UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07173

T. Rowe Price Spectrum Funds II, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: May 31

Date of reporting period: May 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

May 31, 2024

Spectrum Moderate Allocation Fund

This annual shareholder report contains important information about Spectrum Moderate Allocation Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Spectrum Moderate Allocation Fund - I Class | $43 | 0.40% |

What drove fund performance during the past 12 months?

Global stock indexes were broadly positive, while fixed income markets were mixed for the 12 months ended May 31, 2024. Many central banks maintained tight monetary policy to combat inflation, and markets fluctuated amid shifting expectations for interest rate cuts as rates remained higher for longer. Nevertheless, investor sentiment was elevated by resilient corporate earnings and enthusiasm around the potential impacts from artificial intelligence.

Versus the style-specific Morningstar Moderate Target Risk Index, security selection in the underlying large-cap value strategy contributed for the trailing one-year period. The fund’s allocation in this space outperformed its style-specific benchmark, which added value on a relative basis. Likewise, security selection within large-cap growth equities had a positive impact.

On the negative side, security selection in international equities was a leading detractor during the period. In particular, allocations to both emerging markets equities and international developed markets equities trailed their respective benchmarks and weighed on relative performance.

The fund seeks the highest total return over time consistent with an emphasis on both capital growth and income. It is designed to provide investors with a core multi-asset portfolio that is globally diversified across traditional and alternative asset classes, with an emphasis on the roles of broad diversification, fundamental research, tactical allocation, and risk management.

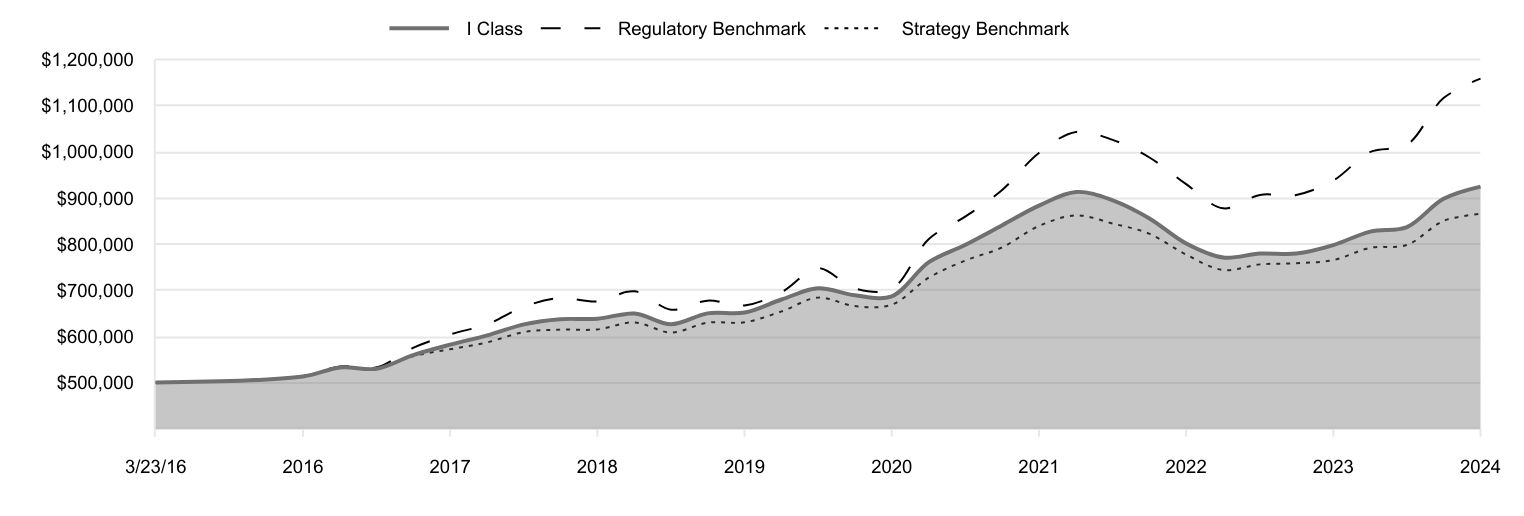

How has the fund performed?

Cumulative Returns of a Hypothetical $500,000 Investment as of May 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 3/23/16 | 500,000 | 500,000 | 500,000 |

| 5/31/16 | 512,965 | 514,168 | 513,380 |

| 8/31/16 | 532,620 | 534,870 | 533,251 |

| 11/30/16 | 529,926 | 533,035 | 530,360 |

| 2/28/17 | 559,364 | 575,132 | 557,056 |

| 5/31/17 | 582,091 | 604,297 | 572,198 |

| 8/31/17 | 602,184 | 626,401 | 587,079 |

| 11/30/17 | 626,118 | 664,378 | 609,451 |

| 2/28/18 | 637,318 | 683,223 | 614,665 |

| 5/31/18 | 638,131 | 675,825 | 615,078 |

| 8/31/18 | 649,502 | 697,876 | 630,305 |

| 11/30/18 | 626,194 | 657,870 | 608,343 |

| 2/28/19 | 649,932 | 677,468 | 629,700 |

| 5/31/19 | 651,624 | 667,085 | 630,552 |

| 8/31/19 | 679,924 | 695,937 | 654,107 |

| 11/30/19 | 704,112 | 747,850 | 684,022 |

| 2/29/20 | 688,970 | 703,794 | 665,713 |

| 5/31/20 | 686,883 | 703,308 | 668,816 |

| 8/31/20 | 760,854 | 810,935 | 727,363 |

| 11/30/20 | 798,747 | 860,095 | 764,564 |

| 2/28/21 | 840,528 | 916,688 | 792,639 |

| 5/31/21 | 883,426 | 997,610 | 839,345 |

| 8/31/21 | 913,031 | 1,043,193 | 862,337 |

| 11/30/21 | 894,943 | 1,025,836 | 844,566 |

| 2/28/22 | 856,108 | 988,272 | 822,674 |

| 5/31/22 | 801,347 | 929,948 | 777,317 |

| 8/31/22 | 770,956 | 877,484 | 743,871 |

| 11/30/22 | 779,615 | 906,626 | 756,083 |

| 2/28/23 | 779,465 | 906,626 | 758,512 |

| 5/31/23 | 797,883 | 937,858 | 765,338 |

| 8/31/23 | 827,193 | 999,894 | 792,057 |

| 11/30/23 | 836,895 | 1,015,537 | 798,102 |

| 2/29/24 | 898,200 | 1,116,497 | 850,356 |

| 5/31/24 | 924,630 | 1,158,784 | 865,517 |

202405-3565004, 202407-3567330

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 3/23/2016 |

|---|

| Spectrum Moderate Allocation Fund (I Class) | 15.89% | 7.25% | 7.80% |

| MSCI All Country World Index Net (Regulatory Benchmark) | 23.56 | 11.68 | 10.81 |

| Morningstar Moderate Target Risk Index (Strategy Benchmark) | 13.09 | 6.54 | 6.93 |

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

| Total Net Assets (000s) | $1,998,361 |

| Number of Portfolio Holdings | 1,788 |

| Investment Advisory Fees Paid (000s) | $7,212 |

| Portfolio Turnover Rate | 46.9% |

What did the fund invest in?

Security Allocation (as a % of Net Assets)

| Common Stocks | 52.7% |

| Bond Mutual Funds | 17.2 |

| Equity Mutual Funds | 11.5 |

| U.S. Government Agency Obligations (Excluding Mortgage-Backed) | 4.2 |

| U.S. Government & Agency Mortgage-Backed Securities | 4.1 |

| Private Investment Companies | 3.9 |

| Corporate Bonds | 3.7 |

| Asset-Backed Securities | 1.1 |

| Short-Term and Other | 1.6 |

Top Ten Holdings (as a % of Net Assets)

| T. Rowe Price Real Assets Fund - I Class | 4.1% |

| T. Rowe Price Institutional Emerging Markets Equity Fund | 4.1 |

| T. Rowe Price International Bond Fund (USD Hedged) - I Class | 4.1 |

| Blackstone Partners Offshore Fund | 3.9 |

| T. Rowe Price Multi-Strategy Total Return Fund - I Class | 3.3 |

| T. Rowe Price Institutional Emerging Markets Bond Fund | 3.2 |

| T. Rowe Price Institutional High Yield Fund - Institutional Class | 3.1 |

| T. Rowe Price Dynamic Global Bond Fund - I Class | 2.7 |

| T. Rowe Price U.S. Treasury Long-Term Index Fund - I Class | 2.6 |

| Microsoft | 2.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

MSCI and Morningstar do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Spectrum Moderate Allocation Fund

I Class (TPPAX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

May 31, 2024

Spectrum Moderate Allocation Fund

This annual shareholder report contains important information about Spectrum Moderate Allocation Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Spectrum Moderate Allocation Fund - Investor Class | $57 | 0.53% |

What drove fund performance during the past 12 months?

Global stock indexes were broadly positive, while fixed income markets were mixed for the 12 months ended May 31, 2024. Many central banks maintained tight monetary policy to combat inflation, and markets fluctuated amid shifting expectations for interest rate cuts as rates remained higher for longer. Nevertheless, investor sentiment was elevated by resilient corporate earnings and enthusiasm around the potential impacts from artificial intelligence.

Versus the style-specific Morningstar Moderate Target Risk Index, security selection in the underlying large-cap value strategy contributed for the trailing one-year period. The fund’s allocation in this space outperformed its style-specific benchmark, which added value on a relative basis. Likewise, security selection within large-cap growth equities had a positive impact.

On the negative side, security selection in international equities was a leading detractor during the period. In particular, allocations to both emerging markets equities and international developed markets equities trailed their respective benchmarks and weighed on relative performance.

The fund seeks the highest total return over time consistent with an emphasis on both capital growth and income. It is designed to provide investors with a core multi-asset portfolio that is globally diversified across traditional and alternative asset classes, with an emphasis on the roles of broad diversification, fundamental research, tactical allocation, and risk management.

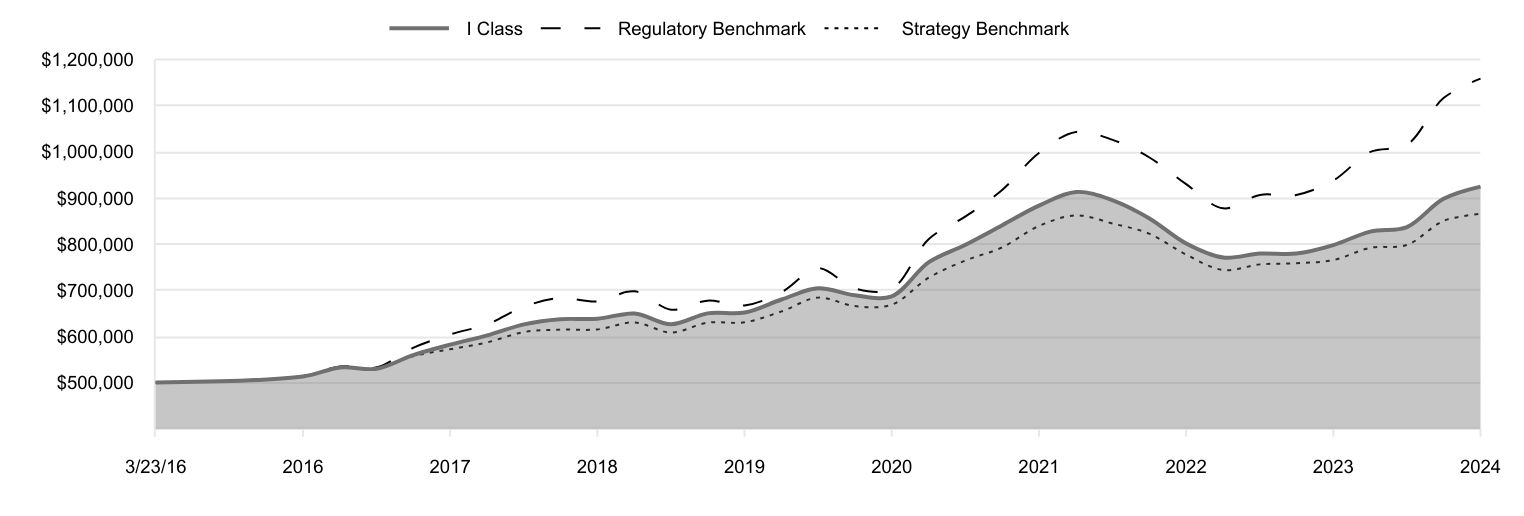

How has the fund performed?

Cumulative Returns of a Hypothetical $10,000 Investment as of May 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

| 2014 | 10,232 | 10,287 | 10,220 |

| 2014 | 10,266 | 10,191 | 10,158 |

| 2015 | 10,488 | 10,386 | 10,287 |

| 2015 | 10,584 | 10,508 | 10,335 |

| 2015 | 10,056 | 9,640 | 9,845 |

| 2015 | 10,283 | 9,937 | 10,028 |

| 2016 | 9,750 | 9,107 | 9,622 |

| 2016 | 10,412 | 9,938 | 10,259 |

| 2016 | 10,806 | 10,339 | 10,656 |

| 2016 | 10,747 | 10,303 | 10,598 |

| 2017 | 11,344 | 11,117 | 11,131 |

| 2017 | 11,800 | 11,681 | 11,434 |

| 2017 | 12,202 | 12,108 | 11,731 |

| 2017 | 12,687 | 12,842 | 12,178 |

| 2018 | 12,909 | 13,206 | 12,283 |

| 2018 | 12,914 | 13,063 | 12,291 |

| 2018 | 13,145 | 13,489 | 12,595 |

| 2018 | 12,668 | 12,716 | 12,156 |

| 2019 | 13,148 | 13,095 | 12,583 |

| 2019 | 13,182 | 12,894 | 12,600 |

| 2019 | 13,749 | 13,452 | 13,071 |

| 2019 | 14,232 | 14,455 | 13,669 |

| 2020 | 13,920 | 13,604 | 13,303 |

| 2020 | 13,877 | 13,594 | 13,365 |

| 2020 | 15,365 | 15,675 | 14,535 |

| 2020 | 16,124 | 16,625 | 15,278 |

| 2021 | 16,962 | 17,719 | 15,839 |

| 2021 | 17,828 | 19,283 | 16,772 |

| 2021 | 18,425 | 20,164 | 17,232 |

| 2021 | 18,047 | 19,829 | 16,877 |

| 2022 | 17,258 | 19,102 | 16,439 |

| 2022 | 16,148 | 17,975 | 15,533 |

| 2022 | 15,529 | 16,961 | 14,865 |

| 2022 | 15,700 | 17,524 | 15,109 |

| 2023 | 15,699 | 17,524 | 15,157 |

| 2023 | 16,057 | 18,128 | 15,293 |

| 2023 | 16,649 | 19,327 | 15,827 |

| 2023 | 16,838 | 19,629 | 15,948 |

| 2024 | 18,057 | 21,581 | 16,992 |

| 2024 | 18,590 | 22,398 | 17,295 |

202405-3565004, 202407-3567330

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Spectrum Moderate Allocation Fund (Investor Class) | 15.78% | 7.12% | 6.40% |

| MSCI All Country World Index Net (Regulatory Benchmark) | 23.56 | 11.68 | 8.40 |

| Morningstar Moderate Target Risk Index (Strategy Benchmark) | 13.09 | 6.54 | 5.63 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

| Total Net Assets (000s) | $1,998,361 |

| Number of Portfolio Holdings | 1,788 |

| Investment Advisory Fees Paid (000s) | $7,212 |

| Portfolio Turnover Rate | 46.9% |

What did the fund invest in?

Security Allocation (as a % of Net Assets)

| Common Stocks | 52.7% |

| Bond Mutual Funds | 17.2 |

| Equity Mutual Funds | 11.5 |

| U.S. Government Agency Obligations (Excluding Mortgage-Backed) | 4.2 |

| U.S. Government & Agency Mortgage-Backed Securities | 4.1 |

| Private Investment Companies | 3.9 |

| Corporate Bonds | 3.7 |

| Asset-Backed Securities | 1.1 |

| Short-Term and Other | 1.6 |

Top Ten Holdings (as a % of Net Assets)

| T. Rowe Price Real Assets Fund - I Class | 4.1% |

| T. Rowe Price Institutional Emerging Markets Equity Fund | 4.1 |

| T. Rowe Price International Bond Fund (USD Hedged) - I Class | 4.1 |

| Blackstone Partners Offshore Fund | 3.9 |

| T. Rowe Price Multi-Strategy Total Return Fund - I Class | 3.3 |

| T. Rowe Price Institutional Emerging Markets Bond Fund | 3.2 |

| T. Rowe Price Institutional High Yield Fund - Institutional Class | 3.1 |

| T. Rowe Price Dynamic Global Bond Fund - I Class | 2.7 |

| T. Rowe Price U.S. Treasury Long-Term Index Fund - I Class | 2.6 |

| Microsoft | 2.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

MSCI and Morningstar do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Spectrum Moderate Allocation Fund

Investor Class (TRPBX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | |

| | | | | 2024 | | | 2023 | |

| | Audit Fees | | | $46,029 | | | | $45,097 | |

| | Audit-Related Fees | | | - | | | | - | |

| | Tax Fees | | | - | | | | 5,727 | |

| | | All Other Fees | | | - | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,230,000 and $1,521,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

TRPBX

Spectrum

Moderate

Allocation

Fund

–

.

TPPAX

Spectrum

Moderate

Allocation

Fund–

.

I Class

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Go

Paperless

Going

paperless

offers

a

host

of

benefits,

which

include:

Timely

delivery

of

important

documents

Convenient

access

to

your

documents

anytime,

anywhere

Strong

security

protocols

to

safeguard

sensitive

data

Waive

your

account

service

fee

by

going

paperless.*

To

Enroll:

˃

If

you

invest

directly

with

T.

Rowe

Price,

go

to

troweprice.com/paperless

.

If

you

invest

through

a

financial

intermediary

such

as

an

investment

advisor,

a

bank,

or

a

brokerage

firm,

please

contact

that

organization

and

ask

if

it

can

provide

electronic

documentation.

Log

in

to

your

account

at

troweprice.com

for

more

information.

*

An

account

service

fee

will

be

charged

annually

for

each

T.

Rowe

Price

mutual

fund

account

unless

you

meet

criteria

for

a

fee

waiver.

Go

to

troweprice.com/personal-investing/

help/fees-and-minimums.html

to

learn

more

about

this

account

service

fee,

including

other

ways

to

waive

it.

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

For

a

share

outstanding

throughout

each

period

Investor

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

NET

ASSET

VALUE

Beginning

of

period

$

21

.67

$

23

.44

$

28

.39

$

23

.21

$

22

.82

Investment

activities

Net

investment

income

(1)(2)

0

.51

0

.41

0

.31

0

.29

0

.35

Net

realized

and

unrealized

gain/loss

2

.85

(

0

.62

)

(

2

.69

)

6

.17

0

.86

Total

from

investment

activities

3

.36

(

0

.21

)

(

2

.38

)

6

.46

1

.21

Distributions

Net

investment

income

(

0

.67

)

(

0

.41

)

(

0

.29

)

(

0

.30

)

(

0

.38

)

Net

realized

gain

(

0

.07

)

(

1

.15

)

(

2

.28

)

(

0

.98

)

(

0

.44

)

Total

distributions

(

0

.74

)

(

1

.56

)

(

2

.57

)

(

1

.28

)

(

0

.82

)

NET

ASSET

VALUE

End

of

period

$

24

.29

$

21

.67

$

23

.44

$

28

.39

$

23

.21

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

Ratios/Supplemental

Data

Total

return

(2)(3)

15

.78

%

(

0

.56

)

%

(

9

.42

)

%

28

.47

%

(4)

5

.27

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0

.71

%

0

.71

%

0

.68

%

0

.66

%

0

.67

%

Net

expenses

after

waivers/

payments

by

Price

Associates

0

.53

%

0

.52

%

0

.51

%

0

.52

%

0

.53

%

Net

investment

income

2

.23

%

1

.87

%

1

.15

%

1

.11

%

1

.50

%

Portfolio

turnover

rate

46

.9

%

65

.5

%

80

.3

%

60

.2

%

71

.0

%

Net

assets,

end

of

period

(in

millions)

$1,048

$1,089

$1,295

$2,254

$1,886

0

%

0

%

0

%

0

%

0

%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

(4)

Total

return

calculated

through

the

fund’s

last

business

day

of

the

fiscal

year,

5/28/21.

Total

return

calculated

as

of

the

close

of

the

reporting

period

is

28.42%.

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

For

a

share

outstanding

throughout

each

period

I

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

NET

ASSET

VALUE

Beginning

of

period

$

21

.66

$

23

.43

$

28

.40

$

23

.21

$

22

.82

Investment

activities

Net

investment

income

(1)(2)

0

.54

0

.44

0

.37

0

.32

0

.37

Net

realized

and

unrealized

gain/loss

2

.84

(

0

.62

)

(

2

.71

)

6

.17

0

.87

Total

from

investment

activities

3

.38

(

0

.18

)

(

2

.34

)

6

.49

1

.24

Distributions

Net

investment

income

(

0

.71

)

(

0

.44

)

(

0

.35

)

(

0

.32

)

(

0

.41

)

Net

realized

gain

(

0

.07

)

(

1

.15

)

(

2

.28

)

(

0

.98

)

(

0

.44

)

Total

distributions

(

0

.78

)

(

1

.59

)

(

2

.63

)

(

1

.30

)

(

0

.85

)

NET

ASSET

VALUE

End

of

period

$

24

.26

$

21

.66

$

23

.43

$

28

.40

$

23

.21

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

Ratios/Supplemental

Data

Total

return

(2)(3)

15

.89

%

(

0

.43

)

%

(

9

.29

)

%

28

.61

%

(4)

5

.41

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0

.58

%

0

.58

%

0

.56

%

0

.56

%

0

.57

%

Net

expenses

after

waivers/

payments

by

Price

Associates

0

.40

%

0

.39

%

0

.39

%

0

.41

%

0

.42

%

Net

investment

income

2

.36

%

2

.01

%

1

.40

%

1

.21

%

1

.59

%

Portfolio

turnover

rate

46

.9

%

65

.5

%

80

.3

%

60

.2

%

71

.0

%

Net

assets,

end

of

period

(in

thousands)

$950,777

$979,573

$1,077,411

$604,872

$428,391

0

%

0

%

0

%

0

%

0

%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

(4)

Total

return

calculated

through

the

fund’s

last

business

day

of

the

fiscal

year,

5/28/21.

Total

return

calculated

as

of

the

close

of

the

reporting

period

is

28.57%.

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

May

31,

2024

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

ASSET-BACKED

SECURITIES

1.1%

522

Funding

Series 2019-5A,

Class

BR,

CLO,

FRN

3M

TSFR

+

1.85%,

7.179%,

4/15/35 (1)

340,000

340

AmeriCredit

Automobile

Receivables

Trust

Series 2020-3,

Class

D

1.49%,

9/18/26

345,000

334

AmeriCredit

Automobile

Receivables

Trust

Series 2021-1,

Class

D

1.21%,

12/18/26

194,000

185

AmeriCredit

Automobile

Receivables

Trust

Series 2023-1,

Class

C

5.80%,

12/18/28

310,000

312

Amur

Equipment

Finance

Receivables

X

Series 2022-1A,

Class

D

2.91%,

8/21/28 (1)

205,000

196

Amur

Equipment

Finance

Receivables

XIII

Series 2024-1A,

Class

A2

5.38%,

1/21/31 (1)

270,000

269

Applebee's

Funding

Series 2023-1A,

Class

A2

7.824%,

3/5/53 (1)

110,000

114

Bayview

Opportunity

Master

Fund

VII

Series 2024-CAR1,

Class

A,

FRN

SOFR30A

+

1.10%,

6.424%,

12/26/31 (1)

232,822

233

Bayview

Opportunity

Master

Fund

VII

Series 2024-CAR1,

Class

C,

FRN

SOFR30A

+

1.50%,

6.824%,

12/26/31 (1)

232,822

233

CarMax

Auto

Owner

Trust

Series 2021-1,

Class

D

1.28%,

7/15/27

810,000

779

CarMax

Auto

Owner

Trust

Series 2022-1,

Class

D

2.47%,

7/17/28

210,000

197

CarMax

Auto

Owner

Trust

Series 2024-1,

Class

B

5.17%,

8/15/29

50,000

50

Carvana

Auto

Receivables

Trust

Series 2024-N1,

Class

A3

5.60%,

3/10/28 (1)

125,000

125

Carvana

Auto

Receivables

Trust

Series 2024-N1,

Class

B

5.63%,

5/10/30 (1)

150,000

150

Crown

Point

Series 2018-7A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.23%,

6.556%,

10/20/31 (1)

355,000

355

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

CyrusOne

Data

Centers

Issuer

I

Series 2024-1A,

Class

A2

4.76%,

3/22/49 (1)

120,000

113

CyrusOne

Data

Centers

Issuer

I

Series 2024-2A,

Class

A2

4.50%,

5/20/49 (1)

715,000

658

CyrusOne

Data

Centers

Issuer

I

Series 2024-3A,

Class

A2

4.65%,

5/20/49 (1)

270,000

243

Dell

Equipment

Finance

Trust

Series 2023-3,

Class

C

6.17%,

4/23/29 (1)

100,000

101

Dell

Equipment

Finance

Trust

Series 2024-1,

Class

A3

5.39%,

3/22/30 (1)

125,000

125

DLLST

Series 2024-1A,

Class

A3

5.05%,

8/20/27 (1)

125,000

124

DLLST

Series 2024-1A,

Class

A4

4.93%,

4/22/30 (1)

30,000

30

Driven

Brands

Funding

Series 2019-1A,

Class

A2

4.641%,

4/20/49 (1)

113,700

110

Driven

Brands

Funding

Series 2020-1A,

Class

A2

3.786%,

7/20/50 (1)

192,500

179

Dryden

Series 2020-86A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.362%,

6.679%,

7/17/34 (1)

390,000

390

Elara

HGV

Timeshare

Issuer

Series 2023-A,

Class

A

6.16%,

2/25/38 (1)

107,694

108

Elara

HGV

Timeshare

Issuer

Series 2023-A,

Class

B

6.53%,

2/25/38 (1)

91,740

92

Elmwood

Series 2022-7A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.50%,

6.823%,

1/17/37 (1)

250,000

250

Enterprise

Fleet

Financing

Series 2024-1,

Class

A2

5.23%,

3/20/30 (1)

250,000

248

Enterprise

Fleet

Financing

Series 2024-1,

Class

A3

5.16%,

9/20/30 (1)

185,000

184

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Exeter

Automobile

Receivables

Trust

Series 2022-3A,

Class

C

5.30%,

9/15/27

385,000

383

Exeter

Automobile

Receivables

Trust

Series 2023-1A,

Class

D

6.69%,

6/15/29

65,000

66

Ford

Credit

Auto

Lease

Trust

Series 2023-A,

Class

C

5.54%,

12/15/26

700,000

698

Ford

Credit

Auto

Lease

Trust

Series 2024-A,

Class

A4

5.05%,

6/15/27

80,000

79

Ford

Credit

Auto

Owner

Trust

Series 2022-C,

Class

C

5.22%,

3/15/30

145,000

144

Ford

Credit

Auto

Owner

Trust

Series 2023-1,

Class

A

4.85%,

8/15/35 (1)

680,000

670

Golub

Capital

Partners

Series 2022-60A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.31%,

10/25/34 (1)(2)

250,000

250

Hardee's

Funding

Series 2021-1A,

Class

A2

2.865%,

6/20/51 (1)

194,500

165

Hardee's

Funding

Series 2024-1A,

Class

A2

7.253%,

3/20/54 (1)

420,000

418

HPEFS

Equipment

Trust

Series 2022-1A,

Class

C

1.96%,

5/21/29 (1)

140,000

138

HPEFS

Equipment

Trust

Series 2022-1A,

Class

D

2.40%,

11/20/29 (1)

260,000

252

HPEFS

Equipment

Trust

Series 2023-2A,

Class

B

6.25%,

1/21/31 (1)

100,000

101

HPEFS

Equipment

Trust

Series 2023-2A,

Class

C

6.48%,

1/21/31 (1)

100,000

101

HPEFS

Equipment

Trust

Series 2023-2A,

Class

D

6.97%,

7/21/31 (1)

100,000

102

Hyundai

Auto

Lease

Securitization

Trust

Series 2024-A,

Class

A4

5.07%,

2/15/28 (1)

100,000

99

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Invesco

U.S.

Series 2023-1A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.57%,

6.856%,

4/22/37 (1)

335,000

338

Jamestown

XV

Series 2020-15A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.37%,

7/15/35 (1)(2)

320,000

320

KKR

Series 40A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.30%,

10/20/34 (1)(2)

250,000

250

Kubota

Credit

Owner

Trust

Series 2023-1A,

Class

A4

5.07%,

2/15/29 (1)

50,000

50

Madison

Park

Funding

LXI

Series 2023-61A,

Class

A,

CLO,

FRN

3M

TSFR

+

1.73%,

7.037%,

1/20/37 (1)

275,000

277

Madison

Park

Funding

XXXIII

Series 2019-33A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.29%,

6.619%,

10/15/32 (1)

350,000

351

MidOcean

Credit

XI

Series 2022-11A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.73%,

7.057%,

10/18/33 (1)

295,000

296

MMAF

Equipment

Finance

Series 2021-A,

Class

A5

1.19%,

11/13/43 (1)

100,000

92

MMAF

Equipment

Finance

Series 2024-A,

Class

A3

4.95%,

7/14/31 (1)

425,000

420

MVW

Series 2023-1A,

Class

A

4.93%,

10/20/40 (1)

419,143

413

MVW

Series 2023-2A,

Class

A

6.18%,

11/20/40 (1)

96,691

98

MVW

Series 2023-2A,

Class

B

6.33%,

11/20/40 (1)

87,901

89

Navient

Private

Education

Refi

Loan

Trust

Series 2020-CA,

Class

B

2.83%,

11/15/68 (1)

350,000

292

Navistar

Financial

Dealer

Note

Master

Owner

Trust

Series 2024-1,

Class

A

5.59%,

4/25/29 (1)

190,000

190

Nissan

Auto

Lease

Trust

Series 2024-A,

Class

A4

4.97%,

9/15/28

105,000

104

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Northwoods

Capital

XIV-B

Series 2018-14BA,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.25%,

6.574%,

11/13/31 (1)

325,000

326

OCP

Series 2014-7A,

Class

A2RR,

CLO,

FRN

3M

TSFR

+

1.912%,

7.236%,

7/20/29 (1)

370,000

370

Octagon

Investment

Partners

49

Series 2020-5A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.52%,

6.811%,

4/15/37 (1)

510,000

512

Octane

Receivables

Trust

Series 2023-1A,

Class

A

5.87%,

5/21/29 (1)

59,777

60

Octane

Receivables

Trust

Series 2023-3A,

Class

B

6.48%,

7/20/29 (1)

105,000

106

Octane

Receivables

Trust

Series 2023-3A,

Class

C

6.74%,

8/20/29 (1)

100,000

101

Octane

Receivables

Trust

Series 2024-1A,

Class

A2

5.68%,

5/20/30 (1)

180,000

180

Palmer

Square

Series 2020-3A,

Class

A1R2,

CLO,

FRN

3M

TSFR

+

1.65%,

6.972%,

11/15/36 (1)

315,000

318

Post

Road

Equipment

Finance

Series 2024-1A,

Class

A2

5.59%,

11/15/29 (1)

100,000

100

Progress

Residential

Trust

Series 2020-SFR3,

Class

B

1.495%,

10/17/27 (1)

100,000

94

RR

28

Series 2024-28RA,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.55%,

6.841%,

4/15/37 (1)

465,000

464

Santander

Bank

Series 2021-1A,

Class

B

1.833%,

12/15/31 (1)

29,021

29

Santander

Drive

Auto

Receivables

Trust

Series 2021-4,

Class

D

1.67%,

10/15/27

225,000

216

Santander

Drive

Auto

Receivables

Trust

Series 2022-5,

Class

C

4.74%,

10/16/28

235,000

232

Santander

Drive

Auto

Receivables

Trust

Series 2022-6,

Class

B

4.72%,

6/15/27

640,000

635

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

SBNA

Auto

Lease

Trust

Series 2024-A,

Class

A3

5.39%,

11/20/26 (1)

115,000

115

SBNA

Auto

Lease

Trust

Series 2024-A,

Class

A4

5.24%,

1/22/29 (1)

110,000

110

SEB

Funding

Series 2024-1A,

Class

A2

7.386%,

4/30/54 (1)

470,000

469

ServiceMaster

Funding

Series 2021-1,

Class

A2I

2.865%,

7/30/51 (1)

410,159

357

SFS

Auto

Receivables

Securitization

Trust

Series 2024-1A,

Class

A4

4.94%,

1/21/31 (1)

85,000

84

SFS

Auto

Receivables

Securitization

Trust

Series 2024-1A,

Class

C

5.51%,

1/20/32 (1)

45,000

44

SFS

Auto

Receivables

Securitization

Trust

Series 2024-2A,

Class

A3

5.33%,

11/20/29 (1)

235,000

234

SFS

Auto

Receivables

Securitization

Trust

Series 2024-2A,

Class

B

5.41%,

8/20/30 (1)

50,000

50

Signal

Peak

Series 2018-5A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.55%,

6.876%,

4/25/37 (1)

625,000

623

SMB

Private

Education

Loan

Trust

Series 2021-A,

Class

B

2.31%,

1/15/53 (1)

341,435

318

Symphony

XVI

Series 2015-16A,

Class

ARR,

CLO,

FRN

3M

TSFR

+

1.20%,

6.523%,

10/15/31 (1)

665,000

664

Tricon

Residential

Trust

Series 2024-SFR2,

Class

A

4.75%,

6/17/40 (1)

410,000

396

Trinitas

VI

Series 2017-6A,

Class

ARRR,

CLO,

FRN

3M

TSFR

+

1.33%,

1/25/34 (1)(2)

725,000

725

U.S.

Bank

Series 2023-1,

Class

B

6.789%,

8/25/32 (1)

194,024

195

Verdant

Receivables

Series 2024-1A,

Class

A2

5.68%,

12/12/31 (1)

100,000

100

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Verizon

Master

Trust

Series 2023-1,

Class

C

4.98%,

1/22/29

185,000

182

Wellfleet

Series 2017-2A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.322%,

6.646%,

10/20/29 (1)

33,979

34

Total

Asset-Backed

Securities

(Cost

$22,782)

22,516

BOND

MUTUAL

FUNDS

17.2%

T.

Rowe

Price

Dynamic

Global

Bond

Fund

-

I

Class,

6.15% (3)

(4)

6,803,582

52,932

T.

Rowe

Price

Inflation

Protected

Bond

Fund

-

I

Class,

9.60% (3)(4)

510,218

5,291

T.

Rowe

Price

Institutional

Emerging

Markets

Bond

Fund,

6.27% (3)(4)

9,475,113

63,010

T.

Rowe

Price

Institutional

Floating

Rate

Fund

-

Institutional

Class,

8.44% (3)(4)

2,548,070

24,156

T.

Rowe

Price

Institutional

High

Yield

Fund

-

Institutional

Class,

7.20% (3)(4)

7,948,401

61,282

T.

Rowe

Price

International

Bond

Fund

(USD

Hedged)

-

I

Class,

3.82% (3)(4)

9,702,640

81,017

T.

Rowe

Price

Limited

Duration

Inflation

Focused

Bond

Fund

-

I

Class,

9.22% (3)(4)

961,765

4,491

T.

Rowe

Price

U.S.

Treasury

Long-Term

Index

Fund

-

I

Class,

4.71% (3)(4)

7,055,175

51,150

Total

Bond

Mutual

Funds

(Cost

$401,531)

343,329

COMMON

STOCKS

52.7%

COMMUNICATION

SERVICES

3.6%

Diversified

Telecommunication

Services

0.3%

BT

Group

(GBP) (5)

836,260

1,400

Frontier

Communications

Parent (6)

13,038

348

KT

(KRW)

38,591

1,030

Nippon

Telegraph

&

Telephone

(JPY)

2,929,100

2,876

5,654

Entertainment

0.5%

Electronic

Arts

12,680

1,685

Liberty

Media

Corp-Liberty

Live,

Class

C (6)

12,506

476

Netflix (6)

10,524

6,753

Sea,

ADR (6)

8,891

600

9,514

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Interactive

Media

&

Services

2.2%

Alphabet,

Class

A (6)

20,293

3,501

Alphabet,

Class

C (6)

139,692

24,301

LY

(JPY)

225,400

536

Match

Group (6)

3,304

101

Meta

Platforms,

Class

A

31,059

14,499

NAVER

(KRW)

7,294

903

Reddit,

Class

A (6)

2,073

113

Tencent

Holdings

(HKD)

11,000

510

Vimeo (6)

52,414

203

44,667

Media

0.2%

Comcast,

Class

A

31,200

1,249

CyberAgent

(JPY)

109,300

659

Ibotta,

Class

A (6)

973

94

WPP

(GBP)

174,647

1,828

3,830

Wireless

Telecommunication

Services

0.4%

T-Mobile

U.S.

40,948

7,164

7,164

Total

Communication

Services

70,829

CONSUMER

DISCRETIONARY

4.8%

Automobile

Components

0.3%

Autoliv,

SDR

(SEK)

14,280

1,826

Denso

(JPY)

106,700

1,734

Dowlais

Group

(GBP)

371,787

330

Magna

International

27,016

1,221

Modine

Manufacturing (6)

1,945

196

Stanley

Electric

(JPY)

29,600

545

5,852

Automobiles

0.4%

Honda

Motor

(JPY)

54,500

617

Suzuki

Motor

(JPY)

105,600

1,259

Tesla (6)

17,362

3,092

Toyota

Motor

(JPY)

161,900

3,527

8,495

Broadline

Retail

1.5%

Alibaba

Group

Holding,

ADR

4,759

373

Amazon.com (6)

159,205

28,090

Etsy (6)

3,100

197

Next

(GBP)

15,488

1,855

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Ollie's

Bargain

Outlet

Holdings (6)

3,957

326

Savers

Value

Village (6)

8,297

112

30,953

Diversified

Consumer

Services

0.1%

Bright

Horizons

Family

Solutions (6)

5,640

593

Duolingo (6)

1,389

266

Service

Corp.

International

4,759

341

Strategic

Education

4,696

532

1,732

Hotels,

Restaurants

&

Leisure

1.1%

Amadeus

IT

Group

(EUR)

22,978

1,640

BJ's

Restaurants (6)

8,924

313

Booking

Holdings

1,380

5,212

Cava

Group (6)

3,602

334

Chipotle

Mexican

Grill (6)

803

2,513

Compass

Group

(GBP)

91,813

2,578

DoorDash,

Class

A (6)

5,358

590

Dutch

Bros,

Class

A (6)

12,217

432

Hilton

Worldwide

Holdings

12,838

2,575

McDonald's

14,690

3,803

Norwegian

Cruise

Line

Holdings (6)

34,822

578

Papa

John's

International

7,211

335

Red

Rock

Resorts,

Class

A

5,698

292

Shake

Shack,

Class

A (6)

3,355

318

Torchys

Holdings,

Class

A,

Acquisition

Date:

11/13/20,

Cost $443 (6)(7)(8)(9)

51,774

227

Wyndham

Hotels

&

Resorts

5,430

384

22,124

Household

Durables

0.3%

Installed

Building

Products

1,441

305

Panasonic

Holdings

(JPY)

138,200

1,221

Persimmon

(GBP)

50,211

938

Skyline

Champion (6)

6,798

473

Sony

Group

(JPY)

27,300

2,242

5,179

Specialty

Retail

0.8%

AutoZone (6)

506

1,402

Burlington

Stores (6)

1,628

391

Caleres

7,688

267

Carvana (6)

15,215

1,521

Five

Below (6)

1,295

179

Floor

&

Decor

Holdings,

Class

A (6)

1,330

155

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Home

Depot

3,274

1,096

Kingfisher

(GBP)

546,001

1,848

Leslie's (6)

25,428

145

O'Reilly

Automotive (6)

1,663

1,602

RH (6)

1,066

290

Ross

Stores

9,041

1,264

TJX

30,218

3,115

Tractor

Supply

9,936

2,835

Warby

Parker,

Class

A (6)

15,142

268

16,378

Textiles,

Apparel

&

Luxury

Goods

0.3%

Cie

Financiere

Richemont

(CHF)

10,560

1,699

Kering

(EUR)

2,949

1,020

Lululemon

Athletica (6)

1,443

450

Moncler

(EUR)

22,518

1,503

NIKE,

Class

B

4,675

444

Samsonite

International

(HKD) (6)

222,600

707

Skechers

USA,

Class

A (6)

5,344

382

6,205

Total

Consumer

Discretionary

96,918

CONSUMER

STAPLES

3.3%

Beverages

0.7%

Boston

Beer,

Class

A (6)

1,606

504

Coca-Cola

101,618

6,395

Coca-Cola

Consolidated

10

10

Diageo

(GBP)

53,190

1,791

Heineken

(EUR)

20,344

2,041

Keurig

Dr

Pepper

82,645

2,830

Kirin

Holdings

(JPY)

44,400

613

14,184

Consumer

Staples

Distribution

&

Retail

0.6%

Dollar

General

9,227

1,263

Dollar

Tree (6)

10,600

1,250

Seven

&

i

Holdings

(JPY)

139,900

1,806

Target

10,610

1,657

Walmart

88,853

5,843

Welcia

Holdings

(JPY)

19,900

275

12,094

Food

Products

0.6%

Barry

Callebaut

(CHF)

564

980

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Farmers

Business

Network,

Acquisition

Date:

11/3/17,

Cost $174 (6)(7)(9)

9,408

35

Mondelez

International,

Class

A

22,889

1,569

Nestle

(CHF)

59,526

6,318

Post

Holdings (6)

4,428

472

Simply

Good

Foods (6)

10,101

389

Utz

Brands

19,023

353

Wilmar

International

(SGD)

515,300

1,182

11,298

Household

Products

0.7%

Colgate-Palmolive

67,080

6,236

Procter

&

Gamble

43,381

7,138

13,374

Personal

Care

Products

0.7%

BellRing

Brands (6)

14,564

847

Kenvue

299,834

5,787

L'Oreal

(EUR) (5)

4,838

2,388

Puig

Brands,

Class

B

(EUR) (6)

24,337

687

Unilever

(GBP)

86,008

4,710

14,419

Total

Consumer

Staples

65,369

ENERGY

2.9%

Energy

Equipment

&

Services

0.8%

Cactus,

Class

A

6,286

323

ChampionX

8,412

274

Expro

Group

Holdings (6)

18,975

416

Halliburton

187,032

6,864

Liberty

Energy

13,235

327

Noble

4,350

202

Schlumberger

127,993

5,874

TechnipFMC

24,330

637

Weatherford

International (6)

5,400

650

15,567

Oil,

Gas

&

Consumable

Fuels

2.1%

Antero

Resources (6)

14,797

527

Chesapeake

Energy

20,132

1,831

Chevron

8,740

1,418

ConocoPhillips

49,604

5,778

Diamondback

Energy

19,724

3,930

DT

Midstream

6,083

408

EQT

140,071

5,755

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Equinor

(NOK)

106,641

3,096

Exxon

Mobil

23,629

2,771

Hess

2,400

370

Kimbell

Royalty

Partners

11,483

193

Kinder

Morgan

41,281

805

Magnolia

Oil

&

Gas,

Class

A

21,226

551

Matador

Resources

4,734

300

Phillips

66

3,348

476

Range

Resources

110,247

4,069

Shell,

ADR

36,216

2,636

SM

Energy

5,048

255

Southwestern

Energy (6)

96,039

723

TotalEnergies

(EUR)

58,193

4,263

Viper

Energy

6,875

264

Williams

19,591

813

41,232

Total

Energy

56,799

FINANCIALS

8.6%

Banks

2.7%

ANZ

Group

Holdings

(AUD)

59,900

1,131

Banc

of

California

15,469

214

Bank

of

America

130,831

5,232

BankUnited

3,362

96

Blue

Foundry

Bancorp (6)

7,122

65

BNP

Paribas

(EUR)

20,639

1,524

Cadence

Bank

14,228

406

Capitol

Federal

Financial

34,284

177

Citigroup

38,669

2,409

Columbia

Banking

System

18,773

362

CRB

Group,

Acquisition

Date:

4/14/22,

Cost $33 (6)(7)(9)

313

23

CrossFirst

Bankshares (6)

15,269

200

DBS

Group

Holdings

(SGD)

51,306

1,368

Dime

Community

Bancshares

9,234

171

DNB

Bank

(NOK)

142,713

2,795

Dogwood

State

Bank,

Non-Voting

Shares,

Acquisition

Date:

5/6/19

-

4/5/24,

Cost $47 (6)(7)(9)

4,663

83

Dogwood

State

Bank,

Voting

Shares,

Acquisition

Date:

5/6/19,

Cost $20 (6)(7)(9)

1,993

35

East

West

Bancorp

16,171

1,200

Eastern

Bankshares

18,108

248

Equity

Bancshares,

Class

A

6,731

227

FB

Financial

9,914

367

First

Bancshares

9,427

239

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Five

Star

Bancorp

9,055

208

Grasshopper

Bancorp,

Acquisition

Date:

10/12/18

-

5/2/19,

Cost $67 (6)(7)(9)

6,708

20

Grasshopper

Bancorp,

Warrants,

10/12/28,

Acquisition

Date:

10/12/18,

Cost $— (6)(7)(9)

1,212

—

HarborOne

Bancorp

9,689

101

HDFC

Bank

(INR)

73,086

1,338

Home

BancShares

11,376

268

ING

Groep

(EUR)

202,230

3,613

Intesa

Sanpaolo

(EUR)

411,331

1,620

JPMorgan

Chase

60,634

12,286

Kearny

Financial

14,663

83

Live

Oak

Bancshares

11,106

383

Mitsubishi

UFJ

Financial

Group

(JPY)

200,800

2,133

National

Bank

of

Canada

(CAD)

29,834

2,550

Origin

Bancorp

8,242

258

Pacific

Premier

Bancorp

9,995

222

Pinnacle

Financial

Partners

6,293

500

PNC

Financial

Services

Group

2,874

452

Popular

3,678

327

Prosperity

Bancshares

5,792

361

SouthState

6,955

538

Standard

Chartered

(GBP)

142,683

1,421

Sumitomo

Mitsui

Trust

Holdings

(JPY)

33,694

783

Svenska

Handelsbanken,

Class

A

(SEK)

165,521

1,558

Texas

Capital

Bancshares (6)

5,081

306

United

Overseas

Bank

(SGD)

85,300

1,945

Wells

Fargo

27,490

1,647

Western

Alliance

Bancorp

6,266

395

53,888

Capital

Markets

1.2%

Bridgepoint

Group

(GBP)

187,308

545

Brookfield

(CAD)

36,289

1,580

Cboe

Global

Markets

4,419

765

Charles

Schwab

54,372

3,984

CME

Group

6,649

1,350

CVC

Capital

Partners

(EUR) (6)

43,957

850

Goldman

Sachs

Group

11,887

5,427

Julius

Baer

Group

(CHF)

25,337

1,522

LPL

Financial

Holdings

8,271

2,367

Macquarie

Group

(AUD)

9,760

1,246

Morgan

Stanley

9,745

954

MSCI

346

171

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Onex

(CAD)

4,219

299

S&P

Global

2,376

1,016

StepStone

Group,

Class

A

8,175

351

Stifel

Financial

3,884

314

TMX

Group

(CAD)

14,380

386

23,127

Consumer

Finance

0.3%

American

Express

21,935

5,264

Encore

Capital

Group (6)

5,404

239

PRA

Group (6)

5,607

121

5,624

Financial

Services

1.9%

Adyen

(EUR) (6)

785

1,018

ANT

Group,

Acquisition

Date:

8/14/23,

Cost $293 (6)(7)(9)

293,381

296

Berkshire

Hathaway,

Class

B (6)

20,330

8,425

Challenger

(AUD)

96,169

416

Corebridge

Financial

32,121

937

Corpay (6)

3,340

894

Fiserv (6)

35,061

5,251

Mastercard,

Class

A

11,919

5,329

Mitsubishi

HC

Capital

(JPY)

107,800

715

PennyMac

Financial

Services

10,011

907

Toast,

Class

A (6)

11,636

282

Visa,

Class

A

50,925

13,875

38,345

Insurance

2.5%

AIA

Group

(HKD)

215,200

1,671

Allstate

25,315

4,241

Assurant

3,995

693

AXA

(EUR)

110,857

4,003

Axis

Capital

Holdings

4,298

318

Bowhead

Specialty

Holdings (6)

1,693

45

Chubb

11,877

3,217

Definity

Financial

(CAD)

20,376

646

First

American

Financial

5,679

316

Goosehead

Insurance,

Class

A (6)

4,906

316

Hanover

Insurance

Group

4,086

539

Hartford

Financial

Services

Group

2,481

257

Mandatum

(EUR)

39,457

177

Marsh

&

McLennan

16,707

3,468

MetLife

67,486

4,884

Munich

Re

(EUR)

9,104

4,540

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Oscar

Health,

Class

A (6)

26,949

538

Progressive

20,104

4,246

RLI

1,981

289

Sampo,

Class

A

(EUR)

45,017

1,927

Selective

Insurance

Group

8,641

843

Storebrand

(NOK)

153,991

1,669

Sun

Life

Financial

(CAD)

35,712

1,790

Tokio

Marine

Holdings

(JPY)

85,200

2,952

Travelers

18,159

3,917

White

Mountains

Insurance

Group

221

399

Zurich

Insurance

Group

(CHF)

4,591

2,416

50,317

Total

Financials

171,301

HEALTH

CARE

7.0%

Biotechnology

0.6%

AbbVie

13,904

2,242

Apellis

Pharmaceuticals (6)

3,636

143

Arcellx (6)

4,179

217

Argenx,

ADR (6)

3,885

1,441

Arrowhead

Pharmaceuticals (6)

8,834

203

Ascendis

Pharma,

ADR (6)

684

92

Black

Diamond

Therapeutics (6)

21,804

104

Blueprint

Medicines (6)

3,215

339

Bridgebio

Pharma (6)

5,450

153

Cabaletta

Bio (6)

7,395

75

CG

oncology (6)

1,498

49

Crinetics

Pharmaceuticals (6)

6,289

279

CRISPR

Therapeutics (6)

1,971

106

Cytokinetics (6)

10,230

496

Genmab

(DKK) (6)

2,814

794

HilleVax (6)

8,828

107

Immatics (6)

17,635

195

Immunocore

Holdings,

ADR (6)

3,065

150

Immunovant (6)

5,969

152

Insmed (6)

7,434

409

Ionis

Pharmaceuticals (6)

7,905

297

Merus (6)

2,400

128

MoonLake

Immunotherapeutics (6)

2,235

91

Nurix

Therapeutics (6)

5,483

86

Prime

Medicine (6)

8,211

53

Sana

Biotechnology (6)

7,560

57

Scholar

Rock,

Warrants,

12/31/25,

Acquisition

Date:

6/17/22,

Cost $— (6)(7)

1,127

5

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Syndax

Pharmaceuticals (6)

2,354

45

Tango

Therapeutics (6)

10,110

70

Vaxcyte (6)

7,461

524

Vertex

Pharmaceuticals (6)

4,048

1,843

Verve

Therapeutics (6)

8,381

44

Xenon

Pharmaceuticals (6)

3,456

132

Zentalis

Pharmaceuticals (6)

8,291

99

11,220

Health

Care

Equipment

&

Supplies

0.8%

Alcon

(CHF)

13,095

1,176

Align

Technology (6)

463

119

Elekta,

Class

B

(SEK)

105,471

868

EssilorLuxottica

(EUR)

7,035

1,578

GE

HealthCare

Technologies

13,458

1,050

Haemonetics (6)

4,605

387

Hologic (6)

10,308

761

Intuitive

Surgical (6)

8,585

3,452

Koninklijke

Philips

(EUR) (6)

66,239

1,809

Masimo (6)

5,624

700

Neogen (6)

26,154

344

Novocure (6)

5,033

111

Pax

Labs,

Class

A,

Acquisition

Date:

4/18/19,

Cost $192 (6)(7)

(9)

51,080

20

Penumbra (6)

1,015

192

PROCEPT

BioRobotics (6)

6,668

443

QuidelOrtho (6)

7,409

327

Siemens

Healthineers

(EUR)

36,886

2,153

Stryker

3,642

1,242

Teleflex

1,110

232

16,964

Health

Care

Providers

&

Services

2.1%

Alignment

Healthcare (6)

28,958

228

Cencora

28,059

6,357

Cigna

Group

5,269

1,816

Elevance

Health

19,392

10,442

Fresenius

(EUR) (6)

40,712

1,299

HCA

Healthcare

4,119

1,399

Humana

2,648

948

Molina

Healthcare (6)

7,870

2,476

NeoGenomics (6)

32,732

449

Privia

Health

Group (6)

22,903

398

RadNet (6)

2,531

148

Tenet

Healthcare (6)

16,754

2,266

T.

ROWE

PRICE

Spectrum

Moderate

Allocation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

U.S.

Physical

Therapy

3,320

341

UnitedHealth

Group

29,062

14,396

42,963

Health

Care

Technology

0.0%

Certara (6)

16,723

283

283

Life

Sciences

Tools

&

Services

0.9%

10X

Genomics,

Class

A (6)

10,602

238

Agilent

Technologies

13,369

1,744

Azenta (6)

1,624

82

Bruker

8,702

570

Danaher

12,627

3,243

Evotec

(EUR) (6)

29,510

280

Repligen (6)

2,068

308

Revvity

14,700

1,606

Sotera

Health (6)

16,361

183

Stevanato

Group

16,300

331

Thermo

Fisher

Scientific

17,133

9,731

18,316

Pharmaceuticals

2.6%

Astellas

Pharma

(JPY)

172,200

1,691

AstraZeneca,

ADR

114,322

8,919

Bayer

(EUR)

29,820

917

Bristol-Myers

Squibb

10,869

447

Elanco

Animal

Health (6)

24,276

429

Eli

Lilly

13,993

11,479

EyePoint

Pharmaceuticals (6)

4,028

43

GSK,

ADR

14,890

667

Johnson

&

Johnson

35,709

5,238

Merck

46,500

5,838

Neumora

Therapeutics (6)

10,232

101

Novartis

(CHF)

35,204

3,644

Novo

Nordisk,

Class

B

(DKK)

33,385

4,523

Otsuka

Holdings

(JPY)

15,900

656

Roche

Holding

(CHF)

11,930

3,046

Sanofi

(EUR)

36,366

3,560

Shionogi

(JPY)

13,500

608

Structure

Therapeutics,

ADR (6)

2,713

93

Zoetis

5,663

960

52,859

Total

Health

Care

142,605

T.

ROWE