UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

Commission file number 1-12551

CENVEO, INC.

(Exact name of Registrant as specified in its charter.)

| COLORADO | 84-1250533 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

ONE CANTERBURY GREEN 201 BROAD STREET | ||

| STAMFORD, CT | 06901 | |

| (Address of principal executive offices) | (Zip Code) | |

| 203-595-3000 | ||

| (Registrant’s telephone number, including area code) | ||

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.01 per share | New York Stock Exchange | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. Large accelerated filer o Accelerated filer ý Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of July 1, 2011, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $341,942,935 based on the closing sale price as reported on the New York Stock Exchange.

As of February 24, 2012, the registrant had 63,429,769 shares of common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part II (Item 5) and Part III of this form (Items 11, 12, 13 and 14, and part of Item 10) is incorporated by reference from the Registrant’s Proxy Statement to be filed pursuant to Regulation 14A with respect to the Registrant’s Annual Meeting of Shareholders to be held on or about May 2, 2012.

TABLE OF CONTENTS

| PAGE | ||

PART I

Item 1. Business

Overview

We are one of the largest diversified printing companies in North America, according to the December 2011 Printing Impressions 400 report. Our broad portfolio of products includes commercial printing, envelope production, labels manufacturing, packaging and publisher offerings. We operate a global network of strategically located printing and manufacturing, fulfillment and distribution facilities, which we refer to as manufacturing facilities, serving a diverse base of over 100,000 customers. We are the successor to Mail-Well, Inc. and were re-incorporated in Colorado in 1997.

Our business strategy has been and continues to be focused on pursuing strategic acquisitions, improving our cost structure and providing a diverse quality product offering portfolio to our customers. We believe this strategy has allowed us to diversify our revenue base, maintain our low cost producer focus and deliver quality product offerings to our customers. Through our execution of this strategy over the past six years, we have made investments in our businesses through fourteen acquisitions of companies that were either highly complementary to our existing operations or provided entry into new niche print related markets. These acquisitions along with our cost savings and restructuring plans have allowed us to mitigate significant capital expenditures by realigning our most efficient equipment throughout our manufacturing platform. Ultimately, we believe this strategy will provide value to our shareholders.

We operate our business in two complementary segments: envelopes and labels and commercial printing.

Envelopes and Labels

Our envelopes and labels segment operates 31 manufacturing facilities in North America. In February 2011, we added to our envelopes and labels business with the acquisition of MeadWestvaco’s Envelope Product Group, which we refer to as EPG. In 2009, we added to our envelopes and labels business with the acquisition of Nashua Corporation, which we refer to as Nashua. Envelopes and labels had net sales of $1,059.2 million, $860.7 million and $719.4 million and operating income of $99.9 million, $79.0 million and $62.2 million, in 2011, 2010 and 2009, respectively. Total assets for envelopes and labels were $703.7 million, $662.5 million and $686.8 million, as of the years ended 2011, 2010 and 2009, respectively.

Commercial Printing

Our commercial printing segment operates 36 manufacturing facilities in the United States, Canada, Latin America and Asia. In August 2011, we added to our commercial printing business with the acquisition of Nesbitt Graphics, Inc., which we refer to as Nesbitt. In 2010, we added to our commercial printing business with the acquisitions of Impaxx, Inc., the sole owner of CMS Gilbreth Packaging Solutions, Inc., which we refer to as Gilbreth, Glyph International and its subsidiaries, which we refer to as Glyph, and Clixx Direct Marketing Services Inc., which we refer to as Clixx, and collectively with Gilbreth and Glyph we refer to as the 2010 Acquisitions. Commercial printing had net sales of $850.0 million, $847.9 million and $895.2 million and operating income (loss) of $61.0 million, $(159.2) million and $(6.4) million in 2011, 2010 and 2009, respectively. Total assets for commercial printing were $586.3 million, $628.0 million and $776.6 million, as of the years ended 2011, 2010 and 2009, respectively.

Our Products and Offerings

Segment Overview

Envelopes and Labels. We are the largest North American envelope manufacturer, a leading labels provider and the largest North American prescription labels manufacturer for retail pharmacy chains. Our envelopes and labels segment represented approximately 55% of our net sales for the year ended 2011, and primarily specializes in the design, manufacturing and printing of:

| • | Direct mail and customized envelopes developed for advertising, billing and remittance; |

| • | Custom labels; and |

| • | Stock envelopes and labels. |

Our envelopes and labels segment serves customers ranging from Fortune 50 companies to middle market and small companies serving niche markets. We offer direct mail products used for customer solicitations and custom envelopes used for billing and remittance by end users including banks, brokerage firms and insurance and credit card companies. We print a diverse line of custom labels for a broad range of industries including manufacturing, warehousing, packaging, food and beverage, and health and beauty, which we sell through extensive networks within the resale channels. We also produce pressure-sensitive prescription labels for the retail pharmacy chain market. We also provide direct mail and overnight packaging labels, food and

1

beverage labels, and shelf and scale labels for national and regional customer accounts. We produce a broad line of stock envelopes and labels that are sold through independent distributors, contract stationers, national catalogs for the office products market, office products superstores and quick printers.

Commercial Printing. We are one of the leading commercial printing companies in North America and one of the largest providers of end-to-end, content management solutions to scientific, technical and medical journals, which we refer to as STM journals. Our commercial printing segment represented approximately 45% of our net sales for the year ended 2011, providing print, design, content management, fulfillment and distribution offerings, including:

| • | High-end color printing of a wide range of premium products for major national and regional customers; |

| • | General commercial printing products for regional and local customers; |

| • | STM journals, special interest and trade magazines for not-for-profit organizations, educational institutions and specialty publishers; and |

| • | Specialty packaging and high quality promotional materials for multinational consumer products companies. |

Our commercial printing segment primarily caters to the consumer products, pharmaceutical, financial services, publishing, and telecommunications industries, with customers ranging from Fortune 50 companies to middle market and small companies operating in niche markets. We provide a wide array of commercial print offerings to our customers including electronic prepress, digital asset archiving, direct-to-plate technology, high-quality color printing on web and sheet-fed presses and digital printing. The broad selection of commercial printing products we produce also includes specialty packaging, full body shrink sleeves, journals and specialized periodicals, annual reports, car brochures, direct mail products, advertising literature, corporate identity materials and brand marketing materials. In our journal and specialty magazine business, we offer complete solutions, including editing, content processing, content management, electronic peer review, production, distribution and reprint marketing. Our primary customers for our specialty packaging and promotional products are pharmaceutical, apparel, tobacco, neutraceutical and other large multi-national consumer product companies.

The primary methods of distribution of the principal products for our two segments are by direct shipment via express mail, the United States postal system or freight carriers.

Our Business Strategy

Our goals are to pursue disciplined growth, improve on our cost structure and provide quality product offerings to our customers. The principal features of our strategy are:

Pursue Strategic Acquisitions. We continue to selectively review opportunities to expand within growing niche markets, broaden our product offerings and increase our economies of scale through acquisitions. Our acquisition strategy is focused on product expansion or expanding our position in the current markets that we operate. We believe this focused approach to acquisitions will allow us to grow at a faster pace than the broader commercial printing industry and continue to leverage our competitive advantage by utilizing our existing infrastructure, operating expertise and customer relationships. We intend to continue practicing acquisition disciplines and pursuing opportunities for greater expected profitability and cash flow or improved operating efficiencies, such as increased utilization of our manufacturing assets. Over the past six years, we have completed fourteen acquisitions that we believe have and will continue to enhance our operating margins and deliver economies of scale. We believe our acquisition strategy will allow us to both realize increased revenue and cost-saving synergies, and apply our management expertise to improve the operations of acquired entities. For example, our 2011 acquisition of EPG provided manufacturing efficiencies due to EPG's unique asset base and geographic overlap of facilities. Our 2010 acquisition of Gilbreth expanded our specialty packaging businesses into the growing shrink sleeve market sector while our 2010 acquisition of Glyph has further enhanced our content management operations. Our 2009 acquisition of Nashua built upon our 2006 acquisition of Rx Technology Corporation, which gave us entry into and a leading market position in the pharmaceutical labels business. Nashua further strengthened our position in the pharmaceutical labels market, while giving us access to new shelf label market customers and allowing us to further enhance our raw material purchasing power and rationalize our manufacturing platform.

Improve our Cost Structure. We regularly assess our operations with a view toward eliminating operations that are not aligned with our core operations or are underperforming. Over the past six years, we have initiated cost savings, restructuring and acquisition integration plans that have included the closure of a significant number of manufacturing facilities throughout our operating platform and a significant number of headcount reductions. We continue to work with our core suppliers to improve all aspects of our purchasing spend and other logistical capabilities as well as to ensure a stable source of supply. We seek to lower costs through more favorable pricing and payment terms, more effective inventory management and improved communications with vendors.

2

Provide Quality Product Offerings. We conduct regular reviews of our product offerings, manufacturing processes and distribution methods to ensure that they meet the changing needs of our customers. We are also investing in digital and variable print technology as we have seen increased demand for these technologies from our customers. By expanding our product offerings, we intend to increase cross-selling opportunities to our existing customer base and mitigate the impact of any decline in a given market.

Our Industry

The United States printing industry is large and highly fragmented with approximately 31,200 estimated participants as reported in the second quarter 2011 United States Department of Labor Quarterly Census of Employment and Wages. This is down from approximately 32,200 participants in the second quarter of 2010. The Printing Industries of America estimated 2010 aggregate shipment revenues for the printing industry were $145 billion. The industry consists of a few large companies with sales in excess of $1 billion, several mid-sized companies with sales in excess of $100 million and thousands of smaller operations. These printing businesses operate in a broad range of sectors, including commercial printing, envelopes and labels, specialty printing, trade publishing, and specialty packaging among others. We estimate that in 2010 the ten largest North American commercial printers by revenue, as reported in the Printing Impressions 400, represented approximately 18% of total industry sales.

Raw Materials

The primary materials used in our businesses are paper, ink, film, offset plates, chemicals and cartons, with paper accounting for the majority of total material costs. We purchase these materials from a number of key suppliers and have not experienced any significant difficulties in obtaining the raw materials necessary for our operations, though, in times of limited supply, we have occasionally experienced minor delays in delivery. We believe that we purchase our materials and supplies at competitive prices primarily due to the size and scope of our purchasing power.

The printing industry continues to experience pricing pressure related to increases in the cost of materials used in the production of our products. Industry prices for most of the raw materials we use in our business increased during 2011 from 2010 pricing levels, primarily due to the mild recovery from the economic downturn. We believe raw material pricing will increase in 2012 as we have received notifications of price increases in the first quarter of 2012.

While we expect to continue to be able to pass along to our customers a substantial portion of the raw material price increases, any price increase passed along carries the risk of an offsetting decrease in demand for our products.

Patents, Trademarks and Trade Names

We market products under a number of trademarks and trade names. We also hold or have rights to use various patents relating to our businesses. Our patents expire between 2013 and 2030 and our trademarks expire between 2012 and 2026. Our sales do not materially depend upon any single patent or group of related patents.

Competition

In selling our envelope products, we compete with a few multi-plant and many single-plant companies that primarily service regional and local markets. We also face competition from alternative sources of communication and information transfer such as electronic mail, the internet, interactive television and electronic retailing. Although these sources of communication and advertising may eliminate some domestic envelope sales in the future, we believe that we will experience continued demand for envelope products due to: (i) the ability of our customers to obtain a relatively low-cost information delivery vehicle that may be customized with text, color, graphics and action devices to achieve the desired presentation effect; (ii) the ability of our direct mail customers to penetrate desired markets as a result of the widespread delivery of mail to residences and businesses through the United States Postal Service; and (iii) the ability of our direct mail customers to include return materials inside their mailings. Principal competitive factors in the envelope business are quality, service and price. Although all three are equally important, various customers may emphasize one or more over the others. In selling our printed labels products, we compete with other label manufacturers with nationwide locations as well as regional and local printers that typically sell within a few hundred mile radius of their plants. Printed labels competition is based mainly on quick-turn customization, quality of products and customer service levels.

Our commercial printing segment provides offerings designed to give customers complete solutions for communicating their messages to targeted audiences. In selling our commercial print product offerings, we compete with large multinational commercial printing companies as well as regional and local printers. The commercial printing industry continues to have excess capacity and is highly competitive in most of our product categories and geographic regions. This excess capacity has resulted in a competitive pricing environment, in which companies have focused on reducing costs in order to preserve operating margins. Competition is based largely on price, quality and servicing the special needs of customers. We believe this environment combined

3

with an extended economic downturn will continue to lead to more consolidation within the commercial print industry as companies seek economies of scale, broader customer relationships, geographic coverage and product breadth to overcome or offset excess industry capacity and pricing pressures.

Seasonality

Our envelopes market and certain segments of the direct mail market have historically experienced seasonality with a higher percentage of volume of products sold to these markets occurring during the fourth quarter of the year primarily related to holiday purchases. Our general labels business has historically experienced a seasonal increase to net sales during the first and second quarters of the year primarily resulting from the release of our product catalogs to the trade channel customers and our customers’ spring advertising campaigns. Our prescription label business has historically experienced seasonality in net sales due to cold and flu seasons generally concentrated in the fourth and first quarters of the year. As a result of these seasonal variations, some of our envelopes and labels operations operate at or near capacity at certain times throughout the year.

Our commercial printing plants also experience seasonal variations. Revenues associated with consumer publications, such as holiday catalogs and automobile brochures tend to be concentrated from July through October. Revenues from annual reports are generally concentrated from February through April. Revenues associated with the educational and scholastic market and promotional materials tend to decline in the summer. As a result of these seasonal variations, some of our commercial printing operations operate at or near capacity at certain times throughout the year.

Backlog

The backlog of customer orders to be produced or shipped was approximately $113.7 million and $85.5 million as of the years ended 2011 and 2010, respectively.

Employees

We employed approximately 8,400 people worldwide as of the year ended 2011, approximately 19% of whom were members of various local labor unions. Collective bargaining agreements, each of which cover the workers at a particular facility, expire from time to time and are negotiated separately. Accordingly, we believe that no single collective bargaining agreement is material to our operations as a whole.

Environmental Regulations

Our operations are subject to federal, state, local and foreign environmental laws and regulations including those relating to air emissions, waste generation, handling, management and disposal, and remediation of contaminated sites. We have implemented environmental programs designed to ensure that we operate in compliance with the applicable laws and regulations governing environmental protection. We believe that we are in substantial compliance with applicable laws and regulations relating to environmental protection. We do not anticipate that material capital expenditures will be required to achieve or maintain compliance with environmental laws and regulations. However, there can be no assurance that newly discovered conditions, or new laws and regulations or stricter interpretations of existing laws and regulations, will not result in increased compliance or remediation costs.

Prior to our acquisition of Nashua, Nashua was involved in certain environmental matters and was designated by the Environmental Protection Agency, which we refer to as the EPA, as a potentially responsible party for certain hazardous waste sites. In addition, Nashua had been notified by certain state environmental agencies that Nashua may bear responsibility for remedial action at other sites which have not been addressed by the EPA. The sites at which Nashua may have remedial responsibilities are in various stages of investigation and remediation. Due to the unique physical characteristics of each site, the remedial technology employed, the extended time frames of each remediation, the interpretation of applicable laws and regulations and the financial viability of other potential participants, our ultimate cost of remediation is an estimate and is contingent on these factors. Based on information currently available, we believe that Nashua’s remediation expense, if any, is not likely to have a material adverse effect on our consolidated financial position or results of operations. In an effort to mitigate any pre-acquisition environmental matters related to Nashua, we purchased an environmental insurance policy providing certain coverages for a ten year period subsequent to the date of acquisition.

4

Executive Officers

The following presents a list of our executive officers, their age, prior and present positions, the year elected to their present position and other positions they have held during the past six years. Robert G. Burton Jr. is the son of Robert G. Burton Sr. There are no undisclosed arrangements or understandings pursuant to which any person was selected as an officer. This information is presented as of the date of the Form 10-K filing.

| Name | Age | Position | Year Elected to Present Position | ||||

| Robert G. Burton, Sr. | 71 | Chairman and Chief Executive Officer | 2005 | ||||

| Mark S. Hiltwein | 48 | Chief Financial Officer | 2009 | ||||

| Dean Cherry | 51 | Executive Vice President, Operations | 2011 | ||||

| Harry Vinson | 51 | President, Envelope and Commercial Print Operations | 2012 | ||||

| Robert G. Burton, Jr. | 36 | President | 2011 | ||||

| Ian Scheinmann | 43 | Senior Vice President, Legal Affairs | 2010 | ||||

Robert G. Burton, Sr. Mr. Burton, 71, has been Cenveo’s Chairman and Chief Executive Officer since September 2005. In January 2003, he formed Burton Capital Management, LLC, a company that invests in manufacturing companies, and has been its Chairman, Chief Executive Officer and sole managing member since its formation. From December 2000 through December 2002, Mr. Burton was the Chairman, President and Chief Executive Officer of Moore Corporation Limited, a leading printing company with over $2.0 billion in revenue for fiscal year 2002. Preceding his employment at Moore, Mr. Burton was Chairman, President, and Chief Executive Officer of Walter Industries, Inc., a diversified holding company. From April 1991 through October 1999, he was the Chairman, President and Chief Executive Officer of World Color Press, Inc., a $3.0 billion diversified printing company. From 1981 through 1991, he held a series of senior executive positions at Capital Cities/ABC, including President of ABC Publishing. Mr. Burton was also employed for 10 years as a senior executive of SRA, the publishing division of IBM.

Mark S. Hiltwein Mr. Hiltwein, 48, has served as Cenveo’s Chief Financial Officer since December 2009 and was Chief Financial Officer from July 2007 to June 2009. From June 2009 to December 2009, Mr. Hiltwein served as Cenveo’s President and Field Sales Manager. From July 2005 to July 2007, he was President of Smartshipper.com, an online third party logistics company. From February 2002 through July 2005, Mr. Hiltwein was Executive Vice President and Chief Financial Officer of Moore Wallace Incorporated, a $3.5 billion printing company. Prior to that, he served as Senior Vice President and Controller from December 2000 to February 2002. Mr. Hiltwein has served in a number of financial positions from 1992 through 2000 with L.P. Thebault Company, a commercial printing company, including Chief Financial Officer from 1997 through 2000. Mr. Hiltwein began his career at Mortenson and Associates, a regional public accounting firm where he held various positions in the audit department. Mr. Hiltwein received his Bachelor's degree in accounting from Keane University and he is a CPA.

Dean E. Cherry Mr. Cherry, 51, has been Cenveo's Executive Vice President, Operations since November 2011. He was previously Cenveo’s President Envelope Operations from February 2010 to November 2011. From July 2009 to February 2010 he was Executive Vice President. From June 2008 through June 2009, Mr. Cherry served as President of our Envelope, Commercial Print and Packaging Operations. From February 1, 2008 to June 1, 2008, he was our President of Envelope Operations. Since October 2006, Mr. Cherry was a private investor in Renovatio Ventures, LLC. From 2004 to 2006, he was Group President of Short-Run Commercial, and Group President of Integrated Print Communications and Global Solutions, a $4.5 billion division of RR Donnelley & Sons, Inc. In this position, Mr. Cherry had global P&L responsibility for Direct Mail, Commercial Print, Global Capital Markets, Business Communication Services, Forms and Labels, Astron (outsourcing) and Latin America. From 2001 to 2004, he held the positions of President, International and Subsidiary Operations and President, Commercial and Subsidiary Operations, for Moore Corporation Limited, a division of RR Donnelley. From 1991 to 1998 he held the following positions at World Color Press, Inc.: 1991 to 1993 Vice President, Operations; 1993 to 1994 Vice President, Regional Plant Manager; 1994 to 1996 Executive Vice President and Senior Vice President, Operations; 1997 to 1998 Executive Vice President, Investor Relations and Corporate Communications. From 1985 to 1991, he held various financial positions at Capital Cities/ABC Publishing division including Vice President, Finance and Operations. Mr. Cherry is a member of University’s Dean’s Advisory Council for the College of Business of Murray State University, and a Trustee for the Murray State University Foundation.

Harry R. Vinson. Mr. Vinson, 51, has served as Cenveo’s President Envelope and Commercial Print Operations since January 2012. He took on the added responsibility for the envelope, Wisco and NIC divisions, while relinquishing the responsibility

5

of the Global Packaging Division. In October of 2009, he took on the added responsibility of Cenveo’s Commercial Print Group after having the Global Packaging Group responsibility added in December of 2008. From March to December of 2007, Mr. Vinson was Cenveo’s Executive Vice President of the Cadmus Publisher Services Group. Prior to his role at Cadmus Publisher Services Group, Mr. Vinson was Cenveo’s Senior Vice President, Purchasing and Logistics from September 2005 to March 2007. From October 2003 until September 2005, he was the General Manager of Central Region Sheetfed Operations of MAN Roland, a printing press manufacturer. From February 2002 until July 2003, Mr. Vinson served as Senior Vice President and General Manager of the Publication and Directory Group at Moore Wallace (formerly Moore Corporation Limited). From February 1990 until February 2002, he served in various senior sales positions at Quebecor World (formerly World Color Press). Mr. Vinson is a graduate of Murray State University with a Bachelor of Science in print management and a minor in marketing.

Robert G. Burton, Jr. Mr. Burton, Jr., 36, has served as Cenveo’s President since August 10, 2011. From December 2010 to August 2011, Mr. Burton was President of Corporate Operations , with a primary focus on M&A, Treasury, IT, Human Resources, Legal and Investor Relations. From September 2005 to December 2010, Mr. Burton was EVP of Investor Relations, Treasury, HR and Legal at Cenveo. He has been a member of the Chairman’s Executive Committee since joining Cenveo. From 2004 to 2005, Mr. Burton was also President of Burton Capital Management, LLC and was the primary investment officer before he joined Cenveo on September 12, 2005. Mr. Burton has over 16 years of business experience as an Investor Relations, M&A and financial professional. Mr. Burton also served as the Senior Vice President, Investor Relations and Corporate Communications for Moore Wallace Incorporated (and its predecessor, Moore) from December 2001 to May 2003. Mr. Burton served as Vice President, Investor relations of Walter Industries in 2000. From 1996 through December 1999, Mr. Burton held various management positions at World Color Press, Inc., to include Vice President, Investor Relations. Mr. Burton earned a Bachelor of Arts degree from Vanderbilt University.

Ian R. Scheinmann Mr. Scheinmann, 43, has served as Cenveo’s Senior Vice President, Legal Affairs since August 2010. From May 2010 until August 2010, he served as Cenveo’s in-house real estate counsel. Prior to joining Cenveo, Mr. Scheinmann was Cenveo’s outside real estate counsel as a member of Rudoler & DeRosa, LLC where his practice covered a wide range of real estate and business transactions. Prior to joining Rudoler & DeRosa, Mr. Scheinmann was a real estate shareholder with Greenberg Traurig, LLP from August 2002 until March 2009. From 1995 until 2002, he was engaged in private practice with (i) Dilworth Paxson, LLP (September 2000 until July 2002), (ii) Anderson, Kill and Olick, P.C. (November 1996 until May 2000) and (iii) Weiner Lesniak (October 1995 until October 1996). Mr. Scheinmann received his B.S.B.A. from the John M. Olin School of Business at Washington University, St. Louis, Missouri and his J.D. with honors from Seton Hall University School of Law.

Cautionary Statements

Certain statements in this report, particularly statements found in “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, we or our representatives have made or continue to make forward-looking statements, orally or in writing, in other contexts. These forward-looking statements generally can be identified by the use of terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “plan,” “foresee,” “believe” or “continue” and similar expressions, or as other statements that do not relate solely to historical facts. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict or quantify. Management believes these statements to be reasonable when made. However, actual outcomes and results may differ materially from what is expressed or forecasted in these forward-looking statements. As a result, these statements speak only as of the date they were made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In view of such uncertainties, investors should not place undue reliance on our forward-looking statements.

Such forward-looking statements involve known and unknown risks, including, but not limited to, those identified in Item 1A. Risk Factors along with changes in general economic, business and labor conditions. More information regarding these and other risks can be found below under “Risk Factors,” “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other sections of this report.

Available Information

Our Internet address is: www.cenveo.com. References to our website address do not constitute incorporation by reference of the information contained on the website, and the information contained on the website is not part of this document. We make available free of charge through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such documents are filed electronically with the Securities and Exchange Commission, which we refer to as the SEC. Our Code of Business Conduct and Ethics is also posted on our website. In addition, our earnings conference calls are archived for replay on our website. In May 2011, we submitted to the New York Stock Exchange a certificate of our Chief Executive

6

Officer certifying that he is not aware of any violation by us of New York Stock Exchange corporate governance listing standards. We also filed as exhibits to our annual report on Form 10-K for our year ended 2010 certificates of the Chief Executive Officer and Chief Financial Officer as required under Section 302 of the Sarbanes-Oxley Act.

The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors

Many of the factors that affect our business and operations involve risks and uncertainties. The factors described below are some of the risks that could materially harm our business, financial conditions, results of operations or prospects.

The recent United States and global economic conditions have adversely affected us and could continue to do so.

The current United States and global economic conditions have affected and, most likely, will continue to affect our results of operations and financial position. A significant part of our business relies on our customers’ printing spend. The prolonged downturn in the United States and global economy and an uncertain economic outlook has reduced the demand for printed materials and related offerings that we provide our customers. Consequently, the reductions and delays in our customers’ spending have adversely impacted and could continue to adversely impact our results of operations, financial position and cash flows. We believe the extended economic uncertainty will continue to impact our operating results. We believe it will also continue to impact our ability to manage our inventory and customer receivables. The extended uncertainty may also result in increased restructuring and related charges, impairments relating to goodwill, intangible assets and other long-lived assets, and write-offs associated with inventories or customer receivables. These uncertainties about future economic conditions in a very challenging operational environment also make it difficult for us to forecast our operating results and make timely decisions about future investments.

Our substantial level of indebtedness could impair our financial condition and prevent us from fulfilling our business obligations.

We currently have a substantial amount of debt, which requires significant principal and interest payments. As of our year ended 2011, our total indebtedness was approximately $1.2 billion. Our level of indebtedness could affect our future operations, for example by:

| • | requiring a substantial portion of our cash flow from operations to be dedicated to the payment of principal and interest on indebtedness instead of funding working capital, capital expenditures, acquisitions and other business purposes; |

| • | making it more difficult for us to satisfy all of our debt obligations, thereby increasing the risk of triggering a cross-default provision; |

| • | increasing our vulnerability to economic downturns or other adverse developments relative to less leveraged competitors; |

| • | limiting our ability to obtain additional financing for working capital, capital expenditures, acquisitions or other corporate purposes in the future; and |

| • | increasing our cost of borrowing to satisfy business needs. |

We may be unable to service or refinance our debt.

Our ability to make scheduled payments on, or to reduce or refinance, our indebtedness will depend on our future financial and operating performance, and prevailing market conditions. Our future performance will be affected by the impact of general economic, financial, competitive and other factors beyond our control, including the availability of financing in the banking and capital markets. We cannot be certain that our business will generate sufficient cash flow from operations in an amount necessary to service our debt. If we are unable to meet our debt obligations or to fund our other liquidity needs, we will be required to restructure or refinance all or a portion of our debt to avoid defaulting on our debt obligations or to meet other business needs. Such a refinancing of our indebtedness could result in higher interest rates, could require us to comply with more onerous covenants that further restrict our business operations, could be restricted by another one of our debt instruments outstanding, or refinancing opportunities may not be available at all.

7

The terms of our indebtedness impose significant restrictions on our operating and financial flexibility.

Our senior subordinated notes, senior note and senior second lien note indentures, along with our senior secured credit facility agreement, contain various covenants that limit our ability to, among other things:

| • | incur or guarantee additional indebtedness; |

| • | make restricted payments, including dividends and prepaying indebtedness; |

| • | create or permit certain liens; |

| • | enter into business combinations and asset sale transactions; |

| • | make investments, including capital expenditures; |

| • | amend organizational documents and change accounting methods; |

| • | enter into transactions with affiliates; and |

| • | enter into new businesses. |

These restrictions could limit our ability to obtain future financing, make acquisitions or incur needed capital expenditures, withstand a future downturn in our business or the economy in general, conduct operations or otherwise take advantage of business opportunities that may arise. Our senior secured credit facility also contains a schedule of financial ratios including a minimum interest coverage ratio that we must comply with on a quarterly basis, and maximum first lien leverage and total leverage financial ratio that we must be in compliance with at all times. Our ability to meet these financial ratios may be affected by events beyond our control, such as further deterioration in general economic conditions. We are also required to provide certain financial information on a quarterly basis. Our failure to maintain applicable financial ratios, in certain circumstances, or effective internal controls would prevent us from borrowing additional amounts, and could result in a default under our senior secured credit facility. A default could cause the indebtedness outstanding under the senior secured credit facility and, by reason of cross-acceleration or cross-default provisions, the senior subordinated, senior and senior second lien notes and any other indebtedness we may then have, to become immediately due and payable. If we are unable to repay those amounts, the lenders under our senior secured credit facility and senior second lien indenture could initiate a bankruptcy or liquidation proceeding, or proceed against the collateral granted to them which secures that indebtedness. If the lenders under our senior secured credit facility agreement and/or our senior second lien indenture were to accelerate the repayment of outstanding borrowings, we might not have sufficient assets to repay our indebtedness.

There are additional borrowings available to us that could further exacerbate our risk exposure from debt.

Despite current indebtedness levels, we may incur substantial additional indebtedness in the future. Our senior secured credit facility and senior subordinated, senior and senior second lien notes indentures and our other debt instruments limit, but do not prohibit, us from incurring additional debt. If we incur additional debt above our current outstanding levels, the risks associated with our substantial leverage would increase.

To the extent that we make select acquisitions, we may not be able to successfully integrate the acquired businesses into our business.

In the past, we have grown rapidly through acquisitions. We intend to continue to pursue select acquisition opportunities within our core and niche businesses. To the extent that we seek to pursue additional acquisitions, we cannot be certain that target businesses will be available on favorable terms or that, if we are able to acquire businesses on favorable terms, we will be able to successfully integrate or profitably manage them. Successfully integrating an acquisition involves minimizing disruptions and efficiently managing substantial changes, some of which may be beyond our control. An acquisition always carries the risk that such changes, including facility and equipment location, management and employee base, policies, philosophies and procedures, could have unanticipated effects, could require more resources than intended and could cause customers to temporarily or permanently seek alternate suppliers. A failure to realize acquisition synergies and savings could negatively impact the results of both our acquired and existing operations.

A decline in our consolidated profitability or profitability within one of our individual reporting units could result in the impairment of assets, including goodwill, other long-lived assets and deferred tax assets.

We have material amounts of goodwill, other long-lived assets and deferred tax assets on our consolidated balance sheet. A decline in expected profitability, particularly the impact of an extended uncertainty in the United States and global economies, could call into question the recoverability of our related goodwill, other long-lived assets, or deferred tax assets and require us to write down or write-off these assets or, in the case of deferred tax assets, recognize a valuation allowance through a charge to

8

income tax expense.

The industries in which we operate our business are highly competitive and extremely fragmented.

The printing industry in which we compete is highly competitive and extremely fragmented. In the commercial printing market, we compete against a few large, diversified and financially stronger printing companies, as well as smaller regional and local commercial printers, many of which are capable of competing with us on volume, price and production quality. In the envelope market, we compete primarily with a few multi-plant and many single-plant companies servicing regional and local markets. We believe there currently is excess capacity in the printing industry, which has resulted in substantial price competition that may continue as customers put product work out for competitive bid. We are constantly seeking ways to reduce our costs, become more efficient and attract customers. We cannot, however, be certain that these efforts will be successful or that our competitors will not be more successful in their similar efforts. If we fail to reduce costs and increase productivity, or to meet customer demand for new value-added products, services or technologies, we may face decreased revenues and profit margins in markets where we encounter price competition, which in turn could reduce our cash flow and profitability.

The printing business we compete in generally does not have long-term customer agreements, and our printing operations may be subject to quarterly and cyclical fluctuations.

The printing industry in which we compete is generally characterized by individual orders from customers or short-term contracts. A significant portion of our customers are not contractually obligated to purchase products or services from us. Most customer orders are for specific printing jobs, and repeat business largely depends on our customers’ satisfaction with our work product. Although our business does not depend on any one customer or group of customers, we cannot be sure that any particular customer will continue to do business with us for any period of time. In addition, the timing of particular jobs or types of jobs at particular times of year may cause significant fluctuations in the operating results of our various printing operations in any given quarter. We depend to some extent on sales to certain industries, such as the financial services, advertising, pharmaceutical, automotive and office products industries. To the extent these industries experience downturns, the results of our operations may be adversely affected.

Factors affecting the United States Postal Service can impact demand for our products.

Postal costs are a significant component of many of our customers’ cost structure. Historically, increases in postal rates have resulted in reductions in the volume of mail sent, including direct mail, which is a meaningful portion of our envelope volume. As postal rate increases in the United States are outside our control, we can provide no assurance that any future increases in United States postal rates will not have a negative effect on the level of mail sent or the volume of envelopes purchased. Additionally, the United States Postal Service has also indicated the potential need to reduce delivery days from six to five. We can provide no assurance that such a change would not impact our customers’ decisions to use direct mail products, which may in turn cause a decrease in our revenues and profitability.

Factors other than postal rates that affect the volume of mail sent through the United States postal system may also negatively affect our business. Congress enacted a federal “Do Not Call” registry in response to consumer backlash against telemarketers and is contemplating enacting so-called “anti-spam” legislation in response to consumer complaints about unsolicited e-mail advertisements. If similar legislation becomes enacted for direct mail advertisers, our business could be adversely affected.

The availability of the internet and other electronic media may adversely affect our business.

Our business is highly dependent upon the demand for envelopes sent through the mail. Such demand comes from utility companies, banks and other financial institutions, among other companies. Our printing business also depends upon demand for printed advertising among other products. Consumers increasingly use the internet and other electronic media to purchase goods and services, and for other purposes, such as paying bills and obtaining electronic versions of printed product. The level of acceptance of electronic media by consumers as well as the extent that consumers are replacing traditional printed reading materials with internet hosted media content or e-reading devices is difficult to predict. Advertisers use the internet and other electronic media for targeted campaigns directed at specific electronic user groups. We cannot be certain that the acceleration of the trend towards electronic media will not cause a decrease in the demand for our products. If demand for our products decreases, our cash flow or profitability could materially decrease.

Increases in paper costs and any decreases in the availability of our raw materials could have a material adverse effect on our business.

Paper costs represent a significant portion of our cost of materials. Changes in paper pricing generally do not affect the operating margins of our commercial printing business because the transactional nature of the business allows us to pass on most

9

announced increases in paper prices to our customers. However, our ability to pass on increases in paper prices is dependent upon the competitive environment at any given time. Paper pricing also affects the operating margins of our envelopes and labels business. We have historically been less successful in immediately passing on such paper price increases due to several factors, including contractual restrictions in certain cases and the inability to quickly update catalog prices in other instances. Moreover, rising paper costs and their consequent impact on our pricing could lead to a decrease in demand for our products.

We depend on the availability of paper in manufacturing most of our products. During periods of tight paper supply, many paper producers allocate shipments of paper based on the historical purchase levels of customers. In the past, we have occasionally experienced minor delays in delivery. Any future delay in availability could negatively impact our cash flow and profitability.

We depend on good labor relations.

As of our year ended 2011, we have approximately 8,400 employees worldwide, of which approximately 19% of our employees are members of various local labor unions. If our unionized employees were to engage in a concerted strike or other work stoppage, or if other employees were to become unionized, we could experience a disruption of operations, higher labor costs or both. A lengthy strike could result in a material decrease in our cash flow or profitability.

Environmental laws may affect our business.

Our operations are subject to federal, state, local and foreign environmental laws and regulations, including those relating to air emissions, wastewater discharge, waste generation, handling, management and disposal, and remediation of contaminated sites. Currently unknown environmental conditions or matters at our existing and prior facilities, new laws and regulations, or stricter interpretations of existing laws and regulations could result in increased compliance or remediation costs that, if substantial, could have a material adverse effect on our business or operations in the future.

We are dependent on key management personnel.

Our success will depend to a significant degree on our executive officers and other key management personnel. We cannot be certain that we will be able to retain our executive officers and key personnel, or attract additional qualified management in the future. In addition, the success of any acquisitions we may pursue may depend, in part, on our ability to retain management personnel of the acquired companies. We do not carry key person insurance on any of our managerial personnel.

We depend upon our information technology systems.

We are increasingly dependent on information technology systems to process transactions, manage inventory, purchase, sell and ship goods on a timely basis and maintain cost-efficient operations. We use information systems to support decision making and to monitor business performance. Our information technology systems depend on global communications providers, telephone systems, hardware, software and other aspects of internet infrastructure that can experience significant system failures and outages. Our systems are susceptible to outages due to fire, floods, power loss, telecommunications failures and similar events. Despite the implementation of network security measures, our systems are vulnerable to computer viruses and similar disruptions from unauthorized tampering with our systems. The occurrence of these or other events could disrupt or damage our information technology systems and inhibit internal operations, the ability to provide customer service or provide management with accurate financial and operational reports essential for making decisions at various levels of management.

We have expanded our international operations and there are risks associated with operating outside of the United States.

In 2010, we expanded our Canadian print operations and our Indian content management operations via acquisition. Our anticipated future annual net sales generated outside of the United States will be approximately five percent of our annual consolidated net sales. There are risks inherent with conducting business outside of the United States, including the impact of economic and political instabilities as well as the impact of changes to tax or regulatory laws. In addition, we may be impacted by significant changes in foreign currency rates, which could negatively impact our net sales, profitability or cash flows.

Item 1B. Unresolved Staff Comments

None

Item 2. Properties

We currently occupy 67 manufacturing facilities, primarily in North America, of which 23 are owned and 44 are leased. In addition to on-site storage at these facilities, we store products in eight warehouses, all of which are leased, and we have seven leased sales offices. In 2011, we ceased operations in five facilities; of which four facility leases expired and one facility was sold.

10

We lease our corporate headquarters space in Stamford, Connecticut. We believe that we have adequate facilities to conduct our current and future operations.

Item 3. Legal Proceedings

From time to time we may be involved in claims or lawsuits that arise in the ordinary course of business. Accruals for claims or lawsuits have been provided for to the extent that losses are deemed probable and estimable. Although the ultimate outcome of these claims or lawsuits cannot be ascertained, on the basis of present information and advice received from counsel, it is our opinion that the disposition or ultimate determination of such claims or lawsuits will not have a material adverse effect on our consolidated financial statements.

In September of 2011, we reached an agreement with all defendants to settle all controversies and disputes and agreed to dismiss all claims against the defendants with prejudice in connection with a civil litigation filed in Minneapolis, Minnesota. In January of 2012, we reached an agreement with all parties to settle all controversies and disputes with prejudice in connection with those certain civil litigations filed in the United States District Court for the Northern District of New York and in the Superior Court of New Jersey, Burlington County.

In the case of administrative proceedings related to environmental matters involving governmental authorities, we do not believe that any imposition of monetary damages or fines would be material.

Item 4. Mine Safety Disclosures

Not applicable.

11

PART II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Cenveo’s certificate of incorporation provides that the total authorized capital stock of the Company is 100 million shares of common stock, $0.01 par value per share, which we refer to as Common Stock. Each share of voting Common Stock is entitled to one vote in respect of each share of Cenveo voting Common Stock held of record on all matters submitted to a vote of stockholders.

Our Common Stock is traded on the New York Stock Exchange, which we refer to as NYSE under the symbol “CVO.” As of February 8, 2012, there were 491 shareholders of record and, as of that date, we estimate that there were approximately 8,898 beneficial owners holding stock in nominee or “street” name. The following table sets forth, for the periods indicated, the range of the high and low closing prices for our Common Stock as reported by the NYSE:

| 2011 | High | Low | |||||

| First Quarter | $ | 6.76 | $ | 5.18 | |||

| Second Quarter | 6.75 | 5.83 | |||||

| Third Quarter | 6.48 | 3.01 | |||||

| Fourth Quarter | 3.92 | 2.74 | |||||

| 2010 | High | Low | |||||

| First Quarter | $ | 9.41 | $ | 6.49 | |||

| Second Quarter | 9.90 | 5.35 | |||||

| Third Quarter | 6.92 | 4.91 | |||||

| Fourth Quarter | 6.32 | 4.85 | |||||

We have not paid a dividend on our Common Stock since our incorporation and do not anticipate paying dividends in the foreseeable future as the instruments governing a significant portion of our debt obligations limit our ability to pay Common Stock dividends.

See Note 12 to our consolidated financial statements included in Item 8 of this Annual Report on Form 10-K for information regarding our stock compensation plans. Compensation information required by Item II will be presented in our 2012 definitive proxy statement, which is incorporated herein by reference.

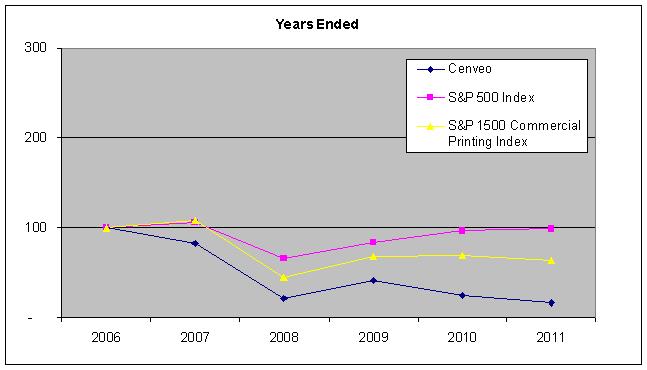

The graph below compares five-year returns of our Common Stock with those of the S&P 500 Index and the S&P 1500 Commercial Printing Index. The graph assumes that $100 was invested as of our year ended 2006 in each of our Common Stock, the S&P 500 Index, and the S&P 1500 Commercial Printing Index and that all dividends were reinvested. The S&P 1500 Commercial Printing Index is a capitalization weighted index designed to measure the performance of all NASDAQ-traded stocks in the commercial printing sector.

| Years Ended | ||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||||

| Cenveo | 100.00 | 82.41 | 20.99 | 41.27 | 25.19 | 16.04 | ||||||||||||

| S&P 500 Index | 100.00 | 105.49 | 66.46 | 84.04 | 96.70 | 98.74 | ||||||||||||

| S&P 1500 Commercial Printing Index | 100.00 | 108.24 | 44.60 | 68.11 | 68.83 | 64.09 | ||||||||||||

12

13

Item 6. Selected Financial Data

The following table sets forth our selected financial and operating data for the years ended December 31, 2011, January 1, 2011, January 2, 2010, January 3, 2009 and December 29, 2007, which we refer to as the years ended 2011, 2010, 2009, 2008 and 2007, respectively.

The following consolidated selected financial data has been derived from, and should be read in conjunction with, the related consolidated financial statements, either elsewhere in this report or in reports we have previously filed with the SEC.

CENVEO, INC. AND SUBSIDIARIES (in thousands, except per share data) | ||||||||||||||||||||

| Years Ended | ||||||||||||||||||||

| Statement of Operations: | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| Net sales | $ | 1,909,187 | $ | 1,708,529 | $ | 1,614,596 | $ | 1,982,884 | $ | 1,924,519 | ||||||||||

| Restructuring, impairment and other charges | 17,812 | 226,150 | (2) | 68,034 | 399,066 | (4) | 40,086 | |||||||||||||

| Operating income (loss) | 117,760 | (117,944 | ) | (2) | 17,150 | (241,361 | ) | (4) | 123,546 | |||||||||||

| (Gain) loss on early extinguishment of debt | (4,011 | ) | 9,592 | (16,917 | ) | (14,642 | ) | 9,256 | ||||||||||||

| Income (loss) from continuing operations | (1,028 | ) | (197,698 | ) | (3) | (49,036 | ) | (307,859 | ) | (5) | 15,504 | |||||||||

| Income (loss) from discontinued operations, net of taxes | (7,537 | ) | (1) | 11,321 | 18,097 | 9,832 | 25,277 | (6) | ||||||||||||

| Net income (loss) | (8,565 | ) | (186,377 | ) | (3) | (30,939 | ) | (298,027 | ) | (5) | 40,781 | (6) | ||||||||

| Income (loss) per share from continuing operations: | ||||||||||||||||||||

| Basic | (0.02 | ) | (3.17 | ) | (0.86 | ) | (5.71 | ) | 0.28 | |||||||||||

| Diluted | (0.02 | ) | (3.17 | ) | (0.86 | ) | (5.71 | ) | 0.28 | |||||||||||

| Income (loss) per share from discontinued operations: | ||||||||||||||||||||

| Basic | (0.12 | ) | 0.18 | 0.32 | 0.18 | 0.48 | ||||||||||||||

| Diluted | (0.12 | ) | 0.18 | 0.32 | 0.18 | 0.47 | ||||||||||||||

| Net income (loss) per share: | ||||||||||||||||||||

| Basic | (0.14 | ) | (2.99 | ) | (0.54 | ) | (5.53 | ) | 0.76 | |||||||||||

| Diluted | (0.14 | ) | (2.99 | ) | (0.54 | ) | (5.53 | ) | 0.75 | |||||||||||

| Balance Sheet data: | ||||||||||||||||||||

| Total assets | $ | 1,385,588 | $ | 1,406,911 | $ | 1,530,723 | $ | 1,552,114 | $ | 2,002,722 | ||||||||||

| Total long-term debt, including current maturities | 1,246,343 | 1,294,003 | 1,233,917 | 1,306,355 | 1,444,637 | |||||||||||||||

__________________________

| (1) | Includes $13.5 million allocated goodwill impairment charges. |

| (2) | Includes $181.4 million pre-tax goodwill and other long-lived asset impairment charges. |

(3) | Includes $157.3 million goodwill and other long-lived asset impairment charges, net of tax benefit of $24.1 million. |

| (4) | Includes $372.8 million pre-tax goodwill impairment charges. |

| (5) | Includes $330.7 million goodwill impairment charges, net of tax benefit of $42.1 million. |

| (6) | Includes a $17.0 million gain on a disposal of discontinued operations, net of taxes of $8.4 million. |

14

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Management’s Discussion and Analysis of Financial Condition and Results of Operations, which we refer to as MD&A, of Cenveo, Inc. and its subsidiaries, which we refer to as Cenveo, should be read in conjunction with our consolidated financial statements included in Item 8 of this Annual Report on Form 10-K, which we refer to as the Form 10-K. Certain statements we make under this Item 7 constitute forward-looking statements under the Private Securities Litigation Reform Act of 1995. See Cautionary Statements regarding forward-looking statements in Item 1 and Risk Factors in Item 1A.

Introduction and Executive Overview

We are one of the largest diversified printing companies in North America, according to the December 2011 Printing Impressions 400 report. We operate a global network of strategically located manufacturing facilities, serving a diverse base of over 100,000 customers. The United States printing industry is highly fragmented, with a broad range of sectors, including commercial printing and envelope converting and labels manufacturing, among others. We believe the printing industry has excess capacity and will continue to be highly competitive.

Our business strategy has been and continues to be focused on pursuing strategic acquisitions, improving our cost structure, providing a diverse quality product offering portfolio to our customers and maintaining reasonable levels of financial flexibility. We believe this strategy has allowed us to diversify our revenue base, maintain our low cost producer focus and deliver quality product offerings to our customers.

We continue to selectively review acquisition opportunities that will allow us to grow in niche markets, broaden our product offerings and increase our economies of scale. Our acquisition strategy is focused on product expansion into highly complimentary niche businesses or expanding our presence in the current markets in which we operate today. Over the past six years we have completed fourteen acquisitions that either provided us entry into new highly complementary print related markets or expanded our existing print or envelope manufacturing platform. We believe our focused approach to acquisitions should allow us to grow at a faster pace than the broader commercial printing industry. We intend to continue practicing our acquisition disciplines and pursuing opportunities that allow for greater expected profitability and cash flows or improved operating efficiencies.

We believe that our manufacturing platform, strategically located facilities and our industry experienced management team enables us to continuously seek improvements to our operating margins. We continue to pursue cost savings measures in an effort to align our cost structure with our anticipated revenues and mitigate the impact of pricing pressures. We work closely with our vendors with a focus on supply chain enhancements that lower our input costs and improve our operating margins. Our acquisitions along with our cost savings and restructuring plans have allowed us to mitigate the need for significant capital expenditures by realigning our most efficient equipment throughout our manufacturing platform while maintaining a reasonable level of financial flexibility during the extended economic uncertainty. Our continued approach to review our cost structure could require additional plant closures, consolidations and employee headcount reductions throughout our operating platform.

Our broad portfolio of products includes envelope converting, commercial printing, labels manufacturing, content management and specialty packaging. Many of our customers focus on price as a key decision driver. We believe that given the extended economic uncertainty, our customers will continue to focus on price. In addition, certain of our key customers have recently provided us the opportunity to become a single source supplier for all of their printed product needs. This trend benefits our customers as they seek to leverage their buying power and helps us improve operating efficiencies in our plants with increased throughput in multiple product lines via a single customer relationship.

Our financial flexibility depends heavily on our ability to maintain relationships with existing customers, attract new financially viable customers and maximize our operating profits, all of which are vital to our ability to service our current debt level. Our level of indebtedness, which requires significant principal and interest payments, could potentially impact our ability to reinvest cash flows from operations into our business via capital expenditures or niche acquisitions. We therefore closely monitor working capital, including the credit we extend to and the collections we receive from customers as well as inventory levels and vendor pricing, while continuously seeking out pricing and manufacturing improvements to increase our cash flow.

See Part 1 Item 1 of this Form 10-K for a more complete description of our business.

15

2012 Outlook

We believe that the mild recovery we experienced in 2011 from the economic downturn will continue in 2012. We believe our efforts to reduce our operating cost structure, which we began implementing at the beginning of the economic downturn, allowed us to mitigate significant impacts to our operating performance and to our business over the past three years. The envelope and print industries are highly competitive and significantly fragmented. We believe these factors combined with a slow general economic recovery will continue to impact our results of operations due to open capacity and pricing pressures.

During 2012, we plan to continue our focus on reducing our debt leverage levels. During the third quarter of 2011, we began a plan to reduce our debt leverage levels to targeted levels through 2013. This plan will require us to continue to focus on all significant cash inflows and outflows throughout our desired timeline while also focusing on reducing our cash conversion cycle and improving our cash flows from operations by enhancing our inventory management and billing and collection processes. We believe that we can achieve significant cash flow from operations improvements as we implement this plan over our targeted timeline. As a result of this plan and our production process during the back half of 2011, we reduced our consolidated inventories in excess of $25.0 million. We believe that we will be able to continue to reduce our inventories to desired levels throughout 2012 as well. In addition, we believe that certain enhancements we have made and are considering making to our billing and collection process will further increase our cash flows from operations throughout 2012.

During 2012, we plan to complete our integration of EPG into our manufacturing platform. We expect that this acquisition will allow us to gain incremental manufacturing efficiencies from the manufacturing equipment we acquired with the acquisition as well as the geographic overlap of facilities.

In December 2013, our 77/8% senior subordinated notes due 2013, which we refer to as 77/8% Notes, are due. In 2012, we will continue to monitor the high yield bond market to evaluate the best time to refinance the 77/8% Notes. We may also consider refinancing our other bond indentures should we elect to enter the bond market for a refinancing opportunity on the 77/8% Notes. In the meantime, on October 28, 2011, we completed an amendment, which we refer to as the 2011 Amendment, of our $150 million revolving credit facility due 2014, which we refer to as our 2010 Revolving Credit Facility and a $380 million term loan due 2016, which we refer to as the Term Loan B, which collectively with the 2010 Revolving Credit Facility we refer to as the 2010 Credit Facilities. The 2011 Amendment allows us to repurchase up to $30 million of our outstanding notes, subject to a maximum leverage ratio and the satisfaction of certain other conditions. Furthermore, in February of 2012, we amended our 2010 Credit Facility, to increase our restricted dispositions basket in order to divest our documents and forms business, which we refer to as the 2012 Amendment. The amendment required that 25% of net proceeds be used to repay our Term Loan B and requires that the remaining amount be used to reinvest in the business. Further, the amendment allows us to repay junior debt in an amount equal to 75% of the net proceeds. We will continue to repurchase these bonds in the open market or privately negotiated transactions. Such repurchases, if any, will depend on prevailing market conditions, our liquidity requirements, contractual restrictions and other factors. Since the 2011 and 2012 Amendments, we have repurchased $25.2 million of our 77/8% Notes, $9.0 million of our 83/8% senior subordinated notes, due 2014, which we refer to as 83/8% Notes and $5.0 million of the 10 ½% senior unsecured notes due 2016, which we refer to as the 10½% Notes, and retired them for $21.1 million, $7.0 million and $4.9 million, respectively. Additionally, we repaid $9.5 million of the Term Loan B in connection with the 2012 Amendment.

Acquisitions

In August of 2011, we completed the acquisition of Nesbitt. Nesbitt is a niche content management business that focuses on high end book content development and project management offerings and was acquired to further enhance our content management operations. Additionally, we expect that Nesbitt will enable us to provide additional cross-selling opportunities to our existing customer base. We believe that the integration efforts related to Nesbitt are minimal and we expect to be completed with those efforts in early 2012.

In February of 2011, we acquired the assets of EPG. EPG manufactures and distributes envelope products for the billing, financial, direct mail and office products markets. We believe EPG will further strengthen our existing envelope operations and will provide for manufacturing efficiencies given EPG's unique asset base and geographic overlap of facilities that exists between EPG and our existing envelope operations. During 2011, we completed the closure and consolidation of three EPG plants into our existing operations and reduced headcount for duplicative functions. We recently completed a significant milestone in the integration of EPG into our existing information technology infrastructure and operational and financial systems and terminated our transition services arrangement. EPG is no longer on their legacy infrastructure or operational and financial systems. As a result, we have improved our visibility to work being performed within our legacy envelope and EPG manufacturing platforms, which provides us with the opportunity to produce work more profitably and with increased customer satisfaction. Further, we believe the integration of EPG will continue to occur into 2012 and may include additional plant closures and consolidations as well as additional headcount reductions for duplicative functions.

16

In November of 2010, we completed the acquisition of Gilbreth. Gilbreth utilizes specialized printing technologies as a manufacturer and marketer of full body shrink sleeves and tamper evident neck bands. We believe the acquisition of Gilbreth will allow us to internally produce product that we historically had to purchase from an outsourced partner. Additionally, we expect that Gilbreth will enable us to provide additional cross-selling opportunities to our existing customer base. We have completed our integration efforts related to Gilbreth.

In May of 2010, we completed the acquisition of Glyph, which we believe will enhance our content management operations. We completed our integration of Glyph in 2011.

In February of 2010, we completed the acquisition of Clixx. Clixx has provided our Canadian print operations with end-of-production capabilities that were previously unavailable to those operations.

Collectively, we refer to Nesbitt and EPG as the 2011 Acquisitions and Gilbreth, Glyph and Clixx as the 2010 Acquisitions.

Discontinued Operations

In 2011, we began exploring our opportunities to divest certain non-strategic or underperforming businesses within our manufacturing platform. As a result, in the fourth quarter of 2011, the financial results of our documents and forms business as well as our wide-format papers business have been accounted for as discontinued operations, which we refer to collectively as the Discontinued Operations, resulting in our historical consolidated balance sheets, statement of operations and statement of cash flows being reclassified to reflect these discontinued operations separately from our continuing operations.

In January of 2012, we completed the sale of our wide-format papers business and received proceeds of $4.6 million. In February of 2012, we completed the sale of our documents and forms business and received proceeds of $36 million, which excludes an additional $4.0 million that is being held in escrow for a period of time subject to terms of the sale agreement.

Goodwill and Intangible Asset Impairments

In the fourth quarter of 2011, we recorded allocated non-cash goodwill impairment charges of $13.5 million related to the Discontinued Operations. These charges were due to our carrying value of the assets, including allocated goodwill and intangible assets, of the Discontinued Operations being in excess of the fair value we received from divesting these businesses.

During the third quarter of 2010, given the continued economic uncertainty that remained in the United States and global economies and revisions to our forecasted operating results, primarily in our Publisher Services Group, which is part of the commercial printing segment and which we refer to as our PSG reporting unit, we believed that there were sufficient indicators that would require us to perform an interim goodwill and long-lived asset impairment analysis as of October 2, 2010.

As a result of our goodwill and long-lived asset impairment analysis, we recorded non-cash impairment charges of $132.2 million related to goodwill and $49.2 million related to other long-lived assets, of which $22.0 million related to an indefinite lived tradename and $27.2 million related to customer relationships within our PSG reporting unit. We believe that these charges primarily resulted from reductions in the estimated fair value of this reporting unit due to: (i) higher discount rates applied to lower estimated future cash flows as compared to our prior year analysis and (ii) continued economic uncertainty, which has increased customer cost awareness resulting in continued price pressures, lower page counts, and a shift from historical web and sheet-fed print products to lower cost digital print products.

Consolidated Operating Results