UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08416

Touchstone Variable Series Trust

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

E. Blake Moore, Jr.

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

| Touchstone Variable Series Trust |

| Touchstone Balanced Fund |

| Touchstone Bond Fund |

| Touchstone Common Stock Fund |

| Touchstone Small Company Fund |

This report identifies the Funds' investments on December 31, 2021. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Variable Series Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, for the twelve months ended December 31, 2021.

A rising inflation theme defined the economic backdrop in the U.S. and developed markets for much of the 2021 calendar year. The U.S. Federal Reserve (Fed) dropped “transitory” from its official statements during the fourth quarter regarding the nature of inflation’s impact on the U.S. economy. This was fortuitous timing because in November, the Fed’s preferred inflation gauge hit 4.7%, the highest level recorded since 1989. Regarding U.S. labor market conditions, job openings remained at a historic high of 11 million while the labor participation rate was at a 45-year low of 61.8%. Labor shortages have impacted the broader economy through supply chain issues, hospital staffing and various retail segments. Given tight labor market conditions and elevated inflation readings, the Fed communicated its intent to tighten fiscal policy and hinted at raising the overnight Federal Funds rate up to three times in 2022. Outside the U.S., developed market central banks largely acted in unison in terms of maintaining highly accommodative monetary policy, with only the Bank of England implementing a 25 basis points increase in overnight rates.

Over the course of the entire calendar year, economic activity remained strong despite headwinds from the aforementioned inflationary pressures, supply chain disruptions and emerging COVID variants such as Delta in the summer and Omicron later in the year. The combination of a highly accommodative monetary policy by the Fed and Congress passing two separate, trillion dollar-plus fiscal stimulus packages, maintained a high level of liquidity and inexpensive financing, and a general tailwind for the capital markets. Re-emerging pandemic concerns and prospects of tighter monetary conditions dampened capital markets overseas, particularly in developing economies which were also impacted by Chinese regulatory pressure and the feared collapse of Chinese property developer, Evergrande.

U.S. equity markets posted strong returns for 2021. Value equities outperformed their growth counterparts within the small and mid-capitalization ranges. Growth outperformed among the mega-caps due largely to the weight and strength of Information Technology constituents, Apple Inc., Microsoft Corp, and NVIDIA Corp. From a market capitalization perspective, small capitalization stocks, which tend to be more economically sensitive, underperformed mid-caps, while mid-caps underperformed large-caps. From a sector perspective, U.S. equities were led by Energy, Real Estate, Financials, and Information Technology.

As previously noted, the Fed continued its near zero overnight rates and direct purchases of various fixed income securities leading to overall low yields. Low quality fixed income such as non-investment grade corporate credit outperformed investment grade corporate credit. Non-investment grade bonds, municipal bonds, and inflation-protected bonds were among the few fixed income areas to end the year in positive territory.

Markets such as these reaffirm our belief in the importance of the steady hands of financial professionals, trust in your investment strategy, and the risks of trying to time the market. Additionally, we believe that environments that are more volatile create more opportunity for active managers to add value, especially those that are Distinctively Active. We greatly value your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

E. Blake Moore Jr.

President

Touchstone Variable Series Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone Balanced Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone Balanced Fund (the “Fund”) seeks to achieve its investment goal of providing investors with capital appreciation and current income by generally investing in a diversified portfolio comprising approximately 60 percent equity securities and 40 percent fixed-income securities.

With respect to equities, the Fund invests primarily in issuers having a market capitalization, at the time of purchase, above $5 billion. Equity securities include common stock and preferred stock. With respect to fixed-income, the Fund invests primarily in bonds, including mortgage-related securities, asset-backed securities, government securities (both U.S. government securities and foreign sovereign debt), and corporate debt securities.

Fund Performance

The Fund (Class I Shares) outperformed its blended benchmark, the 60 percent S&P 500® Index & 40 percent Bloomberg U.S. Aggregate Bond Index, for the 12 month period ended December 31, 2021. The Fund’s total return was 17.07 percent while the total return of the blended benchmark was 15.86 percent.

Market Environment

As we came to the end of 2021, many of the same issues investors faced coming into the year continued to linger as we enter 2022. Markets continue to grapple with the economic impact of COVID-19 as two new variants – Delta and Omicron – reminded us that we are not yet out of the woods with the pandemic. The arrival of the new variants continued to put pressure on supply chains and caused a temporary slowdown in labor demand. In spite of this, the economic recovery persevered on the resiliency of strong consumer spending and business investment. Despite a pullback in growth in the second quarter caused by the Delta variant, consensus estimates of 2021 gross domestic product growth remain above pre-pandemic levels at roughly 6%. In the fourth quarter, the U.S. Federal Reserve Board (Fed) acknowledged that the pace of the economic recovery coupled with persistent supply constraints had pushed inflation beyond levels that warranted a continuation of its asset purchasing program. As we closed out 2021, the Fed made a decidedly hawkish pivot in its policy as it recognized that price increases may be more persistent than initially perceived while stating labor markets had met the requirements towards “substantial further progress.” As a result, the Fed rationalized its decision to accelerate tapering its bond purchases to be completed by the end of March and paved the way to begin raising interest rates in 2022.

To start 2021, the 10 Year Treasury yield jumped almost 80 basis points in the first quarter before eventually ending the year at 1.5%. A notable disconnect throughout 2021 was the level of nominal interest rates versus inflation. Even as inflation reached levels last seen since the late 1980’s, interest rates remained remarkably stable. Thus far, markets seem to be confident that the Fed is taking appropriate measures to tackle inflation without hindering long-term economic growth. As we head into 2022, the speed and aggressiveness at which the Fed eventually pulls back accommodations will shape how risk assets perform.

Amidst this backdrop, fixed income markets faced a challenging year as interest rates were markedly higher, particularly within the intermediate part of the curve, causing the curve to flatten. Emerging Markets lagged all credit markets for the year as COVID-19 and geopolitical events outside the pandemic continued to hamper recovery efforts. However, we believe opportunities in Emerging Markets are likely to persist in countries that were caught in the systemic widening and remain attractive on a country by country basis.

Despite bouts of volatility in interest rates, financial conditions remained extremely accommodative, further bolstering equities. Equity markets continued to march up in 2021 with the S&P 500 ending the year near its all-time high as earnings far outpaced expectations. Mid-Cap equities produced solid returns and outpaced Small-Cap equities. International developed and Emerging Markets equities lagged domestic equites for the year.

Portfolio Review

The Fund began the 12 month period with a slight overweight position to equities versus its strategic benchmark. Over the period, we made two significant changes to positioning. The first such adjustment occurred at the beginning of the second quarter as we eliminated the remaining exposure to High Yield within the fixed income allocation and reallocated proceeds to Investment Grade Credit and Treasuries. The second adjustment came after the end of the third quarter, as we modestly reduced the Fund’s tactical equity target.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Within equities, the Fund’s portfolio was positioned primarily in businesses that have higher returns on capital with barriers to entry. Activity during 2021 moderated relative to 2020, however we continued to find select opportunities that fit our investment process. During the year, new additions for the Fund focused on businesses in the Earnings Power Value and Franchise Value layer. With the slightly elevated risks in our outlook, the portfolio ended the year with a slightly higher cash position relative to year end 2020. We believe our recent moderate reduction in risk in terms of positioning combined with continued disciplined execution of our process will benefit the portfolio going forward.

Within fixed income, we reduced spread risk by trimming half of the Fund's exposure to High Yield to start the 12 month period. Following the end of the first quarter, we eliminated the remaining exposure to High Yield and reallocated proceeds to Investment Grade Credit and Treasuries. At the end of the period the fixed income allocation had a bias to be overweight risk to Securitized Assets, Investment Grade Credit and Emerging Markets Debt. We continue to believe the current macro environment is supportive of risk assets given the strength of the economic recovery and fiscal and monetary policy support.

Outlook and Conclusion

The greatest opportunities for the Fund will be driven by the durability of economic growth, stable inflation, accommodative central bank policy (both domestically and abroad), and decline in COVID-19 risks, which we expect to provide a tailwind to growth moving into 2022. The risk of lingering cases of COVID-19, especially throughout the remaining winter months, creates some near term uncertainty given the possibility of disrupting the momentum and progress made thus far in economic growth. We will continue to closely monitor how this will impact valuations and our assessment for growth going forward. We remain positive on the economy as underlying demand is strong and growth is rebounding. COVID-19 Omicron variant, supply constraints (supply chain and labor), elevated inflation, and tightening policy are risks to monitor over the near-term. Even as the Fed begins tapering asset purchases and contemplates rate hikes, we believe Fed policy will still support the recovery. Amid strong inflation data, labor market conditions will be a key factor for changes in Fed policy over coming months.

We believe consumer demand and business investment supports continued economic growth, and increased productivity could help offset wage gains, lessening inflation pressures. Omicron variant adds new uncertainty, but we believe the underlying fundamentals of the economy are strong.

Our belief in the Fund’s continued overweight position in equities over fixed income is driven by both valuations and an overweight to risk given the economic environment. Within equities, we view the market as fairly valued with earnings likely to be the main driver of returns. Within fixed income, we believe credit valuations are generally fully valued. Solid fundamentals and accommodative policy support current levels. Interest rates reflect growth concern over the new variant. If growth is largely unaffected and inflation remains firm, rates are at risk to rise given potential acceleration of Fed tapering and mid-2022 rate hikes.

We believe the Fund is well positioned given our outlook from both top down sector allocation and security selection.

Management's Discussion of Fund Performance (Unaudited) (Continued)

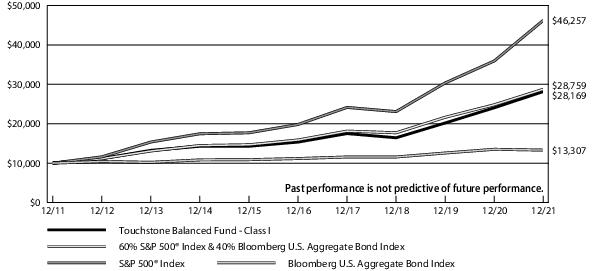

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Balanced Fund Class I, the 60% S&P 500® Index & 40% Bloomberg U.S.Aggregate Bond Index, the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index

| Average Annual Total Returns |

| Touchstone Balanced Fund | 1 Year | 5 Years | 10 Years |

| Class I | 17.07% | 12.91% | 10.91% |

| Class SC* | 17.07% | 12.91% | 10.91% |

| 60% S&P 500® Index & 40% Bloomberg U.S. Aggregate Bond Index | 15.86% | 12.62% | 11.14% |

| S&P 500® Index | 28.71% | 18.47% | 16.55% |

| Bloomberg U.S. Aggregate Bond Index | -1.54% | 3.57% | 2.90% |

| * | The chart above represents performance of Class I shares only, which will vary from the performance of Class SC shares based on the differences in fees paid by shareholders in the different classes. The inception date of Class SC shares was April 13, 2021. Class SC shares performance was calculated using the historical performance of Class I shares for the periods prior to April 13, 2021. The returns have been restated for fees applicable to Class SC shares. |

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

Note to Chart

S&P 500® Index is a group of 500 widely held stocks and is commonly regarded to be representative of the large capitalization stock universe.

Bloomberg U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Bond Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone Bond Fund (the “Fund”) seeks to provide as high a level of current income as is consistent with the preservation of capital. Capital appreciation is a secondary goal. Under normal circumstances, the Fund invests at least 80 percent of its assets in bonds. Bonds include mortgage-related securities, asset-backed securities, government securities and corporate debt securities. The Fund primarily invests in investment-grade debt securities, but may invest up to 30 percent of total assets in non-investment-grade debt securities rated as low as B by a Nationally Recognized Statistical Rating Organization (NRSRO).

Fund Performance

The Fund (Class I Shares) outperformed its benchmark, the Bloomberg U.S. Aggregate Bond Index, for the 12-month period ended December 31, 2021. The Fund’s total return was -1.21 percent, while the total return of the benchmark was -1.54 percent.

Market Environment

As we came to the end of 2021, many of the same issues investors faced coming into the year continued to linger as we enter 2022. Markets continue to grapple with the economic impact of COVID-19 as two new variants – Delta and Omicron – reminded us that we are not yet out of the woods with the pandemic. The arrival of the new variants continued to put pressure on supply chains and caused a temporary slowdown in labor demand. In spite of this, the economic recovery persevered on the resiliency of strong consumer spending and business investment. Despite a pullback in growth in the second quarter caused by the Delta variant, consensus estimates of 2021 gross domestic product growth remain above pre-pandemic levels at roughly 6%. In the fourth quarter, the U.S. Federal Reserve Board (Fed) acknowledged that the pace of the economic recovery coupled with persistent supply constraints had pushed inflation beyond levels that warranted a continuation of its asset purchasing program. As we closed out 2021, the Fed made a decidedly hawkish pivot in its policy, as it recognized that price increases may be more persistent than initially perceived while stating labor markets had met the requirements towards “substantial further progress.” As a result, the Fed rationalized its decision to accelerate tapering its bond purchases to be completed by the end of March and paved the way to begin raising interest rates in 2022.

To start 2021, the 10 Year Treasury yield jumped almost 80 basis points in the first quarter before eventually ending the year at 1.5%. A notable disconnect throughout 2021 was the level of nominal interest rates versus inflation. Even as inflation reached levels last seen since the late 1980’s, interest rates remained remarkably stable. Thus far, markets seem to be confident that the Fed is taking appropriate measures to tackle inflation without hindering long-term economic growth. As we head into 2022, the speed and aggressiveness at which the Fed eventually pulls back accommodations will shape how risk assets perform.

Amidst this backdrop, fixed income markets faced a challenging year as interest rates were markedly higher, particularly within the intermediate part of the curve, causing the curve to flatten. Emerging markets lagged all credit markets for the year as COVID and geopolitical events outside the pandemic continued to hamper recovery efforts. However, we believe opportunities in Emerging Markets are likely to persist in countries that were caught in the systemic widening and remain attractive on a country by country basis.

Portfolio Review

The Fund’s overweight position to spread risk versus the benchmark contributed to returns, specifically due to the Fund’s overweight position to High Yield and Investment Grade Credit. High Yield and Investment Grade Credit ended the period with spreads tightened while Emerging Market Debt spreads widened.

Strong selection from Investment Grade Credit and Securitized Assets contributed to returns for the year. Within Investment Grade Credit, the Fund was positioned with overweights to non-defensive sectors, contributing to performance. Within Securitized Assets, outperformance was largely driven by spread effects due to the retracement in out of index sectors (CMBS, ABS and CLOs).

Lastly, interest rate management as well as the Fund's position to be both short and long duration versus the benchmark slightly detracted from performance. The Fund was also positioned to be both over- and underweight the long end of the curve throughout the one year period.

At the start of the twelve month period, we trimmed half of the Fund’s exposure to High Yield. Following the end of the first quarter, we eliminated the remaining exposure to High Yield and relocated proceeds to Investment Grade Credit and Treasuries.

Management's Discussion of Fund Performance (Unaudited) (Continued)

At the end of the period the Fund had a bias to be overweight risk to Securitized Assets, Investment Grade Credit and Emerging Markets Debt. We continue to believe the current macro environment is supportive of risk assets given the strength of the economic recovery and fiscal and monetary policy support.

Outlook and Conclusion

The greatest opportunities for the Fund will be driven by the durability of economic growth, stable inflation, accommodative central bank policy (both domestically and abroad), and decline in COVID risks, which we expect to provide a tailwind to growth moving into 2022. There remains uncertainty as to whether supply constraints and pace of economic growth will result in sustainable, persistent inflation or whether such factors are simply an adjustment in price levels (i.e., transitory inflation). Should inflation prove to be persistent beyond the initial impact from the economic reopening, we believe the Fed would react as necessary to keep inflation under control, likely resulting in headwinds to economic growth.

Our economic outlook supports credit spreads at current levels and a steady move higher in rates and we believe the Fund is well positioned to outperform the benchmark given our outlook. We look for positive returns to continue to stem from our top down management of interest rates, sector allocation and security selection from our credit and structured products investment teams. We believe valuations of rates across the curve generally reflect the improving economic outlook and will remain low for some time given statements issued and policies enacted by the Fed. Risks to lower interest rates come from increased concerns over the global impact of coronavirus and resulting impact on economic data. Risks to higher interest rates include higher than expected inflation, a shift in Fed policy, and expansionary fiscal policy.

Our preference within the Securitized sector remains in high-quality, non-government securities: ABS, CMBS, and Non-Agency RMBS. The recovery in spreads has been broad-based with the exception of hospitality-related CMBS (low occupancy rates) and certain Whole Business ABS credits (low foot traffic), which have lagged. Within Investment Grade Credit, we believe the Fund is positioned to outperform mainly driven by excess carry and downside avoidance. We are generally favoring down in credit for non-cyclical sectors such as utilities, while selectively adding higher quality names in cyclical sectors such as manufacturing and consumer. While we are still positive on risk assets given the long-term economic outlook and expected policy support, valuations have recovered significantly since the March 2020 selloff. Valuations of High Yield spreads ended the year near the 30th percentile on a historical basis, and we think it is appropriate to slightly reduce exposure at these levels. The Fund continues to have a modest allocation to U.S. dollar denominated Emerging Markets debt but we will continue to monitor the impact of COVID-19 and how emerging economies are able to contain the virus and maintain sustainable economic growth.

Management's Discussion of Fund Performance (Unaudited) (Continued)

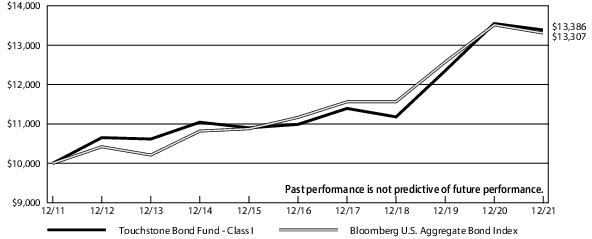

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Bond Fund Class I and the Bloomberg U.S. Aggregate Bond Index

| Average Annual Total Returns |

| Touchstone Bond Fund | 1 Year | 5 Years | 10 Years |

| Class I | -1.21% | 4.02% | 2.96% |

| Class SC* | -1.30% | 3.81% | 2.70% |

| Bloomberg U.S. Aggregate Bond Index | -1.54% | 3.57% | 2.90% |

| * | The chart above represents performance of Class I shares only, which will vary from the performance of Class SC shares based on the differences in fees paid by shareholders in the different classes. The inception date of Class SC shares was July 10, 2019. Class SC shares performance was calculated using the historical performance of Class I shares for the periods prior to July 10, 2019. The returns have been restated for fees applicable to Class SC shares. |

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

Note to Chart

Bloomberg U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Common Stock Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone Common Stock Fund (the “Fund”) seeks to provide investors with capital appreciation. The Fund invests at least 80 percent of its assets in large capitalization equity securities. The Fund’s sub-advisor, Fort Washington Investment Advisors, Inc., seeks to invest in companies that are trading below what is believed to be the estimate of the companies’ intrinsic value and have a sustainable competitive advantage or a high barrier to entry in place. The barrier(s) to entry can be created through a cost advantage, economies of scale, high customer loyalty or a government barrier (e.g. license or subsidy). Fort Washington believes that the strongest barrier to entry is the combination of economies of scale and high customer loyalty.

Fund Performance

The Fund (Class I Shares) underperformed its benchmark, the S&P 500® Index, for the 12-month period ended December 31, 2021. The Fund’s total return was 27.85 percent while the benchmark’s total return was 28.71 percent.

Market Environment

U.S. equities ended 2021 with strong returns for the year due to accommodative financial conditions, corporate earnings growth, and vaccination progress. Energy led the market higher during the year. The Consumer Staples sector was the worst performer for the period.

Portfolio Review

Within the Fund’s portfolio, the sectors where holdings outperformed relative to the benchmark include Real Estate, Financials, Communication Services, Health Care, and Industrials. Sectors where holdings lagged relative to the benchmark include Information Technology, Energy, Consumer Staples, Materials, and Consumer Discretionary. Stock selection detracted slightly from performance for the period. Sector allocation added to performance primarily due to the Fund having no exposure to Utilities and an underweight position in Consumer Staples.

At the holding level, the three largest contributors were Signature Bank (Financials), Alphabet (Communication Services), and Jones Lang LaSalle (Real Estate). The three largest detractors for the period were Alibaba (Consumer Discretionary), Trip.com (Consumer Discretionary), and JD.com (Consumer Discretionary).

Outlook and Conclusion

Politicians avoided a government shutdown and stripped some of the onerous tax provisions from the Build Back Better bill. Entering 2022 there are several lingering headwinds for investors including anticipated Federal Reserve tightening monetary policy, surging COVID-19 cases, elevated inflation, geopolitical flare-ups, and supply chain issues. One of the key risks we will be monitoring in 2022 is the prospect for a negative inflection in global Purchasing Managers’ Indexes or a slowdown in corporate earnings growth during a period when governments are reducing stimulus. In combination, these factors have historically been challenging for the equity market. We currently view the elevated risks in the global economy and weakening market breadth as indications that volatility is likely to continue. However, we see limited signals of a major market pullback in the indicators we prioritize. In terms of valuation, we believe the U.S. equity market in aggregate continues to be priced around fair value. Financial conditions, although poised to tighten in the coming year, remain quite accommodative by historical standards. Consumer demand is healthy buoyed by high personal savings rates. Corporations are well capitalized to pursue capital expenditures as they seek to manage challenges with labor and supply chains among others. Overall, we believe the strength in the U.S. economy, favorable financial conditions, and fair valuations continue to suggest reasonable returns going forward.

At the end of the year, the Fund continued to emphasize businesses with higher barriers to entry and returns on capital. Activity during 2021 moderated relative to 2020 but we have continued to find select opportunities that fit our investment process. During the year, new additions for the portfolio focused on businesses in the Earnings Power Value and Franchise Value layer. With the limited margin of safety in the equity market and the risks noted in our outlook, the portfolio ended the year with a slightly higher cash position relative to year end 2020. We believe our recent moderate reduction in risk in terms of positioning combined with continued disciplined execution of our process will benefit the portfolio going forward.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Common Stock Fund Class I and the S&P 500® Index

| Average Annual Total Returns |

| Touchstone Common Stock Fund | 1 Year | 5 Years | 10 Years |

| Class I | 27.85% | 17.83% | 15.53% |

| Class SC* | 27.57% | 17.52% | 15.19% |

| S&P 500® Index | 28.71% | 18.47% | 16.55% |

| * | The chart above represents performance of Class I shares only, which will vary from the performance of Class SC shares based on the differences in fees paid by shareholders in the different classes. The inception date of Class SC shares was July 10, 2019. Class SC shares performance was calculated using the historical performance of Class I shares for the periods prior to July 10, 2019. The returns have been restated for fees applicable to Class SC shares. |

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

Note to Chart

S&P 500® Index is a group of 500 widely held stocks and is commonly regarded to be representative of the large capitalization stock universe.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Small Company Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone Small Company Fund (the “Fund”) seeks to provide investors with growth of capital by investing primarily in common stocks of small companies that the sub-advisor believes are high quality, have superior business models, solid management teams, sustainable growth potential and are attractively valued.

Fund Performance

The Fund outperformed its benchmark, the Russell 2000® Index, for the 12-month period ended December 31, 2021. The Fund’s total return was 24.18 percent while the return of the benchmark was 14.82 percent.

Market Environment

The Russell 2000® Index posted solid returns for 2021. We believe strong first half returns were driven by a combination of factors. First, the unprecedented fiscal and monetary stimulus in response to the COVID-19 pandemic supported the economy through a phased re-opening of economy activity. Furthermore, developments on the political front with the election of President Biden and Democratic sweep of Congress were well received by equity markets in anticipation of and delivery of the American Rescue plan. Additionally, the COVID-19 vaccine adoption drove market appreciation on hopes of a return to a pre-COVID-19 pandemic way of life. The business cycle experienced a robust V-shaped recovery. Corporate profitability also experienced a V-shaped recovery. In fact, small cap earnings in 2021 were expected to be 45 percent higher than pre-pandemic in 2019. We believe the negative second half returns were also driven by a combination of elements. First, the execution of the ambitious Biden fiscal agenda by Congress did not come to fruition. Second, the surge in economic growth driven by the re-opening and fiscal and monetary stimulus created inflationary pressures. Monetary policy moved from accommodative to tightening as the Federal Reserve tapered bond purchases and discussed future interest rate hikes. Lastly, the return to a pre-pandemic way of life quickly was pushed out, first with the Delta and then Omicron COVID-19 variants which created continued disruption across many sectors.

From a sector perspective, Energy, Real Estate, Financials, Consumer Discretionary, Industrials, Materials, Consumer Staples, and Information Technology outperformed the overall Small Cap market. Utilities, Communication Services, and Health Care underperformed.

Portfolio Review

The Fund’s top contributing sectors were Health Care, Information Technology, Consumer Discretionary, and Industrials. The portfolio’s top four performing stocks were the following: Onto Innovation Inc. (Technology sector), a manufacturer of process control systems for the semiconductor manufacturing industry; Skyline Champion Corp. (Consumer Cyclical sector), a manufacturer of mobile homes and other manufactured housing; Aritzia Inc. (Consumer Cyclical sector), a specialty apparel multi-channel retail company; and Western Alliance Bancorporation (Financial Services sector), a regional bank with national business lending segments as well.

The Fund’s largest detracting sectors were Real Estate and Consumer Staples. The portfolio’s bottom five performing stocks were the following: Cognyte Software Ltd. (Technology sector), a security software provider; Tactile Systems Technology (Healthcare sector), a provider of medical devices to treat chronic diseases at home; 8X8 Inc. (Technology sector), a provider of enterprise communication solutions; Encompass Health Corp. (Healthcare sector), a provider of post-acute health care services; and Addus Homecare Corp. (Healthcare sector), a provider of in-home personal care services.

At the end of the year, the Fund was overweight the following sectors: Consumer Discretionary, Industrials, Information Technology, Materials, and Communication Services. The Fund was underweight the following sectors: Consumer Staples, Energy, Financials, Health Care, Real Estate, and Utilities.

Outlook and Conclusion

We believe that the Small Cap market is focused on where we are in the current economic and corporate earnings cycle, the U.S. Federal Reserve Board and the potential impact of tightening monetary policy, and the confluence of pandemic-related factors impact on both, most recently with the COVID-19 Omicron variant. We remain focused on executing our fundamental stock selection and portfolio management process. We believe that stocks experience a four-stage investment cycle and our research process is focused on the dynamics that apply to each stage of the investment cycle. We believe that excess returns and lower volatility are driven by the ability to successfully identify a stock’s current stage and the potential for it to transition to a different stage of its investment cycle.

Management's Discussion of Fund Performance (Unaudited) (Continued)

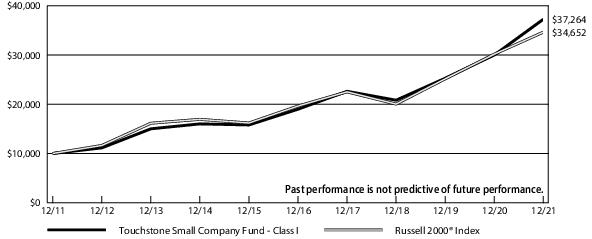

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Small Company Fund Class I and the Russell 2000® Index

| Average Annual Total Returns |

| Touchstone Small Company Fund | 1 Year | 5 Years | 10 Years |

| Class I | 24.18% | 14.42% | 14.06% |

| Russell 2000® Index | 14.82% | 12.02% | 13.23% |

The inception date of the Fund was November 30, 2000.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

Notes to Chart

Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe.

The Frank Russell Company (FRC) is the source and owner of the Russell 2000® Index data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Tabular Presentation of Portfolio of Investments (Unaudited)

December 31, 2021

The tables below provide each Fund’s sector allocation and/or credit quality. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

Touchstone Balanced Fund

| Credit Quality*(% of Fixed Income Securities) |

| AAA/Aaa | 49.9% |

| AA/Aa | 4.6 |

| A/A | 14.9 |

| BBB/Baa | 29.8 |

| BB/Ba | 0.8 |

| Total | 100.0% |

| Sector Allocation**(% of Net Assets) |

| Common Stocks | |

| Information Technology | 19.3% |

| Communication Services | 12.2 |

| Health Care | 8.8 |

| Financials | 7.5 |

| Consumer Discretionary | 6.6 |

| Industrials | 6.0 |

| Consumer Staples | 2.4 |

| Real Estate | 1.7 |

| Energy | 1.4 |

| Materials | 1.0 |

| Corporate Bonds | 15.2 |

| U.S. Treasury Obligations | 14.0 |

| Exchange-Traded Fund | 1.7 |

| U.S. Government Mortgage-Backed Obligations | 0.9 |

| Sovereign Government Obligations | 0.2 |

| Short-Term Investment Fund | 1.2 |

| Other Assets/Liabilities (Net) | (0.1) |

| Total | 100.0% |

Touchstone Bond Fund

| Credit Quality*(% of Fixed Income Securities) |

| AAA/Aaa | 52.5% |

| AA/Aa | 6.2 |

| A/A | 10.7 |

| BBB/Baa | 25.8 |

| BB/Ba | 1.1 |

| B/B | 0.7 |

| CC | 0.1 |

| Cash Equivalents | 2.9 |

| Total | 100.0% |

Touchstone Common Stock Fund

| Sector Allocation**(% of Net Assets) |

| Information Technology | 27.7% |

| Communication Services | 18.1 |

| Health Care | 13.3 |

| Financials | 10.9 |

| Consumer Discretionary | 9.8 |

| Industrials | 9.1 |

| Consumer Staples | 3.5 |

| Real Estate | 2.5 |

| Energy | 2.0 |

| Materials | 1.6 |

| Short-Term Investment Fund | 0.0 |

| Other Assets/Liabilities (Net) | 1.5 |

| Total | 100.0% |

* Credit quality ratings are from Standard & Poor's (“S&P”) and Moody's Investors Service (“Moody's”). If agency ratings differ, the higher rating will be used. Where no rating has been assigned, it may be for reasons unrelated to the creditworthiness of the issuer.

** Sector classifications are based upon the Global Industry Classification Standard (GICS®).

Tabular Presentation of Portfolio of Investments (Unaudited) (Continued)

Touchstone Small Company Fund

| Sector Allocation*(% of Net Assets) |

| Consumer Discretionary | 19.6% |

| Industrials | 17.9 |

| Health Care | 17.0 |

| Information Technology | 16.6 |

| Financials | 13.1 |

| Real Estate | 5.8 |

| Materials | 5.6 |

| Communication Services | 3.8 |

| Consumer Staples | 0.1 |

| Short-Term Investment Fund | 1.1 |

| Other Assets/Liabilities (Net) | (0.6) |

| Total | 100.0% |

* Sector classifications are based upon the Global Industry Classification Standard (GICS®).

Portfolio of Investments

Touchstone Balanced Fund – December 31, 2021

| Shares | | | | Market

Value |

| | Common Stocks — 66.9% | |

| | Information Technology — 19.3% | |

| 19,164 | Apple, Inc. | $ 3,402,952 |

| 4,367 | International Business Machines Corp. | 583,693 |

| 13,113 | Microsoft Corp. | 4,410,164 |

| 11,246 | Oracle Corp. | 980,764 |

| 5,146 | salesforce.com, Inc.* | 1,307,753 |

| 8,036 | SS&C Technologies Holdings, Inc. | 658,791 |

| 5,122 | Texas Instruments, Inc. | 965,343 |

| 3,973 | Visa, Inc. - Class A | 860,989 |

| 2,796 | Workday, Inc. - Class A* | 763,811 |

| | | | | 13,934,260 |

| | Communication Services — 12.2% | |

| 1,080 | Alphabet, Inc. - Class C* | 3,125,077 |

| 9,870 | AT&T, Inc. | 242,802 |

| 16,852 | Comcast Corp. - Class A | 848,161 |

| 11,397 | Fox Corp. - Class A | 420,549 |

| 8,455 | Meta Platforms, Inc. - Class A* | 2,843,839 |

| 1,358 | Netflix, Inc.* | ���818,114 |

| 3,151 | Walt Disney Co. (The)* | 488,059 |

| | | | | 8,786,601 |

| | Health Care — 8.8% | |

| 5,185 | AmerisourceBergen Corp. | 689,034 |

| 7,342 | BioMarin Pharmaceutical, Inc.* | 648,666 |

| 17,880 | Bristol-Myers Squibb Co. | 1,114,818 |

| 3,770 | HCA Healthcare, Inc. | 968,588 |

| 8,130 | Johnson & Johnson | 1,390,799 |

| 3,162 | UnitedHealth Group, Inc. | 1,587,767 |

| | | | | 6,399,672 |

| | Financials — 7.5% | |

| 30,076 | Bank of America Corp. | 1,338,081 |

| 6,010 | Berkshire Hathaway, Inc. - Class B* | 1,796,990 |

| 3,795 | Goldman Sachs Group, Inc. (The) | 1,451,778 |

| 2,577 | Signature Bank | 833,582 |

| | | | | 5,420,431 |

| | Consumer Discretionary — 6.6% | |

| 2,126 | Airbnb, Inc. - Class A* | 353,958 |

| 3,142 | Alibaba Group Holding Ltd. (China) ADR* | 373,238 |

| 720 | Amazon.com, Inc.* | 2,400,725 |

| 7,922 | Hilton Worldwide Holdings, Inc.* | 1,235,753 |

| 3,294 | Starbucks Corp. | 385,299 |

| | | | | 4,748,973 |

| | Industrials — 6.0% | |

| 2,047 | Deere & Co. | 701,896 |

| 1,118 | FedEx Corp. | 289,159 |

| 5,052 | Hubbell, Inc. | 1,052,180 |

| 2,174 | Parker-Hannifin Corp. | 691,593 |

| 14,999 | Raytheon Technologies Corp. | 1,290,814 |

| 7,549 | Southwest Airlines Co.* | 323,399 |

| | | | | 4,349,041 |

| | Consumer Staples — 2.4% | |

| 9,646 | Monster Beverage Corp.* | 926,402 |

| 8,556 | Philip Morris International, Inc. | 812,820 |

| | | | | 1,739,222 |

| | Real Estate — 1.7% | |

| 4,451 | Jones Lang LaSalle, Inc.* | 1,198,832 |

| | Energy — 1.4% | |

| 10,485 | Exxon Mobil Corp. | 641,577 |

| 11,589 | Schlumberger NV | 347,091 |

| | | | | 988,668 |

| Shares | | | | Market

Value |

| | | |

| | Materials — 1.0% | |

| 9,297 | DuPont de Nemours, Inc. | $ 751,012 |

| | Total Common Stocks | $48,316,712 |

Principal

Amount | | | | |

| | Corporate Bonds — 15.2% | |

| | Financials — 4.2% | |

| $ 150,000 | AerCap Ireland Capital DAC / AerCap Global Aviation Trust (Ireland), 2.450%, 10/29/26 | 151,329 |

| 130,000 | Allstate Corp. (The), 1.450%, 12/15/30 | 123,037 |

| 60,000 | American Financial Group, Inc., 5.250%, 4/2/30 | 71,560 |

| 112,000 | Ares Capital Corp., 3.250%, 7/15/25 | 115,721 |

| 81,000 | Bank of America Corp., 2.687%, 4/22/32 | 82,294 |

| 82,000 | Bank of America Corp., 3.705%, 4/24/28 | 89,046 |

| 119,000 | Bank of America Corp., MTN, 4.000%, 1/22/25 | 127,130 |

| 94,000 | Bank of Montreal (Canada), 3.803%, 12/15/32 | 100,895 |

| 70,000 | Berkshire Hathaway Finance Corp., 4.250%, 1/15/49 | 86,252 |

| 142,000 | Charles Schwab Corp. (The), 1.150%, 5/13/26 | 140,164 |

| 128,000 | Citigroup, Inc., 0.981%, 5/1/25 | 127,014 |

| 77,000 | Citigroup, Inc., 3.200%, 10/21/26 | 81,642 |

| 45,000 | Citigroup, Inc., 4.750%, 5/18/46 | 55,511 |

| 138,000 | Corestates Capital III, 144a, (3M LIBOR +0.570%), 0.726%, 2/15/27(A) | 134,232 |

| 122,000 | Goldman Sachs Group, Inc. (The), 2.615%, 4/22/32 | 123,015 |

| 55,000 | Goldman Sachs Group, Inc. (The), 3.691%, 6/5/28 | 59,265 |

| 126,000 | Huntington Bancshares, Inc., 2.550%, 2/4/30 | 128,036 |

| 128,000 | JPMorgan Chase & Co., 2.956%, 5/13/31 | 132,663 |

| 100,000 | JPMorgan Chase & Co., 3.509%, 1/23/29 | 107,205 |

| 200,000 | Lloyds Banking Group PLC (United Kingdom), 3.574%, 11/7/28 | 213,750 |

| 112,000 | Mastercard, Inc., 2.000%, 11/18/31 | 111,795 |

| 109,000 | Morgan Stanley, 3.950%, 4/23/27 | 119,925 |

| 77,000 | Northwestern Mutual Life Insurance Co. (The), 144a, 3.850%, 9/30/47 | 87,095 |

| 132,000 | PNC Capital Trust, (3M LIBOR +0.570%), 0.741%, 6/1/28(A) | 128,418 |

| 120,000 | Toronto-Dominion Bank (The) (Canada), MTN, 1.150%, 6/12/25 | 119,043 |

| 197,000 | Truist Bank, Ser A, (3M LIBOR +0.670%), 0.820%, 5/15/27(A) | 191,568 |

| 22,000 | Truist Financial Corp., MTN, 2.850%, 10/26/24 | 22,993 |

| | | | | 3,030,598 |

| | Industrials — 1.5% | |

| 98,000 | Amcor Flexibles North America, Inc., 2.630%, 6/19/30 | 98,449 |

| 29,000 | Boeing Co. (The), 5.040%, 5/1/27 | 32,673 |

| 31,000 | Boeing Co. (The), 5.805%, 5/1/50 | 42,114 |

| 81,000 | Burlington Northern Santa Fe LLC, 5.750%, 5/1/40 | 112,711 |

| 118,000 | CNH Industrial Capital LLC, 1.450%, 7/15/26 | 115,537 |

| 94,000 | FedEx Corp., 5.100%, 1/15/44 | 119,540 |

| 99,000 | John Deere Capital Corp., MTN, 2.450%, 1/9/30 | 102,070 |

| 81,000 | Norfolk Southern Corp., 4.837%, 10/1/41 | 102,335 |

| 103,000 | Roper Technologies, Inc., 2.950%, 9/15/29 | 106,630 |

| 120,000 | Waste Management, Inc., 2.500%, 11/15/50 | 114,636 |

| 117,000 | Xylem, Inc., 1.950%, 1/30/28 | 115,765 |

| | | | | 1,062,460 |

| | Health Care — 1.4% | |

| 84,000 | AbbVie, Inc., 4.450%, 5/14/46 | 101,909 |

| 76,000 | Becton Dickinson and Co., 4.685%, 12/15/44 | 95,652 |

| 67,000 | Bristol-Myers Squibb Co., 5.000%, 8/15/45 | 89,278 |

| 86,000 | CommonSpirit Health, 4.187%, 10/1/49 | 100,414 |

| 100,000 | CommonSpirit Health, 4.200%, 8/1/23 | 104,581 |

| 73,000 | CVS Health Corp., 5.125%, 7/20/45 | 95,178 |

| 104,000 | DH Europe Finance II Sarl, 3.250%, 11/15/39 | 111,315 |

Touchstone Balanced Fund (Continued)

Principal

Amount | | | | MarketValue |

| | Corporate Bonds — 15.2% (Continued) | |

| | Health Care — (Continued) | |

| $ 45,000 | Johnson & Johnson, 2.900%, 1/15/28 | $ 48,016 |

| 93,000 | Mylan, Inc., 4.550%, 4/15/28 | 104,174 |

| 107,000 | UnitedHealth Group, Inc., 3.500%, 8/15/39 | 118,948 |

| | | | | 969,465 |

| | Energy — 1.3% | |

| 200,000 | Aker BP ASA (Norway), 144a, 3.000%, 1/15/25 | 207,343 |

| 78,000 | Boardwalk Pipelines LP, 4.800%, 5/3/29 | 87,427 |

| 65,000 | Canadian Natural Resources Ltd. (Canada), 6.250%, 3/15/38 | 85,708 |

| 74,000 | Cenovus Energy, Inc. (Canada), 5.250%, 6/15/37 | 87,621 |

| 107,000 | Cheniere Energy Partners LP, 144a, 3.250%, 1/31/32 | 108,070 |

| 60,000 | Continental Resources, Inc., 144a, 5.750%, 1/15/31 | 70,657 |

| 18,000 | Diamondback Energy, Inc., 2.875%, 12/1/24 | 18,678 |

| 115,000 | Energy Transfer LP, 4.150%, 9/15/29 | 123,134 |

| 93,000 | NGPL PipeCo LLC, 144a, 7.768%, 12/15/37 | 130,468 |

| 17,000 | Ovintiv Exploration, Inc., 5.375%, 1/1/26 | 18,838 |

| 20,000 | Sabine Pass Liquefaction LLC, 5.000%, 3/15/27 | 22,476 |

| | | | | 960,420 |

| | Consumer Staples — 1.3% | |

| 127,000 | 7-Eleven, Inc., 144a, 0.950%, 2/10/26 | 123,042 |

| 121,000 | Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc. (Belgium), 4.900%, 2/1/46 | 153,410 |

| 200,000 | Imperial Brands Finance PLC (United Kingdom), 144a, 4.250%, 7/21/25 | 214,816 |

| 64,000 | Kroger Co. (The), 5.000%, 4/15/42 | 81,430 |

| 96,000 | Mars, Inc., 144a, 3.875%, 4/1/39 | 111,247 |

| 55,000 | PepsiCo, Inc., 1.625%, 5/1/30 | 53,394 |

| 132,000 | Reynolds American, Inc. (United Kingdom), 4.450%, 6/12/25 | 142,525 |

| 65,000 | Starbucks Corp., 3.350%, 3/12/50 | 68,220 |

| | | | | 948,084 |

| | Utilities — 1.2% | |

| 52,000 | American Water Capital Corp., 6.593%, 10/15/37 | 75,165 |

| 102,000 | Cleveland Electric Illuminating Co. (The), 144a, 4.550%, 11/15/30 | 117,187 |

| 74,000 | Duke Energy Progress LLC, 4.150%, 12/1/44 | 87,195 |

| 72,000 | Edison International, 4.125%, 3/15/28 | 76,047 |

| 104,000 | Ohio Power Co., 2.900%, 10/1/51 | 100,694 |

| 126,000 | Pacific Gas and Electric Co., 3.500%, 8/1/50 | 117,121 |

| 89,000 | PacifiCorp., 5.750%, 4/1/37 | 117,350 |

| 188,000 | WEC Energy Group, Inc., (3M LIBOR +2.112%), 2.268%, 5/15/67(A) | 174,605 |

| | | | | 865,364 |

| | Communication Services — 1.1% | |

| 42,000 | Alphabet, Inc., 1.900%, 8/15/40 | 38,369 |

| 76,000 | AT&T, Inc., 3.850%, 6/1/60 | 79,717 |

| 54,000 | AT&T, Inc., 4.500%, 5/15/35 | 62,467 |

| 75,000 | Charter Communications Operating LLC / Charter Communications Operating Capital, 6.484%, 10/23/45 | 102,706 |

| 74,000 | Comcast Corp., 4.000%, 3/1/48 | 85,532 |

| 36,000 | Deutsche Telekom International Finance BV (Germany), 8.750%, 6/15/30 | 52,357 |

| 24,000 | Netflix, Inc., 144a, 4.875%, 6/15/30 | 27,990 |

| 118,000 | T-Mobile USA, Inc., 3.875%, 4/15/30 | 129,225 |

| 141,000 | Verizon Communications, Inc., 2.987%, 10/30/56 | 134,050 |

| 76,000 | ViacomCBS, Inc., 4.950%, 5/19/50 | 97,211 |

| | | | | 809,624 |

| | Information Technology — 1.1% | |

| 67,000 | Apple, Inc., 4.650%, 2/23/46 | 88,165 |

Principal

Amount | | | | MarketValue |

| | | |

| | Information Technology — (Continued) | |

| $ 104,000 | Broadcom, Inc., 4.150%, 11/15/30 | $ 115,458 |

| 104,000 | Fiserv, Inc., 3.500%, 7/1/29 | 111,945 |

| 112,000 | Microchip Technology, Inc., 144a, 0.983%, 9/1/24 | 109,965 |

| 49,000 | Microsoft Corp., 3.500%, 2/12/35 | 56,067 |

| 90,000 | NXP BV / NXP Funding LLC (China), 144a, 5.350%, 3/1/26 | 101,731 |

| 46,000 | Oracle Corp., 2.650%, 7/15/26 | 47,299 |

| 65,000 | Visa, Inc., 4.150%, 12/14/35 | 77,901 |

| 96,000 | VMware, Inc., 1.400%, 8/15/26 | 94,402 |

| | | | | 802,933 |

| | Real Estate — 1.0% | |

| 68,000 | American Homes 4 Rent LP REIT, 4.250%, 2/15/28 | 75,385 |

| 100,000 | Crown Castle International Corp. REIT, 3.650%, 9/1/27 | 107,496 |

| 84,000 | Equinix, Inc. REIT, 2.900%, 11/18/26 | 87,071 |

| 98,000 | Healthcare Realty Trust, Inc. REIT, 2.400%, 3/15/30 | 97,620 |

| 122,000 | Host Hotels & Resorts LP REIT, 4.500%, 2/1/26 | 131,504 |

| 55,000 | Mid-America Apartments LP REIT, 3.750%, 6/15/24 | 57,905 |

| 74,000 | Sabra Health Care LP REIT, 5.125%, 8/15/26 | 81,462 |

| 37,000 | STORE Capital Corp. REIT, 4.500%, 3/15/28 | 40,912 |

| 63,000 | STORE Capital Corp. REIT, 4.625%, 3/15/29 | 70,636 |

| | | | | 749,991 |

| | Consumer Discretionary — 0.9% | |

| 60,000 | Ford Motor Co., 3.250%, 2/12/32 | 61,440 |

| 56,000 | General Motors Financial Co., Inc., 5.650%, 1/17/29 | 66,461 |

| 59,000 | Home Depot, Inc. (The), 5.950%, 4/1/41 | 84,866 |

| 94,000 | Hyundai Capital America, 144a, 2.650%, 2/10/25 | 96,368 |

| 113,000 | Lowe's Cos, Inc., 4.500%, 4/15/30 | 131,294 |

| 142,000 | Procter & Gamble Co. (The), 1.200%, 10/29/30 | 134,448 |

| 95,000 | Walmart, Inc., 2.850%, 7/8/24 | 99,289 |

| | | | | 674,166 |

| | Materials — 0.2% | |

| 83,000 | Sherwin-Williams Co. (The), 4.500%, 6/1/47 | 103,777 |

| | Total Corporate Bonds | $10,976,882 |

| | U.S. Treasury Obligations — 14.0% |

| 1,345,000 | U.S. Treasury Bond, 1.750%, 8/15/41 | | | 1,308,223 |

| 95,000 | U.S. Treasury Bond, 1.875%, 2/15/41 | | | 94,328 |

| 1,990,000 | U.S. Treasury Note, 0.125%, 4/30/23 | | | 1,979,428 |

| 2,375,000 | U.S. Treasury Note, 0.250%, 10/31/25 | | | 2,296,421 |

| 1,725,000 | U.S. Treasury Note, 0.375%, 3/31/22 | | | 1,726,170 |

| 1,650,000 | U.S. Treasury Note, 0.750%, 5/31/26 | | | 1,617,000 |

| 1,106,000 | U.S. Treasury Note, 1.625%, 5/15/31 | | | 1,121,208 |

| | Total U.S. Treasury Obligations | $10,142,778 |

| Shares | | | | |

| | Exchange-Traded Fund — 1.7% | |

| 11,188 | iShares JP Morgan USD Emerging Markets Bond ETF | 1,220,163 |

Principal

Amount | | | | |

| | U.S. Government Mortgage-Backed Obligations — 0.9% |

| $ 135,883 | FHLMC, Pool #G05624, 4.500%, 9/1/39 | | | 150,350 |

| 97,296 | FHLMC, Pool #Q29260, 4.000%, 10/1/44 | | | 106,831 |

| 56,293 | FNMA, Pool #725423, 5.500%, 5/1/34 | | | 63,073 |

| 51,327 | FNMA, Pool #725610, 5.500%, 7/1/34 | | | 58,233 |

| 10,206 | FNMA, Pool #890310, 4.500%, 12/1/40 | | | 11,235 |

| 38,195 | FNMA, Pool #AD9193, 5.000%, 9/1/40 | | | 43,120 |

| 178,685 | FNMA, Pool #AL5718, 3.500%, 9/1/44 | | | 192,440 |

| | Total U.S. Government Mortgage-Backed Obligations | $625,282 |

Touchstone Balanced Fund (Continued)

Principal

Amount | | | | MarketValue |

| | Sovereign Government Obligations — 0.2% |

| $ 146,000 | Peruvian Government International Bond, 2.780%, 12/1/60 | $ 128,117 |

| Shares | | | | |

| | Short-Term Investment Fund — 1.2% | |

| 894,202 | Dreyfus Government Cash Management, Institutional Shares, 0.03%∞Ω | $ 894,202 |

| | Total Investment Securities—100.1%

(Cost $60,698,817) | $72,304,136 |

| | Liabilities in Excess of Other Assets — (0.1%) | (62,284) |

| | Net Assets — 100.0% | $72,241,852 |

| (A) | Variable rate security - Rate reflected is the rate in effect as of December 31, 2021. |

| * | Non-income producing security. |

| ∞ | Open-End Fund. |

| Ω | Represents the 7-Day SEC yield as of December 31, 2021. |

| Portfolio Abbreviations: |

| ADR – American Depositary Receipt |

| DAC – Designated Activity Company |

| ETF – Exchange-Traded Fund |

| FHLMC – Federal Home Loan Mortgage Corporation |

| FNMA – Federal National Mortgage Association |

| LIBOR – London Interbank Offered Rate |

| LLC – Limited Liability Company |

| LP – Limited Partnership |

| MTN – Medium Term Note |

| PLC – Public Limited Company |

| REIT – Real Estate Investment Trust |

| 144a - This is a restricted security that was sold in a transaction qualifying for the exemption under Rule 144a of the Securities Act of 1933. This security may be sold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2021, these securities were valued at $1,640,211 or 2.3% of net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Trustees. |

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $48,316,712 | $— | $— | $48,316,712 |

| Corporate Bonds | — | 10,976,882 | — | 10,976,882 |

| U.S. Treasury Obligations | — | 10,142,778 | — | 10,142,778 |

| Exchange-Traded Fund | 1,220,163 | — | — | 1,220,163 |

| U.S. Government Mortgage-Backed Obligations | — | 625,282 | — | 625,282 |

| Sovereign Government Obligations | — | 128,117 | — | 128,117 |

| Short-Term Investment Fund | 894,202 | — | — | 894,202 |

| Total | $50,431,077 | $21,873,059 | $— | $72,304,136 |

See accompanying Notes to Financial Statements.

Portfolio of Investments

Touchstone Bond Fund – December 31, 2021

Principal

Amount | | | | Market

Value |

| | Corporate Bonds — 34.8% | |

| | Financials — 9.8% | |

| $ 400,000 | AerCap Ireland Capital DAC / AerCap Global Aviation Trust (Ireland), 2.450%, 10/29/26 | $ 403,545 |

| 378,000 | Allstate Corp. (The), 1.450%, 12/15/30 | 357,753 |

| 572,579 | American Financial Group, Inc., 5.250%, 4/2/30 | 682,892 |

| 283,000 | Ares Capital Corp., 3.250%, 7/15/25 | 292,401 |

| 200,000 | Bank of America Corp., 2.687%, 4/22/32 | 203,195 |

| 250,000 | Bank of America Corp., 3.705%, 4/24/28 | 271,481 |

| 401,000 | Bank of America Corp., MTN, 4.000%, 1/22/25 | 428,397 |

| 335,000 | Bank of Montreal (Canada), 3.803%, 12/15/32 | 359,572 |

| 230,000 | Bank of Nova Scotia (The) (Canada), (3M LIBOR +0.620%), 0.834%, 9/19/22(A) | 230,794 |

| 374,000 | Bank of Nova Scotia (The) (Canada), Ser 2, 3.625%, 10/27/81 | 361,299 |

| 176,000 | Berkshire Hathaway Finance Corp., 4.250%, 1/15/49 | 216,863 |

| 204,000 | BNP Paribas SA (France), 144a, 4.625%, 3/13/27 | 226,261 |

| 464,000 | Charles Schwab Corp. (The), 1.150%, 5/13/26 | 458,002 |

| 323,000 | Citigroup, Inc., 0.981%, 5/1/25 | 320,512 |

| 225,000 | Citigroup, Inc., 3.200%, 10/21/26 | 238,563 |

| 141,000 | Citigroup, Inc., 4.750%, 5/18/46 | 173,933 |

| 318,000 | Cooperatieve Rabobank UA (Netherlands), 144a, 1.106%, 2/24/27 | 308,693 |

| 365,000 | Corestates Capital III, 144a, (3M LIBOR +0.570%), 0.726%, 2/15/27(A) | 355,035 |

| 352,000 | Goldman Sachs Group, Inc. (The), 2.615%, 4/22/32 | 354,929 |

| 182,000 | Goldman Sachs Group, Inc. (The), 3.691%, 6/5/28 | 196,113 |

| 205,000 | HSBC Holdings PLC (United Kingdom), 3.900%, 5/25/26 | 221,203 |

| 349,000 | Huntington Bancshares, Inc., 2.550%, 2/4/30 | 354,640 |

| 256,000 | JPMorgan Chase & Co., 2.956%, 5/13/31 | 265,326 |

| 336,000 | JPMorgan Chase & Co., 3.509%, 1/23/29 | 360,208 |

| 343,000 | Lloyds Banking Group PLC (United Kingdom), 3.574%, 11/7/28 | 366,582 |

| 374,000 | Mastercard, Inc., 2.000%, 11/18/31 | 373,314 |

| 311,000 | Morgan Stanley, 3.950%, 4/23/27 | 342,172 |

| 273,000 | Northwestern Mutual Life Insurance Co. (The), 144a, 3.850%, 9/30/47 | 308,791 |

| 356,000 | PNC Capital Trust, (3M LIBOR +0.570%), 0.741%, 6/1/28(A) | 346,340 |

| 304,000 | Toronto-Dominion Bank (The) (Canada), MTN, 1.150%, 6/12/25 | 301,576 |

| 551,000 | Truist Bank, Ser A, (3M LIBOR +0.670%), 0.820%, 5/15/27(A) | 535,806 |

| 210,000 | Truist Financial Corp., MTN, 2.850%, 10/26/24 | 219,480 |

| | | | | 10,435,671 |

| | Industrials — 3.1% | |

| 250,000 | Amcor Flexibles North America, Inc., 2.630%, 6/19/30 | 251,145 |

| 79,000 | Boeing Co. (The), 5.040%, 5/1/27 | 89,007 |

| 91,000 | Boeing Co. (The), 5.805%, 5/1/50 | 123,624 |

| 272,000 | Burlington Northern Santa Fe LLC, 5.750%, 5/1/40 | 378,488 |

| 384,000 | CNH Industrial Capital LLC, 1.450%, 7/15/26 | 375,984 |

| 340,000 | FedEx Corp., 5.100%, 1/15/44 | 432,380 |

| 298,000 | John Deere Capital Corp., MTN, 2.450%, 1/9/30 | 307,240 |

| 243,000 | Norfolk Southern Corp., 4.837%, 10/1/41 | 307,006 |

| 285,000 | Roper Technologies, Inc., 2.950%, 9/15/29 | 295,044 |

| 361,000 | Waste Management, Inc., 2.500%, 11/15/50 | 344,864 |

| 423,000 | Weir Group PLC (The) (United Kingdom), 144a, 2.200%, 5/13/26 | 417,322 |

| | | | | 3,322,104 |

| | Energy — 3.0% | |

| 270,000 | Aker BP ASA (Norway), 144a, 3.000%, 1/15/25 | 279,913 |

| 333,000 | Boardwalk Pipelines LP, 4.800%, 5/3/29 | 373,246 |

Principal

Amount | | | | Market

Value |

| | | |

| | Energy — (Continued) | |

| $ 227,000 | Canadian Natural Resources Ltd. (Canada), 6.250%, 3/15/38 | $ 299,319 |

| 207,000 | Cenovus Energy, Inc. (Canada), 5.250%, 6/15/37 | 245,101 |

| 371,000 | Cheniere Energy Partners LP, 144a, 3.250%, 1/31/32 | 374,710 |

| 200,000 | Continental Resources, Inc., 144a, 5.750%, 1/15/31 | 235,524 |

| 395,000 | Energy Transfer LP, 4.150%, 9/15/29 | 422,940 |

| 193,000 | MC Brazil Downstream Trading SARL (Brazil), 144a, 7.250%, 6/30/31 | 192,131 |

| 251,000 | NGPL PipeCo LLC, 144a, 7.768%, 12/15/37 | 352,124 |

| 203,000 | Ovintiv Exploration, Inc., 5.375%, 1/1/26 | 224,952 |

| 206,000 | Petroleos Mexicanos (Mexico), 6.625%, 6/15/35 | 197,924 |

| | | | | 3,197,884 |

| | Communication Services — 3.0% | |

| 104,000 | Alphabet, Inc., 1.900%, 8/15/40 | 95,009 |

| 266,000 | AT&T, Inc., 3.850%, 6/1/60 | 279,011 |

| 238,000 | AT&T, Inc., 4.500%, 5/15/35 | 275,316 |

| 355,000 | British Telecommunications PLC (United Kingdom), 144a, 3.250%, 11/8/29 | 363,220 |

| 209,000 | Charter Communications Operating LLC / Charter Communications Operating Capital, 6.484%, 10/23/45 | 286,208 |

| 243,000 | Comcast Corp., 4.000%, 3/1/48 | 280,867 |

| 124,000 | Deutsche Telekom International Finance BV (Germany), 8.750%, 6/15/30 | 180,342 |

| 310,000 | Netflix, Inc., 144a, 4.875%, 6/15/30 | 361,537 |

| 335,000 | T-Mobile USA, Inc., 3.875%, 4/15/30 | 366,867 |

| 439,000 | Verizon Communications, Inc., 2.987%, 10/30/56 | 417,362 |

| 190,000 | ViacomCBS, Inc., 4.950%, 5/19/50 | 243,028 |

| | | | | 3,148,767 |

| | Consumer Staples — 2.9% | |

| 380,000 | 7-Eleven, Inc., 144a, 0.950%, 2/10/26 | 368,158 |

| 439,000 | Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc. (Belgium), 4.900%, 2/1/46 | 556,588 |

| 434,000 | Imperial Brands Finance PLC (United Kingdom), 144a, 4.250%, 7/21/25 | 466,152 |

| 374,000 | JBS Finance Luxembourg Sarl, 144a, 2.500%, 1/15/27 | 369,796 |

| 213,000 | Kroger Co. (The), 5.000%, 4/15/42 | 271,008 |

| 336,000 | Mars, Inc., 144a, 3.875%, 4/1/39 | 389,363 |

| 454,000 | Reynolds American, Inc. (United Kingdom), 4.450%, 6/12/25 | 490,199 |

| 164,000 | Starbucks Corp., 3.350%, 3/12/50 | 172,126 |

| | | | | 3,083,390 |

| | Information Technology — 2.8% | |

| 344,000 | Apple, Inc., 2.750%, 1/13/25 | 359,508 |

| 234,000 | Apple, Inc., 4.650%, 2/23/46 | 307,919 |

| 330,000 | Broadcom, Inc., 4.150%, 11/15/30 | 366,357 |

| 290,000 | Fiserv, Inc., 3.500%, 7/1/29 | 312,153 |

| 370,000 | Microchip Technology, Inc., 144a, 0.983%, 9/1/24 | 363,279 |

| 148,000 | Microsoft Corp., 3.500%, 2/12/35 | 169,346 |

| 328,000 | NXP BV / NXP Funding LLC (China), 144a, 5.350%, 3/1/26 | 370,751 |

| 174,000 | Oracle Corp., 2.650%, 7/15/26 | 178,913 |

| 220,000 | Visa, Inc., 4.150%, 12/14/35 | 263,665 |

| 332,000 | VMware, Inc., 1.400%, 8/15/26 | 326,474 |

| | | | | 3,018,365 |

| | Health Care — 2.7% | |

| 283,000 | AbbVie, Inc., 4.450%, 5/14/46 | 343,335 |

| 232,000 | Alcon Finance Corp. (Switzerland), 144a, 3.800%, 9/23/49 | 259,261 |

| 221,000 | Becton Dickinson and Co., 4.685%, 12/15/44 | 278,146 |

| 229,000 | Bristol-Myers Squibb Co., 5.000%, 8/15/45 | 305,145 |

Touchstone Bond Fund (Continued)

Principal

Amount | | | | Market

Value |

| | Corporate Bonds — 34.8% (Continued) | |

| | Health Care — (Continued) | |

| $ 263,000 | CommonSpirit Health, 4.187%, 10/1/49 | $ 307,079 |

| 190,000 | CommonSpirit Health, 4.200%, 8/1/23 | 198,703 |

| 240,000 | CVS Health Corp., 5.125%, 7/20/45 | 312,913 |

| 293,000 | DH Europe Finance II Sarl, 3.250%, 11/15/39 | 313,608 |

| 234,000 | Mylan, Inc., 4.550%, 4/15/28 | 262,115 |

| 312,000 | UnitedHealth Group, Inc., 3.500%, 8/15/39 | 346,841 |

| | | | | 2,927,146 |

| | Utilities — 2.6% | |

| 222,000 | American Water Capital Corp., 6.593%, 10/15/37 | 320,896 |

| 349,000 | Cleveland Electric Illuminating Co. (The), 144a, 4.550%, 11/15/30 | 400,961 |

| 93,000 | Duke Energy Progress LLC, 4.150%, 12/1/44 | 109,583 |

| 207,000 | Edison International, 4.125%, 3/15/28 | 218,635 |

| 224,000 | Electricite de France SA (France), 144a, 4.875%, 9/21/38 | 271,605 |

| 85,000 | Fortis, Inc. (Canada), 3.055%, 10/4/26 | 88,529 |

| 338,000 | Ohio Power Co., 2.900%, 10/1/51 | 327,255 |

| 372,000 | Pacific Gas and Electric Co., 3.500%, 8/1/50 | 345,787 |

| 127,000 | PacifiCorp., 5.750%, 4/1/37 | 167,455 |

| 532,000 | WEC Energy Group, Inc., (3M LIBOR +2.112%), 2.268%, 5/15/67(A) | 494,095 |

| | | | | 2,744,801 |

| | Real Estate — 2.2% | |

| 361,000 | Crown Castle International Corp. REIT, 3.650%, 9/1/27 | 388,062 |

| 236,000 | Equinix, Inc. REIT, 2.900%, 11/18/26 | 244,628 |

| 285,000 | Healthcare Realty Trust, Inc. REIT, 2.400%, 3/15/30 | 283,895 |

| 338,000 | Host Hotels & Resorts LP REIT, 4.500%, 2/1/26 | 364,331 |

| 186,000 | Mid-America Apartments LP REIT, 3.750%, 6/15/24 | 195,824 |

| 250,000 | Realty Income Corp. REIT, 4.600%, 2/6/24 | 265,931 |

| 290,000 | Sabra Health Care LP REIT, 5.125%, 8/15/26 | 319,242 |

| 96,000 | STORE Capital Corp. REIT, 4.500%, 3/15/28 | 106,151 |

| 188,000 | STORE Capital Corp. REIT, 4.625%, 3/15/29 | 210,787 |

| | | | | 2,378,851 |

| | Consumer Discretionary — 2.1% | |

| 202,000 | Ford Motor Co., 3.250%, 2/12/32 | 206,848 |

| 169,000 | General Motors Financial Co., Inc., 5.650%, 1/17/29 | 200,571 |

| 227,000 | Home Depot, Inc. (The), 5.950%, 4/1/41 | 326,519 |

| 316,000 | Hyundai Capital America, 144a, 2.650%, 2/10/25 | 323,960 |

| 308,000 | Lowe's Cos, Inc., 4.500%, 4/15/30 | 357,865 |

| 490,000 | Procter & Gamble Co. (The), 1.200%, 10/29/30 | 463,941 |

| 1,334 | United Airlines 2014-2 Class B Pass Through Trust, Ser B, 4.625%, 9/3/22 | 1,357 |

| 333,000 | Walmart, Inc., 2.850%, 7/8/24 | 348,032 |

| | | | | 2,229,093 |

| | Materials — 0.6% | |

| 83,000 | Braskem America Finance Co. (Brazil), 144a, 7.125%, 7/22/41 | 107,174 |

| 176,000 | Braskem Netherlands Finance BV (Brazil), 144a, 5.875%, 1/31/50 | 202,840 |

| 301,000 | Sherwin-Williams Co. (The), 4.500%, 6/1/47 | 376,346 |

| | | | | 686,360 |

| | Total Corporate Bonds | $37,172,432 |

| | U.S. Treasury Obligations — 34.3% |

| 8,875,000 | U.S. Treasury Bond, 1.750%, 8/15/41 | | | 8,632,324 |

| 4,040,000 | U.S. Treasury Bond, 1.875%, 2/15/41 | | | 4,011,436 |

| 9,370,000 | U.S. Treasury Note, 0.125%, 4/30/23 | | | 9,320,222 |

| 2,380,000 | U.S. Treasury Note, 0.250%, 10/31/25 | | | 2,301,255 |

| 4,030,000 | U.S. Treasury Note, 0.375%, 3/31/22 | | | 4,032,734 |

| 4,685,000 | U.S. Treasury Note, 0.750%, 5/31/26 | | | 4,591,300 |

Principal

Amount | | | | Market

Value |

| | U.S. Treasury Obligations — 34.3% (Continued) |

| $ 66,000 | U.S. Treasury Note, 1.250%, 8/15/31 | | | $ 64,608 |

| 3,613,000 | U.S. Treasury Note, 1.625%, 5/15/31 | | | 3,662,679 |

| | Total U.S. Treasury Obligations | $36,616,558 |

| | U.S. Government Mortgage-Backed Obligations — 6.6% |

| 48,279 | FHLMC, Pool #A95946, 4.000%, 1/1/41 | | | 53,041 |

| 37,805 | FHLMC, Pool #A96485, 4.500%, 1/1/41 | | | 41,827 |

| 12,890 | FHLMC, Pool #G03217, 5.500%, 9/1/37 | | | 14,338 |

| 6,506 | FHLMC, Pool #G03781, 6.000%, 1/1/38 | | | 7,490 |

| 254,781 | FHLMC, Pool #G05624, 4.500%, 9/1/39 | | | 281,905 |

| 316,738 | FHLMC, Pool #Q29056, 4.000%, 10/1/44 | | | 347,764 |

| 159,457 | FHLMC, Pool #Q29260, 4.000%, 10/1/44 | | | 175,084 |

| 598,859 | FHLMC REMIC, Pool #QD2143, 2.000%, 12/1/51 | | | 597,865 |

| 3,485 | FNMA, Pool #561741, 7.500%, 1/1/31 | | | 3,902 |

| 211,841 | FNMA, Pool #725423, 5.500%, 5/1/34 | | | 237,355 |

| 190,100 | FNMA, Pool #725610, 5.500%, 7/1/34 | | | 215,676 |

| 4,607 | FNMA, Pool #889734, 5.500%, 6/1/37 | | | 5,265 |

| 28,437 | FNMA, Pool #AB1149, 5.000%, 6/1/40 | | | 32,259 |

| 28,328 | FNMA, Pool #AB1800, 4.000%, 11/1/40 | | | 31,119 |

| 48,869 | FNMA, Pool #AD3795, 4.500%, 4/1/40 | | | 54,038 |

| 68,234 | FNMA, Pool #AD9150, 5.000%, 8/1/40 | | | 77,378 |

| 127,318 | FNMA, Pool #AD9193, 5.000%, 9/1/40 | | | 143,732 |

| 85,679 | FNMA, Pool #AE0548, 4.500%, 11/1/40 | | | 94,739 |

| 70,827 | FNMA, Pool #AE4429, 4.000%, 10/1/40 | | | 77,762 |

| 3,198 | FNMA, Pool #AH2666, 4.000%, 1/1/26 | | | 3,360 |

| 5,783 | FNMA, Pool #AH3493, 4.000%, 2/1/26 | | | 6,089 |

| 113,239 | FNMA, Pool #AJ5457, 4.000%, 11/1/41 | | | 124,356 |

| 105,920 | FNMA, Pool #AL0054, 4.500%, 2/1/41 | | | 117,131 |

| 221,356 | FNMA, Pool #AL5718, 3.500%, 9/1/44 | | | 238,396 |

| 284,143 | FNMA, Pool #AR9195, 3.000%, 3/1/43 | | | 300,364 |

| 94,177 | FNMA, Pool #AS7813, 4.000%, 8/1/46 | | | 102,416 |

| 237,661 | FNMA, Pool #AT2016, 3.000%, 4/1/43 | | | 251,671 |

| 193,845 | FNMA, Pool #BC1158, 3.500%, 2/1/46 | | | 206,916 |

| 363,672 | FNMA, Pool #FM4996, 2.000%, 12/1/50 | | | 363,678 |

| 380,105 | FNMA, Pool #FM5166, 3.000%, 12/1/50 | | | 395,585 |

| 344,464 | FNMA, Pool #FM5279, 3.500%, 11/1/50 | | | 362,856 |

| 278,462 | FNMA, Pool #FM5468, 2.500%, 1/1/36 | | | 288,159 |

| 330,494 | FNMA, Pool #FM5682, 2.500%, 1/1/51 | | | 338,467 |

| 109,401 | FNMA, Pool #MA1175, 3.000%, 9/1/42 | | | 115,565 |

| 73,304 | FNMA, Pool #MA2177, 4.000%, 2/1/35 | | | 79,708 |

| 436,904 | FNMA, Pool #MA4166, 3.000%, 10/1/40 | | | 455,209 |

| 90,437 | GNMA, Pool #4853, 4.000%, 11/20/40 | | | 97,968 |

| 67,746 | GNMA, Pool #4883, 4.500%, 12/20/40 | | | 74,590 |

| 270,022 | GNMA, Pool #5175, 4.500%, 9/20/41 | | | 299,041 |

| 20,947 | GNMA, Pool #736696, 4.500%, 5/15/40 | | | 23,370 |

| 155,215 | GNMA, Pool #AD1745, 3.000%, 2/20/43 | | | 165,295 |

| 100,252 | GNMA, Pool #MA1157, 3.500%, 7/20/43 | | | 107,428 |

| | Total U.S. Government Mortgage-Backed Obligations | $7,010,157 |

| | Asset-Backed Securities — 5.3% |

| 265,000 | Apidos CLO XVIII (Cayman Islands), Ser 2018-18A, Class A1, 144a, (3M LIBOR +1.140%), 1.268%, 10/22/30(A) | | | 265,024 |

| 400,000 | Benefit Street Partners CLO XIX Ltd. (Cayman Islands), Ser 2019-19A, Class B, 144a, (3M LIBOR +2.000%), 2.124%, 1/15/33(A) | | | 400,026 |

| 230,126 | CF Hippolyta LLC, Ser 2020-1, Class A1, 144a, 1.690%, 7/15/60 | | | 228,321 |

| 275,000 | CIFC Funding Ltd. (Cayman Islands), Ser 2016-1A, Class ARR, 144a, (3M LIBOR +1.080%), 1.255%, 10/21/31(A) | | | 274,873 |

| 705,063 | Driven Brands Funding LLC, Ser 2019-1A, Class A2, 144a, 4.641%, 4/20/49 | | | 743,223 |

Touchstone Bond Fund (Continued)

Principal

Amount | | | | Market

Value |

| | Asset-Backed Securities — 5.3% (Continued) |

| $ 350,000 | Driven Brands Funding LLC, Ser 2021-1A, Class A2, 144a, 2.791%, 10/20/51 | | | $ 344,056 |

| 352,822 | Elara HGV Timeshare Issuer LLC, Ser 2019-A, Class B, 144a, 2.910%, 1/25/34 | | | 352,763 |

| 297,750 | Jack In The Box Funding LLC, Ser 2019-1A, Class A2I, 144a, 3.982%, 8/25/49 | | | 299,198 |

| 268,000 | Jersey Mike's Funding, Ser 2019-1A, Class A2, 144a, 4.433%, 2/15/50 | | | 281,338 |

| 241,250 | Jimmy Johns Funding LLC, Ser 2017-1A, Class A2II, 144a, 4.846%, 7/30/47 | | | 254,967 |

| 375,000 | Madison Park Funding XLIX Ltd. (Cayman Islands), Ser 2021-49A, Class B1, 144a, (3M LIBOR +1.700%), 1.819%, 10/19/34(A) | | | 375,105 |

| 275,000 | Madison Park Funding XXXV Ltd. (Cayman Islands), Ser 2019-35A, Class A2AR, 144a, (3M LIBOR +1.200%), 1.331%, 4/20/32(A) | | | 275,050 |

| 289,383 | Mill City Mortgage Loan Trust, Ser 2018-3, Class M3, 144a, 3.250%, 8/25/58(A)(B) | | | 295,960 |

| 350,000 | New Mountain CLO 1 Ltd. (Cayman Islands), Ser CLO-1A, Class AR, 144a, (3M LIBOR +1.200%), 1.317%, 10/15/34(A) | | | 349,998 |

| 286,688 | TAL Advantage VII LLC, Ser 2020-1A, Class A, 144a, 2.050%, 9/20/45 | | | 284,661 |

| 380,000 | Voya CLO Ltd. (Cayman Islands), Ser 2017-4A, Class A1, 144a, (3M LIBOR +1.130%), 1.254%, 10/15/30(A) | | | 380,020 |

| 275,000 | Voya CLO Ltd. (Cayman Islands), Ser 2019-2A, Class A, 144a, (3M LIBOR +1.270%), 1.401%, 7/20/32(A) | | | 275,007 |

| | Total Asset-Backed Securities | $5,679,590 |

| | Commercial Mortgage-Backed Securities — 4.9% |

| 675,000 | BANK, Ser 2018-BN14, Class A3, 3.966%, 9/15/60 | | | 742,924 |

| 750,000 | BHMS, Ser 2018-ATLS, Class A, 144a, (1M LIBOR +1.250%), 1.360%, 7/15/35(A) | | | 749,519 |

| 500,000 | BPR Trust, Ser 2021-KEN, Class B, 144a, (1M LIBOR +1.950%), 2.060%, 2/15/29(A) | | | 499,895 |

| 360,000 | DBUBS Mortgage Trust, Ser 2017-BRBK, Class B, 144a, 3.530%, 10/10/34(A)(B) | | | 372,161 |

| 375,000 | GS Mortgage Securities Corp. II, Ser 2017-SLP, Class B, 144a, 3.772%, 10/10/32 | | | 379,671 |

| 250,000 | GS Mortgage Securities Trust, Ser 2017-FARM, Class B, 144a, 3.541%, 1/10/43(A)(B) | | | 263,335 |

| 315,000 | HONO Mortgage Trust, Ser 2021-LULU, Class B, 144a, (1M LIBOR +1.450%), 1.560%, 10/15/36(A) | | | 314,280 |

| 350,000 | JPMorgan Chase Commercial Mortgage Securities Trust, Ser 2018-MINN, Class A, 144a, (1M LIBOR +1.020%), 2.270%, 11/15/35(A) | | | 351,002 |

| 320,000 | New York City Housing Development Corp., Ser 2014-8SPR, Class B, 3.864%, 2/15/48 | | | 335,588 |

| 675,000 | SG Commercial Mortgage Securities Trust, Ser 2019-787E, Class A, 144a, 4.163%, 2/15/41 | | | 754,645 |

| 481,357 | WFRBS Commercial Mortgage Trust, Ser 2014-C19, Class A3, 3.660%, 3/15/47 | | | 481,572 |

| | Total Commercial Mortgage-Backed Securities | $5,244,592 |

| Shares | | | | |

| | Exchange-Traded Fund — 4.7% | |

| 45,431 | iShares JP Morgan USD Emerging Markets Bond ETF | 4,954,705 |

Principal

Amount | | | | |

| | Non-Agency Collateralized Mortgage Obligations — 3.3% |

| $ 93,080 | Agate Bay Mortgage Trust, Ser 2013-1, Class B3, 144a, 3.580%, 7/25/43(A)(B) | | | 93,831 |

Principal

Amount | | | | MarketValue |

| | Non-Agency Collateralized Mortgage Obligations — 3.3%

(Continued) |

| $ 353,144 | Agate Bay Mortgage Trust, Ser 2015-4, Class B2, 144a, 3.541%, 6/25/45(A)(B) | | | $ 355,793 |

| 322,075 | Agate Bay Mortgage Trust, Ser 2015-7, Class B1, 144a, 3.676%, 10/25/45(A)(B) | | | 325,039 |

| 219,971 | CSMC Trust, Ser 2013-IVR3, Class B2, 144a, 3.378%, 5/25/43(A)(B) | | | 221,565 |

| 278,791 | CSMC Trust, Ser 2015-1, Class B3, 144a, 3.930%, 1/25/45(A)(B) | | | 280,649 |

| 178,513 | CSMC Trust, Ser 2015-WIN1, Class B3, 144a, 3.829%, 12/25/44(A)(B) | | | 178,747 |

| 575 | Deutsche ALT-A Securities, Inc. ALT, Ser 2003-2XS, Class A6, 5.470%, 9/25/33(A)(B) | | | 577 |

| 104,851 | EverBank Mortgage Loan Trust, Ser 2013-1, Class B1, 144a, 3.467%, 3/25/43(A)(B) | | | 105,680 |

| 306,636 | GS Mortgage-Backed Securities Trust, Ser 2021-PJ6, Class A2, 144a, 2.500%, 11/25/51(A)(B) | | | 306,979 |

| 509,634 | JP Morgan Mortgage Trust, Ser 2017-1, Class B2, 144a, 3.469%, 1/25/47(A)(B) | | | 516,015 |

| 80,153 | Residential Asset Securitization Trust, Ser 2006-A1, Class 1A3, 6.000%, 4/25/36 | | | 52,383 |

| 82,157 | Sequoia Mortgage Trust, Ser 2013-10, Class B2, 144a, 3.540%, 8/25/43(A)(B) | | | 82,684 |

| 107,458 | Sequoia Mortgage Trust, Ser 2013-5, Class B1, 144a, 3.505%, 5/25/43(A)(B) | | | 108,385 |

| 453,661 | Sequoia Mortgage Trust, Ser 2018-CH3, Class B1B, 144a, 4.763%, 8/25/48(A)(B) | | | 464,056 |

| 411,130 | Sequoia Mortgage Trust, Ser 2018-CH3, Class B2B, 144a, 4.763%, 8/25/48(A)(B) | | | 419,634 |

| 25,088 | Washington Mutual Mortgage Pass-Through Certificates, Ser 2005-9, Class 2A4, 5.500%, 11/25/35 | | | 25,707 |

| | Total Non-Agency Collateralized Mortgage Obligations | $3,537,724 |

| | Sovereign Government Obligations — 1.8% |

| 210,000 | Bahamas Government International Bond, 144a, 6.000%, 11/21/28 | | | 179,290 |

| 202,000 | Chile Government International Bond, 3.100%, 5/7/41 | | | 197,657 |

| 306,000 | Chile Government International Bond, 3.100%, 1/22/61 | | | 283,772 |

| 206,000 | Colombia Government International Bond, 3.250%, 4/22/32 | | | 185,142 |

| 226,000 | Ecuador Government International Bond, 144a, 5.000%, 7/31/30 | | | 187,297 |

| 210,000 | Egypt Government International Bond, 144a, 5.875%, 2/16/31 | | | 185,783 |

| 210,000 | Ghana Government International Bond, 144a, 7.625%, 5/16/29 | | | 174,783 |

| 205,000 | Nigeria Government International Bond, 144a, 7.625%, 11/28/47 | | | 183,098 |

| 153,000 | Panama Government International Bond, 4.300%, 4/29/53 | | | 164,247 |

| 200,000 | Republic of Uzbekistan International Bond, 144a, 3.700%, 11/25/30 | | | 191,800 |

| | Total Sovereign Government Obligations | $1,932,869 |

| | Agency Collateralized Mortgage Obligations — 0.9% |

| 600,722 | FHLMC REMIC, Ser 3859, Class JB, 5.000%, 5/15/41 | | | 663,787 |

| 16,917 | FNMA REMIC, Ser 2015-51, Class KC, 3.000%, 6/25/45 | | | 17,041 |

| 292,845 | FNMA REMIC, Ser 2017-90, Class KA, 3.000%, 11/25/47 | | | 305,567 |

| | Total Agency Collateralized Mortgage Obligations | $986,395 |

Touchstone Bond Fund (Continued)

| Shares | | | | MarketValue |

| | Short-Term Investment Fund — 3.1% | |

| 3,346,970 | Dreyfus Government Cash Management, Institutional Shares, 0.03%∞Ω | $ 3,346,970 |