UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Lions Gate Entertainment Corp.

(Name of Registrant as Specified In Its Charter)

Mr. Jay Firestone

Dr. Michael Dornemann

Mr. Christopher J. McGurk

Mr. Daniel A. Ninivaggi

Dr. Harold T. Shapiro

Mr. Carl C. Icahn

Mr. Brett Icahn

Mr. Jesse Lynn

High River Limited Partnership

Hopper Investments LLC

Barberry Corp.

Icahn Fund S.à r.l.,

Daazi Holding B.V.

Icahn Partners LP

Icahn Partners Master Fund LP

Icahn Partners Master Fund II LP

Icahn Partners Master Fund III LP

Icahn Enterprises G.P. Inc.

Icahn Enterprises Holdings L.P.

IPH GP LLC

Icahn Capital LP

Icahn Onshore LP

Icahn Offshore LP

Beckton Corp.

7508921 Canada Inc.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

On December 3, 2010 Salem Partners LLC made a presentation to Institutional Shareholder Services. A copy of the presentation is attached hereto as Exhibit 1 and is incorporated herein.

On December 6, 2010 Carl C. Icahn issued a press release. A copy of the press release is attached hereto as Exhibit 2 and is incorporated herein.

ON DECEMBER 6, 2010 MR. JAY FIRESTONE, DR. MICHAEL DORNEMANN, MR. CHRISTOPHER J. MCGURK, MR. DANIEL A. NINIVAGGI, DR. HAROLD T. SHAPIRO, MR. CARL C. ICAHN, MR. BRETT ICAHN, MR. JESSE LYNN, HIGH RIVER LIMITED PARTNERSHIP, HOPPER INVESTMENTS LLC, BARBERRY CORP., ICAHN FUND S.À R.L., DAAZI HOLDING B.V., ICAHN PARTNERS LP, ICAHN PARTNERS MASTER FUND LP, ICAHN PARTNERS MASTER FUND II LP, ICAHN PARTNERS MASTER FUND III LP, ICAHN ENTERPRISES G.P. INC., ICAHN ENTERPRISES HOLDINGS L.P., IPH GP LLC, ICAHN CAPITAL LP, ICAHN ONSHORE LP, ICAHN OFFSHORE LP, BECKTON CORP. AND 7508921 CANADA INC. (THE “PARTICIPANTS”) FILED A DEFINITIVE PROXY STATEMENT ON SCHEDULE 14A WITH THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) IN CONNECTION WITH THE SOLICITATION OF PROXIES FOR THE 2010 ANNUAL GENERAL MEETING OF SHAREHOLDERS OF LIONS GATE (THE “ANNUAL MEETING”). THE PARTICIPANTS HAVE FILED A DEFINITIVE PROXY STATEMENT WITH THE SEC IN CONNECTION WITH THE SOLICITATION OF PROXIES FOR THE ANNUAL MEETING AND MAY FILE OTHER PROXY SOLICITATION MATERIAL IN CONNECTION THEREWITH. SECURITYHOLDERS ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY THE PARTICIPANTS BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. SHAREHOLDERS ARE ABLE TO OBTAIN COPIES OF THESE DOCUMENTS AT NO CHARGE ON THE SEC’S WEBSITE ATWWW.SEC.GOV AND ON SEDAR ATWWW.SEDAR.COM. THESE MATERIALS MAY ALSO BE OBTAINED AT NO CHARGE BY CONTACTING D.F. KING & CO., INC., TOLL FREE FOR SHAREHOLDERS AT (800) 714-3313, AND FOR BANKS AND BROKERS AT (212) 269-5550. THE DEFINITIVE PROXY STATEMENT AND FORM OF PROXY ARE BEING MAILED TO SHAREHOLDERS OF LIONS GATE.

EXHIBIT 1

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 Salem Partners LLC Salem Partners LLC Presentation Regarding Presentation Regarding Prepared for Prepared for Icahn Partners LP Icahn Partners LP and and Institutional Shareholder Institutional Shareholder Services Services December 3, 2010 December 3, 2010 |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 Overview of Salem Partners LLC Founded in 1997, Salem Partners LLC is a leading investment banking firm providing financial advisory and other services to clients in the media and entertainment industry. Since the firm’s inception, we have delivered hundreds of valuations of entertainment companies or assets and have completed mergers and acquisitions or capital raising transactions for companies in various segments of the industry, including film and television production and distribution, cable networks, music and others. Salem Partners has represented large media companies in the past such as Metro-Goldwyn-Mayer, Sony, Liberty Media, Hearst and the Cisneros Group. In addition, Salem Partners has advised on more than 25 entertainment content transactions, including: Sale of Trimark Holdings to Lions Gate Sale of CanWest’s Fireworks Entertainment film library to ContentFilm Sale of Gaylord Entertainment film library to Qualia Capital Sale of Crown Media film library to RHI Entertainment Sale of Rysher Entertainment film library to Qualia Capital - 2 - |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 Introduction and Executive Summary The intention of this presentation is to illustrate to Institutional Shareholder Services that the current Board of Directors of Lions Gate has overseen significant and dramatic underperformance by the Company, including declining asset value, non-strategic acquisitions and an overall lack of strategy. Stock price performance compared to the market overall and its competitors has been poor. $100 invested in Lions Gate stock during the 5 years prior to the initial Icahn tender would have decreased to just $50.24. Over the same period, $100 invested in the S&P 500 would be worth $88.86 (see page 6). For the 5, 2 and 1 year periods prior to the initial Icahn tender offer, the Company’s stock price has significantly underperformed all of the relevant indices, such as the S&P 500 and the S&P Movies and Entertainment Index (see page 7). The Company’s stock price was $5.23 per share before the initial Icahn tender offer, and the only catalyst for any increase in stock price since has been subsequent increases in the Icahn tender offer price (see page 8). Many of Lions Gate’s recent transactions, approved by the Lions Gate Board of Directors, have significantly damaged shareholder value. Over $235 million has been invested in non-core assets that either are losing money (to date the Company has net losses of $77 from its interests in EPIX, FEARnet, Tiger Gate, Break.com and Roadside Attractions) or are in sharp decline, such as TV Guide (see pages 15 – 16). These deals reflect a lack of coherent strategy by the Company. Acquisitions have had questionable strategic value and have made analysis of the business and results more difficult for investors. - 3 - |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 Introduction and Executive Summary Lions Gate’s corporate overhead and management compensation are well above that of comparable companies. Lions Gate’s corporate overhead is 13.5% of SG&A, significantly higher than the 5.9% average of comparable publicly traded media companies (see page 11). Lions Gate’s corporate overhead is 7.1% of revenue, significantly higher than the 1.4% average of comparable companies (see page 11). Total compensation for Lions Gate’s top 5 executives of $15.2 million is nearly double that of the average middle market public company (see page 12). The Company’s “reported library cash flow” is not being generated by library as typically defined in the industry (see pages 13 – 14). In our opinion, Lions Gate’s definition of “library” is inappropriate given industry convention. Equity research analysts do not recognize the difference, as evidenced by the multiple they apply to these cash flows. The Company has actively promoted this misconception of the library. - 4 - |

|

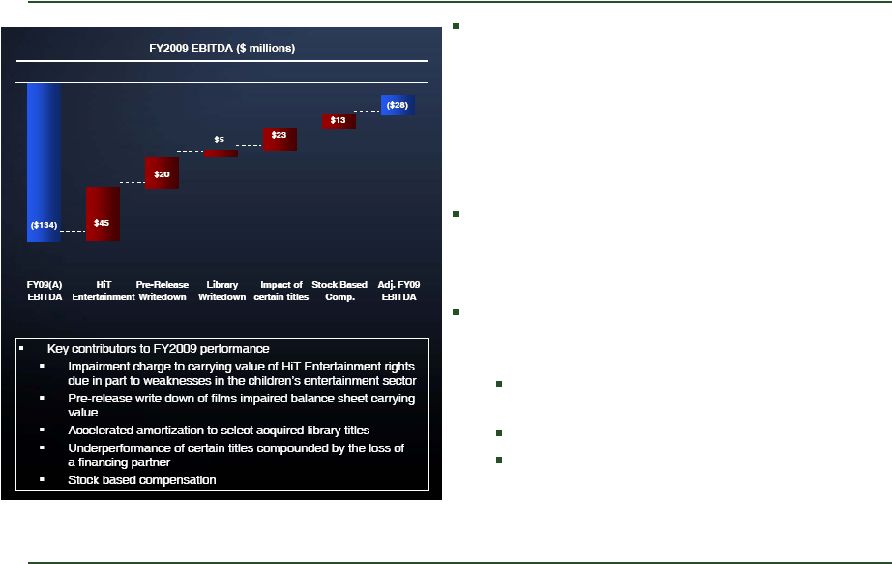

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 Introduction and Executive Summary The Company’s operating performance has deteriorated significantly over the last several years. The cumulative operating losses, net losses and operating cash flow since March 31, 2005 are each over $100 million, and net losses are over $350 million (see page 17). Over that time, the Company’s total debt has increased from $410 million to $816 million (see page 17). The Company has guided investors and analysts toward using a higher “adjusted EBITDA” figure that is not representative of operating performance (see page 18). In 2009 the Company’s “adjusted EBITDA” excluded over $100 million in losses that the Company claimed were non-recurring or extraordinary in nature, but were in fact from ordinary course operations of the Company (see page 18). Lions Gate management has failed to articulate any long term strategy for the Company and instead has been satisfied to jump from one transaction to the next (see page 20). - 5 - |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 6 - Lions Gate’s Stock Price Has Significantly Lagged the Market The chart below illustrates 5 years of Lions Gate’s stock performance for the five years prior to the initial Icahn tender offer on February 16, 2010. The performance is compared to the S&P 500 and the S&P 500 Movies and Entertainment Index, which are used as a basis of comparison by the Company in its public filings. Note: The S&P Movies and Entertainment Index includes News Corp. (NasdaqGS:NWS), Time Warner Inc. (NYSE:TWX), Viacom, Inc. (NYSE:VIA.B) and Walt Disney Co. (NYSE:DIS). Lions Gate 5 Year Stock Price Performance -80% -60% -40% -20% 0% 20% 40% Lions Gate Entertainment Corp. (NYSE:LGF) S&P 500 Index (^SPX) S&P 500 Movies & Entertainment (Sub Ind) Index S&P 500: -11.14% S&P Movies and Entertainment Index: -18.96% Lions Gate: -49.76% |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 Note: The S&P Movies and Entertainment Index includes News Corp. (NasdaqGS:NWS), Time Warner Inc. (NYSE:TWX), Viacom, Inc. (NYSE:VIA.B) and Walt Disney Co. (NYSE:DIS). - 7 - Lions Gate’s Stock Driven by Sequential Tender Offers, Not Operating Performance Stock Price Performance, Prior to Initial Tender Offer on February 16, 2010 5 yrs 2 yrs 1 yr (2/16/05 – 2/12/10) (2/15/08 – 2/12/10) (2/13/09 – 2/12/10) S&P 500 -11.14% -20.33% +30.07% S&P 500 Movies and Entertainment -18.96% -19.53% +68.25% Lions Gate -49.76% -44.06% +21.35% The tables below illustrate Lions Gate’s stock performance against both the S&P 500 index and the S&P 500 Movies and Entertainment Index for the one, two and five years prior to the initial Icahn tender offer on February 16, 2010. |

|

- 8 - Lions Gate’s Stock Driven by Sequential Tender Offers, Not Operating Performance The chart below illustrates Lions Gate’s stock price since the initial Icahn tender offer. Lions Gate stock price prior to the tender was $5.23 per share. Given the recent quarterly net loss of $29.7 million, we believe the stock price would be below $5.23 per share without the tender. The chart shows that as soon as the tender offer has expired, the stock price declines - and only increases when a tender offer is made or increased. SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 6/30/10: Tender offer completed. 7/9/10: Standstill period entered. Stock drops to low of $6.03 per share on 7/19/10. 8/31/10: Tender offer increased to $7.50 per share, stock rises 10% to $7.14 per share. 7/20/10: Tender offer renewed at $6.50 per share. Stock rises 8% to $6.53 per share and rises to $7 a week later. 4/15/10: Tender offer raised to $7 per share, stock rises 8% to $6.87 per share. 2/16/10: Icahn Partners announces tender offer at $6 per share. |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 9 - Lions Gate Has Entered Into Several Recent Transactions that Have Damaged Shareholder Value The acquisition of TV Guide in 2009 for $242 million of cash. The Company has had an overly broad strategy for TV Guide since the initial acquisition, and has unsuccessfully sought to be all things to all people. "We want to turn this into a billion-dollar asset”, said Feltheimer. “Within the next couple of years we expect to be a full- service and full-screen entertainment-focused channel, it's a great fit.” He said Lionsgate planned to expand the channel's programming with original shows, behind-the-scenes movie coverage and other offerings, gradually moving it away from the scrolling grid of show listings that is now its most dominant feature. In the near term, Lionsgate will be able to immediately use the channel to promote its upcoming movies. – January 2009, LA Times “My year one strategy at TV Guide is to produce brand defining specials such as the recent Susan Boyle event, acquire key series such as Curb Your Enthusiasm, and secure the rights to a mix of movies that play well to true TV and pop culture fans.” – Incoming EVP Diane Robina, January 2010 Under the Company’s control, TV Guide has remained a standalone, undercapitalized programming service that lacks sufficient negotiating leverage to secure quality distribution with cable and satellite providers. In the most recent quarter TV Guide saw revenue decline -1% over the prior year, a significant decline in EBITDA of -13% and an even larger decline in audience of -32% as new programming has failed to gain traction and the channel has lost viewers in the transition to digital cable. Cable advertising overall is estimated to be up 12% in the first three quarters of 2010 over the same period in 2009 (a) – therefore the fact that revenue and earnings are down at TV Guide is an indication that something is seriously wrong at the network. The questionable value of the TV Guide acquisition is further highlighted by the Company’s decision to sell 49% of the business to a partner and deconsolidate its financial performance, making evaluation of its performance difficult or impossible. The strategic rationale for the acquisition remains unclear. (a) Source: Magna Global. |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 10 - Lions Gate Has Entered Into Several Recent Transactions that Have Damaged Shareholder Value The Company has acquired several businesses that are duplicative to the Company’s operations, including: Mandate Pictures, acquired in September 2007 for $129 million, is a producer, financier and distributor of feature films of similar size and genre as the Company’s films. Roadside Attractions, interest acquired in July 2007, is a specialty theatrical distribution company. The Company tends to leave acquisitions as standalone companies with significant, unnecessary overhead within Lions Gate. |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 11 - Lions Gate’s Overhead Structure is Out of Proportion to Its Competitors’ Lions Gate’s operating costs are much higher than other public media and entertainment businesses. These figures indicate significant potential cost savings are available at the Company. ($ in millions, except employees) Lions Gate (b) CBS (c) Viacom (d) Disney (e) Average LGF CBS VIA.B DIS of Comparables Operating Cost Metrics Corporate Overhead as a % of Total SG&A (a) 13.5% 8.7% 6.1% 2.9% 5.9% Corporate Overhead as a % of Revenue 7.1% 1.6% 1.3% 1.1% 1.4% Corporate Overhead per Employee $230,191 $8,702 $14,954 $2,819 $8,825 Note: (a) SG&A excludes programming costs, film amortization and other items as specified in each company's public filings. (b) Corporate Overhead defined as "Corporate general and administration" in the 10Q of Sept. 30, 2010 and 10k dated Mar. 31, 2010. Includes stock compensation, legal and professional fees and rent and facility expenses. (c) Corporate Overhead defined as "Operating Income" under "Corporate" in the 10Q of Sept. 30, 2010 and 10k dated Dec. 31, 2009. Includes stock-based compensation and lease fees. (d) Corporate Overhead defined as "Corporate Expenses" in the 10k of Sept. 30, 2010 and 10k dated Dec. 31, 2009. (e) Corporate Overhead defined as "Corporate and unallocated shared expenses" in the 10k of Sept. 30, 2010. Includes information technology and compensation costs, etc. |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 12 - Management Compensation is Out of Proportion With Middle Market Peers Lions Gate’s top management is highly compensated and are significantly more expensive than other middle market companies, as illustrated in the charts below. Lions Gate’s enterprise value is $1.7 billion. The chart below illustrates the average total executive compensation for companies with enterprise values ranging from $1.5 billion to $2 billion. ($ in millions) Lions Gate Top 5 Executives Employee Total Compensation #1 $6.9 #2 3.6 #3 2.1 #4 1.8 #5 0.8 Lions Gate Total $15.2 Total Company Enterprise Value $1,748.2 Note: (a) Source: 10K-A as of March 31, 2010 ($ in millions) Top 5 Executives Average Sector Total Compensation Consumer Discretionary $9.3 Materials 9.0 Consumer Staples 9.0 Information Technology 7.9 Industrials 6.6 Energy 6.5 Healthcare 6.2 Utilities 5.4 Financials 5.1 Lions Gate Total $15.2 Note: Publicly traded companies with enterprise values between $1.5 and $2.0 billion per Capital IQ. |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 13 - Lions Gate’s Library is a Misunderstood Asset The public market perception is that Lions Gate has a core asset, a film and television library, that serves as a bedrock in the Company’s valuation. Several analysts, as well as the Company itself, have referred to a vague concept of “library free cash flow” of between $95 million and $110 million per year. The multiples being used by analysts in valuing the library are consistent with an asset that is viewed as stable and generating predictable, recurring cash flow each year, but in reality, using Lions Gate’s definition of “library” such revenues are declining dramatically. The Company defines “library” revenue as any revenue generated as early as six months after a title is released within each window (television, home video, etc.), thereby adding newly released titles to library significantly more quickly than any other major studio. “In terms of the library, it’s really pretty simple. We define library the same way that we always have, six months after each individual window.” – Jon Feltheimer, CEO, February 17, 2004, Q3 2003 Lions Gate Entertainment Earnings Conference Call The manner in which Lions Gate includes new films in “library” implies that “library cash flow” is skewed by the inclusion of more early and quickly declining home video and television revenue from newer films than it is from older and more stable titles. “Reported library cash flow...for 2010 estimated to be $100-110 million” – Lions Gate investor presentation dated April 2010 “We are valuing the library at 9x free cash flow of $95 million” – Soleil Securities, March 29, 2010 |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 14 - Lions Gate’s Library is a Misunderstood Asset If one looks at a static pool of titles, “Library cash flow” is rapidly declining. The only way that the overall “library” cash flow remains stable is by adding an entire new slate of films every year, and treating titles as “library” very soon after initial release. Such titles are added at a cost of hundreds of millions of dollars. The Company has actively promoted the historical performance of the library and presented it as a stable, consistent and low risk asset, when in fact it is highly dependent on the continued influx and performance of new films and should not be valued at such a high multiple. |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 15 - Opaque Corporate Structure Lions Gate’s corporate structure has become increasingly difficult for investors to understand. Multiple minority investments in companies with no clear strategic importance for the Company. Poorly articulated acquisition and growth strategy. More than $235 million of Lions Gate’s capital has gone into businesses that are not consolidated into Lions Gate’s financials, and which are difficult to evaluate based on the information available to the public. The Company has become highly leveraged in part due to these acquisitions, and has limited its flexibility to operate going forward. All of these businesses are either losing money or are in rapid decline (TV Guide). The strategy of partnerships and non-strategic acquisitions has been opaque and confusing, and equity research analysts have increasingly acknowledged that the arcane nature of the Company’s corporate structure has made valuation extremely difficult. “Diversification makes [the] business ... harder to understand.” – David Bank, RBC Capital Markets, February 10, 2010 “[The Company is] amazingly complex.” – James Marsh, an analyst with Piper Jaffray, Variety, December 2, 2010 |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 16 - Lions Gate Has Entered Into Several Recent Transactions that Have Damaged Shareholder Value The Company has invested significant capital for minority investments in various companies, and has generated significant net losses to date. The Company’s overhead is disproportionately high even before taking account of costs associated with these investments. ($ in millions) Date Ownership Total Capital Lions Gate's Share of Net Income (Loss) to Date Acquired Interest Investment (a) FYE 2007 FYE 2008 FYE 2009 FYE 2010 Q1 2011 Q2 2011 Total EPIX Apr 08 31.2% $80.3 $0.0 $0.0 ($1.0) ($26.6) ($12.0) ($19.8) ($59.4) Break.com Jun 07 42.0% 21.4 - (1.0) (2.6) (0.8) (0.3) 0.0 (4.6) FEARnet Oct 06 33.3% 14.8 (1.5) (5.4) (5.3) (0.6) 0.5 0.5 (11.9) Tiger Gate Apr 10 45.9% - - - - - (0.1) (0.4) (0.5) Roadside Attractions Jul 07 43.0% - - (0.9) (0.1) (0.1) 0.1 (0.0) (1.0) Total $116.5 ($1.5) ($7.3) ($9.0) ($28.1) ($11.7) ($19.8) ($77.4) Notes: Fiscal year ended March 31. (a) As of most recent 10Q dated September 30, 2010. |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 17 - Lions Gate Has Lost $109 Million in Operating Income Since 2005 and has Ceased to Generate Operating Free Cash Flow Lions Gate’s cumulative operating losses since March 31, 2005 have been $109 million, net losses have been $368 million and operating cash flow losses have been $114 million. Over that time its total debt has increased from $410 million to $816 million. Company revenue has only grown an average of 8% per year since fiscal year 2008, a period during which the Company has been generating negative free cash flow from operations at an increasing rate. ($ in millions) Fiscal Year Ended March 31, Fiscal Year 2011 2006 2007 2008 2009 2010 Q1 Q2 Cumulative Operating Income $15.3 $41.9 ($60.1) ($141.2) $52.0 ($37.4) $20.5 ($108.9) Net Income (Loss) ($4.7) $15.5 ($87.4) ($178.5) ($19.5) ($64.1) ($29.7) ($368.3) Free Cash Flow From Operations $55.2 $59.7 $89.2 ($101.9) ($121.8) ($62.9) ($31.9) ($114.4) Note: The Company's fiscal year ends on March 31. |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 18 - The Company’s Definition of Adjusted EBITDA Obscures Actual Performance Significantly This chart is from a presentation by the Company in October 2009, discussing the items added back to actual fiscal year 2009 EBITDA to get to the Company’s definition of “adjusted EBITDA” - a metric which has not been indicative of actual Company operating performance. The Company has sought to classify certain losses as non-recurring and extraordinary that are in fact ordinary course. The chart has over $100 million dollars in adjustments, with 4 of the 5 items from ordinary course poor operating performance, including: Losses from weakness in a market for the Company’s product. Poor new release film performance. Poor library film performance. |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 19 - Lions Gate Lacks a Strategy For Creation of Shareholder Value Lions Gate has not been able to articulate any vision or overall strategy, and has instead taken an opportunistic and haphazard approach toward growing the business, including: Using scarce capital to acquire a non-core asset in TV Guide network. Since the acquisition, the Company has sold a significant minority stake, has failed to execute an overly broad strategy, replaced its CEO and has suffered recent declines in revenue, EBITDA and viewers. Investing significant management focus and capital in television, a highly competitive, low margin business in which no enduring asset value is being created. Minority investments with no control or strategic value to the Company, including Break.com, a comedy and video website and FEARnet, a subscription VOD service for horror films in partnership with Sony and Comcast that has thus far struggled to gain any distribution as a standalone channel. |

|

SEE DISCLAIMERS AND RELATED MATTERS ON PAGE 21 - 20 - Important Disclosures These materials were prepared by Salem Partners LLC (“Salem”) at the request of Icahn Partners LP and its affiliates (“Icahn”). Salem has been retained as an independent contractor to provide financial advisory services to Icahn and has no fiduciary, agency or other relationship to Icahn, Lions Gate Entertainment Corp. or its affiliates (“Lions Gate”), or to any other party, all of which are hereby disclaimed. Therefore, no obligation or responsibility is assumed to any person with respect to these materials. These materials do not purport to be a complete description of the views of or analyses performed by Salem. Nothing contained herein should be construed as providing any legal, tax or accounting advice, and you are encouraged to consult with your legal, tax, accounting and investment advisors. You should consider these materials as only one of many factors to be considered in making any investment or other decisions. Given Salem's past, current or future relationships with companies mentioned in these materials, investors should be aware that the firm could be viewed as having a conflict of interest affecting the objectivity of these materials. See the “Important Disclosures” section at the conclusion of these materials for important required disclosures, including potential conflicts of interest. These materials are based solely on information contained in the public domain and related Salem analyses. Salem has relied upon and assumed, has not attempted to independently investigate or verify and does not assume any responsibility for, the accuracy, completeness or reasonableness of such information, including published or Salem-prepared forecasts, projections, estimates (collectively, "Projections") or other information included or otherwise used herein. Projections involve elements of subjective judgment and analysis, and there can be no assurance that such Projections will be attained. No representation or warranty, express or implied, is made as to the accuracy or completeness of any information included or otherwise used herein, and nothing contained herein is, or shall be relied upon as, a representation or warranty, whether as to the past, the present or the future. Salem has assumed that the Projections included or otherwise used herein have been reasonably prepared and represent reasonable estimates and judgments as to the future financial performance of Lions Gate. We express no view as to any Projections or the assumptions on which they were based. These materials are necessarily based upon information available to Salem, and financial, stock market and other existing conditions and circumstances that are known to Salem, as of the date of these materials. Salem does not have any obligation to update or otherwise revise these materials. The information contained in these materials does not purport to be an appraisal of any of the assets or liabilities of Lions Gate or any of its business units or subsidiaries, and does not express any opinion as to the price at which the securities of any such entities may trade at any time. The information and opinions provided in these materials take no account of any investor's individual circumstances and should not be taken as specific advice on the merits of any investment decision. Moreover, nothing contained herein is intended or written, or should be construed, as providing any legal, tax or accounting advice, and thus, among other things, nothing contained herein is intended or written to be used, or can be used, for the purpose of avoiding tax-related penalties. You should consider these materials as only one of many factors to be considered in making any investment or other decisions. Salem does not accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of these materials. Neither these materials nor their substantial equivalent may be copied, republished or reprinted in their entirety or in part, except for immaterial excerpts, without the prior written permission of Salem. As a general matter, Salem does and seeks to do business with companies covered in its reports, including these materials, and may have acted, act or seek to act as financial advisor in connection with transactions involving companies covered herein. In addition, in the ordinary course of its business, Salem may actively trade securities of Lions Gate or other companies referenced in these materials for its own account and for the accounts of its customers and, accordingly, may at any time hold a long or short position in such securities. SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE SHAREHOLDERS OF LIONS GATE ENTERTAINMENT CORP. (“LIONS GATE”) FOR USE AT THE NEXT MEETING OF SHAREHOLDERS OF LIONS GATE AT WHICH INDIVIDUALS WILL BE ELECTED TO THE BOARD OF DIRECTORS OF LIONS GATE, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO SHAREHOLDERS OF LIONS GATE AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE SEC’S WEBSITE AT WWW.SEC.GOV AND ON SEDAR AT WWW.SEDAR.COM. INFORMATION RELATING TO PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE PRELIMINARY PROXY STATEMENT FILED WITH THE SEC ON NOVEMBER 26, 2010. |

EXHIBIT 2

FOR IMMEDIATE RELEASE

ICAHN RESPONDS TO AMENDED COMPLAINT OF LIONS GATE

New York, New York, December 6, 2010

Contact: Susan Gordon (212) 702-4309

On December 3, 2010, Lions Gate filed an amended complaint in connection with its lawsuit in the United States District Court for the Southern District of New York against Carl Icahn, Brett Icahn and various other members of the Icahn Group. Attached is a copy of the amended complaint. The members of the Icahn Group believe that Lions Gate’s lawsuit and its claims continue to be completely without merit. In a November 2, 2010 court filing, Carl Icahn disclosed that he purchased approximately $145 million of MGM debt in November and December 2008, approximately $51 million in July and November 2009, and an additional $400 million between August and October 2010.

The terms and conditions of the tender offer by Mr. Icahn’s affiliates to acquire any and all of Lions Gate’s outstanding common shares for $7.50 per share, which will expire at 11:59 p.m., Vancouver time, on December 10, 2010, unless extended or withdrawn, are set forth in an Offer to Purchase, Letter of Transmittal and other related materials that have been distributed to holders of Lions Gate’s common shares and were filed with the SEC as exhibits to the Icahn Group’s amended Schedule TO and with the Canadian securities authorities on SEDAR. Shareholders with questions about the tender offer may callD.F. King & Co., Inc., the Information Agent, toll-free at 800-859-8511 (banks and brokers call 212-269-5550).

THIS PRESS RELEASE IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE AN OFFER TO PURCHASE NOR A SOLICITATION FOR ACCEPTANCE OF THE OFFER DESCRIBED ABOVE. THE OFFER IS BEING MADE ONLY PURSUANT TO THE OFFER TO PURCHASE, THE LETTER OF TRANSMITTAL AND RELATED MATERIALS THAT THE ICAHN GROUP HAS FILED WITH THE SEC AS EXHIBITS TO ITS AMENDED SCHEDULE TO AND WITH THE CANADIAN SECURITIES AUTHORITIES ON SEDAR AND HAS DISTRIBUTED TO HOLDERS OF COMMON SHARES. HOLDERS OF COMMON SHARES SHOULD READ CAREFULLY THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND RELATED MATERIALS BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING THE VARIOUS TERMS OF, AND CONDITIONS TO, THE OFFER. HOLDERS OF COMMON SHARES MAY OBTAIN A FREE COPY OF THE AMENDED TENDER OFFER STATEMENT ON SCHEDULE TO, THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND OTHER DOCUMENTS THAT THE ICAHN GROUP HAS FILED (1) WITH THE SEC AT THE SEC’S WEB SITE ATWWW.SEC.GOV AND (2) WITH THE CANADIAN SECURITIES AUTHORITIES ON SEDAR ATWWW.SEDAR.COM.

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE SHAREHOLDERS OF LIONS GATE ENTERTAINMENT CORP. (“LIONS GATE”) FOR USE AT THE NEXT MEETING OF SHAREHOLDERS OF LIONS GATE AT WHICH INDIVIDUALS WILL BE ELECTED TO THE BOARD OF DIRECTORS OF LIONS GATE, BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY ARE BEING MAILED TO SHAREHOLDERS OF LIONS GATE AND ARE ALSO AVAILABLE AT NO CHARGE AT THE SEC’S WEBSITE ATWWW.SEC.GOV AND ON SEDAR ATWWW.SEDAR.COM. INFORMATION RELATING TO PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE DEFINITIVE PROXY STATEMENT FILED WITH THE SEC ON DECEMBER 6, 2010.

| | | | |

| UNITED STATES DISTRICT COURT | | | | |

| SOUTHERN DISTRICT OF NEW YORK | | | | |

| | X | | |

| LIONS GATE ENTERTAINMENT CORP., | | : | | |

| | : | | |

| Plaintiff, | | : | | No. 10-CV-8169 (HB) (KNF) |

| | : | | |

vs. | | : | | ECF CASE |

| | : | | |

| CARL C. ICAHN, BRETT ICAHN, ICAHN PARTNERS LP, | | : | | |

| HIGH RIVER LIMITED PARTNERSHIP, HOPPER | | : | |  |

| INVESTMENTS LLC, BARBERRY CORP., ICAHN | | : | |

| ONSHORE LP, ICAHN OFFSHORE LP, ICAHN CAPITAL | | : | |

| LP, IPH GP LLC, ICAHN ENTERPRISES HOLDINGS L.P., | | : | |

| ICAHN ENTERPRISES G.P. INC., and BECKTON CORP., | | : | |

| | : | |

Defendants. | | : X | |

| | | |

AMENDED COMPLAINT

Plaintiff Lions Gate Entertainment Corp. (“Lionsgate”) by its undersigned counsel alleges, upon knowledge as to itself and its own acts and upon information and belief as to all other matters, as follows against Carl C. Icahn (“Icahn”), Brett Icahn, and the other defendants named above (collectively, the “Icahn Group”):

OVERVIEW

1. In March 2010, corporate raider Carl Icahn declared his intent to take control of Lionsgate, a leading independent film and television studio that produces critically acclaimed hits such as the Oscar-winningPreciousand the Emmy-winning “Mad Men.” Icahn based his campaign for control on the charge that Lionsgate’s management was imprudently pursuing merger transactions, above all what he characterized as a “misguided strategy” of acquiring legendary film studio Metro-Goldwyn-Mayer, Inc. (“MGM”) that he told the market would end in “oblivion” and “bankruptcy.”

2. It turns out that Icahn has been misleading Lionsgate and its shareholders all along. While urging Lionsgate shareholders to support his takeover campaign — either by tendering their stock or by voting for his dissident slate of nominees to Lionsgate’s board of

directors — to ensure that Lionsgate did not pursue what he called a “delusional” MGM transaction, Icahn quietly studied the merits of a Lionsgate-MGM transaction and amassed a huge position in MGM debt with the undisclosed intention of reaping profits from both sides in an eventual merger. After acquiring substantial holdings in both MGM debt and Lionsgate shares, Icahn began aggressively promoting a merger between Lionsgate and MGM.

3. In short, at the same time Icahn was telling the investing public that a Lionsgate-MGM transaction would be a financial debacle, he was secretly plotting to merge the two studios — but onlyafterhe had acquired a sufficiently large position in both companies at depressed prices to ensure that he maximized his own profits.

4. In March, shortly after the Icahn Group launched its first tender offer for all of Lionsgate’s outstanding shares, Icahn began publicly attacking the possibility of a merger between Lionsgate and another film studio. He repeatedly ridiculed the idea of a merger between Lionsgate and MGM, a storied studio with a vast film library but few new movies in its production pipeline, likening it to “tying two one-legged men together.” And in June, aware that Lionsgate was then in advanced merger negotiations with two studios, he publicly threatened to sue any company (including MGM) that entered into a transaction with Lionsgate — because, he said, a deal with a third party would interfere with his plan to gain control of Lionsgate. The talks fell apart.

5. Subsequent developments and deposition testimony have revealed that Icahn was playing a double game. While publicly denouncing a merger with MGM as foolish and MGM itself as a dinosaur with a decaying library, the Icahn Group was analyzing the financial merits of a Lionsgate-MGM transaction and buying up MGM’s privately traded debt. By the early fall, Icahn had amassed more than 10% of MGM’s approximately $4 billion in debt — enough to give him a prominent voice among the creditors running the financially distressed studio. At the same time, through his tender offers, he increased his stake in Lionsgate from approximately 19% in March to approximately 33% by late September.

-2-

6. Icahn established this position in Lionsgate by falsely telling Lionsgate shareholders he would block an MGM deal as “delusional.” Millions of Lionsgate shares were tendered into the Icahn offer on that basis. But it was not true. Icahn was in fact privately preparing to orchestrate an MGM transaction for his own benefit.

7. Icahn opposed a merger with MGM not because it was bad for Lionsgate shareholders, but because it was good — so good, in fact, that he wanted to postpone it until he could buy as much of both companies as he could and thus extract for himself as much of the value stemming from the merger as possible. Similarly, his threats to sue Lionsgate’s potential merger partners were nothing more than blocking tactics designed to preclude a transaction until Icahn could reap the maximum financial benefit for himself. By publicly criticizing a Lionsgate-MGM merger and bullying potential merger partners while failing to disclose his own purchases of privately traded MGM debt, Icahn kept Lionsgate shareholders in the dark about the ultimate likelihood and value of a merger between Lionsgate and another studio and misleadingly induced them to tender their shares into his inadequate tender offer.

8. Completely contradicting his prior disclosures, Icahn subsequently launched a full-court press to cause MGM to merge with Lionsgate. On October 12, Icahn finally admitted that he holds a “significant position[]” in MGM debt. And in late October 2010, Icahn made a series of offers to other holders of MGM debt to acquire effective control of MGM, with the apparent intent of engineering an MGM-Lionsgate deal. These actions confirm that Icahn has been seeking control of Lionsgate with an undisclosed plan to complete an MGM transaction — the very transaction he ridiculed for months — on terms that benefit him as a major MGM debtholder. But Icahn still has not disclosed material information to which shareholders considering his pending tender offer or his proxy solicitations are entitled. Lionsgate shareholders are being asked to decide whether to hand Icahn control of their company. They are entitled to know all material facts about his plans and proposals for Lionsgate, including his course of dealing in MGM debt or other securities, his true views and intentions regarding a potential MGM transaction, and the extent to which his financial interests, as a major MGM debtholder, are not aligned with those of ordinary Lionsgate shareholders.

-3-

9. As detailed below, the Icahn Group has furthered its plan to merge Lionsgate and MGM at a time when it could extract the maximum financial benefit for itself by filing materially false and misleading statements with the Securities and Exchange Commission relating to its stockholdings in Lionsgate, its tender offers for Lionsgate shares, including a pending offer set to expire on December 10, and its proxy solicitations of Lionsgate shareholders, including a current solicitation for the election of its nominees to the board of directors at the annual shareholders’ meeting scheduled for December 14. In addition, the Icahn Group has violated provisions of the federal securities laws requiring it to make tender offers to all Lionsgate shareholders on the same terms. It has also tortiously interfered with Lionsgate’s prospective business relations with potential merger partners.

10. By engaging in this misconduct, the defendants violated Sections 13(d), 14(a), 14(d), and 14(e) of the Securities Exchange Act of 1934, as amended (the “34 Act”), 15 U.S.C. §§ 78m(d) & 78n(a), (d), (e), Rules 13d-l, 14a-9, 14d-6(d), and 14d-10 thereunder, 17 C.F.R. §§ 240. 13d-l, 240. 14a-9, 240. 14d-6(d) & 240. 14d-10, and state tort law. Lionsgate seeks preliminary and permanent injunctive relief on behalf of itself and its shareholders and money damages compensating it for the Icahn Group’s tortious interference in its prospective business relations with potential merger partners.

11. On October 23, 2010, Lionsgate filed an initial complaint in this action. Shortly thereafter, the Icahn Group purported to cure its securities law violations by filing a copy of that complaint with the SEC on Schedule 14A. On November 26, 2010, the Icahn Group announced a five-director slate of dissident nominees for election to Lionsgate’s board. In so doing, the Icahn Group abandoned its prior plan — which had been one of the subjects of Lionsgate’s initial complaint — to nominate Icahn’s son Brett Icahn to the Lionsgate board. While Lionsgate’s initial complaint has thus already achieved benefits for the company and all of its shareholders, Lionsgate files this Amended Complaint to remedy remaining legal wrongs, including the Icahn Group’s continued failure to disclose the extent of the Icahn Group’s MGM debtholdings and the history of its trading activity in MGM debt.

-4-

JURISDICTION AND VENUE

12. This Court has subject-matter jurisdiction over this action pursuant to 28 U.S.C. § 1331, Section 27 of the ‘34 Act, 15 U.S.C. § 78aa, and 28 U.S.C. § 1367.

13. Venue is proper in this district under Section 27 of the ‘34 Act, 15 U.S.C. § 78aa, and under 28 U.S.C. § 1391.

14. All of the defendants reside in this district. Moreover, the Icahn Group’s contacts with this forum are substantial and directly related to this dispute. Its contacts include its transaction of business in this district, including a substantial portion of the activities that give rise to Lionsgate’s claims in this action; its publication and transmittal of misleading and inaccurate SEC filings from and into this district and the purposeful transmission from and into this district of communications relating to the Icahn Group’s tender offers, in each case through the means or instrumentalities of interstate commerce; and its hostile attempt to acquire Lionsgate, a corporation traded on the New York Stock Exchange.

THE PARTIES

15. Plaintiff Lionsgate is a corporation organized under the laws of British Columbia, Canada, with its headquarters in Santa Monica, California. Lionsgate’s common shares are registered pursuant to Section 12 of the ‘34 Act, 15 U.S.C. § 781, and are traded on the New York Stock Exchange.

16. Defendant Carl C. Icahn is an investor who resides in New York, New York. Icahn directly or indirectly controls all of the other defendants.

17. Defendant Brett Icahn is Carl Icahn’s son. He is an investment analyst for the Icahn Group and resides in New York, New York.

18. Defendant Icahn Partners LP is a limited partnership organized under the laws of Delaware with its principal place of business in White Plains, New York.

-5-

19. Defendant High River Limited Partnership is a limited partnership organized under the laws of Delaware with its principal place of business in White Plains, New York.

20. Defendant Hopper Investments LLC is a limited liability company organized under the laws of Delaware with its principal place of business in White Plains, New York.

21. Defendant Barberry Corp. is a corporation organized under the laws of Delaware with its principal place of business in White Plains, New York.

22. Defendant Icahn Onshore LP is a limited partnership organized under the laws of Delaware with its principal place of business in White Plains, New York.

23. Defendant Icahn Offshore LP is a limited partnership organized under the laws of Delaware with its principal place of business in White Plains, New York.

24. Defendant Icahn Capital LP is a limited partnership organized under the laws of Delaware with its principal place of business in White Plains, New York.

25. Defendant IPH GP LLC is a limited liability company organized under the laws of Delaware with its principal place of business in White Plains, New York.

26. Defendant Icahn Enterprises Holdings L.P. is a limited partnership organized under the laws of Delaware with its principal place of business in White Plains, New York.

27. Defendant Icahn Enterprises G.P. Inc. is a corporation organized under the laws of Delaware with its principal place of business in White Plains, New York.

28. Defendant Beckton Corp. is a corporation organized under the laws of Delaware with its principal place of business in White Plains, New York.

FACTUAL ALLEGATIONS

| A. | Lionsgate’s success story |

29. Since its founding in 1997, Lionsgate has established a track record of producing major commercial and critical hits for both the small and silver screens. Approximately 70% of its theatrically released films are profitable — one of the highest success rates in the industry. Its successful films includeAmerican Pyscho, Crash, Monster’s Ball and theSaw horror franchise. Among its more recent box office hits areThe Expendables, The Last

-6-

Exorcism,Tyler Perry’sWhy Did I Get Married Too,andPrecious.Lionsgate also produces successful and critically acclaimed television series such as “Mad Men,” “Weeds” and “Nurse Jackie” and distributes Tyler Perry’s popular “House of Payne” and “Meet the Browns” shows. Lionsgate’s television revenues have grown exponentially in the past ten years, from $8 million in fiscal 1999 to more than $350 million in fiscal 2010. Lionsgate earns substantial revenues from the distribution of its library of films, television programs, and other content through a variety of media, including video-on-demand and other new digital delivery services.

30. Lionsgate is guided by a management team with longtime experience at the company and in the industry. Jon Feltheimer, its chief executive officer since 2000, has worked in the entertainment industry for 25 years. During his tenure, the company’s revenues have grown nearly tenfold from $183 million in fiscal 2000 to $1.6 billion in fiscal 2010. During the same period, Lionsgate’s stock price has appreciated 196%, compared with a 26% decline in the S&P 500 and a 50% decline in the S&P 500 Media Index, and its market capitalization has surged from $70 million to $985 million.

| B. | Icahn and his entertainment industry record |

31. Carl Icahn is a corporate raider who has made billions of dollars breaking up companies, often at the expense of ordinary shareholders. He does not have a record of success in the entertainment industry. In September 1997, Icahn formed Stratosphere Entertainment, a financial failure that ceased activities in 2000. Its most significant film,Hideous Kinky,lost millions of dollars. Icahn’s other major foray into the entertainment industry, an attempt to exercise control of Blockbuster, Inc., ended in disaster for the company’s other shareholders. Between May 2005, when Icahn obtained a seat on Blockbuster’s board of directors, and January 2010, when he resigned, Blockbuster’s share price plummeted from $10.05 to $0.40 per share — a 96% decline in value. On September 23,2010, Blockbuster filed for Chapter 11 protection. While other Blockbuster shareholders lost the entire value of their investment and any equity stake in the company, Icahn maneuvered a soft landing for himself by accumulating as much as a

-7-

third of the company’s distressed debt while its share price collapsed. According to Reuters, a group of hedge fund bondholders led by Icahn will control Blockbuster when it exits bankruptcy.SeeCaroline Hunter,Blockbuster Seeks Turnaround in Bankruptcy,Reuters (Sept. 23, 2010), http://www.reuters.com/article/idUSTRE68M10320100923 (last visited Oct. 27, 2010).

| C. | Icahn sets his sights on acquiring control of |

Lionsgate and begins a pattern of inadequate

and misleading disclosure

32. On October 20, 2008, the Icahn Group disclosed in a Schedule 13D that it had acquired 9.17% of Lionsgate’s outstanding common shares at prices as high as $8.46 per share. Form SC 13D, Item 5 (Oct. 20, 2008). It stated that it had “acquired the Shares in the belief that the Shares were undervalued” and that it “may, from time to time and at any time, acquire additional Shares.”Id.Item 4.

33. On February 23, 2009, the Icahn Group filed an amended Schedule 13D disclosing that it had increased its stake to 14.28%. Form SC 13D/A, Item 5 (Feb. 23, 2009). In the filing, the Icahn Group also acknowledged that it “may seek to add [its] nominees” to the Lionsgate board by adding seats or removing current directors, and that it might do so at the next annual meeting of shareholders or at a special meeting it called.Id.Item 4.

34. The Icahn Group continued to purchase Lionsgate shares over the next twelve months. On February 16, 2010, the Icahn Group disclosed that it held 18.87% of Lionsgate’s outstanding shares and that it planned to make a tender offer of $6.00 in cash per share for up to 13,164,420 of Lionsgate’s common shares. Form SC 13D/A, Item 5 and Ex. 1 (Feb. 16,2010). The announcement noted that if the tender offer was successful, the Icahn Group’s stake in Lionsgate would grow to 29.9%.Id.Ex. 1. Nevertheless, two days later, Icahn flatly stated during an interview on CNBC, “[w]e are not looking to take control of Lionsgate.”

35. On March 1, 2010, the Icahn Group commenced the tender offer, which it set to expire on April 6, 2010. Form SC TO-T (also designated Form SC 13D/A), Ex. (a)(l)(i), at 1 (Mar. 1, 2010). In the Schedule TO the Icahn Group filed the same day, it maintained that the purpose of its tender offer was “not to take control of the business of Lions Gate, but instead in order to increase [its] shareholdings in Lions Gate.”Id.Ex. (a)(1)(i), at 5.

-8-

36. The Icahn Group reversed that position less than a month later. On March 19, 2010, it amended its tender offer, offering to purchase up to all of the shares if the number tendered combined with its existing holdings equaled at least 50.1 % of Lionsgate’s outstanding shares. Form SC TO-T/A (also designated Form SC 13D/A), Ex. (a)(1)(vi), at 5 (Mar. 19, 2010).1 It also extended the offer to April 30.Id. Ex. (a)(1)(vi), at i.

37. In a press release issued the same day, Icahn criticized Lionsgate’s management for its apparent desire to “further leverage up the company to purchase a film library.”Id. Ex. (a)(1)(vi), at 3. He declared his belief that “library values are currently declining due to, in part, weak DVD sales” and that “the best course for Lions Gate is to pursue a strategy aimed more at the consolidation of film and television distributors, as opposed to the acquisition of library assets.”Id. Consequently, he said, the Icahn Group intended to replace Lionsgate’s board of directors and top management if its offer was successful.Id.

| D. | Seeking to mislead Lionsgate shareholders into |

tendering their shares, Icahn publicly attacks

Lionsgate’s merger prospects

38. On March 23, 2010, the Lionsgate board announced that it had unanimously determined that Icahn’s offer was inadequate and recommended that shareholders not tender into Icahn’s offer. At the time, as Icahn knew, Lionsgate’s board and management were actively pursuing possible merger partners for the company. The day after the board issued its negative recommendation, Icahn began a campaign to induce Lionsgate shareholders to tender their shares to him by falsely and misleadingly telling them that Lionsgate had no viable prospects for a value-enhancing merger and that he would oppose a merger with MGM. In fact, Icahn himself

| 1. | On March 19, 2010, the Icahn Group began appending every Schedule TO or amendment thereto that it filed to an independently and contemporaneously filed Schedule 14A. The Icahn Group designated the contents of those Schedule 14A filings as “Soliciting Material Pursuant to §240.14a-12.” |

-9-

believed that a Lionsgate-MGM merger could be beneficial for Lionsgate shareholders, and so intended to delay a transaction until after he could acquire Lionsgate’s shares cheaply and enjoy the merger’s financial benefits at the expense of tendering Lionsgate shareholders.

39. First, Icahn sent an open letter to Lionsgate’s chief executive officer on March 24 mocking the notion that a Lionsgate-MGM merger could be beneficial for shareholders and describing the merger as a “gamble” that would “risk[] the shareholders’ equity:”

Unfortunately, as is often the case, hand-picked boards let self-proclaimed “visionary” CEOs chase their vision indefinitely, even when years pass andtheir vision is clearly a delusion. To make matters worse, I continue to fear (as I have previously expressed) that the current board will allow you to borrow billions to pursue your new “vision” of library consolidation,exhibited by your interest in acquiring MGM and Miramax.This is simply another delusion in my opinion, as library values are currently in a secular decline, never to return to cash flows seen during the heyday of DVD sales.

I believe that you are, as you should be, frustrated by the five-year stagnation of Lions Gate. But more importantly, I am fearful that you have determined to “swing for the fences” using excessive debt and risking the shareholders’ equity.The road to bankruptcy is littered with companies whose CEOs — under the banner of “vision” — have been permitted by lax board oversight to gamble their companies into oblivion.

Form SC TO-T/A (also designated Form SC 13D/A), Ex. (a)(5)(iii) (Mar. 24, 2010) (bold emphasis added, underlining in original).

40. On April 16, 2010, only a few weeks after Icahn warned other Lionsgate shareholders that the company was on the road to “bankruptcy” and “oblivion” if it pursued a merger with MGM, the Icahn Group raised its tender offer to $7.00 per share. Form SC TO-T/A (also designated Form SC 13D/A), Ex. (a)(1)(vii), at 1 (Apr. 16, 2010). In a letter to Lionsgate shareholders filed with the SEC the same day, the Icahn Group again lambasted the idea of a Lionsgate-MGM merger, stating, “We do not feel comfortable that existing management is the right team to guide Lions Gate” because“management’s misguided strategy of late appears to have been pinned on the hopes of acquiring MGM… even though film libraries are essentially depreciating assets that have been likened to ‘melting ice cubes.’”Id.Ex. (a)(5)(vi) (emphasis added).

-10-

41. By June, Lionsgate’s pursuit of potential merger partners had matured into advanced negotiations with two companies, Studio A and Studio B. (Lionsgate is contractually barred from publicly disclosing their identities.) Icahn was aware of the seriousness of the negotiations and the high probability that, barring any interference, Lionsgate would enter into a transaction with one or the other studio that would yield important benefits to Lionsgate and its shareholders but would also significantly dilute his stake in Lionsgate. These potential transactions threatened Icahn’s goal of obtaining control of Lionsgate and his unlawfully undisclosed plan to take control of MGM and cause it to merge with Lionsgate. Icahn therefore took drastic and improper action. In a press release issued June 1, he vowed to challenge any proposed transactions that were “abusive of shareholder rights” and to sue any entity that “tortiously interfere[d]” with the Icahn Group’s tender offer by agreeing to merge with Lionsgate. Form SC TO-T/A (also designated Form SC 13D/A), Ex. (a)(5)(xvi) (June 1, 2010). The press release stated, in pertinent part:

We will challenge any proposed transaction that we perceive to be abusive of shareholder rights or otherwise disadvantageous to Lions Gate, and will seek to hold the directors personally liable for any breach of their fiduciary duty or actions which oppress Lions Gate shareholders or serve simply to entrench themselves.In addition, we will not hesitate to enforce our rights against any third party that attempts to tortiously interfere with our offer by entering into an inappropriate defensive transaction with Lions Gate.

Id.He repeated the threat on June 11 in an open letter to the Lionsgate board. Form SC TO-T/A (also designated Form SC 13D/A), Ex. (a)(5)(viii) (June 11, 2010).

42. These threats were improper. Icahn and the rest of the Icahn Group knew that the potential transactions were not “abusive of shareholder rights” or “inappropriate[ly] defensive” and that neither could be the basis for a tortious interference suit. To the contrary, the Icahn Group itself had privately concluded that at least one of these transactions would be highly

-11-

advantageous for Lionsgate and it shareholders. The Icahn Group made its misleading threat in service of its improperly undisclosed strategy — to block Lionsgate’s ability to complete a transaction until the Icahn Group could acquire even more shares of Lionsgate in its tender offer and more MGM debt, and thus enjoy a greater share of the benefits of an eventual merger.

43. On June 14, Icahn issued another misleading statement intended to scare Lionsgate’s shareholders into tendering. He again threatened to sue Lionsgate’s potential merger partners. He also reiterated his opposition to the prospect of a combination of Lionsgate and MGM, saying that market speculation that Lionsgate would acquire MGM’s film library without a shareholder vote gave him “further cause to question the judgment of management.” Form SC TO-T/A (also designated Form SC 13D/A), Ex. (a)(5)(xix) (June 14, 2010).

44. Although Icahn was careful not to publicly identify Studio A or Studio B as the target of his threats, both studios reasonably understood that his threats were directed at them. Unwilling to become embroiled in vexatious litigation brought by a plaintiff with bottomless pockets, they both walked away from a deal with Lionsgate at that time.

45. Near the same time that Icahn was derailing Lionsgate’s attempt to enter into a transaction by threatening the company’s potential merger partners, the Icahn Group came to an arrangement with a large Lionsgate shareholder, Mark Cuban, in which it offered him special consideration in exchange for his agreement to tender his 5.4% block. Cuban is a business associate of Icahn’s. In 2008, when Icahn was waging a proxy contest for control of Yahoo’s board, Icahn included Cuban on his dissident proxy slate as a director nominee. Cuban owns or partially owns a wide array of entertainment assets, including film production companies HDNet Films and 2929 Productions, film distributor Magnolia Pictures, home video distributor Magnolia Home Entertainment, arthouse cinema chain Landmark Theatres, and high-definition cable networks HDNet and HDNet Movies. Cuban also owns the Dallas Mavericks NBA team.

46. Lionsgate had informed Cuban that a reliable buyer was available and willing to pay more than $7.00 for Cuban’s entire stake. Nevertheless, after meeting in person with Icahn to discuss the matter, Cuban agreed to tender his shares to Icahn for the lower $7.00 per

-12-

share price. In addition to this in-person meeting, Cuban also had multiple telephone conversations with Brett Icahn regarding tendering Cuban’s Lionsgate shares. Of his decision to tender, Cuban told CNBC, “I have my reasons [that] I don’t want to get into. But I think it’s the right move for right now and the right move for the long term, for the company and me.” The same day, theLos Angeles Timescommented that “[g]iven his media background… and his ties to Icahn, Cuban would be a logical candidate for Icahn’s slate of directors” to be nominated for election at the upcoming Lionsgate annual shareholders’ meeting. Ben Fritz & Claudia Eller,Mark Cuban Likely to Tender Lions Gate Shares to Icahn,L.A. Times (June 11, 2010), http://articles.latimes.com/2010/jun/11/business/la-fi-ct-lionsgate-20100611 (last visited Oct. 27, 2010).

47. According to two individuals with knowledge of the arrangement, Cuban tendered his shares after receiving assurances from the Icahn Group that he would receive special consideration, perhaps related to his other business interests, in addition to the $7.00 per share offered to all Lionsgate shareholders in the tender offer. The Icahn Group’s counsel disclosed in a recent filing in this action that one of the individuals with knowledge of this arrangement is Cuban’s business partner Joe Francis, a media entrepreneur known for his production of theGirls Gone WildDVD series. Although Cuban filed an amended Schedule 13D on June 11 disclosing that he had tendered his shares into the Icahn Group’s offer, neither he nor the Icahn Group have ever disclosed their arrangement.

48. On June 16, 2010, the Icahn Group’s tender offer expired, with approximately 13.2% of Lionsgate’s outstanding common shares tendered (including Cuban’s 5.4% stake). Form SC TO-T/A (also designated Form SC 13D/A), Ex. (a)(1)(xii), at 1 (June 17, 2010). The Icahn Group accepted the tendered shares for payment, bringing its stake in Lionsgate to approximately 31.8%, and announced a subsequent offering period expiring June 30, 2010.Id.

49. During the subsequent offering period, Icahn continued to publicly criticize a Lionsgate-MGM transaction. On June 25, he commented to Reuters, “Lions Gate’s got its own problems. It’s analogous to a couple not being able to pay the mortgage on their own home.

-13-

And instead of working on it, they go out and start negotiations to buy an overpriced mansion, and an overpriced mansion that is rumored to be haunted.” Reuters,Icahn Critical of Possible Lions Gate, MGM Merger(June 25, 2010), http://www.reuters.com/article/idUSTRE65O5L120100625.

50. On June 28, Icahn cautioned that Lionsgate “must stop wasting time trying to acquire another film library.Tying two one-legged men together does not mean they will run faster — in fact it will slow them down.”Form SCTO-T/A(also designated Form SC13D/A),Ex. (a)(5)(xxi), at 1 (June 28, 2010) (emphasis added).

51. Also on June 28, Icahn appeared on the CNBC programFast Money.Asked whether “in theory or in practice” Lionsgate needed his approval to merge with MGM, Icahn responded: “The way the [Canadian regulatory] rules are, in order to do a merger, they need two thirds. As of today, I own 32.6%, right? If I don’t want to do that, [they] can’t merge.” On the value of a potential Lionsgate-MGM merger, Icahn commented: “I don’t understand why everybody is excited. MGM’s library is having tremendous problems. They tried to produce movies and failed…. [W]hen you tie two one-legged men together and put them in a race, they’re not going to race [any faster].” Beth Goldman,CNBC Transcript: CNBC’s “Fast Money” Talks with Legendary Activist Investor, Carl Icahn, Today,CNBC (June 29, 2010), http://www.cnbc.com/id/37784840/CNBC_BREAKING_NEWS_ CNBC_TRANSCRIPT_

CNBC_S_FAST_MONEY_TALKS_ WITH_LEGENDARY_ACTIVIST_INVESTOR_CARL_ICAHN_TODAY.

52. Thus, by the close of the subsequent offering period, Icahn had repeatedly publicly criticized a Lionsgate-MGM merger as lacking the potential to produce synergies or other financial benefits for Lionsgate shareholders. Icahn’s criticisms misled Lionsgate shareholders and the rest of the market into believing that he opposed a merger between Lionsgate and MGM as incapable of producing value. In fact, he did believe that such a merger could be beneficial to Lionsgate shareholders, but intended to stop obstructing a deal only after he acquired additional Lionsgate shares. His statements thus had the effect of making his tender

-14-

offer price seem more attractive than it really was and permitted him to acquire more shares in his offer than he would have had he been forthright about his views and plans regarding a Lionsgate-MGM merger.

53. After the subsequent offering period closed and after the Icahn Group made a further open-market purchase on July 1, 2010, the Icahn Group disclosed that it owned approximately 37.87% of Lionsgate’s outstanding shares. Form SC TO-T/A (also designated Form SC 13D/A), Item 5 (July 1, 2010).

54. As Moody’s Investors Service noted in a March 16,2010 press release, a stake this large gave Icahn “effective control” of Lionsgate and “potential veto capability over certain significant transactions and other matters requiring approval by a special resolution of shareholders.”

| E. | Icahn’s undisclosed plan to engineer a |

Lionsgate-MGM merger

55. By the end of the offer period, Icahn and the rest of the Icahn Group had successfully misled Lionsgate shareholders and the market into believing that no value-enhancing merger between Lionsgate and another studio was imminent or possible since Icahn appeared to oppose a merger with any realistic partner. But this was false. In fact, the Icahn Group intended to engineer a merger between Lionsgate and MGM, but only after acquiring a significant portion of MGM’s distressed debt. (Because MGM was on the verge of bankruptcy, a large position in its debt would give Icahn substantial control and influence over the studio’s future.) Then, as a major investor on both sides of the deal, the Icahn Group planned to negotiate a deal to its maximum financial benefit.

56. During 2009, Icahn was reported to have begun purchasing MGM debt. On February 26, 2009,Deadline Hollywoodreported that “Carl Icahn is also buying a lot of MGM debt.” Similarly, on May 14, 2009,Reutersreported “unconfirmed reports that billionaire financier Carl Icahn was buying MGM debt, which sparked speculation he may push for a combination of MGM with Lions Gate Entertainment.” As detailed above, however, between

-15-

March and June 28, 2010, Icahn repeatedly and publicly attacked the financial merit of a Lionsgate-MGM combination, creating the false impression in the marketplace that he opposed such a transaction.

57. Nonetheless, at the same time the Icahn Group was crunching numbers on a Lionsgate-MGM combination. Before Cuban tendered on June 11, 2010, Brett Icahn had created an Excel spreadsheet containing an “LGF MGM Deal Sources Breakdown,” which he described as a “break down of … how a combination could be financed between Lions Gate and MGM.” The spreadsheet also contained an “MGM Deal Cash Flow Yield Estimate,” which Brett described as “[w]orking out what our pro forma ownership would be under certain circumstances if you combine the two companies.” Icahn testified at a recent deposition that his son Brett was the “pointman” on the Icahn Group’s Lionsgate investment.

58. According to Brett Icahn, before July 9, “we [the Icahn Group] were probably already considering that [a Lionsgate-MGM merger] made rational sense. When I say rational I mean from a purely business point of view….” Brett also testified that the Icahn Group’s conclusion regarding the merits of a Lionsgate-MGM transaction “sort of developed over time” and “went back some period of time” before July 9.

59. On July 9, the Icahn Group amended its Schedule 13D to say that, pursuant to a contractual arrangement, it and Lionsgate had “agreed to work together on certain acquisition opportunities beginning on July 9, 2010 and ending on July 19, 2010.” Form SC 13D/A, Item 4 (July 9, 2010). But this disclosure was false too. Icahn did not intend to work with Lionsgate on acquisition opportunities during that period. He instead intended to continue to stockpile MGM debt and Lionsgate shares in furtherance of his plan to maximize his own benefit in an eventual Lionsgate-MGM transaction that he planned to orchestrate only after he had completed his accumulation.

-16-

60. On July 20, the Icahn Group announced in a Schedule TO a second tender offer of $6.50 per share for any and all of Lionsgate’s outstanding shares ($0.50 less than his prior offer), expiring on August 25, 2010. Form SC TO-T (also designated Form SC 13D/A), Ex.(a)(1)(i), at 1 (July 20, 2010). In response to the question “WHAT IS THE PURPOSE OF YOUR OFFER?” the Icahn Group stated:

[I]t is extremely unlikely that the current management and board of directors of Lions Gate will allow shareholders of Lions Gate to make their own determination on the future path of the Company, including decisions to make a major acquisition. The Icahn Group therefore intends to seek to replace all or the lion’s share of Lions Gate’s board of directors with the Icahn Group’s nominees.

Id. Ex.(a)(1)(i), at 7. While the Icahn Group included the boilerplate disclosure that it “reserve[d] the right to engage in discussions with third parties regarding possible future acquisitions” regarding Lionsgate, it did nothing to correct Icahn’s prior misleading disclosures that the apparent desire of Lionsgate management to purchase the film library of MGM or another studio gave him “further cause to question the judgment of management” or to otherwise indicate that Icahn now supported the very transaction he had for months sought to impede.Id.

61. As has now become clear, one of the Icahn Group’s purposes when it launched its second offer was to combine Lionsgate and MGM. The Icahn Group misleadingly omitted this material fact from the Schedule TO because revealing that information would drive up both the cost of the MGM debt Icahn was already buying or intended to buy and would encourage Lionsgate shareholders, once aware of the prospect of a value-enhancing merger, to reject the Icahn Group’s $6.50 per share tender offer as inadequate.

62. The Icahn Group failed to cure the misleading statements and omissions in the July 20 Schedule TO when it filed an amended Schedule TO on August 11 announcing that it was extending the offering period to October 22. Form SC TO-T/A (also designated Form SC 13D/A), Ex.(a)(1)(vi), at 2 (Aug. 11, 2010).

63. On August 31, the Icahn Group announced in another amended Schedule TO that it was raising the tender offer price to $7.50 per share. Form SC TO-T/A (also designated Form SC 13D/A), Ex.(a)(5)(v) (Aug. 31,2010). In a press release, it explained its decision as follows:

The Icahn Group has determined, in order to protect the large position it now holds, that it is necessary to gain control of Lions Gate and remove the current board. We have therefore decided to pay a large premium for control of Lions Gate and are hereby increasing the offer price to $7.50 per share.

-17-

Id. As in its initial July 20 Schedule TO, the Icahn Group also stated that it “reserve[d] the rights to engage in discussions with third parties regarding possible future acquisitions by Lions Gate” but that “there can be no assurance that these discussions will take place.”Id.

64. These statements, like those in the initial July 20 Schedule TO, were false or materially misleading because they continued to fail to disclose a material fact regarding the purpose of the offer and the reason for the price increase — Icahn’s intention to support and promote a merger between Lionsgate and MGM once he acquired sufficient holdings in both Lionsgate stock and MGM debt. These statements were intended to and would have misled a reasonable investor into tendering her shares before learning of the true prospects for a Lionsgate merger and the extent of Icahn’s intended support for a merger between Lionsgate and MGM. In particular, the Icahn Group’s reservation of its “rights to engage in discussions with third parties” regarding a transaction with Lionsgate and its warning that “there can be no assurance” that such discussions will take place misleadingly suggested that the Icahn Group had not recently or was not currently exercising those rights and that it did not plan to lobby MGM creditors in favor of a merger with Lionsgate.

65. In fact, the Icahn Group was accelerating its purchases of MGM bonds during the pendency of the tender offer in anticipation of a Lionsgate-MGM merger, but did not disclose this activity to Lionsgate shareholders in its initial July 20 Schedule TO or any amendments thereto. Nor was information regarding the Icahn Group’s purchases of MGM debt available to Lionsgate shareholders in public filings related to MGM. Because MGM’s debt is privately traded, the Icahn Group and other MGM creditors are not required to report the size of their holdings or trading activity in MGM debt to the SEC as a matter of course.

-18-

| F. | Icahn’s plan to merge Lionsgate and MGM |

begins to come to light

66. On September 8, 2010, theLos Angeles Timesreported that Gary Barber and Roger Birnbaum, the founders of Spyglass Entertainment, a film and television production company, had signed a non-binding letter of intent to manage MGM as co-chairmen and co-chief executives. Under the terms of the prospective deal, which required the approval of MGM’s creditors, MGM would have to file and emerge from a “pre-packaged” bankruptcy before Barber and Birnbaum could assume control.SeeClaudia Eller & Ben Fritz,Spyglass Signs MGM Letter of Intent, Courting Ken Schapiro to Become COO, Sources Say,L.A. Times (Sept. 8, 2010), http://latimesblogs.latimes.com/entertainmentnewsbuzz/2010109/spyglass-courting-qualia-capital-partner-ken-schapiro-as-mgm-coo.html (last visited Oct. 27, 2010).

67. If MGM entered into a binding agreement with Barber and Birnbaum, the potential Lionsgate-MGM deal that Icahn secretly sought would become less likely. Icahn knew this. He was thus forced to expedite his plans. Still covertly collecting MGM debt, Icahn began to aggressively lobby MGM creditors for a Lionsgate-MGM merger. By the end of September, Icahn held approximately $400 million, or 10%, of MGM’s $4 billion in outstanding debt. Yet the Icahn Group still did not disclose to Lionsgate shareholders its growing financial interest in MGM or that Icahn was actively promoting a merger with MGM — which he had previously publicly derided as “misguided.”

68. As theLos Angeles Timesreported on September 30, 2010:

Only three months ago, activist shareholder Carl Icahn frowned upon a potential merger between Lions Gate Entertainment and financially hobbled Metro-Goldwyn-Mayer Inc. In fact, he likened Lions Gate management’s desire to combine with MGM to “a couple not being able to pay their mortgage on a little house and starting to negotiate on a big, overpriced mansion that’s rumored to be haunted.”

But since August, Icahn, the largest shareholder in Lions Gate with about 33%, has been quietly buying up MGM debt. More recently hehas been aggressively promoting the idea of a merger with Lions Gate, according to people briefed on the matter who spoke on condition of anonymity because they were not authorized to discuss it publicly.

-19-

Those people saidIcahn has spoken to some MGM debt holders, who control the cash-strapped studio’s future, about the advantages of a merger with Lions Gate in hopes that it would upset a pending deal with the founders of Spyglass Entertainment.

Claudia Eller & Ben Fritz,Carl Icahn, Once Opposed, Now Favors a Lions Gate-MGM Merger,L.A. Times (Sept. 30, 2010), http://latimesblogs.latimes.com/entertainmentnewsbuzz/2010/09/ carl-icahn-now-favors-a-lions-gate-mgm-merger.html (last visited Oct. 27, 2010) (emphasis added).

69. TheWall Street Journalpublished a similar report the next day:

Billionaire investor Carl Icahn bought a significant chunk of Metro-Goldwyn-Mayer Inc.’s debt and is pushing the beleaguered film studio to merge with rival Lions Gate Entertainment Corp., said people familiar with the matter….

Mr. Icahn told people close to MGM earlier this week he holds somewhere between $400 million and $500 million of MGM’s debt outstanding and is continuing to build his position in the studio, they said. The purchases give Mr. Icahn about 10% of MGM’s outstanding debt.

In discussions with some MGM creditors earlier this week, Mr. Icahn said he believes MGM and Lions Gate could benefit from synergies, the people said.

Mike Spector & Lauren E. Schuker,Icahn Buys MGM Studios’ Debt, Presses for a Lions Gate Merger,Wall St. J. (Oct. 1,2010), http://online.wsj.com/article/SB10001424052748704483004575524301519918116.html (last visited Oct. 27, 2010) (emphasis added).