UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-8372

Travelers Series Fund Inc.

(Exact name of registrant as specified in charter)

| | |

| 125 Broad Street, New York, NY | | 10004 |

| (Address of principal executive offices) | | (Zip code) |

Robert I. Frenkel, Esq.

Smith Barney Fund Management LLC

300 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: October 31

Date of reporting period: October 31, 2004

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

TRAVELERS SERIES FUND INC.

SMITH BARNEY LARGE CAP

VALUE PORTFOLIO

STRATEGIC EQUITY

PORTFOLIO

VAN KAMPEN

ENTERPRISE PORTFOLIO

ANNUAL REPORT | OCTOBER 31, 2004

NOT FDIC INSURED • NOT BANK GUARANTEED • MAY LOSE VALUE

WHAT’S INSIDE

LETTER FROM THE CHAIRMAN

R. JAY GERKEN, CFA

Chairman, President and Chief Executive Officer

Dear Shareholder,

Stock prices collectively advanced over the 12 months ending October 31, 2004, although performance varied sharply among sectors and investment styles. The equity market also shifted gears during the period due to investors’ reactions to mixed signals about the economy.

Last fall, stocks generally continued to rise as many geopolitical concerns began to ease, and a spate of mortgage refinancings freed up investable cash for investors. Despite positive corporate earnings results, stocks traded in a narrow range during the first quarter of this year due to concerns about anemic job growth.i During this time, the economy grew at a moderate pace,ii albeit at significantly stronger levels than during the first half of 2003.

In the spring, the economic recovery became broader-based as labor market growth improved dramatically in March and April, although signs suggested a pickup in inflation in the spring as well. As widely anticipated, the Federal Reserve Board (“Fed”)iii proceeded to push short-term interest rates higher, marking its first hike in four years. The Fed raised its target for the closely watched federal funds rateiv by 0.25% on three occasions during the reporting period, increasing it from a four-decade low of 1.00% in June to 1.75% in September, and then again to 2.00% on November 10, after the fund’s reporting period had ended. Higher interest rates can help slow a potential acceleration of economic growth and thereby help maintain a balance between that growth rate and the inflation rate that can generally accompany it.

As the period came to a close, inflation figures were benign while labor market growth, which had tapered off during the summer, exceeded consensus estimates for October. Crude oil prices, which had risen to record highs in the third quarter, when coupled with investors’ reaction to terrorism concerns, weakened investor sentiment toward the equity markets. However, reports of a pullback in oil prices and strong third-quarter corporate profits gave stock prices a boost in the final month of the period.

Over the 12 months, stocks of small- and mid-capitalization companies continued to outperform large-caps in general. Value-oriented stocks handily outpaced growth-oriented stocks. International stock markets beat out the broad domestic U.S. market by a wide margin.

1 Travelers Series Fund Inc. | 2004 Annual Report

Within this environment, the funds performed as follows1:

PERFORMANCE SNAPSHOT

AS OF OCTOBER 31, 2004

| | | | | | |

| | | 6 Months | | | 12 Months | |

| | | | | | | |

Smith Barney Large Cap Value Portfolio | | 2.70 | % | | 10.69 | % |

| | | | | | | |

S&P 500/Barra Value Index | | 6.00 | % | | 14.46 | % |

| | | | | | | |

Lipper Variable Equity Income Funds Category Average | | 4.66 | % | | 13.27 | % |

| | | | | | | |

Strategic Equity Portfolio | | 2.11 | % | | 8.44 | % |

| | | | | | | |

S&P 500 Index | | 2.96 | % | | 9.41 | % |

| | | | | | | |

Lipper Variable Multi-Cap Core Funds Category Average | | 2.91 | % | | 8.92 | % |

| | | | | | | |

Van Kampen Enterprise Portfolio | | -0.09 | % | | 0.05 | % |

| | | | | | | |

Russell 1000 Growth Index | | -0.73 | % | | 3.38 | % |

| | | | | | | |

S&P 500 Index | | 2.96 | % | | 9.41 | % |

| | | | | | | |

Lipper Variable Multi-Cap Core Funds Category Average | | 2.91 | % | | 8.92 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost.

Returns assume the reinvestment of income dividends and capital gains distributions at net asset value and the deduction of all fund expenses.

Performance figures for Smith Barney Large Cap Value Portfolio, Strategic Equity Portfolio and Van Kampen Enterprise Portfolio may reflect reimbursements or fee waivers, without which the performance would have been lower.

Lipper, Inc. is a major independent mutual fund tracking organization. Returns are based on the period ended October 31, 2004 and include the reinvestment of dividends and capital gains, if any. Returns for the equity income variable funds category average were calculated among the 60 funds for the six-month period and among the 60 funds for the 12-month period. Returns for the multi-cap core variable funds category were calculated among the 137 funds for the six-month period and among the 136 funds for the 12-month period.

| 1 | The funds are underlying investment options of various variable annuity products. A variable annuity product is a contract issued by an insurance company where the annuity premium (a set amount of dollars) is immediately turned into units of a portfolio of securities. Upon retirement, the policyholder is paid according to accumulated units whose dollar value varies according to the performance of the securities within the sub accounts. Its objective is to preserve, through investment, the purchasing value of the annuity, which otherwise is subject to erosion through inflation. The funds’ performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity contracts such as administrative fees, account charges and surrender charges, which if reflected, would reduce the performance of the funds. Past performance is no guarantee of future results. |

2 Travelers Series Fund Inc. | 2004 Annual Report

Please read on for a more detailed look at prevailing economic and market conditions during the fund’s fiscal year and to learn how those conditions have affected fund performance.

Information About Your Fund

As you may be aware several issues in the mutual fund industry have recently come under the scrutiny of federal and state regulators. The funds’ Adviser and some of its affiliates have received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the funds’ response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The funds have been informed that the Adviser and its affiliates are responding to those information requests, but are not in a position to predict the outcome of these requests and investigations.

In November 2003, Citigroup Asset Management (“CAM”) disclosed an investigation by the Securities and Exchange Commission (“SEC”) and the U.S. Attorney relating to Citigroup Asset Management’s entry into the transfer agency business during 1997-1999. Citigroup has disclosed that the Staff of the SEC is considering recommending a civil injunctive action and/or an administrative proceeding against certain advisory and transfer agent entities affiliated with Citigroup, the former CEO of CAM, two former employees and a current employee of CAM, relating to the creation, operation and fees of its internal transfer agent unit that serves various CAM-managed funds. Citigroup is cooperating with the SEC and will seek to resolve this matter in discussion with the SEC Staff. Although there can be no assurance, Citigroup does not believe that this matter will have a material adverse effect on the fund.

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you continue to meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

November 17, 2004

3 Travelers Series Fund Inc. | 2004 Annual Report

MANAGER OVERVIEW

Smith Barney Large Cap Value Portfolio

Special Shareholder Notice

Effective July 1, 2004, the management fee was reduced from 0.65% of the portfolio’s average daily net assets to a fee calculated in accordance with the following breakpoint schedule:

| | | |

Portfolio’s Average Daily Net Assets

| | Fee Rate

| |

Up to $500 million | | 0.60 | % |

| |

In excess of $500 million and up to and including $1 billion | | 0.55 | % |

| |

Over $1 billion | | 0.50 | % |

Effective August 19, 2004, Mark J. McAllister, CFA, currently a co-manager of the portfolio, and Robert Feitler are responsible for the day-to-day management of the portfolio. Mr. McAllister is an investment officer of Smith Barney Fund Management LLC (“SBFM”) and Managing Director of Salomon Brothers Asset Management Inc (“SaBAM”), an affiliate of SBFM and Citigroup Global Markets Inc. Mr. McAllister has 17 years of investment management experience. Mr. Feitler has been with SaBAM since 1995 and is a Director of SaBAM.

Effective November 1, 2004, the fund considers large capitalization companies to be companies with market capitalizations similar to companies in the Russell 1000 Index.v Securities of companies whose market capitalizations no longer meet this definition after purchase by the fund still will be considered securities of large capitalization companies for purposes of the fund’s 80% investment policy.

Performance Review

For the 12 months ended October 31, 2004, the Smith Barney Large Cap Value Portfolio, returned 10.69%.2 The fund underperformed its unmanaged benchmark, the S&P 500/Barra Value Index,vi which returned 14.46% for the

| 2 | The fund is an underlying investment option of various variable annuity products. A variable annuity product is a contract issued by an insurance company where the annuity premium (a set amount of dollars) is immediately turned into units of a portfolio of securities. Upon retirement, the policyholder is paid according to accumulated units whose dollar value varies according to the performance of the securities within the sub accounts. Its objective is to preserve, through investment, the purchasing value of the annuity, which otherwise is subject to erosion through inflation. The fund’s performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity contracts such as administrative fees, account charges and surrender charges, which if reflected, would reduce the performance of the fund. Past performance is no guarantee of future results. |

4 Travelers Series Fund Inc. | 2004 Annual Report

same period. The fund also underperformed the Lipper variable equity income funds category average3, which was 13.27%.

Market Review

The U.S. equity market, despite positive breadth, had experienced poor market volume and low volatility during the 12 months ended October 31, 2004. Less dynamic, “old economy”, industries led the market, while higher beta stocks lagged. The top-performing sector of the S&P 500 was energy, gaining 44.5% and accounting for 24% of the index’s return†. Within this energy sector, the integrated oil stocks were the main contributors to positive performance. Other leading sectors included industrials, financials and consumer discretionary. All sectors had positive returns during the period with the exception of technology, which was slightly negative.

Contributors to Fund Performance

The fund’s underperformance relative to the S&P Barra Value Index during the period was attributable to both security selection and sector allocation.vii Security selection was strongest in the telecommunications and financials sectors and weakest in the healthcare and consumer staples sectors. Top contributors during the period included AT&T Wireless, ChevronTexaco Corp., BP PLC, Total SA and Transocean Inc. We took advantage of the strength in ChevronTexaco Corp.’s share price by reducing the fund’s position. In addition, during the period, we sold all of the shares in both AT&T Wireless and Transocean Inc. that the fund owned.

Detractors from Fund Performance

Stocks that detracted from performance came from a number of different sectors and included Nortel Networks Corp., Merck & Co., Inc., Hewlett-Packard Co., The Kroger Co. and Pfizer Inc. Merck & Co., Inc. fell sharply at the end of September when the company announced that it would pull the arthritis drug Vioxx off the market due to a study that showed an increased relative risk for cardiovascular events after 18 months of use. We were disappointed with the company’s announcement and continue to watch the situation closely. We continue to hold all of these stocks.

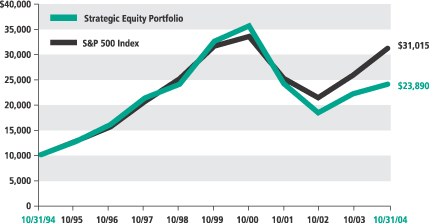

We remain overweight in the technology, healthcare and consumer staples sectors and substantially underweight in the financials sector versus the S&P

| 3 | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 12-month period ended October 31, 2004, calculated among the 60 funds in the fund’s Lipper category, including the reinvestment of dividends and capital gains, if any. |

5 Travelers Series Fund Inc. | 2004 Annual Report

Barra Value Index. We have slightly reduced our technology weighting in the fund and increased our financials and energy weightings during the period.

Thank you for your investment in the Smith Barney Large Cap Value Portfolio. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on seeking to achieve the fund’s investment goals.

Sincerely,

| | |

| |  |

| Mark J. McAllister, CFA | | Robert Feitler |

| Vice President and Investment Officer | | Vice President and Investment Officer |

November 16, 2004

6 Travelers Series Fund Inc. | 2004 Annual Report

MANAGER OVERVIEW

Strategic Equity Portfolio

Performance Review

For the 12 months ended October 31, 2004, the Strategic Equity Portfolio returned 8.44%.4 The fund underperformed its unmanaged benchmark, the S&P 500 Index,viii which returned 9.41% for the same period. It also underperformed the Lipper variable multi-cap core funds category average,5 which was 8.92%.

Comment from Adam Hetnarski, Portfolio Manager of Strategic Equity Portfolio

Market Overview

During the fiscal year, equities produced solid returns as the economic recovery took hold. Most of the gains were realized during the first three months of the reporting period, when economic growth, low interest rates and strong corporate earnings bolstered investor confidence and fueled a broad-based rally. However, since the end of 2003, the markets have stagnated due in part to high energy prices, fears of terrorism and concerns about a slowing economy.

Contributors to Fund Performance

Against this backdrop, the portfolio underperformed its benchmark, the S&P 500 Index. A large overweight in the healthcare sector, particularly within the underperforming pharmaceuticals industry, detracted from the portfolio’s performance relative to the benchmark. The portfolio was also hurt by weak stock selection in the energy sector. Within energy, record high oil and natural gas prices created a positive environment for energy companies, particularly for large integrated oil stocks, which we generally avoided. In the consumer discretionary sector, the portfolio was overweight in the poor-performing media

| 4 | The fund is an underlying investment option of various variable annuity products. A variable annuity product is a contract issued by an insurance company where the annuity premium (a set amount of dollars) is immediately turned into units of a portfolio of securities. Upon retirement, the policyholder is paid according to accumulated units whose dollar value varies according to the performance of the securities within the sub accounts. Its objective is to preserve, through investment, the purchasing value of the annuity, which otherwise is subject to erosion through inflation. The fund’s performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity contracts such as administrative fees, account charges and surrender charges, which if reflected, would reduce the performance of the fund. Past performance is no guarantee of future results. |

| 5 | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 12-month period ended October 31, 2004, calculated among the 136 funds in the fund’s Lipper category, including the reinvestment of dividends and capital gains, if any. |

7 Travelers Series Fund Inc. | 2004 Annual Report

industry, which hurt performance. Media and entertainment stocks had a difficult time due to weak trends in advertising spending.

Contributing to performance was solid security selection and an overweight in the strong-performing industrials sector. Industrial conglomerates benefited from the recovering economy, and aerospace-&-defense companies were helped by increased defense spending. Others sources of positive performance during the fiscal year were the portfolio’s holdings in the financials, telecommunications, and consumer staples sectors.ix

Thank you for your investment in the Strategic Equity Portfolio. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on seeking to achieve the fund’s investment goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

October 31, 2004

8 Travelers Series Fund Inc. | 2004 Annual Report

MANAGER OVERVIEW

Van Kampen Enterprise Portfolio

Special Shareholder Notice

Effective November 15, 2004, the portfolio management team of Van Kampen Enterprise Portfolio consists of Sandip Bhagat, Feng Chang, Kevin Jung, Leah Modigliani and Hooman Yaghoobi, each of Van Kampen Asset Management. Mr. Bhagat, a portfolio manager and Managing Director of Van Kampen Asset Management, is the team leader.

Performance Review

For the 12 months ended October 31, 2004, the Van Kampen Enterprise Portfolio returned 0.05%.6 The fund underperformed both its unmanaged benchmark, the Russell 1000 Growth Index,x which returned 3.38% for the same period and its former benchmark, the S&P 500 Index,viii which returned 9.41% for the same period. It also underperformed the Lipper variable multi-cap core funds category average,7 which was 8.92%.

The portfolio’s performance was hindered by its emphasis on stocks of larger companies, which was higher than the average holding in its current benchmark. During the 12-month reporting period, larger-cap companies underperformed their small- and mid-cap counterparts in the portfolio. Based on previous market patterns, as the economic recovery matures, the portfolio’s emphasis on larger-companies’ stocks could potentially prove beneficial.

Market Review

During the first quarter of the fund’s fiscal period stocks generally continued to rise. However, performance tapered off and equities posted modest returns in early 2004 as concerns about anemic labor marketi growth overshadowed good news regarding corporate profits.

| 6 | The fund is an underlying investment option of various variable annuity products. A variable annuity product is a contract issued by an insurance company where the annuity premium (a set amount of dollars) is immediately turned into units of a portfolio of securities. Upon retirement, the policyholder is paid according to accumulated units whose dollar value varies according to the performance of the securities within the sub accounts. Its objective is to preserve, through investment, the purchasing value of the annuity, which otherwise is subject to erosion through inflation. The fund’s performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity contracts such as administrative fees, account charges and surrender charges, which if reflected, would reduce the performance of the fund. Past performance is no guarantee of future results. |

| 7 | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 12-month period ended October 31, 2004, calculated among the 136 funds in the fund’s Lipper category, including the reinvestment of dividends and capital gains, if any. |

9 Travelers Series Fund Inc. | 2004 Annual Report

Despite a significant pick-up in the growth of non-farm payroll jobs in March and April, stocks again generated only mild gains in the second quarter. This performance was due in significant part to fears that rates were poised to rise coupled with geopolitical concerns. As widely anticipated, the Fediii raised its target for the federal funds rateiv from 1.00% to 1.25% at the end of June, boosted it by 0.25% again in August and eventually to 1.75% in September. (After the fund’s reporting period ended, the Fed raised its target to 2.00% on November 10.)

In the third quarter, stocks drifted lower as the economy hit a “soft patch” and oil prices rose to record levels. Investors’ concerns about the continued turmoil in Iraq and threats of terrorism also hurt investor confidence. As the reporting period came to a close, stocks advanced amid as oil prices slipped back, and strong overall third-quarter corporate profits.

Contributors to Performance

During the fiscal year, we reduced the number of stocks held in the portfolio to better focus on the return potential of the remaining investments. The size of the companies owned increased on average, with a preference for stable companies with more predictable earnings outlooks. From an economic sector perspective, the portfolio was reshaped during the period. For example, the allocation to consumer discretionary stocks was reduced by approximately one-third. This was due to our expectation that the previous stimulus from tax cuts was waning and that consumer spending could correspondingly decline.

The portfolio’s holdings in the financial sector were trimmed as well in anticipation of a higher interest rate environment and the resulting adverse potential impact on lenders. Conversely, we put increased emphasis on stocks in the healthcare sector as companies in this sector offered attractive earnings, targeting issues that in our judgment appeared to be trading at relatively inexpensive valuations. We also increased the portfolio’s exposure to energy and telecommunications stocks.

These portfolio changes met with mixed results. For example, the added exposure to energy enhanced results. On the other hand, the portfolio’s healthcare stocks came under pressure due to the threat of regulatory or legislative actions, which might harm the business outlook for these companies. Our trimming of consumer-related companies such as retailers proved to be premature as the sector went on to produce returns above the benchmark averages.

From a stock-specific perspective, the portfolio benefited most during the period by its ownership of Carnival Corp., a leading cruise ship company. Likewise,

10 Travelers Series Fund Inc. | 2004 Annual Report

the portfolio’s performance was helped by its holding in Starwood Hotels & Resorts Worldwide, Inc. and Marriott International, Inc. Conversely, exposure to VERITAS Software Corp., Watson Pharmaceuticals Inc., ADTRAN Inc., and EMC Corp. detracted from results.xi

Thank you for your investment in the Van Kampen Enterprise Portfolio. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on seeking to achieve the fund’s investment goals.

Sincerely,

| | | | |

| | |

| |  | |  |

| Stephen Lyle Boyd | | Thomas Copper | | Mary Jayne Maly |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

| Van Kampen Asset Management Inc. |

November 22, 2004

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS:

Smith Barney Large Cap Value Portfolio: Keep in mind, common stocks are subject to market fluctuations. Foreign stocks are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. The fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on fund performance.

Strategic Equity Portfolio: The fund may invest in foreign securities. Investing in foreign securities is subject to certain risks not associated with domestic investing, such as currency fluctuations, and changes in political and economic conditions. The fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially, large impact on fund performance.

Van Kampen Enterprise Portfolio: The fund may invest in foreign securities. Investing in foreign securities is subject to certain risks not associated with domestic investing, such as currency fluctuations, and changes in political and economic conditions. These risks are magnified in emerging or developing markets. The fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on fund performance. The fund may invest in small capitalization companies. Small capitalization companies may involve a higher degree of risk and volatility than investments in larger, more established companies. The fund may invest in medium capitalization companies. Medium capitalization companies may involve a higher degree of risk and volatility than investments in larger, more established companies.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

11 Travelers Series Fund Inc. | 2004 Annual Report

| i | Source: Bureau of Economic Analysis, U.S. Department of Commerce. January 2, 2004. |

| ii | Source: Commerce Department (Bureau of Economic Analysis). Refers to quarterly growth of Gross Domestic Product (“GDP”). GDP is a market value of goods and services produced by labor and property in a given country. |

| iii | Source: U.S. Federal Reserve Board. The Fed is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iv | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| v | The Russell 1000 Index measures the performance of the 1000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. |

| vi | The S&P 500/Barra Value Index is a market-capitalization weighted index of stocks in the S&P 500 having lower price-to-book ratios relative to the S&P 500 as a whole. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) |

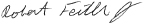

| vii | Portfolio holdings and breakdowns are as of October 31, 2004 and are subject to change and may not be representative of the fund’s current or future investments. The fund’s top ten holdings as of this date were: Bank of America Corp. (3.21%), Pfizer Inc. (2.58%), Altria Group, Inc. (2.46%), American International Group, Inc. (2.07%), Microsoft Corp. (2.00%), Royal Dutch Petroleum Co. (1.97%), Verizon Communications Inc. (1.83%), Total SA (1.80%), Merrill Lynch & Co., Inc. (1.75%), The Kroger Co. (1.74%). Please refer to pages 25 through 29 for a list and percentage breakdown of the fund’s holdings. |

| | The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the fund’s current or future investments. The fund’s top five sector holdings as of October 31, 2004 were: Financials (26.92%); Consumer Discretionary (12.66%); Energy (11.11%); Information Technology (10.42%); Healthcare (8.47%). The fund’s portfolio composition is subject to change at any time. |

| viii | The S&P 500 Index is a market capitalization-weighted index of 500 widely held common stocks. |

| ix | The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the fund’s current or future investments. The fund’s top five sector holdings as of October 31, 2004 were: Information Technology (19.06%); Healthcare (18.30%); Consumer Discretionary (13.29%); Telecommunication Services (12.56%); Financials (12.40%). The fund’s portfolio composition is subject to change at any time. |

| x | The Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. Management has determined that the Russell 1000 Growth Index, which measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values, best represents the universe of stocks available to the fund for investment and will be utilized as the sole benchmark against which performance will be measured. Consequently, the S&P 500 Index will no longer be utilized. |

12 Travelers Series Fund Inc. | 2004 Annual Report

| xi | Portfolio holdings and breakdowns are as of October 31, 2004 and are subject to change and may not be representative of the fund’s current or future investments. The fund’s top ten holdings as of this date were: General Electric Co. (2.95%), Carnival Corp. (2.89%), Dell Inc. (2.55%), Starwood Hotels & Resorts Worldwide, Inc. (2.45%), Schering-Plough Corp. (2.32%), The Procter and Gamble Co. (2.30%), Bank of America Corp. (2.29%), International Business Machines Corp. (2.22%), Wal-Mart Stores, Inc. (2.18%), Microsoft Corp. (2.17%). Please refer to pages 36 through 39 for a list and percentage breakdown of the fund’s holdings. |

| | The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the fund’s current or future investments. The fund’s top five sector holdings as of October 31, 2004 were: Information Technology (23.41%); Healthcare (22.36%); Consumer Discretionary (15.14%); Industrials (10.57%); Financials (8.73%). The fund’s portfolio composition is subject to change at any time. |

13 Travelers Series Fund Inc. | 2004 Annual Report

Smith Barney Large Cap Value Portfolio

Fund at a Glance (unaudited)

14 Travelers Series Fund Inc. | 2004 Annual Report

Strategic Equity Portfolio

Fund at a Glance (unaudited)

15 Travelers Series Fund Inc. | 2004 Annual Report

Van Kampen Enterprise Portfolio

Fund at a Glance (unaudited)

16 Travelers Series Fund Inc. | 2004 Annual Report

Fund Expenses (unaudited)

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on May 1, 2004 and held for the six months ended October 31, 2004.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Based on Actual Total Return(1)

| | | | | | | | | | | | | | | |

| | | Actual Total Return Without Sales Charges(2) | | | Beginning Account Value | | Ending Account Value | | Annualized Expense Ratio | | | Expenses Paid During the Period(3) |

Smith Barney Large Cap Value Portfolio | | 2.70 | % | | $ | 1,000.00 | | $ | 1,027.00 | | 0.65 | % | | $ | 3.31 |

|

Strategic Equity Portfolio | | 2.11 | | | | 1,000.00 | | | 1,021.10 | | 0.85 | | | | 4.32 |

|

Van Kampen Enterprise Portfolio | | (0.09 | ) | | | 1,000.00 | | | 999.10 | | 0.82 | | | | 4.12 |

|

| (1) | | For the six months ended October 31, 2004. |

| (2) | | Assumes reinvestment of dividends and capital gains distributions, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Total returns do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | | Expenses (net of voluntary waiver) are equal to each Funds’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 366. |

17 Travelers Series Fund Inc. | 2004 Annual Report

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Based on Hypothetical Total Return(1)

| | | | | | | | | | | | | | | |

| | | Hypothetical Annualized Total Return | | | Beginning Account Value | | Ending Account Value | | Annualized Expense Ratio | | | Expenses Paid During the Period(2) |

Smith Barney Large Cap Value Portfolio | | 5.00 | % | | $ | 1,000.00 | | $ | 1,021.87 | | 0.65 | % | | $ | 3.30 |

|

Strategic Equity Portfolio | | 5.00 | | | | 1,000.00 | | | 1,020.86 | | 0.85 | | | | 4.32 |

|

Van Kampen Enterprise Portfolio | | 5.00 | | | | 1,000.00 | | | 1,021.01 | | 0.82 | | | | 4.17 |

|

| (1) | | For the six months ended October 31, 2004. |

| (2) | | Expenses (net of voluntary waiver) are equal to each Funds’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 366. |

18 Travelers Series Fund Inc. | 2004 Annual Report

Smith Barney Large Cap Value Portfolio

Average Annual Total Returns† (unaudited)

| | | |

Twelve Months Ended 10/31/04 | | 10.69 | % |

|

|

Five Years Ended 10/31/04 | | 0.01 | |

|

|

Ten Years Ended 10/31/04 | | 8.20 | |

|

|

6/16/94* through 10/31/04 | | 8.04 | |

|

|

Cumulative Total Return† (unaudited)

| | | |

10/31/94 through 10/31/04 | | 119.97 | % |

|

|

| † | | Assumes reinvestment of dividends and capital gains distributions, if any, at net asset value. All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. |

| * | | Commencement of operations. |

19 Travelers Series Fund Inc. | 2004 Annual Report

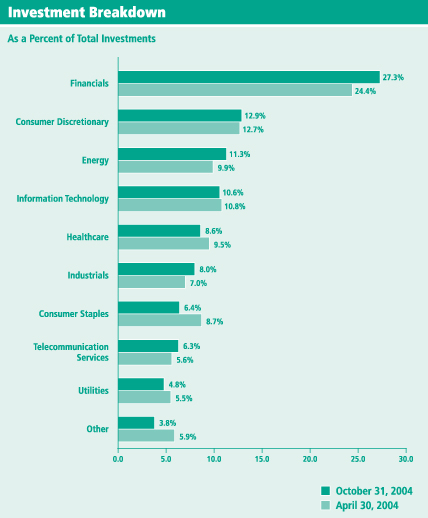

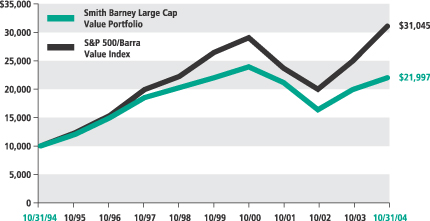

Historical Performance (unaudited)

Value of $10,000 Invested in Shares of

the Smith Barney Large Cap Value Portfolio vs.

S&P 500/Barra Value Index†

October 1994 — October 2004

| † | Hypothetical illustration of $10,000 invested in shares of the Smith Barney Large Cap Value Portfolio on October 31, 1994, assuming reinvestment of dividends and capital gains, if any, at net asset value through October 31, 2004. The S&P 500/Barra Value Index is a market-capitalization weighted index of stocks in the S&P 500 Index having lower price-to-book ratios relative to the S&P 500 Index as a whole. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) The Index is unmanaged and is not subject to the same management and trading expenses of a mutual fund. Please note that an investor cannot invest directly in an index. |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown also do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

20 Travelers Series Fund Inc. | 2004 Annual Report

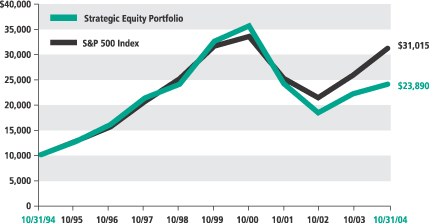

Strategic Equity Portfolio

Average Annual Total Returns† (unaudited)

| | | |

Twelve Months Ended 10/31/04 | | 8.44 | % |

|

|

Five Years Ended 10/31/04 | | (5.91 | ) |

|

|

Ten Years Ended 10/31/04 | | 9.10 | |

|

|

6/16/94* through 10/31/04 | | 9.42 | |

|

|

Cumulative Total Return† (unaudited)

| | | |

10/31/94 through 10/31/04 | | 138.90 | % |

|

|

| † | | Assumes reinvestment of dividends and capital gains distributions, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Total returns do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. |

| * | | Commencement of operations. |

21 Travelers Series Fund Inc. | 2004 Annual Report

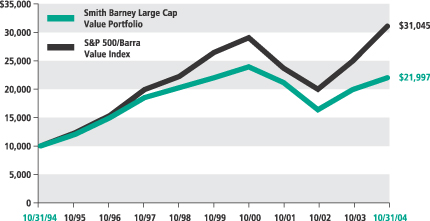

Historical Performance (unaudited)

Value of $10,000 Invested in Shares of the

Strategic Equity Portfolio vs.

S&P 500 Index†

October 1994 — October 2004

| † | Hypothetical illustration of $10,000 invested in shares of the Strategic Equity Portfolio on October 31, 1994 assuming reinvestment of dividends and capital gains, if any, at net asset value through October 31, 2004. The S&P 500 Index is an index composed of widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and over-the-counter markets. Figures for the Index include reinvestment of dividends. The Index is unmanaged and is not subject to the same management and trading expenses of a mutual fund. Please note that an investor cannot invest directly in an index. |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown also do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

22 Travelers Series Fund Inc. | 2004 Annual Report

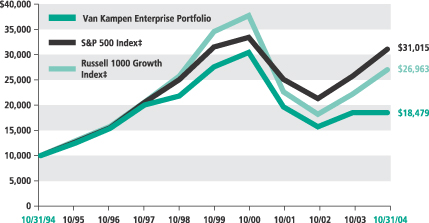

Van Kampen Enterprise Portfolio

Average Annual Total Returns† (unaudited)

| | | | | |

Twelve Months Ended 10/31/04 | | 0.05 | % |

|

|

Five Years Ended 10/31/04 | | (7.66 | ) |

|

|

Ten Years Ended 10/31/04 | | 6.33 | |

|

|

6/16/94* through 10/31/04 | | 6.48 | |

|

|

Cumulative Total Return† (unaudited)

| | | | | |

10/31/94 through 10/31/04 | | 84.79 | % |

|

|

| † | | Assumes reinvestment of dividends and capital gains distributions, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Total returns do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. |

| * | | Commencement of operations. |

23 Travelers Series Fund Inc. | 2004 Annual Report

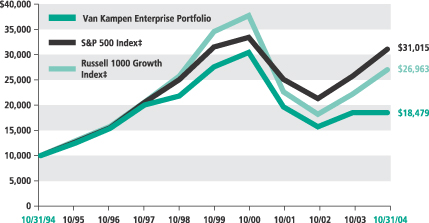

Historical Performance (unaudited)

Value of $10,000 Invested in Shares of the

Van Kampen Enterprise Portfolio vs.

S&P 500 Index and Russell 1000 Growth Index†

October 1994 — October 2004

| † | | Hypothetical illustration of $10,000 invested in shares of the Van Kampen Enterprise Portfolio on October 31, assuming reinvestment of dividends and capital gains, if any, at net asset value through October 31, 2004. The S&P 500 Index is an index of widely held common stocks listed on the New York and American Stock Exchanges and the over-the-counter markets. Figures for the S&P 500 Index include reinvestment of dividends. The Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) The Indexes are unmanaged and are not subject to the same management and trading expenses of a mutual fund. Please note that an investor cannot invest directly in an index. |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown also do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

| ‡ | Management has determined that the Russell 1000 Growth Index best represents the universe of stocks available to the Fund and will be utilized as the sole benchmark against which performance will be measured. Consequently, the S&P 500 Index will not appear in future reports. |

24 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments | | October 31, 2004 |

SMITH BARNEY LARGE CAP VALUE PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| COMMON STOCK — 97.7% |

| CONSUMER DISCRETIONARY — 12.6% |

| Hotels, Restaurants & Leisure — 1.5% |

| 172,000 | | McDonald’s Corp. | | $ | 5,013,800 |

|

| Household Durables — 0.9% |

| 142,700 | | Newell Rubbermaid Inc. | | | 3,076,612 |

|

| Leisure Equipment & Products — 1.2% |

| 224,200 | | Mattel, Inc. | | | 3,925,742 |

|

| Media — 7.2% |

| | | Comcast Corp.: | | | |

| 81,300 | | Class A Shares (a) | | | 2,398,350 |

| 88,300 | | Special Class A Shares (a) | | | 2,564,232 |

| 431,800 | | Liberty Media Corp., Series A Shares (a) | | | 3,851,656 |

| 21,600 | | Liberty Media International, Inc., Series A Shares (a) | | | 778,680 |

| 157,100 | | The News Corp. Ltd., Sponsored ADR (a) | | | 4,939,224 |

| 266,100 | | Time Warner Inc. (a) | | | 4,427,904 |

| 137,700 | | Viacom Inc., Class B Shares | | | 5,024,673 |

|

| | | | | | 23,984,719 |

|

| Multi-Line Retail — 1.8% |

| 55,500 | | Target Corp. | | | 2,776,110 |

| 63,300 | | Wal-Mart Stores, Inc. | | | 3,413,136 |

|

| | | | | | 6,189,246 |

|

| | | TOTAL CONSUMER DISCRETIONARY | | | 42,190,119 |

|

| CONSUMER STAPLES — 6.3% |

| Food & Drug Retailing — 2.6% |

| 384,700 | | The Kroger Co. (a) | | | 5,812,817 |

| 152,700 | | Safeway Inc. (a) | | | 2,785,248 |

|

| | | | | | 8,598,065 |

|

| Household Products — 1.3% |

| 72,900 | | Kimberly-Clark Corp. | | | 4,349,943 |

|

| Tobacco — 2.4% |

| 168,900 | | Altria Group, Inc. | | | 8,184,894 |

|

| | | TOTAL CONSUMER STAPLES | | | 21,132,902 |

|

| ENERGY — 11.1% |

| Energy Equipment & Services — 3.4% |

| 149,700 | | ENSCO International Inc. | | | 4,573,335 |

| 86,700 | | GlobalSantaFe Corp. | | | 2,557,650 |

| 52,800 | | Nabors Industries, Ltd. (a) | | | 2,593,536 |

| 37,000 | | Noble Corp. (a) | | | 1,690,160 |

|

| | | | | | 11,414,681 |

|

See Notes to Financial Statements.

25 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

SMITH BARNEY LARGE CAP VALUE PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| Oil & Gas — 7.7% |

| 87,600 | | BP PLC, Sponsored ADR | | $ | 5,102,700 |

| 60,300 | | ChevronTexaco Corp. | | | 3,199,518 |

| 25,300 | | EOG Resources, Inc. | | | 1,683,968 |

| 81,100 | | Marathon Oil Corp. | | | 3,090,721 |

| 120,900 | | Royal Dutch Petroleum Co., New York Shares | | | 6,557,616 |

| 57,400 | | Total SA, Sponsored ADR | | | 5,985,672 |

|

| | | | | | 25,620,195 |

|

| | | TOTAL ENERGY | | | 37,034,876 |

|

| FINANCIALS — 26.9% | | | |

| Banks — 9.2% |

| 239,000 | | Bank of America Corp. | | | 10,704,810 |

| 111,700 | | The Bank of New York Co., Inc. | | | 3,625,782 |

| 151,600 | | U.S. Bancorp | | | 4,337,276 |

| 97,200 | | Wachovia Corp. | | | 4,783,212 |

| 75,600 | | Washington Mutual, Inc. | | | 2,926,476 |

| 69,800 | | Wells Fargo & Co. | | | 4,168,456 |

|

| | | | | | 30,546,012 |

|

| Diversified Financials — 11.4% |

| 85,200 | | American Express Co. | | | 4,521,564 |

| 71,600 | | Capital One Financial Corp. | | | 5,281,216 |

| 69,500 | | Freddie Mac | | | 4,628,700 |

| 39,500 | | The Goldman Sachs Group, Inc. | | | 3,886,010 |

| 107,400 | | JPMorgan Chase & Co. | | | 4,145,640 |

| 158,700 | | MBNA Corp. | | | 4,067,481 |

| 108,200 | | Merrill Lynch & Co., Inc. | | | 5,836,308 |

| 67,300 | | Morgan Stanley | | | 3,438,357 |

| 101,200 | | Waddell & Reed Financial, Inc., Class A Shares | | | 2,126,212 |

|

| | | | | | 37,931,488 |

|

| Insurance — 4.0% |

| 113,500 | | American International Group, Inc. | | | 6,890,585 |

| 58,700 | | Loews Corp. | | | 3,516,130 |

| 86,200 | | The St. Paul Travelers Cos., Inc. | | | 2,927,352 |

|

| | | | | | 13,334,067 |

|

| Real Estate — 2.3% |

| 141,100 | | Equity Office Properties Trust | | | 3,967,732 |

| 118,300 | | Equity Residential | | | 3,945,305 |

|

| | | | | | 7,913,037 |

|

| | | TOTAL FINANCIALS | | | 89,724,604 |

|

| HEALTHCARE — 8.5% | | | |

| Healthcare Providers & Services — 0.7% |

| 64,700 | | HCA, Inc. | | | 2,376,431 |

|

See Notes to Financial Statements.

26 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

SMITH BARNEY LARGE CAP VALUE PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| Pharmaceuticals — 7.8% |

| 79,400 | | GlaxoSmithKline PLC, ADR | | $ | 3,366,560 |

| 59,600 | | Johnson & Johnson | | | 3,479,448 |

| 48,000 | | Merck & Co., Inc. | | | 1,502,880 |

| 296,900 | | Pfizer Inc. | | | 8,595,255 |

| 195,400 | | Schering-Plough Corp. | | | 3,538,694 |

| 135,400 | | Wyeth | | | 5,368,610 |

|

| | | | | | 25,851,447 |

|

| | | TOTAL HEALTHCARE | | | 28,227,878 |

|

| INDUSTRIALS — 7.9% | | | |

| Aerospace & Defense — 4.4% |

| 98,000 | | The Boeing Co. | | | 4,890,200 |

| 92,000 | | Lockheed Martin Corp. | | | 5,068,280 |

| 26,000 | | Raytheon Co. | | | 948,480 |

| 42,100 | | United Technologies Corp. | | | 3,907,722 |

|

| | | | | | 14,814,682 |

|

| Commercial Services & Supplies — 1.9% |

| 56,900 | | Avery Dennison Corp. | | | 3,461,796 |

| 96,000 | | Waste Management, Inc. | | | 2,734,080 |

|

| | | | | | 6,195,876 |

|

| Industrial Conglomerates — 1.6% |

| 156,400 | | Honeywell International Inc. | | | 5,267,552 |

|

| | | TOTAL INDUSTRIALS | | | 26,278,110 |

|

| INFORMATION TECHNOLOGY — 10.4% | | | |

| Communications Equipment — 4.0% |

| 118,700 | | Comverse Technology, Inc. (a) | | | 2,449,968 |

| 353,600 | | Nokia Oyj, Sponsored ADR | | | 5,452,512 |

| 1,568,300 | | Nortel Networks Corp. (a) | | | 5,316,537 |

|

| | | | | | 13,219,017 |

|

| Computers & Peripherals — 3.0% |

| 173,300 | | Hewlett-Packard Co. | | | 3,233,778 |

| 39,100 | | International Business Machines Corp. | | | 3,509,225 |

| 40,900 | | Lexmark International, Inc., Class A Shares (a) | | | 3,399,199 |

|

| | | | | | 10,142,202 |

|

| Electronic Equipment & Instruments — 1.4% |

| 149,300 | | Celestica, Inc., Subordinate Voting Shares (a) | | | 2,161,864 |

| 487,100 | | Solectron Corp. (a) | | | 2,542,662 |

|

| | | | | | 4,704,526 |

|

See Notes to Financial Statements.

27 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

SMITH BARNEY LARGE CAP VALUE PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| Software — 2.0% |

| 237,700 | | Microsoft Corp. | | $ | 6,653,223 |

|

| | | TOTAL INFORMATION TECHNOLOGY | | | 34,718,968 |

|

| MATERIALS — 2.9% | | | |

| Chemicals — 0.7% |

| 49,300 | | The Dow Chemical Co. | | | 2,215,542 |

|

| Metals & Mining — 1.0% |

| 99,400 | | Alcoa Inc. | | | 3,230,500 |

|

| Paper & Forest Products — 1.2% |

| 108,400 | | International Paper Co. | | | 4,174,484 |

|

| | | TOTAL MATERIALS | | | 9,620,526 |

|

| TELECOMMUNICATION SERVICES — 6.3% | | | |

| Diversified Telecommunication Services — 5.2% |

| 152,800 | | AT&T Corp. | | | 2,614,408 |

| 202,100 | | MCI Inc. | | | 3,486,225 |

| 199,700 | | SBC Communications Inc. | | | 5,044,422 |

| 156,100 | | Verizon Communications Inc. | | | 6,103,510 |

|

| | | | | | 17,248,565 |

|

| Wireless Telecommunication Services — 1.1% |

| 136,100 | | Nextel Communications, Inc., Class A Shares (a) | | | 3,605,289 |

|

| | | TOTAL TELECOMMUNICATION SERVICES | | | 20,853,854 |

|

| UTILITIES — 4.8% | | | |

| Electric Utilities — 2.4% |

| 53,400 | | Ameren Corp. | | | 2,563,200 |

| 53,300 | | FirstEnergy Corp. | | | 2,202,889 |

| 99,200 | | PG&E Corp. (a) | | | 3,178,368 |

|

| | | | | | 7,944,457 |

|

| Gas Utilities — 1.1% |

| 421,100 | | El Paso Corp. | | | 3,764,634 |

|

| Multi-Utilities — 1.3% |

| 196,600 | | NiSource Inc. | | | 4,217,070 |

|

| | | TOTAL UTILITIES | | | 15,926,161 |

|

| | | TOTAL COMMON STOCK

(Cost — $299,801,269) | | | 325,707,998 |

|

See Notes to Financial Statements.

28 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

SMITH BARNEY LARGE CAP VALUE PORTFOLIO

| | | | | |

FACE

AMOUNT | | SECURITY | | VALUE |

| REPURCHASE AGREEMENT — 0.8% | | | |

| $2,692,000 | | UBS Securities LLC dated 10/29/04, 1.840% due 11/1/04; Proceeds at maturity — $2,692,413; (Fully collateralized by various U.S. Government obligations and agencies and International Bank Reconstruction & Development Notes & Bonds, 0.000% to 8.875% due 12/7/04 to 8/6/38; Market value — $2,745,846) (Cost — $2,692,000) | | $ | 2,692,000 |

|

| | | TOTAL INVESTMENTS — 98.5% (Cost — $302,493,269*) | | | 328,399,998 |

| | | Other Assets in Excess of Liabilities — 1.5% | | | 4,951,702 |

|

| | | TOTAL NET ASSETS — 100.0% | | $ | 333,351,700 |

|

| (a) | | Non-income producing security. |

| * | | Aggregate cost for federal income tax purposes is $304,392,953. |

Abbreviation used in this schedule:

ADR — American Depositary Receipt

See Notes to Financial Statements.

29 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

STRATEGIC EQUITY PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| COMMON STOCK — 89.8% | | | |

| CONSUMER DISCRETIONARY — 13.3% | | | |

| Hotels, Restaurants & Leisure — 1.5% | | | |

| 47,700 | | Gaylord Entertainment Co. (a)(b) | | $ | 1,598,427 |

| 126,800 | | International Game Technology | | | 4,189,472 |

| 40,699 | | Shuffle Master, Inc. (a)(b) | | | 1,713,021 |

|

| | | | | | 7,500,920 |

|

| Internet & Catalog Retail — 0.7% |

| 100,800 | | Amazon.com, Inc. (a)(b) | | | 3,440,304 |

|

| Media — 6.7% |

| 3,100 | | DreamWorks Animation SKG, Inc., Class A Shares (a) | | | 121,055 |

| 183,700 | | Lamar Advertising Co., Class A Shares (a) | | | 7,608,854 |

| 64,600 | | Liberty Media Corp., Series A Shares (a) | | | 576,232 |

| 80,913 | | Pixar (a)(b) | �� | | 6,507,023 |

| 24,950 | | Playboy Enterprises, Inc., Class B Shares (a)(b) | | | 276,945 |

| 284,323 | | Viacom Inc., Class B Shares | | | 10,374,946 |

| 176,100 | | The Walt Disney Co. | | | 4,441,242 |

| 125,800 | | XM Satellite Radio Holdings Inc., Class A Shares (a)(b) | | | 4,065,856 |

|

| | | | | | 33,972,153 |

|

| Multi-Line Retail — 3.2% |

| 140,400 | | Nordstrom, Inc. | | | 6,062,472 |

| 188,100 | | Wal-Mart Stores, Inc. | | | 10,142,352 |

|

| | | | | | 16,204,824 |

|

| Specialty Retail — 1.2% |

| 36,442 | | Monro Muffler Brake, Inc. (a)(b) | | | 886,816 |

| 104,700 | | Staples, Inc. | | | 3,113,778 |

| 58,500 | | Urban Outfitters, Inc. (a)(b) | | | 2,398,500 |

|

| | | | | | 6,399,094 |

|

| | | TOTAL CONSUMER DISCRETIONARY | | | 67,517,295 |

|

| CONSUMER STAPLES — 7.4% |

| Beverages — 2.4% |

| 80,700 | | The Coca-Cola Co. | | | 3,281,262 |

| 180,000 | | PepsiCo, Inc. | | | 8,924,400 |

|

| | | | | | 12,205,662 |

|

| Food Products — 3.1% |

| 27,300 | | Bunge Ltd. (b) | | | 1,303,029 |

| 102,310 | | Hormel Foods Corp. | | | 2,875,934 |

| 64,120 | | The J. M. Smucker Co. (b) | | | 2,853,340 |

| 31,900 | | Kellogg Co. | | | 1,371,700 |

| 197,100 | | Kraft Foods Inc., Class A Shares | | | 6,565,401 |

| 23,800 | | Smithfield Foods, Inc. (a) | | | 576,674 |

|

| | | | | | 15,546,078 |

|

See Notes to Financial Statements.

30 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

STRATEGIC EQUITY PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| Household Products — 0.7% |

| 68,500 | | The Procter & Gamble Co. | | $ | 3,505,830 |

|

| Tobacco — 1.2% |

| 130,600 | | Altria Group, Inc. | | | 6,328,876 |

|

| | | TOTAL CONSUMER STAPLES | | | 37,586,446 |

|

| ENERGY — 0.2% |

| Energy Equipment & Services — 0.0% |

| 4,100 | | Rowan Cos., Inc. (a) | | | 104,673 |

|

| Oil & Gas — 0.2% |

| 6,300 | | BP PLC, Sponsored ADR | | | 366,975 |

| 2,209 | | LUKOIL, Sponsored ADR | | | 275,573 |

| 4,070 | | Total SA, Sponsored ADR (b) | | | 424,420 |

|

| | | | | | 1,066,968 |

|

| | | TOTAL ENERGY | | | 1,171,641 |

|

| FINANCIALS — 12.4% |

| Banks — 0.7% |

| 57,200 | | Bank of America Corp. | | | 2,561,988 |

| 4,000 | | Boston Private Financial Holdings, Inc. (b) | | | 98,160 |

| 20,200 | | Wachovia Corp. | | | 994,042 |

|

| | | | | | 3,654,190 |

|

| Diversified Financials — 8.7% |

| 242,500 | | The Charles Schwab Corp. | | | 2,218,875 |

| 77,200 | | The Goldman Sachs Group, Inc. | | | 7,594,936 |

| 228,900 | | Janus Capital Group, Inc. | | | 3,490,725 |

| 217,900 | | Morgan Stanley | | | 11,132,511 |

| 434,650 | | SLM Corp. | | | 19,672,259 |

|

| | | | | | 44,109,306 |

|

| Insurance — 2.9% |

| 12,600 | | Ambac Financial Group Inc. | | | 983,556 |

| 183,900 | | American International Group, Inc. | | | 11,164,569 |

| 30,200 | | The Hartford Financial Services Group, Inc. | | | 1,766,096 |

| 26,040 | | Scottish Re Group Ltd. (b) | | | 585,900 |

|

| | | | | | 14,500,121 |

|

| Real Estate — 0.1% |

| 12,306 | | Redwood Trust, Inc. | | | 740,329 |

|

| | | TOTAL FINANCIALS | | | 63,003,946 |

|

| HEALTHCARE — 15.2% |

| Biotechnology — 2.0% |

| 231,103 | | Dendreon Corp. (a)(b) | | | 2,389,605 |

| 94,800 | | Genentech, Inc. (a) | | | 4,316,244 |

See Notes to Financial Statements.

31 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

STRATEGIC EQUITY PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| Biotechnology — 2.0% (continued) |

| 158,400 | | Millennium Pharmaceuticals, Inc. (a) | | $ | 2,056,032 |

| 19,700 | | OSI Pharmaceuticals, Inc. (a) | | | 1,280,106 |

|

| | | | | | 10,041,987 |

|

| Healthcare Equipment & Supplies — 3.5% |

| 136,180 | | Biomet, Inc. | | | 6,356,882 |

| 16,500 | | Foxhollow Technologies Inc. (a) | | | 339,570 |

| 102,900 | | Guidant Corp. | | | 6,855,198 |

| 62,800 | | Medtronic, Inc. | | | 3,209,708 |

| 16,100 | | Zimmer Holdings, Inc. (a) | | | 1,249,199 |

|

| | | | | | 18,010,557 |

|

| Healthcare Providers & Services — 2.8% |

| 194,000 | | UnitedHealth Group Inc. | | | 14,045,600 |

|

| Pharmaceuticals — 6.9% |

| 67,550 | | Barr Pharmaceuticals, Inc. (a) | | | 2,543,258 |

| 60,700 | | Johnson & Johnson | | | 3,543,666 |

| 136,800 | | Merck & Co., Inc. | | | 4,283,208 |

| 129,800 | | Novartis AG, Sponsored ADR | | | 6,231,698 |

| 641,400 | | Pfizer Inc. | | | 18,568,530 |

|

| | | | | | 35,170,360 |

|

| | | TOTAL HEALTHCARE | | | 77,268,504 |

|

| INDUSTRIALS — 11.3% |

| Aerospace & Defense — 4.2% |

| 152,800 | | Lockheed Martin Corp. | | | 8,417,752 |

| 153,100 | | Northrop Grumman Corp. | | | 7,922,925 |

| 127,900 | | United Defense Industries, Inc. (a) | | | 5,133,906 |

|

| | | | | | 21,474,583 |

|

| Airlines — 2.0% |

| 172,000 | | AirTran Holdings, Inc. (a)(b) | | | 1,998,640 |

| 587,325 | | Delta Air Lines, Inc. (a)(b) | | | 3,200,921 |

| 169,200 | | Northwest Airlines Corp. (a)(b) | | | 1,497,420 |

| 230,600 | | Southwest Airlines Co. | | | 3,636,562 |

|

| | | | | | 10,333,543 |

|

| Electrical Equipment — 0.4% |

| 107,722 | | American Power Conversion Corp. (b) | | | 2,076,880 |

|

| Industrial Conglomerates — 3.7% |

| 120,700 | | General Electric Co. | | | 4,118,284 |

| 291,400 | | Honeywell International Inc. | | | 9,814,352 |

| 64,400 | | Siemens AG, Sponsored ADR (b) | | | 4,813,256 |

|

| | | | | | 18,745,892 |

|

See Notes to Financial Statements.

32 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

STRATEGIC EQUITY PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| Machinery — 0.8% |

| 46,900 | | ITT Industries, Inc. | | $ | 3,805,466 |

|

| Road & Rail — 0.2% |

| 60,573 | | Swift Transportation Co., Inc. (a)(b) | | | 1,144,830 |

|

| | | TOTAL INDUSTRIALS | | | 57,581,194 |

|

| INFORMATION TECHNOLOGY — 17.3% |

| Communications Equipment — 5.5% |

| 395,100 | | Alcatel SA, Sponsored ADR (a)(b) | | | 5,772,411 |

| 1,653,300 | | CIENA Corp. (a) | | | 4,083,651 |

| 379,400 | | Cisco Systems, Inc. (a) | | | 7,288,274 |

| 136,600 | | Extreme Networks, Inc. (a) | | | 799,110 |

| 32,200 | | Finisar Corp. (a) | | | 47,012 |

| 117,100 | | Harmonic Inc. (a)(b) | | | 974,272 |

| 907,200 | | JDS Uniphase Corp. (a)(b) | | | 2,875,824 |

| 60,900 | | Juniper Networks, Inc. (a) | | | 1,620,549 |

| 1,117,100 | | Lucent Technologies Inc. (a)(b) | | | 3,965,705 |

| 28,200 | | Motorola, Inc. | | | 486,732 |

|

| | | | | | 27,913,540 |

|

| Computers & Peripherals — 2.0% |

| 8,504 | | Dell Inc. (a) | | | 298,150 |

| 721,700 | | EMC Corp. (a) | | | 9,288,279 |

| 81,100 | | Western Digital Corp. (a) | | | 675,563 |

|

| | | | | | 10,261,992 |

|

| Electronic Equipment & Instruments — 1.5% |

| 162,300 | | Diebold, Inc. (b) | | | 7,766,055 |

|

| Internet Software & Services — 1.2% |

| 320,190 | | DoubleClick, Inc. (a)(b) | | | 2,036,408 |

| 2,000 | | IAC/InterActiveCorp. (a) | | | 43,240 |

| 40,141 | | NetRatings, Inc. (a)(b) | | | 757,059 |

| 89,500 | | Yahoo! Inc. (a) | | | 3,239,005 |

|

| | | | | | 6,075,712 |

|

| Semiconductor Equipment & Products — 3.7% |

| 77,000 | | Credence Systems Corp. (a)(b) | | | 581,350 |

| 24,200 | | Cymer, Inc. (a)(b) | | | 690,184 |

| 19,000 | | Integrated Circuit Systems, Inc. (a) | | | 428,450 |

| 235,800 | | Integrated Device Technology, Inc. (a)(b) | | | 2,787,156 |

| 70,200 | | LTX Corp. (a)(b) | | | 456,300 |

| 99,300 | | Microchip Technology Inc. | | | 3,003,825 |

| 145,400 | | National Semiconductor Corp. | | | 2,428,180 |

| 96,800 | | PMC-Sierra, Inc. (a)(b) | | | 993,168 |

| 25,800 | | SiRF Technology Holdings, Inc. (a) | | | 305,472 |

| 282,200 | | Texas Instruments Inc. | | | 6,899,790 |

|

| | | | | | 18,573,875 |

|

See Notes to Financial Statements.

33 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

STRATEGIC EQUITY PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| Software — 3.4% |

| 16,400 | | BEA Systems, Inc. (a)(b) | | $ | 133,168 |

| 29,200 | | Cognos, Inc. (a)(b) | | | 1,153,692 |

| 545,423 | | Microsoft Corp. | | | 15,266,390 |

| 17,800 | | NDS Group PLC, Sponsored ADR (a) | | | 465,826 |

| 900 | | Salesforce.com, Inc. (a) | | | 18,288 |

|

| | | | | | 17,037,364 |

|

| | | TOTAL INFORMATION TECHNOLOGY | | | 87,628,538 |

|

| MATERIALS — 0.1% |

| Metals & Mining — 0.1% |

| 10,200 | | Peabody Energy Corp. | | | 650,556 |

|

| TELECOMMUNICATION SERVICES — 12.6% |

| Diversified Telecommunication Services — 12.6% |

| 282,200 | | BellSouth Corp. | | | 7,526,274 |

| 959,000 | | SBC Communications Inc. | | | 24,224,340 |

| 819,700 | | Verizon Communications Inc. | | | 32,050,270 |

|

| | | TOTAL TELECOMMUNICATION SERVICES | | | 63,800,884 |

|

| | | TOTAL COMMON STOCK (Cost — $442,568,878) | | | 456,209,004 |

|

| FOREIGN STOCK – 4.7% |

| Canada — 0.3% |

| 17,400 | | Cognos, Inc. (a) | | | 689,412 |

| 39,100 | | Goldcorp Inc. | | | 540,537 |

| 33,800 | | Meridian Gold Inc. (a)(b) | | | 571,412 |

|

| | | | | | 1,801,361 |

|

| Japan — 1.3% |

| 274,000 | | Fujitsu Ltd. | | | 1,630,768 |

| 40,300 | | Tokyo Electron Ltd. | | | 2,185,672 |

| 566 | | Yahoo Japan Corp. (a)(b) | | | 2,557,197 |

|

| | | | | | 6,373,637 |

|

| Switzerland — 3.1% |

| 153,619 | | Roche Holding AG (b) | | | 15,688,749 |

|

| | | TOTAL FOREIGN STOCK (Cost — $23,852,249) | | | 23,863,747 |

|

| PREFERRED STOCK — 0.2% |

| ENERGY — 0.2% |

| Oil & Gas — 0.2% |

| 12,900 | | Chesapeake Energy Corp., 6.000% Cumulative Convertible

(Cost — $770,517) | | | 1,062,638 |

|

See Notes to Financial Statements.

34 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

STRATEGIC EQUITY PORTFOLIO

| | | | | | |

FACE

AMOUNT | | SECURITY | | VALUE | |

| CONVERTIBLE BONDS — 0.4% | |

| INFORMATION TECHNOLOGY — 0.4% | |

| Communications Equipment — 0.4% | |

| $ 2,550,000 | | CIENA Corp., Notes, 3.750% due 2/1/08

(Cost — $2,322,561) | | $ | 2,129,250 | |

|

|

| REPURCHASE AGREEMENT — 5.9% | |

| 29,617,000 | | State Street Bank & Trust Co. dated 10/29/04, 1.700% due 11/1/04; Proceeds at maturity — $29,621,196; (Fully collateralized by U.S. Treasury Bonds, 6.125% due 8/15/29; Market value — $30,213,659) (Cost — $29,617,000) | | | 29,617,000 | |

|

|

| | | TOTAL INVESTMENTS — 101.0% (Cost — $499,131,205*) | | | 512,881,639 | |

| | | Liabilities in Excess of Other Assets — (1.0)% | | | (4,985,546 | ) |

|

|

| | | TOTAL NET ASSETS — 100.0% | | $ | 507,896,093 | |

|

|

| LOANED SECURITIES COLLATERAL | |

| 50,285,107 | | State Street Navigator Securities Lending Trust Prime Portfolio

(Cost — $50,285,107) | | $ | 50,285,107 | |

|

|

| (a) | | Non-income producing security. |

| (b) | | All or a portion of this security is on loan (See Notes 1 and 3). |

| * | | Aggregate cost for Federal income tax purposes is $502,853,928. |

Abbreviation used in this schedule:

ADR — American Depositary Receipt

See Notes to Financial Statements.

35 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

VAN KAMPEN ENTERPRISE PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| COMMON STOCK — 96.7% | | | |

| CONSUMER DISCRETIONARY — 15.1% | | | |

| Hotels, Restaurants & Leisure — 8.3% | | | |

| 45,300 | | Carnival Corp. | | $ | 2,290,368 |

| 12,700 | | Harrah’s Entertainment, Inc. (a) | | | 743,204 |

| 30,200 | | Marriott International, Inc., Class A Shares | | | 1,645,598 |

| 40,700 | | Starwood Hotels & Resorts Worldwide, Inc. | | | 1,942,611 |

|

| | | | | | 6,621,781 |

|

| Media — 3.7% | | | |

| | | The News Corp. Ltd.: | | | |

| 13,800 | | Sponsored ADR (a) | | | 445,188 |

| 41,100 | | Sponsored Preferred ADR | | | 1,292,184 |

| 46,300 | | The Walt Disney Co. | | | 1,167,686 |

|

| | | | | | 2,905,058 |

|

| Multi-Line Retail — 3.1% | | | |

| 14,900 | | Target Corp. | | | 745,298 |

| 32,100 | | Wal-Mart Stores, Inc. | | | 1,730,832 |

|

| | | | | | 2,476,130 |

|

| | | TOTAL CONSUMER DISCRETIONARY | | | 12,002,969 |

|

| CONSUMER STAPLES — 7.9% | | | |

| Beverages — 1.9% | | | |

| 14,200 | | Brown-Forman Corp., Class B Shares | | | 637,580 |

| 17,600 | | PepsiCo, Inc. | | | 872,608 |

|

| | | | | | 1,510,188 |

|

| Food & Drug Retailing — 1.5% | | | |

| 27,800 | | CVS Corp. | | | 1,208,188 |

|

| Household Products — 2.8% | | | |

| 7,500 | | The Clorox Co. | | | 409,500 |

| 35,700 | | The Procter & Gamble Co. | | | 1,827,126 |

|

| | | | | | 2,236,626 |

|

| Personal Products — 1.7% | | | |

| 23,000 | | Avon Products, Inc. | | | 909,650 |

| 10,000 | | The Gillette Co. | | | 414,800 |

|

| | | | | | 1,324,450 |

|

| | | TOTAL CONSUMER STAPLES | | | 6,279,452 |

|

| ENERGY — 4.8% | | | |

| Energy Equipment & Services — 1.4% | | | |

| 25,200 | | Baker Hughes Inc. | | | 1,079,316 |

|

See Notes to Financial Statements.

36 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

VAN KAMPEN ENTERPRISE PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| Oil & Gas — 3.4% | | | |

| 13,200 | | ConocoPhillips | | $ | 1,112,892 |

| 22,400 | | Exxon Mobil Corp. | | | 1,102,528 |

| 4,900 | | Total SA, Sponsored ADR (a) | | | 510,972 |

|

| | | | | | 2,726,392 |

|

| | | TOTAL ENERGY | | | 3,805,708 |

|

| FINANCIALS — 8.7% | | | |

| Banks — 4.1% | | | |

| 40,500 | | Bank of America Corp. | | | 1,813,995 |

| 24,000 | | Wells Fargo & Co. | | | 1,433,280 |

|

| | | | | | 3,247,275 |

|

| Diversified Financials — 4.6% | | | |

| 27,900 | | American Express Co. | | | 1,480,653 |

| 31,750 | | JPMorgan Chase & Co. | | | 1,225,550 |

| 17,900 | | Merrill Lynch & Co., Inc. | | | 965,526 |

|

| | | | | | 3,671,729 |

|

| | | TOTAL FINANCIALS | | | 6,919,004 |

|

| HEALTHCARE — 22.4% | | | |

| Biotechnology — 6.5% | | | |

| 26,300 | | Amgen Inc. (b) | | | 1,493,840 |

| 14,700 | | Biogen Idec Inc. (b) | | | 854,952 |

| 46,400 | | Celgene Corp. (b) | | | 1,374,368 |

| 41,500 | | Gilead Sciences, Inc. (b) | | | 1,437,145 |

|

| | | | | | 5,160,305 |

|

| Healthcare Equipment & Supplies — 4.0% | | | |

| 29,300 | | Medtronic, Inc. | | | 1,497,523 |

| 10,800 | | St. Jude Medical, Inc. (b) | | | 826,956 |

| 11,300 | | Zimmer Holdings, Inc. (b) | | | 876,767 |

|

| | | | | | 3,201,246 |

|

| Healthcare Providers & Services — 3.0% | | | |

| 24,200 | | Laboratory Corp. of America Holdings (b) | | | 1,108,360 |

| 17,000 | | UnitedHealth Group Inc. | | | 1,230,800 |

|

| | | | | | 2,339,160 |

|

| Pharmaceuticals — 8.9% | | | |

| 14,300 | | Allergan, Inc. | | | 1,023,308 |

| 15,600 | | Eli Lilly and Co. | | | 856,596 |

| 22,500 | | Johnson & Johnson | | | 1,313,550 |

| 25,450 | | Pfizer Inc. | | | 736,778 |

| 101,500 | | Schering-Plough Corp. | | | 1,838,165 |

See Notes to Financial Statements.

37 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

VAN KAMPEN ENTERPRISE PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| Pharmaceuticals — 8.9% (continued) |

| 31,700 | | Wyeth | | $ | 1,256,905 |

|

| | | | | | 7,025,302 |

|

| | | TOTAL HEALTHCARE | | | 17,726,013 |

|

| INDUSTRIALS — 10.6% | | | |

| Aerospace & Defense — 2.5% | | | |

| 28,000 | | Goodrich Corp. | | | 863,240 |

| 11,700 | | United Technologies Corp. | | | 1,085,994 |

|

| | | | | | 1,949,234 |

|

| Commercial Services & Supplies — 1.4% | | | |

| 25,500 | | Automatic Data Processing, Inc. | | | 1,106,445 |

|

| Industrial Conglomerates — 5.0% | | | |

| 68,500 | | General Electric Co. | | | 2,337,220 |

| 51,900 | | Tyco International Ltd. | | | 1,616,685 |

|

| | | | | | 3,953,905 |

|

| Machinery — 1.7% | | | |

| 13,600 | | Danaher Corp. | | | 749,768 |

| 9,100 | | Ingersoll-Rand Co., Class A Shares | | | 622,804 |

|

| | | | | | 1,372,572 |

|

| | | TOTAL INDUSTRIALS | | | 8,382,156 |

|

| INFORMATION TECHNOLOGY — 23.4% | | | |

| Communications Equipment — 7.1% | | | |

| 25,900 | | ADTRAN, Inc. | | | 559,440 |

| 25,600 | | Andrew Corp. (a)(b) | | | 357,888 |

| 42,500 | | Cisco Systems, Inc. (b) | | | 816,425 |

| 69,000 | | Comverse Technology, Inc. (b) | | | 1,424,160 |

| 28,900 | | QUALCOMM Inc. | | | 1,208,309 |

| 14,300 | | Research In Motion Ltd. (b) | | | 1,261,260 |

|

| | | | | | 5,627,482 |

|

| Computers & Peripherals — 6.5% | | | |

| 57,700 | | Dell Inc. (b) | | | 2,022,962 |

| 64,100 | | EMC Corp. (b) | | | 824,967 |

| 19,600 | | International Business Machines Corp. | | | 1,759,100 |

| 6,800 | | Lexmark International, Inc., Class A Shares (b) | | | 565,148 |

|

| | | | | | 5,172,177 |

|

| Electronic Equipment & Instruments — 0.4% | | | |

| 6,400 | | Mettler-Toledo International Inc. (b) | | | 306,560 |

|

| Internet Software & Services — 1.7% | | | |

| 36,400 | | Yahoo! Inc. (b) | | | 1,317,316 |

|

See Notes to Financial Statements.

38 Travelers Series Fund Inc. | 2004 Annual Report

| | |

| Schedule of Investments (continued) | | October 31, 2004 |

VAN KAMPEN ENTERPRISE PORTFOLIO

| | | | | | |

| SHARES | | SECURITY | | VALUE | |

| Semiconductor Equipment & Products — 1.7% | | | | |

| 7,400 | | Analog Devices, Inc. | | $ | 297,924 | |

| 28,400 | | Intel Corp. | | | 632,184 | |

| 10,600 | | Linear Technology Corp. | | | 401,528 | |

|

|

| | | | | | 1,331,636 | |

|

|

| Software — 6.0% | | | | |

| 22,600 | | Adobe Systems, Inc. | | | 1,266,278 | |

| 61,400 | | Microsoft Corp. | | | 1,718,586 | |

| 33,000 | | SAP AG, Sponsored ADR | | | 1,407,450 | |

| 7,200 | | Symantec Corp. (b) | | | 409,968 | |

|

|

| | | | | | 4,802,282 | |

|

|