UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08426

ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: June 30, 2010

Date of reporting period: June 30, 2010

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

ANNUAL REPORT

AllianceBernstein International Growth Fund

Annual Report

Investment Products Offered

| | • | | Are Not Bank Guaranteed |

The investment return and principal value of an investment in the Fund will fluctuate as the prices of the individual securities in which it invests fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. You should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For a free copy of the Fund’s prospectus, which contains this and other information, visit our web site at www.alliancebernstein.com or call your financial advisor or AllianceBernstein® at (800) 227-4618. Please read the prospectus carefully before you invest.

You may obtain performance information current to the most recent month-end by visiting www.alliancebernstein.com.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AllianceBernstein’s web site at www.alliancebernstein.com, or go to the Securities and Exchange Commission’s (the “Commission”) web site at www.sec.gov, or call AllianceBernstein at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s web site at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. AllianceBernstein publishes full portfolio holdings for the Fund monthly at www.alliancebernstein.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AllianceBernstein family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the manager of the funds.

AllianceBernstein® and the AB Logo are registered trademarks and service marks used by permission of the owner, AllianceBernstein L.P.

August 20, 2010

Annual Report

This report provides management’s discussion of fund performance for AllianceBernstein International Growth Fund (the “Fund”) for the annual reporting period ended June 30, 2010.

Investment Objective and Policies

The Fund’s investment objective is long-term growth of capital. The Fund invests primarily in an international portfolio of equity securities of companies selected by AllianceBernstein L.P. (the “Adviser”) for their growth potential within various market sectors. Examples of the types of market sectors in which the Fund may invest include, but are not limited to, information technology, telecommunications, health care, financial services, infrastructure, energy and natural resources, and consumer growth.

The Fund invests, under normal circumstances, in the equity securities of companies located in at least three countries (and normally substantially more) other than the United States. The Fund invests in securities of companies in both developed and emerging market countries. Geographic distribution of the Fund’s investments among countries or regions also will be a product of the stock selection process rather than a pre-determined allocation. The Fund may also invest in synthetic foreign equity securities. The Adviser expects that normally the Fund’s portfolio will tend to emphasize investments in larger capitalization companies, although the Fund may invest in smaller or medium capitalization companies. The Fund normally invests in approximately 90-130 companies.

Currencies can have a dramatic impact on equity returns, significantly adding to returns in some years and greatly diminishing them in others. Currency and equity positions are evaluated separately. The Adviser may seek to hedge the currency exposure resulting from securities positions when it finds the currency exposure unattractive. To hedge a portion of its currency risk, the Fund may from time to time invest in currency-related derivatives, including forward currency exchange contracts, futures, options on futures, swaps and other options. The Adviser may also seek investment opportunities by taking long or short positions in currencies through the use of currency-related derivatives.

Investment Results

The table on page 5 provides the performance results for the Fund and its primary benchmark, the MSCI World (ex-US) Index (net). Also included are returns for the Fund’s secondary benchmark, the MSCI AC World (ex-US) Index (net and gross) for the six- and 12-month periods ended June 30, 2010.

The Fund’s Class A shares without sales charges underperformed the MSCI AC World (ex-US) Index (net and gross) and outperformed the MSCI World (ex-US) Index (net) for the six-month period ended June 30, 2010 (the Fund and both benchmarks posted negative returns for the period). For the six-month period, poor stock selection drove underperformance predominantly in the energy and materials sectors. The largest detractor from relative

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 1 |

performance was global integrated oil company BP, which was hit by political pressure to stem the Gulf of Mexico oil spill. The Fund exited this position despite BP’s attractive fundamentals, given risks from the political uncertainty surrounding the company. Sector selection contributed modestly to performance during the period, bolstered by an overweight in the consumer discretionary sector.

The Fund’s Class A shares without sales charges marginally underperformed the MSCI AC World (ex-US) Index (net and gross) while outperforming the MSCI World (ex-US) Index (net) for the 12-month period ended June 30, 2010. Security selection contributed somewhat, with stock selection in the consumer discretionary sector boosting performance, but poor selection in other sectors, like information technology and financials, detracted from performance. Sector allocation was flat overall: an underweight to utilities and an overweight to healthcare and consumer discretionary contributed to performance while an overweight to energy and other sectors detracted from performance.

Market Review and Investment Strategy

The first half of 2010 left the markets down with the MSCI AC World

(ex-US) Index (net) declining -11.06% for the six-month period ended June 30, 2010. The 12-month reporting period showed strength, however, with 2009’s rally positively affecting performance despite 2010’s challenges. For the 12-month period ending June 30, 2010, the MSCI AC World (ex-US) Index (net) returned 10.43%. From a style perspective, the growth style outperformed the value style for both the six- and 12-month periods.

The market rally of 2009 matured in the latter half of the year, and investors showed their confidence by supporting security-specific fundamentals. However, in a sharp turnaround in sentiment, international equity markets declined in the first half of 2010. Even though indicators suggest the economic recovery remains on track, a confluence of forces raised investor jitters in the first half of this year: concerns about sovereign debt emanated from Greece to other European countries, questions mounted over financial burdens in the US and the UK, and investors worried whether China would maintain its pace of expansion, among other things. While the six-month period was a difficult time for the markets, the 12-month period embodied both confidence and pessimism.

| | |

| 2 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

HISTORICAL PERFORMANCE

An Important Note About the Value of Historical Performance

The performance shown on the following pages represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.alliancebernstein.com. The investment return and principal value of an investment in the Fund will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.alliancebernstein.com or contact your AllianceBernstein Investments representative. Please read the prospectus and/or summary prospectus carefully before investing.

All fees and expenses related to the operation of the Fund have been deducted. NAV returns do not reflect sales charges; if sales charges were reflected, the Fund’s quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares; the applicable contingent deferred sales charge for Class B shares (4% year 1, 3% year 2, 2% year 3, 1% year 4); a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

Benchmark Disclosure

Neither the unmanaged Morgan Stanley Capital International (MSCI) World (ex-US) Index (net) nor the unmanaged MSCI All Country (AC) World (ex-US) Index (net) reflect fees and expenses associated with the active management of a mutual fund portfolio. The MSCI World (ex-US) Index (net) is a free float-adjusted market capitalization index that is designed to measure global developed market equity performance in 23 developed market countries, excluding the US. The MSCI AC World (ex-US) Index (net) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets, excluding the US. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

The MSCI World (ex-US) Index values are calculated using net returns. The MSCI AC World (ex-US) Index values are calculated using net and gross returns. Net returns approximate the minimum possible dividend reinvestment—the dividend reinvested after deduction of withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. For values calculated using gross returns, the index series approximates the maximum possible dividend reinvestment. The amount reinvested is the dividend distributed to individuals resident in the country of the company, but does not include tax credits.

A Word About Risk

Substantially all of the Fund’s assets will be invested in foreign securities which may magnify fluctuations due to changes in foreign exchange rates and the possibility of substantial volatility due to political and economic uncertainties in foreign countries. The Fund may invest in securities of emerging market nations. These investments have additional risks, such as those presented by illiquid or thinly traded markets, company management risk, heightened political instability and currency volatility. Accounting standards and market regulations in emerging market nations are not the

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 3 |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

same as those in the US. Growth investing does not guarantee a profit or eliminate

risk. The stocks of these companies have relatively high valuations. Because of these high valuations, an investment in a growth stock can be more risky than an investment in a company with more modest growth expectations. If a growth stock company should fail to meet these high earnings expectations, the price of these stocks can be severely negatively affected. When a Fund borrows money or otherwise leverages its portfolio, it may be volatile because leverage tends to exaggerate the effect of any increase or decrease in the value of the Fund’s investments. The Fund may create leverage through the use of reverse repurchase arrangements, forward currency exchange contracts, forward commitments, dollar rolls or futures contracts or by borrowing money. While the Fund invests principally in common stocks and other equity securities, in order to achieve its investment objectives, the Fund may at times use certain types of investment derivatives, such as options, futures, forwards and swaps. These instruments involve risks different from, and in certain cases, greater than, the risks presented by more traditional investments. These risks are fully discussed in the Fund’s prospectus.

(Historical Performance continued on next page)

| | |

| 4 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| | | | | | |

THE FUND VS. ITS BENCHMARKS PERIODS ENDED JUNE 30, 2010 | | Returns | | |

| | 6 Months | | 12 Months | | |

AllianceBernstein International Growth Fund | | | | | | |

Class A | | -12.43% | | 10.39% | | |

| |

Class B* | | -12.87% | | 9.49% | | |

| |

Class C | | -12.76% | | 9.56% | | |

| |

Advisor Class† | | -12.30% | | 10.77% | | |

| |

Class R† | | -12.53% | | 10.17% | | |

| |

Class K† | | -12.40% | | 10.51% | | |

| |

Class I† | | -12.31% | | 10.86% | | |

| |

MSCI World (ex-US) Index (Net)†† | | -12.47% | | 7.03% | | |

| |

MSCI All Country (AC) World (ex-US) Index (Net) | | -11.06% | | 10.43% | | |

| |

MSCI All Country (AC) World (ex-US) Index (Gross) | | -10.80% | | 10.87% | | |

| |

* Effective January 31, 2009, Class B shares are no longer available for purchase to new investors. Please see Note A for more information. † Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Funds. †† The MSCI World Index (Net) reflects no deduction for fees, expenses or taxes except there investment of dividends at nonwithholding taxes. Please keep in mind that high, double-digit returns are highly unusual and cannot be sustained. Investors should also be aware that these returns were primarily achieved during favorable market conditions. |

| | | | | | |

See Historical Performance and Benchmark disclosures on pages 3-4.

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 5 |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

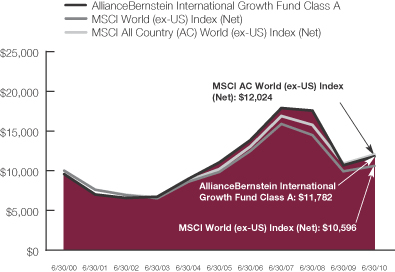

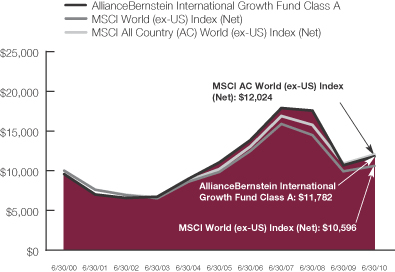

GROWTH OF A $10,000 INVESTMENT IN THE FUND

6/30/00 TO 6/30/10

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein International Growth Fund Class A shares (from 6/30/00 to 6/30/10) as compared to the performance of the Fund’s benchmarks. The chart reflects the deduction of the maximum 4.25% sales charge from the initial $10,000 investment in the Fund and assumes the reinvestment of dividends and capital gains distributions.

See Historical Performance and Benchmark disclosures on pages 3-4.

(Historical Performance continued on next page)

| | |

| 6 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | |

| AVERAGE ANNUAL RETURNS AS OF JUNE 30, 2010 | |

| | | NAV Returns | | | SEC Returns | |

| | | | | | |

| Class A Shares | | | | | | |

1 Year | | 10.39 | % | | 5.69 | % |

5 Years | | 1.28 | % | | 0.41 | % |

10 Years | | 2.09 | % | | 1.65 | % |

| | | | | | |

| Class B Shares | | | | | | |

1 Year | | 9.49 | % | | 5.49 | % |

5 Years | | 0.50 | % | | 0.50 | % |

10 Years(a) | | 1.48 | % | | 1.48 | % |

| | | | | | |

| Class C Shares | | | | | | |

1 Year | | 9.56 | % | | 8.56 | % |

5 Years | | 0.57 | % | | 0.57 | % |

10 Years | | 1.35 | % | | 1.35 | % |

| | | | | | |

| Advisor Class Shares† | | | | | | |

1 Year | | 10.77 | % | | 10.77 | % |

5 Years | | 1.59 | % | | 1.59 | % |

10 Years | | 2.41 | % | | 2.41 | % |

| | | | | | |

| Class R Shares† | | | | | | |

1 Year | | 10.17 | % | | 10.17 | % |

5 Years | | 1.03 | % | | 1.03 | % |

Since Inception* | | 0.48 | % | | 0.48 | % |

| | | | | | |

| Class K Shares† | | | | | | |

1 Year | | 10.51 | % | | 10.51 | % |

5 Years | | 1.31 | % | | 1.31 | % |

Since Inception* | | 0.75 | % | | 0.75 | % |

| | | | | | |

| Class I Shares† | | | | | | |

1 Year | | 10.86 | % | | 10.86 | % |

5 Years | | 1.69 | % | | 1.69 | % |

Since Inception* | | 1.12 | % | | 1.12 | % |

The Fund’s current prospectus fee table shows the Fund’s total annual operating expense ratios as 1.34%, 2.12%, 2.07%, 1.05%, 1.56%, 1.28%, and 0.86% for Class��A, Class B, Class C, Advisor Class, Class R, Class K and Class I shares, respectively. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| (a) | | Assumes conversion of Class B shares into Class A shares after eight years. |

| * | | Inception Date: 3/1/05 for Class R, Class K and Class I shares. |

| † | | These share classes are offered at net asset value (NAV) to eligible investors and their SEC returns are the same as the NAV returns. Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Funds. The inception date for Class R, Class K and Class I shares is listed above. |

See Historical Performance disclosures on pages 3-4.

(Historical Performance continued on next page)

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 7 |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (JUNE 30, 2010) | |

| | | SEC Returns | |

| Class A Shares | | | |

1 Year | | 5.69 | % |

5 Years | | 0.41 | % |

10 Years | | 1.65 | % |

| | | |

| Class B Shares | | | |

1 Year | | 5.49 | % |

5 Years | | 0.50 | % |

10 Years(a) | | 1.48 | % |

| | | |

| Class C Shares | | | |

1 Year | | 8.56 | % |

5 Years | | 0.57 | % |

10 Years | | 1.35 | % |

| | | |

| Advisor Class Shares† | | | |

1 Year | | 10.77 | % |

5 Years | | 1.59 | % |

10 Years | | 2.41 | % |

| | | |

| Class R Shares† | | | |

1 Year | | 10.17 | % |

5 Years | | 1.03 | % |

Since Inception* | | 0.48 | % |

| | | |

| Class K Shares† | | | |

1 Year | | 10.51 | % |

5 Years | | 1.31 | % |

Since Inception* | | 0.75 | % |

| | | |

| Class I Shares† | | | |

1 Year | | 10.86 | % |

5 Years | | 1.69 | % |

Since Inception* | | 1.12 | % |

| (a) | | Assumes conversion of Class B shares into Class A shares after eight years. |

| * | | Inception Date: 3/1/05 for Class R, Class K and Class I shares. |

| † | | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Funds. The inception date for Class R, Class K and Class I shares is listed above. |

See Historical Performance disclosures on pages 3-4.

| | |

| 8 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Historical Performance

FUND EXPENSES

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

January 1, 2010 | | Ending

Account Value

June 30, 2010 | | Expenses Paid

During Period* |

| | | Actual | | Hypothetical | | Actual | | Hypothetical** | | Actual | | Hypothetical |

| Class A | | $ | 1,000 | | $ | 1,000 | | $ | 875.71 | | $ | 1,018.15 | | $ | 6.23 | | $ | 6.71 |

| Class B | | $ | 1,000 | | $ | 1,000 | | $ | 871.29 | | $ | 1,014.18 | | $ | 9.93 | | $ | 10.69 |

| Class C | | $ | 1,000 | | $ | 1,000 | | $ | 872.37 | | $ | 1,014.53 | | $ | 9.61 | | $ | 10.34 |

Advisor Class | | $ | 1,000 | | $ | 1,000 | | $ | 877.02 | | $ | 1,019.64 | | $ | 4.84 | | $ | 5.21 |

| Class R | | $ | 1,000 | | $ | 1,000 | | $ | 874.73 | | $ | 1,016.91 | | $ | 7.39 | | $ | 7.95 |

| Class K | | $ | 1,000 | | $ | 1,000 | | $ | 875.98 | | $ | 1,018.50 | | $ | 5.91 | | $ | 6.36 |

| Class I | | $ | 1,000 | | $ | 1,000 | | $ | 876.94 | | $ | 1,020.38 | | $ | 4.14 | | $ | 4.46 |

| * | | Expenses are equal to the classes’ annualized expense ratios of 1.34%, 2.14%, 2.07%, 1.04%, 1.59%, 1.27% and 0.89%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| ** | | Assumes 5% return before expenses. |

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 9 |

Fund Expenses

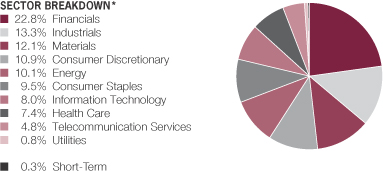

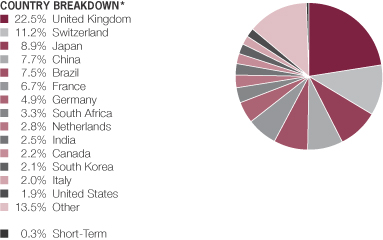

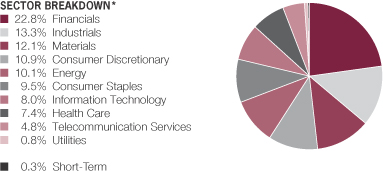

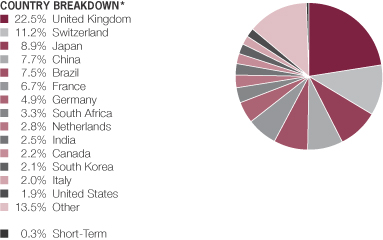

PORTFOLIO SUMMARY

June 30, 2010 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $1,555.3

| * | | All data are as of June 30, 2010. The Fund’s sector and country breakdowns are expressed as a percentage of total investments and may vary over time. “Other” country weightings represent less than 1.9% weightings in the following countries: Australia, Belgium, Egypt, Hong Kong, Indonesia, Ireland, Israel, Mexico, Nigeria, Russia, Singapore, Spain, Sweden and Turkey. |

Please note: The sector classifications presented herein are based on the Global Industry Classification Standard (GICS) which was developed by Morgan Stanley Capital International and Standard and Poor’s. The components are divided into sector, industry group, and industry sub-indices as classified by the GICS for each of the market capitalization indices in the Broad Market. These sector classifications are broadly defined. The “Portfolio of Investments” section of the report reflects more specific industry information and is consistent with the investment restrictions discussed in the Fund’s prospectus.

| | |

| 10 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Portfolio Summary

TEN LARGEST HOLDINGS*

June 30, 2010 (unaudited)

| | | | | | |

| Company | | U.S. $ Value | | Percent of

Net Assets | |

Investimentos Itau SA (Preference Shares) | | $ | 49,242,313 | | 3.2 | % |

Nestle SA | | | 36,309,987 | | 2.3 | |

British American Tobacco PLC | | | 33,124,188 | | 2.1 | |

HSBC Holdings PLC | | | 33,035,337 | | 2.1 | |

Partners Group Holding AG | | | 31,400,692 | | 2.0 | |

Tesco PLC | | | 30,933,835 | | 2.0 | |

Schlumberger Ltd. | | | 30,026,211 | | 1.9 | |

Standard Chartered PLC | | | 29,953,740 | | 1.9 | |

Rio Tinto PLC | | | 27,382,728 | | 1.8 | |

Equinox Minerals Ltd. | | | 25,956,746 | | 1.7 | |

| | $ | 327,365,777 | | 21.0 | % |

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 11 |

Ten Largest Holdings

PORTFOLIO OF INVESTMENTS

June 30, 2010

| | | | | |

| Company | | Shares | | U.S. $ Value |

| | | | | | |

| | | | | |

COMMON STOCKS – 99.9% | | | | | |

Financials – 22.3% | | | | | |

Capital Markets - 5.6% | | | | | |

Azimut Holding SpA | | 583,827 | | $ | 4,819,196 |

Credit Suisse Group AG | | 369,211 | | | 13,881,315 |

GAM Holding Ltd.(a) | | 595,352 | | | 6,433,688 |

Julius Baer Group Ltd. | | 702,606 | | | 20,033,115 |

Man Group PLC | | 3,290,849 | | | 10,908,854 |

Partners Group Holding AG | | 260,244 | | | 31,400,692 |

| | | | | |

| | | | | 87,476,860 |

| | | | | |

Commercial Banks – 13.4% | | | | | |

Bank Central Asia TBK PT | | 17,370,000 | | | 11,301,806 |

BNP Paribas | | 238,314 | | | 12,821,482 |

Commercial International Bank Egypt SAE | | 556,635 | | | 6,487,463 |

HDFC Bank Ltd. | | 535 | | | 22,131 |

HSBC Holdings PLC | | 3,616,069 | | | 33,035,337 |

Industrial & Commercial Bank of China-Class H | | 34,580,000 | | | 25,178,582 |

Investimentos Itau SA (Preference Shares) | | 8,299,008 | | | 49,242,313 |

Standard Bank Group Ltd. | | 407,376 | | | 5,402,248 |

Standard Chartered PLC | | 1,230,112 | | | 29,953,740 |

Turkiye Garanti Bankasi AS | | 3,355,212 | | | 13,963,162 |

United Overseas Bank Ltd. | | 1,435,000 | | | 19,963,532 |

| | | | | |

| | | | | 207,371,796 |

| | | | | |

Diversified Financial Services – 1.9% | | | | | |

FirstRand Ltd. | | 2,723,569 | | | 6,374,993 |

IG Group Holdings PLC | | 2,344,668 | | | 14,648,565 |

Singapore Exchange Ltd. | | 1,634,000 | | | 8,569,082 |

| | | | | |

| | | | | 29,592,640 |

| | | | | |

Insurance – 1.4% | | | | | |

China Life Insurance Co., Ltd. - Class H | | 5,099,000 | | | 22,266,920 |

| | | | | |

| | | | | 346,708,216 |

| | | | | |

Industrials – 13.4% | | | | | |

Aerospace & Defense – 0.8% | | | | | |

Safran SA | | 443,200 | | | 12,363,181 |

| | | | | |

| | |

Airlines – 0.5% | | | | | |

British Airways PLC(a) | | 2,508,276 | | | 7,287,226 |

| | | | | |

| | |

Commercial Services & Supplies – 0.8% | | | | | |

Secom Co., Ltd. | | 289,100 | | | 12,837,794 |

| | | | | |

| | |

Construction & Engineering – 1.7% | | | | | |

Samsung Engineering Co., Ltd. | | 138,111 | | | 12,790,071 |

Vinci SA | | 320,118 | | | 13,291,830 |

| | | | | |

| | | | | 26,081,901 |

| | | | | |

| | |

| 12 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Portfolio of Investments

| | | | | |

| Company | | Shares | | U.S. $ Value |

| |

| | | | | |

Electrical Equipment – 1.9% | | | | | |

ABB Ltd.(a) | | 1,013,174 | | $ | 17,639,969 |

SMA Solar Technology AG | | 112,398 | | | 11,512,240 |

| | | | | |

| | | | | 29,152,209 |

| | | | | |

Industrial Conglomerates – 1.3% | | | | | |

Koninklijke Philips Electronics NV | | 664,203 | | | 19,834,474 |

| | | | | |

| | |

Machinery – 3.0% | | | | | |

Komatsu Ltd. | | 872,600 | | | 15,712,149 |

MAN SE | | 188,011 | | | 15,500,006 |

SKF AB | | 868,290 | | | 15,583,363 |

| | | | | |

| | | | | 46,795,518 |

| | | | | |

Marine – 1.4% | | | | | |

China Shipping Development Co.,

Ltd. - Class H | | 10,196,000 | | | 12,862,813 |

Orient Overseas International Ltd.(a) | | 1,388,500 | | | 9,837,172 |

| | | | | |

| | | | | 22,699,985 |

| | | | | |

Road & Rail – 1.1% | | | | | |

East Japan Railway Co. | | 254,700 | | | 16,959,344 |

| | | | | |

| | |

Trading Companies & Distributors – 0.9% | | | | | |

Mitsubishi Corp. | | 720,100 | | | 14,897,747 |

| | | | | |

| | | | | 208,909,379 |

| | | | | |

Materials – 12.2% | | | | | |

Chemicals – 0.3% | | | | | |

Lanxess AG | | 97,900 | | | 4,120,753 |

| | | | | |

| | |

Construction Materials – 0.6% | | | | | |

CRH PLC (London) | | 466,511 | | | 9,611,576 |

| | | | | |

| | |

Metals & Mining – 10.3% | | | | | |

ArcelorMittal (Euronext Amsterdam) | | 277,400 | | | 7,440,363 |

Centamin Egypt Ltd.(a) | | 1,769,600 | | | 4,314,823 |

Equinox Minerals Ltd.(a) | | 7,408,111 | | | 25,956,746 |

Evraz Group SA (Sponsored GDR)(a)(b) | | 291,348 | | | 6,795,127 |

Impala Platinum Holdings Ltd. | | 460,494 | | | 10,717,570 |

MMX Mineracao e Metalicos SA(a) | | 1,208,458 | | | 7,043,201 |

Rio Tinto PLC | | 623,548 | | | 27,382,728 |

Sterlite Industries India Ltd. (ADR) | | 1,079,200 | | | 15,367,808 |

Usinas Siderurgicas de Minas Gerais SA - Class A (Preference Shares) | | 729,036 | | | 19,431,536 |

Vale SA (Sponsored ADR) (Local Preference Shares) | | 684,903 | | | 14,396,661 |

Xstrata PLC | | 1,692,860 | | | 22,167,423 |

| | | | | |

| | | | | 161,013,986 |

| | | | | |

Paper & Forest Products – 1.0% | | | | | |

Fibria Celulose SA (Sponsored ADR)(a) | | 1,027,788 | | | 15,211,262 |

| | | | | |

| | | | | 189,957,577 |

| | | | | |

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 13 |

Portfolio of Investments

| | | | | |

| Company | | Shares | | U.S. $ Value |

| |

| | | | | |

| | | | | |

Consumer Discretionary – 11.0% | | | | | |

Automobiles – 2.0% | | | | | |

Daimler AG(a) | | 378,826 | | $ | 19,163,104 |

Fiat SpA | | 1,113,353 | | | 11,435,926 |

| | | | | |

| | | | | 30,599,030 |

| | | | | |

Distributors – 0.9% | | | | | |

Imperial Holdings Ltd. | | 1,206,158 | | | 13,413,942 |

| | | | | |

| | |

Hotels, Restaurants & Leisure – 2.0% | | | | | |

Carnival PLC | | 389,843 | | | 12,627,555 |

Compass Group PLC | | 594,717 | | | 4,524,300 |

Ctrip.com International Ltd. (ADR)(a) | | 201,200 | | | 7,557,072 |

Oriental Land Co., Ltd. | | 81,900 | | | 6,844,611 |

| | | | | |

| | | | | 31,553,538 |

| | | | | |

Media – 3.6% | | | | | |

British Sky Broadcasting Group PLC | | 277,176 | | | 2,894,212 |

CTC Media, Inc. | | 179,867 | | | 2,597,279 |

Eutelsat Communications | | 646,827 | | | 21,654,228 |

Informa PLC | | 1,311,492 | | | 6,929,069 |

Naspers Ltd. - Class N | | 178,479 | | | 6,010,367 |

SES SA (FDR) | | 489,168 | | | 10,172,992 |

WPP PLC | | 632,853 | | | 5,961,783 |

| | | | | |

| | | | | 56,219,930 |

| | | | | |

Specialty Retail – 1.8% | | | | | |

Belle International Holdings Ltd. | | 6,242,000 | | | 8,871,302 |

Fast Retailing Co., Ltd. | | 61,700 | | | 9,336,105 |

Zhongsheng Group Holdings Ltd.(a) | | 8,160,500 | | | 10,112,988 |

| | | | | |

| | | | | 28,320,395 |

| | | | | |

Textiles, Apparel & Luxury Goods – 0.7% | | | | | |

Cie Financiere Richemont SA | | 333,659 | | | 11,648,797 |

| | | | | |

| | | | | 171,755,632 |

| | | | | |

Energy – 10.2% | | | | | |

Energy Equipment & Services – 2.9% | | | | | |

Saipem SpA | | 497,835 | | | 15,163,171 |

Schlumberger Ltd. | | 542,577 | | | 30,026,211 |

| | | | | |

| | | | | 45,189,382 |

| | | | | |

Oil, Gas & Consumable Fuels – 7.3% | | | | | |

Afren PLC(a) | | 14,789,811 | | | 18,677,035 |

BG Group PLC | | 978,953 | | | 14,559,812 |

China Coal Energy Co.- Class H | | 12,908,000 | | | 16,060,745 |

China Shenhua Energy Co., Ltd.- Class H | | 2,091,500 | | | 7,545,515 |

Gulf Keystone Petroleum Ltd.(a) | | 7,791,300 | | | 7,857,802 |

Heritage Oil PLC(a) | | 1,752,042 | | | 10,260,931 |

Karoon Gas Australia Ltd.(a) | | 1,064,195 | | | 5,279,020 |

Oando PLC | | 19,874,701 | | | 9,063,382 |

Suncor Energy, Inc. (Toronto) | | 286,187 | | | 8,422,562 |

Tullow Oil PLC | | 1,016,057 | | | 15,114,166 |

| | | | | |

| | | | | 112,840,970 |

| | | | | |

| | | | | 158,030,352 |

| | | | | |

| | |

| 14 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Portfolio of Investments

| | | | | |

| Company | | Shares | | U.S. $ Value |

| |

| | | | | |

Consumer Staples – 9.6% | | | | | |

Beverages – 1.4% | | | | | |

Anheuser-Busch InBev NV | | 304,309 | | $ | 14,631,565 |

| | | | | |

Cia de Bebidas das Americas

(Preference Shares) | | 66,500 | | | 6,628,263 |

| | | | | |

| | | | | 21,259,828 |

| | | | | |

Food & Staples Retailing – 3.1% | | | | | |

Seven & I Holdings Co., Ltd. | | 491,600 | | | 11,263,190 |

Tesco PLC | | 5,483,348 | | | 30,933,835 |

Wal-Mart de Mexico SAB de CV | | 2,753,974 | | | 6,100,754 |

| | | | | |

| | | | | 48,297,779 |

| | | | | |

Food Products – 3.0% | | | | | |

Danone | | 186,744 | | | 10,011,382 |

Nestle SA | | 753,025 | | | 36,309,987 |

| | | | | |

| | | | | 46,321,369 |

| | | | | |

Tobacco – 2.1% | | | | | |

British American Tobacco PLC | | 1,043,748 | | | 33,124,188 |

| | | | | |

| | | | | 149,003,164 |

| | | | | |

Information Technology – 8.1% | | | | | |

Communications Equipment – 0.9% | | | | | |

Telefonaktiebolaget LM Ericsson—Class B | | 1,093,072 | | | 12,124,599 |

ZTE Corp.—Class H | | 829,400 | | | 2,518,356 |

| | | | | |

| | | | | 14,642,955 |

| | | | | |

Electronic Equipment, Instruments & Components – 1.1% | | | | | |

Samsung Electro-Mechanics Co., Ltd. | | 80,624 | | | 10,082,011 |

Taiyo Yuden Co., Ltd. | | 486,000 | | | 6,526,577 |

| | | | | |

| | | | | 16,608,588 |

| | | | | |

Internet Software & Services – 0.5% | | | | | |

Yahoo! Japan Corp. | | 20,446 | | | 8,149,263 |

| | | | | |

| | |

IT Services – 1.3% | | | | | |

Cap Gemini SA | | 203,664 | | | 8,950,949 |

Infosys Technologies Ltd. (Sponsored ADR) | | 182,555 | | | 10,936,870 |

| | | | | |

| | | | | 19,887,819 |

| | | | | |

Office Electronics – 0.8% | | | | | |

Canon, Inc. | | 352,600 | | | 13,141,209 |

| | | | | |

| | |

Semiconductors & Semiconductor Equipment – 2.2% | | | | | |

Aixtron AG | | 271,765 | | | 6,424,872 |

ARM Holdings PLC | | 1,853,371 | | | 7,670,890 |

ASML Holding NV | | 337,617 | | | 9,291,174 |

Samsung Electronics Co., Ltd. | | 16,060 | | | 10,073,061 |

| | | | | |

| | | | | 33,459,997 |

| | | | | |

Software – 1.3% | | | | | |

Autonomy Corp. PLC(a) | | 291,360 | | | 7,942,002 |

Nintendo Co., Ltd. | | 40,300 | | | 11,832,451 |

| | | | | |

| | | | | 19,774,453 |

| | | | | |

| | | | | 125,664,284 |

| | | | | |

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 15 |

Portfolio of Investments

| | | | | |

| Company | | Shares | | U.S. $ Value |

| |

| | | | | |

Health Care – 7.4% | | | | | |

Health Care Providers & Services – 0.9% | | | | | |

Diagnosticos da America SA | | 678,200 | | $ | 6,383,722 |

Fresenius Medical Care AG & Co. KGaA | | 143,324 | | | 7,732,983 |

| | | | | |

| | | | | 14,116,705 |

| | | | | |

Life Sciences Tools & Services – 0.4% | | | | | |

QIAGEN NV(a) | | 332,299 | | | 6,464,857 |

| | | | | |

| | |

Pharmaceuticals – 6.1% | | | | | |

Aspen Pharmacare Holdings Ltd.(a) | | 432,719 | | | 4,273,049 |

Bayer AG | | 231,307 | | | 12,925,763 |

Mitsubishi Tanabe Pharma Corp. | | 393,000 | | | 5,987,791 |

Novartis AG | | 404,380 | | | 19,597,520 |

Roche Holding AG | | 142,252 | | | 19,579,810 |

Sanofi-Aventis SA | | 194,606 | | | 11,720,594 |

Shire PLC | | 419,236 | | | 8,600,309 |

Teva Pharmaceutical Industries Ltd. (Sponsored ADR) | | 239,933 | | | 12,474,117 |

| | | | | |

| | | | | 95,158,953 |

| | | | | |

| | | | | 115,740,515 |

| | | | | |

Telecommunication Services – 4.9% | | | | | |

Diversified Telecommunication

Services – 1.3% | | | | | |

Iliad SA | | 62,654 | | | 4,865,324 |

Telefonica SA | | 774,578 | | | 14,348,818 |

XL Axiata TBK PT(a) | | 2,910,000 | | | 1,301,347 |

| | | | | |

| | | | | 20,515,489 |

| | | | | |

Wireless Telecommunication

Services – 3.6% | | | | | |

America Movil SAB de CV Series L (ADR) | | 223,013 | | | 10,593,118 |

China Mobile Ltd. | | 866,500 | | | 8,583,617 |

MTN Group Ltd. | | 431,903 | | | 5,660,155 |

NTT DoCoMo, Inc. | | 4,070 | | | 6,163,159 |

VimpelCom Ltd. (Sponsored ADR)(a) | | 229,845 | | | 3,718,892 |

Vodafone Group PLC | | 10,031,245 | | | 20,669,304 |

| | | | | |

| | | | | 55,388,245 |

| | | | | |

| | | | | 75,903,734 |

| | | | | |

Utilities – 0.8% | | | | | |

Independent Power Producers & Energy Traders – 0.8% | | | | | |

NTPC Ltd. | | 2,923,454 | | | 12,503,928 |

| | | | | |

Total Common Stocks

(cost $1,506,844,643) | | | | | 1,554,176,781 |

| | | | | |

| | |

WARRANTS – 0.8% | | | | | |

Financials – 0.8% | | | | | |

Sberbank of Russian Federation, Merrill Lynch, expiring 11/05/12(a)

(cost $13,671,742) | | 4,779,367 | | | 11,709,449 |

| | | | | |

| | |

| 16 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Portfolio of Investments

| | | | | | | |

| | | Principal Amount

(000) | | U.S. $ Value | |

| | |

SHORT-TERM INVESTMENTS – 0.3% | | | | | | | |

Time Deposit – 0.3% | | | | | | | |

Commerzbank 0.01%, 7/01/10

(cost $5,200,000) | | $ | 5,200 | | $ | 5,200,000 | |

| | | | | | | |

Total Investments – 101.0%

(cost $1,525,716,385) | | | | | | 1,571,086,230 | |

Other assets less liabilities – (1.0)% | | | | | | (15,798,604 | ) |

| | | | | | | |

Net Assets – 100.0% | | | | | $ | 1,555,287,626 | |

| | | | | | | |

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 17 |

Portfolio of Investments

FORWARD CURRENCY EXCHANGE CONTRACTS (see Note D)

| | | | | | | | | | | | |

| | | Contract

Amount

(000) | | U.S. $ Value on

Origination

Date | | U.S. $ Value at June 30, 2010 | | Unrealized

Appreciation/

(Depreciation) | |

Buy Contracts: | | | | | | | | | | | | |

Australian Dollar settling 8/16/10 | | 111,666 | | $ | 99,340,307 | | $ | 93,485,109 | | $ | (5,855,198) | |

British Pound settling 8/16/10 | | 39,461 | | | 58,486,727 | | | 58,957,028 | | | 470,301 | |

British Pound settling 8/16/10 | | 20,087 | | | 30,321,327 | | | 30,011,146 | | | (310,181 | ) |

Euro settling 8/16/10 | | 14,561 | | | 18,017,636 | | | 17,810,074 | | | (207,562 | ) |

Euro settling 8/16/10 | | 63,459 | | | 78,028,552 | | | 77,618,947 | | | (409,605 | ) |

Japanese Yen settling 8/16/10 | | 1,417,713 | | | 15,703,859 | | | 16,046,644 | | | 342,785 | |

Japanese Yen settling 8/16/10 | | 6,182,005 | | | 66,779,063 | | | 69,972,156 | | | 3,193,093 | |

Japanese Yen settling 8/16/10 | | 1,005,184 | | | 11,032,521 | | | 11,377,359 | | | 344,838 | |

New Zealand Dollar settling 8/16/10 | | 9,531 | | | 6,735,557 | | | 6,515,546 | | | (220,011 | ) |

New Zealand Dollar settling 8/16/10 | | 121,076 | | | 86,266,650 | | | 82,769,521 | | | (3,497,129 | ) |

Norwegian Krone settling 8/16/10 | | 541,518 | | | 87,478,474 | | | 83,015,017 | | | (4,463,457 | ) |

Norwegian Krone settling 8/16/10 | | 310,210 | | | 48,092,336 | | | 47,555,369 | | | (536,967 | ) |

Swedish Krona settling 8/16/10 | | 122,731 | | | 15,836,933 | | | 15,739,833 | | | (97,100 | ) |

Swedish Krona settling 8/16/10 | | 665,436 | | | 87,474,498 | | | 85,339,901 | | | (2,134,597 | ) |

| | | | | | | | | | | | |

Sale Contracts: | | | | | | | | | | | | |

Australian Dollar settling 8/16/10 | | 22,935 | | | 20,216,285 | | | 19,200,840 | | | 1,015,445 | |

Australian Dollar settling 8/16/10 | | 19,249 | | | 15,842,120 | | | 16,114,976 | | | (272,856 | ) |

British Pound settling 8/16/10 | | 110,489 | | | 161,769,155 | | | 165,076,989 | | | (3,307,834 | ) |

Canadian Dollar settling 8/16/10 | | 9,047 | | | 8,911,018 | | | 8,496,048 | | | 414,970 | |

Euro settling 8/16/10 | | 41,462 | | | 51,134,670 | | | 50,713,638 | | | 421,032 | |

Euro settling 8/16/10 | | 34,043 | | | 42,148,298 | | | 41,639,197 | | | 509,101 | |

Euro settling 8/16/10 | | 86,498 | | | 108,778,154 | | | 105,798,762 | | | 2,979,392 | |

New Zealand Dollar settling 8/16/10 | | 14,796 | | | 9,911,101 | | | 10,114,786 | | | (203,685 | ) |

New Zealand Dollar settling 8/16/10 | | 5,939 | | | 3,986,257 | | | 4,059,997 | | | (73,740 | ) |

New Zealand Dollar settling 8/16/10 | | 6,544 | | | 4,426,885 | | | 4,473,585 | | | (46,700 | ) |

Norwegian Krone settling 8/16/10 | | 327,613 | | | 50,623,966 | | | 50,223,259 | | | 400,707 | |

Swedish Krona settling 8/16/10 | | 625,019 | | | 80,229,591 | | | 80,156,558 | | | 73,033 | |

Swiss Franc settling 8/16/10 | | 104,540 | | | 93,927,169 | | | 97,065,473 | | | (3,138,304 | ) |

Swiss Franc settling 8/16/10 | | 26,914 | | | 23,282,611 | | | 24,989,670 | | | (1,707,059 | ) |

| (a) | | Non-income producing security. |

| (b) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security is considered liquid and may be resold in transactions exempt from registration, normally to qualified institutional buyers. At June 30, 2010, the market value of this security amounted to $6,795,127 or 0.4% of net assets. |

Glossary:

ADR – American Depository Receipt

FDR – Fiduciary Depositary Receipt

GDR – Global Depository Receipt

See notes to financial statements.

| | |

| 18 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Portfolio of Investments

STATEMENT OF ASSETS & LIABILITIES

June 30, 2010

| | | | |

| Assets | | | | |

Investments in securities, at value (cost $1,525,716,385) | | $ | 1,571,086,230 | |

Cash | | | 85,565 | |

Foreign currencies, at value (cost $15,949,205) | | | 15,996,341 | |

Receivable for investment securities sold and foreign

currency contracts | | | 13,937,587 | |

Unrealized appreciation of forward currency exchange contracts | | | 10,164,697 | |

Dividends and interest receivable | | | 6,385,088 | |

Receivable for capital stock sold | | | 2,295,038 | |

| | | | |

Total assets | | | 1,619,950,546 | |

| | | | |

| Liabilities | | | | |

Unrealized depreciation of forward currency exchange contracts | | | 26,481,985 | |

Payable for investment securities purchased and foreign currency contracts | | | 19,151,815 | |

Payable for capital stock redeemed | | | 16,604,659 | |

Advisory fee payable | | | 1,014,029 | |

Distribution fee payable | | | 463,275 | |

Transfer Agent fee payable | | | 147,277 | |

Administrative fee payable | | | 28,532 | |

Accrued expenses and other liabilities | | | 771,348 | |

| | | | |

Total liabilities | | | 64,662,920 | |

| | | | |

Net Assets | | $ | 1,555,287,626 | |

| | | | |

| Composition of Net Assets | | | | |

Capital stock, at par | | $ | 127,773 | |

Additional paid-in capital | | | 2,648,669,215 | |

Undistributed net investment income | | | 43,656,649 | |

Net realized loss on investment and foreign currency transactions | | | (1,166,119,679 | ) |

Net unrealized appreciation of investments and foreign currency denominated assets and liabilities | | | 28,953,668 | |

| | | | |

| | $ | 1,555,287,626 | |

| | | | |

Net Asset Value Per Share—21 billion shares of capital stock authorized, $.001 par value

| | | | | | | | | |

| Class | | Net Assets | | Shares

Outstanding | | Net Asset

Value | |

| A | | $ | 935,694,939 | | 75,910,294 | | $ | 12.33 | * |

| | |

| B | | $ | 44,166,231 | | 3,952,581 | | $ | 11.17 | |

| | |

| C | | $ | 185,848,219 | | 16,581,616 | | $ | 11.21 | |

| | |

| Advisor | | $ | 306,230,858 | | 24,547,247 | | $ | 12.48 | |

| | |

| R | | $ | 42,586,630 | | 3,486,090 | | $ | 12.22 | |

| | |

| K | | $ | 12,116,981 | | 986,075 | | $ | 12.29 | |

| | |

| I | | $ | 28,643,768 | | 2,309,376 | | $ | 12.40 | |

| | |

| * | | The maximum offering price per share for Class A shares was $12.88 which reflects a sales charge of 4.25%. |

See notes to financial statements.

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 19 |

Statement of Assets & Liabilities

STATEMENT OF OPERATIONS

Year Ended June 30, 2010

| | | | | | | |

| Investment Income | | | | | | | |

Dividends (net of foreign taxes withheld of $3,186,316) | | $ | 39,499,317 | | | | |

Interest | | | 16,106 | | $ | 39,515,423 | |

| | | | | | | |

| Expenses | | | | | | | |

Advisory fee (see Note B) | | | 14,394,558 | | | | |

Distribution fee—Class A | | | 3,544,040 | | | | |

Distribution fee—Class B | | | 576,319 | | | | |

Distribution fee—Class C | | | 2,372,649 | | | | |

Distribution fee—Class R | | | 242,813 | | | | |

Distribution fee—Class K | | | 32,656 | | | | |

Transfer agency—Class A | | | 2,216,574 | | | | |

Transfer agency—Class B | | | 161,642 | | | | |

Transfer agency—Class C | | | 513,395 | | | | |

Transfer agency—Advisor Class | | | 665,321 | | | | |

Transfer agency—Class R | | | 126,263 | | | | |

Transfer agency—Class K | | | 25,556 | | | | |

Transfer agency—Class I | | | 18,784 | | | | |

Printing | | | 424,519 | | | | |

Custodian | | | 392,791 | | | | |

Registration fees | | | 164,089 | | | | |

Administrative | | | 101,311 | | | | |

Audit | | | 63,222 | | | | |

Legal | | | 52,554 | | | | |

Directors’ fees | | | 51,607 | | | | |

Miscellaneous | | | 71,666 | | | | |

| | | | | | | |

Total expenses | | | | | | 26,212,329 | |

| | | | | | | |

Net investment income | | | | | | 13,303,094 | |

| | | | | | | |

| Realized and Unrealized Gain (Loss) on Investment and Foreign Currency Transactions | | | | | | | |

Net realized gain on: | | | | | | | |

Investment transactions | | | | | | 54,033,816 | (a) |

Foreign currency transactions | | | | | | 50,923,428 | |

Net change in unrealized appreciation/depreciation of: | | | | | | | |

Investments | | | | | | 99,111,126 | |

Foreign currency denominated assets and liabilities | | | | | | (3,806,543 | ) |

| | | | | | | |

Net gain on investment and foreign currency transactions | | | | | | 200,261,827 | |

| | | | | | | |

Contributions from Adviser (see Note B) | | | | | | 4,618 | |

| | | | | | | |

Net Increase in Net Assets from Operations | | | | | $ | 213,569,539 | |

| | | | | | | |

| (a) | | Net of foreign capital gain taxes of $703,898. |

See notes to financial statements.

| | |

| 20 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Statement of Operations

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended

June 30, 2010 | | | Year Ended

June 30, 2009 | |

| Increase (Decrease) in Net Assets from Operations | | | | | | | | |

Net investment income | | $ | 13,303,094 | | | $ | 31,064,691 | |

Net realized gain (loss) on investment and foreign currency transactions | | | 104,957,244 | | | | (1,188,012,361 | ) |

Net change in unrealized appreciation/depreciation of investments and foreign currency denominated assets and liabilities | | | 95,304,583 | | | | (319,926,118 | ) |

Contributions from Adviser (see Note B) | | | 4,618 | | | | – 0 | – |

| | | | | | | | |

Net increase (decrease) in net assets from operations | | | 213,569,539 | | | | (1,476,873,788 | ) |

Dividends and Distributions

to Shareholders from | | | | | | | | |

Net investment income | | | | | | | | |

Class A | | | (35,172,897 | ) | | | (31,031,193 | ) |

Class B | | | (1,314,108 | ) | | | (1,246,157 | ) |

Class C | | | (5,375,791 | ) | | | (5,865,485 | ) |

Advisor Class | | | (10,430,217 | ) | | | (8,973,727 | ) |

Class R | | | (1,346,084 | ) | | | (868,294 | ) |

Class K | | | (388,029 | ) | | | (218,825 | ) |

Class I | | | (1,084,276 | ) | | | (469,533 | ) |

Net realized gain on investment and foreign currency transactions | | | | | | | | |

Class A | | | – 0 | – | | | (2,224,458 | ) |

Class B | | | – 0 | – | | | (130,488 | ) |

Class C | | | – 0 | – | | | (614,186 | ) |

Advisor Class | | | – 0 | – | | | (566,166 | ) |

Class R | | | – 0 | – | | | (68,640 | ) |

Class K | | | – 0 | – | | | (15,686 | ) |

Class I | | | – 0 | – | | | (28,456 | ) |

| Capital Stock Transactions | | | | | | | | |

Net decrease | | | (375,161,438 | ) | | | (136,254,236 | ) |

| Capital Contributions | | | | | | | | |

Proceeds from third party regulatory settlement (see Note E) | | | 278,367 | | | | – 0 | – |

| | | | | | | | |

Total decrease | | | (216,424,934 | ) | | | (1,665,449,318 | ) |

| Net Assets | | | | | | | | |

Beginning of period | | | 1,771,712,560 | | | | 3,437,161,878 | |

| | | | | | | | |

End of period (including undistributed net investment income of $43,656,649 and $34,587,152, respectively) | | $ | 1,555,287,626 | | | $ | 1,771,712,560 | |

| | | | | | | | |

See notes to financial statements.

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 21 |

Statement of Changes in Net Assets

NOTES TO FINANCIAL STATEMENTS

June 30, 2010

NOTE A

Significant Accounting Policies

AllianceBernstein International Growth Fund, Inc. (the “Fund”), organized as a Maryland corporation on March 16, 1994, is registered under the Investment Company Act of 1940 as a diversified open-end management investment company. The Fund offers Class A, Class B, Class C, Advisor Class, Class R, Class K and Class I shares. Class A shares are sold with a front-end sales charge of up to 4.25% for purchases not exceeding $1,000,000. With respect to purchases of $1,000,000 or more, Class A shares redeemed within one year of purchase may be subject to a contingent deferred sales charge of 1%. Class B shares are currently sold with a contingent deferred sales charge which declines from 4% to zero depending on the period of time the shares are held. Effective January 31, 2009, sales of Class B shares of the Fund to new investors were suspended. Class B shares will only be issued (i) upon the exchange of Class B shares from another AllianceBernstein Fund, (ii) for purposes of dividend reinvestment, (iii) through the Fund’s Automatic Investment Program (the “Program”) for accounts that established the Program prior to January 31, 2009, and (iv) for purchases of additional shares by Class B shareholders as of January 31, 2009. The ability to establish a new Program for accounts containing Class B shares was suspended as of January 31, 2009. Class B shares will automatically convert to Class A shares eight years after the end of the calendar month of purchase. Class C shares are subject to a contingent deferred sales charge of 1% on redemptions made within the first year after purchase. Class R and Class K shares are sold without an initial or contingent deferred sales charge. Advisor Class and Class I shares are sold without an initial or contingent deferred sales charge and are not subject to ongoing distribution expenses. All seven classes of shares have identical voting, dividend, liquidation and other rights, except that the classes bear different distribution and transfer agency expenses. Each class has exclusive voting rights with respect to its distribution plan. The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”), which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund.

1. Security Valuation

Portfolio securities are valued at their current market value determined on the basis of market quotations or, if market quotations are not readily available or are deemed unreliable, at “fair value” as determined in accordance with procedures established by and under the general supervision of the Fund’s Board of Directors.

In general, the market value of securities which are readily available and deemed reliable are determined as follows. Securities listed on a national securities

| | |

| 22 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Notes to Financial Statements

exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices on such day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed put or call options are valued at the last sale price. If there has been no sale on that day, such securities will be valued at the closing bid prices on that day; open futures contracts and options thereon are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; securities traded in the over-the-counter market (“OTC”) are valued at the mean of the current bid and asked prices as reported by the National Quotation Bureau or other comparable sources; U.S. government securities and other debt instruments having 60 days or less remaining until maturity are valued at amortized cost if their original maturity was 60 days or less; or by amortizing their fair value as of the 61st day prior to maturity if their original term to maturity exceeded 60 days; fixed-income securities, including mortgage backed and asset backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker/dealers. In cases where broker/dealer quotes are obtained, AllianceBernstein L.P. (the “Adviser”) may establish procedures whereby changes in market yields or spreads are used to adjust, on a daily basis, a recently obtained quoted price on a security; and OTC and other derivatives are valued on the basis of a quoted bid price or spread from a major broker/dealer in such security. Investments in money market funds are valued at their net asset value each day.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time (see Note A.2).

2. Fair Value Measurements

In accordance with U.S. GAAP regarding fair value measurements, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The U.S. GAAP disclosure requirements establish a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 23 |

Notes to Financial Statements

asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of June 30, 2010:

| | | | | | | | | | | | | | | | |

Investments in

Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks: | | | | | | | | | | | | | | | | |

Financials | | $ | 49,242,313 | | | $ | 297,465,903 | | | $ | – 0 | – | | $ | 346,708,216 | |

Industrials | | | – 0 | – | | | 208,909,379 | | | | – 0 | – | | | 208,909,379 | |

Materials | | | 83,010,553 | | | | 106,947,024 | | | | – 0 | – | | | 189,957,577 | |

Consumer Discretionary | | | 20,267,339 | | | | 151,488,293 | | | | – 0 | – | | | 171,755,632 | |

Energy | | | 38,448,773 | | | | 119,581,579 | | | | – 0 | – | | | 158,030,352 | |

Consumer Staples | | | 12,729,017 | | | | 136,274,147 | | | | – 0 | – | | | 149,003,164 | |

Information Technology | | | 10,936,870 | | | | 114,727,414 | | | | – 0 | – | | | 125,664,284 | |

Health Care | | | 18,857,839 | | | | 96,882,676 | | | | – 0 | – | | | 115,740,515 | |

Telecommunication Services | | | 14,312,009 | | | | 61,591,725 | | | | – 0 | – | | | 75,903,734 | |

Utilities | | | – 0 | – | | | 12,503,928 | | | | – 0 | – | | | 12,503,928 | |

Warrants | | | – 0 | – | | | – 0 | – | | | 11,709,449 | | | | 11,709,449 | |

Short-Term-Investments | | | – 0 | – | | | 5,200,000 | | | | – 0 | – | | | 5,200,000 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | 247,804,713 | | | | 1,311,572,068 | † | | | 11,709,449 | | | | 1,571,086,230 | |

Other Financial Instruments*: | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | |

Forward Currency Exchange Contracts | | | – 0 | – | | | 10,164,697 | | | | – 0 | – | | | 10,164,697 | |

Liabilities | | | | | | | | | | | | | | | | |

Forward Currency Exchange Contracts | | | – 0 | – | | | (26,481,985 | ) | | | – 0 | – | | | (26,481,985 | ) |

| | | | | | | | | | | | | | | | |

Total | | $ | 247,804,713 | | | $ | 1,295,254,780 | | | $ | 11,709,449 | | | $ | 1,554,768,942 | |

| | | | | | | | | | | | | | | | |

| * | | Other financial instruments are derivative instruments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation/depreciation on the instrument. |

| | |

| 24 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Notes to Financial Statements

| † | | The earlier close of the foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred between the close of the foreign markets and the time at which the Fund values its securities which may materially affect the value of securities trading in such markets. To account for this, the Fund may frequently value many of its foreign equity securities using fair value prices based on third party vendor modeling tools to the extent available. Accordingly, a significant portion of the Fund’s investments are categorized as Level 2 investments. |

Following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining value:

| | | | | | | | | | | | |

| | | Financials | | | Warrants | | | Total | |

Balance as of 6/30/09 | | $ | 26,578,882 | | | $ | – 0 | – | | $ | 26,578,882 | |

Accrued discounts/premiums | | | – 0 | – | | | – 0 | – | | | – 0 | – |

Realized gain (loss) | | | (8,126,368 | ) | | | (70,493 | ) | | | (8,196,861 | ) |

Change in unrealized appreciation/depreciation | | | 9,815,046 | | | | (1,962,293 | ) | | | 7,852,753 | |

Net purchases (sales) | | | (28,267,560 | ) | | | 13,742,235 | | | | (14,525,325 | ) |

Net transfers into Level 3 | | | – 0 | – | | | – 0 | – | | | – 0 | – |

Net transfers out of Level 3 | | | – 0 | – | | | – 0 | – | | | – 0 | – |

| | | | | | | | | | | | |

Balance as of 6/30/10 | | $ | – 0 | – | | $ | 11,709,449 | | | $ | 11,709,449 | |

| | | | | | | | | | | | |

Net change in unrealized appreciation/depreciation from investments held as of 6/30/10 | | $ | – 0 | – | | $ | (1,962,293 | ) | | $ | (1,962,293 | ) ** |

| | | | | | | | | | | | |

| ** | | The unrealized appreciation/depreciation is included in net change in unrealized appreciation/depreciation of investments in the accompanying statement of operations. |

3. Currency Translation

Assets and liabilities denominated in foreign currencies and commitments under forward currency exchange contracts are translated into U.S. dollars at the mean of the quoted bid and asked prices of such currencies against the U.S. dollar. Purchases and sales of portfolio securities are translated into U.S. dollars at the rates of exchange prevailing when such securities were acquired or sold. Income and expenses are translated into U.S. dollars at rates of exchange prevailing when accrued.

Net realized gain or loss on foreign currency transactions represents foreign exchange gains and losses from sales and maturities of foreign fixed income investments, foreign currency exchange contracts, holding of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign investment transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains and losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation and depreciation of investments and foreign currency denominated assets and liabilities.

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 25 |

Notes to Financial Statements

4. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required. The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued and applied to net investment income, net realized gains and net unrealized appreciation/depreciation as such income and/or gains are earned.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund’s financial statements.

5. Investment Income and Investment Transactions

Dividend income is recorded on the ex-dividend date or as soon as the Fund is informed of the dividend. Interest income is accrued daily. Investment transactions are accounted for on the date securities are purchased or sold. Investment gains and losses are determined on the identified cost basis. The Fund amortizes premiums and accretes discounts as adjustments to interest income.

6. Class Allocations

All income earned and expenses incurred by the Fund are borne on a pro-rata basis by each settled class of shares, based on the proportionate interest in the Fund represented by the net assets of such class, except for class specific expenses which are allocated to the respective class. Realized and unrealized gains and losses are allocated among the various share classes based on their respective net assets.

7. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

| | |

| 26 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Notes to Financial Statements

NOTE B

Advisory Fee and Other Transactions with Affiliates

Under the terms of the investment advisory agreement, the Fund pays the Adviser an advisory fee at an annual rate of .75% of the first $2.5 billion, .65% of the next $2.5 billion and .60% in excess of $5 billion, of the Fund’s average daily net assets. The fee is accrued daily and paid monthly.

The Adviser had agreed to waive its fees and bear certain expenses to the extent necessary to limit total operating expenses on an annual basis to 1.65%, 2.35%, 2.35%, 1.35%, 1.85%, 1.60% and 1.35% of the daily average net assets for the Class A, Class B, Class C, Advisor Class, Class R, Class K and Class I shares, respectively (the “Expense Caps”). The Expense Caps will expire on June 30, 2011 and then may be extended by the Adviser for additional one year terms. For the year ended June 30, 2010, there was no such reimbursement.

For the year ended June 30, 2010, the Adviser reimbursed the Fund $4,618 for trading losses incurred due to trade entry errors.

Pursuant to the investment advisory agreement, the Fund may reimburse the Adviser for certain legal and accounting services provided to the Fund by the Adviser. For the year ended June 30, 2010, such fee amounted to $101,311.

The Fund compensates AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Adviser, under a Transfer Agency Agreement for providing personnel and facilities to perform transfer agency services for the Fund. ABIS may make payments to intermediaries that provide omnibus account services, sub-accounting services and/or networking services. Such compensation retained by ABIS amounted to $1,361,056 for the year ended June 30, 2010.

For the year ended June 30, 2010, there was no reduction to the expenses of Class A, Class B, Class C and Advisor Class shares under an expense offset arrangement with ABIS.

AllianceBernstein Investments, Inc. (the “Distributor”), a wholly-owned subsidiary of the Adviser, serves as the distributor of the Fund’s shares. The Distributor has advised the Fund that it has retained front-end sales charges of $488,819 from the sale of Class A shares and received $11,426, $76,028 and $10,095 in contingent deferred sales charges imposed upon redemptions by shareholders of Class A, Class B and Class C shares, respectively, for the year ended June 30, 2010.

Brokerage commissions paid on investment transactions for the year ended June 30, 2010, amounted to $5,164,737, none of which was paid to Sanford C. Bernstein & Co. LLC and Sanford C. Bernstein Limited, affiliates of the Adviser.

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 27 |

Notes to Financial Statements

NOTE C

Distribution Services Agreement

The Fund has adopted a Distribution Services Agreement (the “Agreement”) pursuant to Rule 12b-1 under the Investment Company Act of 1940. Under the Agreement, the Fund pays distribution and servicing fees to the Distributor at an annual rate of up to .30% of the Fund’s average daily net assets attributable to Class A shares, 1% of the Fund’s average daily net assets attributable to both Class B and Class C shares, .50% of the Fund’s average daily net assets attributable to Class R shares and .25% of the Fund’s average daily net assets attributable to Class K shares. There are no distribution and servicing fees on the Advisor Class and Class I shares. The fees are accrued daily and paid monthly. The Agreement provides that the Distributor will use such payments in their entirety for distribution assistance and promotional activities. Since the commencement of the Fund’s operations, the Distributor has incurred expenses in excess of the distribution costs reimbursed by the Fund in the amounts of $5,994,117, $3,860,056, $495,527 and $111,849 for Class B, Class C, Class R and Class K shares, respectively. While such costs may be recovered from the Fund in future periods so long as the Agreement is in effect, the rate of the distribution and servicing fees payable under the Agreement may not be increased without a shareholder vote. In accordance with the Agreement, there is no provision for recovery of unreimbursed distribution costs incurred by the Distributor beyond the current fiscal year for Class A shares. The Agreement also provides that the Adviser may use its own resources to finance the distribution of the Fund’s shares.

NOTE D

Investment Transactions

Purchases and sales of investment securities (excluding short-term investments) for the year ended June 30, 2010 were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

Investment securities (excluding U.S. government securities) | | $ | 2,236,696,398 | | | $ | 2,583,548,128 | |

U.S. government securities | | | – 0 | – | | | – 0 | – |

The cost of investments for federal income tax purposes, gross unrealized appreciation and unrealized depreciation (excluding forward currency exchange contracts) are as follows:

| | | | |

Cost | | $ | 1,550,378,985 | |

| | | | |

Gross unrealized appreciation | | $ | 163,999,281 | |

Gross unrealized depreciation | | | (143,292,036 | ) |

| | | | |

Net unrealized appreciation | | $ | 20,707,245 | |

| | | | |

| | |

| 28 | | • ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND |

Notes to Financial Statements

1. Derivative Financial Instruments

The Fund may use derivatives to earn income and enhance returns, to hedge or adjust the risk profile of its portfolio, to replace more traditional direct investments, or to obtain exposure to otherwise inaccessible markets. The Fund may also use derivatives for non-hedging purposes as a means of making direct investment in foreign currencies, as described below under “Currency Transactions”.

The principal type of derivatives utilized by the Fund, as well as the methods in which they may be used are:

| | • | | Forward Currency Exchange Contracts |

The Fund may enter into forward currency exchange contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to hedge certain firm purchase and sale commitments denominated in foreign currencies and for non-hedging purposes as a means of making direct investments in foreign currencies, as described below under “Currency Transactions”.

A forward currency exchange contract is a commitment to purchase or sell a foreign currency at a future date at a negotiated forward rate. The gain or loss arising from the difference between the original contract and the closing of such contract would be included in net realized gain or loss on foreign currency transactions. Fluctuations in the value of open forward currency exchange contracts are recorded for financial reporting purposes as unrealized appreciation and/or depreciation by the Fund. Risks may arise from the potential inability of a counterparty to meet the terms of a contract and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. The face or contract amount, in U.S. dollars reflects the total exposure the Fund has in that particular currency contract.

At June 30, 2010, the Fund had entered into the following derivatives:

| | | | | | | | | | |

| | | Asset Derivative | | Liability Derivatives |

Derivative Type | | Statement of

Assets and

Liabilities

Location | | Fair Value | | Statement of

Assets and

Liabilities

Location | | Fair Value |

Foreign exchange contracts | | Unrealized appreciation of forward currency exchange contracts | | $ | 10,164,697 | | Unrealized depreciation of forward currency exchange contracts | | $ | 26,481,985 |

| | |

| ALLIANCEBERNSTEIN INTERNATIONAL GROWTH FUND • | | 29 |

Notes to Financial Statements

The effect of derivative instruments on the statement of operations for the year ended June 30, 2010.

| | | | | | | | | |

Derivative Type | | Location of Gain

or (Loss) on

Derivatives | | Realized Gain

or (Loss) on

Derivatives | | Change in

Unrealized

Appreciation or

(Depreciation) | |

Foreign exchange contracts | | Net realized gain (loss) on foreign currency transactions; Net change in unrealized appreciation/depreciation of foreign currency denominated assets and liabilities | | $ | 48,275,549 | | $ | (5,192,537 | ) |

For the year ended June 30, 2010, the average monthly principal amount of forward currency exchange contracts was $1,197,306,714.

2. Currency Transactions