UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07185 | |||||||

| ||||||||

Morgan Stanley Select Dimensions Investment Series | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

522 Fifth Avenue, New York, New York |

| 10036 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Arthur Lev 522 Fifth Avenue, New York, New York 10036 | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | 201-830-8894 |

| ||||||

| ||||||||

Date of fiscal year end: | December 31, 2012 |

| ||||||

| ||||||||

Date of reporting period: | December 31, 2012 |

| ||||||

Item 1 - Report to Shareholders

MORGAN STANLEY

SELECT DIMENSIONS INVESTMENT SERIES

Annual Report

DECEMBER 31, 2012

The Portfolios are intended to be the funding vehicle for variable annuity contracts and variable life insurance policies offered by the separate accounts of certain life insurance companies.

Morgan Stanley Select Dimensions Investment Series

Table of Contents

| Letter to the Shareholders | 1 | ||||||

| Expense Example | 15 | ||||||

Portfolio of Investments: | |||||||

| Money Market | 19 | ||||||

| Flexible Income | 23 | ||||||

| Global Infrastructure | 37 | ||||||

| Growth | 40 | ||||||

| Focus Growth | 43 | ||||||

| Multi Cap Growth | 45 | ||||||

| Mid Cap Growth | 48 | ||||||

Financial Statements: | |||||||

| Statements of Assets and Liabilities | 52 | ||||||

| Statements of Operations | 54 | ||||||

| Statements of Changes in Net Assets | 56 | ||||||

| Notes to Financial Statements | 62 | ||||||

| Financial Highlights | 92 | ||||||

| Report of Independent Registered Public Accounting Firm | 100 | ||||||

| Trustee and Officer Information | 101 | ||||||

| Federal Tax Notice | 106 | ||||||

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited)

Dear Shareholder:

In 2012, policy was a dominant theme driving global financial markets. Expectations and disappointments regarding the European Union initiatives addressing the credit crisis, the debate over the "fiscal cliff" in the U.S. Congress, and monetary easing from the U.S. Federal Reserve (the Fed), European Central Bank (ECB), Bank of Japan and other central banks contributed to volatility in the global markets throughout the year. Ultimately, the liquidity provided by the central banks and the reduced risk of financial crisis in Europe helped risk assets outperform relatively safer asset classes, despite some looming macroeconomic uncertainties.

Domestic Equity Overview

U.S. stocks, as measured by the S&P 500® Index, were up 16% for the year ended December 31, 2012. Gross domestic product (GDP) growth remained lackluster, registering 2.0% in the first quarter of 2012, 1.3% in the second quarter, and 3.1% in the third quarter. (Fourth quarter GDP estimates were not released at the time of this writing.) Unemployment declined during the period, but remained uncomfortably elevated. The housing market began to show signs of stabilization. Corporate profits continued to be surprisingly robust, although many expect that the strength has run its course. The Federal Open Market Committee enacted a number of measures intended to support the economy, including a third round of quantitative easing, extending its timeline for keeping the federal funds target rate near zero, and announcing late in the year that it would keep the rate low until unemployment reached 6.5% so long as the central bank's inflation projections stayed below 2.5%.

Stocks began the year on a relatively high note but investor sentiment deteriorated in the spring amid weaker economic data and renewed risks in the euro zone. The market turned positive in the summer on expectations of further stimulative actions from the Fed and additional measures from the European Central Bank to bolster the financial system. Later in the year, uncertainties about the fiscal cliff drove stocks lower as lawmakers debated until the very last hours of the deadline before coming to an agreement.

Fixed Income Overview

As in other asset classes during the review period, riskier segments of the fixed income market delivered stronger relative performance as investors grew more confident about global economic conditions and the European debt crisis. Emerging market debt and U.S. corporate debt outperformed "safe haven" Treasury securities.

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

Emerging market debt began the year on a positive note but trended lower in the second quarter amid rising risk premiums in Europe and weaker economic data in China. However, losses were recovered in the third and fourth quarters, as investor sentiment was more optimistic regarding global growth prospects and the lower probability of Greece exiting the European Union. New issuance and fund flows both increased during 2012 from 2011 levels, further supporting the asset class.

Within the U.S. corporate sector, investment-grade debt performed very well, led by the financials sector. Investment-grade corporate spreads ended the year almost 100 basis points tighter, while financials spreads were 185 basis points tighter. High-yield corporate spreads narrowed by 180 basis points.

Mortgage-backed securities also performed well during the year. The Fed's quantitative easing announcement in September, focused on mortgages, led to a substantial tightening in lower coupon fixed rate mortgage spreads. Despite historically low mortgage rates, refinancing activity had been slower than it has been in the past under similar rate incentives, although with further quantitative easing, there has been an increase in mortgage refinancing.

The intermediate part of the U.S. Treasury yield curve performed the best as 10-year yields declined by 14 basis points. The 10-year Treasury yield reached an all time low of 1.47% at the beginning of June. Two-year yields were unchanged, whereas 30-year yields rose by 11 basis points.

Money market yields continued to be constrained by the Fed's near-zero interest rate policy. Even with the Fed now tying its interest policy to unemployment and inflation rates, rather than a date (previously expected to be 2015 or later), observers believe the near-zero rates are likely to continue beyond 2015.

International Equity Overview

International equity markets performed well in the 12 months ended December 31, 2012, with emerging market equities outpacing developed market equities and, among developed markets, Europe leading the U.S. and Japan.

In Europe, despite a double-dip recession with GDP growth and earnings estimates being revised downward during the course of the year, equity markets performed strongly. Market turbulence in the spring was driven by renewed concerns about Greece and Spain. However, markets rallied following ECB President Mario Draghi's pledge in July to preserve the euro no matter what and an announcement in September for a program of unlimited support for countries that agree to certain reforms. In essence, the ECB now provides a back-stop against further credit stress in the region. This helped bond yields among the most indebted European nations decline considerably. European Union finance ministers also appeared to make progress toward a single banking union.

2

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

Japan's equity market began the year on strong footing, but slumped for most of the remainder of the year amid concerns about slowing exports to Europe and China. However, a sharply lower yen, which benefits exporting companies, and the election of the Liberal Democratic Party and its promises of reflation led Japanese stocks to rally dramatically in the final months of 2012.

As with other global risk assets, emerging market stocks were volatile throughout the year in response to global growth concerns and the European debt crisis. However, in the second half of the year, emerging market equities advanced strongly due to the weaker yen (which prompts investors to seek relatively higher yielding assets elsewhere), improved manufacturing data from China, and the reduced risk of a financial crisis in Europe.

Money Market Portfolio

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of an investment at $1.00 per share, it is possible to lose money by investing in such funds.

As of December 31, 2012, Select Dimensions – Money Market Portfolio had net assets of approximately $71 million with an average portfolio maturity of 29 days. For the seven-day period ended December 31, 2012, the Portfolio's Class X shares provided an effective annualized yield of 0.01% (subsidized) and – 0.51% (non-subsidized) and a current yield of 0.01% (subsidized) and – 0.51% (non-subsidized), while its 30-day moving average yield for December was 0.01% (subsidized) and – 0.45% (non-subsidized). Yield quotations more closely reflect the current earnings of the Portfolio. The non-subsidized yield reflects what the yield would have been had a fee and/or expense waiver not been in place during the period shown. For the 12-month period ended December 31, 2012, the Portfolio's Class X shares returned 0.01%. Past performance is no guarantee of future results.

For the seven-day period ended December 31, 2012, the Portfolio's Class Y shares provided an effective annualized yield of 0.01% (subsidized) and – 0.76% (non-subsidized) and a current yield of 0.01% (subsidized) and – 0.76% (non-subsidized), while its 30-day moving average yield for December was 0.01% (subsidized) and – 0.70% (non-subsidized). Yield quotations more closely reflect the current earnings of the Portfolio. The non-subsidized yield reflects what the yield would have been had a fee and/or expense waiver not been in place during the period shown. For the 12-month period ended December 31, 2012, the Portfolio's Class Y shares returned 0.01%. Past performance is no guarantee of future results.

3

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

We continued to remain cautious in our investment approach, focusing on securities with what we believe are high liquidity and short durations. We believe this approach, together with our investment process, has put us in a favorable position to respond to market uncertainty.

During the period, we sought to purchase high-quality fixed and floating rate paper, while maintaining our conservative liquidity metrics. Our management strategy for the Portfolio remained consistent with our long-term focus on capital preservation and high liquidity.

There is no guarantee that any sectors mentioned will continue to perform as discussed above or that securities in such sectors will be held by the Portfolio in the future.

Flexible Income Portfolio

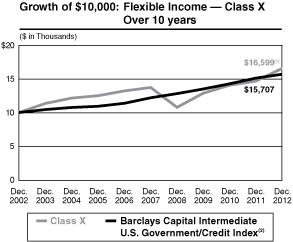

For the 12-month period ended December 31, 2012, Select Dimensions – Flexible Income Portfolio Class X shares produced a total return of 12.98%, outperforming the Barclays Capital Intermediate U.S. Government/Credit Index (the "Index"), which returned 3.89%. For the same period, the Portfolio's Class Y shares returned 12.75%. Past performance is no guarantee of future results.

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please contact the issuing insurance company or speak with your Financial Advisor. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2012

1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

Class X | 12.98 | % | 3.86 | % | 5.20 | % | 4.33 | % | |||||||||||

Class Y | 12.75 | % | 3.59 | % | 4.93 | % | 3.85 | % | |||||||||||

(1) Ending value on December 31, 2012 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Barclays Capital Intermediate U.S. Government/Credit Index tracks the performance of U.S. government and corporate obligations, including U.S. government agency and Treasury securities, and corporate and Yankee bonds with maturities of 1 to 10 years. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

4

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

The Portfolio's exposure to corporate bonds across the quality spectrum contributed significantly to performance given the tightening of spreads over the year as policy makers attempted to reduce tail risks globally. Within high yield, the benefit came from exposure to a variety of corporate sectors. The financials sector was the largest single contributor among the Portfolio's investment grade corporate holdings.

The Portfolio also benefitted from exposure to emerging markets and non-agency mortgage-backed securities. Within emerging markets, the principal countries contributing to performance were Russia, Brazil, Indonesia, Mexico and Venezuela. The Portfolio's exposure to non-agency mortgages benefited from the beginning of a recovery in the housing market in 2012, as well as the decision of the Federal Reserve to buy mortgage-backed securities as part of its quantitative easing policy.

The Portfolio's interest-rate positioning in the U.S. was a small additive to relative performance and the underweight in German interest rates detracted slightly. During the year, interest rates fell in most bond markets.

Currency positions, which are managed through the use of currency forwards, added a small amount to performance overall, largely via exposure to the Mexican peso and being long the Norwegian krone versus short the Swedish krone.

There is no guarantee that any sectors mentioned will continue to perform as discussed above or that securities in such sectors will be held by the Portfolio in the future.

5

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

Global Infrastructure Portfolio

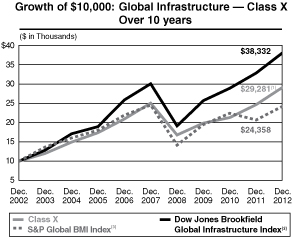

For the 12-month period ended December 31, 2012, Select Dimensions – Global Infrastructure Portfolio Class X shares produced a total return of 18.14%, outperforming the Dow Jones Brookfield Global Infrastructure Index (the "Index"), which returned 16.01%, and the S&P Global BMI Index, which returned 17.15%. For the same period, the Portfolio's Class Y shares returned 17.79%. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

Infrastructure shares appreciated 16.01% during 2012, as measured by the Index. Among the major infrastructure sectors, the communications and European regulated utilities sectors exhibited relative outperformance, while the transmission and distribution, gas midstream, gas distribution utilities, and pipeline companies sectors underperformed the Index. Toll roads performed largely in line with the Index for the year. Among the smaller sectors, the airports, water, ports, and diversified sectors all outperformed the Index.

For full-year 2012, the Portfolio realized favorable performance from both bottom-up stock selection and top-down allocation, with bottom-up stock selection being the more significant driver of outperformance, as in past years. From a bottom-up

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please contact the issuing insurance company or speak with your Financial Advisor. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2012

1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

Class X | 18.14 | % | 3.07 | % | 11.34 | % | 9.62 | % | |||||||||||

Class Y | 17.79 | % | 2.80 | % | 11.06 | % | 3.66 | % | |||||||||||

(1) Ending value on December 31, 2012 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Dow Jones Brookfield Global Infrastructure IndexSM is a float-adjusted market capitalization weighted index that measures the stock performance of companies that exhibit strong infrastructure characteristics. The Index intends to measure all sectors of the infrastructure market. The Index was first published in July 2008; however, back-tested hypothetical performance information is available for this Index since December 31, 2002. Returns are calculated using the return data of the S&P Global BMI Index through December 31, 2002 and the return data of the Dow Jones Brookfield Global Infrastructure Index for periods thereafter. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(3) The Standard & Poor's Global BMI Index (S&P Global BMI Index) is a broad market index designed to capture exposure to equities in all countries in the world that meet minimum size and liquidity requirements. As of the date of this Report, there are approximately 11,000 index members representing 26 developed and 20 emerging market countries. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

6

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

perspective, stock selection was particularly favorable in the gas distribution utilities, communications, transmission and distribution, toll roads, and European regulated utilities sectors, only partially offset by adverse selection in the pipeline companies and gas midstream sectors. From a top-down perspective, our positioning was favorable or largely neutral in all sectors except for the negative impact of our cash holdings and an underweight to the water sector.

We attribute 2012 sector outperformance or underperformance within the infrastructure universe to a combination of macroeconomic and company/sector-specific considerations. On the macroeconomic front, we attribute the strong performance of European regulated utilities and toll roads largely to declining sovereign yields and lower perceived event risk in continental Europe, which has lowered the current market-derived cost of capital to levels closer to the medium- to longer-term levels appropriate for the asset class. In the U.S., we attribute the underperformance of transmission and distribution, gas distribution utilities, and pipeline companies to concerns over dividend and investment tax policies (debated during U.S. fiscal cliff negotiations), as well as to the potential for declining regulated returns resulting from low North American bond rates. These sectors, in our opinion, were also largely unfavorable from a valuation perspective.

With regard to company/sector fundamentals regionally, European regulated utilities benefited from increased/improved visibility in connection with several regulatory initiatives. In Asia, gas distribution utilities in China continued to benefit from strong demand for natural gas, as industrial customers looked to lower their cost structures and the central government attempted to reign in pollution created by the significant use of coal-fired power generation. In the U.S., we attribute the outperformance of the communications sector to the ongoing demand by telecommunications providers for wireless towers in order to meet the demands of customers using data-driven devices like smartphones and tablets. Also in North America, we attribute the underperformance of the gas midstream sector to concerns over excess natural gas and natural gas liquids (NGL) supply and the resultant impact on drilling patterns of exploration and production company customers as natural gas prices remain low and NGL prices declined from historical averages.

We remain committed to our core investment philosophy as an infrastructure value investor. As value-oriented, bottom-up driven investors, our investment perspective is that over the medium and long term, the key factor in determining the performance of infrastructure securities will be underlying infrastructure asset values. Given the large and growing private infrastructure market, we believe that there are limits as to the level of premium or discount at which the public sector should trade relative to its underlying private

7

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

infrastructure value. These limits can be viewed as the point at which the arbitrage opportunity between owning infrastructure in the private versus public markets becomes compelling. In aiming to achieve core infrastructure exposure in a cost effective manner, we invest in equity securities of publicly listed infrastructure companies we believe offer the best value relative to their underlying infrastructure value and net asset value growth prospects. Our research currently leads us to an overweighting in the Portfolio (amongst the largest sectors) to a group of companies in the gas distribution, toll road, pipeline companies, and communications sectors, and an underweighting to companies in the gas midstream, transmission and distribution, and European regulated utilities sectors.

We started 2013, positioned largely the same from a sector perspective as we began 2012 (although some of our individual company weightings have meaningfully changed). We acknowledge that increased optimism over a potential upturn in global economic growth (as espoused by many market pundits and supported by an upturn in the equity markets witnessed in early 2013 at the time of writing) might argue for an increased weighting to GDP-growth/trade-leveraged sectors, particularly within transportation; however, we remain committed to and positive on existing positions in the Portfolio, as we believe such positions provide favorable total return potential going forward whether or not this economic upturn of the magnitude anticipated materializes. Our preference as in the past remains to find opportunities within the infrastructure universe that do not rely on meaningful improvements to economic growth, rather than relying on secular themes to drive fundamental growth or relying on a valuation gap that can be closed without a strong improvement in macroeconomic growth. While we concur in some cases with those who believe there is reason for optimism regarding the global economy over the near term, we also remain cautious due to concerns over the massive, unprecedented monetary policy being used to support current growth and the unanticipated consequences these policies might have.

There is no guarantee that any sectors mentioned will continue to perform as discussed above or that securities in such sectors will be held by the Portfolio in the future.

8

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

Growth Portfolio

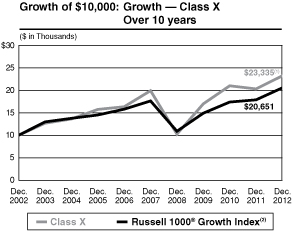

For the 12-month period ended December 31, 2012, Select Dimensions – Growth Portfolio Class X shares produced a total return of 14.50%, underperforming the Russell 1000® Growth Index (the "Index"), which returned 15.26% For the same period, the Portfolio's Class Y shares returned 14.18%. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

Stock selection in the technology sector dampened relative returns, with a holding in a social networking web site detracting the most. Stock selection in the energy sector also hurt relative performance but the negative influence was moderately offset by the benefit of an underweight in the sector. Stock selection in materials and processing was detrimental as well, driven by weakness from a position in a rare earths miner.

Conversely, stock selection in the consumer discretionary sector was the largest contributor to relative performance. Within the sector, a position in an online retailer led gains. The financial services sector also drove positive relative performance, due to both stock selection and an overweight in the sector. A holding in a global asset manager focused on property, power and infrastructure assets was the

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please contact the issuing insurance company or speak with your Financial Advisor. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2012

1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

Class X | 14.50 | % | 3.13 | % | 8.84 | % | 7.05 | % | |||||||||||

Class Y | 14.18 | % | 2.87 | % | 8.57 | % | 0.94 | % | |||||||||||

(1) Ending value on December 31, 2012 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Index is an index of approximately 1,000 of the largest U.S. companies based on a combination of market capitalization and current index membership. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

9

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

top contributor in the sector. An underweight to the consumer staples sector benefited relative performance as well.

There is no guarantee that any sectors mentioned will continue to perform as discussed above or that securities in such sectors will be held by the Portfolio in the future.

Focus Growth Portfolio

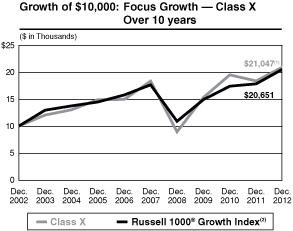

For the 12-month period ended December 31, 2012, Select Dimensions – Focus Growth Portfolio Class X shares produced a total return of 14.10%, underperforming the Russell 1000® Growth Index (the "Index"), which returned 15.26%. For the same period, the Portfolio's Class Y shares returned 13.83%. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

Stock selection in the technology sector dampened relative returns, with a holding in an online deals provider detracting the most. Stock selection in materials and processing was detrimental as well, driven by weakness from a position in a rare earths miner. Another area of weakness was the producer durables sector. Both stock selection and an underweight in the sector were unfavorable to relative results. Holdings in a global logistics firm and a global consumer goods sourcing company

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please contact the issuing insurance company or speak with your Financial Advisor. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2012

1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

Class X | 14.10 | % | 2.72 | % | 7.73 | % | 8.94 | % | |||||||||||

Class Y | 13.83 | % | 2.46 | % | 7.45 | % | 0.61 | % | |||||||||||

(1) Ending value on December 31, 2012 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Index is an index of approximately 1,000 of the largest U.S. companies based on a combination of market capitalization and current index membership. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

10

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

based in China (and not represented in the Index) were the main detractors.

Conversely, stock selection in the consumer discretionary sector was the largest contributor to relative performance. Within the sector, a position in an online retailer led gains. The financial services sector also drove positive relative performance, due to both stock selection and an overweight in the sector. A holding in a global asset manager focused on property, power and infrastructure assets was the top contributor in the sector. An underweight to the consumer staples sector benefited relative performance as well.

There is no guarantee that any sectors mentioned will continue to perform as discussed above or that securities in such sectors will be held by the Portfolio in the future.

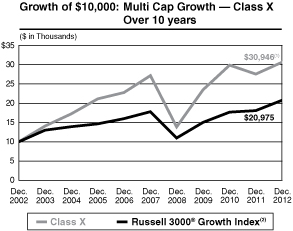

Multi Cap Growth Portfolio

For the 12-month period ended December 31, 2012, Select Dimensions – Multi Cap Growth Portfolio Class X shares produced a total return of 11.31%, underperforming the Russell 3000® Growth Index (the "Index"), which returned 15.21%. For the same period, the Portfolio's Class Y shares returned 11.11%. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please contact the issuing insurance company or speak with your Financial Advisor. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2012

1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

Class X | 11.31 | % | 2.46 | % | 11.96 | % | 4.05 | % | |||||||||||

Class Y | 11.11 | % | 2.21 | % | 11.69 | % | –3.07 | % | |||||||||||

(1) Ending value on December 31, 2012 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Russell 3000® Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of January 21, 1997 for Class X and July 24, 2000 for Class Y.

11

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

The technology sector was the largest relative detractor during the period due to unfavorable stock selection. Exposure to an online deals provider was the most detrimental to performance within the sector. Stock selection and a slight overweight to the materials and processing sector hampered relative results. Holdings in two rare earths miners hurt performance. Stock selection in the energy sector also dampened returns, although an underweight in the sector helped slightly.

Positive contributions came from stock selection in health care, where all of the Portfolio's holdings performed well. An underweight in the consumer staples sector was also beneficial to relative returns. Stock selection in the consumer discretionary sector was another area of strength, despite the modestly dampening effect of the Portfolio's underweight in the sector. Within the sector, gains were led by a holding in an online retailer.

There is no guarantee that any sectors mentioned will continue to perform as discussed above or that securities in such sectors will be held by the Portfolio in the future.

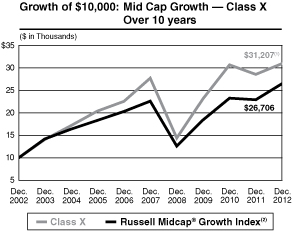

Mid Cap Growth Portfolio

For the 12-month period ended December 31, 2012, Select Dimensions – Mid Cap Growth Portfolio Class X shares produced a total return of 8.51%, underperforming the Russell Midcap® Growth Index (the "Index"), which returned 15.81%. For the same period, the Portfolio's Class Y shares returned 8.24%. Past performance is no guarantee of future results.

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please contact the issuing insurance company or speak with your Financial Advisor. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2012

1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

Class X | 8.51 | % | 2.24 | % | 12.05 | % | 9.81 | % | |||||||||||

Class Y | 8.24 | % | 1.99 | % | 11.78 | % | 2.85 | % | |||||||||||

(1) Ending value on December 31, 2012 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Russell Midcap® Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap® Index is a subset of the Russell 1000® Index and includes approximately 800 of the smallest securities in the Russell 1000® Index, which in turn consists of approximately 1,000 of the largest U.S. securities based on a combination of market capitalization and current index membership. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

12

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

Stock selection in the materials and processing sector hampered relative performance, primarily due to exposure to two rare earths miners. An underweight in the sector also cost the Portfolio relative performance, as materials and processing was Index's best performing sector. The technology sector detracted from performance, hurt by both stock selection and an overweight in the sector. Holdings in a social network gaming developer and an online deals site performed unfavorably. Stock selection in the financial services sector was disadvantageous. An investment data and services provider was the main detractor, with a lack of exposure to groups that performed well during the period such as real estate investment trusts and asset managers further dampening performance.

However, positive contributions came from stock selection in the producer durables sector. A holding in a product testing and inspection firm (its stock is not represented in the Index) was the largest contributor in the sector. The utilities sector was additive as well, although the relative gains somewhat offset by the negative effect of an overweight in the sector. Exposure to an infrastructure asset management company was beneficial to performance.

There is no guarantee that any sectors mentioned will continue to perform as discussed above or that securities in such sectors will be held by the Portfolio in the future.

We appreciate your ongoing support of Morgan Stanley Select Dimensions Investment Series and look forward to continuing to serve your investment needs.

Very truly yours,

Arthur Lev

President and Principal Executive Officer

13

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2012 (unaudited) continued

For More Information About Portfolio Holdings

Each Morgan Stanley fund provides a complete schedule of portfolio holdings in its semiannual and annual reports within 60 days of the end of the fund's second and fourth fiscal quarters. The semiannual reports and the annual reports are filed electronically with the Securities and Exchange Commission (SEC) on Form N-CSRS and Form N-CSR, respectively. Morgan Stanley also delivers the semiannual and annual reports to fund shareholders and makes these reports available on its public web site, www.morganstanley.com. Each Morgan Stanley fund also files a complete schedule of portfolio holdings with the SEC for the fund's first and third fiscal quarters on Form N-Q and monthly holdings for each money market fund on Form N-MFP. Morgan Stanley does not deliver these reports to shareholders, nor are the first and third fiscal quarter reports posted to the Morgan Stanley public web site. However, the holdings for each money market fund are posted to the Morgan Stanley public web site. You may obtain the Form N-Q filings (as well as the Form N-CSR, N-CSRS and N-MFP filings) by accessing the SEC's web site, http://www.sec.gov. You may also review and copy them at the SEC's public reference room in Washington, DC. Information on the operation of the SEC's public reference room may be obtained by calling the SEC at (800) SEC-0330. You can also request copies of these materials, upon payment of a duplicating fee, by electronic request at the SEC's e-mail address (publicinfo@sec.gov) or by writing the public reference section of the SEC, Washington, DC 20549-1520.

Proxy Voting Policy and Procedures and Proxy Voting Record

You may obtain a copy of the Portfolio's Proxy Voting Policy and Procedures without charge, upon request, by calling toll free (800) 869-NEWS or by visiting the Mutual Fund Center on our web site at www.morganstanley.com. It is also available on the SEC's web site at http://www.sec.gov.

You may obtain information regarding how the Portfolios voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 without charge by visiting the Mutual Fund Center on our web site at www.morganstanley.com. This information is also available on the SEC's web site at http://www.sec.gov.

14

Morgan Stanley Select Dimensions Investment Series

Expense Example n December 31, 2012 (unaudited)

As a shareholder of the Portfolio, you incur two types of costs: (1) insurance company charges; and (2) ongoing costs, including advisory fees; administration fees; distribution and service (12b-1) fees; and other Portfolio expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period 07/01/12 – 12/31/12.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Please note that "Expenses Paid During Period" are grossed up to reflect Fund expenses prior to the effect of Expense Offset (See Note 9 in the Notes to Financial Statements). Therefore, the annualized net expense ratios may differ from the ratio of expenses to average net assets shown in the Financial Highlights.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical expenses based on the Portfolio's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any insurance company charges. Therefore, the second line of the table is useful in comparing ongoing costs, and will not help you determine the relative total cost of owning different funds. In addition, if these insurance company charges were included, your costs would have been higher.

15

Morgan Stanley Select Dimensions Investment Series

Expense Example n December 31, 2012 (unaudited) continued

Money Market

| Beginning Account Value | Ending Account Value | Expenses Paid During Period@ | |||||||||||||

07/01/12 | 12/31/12 | 07/01/12 – 12/31/12 | |||||||||||||

Class X | |||||||||||||||

| Actual (0.01% return) | $ | 1,000.00 | $ | 1,000.10 | $ | 1.47 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,023.81 | $ | 1.48 | |||||||||

Class Y | |||||||||||||||

| Actual (0.01% return) | $ | 1,000.00 | $ | 1,000.10 | $ | 1.47 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,023.81 | $ | 1.48 | |||||||||

@ Expenses are equal to the Portfolio's annualized expense ratios of 0.29% and 0.29% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 185/366 (to reflect the one-half year period). If the Portfolio had borne all of its expenses, the annualized expense ratios would have been 0.66% and 0.91% for Class X and Class Y shares, respectively.

Flexible Income

| Beginning Account Value | Ending Account Value | Expenses Paid During Period@ | |||||||||||||

07/01/12 | 12/31/12 | 07/01/12 – 12/31/12 | |||||||||||||

Class X | |||||||||||||||

| Actual (6.83% return) | $ | 1,000.00 | $ | 1,068.30 | $ | 6.13 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,019.20 | $ | 5.99 | |||||||||

Class Y | |||||||||||||||

| Actual (6.70% return) | $ | 1,000.00 | $ | 1,067.00 | $ | 7.43 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,017.95 | $ | 7.25 | |||||||||

@ Expenses are equal to the Portfolio's annualized expense ratios of 1.18% and 1.43% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Global Infrastructure

| Beginning Account Value | Ending Account Value | Expenses Paid During Period@ | |||||||||||||

07/01/12 | 12/31/12 | 07/01/12 – 12/31/12 | |||||||||||||

Class X | |||||||||||||||

| Actual (10.58% return) | $ | 1,000.00 | $ | 1,105.80 | $ | 5.98 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,019.46 | $ | 5.74 | |||||||||

Class Y | |||||||||||||||

| Actual (10.40% return) | $ | 1,000.00 | $ | 1,104.00 | $ | 7.30 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,018.20 | $ | 7.00 | |||||||||

@ Expenses are equal to the Portfolio's annualized expense ratios of 1.13% and 1.38% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

16

Morgan Stanley Select Dimensions Investment Series

Expense Example n December 31, 2012 (unaudited) continued

Growth Portfolio

| Beginning Account Value | Ending Account Value | Expenses Paid During Period@ | |||||||||||||

07/01/12 | 12/31/12 | 07/01/12 – 12/31/12 | |||||||||||||

Class X | |||||||||||||||

| Actual (3.57% return) | $ | 1,000.00 | $ | 1,035.70 | $ | 6.35 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,018.90 | $ | 6.29 | |||||||||

Class Y | |||||||||||||||

| Actual (3.40% return) | $ | 1,000.00 | $ | 1,034.00 | $ | 7.62 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,017.65 | $ | 7.56 | |||||||||

@ Expenses are equal to the Portfolio's annualized expense ratios of 1.24% and 1.49% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Focus Growth

| Beginning Account Value | Ending Account Value | Expenses Paid During Period@ | |||||||||||||

07/01/12 | 12/31/12 | 07/01/12 – 12/31/12 | |||||||||||||

Class X | |||||||||||||||

| Actual (3.01% return) | $ | 1,000.00 | $ | 1,030.10 | $ | 4.29 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,020.91 | $ | 4.27 | |||||||||

Class Y | |||||||||||||||

| Actual (2.88% return) | $ | 1,000.00 | $ | 1,028.80 | $ | 5.56 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,019.66 | $ | 5.53 | |||||||||

@ Expenses are equal to the Portfolio's annualized expense ratios of 0.84% and 1.09% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Multi Cap Growth

| Beginning Account Value | Ending Account Value | Expenses Paid During Period@ | |||||||||||||

07/01/12 | 12/31/12 | 07/01/12 – 12/31/12 | |||||||||||||

Class X | |||||||||||||||

| Actual (1.93% return) | $ | 1,000.00 | $ | 1,019.30 | $ | 7.51 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,017.70 | $ | 7.51 | |||||||||

Class Y | |||||||||||||||

| Actual (1.86% return) | $ | 1,000.00 | $ | 1,018.60 | $ | 8.78 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,016.44 | $ | 8.77 | |||||||||

@ Expenses are equal to the Portfolio's annualized expense ratios of 1.48% and 1.73% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

17

Morgan Stanley Select Dimensions Investment Series

Expense Example n December 31, 2012 (unaudited) continued

Mid Cap Growth

| Beginning Account Value | Ending Account Value | Expenses Paid During Period@ | |||||||||||||

07/01/12 | 12/31/12 | 07/01/12 – 12/31/12 | |||||||||||||

Class X | |||||||||||||||

| Actual (2.02% return) | $ | 1,000.00 | $ | 1,020.20 | $ | 5.79 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,019.41 | $ | 5.79 | |||||||||

Class Y | |||||||||||||||

| Actual (1.87% return) | $ | 1,000.00 | $ | 1,018.70 | $ | 7.05 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,018.15 | $ | 7.05 | |||||||||

@ Expenses are equal to the Portfolio's annualized expense ratios of 1.14% and 1.39% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

18

Money Market

Portfolio of Investments n December 31, 2012

| PRINCIPAL AMOUNT (000) | ANNUALIZED YIELD ON DATE OF PURCHASE | MATURITY DATE | VALUE | ||||||||||||||||

Repurchase Agreements (50.3%) | |||||||||||||||||||

$ | 10,000 | Bank of Nova Scotia, (dated 12/31/12; proceeds $10,000,100; fully collateralized by a U.S. Government Obligation; U.S. Treasury Note 1.88% due 06/30/15; valued at $10,200,000) | 0.18 | % | 01/02/13 | $ | 10,000,000 | ||||||||||||

2,000 | Barclays Capital, Inc., (dated 12/26/12; proceeds $2,000,054; fully collateralized by a U.S. Government Obligation; U.S. Treasury Note 2.13% due 11/30/14; valued at $2,040,016) | 0.14 | 01/02/13 | 2,000,000 | |||||||||||||||

1,000 | BNP Paribas Securities Corp., (dated 12/28/12; proceeds $1,000,019; fully collateralized by U.S. Government Agencies; Federal Home Loan Mortgage Corporation 5.50% due 02/01/36; Federal National Mortgage Association 2.29% - 5.00% due 09/01/19 - 10/01/35; valued at $1,030,000) | 0.10 | 01/04/13 | 1,000,000 | |||||||||||||||

1,000 | BNP Paribas Securities Corp., (dated 12/06/12; proceeds $1,001,006; fully collateralized by U.S. Government Agencies; Federal Home Loan Mortgage Corporation 5.50% due 03/01/34; Federal National Mortgage Association 4.50% - 5.50% due 03/01/21 - 09/01/41; valued at $1,030,000) (Demand 01/07/13) | 0.20 | (a) | 06/05/13 | 1,000,000 | ||||||||||||||

1,000 | BNP Paribas Securities Corp., (dated 10/24/12; proceeds $1,001,062; fully collateralized by U.S. Government Agencies; Federal Home Loan Mortgage Corporation 5.50% due 04/01/16; Federal National Mortgage Association 5.50% due 04/01/18; Government National Mortgage Association 3.00% due 10/20/42; valued at $1,030,001) (Demand 01/07/13) | 0.21 | (a) | 04/24/13 | 1,000,000 | ||||||||||||||

See Notes to Financial Statements

19

Money Market

Portfolio of Investments n December 31, 2012 continued

| PRINCIPAL AMOUNT (000) | ANNUALIZED YIELD ON DATE OF PURCHASE | MATURITY DATE | VALUE | ||||||||||||||||

$ | 1,000 | BNP Paribas Securities Corp., (dated 12/04/12; proceeds $1,001,056; fully collateralized by U.S. Government Agencies; Federal Home Loan Mortgage Corporation 5.00% - 5.50% due 03/01/34 - 10/01/35; Federal National Mortgage Association 4.50% due 02/01/41; valued at $1,030,000) (Demand 01/07/13) | 0.21 | (a) % | 06/03/13 | $ | 1,000,000 | ||||||||||||

9,620 | BNP Paribas Securities Corp., (dated 12/31/12; proceeds $9,620,118; fully collateralized by U.S. Government Agencies; Government National Mortgage Association 2.50% - 7.10% due 09/15/18 - 10/15/54; valued at $9,908,601) | 0.22 | 01/02/13 | 9,620,000 | |||||||||||||||

10,000 | Mizuho Securities USA, Inc., (dated 12/31/12; proceeds $10,000,156; fully collateralized by a U.S. Government Agency; Government National Mortgage Association 5.00% due 08/15/40; valued at $10,300,000) | 0.28 | 01/02/13 | 10,000,000 | |||||||||||||||

| Total Repurchase Agreements (Cost $35,620,000) | 35,620,000 | ||||||||||||||||||

Commercial Paper (24.9%) | |||||||||||||||||||

Automobiles (5.1%) | |||||||||||||||||||

| 2,250 | American Honda Finance Corp. | 0.15 | 01/25/13 | 2,249,775 | |||||||||||||||

1,360 | Toyota Motor Credit Corp. | 0.17 - 0.25 | 01/04/13 - 02/13/13 | 1,359,822 | |||||||||||||||

3,609,597 | |||||||||||||||||||

Food & Beverage (0.7%) | |||||||||||||||||||

500 | Coca-Cola Co. (b) | 0.26 - 0.27 | 05/01/13 - 05/14/13 | 499,540 | |||||||||||||||

International Banks (19.1%) | |||||||||||||||||||

350 | ABN Amro Funding USA LLC (b) | 0.32 | 02/01/13 | 349,907 | |||||||||||||||

| 3,000 | Credit Suisse | 0.26 | 04/05/13 | 2,997,963 | |||||||||||||||

500 | DBS Bank Ltd. (b) | 0.45 | 01/14/13 | 499,920 | |||||||||||||||

2,300 | Nordea North America, Inc. | 0.30 - 0.41 | 01/18/13 - 06/12/13 | 2,298,641 | |||||||||||||||

3,000 | NRW Bank (b) | 0.21 - 0.22 | 01/09/13 - 02/01/13 | 2,999,583 | |||||||||||||||

500 | Oversea Chinese Banking | 0.48 | 01/02/13 | 499,993 | |||||||||||||||

3,000 | Rabobank USA Financial Corp. | 0.38 - 0.52 | 02/01/13 - 04/05/13 | 2,998,134 | |||||||||||||||

625 | Svenska Handelsbanken AB (b) | 0.31 | 05/01/13 | 624,375 | |||||||||||||||

300 | Westpac Securities NZ Ltd. (b) | 0.30 | 05/17/13 | 299,660 | |||||||||||||||

13,568,176 | |||||||||||||||||||

| Total Commercial Paper (Cost $17,677,313) | 17,677,313 | ||||||||||||||||||

See Notes to Financial Statements

20

Money Market

Portfolio of Investments n December 31, 2012 continued

| PRINCIPAL AMOUNT (000) | ANNUALIZED YIELD ON DATE OF PURCHASE | MATURITY DATE | VALUE | ||||||||||||||||

Certificates of Deposit (5.3%) | |||||||||||||||||||

International Banks | |||||||||||||||||||

$ | 450 | Bank of Montreal | 0.30 | % | 05/09/13 - 05/13/13 | $ | 450,000 | ||||||||||||

2,300 | Sumitomo Mitsui Banking Corp. | 0.26 | 03/14/13 - 04/05/13 | 2,299,979 | |||||||||||||||

1,000 | Svenska Handelsbanken AB | 0.31 | 06/05/13 | 1,000,022 | |||||||||||||||

| Total Certificates of Deposit (Cost $3,750,001) | 3,750,001 | ||||||||||||||||||

COUPON RATE(a) | DEMAND DATE(c) | ||||||||||||||||||||||

Floating Rate Notes (15.3%) | |||||||||||||||||||||||

International Banks | |||||||||||||||||||||||

2,500 | Bank of Nova Scotia | 0.31 - 0.40 | % | 01/02/13 - 01/28/13 | 04/26/13 - 07/02/13 | 2,499,953 | |||||||||||||||||

2,000 | Deutsche Bank AG | 0.71 | 03/15/13 | 03/15/13 | 2,000,000 | ||||||||||||||||||

1,300 | National Australia Bank | 0.31 | 02/11/13 | 08/09/13 | 1,300,000 | ||||||||||||||||||

1,000 | Royal Bank of Canada | 0.40 | 01/11/13 | 07/11/13 | 1,000,000 | ||||||||||||||||||

2,510 | Toronto Dominion Bank | 0.31 - 0.32 | 01/22/13 - 03/13/13 | 07/26/13 - 10/21/13 | 2,510,000 | ||||||||||||||||||

1,500 | Westpac Banking Corp. (b) | 0.31 - 0.40 | 01/03/13 - 02/27/13 | 04/03/13 - 08/27/13 | 1,499,960 | ||||||||||||||||||

| Total Floating Rate Notes (Cost $10,809,913) | 10,809,913 | ||||||||||||||||||||||

Tax-Exempt Instruments (4.2%) | |||||||||||||||||||||||

Weekly Variable Rate Bond (2.8%) | |||||||||||||||||||||||

2,000 | Miami-Dade County, FL, Professional Sports Franchise Facilities Tax Ser 2009 E | 0.15 | 01/07/13 | 10/01/48 | 2,000,000 | ||||||||||||||||||

| COUPON RATE | YIELD TO MATURITY ON DATE OF PURCHASE | ||||||||||||||||||||||

Municipal Bond (1.4%) | |||||||||||||||||||||||

1,000 | California, Ser 2012-13 A-2 RANs, dtd 08/23/12 | 2.50 | % | 0.43 | % | 06/20/13 | 1,009,607 | ||||||||||||||||

| Total Tax-Exempt Instruments (Cost $3,009,607) | 3,009,607 | ||||||||||||||||||||||

| Total Investments (Cost $70,866,834) | 100.0 | % | 70,866,834 | ||||||||||||||||||||

Liabilities in Excess of Other Assets | 0.0 | (d) | (4,524 | ) | |||||||||||||||||||

Net Assets | 100.0 | % | $ | 70,862,310 | |||||||||||||||||||

See Notes to Financial Statements

21

Money Market

Portfolio of Investments n December 31, 2012 continued

RANs Revenue Anticipation Notes.

(a) Rate shown is the rate in effect at December 31, 2012.

(b) 144A security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

(c) Date of next interest rate reset.

(d) Amount is less than 0.05%.

MATURITY SCHEDULE†

| 1 - 30 Days | 70.3 | % | |||||

| 31 - 60 Days | 10.2 | ||||||

| 61 - 90 Days | 5.0 | ||||||

| 91 - 120 Days | 7.9 | ||||||

| 121 + Days | 6.6 | ||||||

100.0 | % | ||||||

† As a percentage of total investments

See Notes to Financial Statements

22

Flexible Income

Portfolio of Investments n December 31, 2012

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Corporate Bonds (59.8%) | |||||||||||||||||||

Australia (1.3%) | |||||||||||||||||||

Basic Materials | |||||||||||||||||||

$ | 35 | FMG Resources August 2006 Pty Ltd. (a) | 6.375 | % | 02/01/16 | $ | 36,400 | ||||||||||||

100 | FMG Resources August 2006 Pty Ltd. (a) | 6.875 | 02/01/18 | 103,625 | |||||||||||||||

140,025 | |||||||||||||||||||

Consumer, Cyclical | |||||||||||||||||||

35 | Wesfarmers Ltd. (a) | 2.983 | 05/18/16 | 36,665 | |||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

45 | Woolworths Ltd. (a) | 4.00 | 09/22/20 | 48,705 | |||||||||||||||

Finance | |||||||||||||||||||

50 | Dexus Diversified Trust/Dexus Office Trust (a) | 5.60 | 03/15/21 | 53,836 | |||||||||||||||

Total Australia | 279,231 | ||||||||||||||||||

Belgium (0.1%) | |||||||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

32 | Delhaize Group SA | 5.70 | 10/01/40 | 30,095 | |||||||||||||||

Brazil (0.3%) | |||||||||||||||||||

Basic Materials | |||||||||||||||||||

50 | Vale Overseas Ltd. | 5.625 | 09/15/19 | 57,100 | |||||||||||||||

5 | Vale Overseas Ltd. | 6.875 | 11/10/39 | 6,294 | |||||||||||||||

Total Brazil | 63,394 | ||||||||||||||||||

Canada (1.8%) | |||||||||||||||||||

Basic Materials | |||||||||||||||||||

100 | HudBay Minerals, Inc. (a) | 9.50 | 10/01/20 | 106,125 | |||||||||||||||

100 | Inmet Mining Corp. (a) | 8.75 | 06/01/20 | 109,750 | |||||||||||||||

215,875 | |||||||||||||||||||

Communications | |||||||||||||||||||

100 | MDC Partners, Inc. | 11.00 | 11/01/16 | 110,375 | |||||||||||||||

Energy | |||||||||||||||||||

50 | Canadian Oil Sands Ltd. (a) | 7.75 | 05/15/19 | 63,799 | |||||||||||||||

Total Canada | 390,049 | ||||||||||||||||||

France (0.9%) | |||||||||||||||||||

Communications | |||||||||||||||||||

15 | France Telecom SA | 8.50 | 03/01/31 | 22,514 | |||||||||||||||

Diversified | |||||||||||||||||||

75 | LVMH Moet Hennessy Louis Vuitton SA (a) | 1.625 | 06/29/17 | 76,320 | |||||||||||||||

See Notes to Financial Statements

23

Flexible Income

Portfolio of Investments n December 31, 2012 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Energy | |||||||||||||||||||

$ | 50 | Total Capital International SA | 2.875 | % | 02/17/22 | $ | 52,296 | ||||||||||||

Finance | |||||||||||||||||||

50 | BNP Paribas SA | 5.00 | 01/15/21 | 56,251 | |||||||||||||||

Total France | 207,381 | ||||||||||||||||||

Germany (0.2%) | |||||||||||||||||||

Communications | |||||||||||||||||||

25 | Deutsche Telekom International Finance BV | 8.75 | 06/15/30 | 37,555 | |||||||||||||||

Greece (0.4%) | |||||||||||||||||||

Industrials | |||||||||||||||||||

100 | DryShips, Inc. | 5.00 | 12/01/14 | 79,500 | |||||||||||||||

Ireland (0.2%) | |||||||||||||||||||

Industrials | |||||||||||||||||||

45 | CRH America, Inc. | 6.00 | 09/30/16 | 50,606 | |||||||||||||||

Israel (0.4%) | |||||||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

80 | Teva Pharmaceutical Finance IV BV | 3.65 | 11/10/21 | 85,781 | |||||||||||||||

Italy (0.6%) | |||||||||||||||||||

Communications | |||||||||||||||||||

25 | Telecom Italia Capital SA | 6.999 | 06/04/18 | 28,700 | |||||||||||||||

Utilities | |||||||||||||||||||

100 | Enel Finance International N.V. (a) | 5.125 | 10/07/19 | 105,837 | |||||||||||||||

Total Italy | 134,537 | ||||||||||||||||||

Mexico (0.5%) | |||||||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

100 | Grupo Bimbo SAB de CV (a) | 4.875 | 06/30/20 | 113,883 | |||||||||||||||

Netherlands (0.5%) | |||||||||||||||||||

Finance | |||||||||||||||||||

75 | Aegon N.V. | 4.625 | 12/01/15 | 81,817 | |||||||||||||||

25 | Cooperatieve Centrale Raiffeisen-Boerenleenbank BA | 3.875 | 02/08/22 | 26,955 | |||||||||||||||

Total Netherlands | 108,772 | ||||||||||||||||||

Spain (1.6%) | |||||||||||||||||||

Communications | |||||||||||||||||||

200 | Nara Cable Funding Ltd. (a) | 8.875 | 12/01/18 | 201,500 | |||||||||||||||

45 | Telefonica Europe BV | 8.25 | 09/15/30 | 53,494 | |||||||||||||||

254,994 | |||||||||||||||||||

See Notes to Financial Statements

24

Flexible Income

Portfolio of Investments n December 31, 2012 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Finance | |||||||||||||||||||

$ | 30 | Santander Holdings USA, Inc. | 4.625 | % | 04/19/16 | $ | 31,389 | ||||||||||||

Utilities | |||||||||||||||||||

75 | Iberdrola Finance Ireland Ltd. (a) | 5.00 | 09/11/19 | 78,681 | |||||||||||||||

Total Spain | 365,064 | ||||||||||||||||||

Switzerland (0.8%) | |||||||||||||||||||

Finance | |||||||||||||||||||

65 | ABB Treasury Center USA, Inc. (a) | 2.50 | 06/15/16 | 67,641 | |||||||||||||||

70 | Credit Suisse | 5.40 | 01/14/20 | 78,824 | |||||||||||||||

5 | Credit Suisse | 6.00 | 02/15/18 | 5,755 | |||||||||||||||

152,220 | |||||||||||||||||||

Industrials | |||||||||||||||||||

25 | Holcim US Finance Sarl & Cie SCS (a) | 6.00 | 12/30/19 | 28,397 | |||||||||||||||

Total Switzerland | 180,617 | ||||||||||||||||||

United Kingdom (2.7%) | |||||||||||||||||||

Communications | |||||||||||||||||||

100 | WPP Finance UK | 8.00 | 09/15/14 | 110,629 | |||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

50 | Diageo Capital PLC | 1.50 | 05/11/17 | 50,760 | |||||||||||||||

Finance | |||||||||||||||||||

120 | Nationwide Building Society (a) | 6.25 | 02/25/20 | 141,934 | |||||||||||||||

Industrials | |||||||||||||||||||

100 | BAA Funding Ltd. (a) | 4.875 | 07/15/21 | 109,326 | |||||||||||||||

200 | CEVA Group PLC (a) | 8.375 | 12/01/17 | 199,000 | |||||||||||||||

308,326 | |||||||||||||||||||

Total United Kingdom | 611,649 | ||||||||||||||||||

United States (47.5%) | |||||||||||||||||||

Basic Materials | |||||||||||||||||||

100 | American Gilsonite Co. (a) | 11.50 | 09/01/17 | 103,500 | |||||||||||||||

40 | Barrick North America Finance LLC | 4.40 | 05/30/21 | 43,943 | |||||||||||||||

65 | Georgia-Pacific LLC | 8.875 | 05/15/31 | 97,723 | |||||||||||||||

100 | Kraton Polymers LLC/Kraton Polymers Capital Corp. | 6.75 | 03/01/19 | 103,875 | |||||||||||||||

100 | Prince Mineral Holding Corp. (a) | 11.50 | 12/15/19 | 104,000 | |||||||||||||||

100 | Taminco Acquisition Corp. (a) | 9.125 | (b) | 12/15/17 | 99,250 | ||||||||||||||

74 | Tronox Finance LLC (a) | 6.375 | 08/15/20 | 75,018 | |||||||||||||||

627,309 | |||||||||||||||||||

See Notes to Financial Statements

25

Flexible Income

Portfolio of Investments n December 31, 2012 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

Communications | |||||||||||||||||||

$ | 25 | CC Holdings GS V LLC (a) | 3.849 | % | 04/15/23 | $ | 25,487 | ||||||||||||

140 | CCO Holdings LLC/CCO Holdings Capital Corp. | 6.50 | 04/30/21 | 151,725 | |||||||||||||||

30 | CenturyLink, Inc. | 6.45 | 06/15/21 | 33,205 | |||||||||||||||

50 | Crown Castle International Corp. (a) | 5.25 | 01/15/23 | 53,687 | |||||||||||||||

100 | CSC Holdings LLC | 8.625 | 02/15/19 | 120,000 | |||||||||||||||

25 | DirecTV Holdings LLC/DirecTV Financing Co., Inc. | 3.80 | 03/15/22 | 25,841 | |||||||||||||||

100 | DISH DBS Corp. | 6.75 | 06/01/21 | 114,500 | |||||||||||||||

100 | GXS Worldwide, Inc. | 9.75 | 06/15/15 | 104,625 | |||||||||||||||

150 | Harron Communications LP/Harron Finance Corp. (a) | 9.125 | 04/01/20 | 165,000 | |||||||||||||||

100 | inVentiv Health, Inc. (a) | 9.00 | 01/15/18 | 101,250 | |||||||||||||||

100 | Mediacom LLC/Mediacom Capital Corp. | 7.25 | 02/15/22 | 108,000 | |||||||||||||||

50 | Motorola Solutions, Inc. | 3.75 | 05/15/22 | 51,186 | |||||||||||||||

25 | NBC Universal Media LLC | 5.95 | 04/01/41 | 30,766 | |||||||||||||||

50 | Omnicom Group, Inc. | 3.625 | 05/01/22 | 52,189 | |||||||||||||||

25 | Time Warner Cable, Inc. | 4.50 | 09/15/42 | 24,480 | |||||||||||||||

25 | Time Warner, Inc. | 4.90 | 06/15/42 | 26,926 | |||||||||||||||

65 | Verizon Communications, Inc. | 6.35 | 04/01/19 | 82,256 | |||||||||||||||

70 | XM Satellite Radio, Inc. (a) | 7.625 | 11/01/18 | 78,400 | |||||||||||||||

1,349,523 | |||||||||||||||||||

Consumer, Cyclical | |||||||||||||||||||

70 | Ameristar Casinos, Inc. | 7.50 | 04/15/21 | 76,213 | |||||||||||||||

50 | Caesars Entertainment Operating Co., Inc. | 8.50 | 02/15/20 | 49,781 | |||||||||||||||

80 | Caesars Entertainment Operating Co., Inc. | 10.00 | 12/15/18 | 53,400 | |||||||||||||||

100 | CCM Merger, Inc. (a) | 9.125 | 05/01/19 | 101,250 | |||||||||||||||

100 | Chester Downs & Marina LLC (a) | 9.25 | 02/01/20 | 98,750 | |||||||||||||||

150 | Continental Airlines 2012-3 Class C Pass-Thru Certificates | 6.125 | 04/29/18 | 151,125 | |||||||||||||||

125 | Dana Holding Corp. | 6.50 | 02/15/19 | 134,062 | |||||||||||||||

100 | Exide Technologies | 8.625 | 02/01/18 | 85,250 | |||||||||||||||

30 | Gap, Inc. (The) | 5.95 | 04/12/21 | 34,378 | |||||||||||||||

65 | Home Depot, Inc. | 5.875 | 12/16/36 | 85,729 | |||||||||||||||

150 | IDQ Holdings, Inc. (a) | 11.50 | 04/01/17 | 162,375 | |||||||||||||||

100 | Levi Strauss & Co. | 7.625 | 05/15/20 | 109,500 | |||||||||||||||

100 | Logan's Roadhouse, Inc. | 10.75 | 10/15/17 | 93,375 | |||||||||||||||

100 | MGM Resorts International | 7.75 | 03/15/22 | 107,500 | |||||||||||||||

50 | QVC, Inc. (a) | 7.125 | 04/15/17 | 52,438 | |||||||||||||||

299 | Resort at Summerlin LP, Series B (c)(d)(e)(f) | 13.00 | (b) | 12/15/07 | 0 | ||||||||||||||

100 | Sabre Holdings Corp. | 8.35 | 03/15/16 | 107,000 | |||||||||||||||

100 | Tenneco, Inc. | 7.75 | 08/15/18 | 109,000 | |||||||||||||||

See Notes to Financial Statements

26

Flexible Income

Portfolio of Investments n December 31, 2012 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

$ | 150 | VWR Funding, Inc. (a) | 7.25 | % | 09/15/17 | $ | 158,250 | ||||||||||||

35 | Wal-Mart Stores, Inc. | 5.25 | 09/01/35 | 42,669 | |||||||||||||||

70 | Wyndham Worldwide Corp. | 4.25 | 03/01/22 | 72,410 | |||||||||||||||

45 | Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp. | 7.75 | 08/15/20 | 51,525 | |||||||||||||||

30 | Yum! Brands, Inc. | 6.875 | 11/15/37 | 41,104 | |||||||||||||||

1,977,084 | |||||||||||||||||||

Consumer, Non-Cyclical | |||||||||||||||||||

30 | AbbVie, Inc. (a) | 4.40 | 11/06/42 | 32,030 | |||||||||||||||

50 | Aetna, Inc. | 2.75 | 11/15/22 | 49,695 | |||||||||||||||

25 | Altria Group, Inc. | 2.85 | 08/09/22 | 24,790 | |||||||||||||||

25 | Amgen, Inc. | 3.875 | 11/15/21 | 27,505 | |||||||||||||||

116 | Armored Autogroup, Inc. | 9.25 | 11/01/18 | 98,890 | |||||||||||||||

40 | Boston Scientific Corp. | 6.00 | 01/15/20 | 46,726 | |||||||||||||||

25 | Cigna Corp. | 2.75 | 11/15/16 | 26,323 | |||||||||||||||

45 | Coventry Health Care, Inc. | 5.45 | 06/15/21 | 53,578 | |||||||||||||||

40 | Express Scripts Holding Co. (a) | 2.65 | 02/15/17 | 41,616 | |||||||||||||||

25 | Express Scripts Holding Co. (a) | 3.90 | 02/15/22 | 27,008 | |||||||||||||||

100 | Gilead Sciences, Inc. | 4.50 | 04/01/21 | 114,485 | |||||||||||||||

160 | Kindred Healthcare, Inc. | 8.25 | 06/01/19 | 156,400 | |||||||||||||||

26 | Kraft Foods Group, Inc. (a) | 5.375 | 02/10/20 | 31,266 | |||||||||||||||

50 | Life Technologies Corp. | 6.00 | 03/01/20 | 59,348 | |||||||||||||||

24 | Mondelez International, Inc. | 5.375 | 02/10/20 | 29,018 | |||||||||||||||

100 | ServiceMaster Co. | 8.00 | 02/15/20 | 104,750 | |||||||||||||||

100 | Smithfield Foods, Inc. | 6.625 | 08/15/22 | 110,750 | |||||||||||||||

20 | UnitedHealth Group, Inc. | 1.40 | 10/15/17 | 20,054 | |||||||||||||||

10 | UnitedHealth Group, Inc. | 2.75 | 02/15/23 | 10,112 | |||||||||||||||

35 | Verisk Analytics, Inc. | 5.80 | 05/01/21 | 39,288 | |||||||||||||||

1,103,632 | |||||||||||||||||||

Energy | |||||||||||||||||||

100 | Concho Resources, Inc. | 7.00 | 01/15/21 | 112,000 | |||||||||||||||

100 | Continental Resources, Inc. | 5.00 | 09/15/22 | 108,250 | |||||||||||||||

100 | Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp. | 7.75 | 04/01/19 | 104,250 | |||||||||||||||

100 | Crosstex Energy LP/Crosstex Energy Finance Corp. (a) | 7.125 | 06/01/22 | 104,750 | |||||||||||||||

30 | Marathon Petroleum Corp. | 5.125 | 03/01/21 | 35,365 | |||||||||||||||

150 | Northern Oil and Gas, Inc. | 8.00 | 06/01/20 | 153,750 | |||||||||||||||

100 | Pioneer Natural Resources Co. | 7.50 | 01/15/20 | 126,881 | |||||||||||||||

100 | SM Energy Co. | 6.50 | 01/01/23 | 107,500 | |||||||||||||||

50 | Tesoro Corp. | 5.375 | 10/01/22 | 53,500 | |||||||||||||||

See Notes to Financial Statements

27

Flexible Income

Portfolio of Investments n December 31, 2012 continued

| PRINCIPAL AMOUNT (000) | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

$ | 50 | Weatherford International Ltd. | 4.50 | % | 04/15/22 | $ | 53,162 | ||||||||||||

80 | Williams Cos., Inc. (The) | 7.875 | 09/01/21 | 103,239 | |||||||||||||||

1,062,647 | |||||||||||||||||||

Finance | |||||||||||||||||||

25 | Alexandria Real Estate Equities, Inc. | 4.60 | 04/01/22 | 26,884 | |||||||||||||||

72 | Citigroup, Inc. (See Note 6) | 8.50 | 05/22/19 | 96,940 | |||||||||||||||

70 | CNA Financial Corp. | 5.75 | 08/15/21 | 82,246 | |||||||||||||||

125 | DPL, Inc. | 7.25 | 10/15/21 | 134,375 | |||||||||||||||

200 | Ford Motor Credit Co., LLC | 4.207 | 04/15/16 | 213,487 | |||||||||||||||

40 | General Electric Capital Corp. | 5.30 | 02/11/21 | 46,509 | |||||||||||||||

50 | Genworth Financial, Inc. | 7.20 | 02/15/21 | 54,084 | |||||||||||||||

135 | Goldman Sachs Group, Inc. (The) | 6.15 | 04/01/18 | 158,775 | |||||||||||||||

35 | Harley-Davidson Funding Corp. (a) | 6.80 | 06/15/18 | 43,042 | |||||||||||||||

60 | Hartford Financial Services Group, Inc. (See Note 6) | 5.50 | 03/30/20 | 69,819 | |||||||||||||||

75 | HCP, Inc. | 5.625 | 05/01/17 | 85,743 | |||||||||||||||

100 | Host Hotels & Resorts LP | 6.00 | 10/01/21 | 115,250 | |||||||||||||||

25 | JPMorgan Chase & Co. | 4.50 | 01/24/22 | 28,334 | |||||||||||||||

65 | JPMorgan Chase & Co. | 4.625 | 05/10/21 | 74,241 | |||||||||||||||

100 | Merrill Lynch & Co., Inc. | 6.11 | 01/29/37 | 109,511 | |||||||||||||||

25 | MetLife, Inc. | 7.717 | 02/15/19 | 32,817 | |||||||||||||||

100 | Nationstar Mortgage LLC/Nationstar Capital Corp. (a) | 7.875 | 10/01/20 | 106,000 | |||||||||||||||

35 | Nationwide Financial Services, Inc. (a) | 5.375 | 03/25/21 | 37,467 | |||||||||||||||

35 | Prudential Financial, Inc., MTN | 6.625 | 12/01/37 | 43,754 | |||||||||||||||

150 | Rivers Pittsburgh Borrower LP/Rivers Pittsburgh Finance Corp. (a) | 9.50 | 06/15/19 | 163,500 | |||||||||||||||

10 | Santander Holdings USA, Inc. | 3.00 | 09/24/15 | 10,190 | |||||||||||||||

60 | SLM Corp., MTN | 8.00 | 03/25/20 | 68,850 | |||||||||||||||

1,801,818 | |||||||||||||||||||

Industrials | |||||||||||||||||||