SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant¨

Filed by a Party other than the Registrantx

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Forest Laboratories, Inc.

(Name of Registrant as Specified In Its Charter)

Carl C. Icahn

Dr. Eric J. Ende

Daniel A. Ninivaggi

Pierre Legault

Andrew J. Fromkin

Icahn Partners LP

Icahn Partners Master Fund LP

Icahn Partners Master Fund II L.P.

Icahn Partners Master Fund III L.P.

High River Limited Partnership

Hopper Investments LLC

Barberry Corp.

Icahn Onshore LP

Icahn Offshore LP

Icahn Capital L.P.

IPH GP LLC

Icahn Enterprises Holdings L.P.

Icahn Enterprises G.P. Inc.

Beckton Corp.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

ON JULY 23, 2012, THE PARTICIPANTS (AS DEFINED BELOW) FILED A DEFINITIVE PROXY STATEMENT WITH THE SECURITIES AND EXCHANGE COMMISSION. SECURITY HOLDERS ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN, DR. ERIC J. ENDE, PIERRE LEGAULT, ANDREW J. FROMKIN,DANIEL A. NINIVAGGI, ICAHN PARTNERS LP, ICAHN PARTNERS MASTER FUND LP, ICAHN PARTNERS MASTER FUND II L.P., ICAHN PARTNERS MASTER FUND III L.P., HIGH RIVER LIMITED PARTNERSHIP, HOPPER INVESTMENTS LLC, BARBERRY CORP., ICAHN ENTERPRISES G.P. INC., ICAHN ENTERPRISES HOLDINGS L.P., IPH GP LLC, ICAHN CAPITAL L.P., ICAHN ONSHORE LP, ICAHN OFFSHORE LP, AND BECKTON CORP. (COLLECTIVELY, THE “PARTICIPANTS”) FROM THE STOCKHOLDERS OF FOREST LABORATORIES, INC. FOR USE AT ITS 2012 ANNUAL MEETING OF STOCKHOLDERS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS. THE DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY IS AVAILABLE TO STOCKHOLDERS OF FOREST LABORATORIES, INC. FROM THE PARTICIPANTS AT NO CHARGE AND IS ALSO AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION'S WEBSITE AT HTTP://WWW.SEC.GOV OR BY CONTACTING D.F. KING & CO., INC. BY TELEPHONE AT THE FOLLOWING NUMBERS: STOCKHOLDERS CALL TOLL−FREE: (800) 697−6975 AND BANKS AND BROKERAGE FIRMS CALL: (212) 269−5550. CONSENT OF THE AUTHOR OR PUBLICATION WAS NEITHER SOUGHT NOR OBTAINED TO USE THE ARTICLES OR REPORTS MENTIONED HEREIN AS PROXY SOLICITING MATERIAL.

Icahn Responds to Forest Management Presentation

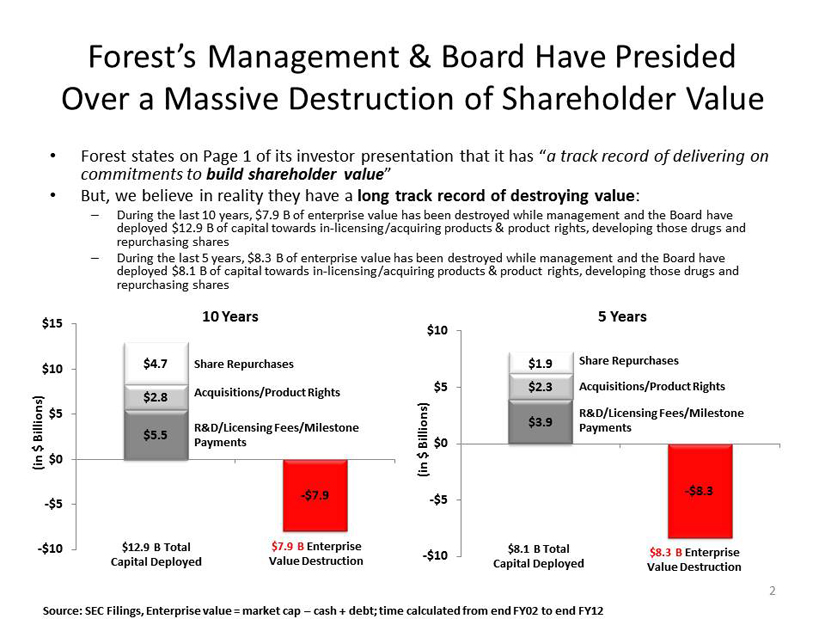

Forest’s Management & Board Have Presided Over a Massive Destruction of Shareholder Value • Forest states on Page 1 of its investor presentation that it has “ a track record of delivering on commitments to build shareholder value ” • But, we believe in reality they have a long track record of destroying value : – During the last 10 years, $7.9 B of enterprise value has been destroyed while management and the Board have deployed $12.9 B of capital towards in - licensing/acquiring products & product rights, developing those drugs and repurchasing shares – During the last 5 years, $8.3 B of enterprise value has been destroyed while management and the Board have deployed $8.1 B of capital towards in - licensing/acquiring products & product rights, developing those drugs and repurchasing shares $5.5 $2.8 $4.7 - $7.9 -$10 -$5 $0 $5 $10 $15 (in $ Billions) $7.9 B Enterprise Value Destruction R&D/Licensing Fees/Milestone Payments Acquisitions/Product Rights Share Repurchases $3.9 $2.3 $1.9 - $8.3 -$10 -$5 $0 $5 $10 (in $ Billions) $8.3 B Enterprise Value Destruction R&D/Licensing Fees/Milestone Payments Acquisitions/Product Rights $8.1 B Total Capital Deployed Share Repurchases $12.9 B Total Capital Deployed 10 Years 5 Years Source: SEC Filings, Enterprise value = market cap – cash + debt; time calculated from end FY02 to end FY12 2

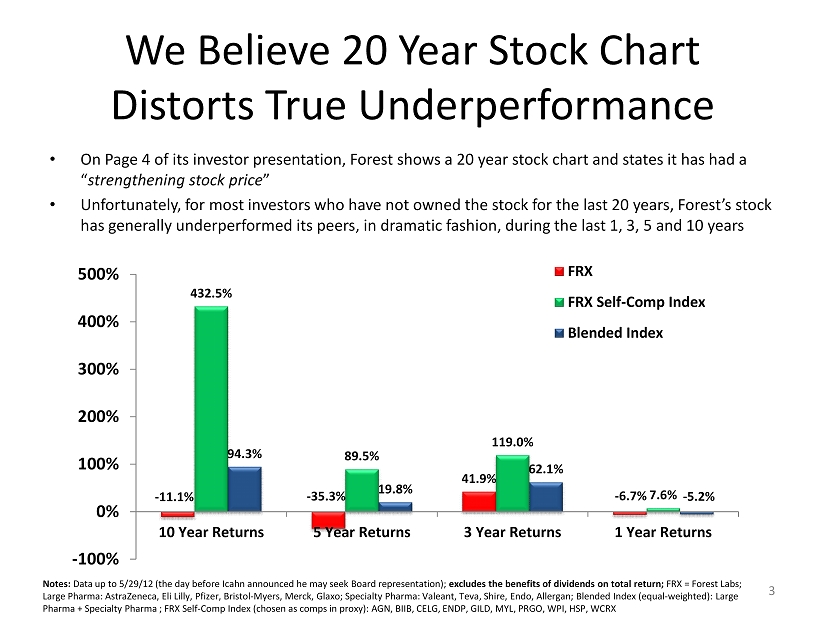

We Believe 20 Year Stock Chart Distorts True Underperformance • On Page 4 of its investor presentation, Forest shows a 20 year stock chart and states it has had a “ strengthening stock price ” • Unfortunately, for most investors who have not owned the stock for the last 20 years, Forest’s stock has generally underperformed its peers, in dramatic fashion, during the last 1, 3, 5 and 10 years - 11.1% - 35.3% 41.9% - 6.7% 432.5% 89.5% 119.0% 7.6% 94.3% 19.8% 62.1% - 5.2% -100% 0% 100% 200% 300% 400% 500% 10 Year Returns 5 Year Returns 3 Year Returns 1 Year Returns FRX FRX Self-Comp Index Blended Index Notes: Data up to 5/29/12 (the day before Icahn announced he may seek Board representation); excludes the benefits of dividends on total return; FRX = Forest Labs; Large Pharma: AstraZeneca, Eli Lilly, Pfizer, Bristol - Myers, Merck, Glaxo; Specialty Pharma: Valeant, Teva, Shire, Endo, Allerga n; Blended Index (equal - weighted): Large Pharma + Specialty Pharma ; FRX Self - Comp Index (chosen as comps in proxy): AGN, BIIB, CELG, ENDP, GILD, MYL, PRGO, WPI, HSP, WC RX 3

Distorting Our Point Related to Achieving Its Cost of Capital • On page 21 of Forest’s investor presentation, the company states that “Mr. Icahn created a misleading chart” • Management is taking the chart out of context and attempting to confuse investors • The chart being referenced from the Appendix on slide 73 of the Icahn presentation is data behind a more important chart on slide 17 of the Icahn presentation that shows that as the Lexapro patent cliff approached, management had to put more capital at - risk for each product obtained • The key point of the Icahn presentation is that because more capital has had to be put at risk due to, what we believe was increasing desperation of management to fill its revenue shortfalls and/or increased competition for products, it is less likely that product licensing is achieving the company’s cost of capital • If the company is not achieving its cost of capital then despite licensing and launching multiple products, value will be destroyed, which is what we believe has happened Source: Company SEC Filings; Icahn presentation filed with SEC 4

Distorting the Facts on Compensation vs. Its Proxy Peers • On slide 28 of its presentation, management purportedly compared CEO compensation to its proxy peers • However, the proxy peers it used in the analysis are NOT the same proxy peers it lists in its 2012 proxy statement • We believe it used large pharma CEOs in its analysis to overstate the proxy peer CEO compensation which allowed them to claim Forest’s CEO compensation is “appropriate and in - line with peers” • Also, by comparison, the average market cap of the proxy peers used in Forest’s 2012 proxy statement is $17 B vs. Forest’s $9 .5 B and the relative stock performance of Forest vs. these peers is - 443%, - 125% and - 15% during the last 10, 5 and 1 year • So, Forest generally paid more and performed worse than the peers used in its 2012 proxy statement 8.3 8.9 8.5 6.5 7.5 8.6 13.4 14.6 13.7 - 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 2009 2010 2011 (in $ MM) Forest CEO Comp Peer CEO Comp Used in Forest's 2012 Proxy Statement Peer CEO Comp Used in Forest Presentation Notes: Forest used the following proxy peers ( median) Allergan , AstraZeneca, Lilly, Endo, Merck, Pfizer, Shire, and Warner Chilcott . However, the proxy comps (median) listed in its 2012 proxy statement are: Allergan , BiogenIDEC , Celgene , Cephalon , Endo, Gilead, Hospira , Mylan , Perrigo , Warner Chilcott and Watson. Stock performance is measured up to 5/29/12 (the day before Icahn announced he may seek Board representation); excludes the benefits of dividends on total return 5

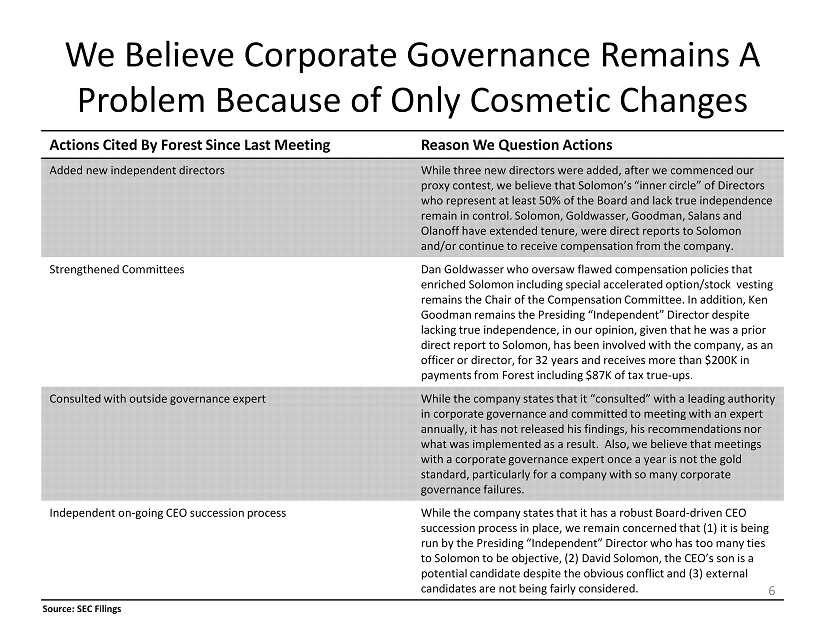

We Believe Corporate Governance Remains A Problem Because of Only Cosmetic Changes Actions Cited By Forest Since Last Meeting Reason We Question Actions Added new independent directors While three new directors were added, after we commenced our proxy contest, we believe that Solomon’s “inner circle” of Directors who represent at least 50% of the Board and lack true independence remain in control . Solomon, Goldwasser , Goodman, Salans and Olanoff have extended tenure, were direct reports to Solomon and/or continue to receive compensation from the company. Strengthened Committees Dan Goldwasser who oversaw flawed compensation policies that enriched Solomon including special accelerated option/stock vesting remains the Chair of the Compensation Committee. In addition, Ken Goodman remains the Presiding “Independent” Director despite lacking true independence, in our opinion, given that he was a prior direct report to Solomon, has been involved with the company, as an officer or director, for 32 years and receives more than $200K in payments from Forest including $87K of tax true - ups. Consulted with outside governance expert While the company states that it “consulted” with a leading authority in corporate governance and committed to meeting with an expert annually, it has not released his findings, his recommendations nor what was implemented as a result. Also, we believe that meetings with a corporate governance expert once a year is not the gold standard, particularly for a company with so many corporate governance failures. Independent on - going CEO succession process While the company states that it has a robust Board - driven CEO succession process in place, we remain concerned that (1) it is being run by the Presiding “Independent” Director who has too many ties to Solomon to be objective, (2) David Solomon, the CEO’s son is a potential candidate despite the obvious conflict and (3) external candidates are not being fairly considered. Source: SEC Filings 6

New Products Have Been Underperforming Company Guidance • In slide 10 of its presentation, management shows the growth trajectory of older products, but fails to share that newer products have missed company guidance 8 of 11 times • Because of weaker than expected launches, we are concerned that new products will not fill revenue holes being created by the Lexapro and Namenda patent cliffs • Analysts are also concerned: – “ Daliresp’s ramp (while consistent) remains slower than we had anticipated…Overall, we are assuming more gradual launch curves for Forest’s upcoming product opportunities given today’s more difficult primary care environment. ” – Chris Schott JP Morgan, June 20, 2012* – “ We are wary on FRX’s ability to generate strong sales for its “next nine” products, including aclidinium , linaclotide , cariprazine & levomilnacipran .” -- John Boris, Citi, July 6, 2012* – “ Daliresp / Teflaro are off to slow starts & we maintain our aclidinium / linaclotide expectations of $20M/$31M vs. FRX’s $35M/$60M. We also maintain our lower levomilnacipran / cariprazine estimates.” -- John Boris, Citi, July 6, 2012* Source: SEC Filings, analyst reports * Consent of the author and publication neither sought nor obtained to use this material as proxy soliciting material. 7

Where is the Operating Leverage? • On slides 12 & 13 of its presentation, management discusses “significant operating leverage from cross - promoting multiple products to PCPs” • But, analysts expect operating margins to deteriorate from 33.3% in FY 11 to 6.9% in FY13 and expect them to remain depressed as multiple unrelated products have been launched • Analysts expect SG&A as a percent of revenues to reach 48% in FY13 versus 30% for its peers • Analysts are also skeptical about the potential for operating leverage: – “However, this diversification as well as the continued focus on primary care is expensive and requires a build out of a larger sales & marketing organization to support it…” – Marc Goodman, UBS, June 21, 2012* – “But, a key variable is how much FRX will need to spend to ensure future success…it seems to us that it will be difficult to constrain SG&A when it is imperative that all new product s launch well. Moreover, many of FRX’s products will compete in crowded therapeutic markets where marketing “muscle “ matters.” – David Steinberg, Deutsche Bank, June 21, 2012* – “ The company added several hundred sales reps earlier this year to support linaclotide and aclidinium and will likely add a similar amount next year to support cariprazine and levomilnacipran …we are again modestly reducing our EPS estimates for the company as both SG&A and R&D are expected to continue to grow over the next several years.” – Chris Schott JP Morgan, June 20, 2012* Source: SEC Filings, analyst reports * Consent of the author and publication neither sought nor obtained to use this material as proxy soliciting material. 8

We Believe Extremely Optimistic Growth Goals Set By Management Are Unlikely to Be Achieved • On slide 16 of its presentation, management states its growth goals from FY13 to FY18, which we believe are overly optimistic and self - serving • Based on the company’s stated “growth goals,” it is expecting FY18 revenue of $6.6 B vs. $3.3 B in FY13 and adjusted EPS of $7.21 - $8.35 vs. $0.95 - $1.10 in FY13 • Even an analyst quote used by management to support its position casts doubt on the credibility of its growth goals – “ We estimate that by FY2019, FRX’s new product launches and late stage pipeline have the potential to generate sales of $4B+…” – Louise Chen, Auriga 4/26/12* • Other analysts also doubt its credibility: – “ However, despite five launches in recent years, two pending NDAs, and two products in late stage development…Our sense is that profitability probably will not return to FY12 levels [$3.57] until the 2018 timeframe, at the earliest .” – David Steinberg, Deutsche Bank, June 21, 2012* – “Yet we struggle to get back anywhere close to $4.00 in earnings and in our model it takes until FY2020 to break $3.00 again because spending keeps going up too . Clearly something has to give.” – Marc Goodman, UBS, June 21, 2012 * Source: SEC Filings, analyst reports * Consent of the author and publication neither sought nor obtained to use this material as proxy soliciting material . 9

Vote the GOLD Proxy Card