UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07175

Name of Registrant: | | Vanguard Tax-Managed Funds |

Address of Registrant: | | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| | |

Name and address of agent for service: | | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2018—December 31, 2018

Item 1: Reports to Shareholders

Annual Report | December 31, 2018 Vanguard Tax-Managed Funds |

Vanguard Tax-Managed Balanced Fund Vanguard Tax-Managed Capital Appreciation Fund Vanguard Tax-Managed Small-Cap Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. |

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com.

You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.

Contents | |

| |

A Note From Our CEO | 1 |

Your Fund’s Performance at a Glance | 2 |

About Your Fund’s Expenses | 3 |

Tax-Managed Balanced Fund | 5 |

Tax-Managed Capital Appreciation Fund | 88 |

Tax-Managed Small-Cap Fund | 108 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

A Note From Our CEO

Tim Buckley

Chairman and Chief Executive Officer

Dear Shareholder,

Over the years, I’ve found that prudent investors exhibit a common trait: discipline. No matter how the markets move or what new investing fad hits the headlines, those who stay focused on their goals and tune out the noise are set up for long-term success.

The prime gateway to investing is saving, and you don’t usually become a saver without a healthy dose of discipline. Savers make the decision to sock away part of their income, which means spending less and delaying gratification, no matter how difficult that may be.

Of course, disciplined investing extends beyond diligent saving. The financial markets, in the short term especially, are unpredictable; I have yet to meet the investor who can time them perfectly. It takes discipline to resist the urge to go all-in when markets are frothy or to retreat when things look bleak.

Staying put with your investments is one strategy for handling volatility. Another, rebalancing, requires even more discipline because it means steering your money away from strong performers and toward poorer performers.

Patience—a form of discipline—is also the friend of long-term investors. Higher returns are the potential reward for weathering the market’s turbulence and uncertainty.

It’s important to be prepared for that turbulence, whenever it appears. Don’t panic. Don’t chase returns or look for answers outside the asset classes you trust. And be sure to rebalance periodically, even when there’s turmoil.

Whether you’re a master of self-control, get a boost from technology, or work with a professional advisor, know that discipline is necessary to get the most out of your investment portfolio. And know that Vanguard is with you for the entire ride.

Thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

Chairman and Chief Executive Officer

January 17, 2019

1

Your Fund’s Performance at a Glance

· U.S. stocks declined over the 12 months ended December 31, 2018, ending a nine-calendar-year run of gains. Investors were shaken late in the year by concerns about economic growth, U.S. monetary policy, and political uncertainty, including over a partial U.S. government shutdown, U.S.–China trade tensions, and Brexit negotiations.

· For the period, returns for the Vanguard Tax-Managed Funds ranged from –1.43% for Vanguard Tax-Managed Balanced Fund to –8.62% for Vanguard Tax-Managed Small-Cap Fund. The –4.97% return of Vanguard Tax-Managed Capital Appreciation Fund fell in between. (Returns cited are for Admiral Shares.)

· All three funds performed in line with their benchmark indexes.

· The municipal bond market, as measured by the Bloomberg Barclays 1–15 Year Municipal Bond Index, returned 1.58% for the 12 months. Municipal bonds make up about half the Balanced Fund’s assets.

Market Barometer | | | | | | | |

| | Average Annual Total Returns | |

| | Periods Ended December 31, 2018 | |

| | One Year | | Three Years | | Five Years | |

Stocks | | | | | | | |

Russell 1000 Index (Large-caps) | | -4.78% | | 9.09% | | 8.21% | |

Russell 2000 Index (Small-caps) | | -11.01 | | 7.36 | | 4.41 | |

Russell 3000 Index (Broad U.S. market) | | -5.24 | | 8.97 | | 7.91 | |

FTSE All-World ex US Index (International) | | -14.13 | | 4.58 | | 1.05 | |

| | | | | | | |

Bonds | | | | | | | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | | | | | |

(Broad taxable market) | | 0.01% | | 2.06% | | 2.52% | |

Bloomberg Barclays Municipal Bond Index | | | | | | | |

(Broad tax-exempt market) | | 1.28 | | 2.30 | | 3.82 | |

FTSE Three-Month U.S. Treasury Bill Index | | 1.86 | | 0.98 | | 0.59 | |

| | | | | | | |

CPI | | | | | | | |

Consumer Price Index | | 1.91% | | 2.03% | | 1.51% | |

2

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

· Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

· Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

3

Six Months Ended December 31, 2018 | | | |

| Beginning

Account Value

6/30/2018 | Ending

Account Value

12/31/2018 | Expenses

Paid During

Period |

Based on Actual Fund Return | | | |

Tax-Managed Balanced Fund | $1,000.00 | $972.54 | $0.45 |

Tax-Managed Capital Appreciation Fund | | | |

Admiral™ Shares | $1,000.00 | $924.92 | $0.44 |

Institutional Shares | 1,000.00 | 925.10 | 0.29 |

Tax-Managed Small-Cap Fund | | | |

Admiral Shares | $1,000.00 | $836.30 | $0.42 |

Institutional Shares | 1,000.00 | 836.52 | 0.28 |

Based on Hypothetical 5% Yearly Return | | | |

Tax-Managed Balanced Fund | $1,000.00 | $1,024.75 | $0.46 |

Tax-Managed Capital Appreciation Fund | | | |

Admiral Shares | $1,000.00 | $1,024.75 | $0.46 |

Institutional Shares | 1,000.00 | 1,024.90 | 0.31 |

Tax-Managed Small-Cap Fund | | | |

Admiral Shares | $1,000.00 | $1,024.75 | $0.46 |

Institutional Shares | 1,000.00 | 1,024.90 | 0.31 |

The calculations are based on expenses incurred in the most recent six-month period. The funds’ annualized six-month expense ratios for that period are: for the Tax-Managed Balanced Fund, 0.09%; for the Tax-Managed Capital Appreciation Fund, 0.09% for Admiral Shares and 0.06% for Institutional Shares; and for the Tax-Managed Small-Cap Fund, 0.09% for Admiral Shares and 0.06% for Institutional Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (184/365).

4

Tax-Managed Balanced Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

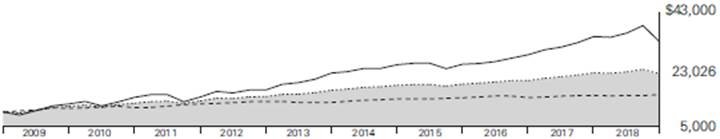

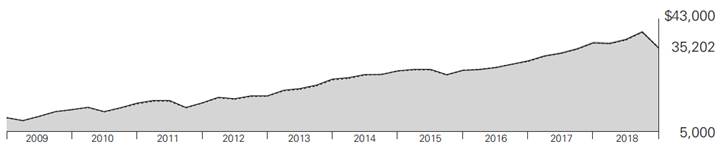

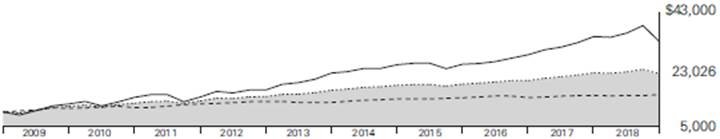

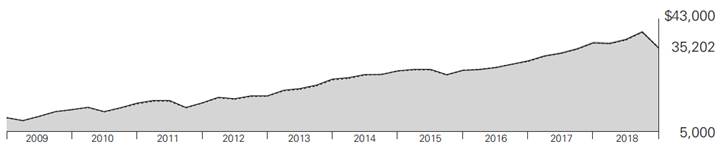

Cumulative Performance: December 31, 2008, Through December 31, 2018

Initial Investment of $10,000

| | | | Average Annual Total Returns | | |

| | | | Periods Ended December 31, 2018 | | |

| | | | | | | | | | Final Value |

| | | | One | | Five | | Ten | | of a $10,000 |

| | | | Year | | Years | | Years | | Investment |

| | Tax-Managed Balanced Fund | | -1.43% | | 5.74% | | 8.70% | | $23,026 |

| | Tax-Managed Balanced Composite Index | | -1.29 | | 5.82 | | 8.89 | | 23,438 |

| | Bloomberg Barclays Municipal Bond Index | | 1.28 | | 3.82 | | 4.85 | | 16,060 |

| | Dow Jones U.S. Total Stock Market Float Adjusted Index | | -5.30 | | 7.86 | | 13.22 | | 34,625 |

Tax-Managed Balanced Composite Index: Weighted 50% Russell 1000 Index and 50% Bloomberg Barclays 7 Year Municipal Bond Index through January 31, 2002, and 50% Russell 1000 Index and 50% Bloomberg Barclays 1–15 Year Municipal Bond Index thereafter.

See Financial Highlights for dividend and capital gains information.

5

Tax-Managed Balanced Fund

Portfolio Allocation

As of December 31, 2018

Equity Exposure

Consumer Discretionary | | 14.3 | % |

Consumer Staples | | 6.3 | |

Energy | | 5.1 | |

Financial Services | | 20.3 | |

Health Care | | 14.4 | |

Materials & Processing | | 3.3 | |

Other | | 0.0 | |

Producer Durables | | 10.1 | |

Technology | | 20.7 | |

Utilities | | 5.5 | |

The table reflects the fund’s equity exposure, based on its investments in stocks and stock index futures. Any holdings in short-term reserves are excluded. Sector categories are based on the Russell Global Sectors (“RGS”), except for the “Other” category (if applicable), which includes securities that have not been provided a RGS classification as of the effective reporting period.

Fixed Income Exposure | | | |

| | | |

New York | | 6.7 | % |

Texas | | 5.7 | |

California | | 5.2 | |

Illinois | | 3.0 | |

Pennsylvania | | 2.7 | |

Florida | | 2.6 | |

Maryland | | 1.6 | |

New Jersey | | 1.6 | |

Ohio | | 1.6 | |

Georgia | | 1.4 | |

Top Ten | | 32.1 | % |

The table excludes any fixed income futures contracts.

6

Tax-Managed Balanced Fund

Financial Statements

Statement of Net Assets

As of December 31, 2018

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov.

| | | Market |

| | | Value· |

| | Shares | ($000) |

Common Stocks (48.1%)1 | | |

Consumer Discretionary (6.9%) | | |

* | Amazon.com Inc. | 36,564 | 54,918 |

| Home Depot Inc. | 102,199 | 17,560 |

| Walt Disney Co. | 130,166 | 14,273 |

| Comcast Corp. Class A | 398,889 | 13,582 |

| McDonald’s Corp. | 68,274 | 12,123 |

| Walmart Inc. | 129,349 | 12,049 |

* | Netflix Inc. | 36,567 | 9,788 |

| NIKE Inc. Class B | 110,228 | 8,172 |

| Costco Wholesale Corp. | 37,193 | 7,577 |

| Starbucks Corp. | 107,823 | 6,944 |

* | Booking Holdings Inc. | 3,996 | 6,883 |

| Lowe’s Cos. Inc. | 69,297 | 6,400 |

| TJX Cos. Inc. | 101,872 | 4,558 |

* | Charter Communications Inc. Class A | 14,541 | 4,144 |

* | Tesla Inc. | 12,335 | 4,105 |

| Twenty-First Century Fox Inc. Class A | 85,251 | 4,102 |

| General Motors Co. | 105,600 | 3,532 |

* | Dollar Tree Inc. | 36,234 | 3,273 |

* | O’Reilly Automotive Inc. | 8,852 | 3,048 |

| Marriott International Inc. Class A | 27,645 | 3,001 |

| Target Corp. | 41,967 | 2,774 |

* | eBay Inc. | 97,361 | 2,733 |

| Ross Stores Inc. | 32,367 | 2,693 |

* | AutoZone Inc. | 3,166 | 2,654 |

| Dollar General Corp. | 21,792 | 2,355 |

| Ford Motor Co. | 301,100 | 2,303 |

| Estee Lauder Cos. Inc. Class A | 17,690 | 2,301 |

| Yum! Brands Inc. | 23,605 | 2,170 |

| Domino’s Pizza Inc. | 8,213 | 2,037 |

| VF Corp. | 26,400 | 1,883 |

* | Live Nation Entertainment Inc. | 36,660 | 1,805 |

| CBS Corp. Class B | 41,216 | 1,802 |

* | NVR Inc. | 702 | 1,711 |

| Twenty-First Century Fox Inc. | 35,700 | 1,706 |

* | Lululemon Athletica Inc. | 13,633 | 1,658 |

* | Sirius XM Holdings Inc. | 274,776 | 1,569 |

* | LKQ Corp. | 64,985 | 1,542 |

* | Ulta Beauty Inc. | 6,136 | 1,502 |

| Las Vegas Sands Corp. | 28,700 | 1,494 |

| Royal Caribbean Cruises Ltd. | 15,032 | 1,470 |

* | Madison Square Garden Co. Class A | 5,455 | 1,460 |

| Hilton Worldwide Holdings Inc. | 19,234 | 1,381 |

| Carnival Corp. | 27,950 | 1,378 |

| MGM Resorts International | 52,646 | 1,277 |

| Expedia Group Inc. | 11,176 | 1,259 |

| DR Horton Inc. | 34,933 | 1,211 |

| Lear Corp. | 9,633 | 1,184 |

* | Mohawk Industries Inc. | 10,016 | 1,171 |

| Yum China Holdings Inc. | 34,065 | 1,142 |

* | WABCO Holdings Inc. | 10,448 | 1,121 |

| Service Corp. International | 26,808 | 1,079 |

| Omnicom Group Inc. | 14,479 | 1,060 |

| Aptiv plc | 17,093 | 1,052 |

| Tractor Supply Co. | 12,514 | 1,044 |

* | Visteon Corp. | 16,649 | 1,004 |

* | ServiceMaster Global Holdings Inc. | 27,158 | 998 |

| Advance Auto Parts Inc. | 6,304 | 993 |

| Gentex Corp. | 46,360 | 937 |

* | Liberty Media Corp-Liberty SiriusXM Class C | 25,005 | 925 |

* | CarMax Inc. | 14,734 | 924 |

| Lennar Corp. Class A | 22,169 | 868 |

| Dunkin’ Brands Group Inc. | 13,333 | 855 |

* | Norwegian Cruise Line Holdings Ltd. | 20,099 | 852 |

| Genuine Parts Co. | 8,703 | 836 |

| Tapestry Inc. | 24,420 | 824 |

7

Tax-Managed Balanced Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

* | Liberty Media Corp-Liberty SiriusXM Class A | 22,216 | 818 |

| News Corp. Class A | 71,840 | 815 |

| Best Buy Co. Inc. | 15,300 | 810 |

| Wendy’s Co. | 51,618 | 806 |

| PVH Corp. | 8,403 | 781 |

| Kohl’s Corp. | 11,385 | 755 |

| Wynn Resorts Ltd. | 7,591 | 751 |

* | Bright Horizons Family Solutions Inc. | 6,390 | 712 |

| Darden Restaurants Inc. | 7,080 | 707 |

| Fortune Brands Home & Security Inc. | 18,483 | 702 |

| Newell Brands Inc. | 35,513 | 660 |

* | TripAdvisor Inc. | 12,195 | 658 |

* | Chipotle Mexican Grill Inc. Class A | 1,519 | 656 |

* | Liberty Broadband Corp. | 8,992 | 648 |

* | Discovery Communications Inc. | 26,958 | 622 |

* | Liberty Expedia Holdings Inc. Class A | 15,603 | 610 |

| Thor Industries Inc. | 11,733 | 610 |

| Macy’s Inc. | 20,100 | 599 |

| AMERCO | 1,804 | 592 |

* | Burlington Stores Inc. | 3,517 | 572 |

| Vail Resorts Inc. | 2,700 | 569 |

* | Hilton Grand Vacations Inc. | 21,558 | 569 |

* | Under Armour Inc. Class A | 31,760 | 561 |

| Tiffany & Co. | 6,700 | 539 |

* | Liberty Broadband Corp. Class A | 7,384 | 530 |

| Wyndham Hotels & Resorts Inc. | 11,225 | 509 |

* | Liberty Media Corp-Liberty Formula One | 16,491 | 506 |

* | GCI Liberty Inc. Class A | 11,360 | 468 |

* | Qurate Retail Group Inc. QVC Group Class A | 23,423 | 457 |

| Hasbro Inc. | 5,400 | 439 |

| Viacom Inc. Class B | 17,024 | 438 |

| L Brands Inc. | 16,900 | 434 |

| Gap Inc. | 16,771 | 432 |

| John Wiley & Sons Inc. Class A | 9,018 | 424 |

| Harley-Davidson Inc. | 12,290 | 419 |

* | AutoNation Inc. | 11,211 | 400 |

* | Under Armour Inc. | 24,748 | 400 |

| Polaris Industries Inc. | 5,200 | 399 |

| Lions Gate Entertainment Corp. Class B | 25,277 | 376 |

* | DISH Network Corp. Class A | 14,505 | 362 |

* | frontdoor Inc. | 13,579 | 361 |

| Nielsen Holdings plc | 14,928 | 348 |

| Hanesbrands Inc. | 27,600 | 346 |

* | Urban Outfitters Inc. | 10,257 | 341 |

| Interpublic Group of Cos. Inc. | 15,783 | 326 |

* | Capri Holdings Ltd. | 8,446 | 320 |

| Ralph Lauren Corp. Class A | 3,073 | 318 |

| BorgWarner Inc. | 8,952 | 311 |

| Hyatt Hotels Corp. Class A | 4,521 | 306 |

* | Mattel Inc. | 29,845 | 298 |

| Aramark | 9,398 | 272 |

* | Wayfair Inc. | 3,003 | 271 |

| Foot Locker Inc. | 4,900 | 261 |

* | Grand Canyon Education Inc. | 2,711 | 261 |

| Whirlpool Corp. | 2,408 | 257 |

* | Sally Beauty Holdings Inc. | 14,853 | 253 |

| Nordstrom Inc. | 5,400 | 252 |

* | AMC Networks Inc. Class A | 4,574 | 251 |

* | Murphy USA Inc. | 3,205 | 246 |

| Dillard’s Inc. Class A | 3,953 | 238 |

| Garmin Ltd. | 3,700 | 234 |

* | Liberty Media Corp-Liberty Formula One Class A | 7,814 | 232 |

| Brinker International Inc. | 5,137 | 226 |

* | Skechers U.S.A. Inc. Class A | 9,179 | 210 |

| Williams-Sonoma Inc. | 4,000 | 202 |

* | Tempur Sealy International Inc. | 4,665 | 193 |

* | Fitbit Inc. Class A | 37,908 | 188 |

| PulteGroup Inc. | 7,000 | 182 |

* | Floor & Decor Holdings Inc. Class A | 6,974 | 181 |

| KAR Auction Services Inc. | 3,700 | 177 |

* | 2U Inc. | 3,296 | 164 |

* | Michaels Cos. Inc. | 12,033 | 163 |

| Lions Gate Entertainment Corp. Class A | 10,046 | 162 |

| Coty Inc. Class A | 19,362 | 127 |

| Goodyear Tire & Rubber Co. | 5,972 | 122 |

| Pool Corp. | 800 | 119 |

* | Discovery Communications Inc. Class A | 3,841 | 95 |

* | Pandora Media Inc. | 11,184 | 90 |

| Penske Automotive Group Inc. | 2,200 | 89 |

* | Vista Outdoor Inc. | 7,611 | 86 |

| Adient plc | 5,647 | 85 |

| Leggett & Platt Inc. | 2,300 | 82 |

| Toll Brothers Inc. | 2,401 | 79 |

* | Avis Budget Group Inc. | 3,466 | 78 |

* | Caesars Entertainment Corp. | 11,000 | 75 |

* | Garrett Motion Inc. | 5,413 | 67 |

| H&R Block Inc. | 2,600 | 66 |

* | Hertz Global Holdings Inc. | 3,462 | 47 |

| Lennar Corp. Class B | 1,151 | 36 |

8

Tax-Managed Balanced Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

| Carter’s Inc. | 400 | 33 |

| Brunswick Corp. | 400 | 19 |

* | Dropbox Inc. Class A | 462 | 9 |

| Entercom Communications Corp. Class A | 171 | 1 |

| | | 299,900 |

Consumer Staples (3.0%) | | |

| Procter & Gamble Co. | 228,656 | 21,018 |

| Coca-Cola Co. | 340,064 | 16,102 |

| PepsiCo Inc. | 124,264 | 13,729 |

| Philip Morris International Inc. | 145,949 | 9,744 |

| Altria Group Inc. | 178,880 | 8,835 |

| CVS Health Corp. | 115,996 | 7,600 |

| Mondelez International Inc. Class A | 118,037 | 4,725 |

| Walgreens Boots Alliance Inc. | 68,678 | 4,693 |

| Colgate-Palmolive Co. | 71,470 | 4,254 |

* | Monster Beverage Corp. | 73,396 | 3,613 |

| Kimberly-Clark Corp. | 27,721 | 3,158 |

* | Herbalife Nutrition Ltd. | 40,994 | 2,417 |

| Sysco Corp. | 36,397 | 2,281 |

| Kraft Heinz Co. | 52,359 | 2,254 |

| Constellation Brands Inc. Class A | 12,436 | 2,000 |

| General Mills Inc. | 46,714 | 1,819 |

| McCormick & Co. Inc. | 12,780 | 1,779 |

| Church & Dwight Co. Inc. | 25,710 | 1,691 |

| Archer-Daniels-Midland Co. | 40,473 | 1,658 |

| Kroger Co. | 58,600 | 1,611 |

* | US Foods Holding Corp. | 49,882 | 1,578 |

| Clorox Co. | 10,000 | 1,541 |

| Tyson Foods Inc. Class A | 27,013 | 1,442 |

| Hershey Co. | 13,200 | 1,415 |

| Brown-Forman Corp. Class B | 28,063 | 1,335 |

| Hormel Foods Corp. | 30,684 | 1,310 |

* | Post Holdings Inc. | 12,502 | 1,114 |

| JM Smucker Co. | 9,651 | 902 |

| Kellogg Co. | 15,275 | 871 |

| Ingredion Inc. | 9,319 | 852 |

| Molson Coors Brewing Co. Class B | 14,200 | 797 |

| Conagra Brands Inc. | 30,024 | 641 |

| Lamb Weston Holdings Inc. | 7,600 | 559 |

* | Sprouts Farmers Market Inc. | 23,225 | 546 |

| Keurig Dr Pepper Inc. | 16,512 | 423 |

| Bunge Ltd. | 7,914 | 423 |

* | Pilgrim’s Pride Corp. | 20,390 | 316 |

| Energizer Holdings Inc. | 6,965 | 314 |

* | TreeHouse Foods Inc. | 5,369 | 272 |

* | Campbell Soup Co. | 6,200 | 205 |

| Spectrum Brands Holdings Inc. | 3,200 | 135 |

* | Hain Celestial Group Inc. | 6,100 | 97 |

| Flowers Foods Inc. | 4,800 | 89 |

* | Edgewell Personal Care Co. | 1,441 | 54 |

| Casey’s General Stores Inc. | 200 | 26 |

| | | 132,238 |

Energy (2.4%) | | |

| Exxon Mobil Corp. | 387,115 | 26,397 |

| Chevron Corp. | 175,232 | 19,064 |

| ConocoPhillips | 96,912 | 6,042 |

| Schlumberger Ltd. | 123,567 | 4,458 |

| EOG Resources Inc. | 47,356 | 4,130 |

| Occidental Petroleum Corp. | 66,066 | 4,055 |

| Marathon Petroleum Corp. | 57,171 | 3,374 |

| Phillips 66 | 34,675 | 2,987 |

| Valero Energy Corp. | 36,500 | 2,736 |

* | Concho Resources Inc. | 23,594 | 2,425 |

| Kinder Morgan Inc. | 152,900 | 2,352 |

| Pioneer Natural Resources Co. | 17,381 | 2,286 |

| Williams Cos. Inc. | 98,560 | 2,173 |

| Diamondback Energy Inc. | 21,019 | 1,948 |

| Halliburton Co. | 63,425 | 1,686 |

| Anadarko Petroleum Corp. | 37,492 | 1,644 |

| ONEOK Inc. | 29,384 | 1,585 |

* | Cheniere Energy Inc. | 24,543 | 1,453 |

* | Continental Resources Inc. | 31,835 | 1,279 |

* | Transocean Ltd. | 140,144 | 973 |

| Marathon Oil Corp. | 57,682 | 827 |

| Cabot Oil & Gas Corp. | 31,004 | 693 |

| Hess Corp. | 16,730 | 678 |

| Devon Energy Corp. | 29,554 | 666 |

| Baker Hughes a GE Co. Class A | 30,650 | 659 |

| HollyFrontier Corp. | 12,392 | 634 |

| Cimarex Energy Co. | 9,876 | 609 |

| Apache Corp. | 21,238 | 558 |

| National Oilwell Varco Inc. | 21,529 | 553 |

| Noble Energy Inc. | 28,498 | 535 |

* | Newfield Exploration Co. | 36,054 | 529 |

| Targa Resources Corp. | 13,400 | 483 |

| Helmerich & Payne Inc. | 7,915 | 379 |

* | WPX Energy Inc. | 33,156 | 376 |

* | Parsley Energy Inc. Class A | 22,957 | 367 |

* | CNX Resources Corp. | 29,651 | 339 |

| EQT Corp. | 17,576 | 332 |

| Valvoline Inc. | 17,015 | 329 |

* | Antero Resources Corp. | 32,958 | 309 |

| Patterson-UTI Energy Inc. | 28,702 | 297 |

* | Centennial Resource Development Inc. Class A | 25,688 | 283 |

* | Equitrans Midstream Corp. | 14,060 | 282 |

* | Chesapeake Energy Corp. | 132,158 | 278 |

9

Tax-Managed Balanced Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

| RPC Inc. | 26,456 | 261 |

| PBF Energy Inc. Class A | 7,200 | 235 |

* | QEP Resources Inc. | 32,295 | 182 |

* | Arcosa Inc. | 6,366 | 176 |

| Murphy Oil Corp. | 7,300 | 171 |

* | CONSOL Energy Inc. | 5,029 | 159 |

* | Kosmos Energy Ltd. | 35,887 | 146 |

* | Extraction Oil & Gas Inc. | 33,774 | 145 |

* | Whiting Petroleum Corp. | 5,656 | 128 |

* | First Solar Inc. | 2,122 | 90 |

* | Oceaneering International Inc. | 6,475 | 78 |

* | Laredo Petroleum Inc. | 18,354 | 66 |

* | Apergy Corp. | 2,431 | 66 |

| Range Resources Corp. | 6,046 | 58 |

* | Diamond Offshore Drilling Inc. | 5,249 | 50 |

* | Rowan Cos. plc Class A | 4,859 | 41 |

| SM Energy Co. | 2,600 | 40 |

| Nabors Industries Ltd. | 16,420 | 33 |

* | Weatherford International plc | 52,044 | 29 |

| | | 106,196 |

Financial Services (9.8%) | | |

* | Berkshire Hathaway Inc. Class B | 176,419 | 36,021 |

| JPMorgan Chase & Co. | 301,316 | 29,414 |

| Visa Inc. Class A | 159,019 | 20,981 |

| Bank of America Corp. | 824,936 | 20,326 |

| Wells Fargo & Co. | 383,791 | 17,685 |

| Mastercard Inc. Class A | 81,300 | 15,337 |

| Citigroup Inc. | 217,036 | 11,299 |

* | PayPal Holdings Inc. | 104,653 | 8,800 |

| American Tower Corp. | 40,219 | 6,362 |

| CME Group Inc. | 30,895 | 5,812 |

| US Bancorp | 126,972 | 5,803 |

| American Express Co. | 59,335 | 5,656 |

| Goldman Sachs Group Inc. | 30,693 | 5,127 |

| Simon Property Group Inc. | 29,828 | 5,011 |

| Chubb Ltd. | 37,902 | 4,896 |

| PNC Financial Services Group Inc. | 38,140 | 4,459 |

| Crown Castle International Corp. | 39,583 | 4,300 |

| BlackRock Inc. | 10,931 | 4,294 |

| Charles Schwab Corp. | 101,705 | 4,224 |

| Morgan Stanley | 106,019 | 4,204 |

| Bank of New York Mellon Corp. | 77,301 | 3,639 |

| S&P Global Inc. | 20,231 | 3,438 |

* | Fiserv Inc. | 46,422 | 3,412 |

| Intercontinental Exchange Inc. | 44,887 | 3,381 |

| Prologis Inc. | 56,910 | 3,342 |

| Aon plc | 22,428 | 3,260 |

| Marsh & McLennan Cos. Inc. | 40,397 | 3,222 |

| American International Group Inc. | 80,341 | 3,166 |

* | SBA Communications Corp. Class A | 19,275 | 3,120 |

| Public Storage | 14,772 | 2,990 |

| MetLife Inc. | 69,340 | 2,847 |

| Equity Commonwealth | 94,595 | 2,839 |

| Capital One Financial Corp. | 37,492 | 2,834 |

| Progressive Corp. | 45,397 | 2,739 |

| Aflac Inc. | 59,874 | 2,728 |

| E*TRADE Financial Corp. | 59,940 | 2,630 |

| Prudential Financial Inc. | 32,032 | 2,612 |

| BB&T Corp. | 59,919 | 2,596 |

| Fidelity National Information Services Inc. | 25,181 | 2,582 |

| Equinix Inc. | 7,096 | 2,502 |

| Travelers Cos. Inc. | 20,346 | 2,436 |

| Welltower Inc. | 34,803 | 2,416 |

* | Square Inc. | 40,533 | 2,274 |

| Allstate Corp. | 27,285 | 2,255 |

| Equity Residential | 33,625 | 2,220 |

* | Markel Corp. | 2,020 | 2,097 |

| Moody’s Corp. | 14,200 | 1,989 |

* | SVB Financial Group | 10,384 | 1,972 |

| Digital Realty Trust Inc. | 18,310 | 1,951 |

| Ventas Inc. | 33,100 | 1,939 |

| MSCI Inc. Class A | 13,073 | 1,927 |

| SunTrust Banks Inc. | 37,898 | 1,912 |

* | CBRE Group Inc. Class A | 46,565 | 1,864 |

| State Street Corp. | 28,698 | 1,810 |

| Alleghany Corp. | 2,888 | 1,800 |

| AvalonBay Communities Inc. | 10,200 | 1,775 |

| Global Payments Inc. | 16,878 | 1,741 |

* | Arch Capital Group Ltd. | 64,698 | 1,729 |

* | Credit Acceptance Corp. | 4,431 | 1,692 |

* | Worldpay Inc. Class A | 21,464 | 1,640 |

| Synchrony Financial | 69,572 | 1,632 |

| Total System Services Inc. | 19,350 | 1,573 |

| Annaly Capital Management Inc. | 158,700 | 1,558 |

| Weyerhaeuser Co. | 70,486 | 1,541 |

| T. Rowe Price Group Inc. | 16,674 | 1,539 |

| Realty Income Corp. | 24,100 | 1,519 |

| Hartford Financial Services Group Inc. | 33,742 | 1,500 |

* | First Republic Bank | 17,226 | 1,497 |

| Loews Corp. | 32,874 | 1,496 |

| Essex Property Trust Inc. | 5,973 | 1,465 |

* | Howard Hughes Corp. | 14,745 | 1,439 |

| Boston Properties Inc. | 12,781 | 1,439 |

| Discover Financial Services | 24,229 | 1,429 |

| Comerica Inc. | 20,726 | 1,424 |

10

Tax-Managed Balanced Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

| Zions Bancorp NA | 34,541 | 1,407 |

| M&T Bank Corp. | 9,799 | 1,403 |

| Willis Towers Watson plc | 9,000 | 1,367 |

| Equity LifeStyle Properties Inc. | 13,123 | 1,275 |

* | First Data Corp. Class A | 74,086 | 1,253 |

| KeyCorp | 84,218 | 1,245 |

| Torchmark Corp. | 16,679 | 1,243 |

| AGNC Investment Corp. | 69,800 | 1,224 |

| TransUnion | 21,483 | 1,220 |

| Franklin Resources Inc. | 40,775 | 1,209 |

| Extra Space Storage Inc. | 13,300 | 1,203 |

| Nasdaq Inc. | 14,723 | 1,201 |

| WR Berkley Corp. | 15,951 | 1,179 |

| Reinsurance Group of America Inc. Class A | 8,395 | 1,177 |

| Regions Financial Corp. | 87,002 | 1,164 |

| TD Ameritrade Holding Corp. | 23,647 | 1,158 |

| Equifax Inc. | 12,213 | 1,137 |

| Brown & Brown Inc. | 41,088 | 1,132 |

| FactSet Research Systems Inc. | 5,644 | 1,130 |

| Cboe Global Markets Inc. | 11,525 | 1,127 |

| Northern Trust Corp. | 13,372 | 1,118 |

| HCP Inc. | 38,900 | 1,086 |

| Huntington Bancshares Inc. | 89,700 | 1,069 |

* | FleetCor Technologies Inc. | 5,628 | 1,045 |

| Signature Bank | 10,103 | 1,039 |

| Commerce Bancshares Inc. | 18,246 | 1,029 |

| RenaissanceRe Holdings Ltd. | 7,551 | 1,010 |

| Assured Guaranty Ltd. | 26,202 | 1,003 |

| Host Hotels & Resorts Inc. | 59,699 | 995 |

| Fifth Third Bancorp | 41,575 | 978 |

| Vornado Realty Trust | 15,600 | 968 |

| JBG SMITH Properties | 27,687 | 964 |

* | Western Alliance Bancorp | 24,375 | 963 |

| Everest Re Group Ltd. | 4,400 | 958 |

| American Homes 4 Rent Class A | 47,925 | 951 |

| Camden Property Trust | 10,700 | 942 |

| Lamar Advertising Co. Class A | 13,558 | 938 |

| Popular Inc. | 19,791 | 935 |

| Assurant Inc. | 10,042 | 898 |

| Ameriprise Financial Inc. | 8,593 | 897 |

| East West Bancorp Inc. | 20,444 | 890 |

| Mid-America Apartment Communities Inc. | 9,294 | 889 |

| SEI Investments Co. | 18,913 | 874 |

| Federal Realty Investment Trust | 7,319 | 864 |

| Raymond James Financial Inc. | 11,434 | 851 |

| Citizens Financial Group Inc. | 28,543 | 849 |

| Lincoln National Corp. | 16,530 | 848 |

| Morningstar Inc. | 7,630 | 838 |

| Apartment Investment & Management Co. | 18,776 | 824 |

| Douglas Emmett Inc. | 24,033 | 820 |

| Hanover Insurance Group Inc. | 6,939 | 810 |

| SL Green Realty Corp. | 10,059 | 795 |

* | Zillow Group Inc. | 24,978 | 789 |

| Arthur J Gallagher & Co. | 10,570 | 779 |

| Dun & Bradstreet Corp. | 5,400 | 771 |

| Kilroy Realty Corp. | 12,189 | 766 |

| White Mountains Insurance Group Ltd. | 882 | 756 |

| TCF Financial Corp. | 37,574 | 732 |

| Synovus Financial Corp. | 22,625 | 724 |

| Unum Group | 24,293 | 714 |

| Alexandria Real Estate Equities Inc. | 6,130 | 706 |

| Associated Banc-Corp | 35,476 | 702 |

| Principal Financial Group Inc. | 15,890 | 702 |

| Iron Mountain Inc. | 21,600 | 700 |

| Regency Centers Corp. | 11,800 | 692 |

| Cincinnati Financial Corp. | 8,401 | 650 |

| Jones Lang LaSalle Inc. | 5,012 | 635 |

| Broadridge Financial Solutions Inc. | 6,331 | 609 |

* | Athene Holding Ltd. Class A | 14,991 | 597 |

| New Residential Investment Corp. | 40,400 | 574 |

| Alliance Data Systems Corp. | 3,804 | 571 |

| Ally Financial Inc. | 24,954 | 565 |

| UDR Inc. | 13,895 | 551 |

| WP Carey Inc. | 8,400 | 549 |

| Empire State Realty Trust Inc. | 37,439 | 533 |

| TFS Financial Corp. | 32,290 | 521 |

| Starwood Property Trust Inc. | 24,500 | 483 |

| Jack Henry & Associates Inc. | 3,732 | 472 |

| Omega Healthcare Investors Inc. | 13,300 | 467 |

| VEREIT Inc. | 64,500 | 461 |

| Kimco Realty Corp. | 31,300 | 459 |

| Invitation Homes Inc. | 21,896 | 440 |

| Duke Realty Corp. | 16,813 | 435 |

* | WEX Inc. | 3,040 | 426 |

| Santander Consumer USA Holdings Inc. | 23,585 | 415 |

| Wyndham Destinations Inc. | 11,225 | 402 |

| CNA Financial Corp. | 8,693 | 384 |

| Sun Communities Inc. | 3,700 | 376 |

| First Hawaiian Inc. | 16,576 | 373 |

| Invesco Ltd. | 22,111 | 370 |

| Legg Mason Inc. | 14,354 | 366 |

| Affiliated Managers Group Inc. | 3,684 | 359 |

11

Tax-Managed Balanced Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

| Fidelity National Financial Inc. | 11,132 | 350 |

| Macerich Co. | 7,827 | 339 |

| Park Hotels & Resorts Inc. | 13,014 | 338 |

| People’s United Financial Inc. | 23,399 | 338 |

| PacWest Bancorp | 9,700 | 323 |

* | CoreLogic Inc. | 9,161 | 306 |

| BOK Financial Corp. | 4,040 | 296 |

| MarketAxess Holdings Inc. | 1,400 | 296 |

| Brookfield Property REIT Inc. Class A | 18,200 | 293 |

| First Horizon National Corp. | 21,630 | 285 |

| Western Union Co. | 16,676 | 284 |

| National Retail Properties Inc. | 5,800 | 281 |

| Bank OZK | 12,100 | 276 |

| Uniti Group Inc. | 16,800 | 262 |

| Gaming and Leisure Properties Inc. | 8,000 | 258 |

| VICI Properties Inc. | 12,500 | 235 |

* | OneMain Holdings Inc. | 9,270 | 225 |

* | Euronet Worldwide Inc. | 2,192 | 224 |

| Senior Housing Properties Trust | 19,100 | 224 |

| Retail Properties of America Inc. | 19,700 | 214 |

* | Texas Capital Bancshares Inc. | 4,028 | 206 |

| ProAssurance Corp. | 5,000 | 203 |

| CIT Group Inc. | 5,244 | 201 |

| Voya Financial Inc. | 4,700 | 189 |

| Lazard Ltd. Class A | 5,025 | 185 |

| CyrusOne Inc. | 3,500 | 185 |

| American Financial Group Inc. | 2,020 | 183 |

| Spirit Realty Capital Inc. | 5,100 | 180 |

* | SLM Corp. | 21,360 | 178 |

| Colony Capital Inc. | 35,200 | 165 |

| Liberty Property Trust | 3,800 | 159 |

| Jefferies Financial Group Inc. | 8,733 | 152 |

| Weingarten Realty Investors | 5,400 | 134 |

| Old Republic International Corp. | 6,300 | 130 |

| American Campus Communities Inc. | 3,100 | 128 |

* | Donnelley Financial Solutions Inc. | 9,058 | 127 |

| Medical Properties Trust Inc. | 7,900 | 127 |

| Brixmor Property Group Inc. | 8,100 | 119 |

* | Brighthouse Financial Inc. | 3,422 | 104 |

| Interactive Brokers Group Inc. | 1,820 | 99 |

| CubeSmart | 3,300 | 95 |

| STORE Capital Corp. | 3,300 | 93 |

* | Fair Isaac Corp. | 400 | 75 |

| Healthcare Trust of America Inc. Class A | 2,800 | 71 |

* | Zillow Group Inc. Class A | 2,247 | 71 |

| Paramount Group Inc. | 4,666 | 59 |

| LPL Financial Holdings Inc. | 900 | 55 |

| Retail Value Inc. | 2,148 | 55 |

| Axis Capital Holdings Ltd. | 1,000 | 52 |

| EPR Properties | 800 | 51 |

| First American Financial Corp. | 1,000 | 45 |

| Cullen/Frost Bankers Inc. | 500 | 44 |

| Webster Financial Corp. | 500 | 25 |

| SITE Centers Corp. | 2,200 | 24 |

| AXA Equitable Holdings Inc. | 1,456 | 24 |

| Eaton Vance Corp. | 600 | 21 |

| Highwoods Properties Inc. | 500 | 19 |

| Navient Corp. | 1,600 | 14 |

| | | 427,042 |

Health Care (6.9%) | | |

| Johnson & Johnson | 244,344 | 31,533 |

| Pfizer Inc. | 530,487 | 23,156 |

| UnitedHealth Group Inc. | 87,662 | 21,838 |

| Merck & Co. Inc. | 237,221 | 18,126 |

| AbbVie Inc. | 137,354 | 12,663 |

| Medtronic plc | 126,010 | 11,462 |

| Amgen Inc. | 58,556 | 11,399 |

| Abbott Laboratories | 157,288 | 11,377 |

| Eli Lilly & Co. | 84,100 | 9,732 |

| Thermo Fisher Scientific Inc. | 34,167 | 7,646 |

| Bristol-Myers Squibb Co. | 146,560 | 7,618 |

| Gilead Sciences Inc. | 118,574 | 7,417 |

* | Cigna Corp. | 32,277 | 6,130 |

| Anthem Inc. | 22,796 | 5,987 |

| Danaher Corp. | 52,651 | 5,429 |

* | Biogen Inc. | 17,830 | 5,365 |

| Becton Dickinson and Co. | 22,369 | 5,040 |

* | Intuitive Surgical Inc. | 9,829 | 4,707 |

* | Boston Scientific Corp. | 131,620 | 4,651 |

| Stryker Corp. | 29,249 | 4,585 |

| Allergan plc | 29,308 | 3,917 |

* | Celgene Corp. | 60,826 | 3,898 |

* | Illumina Inc. | 12,140 | 3,641 |

* | Vertex Pharmaceuticals Inc. | 21,731 | 3,601 |

| HCA Healthcare Inc. | 27,987 | 3,483 |

| Zoetis Inc. | 38,668 | 3,308 |

| Humana Inc. | 11,048 | 3,165 |

| Baxter International Inc. | 40,800 | 2,685 |

* | Edwards Lifesciences Corp. | 17,320 | 2,653 |

* | Regeneron Pharmaceuticals Inc. | 6,817 | 2,546 |

* | Cerner Corp. | 39,125 | 2,052 |

| Agilent Technologies Inc. | 29,707 | 2,004 |

| Cooper Cos. Inc. | 6,988 | 1,778 |

* | Alexion Pharmaceuticals Inc. | 17,657 | 1,719 |

| McKesson Corp. | 15,536 | 1,716 |

* | Centene Corp. | 14,775 | 1,704 |

* | Laboratory Corp. of America Holdings | 12,653 | 1,599 |

12

Tax-Managed Balanced Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

* | QIAGEN NV | 45,032 | 1,551 |

| Zimmer Biomet Holdings Inc. | 14,270 | 1,480 |

* | IQVIA Holdings Inc. | 12,114 | 1,407 |

* | Varian Medical Systems Inc. | 12,140 | 1,376 |

* | Mylan NV | 49,481 | 1,356 |

* | Align Technology Inc. | 6,329 | 1,325 |

* | IDEXX Laboratories Inc. | 7,003 | 1,303 |

| PerkinElmer Inc. | 16,358 | 1,285 |

* | BioMarin Pharmaceutical Inc. | 14,634 | 1,246 |

| Universal Health Services Inc. Class B | 10,172 | 1,186 |

* | ABIOMED Inc. | 3,435 | 1,117 |

* | DaVita Inc. | 21,419 | 1,102 |

| AmerisourceBergen Corp. Class A | 14,706 | 1,094 |

| Hill-Rom Holdings Inc. | 11,772 | 1,042 |

| Cardinal Health Inc. | 23,145 | 1,032 |

| ResMed Inc. | 9,000 | 1,025 |

* | Hologic Inc. | 23,986 | 986 |

| Bio-Techne Corp. | 6,325 | 915 |

* | Premier Inc. Class A | 24,414 | 912 |

* | Henry Schein Inc. | 11,560 | 908 |

* | Charles River Laboratories International Inc. | 7,921 | 897 |

* | Incyte Corp. | 13,568 | 863 |

* | Veeva Systems Inc. Class A | 9,583 | 856 |

* | DexCom Inc. | 6,272 | 751 |

* | WellCare Health Plans Inc. | 3,162 | 747 |

| Dentsply Sirona Inc. | 19,508 | 726 |

* | Ionis Pharmaceuticals Inc. | 13,354 | 722 |

* | athenahealth Inc. | 5,271 | 695 |

| Quest Diagnostics Inc. | 8,019 | 668 |

* | Bio-Rad Laboratories Inc. Class A | 2,729 | 634 |

| Teleflex Inc. | 2,438 | 630 |

* | Seattle Genetics Inc. | 10,129 | 574 |

* | Exact Sciences Corp. | 8,800 | 555 |

* | United Therapeutics Corp. | 4,843 | 527 |

* | Alnylam Pharmaceuticals Inc. | 7,037 | 513 |

* | Sarepta Therapeutics Inc. | 4,700 | 513 |

* | Alkermes plc | 15,995 | 472 |

* | Neurocrine Biosciences Inc. | 6,346 | 453 |

* | Molina Healthcare Inc. | 3,600 | 418 |

| STERIS plc | 3,700 | 395 |

* | Exelixis Inc. | 19,781 | 389 |

| Perrigo Co. plc | 9,600 | 372 |

* | Penumbra Inc. | 2,982 | 364 |

* | Bluebird Bio Inc. | 3,600 | 357 |

* | Nektar Therapeutics Class A | 9,700 | 319 |

* | PRA Health Sciences Inc. | 3,208 | 295 |

* | Jazz Pharmaceuticals plc | 2,300 | 285 |

* | Sage Therapeutics Inc. | 2,900 | 278 |

| West Pharmaceutical Services Inc. | 2,341 | 230 |

* | Agios Pharmaceuticals Inc. | 4,742 | 219 |

* | TESARO Inc. | 2,830 | 210 |

* | Masimo Corp. | 1,878 | 202 |

* | Insulet Corp. | 2,319 | 184 |

| Encompass Health Corp. | 2,800 | 173 |

* | ICU Medical Inc. | 700 | 161 |

* | Integra LifeSciences Holdings Corp. | 3,413 | 154 |

* | Acadia Healthcare Co. Inc. | 5,870 | 151 |

* | Allscripts Healthcare Solutions Inc. | 14,086 | 136 |

* | MEDNAX Inc. | 3,331 | 110 |

* | Varex Imaging Corp. | 4,097 | 97 |

* | Mallinckrodt plc | 5,898 | 93 |

* | Endo International plc | 11,541 | 84 |

| Patterson Cos. Inc. | 3,600 | 71 |

* | Intercept Pharmaceuticals Inc. | 694 | 70 |

* | Catalent Inc. | 2,000 | 62 |

* | Tenet Healthcare Corp. | 3,620 | 62 |

* | Intrexon Corp. | 8,508 | 56 |

| Bruker Corp. | 1,500 | 45 |

* | OPKO Health Inc. | 12,214 | 37 |

* | Elanco Animal Health Inc. | 205 | 6 |

| | | 302,859 |

Materials & Processing (1.6%) | | |

| DowDuPont Inc. | 212,573 | 11,368 |

| Linde plc | 49,487 | 7,722 |

| Ecolab Inc. | 20,100 | 2,962 |

| Air Products & Chemicals Inc. | 17,100 | 2,737 |

| Sherwin-Williams Co. | 6,460 | 2,542 |

| LyondellBasell Industries NV Class A | 26,738 | 2,223 |

| Ingersoll-Rand plc | 20,400 | 1,861 |

| Freeport-McMoRan Inc. | 179,724 | 1,853 |

| PPG Industries Inc. | 17,600 | 1,799 |

| Newmont Mining Corp. | 50,141 | 1,737 |

| Ball Corp. | 30,836 | 1,418 |

| Vulcan Materials Co. | 13,986 | 1,382 |

| Celanese Corp. Class A | 15,082 | 1,357 |

| Lennox International Inc. | 6,181 | 1,353 |

| International Paper Co. | 33,043 | 1,334 |

* | Crown Holdings Inc. | 31,248 | 1,299 |

| Martin Marietta Materials Inc. | 6,586 | 1,132 |

| Nucor Corp. | 20,743 | 1,075 |

* | Berry Global Group Inc. | 20,808 | 989 |

* | Owens-Illinois Inc. | 56,901 | 981 |

| Fastenal Co. | 17,923 | 937 |

| Southern Copper Corp. | 28,916 | 890 |

| Hexcel Corp. | 15,266 | 875 |

| USG Corp. | 20,134 | 859 |

| Armstrong World Industries Inc. | 14,139 | 823 |

13

Tax-Managed Balanced Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

| International Flavors & Fragrances Inc. | 6,030 | 810 |

| Albemarle Corp. | 10,400 | 801 |

| CF Industries Holdings Inc. | 16,859 | 734 |

| Eagle Materials Inc. | 11,442 | 698 |

| Sealed Air Corp. | 19,269 | 671 |

| NewMarket Corp. | 1,629 | 671 |

* | Axalta Coating Systems Ltd. | 28,318 | 663 |

| FMC Corp. | 8,798 | 651 |

| Mosaic Co. | 21,930 | 641 |

| Owens Corning | 13,342 | 587 |

| Valmont Industries Inc. | 4,936 | 548 |

| Westrock Co. | 14,360 | 542 |

| Reliance Steel & Aluminum Co. | 7,600 | 541 |

| Eastman Chemical Co. | 7,119 | 520 |

| Westlake Chemical Corp. | 7,433 | 492 |

| Silgan Holdings Inc. | 18,967 | 448 |

| Ashland Global Holdings Inc. | 6,198 | 440 |

| WR Grace & Co. | 6,600 | 428 |

* | Alcoa Corp. | 15,841 | 421 |

| Masco Corp. | 13,389 | 391 |

| Packaging Corp. of America | 4,252 | 355 |

| Scotts Miracle-Gro Co. | 5,042 | 310 |

| RPM International Inc. | 4,800 | 282 |

* | Univar Inc. | 15,716 | 279 |

| Steel Dynamics Inc. | 8,373 | 251 |

| Royal Gold Inc. | 2,800 | 240 |

* | AdvanSix Inc. | 9,636 | 235 |

* | Platform Specialty Products Corp. | 21,987 | 227 |

| Versum Materials Inc. | 6,923 | 192 |

* | Tahoe Resources Inc. | 48,886 | 178 |

| United States Steel Corp. | 8,000 | 146 |

| AptarGroup Inc. | 1,500 | 141 |

| Chemours Co. | 4,700 | 133 |

| Sonoco Products Co. | 1,300 | 69 |

| Acuity Brands Inc. | 600 | 69 |

| Huntsman Corp. | 1,800 | 35 |

| Watsco Inc. | 200 | 28 |

| Bemis Co. Inc. | 500 | 23 |

| | | 68,399 |

Other (0.0%) | | |

*,§ | Herbalife Ltd. CVR | 3,294 | 32 |

| | | |

Producer Durables (4.9%) | | |

| Boeing Co. | 48,120 | 15,519 |

| 3M Co. | 49,087 | 9,353 |

| Union Pacific Corp. | 63,550 | 8,785 |

| Honeywell International Inc. | 63,834 | 8,434 |

| Accenture plc Class A | 55,631 | 7,845 |

| United Technologies Corp. | 69,386 | 7,388 |

| Caterpillar Inc. | 48,456 | 6,157 |

| General Electric Co. | 747,715 | 5,660 |

| United Parcel Service Inc. Class B | 57,881 | 5,645 |

| Lockheed Martin Corp. | 20,692 | 5,418 |

| Automatic Data Processing Inc. | 36,334 | 4,764 |

| CSX Corp. | 65,518 | 4,071 |

| Deere & Co. | 26,280 | 3,920 |

| Raytheon Co. | 23,135 | 3,548 |

| FedEx Corp. | 20,969 | 3,383 |

| Illinois Tool Works Inc. | 26,375 | 3,342 |

* | Norfolk Southern Corp. | 21,800 | 3,260 |

| General Dynamics Corp. | 20,614 | 3,241 |

* | United Continental Holdings Inc. | 38,118 | 3,192 |

| Northrop Grumman Corp. | 12,846 | 3,146 |

| Emerson Electric Co. | 50,990 | 3,047 |

| Waste Management Inc. | 33,651 | 2,995 |

| Delta Air Lines Inc. | 58,199 | 2,904 |

* | Verisk Analytics Inc. Class A | 25,809 | 2,814 |

* | TransDigm Group Inc. | 7,508 | 2,553 |

| Southwest Airlines Co. | 50,666 | 2,355 |

| Roper Technologies Inc. | 8,710 | 2,321 |

| Eaton Corp. plc | 33,345 | 2,290 |

| Johnson Controls International plc | 69,392 | 2,058 |

* | Mettler-Toledo International Inc. | 3,387 | 1,916 |

| Cintas Corp. | 11,403 | 1,916 |

* | Copart Inc. | 37,847 | 1,808 |

* | Waters Corp. | 9,533 | 1,798 |

| Xylem Inc. | 24,814 | 1,656 |

| AMETEK Inc. | 22,442 | 1,519 |

| Paychex Inc. | 22,784 | 1,484 |

| Parker-Hannifin Corp. | 9,302 | 1,387 |

| Fortive Corp. | 20,386 | 1,379 |

| Cummins Inc. | 10,321 | 1,379 |

| Spirit AeroSystems Holdings Inc. Class A | 19,094 | 1,377 |

| IDEX Corp. | 10,862 | 1,372 |

| PACCAR Inc. | 23,928 | 1,367 |

| Textron Inc. | 29,375 | 1,351 |

| Expeditors International of Washington Inc. | 19,686 | 1,340 |

| Huntington Ingalls Industries Inc. | 6,994 | 1,331 |

| Quanta Services Inc. | 44,131 | 1,328 |

| Nordson Corp. | 10,592 | 1,264 |

| CH Robinson Worldwide Inc. | 15,011 | 1,262 |

| Rockwell Automation Inc. | 8,203 | 1,234 |

| Stanley Black & Decker Inc. | 10,210 | 1,223 |

| Republic Services Inc. Class A | 16,510 | 1,190 |

* | HD Supply Holdings Inc. | 31,487 | 1,181 |

| Landstar System Inc. | 11,985 | 1,147 |

14

Tax-Managed Balanced Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

| Jacobs Engineering Group Inc. | 18,761 | 1,097 |

* | United Rentals Inc. | 10,658 | 1,093 |

| Toro Co. | 19,411 | 1,085 |

* | CoStar Group Inc. | 3,210 | 1,083 |

| Allegion plc | 13,283 | 1,059 |

* | Kirby Corp. | 15,366 | 1,035 |

| JB Hunt Transport Services Inc. | 11,052 | 1,028 |

| FLIR Systems Inc. | 23,291 | 1,014 |

| Oshkosh Corp. | 16,505 | 1,012 |

* | Sensata Technologies Holding plc | 21,906 | 982 |

* | Keysight Technologies Inc. | 15,798 | 981 |

* | AECOM | 36,300 | 962 |

| AO Smith Corp. | 22,475 | 960 |

* | Zebra Technologies Corp. | 5,920 | 943 |

| Wabtec Corp. | 13,415 | 942 |

| BWX Technologies Inc. | 24,302 | 929 |

| ITT Inc. | 18,544 | 895 |

| Carlisle Cos. Inc. | 8,633 | 868 |

| American Airlines Group Inc. | 26,130 | 839 |

| Robert Half International Inc. | 14,500 | 829 |

| AGCO Corp. | 14,395 | 801 |

| L3 Technologies Inc. | 4,589 | 797 |

* | XPO Logistics Inc. | 13,749 | 784 |

| Lincoln Electric Holdings Inc. | 9,765 | 770 |

| WW Grainger Inc. | 2,682 | 757 |

* | Trimble Inc. | 22,307 | 734 |

* | Welbilt Inc. | 62,683 | 696 |

* | Clean Harbors Inc. | 14,036 | 693 |

| National Instruments Corp. | 14,511 | 659 |

| Air Lease Corp. Class A | 20,291 | 613 |

* | Middleby Corp. | 5,688 | 584 |

| Donaldson Co. Inc. | 13,286 | 577 |

| Flowserve Corp. | 14,313 | 544 |

| Dover Corp. | 7,363 | 522 |

* | WESCO International Inc. | 10,689 | 513 |

* | Stericycle Inc. | 13,421 | 492 |

| Kansas City Southern | 5,000 | 477 |

| Arconic Inc. | 28,166 | 475 |

| MSC Industrial Direct Co. Inc. Class A | 5,300 | 408 |

* | Conduent Inc. | 37,900 | 403 |

| Trinity Industries Inc. | 19,100 | 393 |

| Pentair plc | 10,087 | 381 |

* | JetBlue Airways Corp. | 23,644 | 380 |

* | Genesee & Wyoming Inc. Class A | 5,058 | 374 |

| ManpowerGroup Inc. | 5,650 | 366 |

* | Teledyne Technologies Inc. | 1,706 | 353 |

| Old Dominion Freight Line Inc. | 2,637 | 326 |

| Snap-on Inc. | 2,197 | 319 |

| Copa Holdings SA Class A | 4,039 | 318 |

* | Colfax Corp. | 14,622 | 306 |

| Genpact Ltd. | 11,065 | 299 |

| Avery Dennison Corp. | 3,200 | 288 |

* | Spirit Airlines Inc. | 4,935 | 286 |

| Alaska Air Group Inc. | 4,200 | 256 |

| Fluor Corp. | 7,858 | 253 |

* | Gardner Denver Holdings Inc. | 11,544 | 236 |

| nVent Electric plc | 10,087 | 227 |

| Graco Inc. | 4,912 | 206 |

* | Resideo Technologies Inc. | 9,655 | 198 |

| Regal Beloit Corp. | 2,800 | 196 |

| Xerox Corp. | 9,663 | 191 |

| Booz Allen Hamilton Holding Corp. Class A | 4,000 | 180 |

| Hubbell Inc. Class B | 1,000 | 99 |

* | Gates Industrial Corp. plc | 6,900 | 91 |

| Terex Corp. | 2,800 | 77 |

| Rollins Inc. | 1,950 | 70 |

| Ryder System Inc. | 1,400 | 67 |

* | Herc Holdings Inc. | 2,550 | 66 |

| Allison Transmission Holdings Inc. | 1,200 | 53 |

| HEICO Corp. Class A | 400 | 25 |

| Littelfuse Inc. | 100 | 17 |

| Altra Industrial Motion Corp. | 528 | 13 |

| | | 212,462 |

Technology (10.0%) | | |

| Microsoft Corp. | 685,975 | 69,674 |

| Apple Inc. | 429,849 | 67,804 |

* | Alphabet Inc. Class C | 27,087 | 28,052 |

* | Alphabet Inc. Class A | 26,836 | 28,043 |

* | Facebook Inc. Class A | 212,161 | 27,812 |

| Intel Corp. | 413,800 | 19,420 |

| Cisco Systems Inc. | 417,381 | 18,085 |

| Oracle Corp. | 244,790 | 11,052 |

* | Adobe Inc. | 42,977 | 9,723 |

| International Business Machines Corp. | 84,403 | 9,594 |

| Broadcom Inc. | 37,499 | 9,535 |

* | salesforce.com Inc. | 62,163 | 8,514 |

| Texas Instruments Inc. | 86,640 | 8,187 |

| QUALCOMM Inc. | 132,698 | 7,552 |

| NVIDIA Corp. | 52,062 | 6,950 |

| Intuit Inc. | 19,824 | 3,902 |

| NXP Semiconductors NV | 42,194 | 3,092 |

* | Micron Technology Inc. | 96,110 | 3,050 |

| Activision Blizzard Inc. | 65,160 | 3,034 |

* | Autodesk Inc. | 22,929 | 2,949 |

| Cognizant Technology Solutions Corp. Class A | 46,115 | 2,927 |

| Applied Materials Inc. | 87,615 | 2,868 |

* | Red Hat Inc. | 14,330 | 2,517 |

| HP Inc. | 122,573 | 2,508 |

15

Tax-Managed Balanced Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

* | IAC/InterActiveCorp | 13,641 | 2,497 |

| Analog Devices Inc. | 28,308 | 2,430 |

* | ServiceNow Inc. | 13,556 | 2,414 |

* | Cadence Design Systems Inc. | 52,232 | 2,271 |

* | VeriSign Inc. | 14,611 | 2,167 |

| Amphenol Corp. Class A | 26,138 | 2,118 |

| Motorola Solutions Inc. | 17,978 | 2,068 |

| Corning Inc. | 68,131 | 2,058 |

* | Synopsys Inc. | 23,874 | 2,011 |

| Lam Research Corp. | 14,225 | 1,937 |

* | Electronic Arts Inc. | 24,214 | 1,911 |

| Xilinx Inc. | 21,429 | 1,825 |

* | Workday Inc. Class A | 11,178 | 1,785 |

* | Twitter Inc. | 58,453 | 1,680 |

* | GoDaddy Inc. Class A | 25,596 | 1,680 |

| Citrix Systems Inc. | 16,127 | 1,652 |

| Hewlett Packard Enterprise Co. | 120,529 | 1,592 |

| Match Group Inc. | 36,165 | 1,547 |

* | Advanced Micro Devices Inc. | 80,623 | 1,488 |

| DXC Technology Co. | 25,725 | 1,368 |

* | IHS Markit Ltd. | 25,965 | 1,246 |

| Teradyne Inc. | 37,832 | 1,187 |

* | Palo Alto Networks Inc. | 5,928 | 1,117 |

| Dolby Laboratories Inc. Class A | 17,775 | 1,099 |

| Juniper Networks Inc. | 40,200 | 1,082 |

| Microchip Technology Inc. | 14,970 | 1,077 |

* | Splunk Inc. | 10,165 | 1,066 |

| Harris Corp. | 7,581 | 1,021 |

* | Atlassian Corp. plc Class A | 11,470 | 1,021 |

| Skyworks Solutions Inc. | 15,100 | 1,012 |

| NetApp Inc. | 16,671 | 995 |

| VMware Inc. Class A | 6,944 | 952 |

* | ARRIS International plc | 29,229 | 893 |

| Symantec Corp. | 46,939 | 887 |

| Western Digital Corp. | 23,616 | 873 |

| Maxim Integrated Products Inc. | 16,929 | 861 |

* | Akamai Technologies Inc. | 14,037 | 857 |

| CDK Global Inc. | 17,835 | 854 |

* | F5 Networks Inc. | 5,263 | 853 |

| Amdocs Ltd. | 14,500 | 849 |

* | Teradata Corp. | 21,724 | 833 |

* | Take-Two Interactive Software Inc. | 8,090 | 833 |

| KLA-Tencor Corp. | 9,217 | 825 |

* | Gartner Inc. | 5,998 | 767 |

* | Qorvo Inc. | 12,589 | 764 |

* | Arista Networks Inc. | 3,595 | 757 |

* | NCR Corp. | 30,469 | 703 |

| Avnet Inc. | 19,000 | 686 |

* | ON Semiconductor Corp. | 40,638 | 671 |

* | ANSYS Inc. | 4,658 | 666 |

| CDW Corp. | 8,057 | 653 |

* | Fortinet Inc. | 8,538 | 601 |

* | PTC Inc. | 7,248 | 601 |

| Sabre Corp. | 27,200 | 589 |

* | Tyler Technologies Inc. | 3,060 | 569 |

* | Okta Inc. | 8,739 | 558 |

| Leidos Holdings Inc. | 10,350 | 546 |

* | Black Knight Inc. | 11,628 | 524 |

* | Tableau Software Inc. Class A | 4,356 | 523 |

* | Dell Technologies Inc. | 10,571 | 517 |

* | CommScope Holding Co. Inc. | 30,047 | 492 |

* | Arrow Electronics Inc. | 6,539 | 451 |

| SS&C Technologies Holdings Inc. | 9,500 | 429 |

* | Twilio Inc. Class A | 4,685 | 418 |

* | Ultimate Software Group Inc. | 1,595 | 391 |

| Marvell Technology Group Ltd. | 23,155 | 375 |

* | Pluralsight Inc. Class A | 13,712 | 323 |

* | DocuSign Inc. Class A | 7,795 | 312 |

* | GrubHub Inc. | 3,900 | 300 |

* | Nutanix Inc. | 7,012 | 292 |

* | Zynga Inc. Class A | 72,763 | 286 |

* | RingCentral Inc. Class A | 3,330 | 274 |

* | IPG Photonics Corp. | 2,255 | 255 |

* | Guidewire Software Inc. | 3,086 | 248 |

| Universal Display Corp. | 2,600 | 243 |

* | Pure Storage Inc. Class A | 14,000 | 225 |

* | Coherent Inc. | 2,041 | 216 |

* | Ceridian HCM Holding Inc. | 5,844 | 202 |

* | FireEye Inc. | 11,675 | 189 |

* | Manhattan Associates Inc. | 4,417 | 187 |

| Cognex Corp. | 4,580 | 177 |

* | Cree Inc. | 3,803 | 163 |

* | RealPage Inc. | 3,138 | 151 |

* | Aspen Technology Inc. | 1,800 | 148 |

* | Nuance Communications Inc. | 11,164 | 148 |

* | Paycom Software Inc. | 1,100 | 135 |

* | Zendesk Inc. | 2,300 | 134 |

* | EPAM Systems Inc. | 1,000 | 116 |

* | EchoStar Corp. Class A | 1,746 | 64 |

* | Groupon Inc. Class A | 18,670 | 60 |

* | Inovalon Holdings Inc. Class A | 4,102 | 58 |

* | Yelp Inc. Class A | 1,467 | 51 |

| Cypress Semiconductor Corp. | 3,200 | 41 |

| Perspecta Inc. | 1,712 | 29 |

* | Proofpoint Inc. | 300 | 25 |

| LogMeIn Inc. | 300 | 24 |

| Monolithic Power Systems Inc. | 200 | 23 |

| | | 435,986 |

16

Tax-Managed Balanced Fund

| | | Market |

| | | Value· |

| | Shares | ($000) |

Utilities (2.6%) | | |

| Verizon Communications Inc. | 364,574 | 20,496 |

| AT&T Inc. | 639,206 | 18,243 |

| NextEra Energy Inc. | 45,342 | 7,881 |

| Duke Energy Corp. | 68,972 | 5,952 |

| Dominion Energy Inc. | 64,274 | 4,593 |

| Southern Co. | 102,048 | 4,482 |

| Exelon Corp. | 84,900 | 3,829 |

| American Electric Power Co. Inc. | 45,700 | 3,416 |

| Sempra Energy | 26,229 | 2,838 |

* | T-Mobile US Inc. | 41,635 | 2,648 |

| Public Service Enterprise Group Inc. | 49,300 | 2,566 |

| Consolidated Edison Inc. | 33,400 | 2,554 |

* | Vistra Energy Corp. | 110,388 | 2,527 |

| WEC Energy Group Inc. | 27,832 | 1,928 |

| Xcel Energy Inc. | 37,404 | 1,843 |

| PPL Corp. | 62,356 | 1,767 |

| American Water Works Co. Inc. | 18,678 | 1,695 |

| NRG Energy Inc. | 39,365 | 1,559 |

| Edison International | 27,017 | 1,534 |

* | United States Cellular Corp. | 28,667 | 1,490 |

| FirstEnergy Corp. | 38,600 | 1,449 |

| Eversource Energy | 22,187 | 1,443 |

| DTE Energy Co. | 12,667 | 1,397 |

* | PG&E Corp. | 56,246 | 1,336 |

| UGI Corp. | 23,161 | 1,236 |

| NiSource Inc. | 42,649 | 1,081 |

| CenterPoint Energy Inc. | 36,500 | 1,030 |

| Ameren Corp. | 15,737 | 1,027 |

* | Alliant Energy Corp. | 24,226 | 1,024 |

| CMS Energy Corp. | 20,227 | 1,004 |

| OGE Energy Corp. | 25,486 | 999 |

| Entergy Corp. | 11,483 | 988 |

| Aqua America Inc. | 28,286 | 967 |

| Evergy Inc. | 16,735 | 950 |

| CenturyLink Inc. | 60,929 | 923 |

| AES Corp. | 53,469 | 773 |

| Telephone & Data Systems Inc. | 23,346 | 760 |

* | Zayo Group Holdings Inc. | 31,847 | 727 |

| Atmos Energy Corp. | 5,445 | 505 |

| SCANA Corp. | 10,200 | 487 |

| Pinnacle West Capital Corp. | 5,558 | 474 |

| National Fuel Gas Co. | 5,771 | 295 |

| Vectren Corp. | 3,800 | 274 |

| MDU Resources Group Inc. | 9,950 | 237 |

| Avangrid Inc. | 4,545 | 228 |

* | Sprint Corp. | 22,237 | 129 |

| | | 115,584 |

Total Common Stocks | | |

(Cost $1,380,250) | | 2,100,698 |

| | | | | Face | Market |

| | | Maturity | | Amount | Value· |

| | Coupon | Date | | ($000) | ($000) |

Tax-Exempt Municipal Bonds (50.8%) | | | | | |

Alabama (0.6%) | | | | | |

| Alabama 21st Century Authority Tobacco Settlement Revenue | 5.000% | 6/1/20 | | 500 | 519 |

| Alabama Economic Settlement Authority BP Settlement Revenue | 4.000% | 9/15/33 | | 500 | 517 |

| Alabama Incentives Financing Authority Special Obligation Revenue | 5.000% | 9/1/32 | | 380 | 410 |

| Birmingham-Jefferson AL Civic Center Authority Special Tax Revenue | 5.000% | 7/1/31 | | 1,100 | 1,283 |

2 | Black Belt Energy Gas District Alabama Gas Prepay Revenue (Project No. 3) PUT | 2.474% | 12/1/23 | | 1,000 | 974 |

| Black Belt Energy Gas District Alabama Gas Prepay Revenue (Project No. 3) PUT | 4.000% | 12/1/23 | | 1,800 | 1,879 |

| Black Belt Energy Gas District Alabama Gas Supply Revenue PUT | 4.000% | 6/1/21 | | 3,885 | 4,006 |

| Black Belt Energy Gas District Alabama Gas Supply Revenue PUT | 4.000% | 7/1/22 | | 430 | 447 |

| Huntsville AL Electric System Revenue | 5.000% | 12/1/30 | | 510 | 602 |

| Huntsville AL GO | 5.000% | 5/1/35 | | 1,125 | 1,313 |

17

Tax-Managed Balanced Fund

| | | | | Face | Market |

| | | Maturity | | Amount | Value· |

| | Coupon | Date | | ($000) | ($000) |

| Jefferson County AL Revenue | 5.000% | 9/15/29 | | 1,020 | 1,179 |

| Jefferson County AL Revenue | 5.000% | 9/15/33 | | 1,000 | 1,136 |

| Jefferson County AL Sewer Revenue | 5.000% | 10/1/23 | | 500 | 547 |

| Jefferson County AL Sewer Revenue | 0.000% | 10/1/25 | (4) | 500 | 407 |

| Southeast Alabama Gas Supply District Revenue PUT | 4.000% | 4/1/24 | | 6,185 | 6,461 |

| Southeast Alabama Gas Supply District Revenue PUT | 4.000% | 6/1/24 | | 1,105 | 1,155 |

| Tuscaloosa AL City Board of Education School Tax Warrants Revenue | 5.000% | 8/1/27 | | 530 | 620 |

| Tuscaloosa AL City Board of Education School Tax Warrants Revenue | 5.000% | 8/1/28 | | 950 | 1,102 |

| University of South Alabama University Facilities Revenue | 5.000% | 11/1/23 | (4) | 740 | 835 |

| | | | | | 25,392 |

Alaska (0.1%) | | | | | |

| Alaska Housing Finance Corp. Revenue | 5.000% | 6/1/22 | (Prere.) | 425 | 467 |

| Alaska Housing Finance Corp. Revenue | 5.000% | 12/1/29 | | 75 | 81 |

| Alaska Municipal Bond Bank Authority Revenue | 5.000% | 9/1/21 | | 1,650 | 1,777 |

| Matanuska-Susitna Borough AK Lease Revenue (Goose Creek Correctional Center) GO | 5.000% | 9/1/31 | | 1,345 | 1,509 |

| | | | | | 3,834 |

Arizona (1.3%) | | | | | |

| Arizona Board of Regents Arizona State University System Revenue | 5.000% | 7/1/30 | | 675 | 775 |

| Arizona Board of Regents Arizona State University System Revenue | 5.000% | 7/1/31 | | 545 | 618 |

| Arizona Health Facilities Authority Revenue (Banner Health) VRDO | 1.750% | 1/2/19 | LOC | 3,200 | 3,200 |

3 | Arizona Lottery Revenue | 5.000% | 7/1/28 | | 1,000 | 1,165 |

| Arizona School Facilities Board COP | 5.000% | 9/1/21 | | 1,355 | 1,463 |

| Arizona State University Revenue (McAllister Academic Village LLC) | 5.000% | 7/1/36 | | 1,140 | 1,299 |

| Arizona Transportation Board Excise Tax Revenue | 5.000% | 7/1/21 | | 2,240 | 2,412 |

| Arizona Transportation Board Excise Tax Revenue | 5.000% | 7/1/23 | | 2,070 | 2,343 |

| Arizona Transportation Board Excise Tax Revenue | 5.000% | 7/1/24 | | 2,100 | 2,427 |

| Arizona Transportation Board Excise Tax Revenue (Maricopa County Regional Area) | 5.000% | 7/1/20 | (Prere.) | 500 | 523 |

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/22 | (Prere.) | 500 | 551 |

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/22 | | 2,015 | 2,227 |

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/32 | | 1,000 | 1,159 |

| Chandler AZ GO | 5.000% | 7/1/23 | | 1,095 | 1,239 |

| Gilbert AZ GO | 5.000% | 7/1/20 | | 2,480 | 2,597 |

| Glendale AZ Industrial Development Authority Revenue (Midwestern University) | 5.000% | 5/15/30 | | 335 | 348 |

3 | Maricopa County AZ Industrial Development uthority Hospital Revenue (Honorhealth) | 5.000% | 9/1/33 | | 830 | 946 |

18

Tax-Managed Balanced Fund

| | | | | Face | Market |

| | | Maturity | | Amount | Value· |

| | Coupon | Date | | ($000) | ($000) |

| Maricopa County AZ School District No. 28 (Kyrene Elementary) GO | 4.000% | 7/1/19 | | 900 | 910 |

| Phoenix AZ Civic Improvement Corp. Airport Revenue | 5.000% | 7/1/20 | (Prere.) | 365 | 382 |

| Phoenix AZ Civic Improvement Corp. Excise Tax Revenue | 5.000% | 7/1/22 | | 1,145 | 1,263 |

| Phoenix AZ Civic Improvement Corp. Wastewater System Revenue | 5.000% | 7/1/22 | | 2,190 | 2,416 |

| Phoenix AZ Civic Improvement Corp. Wastewater System Revenue | 5.000% | 7/1/27 | | 1,285 | 1,520 |

| Phoenix AZ Civic Improvement Corp. Wastewater System Revenue | 4.000% | 7/1/28 | | 2,000 | 2,157 |

| Phoenix AZ Civic Improvement Corp. Water System Revenue | 5.000% | 7/1/21 | | 525 | 565 |

| Phoenix AZ Civic Improvement Corp. Water System Revenue | 5.000% | 7/1/22 | | 1,215 | 1,342 |

| Phoenix AZ Civic Improvement Corp. Water System Revenue | 5.000% | 7/1/23 | | 2,010 | 2,271 |

| Phoenix AZ Civic Improvement Corp. Water System Revenue | 5.000% | 7/1/26 | | 2,520 | 2,883 |

| Phoenix AZ Civic Improvement Corp. Water System Revenue | 5.000% | 7/1/35 | | 1,900 | 2,181 |

| Phoenix AZ Industrial Development Authority Lease Revenue (Downtown Phoenix Student Housing LLC) | 5.000% | 7/1/27 | | 300 | 338 |

| Phoenix AZ Industrial Development Authority Lease Revenue (Downtown Phoenix Student Housing LLC) | 5.000% | 7/1/28 | | 250 | 282 |

| Pima County AZ Sewer Revenue | 5.000% | 7/1/20 | | 500 | 523 |

| Pima County AZ Sewer Revenue | 5.000% | 7/1/20 | | 1,000 | 1,047 |

| Pima County AZ Sewer Revenue | 5.000% | 7/1/24 | | 1,055 | 1,214 |

| Regional Public Transportation Authority Arizona Excise Tax Revenue (Maricopa County Public Transportation) | 5.250% | 7/1/24 | | 1,035 | 1,204 |

| Salt River Project Arizona Agricultural Improvement & Power District Revenue | 5.000% | 1/1/19 | (Prere.) | 750 | 750 |

| Salt River Project Arizona Agricultural Improvement & Power District Revenue | 5.000% | 12/1/28 | | 515 | 557 |

| Salt River Project Arizona Agricultural Improvement & Power District Revenue | 5.000% | 12/1/29 | | 2,000 | 2,180 |

| Salt River Project Arizona Agricultural Improvement & Power District Revenue | 5.000% | 1/1/36 | | 1,540 | 1,780 |

| Salt Verde AZ Financial Corp. Gas Revenue | 5.250% | 12/1/24 | | 910 | 1,032 |

| Salt Verde AZ Financial Corp. Gas Revenue | 5.250% | 12/1/28 | | 640 | 746 |

| University Medical Center Corp. Arizona Hospital Revenue | 5.000% | 7/1/19 | (ETM) | 500 | 508 |

| Yavapai County AZ Industrial Development Authority Hospital Facility Revenue (Northern Arizona Healthcare System) | 5.250% | 10/1/22 | | 500 | 543 |

| | | | | | 55,886 |

Arkansas (0.2%) | | | | | |

| Arkansas Development Finance Authority | | | | | |

| Healthcare Revenue (Baptist Health) PUT | 3.750% | 9/1/25 | | 2,000 | 2,025 |

| Pulaski County AR Hospital Revenue (Arkansas Children’s Hospital) | 5.000% | 3/1/29 | | 1,055 | 1,213 |

19

Tax-Managed Balanced Fund

| | | | | Face | Market |

| | | Maturity | | Amount | Value· |

| | Coupon | Date | | ($000) | ($000) |

| Rogers AR Sales & Use Tax Revenue | 2.125% | 11/1/21 | (Prere.) | 120 | 120 |

| Springdale AR Sales and Use Revenue | 5.000% | 4/1/37 | (15) | 1,000 | 1,098 |

| Springdale AR School District No. 50 GO | 4.000% | 6/1/27 | | 1,190 | 1,263 |

| Springdale AR School District No. 50 GO | 4.000% | 6/1/32 | | 1,155 | 1,209 |

| University of Arkansas Revenue | 5.000% | 11/1/21 | | 750 | 813 |

| University of Arkansas Revenue | 5.000% | 11/1/24 | | 775 | 894 |

| University of Arkansas Revenue | 5.000% | 11/1/30 | | 750 | 875 |

| | | | | | 9,510 |

California (5.2%) | | | | | |

| ABAG Finance Authority for Nonprofit Corps. California Revenue (Episcopal Senior Communities) | 5.000% | 7/1/22 | | 500 | 549 |

| ABAG Finance Authority for Nonprofit Corps. California Revenue (Jackson Laboratory) | 5.000% | 7/1/21 | | 760 | 817 |

| ABAG Finance Authority for Nonprofit Corps. California Revenue (Windemere Ranch Infrastructure Financing Program) | 5.000% | 9/2/30 | (4) | 1,050 | 1,237 |

| Alameda CA Corridor Transportation Authority Revenue | 0.000% | 10/1/30 | (2) | 740 | 476 |

| Alameda CA Corridor Transportation Authority Revenue | 0.000% | 10/1/32 | (14) | 1,650 | 1,001 |

| Anaheim CA Housing & Public Improvements Authority Revenue (Electric Utility Distribution System) | 5.000% | 10/1/30 | | 1,000 | 1,112 |

| Anaheim CA Housing & Public Improvements Authority Revenue (Electric Utility Distribution System) | 5.000% | 10/1/33 | | 1,015 | 1,123 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) | 5.000% | 10/1/20 | (Prere.) | 500 | 529 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) | 5.000% | 4/1/23 | (Prere.) | 1,000 | 1,135 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) | 5.000% | 4/1/31 | | 500 | 545 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) | 4.000% | 4/1/33 | | 1,000 | 1,073 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) | 4.000% | 4/1/37 | | 820 | 856 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 1.375% | 4/1/20 | | 1,000 | 995 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 1.875% | 4/1/20 | | 1,500 | 1,501 |

2 | Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 2.310% | 4/1/20 | | 1,000 | 1,001 |

2 | Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 2.410% | 4/1/21 | | 1,000 | 1,003 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 2.100% | 4/1/22 | | 1,150 | 1,152 |

2 | Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 2.610% | 5/1/23 | | 1,000 | 1,011 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 2.125% | 4/1/25 | | 2,950 | 2,908 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 2.950% | 4/1/26 | | 1,000 | 1,034 |

20

Tax-Managed Balanced Fund

| | | | | Face | Market |

| | | Maturity | | Amount | Value· |

| | Coupon | Date | | ($000) | ($000) |

| Brea CA Redevelopment Agency Successor Agency Tax Allocation Revenue (Redevelopment Project AB) | 0.000% | 8/1/29 | (2) | 1,000 | 712 |

| California Department of Water Resources Power Supply Revenue | 5.000% | 5/1/20 | | 590 | 617 |

| California Economic Recovery GO | 5.000% | 7/1/19 | (Prere.) | 500 | 509 |

| California Economic Recovery GO | 5.000% | 7/1/19 | (ETM) | 500 | 509 |

| California Economic Recovery GO | 5.250% | 7/1/19 | (Prere.) | 315 | 321 |

| California Economic Recovery GO | 5.250% | 7/1/19 | (Prere.) | 185 | 188 |

| California GO | 5.000% | 2/1/20 | | 500 | 518 |

| California GO | 5.000% | 10/1/20 | | 2,000 | 2,116 |

| California GO | 5.000% | 8/1/22 | | 1,000 | 1,110 |

| California GO | 5.000% | 9/1/22 | | 1,805 | 2,008 |

| California GO | 5.000% | 11/1/23 | | 1,155 | 1,319 |

| California GO | 5.000% | 10/1/24 | | 2,000 | 2,329 |

| California GO | 5.000% | 10/1/25 | | 2,500 | 2,961 |

| California GO | 5.000% | 3/1/26 | | 660 | 770 |

| California GO | 3.500% | 8/1/27 | | 1,515 | 1,650 |

| California GO | 5.000% | 2/1/28 | | 690 | 764 |

| California GO | 5.750% | 4/1/29 | | 500 | 505 |

| California GO | 5.000% | 9/1/29 | | 455 | 536 |

| California GO | 5.000% | 11/1/29 | | 1,700 | 1,906 |

| California GO | 5.250% | 3/1/30 | | 500 | 518 |

| California GO | 5.000% | 9/1/30 | | 1,000 | 1,075 |

| California GO | 5.250% | 9/1/30 | | 500 | 541 |

| California GO | 4.000% | 8/1/31 | | 1,675 | 1,799 |

| California GO | 5.000% | 2/1/32 | | 500 | 541 |

| California GO | 5.000% | 10/1/32 | | 1,875 | 2,120 |

| California GO | 4.000% | 8/1/33 | | 1,520 | 1,621 |

| California GO | 5.000% | 8/1/33 | | 2,865 | 3,316 |

| California GO | 4.000% | 9/1/33 | | 2,000 | 2,134 |

| California Health Facilities Financing Authority Revenue (Adventist Health System/West) | 5.000% | 3/1/23 | | 1,145 | 1,283 |

| California Health Facilities Financing Authority Revenue (Children’s Hospital of Los Angeles) | 5.000% | 11/15/23 | | 1,000 | 1,099 |

| California Health Facilities Financing Authority Revenue (Kaiser Permanente) | 5.000% | 11/1/27 | | 1,115 | 1,363 |

| California Health Facilities Financing Authority Revenue (Kaiser Permanente) | 4.000% | 11/1/38 | | 2,000 | 2,078 |

| California Health Facilities Financing Authority Revenue (Kaiser Permanente) PUT | 5.000% | 11/1/22 | | 760 | 844 |

| California Health Facilities Financing Authority Revenue (Lucile Salter Packard Children’s Hospital at Stanford) | 5.000% | 8/15/20 | | 520 | 548 |

| California Health Facilities Financing Authority Revenue (Providence St. Joseph Health Obligated Group) PUT | 4.000% | 10/1/24 | | 1,195 | 1,310 |

| California Health Facilities Financing Authority Revenue (Rady Children’s Hospital) | 5.000% | 8/15/31 | | 965 | 1,036 |

| California Health Facilities Financing Authority Revenue (Sutter Health) | 5.500% | 8/15/20 | (Prere.) | 500 | 531 |

| California Health Facilities Financing Authority Revenue (Sutter Health) | 5.000% | 11/15/33 | | 1,015 | 1,175 |

| California Health Facilities Financing Authority Revenue (Sutter Health) | 5.000% | 11/15/36 | | 1,000 | 1,137 |

21

Tax-Managed Balanced Fund

| | | | | Face | Market |

| | | Maturity | | Amount | Value· |

| | Coupon | Date | | ($000) | ($000) |

| California Infrastructure & Economic Development Bank Revenue (Bay Area Toll Bridges Seismic Retrofit) | 5.000% | 1/1/28 | (Prere.) | 500 | 619 |

| California Municipal Finance Authority Revenue (Anaheim Electric Utility Distribution System) | 5.000% | 10/1/30 | | 965 | 1,122 |

| California Municipal Finance Authority Revenue (University of La Verne) | 6.125% | 6/1/20 | (Prere.) | 500 | 531 |

| California Pollution Control Financing Authority Water Furnishing Revenue (San Diego County Water Authority Desalination Project Pipeline) | 5.000% | 7/1/37 | | 1,000 | 1,007 |

| California Public Works Board Lease Revenue (Davidson Library) | 5.000% | 3/1/23 | (Prere.) | 20 | 23 |

| California Public Works Board Lease Revenue (Department of Corrections) | 5.000% | 6/1/22 | | 1,000 | 1,103 |

| California Public Works Board Lease Revenue (Department of Corrections) | 5.000% | 6/1/27 | | 1,050 | 1,148 |

| California Public Works Board Lease Revenue (Judicial Council Projects) | 5.000% | 10/1/26 | | 1,200 | 1,381 |

| California Public Works Board Lease Revenue (Judicial Council Projects) | 5.000% | 3/1/28 | | 300 | 331 |

| California Public Works Board Lease Revenue (Judicial Council Projects) | 5.125% | 12/1/29 | | 260 | 283 |

| California Public Works Board Lease Revenue (Regents of The University of California) | 5.000% | 4/1/19 | (Prere.) | 70 | 71 |

| California Public Works Board Lease Revenue (Regents of The University of California) | 5.000% | 4/1/19 | (Prere.) | 120 | 121 |

| California Public Works Board Lease Revenue (Regents of The University of California) | 5.000% | 12/1/21 | (Prere.) | 35 | 38 |

| California Public Works Board Lease Revenue (Various Capital Projects) | 5.375% | 3/1/20 | (Prere.) | 1,000 | 1,044 |

| California Public Works Board Lease Revenue (Various Capital Projects) | 5.000% | 12/1/21 | (Prere.) | 25 | 27 |

| California Public Works Board Lease Revenue (Various Capital Projects) | 4.000% | 11/1/31 | | 1,840 | 1,962 |

| California Public Works Board Lease Revenue (Various Capital Projects) | 5.000% | 11/1/31 | | 1,000 | 1,090 |

| California Public Works Board Lease Revenue (Various Capital Projects) | 5.000% | 4/1/32 | | 350 | 379 |

| California State Educational Facilities Authority Revenue | 6.125% | 10/1/21 | (Prere.) | 245 | 274 |

| California State Educational Facilities Authority Revenue | 6.125% | 10/1/21 | (Prere.) | 255 | 285 |

| California State University Systemwide Revenue | 5.250% | 5/1/19 | (Prere.) | 300 | 304 |