UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to § 240.14a-12 |

Lions Gate Entertainment Corp.

(Name of Registrant as Specified In Its Charter)

Mr. Jay Firestone

Dr. Michael Dornemann

Mr. Christopher J. McGurk

Mr. Daniel A. Ninivaggi

Dr. Harold T. Shapiro

Mr. Carl C. Icahn

Mr. Brett Icahn

Mr. Jesse Lynn

High River Limited Partnership

Hopper Investments LLC

Barberry Corp.

Icahn Fund S.à r.l.,

Daazi Holding B.V.

Icahn Partners LP

Icahn Partners Master Fund LP

Icahn Partners Master Fund II LP

Icahn Partners Master Fund III LP

Icahn Enterprises G.P. Inc.

Icahn Enterprises Holdings L.P.

IPH GP LLC

Icahn Capital LP

Icahn Onshore LP

Icahn Offshore LP

Beckton Corp.

7508921 Canada INC.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Attached as Exhibits 2 and 3 are copies of presentations that the Icahn Group made to Institutional Shareholder Services on December 1, 2010 and December 3, 2010.

ON NOVEMBER 26, 2010, CARL ICAHN AND HIS AFFILIATES FILED A PRELIMINARY PROXY STATEMENT ON SCHEDULE 14A WITH THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) IN CONNECTION WITH THE SOLICITATION OF PROXIES FOR THE 2010 ANNUAL GENERAL MEETING OF SHAREHOLDERS OF LIONS GATE (THE “ANNUAL MEETING”). CARL ICAHN AND HIS AFFILIATES EXPECT TO FILE A DEFINITIVE PROXY STATEMENT WITH THE SEC IN CONNECTION WITH THE SOLICITATION OF PROXIES FOR THE ANNUAL MEETING AND MAY FILE OTHER PROXY SOLICITATION MATERIAL IN CONNECTION THEREWITH. SECURITYHOLDERS ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL ICAHN AND HIS AFFILIATES BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATED TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. SHAREHOLDERS WILL BE ABLE TO OBTAIN COPIES OF THESE DOCUMENTS (WHEN COMPLETED) AT NO CHARGE ON THE SEC’S WEBSITE ATWWW.SEC.GOV AND ON SEDAR ATWWW.SEDAR.COM. THESE MATERIALS MAY ALSO BE OBTAINED AT NO CHARGE BY CONTACTING D.F. KING & CO., INC., TOLL FREE FOR SHAREHOLDERS AT (800) 714-3313, AND FOR BANKS AND BROKERS AT (212) 269-5550. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND FORM OF PROXY WILL BE MAILED TO SHAREHOLDERS OF LIONS GATE.

EXHIBIT 1

PARTICIPANTS

The participants in the solicitation of proxies (the “Participants”) are the following: Mr. Jay Firestone, Dr. Michael Dornemann, Mr. Christopher J. McGurk, Mr. Daniel A. Ninivaggi, Dr. Harold T. Shapiro, Mr. Carl C. Icahn, Mr. Brett Icahn, Mr. Jesse Lynn, High River Limited Partnership, Hopper Investments LLC, Barberry Corp., Icahn Partners LP, Icahn Partners Master Fund LP, Icahn Partners Master Fund II LP, Icahn Partners Master Fund III LP, Beckton Corp., Icahn Enterprises G.P. Inc., Icahn Enterprises Holdings L.P., IPH GP LLC, Icahn Capital LP, Icahn Onshore LP, Icahn Offshore LP, Icahn Fund S.à r.l., Daazi Holding B.V. and 7508921 Canada Inc.

A DESCRIPTION OF THE DIRECT AND INDIRECT INTERESTS OF EACH OF THE PARTICIPANTS IN LIONS GATE ENTERTAINMENT CORP. IS CONTAINED IN THE PRELIMINARY PROXY STATEMENT ON SCHEDULE 14A FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON NOVEMBER 26, 2010 BY MR. JAY FIRESTONE, DR. MICHAEL DORNEMANN, MR. CHRISTOPHER J. MCGURK, MR. DANIEL A. NINIVAGGI, DR. HAROLD T. SHAPIRO, MR. CARL C. ICAHN, MR. BRETT ICAHN, MR. JESSE LYNN, HIGH RIVER LIMITED PARTNERSHIP, HOPPER INVESTMENTS LLC, BARBERRY CORP., ICAHN FUND S.À R.L., DAAZI HOLDING B.V., ICAHN PARTNERS LP, ICAHN PARTNERS MASTER FUND LP, ICAHN PARTNERS MASTER FUND II LP, ICAHN PARTNERS MASTER FUND III LP, ICAHN ENTERPRISES G.P. INC., ICAHN ENTERPRISES HOLDINGS L.P., IPH GP LLC, ICAHN CAPITAL LP, ICAHN ONSHORE LP, ICAHN OFFSHORE LP, BECKTON CORP. AND 7508921 CANADA INC. A COPY OF THE SCHEDULE 14A IS AVAILABLE AT NO CHARGE ON THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE ATWWW.SEC.GOV AND ON SEDAR ATWWW.SEDAR.COM.

EXHIBIT 2

Why Change is Needed at Lions Gate |

Background • Icahn is soliciting proxies for five (5) nominees to LGF's board • The nominees of Icahn are: – Mr. Jay Firestone – Dr. Michael Dornemann – Mr. Christopher J. McGurk – Mr. Daniel A. Ninivaggi – Dr. Harold T. Shapiro • On July 20, 2010 Icahn launched a tender offer for up to all of the issued and outstanding common shares of LGF for US$7.50 per share. – The tender offer expires at 11:59 p.m. (Vancouver time) on December 10, 2010, unless extended or withdrawn by Icahn. – Other than customary conditions, the only condition is that the New York State Supreme Court shall have granted, by 11:59 p.m. (Vancouver time) on December 10, 2010 Icahn’s pending motion for a preliminary injunction preventing the LGF shares issued on July 20, 2010 to a fund controlled by Mark Rachesky from being voted at the 2010 annual general meeting of LGF shareholders. |

LGF – Losing and Lagging Behind • In each of Lions Gate’s last three fiscal years, the company has lost money. - Lions Gate had a net loss of over $28 million for the year ended March 31, 2010, a net loss of over $178 million for the year ended March 31, 2009 and a net loss of over $87 million for the year ended March 31, 2008. - For the six months ended September 30, 2010, Lions Gate had a net loss of over $93 million. • Over the past five years, Lions Gate’s common shares have also significantly underperformed, with their price declining more than 43%. - According to Lions Gate’s own annual report, an investment of $100 in Lions Gate shares on March 31, 2005, would have been worth only $56.47 on March 31, 2010. - In contrast, a $100 investment in the NYSE Composite Index over the same period would have grown to $117.20, assuming all dividends were reinvested. - Over this same period, Icahn’s hedge fund achieved a cumulative return of over 45%. • During the same five-year period, overhead spending and compensation of senior management have ballooned to epic proportions. 3 |

Icahn Focus on Management Accountability • Over the years, Icahn admittedly has had some losing investments but there have been many more successes than failures. – Icahn, as an active investor, promulgated changes at the board level. The boards became more cognizant of their responsibilities, especially in holding management accountable. – When held accountable, even a poor management tends to perform better, and a strong management will outperform. Most of Icahn’s successes have increased shareholder value by billions of dollars. – The following are just a few examples of companies in which Icahn’s involvement helped to dramatically increase value for all shareholders – Texaco, Reynolds Tobacco, U. S. Steel, Imclone, Biogen, BEA, Time Warner, Medimune, Kerr-McGee, Korean Tobacco, Genzyme, etc. 4 |

LGF’s Poor Governance Track Record • LGF has, to be euphemistic, an extremely poor record in corporate governance and management accountability. The following are just a few examples: • Certain of LGF’s credit agreements provided for an event of default if any person or group acquired more than 20% of LGF’s outstanding shares, a measure that RiskMetrics Group has stated is designed to deter a proxy fight. — it was only when Icahn made it clear that this “banker made me do it” defensive tactic would not deter the advancement of the Icahn bid that LGF acted to raise the 20% change of control threshold to 50%. — certain credit agreements also provide for an event of default if LGF’s board is comprised of a majority of members that have not been approved by the incumbent board or if certain management members cease to hold their positions. • Employment agreements of top executives provide that if any person or group acquires 33% or more of LGF’s outstanding shares, those executives would be entitled to golden parachute payments and other benefits potentially worth in excess of $30 million. — Some of these executives had their then-outstanding equity awards accelerate at the conclusion of the first Icahn bid. — LGF set up a trust to hold approximately $16 million in cash to fund severance obligations to senior management if there was a change in control and their employment was terminated by LGF or they voluntarily terminated their employment. • But all this pales in comparison to the July 20 Entrenching Devices: In Icahn’s opinion one of the worst transgressions in the history of corporate governance. 5 |

The Entrenching Device • Prior to July 20 – 120.4 million shares outstanding – Icahn – 44.7 million (37.2%) – Rachesky – 23.2 million (19.2%) • The Entrenching Device: 1. LGF exchanges $97M in convertible notes held by Kornitzer for new notes with a below market value strike price for a 2-day period – the conversion rate is dropped from $11.50 and $14.28 to $6.20 per share 2. LGF immediately arranges for Kornitzer to sell the new notes to Rachesky for $105M in cash 3. Rachesky converts the new notes and LGF issues him 16,236,305 new shares of common stock for the bargain price of $6.20 per share after telling shareholders that the shares are worth $8.85 and that they should NOT tender to Icahn at $7.00 THE RESULT: LGF trades 16+M shares of common stock for $97M in convertible debt and records a $14.5M loss. However, the board and management must have believed this money was well spent since it had the effect of raising Rachesky’s percentage ownership to 28.5% of the company and lowering Icahn’s percentage ownership to 32.8% from 38.5%. Michael Burns boasted to Icahn – immediately after the July 20 transaction –that as a result of the transaction, Rachesky’s percentage ownership plus Capital Research’s 11% ownership (a supposed ally of Burns) and management’s 4% gave them approximately 43% and a stranglehold on the company. Icahn is currently suing to set aside the voting rights Rachesky acquired in the Entrenching Device. • After the Entrenching Device – 136.6 million shares outstanding – Icahn – 44.7 million (32.8%) – Rachesky – 39.4 million (28.8%) 6 |

The Purpose Of The Entrenching Device • Burns: "We will win the proxy fight and dilute the shit out of him in the meantime." • LGF's financial advisors' notes: July 20 Transactions were "all about Icahn" • Burns: "the dilutive effect on Icahn was in the best interests of the Company“ • Icahn believes that the standstill period was a scheme to conveniently hold Icahn back from purchasing so that stock would fall to a lower price enabling Rachesky to benefit from buying the notes and converting them at the lower price. 7 |

LGF's Misconduct to Dilute Icahn 1. Icahn alleges that LGF breached its Standstill Agreement with Icahn, including its promises not to: – "enter into an understanding" with Rachesky regarding his purchase of LGF securities – "propose the issuance" of LGF securities to Rachesky – "engage in active negotiations" concerning the issuance of securities in excess of 5% of the company – "arrange for" or "encourage" other parties to buy LGF securities during the July 9-19 standstill period. 8 |

LGF's Misconduct To Dilute Icahn (continued) 2. Icahn believes that LGF gutted its own insider trading policy to facilitate Rachesky's purchase. – LGF's existing policy barred trading by insiders for 45 days, from two days before quarter end (June 28) through two days after earnings announcement (August 11) – To facilitate Rachesky's purchase of 16 million shares on July 20, LGF amended its company-wide policy to only restrict trading in the 15 days prior to earnings announcement (July 25 – August 9) – NIRI Survey, March 2010: • Companies with restricted periods >30 days: 70% • Companies with restricted periods 20-30 days: 30% • Companies with restricted periods <20 days: 0% – LGF's board voted to approve this amendment at a midnight meeting on July 20, without consideration by its regular Nominating and Corporate Governance Committee. 9 |

LGF's Misconduct To Dilute Icahn (continued) 3. Icahn alleges that Burns and Rachesky conspired to knowingly evade the 5% issuance restriction in the Standstill Agreement. – When Rachesky wanted to buy all of Kornitzer's notes (convertible to 13% of company) despite Standstill Agreement restricting LGF to <5%: • Burns: "you are missing the nuance big time" • Rachesky: "get me all and he may leave" • Burns: "trying like hell" – When LGF's own lawyers resisted the planned transaction: • Rachesky: "You need to be the quarterback. I can only fail because you don’t put enough effort in dealing with all these crazy lawyer egos. They are not on the same page yet." • Burns: "They will be." "Beating shit out of lawyers. Making progress." 10 |

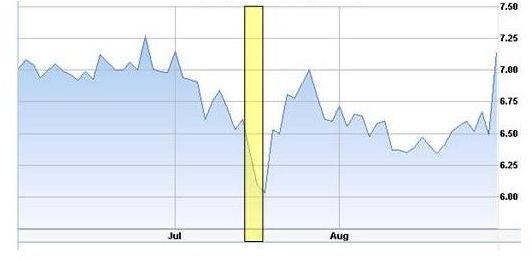

LGF's Misconduct To Dilute Icahn (continued) 4. Despite his duty to enhance the value of LGF, Icahn believes that Burns helped Rachesky lower the new notes’ conversion price, at a substantial cost to LGF. – When Rachesky was "lamenting" that his average cost basis was too high, Icahn believes Burns helped Rachesky renegotiate the terms of his note purchase from Kornitzer from a $6.32 conversion price to $6.20. • Burns asked his financial advisors to repeatedly analyze Rachesky's average cost basis as a parameter of the July 20 deal • After convincing the board to accept these new terms, Burns told Rachesky "I took the hit" • LGF approved the $6.20 conversion price using lowest VWAP in months, one month after having recommended that shareholders reject Icahn's $7 tender offer price because they believed the fair value was $8.85. 11 (July 15, 16 and 19 highlighted) Lions Gate stock price and the 3-day VWAP |

LGF's Misconduct To Dilute Icahn (continued) 5. Icahn alleges that Ludwig and Simmons permitted Burns to supplant the Special Committee. – Despite the board's deliberate decision to appoint only independent members to its Special Committee to negotiate with Icahn, the Special Committee, including its chairman Ludwig and member Simmons, permitted Burns, a member of management whose own job was on the line, to: • Be the company's sole direct negotiator with Icahn; • Use and control the Special Committee's legal and financial advisors; • Selectively report the progress of his dealings with Icahn 6. Simmons admitted to plotting against Icahn during the standstill period. – Upon learning that Icahn had launched a tender offer after the standstill period expired, Simmons wrote to Burns: "Gives us cover by showing he was plotting too" 12 |

The Unvarnished Facts • My intentions are to complete the tender offer...I will then conduct a proxy fight to seek to replace the board at the upcoming annual general meeting. I must state that I unfortunately see very little hope for the company if we are not successful replacing the board. Hopefully, our slate will prevail. If not, I have no intention of remaining an investor in Lions Gate with this management team. (Mr. Carl Icahn, Press Release dated June 14, 2010) • will win the proxy fight and dilute the shit out of [Icahn][in] the meantime” (Email from Michael Burns, Vice-Chairman of Lions Gate, July 4, 2010) • already. [Icahn] is going to create a self fulfilling prophecy and make us completely align ourselves with [Rachesky]” (Email from Burns, July 4, 2010) • “What exactly does [K]ornitzer own?” (PIN Message from Mark Rachesky, Director of Lions Gate, to Burns, July 5, 2010) • “I have a potential solution for our problem. Need to discuss with you tomorrow”...“What’s idea” ...“Along the lines we discussed yesterday”... “We need to do what I said. Imperative.” (PIN Messages between Burns and Rachesky, July 6, 2010) 13 “Enough “We |

The Unvarnished Facts (continued) • “How does [Icahn] now know about us talking about the converts”... “He can’t” ...“Did he talk to Kornitzer”...“No way”...“Can I buy [the converts]. We think maybe.” (PIN Messages between Burns and Rachesky, July 6, 2010) • “Michael, what was the method you were thinking of to get [Rachesky] more stock?” (Harald Ludwig, Chair of Lions Gate Special Committee, to Burns, July 12, 2010) • “Get me all and [Icahn] may leave. It’s our only chance. I haven’t been wrong yet about him. You have to trust me.” (PIN Message from Rachesky to Burns, July 15, 2010) • “Told better not to even pin you” (PIN Message from Burns to Rachesky, July 16, 2010) • “Fuck [Icahn]. Onward” (Burns to Jon Feltheimer, CEO of Lions Gate, July 16, 2010) 14 |

The Unvarnished Facts (continued) • “Can only negotiate about 4.9% while standstill. After midnight Monday – can deal with the rest.” (Handwritten notes of discussions between Kornitzer representative and Lions Gate’s counsel, July 18, 2010) • “ us cover by showing [Icahn] was plotting too. Hope we get done today.” (Hardwick Simmons, Director/Lions Gate Special Committee Member, to Burns, July 20, 2010) • “Michael, I just heard about the devil’s offer on the radio. I hope you can block it. Thinking of you.” “All going down as planned in one hour” (Email from supporter of Burns and response of Burns, July 20, 2010) • “Deleverage and dilute. Genius.” “:)” (PIN Message from supporter of Burns and response of Burns, July 20, 2010) 15 Gives |

LGF’s Poison Pill Overdose • On March 12, 2010, LGF’s board adopted the first poison pill in an attempt to thwart the Icahn offer. • The British Columbia Securities Commission (BCSC) struck down the poison pill on the basis that LGF was not seeking competitive bids or alternative transactions in an attempt to increase shareholder value. – principal basis for the decision was that LGF shareholders must be given the opportunity to decide whether to tender • On July 1, 2010, after the expiration of the first Icahn bid, LGF’s board implemented another poison pill even though it was clear from the BCSC’s prior decision that the second poison pill would be struck as well. – Icahn believes this was a waste of LGF resources given the inevitability that the pill would be removed, and – demonstrates lack of LGF concern about shareholders’ right to decide • On October 18, 2010, the BCSC struck down LGF’s second poison pill. 16 |

LGF’s Disregard of the proxy rules • For many months, Icahn made repeated and clear statements about intention to wage a dissident proxy campaign. – ample notice to LGF through numerous Schedule 14A filings • In spite of knowing that a contested election was coming, LGF filed a definitive proxy statement with the SEC and mailed it the next day: 1. Violates the SEC’s requirement to file a preliminary proxy statement in a contested election that must be cleared with the SEC before mailed to shareholders 2. No mention of Icahn’s forthcoming proxy campaign is a glaring omission 3. Puts Icahn campaign at a substantial timing disadvantage because Icahn has complied with the rules and filed a preliminary proxy statement 4. Coercive to LGF shareholders who are not able to properly consider the Icahn slate • LGF had already been admonished by the SEC in April for doing the same thing in connection with the shareholder meeting to consider the first poison pill. – had told the SEC that the first violation was “a regrettable error that will not be repeated” 17 |

LGF’s Early Proxy Cut-off • LGF proxy statement requires proxies to be received by no later than 10:00 am (Pacific time) on Friday, December 10, 2010. – 2 business days and 4 calendar days in advance of the meeting • No provision in British Columbia corporate law or LGF’s corporate documents contemplates an early cut-off date. – in fact, leading British Columbia law firms, including the one representing LGF, have supported the view that a proxy cut-off is invalid in the absence of statutory or corporate constitutional authority to do so. – when combined with LGF’s attempt to obtain a “fast track” advantage by not filing a preliminary proxy statement, this early proxy cut-off coerces shareholders into making a voting decision before they have to do so and severely restricts LGF shareholders from being able to vote for the Icahn slate if they would like to do so. 18 |

Icahn’s Director Nominees 19 |

Mr. Christopher J. McGurk, age 53 From 2006 to 2010, Mr. Christopher McGurk was the Chief Executive Officer of Overture Films, LLC (“Overture Films”), a motion picture studio he founded in 2006 that financed, produced, acquired, and distributed feature-length films in all media. From 2008 to 2010, Mr. McGurk was also the Chief Executive Officer of Anchor Bay Entertainment (“Anchor Bay”), the company that distributed Overture Films’ product in home entertainment. Anchor Bay is an independent home entertainment distributor with a catalogue of over 2,500 titles and operations in the United States, Canada, Australia, and the United Kingdom. In total, Overture Films released 19 films, generating over $335 million at the box office, as well as one Academy Award® and two Golden Globe nominations. In 2006, prior to assuming his role at Overture Films, Mr. McGurk served as Senior Advisor, New Ventures for IDT Entertainment. From 1999 to 2005, Mr. McGurk was Vice Chairman of the Board and Chief Operating Officer of Metro-Goldwyn-Mayer Inc. (“MGM”), acting as the company’s lead operating executive until MGM was sold for approximately $5 billion to a consortium of investors. Under his guidance, MGM had six consecutive profitable film slates with several No. 1 box-office hits, as well as 7 Academy Award® and 18 Golden Globe nominations. Mr. McGurk joined MGM from Universal Pictures, where he served as President and Chief Operating Officer from 1996 to 1999. 20 |

Since 2006, Mr. McGurk has been a member of the Board of Directors for BRE Properties, Inc. (“BRE”), a NYSE-listed real estate investment trust, and is a member of BRE’s Real Estate Investment and Compensation Committees. He previously served on BRE’s Audit Committee. From 2006 until 2010, Mr. McGurk also served on the Board of Directors and was Chairman of the Nominating and Governance Committee for DivX Inc. (“DivX”), a NASDAQ-listed new media technology company. He also served on the Audit Committee for DivX. Mr. McGurk was integral in taking DivX public in 2006 and negotiating the sale of the company to Sonic Solutions, which closed in October, 2010. Mr. McGurk also served on the Board of Directors for DIC Entertainment (“DIC”), an AIM-listed integrated children’s entertainment company, which he helped to take public in 2006. In 2005, Mr. McGurk served on the Board of Directors for Pricegrabber.com, Inc. (“Pricegrabber”), a privately held e-commerce company. He assisted in the sale of that company in 2005 to Experian Interactive. He chaired the Audit Committees for both DIC and Pricegrabber. Additionally, Mr. McGurk was Vice Chairman of the Board for MGM Studios Inc., an NYSE-listed company, from 1999 until 2005. Mr. McGurk received a Bachelor of Science degree, summa cum laude, from the Syracuse University School of Management and a Master of Business Administration degree from the University of Chicago Graduate School of Business. Based on Mr. McGurk’s extensive experience in the entertainment industry, the Icahn Parties believe that he would bring significant strategic and operational experience to the Board. The business address of Mr. McGurk is 9100 Wilshire Boulevard, Suite 400W, Beverly Hills, California 90212. Mr. McGurk resides in Beverly Hills, California. Mr. Christopher J. McGurk, age 53 (continued) 21 |

Dr. Michael Johanne Heinrich Dornemann, age 65 Dr. Michael Dornemann is an entertainment and marketing executive with more than 30 years of management consulting, corporate development, strategic advisory and media experience. Since 2001, Dr. Dornemann has served on several boards and currently serves on the board of directors of Jet Set AG, a worldwide fashion company based in Switzerland; is lead independent director of Take-Two Interactive Software, Inc. (“Take-Two”), a leading worldwide publisher and developer of interactive entertainment software; is the Vice-Chairman of Access Worldwide Communications, Inc., a leading business process outsourcing and marketing company; and is a member of the board of directors of Columbia Music Entertainment of Japan. Carl Icahn and his affiliated entities own approximately 13.7% of the common stock of Take-Two. In 2001, Dr. Dornemann founded Dornemann & Co., LLC, a media consulting firm for which he serves as President. Prior to 2001, Dr. Dornemann was an executive board member of Bertelsmann AG for 16 years and Chief Executive Officer of Bertelsmann Entertainment (music and television division) and held various other positions with IBM and Boston Consulting Group. He has a master’s degree in business administration and a Ph.D. in economics from the Technical University in Berlin. Based on Dr. Dornemann’s extensive experience in the media and entertainment industry and serving on the boards of companies, the Icahn Parties believe that he has the requisite skills to serve as a Board member of Lions Gate. The business address of Dr. Dornemann is 390 Lake Avenue, Greenwich, Connecticut 06830. Dr. Dornemann resides in Greenwich, Connecticut. 22 |

Mr. Jay Firestone, age 54 Mr. Jay Firestone is one of Canada’s most successful and prolific film and television producers. Since he founded the company in 2006, Mr. Firestone has been the Chairman and Chief Executive Officer of Prodigy Pictures Inc. (“Prodigy Pictures”), an emerging leader in the production of quality film, television and cross-platform media. Its credits include the critically acclaimed feature Stuck and the television mini-series XIII, broadcast on Canwest and NBC. In 2010, Prodigy Pictures produced the highly successful first season of Lost Girl for Showcase Television and is currently developing season two. Previously, Mr. Firestone established Fireworks Entertainment Inc. (“Fireworks Entertainment”) in 1996 to produce, distribute and finance television programs and feature films. After a successful initial public offering in 1997, Fireworks Entertainment was acquired by CanWest Global Communications Corp. in May 1998. As Chairman and Chief Executive Officer of Fireworks Entertainment, Mr. Firestone oversaw the company’s Los Angeles and London based television operations, as well as its Los Angeles feature film division, Fireworks Pictures. This entity was responsible for such films as Rules of Engagement, Rat Race, Hardball, I-60, American Rhapsody and The Believer, winner of Best Film at the Moscow International Film Festival, 2001, and awarded the Grand Jury Award at the 2001 Sundance Film Festival. Mr. Firestone has served on the Board of Directors for both the Academy of Canadian Cinema and Television and the Board of Directors of the ATAS (Academy of Television Arts and Sciences) International Council in Los Angeles. Mr. Firestone received a Bachelor of Commerce (Honors) from McMaster University and a Chartered Accountants Designation from the Institute of Charter Accountants of Ontario. Based upon his extensive experience in the film industry, the Icahn Parties believe that Mr. Firestone has the requisite set of skills to serve as a Board member of Lions Gate. The business address of Mr. Firestone is c/o Prodigy Pictures, Inc., 85 Bloor Street East, Suite 1413, Toronto, Ontario M4W 3Y1. Mr. Firestone resides in Toronto, Ontario. 23 |

Dr. Harold T. Shapiro, age 75 Dr. Harold T. Shapiro has been a professor of economics and public affairs at Princeton University since 1988. Dr. Shapiro served as Princeton University’s 18th president, from 1988 to 2001. Since May 2010, Dr. Shapiro has served as the Chair of the InterAcademy Council Committee on the Review of the International Panel on Climate Change. Since 2001, he has served as a member of the Board of Directors of DeVry, Inc. (“DeVry”), and has served as Chair of the Board of Directors of DeVry since 2008. Since 2006, he has served as a member of the Board of Trustees of Princeton HealthCare Systems and a member of the National Institute of Health’s National Human Genome Research Institute Council Subcommittee. Since 2004, Dr. Shapiro has been a member of the Merck Vaccine Advisory Board, the Johnson & Johnson Advisory Committee on Stem Cell Initiatives and the National Academy of Science Committee on Policy and Global Affairs. Since 1997, he has served as a member of the Board of Directors of the Foundation for a Greater Opportunity. Dr. Shapiro served as a Director of Dow Chemical Co. from 1985 to 2006, serving as its Lead Director from 2003 to 2006. He served as a Director of HCA Inc. from 2001 to 2006. He also served previously on the boards of the Kellogg Cereal Company and Unisys Corporation. Dr. Shapiro received the Council of Scientific Society Presidents 2000 Citation for Outstanding Leadership, the William D. Carey Lectureship Award for Leadership in Science Policy in 2006 and the Clark Kerr Award for Lifetime Achievement in Higher Education from the University of California Berkeley in 2009. Dr. Shapiro came to Princeton University in 1988 from the University of Michigan where he served on the faculty for twenty-four years as professor of economics and public policy and as president from 1980- 1988. Dr. Shapiro received his bachelor’s degree from McGill University in 1956. As a student of McGill’s Faculty of Commerce, he was awarded the Lieutenant Governor’s Medal. Then, after five years in business, he enrolled in the Graduate School at Princeton University and earned his Ph.D. Based upon Dr. Shapiro’s financial experience and expertise and his experience serving on the boards of many organizations, the Icahn Parties believe that he has the requisite skills to serve as a Board member of Lions Gate. 24 |

The business address of Dr. Shapiro is c/o the Department of Economics and The Woodrow Wilson School of Public and International Affairs, 359 Wallace Hall, Princeton, New Jersey 08544- 0015. Dr. Shapiro resides in Princeton, New Jersey. Dr. Harold T. Shapiro, age 75 (continued) 25 |

Mr. Daniel A. Ninivaggi, age 46 Mr. Daniel A. Ninivaggi has served as President of Icahn Enterprises since April 2010. Previously, Mr. Ninivaggi served as Of Counsel to the international law firm of Winston & Strawn LLP from July 2009 to March 2010. From 2003 until July 2009, Mr. Ninivaggi served in a variety of executive positions at Lear Corporation, including as General Counsel from 2003 through 2007, as Senior Vice President from 2004 until 2006, and most recently as Executive Vice President and Chief Administrative Officer from 2006. Lear Corporation filed for bankruptcy in July 2009. In September 2006, several plaintiffs filed a class action law suit in the United States District Court for the Eastern District of Michigan, Southern Division, against Lear Corporation and its directors and officers, including Mr. Ninivaggi, claiming that the defendants breached their fiduciary duties under the Employee Retirement Income Security Act of 1974. The case was settled in 2009. The defendants agreed to create a settlement fund of $5.25 million, plus interest, to be divided among eligible class members. Prior to joining Lear Corporation, from 1998 to 2003, Mr. Ninivaggi was a partner of Winston & Strawn LLP, specializing in corporate finance, mergers and acquisitions, and corporate governance. Since August 2010, Mr. Ninivaggi has served as a director of XO Holdings, Inc. Carl Icahn’s affiliates own approximately 91.39% of the common stock of XO Holdings, Inc. Since December 2009, Mr. Ninivaggi has served as a director of CIT Group Inc., a bank holding company, and since March 2010 Mr. Ninivaggi has served as a director of Federal-Mogul Corporation, a global automotive company. Carl Icahn’s affiliates own approximately 76% of the common stock of Federal-Mogul Corporation. Mr. Ninivaggi received a B.A. in History from Columbia University in 1986, a Masters of Business Administration from the University of Chicago in 1988 and a J.D. from Stanford Law School in 1991. Mr. Ninivaggi is familiar with Carl Icahn’s business strategy of acquiring significant interests in underperforming companies, such as Lions Gate, and then making changes to those entities to enhance their financial performance. Based on Mr. Ninivaggi’s experience as a corporate lawyer and serving on the boards of companies, the Icahn Parties believe that he has the requisite set of skills to serve as a Board member of Lions Gate. The business address of Mr. Ninivaggi is c/o Icahn Enterprises L.P., 767 Fifth Avenue, Suite 4700, New York, New York 10153. Mr. Ninivaggi resides in New York, New York. 26 |

Cautionary Statement THIS MATERIAL IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE AN OFFER TO PURCHASE NOR A SOLICITATION FOR ACCEPTANCE OF THE OFFER DESCRIBED ABOVE. THE OFFER IS BEING MADE ONLY PURSUANT TO THE OFFER TO PURCHASE, THE LETTER OF TRANSMITTAL AND RELATED MATERIALS THAT THE ICAHN GROUP HAS FILED WITH THE SEC AS EXHIBITS TO ITS AMENDED SCHEDULE TO AND WITH THE CANADIAN SECURITIES AUTHORITIES ON SEDAR AND HAS DISTRIBUTED TO HOLDERS OF COMMON SHARES. HOLDERS OF COMMON SHARES SHOULD READ CAREFULLY THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND RELATED MATERIALS BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING THE VARIOUS TERMS OF, AND CONDITIONS TO, THE OFFER. HOLDERS OF COMMON SHARES MAY OBTAIN A FREE COPY OF THE AMENDED TENDER OFFER STATEMENT ON SCHEDULE TO, THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND OTHER DOCUMENTS THAT THE ICAHN GROUP HAS FILED (1) WITH THE SEC AT THE SEC’S WEB SITE AT WWW.SEC.GOV AND (2) WITH THE CANADIAN SECURITIES AUTHORITIES ON SEDAR AT WWW.SEDAR.COM. SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE SHAREHOLDERS OF LIONS GATE ENTERTAINMENT CORP. (“LIONS GATE”) FOR USE AT THE NEXT MEETING OF SHAREHOLDERS OF LIONS GATE AT WHICH INDIVIDUALS WILL BE ELECTED TO THE BOARD OF DIRECTORS OF LIONS GATE, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO SHAREHOLDERS OF LIONS GATE AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE SEC’S WEBSITE AT WWW.SEC.GOV AND ON SEDAR AT WWW.SEDAR.COM. INFORMATION RELATING TO PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE PRELIMINARY PROXY STATEMENT FILED WITH THE SEC ON NOVEMBER 26, 2010. |

EXHIBIT 3

Which slate is better qualified?

As evidenced by their proxy materials, Lions Gate’s Directors Have Almost No Direct Entertainment Business Experience

Only one of the company’s independent Board members, Phyllis Yaffe, has any direct operating experience in the entertainment industry and only two of its management directors, Feltheimer and Burns have any operating experience in the entertainment industry. While this fact has been disclosed in the materials Lions Gate has sent to shareholders, what has not been disclosed is as follows:

Michael Burns

Mr. Burns, with the blessing and assistance of the entire board, and the direct involvement of the Strategic Advisory Committee, orchestrated what we have come to call “The Entrenchment Transaction:” a sweetheart debt/equity swap transaction that cost Lions Gate shareholders $14.5 million.

In an effort to dilute our shares and block our attempt to add directors to the board who will be truly independent and ensure the company acts in the best interest of all of its shareholders, Lions Gate exchanged $97M in convertible notes held by Kornitzer Capital Management for new notes with a below market conversion price of $6.20 measured over as short a period as two days. The conversion rate was dropped from $11.50 and $14.28, respectively. Bear in mind that in rejecting the first Icahn offer of $7.00 one month earlier, the board claimed the shares were worth $8.85. Then, in an obviously prearranged deal, Lions Gate immediately arranged for Kornitzer to sell the new notes to Rachesky for $105M in cash who immediately converted them and then Lions Gate issued him 16,236,305 new shares of common stock for the bargain price of $6.20 per share — notwithstanding the fact that they told shareholders that the shares are worth $8.85 and that they should NOT tender to Icahn at $7.00.

The result of the Entrenchment Transaction was that Lions Gate traded more than 16M shares of common stock for $97M in convertible debt and recorded it as a $14.5M loss, while director Mark Rachesky made a gain of many millions of dollars.

Additionally, Mr. Burns is a director of Next Point, Inc., a private company of which Lions Gate owns a 42% interest (“Break.com”). In 2007, Lions Gate purchased that interest for over $21 million by issuing 1,890,189 of its common shares. According to Lions Gate’s filings with the SEC, it continues to make loans to Break.com.

G. Scott Paterson

Under Mr. Paterson’s tenure as CEO, Yorkton Securities was fined over $2.5 million by the Ontario Securities Commission after they determined Yorkton promoted shares to investors in which they held stakes and executive positions. Paterson was personally fined $1.1 million dollars, given a 6-month trading ban, and barred from acting as an

officer or director of a brokerage firm for two years. Shortly before the penalties were announced, Paterson was fired by Yorkton’s board. At the time, Paterson was chairman of the Canadian Venture Exchange and was about to be made vice-chairman of the Toronto Stock Exchange. As far as we can tell, Paterson has no media experience or any operating company experience. Mr. Paterson is also a member of the Strategic Advisory Committee, which was instrumental in facilitating the odious Entrenchment Transaction discussed above.

Hardwick “Wick” Simmons

Mr. Simmons served as president and CEO of Prudential Securities from 1991-2000, the same time frame that fellow board member Michael Burns worked there. During their tenure with that firm, it was confronted with a massive scandal arising from the loss of hundreds of millions of dollars in limited partnerships sold by Prudential Securities brokers. During the 1990’s, the firm’s competitive position on Wall Street eroded. Simmons abruptly quit in 2000.

Mr. Simmons went to NASDAQ in 2001 as CEO. In July 2002 it went public at $15. When Mr. Simmons ended his tenure at NASDAQ, the stock was trading at $6.20. Mr. Simmons also was critical of corporate governance while chairman and CEO of NASDAQ, stating that “All the academic literature I’ve ever seen — and I mean there is none on the other side — shows there is absolutely no correlation between the independence of one’s board and the performance of one’s company. In fact, it works exactly the opposite…”

Throughout his career, Mr. Simmons has been no stranger to troubled companies. He started out at Hayden Stone & Co. (a company founded by his great-grandfather in 1892). In 1967, when that firm imploded, he moved on to Cogan, Berlind, Weill & Levitt. In the mid 1980’s, he found himself at Shearson Lehman Brothers, which “grew too big, too fast – a strategy supported by Mr. Simmons – and had to be bailed out by parent American Express” (The New York Observer, December 3, 2000). Mr. Simmons resigned and ended up at Prudential Securities, as mentioned above.

Mr. Simmons is also a member of the Strategic Advisory Committee, which was instrumental in facilitating the abhorrent Entrenchment Transaction discussed above. Lions Gate’s proxy statement ironically states that Mr. Simmons “brings important business and financial expertise to the Board in its deliberations on complex transactions and other financial matters.” If the Entrenchment Transaction is an example of this, we certainly need a change.

Mark H. Rachesky

In addition to being one of the ringleaders and beneficiaries of The Entrenchment Transaction described above (to the tune of many millions of dollars), according to information we have seen, Mr. Rachesky has a history of unfair and misleading transactions for shareholders while on company boards. He is currently Chairman of the

Board of Leap Wireless, a telecommunications company, which settled a federal class action lawsuit in October 2010 stemming from restatement of results.

In September 2008, a Delaware court ruled that the terms of a $300 million convertible preferred stock financing provided by MHR Fund Management LLC (Mark Rachesky’s fund) to Loral Space & Communications Inc. were unfair to the company, reformed the financing to convert the convertible preferred stock into non-voting common stock at a “fair price”.

Harald Ludwig

Mr. Ludwig has the longest tenure of failure on the Lions Gate board, and the longest history of embracing cronyism, serving on its board since its inception, serving as Vice Chairman and Co-Chairman and being intimately involved in the decisions that led to the company’s current state today. Over the past five years, Lions Gate’s common shares have significantly underperformed, with their price declining more than 43%. According to Lions Gate’s own annual report, an investment of $100 in Lions Gate shares on March 31, 2005, would have been worth only $56.47 on March 31, 2010. In contrast, a $100 investment in the NYSE Composite Index over the same period would have grown to $117.20, assuming all dividends were reinvested. Icahn’s hedge fund, over this same period, achieved a cumulative return of over 45%. During this five-year period, overhead spending and compensation of senior management have ballooned to epic proportions. The company’s results scream for change.

Mr. Ludwig’s only business experience appears to be running Macluan Capital Corporation, a leveraged buy-out company. Mr. Ludwig is also a member of the Strategic Advisory Committee, which was instrumental in facilitating the repugnant Entrenchment Transaction discussed above. Lions Gate’s proxy statement states that Mr. Ludwig “provides unique insight and valuable advice on business practices.” We agree that his advice seems to have been extremely valuable to director Mark Rachesky, but we can’t see how it has helped shareholders very much.

Now, compare that to our nominees:

Jay Firestone

Jay Firestone is one of Canada’s most successful and prolific film and television producers. He has been Chairman and Chief Executive Officer of Prodigy Pictures Inc., an emerging leader in the production of quality film, television and cross-platform media. Its credits include the critically acclaimed feature Stuck and the television mini-series XIII, broadcast on Canwest and NBC. In 2010, Prodigy Pictures produced the highly successful first season of Lost Girl for Showcase Television and is currently developing season two. Previously, Mr. Firestone established Fireworks Entertainment Inc. (“Fireworks Entertainment”) in 1996 to produce, distribute and finance television programs and feature films.

After a successful initial public offering in 1997, Fireworks Entertainment was acquired by CanWest Global Communications Corp. in May 1998. As Chairman and Chief Executive Officer of Fireworks Entertainment, Mr. Firestone oversaw the company’s Los Angeles and London based television operations, as well as its Los Angeles feature film division, Fireworks Pictures. This entity was responsible for such films as Rules of Engagement, Rat Race, Hardball, I-60, American Rhapsody and The Believer, winner of Best Film at the Moscow International Film Festival, 2001, and awarded the Grand Jury Award at the 2001 Sundance Film Festival.

Mr. Firestone has served on the Board of Directors for both the Academy of Canadian Cinema and Television and the Board of Directors of the ATAS (Academy of Television Arts and Sciences) International Council in Los Angeles. Based upon his extensive experience in the film industry, the Icahn Parties believe that Mr. Firestone has the requisite set of skills to serve as a Board member of Lions Gate.

Michael Dornemann

Dr. Michael Dornemann is an entertainment and marketing executive with more than 30 years of management consulting, corporate development, strategic advisory and media experience. Since 2001, Dr. Dornemann has served on several boards and currently serves on the board of directors of Jet Set AG, a worldwide fashion company based in Switzerland; is lead independent director of Take-Two Interactive Software, Inc. (“Take-Two”), a leading worldwide publisher and developer of interactive entertainment software; is the Vice-Chairman of Access Worldwide Communications, Inc., a leading business process outsourcing and marketing company; and is a member of the board of directors of Columbia Music Entertainment of Japan. Carl Icahn and his affiliated entities own approximately 13.7% of the common stock of Take-Two.

In 2001, Dr. Dornemann founded Dornemann & Co., LLC, a media consulting firm for which he serves as President. Prior to 2001, Dr. Dornemann was an executive board member of Bertelsmann AG for 16 years and Chief Executive Officer of Bertelsmann Entertainment (music and television division) and held various other positions with IBM and Boston Consulting Group. He has a master’s degree in business administration and a Ph.D. in economics from the Technical University in Berlin. Based on Dr. Dornemann’s extensive experience in the media and entertainment industry and serving on the boards of companies, the Icahn Parties believe that he has the requisite skills to serve as a Board member of Lions Gate.

Christopher J. McGurk

From 2006 to 2010, Mr. Christopher McGurk was the Chief Executive Officer of Overture Films, LLC (“Overture Films”), a motion picture studio he founded in 2006 that financed, produced, acquired, and distributed feature-length films in all media. From 2008 to 2010, Mr. McGurk was also the Chief Executive Officer of Anchor Bay Entertainment (“Anchor Bay”), the company that distributed Overture Films’ product in home entertainment. Anchor Bay is an independent home entertainment distributor with a

catalogue of over 2,500 titles and operations in the United States, Canada, Australia, and the United Kingdom. In total, Overture Films released 19 films, generating over $335 million at the box office, as well as one Academy Award® and two Golden Globe nominations. In 2006, prior to assuming his role at Overture Films, Mr. McGurk served as Senior Advisor, New Ventures for IDT Entertainment.

From 1999 to 2005, Mr. McGurk was Vice Chairman of the Board and Chief Operating Officer of Metro-Goldwyn-Mayer Inc. (“MGM”), acting as the company’s lead operating executive until MGM was sold for approximately $5 billion to a consortium of investors. Under his guidance, MGM had six consecutive profitable film slates with several No. 1 box-office hits, as well as 7 Academy Award® and 18 Golden Globe nominations. Mr. McGurk joined MGM from Universal Pictures, where he served as President and Chief Operating Officer from 1996 to 1999.

Since 2006, Mr. McGurk has been a member of the Board of Directors for BRE Properties, Inc. (“BRE”), a NYSE-listed real estate investment trust, and is a member of BRE’s Real Estate Investment and Compensation Committees. He previously served on BRE’s Audit Committee. From 2006 until 2010, Mr. McGurk also served on the Board of Directors and was Chairman of the Nominating and Governance Committee for DivX Inc. (“DivX”), a NASDAQ-listed new media technology company. He also served on the Audit Committee for DivX. Mr. McGurk was integral in taking DivX public in 2006 and negotiating the sale of the company to Sonic Solutions, which closed in October, 2010. Mr. McGurk also served on the Board of Directors for DIC Entertainment (“DIC”), an AIM-listed integrated children’s entertainment company, which he helped to take public in 2006. In 2005, Mr. McGurk served on the Board of Directors for Pricegrabber.com, Inc. (“Pricegrabber”), a privately held e-commerce company. He assisted in the sale of that company in 2005 to Experian Interactive. He chaired the Audit Committees for both DIC and Pricegrabber. Additionally, Mr. McGurk was Vice Chairman of the Board for MGM Studios Inc., an NYSE-listed company, from 1999 until 2005. Mr. McGurk received a Bachelor of Science degree, summa cum laude, from the Syracuse University School of Management and a Master of Business Administration degree from the University of Chicago Graduate School of Business. Based on Mr. McGurk’s extensive experience in the entertainment industry, the Icahn Parties believe that he would bring significant strategic and operational experience to the Board.

Mr. Daniel A. Ninivaggi

Mr. Ninivaggi’s principal occupation is Principal Executive Officer and President of Icahn Enterprises GP and President of Icahn Enterprises and Icahn Enterprises Holdings. Mr. Ninivaggi has served as Principal Executive Officer and President of Icahn Enterprises GP since August 2010. Since April 2010, Mr. Ninivaggi has served as President of Icahn Enterprises, Icahn Enterprises Holdings and Icahn Enterprises GP. Mr. Ninivaggi also serves as a director of Motorola Mobility Holdings, Inc., CIT Group Inc., XO Holdings, Inc., and Federal Mogul Corporation. With respect to each company mentioned above, Carl Icahn, directly or indirectly, either (i) controls such company or (ii) has an interest in such company through the ownership of securities. From July 2009

to April 2010, Mr. Ninivaggi served of counsel to the international law firm of Winston & Strawn LLP. From 2003 until July 2009, Mr. Ninivaggi served in a variety of executive positions at Lear Corporation, a global supplier of automotive seating systems and electrical power management systems, including as General Counsel from 2003 through 2007, as Senior Vice President from 2004 until 2006, and most recently as Executive Vice President and Chief Administrative Officer from 2006 to July 2009. Lear Corporation filed for bankruptcy in July 2009. In September 2006, several plaintiffs filed a class action law suit in the United States District Court for the Eastern District of Michigan, Southern Division, against Lear Corporation and its directors and officers, including Mr. Ninivaggi, claiming that the defendants breached their fiduciary duties under the Employee Retirement Income Security Act of 1974. The case was settled in 2009. The defendants agreed to create a settlement fund of $5.25 million, plus interest, to be divided among eligible class members. Prior to joining Lear Corporation, from 1998 to 2003, Mr. Ninivaggi was a partner of Winston & Strawn LLP. Mr. Ninivaggi received a B.A. in History from Columbia University in 1986, a Masters of Business Administration from the University of Chicago in 1988 and a J.D. from Stanford Law School in 1991. Mr. Ninivaggi is familiar with Carl Icahn’s business strategy of acquiring significant interests in underperforming companies, such as Lions Gate, and then making changes to those entities to enhance their financial performance. Based on Mr. Ninivaggi’s experience as a corporate lawyer and serving on the boards of companies, the Icahn Parties believe that he has the requisite set of skills to serve as a Board member of Lions Gate. The business address of Mr. Ninivaggi is c/o Icahn Enterprises L.P., 767 Fifth Avenue, Suite 4700, New York, New York 10153. Mr. Ninivaggi resides in New York, New York.

Dr. Harold T. Shapiro

Dr. Shapiro has been a professor of economics and public affairs at Princeton University since 1988. Dr. Shapiro served as Princeton University’s 18th president, from 1988 to 2001. A renowned figure internationally in the field of ethics, Dr. Shapiro chaired the National Bioethics Advisory Commission from 1996 to 2001 , dealing with some of the most difficult medical ethics dilemmas of our time involving such issues as stem cell research and human cell cloning. While serving as Princeton’s president, Dr. Shapiro also took time to teach bioethics.

Since May 2010, Dr. Shapiro has served as the Chair of the InterAcademy Council Committee on the Review of the International Panel on Climate Change. Since 2001, he has served as a member of the Board of Directors of DeVry, Inc. (“DeVry”), and has served as Chair of the Board of Directors of DeVry since 2008. Since 2006, he has served as a member of the Board of Trustees of Princeton HealthCare Systems and a member of the National Institute of Health’s National Human Genome Research Institute Council Subcommittee. Since 2004, Dr. Shapiro has been a member of the Merck Vaccine Advisory Board, the Johnson & Johnson Advisory Committee on Stem Cell Initiatives and the National Academy of Science Committee on Policy and Global Affairs. Since 1997, he has served as a member of the Board of Directors of the Foundation for a Greater Opportunity. Dr. Shapiro served as a Director of Dow Chemical Co. from 1985

to 2006, serving as its Lead Director from 2003 to 2006. He served as a Director of HCA Inc. from 2001 to 2006. He also served previously on the boards of the Kellogg Cereal Company and Unisys Corporation.

Dr. Shapiro received the Council of Scientific Society Presidents 2000 Citation for Outstanding Leadership, the William D. Carey Lectureship Award for Leadership in Science Policy in 2006 and the Clark Kerr Award for Lifetime Achievement in Higher Education from the University of California Berkeley in 2009. Dr. Shapiro came to Princeton University in 1988 from the University of Michigan where he served on the faculty for twenty-four years as professor of economics and public policy and as president from 1980-1988. Dr. Shapiro received his bachelor’s degree from McGill University in 1956. As a student of McGill’s Faculty of Commerce, he was awarded the Lieutenant Governor’s Medal. Then, after five years in business, he enrolled in the Graduate School at Princeton University and earned his Ph.D. Based upon Dr. Shapiro’s financial experience and expertise and his experience serving on the boards of many organizations, the Icahn Parties believe that he has the requisite skills to serve as a Board member of Lions Gate.