UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07153

| T. Rowe Price Fixed Income Series, Inc. |

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2012

Item 1. Report to Shareholders

|

| Prime Reserve Portfolio | June 30, 2012 |

| Highlights |

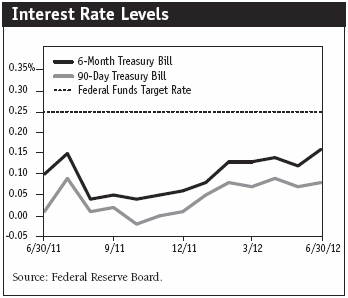

- Money market interest rates remained very low as the Federal Reserve kept the fed funds target rate in the 0.00% to 0.25% range in the first half of 2012.

- The Prime Reserve Portfolio performed in line with its peer group average in the six-month period ended June 30, 2012.

- Treasury debt, Treasury-guaranteed debt, and Canadian debt, as well as banks in Canada and Australia, represent our largest positions in an otherwise highly diversified portfolio. The portfolio now has no unsecured exposure to European banks.

- Our focus remains on principal stability, quality, and liquidity—even though the interest rate environment currently results in little return for money market investors.

The views and opinions in this report were current as of June 30, 2012. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

Manager’s Letter

T. Rowe Price Prime Reserve Portfolio

Dear Investor

The Federal Reserve kept short-term interest rates extremely low in the first half of 2012, and central bank officials project that they will remain low until late 2014 to support a subpar U.S. economic recovery. Like many other money market funds, the T. Rowe Price Prime Reserve Portfolio continued to offer investors principal stability and liquidity, albeit with yields and total returns barely above 0%.

Economy and Interest Rates

The U.S. economy expanded in the first half of the year, albeit at a modest pace compared with what is typically seen in the years following a deep recession. The manufacturing sector is healthy, and job growth accelerated in the early months of 2012 before moderating in the second quarter. The housing market remains in the doldrums, however, and national unemployment remains somewhat elevated. Still, the economy has shown resilience in the face of a nascent recession and ongoing sovereign debt crisis in Europe, a slowdown in Chinese growth, and bouts of global market volatility. We believe growth will continue at a modest to moderate pace in the months ahead, but there is the possibility that disruptive events overseas or a U.S. government failure to prevent or moderate tax increases and spending cuts scheduled to take place at the end of 2012 could jeopardize the expansion.

To support the economy, the Federal Reserve maintained highly accommodative monetary policies in the first half of the portfolio’s fiscal year, keeping the fed funds target rate in its 0.00% to 0.25% range established at the end of 2008. Also, central bank officials indicated that they would likely keep short-term interest rates very low until late 2014. In addition, the Fed announced in late June that it would extend its maturity extension program, which was set to expire at the end of our reporting period. Through this program, the Fed sold $400 billion of its short-term Treasuries and purchased an equal amount of long-term Treasuries since autumn 2011. By the end of 2012, the central bank plans to exchange an additional $267 billion in short-term Treasuries for long-term government bonds.

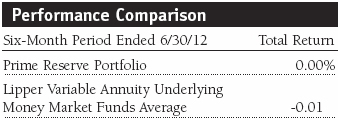

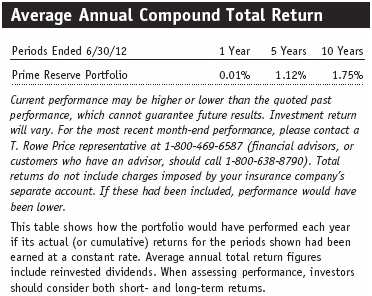

Performance Comparison

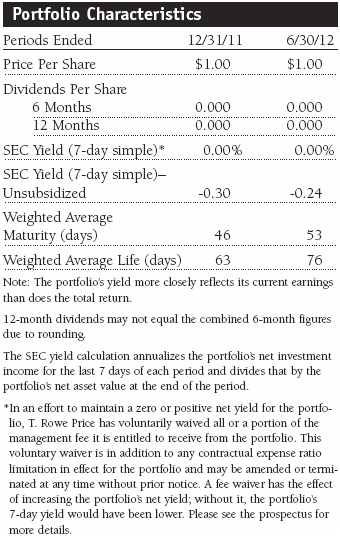

The Prime Reserve Portfolio returned 0.00% in the six-month period ended June 30, 2012. As shown in the Performance Comparison table, the portfolio performed in line with its peer group average. Like many of its peers, T. Rowe Price has voluntarily waived all or a portion of the management fee it is entitled to receive from the portfolio in an effort to maintain a 0% or positive net yield for the portfolio. The Lipper benchmark’s negative return reflects the fact that some of the portfolios represented in the peer group average are cash management accounts whose annuity unit values—which are not necessarily fixed at $1.00—declined slightly during our reporting period.

Portfolio Review

Financial markets continue to be unsettled by a series of worries emanating from multiple directions. The slowly spreading sovereign debt and banking crisis in Europe, the disappointing U.S. employment trends, and the possibility that our economy could be undercut by a significant tightening of fiscal policy—a so-called fiscal cliff—around year-end have combined to create a mood of uncertainty for investors. Such uncertainty defers economic recovery and leaves the Federal Reserve few options other than to continue its massively stimulative monetary policy. Although we are more than three and a half years into the era of 0% interest rates, it seems this extraordinary policy will be with us for quite some time to come.

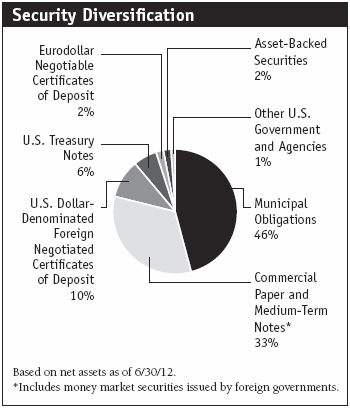

Money market funds have to contend not only with ultra-low interest rates, but also with a significantly changing credit situation. The European crisis has caused most investors to rethink their views toward many European bank borrowers; indeed, the portfolio now has no unsecured exposure to European banks. The pullback in European bank funding by money funds has been compounded by a systematic series of ratings agency downgrades by Moody’s, which, when complete, will render many money-center banks unable to tap money funds for the short-term unsecured funding to which they had grown accustomed. The money fund industry, as a whole, appears well prepared for such changes. Most funds have become quite discerning as to whom they are willing to lend to, and for how long. Still, the number of high-quality borrowers continues to shrink, and the opportunities for yield enhancement have been virtually eliminated from our market.

Rates in the money market space showed little change over the past six months. The U.S. Treasury bill market remains subject to limited supply and episodic flights to quality. Treasury yields are up somewhat from our last report. As of June 30, 2012, three-month bills yielded about 0.08%, six-month bills 0.16%, and the one-year bill around 0.22%. Ninety-day LIBOR, the basis for pricing in most of the commercial paper and certificate of deposit (CD) markets, was at 0.46%, slightly lower than it was at the end of 2011. Nevertheless, most of the high-quality names in which we invest have much lower yields. Municipal variable rate securities, which have come to represent a sizable portion of the portfolio, have recently risen to around 0.16% versus 0.11% six months ago.

Portfolio holdings continue to represent our bias toward quality. Treasury debt, Treasury-guaranteed debt, and Canadian debt, as well as banks in Canada and Australia, represent our largest positions in an otherwise highly diversified portfolio. Municipal variable rate demand notes represented more than 40% of the portfolio, as their yields and liquidity attributes make them attractive investments for now. We’ve also opportunistically added some very high-quality asset-backed debt when we felt their structures presented value. Recently, we have begun adding very high-quality industrial and pharmaceutical names to the portfolio.

While we remain very defensive in our posture toward credit risk, we are also quite aggressive in our posture toward interest rates. Barring a credit-negative headline event or a significant shift in Fed policy, most money market rates should continue to crowd around 0% for some time to come. Thus, we are quite comfortable keeping the portfolio’s weighted average maturity near the permissible maximum of 60 days.

Outlook

With the potential for the U.S. economy to stall, Europe still simmering, and the inability of Washington to address significant policy matters, our view is that the Fed has no choice but to leave its 0% interest rate policy in place at least until late 2014. This, unfortunately, means that money fund returns are likely to remain very low for some time. Nevertheless, our focus remains on principal stability, quality, and liquidity.

Respectfully submitted,

Joseph K. Lynagh

Chairman of the portfolio’s Investment Advisory Committee

July 12, 2012

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the portfolio’s investment program.

| Risks of Investing in Money Market Securities |

Since money market portfolios are managed to maintain a constant $1.00 share price, there should be little risk of principal loss. However, there is no assurance the portfolio will avoid principal losses if holdings default or are downgraded or if interest rates rise sharply in an unusually short period. In addition, the portfolio’s yield will vary; it is not fixed for a specific period like the yield on a bank certificate of deposit. An investment in the portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although a money market portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in it.

| Glossary |

Fed funds target rate: The interest rate charged on overnight loans of reserves by one financial institution to another in the United States. The Federal Reserve sets a target federal funds rate to affect the direction of interest rates.

LIBOR: The London Interbank Offered Rate, which is a benchmark for short-term taxable rates.

Lipper average: The averages of available mutual fund performance returns for specified time periods in categories defined by Lipper Inc.

SEC yield (7-day unsubsidized simple): A method of calculating a money fund’s yield by annualizing the fund’s net investment income for the last seven days of each period divided by the fund’s net asset value at the end of the period. Yield will vary and is not guaranteed.

Weighted average life: A measure of a fund’s credit quality risk. In general, the longer the average life, the greater the fund’s credit quality risk. The average life is the dollar-weighted average maturity of a portfolio’s individual securities without taking into account interest rate readjustment dates. Money funds must maintain a weighted average life of less than 120 days.

Weighted average maturity: A measure of a fund’s interest rate sensitivity. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. The weighted average maturity may take into account the interest rate readjustment dates for certain securities. Money funds must maintain a weighted average maturity of less than 60 days.

Performance and Expenses

T. Rowe Price Prime Reserve Portfolio

| Growth of $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the portfolio over the past 10 fiscal year periods or since inception (for portfolios lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from portfolio returns as well as mutual fund averages and indexes.

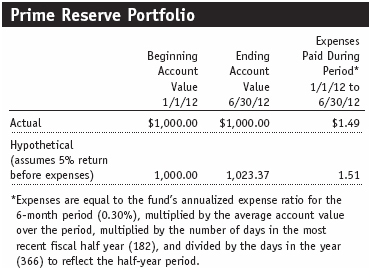

Fund Expense Example

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and actual expenses. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

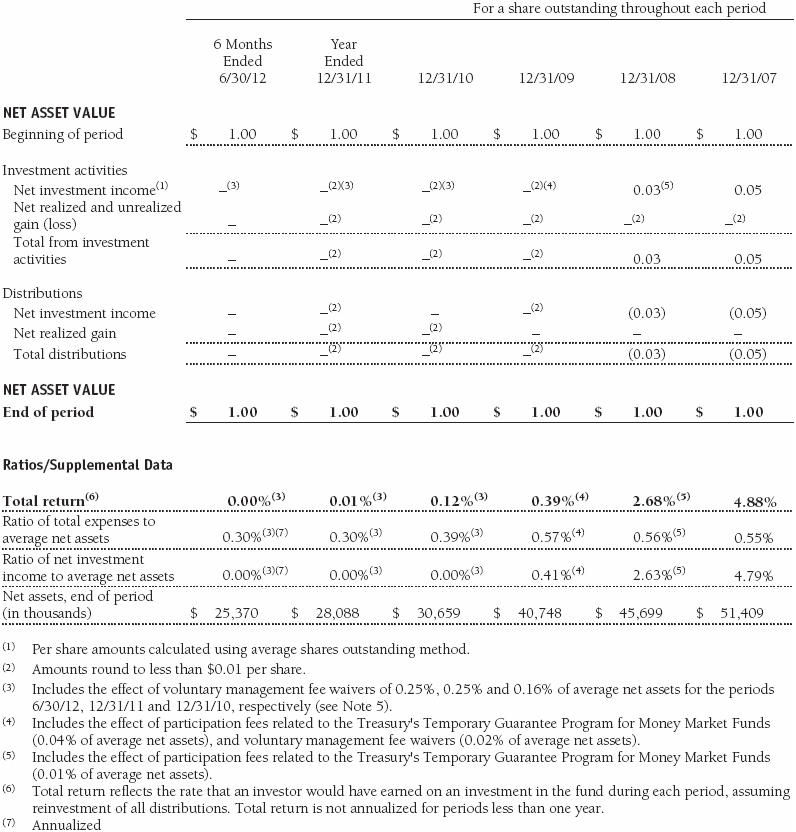

Financial Highlights

T. Rowe Price Prime Reserve Portfolio

(Unaudited)

The accompanying notes are an integral part of these financial statements.

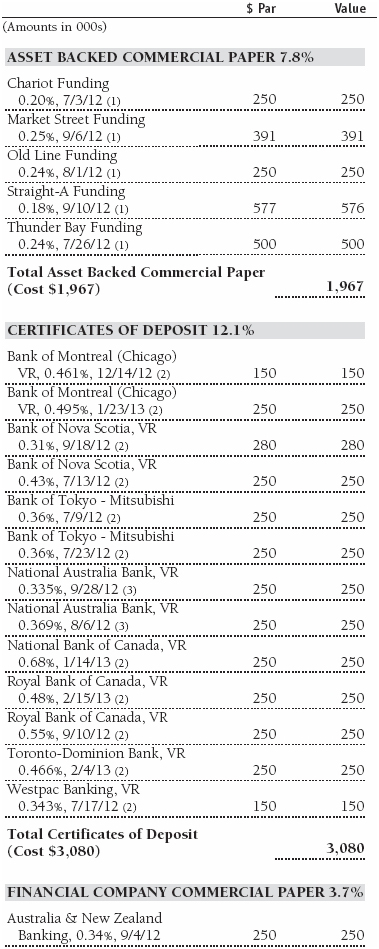

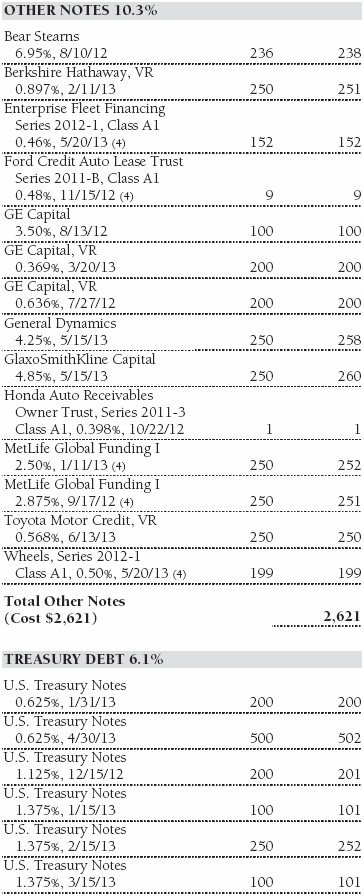

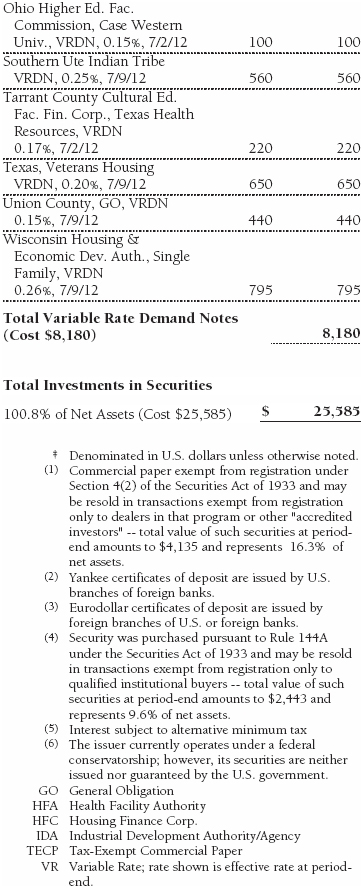

Portfolio of Investments‡

T. Rowe Price Prime Reserve Portfolio

June 30, 2012 (Unaudited)

The accompanying notes are an integral part of these financial statements.

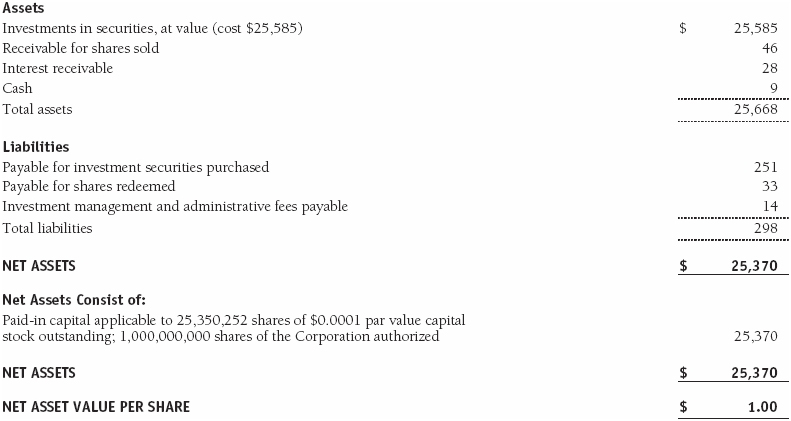

Statement of Assets and Liabilities

T. Rowe Price Prime Reserve Portfolio

June 30, 2012 (Unaudited)

($000s, except shares and per share amounts)

The accompanying notes are an integral part of these financial statements.

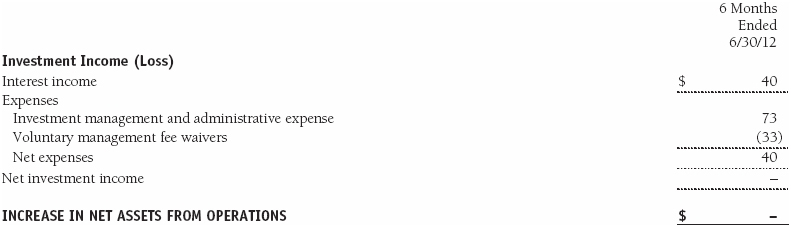

Statement of Operations

T. Rowe Price Prime Reserve Portfolio

(Unaudited)

($000s)

The accompanying notes are an integral part of these financial statements.

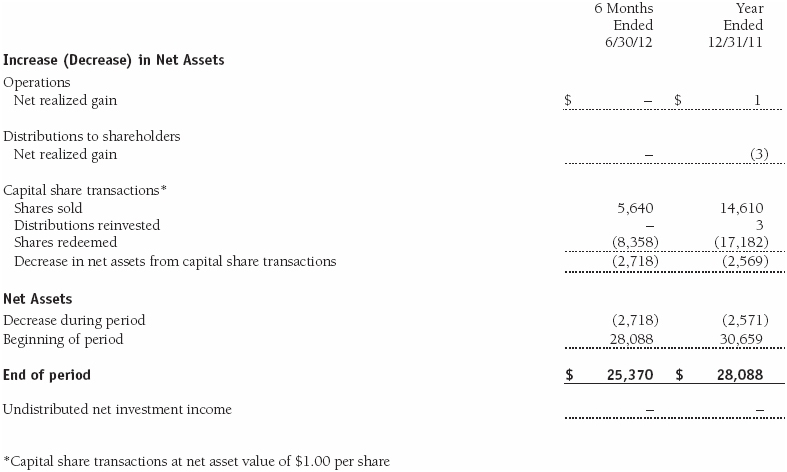

Statement of Changes in Net Assets

T. Rowe Price Prime Reserve Portfolio

(Unaudited)

($000s)

The accompanying notes are an integral part of these financial statements.

Notes to Financial Statements

T. Rowe Price Prime Reserve Portfolio

June 30, 2012 (Unaudited)

T. Rowe Price Fixed Income Series, Inc. (the corporation), is registered under the Investment Company Act of 1940 (the 1940 Act). The Prime Reserve Portfolio (the fund) is a diversified, open-end management investment company established by the corporation. The fund commenced operations on December 31, 1996. The fund seeks preservation of capital, liquidity, and, consistent with these, the highest possible current income. Shares of the fund are currently offered only through certain insurance companies as an investment medium for both variable annuity contracts and variable life insurance policies.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Paydown gains and losses are recorded as an adjustment to interest income. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared daily and paid monthly.

Credits Credits are earned on the fund’s temporarily uninvested cash balances held at the custodian and such credits reduce the amount paid by the manager for custody of the fund’s assets. In order to pass the benefit of custody credits to the fund, the manager has voluntarily reduced its investment management and administrative expense in the accompanying financial statements.

New Accounting Pronouncements In May 2011, the Financial Accounting Standards Board (FASB) issued amended guidance to align fair value measurement and disclosure requirements in U.S. GAAP with International Financial Reporting Standards. The guidance is effective for fiscal years and interim periods beginning on or after December 15, 2011. Adoption had no effect on net assets or results of operations.

In December 2011, the FASB issued amended guidance to enhance disclosure for offsetting assets and liabilities. The guidance is effective for fiscal years and interim periods beginning on or after January 1, 2013. Adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund values its investments and computes its net asset value per share each day that the New York Stock Exchange is open for business. In accordance with Rule 2a-7 under the 1940 Act, securities are valued at amortized cost, which approximates fair value. Securities for which amortized cost is deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical financial instruments

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar financial instruments, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. For example, securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market. On June 30, 2012, all of the fund’s financial instruments were classified as Level 2, based on the inputs used to determine their values.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

Repurchase Agreements All repurchase agreements are fully collateralized by U.S. government securities. Collateral is in the possession of the fund’s custodian or, for tri-party agreements, the custodian designated by the agreement. Collateral is evaluated daily to ensure that its market value exceeds the delivery value of the repurchase agreements at maturity. Although risk is mitigated by the collateral, the fund could experience a delay in recovering its value and a possible loss of income or value if the counterparty fails to perform in accordance with the terms of the agreement.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

The fund intends to retain realized gains to the extent of available capital loss carryforwards. Net realized capital losses may be carried forward indefinitely to offset future realized capital gains.

At June 30, 2012, the cost of investments for federal income tax purposes was $25,585,000.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management and administrative agreement between the fund and Price Associates provides for an all-inclusive annual fee equal to 0.55% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The all-inclusive fee covers investment management, shareholder servicing, transfer agency, accounting, and custody services provided to the fund, as well as fund directors’ fees and expenses; interest, taxes, brokerage commissions, and extraordinary expenses are paid directly by the fund.

Price Associates may voluntarily waive all or a portion of its management fee and reimburse operating expenses to the extent necessary for the fund to maintain a zero or positive net yield (voluntary waiver). Any amounts waived or reimbursed under this voluntary agreement are not subject to repayment by the fund. Price Associates may amend or terminate this voluntary arrangement at any time without prior notice. For the six months ended June 30, 2012, management fees waived and operating expenses reimbursed totaled $33,000.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov. The description of our proxy voting policies and procedures is also available on our website, troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| Approval of Investment Management Agreement |

On March 6, 2012, the fund’s Board of Directors (Board), including a majority of the fund’s independent directors, approved the continuation of the investment management agreement (Advisory Contract) between the fund and its investment advisor, T. Rowe Price Associates, Inc. (Advisor). In connection with its deliberations, the Board requested, and the Advisor provided, such information as the Board (with advice from independent legal counsel) deemed reasonably necessary. The Board considered a variety of factors in connection with its review of the Advisory Contract, also taking into account information provided by the Advisor during the course of the year, as discussed below:

Services Provided by the Advisor

The Board considered the nature, quality, and extent of the services provided to the fund by the Advisor. These services included, but were not limited to, directing the fund’s investments in accordance with its investment program and the overall management of the fund’s portfolio, as well as a variety of related activities such as financial, investment operations, and administrative services; compliance; maintaining the fund’s records and registrations; and shareholder communications. The Board also reviewed the background and experience of the Advisor’s senior management team and investment personnel involved in the management of the fund, as well as the Advisor’s compliance record. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Advisor.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total returns over the three-month and 1-, 3-, 5-, and 10-year periods, as well as the fund’s year-by-year returns, and compared these returns with a wide variety of previously agreed upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Advisor under the Advisory Contract and other benefits that the Advisor (and its affiliates) may have realized from its relationship with the fund, including any research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Advisor may receive some benefit from soft-dollar arrangements pursuant to which research is received from broker-dealers that execute the applicable fund’s portfolio transactions. The Board received information on the estimated costs incurred and profits realized by the Advisor from managing T. Rowe Price mutual funds. While the Board did not review information regarding profits realized from managing the fund in particular because the fund had not achieved sufficient scale to produce meaningful profit margin percentages, the Board concluded that the Advisor’s profits were reasonable in light of the services provided to the fund.

The Board also considered whether the fund benefits under the fee levels set forth in the Advisory Contract from any economies of scale realized by the Advisor. The Board noted that, under the Advisory Contract, the fund pays the Advisor a single fee based on the fund’s average daily net assets that includes investment management services and provides for the Advisor to pay all expenses of the fund’s operations except for interest, taxes, portfolio transaction fees, and any nonrecurring extraordinary expenses that may arise. The Board also noted that an arrangement is in place whereby the Advisor may voluntarily waive all or a portion of the management fee it is entitled to receive from the fund or pay all or a portion of the fund’s operating expenses in order to maintain a zero or positive net yield for the fund. The Board concluded that, based on the profitability data it reviewed and consistent with this single-fee structure, the Advisory Contract provided for a reasonable sharing of any benefits from economies of scale with the fund.

Fees

The Board was provided with information regarding industry trends in management fees and expenses and the Board reviewed the fund’s single-fee structure in comparison with fees and expenses of other comparable funds based on information and data supplied by Lipper. For these purposes, the Board assumed that the fund’s management fee rate was equal to the single fee less the fund’s operating expenses. After including reductions resulting from voluntary management fee waivers and expenses paid by the Advisor, the information provided to the Board indicated that the fund’s management fee rate was below the median for comparable funds and that the fund’s total expense ratio was above the median for comparable funds.

The Board also reviewed the fee schedules for institutional accounts and private accounts with similar mandates that are advised or subadvised by the Advisor and its affiliates. Management provided the Board with information about the Advisor’s responsibilities and services provided to institutional account clients, including information about how the requirements and economics of the institutional business are fundamentally different from those of the mutual fund business. The Board considered information showing that the mutual fund business is generally more complex from a business and compliance perspective than the institutional business and that the Advisor generally performs significant additional services and assumes greater risk in managing the fund and other T. Rowe Price mutual funds than it does for institutional account clients.

On the basis of the information provided and the factors considered, the Board concluded that the fees paid by the fund under the Advisory Contract are reasonable.

Approval of the Advisory Contract

As noted, the Board approved the continuation of the Advisory Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund and its shareholders for the Board to approve the continuation of the Advisory Contract (including the fees to be charged for services thereunder). The independent directors were advised throughout the process by independent legal counsel.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Fixed Income Series, Inc.

| By | /s/ Edward C. Bernard | |

| Edward C. Bernard | ||

| Principal Executive Officer | ||

| Date August 16, 2012 | ||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ Edward C. Bernard | |

| Edward C. Bernard | ||

| Principal Executive Officer | ||

| Date August 16, 2012 | ||

| By | /s/ Gregory K. Hinkle | |

| Gregory K. Hinkle | ||

| Principal Financial Officer | ||

| Date August 16, 2012 | ||