |

Shareholder Fees | | | | |

(fees paid directly from your investment) | | | | |

Redemption Fee (as a percentage of the amount redeemed on shares held for less than 30 days) | | | 1.00 | % |

Annual Fund Operating Expenses | | | | |

(expenses that you pay each year as a percentage of the value of your investment) | | | | |

Management Fees | | | 0.65 | % |

Distribution and Service (12b-1) Fees | | | 0.00 | % |

Other Expenses | | | 0.49 | % |

| | | | |

Total Annual Fund Operating Expenses | | | 1.14 | % |

Fee Cap and/or Expense Reimbursement(1) | | | -0.34 | % |

| | | | |

Total Annual Fund Operating Expenses After Fee Cap and/or Expense Reimbursement(1) | | | 0.80 | % |

| | | | |

| (1) | Luther King Capital Management Corporation, the Fund’s investment adviser, has contractually agreed to cap all or a portion of its management fee and/or reimburse the Fund through April 30, 2013 in order to limit the Fund’s Total Annual Fund Operating Expenses After Fee Cap and/or Expense Reimbursement to 0.80%. This expense limitation excludes interest, taxes, brokerage commissions, costs relating to investment in Acquired Funds and extraordinary expenses. The fee reduction and expense reimbursement agreement may be terminated or changed at any time only with the consent of the Board of Trustees. |

Example

The following example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be as follows:

| | | | | | |

1 Year | | 3 Years | | 5 Years | | 10 Years |

| $82 | | $329 | | $595 | | $1,356 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 34% of the average value of its portfolio.

Principal Investment Strategies: The Fund seeks to achieve its investment objective by investing primarily in a portfolio of equity and fixed income securities, including common stocks, income producing securities convertible into common stocks, fixed income securities and cash equivalent securities. The Fund may invest in securities of small, mid and large capitalization companies. The Fund seeks to invest in the equity securities of high quality companies that exhibit certain qualities, including profitability levels, balance sheet quality, competitive advantages, ability to generate excess cash flows, meaningful management ownership stakes, reinvestment opportunities, market share positions, and relative valuation. These equity securities may include common stocks, preferred stocks, securities convertible into common stock, American Depositary Receipts, rights and warrants.

The Fund’s investments in fixed-income securities consist primarily of investment grade corporate and U.S. Government issues with intermediate-term maturities from one to ten years. Under normal circumstances, 25% or more of the Fund’s total assets consist of fixed income securities. Investment grade debt securities are considered to be those rated within the four highest ratings by nationally recognized statistical rating organizations.

The Fund does not presently intend to invest more than 20% of its total assets in equity securities that do not pay dividends. A majority of the equity securities in which the Fund invests typically are listed on a national securities exchange or traded on the Nasdaq Stock Market, Inc. or in the U.S. over-the-counter markets. The Fund also may invest in securities issued or guaranteed by the U.S. Government, its agencies or instrumentalities, corporate bonds and debentures, high-grade commercial paper, preferred stocks, certificates of deposit or other securities of U.S. issuers when the Adviser perceives attractive opportunities from such securities, or so that the Fund may receive a competitive return on its uninvested cash.

Principal Risks: The greatest risk of investing in the Fund is that you could lose money. Investments in the Fund also are subject to the following principal risks:

| | • | | General Market Risk – Factors that affect the stock market in general, such as economic production, interest rate levels, geopolitical events or volatility may negatively affect secondary markets and cause them to experience lower valuations, reduced liquidity, price volatility, credit downgrades, increased likelihood of default and valuation difficulties. Such factors likely would lead to a decline in the value of your investment in the Fund. |

9

| | • | | Inflation Risk – Higher actual or anticipated inflation may have an adverse effect on corporate profits or consumer spending and result in lower values for securities held by the Fund. |

| | • | | Stock Market Risk – The Fund invests in equity securities and therefore is subject to stock market risks and significant fluctuations in value. The Fund’s investments in equity securities may include common stocks, preferred stocks, securities convertible into common stock, American Depositary Receipts, rights and warrants. ADRs are receipts issued by domestic banks or trust companies that represent the deposit of a security of a foreign issuer and are publicly traded in the United States. Investments in ADRs are subject to certain of the risks associated with investing directly in foreign securities, such as currency fluctuations, political and economic instability, less government regulation, less publicly available information, and differences in financial reporting standards. Investing in such securities may expose the Fund to additional risk. Common stock generally is subordinate to preferred stock upon the liquidation or bankruptcy of the issuing company. Preferred stocks and convertible securities are sensitive to movements in interest rates. In addition, convertible securities are subject to the risk that the credit standing of the issuer may have an effect on the convertible securities’ investment value. |

| | • | | Security Selection Risk – Equity and fixed income securities held by the Fund may not perform as anticipated due to a number of factors impacting the company that issued the securities, such as poor management, weak demand for the company’s products, or the company’s failure to meet earnings expectations. |

| | • | | Small and Mid Cap Risk – The Fund may invest in small and mid capitalization companies that may not have the size, resources and other assets of large capitalization companies. As a result, the securities of small and mid capitalization companies held by the Fund may be subject to greater market risks and fluctuations in value than large capitalization companies or may not correspond to changes in the stock market in general. |

| | • | | Interest Rate Risk – Market values of fixed income securities are inversely related to actual changes in interest rates, and the Fund’s fixed income securities holdings and net asset value may decline if interest rates rise. |

| | • | | Credit Risk – If the Fund holds fixed income securities of a company that experiences financial problems, the securities will likely decline in value or the company may fail to make timely payments of interest or principal on the securities. |

| | • | | Bond Market Risk – A bond’s market value is affected significantly by changes in interest rates – generally, when interest rates rise, the bond’s market value declines and when interest rates decline, its market value rises. Generally, a bond with a longer maturity will entail greater interest rate risk but have a higher yield. Conversely, a bond with a shorter maturity will entail less interest rate risk but have a lower yield. A bond’s value may also be affected by changes in its credit quality rating or the issuer’s financial condition. |

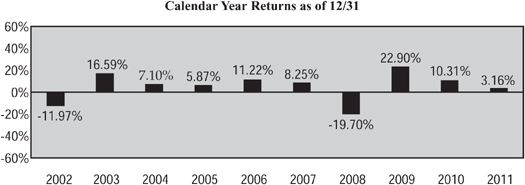

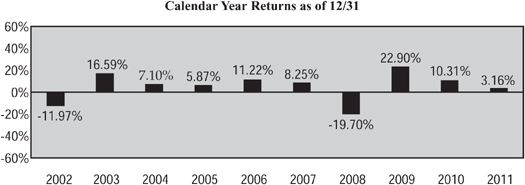

Performance: The bar chart and table that follow illustrate annual Fund returns for periods ended December 31. This information is intended to give you some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and how the Fund’s average annual returns over time compare with those of a broad measure of market performance, including an additional index that tracks the performance of fixed-income debt securities and a second additional index that shows how the Fund’s performance compares with the returns of an index of funds with similar investment objectives. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.lkcmfunds.com or by calling the Fund toll-free at 1-800-688-LKCM.

10

During the period shown on the bar chart, the Fund’s best and worst quarters are shown below:

Best and Worst Quarterly Returns

| | | | |

11.66% | | | 3rd quarter, 2009 | |

-10.13% | | | 4th quarter, 2008 | |

Average Annual Total Returns for Periods Ended December 31, 2011

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Return Before Taxes | | | 3.16 | % | | | 3.98 | % | | | 4.64 | % |

Return After Taxes on Distributions | | | 2.98 | % | | | 3.54 | % | | | 4.15 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | | 2.29 | % | | | 3.28 | % | | | 3.83 | % |

| | | | | | | | | | | | |

S&P 500 Index (reflects no deduction for fees, expenses or taxes) | | | 2.11 | % | | | -0.25 | % | | | 2.92 | % |

Barclays Capital U.S. Intermediate Government/Credit Bond Index

(reflects no deduction for fees, expenses or taxes) | | | 5.80 | % | | | 5.88 | % | | | 5.20 | % |

Lipper Mixed-Asset Target Allocation Growth Funds Index

(reflects no deduction for taxes) | | | -0.54 | % | | | 1.32 | % | | | 4.44 | % |

| | | | | | | | | | | | |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans and individual retirement accounts because such accounts are only subject to taxes upon redemption.

Investment Adviser: Luther King Capital Management Corporation.

Portfolio Managers:

| | | | |

Name | | Title | | Experience with the Fund |

Scot C. Hollmann, CFA | | Principal, Vice President and Portfolio Manager | | Since Inception in 1997 |

J. Luther King, Jr., CFA | | Principal, President and Portfolio Manager | | Since Inception in 1997 |

Mark L. Johnson, CFA | | Vice President and Portfolio Manager | | Since 2010 |

Purchase and Sale of Fund Shares: Investors may purchase, exchange or redeem Fund shares by mail (LKCM Funds, c/o U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, 3rd Floor, Milwaukee, WI 53201-0701), or by telephone at 1-800-688-LKCM. Redemptions by telephone are only permitted upon previously receiving appropriate authorization. Transactions will only occur on days the New York Stock Exchange is open. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the financial intermediary directly for information relative to the purchase or sale of Fund shares. The minimum initial amount of investment in the Fund and exchanges into the Fund from another fund in the LKCM Funds is $2,000. Subsequent investments in the Fund for all types of accounts may be made with a minimum investment of $1,000.

Tax Information: The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

Payments to Broker-Dealers and Other Financial Intermediaries: If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a financial adviser), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. If made, these payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

11

LKCM FIXED INCOME FUND

Investment Objective: The Fund seeks current income.

Fees and Expenses of the Fund: The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

| | | | |

Shareholder Fees | | | | |

(fees paid directly from your investment) | | | | |

Redemption Fee (as a percentage of the amount redeemed on shares held for less than 30 days) | | | 1.00 | % |

Annual Fund Operating Expenses | | | | |

(expenses that you pay each year as a percentage of the value of your investment) | | | | |

Management Fees | | | 0.50 | % |

Distribution and Service (12b-1) Fees | | | 0.00 | % |

Other Expenses | | | 0.22 | % |

| | | | |

Total Annual Fund Operating Expenses | | | 0.72 | % |

Fee Cap and/or Expense Reimbursement(1) | | | -0.07 | % |

| | | | |

Total Annual Fund Operating Expenses After Fee Cap and/or Expense Reimbursement(1) | | | 0.65 | % |

| | | | |

| (1) | Luther King Capital Management Corporation, the Fund’s investment adviser, has contractually agreed to cap all or a portion of its management fee and/or reimburse the Fund through April 30, 2013 in order to limit the Fund’s Total Annual Fund Operating Expenses After Fee Cap and/or Expense Reimbursement to 0.65%. This expense limitation excludes interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses. The fee reduction and expense reimbursement agreement may be terminated or changed at any time only with the consent of the Board of Trustees. |

Example

The following example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be as follows:

| | | | | | |

1 Year | | 3 Years | | 5 Years | | 10 Years |

| $66 | | $223 | | $394 | | $888 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 24% of the average value of its portfolio.

Principal Investment Strategies: The Fund seeks to achieve its investment objective by investing under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in a portfolio of investment grade corporate and U.S. Government fixed income securities. The Fund typically invests in bonds with short- to intermediate-term maturities (those with maturities from one to ten years) issued by corporations, the U.S. Government, agencies or instrumentalities of the U.S. Government and cash equivalent securities. Investment grade debt securities are considered to be those rated within the four highest ratings assigned by nationally recognized statistical rating organizations.

The Fund seeks to maintain a dollar-weighted average expected maturity between three and 10 years under normal market and economic conditions. The expected maturity of securities with sinking fund or other early redemption features will be estimated by the Adviser, based upon prevailing interest rate trends and the issuer’s financial position. The average expected maturity may be less than three years if the Adviser believes a temporary, defensive posture is appropriate.

The Fund may invest in all types of domestic or U.S. dollar-denominated foreign fixed income securities in any proportion, including bonds, notes, convertible bonds, mortgage-backed and asset-backed securities, government and government agency securities, zero coupon bonds, floating rate bonds, preferred stock and short-term obligations such as commercial paper and notes, bank deposits and other financial obligations, and repurchase agreements. In determining whether or not to invest in a particular debt security, the Adviser considers factors such as the price, coupon, yield to maturity, the credit quality of the issuer, the issuer’s cash flow and related coverage ratios, the property, if any, securing the obligation and the terms of the debt instrument, including subordination, default, sinking fund and early redemption provisions. The Fund generally intends to purchase securities that are rated investment grade at the time of its purchase. If an issue of securities is downgraded, the Adviser will consider whether to continue to hold the obligation.

12

Principal Risks: The greatest risk of investing in the Fund is that you could lose money. Investments in the Fund also are subject to the following principal risks:

| | • | | General Market Risk – Factors that affect the stock market in general, such as economic production, interest rate levels, geopolitical events or volatility may negatively affect secondary markets and cause them to experience lower valuations, reduced liquidity, price volatility, credit downgrades, increased likelihood of default and valuation difficulties. Such factors likely would lead to a decline in the value of your investment in the Fund. |

| | • | | Inflation Risk – Higher actual or anticipated inflation may have an adverse effect on corporate profits or consumer spending and result in lower values for securities held by the Fund. |

| | • | | Interest Rate Risk – Market values of fixed income securities are inversely related to actual changes in interest rates, and the Fund’s fixed income securities holdings and net asset value may decline if interest rates rise. |

| | • | | Credit Risk – If the Fund holds fixed income securities of a company that experiences financial problems, the securities will likely decline in value or the company may fail to make timely payments of interest or principal on the securities. |

| | • | | Bond Market Risk – A bond’s market value is affected significantly by changes in interest rates – generally, when interest rates rise, the bond’s market value declines and when interest rates decline, its market value rises. Generally, a bond with a longer maturity will entail greater interest rate risk but have a higher yield. Conversely, a bond with a shorter maturity will entail less interest rate risk but have a lower yield. A bond’s value may also be affected by changes in its credit quality rating or the issuer’s financial condition. |

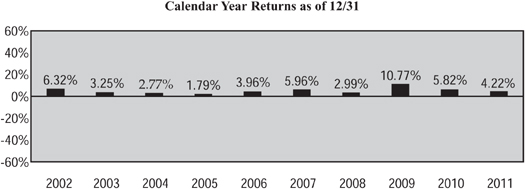

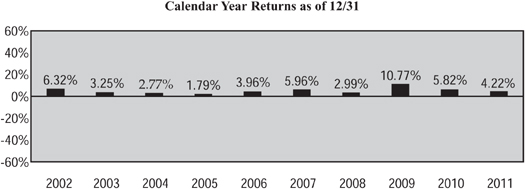

Performance: The bar chart and table that follow illustrate annual Fund returns for periods ended December 31. This information is intended to give you some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and how the Fund’s average annual returns over time compare with an index that tracks the performance of fixed-income debt securities and an additional index that shows how the Fund’s performance compares with the returns of an index of funds with similar investment objectives. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.lkcmfunds.com or by calling the Fund toll-free at 1-800-688-LKCM.

During the period shown on the bar chart, the Fund’s best and worst quarters are shown below:

| | |

Best and Worst Quarterly Returns |

| 4.03% | | 3rd quarter, 2009 |

| -2.18% | | 2nd quarter, 2004 |

13

Average Annual Total Returns for Periods Ended December 31, 2011

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Return Before Taxes | | | 4.22 | % | | | 5.92 | % | | | 4.76 | % |

Return After Taxes on Distributions | | | 2.92 | % | | | 4.44 | % | | | 3.27 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | | 2.89 | % | | | 4.22 | % | | | 3.19 | % |

| | | | | | | | | | | | |

Barclays Capital U.S. Intermediate Government/Credit Bond Index (reflects no deduction for fees, expenses or taxes) | | | 5.80 | % | | | 5.88 | % | | | 5.20 | % |

Lipper Short Intermediate Investment-Grade Debt Funds Index (reflects no deduction for taxes) | | | 3.99 | % | | | 4.80 | % | | | 4.29 | % |

| | | | | | | | | | | | |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans and individual retirement accounts because such accounts are only subject to taxes upon redemption.

Investment Adviser: Luther King Capital Management Corporation.

Portfolio Managers:

| | | | |

Name | | Title | | Experience with the Fund |

Joan M. Maynard | | Vice President and Portfolio Manager | | Since Inception in 1997 |

Scot C. Hollmann, CFA | | Principal, Vice President and Portfolio Manager | | Since 2010 |

Mark L. Johnson, CFA | | Vice President and Portfolio Manager | | Since 2010 |

Purchase and Sale of Fund Shares: Investors may purchase, exchange or redeem Fund shares by mail (LKCM Funds, c/o U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, 3rd Floor, Milwaukee, WI 53201-0701), or by telephone at 1-800-688-LKCM. Redemptions by telephone are only permitted upon previously receiving appropriate authorization. Transactions will only occur on days the New York Stock Exchange is open. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the financial intermediary directly for information relative to the purchase or sale of Fund shares. The minimum initial amount of investment in the Fund and exchanges into the Fund from another fund in the LKCM Funds is $2,000. Subsequent investments in the Fund for all types of accounts may be made with a minimum investment of $1,000.

Tax Information: The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

Payments to Broker-Dealers and Other Financial Intermediaries: If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a financial adviser), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. If made, these payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

14

ADDITIONAL INFORMATION REGARDING THE INVESTMENT OBJECTIVES

AND PRINCIPAL INVESTMENT STRATEGIES OF THE FUNDS

| | |

| Small Cap Equity Fund | | The Fund seeks to achieve its investment objective by primarily choosing investments that the Adviser believes are likely to have above-average growth in revenue and/or earnings and potential for above-average capital appreciation. The Fund invests under normal circumstances at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of smaller companies. Smaller companies are those with market capitalizations at the time of investment between $400 million and $2.5 billion. The Fund is not required to sell equity securities whose market values appreciate or depreciate outside this market capitalization range. The equity securities in which the Fund may invest include common stocks, preferred stocks, securities convertible into common stock, American Depositary Receipts, rights and warrants. The Adviser’s primary strategy in managing the Fund is to identify high quality companies that exhibit certain qualities, including profitability levels, balance sheet quality, competitive advantages, ability to generate excess cash flows, meaningful management ownership stakes, reinvestment opportunities, market share positions, and relative valuation. |

| |

Small-Mid Cap Equity

Fund | | The Fund seeks to achieve its investment objective by primarily choosing investments that the Adviser believes are likely to have above-average growth in revenue and/or earnings and potential for above- average capital appreciation. The Fund invests under normal circumstances at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of small-mid capitalization companies. Small-mid capitalization companies are those with market capitalizations at the time of investment between $1 billion and $7 billion. The Fund is not required to sell equity securities whose market values appreciate or depreciate outside this market capitalization range. The equity securities in which the Fund may invest include common stocks, preferred stocks, securities convertible into common stock, American Depositary Receipts, rights and warrants. |

| |

| | The Adviser’s primary strategy in managing the Fund is to identify high quality companies that exhibit certain qualities, including profitability levels, balance sheet quality, competitive advantages, ability to generate excess cash flows, meaningful management ownership stakes, reinvestment opportunities, market share positions, and relative valuation. |

| |

| Equity Fund | | The Fund seeks to achieve its investment objective by primarily choosing investments that the Adviser believes are likely to have above-average growth in revenue and/or earnings, above-average returns on shareholders’ equity, under-leveraged balance sheets, and potential for above-average capital appreciation. The Fund invests under normal circumstances at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities. These equity securities may include common stocks, preferred stocks, securities convertible into common stocks, American Depositary Receipts, rights and warrants. The Fund may invest in equity securities of small, mid and large capitalization companies. The Adviser’s primary strategy in managing the Fund is to identify high quality companies that exhibit certain qualities, including profitability levels, balance sheet quality, competitive advantages, ability to generate excess cash flows, meaningful management ownership stakes, reinvestment opportunities, market share positions, and relative valuation. |

| |

| Balanced Fund | | The Fund seeks to achieve its investment objective by investing primarily in a portfolio of equity and fixed income securities, including common stocks, preferred stocks, securities convertible into common stocks, American Depositary Receipts, rights and warrants. The Fund’s investments in fixed income securities will consist primarily of investment grade corporate and U.S. Government and agency issues with intermediate maturities from one to ten years. |

| |

| | The Adviser’s primary strategy in managing the Fund is to identify high quality companies that exhibit certain qualities, including profitability levels, balance sheet quality, competitive advantages, ability to generate excess cash flows, meaningful management ownership stakes, reinvestment opportunities, market share positions, and relative valuation. The Fund may invest in securities of small, mid and large capitalization companies. |

| |

| Fixed Income Fund | | The Fund invests under normal circumstances at least 80% of its net assets (plus any borrowings for investment purposes) in a portfolio of investment grade corporate and U.S. Government fixed-income securities. The Fund typically invests in bonds with short- and intermediate-term maturities from one to ten years, and cash equivalent securities. The Adviser’s primary strategy in managing the Fund is to select debt securities based on factors such as price, yield and credit quality. |

15

Each Fund has adopted a non-fundamental policy to notify its shareholders at least 60 days before it changes its 80% investment policy as described above. Each Fund’s investment objective is non-fundamental, which means that it may be changed by action of the Board of Trustees of the Trust without shareholder approval.

DISCUSSION OF INVESTMENT APPROACH

| | | | |

Small Cap Equity,

Small-Mid Cap

Equity, Equity,

and Balanced Funds | | Luther King Capital Management Corporation (the “Adviser”) follows an equity investment approach grounded in the fundamental analysis of individual companies and comprised of two distinct but complementary components. First, the Adviser seeks to identify high quality companies based on various financial and fundamental criteria. Companies meeting these criteria will typically exhibit a number of the following characteristics: |

| |

| | • High profitability levels; |

| | • Strong balance sheet quality; |

| | • Competitive advantages; |

| | • Market share positions; |

| | • Reinvestment opportunities; |

| | • Ability to generate excess cash flow after capital expenditures; |

| | • Management with a meaningful ownership stake in the company; and |

| | • Undervaluation based upon various quantitative criteria. |

| |

| | The Adviser may also invest in companies whose assets the Adviser has determined are undervalued in the marketplace. These include companies with tangible assets as well as companies that own valuable intangible assets. As with the primary approach described above, both qualitative as well as quantitative factors are important criteria in the investment analysis. |

| |

Balanced

and Fixed

Income Funds | | The Adviser’s fixed income investment approach concentrates primarily on investment-grade corporate and U.S. Government issues with short and intermediate effective maturities. The Adviser’s fixed income philosophy combines noncallable bonds for their offensive characteristics with callable bonds for their defensive characteristics in an attempt to enhance returns while controlling the level of risk. The security selection process for noncallable corporate bonds is heavily credit-driven and focuses on the issuer’s earning and cash flow trends, its competitive positioning and the dynamics of its industry. |

| |

| | A second component of the Adviser’s fixed income philosophy is the identification of undervalued securities with a combination of high coupons and various early redemption features. These defensive issues can offer high levels of current income with relatively limited price volatility due to the possibility that they will be retired by the issuer much sooner than the final maturity. Callable bonds are used as alternatives to traditional short-term noncallable issues. Maturity decisions are primarily a function of the Adviser’s macroeconomic analysis and are implemented utilizing intermediate maturity, noncallable securities. Finally, the credit analysis performed by the Adviser on individual companies, as well as industries, is enhanced by the Adviser’s experience in the equity markets. The analytical effort concentrates on market leading, profitable, well-financed debt issuers. |

To respond to adverse market, economic, political or other conditions, the Small Cap Equity, Small-Mid Cap Equity, Equity, Balanced and Fixed Income Funds may invest in time deposits, commercial paper, certificates of deposits, short term corporate and government obligations, repurchase agreements and bankers’ acceptances. To the extent that a Fund engages in a temporary, defensive strategy, the Fund may not achieve its investment objective.

ADDITIONAL INFORMATION REGARDING THE PRINCIPAL RISKS OF INVESTING IN THE FUNDS

An investment in any of the Funds entails risks. You should be aware that you may lose money by investing in the Funds, and the Funds’ performance could trail that of other investment alternatives. The table below provides additional principal risks of investing in the Funds. Following the table, each risk is explained.

16

| | | | | | | | | | |

| | | Small Cap | | Small-Mid Cap | | Equity | | Balanced | | Fixed |

| | | Equity Fund | | Equity Fund | | Fund | | Fund | | Income Fund |

General Market Risk | | X | | X | | X | | X | | X |

Inflation Risk | | X | | X | | X | | X | | X |

Stock Market Risk | | X | | X | | X | | X | | |

Stock Selection Risk | | X | | X | | X | | X | | |

Small Cap Risk | | X | | | | | | | | |

Small and Mid Cap Risk | | | | X | | X | | X | | X |

Interest Rate Risk | | | | | | | | X | | X |

Credit Risk | | | | | | | | X | | X |

Bond Market Risk | | | | | | | | X | | X |

| | |

| General Market Risk: | | Factors that affect the stock and bond markets include domestic and foreign economic growth or decline, interest rate levels and political events. These factors may negatively affect the markets and, thus, an investment in any of the Funds may decline. Decreases in the value of stocks are generally greater than for bonds or other debt investments. In addition, U.S. and international markets may experience dramatic volatility, which may lead to substantially lower valuations, reduced liquidity, price volatility, credit downgrades, increased likelihood of default and valuation difficulties. As a result, many of the Funds’ other risks may be increased. Continuing market problems may have adverse effects on the Funds. |

| |

| Inflation Risk: | | Stocks and bonds may fall in value due to higher actual or anticipated inflation. Further, a rapid increase in prices for goods and services may have an adverse effect on corporate profits and consumer spending, which also may result in lower stock and bond values. |

| |

| Stock Market Risk: | | Funds that invest in equity securities are subject to stock market risks and significant fluctuations in price. A Fund’s investments in equity securities may include equity securities such as common stocks, preferred stocks, securities convertible into U.S. common stocks, American Depositary Receipts, rights and warrants. Investing in such securities may expose the Funds to additional risks. |

| |

| | • Common Stock. Common stock generally is subordinate to the issuing company’s debt securities and preferred stock upon the dissolution or bankruptcy of the issuing company. |

| |

| | • Preferred Stocks. If interest rates rise, the dividend on preferred stocks may be less attractive, causing the price of preferred stocks to decline. Preferred stock may have mandatory sinking fund provisions, as well as provisions for their call or redemption prior to maturity which can have a negative effect on their prices when interest rates decline. Preferred stocks are equity securities because they do not constitute a liability of the issuer and therefore do not offer the same degree of protection of capital or continuation of income as debt securities. The rights of preferred stock on distribution of a corporation’s assets in the event of its liquidation are generally subordinated to the rights associated with a corporation’s debt securities. Preferred stock may also be subject to credit risk. |

| |

| | • Convertible Securities. The value of a convertible security (“convertible”) is influenced by both the yield of non-convertible securities of comparable issuers and by the value of the underlying common stock. The investment value of a convertible is based on its yield and tends to decline as interest rates increase. The conversion value of a convertible is the market value that would be received if the convertible were converted to its underlying common stock. The conversion value will decrease as the price of the underlying common stock decreases. When conversion value is substantially below investment value, the convertible’s price tends to be influenced more by its yield, so changes in the price of the underlying common stock may not have as much of an impact. Conversely, the convertible’s price tends to be influenced more by the price of the underlying common stock when conversion value is comparable to or exceeds investment value. The value of a synthetic convertible security will respond differently to market fluctuations than a convertible security, because a synthetic convertible is composed of two or more separate securities, each with its own market value. Convertible securities may be subject to general market risk, credit risk and interest rate risk. |

| |

| | • American Depositary Receipts. Investments in ADRs are subject to certain of the risks associated with investing directly in foreign securities. Including, but not limited to, currency fluctuations and political and financial instability in the home country of a particular ADR. Such events could negatively affect the value of the Fund’s shares. |

17

| | |

| |

| | • Rights and Warrants. Investments in rights and warrants may be more speculative than certain other types of investments because rights and warrants do not carry with them dividend or voting rights with respect to the underlying securities, or any rights in the assets of the issuer. In addition, the value of a right or a warrant does not necessarily change with the value of the underlying securities, and a right or a warrant ceases to have value if it is not exercised prior to its expiration date. |

| |

| Stock Selection Risk: | | Stocks selected by the Adviser may decline in value or not increase in value when the stock market in general is rising. |

| |

| Small-Cap Risk: | | Small capitalization companies may not have the size, resources or other assets of mid or large capitalization companies. These small capitalization companies may be subject to greater market risks and fluctuations in value than mid or large capitalization companies and may not correspond to changes in the stock market in general. |

| |

| Small and Mid Cap Risk: | | Small and mid capitalization companies may not have the size, resources and other assets of large capitalization companies. These small and mid capitalization companies may be subject to greater market risks and fluctuations in value than large capitalization companies and may not correspond to changes in the stock market in general. |

| |