| | | |

| Vanguard® Tax-Managed Funds | | |

| | | |

| | | |

| | | |

| > Annual Report | | |

| | | |

| | | |

| | | |

| December 31, 2006 | | |

| | | |

|

|

| | |

| | |

| Vanguard Tax-Managed Balanced Fund | |

| | |

| Vanguard Tax-Managed Growth and Income Fund | |

| | |

| Vanguard Tax-Managed Capital Appreciation Fund | |

| | |

| Vanguard Tax-Managed Small-Cap Fund | |

| | |

| Vanguard Tax-Managed International Fund | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | |

> | Vanguard Tax-Managed Fund returns ranged from 26.3% (Investor Shares) for the international portfolio to 9.1% for the balanced fund. |

> | Gains were strong across stock sectors, particularly among financials, telecommunication services, and commodities stocks. |

> | The funds have continued to avoid any taxable capital gain distributions to shareholders. |

Contents | |

| |

Your Fund’s Total Returns | 1 |

Chairman’s Letter | 2 |

Tax-Managed Balanced Fund | 8 |

Tax-Managed Growth and Income Fund | 16 |

Tax-Managed Capital Appreciation Fund | 26 |

Tax-Managed Small-Cap Fund | 36 |

Tax-Managed International Fund | 45 |

Your Fund’s After-Tax Returns | 58 |

About Your Fund’s Expenses | 60 |

Glossary | 62 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the cover of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Fiscal Year Ended December 31, 2006 | |

| Total |

| Returns |

Vanguard Tax-Managed Balanced Fund | 9.1% |

Tax-Managed Balanced Composite Index1 | 9.6 |

Average Mixed-Asset Target Moderate Fund2 | 11.1 |

| |

Vanguard Tax-Managed Growth and Income Fund | |

Investor Shares | 15.7% |

Admiral™ Shares3 | 15.8 |

Institutional Shares4 | 15.8 |

S&P 500 Index | 15.8 |

Average Large-Cap Core Fund2 | 13.5 |

| |

Vanguard Tax-Managed Capital Appreciation Fund | |

Investor Shares | 14.4% |

Admiral Shares | 14.4 |

Institutional Shares | 14.5 |

Russell 1000 Index | 15.5 |

Average Multi-Cap Core Fund2 | 13.3 |

| |

Vanguard Tax-Managed Small-Cap Fund | |

Investor Shares | 14.2% |

Institutional Shares | 14.2 |

S&P SmallCap 600 Index | 15.1 |

Average Small-Cap Core Fund2 | 14.9 |

| |

Vanguard Tax-Managed International Fund | |

Investor Shares | 26.3% |

Institutional Shares | 26.4 |

MSCI EAFE Index | 26.3 |

Average International Fund2 | 24.8 |

1 50% Russell 1000 Index, 50% Lehman Brothers 7 Year Municipal Bond Index.

2 Derived from data provided by Lipper Inc.

3 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

4 This class of shares also carries low expenses and is available for a minimum investment of $5 million.

1

Chairman’s Letter

Dear Shareholder,

Calendar-year 2006 provided robust gains across stock markets, particularly outside the United States. Gains were more modest for bonds, given rising interest rates during the first half of the year. The returns of the Vanguard Tax-Managed Funds ranged from 9.1% for the Tax-Managed Balanced Fund to 26.3% for the Investor Shares of the Tax-Managed International Fund.

The funds met their tax-management objectives, as they have since their inceptions. From the Performance at a Glance chart on page 7, you can see that the funds’ managers, Vanguard’s Quantitative Equity and Fixed Income Groups, continued to avoid distributing capital gains, even after four consecutive years of positive stock performance. The funds’ managers used a variety of strategies to avoid realizing capital gains, yet strayed from a pure indexing strategy as little as possible. Some of the funds also focus on minimizing dividend income, which is taxable at 15% for most investors. For the year, this strategy hurt performance relative to several of the funds’ target indexes, because the highest-yielding stocks were the top performers in the market.

Strong second half pushed stocks to new high

Beginning in mid-July, stocks climbed steadily through the remainder of the year, with the Dow Jones Industrial Average setting a record high on December 27. For the year, the broad U.S. stock market gained 15.9%. Despite a soft housing

2

sector and ongoing troubles within the U.S. auto industry, the economy continued to grow and corporate profits remained strong.

For the year, small-capitalization stocks beat out large-cap issues, and value stocks outperformed their growth-oriented counterparts. International stocks continued to best domestic equities, particularly in emerging markets and Europe. A declining dollar further enhanced returns abroad for U.S.-based investors.

Bond returns remained modest as the Fed paused its rate hikes

The Federal Reserve Board extended its money-tightening campaign during the first half of the year, raising its target for the federal funds rate four times. The Fed then paused, leaving the target rate unchanged at 5.25% for the rest of the year, and inflation fears eased. Bond yields declined in the second half of the year, and short-term yields were higher than longer-term yields.

Fixed income returns for 2006 were modest, with the broad taxable bond market returning 4.3% and municipal bonds providing 4.8%.

All sectors notched gains; value segments were extra-strong

Returns were clustered between 14% and 16% for Vanguard Tax-Managed Small-Cap, Capital Appreciation, and Growth and Income Funds. These funds invest, respectively, in small-cap, large- and mid-cap, and large-cap stocks. In all three cases, returns were positive across all ten economic sectors encompassed by the funds.

Market Barometer | | | |

| | Average Annual Total Returns |

| Periods Ended December 31, 2006 |

| One Year | Three Years | Five Years |

Stocks | | | |

Russell 1000 Index (Large-caps) | 15.5% | 11.0% | 6.8% |

Russell 2000 Index (Small-caps) | 18.4 | 13.6 | 11.4 |

Dow Jones Wilshire 5000 Index (Entire market) | 15.9 | 11.5 | 7.6 |

MSCI All Country World Index ex USA (International) | 27.2 | 21.8 | 16.9 |

| | | |

Bonds | | | |

Lehman Aggregate Bond Index (Broad taxable market) | 4.3% | 3.7% | 5.1% |

Lehman Municipal Bond Index | 4.8 | 4.3 | 5.5 |

Citigroup 3-Month Treasury Bill Index | 4.8 | 3.0 | 2.3 |

| | | |

CPI | | | |

Consumer Price Index | 2.5% | 3.1% | 2.7% |

3

For the two funds in this group of three that focus on larger stocks, one of the strongest categories was financials stocks, which represented roughly one-fifth of the holdings in both Capital Appreciation and Growth and Income. Banks, brokerage firms, asset managers, real estate investment trusts (REITs), and commodity stock exchanges all turned in excellent performances. Not only did many of these companies produce record earnings, but they also benefited from an active market for mergers and acquisitions (M&As). Such activity often boosts the stocks of both acquired companies and those companies the market deems likely to be acquired.

The M&A theme also played out among companies in telecommunication services, the best-performing sector in both the Capital Appreciation and Growth and Income Funds. Merger partners BellSouth and AT&T were up 80% and 53%, respectively, and competitor Verizon rose 35%. Other strong gains came in the energy, utilities, and materials sectors. Health care and information technology were the weakest sectors, with gains in the single digits.

Within small-cap stocks, the industrials sector made the greatest contribution to returns. Many industrial companies benefited from a strong export market for goods ranging from air compressors, to lighting equipment, to refrigeration equipment. Within this category, defense contractors also performed well. Financials provided the second-largest contribution to returns, with REITs, insurance companies, and banks driving gains.

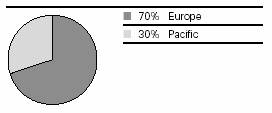

Turning to international markets, the Tax-Managed International Fund’s 26.3% gain (Investor Shares) reflected prospering economies across Europe. As in the United States, economic growth was strong and M&A activity was a factor. U.S. investors also benefited from the dollar’s decline against most major currencies, which boosts returns when gains are translated into U.S. dollars. For the year, the dollar was down 10.2% versus the euro and 12.2% against the British pound. After soaring in 2005, the Japanese economy cooled in 2006, hurting returns in that market.

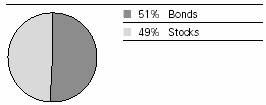

The Tax-Managed Balanced Fund’s 9.1% gain reflected its equal weighting between a stock index and a municipal bond index that returned 15.5% and 4.0%, respectively.

Funds start with advantages that grow each April

From the chart on page 5, you can see that each of the Tax-Managed Funds is ahead of the average return for peer funds within its category. This achievement reflects the skillful execution of a disciplined and broadly diversified tax-management strategy, as well as the funds’ low costs.

4

The chart shows only pre-tax returns. The funds’ performance advantage would widen on an after-tax basis because, unlike many peers, the funds have not generated capital gains distributions to shareholders. Taxes are due each April on any capital gain distribution that investors received in the prior year. Investors in Vanguard’s Tax-Managed Funds have never had to pay taxes for merely holding the fund—only when they sell shares that have appreciated. By keeping an eye on the tax consequences of each stock purchase or sale, Vanguard’s managers hope to continue this record for years to come.

Funds are structured to protect interests of long-term investors

The Vanguard Tax-Managed Funds charge a 1% fee to investors who redeem any portion of their investment within five

Total Returns | | |

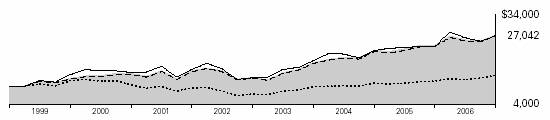

Ten Years Ended December 31, 20061 | | |

| Average | Final Value of a $10,000 |

| Annual Return | Initial Investment |

Tax-Managed Balanced Fund | 7.2% | $20,130 |

Tax-Managed Balanced Composite Index2 | 7.3 | 20,194 |

Average Mixed-Asset Target Moderate Fund3 | 6.6 | 18,924 |

| | |

Tax-Managed Growth and Income Fund Investor Shares | 8.4% | $22,461 |

S&P 500 Index | 8.4 | 22,447 |

Average Large-Cap Core Fund3 | 6.7 | 19,050 |

| | |

Tax-Managed Capital Appreciation Fund Investor Shares | 8.6% | $22,920 |

Russell 1000 Index | 8.6 | 22,914 |

Average Multi-Cap Core Fund3 | 7.9 | 21,468 |

| | |

Tax-Managed Small-Cap Fund Investor Shares | 13.7% | $27,042 |

S&P SmallCap 600 Index | 13.5 | 26,791 |

Average Small-Cap Core Fund3 | 13.6 | 26,910 |

| | |

Tax-Managed International Fund Investor Shares | 6.8% | $16,207 |

MSCI EAFE Index | 6.7 | 16,167 |

Average International Fund3 | 6.3 | 15,721 |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

1 Annualized returns are since inception for the Tax-Managed Small-Cap Fund (March 25, 1999) and the Tax-Managed International Fund (August 17, 1999).

2 50% Russell 1000 Index, 50% Lehman Brothers 7 Year Municipal Bond Index.

3 Derived from data provided by Lipper Inc.

5

years of opening a Tax-Managed Fund account. This policy benefits our investors in two ways:

• Any redemption fees are retained by the fund in order to offset transaction costs caused by redemptions.

• The penalty helps to screen out short-term investors, who increase transactions within the fund and make it more difficult to control the timing and tax consequences of sales from the portfolio.

Vanguard’s success as a mutual fund company turns on being a responsible caretaker of our clients’ money. That entails charging low fees for industry-leading products and encouraging responsible behavior: Invest for the long-term and remain diversified. This tax-managed group of funds is itself a diversified offering, and it can be used in combination with other Vanguard funds to design a portfolio that matches your own time horizon, risk tolerance, and investment goals.

Expense Ratios1 | |

Your fund compared with its peer group | |

| Expense |

Tax-Managed Fund | Ratio |

Balanced | 0.12% |

Average Mixed-Asset Target Moderate Fund | 1.15 |

Growth and Income | |

Investor Shares | 0.15% |

Admiral Shares | 0.10 |

Institutional Shares | 0.07 |

Average Large-Cap Core Fund | 1.41 |

Capital Appreciation | |

Investor Shares | 0.15% |

Admiral Shares | 0.10 |

Institutional Shares | 0.07 |

Average Multi-Cap Core Fund | 1.28 |

Small-Cap | |

Investor Shares | 0.14% |

Institutional Shares | 0.09 |

Average Small-Cap Core Fund | 1.53 |

International | |

Investor Shares | 0.20% |

Institutional Shares | 0.14 |

Average International Fund | 1.65 |

1 Fund expense ratios reflect the 12 months ended December 31, 2006. Peer-group expense ratios are derived from data provided by Lipper Inc. and capture information through year-end 2005.

6

Thank you for investing your assets with Vanguard.

Sincerely,

John J. Brennan

Chairman and Chief Executive Officer

January 18, 2007

Your Fund’s Performance at a Glance | | | | |

December 31, 2005–December 31, 2006 | | | | |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

Tax-Managed Fund | Share Price | Share Price | Dividends | Gains |

Balanced | $18.88 | $20.02 | $0.550 | $0.000 |

Growth and Income | | | | |

Investor Shares | $27.15 | $30.87 | $0.511 | $0.000 |

Admiral Shares | 55.80 | 63.44 | 1.077 | 0.000 |

Institutional Shares | 27.15 | 30.87 | 0.534 | 0.000 |

Capital Appreciation | | | | |

Investor Shares | $29.80 | $33.62 | $0.472 | $0.000 |

Admiral Shares | 60.00 | 67.68 | 0.990 | 0.000 |

Institutional Shares | 29.81 | 33.63 | 0.500 | 0.000 |

Small-Cap | | | | |

Investor Shares | $22.70 | $25.72 | $0.194 | $0.000 |

Institutional Shares | 22.74 | 25.77 | 0.207 | 0.000 |

International | | | | |

Investor Shares | $11.48 | $14.16 | $0.336 | $0.000 |

Institutional Shares | 11.48 | 14.17 | 0.343 | 0.000 |

8

Tax-Managed Balanced Fund

Fund Profile

As of December 31, 2006

Total Fund Characteristics | |

| |

Yield | 2.6% |

Turnover Rate | 4% |

Expense Ratio | 0.12% |

Short-Term Reserves | 0% |

Total Fund Volatility Measures1 | |

| Fund Versus | Fund Versus |

| Composite Index2 | Broad Index3 |

R-Squared | 0.99 | 0.85 |

Beta | 1.00 | 0.47 |

Equity Characteristics | | | |

| | Comparative | Broad |

| Fund | Index4 | Index3 |

Number of Stocks | 599 | 987 | 4,964 |

Median Market Cap | $41.1B | $41.8B | $30.7B |

Price/Earnings Ratio | 17.3x | 17.5x | 18.0x |

Price/Book Ratio | 2.9x | 2.9x | 2.8x |

Dividend Yield | 1.5% | 1.8% | 1.7% |

Return on Equity | 18.9% | 18.8% | 17.8% |

Earnings Growth Rate | 20.2% | 18.6% | 18.5% |

Foreign Holdings | 0.0% | 0.0% | 1.1% |

Sector Diversification (% of equity portfolio) |

| | Comparative | Broad |

| Fund | Index4 | Index3 |

Consumer Discretionary | 12% | 11% | 12% |

Consumer Staples | 8 | 9 | 9 |

Energy | 9 | 9 | 9 |

Financials | 21 | 22 | 23 |

Health Care | 13 | 12 | 12 |

Industrials | 11 | 11 | 11 |

Information Technology | 17 | 15 | 15 |

Materials | 3 | 3 | 3 |

Telecommunication Services | 3 | 4 | 3 |

Utilities | 3 | 4 | 3 |

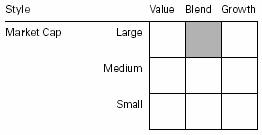

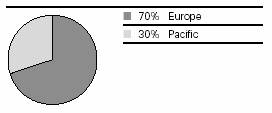

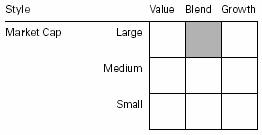

Equity Investment Focus

Ten Largest Stocks5 (% of equity portfolio) | |

| | |

ExxonMobil Corp. | integrated oil and gas | 3.4% |

General Electric Co. | industrial conglomerates | 2.6 |

Citigroup, Inc. | diversified financial services | 2.0 |

Microsoft Corp. | systems software | 1.9 |

Bank of America Corp. | diversified financial services | 1.6 |

The Procter & Gamble Co. | household products | 1.6 |

Johnson & Johnson | pharmaceuticals | 1.4 |

Cisco Systems, Inc. | communications equipment | 1.2 |

Pfizer Inc. | pharmaceuticals | 1.2 |

American International Group, Inc. | multi-line insurance | 1.1 |

Top Ten | | 18.0% |

Top Ten as % of Total Net Assets | 8.9% |

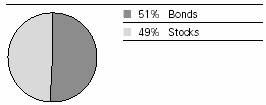

Fund Asset Allocation

1 For an explanation of R-squared, beta, and other terms used here, see the Glossary on pages 62–63.

2 50% Russell 1000 Index, 50% Lehman 7 Year Municipal Bond Index.

3 Dow Jones Wilshire 5000 Index.

4 Russell 1000 Index.

5 “Ten Largest Stocks” excludes any temporary cash investments and equity index products.

8

Tax-Managed Balanced Fund

Fixed Income Characteristics | | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Number of Bonds | 146 | 4,117 | 39,486 |

Yield to Maturity | 3.8%3 | 3.7% | 3.9% |

Average Coupon | 5.1% | 5.1% | 5.0% |

Average Effective Maturity | 6.5 years | 6.9 years | 13.3 years |

Average Quality | AA+ | AAA | AA+ |

Average Duration | 5.2 years | 5.2 years | 6.1 years |

Distribution by Credit Quality (% of fixed income portfolio) | |

| |

AAA | 76% |

AA | 22 |

A | 1 |

BBB | 1 |

Distribution by Maturity (% of fixed income portfolio) | |

| |

Under 1 Year | 7% |

1–5 Years | 34 |

5–10 Years | 44 |

10–20 Years | 15 |

Fixed Income Investment Focus

Largest State Concentrations4 (% of fixed income portfolio) | |

| |

Ohio | 9% |

Massachusetts | 8 |

New York | 8 |

Texas | 8 |

New Jersey | 8 |

California | 5 |

South Carolina | 4 |

Tennessee | 4 |

Colorado | 4 |

Michigan | 4 |

Top Ten | 62% |

1 Lehman 7 Year Municipal Bond Index. |

2 Lehman Municipal Bond Index. |

3 Before expenses. |

4 “Largest State Concentrations” figures exclude any fixed income futures contracts. |

9

Tax-Managed Balanced Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

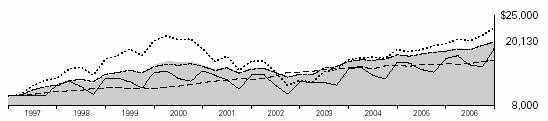

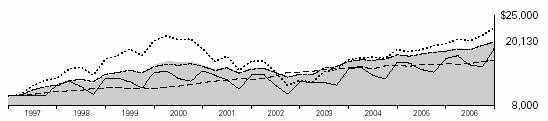

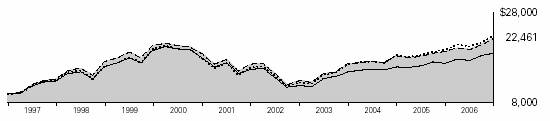

Cumulative Performance: December 31, 1996–December 31, 2006

Initial Investment of $10,000

| Average Annual Total Returns | Final Value |

| Periods Ended December 31, 2006 | of a $10,000 |

| One Year | Five Years | Ten Years | Investment |

Tax-Managed Balanced Fund | 9.09% | 5.91% | 7.25% | $20,130 |

Fee-Adjusted Returns1 | 8.02 | 5.91 | 7.25 | 20,130 |

Russell 1000 Index | 15.46 | 6.82 | 8.64 | 22,914 |

Lehman 7 Year Municipal Bond Index | 3.98 | 4.89 | 5.22 | 16,634 |

Tax-Managed Balanced Composite Index2 | 9.63 | 6.12 | 7.28 | 20,194 |

Average Mixed-Asset Target Moderate Fund3 | 11.06 | 6.19 | 6.59 | 18,924 |

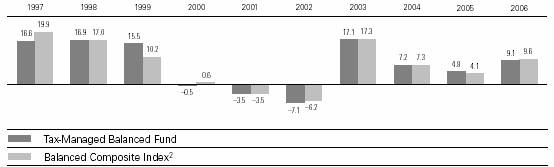

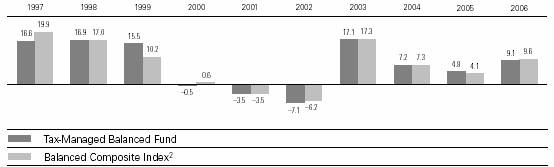

Fiscal-Year Total Returns (%): December 31, 1996–December 31, 2006

1 Reflective of the 1% fee assessed on redemptions of shares held in the fund for less than five years.

2 50% Russell 1000 Index, 50% Lehman 7 Year Municipal Bond Index.

3 Derived from data provided by Lipper Inc.

Note: See Financial Highlights table on page 13 for dividend and capital gains information.

10

Tax-Managed Balanced Fund

Financial Statements

The Statement of Net Assets—an integral part of the Financial Statements for Vanguard Tax-Managed Balanced Fund—is included as an insert to this report.

Statement of Operations

| Year Ended |

| December 31, 2006 |

| ($000) |

Investment Income | |

Income | |

Dividends | 4,927 |

Interest | 13,757 |

Total Income | 18,684 |

Expenses | |

The Vanguard Group—Note B | |

Investment Advisory Services | 66 |

Management and Administrative | 530 |

Marketing and Distribution | 105 |

Custodian Fees | 7 |

Auditing Fees | 21 |

Shareholders’ Reports | 11 |

Trustees’ Fees and Expenses | 1 |

Total Expenses | 741 |

Expenses Paid Indirectly—Note C | (11) |

Net Expenses | 730 |

Net Investment Income | 17,954 |

Realized Net Gain (Loss) on Investment Securities Sold | 5,417 |

Change in Unrealized Appreciation (Depreciation) of Investment Securities | 31,865 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 55,236 |

11

Tax-Managed Balanced Fund

Statement of Changes in Net Assets

| Year Ended December 31, |

| 2006 | 2005 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 17,954 | 15,359 |

Realized Net Gain (Loss) | 5,417 | 2,491 |

Change in Unrealized Appreciation (Depreciation) | 31,865 | 9,712 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 55,236 | 27,562 |

Distributions | | |

Net Investment Income | (17,991) | (15,286) |

Realized Capital Gain | — | — |

Total Distributions | (17,991) | (15,286) |

Capital Share Transactions—Note F | | |

Issued | 54,013 | 70,173 |

Issued in Lieu of Cash Distributions | 15,248 | 12,950 |

Redeemed1 | (50,805) | (50,278) |

Net Increase (Decrease) from Capital Share Transactions | 18,456 | 32,845 |

Total Increase (Decrease) | 55,701 | 45,121 |

Net Assets | | |

Beginning of Period | 606,459 | 561,338 |

End of Period2 | 662,160 | 606,459 |

1 Net of redemption fees of $164,000 and $210,000.

2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($837,000) and ($800,000).

12

Tax-Managed Balanced Fund

Financial Highlights

| | | Year Ended December 31, |

For a Share Outstanding Throughout Each Period | 2006 | 2005 | 2004 | 2003 | 2002 |

Net Asset Value, Beginning of Period | $18.88 | $18.49 | $17.72 | $15.54 | $17.18 |

Investment Operations | | | | | |

Net Investment Income | .54 | .496 | .481 | .42 | .44 |

Net Realized and Unrealized | | | | | |

Gain (Loss) on Investments2 | 1.15 | .380 | .77 | 2.20 | (1.65) |

Total from Investment Operations | 1.69 | .876 | 1.25 | 2.62 | (1.21) |

Distributions | | | | | |

Dividends from Net Investment Income3 | (.55) | (.486) | (.48) | (.44) | (.43) |

Distributions from Realized Capital Gains | — | — | — | — | — |

Total Distributions | (.55) | (.486) | (.48) | (.44) | (.43) |

Net Asset Value, End of Period | $20.02 | $18.88 | $18.49 | $17.72 | $15.54 |

| | | | | |

Total Return4 | 9.09% | 4.80% | 7.16% | 17.05% | –7.07% |

| | | | | |

Ratios/Supplemental Data | | | | | |

Net Assets, End of Period (Millions) | $662 | $606 | $561 | $498 | $416 |

Ratio of Total Expenses to | | | | | |

Average Net Assets | 0.12% | 0.12% | 0.12% | 0.17% | 0.18% |

Ratio of Net Investment Income to | | | | | |

Average Net Assets | 2.84% | 2.64% | 2.70%1 | 2.58% | 2.69% |

Portfolio Turnover Rate | 4% | 10% | 15% | 16% | 24% |

1 Net investment income per share and ratio of net investment income to average net assets include $.02 and 0.13%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Includes increases from redemption fees of $.00, $.01, $.01, $.01, and $.01.

3 For tax purposes, nontaxable dividends represent 74%, 76%, 73%, 77%, and 82% of dividends from net investment income.

4 Total returns do not reflect the 1% redemption fee on shares held less than five years or the 2% redemption fee assessed prior to September 14, 2005, on shares held less than one year.

See accompanying Notes, which are an integral part of the Financial Statements.

13

Tax-Managed Balanced Fund

Notes to Financial Statements

Vanguard Tax-Managed Balanced Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in debt instruments of many municipal issuers; the issuers’ abilities to meet their obligations may be affected by economic and political developments in a specific state or region.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4:00 p.m. Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Bonds, and temporary cash investments acquired over 60 days to maturity, are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

3. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

4. Other: Dividend income is recorded on the ex-dividend date. Interest income is accrued daily. Premiums and discounts on municipal bonds are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees assessed on redemptions of capital shares are credited to paid-in capital.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At December 31, 2006, the fund had contributed capital of $65,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.06% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. The fund’s investment advisor may direct new issue purchases, subject to obtaining the best price and execution, to underwriters who have agreed to rebate or credit to the fund part of the underwriting fees generated. Such rebates or credits are used solely to reduce the fund’s management and administrative expenses. The fund’s custodian bank has also agreed to reduce its fees when the fund maintains cash on deposit in the non-interest-bearing custody account. For the year ended December 31, 2006, these arrangements reduced the fund’s management and administrative expenses by $6,000 and custodian fees by $5,000.

14

Tax-Managed Balanced Fund

D. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

For tax purposes, at December 31, 2006, the fund had $131,000 of ordinary income available for distribution. The fund had available realized losses of $27,773,000 to offset future net capital gains of $2,594,000 through December 31, 2009, $15,836,000 through December 31, 2010, and $9,343,000 through December 31, 2011.

At December 31, 2006, the cost of investment securities for tax purposes was $503,750,000. Net unrealized appreciation of investment securities for tax purposes was $153,920,000, consisting of unrealized gains of $155,612,000 on securities that had risen in value since their purchase and $1,692,000 in unrealized losses on securities that had fallen in value since their purchase.

E. During the year ended December 31, 2006, the fund purchased $77,420,000 of investment securities and sold $26,700,000 of investment securities, other than temporary cash investments.

F. Capital shares issued and redeemed were:

| Year Ended December 31, |

| 2006 | 2005 |

| Shares | Shares |

| (000) | (000) |

Issued | 2,805 | 3,788 |

Issued in Lieu of Cash Distributions | 788 | 697 |

Redeemed | (2,640) | (2,721) |

Net Increase (Decrease) in Shares Outstanding | 953 | 1,764 |

G. In June 2006, the Financial Accounting Standards Board issued Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes.” FIN 48 establishes the minimum threshold for recognizing, and a system for measuring, the benefits of tax-return positions in financial statements. FIN 48 will be effective for the fund’s fiscal year ending December 31, 2007. Management is in the process of analyzing the fund’s tax positions for purposes of implementing FIN 48; based on the analysis completed to date, management does not believe the adoption of FIN 48 will result in any material impact to the fund’s financial statements.

15

Tax-Managed Growth and Income Fund

Fund Profile

As of December 31, 2006

Portfolio Characteristics | | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Number of Stocks | 506 | 500 | 4,964 |

Median Market Cap | $58.8B | $58.8B | $30.7B |

Price/Earnings Ratio | 17.1x | 17.1x | 18.0x |

Price/Book Ratio | 2.9x | 2.9x | 2.8x |

Yield | | 1.8% | 1.7% |

Investor Shares | 1.6% | | |

Admiral Shares | 1.7% | | |

Institutional Shares | 1.7% | | |

Return on Equity | 19.1% | 19.1% | 17.8% |

Earnings Growth Rate | 18.8% | 18.8% | 18.5% |

Foreign Holdings | 0.0% | 0.0% | 1.1% |

Turnover Rate | 6% | — | — |

Expense Ratio | | — | — |

Investor Shares | 0.15% | | |

Admiral Shares | 0.10% | | |

Institutional Shares | 0.07% | | |

Short-Term Reserves | 0% | — | — |

Volatility Measures3 | |

| Fund Versus | Fund Versus |

| Comparative Index1 | Broad Index2 |

R-Squared | 1.00 | 0.97 |

Beta | 1.00 | 0.88 |

Investment Focus

Sector Diversification (% of portfolio) | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Consumer Discretionary | 11% | 11% | 12% |

Consumer Staples | 9 | 9 | 9 |

Energy | 10 | 10 | 9 |

Financials | 22 | 22 | 23 |

Health Care | 12 | 12 | 12 |

Industrials | 11 | 11 | 11 |

Information Technology | 15 | 15 | 15 |

Materials | 3 | 3 | 3 |

Telecommunication Services | 3 | 3 | 3 |

Utilities | 4 | 4 | 3 |

Ten Largest Holdings4 (% of total net assets) |

| | |

ExxonMobil Corp. | integrated oil and gas | 3.5% |

General Electric Co. | industrial conglomerates | 3.0 |

Citigroup, Inc. | diversified financial services | 2.1 |

Microsoft Corp. | systems software | 2.0 |

Bank of America Corp. | diversified financial services | 1.9 |

The Procter & Gamble Co. | household products | 1.6 |

Johnson & Johnson | pharmaceuticals | 1.5 |

Pfizer Inc. | pharmaceuticals | 1.5 |

American International Group, Inc. | multi-line insurance | 1.5 |

Altria Group, Inc. | tobacco | 1.4 |

Top Ten | | 20.0% |

1 S&P 500 Index.

2 Dow Jones Wilshire 5000 Index.

3 For an explanation of R-squared, beta, and other terms used here, see the Glossary on pages 62–63.

4 “Ten Largest Holdings” excludes any temporary cash investments and equity index products.

16

Tax-Managed Growth and Income Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

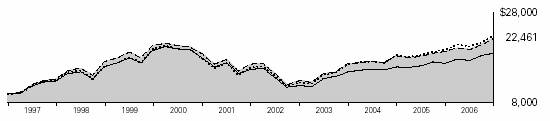

Cumulative Performance: December 31, 1996–December 31, 2006

Initial Investment of $10,000

| Average Annual Total Returns | Final Value |

| Periods Ended December 31, 2006 | of a $10,000 |

| One Year | Five Years | Ten Years | Investment |

Tax-Managed Growth and Income Fund | | | | |

Investor Shares | 15.73% | 6.18% | 8.43% | $22,461 |

Fee-Adjusted Returns1 | 14.59 | 6.18 | 8.43 | 22,461 |

Dow Jones Wilshire 5000 Index | 15.87 | 7.65 | 8.67 | 22,961 |

S&P 500 Index | 15.79 | 6.19 | 8.42 | 22,447 |

Average Large-Cap Core Fund2 | 13.53 | 4.27 | 6.66 | 19,050 |

| | | | Final Value of |

| | Five | Since | a $100,000 |

| One Year | Years | Inception3 | Investment |

Tax-Managed Growth and Income Fund | | | | |

Admiral Shares | 15.77% | 6.23% | 6.65% | $139,149 |

Fee-Adjusted Returns1 | 14.63 | 6.23 | 6.65 | 139,149 |

Dow Jones Wilshire 5000 Index | 15.87 | 7.65 | 8.32 | 150,735 |

S&P 500 Index | 15.79 | 6.19 | 6.61 | 138,906 |

1 Reflective of the 1% fee assessed on redemptions of shares held in the fund for less than five years.

2 Derived from data provided by Lipper Inc.

3 November 12, 2001.

17

Tax-Managed Growth and Income Fund

| Average Annual Total Returns | |

| Periods Ended December 31, 2006 | Final Value of |

| One | Five | Since | a $5,000,000 |

| Year | Years | Inception1 | Investment |

Tax-Managed Growth and Income Fund | | | | |

Institutional Shares | 15.82% | 6.26% | 3.37% | $6,482,520 |

Fee-Adjusted Returns2 | 14.68 | 6.26 | 3.37 | 6,482,520 |

Dow Jones Wilshire 5000 Index | 15.87 | 7.65 | 4.46 | 7,036,200 |

S&P 500 Index | 15.79 | 6.19 | 3.28 | 6,438,269 |

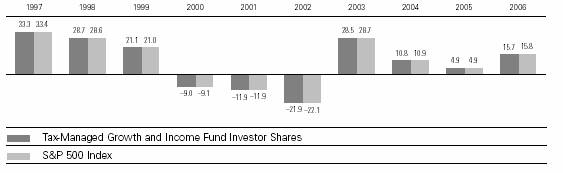

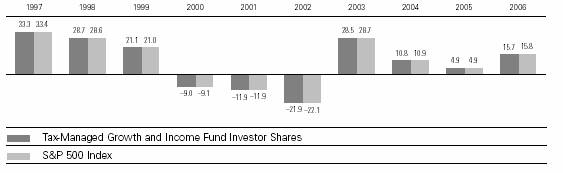

Fiscal-Year Total Returns (%): December 31, 1996–December 31, 2006

1 March 4, 1999.

2 Reflective of the 1% fee assessed on redemptions of shares held for less than five years.

Note: See Financial Highlights tables on pages 21–23 for dividend and capital gains information.

18

Tax-Managed Growth and Income Fund

Financial Statements

The Statement of Net Assets—an integral part of the Financial Statements for Vanguard Tax-Managed Growth and Income Fund—is included as an insert to this report.

Statement of Operations

| Year Ended |

| December 31, 2006 |

| ($000) |

Investment Income | |

Income | |

Dividends | 54,326 |

Interest1 | 80 |

Total Income | 54,406 |

Expenses | |

The Vanguard Group—Note B | |

Investment Advisory Services | 66 |

Management and Administrative | |

Investor Shares | 928 |

Admiral Shares | 1,322 |

Institutional Shares | 148 |

Marketing and Distribution | |

Investor Shares | 149 |

Admiral Shares | 250 |

Institutional Shares | 59 |

Custodian Fees | 52 |

Auditing Fees | 22 |

Shareholders’ Reports | |

Investor Shares | 24 |

Admiral Shares | 5 |

Institutional Shares | — |

Trustees’ Fees and Expenses | 3 |

Total Expenses | 3,028 |

Net Investment Income | 51,378 |

Realized Net Gain (Loss) on Investment Securities Sold | 2,041 |

Change in Unrealized Appreciation (Depreciation) of Investment Securities | 368,009 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 421,428 |

1 Interest income from an affiliated company of the fund was $68,000.

19

Tax-Managed Growth and Income Fund

Statement of Changes in Net Assets

| Year Ended December 31, |

| 2006 | 2005 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 51,378 | 47,158 |

Realized Net Gain (Loss) | 2,041 | (34,119) |

Change in Unrealized Appreciation (Depreciation) | 368,009 | 112,439 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 421,428 | 125,478 |

Distributions | | |

Net Investment Income | | |

Investor Shares | (13,535) | (18,610) |

Admiral Shares | (31,978) | (24,005) |

Institutional Shares | (6,367) | (5,290) |

Realized Capital Gain | | |

Investor Shares | — | — |

Admiral Shares | — | — |

Institutional Shares | — | — |

Total Distributions | (51,880) | (47,905) |

Capital Share Transactions—Note E | | |

Investor Shares | (122,838) | (617,688) |

Admiral Shares | 134,096 | 580,021 |

Institutional Shares | 42,048 | 28,881 |

Net Increase (Decrease) from Capital Share Transactions | 53,306 | (8,786) |

Total Increase (Decrease) | 422,854 | 68,787 |

Net Assets | | |

Beginning of Period | 2,683,971 | 2,615,184 |

End of Period1 | 3,106,825 | 2,683,971 |

1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($3,721,000) and ($3,219,000).

20

Tax-Managed Growth and Income Fund

Financial Highlights

Investor Shares | | | | | |

| | | | | |

| | | Year Ended December 31, |

For a Share Outstanding Throughout Each Period | 2006 | 2005 | 2004 | 2003 | 2002 |

Net Asset Value, Beginning of Period | $27.15 | $26.36 | $24.23 | $19.15 | $24.93 |

Investment Operations | | | | | |

Net Investment Income | .504 | .467 | .471 | .34 | .313 |

Net Realized and Unrealized | | | | | |

Gain (Loss) on Investments2 | 3.727 | .801 | 2.13 | 5.08 | (5.768) |

Total from Investment Operations | 4.231 | 1.268 | 2.60 | 5.42 | (5.455) |

Distributions | | | | | |

Dividends from Net Investment Income | (.511) | (.478) | (.47) | (.34) | (.325) |

Distributions from Realized Capital Gains | — | — | — | — | — |

Total Distributions | (.511) | (.478) | (.47) | (.34) | (.325) |

Net Asset Value, End of Period | $30.87 | $27.15 | $26.36 | $24.23 | $19.15 |

| | | | | |

Total Return3 | 15.73% | 4.87% | 10.83% | 28.53% | –21.95% |

| | | | | |

Ratios/Supplemental Data | | | | | |

Net Assets, End of Period (Millions) | $784 | $806 | $1,395 | $1,321 | $1,077 |

Ratio of Total Expenses to | | | | | |

Average Net Assets | 0.15% | 0.14% | 0.14% | 0.17% | 0.17% |

Ratio of Net Investment Income to | | | | | |

Average Net Assets | 1.77% | 1.78% | 1.89%1 | 1.63% | 1.44% |

Portfolio Turnover Rate | 6% | 10% | 8% | 5% | 9% |

1 Net investment income per share and the ratio of net investment income to average net assets include $.08 and 0.31%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Includes increases from redemption fees of $.00, $.01, $.01, $.01, and $.03.

3 Total returns do not reflect the 1% redemption fee on shares held less than five years or the 2% redemption fee assessed prior to September 14, 2005, on shares held less than one year.

21

Tax-Managed Growth and Income Fund

Admiral Shares | | | | | |

| | | | | |

| | | Year Ended December 31, |

For a Share Outstanding Throughout Each Period | 2006 | 2005 | 2004 | 2003 | 2002 |

Net Asset Value, Beginning of Period | $55.80 | $54.17 | $49.80 | $39.35 | $51.24 |

Investment Operations | | | | | |

Net Investment Income | 1.069 | .989 | .991 | .733 | .673 |

Net Realized and Unrealized | | | | | |

Gain (Loss) on Investments2 | 7.648 | 1.645 | 4.37 | 10.443 | (11.870) |

Total from Investment Operations | 8.717 | 2.634 | 5.36 | 11.176 | (11.197) |

Distributions | | | | | |

Dividends from Net Investment Income | (1.077) | (1.004) | (.99) | (.726) | (.693) |

Distributions from Realized Capital Gains | — | — | — | — | — |

Total Distributions | (1.077) | (1.004) | (.99) | (.726) | (.693) |

Net Asset Value, End of Period | $63.44 | $55.80 | $54.17 | $49.80 | $39.35 |

| | | | | |

Total Return3 | 15.77% | 4.93% | 10.87% | 28.64% | –21.92% |

| | | | | |

Ratios/Supplemental Data | | | | | |

Net Assets, End of Period (Millions) | $1,935 | $1,575 | $954 | $777 | $520 |

Ratio of Total Expenses to | | | | | |

Average Net Assets | 0.10% | 0.10% | 0.10% | 0.11% | 0.11% |

Ratio of Net Investment Income to | | | | | |

Average Net Assets | 1.82% | 1.82% | 1.96%1 | 1.69% | 1.52% |

Portfolio Turnover Rate | 6% | 10% | 8% | 5% | 9% |

1 Net investment income per share and the ratio of net investment income to average net assets include $.16 and 0.31%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Includes increases from redemption fees of $.01, $.01, $.02, $.02, and $.05.

3 Total returns do not reflect the 1% redemption fee on shares held less than five years or the 2% redemption fee assessed prior to September 14, 2005, on shares held less than one year.

22

Tax-Managed Growth and Income Fund

Institutional Shares | | | | | |

| | | | | |

| | | Year Ended December 31, |

For a Share Outstanding Throughout Each Period | 2006 | 2005 | 2004 | 2003 | 2002 |

Net Asset Value, Beginning of Period | $27.15 | $26.36 | $24.24 | $19.15 | $24.93 |

Investment Operations | | | | | |

Net Investment Income | .527 | .485 | .4791 | .369 | .331 |

Net Realized and Unrealized | | | | | |

Gain (Loss) on Investments2 | 3.727 | .801 | 2.130 | 5.080 | (5.768) |

Total from Investment Operations | 4.254 | 1.286 | 2.609 | 5.449 | (5.437) |

Distributions | | | | | |

Dividends from Net Investment Income | (.534) | (.496) | (.489) | (.359) | (.343) |

Distributions from Realized Capital Gains | — | — | — | — | — |

Total Distributions | (.534) | (.496) | (.489) | (.359) | (.343) |

Net Asset Value, End of Period | $30.87 | $27.15 | $26.36 | $24.24 | $19.15 |

| | | | | |

Total Return3 | 15.82% | 4.94% | 10.87% | 28.69% | –21.88% |

| | | | | |

Ratios/Supplemental Data | | | | | |

Net Assets, End of Period (Millions) | $389 | $303 | $266 | $217 | $167 |

Ratio of Total Expenses to | | | | | |

Average Net Assets | 0.07% | 0.07% | 0.07% | 0.08% | 0.08% |

Ratio of Net Investment Income to | | | | | |

Average Net Assets | 1.85% | 1.85% | 1.97%1 | 1.72% | 1.54% |

Portfolio Turnover Rate | 6% | 10% | 8% | 5% | 9% |

1 Net investment income per share and the ratio of net investment income to average net assets include $.077 and 0.31%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Includes increases from redemption fees of $.00, $.01, $.01, $.01, and $.03.

3 Total returns do not reflect the 1% redemption fee on shares held less than five years or the 2% redemption fee assessed prior to September 14, 2005, on shares held less than one year.

See accompanying Notes, which are an integral part of the Financial Statements.

23

Tax-Managed Growth and Income Fund

Notes to Financial Statements

Vanguard Tax-Managed Growth and Income Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers three classes of shares: Investor Shares, Admiral Shares, and Institutional Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, servicing, tenure, and account-size criteria. Institutional Shares are designed for investors who meet certain administrative and servicing criteria and invest a minimum of $5 million.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4:00 p.m. Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

3. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

4. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees assessed on redemptions of capital shares are credited to paid-in capital.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At December 31, 2006, the fund had contributed capital of $300,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.30% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

24

Tax-Managed Growth and Income Fund

For tax purposes, at December 31, 2006, the fund had $357,000 of ordinary income available for distribution. The fund had available realized losses of $442,807,000 to offset future net capital gains of $34,004,000 through December 31, 2008, $81,507,000 through December 31, 2009, $201,652,000 through December 31, 2010, $92,868,000 through December 31, 2011, $31,345,000 through December 31, 2013, and $1,431,000 through December 31, 2014.

At December 31, 2006, the cost of investment securities for tax purposes was $1,947,701,000. Net unrealized appreciation of investment securities for tax purposes was $1,163,287,000, consisting of unrealized gains of $1,197,220,000 on securities that had risen in value since their purchase and $33,933,000 in unrealized losses on securities that had fallen in value since their purchase.

D. During the year ended December 31, 2006, the fund purchased $217,468,000 of investment securities and sold $169,465,000 of investment securities, other than temporary cash investments.

E. Capital share transactions for each class of shares were:

| Year Ended December 31, |

| | 2006 | | 2005 |

| Amount | Shares | Amount | Shares |

| ($000) | (000) | ($000) | (000) |

Investor Shares | | | | |

Issued | 70,085 | 2,458 | 89,341 | 3,418 |

Issued in Lieu of Cash Distributions | 11,722 | 407 | 16,179 | 616 |

Redeemed1 | (204,645) | (7,168) | (723,208) | (27,273) |

Net Increase (Decrease)—Investor Shares | (122,838) | (4,303) | (617,688) | (23,239) |

Admiral Shares | | | | |

Issued | 206,113 | 3,509 | 653,973 | 11,983 |

Issued in Lieu of Cash Distributions | 25,316 | 426 | 18,694 | 343 |

Redeemed1 | (97,333) | (1,661) | (92,646) | (1,718) |

Net Increase (Decrease)—Admiral Shares | 134,096 | 2,274 | 580,021 | 10,608 |

Institutional Shares | | | | |

Issued | 55,863 | 1,933 | 33,835 | 1,274 |

Issued in Lieu of Cash Distributions | 4,524 | 157 | 3,620 | 137 |

Redeemed1 | (18,339) | (662) | (8,574) | (325) |

Net Increase (Decrease)—Institutional Shares | 42,048 | 1,428 | 28,881 | 1,086 |

F. In June 2006, the Financial Accounting Standards Board issued Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes.” FIN 48 establishes the minimum threshold for recognizing, and a system for measuring, the benefits of tax-return positions in financial statements. FIN 48 will be effective for the fund’s fiscal year ending December 31, 2007. Management is in the process of analyzing the fund’s tax positions for purposes of implementing FIN 48; based on the analysis completed to date, management does not believe the adoption of FIN 48 will result in any material impact to the fund’s financial statements.

1 Net of redemption fees for 2006 and 2005 of $423,000 and $650,000, respectively (fund totals).

25

Tax-Managed Capital Appreciation Fund

Fund Profile

As of December 31, 2006

Portfolio Characteristics | | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Number of Stocks | 636 | 987 | 4,964 |

Median Market Cap | $35.0B | $41.8B | $30.7B |

Price/Earnings Ratio | 17.4x | 17.5x | 18.0x |

Price/Book Ratio | 2.9x | 2.9x | 2.8x |

Yield | | 1.8% | 1.7% |

Investor Shares | 1.3% | | |

Admiral Shares | 1.4% | | |

Institutional Shares | 1.4% | | |

Return on Equity | 19.0% | 18.8% | 17.8% |

Earnings Growth Rate | 19.7% | 18.6% | 18.5% |

Foreign Holdings | 0.0% | 0.0% | 1.1% |

Turnover Rate | 5% | — | — |

Expense Ratio | | — | — |

Investor Shares | 0.15% | | |

Admiral Shares | 0.10% | | |

Institutional Shares | 0.07% | | |

Short-Term Reserves | 0% | — | — |

Volatility Measures3 | |

| Fund Versus | Fund Versus |

| Comparative Index1 | Broad Index2 |

R-Squared | 0.99 | 0.99 |

Beta | 1.07 | 0.98 |

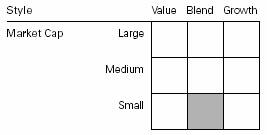

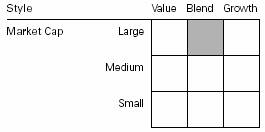

Investment Focus

Sector Diversification (% of portfolio) | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Consumer Discretionary | 12% | 11% | 12% |

Consumer Staples | 9 | 9 | 9 |

Energy | 9 | 9 | 9 |

Financials | 22 | 22 | 23 |

Health Care | 13 | 12 | 12 |

Industrials | 11 | 11 | 11 |

Information Technology | 15 | 15 | 15 |

Materials | 3 | 3 | 3 |

Telecommunication Services | 3 | 4 | 3 |

Utilities | 3 | 4 | 3 |

Ten Largest Holdings4 (% of total net assets) |

| | |

ExxonMobil Corp. | integrated oil and gas | 3.3% |

General Electric Co. | industrial conglomerates | 2.6 |

Citigroup, Inc. | diversified financial services | 1.9 |

Microsoft Corp. | systems software | 1.7 |

Bank of America Corp. | diversified financial services | 1.6 |

The Procter & Gamble Co. | household products | 1.5 |

Johnson & Johnson | pharmaceuticals | 1.4 |

Cisco Systems, Inc. | communications equipment | 1.2 |

Pfizer Inc. | pharmaceuticals | 1.2 |

American International Group, Inc. | multi-line insurance | 1.2 |

Top Ten | | 17.6% |

1 Russell 1000 Index.

2 Dow Jones Wilshire 5000 Index.

3 For an explanation of R-squared, beta, and other terms used here, see the Glossary on pages 62–63.

4 “Ten Largest Holdings” excludes any temporary cash investments and equity index products.

26

Tax-Managed Capital Appreciation Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

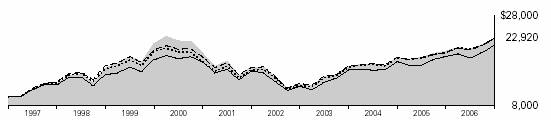

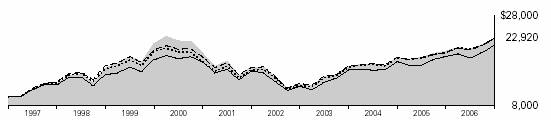

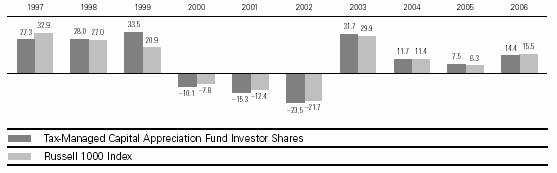

Cumulative Performance: December 31, 1996–December 31, 2006

Initial Investment of $10,000

| Average Annual Total Returns | Final Value |

| Periods Ended December 31, 2006 | of a $10,000 |

| One Year | Five Years | Ten Years | Investment |

Tax-Managed Capital Appreciation Fund | | | | |

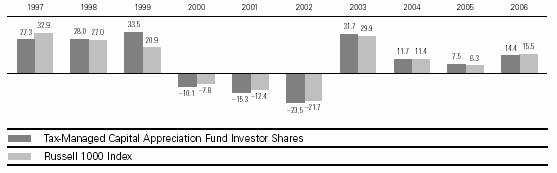

Investor Shares | 14.40% | 6.74% | 8.65% | $22,920 |

Fee-Adjusted Returns1 | 13.27 | 6.74 | 8.65 | 22,920 |

Dow Jones Wilshire 5000 Index | 15.87 | 7.65 | 8.67 | 22,961 |

Russell 1000 Index | 15.46 | 6.82 | 8.64 | 22,914 |

Average Multi-Cap Core Fund2 | 13.31 | 6.39 | 7.94 | 21,468 |

| | | | Final Value of |

| One | Five | Since | a $100,000 |

| Year | Years | Inception3 | Investment |

Tax-Managed Capital Appreciation Fund | | | | |

Admiral Shares | 14.44% | 6.80% | 7.48% | $144,856 |

Fee-Adjusted Returns1 | 13.32 | 6.80 | 7.48 | 144,856 |

Dow Jones Wilshire 5000 Index | 15.87 | 7.65 | 8.32 | 150,735 |

Russell 1000 Index | 15.46 | 6.82 | 7.31 | 143,684 |

1 Reflective of the 1% fee assessed on redemptions of shares held for less than five years.

2 Derived from data provided by Lipper Inc.

3 November 12, 2001.

27

Tax-Managed Capital Appreciation Fund

| Average Annual Total Returns | |

| Periods Ended December 31, 2006 | Final Value of |

| One | Five | Since | a $5,000,000 |

| Year | Years | Inception1 | Investment |

Tax-Managed Capital Appreciation Fund | | | | |

Institutional Shares | 14.49% | 6.83% | 4.22% | $6,914,785 |

Fee-Adjusted Returns2 | 13.36 | 6.83 | 4.22 | 6,914,785 |

Dow Jones Wilshire 5000 Index | 15.87 | 7.65 | 4.39 | 7,003,195 |

Russell 1000 Index | 15.46 | 6.82 | 3.77 | 6,685,126 |

Fiscal-Year Total Returns (%): December 31, 1996–December 31, 2006

1 February 24, 1999.

2 Reflective of the 1% fee assessed on redemptions of shares held for less than five years.

Note: See Financial Highlights tables on pages 31–33 for dividend and capital gains information.

28

Tax-Managed Capital Appreciation Fund

Financial Statements

The Statement of Net Assets—an integral part of the Financial Statements for Vanguard Tax-Managed Capital Appreciation Fund—is included as an insert to this report.

Statement of Operations

| Year Ended |

| December 31, 2006 |

| ($000) |

Investment Income | |

Income | |

Dividends | 60,695 |

Interest1 | 118 |

Total Income | 60,813 |

Expenses | |

The Vanguard Group—Note B | |

Investment Advisory Services | 74 |

Management and Administrative | |

Investor Shares | 1,006 |

Admiral Shares | 2,061 |

Institutional Shares | 100 |

Marketing and Distribution | |

Investor Shares | 160 |

Admiral Shares | 377 |

Institutional Shares | 29 |

Custodian Fees | 18 |

Auditing Fees | 22 |

Shareholders’ Reports | |

Investor Shares | 22 |

Admiral Shares | 8 |

Institutional Shares | — |

Trustees’ Fees and Expenses | 3 |

Total Expenses | 3,880 |

Net Investment Income | 56,933 |

Realized Net Gain (Loss) on Investment Securities Sold | 59,140 |

Change in Unrealized Appreciation (Depreciation) of Investment Securities | 385,292 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 501,365 |

1 Interest income from an affiliated company of the fund was $118,000.

29

Tax-Managed Capital Appreciation Fund

Statement of Changes in Net Assets

| Year Ended December 31, |

| 2006 | 2005 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 56,933 | 40,837 |

Realized Net Gain (Loss) | 59,140 | 5,891 |

Change in Unrealized Appreciation (Depreciation) | 385,292 | 191,693 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 501,365 | 238,421 |

Distributions | | |

Net Investment Income | | |

Investor Shares | (11,552) | (10,082) |

Admiral Shares | (42,410) | (28,472) |

Institutional Shares | (3,220) | (2,552) |

Realized Capital Gain | | |

Investor Shares | — | — |

Admiral Shares | — | — |

Institutional Shares | — | — |

Total Distributions | (57,182) | (41,106) |

Capital Share Transactions—Note E | | |

Investor Shares | (124,968) | (812,241) |

Admiral Shares | 262,868 | 849,487 |

Institutional Shares | (10,718) | 90,644 |

Net Increase (Decrease) from Capital Share Transactions | 127,182 | 127,890 |

Total Increase (Decrease) | 571,365 | 325,205 |

Net Assets | | |

Beginning of Period | 3,420,245 | 3,095,040 |

End of Period1 | 3,991,610 | 3,420,245 |

1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($3,947,000) and ($3,698,000).

30

Tax-Managed Capital Appreciation Fund

Financial Highlights

Investor Shares

| | | Year Ended December 31, |

For a Share Outstanding Throughout Each Period | 2006 | 2005 | 2004 | 2003 | 2002 |

Net Asset Value, Beginning of Period | $29.80 | $28.05 | $25.43 | $19.49 | $25.73 |

Investment Operations | | | | | |

Net Investment Income | .471 | .352 | .3651 | .238 | .196 |

Net Realized and Unrealized | | | | | |

Gain (Loss) on Investments2 | 3.821 | 1.752 | 2.622 | 5.940 | (6.231) |

Total from Investment Operations | 4.292 | 2.104 | 2.987 | 6.178 | (6.035) |

Distributions | | | | | |

Dividends from Net Investment Income | (.472) | (.354) | (.367) | (.238) | (.205) |

Distributions from Realized Capital Gains | — | — | — | — | — |

Total Distributions | (.472) | (.354) | (.367) | (.238) | (.205) |

Net Asset Value, End of Period | $33.62 | $29.80 | $28.05 | $25.43 | $19.49 |

| | | | | |

Total Return3 | 14.40% | 7.49% | 11.75% | 31.72% | –23.45% |

| | | | | |

Ratios/Supplemental Data | | | | | |

Net Assets, End of Period (Millions) | $832 | $857 | $1,596 | $1,466 | $1,154 |

Ratio of Total Expenses to | | | | | |

Average Net Assets | 0.15% | 0.14% | 0.14% | 0.17% | 0.17% |

Ratio of Net Investment Income to | | | | | |

Average Net Assets | 1.51% | 1.25% | 1.40%1 | 1.09% | 0.87% |

Portfolio Turnover Rate | 5% | 8% | 5% | 11% | 10% |

1 Net investment income per share and the ratio of net investment income to average net assets include $.061 and 0.24%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Includes increases from redemption fees of $.00, $.01, $.01, $.01, and $.02.

3 Total returns do not reflect the 1% redemption fee on shares held less than five years or the 2% redemption fee assessed prior to September 14, 2005, on shares held less than one year.

31

Tax-Managed Capital Appreciation Fund

Admiral Shares | | | | | |

| | | | | |

| | | Year Ended December 31, |

For a Share Outstanding Throughout Each Period | 2006 | 2005 | 2004 | 2003 | 2002 |

Net Asset Value, Beginning of Period | $60.00 | $56.46 | $51.20 | $39.24 | $51.79 |

Investment Operations | | | | | |

Net Investment Income | .99 | .729 | .7621 | .51 | .42 |

Net Realized and Unrealized | | | | | |

Gain (Loss) on Investments2 | 7.68 | 3.543 | 5.263 | 11.96 | (12.53) |

Total from Investment Operations | 8.67 | 4.272 | 6.025 | 12.47 | (12.11) |

Distributions | | | | | |

Dividends from Net Investment Income | (.99) | (.732) | (.765) | (.51) | (.44) |

Distributions from Realized Capital Gains | — | — | — | — | — |

Total Distributions | (.99) | (.732) | (.765) | (.51) | (.44) |

Net Asset Value, End of Period | $67.68 | $60.00 | $56.46 | $51.20 | $39.24 |

| | | | | |

Total Return3 | 14.44% | 7.56% | 11.77% | 31.80% | –23.38% |

| | | | | |

Ratios/Supplemental Data | | | | | |

Net Assets, End of Period (Millions) | $2,941 | $2,360 | $1,397 | $1,103 | $741 |

Ratio of Total Expenses to | | | | | |

Average Net Assets | 0.10% | 0.10% | 0.10% | 0.11% | 0.11% |

Ratio of Net Investment Income to | | | | | |

Average Net Assets | 1.56% | 1.29% | 1.47%1 | 1.16% | 0.95% |

Portfolio Turnover Rate | 5% | 8% | 5% | 11% | 10% |

1 Net investment income per share and the ratio of net investment income to average net assets include $.122 and 0.24%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Includes increases from redemption fees of $.01, $.01, $.01, $.02, and $.03.

3 Total returns do not reflect the 1% redemption fee on shares held less than five years or the 2% redemption fee assessed prior to September 14, 2005, on shares held less than one year.

32

Tax-Managed Capital Appreciation Fund

Institutional Shares | | | | | |

| | | | | |

| | | Year Ended December 31, |

For a Share Outstanding Throughout Each Period | 2006 | 2005 | 2004 | 2003 | 2002 |

Net Asset Value, Beginning of Period | $29.81 | $28.05 | $25.44 | $19.49 | $25.73 |

Investment Operations | | | | | |

Net Investment Income | .50 | .384 | .3751 | .267 | .216 |

Net Realized and Unrealized | | | | | |

Gain (Loss) on Investments2 | 3.82 | 1.752 | 2.622 | 5.940 | (6.231) |

Total from Investment Operations | 4.32 | 2.136 | 2.997 | 6.207 | (6.015) |

Distributions | | | | | |

Dividends from Net Investment Income | (.50) | (.376) | (.387) | (.257) | (.225) |

Distributions from Realized Capital Gains | — | — | — | — | — |

Total Distributions | (.50) | (.376) | (.387) | (.257) | (.225) |

Net Asset Value, End of Period | $33.63 | $29.81 | $28.05 | $25.44 | $19.49 |

| | | | | |

Total Return3 | 14.49% | 7.61% | 11.78% | 31.87% | –23.37% |

| | | | | |

Ratios/Supplemental Data | | | | | |

Net Assets, End of Period (Millions) | $218 | $204 | $102 | $104 | $106 |

Ratio of Total Expenses to | | | | | |

Average Net Assets | 0.07% | 0.07% | 0.07% | 0.08% | 0.08% |

Ratio of Net Investment Income to | | | | | |

Average Net Assets | 1.59% | 1.32% | 1.47%1 | 1.17% | 0.98% |

Portfolio Turnover Rate | 5% | 8% | 5% | 11% | 10% |

1 Net investment income per share and the ratio of net investment income to average net assets include $.061 and 0.24%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Includes increases from redemption fees of $.00, $.00, $.01, $.01, and $.02.

3 Total returns do not reflect the 1% redemption fee on shares held less than five years or the 2% redemption fee assessed prior to September 14, 2005, on shares held less than one year.

See accompanying Notes, which are an integral part of the Financial Statements.

33

Tax-Managed Capital Appreciation Fund

Notes to Financial Statements

Vanguard Tax-Managed Capital Appreciation Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers three classes of shares: Investor Shares, Admiral Shares, and Institutional Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, servicing, tenure, and account-size criteria. Institutional Shares are designed for investors who meet certain administrative and servicing criteria and invest a minimum of $5 million.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4:00 p.m. Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

3. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

4. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees assessed on redemptions of capital shares are credited to paid-in capital.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At December 31, 2006, the fund had contributed capital of $387,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.39% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

34

Tax-Managed Capital Appreciation Fund

For tax purposes, at December 31, 2006, the fund had $681,000 of ordinary income available for distribution. The fund had available realized losses of $509,348,000 to offset future net capital gains of $239,522,000 through December 31, 2009, $106,018,000 through December 31, 2010, and $163,808,000 through December 31, 2011.

At December 31, 2006, the cost of investment securities for tax purposes was $2,263,742,000. Net unrealized appreciation of investment securities for tax purposes was $1,725,818,000, consisting of unrealized gains of $1,753,592,000 on securities that had risen in value since their purchase and $27,774,000 in unrealized losses on securities that had fallen in value since their purchase.

D. During the year ended December 31, 2006, the fund purchased $308,784,000 of investment securities and sold $183,759,000 of investment securities, other than temporary cash investments.

E. Capital share transactions for each class of shares were:

| Year Ended December 31, |

| | 2006 | | 2005 |

| Amount | Shares | Amount | Shares |

| ($000) | (000) | ($000) | (000) |

Investor Shares | | | | |

Issued | 85,007 | 2,726 | 132,702 | 4,704 |

Issued in Lieu of Cash Distributions | 10,331 | 306 | 8,922 | 297 |

Redeemed1 | (220,306) | (7,022) | (953,865) | (33,164) |

Net Increase (Decrease)—Investor Shares | (124,968) | (3,990) | (812,241) | (28,163) |

Admiral Shares | | | | |

Issued | 357,983 | 5,676 | 1,002,550 | 17,285 |

Issued in Lieu of Cash Distributions | 34,083 | 502 | 23,431 | 388 |

Redeemed1 | (129,198) | (2,054) | (176,494) | (3,084) |

Net Increase (Decrease)—Admiral Shares | 262,868 | 4,124 | 849,487 | 14,589 |

Institutional Shares | | | | |

Issued | 15,940 | 515 | 104,124 | 3,675 |

Issued in Lieu of Cash Distributions | 1,584 | 47 | 1,227 | 41 |

Redeemed1 | (28,242) | (910) | (14,707) | (521) |

Net Increase (Decrease)—Institutional Shares | (10,718) | (348) | 90,644 | 3,195 |

F. In June 2006, the Financial Accounting Standards Board issued Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes.” FIN 48 establishes the minimum threshold for recognizing, and a system for measuring, the benefits of tax-return positions in financial statements. FIN 48 will be effective for the fund’s fiscal year ending December 31, 2007. Management is in the process of analyzing the fund’s tax positions for purposes of implementing FIN 48; based on the analysis completed to date, management does not believe the adoption of FIN 48 will result in any material impact to the fund’s financial statements.

1 Net of redemption fees for 2006 and 2005 of $468,000 and $610,000, respectively (fund totals).

35

Tax-Managed Small-Cap Fund

Fund Profile

As of December 31, 2006

Portfolio Characteristics | | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Number of Stocks | 598 | 600 | 4,964 |

Median Market Cap | $1.3B | $1.3B | $30.7B |

Price/Earnings Ratio | 20.5x | 20.6x | 18.0x |

Price/Book Ratio | 2.4x | 2.3x | 2.8x |

Yield | | 0.9% | 1.7% |

Investor Shares | 0.8% | | |

Institutional Shares | 0.8% | | |

Return on Equity | 13.9% | 13.9% | 17.8% |

Earnings Growth Rate | 17.5% | 17.0% | 18.5% |

Foreign Holdings | 0.0% | 0.0% | 1.1% |

Turnover Rate | 42% | — | — |

Expense Ratio | | — | — |

Investor Shares | 0.14% | | |

Institutional Shares | 0.09% | | |

Short-Term Reserves | 0% | — | — |

Volatility Measures3 | |

| Fund Versus | Fund Versus |

| Comparative Index1 | Broad Index2 |

R-Squared | 1.00 | 0.81 |

Beta | 1.00 | 1.49 |

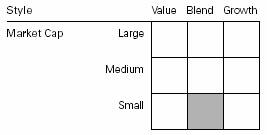

Investment Focus

Sector Diversification (% of portfolio) | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Consumer Discretionary | 17% | 16% | 12% |

Consumer Staples | 4 | 4 | 9 |

Energy | 8 | 7 | 9 |

Financials | 15 | 17 | 23 |

Health Care | 12 | 12 | 12 |

Industrials | 17 | 17 | 11 |

Information Technology | 17 | 17 | 15 |

Materials | 5 | 5 | 3 |

Telecommunication Services | 0 | 0 | 3 |

Utilities | 5 | 5 | 3 |

Ten Largest Holdings4 (% of total net assets) |

| | |

The Manitowoc Co., Inc. | construction and farm machinery and heavy trucks | 0.6% |

Energen Corp. | gas utilities | 0.6 |

NVR, Inc. | homebuilding | 0.6 |

Frontier Oil Corp. | oil and gas refining and marketing | 0.6 |

Global Payments Inc. | data processing and outsourced services | 0.6 |

Veritas DGC Inc. | oil and gas equipment and services | 0.6 |

Cimarex Energy Co. | oil and gas exploration and production | 0.5 |

Southern Union Co. | gas utilities | 0.5 |

Cerner Corp. | health care technology | 0.5 |

Helix Energy Solutions Group, Inc. | oil and gas exploration and production | 0.5 |

Top Ten | | 5.6% |

1 S&P SmallCap 600 Index.

2 Dow Jones Wilshire 5000 Index.

3 For an explanation of R-squared, beta, and other terms used here, see the Glossary on pages 62–63.

4 “Ten Largest Holdings” excludes any temporary cash investments and equity index products.

36

Tax-Managed Small-Cap Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

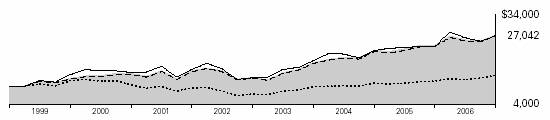

Cumulative Performance: March 25, 1999–December 31, 2006

Initial Investment of $10,000

| Average Annual Total Returns | |

| Periods Ended December 31, 2006 | Final Value |

| One | Five | Since | of a $10,000 |

| Year | Years | Inception1 | Investment |

Tax-Managed Small-Cap Fund | | | | |

Investor Shares | 14.15% | 12.35% | 13.66% | $27,042 |

Fee-Adjusted Returns2 | 13.02 | 12.35 | 13.66 | 27,042 |

Dow Jones Wilshire 5000 Index | 15.87 | 7.65 | 4.10 | 13,664 |

S&P SmallCap 600 Index | 15.12 | 12.49 | 13.52 | 26,791 |

Average Small-Cap Core Fund3 | 14.87 | 11.29 | 13.59 | 26,910 |

1 March 25, 1999.

2 Reflective of the 1% fee assessed on redemptions of shares held for less than five years.

3 Derived from data provided by Lipper Inc.

37

Tax-Managed Small-Cap Fund

| Average Annual Total Returns | |

| Periods Ended December 31, 2006 | Final Value of |

| One | Five | Since | a $5,000,000 |

| Year | Years | Inception1 | Investment |

Tax-Managed Small-Cap Fund | | | | |

Institutional Shares | 14.23% | 12.43% | 12.85% | $12,676,388 |

Fee-Adjusted Returns2 | 13.09 | 12.43 | 12.85 | 12,676,388 |

Dow Jones Wilshire 5000 Index | 15.87 | 7.65 | 3.56 | 6,544,003 |

S&P SmallCap 600 Index | 15.12 | 12.49 | 12.69 | 12,537,670 |

Fiscal-Year Total Returns (%): March 25, 1999–December 31, 2006

1 April 21, 1999.