UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07153

| T. Rowe Price Fixed Income Series, Inc. |

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Item 1. Report to Shareholders

|

| Government Money Portfolio | December 31, 2016 |

| Highlights |

| ● | Money market yields increased in 2016—a welcome development for money fund investors. |

| ● | Your portfolio slightly lagged its Lipper peer group average in our 6- and 12-month reporting periods. |

| ● | With a significant asset shift into Treasury and government money funds leading to heightened demand that suppressed T-bill yields, we maintained a weighted average maturity that was somewhat longer than that of our peer group average. |

| ● | While the Fed raised rates in December, inflation remains fairly low, so we expect that the future pace of Fed tightening will be very deliberate. Money market investors should expect returns to remain subdued for some time. |

The views and opinions in this report were current as of December 31, 2016. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

Manager’s Letter

T. Rowe Price Government Money Portfolio

Dear Investor

Money market yields increased in 2016—a welcome development for money fund investors. Treasury bill yields were little changed for much of the year, as the SEC’s long-planned money market fund reforms, which took effect in October, prompted a broad shift in money market fund assets to U.S. government securities. However, T-bill yields rose in the last few months in anticipation of a Federal Reserve interest rate increase, which occurred on December 14. Yields of nongovernment money market securities, such as commercial paper, increased in 2016, in part because of decreased demand stemming from money fund reforms.

Economy and Interest Rates

U.S. economic growth has picked up recently after sluggish results in the first half of the year. According to the Commerce Department’s latest estimate, third-quarter gross domestic product grew at an annualized pace of 3.5%, following readings of 0.8% and 1.4% in the first and second quarters, respectively. Although the pace of employment growth has moderated, the labor market remains strong, and wage growth has accelerated. The unemployment rate was 4.7% in December, near a nine-year low. Inflation pressures have been firming in recent months as commodity prices have rebounded from early-2016 lows.

For most of 2016, the Federal Reserve kept its federal funds target rate in the 0.25% to 0.50% range it established when it raised rates in December 2015 for the first time in nine years. While the Fed was on hold for most of the year, central bank officials have been indicating in recent months that the case for raising short-term rates “has strengthened,” thus warning the financial markets that another rate increase was approaching. This put some upward pressure on T-bill yields, but the heightened demand for T-bills ahead of the October 14 money fund reform deadline tempered their increase.

On December 14, 2016, the Federal Reserve lifted the fed funds target rate to a range of 0.50% to 0.75%—an increase of 25 basis points—citing an improving labor market and rising inflation. (One hundred basis points equal one percentage point.) The central bank’s economic forecasts were little changed, but median interest rate projections for 2017 shifted slightly higher. We believe the Fed is likely to watch the effects of its latest rate increase on the economy and financial markets for several months before deciding whether to raise rates again. The Fed will also need to take into account the new president’s fiscal policies and their effects on economic growth and inflation.

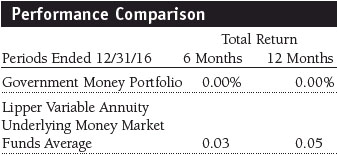

Performance and Portfolio Review

The Government Money Portfolio returned 0.00% in the last six months and 0.00% for the 12-month period ended December 31, 2016. As shown in the Performance Comparison table, the portfolio slightly lagged its benchmark, the Lipper Variable Annuity Underlying Money Market Funds Average, in both periods.

The accelerating demand for Treasury and government obligations contained T-bill yields for most of the year. Once money fund reforms took effect, and once the November elections passed, T-bill yields rose in anticipation of the Fed’s December rate hike. From the end of 2015 through the end of October 2016, three-month Treasury bill yields increased from 0.16% to 0.34%, and then they rose to 0.51% at the end of 2016. Six-month T-bill yields rose from 0.49% to 0.51% through the end of October, and then they rose to 0.62% at the end of 2016. One-year Treasury bill yields, which were at 0.65% at the end of 2015, increased to 0.85% by the end of 2016. Yields of agency discount notes, because of strong demand from money fund investors, generally tracked Treasury bill yields.

Significant uncertainty dominated the money markets in the final months of 2016. Both money fund reform and expectations around the Fed’s timing for rate hikes dominated our thinking. With a significant asset shift into Treasury and government money funds leading to heightened demand that suppressed T-bill yields, we maintained a weighted average maturity that was somewhat longer than that of our peer group average. This strategy enabled us to take advantage of rates moving gradually higher—without compromising the portfolio’s high degree of liquidity—as we moved toward year-end and the likelihood of a Fed rate hike. We expect to maintain a similar weighted average maturity in the early months of 2017.

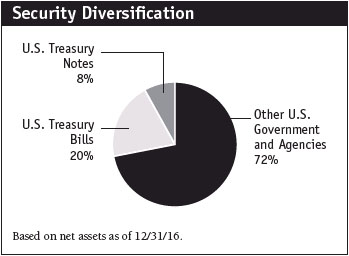

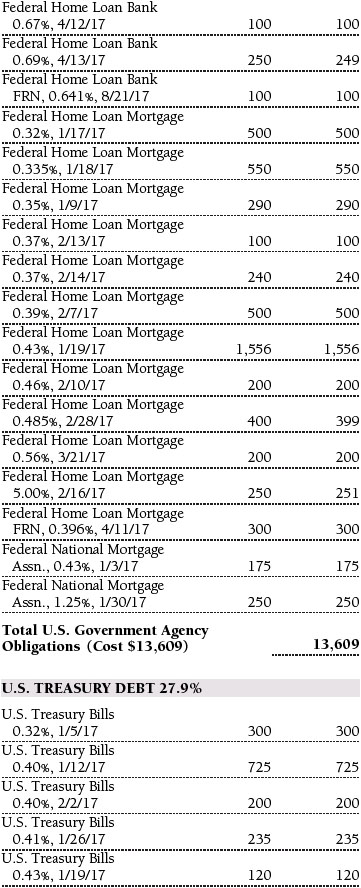

As a government money fund, the portfolio is required to invest almost exclusively in T-bills and other U.S. government securities. Of course, the portfolio is not subject to the liquidity fees and redemption restrictions (also known as “gates”) that may be applied to nongovernment money funds during times of severe redemption activity. At the end of December, approximately 28% of portfolio assets were invested in U.S. Treasury bills and notes while other U.S. government and agency securities represented about 72%.

Outlook

While the Fed raised rates in December, inflation remains fairly low, so we expect that the future pace of Fed tightening will be very deliberate. With this forecast, money market investors should expect returns to remain subdued for some time. In any event, we remain committed to managing a high-quality, diversified portfolio focused on liquidity and stability of principal, which we deem of utmost importance to our shareholders.

As always, thank you for investing with T. Rowe Price.

Respectfully submitted,

Joseph K. Lynagh

Chairman of the portfolio’s Investment Advisory Committee

January 20, 2017

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing its investment program.

| Risks of Investing in Government Money Market Funds |

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

| Glossary |

Basis point: One one-hundredth of one percentage point, or 0.01%.

Federal funds target rate: The interest rate charged on overnight loans of reserves by one financial institution to another in the United States. The Federal Reserve sets a target federal funds rate to affect the direction of interest rates.

Gross domestic product: The total market value of all goods and services produced in a country in a given year.

Lipper indexes: Fund benchmarks that consist of a small number (10 to 30) of the largest mutual funds in a particular category as tracked by Lipper Inc.

SEC yield (7-day simple): A method of calculating a money fund’s yield by annualizing the fund’s net investment income for the last seven days of each period divided by the fund’s net asset value at the end of the period. Yield will vary and is not guaranteed.

Weighted average life: A measure of a fund’s credit quality risk. In general, the longer the average life, the greater the fund’s credit quality risk. The average life is the dollar-weighted average maturity of a portfolio’s individual securities without taking into account interest rate readjustment dates. Money funds must maintain a weighted average life of less than 120 days.

Weighted average maturity: A measure of a fund’s interest rate sensitivity. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. The weighted average maturity may take into account the interest rate readjustment dates for certain securities. Money funds must maintain a weighted average maturity of less than 60 days.

Performance and Expenses

T. Rowe Price Government Money Portfolio

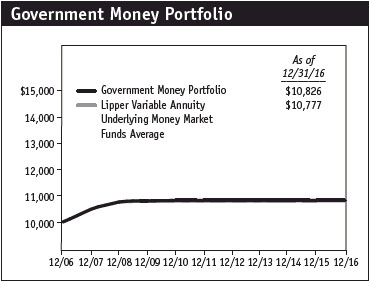

| Growth of $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the portfolio over the past 10 fiscal year periods or since inception (for portfolios lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from portfolio returns as well as mutual fund averages and indexes.

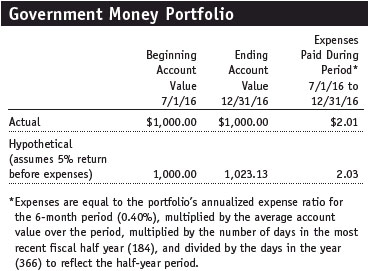

Fund Expense Example

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and actual expenses. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

Financial Highlights

T. Rowe Price Government Money Portfolio

The accompanying notes are an integral part of these financial statements.

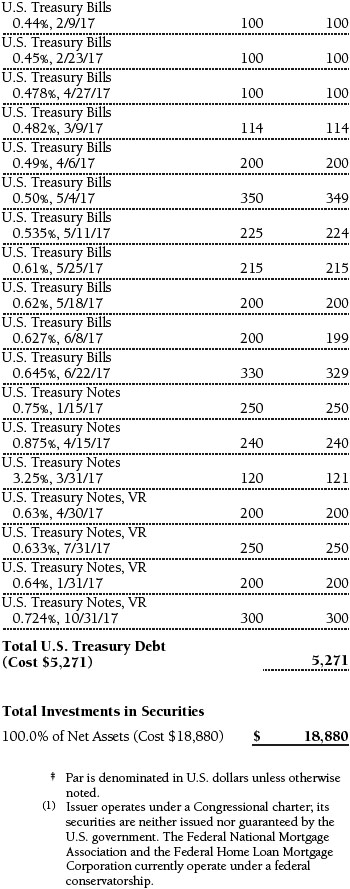

Portfolio of Investments‡

T. Rowe Price Government Money Portfolio

December 31, 2016

The accompanying notes are an integral part of these financial statements.

Statement of Assets and Liabilities

T. Rowe Price Government Money Portfolio

December 31, 2016

($000s, except shares and per share amounts)

The accompanying notes are an integral part of these financial statements.

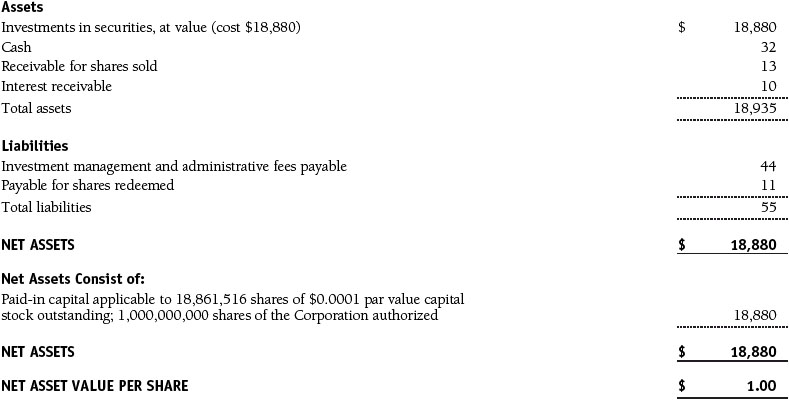

Statement of Operations

T. Rowe Price Government Money Portfolio

($000s)

The accompanying notes are an integral part of these financial statements.

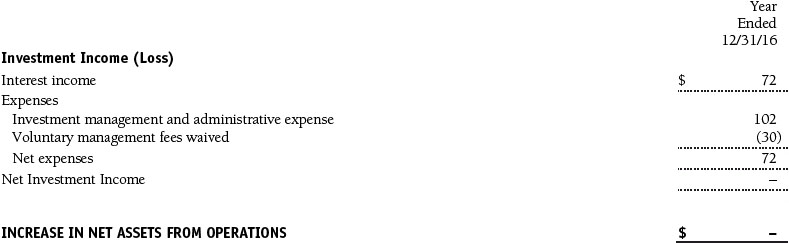

Statement of Changes in Net Assets

T. Rowe Price Government Money Portfolio

($000s)

The accompanying notes are an integral part of these financial statements.

Notes to Financial Statements

T. Rowe Price Government Money Portfolio

December 31, 2016

T. Rowe Price Fixed Income Series, Inc. (the corporation), is registered under the Investment Company Act of 1940 (the 1940 Act). The T. Rowe Price Government Money Portfolio (the fund), formerly the T. Rowe Price Prime Reserve Portfolio, is a diversified, open-end management investment company established by the corporation. The fund seeks preservation of capital, liquidity, and, consistent with these, the highest possible current income. Shares of the fund are currently offered only through certain insurance companies as an investment medium for both variable annuity contracts and variable life insurance policies.

In accordance with amendments to rules governing money market funds under the 1940 Act (amendments) and as approved by the fund’s Board, the fund intends to operate as a government money market fund. On May 1, 2016, the fund adopted a policy to, under normal conditions, invest at least 80% of its net assets in U.S. government securities and repurchase agreements that are collateralized by U.S. government securities. On October 14, 2016, the fund also adopted a policy to invest at least 99.5% of its total assets in cash, U.S. government securities, and/or repurchase agreements that are collateralized by U.S. government securities or cash. The fund will generally continue to value its securities at amortized cost and transact at a stable $1.00 net asset value per share. The amendments do not require government money market funds to, and the fund has no intention to voluntarily, impose liquidity fees on redemptions or temporarily suspend redemptions.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Paydown gains and loses are recorded as an adjustment to interest income. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Income distributions are declared daily and paid monthly. Distributions to shareholders are recorded on the ex-dividend date. Capital gain distributions are generally declared and paid by the fund annually.

New Accounting Guidance In October 2016, the Securities and Exchange Commission (SEC) issued a new rule, Investment Company Reporting Modernization, which, among other provisions, amends Regulation S-X to require standardized, enhanced disclosures, particularly related to derivatives, in investment company financial statements. Compliance with the guidance is required for financial statements filed with the SEC on or after August 1, 2017; adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s financial instruments are valued and its net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. The fund’s financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value. The T. Rowe Price Valuation Committee (the Valuation Committee) is an internal committee that has been delegated certain responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values. For example, securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

In accordance with Rule 2a-7 under the 1940 Act, the fund values its securities at amortized cost, which approximates fair value. Securities for which amortized cost is deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. On December 31, 2016, all of the fund’s financial instruments were classified as Level 2 in the fair value hierarchy.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Mortgage-Backed Securities The fund may invest in mortgage-backed securities (MBS or pass-through certificates) that represent an interest in a pool of specific underlying mortgage loans and entitle the fund to the periodic payments of principal and interest from those mortgages. MBS may be issued by government agencies or corporations, or private issuers. Most MBS issued by government agencies are guaranteed; however, the degree of protection differs based on the issuer. MBS, are sensitive to changes in economic conditions that affect the rate of prepayments and defaults on the underlying mortgages; accordingly, the value, income, and related cash flows from MBS may be more volatile than other debt instruments.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Distributions during the year ended December 31, 2015 were characterized for tax purposes as $2,000 of ordinary income. There were no distributions in the year ended December 31, 2016. At December 31, 2016, the tax-basis cost of investments and components of net assets were as follows:

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management and administrative agreement between the fund and Price Associates provides for an all-inclusive annual fee equal to 0.55% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The all-inclusive fee covers investment management, shareholder servicing, transfer agency, accounting, and custody services provided to the fund, as well as fund directors’ fees and expenses. Interest, taxes, brokerage commissions, and other non-recurring expenses permitted by the investment management agreement are paid directly by the fund.

Price Associates may voluntarily waive all or a portion of its management fee and reimburse operating expenses to the extent necessary for the fund to maintain a zero or positive net yield (voluntary waiver). Any amounts waived/paid by Price Associates under this voluntary agreement are not subject to repayment by the fund. Price Associates may amend or terminate this voluntary arrangement at any time without prior notice. For the year ended December 31, 2016, expenses waived/repaid totaled $30,000.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the year ended December 31, 2016, the fund had no purchases or sales cross trades with other funds or accounts advised by Price Associates.

Report of Independent Registered Public Accounting Firm

To the Board of Directors of T. Rowe Price Fixed Income Series, Inc. and Shareholders of T. Rowe Price

Government Money Portfolio (formerly known as T. Rowe Price Prime Reserve Portfolio)

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Government Money Portfolio (formerly known as T. Rowe Price Prime Reserve Portfolio) (one of the portfolios constituting T. Rowe Price Fixed Income Series, Inc., hereafter referred to as the “Fund”) as of December 31, 2016, the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities as of December 31, 2016 by correspondence with the custodian, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 8, 2017

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www3.troweprice.com/usis/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Portfolio’s Directors and Officers |

Your portfolio is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting or potentially affecting the portfolio, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and business and regulatory affairs. The Board elects the portfolio’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the portfolio directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

Independent Directors

| Name (Year of Birth) Year Elected* [Number of T. Rowe Price Portfolios Overseen] | Principal Occupation(s) and Directorships of Public Companies and Other Investment Companies During the Past Five Years | |

| William R. Brody, M.D., Ph.D. (1944) 2009 [187] | President and Trustee, Salk Institute for Biological Studies (2009 to present); Director, BioMed Realty Trust (2013 to 2016); Chairman of the Board, Mesa Biotech, a molecular diagnostic company (March 2016 to present); Director, Radiology Partners, an integrated radiology practice management company (June 2016 to present); Director, Novartis, Inc. (2009 to 2014); Director, IBM (2007 to present) | |

| Anthony W. Deering (1945) 1994 [187] | Chairman, Exeter Capital, LLC, a private investment firm (2004 to present); Director, Brixmor Real Estate Investment Trust (2012 to present); Director and Advisory Board Member, Deutsche Bank North America (2004 to present); Director, Under Armour (2008 to present); Director, Vornado Real Estate Investment Trust (2004 to 2012) | |

| Bruce W. Duncan (1951) 2013 [187] | Chief Executive Officer and Director (2009 to present), Chairman of the Board (January 2016 to present), and President (2009 to September 2016), First Industrial Realty Trust, an owner and operator of industrial properties; Chairman of the Board (2005 to May 2016) and Director (1999 to May 2016), Starwood Hotels & Resorts, a hotel and leisure company; Director, Boston Properties (May 2016 to present) | |

| Robert J. Gerrard, Jr. (1952) 2013 [187] | Advisory Board Member, Pipeline Crisis/Winning Strategies, a collaborative working to improve opportunities for young African Americans (1997 to present) | |

| Paul F. McBride (1956) 2013 [187] | Advisory Board Member, Vizzia Technologies (2015 to present) | |

| Cecilia E. Rouse, Ph.D. (1963) 2013 [187] | Dean, Woodrow Wilson School (2012 to present); Professor and Researcher, Princeton University (1992 to present); Director, MDRC, a nonprofit education and social policy research organization (2011 to present); Member of National Academy of Education (2010 to present); Research Associate of Labor Program (2011 to present) and Board Member (2015 to present), National Bureau of Economic Research (2011 to present); Chair of Committee on the Status of Minority Groups in the Economic Profession (2012 to present) and Vice President (2015 to present), American Economic Association | |

| John G. Schreiber (1946) 1994 [187] | Owner/President, Centaur Capital Partners, Inc., a real estate investment company (1991 to present); Cofounder, Partner, and Cochairman of the Investment Committee, Blackstone Real Estate Advisors, L.P. (1992 to 2015); Director, General Growth Properties, Inc. (2010 to 2013); Director, Blackstone Mortgage Trust, a real estate finance company (2012 to 2016); Director and Chairman of the Board, Brixmor Property Group, Inc. (2013 to present); Director, Hilton Worldwide (2013 to present); Director, Hudson Pacific Properties (2014 to 2016) | |

| Mark R. Tercek (1957) 2009 [187] | President and Chief Executive Officer, The Nature Conservancy (2008 to present) | |

| *Each independent director serves until retirement, resignation, or election of a successor. | ||

| Inside Director | ||

| Name (Year of Birth) Year Elected* [Number of T. Rowe Price Portfolios Overseen] | Principal Occupation(s) and Directorships of Public Companies and Other Investment Companies During the Past Five Years | |

| Edward C. Bernard (1956) 2006 [187] | Director and Vice President, T. Rowe Price; Vice Chairman of the Board, Director, and Vice President, T. Rowe Price Group, Inc.; Chairman of the Board, Director, and President, T. Rowe Price Investment Services, Inc.; Chairman of the Board and Director, T. Rowe Price Retirement Plan Services, Inc., and T. Rowe Price Services, Inc.; Chairman of the Board, Chief Executive Officer, Director, and President, T. Rowe Price International and T. Rowe Price Trust Company; Chairman of the Board, all funds | |

| Edward A. Wiese, CFA (1959) 2015 [56] | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price International, and T. Rowe Price Trust Company; President, Fixed Income Series | |

| *Inside director serves until retirement, resignation, or election of a successor. | ||

| Officers | ||

| Name (Year of Birth) Position Held With Fixed Income Series | Principal Occupation(s) | |

| Darrell N. Braman (1963) Vice President and Secretary | Vice President, Price Hong Kong, Price Singapore, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price International, T. Rowe Price Investment Services, Inc., and T. Rowe Price Services, Inc. | |

| Steven G. Brooks, CFA (1954) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Jason T. Collins (1971) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| M. Helena Condez (1962) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Levent Demirekler (1974) Vice President | Vice President, T. Rowe Price | |

| G. Richard Dent (1960) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Stephanie A. Gentile, CFA (1956) Vice President | Vice President, T. Rowe Price; formerly, Director, Credit Suisse Securities (to 2014) | |

| John R. Gilner (1961) Chief Compliance Officer | Chief Compliance Officer and Vice President, T. Rowe Price; Vice President, T. Rowe Price Group, Inc., and T. Rowe Price Investment Services, Inc. | |

| Michael J. Grogan, CFA (1971) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Geoffrey M. Hardin (1971) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Charles B. Hill, CFA (1961) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Keir R. Joyce, CFA (1972) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Steven M. Kohlenstein (1987) Assistant Vice President | Assistant Vice President, T. Rowe Price | |

| Paul J. Krug, CPA (1964) Vice President | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company | |

| Marcy M. Lash (1963) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Alan D. Levenson, Ph.D. (1958) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Joseph K. Lynagh, CFA (1958) Executive Vice President | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company | |

| Catherine D. Mathews (1963) Treasurer and Vice President | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company | |

| Andrew C. McCormick (1960) Vice President | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company | |

| Cheryl A. Mickel, CFA (1967) Vice President | Director and Vice President, T. Rowe Price Trust Company; Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| David Oestreicher (1967) Vice President | Director, Vice President, and Secretary, T. Rowe Price Investment Services, Inc., T. Rowe Price Retirement Plan Services, Inc., T. Rowe Price Services, Inc., and T. Rowe Price Trust Company; Chief Legal Officer, Vice President, and Secretary, T. Rowe Price Group, Inc.; Vice President and Secretary, T. Rowe Price and T. Rowe Price International; Vice President, Price Hong Kong and Price Singapore | |

| John W. Ratzesberger (1975) Vice President | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company; formerly, North American Head of Listed Derivatives Operation, Morgan Stanley (to 2013) | |

| Shannon H. Rauser (1987) Assistant Secretary | Employee, T. Rowe Price | |

| Vernon A. Reid, Jr. (1954) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Michael F. Reinartz (1973) Executive Vice President | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company | |

| Deborah D. Seidel (1962) Vice President | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price Investment Services, Inc., and T. Rowe Price Services, Inc. | |

| Chen Shao (1980) Vice President | Vice President, T. Rowe Price | |

| Douglas D. Spratley, CFA (1969) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Robert D. Thomas (1971) Vice President | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| John D. Wells (1960) Vice President | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least 5 years. | ||

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Bruce W. Duncan qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Duncan is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $2,146,000 and $2,158,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Fixed Income Series, Inc.

| By | /s/ Edward C. Bernard | |

| Edward C. Bernard | ||

| Principal Executive Officer | ||

| Date February 8, 2017 | ||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ Edward C. Bernard | |

| Edward C. Bernard | ||

| Principal Executive Officer | ||

| Date February 8, 2017 | ||

| By | /s/ Catherine D. Mathews | |

| Catherine D. Mathews | ||

| Principal Financial Officer | ||

| Date February 8, 2017 | ||