UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-8372

Travelers Series Fund Inc.

(Exact name of registrant as specified in charter)

| | |

| 125 Broad Street, New York, NY | | 10004 |

|

| (Address of principal executive offices) | | (Zip code) |

Robert I. Frenkel, Esq.

Smith Barney Fund Management LLC

300 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: October 31

Date of reporting period: April 30, 2005

| | |

| ITEM 1. | | REPORT TO STOCKHOLDERS. |

|

The Semi-Annual Report to Stockholders is filed herewith. |

[INSERT SHAREHOLDER REPORT]

TRAVELERS SERIES FUND INC.

SMITH BARNEY

INTERNATIONAL ALL CAP

GROWTH PORTFOLIO

SALOMON BROTHERS

STRATEGIC TOTAL RETURN

BOND PORTFOLIO

SB ADJUSTABLE RATE

INCOME PORTFOLIO

SEMI-ANNUAL REPORT | APRIL 30, 2005

NOT FDIC INSURED • NOT BANK GUARANTEED • MAY LOSE VALUE

WHAT’S INSIDE

LETTER FROM THE CHAIRMAN

R. JAY GERKEN, CFA

Chairman, President and Chief Executive Officer

Dear Shareholder,

Despite generally lackluster economic news, the international equity markets generated solid results for the six-month reporting period covered by this report. A recent International Monetary Fund’s World Economic Outlook projected a modest 1.6% growth rate for the Eurozone in 2005, and Japanese growth is expected to be 0.8% in 2005, compared to 2.6% in 2004.i Yet, international equities, as measured by the MSCI EAFE Index,ii returned 8.71% over the reporting period. In contrast to the MSCI EAFE Index, U.S. stocks, as measured by the S&P 500 Index,iii rose only 3.28% over the same period.

The reporting period began on a bright note, as the international equity markets rallied sharply in November and December 2004. Investors were drawn to stocks as oil prices retreated from their record highs and the uncertainty of the U.S. Presidential election ended. Thus far in 2005, however, the equity markets have been volatile. International equities were weak in January but then rallied strongly in February. However, they again fell in March and April. The market’s recent gyrations have been attributed to mixed economic data and continued high oil prices.

Given the overall strength of the economy, the Federal Reserve Board (“Fed”)iv continued to raise interest rates over the period in an attempt to ward off inflation. Following three rate hikes from June through September 2004, the Fed again increased its target for the federal funds ratev in 0.25% increments four times during the reporting period. After the Fund’s reporting period had ended, at its May meeting, the Fed once again raised its fed funds target rate by 0.25% to 3.00%.

During the first half of the reporting period, the U.S. fixed income market confounded many investors as short-term interest rates rose in concert with the Fed rate tightening, while longer-term rates, surprisingly, remained fairly steady. However, this began to change in late February 2005, as strong economic data and inflationary concerns caused longer-term rates to rise as well. This continued through March, before longer-term rates again declined on the back of mixed economic data. Looking at the six-month period as a whole, the overall U.S. bond market, as measured by the Lehman Brothers Aggregate Bond Index,vi

1 Travelers Series Fund Inc. | 2005 Semi-Annual Report

returned 0.98%. Elsewhere, the global bond market, as measured by the JPMorgan Global Government Bond Index—Unhedgedvii returned 4.20% over the same period.

Within this environment, the Funds performed as follows:viii

PERFORMANCE OF THE FUNDS

AS OF APRIL 30, 2005

(unaudited)

| | | |

| | | 6 Months | |

| | | | |

Smith Barney International All Cap Growth Portfolio | | 8.07 | % |

| | | | |

MSCI EAFE Growth Index | | 8.30 | % |

| | | | |

MSCI EAFE Index | | 8.71 | % |

| | | | |

Lipper Variable International Growth Funds Category Average | | 7.28 | % |

| | | | |

Salomon Brothers Strategic Total Return Bond Portfolio | | 1.81 | % |

| | | | |

Lehman Brothers Aggregate Bond Index | | 0.98 | % |

| | | | |

JPMorgan Global Government Bond Index—Unhedged | | 4.20 | % |

| | | | |

Lipper Variable Global Income Funds Category Average | | 3.40 | % |

| | | | |

SB Adjustable Rate Income Portfolio | | 0.77 | % |

| | | | |

Citigroup 6-Month U.S. Treasury Bill Index | | 1.10 | % |

| | | | |

Lipper Variable Short-Intermediate Investment Grade Debt Funds Category Average | | 0.37 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost.

The 30-Day SEC Yield for SB Adjustable Rate Income Portfolio was 2.43%. Management has contractually agreed to waive fees and/or reimburse expenses through a period of 16 months from October 31, 2004. Absent these reimbursements or fee waivers, the 30-day SEC yield would have been 2.28%.

Fund returns assume the reinvestment of income dividends and capital gains distributions at net asset value and the deduction of all fund expenses.

Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the six-month period ended April 30, 2005 and include the reinvestment of dividends and capital gains distributions, if any. Returns were calculated among the 53 funds in the variable international growth funds category. Returns were calculated among the 31 funds in the variable global income funds category. Returns were calculated among the 32 funds in the variable short-intermediate investment grade debt funds category.

2 Travelers Series Fund Inc. | 2005 Semi-Annual Report

Smith Barney International All Cap Growth Portfolio

Performance Updateviii

For the six months ended April 30, 2005, the Smith Barney International All Cap Growth Portfolio returned 8.07%. The Fund’s unmanaged benchmark, the MSCI EAFE Growth Index,ix returned 8.30% while the Fund’s previous benchmark, the MSCI EAFE Index,ii returned 8.71% for the same period. The Lipper Variable International Growth Funds Category Average1 was 7.28%.

Salomon Brothers Strategic Total Return Bond Portfolio

Special Shareholder Notice

At meetings held on March 24, 2005 and April 20, 2005, the Board of Directors approved a proposal to reorganize the Salomon Brothers Strategic Total Return Bond Portfolio (the “Acquired Fund”) of Travelers Series Fund Inc. (“TSF”) into a newly organized “shell” portfolio (the “Acquiring Fund”) of Travelers Series Trust (“TST”) (the “Reorganization”).

In connection with the Reorganization, the Board of Directors approved an Agreement and Plan of Reorganization (the “Plan”) between TSF, on behalf of the Acquired Fund, and TST, on behalf of the Acquiring Fund, under which the Acquiring Fund would acquire all of the assets of the Acquired Fund and assume all of the liabilities of the Acquired Fund. The Reorganization is being proposed to the Acquired Fund’s shareholders because Travelers Investment Adviser Inc., which serves as investment adviser to the Acquired Fund and is currently an indirect wholly owned subsidiary of Citigroup Inc. (“Citigroup”), will become an indirect wholly owned subsidiary of MetLife, Inc. (“MetLife”) as part of MetLife’s acquisition of Travelers Life & Annuity, the life insurance and annuity businesses of Citigroup.

A Special Meeting of Shareholders of the Acquired Fund has been called on June 29, 2005 for the purpose of submitting the Plan and such other matters as may properly come before the meeting to the stockholders of the Acquired Fund for approval. The close of business on April 15, 2005 has been fixed as the record date for the determination of stockholders of the Acquired Fund, who are entitled to notice of, and to vote at, the Special Meeting of Shareholders, including any adjournment or adjournments thereof.

Effective April 1, 2005, Roger Lavan and David Scott replaced Beth A. Semmel as co-managers of the Fund. Both are Managing Directors of the manager and portfolio managers of other funds advised by the manager.

| 1 | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 6-month period ended April 30, 2005, including the reinvestment of dividends and capital gains distributions, if any, calculated among the 53 funds in the Fund’s Lipper category, and excluding sales charges. |

3 Travelers Series Fund Inc. | 2005 Semi-Annual Report

Performance Updateviii

For the six months ended April 30, 2005, the Salomon Brothers Strategic Total Return Bond Portfolio returned 1.81%. The Fund’s unmanaged benchmark, the Lehman Brothers Aggregate Bond Index,vi returned 0.98% while the Fund’s previous benchmark, the JPMorgan Global Government Bond Index—Unhedged,vii returned 4.20% for the same period. The Lipper Variable Global Income Funds Category Average2 was 3.40%.

SB Adjustable Rate Income Portfolio

Performance Updateviii

For the six months ended April 30, 2005, SB Adjustable Rate Income Portfolio returned 0.77%. The Fund’s unmanaged benchmark, the Citigroup 6-Month U.S. Treasury Bill Index,x returned 1.10% for the same period. The Lipper Variable Short-Intermediate Investment Grade Debt Funds Category Average3 was 0.37%.

Information About Your Funds

As you may be aware, several issues in the mutual fund industry have recently come under the scrutiny of federal and state regulators. The Funds’ Adviser and some of its affiliates have received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the Funds’ response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Funds have been informed that the Adviser and its affiliates are responding to those information requests, but are not in a position to predict the outcome of these requests and investigations.

Important information concerning the Funds and their Adviser with regard to recent regulatory developments is contained in the “Additional Information” note in the Notes to the Financial Statements included in this report.

| 2 | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 6-month period ended April 30, 2005, including the reinvestment of dividends and capital gains distributions, if any, calculated among the 31 funds in the Fund’s Lipper category, and excluding sales charges. |

| 3 | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 6-month period ended April 30, 2005, including the reinvestment of dividends and capital gains distributions, if any, calculated among the 32 funds in the Fund’s Lipper category, and excluding sales charges. |

4 Travelers Series Fund Inc. | 2005 Semi-Annual Report

As always, thank you for your continued confidence in our stewardship of your assets. We look forward to helping you continue to meet your financial goals.

Sincerely,

/s/ R. Jay Gerken

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

May 17, 2005

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

Portfolio holdings and breakdowns are as of April 30, 2005 and are subject to change. Please refer to pages 12 through 33 for a list and percentage breakdown of the Funds’ holdings.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor can not invest directly in an index.

5 Travelers Series Fund Inc. | 2005 Semi-Annual Report

RISKS:

Smith Barney International All Cap Growth Portfolio: Keep in mind, the Fund is subject to certain risks of overseas investing, not associated with domestic investing, including currency fluctuations, change in political and economic conditions, differing securities regulations and periods of illiquidity, which could result in significant market fluctuations. These risks are magnified in emerging markets. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for more information on these and other risks.

Salomon Brothers Strategic Total Return Bond Portfolio: Investments in high-yield securities and foreign companies and governments, including emerging markets involve risks beyond those inherent solely in higher-rated and domestic investments. The risks of high-yield securities include, but are not limited to, price volatility and the possibility of default in the timely payment of interest and principal. Foreign stocks are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on fund performance. The Fund is not diversified, which may magnify the Fund’s losses from adverse events affecting a particular issuer. Please see the Fund’s prospectus for more information on these and other risks.

SB Adjustable Rate Income Portfolio: Keep in mind, the Fund is subject to fluctuations in share price as interest rates rise and fall. Adjustable rate securities are subject to additional risks such as prepayment risk. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | Source: International Monetary Fund, World Economic Outlook, April 2005. |

| ii | The MSCI EAFE Index is an unmanaged index of common stocks of companies located in Europe, Australasia and the Far East. |

| iii | The S&P 500 Index is a market capitalization-weighted index of 500 widely held common stocks. |

| iv | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| v | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| vi | The Lehman Brothers Aggregate Bond Index is a broad-based bond index comprised of Government, Corporate, Mortgage and Asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| vii | The JPMorgan Global Government Bond Index—Unhedged is a daily, market capitalization-weighted, international fixed-income index consisting of 13 countries. |

| viii | The Funds are underlying investment options of various variable annuity and variable life insurance products. A variable annuity product is a contract issued by an insurance company where the annuity premium (a set amount of dollars) is immediately turned into units of a portfolio of securities. The Funds’ performance returns do not reflect the deduction of initial sales charges and expenses imposed in connection with investing in variable annuity and variable life insurance contracts, such as administrative fees, account charges, and surrender charges which, if reflected, would reduce the performance of the Funds. Past performance is no guarantee of future results. |

| ix | The MSCI EAFE Growth Index is an unmanaged index of growth stocks of companies located in Europe, Australasia and the Far East. |

| x | The Citigroup 6-Month U.S. Treasury Bill Index performance is an average of the last 6-Month Treasury Bill issues. 6-Month U.S. Treasury Bills are guaranteed by the U.S. government and provide a fixed rate of return when held to maturity. |

6 Travelers Series Fund Inc. | 2005 Semi-Annual Report

Smith Barney International All Cap Growth Portfolio

Fund at a Glance (unaudited)

7 Travelers Series Fund Inc. | 2005 Semi-Annual Report

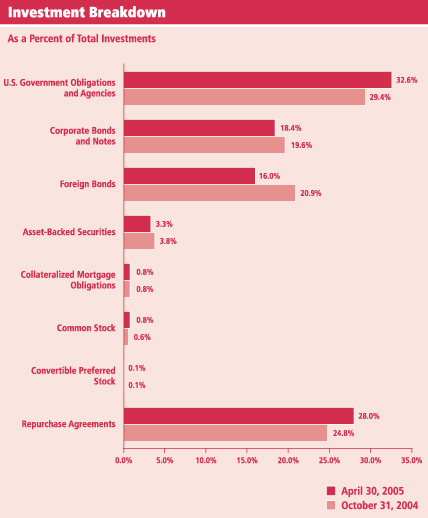

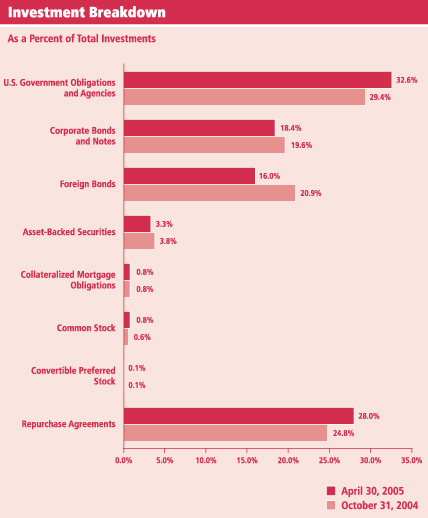

Salomon Brothers Strategic Total Return Bond Portfolio

Fund at a Glance (unaudited)

8 Travelers Series Fund Inc. | 2005 Semi-Annual Report

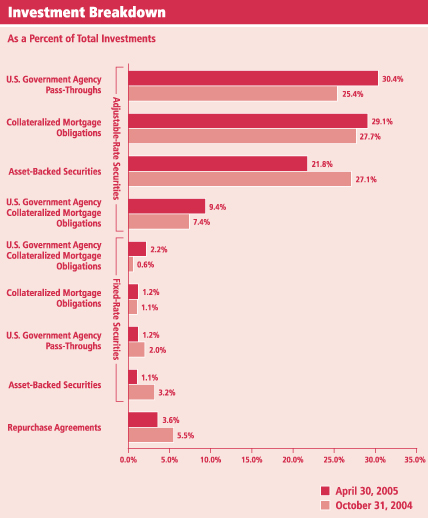

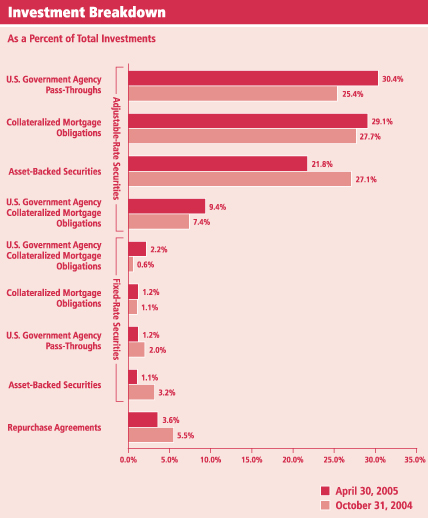

SB Adjustable Rate Income Portfolio

Fund at a Glance (unaudited)

9 Travelers Series Fund Inc. | 2005 Semi-Annual Report

Fund Expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on November 1, 2004 and held for the six months ended April 30, 2005.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| | | | | | | | | | | | | | | |

| Based on Actual Total Return(1) | | | |

| | | | | | | | | | | | | | | | |

| | | Actual Total

Return(2) | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(3) |

Smith Barney International All Cap Growth Portfolio | | 8.07 | % | | $ | 1,000.00 | | $ | 1,080.70 | | 0.98 | % | | $ | 5.06 |

|

Salomon Brothers Strategic Total Return Bond Portfolio | | 1.81 | | | | 1,000.00 | | | 1,018.10 | | 1.34 | | | | 6.71 |

|

SB Adjustable Rate Income Portfolio | | 0.77 | | | | 1,000.00 | | | 1,007.70 | | 1.00 | | | | 4.98 |

|

| (1) | | For the six months ended April 30, 2005. |

| (2) | | Assumes reinvestment of all dividends and capital gain distributions, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Total returns do not reflect expenses associated with the separate account such as administrative fees, account charges and surrender charges which, if reflected, would reduce the total returns. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | | Expenses (net of contractual or voluntary fee waiver) are equal to each Fund’s respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

10 Travelers Series Fund Inc. | 2005 Semi-Annual Report

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| Based on Hypothetical Total Return(1) | | | |

| | | | | | | | | | | | | | | | |

| | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratios | | | Expenses

Paid During

the Period(2) |

Smith Barney International All Cap Growth Portfolio | | 5.00 | % | | $ | 1,000.00 | | $ | 1,019.93 | | 0.98 | % | | $ | 4.91 |

|

Salomon Brothers Strategic Total Return Bond Portfolio | | 5.00 | | | | 1,000.00 | | | 1,018.15 | | 1.34 | | | | 6.71 |

|

SB Adjustable Rate Income Portfolio | | 5.00 | | | | 1,000.00 | | | 1,019.84 | | 1.00 | | | | 5.01 |

|

| (1) | | For the six months ended April 30, 2005. |

| (2) | | Expenses (net of contractual or voluntary fee waiver) are equal each Fund’s respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

11 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) | | April 30, 2005 |

SMITH BARNEY INTERNATIONAL ALL CAP GROWTH PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| | | | | | |

| COMMON STOCK — 97.8% | | | |

Australia (a) — 1.6% | | | |

| 62,000 | | Macquarie Bank Ltd. | | $ | 2,236,443 |

| 27,000 | | Westpac Banking Corp. | | | 412,535 |

|

| | | | | | 2,648,978 |

|

Denmark (a) — 1.1% | | | |

| 35,000 | | Novo Nordisk A/S, Class B Shares | | | 1,771,935 |

|

Finland (a) — 2.2% | | | |

| 220,000 | | Nokia Oyj (b) | | | 3,529,409 |

|

France (a) — 6.0% | | | |

| 70,000 | | Axa (b) | | | 1,732,345 |

| 32,000 | | Essilor International SA (b) | | | 2,294,393 |

| 30,000 | | Groupe Danone (b) | | | 2,822,384 |

| 13,000 | | Total SA (b) | | | 2,896,187 |

|

| | | | | | 9,745,309 |

|

Germany (a) — 3.5% | | | |

| 25,300 | | BASF AG (b) | | | 1,644,002 |

| 12,500 | | SAP AG (b) | | | 1,973,756 |

| 65,400 | | Stada Arzneimittel AG (b) | | | 2,064,243 |

|

| | | | | | 5,682,001 |

|

Greece (a) — 0.9% | | | |

| 25,000 | | EFG Eurobank Ergasias (c) | | | 756,483 |

| 45,000 | | Piraeus Bank S.A. | | | 761,912 |

|

| | | | | | 1,518,395 |

|

Hong Kong (a) — 2.8% | | | |

| 118,000 | | Hutchinson Whampoa Ltd. (b) | | | 1,058,374 |

| 826,000 | | Li & Fung Ltd. | | | 1,586,863 |

| 745,000 | | Luen Thai Holdings Ltd. (c) | | | 280,919 |

| 191,000 | | Swire Pacific Ltd. | | | 1,605,062 |

|

| | | | | | 4,531,218 |

|

Ireland (a) — 9.1% | | | |

| 103,000 | | Bank of Ireland | | | 1,565,715 |

| 168,000 | | CRH PLC | | | 4,184,392 |

| 584,000 | | Grafton Group PLC | | | 6,660,194 |

| 180,740 | | Irish Continental Group PLC | | | 2,237,879 |

|

| | | | | | 14,648,180 |

|

Italy (a) — 0.9% | | | |

| 112,000 | | Saipem S.p.A. (b) | | | 1,405,346 |

|

See Notes to Financial Statements.

12 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SMITH BARNEY INTERNATIONAL ALL CAP GROWTH PORTFOLIO

| | | | | |

| SHARES | | SECURITY | | VALUE |

| | | | | | |

Japan (a) — 17.9% | | | |

| 65,000 | | CANON INC. | | $ | 3,396,785 |

| 30,000 | | DaiichiKosho Co., Ltd. | | | 777,529 |

| 300 | | Dentsu Inc. | | | 768,807 |

| 179,000 | | Dowa Mining Co., Ltd. | | | 1,180,971 |

| 44,500 | | Honda Motor Co., Ltd. | | | 2,148,504 |

| 16,000 | | Hoya Corp. (b) | | | 1,677,204 |

| 30,000 | | Ito-Yokado Co., Ltd. | | | 1,032,284 |

| 298 | | Mitsubishi Tokyo Financial Group, Inc. (b) | | | 2,593,989 |

| 27,000 | | Nichii Gakkan Co. | | | 776,960 |

| 8,500 | | Nidec Corp. (b) | | | 999,949 |

| 159,000 | | Nomura Holdings, Inc. | | | 2,026,359 |

| 350 | | NTT Data Corp. | | | 1,081,609 |

| 580 | | NTT DoCoMo, Inc. | | | 898,728 |

| 6,500 | | Orix Corp. | | | 888,130 |

| 1,080 | | Rakuten, Inc. (b) | | | 908,132 |

| 12,000 | | Rohm Co., Ltd. | | | 1,135,009 |

| 26,000 | | Seven-Eleven Japan Co., Ltd. | | | 733,917 |

| 100,000 | | Sharp Corp. | | | 1,568,010 |

| 55,000 | | Shin-Etsu Chemical Co., Ltd. | | | 2,039,166 |

| 75,000 | | Terumo Corp. | | | 2,237,970 |

|

| | | | | | 28,870,012 |

|

Mexico (a) — 1.8% | | | |

| 773,100 | | Wal-Mart De Mexico S.A. de C.V. | | | 2,859,019 |

|

The Netherlands (a) — 3.2% | | | |

| 39,351 | | ING Groep N.V. (b) | | | 1,083,137 |

| 65,088 | | Randstad Holdings N.V. | | | 2,660,992 |

| 25,000 | | Royal Dutch Petroleum Co. | | | 1,463,743 |

|

| | | | | | 5,207,872 |

|

Norway (a) — 0.7% | | | |

| 157,000 | | Stolt Offshore S.A. (b)(c) | | | 1,154,108 |

|

Singapore (a) — 1.4% | | | |

| 172,000 | | DBS Group Holdings, Ltd. | | | 1,507,532 |

| 289,000 | | Singapore Press Holdings, Ltd. | | | 771,683 |

|

| | | | | | 2,279,215 |

|

Spain (a) — 5.2% | | | |

| 111,000 | | Banco Bilbao Vizcaya Argentaria, S.A. | | | 1,726,134 |

| 200,000 | | Indra Sistemas, S.A. (b) | | | 3,474,582 |

| 190,000 | | Telefonica S.A. | | | 3,243,474 |

|

| | | | | | 8,444,190 |

|

Sweden (a) — 2.0% | | | |

| 37,000 | | Atlas Copco AB (b) | | | 1,688,386 |

| 534,000 | | Telefonaktiebolaget LM Ericsson (b)(c) | | | 1,589,532 |

|

| | | | | | 3,277,918 |

|

See Notes to Financial Statements.

13 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SMITH BARNEY INTERNATIONAL ALL CAP GROWTH PORTFOLIO

| | | | | | |

| SHARES | | SECURITY | | VALUE | |

| | | | | | | |

Switzerland (a) — 11.8% | | | | |

| 115,000 | | Mettler-Toledo International Inc. (c) | | $ | 5,272,750 | |

| 6,500 | | Nestle SA (b) | | | 1,714,437 | |

| 41,000 | | Novartis AG (b) | | | 2,004,000 | |

| 45,000 | | Roche Holding AG | | | 5,468,098 | |

| 8,800 | | Synthes, Inc. (c) | | | 1,002,339 | |

| 45,000 | | UBS AG (b) | | | 3,623,909 | |

|

|

| | | | | | 19,085,533 | |

|

|

United Kingdom (a) — 24.7% | | | | |

| 50,000 | | BOC Group PLC | | | 928,890 | |

| 330,700 | | BP PLC | | | 3,377,141 | |

| 620,000 | | Capita Group PLC | | | 4,471,988 | |

| 154,000 | | Diageo PLC | | | 2,285,675 | |

| 88,872 | | HSBC Holdings PLC (b) | | | 1,445,436 | |

| 880,000 | | mm02 PLC (c) | | | 1,981,954 | |

| 70,000 | | Rio Tinto PLC | | | 2,116,452 | |

| 57,647 | | Royal Bank of Scotland Group PLC | | | 1,743,702 | |

| 1,047,000 | | Serco Group PLC | | | 4,792,717 | |

| 150,000 | | Smith & Nephew PLC | | | 1,548,163 | |

| 565,145 | | Tesco PLC | | | 3,343,752 | |

| 350,000 | | Tomkins PLC | | | 1,649,910 | |

| 3,196,000 | | Vodafone Group PLC | | | 8,363,300 | |

| 162,000 | | WPP Group PLC | | | 1,767,550 | |

|

|

| | | | | | 39,816,630 | |

|

|

United States — 1.0% | | | | |

| 100,012 | | News Corp., Class B Shares | | | 1,592,191 | |

|

|

| | | TOTAL COMMON STOCK

(Cost — $117,446,732) | | | 158,067,459 | |

|

|

FACE AMOUNT | | | | | |

| SHORT-TERM INVESTMENTS — 14.2% | | | | |

| REPURCHASE AGREEMENT — 2.0% | | | | |

| $ 3,202,000 | | Interest in $398,063,000 joint tri-party repurchase agreement dated 4/29/05 with Goldman Sachs, 2.940% due 5/2/05; Proceeds at maturity — $3,202,784; (Fully collateralized by various Government Agency Obligations, 1.250% to 12.750% due 5/31/05 to 11/15/24; Market value — $3,266,047) (Cost — $3,202,000) | | | 3,202,000 | |

|

|

| SECURITIES PURCHASED FROM SECURITIES LENDING COLLATERAL — 12.2% | |

| 19,628,867 | | State Street Navigator Securities Lending Trust Prime Portfolio

(Cost — $19,628,867) | | | 19,628,867 | |

|

|

| | | TOTAL SHORT-TERM INVESTMENTS (Cost — $22,830,867) | | | 22,830,867 | |

|

|

| | | TOTAL INVESTMENTS — 112.0% (Cost — $140,277,599*) | | | 180,898,326 | |

| | | Liabilities in Excess of Other Assets — (12.0)% | | | (19,354,785 | ) |

|

|

| | | TOTAL NET ASSETS — 100.0% | | $ | 161,543,541 | |

|

|

| (a) | | Securities are fair valued at April 30, 2005 in accordance with the policies adopted by the Board of Directors (See Note 1). |

| (b) | | All or a portion of this security is on loan (See Notes 1 and 3). |

| (c) | | Non-income producing security. |

| * | | Aggregate cost for federal income tax purposes is substantially the same. |

See Notes to Financial Statements.

14 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

| | | |

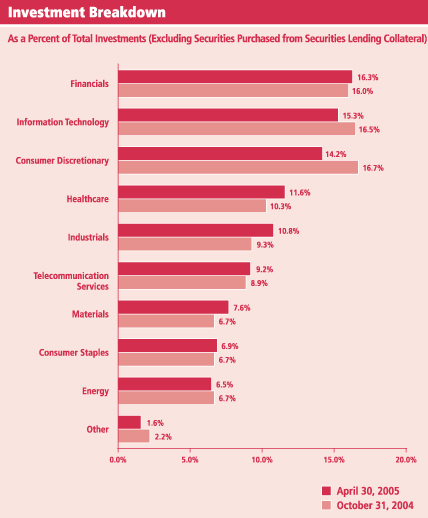

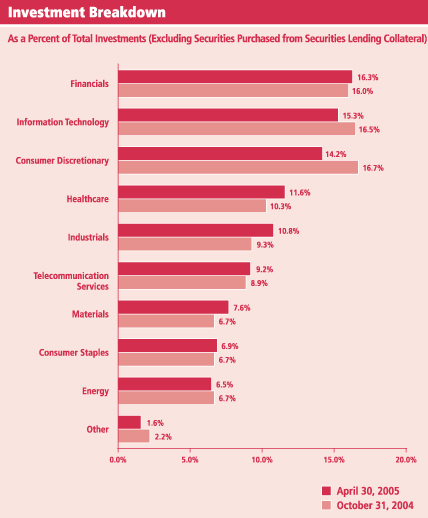

| Summary of Investments by Sector† | | | |

Financials | | 16.3 | % |

Information Technology | | 15.3 | |

Consumer Discretionary | | 14.2 | |

Healthcare | | 11.6 | |

Industrials | | 10.8 | |

Telecommunication Services | | 9.2 | |

Materials | | 7.6 | |

Consumer Staples | | 6.9 | |

Energy | | 6.5 | |

Other | | 1.6 | |

|

|

| | | 100.0 | % |

|

|

| † | | As a percentage of total investments excluding securities purchased from securities lending collateral. Please note that Fund holdings are subject to change. |

See Notes to Financial Statements.

15 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SALOMON BROTHERS STRATEGIC TOTAL RETURN BOND PORTFOLIO

| | | | | | | |

FACE

AMOUNT† | | | | SECURITY | | VALUE |

| U.S. GOVERNMENT OBLIGATIONS AND AGENCIES — 44.2% | | | |

| | | | | U.S. Treasury Notes: | | | |

| 450,000 | | | | 4.875% due 2/15/12 (a) | | $ | 472,905 |

| 205,000 | | | | 4.000% due 2/15/14 (b) | | | 202,670 |

| 400,000 | | | | U.S. Treasury Bonds, 6.250% due 5/15/30 (a) | | | 498,141 |

| | | | | Federal Home Loan Mortgage Corp.: | | | |

| 1,000,000 | | | | 5.000% due 5/1/35 (c)(d) | | | 990,312 |

| 1,250,000 | | | | 6.000% due 5/1/35 (c)(d) | | | 1,283,203 |

| | | | | Federal National Mortgage Association: | | | |

| 500,000 | | | | 4.000% due 5/1/20 (c)(d) | | | 484,844 |

| 250,000 | | | | 5.000% due 5/1/35 (c)(d) | | | 247,578 |

| 2,410,000 | | | | 6.500% due 5/1/35 (c)(d) | | | 2,506,400 |

|

| | | | | TOTAL U.S. GOVERNMENT OBLIGATIONS AND AGENCIES (Cost — $6,630,308) | | | 6,686,053 |

|

| | | |

| | | RATING(e) | | | | |

| COLLATERALIZED MORTGAGE OBLIGATIONS — 1.1% | | | |

| 43,834 | | A+ | | Commercial Mortgage Pass-Through Certificates, Series 2003-FL9, Class E, 3.954% due 11/15/15 (b)(f)(g) | | | 44,097 |

| 125,000 | | A2* | | Merit Securities Corp., Series 11PA, Class B2, 4.560% due 9/28/32 (b)(f)(g) | | | 123,783 |

|

| | | | | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost — $156,497) | | | 167,880 |

|

| ASSET-BACKED SECURITIES — 4.4% | | | |

| 150,000 | | A+ | | Amortizing Residential Collateral Trust, Series 2002-BC6, Class M2, 4.220% due 8/25/32 (b)(g) | | | 151,456 |

| 250,000 | | NR | | Bayview Financial Acquisition Trust, Series 2001-CA, Class M3, 4.270% due 8/25/36 (b)(f)(g) | | | 249,531 |

| | | | | Bear Stearns Asset Backed Securities: | | | |

| 9,297 | | BBB | | Series 2003-HE1N, Class N1, 6.500% due 8/25/05 (f) | | | 9,310 |

| 19,138 | | BBB | | Series 2004-FR1N, Class A1, 5.000% due 5/25/34 (f) | | | 19,038 |

| 19,713 | | BBB | | Series 2004-HE6, Class A1, 5.250% due 8/25/34 (f) | | | 19,641 |

| | | | | Countrywide Asset-Backed Certificates: | | | |

| 50,000 | | AA | | Series 2004-5, Class M4, 4.270% due 6/25/34 (b)(g) | | | 50,871 |

| 20,414 | | BBB | | Series 2004-5N, Class N1, 5.500% due 10/25/35 (f) | | | 20,367 |

| 41,551 | | B | | First Consumers Master Trust, Series 2001-A, Class A, 3.264% due 9/15/08 (b)(g) | | | 41,315 |

| 70,000 | | BBB | | Metris Master Trust, Series 2001-2, Class B, 4.070% due 11/20/09 (b)(g) | | | 70,232 |

| 20,000 | | A | | Novastar Home Equity Loan Trust, Series 2003-4, Class M2, 4.645% due 2/25/34 (g) | | | 20,614 |

See Notes to Financial Statements.

16 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SALOMON BROTHERS STRATEGIC TOTAL RETURN BOND PORTFOLIO

| | | | | | | |

FACE

AMOUNT† | | RATING(e) | | SECURITY | | VALUE |

| ASSET-BACKED SECURITIES — 4.4% (continued) | | | |

| | | | | Sail Net Interest Margin Notes: | | | |

| 1,363 | | BBB | | Series 2003-3, Class A, 7.750% due 4/27/33 (f) | | $ | 1,366 |

| 17,698 | | BBB+ | | Series 2004-4A, Class A, 5.000% due 4/27/34 (f) | | | 17,728 |

|

| | | | | TOTAL ASSET-BACKED SECURITIES

(Cost — $852,566) | | | 671,469 |

|

| CORPORATE BONDS AND NOTES — 25.0% | | | |

Aerospace/Defense — 0.4% | | | |

| 25,000 | | B | | Alliant Techsystems Inc., Sr. Sub. Notes, 8.500% due 5/15/11 (b) | | | 26,688 |

| 25,000 | | BB- | | Sequa Corp., Sr. Notes, 9.000% due 8/1/09 (b) | | | 26,500 |

|

| | | | | | | | 53,188 |

|

Airlines — 0.2% | | | |

| 25,000 | | B+ | | Continental Airlines, Inc., Pass-Through Certificates, Series 98-3, Class C-2, 7.250% due 11/1/05 | | | 23,810 |

|

Automotive — 0.5% | | | |

| 50,000 | | BBB | | DaimerChrysler NA Holding Corp., Notes, 4.050% due 6/4/08 | | | 48,199 |

| 22,000 | | BB- | | TRW Automotive Inc., Sr. Notes, 9.375% due 2/15/13 | | | 22,880 |

|

| | | | | | | | 71,079 |

|

Business Services — 0.2% | | | |

| 22,000 | | Caa2* | | SITEL Corp., Sr. Sub. Notes, 9.250% due 3/15/06 | | | 22,110 |

|

Chemicals — 1.7% | | | |

| 2,727 | | NR | | Applied Extrusion Technologies, Inc., Sr. Notes, 12.000% due 3/15/12 (f) | | | 2,718 |

| 25,000 | | BB+ | | FMC Corp., Sr. Debentures, 7.750% due 7/1/11 (b) | | | 26,750 |

| 25,000 | | BB- | | Huntsman Advanced Materials LLC, Sr. Secured Second Lien Notes, 11.000% due 7/15/10 (b)(f) | | | 28,625 |

| 14,000 | | B | | Huntsman ICI Chemicals LLC, Sr. Sub. Notes, 10.125% due 7/1/09 | | | 14,595 |

| 25,000 | | BB- | | ISP Chemco Inc., Sr. Sub. Notes, Series B, 10.250% due 7/1/11 (b) | | | 27,187 |

| 25,000 | | BB- | | Lyondell Chemical Co., Sr. Secured Notes, 11.125% due 7/15/12 (b) | | | 28,688 |

| 25,000 | | BBB- | | Methanex Corp., Sr. Notes, 8.750% due 8/15/12 (b) | | | 29,125 |

| 25,000 | | BB- | | Millennium America Inc., Sr. Notes, 9.250% due 6/15/08 (b) | | | 26,750 |

| 25,000 | | CCC | | Resolution Performance Products LLC, Sr. Sub. Notes, 13.500% due 11/15/10 (b) | | | 27,188 |

| 25,000 | | CCC+ | | Rhodia S.A., Sr. Sub. Notes, 8.875% due 6/1/11 | | | 23,500 |

| 16,000 | | BB- | | Westlake Chemical Corp., Sr. Notes, 8.750% due 7/15/11 | | | 17,480 |

|

| | | | | | | | 252,606 |

|

See Notes to Financial Statements.

17 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SALOMON BROTHERS STRATEGIC TOTAL RETURN BOND PORTFOLIO

| | | | | | | |

FACE

AMOUNT† | | RATING(e) | | SECURITY | | VALUE |

Consumer Products & Services — 0.6% | | | |

| 1,000 | | CCC | | Applica Inc., Sr. Sub. Notes, 10.000% due 7/31/08 | | $ | 905 |

| 25,000 | | CCC+ | | Home Interiors & Gifts, Inc., Sr. Sub. Notes, 10.125% due 6/1/08 | | | 21,250 |

| 25,000 | | CCC- | | ICON Health & Fitness, Inc., Sr. Sub. Notes, 11.250% due 4/1/12 | | | 17,875 |

| 16,000 | | B- | | Jafra Cosmetics International, Inc./Distribuidora Comercial Jafra, S.A. de C.V., Sr. Sub. Notes, 10.750% due 5/15/11 | | | 18,080 |

| 20,000 | | B- | | Levi Strauss & Co., Sr. Notes, 12.250% due 12/15/12 | | | 21,300 |

| 16,000 | | B | | Tempur-Pedic, Inc./Tempur Production USA, Inc., Sr. Sub. Notes, 10.250% due 8/15/10 | | | 17,920 |

|

| | | | | | | | 97,330 |

|

Energy — 0.8% | | | |

| 50,000 | | BBB | | Devon Financing Corp., ULC, Notes, 6.875% due 9/30/11 (b) | | | 55,601 |

| 16,000 | | B+ | | Magnum Hunter Resources, Inc., Sr. Notes, 9.600% due 3/15/12 | | | 17,840 |

| 25,000 | | B+ | | Stone Energy Corp., Sr. Sub. Notes, 8.250% due 12/15/11 (b) | | | 25,750 |

| 25,000 | | B | | Vintage Petroleum, Inc., Sr. Sub. Notes, 7.875% due 5/15/11 (b) | | | 26,125 |

|

| | | | | | | | 125,316 |

|

Environmental Services — 0.3% | | | |

| 17,000 | | BB- | | Allied Waste North America, Inc., Sr. Notes, Series B, 9.250% due 9/1/12 | | | 18,020 |

| 25,000 | | B- | | IMCO Recycling Inc., Sr. Secured Notes, Series B, 10.375% due 10/15/10 (b) | | | 27,312 |

|

| | | | | | | | 45,332 |

|

Financial Services — 5.7% | | | |

| 85,000 | | A+ | | Bank of America Corp., Sub. Notes, 7.400% due 1/15/11 (b) | | | 96,811 |

| 16,000 | | B- | | BCP Caylux Holdings Luxembourg S.C.A., Sr. Sub. Notes, 9.625% due 6/15/14 (b) | | | 17,720 |

| 50,000 | | BBB | | Capital One Bank, Notes, 4.875% due 5/15/08 (b) | | | 50,451 |

| 75,000 | | A | | CIT Group Inc., Sr. Notes, 7.750% due 4/2/12 (b) | | | 87,575 |

| 75,000 | | A | | Countrywide Financial Corp., Medium-Term Notes, Series L, 4.000% due 3/22/11 (b) | | | 71,917 |

| 50,000 | | A- | | Encana Holdings Financial Corp., Notes, 5.800% due 5/1/14 (b) | | | 52,950 |

| 75,000 | | A | | HSBC Finance Corp., Notes, 5.250% due 4/15/15 (a) | | | 76,089 |

| 50,000 | | AA- | | International Lease Finance Corp., Medium-Term Notes, Series O, 4.375% due 11/1/09 (b) | | | 49,640 |

| 50,000 | | BBB- | | iStar Financial Inc., Sr. Notes, 5.150% due 3/1/12 (b) | | | 48,950 |

| 70,000 | | A | | JPMorgan Chase & Co., Sub. Notes, 6.625% due 3/15/12 (b) | | | 77,401 |

| 25,000 | | A | | Lehman Brothers Holdings Inc., Notes, 3.500% due 8/7/08 (b) | | | 24,527 |

| 55,000 | | BBB | | MBNA Corp., Sr. Medium-Term Notes, 4.625% due 9/15/08 (b) | | | 54,958 |

| 75,000 | | A+ | | Morgan Stanley, Notes, 6.600% due 4/1/12 (b) | | | 82,247 |

| 50,000 | | A- | | Standard Chartered Bank, Sub. Notes, 8.000% due 5/30/31 (b)(f) | | | 66,390 |

|

| | | | | | | | 857,626 |

|

Food & Beverage — 0.3% | | | |

| 40,000 | | BBB+ | | Kraft Foods Inc., Notes, 5.625% due 11/1/11 (b) | | | 42,014 |

|

See Notes to Financial Statements.

18 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SALOMON BROTHERS STRATEGIC TOTAL RETURN BOND PORTFOLIO

| | | | | | | |

FACE

AMOUNT† | | RATING(e) | | SECURITY | | VALUE |

Healthcare — 0.8% | | | |

| 25,000 | | D | | aaiPharma Inc., Sr. Sub. Notes, 11.500% due 4/1/10 (g)(h) | | $ | 9,125 |

| 25,000 | | B | | Extendicare Health Services, Inc., Sr. Notes, 9.500% due 7/1/10 (b) | | | 27,281 |

| 25,000 | | B | | Tenet Healthcare Corp., Sr. Notes, 9.875% due 7/1/14 (b) | | | 25,813 |

| 10,000 | | CCC+ | | Vanguard Health Holding Co. I, LLC, Sr. Discount Notes, zero coupon until 10/1/07, 11.250% thereafter, due 10/1/15 | | | 6,850 |

| 50,000 | | A | | Wyeth, Notes, 5.500% due 3/15/13 (b)(g) | | | 51,864 |

|

| | | | | | | | 120,933 |

|

Hotel/Casino — 0.7% | | | |

| 25,000 | | B+ | | Host Marriott, L.P., Sr. Notes, 7.125% due 11/1/13 (b) | | | 25,437 |

| 25,000 | | B | | John Q. Hammons Hotels L.P./John Q. Hammons Hotels Finance Corp. III, First Mortgage Notes, Series B, 8.875% due 5/15/12 (b) | | | 26,750 |

| 25,000 | | BB | | MGM Mirage Inc., Sr. Notes, 6.750% due 9/1/12 (b) | | | 25,125 |

| 25,000 | | B+ | | Turning Stone Casino Resort Enterprise, Sr. Notes, 9.125% due 12/15/10 (b)(f) | | | 25,750 |

|

| | | | | | | | 103,062 |

|

Machinery — 0.5% | | | |

| 25,000 | | BB- | | Case New Holland Inc., Sr. Notes, 9.250% due 8/1/11 (b)(f) | | | 25,625 |

| 25,000 | | B+ | | NMHG Holding Co., Sr. Notes, 10.000% due 5/15/09 (b) | | | 27,062 |

| 25,000 | | B | | Terex Corp., Sr. Sub. Notes, Series B, 10.375% due 4/1/11 (b) | | | 27,250 |

|

| | | | | | | | 79,937 |

|

Manufacturing — 0.2% | | | |

| 25,000 | | B- | | Medical Device Manufacturing Inc., Sr. Sub. Notes, 10.000% due 7/15/12 (b) | | | 26,875 |

|

Media — 2.1% | | | |

| | | | | Charter Communications Holdings, LLC/Charter Communications Holdings Capital Corp., Sr. Notes: | | | |

| 50,000 | | CCC- | | 10.250% due 1/15/10 (b) | | | 37,000 |

| 10,000 | | CCC- | | 10.000% due 5/15/11 | | | 7,050 |

| 50,000 | | BBB | | Comcast Cable Communications Holdings, Notes, 8.375% due 3/15/13 (b) | | | 60,791 |

| 25,000 | | B+ | | CSC Holdings, Inc., Sr. Sub. Debentures, 10.500% due 5/15/16 (b) | | | 27,437 |

| 25,000 | | BB- | | DIRECTV Holdings LLC/DIRECTV Financing Co., Inc., Sr. Notes, 8.375% due 3/15/13 (b) | | | 27,187 |

| 25,000 | | CCC+ | | Loews Cineplex Entertainment Corp., Sr. Sub. Notes, 9.000% due 8/1/14 (b)(f) | | | 24,125 |

| 25,000 | | B | | Mediacom LLC/Mediacom Capital Corp., Sr. Notes, 9.500% due 1/15/13 (b) | | | 24,062 |

| 25,000 | | CCC- | | Muzak LLC/Muzak Finance Corp., Sr. Notes, 10.000% due 2/15/09 (b) | | | 21,125 |

See Notes to Financial Statements.

19 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SALOMON BROTHERS STRATEGIC TOTAL RETURN BOND PORTFOLIO

| | | | | | | |

FACE

AMOUNT† | | RATING(e) | | SECURITY | | VALUE |

Media — 2.1% (continued) | | | |

| 25,000 | | B- | | Nextmedia Operating, Inc., Sr. Sub. Notes, 10.750% due 7/1/11 (b) | | $ | 27,031 |

| 50,000 | | BBB+ | | Time Warner Inc., Debentures, 7.625% due 4/15/31 (b) | | | 61,121 |

|

| | | | | | | | 316,929 |

|

Metals/Mining — 0.3% | | | |

| 25,000 | | B+ | | AK Steel Corp., Sr. Notes, 7.875% due 2/15/09 | | | 23,063 |

| 25,000 | | B- | | Mueller Group, Inc., Sr. Sub. Notes, 10.000% due 5/1/12 (b) | | | 27,000 |

| 200,000 | | NR | | Republic Technologies International, LLC/RTI Capital Corp., Sr. Secured Notes, 13.750% due 7/15/09 (h)(j)# | | | 0 |

|

| | | | | | | | 50,063 |

|

Packaging/Containers — 0.8% | | | |

| 25,000 | | B- | | Berry Plastics Corp., Sr. Sub. Notes, 10.750% due 7/15/12 (b) | | | 27,750 |

| 25,000 | | B | | Jefferson Smurfit Corp. (U.S.), Sr. Notes, 8.250% due 10/1/12 (b) | | | 24,625 |

| 25,000 | | B+ | | Plastipak Holdings, Inc., Sr. Notes, 10.750% due 9/1/11 (b) | | | 27,375 |

| 25,000 | | CCC+ | | Pliant Corp., Sr. Secured Notes, 11.125% due 9/1/09 (b) | | | 22,875 |

| 25,000 | | CCC- | | Radnor Holdings Corp., Sr. Notes, 11.000% due 3/15/10 (b) | | | 16,750 |

|

| | | | | | | | 119,375 |

|

Paper/Forestry Products — 0.5% | | | |

| 25,000 | | B | | Buckeye Technologies Inc., Sr. Sub. Notes, 8.000% due 10/15/10 (b) | | | 24,625 |

| 60,000 | | BBB- | | Domtar Inc., Notes, 5.375% due 12/1/13 (b) | | | 54,772 |

|

| | | | | | | | 79,397 |

|

Printing/Publishing — 0.5% | | | |

| 25,000 | | B+ | | Cenveo Corp., Sr. Notes, 9.625% due 3/15/12 (b) | | | 26,750 |

| 23,000 | | B | | Dex Media West LLC/Dex Media West Finance Co., Sr. Sub. Notes, Series B, 9.875% due 8/15/13 (b) | | | 25,645 |

| 25,000 | | B+ | | R.H. Donnelley Finance Corp I, Sr. Sub. Notes, 10.875% due 12/15/12 (b)(f) | | | 28,687 |

|

| | | | | | | | 81,082 |

|

Real Estate — 0.6% | | | |

| 65,000 | | BBB | | Boston Properties L.P., Sr. Notes, 6.250% due 1/15/13 (b) | | | 69,945 |

| 25,000 | | CCC+ | | MeriStar Hospitality Operating Partnership, L.P./MeriStar Hospitality Finance Corp. II, Sr. Notes, 10.500% due 6/15/09 (b) | | | 26,375 |

|

| | | | | | | | 96,320 |

|

Retail — 1.3% | | | |

| 25,000 | | B | | Jean Coutu Group (PJC) Inc., Sr. Sub. Notes,

8.500% due 8/1/14 (b) | | | 23,688 |

| 60,000 | | BBB | | Limited Brands, Inc., Exchange Debentures, 6.950% due 3/1/33 (b) | | | 61,912 |

| 25,000 | | B+ | | PETCO Animal Supplies, Inc., Sr. Sub. Notes, 10.750% due 11/1/11 (b) | | | 27,875 |

| 75,000 | | BBB | | Safeway Inc., Debentures, 7.250% due 2/1/31 (b) | | | 83,033 |

|

| | | | | | | | 196,508 |

|

See Notes to Financial Statements.

20 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SALOMON BROTHERS STRATEGIC TOTAL RETURN BOND PORTFOLIO

| | | | | | | |

FACE

AMOUNT† | | RATING(e) | | SECURITY | | VALUE |

Technology — 0.1% | | | |

| 25,000 | | CCC+ | | Amkor Technology, Inc., Sr. Sub. Notes, 10.500% due 5/1/09 (b) | | $ | 20,000 |

|

Telecommunications — 3.0% | | | |

| 7,000 | | CCC+ | | Alamosa (Delaware), Inc., Sr. Notes, 11.000% due 7/31/10 | | | 7,849 |

| 1,000 | | CCC | | American Tower Corp., Sr. Notes, 9.375% due 2/1/09 | | | 1,051 |

| 50,000 | | A | | AT&T Wireless Services, Inc., Sr. Notes, 8.750% due 3/1/31 (b) | | | 68,396 |

| 25,000 | | CCC | | Centennial Communications Corp./Centennial Cellular Operating Co. LLC/Centennial Puerto Rico Operations Corp., Sr. Notes, 8.125% due 2/1/14 (b) | | | 25,062 |

| 25,000 | | CCC+ | | Crown Castle International Corp., Sr. Notes, 10.750% due 8/1/11 (b) | | | 26,875 |

| 15,000 | | B+ | | Insight Midwest L.P./Insight Capital, Inc., Sr. Notes, 10.500% due 11/1/10 (b) | | | 16,050 |

| 10,000 | | B | | INTELSAT/Zeus Special, Sr. Discount Notes, zero coupon until 2/1/10, 9.250% thereafter, due 2/1/15 (f) | | | 6,100 |

| 25,000 | | BB+ | | L-3 Communications Corp., Sr. Sub. Notes, 7.625% due 6/15/12 (b) | | | 26,562 |

| 25,000 | | B | | Lucent Technologies Inc., Debentures, 6.450% due 3/15/29 | | | 21,219 |

| 25,000 | | BB | | Nextel Communications Inc., Sr. Notes, 6.875% due 10/31/13 (b) | | | 26,375 |

| 16,000 | | B+ | | PanAmSat Corp., Sr. Notes, 9.000% due 8/15/14 (b) | | | 16,720 |

| | | | | Qwest Services Corp., Notes: | | | |

| 25,000 | | B | | 14.000% due 12/15/10 (b)(f) | | | 28,250 |

| 25,000 | | B | | 14.500% due 12/15/14 (b)(f) | | | 29,125 |

| 25,000 | | B- | | SpectraSite, Inc., Sr. Notes, 8.250% due 5/15/10 (b) | | | 26,187 |

| 50,000 | | BBB- | | Sprint Capital Corp., Global Notes, 8.375% due 3/15/12 (b) | | | 59,289 |

| 70,000 | | A+ | | Verizon Florida Inc., Sr. Debentures, Series F, 6.125% due 1/15/13 (b) | | | 73,976 |

|

| | | | | | | | 459,086 |

|

Utilities — 2.9% | | | |

| 25,000 | | B- | | The AES Corp., Sr. Notes, 9.500% due 6/1/09 (a) | | | 27,250 |

| 9,000 | | BB- | | Allegheny Energy Supply Co., LLC, Secured Notes, 10.250% due 11/15/07 (f) | | | 9,945 |

| 50,000 | | BBB | | Appalachian Power Co., Bonds, Series H, 5.950% due 5/15/33 (b) | | | 52,285 |

| | | | | Calpine Corp.: | | | |

| 25,000 | | B | | Second Priority Sr. Secured Notes, 8.500% due 7/15/10 (b)(f) | | | 17,500 |

| 25,000 | | CCC+ | | Sr. Notes, 8.750% due 7/15/07 (b) | | | 14,125 |

| 50,000 | | BBB | | Duke Energy Corp., Sr. Notes, 4.200% due 10/1/08 (b) | | | 49,787 |

| 25,000 | | B- | | Dynegy Holdings Inc., Second Priority Sr. Secured Notes, 9.875% due 7/15/10 (b)(f) | | | 25,375 |

| 15,000 | | B+ | | Edison Mission Energy, Sr. Notes, 9.875% due 4/15/11 (b) | | | 17,025 |

| 50,000 | | CCC+ | | El Paso Corp., Global Medium-Term Notes, 7.375% due 12/15/12 (b) | | | 47,500 |

See Notes to Financial Statements.

21 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SALOMON BROTHERS STRATEGIC TOTAL RETURN BOND PORTFOLIO

| | | | | | | |

FACE

AMOUNT† | | RATING(e) | | SECURITY | | VALUE |

Utilities — 2.9% (continued) | | | |

| 75,000 | | BBB+ | | Entergy Gulf States Inc., First Mortgage Bonds, 6.200% due 7/1/33 (b) | | $ | 76,720 |

| 25,000 | | NR | | Mirant Americas Generation, Inc., Sr. Notes, 9.125% due 5/1/31 (b)(h) | | | 26,500 |

| 20,000 | | B | | NRG Energy, Inc., Second Priority Sr. Secured Notes, 8.000% due 12/15/13 (b)(f) | | | 20,300 |

| 25,000 | | B+ | | Reliant Energy, Inc., Sr. Secured Notes, 9.250% due 7/15/10 (b) | | | 25,687 |

| 25,000 | | B+ | | The Williams Cos., Inc., Notes, 7.625% due 7/15/19 (b) | | | 26,938 |

|

| | | | | | | | 436,937 |

|

| | | | | TOTAL CORPORATE BONDS AND NOTES

(Cost — $3,857,710) | | | 3,776,915 |

|

| | | |

| SHARES | | | | | | |

| COMMON STOCK (i) — 1.0% | | | |

Chemicals — 0.0% | | | |

| 259 | | | | Applied Extrusion Technologies, Inc., Class B Shares (j) | | | 6,030 |

|

Media — 0.1% | | | |

| 1,997 | | | | UnitedGlobalCom, Inc., Class A Shares (b) | | | 17,873 |

|

Telecommunications — 0.9% | | | |

| 653 | | | | NTL Inc. (b) | | | 41,779 |

| 1,050 | | | | SpectraSite, Inc. (b) | | | 58,937 |

| 1,719 | | | | Telewest Global, Inc. (b) | | | 31,870 |

|

| | | | | | | | 132,586 |

|

| | | | | TOTAL COMMON STOCK (Cost — $114,036) | | | 156,489 |

|

| CONVERTIBLE PREFERRED STOCK — 0.2% | | | |

Telecommunications — 0.2% | | | |

| 25 | | | | Alamosa Holdings, Inc., 7.500% Cumulative, Series B (b) (Cost —$7,125) | | | 24,372 |

|

| | | |

| WARRANTS | | | | | | |

| WARRANTS (i) — 0.0% | | | |

Consumer Products & Services — 0.0% | | | |

| 200 | | | | Brown Jordan International, Inc., Expire 8/15/07 (f)# | | | 2 |

| 1,701 | | | | Pillowtex Corp., Expire 11/24/09 (j)# | | | 2 |

|

| | | | | | | | 4 |

|

Telecommunications — 0.0% | | | |

| 15 | | | | American Tower Corp., Expire 8/1/08 (f) | | | 3,653 |

|

| | | | | TOTAL WARRANTS (Cost — $4,367) | | | 3,657 |

|

See Notes to Financial Statements.

22 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SALOMON BROTHERS STRATEGIC TOTAL RETURN BOND PORTFOLIO

| | | | | | | | |

FACE

AMOUNT† | | | RATING(e) | | SECURITY | | VALUE |

| FOREIGN BONDS — 21.7% | | | |

| Argentina — 0.4% | | | |

| 100,000 | | | D | | Republic of Argentina, Debt Conversion Bonds, Series L-GP, 6.000% due 3/31/23 (b)(g) | | $ | 58,220 |

|

| Brazil — 2.8% | | | |

| | | | | | Federal Republic of Brazil: | | | |

| 131,937 | | | BB- | | Capitalization Bonds, 8.000% due 4/15/14 (b) | | | 131,607 |

| 123,529 | | | BB- | | Debt Conversion Bonds, Series L, 4.313% due 4/15/12 (b)(g) | | | 115,770 |

| | | | | | Global Bonds: | | | |

| 25,000 | | | BB- | | 10.500% due 7/14/14 (b) | | | 28,219 |

| 25,000 | | | BB- | | 10.125% due 5/15/27 (b) | | | 27,044 |

| 75,000 | | | BB- | | 12.250% due 3/6/30 (b) | | | 92,887 |

| 25,000 | | | BB- | | 11.000% due 8/17/40 (b) | | | 28,325 |

|

| | | | | | | | | 423,852 |

|

| Bulgaria — 0.2% | | | |

| 25,000 | | | BBB- | | Republic of Bulgaria, Euro-Dollar Bonds, Series REG S, 8.250% due 1/15/15 (b) | | | 31,094 |

|

| Colombia — 0.5% | | | |

| | | | | | Republic of Colombia, Global Notes: | | | |

| 25,000 | | | BB | | 10.000% due 1/23/12 (b) | | | 27,425 |

| 25,000 | | | BB | | 8.125% due 5/21/24 (b) | | | 23,000 |

| 25,000 | | | BB | | 10.375% due 1/28/33 (b) | | | 27,062 |

|

| | | | | | | | | 77,487 |

|

| France — 2.0% | | | |

| 230,000 | EUR | | AAA | | Government of France, Treasury Notes, 3.000% due 1/12/10 (b) | | | 300,025 |

|

| Germany — 3.3% | | | |

| 340,000 | EUR | | AAA | | Federal Republic of Germany, Bonds, 5.250% due 1/4/11 (b) | | | 492,974 |

|

| Italy — 0.7% | | | |

| 100,000 | | | AA- | | Region of Lombardy, Global Notes, 5.804% due 10/25/32 (b) | | | 110,279 |

|

| Mexico — 2.3% | | | | | |

| | | | | | United Mexican States: | | | |

| 150,000 | | | BBB | | Global Notes, 6.625% due 3/3/15 (b) | | | 159,075 |

| | | | | | Medium-Term Notes, Series A: | | | |

| 25,000 | | | BBB | | 6.375% due 1/16/13 (b) | | | 26,125 |

| 125,000 | | | BBB | | 5.875% due 1/15/14 (b) | | | 126,344 |

| 25,000 | | | BBB | | 8.000% due 9/24/22 (b) | | | 29,100 |

|

| | | | | | | | | 340,644 |

|

| The Netherlands — 3.2% | | | |

| 340,000 | EUR | | AAA | | Kingdom of the Netherlands, Bonds, 5.000% due 7/15/11 (b) | | | 488,023 |

|

See Notes to Financial Statements.

23 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SALOMON BROTHERS STRATEGIC TOTAL RETURN BOND PORTFOLIO

| | | | | | | |

FACE

AMOUNT† | | RATING(e) | | SECURITY | | VALUE |

Panama — 0.3% | | | |

| | | | | Republic of Panama, Global Bonds: | | | |

| 25,000 | | BB | | 9.625% due 2/8/11 (b) | | $ | 29,500 |

| 10,000 | | BB | | 9.375% due 1/16/23 | | | 11,788 |

|

| | | | | | | | 41,288 |

|

Peru — 0.7% | | | |

| | | | | Republic of Peru: | | | |

| 50,000 | | BB | | Global Notes, 9.125% due 2/21/12 (b) | | | 57,500 |

| 21,250 | | BB- | | Past-Due Interest Bonds, 5.000% due 3/7/17 (g) | | | 20,294 |

| 24,750 | | BB- | | Restructured Debt, 5.000% due 3/7/17 (g) | | | 23,203 |

|

| | | | | | | | 100,997 |

|

The Philippines — 0.5% | | | |

| | | | | Republic of the Philippines: | | | |

| 25,000 | | BB- | | Global Bonds, 9.875% due 1/15/19 (b) | | | 26,266 |

| 50,000 | | BB- | | Global Notes, 8.375% due 3/12/09 (b) | | | 52,685 |

|

| | | | | | | | 78,951 |

|

Russia — 2.8% | | | |

| | | | | Russian Federation, Euro-Dollar Bonds: | | | |

| 50,000 | | BBB- | | 8.250% due 3/31/10 (b) | | | 54,875 |

| 100,000 | | BBB- | | 11.000% due 7/24/18 (b) | | | 143,500 |

| 205,400 | | BBB- | | 5.000% due 3/31/30 (b) | | | 218,751 |

|

| | | | | | | | 417,126 |

|

South Africa — 0.2% | | | |

| 25,000 | | BBB | | Republic of South Africa, Global Notes, 6.500% due 6/2/14 (b) | | | 27,125 |

|

Supranational — 0.7% | | | |

| 100,000 | | A | | Corporación Andinade Fomento, Notes, Series B, 6.875% due 3/15/12 (b) | | | 111,245 |

|

Turkey — 0.5% | | | | | |

| 75,000 | | BB- | | Republic of Turkey, Global Notes, 9.000% due 6/30/11 (b) | | | 81,750 |

|

Venezuela — 0.6% | | | |

| | | | | Republic of Venezuela, Global Notes: | | | |

| 25,000 | | B | | 8.500% due 10/8/14 (b) | | | 24,713 |

| 75,000 | | B | | 9.250% due 9/15/27 (b) | | | 73,988 |

|

| | | | | | | | 98,701 |

|

| | | | | TOTAL FOREIGN BONDS (Cost — $2,907,645) | | | 3,279,781 |

|

| | | | | SUB-TOTAL INVESTMENTS (Cost — $14,530,254) | | | 14,766,616 |

|

See Notes to Financial Statements.

24 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SALOMON BROTHERS STRATEGIC TOTAL RETURN BOND PORTFOLIO

| | | | | | | | |

FACE

AMOUNT† | | | | SECURITY | | VALUE | |

REPURCHASE AGREEMENTS (a) — 38.0% | | | | |

| 752,000 | | Interest in $1,326,764,000 joint tri-party repurchase agreement dated 4/29/05 with Bank of America, 2.960% due 5/2/05; Proceeds at maturity — $752,185; (Fully collateralized by various U.S. government agency obligations, 0.000% to 3.350% due 7/27/05 to 11/9/07; Market value — $767,040) | | $ | 752,000 | |

| 1,000,000 | | Interest in $629,394,000 joint tri-party repurchase agreement dated 4/29/05 with Deutsche Bank Securities, 2.960% due 5/2/05; Proceeds at maturity — $1,000,247; (Fully collateralized by various U.S. government agency obligations and U.S. Treasury Bills, 0.000% to 9.500% due 9/15/05 to 4/1/35; Market value — $1,020,795) | | | 1,000,000 | |

| 1,000,000 | | Interest in $398,063,000 joint tri-party repurchase agreement dated 4/29/05 with Goldman Sachs Group, 2.940% due 5/2/05; Proceeds at maturity — $1,000,245; (Fully collateralized by U.S. Treasury Obligations, 1.250% to 12.750% due 2/15/06 to 11/15/24; Market value — $1,020,002) | | | 1,000,000 | |

| 1,000,000 | | Interest in $59,758,000 joint tri-party repurchase agreement dated 4/29/05 with Merrill Lynch, 2.920% due 5/2/05; Proceeds at maturity — $1,000,243; (Fully collateralized by U.S. Treasury Notes, 3.125% due 1/31/07; Market value — $1,020,025) | | | 1,000,000 | |

| 1,000,000 | | Interest in $485,347,000 joint tri-party repurchase agreement dated 4/29/05 with Morgan Stanley, 2.950% due 5/2/05; Proceeds at maturity — $1,000,246; (Fully collateralized by various government agency obligations, 0.000% to 6.000% due 3/3/08 to 3/3/25; Market value — $1,027,423) | | | 1,000,000 | |

| 1,000,000 | | Interest in $850,128,000 joint tri-party repurchase agreement dated 4/29/05 with UBS Securities LLC, 2.950% due 5/2/05; Proceeds at maturity — $1,000,246; (Fully collateralized by various U.S. government agency obligations, 0.000% to 8.875% due 5/26/05 to 8/6/38; Market value — $1,020,004) | | | 1,000,000 | |

|

|

| | | TOTAL REPURCHASE AGREEMENTS

(Cost — $5,752,000) | | | 5,752,000 | |

|

|

| | | TOTAL INVESTMENTS — 135.6%

(Cost — $20,282,254**) | | | 20,518,616 | |

| | | Liabilities in Excess of Other Assets — (35.6)% | | | (5,394,325 | ) |

|

|

| | | TOTAL NET ASSETS — 100.0% | | $ | 15,124,291 | |

|

|

| (a) | | All or a portion of this security is held as collateral for open futures contracts. |

| (b) | | All or a portion of this security has been segregated for open futures contracts and/or “to-be-announced” securities. |

| (c) | | Security is issued on a “to-be-announced” basis. |

| (d) | | Security acquired under mortgage dollar roll agreement. |

| (e) | | All ratings are by Standard & Poor’s Ratings Services, except for those identified by an asterisk (*), which are rated by Moody’s Investors Service. |

See Notes to Financial Statements.

25 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

| (f) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. These securities have been deemed liquid pursuant to guidelines approved by the Board of Directors. |

| (g) | | Variable-rate security. Rate shown is rate in effect on April 30, 2005. |

| (h) | | Security is currently in default. |

| (i) | | Non-income producing security. |

| (j) | | Security is valued in good faith at fair value by or under the direction of the Board of Directors. |

| † | | Face amount denominated in U.S. dollars unless noted otherwise. |

| ** | | Aggregate cost for federal income tax purposes is substantially the same. |

| # | | This security has been deemed illiquid. |

| | | | |

Abbreviations used in this schedule:

|

| | | | |

| EUR | | — | | Euro |

| SEK | | — | | Swedish Krona |

See Notes to Financial Statements.

26 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SB ADJUSTABLE RATE INCOME PORTFOLIO

| | | | | | | |

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE |

| ADJUSTABLE-RATE SECURITIES — 90.7% | | | |

| ASSET-BACKED SECURITIES — 21.8% | | | |

| $ 250,000 | | AAA | | Advanta Business Card Master Trust, Series 2003-B, Class A, 3.340% due 12/22/08 | | $ | 250,547 |

| 208,837 | | AAA | | Ameriquest Mortgage Securities Inc., Series 2004-R8, Class A5, 3.390% due 9/25/34 | | | 209,517 |

| 54,857 | | AAA | | Amortizing Residential Collateral Trust, Series 2002-BC10, Class A3, 3.450% due 1/25/33 | | | 54,926 |

| 253,893 | | AAA | | Argent Securities Inc., Series 2004-W10, Class A2, 3.410% due 10/25/34 | | | 254,590 |

| | | | | Asset Backed Securities Corp., Home Equity Loan Trust: | | | |

| 283,845 | | AAA | | Series 2001-HE3, Class A1, 3.224% due 11/15/31 | | | 284,141 |

| 69,441 | | AAA | | Series 2003-HE3, Class A2, 3.304% due 6/15/33 | | | 69,501 |

| | | | | Bayview Financial Acquisition Trust: | | | |

| 150,000 | | AAA | | Series 2001-CA, Class A1, 3.390% due 8/25/36 (b) | | | 150,118 |

| 159,164 | | AAA | | Series 2002-DA, Class A, 3.450% due 8/25/32 (b) | | | 159,470 |

| 60,671 | | AAA | | Series 2003-E, Class A, 3.560% due 10/28/34 | | | 60,895 |

| 130,000 | | AAA | | Series 2003-G, Class A1, 3.660% due 1/28/39 | | | 130,284 |

| 214,589 | | AAA | | Bear Stearns Asset Backed Securities I Trust, Series 2004-B01, Class 2A2, 3.420% due 9/25/34 | | | 214,994 |

| | | | | Bear Stearns Asset Backed Securities Trust: | | | |

| 139,031 | | AAA | | Series 2003-1, Class A1, 3.520% due 11/25/42 | | | 139,706 |

| 91,233 | | AAA | | Series 2003-SD1, Class A, 3.470% due 12/25/33 | | | 91,560 |

| 109,751 | | AAA | | Series 2003-SD3, Class A, 3.500% due 12/25/42 | | | 110,003 |

| | | | | Business Loan Express: | | | |

| 131,654 | | Aaa* | | Series 2001-1A, Class A, 3.640% due 7/20/27 (b) | | | 132,587 |

| 163,771 | | AAA | | Series 2002-AA, Class A, 3.670% due 6/25/28 (b) | | | 165,036 |

| 118,142 | | AAA | | Series 2003-2A, Class A, 3.820% due 1/25/32 (b) | | | 119,523 |

| 217,811 | | AAA | | Series 2003-AA, Class A, 3.904% due 5/15/29 (b) | | | 221,650 |

| 375,000 | | AAA | | Capital One Master Trust, Series 2001-1, Class A, 3.154% due 12/15/10 | | | 376,966 |

| 247,113 | | AAA | | CDC Mortgage Capital Trust, Series 2002-HE1, Class A, 3.330% due 1/25/33 | | | 247,751 |

| 210,371 | | AAA | | Cendant Mortgage Corp., Series 2003-A, Class A3, 3.570% due 7/25/43 (b) | | | 211,287 |

| 225,000 | | AAA | | Circuit City Credit Card Master Trust, Series 2003-2, Class A, 3.384% due 4/15/11 | | | 225,761 |

| 250,000 | | AAA | | Countrywide Asset-Backed Certificates, Series 2004-6, Class 2A4, 3.470% due 11/25/34 | | | 251,374 |

| 248,000 | | AA+ | | CS First Boston Mortgage Securities Corp., Series 2001-HE16, Class M1, 3.670% due 11/25/31 | | | 249,289 |

| 180,108 | | AAA | | First Franklin Mortgage Loan Trust, Series 2002-FF3, Class A2, 3.480% due 8/25/32 | | | 180,475 |

| 156,871 | | AAA | | Fremont Home Loan Trust, Series 2003-A, Class 2A2, 3.375% due 8/25/33 | | | 157,305 |

See Notes to Financial Statements.

27 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SB ADJUSTABLE RATE INCOME PORTFOLIO

| | | | | | | |

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE |

| ASSET-BACKED SECURITIES — 21.8% (continued) | | | |

| $ 250,000 | | AAA | | GMAC Mortgage Corporation Loan Trust, Series 2004-HE2, Class A2, 2.880% due 10/25/33 | | $ | 246,847 |

| 100,189 | | AAA | | Household Home Equity Loan Trust, Series 2002-4, Class A, 3.540% due 10/20/32 | | | 100,413 |

| 344,713 | | AAA | | Morgan Stanley ABS Capital I Inc. Trust, Series 2003-HE1, Class A4, 3.520% due 5/25/33 | | | 345,965 |

| 450,000 | | AA | | New Century Home Equity Loan Trust, Series 2004-2, Class M2, 3.640% due 8/25/34 (c) | | | 452,685 |

| 64,315 | | AAA | | Option One Mortgage Loan Trust, Series 2003-1, Class A2, 3.440% due 2/25/33 | | | 64,552 |

| 278,162 | | AAA | | Renaissance Home Equity Loan Trust, Series 2003-3, Class A, 3.520% due 12/25/33 | | | 279,658 |

| 31,288 | | AAA | | Saxon Asset Securities Trust, Series 2002-1, Class AV1, 3.270% due 3/25/32 | | | 31,357 |

| 173,321 | | AAA | | Securitized Asset Backed Receivables LLC Trust, Series 2004-OP1, Class A2, 3.270% due 2/25/34 | | | 173,422 |

| 87,995 | | AAA | | Soundview Home Equity Loan Trust, Series 2003-1, Class A, 3.470% due 8/25/31 | | | 88,270 |

| 58,932 | | Aaa* | | Specialty Underwriting & Residential Finance Trust, Series 2003-BC1, Class A, 3.360% due 1/25/34 | | | 59,016 |

| | | | | Structured Asset Investment Loan Trust: | | | |

| 120,112 | | AAA | | Series 2003-BC1, Class A2, 3.360% due 1/25/33 | | | 120,435 |

| 450,000 | | AAA | | Series 2003-BC10, Class 3A5, 3.500% due 10/25/33 (c) | | | 451,197 |

| 200,000 | | AAA | | World Financial Network Credit Card Master Note Trust, Series 2003-A, Class A2, 3.324% due 5/15/12 | | | 201,183 |

|

| | | | | TOTAL ASSET-BACKED SECURITIES (Cost — $7,321,281) | | | 7,334,256 |

|

| COLLATERALIZED MORTGAGE OBLIGATIONS — 29.1% | | | |

| 270,182 | | AAA | | Banc of America Mortgage Securities, Inc., Series 2003-F, Class 1A1, 2.969% due 7/25/33 | | | 267,633 |

| 349,347 | | AAA | | Bear Stearns ARM, Series 2004-12, Class 1A1, 4.267% due 2/25/35 | | | 349,019 |

| 231,769 | | AAA | | Bear Stearns Asset Backed Securities Trust, Series 2003-AC5, Class A3, 3.620% due 10/25/33 | | | 231,903 |

| | | | | CHL Mortgage Pass-Through Trust: | | | |

| 311,809 | | AAA | | Series 2001-HYB1, Class 1A1, 4.093% due 6/19/31 | | | 314,566 |

| 147,699 | | AAA | | Series 2002-26, Class A4, 3.520% due 12/25/17 | | | 148,133 |

| 160,012 | | AAA | | Series 2003-HYB3, Class 7A1, 3.810% due 11/19/33 | | | 156,561 |

| 21,619 | | AAA | | Credit-Based Asset Servicing and Securitization LLC, Series 2002-CB6, Class 2A1, 3.520% due 1/25/33 | | | 21,641 |

| 465,723 | | AAA | | Deutsche Mortgage Securities, Inc. Mortgage Loan Trust, Series 2004-4, Class 7AR2, 3.470% due 6/25/34 (c) | | | 467,108 |

| 115,306 | | AAA | | GGP Mall Properties Trust, Series 2001-C1A, Class A3, 3.654% due 2/15/14 (b) | | | 115,831 |

| 451,648 | | AAA | | GMAC Commercial Mortgage Asset Corp., Series 2003-SNFA, Class A, 3.770% due 1/17/18 (b)(c) | | | 452,677 |

See Notes to Financial Statements.

28 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SB ADJUSTABLE RATE INCOME PORTFOLIO

| | | | | | | |

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE |

| COLLATERALIZED MORTGAGE OBLIGATIONS — 29.1% (continued) | | | |

| $ 359,506 | | AA+ | | Impac CMB Trust, Series 2003-8, Class 1A2, 3.520% due 10/25/33 | | $ | 360,048 |

| 167,791 | | AAA | | Impac Secured Assets Corp., Series 2004-3, Class 1A4, 3.420% due 11/25/34 | | | 168,831 |

| 6,349 | | AAA | | Long Beach Mortgage Loan Trust, Series 2002-2, Class 2A, 3.300% due 7/25/32 | | | 6,354 |

| 415,161 | | AAA | | MASTR Alternative Loan Trust, Series 2003-7, Class 7A1, 3.420% due 11/25/33 (c) | | | 415,484 |

| 291,899 | | AAA | | Merrill Lynch Mortgage Investors Trust, Series 2005-A2, Class A4, 4.507% due 2/25/35 | | | 291,671 |

| 190,256 | | AAA | | Morgan Stanley Mortgage Loan Trust, Series 2004-5AR, Class 1A2, 3.136% due 7/25/34 | | | 189,661 |

| | | | | Residential Asset Securitization Trust: | | | |

| 175,891 | | AAA | | Series 2003-A11, Class A2, 3.470% due 11/25/33 | | | 175,889 |

| 388,640 | | AAA | | Series 2004-A2, Class 1A3, 3.420% due 5/25/34 | | | 389,742 |

| 77,139 | | AAA | | Series 2004-A4, Class A2, 3.370% due 8/25/34 | | | 77,133 |

| 141,148 | | AAA | | Residential Funding Mortgage Securities I Trust, Series 2003-S10, Class A2, 3.420% due 6/25/33 | | | 141,220 |

| | | | | Sequoia Mortgage Trust: | | | |

| 83,545 | | AAA | | Series 9, Class 2A, 4.230% due 9/20/32 | | | 85,556 |

| 220,980 | | AAA | | Series 2003-2, Class A1, 3.320% due 6/20/33 | | | 221,159 |

| | | | | Structured ARM Loan Trust: | | | |

| 296,525 | | AAA | | Series 2004-1, Class 1A, 4.832% due 2/25/34 | | | 302,613 |

| 94,534 | | AAA | | Series 2004-1, Class 2A, 3.330% due 2/25/34 | | | 94,622 |

| 130,627 | | AAA | | Series 2004-7, Class A1, 3.290% due 6/25/34 | | | 130,691 |

| 166,565 | | Aaa* | | Series 2004-17, Class A1, 3.601% due 11/25/34 | | | 166,760 |

| 150,000 | | AAA | | Series 2005-3XS, Class A2, 3.270% due 1/25/35 | | | 150,205 |

| | | | | Structured Asset Mortgage Investments Inc.: | | | |

| 74,956 | | AAA | | Series 2002-AR1, Class 1A, 4.599% due 3/25/32 | | | 75,391 |

| 106,118 | | AAA | | Series 2002-AR1, Class 2A, 4.042% due 3/25/32 | | | 107,114 |

| 424,246 | | AAA | | Series 2003-AR2, Class A1, 3.350% due 12/19/33 (c) | | | 426,100 |

| | | | | Structured Asset Securities Corp.: | | | |

| 129,457 | | AA‡ | | Series 1998-3, Class M1, 4.020% due 3/25/28 | | | 129,612 |

| 145,056 | | AA | | Series 1998-8, Class M1, 3.960% due 8/25/28 | | | 145,224 |

| 286,777 | | AAA | | Series 2002-8A, Class 7A1, 4.241% due 5/25/32 | | | 290,329 |

| 131,372 | | AAA | | Series 2002-16A, Class 1A1, 4.762% due 8/25/32 | | | 133,671 |

| 113,472 | | AAA | | Series 2002-18A, Class 4A, 4.820% due 9/25/32 | | | 117,135 |

| 51,333 | | AAA | | Series 2003-8, Class 2A9, 3.520% due 4/25/33 | | | 51,353 |

| 18,949 | | AAA | | Series 2003-NP3, Class A1, 3.520% due 11/25/33 (b) | | | 18,972 |

| 306,988 | | AAA | | Series 2004-NP1, Class A, 3.420% due 9/25/33 (b) | | | 307,370 |

| | | | | Thornburg Mortgage Securities Trust: | | | |

| 310,369 | | AAA | | Series 2004-1, Class I2A, 3.470% due 3/25/44 | | | 311,306 |

| 240,830 | | AAA | | Series 2004-3, Class A, 3.390% due 9/25/34 | | | 241,600 |

| | | | | Washington Mutual Mortgage Pass-Through Certificates: | | | |

| 210,632 | | AAA | | Series 2002-AR1, Class 1A1, 4.626% due 11/25/30 | | | 210,841 |

| 127,779 | | AAA | | Series 2003-AR10, Class A3B, 3.890% due 10/25/33 | | | 127,548 |

See Notes to Financial Statements.

29 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SB ADJUSTABLE RATE INCOME PORTFOLIO

| | | | | | | |

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE |

| COLLATERALIZED MORTGAGE OBLIGATIONS — 29.1% (continued) | | | |

| $ 279,085 | | AAA | | Series 2003-S6, Class 2A8, 3.420% due 7/25/18 | | $ | 279,398 |

| 168,006 | | AAA | | Series 2004-AR2, Class A, 3.571% due 4/25/44 | | | 169,838 |

| | | | | Wells Fargo Mortgage Backed Securities Trust: | | | |

| 143,120 | | Aaa* | | Series 2003-5, Class A4, 3.420% due 5/25/33 | | | 143,282 |

| 200,000 | | AAA | | Series 2004-N, Class A2, 3.599% due 8/25/34 | | | 199,465 |

| 168,144 | | AAA | | Series 2004-S, Class A2, 3.541% due 9/25/34 | | | 167,873 |

| 277,394 | | AAA | | Series 2004-Y, Class 1A1, 4.578% due 11/25/34 | | | 275,932 |

|

| | | | | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost — $9,831,417) | | | 9,822,065 |

|

| U.S. GOVERNMENT AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS — 9.4% |

| | | | | Fannie Mae Grantor Trust: | | | |

| 461,554 | | | | Series 2001-T1, Class A2, 4.562% due 10/25/40 (c) | | | 472,256 |

| 273,769 | | | | Series 2002-T18, Class A5, 4.422% due 5/25/42 | | | 280,475 |

| 211,398 | | | | Series 2002-T19, Class A4, 4.409% due 3/25/42 | | | 216,016 |

| 271,881 | | | | Series 2004-T2, Class 2A, 4.297% due 7/25/43 | | | 277,299 |

| | | | | Fannie Mae REMIC Trust: | | | |

| 316,237 | | | | Series 1997-20, Class F, 2.629% due 3/25/27 | | | 314,083 |

| | | | | Series 2003-117: | | | |

| 137,116 | | | | Class DF, 3.570% due 12/25/33 | | | 137,173 |

| 381,121 | | | | Class KF, 3.420% due 8/25/33 | | | 382,662 |

| 77,545 | | | | Series 2003-124, Class F, 3.320% due 1/25/34 | | | 77,789 |

| 437,538 | | | | Series 2004-31, Class FG, 3.420% due 8/25/33 (c) | | | 439,044 |

| | | | | Fannie Mae Whole Loan: | | | |

| 122,383 | | | | Series 2003-W6, Class F, 3.370% due 9/25/42 | | | 123,041 |

| 156,191 | | | | Series 2003-W14, Class 2A, 4.309% due 1/25/43 | | | 159,965 |

| 268,258 | | | | Series 2003-W15, Class 3A, 4.306% due 12/25/42 | | | 274,186 |

|

| | | | | TOTAL U.S. GOVERNMENT AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS (Cost — $3,155,001) | | | 3,153,989 |

|

| U.S. GOVERNMENT AGENCY PASS-THROUGHS — 30.4% | | | |

Federal Home Loan Mortgage Corporation (FHLMC) — 4.7% | | | |

| | | | | FHLMC One Year CMT ARM: | | | |

| 227,931 | | | | 4.061% due 2/1/23 | | | 233,684 |

| 185,656 | | | | 4.056% due 4/1/26 | | | 190,821 |

| 120,172 | | | | 4.162% due 8/1/30 | | | 123,898 |

| | | | | FHLMC 3/1 Hybrid ARM: | | | |

| 263,055 | | | | 4.205% due 7/1/29 | | | 270,206 |

| 172,806 | | | | 3.377% due 10/1/33 | | | 174,039 |

| 591,668 | | | | FHLMC 5/1 Hybrid ARM, 4.075% due 5/1/33 (c) | | | 591,043 |

|

| | | | | | | | 1,583,691 |

|

Federal National Mortgage Association (FNMA) — 22.2% | | | |

| | | | | FNMA Six Month LIBOR: | | | |

| 119,214 | | | | 4.886% due 2/1/33 | | | 121,057 |

| 298,257 | | | | 4.303% due 4/1/33 | | | 300,189 |

See Notes to Financial Statements.

30 Travelers Series Fund Inc. | 2005 Semi-Annual Report

| | |

| Schedules of Investments (unaudited) (continued) | | April 30, 2005 |

SB ADJUSTABLE RATE INCOME PORTFOLIO

| | | | | | | |

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE |

Federal National Mortgage Association (FNMA) — 22.2% (continued) | | | |

| $ 136,772 | | | | 4.617% due 4/1/33 | | $ | 138,301 |

| 334,027 | | | | 4.917% due 4/1/33 | | | 341,646 |

| 151,955 | | | | 4.562% due 5/1/33 | | | 153,694 |

| 55,994 | | | | 4.440% due 6/1/33 | | | 56,496 |

| 423,566 | | | | 4.002% due 8/1/34 | | | 420,382 |

| 292,024 | | | | 4.513% due 10/1/34 | | | 292,427 |

| 446,370 | | | | 4.780% due 10/1/34 | | | 451,886 |

| | | | | FNMA One Year LIBOR: | | | |

| 128,338 | | | | 4.068% due 1/1/33 | | | 129,090 |

| 220,851 | | | | 4.220% due 6/1/33 | | | 221,315 |

| 313,946 | | | | 4.060% due 7/1/33 | | | 313,608 |

| 161,557 | | | | 4.159% due 10/1/33 | | | 161,801 |

| 500,000 | | | | 4.316% due 3/1/35 | | | 498,437 |

| 187,297 | | | | 3.424% due 7/1/43 | | | 188,522 |

| | | | | FNMA One Year CMT ARM: | | | |

| 521,200 | | | | 3.752% due 8/1/15 | | | 519,918 |

| 353,626 | | | | 4.035% due 4/1/20 | | | 353,524 |

| 362,696 | | | | 4.205% due 11/1/25 | | | 369,330 |

| 470,874 | | | | 4.367% due 1/1/26 | | | 483,022 |

| 201,102 | | | | 4.240% due 7/1/26 | | | 204,845 |

| 292,281 | | | | 4.059% due 5/1/28 | | | 295,886 |

| 240,839 | | | | 4.404% due 5/1/28 | | | 246,594 |

| 158,101 | | | | 4.475% due 5/1/28 | | | 162,869 |

| 160,847 | | | | 4.741% due 9/1/32 | | | 163,325 |

| 149,069 | | | | 3.844% due 1/1/33 | | | 151,540 |

| 145,598 | | | | 4.287% due 2/1/33 | | | 146,917 |

| 144,713 | | | | 4.066% due 5/1/33 | | | 144,039 |

| 296,991 | | | | 4.204% due 7/1/33 | | | 295,454 |

| 167,355 | | | | 3.140% due 8/1/33 | | | 166,251 |

|

| | | | | | | | 7,492,365 |

|

Government National Mortgage Association (GNMA) — 3.5% |

| | | | | GNMA II One Year CMT ARM: | | | |

| 150,144 | | | | 3.375% due 5/20/26 | | | 152,028 |

| 146,899 | | | | 3.375% due 5/20/32 | | | 148,836 |

| 88,860 | | | | 3.500% due 7/20/34 | | | 86,836 |

| 490,527 | | | | 4.000% due 1/20/35 | | | 495,510 |

| 297,244 | | | | 4.000% due 2/20/35 | | | 293,094 |

|

| | | | | | | | 1,176,304 |

|

| | | | | TOTAL U.S. GOVERNMENT AGENCY

PASS-THROUGHS (Cost — $10,311,808) | | | 10,252,360 |

|