PSS WORLD MEDICAL INVESTOR DAY 2012 May 24, 2012 InterContinental Hotel - Times Square New York, NY EXHIBIT 99.1 |

FORWARD-LOOKING STATEMENTS During this meeting and its replay, we may make a number of forward-looking statements regarding revenue, gross margin, operating expenses, operating margins, earnings per share and other matters that are not historical facts. Additionally, we may include statements regarding the plans, strategies and objectives of management for future operations, including execution of our restructuring plans, and the additional investment in, and disposition of, certain business operations; statements or projections of cost savings, growth rates, profitability, investment levels or other financial items; statements regarding anticipated operational results and management’s estimate of pro forma financial results, and any statements of assumptions underlying any of the foregoing. Those statements involve a number of risks and uncertainties that could cause actual results to differ materially from what is expressed or forecasted. For a list and descriptions of certain of these risks and uncertainties, we refer you to the forward-looking statement disclosure and other information provided in our most recent Form 10-K and other SEC filings, copies of which are available from the SEC, from the investor relations section of our website, or requested from us in investor relations. The Company wishes to caution listeners of the conference and its replay and/or participants in this meeting not to place undue reliance on any such forward-looking statements, which statements are made pursuant to the Private Securities Litigation Reform Act of 1995 and, as such, speak only as of the date made. The Company also wishes to caution listeners and participants that it undertakes no duty or is under no obligation to update or revise any forward-looking statements, except as may be required by law. We may reference certain non-GAAP financial measures in an effort to provide additional information to investors. All non-GAAP measures have been reconciled to the related GAAP measures in accordance with SEC rules. You'll find reconciliation charts in this presentation and in the Financial Supplement on our website, at www.pssworldmedical.com. 2 |

AGENDA 3 INDUSTRY OVERVIEW AND STRATEGIC TRANSFORMATION FINANCIAL TRANSFORMATION GO TO MARKET STRATEGIES OPERATIONS OVERVIEW SUMMARY QUESTIONS AND ANSWERS Gary Corless, President & CEO David Bronson, EVP & CFO Eddie Dienes, President, PSS Brad Hilton, Chief Service Officer Gary Corless, President & CEO |

INDUSTRY OVERVIEW AND STRATEGIC TRANSFORMATION 4 Gary Corless, President & CEO |

5 Healthcare Costs as % of U.S. GDP Source: Centers for Medicare & Medicaid Services 16% 17% 18% 20% 2005 2010 2015 2020 THE HEALTHCARE INDUSTRY MUST CHANGE |

Time Reimbursement Pressures Healthcare Reform Consolidation Economic Environment Unemployment Lower Utilization RAPID CHANGE REQUIRES BOLD ACTION 6 |

OUR VISION FOR MOVING FORWARD 7 Common Distribution Infrastructure World-Class Shared Services Team Information Technology Platform 1 |

RATIONALE FOR FOUR VERTICALS 8 Payer & Patient Preferred Higher Growth Demonstrated Core Competency Higher Profitability |

FOCUSED ON GROWTH AND MARGIN 9 Market Growth Rate (%) $ in Billions 2 0 2 4 6 8 10 12 - $8 $8 Physician Laboratory In-Office Dispensing Skilled Nursing Facilities Home Care & Hospice $8 $5 $1.5 16 14 12 10 8 6 4 2 0 Specialty Dental |

FOCUSED STRUCTURE FOR GROWTH Physician Business Extended Care 10 POST-TRANSFORMATION Skilled Nursing Specialty Dental PRE-TRANSFORMATION |

TARGET MARKET OPPORTUNITY 11 STRATEGIC OBJECTIVE • Size: $7-9 Billion • Historic growth rate: 2-4% • Number of sites: >200,000 • Current market share: 15% Accelerate revenue growth through innovative and differentiated solutions that strengthen primary care and front line specialists in a range of practices including health systems COMPETITIVE ADVANTAGES • Large, well-trained sales force • Differentiated service model • Industry-leading private label offering PHYSICIAN 5 Year Market Share Goal: 25% |

TARGET MARKET OPPORTUNITY 12 STRATEGIC OBJECTIVE • Size: $6-9 Billion • Historic growth rate: 5-6% • Number of sites: 100,000 physician office laboratories • Current market share: 6-8% Market-leading distributor of laboratory products and services to physician offices, independent clinical labs & small hospitals COMPETITIVE ADVANTAGES • Laboratory expertise • Breadth of offering • Size and knowledge of sales force LABORATORY 5 Year Market Share Goal: 15% |

TARGET MARKET OPPORTUNITY 13 STRATEGIC OBJECTIVE • Size: $1-2 Billion • Historic growth rate: 10-15% • Number of sites: 40,000 • Current market share: 6-8% Market leader for in-office dispensing solutions for physician offices, urgent care, work-site clinics and community health centers COMPETITIVE ADVANTAGES • Industry-leading customer technology platform • Full service turnkey dispensing solutions • Size and knowledge of sales force DISPENSING 5 Year Market Share Goal: 20-25% |

TARGET MARKET OPPORTUNITY 14 STRATEGIC OBJECTIVE • Size: $1-5 Billion • Historic growth rate: 7-8% • Number of sites: 12,000 agencies and 3,500 hospice sites • Current market share: 10% Market leader for innovative products and services for home care agencies and hospice providers COMPETITIVE ADVANTAGES • Broad product and service offering • Differentiated service model • Customer technology solutions HOME CARE & HOSPICE 5 Year Market Share Goal: 10-15% |

5 YEAR VISION 15 2X Revenues 10% Operating Margin |

FOCUSED FOR GROWTH 16 “External opportunities met with internal competencies in a unique way.” |

FINANCIAL TRANSFORMATION 17 David Bronson, EVP & CFO |

2011 INVESTOR DAY REPORT CARD 18 FY12 Goal FY12 Actual Revenue Growth 7-9% 3.3% EPS $1.46-1.50 $1.38 Operating Cash Flow $115-120 million $128.4 million |

TRANSFORMING FOR GROWTH 19 Focused Growth Leadership Team Experience Strong Financial Base |

($ in millions) Revenue Gross Profit Gross Percentage SG&A Operating Income Operating Percentage Interest/Other Pre-tax Taxes Net Income EPS EBITDA FY12 PRO FORMA CARVE-OUT INCOME STATEMENT 20 * Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and represents management’s best estimate as of the date of this presentation and may differ materially from actual pro forma financial results. Skilled Nursing $ 485 137 28.3% 120 17 3.6% - 17 6 11 $ 0.21 $ 23 FY12 (As Reported) Consolidated $ 2,102 674 32.1% 541 133 6.3% 18 115 41 74 $ 1.38 $ 171 FY12 Pro Forma $ 1,571 522 33.2% 413 109 6.9% 18 91 32 59 $ 1.08 $ 141 Specialty Dental $ 46 15 33.0% 8 7 15.8% - 7 3 4 $ 0.09 $ 7 |

FY11-12 PRO FORMA INCOME STATEMENT 21 * Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and represents management’s best estimate as of the date of this presentation and may differ materially from actual pro forma financial results. ($ in millions) FY12 Pro Forma FY11 Pro Forma Percent Change Revenue $ 1,571 $ 1,485 5.8% Gross Profit 522 478 Gross Percentage 33.2% 32.2% 98 bp SG&A 413 379 Operating Income 109 99 9.5% Operating Percentage 6.9% 6.7% 23 bp Interest/Other 18 15 Pre-tax 91 84 Taxes 32 31 Net Income 59 53 EPS $ 1.08 $ 0.94 15.6% EBITDA $ 141 $ 127 |

GROWTH EXPECTATIONS BY VERTICAL 22 * Baseline is estimated FY12 pro forma financial information adjusted for recent acquisitions. Physician $ 1,030 12-13% 3-5% 9-10% Total $ 1,700 13-15% 5-7% 10% ($ in millions) BASELINE Revenue 5 YEAR TARGET Revenue CAGR % Revenue Growth from M&A Operating Margin Laboratory $ 460 15-16% 5-10% 10-12% Dispensing $ 110 25-30% 5-10% 10-12% Home Care & Hospice $ 100 18-20% 10-12% 8-10% |

OPERATING MARGIN EXPANSION 23 * Base is FY12 Pro Forma income statement operating margin. Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and represents management’s best estimate as of the date of this presentation and may differ materially from actual pro forma financial results. |

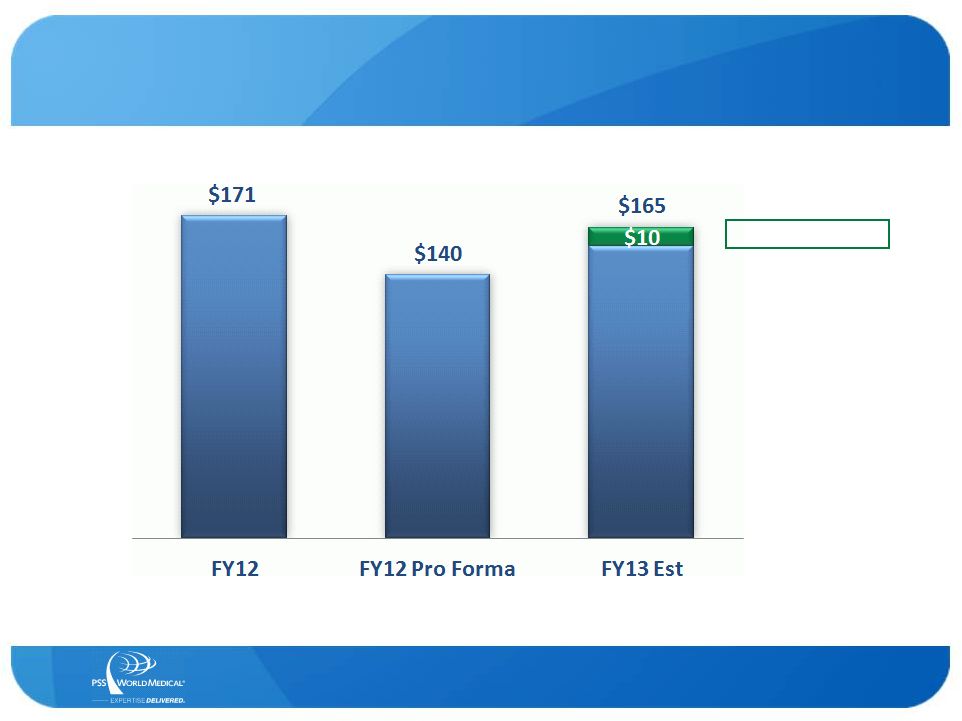

EBITDA ANALYSIS 24 $ in millions FY13 M&A to Date * Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and represents management’s best estimate as of the date of this presentation and may differ materially from actual pro forma financial results. |

EBITDA LONG-TERM OUTLOOK 25 * Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and represents management’s best estimate as of the date of this presentation and may differ materially from actual pro forma financial results. |

FINANCIAL RESOURCES 26 ($ in millions) FY13 Est FY14 Est FY15 Est FY16 Est FY17 Est Operating Cash Flow $ 105 $ 125 $ 150 $ 185 $ 220 Capital Expenditures (25) (27) (30) (33) (37) Free Cash Flow 80 98 120 152 183 Debt Gross 465 475 250 250 250 Net 120 210 260 215 155 Leverage Gross 2.8x 2.3x 1.0x 0.8x 0.7x Net 0.7x 1.0x 1.0x 0.7x 0.4x • Includes estimated divestiture proceeds, M&A activity, share repurchases to offset annual dilution and convertible debt repayment in 2014. This represents management’s best estimate as of the date of this presentation which may differ materially from actual results. |

Skilled Nursing Goldman Sachs $480 million $30 million 6 – 9x 6 – 9 months Strategic or Financial DIVESTITURE PROCESS Advisor Revenues Adjusted EBITDA* Expected multiple Expected timing Expected buyer 27 Use of Proceeds: M&A strategy Share repurchases Pay down debt * Information represents management’s best estimate as of the date of this presentation and may differ materially from actual results. Adjusted EBITDA includes estimated stand alone business synergies. Specialty Dental William Blair $47 million $7 – 8 million 8 – 10x 3 – 6 months Strategic or Financial |

FY13 FINANCIAL GUIDANCE 28 10-12% Consolidated Revenue Growth From FY12 Pro Forma $1.11-1.15 EPS From Continuing Operations $100-110 mm Consolidated Operating Cash Flow |

GO TO MARKET STRATEGIES 29 Eddie Dienes, President, PSS |

OUR VISION FOR MOVING FORWARD 30 Common Distribution Infrastructure World-Class Shared Services Team Information Technology Platform 1 |

GO TO MARKET STRATEGY 31 PSS Generalist Sales Force PSS Home Care & Hospice Sales Force PSS Specialist Health Systems PSS Specialist Laboratory Consultant PSS Specialist Dispensing Solutions Manufacturer’s Specialist Manufacturer’s Specialist Manufacturer’s Specialist |

2013 SALES FORCE FOCUS Improve Caregivers Efficiencies REACH OUR HEALTH STRENGTHEN SALES FORCE PRODUCTIVITY HEALTH SYSTEMS Online Penetration Programs Sales Force Expansion Workflow Improvements Total Customer Solutions Online Sales Growth Increase Caregivers Revenues Reduce Caregivers Expenses Margin Expansion Compensation Plan Our Brands Strategic Partnerships Efficiency Programs Reach Programs Business Conversations Our Brands Reach Programs Defined Rep And Leader Roles M & A Lower the Cost to Serve Dramatically increase and penetrate the number of caregivers we Significantly increase sales representatives selling time Dramatically increase our share of Health Systems Maximize our profitability through strategic products, pricing, a lower cost to serve and a fully aligned comp plan Strengthen the clinical success & financial health of our caregivers by improving their financial performance by 20% serve 32 |

• Consultative selling • Account penetration • Expanding sales force • Increased national account expertise 33 KEYS TO SUCCESS • Build a focused leadership team • Align compensation programs • Continue growth of Our Brands • Complete expansion of our health systems resources FY13 MILESTONES PHYSICIAN 33 |

HEALTH SYSTEMS: IMPACT OF CONSOLIDATION 34 Ownership Caregiver Locations 34 |

LARGE AND GROWING CUSTOMER BASE 35 35 PSS Serves a Broad Range of Health Systems |

HEALTH SYSTEM COMPETITIVE ADVANTAGES • High Level Service Model of Distribution – Ease of ordering & returns; late cut off times – Next day delivery by PSS Delivery Professionals • Product & Pricing Standardization – Product formularies – GPO relationships • Breadth of Products – Our Brands • Large, Well Trained Sales Force – Generalists & Specialists 36 |

FOCUSED INVESTMENT IN HEALTH SYSTEMS 37 FY12 FY13 Strategic Account Executives 6 12 Strategic Account Managers 0 4 GPO Directors 1 3 Health System Analysts 0 2 Dedicated Marketing Managers 0 2 Total 7 23 |

SUPERIOR LEVEL OF SERVICE 38 LISA BOYD Account Representative Health System with 55,000 employees, including several thousand physicians; PSS ships to more than 400 locations in 12 states in the South and Midwest “The reason I prefer PSS is simple. It is the level of service we receive from your support staff… With these individuals in place as well as many others, I have a confidence level with PSS that no other company has been able to match.” |

“Baptist Health System cemented a partnership with PSS to streamline and standardize the supply acquisition process in our clinics. PSS turned out to be the perfect partner to bring the necessary resources to help BHS make changes to be successful. From electronic ordering to standardizing product to utilizing generic products, the program was solid.” 39 MICHAEL LOUVIERE Vice President, Supply Chain Health System with 85 physicians; PSS ships to more than 45 locations in Alabama OUR BRANDS PROVIDE ATTRACTIVE SOLUTION |

“CFMG chose PSS as a service provider because of their quality medical products and outstanding customer service. Our physician’s network benefits tremendously from the size of their medical services inventory and participating manufacturers.” BREADTH OF INVENTORY 40 LENDA TOWNSEND-WILLIAMS, MBA Chief Operating Officer Health System with 500 physicians; PSS ships to more than 60 locations in the greater Oakland, CA, area |

“For the nurses dealing with the PSS drivers – in-stock items, next-day delivery of orders placed by 8:00 pm, a reliable delivery fleet and a promise to understand each physician customer – made the difference.” EASY TO DO BUSINESS WITH 41 MICHAEL REICH Director for Lab & Medical Sourcing Health System with 1,200 physicians; PSS ships to more than 60 locations in the New York region |

“Private Practice Doctors and PSS share the vision of preserving high quality patient care through private practice medicine. PPD is thrilled to be working with PSS.” FOCUS ON SUPPORTING CAREGIVERS 42 ALEXANDRA BROUSSEAU, PHD PPD Membership Management Services Organization with 180 physicians; PSS ships to more than 60 locations in the greater Los Angeles area |

OUR VISION FOR MOVING FORWARD 43 Common Distribution Infrastructure World-Class Shared Services Team Information Technology Platform 1 |

44 LABORATORY • Laboratory expertise • Competency in complex capital equipment sales • Differentiated offering • Sourcing and Our Brands • Build a focused leadership team • Define and realign roles for sales force • Expand product offering • Establish key GPO relationships • Integrate acquired businesses KEYS TO SUCCESS FY13 MILESTONES |

45 DISPENSING • Turnkey installation and solution management • Claims processing expertise • Repackaging and fulfillment capabilities • Leveraging generalist sales force • Build a focused leadership team • Integrate acquired businesses • Implement branding of offering • Train and engage sales reps • Expand customer reach FY13 MILESTONES KEYS TO SUCCESS |

46 EASY TO USE SOLUTION |

• Dedicated, experienced sales force • Logistics expertise • Differentiated service model • Navigation of reimbursement and competitive bidding 47 KEYS TO SUCCESS • Build a focused leadership team • Transition to separate sales team split from Skilled Nursing Facilities business • Integrate operations and distribution • Realign and brand the offering FY13 MILESTONES HOME CARE & HOSPICE |

SUPERIOR COMBINATION OF SERVICES 48 BONNIE ALKEMA Executive Director Hospice Agency based in Miami, FL with 4 branches servicing 600+ patients; Supplies are shipped to more than 700,000 patient’s homes across the country each year “We are very excited to have chosen your Company as our supplier for our Hospice program. Your combination of better Service, Online Technology, Patient Home Delivery and Cost Savings versus your competition drove us to you. We choose our partners carefully and you are now one of them.” |

ROBUST TECHNOLOGY INTEGRATION 49 BARRY DAVIS Chief Operation Officer Home Health and Hospice Agency based in Jackson, MS with 35 branches “Sta-Home chose your Company because of the cost containment program, sales rep support and most importantly, because you were fully interfaced with our Point- of-Care software system, Homecare Homebase. Being able to interface to our Home Care software system is critical for our Operational Efficiency.” |

OUR VISION FOR MOVING FORWARD 50 Common Distribution Infrastructure World-Class Shared Services Team Information Technology Platform 1 |

OPERATIONS OVERVIEW 51 Brad Hilton, Chief Service Officer |

OUR VISION FOR MOVING FORWARD 52 Common Distribution Infrastructure World-Class Shared Services Team Information Technology Platform 1 |

53 Customer Solutions Professional Delivery Order Fulfillment ONE COMMON DISTRIBUTION INFRASTRUCTURE |

ONE WORLD-CLASS SHARED SERVICES TEAM 54 Customer Service Supplier Services Team Member Services Financial Legal & Compliance Information Technology |

ONE INFORMATION TECHNOLOGY PLATFORM 55 Customer Experience Systems Order Processing Systems IT Infrastructure Business Information & Reporting Systems |

OUR VISION FOR MOVING FORWARD 56 Common Distribution Infrastructure World-Class Shared Services Team Information Technology Platform |

SUMMARY 57 Gary Corless, President & CEO |

EXPERIENCED TEAM REDUCES RISK 2003 Strategic Transformation: • Divested imaging business • Consolidated distribution infrastructure, rationalizing half of existing locations • Implemented standardized ERP system • Launched global sourcing effort 58 Then Now Revenues $1.1 bn $2.1 bn Margins 2% 6% ROCC 7% 35% Fiscal year end stock price $9.80 $25.34 RESULTS • Designed shared service approach for back office • Instituted long-term strategic planning process • Implemented long-term incentive programs |

TRANSFORMATION DRIVEN BY OUR PURPOSE AND MISSION 59 PURPOSE Strengthen the clinical success and financial health of caregivers by solving their biggest problems. MISSION Improve caregivers’ financial performance by 20%. |

OUR VISION FOR MOVING FORWARD 60 Common Distribution Infrastructure World-Class Shared Services Team Information Technology Platform 1 |

PSS WORLD MEDICAL INVESTOR DAY 2012 May 24, 2012 InterContinental Hotel - Times Square New York, NY |

APPENDIX 62 |

63 FY11 PRO FORMA CONTINUING OPERATIONS RECONCILIATION * Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and represents management’s best estimate as of the date of this presentation and may differ materially from actual pro forma financial results. ($ in millions) FY11 (As Reported) Consolidated Skilled Nursing Specialty Dental FY11 Pro Forma Continuing Operations Revenue $ 2,035 $ 506 $ 44 $ 1,485 Gross Profit 636 144 14 478 Gross Margin 31.2% 28.4% 31.0% 32.2% SG&A 502 116 7 379 Operating Income 134 28 7 99 Operating Margin 6.6% 5.5% 14.4% 6.7% Interest/Other 15 - - 15 Pre-tax 119 28 7 84 Taxes 44 11 2 31 Net Income $ 75 $ 17 $ 5 $ 53 EPS $ 1.32 $ 0.31 $ 0.07 $ 0.94 EBITDA $ 168 $ 34 $ 7 $ 127 |

64 ($ in millions) FY12 FY11 Revenues $ 531 $ 550 Gross Profit 152 158 Gross Percentage 28.7% 28.6% SG&A 128 123 Operating Income 24 35 Operating Percentage 4.6% 6.2% Net Income 15 22 EPS $ 0.30 $ 0.38 EBITDA $ 30 $ 41 FY11-12 PRO FORMA SKILLED NURSING & SPECIALTY DENTAL * Pro forma financial information for Skilled Nursing and Specialty Dental businesses which represents management’s best estimate as of the date of this presentation and may differ materially from actual pro forma financial results. |

FY12 EBITDA CALCULATION ($ in millions) FY12 (as reported) Skilled Nursing Specialty Dental FY12 Pro Forma NET INCOME $ 74 $ 11 $ 4 $ 59 Plus: Interest expense 20 - - 20 Less: Interest and investment income - - - - Plus: Provision for income taxes 41 6 3 32 Plus: Depreciation 27 5 - 22 9 1 - 8 EBITDA $ 171 $ 23 $ 7 $ 141 65 * Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and represents management’s best estimate as of the date of this presentation and may differ materially from actual pro forma financial results. Plus: Amortization of intangible assets |

FY11 EBITDA CALCULATION ($ in millions) FY11 (as reported) Skilled Nursing Specialty Dental FY11 Pro Forma NET INCOME $ 75 $ 17 $ 5 $ 53 Plus: Interest expense 17 - - 17 Less: Interest and investment income - - - - Plus: Provision for income taxes 44 11 2 31 Plus: Depreciation 25 4 - 21 7 2 - 5 EBITDA 66 * Pro forma financial information excludes Skilled Nursing and Specialty Dental businesses and represents management’s best estimate as of the date of this presentation and may differ materially from actual pro forma financial results. Plus: Amortization of intangible assets $ 168 $ 34 $ 7 $ 127 |