UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-8372

Travelers Series Fund Inc.

(Exact name of registrant as specified in charter)

125 Broad Street, New York, NY 10004

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

300 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: October 31

Date of reporting period: October 31, 2005

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

EXPERIENCE

ANNUAL REPORT

OCTOBER 31, 2005

Travelers Series Fund Inc.

Smith Barney Large Cap Value Portfolio

Smith Barney Large Capitalization Growth Portfolio

Smith Barney Mid Cap Core Portfolio

Smith Barney Aggressive Growth Portfolio

Smith Barney International All Cap Growth Portfolio

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Travelers Series Fund Inc.

Annual Report • October 31, 2005

What’s

Inside

Under a licensing agreement between Citigroup and Legg Mason, the names of funds, the names of any classes of shares of funds, and the names of investment advisers of funds, as well as all logos, trademarks and service marks related to Citigroup or any of its affiliates (“Citi Marks”) are licensed for use by Legg Mason. Citi Marks include, but are not limited to, “Smith Barney,” “Salomon Brothers,” “Citi,” “Citigroup Asset Management,” and “Davis Skaggs Investment Management”. Legg Mason and its affiliates, as well as the Funds’ investment manager, are not affiliated with Citigroup.

All Citi Marks are owned by Citigroup, and are licensed for use until no later than one year after the date of the licensing agreement.

Letter from the Chairman

R. JAY GERKEN, CFA

Chairman, President and Chief Executive Officer

Dear Shareholder,

The U.S. economy was surprisingly resilient during the fiscal year. While surging oil prices, rising interest rates, and the impact of Hurricanes Katrina and Rita threatened to derail the economic expansion, growth remained solid throughout the period. After a 3.3% advance in the second quarter of 2005, third quarter gross domestic product (“GDP”)i growth grew to 4.3%, marking the tenth consecutive quarter in which GDP growth grew 3.0% or more.

As expected, the Federal Reserve Board (“Fed”)ii continued to raise interest rates in an attempt to ward off inflation. After raising rates three times from June 2004 through September 2004, the Fed increased its target for the federal funds rateiii in 0.25% increments eight additional times over the reporting period. The Fed again raised rates in early November, after the Funds’ reporting period had ended. All told, the Fed’s twelve rate hikes have brought the target for the federal funds rate from 1.00% to 4.00%. This represents the longest sustained Fed tightening cycle since 1976-1979.

During the 12-month period covered by this report, the U.S. stock market generated solid results, with the S&P 500 Indexiv returning 8.72%. Generally positive economic news, relatively benign core inflation, and strong corporate profits supported the market during much of the period.

Looking at the fiscal year as a whole, mid-cap stocks generated superior returns, with the Russell Midcapv, Russell 1000vi, and Russell 2000vii Indexes returning 18.09%, 10.47%, and 12.08%, respectively. From a market style perspective, value-oriented stocks significantly outperformed their growth counterparts, with the Russell 3000 Valueviii and Russell 3000 Growthix Indexes returning 11.96% and 8.99%, respectively.

Travelers Series Fund Inc. 1

International stocks generated strong returns over the fiscal year, with the MSCI EAFE Growth Indexx returning 17.65% during the 1-year period ended October 31, 2005. European stocks were supported by increased confidence over the strength of corporate earnings. Japanese stocks also performed well, as investors became increasingly optimistic regarding the country’s long anemic economy. In addition, the landslide victory of Prime Minister Koizumi’s Liberal Democratic Party improved market sentiment, especially among non-Japanese investors.

Within this environment, the Funds performed as follows:

| | | | |

| Fund Performance as of October 31, 2005 (unaudited) |

| | | 6 Months | | 12 Months |

| | | | | |

Smith Barney Large Cap Value Portfolio | | 7.43% | | 10.26% |

|

S&P 500/Barra Value Index | | 6.44% | | 10.17% |

|

Lipper Variable Large-Cap Value Funds Category Average | | 4.34% | | 9.27% |

|

Smith Barney Large Capitalization Growth Portfolio | | 9.92% | | 10.74% |

|

Russell 1000 Growth Index | | 7.59% | | 8.81% |

|

Lipper Variable Large-Cap Growth Funds Category Average | | 9.93% | | 11.36% |

|

Smith Barney Mid Cap Core Portfolio | | 10.81% | | 12.33% |

|

S&P MidCap 400 Index | | 11.33% | | 17.65% |

|

Lipper Variable Mid-Cap Core Funds Category Average | | 10.54% | | 16.29% |

|

Smith Barney Aggressive Growth Portfolio | | 15.56% | | 16.94% |

|

Russell 3000 Growth Index | | 8.04% | | 8.99% |

|

Lipper Variable Multi-Cap Growth Funds Category Average | | 12.84% | | 14.64% |

|

Smith Barney International All Cap Growth Portfolio | | 7.53% | | 16.21% |

|

MSCI EAFE Growth Index | | 8.63% | | 17.65% |

|

Lipper Variable International Growth Funds Category Average | | 9.60% | | 18.01% |

|

| The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.citigroupam.com. |

| Fund returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. |

| Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the period ended October 31, 2005 and include the reinvestment of all distributions, including returns of capital, if any. Returns were calculated among the 97 funds for the six-month period and among the 94 funds for the 12-month period in the variable large-cap value funds category. Returns were calculated among the 185 funds for the six-month period and among the 184 funds for the 12-month period in the variable large-cap growth funds category. Returns were calculated among the 82 funds for the six-month period and among the 77 funds for the 12-month period in the variable mid-cap core funds category. Returns were calculated among the 117 funds for the six-month period and among the 116 funds for the 12-month period in the variable multi-cap growth funds category. Returns were calculated among the 57 funds for the six-month period and among the 50 funds for the 12-month period in the variable international growth funds category. |

2 Travelers Series Fund Inc.

Please read on for a more detailed look at prevailing economic and market conditions during the Funds’ fiscal year and to learn how those conditions have affected Funds performance.

Special Shareholder Notice

On December 1, 2005, Citigroup Inc. (“Citigroup”) completed the sale of substantially all of its asset management business, Citigroup Asset Management, to Legg Mason, Inc. (“Legg Mason”). As a result, the Funds’ investment manager, Smith Barney Fund Management LLC (the “Manager”), previously an indirect wholly-owned subsidiary of Citigroup, has become a whole-owned subsidiary of Legg Mason. Completion of the sale caused the existing investment management contracts to terminate. Each Fund’s shareholders previously approved a new investment management contract between the Funds and the Manager, which became effective December 1, 2005.

Information About Your Fund

As you may be aware, several issues in the mutual fund industry have recently come under the scrutiny of federal and state regulators. The Funds’ Manager and some of its affiliates have received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the Funds’ response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Funds have been informed that the Manager and its affiliates are responding to those information requests, but are not in a position to predict the outcome of these requests and investigations.

Important information concerning the Funds and their Manager with regard to recent regulatory developments is contained in the Notes to the Financial Statements included in this report.

Travelers Series Fund Inc. 3

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you continue to meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

December 1, 2005

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | | Gross domestic product is a market value of goods and services produced by labor and property in a given country. |

| ii | | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iii | | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| iv | | The S&P 500 Index is an unmanaged index of 500 stocks that is generally representative of the performance of larger companies in the U.S. |

| v | | The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index whose average market capitalization was approximately $4.7 billion as of 6/24/05. |

| vi | | The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. |

| vii | | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. |

| viii | | The Russell 3000 Value Index measures the performance of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) |

| ix | | The Russell 3000 Growth Index measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. |

| x | | The MSCI EAFE Growth Index is an unmanaged index of growth stocks of companies located in Europe, Australasia and the Far East. |

4 Travelers Series Fund Inc.

Manager Overview

Smith Barney Large Cap Value Portfolio

Q. What were the overall market conditions during the Fund’s reporting period?

A. There was no shortage of problems for the U.S. economy to overcome during the reporting period. These included record high oil prices, rising short-term interest rates, the devastation inflicted by Hurricanes Katrina and Rita, geopolitical issues and falling consumer confidence. However, the economy proved to be surprisingly resilient during the fiscal year.

The Federal Reserve Board (“Fed”)i continued to raise interest rates over the period in an attempt to ward off inflation. All told, the Fed’s eleven rate hikes have brought the target for the federal funds rateii from 1.00% to 3.75%. This represents the longest sustained Fed tightening cycle since 1976-1979. Following the end of the Fund’s reporting period, at its November meeting, the Fed once again raised the target rate by 0.25% to 4.00%.

The top-performing sector of the S&P 500 Indexiii was energy, gaining 33.71% during the period. Other leading sectors included utilities (23.86%) and consumer staples (10.18%). All sectors had positive returns during the period with the exception of consumer discretionary (-1.06%) and telecommunications (-0.46%).

Performance Update1

For the 12 months ended October 31, 2005, the Smith Barney Large Cap Value Portfolio returned 10.26%. The Fund outperformed its unmanaged benchmark, the S&P 500/Barra Value Index,iv which returned 10.17% for the same period. It also outperformed the Lipper Variable Large-Cap Value Funds Category Average2, which increased 9.27%.

Q. What were the most significant factors affecting Fund performance?

A. The Fund’s outperformance relative to the S&P 500/Barra Value Index during the period was attributable to both sector allocation and security selection. An overweight position in both energy and technology contributed positively to performance; however, this benefit was partially offset by the underweight position in utilities and the overweight position in consumer discretionary, which held back performance. Security selection was strongest in the consumer discretionary and consumer staples sectors and weakest in the technology and health care sectors.

| 1 | | The Fund is an underlying investment option of various variable annuity and variable life insurance products. The Fund’s performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity or variable life insurance contracts, such as administrative fees, account charges, and surrender charges, which, if reflected, would reduce the performance of the Fund. Past performance is no guarantee of future results. |

| 2 | | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 12-month period ended October 31, 2005, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 94 funds in the Fund’s Lipper category. |

Travelers Series Fund Inc. 2005 Annual Report 5

What were the leading contributors to performance?

A. Top contributors during the period included Altria Group Inc., ENSCO International Inc., Marathon Oil Corp., Loews Corp. and Boeing Co.

What were the leading detractors from performance?

A. Stocks that detracted from performance came from a number of different sectors and included Lexmark International Inc., Pfizer Inc., News Corp., Solectron Corp. and Sprint Nextel Corp. In October, Lexmark shares fell sharply after the company pre-announced it was slashing its profit forecast. The company underestimated the competitive pressures in the printer industry and was forced to cut prices to stem market share losses. We sold our position in the Fund since we believe the investment thesis is impaired.

Q. Were there any significant changes to the Fund during the reporting period?

A. During the period, we have reduced our technology and utilities exposure in the portfolio and increased our financials weighting. We are currently overweight in the consumer staples, health care and energy sectors and underweight in the financials, utilities and materials sectors versus the S&P 500/Barra Value Index.

Thank you for your investment in the Smith Barney Large Cap Value Portfolio. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on seeking to achieve the Fund’s investment goals.

Sincerely,

| | |

| |  |

Mark J. McAllister, CFA Co-Portfolio Manager | | Robert Feitler Co-Portfolio Manager |

December 1, 2005

6 Travelers Series Fund Inc. 2005 Annual Report

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

Portfolio holdings and breakdowns are as of October 31, 2005 and are subject to change and may not be representative of the portfolio manager’s current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of this date were: Altria Group Inc. (3.4%), Bank of America Corp. (3.3%), Sprint Nextel Corp. (3.1%), News Corp., Class B Shares (2.3%), American International Group Inc. (2.3%), Total SA, Sponsored ADR (2.3%), Capital One Financial Corp. (2.3%), Merrill Lynch & Co. Inc. (2.2%), ENSCO International Inc. (2.2%) and Wells Fargo & Co. (2.1%). Please refer to pages 37 through 40 for a list and percentage breakdown of the Fund’s holdings.

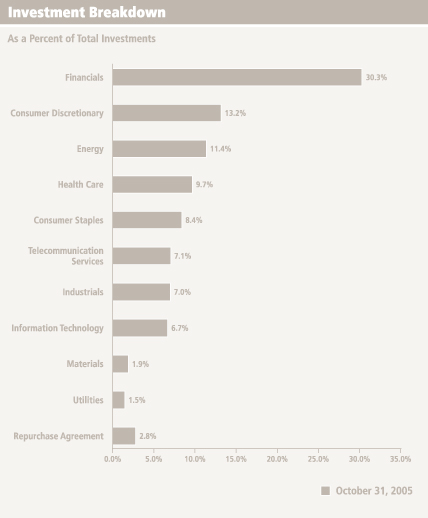

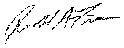

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the portfolio manager’s current or future investments. The Fund’s top five sector holdings (as a percentage of net assets) as of October 31, 2005 were: Financials (30.2%), Consumer Discretionary (13.1%), Energy (11.3%), Health Care (9.7%) and Consumer Staples (8.3%). The Fund’s portfolio composition is subject to change at any time.

RISKS: Keep in mind, common stocks are subject to market fluctuations. Foreign stocks are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| ii | | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| iii | | The S&P 500 Index is an unmanaged index of 500 stocks that is generally representative of the performance of larger companies in the U.S. |

| iv | | The S&P 500/Barra Value Index is a market-capitalization weighted index of stocks in the S&P 500 having lower price-to-book ratios relative to the S&P 500 as a whole. |

Travelers Series Fund Inc. 2005 Annual Report 7

Manager Overview

Smith Barney Large Capitalization Growth Portfolio

Special Shareholder Notice

Effective November 1, 2005, the management fee payable by Smith Barney Large Capitalization Growth Portfolio is calculated in accordance with the following breakpoint schedule with the management fee reduced at breakpoints at asset levels over $1 billion:

| | |

| |

Breakpoint Schedule

Based on Net Assets of the Fund | | Management Fee |

First $1 Billion | | 0.750% |

|

Next $1 Billion | | 0.725% |

|

Next $3 Billion | | 0.700% |

|

Next $5 Billion | | 0.675% |

|

Over $10 Billion | | 0.650% |

Q. What were the overall market conditions during the Fund’s reporting period?

A. Despite a number of setbacks and obstacles, the domestic economy continued to expand during the 12-month reporting period. The major roadblocks to progress were the same for much of the past year: the Federal Reserve Board (“Fed”)i continued to raise interest rates; oil and energy prices reached new record highs; and the effects of the hurricanes on the Gulf Coast. The price of oil skyrocketed throughout the year, from $43 per barrel at the start of 2005 to a high of just under $70 at the end of August, as a result of tension in the Middle East, increased demand from China, labor strikes in Venezuela, and weather-related supply interruptions. Several of these factors, especially higher energy prices, have weighed heavily on the consumer resulting in some reining-in of consumer spending. The housing market continued at a torrid pace throughout the year, showing signs of cooling only in the last few months, despite increasing short-term interest rates throughout the year and recent credit tightening from banks. The war in Iraq continued to put a strain on international relations and domestic spending. The continued dual deficits (both trade and budget deficits) have become a concern to the market with regard to their effect on long-term growth.

While the market experienced some short-term volatility during the period, especially in the first quarter of 2005, the domestic stock market in general registered gains over the past twelve months. However, most of the gains occurred at the end of 2004 following the Presidential election. With the uncertainty from the election removed, the S&P 500 Indexii rallied over 7% from Election Day until the end of year. But in 2005, the equity market has stayed within a narrow range, with the S&P 500 Index ending the third quarter of 2005 virtually flat for the year. In general, market leadership over the period came from the mid- and small-cap stocks, as large-caps had positive returns but lagged their smaller counterparts, while value-oriented stocks continued to outperform growth-oriented stocks.

8 Travelers Series Fund Inc. 2005 Annual Report

Performance Update1

For the 12 months ended October 31, 2005, the Smith Barney Large Capitalization Growth Portfolio, returned 10.74%. The Fund outperformed its unmanaged benchmark, the Russell 1000 Growth Index,iii which returned 8.81% for the same period. The Fund’s Lipper Variable Large-Cap Growth Funds Category Average2 increased 11.36% over the same time frame.

Q. What were the most significant factors affecting Fund performance?

A. Compared to the benchmark index, the Portfolio’s sector allocation had a negative effect on performance while stock selection had a significant positive effect. Stock selection in information technology, consumer staples and health care made a significant contribution to performance, while sector allocation in energy and consumer discretionary had a negative effect on performance.

What were the leading contributors to performance?

A. In terms of individual stock holdings, the leading contributors to performance included positions in Genentech Inc. and Amgen Inc. in health care, Gillette Co. in consumer staples (which was acquired by Procter & Gamble Co. during the period) and Motorola Inc. and Red Hat Inc., both in information technology.

What were the leading detractors from performance?

A. In terms of individual stock holdings, the leading detractors from performance included positions in Biogen Idec Inc. and Pfizer Inc. in health care, Xilinx Inc., Lucent Technologies Inc. and Juniper Networks Inc. in information technology, and Expedia Inc. (which was spun-off from IAC/InterActive Corp. during the period) in consumer discretionary.

Q. Were there any significant changes to the Fund during the reporting period?

A. New positions established during the period included Bed Bath & Beyond Inc., Amazon.com Inc. and new spin-off Expedia Inc. in consumer discretionary, as well as Yahoo! Inc. and Electronic Arts Inc. in information technology. One of the Portfolio’s top ten holdings, Gillette, was acquired during the period by Procter & Gamble Co. Several positions were eliminated during the period including holdings in Veritas Software Corp., Lucent Technologies Inc. and Freescale Semiconductor Inc. in information technology,

| 1 | | The Fund is an underlying investment option of various variable annuity and variable life insurance products. The Fund’s performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity or variable life insurance contracts, such as administrative fees, account charges, and surrender charges, which, if reflected, would reduce the performance of the Fund. Past performance is no guarantee of future results. |

| 2 | | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 12-month period ended October 31, 2005, including the reinvestment of distributions, including returns of capital, if any, calculated among the 184 funds in the Fund’s Lipper category. |

Travelers Series Fund Inc. 2005 Annual Report 9

Viacom Inc. in consumer discretionary, and Cendant Corp. in industrials. At the close of the period, the Portfolio remained overweight consumer discretionary, financials, information technology and health care, underweight industrials and consumer staples, and did not have significant holdings in energy, materials, telecommunication services or utilities.

Thank you for your investment in the Smith Barney Large Capitalization Growth Portfolio. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on seeking to achieve the Fund’s investment goals.

Sincerely,

Alan Blake

Portfolio Manager

December 1, 2005

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

Portfolio holdings and breakdowns are as of October 31, 2005 and are subject to change and may not be representative of the portfolio manager’s current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of this date were: Genentech Inc. (6.2%) Amazon.com Inc., (5.5%), Amgen Inc. (5.2%), Merrill Lynch and Co. Inc. (4.2%), Texas Instruments Inc. (4.0%), Proctor and Gamble Co. (3.9%), Motorola Inc. (3.9%), Time Warner Inc. (3.8%), Home Depot Inc. (3.7%) and Berkshire Hathaway Inc. (3.0%). Please refer to pages 41 and 42 for a list and percentage breakdown of the Fund’s holdings.

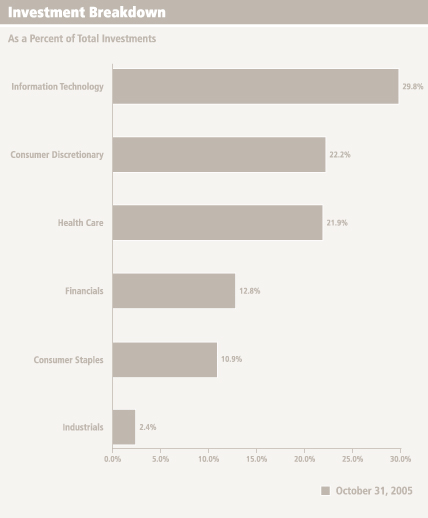

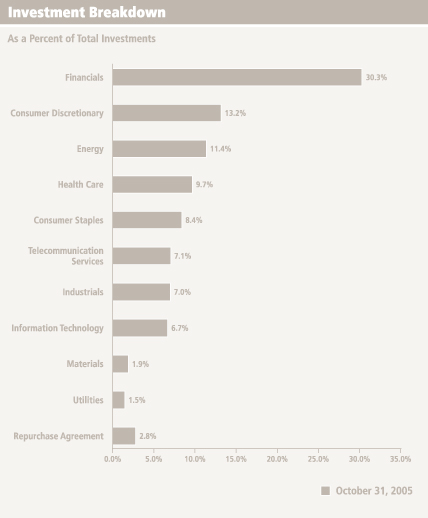

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the portfolio manager’s current or future investments. The Fund’s top five sector holdings (as a percentage of net assets) as of October 31, 2005 were: Information Technology (29.8%), Consumer Discretionary (22.3%), Health Care (22.0%), Financials (12.8%) and Consumer Staples (10.9%). The Fund’s portfolio composition is subject to change at any time.

RISKS: Keep in mind, common stocks are subject to market fluctuations. Please see the Fund’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| ii | | The S&P 500 Index is an unmanaged index of 500 stocks that is generally representative of the performance of larger companies in the U.S. |

| iii | | The Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. |

10 Travelers Series Fund Inc. 2005 Annual Report

Manager Overview

Smith Barney Mid Cap Core Portfolio

Q. What were the overall market conditions during the Fund’s reporting period?

A. Despite some headwinds, the domestic economy continued to expand during the 12-month reporting period as gross domestic product (“GDP”)i grew in excess of 3% during the first three quarters 2005 and the mid-cap indexes advanced at very respectable double-digit rates.

The major roadblocks to progress were the same for much of the past year: the Federal Reserve Board (“Fed”)ii continued to raise interest rates; oil and energy prices reached new highs; and weather-related catastrophes took a heavy human and economic toll in the Gulf region. The price of oil skyrocketed throughout the year, from $43 per barrel at the start of 2005 to a high of just under $70 at the end of August, as a result of tension in the Middle East, increased demand from China, labor strikes in Venezuela, and weather-related supply interruptions. During this period, the Fed continued its tightening policy with 12 consecutive fed funds rateiii hikes occurring between June 2004 (before the start of the annual period) and November 2005. The Gulf region hurricanes added insult to injury for the consumer and certain business segments already feeling the strain from higher energy prices and interest rates. Despite this difficult economic environment, equities were able to advance, in part due to attractive valuations and strong corporate profits: for the past fourteen consecutive quarters companies in the S&P 500 Indexiv have reported double-digit profit growth and corporate balance sheets of remain in very good shape, with the highest percentage of cash on their books since 1988.

In the mid-cap equity market, industry leadership during this period was dominated by the energy sector, which advanced by more than 50% driven by sharply higher commodity prices, followed by consumer staples and health care, as measured by the S&P MidCap 400 Index.v No sectors had negative returns during the period but the worst performing sectors were telecommunication services, materials and consumer discretionary.

Performance Update1

For the 12 months ended October 31, 2005, the Smith Barney Mid Cap Core Portfolio, excluding sales charges, returned 12.33%. These shares underperformed the Lipper Variable Mid-Cap Core Funds Category Average,2 which increased 16.29%. The Fund’s unmanaged benchmark, the S&P MidCap 400 Index, returned 17.65% for the same period.

| 1 | | The Fund is an underlying investment option of various variable annuity and variable life insurance products. The Fund’s performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity or variable life insurance contracts, such as administrative fees, account charges, and surrender charges, which, if reflected, would reduce the performance of the Fund. Past performance is no guarantee of future results. |

| 2 | | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 12-month period ended October 31, 2005, including the reinvestment of distributions, including returns of capital, if any, calculated among the 77 funds in the Fund’s Lipper category. |

Travelers Series Fund Inc. 2005 Annual Report 11

Q. What were the most significant factors affecting Fund performance?

A. In the middle of the annual period in May of 2005 the Fund’s previous Portfolio Manager was replaced with a new team of managers. The current Portfolio Management team restructured the Fund, replacing much of the Fund’s holdings to better reflect the new team’s investment philosophy and process. Portfolio turnover for the entire period, including changes made by the former manager, exceeded 100%. The Fund’s returns for the most recent six-month period largely reflect the current Fund and Portfolio Management, as opposed to the returns for the full 12-month period, which include returns achieved under the previous manager, prior to the restructuring. Compared to the benchmark index, both the Fund’s sector allocation and stock selection had a negative effect, but the impact of stock selection accounted for the majority of the underperformance over the annual period.

What were the leading contributors to performance?

A. In terms of individual stock holdings, the leading contributors to performance included positions in SanDisk Corp. in information technology, Legg Mason Inc. in financials, Boyd Gaming Corp. and Ryland Group, Inc. in consumer discretionary, and Nexen Inc. in energy. In terms of sectors, the greatest contributors to relative performance were the consumer discretionary, financials, and the information technology sectors.

What were the leading detractors from performance?

A. In terms of individual stock holdings, the leading detractors from performance included positions in DreamWorks Animation SKG, Inc. in consumer discretionary, Medicis Pharmaceutical Corp., OSI Pharmaceuticals, Inc. and MGI Pharma Inc. in health care, and Cytec Industries Inc. in materials. In terms of sectors, the greatest detractors from relative performance were the health care, materials, industrials, consumer staples and utilities sectors.

Q. Were there any significant changes to the Fund during the reporting period?

A. As noted earlier, the Portfolio Management team was replaced during the period, and a subsequent restructuring of the Portfolio resulted in many of the existing holdings being replaced. The portfolio was brought into better alignment with the new Managers’ emphasis on companies that generate abundant cash flow, have strong or improving balance sheets, and/or whose share prices reflect unappreciated growth expectations.

At the close of the period, the Fund was overweight the health care, information technology, energy and consumer staples sectors, approximately market weight in the consumer discretionary sector, and underweight the industrials, financials, utilities, materials and telecommunications services sectors.

12 Travelers Series Fund Inc. 2005 Annual Report

Thank you for your investment in the Smith Barney Mid Cap Core Portfolio. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on seeking to achieve the Fund’s investment goals.

Sincerely,

December 1, 2005

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

Portfolio holdings and breakdowns are as of October 31, 2005 and are subject to change and may not be representative of the portfolio manager’s current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of this date were: SanDisk Corp. (2.6%), ImClone Systems Inc. (2.1%), Bed Bath & Beyond Inc. (2.0%), New York Community Bancorp Inc. (1.9%), Weatherford International Ltd. (1.9%), Acxiom Corp. (1.8%), Hormel Foods Corp. (1.8%), Thermo Electron Corp. (1.8%), Laureate Education Inc. (1.8%) and DaVita Inc. (1.8%). Please refer to pages 43 through 47 for a list and percentage breakdown of the Fund’s holdings.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the portfolio manager’s current or future investments. The Fund’s top five sector holdings (as a percentage of net assets) as of October 31, 2005 were: Information Technology (17.5%), Consumer Discretionary (16.3%), Financials (15.5%), Health Care (13.8%) and Energy (9.5%). The Fund’s portfolio composition is subject to change at any time.

RISKS: Mid-cap stocks may be more volatile than large-cap stocks. Additionally, the Fund’s performance may be influenced by political, social and economic factors affecting investments in companies in foreign countries. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | | Gross domestic product is a market value of goods and services produced by labor and property in a given country. |

| ii | | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iii | | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| iv | | The S&P 500 Index is an unmanaged index of 500 stocks that is generally representative of the performance of larger companies in the U.S. |

| v | | The S&P MidCap 400 Index is a market-value weighted index which consists of 400 domestic stocks chosen for market size, liquidity, and industry group representation. |

Travelers Series Fund Inc. 2005 Annual Report 13

Manager Overview

Smith Barney Aggressive Growth Portfolio

Special Shareholder Notice

Effective November 1, 2005, the management fee payable by Smith Barney Aggressive Growth Portfolio was reduced from 0.80% to 0.75% for asset levels up to $1 billion and is calculated in accordance with the following breakpoint schedule with the management fee reduced at breakpoints beginning at asset levels over $1 billion:

| | |

| |

Breakpoint Schedule

Based on Net Assets of the Fund | | Management Fee |

First $1 Billion | | 0.750% |

|

Next $1 Billion | | 0.725% |

|

Next $3 Billion | | 0.700% |

|

Next $5 Billion | | 0.675% |

|

Over $10 Billion | | 0.650% |

Q. What were the overall market conditions during the Fund’s reporting period?

A. Despite a number of setbacks and obstacles, the domestic economy continued to expand during the 12-month reporting period. The major roadblocks to progress were the same for much of the past year: the Federal Reserve Board (“Fed”)i continued to raise interest rates; oil and energy prices reached new record highs; and the effects of the hurricanes on the Gulf Coast. The price of oil skyrocketed throughout the year, from $43 per barrel at the start of 2005 to a high of just under $70 at the end of August, as a result of tension in the Middle East, increased demand from China, labor strikes in Venezuela, and weather-related supply interruptions. Several of these factors, especially higher energy prices, have weighed heavily on the consumer resulting in some reining-in of consumer spending. The housing market continued at a torrid pace throughout the year, showing signs of cooling only in the last few months, despite increasing short-term interest rates throughout the year and recent credit tightening from banks. The war in Iraq continued to put a strain on international relations and domestic spending. The continued dual deficits (both trade and budget deficits) have become a concern to the market with regard to their effect on long-term growth.

While the market experienced some short-term volatility during the period, especially in the first quarter of 2005, the domestic stock market in general registered gains over the past twelve months. However, most of the gains occurred at the end of 2004 following the Presidential election. With the uncertainty from the election removed, the S&P 500 Indexii rallied over 7% from Election Day until the end of year. But in 2005, the equity market has stayed within a narrow range, with the S&P 500 Index ending the third quarter of 2005 virtually flat for the year. In general, market leadership over the period came from the mid- and small-cap stocks, as large-caps had positive returns but lagged their smaller counterparts, while value-oriented stocks continued to outperform growth-oriented stocks.

14 Travelers Series Fund Inc. 2005 Annual Report

Performance Update1

For the 12 months ended October 31, 2005, the Smith Barney Aggressive Growth Portfolio returned 16.94%. The Fund outperformed its unmanaged benchmark, the Russell 3000 Growth Index,iii which returned 8.99% for the same period. It also outperformed the Fund’s Lipper Variable Multi-Cap Growth Funds Category Average2, which increased 14.64%.

Q. What were the most significant factors affecting Fund performance?

A. Compared to the benchmark index, both the Fund’s sector allocation and stock selection had a significant positive effect. The Fund remained fairly concentrated throughout the period, with considerable overweights to the energy, health care, and financials sectors, and a sizable underweight to information technology, all of which made significant contributions to the Fund’s outperformance of the benchmark. In particular, the Fund’s overweight allocation to energy stocks — more than three times that of the benchmark index — and its focus on oil drilling, production and related services and equipment stocks, had an especially large impact on Fund outperformance due in part to the record high prices set for oil during the period. Stock selection in information technology and financials also made a very large contribution to performance for the period.

What were the leading contributors to performance?

A. In terms of individual stock holdings, the leading contributors to performance included positions in UnitedHealth Group Inc., Genzyme Corp. and Amgen Inc. in health care, Lehman Brothers Holdings Inc. in financials and Anadarko Petroleum Corp. in energy.

What were the leading detractors from performance?

A. In terms of individual stock holdings, the leading detractors from performance included positions in Biogen Idec Inc., Forest Laboratories Inc., ImClone Systems Inc., and Millennium Pharmaceuticals Inc., all in health care, and Tyco International Ltd. in industrials.

Q. Were there any significant changes to the Fund during the reporting period?

A. No significant changes were made during the period. At the close of the period, the portfolio remained overweight health care, energy, and financials, market weight consumer discretionary, underweight information technology, industrials and telecommunication services, with no significant holdings in consumer staples, materials or utilities.

| 1 | | The Fund is an underlying investment option of various variable annuity and variable life insurance products. The Fund’s performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity or variable life insurance contracts, such as administrative fees, account charges, and surrender charges, which, if reflected, would reduce the performance of the Fund. |

| 2 | | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 12-month period ended October 31, 2005, including the reinvestment of distributions, including returns of capital, if any, calculated among the 116 funds in the Fund’s Lipper category. |

Travelers Series Fund Inc. 2005 Annual Report 15

Thank you for your investment in the Smith Barney Aggressive Growth Portfolio. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on seeking to achieve the Fund’s investment goals.

Sincerely,

Richard Freeman

Portfolio Manager

December 1, 2005

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

Portfolio holdings and breakdowns are as of October 31, 2005 and are subject to change and may not be representative of the portfolio manager’s current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of this date were: UnitedHealth Group Inc. (9.0%), Lehman Brothers Holdings Inc. (6.8%), Anadarko Petroleum Corp. (6.7%), Genzyme Corp. (5.3%), Amgen Inc. (5.2%), Weatherford International Ltd. (4.3%), Forest Laboratories Inc. (3.5%), Chiron Corp. (3.5%), Comcast Corp. Special Class A Shares (3.4%) and Time Warner Inc. (3.0%). Please refer to pages 48 through 51 for a list and percentage breakdown of the fund’s holdings.

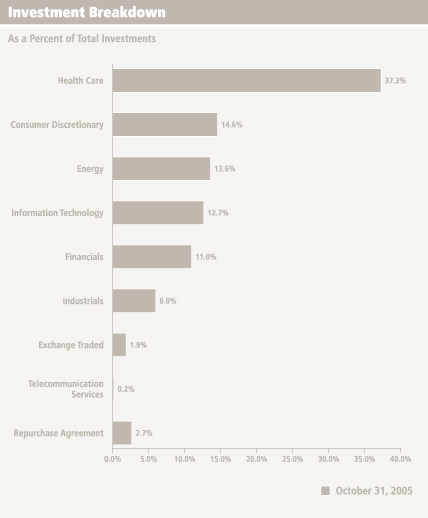

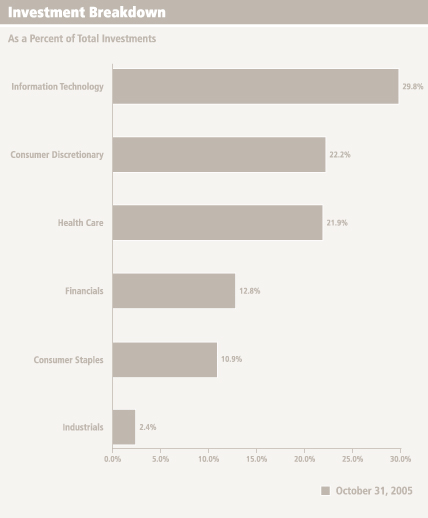

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the portfolio manager’s current or future investments. The Fund’s top five sector holdings (as a percentage of net assets) as of October 31, 2005 were: Health Care (37.4%), Consumer Discretionary (14.6%), Energy (13.6%), Information Technology (12.8%) and Financials (11.0%). The Fund’s portfolio composition is subject to change at any time.

RISKS: The Fund may invest a significant portion of its assets in small- and mid-cap companies which may be more volatile than an investment that focuses only on large-cap companies. Please see the Fund’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| ii | | The S&P 500 Index is an unmanaged index of 500 stocks that is generally representative of the performance of larger companies in the U.S. |

| iii | | The Russell 3000 Growth Index measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. |

16 Travelers Series Fund Inc. 2005 Annual Report

Manager Overview

Smith Barney International All Cap Growth Portfolio

Special Shareholder Notice

Effective November 1, 2005, the management fee payable by Smith Barney International All Cap Growth Portfolio is calculated in accordance with the following breakpoint schedule with the management fee reduced at breakpoints beginning at asset levels over $1 billion:

| | |

| |

Breakpoint Schedule

Based on Net Assets of the Fund | | Management Fee |

First $1 Billion | | 0.850% |

|

Next $1 Billion | | 0.825% |

|

Next $3 Billion | | 0.800% |

|

Next $5 Billion | | 0.775% |

|

Over $10 Billion | | 0.750% |

Q. What were the overall market conditions during the Fund’s reporting period?

A. International equity markets in general rewarded investors over the twelve months ended October 2005 with positive returns. The period was marked by good corporate earnings gains in many sectors. Many corporate management teams used improved cash flows to further strengthen already robust balance sheets and increase cash returns to shareholders.

Though the rapid rise of energy and other commodity prices caused some cost pressure and operating profit margin contraction in selected sectors, companies overall were able to handle the cost increases through modest price increases and improved productivity. International merger and acquisition activity increased sharply, a reflection, in the Manager’s view, of attractive valuations and management confidence in underlying business conditions as well as the availability of capital at favorable cost.

International stocks in general outperformed U.S. equities during the period. The outperformance occurred despite the substantial increase of the U.S. dollar versus the currencies underlying the benchmark index, which decreased portfolio returns. The U.S. dollar increased versus major trading currencies as a result of the increase of U.S. short-term interest rates and due to the preferential tax treatment of U.S. multinationals repatriating foreign earnings.

Performance Update1

For the 12 months ended October 31, 2005, the Smith Barney International All Cap Growth Portfolio, returned 16.21%. In comparison, the Fund’s unmanaged benchmark,

| 1 | | The Fund is an underlying investment option of various variable annuity and variable life insurance products. The Fund’s performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity or variable life insurance contracts, such as administrative fees, account charges, and surrender charges, which, if reflected, would reduce the performance of the Fund. Past performance is no guarantee of future results. |

Travelers Series Fund Inc. 2005 Annual Report 17

the MSCI EAFE Growth Indexi, returned 17.65% for the same period. The Fund’s Lipper Variable International Growth Funds Category Average2 increased 18.01%.

Q. What were the most significant factors affecting Fund performance?

A. The overall effect of sector allocation during the period was positive, but the impact of stock selection was slightly negative. Stock selection in the industrials, consumer discretionary and financials sectors detracted from relative performance while it contributed to performance in the information technology (IT), telecommunication services (telecom) and health care sectors. In terms of the portfolio’s sector allocation, an overweight to IT had a negative effect while underweights to consumer discretionary and telecom and an overweight to financials contributed to relative performance.

What were the leading contributors to performance?

A. In terms of individual stock holdings, the leading contributors to performance included positions in Roche Holding AG in health care, O2 PLC in telecom, Wal-Mart de Mexico SA de C.V. in consumer staples, Macquarie Bank Ltd. in financials and Indra Sistemas SA in IT.

What were the leading detractors from performance?

A. In terms of individual stock holdings, the leading detractors from performance included positions in Daiichikosho Co. Ltd., News Corp. and Rakuten Inc. in consumer discretionary, Trend Micro Inc. in IT and Nichii Gakkan Co. in health care.

Q. Were there any significant changes to the Fund during the reporting period?

A. The Manager took a more positive outlook on the Japanese economy and stock market as the year progressed. In the Manager’s opinion, the economic recovery in Japan, based on exports to China and other Asian markets, combined with an upturn of domestic demand, has led to a good earnings recovery in Japan. In addition, in the Manager’s view, financial institutions are presently in the best condition of the past decade.

The portfolio allocation to the Japanese equity market increased as the fiscal year progressed, from an underweight to a modest overweight position, partly due to stock price increases as well as to capital reallocation from European stocks to the Japanese market.

2 Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 12-month period ended October 31, 2005, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 50 funds in the Fund’s Lipper category.

18 Travelers Series Fund Inc. 2005 Annual Report

Thank you for your investment in the Smith Barney International All Cap Growth Portfolio. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on seeking to achieve the Fund’s investment goals.

Sincerely,

Jeffrey Russell

Portfolio Manager

December 1, 2005

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

Portfolio holdings and breakdowns are as of October 31, 2005 and are subject to change and may not be representative of the portfolio manager’s current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of this date were: Roche Holding AG (4.3%), Grafton Group PLC (3.6%), Serco Group PLC (3.1%), Mettler-Toledo International Inc. (3.1%), Vodafone Group PLC (3.0%), Mitsubishi Tokyo Financial Group Inc. (3.0%), Indra Sistemas SA (2.6%), Nokia Oyj (2.4%), BP PLC (2.3%) and Capita Group PLC (2.2%). Please refer to pages 52 through 55 for a list and percentage breakdown of the Fund’s holdings.

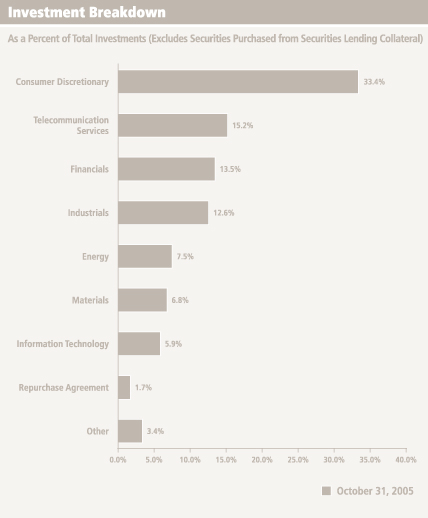

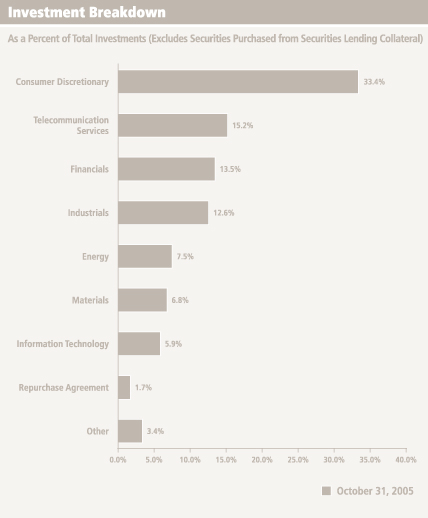

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the portfolio manager’s current or future investments. The Fund’s top five sector holdings (as a percentage of net assets) as of October 31, 2005 were: Consumer Discretionary (33.4%), Telecommunication Services (15.2%), Financials (13.5%), Industrials (12.6%) and Energy (7.5%) . The Fund’s portfolio composition is subject to change at any time.

RISKS: Keep in mind, the Fund is subject to certain risks of overseas investing, not associated with domestic investing, including currency fluctuations, change in political and economic conditions, differing securities regulations and periods of illiquidity, which could result in significant market fluctuations. These risks are magnified in emerging markets. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for more information on these and other risks

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | | The MSCI EAFE Growth Index is an unmanaged index of growth stocks of companies located in Europe, Australasia and the Far East. |

Travelers Series Fund Inc. 2005 Annual Report 19

Fund at a Glance (unaudited)

Smith Barney Large Cap Value Portfolio

20 Travelers Series Fund Inc. 2005 Annual Report

Fund at a Glance (unaudited)

Smith Barney Large Capitalization Growth Portfolio

Travelers Series Fund Inc. 2005 Annual Report 21

Fund at a Glance (unaudited)

Smith Barney Mid Cap Core Portfolio

22 Travelers Series Fund Inc. 2005 Annual Report

Fund at a Glance (unaudited)

Smith Barney Aggressive Growth Portfolio

Travelers Series Fund Inc. 2005 Annual Report 23

Fund at a Glance (unaudited)

Smith Barney International All Cap Growth Portfolio

24 Travelers Series Fund Inc. 2005 Annual Report

Fund Expenses (unaudited)

As a shareholder of the Funds, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on May 1, 2005 and held for the six months ended October 31, 2005.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| | | | | | | | | | | | | | | |

| Based on Actual Total Return(1) | | | | | | | | | | | | | |

| | | | | |

| | | Actual Total

Return(2) | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(3) |

Smith Barney Large Cap Value Portfolio | | 7.43 | % | | $ | 1,000.00 | | $ | 1,074.30 | | 0.64 | % | | $ | 3.35 |

|

Smith Barney Large Capitalization Growth Portfolio | | 9.92 | | | | 1,000.00 | | | 1,099.20 | | 0.79 | | | | 4.18 |

|

Smith Barney Mid Cap Core Portfolio | | 10.81 | | | | 1,000.00 | | | 1,108.10 | | 0.81 | | | | 4.30 |

|

Smith Barney Aggressive Growth Portfolio | | 15.56 | | | | 1,000.00 | | | 1,155.60 | | 0.82 | | | | 4.46 |

|

Smith Barney International All Cap Growth Portfolio | | 7.53 | | | | 1,000.00 | | | 1,075.30 | | 1.02 | | | | 5.34 |

|

| (1) | | For the six months ended October 31, 2005. |

| (2) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Total returns do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges which, if reflected, would reduce the total returns. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | | Expenses are equal to each Fund’s respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

Travelers Series Fund Inc. 2005 Annual Report 25

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| Based on Hypothetical Total Return(1) |

| | | | | |

| | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(2) |

Smith Barney Large Cap Value Portfolio | | 5.00 | % | | $ | 1,000.00 | | $ | 1,021.98 | | 0.64 | % | | $ | 3.26 |

|

Smith Barney Large Capitalization Growth Portfolio | | 5.00 | | | | 1,000.00 | | | 1,021.22 | | 0.79 | | | | 4.02 |

|

Smith Barney Mid Cap Core Portfolio | | 5.00 | | | | 1,000.00 | | | 1,021.12 | | 0.81 | | | | 4.13 |

|

Smith Barney Aggressive Growth Portfolio | | 5.00 | | | | 1,000.00 | | | 1,021.07 | | 0.82 | | | | 4.18 |

|

Smith Barney International All Cap Growth Portfolio | | 5.00 | | | | 1,000.00 | | | 1,020.06 | | 1.02 | | | | 5.19 |

|

| (1) | | For the six months ended October 31, 2005. |

| (2) | | Expenses are equal to each Fund’s respective annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

26 Travelers Series Fund Inc. 2005 Annual Report

Fund Performance

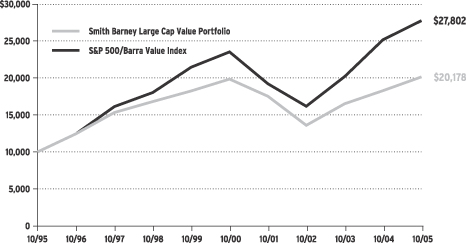

Smith Barney Large Cap Value Portfolio

| | | |

| Average Annual Total Returns† (unaudited) | | | |

Twelve Months Ended 10/31/05 | | 10.26 | % |

|

|

Five Years Ended 10/31/05 | | 0.32 | |

|

|

Ten Years Ended 10/31/05 | | 7.27 | |

|

|

6/16/94* through 10/31/05 | | 8.23 | |

|

|

| | | |

| Cumulative Total Return† (unaudited) | | | |

10/31/95 through 10/31/05 | | 101.78 | % |

|

|

| † | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| * | | Commencement of operations. |

Travelers Series Fund Inc. 2005 Annual Report 27

Fund Performance (continued)

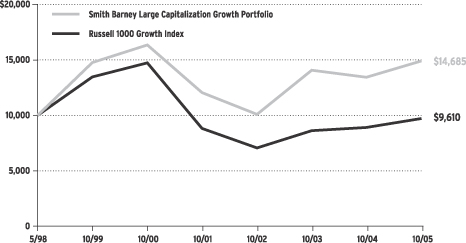

Smith Barney Large Capitalization Growth Portfolio

| | | |

| Average Annual Total Returns† (unaudited) | | | |

Twelve Months Ended 10/31/05 | | 10.74 | % |

|

|

Five Years Ended 10/31/05 | | (1.83 | ) |

|

|

5/1/98* through 10/31/05 | | 5.26 | |

|

|

| | | |

| Cumulative Total Return† (unaudited) | | | |

5/1/98* through 10/31/05 | | 46.85 | % |

|

|

| † | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| * | | Commencement of operations. |

28 Travelers Series Fund Inc. 2005 Annual Report

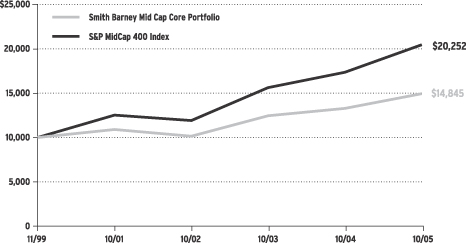

Fund Performance (continued)

Smith Barney Mid Cap Core Portfolio

| | | |

| Average Annual Total Returns† (unaudited) | | | |

Twelve Months Ended 10/31/05 | | 12.33 | % |

|

|

Five Years Ended 10/31/05 | | 0.84 | |

|

|

11/1/99* through 10/31/05 | | 6.81 | |

|

|

| | | |

| Cumulative Total Return† (unaudited) | | | |

11/1/99* through 10/31/05 | | 48.45 | % |

|

|

| † | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| * | | Commencement of operations. |

Travelers Series Fund Inc. 2005 Annual Report 29

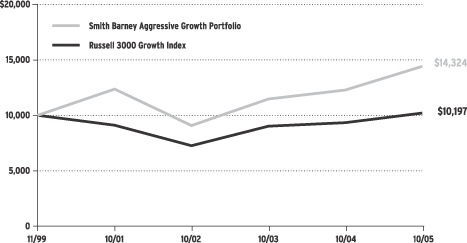

Fund Performance (continued)

Smith Barney Aggressive Growth Portfolio

| | | |

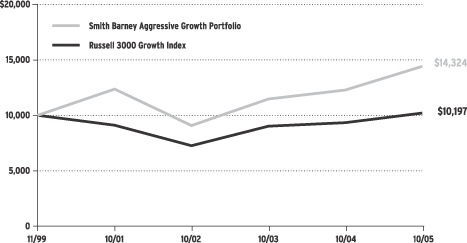

| Average Annual Total Returns† (unaudited) | | | |

Twelve Months Ended 10/31/05 | | 16.94 | % |

|

|

Five Years Ended 10/31/05 | | (0.97 | ) |

|

|

11/1/99* through 10/31/05 | | 6.17 | |

|

|

| | | |

| Cumulative Total Return† (unaudited) | | | |

11/1/99* through 10/31/05 | | 43.24 | % |

|

|

| † | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| * | | Commencement of operations. |

30 Travelers Series Fund Inc. 2005 Annual Report

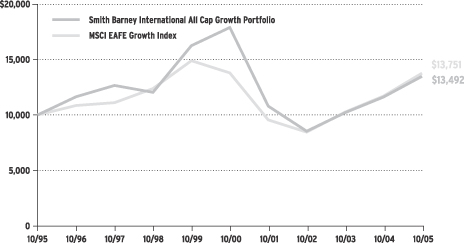

Fund Performance (continued)

Smith Barney International All Cap Growth Portfolio

| | | |

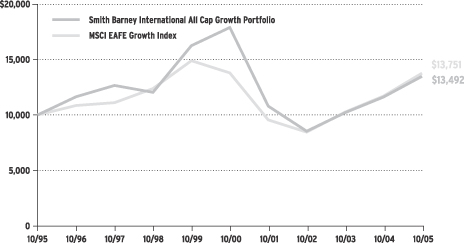

| Average Annual Total Returns† (unaudited) | | | |

Twelve Months Ended 10/31/05 | | 16.21 | % |

|

|

Five Years Ended 10/31/05 | | (5.48 | ) |

|

|

Ten Years Ended 10/31/05 | | 3.04 | |

|

|

6/16/94* through 10/31/05 | | 3.09 | |

|

|

| | | |

| Cumulative Total Return† (unaudited) | | | |

10/31/95 through 10/31/05 | | 34.92 | % |

|

|

| † | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges which, if reflected, would reduce the total returns. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| * | | Commencement of operations. |

Travelers Series Fund Inc. 2005 Annual Report 31

Historical Performance (unaudited)

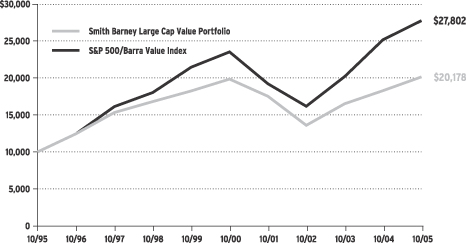

Value of $10,000 Invested in Shares of the Smith Barney Large Cap Value Portfolio vs. S&P 500/Barra Value Index† (October 1995 — October 2005)

| † | | Hypothetical illustration of $10,000 invested in shares of the Smith Barney Large Cap Value Portfolio on October 31, 1995, assuming reinvestment of all distributions, including returns of capital, if any, at net asset value through October 31, 2005. The S&P 500/Barra Value Index is a market-capitalization weighted index of stocks in the S&P 500 Index having lower price-to-book ratios relative to the S&P 500 Index as a whole. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) The Index is unmanaged and is not subject to the same management and trading expenses of a mutual fund. Please note that an investor cannot invest directly in an index. |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which if reflected would reduce the total returns.

32 Travelers Series Fund Inc. 2005 Annual Report

Historical Performance (unaudited) (continued)

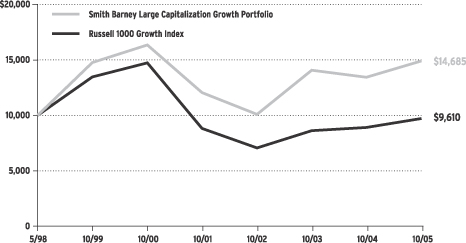

Value of $10,000 Invested in Shares of the Smith Barney Large Capitalization Growth Portfolio vs. Russell 1000 Growth Index† (May 1998 — October 2005)

| † | | Hypothetical illustration of $10,000 invested in shares of the Smith Barney Large Capitalization Growth Portfolio on May 1, 1998 (commencement of operations), assuming reinvestment of all distributions, including returns of capital, if any, at net asset value through October 31, 2005. The Russell 1000 Growth Index is considered indicative of the growth-oriented domestic stock market in general and is comprised of stocks in the Russell 1000 Index that have higher price-to-book ratios and higher forecasted growth values as a whole. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) Figures for the Index include reinvestment of dividends. The Index is unmanaged and is not subject to the same management and trading expenses of a mutual fund. Please note that an investor cannot invest directly in an index. |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which if reflected, would reduce the total returns.

Travelers Series Fund Inc. 2005 Annual Report 33

Historical Performance (unaudited) (continued)

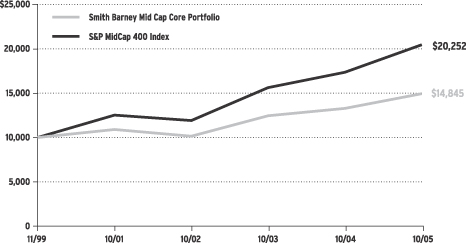

Value of $10,000 Invested in Shares of the Smith Barney Mid Cap Core Portfolio vs. the S&P MidCap 400 Index† (November 1999 — October 2005)

| † | | Hypothetical illustration of $10,000 invested in shares of the Smith Barney Mid Cap Core Portfolio on November 1, 1999 (commencement of operations), assuming reinvestment of all distributions, including returns of capital, if any, at net asset value through October 31, 2005. The S&P MidCap 400 Index is a widely recognized index of 400 medium-capitalization stocks. Figures for the S&P MidCap 400 Index include reinvestment of dividends. The Index is unmanaged and is not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index. |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which if reflected, would reduce the total returns.

34 Travelers Series Fund Inc. 2005 Annual Report

Historical Performance (unaudited) (continued)

Value of $10,000 Invested in Shares of the Smith Barney Aggressive Growth Portfolio vs. Russell 3000 Growth Index† (November 1999 — October 2005)

| † | | Hypothetical illustration of $10,000 invested in shares of the Smith Barney Aggressive Growth Portfolio on November 1, 1999 (commencement of operations), assuming reinvestment of all distributions, including returns of capital, if any, at net asset value through October 31, 2005. The Russell 3000 Growth Index measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values as a whole. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) The Index is unmanaged and is not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index. |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges, which if reflected, would reduce the total returns.

Travelers Series Fund Inc. 2005 Annual Report 35

Historical Performance (unaudited) (continued)

Value of $10,000 Invested in Shares of the Smith Barney International All Cap Growth Portfolio vs. MSCI EAFE Growth Index† (October 1995 — October 2005)

| † | | Hypothetical illustration of $10,000 invested in shares of the Smith Barney International All Cap Growth Portfolio on October 31, 1995, assuming reinvestment of all distributions, including returns of capital, if any, at net asset value through October 31, 2005. The Morgan Stanley Capital International Europe, Australasia and the Far East Growth Index (“MSCI EAFE Growth Index”) is an unmanaged index composed of growth stocks of companies located in Europe, Australasia and the Far East. The Index is unmanaged and is not subject to the same management and trading expenses of a mutual fund. Please note that an investor cannot invest directly in an index. |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges which, if reflected, would reduce the total returns.

36 Travelers Series Fund Inc. 2005 Annual Report

Schedules of Investments (October 31, 2005)

SMITH BARNEY LARGE CAP VALUE PORTFOLIO

| | | | | |

| | |

| Shares | | Security | | Value |

| | | | | | |

| COMMON STOCKS — 96.6% | | | |

| CONSUMER DISCRETIONARY — 13.1% | | | |

| Hotels, Restaurants & Leisure — 1.5% | | | |

| 145,000 | | McDonald’s Corp. | | $ | 4,582,000 |

|

| Household Durables — 1.0% | | | |

| 136,500 | | Newell Rubbermaid Inc. | | | 3,138,135 |

|

| Media — 8.5% | | | |

| 162,300 | | Comcast Corp., Class A Shares* | | | 4,516,809 |

| 101,900 | | EchoStar Communications Corp., Class A Shares* | | | 2,738,053 |

| | | Liberty Global Inc.: | | | |

| 20,700 | | Class A Shares* | | | 512,739 |

| 20,700 | | Series C Shares* | | | 491,004 |

| 413,100 | | Liberty Media Corp., Class A Shares* | | | 3,292,407 |

| 470,800 | | News Corp., Class B Shares | | | 7,090,248 |

| 112,700 | | SES Global SA, FDR (a) | | | 1,782,362 |

| 296,800 | | Time Warner Inc. | | | 5,291,944 |

|

| | | Total Media | | | 25,715,566 |

|

| Multiline Retail — 2.1% | | | |

| 63,400 | | J.C. Penney Co. Inc. | | | 3,246,080 |

| 53,200 | | Target Corp. | | | 2,962,708 |

|

| | | Total Multiline Retail | | | 6,208,788 |

|

| | | TOTAL CONSUMER DISCRETIONARY | | | 39,644,489 |

|

| CONSUMER STAPLES — 8.3% | | | |

| Food & Staples Retailing — 3.0% | | | |

| 258,400 | | Kroger Co.* | | | 5,142,160 |

| 82,900 | | Wal-Mart Stores Inc. | | | 3,921,999 |

|

| | | Total Food & Staples Retailing | | | 9,064,159 |

|

| Food Products — 0.8% | | | |

| 145,100 | | Sara Lee Corp. | | | 2,590,035 |

|

| Household Products — 1.1% | | | |

| 57,900 | | Kimberly-Clark Corp. | | | 3,291,036 |

|

| Tobacco — 3.4% | | | |

| 136,100 | | Altria Group Inc. | | | 10,214,305 |

|

| | | TOTAL CONSUMER STAPLES | | | 25,159,535 |

|

| ENERGY — 11.3% | | | |

| Energy Equipment & Services — 4.1% | | | |

| 146,100 | | ENSCO International Inc. | | | 6,660,699 |

| 84,500 | | GlobalSantaFe Corp. | | | 3,764,475 |

| 33,600 | | Halliburton Co. | | | 1,985,760 |

|

| | | Total Energy Equipment & Services | | | 12,410,934 |

|

See Notes to Financial Statements.

Travelers Series Fund Inc. 2005 Annual Report 37

Schedules of Investments (October 31, 2005) (continued)

| | | | | |

| | |

| Shares | | Security | | Value |

| | | | | | |

| Oil, Gas & Consumable Fuels — 7.2% | | | |

| 38,300 | | Burlington Resources Inc. | | $ | 2,766,026 |

| 90,000 | | Marathon Oil Corp. | | | 5,414,400 |

| 24,200 | | Nexen Inc. | | | 1,000,428 |