QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Southwest Water Company |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

| | | Southwest Water Company

One Wilshire Building

624 South Grand Avenue, Suite 2900

Los Angeles, California 90017

www.swwc.com |

|

|

Anton C. Garnier

Chairman of the Board and

Chief Executive Officer |

To our Stockholders:

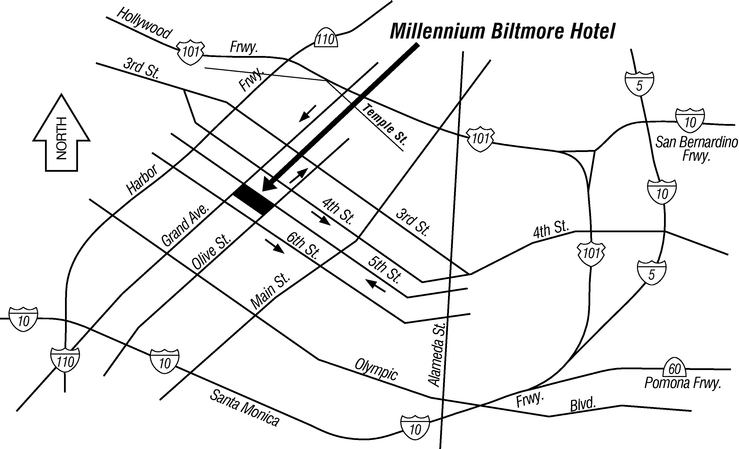

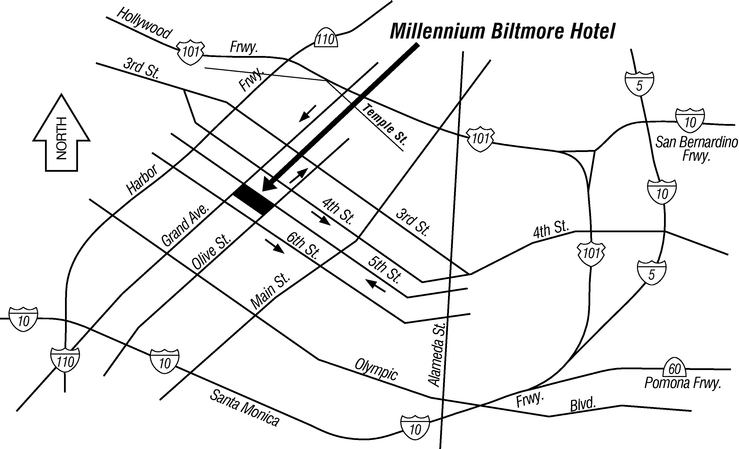

We cordially invite you to attend the 2004 Annual Meeting of Stockholders of Southwest Water Company to be held on Thursday, May 13, 2004, at 10 a.m. at the Millennium Biltmore Hotel located at 506 South Grand Avenue, Los Angeles, California 90071. Details regarding the business to be conducted are more fully described in the accompanying Notice of Annual Meeting and Proxy Statement.

I hope you will participate in this overview of our company's business and operations. We will review the major developments of 2003, take a look at our plans for the future and answer your questions.

We have enclosed our 2003 Annual Report for your reference. Also enclosed in this package is a proxy card for you to record your vote and a return envelope for your proxy card.

Your vote is important. Whether you own a few shares or many, it is important that your shares are represented. You may vote by telephone or by completing and mailing the enclosed proxy card. Voting by phone or by written proxy will ensure your representation at the Annual Meeting, if you do not attend in person. Please review the instructions on the proxy card regarding each of these voting options.

Thank you for your ongoing support of and continued interest in Southwest Water Company.

Sincerely,

Anton C. Garnier

2004 ANNUAL MEETING OF STOCKHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

| | Page

|

|---|

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | | 1 |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

AND THE ANNUAL MEETING |

|

2 |

| | Why have I received these materials? | | 2 |

| | Who can attend the Annual Meeting? | | 2 |

| | Who is entitled to vote at this Annual Meeting? | | 2 |

| | What is the quorum requirement for the Annual Meeting? | | 2 |

| | What are the costs of proxy distribution and solicitation? | | 2 |

| | What information is contained in these materials? | | 3 |

| | What proposals will be voted on at the Annual Meeting? | | 3 |

| | What is Southwest Water's voting recommendation? | | 3 |

| | What shares owned by me can be voted? | | 3 |

| | What is the difference between holding shares as a stockholder of record and as a beneficial owner? | | 3 |

| | How can I vote my shares in person at the Annual Meeting? | | 4 |

| | How can I vote my shares without attending the Annual Meeting? | | 4 |

| | Can I change my vote? | | 4 |

| | How are votes cast? | | 5 |

| | What is the voting requirement to approve each of the proposals? | | 5 |

| | What does it mean if I receive more than one proxy or voting instruction card? | | 5 |

| | Who will serve as inspector of election? | | 5 |

| | What documents are incorporated by reference? | | 6 |

| | Where can I find voting results from this Annual Meeting? | | 6 |

PROPOSAL 1 – ELECTION OF DIRECTORS |

|

7 |

| | Information on Nominees and Continuing Directors | | 7 |

| | Nominees for Directors Standing for Election in 2004 | | 8 |

| | Directors Whose Terms Will Expire in 2005 | | 9 |

| | Directors Whose Terms Will Expire in 2006 | | 9 |

| | Board and Committee Independence | | 9 |

| | Board Structure and Committee Membership | | 10 |

| | Audit Committee | | 10 |

| | Audit Committee Financial Expert | | 10 |

| | Financial Planning and Investment Committee | | 11 |

| | Compensation Committee | | 11 |

| | Nominating and Governance Committee | | 11 |

| | Compensation Committee Interlocks and Insider Participation | | 11 |

DIRECTOR COMPENSATION AND STOCK OWNERSHIP |

|

12 |

| | Non-Employee Director Stock Options Granted in 2003 | | 13 |

| | Non-Employee Director Option Exercises in 2003 and Year-End Option Values | | 13 |

| | | |

| CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | | 14 |

| | Statement of Corporate Governance | | 14 |

| | Code of Ethical Conduct | | 14 |

| | Director Qualifications | | 14 |

| | Identifying and Evaluating Nominees for Directors | | 14 |

| | Stockholder Nominations | | 15 |

| | Independent Director Sessions | | 15 |

| | Communications to the Board | | 15 |

BENEFICIAL OWNERSHIP OF MANAGEMENT AND DIRECTORS |

|

16 |

| | Significant Stockholders | | 17 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 17 |

PERFORMANCE GRAPH |

|

18 |

EXECUTIVE COMPENSATION |

|

19 |

| | Report of the Compensation Committee | | 19 |

| | Summary Compensation Table | | 21 |

| | Executive Officers' Change of Control Compensation Agreements | | 21 |

| | Option Grants to Named Executive Officers in 2003 | | 23 |

| | Options Exercised in 2003 and Year-End Option Values | | 24 |

| | Equity Compensation Plan Information | | 25 |

| | Supplemental Executive Retirement Plan | | 26 |

AUDIT-RELATED MATTERS |

|

27 |

| | Report of the Audit Committee | | 27 |

| | Principal Auditor Fees and Services | | 28 |

PROPOSAL 2 – TO AMEND THE COMPANY'S RESTATED CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES FROM 25,000,000 SHARES TO 75,000,000 SHARES |

|

29 |

PROPOSAL 3 – APPROVAL OF AN AMENDMENT TO THE AMENDED AND RESTATED STOCK OPTION PLAN FOR NON-EMPLOYEE DIRECTORS OF SOUTHWEST WATER COMPANY |

|

30 |

REQUIREMENTS, INCLUDING DEADLINES, FOR SUBMISSION OF PROXY PROPOSALS, NOMINATION OF DIRECTORS AND OTHER BUSINESS OF STOCKHOLDERS |

|

34 |

APPENDIX A – CHARTER FOR THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS |

|

A-1 |

APPENDIX B – CERTIFICATE OF AMENDMENT OF RESTATED CERTIFICATE OF INCORPORATION OF SOUTHWEST WATER COMPANY |

|

B-1 |

APPENDIX C – AMENDMENT TO THE AMENDED AND RESTATED STOCK OPTION PLAN FOR NON-EMPLOYEE DIRECTORS OF SOUTHWEST WATER COMPANY |

|

C-1 |

DIRECTIONS TO ANNUAL MEETING |

|

Back Cover |

SOUTHWEST WATER COMPANY

One Wilshire Building

624 South Grand Avenue, Suite 2900

Los Angeles, California 90017

(213) 929-1800

NOTICE OF THE

2004 ANNUAL MEETING OF STOCKHOLDERS

April 2, 2004

To our Stockholders:

The 2004 Annual Meeting of Stockholders ("Annual Meeting") of Southwest Water Company, a Delaware corporation ("Southwest Water," "Company," "we" or "us"), will be held on Thursday, May 13, 2004 at 10:00 a.m., Pacific Time, at the Millennium Biltmore Hotel, 506 South Grand Avenue, Los Angeles, California 90071 for the following purposes:

- (1)

- To elect three persons as Class III Directors to a three-year term and until their successors are duly elected and qualified;

- (2)

- To approve an amendment to the Company's Amended and Restated Certificate of Incorporation increasing the number of authorized shares of common stock from 25,000,000 shares to 75,000,000 shares;

- (3)

- To approve an amendment to the Amended and Restated Stock Option Plan for Non-Employee Directors, which includes an increase of 250,000 shares authorized for issuance under the plan, an increase of 5,000 shares to the initial and annual stock option grants to non-employee directors ("Non-Employee Directors") and a four-year extension to the term of the plan; and

- (4)

- To consider such other business as may properly come before the meeting.

The record date for the determination of the stockholders entitled to vote at the meeting is the close of business on March 18, 2004.

A list of stockholders entitled to vote at the Annual Meeting will be open to examination by any stockholder, for any purpose germane to the meeting, at the location of the Annual Meeting on May 13, 2004, and during ordinary business hours for 10 days before the meeting at One Wilshire Building, 624 South Grand Avenue, Suite 2900, Los Angeles, California 90017.

It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the proxy card sent to you. You also have the option of voting your shares by telephone. Voting instructions are printed on your proxy card and included in the accompanying proxy statement ("Proxy Statement"). You can revoke or change your proxy at any time prior to its exercise at the meeting by following the instructions in the Proxy Statement.

By Order of the Board of Directors

Shelley A. Farnham

Secretary

WE URGE STOCKHOLDERS TO MARK, SIGN AND RETURN

PROMPTLY THE ACCOMPANYING PROXY CARD

OR TO VOTE BY TELEPHONE.

This Notice of Annual Meeting and Proxy Statement and Form of Proxy are being distributed on or about April 8, 2004.

1

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

AND THE ANNUAL MEETING

- Q:

- Why have I received these materials?

- A:

- The Company is providing these proxy materials for you, as a stockholder of Southwest Water, in connection with solicitation by our Board of Directors (the "Board") of proxies to be voted at our 2004 Annual Meeting of Stockholders and at any adjournment or postponement of that meeting. This Proxy Statement, form of proxy and voting instructions are being mailed on or about April 8, 2004.

You are invited to attend our Annual Meeting on May 13, 2004, at 10:00 a.m., Pacific Time. The Annual Meeting will be held at the Millennium Biltmore Hotel, 506 South Grand Avenue, Los Angeles, California. A map showing directions to the hotel is on the back cover of this Proxy Statement.

- Q:

- Who can attend the Annual Meeting?

- A:

- Our stockholders and Company representatives and guests can attend the meeting. Admission to the meeting depends on how your ownership of your shares is recorded. If your shares are held in the name of a bank, broker or other holder of record and you plan to attend the Annual Meeting, please obtain proof of ownership, such as a current brokerage account statement or certification from your broker. If your shares are registered with our transfer agent, all you need is proof of identification; no proof of ownership is needed.

- Q:

- Who is entitled to vote at this Annual Meeting?

- A:

- Owners of Southwest Water common stock or preferred Series A stock at the close of business on March 18, 2004, are entitled to receive this notice and to vote their shares at the Annual Meeting. As of that date, there were 14,804,393 shares of common stock outstanding and 9,327 shares of preferred Series A stock outstanding. On each matter properly brought before the Annual Meeting, common shares will be entitled to one vote per share, and preferred Series A shares will be entitled to five votes per share. The combined total number of eligible votes is 14,851,028 shares.

- Q:

- What is the quorum requirement for the Annual Meeting?

- A:

- The presence at the meeting, in person or by proxy, of the holders of a majority of the eligible votes on the record date will constitute a quorum, permitting the meeting to conduct its business. Proxies received, but marked as abstentions, and broker non-votes (i.e., shares that are not voted by the broker who is the record holder of the shares because the broker is not instructed to vote and does not have discretionary authority to vote such shares) will be included in the calculation of the number of votes considered to be present at the meeting.

- Q:

- What are the costs of proxy distribution and solicitation?

- A:

- Southwest Water will bear the entire cost of this solicitation of proxies, including the preparation, assembly, printing and mailing of this Proxy Statement, the proxy and any additional solicitation material that Southwest Water may provide to stockholders. Copies of solicitation material will be provided to brokerage firms, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to beneficial owners. In addition, Southwest Water has retained Morrow and Company ("Morrow") to act as a proxy solicitor for the meeting. Southwest Water has agreed to pay Morrow $5,000, plus reasonable out-of-pocket expenses, for proxy solicitation services. The original solicitation of proxies by mail may be supplemented by solicitation by telephone, telegram and other means by directors ("Director" or

2

"Directors"), officers and employees of Southwest Water. No additional compensation will be paid to these individuals for their services.

- Q:

- What information is contained in these materials?

- A:

- The information included in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of Directors and our most highly paid officers, and certain other required information. Southwest Water's 2003 Annual Report and audited financial statements, proxy card and return envelope are also enclosed.

- Q:

- What proposals will be voted on at the Annual Meeting?

- A:

- There are three proposals to be voted on at the Annual Meeting:

- •

- The election of three persons as Class III Directors for a three-year term or until their successors are duly elected and qualified;

- •

- Approval of an amendment to the Company's Amended and Restated Certificate of Incorporation increasing the number of authorized shares of common stock from 25,000,000 shares to 75,000,000 shares; and

- •

- Approval of an amendment to the Amended and Restated Stock Option Plan for Non-Employee Directors, which include an increase of 250,000 shares (from 437,555 shares to 687,555 shares) authorized for issuance under the plan, an increase of 5,000 shares to the initial and annual stock option grants to Non-Employee Directors (from 5,000 shares to 10,000 shares) and a four-year extension to the term of the plan to May 13, 2014.

- Q:

- What is Southwest Water's voting recommendation?

- A:

- Southwest Water's Board recommends that you vote your shares "FOR" each of the nominees to the Board, "FOR" the approval of an Amendment to the Amended and Restated Certificate of Incorporation and "FOR" the approval of the Amended and Restated Stock Option Plan for Non-Employee Directors.

- Q:

- What shares owned by me can be voted?

- A:

- Each share of Southwest Water stock issued and outstanding as of the close of business on March 18, 2004 (the "Record Date"), is entitled to vote on all items being voted upon at the Annual Meeting. You may cast one vote per share of common stock that you held on the Record Date. Holders of Series A Preferred Stock may cast five votes per share of preferred stock beneficially owned by them. You may vote all shares owned by you as of the Record Date, including shares that are: (1) held directly in your name as the stockholder of record or (2) held for you as the beneficial owner through a stockbroker, bank or other nominee.

- Q:

- What is the difference between holding shares as a stockholder of record and as a beneficial owner?

- A:

- Most stockholders of Southwest Water hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with Southwest Water's transfer agent, Mellon Investor Services LLC, you are considered the stockholder of record, and these proxy materials are being sent directly to you by Southwest Water. As the stockholder of record, you have the right to grant your voting proxy directly to Southwest Water or to vote in person at the Annual Meeting. Southwest Water has enclosed a proxy card for you to use. You may also vote by telephone as described below under "How can I vote my shares without attending the Annual Meeting?"

3

Beneficial Owner of Shares Held in Street Name

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a signed proxy from your broker. Your broker or nominee has enclosed a voting instruction card for you to use in directing the broker or nominee regarding how to vote your shares. You may also vote by telephone as described below under "How can I vote my shares without attending the Annual Meeting?"

- Q:

- How can I vote my shares in person at the Annual Meeting?

- A:

- Shares held directly in your name as the stockholder of record may be voted in person at the Annual Meeting. If you choose to do so, please bring the enclosed proxy card or proof of identification. Even if you plan to attend the Annual Meeting, Southwest Water recommends that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

Shares held beneficially in street name may be voted in person by you only if you obtain a signed proxy from the record holder (e.g., your broker) giving you the right to vote the shares in person.

- Q:

- How can I vote my shares without attending the Annual Meeting?

- A:

- If you complete and properly sign the accompanying proxy card and return it to the Company, it will be voted as you direct. If you are a registered stockholder, you may vote by telephone, by following the instructions included with your proxy card. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or nominee. For instructions on how to vote, please refer to the instructions below and those included on your proxy card or, for shares held beneficially in street name, the voting instruction card provided by your broker, trustee or nominee. The deadline for voting by telephone is 11:59 p.m., Eastern Time, on May 12, 2004.

By Telephone – Stockholders of record of Southwest Water stock who live in the United States or Canada may submit proxies by following the "Vote by Phone" instructions on their proxy cards. Most Southwest Water stockholders who hold shares beneficially in street name and live in the United States or Canada may vote by phone by calling the number specified on the voting instruction cards provided by their brokers, trustee or nominees.

By Mail – Stockholders of record of Southwest Water stock may submit proxies by completing, signing and dating their proxy cards and mailing them in the accompanying pre-addressed envelopes. Southwest Water stockholders who hold shares beneficially in street name may vote by mail by completing, signing and dating the voting instruction cards and providing and mailing them in the accompanying pre-addressed envelopes.

- Q:

- Can I change my vote?

- A:

- As a stockholder of record, you may revoke your proxy at any time before it is voted at the Annual Meeting by doing any of the following:

- •

- Delivering to the Secretary of the Company a signed notice of revocation, bearing a date later than the date of the proxy, stating that the vote is revoked;

- •

- Granting a new proxy, relating to the same shares and bearing a date later than the date of the earlier proxy; or

4

- •

- Attending the Annual Meeting and voting in person. However, attendance at the Annual Meeting will not, by itself, revoke your proxy.

If your shares are held in the name of a broker, bank or other nominee, you may change your vote by submitting new voting instructions to your bank, broker or other record holder. You must contact your bank, broker or other record holder to find out how to do so.

Please note that if your shares are held of record by a broker, bank or other nominee, and you decide to attend and vote at the Annual Meeting, your vote in person at the Annual Meeting will not be effective unless you have obtained and present a proxy issued in your name from the record holder, your broker.

Written notices of revocation of proxies should be addressed to:

Southwest Water Company

c/o Secretary

One Wilshire Building

624 South Grand Avenue, Suite 2900

Los Angeles, CA 90017

- Q:

- How are votes cast?

- A:

- In the election of Directors, you may vote "FOR" all of the nominees or your vote may be "WITHHELD" with respect to one or more of the nominees. For all other proposals, you may vote "FOR," "AGAINST" or "ABSTAIN" on each such proposal. If you "ABSTAIN" it has the same effect as a vote "AGAINST." If you sign your proxy card or broker voting instruction card with no further instructions, your shares will be voted in accordance with the recommendations of the Board.

- Q:

- What is the voting requirement to approve each of the proposals?

- A:

- For Proposal One, the three nominees receiving the highest number of affirmative votes of the outstanding shares of the Company's securities, present or represented by proxy and entitled to vote, shall be elected as Directors to serve until their successors have been elected and qualified. The election of Directors is a matter on which a broker or other nominee is generally empowered to vote, and therefore, no broker non-votes will likely exist in connection with Proposal One.

Approval of Proposal Two requires an affirmative vote of a majority of the outstanding shares of the Company's securities entitled to vote on the Item. Approval of Proposal Three requires an affirmative vote of a majority of the outstanding shares of the Company's securities, present or represented by proxy and voting on the proposal. If you are a beneficial owner and do not provide the stockholder of record with voting instructions, your shares may constitute broker non-votes, as described in "What is the quorum requirement for the Annual Meeting." Brokers are authorized to vote on Proposal Two; thus, broker non-votes likely will not have any effect on Proposal Two. Brokers, however, are not authorized to vote on Proposal Three. Thus, broker non-votes may result, but since they are not considered a vote on the proposal they will not have any effect on the outcome of Proposal Three. Abstentions will count as a vote against Proposal Two, but will have no effect on Proposal Three.

- Q:

- What does it mean if I receive more than one proxy or voting instruction card?

- A:

- It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive.

- Q:

- Who will serve as inspector of election?

- A:

- The inspector of election will be a representative of Mellon Investor Services, LLC.

5

- Q:

- What documents are incorporated by reference?

- A:

- The Report of the Compensation Committee of the Board on Executive Compensation, the Audit Committee Report (including reference to the independence of the Audit Committee members) and the Stock Price Performance Graph, are not deemed filed with the SEC and shall not be deemed incorporated by reference into any prior or future filings made by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates such information by reference.

- Q:

- Where can I find the voting results of the Annual Meeting?

- A:

- Southwest Water intends to announce preliminary voting results at the Annual Meeting and publish final results in our quarterly report on Form 10-Q for the second quarter of fiscal 2004.

6

PROPOSAL 1 – ELECTION OF DIRECTORS

General

The Company's Board is currently divided into three classes serving staggered three-year terms. Directors for each class are elected at the Annual Meeting held in the year in which the term for their class expires.

Our Board currently has eight Directors. The terms for three Directors will expire at this 2004 Annual Meeting. Votes cannot be cast and proxies cannot be voted other than for the three nominees named below. Directors elected at the 2004 Annual Meeting will hold office for a three-year term expiring at the Annual Meeting in 2007. All of the nominees are currently Directors of the Company. There are no family relationships among the Company's executive officers and Directors. There are no legal proceedings that involve any Director requiring disclosure pursuant to the SEC instructions to this item.

The Class III Directors nominated for election by the Board at the 2004 Annual Meeting are H. Frederick Christie, Anton C. Garnier and Peter J. Moerbeek. Beginning on the next page, the principal occupation and certain other information are set forth regarding the nominees. See page 9 for the Directors whose terms of office will continue after the Annual Meeting. Information about the beneficial ownership of the nominees and other Directors can be found on page 16.

Information on Nominees and Continuing Directors

The following table provides information on the people who serve as Directors as of March 18, 2004:

Name

| | Age

| | Position

| | Term Expires

|

|---|

| Anton C. Garnier | | 63 | | Chairman and CEO | | 2004 |

| Peter J. Moerbeek | | 56 | | President and COO | | 2004 |

| H. Frederick Christie | | 70 | | Director | | 2004 |

| James C. Castle, Ph.D | | 67 | | Director | | 2005 |

| Maureen A. Kindel | | 66 | | Director | | 2005 |

| Linda Griego | | 55 | | Director | | 2006 |

| Donovan D. Huennekens | | 67 | | Director | | 2006 |

| Richard G. Newman | | 69 | | Director | | 2006 |

7

Nominees for Directors Standing for Election in 2004 (Class III)

H. Frederick Christie

Age 70 | | Mr. Christie is an independent consultant. He retired in 1990 as president and chief executive officer of the Mission Group, a subsidiary of SCEcorp (now Edison International), which oversaw SCEcorp's non-utility businesses. From 1984 to 1987, he served as president of Southern California Edison Company, a subsidiary of SCEcorp. Mr. Christie is a director of Valero L.P., IHOP Corporation and Ducommun Incorporated and also serves on the boards of 19 mutual funds managed by the Capital Research and Management Company. Mr. Christie was first elected a Director in 1996. |

Anton C. Garnier

Age 63 |

|

Mr. Garnier has served as chief executive officer of the Company since 1968. He was first elected a Director in 1968. Mr. Garnier has served as our Chairman of the Board since 1996. |

Peter J. Moerbeek

Age 56 |

|

Mr. Moerbeek was appointed the Company's president and chief operating officer in February 2004. He joined the Company in 1995 as chief financial officer and secretary. He has been the president of the Company's non-regulated business since 2002. Mr. Moerbeek was first elected a Director in April 2001. |

Southwest Water's Board recommends a vote FOR the election to the Board

of each of the foregoing nominees.

8

The Company's Directors whose terms are not expiring this year will continue in office for the remainder of their terms or earlier in accordance with the Company's bylaws. Information regarding their business experience follows:

Directors Whose Terms Will Expire in 2005 (Class I)

James C. Castle, Ph.D

Age 67 | | Mr. Castle is president and chief executive officer of Castle Information Technologies, LLC, an information technology consulting firm. He serves on the boards of PMI Group, Inc. and ADC Telecommunications Inc. Mr. Castle was first elected a Director in 2002. |

Maureen A. Kindel

Age 66 |

|

Ms. Kindel is president of Rose & Kindel, a public affairs firm. Ms. Kindel is past president of the City of Los Angeles Board of Public Works, a founding and current member of each of the Pacific Counsel on International Policy, the Board of Governors of Town Hall of Los Angeles and the Los Angeles Amateur Athletic Foundation. She is also a regent of Loyola Marymount University and on the board of directors of the Los Angeles Chamber of Commerce. Ms. Kindel was first elected a Director in 1997. |

Directors Whose Terms Will Expire in 2006 (Class II)

Linda Griego

Age 55 | | Ms. Griego is the founder and managing general partner of the Engine Company No. 28, a Los Angeles restaurant, president and chief executive officer of Griego Enterprises Inc., a management company, and president, a developer and producer of Zapgo Entertainment Group, television programming aimed at the young Latino market. She serves on the boards of Blockbuster, Inc. and Granite Construction, Inc. and the advisory board of U.S. Bank. She is also a director of the Federal Reserve Bank of San Francisco and a trustee of the Robert Wood Johnson Foundation. Ms. Griego was first elected a Director in 2001. |

Donovan D. Huennekens

Age 67 |

|

Mr. Huennekens is a partner of HQT Homes, a real estate development company, and a director of Bixby Ranch Company. Mr. Huennekens was first elected a Director in 1969. |

Richard G. Newman

Age 69 |

|

Mr. Newman is chairman, chief executive officer and a director of AECOM Technology Corporation, the parent of several subsidiaries that provide engineering and diversified technical professional services internationally. Mr. Newman is a director of Sempra Energy Company. He also serves on the boards of 13 mutual funds managed by the Capital Research and Management Company. Mr. Newman was first elected a Director in 1991. |

Board and Committee Independence

The Board has determined that each of the current Directors, except the chairman of the board and chief executive officer (Mr. Garnier) and the president and chief operating officer (Mr. Moerbeek), has no material relationship with Southwest Water (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company) and is "independent" within the meaning of the NASDAQ Stock Market, Inc. ("NASDAQ") director independence standards, as currently in effect. Furthermore, the Board has determined that each of the members of the Audit, Compensation, and Nominating and Governance Committees has no material relationship with Southwest Water (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company) and is "independent" within the meaning of NASDAQ's director independence standards.

9

COMMITTEES OF THE BOARD OF DIRECTORS

Board Structure and Committee Membership

As of the date of this Proxy Statement, our Board has eight Directors and the following four standing committees ("Committee" or "Committees"): (1) Audit, (2) Financial Planning and Investment, (3) Compensation and (4) Nominating and Governance. The membership during the last fiscal year and the function of each of the Committees are described below. Each of the Committees operates under a written charter adopted by the Board. The Committee charters are available on Southwest Water's website atwww.swwc.com. During fiscal 2003, the Board held 11 meetings. Each Director attended at least 75% of all Board and applicable Committee meetings. Directors are encouraged to attend Annual Meetings of Southwest Water's stockholders. All Directors attended the 2003 Annual Meeting of Stockholders.

Name of Director

| | Audit

| | Financial

Planning &

Investment

| | Compensation

| | Nominating

and

Governance

|

|---|

| Non-Employee Directors: | | | | | | | | |

| James C. Castle, Ph.D | | X | | X | | | | |

| H. Frederick Christie | | X | | X | | X* | | X |

| Linda Griego | | | | | | X | | X |

| Donovan D. Huennekens | | X* | | | | X | | |

| Maureen A. Kindel | | X | | | | | | X* |

| Richard G. Newman | | | | X* | | X | | X |

| Employee Directors: | | | | | | | | |

| Anton C. Garnier | | | | X | | | | |

| Peter J. Moerbeek | | | | X | | | | |

| | | | | | | | | |

| Number of Meetings in Fiscal 2003 | | 11 | | 5 | | 5 | | 2 |

X = Committee member; * = Chair

Audit Committee

The Company has an Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee is charged with assisting the Board in monitoring the integrity of the Company's internal controls and financial reporting process, monitoring the independence and performance of the Company's external independent auditors, assuring compliance with legal and regulatory requirements and reviewing areas of significant financial risk to the Company. The Audit Committee prepares an Audit Committee report and annually reviews the Audit Committee charter and the Committee's performance. The Audit Committee appoints, evaluates and determines the compensation of Southwest Water's independent auditors; reviews and approves the scope of the annual audit, the audit fees and the financial statements; grants advance approval of any non-audit services provided by the independent auditors; sets policies with respect to financial information and earnings guidance; and oversees investigations into complaints concerning financial matters.

The report of the Audit Committee is included on page 27. The charter of the Audit Committee is available atwww.swwc.com and is also included as Appendix A to this Proxy Statement.

Audit Committee Financial Expert

The Board has determined that at least one member of the Audit Committee, Donovan D. Huennekens, qualifies as the "Audit Committee Financial Expert" under the guidelines promulgated by the SEC. The Board has also determined that each of the Audit Committee members satisfies the SEC rules regarding independence.

10

Financial Planning and Investment Committee

The Financial Planning and Investment Committee assists the Board in overseeing the Company's long-term strategic planning, new business development, acquisitions and mergers and overall investment policy. The Committee reviews and analyzes significant financial matters, such as assisting in the evaluation of proposed merger and acquisition transactions and other financial investment activities. It also reviews Southwest Water's capitalization, including credit management, risk concentration and return on invested capital. The Committee reviews and evaluates annually its performance and its charter.

The charter of the Financial Planning and Investment Committee is available atwww.swwc.com.

Compensation Committee

The Compensation Committee assists the Board in reviewing the performance and approving the compensation of Southwest Water's executives and the Committee produces a report on executive compensation. The Committee provides general oversight of Southwest Water's equity compensation plans and benefits programs. The Committee reviews and evaluates annually its performance and its charter.

The report of the Compensation Committee is included beginning on page 19. The charter of the Compensation Committee is available atwww.swwc.com.

Nominating and Governance Committee

The Nominating and Governance Committee identifies individuals qualified to become Board members; recommends Director candidates to the Board for election and re-election; and develops and recommends corporate governance principles, including giving proper attention and making effective responses to stockholder concerns regarding corporate governance. Please refer to our section on "Corporate Governance Principles and Board Matters" for more information on the Company's governance policies. The Committee reviews and evaluates annually its performance and its charter.

The charter of the Nominating and Governance Committee is available atwww.swwc.com.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is composed of Messrs. Christie, Huennekens, Newman and Ms. Griego. No member of the Company's Compensation Committee is a current or a former officer or employee of the Company or any of its subsidiaries. No executive officer of the Company serves on the Board or Compensation Committee of any entity that has one or more executive officers serving as members of the Company's Board or Compensation Committee.

11

DIRECTOR COMPENSATION AND STOCK OWNERSHIP

The following table provides information on Southwest Water's compensation practices during fiscal 2003 for Non-Employee Directors, as well as the range of compensation paid to Non-Employee Directors who served during 2003. Mr. Garnier and Mr. Moerbeek did not receive any separate compensation for their Board activities.

In May 2003, based upon the recommendation of the Compensation Committee and based on competitive data, the Board adopted changes to the Non-Employee Director cash compensation effective May 18, 2003, on a pro-rated basis through the end of the year, as follows:

NON-EMPLOYEE DIRECTOR COMPENSATION

FOR 2003

| Annual retainer(1) | | $ | 14,250 | (1) |

Annual Stock Option Award(2) |

|

|

5,000 |

(2) |

Additional retainer for Chair of any Committee |

|

$ |

3,000 |

(3) |

| | |

| |

Total combined value of compensation and equity(3) |

|

$ |

45,445 |

(4) |

| | |

| |

- (1)

- Non-Employee Directors continue to receive a fee of $1,000 for attending each Board meeting, Committee meeting and long-range planning meeting. The total combined value shown above does not reflect any per-meeting fees. The annual retainer increased from $12,000 to $15,000 effective May 18, 2003. The annual retainer amount in the table above reflects the actual retainer paid to each Non-Employee Director during 2003.

- (2)

- Non-Employee Directors receive an initial option grant of 5,000 shares of the Company's common stock upon becoming a Director. In addition, at each subsequent Annual Meeting each Director receives an automatic award of options for 5,000 shares. Exercise prices for all options granted equal the last sales price on NASDAQ on the trading day preceding the date of grant.

- (3)

- The chair of each Committee receives as of May 2003 an annual retainer of $3,000, except the chair of the Audit Committee, who receives an annual retainer of $3,600.

- (4)

- This aggregate dollar amount (i) assumes the annual retainer received by Non-Employee Directors for 2003 ($14,250); (ii) includes additional retainers to be paid for serving as chairperson for each of the committees ($3,000); (iii) includes attending a combination of ten Board meetings and Committee meetings ($10,000); and (iv) includes the grant to each Non-Employee Director of shares of Southwest Water common stock having a fair market value of $18,195 on the date of the grant (equal to 30 percent value of the share price of $12.13 on May 6, 2003 based on estimated Black-Sholes formula calculations).

12

Non-Employee Director Stock Options Granted in 2003

The following table sets forth information regarding stock option grants made to Non-Employee Directors during the year ended December 31, 2003.

Eligible Directors

| | Options

(#)(1)(2)

| | Exercise

Base Price

($/sh.)

| | Expiration

Date

|

|---|

| James C. Castle, Ph.D | | 6,667 | | 9.09 | | 5/9/10 |

| H. Frederick Christie | | 6,667 | | 9.09 | | 5/9/10 |

| Linda Griego | | 6,667 | | 9.09 | | 5/9/10 |

| Donovan D. Huennekens | | 6,667 | | 9.09 | | 5/9/10 |

| Maureen A. Kindel | | 6,667 | | 9.09 | | 5/9/10 |

| Richard G. Newman | | 6,667 | | 9.09 | | 5/9/10 |

- (1)

- Options vest 50% each year for two years.

- (2)

- All options and option exercise prices reflect a 4 for 3 stock dividend on January 1, 2004, which resulted in an adjustment to all outstanding options.

Non-Employee Director Option Exercises in 2003 and Year-End Option Values

The following table sets forth for each Non-Employee Director certain information about stock options exercised during the year ended December 31, 2003, and unexercised stock options held at the end of the 2003 fiscal year.

Non-Employee Director Name

| | Shares

Acquired

on

Exercise

(#)(1)

| | Value

Realized

($)

| | Number of

Unexercised Options

at December 31, 2003

Exercisable/Unexercisable

| | Value of Unexercised In

the-Money Options at

December 31, 2003

Exercisable/Unexercisable

($)(2)

|

|---|

| James C. Castle, Ph.D | | 0 | | 0 | | 6,998 / 13,669 | | 8,687 / 27,893 |

| H. Frederick Christie | | 0 | | 0 | | 33,046 / 10,168 | | 167,847 / 20,246 |

| Linda Griego | | 0 | | 0 | | 10,499 / 10,168 | | 13,685 / 20,246 |

| Donovan D. Huennekens | | 0 | | 0 | | 33,046 / 10,168 | | 167,847 / 20,246 |

| Maureen A. Kindel | | 0 | | 0 | | 30,291 / 10,168 | | 144,007 / 20,246 |

| Richard G. Newman | | 0 | | 0 | | 33,046 / 10,168 | | 167,847 / 20,246 |

- (1)

- Shares shown reflect adjustment to give effect to a 4 for 3 stock dividend on January 1, 2004.

- (2)

- Difference between fair market value at fiscal year-end of $11.97 per option and option exercise price.

At December 31, 2003, the Non-Employee Director group had a total of 211,435 stock options outstanding with a weighted average exercise price of $7.97 per share. The stock options shown in the above table include stock options granted under the current Amended Stock Option Plan for Non-Employee Directors and those granted previously under the Company's Second Amended and Restated Stock Option Plan.

13

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

Statement of Corporate Governance

Southwest Water is committed to having sound corporate governance principles. Our Board believes that the purpose of corporate governance is to ensure we maximize stockholder value in a manner consistent with the legal requirements and the highest standards of integrity. The Board has adopted and adheres to corporate governance practices which the Board and senior management believe promotes this purpose. We continually review these governance practices, Delaware law (the state in which we are incorporated), the rules and listing standards of NASDAQ and SEC regulations, as well as best practices suggested by recognized governance authorities.

Southwest Water maintains a corporate governance page on its website, which includes key information about its corporate governance initiatives, including Southwest Water's Corporate Governance Guidelines, and charters for each of the Committees of the Board. The corporate governance page of the Company can be found atwww.swwc.com, by clicking on "Investor Relations" and "Corporate Governance."

Code of Ethical Conduct

Our website,www.swwc.com, contains our Code of Ethical Conduct for all employees and our Code of Ethics for Directors and Executive Officers. The Code of Ethics for Directors and Executive Officers is intended to comply with the requirements of the Sarbanes Oxley Act of 2002 and applies to our Directors and to executive officers, including our chief executive officer, senior financial officers and other executive officers. We will provide without charge to any person, on the written or oral request, a copy of our Code of Ethics. Requests should be directed to the Director of Corporate Communications, Southwest Water Company, One Wilshire Building, 624 South Grand Avenue, Suite 2900, Los Angeles, California 90017. Waivers from, and amendments to, the Code of Ethics for Directors and Executive Officers that apply to our chief executive officer, chief financial officer or persons performing similar functions will be posted on our website atwww.swwc.com within (5) days following the date of the waiver or amendment.

Director Qualifications

Southwest Water's Corporate Governance Guidelines contain Board membership criteria that apply to nominees for a position on Southwest Water's Board. Under these criteria, members of the Board must have professional and personal ethics and values, consistent with longstanding Southwest Water values and standards. They should have broad experience at the policy-making level in business, government, education, technology or public interest. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all Director duties. Each Director must represent the interests of all stockholders.

Identifying and Evaluating Nominees for Directors

The Nominating and Governance Committee uses a variety of methods to identify and evaluate nominees for Director, including materials provided by professional search firms or other parties. In the event that Board vacancies are anticipated, or otherwise arise, the Nominating and Governance Committee considers various potential candidates for Director. Candidates may come to the attention of the Nominating and Governance Committee through current Board members, professional search firms, stockholders or other persons.

The Board shall nominate the Director candidates it deems most qualified for election by the stockholders. In accordance with the bylaws of the Company, the Board will be responsible for filling

14

vacancies or newly created directorships on the Board that may occur between annual meetings of stockholders. The Nominating and Governance Committee is also responsible for identifying, screening and recommending candidates to the entire Board for membership. These candidates are evaluated at meetings of the Nominating and Governance Committee, and may be considered at anytime during the year. In evaluating such nominations, the Nominating and Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board.

Stockholder Nominations

Stockholders may recommend Director nominees for consideration by the Nominating and Governance Committee by writing to the Corporate Secretary at least 120 days before the Annual Meeting specifying the nominee's name and qualifications for Board membership. Following verification of the stockholder status of the person submitting the recommendation and review of minimum qualifying standards, all properly submitted recommendations are brought to the attention of the Nominating and Governance Committee at the next Committee meeting. Candidates recommended by a stockholder will be evaluated in the same manner as any candidate identified by the Nominating and Governance Committee.

Independent Director Sessions

Independent Director sessions of Non-Employee Directors are held at least four times a year. The sessions are scheduled and chaired by an independent Director selected by the Board from time to time. Any Director can request an additional independent Director session be scheduled.

Communication to the Board

Stockholders and other interested parties may communicate with the Board by writing to Secretary, Southwest Water Company, One Wilshire Building, 624 South Grand Avenue, Suite 2900, Los Angeles, California 90017. The Secretary will forward all communications to the full Board or the appropriate committee with a copy to the Chairperson of the Nominating and Governance Committee.

15

BENEFICIAL OWNERSHIP OF COMMON STOCK

Management and Directors

The following table sets forth information concerning the beneficial ownership of our common stock as of March 18, 2004 for: (i) each Director and nominee for Director of the Company, (ii) the person who in fiscal 2003 was the chief executive officer of the Company, (iii) the four other most highly compensated executive officers named in the Summary Compensation Table on page 21, and (iv) the Directors and executive officers as a group. Except as otherwise noted, the named individual or their family members have sole voting and investment power with respect to such securities.

Name of Beneficial Owner

| | Number of

Shares

Beneficially

Owned

| | Exercisable

Options

Beneficially

Owned(a)

| | Total Number of Shares and

Exercisable Options

Beneficially Owned

| | Percentage

of Class(b)

| |

|---|

| (i) | | | | | | | | | |

| James C. Castle, Ph.D | | 2,800 | (c) | 17,333 | | 20,133 | | * | |

| H. Frederick Christie | | 18,230 | | 44,652 | | 62,882 | | * | |

| Linda Griego | | 0 | | 17,333 | | 17,333 | | * | |

| Donovan D. Huennekens | | 73,853 | (d) | 39,880 | | 113,733 | | * | |

| Maureen A. Kindel | | 6,596 | | 37,125 | | 43,721 | | * | |

| Richard G. Newman | | 38,946 | (e) | 50,108 | | 89,054 | | * | |

| (ii) | | | | | | | | | |

| Anton C. Garnier | | 309,503 | (f) | 469,844 | | 779,347 | | 5.10 | % |

| (iii) | | | | | | | | | |

| Peter J. Moerbeek | | 28,742 | (g) | 409,760 | | 438,498 | | 2.88 | % |

| Richard J. Shields | | 1,400 | | 13,732 | | 15,132 | | * | |

| Michael O. Quinn | | 26,249 | (h) | 23,926 | | 50,175 | | * | |

| Robert W. Monette | | 31,500 | | 25,230 | | 56,730 | | * | |

| (iv) | | | | | | | | | |

| All Directors and Executive Officers as a Group (11) | | 537,819 | | 1,148,923 | | 1,686,738 | | 10.57 | % |

*Indicates less than one percent of class of stock.

- (a)

- Includes options that become exercisable on or before May 18, 2004.

- (b)

- Based on 14,804,393 shares of common stock outstanding. Due to the voting rights of the outstanding shares of Series A preferred stock, 14,851,031 votes may be cast at the meeting. Since the holders of the preferred stock are entitled to cast only approximately 46,600 votes, the "percentage of class" shown in the table is substantially similar to the percentage of voting power held.

- (c)

- Mr. and Mrs. Castle hold all 2,800 shares of common stock as trustees of a revocable trust for their benefit. Mr. Castle is a trustee of the trust and has shared voting and investment power with respect to the shares.

- (d)

- Mr. and Mrs. Huennekens hold all 73,853 shares of common stock as trustees of a revocable trust for their benefit. Mr. Huennekens is a trustee of the trust and has shared voting and investment power with respect to the shares.

- (e)

- Mr. and Mrs. Newman hold all 38,946 shares of common stock as trustees of a revocable trust for their benefit. Mr. Newman is a trustee of the trust and has shared voting and investment power with respect to the shares.

- (f)

- Included in the table are 287,454 common shares owned by Mr. and Mrs. Garnier as trustees of a revocable trust for their benefit. Mr. Garnier is a trustee of the trust and has shared voting and investment power with respect to the shares. Also included in the table are 22,049 common shares representing Mr. Garnier's interest in a corporation of which Mr. Garnier is a director and a stockholder. Mr. Garnier has sole voting and investment power with respect to these shares.

- (g)

- Mr. and Mrs. Moerbeek hold all 28,742 shares of common stock as trustees of a revocable trust for their benefit. Mr. Moerbeek is a trustee of the trust and has shared voting and investment power with respect to the shares.

- (h)

- Mr. and Mrs. Quinn hold all 26,249 shares of common stock as trustees of a revocable trust for their benefit. Mr. Quinn is a trustee of the trust and has shared voting and investment power with respect to the shares.

16

Significant Stockholders

The following table identifies significant stockholders who own more than five percent of any class or series of the Company's outstanding voting securities as of March 18, 2004:

Class of Stock

| | Name and Address

of Beneficial Owner

| | Number of Shares

Beneficially

Owned

| | Percentage

of Class(1)

|

|---|

| Common Stock | | T. Rowe Price Associates, Inc.

100 E. Pratt Street

Baltimore, MD 21202 | | 1,017,400(1) | | 6.87% |

Common Stock |

|

T. Rowe Price Small-Cap Value Fund, Inc.

100 E. Pratt Street

Baltimore, MD 21202 |

|

868,400(2) |

|

5.87% |

- (1)

- Based on 14,804,393 shares of common stock outstanding. Due to the voting rights of the outstanding shares of Series A preferred stock, 14,851,031 votes may be cast at the meeting. Since the holders of the preferred stock are entitled to cast only approximately 46,600 votes, the "percentage of class" shown in the table is substantially similar to the percentage of voting power held. Based on a Schedule 13G filed with the SEC on February 10, 2004. These securities are owned by various individual and institutional investors for whom T. Rowe Price Associates, Inc. serves as an investment adviser. T. Rowe Price Associates, Inc. has sole voting power over 149,000 shares and sole dispositive power over 1,017,400 shares. For purposes of reporting requirements of the Securities Exchange Act of 1934, T. Rowe Price Associates, Inc. is deemed to be a beneficial owner of such securities; however, T. Rowe Price Associates, Inc. expressly disclaims that it is, in fact, the beneficial owner of such securities.

- (2)

- Based on a Schedule 13G filed with the SEC on February 10, 2004. T. Rowe Price Small-Cap Value Fund, Inc. has sole voting power over 868,400 shares.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires Directors and certain officers of Southwest Water, as well as persons who own more than 10 percent of Southwest Water's common stock, to file with the SEC initial reports of beneficial ownership (Form 3) and reports of subsequent changes in their beneficial ownership (Form 4 or Form 5) of the Company's common stock. The SEC has established specific due dates for these reports, and Southwest Water is required to disclose in this Proxy Statement any late filings or failures to file.

Southwest Water believes that its Directors, reporting officers and greater-than-10-percent stockholders complied with all these filing requirements for the year ended December 31, 2003, except (i) Donovan D. Huennekens, who filed a Form 4 reporting the following two transactions in Southwest Water's common stock that were inadvertently not timely reported: his acquisition of 218 shares on October 17, 2003 and his acquisition of 203 shares on October 17, 2003, through the Dividend Reinvestment Program, and (ii) Michael O. Quinn, who filed an amended Form 4 reporting the following two transactions in Southwest Water's common stock that were inadvertently not timely reported: his option exercise and sale of 2,000 shares on September 17, 2003, and his option exercise and sale of 11,237 shares on September 18, 2003.

17

PERFORMANCE GRAPH

The following graph compares the cumulative total return to holders of the Company's common stock during the five most recent fiscal years versus the cumulative total return during the same period achieved by 11 publicly held water utilities listed in the A.G. Edwards Water Utility Index and that achieved by the Standard & Poor's 500 Stock Index on December 31st of each year. The comparison assumes an initial investment of $100 made on December 31, 1998 in each of the Company's common stock, the A.G. Edwards Water Utility Index and the Standard & Poor's 500 Stock Index. The cumulative total returns assume the reinvestment of all dividends. The historical stock performance reflected in the graph is not necessarily indicative of future stock performance.

COMPARISON OF CUMULATIVE FIVE YEAR TOTAL RETURN

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

|

|---|

| Southwest Water Company (SWWC) | | $ | 100.00 | | $ | 146.65 | | $ | 148.39 | | $ | 187.91 | | $ | 187.93 | | $ | 230.21 |

| AG Edwards Water Utility Index | | $ | 100.00 | | $ | 135.75 | | $ | 129.56 | | $ | 156.39 | | $ | 154.24 | | $ | 186.78 |

| S&P 500 Composite Index | | $ | 100.00 | | $ | 121.04 | | $ | 110.02 | | $ | 96.95 | | $ | 75.54 | | $ | 97.19 |

Source: A.G. Edwards & Sons, Inc.

18

EXECUTIVE COMPENSATION

Report of the Compensation Committee

Executive Officer Compensation Philosophy

The compensation philosophy for executive officers is to ensure that compensation is directly linked to continuous improvements in the Company's financial performance and stockholder value. To implement this philosophy, the Committee is guided by the following objectives: (1) enable the Company to attract and retain highly qualified executives, (2) focus executives' efforts on the fulfillment of Company annual and long-term business objectives and strategies, and (3) ensure that a portion of executive compensation is tied to specific performance measures. The Committee has retained outside consultants and executive compensation specialists in evaluating and modifying the current executive compensation plan.

Executive Compensation

In determining the base salary levels of executives, including the chief executive officer, the Committee considers individual performance, the performance of the operations directed by the executive, and the competitive salary levels of executives in companies of similar size and complexity. Competitive salary information, obtained primarily through published compensation surveys, is used to determine the reasonableness of total compensation, which includes base salary and incentive compensation. For executives other than the chief executive officer, the Compensation Committee also considers the recommendations of the Chief Executive Officer.

Annual Incentive Compensation

The Committee believes that the Company's short-term objectives are enhanced with annual performance-based incentive compensation for its executives. Annual incentive awards are based on the attainment of meeting certain financial objectives for the Company and on an executive's achievement of goals in his or her area of functional responsibility. Executive performance objectives include both quantitative and qualitative criteria. As an executive's level of responsibility increases, a greater portion of potential total cash compensation is at risk in the form of annual performance-based incentives.

The Compensation Committee establishes financial goals and performance-based measures at the beginning of each year. Awards are made at the end of the year based on actual performance. Each year, the Committee establishes performance objectives. No awards are made if performance objectives are not attained. In 2003, in those areas where the actual results for the year met or exceeded the objectives set by the Committee, incentive compensation awards were approved for the Company's executives.

Long-term Incentive Compensation

The primary purpose of long-term incentives is to encourage and facilitate long-term Company performance by greater personal stock ownership by the executive officers and thus strengthen both their personal commitments to the Company and a longer-term perspective in their managerial responsibilities. This component of an executive officer's compensation directly links the officer's interests with the Company's long-term goals and with the interests of the Company's other stockholders. Currently, the primary form of long-term incentive compensation is non-qualified stock options. The Compensation Committee approves stock options for all executives and managers.

In determining the number of stock options awarded, the Compensation Committee considers a number of factors including the executive's pay level, responsibilities in the organization, and ability to significantly improve future financial results. In addition, the Compensation Committee compares the Company's option grant levels with similar industry practices.

19

Chief Executive Officer Compensation

Anton C. Garnier has been chief executive officer of the Company since November 1968, and has been Chairman of the Board since August 1996. The Committee reviewed Mr. Garnier's 2003 performance based on the performance of the Company as a whole and his performance with respect to quantitative and qualitative objectives approved at the start of the year by the Committee. The Committee carefully considered the Company's continuing improvements in short-term and long-term financial results, including earnings improvement, new business development, management development, return on equity and the creation of stockholder value. The Committee also evaluated Mr. Garnier's progress in attaining qualitative objectives in such areas such as investor relations, planning for the Company's long-term future, setting strategic objectives, and employee involvement and communications. The Committee did not use specific weighting factors with respect to quantitative and qualitative performance measures.

In evaluating Mr. Garnier's performance for 2003, the Committee gave particular emphasis to the Company's consistent earnings while continuing to provide attractive shareholder returns during a challenging year, as well as positioning the Company for the future. After the Committee's deliberations, the Committee increased Mr. Garnier's annual salary from $350,000 to $367,500, effective January 1, 2004, and awarded him an incentive compensation amount of $198,750 for 2003. In addition, on February 11, 2004, the Committee awarded Mr. Garnier a stock option grant of 75,000 shares of the Company's common stock in recognition of the Company's long-term performance.

Compensation Committee

H. Frederick Christie (Chair)

Linda Griego

Donovan D. Huennekens

Richard G. Newman

February 11, 2004

20

Summary Compensation Table

The following table sets forth the compensation awarded to, earned by or paid to Southwest Water's chief executive officer and its four other most highly compensated executive officers for services rendered in all capacities during the year ended December 31, 2003, and each of the previous two years if such individual was an executive officer.

| |

| | Annual Compensation

| | Long-Term

Compensation

|

|---|

Name and Principal Position in 2003

| | Year

| | Salary

($)

| | Bonus

($)

| | Stock

Options

(#)

|

|---|

Anton C. Garnier

Chairman, Chief Executive Officer and President | | 2003

2002

2001 | | 350,000

320,000

290,000 | | 198,750

180,000

160,000 | | 66,667

57,750

62,017 |

Peter J. Moerbeek

Executive Vice President and Secretary |

|

2003

2002

2001 |

|

251,500

235,400

210,000 |

|

150,000

100,000

54,600 |

|

53,333

46,200

47,408 |

Richard J. Shields(1)

Chief Financial Officer |

|

2003

2002

2001 |

|

190,000

30,692

– |

|

71,250

30,000

– |

|

42,000

31,500

– |

Michael O. Quinn

President, Southwest Water Utility Group President, Suburban Water Systems |

|

2003

2002

2001 |

|

197,600

184,500

170,498 |

|

120,000

51,425

44,465 |

|

13,333

7,000

7,351 |

Robert W. Monette(2)

Vice President of the Company President,

Operations Technologies, Inc. |

|

2003

2002

2001 |

|

200,000

200,000

66,667 |

|

120,000

13,000

35,000 |

|

10,667

21,000

36,751 |

- (1)

- Mr. Shields joined the Company in October 2002.

- (2)

- Mr. Monette joined the Company in September 2001.

Executive Officers' Change of Control Compensation Agreements

In 1998, Messrs. Garnier and Moerbeek entered into change of control compensation agreements with the Company, and in 2001 and 2002, Messrs. Monette and Shields, respectively, entered into similar change of control agreements. The Company has agreed to provide benefits and payments to Messrs. Garnier, Moerbeek, Monette and Shields based on 2.99 times their respective average five-year compensation if certain conditions are met.

In 1995, Mr. Quinn entered into a change of control compensation agreement with the Company. Under this agreement, the Company has agreed to provide severance benefits and payments to Mr. Quinn based on 1.5 times his average five-year compensation if certain conditions are met.

For the purpose of these agreements, a "change in control" is generally defined as a change in the person or persons owning, directly or indirectly, sufficient voting stock to elect the Board for the entity that employs an executive. These compensation agreements are in addition to the plans described under the heading "Supplemental Executive Retirement Plan."

The agreements for Messrs. Garnier, Moerbeek, Monette, Shields and Quinn will be triggered if there is a change of control and either of the following conditions is met: (1) termination of the executive's employment by his employer prior to the second anniversary of a change in control, other than termination by retirement or for death, disability or cause; or (2) termination of executive's employment by the

21

executive within two years after a change in control for "good reason" (including assignment of executive to duties inconsistent with executive's position, duties, responsibilities and status prior to the change in control or, alternatively, a reduction in salary, a significant reduction in benefits, an elimination of stock plans or a relocation of employment greater than 50 miles). Under these agreements, cash severance payments are based upon base salary, auto benefits, bonuses and certain life insurance premium amounts paid by the employer. Cash severance payments are payable within five days after termination of employment. Cash severance amounts as of December 31, 2003, assuming termination met the requirements for a severance payment are as follows: Mr. Garnier – $1,460,481; Mr. Moerbeek—$1,037,022; Mr. Monette – $632,551, Mr. Shields – $535,647 and Mr. Quinn – $351,816. In addition to the cash payment, each executive is entitled to certain health insurance benefits with a value of approximately $25,000, and outplacement services with a maximum benefit of $15,000 each for Messrs. Garnier, Moerbeek, Monette and Shields, and $4,000 for Mr. Quinn. These payments and benefits are subject to certain Internal Revenue Service limitations and may be reduced if these limitations are met.

22

Option Grants to Named Executive Officers in 2003

The following table sets forth information regarding stock option grants under Southwest Water's Stock Option Plan during the fiscal year ended December 31, 2003, to the named executive officers. The amounts shown for each named executive officer as potential realizable values are based entirely on assumed annualized rates of stock price appreciation of 5% and 10% over the full term of the options. These assumed rates of growth were selected by the SEC for illustration purposes only and are not intended to predict future stock price, which will depend on overall performance and prospects. Consequently, there can be no assurance that the potential realizable values shown in this table will be achieved.

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for 7-Year Option Term

|

|---|

| | Individual Grants

| |

|

|---|

| |

| | % of Total

Options

Granted to

Employees

in Fiscal Year

2003

| |

| |

|

|---|

| |

| | Exercise

or

Base

Price

($/sh.)(2)

| |

|

|---|

Executive

| | Options

Granted

(#)(1)

| | Expiration

Date

| | At 5%

Annual

Growth

Rate($)(3)

| | At 10%

Annual

Growth

Rate($)(3)

|

|---|

| Anton C. Garnier | | 66,667 | | 19% | | 9.30 | | 4/01/10 | | 252,549 | | 588,601 |

| Peter J. Moerbeek | | 53,333 | | 15% | | 9.30 | | 4/01/10 | | 202,037 | | 470,876 |

| Richard J. Shields | | 26,667 | | 7% | | 9.30 | | 4/01/10 | | 101,020 | | 235,442 |

| Michael O. Quinn | | 5,250 | | 2% | | 9.30 | | 4/01/10 | | 50,508 | | 117,716 |

| Robert W. Monette | | 15,750 | | 5% | | 9.30 | | 4/01/10 | | 40,408 | | 94,128 |

- (1)

- Options vest 20% per year until fully vested. The options were granted for a term of seven years and one day, subject to earlier cancellation upon certain events related to termination of employment. The exercise price and tax withholding obligations related to exercise may be paid by delivery of already owned shares or by offsetting the underlying shares, subject to certain conditions.

- (2)

- All exercise prices represent fair market value on the date of grant and reflect a 4 for 3 stock dividend on January 1, 2004.

- (3)

- Potential realizable values are based on assumed annual rates of return specified by the SEC. Southwest Water's management has consistently cautioned stockholders and option holders that such increases in values are based on speculative assumptions and should not inflate expectations of the future value of their holdings.

23

Options Exercised in 2003 and Year-End Option Values

The following table shows information on exercised and unexercised stock options, value realized and the value of unexercised options during the Company's most recent fiscal year for the chief executive officer of the Company and the other named executive officers.

Executive

| | Shares

Acquired

on

Exercise

(#)

| | Value

Realized

($)(1)

| | Number of Unexercised

Options

at December 31, 2003

Exercisable/Unexercisable

(#)(3)

| | Value of Unexercised

In-the-Money Options

at December 31, 2003

Exercisable/Unexercisable

($)(2)(3)

|

|---|

| Anton C. Garnier | | 0 | | 0 | | 393,335 / 221,983 | | 2,786,374 / 744,005 |

| Peter J. Moerbeek | | 0 | | 0 | | 347,854 / 190,343 | | 2,424,555 / 637,007 |

| Richard J. Shields | | 0 | | 0 | | 8,399 / 60,268 | | 21,345 / 156,594 |

| Michael O. Quinn | | 17,649 | | 116,063 | | 15,357 / 27,481 | | 79,137 / 88,315 |

| Robert W. Monette | | 0 | | 0 | | 18,897 / 49,519 | | 58,125 / 138,622 |

- (1)

- The value realized is based upon the difference between the market price of the shares purchased on the exercise date and the exercise price times the number of shares covered by the exercised option.

- (2)

- The value of unexercised options is based upon the difference between the exercise price and the closing market price on December 31, 2003, which was $11.97 per share.

- (3)

- The number of stock options has been adjusted to give effect to the 4 for 3 stock dividend on January 1, 2004.

24

Equity Compensation Plan Information

The following table sets forth certain information as of December 31, 2003, with respect to compensation plans under which shares of Southwest Water's common stock may be issued. This table excludes the 25,000 additional shares of common stock that may be issued under Southwest Water's Non-Employee Director Plan if approved by the stockholders at the Annual Meeting.

| | (a)

| | (b)

| | (c)

|

|---|

Plan Category

| | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

available for future

issuance under equity

compensation plans

|

|---|

| Equity compensation plans approved by stockholders | | 2,360,452 | | $7.04 | | 1,995,290 |

Employee Stock Purchase Plan approved by stockholders |

|

N/A |

|

N/A |

|

870,249 |

Equity compensation plans not approved by stockholders |

|

N/A |

|

N/A |

|

N/A |

| |

Total: |

|

2,360,452 |

|

$7.04 |

|

2,865,539 |

25

Supplemental Executive Retirement Plan

The Southwest Water Company Supplemental Executive Retirement Plan (the "SERP") was adopted by Southwest Water Company effective May 8, 2000. Two executive officers of the Company have been selected by the Compensation Committee as participants in the SERP: Messrs. Garnier and Moerbeek. Under the SERP, in most cases, a vested participant with five to 10 years of service will be eligible for a yearly benefit for his or her lifetime beginning at age 65 equal to: the participant's average annual compensation multiplied by the applicable compensation percentage as defined by the SERP, less (1) the Social Security benefit for the most recent five years of employment and less (2) benefits received under the Company-sponsored Noncontributory Defined Benefit Pension Plan, which was terminated effective December 30, 1999.

The following table shows the estimated annual benefits that would be payable to participants in the SERP at age 65.

5-Year Average

Annual Compensation

$

| | Estimated Annual Benefit

for Years of Service

Indicated

$

|

|---|

| | 15 Years

| | 25 Years

| | 35 Years

|

|---|

| 200,000 | | 21,100 | | 15,200 | | 24,400 |

| 240,000 | | 33,100 | | 35,200 | | 52,400 |

| 280,000 | | 45,100 | | 55,200 | | 80,400 |

| 320,000 | | 57,100 | | 75,200 | | 108,400 |

The compensation used in determining final average compensation under the SERP is the participant's base salary and excludes bonuses and other forms of compensation.

On December 31, 2003, the base compensation for the participating officers was: Anton C. Garnier – $350,000 and Peter J. Moerbeek – $251,500. Their years of credited service were 34 and nine, respectively. The SERP is an unfunded plan. The Company, however, has invested in a corporate-owned life insurance policy to assist in funding the Company's obligations under the SERP.

26

AUDIT RELATED MATTERS

Report of the Audit Committee

The Audit Committee of the Board of Directors is composed of four independent directors, in compliance with the listing standards of the NASDAQ Stock Market and the SEC rules. The Audit Committee operates under a written charter adopted by the Board of Directors.

The Board of Directors has adopted a written charter setting forth the audit-related functions the Audit Committee is to perform. The Audit Committee reviewed this charter in March 2004. A copy of the charter is attached to this 2004 Proxy Statement.