Subordinated Notes Offering November 2021 Filed Pursuant to Rule 433 Supplementing the Preliminary Prospectus Dated November 17, 2021 Registration No. 333 - 260993 November 17, 2021

2 Forward - Looking Statements & Other Disclaimers This presentation contains forward - looking statements within the meaning of the federal securities laws . These statements include statements with respect to Flushing Financial Corporation’s (“we”, “our”, “us” or the “Company”) beliefs , plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and future performance and involve known and unknown risks, uncertainties and other factors, many of which may be beyond our control and that may cause the actual results, performance or achievements of the Company to be materially different from future results , performance or achievements expressed or implied by such forward - looking statements . All forward - looking statements are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements to differ materially from any results expressed or implied by such forward - looking statements . Such factors include, among others the impact of the COVID - 19 pandemic on our financial condition and results of operations ; changes in interest rates ; risks that may be exacerbated depending on the mix of loan types we use in lending activities ; failure to effectively manage our liquidity ; our ability to obtain brokered deposits as an additional funding source ; the highly competitive markets in which we operate ; changes in national and/or local economic conditions ; changes in laws and regulations ; current conditions in, and regulation of, the banking industry ; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers, including as a result of cyberattacks ; increased delays in foreclosure proceedings ; our inability to hire or retain key personnel ; impairment of goodwill recorded as a result of acquisitions ; inability to fully realize the expected benefit of our deferred tax assets ; uncertainty surrounding the elimination of LIBOR and the proposed transition to SOFR ; and the ultimate success of integrating Empire Bancorp, Inc . , which the Company recently acquired, into the Company’s operations . These and other factors are more fully described under “Risk Factors” in Item 1 A of our most recent Annual Report on Form 10 - K for the fiscal year ended December 31 , 2020 , filed with the SEC on March 16 , 2021 , and other factors discussed in the filings we make with the SEC under the Securities Exchange Act of 1934 , as amended . All forward - looking statements attributable to the Company are expressly qualified in their entirety by these cautionary statements . Forward - looking statements speak only as of the date on which such statements are made . Except as required by law, we disclaim any obligation to update these forward - looking statements, whether as a result of new information, future events or otherwise . There is no assurance that future results, levels of activity, performance or goals will be achieved .

3 Additional Information and Where to Find It The Company has filed a registration statement (including a prospectus) (File No . 333 - 260993 ) and a preliminary prospectus supplement with the Securities and Exchange Commission ("SEC") for the offering to which this presentation relates . Before you invest, you should read the prospectus and the preliminary prospectus supplement and the other documents that the Company has filed with the SEC for more complete information about the Company and the offering . You may get these documents for free by visiting EDGAR on the SEC's website at www . sec . gov . Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you copies of the prospectus and the preliminary prospectus supplement relating to the offering if you request it by emailing Piper Sandler & Co . at fsg - dcm@psc . com .

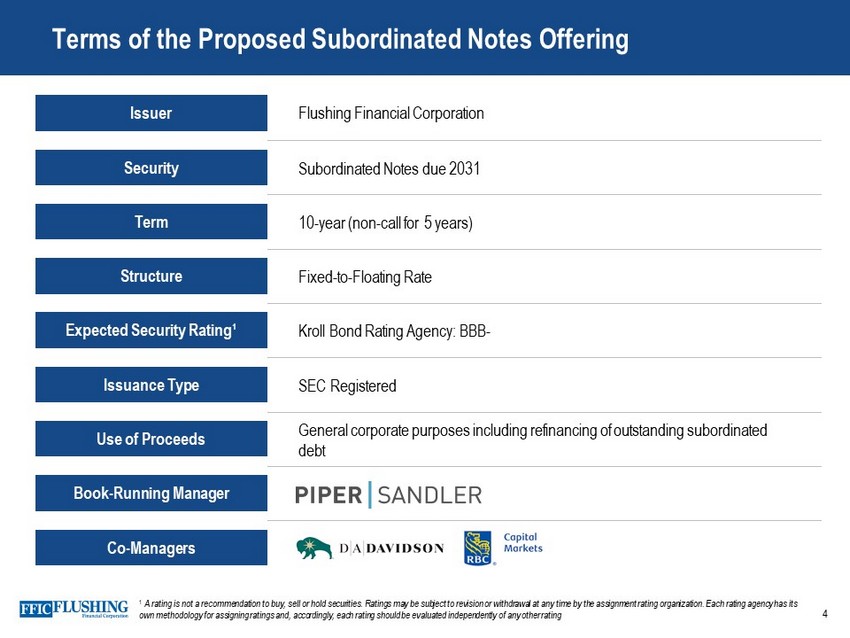

4 Terms of the Proposed Subordinated Notes Offering Flushing Financial Corporation Issuer Subordinated Notes due 2031 Security Fixed - to - Floating Rate Structure 10 - year (non - call for 5 years) Term Book - Running Manager General corporate purposes including refinancing of outstanding subordinated debt Use of Proceeds SEC Registered Issuance Type Kroll Bond Rating Agency: BBB - Expected Security Rating¹ Co - Managers 1 A rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any tim e b y the assignment rating organization. Each rating agency has its own methodology for assigning ratings and, accordingly, each rating should be evaluated independently of any other rating

5 Investment Highlights Conservative Underwriting with History of Solid Value Creation ► Leading Community Bank in the Greater NYC Area ► Well Diversified and Low Risk Loan Portfolio ► History of Sound Credit Quality since IPO in 1995 ► Asian Banking Niche ► Beneficiary of a Steepening Yield Curve

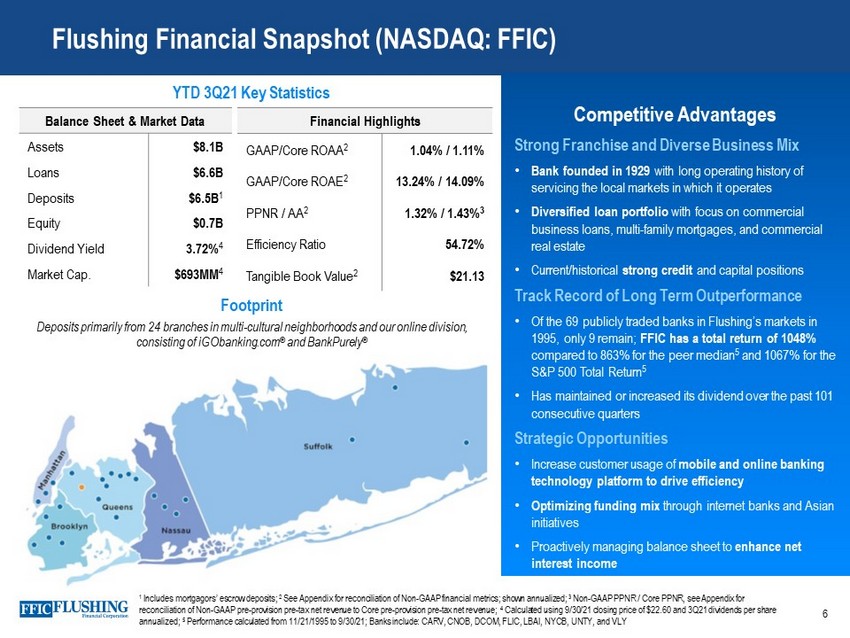

6 Flushing Financial Snapshot (NASDAQ: FFIC) Competitive Advantages Balance Sheet & Market Data Assets $8.1B Loans $6.6B Deposits $6.5B 1 Equity $0.7B Dividend Yield 3.72% 4 Market Cap. $ 693MM 4 Financial Highlights GAAP/Core ROAA 2 1.04% / 1.11% GAAP/Core ROAE 2 13.24% / 14.09% PPNR / AA 2 1.32% / 1.43% 3 Efficiency Ratio 54.72% Tangible Book Value 2 $21.13 YTD 3Q21 Key Statistics Footprint Deposits primarily from 24 branches in multi - cultural neighborhoods and our online division, consisting of iGObanking.com ® and BankPurely ® Strong Franchise and Diverse Business Mix • Bank founded in 1929 with long operating history of servicing the local markets in which it operates • Diversified loan portfolio with focus on commercial business loans, multi - family mortgages, and commercial real estate • Current/historical strong credit and capital positions Track Record of Long Term Outperformance • Of the 69 publicly traded banks in Flushing’s markets in 1995, only 9 remain; FFIC has a total return of 1048% compared to 863% for the peer median 5 and 1067% for the S&P 500 Total Return 5 • Has maintained or increased its dividend over the past 101 consecutive quarters Strategic Opportunities • Increase customer usage of mobile and online banking technology platform to drive efficiency • Optimizing funding mix through internet banks and Asian initiatives • Proactively managing balance sheet to enhance net interest income 1 Includes mortgagors’ escrow deposits; 2 See Appendix for reconciliation of Non - GAAP financial metrics; shown annualized; 3 Non - GAAP PPNR / Core PPNR, see Appendix for reconciliation of Non - GAAP pre - provision pre - tax net revenue to Core pre - provision pre - tax net revenue; 4 Calculated using 9/30/21 closing price of $22.60 and 3Q21 dividends per share annualized; 5 Performance calculated from 11/21/1995 to 9/30/21; Banks include: CARV, CNOB, DCOM, FLIC, LBAI, NYCB, UNTY, and VLY

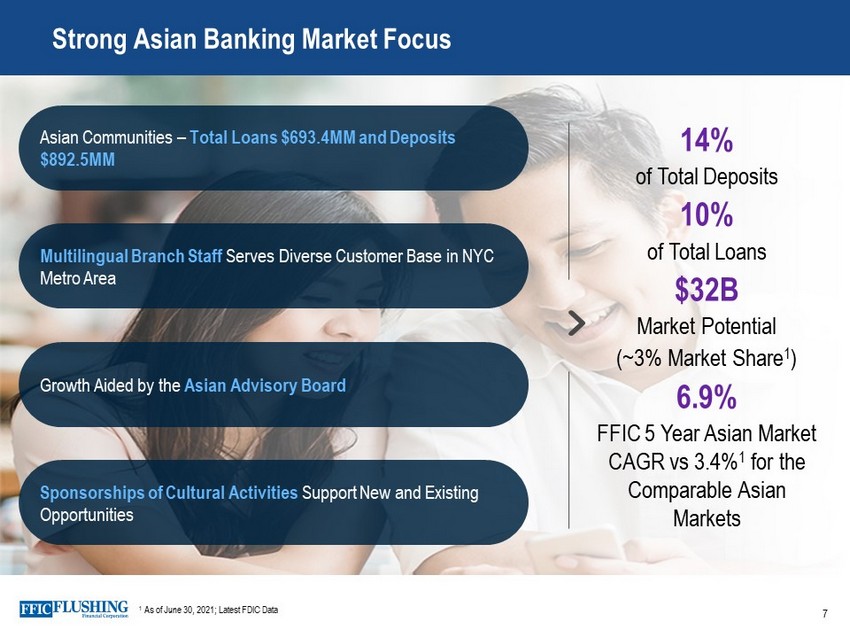

7 Strong Asian Banking Market Focus 14% of Total Deposits 10% of Total Loans $32B Market Potential (~3% Market Share 1 ) 6.9% FFIC 5 Year Asian Market CAGR vs 3.4% 1 for the Comparable Asian Markets Asian Communities – Total Loans $693.4MM and Deposits $892.5MM Multilingual Branch Staff Serves Diverse Customer Base in NYC Metro Area Growth Aided by the Asian Advisory Board Sponsorships of Cultural Activities Support New and Existing Opportunities 1 As of June 30, 2021; Latest FDIC Data

8 Experienced Executive Leadership Team All Senior Executives Have Over 20 years of Experience in Banking Aligned Investor Interest with Insider Ownership of 5.4%² John Buran President and CEO Maria Grasso SEVP, COO, Corporate Secretary Susan Cullen SEVP, CFO, Treasurer Francis Korzekwinski SEVP, Chief of Real Estate Michael Bingold SEVP, Chief Retail and Client Development Officer FFIC: 21 years Industry: 44 years 15 years 35 years 6 years 31 years 28 years 32 years 8 years 38 years Allen Brewer SEVP, Chief Information Officer Tom Buonaiuto SEVP, Chief of Staff, Deposit Channel Executive Vincent Giovinco EVP, Commercial Real Estate Lending Jeoung Jin EVP, Residential and Mixed Use Theresa Kelly EVP, Business Banking Patricia Mezeul EVP, Director of Government Banking 13 years 47 years 14 years 1 29 years 2 years 23 years 23 years 28 years 15 years 37 years 14 years 41 years 1 Previously President and COO of Empire Bancorp and Empire National Bank from its inception in February 2008 until the sale to Fl ushing in October 2020. 2 Directors and executive officers as of September 30, 2021.

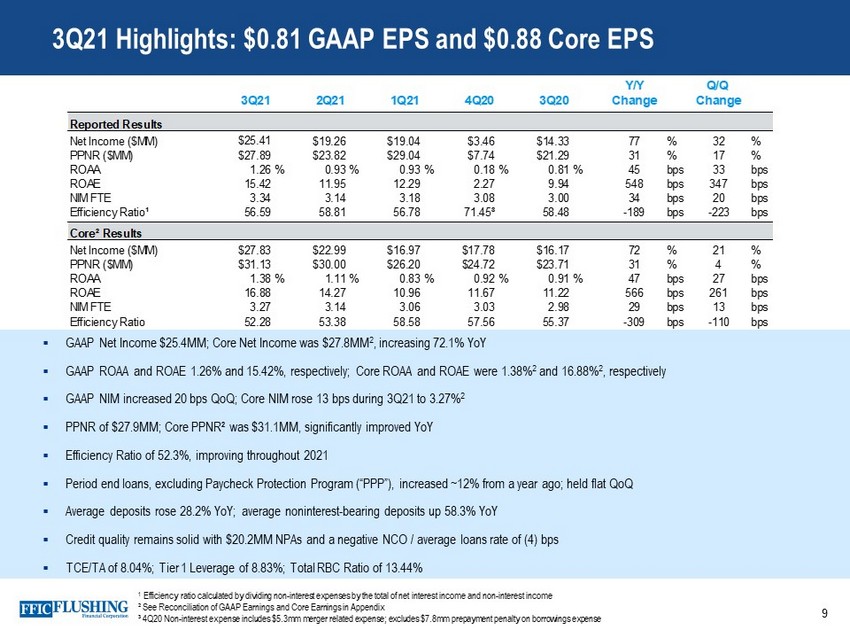

▪ GAAP Net Income $25.4MM; Core Net Income was $ 27.8MM 2 , increasing 72.1% YoY ▪ GAAP ROAA and ROAE 1.26% and 15.42%, respectively; Core ROAA and ROAE were 1.38% 2 and 16.88% 2 , respectively ▪ GAAP NIM increased 20 bps QoQ; Core NIM rose 13 bps during 3Q21 to 3.27% 2 ▪ PPNR of $27.9MM; Core PPNR² was $31.1MM, significantly improved YoY ▪ Efficiency Ratio of 52.3%, improving throughout 2021 ▪ Period end loans, excluding Paycheck Protection Program (“PPP”), increased ~12% from a year ago; held flat QoQ ▪ Average deposits rose 28.2% YoY; average noninterest - bearing deposits up 58.3% YoY ▪ Credit quality remains solid with $20.2MM NPAs and a negative NCO / average loans rate of (4) bps ▪ TCE/TA of 8.04%; Tier 1 Leverage of 8.83%; Total RBC Ratio of 13.44% 9 3Q21 Highlights: $0.81 GAAP EPS and $0.88 Core EPS 1 Efficiency ratio calculated by dividing non - interest expenses by the total of net interest income and non - interest income ² See Reconciliation of GAAP Earnings and Core Earnings in Appendix ³ 4Q20 Non - interest expense includes $5.3mm merger related expense; excludes $7.8mm prepayment penalty on borrowings expense Y/Y Q/Q 3Q21 2Q21 1Q21 4Q20 3Q20 Change Change Reported Results Net Income ($MM) $25.41 $19.26 $19.04 $3.46 $14.33 77 % 32 % PPNR ($MM) $27.89 $23.82 $29.04 $7.74 $21.29 31 % 17 % ROAA 1.26% 0.93% 0.93% 0.18% 0.81% 45 bps 33 bps ROAE 15.42 11.95 12.29 2.27 9.94 548 bps 347 bps NIM FTE 3.34 3.14 3.18 3.08 3.00 34 bps 20 bps Efficiency Ratio¹ 56.59 58.81 56.78 71.45³ 58.48 -189 bps -223 bps Core² Results Net Income ($MM) $27.83 $22.99 $16.97 $17.78 $16.17 72 % 21 % PPNR ($MM) $31.13 $30.00 $26.20 $24.72 $23.71 31 % 4 % ROAA 1.38% 1.11% 0.83% 0.92% 0.91% 47 bps 27 bps ROAE 16.88 14.27 10.96 11.67 11.22 566 bps 261 bps NIM FTE 3.27 3.14 3.06 3.03 2.98 29 bps 13 bps Efficiency Ratio 52.28 53.38 58.58 57.56 55.37 -309 bps -110 bps

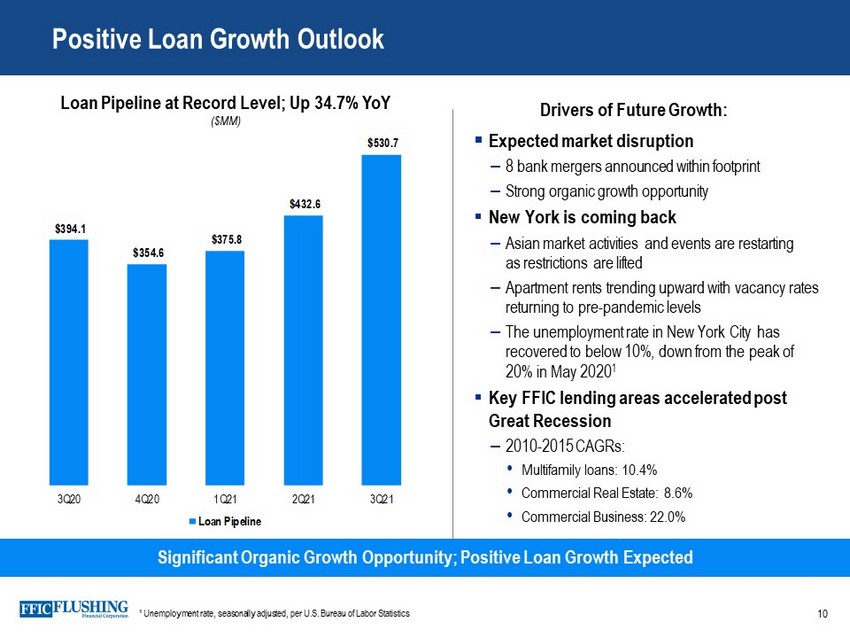

Positive Loan Growth Outlook 10 ▪ Expected market disruption – 8 bank mergers announced within footprint – Strong organic growth opportunity ▪ New York is coming back – Asian market activities and events are restarting as restrictions are lifted – Apartment rents trending upward with vacancy rates returning to pre - pandemic levels – The unemployment rate in New York City has recovered to below 10%, down from the peak of 20% in May 2020 1 ▪ Key FFIC lending areas accelerated post Great Recession – 2010 - 2015 CAGRs: • Multifamily loans: 10.4% • Commercial Real Estate: 8.6% • Commercial Business: 22.0% Significant Organic Growth Opportunity; Positive Loan Growth Expected Loan Pipeline at Record Level; Up 34.7% YoY ($MM) $394.1 $354.6 $375.8 $432.6 $530.7 $- $100.0 $200.0 $300.0 $400.0 $500.0 3Q20 4Q20 1Q21 2Q21 3Q21 Loan Pipeline Drivers of Future Growth: ¹ Unemployment rate, seasonally adjusted, per U.S. Bureau of Labor Statistics

11 25 Year Track Record of Steady Growth Core PPNR ($MM)³ Core Net Income ($MM)³ Tangible Book Value Per Share ($) Assets ($B) Total Gross Loans ($B)¹ Total Deposits ($B) ² $3.3 $67.8 1995 2000 2005 2010 2015 2020 YTD 3Q21 $6.3 $87.3 1995 2000 2005 2010 2015 2020 YTD 3Q21 $0.6 $6.5 1995 2000 2005 2010 2015 2020 3Q21 $0.3 $6.6 1995 2000 2005 2010 2015 2020 3Q21 $0.7 $8.1 1995 2000 2005 2010 2015 2020 3Q21 10% CAGR 10% CAGR 13% CAGR 11% CAGR 12% CAGR $4.86 $21.13 0.00 5.00 10.00 15.00 20.00 25.00 1995 2000 2005 2010 2015 2020 3Q21 6% CAGR Note: Acquisition of Empire Bancorp in 2020 (loans and deposits acquired of $685MM and $854MM, respectively; assets acquired of $982MM); See Reconciliation of GAAP Earnings and Core Earnings as well as GAAP revenue to Core PPMR in Appendix ¹ Includes PPP balances of $151.9M and $130.8M as of December 31, 2020 and September 30, 2021, respectively ² Includes mortgagors’ escrow deposits ³ For the 12 - month period ending December 31, 1995, December 31, 2000 and December 31, 2005, core financial metrics are assumed to equal GAAP financial metric s Aggregate Dividends Paid Since 1995: $309.1MM Aggregate Share Buybacks Completed Since 1995: $221.1MM

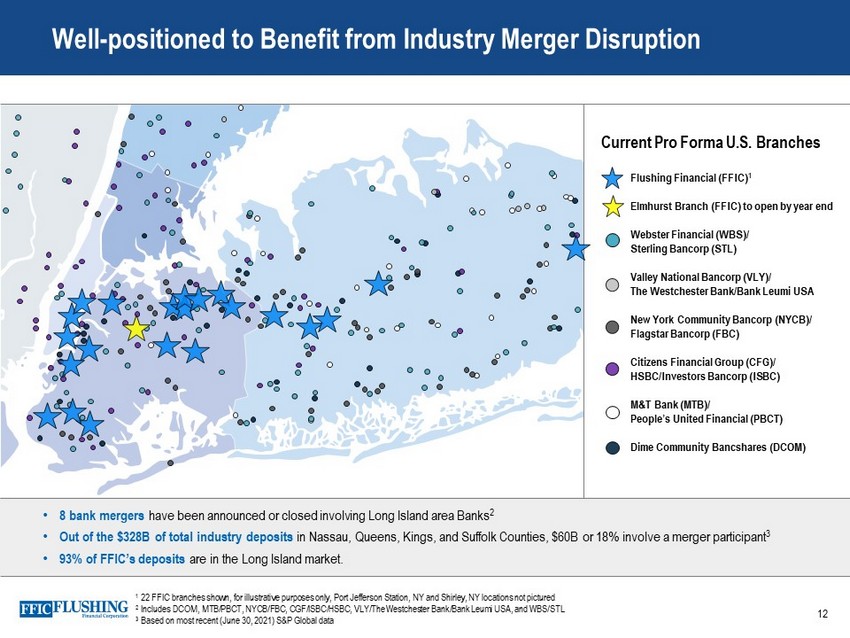

12 Well - positioned to Benefit from Industry Merger Disruption • 8 bank mergers have been announced or closed involving Long Island area Banks 2 • Out of the $328B of total industry deposits in Nassau, Queens, Kings, and Suffolk Counties, $60B or 18% involve a merger participant 3 • 93% of FFIC’s deposits are in the Long Island market. Flushing Financial (FFIC) 1 Elmhurst Branch (FFIC) to open by year end Webster Financial (WBS)/ Sterling Bancorp (STL) Valley National Bancorp (VLY)/ The Westchester Bank/Bank Leumi USA New York Community Bancorp (NYCB)/ Flagstar Bancorp (FBC) Citizens Financial Group (CFG)/ HSBC/Investors Bancorp (ISBC) M&T Bank (MTB)/ People’s United Financial (PBCT) Dime Community Bancshares (DCOM) Current Pro Forma U.S. Branches 1 22 FFIC branches shown, for illustrative purposes only, Port Jefferson Station, NY and Shirley, NY locations not pictured 2 Includes DCOM, MTB/PBCT, NYCB/FBC, CGF/ISBC/HSBC, VLY/The Westchester Bank/Bank Leumi USA, and WBS/STL 3 Based on most recent (June 30, 2021) S&P Global data

Scaling through Digital Banking Growth 13 In Early Stages of Our Technology Enhancements – More to Come Note: YoY growth or decline as of September 30, 2021 39% Increase in Monthly Mobile Active Users YoY ~22,000 Active Online Banking Users 51 % YoY Growth 23% Digital Banking Enrollment YoY Growth Numerated Improving Customer Experience through Automated Approval and Origination JAM FINTOP Early Look at Emerging Technology

14 Strategic Objectives ENSURE appropriate risk - adjusted returns for loans while optimizing cost of funds MAINTAIN strong historical loan growth ENHANCE core earnings power by improving scalability and efficiency MANAGE asset quality with consistently disciplined underwriting 1 2 3 4

Record Core Net Interest Income FTE for the Sixth Consecutive Quarter 15 Base NIM FTE 2.89% 2.97% 3.01% 3.04% 3.15% GAAP NIM FTE 3.00% 3.08% 3.18% 3.14% 3.34% $49.8 $54.8 $58.7 $61.3 $62.2 2.98% 3.03% 3.06% 3.14% 3.27% 4.07% 4.06% 3.99% 4.06% 4.09% 0.57% 0.47% 0.39% 0.34% 0.29% -0.25% 0.75% 1.75% 2.75% 3.75% 4.75% 5.75% 6.75% $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 3Q20 4Q20 1Q21 2Q21 3Q21 Base NII FTE Net Prepayment Penalties Core NII FTE Core NIM FTE Core Loan Yields Deposit Costs ($MM) See Appendix for definitions of Core and Base NII FTE and Core NIM, and Net Prepayment Penalties

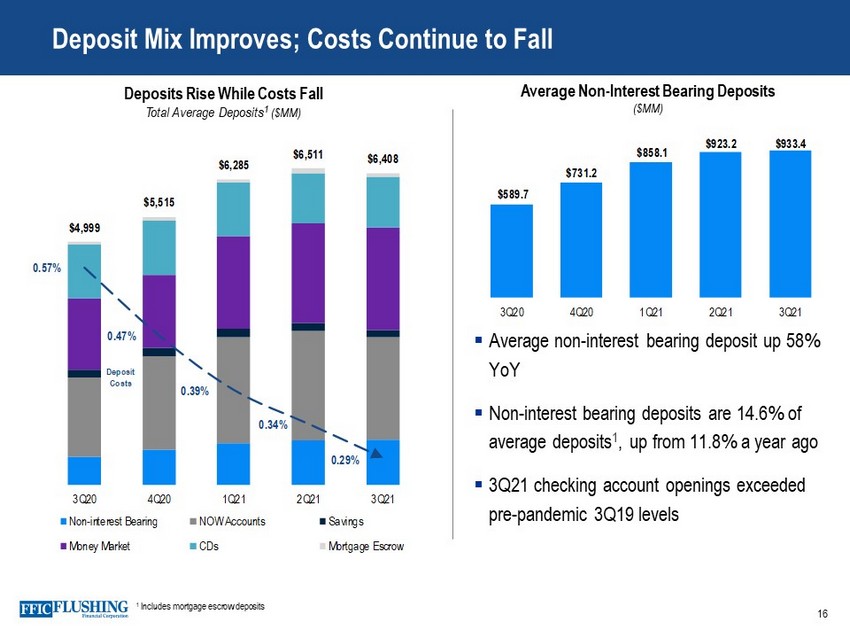

Deposit Mix Improves; Costs Continue to Fall 16 Deposits Rise While Costs Fall Total Average Deposits 1 ($MM) 1 Includes mortgage escrow deposits ▪ Average non - interest bearing deposit up 58% YoY ▪ Non - interest bearing deposits are 14.6% of average deposits 1 , up from 11.8% a year ago ▪ 3Q21 checking account openings exceeded pre - pandemic 3Q19 levels $4,999 $5,515 $6,285 $6,511 $6,408 0.57% 0.47% 0.39% 0.34% 0.29% 0% 0% 0% 1% 1% 1% 0 1000 2000 3000 4000 5000 6000 7000 3Q20 4Q20 1Q21 2Q21 3Q21 Non-interest Bearing NOW Accounts Savings Money Market CDs Mortgage Escrow Deposit Costs Average Non - Interest Bearing Deposits ($MM) $589.7 $731.2 $858.1 $923.2 $933.4 0 100 200 300 400 500 600 700 800 900 1000 3Q20 4Q20 1Q21 2Q21 3Q21

$5,928 $6,702 $6,746 $6,717 $6,627 - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 3Q20 4Q20 1Q21 2Q21 3Q21 Multifamily Commercial Real Estate Construction 1-4 Family Business Banking Loans Flat QoQ Excluding PPP; Pipelines Rise 17 Core Loan Yields 4.07% 4.06% 3.99% 4.06% 4.09% Loan Composition Period End Loans ($MM) Base Loan Yields 3.98% 3.99% 3.93% 3.94% 3.96% ▪ Gross loans, excluding PPP, increased 11.6% YoY and were flat QoQ ▪ PPP loans declined to $130.8MM QoQ ▪ Loan pipeline totaled $530.7MM at September 30, 2021, up 22.7% QoQ and 34.7% YoY; pipeline rates stable versus 2Q21 ▪ Loan growth positioned to improve in 4Q21 as New York Metropolitan market reopens ▪ Base loan yields were stable QoQ ▪ Rates on loan closings increased 13 bps to 3.64% from 3.51% in 2Q21 See Appendix for definitions of Core and Base Loan Yields

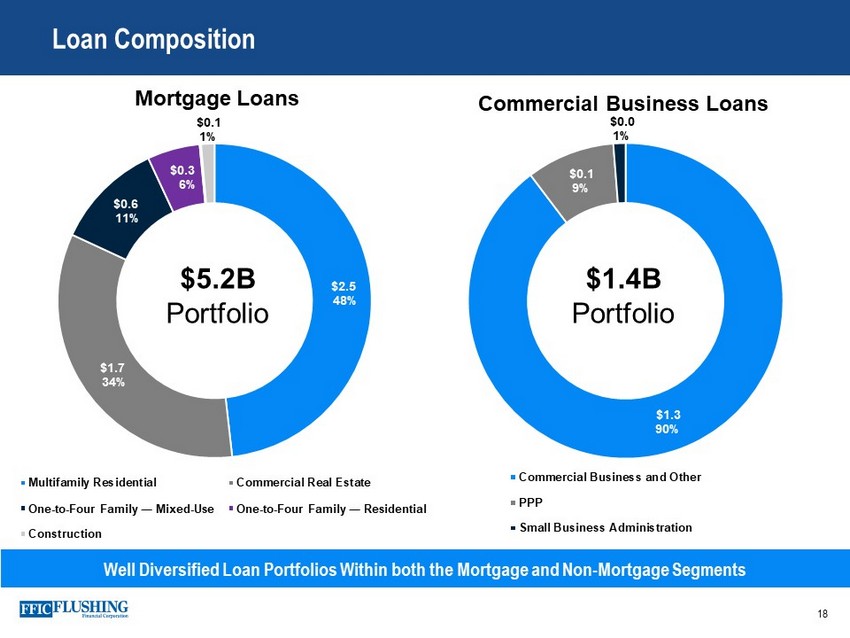

18 Loan Composition Mortgage Loans $2.5 48% $1.7 34% $0.6 11% $0.3 6% $0.1 1% Multifamily Residential Commercial Real Estate One - to - Four Family ― Mixed - Use One - to - Four Family ― Residential Construction $5.2B Portfolio Commercial Business Loans $1.4B Portfolio Well Diversified Loan Portfolios Within both the Mortgage and Non - Mortgage Segments $1.3 90% $0.1 9% $0.0 1% Commercial Business and Other PPP Small Business Administration

Well Secured Multifamily and CRE Portfolios with DCR of 1.8x 19 Underwrite Real Estate Loans with a Cap Rate in Mid - 5s and Stress Test Each Loan Multifamily Geography 17% 30% 18% 18% 17% Bronx Kings Manhattan Queens Other $ 2.5B Portfolio • Average loan size: $ 1.1MM • Average monthly rent of $1,307 vs $ 2,839 1 for the market • Weighted average LTV 2 is 46%, only $11MM of loans with an LTV above 75% LTV • Weighted average DCR is ~1.8x 3 • Borrowers typically do not sell properties, but refinance to buy more properties • Average loan size: $2.2MM • Weighted average LTV 2 is 50%, no loans with an LTV above 75% • Weighted average DCR is ~1.8x 3 • Borrowers have ~50% equity • Require primary operating accounts Non - Owner Occupied CRE Geography 9% 18% 17% 22% 8% 7% 10% 3% 6% Bronx Kings Manhattan Queens Other NY Nassau Suffolk NJ CT/Other $ 1.7B Portfolio 1 CoStar New York Multifamily Market Report, 10 - 19 - 2021 2 LTVs are based on value at origination 3 Based on most recent Annual Loan Review

20 Loans Secured by Real Estate Have an Average LTV of <38 % Multifamily ▪ In market lending ▪ Review net operating income and the collateral plus the financial resources and income level of the borrower (including experience in managing or owning similar properties) ▪ ARMs adjust each 5 - year period with terms up to 30 years and comprise 81% of the portfolio; prepayment penalties are reset for each 5 - year period Commercial Real Estate ▪ Secured by in market office buildings, hotels/motels, small business facilities, strip shopping centers, and warehouses ▪ Similar underwriting standards as multifamily ▪ ARMs adjust each 5 - year period with terms up to 30 years and comprise 80% of the portfolio Well Secured and Diversified Real Estate Portfolio Data as of September 30 , 2021 59% 11% 7% 8% 4% 6% 3% 2% Multifamily: 59% General Commercial: 11% CRE - Shopping Center: 7% CRE - Strip Mall: 8% CRE - Single Tenant: 4% Office: 6% Industrial: 3% Commercial Special Use: 2% $4.2B Total Portfolio

21 Well Diversified Commercial Business Portfolio Commercial Business ▪ In market lending ▪ Annual sales up to $250MM ▪ Lines of credit and term loans including owner occupied mortgages ▪ Loans secured by business assets, including account receivables, inventory, equipment and real estate and generally require personal guarantees ▪ Originations are generally $100,000 to $10MM ▪ Adjustable rate loans with adjustment periods of five years for owner occupied mortgages and for lines of credit the adjustment period is generally monthly ▪ Generally not subject to limitations on interest rate increases but have interest rate floors Average loan size of $1MM, excluding PPP 1 9% 7% 6% 10% 6% 6% 7% 5% 5% 4% 3% 7% 5% 3% 3% 15% Hotels: 9% Manufacturing: 7% Transportation: 6% Commercial Wholesalers: 10% Medical: 6% Contractor/Construction: 6% Real Estate Management: 7% Finance & Insurance: 5% Retail: 5% Air Carriers & Air Transportation: 4% Professional Services: 3% Entertainment: 7% Business Services: 5% Not For Profit: 3% Food & Beverage: 3% Other: 15% $1.4B Total Portfolio Real Estate Collateral $ 580.4MM Data as of September 30 , 2021 1 SBA Payment Protection Program (“PPP”)

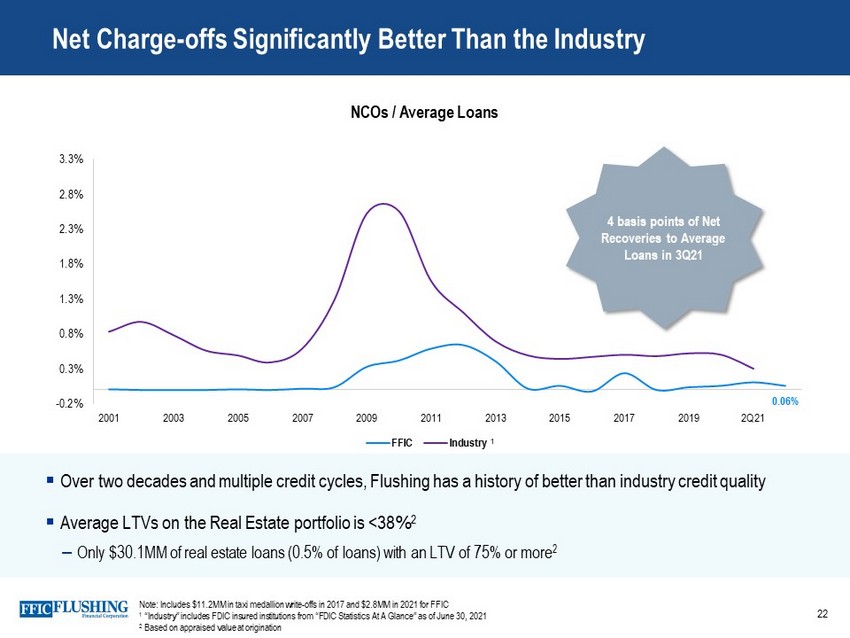

Net Charge - offs Significantly Better Than the Industry 22 NCOs / Average Loans 0.06% -0.2% 0.3% 0.8% 1.3% 1.8% 2.3% 2.8% 3.3% 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 2Q21 FFIC Industry 4 basis points of Net Recoveries to Average Loans in 3Q21 1 Note: Includes $11.2MM in taxi medallion write - offs in 2017 and $2.8MM in 2021 for FFIC 1 “Industry” includes FDIC insured institutions from “FDIC Statistics At A Glance” as of June 30, 2021 2 Based on appraised value at origination ▪ Over two decades and multiple credit cycles, Flushing has a history of better than industry credit quality ▪ Average LTVs on the Real Estate portfolio is <38% 2 – Only $30.1MM of real estate loans (0.5% of loans) with an LTV of 75% or more 2

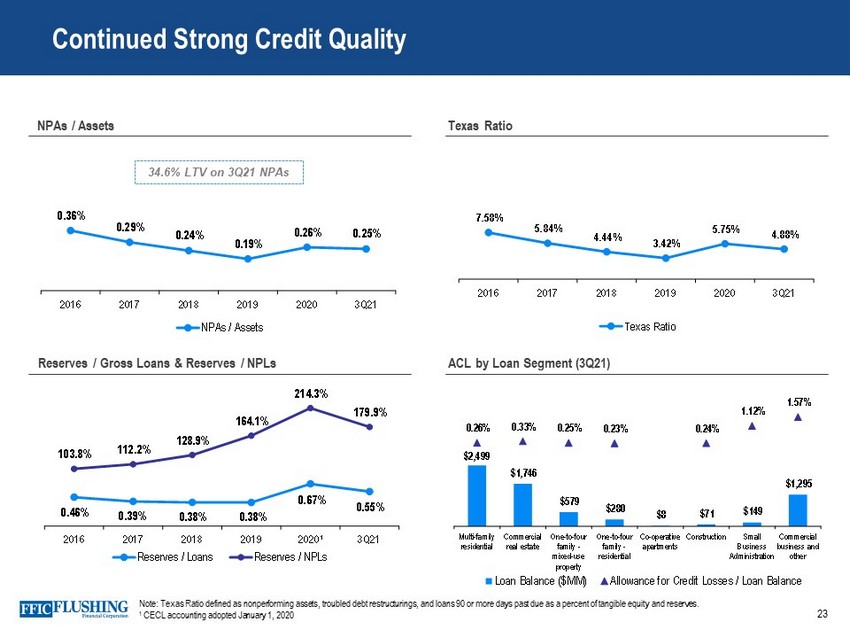

23 Continued Strong Credit Quality Note: Texas Ratio defined as nonperforming assets, troubled debt restructurings, and loans 90 or more days past due as a percent of tangible equity and reserves. 1 CECL accounting adopted January 1, 2020 NPAs / Assets Texas Ratio Reserves / Gross Loans & Reserves / NPLs ACL by Loan Segment (3Q21) 0.36% 0.29% 0.24% 0.19% 0.26% 0.25% 2016 2017 2018 2019 2020 3Q21 NPAs / Assets 34.6% LTV on 3Q21 NPAs 0.46% 0.39% 0.38% 0.38% 0.67% 0.55% 103.8% 112.2% 128.9% 164.1% 214.3% 179.9% 2016 2017 2018 2019 2020¹ 3Q21 Reserves / Loans Reserves / NPLs 7.58% 5.84% 4.44% 3.42% 5.75% 4.88% 2016 2017 2018 2019 2020 3Q21 Texas Ratio $2,499 $1,746 $579 $280 $8 $71 $149 $1,295 0.26% 0.33% 0.25% 0.23% 0.24% 1.12% 1.57% Multi-family residential Commercial real estate One-to-four family - mixed-use property One-to-four family - residential Co-operative apartments Construction Small Business Administration Commercial business and other Loan Balance ($MM) Allowance for Credit Losses / Loan Balance

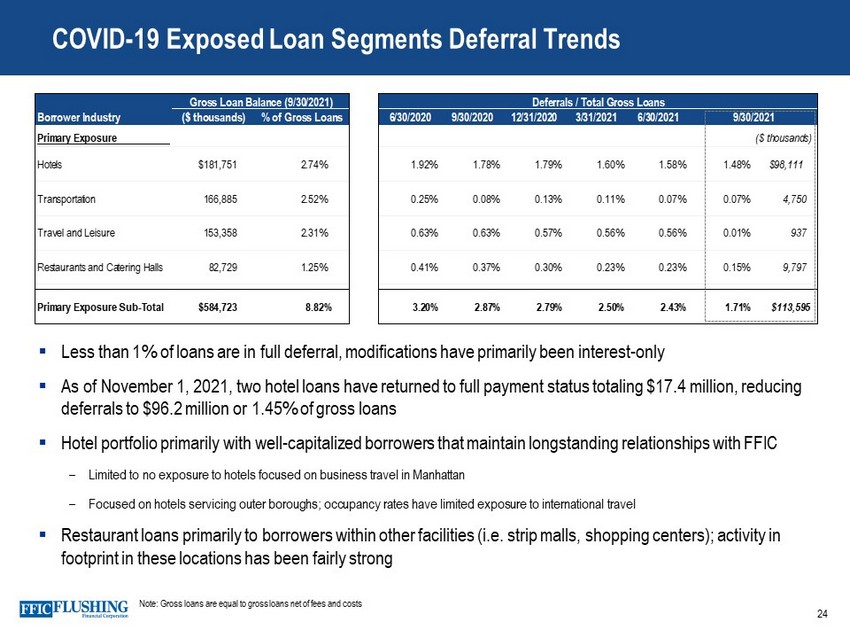

24 COVID - 19 Exposed Loan Segments Deferral Trends Note: Gross loans are equal to gross loans net of fees and costs ▪ Less than 1% of loans are in full deferral, modifications have primarily been interest - only ▪ As of November 1, 2021, two hotel loans have returned to full payment status totaling $17.4 million, reducing deferrals to $96.2 million or 1.45% of gross loans ▪ Hotel portfolio primarily with well - capitalized borrowers that maintain longstanding relationships with FFIC – Limited to no exposure to hotels focused on business travel in Manhattan – Focused on hotels servicing outer boroughs; occupancy rates have limited exposure to international travel ▪ Restaurant loans primarily to borrowers within other facilities (i.e. strip malls, shopping centers); activity in footprint in these locations has been fairly strong Gross Loan Balance (9/30/2021) Deferrals / Total Gross Loans Borrower Industry ($ thousands) % of Gross Loans Primary Exposure Hotels $181,751 2.74% Transportation 166,885 2.52% Travel and Leisure 153,358 2.31% Restaurants and Catering Halls 82,729 1.25% Primary Exposure Sub-Total $584,723 8.82% Deferrals / Total Gross Loans Mods 6/30/2020 9/30/2020 12/31/2020 3/31/2021 6/30/2021 9/30/2021 ($ thousands) 1.92% 1.78% 1.79% 1.60% 1.58% 1.48% $98,111 0.25% 0.08% 0.13% 0.11% 0.07% 0.07% 4,750 0.63% 0.63% 0.57% 0.56% 0.56% 0.01% 937 0.41% 0.37% 0.30% 0.23% 0.23% 0.15% 9,797 3.20% 2.87% 2.79% 2.50% 2.43% 1.71% $113,595

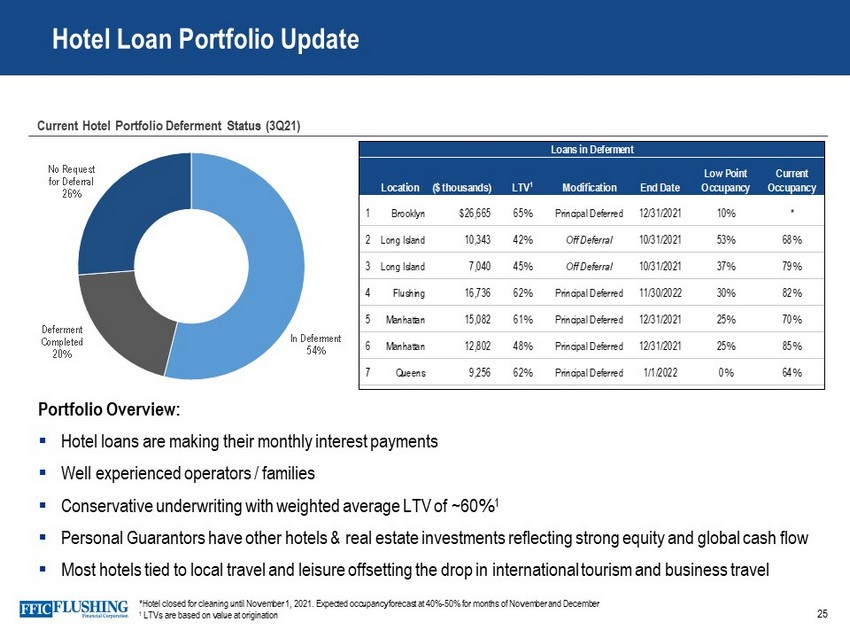

25 Hotel Loan Portfolio Update *Hotel closed for cleaning until November 1, 2021. Expected occupancy forecast at 40% - 50% for months of November and December 1 LTVs are based on value at origination Portfolio Overview: ▪ Hotel loans are making their monthly interest payments ▪ Well experienced operators / families ▪ Conservative underwriting with weighted average LTV of ~60% 1 ▪ Personal Guarantors have other hotels & real estate investments reflecting strong equity and global cash flow ▪ Most hotels tied to local travel and leisure offsetting the drop in international tourism and business travel In Deferment 54% Deferment Completed 20% No Request for Deferral 26% Current Hotel Portfolio Deferment Status (3Q21) Loans in Deferment Location ($ thousands) LTV 1 Modification End Date Low Point Occupancy Current Occupancy 1 Brooklyn $26,665 65% Principal Deferred 12/31/2021 10% * 2 Long Island 10,343 42% Off Deferral 10/31/2021 53% 68% 3 Long Island 7,040 45% Off Deferral 10/31/2021 37% 79% 4 Flushing 16,736 62% Principal Deferred 11/30/2022 30% 82% 5 Manhattan 15,082 61% Principal Deferred 12/31/2021 25% 70% 6 Manhattan 12,802 48% Principal Deferred 12/31/2021 25% 85% 7 Queens 9,256 62% Principal Deferred 1/1/2022 0% 64%

26 Liquidity & Securities Liquidity Position & Sources (3Q21) AFS Securities Portfolio (3Q21) HTM Securities Portfolio (3Q21) Agency MBS $7.9 Muni Tax Exempt $50.0 ABS $86.9 CMO $229.9 Agency MBS $354.3 Common Stock $1.5 Corporate Bonds $106.0 Mutual Fund $12.6 SBA Loan Pools $5.6 $58MM Total Portfolio $797MM Total Portfolio Excess Cash 3% FHLB Borrowing Capacity 62% Cash Lines 19% Unencumbered Securities Collateral 16% $3.3B Source $MM Excess Cash 102.9 FHLB Borrowing Capacity 2,045.9 Cash Lines with Commercial Banks 618.0 Unencumbered Securities Collateral 530.1 Total $ 3,296.9 40.8%¹ Total Liquidity / Total Assets 1 Total Liquidity to Total Assets assumes 5% haircut on unencumbered securities collateral

27 Double Leverage & Interest Coverage For the Twelve Months Ended, Year-to-Date ($ in thousands) 12/31/2018 12/31/2019 12/31/2020 9/30/2021 Investment in Subsidiaries $662,300 $685,975 $728,097 $804,449 Consolidated Equity $549,464 $579,672 $618,997 $668,096 Double Leverage Ratio 120.5% 118.3% 117.6% 120.4% Pre-Tax Income (A) $65,485 $53,331 $45,182 $86,452 Interest Expense Before New Subordinated Debt (B) $89,592 $117,016 $69,128 $31,537 Income Available to Service All Interest (C = A + B) $155,077 $170,347 $114,310 $117,989 Interest Coverage Before New Subordinated Debt (D = C / B) 1.73 1.46 1.65 3.74 New Subordinated Debt Interest (E) $3,250 $3,250 $3,250 $2,438 Total Pro Forma Interest Expense Pre-Redemption (F = B + E) $92,842 $120,266 $72,378 $33,975 Interest Coverage Pre-Redemption of Debt (G = C / F) 1.67 1.42 1.58 3.47 Interest on Current Subordinated Debt to be Redeemed (H)¹ $4,239 $4,256 $4,441 $3,921 Total Pro Forma Interest Expense Post-Redemption (I = F - H) $88,603 $116,010 $67,937 $30,054 Income Available to Service All Interest (C) $155,077 $170,347 $114,310 $117,989 Total Pro Forma Interest Expense Post-Redemption (I) $88,603 $116,010 $67,937 $30,054 Interest Coverage Post-Redemption of Debt (J = C / I) 1.75 1.47 1.68 3.93 Note: For illustrative purposes, assumes $100 million of gross proceeds from the subordinated notes (net proceeds of $98.25 million after 1.25% underwriting spread and $500k of expenses) and 0% downstreamed to the Bank; Assumes 3.25% interest rate on current issuance of subordinated debt 1 Subordinated debt to be redeemed comprised of $75.00MM of subordinated debt with a 5.25% fixed coupon callable in December 20 21 at par, $7.75MM of legacy Empire subordinated debt with a 5.00% coupon callable in December 2021 at par and $7.50MM of legacy Empire sub debt with a 7.375% coupon callable in December 2021 at 102.5

28 Pro Forma Capitalization: Holding Company Sub Debt Pro Forma Sub Debt Pro Forma Actual Issuance For Sub Debt Refinance For Sub Debt Refi ($ in thousands) 9/30/2021 Adjustments 9/30/2021 Adjustments¹ 9/30/2021 Holding Company Regulatory Capital Common Equity Tier 1 Capital $661,340 – $661,340 ($202) $661,138 Other Tier 1 Instruments 49,936 – 49,936 – 49,936 Tier 1 Capital Deductions – – – – – Tier 1 Capital 711,276 – 711,276 (202) 711,074 ALLL 33,779 – 33,779 – 33,779 Existing Sub Debt Tier 2 Capital 87,200 – 87,200 (87,200) – Proposed Sub Debt – 100,000 100,000 – 100,000 Unrealized Gain on AFS Securities – – – – – Tier 2 Capital 120,979 100,000 220,979 (87,200) 133,779 Total Capital $832,255 $100,000 $932,255 ($87,604) $844,651 Total Assets for Regulatory Ratios Risk-Weighted Assets $6,194,207 $19,650 $6,213,857 ($18,050) $6,195,807 Total Assets For Leverage Ratio $8,058,710 $98,250 $8,156,960 ($90,452) $8,066,508 TCE / TA Tangible Common Equity $648,039 – $648,039 – $648,039 Tangible Assets $8,057,277 $98,250 $8,155,527 ($90,452) $8,065,075 Capital Ratios TCE / TA 8.04% – 7.95% – 8.04% Leverage Ratio 8.83% – 8.72% – 8.82% Common Equity Tier 1 Ratio 10.68% – 10.64% – 10.67% Tier 1 Ratio 11.48% – 11.45% – 11.48% Total Capital Ratio 13.44% – 15.00% – 13.63% Note: For illustrative regulatory capital purposes , assumes $100 million of gross proceeds from the subordinated notes (net proceeds of $98.25 million after 1.25% underwriting spread and $500k of expenses) and a risk – weighting of 20% 1 Subordinated debt refinance common equity tier 1 capital impact represents call premium on $7.5 million Empire Bancorp Inc. S ubo rdinated Notes at 102.5, assuming repayment on or after December 20, 2021 and the accelerated interest expense on redemption of subordinated debt, tax effected at an illustrative 27%.

29 Historical Consolidated Regulatory Capital Ratios Tangible Common Equity / Tangible Assets (%) Tier 1 Leverage Ratio (%) Tier 1 Ratio (%) Total Risk - Based Capital Ratio (%) 8.2% 8.2% 7.8% 8.0% 7.5% 8.0% 7.9% 8.0% 2016 2017 2018 2019 2020 Sept 30 2021 Sub Debt Issuance Sub Debt Redemption 9.0% 9.0% 8.7% 8.7% 8.4% 8.8% 8.7% 8.8% 2016 2017 2018 2019 2020 Sept 30 2021 Sub Debt Issuance Sub Debt Redemption 12.6% 12.4% 11.8% 11.8% 10.5% 11.5% 11.4% 11.5% 2016 2017 2018 2019 2020 Sept 30 2021 Sub Debt Issuance Sub Debt Redemption 14.8% 14.5% 13.7% 13.6% 12.6% 13.4% 15.0% 13.6% 2016 2017 2018 2019 2020 Sept 30 2021 Sub Debt Issuance Sub Debt Redemption Q3’21 Pro Forma for: Q3’21 Pro Forma for: Q3’21 Pro Forma for: Q3’21 Pro Forma for: Historical and Pro Forma Capital for Subordinated Notes Issuance Note: See page 28 for detailed assumptions on issuance amount and illustrative terms; Financial data as of September 30, 2021

30 Investment Highlights Conservative Underwriting with History of Solid Value Creation ► Leading Community Bank in the Greater NYC Area ► Well Diversified and Low Risk Loan Portfolio ► History of Sound Credit Quality since IPO in 1995 ► Asian Banking Niche ► Beneficiary of a Steepening Yield Curve

Appendix

($ in thousands) For the Year Ended December 31, As of Quarter Ended 2016 2017 2018 2019 2020 September 30, 2021 Cash and due from banks $35,857 $51,546 $118,561 $49,787 $157,388 $178,598 Securities held to maturity: Mortgage-backed securities - 7,973 7,953 7,934 7,914 7,899 Other securities 37,735 22,913 24,065 50,954 49,918 49,989 Securities available for sale, at fair value: Mortgage-backed securities 516,476 509,650 557,953 523,849 404,460 584,145 Other securities 344,905 228,704 264,702 248,651 243,514 212,654 Loans, net of fees and costs 4,835,693 5,176,999 5,551,484 5,772,206 6,704,674 6,630,354 Less: Allowance for loan losses (22,229) (20,351) (20,945) (21,751) (45,153) (36,363) Net loans $4,813,464 $5,156,648 $5,530,539 $5,750,455 $6,659,521 $6,593,991 Interest and dividends receivable 20,228 21,405 25,485 25,722 44,041 40,912 Bank premises and equipment, net 26,561 30,836 30,418 28,676 28,179 24,018 Federal Home Loan Bank of NY stock, at cost 59,173 60,089 57,282 56,921 43,439 36,158 Bank owned life insurance 132,508 131,856 131,788 157,713 181,710 184,730 Goodwill 16,127 16,127 16,127 16,127 17,636 17,636 Other real estate owned, net - - - 239 - - Core deposit intangibles - - - - 3,172 2,708 Right of Use Asset - - - 41,254 50,743 50,155 Other assets 55,453 61,527 69,303 59,494 84,759 93,741 Total assets $6,058,487 $6,299,274 $6,834,176 $7,017,776 $7,976,394 $8,077,334 Due to depositors: Non-interest bearing 333,163 385,269 413,747 435,072 778,672 941,259 Interest-bearing 3,832,252 3,955,403 4,502,176 4,586,977 5,312,061 5,480,132 Total deposits $4,165,415 $4,340,672 $4,915,923 $5,022,049 $6,090,733 $6,421,391 Mortgagors' escrow deposits 40,216 42,606 44,861 44,375 45,622 67,207 Borrowed funds: Federal Home Loan Bank advances 1,159,190 1,198,968 1,134,993 1,118,528 887,579 611,186 Subordinated debentures 73,414 73,699 74,001 74,319 90,180 90,161 Junior subordinated debentures, at fair value 33,959 36,986 41,849 44,384 43,136 51,578 Total borrowed funds $1,266,563 $1,309,653 $1,250,843 $1,237,231 $1,020,895 $752,925 Operating lease liability - - - 49,367 59,100 54,239 Other liabilities 72,440 73,735 73,085 85,082 141,047 113,476 Total liabilities $5,544,634 $5,766,666 $6,284,712 $6,438,104 $7,357,397 $7,409,238 Stockholders' equity Common stock $315 $315 $315 $315 $341 $341 Additional paid-in capital 214,462 217,906 222,720 226,691 261,533 262,009 Treasury stock (53,754) (57,675) (75,146) (71,487) (69,400) (71,738) Retained earnings 361,192 381,048 414,327 433,960 442,789 486,418 Accumulated other comprehensive loss, net of taxes (8,362) (8,986) (12,752) (9,807) (16,266) (8,934) Total stockholders' equity $513,853 $532,608 $549,464 $579,672 $618,997 $668,096 32 Historical Consolidated Balance Sheet

33 Historical Consolidated Income Statement ($ in thousands) For the Year Ended December 31, Nine Months Ended 2016 2017 2018 2019 2020 September 30, 2021 Interest Income $220,997 $234,585 $256,998 $278,956 $264,327 $216,832 Interest Expense 53,911 61,478 89,592 117,016 69,128 31,537 Net Interest Income $167,086 $173,107 $167,406 $161,940 $195,199 $185,295 Provision (Benefit) for Loan and Losses - 9,861 575 2,811 22,563 (5,705) Net Interest income after provision for credit loss $167,086 $163,246 $166,831 $159,129 $172,070 $191,000 Banking services fee income $3,758 $4,156 $4,030 $3,723 $4,500 $4,823 Net gain on sale of loans 584 603 168 870 48 289 Net (loss) gain on sale of securities 1,524 (186) (1,920) (15) (701) 113 Net gain on sale of assets 48,018 - 1,141 770 - 621 Net loss from fair value adjustments (3,434) (3,465) (4,122) (5,353) (2,142) (7,855) Federal Home Loan Bank of New York stock dividends 2,664 3,081 3,576 3,589 3,453 1,680 Life insurance proceeds 460 1,405 2,998 462 659 - Bank owned life insurance 2,797 3,227 3,099 3,534 3,814 3,021 Other income 1,165 1,541 1,367 1,891 1,412 1,275 Total Noninterest Income $57,536 $10,362 $10,337 $9,471 $11,043 $3,967 Compensation & Benefits $60,825 $62,087 $64,560 $67,765 $74,228 $63,087 Occupancy & Equipment 9,848 10,409 10,079 11,328 12,134 10,423 Professional services 7,720 7,500 8,360 8,358 9,374 6,287 FDIC deposit insurance 2,993 1,815 2,115 869 2,676 2,560 Data processing 4,364 5,238 5,663 5,878 8,586 5,287 Depreciation and amortization 4,450 4,832 5,792 5,930 6,212 4,904 Other real estate owned / foreclosure expense 1,307 404 (94) 204 216 194 Net loss (gain) from sales of real estate owned - (50) (27) - 36 - Prepayment penalty on borrowings 10,356 - - - 7,834 - Other Operating Expenses 16,740 15,239 15,235 14,937 16,635 15,773 Total Noninterest Expense $118,603 $107,474 $111,683 $115,269 $137,931 $108,515 Pre-Tax Income $106,019 $66,134 $65,485 $53,331 $45,182 $86,452 Provision for Taxes 41,103 25,013 10,395 12,052 10,508 22,742 Effective Tax Rate (%) 38.8% 37.8% 15.9% 22.6% 23.3% 26.3% Net Income $64,916 $41,121 $55,090 $41,279 $34,674 $63,710

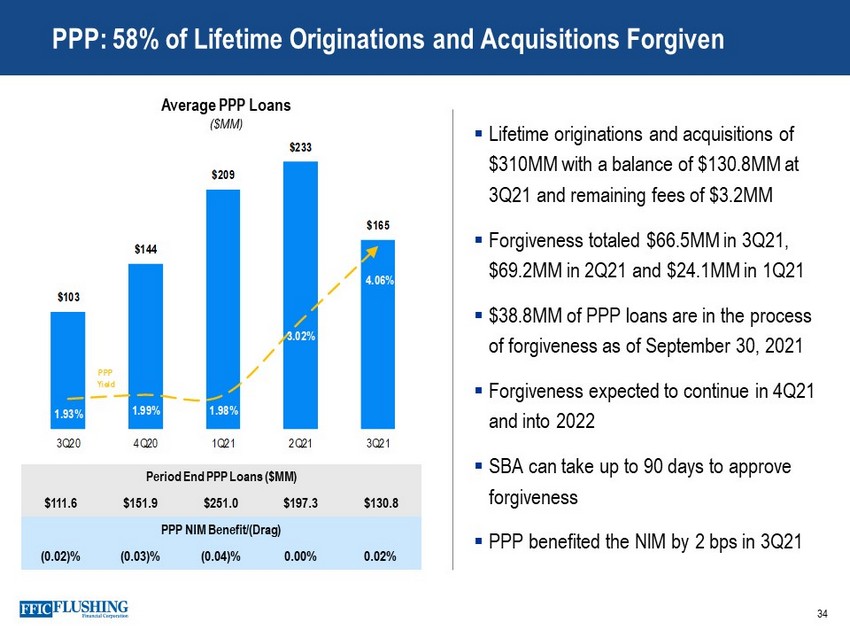

PPP: 58% of Lifetime Originations and Acquisitions Forgiven 34 Period End PPP Loans ($MM) $111.6 $151.9 $251.0 $197.3 $130.8 Average PPP Loans ($MM) PPP NIM Benefit/(Drag) (0.02)% (0.03)% (0.04)% 0.00% 0.02% ▪ Lifetime originations and acquisitions of $310MM with a balance of $130.8MM at 3Q21 and remaining fees of $3.2MM ▪ Forgiveness totaled $66.5MM in 3Q21, $69.2MM in 2Q21 and $24.1MM in 1Q21 ▪ $38.8MM of PPP loans are in the process of forgiveness as of September 30, 2021 ▪ Forgiveness expected to continue in 4Q21 and into 2022 ▪ SBA can take up to 90 days to approve forgiveness ▪ PPP benefited the NIM by 2 bps in 3Q21 $103 $144 $209 $233 $165 1.93% 1.99% 1.98% 3.02% 4.06% 0 50 100 150 200 250 3Q20 4Q20 1Q21 2Q21 3Q21 PPP Yield

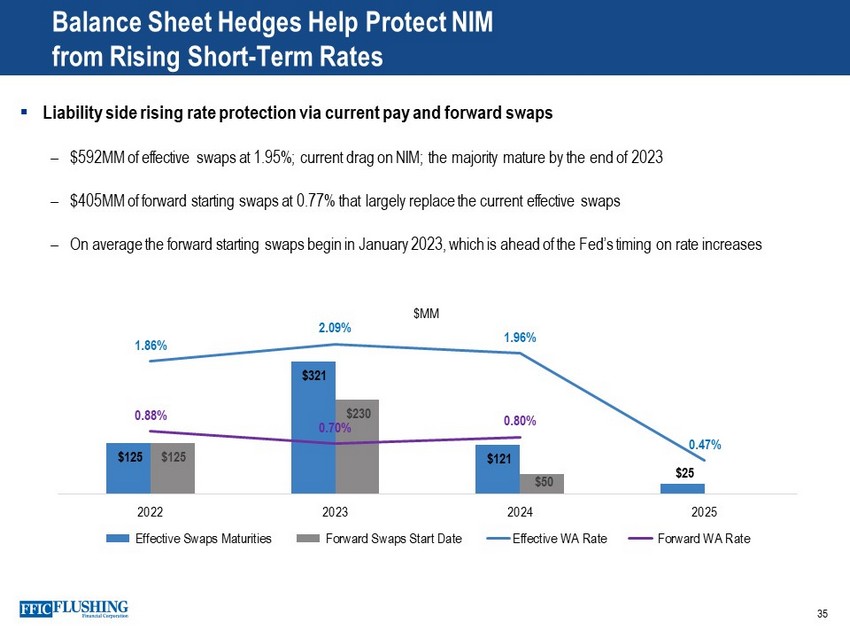

▪ Liability side rising rate protection via current pay and forward swaps – $592MM of effective swaps at 1.95%; current drag on NIM; the majority mature by the end of 2023 – $405MM of forward starting swaps at 0.77% that largely replace the current effective swaps – On average the forward starting swaps begin in January 2023, which is ahead of the Fed’s timing on rate increases 35 Balance Sheet Hedges Help Protect NIM from Rising Short - Term Rates $125 $321 $121 $25 $125 $230 $50 1.86% 2.09% 1.96% 0.47% 0.88% 0.70% 0.80% 2022 2023 2024 2025 Effective Swaps Maturities Forward Swaps Start Date Effective WA Rate Forward WA Rate $MM

Non - cash Fair Value Adjustments to GAAP Earnings The variance in GAAP and core earnings is partly driven by the impact of non - cash net gains and losses from fair value adjustments . These fair value adjustments relate primarily to swaps designated to protect against rising rates and borrowing carried at fair value under the fair value option . As the swaps get closer to maturity, the volatility in fair value adjustments will dissipate . In a declining interest rate environment, the movement in the curve exaggerates our mark - to - market loss position . In a rising interest rate environment or a steepening of the yield curve, the loss position would experience an improvement . Core Net Income, Core Diluted EPS, Core ROAE, Core ROAA, Core Net Interest Income FTE, Core Net Interest Margin FTE, Base Net Interest Income FTE, Base Net Interest Margin FTE, Core Interest Income and Yield on Total Loans, Base Interest Income and Yield on Total Loans, Core Non - interest Income, Core Non - interest Expense and Tangible Book Value per common share are each non - GAAP measures used in this presentation . A reconciliation to the most directly comparable GAAP financial measures appears below in tabular form . The Company believes that these measures are useful for both investors and management to understand the effects of certain interest and non - interest items and provide an alternative view of the Company's performance over time and in comparison to the Company's competitors . These measures should not be viewed as a substitute for net income . The Company believes that tangible book value per common share is useful for both investors and management as these are measures commonly used by financial institutions, regulators and investors to measure the capital adequacy of financial institutions . The Company believes these measures facilitate comparison of the quality and composition of the Company's capital over time and in comparison to its competitors . These measures should not be viewed as a substitute for total shareholders' equity . These non - GAAP measures have inherent limitations, are not required to be uniformly applied and are not audited . They should not be considered in isolation or as a substitute for analysis of results reported under GAAP . These non - GAAP measures may not be comparable to similarly titled measures reported by other companies . 36 Reconciliation of GAAP Earnings and Core Earnings

37 (Dollars in thousands, except per share data) GAAP income before income taxes $ 34,812 $ 25,416 $ 26,224 $ 3,878 $ 18,820 $ 86,452 $ 41,304 Day 1, Provision for Credit Losses - Empire transaction (Provision for credit losses) — — — 1,818 — — — Net (gain) loss from fair value adjustments (Non-interest income (loss)) 2,289 6,548 (982) 4,129 2,225 7,855 (1,987) Net (gain) loss on sale of securities (Non-interest income (loss)) 10 (123) — 610 — (113) 91 Life insurance proceeds (Non-interest income (loss)) — — — — — — (659) Net gain on disposition of assets (Non-interest income (loss)) — — (621) — — (621) — Net (gain) loss from fair value adjustments on qualifying hedges (Interest and fees on loans) (194) 664 (1,427) (1,023) (230) (957) 2,208 Prepayment penalty on borrowings (Non-interest expense) — — — 7,834 — — — Net amortization of purchase accounting adjustments (Various) (958) (418) (789) 80 — (2,165) — Merger (benefit) expense (Various) 2,096 (490) 973 5,349 422 2,579 1,545 Core income before taxes 38,055 31,597 23,378 22,675 21,237 93,030 42,502 Provision for income taxes for core income 10,226 8,603 6,405 4,891 5,069 25,234 10,537 Core net income $ 27,829 $ 22,994 $ 16,973 $ 17,784 $ 16,168 $ 67,796 $ 31,965 GAAP diluted earnings per common share $ 0.81 $ 0.61 $ 0.60 $ 0.11 $ 0.50 $ 2.02 $ 1.08 Day 1, Provision for Credit Losses - Empire transaction, net of tax — — — 0.05 — — — Net (gain) loss from fair value adjustments, net of tax 0.05 0.15 (0.02) 0.11 0.06 0.18 (0.05) Net loss on sale of securities, net of tax — — �� 0.02 — — — Life insurance proceeds — — — — — — (0.02) Net gain on disposition of assets, net of tax — — (0.01) — — (0.01) — Net (gain) loss from fair value adjustments on qualifying hedges, net of tax — 0.02 (0.03) (0.03) (0.01) (0.02) 0.06 Prepayment penalty on borrowings, net of tax — — — 0.20 — — — Net amortization of purchase accounting adjustments, net of tax (0.02) (0.01) (0.02) — — (0.05) — Merger (benefit) expense, net of tax 0.05 (0.01) 0.02 0.14 0.01 0.06 0.04 NYS tax change — (0.02) — — — (0.02) — Core diluted earnings per common share (1) $ 0.88 $ 0.73 $ 0.54 $ 0.58 $ 0.56 $ 2.14 $ 1.11 Core net income, as calculated above $ 27,829 $ 22,994 $ 16,973 $ 17,784 $ 16,168 $ 67,796 $ 31,965 Average assets 8,072,918 8,263,553 8,147,714 7,705,407 7,083,028 8,161,121 7,131,850 Average equity 659,288 644,690 619,647 609,463 576,512 641,354 570,198 Core return on average assets (2) 1.38 % 1.11 % 0.83 % 0.92 % 0.91 % 1.11 % 0.60 % Core return on average equity (2) 16.88 % 14.27 % 10.96 % 11.67 % 11.22 % 14.09 % 7.47 % For the three months ended For the nine months ended September 30, 2021 2020 September 30, March 31, December 31, 2020 2020 September 30, 2021 September 30, June 30, 2021 2021 1 Core diluted earnings per common share may not foot due to rounding 2 Ratios are calculated on an annualized basis Reconciliation of GAAP NII & NIM to CORE and Base NII & NIM

38 Reconciliation of GAAP Revenue and Pre - provision Pre - tax Net Revenue (Dollars in thousands) GAAP Net interest income $ 63,364 $ 61,039 $ 60,892 $ 55,732 $ 49,924 $ 185,295 $ 139,467 Net (gain) loss from fair value adjustments on qualifying hedges (194) 664 (1,427) (1,023) (230) (957) 2,208 Net amortization of purchase accounting adjustments (1,100) (565) (922) (11) — (2,587) — Core Net interest income $ 62,070 $ 61,138 $ 58,543 $ 54,698 $ 49,694 $ 181,751 $ 141,675 GAAP Non-interest income (loss) $ 866 $ (3,210) $ 6,311 $ (1,181) $ 1,351 $ 3,967 $ 12,224 Net (gain) loss from fair value adjustments 2,289 6,548 (982) 4,129 2,225 7,855 (1,987) Net loss on sale of securities 10 (123) — 610 — (113) 91 Life insurance proceeds — — — — — — (659) Net gain on sale of assets — — (621) — — (621) — Core Non-interest income $ 3,165 $ 3,215 $ 4,708 $ 3,558 $ 3,576 $ 11,088 $ 9,669 GAAP Non-interest expense $ 36,345 $ 34,011 $ 38,159 $ 46,811 $ 29,985 $ 108,515 $ 91,120 Prepayment penalty on borrowings — — — (7,834) — — — Net amortization of purchase accounting adjustments (142) (147) (133) (91) — (422) — Merger (benefit) expense (2,096) 490 (973) (5,349) (422) (2,579) (1,545) Core Non-interest expense $ 34,107 $ 34,354 $ 37,053 $ 33,537 $ 29,563 $ 105,514 $ 89,575 Net interest income $ 63,364 $ 61,039 $ 60,892 $ 55,732 $ 49,924 $ 185,295 $ 139,467 Non-interest income (loss) 866 (3,210) 6,311 (1,181) 1,351 3,967 12,224 Non-interest expense (36,345) (34,011) (38,159) (46,811) (29,985) (108,515) (91,120) Pre-provision pre-tax net revenue $ 27,885 $ 23,818 $ 29,044 $ 7,740 $ 21,290 $ 80,747 $ 60,571 Core: Net interest income $ 62,070 $ 61,138 $ 58,543 $ 54,698 $ 49,694 $ 181,751 $ 141,675 Non-interest income 3,165 3,215 4,708 3,558 3,576 11,088 9,669 Non-interest expense (34,107) (34,354) (37,053) (33,537) (29,563) (105,514) (89,575) Pre-provision pre-tax net revenue $ 31,128 $ 29,999 $ 26,198 $ 24,719 $ 23,707 $ 87,325 $ 61,769 Efficiency Ratio 52.3 % 53.4 % 58.6 % 57.6 % 55.4 % 54.7 % 59.1 % For the three months ended For the nine months ended September 30, June 30, March 31, December 31, September 30, September 30, September 30, 20202021 2021 2021 2020 2020 2021

39 (Dollars in thousands) GAAP net interest income $ 63,364 $ 61,039 $ 60,892 $ 55,732 $ 49,924 $ 185,295 $ 139,467 Net (gain) loss from fair value adjustments on qualifying hedges (194) 664 (1,427) (1,023) (230) (957) 2,208 Net amortization of purchase accounting adjustments (1,100) (565) (922) (11) — (2,587) — Tax equivalent adjustment 113 113 111 114 117 337 394 Core net interest income FTE $ 62,183 $ 61,251 $ 58,654 $ 54,812 $ 49,811 $ 182,088 $ 142,069 Prepayment penalties received on loans and securities, net of reversals and recoveries of interest from non-accrual loans (2,136) (2,046) (948) (1,093) (1,518) (5,130) (3,483) Base net interest income FTE $ 60,047 $ 59,205 $ 57,706 $ 53,719 $ 48,293 $ 176,958 $ 138,586 Total average interest-earning assets (1) $ 7,616,332 $ 7,799,176 $ 7,676,833 $ 7,245,147 $ 6,675,896 $ 7,697,229 $ 6,734,979 Core net interest margin FTE 3.27 % 3.14 % 3.06 % 3.03 % 2.98 % 3.15 % 2.81 % Base net interest margin FTE 3.15 % 3.04 % 3.01 % 2.97 % 2.89 % 3.07 % 2.74 % GAAP interest income on total loans, net $ 69,198 $ 67,999 $ 69,021 $ 66,120 $ 60,367 $ 206,218 $ 182,033 Net (gain) loss from fair value adjustments on qualifying hedges (194) 664 (1,427) (1,023) (230) (957) 2,208 Net amortization of purchase accounting adjustments (1,126) (624) (728) (356) — (2,478) — Core interest income on total loans, net $ 67,878 $ 68,039 $ 66,866 $ 64,741 $ 60,137 $ 202,783 $ 184,241 Prepayment penalties received on loans, net of reversals and recoveries of interest from non- accrual loans (2,135) (2,046) (947) (1,093) (1,443) (5,128) (3,408) Base interest income on total loans, net $ 65,743 $ 65,993 $ 65,919 $ 63,648 $ 58,694 $ 197,655 $ 180,833 Average total loans, net (1) $ 6,642,434 $ 6,697,103 $ 6,711,446 $ 6,379,429 $ 5,904,051 $ 6,683,412 $ 5,881,858 Core yield on total loans 4.09 % 4.06 % 3.99 % 4.06 % 4.07 % 4.05 % 4.18 % Base yield on total loans 3.96 % 3.94 % 3.93 % 3.99 % 3.98 % 3.94 % 4.10 % For the nine months ended September 30, September 30, 2021 20202021 2021 2021 2020 2020 For the three months ended September 30, June 30, March 31, December 31, September 30, Note: Core and Base yield on total loans calculated as core interest income on total loans, net and Base interest income on total l oan s, net, respectively divided by average total loans, annualized 1 Excludes purchase accounting average balances for the quarters ended September 30, 2021, June 30, 2021, March, 31, 2021, and December 31, 2020 Reconciliation of GAAP NII & NIM to CORE and Base NII & NIM

40 Calculation of Tangible Stockholders’ Common Equity to Tangible Assets September 30, December 31, December 31, December 31, December 31, December 31, (Dollars in thousands) 2021 2020 2019 2018 2017 2016 Total Equity $ 668,096 $ 618,997 $ 579,672 $ 549,464 $ 532,608 $ 513,853 Less: Goodwill (17,636) (17,636) (16,127) (16,127) (16,127) (16,127) Core deposit Intangibles (2,708) (3,172) ----- ----- ----- ----- -- Intangible deferred tax liabilities 287 287 292 290 291 389 Tangible Stockholders' Common Equity $ 648,039 $ 598,476 $ 563,837 $ 533,627 $ 516,772 $ 498,115 Total Assets $ 8,077,334 $ 7,976,394 $ 7,017,776 $ 6,834,176 $ 6,299,274 $ 6,058,487 Less: Goodwill (17,636) (17,636) (16,127) (16,127) (16,127) (16,127) Core deposit Intangibles (2,708) (3,172) ----- ----- ----- ----- Intangible deferred tax liabilities 287 287 292 290 291 389 Tangible Assets $ 8,057,277 $ 7,955,873 $ 7,001,941 $ 6,818,339 $ 6,283,438 $ 6,042,749 Tangible Stockholders' Common Equity to Tangible Assets 8.04 % 7.52 % 8.05 % 7.83 % 8.22 % 8.24 %