Exhibit 96.4

Explanatory Note

SSR Mining Inc. (the “Company”) previously filed the Puna 2021 Technical Report Summary (the “Puna21TRS”), with an effective date of December 31, 2021 and issued on February 23, 2022, as Exhibit 96.4 to its Annual Report on Form 10-K for the year ended December 31, 2021, as amended (the “Form 10-K/A”). The Puna21TRS has been amended to reflect certain revisions in compliance with Subpart 1300 of Regulation S-K, which revisions consist of adding confirmatory statements and other modifications that SSR does not consider material. The amended Puna21TRS has been reissued as of September 29, 2022 and is presented with an effective date of December 31, 2021. The information in this amended Puna21TRS has not been updated to reflect events, information or developments occurring after the effective date.

The Contained Metal amounts for lead and zinc are reported in Table 1.1, Table 1.3, Table 1.5, and Table 11.11 of the Puna21TRS in thousands of pounds (klb) for internal consistency. In the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in its Form 10-K/A, the same information is reported in millions of pounds (Mlb). Any inconsistencies between the amounts reported in the Puna21TRS and the amounts reported in other SEC filings of the Company are generally a result of rounding through the conversion.

The Form 10-K/A reported the inferred contained metal amount of zinc incorrectly on page 37 due to a typographical error. The amount presented in the Puna21TRS in Table 1.3 and Table 11.11 (177,394 klb) is consistent with the information correctly reported elsewhere in the Form 10-K/A.

The Form 10-K/A reported the probable zinc reserve for Chinchillas (Stockpile) incorrectly on page 36 due to a typographical error. The amount presented in the Puna21TRS in Table 1.5 and Table 12.1 (2,056 klb) is consistent with the information correctly reported elsewhere in the Form 10-K/A.

The Form 10-K/A reported the indicated and measured and indicated contained metal amounts of lead in respect of the Pirquitas property incorrectly on page 37 due to immaterial rounding errors. The amounts presented in the Puna21TRS in Table 1.3 and Table 11.11 (895 klb and 1,240 klb, respectively) are correct and consistent with other information regarding lead amounts correctly reported elsewhere in the Form 10-K/A.

This page does not constitute a part of the amended Puna21TRS.

Title Page

| | | | | |

| Project Name: | Puna Operations |

| Title: | Puna 2021 Technical Report Summary |

| Location: | Jujuy, Argentina |

| Effective Date of Technical Report Summary: | 31 December 2021 |

| Effective Date of Mineral Resources: | 31 December 2021 |

| Effective Date of Mineral Reserves: | 31 December 2021 |

Qualified Persons (QPs):

•Gregory Gibson, BSc (Mining Engineering), MSc (Mining & Earth Systems Engineering), SME Registered Member (4134135), employed by SSR Mining Inc. as Vice President of Operations - Americas, was responsible for the preparation of Sections 1 to 25.

•Bernard Peters, BEng (Mining), FAusIMM (201743), employed by OreWin Pty Ltd as Technical Director – Mining, was responsible for the overall preparation, the Mineral Reserves estimates, and Sections 1 to 5; Section 10; and Sections 12 to 25.

•Sharron Sylvester, BSc (Geol), RPGeo AIG (10125), employed by OreWin Pty Ltd as Technical Director – Geology, was responsible for the preparation of the Mineral Resources, Sections 1 to 3; Sections 6 to 9; Section 11; and Sections 22 to 25.

OreWin Pty Ltd ACN 165 722 574

140 South Terrace Adelaide 5000

P +61 8 8210 5600 E orewin@orewin.com W orewin.comi

Signature Page

| | | | | |

| Project Name: | Puna Operations |

| Title: | Puna 2021 Technical Report Summary |

| Location: | Jujuy, Argentina |

| Date of Signing: | 29 September 2022 |

| Effective Date of Technical Report Summary: | 31 December 2021 |

/s/ Gregory Gibson

Gregory Gibson, Vice President Operations - Americas, SSR Mining Inc., BSc (Mining Engineering), MSc (Mining & Earth Systems Engineering), SME Registered Member (4134135)

/s/ Bernard Peters

Bernard Peters, Technical Director – Mining, OreWin Pty Ltd, BEng (Mining), FAusIMM (201743)

/s/ Sharron Sylvester

Sharron Sylvester, Technical Director – Geology, OreWin Pty Ltd, BSc (Geol), RPGeo AIG (10125)

21015Puna21TRS220927Rev0.docx ii

TABLE OF CONTENTS

21015Puna21TRS220927Rev0.docx iii

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| 20 |

| 20 |

| 21 |

| 21 |

| 22 |

| 23 |

| 23 |

| 25 |

| 27 |

| 28 |

| 28 |

| 28 |

| 29 |

| 29 |

| 30 |

| 31 |

| 31 |

21015Puna21TRS220927Rev0.docx iv

| | | | | |

| 32 |

| 33 |

| 33 |

| 33 |

| 33 |

| 34 |

| 37 |

| 39 |

| 39 |

| 48 |

| 54 |

| 54 |

| 54 |

| 54 |

| 55 |

| 57 |

| 58 |

| 58 |

| 58 |

| 58 |

| 58 |

| 58 |

| 59 |

| 59 |

| 65 |

| 65 |

21015Puna21TRS220927Rev0.docx v

| | | | | |

| 65 |

| 66 |

| 66 |

| 67 |

| 68 |

| 68 |

| 68 |

| 69 |

| 69 |

| 69 |

| 69 |

| 70 |

| 71 |

| 71 |

| 71 |

| 71 |

| 72 |

| 72 |

| 72 |

| 72 |

| 73 |

| 77 |

| 77 |

| 78 |

| 79 |

| 79 |

21015Puna21TRS220927Rev0.docx vi

| | | | | |

| 80 |

| 80 |

| 80 |

| 81 |

| 81 |

| 83 |

| 83 |

| 89 |

| 89 |

| 90 |

| 91 |

| 92 |

| 92 |

| 93 |

| 94 |

| 98 |

| 98 |

| 98 |

| 98 |

| 102 |

| 103 |

| 105 |

| 106 |

| 109 |

| 109 |

| 109 |

21015Puna21TRS220927Rev0.docx vii

| | | | | |

| 109 |

| 109 |

| 109 |

| 110 |

| 110 |

| 110 |

| 110 |

| 112 |

| 112 |

| 113 |

| 113 |

| 113 |

| 115 |

| 117 |

| 117 |

| 117 |

| 118 |

| 119 |

| 119 |

| 121 |

| 121 |

| 122 |

| 122 |

| 124 |

21015Puna21TRS220927Rev0.docx viii

| | | | | |

| 124 |

| 125 |

| 125 |

| 125 |

| 126 |

| 127 |

| 127 |

| 128 |

| 129 |

| 129 |

| 130 |

| 130 |

| 130 |

| 131 |

| 132 |

| 132 |

| 133 |

| 133 |

| 134 |

| 134 |

| 134 |

| 136 |

| 137 |

| 137 |

| 137 |

21015Puna21TRS220927Rev0.docx ix

| | | | | |

| 138 |

| 139 |

| 141 |

| 143 |

| 146 |

| 148 |

| 148 |

| 148 |

| 149 |

| 151 |

| 151 |

| 151 |

| 151 |

| 152 |

| 152 |

| 155 |

| 156 |

| 157 |

| 157 |

| 157 |

| 159 |

| 159 |

| 159 |

| 160 |

| 160 |

| 162 |

21015Puna21TRS220927Rev0.docx x

TABLES

21015Puna21TRS220927Rev0.docx xi

| | | | | |

| |

| |

| 23 |

| 25 |

| 54 |

| 57 |

| 59 |

| 76 |

| 78 |

| 78 |

| 78 |

| 82 |

| 83 |

| 89 |

| 92 |

| 94 |

| 95 |

| 99 |

| 102 |

| 104 |

| 104 |

| 105 |

21015Puna21TRS220927Rev0.docx xii

| | | | | |

| 106 |

| 107 |

| 108 |

| 111 |

| 112 |

| 116 |

| 117 |

| 122 |

| 128 |

| 134 |

| 135 |

| 157 |

| 158 |

| 159 |

| 159 |

| 161 |

| 162 |

| 164 |

| 164 |

| 165 |

| 166 |

| 166 |

21015Puna21TRS220927Rev0.docx xiii

FIGURES

| | | | | |

| 11 |

| 12 |

| 12 |

| |

| 21 |

| 22 |

| 24 |

| 26 |

| 35 |

| 36 |

| 38 |

| 39 |

| 40 |

| 41 |

| 42 |

| 43 |

| 45 |

| 47 |

| 48 |

21015Puna21TRS220927Rev0.docx xiv

| | | | | |

| 49 |

| 50 |

| 51 |

| 52 |

| 55 |

| 61 |

| 62 |

| 62 |

| 63 |

| 63 |

| 64 |

| 65 |

| 70 |

| 74 |

| 75 |

| 81 |

| 83 |

| 84 |

| 85 |

| 86 |

| 87 |

| 88 |

21015Puna21TRS220927Rev0.docx xv

| | | | | |

| 90 |

| 91 |

| 93 |

| 95 |

| 96 |

| 97 |

| 100 |

| 114 |

| 115 |

| 120 |

| 121 |

| 123 |

| 124 |

| 125 |

| 126 |

| 127 |

| 129 |

| 131 |

| 135 |

| 138 |

| 142 |

| 143 |

| 144 |

21015Puna21TRS220927Rev0.docx xvi

21015Puna21TRS220927Rev0.docx xvii

1 EXECUTIVE SUMMARY

1.1 Introduction

This Puna 2021 Technical Report Summary (Puna21TRS) is an independent Technical Report Summary that has been prepared in accordance with the U.S. Securities and Exchange Commission (US SEC) Regulation S-K subpart 1300 rules for Property Disclosures for Mining Registrants (S-K 1300) for SSR Mining Inc. (SSR), on the Puna project (Puna, or the Project).

The Project comprises the Chinchillas property and the Pirquitas property, both of which are located the Jujuy Province in far north Argentina.

Puna is directly owned (100%) by SSR through a subsidiary company Puna Operations Inc. (POI), which, through other 100% owned subsidiaries owns Mina Pirquitas S.A. (MPSA). MPSA operates the Project.

Ore from the Chinchillas mine is transported to the Pirquitas plant for processing. The Chinchillas mine is located approximately 45 km from the Pirquitas plant. The open pit mine at Pirquitas has been completed.

SSR is a gold mining company with four producing assets located in the USA, Turkey, Canada, and Argentina, and with development and exploration assets in the USA, Turkey, Mexico, Peru, and Canada. SSR is listed on the NASDAQ (NASDAQ:SSRM), the Toronto Stock Exchange (TSX:SSRM), and the Australian Stock Exchange (ASX:SSR).

The Puna21TRS Qualified Persons (QPs) have reviewed the supplied data and information and accept this information as being accurate and complete and suitable for use in the Puna21TRS. Information and data supplied by SSR that were outside the areas of expertise of the QPs and was relied upon when forming the findings and conclusions of this report are detailed in Section 25. Any individual or entity referenced as having completed work relevant to the Puna21TRS, but not identified therein as a QP, does not constitute a QP for the Puna21TRS.

The Puna21TRS should be construed in light of the methods, procedures, and techniques used to prepare the Puna21TRS. Sections or parts of the Puna21TRS should not be read in isolation of, or removed from, their original context.

1.2 Land Tenure and Ownership

The Chinchillas property is composed of three contiguous claims totalling 2,041 ha, and the Pirquitas property includes surface rights covering an area of approximately 7,500 ha, which is used for purposes such as housing, infrastructure facilities, processing facilities, tailings facility and other facilities to support mining operations for the Project.

POI holds a 100% interest in the property.

21015Puna21TRS220927Rev0.docx Page 1 of 175

1.3 Property Description and Location

1.3.1 Property Description and Location – Chinchillas

The Chinchillas property is located in the Puna region of north-western Argentina, in the province of Jujuy, department of Rinconada, approximately 290 km north-west of San Salvador de Jujuy, the capital of Jujuy Province. The property is centred at approximately 3,473,150E and 7,512,360N (Gauss Kruger, Argentina, Posgar Zone 3; 22°30′13″ S, 66°15′39″ W) at elevations ranging from 4,000–4,200 metres above sea level (masl).

Access to the Chinchillas property is by paved road to the town of Abra Pampa via National Route No. 9 and then 66 km west across public gravel roads, through the village of Santo Domingo. Santo Domingo is serviced with electricity and water. Abra Pampa has a hospital, and, along with San Salvador, provides other supplies necessary for exploration.

Access between the Pirquitas Operation and the Chinchillas property is via National Route No. 40 that leads to Provincial Route No. 70.

1.3.2 Property Description and Location – Pirquitas

The Pirquitas property is also located in the Rinconada Department in the Province of Jujuy, approximately 45 km south-west of the Chinchillas property and approximately 335 km north-west of San Salvador. Activities at the Property are centred at 22°42′ south latitude and 66°30′ west longitude at elevations of between 4,000–4,450 masl.

1.4 Geological Setting and Mineralisation

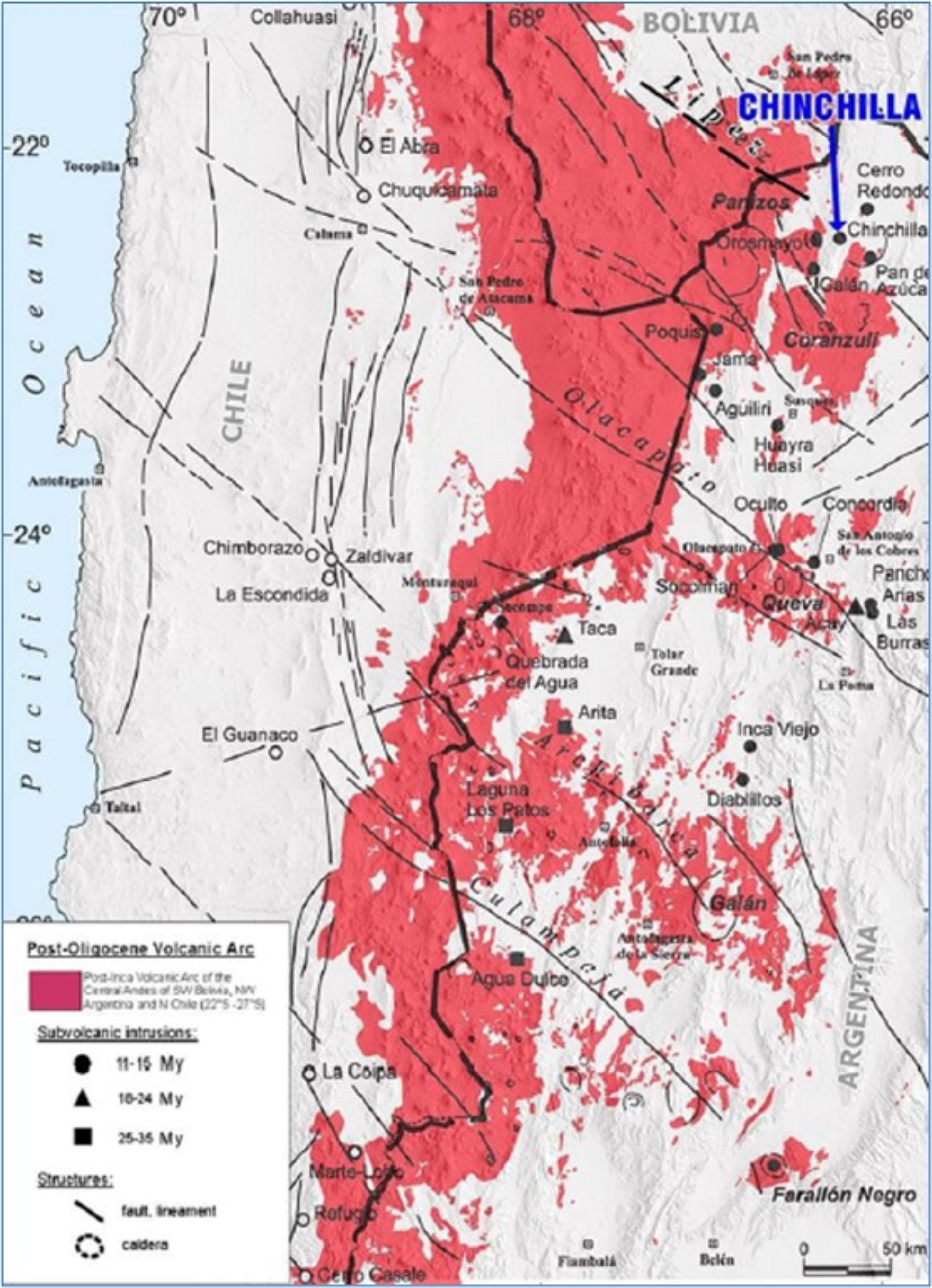

The Chinchillas and Pirquitas properties are within the Bolivian tin-silver-zinc belt that extends from the San Rafael tin copper deposit in southern Peru into the Puna region of Jujuy. Deposits with similar environments and styles of mineralisation include San Cristóbal, Potosí, and Pulacayo.

These deposits are generally associated with intrusion of dacite dome complexes. Mineralisation is hosted in shear zones and breccias within the dacite domes and/or shear zones and breccias within the host rocks. More rarely, as in the case of the Chinchillas property and San Cristóbal, the deposits also contain flat-lying manto bodies within sedimentary and pyroclastic rocks that are cut by ‘feeder’ shear zones. All the deposits have large vertical extents.

The Chinchillas and Pirquitas properties are within the Puna geological belt. Stratigraphy in the belt includes metamorphosed Proterozoic sedimentary rocks in the basement, Paleozoic marine back arc sedimentary rocks, and younger volcanic and continental sedimentary rocks. In the Jujuy Province, the Puna terrane is an important host for mineral deposits, including mesothermal quartz veins with native gold and base metals; polymetallic quartz-sulfide veins with base and precious metals; gold, tin, and copper placer deposits; sedimentary exhalative (SEDEX) deposits with lead zinc–silver; and Bolivian-type tin-silver-sulfide veins related to intrusive stocks.

21015Puna21TRS220927Rev0.docx Page 2 of 175

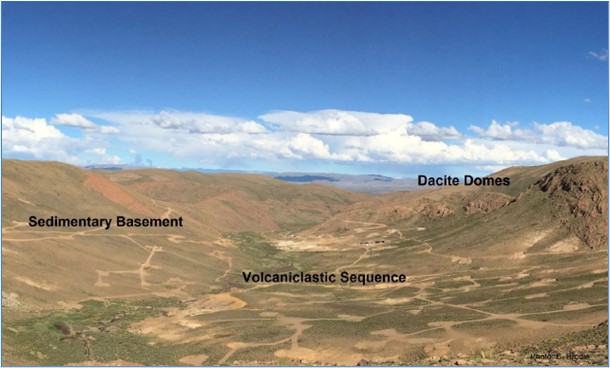

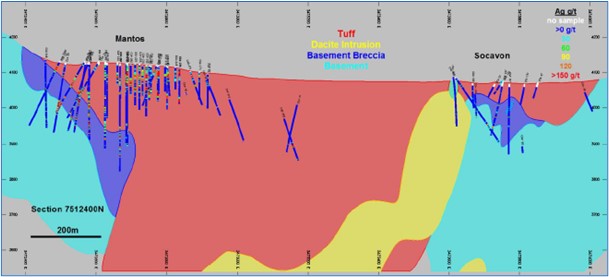

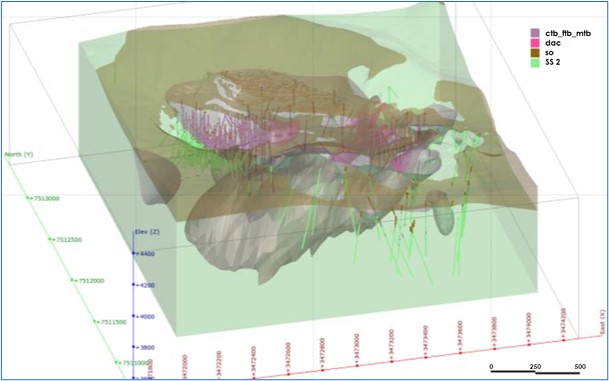

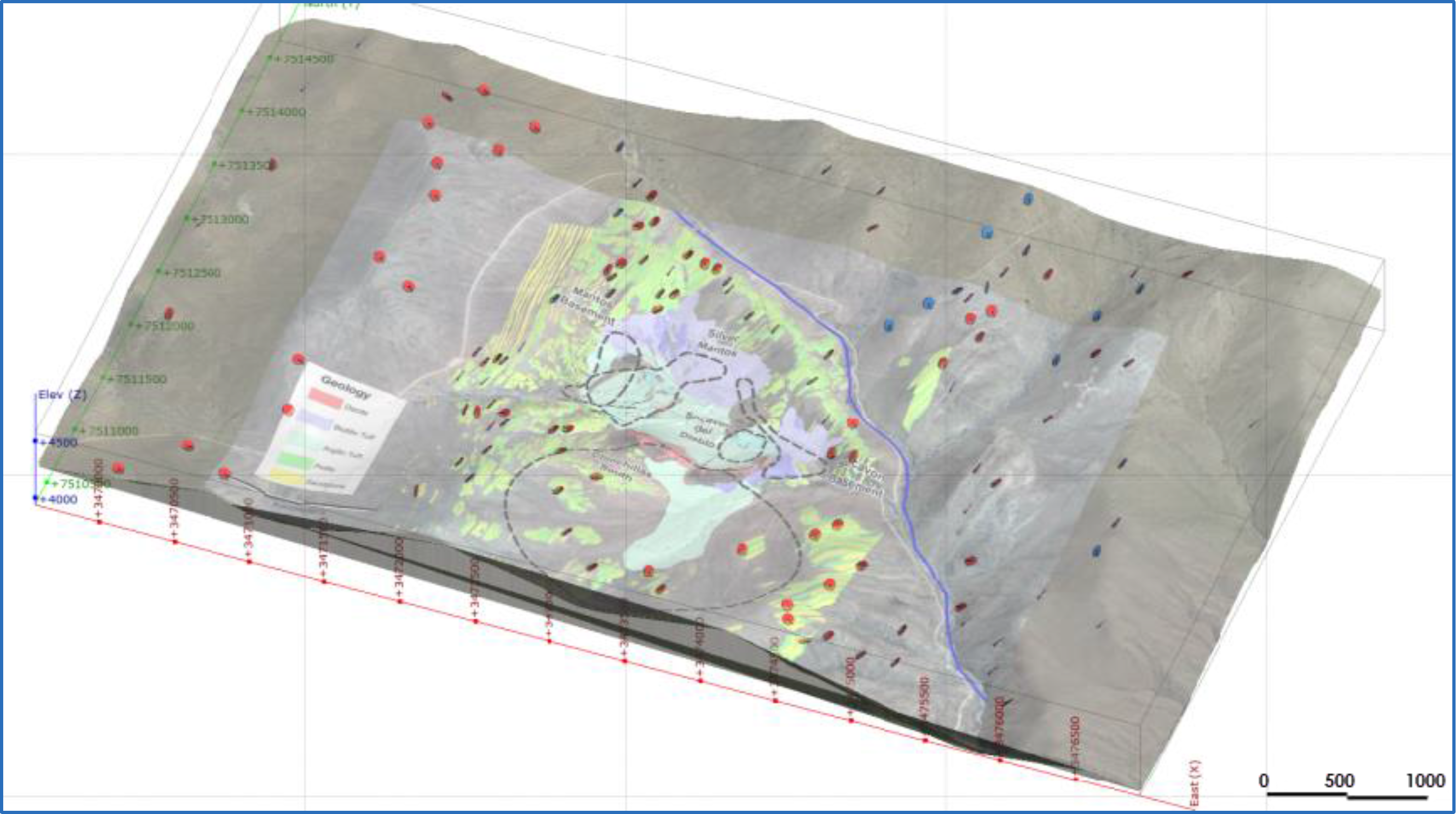

1.4.1 Geological Setting and Mineralisation – Chinchillas

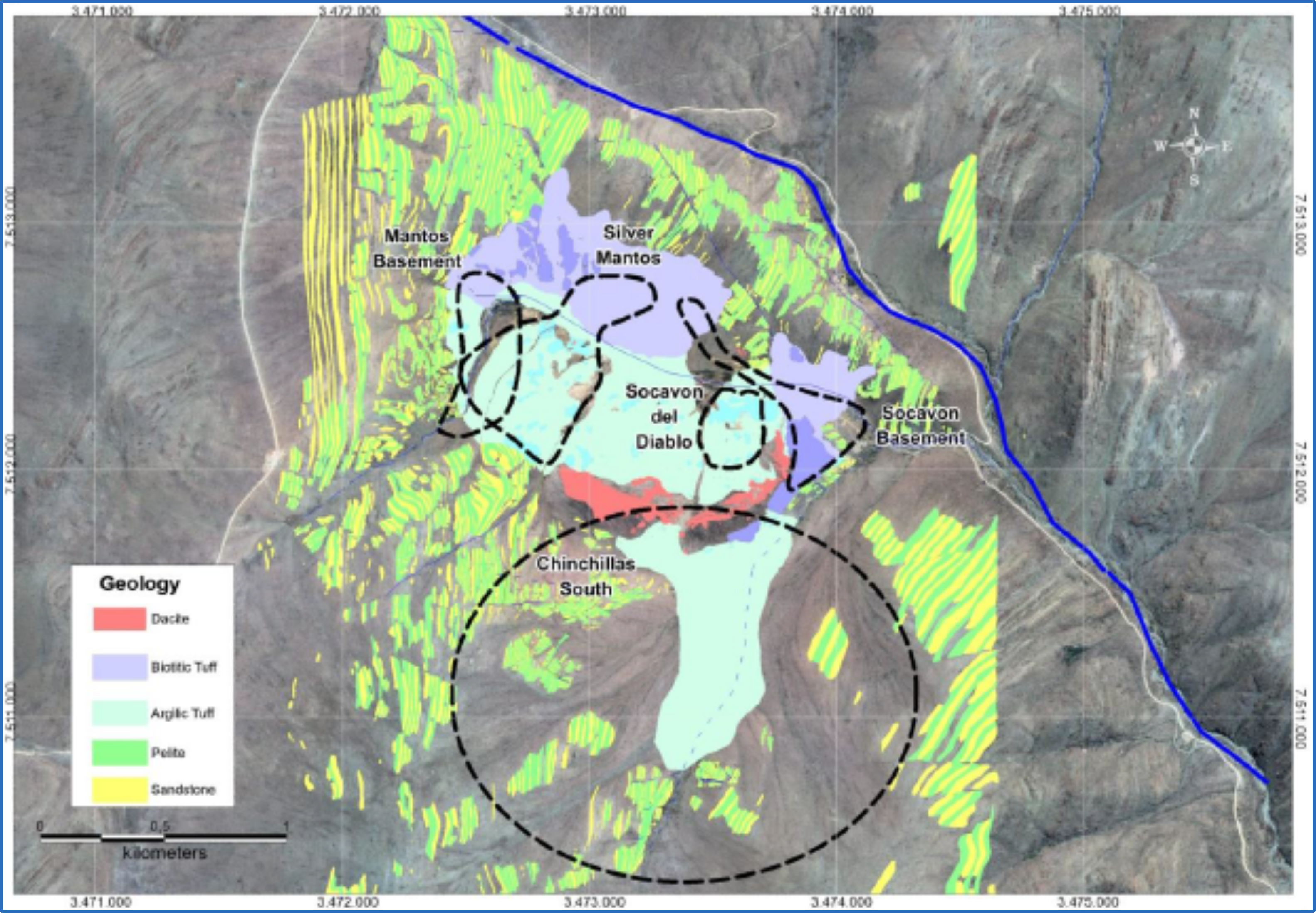

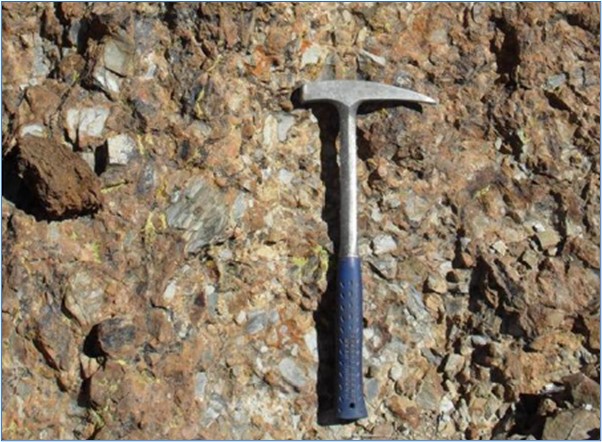

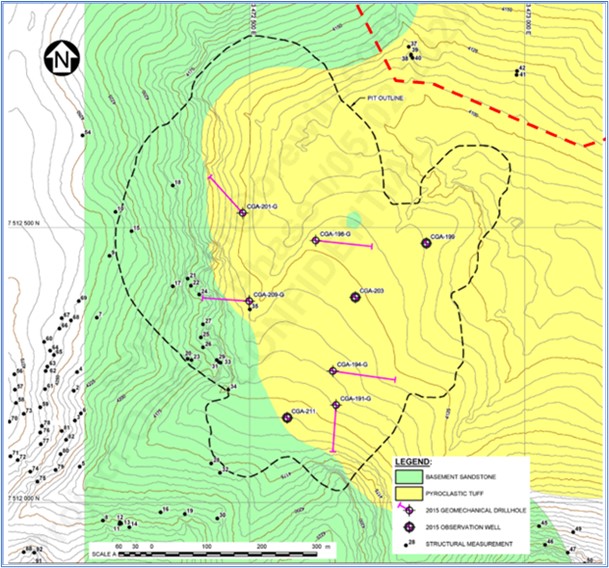

The Chinchillas deposit is within a dacitic volcanic centre. The deposit was controlled by a dilational jog on a regional scale east–west trending fault where magma has intruded through marine meta-sedimentary basement rocks. The explosive volcanic eruption resulted in an elliptical shaped topographic depression approximately 2 km long by 1.6 km wide, subsequently infilled with pyroclastic rocks including breccias and tuffs. At the contact between pyroclastic volcanic rocks and basement metasedimentary rock, a wide zone of hydraulic fracturing and brecciation formed. Dacitic lavas, flow domes and subvolcanic intrusions occur on the southern margin of the basin at the contact between metasedimentary and pyroclastic rocks.

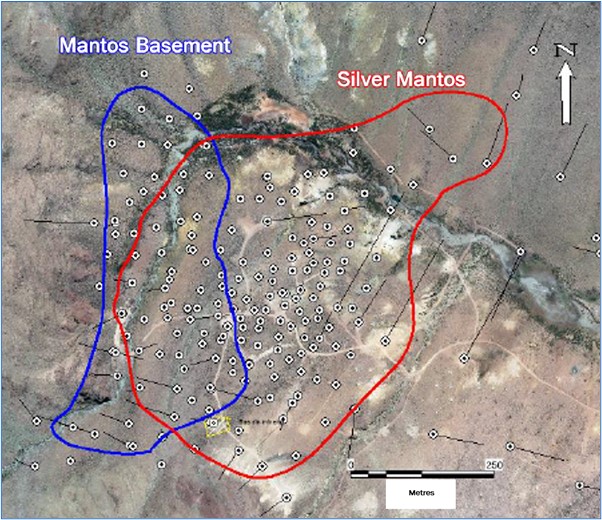

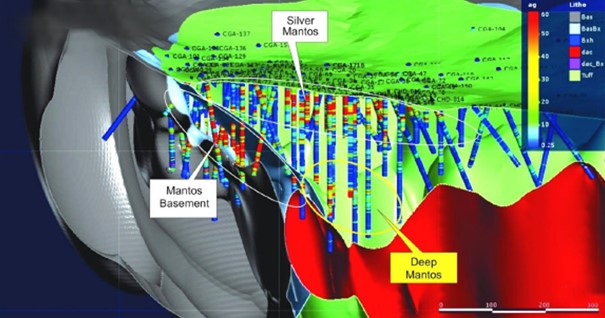

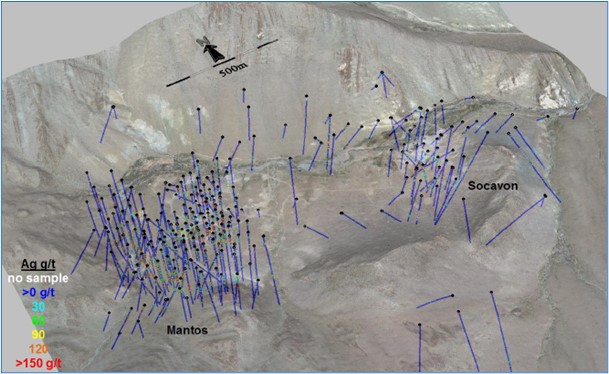

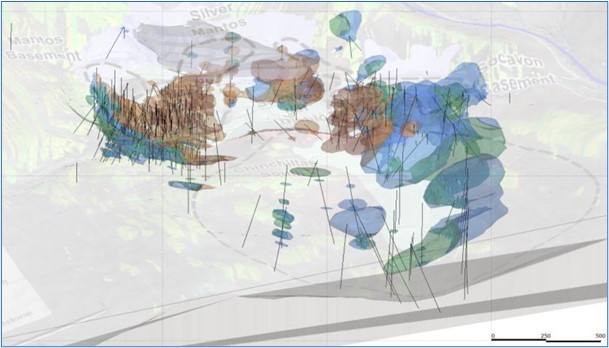

Significant silver-lead-zinc mineralisation occurs in four main areas at Chinchillas: the Silver Mantos and Mantos Basement zones in the west part of the Project, and the Socavon del Diablo and Socavon Basement zones in the east part.

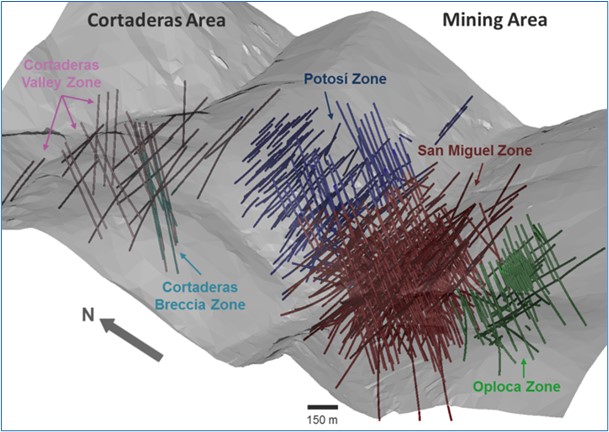

1.4.2 Geological Setting and Mineralisation – Pirquitas

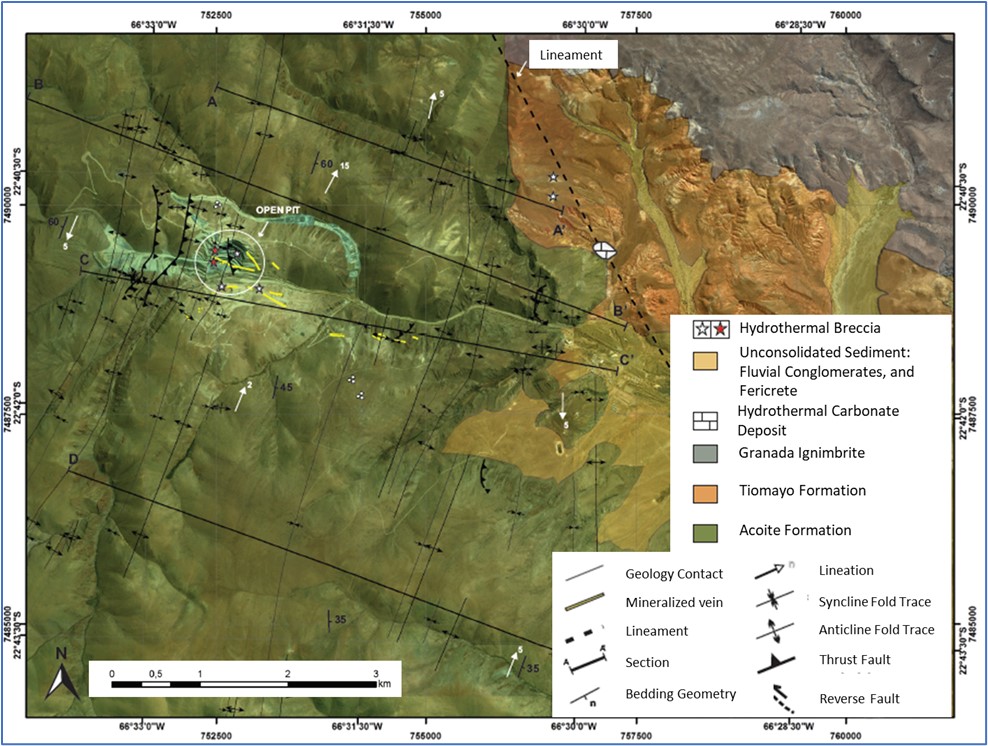

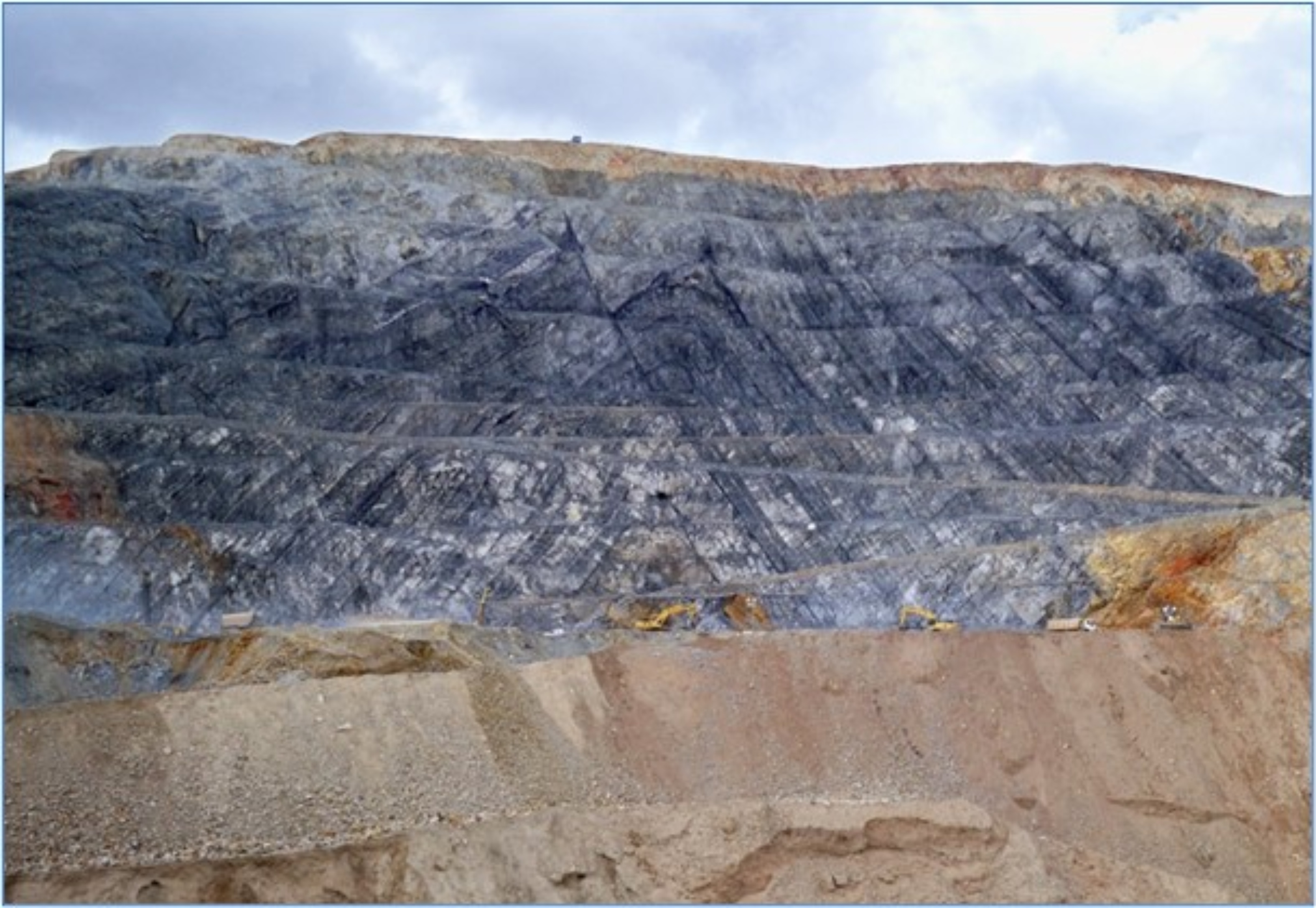

The Pirquitas deposit is hosted by the Ordovician Acoite Formation, a strongly folded package of low-grade metamorphosed marine sandstone, siltstone, and minor shale beds. These rocks crop out within fault-bounded and likely uplifted structural blocks that occur south-west and east of the mine area. Late Ordovician to Early Devonian compressional tectonism resulted infolding of the Paleozoic sedimentary rocks and development of well-defined axial planar cleavage. High-angle thrust faults were also generated during this event. In the area of the mine, axial planes of folds strike north to north–north-east and are sub-vertical to moderately inclined.

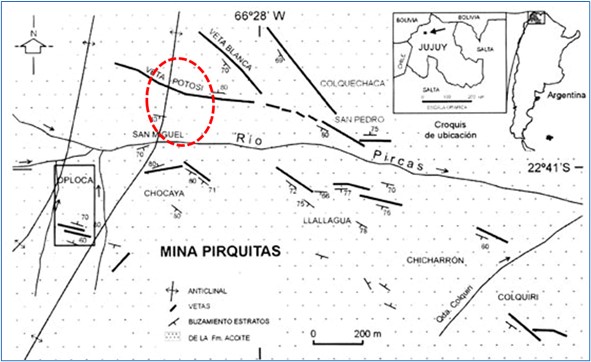

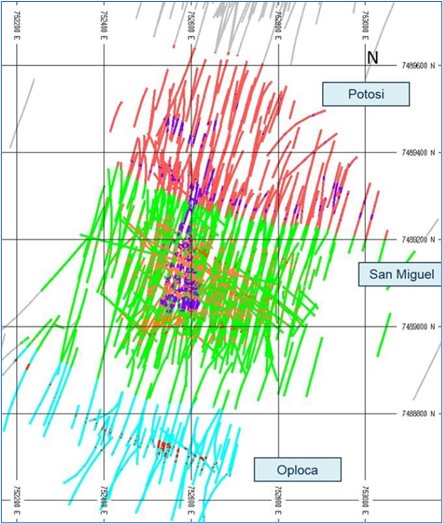

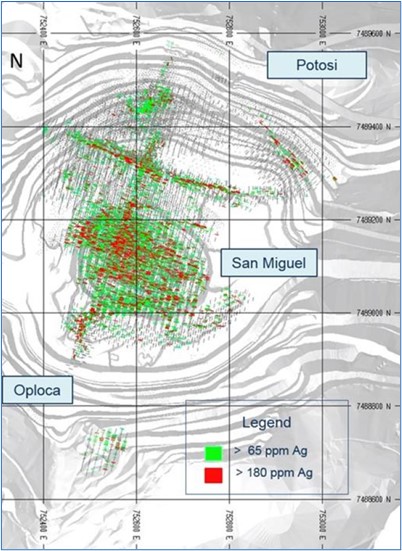

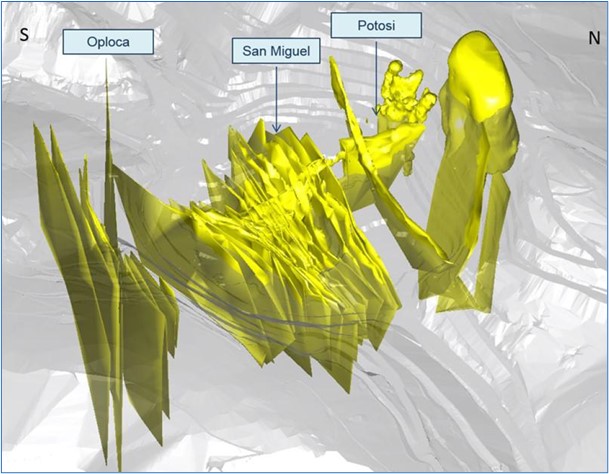

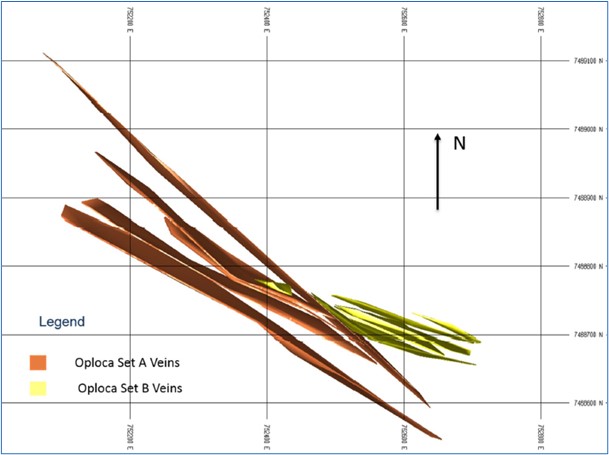

Sulphide-rich veins cut the axial planes of the folds and the related axial planar cleavage at high angles. Four main vein sets are recognised on the Pirquitas property.

Bolivian-type Ag-Sn deposits generally consist of sulphide and quartz-sulphide vein systems typically containing cassiterite and a diverse suite of base and trace metals, including silver, in a complex assemblage of sulphide and sulfosalt minerals. The vein systems are generally spatially and likely genetically associated with epizonal (subvolcanic) quartz-bearing peraluminous intrusions 1–2 km in diameter but may be entirely hosted by the country rocks into which the intrusive stocks were emplaced.

1.5 Exploration

1.5.1 Exploration Activities – Chinchillas

At Chinchillas, surface exploration programmes included detailed mapping with emphasis on structure, rock chip sampling, trenching, soil sampling and talus sampling. These programmes identified major structural zones, the strong east–west control on basin formation, and new mineralised target areas. Geophysical surveys were also conducted, including induced polarisation / resistivity (IP), controlled source audio-frequency magneto-telluric (CSAMT) surveys, and magnetics.

Prior to SSR, Golden Arrow completed five drilling programmes (~50,000 m of drilling) that contributed to the initial resource database.

21015Puna21TRS220927Rev0.docx Page 3 of 175

1.5.2 Exploration Activities – Pirquitas

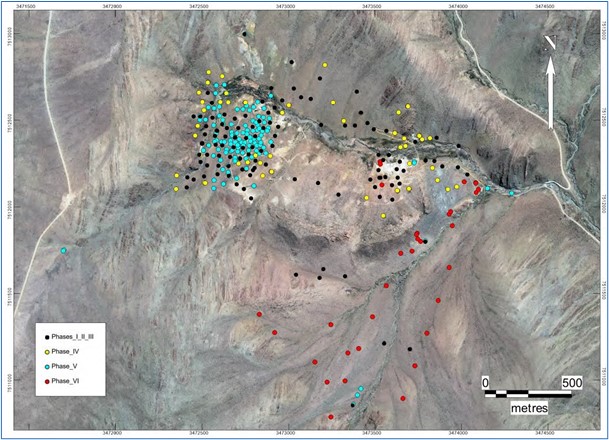

Prior to SSR, the Sunshine Mining and Refining Company (Sunshine) completed comprehensive mineral exploration on the Pirquitas property, including geological mapping, geophysical surveying (44 line-kilometres of ground magnetics and 19.2 line-kilometres of induced polarisation surveying), underground rock samplin,g and multiple programmes of reverse circulation (RC) and diamond drilling (DD). In May 2004, SSR fully acquired Sunshine’s ownership in the property and continued to advance the project through detailed drilling, underground resource definition, and mining.

1.6 Sample Preparation, Analyses, and Security

All drilling was completed by professional drilling companies using standard industry methods.

Sample and assay procedures applied in the drilling programme are consistent with generally accepted industry best practices. The statistical analysis of quality control data shows good accuracy and precision with no significant contamination.

1.7 Data Verification

No material sample bias was identified during the review of the drill data and assays. SSR has identified an issue with some pre-2009 drillhole collar locations in the Pirquitas drilling and has made a reasonable attempt at rectifying the issue. This issue is not expected to have a material effect on the quantity and quality of the Mineral Resources inventory and should be able to be managed operationally.

Data collection procedures are in accordance with generally accepted industry best practices and the resultant data is suitable for use in mineral resource estimation.

1.8 Mineral Resources Estimates

1.8.1 Mineral Resources Estimate – Chinchillas Property

The Mineral Resources have been estimated for the Chinchillas property in conformity with generally accepted practices and reported in accordance with S-K 1300. The Chinchillas resource model presented in this Puna21TRS was completed on 28 August 2020.

The Mineral Resources estimate has been generated for the Mantos deposit from drillhole sample assay results and the interpretation of a geological model which relates to the spatial distribution of silver, lead, and zinc. Interpolation characteristics were defined based on the geology, drillhole spacing, and geostatistical analysis of the data.

Estimations were made from three-dimensional (3D) cell models based on geostatistical applications using commercial software. The model uses a cell size of 8 m L x 8 m W x 5 m H.

The Mineral Resources were classified according to proximity to sample data locations.

Table 1.1 and Table 1.2 summarise the estimate of Mineral Resources for the Chinchillas project, effective as at 31 December 2021. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. The quantity and grade of reported Inferred Mineral Resources are uncertain in nature and there has been insufficient exploration to classify these Inferred Mineral Resources as Indicated or Measured Mineral Resources. It cannot be assumed that all or any part of an Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resources as a result of continued exploration.

21015Puna21TRS220927Rev0.docx Page 4 of 175

In determining the cut-off grade, the reasonable prospects for eventual economic extraction requirement generally implies that the quantity and grade estimates meet certain economic thresholds taking into account an open pit extraction scenario with road transport and processing at the Pirquitas Operation. This includes consideration of the technical and economic parameters listed above, but also includes additional operating costs, estimated at $12/t, related to the handling and transportation of ore from the Chinchillas property to the Pirquitas Operation.

1.8.1.1 Mineral Resources Estimate – Socavon Deposit

A review of the pit optimisation work for the Socavon deposit was undertaken using the NSR and other assumptions used for the Mantos deposit. The review concluded that there was no suitable pit shell produced to meet the standard of reasonable prospects for extraction. Therefore, the Socavon Mineral Resources previously reported by SSR have not been included in the 2021 Puna Mineral Resources.

Table 1.1 Summary of Chinchillas Mineral Resources Estimate Exclusive of Mineral Reserves (as at 31 December 2021)

Based on $22.00/oz Silver, $0.95/lb Lead, and $1.15/lb Zinc

| | | | | | | | | | | | | | | | | | | | | | | |

| Mineral Resources Classification | Tonnage

(kt) | Grades | Contained Metal |

Ag

(g/t) | Pb

(%) | Zn

(%) | Silver

(koz) | Lead

(klb) | Zinc

(klb) |

| Measured | 1,110 | 99.2 | 0.86 | 0.31 | 3,540 | 21,015 | 7,552 |

| Indicated | 4,904 | 101.1 | 0.88 | 0.19 | 15,943 | 95,632 | 20,454 |

| Measured + Indicated | 6,013 | 100.8 | 0.88 | 0.21 | 19,483 | 116,647 | 28,006 |

| Inferred | 165 | 101.9 | 0.48 | 0.16 | 540 | 1,746 | 582 |

1. Mineral Resources are reported based on 31 December 2021 topography surface.

2. The Mineral Resources are contained within a pit shell generated using an NSR cut-off of $33.20/t.

3. The Mineral Resources estimates are based on metal price assumptions of $22.00/oz silver, $0.95/lb lead, and $1.15/lb zinc.

4. Metallurgical recoveries vary with grade and average recoveries are, 98% silver, 95% lead and 63% for zinc.

5. The point of reference for Mineral Resources is the point of feed into the processing facility.

6. Mineral Resources are reported exclusive of Mineral Reserves.

7. SSR has 100% ownership of the Project.

8. All ounces reported represent troy ounces, and g/t represents grams per metric tonne.

9. Totals may vary due to rounding.

21015Puna21TRS220927Rev0.docx Page 5 of 175

Table 1.2 Summary of Metallurgical Recoveries and Cut-off Values of Chinchillas Mineral Resources Estimate Exclusive of Mineral Reserves

(as at 31 December 2021)

Based on $22.00/oz Silver, $0.95/lb Lead, and $1.15/lb Zinc

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mineral Resources Classification | Tonnage

(kt) | Grades | Metallurgical Recovery | Cut-off NSR ($/t) |

Ag

(g/t) | Pb

(%) | Zn

(%) | Silver

(%) | Lead

(%) | Zinc

(%) |

| Measured | 1,110 | 99.2 | 0.86 | 0.31 | 98 | 95 | 63 | 33.2 |

| Indicated | 4,904 | 101.1 | 0.88 | 0.19 | 98 | 95 | 63 | 33.2 |

| Measured + Indicated | 6,013 | 100.8 | 0.88 | 0.21 | 98 | 95 | 63 | 33.2 |

| Inferred | 165 | 101.9 | 0.48 | 0.16 | 98 | 95 | 63 | 33.2 |

1. Mineral Resources are reported based on 31 December 2021 topography surface.

2. The Mineral Resources are contained within a pit shell generated using an NSR cut-off of $33.20/t.

3. The Mineral Resources estimates are based on metal price assumptions of $22.00/oz silver, $0.95/lb lead, and $1.15/lb zinc.

4. Metallurgical recoveries vary with grade and average recoveries are, 98% silver, 95% lead and 63% for zinc.

5. The point of reference for Mineral Resources is the point of feed into the processing facility.

6. Mineral Resources are reported exclusive of Mineral Reserves.

7. SSR has 100% ownership of the Project.

8. All ounces reported represent troy ounces, and g/t represents grams per metric tonne.

9. Totals may vary due to rounding.

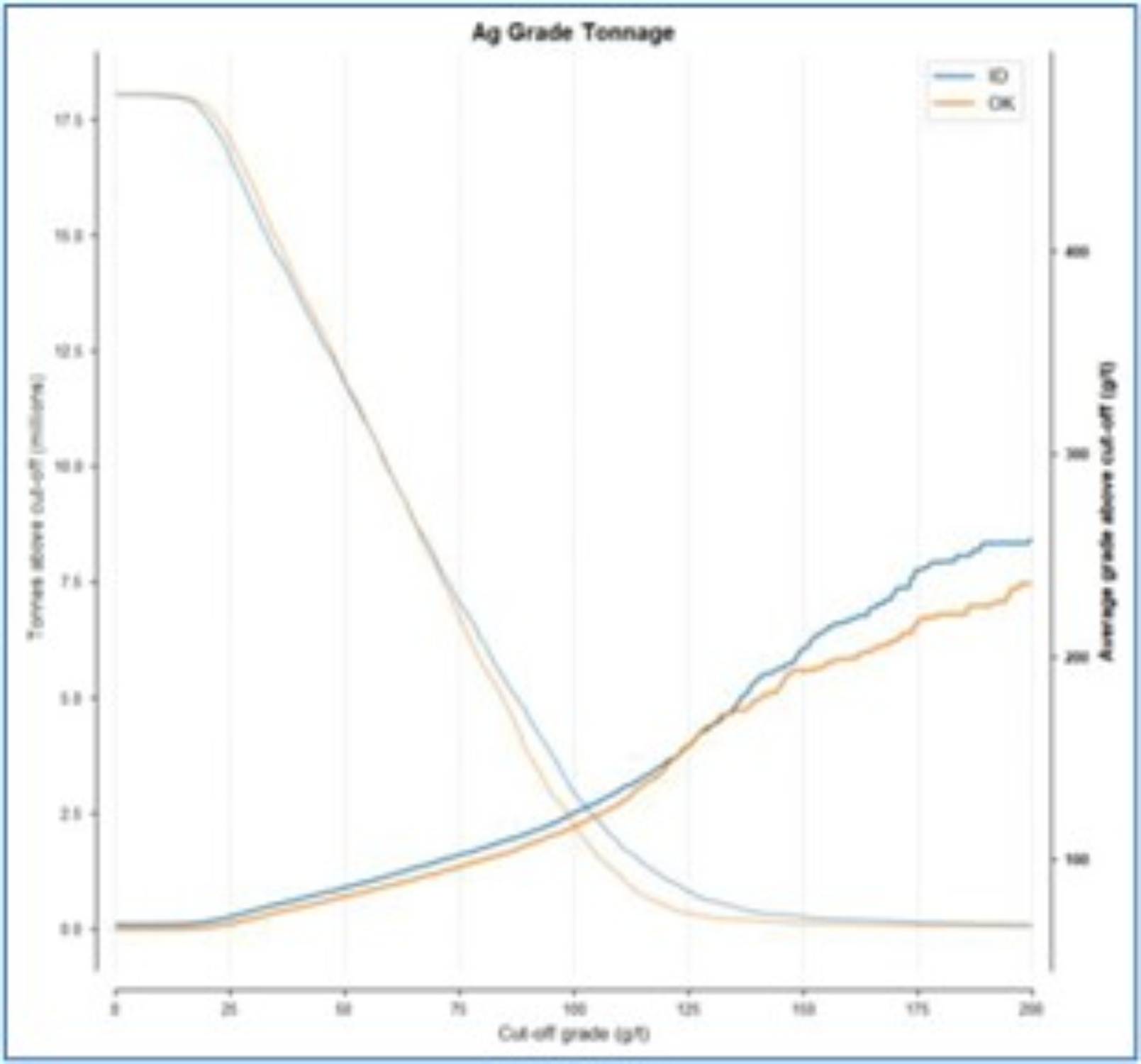

1.8.2 Mineral Resources Estimate – Pirquitas Deposit

The Mineral Resources have been estimated for the Pirquitas property in conformity with generally accepted guidelines and reported in accordance with S-K 1300. The Pirquitas resource model presented in this Puna21TRS was completed on 30 September 2013 and the reasonable prospects of the underground mining scenario was completed on 24 January 2018.

The Mineral Resources estimate has been generated for the Mining Area veins from drillhole sample assay results and the interpretation of a geological model which relates to the spatial distribution of silver and zinc. Interpolation characteristics were defined based on the geology, drillhole spacing, and geostatistical analysis of the data.

Estimations were made from 3D cell models based on geostatistical applications using commercial software. The model uses a cell size of 4 m x 4 m x 8 m cells to be compatible with the grade control model.

The Mineral Resources were classified according to proximity to sample data locations.

Table 1.3 and Table 1.4 summarise the estimate of Mineral Resources for the Pirquitas project effective as of 31 December 2021. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. The quantity and grade of reported Inferred Mineral Resources are uncertain in nature and there has been insufficient exploration to classify these Inferred Mineral Resources as Indicated or Measured Mineral Resources. It cannot be assumed that all or any part of an Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resources as a result of continued exploration.

In determining the cut-off grade, the reasonable prospects for eventual economic extraction requirement generally implies that the quantity and grade estimates meet certain economic thresholds, taking into account an underground mining extraction scenario.

21015Puna21TRS220927Rev0.docx Page 6 of 175

Table 1.3 Summary of Pirquitas Mineral Resources Estimate Exclusive of Mineral Reserves (as at 31 December 2021)

Based on $20.00/oz Silver, $1.10/lb Lead, and $1.30/lb Zinc

| | | | | | | | | | | | | | | | | | | | | | | |

| Mineral Resources Classification | Tonnage

(kt) | Grades | Contained Metal |

Ag

(g/t) | Pb

(%) | Zn

(%) | Silver

(koz) | Lead

(klb) | Zinc

(klb) |

| Measured | 79 | 444.5 | 0.197 | 1.17 | 1,129 | 343 | 2,044 |

| Indicated | 2,555 | 287.7 | 0.016 | 4.56 | 23,627 | 895 | 256,672 |

| Measured + Indicated | 2,634 | 292.4 | 0.021 | 4.46 | 24,756 | 1,240 | 258,715 |

| Inferred | 1,080 | 206.9 | 0.004 | 7.45 | 7,185 | 95 | 177,394 |

1. The Mineral Resources estimates are contained within underground mining shapes based on $90/t to $100/t NSR cut-off.

2. The Mineral Resources estimates are based on metal price assumptions of $20.00/oz silver, $1.30/lb zinc, and $1.10/lb lead.

3. Metallurgical recoveries vary with grade and on average are, 87% silver and 85% for zinc and 50% for lead.

4. The point of reference for Mineral Resources is the point of feed into the processing facility

5. Mineral Resources are reported exclusive of Mineral Reserves.

6. SSR has 100% ownership of the Project.

7. All ounces reported represent troy ounces, and g/t represents grams per metric tonne.

8. Totals may vary due to rounding.

Table 1.4 Summary of Metallurgical Recoveries and Ownership of Pirquitas Mineral Resources Estimate Exclusive of Mineral Reserves (as at 31 December 2021) Based on $20.00/oz Silver, $1.10/lb Lead, and $1.30/lb Zinc

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mineral Resources Classification | Tonnage

(kt) | Grades | Metallurgical Recovery | Cut-off NSR ($/t) |

Ag

(g/t) | Pb

(%) | Zn

(%) | Silver

(%) | Lead

(%) | Zinc

(%) |

| Measured | 79 | 444.5 | 0.197 | 1.17 | 87 | 50 | 85 | 100 |

| Indicated | 2,555 | 287.7 | 0.016 | 4.56 | 87 | 50 | 85 | 100 |

| Measured + Indicated | 2,634 | 292.4 | 0.021 | 4.46 | 87 | 50 | 85 | 100 |

| Inferred | 1,080 | 206.9 | 0.004 | 7.45 | 87 | 50 | 85 | 100 |

1. The Mineral Resources estimate is contained within underground mining shapes based on $90/t to $100/t NSR cut-off.

2. The Mineral Resources estimates are based on metal price assumptions of $20.00/oz silver, $1.30/lb zinc, and $1.10/lb lead.

3. Metallurgical recoveries vary with grade and on average are, 87% silver and 85% for zinc and 50% for lead.

4. The point of reference for Mineral Resources is the point of feed into the processing facility

5. Mineral Resources are reported exclusive of Mineral Reserves.

6. SSR has 100% ownership of the Project.

7. All ounces reported represent troy ounces, and g/t represents grams per metric tonne.

8. Totals may vary due to rounding.

21015Puna21TRS220927Rev0.docx Page 7 of 175

1.9 Mineral Reserves Estimates

1.9.1 Mineral Reserves Estimate – Chinchillas

Open pit mining is carried out by MPSA as an owner-mining operation with ore hauled from the Chinchillas pit to the Pirquitas plant. The Mineral Reserves were developed based on mine planning work completed in 2021 that included pit optimisation and re-design of the pit phases. Table 1.5 and Table 1.6 summarise the Mineral Reserves for Chinchillas. The Chinchillas Mineral Reserves estimate has been generated for the Mantos deposit based on the following inputs: metal prices, resource model, geotechnical information, operating costs, mineral processing recoveries, concentrate transport, and off site costs and charges. Costs for all areas of the operation are estimated from actual costs. These were used to calculate a net smelter return (NSR) and $44.11/t NSR was used for the Mineral Reserves cut-off.

Metal prices for the Mineral Reserves cut-off were estimated after analysis of consensus industry forecasts and compared to metal prices used in other published studies. The prices selected were then reduced from the average long-term prices to take a conservative view of the long-term price. The long-term prices for the cut-off were assumed to apply from the start of 2026. The metal prices are representative of the range of price estimates publicly reported for Mineral Reserves cut-offs.

Table 1.5 Summary of Chinchillas Mineral Reserves Estimate (as at 31 December 2021)

Based on $18.50/oz Silver, $0.90/lb Lead, and $1.05/lb Zinc

| | | | | | | | | | | | | | | | | | | | | | | |

| Mineral Reserves Classification | Tonnage

(kt) | Grade | Contained Metal |

Ag

(g/t) | Pb

(%) | Zn

(%) | Silver

(koz) | Lead

(klb) | Zinc

(klb) |

| Proven | 2,379 | 168.9 | 1.33 | 0.34 | 12,918 | 69,735 | 17,827 |

| Probable | 5,041 | 155.3 | 1.29 | 0.25 | 25,174 | 143,344 | 27,780 |

| Probable Stockpiles | 187 | 141.0 | 1.33 | 0.50 | 846 | 5,470 | 2,056 |

| Proven + Probable | 7,606 | 159.2 | 1.30 | 0.28 | 38,938 | 218,681 | 47,692 |

1. Mineral Reserves are reported based on 31 December 2021 topography surface.

2. The Mineral Reserves estimates are based on metal price assumptions of $18.50/oz silver, $0.90/lb lead, and $1.05/lb zinc.

3. The Mineral Reserves estimates are reported at a cut-off grade of $44.11/t NSR.

4. Economic analysis for the Mineral Reserves has been prepared using long-term metal prices of $21.00/oz silver, $0.90/lb lead, and $1.20/lb zinc

5. Processing recoveries vary based on the feed grade. The average recovery is estimated to be 98% for silver, 95% for lead and approximately 63% for zinc.

6. Metals shown in this table are the contained metals in ore mined and processed.

7. The point of reference for Mineral Resources is the point of feed into the processing facility.

8. SSR has 100% ownership of the Project.

9. All ounces reported represent troy ounces, and g/t represents grams per metric tonne.

10. Totals may vary due to rounding.

21015Puna21TRS220927Rev0.docx Page 8 of 175

Table 1.6 Summary of Metallurgical Recoveries of Chinchillas Mineral Reserves Estimate (as at 31 December 2021)

Based on $18.50/oz Silver, $0.90/lb Lead, and $1.05/lb Zinc

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mineral Reserves Classification | Tonnage

(kt) | Grades | Metallurgical Recovery | Cut-off NSR ($/t) |

Ag

(g/t) | Pb

(%) | Zn

(%) | Silver

(%) | Lead

(%) | Zinc

(%) |

| Proven | 2,379 | 168.9 | 1.33 | 0.34 | 98 | 95 | 63 | 44.11 |

| Probable | 5,041 | 155.3 | 1.29 | 0.25 | 98 | 95 | 63 | 44.11 |

| Probable Stockpiles | 187 | 141.0 | 1.33 | 0.50 | 98 | 95 | 63 | 44.11 |

| Proven + Probable | 7,606 | 159.2 | 1.30 | 0.28 | 98 | 95 | 63 | 44.11 |

1. Mineral Reserves are reported based on 31 December 2021 topography surface.

2. The Mineral Reserves estimates are based on metal price assumptions of $18.50/oz silver, $0.90/lb lead, and $1.05/lb zinc.

3. The Mineral Reserves estimates are reported at a cut-off grade of $44.11/t NSR.

4. Economic analysis for the Mineral Reserves has been prepared using long-term metal prices of $21.00/oz silver, $0.90/lb lead, and $1.20/lb zinc

5. Processing recoveries vary based on the feed grade. The average recovery is estimated to be 98% for silver, 95% for lead and approximately 63% for zinc.

6. Metals shown in this table are the contained metals in ore mined and processed.

7. The point of reference for Mineral Resources is the point of feed into the processing facility.

8. SSR has 100% ownership of the Project.

9. All ounces reported represent troy ounces, and g/t represents grams per metric tonne.

10. Totals may vary due to rounding.

1.10 Metallurgy and Processing

The metallurgical testing of Chinchillas ore types commenced in 2013 and continued until 2016. The first testwork was focused on silver recovery by both leaching and flotation methods with flotation proving to be superior at this early stage. The second programme continued process development of flotation into separate lead / silver and zinc concentrates. The third testwork campaign was designed to advance the flotation process and test specifically these ore types in the Pirquitas mill flow sheet.

The Pirquitas process plant operating performance since commencement on Chinchillas ores is used to provide the concentrate grade recovery and mass pull relationships, Table 1.7 and Table 1.8.

Table 1.7 Silver / Lead Concentrate Relationships

| | | | | |

| Variable | Variable Formula |

| Ag Recovery | (–0.0631 x Pb recovery2) + (11.655 x Pb recovery) -447.4 |

| Pb Recovery | (–2.6303x Pb Feed2) + (12.329 x Pb Feed) + 80.654 |

| Zn Recovery | (-5.2817 x Zn Feed2)+(Zn Feed x –6.31) + 20.546 |

| Mass Pull | (–0.0024 x Pb Feed2) + (0.0164 x Pb Feed)+-0.0007 |

21015Puna21TRS220927Rev0.docx Page 9 of 175

Table 1.8 Zinc Concentrate Relationships

| | | | | |

| Variable | Variable Formula |

| Ag recovery | (–3.4843 x Zn feed2) + (7.2499 x Zn feed)+0.8295 |

| Pb recovery | (0.024 x (Pb feed / Zn feed)2) + (-0.5988 x (Pb feed / Zn feed)+ 3.1292 |

| Zn recovery | (–195921 x (mass pull Zn)2 + (5620.3 x mass pull Zn)+28.709 |

| Mass Pull | (0.007 x Zn feed2) + (0.0041 x Zn feed+0.0011 |

1.11 Environment, Communities, and Permitting

There are seven communities located in the project's area of influence. and are included in management plans for training and capacity building.

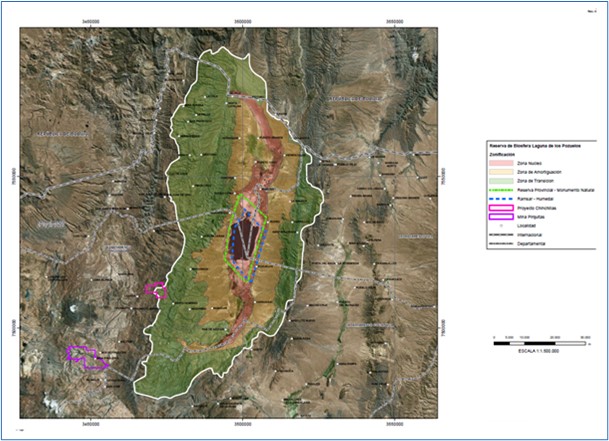

The Puna project does not intrude upon any protected areas. Water quality in the surface waters draining the Project area is typical of a mineralised zone, including some observed elevated metals parameters, but with generally neutral pH. The waste rock is expected to be largely non-acid generating, with a small portion that may be weakly acid generating under certain oxidising conditions. The waste rock with potential for acid production will be placed so any drainage will report to the pit and avoid introduction to the environment.

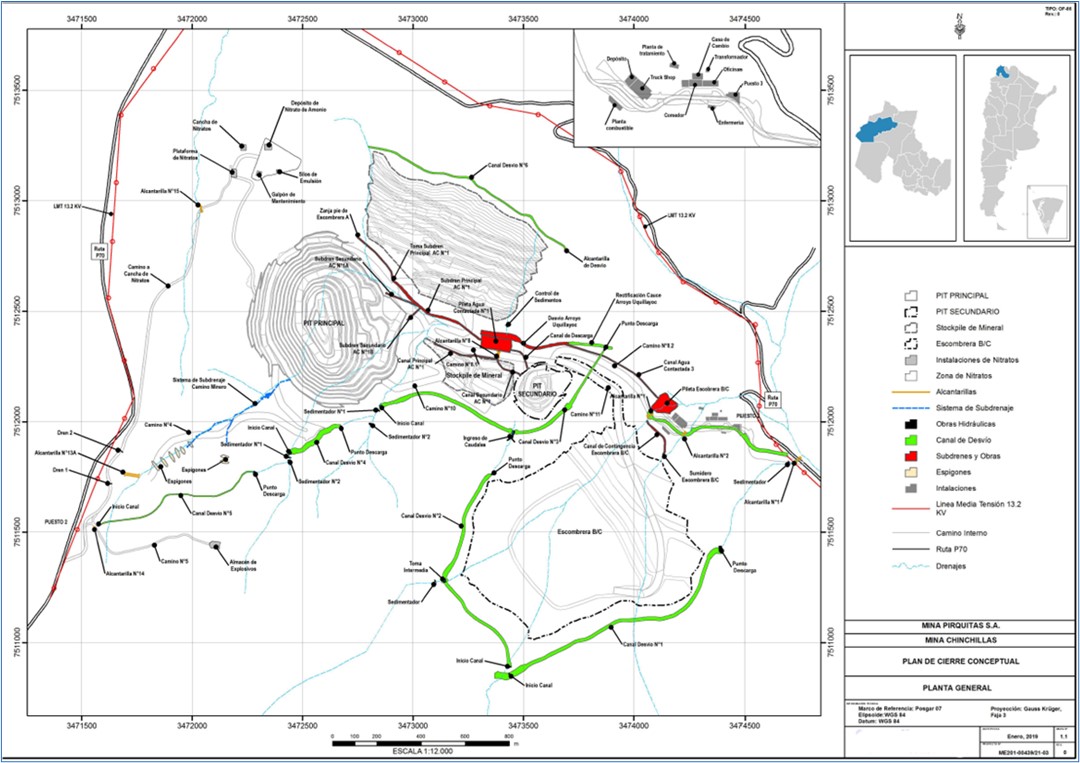

Although there is no specific mine closure legislation nor bonding requirements in Argentina, a conceptual closure plan has been developed for the Project. Closure costs are estimated at $30.6M. MPSA is also responsible for the closure costs associated with the Pirquitas pit.

An Environmental and Social Impact Assessment (ESIA) was completed for the Chinchillas project and submitted to the regulatory authorities of the province of Jujuy for review, with the license obtained in December 2017. The biannual update of the ESIA was submitted in due time and form, being pending approval by the regulatory authorities of the province of Jujuy. In addition, an addendum to the ESIA for the Pirquitas mine was obtained from MPSA to use the Pirquitas pit for tailings deposition at the Pirquitas Operation, and this authorization must be renewed.

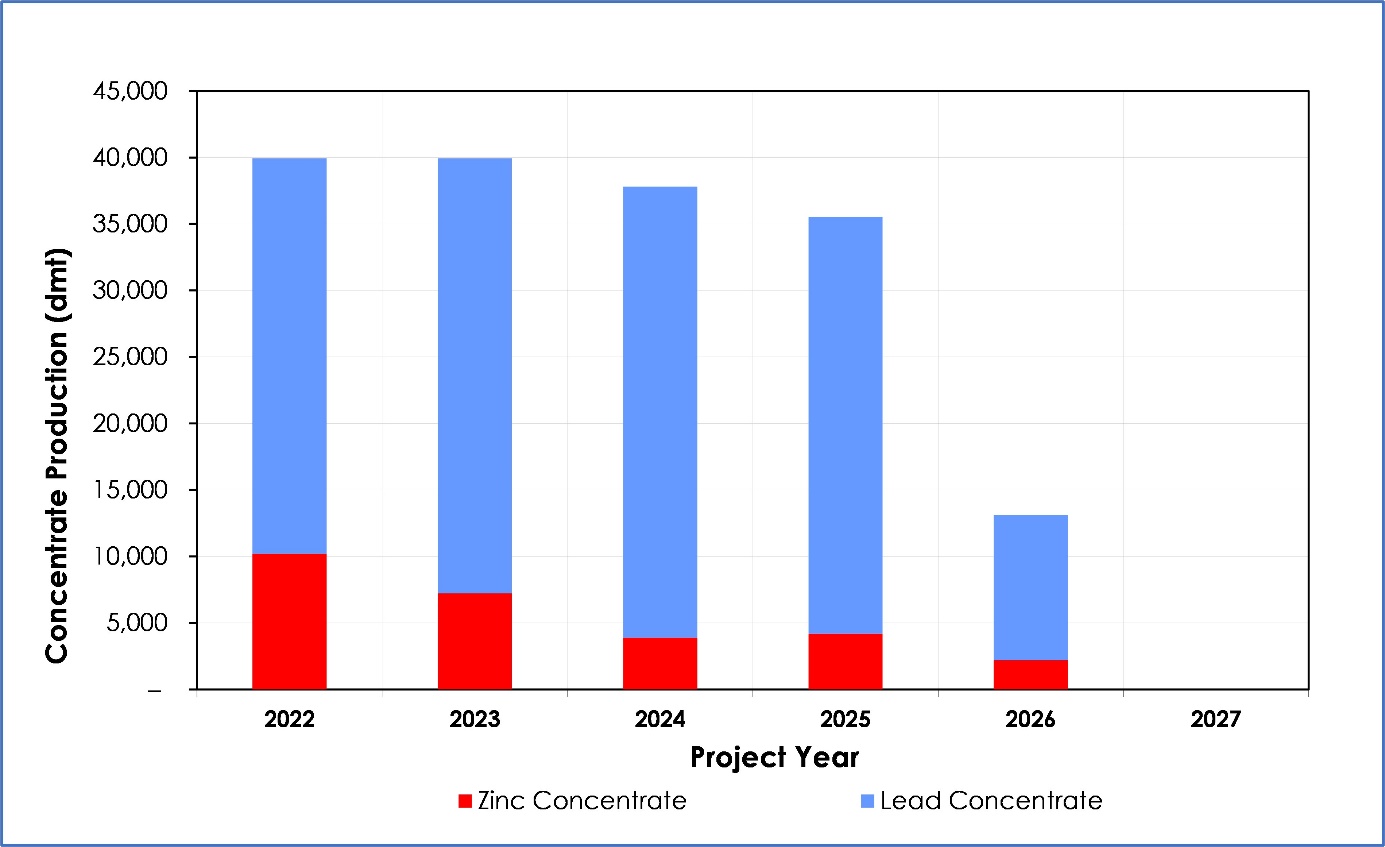

1.12 Production

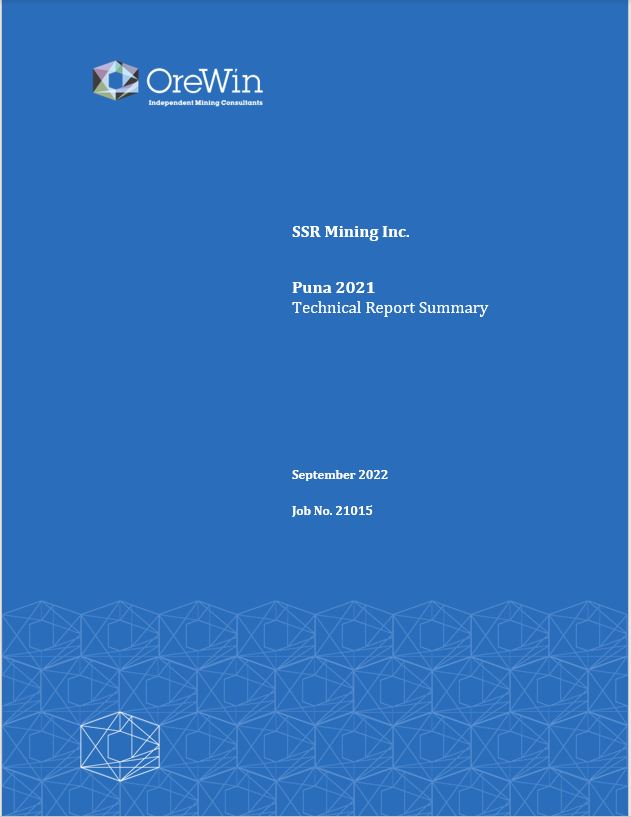

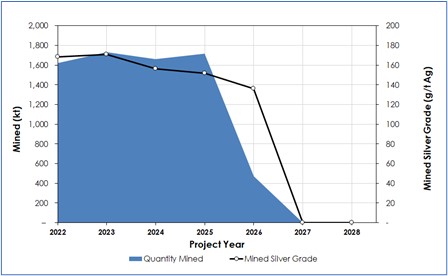

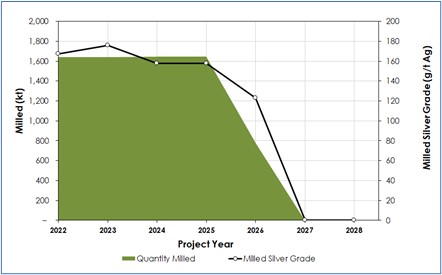

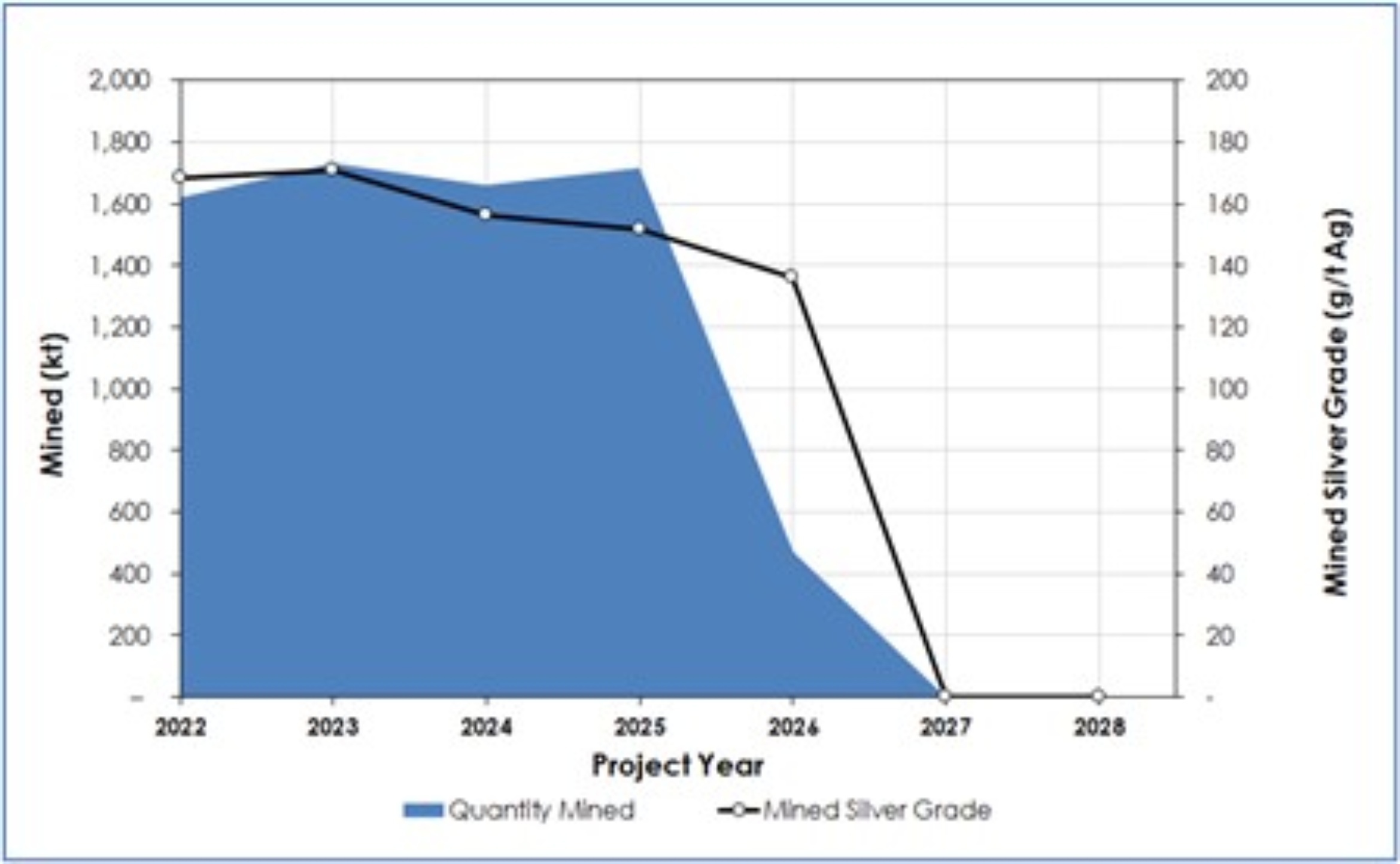

Future proposed mine production has been scheduled to optimise the mine output and meet the plant capacity. The mining production forecasts are shown in Table 1.9. Mine, process, and metal production are shown in Figure 1.1 to Figure 1.3.

21015Puna21TRS220927Rev0.docx Page 10 of 175

Table 1.9 Mining Production Statistics

| | | | | | | | |

| Item | Unit | Total LOM |

| Ore Processed | | |

| Processed | kt | 7,352 |

| Ag Feed Grade | g/t | 160 |

| Pb Feed grade | % | 1.32 |

| Zn Feed grade | % | 0.29 |

| Silver Recovery | % | 95.5 |

| Concentrate Produced | | |

| Lead Concentrate – in Stockpile | kt | 4 |

| Zinc Concentrate – in Stockpile | kt | 1 |

| Lead Concentrate – Produced | kt | 135 |

| Zinc Concentrate – Produced | kt | 27 |

| Lead Concentrate - Total | kt | 139 |

| Zinc Concentrate - Total | kt | 28 |

| Metal Produced | | |

| Silver | koz | 37,210 |

| Lead | Mlb | 204 |

| Zinc | Mlb | 29 |

Metal produced includes current concentrate stockpiles containing 242 koz silver and 5 Mlb lead.

Figure 1.1 Mining Production Profile

OreWin, 2021

21015Puna21TRS220927Rev0.docx Page 11 of 175

Figure 1.2 Process Feed Profile

OreWin, 2021

Figure 1.3 Silver Production

OreWin, 2021

21015Puna21TRS220927Rev0.docx Page 12 of 175

1.13 Capital and Operating Costs

The cost estimate was prepared by the SSR technical department at site. The QPs reviewed the assumptions, parameters, and methods used to prepare the cost estimate and are of the opinion that they are sufficient for the purposes of validating the economics of the Mineral Reserves. Total capital expenditure is estimated to be $99M.

The life-of-mine (LOM) operating costs are approximately $52.67/t of ore milled, as summarised in Table 1.10.

Table 1.10 Operating Costs Estimate

| | | | | | | | |

| Cost Component | Amount

($M) | LOM Average

($/t milled) |

| Mining | 110 | 15.01 |

| Processing | 183 | 24.95 |

| G&A | 93 | 12.71 |

| Total Operating Costs | 387 | 52.67 |

1.14 Economic Analysis

The estimates of cash flows have been prepared on a real basis as at 1 January 2022 and a mid-year discounting is used to calculate NPV.

The projected financial results include:

•After-tax NPV at a 5% real discount rate is $228M.

•Mine life of five years.

The estimated total cash costs for the LOM is $11.63/oz payable silver. The all-in sustaining costs (AISC) for the LOM, which includes infrastructure capital, capital development and reclamation, averages $13.57/oz payable silver. Unit costs include concentrate in stockpile. Silver provides the primary revenue for the analysis, with contributions from lead and zinc. Credits from lead and zinc are included in the cash cost.

Metal price assumptions used for the economic analysis are shown in Table 1.11.

Table 1.11 Metal Price Assumptions

| | | | | | | | | | | | | | | | | | | | |

| Commodity | Unit | 2022 | 2023 | 2024 | 2025 | Long-Term |

| Silver | $/oz | 24.00 | 23.00 | 22.00 | 21.00 | 21.00 |

| Lead | $/lb | 1.00 | 0.95 | 0.93 | 0.92 | 0.90 |

| Zinc | $/lb | 1.30 | 1.20 | 1.20 | 1.20 | 1.20 |

Other key economic assumptions for the discounted cash flow analyses are shown in Table 1.12.

21015Puna21TRS220927Rev0.docx Page 13 of 175

Table 1.12 Key Economic Assumptions

| | | | | | | | | | | |

| Model Assumption | Unit | Lead Concentrate | Zinc Concentrate |

| Treatment Charge and Refinery Charge(TCRC) | $/t Conc. | 1,191 | 724 |

| Payability – Silver | % | 95 | 75 |

| Payability – Lead | % | 95 | |

| Payability – Zinc | % | | 85 |

| Deduction – Lead | % | 3 | |

| Deduction – Zinc | % | | 8 |

| Minimum Payout Factor | % | 63 | 39 |

| Royalty | % | 3 | 3 |

| Export Duty (revenue minus TCRC's) | % | 4.5 | 4.5 |

| Puna Credit (revenue minus TCRC's) | % | 2.5 | 2.5 |

The key results of the Puna21TRS are summarised in Table 1.13. The projected financial results at a range of discount rates for undiscounted and discounted cash flows and before and after tax are shown in Table 1.14.

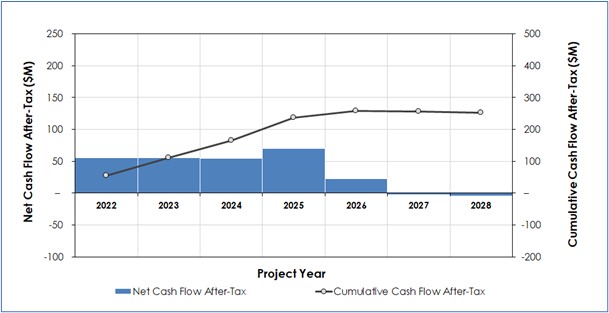

The results of NPV5% sensitivity analysis to a range of changes in silver price (primary commodity) and discount rates is shown in Table 1.15. A chart of the cumulative cash flow is shown in Figure 1.4.

21015Puna21TRS220927Rev0.docx Page 14 of 175

Table 1.13 Puna21TRS Results Summary

| | | | | | | | |

| Description | Unit | Total LOM |

| Ore Processed | | |

| Ore Tonnes Treated | kt | 7,352 |

| Ag Feed grade | g/t | 160 |

| Pb Feed grade | % | 1.32 |

| Zn Feed grade | % | 0.29 |

| Silver Recovery | % | 95.5 |

| Concentrates | | |

| Lead Concentrate – in Stockpile | kt | 4 |

| Zinc Concentrate – in Stockpile | kt | 1 |

| Lead Concentrate – Produced | kt | 135 |

| Zinc Concentrate – Produced | kt | 27 |

| Lead Concentrate - Total | kt | 139 |

| Zinc Concentrate - Total | kt | 28 |

| Metal Produced | | |

| Silver | koz | 37,210 |

| Lead | Mlb | 204 |

| Zinc | Mlb | 29 |

| Key Financial Results | | |

| Mine Site Cash Cost | $/oz payable silver | 11.61 |

Royalties and Refining Costs1 | $/oz payable silver | 6.10 |

| Credits | $/oz payable silver | –6.08 |

Total Cash Costs (CC) (after credits)1 | $/oz payable silver | 11.63 |

| All-in Sustaining Costs (AISC) | $/oz payable silver | 13.57 |

| Site Operating Costs | $/t milled | 52.67 |

| Average Silver Price | $/oz | 22.38 |

NPV1 | $M | 228 |

| Discount Rate | % | 5 |

| Mine Life | years | 5 |

1 Metal produced includes current concentrate stockpiles containing 242 koz silver and 5 Mlb lead.

21015Puna21TRS220927Rev0.docx Page 15 of 175

Table 1.14 Financial Results

| | | | | | | | |

| Discount Rate | NPV

($M) |

| Before-Tax | After-Tax |

| Undiscounted | 279 | 253 |

| 2% | 268 | 242 |

| 5% | 253 | 228 |

| 10% | 231 | 206 |

| 12% | 223 | 199 |

| 15% | 212 | 188 |

| 18% | 202 | 179 |

| 20% | 195 | 173 |

Note: NPV includes concentrate in stockpile

Table 1.15 After-Tax NPV Sensitivity to Silver Price and Discount Rates

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| After-Tax NPV | Silver Price

($/oz) |

| 10.00 | 15.00 | 18.50 | 19.00 | 21.00 | 22.00 | 24.00 | 27.00 | 30.00 |

| Discount Rate | $M | $M | $M | $M | $M | $M | $M | $M | $M |

| Undiscounted | –17 | 105 | 192 | 204 | 253 | 278 | 327 | 401 | 474 |

| 2% | –17 | 101 | 183 | 195 | 242 | 266 | 313 | 384 | 454 |

| 5% | –16 | 95 | 172 | 183 | 228 | 250 | 294 | 360 | 427 |

| 10% | –14 | 86 | 156 | 166 | 206 | 226 | 266 | 327 | 387 |

| 12% | –14 | 83 | 150 | 160 | 199 | 218 | 257 | 315 | 373 |

21015Puna21TRS220927Rev0.docx Page 16 of 175

Figure 1.4 After-Tax Annual and Cumulative Cash Flow

OreWin, 2021

1.15 Interpretation and Conclusions

1.15.1 Mineral Resources

Mineral Resources for the Puna21TRS are reported in accordance with S-K 1300.

Areas of uncertainty that may materially impact the Mineral Resources estimates include:

•Assumptions used to generate the data for consideration of reasonable prospects of eventual economic extraction for the Puna deposit.

•Environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

•Commodity prices and exchange rates.

•Cut-off grades.

1.15.1.1 Chinchillas

The resource model developed for the Chinchillas deposit uses accepted modelling and grade estimation methods. The model is a reasonable reflection of deposit geology. The approach used to generate the cell model is in accordance with accepted industry standards. The QP has checked the data and methods used to develop the resource model and has validated the resource models. The methods used for the estimate of Mineral Resources and Mineral Reserves is in accordance with S-K 1300.

21015Puna21TRS220927Rev0.docx Page 17 of 175

1.15.1.2 Pirquitas

The resource model developed for the Pirquitas deposit uses accepted modelling and grade estimation methods. The model is a reasonable reflection of deposit geology. The approach used to generate the cell model is in accordance with accepted industry standards. The QP has checked the data and methods used to develop the resource model and has validated the resource models. The methods used for the estimate of Mineral Resources and Mineral Reserves is in accordance with S-K 1300.

1.15.2 Mineral Reserves

Mineral Reserves for the Puna21TRS are reported in accordance with S-K 1300.

Areas of uncertainty that may impact the Mineral Reserves estimate include:

•Any changes to the resource model as a result of further definition drilling at the site.

•Changes to mining conditions that have an impact to operating costs, production rates or mining recovery factors.

•Commodity prices and exchange rates.

1.16 Recommendations

The QPs are not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

1.16.1 Further Assessment

The key areas for further studies / work are:

•Potential remains to expand the current Mineral Resource, and to define new Mineral Resources on the property.

•Optimisation of metal prices and cost input parameters.

•More detailed planning and design for rock storage and the general site layout.

•Additional metallurgical laboratory testwork as detailed in Section 10.4.

•Update site standard operating procedures to include a transparent Mineral Resources estimation and Mineral Reserves estimation process, clearly documenting the key input parameters applied, and an audit trail of approvals for each phase of the work performed.

•Continue with ongoing review of capital and operating cost estimates and performance and productivity tracking.

21015Puna21TRS220927Rev0.docx Page 18 of 175

2 INTRODUCTION

The Puna21TRS has been in prepared in accordance with the U.S. Securities and Exchange Commission (US SEC) Regulation S-K subpart 1300 rules for Property Disclosures for Mining Registrants (S-K 1300). This is the first Technical Report Summary for the Puna project.

The Puna project (Puna, or the Project) is directly owned (100%) by SSR Mining Inc. (SSR) through a subsidiary company Puna Operations Inc. (POI) which through other 100% owned subsidiaries owns Mina Pirquitas S.A. (MPSA). MPSA operates the project. SSR has reported that the total cost of the gross mineral properties, plant, and equipment as of 31 December 2021 was $372.4M.

SSR is a gold mining company with four producing assets located in the USA, Turkey, Canada, and Argentina, and with development and exploration assets in the USA, Turkey, Mexico, Peru, and Canada. SSR is listed on the NASDAQ Capital Markets (NASDAQ:SSRM), the Toronto Stock Exchange (TSX:SSRM), and the Australian Stock Exchange (ASX:SSR).

The Project comprises Chinchillas and the Pirquitas property, both of which are located the Jujuy Province in far north Argentina. Ore from the Chinchillas mine is transported to the Pirquitas plant for processing. The Chinchillas mine is located approximately 45 km from the Pirquitas plant. The open pit mine at Pirquitas has been completed.

2.1 Terms of Reference

The Puna21TRS is an independent Technical Report Summary (TRS) on the Project, prepared for SSR by the Puna21TRS Qualified Persons (QPs). The Puna21TRS is based on information and data supplied to the QPs by SSR and other parties where necessary. Any individual or entity referenced as having completed work relevant to the Puna21TRS, but not identified therein as a QP, does not constitute a QP. Puna21TRS QPs have reviewed the supplied data and information and accept this information as being accurate and complete and suitable for use in the Puna21TRS. The primary source of data for the Puna21TRS is the Puna 2021 Project Update Report.

Section 25 describes any information and data supplied by SSR that was outside the areas of expertise of the QPs and was relied upon when forming the findings and conclusions of this report.

The QPs have used their experience and industry expertise to produce the estimates and approximations in the Puna21TRS. It should be noted that all estimates and approximations contained in the Puna21TRS will be prone to fluctuations with time and changing industry circumstances.

The purpose of this Puna21TRS is to report the Mineral Resources and Mineral Reserves for the project. This report is a Feasibility Study (FS) that represents forward-looking information. The forward-looking information includes metal price assumptions, cash flow forecasts, projected capital and operating costs, metal recoveries, mine life and production rates, and other assumptions used in the FS. Readers are cautioned that actual results may vary from those presented. The factors and assumptions used to develop the forward-looking information, and the risks that could cause the actual results to differ materially are presented in the body of this report under each relevant section.

The conclusions and estimates stated in the Puna21TRS are to the accuracy stated in the Puna21TRS only and rely on assumptions stated in the Puna21TRS. The results of further work may indicate that the conclusions, estimates, and assumptions in the Puna21TRS need to be revised or reviewed.

21015Puna21TRS220927Rev0.docx Page 19 of 175

The Puna21TRS should be construed in light of the methods, procedures, and techniques used to prepare the Puna21TRS. Sections or parts of the Puna21TRS should not be read in isolation of, or removed from, their original context.

The Puna21TRS is intended to be used by SSR, subject to the terms and conditions of its contract with OreWin. Recognising that SSR has legal and regulatory obligations, OreWin has consented to the filing of the Puna21TRS with US SEC. Except for the purposes legislated, any other use of this report by any third party is at that party's sole risk.

A list of the references used to prepare the Puna21TRS is provided in Section 24.

2.2 Qualified Persons

The following people served as the QPs as defined in subpart 1300 of US Regulation S-K Mining Property Disclosure Rules (S-K 1300):

•Gregory Gibson, BSc (Mining Engineering), MSc (Mining & Earth Systems Engineering), SME Registered Member (4134135), employed by SSR Mining Inc. as Vice President of Operations - Americas, was responsible for the preparation of Sections 1 to 25.

•Bernard Peters, BEng (Mining), FAusIMM (201743), employed by OreWin Pty Ltd as Technical Director – Mining, was responsible for the overall preparation, the Mineral Reserves estimates, and Sections 1 to 5; Section 10; and Sections 12 to 25.

•Sharron Sylvester, BSc (Geol), RPGeo AIG (10125), employed by OreWin Pty Ltd as Technical Director – Geology, was responsible for the preparation of the Mineral Resources, Sections 1 to 3; Sections 6 to 9; Section 11; and Sections 22 to 25.

2.3 Qualified Persons Property Inspections

Gregory Gibson visited the project 17 June 2021 to 1 July 2021 and 28 January 2022 to 9 February 2022. The site visits included briefings on geology, mine operations, processing, environmental, permitting, and site inspections of current mining and plant and infrastructure. In addition, Gregory has weekly calls with site leadership regarding the day-to-day operations and quarterly reviews of the operation performance.

Bernard Peters has not visited the site due to travel restrictions.

Sharron Sylvester has not visited the site due to travel restrictions.

2.4 Units and Currency

This Technical Report Summary uses metric measurements except where otherwise noted. The currency used is US dollars ($) unless otherwise stated.

2.5 Effective Dates

The report has several effective dates, as follows:

•Effective date of the Technical Report Summary: 31 December 2021

•Effective date of Mineral Resources: 31 December 2021

•Effective date of Mineral Reserves: 31 December 2021

21015Puna21TRS220927Rev0.docx Page 20 of 175

3 PROPERTY DESCRIPTION

3.1 Location

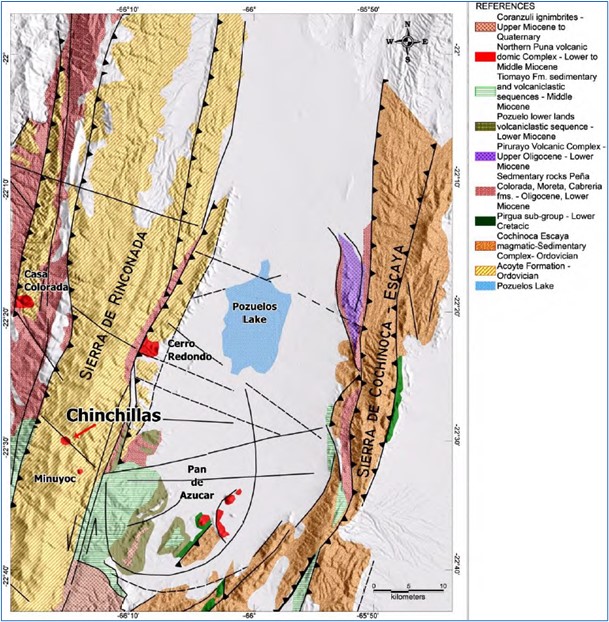

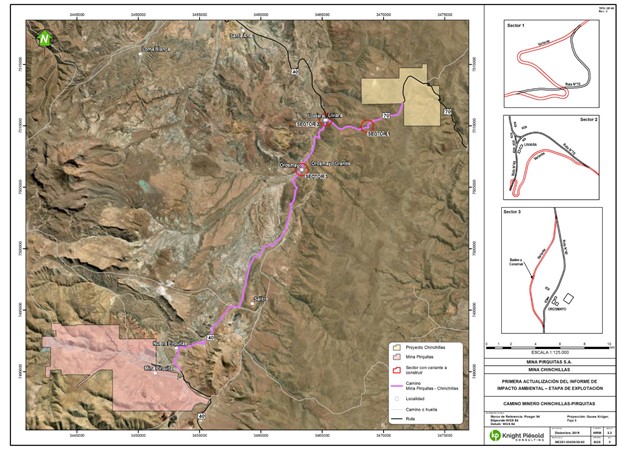

The Chinchillas property is located in the Puna region of north-western Argentina, in the province of Jujuy, department of Rinconada, approximately 290 km from the provincial capital of San Salvador de Jujuy (Figure 3.1). The property is centred at approximately at 3,473,150 mE and 7,512,360 mN (Gauss Kruger, Argentina, Posgar Zone 3; 22°30′13″ S, 66°15′39″ W) at elevations ranging from 4,000–4,200 metres above sea level (masl).

The Pirquitas Operation is also located in the Rinconada Department in the Province of Jujuy. The property is centred at 22°42′ south latitude and 66°30′ minutes west longitude. The city of San Salvador de Jujuy, (Jujuy) the provincial capital, is located approximately 335 km south-east of the property (Figure 1.2). The property is characterised by sparsely vegetated, mountainous terrain at elevations of between 4,000–4,450 masl.

Figure 3.1 Puna Operation Location

SSR, 2021

21015Puna21TRS220927Rev0.docx Page 21 of 175

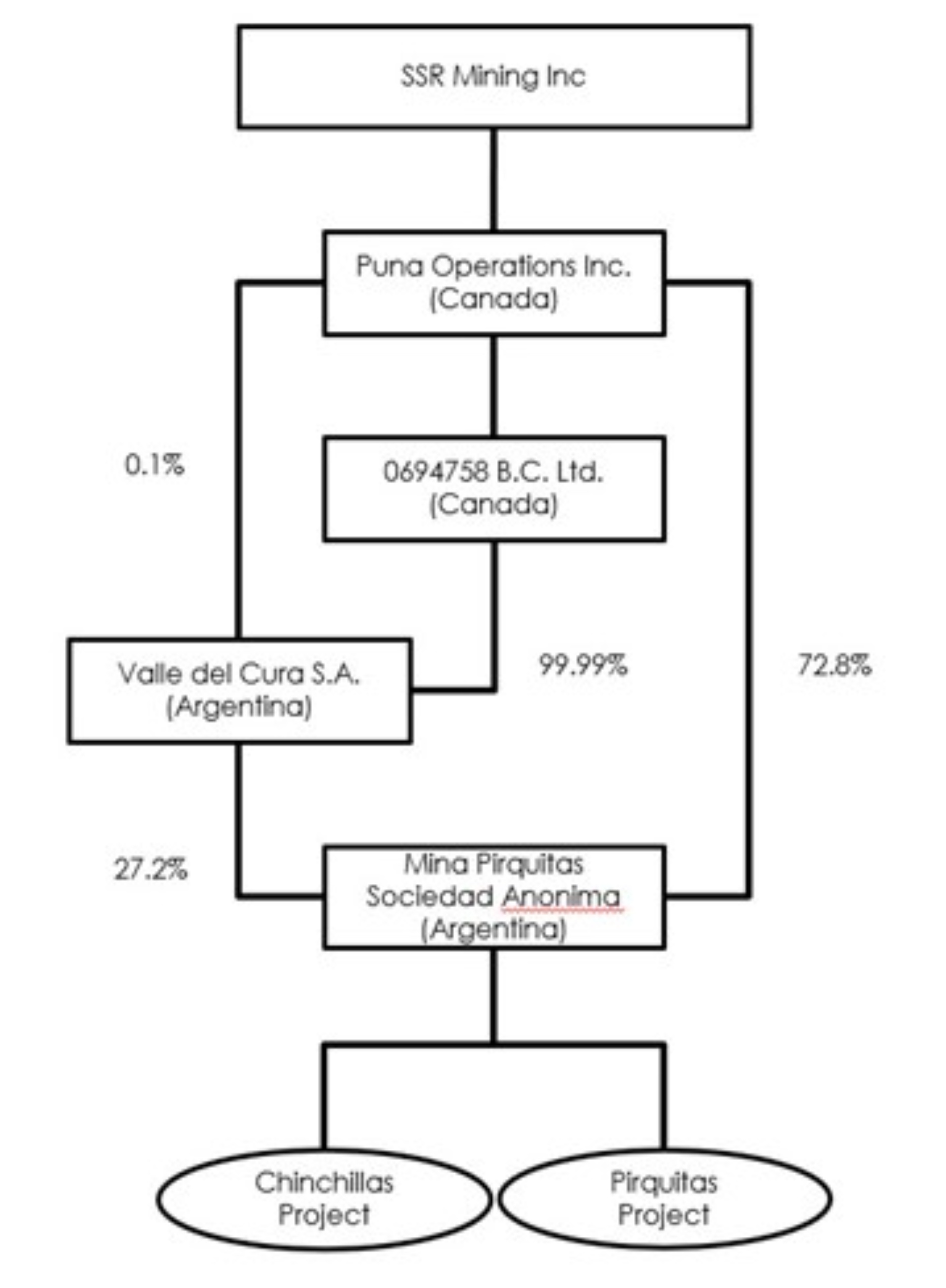

3.2 Ownership

SSR has 100% ownership of the Puna project. Puna is directly owned (100%) by SSR Mining Inc. (SSR) through a subsidiary company Puna Operations Inc. (POI) which through other 100% owned subsidiaries owns Mina Pirquitas S.A. (MPSA). MPSA operates the project. The corporate structure that links the Puna project and SSR is shown in Figure 3.2.

Figure 3.2 Puna Corporate Structure

SSR, 2021

21015Puna21TRS220927Rev0.docx Page 22 of 175

3.3 Mineral Tenure

3.3.1 Chinchillas Mineral Tenure

Exploitation concessions in Argentina are called ‘Minas’. Minas are defined by the following categories:

•First Category Minas include substances such as gold, silver, platinum, iron, lead, copper, zinc, aluminium, lithium, potassium, etc., and

•Second Category Minas comprise substances such as precious stones in riverbeds, any metal not included in the first category, and others.

The Mina is comprised of one or more ‘pertenencias’, which are units of mining properties. Pertenencias must be rectangular in shape.

In disseminated deposits, such as Chinchillas, the pertenencias can encompass up to 100 ha. The mining property fee or ‘canon’ for a Mina is charged every year. It is currently ARS$320 per pertenencia per year (article 215 Mining Code).

Individuals are entitled to explore for, exploit, and dispose of Minas as owners by means of a legal licence or legal concession granted by the competent authority under the provisions of the Argentine Mining Code. The legal concessions granted for the exploitation of Minas are valid for an undetermined period of time and are considered ‘real property’ giving the concessionaire the right to recover metals from the subsurface vertically underneath the concession, provided that the title holder complies with the obligations set out in the Argentine Mining Code.

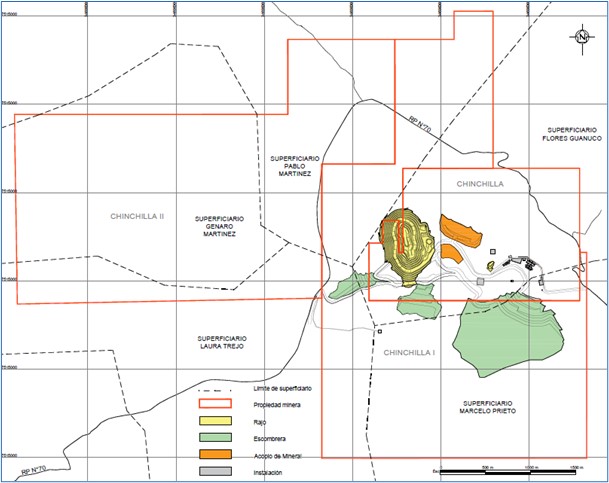

The Chinchillas property consists of three contiguous First Category Minas that cover an area of approximately 2,042.56 ha, as set out in Table 3.1 (see also Figure 3.3).

Table 3.1 Chinchillas Exploitation Concessions

| | | | | | | | |

| Concession | File No. | Area

(ha) |

| Chinchilla | 469-M-56 | 329 |

| Chinchilla I | 079-D-96 | 830.98 |

| Chinchilla II | 1943-V-2013 | 882.58 |

The Chinchilla Mina comprises four pertenencias, while the Chinchilla I and Chinchilla II Minas each comprise nine pertenencias.

All Minas are valid and in good standing.

By July 2015, Valle Del Cura S.A. (VDC) completed option payments to earn a 100% interest in the Chinchilla and Chinchilla I properties, to a total of $1,866,000 paid.

Subsequently, Mina Pirquitas S.A., upon commencement to build a mine on these two properties, paid $1,200,000 to the vendors.

The Chinchilla II Mina was acquired directly by VDC and is not subject to option payments.

Concentrates produced at the Project are subject to a maximum 3% ‘mouth of mine value’ royalty that is payable to the Province of Jujuy. This royalty payment is based on the net recoverable value of the contained metals less certain operating costs.

21015Puna21TRS220927Rev0.docx Page 23 of 175

MPSA and SSR have advised that all necessary permits and titles are in place for the current operations. Additional permitting updates may be required but MPSA advise that these are expected to be approved.

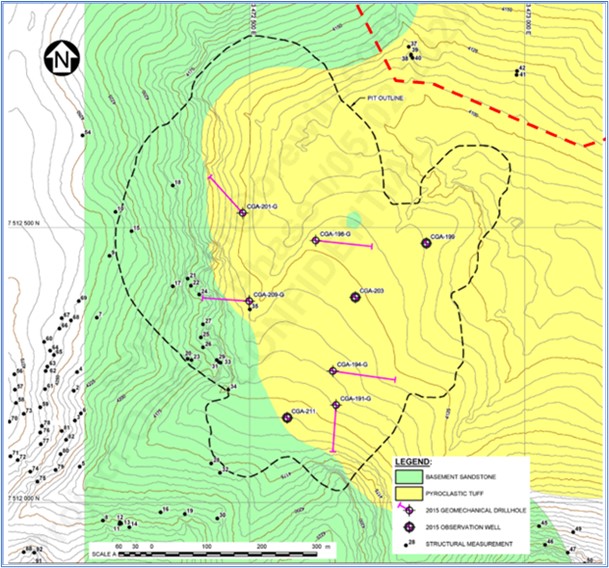

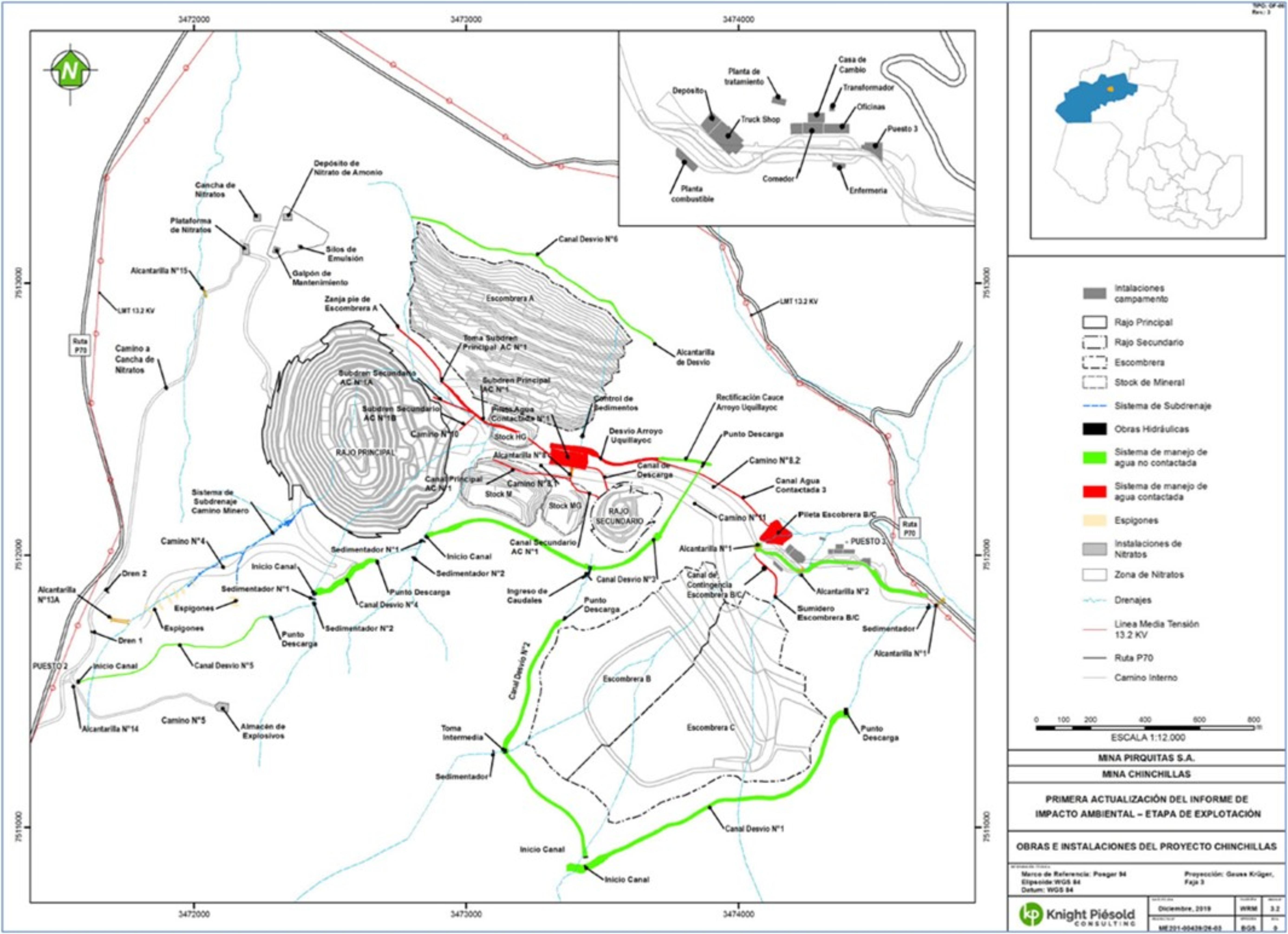

Figure 3.3 Property Map Showing Chinchilla, Chinchilla I and Chinchilla II Concessions

SSR, 2021

3.3.1.1 Chinchillas Surface Rights

MPSA entered into agreements with occupants and owners of the land on which Mina Chinchilla, Mina Chinchilla I, and Mina Chinchilla II are located to acquire the rights to carry out the Project. All of the Minas comprising the Chinchillas property, which provide exploration and exploitation rights, are valid and in good standing.

3.3.1.2 Chinchillas Permitting

According to the biannual Environmental Impact Study renewal, MPSA also submitted the second Update of Chinchillas mine in October 2021. This report is currently being reviewed by Mining Authorities.

21015Puna21TRS220927Rev0.docx Page 24 of 175

3.3.1.3 Chinchillas Environmental Liabilities

Prior to initiating work on the Chinchilla Mina, an inspection was performed by the mining and environmental authorities regarding potential pre-existing environmental liabilities. There are remnants of historical mining activities in the Project area, such as small buildings, small areas of workings excavated in the 1960’s, historical drilling platforms, trenches and holes. All of these liabilities were declared as pre-existing in Golden Arrow’s ESIA for the Chinchilla Mina, there were no findings and/or requests by the environmental authorities, and the Chinchilla ESIA report was approved.

3.3.1.4 Chinchillas Tenure Factors and Risks

Except as set out herein, to the extent known, there are no additional factors or risks that may affect the access, title, right or ability to perform work on the Chinchillas property.

3.3.2 Pirquitas Mineral Tenure

MPSA and SSR have advised that all necessary permits and titles are in place for the current operations. Additional permitting updates may be required but MPSA advise that these are expected to be approved.

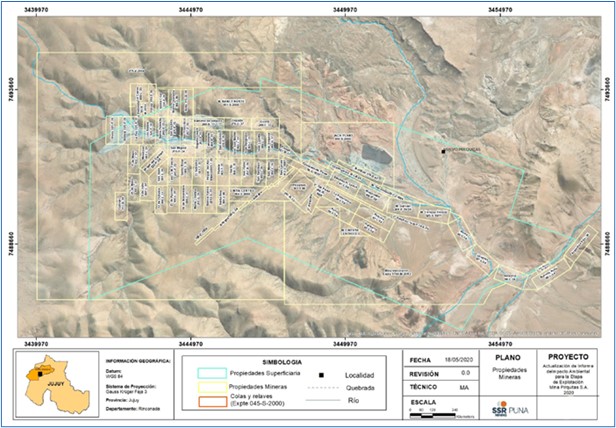

3.3.2.1 Pirquitas Operation Surface Rights

The Pirquitas Operation includes the surface rights to a group of nine contiguous land parcels covering an area of approximately 7,500 ha, as set out in Table 3.2 and shown in Figure 3.4. This area corresponds to the surface property owned by MPSA, the area of the mining concession is larger.

3.3.2.2 Pirquitas Exploitation Concessions

Mina Pirquitas comprises 54 mining properties (concessions) that cover an area of approximately 9,742 ha shown in Figure 3.4. These parcels were used for purposes such as housing, infrastructure, processing, and tailings facilities. MPSA is the freehold title holder of the area covered by such surface rights.

Table 3.2 Pirquitas Operation Surface Rights

| | | | | | | | |

| Parcel No. | Registration No. | Area

(ha) |

| 531 | L-1111 | 1,000.1 |

| 532 | L-1112 | 1,000.0 |

| 533 | L-1113 | 750.0 |

| 534 | L-1114 | 749.6 |

| 535 | L-1115 | 1,000.0 |

| 536 | L-1116 | 1,000.0 |

| 537 | L-1117 | 1,005.0 |

| 538 | L-1118 | 496.0 |

| 539 | L-1119 | 500.1 |

21015Puna21TRS220927Rev0.docx Page 25 of 175

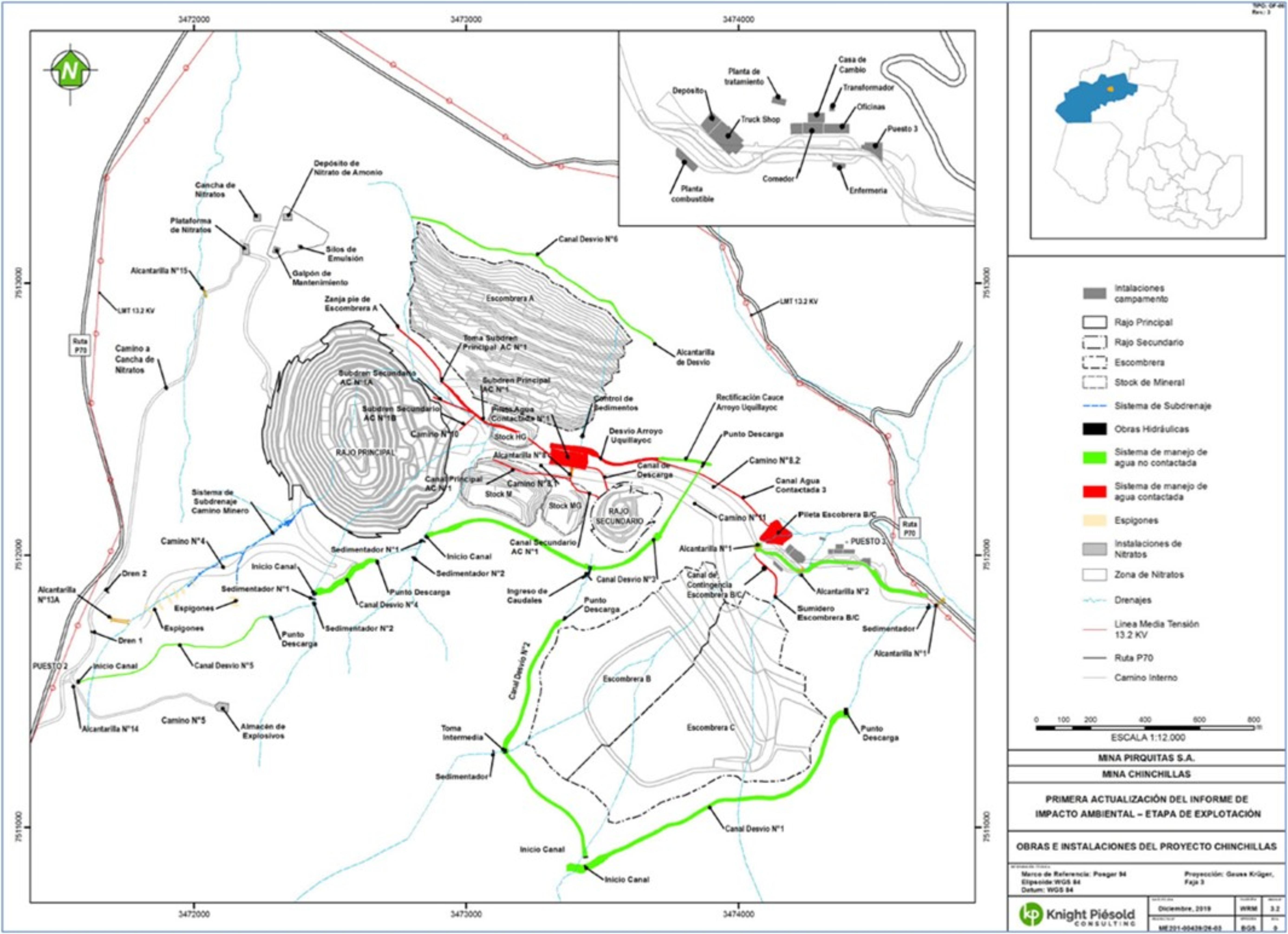

Figure 3.4 Property Map Showing Pirquitas Concessions

MPSA, 2020

3.3.2.3 Pirquitas Operation Permitting

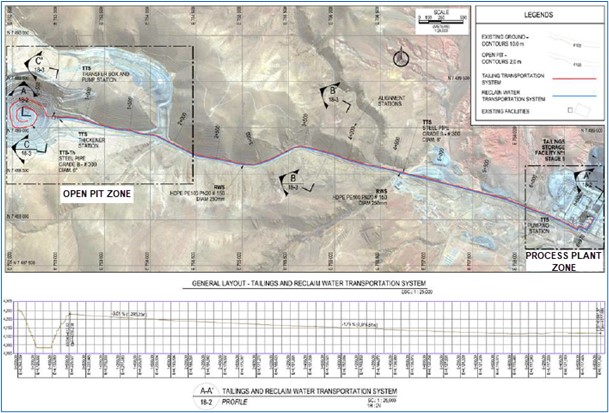

The capacity of the current tailings facility at Pirquitas has been exhausted and to maintain mining and processing production disposal of tailings has been into the Pirquitas pit. Mining at the Pirquitas pit was completed in January 2017, a number of upgrades have been undertaken to allow tailings to be transported from the Chinchillas Project to a portion of the Pirquitas pit. These upgrades included constructing a pipeline for in-pit disposal, and construction of the discharge system from the tailings transport pipeline, an in-pit water reclaim system, and a pipeline from the Pirquitas pit to the Pirquitas plant to return water for reuse. These upgrades have allowed for additional tailings capacity for the processing of Chinchillas ore.

The use of the Pirquitas pit for tailings deposition at the Pirquitas Operation is a modification to the mining activities not contemplated in MPSA’s ESIA for the Pirquitas mine until 2016. On August 2017 MPSA issued to Mining Authorities an Addendum of the 2016 ESIA Update that included the upgrades to conduct the tailings to the pit of Mina Pirquitas. The permit was obtained on 24 September 2018 by Resolution No. 056/2018. Since then, MPSA has submitted to Mining Authorities the ESIA Update for Mina Pirquitas in September 2020, which is under review.

21015Puna21TRS220927Rev0.docx Page 26 of 175

3.3.2.4 Pirquitas Tenure Factors and Risks

Except as set out herein, to the extent known, there are no additional factors or risks that may affect the access, title, right or ability to perform work on the Pirquitas property.

3.4 Other Significant Factors and Risks

SSR have advised that there are no other known significant risks that may affect access, title or the right or ability to perform mining related work on the Property.

Legal matters such as statutory and regulatory interpretations affecting the mine plan and environmental matters are outside the expertise of the QPs (see Section 25).

The Puna21TRS QPs consider it reasonable to rely on SSR because SSR employs professionals and other personnel with responsibility in these areas and these personnel have the best understanding of these areas.

Additionally, the project has been in operation for a number of years, and following a review of the current supplied information, the opinion of the Puna21TRS QPs is that the current plans appear adequate to address any issues related to environmental compliance, permitting, and local individuals or groups.

21015Puna21TRS220927Rev0.docx Page 27 of 175

4 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY

Ore from the Chinchillas mine is transported to the Pirquitas plant for processing. The Chinchillas mine is located approximately 45 km from the Pirquitas plant.

4.1 Accessibility

The Chinchillas property is accessed most directly from the provincial capital of San Salvador de Jujuy via National Route No. 9, northwards along the Humahuaca River to the town of Abra Pampa. The route continues along Provincial Route No. 7 westward for 66 km, through the village of Santo Domingo. The roads are maintained by the Province and are accessible year round. Several temporary rivers cross the route so four wheel drive vehicles are recommended in the rainy season.

The other route to the Chinchillas property and to the Pirquitas Operation follows National Route No. 9 northwards from San Salvador de Jujuy to Purmamarca, then turns north-west on paved road No. 52 to the town of Susques. From there, National Route No. 40 heads to Provincial Route No. 70 that leads to Chinchillas at the Fundiciones mountain pass. This route is more appropriate for heavy transport vehicles and is used by traffic to the Pirquitas mine and mill, located approximately 45 km to the south-west of Chinchillas along the route.

Concentrate shipments from Pirquitas are currently trucked to Susques, Jujuy from Pirquitas via Route 77, and from there to Buenos Aires via Route 9. At arrival to the terminal, the material is directly dispatched from the port facilities to the concentrate buyers.

4.2 Physiography, Climate, and Vegetation

The Chinchillas deposit terrain has an elliptical, caldera-like shape with steep rolling hills surrounding the caldera depression. It is located near the Fundiciones mountain pass, with the Rinconada and Carahuasi ranges extending from north–south. Elevations range from about 4,000–4,200 masl. The highest elevation in the area is Cerro Granada at 5,696 masl, 28 km to the south-west. The Uquillayoc river runs through the Project area and is fed by many small tributaries.

At Pirquitas, elevations on the property range from 4,000–4,450 masl. The processing plant, tailings impoundment and main workers camp are located in the eastern third of the Pirquitas property in an area of relatively open ground that lies at an elevation of 4,100 masl, and the Pirquitas pit, which ceased mining operations in January 2017, is situated about 7 km west of the mill at a slightly higher elevation.

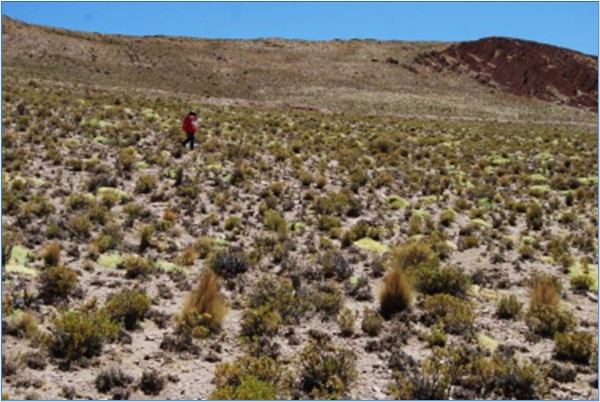

The regional climate is similar at both Chinchillas and Pirquitas and is arid to semi-arid, tropical-subtropical influenced by high desert (Blasco, 2011). Rain is scarce and mainly occurs during the rainy season (November to March), with a mean annual precipitation of 300 mm. The annual mean temperature is 18°C, however during the winter it ranges down to –7.7 ºC to 7.5 ºC. Dry and windy conditions often prevail in the area. Natural vegetation is patchy to sparse and consists of xerophilous and steppe bushes like iro (Festuca ortophylia), and coirón (Stipachrysophylla). Acantoliphia haustata is the predominant species with the Yareta (Azorella compacta), less frequent. The tola (Parastrepia ssp.) and small trees like the queñoa (Polylepis tomentella) can be found in depressions (Blasco, 2011).

Animal species found in the area include mammals such as llamas, puna foxes, and vizcachas, as well as several mice species, chinchillas and ferrets. Other fauna in the area include lizards, and birds such as small rheas, owls, ducks, condors, and falcons (Blasco, 2011).

21015Puna21TRS220927Rev0.docx Page 28 of 175

4.3 Local Resources and Infrastructure

Chinchillas and Pirquitas are located in the rural zone of Rinconada Department, with an approximate population of 2,500 people. It covers an area of 6,407 km2, includes over twenty small communities, and has basic public services including a police department and health centre. The nearest community to Chinchillas is the village of Santo Domingo, and nearest to Pirquitas is the village of Nuevo Pirquitas. Historically, the local population was mainly employed in ranching, however the operation at Pirquitas has created a significant local trained mining workforce. Basic amenities are supplied from Susques and Abra Pampa, while supplies for mining are obtained through the provincial capital of San Salvador de Jujuy, which has an airport with daily commercial air service to Buenos Aires.

The nearest hospital is located in Abra Pampa, 66 km east of Chinchillas.

4.3.1 Chinchillas Infrastructure

The Chinchillas site has offices, workshops, a lunchroom, change room, explosives magazines, security and first aid buildings, solid waste storage facility, open pit, and waste dumps at the site. Existing exploration infrastructure includes two office containers, a core logging facility, a core cutting machine, two storage tents, two cisterns for diesel fuel (1,500 and 10,000 litres) and six warehouses of 144 m2 each, for the storage of the core boxes.

To generate electricity, the Pirquitas Operation uses natural gas to power three Wärtsila generator sets, each with a capacity of five megawatts (MW) of power. In addition, the same electrical plant has three diesel-powered Cummins generators, each yielding 1.1 MW. There is 6.7 km of gas pipeline on the Pirquitas property. The pipeline is 152 mm diameter and constructed of API5L Grade B steel with 4.8 mm wall thickness in normal applications and 7.1 mm wall thickness at river or drainage crossings.

Power for the Chinchillas mine site supplied along existing power lines from the natural gas powered generators at Pirquitas. EJESA is the local power authority that owns the lines. The power line from Pirquitas that goes directly past the rural EJESA line at the town of Nuevo Pirquitas (approximately 5 km from Pirquitas). The rural power line then goes from Nuevo Pirquitas to all villages along Route No. 40 and Route No. 70 and directly to Santo Domingo. This line is able to carry the 1 MW load for Chinchillas, with a small spur line (approximately 4 km in length) to take power into the mine.

No ore processing is done at Chinchillas therefore power requirements are minimal. In the event of power loss at Pirquitas. Back-up power from the EJESA grid that amounts to 100 kVa can be drawn. This back-up power is designated for critical telecommunications systems and the first aid building.

21015Puna21TRS220927Rev0.docx Page 29 of 175

4.3.2 Pirquitas Infrastructure

Pirquitas has been a permitted commercial mine operated by SSR since December 2009, with existing infrastructure that includes:

•A processing plant;

•A permitted tailings facility;

•A fully serviced workers camp sufficient for approximately 670 personnel;

•A communications system including cellular and intranet access;

•Fully serviced office buildings; and

•Wastewater treatment facilities, organic waste landfill and a recycling centr.e

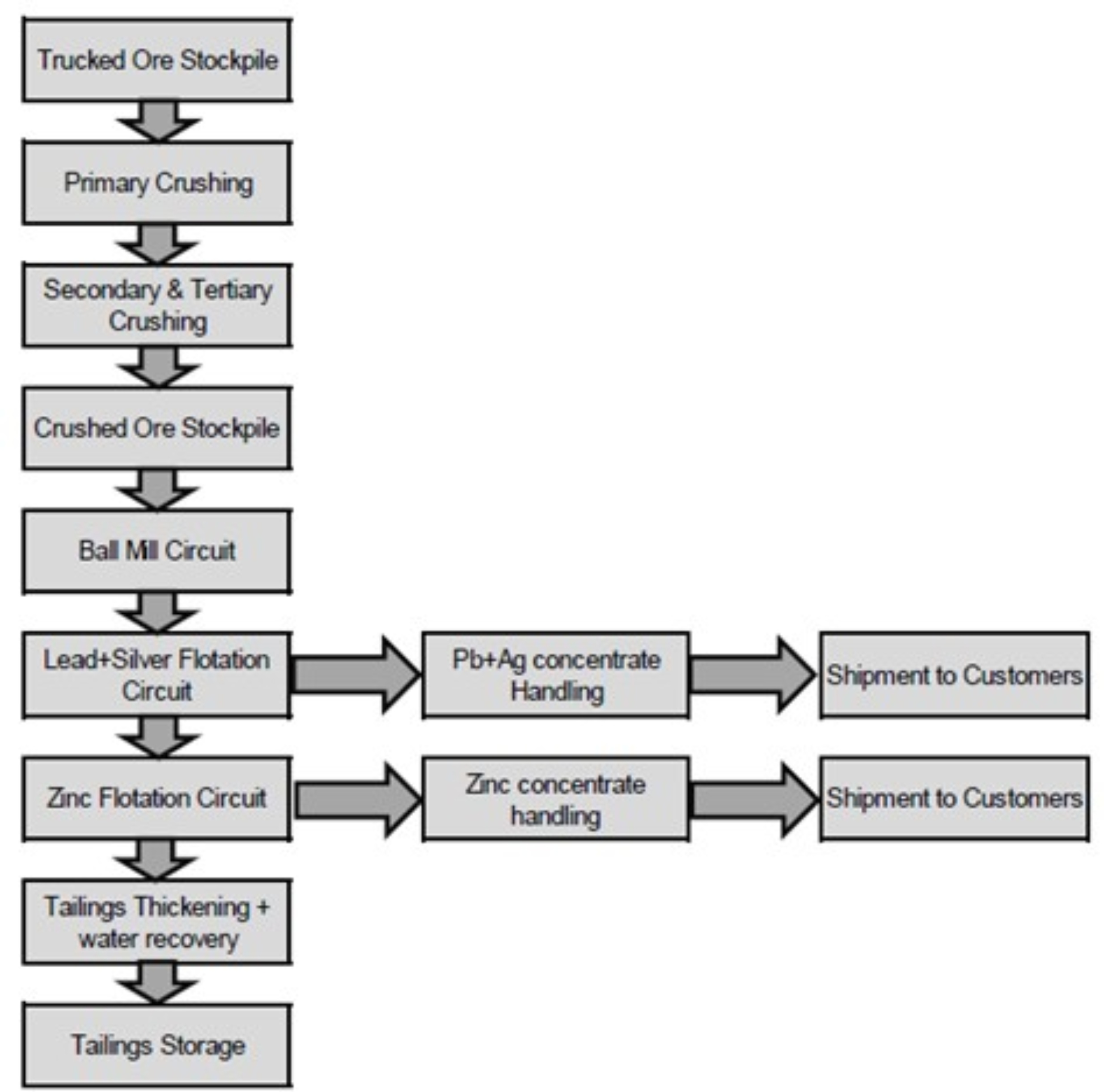

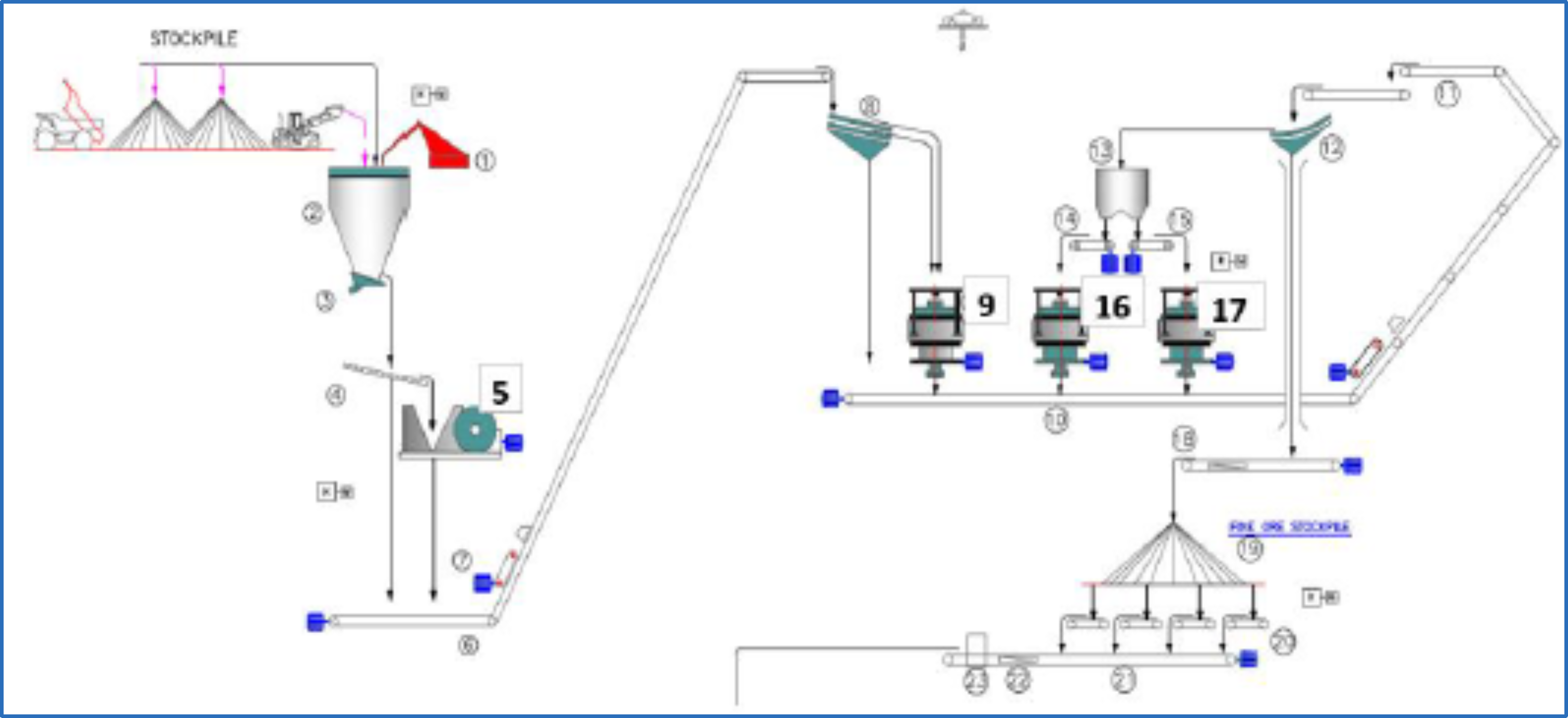

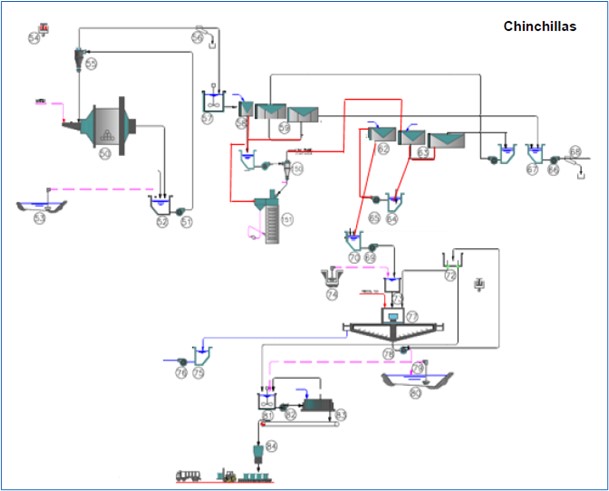

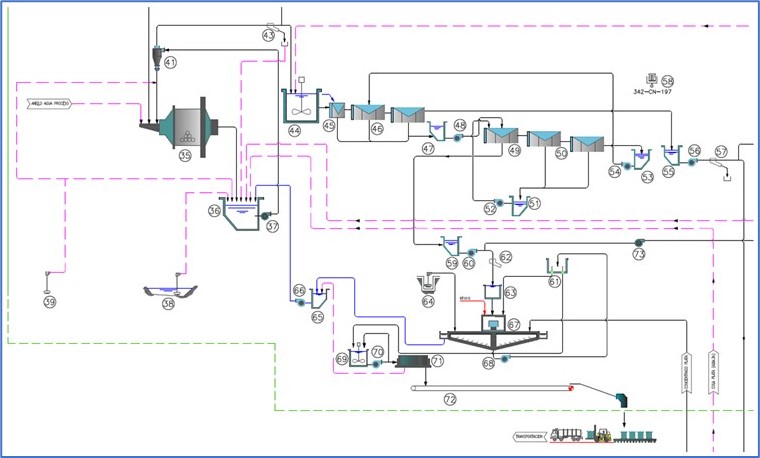

The Pirquitas processing plant consists of primary, secondary, and tertiary crushing operations which deliver ore to a stockpile. The crushing circuit throughput is 6,000 tpd. Ore is transferred from the crushed ore stockpile to a ball mill and after that a differential flotation circuit to obtain lead / silver and zinc concentrates.

The Pirquitas plant uses a tailings thickener to improve water recovery. Post thickened tailings are deposited in the tailings storage facility and secondary water recovery is achieved using barge mounted reclaim pumps.

MPSA has the surface rights covering the Pirquitas Operation. Electricity is produced from natural gas and diesel generators at the Pirquitas site.

Water supply is from a San Marcos, which is located within the property a short distance downstream from where the Pirquitas River drains into the Collahuaima River. Domestic water is pumped from a diversion upstream of the open pit for use at the camp. Potable water is supplied by MPSA from bottled water.

Pirquitas has a trained workforce for the processing plant and open pit mining operations, including local workers, operators, supervision, management, and senior staff.

21015Puna21TRS220927Rev0.docx Page 30 of 175

5 HISTORY

5.1 Chinchillas History

Chinchillas was first prospected and mined in small scale in the eighteenth century by Jesuit missionaries. Relics of furnaces used to melt lead and silver can still be found at the Chinchillas property (Kulemeyer, 2011). In 1956, Mr. Antonio Mercado requested a concession based on the discovery of galena veins in the basement rock. In 1968, the mine was sold to Ing. Pichetti, who later formed the Sociedad Pirquihuasi Company together with the Pirquitas Company, and some adits and tunnels were opened for small scale production. In 1982, the mine licence expired, and the mine was acquired by Shell CAPSA S.A. From December 1982 to 1989, a consulting geologist for Shell, Jorge Daroca, carried out exploration work and, after Shell dropped the property, Mr. Daroca requested it for himself, convinced of the good potential of the area (Daroca, undated). Roads, remnants of infrastructure, and minor underground workings remain from this activity, but no records of this work are available.

In 1994, Aranlee Resources conducted surface sampling and drilled seven reverse circulation drillholes for a total of approximately 780 m. Assay results from this work are available, but there are no samples for re-analysis or quality control information, therefore the data have not been incorporated into the Mineral Resources estimate. In 2004 Silex, a subsidiary of Apex Silver, conducted preliminary reconnaissance work including trenching, pitting and surface sampling, with a total of 165 samples taken. Between October 2007 and July 2008, 40 manual pits and nine trenches were sampled. Surface mapping was also completed at different scales across the Chinchillas property, and a total of 1,036 surface samples were collected. At the beginning of 2008, Quantec Geoscience Argentina S.A. (Quantec) performed a 16 km IP resistivity survey, comprising nine sections. The pole-dipole interval was 50 m with 300 m depth readings. The objective of the programme was to detect and delineate sulfides related to an intermediate to high-sulfidation epithermal system, however the mineralised zones at Chinchillas do not appear to be related to chargeability. Nevertheless, there is a strong resistivity contrast between volcanic units and basement schists and the resistivity data have been an effective tool for imaging the volcanic diatreme shape (Quantec, 2008). Silex subsequently drilled 2,220 m in seven diamond drillholes with drillhole samples taken at 1–2 m intervals. Silex had planned to drill 22 holes but cut the programme short during the 2008–2009 global financial crisis. In early 2009 Apex entered Chapter 11 bankruptcy protection, and with a payment due on the property, opted to drop Chinchillas in favour of its more advanced El Quevar project. The core from the Silex drill programme remains at Chinchillas (Silex, 2008 and Caranza and Carlson, 2012).

In 2011, Golden Arrow acquired the property, completed five phases of drilling over the subsequent five years and outlined mineral resources which are summarised in six technical reports and preliminary economic assessments (Davis and Howie 2013, Davis et al., 2014, Davis et al., 2015, Davis et al., 2016, Kuchling et al., 2014, Kuchling et al., 2015). In October 2015 Golden Arrow announced that it had entered into the Agreement with SSR to form a joint venture comprising of the Chinchillas property, the Pirquitas pit and the Pirquitas Operation. The agreement included an 18-month pre-development period to advance Chinchillas, including the infill drilling, engineering and environmental studies, and permitting.

On 18 September 2019, the Company completed the acquisition of the remaining 25% interest in Puna from Golden Arrow Resources Corporation for aggregate consideration totalling approximately $32.4M. The transaction allowed the Company to consolidate ownership in Puna and streamline its reporting.

21015Puna21TRS220927Rev0.docx Page 31 of 175

5.2 Pirquitas History

Between the 1930s and 1995, the area of the Pirquitas mine had multiple small mining operations to recover silver and tin from placer and vein deposits.

The Argentine branch of Sunshine Mining and Refining Company acquired the Pirquitas mining concessions in November 1995. In the years following its acquisition of Pirquitas, Sunshine Argentina carried out comprehensive mineral exploration on the property, including underground rock sampling and multiple programmes of revere circulation and diamond drilling. These culminated in a feasibility study in February of 2000.

In May 2002, Silver Standard acquired 43.4% of Sunshine Argentina, Inc. (Sunshine Argentina) from Stonehill Capital Management of New York and in October 2004. Silver Standard acquired the remaining 56.6% of Sunshine Argentina from Elliott International L.P., The Liverpool Limited Partnership and Highwood Partners, L.P. Silver Standard operated the Pirquitas mine property as Sunshine Argentina until it changed the company name to Mina Pirquitas, Inc. in May 2008, and further changed the name to MPLLC in December 2014. In August 2018, Mina Pirquitas LLC. changed its name to Mina Pirquitas S.A.(MPSA).

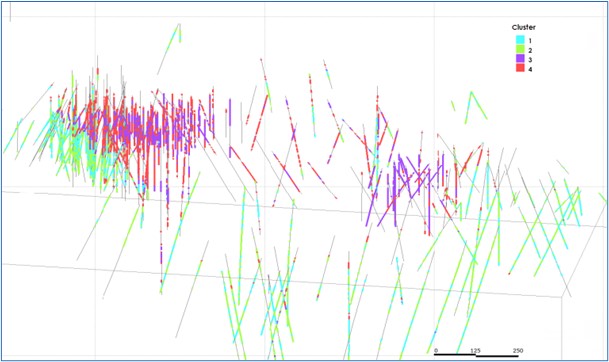

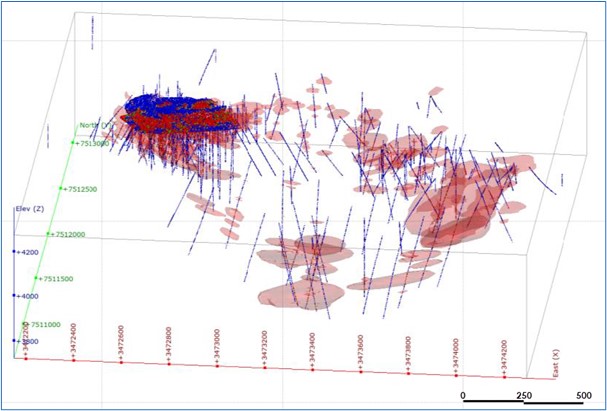

On 24 November 2015, MPSA was incorporated as 1056353 B.C. Ltd., and changed its name to Puna Operations Inc. on 2 May 2017.