UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08360 |

|

GUINNESS ATKINSON FUNDS |

(Exact name of registrant as specified in charter) |

|

21550 Oxnard Street, Suite 850 Woodland Hills, CA | | 91367 |

(Address of principal executive offices) | | (Zip code) |

|

James J. Atkinson, Jr. 21550 Oxnard Street, Suite 850 Woodland Hills, CA 91367 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800-915-6566) | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2013 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

2

Guinness AtkinsonTM Funds

Annual Report

December 31, 2013

TABLE OF CONTENTS

| | 5 | | | Letter to Shareholders | |

| | 7 | | | Expense Example | |

| | 8 | | | Alternative Energy Fund | |

| | 16 | | | Asia Focus Fund | |

| | 22 | | | Asia Pacific Dividend Fund | |

| | 28 | | | China & Hong Kong Fund | |

| | 34 | | | Global Energy Fund | |

| | 42 | | | Global Innovators Fund | |

| | 49 | | | Inflation Managed Dividend FundTM | |

| | 57 | | | Renminbi Yuan & Bond Fund | |

| | 63 | | | Statements of Assets and Liabilities | |

| | 65 | | | Statements of Operations | |

| | 67 | | | Statements of Changes in Net Assets | |

| | 70 | | | Financial Highlights | |

| | 78 | | | Notes to Financial Statements | |

| | 91 | | | Report of Independent Registered Public Accounting Firm | |

| | 92 | | | Trustee and Officer Information | |

| | 95 | | | Privacy Notice | |

| | 99 | | | Guinness Atkinson Funds Information | |

3

The table below provides total return data for each of the Funds over the one, three, five, ten and from inception periods through December 31, 2013. Also included in the table is the expense ratio data from the most recent prospectus dated May 1, 2013.

Fund (inception date) | | 1-year | | 3-year | | 5-year | | 10-year | | From Inception | | Expense Ratio | |

Alternative Energy Fund (March 31, 2006) | | | 61.54 | % | | | -7.66 | % | | | -3.88 | % | | | — | | | | -12.20 | % | | 2.32% gross; 2.02% net† | |

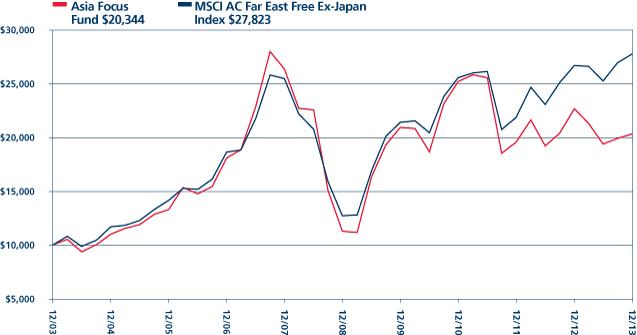

Asia Focus (April 29, 1996) | | | -10.38 | % | | | -6.92 | % | | | 12.56 | % | | | 7.36 | % | | | 2.58 | % | | 1.71% | |

Asia Pacific Dividend Fund (March 31, 2006) | | | -2.06 | % | | | 1.30 | % | | | 16.20 | % | | | — | | | | 4.70 | % | | 3.57% gross; 1.98% net† | |

China & Hong Kong (June 30, 1994) | | | 6.45 | % | | | -4.07 | % | | | 14.45 | % | | | 9.44 | % | | | 7.68 | % | | 1.52% | |

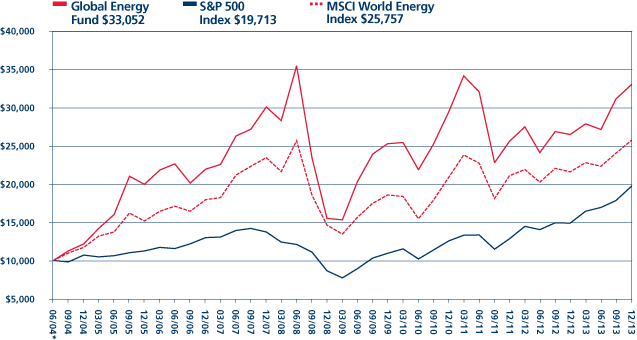

Global Energy Fund (June 30, 2004) | | | 24.48 | % | | | 3.83 | % | | | 16.34 | % | | | — | | | | 13.41 | % | | 1.35% | |

Global Innovators Fund (December 15, 1998) | | | 45.29 | % | | | 17.66 | % | | | 22.57 | % | | | 10.42 | % | | | 7.09 | % | | 1.51% | |

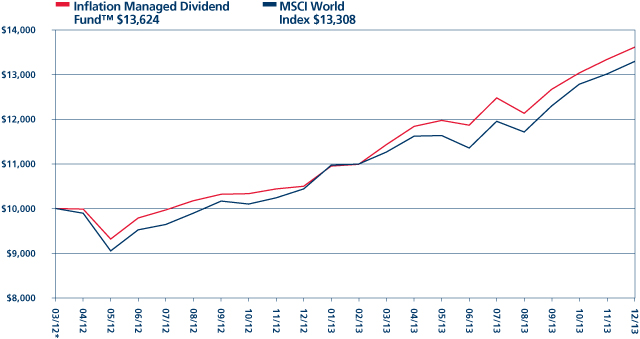

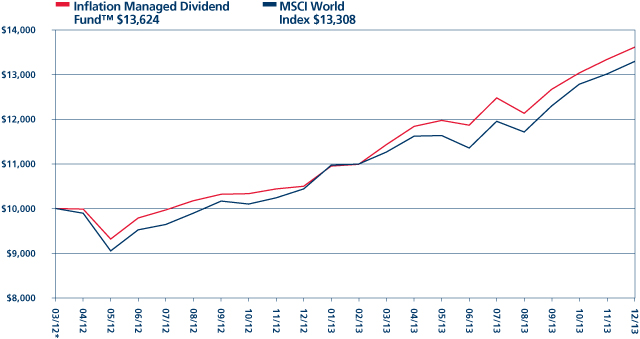

Inflation Managed Dividend FundTM (March 30, 2012) | | | 29.77 | % | | | — | | | | — | | | | — | | | | 19.24 | % | | 7.05% gross; 0.68% net† | |

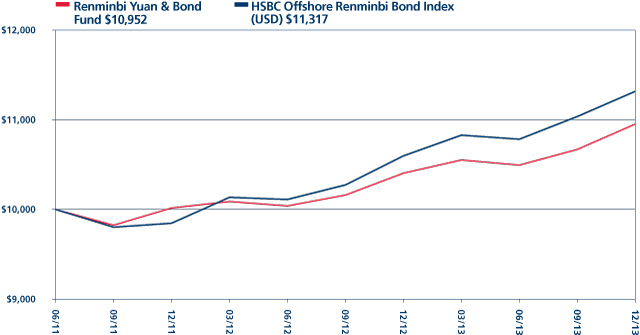

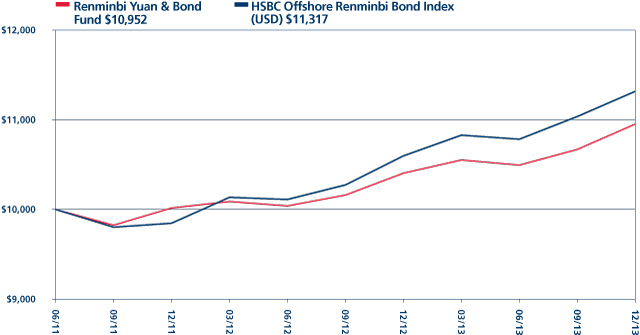

Renminbi Yuan & Bond Fund (June 30, 2011) | | | 5.26 | % | | | — | | | | — | | | | — | | | | 3.70 | % | | 0.90% | |

Periods of greater than one year are average annualized returns; one year and shorter period returns are actual returns. All returns are for the periods ending December 31, 2013.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Each Fund imposes a 2% redemption fee on shares held less than 30 days. Performance data quoted does not reflect this fee. If it had, total return would be lower.

Expense ratios are from the most recent prospectus (dated May 1, 2013) and are from the most recent audited financials (period ending December 31, 2012) at the time that prospectus was completed.

†All of the Guinness Atkinson Funds have an expense cap in place and the advisor is contractually obligated to cap the Funds' total expenses at least through June 30, 2014. For the Inflation Managed Dividend Fund, the advisor is contractually obligated to cap total expenses at least through March 31, 2015.

4

Dear Guinness Atkinson Funds Shareholders,

Once again we're happy to report that the world didn't end during the previous year. In fact, 2013 was a pretty good year, particularly for shareholders in most of the Guinness Atkinson Funds. Before we get to the performance details, it might be worthwhile to once again speak out for optimism and acknowledge what we find obvious: human progress is alive and well and for the majority of the planet life has never been better. As we mentioned, we find this qualitative judgment to be a matter of fact: humans are living longer, healthier lives; earning increasingly higher amounts and are on average more educated and connected to information and entertainment than ever before.

Notwithstanding that these are factual statements the majority of us believe the opposite, namely that the state of humanity is poor and declining. There is a pessimism that permeates the national and global zeitgeist. We accept that the world isn't going to come around to our point of view no matter how loud we shout the optimistic truth. But we do feel it is important to share our view and the facts about the human condition because we believe this unfounded pessimism and angst has some effect on investment behavior. Investors with a better understanding of the true state of the human condition might be in a position to make more informed investment decisions. Investing isn't just about the long term, of course and we are cognizant that economic events bring both the good and the bad. We are not blind to the fact that markets fluctuate or that bad things happen. That is part of the exercise. Our point is more that investing can benefit from a long term view and, importantly, it is helpful if that long term view is grounded in facts and empirical data rather than on subjective misinformation.

2013 Performance

We're delighted to acknowledge that the Guinness Atkinson Alternative Energy Fund had a stellar 2013, generating a total return of 61.54% for the year. This is particularly welcome news given the generally dismal performance of this Fund in recent years. In 2013 this Fund benefitted greatly from the strong performance of the sector. Previously this Fund had suffered greatly from the very weak performance of the sector. As the name of the Fund suggests, the Alternative Energy Fund invests in the alternative energy sector. Our philosophy for this Fund, and indeed in all of the Guinness Atkinson Funds, is to invest shareholder assets in the manner suggested by the Fund's name. For the Alternative Energy Fund this means investing in companies that generate at least 50% of their earnings or revenues from alternative energy. Thus, when the sector was weak in recent years the Fund produced poor results. But, maintaining the course paid off handsomely in 2013. Our view on alternative energy is simple; over time the price of alternative energy will decline while conventional energy costs will rise. This formula, coupled with increasing environmental concerns should result in a dramatic increase in alternative energy generation. Put another way, our view is that over time alternative energy will become conventional. We know the short term for this industry can be extremely volatile, but our view on the long term is optimistic.

The Global Innovators Fund also had an excellent 2013, generating a total return of 45.29%. In fact, this Fund has put together an exceptional long term track record (details are provided in the table above). The philosophy behind this Fund is simple: Companies that demonstrate an ability to innovate can achieve a competitive advantage. The Global Innovators Fund is populated with companies from a variety of industries that have found a competitive advantage through innovation. We believe the excellent long term track record for this Fund supports our view that innovation matters.

The newest Guinness Atkinson Fund, the Inflation Managed Dividend FundTM, had an excellent year, providing a total return of 29.77% in 2013. We're the first to admit that this Fund has an unusual name. The Fund seeks to offer a moderate dividend yield that importantly grows at a rate that is greater than the rate of inflation. In simple terms the Fund could be described as a growing dividend Fund. But central to the Fund is the principle that any rising dividend strategy needs to be cognizant of the rate of inflation.

The Global Energy Fund also had a standout year, generating a total return of 24.48% over the calendar year, despite the fact that the price of oil was relatively stable over the course of 2013. Notwithstanding this performance, the energy sector has actually been a bit out of favor of late and arguably undervalued versus the market as a whole. Time will tell on this point, but our view is that despite the excellent performance of 2013 the energy sector is relatively undervalued.

The China & Hong Kong Fund produced a total return of 6.45% for the year. Shareholders in this Fund will know from experience that while the long term track record is quite good, the ride can be rather bumpy. That is to be expected given the transition from emerging market into a developed world power. Our view on China is the same today as it was when this Fund launched in 1994, specifically, that China is on a path to become the world's largest economy. The transition to a modern capitalist economy is just over 30 years old and the dramatic rise in gross domestic product (GDP) (both absolute and on a per capita basis) is extremely

5

impressive. More impressive is that this economic advancement has occurred across a population base of 1.2 billion. This rapid advancement for such a large population base has never before occurred in human history. There have been setbacks along the way, and we're sure there will be some in the years ahead – hence the volatility – but there is no denying the China success story.

The Renminbi Yuan & Bond Fund finished 2013 with a total return for the year of 5.26%. The increasing adoption, globally, for the Renminbi continues and the currency is increasingly gaining the status as a major world currency. This is exactly what one should expect given that China is the world's second largest economy.

The Asia Focus Fund (-10.38%) and the Asia Pacific Dividend Fund (-2.06%) were the two Guinness Atkinson Funds that produced negative total returns for the year. And while we're not happy about these results we remain steadfast in our long term view and recognize that these markets have been – and likely will continue to be – bumpy. Over the longer term the Asian economies have been experiencing profound growth. But we know that this growth has been subject to setbacks and the markets have been subject to volatility. But these negative developments do not undermine the main story of long term growth. Our investment team has provided a detailed commentary for each of the Guinness Atkinson Funds adjacent to each Fund's financial results.

As usual, we appreciate the confidence you have placed in us and our management team and look forward to what will hopefully be a great 2014.

We encourage you to visit gafunds.com for the latest news and announcements on the Guinness Atkinson Funds. In particular, we encourage investors to subscribe to our series of topical briefs. These briefs are meant to provide investors with our current thinking about each of the themes and markets which make up the Guinness Atkinson Fund range.

Sincerely,

| |

| |

Timothy Guinness | | James Atkinson | |

The Funds invest in foreign securities, which involves greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets countries. Non-diversified Funds' assets may be concentrated in fewer individual holdings than diversified funds. Therefore, these Funds are more exposed to individual stock volatility than diversified funds. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise, which can be greater for longer-term debt securities. Investments in derivatives involve risks different from, and in certain cases, greater than the risks presented by traditional investments. Investments focused in a single geographic region may be exposed to greater risk than investments diversified among various geographies. Investments focused on the energy sector may be exposed to greater risk than an investments diversified among various sectors.

6

Expense Examples (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) redemption fees; and (2) ongoing costs, including advisory fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period shown and held for the entire period from July 1, 2013 to December 31, 2013.

Actual Expenses

For each Fund, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid during Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Fund, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any redemption fees. Therefore, the second line for each Fund of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these redemption fees were included, your costs would have been higher.

| | | Beginning

Account

Value

(07/01/13) | | Ending

Account

Value

(12/31/13) | | Expenses Paid

During Period*

(07/01/13 to

12/31/13) | | Expense Ratios

During Period*

(07/01/13 to

12/31/13) | |

Guinness Atkinson Alternative Energy Fund Actual | | $ | 1,000.00 | | | $ | 1,278.80 | | | $ | 11.37 | | | | 1.98 | %† | |

Guinness Atkinson Alternative Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 10.06 | | | | 1.98 | %† | |

Guinness Atkinson Asia Focus Fund Actual | | $ | 1,000.00 | | | $ | 1,048.70 | | | $ | 9.71 | | | | 1.88 | % | |

Guinness Atkinson Asia Focus Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.73 | | | $ | 9.55 | | | | 1.88 | % | |

Guinness Atkinson Asia Pacific Dividend Fund Actual | | $ | 1,000.00 | | | $ | 977.90 | | | $ | 9.87 | | | | 1.98 | %† | |

Guinness Atkinson Asia Pacific Dividend Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 10.06 | | | | 1.98 | %† | |

Guinness Atkinson China & Hong Kong Fund Actual | | $ | 1,000.00 | | | $ | 1,191.60 | | | $ | 8.56 | | | | 1.55 | % | |

Guinness Atkinson China & Hong Kong Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.39 | | | $ | 7.88 | | | | 1.55 | % | |

Guinness Atkinson Global Energy Fund Actual | | $ | 1,000.00 | | | $ | 1,215.10 | | | $ | 7.31 | | | | 1.31 | % | |

Guinness Atkinson Global Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.63 | | | $ | 6.67 | | | | 1.31 | % | |

Guinness Atkinson Global Innovators Fund Actual | | $ | 1,000.00 | | | $ | 1,241.30 | | | $ | 8.19 | | | | 1.45 | % | |

Guinness Atkinson Global Innovators Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.90 | | | $ | 7.37 | | | | 1.45 | % | |

Guinness Atkinson Inflation Managed Dividend Fund Actual | | $ | 1,000.00 | | | $ | 1,147.60 | | | $ | 3.68 | | | | 0.68 | %† | |

Guinness Atkinson Inflation Managed Dividend Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.78 | | | $ | 3.47 | | | | 0.68 | %† | |

Guinness Atkinson Renminbi Yuan & Bond Fund Actual | | $ | 1,000.00 | | | $ | 1,043.60 | | | $ | 4.64 | | | | 0.90 | %† | |

Guinness Atkinson Renminbi Yuan & Bond Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.67 | | | $ | 4.58 | | | | 0.90 | %† | |

*Expenses are equal to the Funds' annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by the number of days in most recent fiscal half-year period (184), then divided by the number of days in the fiscal year (365) (to reflect the one-half year period).

†Net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

7

ALTERNATIVE ENERGY FUND for the period ended December 31, 2013

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year

(Actual) | | 3 Years | | 5 Years | | Since

Inception

(March 31, 2006) | |

Fund | | | 61.54 | % | | | -7.66 | % | | | -3.88 | % | | | -12.20 | % | |

Benchmark Indices: | |

Wilderhill New Energy Global Innovation Index | | | 55.57 | % | | | -3.08 | % | | | 2.10 | % | | | -3.61 | % | |

Wilderhill Clean Energy Index | | | 58.54 | % | | | -13.44 | % | | | -4.33 | % | | | -14.03 | % | |

MSCI World Index | | | 27.49 | % | | | 12.25 | % | | | 15.81 | % | | | 5.78 | % | |

The Fund's gross expense ratio is 2.32% and net expense ratio is 2.02% per the Summary Prospectus dated May 1, 2013. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2014. To the extent that the Advisor waives fees, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect fee limitations in effect and in the absence of these limitations total returns would have been lower.

The Guinness Atkinson Alternative Energy Fund was up 61.54% in 2013. This compared to a rise in the Wilderhill New Energy Global Innovation Index of 55.57% and in the Wilderhill Clean Energy Index of 58.54%. The Fund outperformed its benchmark indices and significantly outperformed the MSCI World Index in 2013.

The Fund had a flat first quarter, with strong second and third quarters followed by retrenching in the fourth quarter.

The main drivers of performance in the year were the portfolio's solar and wind stocks. The solar industry began to recover as we saw the expected increase in demand for solar globally in response to lower installation prices. In particular we have seen a transition from Europe as the main source of global demand to China, Japan and the U.S. which provides a much broader base for demand in the future. This has resulted in solar module prices stabilising, allowing many of the solar manufacturers to return to profitability and rebuild balance sheets. Within the wind sector, the wind turbine manufacturers performed well as they saw the benefits of cost restructurings and as the U.S. market recovered allowing backlogs to recover and pricing to stabilise. The second source of wind returns were the portfolio's holdings in Chinese wind utilities, who benefitted from low turbine prices in China, improving margins as the required grid infrastructure was put in place allowing them to sell more of their output and a continued commitment by China to developing alternative energy technologies.

8

2. Portfolio

Sector | | % of Assets | |

Solar | | | 26.40 | % | |

Wind | | | 49.99 | % | |

Efficiency | | | 12.06 | % | |

Geothermal | | | 3.64 | % | |

Hydro | | | 6.61 | % | |

Biomass Energy | | | 3.72 | % | |

Cash | | | -2.42 | % | |

| | | | 100.00 | % | |

Domicile | | % of Assets | |

Europe | | | 42.27 | % | |

North America | | | 22.53 | % | |

Asia | | | 34.57 | % | |

Latin America | | | 3.04 | % | |

Australasia | | | 0.00 | % | |

Cash | | | -2.41 | % | |

| | | | 100.00 | % | |

* region is as per company domicile.

The portfolio is quite concentrated in the wind and solar sectors, with 26.40% in solar and 49.99% in wind. We believe these sectors have the best long-term growth potential of the alternative energy space.

Within the solar sector, we are invested in a mix of low cost Asian solar cell and module manufacturers and volume plays including one inverter manufacturer and a Chinese solar installer.

For our wind exposure we are invested in both turbine manufacturers and wind farm developers. The split is 28.09% in large wind utilities, 11.27% in small utilities and 10.61% in wind turbine manufacturers. In the long run there are good potential returns both from owning wind assets and investing in the turbine value chain as the wind industry becomes more mainstream and as offshore wind gains traction.

Further investments are in a hydroelectric power producer in Latin America, an Austrian hydropower utility, a ground source heat pump company, a lithium mining company and a metering company.

The Fund has 42.27% of its holdings in companies domiciled in Europe. North America accounts for 22.53% of the Fund. The Fund's 37.61% of emerging markets holdings is predominantly held in Chinese companies, which account for 31.15% of the portfolio.

Mkt Cap $m | | Positions | | % of Asset | |

>1000 | | | 17 | | | | 57.98 | % | |

500-1000 | | | 3 | | | | 11.15 | % | |

250-500 | | | 6 | | | | 13.75 | % | |

100-250 | | | 3 | | | | 11.96 | % | |

50-100 | | | 2 | | | | 7.12 | % | |

<50 | | | 2 | | | | 0.45 | % | |

9

Position size | | Positions | | % of Assets | |

Full | | | 29 | | | | 101.96 | % | |

Half | | | 0 | | | | 0.00 | % | |

Research | | | 2 | | | | 0.45 | % | |

The liquidity of the Fund has become lower as the percentage of the Fund in companies with a market capitalization over US$1,000 million has risen back to 56.96% from 49.28% at the end of the first quarter. One holding is now in a company with a market capitalisation lower than $50 million – Good Energy. The Fund now has 29 full units and two research holdings and was in the process of acquiring a 30th unit at the end of the year to return the Fund to its target 30 unit structure.

3. Activity

Over 2013 the Fund acquired holdings in Maple Energy, Jinko Solar and China Singyes. The Fund sold its positions in Power One, Suntech, Thermal Energy International and LDK Solar.

Maple Energy is a Peruvian ethanol manufacturer with one of the lowest ethanol cost bases as it produces from sugarcane irrigated in a high insolation location. Jinkosolar is the lowest cost Chinese solar module manufacturer, has good political connections and is one of the first of the Chinese solar companies to return to profitability. China Singyes are a leading installer of solar systems in China.

Power One was a manufacturer of solar inverters and was acquired by ABB. Suntech and LDK Solar were leading solar manufacturers whose balance sheets become overstretched. Thermal Energy International was a research holding who specialised in heat recover systems for manufacturing processes.

4. Outlook

The outlook for alternative energy remains challenging, with government budgets still under pressure, natural gas price weakness in the U.S. and project financing still challenging. However, it is the potential for these challenges to be overcome or to dissipate that provides us with cause for optimism for the Fund.

The area that we are most excited about for 2014 and beyond remains solar. The best in class cost of solar installations has fallen to about $1.30/Watt from about $6.00/Watt in 2008. This means that solar is now competitive without subsidies in an increasing number of countries, particularly more emerging economies with structural electricity deficits and high electricity prices from use of diesel plants. Even in Germany and the UK a consumer can earn 10%+ returns on an installation based on the avoided cost of electricity from the grid.

The industry is also much less reliant on any one country compared to the over-reliance on Spain, Italy and Germany that has been seen historically and this combined with increasing unsubsidised demand means that the risk of market volumes falling is much lower. This has been further helped by the EU imposition on a floor for prices of Chinese modules, which has made the EU a far less competitive market from a price perspective to the benefit of the manufacturers. A number of analysts are forecasting growth of the market to 40-50GW (gigawatts) and we believe that estimates are likely to be revised upwards. This means that the industry is in less of a state of oversupply. In fact we think that the potential growth in demand from current low price of modules is likely to lead to a plateau in pricing for a number of years. Solar companies are now competing against retail electricity costs for the first time and this provides extra support to solar module prices.

For the wind industry, we see potential upside to global demand from the emerging economies. Europe and China do not offer major growth opportunities although we would expect installations to continue at roughly currently levels. The U.S. is hard to predict, although past experience would lead to expectations that after an expected good year in 2014, there may be a fall in 2015 if supporting legislation is allowed to lapse at the end of 2014. However, an early extension would allow maintenance of installations. With wind costs now able to deliver electricity at 5cents/kilowatt hour (c/kWh) or less in some geographies, we see the main wind industry growth coming from developing economies, where the electricity cost is again the more important driver. We see specific opportunities in a recovery in valuations for the large cap European renewables utilities held in the portfolio and even more potential from the smaller cap utilities who are bringing assets into production at a faster rate as a result of their stage of maturity.

10

Other holdings are in more stock specific type opportunities in hydro, geothermal, efficiency and biofuels companies. These range from turnaround situations to larger cap undervalued companies.

As one of the only funds that is investing in alternative energy as a pureplay strategy, we believe we are well placed to capture the potential returns from the growth of an industry that is only now beginning to recover from 2008.

The long term outlook for alternative energy remains good. The key drivers remain in place: dwindling fossil fuel supplies; energy security concerns; environmental issues; and climate change. The reduced cost of alternative energy technologies is likely to accelerate the growth of the alternative energy sector. We continue to position the Fund to benefit from the long term growth of the sector.

Edward Guinness

The Fund invests in foreign securities, which will involve political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. The Fund invests in smaller companies, which will involve additional risks such as limited liquidity and greater volatility. The Fund's focus on the energy sector to the exclusion of other sectors exposes the Fund to greater market risk and potential monetary losses than if the Fund's assets were diversified among various sectors.

The Wilderhill New Energy Global Innovation Index (NEX) is a modified dollar-weighted index of publicly traded companies that are active in renewable and low-carbon energy, and that stand to benefit from responses to climate change and energy security concerns. The Wilderhill Clean Energy Index (ECO) is a modified equal dollar weighted index comprised of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation. The MSCI World Energy Index is an unmanaged index composed of more than 1,400 stocks listed on exchanges in the U.S. Europe, Canada, Australia, New Zealand, and the Far East. These indices are unmanaged, not available for investment and do not incur expenses.

Please refer to the Schedule of Investments for details on fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

11

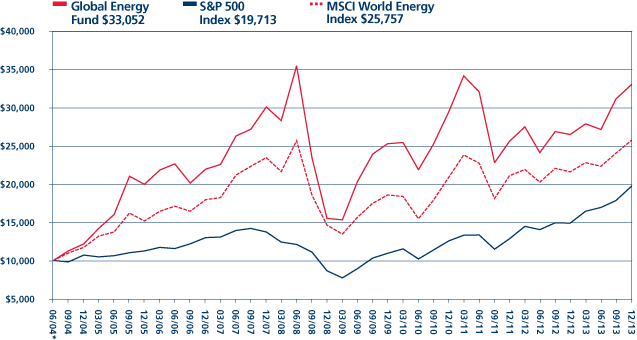

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2013

| One Year | | Five Years | | Since Inception

(03/31/06) | |

| | 61.54 | % | | | -3.88 | % | | | -12.20 | % | |

*Inception date 03/31/06.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The Wilderhill New Energy Global Innovations Index (NEX) is a modified dollar weighted index of publicly traded companies, which are active in renewable and low-carbon energy, and which stand to benefit from responses to climate change and energy security concern. The Wilderhill Clean Energy Index (ECO) is a modified equal dollar weighted index comprised of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation.

12

FUND HIGHLIGHTS at December 31, 2013

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

# of Holdings in Portfolio: | | | 31 | | |

Portfolio Turnover: | | | 60.2 | % | |

% of Stocks in Top 10: | | | 39.4 | % | |

Fund Manager:

Top 10 Holdings (% of net assets) | | | | Sector Breakdown (% of net assets) | | | |

JinkoSolar Holding Co-ADR | | | 4.8 | % | | Wind | | | 49.8 | % | |

Canada Lithium Corp. | | | 4.2 | % | | Solar | | | 26.3 | % | |

WaterFurnace Renewable Energy Inc. | | | 4.0 | % | | Efficiency | | | 12.0 | % | |

Theolia SA | | | 4.0 | % | | Hydro | | | 6.6 | % | |

Gamesa Corporation Tecnologica S.A. | | | 3.9 | % | | Geothermal | | | 3.6 | % | |

Vestas Wind Systems A/S | | | 3.9 | % | | Biofuel | | | 3.6 | % | |

Enel Green Power SpA | | | 3.7 | % | | | | | | | |

Greentech Energy Systems | | | 3.7 | % | | | | | | | |

Maple Energy PLC | | | 3.6 | % | | | | | | | |

Ormat Technologies, Inc. | | | 3.6 | % | | | | | | | |

13

SCHEDULE OF INVESTMENTS

December 31, 2013

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Shares | | COMMON STOCKS: 101.9% | | Value | |

Biofuel: 3.6% | | | |

| | 2,126,280 | | | Maple Energy PLC* | | $ | 862,652 | | |

Efficiency: 12.0% | | | |

| | 146,000 | | | Applied Intellectual Capital Ltd.*†^ | | | — | | |

| | 2,912,100 | | | Canada Lithium Corp.* | | | 1,000,627 | | |

| | 760,987 | | | Carmanah Technologies Corp.* | | | 107,459 | | |

| | 18,700 | | | Itron, Inc.* | | | 774,741 | | |

| | 42,500 | | | WaterFurnace Renewable Energy Inc. | | | 959,826 | | |

| | | | | | | | 2,842,653 | | |

Geothermal: 3.6% | | | |

| | 31,659 | | | Ormat Technologies, Inc. | | | 861,441 | | |

Hydro: 6.6% | | | |

| | 92,459 | | | Cia Energetica de Minas Gerais ADR | | | 720,256 | | |

| | 39,650 | | | Verbund AG | | | 846,292 | | |

| | | | | | | | 1,566,548 | | |

Solar: 26.3% | | | |

| | 806,000 | | | China Singyes Solar Tech | | | 810,750 | | |

| | 85,700 | | | JA Solar Holdings Co., Ltd.* | | | 785,869 | | |

| | 39,000 | | | Jinkosolar Holding Co - ADR* | | | 1,142,700 | | |

| | 191,100 | | | Renesola Ltd. - ADR* | | | 659,295 | | |

| | 20,220 | | | SMA Solar Technology AG | | | 638,673 | | |

| | 25,750 | | | SunPower Corp. - Class B * | | | 767,607 | | |

| | 55,720 | | | Trina Solar Ltd. - ADR* | | | 761,692 | | |

| | 136,500 | | | Yingli Green Energy Holding Co., Ltd. - ADR* | | | 689,325 | | |

| | | | | | | | 6,255,911 | | |

Wind: 49.8% | | | |

| | 14,200 | | | Acciona S.A. | | | 815,880 | | |

| | 83,687 | | | Boralex Inc. - Class A* | | | 852,430 | | |

| | 3,888,000 | | | China Datang Corp. Renewable Power Co. Ltd. - H Shares | | | 822,295 | | |

| | 639,000 | | | China Longyuan Power Group Corp. - H Shares | | | 823,235 | | |

| | 2,269,000 | | | China Suntien Green Energy Corp. Ltd. - H Shares | | | 851,500 | | |

| | 153,000 | | | EDP Renovaveis SA | | | 812,674 | | |

| | 350,300 | | | Enel Green Power SpA | | | 882,376 | | |

| | 89,900 | | | Gamesa Corporation Tecnologica S.A.* | | | 937,463 | | |

| | 212,941 | | | Good Energy Group PLC | | | 807,503 | | |

| | 407,600 | | | Greentech Energy Systems* | | | 879,428 | | |

| | 1,760,000 | | | Huaneng Renewables Corp. Ltd. - H Shares | | | 844,332 | | |

| | 48,900 | | | Nordex SE* | | | 645,946 | | |

| | 569,108 | | | Theolia SA* | | | 939,510 | | |

| | 31,515 | | | Vestas Wind Systems A/S* | | | 931,023 | | |

| | | | | | | | 11,845,595 | | |

| | | | | Total Common Stocks

(costs $31,714,482) | | | 24,234,800 | | |

The accompanying notes are an integral part of these financial statements.

14

| | | | | Value | |

| | | Total Investments in Securities

(costs $31,714,482): 101.9% | | $ | 24,234,800 | | |

| | | Liabilities in Excess of Other Assets: (1.9%) | | | (458,802 | ) | |

| | | Net Assets: 100.0% | | $ | 23,775,998 | | |

* Non-income producing security.

† Illiquid. Illiquid securities represent 0.0% of net assets.

^ Fair value under direction of the Board of Trustees. Fair valued securities represent 0.0% of net assets.

ADR - American Depository Receipt

The accompanying notes are an integral part of these financial statements.

15

ASIA FOCUS FUND for the period ended December 31, 2013

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year

(actual) | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | -10.38 | % | | | -6.92 | % | | | 12.56 | % | | | 7.36 | % | |

Benchmark Index: | |

MSCI AC Far East Free Ex Japan Index | | | 3.94 | % | | | 2.86 | % | | | 17.17 | % | | | 11.16 | % | |

S&P 500 Index | | | 32.38 | % | | | 16.16 | % | | | 17.92 | % | | | 7.40 | % | |

The Fund's gross expense ratio is 1.71% per the Summary Prospectus dated May 1, 2013. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2014. To the extent that the Advisor waives fees and/or reimburses expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect fee limitations in effect and, in the absence of these limitations, total returns would have been lower.

The Fund fell 10.38% during the year compared to the benchmark which rose 3.94%. We are clearly not happy to report these numbers but we do see the performance of this Fund is now starting to turn. The Fund has maintained a high exposure to China especially in energy materials and industrials which we believe were and remain undervalued. We believe that China is very cheap, that investors have been overly bearish, concerned about slower growth as well as the China's debt position. However, we also believe that China is due recovery once policy become clearer. We have not therefore, turned over the portfolio but have held our position.

China's stock market doldrums have been to the benefit of south east Asia where stock markets there have been strong. We have not been convinced by the underlying fundamentals especially of markets like Indonesia, Malaysia and the Philippines. Indonesia has come under pressure in recent months as the flows of hot money reversed. In spite of arguments offered to support Indonesia's strong stock market performance underlying weaknesses – the under-developed consumer market, bureaucratic inefficiency and the current account deficit – have not gone away.

In Thailand, political protests have paralyzed government in Bangkok, which of course has hit the stock market there. Yet companies once again have displayed their resilience and operations have continued. The most affected have been those whose investment plans hinge on government policy. However, ongoing operations of other domestic and export manufacturers have not been significantly disrupted.

2. Portfolio Position

Geographical exposure is dominated by China and Hong Kong but the Fund also has significant weightings in Taiwan and Thailand. By sector the Fund has high exposure to energy and materials, which have been reduced somewhat as stocks recovered in the second half, and has increased exposure to technology and consumer discretionary.

3. Outlook

Our views on China are more fully discussed in the China & Hong Kong Fund and the Renminbi Yuan & Bond Fund letters but we believe this is likely to be the beginning of a strong run in Chinese stocks from valuations that now languish at multi-year lows. Outside China, North Asia looks more attractive to us than south-east Asia, although we keep faith with Thailand whose export manufacturing sector is often overlooked and has sustained performance through both natural disaster and political turbulence.

16

North Asia's technology sector looks bright to us, especially in the area of consumer electronics related to smartphones and tablet computers. The main growth drivers for these products, apart from new models, are growing demand from margining markets and rollout of 4G telecom technology.

Overall, with market conditions turning more favourable toward the style we employ to manage the Fund's investments supported by low current valuations and rising momentum.

Edmund Harriss

The Fund invests in foreign securities, which involves political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The MSCI AC (All Country) Far East ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of the Far East, excluding Japan. The Standard & Poor's 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks of U.S. companies. These indices are unmanaged, not available for investment and do not incur expenses.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

17

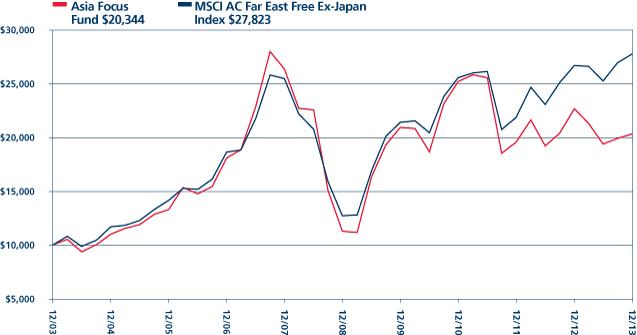

GUINNESS ATKINSON ASIA FOCUS FUND

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2013

| One Year | | Five Years | | Ten Years | |

| | -10.38 | % | | | 12.56 | % | | | 7.36 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Far East Free ex-Japan Index (MSCI AC Far East Free ex-Japan Index) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance in the Asia region excluding Japan. The index referenced in this chart is not available for investment and does not incur expenses.

18

FUND HIGHLIGHTS at December 31, 2013

GUINNESS ATKINSON ASIA FOCUS FUND

# of Holdings in Portfolio: | | | 37 | | |

Portfolio Turnover: | | | 7.4 | % | |

% of Stocks in Top 10: | | | 41.3 | % | |

Fund Manager: | |

Edmund Harriss | | | |

Top 10 Holdings (% of net assets) | |

Samsung Elect Co., Ltd. | | | 5.9 | % | | Soho China, Ltd. | | | 3.7 | % | |

Galaxy Entertainment Group Ltd. | | | 5.6 | % | | CNOOC Ltd. - ADR | | | 3.6 | % | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 4.8 | % | | HSBC Holdings PLC | | | 3.3 | % | |

Kunlun Energy Co., Ltd. | | | 3.9 | % | | Sohu.com Inc. | | | 3.3 | % | |

Hyundai Mobis | | | 3.9 | % | | Novatek Microelectronics Corp. Ltd. | | | 3.3 | % | |

Sector Breakdown (% of net assets) | | | | | | | |

Oil Company - Exploration & Production | | | 10.2 | % | | Telecommunication Services | | | 3.0 | % | |

Semiconductor Components - Integrated Circuits | | | 8.0 | % | | Auto-Cars/Light Trucks | | | 2.9 | % | |

Auto/Truck Parts & Equipment | | | 6.8 | % | | Building Products - Air & Heating | | | 2.9 | % | |

Electronic Components - Semiconductor | | | 5.9 | % | | Computers | | | 2.7 | % | |

Casino Hotels | | | 5.6 | % | | Metal - Copper | | | 2.7 | % | |

Real Estate Operations/Development | | | 5.5 | % | | Cellular Telecommunications | | | 2.6 | % | |

Electric - Generation | | | 5.2 | % | | Exchange Traded Funds | | | 2.6 | % | |

Oil Company - Integrated | | | 5.1 | % | | Electronic Component - Miscellaneous | | | 2.5 | % | |

Coal | | | 4.9 | % | | Chemicals - Other | | | 2.0 | % | |

Commercial Banks | | | 3.3 | % | | Power Conversion/Supply Equipment | | | 2.0 | % | |

Web Portals/ISP | | | 3.3 | % | | Public Thoroughfares | | | 2.0 | % | |

Building & Construction Products | | | 3.2 | % | | Non-Ferrous Metals | | | 1.1 | % | |

Photo Equipment & Supplies | | | 3.0 | % | | Machinery | | | 0.5 | % | |

19

SCHEDULE OF INVESTMENTS

December 31, 2013

GUINNESS ATKINSON ASIA FOCUS FUND

Shares | | COMMON STOCKS: 99.5% | | Value | |

China: 41.7% | | | |

| | 58,000 | | | AAC Technologies Holdings Inc. | | $ | 281,611 | | |

| | 171,000 | | | Anhui Conch Cement Co Ltd. - H Shares | | | 634,003 | | |

| | 1,014,000 | | | China Lesso Group Holdings | | | 706,137 | | |

| | 55,500 | | | China Mobile Ltd | | | 575,448 | | |

| | 173,000 | | | China Shenhua Energy Co Ltd. - H Shares | | | 545,484 | | |

| | 419,000 | | | CNOOC Ltd. - ADR | | | 779,178 | | |

| | 784,900 | | | db x-trackers CSI300 Index ETF | | | 567,851 | | |

| | 248,000 | | | Dongfang Electric Corp. Ltd. - H Shares | | | 434,959 | | |

| | 324,000 | | | Jiangxi Copper Co., Ltd. - H Shares | | | 584,966 | | |

| | 490,000 | | | Lenovo Group Ltd. | | | 595,889 | | |

| | 562,000 | | | PetroChina Co., Ltd. - H Shares | | | 616,045 | | |

| | 968,000 | | | Shenzhen Expressway Co., Ltd. - H Shares | | | 435,671 | | |

| | 939,000 | | | Soho China, Ltd. | | | 808,909 | | |

| | 9,800 | | | Sohu.com Inc.* | | | 714,714 | | |

| | 156,000 | | | Weichai Power Co., Ltd. - H Shares | | | 628,683 | | |

| | 250,800 | | | Yanzhou Coal Mining Co., Ltd. - H Shares | | | 228,991 | | |

| | | | | | | | 9,138,539 | | |

Hong Kong: 15.14% | | | |

| | 380,000 | | | Chen Hsong Holdings | | | 118,592 | | |

| | 137,000 | | | Galaxy Entertainment Group Ltd.* | | | 1,228,783 | | |

| | 67,091 | | | HSBC Holdings PLC | | | 728,074 | | |

| | 168,200 | | | Kingboard Chemical Holdings Ltd. | | | 439,247 | | |

| | 484,000 | | | Kunlun Energy Co., Ltd. | | | 852,616 | | |

| | | | | | | | 3,367,312 | | |

Indonesia: 2.5% | | | |

| | 129,000 | | | Indo Tambangraya Megah PT | | | 302,095 | | |

| | 1,133,000 | | | Vale Indonesia Tbk | | | 246,709 | | |

| | | | | | | | 548,804 | | |

Malaysia: 5.9% | | | |

| | 439,000 | | | DiGi.Com Bhd | | | 664,766 | | |

| | 170,000 | | | UMW Holdings Bhd | | | 625,920 | | |

| | | | | | | | 1,290,686 | | |

South Korea: 9.8% | | | |

| | 3,062 | | | Hyundai Mobis | | | 851,563 | | |

| | 1,001 | | | Samsung Electronics Co., Ltd. | | | 1,301,343 | | |

| | | | | | | | 2,152,906 | | |

Taiwan: 12.2% | | | |

| | 16,000 | | | Largan Precision Co | | | 652,272 | | |

| | 174,000 | | | Novatek Microelectronics Corp. Ltd. | | | 712,265 | | |

| | 2 | | | Shin Zu Shing Co., Ltd. | | | 5 | | |

| | 295,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 1,044,257 | | |

| | 44,000 | | | TPK Holding Co. Ltd. | | | 259,835 | | |

| | | | | | | | 2,668,634 | | |

The accompanying notes are an integral part of these financial statements.

20

Shares | | COMMON STOCKS: 99.5% (Continued) | | Value | |

Thailand: 12.0% | | | |

| | 137,500 | | | Electricity Generating PLC/Foreign | | $ | 512,591 | | |

| | 294,000 | | | Glow Energy PCL/Foreign | | | 630,767 | | |

| | 824,000 | | | LPN Development PCL/Foreign | | | 388,679 | | |

| | 117,198 | | | PTT Exploration & Production PCL/Foreign | | | 593,837 | | |

| | 56,700 | | | PTT PCL/Foreign | | | 493,494 | | |

| | | | | | | | 2,619,368 | | |

| | | | | Total Common Stocks

(costs $17,403,580) | | | 21,786,249 | | |

| | | | | Total Investments in Securities

(costs $17,403,580): 99.5% | | | 21,786,249 | | |

| | | | | Other Assets less Liabilities: 0.5% | | | 116,672 | | |

| | | | | Net Assets: 100.0% | | $ | 21,902,921 | | |

* Non-income producing security.

ADR - American Depository Receipt

The accompanying notes are an integral part of these financial statements.

21

ASIA PACIFIC DIVIDEND FUND for the period ended December 31, 2013

1. Performance

ANNUALIZED TOTAL RETURNS

| | | 1 Year

(Actual) | | 3 Years | | 5 Years | | Since

Launch

(March 31, 2006) | |

Fund | | | -2.06 | % | | | 1.30 | % | | | 16.20 | % | | | 4.70 | % | |

Benchmark Index: | |

MSCI Pacific Ex Japan Index | | | 4.58 | % | | | 3.83 | % | | | 18.01 | % | | | 8.80 | % | |

S&P 500 Index | | | 32.38 | % | | | 16.16 | % | | | 17.92 | % | | | 6.96 | % | |

The Fund's gross expense ratio is 3.57% and net expense ratio is 1.98% per the Summary Prospectus dated May 1, 2013. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2014. To the extent that the Advisor waives fees and/or reimburses expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect expense limitations in effect and, in the absence of these imitations, total returns would have been lower.

The Fund ended the year down 2.06% compared to the benchmark index which rose 4.58%. Having been defensive in the first half of the year the overall portfolio did not take advantage of the market recovery in the second half. The Fund's holdings in China and Hong Kong generally did well but were offset by weakness in the Thai and Taiwanese positions.

We have reviewed and made some changes to the way the portfolio is constructed and specifically to kinds of stocks in which the Fund will invest. We have refined the universe of potential investments to those stocks that have demonstrated an ability to sustain profitability through the business cycle by their competitive advantage, management efficiency, product development and distribution or a combination of those factors.

This ability is reflected in their ability to generate a real cash flow return on investment defined as cash flow divided by invested capital after stripping out the effects of inflation. We have identified all those companies in Asia, or outside Asia but who generate over 50% of profits from the region, that have generated a real return of 8% or more for 8 years or more. The companies that have achieved this are likely more often than not to repeat this the following year.

We have added further criteria in that the companies must have a market capitalization (the share price multiplied by the number of shares in issue) of over $500 million and their debt should not exceed their equity. These companies are ones we deem to have a demonstrably resilient business structure and operation. As a final criteria we look for companies that have a track record in paying dividends and whose historic dividend yield when taking the dividend paid in the prior year divided by the latest share price is 2% or more. By applying the dividend factor we are then focusing on those companies that have been able to generate excess cash flow and willing to pay out to shareholders.

This approach is one which we believe will generate a steadier performance than the broad market and that will outperform the broad market over time.

22

ASIA PACIFIC DIVIDEND FUND

2. Portfolio Position

At the year end the portfolio had 11% in Australia, 24% in China, 19% in Hong Kong, 6% in Singapore, 17% in Taiwan and 10% in Thailand. The balance was split between Japan, South Korea, Malaysia and one position in a US company. Sector exposure was also spread but with greater concentrations in Consumer discretionary, Financials, Technology and the rest split between Healthcare, Telecom services and Real Estate Investment Trusts (REITs). Possibly to the surprise of some we have little exposure to utilities which is the result of their regulated environment which caps their returns on investment.

3. Outlook

We believe this to be a portfolio that strikes a balance between growth and income. We therefore believe that these companies will participate in regional growth but with less volatility. The portfolio is positioned to benefit from rising consumption growth not only in China but also around the region.

Edmund Harriss

The Fund invests in foreign securities, which involves political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The MSCI AC Pacific ex-Japan Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance of the developed and emerging markets in the Pacific region, excluding Japan. The Standard & Poor's 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks of U.S. companies. These indices are unmanaged and not available for investment and do not incur expenses.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g., depreciation) and interest expense to pretax income.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

23

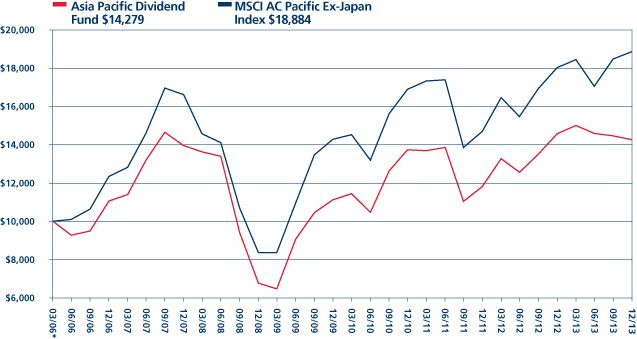

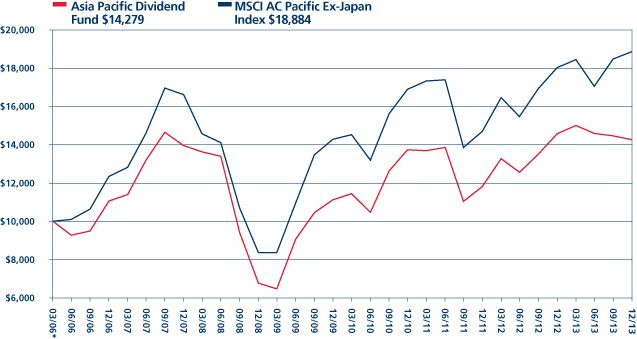

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND FUND

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2013

| One Year | | Five Years | | Since Inception

(03/31/06) | |

| | -2.06 | % | | | 16.20 | % | | | 4.70 | % | |

*Inception date 03/31/06.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Pacific Free ex-Japan Index (MSCI AC Pacific ex-Japan Index) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance in the Pacific region including Japan.

24

FUND HIGHLIGHTS at December 31, 2013

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND FUND

# of Holdings in Portfolio: | | | 36 | | |

Portfolio Turnover: | | | 57.0 | % | |

% of Stocks in Top 10: | | | 28.6 | % | |

Fund Manager:

Top 10 Holdings (% of net assets) | | | | | | | |

Henderson Group PLC | | | 3.0 | % | | Sonic Healthcare Ltd. | | | 2.8 | % | |

JB Hi-Fi Ltd. | | | 2.9 | % | | Delta Electronics Thailand PCL/ Foreign | | | 2.8 | % | |

iiNET Ltd. | | | 2.9 | % | | CapitaMall Trust - REIT | | | 2.8 | % | |

Relo Holdings Inc. | | | 2.9 | % | | QUALCOMM Inc. | | | 2.8 | % | |

China Merchants Bank Co. Ltd. - H Shares | | | 2.9 | % | | Li & Fung Ltd. | | | 2.8 | % | |

Sector Breakdown (% of net assets) | | | | | | | |

Commercial Banks | | | 13.5 | % | | Cellular Telecommunications | | | 2.7 | % | |

Semiconductor Components - Integrated Circuits | | | 8.2 | % | | Chemicals - Specialty | | | 2.7 | % | |

REITS - Shopping Centers | | | 5.5 | % | | Metal Processors & Fabricators | | | 2.7 | % | |

Investment Management/Advisory Service | | | 3.0 | % | | Optical Supplies | | | 2.7 | % | |

Real Estate Management/Service | | | 2.9 | % | | REITS - Diversified | | | 2.7 | % | |

Retail - Consumer Electronics | | | 2.9 | % | | Telecommunication Equipment | | | 2.7 | % | |

Web Portals/ISP | | | 2.9 | % | | Telecommunication Services | | | 2.7 | % | |

Computers | | | 2.8 | % | | Textile - Apparel | | | 2.7 | % | |

Distribution/Wholesale | | | 2.8 | % | | Textile - Products | | | 2.7 | % | |

Electronic Component - Miscellaneous | | | 2.8 | % | | Tobacco | | | 2.7 | % | |

MRI/Medical Diagnostics Imaging | | | 2.8 | % | | Oil Company - Integrated | | | 2.6 | % | |

Retail - Jewelry | | | 2.8 | % | | Water | | | 2.6 | % | |

Shipbuilding | | | 2.8 | % | | Oil Company - Exploration & Production | | | 2.4 | % | |

Apparel Manufacturers | | | 2.7 | % | | Real Estate Operations/Development | | | 2.4 | % | |

Casino Hotels | | | 2.7 | % | | | | | |

25

SCHEDULE OF INVESTMENTS

December 31, 2013

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND FUND

Shares | | COMMON STOCKS: 98.1% | | Value | |

Australia: 11.7% | | | |

| | 34,600 | | | Henderson Group PLC | | $ | 129,447 | | |

| | 21,300 | | | iiNET Ltd. | | | 123,812 | | |

| | 6,500 | | | JB Hi-Fi Ltd. | | | 124,782 | | |

| | 8,160 | | | Sonic Healthcare Ltd. | | | 120,803 | | |

| | | | | | | | 498,844 | | |

Cambodia: 2.7% | | | |

| | 108,000 | | | NagaCorp Ltd. | | | 113,790 | | |

China: 24.1% | | | |

| | 148,000 | | | China Construction Bank Corp. - H Shares | | | 111,654 | | |

| | 57,000 | | | China Merchants Bank Co. Ltd. - H Shares | | | 121,435 | | |

| | 11,000 | | | China Mobile Ltd. | | | 114,053 | | |

| | 550 | | | CNOOC Ltd. - ADR | | | 103,213 | | |

| | 101,500 | | | China Minsheng Banking Corp. Ltd. - H Share | | | 112,701 | | |

| | 167,000 | | | Industrial & Commercial Bank of China Ltd - H Shares | | | 112,851 | | |

| | 186,000 | | | China Lilang Ltd. | | | 114,656 | | |

| | 31,000 | | | Shenzhou Int'l Group | | | 116,335 | | |

| | 126,000 | | | Yangzijiang Shipbuilding Holdings Ltd. | | | 118,317 | | |

| | | | | | | | 1,025,215 | | |

Hong Kong: 19.0% | | | |

| | 36,000 | | | BOC Hong Kong Holdings Ltd. | | | 115,368 | | |

| | 207,000 | | | Huabao International Holdings Ltd. | | | 114,521 | | |

| | 92,000 | | | Li & Fung Ltd. | | | 118,644 | | |

| | 31,000 | | | Luk Fook Holdings International Ltd. | | | 117,935 | | |

| | 75,000 | | | Pacific Textiles Holdings Ltd. | | | 114,711 | | |

| | 23,500 | | | The Link - REIT | | | 113,950 | | |

| | 8,700 | | | Vtech Holdings Ltd. | | | 112,981 | | |

| | | | | | | | 808,110 | | |

Japan: 2.9% | | | |

| | 2,400 | | | Relo Holdings Inc. | | | 122,382 | | |

Malaysia: 2.7% | | | |

| | 75,700 | | | DiGi.Com Bhd | | | 114,630 | | |

Singapore: 5.5% | | | |

| | 67,000 | | | Ascendas - REIT | | | 116,803 | | |

| | 79,000 | | | CapitaMall Trust - REIT | | | 119,256 | | |

| | | | | | | | 236,059 | | |

South Korea: 2.7% | | | |

| | 1,610 | | | KT&G Corp. | | | 113,654 | | |

The accompanying notes are an integral part of these financial statements.

26

Shares | | COMMON STOCKS: 98.1% (Continued) | | Value | |

Taiwan: 13.6% | | | |

| | 13,000 | | | Asustek Computer Inc. | | $ | 116,899 | | |

| | 18,000 | | | Catcher Technology Co. Ltd. | | | 116,865 | | |

| | 28,000 | | | Novatek Microelectronics Corp. | | | 114,617 | | |

| | 4,000 | | | St. Shine Optical Co. Ltd. | | | 114,215 | | |

| | 33,000 | | | Taiwan Semiconductor Manufacturing Co. Ltd. | | | 116,815 | | |

| | | | | | | | 579,411 | | |

Thailand: 10.4% | | | |

| | 74,000 | | | Delta Electronics Thailand PCL/ Foreign | | | 120,481 | | |

| | 212,000 | | | LPN Development PCL/ Foreign | | | 100,000 | | |

| | 12,800 | | | PTT PCL/Foreign | | | 111,406 | | |

| | 368,000 | | | Thai Tap Water Supply PCL/Foreign | | | 111,990 | | |

| | | | | | | | 443,877 | | |

United States: 2.8% | | | |

| | 1,600 | | | QUALCOMM Inc. | | | 118,800 | | |

| | | | | Total Common Stocks

(costs $3,688,684) | | | 4,174,772 | | |

| | | | | Total Investments in Securities

(costs $3,688,684): 98.1% | | | 4,174,772 | | |

| | | | | Other Assets less Liabilities: 1.9% | | | 78,979 | | |

| | | | | Net Assets: 100.0% | | $ | 4,253,751 | | |

ADR - American Depository Receipt

REIT - Real Estate Investment Trust

The accompanying notes are an integral part of these financial statements.

27

CHINA & HONG KONG FUND for the period ended December 31, 2013

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year

(Actual) | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | 6.45 | % | | | -4.07 | % | | | 14.45 | % | | | 9.44 | % | |

Benchmark Index: | |

Hang Seng Index | | | 6.52 | % | | | 4.00 | % | | | 13.80 | % | | | 9.99 | % | |

Hang Seng Composite Index | | | 8.11 | % | | | 3.39 | % | | | 13.78 | % | | | 10.66 | % | |

S&P 500 Index | | | 32.38 | % | | | 16.16 | % | | | 17.92 | % | | | 7.40 | % | |

The Fund's gross expense ratio is 1.52% per the Summary Prospectus dated May 1, 2013. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2014. To the extent that the Advisor waives fees and/or reimburses expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect expense limitations in effect and, in the absence of these limitations, total returns would have been lower.

The Fund ended the year up 6.45% compared to the Hang Seng index up 6.52% and the Hang Seng Composite up 8.11%. Hong Kong and China stocks had a better second half of the year as a reform framework emerged following the CCP plenum. Over the second half of 2013 the Fund rose 19.14% compared to the benchmark which rose 15.12%

Economic momentum turned positive in June and remained positive for the rest of the year. Exports and imports reached $4.16 trillion making China the world's largest trader of goods and the renminbi overtook the Euro in October to become the second most used currency in trade settlement. There was also positive momentum in manufacturing and purchasing managers indices indicated expansion. At the same time there seemed to be little inflationary pressure in producer or consumer prices.

There was a significant government meeting in November at which an economic roadmap was laid out covering the next ten years. There was of course not a great level of detail in how the goals are to be achieved but the scale and ambition are impressive. If only half is achieved China's economy will be transformed, as profoundly as it has been over the past twenty years. The program addresses governmental reform, financial sector de-regulation, energy and environmental issues, welfare, pensions, industrial planning and state-owned enterprise reform. The issues of corruption, excessive debt financed investment and environmental damage are also tackled.

Investors were impressed but as doubts once again re-emerged and market rally that followed the meeting petered out. However, as we have argued all along this is not a program that can be delivered in a neat little package in a couple of weeks but there is ample evidence that the government is set on its course. We have already seen a definitive move to rein in credit (discussed in the Renminbi Yuan & Bond Fund letter) and we have also seen high profile moves against corruption. At the time of writing we are seeing action on SOE reform in the oil and telecom sectors.

2. Portfolio Position

At the end of 2013 the portfolio was most heavily exposed to Technology, Industrials, Financials, Consumer discretionary and Energy. Since the middle of the year energy exposure has reduced in favour of consumer discretionary stocks and to industrial stocks whose weight in the portfolio increased as stock prices rebounded. Since the end of the year we have cut back exposure to

28

certain industrial and energy stocks and have cut back the positions in some of the Fund's top performers to move into banking names that trade at exceptionally low valuations.

3. Outlook

At the time of writing valuations of Chinese stocks traded internationally are at multi-year lows on an earnings, cash flow or book value basis. Clearly investors are sceptical about the quality of earnings and cash flows and we believe this is attributable to concerns about slower economic growth, debt and the integrity of China's financial system.

We believe these fears are significantly overdone: slower growth does not automatically equal lower earnings. Not all companies depend on 10% growth for profits and in any case, economic growth is still projected to above 7%. The debt burden has been a concern but closer examination suggests that the burden is manageable but it is the growth rate we should focus on. In this respect we have already seen a marked slowdown in credit growth from almost 14% in 2012 to approximately 4.5% in 2013. Moves to restrain banks further are discussed in the Renminbi Yuan & Bond Fund letter.

We therefore believe that there are significant opportunities amongst Chinese stocks. We have already increased exposures to Chinese banks which we believe have more than priced in bad debt risks. We also expect that China's reform programme and China's demographic profile which is changing inexorably will also provide opportunities. For example the declines in the population group aged 15 -39 years old will be matched by the growth in the 40-65 year old segment. The consumption patterns of the two groups are different and over the long term will likely drive the services and consumer side of China's economy.

China's economic transformation programme will take time but we believe that time is on China's side so long as that time is not squandered. The signs are there that momentum is building.

Edmund Harriss

The Fund invests in foreign securities, which involves political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The Hang Seng Composite Index is a market capitalization-weighted index that is comprised of the top 200 companies listed on the Hong Kong Stock Exchange, based on the average market capitalization for the past twelve months. The Hang Seng Index is a barometer of the Hong Kong Stock Market, whose aggregate market capitalization accounts for about 70% of the total market-capitalization of the Stock Exchange of Hong Kong Limited. The Standard & Poor's 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks of U.S. companies. These indices are unmanaged and not available for investment, and do not incur expenses.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

29

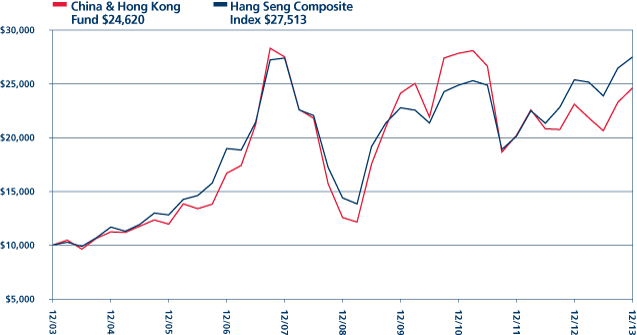

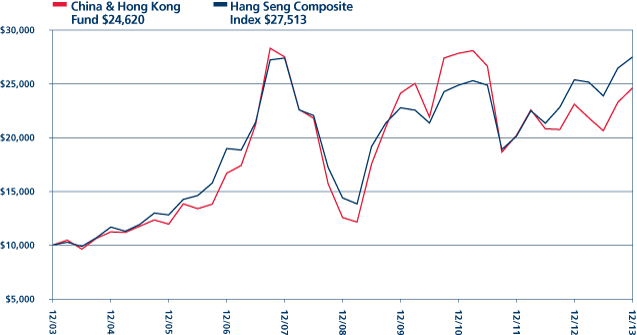

GUINNESS ATKINSON CHINA & HONG KONG FUND

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2013

| One Year | | Five Years | | Ten Years | |

| | 6.45 | % | | | 14.45 | % | | | 9.44 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The Hang Seng Composite Index is a market-capitalization weighted index that comprises the top 200 companies listed on the Hong Kong Stock Exchange, based on the average market capitalization for the past twelve months. The index referenced in this chart is not available for investment and does not incur expenses.

30

FUND HIGHLIGHTS at December 31, 2013

GUINNESS ATKINSON CHINA & HONG KONG FUND

# of Holdings in Portfolio: | | | 33 | | |

Portfolio Turnover: | | | 6.9 | % | |

% of Stocks in Top 10: | | | 47.6 | % | |

Fund Manager: | |

Edmund Harriss | |

Top 10 Holdings (% of net assets) | |

Tencent Holdings Ltd. | | | 7.3 | % | | Soho China Ltd. | | | 4.5 | % | |

Galaxy Entertainment Group Ltd. | | | 6.2 | % | | Beijing Enterprises Holdings Ltd. | | | 4.0 | % | |

Lenovo Group Ltd. | | | 5.6 | % | | Kunlun Energy Co., Ltd. | | | 3.8 | % | |

NetEase Inc - ADR | | | 4.8 | % | | BOC Hong Kong Holdings Ltd. | | | 3.5 | % | |

CNOOC Ltd. | | | 4.5 | % | | HSBC Holdings PLC | | | 3.4 | % | |

Sector Breakdown (% of net assets) | |

Commercial Banks | | | 15.6 | % | | Web Portals/ISP | | | 2.9 | % | |

Oil Company - Exploration & Production | | | 8.3 | % | | Auto/Truck Parts & Equipment | | | 2.8 | % | |

Internet Application Software | | | 7.3 | % | | Retail - Automobile | | | 2.7 | % | |

Casino Hotels | | | 6.2 | % | | Airlines | | | 2.5 | % | |

Building Products | | | 5.8 | % | | Electronic Component - Miscellaneous | | | 2.5 | % | |

Computers | | | 5.6 | % | | Auto-Cars/Light Trucks | | | 2.4 | % | |

Internet Content - Entertainment | | | 4.8 | % | | Exchange Traded Funds | | | 2.3 | % | |

Real Estate Operations/Development | | | 4.5 | % | | Metal - Copper | | | 2.1 | % | |

Gas - Distribution | | | 4.0 | % | | Chemicals - Other | | | 1.9 | % | |

Telecommunication Equipment | | | 3.3 | % | | Power Converson/Supply Equipment | | | 1.8 | % | |

Cellular Telecommunications | | | 3.2 | % | | Public Thoroughfares | | | 1.1 | % | |

Coal | | | 3.1 | % | | Machinery - General Industries | | | 0.7 | % | |

Oil Company - Integrated | | | 3.0 | % | | | | | | | | | |

31

SCHEDULE OF INVESTMENTS

December 31, 2013

GUINNESS ATKINSON CHINA & HONG KONG FUND

Shares | | COMMON STOCKS: 100.4% | | Value | |

Airlines: 2.5% | | | |

| | 1,306,000 | | | Cathay Pacific Airways Ltd. | | $ | 2,762,132 | | |

Auto/Truck Parts & Equipment: 2.8% | | | |

| | 750,120 | | | Weichai Power Co., Ltd. - H Shares | | | 3,023,000 | | |

Auto – Cars/Light Trucks: 2.4% | | | |

| | 5,500,000 | | | Geely Automobile Holdings Ltd. | | | 2,659,815 | | |

Building Products: 5.8% | | | |

| | 733,000 | | | Anhui Conch Cement Co Ltd. - H Shares | | | 2,717,686 | | |

| | 5,256,000 | | | China Lesso Group Holdings Ltd. | | | 3,660,214 | | |

| | | | | | | | 6,377,900 | | |

Casino Hotels: 6.2% | | | |

| | 762,000 | | | Galaxy Entertainment Group Ltd.* | | | 6,834,543 | | |

Cellular Telecommunications: 3.2% | | | |

| | 344,000 | | | China Mobile Ltd. | | | 3,566,744 | | |