UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-08532 | |||||

| AMERICAN CENTURY STRATEGIC ASSET ALLOCATIONS, INC. | ||||||

| (Exact name of registrant as specified in charter) | ||||||

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 | |||||

| (Address of principal executive offices) | (Zip Code) | |||||

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | ||||||

| (Name and address of agent for service) | ||||||

| Registrant’s telephone number, including area code: | 816-531-5575 | |||||

| Date of fiscal year end: | 11-30 | |||||

| Date of reporting period: | 11-30-2017 | |||||

ITEM 1. REPORTS TO STOCKHOLDERS.

| Annual Report | |

| November 30, 2017 | |

| Multi-Asset Income Fund | |

| Table of Contents |

| President’s Letter | 2 | |

| Performance | 3 | |

| Portfolio Commentary | ||

| Fund Characteristics | ||

| Shareholder Fee Example | ||

| Schedule of Investments | ||

| Statement of Assets and Liabilities | ||

| Statement of Operations | ||

| Statement of Changes in Net Assets | ||

| Notes to Financial Statements | ||

| Financial Highlights | ||

| Report of Independent Registered Public Accounting Firm | ||

| Management | ||

| Approval of Management Agreement | ||

| Proxy Voting Results | ||

| Additional Information | ||

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

| President’s Letter |

Jonathan Thomas

Jonathan ThomasDear Investor:

Thank you for reviewing this annual report for the 12 months ended November 30, 2017. Annual reports help convey important information about fund returns, including market factors that affected performance during the reporting period. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

Upbeat Earnings, Economic Data Sparked Strong Gains for Global Stocks

Throughout the world, improving economic activity, healthy corporate earnings growth, and supportive central bank policies helped fuel robust double-digit gains for global stocks. The rally began early in the period, largely in response to the economic-growth implications of Donald Trump’s presidential election victory, and it forged ahead with few interruptions through November 2017. The 12-month period included several potential sources of financial market disruption, including acts of terrorism, North Korean saber-rattling, and an active and destructive hurricane season. Yet any resulting volatility was short-lived, as investors remained focused on positive economic and earnings news. Furthermore, in the U.S., the prospect for pro-growth tax reform propelled major stock indices to several record-high levels.

Among the developed markets, equity performance was notably strong in Europe, where solid corporate profits, improving economic growth rates, declining unemployment, and perceived market-friendly election results in France and Germany supported gains. In addition, the European Central Bank continued to provide stimulus support in the wake of persistently low inflation, which also helped stocks advance. Returns for emerging markets stocks were even stronger, bolstered by improving global and local economic and business fundamentals and rising oil prices.

The broad “risk-on” sentiment also extended to the global fixed-income market, where emerging markets bonds and high-yield corporate bonds were top performers. These securities satisfied investor demand for yield as interest rates remained relatively low throughout the world.

With global growth synchronizing and strengthening and central banks pursuing varying degrees of policy normalization, investors likely will face new opportunities and challenges in the months ahead. We believe this scenario warrants a disciplined, diversified, and risk-aware approach, using professionally managed portfolios in pursuit of investment goals. We appreciate your continued trust and confidence in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

| Performance |

| Total Returns as of November 30, 2017 | ||||

| Average Annual Returns | ||||

| Ticker Symbol | 1 year | Since Inception | Inception Date | |

| Investor Class | AMJVX | 11.35% | 5.66% | 12/1/14 |

| Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index | — | 9.16% | 5.99% | — |

| Russell 3000 Value Index | — | 14.70% | 8.73% | — |

| Bloomberg Barclays U.S. Aggregate Bond Index | — | 3.21% | 2.15% | — |

| MSCI ACWI ex-U.S. Value Index | — | 24.21% | 4.40% | — |

| Blended Index | — | 11.04% | 6.00% | — |

| I Class | AMJIX | 11.57% | 5.87% | 12/1/14 |

| Y Class | AMJYX | — | 5.17% | 4/10/17 |

| A Class | AMJAX | 12/1/14 | ||

| No sales charge | 11.08% | 5.40% | ||

| With sales charge | 4.70% | 3.34% | ||

| C Class | AMJCX | 10.16% | 4.59% | 12/1/14 |

| R Class | AMJWX | 10.81% | 5.14% | 12/1/14 |

| R5 Class | AMJGX | — | 5.17% | 4/10/17 |

| R6 Class | AMJRX | 11.73% | 6.03% | 12/1/14 |

Fund returns would have been lower if a portion of the fees had not been waived. The blended index combines monthly returns of widely known indices. The Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index represents 40%, the Russell 3000 Value Index represents 30%, the Bloomberg Barclays U.S. Aggregate Bond Index represents 20% and the MSCI ACWI ex-U.S. Value Index represents 10% of the blended index. Prior to April 10, 2017, the I Class was referred to as the Institutional Class.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

3

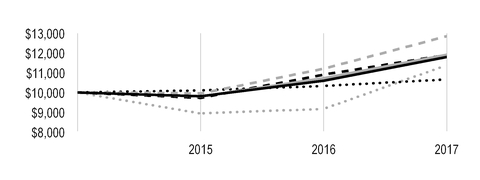

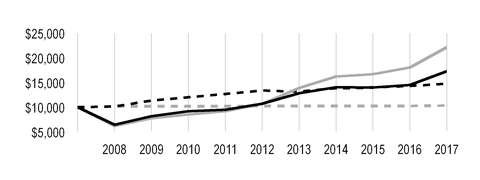

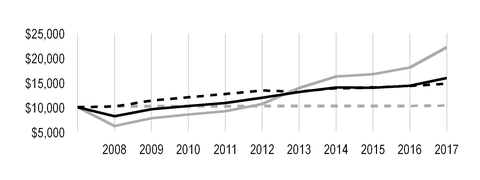

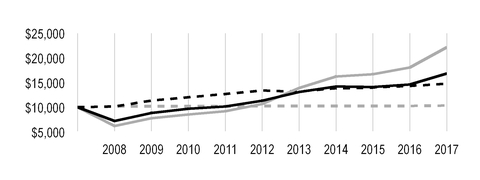

| Growth of $10,000 Over Life of Class |

| $10,000 investment made December 1, 2014 |

| Performance for other share classes will vary due to differences in fee structure. |

| Value on November 30, 2017 | |

| Investor Class — $11,795 | |

| Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index — $11,905 | |

| Russell 3000 Value Index — $12,853 | |

| Bloomberg Barclays U.S. Aggregate Bond Index — $10,660 | |

| MSCI ACWI ex-U.S. Value Index — $11,379 | |

| Blended Index — $11,911 | |

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

Total Annual Fund Operating Expenses | |||||||

Investor Class | I Class | Y Class | A Class | C Class | R Class | R5 Class | R6 Class |

| 1.33% | 1.13% | 0.98% | 1.58% | 2.33% | 1.83% | 1.13% | 0.98% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

4

| Portfolio Commentary |

Portfolio Managers: Rich Weiss, Scott Wilson, and Radu Gabudean

In June 2017, Scott Wittman left the fund's management team.

Performance Summary

Multi-Asset Income returned 11.35%* for the reporting period ended November 30, 2017. The strategy outperformed the return of its custom-blended benchmark, which consists of 40% equity and 60% fixed-income investments. The portfolio benefited from strong manager selection overall and positive asset allocation, which included more exposure to non-U.S. equity, which performed well, and broad diversification across high income-producing assets, such as utilities and convertible bonds.

As of November 30, 2017, Multi-Asset Income’s 30-day SEC yield was 2.91% after the fee waiver. Without the waiver, the 30-day SEC yield would have been 2.61%. At period end, the fund’s annual distribution rate was 4.63%.

Fund Strategy and Positioning

The fund’s primary objective is income generation, with long-term capital appreciation as a secondary objective. Our asset allocation strategy diversifies investments directly or indirectly among a range of U.S. and foreign income-oriented equity and fixed-income securities. The fund is not required to allocate its assets in any proportion, but maintains broad allocation ranges of 20% to 80% for equities and 20% to 80% for fixed-income securities to allow the team flexibility in pursuing attractive income-generating opportunities across the globe. To gain exposure to broad investment disciplines and categories, the fund invests in varying combinations of other American Century Investments funds (affiliated funds), unaffiliated funds such as exchange-traded funds (ETFs), equity and debt securities, and certain derivative instruments. At period end, the fund’s allocation was 45% equity, 40% fixed-income instruments (including investments in equity and fixed-income mutual funds and ETFs) and 15% in preferred and convertible securities.

High-Yield Fund was the largest holding, and allocation to it was steady throughout the year at roughly one-fifth of the fund. During the reporting period, we increased our exposure to non-U.S. value equities, investment-grade fixed income and master limited partnerships (MLPs) while reducing our weightings in global real estate investment trusts (REITs), convertible bonds, and emerging markets debt. Tactical tilts toward non-U.S. and emerging markets value stocks were beneficial along with an underweight in MLPs for most of the reporting period, which declined slightly. Positioning that detracted somewhat included the fund’s reduction in exposure to convertible bonds, which performed strongly during the period.

Non-U.S. Value Adds to Returns

Fund returns benefited largely from strong manager selection overall and from exposure to non-U.S. equity as well as U.S. value equity. Manager selection was particularly beneficial in MLPs, investment-grade fixed income, and global real estate. The largest contribution to fund results came from International Value Fund, global real estate, High-Yield Fund, and U.S. value equity. In terms of income generation, High-Yield Fund, global real estate, and preferred equities made the greatest contributions to fund performance. The fund benefited from maintaining overweight positions in these top-yielding asset classes.

*All fund returns and yields referenced in this commentary are for Investor Class shares. Fund returns would have been lower if a portion of the fees had not been waived. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund's benchmark, other share classes may not. See page 3 for returns for all share classes.

5

Scaling Back on Convertible Bonds Hurt Returns

One tactical move that was costly was a reduction in exposure to convertible bonds, which performed well during the period. Security selection detracted from returns in High-Yield Fund and Utilities Fund. MLPs also declined slightly during the period, but the impact of that was offset by strong security selection.

Outlook

As 2017 comes toward a close, we see significant tension in financial markets, with competing economic and market trends leaving us with no compelling case for over- or underweighting risk assets. On the one hand, global economic growth has accelerated after years of unprecedented monetary stimulus. However, inflation remains tame and interest rates remain historically low. These conditions support corporate earnings growth, and help justify the lofty valuations of stocks and corporate bonds. On the other hand, central banks around the world are beginning to wind down their stimulus policies, which presents a risk for financial markets that have benefited from government support since the financial crisis. And because stock and bond valuations are high by almost any measure, the risk/reward relationship is skewed. Although valuation is not a good short-term buy/sell signal, it is a good indicator of future expected returns: Higher valuations today suggest more muted returns over the intermediate to longer term. At period end, we raised our expectations for non-U.S. equity returns, preferred equity, and global real estate. Within non-U.S. equity, we believe emerging markets value is attractive because of higher expected yields. Among fixed income assets, we prefer U.S. high yield to investment grade for the yield premium and we have lowered our targets on yield from emerging markets debt.

Multi-Asset Income was created to meet the evolving needs of clients who desire a total income solution. We believe that the pursuit of high income today shouldn’t jeopardize the potential for income tomorrow. Our broadly diversified investment approach, combining the best top-down ideas of American Century Investments’ Multi-Asset Strategies team with the bottom-up security selection of our underlying segment management teams, is designed to create an income-generating portfolio optimized for yield, total return, and risk.

6

| Fund Characteristics |

| NOVEMBER 30, 2017 | |

Types of Investments in Portfolio | % of net assets |

| Mutual Funds | 44.0% |

| Common Stocks | 26.1% |

| Preferred Stocks | 9.0% |

| Corporate Bonds | 5.3% |

| Convertible Preferred Stocks | 2.9% |

| Convertible Bonds | 2.7% |

| Collateralized Mortgage Obligations | 2.6% |

| Asset-Backed Securities | 1.6% |

| Commercial Mortgage-Backed Securities | 1.2% |

| Exchange-Traded Funds | 0.7% |

| Temporary Cash Investments | 3.7% |

| Other Assets and Liabilities | 0.2% |

7

| Shareholder Fee Example |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from June 1, 2017 to November 30, 2017.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

| Beginning Account Value 6/1/17 | Ending Account Value 11/30/17 | Expenses Paid During Period(1) 6/1/17 - 11/30/17 | Annualized Expense Ratio(1) | |

Actual | ||||

| Investor Class | $1,000 | $1,037.60 | $2.96 | 0.58% |

| I Class | $1,000 | $1,038.60 | $1.94 | 0.38% |

| Y Class | $1,000 | $1,038.30 | $1.18 | 0.23% |

| A Class | $1,000 | $1,036.30 | $4.24 | 0.83% |

| C Class | $1,000 | $1,031.40 | $8.05 | 1.58% |

| R Class | $1,000 | $1,035.00 | $5.51 | 1.08% |

| R5 Class | $1,000 | $1,038.60 | $1.94 | 0.38% |

| R6 Class | $1,000 | $1,039.40 | $1.18 | 0.23% |

| Hypothetical | ||||

| Investor Class | $1,000 | $1,022.16 | $2.94 | 0.58% |

| I Class | $1,000 | $1,023.16 | $1.93 | 0.38% |

| Y Class | $1,000 | $1,023.92 | $1.17 | 0.23% |

| A Class | $1,000 | $1,020.91 | $4.20 | 0.83% |

| C Class | $1,000 | $1,017.15 | $7.99 | 1.58% |

| R Class | $1,000 | $1,019.65 | $5.47 | 1.08% |

| R5 Class | $1,000 | $1,023.16 | $1.93 | 0.38% |

| R6 Class | $1,000 | $1,023.92 | $1.17 | 0.23% |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 183, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses. |

9

| Schedule of Investments |

NOVEMBER 30, 2017

| Shares/ Principal Amount | Value | ||||||

MUTUAL FUNDS(1) — 44.0% | |||||||

| Emerging Markets Debt Fund R6 Class | 469,573 | $ | 4,892,956 | ||||

| High-Yield Fund R6 Class | 2,107,482 | 12,075,874 | |||||

| International Value Fund R6 Class | 866,270 | 7,779,108 | |||||

| Utilities Fund Investor Class | 31,264 | 590,581 | |||||

TOTAL MUTUAL FUNDS (Cost $23,809,485) | 25,338,519 | ||||||

| COMMON STOCKS — 26.1% | |||||||

| Air Freight and Logistics — 0.1% | |||||||

| United Parcel Service, Inc., Class B | 454 | 54,562 | |||||

Airlines† | |||||||

| AirAsia Bhd | 6,900 | 5,297 | |||||

Korean Air Lines Co. Ltd.(2) | 154 | 4,436 | |||||

| 9,733 | |||||||

| Automobiles — 0.1% | |||||||

| Geely Automobile Holdings Ltd. | 2,000 | 7,039 | |||||

| Honda Motor Co. Ltd. ADR | 541 | 18,037 | |||||

| Hyundai Motor Co. Preference Shares | 68 | 6,086 | |||||

| Toyota Motor Corp. ADR | 71 | 8,970 | |||||

| 40,132 | |||||||

| Banks — 1.6% | |||||||

| Agricultural Bank of China Ltd., H Shares | 49,000 | 22,848 | |||||

| Banco Bradesco SA Preference Shares | 4,000 | 39,897 | |||||

| Banco Santander Brasil SA ADR | 1,000 | 8,750 | |||||

| Bank Negara Indonesia Persero Tbk PT | 33,400 | 20,005 | |||||

| Bank of China Ltd., H Shares | 57,000 | 27,784 | |||||

| Bank of Communications Co. Ltd., H Shares | 7,000 | 5,198 | |||||

| Bank of the Philippine Islands | 7,800 | 15,980 | |||||

| Bank Rakyat Indonesia (Persero) Tbk PT | 74,000 | 17,564 | |||||

| Barclays Africa Group Ltd. | 1,248 | 14,372 | |||||

| China CITIC Bank Corp. Ltd., H Shares | 10,000 | 6,487 | |||||

| China Construction Bank Corp., H Shares | 67,000 | 58,692 | |||||

| China Merchants Bank Co. Ltd., H Shares | 1,500 | 5,893 | |||||

| Chongqing Rural Commercial Bank Co. Ltd., H Shares | 14,000 | 9,981 | |||||

| CIMB Group Holdings Bhd | 11,900 | 17,618 | |||||

| Comerica, Inc. | 74 | 6,165 | |||||

| Commerce Bancshares, Inc. | 289 | 16,349 | |||||

| First Financial Holding Co. Ltd. | 20,000 | 12,875 | |||||

Grupo Financiero Santander Mexico SAB de CV, Series B ADR | 1,600 | 13,008 | |||||

| Hana Financial Group, Inc. | 147 | 6,407 | |||||

| Hong Leong Bank Bhd | 2,300 | 8,542 | |||||

| Industrial & Commercial Bank of China Ltd., H Shares | 66,000 | 51,757 | |||||

10

| Shares/ Principal Amount | Value | ||||||

| Itau Unibanco Holding SA ADR | 900 | $ | 11,295 | ||||

| JPMorgan Chase & Co. | 1,401 | 146,432 | |||||

| KB Financial Group, Inc. | 79 | 4,346 | |||||

| Malayan Banking Bhd | 8,300 | 18,750 | |||||

| Nedbank Group Ltd. | 783 | 13,213 | |||||

| PNC Financial Services Group, Inc. (The) | 1,126 | 158,271 | |||||

| Public Bank Bhd | 1,300 | 6,329 | |||||

| Standard Bank Group Ltd. | 1,931 | 24,363 | |||||

| SunTrust Banks, Inc. | 1,484 | 91,459 | |||||

| U.S. Bancorp | 583 | 32,152 | |||||

| Wells Fargo & Co. | 189 | 10,673 | |||||

| Woori Bank | 578 | 8,603 | |||||

| 912,058 | |||||||

| Capital Markets — 0.3% | |||||||

| AllianceBernstein Holding LP | 1,038 | 25,950 | |||||

| Bank of New York Mellon Corp. (The) | 1,794 | 98,204 | |||||

| BlackRock, Inc. | 13 | 6,515 | |||||

| China Cinda Asset Management Co. Ltd., H Shares | 21,000 | 7,810 | |||||

| China Huarong Asset Management Co. Ltd., H Shares | 30,000 | 13,834 | |||||

| Invesco Ltd. | 167 | 6,040 | |||||

| Investec Ltd. | 1,606 | 11,143 | |||||

| Northern Trust Corp. | 270 | 26,401 | |||||

| 195,897 | |||||||

| Chemicals — 0.3% | |||||||

| Air Products & Chemicals, Inc. | 579 | 94,400 | |||||

| Hanwha Chemical Corp. | 589 | 15,824 | |||||

| Hyosung Corp. | 143 | 17,740 | |||||

| LG Chem Ltd. Preference Shares | 40 | 9,223 | |||||

| Lotte Chemical Corp. | 59 | 19,536 | |||||

| Nan Ya Plastics Corp. | 7,000 | 17,685 | |||||

| Sinopec Shanghai Petrochemical Co. Ltd., H Shares | 26,000 | 15,522 | |||||

| 189,930 | |||||||

| Commercial Services and Supplies — 0.3% | |||||||

| Republic Services, Inc. | 2,618 | 170,013 | |||||

| Communications Equipment — 0.1% | |||||||

| Cisco Systems, Inc. | 1,497 | 55,838 | |||||

Construction and Engineering† | |||||||

| China Railway Group Ltd., H Shares | 19,000 | 14,251 | |||||

| Hyundai Engineering & Construction Co. Ltd. | 181 | 5,842 | |||||

| 20,093 | |||||||

Construction Materials† | |||||||

Cemex SAB de CV ADR(2) | 2,100 | 15,939 | |||||

| Containers and Packaging — 0.1% | |||||||

| Bemis Co., Inc. | 968 | 45,419 | |||||

| International Paper Co. | 446 | 25,248 | |||||

| 70,667 | |||||||

11

| Shares/ Principal Amount | Value | ||||||

Distributors† | |||||||

| Genuine Parts Co. | 96 | $ | 8,925 | ||||

Diversified Consumer Services† | |||||||

| New Oriental Education & Technology Group, Inc. ADR | 100 | 8,486 | |||||

| TAL Education Group ADR | 200 | 5,576 | |||||

| 14,062 | |||||||

| Diversified Financial Services — 0.1% | |||||||

| Chailease Holding Co. Ltd. | 6,000 | 17,486 | |||||

| FirstRand Ltd. | 1,645 | 6,774 | |||||

| 24,260 | |||||||

| Diversified Telecommunication Services — 0.4% | |||||||

| AT&T, Inc. | 3,935 | 143,156 | |||||

| China Communications Services Corp. Ltd., H Shares | 22,000 | 14,058 | |||||

Orange Polska SA(2) | 7,751 | 11,983 | |||||

| Telekomunikasi Indonesia Persero Tbk PT | 13,600 | 4,201 | |||||

| Verizon Communications, Inc. | 853 | 43,409 | |||||

| 216,807 | |||||||

| Electric Utilities — 0.9% | |||||||

| Edison International | 1,400 | 113,778 | |||||

| Enel Chile SA | 114,878 | 12,429 | |||||

| Eversource Energy | 1,582 | 102,593 | |||||

| Inter RAO UES PJSC | 177,000 | 11,040 | |||||

| Interconexion Electrica SA ESP | 2,602 | 11,904 | |||||

| PG&E Corp. | 1,116 | 60,532 | |||||

| Pinnacle West Capital Corp. | 1,240 | 113,844 | |||||

| Xcel Energy, Inc. | 1,373 | 70,861 | |||||

| 496,981 | |||||||

| Electrical Equipment — 0.1% | |||||||

| Emerson Electric Co. | 427 | 27,678 | |||||

| Electronic Equipment, Instruments and Components — 0.1% | |||||||

| AU Optronics Corp. | 16,000 | 6,837 | |||||

| Hon Hai Precision Industry Co. Ltd. | 17,000 | 57,262 | |||||

| 64,099 | |||||||

| Energy Equipment and Services — 0.3% | |||||||

| Schlumberger Ltd. | 2,504 | 157,376 | |||||

| Equity Real Estate Investment Trusts (REITs) — 7.2% | |||||||

| American Tower Corp. | 239 | 34,399 | |||||

| Boston Properties, Inc. | 150 | 18,807 | |||||

| Brixmor Property Group, Inc. | 6,514 | 117,708 | |||||

| Community Healthcare Trust, Inc. | 9,700 | 264,422 | |||||

| Concentradora Fibra Hotelera Mexicana SA de CV | 115,063 | 74,094 | |||||

| CoreCivic, Inc. | 5,226 | 122,863 | |||||

| CubeSmart | 5,483 | 156,485 | |||||

| Fibra Uno Administracion SA de CV | 3,900 | 6,098 | |||||

| Fortress REIT Ltd., A Shares | 14,226 | 17,895 | |||||

| Gaming and Leisure Properties, Inc. | 6,045 | 219,554 | |||||

| GEO Group, Inc. (The) | 5,018 | 133,178 | |||||

12

| Shares/ Principal Amount | Value | ||||||

| Healthcare Trust of America, Inc., Class A | 8,918 | $ | 272,802 | ||||

| Iron Mountain, Inc. | 6,447 | 263,489 | |||||

| Kimco Realty Corp. | 6,681 | 123,732 | |||||

| Klepierre SA | 4,628 | 191,238 | |||||

| Macerich Co. (The) | 2,152 | 139,342 | |||||

| Medical Properties Trust, Inc. | 18,041 | 246,981 | |||||

| MGM Growth Properties LLC, Class A | 7,932 | 232,249 | |||||

| NorthStar Realty Europe Corp. | 20,045 | 290,853 | |||||

| Pebblebrook Hotel Trust | 4,827 | 185,695 | |||||

| Spirit Realty Capital, Inc. | 25,323 | 216,258 | |||||

| STAG Industrial, Inc. | 9,584 | 271,227 | |||||

| STORE Capital Corp. | 10,697 | 276,197 | |||||

| VEREIT, Inc. | 22,838 | 178,136 | |||||

| Weyerhaeuser Co. | 2,612 | 92,413 | |||||

| 4,146,115 | |||||||

| Food and Staples Retailing — 0.2% | |||||||

| CVS Health Corp. | 574 | 43,968 | |||||

| Wal-Mart Stores, Inc. | 795 | 77,298 | |||||

| 121,266 | |||||||

| Food Products — 0.3% | |||||||

| Campbell Soup Co. | 136 | 6,705 | |||||

| General Mills, Inc. | 2,289 | 129,466 | |||||

| Mondelez International, Inc., Class A | 961 | 41,265 | |||||

| 177,436 | |||||||

| Gas Utilities — 0.6% | |||||||

| Atmos Energy Corp. | 1,182 | 109,087 | |||||

| ONE Gas, Inc. | 1,671 | 132,427 | |||||

| Spire, Inc. | 1,325 | 108,981 | |||||

| 350,495 | |||||||

| Health Care Equipment and Supplies — 0.3% | |||||||

| Medtronic plc | 2,067 | 169,763 | |||||

| Health Care Providers and Services — 0.1% | |||||||

| Qualicorp SA | 600 | 5,622 | |||||

| Quest Diagnostics, Inc. | 223 | 21,956 | |||||

| 27,578 | |||||||

Hotels, Restaurants and Leisure† | |||||||

| Genting Bhd | 6,100 | 13,133 | |||||

Household Durables† | |||||||

| LG Electronics, Inc. | 185 | 15,374 | |||||

| Household Products — 0.5% | |||||||

| Procter & Gamble Co. (The) | 2,995 | 269,520 | |||||

Independent Power and Renewable Electricity Producers† | |||||||

| Enel Generacion Chile SA ADR | 200 | 4,928 | |||||

| Industrial Conglomerates — 0.3% | |||||||

| 3M Co. | 339 | 82,425 | |||||

| DMCI Holdings, Inc. | 51,200 | 15,359 | |||||

| Fosun International Ltd. | 8,000 | 16,736 | |||||

13

| Shares/ Principal Amount | Value | ||||||

| Hanwha Corp. | 422 | $ | 16,090 | ||||

| LG Corp. | 127 | 10,619 | |||||

| SK Holdings Co. Ltd. | 20 | 5,365 | |||||

| 146,594 | |||||||

| Insurance — 0.4% | |||||||

| BB Seguridade Participacoes SA | 600 | 4,927 | |||||

| China Life Insurance Co. Ltd., H Shares | 2,000 | 6,517 | |||||

| Chubb Ltd. | 608 | 92,483 | |||||

| Dongbu Insurance Co. Ltd. | 288 | 18,123 | |||||

| Hyundai Marine & Fire Insurance Co. Ltd. | 188 | 7,495 | |||||

| Marsh & McLennan Cos., Inc. | 383 | 32,145 | |||||

| MetLife, Inc. | 456 | 24,478 | |||||

| MMI Holdings Ltd. | 4,330 | 6,338 | |||||

People's Insurance Co. Group of China Ltd. (The), H Shares | 21,000 | 10,904 | |||||

| Ping An Insurance Group Co., H Shares | 1,000 | 9,888 | |||||

| Sul America SA | 1,500 | 8,198 | |||||

| 221,496 | |||||||

| Internet Software and Services — 0.1% | |||||||

Alibaba Group Holding Ltd. ADR(2) | 45 | 7,968 | |||||

| Tencent Holdings Ltd. | 200 | 10,324 | |||||

YY, Inc. ADR(2) | 100 | 10,319 | |||||

| 28,611 | |||||||

| IT Services — 0.1% | |||||||

| Automatic Data Processing, Inc. | 460 | 52,652 | |||||

| Infosys Ltd. ADR | 200 | 3,112 | |||||

| International Business Machines Corp. | 159 | 24,481 | |||||

| 80,245 | |||||||

Media† | |||||||

| Astro Malaysia Holdings Bhd | 16,100 | 11,181 | |||||

| Time Warner, Inc. | 136 | 12,445 | |||||

| 23,626 | |||||||

| Metals and Mining — 0.2% | |||||||

| Alrosa PJSC | 8,500 | 11,163 | |||||

Aluminum Corp. of China Ltd., H Shares(2) | 16,000 | 10,623 | |||||

Jastrzebska Spolka Weglowa SA(2) | 388 | 9,835 | |||||

| Vale SA ADR | 4,100 | 43,870 | |||||

| Vedanta Resources plc | 1,655 | 15,479 | |||||

| 90,970 | |||||||

| Mortgage Real Estate Investment Trusts (REITs) — 1.5% | |||||||

| Blackstone Mortgage Trust, Inc., Class A | 8,916 | 291,731 | |||||

| New Residential Investment Corp. | 16,190 | 286,401 | |||||

| Starwood Property Trust, Inc. | 13,085 | 283,683 | |||||

| 861,815 | |||||||

| Multi-Utilities — 0.2% | |||||||

| Ameren Corp. | 1,034 | 66,135 | |||||

14

| Shares/ Principal Amount | Value | ||||||

| NorthWestern Corp. | 896 | $ | 57,577 | ||||

| 123,712 | |||||||

| Oil, Gas and Consumable Fuels — 7.2% | |||||||

| Adaro Energy Tbk PT | 65,900 | 8,318 | |||||

| Antero Midstream Partners LP | 11,233 | 309,469 | |||||

BP Midstream Partners LP(2) | 10,138 | 185,221 | |||||

| Chevron Corp. | 1,121 | 133,388 | |||||

| China Petroleum & Chemical Corp., H Shares | 40,000 | 28,663 | |||||

| China Shenhua Energy Co. Ltd., H Shares | 8,000 | 19,792 | |||||

| CNOOC Ltd. | 13,000 | 17,788 | |||||

| Enterprise Products Partners LP | 25,911 | 638,188 | |||||

| EQT GP Holdings LP | 6,279 | 160,554 | |||||

| EQT Midstream Partners LP | 3,249 | 222,946 | |||||

| Exxaro Resources Ltd. | 538 | 5,790 | |||||

| Exxon Mobil Corp. | 170 | 14,159 | |||||

| Formosa Petrochemical Corp. | 4,000 | 14,146 | |||||

| Gazprom PJSC ADR | 924 | 4,132 | |||||

| Grupa Lotos SA | 263 | 4,197 | |||||

| GS Holdings Corp. | 304 | 17,069 | |||||

| Hess Midstream Partners LP | 8,711 | 184,151 | |||||

| LUKOIL PJSC ADR | 304 | 16,899 | |||||

| MPLX LP | 6,152 | 220,611 | |||||

| Noble Midstream Partners LP | 3,993 | 197,454 | |||||

| Occidental Petroleum Corp. | 295 | 20,798 | |||||

Petroleo Brasileiro SA ADR(2) | 3,100 | 29,078 | |||||

| Phillips 66 Partners LP | 6,991 | 327,598 | |||||

| Plains All American Pipeline LP | 10,161 | 198,140 | |||||

| Polski Koncern Naftowy Orlen SA | 335 | 10,524 | |||||

| Reliance Industries Ltd. GDR | 727 | 20,266 | |||||

| Royal Dutch Shell plc, Class A ADR | 899 | 57,644 | |||||

| Shell Midstream Partners LP | 13,543 | 366,338 | |||||

| SK Innovation Co. Ltd. | 38 | 7,268 | |||||

| Spectra Energy Partners LP | 9,926 | 406,172 | |||||

| TOTAL SA ADR | 2,888 | 163,316 | |||||

| Transneft PJSC Preference Shares | 4 | 12,250 | |||||

| Tupras Turkiye Petrol Rafinerileri AS | 312 | 9,659 | |||||

| Williams Partners LP | 3,074 | 112,816 | |||||

| Yanzhou Coal Mining Co. Ltd., H Shares | 8,000 | 7,532 | |||||

| 4,152,334 | |||||||

| Personal Products — 0.1% | |||||||

| LG Household & Health Care Ltd. Preference Shares | 25 | 16,167 | |||||

| Unilever NV ADR | 692 | 39,956 | |||||

| 56,123 | |||||||

| Pharmaceuticals — 1.0% | |||||||

| Eli Lilly & Co. | 244 | 20,652 | |||||

| Johnson & Johnson | 1,798 | 250,515 | |||||

| Merck & Co., Inc. | 988 | 54,607 | |||||

15

| Shares/ Principal Amount | Value | ||||||

| Pfizer, Inc. | 2,715 | $ | 98,446 | ||||

| Roche Holding AG ADR | 4,822 | 152,279 | |||||

| 576,499 | |||||||

| Real Estate Management and Development — 0.1% | |||||||

China Evergrande Group(2) | 5,000 | 16,734 | |||||

| China Vanke Co. Ltd., H Shares | 4,800 | 17,575 | |||||

| Country Garden Holdings Co. | 9,000 | 14,286 | |||||

| Shimao Property Holdings Ltd. | 4,000 | 7,899 | |||||

| Sino-Ocean Group Holding Ltd. | 24,500 | 15,446 | |||||

| 71,940 | |||||||

Road and Rail† | |||||||

| Norfolk Southern Corp. | 42 | 5,822 | |||||

| Semiconductors and Semiconductor Equipment — 0.3% | |||||||

| Applied Materials, Inc. | 670 | 35,356 | |||||

| Maxim Integrated Products, Inc. | 1,711 | 89,536 | |||||

| Phison Electronics Corp. | 1,000 | 10,190 | |||||

| SK Hynix, Inc. | 166 | 11,830 | |||||

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | 200 | 7,920 | |||||

| 154,832 | |||||||

| Software — 0.2% | |||||||

| Microsoft Corp. | 375 | 31,564 | |||||

| Oracle Corp. (New York) | 1,964 | 96,354 | |||||

| 127,918 | |||||||

| Technology Hardware, Storage and Peripherals — 0.2% | |||||||

| Catcher Technology Co. Ltd. | 1,000 | 10,875 | |||||

| Compal Electronics, Inc. | 12,000 | 8,360 | |||||

| Lite-On Technology Corp. | 7,000 | 8,652 | |||||

| Pegatron Corp. | 5,000 | 11,494 | |||||

| Samsung Electronics Co. Ltd. | 29 | 68,136 | |||||

| Samsung Electronics Co. Ltd. Preference Shares | 5 | 9,723 | |||||

| Wistron Corp. | 15,000 | 11,659 | |||||

| 128,899 | |||||||

| Thrifts and Mortgage Finance — 0.1% | |||||||

| Capitol Federal Financial, Inc. | 4,445 | 62,497 | |||||

Tobacco† | |||||||

| Gudang Garam Tbk PT | 2,900 | 16,430 | |||||

Transportation Infrastructure† | |||||||

| Zhejiang Expressway Co. Ltd., H Shares | 8,000 | 9,610 | |||||

Water Utilities† | |||||||

| Cia de Saneamento Basico do Estado de Sao Paulo ADR | 700 | 6,979 | |||||

| Wireless Telecommunication Services — 0.1% | |||||||

| America Movil SAB de CV, Series L ADR | 800 | 13,680 | |||||

| China Mobile Ltd. | 4,000 | 40,590 | |||||

| SK Telecom Co. Ltd. | 30 | 7,304 | |||||

16

| Shares/ Principal Amount | Value | ||||||

| Vodacom Group Ltd. | 1,554 | $ | 16,450 | ||||

| 78,024 | |||||||

TOTAL COMMON STOCKS (Cost $14,059,987) | 15,065,634 | ||||||

| PREFERRED STOCKS — 9.0% | |||||||

| Banks — 5.0% | |||||||

| Bank of America Corp., 5.20% | 33,000 | 34,199 | |||||

| Bank of America Corp., 6.50% | 712,000 | 810,861 | |||||

| Citigroup, Inc., 5.90% | 33,000 | 35,627 | |||||

| Citigroup, Inc., 5.95% | 774,000 | 832,630 | |||||

| U.S. Bancorp, 5.30% | 269,000 | 292,538 | |||||

| U.S. Bancorp, 6.50% | 18,100 | 520,737 | |||||

| Wells Fargo & Co., 8.00% | 14,258 | 365,005 | |||||

| 2,891,597 | |||||||

| Capital Markets — 1.0% | |||||||

| Goldman Sachs Group, Inc. (The), 5.30% | 537,000 | 574,321 | |||||

| Electric Utilities — 0.8% | |||||||

| Pacific Gas & Electric Co., 4.50% | 9,388 | 239,864 | |||||

| Pacific Gas & Electric Co., 4.80% | 1,937 | 50,943 | |||||

| Pacific Gas & Electric Co., 5.00% | 5,666 | 147,939 | |||||

| 438,746 | |||||||

| Equity Real Estate Investment Trusts (REITs) — 0.8% | |||||||

| DDR Corp., 6.25% | 500 | 12,640 | |||||

| Federal Realty Investment Trust, 5.00% | 318 | 7,925 | |||||

| Kimco Realty Corp., 5.625% | 530 | 13,451 | |||||

| Public Storage, 5.40% | 16,039 | 415,731 | |||||

| 449,747 | |||||||

| Industrial Conglomerates — 0.4% | |||||||

| General Electric Co., 5.00% | 217,000 | 222,154 | |||||

| Multi-Utilities — 1.0% | |||||||

| SCE Trust II, 5.10% | 23,483 | 599,521 | |||||

TOTAL PREFERRED STOCKS (Cost $4,920,586) | 5,176,086 | ||||||

| CORPORATE BONDS — 5.3% | |||||||

| Automobiles — 0.2% | |||||||

Daimler Finance North America LLC, 2.00%, 8/3/18(3) | $ | 10,000 | 10,007 | ||||

| Ford Motor Co., 4.35%, 12/8/26 | 45,000 | 46,924 | |||||

| General Motors Financial Co., Inc., 5.25%, 3/1/26 | 35,000 | 38,068 | |||||

| 94,999 | |||||||

| Banks — 1.0% | |||||||

| Capital One Financial Corp., 4.20%, 10/29/25 | 40,000 | 41,000 | |||||

| Citigroup, Inc., 4.00%, 8/5/24 | 35,000 | 36,334 | |||||

SunTrust Banks, Inc., VRN, 5.125%, 12/15/27(4) | 148,000 | 146,612 | |||||

| Wells Fargo & Co., MTN, 4.65%, 11/4/44 | 25,000 | 26,853 | |||||

Wells Fargo & Co., VRN, 7.98%, 3/15/18(4) | 351,000 | 356,914 | |||||

| 607,713 | |||||||

17

| Shares/ Principal Amount | Value | ||||||

| Beverages — 0.1% | |||||||

| Constellation Brands, Inc., 4.75%, 12/1/25 | $ | 35,000 | $ | 38,426 | |||

| Biotechnology — 0.1% | |||||||

| AbbVie, Inc., 3.60%, 5/14/25 | 25,000 | 25,580 | |||||

| Celgene Corp., 5.00%, 8/15/45 | 25,000 | 27,594 | |||||

| 53,174 | |||||||

| Building Products — 0.1% | |||||||

| Masco Corp., 4.45%, 4/1/25 | 35,000 | 37,282 | |||||

| Capital Markets — 0.3% | |||||||

Charles Schwab Corp. (The), VRN, 5.00%, 12/1/27(4) | 160,000 | 161,600 | |||||

| Diversified Financial Services — 0.2% | |||||||

JPMorgan Chase & Co., VRN, 5.15%, 5/1/23(4) | 75,000 | 78,187 | |||||

| Morgan Stanley, MTN, 4.00%, 7/23/25 | 40,000 | 41,921 | |||||

| 120,108 | |||||||

| Diversified Telecommunication Services — 0.1% | |||||||

| AT&T, Inc., 4.45%, 4/1/24 | 39,000 | 41,199 | |||||

| Energy Equipment and Services — 0.1% | |||||||

| Ensco plc, 8.00%, 1/31/24 | 11,000 | 10,835 | |||||

Transocean, Inc., 9.00%, 7/15/23(3) | 25,000 | 27,094 | |||||

| 37,929 | |||||||

| Equity Real Estate Investment Trusts (REITs) — 0.2% | |||||||

| American Tower Corp., 3.375%, 10/15/26 | 25,000 | 24,586 | |||||

| AvalonBay Communities, Inc., MTN, 3.20%, 1/15/28 | 35,000 | 34,683 | |||||

| Crown Castle International Corp., 5.25%, 1/15/23 | 20,000 | 21,983 | |||||

| MGM Growth Properties Operating Partnership LP / MGP Finance Co-Issuer, Inc., 4.50%, 9/1/26 | 35,000 | 35,437 | |||||

| VEREIT Operating Partnership LP, 4.125%, 6/1/21 | 20,000 | 20,810 | |||||

| 137,499 | |||||||

Food and Staples Retailing† | |||||||

| Tesco plc, MTN, 5.50%, 12/13/19 | GBP | 10,000 | 14,676 | ||||

| Gas Utilities — 0.8% | |||||||

| Enbridge, Inc., 4.50%, 6/10/44 | $ | 25,000 | 25,320 | ||||

| Kinder Morgan Energy Partners LP, 6.50%, 9/1/39 | 35,000 | 40,650 | |||||

| MPLX LP, 4.875%, 12/1/24 | 22,000 | 23,659 | |||||

Plains All American Pipeline LP, VRN, 6.125%, 11/15/22(4) | 330,000 | 327,113 | |||||

| Sunoco Logistics Partners Operations LP, 4.00%, 10/1/27 | 30,000 | 29,567 | |||||

| Williams Cos., Inc. (The), 3.70%, 1/15/23 | 35,000 | 35,175 | |||||

| 481,484 | |||||||

| Health Care Equipment and Supplies — 0.1% | |||||||

| Abbott Laboratories, 3.75%, 11/30/26 | 25,000 | 25,533 | |||||

| Medtronic, Inc., 3.50%, 3/15/25 | 35,000 | 36,195 | |||||

| 61,728 | |||||||

| Health Care Providers and Services — 0.2% | |||||||

| DaVita, Inc., 5.125%, 7/15/24 | 35,000 | 35,678 | |||||

| Express Scripts Holding Co., 4.50%, 2/25/26 | 25,000 | 26,415 | |||||

| HCA, Inc., 3.75%, 3/15/19 | 25,000 | 25,375 | |||||

| Tenet Healthcare Corp., 4.75%, 6/1/20 | 25,000 | 25,632 | |||||

18

| Shares/ Principal Amount | Value | ||||||

| UnitedHealth Group, Inc., 3.75%, 7/15/25 | $ | 35,000 | $ | 36,843 | |||

| 149,943 | |||||||

| Hotels, Restaurants and Leisure — 0.2% | |||||||

International Game Technology plc, 6.25%, 2/15/22(3) | 35,000 | 38,369 | |||||

| MGM Resorts International, 6.625%, 12/15/21 | 25,000 | 27,875 | |||||

| Royal Caribbean Cruises Ltd., 5.25%, 11/15/22 | 45,000 | 49,644 | |||||

| 115,888 | |||||||

| Household Durables — 0.2% | |||||||

| Lennar Corp., 4.75%, 5/30/25 | 35,000 | 36,269 | |||||

| M.D.C. Holdings, Inc., 5.50%, 1/15/24 | 35,000 | 37,089 | |||||

| Toll Brothers Finance Corp., 5.625%, 1/15/24 | 25,000 | 27,344 | |||||

| 100,702 | |||||||

| Insurance — 0.1% | |||||||

| American International Group, Inc., 4.125%, 2/15/24 | 25,000 | 26,410 | |||||

Liberty Mutual Group, Inc., VRN, 4.23%, 12/15/17, resets quarterly off the 3-month LIBOR plus 2.91%(3) | 25,000 | 24,563 | |||||

| 50,973 | |||||||

| Internet and Direct Marketing Retail — 0.1% | |||||||

Amazon.com, Inc., 3.15%, 8/22/27(3) | 50,000 | 50,120 | |||||

| Internet Software and Services — 0.1% | |||||||

Symantec Corp., 5.00%, 4/15/25(3) | 50,000 | 52,500 | |||||

| Machinery — 0.1% | |||||||

| Oshkosh Corp., 5.375%, 3/1/22 | 35,000 | 36,313 | |||||

| Media — 0.4% | |||||||

| 21st Century Fox America, Inc., 6.90%, 8/15/39 | 25,000 | 33,370 | |||||

| Comcast Corp., 4.75%, 3/1/44 | 25,000 | 27,775 | |||||

| CSC Holdings LLC, 6.75%, 11/15/21 | 15,000 | 16,163 | |||||

| Discovery Communications LLC, 3.95%, 3/20/28 | 30,000 | 29,417 | |||||

| DISH DBS Corp., 5.125%, 5/1/20 | 35,000 | 36,094 | |||||

| Lamar Media Corp., 5.375%, 1/15/24 | 35,000 | 36,925 | |||||

| Time Warner, Inc., 3.80%, 2/15/27 | 35,000 | 34,959 | |||||

| Viacom, Inc., 3.125%, 6/15/22 | 50,000 | 49,004 | |||||

| 263,707 | |||||||

| Metals and Mining — 0.1% | |||||||

| Steel Dynamics, Inc., 5.00%, 12/15/26 | 35,000 | 37,078 | |||||

| Teck Resources Ltd., 4.75%, 1/15/22 | 15,000 | 15,825 | |||||

| 52,903 | |||||||

Mortgage Real Estate Investment Trusts (REITs)† | |||||||

| Starwood Property Trust, Inc., 5.00%, 12/15/21 | 15,000 | 15,656 | |||||

| Multi-Utilities — 0.2% | |||||||

| Dominion Energy, Inc., 4.90%, 8/1/41 | 25,000 | 28,206 | |||||

| Exelon Corp., 4.45%, 4/15/46 | 25,000 | 26,763 | |||||

| NextEra Energy Capital Holdings, Inc., VRN, 4.66%, 12/2/17, resets quarterly off the 3-month LIBOR plus 3.35% | 40,000 | 40,000 | |||||

| 94,969 | |||||||

| Oil, Gas and Consumable Fuels — 0.1% | |||||||

| Newfield Exploration Co., 5.75%, 1/30/22 | 35,000 | 37,581 | |||||

19

| Shares/ Principal Amount | Value | ||||||

Petrobras Global Finance BV, 5.30%, 1/27/25(3) | $ | 14,000 | $ | 14,014 | |||

| Sunoco LP / Sunoco Finance Corp., 5.50%, 8/1/20 | 15,000 | 15,440 | |||||

| 67,035 | |||||||

Paper and Forest Products† | |||||||

| International Paper Co., 4.40%, 8/15/47 | 25,000 | 25,650 | |||||

| Pharmaceuticals — 0.1% | |||||||

| Allergan Funding SCS, 3.85%, 6/15/24 | 25,000 | 25,602 | |||||

| Shire Acquisitions Investments Ireland DAC, 2.40%, 9/23/21 | 35,000 | 34,464 | |||||

| 60,066 | |||||||

| Specialty Retail — 0.1% | |||||||

| Sally Holdings LLC / Sally Capital, Inc., 5.625%, 12/1/25 | 35,000 | 35,175 | |||||

Technology Hardware, Storage and Peripherals† | |||||||

| Seagate HDD Cayman, 4.75%, 6/1/23 | 24,000 | 24,345 | |||||

TOTAL CORPORATE BONDS (Cost $3,064,931) | 3,083,762 | ||||||

| CONVERTIBLE PREFERRED STOCKS — 2.9% | |||||||

| Banks — 1.2% | |||||||

| Bank of America Corp., 7.25% | 420 | 553,560 | |||||

| Wells Fargo & Co., 7.50% | 84 | 112,644 | |||||

| 666,204 | |||||||

| Equity Real Estate Investment Trusts (REITs) — 0.8% | |||||||

| Welltower, Inc., 6.50% | 7,804 | 485,487 | |||||

| Machinery — 0.9% | |||||||

| Stanley Black & Decker, Inc., 5.375%, 5/15/20 | 4,481 | 548,922 | |||||

TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $1,568,163) | 1,700,613 | ||||||

| CONVERTIBLE BONDS — 2.7% | |||||||

| Air Freight and Logistics — 0.3% | |||||||

Air Transport Services Group, Inc., 1.125%, 10/15/24(3) | $ | 57,000 | 59,422 | ||||

Canadian Imperial Bank of Commerce, (convertible into United Parcel Service, Inc., Class B), 2.65%, 3/29/18(3)(5) | 695 | 83,270 | |||||

Credit Suisse AG, (convertible into United Parcel Service, Inc., Class B), 2.90%, 1/30/18(3)(5) | 407 | 46,949 | |||||

| 189,641 | |||||||

| Diversified Financial Services — 0.3% | |||||||

Canadian Imperial Bank of Commerce, (convertible into Berkshire Hathaway, Inc., Class B), 1.13%, 3/15/18(3)(5) | 813 | 147,155 | |||||

| Food Products — 0.1% | |||||||

Credit Suisse AG, (convertible into Mondelez International, Inc., Class A), 3.85%, 1/9/18(3)(5) | 213 | 9,211 | |||||

UBS AG, (convertible into Mondelez International, Inc., Class A), 3.35%, 3/9/18(3)(5) | 1,734 | 74,488 | |||||

| 83,699 | |||||||

| Health Care Equipment and Supplies — 0.1% | |||||||

Morgan Stanley B.V., (convertible into Zimmer Biomet Holdings, Inc.), 1.80%, 5/4/18(3)(5) | 371 | 43,326 | |||||

| Multiline Retail — 0.1% | |||||||

Royal Bank of Canada, (convertible into Target Corp.), 7.10%, 5/25/18(3)(5) | 939 | 53,071 | |||||

20

| Shares/ Principal Amount | Value | ||||||

| Oil, Gas and Consumable Fuels — 0.3% | |||||||

Goldman Sachs International, (convertible into EQT Corp.), 3.43%, 12/11/17(3)(5) | $ | 2,768 | $ | 160,046 | |||

| Semiconductors and Semiconductor Equipment — 1.4% | |||||||

| Intel Corp., 3.49%, 12/15/35 | 31,000 | 51,770 | |||||

Microchip Technology, Inc., 1.625%, 2/15/27(3) | 371,000 | 433,838 | |||||

Teradyne, Inc., 1.25%, 12/15/23(3) | 205,000 | 285,335 | |||||

| 770,943 | |||||||

| Specialty Retail — 0.2% | |||||||

Goldman Sachs International, (convertible into L Brands, Inc.), 12.93%, 1/16/18(3)(5) | 544 | 25,415 | |||||

Merrill Lynch International & Co C.V., (convertible into Lowe’s Cos., Inc), 4.80%, 5/17/18(3)(5) | 862 | 69,723 | |||||

| 95,138 | |||||||

TOTAL CONVERTIBLE BONDS (Cost $1,378,151) | 1,543,019 | ||||||

COLLATERALIZED MORTGAGE OBLIGATIONS(6) — 2.6% | |||||||

| Private Sponsor Collateralized Mortgage Obligations — 1.8% | |||||||

Bear Stearns Adjustable Rate Mortgage Trust, Series 2004-12, Class 2A1, VRN, 3.48%, 12/1/17(7) | 20,118 | 20,391 | |||||

Bear Stearns Adjustable Rate Mortgage Trust, Series 2004-8, Class 2A1, VRN, 3.61%, 12/1/17(7) | 4,721 | 4,616 | |||||

Bear Stearns Adjustable Rate Mortgage Trust, Series 2006-1, Class A1, VRN, 3.67%, 12/1/17(7) | 57,584 | 57,848 | |||||

Chase Mortgage Finance Trust, Series 2007-A2, Class 6A2 SEQ, VRN, 3.52%, 12/1/17(7) | 1,595 | 1,546 | |||||

| Citicorp Mortgage Securities, Inc., Series 2007-8, Class 1A3, 6.00%, 9/25/37 | 5,012 | 5,178 | |||||

Citigroup Mortgage Loan Trust, Inc., Series 2004-UST1, Class A5, VRN, 3.09%, 12/1/17(7) | 25,074 | 24,874 | |||||

Citigroup Mortgage Loan Trust, Inc., Series 2005-4, Class A, VRN, 3.54%, 12/1/17(7) | 8,208 | 8,157 | |||||

Citigroup Mortgage Loan Trust, Inc., Series 2005-6, Class A2, VRN, 3.18%, 12/1/17(7) | 30,346 | 30,703 | |||||

Credit Suisse First Boston Mortgage-Backed Pass-Through Certificates, Series 2005-3, Class 1A1, VRN, 5.41%, 12/1/17(7) | 8,751 | 8,392 | |||||

GSR Mortgage Loan Trust, Series 2005-AR6, Class 2A1, VRN, 3.37%, 12/1/17(7) | 30,451 | 31,168 | |||||

GSR Mortgage Loan Trust, Series 2005-AR6, Class 4A5, VRN, 3.51%, 12/1/17(7) | 19,225 | 19,433 | |||||

JPMorgan Mortgage Trust, Series 2005-A4, Class 1A1, VRN, 3.49%, 12/1/17(7) | 11,098 | 11,149 | |||||

JPMorgan Mortgage Trust, Series 2005-A4, Class 2A1, VRN, 3.67%, 12/1/17(7) | 8,142 | 8,154 | |||||

JPMorgan Mortgage Trust, Series 2005-A6, Class 7A1, VRN, 3.61%, 12/1/17(7) | 5,673 | 5,535 | |||||

JPMorgan Mortgage Trust, Series 2005-S2, Class 3A1, VRN, 7.15%, 12/1/17(7) | 532 | 556 | |||||

MASTR Adjustable Rate Mortgages Trust, Series 2004-13, Class 3A7, VRN, 3.47%, 12/1/17(7) | 28,587 | 29,402 | |||||

Sequoia Mortgage Trust, Series 2017-CH2, Class A10 SEQ, VRN, 4.00%, 12/1/17(3)(7) | 75,000 | 76,819 | |||||

Thornburg Mortgage Securities Trust, Series 2006-4, Class A2B, VRN, 3.04%, 12/26/17(7) | 28,749 | 28,130 | |||||

21

| Shares/ Principal Amount | Value | ||||||

WaMu Mortgage Pass-Through Certificates, Series 2005-AR3, Class A1, VRN, 3.07%, 12/1/17(7) | $ | 12,003 | $ | 11,832 | |||

WaMu Mortgage Pass-Through Certificates, Series 2005-AR7, Class A3, VRN, 3.23%, 12/1/17(7) | 5,572 | 5,618 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2004-A, Class A1, VRN, 3.32%, 12/1/17(7) | 12,249 | 12,673 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2004-Z, Class 2A2, VRN, 3.69%, 12/1/17(7) | 15,330 | 15,650 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2005-17, Class 2A1, 5.50%, 1/25/36 | 86,577 | 86,483 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2005-18, Class 1A1, 5.50%, 1/25/36 | 20,760 | 20,654 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2005-AR4, Class 2A1, VRN, 3.36%, 12/1/17(7) | 4,837 | 4,881 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2005-AR7, Class 1A1, VRN, 3.34%, 12/1/17(7) | 5,501 | 5,540 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-4, Class 2A1, 6.00%, 4/25/36 | 15,006 | 14,909 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-6, Class 1A16 SEQ, 5.75%, 5/25/36 | 22,265 | 22,362 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-8, Class A10 SEQ, 6.00%, 7/25/36 | 13,415 | 13,543 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-8, Class A15, 6.00%, 7/25/36 | 90,129 | 90,989 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR1, Class 2A5 SEQ, VRN, 3.17%, 12/1/17(7) | 7,211 | 7,021 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR10, Class 1A1, VRN, 3.34%, 12/1/17(7) | 4,205 | 4,106 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR10, Class 4A1, VRN, 3.23%, 12/1/17(7) | 25,578 | 25,862 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR10, Class 5A6 SEQ, VRN, 3.39%, 12/1/17(7) | 50,395 | 50,902 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR12, Class 1A1, VRN, 3.75%, 12/1/17(7) | 25,706 | 25,728 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR14, Class 2A1, VRN, 3.62%, 12/1/17(7) | 15,616 | 15,418 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR16, Class A1, VRN, 3.72%, 12/1/17(7) | 36,514 | 35,775 | |||||

Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR19, Class A1, VRN, 3.68%, 12/1/17(7) | 38,534 | 36,077 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2007-11, Class A36, 6.00%, 8/25/37 | 22,482 | 22,538 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2007-15, Class A1, 6.00%, 11/25/37 | 11,509 | 11,467 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2007-4, Class A15, 6.00%, 4/25/37 | 9,607 | 9,751 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2007-7, Class A1, 6.00%, 6/25/37 | 20,216 | 20,152 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2007-8, Class 1A5 SEQ, 6.00%, 7/25/37 | 34,412 | 34,634 | |||||

| Wells Fargo Mortgage-Backed Securities Trust, Series 2007-8, Class 2A2, 6.00%, 7/25/37 | 54,384 | 54,759 | |||||

| 1,031,375 | |||||||

| U.S. Government Agency Collateralized Mortgage Obligations — 0.8% | |||||||

| FHLMC, Series 2015-HQ2, Class M3, VRN, 4.58%, 12/26/17, resets monthly off the 1-month LIBOR plus 3.25% | 50,000 | 56,034 | |||||

22

| Shares/ Principal Amount | Value | ||||||

| FHLMC, Series 2017-DNA2, Class M1, VRN, 2.53%, 12/26/17, resets monthly off the 1-month LIBOR plus 1.20% | $ | 96,908 | $ | 98,263 | |||

| FNMA, Series 2014-C02, Class 1M2, VRN, 3.93%, 12/27/17, resets monthly off the 1-month LIBOR plus 2.60% | 20,000 | 21,071 | |||||

| FNMA, Series 2016-C03, Class 2M2, VRN, 7.23%, 12/27/17, resets monthly off the 1-month LIBOR plus 5.90% | 5,000 | 5,793 | |||||

| FNMA, Series 2016-C04, Class 1M1, VRN, 2.78%, 12/27/17, resets monthly off the 1-month LIBOR plus 1.45% | 19,446 | 19,648 | |||||

| FNMA, Series 2016-C04, Class 1M2, VRN, 5.58%, 12/27/17, resets monthly off the 1-month LIBOR plus 4.25% | 10,000 | 11,134 | |||||

| FNMA, Series 2016-C05, Class 2M1, VRN, 2.68%, 12/27/17, resets monthly off the 1-month LIBOR plus 1.35% | 32,690 | 32,898 | |||||

| FNMA, Series 2017-C03, Class 1M1, VRN, 2.28%, 12/27/17, resets monthly off the 1-month LIBOR plus 0.95% | 128,113 | 128,807 | |||||

| FNMA, Series 2017-C05, Class 1M2, VRN, 3.53%, 12/27/17, resets monthly off the 1-month LIBOR plus 2.20% | 50,000 | 49,815 | |||||

| FNMA, Series 2017-C06, Class 1M1, VRN, 2.08%, 12/27/17, resets monthly off the 1-month LIBOR plus 0.75% | 44,443 | 44,555 | |||||

| 468,018 | |||||||

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $1,472,500) | 1,499,393 | ||||||

ASSET-BACKED SECURITIES(6) — 1.6% | |||||||

Avis Budget Rental Car Funding AESOP LLC, Series 2013-1A, Class A SEQ, 1.92%, 9/20/19(3) | 50,000 | 49,909 | |||||

Avis Budget Rental Car Funding AESOP LLC, Series 2013-1A, Class B, 2.62%, 9/20/19(3) | 15,000 | 15,024 | |||||

Avis Budget Rental Car Funding AESOP LLC, Series 2015-2A, Class B, 3.42%, 12/20/21(3) | 25,000 | 25,169 | |||||

BRE Grand Islander Timeshare Issuer LLC, Series 2017-1A, Class A SEQ, 2.94%, 5/25/29(3) | 42,418 | 42,270 | |||||

BRE Grand Islander Timeshare Issuer LLC, Series 2017-1A, Class B, 3.24%, 5/25/29(3) | 21,209 | 21,064 | |||||

Colony American Homes, Series 2014-2A, Class A, VRN, 2.20%, 12/17/17, resets monthly off the 1-month LIBOR plus 0.95%(3) | 33,230 | 33,317 | |||||

Colony Starwood Homes, Series 2016-2A, Class A, VRN, 2.50%, 12/17/17, resets monthly off the 1-month LIBOR plus 1.25%(3) | 24,880 | 25,048 | |||||

Enterprise Fleet Financing LLC, Series 2017-2, Class A2 SEQ, 1.97%, 1/20/23(3) | 25,000 | 24,973 | |||||

Hertz Vehicle Financing LLC, Series 2013-1A, Class A2 SEQ, 1.83%, 8/25/19(3) | 75,000 | 74,935 | |||||

Hertz Vehicle Financing LLC, Series 2013-1A, Class B2, 2.48%, 8/25/19(3) | 40,000 | 39,856 | |||||

Hilton Grand Vacations Trust, Series 2013-A, Class A SEQ, 2.28%, 1/25/26(3) | 5,648 | 5,616 | |||||

Hilton Grand Vacations Trust, Series 2014-AA, Class A SEQ, 1.77%, 11/25/26(3) | 39,465 | 38,915 | |||||

Hilton Grand Vacations Trust, Series 2017-AA, Class A SEQ, 2.66%, 12/26/28(3) | 8,490 | 8,456 | |||||

Invitation Homes Trust, Series 2017-SFR2, Class A, VRN, 2.10%, 12/17/17, resets monthly off the 1-month LIBOR plus 0.85%(3) | 25,000 | 25,135 | |||||

Invitation Homes Trust, Series 2017-SFR2, Class B, VRN, 2.40%, 12/17/17, resets monthly off the 1-month LIBOR plus 1.15%(3) | 25,000 | 25,197 | |||||

23

| Shares/ Principal Amount | Value | ||||||

Marriott Vacation Club Owner Trust, Series 2012-1A, Class B, VRN, 3.50%, 12/20/17(3)(7) | $ | 5,963 | $ | 5,998 | |||

MVW Owner Trust, Series 2013-1A, Class A SEQ, 2.15%, 4/22/30(3) | 37,161 | 36,734 | |||||

MVW Owner Trust, Series 2013-1A, Class B, 2.74%, 4/22/30(3) | 6,193 | 6,139 | |||||

MVW Owner Trust, Series 2017-1A, Class B, 2.75%, 12/20/34(3) | 48,590 | 48,198 | |||||

Progress Residential Trust, Series 2017-SFR2, Class A, 2.90%, 12/17/34(3)(8) | 25,000 | 24,896 | |||||

Progress Residential Trust, Series 2016-SFR2, Class A, VRN, 2.67%, 12/18/17, resets monthly off the 1-month LIBOR plus 1.40%(3) | 15,000 | 15,162 | |||||

Progress Residential Trust, Series 2017-SFR1, Class A, 2.77%, 8/17/34(3) | 24,957 | 24,818 | |||||

Sierra Receivables Funding Co. LLC, Series 2017-1A, Class A SEQ, 2.91%, 3/20/34(3) | 6,391 | 6,392 | |||||

Sierra Timeshare Receivables Funding LLC, Series 2013-2A, Class A SEQ, VRN, 2.28%, 12/20/17(3)(7) | 17,235 | 17,235 | |||||

Sierra Timeshare Receivables Funding LLC, Series 2015-1A, Class A, 2.40%, 3/22/32(3) | 5,840 | 5,826 | |||||

Sierra Timeshare Receivables Funding LLC, Series 2015-2A, Class A, 2.43%, 6/20/32(3) | 13,146 | 13,099 | |||||

Sierra Timeshare Receivables Funding LLC, Series 2015-3A, Class A SEQ, 2.58%, 9/20/32(3) | 16,014 | 16,027 | |||||

Sierra Timeshare Receivables Funding LLC, Series 2016-2A, Class A SEQ, 2.33%, 7/20/33(3) | 4,424 | 4,406 | |||||

TAL Advantage V LLC, Series 2014-2A, Class B, 3.97%, 5/20/39(3) | 9,750 | 9,375 | |||||

Towd Point Mortgage Trust, Series 2017-6, Class A1, VRN, 2.75%, 12/1/17(3)(7) | 75,000 | 75,215 | |||||

Towd Point Mortgage Trust 2017-3, Series 2017-3, Class M1, VRN, 3.50%, 12/1/17(3)(7) | 100,000 | 100,669 | |||||

Volvo Financial Equipment Master Owner Trust, Series 2017-A, Class A, VRN, 1.76%, 12/15/17, resets monthly off the 1-month LIBOR plus 0.50%(3) | 50,000 | 50,160 | |||||

VSE VOI Mortgage LLC, Series 2016-A, Class A SEQ, 2.54%, 7/20/33(3) | 33,478 | 33,239 | |||||

TOTAL ASSET-BACKED SECURITIES (Cost $948,700) | 948,472 | ||||||

COMMERCIAL MORTGAGE-BACKED SECURITIES(6) — 1.2% | |||||||

Bank of America Merrill Lynch Commercial Mortgage Securities Trust, Series 2015-200P, Class B, 3.49%, 4/14/33(3) | 25,000 | 25,311 | |||||

BB-UBS Trust, Series 2012-SHOW, Class A SEQ, 3.43%, 11/5/36(3) | 50,000 | 50,809 | |||||

COMM Mortgage Trust, Series 2017-PANW, Class A, 3.24%, 10/10/29(3) | 25,000 | 25,262 | |||||

Commercial Mortgage Pass-Through Certificates, Series 2014-CR15, Class B, VRN, 4.86%, 12/1/17(7) | 25,000 | 26,829 | |||||

Commercial Mortgage Pass-Through Certificates, Series 2014-LC17, Class B, VRN, 4.49%, 12/1/17(7) | 10,000 | 10,523 | |||||

Commercial Mortgage Pass-Through Certificates, Series 2016-CR28, Class B, VRN, 4.80%, 12/1/17(7) | 35,000 | 37,449 | |||||

Commercial Mortgage Trust, Series 2014-UBS5, Class B, VRN, 4.51%, 12/1/17(7) | 15,000 | 15,643 | |||||

24

| Shares/ Principal Amount | Value | ||||||

Commercial Mortgage Trust, Series 2015-CR22, Class B, VRN, 3.93%, 12/1/17(7) | $ | 25,000 | $ | 25,243 | |||

Core Industrial Trust, Series 2015-CALW, Class B, 3.25%, 2/10/34(3) | 25,000 | 25,408 | |||||

Core Industrial Trust, Series 2015-CALW, Class C, 3.56%, 2/10/34(3) | 25,000 | 25,449 | |||||

Core Industrial Trust, Series 2015-TEXW, Class B, 3.33%, 2/10/34(3) | 25,000 | 25,258 | |||||

| CSAIL Commercial Mortgage Trust, Series 2017-CX10, Class AS, 3.67%, 11/15/27 | 25,000 | 25,750 | |||||

DBCG Mortgage Trust, Series 2017-BBG, Class A, VRN, 1.95%, 12/15/17, resets monthly off the 1-month LIBOR plus 0.70%(3) | 50,000 | 50,093 | |||||

| GS Mortgage Securities Corp. II, Series 2015-GC28, Class AS, 3.76%, 2/10/48 | 15,000 | 15,225 | |||||

GS Mortgage Securities Corp. II, Series 2016-GS2, Class B, VRN, 3.76%, 12/1/17(7) | 25,000 | 25,499 | |||||

Hudson Yards Mortgage Trust, Series 2016-10HY, Class A SEQ, 2.84%, 8/10/38(3) | 25,000 | 24,504 | |||||

Hudson Yards Mortgage Trust, Series 2016-10HY, Class B, VRN, 3.08%, 12/1/17(3)(7) | 10,000 | 9,712 | |||||

JPMBB Commercial Mortgage Securities Trust, Series 2014-C21, Class B, VRN, 4.34%, 12/1/17(7) | 25,000 | 25,748 | |||||

| JPMDB Commercial Mortgage Securities Trust, Series 2017-C5, Class A4, 3.41%, 3/15/50 | 20,000 | 20,463 | |||||

JPMorgan Chase Commercial Mortgage Securities Trust, Series 2013-C16, Class B, VRN, 5.08%, 12/15/17(7) | 25,000 | 26,705 | |||||

| JPMorgan Chase Commercial Mortgage Securities Trust, Series 2016-JP2, Class B, 3.46%, 8/15/49 | 25,000 | 24,730 | |||||

| JPMorgan Chase Commercial Mortgage Securities Trust, Series 2016-JP3, Class AS, 3.14%, 8/15/49 | 25,000 | 24,533 | |||||

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2017-C34, Class A3 SEQ, 3.28%, 11/15/52 | 25,000 | 25,304 | |||||

| UBS Commercial Mortgage Trust, Series 2017-C1, Class A3, 3.20%, 6/15/50 | 50,000 | 50,270 | |||||

| Wells Fargo Commercial Mortgage Trust, Series 2017-C38, Class A4, 3.19%, 7/15/50 | 25,000 | 25,274 | |||||

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES (Cost $673,229) | 666,994 | ||||||

| EXCHANGE-TRADED FUNDS — 0.7% | |||||||

| iShares MSCI Emerging Markets Index Fund | 500 | 23,050 | |||||

| iShares MSCI India ETF | 4,050 | 140,859 | |||||

| iShares MSCI South Korea Capped ETF | 173 | 13,001 | |||||

| iShares MSCI Thailand Capped ETF | 620 | 55,571 | |||||

| iShares Russell 1000 Value ETF | 1,310 | 161,169 | |||||

TOTAL EXCHANGE-TRADED FUNDS (Cost $381,362) | 393,650 | ||||||

25

| Shares/ Principal Amount | Value | ||||||

| TEMPORARY CASH INVESTMENTS — 3.7% | |||||||

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 2,077,039 | $ | 2,077,039 | ||||

U.S. Treasury Bills, 1.30%, 5/3/18(9)(10) | $ | 50,000 | 49,722 | ||||

TOTAL TEMPORARY CASH INVESTMENTS (Cost $2,126,768) | 2,126,761 | ||||||

TOTAL INVESTMENT SECURITIES — 99.8% (Cost $54,403,862) | 57,542,903 | ||||||

| OTHER ASSETS AND LIABILITIES — 0.2% | 93,233 | ||||||

| TOTAL NET ASSETS — 100.0% | $ | 57,636,136 | |||||

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation (Depreciation) | ||||||

| ARS | 684,748 | USD | 38,057 | Goldman Sachs & Co. | 12/20/17 | $ | 1,138 | |||

| ARS | 113,149 | USD | 6,183 | Goldman Sachs & Co. | 12/20/17 | 294 | ||||

| USD | 43,967 | ARS | 797,897 | Goldman Sachs & Co. | 12/20/17 | (1,705 | ) | |||

| USD | 134,995 | AUD | 176,414 | JPMorgan Chase Bank N.A. | 12/20/17 | 1,569 | ||||

| USD | 135,092 | AUD | 177,373 | JPMorgan Chase Bank N.A. | 12/20/17 | 940 | ||||

| USD | 879 | AUD | 1,154 | JPMorgan Chase Bank N.A. | 12/20/17 | 6 | ||||

| BRL | 1,106 | USD | 349 | Morgan Stanley | 12/20/17 | (12 | ) | |||

| BRL | 10,899 | USD | 3,426 | Morgan Stanley | 12/20/17 | (103 | ) | |||

| BRL | 288,030 | USD | 88,285 | Morgan Stanley | 12/20/17 | (450 | ) | |||

| BRL | 150,000 | USD | 45,995 | Morgan Stanley | 12/20/17 | (253 | ) | |||

| USD | 121,089 | BRL | 378,319 | Morgan Stanley | 12/20/17 | 5,720 | ||||

| USD | 22,439 | BRL | 71,716 | Morgan Stanley | 12/20/17 | 569 | ||||

| CHF | 1,844 | USD | 1,899 | Credit Suisse AG | 12/20/17 | (22 | ) | |||

| CHF | 7,198 | USD | 7,244 | Credit Suisse AG | 12/20/17 | 83 | ||||

| CHF | 136,263 | USD | 137,168 | Credit Suisse AG | 12/20/17 | 1,534 | ||||

| CHF | 3,218 | USD | 3,299 | Credit Suisse AG | 12/29/17 | (20 | ) | |||

| USD | 81,287 | CHF | 76,490 | Credit Suisse AG | 12/20/17 | 3,427 | ||||

| USD | 763 | CHF | 728 | Credit Suisse AG | 12/20/17 | 21 | ||||

| USD | 115,816 | CHF | 110,592 | Credit Suisse AG | 12/20/17 | 3,244 | ||||

| USD | 1,689 | CHF | 1,628 | Credit Suisse AG | 12/20/17 | 32 | ||||

| USD | 34,531 | CHF | 33,247 | Credit Suisse AG | 12/20/17 | 689 | ||||

| USD | 1,108 | CHF | 1,074 | Credit Suisse AG | 12/20/17 | 14 | ||||

| USD | 2,382 | CHF | 2,317 | Credit Suisse AG | 12/20/17 | 24 | ||||

| USD | 233,828 | CHF | 228,824 | Credit Suisse AG | 12/20/17 | 907 | ||||

| USD | 1,136 | CHF | 1,105 | Credit Suisse AG | 12/20/17 | 12 | ||||

| USD | 3,696 | CHF | 3,677 | Credit Suisse AG | 12/20/17 | (47 | ) | |||

| USD | 130,060 | CHF | 125,622 | Credit Suisse AG | 12/29/17 | 2,069 | ||||

| USD | 5,504 | CHF | 5,358 | Credit Suisse AG | 12/29/17 | 45 | ||||

| USD | 5,193 | CHF | 5,141 | Credit Suisse AG | 12/29/17 | (45 | ) | |||

| CLP | 1,562,232 | USD | 2,480 | JPMorgan Chase Bank N.A. | 12/20/17 | (67 | ) | |||

| CLP | 58,341,100 | USD | 90,827 | JPMorgan Chase Bank N.A. | 12/20/17 | (700 | ) | |||

| USD | 81,566 | CLP | 50,407,980 | JPMorgan Chase Bank N.A. | 12/20/17 | 3,694 | ||||

| USD | 14,824 | CLP | 9,495,352 | JPMorgan Chase Bank N.A. | 12/20/17 | 155 | ||||

26

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation (Depreciation) | ||||||

| COP | 354,977,277 | USD | 120,403 | Goldman Sachs & Co. | 12/20/17 | $ | (2,912 | ) | ||

| COP | 45,466,399 | USD | 15,318 | Goldman Sachs & Co. | 12/20/17 | (270 | ) | |||

| COP | 4,589,199 | USD | 1,549 | Goldman Sachs & Co. | 12/20/17 | (30 | ) | |||

| COP | 410,203,118 | USD | 134,446 | Goldman Sachs & Co. | 12/20/17 | 1,323 | ||||

| COP | 2,761,623 | USD | 900 | Goldman Sachs & Co. | 12/20/17 | 14 | ||||

| COP | 7,308,668 | USD | 2,406 | Goldman Sachs & Co. | 12/20/17 | 13 | ||||

| USD | 135,943 | COP | 405,032,875 | Goldman Sachs & Co. | 12/20/17 | 1,885 | ||||

| USD | 1,832 | COP | 5,541,292 | Goldman Sachs & Co. | 12/20/17 | (2 | ) | |||

| EUR | 118,275 | USD | 139,701 | JPMorgan Chase Bank N.A. | 12/20/17 | 1,227 | ||||

| EUR | 189 | USD | 221 | JPMorgan Chase Bank N.A. | 12/20/17 | 4 | ||||

| EUR | 3,475 | USD | 4,101 | UBS AG | 12/29/17 | 43 | ||||

| EUR | 4,645 | USD | 5,435 | UBS AG | 12/29/17 | 103 | ||||

| EUR | 6,059 | USD | 7,069 | UBS AG | 12/29/17 | 156 | ||||

| EUR | 5,833 | USD | 6,817 | UBS AG | 12/29/17 | 137 | ||||

| EUR | 5,219 | USD | 6,057 | UBS AG | 12/29/17 | 166 | ||||

| EUR | 3,954 | USD | 4,673 | UBS AG | 12/29/17 | 41 | ||||

| EUR | 4,234 | USD | 5,009 | UBS AG | 12/29/17 | 40 | ||||

| EUR | 11,501 | USD | 13,679 | UBS AG | 12/29/17 | 35 | ||||

| USD | 2,406 | EUR | 2,066 | JPMorgan Chase Bank N.A. | 12/20/17 | (56 | ) | |||

| USD | 561 | EUR | 480 | JPMorgan Chase Bank N.A. | 12/20/17 | (11 | ) | |||

| USD | 203,279 | EUR | 174,110 | JPMorgan Chase Bank N.A. | 12/20/17 | (4,178 | ) | |||

| USD | 104,894 | EUR | 88,498 | UBS AG | 12/29/17 | (629 | ) | |||

| USD | 186,057 | EUR | 156,974 | UBS AG | 12/29/17 | (1,116 | ) | |||

| USD | 5,514 | EUR | 4,656 | UBS AG | 12/29/17 | (38 | ) | |||

| USD | 9,130 | EUR | 7,728 | UBS AG | 12/29/17 | (85 | ) | |||

| USD | 7,860 | EUR | 6,649 | UBS AG | 12/29/17 | (68 | ) | |||

| USD | 88,311 | EUR | 75,555 | UBS AG | 12/29/17 | (1,780 | ) | |||

| USD | 4,899 | EUR | 4,212 | UBS AG | 12/29/17 | (123 | ) | |||

| USD | 4,136 | EUR | 3,555 | UBS AG | 12/29/17 | (104 | ) | |||

| USD | 3,951 | EUR | 3,386 | UBS AG | 12/29/17 | (87 | ) | |||

| USD | 5,081 | EUR | 4,378 | UBS AG | 12/29/17 | (139 | ) | |||

| GBP | 61,380 | USD | 81,309 | Credit Suisse AG | 12/20/17 | 1,752 | ||||

| GBP | 10,607 | USD | 14,263 | Credit Suisse AG | 12/20/17 | 91 | ||||

| GBP | 1,789 | USD | 2,366 | Morgan Stanley | 12/29/17 | 56 | ||||

| GBP | 1,063 | USD | 1,396 | Morgan Stanley | 12/29/17 | 43 | ||||

| GBP | 1,415 | USD | 1,872 | Morgan Stanley | 12/29/17 | 44 | ||||

| USD | 14,580 | GBP | 11,085 | Credit Suisse AG | 12/20/17 | (421 | ) | |||

| USD | 582 | GBP | 440 | Credit Suisse AG | 12/20/17 | (14 | ) | |||

| USD | 573 | GBP | 431 | Credit Suisse AG | 12/20/17 | (10 | ) | |||

| USD | 1,959 | GBP | 1,463 | Credit Suisse AG | 12/20/17 | (21 | ) | |||

| USD | 1,846 | GBP | 1,361 | Credit Suisse AG | 12/20/17 | 5 | ||||

| USD | 90,941 | GBP | 68,292 | Credit Suisse AG | 12/20/17 | (1,474 | ) | |||

| USD | 48,567 | GBP | 35,956 | Morgan Stanley | 12/29/17 | (112 | ) | |||

| USD | 1,356 | GBP | 1,009 | Morgan Stanley | 12/29/17 | (10 | ) | |||

| USD | 1,436 | GBP | 1,081 | Morgan Stanley | 12/29/17 | (27 | ) | |||

| USD | 2,526 | GBP | 1,930 | Morgan Stanley | 12/29/17 | (88 | ) | |||

27

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation (Depreciation) | ||||||

| USD | 2,703 | GBP | 2,053 | Morgan Stanley | 12/29/17 | $ | (76 | ) | ||

| USD | 1,312 | GBP | 975 | Morgan Stanley | 12/29/17 | (8 | ) | |||

| HUF | 503,386 | USD | 1,927 | JPMorgan Chase Bank N.A. | 12/20/17 | (12 | ) | |||

| HUF | 269,634 | USD | 1,011 | JPMorgan Chase Bank N.A. | 12/20/17 | 15 | ||||

| USD | 137,162 | HUF | 36,268,377 | JPMorgan Chase Bank N.A. | 12/20/17 | (860 | ) | |||

| USD | 1,934 | HUF | 508,426 | JPMorgan Chase Bank N.A. | 12/20/17 | (1 | ) | |||

| USD | 572 | HUF | 151,697 | JPMorgan Chase Bank N.A. | 12/20/17 | (5 | ) | |||

| USD | 140,503 | HUF | 37,472,938 | JPMorgan Chase Bank N.A. | 12/20/17 | (2,103 | ) | |||

| IDR | 710,326,651 | USD | 52,230 | Goldman Sachs & Co. | 12/20/17 | 107 | ||||

| IDR | 3,046,543,988 | USD | 224,324 | Goldman Sachs & Co. | 12/20/17 | 144 | ||||

| IDR | 3,046,543,988 | USD | 224,324 | Goldman Sachs & Co. | 12/20/17 | 144 | ||||

| INR | 162,543 | USD | 2,473 | Goldman Sachs & Co. | 12/20/17 | 39 | ||||

| USD | 119,243 | INR | 7,697,104 | Goldman Sachs & Co. | 12/20/17 | 299 | ||||

| USD | 360 | INR | 23,271 | Goldman Sachs & Co. | 12/20/17 | 1 | ||||

| USD | 19,676 | INR | 1,297,213 | Goldman Sachs & Co. | 12/20/17 | (370 | ) | |||

| JPY | 13,258,173 | USD | 122,603 | Credit Suisse AG | 12/20/17 | (4,696 | ) | |||

| JPY | 28,736 | USD | 262 | Credit Suisse AG | 12/20/17 | (6 | ) | |||

| JPY | 12,897,507 | USD | 116,842 | Credit Suisse AG | 12/20/17 | (2,142 | ) | |||

| JPY | 80,009 | USD | 721 | Credit Suisse AG | 12/20/17 | (9 | ) | |||

| JPY | 114,076 | USD | 1,028 | Credit Suisse AG | 12/20/17 | (14 | ) | |||

| JPY | 205,217 | USD | 1,836 | Credit Suisse AG | 12/20/17 | (11 | ) | |||

| JPY | 90,291 | USD | 804 | Credit Suisse AG | 12/20/17 | (1 | ) | |||

| JPY | 4,623,854 | USD | 41,220 | Credit Suisse AG | 12/20/17 | (100 | ) | |||

| JPY | 306,863 | USD | 2,732 | Credit Suisse AG | 12/20/17 | (3 | ) | |||

| JPY | 82,159 | USD | 733 | Credit Suisse AG | 12/20/17 | (3 | ) | |||

| JPY | 25,991,963 | USD | 230,712 | Credit Suisse AG | 12/20/17 | 439 | ||||

| JPY | 157,431 | USD | 1,393 | Credit Suisse AG | 12/20/17 | 7 | ||||

| JPY | 582,336 | USD | 5,130 | Credit Suisse AG | 12/20/17 | 49 | ||||

| JPY | 417,162 | USD | 3,671 | Credit Suisse AG | 12/20/17 | 39 | ||||

| JPY | 38,671 | USD | 342 | Credit Suisse AG | 12/29/17 | 3 | ||||

| USD | 3,211 | JPY | 353,681 | Credit Suisse AG | 12/20/17 | 66 | ||||

| USD | 1,514 | JPY | 169,760 | Credit Suisse AG | 12/20/17 | 4 | ||||

| USD | 15,110 | JPY | 1,710,944 | Credit Suisse AG | 12/20/17 | (106 | ) | |||

| USD | 1,956 | JPY | 221,835 | Credit Suisse AG | 12/20/17 | (17 | ) | |||

| USD | 9,700 | JPY | 1,078,261 | Credit Suisse AG | 12/29/17 | 104 | ||||

| USD | 266 | JPY | 29,813 | Credit Suisse AG | 12/29/17 | — | ||||

| USD | 226 | JPY | 25,586 | Credit Suisse AG | 12/29/17 | (2 | ) | |||

| USD | 3,178 | JPY | 361,683 | Credit Suisse AG | 12/29/17 | (40 | ) | |||

| USD | 381 | JPY | 43,380 | Credit Suisse AG | 12/29/17 | (5 | ) | |||

| USD | 384 | JPY | 43,860 | Credit Suisse AG | 12/29/17 | (6 | ) | |||

| USD | 327 | JPY | 36,972 | Credit Suisse AG | 12/29/17 | (2 | ) | |||

| USD | 7,831 | JPY | 883,204 | Credit Suisse AG | 12/29/17 | (28 | ) | |||

| USD | 1,775 | JPY | 199,629 | Credit Suisse AG | 12/29/17 | (1 | ) | |||

| KRW | 263,556,289 | USD | 229,923 | Morgan Stanley | 12/21/17 | 12,392 | ||||

| USD | 199,509 | KRW | 225,155,412 | Morgan Stanley | 12/21/17 | (7,501 | ) | |||

| USD | 2,007 | KRW | 2,264,625 | Morgan Stanley | 12/21/17 | (75 | ) | |||

28

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation (Depreciation) | ||||||

| USD | 31,577 | KRW | 36,136,252 | Morgan Stanley | 12/21/17 | $ | (1,647 | ) | ||

| MYR | 1,454,007 | USD | 346,936 | Goldman Sachs & Co. | 12/20/17 | 8,502 | ||||

| MYR | 243,803 | USD | 57,716 | Goldman Sachs & Co. | 12/20/17 | 1,883 | ||||

| MYR | 18,603 | USD | 4,405 | Goldman Sachs & Co. | 12/20/17 | 142 | ||||

| MYR | 4,521 | USD | 1,072 | Goldman Sachs & Co. | 12/20/17 | 33 | ||||

| MYR | 5,067 | USD | 1,201 | Goldman Sachs & Co. | 12/20/17 | 38 | ||||

| MYR | 2,482 | USD | 588 | Goldman Sachs & Co. | 12/20/17 | 19 | ||||

| USD | 4,739 | MYR | 19,921 | Goldman Sachs & Co. | 12/20/17 | (131 | ) | |||

| USD | 11,143 | MYR | 46,587 | Goldman Sachs & Co. | 12/20/17 | (246 | ) | |||

| USD | 11,086 | MYR | 46,857 | Goldman Sachs & Co. | 12/20/17 | (368 | ) | |||

| USD | 1,820 | MYR | 7,631 | Goldman Sachs & Co. | 12/20/17 | (46 | ) | |||

| NOK | 625,124 | USD | 80,897 | JPMorgan Chase Bank N.A. | 12/20/17 | (5,716 | ) | |||

| NOK | 4,907 | USD | 625 | JPMorgan Chase Bank N.A. | 12/20/17 | (35 | ) | |||

| NOK | 4,957 | USD | 636 | JPMorgan Chase Bank N.A. | 12/20/17 | (40 | ) | |||

| NOK | 119,383 | USD | 15,023 | JPMorgan Chase Bank N.A. | 12/20/17 | (665 | ) | |||

| NOK | 3,800 | USD | 465 | JPMorgan Chase Bank N.A. | 12/20/17 | (8 | ) | |||

| NOK | 1,178,268 | USD | 143,514 | JPMorgan Chase Bank N.A. | 12/20/17 | (1,809 | ) | |||

| USD | 2,930 | NOK | 22,829 | JPMorgan Chase Bank N.A. | 12/20/17 | 184 | ||||

| USD | 337 | NOK | 2,626 | JPMorgan Chase Bank N.A. | 12/20/17 | 21 | ||||

| NZD | 5,007 | USD | 3,658 | JPMorgan Chase Bank N.A. | 12/20/17 | (237 | ) | |||

| NZD | 636 | USD | 446 | JPMorgan Chase Bank N.A. | 12/20/17 | (12 | ) | |||

| NZD | 129,394 | USD | 88,818 | JPMorgan Chase Bank N.A. | 12/20/17 | (399 | ) | |||

| USD | 79,965 | NZD | 110,858 | JPMorgan Chase Bank N.A. | 12/20/17 | 4,212 | ||||

| USD | 15,149 | NZD | 20,989 | JPMorgan Chase Bank N.A. | 12/20/17 | 806 | ||||

| USD | 1,142 | NZD | 1,597 | JPMorgan Chase Bank N.A. | 12/20/17 | 51 | ||||

| USD | 1,131 | NZD | 1,593 | JPMorgan Chase Bank N.A. | 12/20/17 | 42 | ||||

| PEN | 389,109 | USD | 119,645 | Morgan Stanley | 12/20/17 | 632 | ||||

| PEN | 739 | USD | 228 | Morgan Stanley | 12/20/17 | 1 | ||||