QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Southwest Water Company |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Dear SouthWest Water Stockholder:

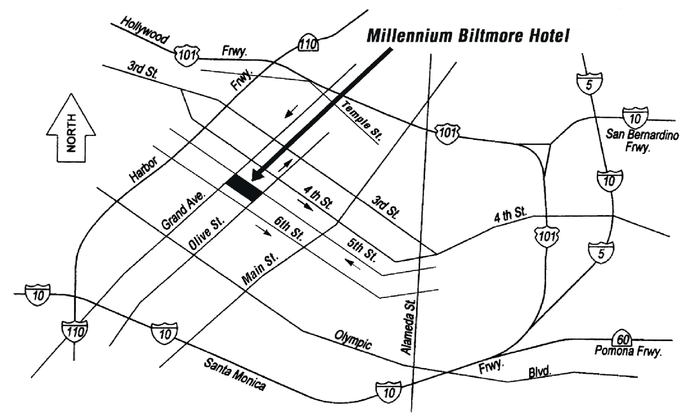

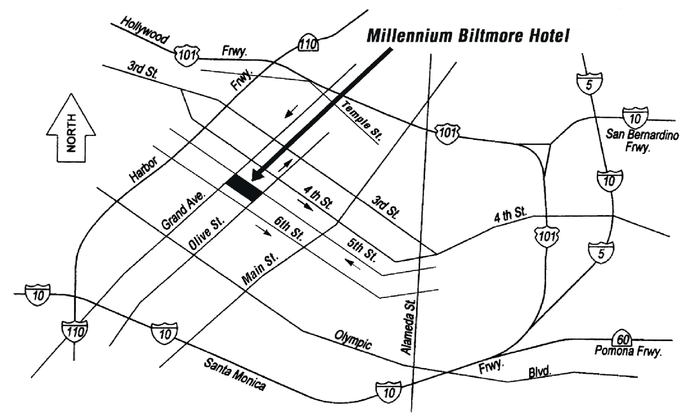

We cordially invite you to attend the 2008 Annual Meeting of Stockholders of SouthWest Water Company (NASDAQ: SWWC) to be held on Tuesday, May 20, 2008, at 10:00 a.m., Pacific Time, at the Millennium Biltmore Hotel Los Angeles, located at 506 South Grand Avenue, Los Angeles, California 90071. (See Map on back Cover)

Details of the business to be conducted at the Annual Meeting are provided in the accompanying Notice of Annual Meeting and Proxy Statement.

Included with this Proxy Statement is a copy of the Annual Report on Form 10-K for fiscal year 2007. We encourage you to read the enclosed materials.

Thank you for your ongoing support and continued interest in SouthWest Water Company.

Sincerely,

Mark A. Swatek

Chief Executive Officer

and Chairman of the Board

SOUTHWEST WATER COMPANY

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 20, 2008

Dear SouthWest Water Stockholder:

The Annual Meeting of Stockholders of SouthWest Water Company, a Delaware corporation, will be held on Tuesday, May 20, 2008, at 10:00 a.m., Pacific Time, at the Millennium Biltmore Hotel Los Angeles, 506 South Grand Avenue, Los Angeles, California 90071 for the following purposes:

- (1)

- To approve the amendment to the Company's Restated Certificate of Incorporation to eliminate the classified Board;

- (2)

- To elect three persons as Class I Directors;

- (3)

- To ratify the selection of PricewaterhouseCoopers (PWC), as the Company's independent public accountants for the fiscal year ending December 31, 2008; and

- (4)

- To consider such other business as may properly come before the meeting.

Only Stockholders of record at the close of business on March 20, 2008, are entitled to notice of, and to vote at, this meeting

By Order of the Board of Directors,

William K. Dix

Vice President General Counsel & Secretary

Los Angeles, California

March 20, 2008

YOUR VOTE IS IMPORTANT: Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to submit your proxy by telephone or our websitehttp://www.proxyvoting.com/swwc. These are quick and cost effective ways for you to submit your proxy. If you would prefer to vote by mail, please sign, date and return the enclosed proxy card in the postage-paid envelope provided. Please review the instructions on the proxy card for each of these voting options. If you return an executed proxy, and then attend the meeting, you may revoke your proxy and vote in person. Attendance at the meeting will not by itself revoke a proxy.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 20, 2008

This proxy statement and the accompanying annual report are available atwww.swwc.com

Among other things, the proxy statement contains information regarding:

- •

- The date, time and location of the meeting;

- •

- A list of the matters being submitted to the Stockholders; and

- •

- Information concerning voting in person.

TABLE OF CONTENTS

| | Page

|

|---|

| SOLICITATION | | 1 |

INFORMATION ABOUT THE ANNUAL MEETING OF STOCKHOLDERS |

|

1 |

| What is the purpose of the Annual Meeting? | | 1 |

| Who can attend the Annual Meeting? | | 1 |

| Who can vote at this Annual Meeting? | | 1 |

| What is the quorum requirement for the Annual Meeting? | | 1 |

| What are the costs of proxy distribution and solicitation and who pays for them? | | 1 |

| What information is contained in these materials? | | 2 |

| What proposals will be voted on at the Annual Meeting? | | 2 |

| What shares owned by me can be voted? | | 2 |

| What is the difference between holding shares as a Stockholder of record and as a beneficial owner? | | 2 |

| How can I vote my shares in person at the Annual Meeting? | | 3 |

| How can I vote my shares without attending the Annual Meeting? | | 3 |

| Can I change my vote after I submit a proxy? | | 4 |

| How are votes cast? | | 4 |

| What is the voting requirement to approve each of these proposals? | | 4 |

| What does it mean if I receive more than one proxy or voting instruction card? | | 4 |

| Who will count the votes? | | 4 |

| Where can I find voting results of the Annual Meeting? | | 4 |

| How would my shares be voted if I do not specify how they should be voted? | | 5 |

PROPOSAL 1: AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE THE CLASSIFIED BOARD |

|

6 |

INFORMATION ON BENEFICIAL OWNERSHIP |

|

8 |

| Principal Stockholders | | 8 |

| Directors and Named Executive Officers | | 9 |

PROPOSAL 2: ELECTION OF DIRECTORS |

|

10 |

| General | | 10 |

| Nominees and Continuing Directors | | 10 |

| Nominees for Election at Annual Meeting (Class I) | | 11 |

| Directors continuing in office with terms expiring 2009 (Class II) | | 12 |

| Directors continuing in office with terms expiring in 2010 (Class III) | | 13 |

GOVERNANCE OF THE COMPANY |

|

14 |

| Corporate General Guidelines | | 14 |

| Code of Ethics | | 14 |

| Board Meeting Criteria | | 14 |

| Nominations for Directors | | 14 |

| Stockholder Recommendations | | 15 |

| Director Independence | | 16 |

| Certain Relationships and Related Party Transactions | | 16 |

| Confidential Rights, Complaints and Communication with the Board | | 16 |

BOARD MEETINGS |

|

17 |

COMMITTEES OF THE BOARD |

|

17 |

| Audit Committee | | 18 |

| Compensation and Organization Committee | | 18 |

| Financial Planning and Investment Committee | | 18 |

| Nominating and Governance Committee | | 18 |

COMPENSATION DISCUSSION AND ANALYSIS |

|

19 |

| Summary Compensation Table | | 25 |

| Grants of Plan Based Awards | | 26 |

| Outstanding Equity Awards at the Fiscal Year-End | | 27 |

| Option Exercises and Stock Vested | | 29 |

| Pension Benefits | | 30 |

| Nonqualified Deferred Compensation | | 31 |

| Potential Payments Upon Termination or Change of Control | | 32 |

| Equity Compensation Information | | 37 |

| Director Compensation | | 38 |

AUDIT COMMITTEE REPORT |

|

39 |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

|

40 |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION |

|

40 |

PROPOSAL 3: RATIFICATION OF SELECTION OF INDEPENDENT ACCOUNTANT |

|

41 |

STOCKHOLDER PROPOSALS |

|

42 |

ANNUAL REPORT ON FORM 10-K |

|

43 |

WHERE YOU CAN FIND MORE INFORMATION |

|

43 |

APPENDIX 1 |

|

44 |

DIRECTIONS TO SOUTHWEST WATER COMPANY ANNUAL MEETING OF STOCKHOLDERS |

|

Back Cover |

2008 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

SOLICITATION

This proxy statement ("Proxy Statement") is furnished by and on behalf of the Board of Directors (the "Board" or "Directors") of SouthWest Water Company, a Delaware corporation ("SouthWest Water," "the Company," "we," or "us"), in connection with its solicitation of proxies to be voted at the Annual Meeting to be held on Tuesday, May 20, 2008 (the "Annual Meeting"), beginning at 10:00 a.m., Pacific Time, at the Millennium Biltmore Hotel Los Angeles, 506 South Grand Avenue, Los Angeles, California 90071 for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. This Proxy Statement and enclosed proxy card will be mailed on or about April 14, 2008 to the Company's Stockholders of record (the "Stockholders") as of March 20, 2008 (the "Record Date").

INFORMATION ABOUT THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 20, 2008

Q: What is the purpose of the Annual Meeting?

- A:

- At our Annual Meeting, we are asking Stockholders to consider and vote upon matters described in the Notice of Annual Meeting of Stockholders. In addition, management will report on the performance of the Company and respond to questions from Stockholders.

Q: Who can attend the Annual Meeting?

- A:

- Our Stockholders, Company representatives and Company guests can attend our Annual Meeting. Admission to the meeting depends on how your stock ownership is recorded. If your stock is held in the name of a bank, broker or other holder of record and you plan to attend the Annual Meeting, please obtain proof of ownership, such as a current brokerage account statement or certification from your broker. If your stock is registered with our transfer agent, The Bank of New York Mellon Corporation ("BNY Mellon" and/or "transfer agent"), all you need is proof of identify; no proof of ownership is needed.

Q: Who can vote at this Annual Meeting?

- A:

- Owners of SouthWest Water common stock or Series A preferred stock at the close of business on the Record Date are entitled to receive this notice and to vote their shares at the Annual Meeting. As of that date, there were24,435,213 shares of common stock outstanding and9,156 shares of Series A preferred stock outstanding. On each matter properly brought before the Annual Meeting, common shares will be entitled to one vote per share, and Series A Preferred shares will be entitled to five votes per share. The combined total number of eligible votes is24,444,369 shares.

Q: What is the quorum requirement for the Annual Meeting?

- A:

- The presence at the meeting, in person or by proxy, of the holders of a majority of the eligible votes on the Record Date will constitute a quorum, permitting business to be conducted at the Annual Meeting. Proxies received, but marked as abstentions, and broker non-votes (i.e., shares that are not voted by the broker who is the record holder of the shares because the broker is not instructed to vote by the actual owner of the shares and does not have discretionary authority to vote such shares) will be included in the calculation of the number of votes considered to be present at the meeting. Abstentions and broker non-votes will not be counted "for" or "against" any matter.

Q: What are the costs of proxy distribution and solicitation and who pays them?

- A:

- SouthWest Water will bear the entire cost of this solicitation of proxies, including the preparation, assembly, printing and mailing of this Proxy Statement, the proxy card and any additional

1

solicitation material that SouthWest Water may provide to Stockholders. Copies of solicitation material will be provided to brokerage firms, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to beneficial owners. In addition, SouthWest Water has retained Morrow and Company ("Morrow") to act as a proxy solicitor for the Annual Meeting. SouthWest Water has agreed to pay Morrow $5,000, plus reasonable out-of-pocket expenses, for proxy solicitation services. The original solicitation of proxies by mail may be supplemented by solicitation by telephone, facsimile and other means by Directors, officers and employees of SouthWest Water. No additional compensation will be paid to these individuals for their services.

Q: ��What information is contained in these materials?

- A:

- The information included in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of Directors and our most highly paid officers or named executive officers, and certain other required information. SouthWest Water's 2007 Annual Report, proxy card and a return envelope are also enclosed.

Q: What proposals will be voted on at the Annual Meeting?

- A:

- There are three proposals to be voted on at the Annual Meeting:

- •

- Amendment to the Restated Certificate of Incorporation to eliminate the classified Board of Directors;(For information about this proposal, please see page 6.)

- •

- The election of three persons as Class I Directors;(For information about this proposal, please see page 10.); and

- •

- Ratification of the selection of PricewaterhouseCoopers as the Company's independent public accountants for the fiscal year ending December 31, 2008.(For information about this proposal, please see page 41).

If any other matters are properly presented at the Annual Meeting for consideration, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place, the persons named in the proxy will have discretion to vote on these matters in accordance with their best judgment.

Q: What shares owned by me can be voted?

- A:

- Each share of SouthWest Water stock issued and outstanding as of the close of business on the Record Date is entitled to vote on all items being voted upon at the Annual Meeting. You may cast one vote per share of common stock that you held on the Record Date. Holders of Series A preferred stock may cast five votes per share of preferred stock owned by them on the Record Date. You may vote all shares owned by you as of the Record Date, including shares that are: (1) held directly in your name as the Stockholder of record; or (2) held for you as the beneficial owner through a stockbroker, bank or other nominee.

Q: What is the difference between holding shares as a Stockholder of record and as a beneficial owner?

- A:

- Most Stockholders of SouthWest Water hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with BNY Mellon, you are considered the Stockholder of record, and these proxy materials are being sent directly to you by SouthWest Water. As the Stockholder of record, you have the right to grant your voting proxy directly to SouthWest Water or to vote in person at the Annual Meeting. SouthWest Water has enclosed a

2

proxy card for your use. You may also vote by Internet or the telephone as described below under"How can I vote my shares without attending the Annual Meeting?"

Beneficial Owner of Shares Held in Street Name

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the Stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the Annual Meeting. Because you are not the Stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a signed proxy from the record holder (e.g. your broker) giving you the right to vote the shares in person. Your broker or nominee has enclosed a voting instruction card for you to use in directing the broker or nominee how to vote your shares. Most Stockholders may also vote by Internet or by the telephone, as described below under"How can I vote my shares without attending the Annual Meeting?"

Q: How can I vote my shares in person at the Annual Meeting?

- A:

- Shares held directly in your name as the Stockholder of record may be voted in person at the Annual Meeting. If you choose to do so, please bring the enclosed proxy card or proof of identification. Even if you plan to attend the Annual Meeting, SouthWest Water recommends that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the Annual Meeting. Shares held beneficially in a street name may be voted in person by you only if you obtain a signed proxy from the record holder (e.g. your broker) giving you the right to vote the shares in person.

Q: How can I vote my shares without attending the Annual Meeting?

- A:

- If you are a registered Stockholder, you may vote by Internet or the telephone, by following the instructions included with your proxy card. You may also complete and properly sign the accompanying proxy card and return it to BNY Mellon and it will be voted according to your instructions. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or nominee. A large number of banks and brokerage firms are participating in the ADP Investor Communications Services online program, which provides eligible Stockholders who hold their shares in street name to vote by the Internet or telephone. If your bank or brokerage firm is participating in ADP's program, your voting form will provide instructions. Please refer to the voting instructions below and those included on your proxy card or, for shares held beneficially in street name, the voting instruction card provided by your broker, trustee or nominee. The deadline for voting by Internet and the telephone is 11:59 p.m., Eastern Time, on May 19, 2008.If you vote by Internet or telephone, do not return your proxy card.

By the Internet –The website for Internet voting for Stockholders of record ishttp://www.proxyvoting.com/swwc. As with telephone voting, you can confirm that your instructions have been recorded. You can also request electronic delivery of future proxy materials with Internet voting. Most SouthWest Water Stockholders who hold shares beneficially in street name and live in the United States or Canada may vote by going to the site specified on the voting instruction card provided by their brokers, trustees or nominees.

By Telephone –Stockholders of record of SouthWest Water stock who live in the United States or Canada may submit proxies by following the "Vote by Phone" instructions on their proxy card. Most SouthWest Water Stockholders who hold shares beneficially in street name and live in the United States or Canada may vote by phone by calling the number specified on the voting instruction card provided by their brokers, trustees or nominees.

By Mail –Stockholders of record of SouthWest Water stock may submit proxies by completing, signing and dating their proxy card and mailing it in the accompanying pre-addressed envelope. SouthWest Water Stockholders who hold shares beneficially in street name may vote by mail by

3

Q: Can I change my vote after I submit a proxy?

- A:

- As a Stockholder of record, you may revoke your proxy at any time before it is voted at the Annual Meeting by doing any of the following:

- •

- Granting a new proxy, relating to the same shares and bearing a later date;

- •

- Attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, revoke your proxy. In order to revoke your proxy you must vote at the meeting; or

- •

- If your shares are held in the name of a broker, bank or other nominee, you may change your vote by submitting new voting instructions to your bank, broker or other record holder. You must contact your bank, broker or other record holder to find out how to do so.

Q: How are votes cast?

- A:

- In the election of Directors, you may vote "FOR" one or more of the nominees or your vote may be "WITHHELD" for one or more of the nominees. For all other proposals, you may vote "FOR," "AGAINST" or "ABSTAIN" on each such proposal. If you vote "WITHHELD" or "ABSTAIN" it has the same effect as a vote "AGAINST."

Q: What is the voting requirement to approve each of the proposals?

- A:

- For Proposal 1, the affirmative vote of a majority of votes cast by the holders of shares entitled to vote, voting in person or by proxy at the Annual Meeting is required for approval. Abstentions on this proposal will have the effect of a vote against such proposal. Brokers are authorized to vote on this proposal.

For Proposal 2, each nominee who receives the affirmative vote of a majority of votes cast by the holders of shares entitled to vote, voting in person or by proxy at the Annual Meeting, shall be elected a Director to serve for three years or until his or her successor has been elected and qualified. However, if Proposal 1 is approved by the Stockholders, then the persons elected would serve until the Annual Meeting held in 2009 and until each successor has been elected and qualified. Brokers are authorized to vote on this proposal.

For Proposal 3, the affirmative vote of a majority of votes cast by the holders of shares entitled to vote, voting in person or by proxy at the Annual Meeting is required for approval. Abstentions on this proposal will have the effect of a vote against such proposal. Brokers are authorized to vote on this proposal.

Q: What does it mean if I receive more than one proxy or voting instruction card?

- A:

- It means your shares are registered differently or are in more than one account. Please provide voting instructions for each proxy and voting instruction card you receive.

Q: Who will count the votes?

- A:

- The inspector of election, a representative of BNY Mellon, will be present at the meeting and will count the votes.

Q: Where can I find the voting results of the Annual Meeting?

- A:

- SouthWest Water intends to announce preliminary voting results at the Annual Meeting and publish final results in its quarterly report on Form 10-Q for the second quarter of fiscal 2008.

4

Q: How would my shares be voted if I do not specify how they should be voted?

- A:

- If you sign and return your proxy card without indicating how you want your shares to be voted, the person who is named on the proxy card as the proxy holder appointed by you, will vote your shares in accordance with the recommendations of the Board as follows:

Proposal 1: For approval of the amendment to the Restated Certificate of Incorporation to eliminate the classified Board of Directors;

Proposal 2: For the election of all three nominees for Class I Directors; and

Proposal 3: For the ratification of PricewaterhouseCoopers, as the Company's independent public accountants for the fiscal year ending December 31, 2008.

5

PROPOSAL 1 – AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE THE CLASSIFIED BOARD OF DIRECTORS

The Company's Restated Certificate of Incorporation provides that the Board of Directors shall be divided into three classes, with each class having a three-year term. In February 2008, the Board of Directors adopted, subject to Stockholder approval, amendments to revise Article Sixth of the Restated Certificate of Incorporation to eliminate the classified Board of Directors. The proposal would allow for the annual election of Directors in the manner described below. The Board of Directors has set the current number of Directors at nine. The proposal would not change the present number of Directors and the Board of Directors would retain the authority to change that number and to fill any vacancies or newly created Directorships.

Background of Proposal

Classified or staggered boards have been widely adopted and have a long history in corporate law. Proponents of classified boards assert they promote the independence of Directors because Directors elected for multi-year terms are less subject to outside influence. Proponents of a classified structure for the election of Directors also believe it provides continuity and stability in the management of the business and affairs of a company because a majority of Directors always has prior experience as Directors of the company. Proponents further assert that classified boards may enhance Stockholder value by forcing an entity seeking control of a target company to initiate arms-length discussions with the board of a target company because the entity is unable to replace the entire board in a single election.

Alternatively, some investors view classified boards as having the effect of reducing the accountability of Directors to Stockholders because classified boards limit the ability of Stockholders to evaluate and elect all Directors on an annual basis. The election of Directors is a primary means for Stockholders to influence corporate governance policies and to hold management accountable for implementing those policies. In addition, opponents of classified boards assert that a classified structure for the election of Directors may discourage proxy contests in which Stockholders have an opportunity to vote for a competing slate of nominees and therefore may erode Stockholder value.

In December of 2007, the Company received a Stockholder proposal requesting that the Company submit a proposal to the Stockholders seeking their approval of a request that the Board take all necessary steps to elect the Directors annually. After a review by the Company's Nominating and Governance Committee and the Board, the Board, based upon the recommendation of the Nominating and Governance Committee, decided that it was an appropriate time to propose eliminating the classified Board. This determination by the Board also furthers its goal of ensuring that the Company's corporate governance policies maximize management accountability to Stockholders and would, if adopted, allow Stockholders the opportunity each year to register their views on the performance of the entire Board of Directors. Accordingly, the Board has determined that eliminating the classified Board is in the best interests of the Company and its Stockholders.

The elimination of the classified board would require amendments to the Restated Certificate of Incorporation. If this proposal is approved by the Stockholders, current Director nominees' terms would expire at the 2009 Annual Meeting of Stockholders, but sitting Directors' terms would not be shortened. Those Directors whose terms expire at the 2009 Annual Meeting of Stockholders will similarly be elected for a one-year term to expire in 2010. Beginning with the 2010 Annual Meeting, all Directors would be elected for one-year terms at each Annual Meeting. Board candidates receiving the highest number of votes of the shares entitled to be voted, up to the number of Directors to be elected by such shares, shall be declared elected.

If this proposal is adopted, any Director appointed by the Board as a result of a newly created Directorship or to fill a vacancy on the Board of Directors would hold office until the next Annual Meeting.

The amendments to the Restated Certificate of Incorporation to implement this proposal are substantially set forth in Appendix 1, and the Company has shown the changes to the relevant sections

6

of Article Sixth resulting from the proposed amendment with deletions indicated by strike-outs. If approved, this proposal will become effective upon the filing of a Certificate of Amendment to the Restated Certificate of Incorporation with the Secretary of State of the State of Delaware containing substantially these amendments, which the Company would do promptly after approval by the Stockholders. Thereafter, the Board will consider amendments to the Company's Bylaws that would make the Bylaws consistent with the proposed amendment to eliminate the classified Board.

Required Vote and Board of Directors Recommendation

Approval of this proposal requires the affirmative vote of a majority of votes cast by the holders of shares outstanding as of the Record Date entitled to vote, voting in person or by proxy at the Annual Meeting. Abstentions and broker non-votes will be counted as present for purposes of determining if a quorum is present, but will have the same effect as a negative vote on the outcome of this proposal. Brokers are authorized to vote on this proposal.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" APPROVAL OF THE AMENDMENTS TO THE RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE THE CLASSIFIED BOARD.

7

INFORMATION ON BENEFICIAL OWNERSHIP OF PRINCIPAL STOCKHOLDERS

As of March 20, 2008, the Company's records and other information available from outside sources indicated that the following Stockholders were beneficial owners of more than five percent of the outstanding shares of the Company's common stock. The information below is as reported in their filing with the Securities and Exchange Commission ("SEC"). The Company is not aware of any other beneficial owner of more than 5% of the Company's common stock.

Class of Stock

| | Name and Address of Beneficial Owner

| | Number of Shares

Beneficially Owned

| | Percentage

of Class

| |

|---|

| Common Stock | | Pictet Asset Management SA(1)

60 Route Des Acacias

Geneva 73

Switzerland CH-12 11 | | 2,301,100 | | 9.496 | % |

Common Stock |

|

Invesco Ltd.(2)

Stein Roe Investment Counsel, Inc.

PowerShares Capital Management LLC

1360 Peachtree Street NE

Atlanta, GA 30309 |

|

2,222,927 |

|

9.17 |

% |

- (1)

- Based on a Schedule 13G/A filed with the SEC on January 11, 2008, these securities are owned by various individual and institutional investors for whom Pictet Asset Management SA ("PAM SA") serves as an investment advisor. Included in this amount are 2,301,100 shares held by PAM SA. PAM SA has sole voting power over 2,301,100 shares and sole dispositive power over 2,301,100 shares.

- (2)

- Based on a Schedule 13G/A filed with the SEC on February 13, 2008, these securities are owned by various individual and institutional investors for whom Invesco Ltd., the parent company to Stein Roe Investment Counsel, Inc., and PowerShares Capital Management LLC (jointly "Invesco") serves as an investment advisor. Included in this amount are 500 shares held by Stein Roe Investment Counsel, Inc. and 2,222,427 held by PowerShares Capital Management LLC. Invesco has sole voting power over 2,222,427 shares and sole dispositive power over 2,222,927 shares.

8

INFORMATION ON BENEFICIAL OWNERSHIP OF DIRECTORS

AND NAMED EXECUTIVE OFFICERS

The following table provides information concerning the beneficial ownership of our common stock as of March 20, 2008 for: (i) each Director and nominee for Director of the Company, (ii) each executive officer named in the Summary Compensation Table on page 26, and (iii) all Directors (including nominees) and executive officers as a group. Except as otherwise noted, to our knowledge, the named individual or their family members have sole voting and investment power with respect to the securities beneficially owned by the Stockholder.

We calculate beneficial ownership by including shares owned in each Director's or named executive officer's name (or by any member of his or her immediate family). Also, in calculating the percentage ownership, we count securities which the Director or named executive officer could purchase within 60 days of March 20, 2008 (such as exercisable stock options that are listed in a separate column as outstanding securities). No Director or named executive officer owns shares of our preferred stock.

Name of Beneficial Owner

| | Common

Stock(1)

| | Exercisable

Options(2)

| | Total Stock

Shares and

Exercisable

Options

|

|---|

| Directors | | | | | | |

| H. Frederick Christie | | 41,359 | | 65,780 | | 107,139 |

| Anton C. Garnier | | 327,692 | | 373,790 | | 701,482 |

| Linda Griego | | 13,006 | | 10,500 | | 23,506 |

| Donovan D. Huennekens | | 108,125 | | 71,543 | | 179,668 |

| Thomas Iino | | 2,756 | | 0 | | 2,756 |

| William D. Jones | | 6,891 | | 33,050 | | 39,941 |

| Maureen A. Kindel | | 10,423 | | 65,780 | | 76,203 |

| Richard G. Newman | | 68,518 | | 60,999 | | 129,517 |

| Named Executive Officers | | | | | | |

| Mark A. Swatek | | 35,647 | | 45,750 | | 81,397 |

| Cheryl L. Clary | | 14,446 | | 30,065 | | 44,511 |

| David Stanton | | 11,525 | | 11,550 | | 23,075 |

| Michael O. Quinn | | 40,358 | | 63,196 | | 103,500 |

| Stephen C. Held | | 5,000 | | 41,941 | | 46,941 |

| All Directors and Executive Officers as a Group (13) | | 685,746 | | 873,944 | | 1,559,690 |

- (1)

- Includes shares held directly or in joint tenancy, shares held in trust, by broker, bank nominee or other indirect means over which the individual has voting or shared voting and/or investment power.

- (2)

- Includes options that become exercisable within 60 days of March 20, 2008.

9

PROPOSAL 2: ELECTION OF CLASS I DIRECTORS

General

The Board of Directors currently consists of nine Directors divided into three classes consisting of three Directors each (Class I, Class II and Class III). Directors in each class are elected to serve for three-year terms that expire in successive years so that the Stockholders elect one class of Directors at each annual meeting. The terms of the Class I Directors will expire at the upcoming Annual Meeting. The Board has nominated Thomas Iino, William D. Jones and Maureen A. Kindel for election as Class I Directors. If Proposal 1 is not approved, the Class I Directors will serve for three-year terms expiring at the annual meeting of Stockholders to be held in 2011. However, if Proposal 1 is approved by the Stockholders, then Class I Directors would serve for a one-year term, expiring at the annual meeting of Stockholders to be held in 2009 or until their successors are elected and qualified. Each nominee currently serves as a Class I Director.

Each nominee has consented to being named in this Proxy Statement and has agreed to serve if elected. The affirmative vote of a majority of the votes cast at the Annual Meeting is required to elect the three nominees as Directors. This means that the three nominees will be elected if they receive more affirmative votes than any other person. Beginning on the next page, the principal occupation and certain other information is provided on the nominees and the Directors whose terms of office will continue after the Annual Meeting.

Nominees and Continuing Directors

The following table provides information on the people who serve as Directors as of March 20, 2008:

Class

| | Names

|

|---|

| Class I Directors (expires at this meeting) | | Thomas Iino

William D. Jones

Maureen A. Kindel |

Class II Directors (expires 2009) |

|

Donovan D. Huennekens

Richard G. Newman

Mark A. Swatek |

Class III Directors (expires 2010) |

|

H. Frederick Christie

Anton C. Garnier

Linda Griego |

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THOMAS IINO, WILLIAM D. JONES AND MAUREEN A. KINDEL AS DIRECTORS. THE PERSONS NAMED IN THE ENCLOSED PROXY WILL VOTE YOUR PROXY IN FAVOR OF THESE NOMINEES UNLESS YOU SPECIFY A DIFFERENT CHOICE IN YOUR PROXY.

10

NOMINEES FOR ELECTION AT ANNUAL MEETING (CLASS I)

| | Thomas Iino, 65 Director since 2007

Mr. Iino is Chairman of the Board of Los Angeles-based Pacific Commerce Bank. Previously, he served as partner-in-charge of Deloitte & Touche LLC's International Practice in Southern California, focusing on audit, strategic planning, merger and acquisitions and managing bottom-line results. Mr. Iino is a CPA and past president of both the National Association of State Boards of Accountancy and the California State Board of Accountancy. He has also served on the board of directors for the Japanese American Community Cultural Center, the board of governors for the Japanese American National Museum and the board of governors, UCLA Foundation. He has been an active participant in several civic organizations throughout his career and received distinguished service awards from the National Association of State Boards and the California Society of Certified Public Accountants. Mr. Iino earned his bachelor of science degree in accounting from UCLA. Mr. Iino was introduced to SouthWest in 2007 by a Non-Management Director to fill a vacancy created by the retirement of a previous director. |

|

|

|

|

|

William D. Jones, 52 Director since 2004

Mr. Jones is president, chief executive officer and owner of CityLink Investment Corporation and City Scene Management Company. Prior to founding CityLink Investment Corporation Mr. Jones served as general manager of a $400 million commercial real estate portfolio in the northwest for Prudential Realty Group. He is a director of Sempra Energy, certain funds in the American Funds Family, the Federal Reserve Bank of San Francisco and the San Diego Padres. Mr. Jones also serves on the board of trustees of the Francis Parker School. |

|

|

|

|

|

Maureen A. Kindel, 70 Director since 1997

Ms. Kindel currently serves as senior managing Director of GCG Rose & Kindel, a consulting and public affairs firm. She is past president of the City of Los Angeles Board of Public Works, a founding and current member of each of the Pacific Counsel on International Policy, and the LA 84 Foundation. She serves on the board of the International Foundation of Election Systems on which she chairs the Nominating Committee, and is a regent of Loyola Marymount University. Ms Kindel also sits on the board of Directors of the Los Angeles Chamber of Commerce. In 2007 she received her MBA from Loyola Marymount University and is currently a Doctoral student in Education. |

11

DIRECTORS CONTINUING IN OFFICE WITH TERMS EXPIRING IN 2009 (CLASS II)

| | Donovan D. Huennekens, 71 Director since 1969

Mr. Huennekens serves as Chairman to the Company's Audit Committee. He is a partner of HQT Homes, a real estate development company, a private real estate investor, and a director of Bixby Ranch Company, a privately owned family company primarily in the business of developing, managing and owning commercial real estate. Mr. Huennekens also serves on the Compensation Committee of the Board of Bixby Ranch Company. He has been an active member of numerous business and professional organizations, including the Federal National Mortgage Associations advisory board and the Financial Executives Institute. |

|

|

|

|

|

Richard G. Newman, 73 Director since 1991

Mr. Newman serves as Chairman to the Company's Financial Planning and Investment Committee. He is founder, chairman and a director of AECOM Technology Corporation, the parent of several subsidiaries that provide engineering and diversified professional, technical and management support services throughout the world. Mr. Newman is also a director of Sempra Energy Company and serves on the boards of 14 mutual funds managed by the Capital Research and Management Company. He is a member of the College of Fellows of the Institute for the Advancement of Engineering and a member of the Chief Executives Organization, American Society of Civil Engineers and National Society of Professional Engineers. |

|

|

|

|

|

Mark A. Swatek, 55 Chairman of the Board since 2006

Mr. Swatek joined SouthWest Water Company as chief executive officer in May 2006. From 2005 until joining SouthWest Water, he was president of MWH Municipal and State Services, the largest operating division of MWH Global. In this capacity, he managed municipal operations, primarily involving water/wastewater engineering, program management, and facility design-build activities for city, county and state governments throughout the U.S. From 2000 to 2005, Mr. Swatek was president of MWH Constructors, the design-build construction subsidiary of MWH Global. Mr. Swatek also served as a member of the board of directors of MWH Global from 2003 to 2006, MWH Constructors from 2000 to 2006 and MWH Americas from 2005 to 2006. A registered professional civil engineer, he has served as a director on a number of boards of engineering and construction companies. |

12

DIRECTORS CONTINUING IN OFFICE WITH TERMS EXPIRING IN 2010 (CLASS III)

| | H. Frederick Christie, 74 Director since 1996

Mr. Christie has served as Lead Director since May 2006 and is Chairman of the Company's Compensation and Organization Committee. An independent consultant, he retired in 1990 as president and chief executive officer of the Mission Group, a subsidiary of SCEcorp (now Edison International). From 1984 to 1987, he served as president of Southern California Edison Company, a subsidiary of SCEcorp. Mr. Christie is a director of IHOP Corporation, AECOM and Ducommun Incorporated. He also serves on the boards of 21 mutual funds managed by the Capital Research and Management Company. |

|

|

|

|

|

Anton C. Garnier, 67 Director since 1968

Executive Vice Chair since 2006

Mr. Garnier joined the Company in 1968 and retired as chief executive officer and chairman of the Board in May of 2006. He is now the executive vice chairman of the Board of Directors of the Company. He is past president of the National Association of Water Companies and has been actively involved in the American Water Works Association and California Water Association. Other current and past affiliations include the World Business Council, Chief Executives Organization and Young Presidents Organization. |

|

|

|

|

|

Linda Griego, 60 Director since 2006

Ms. Griego serves as Chairman to the Company's Nominating and Governance Committee. She is founder and managing general partner of the Engine Company No. 28, a Los Angeles restaurant and president and chief executive officer of Griego Enterprises, Inc., a business management company. From 1990 to 2000, Ms. Griego held a number of government-related appointments, including deputy mayor of Los Angeles, and President & CEO, Los Angeles Community Development Bank. Ms. Griego's other public company directorships include CBS Corporation, City National Bank and AECOM Technology Corporation. She also serves on the boards of directors of non-profit organizations, including current service on the boards of the Robert Wood Foundation, the David and Lucile Packard Foundation, the Public Policy Institute of California and the YMCA of Greater Los Angeles. |

13

GOVERNANCE OF THE COMPANY

Corporate General Guidelines

SouthWest Water is committed to having sound corporate governance principles. Our Board believes that the purpose of corporate governance is to ensure we maximize Stockholder value while meeting applicable legal requirements with the highest standards of integrity. The Board has adopted and adheres to corporate governance practices, which the Board and senior management believe promotes this purpose. We continually review these governance practices, Delaware law (the state in which we are incorporated), the rules and listing standards of The NASDAQ Stock Market, LLC. ("NASDAQ") and SEC regulations, as well as best practices suggested by recognized governance authorities.

SouthWest Water maintains a corporate governance page on its website, which includes key information about its corporate governance initiatives, including SouthWest Water'sCorporate Governance Guidelines and charters for each of the Committees of the Board. The corporate governance page of the Company can be found atwww.swwc.com by clicking on Investor Relations then Governance & Management.

Code of Ethics

OurCode of Ethical Conduct for all employees and ourCode of Ethics for Directors and Executive Officers ("Code of Ethics") can also be found on our websitewww.swwc.com by clicking on Investor Relations then Governance & Management. TheCode of Ethics is intended to comply with the requirements of the Sarbanes Oxley Act of 2002 and applies to our Directors and named executive officers, including our chief executive officer, senior financial officers and other members of the Company's senior management team. We will provide without charge to any person, by written or oral request, a copy of ourCode of Ethics. Requests should be directed to Corporate Communications, SouthWest Water Company, One Wilshire Building, 624 South Grand Avenue, Suite 2900, Los Angeles, California 90017.

Board Meeting Criteria

SouthWest Water'sCorporate Governance Guidelines contain Board membership criteria that apply to nominees for a position on SouthWest Water's Board. Under these criteria, members of the Board must have professional and personal ethics and values consistent with longstanding SouthWest Water values and standards. They should have broad experience at the policy-making level in business, government, education, technology or public interest. They should be committed to enhancing Stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform all Director duties responsibly. Each Director must represent the interests of all Stockholders of the Company.

Nominations for Directors

The Nominating and Governance Committee uses a variety of methods to identify and evaluate nominees for Director, including materials provided by professional search firms or other parties. In the event that Board vacancies are anticipated, or otherwise arise, the Nominating and Governance Committee considers various potential candidates for Director. Candidates may come to the attention of the Nominating and Governance Committee through current Board members, professional search firms, Stockholders or other persons. These candidates are evaluated at meetings of the Nominating and Governance Committee, and may be considered at anytime during the year. In evaluating such nominations, the Nominating and Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board.

In evaluating Director nominees, the Nominating and Governance Committee considers the following:

- •

- The appropriate size of the Board;

- •

- The needs of the Company with respect to the particular talents and experience of the Directors;

14

- •

- The knowledge, skills and experience of nominees, including experience in utilities, business, finance, administration or public service, in light of prevailing business conditions, and the knowledge, skills and experience already possessed by other members of the Board;

- •

- Familiarity with national and international business matters;

- •

- Experience in political affairs;

- •

- Experience with accounting rules and practices;

- •

- Appreciation of the relationship of our business to the changing needs of society;

- •

- The nominee's other commitments, including the other boards on which nominee serves; and

- •

- The desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members.

The Nominating and Governance Committee's goal is to assemble a Board that brings to us a variety of perspectives and skills derived from high quality business and professional experience. In doing so, the Nominating and Governance Committee also considers candidates with appropriate non-business backgrounds.

Other than the foregoing, there are no stated minimum criteria for Director nominees, although the Nominating and Governance Committee may also consider such other factors as it may deem are in the best interest of us and our Stockholders. The Nominating and Governance Committee does, however, believe it appropriate for at least one, and preferably several, members of the Board to meet the criteria for an "audit committee financial expert" as defined by SEC rules, and that a majority of the members of the Board meet the definition of "independent director" under NASDAQ rules. The Nominating and Governance Committee also believes it is in the Stockholders' best interest for certain key members of our current and former management to participate as members of the Board. The Nominating and Governance Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the Nominating and Governance Committee or the Board decides not to re-nominate a member for re-election, the Nominating and Governance Committee identifies the desired skills and experience of a new nominee based on the criteria above.

The Board nominates the Director candidates it deems most qualified for election by the Stockholders after consideration of the recommendation by the Nominating and Governance Committee. In accordance with the bylaws of the Company, the Board will be responsible for filling vacancies or newly created Directorships on the Board that may occur between annual meetings of Stockholders.

Stockholder Recommendations

The Company'sCorporate Governance Guidelines allow Stockholders to recommend Director nominees for consideration by the Nominating and Governance Committee by writing to the Corporate Secretary at least 90 days before the Annual Meeting, specifying the nominee's name and qualifications for Board membership. Following verification of the Stockholder status of the person submitting the recommendation and review of minimum qualifying standards, all properly submitted recommendations are brought to the attention of the Nominating and Governance Committee at the next Committee meeting. Candidates recommended by a Stockholder will be evaluated in the same manner as any candidate identified by the Nominating and Governance Committee.

The Company's Amended and Restated Bylaws ("Bylaws") allow Stockholders to recommend business, including recommending Director nominees, to come before a special meeting or Annual Meeting of the Company by providing notice to the Corporate Secretary at least 90 days before the Annual Meeting. Such notice must comply with the requirements of our Bylaws.

15

Director Independence

Based on information solicited from each Director in the form of an annual questionnaire and upon the advice and recommendation of the Company's Nominating and Governance Committee, the Board has determined that each of the current Directors, except the Chairman of the Board and Chief Executive Officer (Mr. Swatek) and the Executive Vice Chairman (Mr. Garnier), have no material relationship with SouthWest Water (either directly or as a partner, Stockholder or officer of an organization that has a relationship with the Company) and is "independent" within the meaning of the Director independence standards, as currently in effect. The NASDAQ independence definition includes a series of objective tests, such as the Director is not an employee of the Company and not engaged in various types of business dealings with the Company. Furthermore, the Board has determined that each of the members of the Audit, Compensation and Organization, and Nominating and Governance Committees has no material relationship with SouthWest Water (either directly or as a partner, Stockholder or officer of an organization that has a relationship with the Company), and is "independent" within the meaning of NASDAQ's Director independence standards.

Independent Director sessions of Non-employee Directors are held at each regularly scheduled Board meeting. The sessions are chaired by an independent Director selected by the Board from time to time. Any Director can request that an additional independent Director session be scheduled.

Certain Relationships and Related Transactions

The Company is required by law and generally accepted accounting principles to disclose to investors certain transactions between the Company and a related party. A related party would include a Director, nominee for Director, executive officer, certain Stockholders, and certain others. As a part of the process in determining its disclosure obligations, the Company circulates a questionnaire to each Director, nominee for Director, executive officer, and other persons who the Company believes could be a related party containing questions calculated to discover the existence of a related party transaction. The Company also conducts such other investigations, as it deems appropriate under the circumstances.

Our Code of Ethics for Directors and Executive Officers states that our executive officers and Directors, including their family members, are charged with avoiding situations in which their personal, family or financial interests conflict with those of the Company. The Board is responsible for reviewing and approving all related person transactions between the Company and any Directors or executive officers. The Compensation and Organization Committee reviews compensation related transactions with Directors or executive officers (such as salary and bonus). Any request for us to enter into a transaction with an executive officer or Director, or any such persons' immediate family members or affiliates, must be presented to the Board for review and approval. In considering the proposed agreement, the Board will consider the relevant facts and circumstances and the potential for conflicts of interest or improprieties.

No Director, nominee, executive officer or any member of their family had any indebtedness to the Company, any business relationship with the Company or any transaction with the Company in 2007. No Director, nominee, executive officer or any member of their family, at any time during the past three years, has been employed by any entity, including a charitable organization, that has made payments to, or received payments from, including charitable contributions, the Company for property or services in an amount which, in any single fiscal year, exceeded the greater of $1 million or 2% of the other entities consolidated gross revenues reported for that fiscal year.

Confidential Rights, Complaints and Communication with the Board

The Board has established procedures, which enable the Company's employees and Stockholders to submit anonymous and confidential reports of suspected or actual violations of the Company's Code of Ethics or any of the following: Violations of law, illegal or unsound accounting practices; internal accounting controls; theft or fraud; insider trading; or conflicts of interest. All employees are informed on a regular basis of the toll-free number available to them 24 hours a day, seven days a week.

Stockholders may communicate with the Board by writing to the Secretary, SouthWest Water Company, One Wilshire Building, 624 South Grand Avenue, Suite 2900, Los Angeles, California 90017. The Secretary will forward all communications to the full Board or the appropriate committee with a copy to the Chairperson of the Nominating and Governance Committee.

16

BOARD MEETINGS

The Board met eleven (11) times during fiscal 2007. Each Director attended at least 75% of all Board and applicable Committee meetings. The Board also encourages attendance at the Annual Meeting of Stockholders by all nominees for election as Directors and all Directors whose term of office will continue after the meeting. Last year all Directors attended the Annual Meeting, with the exception of Linda Griego, who attended a portion of the meeting telephonically. Under the Company'sCorporate Governance Guidelines, each Director is expected to dedicate sufficient time, energy and attention to ensure the diligent performance of his or her duties, including attending the Annual Meeting of Stockholders of the Company, meetings of the Board and Committee meetings of which he or she is a member.

Annually the Board elects a lead director to serve for a year.

The Board has four standing committees: (i) Audit; (ii) Compensation and Organization; (iii) Financial Planning and Investment; and (iv) Nominating and Governance. Each of the Committees operates under a written charter adopted by the Board. The Committee charters are available on SouthWest Water's website atwww.swwc.com under the Investor Relations tab, Governance and Management.

COMMITTEES OF THE BOARD

The Committees of the Board on which certain Directors served during 2007, and the number of meetings held in 2007 by the Committees are identified below.

|

|---|

Name of Director

| | Lead

Director

| | Audit

| | Compensation

and

Organization

| | Financial Planning

and

Investment

| | Nominating

and

Governance

|

|---|

| Non-Employee Directors: | | | | | | | | | | |

| James C. Castle, PhD(1) | | | | X | | | | X | | |

| H. Frederick Christie(2) | | X | | X | | Chair | | | | X |

| Linda Griego(3) | | | | | | | | X | | Chair |

| Donovan D. Huennekens | | | | Chair | | X | | | | |

| Thomas Iino(4) | | | | X | | | | X | | |

| William D. Jones(5) | | | | X | | X | | X | | X |

| Maureen A. Kindel(6) | | | | | | X | | | | X |

| Richard G. Newman | | | | | | X | | Chair | | |

| Employee Directors | | | | | | | | | | |

| Anton C. Garnier | | | | | | | | | | |

| Mark A. Swatek | | | | | | | | | | |

| Number of Meetings in Fiscal 2007 | | | | 8 | | 7 | | 3 | | 4 |

X = Committee member

- (1)

- James C. Castle was a member of the Audit Committee and Financial Planning and Investment Committee until June 2007 when he retired from the Board.

- (2)

- H. Frederick Christie was elected Lead Director in May 2007 and was a member of the Financial Planning and Investment Committee until May 2007.

- (3)

- Linda Griego was a member of the Compensation and Organization Committee until May 2007.

- (4)

- Thomas Iino became a member of the Audit and the Nominating and Governance Committees when he joined the Board August 2007.

- (5)

- William D. Jones became a member of the Compensation and Organization Committee in May 2007.

- (6)

- Maureen A. Kindel was a member of the Audit Committee until May 2007.

17

Audit Committee

The Audit Committee of SouthWest Water's Board of Directors consists of four independent Directors, in compliance with the listing standards of NASDAQ and the SEC rules. They are Messrs. Huennekens (Chair), Christie, Jones and Iino. The Audit Committee operates under a written charter adopted by the Board of Directors that sets forth its responsibilities and authority. The Audit Committee Charter is available on SouthWest Water's website atwww.swwc.com.

The Audit Committee has the duties prescribed in its Charter and is responsible for overseeing the Company's financial reporting and disclosure process on behalf of the Board of Directors. It reviews, acts on and reports to the Board of Directors with respect to (among other things) auditing performance and practices, accounting policies, financial reporting, and disclosure practices of the Company.

The Board of Directors has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on this Committee. In addition the Board has determined that at least one member of the Audit Committee, Donovan D. Huennekens, qualifies as an "Audit Committee Financial Expert" as defined by the SEC rules. The Board has also determined that each of the Audit Committee members satisfies the SEC rules regarding independence and the NASDAQ requirements for Audit Committee membership including financial sophistication. Stockholders should understand that the "financial expert" designation is a disclosure requirement of the SEC related to Mr. Huennekens experience and understanding with respect to certain accounting and auditing matters. The designation does not impose upon Mr. Huennekens any duties, obligations or liabilities that are greater than are generally imposed on him as a member of the Audit Committee and the Board. His designation as an Audit Committee Financial Expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board. The Committee reviews and evaluates annually its performance and charter.

Compensation and Organization Committee

The Compensation and Organization Committee assists the Board in reviewing the performance and approving the compensation of SouthWest Water's executives. The Committee provides general oversight of SouthWest Water's equity compensation plans and benefits programs and approves grants of equity compensation under the Company's equity incentive plans. The Committee reviews and evaluates annually its performance and charter.

Financial Planning and Investment Committee

The Financial Planning and Investment Committee assists the Board in overseeing the Company's long-term strategic planning, new business development, acquisitions, mergers and overall investment policy. The Committee reviews and analyzes significant financial matters, such as assisting in the evaluation of proposed merger and acquisition transactions and other financial investment activities. It also reviews SouthWest Water's capitalization, including credit management, risk concentration and return on invested capital. The Committee reviews and evaluates annually its performance and charter.

Nominating and Governance Committee

The Nominating and Governance Committee identifies individuals qualified to become Board members; recommends Director candidates to the Board for election and re-election; and develops and recommends corporate governance principles, including giving proper attention and making effective responses to Stockholder concerns regarding corporate governance. Please refer to our section on "Governance of the Company" for more information on the Company's governance guidelines. The Committee reviews and evaluates annually its performance and charter.

18

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This Compensation Discussion and Analysis describes how we compensated the persons who served as the Company's Chief Executive Officer and Chief Financial Officer and the other persons included in the Summary Compensation Table on page 25 during fiscal year 2007. Collectively, this group of executive officers is referred to as the named executive officers (the "NEO or NEO's").

The Compensation and Organization Committee (the "Committee") of our Board of Directors is responsible for determining the compensation of the named executive officers and the other members of the Company's senior management team. The Committee also reviews and oversees all long-term incentive and equity-based plans, defined contribution plans, our deferred compensation plan, the Supplemental Executive Retirement Plan, and change-of-control agreements.

Objectives

Our executive compensation programs are designed with the intent of attracting, motivating and retaining experienced executives and rewarding them for their contributions to the Company's achievement of its annual and long-term goals. We believe that in this way we can align the interests of our executives with those of our stockholders. We put a greater relative emphasis on at risk, performance based incentives to increase the relationship of pay to Company performance and offer greater compensation potential for superior performance.

Role of Executive Officers in Compensation Decision

Our Chief Executive Officer, other members of management and outside advisors may be invited to attend Committee meetings from time to time depending on the matters to be discussed. The Committee may solicit the input of the Chief Executive Officer as it relates to the compensation of other named executive officers. However, neither the Chief Executive Officer nor any other member of management votes on items before the Committee.

Setting Executive Compensation

The Committee has structured base salary, non-equity incentive plan awards and long-term equity based incentive awards to motivate named executive officers to achieve goals set by the Company and to reward achievement of those goals. From time to time the Committee engages independent compensation consultants to assist with the review and development of the total compensation provided to its named executive officers. The Committee engaged Towers Perrin, a global professional HR services firm, during 2006 to assist with the review of total compensation evaluations conducted in 2007.

The Committee reviews the base salaries of each of our named executive officers annually and the overall executive salary ranges periodically. The Committee determines the base salary of each named executive officer after considering the pay levels of our peer group, the executive's individual performance, his or her long-term contributions, and the pay of others on the executive team. We target our executive base salary to be in the 50th percentile of our peer group. Adjustments may be made at the discretion of the Committee due to superior performance of the officer involved. Historically, our peer group consisted of four water utility companies and four services companies that provide services in a market similar to that which we serve or to the same clients we serve. These companies are:

Utility

| | Services

|

|---|

| • American States Water Company | | • Keith Companies, Inc. |

| • Aqua America | | • Matrix Service Company |

| • California Water Service Group | | • Michael Baker Company |

| • SJW Corporation | | • TRC Companies |

19

Periodically the peer group companies are reviewed with an outside compensation consultant and updated. To a lesser extent the Committee also considers base salary for individuals in comparable positions based on general industry trends, the business requirements for certain skills, and the responsibilities of the executive.

Components of Executive Compensation

The basic elements of compensation for our named executive officers are:

- •

- Base salary;

- •

- Non-equity incentive plan awards;

- •

- Long-term equity based incentive awards;

- •

- Retirement and other benefits; and

- •

- Perquisites.

Our named executive officers are compensated with a mix of these key components of compensation. The Committee reviews each element separately and then considers all elements together to ensure that the goals and objectives of our total compensation philosophy are met. For 2007, each officer's base salary was the subject of a discretionary review by the Committee taking into account the officer's personal performance for the year and factoring into consideration related cost of living adjustments. Non-equity incentive plan awards were based on a percentage formulation for each officer dependent upon the Company meeting certain established financial goals as well as the officer's personal goals and objectives as established by the Chief Executive Officer and the Committee.

Base Salary

Our objectives in setting, reviewing and adjusting base salary are twofold: to attract and retain executive talent and to meet competitive practices. Our base salary is intended to provide reasonable and competitive pay for services to the Company. The Committee, after considering similarly situated competitors and taking into consider the performance history of the officers involved seek to annually establish the base salary for such affected officers. In using this methodology, the base salary adjustment has both quantitative and qualitative components.

Non-Equity Incentive Plan Awards

Our objective in providing annual non-equity incentive compensation in the form of cash awards is to motivate executives to make improvements in individual and Company performance and to align the executive's compensation with the Company's performance and objectives; the greater the improvement in Company performance, the greater the incentive opportunity. We also believe annual non-equity incentive compensation is necessary to remain competitive with our peer group.

The Committee annually reviews non-equity incentives for executives generally in February or March to determine award payments for the last completed fiscal year, as well as to set performance goals and incentive targets for the current fiscal year. Non-equity incentives (Short-Term Incentives or STI) are based on performance against both formulaic financial objectives and discretionary non-financial personal goals. The financial objectives may include objectives relating to EPS, Pre-Tax Income, Group or Division Income, or other financial metric measures that are pertinent to the individual's span of control. Each NEO has a large portion of his/her STI associated with total Company financial performance and to a lesser degree that executive's individual operational performance. Non-financial goals are established to assure focus on activities that help the Company achieve its strategic incentives, such as its Cornerstone business reengineering project, critical acquisitions or realignment of individual operations. When these targets are met, the awards are paid in cash. For the Chief Executive Officer the non-equity incentive award cannot exceed 100% of base salary and for other executives, the percentage varies but can not exceed 100%. The Committee approves the incentive level for the Chief Executive Officer and for each named executive officer taking into consideration the Chief Executive Officer's recommendations. For 2007, the Company did not meet its proposed financial goals, but significant progress was made in restructuring the company and implementing its Cornerstone Project. As a result, the non-equity incentive awards are for performance towards the

20

executive's non-financial objectives and are significantly less than would have been the case had the Company met its financial goals. The non-equity incentive awards granted to the named executive officers are detailed in the Grants of Plan-Based Awards table on page 26. The Chief Executive Officer, in recognition that the company did not achieve its 2007 financial goals, declined a grant of a non-equity incentive award.

Long-Term Incentive Awards

The Company believes that stock-based long-term incentive awards align the interests of executives with those of stockholders. Both wish to see an increase in value. In addition, we believe stock ownership encourages executives to take a more entrepreneurial and longer term view of the Company and its business. In 2007 the Committee used non-qualified stock options and restricted stock awards as the form of long-term incentive as permitted under the Equity Incentive Plan. The amount of the option and stock awards are based on rewarding individual contributions and a target of competitive total compensation relative to our peers. The non-qualified stock options awarded in March of 2007 have a term of 7 years from the grant date and they vest ratably 33% each year over 3 years. The exercise price is the fair market value of the stock on the grant date. The restricted stock awards given in March of 2007 vest ratably 33% each year over 3 years.

Most of the long-term incentive awards made to named executive officers are made during the same time each year, typically February or March. These awards are referred to as in-cycle awards. The process for these awards is structured. The Chief Executive Officer reviews the performance of the named executive officers and management against long-term goals of the organization, strategic initiatives and the role each individual may have in moving the Company toward those goals and initiatives. The Chief Executive Officer recommends long-term incentive awards to the Committee, and the Committee, after discussion and review, approves final awards.

Long-term incentive awards made to non-employee Directors were made following the Annual Meeting of Stockholders in May each year. Each non-employee Director is awarded the same number of non-qualified options. The non-qualified stock option awarded to non-employee Directors in May of 2007 have a term of 7 years and a day from the grant date, they vest ratably 50% each year over 2 years, and the exercise price is the fair market value of the stock on the grant date. The value of the awards made to the non-employee Directors in 2007 is detailed in the Directors Compensation table on page 38.

Occasionally, out-of-cycle long-term incentives are made to named executive officers. The most typical out-of-cycle awards are made when an executive is first hired or is promoted. These out-of-cycle long-term incentive awards, if more than 2,500 shares, require the Committee's approval and are made effective as of the fifth business day following the date of hire. The Committee has delegated to the Chief Executive Officer the authority to make out-of-cycle long-term incentive awards of non-qualified stock options up to 2,500 shares, with the provision that the Committee is informed of the award at the next Committee meeting.

All options are granted at fair market value of the stock on the date of grant. Fair market value is determined as the closing price of the Company's stock on the NASDAQ on the date of grant.

All the grants awarded to the named executive officers, both in-cycle and out-of-cycle, are detailed in the Grants of Plan-Based Awards table on page 26.

Retirement and Other Benefits

- •

- Profit Sharing/Savings Plans. All employees, including named executive officers, may participate in one of two 401(k) Plans depending on the subsidiary in which they work. The Services Group companies' employees typically participate in the Profit Sharing 401(k) Plan, established in 1988 and the Utility Group companies' employees typically participate in the 401(k) Retirement and Savings Plan, established in 1994.

- •

- In both plans, employees may elect to make before tax contributions of up to 60% of their base salary, subject to current Internal Revenue Service limits. Neither 401(k) Plan permits

21

an investment in our stock. The Company matches employee contributions up to a set percentage of the employee's contribution depending on the specific plan and the Company contributed portion has a specific vesting period. For the Profit Sharing 401(k) Plan, the Company matches 50% of the first 2% of the employee's contribution. The Company's contribution vests 100% after one year of service. For the 401(k) Retirement and Savings Plan, the Company matches 100% of the first 2% of the employee's contribution and 50% of the next 4%. The Company match vests at a graduated rate over 6 years.

- •

- Employee Stock Purchase Plan. All employees, including named executive officers, may participate in the Employee Stock Purchase Plan (the ESPP), established in 1989, when they meet the eligibility requirements. Eligible employees are those who work more than 20 hours a week and are employed at least 90 days. The ESPP provides eligible employees an option to purchase the Company stock at a discounted price at the end of a set offering period. Our offering period is quarterly. The discount in the ESPP is 10% off the lesser of the Company's stock price based on the average of the high and low price for the last or first three (3) days of the offering period. Employees can participate through payroll deduction and there is an annual Internal Revenue Service limit of $25,000 in value of stock that can be purchased through the ESPP.

- •