Armata Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Organization and Description of the Business

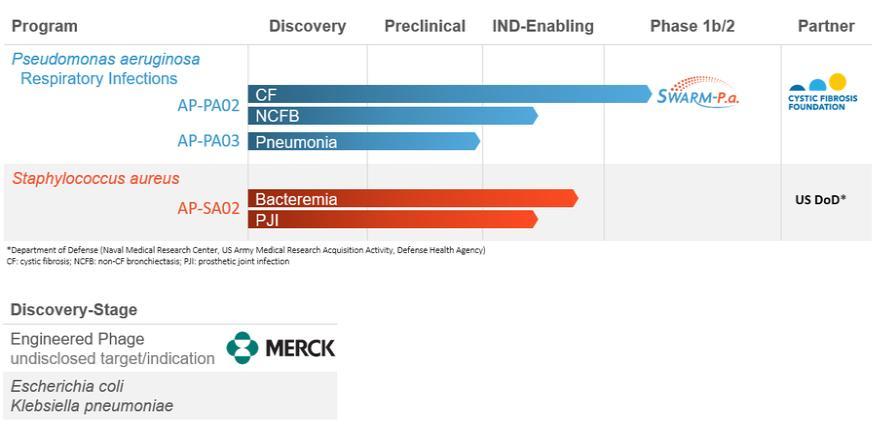

Armata Pharmaceuticals, Inc. (“Armata”, and together with its subsidiaries referred to herein as, the “Company”) is a clinical-stage biotechnology company focused on the development of precisely targeted bacteriophage therapeutics for the treatment of antibiotic-resistant and difficult-to-treat bacterial infections using its proprietary bacteriophage-based technology. The Company was created as a result of a business combination between C3J Therapeutics, Inc. (“C3J”), a Washington corporation, and AmpliPhi Biosciences Corporation (“AmpliPhi”) that closed on May 9, 2019, where Ceres Merger Sub, Inc., a wholly owned subsidiary of AmpliPhi, merged with and into C3J (the ”Merger”), with C3J surviving the Merger as a wholly owned subsidiary of AmpliPhi. Immediately prior to the closing of the Merger, AmpliPhi changed its name to Armata Pharmaceuticals, Inc. Armata’s common stock is traded on the NYSE American exchange under the ticker symbol “ARMP”.

2. Liquidity

The Company has prepared its consolidated financial statements on a going concern basis, which assumes that the Company will realize its assets and satisfy its liabilities in the normal course of business. However, the Company has incurred net losses since its inception and has negative operating cash flows. These circumstances raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result from the outcome of the uncertainty concerning the Company’s ability to continue as a going concern.

On October 28, 2021, the Company entered into a securities purchase agreement (the “October 2021 Securities Purchase Agreement”) with the Cystic Fibrosis Foundation, a Delaware corporation (“CFF”), the Company’s partner for its lead Phase 1b/2 clinical development program, and Innoviva Strategic Opportunities LLC, a wholly-owned subsidiary of Innoviva, Inc. (Nasdaq: INVA) (collectively, “Innoviva”) for the private placement of newly issued shares of common stock, par value $0.01 per share, of the Company (“Common Stock”). Pursuant to the October 2021 Securities Purchase Agreement, the Company issued and sold 909,091 shares to CFF and 1,212,122 shares to Innoviva, each at a per share price of $3.30 (the “October 2021 Private Placements”). The Company received aggregate gross proceeds from the October 2021 Private Placements of approximately $7.0 million, before deducting transaction expenses.

On January 26, 2021, the Company entered into a securities purchase agreement (the “January 2021 Securities Purchase Agreement”) with Innoviva, pursuant to which the Company agreed to issue and sell to Innoviva, in a private placement, up to 6,153,847 newly issued shares of Common Stock, and warrants (the “Common Warrants”) to purchase up to 6,153,847 shares of Common Stock, with an exercise price per share of $3.25 (the “January 2021 Private Placement”).

The January 2021 Private Placement closed in two tranches. On January 26, 2021 and concurrently with entering into the January 2021 Securities Purchase Agreement, the Company completed the first tranche (the “First Closing”) of the January 2021 Private Placement. At the First Closing, Innoviva purchased 1,867,912 shares of Common Stock and Common Warrants to purchase 1,867,912 shares of common stock, for an aggregate purchase price of approximately $6.1 million.

At the closing of the second tranche (the “Second Closing”), which was approved by the Company’s stockholders, Innoviva purchased 4,285,935 shares of Common Stock and Common Warrants to purchase 4,285,935 shares of Common Stock for an aggregate purchase price of $13.9 million. The Second Closing was completed on March 17, 2021.

On March 27, 2020, the Company completed a private placement transaction and sold to Innoviva Inc. 8,710,800 newly issued shares of Common Stock and warrants to purchase 8,710,800 shares of common stock, with an exercise