SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant [ ]

Filed by a Party other than the Registrant [x]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [X] | Soliciting Material Pursuant to § 240.14a-12 |

Forest Laboratories, Inc.

(Name of Registrant as Specified In Its Charter)

Icahn Partners LP

Icahn Partners Master Fund LP

Icahn Partners Master Fund II L.P.

Icahn Partners Master Fund III L.P.

High River Limited Partnership

Hopper Investments LLC

Barberry Corp.

Icahn Onshore LP

Icahn Offshore LP

Icahn Capital L.P.

IPH GP LLC

Icahn Enterprises Holdings L.P.

Icahn Enterprises G.P. Inc.

Beckton Corp.

Carl C. Icahn

Dr. Eric J. Ende

Pierre Legault

Andrew J. Fromkin

Daniel A. Ninivaggi

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF FOREST LABORATORIES, INC. FOR USE AT ITS 2012 ANNUAL MEETING WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF FOREST LABORATORIES, INC. AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE AMENDED PRELIMINARY PROXY STATEMENT FILED BY MR. ICAHN AND HIS AFFILIATES ON JULY 11, 2012 (THE “PRELIMINARY PROXY”). EXCEPT AS OTHERWISE DISCLOSED HEREIN OR IN THE PRELIMINARY PROXY, THE PARTICIPANTS HAVE NO INTEREST IN FOREST LABORATORIES, INC. OTHER THAN THROUGH THE BENEFICIAL OWNERSHIP OF SHARES OF COMMON STOCK, PAR VALUE $0.10 PER SHARE, OF FOREST LABORATORIES, INC., AS DISCLOSED IN THE PRELIMINARY PROXY. THE PRELIMINARY PROXY IS AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV.

Forest Laboratories

Shareholder Presentation

July 2012

Disclaimer

Special note regarding this presentation

• This presentation includes information based on data found in filings with the SEC, independent industry publications and other

sources. Although we believe that the data is reliable, we do not guarantee the accuracy or completeness of this information and have

not independently verified any such information. We have not sought, nor have we received, permission from any third-party to

include their information in this presentation.

sources. Although we believe that the data is reliable, we do not guarantee the accuracy or completeness of this information and have

not independently verified any such information. We have not sought, nor have we received, permission from any third-party to

include their information in this presentation.

• Many of the statements in this presentation reflect our subjective belief. Although we have reviewed and analyzed the information

that has informed our opinions, we do not guarantee the accuracy of any such beliefs.

that has informed our opinions, we do not guarantee the accuracy of any such beliefs.

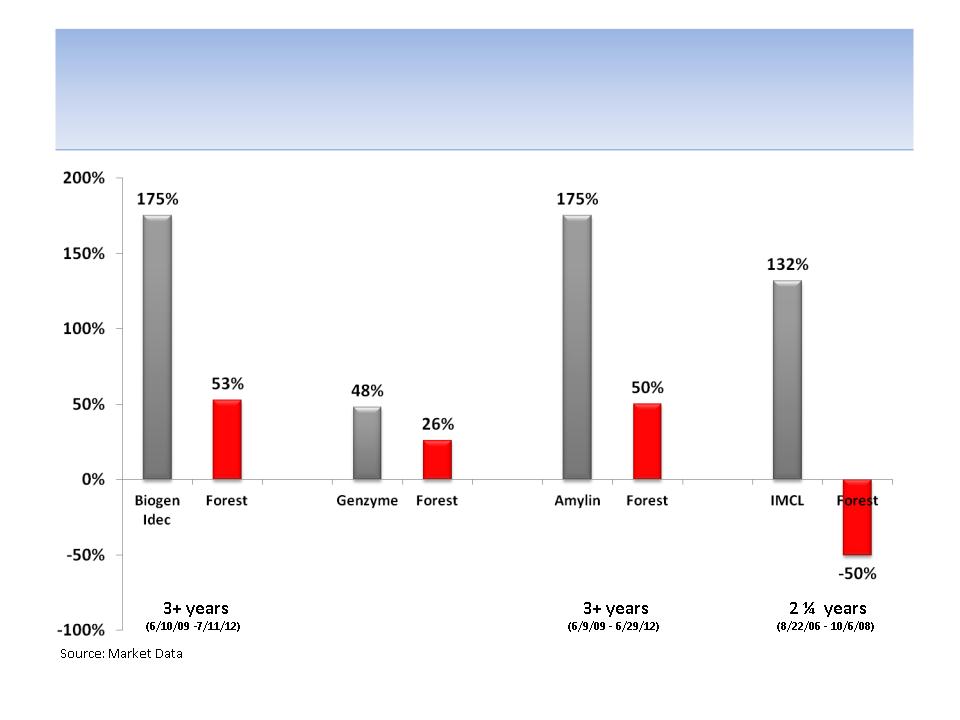

• Sections of this presentation refer to our track record of Board representation at Biogen Idec, ImClone Systems Inc., Genzyme

Corporation, and Amylin Pharmaceuticals. We believe our experience at these companies was a success and resulted in an increase in

shareholder value that benefited all shareholders. However, this success at these companies is not necessarily indicative of future

results at Forest Laboratories if our nominees were to be elected to the Forest Laboratories Board of Directors.

Corporation, and Amylin Pharmaceuticals. We believe our experience at these companies was a success and resulted in an increase in

shareholder value that benefited all shareholders. However, this success at these companies is not necessarily indicative of future

results at Forest Laboratories if our nominees were to be elected to the Forest Laboratories Board of Directors.

• SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF

PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF FOREST LABORATORIES, INC. FOR USE AT ITS 2012

ANNUAL MEETING WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING

INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT

AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF FOREST LABORATORIES, INC. AND WILL ALSO BE AVAILABLE AT NO

CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE

PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE AMENDED PRELIMINARY PROXY STATEMENT FILED BY MR. ICAHN

AND HIS AFFILIATES ON JULY 11, 2012 (THE “PRELIMINARY PROXY”). EXCEPT AS OTHERWISE DISCLOSED HEREIN OR IN THE

PRELIMINARY PROXY, THE PARTICIPANTS HAVE NO INTEREST IN FOREST LABORATORIES, INC. OTHER THAN THROUGH THE BENEFICIAL

OWNERSHIP OF SHARES OF COMMON STOCK, PAR VALUE $0.10 PER SHARE, OF FOREST LABORATORIES, INC., AS DISCLOSED IN THE

PRELIMINARY PROXY. THE PRELIMINARY PROXY IS AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S

WEBSITE AT HTTP://WWW.SEC.GOV.

PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF FOREST LABORATORIES, INC. FOR USE AT ITS 2012

ANNUAL MEETING WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING

INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT

AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF FOREST LABORATORIES, INC. AND WILL ALSO BE AVAILABLE AT NO

CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE

PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE AMENDED PRELIMINARY PROXY STATEMENT FILED BY MR. ICAHN

AND HIS AFFILIATES ON JULY 11, 2012 (THE “PRELIMINARY PROXY”). EXCEPT AS OTHERWISE DISCLOSED HEREIN OR IN THE

PRELIMINARY PROXY, THE PARTICIPANTS HAVE NO INTEREST IN FOREST LABORATORIES, INC. OTHER THAN THROUGH THE BENEFICIAL

OWNERSHIP OF SHARES OF COMMON STOCK, PAR VALUE $0.10 PER SHARE, OF FOREST LABORATORIES, INC., AS DISCLOSED IN THE

PRELIMINARY PROXY. THE PRELIMINARY PROXY IS AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S

WEBSITE AT HTTP://WWW.SEC.GOV.

2

Key Conclusions of Report

3

Key Conclusion | Pages |

Today, We Believe Forest is in Crisis - CEO Solomon Was Wrong in the Past With His Overly Optimistic Predictions Results: Forest’s stock is down 11% in the past 10 years and more than 50% from the peak - The company was completely unprepared for the Lexapro patent cliff since earnings are expected to decline by ~80% in FY13 | 7 - 10 22 - 23 |

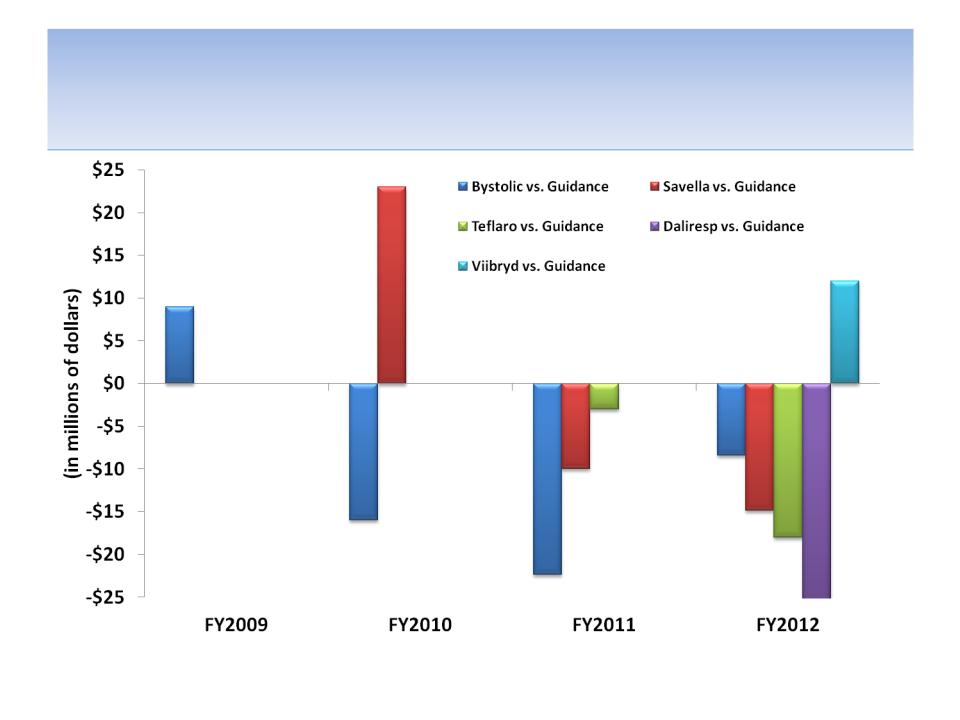

We Are Very Concerned Solomon Will Be Wrong Again About His Currently Optimistic View of the Company’s Pipeline Since New Pipeline Drugs Have Missed Guidance 8 out of 11 Times in Past Several Years | 24 |

The Current Strategy Is Not Expected to Offset Lost Revenues From the Lexapro Patent Cliff (~$1 B Shortfall in FY13) and Not Projected to Offset Namenda ($1.4 B in FY12) Patent Cliff in FY16 - We are concerned the current Board will permit Solomon to risk the company’s cash to make up for the projected shortfall | 19 - 23 |

We Believe Strategic Flaws Have Caused Lack Of Focus & Cost Inefficiency | 25 - 28 |

Weak History of Capital Allocation Causes Us to Fear Future Uses for Forest’s $3.2 B of Cash | 29 - 31 |

We Believe at Least 50% (5 of 10) of Board Lacks Independence Including Presiding “Independent” Director | 33 |

Flawed Compensation Policies Have Enriched CEO & Others; Chair of Compensation Committee Still in Role | 34 - 35 |

CEO Has Had Well-Timed Stock Sales Including While Company Repurchased Stock | 36 - 38 |

CEO Solomon’s Son, After Only 5 Years at Forest, Was Promoted and Given Significant Responsibility for Business Development and Strategic Planning; We Believe He Is Significantly Responsible for the Company’s Current Predicament; Despite His Failures, He Has Been Promoted to SVP Business Development and Strategic Planning and He Is Now a Candidate for CEO; How Can a Board that Calls Itself “Strong & Independent” Be Responsible For This? | 39 - 40 |

We Believe Management Has Not Delivered On Its Word | 42 |

If Solomon is Wrong Again as it Appears to Us He Will Be Based On Disappointing Results of Current Pipeline Drugs, It Will Be Devastating for the Company. To Avoid This Outcome, We Believe A Strong & Truly Independent Board Which Will Hold Management Accountable Is Extremely Necessary. | 24 54 - 58 |

Icahn’s Track Record of Board Representation in Biopharma Shows an Impressive Creation of Shareholder Value and Is Well Aligned With All Shareholders | 59 - 60 |

Presentation Summary

• We believe Change is Needed as the Board has overseen:

– significant stock underperformance (p. 7 - 11) and massive destruction of value (p. 12)

– an inadequate and flawed company strategy (p. 15 - 28)

– significant corporate waste and cost structure inefficiency (p. 27 - 28)

– inefficient and ineffective deployment of capital (p. 29 - 31)

– corporate governance failures (p. 32)

• we believe that 50% of Board lacks independence (p.33)

• CEO Solomon’s Son, After Only 5 Years at Forest, Was Promoted and Given Significant Responsibility for Business Development

and Strategic Planning; We Believe He Is Significantly Responsible for the Company’s Current Predicament; Despite His

Failures, He Has Been Promoted to SVP Business Development and Strategic Planning and He Is Now a Candidate for CEO; How

Can a Board that Calls Itself “Strong & Independent” Be Responsible For This? (p. 39 - 40)

and Strategic Planning; We Believe He Is Significantly Responsible for the Company’s Current Predicament; Despite His

Failures, He Has Been Promoted to SVP Business Development and Strategic Planning and He Is Now a Candidate for CEO; How

Can a Board that Calls Itself “Strong & Independent” Be Responsible For This? (p. 39 - 40)

• We believe we Have a Viable Plan for Change (p. 44 - 51)

• We believe we Will Help Generate Change (p. 53 - 58) superior to existing Board based on:

– highly relevant experience in all aspects of biopharmaceuticals and related areas necessary for success in this new era of

reimbursement and cost effectiveness

reimbursement and cost effectiveness

– greater independence

– fresh perspectives from outside of Forest

– better alignment with shareholders; track record of outperformance in biopharma (p. 59 - 60)

– consistent accountability

4

Company Background

• Founded in 1956 - Howard Solomon has been CEO since 1977

• Develops, manufactures and markets drugs with sales derived

primarily from neurology

primarily from neurology

• FY12A total revenues of $4.6 B; FY13E total revenues of $3.3

B; FY16E total revenues of $3.7 B

B; FY16E total revenues of $3.7 B

• Lexapro for depression/anxiety was ~49% of FY12 product

sales; Lost patent protection in FY12

sales; Lost patent protection in FY12

• Namenda for Alzheimer’s was ~32% of FY12 product sales;

Loses patent protection in 2015

Loses patent protection in 2015

• “Next Nine” pipeline drugs represent nine new drugs

launching from 2008 - 2013

launching from 2008 - 2013

Source: Company documents; Analyst Estimates; Forest’s fiscal year (FY) end is March 31st

5

Why We Believe Meaningful &

Sustainable Change is Needed at

Forest Labs

Sustainable Change is Needed at

Forest Labs

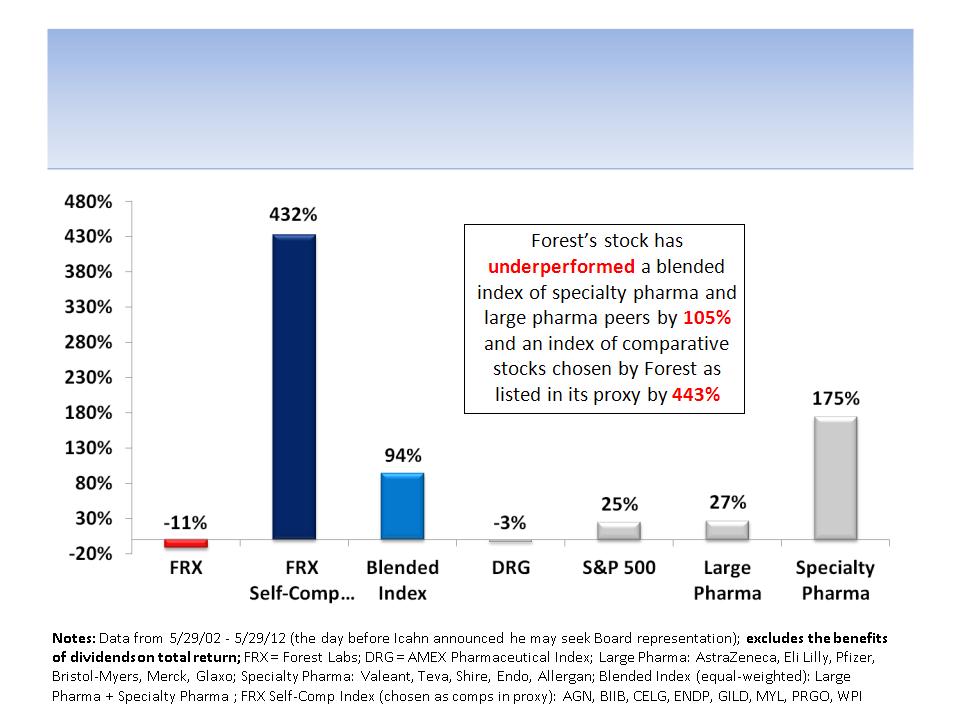

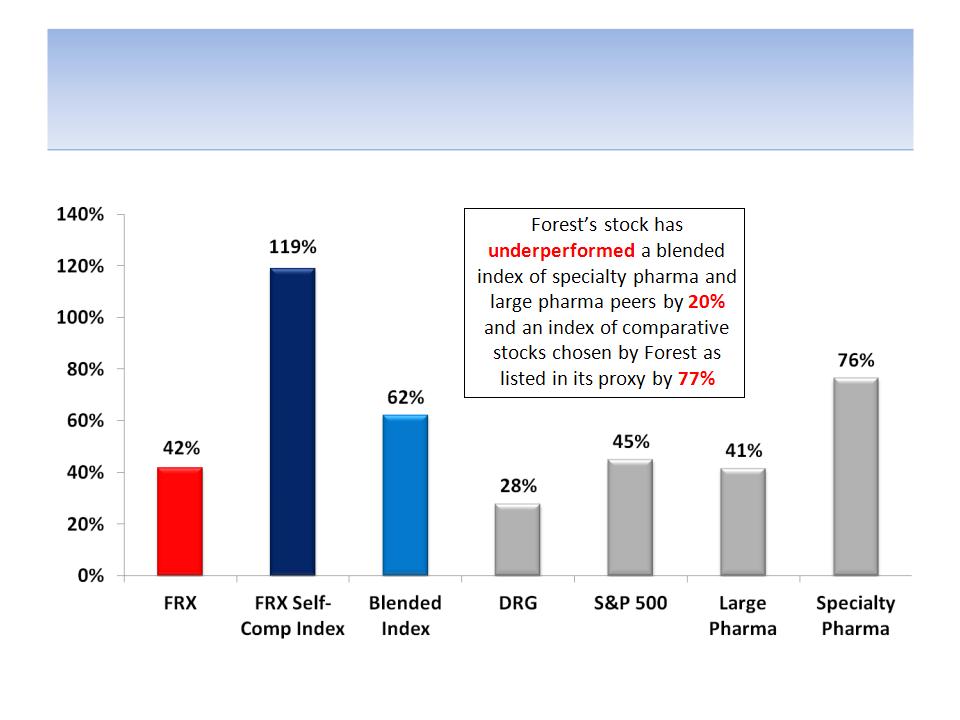

Forest’s Stock Has

Underperformed For 10 Years

Underperformed For 10 Years

7

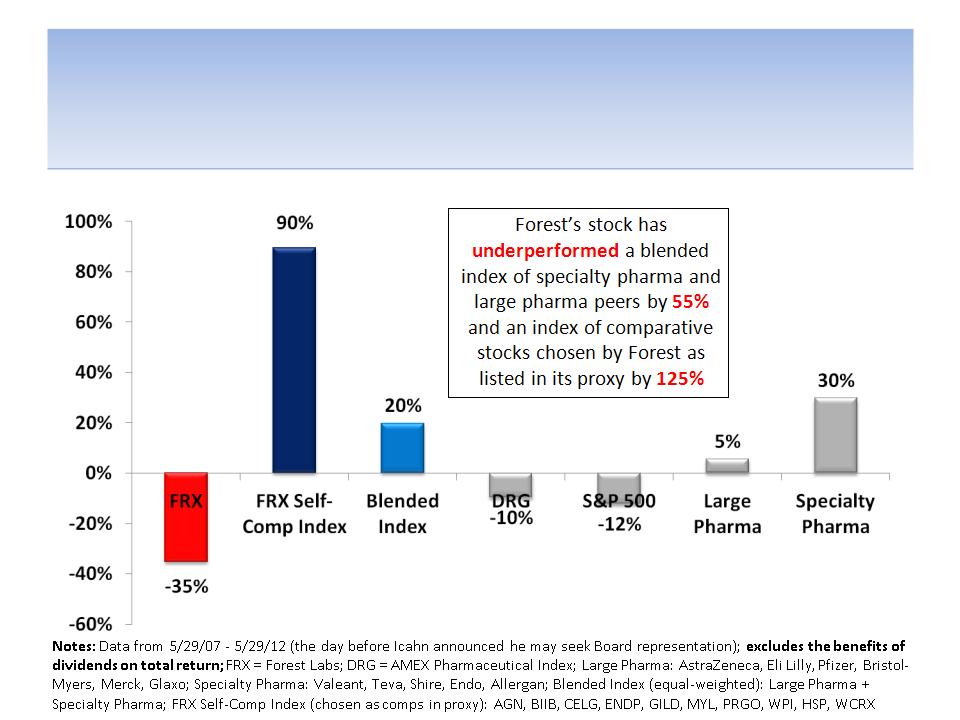

Forest’s Stock Has

Underperformed For 5 Years

Underperformed For 5 Years

8

Forest’s Stock Has Underperformed

Against Most Measures For 3 Years

Against Most Measures For 3 Years

Notes: Data from 5/29/09 - 5/29/12 (the day before Icahn announced he may seek Board representation); excludes the benefits of

dividends on total return; FRX = Forest Labs; DRG = AMEX Pharmaceutical Index; Large Pharma: AstraZeneca, Eli Lilly, Pfizer, Bristol-

Myers, Merck, Glaxo; Specialty Pharma: Valeant, Teva, Shire, Endo, Allergan; Blended Index (equal-weighted): Large Pharma +

Specialty Pharma; FRX Self-Comp Index (chosen as comps in proxy): AGN, BIIB, CELG, ENDP, GILD, MYL, PRGO, WPI, HSP, WCRX

dividends on total return; FRX = Forest Labs; DRG = AMEX Pharmaceutical Index; Large Pharma: AstraZeneca, Eli Lilly, Pfizer, Bristol-

Myers, Merck, Glaxo; Specialty Pharma: Valeant, Teva, Shire, Endo, Allergan; Blended Index (equal-weighted): Large Pharma +

Specialty Pharma; FRX Self-Comp Index (chosen as comps in proxy): AGN, BIIB, CELG, ENDP, GILD, MYL, PRGO, WPI, HSP, WCRX

9

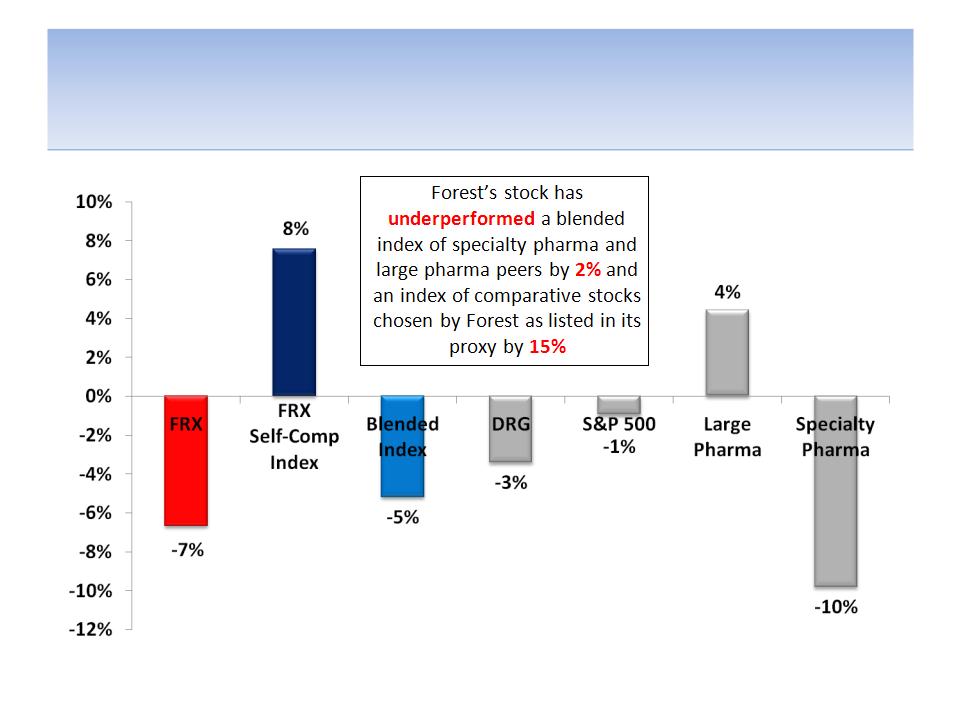

Forest’s Stock Has Underperformed

Against Most Measures For 1 Year

Against Most Measures For 1 Year

Notes: Data from 5/29/11 - 5/29/12 (the day before Icahn announced he may seek Board representation); excludes the benefits of

dividends on total return; FRX = Forest Labs; DRG = AMEX Pharmaceutical Index; Large Pharma: AstraZeneca, Eli Lilly, Pfizer, Bristol

-Myers, Merck, Glaxo; Specialty Pharma: Valeant, Teva, Shire, Endo, Allergan; Blended Index (equal-weighted): Large Pharma +

Specialty Pharma; FRX Self-Comp Index (chosen as comps in proxy): AGN, BIIB, CELG, ENDP, GILD, MYL, PRGO, WPI, HSP, WCRX

dividends on total return; FRX = Forest Labs; DRG = AMEX Pharmaceutical Index; Large Pharma: AstraZeneca, Eli Lilly, Pfizer, Bristol

-Myers, Merck, Glaxo; Specialty Pharma: Valeant, Teva, Shire, Endo, Allergan; Blended Index (equal-weighted): Large Pharma +

Specialty Pharma; FRX Self-Comp Index (chosen as comps in proxy): AGN, BIIB, CELG, ENDP, GILD, MYL, PRGO, WPI, HSP, WCRX

10

…And It Hasn’t Gotten Better Since

Last Year’s Annual Meeting

Last Year’s Annual Meeting

Notes: Data from 8/18/11 - 5/29/12 (the day before Icahn announced he may seek Board representation); excludes the

benefits of dividends on total return; FRX = Forest Labs; DRG = AMEX Pharmaceutical Index; Large Pharma: AstraZeneca, Eli

Lilly, Pfizer, Bristol-Myers, Merck, Glaxo; Specialty Pharma: Valeant, Teva, Shire, Endo, Allergan; Blended Index (equal-

weighted): Large Pharma + Specialty Pharma

benefits of dividends on total return; FRX = Forest Labs; DRG = AMEX Pharmaceutical Index; Large Pharma: AstraZeneca, Eli

Lilly, Pfizer, Bristol-Myers, Merck, Glaxo; Specialty Pharma: Valeant, Teva, Shire, Endo, Allergan; Blended Index (equal-

weighted): Large Pharma + Specialty Pharma

11

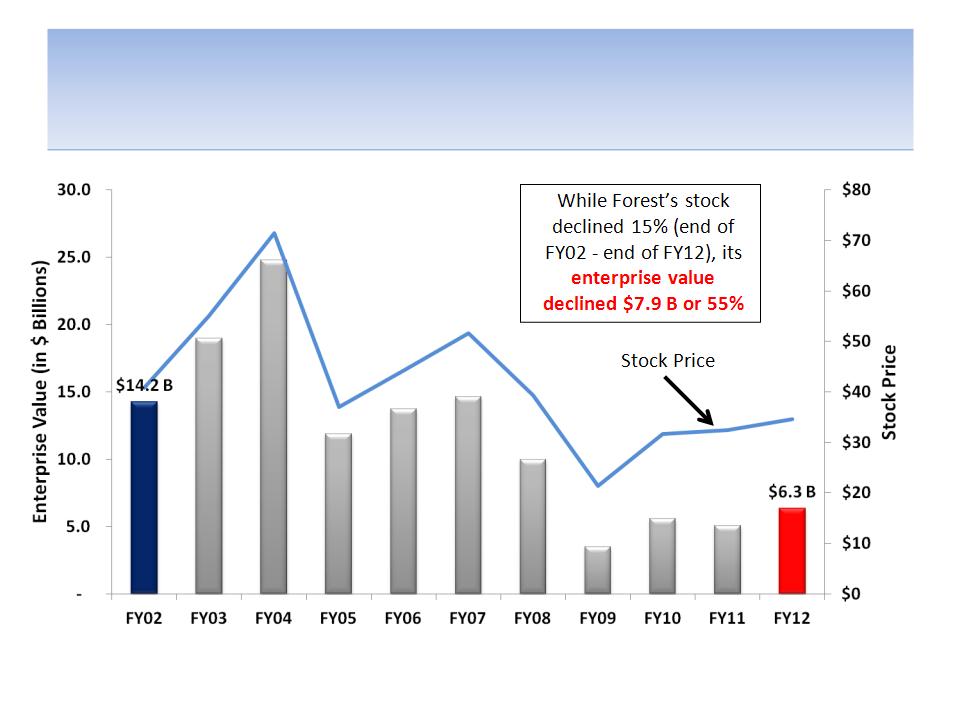

Share Buyback Masked True Extent of

Value Destruction Over 10 Years

Value Destruction Over 10 Years

Source: Company documents; all data measured from fiscal YE02 to fiscal YE12; Enterprise value = Market

Cap + Debt-Cash

Cap + Debt-Cash

12

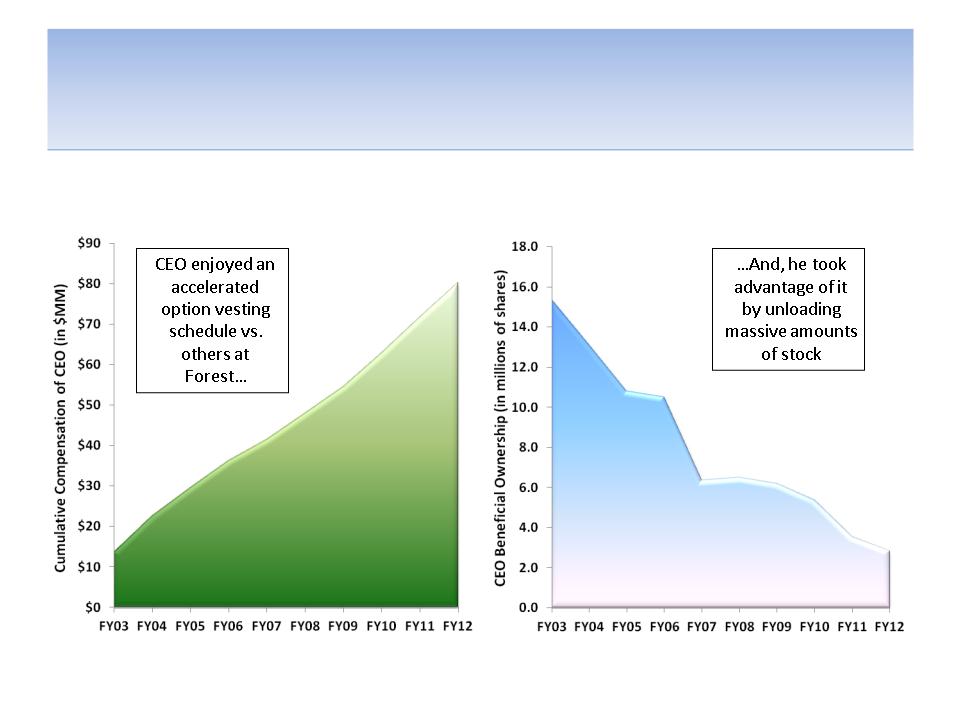

While Shareholders Lost Billions of

Dollars, CEO Solomon Made A Fortune

Dollars, CEO Solomon Made A Fortune

Paid Over $80 MM

Sold Stock Worth $572 MM;

Ownership Reduced by 82%

Ownership Reduced by 82%

Source: Company documents

13

Management Claims it Has Done a Great Job

Then,

(1)Why has the stock underperformed its peer indices

for 1, 3, 5 and 10 years?

for 1, 3, 5 and 10 years?

And,

(2) Why has so much value been destroyed during that

same period of time?

same period of time?

We believe the answer is:

Strategic Failure by the Management & Board

14

We Believe Forest Had an Inadequate & Flawed

Strategy That Destroyed Shareholder Value

Strategy That Destroyed Shareholder Value

• Inadequate Strategy: Management and the Board implemented a strategy that we

believe was inadequate to offset declining revenues and profits due to generic

competition for Lexapro and Namenda

believe was inadequate to offset declining revenues and profits due to generic

competition for Lexapro and Namenda

– The strategy was implemented too late even though there was plenty of time to prepare

– An increasing amount of capital has had to be put at risk for each product

– In spite of all the capital used, a massive amount of value was destroyed

– Pipeline planning to offset lost revenues was insufficient

– Revenues from “Next Nine” drug launches have missed company guidance

– Revenues & profits are expected to remain depressed for the foreseeable future

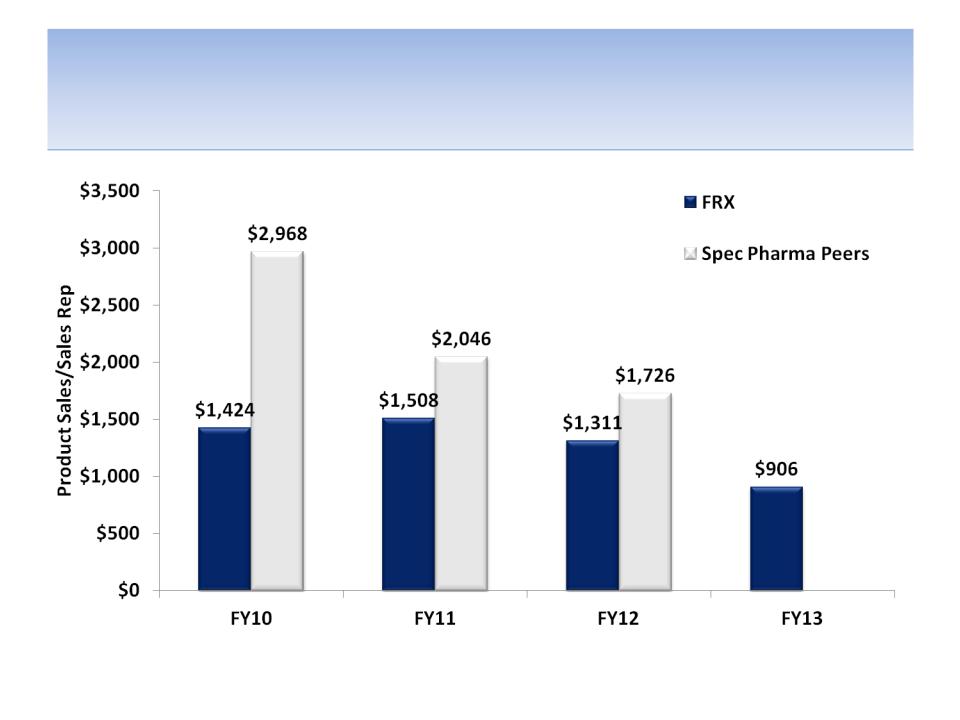

• Flawed Strategy: We believe the “opportunistic” strategy has caused business

development & Forest’s pipeline to become highly unfocused

development & Forest’s pipeline to become highly unfocused

– Lack of company expertise and critical mass in specific areas

– Sales rep productivity has declined and is below specialty pharma peers

– Loss of cost synergies within sales and marketing, G&A as well as R&D

Source: Company documents; Analyst estimates

15

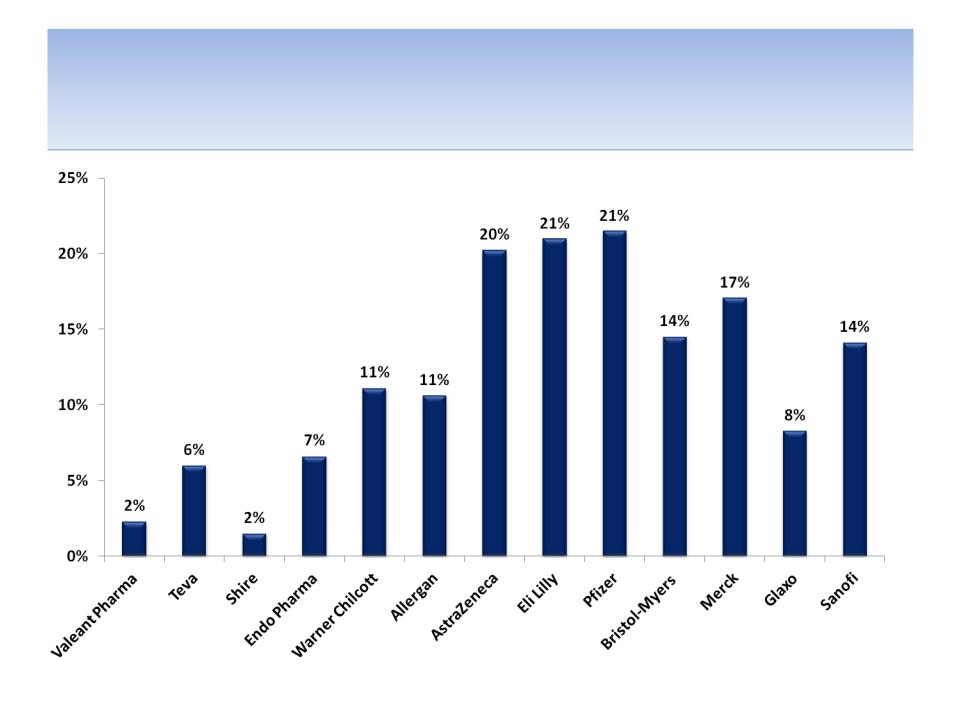

Management Had Plenty of Time to Prepare

For the Patent Cliff, But Started Too Late

For the Patent Cliff, But Started Too Late

Source: Company documents and analyst estimates

Note: Peer specialty pharmaceutical companies consist of Valeant, Teva, Shire, Endo, Warner Chilcott & Allergan ; Peer

large pharmaceutical companies consist of AstraZeneca, Eli Lilly, Pfizer, Bristol, Merck, Glaxo, Sanofi-Aventis

large pharmaceutical companies consist of AstraZeneca, Eli Lilly, Pfizer, Bristol, Merck, Glaxo, Sanofi-Aventis

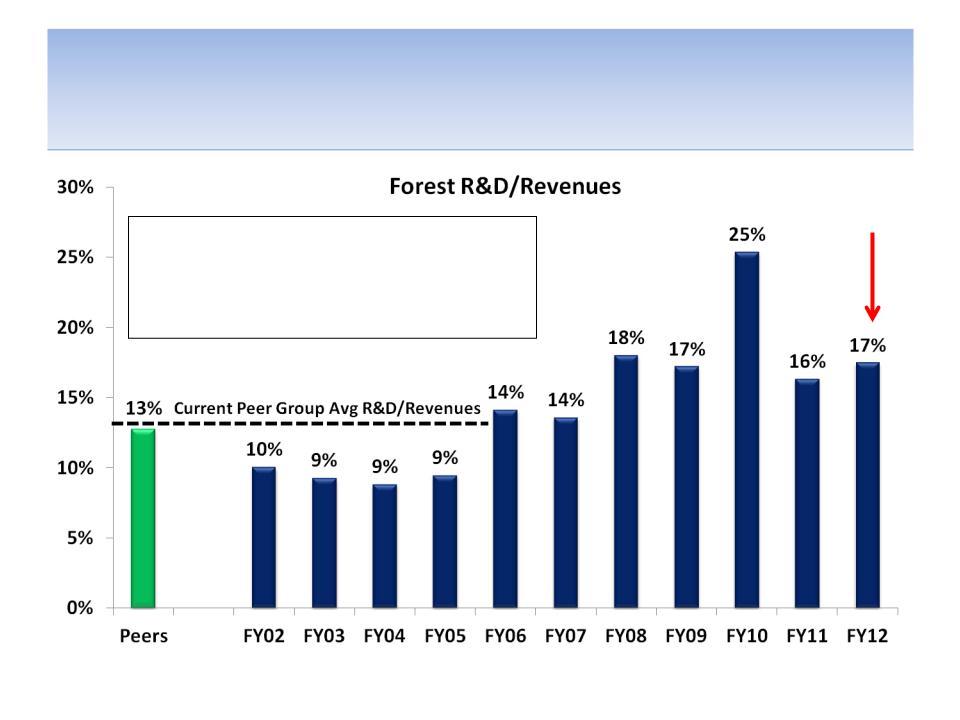

Management/Board underinvested in R&D for

several years forcing them to try to “catch up”

later. Depending on the stage of development

that a product is licensed, clinical development of

a single drug can take up to 10 years

several years forcing them to try to “catch up”

later. Depending on the stage of development

that a product is licensed, clinical development of

a single drug can take up to 10 years

Loss of

Lexapro

patent

Lexapro

patent

16

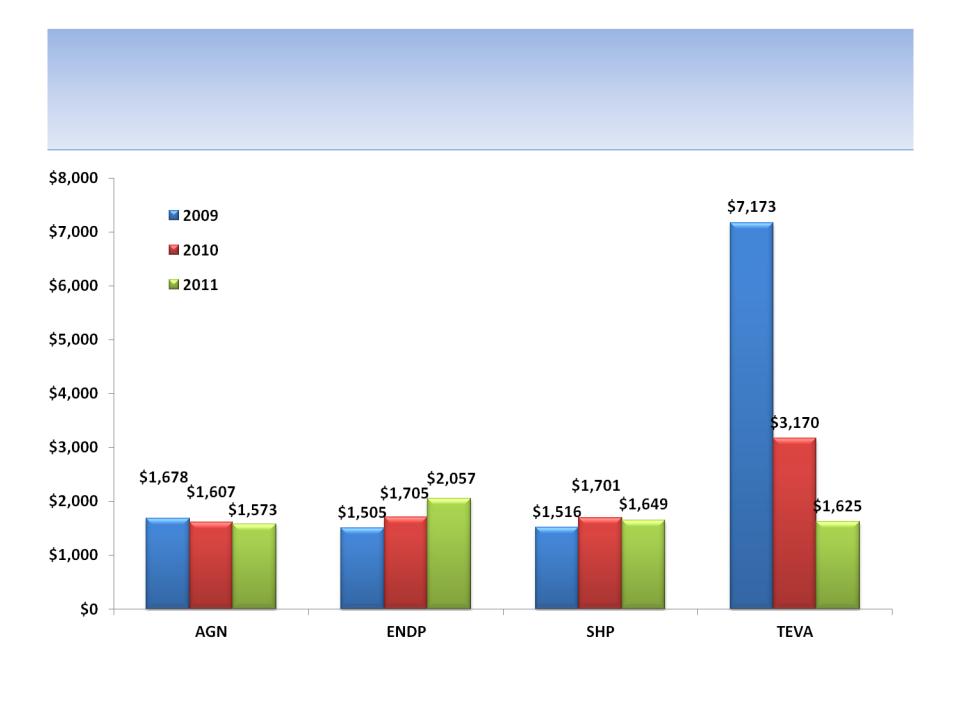

More Capital Had to be Put at Risk to

Obtain Each Additional Product

Obtain Each Additional Product

Source: Company documents

Notes: Capital at-risk is calculated for each product based on up-front payments + acquisition payments; Each year is

calculated based on a cumulative capital at-risk divided by the cumulative number of products

calculated based on a cumulative capital at-risk divided by the cumulative number of products

17

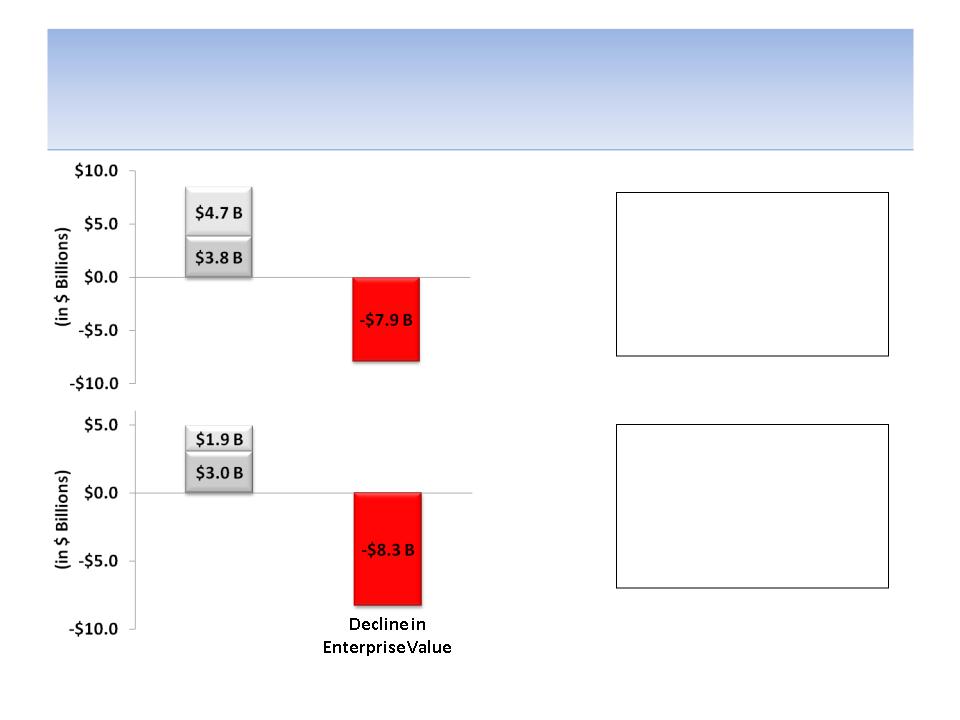

Despite All the Money Spent on Products,

Massive Value Has Been Destroyed

Massive Value Has Been Destroyed

During the last 10 years,

Forest spent $8.3 B on R&D,

licensing/milestone payments

and product/rights

acquisitions. At the same

time, $7.9 B of Enterprise

Value was destroyed

Forest spent $8.3 B on R&D,

licensing/milestone payments

and product/rights

acquisitions. At the same

time, $7.9 B of Enterprise

Value was destroyed

During the last 5 years, Forest

spent more than $6.2 B on

R&D, licensing/rights

payments and product/rights

acquisitions. At the same

time, $8.3 B of Enterprise

Value was destroyed

spent more than $6.2 B on

R&D, licensing/rights

payments and product/rights

acquisitions. At the same

time, $8.3 B of Enterprise

Value was destroyed

Source: Company documents

Notes: Enterprise value is calculated from FY03 through FY12 (10 yrs) and from FY07 through FY12 (5 yrs)

Acquisitions of companies/product rights

Acquisitions of companies/product rights

R&D/licensing & milestones payments

R&D/licensing & milestones payments

18

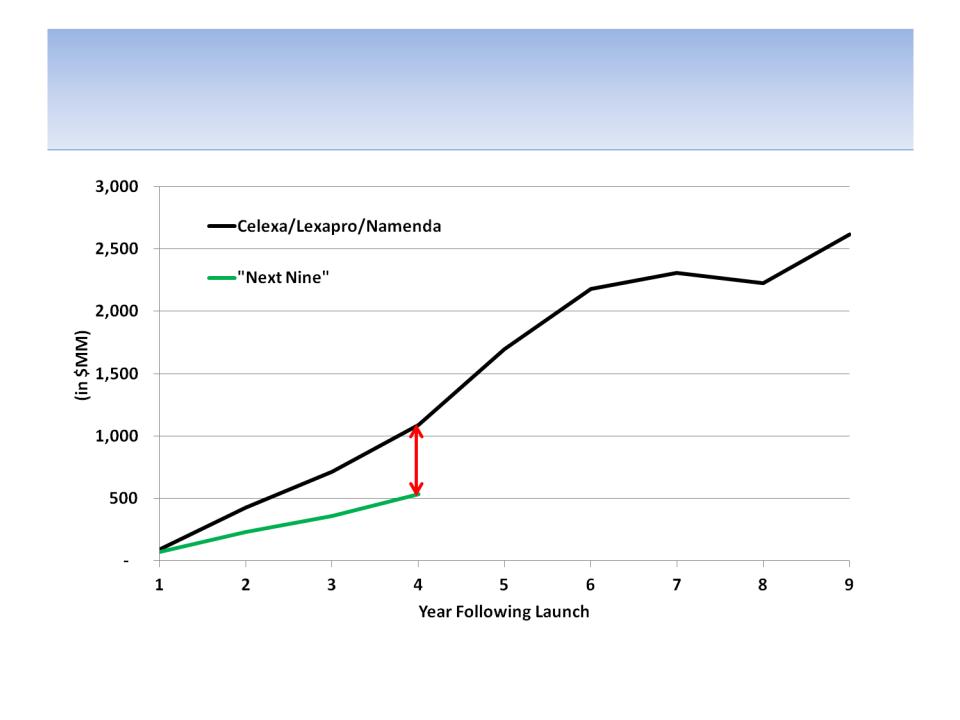

It’s Hard For Us to See How the “Next Nine”

Drugs Will Fill the Revenue Holes

Drugs Will Fill the Revenue Holes

Source: Company documents

Notes: Combined product launch curves are measured for the combined drugs assuming that the 1st year is for the 1st product

launched; additional launches are added as they occur

launched; additional launches are added as they occur

-$554 MM

19

Even If All Pipeline Drugs Were Successful, Sales

Probably Wouldn’t Have Been Enough in FY2013

Probably Wouldn’t Have Been Enough in FY2013

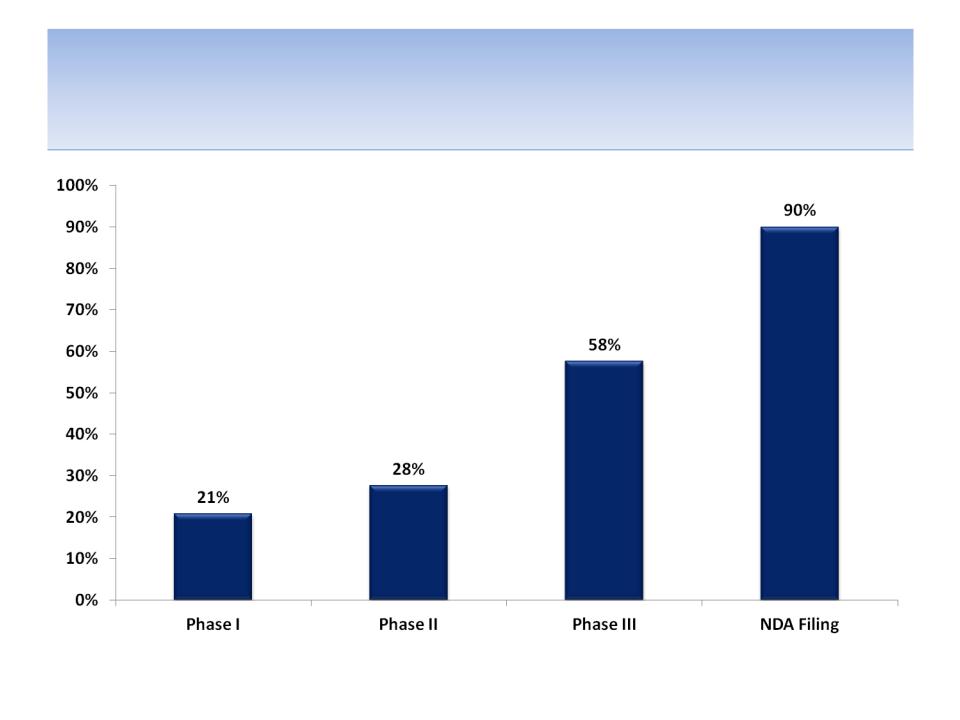

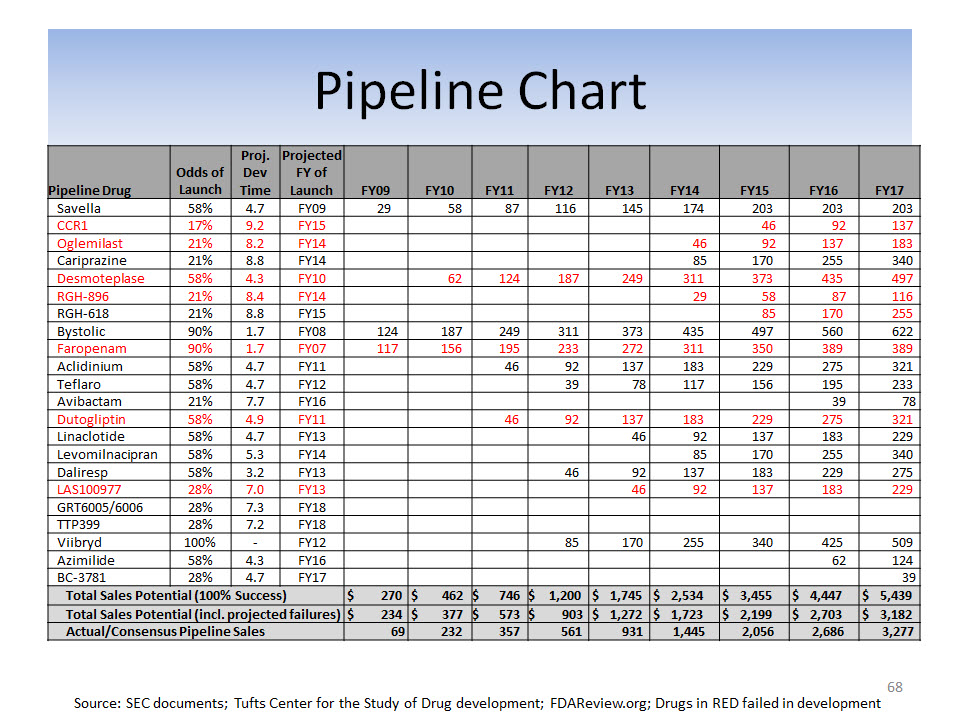

Source: Company documents and analyst estimates; Tufts Center for the Study of Drug Development for average peak drug sales,

average time to peak sales and average clinical development time by therapeutic class; FDAReview.org for probabilities of drug launch

based on stage of development (phase I = 21%; phase II = 28%; phase III = 58% and NDA filed = 90%); SEE APPENDIX C

average time to peak sales and average clinical development time by therapeutic class; FDAReview.org for probabilities of drug launch

based on stage of development (phase I = 21%; phase II = 28%; phase III = 58% and NDA filed = 90%); SEE APPENDIX C

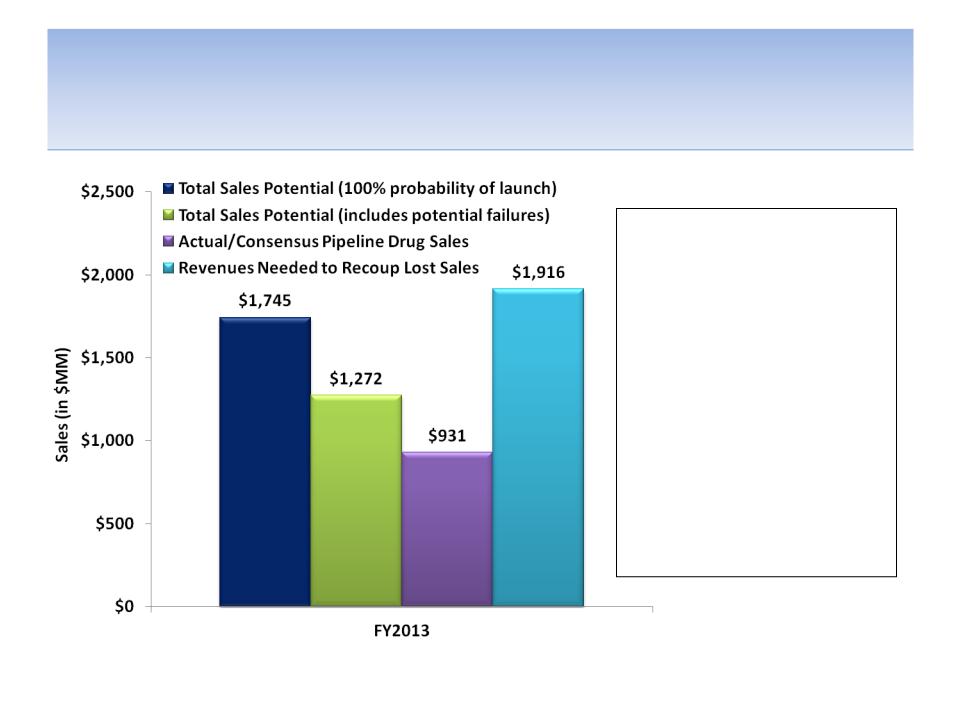

Using industry average peak sales

by therapeutic class, time to peak

sales by therapeutic class and

time in development by

therapeutic class, even

EXCLUDING the likelihood of

failure of some drugs in clinical

development, the sales potential

of drugs licensed by Forest since

2002 were well short of those

needed to offset the loss of the

Lexapro patent. Assuming

industry average drug

development failure rates, FY13

sales potential is about $650 MM

short of what was needed.

by therapeutic class, time to peak

sales by therapeutic class and

time in development by

therapeutic class, even

EXCLUDING the likelihood of

failure of some drugs in clinical

development, the sales potential

of drugs licensed by Forest since

2002 were well short of those

needed to offset the loss of the

Lexapro patent. Assuming

industry average drug

development failure rates, FY13

sales potential is about $650 MM

short of what was needed.

20

It Doesn’t Appear to Us That Pipeline

Planning for FY2016 Was Much Better…

Planning for FY2016 Was Much Better…

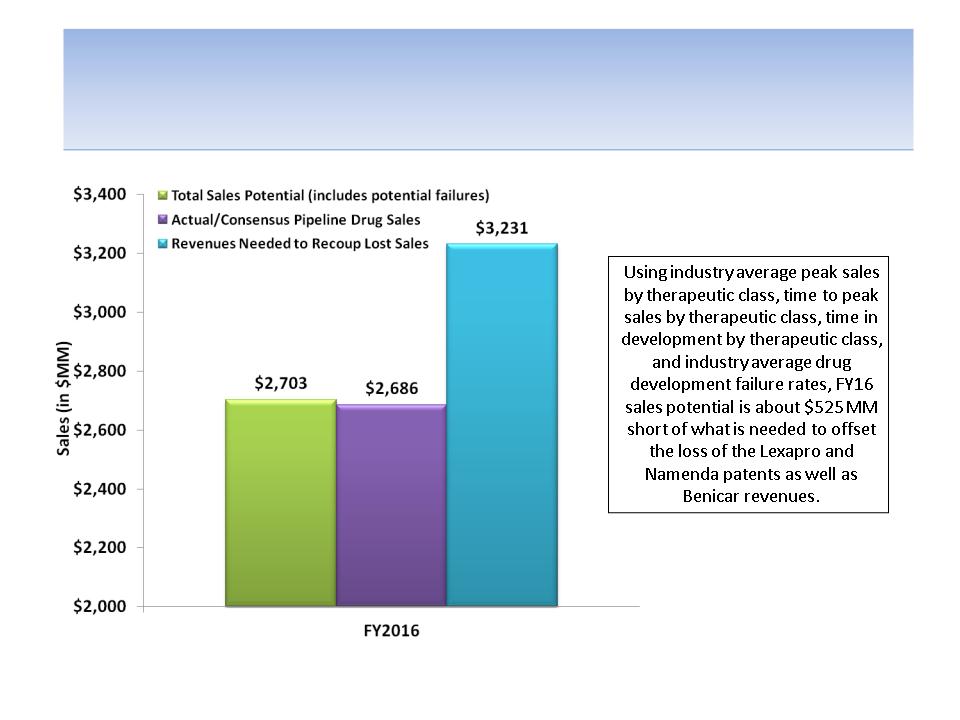

Source: Company documents and analyst estimates; Tufts Center for the Study of Drug Development for average peak drug sales,

average time to peak sales and average clinical development time by therapeutic class; FDAReview.org for probabilities of drug launch

based on stage of development (phase I = 21%; phase II = 28%; phase III = 58% and NDA filed = 90%); SEE APPENDIX C

average time to peak sales and average clinical development time by therapeutic class; FDAReview.org for probabilities of drug launch

based on stage of development (phase I = 21%; phase II = 28%; phase III = 58% and NDA filed = 90%); SEE APPENDIX C

21

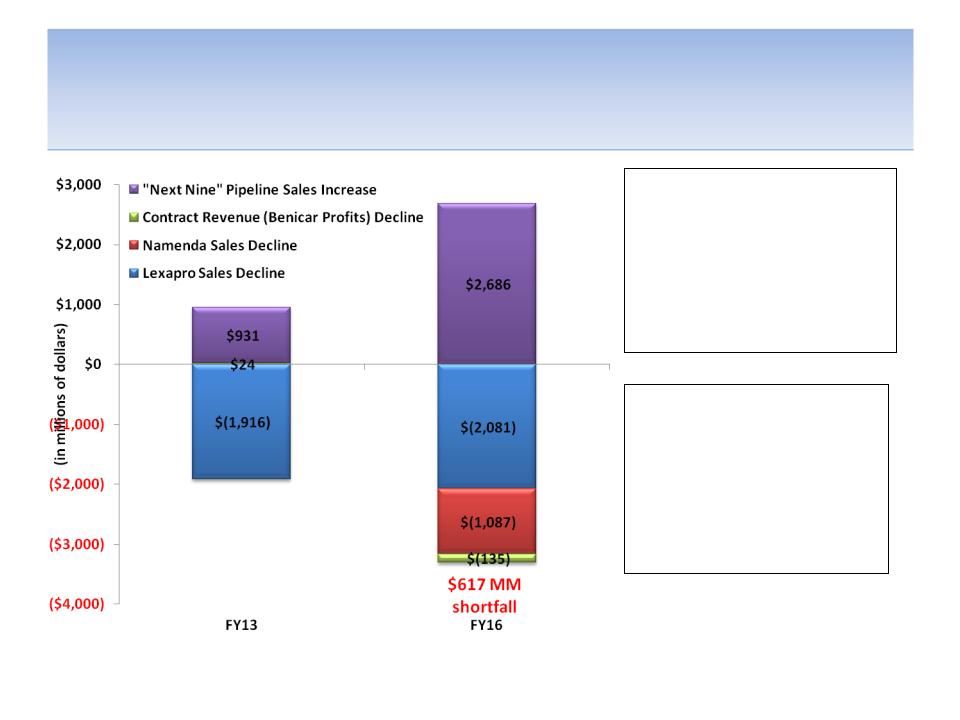

According to Analysts, Sales from “Next Nine” Pipeline

Products Not Projected to Offset Revenue Declines

Products Not Projected to Offset Revenue Declines

Source: Company documents and analyst estimates; Quote from presentation filed by company during 2011 proxy contest

Note: Lexapro sales decline is measured from FY12; Namenda sales decline is measured from FY15; Contract Revenue

decline is measured from FY13; Assumes ALL pipeline products are successfully launched

decline is measured from FY13; Assumes ALL pipeline products are successfully launched

$960 MM

shortfall

“Management efforts over

the last eight years have

built Forest’s pipeline to

offset the Loss of Exclusivity

for these two drugs [Lexapro

& Namenda]…” - company

presentation filed with SEC (2011)

the last eight years have

built Forest’s pipeline to

offset the Loss of Exclusivity

for these two drugs [Lexapro

& Namenda]…” - company

presentation filed with SEC (2011)

Revenues from the “Next

Nine” pipeline drugs are not

expected by analysts to be

enough to offset the effect

of generic competition to

Lexapro/ Namenda and lost

Benicar profits

Nine” pipeline drugs are not

expected by analysts to be

enough to offset the effect

of generic competition to

Lexapro/ Namenda and lost

Benicar profits

22

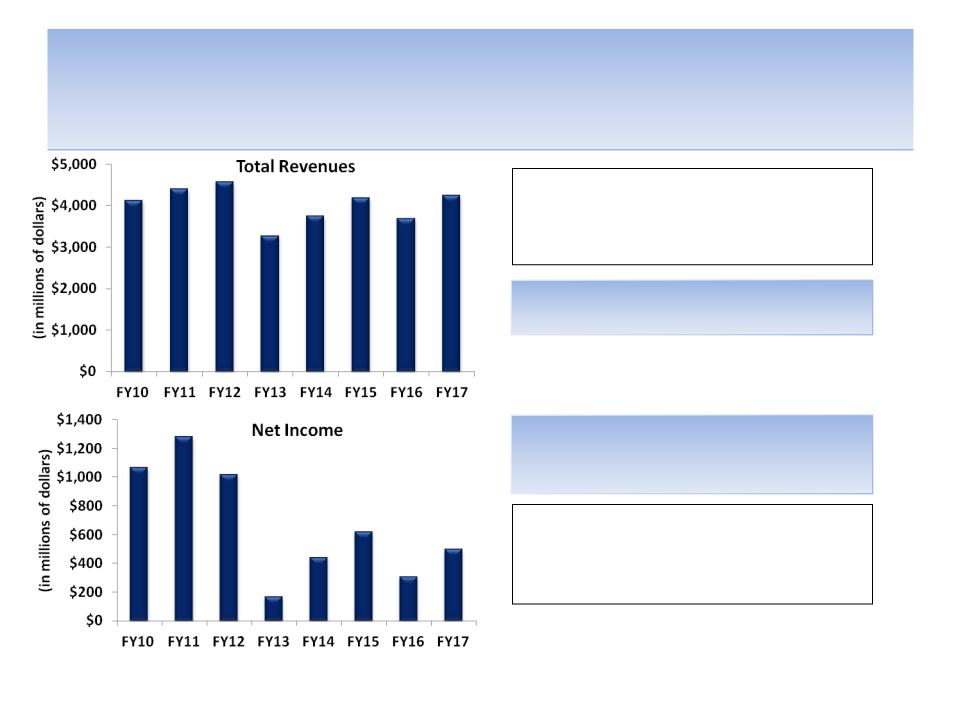

Revenues Are Projected to Decline But Profits

Are Expected to Get Hit Even Harder

Are Expected to Get Hit Even Harder

Source: Company documents and analyst estimates; Frank Perrier quote from Oct. 13, 2011

Total revenues are not expected by analysts

to regain the FY12 peak until after FY17

to regain the FY12 peak until after FY17

Even worse, net income is not expected by

analysts to regain the FY11 peak until well

after FY17

analysts to regain the FY11 peak until well

after FY17

"We think we're in a good place in

managing the next two patent expirations

in Lexapro and Namenda…“ -- Frank Perier,

CFO Forest Labs

managing the next two patent expirations

in Lexapro and Namenda…“ -- Frank Perier,

CFO Forest Labs

We don’t think being “in a good place in

managing the next two patent expirations”

means estimated net income should decline

by 75% from FY11 to FY16

managing the next two patent expirations”

means estimated net income should decline

by 75% from FY11 to FY16

23

While Forest Has Launched Multiple Products,

They Have Consistently Missed Guidance

They Have Consistently Missed Guidance

Source: Company documents; company press releases for fiscal year end results, which provide next fiscal year product sales

guidance; See APPENDIX A for actual sales guidance for each product

guidance; See APPENDIX A for actual sales guidance for each product

24

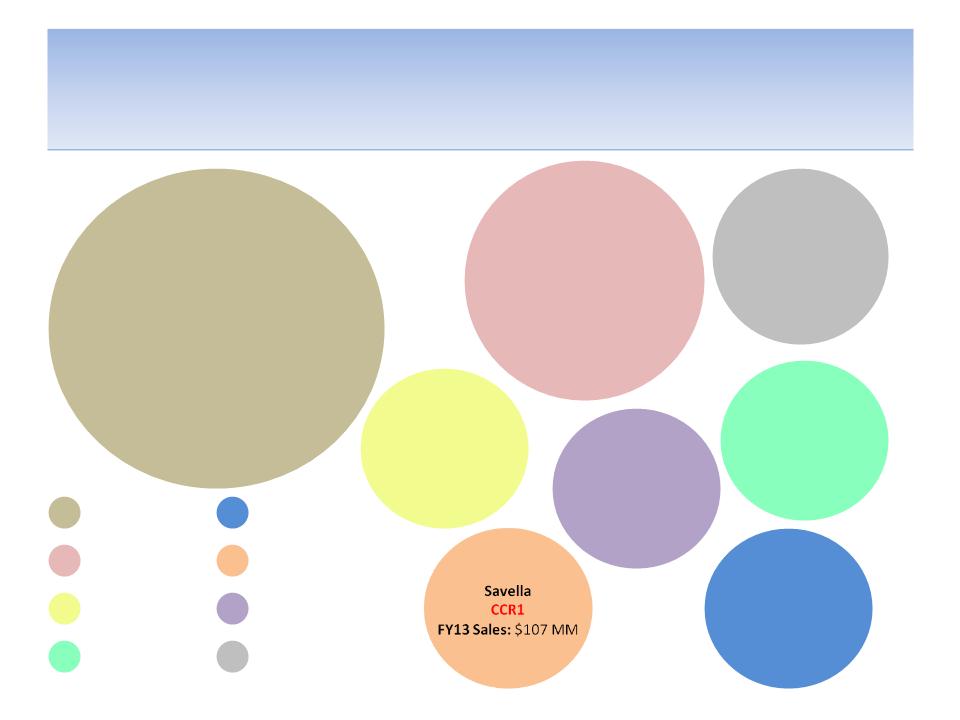

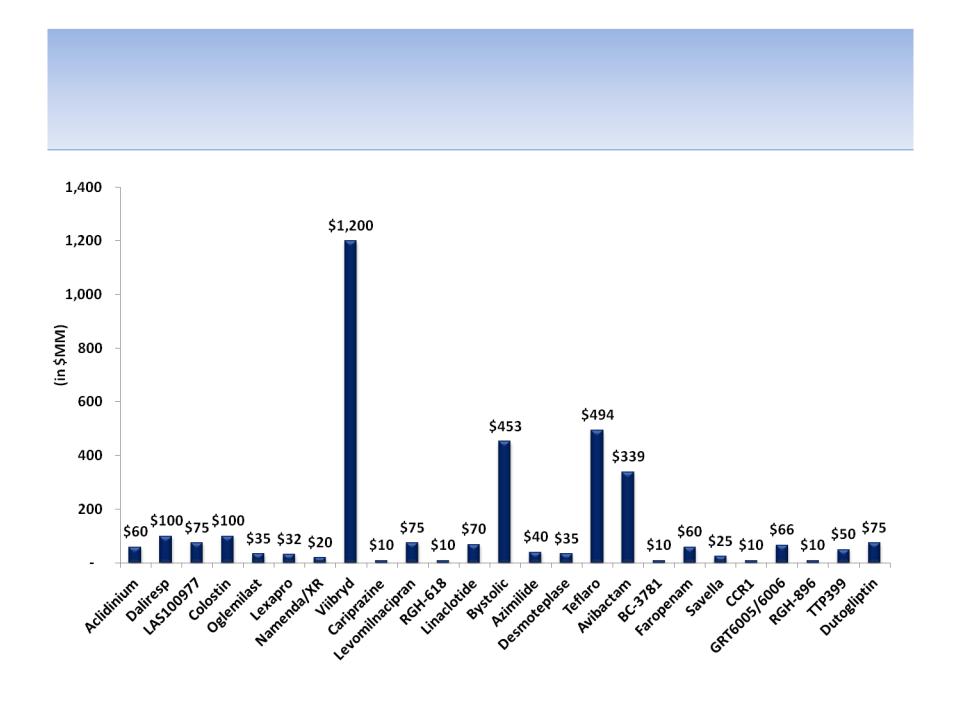

We Believe “Opportunistic” Business

Development Has Led to a Lack of Focus

Development Has Led to a Lack of Focus

TTP399

Dutogliptin

FY13 Sales: $0 MM

Linaclotide

FY13 Sales: $40 MM

GRT6005/6006

RGH-896

FY13 Sales: $0 MM

Teflaro

Avibactam

BC-3781

Faropenam

FY13 Sales: $58 MM

Daliresp

Colostin

Aclidinium

LAS100977

Oglemilast

FY13 Sales: $109 MM

Bystolic

Azimilide

Desmoteplase

FY13 Sales: $438 MM

Lexapro

Namenda

Viibryd

Cariprazine

Levomilnacipran

RGH-618

FY13 Sales: $2.0 B

Neurology

Cardiology

Diabetes

Respiratory

Pain

Other/Inflammation

Antibiotics

Gastrointestinal

Source: Company documents; Analyst estimates; BOLD RED = Failed Projects; BOLD BLACK = LAUNCHED PRODUCTS; Blue = In Development

25

We Believe Lack of Therapeutic Focus

is Hurting Sales Rep Productivity

is Hurting Sales Rep Productivity

Source: Company documents and analyst estimates

Note: Peer specialty pharmaceutical companies include Valeant, Shire, Endo & Allergan; other peers are not available in SEC filings; FRX

operates on a March fiscal year (FY12 ended in March 2012), thus peer data is for most recent fiscal year, i.e. FY12 = FY11 for peers

operates on a March fiscal year (FY12 ended in March 2012), thus peer data is for most recent fiscal year, i.e. FY12 = FY11 for peers

26

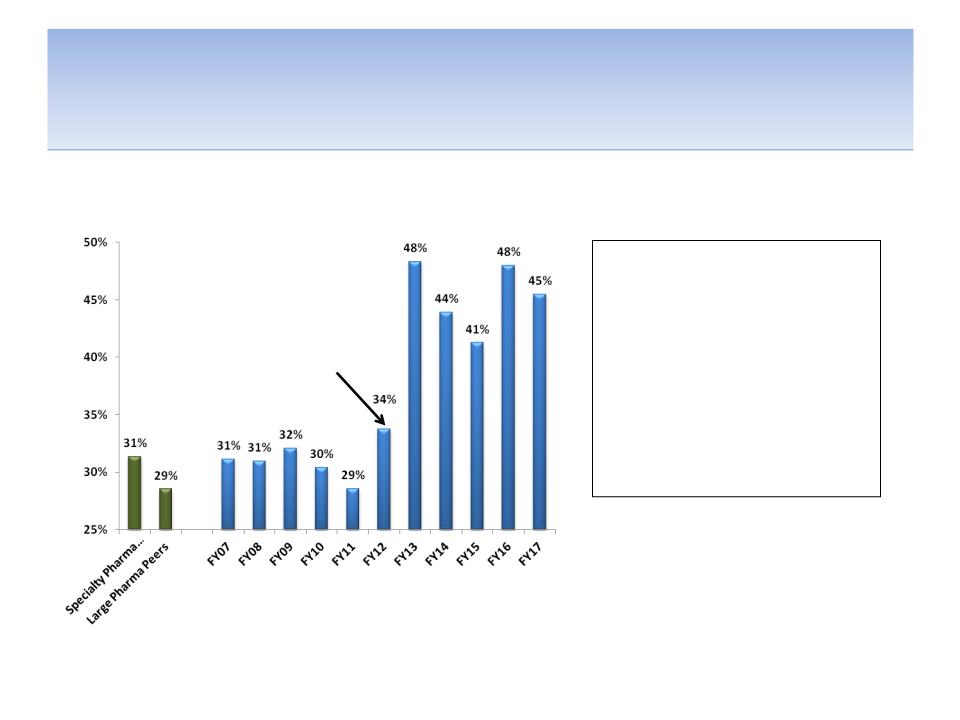

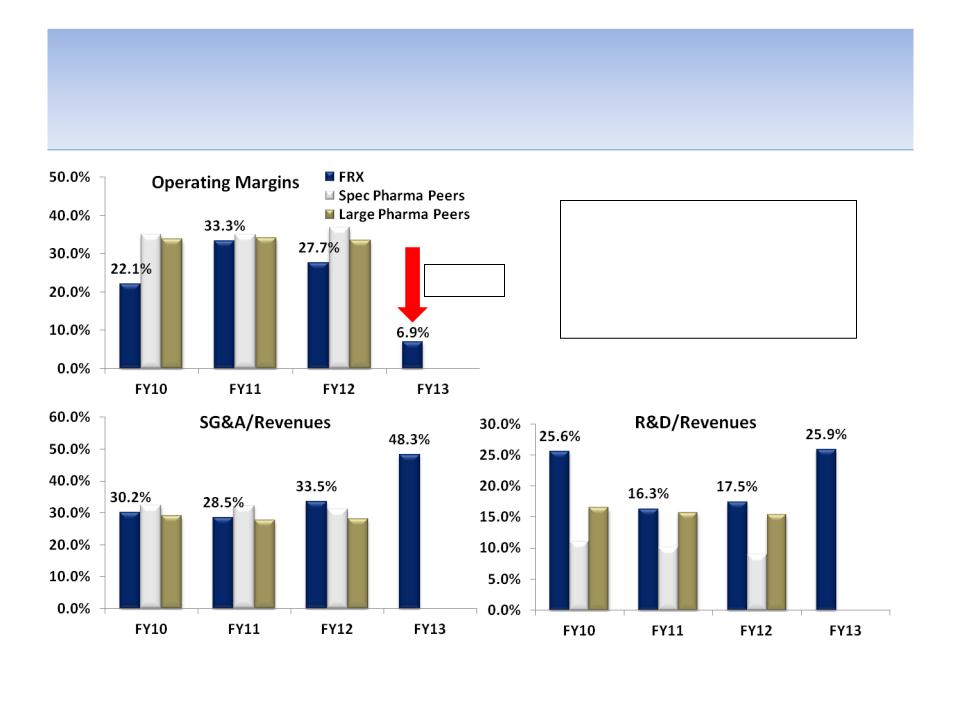

We Believe Loss of Lexapro Sales Has Further Exposed

Massive Corporate Inefficiency & Lack of Cost Synergies

Massive Corporate Inefficiency & Lack of Cost Synergies

SG&A/Revenues (Forest vs. Peers)

Lack of Critical Mass

Source: Company documents and analyst estimates

Note: Peer specialty pharmaceutical companies include Valeant, Teva, Shire, Endo, Warner Chilcott & Allergan ; Peer large

pharmaceutical companies include AstraZeneca, Eli Lilly, Pfizer, Bristol, Merck, Glaxo, Sanofi-Aventis

pharmaceutical companies include AstraZeneca, Eli Lilly, Pfizer, Bristol, Merck, Glaxo, Sanofi-Aventis

Loss of

Lexapro

patent

Lexapro

patent

27

• With the loss of Lexapro sales

due to generic competition, it

has become very clear to us

that SG&A is too high

due to generic competition, it

has become very clear to us

that SG&A is too high

• Without critical mass within

specific therapeutic areas, the

significant fixed costs

associated with the addition

of incremental sales reps

creates cost inefficiency

specific therapeutic areas, the

significant fixed costs

associated with the addition

of incremental sales reps

creates cost inefficiency

Operating Margins Are Trending in the

Wrong Direction

Wrong Direction

Operating margins have been

and analysts expect them to

continue getting compressed as

SG&A and R&D as a percentage

of revenues increases

and analysts expect them to

continue getting compressed as

SG&A and R&D as a percentage

of revenues increases

Source: Company documents; analyst estimates; FRX operates on a March fiscal year (FY12 ended in March 2012),

thus peer data is for most recent fiscal year, i.e. FY12 = FY11 for peers

thus peer data is for most recent fiscal year, i.e. FY12 = FY11 for peers

-26.4%

28

We Believe Management & Board Have a

Poor Track Record of Allocating Capital

Poor Track Record of Allocating Capital

Cash used for share repurchases

Cash used for licensing or acquiring products

Source: Company documents; 10 year values measured from YE 2002 through YE 2012; 5 Year

values measured from YE07 through YE12; Enterprise Value = Market Cap + Debt - Cash

values measured from YE07 through YE12; Enterprise Value = Market Cap + Debt - Cash

Cash used for share repurchases

Cash used for licensing or acquiring products

During the past 10 years as

$8.5 B of capital was

deployed for obtaining

products and repurchasing

shares, there was a decline

in enterprise value of $7.9 B

$8.5 B of capital was

deployed for obtaining

products and repurchasing

shares, there was a decline

in enterprise value of $7.9 B

During the past 5 years as

$4.9 B of capital was

deployed for obtaining

products and repurchasing

shares, there was a decline

in enterprise value of $8.3 B

$4.9 B of capital was

deployed for obtaining

products and repurchasing

shares, there was a decline

in enterprise value of $8.3 B

29

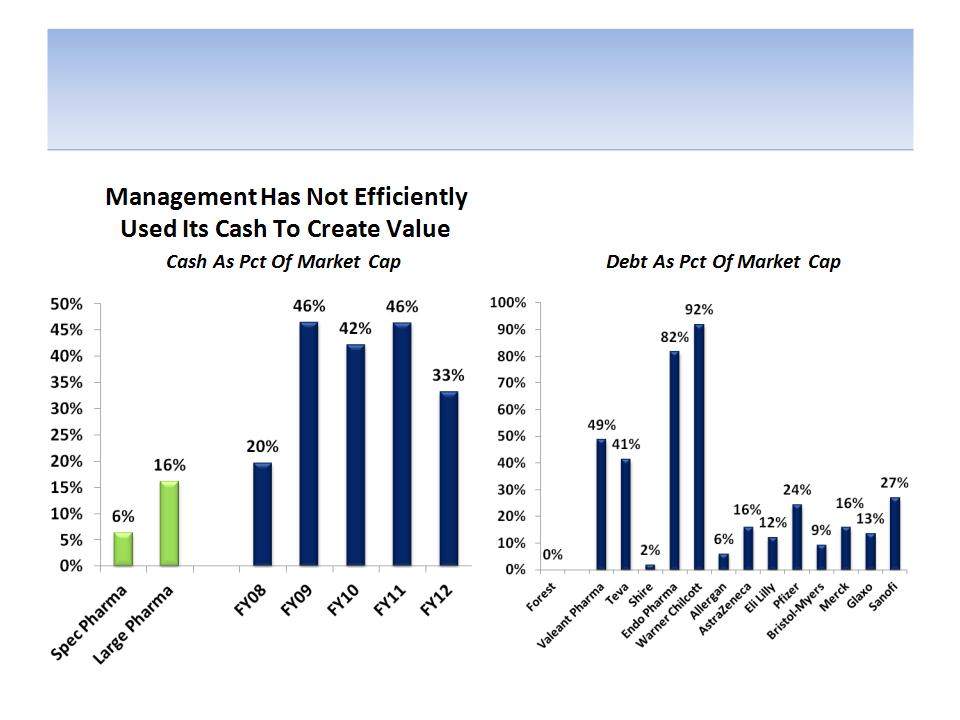

We Believe Management & Board Have Not

Efficiently Used Forest’s Balance Sheet

Efficiently Used Forest’s Balance Sheet

Management Is Not Efficiently

Using Leverage To Create Value

Using Leverage To Create Value

Source: Company documents and analyst estimates

Note: Peer spec pharmaceutical companies include Valeant, Teva, Shire, Endo, Warner Chilcott & Allergan ; Peer large pharmaceutical

companies include AstraZeneca, Eli Lilly, Pfizer, Bristol, Merck, Glaxo, Sanofi-Aventis

companies include AstraZeneca, Eli Lilly, Pfizer, Bristol, Merck, Glaxo, Sanofi-Aventis

30

We Are Concerned About How Management

May Use the Cash Given Its Track Record

May Use the Cash Given Its Track Record

• Given its history of destroying significant value during the last 10

years, we are very concerned about how management may choose

to use the company’s $3.2 B of cash

years, we are very concerned about how management may choose

to use the company’s $3.2 B of cash

• Because of the current & projected revenue shortfalls from generic

competition, we believe management may “swing for the fences”

competition, we believe management may “swing for the fences”

• Analysts do not believe what they have in the pipeline is enough

and therefore may need to do acquisitions:

and therefore may need to do acquisitions:

– “The pipeline, as currently constituted, is not nearly enough to replace

the lost revenue from losing Lexapro and Namenda to generics.” --

David Amsellem of Piper Jaffray

the lost revenue from losing Lexapro and Namenda to generics.” --

David Amsellem of Piper Jaffray

– “I don’t think what they have in their pipeline is enough . At some

point, you’re going to see them use that balance sheet” - Gary

Nachman of Susquehanna

point, you’re going to see them use that balance sheet” - Gary

Nachman of Susquehanna

31

Source: Company documents; SEC filings; quotes from Bloomberg article from July 6, 2012

We Remain Concerned About Corporate

Governance Issues

Governance Issues

• At least 50% of the Board continues to lack true independence, in our

opinion

opinion

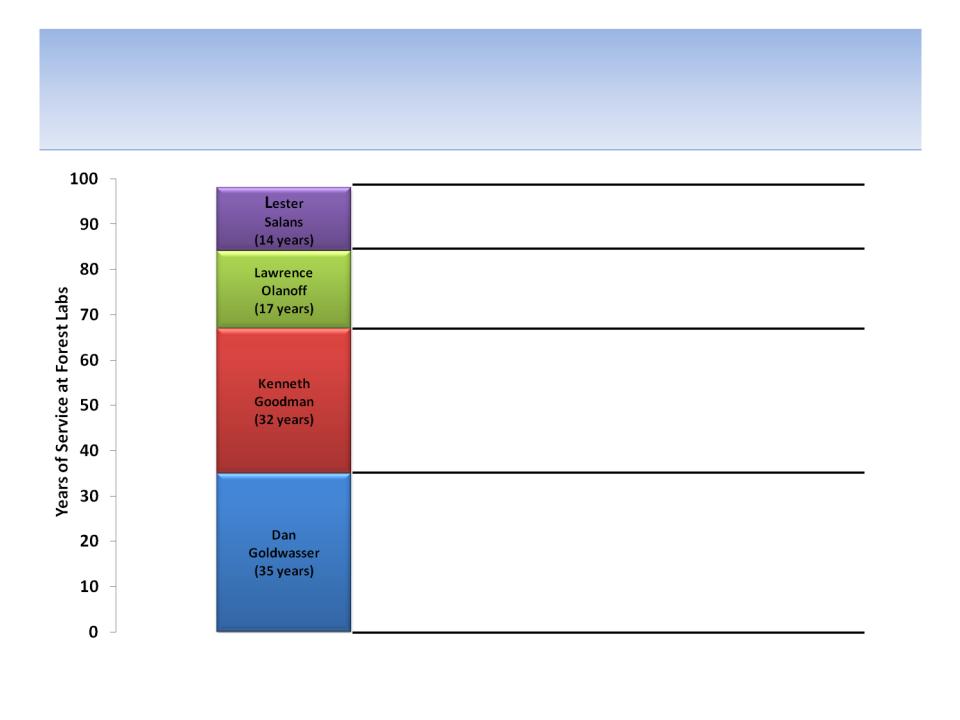

– The Presiding “Independent” Director (Kenneth Goodman) lacks true independence

yet he still remains in this important role

yet he still remains in this important role

– The Chair of the Compensation Committee (Dan Goldwasser) who oversaw seriously

flawed compensation policies inexplicably remains in place

flawed compensation policies inexplicably remains in place

• The CEO (Howard Solomon) has had extremely fortunate timing on

large sales of stock

large sales of stock

• The CEO succession plan seems to include the CEO’s son but doesn’t

appear to us to equitably include external candidates

appear to us to equitably include external candidates

• Promotion of CEO’s son to crucial role as head of Strategic Planning

despite relative inexperience in the area

despite relative inexperience in the area

• The Company has had $423 MM of legal settlements including a guilty

plea to a felony charge of obstruction of justice

plea to a felony charge of obstruction of justice

32

Source: Company documents; SEC filings

We Believe At Least 50% of the Board Continues to

Lack True Independence (5 out of 10 Directors)

Lack True Independence (5 out of 10 Directors)

Source: Company documents

33

Compensation Policies Have Been

Flawed But Chairman Remains at Helm

Flawed But Chairman Remains at Helm

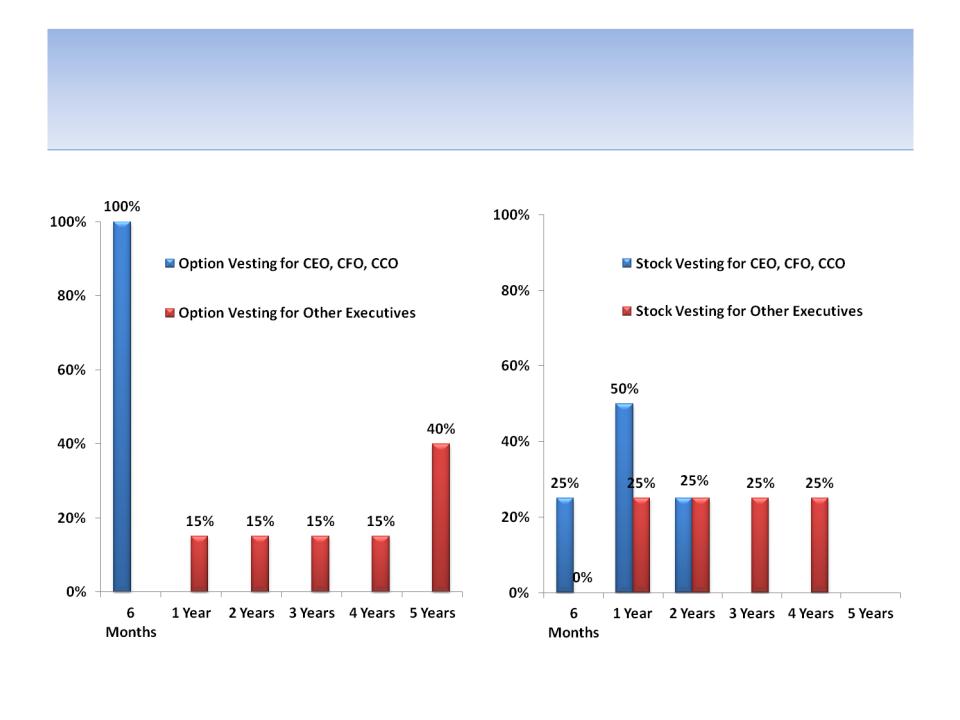

• Chair of Compensation Committee (Dan Goldwasser - Board member for 35

years) presided over serious problems related to compensation policy

years) presided over serious problems related to compensation policy

• Policy changes during the last year confirm these problems

– Vesting schedules of equity awards were too short, not linked to performance

and favored the CEO

and favored the CEO

– The Compensation Committee had not previously engaged an independent

compensation consultant

compensation consultant

– The Chair of the Committee chose the peer group for comparison purposes

– The Chair circulated a report of factors he believed were relevant to

determining compensation including a report prepared directly by management

determining compensation including a report prepared directly by management

– Compensation was not linked to pre-determined performance measures

– There were no stock ownership requirements

• Then, why is Dan Goldwasser still Chair of the Compensation

Committee given these problems with compensation policy?

Committee given these problems with compensation policy?

Source: Company documents

34

CEO’s Preferential Option & Stock

Vesting Schedule

Vesting Schedule

35

Source: 2011 proxy statement; CEO = Howard Solomon; CFO = Frank Perier; CCO (chief commercial officer) = Elaine Hochberg

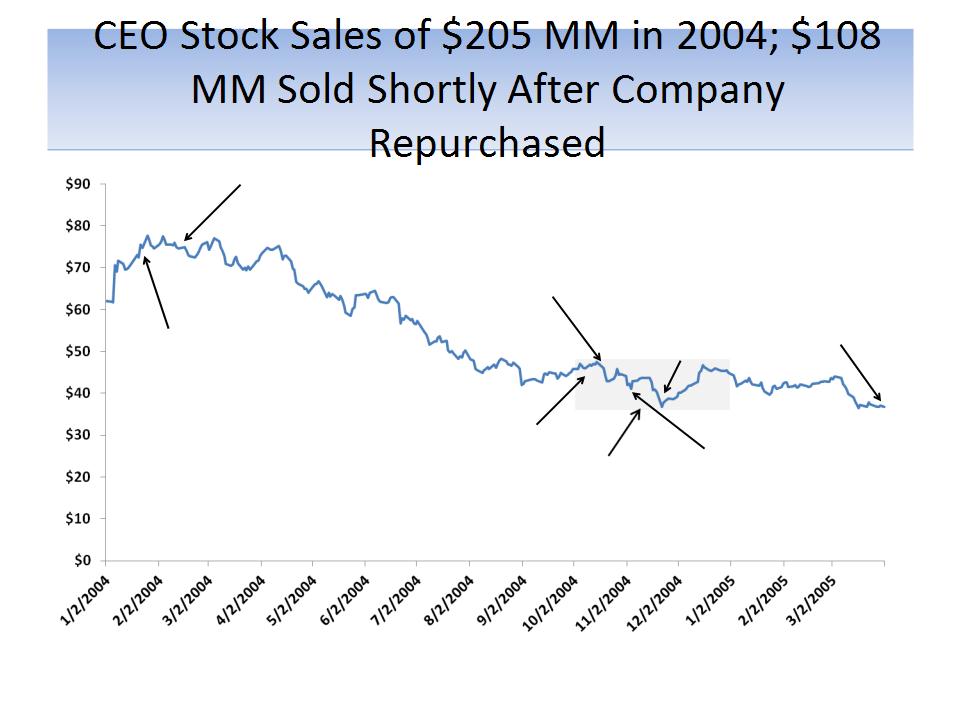

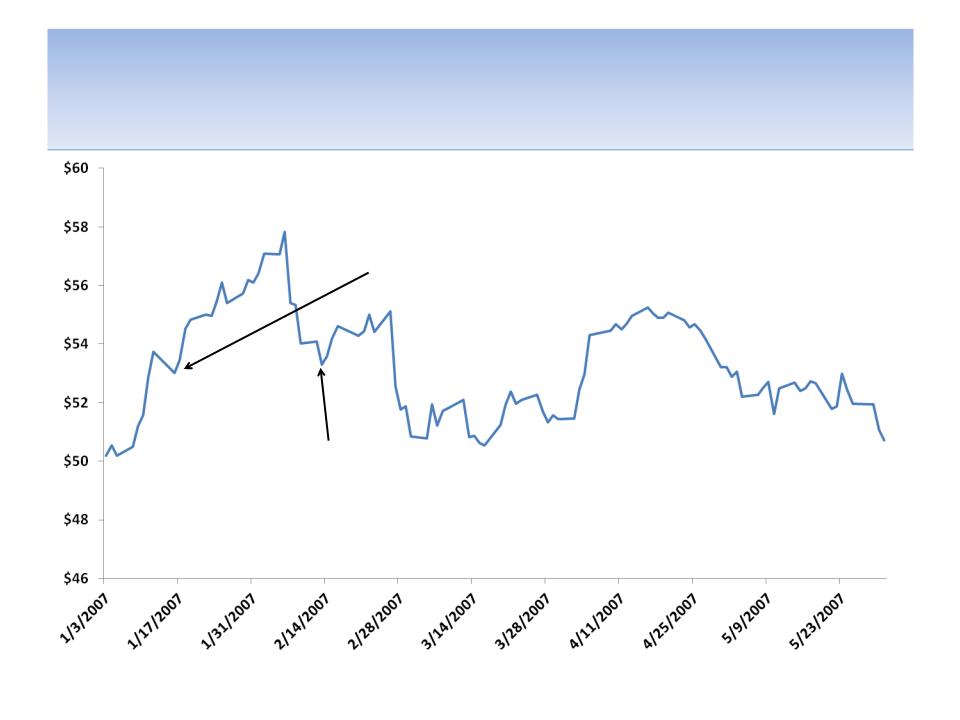

Fortunately Timed Stock Sales by CEO

36

Nov ‘04: CEO Solomon sold 2.5

MM shares at $43.26 per share

for proceeds of $108.2 MM

MM shares at $43.26 per share

for proceeds of $108.2 MM

Feb ‘07: CEO Solomon sold 4.3

MM shares at $52.60 per share

for proceeds of $226.2 MM

MM shares at $52.60 per share

for proceeds of $226.2 MM

Source: SEC filings; three largest sales by CEO during period

“Our financial performance for

the remainder of the fiscal year

ending March 31, 2004 should

result in earnings per share for

the year at the high end of our

previously issued guidance

[$1.92]. Regarding fiscal 2005

EPS, we continue to project a

range of $2.30 - $2.50.” - Jan 20,

2004

the remainder of the fiscal year

ending March 31, 2004 should

result in earnings per share for

the year at the high end of our

previously issued guidance

[$1.92]. Regarding fiscal 2005

EPS, we continue to project a

range of $2.30 - $2.50.” - Jan 20,

2004

CEO Howard Solomon sells 1.3

MM shares at $74.85 for

proceeds of $97.3 MM from

2/11/04 - 2/17/04

MM shares at $74.85 for

proceeds of $97.3 MM from

2/11/04 - 2/17/04

“Forest Laboratories

to Exceed Fiscal 2005

Second And Third

Quarter Mean

earnings Per Share

Estimates” - Oct. 4,

2004

to Exceed Fiscal 2005

Second And Third

Quarter Mean

earnings Per Share

Estimates” - Oct. 4,

2004

“All of our principal promoted

brands exhibited strong

growth…and we expect this

performance to continue in the

future…Given the underlying

strength…we are increasing our

projected EPS for the fiscal year

ending March 31, 2005 to at least

$2.70.” - Oct 18, 2004

brands exhibited strong

growth…and we expect this

performance to continue in the

future…Given the underlying

strength…we are increasing our

projected EPS for the fiscal year

ending March 31, 2005 to at least

$2.70.” - Oct 18, 2004

“Forest Laboratories …has

revised its guidance for

diluted earnings per share

for the fiscal year ending

March 31, 2005 [to]

approximately $2.50.” - Nov

1, 2004

revised its guidance for

diluted earnings per share

for the fiscal year ending

March 31, 2005 [to]

approximately $2.50.” - Nov

1, 2004

Fiscal Year ending

March 31, 2005 EPS

of $2.25

March 31, 2005 EPS

of $2.25

CEO Howard Solomon sells

2.5 MM shares at $43.26 for

proceeds of $108 MM from

11/8/04 - 11/17/04

2.5 MM shares at $43.26 for

proceeds of $108 MM from

11/8/04 - 11/17/04

Forest repurchases 13.8

MM shares during the 4th

quarter of 2004; it bought

2.3 MM in Nov. at an avg.

price of $37.64

MM shares during the 4th

quarter of 2004; it bought

2.3 MM in Nov. at an avg.

price of $37.64

Source: SEC filings; company press releases; Direct quotes from Howard Solomon

37

CEO Sells Stock Worth $226 MM All On One Day in

2007 And Says It Was For Estate Planning Purposes

2007 And Says It Was For Estate Planning Purposes

CEO Howard Solomon sells 4.3 MM shares at

$52.60 for proceeds of $226 MM on 2/12/07;

Solomon states, “I have reached an age when it is

necessary for me to further an estate plan... These

share dispositions are being undertaken solely for

those purposes.”

$52.60 for proceeds of $226 MM on 2/12/07;

Solomon states, “I have reached an age when it is

necessary for me to further an estate plan... These

share dispositions are being undertaken solely for

those purposes.”

“We are encouraged by both

the performance of our key

marketed products and by the

opportunities we currently

have in our development

pipeline...“ - CEO Howard

Solomon Jan 16, 2007

the performance of our key

marketed products and by the

opportunities we currently

have in our development

pipeline...“ - CEO Howard

Solomon Jan 16, 2007

Source: SEC filings; company press releases

38

We Believe CEO Succession Is Long Overdue &

Should Equitably Include External Candidates

Should Equitably Include External Candidates

• Howard Solomon is currently 84 years old, has been CEO for 35 years and the

government considered excluding Solomon from government contracts as recently as 1

year ago so succession planning is long overdue

government considered excluding Solomon from government contracts as recently as 1

year ago so succession planning is long overdue

• Instead of preparing for succession by reducing his responsibilities, CEO Solomon took

on a larger role as President after COO Olanoff retired in 2010 and hasn’t yet

relinquished the role

on a larger role as President after COO Olanoff retired in 2010 and hasn’t yet

relinquished the role

• David Solomon, CEO Howard Solomon’s son and still independent movie producer, has

been promoted as an apparent contender for CEO, which we believe represents a

significant conflict and may be setting the stage for the creation of a dynasty

been promoted as an apparent contender for CEO, which we believe represents a

significant conflict and may be setting the stage for the creation of a dynasty

• Other recent promotions of Hochberg, Taglietti, and Perier collectively oversaw the

inadequate execution of the company ‘s flawed strategy, in our opinion

inadequate execution of the company ‘s flawed strategy, in our opinion

• Given potential conflicts, a lack of execution by internal candidates and the need for a

fresh perspective, it is crucial for external candidates to be evaluated as well, in our

opinion

fresh perspective, it is crucial for external candidates to be evaluated as well, in our

opinion

Source: Company documents, company comments, press releases and analyst comments

39

CEOs Son Promoted to Key Role of

Strategic Planning

Strategic Planning

• Business development and strategic planning involve building the

company’s pipeline for future growth

company’s pipeline for future growth

• In Forest’s case, because of the huge revenue holes being generated by

the patent expirations of Lexapro and Namenda, which represent 80% of

revenues, the role has outsized importance

the patent expirations of Lexapro and Namenda, which represent 80% of

revenues, the role has outsized importance

• David Solomon, the CEOs son with a background as a movie producer and

entertainment lawyer, was promoted into this crucial area just 5 years

after joining Forest. And, he was promoted to become the Head of the

division just 4 years later

entertainment lawyer, was promoted into this crucial area just 5 years

after joining Forest. And, he was promoted to become the Head of the

division just 4 years later

• Because the company has not adequately offset the revenue shortfalls

due to the patent cliffs, we believe he has failed in this role

due to the patent cliffs, we believe he has failed in this role

• Therefore, we believe strategic failure of the company rests on his

shoulders and the irresponsible actions of the Board and management

which lead to his promotion

shoulders and the irresponsible actions of the Board and management

which lead to his promotion

40

Poor Risk Management & Compliance Has

Resulted in $423 MM in Legal Settlements

Resulted in $423 MM in Legal Settlements

• We do not see how Lester Salans, a Clinical Professor and physician, as

Chair of the Compliance Committee has any qualifications as a compliance

expert

Chair of the Compliance Committee has any qualifications as a compliance

expert

• These payments may be representative of a lax culture and complacency

at the Board level

at the Board level

• $313 MM related to doctor kickbacks, off-label promotion for children and

obstructing an agency proceeding

obstructing an agency proceeding

• $65 MM related to making false and misleading statements with respect

to anti-depression drugs

to anti-depression drugs

• $25 MM for securities claims against Forest and certain officers

• $20 MM for a patent infringement suit related to Lexapro

• $100 MM gender discrimination class action filed recently

Source: Company documents

41

We Do Not Believe Management Has

Delivered on Its Word

Delivered on Its Word

What They Said … | What Happened … |

Management said, they were “in a good place in managing the next two patent expirations in Lexapro and Namenda…“ -- Frank Perrier, CFO quote from Oct. 13, 2011 | FY13 guidance was for revenues to decline by more that $1 B from FY12 and EPS to decline by almost 80% and almost $3 from FY12 |

“Management efforts over the last eight years have built Forest’s pipeline to offset the Loss of Exclusivity for these two drugs [Lexapro & Namenda]…” - Company presentation filed during 2011 proxy contest | Pipeline product sales have missed initial annual company guidance 8 out of 11 times. Sales from pipeline products will fall ~$1 B short of “offsetting…these two drugs” during FY13. |

Management said that FY13 EPS would not be less than $1.20 - company press release from April 19, 2011 | Management lowered FY13 EPS guidance twice, ultimately to $0.65 - $0.80 |

Management said that they had an “excellent track record of creating shareholder value.” -- Company presentation filed during 2011 proxy contest | During the past 10 years, the company’s equity value has declined by $5.6 B or 37% and its enterprise value by $7.9 B or 55% |

Management claimed to have a long-term incentive plan with stock and options that “vest over time and thus reward sustained performance by executive officers and discourage unnecessary risk.” - proxy statement filed with SEC in 2011 | Three executives including CEO Howard Solomon enjoyed an accelerated vesting schedule for stock and options |

“…therapeutic diversification creates tremendous synergy, as most of these products are to be marketed by our primary care sales forces to a common group of primary care physicians…” -- DEFA14A 8/1/11 | Operating margins have been deteriorating as the direct result of climbing SG&A spending associated with the company’s entrance into multiple unrelated therapeutic areas |

Forest has a longstanding track record of delivering … superior value for shareholders, including share appreciation that has exceeded the S&P 500 and the AMEX Pharmaceutical Index - SEC filing July 29th, 2011 | The stock has underperformed most relevant indices over 1, 3, 5, and 10 years |

Source: Company documents, press releases, presentations

42

Icahn Nominee Plan For Meaningful

Change at Forest Labs

Change at Forest Labs

Icahn Recommendations

How to Get the Forest Growing Again

How to Get the Forest Growing Again

• Independently evaluate current business development strategy, which we

believe is unfocused

believe is unfocused

• Develop a clear strategy focused on creating shareholder value

• Assess potential divestiture of non-core assets

• Evaluate ways to reduce SG&A spending

• Evaluate development programs for potential rationalization

• Identify ways to improve revenue growth with modernized sales &

marketing effort

marketing effort

• Increase efficiency & effectiveness of capital allocation decisions

• Improve corporate governance

• Review current management team as well as culture and implement any

necessary changes

necessary changes

44

Independently Evaluate and Potentially

Change Current Business Development

Strategy

Change Current Business Development

Strategy

• We believe the “Opportunistic” approach by the company has caused

it to lose its focus and has resulted in an inefficient cost structure

it to lose its focus and has resulted in an inefficient cost structure

• Engage an independent consultant to evaluate the company’s business

strategy and its long-term potential

strategy and its long-term potential

• Identify specific therapeutic areas that meet pre-determined criteria

• If a new strategy is focused on specific therapeutic areas then divest

non-core assets and programs

non-core assets and programs

• Focus on a strategy that will better leverage its existing infrastructure

• Only enter into product licensing deals and acquisitions that strictly

adhere to specific return on investment criteria

adhere to specific return on investment criteria

45

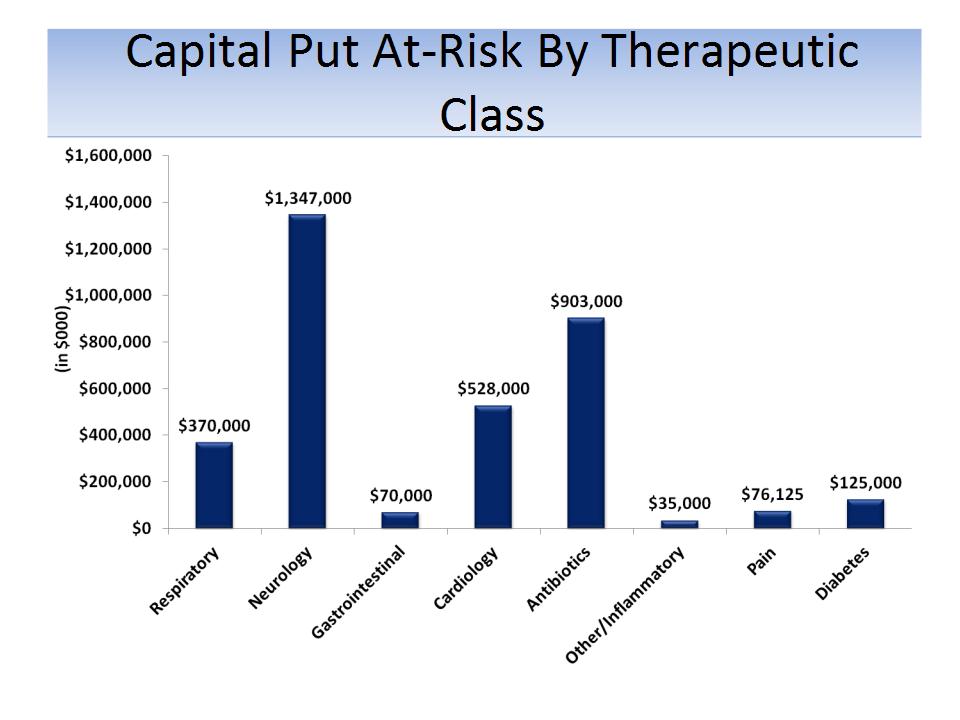

Focus on Specific Therapeutic Categories

Likely to Provide The Best Returns

Likely to Provide The Best Returns

Source: company documents; analyst projections; capital at risk = upfront cash payments as part

of licensing deals and cash acquisitions of companies or product rights

of licensing deals and cash acquisitions of companies or product rights

46

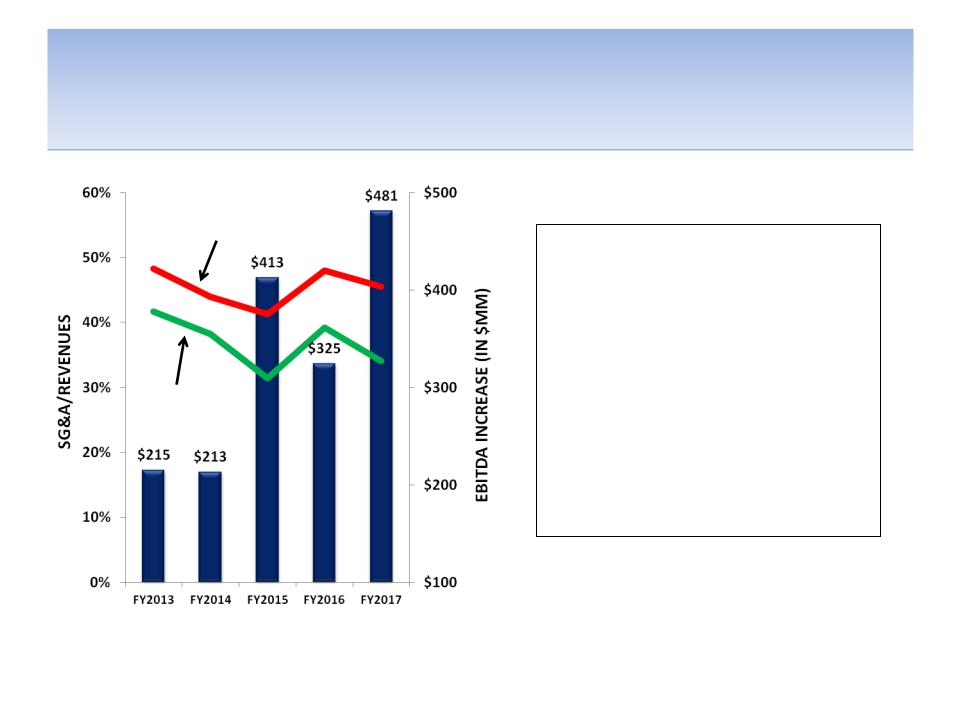

SG&A Efficiencies Could Increase EBITDA

By Almost $500 MM

By Almost $500 MM

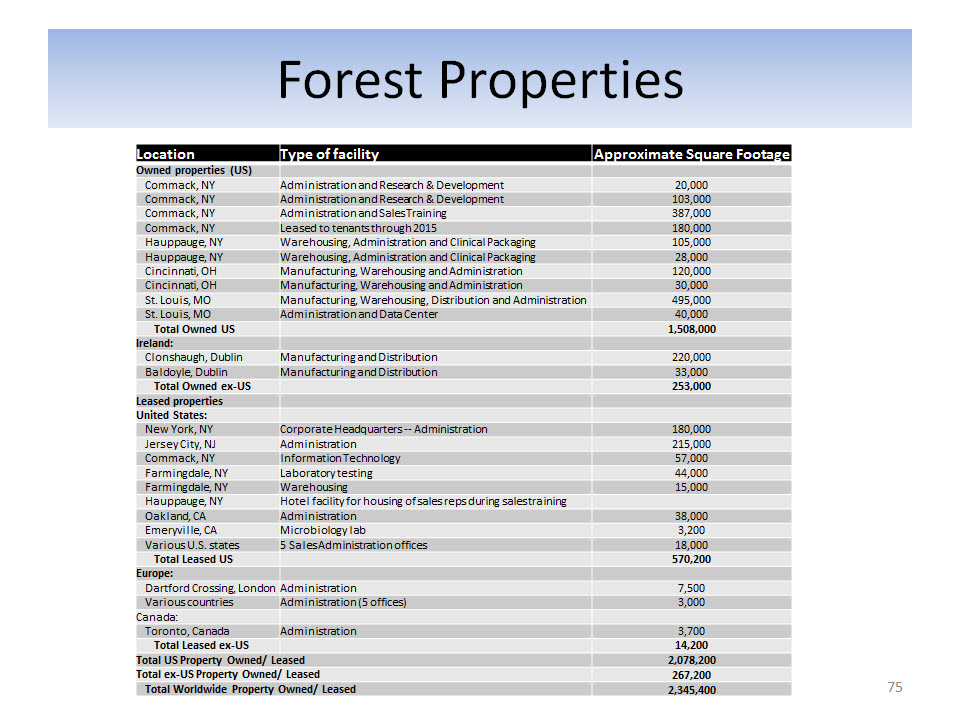

• Greater focus within a few key

therapeutic categories should

allow for greater cost synergies

therapeutic categories should

allow for greater cost synergies

• Potential G&A cuts including

procurement efficiencies, head

count reductions and

consolidation of existing

properties

procurement efficiencies, head

count reductions and

consolidation of existing

properties

• Increase efficiency of sales and

marketing effort through

restructuring, retraining and

outsourcing where prudent

marketing effort through

restructuring, retraining and

outsourcing where prudent

Source: Company documents; analyst estimates

Notes: SG&A consists of general & administrative (G&A) and sales & marketing (S&M) costs; Assumes FY12 G&A costs of $350 MM

growing at 3% (long-term inflation rate); S&M costs vary by year depending on new product launches -- associated promotional

spending ($400 - 500 MM per year) and need for reps (3,600 - 3,800) and promotional & rep costs for previously launched drugs

growing at 3% (long-term inflation rate); S&M costs vary by year depending on new product launches -- associated promotional

spending ($400 - 500 MM per year) and need for reps (3,600 - 3,800) and promotional & rep costs for previously launched drugs

Consensus estimates

Post-cost cuts

47

Evaluate Current Pipeline for Potential

Development Program Rationalization

Development Program Rationalization

• Identify existing projects that do not fit within the new

business development strategy or do not achieve pre-

determined return on investment (IRR) criteria

business development strategy or do not achieve pre-

determined return on investment (IRR) criteria

• Reduce R&D spending

– Terminate poorly performing R&D programs

– Evaluate projects for out-licensing

• Consider re-investing R&D expense savings into:

– newly licensed drugs under new business development strategy

– existing programs for which additional resources can be

justified based on strict IRR criteria

justified based on strict IRR criteria

48

Evaluate Capital Allocation Decisions and

Optimize Balance Sheet

Optimize Balance Sheet

• Potentially increase company leverage while

maintaining strong Net Debt/EBITDA and

EBITDA/Interest Expense ratios

maintaining strong Net Debt/EBITDA and

EBITDA/Interest Expense ratios

• Evaluate the best potential uses for excess cash on

the balance sheet that are most likely to enhance

shareholder value

the balance sheet that are most likely to enhance

shareholder value

49

Corporate Governance Changes

• Replace four current Board members with Icahn Nominees who

we believe will continually hold management accountable

we believe will continually hold management accountable

• Split CEO and Chairman roles

• Appoint new Chairs to Compensation and Compliance

Committees

Committees

• Replace the current Presiding “Independent” Director with an

independent Chairman

independent Chairman

• Expand consultations with leading corporate governance experts

and assess need for any appropriate reforms

and assess need for any appropriate reforms

• Monitor CEO succession plan and confirm that viable external

candidates are appropriately included

candidates are appropriately included

50

Four Directors That We Believe Have

Trouble “Seeing the FOREST For the Trees”

Trouble “Seeing the FOREST For the Trees”

Source: Company documents

51

• Potential lack of independence due to length of Board tenure

• Need for fresh perspective after 35 years on the Board

• Lack of any biopharma experience outside of Forest

• Oversaw flawed compensation policy as Chair of Compensation Committee

• No other recent public Board experience

• Potential lack of independence due to length of tenure

• Lack of recent relevant operational experience

• No other recent public Board experience

• Lacks independence due to long tenure at Forest and continued compensation as consultant

• One of three former or current Forest executives on Board; Direct report to Solomon

• Need for fresh perspectives from outside of Forest; Employed by Forest for 15 years

• Presided over implementation of, in our belief, inadequate and flawed business strategy

• Potential lack of independence due to long tenure at Forest and direct report to Solomon

• One of three former or current Forest executives on Board

• Need for fresh perspectives from outside of Forest; Employed by Forest for 26 years

• Presided over implementation of, in our belief, inadequate and flawed business strategy

• No other recent public Board experience

98 Years

Icahn Nominees Are Highly Qualified

to Help Produce Positive Change

to Help Produce Positive Change

We Believe the Collective Experience of Icahn

Slate Will Help Create Shareholder Value

Slate Will Help Create Shareholder Value

• A history of helping create shareholder value & stock price appreciation

• Value-enhancing capital allocation & efficient use of balance sheet

• Successful turnarounds of underperforming business operations

• Implemented sales force modernization policies

• Cost structure optimization and right-sizing of organizations

• Public Boards of other biopharmaceutical companies

• Highly efficient clinical development of new drugs with “first-pass” FDA

regulatory approval

regulatory approval

• Multiple successful product launches

• Product licensing focused on creating shareholder value

• Integration of acquisitions and sale of existing businesses

• Effective management of payer relationships and global alliances

53

We Believe the Icahn Slate Will Improve Oversight

and Bring a Fresh & Independent Perspective

and Bring a Fresh & Independent Perspective

Nominee | Background and Experience |

Eric J. Ende, MD | üAs biopharmaceutical analyst for 11 years, he analyzed hundreds of companies with respect to financial statements, cost structure, drug markets, acquisitions & divestitures, clinical data, competitive landscape & product licensing üAs Director of Genzyme on Audit & Risk Management Committees, he worked constructively with existing Board to objectively analyze potential acquisitions, licensing opportunities, divestitures, cost reductions, capital allocation decisions and key business risks while holding the Board and management accountable üMD and MBA degrees enhances understanding of the physician decision-making process from a business perspective, which is highly relevant to commercialization efforts |

Andrew J. Fromkin | üMost recently, as former CEO of Clinical Data, Inc. (acquired by Forest in 2011 for $1.2 B), he gained significant operational experience having managed CLDA’s successful strategic turnaround, highly efficient drug development, first-pass FDA drug approval, product licensing, company acquisitions and divestitures and public Board experience. Significant role in getting FDA approval of Viibryd, one of Forest’s most promising products. üHaving held CEO /President , Corporate Development , COO and other key senior management across healthcare sectors, brings vital, strategic understanding of payer reimbursement, PBM and pharmacy positioning strategies, data strategies for comparative effectiveness, disease and utilization management, provider prescribing requirements and other areas that are necessary for prescription drug adoption and reimbursement. |

Pierre LeGault | üAs President & CEO of Prosidion and CFO of OSI Pharma, he gained valuable experience redefining company strategy, processes, developing drugs, identifying cost savings in addition to divesting and selling both drugs and entire companies üAs Worldwide President of a major division of Sanofi-Aventis, CFO and deputy CEO of several Aventis divisions, CAO of Rite-Aid, Sr. EVP of PJC, and US President of Eckerd, he successfully managed strategic turnarounds, global integrations, product launches, product in-licensings, global alliances, major cost saving efforts, large sales force & marketing groups, FDA product approvals, corporate development strategies and service on public/private Boards |

Dan Ninivaggi | üAs President of Icahn Enterprises and a variety of executive positions at Lear, he gained valuable experience managing strategic turnarounds and cutting costs in dynamic business environments. üAs a director of Icahn Enterprises, CIT Group, Federal-Mogul Corp., XO Holdings, CVR Energy and Motorola Mobility Holdings, he gained valuable experience holding managements accountable and overseeing needed corporate change üAs a lawyer at both a large law firm and in a $17 billion company, he has extensive experience and expertise in corporate governance |

54

We Believe Eric Ende’s Highly Relevant

Experience Will Help Resolve Forest’s Issues

Experience Will Help Resolve Forest’s Issues

Our Issues with Forest Labs | Our Potential Solutions | Relevant Experience |

Long-tenured Directors that lacked independence | Replace long tenured Directors and work constructively with remaining Board | üGenzyme Board contained many long tenured directors üWorked constructively, objectively and independently to gain trust of existing Board üHelped re-focus Board on fiduciary responsibility to all shareholders |

Margin pressure due to corporate inefficiency and a lack of operating leverage in business model | Evaluate company for areas of potential cost reductions | üAs Genzyme audit committee member, oversaw $350 MM of cost reductions and 1,000 person RIF |

Company lacks therapeutic focus | Evaluate each therapeutic area for potential divestiture | üAt Genzyme, evaluated each business unit for potential divestiture, eventually divesting 3 units with cash returned to shareholders |

Business development strategy is not enhancing shareholder value | Evaluate current business development strategy for potential modification | üAs analyst for 11 years, evaluated many company’s strategic direction üAs Genzyme Board member, re-focused strategy towards businesses with high CROIs |

Poor risk management and compliance | Initiate proper execution of comprehensive risk management and compliance program | üAs risk oversight committee member, oversaw initiation and implementation of comprehensive risk management program |

55

We Believe Drew Fromkin’s Highly Relevant

Experience Will Help Resolve Forest’s Issues

Experience Will Help Resolve Forest’s Issues

Our Issues with Forest Labs | Our Potential Solutions | Relevant Experience |

Business development strategy is not enhancing shareholder value | Evaluate current business development strategy for potential modification | üIdentified and executed valuable transactions that enhanced CLDA’s strategic turnaround as CEO and President of Clinical Data (NASDAQ - CLDA) üResponsible for leading numerous M&A, strategic partnerships as VP, Business Development at Medco and during his tenure as CEO, President and other senior roles with healthcare companies. |

Significant stock underperformance | Implement strategy focused on specific therapeutic areas allowing for greater shareholder value creation | üEnacted impressive strategic turnaround at Clinical Data, resulting in stock price rise of 10x during tenure as CEO üCompany was acquired by Forest for $1.2 B and up to an additional $6 per share in CVR’s |

Forest’s operating performance is suboptimal | Drive company growth while maintaining strict cost controls | üTransformed CLDA through organic and inorganic activity while buying, selling, integrating geographically and sector diverse companies. üOperated companies with tight fiscal constraints; understands and managed all aspects of corporate operations and governance. |

Poor commercial uptake of drugs in the market and choices of R&D, drug acquisition | Assess all potential uses of capital utilizing strict criteria to enhance shareholder value | üEnacted aggressive in-licensing and acquisition program to enhance shareholder value as CEO of Clinical Data üStrong strategic understanding of payer reimbursement, PBM and pharmacy positioning strategies, data strategies for comparative effectiveness, disease and utilization management, provider prescribing requirement. |

56

We Believe Pierre Legault’s Highly Relevant

Experience Will Help Resolve Forest’s Issues

Experience Will Help Resolve Forest’s Issues

Our Issues with Forest Labs | Our Potential Solutions | Relevant Experience |

Business development strategy is not enhancing shareholder value | Evaluate current business development strategy for potential modification | üSet successful strategy and negotiated the sales of companies Prosidion to Royalty Pharma & AstraZeneca, OSI Pharma to Astellas and Eckerd to Rite-Aid üSuccessfully turned around global division at Sanofi-Aventis as Worldwide President |

Margin pressure due to corporate inefficiency and a lack of operating leverage in business model | Evaluate company for areas of potential cost reductions | üConsolidated US operations at OSI Pharma resulting in significant cost savings üProduced meaningful cost savings and expense reductions at Aventis üIdentified substantial procurement savings at Rite-Aid |

Sales force productivity is underperforming its peers | Sales force modernization | üLed e-business unit at Aventis with primary focus on sales force modernization (technology & business processes) |

In-licensing and acquisition of drugs has not created value | Set and adhere to specific criteria for product in- licensing and acquisitions | üSuccessfully in-licensed many products as Worldwide President of Sanofi division |

Product launches have lagged expectations | Increase focus and modernize sales force effort | üSuccessfully launched 4 new products as Worldwide President of major Sanofi division |

57

We Believe Dan Ninivaggi’s Highly Relevant

Experience Will Help Resolve Forest’s Issues

Experience Will Help Resolve Forest’s Issues

Our Issues with Forest Labs | Our Potential Solutions | Relevant Experience |

Long-tenured Directors that lacked independence | Replace long tenured Directors and work constructively with remaining Board | üWorked with existing Boards of several companies to help enact productive change, including CIT Group, Inc., Federal−Mogul Corporation, XO Holdings, CVR Energy, Inc., and Motorola Mobility Holdings, Inc. |

Corporate governance needs to be improved | Engage independent Corporate Governance experts to provide industry “best practices” | üWas a partner with the law firm of Winston & Strawn LLP, specializing in corporate finance, mergers and acquisitions, and corporate governance |

Business development strategy is not enhancing shareholder value | Evaluate current business development strategy for potential modification | üMultiple operational roles in a variety of industries in which he helped enact strategic turnarounds |

Margin pressure due to corporate inefficiency and a lack of operating leverage in business model; concerns over misuse of $3.2B of cash | Evaluate company for areas of potential cost reductions; monitor $3.2B of company cash to protect against misuse or inefficient use | üIn multiple operational roles at a variety of companies and as a director of Motorola Mobility, he enacted significant cost reductions focused on operating improvements and G&A spending and oversaw efficient capital allocation |

58

Icahn’s Track Record of Board Representation in

Biopharma Shows Impressive Creation of Shareholder

Value

Biopharma Shows Impressive Creation of Shareholder

Value

Note: All time periods are measured from the day that Icahn gained (or announced gaining) Board representation until the most recent

date of update or when an acquisition price was revealed; This track record represents a sample and does not include all Icahn Board

representation in biopharmaceuticals

date of update or when an acquisition price was revealed; This track record represents a sample and does not include all Icahn Board

representation in biopharmaceuticals

59

8 Months

(6/16/10 - 2/16/11)

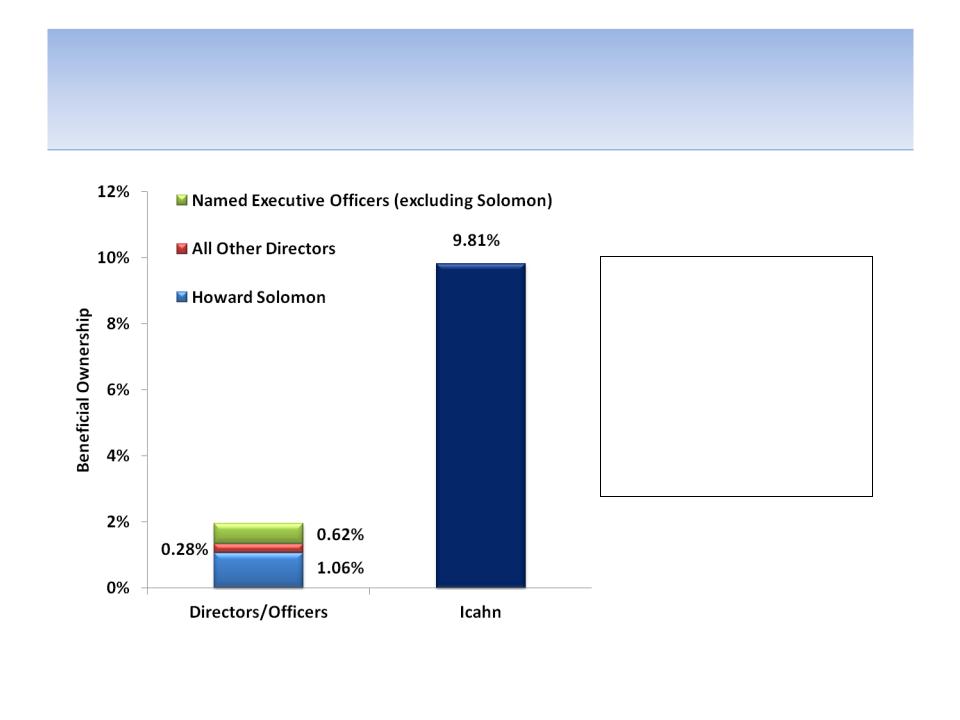

Icahn is Fully Aligned With Shareholders

Despite the Board and

executive officers having a

combined 197 years at the

company, they only own

1.95% of the company

versus Icahn’s 9.81%. Who

do you think is better

aligned with the best

interests of shareholders?

executive officers having a

combined 197 years at the

company, they only own

1.95% of the company

versus Icahn’s 9.81%. Who

do you think is better

aligned with the best

interests of shareholders?

Source: Company documents; proxy statement

Note: Executive officers include Elaine Hochberg, Francis Perier, Marco Taglietti, Howard Solomon and David Solomon

60

We Believe Ende Agreement Fully Aligns

Performance With All Shareholders

Performance With All Shareholders

61

Source: SEC filings; Howard Solomon and Lawrence Olanoff are not considered independent directors by the Company

Appendix A: Pipeline Strategy

New Pipeline Drug Sales vs. Guidance

Source: Company documents and SEC Filings

63

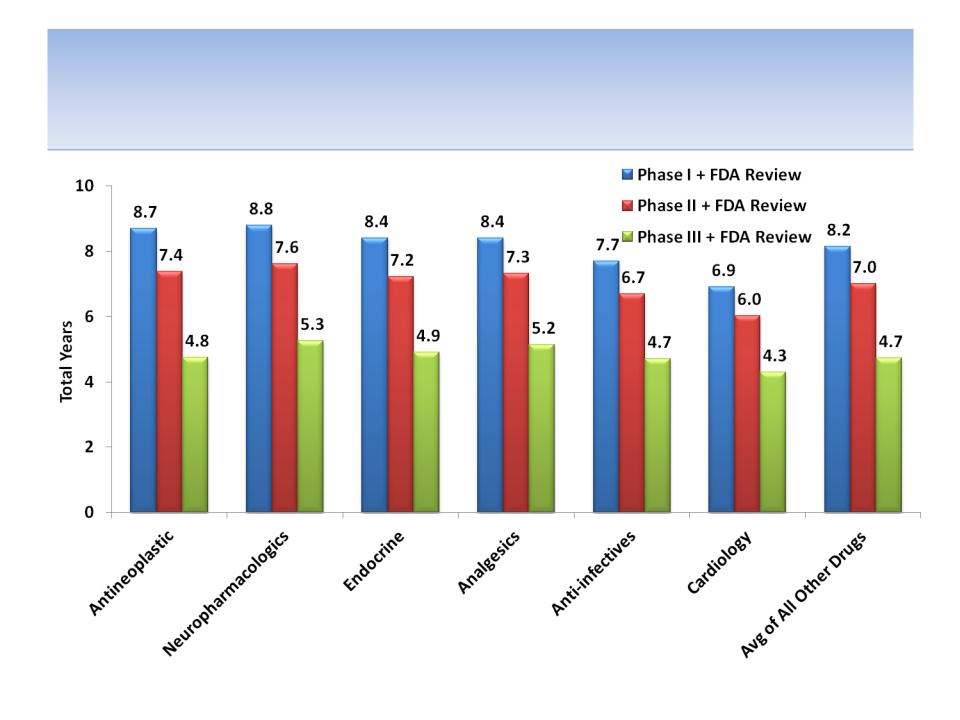

Average Drug Development Timelines

By Therapeutic Class

By Therapeutic Class

Source: Tufts Center for the Study of Drug development

64

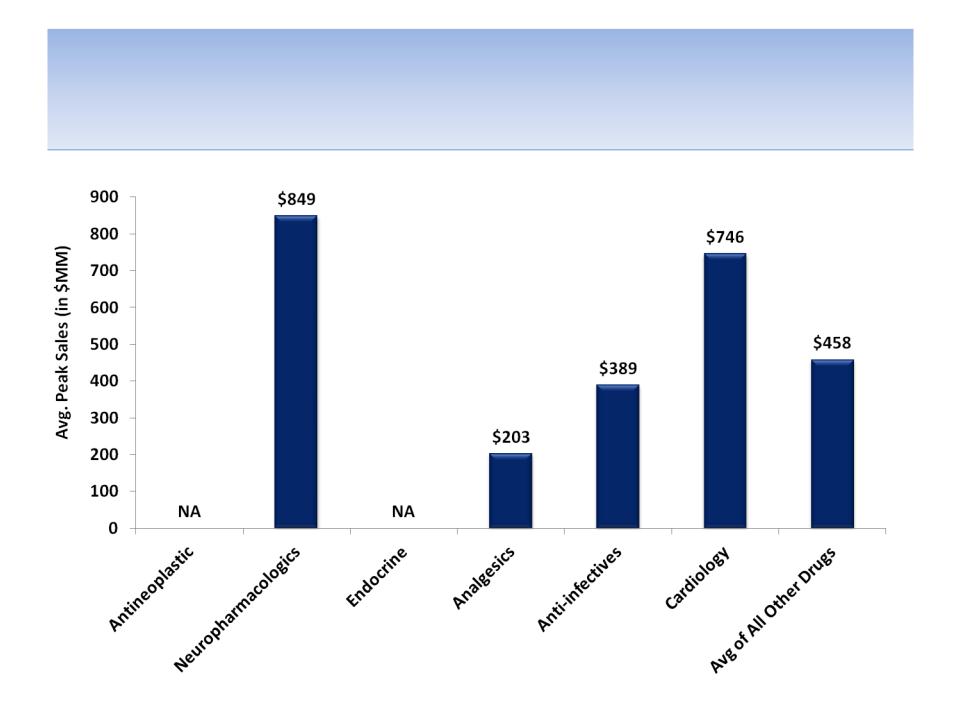

Average Peak Sales by Therapeutic Class

Source: Tufts Center for the Study of Drug development

65

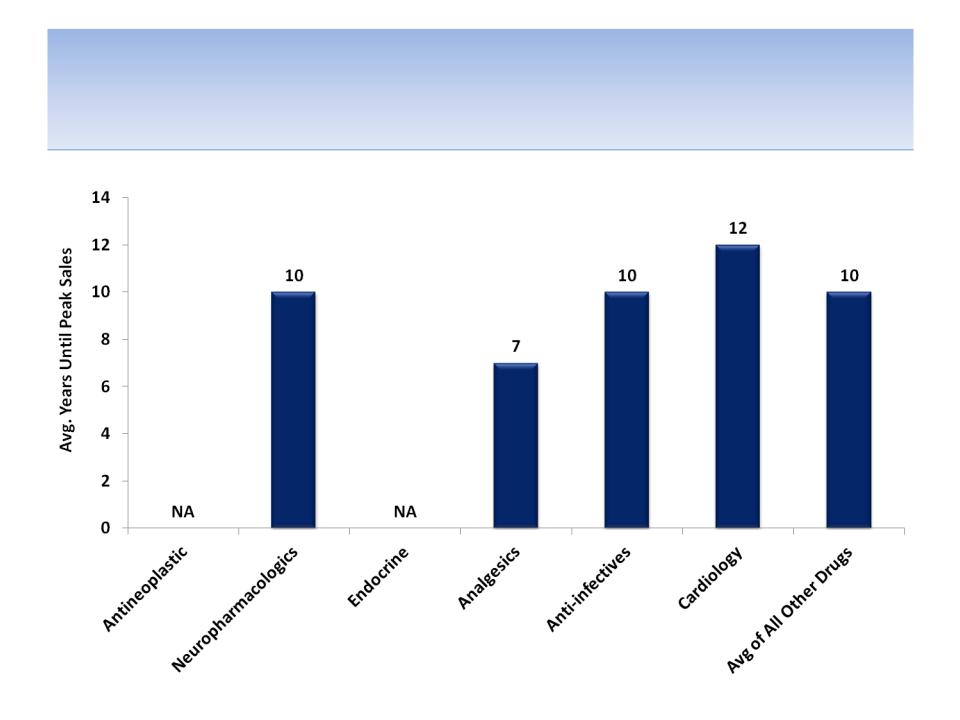

Average Time (years) Until Peak Sales

by Therapeutic Class

by Therapeutic Class

Source: Tufts Center for the Study of Drug development

66

Clinical Development Probabilities

Source: FDAReview.org; odds of product approval assuming entrance into each stage of development

67

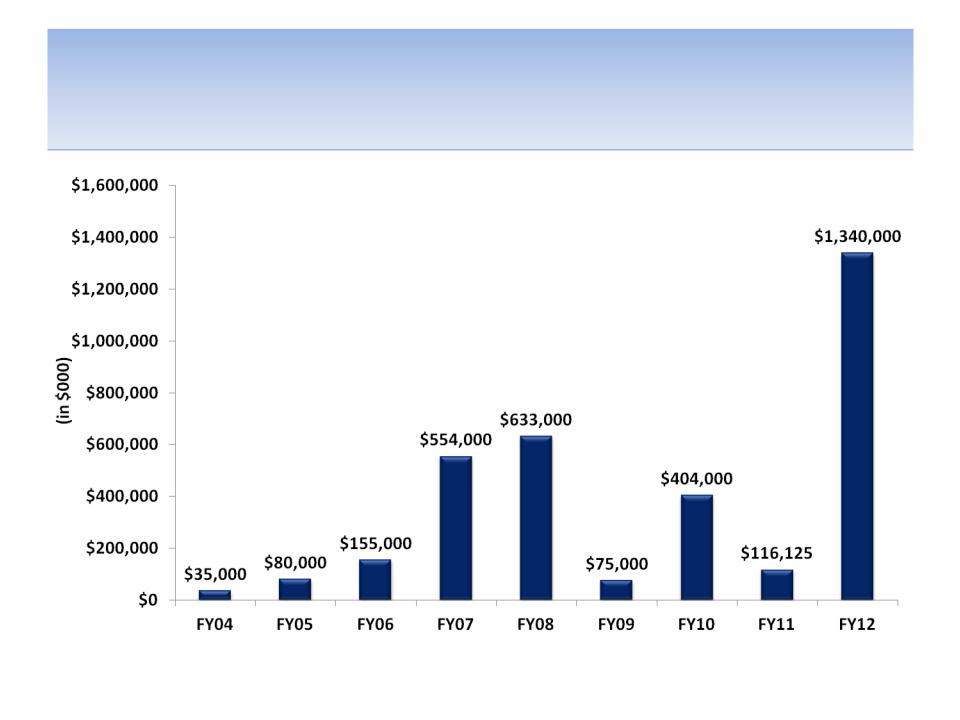

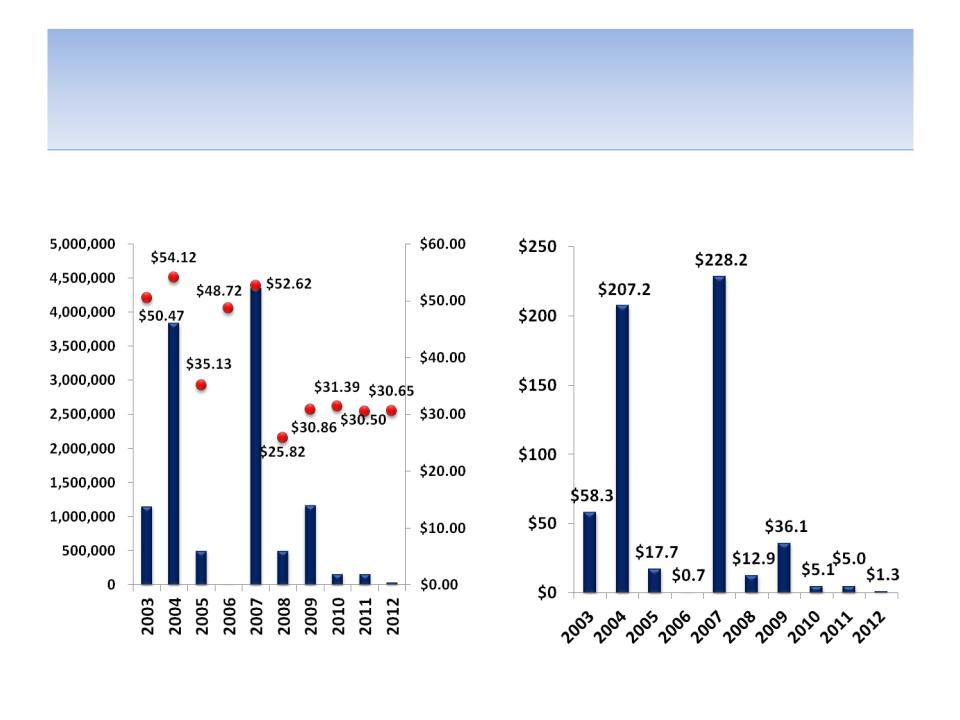

Appendix B: Capital Deployment

Capital Put At-Risk By Year

Source: SEC filings

Notes: All products licensed FY04 - FY13; Capital At-Risk defined as up-front payments and acquisition of products or product rights

70

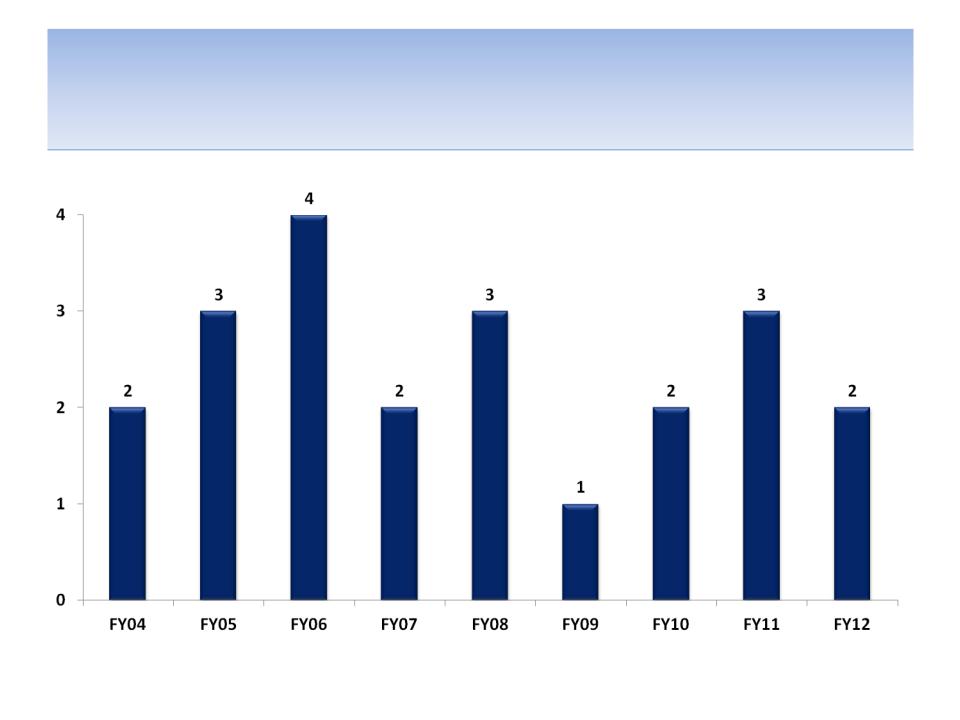

Number of Products Licensed By Year

Notes: All products licensed FY04 - FY13; SEC filing and company documents

71

Source: SEC filings

Notes: All products licensed FY04 - FY13 (includes Lexapro and Namenda, which were licensed 1998 and 2000, respectively); Capital

At-Risk defined as up-front payments and acquisition of products or product rights

At-Risk defined as up-front payments and acquisition of products or product rights

72

Capital Put At-Risk By Product

Source: SEC filings

Notes: All products licensed FY04 - FY13 (includes Lexapro and Namenda, which were licensed 1998 and 2000, respectively); Capital

At-Risk defined as up-front payments and acquisition of products or product rights

At-Risk defined as up-front payments and acquisition of products or product rights

73

Share Repurchases

Source: SEC filings

74

Appendix C: CEO Compensation

& Stock Sales

& Stock Sales

CEO Stock Sales

Shares Sold (& Price) By Year

Total Proceeds ($MM)

Source: SEC filings

77

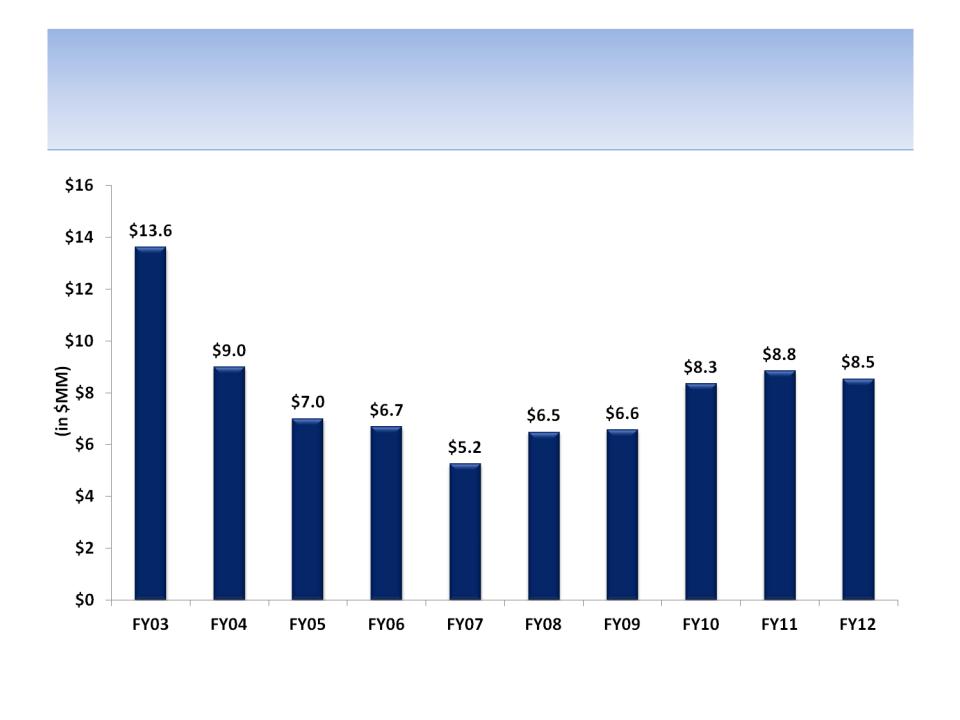

CEO Compensation by Year

Source: SEC filings

78

Appendix D: Comparative

Companies

Companies

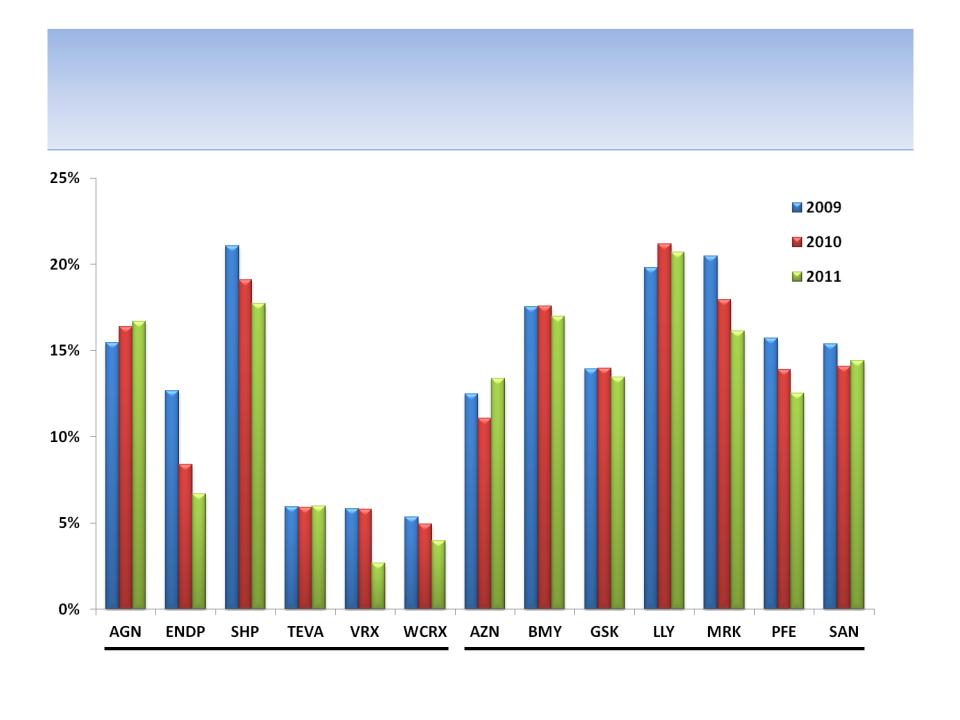

SG&A/Revenues

Specialty Pharmaceuticals

Large Pharmaceuticals

Source: SEC filings

80

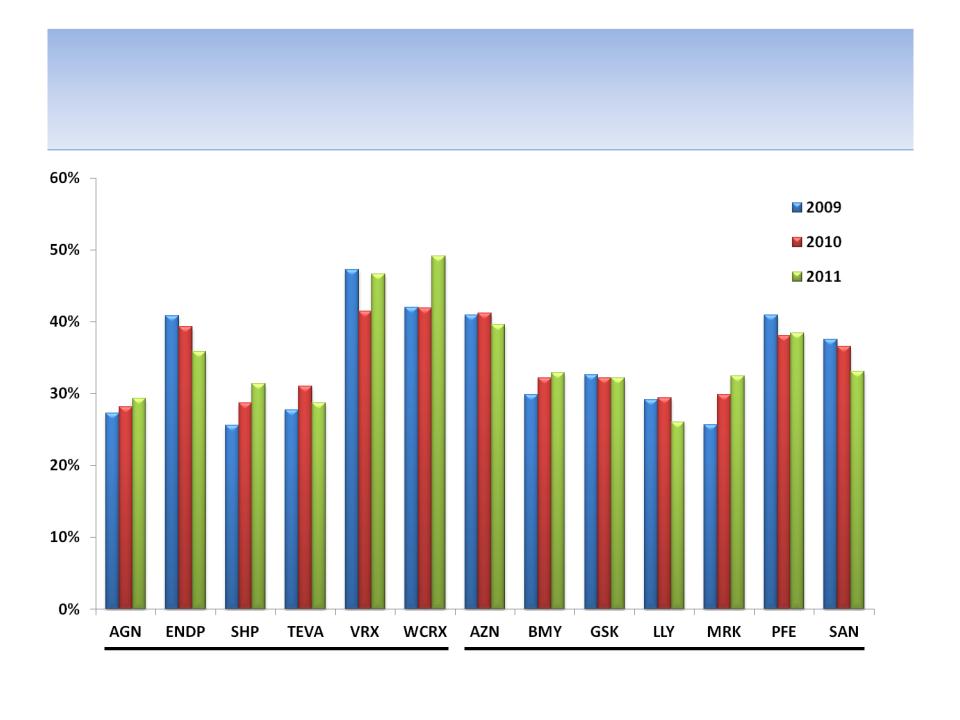

R&D/Revenues

Specialty Pharmaceuticals

Large Pharmaceuticals

Source: SEC filings

81

Operating Margins

Specialty Pharmaceuticals

Large Pharmaceuticals

Source: SEC filings

82

Revenues/Sales Rep

Source: SEC filings

83

Cash as a Percent of Market Cap

Source: SEC filings

84