UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

July 25, 2006

(Date of earliest event reported)

LABORATORY CORPORATION OF

AMERICA HOLDINGS

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

| DELAWARE | | 1-11353 | | 13-3757370 |

| |

| |

|

(State or other jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | |

358 SOUTH MAIN STREET,

BURLINGTON, NORTH CAROLINA | | 27215 | | 336-229-1127 |

| |

| |

|

| (Address of principal executive offices) | | (Zip Code)

| | (Registrant's telephone number including area code) |

ITEM 7.01. Regulation FD Disclosure

Summary information of the Company dated July 25, 2006.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | Laboratory Corporation of America Holdings

(Registrant)

| |

| Date: July 25, 2006 | By: | /s/Bradford T. Smith | |

| | | Bradford T. Smith, Executive Vice President

and Secretary | |

| | | | |

| |

8-K Filed July 25, 2006

This slide presentation contains forward-looking

statements which are subject to change based on

various important factors, including without

limitation, competitive actions in the marketplace and

adverse actions of governmental and other third-party

payors. Actual results could differ materially from

those suggested by these forward-looking statements.

Further information on potential factors that could

affect the Company’s financial results is included in

the Company’s Form 10-K for the year ended

December 31, 2005, and subsequent filings.

2

The Clinical Laboratory Testing

Market - $40 billion Annually

Independent clinical lab share

is $16 billion

Represents 2% to 3% of all

health care spending

Influences /directs

approximately 80% of health

care spending

Rapidly evolving technology,

emphasis on preventative

medicine and aging of

population are all driving

growth

Has grown at a CAGR of

between 5% and 6%

Source: Company estimates, industry reports and 2005 revenue for LabCorp.

3

Profile of LabCorp

A leader in the esoteric and genomic testing

market and second-largest clinical laboratory

company in North America

Offers a broad range of routine and

esoteric/genomic tests

Conducts approximately 1.1 million tests daily on

more than 370,000 specimens

Provides lab services to physicians and other

health care providers

Approximately 24,000 employees nationwide

4

Primary Testing Locations

Primary LabCorp Testing Locations

Corporate Headquarters

Burlington, NC

5

LabCorp’s Strategy

To lead the industry in achieving long-

term growth and profitability by

strengthening our nationwide core

testing business and expanding our

higher-growth, higher-value esoteric and

genomic businesses.

6

Strategic Focus Areas

Scientific

Leadership

Managed

Care

Customer

Retention

-Licensing/partnerships

-Cancer

-Specimen tracking

-Call center consolidation

-Report improvement

-Acquisitions

-Appropriate prices

-Reduce leakage

-Value of new lab tests

-Customer connectivity

7

LabCorp’s Investment and

Performance Fundamentals

History of Strong Financial

Performance

Significant Cash Generator

Industry leading EBITDA margins

Strong Balance Sheet

Investment Grade Credit Ratings

8

Net Sales (in millions)

9

EBITDA Margin

(1) Excluding the impact in 2005 of restructuring and other special charges, and a non-recurring investment loss.

(1)

10

EPS

(1) Excluding the $0.09 per diluted share impact in 2005 of restructuring and other special charges, and a non-recurring investment loss.

(1)

11

Operating Cash Flow (in millions)

(1) Includes approximately $50 million of benefit from one-time tax credits recorded in 2003.

(1)

12

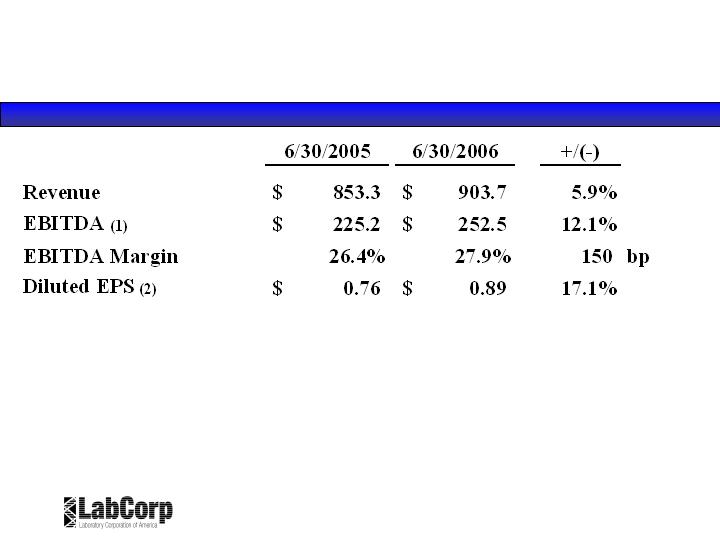

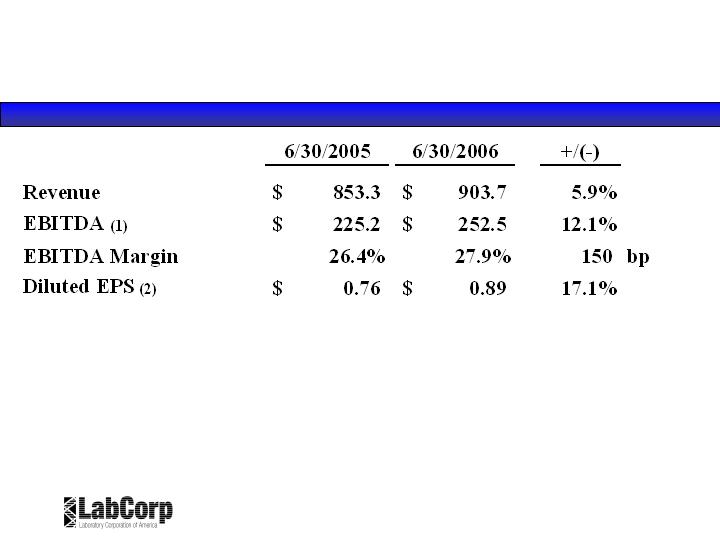

Second Quarter Results (in millions, except per share data)

(1) Excludes a $3.1 million non-recurring investment loss recorded by the Company in the second quarter of 2005, and $5.4 million of

stock compensation expense recorded by the Company for the three months ended June 30, 2006 from the adoption of SFAS 123(R).

(2) Excluding the $0.02 per diluted share impact of the non-recurring investment loss in 2005, and the $0.02 per diluted share impact of

the required change in accounting for stock based compensation adopted in 2006.

13

Six-Month Results (in millions, except per share data)

(1) Excludes a $3.1 million non-recurring investment loss recorded by the Company in the second quarter of 2005, and $11.3 million of

stock compensation expense recorded by the Company for the three months ended June 30, 2006 from the adoption of SFAS 123(R).

(2) Excluding the $0.02 per diluted share impact of the non-recurring investment loss in 2005, and the $0.05 per diluted share impact of

the required change in accounting for stock based compensation adopted in 2006.

14

2006 Six-Month Financial

Achievements

Diluted EPS of $1.67 (1)

EBITDA margin of 27.1% of sales (2)

Operating cash flow of $301.1 million

Increased revenues 7.9% (3.2% volume; 4.7% price)

Repurchased approximately $185 million of

LabCorp stock

(1)

Excluding the $0.05 per diluted share impact of the required change in accounting for stock based compensation.

(2)

Based on EBITDA of $482.2 million, excluding $11.3 million impact of change in accounting for stock based

compensation.

15

Financial Performance

Price & Volumes: Trends by Payer Type

16

Financial Performance

Revenue Analysis by Business Area

% Accns

Accns

17

Free Cash Flow Investment Strategy

Acquisitions

Stock repurchase program

Retain flexibility in utilizing remaining

cash

18

2006 Financial Guidance

Excluding the impact of the required change in accounting for stock based

compensation, any share repurchase activity after June 30, 2006, and any

accounting impact related to the previously announced retirement of the Chief

Executive Officer of the Company, guidance for 2006 is as follows:

Revenue growth of approximately 6.5% to 7.2% compared to 2005.

EBITDA margins of 26.5 to 27.0% of revenues.

Diluted EPS in the range of $3.28 to $3.33.

Operating cash flow of between $610 and $630 million.

Capital expenditures of between $95 and $110 million.

Net interest expense of between $43 and $45 million.

Bad debt rate of approximately 4.8% of sales for the remainder of the year.

We estimate that the implementation of the required change in accounting for

stock based compensation will have an EBITDA impact of approximately $22

million to $23 million and a diluted EPS impact of approximately $0.10.

19

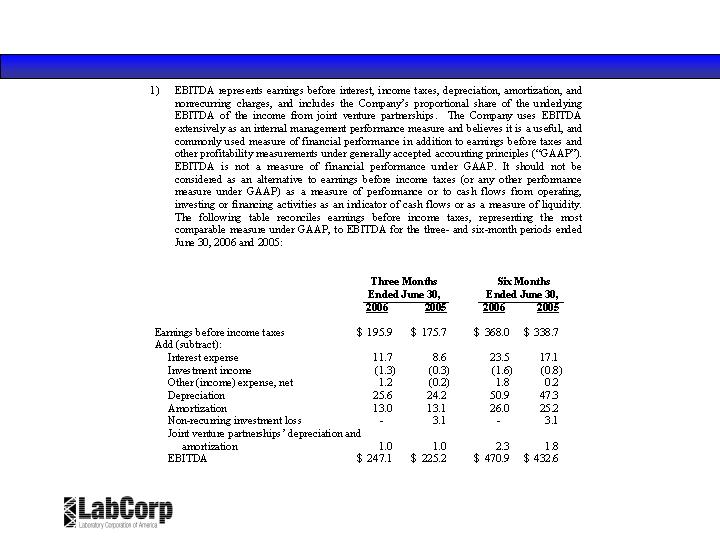

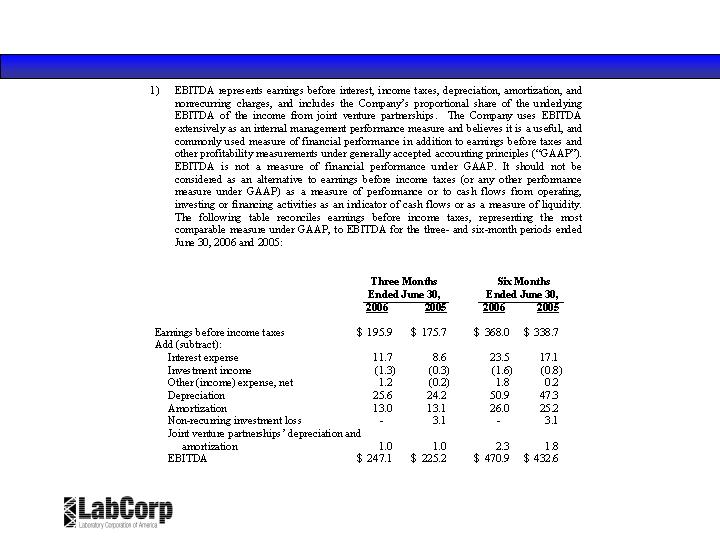

Reconciliation of Non-GAAP Financial Measures ($ in millions)

20

Supplemental Financial Information

21