QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Southwest Water Company |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Southwest Water Company

One Wilshire Building

624 South Grand Avenue, Suite 2900

Los Angeles, California 90017

www.swwc.com | | Anton C. Garnier

Chairman of the Board and

Chief Executive Officer |

Dear Southwest Water Stockholder:

We cordially invite you to attend the 2005 Annual Meeting of Stockholders of Southwest Water Company (NASDAQ: SWWC) to be held on Thursday, May 12, 2005, at 10 a.m. (Pacific Time) at the Omni Los Angeles Hotel located at 251 South Olive Street, Los Angeles, California 90012-3002.

At the meeting, we will focus on the business items listed in the Notice of Meeting, which follows on the next page. Included with this Proxy Statement is a copy of the Annual Report on Form 10-K for fiscal year 2004. We encourage you to read the Form 10-K. It includes information on our operations, markets, products and services, as well as our audited financial statements.

YOUR VOTE IS IMPORTANT: Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to vote and submit your proxy by telephone or via our Internet website. These are quick, cost effective and easy ways for you to submit your proxy. If you would prefer to vote by mail, please sign, date and return the enclosed proxy form in the postage-paid envelope provided. Please review the instructions on the proxy card regarding each of these voting options.

Thank you for your ongoing support of and continued interest in Southwest Water Company.

Very Truly Yours,

SOUTHWEST WATER COMPANY

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 12, 2005

Dear Southwest Water Stockholder:

The 2005 Annual Meeting of Stockholders ("Annual Meeting") of Southwest Water Company, a Delaware corporation ("Southwest Water," "Company," "we" or "us"), will be held on Thursday, May 12, 2005 at 10:00 a.m. (Pacific Time) at the Omni Los Angeles Hotel, 251 South Olive Street, Los Angeles, California 90012-3002 for the following purposes:

- (1)

- To elect three persons as Class I Directors each to a three-year term;

- (2)

- To approve an amendment to the Company's Amended and Restated Certificate of Incorporation deleting all references to our Series D Preferred Stock all of which has been cancelled;

- (3)

- To approve an amendment to the Company's Amended and Restated Certificate of Incorporation to provide that the authorized number of Directors of the Board of Directors will be as set forth in the Company's Bylaws; and

- (4)

- To consider such other business as may properly come before the meeting.

The record date for the determination of the stockholders entitled to vote at the meeting is the close of business on March 31, 2005.

By Order of the Board of Directors,

Shelley Farnham

Secretary

Los Angeles, California

April 6, 2005

2005 PROXY STATEMENT

TABLE OF CONTENTS

| | Page

|

|---|

| INFORMATION ABOUT THE ANNUAL MEETING | | 1 |

| What is the purpose of the Annual Meeting? | | 1 |

| Who can attend the Annual Meeting? | | 1 |

| Who can vote at this Annual Meeting? | | 1 |

| What makes up the quorum requirement for the Annual Meeting? | | 2 |

| What are the costs of proxy distribution and solicitation? | | 2 |

| What information is contained in these materials? | | 2 |

| What proposals will be voted on at the Annual Meeting? | | 2 |

| How does the Board recommend I vote on the proposals? | | 3 |

| What shares owned by me can be voted? | | 3 |

| What is the difference between holding shares as a stockholder of record and as a beneficial owner? | | 3 |

| How can I vote my shares in person at the Annual Meeting? | | 3 |

| How can I vote my shares without attending the Annual Meeting? | | 4 |

| Can I change my vote after I submit a proxy? | | 4 |

| How are votes cast? | | 4 |

| What is the voting requirement to approve each of the proposals? | | 5 |

| What does it mean if I receive more than one proxy or voting instruction card? | | 5 |

| Who will serve as inspector of election? | | 5 |

| What documents are not incorporated by reference? | | 5 |

| Where can I find the voting results of the Annual Meeting? | | 5 |

STOCK OWNERSHIP |

|

6 |

| Who are the largest owners of the Company's Stock? | | 6 |

| How much stock do the Company's Directors and executive officers own? | | 7 |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

|

8 |

PROPOSAL 1 – ELECTION OF DIRECTORS |

|

9 |

| Information on Nominees and Continuing Directors | | 9 |

| Nominees for Election at Annual Meeting (Class I) | | 10 |

| Directors Continuing in Office With Terms Expiring in 2006 (Class II) | | 11 |

| Directors Continuing in Office With Terms Expiring in 2007 (Class III) | | 12 |

| Board Structure and Committee Membership | | 13 |

| Audit Committee | | 13 |

| Financial Planning and Investment Committee | | 14 |

| Compensation Committee | | 14 |

| Nominating and Governance Committee | | 14 |

DIRECTOR COMPENSATION AND STOCK OWNERSHIP |

|

15 |

| Non-Employee Director Stock Options Granted in 2004 | | 16 |

| Non-Employee Director Option Exercises in 2004 and Year-End Option Values | | 17 |

| | | |

GOVERNANCE OF THE COMPANY |

|

18 |

| Does the Company have a Statement of Corporate Governance? | | 18 |

| Does the Company have a Code of Ethical Conduct? | | 18 |

| What are the Company's qualifications for a Director? | | 18 |

| How are nominees to the Board evaluated and identified? | | 18 |

| Can Stockholders nominate Directors to the Board? | | 19 |

| Certain Relationships and Party Transactions – What related party transactions involved Directors? | | 19 |

| How does the Board determine which Directors are considered independent? | | 19 |

| Does the Company's Board hold Independent Director Sessions? | | 19 |

| How do Stockholders communicate to the Board? | | 19 |

AUDIT COMMITTEE REPORT |

|

20 |

EXECUTIVE COMPENSATION |

|

21 |

| Report of the Compensation Committee | | 21 |

| Summary Compensation Table | | 24 |

| Compensation Committee Interlocks and Insider Participation | | 24 |

| Change of Control Compensation Agreements | | 25 |

| Other Agreements | | 25 |

| Option Grants to Named Executive Officers in 2004 | | 26 |

| Options Exercised in 2004 and Year-End Option Values | | 27 |

| Supplemental Executive Retirement Plan Information | | 28 |

| Equity Compensation Plan Information | | 29 |

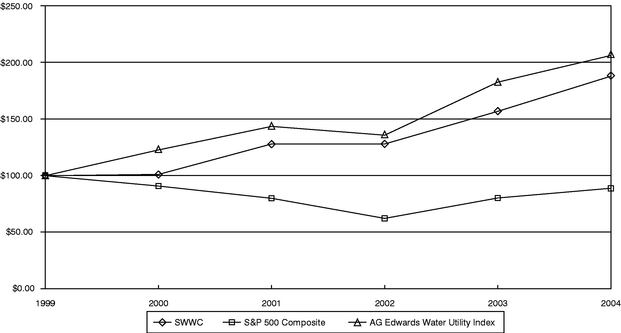

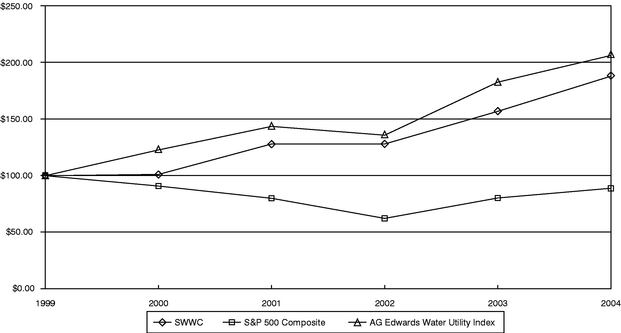

STOCK PERFORMANCE GRAPH |

|

30 |

Principal Auditor Fees and Services |

|

31 |

PROPOSAL 2: TO AMEND THE COMPANY'S RESTATED CERTIFICATE OF INCORPORATION TO DELETE ALL REFERENCES TO THE COMPANY'S SERIES D PREFERRED STOCK |

|

32 |

PROPOSAL 3: TO AMEND THE COMPANY'S RESTATED CERTIFICATE OF INCORPORATION TO PROVIDE THAT THE AUTHORIZED NUMBER OF DIRECTORS ON THE BOARD SHALL BE AS PROVIDED BY THE COMPANY'S BYLAWS |

|

33 |

PROPOSALS FOR THE NEXT ANNUAL MEETING |

|

34 |

DIRECTIONS TO SOUTHWEST WATER COMPANY ANNUAL MEETING OF STOCKHOLDERS |

|

Back

Cover |

One Wilshire Building

624 South Grand Avenue, Suite 2900

Los Angeles, CA 90017

INFORMATION ABOUT SOUTHWEST WATER COMPANY

Southwest Water Company provides a broad range of services, primarily in the $56 billion public water supply and wastewater treatment industry. Through its operating subsidiaries, the company combines ownership of regulated utility assets with the growing nationwide trend toward outsourcing of municipal services, thereby maintaining an investment profile that offers both stability and long-term growth potential.

PROXY STATEMENT

Southwest Water's proxy statement ("Proxy Statement") is furnished by and on behalf of the Board of Directors (the "Board") of Southwest Water, in connection with the solicitation of proxies for use at the Annual Meeting to be held on Thursday, May 12, 2005, beginning at 10:00 a.m. (Pacific Time) at the Omni Los Angeles Hotel, 251 South Olive Street, Los Angeles, California. This Proxy Statement and enclosed proxy card will be mailed on or about April 11, 2005 to the Company's stockholders of record as of March 31, 2005 (the "Record Date"). This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. A map showing directions to the hotel is on the back cover of this Proxy Statement.

INFORMATION ABOUT THE ANNUAL MEETING

- Q:

- What is the purpose of the Annual Meeting?

- A:

- At our Annual Meeting, stockholders will act upon matters outlined in the Notice of Meeting of this Proxy Statement. In addition, management will report on the performance of the Company and respond to questions from stockholders.

- Q:

- Who can attend the Annual Meeting?

- A:

- Our stockholders and Company representatives and guests can attend our Annual Meeting. Admission to the meeting depends on how your share ownership is recorded. If your shares are held in the name of a bank, broker or other holder of record and you plan to attend the Annual Meeting, please obtain proof of ownership, such as a current brokerage account statement or certification from your broker. If your shares are registered with our transfer agent, all you need is proof of identification; no proof of ownership is needed.

- Q:

- Who can vote at this Annual Meeting?

- A:

- Owners of Southwest Water common stock or Series A Preferred Stock at the close of business on the Record Date, are entitled to receive this notice and to vote their shares at the Annual Meeting. As of that date, there were 19,414,597 shares of common stock outstanding and 9,218 shares of Series A Preferred Stock outstanding. On each matter properly brought before the Annual Meeting, common shares will be entitled to one vote per share, and Series A Preferred shares will be entitled to five votes per share. The combined total number of eligible votes is 19,460,687 shares.

1

- Q:

- What makes up the quorum requirement for the Annual Meeting?

- A:

- The presence at the meeting, in person or by proxy, of the holders of a majority of the eligible votes on the Record Date will constitute a quorum, permitting the meeting to conduct its business. Proxies received, but marked as abstentions, and broker non-votes (i.e., shares that are not voted by the broker who is the record holder of the shares because the broker is not instructed to vote by the actual owner of the shares and does not have discretionary authority to vote such shares) will be included in the calculation of the number of votes considered to be present at the meeting.

- Q:

- What are the costs of proxy distribution and solicitation?

- A:

- Southwest Water will bear the entire cost of this solicitation of proxies, including the preparation, assembly, printing and mailing of this Proxy Statement, the proxy and any additional solicitation material that Southwest Water may provide to stockholders. Copies of solicitation material will be provided to brokerage firms, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to beneficial owners. In addition, Southwest Water has retained Morrow and Company ("Morrow") to act as a proxy solicitor for the Annual Meeting. Southwest Water has agreed to pay Morrow $5,000, plus reasonable out-of-pocket expenses, for proxy solicitation services. The original solicitation of proxies by mail may be supplemented for solicitation by telephone, telegram and other means by Directors ("Directors"), officers and employees of Southwest Water. No additional compensation will be paid to these individuals for their services.

- Q:

- What information is contained in these materials?

- A:

- The information included in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of Directors and our most highly paid officers, and certain other required information. Southwest Water's 2004 Annual Report, proxy card and a return envelope are also enclosed.

- Q:

- What proposals will be voted on at the Annual Meeting?

- A:

- There are three proposals to be voted on at the Annual Meeting:

- •

- The election of three persons as Class I Directors, each for a three-year term or until their successors are duly elected and qualified;

- •

- Approval of an amendment to the Company's Amended and Restated Certificate of Incorporation deleting all references to Series D Preferred Stock, which stock has been cancelled and no further shares are outstanding; and

- •

- Approval of an amendment to the Company's Amended and Restated Certificate of Incorporation providing that the authorized number of Directors of the Board be as set forth in the Company's Bylaws.

If any other matters are properly presented at the Annual Meeting for consideration, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place, the persons named in the proxy will have discretion to vote on these matters in accordance with their best judgment.

2

- Q:

- How does the Board recommend I vote on the proposals?

- A:

- Southwest Water's Board recommends that you vote your shares "FOR" each of the nominees to the Board and "FOR" the approval of both proposed amendments to the Amended and Restated Certificate of Incorporation.

- Q:

- What shares owned by me can be voted?

- A:

- Each share of Southwest Water stock issued and outstanding as of the close of business on the Record Date is entitled to vote on all items being voted upon at the Annual Meeting. You may cast one vote per share of common stock that you held on the Record Date. Holders of Series A Preferred Stock may cast five votes per share of preferred stock beneficially owned by them on the Record Date. You may vote all shares owned by you as of the Record Date, including shares that are: (1) held directly in your name as the stockholder of record or (2) held for you as the beneficial owner through a stockbroker, bank or other nominee.

- Q:

- What is the difference between holding shares as a stockholder of record and as a beneficial owner?

- A:

- Most stockholders of Southwest Water hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with Southwest Water's transfer agent, Mellon Investor Services LLC, you are considered the stockholder of record, and these proxy materials are being sent directly to you by Southwest Water. As the stockholder of record, you have the right to grant your voting proxy directly to Southwest Water or to vote in person at the Annual Meeting. Southwest Water has enclosed a proxy card for you to use. You may also vote by telephone or via the Internet as described below under "How can I vote my shares without attending the Annual Meeting?"

Beneficial Owner of Shares Held in Street Name

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the Annual Meeting. Since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting without obtaining a legal proxy from your broker. Your broker or nominee has enclosed a voting instruction card for you to use in directing the broker or nominee regarding how to vote your shares. You may also vote by telephone or by the Internet as described below under "How can I vote my shares without attending the Annual Meeting?"

- Q:

- How can I vote my shares in person at the Annual Meeting?

- A:

- Shares held directly in your name as the stockholder of record may be voted in person at the Annual Meeting. If you choose to do so, please bring the enclosed proxy card or proof of identification. Even if you plan to attend the Annual Meeting, Southwest Water recommends that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the Annual Meeting. Shares held beneficially in street name may be voted in person by you only if you obtain a signed proxy from the record holder (e.g., your broker) giving you the right to vote the shares in person.

3

- Q:

- How can I vote my shares without attending the Annual Meeting?

- A:

- If you complete and properly sign the accompanying proxy card and return it to the Company, it will be voted as you direct. If you are a registered stockholder, you may vote by telephone or via the Internet, by following the instructions included with your proxy card. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or nominee. A large number of banks and brokerage firms are participating in the ADP Investor Communications Services online program, which provides eligible stockholders who hold their shares in street name to vote via the Internet or by telephone. If your bank or brokerage firm is participating in ADP's program, your voting form will provide instructions. For instructions on how to vote, please refer to the instructions below and those included on your proxy card or, for shares held beneficially in street name, the voting instruction card provided by your broker, trustee or nominee. The deadline for voting by telephone and the Internet is 11:59 p.m., Eastern Time, on May 11, 2005. If you vote by Internet or telephone, you need not return your proxy card or voting form by mail.

By Telephone –Stockholders of record of Southwest Water stock who live in the United States or Canada may submit proxies by following the "Vote by Phone" instructions on their proxy cards. Most Southwest Water stockholders who hold shares beneficially in street name and live in the United States or Canada may vote by phone by calling the number specified on the voting instruction cards provided by their brokers, trustee or nominees.

By Mail –Stockholders of record of Southwest Water stock may submit proxies by completing, signing and dating their proxy cards and mailing them in the accompanying pre-addressed envelopes. Southwest Water stockholders who hold shares beneficially in street name may vote by mail by completing, signing and dating the voting instruction cards and providing and mailing them to their broker or other nominee in the accompanying pre-addressed envelopes.

By Internet –You also can choose to vote on the Internet. The website for internet voting for stockholders of record ishttp://www.proxyvoting.com/swwc. As with telephone voting, you can confirm that your instructions have been recorded. You can also request electronic delivery of future proxy materials with Internet voting.

- Q:

- Can I change my vote after I submit a proxy?

- A:

- As a stockholder of record, you may revoke your proxy at any time before it is voted at the Annual Meeting by doing any of the following:

- •

- Granting a new proxy, relating to the same shares and bearing a later date; or

- •

- Attending the Annual Meeting and voting in person. However, attendance at the Annual Meeting will not, by itself, revoke your proxy.

If your shares are held in the name of a broker, bank or other nominee, you may change your vote by submitting new voting instructions to your bank, broker or other record holder. You must contact your bank, broker or other record holder to find out how to do so.

- Q:

- How are votes cast?

- A:

- In the election of Directors, you may vote "FOR" all of the nominees or your vote may be "WITHHELD" with respect to one or more of the nominees. For all other proposals, you may vote "FOR," "AGAINST" or "ABSTAIN" on each such proposal. If you "ABSTAIN" it has the same effect as a vote "AGAINST." If you sign and submit your proxy card with no further instructions, your shares will be voted in accordance with the recommendations of the Board.

4

- Q:

- What is the voting requirement to approve each of the proposals?

- A:

- For Proposal One, the three nominees receiving the highest number of affirmative votes of the outstanding shares of the Company's securities, present or represented by proxy and entitled to vote, shall be elected as Directors to serve until their successors have been elected and qualified. The election of Directors is a matter on which a broker or other nominee is generally empowered to vote, and therefore, no broker non-votes in connection with Proposal One will exist.

The affirmative vote of a majority of the outstanding shares of the Company's securities (common stock and preferred stock voting together as a class) entitled to vote on the proposal, is required for approval of Proposals Two and Three. Abstentions on these proposals will have the effect of a vote against such proposals. Brokers are authorized to vote on these proposals, thus no broker non-votes will likely result.

- Q:

- What does it mean if I receive more than one proxy or voting instruction card?

- A:

- It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive.

- Q:

- Who will serve as inspector of election?

- A:

- The inspector of election will be a representative of Mellon Investor Services, LLC.

- Q:

- What documents are not incorporated by reference?

- A:

- The Report of the Compensation Committee of the Board on Executive Compensation, the Audit Committee Report (including reference to the independence of the Audit Committee members) and the Stock Performance Graph, are not deemed filed with the Securities and Exchange Commission (the "SEC") and shall not be deemed incorporated by reference into any prior or future filings made by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the "Exchange Act") except to the extent that the Company specifically incorporates such information by reference. Information on our website, other than our Proxy Statement and form of proxy, is not part of the proxy soliciting material and is not incorporated by reference.

- Q:

- Where can I find the voting results of the Annual Meeting?

- A:

- Southwest Water intends to announce preliminary voting results at the Annual Meeting and publish final results in its quarterly Report on Form 10-Q for the second quarter of fiscal 2005.

5

STOCK OWNERSHIP

Who are the largest owners of the Company's stock?

The following table identifies significant stockholders who own more than five percent of any class or series of the Company's outstanding voting securities as of the Record Date:

Class of Stock

| | Name and Address

of Beneficial Owner

| | Number of Shares

Beneficially

Owned

| | Percentage of Class(1)

| |

|---|

Common

Stock | | T. Rowe Price Associates, Inc.

100 E. Pratt Street

Baltimore, MD 21202 | | 1,378,124 | (2) | 7.10 | % |

- (1)

- Based on 19,414,597 shares of common stock outstanding on the Record Date.

- (2)

- Based on a Schedule 13G filed with the SEC on February 14, 2005. These securities are owned by various individual and institutional investors for whom T. Rowe Price Associates, Inc. serves as an investment adviser. Included in this amount are 1,207,500 shares held by T. Rowe Price Small-Cap Value Fund, Inc. (the "T-Rowe Fund). The T-Rowe Fund has sole voting power over 170,624 shares and sole dispositive power over 1,378,124 shares.

6

How much stock do the Company's Directors and executive officers own?

The following table sets forth information concerning the beneficial ownership of our common stock as of the Record Date for: (i) each Director and nominee for Director of the Company, (ii) the person who in fiscal 2004 was the chief executive officer of the Company, (iii) the five other most highly compensated executive officers named in the Summary Compensation Table on page 29, and (iv) the Directors and executive officers as a group. Except as otherwise noted, the named individual or their family members have sole voting and investment power with respect to such securities.

We calculate beneficial ownership by including shares owned in each Director's or officer's name (or by any member of his or her immediate family). Also, in calculating the percentage ownership of such person only, we count securities which the officer or Director could purchase within 60 days (such as exercisable stock options that are listed in a separate column as outstanding securities). No Director or officer owns shares of our preferred stock.

Name of Beneficial Owner

| | Number of Shares Beneficially Owned

| | Exercisable Options Beneficially Owned (a)

| | Total Number of Shares and Exercisable Options Beneficially Owned

| | Percentage of Class (b)

|

|---|

| (i) Directors | | | | | | | | |

| James C. Castle, Ph.D | | 2,940 | (c) | 26,950 | | 29,890 | | * |

| H. Frederick Christie | | 19,142 | | 55,635 | | 74,777 | | * |

| Linda Griego | | 0 | | 26,950 | | 26,950 | | * |

| Donovan D. Huennekens | | 79,744 | (d) | 50,624 | | 130,368 | | * |

| William D. Jones | | 1,785 | (e) | 0 | | 1,785 | | * |

| Maureen A. Kindel | | 7,025 | | 47,731 | | 54,756 | | * |

| Richard G. Newman | | 46,656 | (f) | 58,499 | | 105,155 | | * |

| (ii) Top Executive | | | | | | | | |

| Anton C. Garnier | | 387,994 | (g) | 498,746 | | 886,740 | | 4.45 |

| (iii) Other Executives | | | | | | | | |

| Peter J. Moerbeek | | 52,229 | (h) | 480,806 | | 533,035 | | 2.68 |

| Richard J. Shields | | 1,470 | | 33,457 | | 34,927 | | * |

| Michael O. Quinn | | 27,561 | (i) | 35,242 | | 62,803 | | * |

| James C. Wisener | | 761 | | 40,524 | | 41,285 | | * |

| Maurice W. Gallarda | | 10 | | 59,645 | | 59,655 | | * |

| (iv) | | | | | | | | |

All Directors and Executive

Officers as a Group (13) | | 627,317 | | 1,414,809 | | 2,042,126 | | 10.02 |

* Indicated less than one percent of the Company's outstanding shares of common stock based on 19,414,597 shares of common stock outstanding on the Record Date.

- (a)

- Includes options that become exercisable on or before May 31, 2005.

- (b)

- Based on 19,414,597 shares of common stock outstanding. Due to the voting rights of the outstanding shares of Series A preferred stock, 19,460,687 votes may be cast at the meeting. Since the holders of the preferred stock are entitled to cast only approximately 46,090 votes, the "percentage of class" shown in the table is substantially similar to the percentage of voting power held.

- (c)

- Mr. and Mrs. Castle hold all 2,940 shares of common stock as co-trustees of a revocable trust for their benefit.

- (d)

- Mr. and Mrs. Huennekens hold all 79,744 shares of common stock as co-trustees of a revocable trust for their benefit.

- (e)

- Mr. and Mrs. Newman hold all 46,656 shares of common stock as co-trustees of a revocable trust for their benefit.

7

- (f)

- Mr. and Mrs. Jones hold all 1,785 shares of common stock as co-trustees of a revocable trust for their benefit.

- (g)

- Includes 364,843 shares of common stock owned by Mr. and Mrs. Garnier as co-trustees of a revocable trust for their benefit. Also includes 23,151 common shares representing Mr. Garnier's interest in a corporation of which Mr. Garnier is a director and a stockholder. Mr. Garnier has sole voting and investment power with respect to these shares.

- (h)

- Mr. and Mrs. Moerbeek hold all 52,229 shares of common stock as co-trustees of a revocable trust for their benefit.

- (i)

- Mr. and Mrs. Quinn hold all 27,561 shares of common stock as co-trustees of a revocable trust for their benefit.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Our executive officers, Directors and owners of more than 10 percent of our securities are required under Section 16(a) of the Exchange Act, to file reports of ownership and changes in ownership with the SEC. Pursuant to regulations adopted under the Sarbanes-Oxley Act of 2002, most transactions are now reportable within two days of the transaction and are required to be filed electronically with the SEC through its EDGAR system. To facilitate compliance, we have undertaken the responsibility to prepare and file these reports on behalf of our executive officers and Directors. Southwest Water is required to disclose in this Proxy Statement any late filings or failures to file.

Based upon a review of the filings made on their behalf during 2004 as well as our Company records, all reports were timely filed except for Donovan D. Huennekens, for whom the Company filed a late Form 4 reporting the following transactions in Southwest Water's common stock: his acquisition of 206 shares on January 20, 2004 and his acquisition of 238 shares on October 21, 2004, through the Dividend Reinvestment Program.

8

PROPOSAL 1: ELECTION OF DIRECTORS

General

The Board of Directors currently consists of nine Directors divided into three classes (Class I, Class II and Class III). Directors in each class are elected to serve for three-year staggered terms that expire in successive years. The term of the Class I Directors will expire at the upcoming Annual Meeting. The Board has nominated James C. Castle, Maureen A. Kindel and William D. Jones for election as Class I Directors for three-year terms expiring at the annual meeting of stockholders to be held in 2008 and until their successors are elected and qualified. Each nominee currently serves as a Class I Director. Mr. Castle and Ms. Kindel are nominated for re-election and serve their current term based on their election by the stockholders in 2002. Mr. Jones was appointed to the Board in September 2004 and was originally recommended for consideration as a Board member by Director Richard G. Newman.

Each nominee has consented to being named in this Proxy Statement and has agreed to serve if elected. The affirmative vote of a plurality of the votes cast at the Annual Meeting is required to elect the three nominees as Directors. This means that the three nominees will be elected if they receive more affirmative votes than any other person. Beginning on the next page, the principal occupation and certain other information is provided on the nominees and the Directors whose terms of office will continue after the Annual Meeting.

Information on Nominees and Continuing Directors

The following table provides information on the people who serve as Directors as of March 31, 2005:

Name

| | Age

| | Position

| | Term Expires

|

|---|

| James C. Castle, Ph.D | | 68 | | Director | | 2005 |

| Maureen A. Kindel | | 67 | | Director | | 2005 |

| William D. Jones | | 49 | | Director | | 2005 |

| Linda Griego | | 57 | | Director | | 2006 |

| Donovan D. Huennekens | | 68 | | Director | | 2006 |

| Richard G. Newman | | 70 | | Director | | 2006 |

| H. Frederick Christie | | 71 | | Director | | 2007 |

| Anton C. Garnier | | 64 | | Chairman and CEO | | 2007 |

| Peter J. Moerbeek | | 57 | | President and COO | | 2007 |

9

NOMINEES FOR ELECTION AT ANNUAL MEETING (CLASS I)

|

|

James C. Castle, PhD Director of Southwest Water since 2002

Dr. Castle has served as President and Chief Executive Officer of Castle Information Technologies, LLC, a provider of information technology and board of directors consulting services since 2001. He serves on the Boards of PMI Group, Inc., an international provider of credit enhancement products and lender services, since 1997, ADC Telecommunications, Inc., a provider of global network products and services, since 1997 and VeriFone, Inc. Dr. Castle is also trustee on the West Point AOG Board of Trustees and serves on the Board of the Chief Executives Organization. |

| | |

|

|

|

Maureen A. Kindel Director of Southwest Water since 1997

Ms. Kindel has served as Senior Managing Director of GCG Rose & Kindel, a global consulting and public affairs firm, since 1987. Ms. Kindel is past president of the City of Los Angeles Board of Public Works, a founding and current member of each of the Pacific Counsel on International Policy, the Board of Governors of Town Hall of Los Angeles and the Los Angeles Amateur Athletic Foundation. Ms. Kindel serves on the Board of the International Foundation of Election Systems on which she chairs the Nominating Committee. She is also a regent of Loyola Marymount University and on the Board of Directors of the Los Angeles Chamber of Commerce. |

| | |

|

|

|

William D. Jones Director of Southwest Water since 2004

Mr. Jones has served as President, Chief Executive Officer and owner of CityLink Investment Corporation, a real estate investment, development and management firm, since 1994. He is a former chairman of the Federal Reserve Bank of San Francisco-Los Angeles branch, and he is director of Sempra Energy, an energy services company, since 1994, the San Diego Economic Regional Corporation and the San Diego Padres. From 1989 to 1993, Mr. Jones served as general manager of a $400 million commercial real estate portfolio in the northwest for Prudential Fidelity Group. |

SOUTHWEST WATER'S BOARD RECOMMENDS A VOTEFOR THE ELECTION TO THE BOARD

OF EACH OF THE NOMINEES ABOVE.

10

DIRECTORS CONTINUING IN OFFICE WITH TERMS EXPIRING IN 2006 (CLASS II)

|

|

Linda Griego Director of Southwest Water since 2001

Ms. Griego has served as President of Zapgo Entertainment Group, LLC, a television programming production company, since 1997 and is the founder and managing partner of Engine Company No. 28, a restaurant that she founded in 1988. From July 1999 until January 2000, Ms. Griego served as interim President and Chief Executive Officer of the Los Angeles Community Development Bank, a $430 million funded community development bank. |

| | |

|

|

|

Donovan D. Huennekens Director of Southwest Water since 1969

Mr. Huennekens has served as a partner of HQT Homes, a real estate development company since 1993, and is a director of Bixby Ranch Company, a privately owned family company with primary business of developing, managing and owning commercial real estate. Mr. Huennekens also serves on the Compensation Committee of the Board of Bixby Ranch Company. |

| | |

|

|

|

Richard G. Newman Director of Southwest Water since 1991

Mr. Newman has served as the chairman, chief executive officer and a director of AECOM Technology Corporation, the parent of several subsidiaries that provide engineering and diversified technical professional services internationally, since 1991. Mr. Newman is a director of Sempra Energy Company, an energy services company since 2003. He also serves on the boards of 13 mutual funds managed by the Capital Research and Management Company. He is also member of the College of Fellows of the Institute for the Advancement of Engineering and a member of the Chief Executives Organization, American Society of Civil Engineers and National Society of Professional Engineers. |

11

DIRECTORS CONTINUING IN OFFICE WITH TERMS EXPIRING IN 2007 (CLASS III)

|

|

H. Frederick Christie Director of Southwest Water since 1996

Mr. Christie is an independent consultant. He retired in 1990 as president and chief executive officer of the Mission Group, a subsidiary of SCEcorp (now Edison International), which oversaw SCEcorp's non-utility businesses. From 1984 to 1987, he served as president of Southern California Edison Company, a subsidiary of SCEcorp. Mr. Christie is a director of Valero L.P., a provider of oil well services and equipment, since 2002, IHOP Corporation, which develops, operates and franchises International House of Pancake restaurants, since 1992, and Ducommun Incorporated, a premiere supplier of worldwide aerospace and related high technology markets, since 1985. Beginning in 1972, he has served on the boards of 19 mutual funds managed by the Capital Research and Management Company. |

| | |

|

|

|

Anton C. Garnier Director of Southwest Water since 1968

Mr. Garnier has served as chief executive officer and Director of the Company since 1968. Mr. Garnier has served as our Chairman of the Board since 1996. |

| | |

|

|

|

Peter J. Moerbeek Director of Southwest Water since 2001

Mr. Moerbeek was appointed the Company's president and chief operating officer in February 2004. He joined the Company in 1995 and served as chief financial officer and executive vice president through 2001. Mr. Moerbeek served as secretary from 1995 to 2004. He has been the president of the Company's non-regulated business since 1997. |

12

BOARD STRUCTURE AND COMMITTEE MEMBERSHIP

Who are the current members of the Board and its Committees?

The members of the Board, the Committees of the Board on which they currently serve, and the number of meetings held in 2004 by the Committees are identified below.

Name of Director

| | Audit

| | Financial

Planning &

Investment

| | Compensation

| | Nominating and

Governance

|

|---|

| Non-Employee Directors: | | | | | | | | |

| James C. Castle, Ph.D | | X | | X | | | | |

| H. Frederick Christie | | | | X | | Chair | | X |

| Linda Griego | | | | | | X | | X |

| Donovan D. Huennekens | | Chair | | | | X | | |

| William D. Jones | | X | | | | | | |

| Maureen A. Kindel | | X | | | | | | Chair |

| Richard G. Newman | | | | Chair | | X | | X |

| Employee Directors: | | | | | | | | |

| Anton C. Garnier | | | | X | | | | |

| Peter J. Moerbeek | | | | X | | | | |

| | | | | | | | | |

| Number of Meetings in 2004 | | 11 | | 9 | | 11 | | 4 |

X = Committee member

How often did the Board meet during fiscal 2004?

The Board met eleven times during fiscal 2004. Each Director attended at least 75% of all Board and applicable Committee meetings. The Board also encourages attendance at the Annual Meeting of Stockholders by all nominees for election as directors and all directors whose term of office will continue after the meeting. Last year all but one director attended the meeting. Under the Company'sCorporate Governance Guidelines, each Director is expected to dedicate sufficient time, energy and attention to ensure the diligent performance of his or her duties, including attending the Annual Meeting of Stockholders of the Company, meetings of the Board and Committee meetings of which he or she is a member.

What is the role of the Board committees?

The Board has four standing Committees; Audit; Nominating and Governance; Compensation; and Financial Planning and Investment. Each of the Committees operates under a written charter adopted by the Board. The Committee charters are available on Southwest Water's website atwww.swwc.com

Audit Committee. The Company has an Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee is charged with assisting the Board in monitoring the integrity of the Company's internal controls and financial reporting process, monitoring the independence and performance of the Company's external independent auditors, assuring compliance with legal and regulatory requirements and reviewing areas of significant financial risk to the Company. The Audit Committee prepares an Audit Committee report and annually reviews the Audit Committee charter and the Committee's performance. The Audit Committee appoints, evaluates and determines the compensation of Southwest Water's independent auditors; reviews and approves the scope of the annual audit, the audit fees and the financial statements; grants advance approval of any non-audit services provided by the independent auditors; sets policies with respect to financial information and earnings guidance; and oversees investigations into complaints concerning financial matters.

13

The Board has determined that at least one member of the Audit Committee, the Chairperson, Donovan D. Huennekens, qualifies as the "Audit Committee Financial Expert" under the rules and regulations of the SEC for purposes of Section 407 of the Sarbanes-Oxley Act of 2002. The Board has also determined that each of the Audit Committee members satisfies the SEC rules regarding independence requirements and the NASDAQ requirements for Audit Committee membership including financial sophistication. Stockholders should understand that the "financial expert" designation is a disclosure requirement of the SEC related to Mr. Huennekens experience and understanding with respect to certain accounting and auditing matters. The designation does not impose upon Mr. Huennekens any duties, obligations or liabilities that are greater than are generally imposed on him as a member of the Audit Committee and the Board, and his designation as an Audit Committee Financial Expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board.

Financial Planning and Investment Committee. The Financial Planning and Investment Committee assists the Board in overseeing the Company's long-term strategic planning, new business development, acquisitions and mergers and overall investment policy. The Committee reviews and analyzes significant financial matters, such as assisting in the evaluation of proposed merger and acquisition transactions and other financial investment activities. It also reviews Southwest Water's capitalization, including credit management, risk concentration and return on invested capital.

Compensation Committee. The Compensation Committee assists the Board in reviewing the performance and approving the compensation of Southwest Water's executives, and the Committee produces a report on executive compensation. The Committee provides general oversight and administration of Southwest Water's equity compensation plans and benefits programs. The Committee also reviews and evaluates annually its performance and its charter.

Nominating and Governance Committee. The Nominating and Governance Committee identifies individuals qualified to become Board members; recommends Director candidates to the Board for election and re-election; and develops and recommends corporate governance principles, including giving proper attention and making effective responses to stockholder concerns regarding corporate governance. Please refer to our section on "Governance of the Company" for more information on the Company's governance guidelines. The Committee reviews and evaluates annually its performance and its charter.

14

DIRECTOR COMPENSATION AND STOCK OWNERSHIP

The following table provides information on Southwest Water's compensation practices during fiscal 2004 for Non-Employee Directors, as well as the range of compensation paid to Non-Employee Directors who served during 2004 fiscal year. Directors who are also employees of the Company receive no additional compensation for service as a Director.

NON-EMPLOYEE DIRECTOR COMPENSATION FOR 2004

| |

| | | | | |

| Annual Stock Option Award(1) | | | 10,000 | |

| Annual Retainer | | $ | 15,000 | |

| Per Meeting Fee(2) | | $ | 1,000 | |

| Additional Retainer for Chair of any Committee(3) | | $ | 3,000 | |

| Total Combined Value of Compensation and Equity(4) | | $ | 65,420 | |

- (1)

- A Non-Employee Director receives an initial option grant of 10,000 shares of the Company's common stock when he or she becomes a Director. In addition, at each subsequent Annual Meeting each Director receives an automatic award of options for 10,000 shares. The initial grant and annual stock option award increased from 5,000 to 10,000 shares effective May 13, 2004. Exercise prices for all options granted equals the last sales price on NASDAQ on the preceding trading day of the date of grant.

- (2)

- Non-Employee Directors receive a fee of $1,000 for attending each Board meeting, Committee meeting and long-range planning meeting.

- (3)

- The chair of each Committee receives an annual retainer of $3,000, except the chair of the Audit Committee, who receives an annual retainer of $3,600.

- (4)

- This aggregate dollar amount assumes (i) the annual retainer received by Non-Employee Directors for 2004 ($15,000); (ii) one additional retainer paid for serving as chairperson for a committee ($3,000); (iii) attending a combination of eleven Board meetings and Committee meetings ($11,000); and (iv) the grant to each Non-Employee Director of shares of Southwest Water common stock having a fair market value of $36,420 on the date of the grant (equal to approximately 30 percent value of the share price of $12.14 on May 13, 2004).

15

NON-EMPLOYEE DIRECTOR STOCK OPTIONS GRANTED IN 2004

The following table sets forth information regarding stock option grants made to Non-Employee Directors during the year ended December 31, 2004.

Eligible Directors

| | Options

(#)(1)(2)

| | Exercise

Base Price

($/sh.)

| | Expiration

Date

|

|---|

| James C. Castle, Ph.D | | 10,500 | | 12.14 | | 5/14/11 |

| H. Frederick Christie | | 10,500 | | 12.14 | | 5/14/11 |

| Linda Griego | | 10,500 | | 12.14 | | 5/14/11 |

| Donovan D. Huennekens | | 10,500 | | 12.14 | | 5/14/11 |

| William D. Jones(3) | | 10,500 | | 11.62 | | 9/2/11 |

| Maureen A. Kindel | | 10,500 | | 12.14 | | 5/14/11 |

| Richard G. Newman | | 10,500 | | 12.14 | | 5/14/11 |

- (1)

- Options vest 50% for two years on the anniversary of the grant date.

- (2)

- All options and option exercise prices reflect a 5% stock dividend on January 3, 2005, which resulted in an adjustment to all outstanding options.

- (3)

- Mr. Jones received an initial grant of 10,500 (split-adjusted) shares when he joined Southwest Water as a Director on September 1, 2004.

16

NON-EMPLOYEE DIRECTOR OPTION EXERCISES IN 2004 AND YEAR-END OPTION VALUES

The following table sets forth for each Non-Employee Director certain information about stock options exercised during the year ended December 31, 2004, and unexercised stock options held at the end of the 2004 fiscal year.

Non-Employee Director Name

| | Shares Acquired on Exercise (#)(1)

| | Value Realized ($)

| | Number of Unexercised

Options at

December 31, 2004 Exercisable/Un-exercisable

| | Value of Unexercised

In the-Money Options

at December 31, 2004

Exercisable/Un-exercisable ($)(2)

|

|---|

| James C. Castle, Ph.D | | 0 | | 0 | | 18,200 / 14,000 | | 64,291 / 30,500 |

| H. Frederick Christie | | 0 | | 0 | | 46,885 / 14,000 | | 319,223 / 30,500 |

| Linda Griego | | 0 | | 0 | | 18,200 / 14,000 | | 61,640 / 30,500 |

| Donovan D. Huennekens | | 2,864 | | 34,491 | | 41,874 / 14,000 | | 264,335 / 30,500 |

| William D. Jones | | 0 | | 0 | | 0 / 10,500 | | 0 / 19,215 |

| Maureen A. Kindel | | 0 | | 0 | | 38,981 / 14,000 | | 234,562 / 30,500 |

| Richard G. Newman | | 2,864 | | 34,691 | | 49,749 / 14,000 | | 352,657 / 30,500 |

- (1)

- Shares shown reflect adjustment to give effect to a 5% stock dividend on January 3, 2005

- (2)

- Differences between fair market value at fiscal year-end of $13.45 per option and option exercise price.

17

GOVERNANCE OF THE COMPANY

Does the Company have a Statement of Corporate Governance?

Southwest Water is committed to having sound corporate governance principles. Our Board believes that the purpose of corporate governance is to ensure we maximize stockholder value while meeting applicable legal requirements with the highest standards of integrity. The Board has adopted and adheres to corporate governance practices which the Board and senior management believe promotes this purpose. We continually review these governance practices, Delaware law (the state in which we are incorporated), the rules and listing standards of NASDAQ and SEC regulations, as well as best practices suggested by recognized governance authorities.

Southwest Water maintains a corporate governance page on its website, which includes key information about its corporate governance initiatives, including Southwest Water's Corporate Governance Guidelines, and charters for each of the Committees of the Board. The corporate governance page of the Company can be found atwww.swwc.com by clicking on "Investor Relations" and "Corporate Governance."

Does the Company have a Code of Ethical Conduct?

Our website,www.swwc.com contains ourCode of Ethical Conductfor all employees and our Code of Ethics for Directors and Executive Officers. TheCode of Ethics for Directors and Executive Officersis intended to comply with the requirements of the Sarbanes-Oxley Act of 2002 and applies to our Directors and to executive officers, including our chief executive officer, senior financial officers and other executive officers. We will provide without charge to any person, by written or oral request, a copy of ourCode of Ethics. Requests should be directed to the Director of Corporate Communications, Southwest Water Company, One Wilshire Building, 624 South Grand Avenue, Suite 2900, Los Angeles, California 90017. We intend to disclose future amendments to or waivers of certain provisions of ourCode of Ethics for Directors and Executive Officersas applicable to our principal executive officer, principal financial officer, principal accounting officer, controller and persons performing similar functions on our website atwww.swwc.com within five business days or as otherwise required by the SEC or the NASDAQ Stock Market.

What are the Company's qualifications for a Director?

Southwest Water's Corporate Governance Guidelines contain Board membership criteria that apply to nominees for a position on Southwest Water's Board. Under these criteria, members of the Board must have professional and personal ethics and values, consistent with longstanding Southwest Water values and standards. They should have broad experience at the policy-making level in business, government, education, technology or public interest. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all Director duties. Each Director must represent the interests of all stockholders.

How are nominees to the Board evaluated and identified?

The Nominating and Governance Committee uses a variety of methods to identify and evaluate nominees for Director, including materials provided by professional search firms or other parties. In the event that Board vacancies are anticipated, or otherwise arise, the Nominating and Governance Committee considers various potential candidates for Director. Candidates may come to the attention of the Nominating and Governance Committee through current Board members, professional search firms, stockholders or other persons. These candidates are evaluated at meetings of the Nominating and Governance Committee, and may be considered at anytime during the year. In evaluating such nominations, the Nominating and Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board.

18

The Board nominates the Director candidates it deems most qualified for election by the stockholders after consideration of the recommendation by the Nominating and Governance Committee. In accordance with the bylaws of the Company, the Board will be responsible for filling vacancies or newly created Directorships on the Board that may occur between annual meetings of stockholders.

Can stockholders nominate Directors to the Board?

The Company's CorporateGovernance Guidelinesallow stockholders to recommend Director nominees for consideration by the Nominating and Governance Committee by writing to the Corporate Secretary at least 120 days before the Annual Meeting, specifying the nominee's name and qualifications for Board membership. Following verification of the stockholder status of the person submitting the recommendation and review of minimum qualifying standards, all properly submitted recommendations are brought to the attention of the Nominating and Governance Committee at the next Committee meeting. Candidates recommended by a stockholder will be evaluated in the same manner as any candidate identified by the Nominating and Governance Committee.

The Company's Amended and Restated Bylaws ("Bylaws") allow stockholders to recommend business, including recommending Director nominees, to come before a special meeting or Annual Meeting of the Company by providing notice to the Corporate Secretary at least 90 days before the Annual Meeting. Such notice must comply with the requirements of our Bylaws. See "Proposals for the Next Annual Meeting" on page 40.

Certain Relationships and Party Transactions – What related party transactions involved Directors?

No director, nominee, executive officer or any member of their family had any indebtedness to the Company, any business relationship with the Company or any transaction with the Company in 2004. No Director, nominee, executive officer or any member of their family, at any time during the past three years, has been employed by any entity, including a charitable organization, that has made payments to, or received payments from, including charitable contributions, the Company for property or services in an amount which, in any single fiscal year, exceeded the greater of $1 million or 2% of the other entities consolidated gross revenues reported for that fiscal year.

How does the Board determine which Directors are considered independent?

Based on information solicited from each director and upon the advice and recommendation of the Company's Nominating and Governance Committee, the Board has determined that each of the current Directors, except the Chairman of the Board and Chief Executive Officer (Mr. Garnier) and the President and Chief Operating Officer (Mr. Moerbeek), has no material relationship with Southwest Water (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company) and is "independent" within the meaning of the NASDAQ Stock Market, Inc. ("NASDAQ") director independence standards, as currently in effect. The NASDAQ independent definition includes a series of objective tests, such as that the director is not an employee of the Company and not engaged in various types of business dealings with the Company. Furthermore, the Board has determined that each of the members of the Audit, Compensation, and Nominating and Governance Committees has no material relationship with Southwest Water (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company), and is "independent" within the meaning of NASDAQ's Director independence standards.

Does the Company's Board hold Independent Director sessions?

Independent Director sessions of Non-Employee Directors are held each regularly scheduled Board meeting. The sessions are scheduled and chaired by an independent Director selected by the Board from time to time. Any Director can request that an additional independent Director session be scheduled.

How do stockholders communicate to the Board?

Stockholders and other interested parties may communicate with the Board by writing to the Secretary, Southwest Water Company, One Wilshire Building, 624 South Grand Avenue, Suite 2900, Los Angeles, California 90017. The Secretary will forward all communications to the full Board or the appropriate Committee, with a copy to the Chair of the Nominating and Governance Committee.

19

AUDIT COMMITTEE REPORT

The Audit Committee of Southwest Water's Board of Directors is composed of four independent Directors, in compliance with the listing standards of the NASDAQ Stock Market and the SEC rules. The Audit Committee operates under a written charter adopted by the Board of Directors that sets forth the responsibilities and authority of the Audit Committee. The Audit Committee approved this charter in March 2004. The Audit Committee Charter was attached to our 2004 Proxy Statement and is available on Southwest Water's website atwww.swwc.com.

The Audit Committee is responsible for overseeing the Company's financial reporting process on behalf of the Board of Directors. Management has primary responsibility for Southwest Water's financial reporting process, internal controls, and compliance with laws and regulations and ethical business standards. The independent auditors are responsible for performing an independent audit of Southwest Water's consolidated financial statements in accordance with the Standards of the Public Company Accounting Board (United States) and for issuing an opinion as to the conformity of such financial statements.

In this context, and in accordance with its Charter, the Committee has met and held separate discussions with management and the independent auditors, KPMG. The Committee meets separately with Southwest Water's independent auditors. Management represented to the Committee that Southwest Water's audited consolidated financial statements for the fiscal year ended December 31, 2004 (the "Financial Statements"), were prepared in accordance with generally accepted accounting principles, and the Committee has reviewed and discussed the Financial Statements with management and the independent auditors. The Committee also discussed with the independent auditors the matters required to be discussed by the Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards).

In addition, the Committee has received from the independent auditors the written disclosures and the letter required by the Independence Standards Board No. 1 (Independence Discussion with Audit Committees) and discussed with the independent auditors the auditors' independence from Southwest Water and its management. The Committee considered the non-audit services that the independent auditors provided in fiscal year 2004 and determined that the provision of those services is compatible with and does not impair the auditors' independence. In accordance with the Sarbanes-Oxley Act of 2002, the Committee pre-approves all audit and non-audit services performed by the independent auditors.

Based upon the Audit Committee's review and discussions of the matters referred to above, the Committee has recommended to the Board of Directors that the Financial Statements be included in Southwest Water's Annual Report on Form 10-K for the year ended December 31, 2004, for filing with the Securities and Exchange Commission.

Audit Committee

Donovan D. Huennekens, Chairperson

James C. Castle, Ph.D

William D. Jones

Maureen A. Kindel

March 30, 2005

20

EXECUTIVE COMPENSATION

General. The Compensation Committee of the Board of Directors ("Committee") is responsible for establishing the Company's executive compensation program, including matters relating to the grant of options to purchase Company stock and any performance-based compensation for Company executives. The Committee operates under a written charter adopted by the Board of Directors. The Committee is comprised solely of four independent directors independent within the meaning of the NASDAQ Stock Market, Inc. listing standards – H. Frederick Christie, Linda Griego, Donovan D. Huennekens and Richard G. Newman.

Executive Officer Compensation Philosophy. The executive compensation program is designed to reward, motivate and retain the skilled management necessary to achieve the Company's goals of increasing stockholder value and maintaining a leadership position within the industry. The Committee's practices reflect policies that compensation should (i) provide fair, equitable and reasonable compensation, (ii) focus executives' efforts on the fulfillment of Company annual long-term and short-term business objectives and strategies (iii) reward excellent team performance, and individual job performance and abilities, and (iv) align the interests of management with the interests of stockholders. The Committee recognizes the Company's business is dependent upon the regulatory process governing the utilities, weather, water quality and supply, as well as a number of other factors. As a result, executive compensation is based on a number of subjective and objective factors beyond the recent financial performance of the Company.

Executive Compensation Program. Total compensation consists of three components – base salary, annual incentive compensation and long-term incentives in the form of stock options. In determining individual compensation, the Committee considers the executive officer's duties, the quality of his or her performance of those duties, and the contribution that each individual has made to the Company's overall performance and its strategic positioning for the future. The Committee also considers whether an executive officer's duties have expanded or otherwise materially changed from the previous year, the officer's experience and the value to the Company. The Committee meets with the chief executive officer and the president to evaluate the performance of the other executive officers and meets in the absence of the chief executive officer and president to evaluate those officers' individual performance. In determining any component of compensation, the Committee takes into consideration all forms and the value of all compensation paid, including salary, bonus, outstanding equity awards, supplemental executive retirement benefits and all other perquisites.

Salary Compensation. In addition to the factors mentioned above, the Committee determines base salary ranges for executive officers based upon competitive pay practices, including those in the water utilities and services industries. The pay practices of the peer group, a group of eight companies identified by an independent, outside compensation consulting firm, are reviewed each year. Four of the companies are water utilities included in the performance graph comparison of the AG Edwards Water Utility Index found on page 36. The other four companies have been selected from various segments of the services industry provide a frame of reference for the role that services play in the Company's operations. In making its 2004 base salary determinations, the Committee reviewed (i) a report of U.S. Salary Budget Trends and (ii) as in years past, a report from an independent, outside compensation consulting firm hired by the Committee. The report compared base salary ranges for our executive officers with base salary ranges for similar positions at the peer group companies. The consultant also provided information regarding total cash and equity compensation provided by these companies. The Committee also considered past performance and past pay increases, job duties, performance, scope and responsibilities, and expected future contributions. The most recent past performance was given the most weight. For 2004, the Committee determined that salary adjustments should remain competitive within general business guidelines and recognize the results of 2003. These salary adjustments for 2003 performance awarded in 2004 for executive officers averaged 5.2%.

Annual Incentive Compensation. The Committee believes that the Company's short-term objectives are enhanced with annual performance-based incentive compensation for its executives. Annual incentive awards are based on meeting certain financial objectives for the Company and on the executive's achievement of

21

goals in his or her area of functional responsibility. Executive performance objectives include both qualitative and quantitative criteria. As an executive's level of responsibility increases, a greater portion of potential total cash compensation is at risk in the form of annual performance-based incentive.

The Committee establishes financial goals and performance-based measures at the beginning of each year. Awards are made following the end of the fiscal year based on actual performance for that fiscal year. No awards are made if the targeted performance objectives are not met. Annual incentive compensation payout targets with respect to fiscal 2004 were set for certain executives, including Mr. Garnier, Chief Executive Officer, 25% of which was based upon a pre-determined earnings per share target from continuing operations, 25% based upon a pre-determined net income target and 50% based on individual performance objectives. The annual incentive payout amount was based on a percentage of salary depending on the executive's position. The annual incentive range for Mr. Garnier was up to a maximum of 100% of his base salary. There is no one single bonus trigger and a bonus can be paid for meeting one target while another target is not met, which would be reflected in a lower bonus amount. In 2004, earnings per share targets and net income targets were not met, but in those areas where the actual results for the year met or exceeded the individual performance objectives set by the Committee, incentive compensation awards were approved for the Company's executives. 2004 Awards are detailed in the Summary Compensation Table.

Long-term Incentive Compensation. The Company's long-term incentive based compensation consists of stock options that are granted under the Company's Second Amended and Restated Stock Option Plan for Employees (the "Plan") and are designed to align management interests with those of stockholders. The primary form of long-term incentive compensation is non-qualified stock options granted under the Plan. The Committee approves stock option grant awards for all executives and managers.

The Committee bases stock option grant awards on various factors including an executive's pay level, responsibilities in the organization, and ability to significantly improve future financial results. In addition, the Committee compares the Company's option grant levels with similar industry practices, water utility companies and services industry companies. The Committee believes that stock options enable the Company to compete in the marketplace for executive talent and further align the interests of executives with those of stockholders.

Executive Officer Compensation. The Committee determined the total compensation for the top executives, notably the Chairman and Chief Executive Officer, and the President and Chief Operating Officer by evaluating their performance as leaders and managers of the Company and its overall performance. The Company's financial results for 2004 were below the pre-determined targets for 2004; in particular due to Services Group profitability and greater sales, general and administrative (SG&A) expenses. As a result, the Company's earnings per share were significantly lower than targeted. The total compensation of the top executives was carefully and thoughtfully reviewed especially in light of the Company's performance. Because Company performance for 2004 was very disappointing, the Committee decided to make no increase in base salary in 2005, award no annual incentive compensation for 2004, and award no stock option grants in 2005 to the Chief Executive Officer. The Committee determined that salary adjustments should remain small in light of the Company's performance in 2004. The salary adjustments for 2004 performance awarded in 2005 for other executive officers averaged 2.7%. Bonuses were awarded to other executive officers based on their functional areas of responsibility. Mr. Gallarda, Vice President of Business Development participated in a business development incentive plan.

Base Salary. The Committee has chosen not to adopt a direct formula approach in determining Mr. Garnier's base salary as with the compensation of the Company's other executive officers. Rather, the Committee reviewed a number of objective and subjective measures for Mr. Garnier's position which included (i) the performance of the Company as a whole, (ii) his effectiveness in addressing local, industry-wide and specific issues facing the Company, (iii) business development, (iv) the Company's immediate and long-term financial health and (v) the performance of the Company's stock price. Even though some number of the performance measures above were met or exceeded, after the Committee's deliberations and review, the Committee determined that Mr. Garnier's annual salary should remain at $367,500.

22

Annual Incentive Compensation. There was no annual incentive compensation award made to Mr. Garnier for 2004 because the pre-determined targets for fiscal 2004 were not met and the committee did not award any discretionary amounts.

Long-Term Incentive. The Committee recognized that though stock options are awarded for the Company's long-term performance and that, though the fundamentals of the business remain strong, the amount by which the Company missed its fiscal 2004 targets did not warrant awarding Mr. Garnier any stock options.

Federal Income Tax Considerations. The Compensation Committee has considered the impact of Section 162(m) of the Internal Revenue Code. This section disallows tax deductions for any publicly-held corporation for individual compensation paid to the chief executive officer and any of its other named executive officers of such corporation exceeding $1.0 million in any taxable year. Certain "performance-based compensation" is specifically exempted from the deduction limit. All stock option grants are intended to qualify as "performance based compensation" and thus any gain realized from such awards would be excluded from such $1.0 million limitation. No compensation paid to any of Southwest Water's executive officers in 2004 exceeded the $1.0 million dollar limit.

Compensation Committee

H. Frederick Christie (Chair)

Linda Griego

Donovan D. Huennekens

Richard G. Newman

March 22, 2005

The foregoing Compensation Committee Report on Executive Compensation does not constitute soliciting material and shall not be deemed incorporated by reference by any general statement incorporating this Proxy Statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

23

SUMMARY COMPENSATION TABLE

The following table details the compensation paid to or earned by (i) the Company's chief executive officer, (ii) the Company's four other most highly compensated executive officers in fiscal 2004, and (iii) one additional executive officer whose employment was terminated prior to the end of the year, during each of the Company's last three fiscal years.

Compensation

| |

| |

| |

|---|

| |

Annual Compensation

| |

| |

| |

|---|

| | Long-Term

Securities

Underlying

Options(#)

| |

| |

|---|

Name and Principal Position

| |

Fiscal

Year

| | Salary($)

| | Bonus($)

| | All Other

Compensation

($)

| |

|---|

Anton C. Garnier

Chairman and Chief Executive Officer | | 2004

2003

2002 | | 367,500

350,000

320,000 | | 0

198,750

180,000 | | 78,750

70,000

80,850 | | —

—

— | |

Peter J. Moerbeek

President and Chief Operating Officer |

|

2004

2003

2002 |

|

270,000

251,500

240,000 |

|

0

150,000

100,000 |

|

52,500

56,000

64,680 |

|

—

—

— |

|

Richard J. Shields(1)

Chief Financial Officer and Assistant Secretary |

|

2004

2003

2002 |

|

200,000

190,000

30,692 |

|

0

71,250

30,000 |

|

23,100

28,000

44,100 |

|

225,000

—

— |

(1)

|

Michael O. Quinn

President, Southwest Water Utility Group and President, Suburban Water Systems |

|

2004

2003

2002 |

|

207,500

197,600

190,000 |

|

75,000

120,000

51,425 |

|

15,750

14,000

7,350 |

|

—

—

— |

|

Maurice W. Gallarda

Vice President, Business Development |

|

2004

2003

2002 |

|

187,100

181,200

175,000 |

|

45,000

140,000

60,325 |

|

15,750

21,000

22,050 |

|

—

— |

|

James C. Wisener(2)

Former Chief Operating Officer, Services

Group and President, Master Tek International, Inc. |

|

2004

2003

2002 |

|

207,500

185,000

175,000 |

|

0

180,000

35,000 |

|

36,750

16,800

22,050 |

|

300,000

—

— |

(2)

|

- (1)

- Mr. Shields became Chief Financial Officer of Southwest Water in October 2002. The Company and Mr. Shields entered into a Retenion Agreement on November 9, 2004 pursuant to which he will receive a payment of $225,000 upon his resignation following the filing of the Company's Annual Report on Form 10-K for the year ended December 31, 2004. See "Other Agreements."

- (2)

- Mr. Wisener became Chief Operating Officer of Southwest Water Services Group effective February 2004. He served in that position until December 23, 2004. He received a payment of $300,000 pursuant to a Severance Agreement with the Company entered into on December 15, 2004. The Company and Mr. Wisener also entered into a 10-month consulting agreement. See "Other Agreements."

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is composed of Messrs. Christie, Huennekens, Newman and Ms. Griego. No member of the Company's Compensation Committee is a current or a former officer or employee of the Company or any of its subsidiaries. No executive officer of the Company serves on the Board or Compensation Committee of any entity that has one or more executive officers serving as members of the Company's Board or Compensation Committee. No member of the committee had any relationship with the Company requiring disclosure under Item 404 of SEC Regulation S-K.

24

Change of Control Compensation Agreements