UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08544

fpa FUNDS TRUST

(Exact name of registrant as specified in charter)

11601 WILSHIRE BLVD., STE. 1200

LOS ANGELES, CALIFORNIA 90025

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

J. RICHARD ATWOOD, PRESIDENT FPA FUNDS TRUST 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 |

Registrant’s telephone number, including area code: (310) 473-0225

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Item 1: Report to Shareholders.

| (a) | The Reports to Shareholders are attached herewith. |

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of the Fund's shareholder reports, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the FPA Funds website (fpa.com/funds), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll in e-delivery at fpa.com (for accounts held directly with the Fund).

You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you may inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 638-3060. Your election to receive reports in paper will apply to all funds held with the FPA Funds or through your financial intermediary.

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Dear Shareholders:

Overview

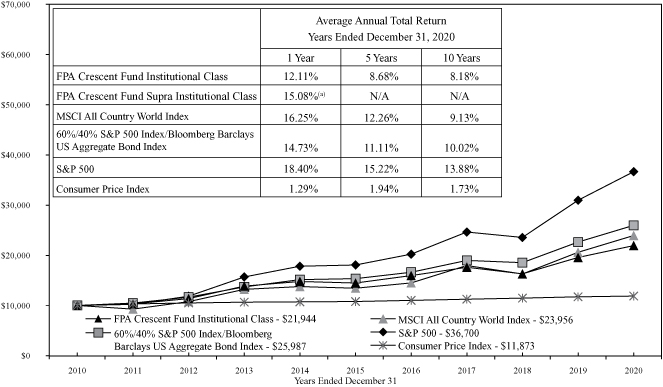

The FPA Crescent Fund — Institutional Class ("Fund" or "Crescent") gained 18.15% for the fourth quarter and 12.11% for the full year 2020.1

The Fund's performance and that of its underlying equity exposure can be considered in the context of the following illustrative indices.

Exhibit A: Performance versus Illustrative Indices2

| | | Q4 2020 | | 2020 | |

Crescent | | | 18.2 | % | | | 12.1 | % | |

Crescent — Long Equity | | | 23.8 | % | | | 12.6 | % | |

S&P 500 | | | 12.2 | % | | | 18.4 | % | |

MSCI ACWI | | | 14.7 | % | | | 16.3 | % | |

Including some minor risk assets and cash held, the Fund generated 135.3% of the average of the S&P 500 and MSCI ACWI return in the fourth quarter. The Fund outperformed its own risk exposure of 79.0%, on average, during the quarter.3

The Fund's strategy may have appeared out of step in the first quarter, and as we argued at the time in the Fund's Q1 2020 commentary: "Businesses owned by the Fund may have seen their stock value move 25% day-to-day, or even intra-day, but in our assessment their business value did not similarly change."

Stock prices generally appreciated over the last three months; and in many cases increased by quite a lot. While the Fund showed an outsized improvement in the fourth quarter, which was generally a function of the many positions we pointed out as being inexpensive in our Q3 2020 commentary. And still, in our assessment, not a lot has changed in the underlying fundamentals of the companies held in the portfolio.

1 Effective September 4, 2020, the current single class of shares of the Fund was renamed the Institutional Class shares. Unless otherwise noted, all data herein is representative of the Institutional Share Class.

2 Comparison to the indices is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. An investor cannot invest directly in an index. The long equity segment of the Fund is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Long equity holdings only includes equity securities excluding paired trades, short-sales, and preferred securities. The long equity performance information shown herein is for illustrative purposes only and may not reflect the impact of material economic or market factors. No representation is being made that any account, product or strategy will or is likely to achieve profits, losses, or results similar to those shown. Long equity performance does not represent the return an investor in the Fund can or should expect to receive. Fund shareholders may only invest or redeem their shares at net asset value.

3 Risk assets are any assets that are not risk free and generally refers to any financial security or instrument, such as equities, commodities, high-yield bonds, and other financial products that are likely to fluctuate in price. Risk exposure refers to the Fund's exposure to risk assets as a percent of total assets. The Fund's net risk exposure as of December 31, 2020 was 78.5%.

Past performance is no guarantee, nor is it indicative, of future results.

1

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Portfolio discussion

It's been a year of extreme, nerve-wracking volatility. Our longer-term mindset is our anchor in choppy seas, guiding us to seek out what is currently out of favor while avoiding the inflated valuations of what is in vogue. However, these portfolio decisions can cause us to appear out of touch with the crowd — hopefully a temporary phenomenon, and incumbent on us to prove to you over time.

In our Q2 2020 commentary earlier this year, we shared what we believed would be temporary impacts on certain businesses: that people would get on planes and stay in hotels again, and what that might mean for the travel and aerospace industries, for example.

We owned and subsequently purchased many stocks that experienced dramatic price declines in the first quarter. The shares of these companies were priced at such low valuations, suggesting that their businesses would never recover.

As a result, the Fund saw more changes in its portfolio last year than it has had in many years. We took the opportunity to increase equity exposure earlier in 2020 as investors were running for the exits. We reset the portfolio by reducing or eliminating certain holdings that in our view offered less attractive long-term potential, while increasing existing and new positions in those businesses that we believed were temporarily harmed by the global pandemic but whose stock prices were disproportionately decimated.

The contributors to and detractors from the Fund's trailing 12-month returns are listed below and reflect the realities of 2020: technology and other growth stocks performed well, while more cyclical "value" stocks did not.

Exhibit B: Trailing Twelve Month Contributors and Detractors as of December 31, 20204

Contributors | | Perf.

Cont. | | Avg. %

of Port. | | Detractors | | Perf.

Cont. | | Avg. %

of Port. | |

Alphabet | | | 2.02 | % | | | 5.3 | % | | Howmet Aerospace | | | -1.25 | % | | | 1.9 | % | |

Broadcom | | | 1.64 | % | | | 2.8 | % | | McDermott (multiple issues) | | | -1.09 | % | | | 0.8 | % | |

Naspers & Prosus | | | 1.35 | % | | | 3.0 | % | | Wells Fargo | | | -0.99 | % | | | 1.6 | % | |

Baidu | | | 1.22 | % | | | 1.6 | % | | Ally Financial | | | -0.94 | % | | | 0.2 | % | |

Facebook | | | 1.17 | % | | | 2.5 | % | | Raytheon & Otis | | | -0.80 | % | | | 0.7 | % | |

| | | | 7.41 | % | | | 15.1 | % | | | | | -5.07 | % | | | 5.2 | % | |

4 Reflects the top five contributors and detractors to the Fund's performance based on contribution to return for the trailing twelve months ("TTM"). Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. A copy of the methodology used and a list of every holding's contribution to the overall Fund's performance during the TTM is available by contacting FPA Client Service at crm@fpa.com. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed. Positions in Naspers and Prosus are look-through investments to gain exposure to Tencent. Raytheon and Otis were results of a Merger between Raytheon and United Technologies. As such, the contribution to return and weight of these separate companies has been combined for purposes of this analysis.

Past performance is no guarantee, nor is it indicative, of future results.

2

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Technology: It's no great surprise that the top five contributors to performance over the last year were our technology investments that floated upwards on the rising tide. Despite taking some profits, we retained many of these positions. These companies share the common characteristic that they operate successful business models and trade at valuations that, although not as inexpensive as they once were, we believe will still provide a reasonable return in the years to come.

Financials: The financials in our portfolio underperformed as investors sold shares in a panic, fearing that the economic downturn would cause such damage to loan and investment portfolios and that there would be, in general, less demand for their products and services. The market was correct that their businesses would be harmed, but not to the degree that was ultimately priced into their stocks. There has been some recent recognition of this as financials were strong performers in Q4 and in the early days of 2021. Given strong balance sheets, a post-COVID economy within sight, stimulus packages, and the Fed's security purchase support, combined with inexpensive valuations, we suspect that there is still gas left in their collective tank.

Aerospace: We own two aerospace suppliers, Howmet and Meggitt, which saw their stock prices decline by around two-thirds from their Q1 2020 highs.5 Howmet's price increased about three times from its low and ended the year at its all-time high. Meggitt's stock price doubled from its bottom but is still significantly below its peak. The value of their necessary and large market share businesses did not fluctuate as much as their stock prices.

When things look bleakest, the prospects for returns are typically brightest. As much as that might have been the case earlier this year, in our assessment the opposite is true today. Now that the stock market has run to new highs, we would suggest that we have borrowed from future returns.6 In general, the more you pay for an asset, the lower you can expect for its future return. We therefore retain approximately 25% in cash and conservative fixed income as available to be redirected for future opportunities.

Markets and Economy

It's always good to take stock at the end of a calendar year, and no better time than now with 2020 delivering more than the usual share of surprises.

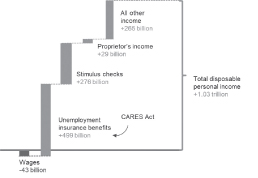

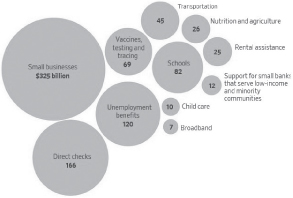

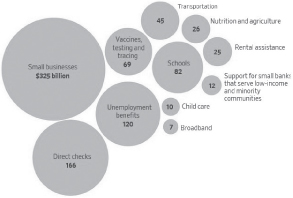

At the end of 2019, no one predicted that the unemployment rate would hit its highest level since the Great Depression and most Americans would struggle financially; US national debt would cross $27 trillion, an increase of almost $5 trillion; GDP would shrink 3.5%; average wages would decline but household incomes would increase, thanks to government stimulus checks (Exhibit C); yet the stock market would hit new highs, delivering a double-digit rate of return.

5 As of December 31, 2020. The TTM average portfolio weight of and contribution by Meggitt were 0.8% and -0.43%, respectively. The TTM average portfolio weight of and contribution by Howmet were 1.9% and -1.25%, respectively.

6 Unless otherwise noted, any references to "market" in this Commentary refers to the S&P 500 Index.

Past performance is no guarantee, nor is it indicative, of future results.

3

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit C: Personal Income Increased in 2020 Despite a Decline in Wages in the U.S.7

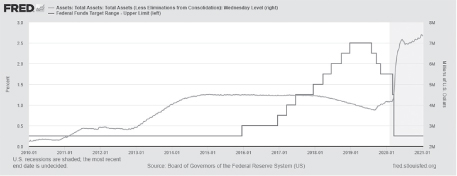

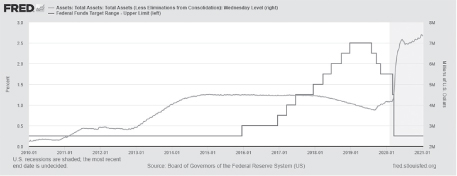

The economy and, by extension, the securities markets have been supported by the friendliest financial conditions in U.S. history including: a negative real rate of interest, liberal fiscal policy, business subsidies, stimulus checks for most individuals, and a ballooning Fed balance sheet used to buy treasuries, agencies, and now corporate bonds.

People were fearful of what might be. As is usually the case, however, more things could happen than will happen. We certainly did not predict that 2020 would unfold as it did, but the three meta-points we communicated in our Q1 2020 commentary, when fear was near its peak, reflect our steady bearing.

We said then that;

1) "...the world isn't coming to an end. The impact on the Fund is largely a mark-to-market exercise in the midst of the most unsettling series of events that many of us have ever experienced."

2) "We put almost 30 percent of the Fund's cash to work during the quarter, with its cash position shrinking to 26% of the portfolio from 36%. We added more than a dozen new holdings and are genuinely happy with what we own...."

3) "We believe Crescent's portfolio of securities at the end of this tumultuous quarter is attractive...."

Investors typically anchor to the average annual market return, while disregarding that the actual annual returns vacillate tremendously around that average.

7 Source: Bureau of Economic Analysis. Data is from March 2020 through November 2020 and compared to the same time period in 2019.

Past performance is no guarantee, nor is it indicative, of future results.

4

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Ironically, people will one day look back at 2020 and see a year that delivered a market return of approximately 2x the long-term average. There will be less attention paid to the market having declined approximately 34%, only to then rebound approximately 67%.8 That's comforting in a way as it suggests that this unusual year was not really so abnormal.

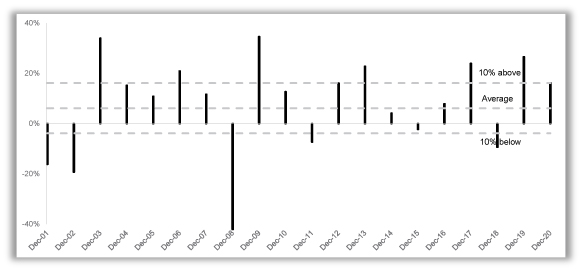

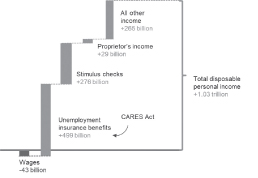

Investors focus on average annual stock market returns without often appreciating that the stock market never returns the average. Long-term equity returns are achieved with significant variability around the mean. The MSCI ACWI Net Return Index has returned an average of 6.12% over the past 20 years, but in only three instances were the returns even within 2% of the average. In 65% of the cases, the returns were more than 10 percentage points higher or lower than the average, with a 77% spread between the best and worst years (34.6% in 2009; -42.2% in 2008). Therefore, notwithstanding the tremendous volatility during the year, as it relates to the global stock market returns for the full calendar year 2020, it was truly an exceptionally unexceptional year (Exhibit D).

Exhibit D: MSCI ACWI Returns 2001 to 20209

The pendulum swung hard to the downside in March and now has swung even harder to the upside since those market lows. We also wrote in our Q1 2020 commentary that "As emotion is wrung from the stock market, it tends to look forward to what the economy looks like on the other side of a virulent downturn." That happened sooner than we expected. Far be it from us to say this rebound was overdone, but there's little question that the markets are pricing in a COVID-free world (Exhibit E).

8 Source: Bloomberg. As of December 31, 2020. The 'market' statistics noted refer to the S&P 500 Index.

9 Source: Bloomberg. As of December 31, 2020. MSCI ACWI Net Return Index.

Past performance is no guarantee, nor is it indicative, of future results.

5

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

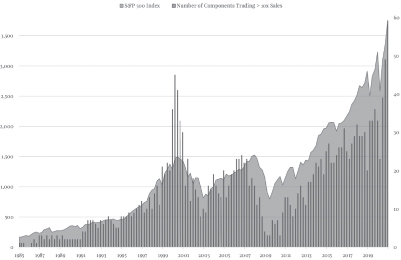

Exhibit E: Global Valuations10

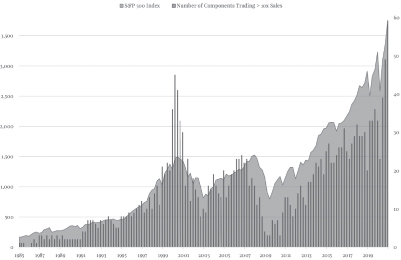

In comparison to trailing indicators, large-cap US stocks (S&P 500) trade at 22.3x forward earnings at year-end, 45% higher than the 20-year average. 11 Larger market cap companies based outside the U.S. (ACWI ex-U.S.) trade less expensively at 16.7x, although still 25% higher than its 20-year average. These higher valuations can, in part, be supported by lower interest rates and the higher growth rates of many businesses. However, ~12% of the S&P 500 now trades at more than 10x sales — its largest percentage and more than during the dotcom bubble (Exhibit F). Only time will tell if it is truly different this time, but it has always been dangerous to utter those words during previous periods of market exuberance.

10 Source: Factset. As of December 31, 2020. Data is represented by the respective indices in the charts.

11 Source: J.P. Morgan Asset Management, Guide to the Markets. Slide 55. As of December 31, 2020.

Past performance is no guarantee, nor is it indicative, of future results.

6

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit F: Valuation Extreme12

International stocks continue to trade more inexpensively (relatively) when compared to U.S. stocks even with many operating globally (Exhibit G). A lower valuation on its own, though, does not warrant a place for a stock in our portfolio. Those slots are reserved for growing businesses. We have been fortunate to find many such companies in the last couple of years, which explains our 40.7% exposure (as a percent of net equity investments) to foreign-domiciled companies; including global companies like Lafargeholcim, Groupe Bruxelles Lambert, Glencore, and Richemont.13

12 Source: What were you thinking? Part Tres. Jesse Felder, The Felder Report. Data as of December 31, 2020. The 'number of components' refers to individual stocks.

13 Portfolio composition will change due to ongoing management of the Fund.

Past performance is no guarantee, nor is it indicative, of future results.

7

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit G: Relative Forward P/E Ratio of S&P 500 vs. MSCI ACWI ex-U.S.14

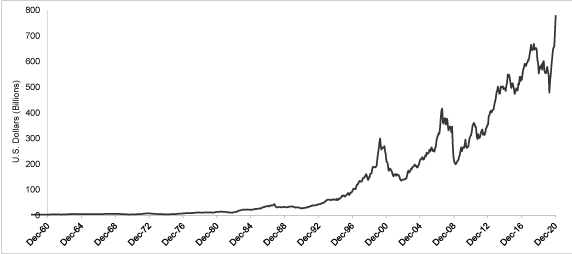

Generally high valuations create a friendly market for raising capital. This past year was no different. Initial public offering volume hit a record $175 billion; while SPACS, the special purpose acquisition companies that have a "blank check" to invest, have raised more than $60 billion.15

According to Bloomberg, "a record $120 trillion of stock changed hands on U.S. stock exchanges last year, up 50% year-over year. The average Russell 3000 stock saw average daily share volume surge 46% to 1.9 million shares."16 The stocks that performed best were those with better projected prospects than current earnings and companies that were either less impacted by or benefited from the pandemic. Needless to say, we did not own many of these companies. The momentum-driven buying of many individuals, including those utilizing commission-less platforms like Robinhood, have helped drive stock prices higher. Many of these "investors" operate with the core tenet that past performance is indicative of future performance, and have piled into stocks with the aid of record amounts of borrowed money and the use of derivatives (Exhibits H & I).

14 Source: Factset. As of December 31, 2020.

15 Source: A Speculative Frenzy is Sweeping Wall Street and World Markets. Bloomberg News. As of December 19, 2020.

16 Source: Day Traders Put Stamp on Market with Unprecedented Stock Frenzy. Bloomberg Quint. As of January 1, 2021.

Past performance is no guarantee, nor is it indicative, of future results.

8

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit H: Margin Debt17

Exhibit I: Call Options Traded 20-Day Moving Average18

17 Source: Yardeni Research, Inc. As of December 31, 2020. Debit balances in margin accounts at broker/dealers. Beginning in 1997, data reflects debit Balances in customers' securities margin accounts.

18 Source: Bloomberg. U.S. Total Option Call Volumes. As of December 31, 2020.

Past performance is no guarantee, nor is it indicative, of future results.

9

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

It's interesting to see how people find solace in different industries in which they have little grasp of the economics, let alone what might be the right price to pay. Momentum, more than understanding, drove the Nifty 50 in the 70s; Oil stocks in the 80s; Tech stocks in the 90s; Diversified industrial stocks and certain financials — like General Electric and Bank of America in the 00s; and now back to technology and healthcare stocks today. 19

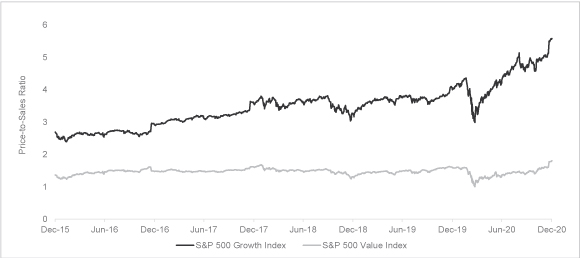

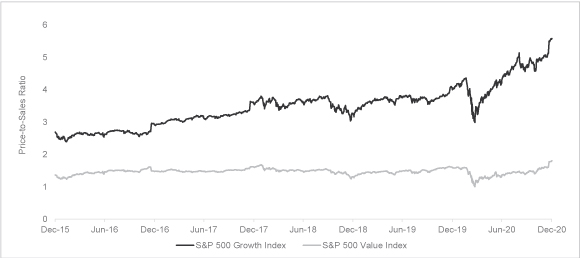

This has led to a clear bifurcation in the market with a widening gulf between the haves and have-nots — as pronounced as we've ever seen it (Exhibit J). The valuations of many "haves" are too rich for our blood and are less likely to deliver reasonable returns over time, despite many high quality businesses in the mix. The lower valuations of the "have-nots" can often be appropriately justified by the secular challenges these businesses face. As price conscious investors, we focus on the cohort in between. Much of the oxygen in the room has gotten sucked up by those stocks that have been "working", leaving the share prices of many good businesses gasping for air.

Exhibit J: Price/Sales: S&P 500 Growth Index vs S&P 500 Value Index20

Grounded in the philosophy of not paying more for an asset than we believe it is worth, our true north remains bottom-up security selection. We evaluate the risk/reward of each of our investments over a three to five-year period, and innately believe that anything less is speculation. As risky as investing in stocks appeared at the March lows, particularly with regard to the financial, travel, and aerospace sectors, we'd argue that higher stock prices today, all else equal, translates to greater risk.

19 Nifty 50 was an informal designation for fifty popular large-cap stocks on the New York Stock Exchange in the 1960s and 1970s that were widely regarded as solid buy and hold growth stocks, or "Blue-chip" stocks.

20 Source: Bloomberg. As of December 31, 2020.

Past performance is no guarantee, nor is it indicative, of future results.

10

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

We therefore expend the bulk of our energy and capital on those businesses that we believe offer secular growth, good returns on capital, have operators who are either owners or function with an owner mentality and, finally, trade at prices that should allow for an acceptable rate of return over time.

Investors today are paying more for certainty — or for the illusion of certainty. However, there are numerous companies (many with unproven business models) whose valuations can only be justified by high earnings growth well into the future. Further, achieving those growth rates does not assure good stock price performance. Take Microsoft for example. It posted 19.5% earnings growth through the first decade of the millennium, but its stock price declined 48% in that time.21 Price may not matter over the short-term, but it certainly does over the long-term. The Crescent portfolio will hopefully continue to prove that point.

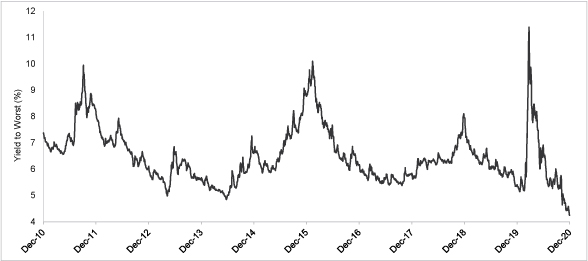

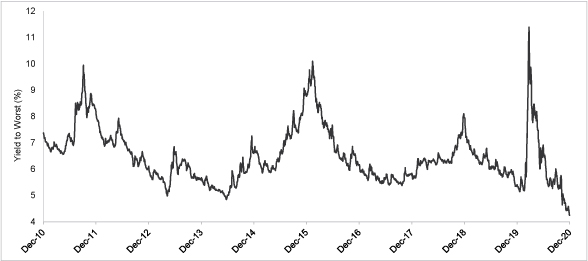

High Yield and Distressed Debt

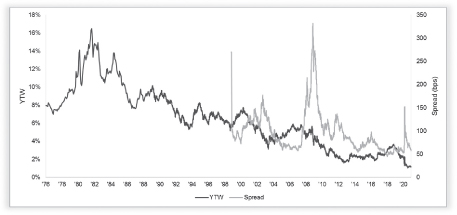

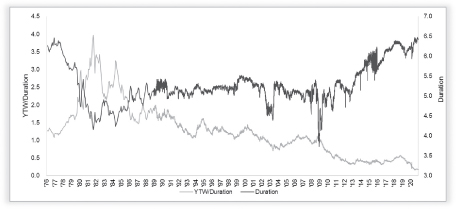

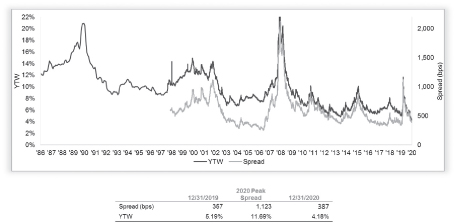

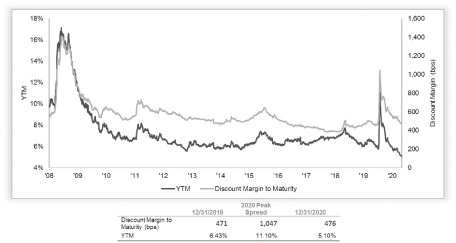

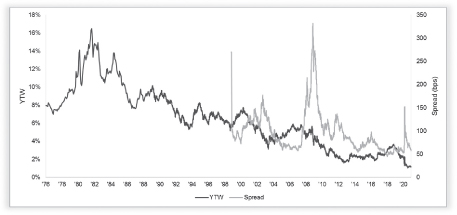

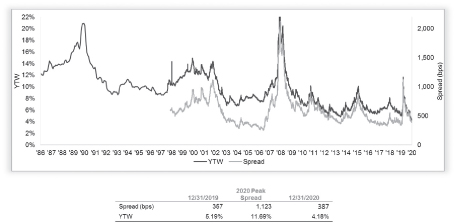

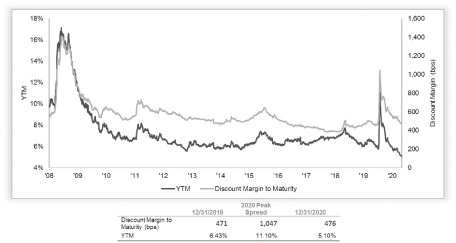

Our inability to find attractive high yield and distressed debt opportunities has been disappointing. Higher yielding corporate debt had always been an integral part of our portfolio, yet we have been sidelined for much of the last decade. We watched the yields of lower tier corporate credits decline over the last decade, and then decline some more.

In a quest for return, investors have bid up the price of high yield bonds so that this yield is now at an all-time low of 4.2%, and that's a gross yield before some measure of defaults (Exhibit K).

Exhibit K: BofA US High Yield Index Yield to Worst22

21 Source: Bloomberg, for the period 12/31/1999 to 12/31/2009. Microsoft's stock price on the respective dates was $58.38 and $30.48.

22 Source: Bloomberg. As of December 31, 2020. High yield bonds market data represented by ICE BofA US High Yield Index. Yield to worst is a measure of the lowest possible yield that a bond can receive operating within the terms of its contract without defaulting.

Past performance is no guarantee, nor is it indicative, of future results.

11

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

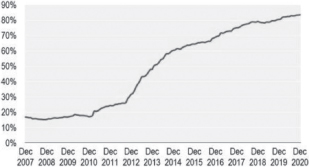

Adding to the risk factors, corporate debt generally has the worst lender protection in its history; i.e., fewer and weaker covenants and more covenant relief than we've ever seen (Exhibits L & M).

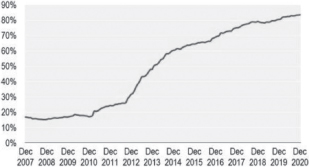

Exhibit L: Covenant-lite Share of Outstanding US Leverage Loans23

23 Source: LCD, S&P Global Market Intelligence. As of December 31, 2020.

Past performance is no guarantee, nor is it indicative, of future results.

12

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit M: Covenant Relief Count24

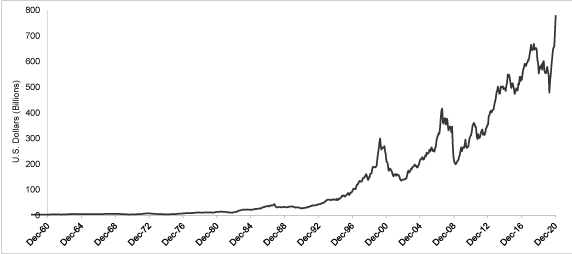

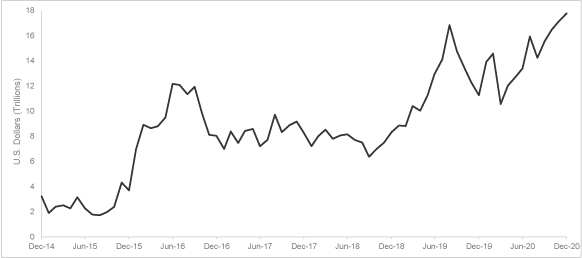

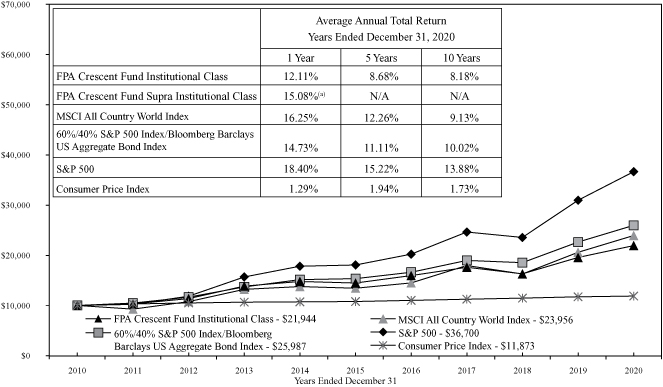

Should we once again see opportunities in high yield (higher yields with the necessary lender protection), then you will likely see more fund exposure to the asset class. There is, unfortunately, no guarantee that this will materialize, particularly in a world where lenders are now paying borrowers. Almost $18 trillion of global debt now has a negative yield (Exhibit N).

24 Source: Markets betting on the Fed's dovish policy shift on inflation, Credit. The Daily Shot, as of August 27, 2020. Data for 2020 is through July 31. Data for 2020 is through July 31, 2020 and is sourced from LCD, an offering of S&P Global Market Intelligence.

Past performance is no guarantee, nor is it indicative, of future results.

13

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit N: Negative Yielding Global Debt25

Closing

What was a bad year in March turned into an average year by December, emphasizing how noisy short-term performance can be for long duration assets. From a valuation perspective, we believe we are well-positioned for future performance, although more relatively than absolutely: our portfolio is less expensive than the market but certainly not as cheap as it was in March.26 And we have available liquidity that will allow us to capitalize on future opportunities.

Although we do not like losing money, we can't forget about making money. This balance between capital preservation and appreciation must always consider the macro environment: the sovereign desire to inflate, the continued low interest rates, and the negative real return on cash. Given that setup, if we can continue to be successful with our long equity security selection, then we should run Crescent more invested even if that may involve greater volatility.27

25 Source: Bloomberg. Bloomberg Barclays Global Aggregate Negative Yielding Debt Index Market Value. As of December 31, 2020.

26 The forward P/E of the Fund's long equity and the S&P 500 Index as of 03/31/2020 and 12/31/2020 were 11.8x and 16.1x; 26.9x and 29.8x, respectively.

27 For illustrative purposes only. The long equity segment of the Fund is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Long equity holdings only includes equity securities excluding paired trades, short-sales, and preferred securities. The long equity performance information shown herein is for illustrative purposes only and may not reflect the impact of material economic or market factors. No representation is being made that any account, product or strategy will or is likely to achieve profits, losses, or results similar to those shown. Long equity performance does not represent the return an investor in the Fund can or should expect to receive. Fund shareholders may only invest or redeem their shares at net asset value.

Past performance is no guarantee, nor is it indicative, of future results.

14

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

We will continue to pay closer attention to how things might unfold over time, rather than to emphasize any moment in time.

Respectfully submitted,

Steven Romick

Co-Portfolio Manager

January 29, 2021

15

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. These views may not be relied upon as investment advice or as an indication of trading intent on behalf of any First Pacific Advisors portfolio. Security examples featured are samples for presentation purposes and are intended to illustrate our investment philosophy and its application. It should not be assumed that most recommendations made in the future will be profitable or will equal the performance of the securities. This information and data has been prepared from sources believed reliable. The accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

16

FPA CRESCENT FUND

HISTORICAL PERFORMANCE

(Unaudited)

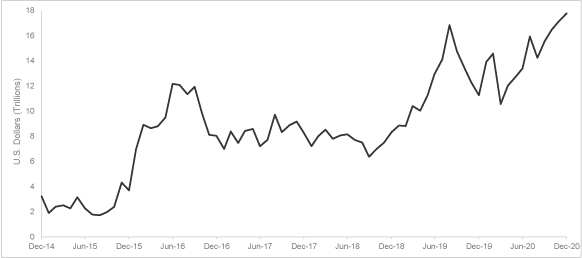

Change in Value of a $10,000 Investment in FPA Crescent Fund Institutional Class vs. S&P 500, MSCI All Country World Index, 60%/40% S&P 500 Index/Bloomberg Barclays US Aggregate Bond Index and Consumer Price Index for the Ten Years Ended December 31, 2020

(a) Period from September 4, 2020, date operations commenced, through December 31, 2020.

The Standard & Poor's 500 Stock Index (S&P 500) is a capitalization-weighted index which covers industrial, utility, transportation and financial service companies, and represents approximately 75% of the New York Stock Exchange (NYSE) capitalization and 30% of NYSE issuers and is considered a measure of large capitalization stock performance. The MSCI All Country World Index is a float-adjusted market capitalization index that is designed to measure the combined equity market performance of developed and emerging market countries. The 60%/40% S&P 500 Index/Bloomberg Barclays U.S. Aggregate Bond Index is a composite blend of 60% of the S&P 500 Index and 40% of the Bloomberg Barclays U.S. Aggregate Bond Index. The Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of U.S. consumer prices as determined by the U.S. Bureau of Labor Statistics. The S&P 500, MSCI All Country World and 60%/40% S&P 500/Bloomberg Barclays U.S. Aggregate Bond indexes are included as broad-based comparisons to the capitalization characteristics of the Fund's portfolio. The CPI is included as comparison of the Fund's results to inflation.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpa.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio and redemption fees can be found on pages 38, 39 and 44. The Prospectus details the Fund's objective and policies, sales charges, and other matters of interest to prospective investors. Please read the Prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpa.com, by email at crm@fpa.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

17

FPA CRESCENT FUND

PORTFOLIO SUMMARY

December 31, 2020

Common Stocks | | | | | 74.6 | % | |

Internet Media | | | 12.4 | % | | | |

Semiconductor Devices | | | 6.6 | % | | | |

Cable & Satellite | | | 6.1 | % | | | |

Cement & Aggregates | | | 3.9 | % | | | |

Industrial Distribution & Rental | | | 3.6 | % | | | |

Banks | | | 3.4 | % | | | |

P&C Insurance | | | 2.9 | % | | | |

Institutional Brokerage | | | 2.8 | % | | | |

Diversified Banks | | | 2.7 | % | | | |

Electrical Components | | | 2.7 | % | | | |

Investment Companies | | | 2.7 | % | | | |

Base Metals | | | 2.1 | % | | | |

Insurance Brokers | | | 2.1 | % | | | |

Internet Based Services | | | 1.9 | % | | | |

Railroad Rolling Stock | | | 1.6 | % | | | |

Computer Hardware & Storage | | | 1.5 | % | | | |

Application Software | | | 1.4 | % | | | |

Midstream — Oil & Gas | | | 1.2 | % | | | |

Hotels, Restaurants & Leisure | | | 1.2 | % | | | |

Telecom Carriers | | | 1.2 | % | | | |

E-Commerce Discretionary | | | 1.2 | % | | | |

Apparel, Footwear & Accessory Design | | | 1.1 | % | | | |

Commercial & Residential Building

Equipment & Systems | | | 1.1 | % | | | |

Specialty Chemicals | | | 1.0 | % | | | |

Aircraft & Parts | | | 1.0 | % | | | |

Wealth Management | | | 1.0 | % | | | |

Other Common Stocks | | | 0.9 | % | | | |

Infrastructure Software | | | 0.9 | % | | | |

Medical Equipment | | | 0.8 | % | | | |

Real Estate Owners & Developers | | | 0.6 | % | | | |

Integrated Utilities | | | 0.4 | % | | | |

Oil & Gas Services & Equipment | | | 0.3 | % | | | |

Marine Shipping | | | 0.3 | % | | | |

Closed End Fund | | | | | 0.7 | % | |

Limited Partnerships | | | | | 1.4 | % | |

Preferred Stocks | | | | | 1.1 | % | |

Automobiles | | | 1.0 | % | | | |

Engineering Services | | | 0.1 | % | | | |

Energy | | | 0.0 | % | | | |

Warrants | | | | | 0.0 | % | |

18

FPA CRESCENT FUND

PORTFOLIO SUMMARY (Continued)

December 31, 2020

Bonds & Debentures | | | | | 10.4 | % | |

U.S. Treasuries | | | 6.0 | % | | | |

Corporate Bonds & Notes | | | 2.1 | % | | | |

Municipals | | | 1.2 | % | | | |

Corporate Bank Debt | | | 1.1 | % | | | |

Asset-Backed Securities | | | 0.0 | % | | | |

Short-term Investments | | | | | 12.0 | % | |

Securities Sold Short | | | | | (3.8 | )% | |

Other Assets And Liabilities, Net | | | | | 3.6 | % | |

Net Assets | | | | | 100.0 | % | |

19

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS

December 31, 2020

COMMON STOCKS | | Shares | | Fair Value | |

INTERNET MEDIA — 12.4% | |

Alphabet, Inc. (Class A)(a) | | | 155,782 | | | $ | 273,029,769 | | |

Alphabet, Inc. (Class C)(a) | | | 149,898 | | | | 262,603,308 | | |

Baidu, Inc. (ADR) (China)(a) | | | 692,881 | | | | 149,828,587 | | |

Facebook, Inc. (Class A)(a) | | | 901,184 | | | | 246,167,422 | | |

Naspers, Ltd. (N Shares) (South Africa) | | | 999,707 | | | | 204,714,599 | | |

Prosus NV (Netherlands)(a) | | | 1,071,980 | | | | 115,750,985 | | |

| | | $ | 1,252,094,670 | | |

SEMICONDUCTOR DEVICES — 6.6% | |

Analog Devices, Inc. | | | 1,929,660 | | | $ | 285,068,672 | | |

Broadcom, Inc. | | | 680,788 | | | | 298,083,026 | | |

NXP Semiconductors NV (Netherlands) | | | 495,130 | | | | 78,730,621 | | |

| | | $ | 661,882,319 | | |

CABLE & SATELLITE — 6.1% | |

Charter Communications, Inc. (Class A)(a)(b) | | | 407,280 | | | $ | 269,436,084 | | |

Comcast Corp. (Class A)(b) | | | 6,679,349 | | | | 349,997,888 | | |

| | | $ | 619,433,972 | | |

CEMENT & AGGREGATES — 3.9% | |

HeidelbergCement AG (Germany) | | | 1,246,654 | | | $ | 92,820,225 | | |

LafargeHolcim Ltd. (Switzerland)(a) | | | 5,386,620 | | | | 295,659,543 | | |

| | | $ | 388,479,768 | | |

INDUSTRIAL DISTRIBUTION & RENTAL — 3.6% | |

GEA Group AG (Germany) | | | 1,017,395 | | | $ | 36,389,365 | | |

Howmet Aerospace, Inc. | | | 6,464,080 | | | | 184,484,843 | | |

LG Corp. (South Korea) | | | 1,772,486 | | | | 143,026,918 | | |

| | | $ | 363,901,126 | | |

BANKS — 3.4% | |

CIT Group, Inc. | | | 1,109,274 | | | $ | 39,822,937 | | |

Signature Bank | | | 826,280 | | | | 111,787,421 | | |

Wells Fargo & Co. | | | 6,360,024 | | | | 191,945,524 | | |

| | | $ | 343,555,882 | | |

P&C INSURANCE — 2.9% | |

American International Group, Inc.(b) | | | 7,752,935 | | | $ | 293,526,119 | | |

INSTITUTIONAL BROKERAGE — 2.8% | |

Jefferies Financial Group, Inc.(b) | | | 11,415,011 | | | $ | 280,809,271 | | |

20

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2020

COMMON STOCKS — Continued | | Shares | | Fair Value | |

DIVERSIFIED BANKS — 2.7% | |

Bank of America Corp. | | | 1,322,205 | | | $ | 40,076,034 | | |

Citigroup, Inc. | | | 3,820,250 | | | | 235,556,615 | | |

| | | $ | 275,632,649 | | |

ELECTRICAL COMPONENTS — 2.7% | |

TE Connectivity, Ltd. (Switzerland) | | | 2,263,442 | | | $ | 274,034,923 | | |

INVESTMENT COMPANIES — 2.7% | |

Groupe Bruxelles Lambert SA (Belgium) | | | 2,698,000 | | | $ | 271,942,296 | | |

BASE METALS — 2.1% | |

Glencore plc (Switzerland)(a) | | | 67,586,309 | | | $ | 214,640,167 | | |

INSURANCE BROKERS — 2.1% | |

Aon plc (Class A) (Britain) | | | 983,127 | | | $ | 207,705,241 | | |

INTERNET BASED SERVICES — 1.9% | |

Booking Holdings, Inc.(a) | | | 87,262 | | | $ | 194,356,035 | | |

RAILROAD ROLLING STOCK — 1.6% | |

Westinghouse Air Brake Technologies Corp. | | | 2,162,605 | | | $ | 158,302,686 | | |

COMPUTER HARDWARE & STORAGE — 1.5% | |

Dell Technologies (C Shares)(a) | | | 2,102,833 | | | $ | 154,116,631 | | |

APPLICATION SOFTWARE — 1.4% | |

Epic Games, Inc.(d)(e) | | | 33,130 | | | $ | 19,049,750 | | |

Nexon Co. Ltd. (Japan) | | | 3,964,090 | | | | 122,311,541 | | |

| | | $ | 141,361,291 | | |

MIDSTREAM — OIL & GAS — 1.2% | |

Kinder Morgan, Inc.(b) | | | 8,905,679 | | | $ | 121,740,632 | | |

HOTELS, RESTAURANTS & LEISURE — 1.2% | |

Marriott International, Inc. (Class A) | | | 921,818 | | | $ | 121,606,231 | | |

TELECOM CARRIERS — 1.2% | |

SoftBank Group Corp. (Japan) | | | 1,522,000 | | | $ | 118,160,488 | | |

21

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2020

COMMON STOCKS — Continued | | Shares | | Fair Value | |

E-COMMERCE DISCRETIONARY — 1.2% | |

Alibaba Group Holding Ltd. (ADR) (China)(a) | | | 500,827 | | | $ | 116,557,468 | | |

APPAREL, FOOTWEAR & ACCESSORY DESIGN — 1.1% | |

Cie Financiere Richemont SA (Switzerland) | | | 1,260,768 | | | $ | 113,900,255 | | |

COMMERCIAL & RESIDENTIAL BUILDING EQUIPMENT &

SYSTEMS — 1.1% | |

Samsung C&T Corp. (South Korea) | | | 859,404 | | | $ | 109,397,064 | | |

SPECIALTY CHEMICALS — 1.0% | |

Univar Solutions, Inc.(a) | | | 5,500,735 | | | $ | 104,568,972 | | |

AIRCRAFT & PARTS — 1.0% | |

Meggitt plc (Britain)(a) | | | 16,338,300 | | | $ | 103,897,155 | | |

WEALTH MANAGEMENT — 1.0% | |

LPL Financial Holdings, Inc. | | | 968,110 | | | $ | 100,896,424 | | |

INFRASTRUCTURE SOFTWARE — 0.9% | |

FirstEnergy Corp. | | | 2,789,666 | | | $ | 85,391,676 | | |

MEDICAL EQUIPMENT — 0.8% | |

Olympus Corp. (Japan) | | | 3,471,210 | | | $ | 75,998,310 | | |

REAL ESTATE OWNERS & DEVELOPERS — 0.6% | |

Swire Pacific Ltd. (Class A) (Hong Kong) | | | 10,152,602 | | | $ | 55,924,656 | | |

INTEGRATED UTILITIES — 0.4% | |

PG&E Corp.(a) | | | 3,597,611 | | | $ | 44,826,233 | | |

OIL & GAS SERVICES & EQUIPMENT — 0.3% | |

Mcdermott International Ltd.(a)(c) | | | 39,633,209 | | | $ | 32,102,899 | | |

MARINE SHIPPING — 0.3% | |

Sound Holding FP (Luxembourg)(c)(d)(e)(f) | | | 1,146,250 | | | $ | 31,923,993 | | |

22

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2020

COMMON STOCKS — Continued | | Shares or

Principal

Amount | | Fair Value | |

| OTHER COMMON STOCKS — 0.9%(k) | | | | $ | 90,914,317 | | |

| | | $ | 90,914,317 | | |

| TOTAL COMMON STOCKS — 74.6% (Cost $4,967,890,227) | | $ | 7,523,581,819 | | |

CLOSED END FUND — 0.7% | |

Altaba Escrow(a)(d)(e)(Cost $0) | | | 4,756,180 | | | $ | 67,513,975 | | |

LIMITED PARTNERSHIPS | |

U.S. Farming Realty Trust, L.P. (Real Estate)(c)(d)(e) | | | 350,000 | | | $ | 17,906,498 | | |

U.S. Farming Realty Trust II, L.P. (Real Estate)(c)(d)(e) | | | 120,000 | | | | 8,544,132 | | |

GACP II LP (Credit)(d)(e) | | | 958,312 | | | | 37,883,328 | | |

FPS LLC (Marine Shipping)(c)(d)(e)(f) | | | 1,076,253 | | | | 65,661,790 | | |

FPS Shelby Holding I LLC (Marine Shipping)(c)(d)(e)(f) | | | 107,799 | | | | 9,464,470 | | |

| TOTAL LIMITED PARTNERSHIPS — 1.4% (Cost $163,209,900) | | $ | 139,460,218 | | |

PREFERRED STOCKS | |

AUTOMOBILES — 1.0% | |

Porsche Automobil Holding SE (Germany) | | | 1,539,070 | | | $ | 106,314,078 | | |

ENGINEERING SERVICES — 0.1% | |

McDermott International, Inc.(d)(e) | | | 225,906 | | | $ | 7,906,722 | | |

| TOTAL PREFERRED STOCKS — 1.1% (Cost $88,712,586) | | $ | 114,220,800 | | |

WARRANT — 0.0% | |

ENERGY — 0.0% | |

Cie Financiere Richemont SA 11/22/2023(a) (Cost $0) | | | 2,521,536 | | | $ | 655,092 | | |

BONDS & DEBENTURES | |

ASSET-BACKED SECURITY — 0.0% | |

MARINE SHIPPING — 0.0% | |

Kamsarmax Shipping — 7.000% 11/4/2021(d)(e) (Cost $6,064,516) | | $ | 6,064,516 | | | $ | 4,410,116 | | |

CORPORATE BONDS & NOTES | |

COMMUNICATIONS — 0.1% | |

Uber Technologies, Inc. — 8.000% 11/1/2026(g) | | $ | 7,066,000 | | | $ | 7,711,620 | | |

23

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2020

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

CONSUMER, CYCLICAL — 1.0% | |

Carnival Corp. — 11.500% 4/1/2023(g) | | $ | 30,383,000 | | | $ | 35,132,471 | | |

Royal Caribbean Cruises Ltd. — 11.500% 6/1/2025(g) | | | 61,108,000 | | | | 71,285,537 | | |

| | | $ | 106,418,008 | | |

ENERGY — 0.3% | |

Gulfport Energy Corp. — 6.000% 10/15/2024 | | $ | 18,209,000 | | | $ | 12,131,746 | | |

Gulfport Energy Corp. — 6.375% 5/15/2025 | | | 8,822,000 | | | | 5,844,575 | | |

Gulfport Energy Corp. — 6.375% 1/15/2026 | | | 9,128,000 | | | | 6,070,120 | | |

Gulfport Energy Corp. — 6.625% 5/1/2023 | | | 9,417,000 | | | | 6,344,704 | | |

| | | $ | 30,391,145 | | |

INDUSTRIAL — 0.7% | |

Bombardier, Inc. — 7.450% 5/1/2034(g) | | $ | 5,800,000 | | | $ | 5,017,000 | | |

Bombardier, Inc. — 7.500% 3/15/2025(g) | | | 66,677,000 | | | | 62,342,995 | | |

| | | $ | 67,359,995 | | |

TOTAL CORPORATE BONDS & NOTES — 2.1%

(Cost $167,068,217) | | $ | 211,880,768 | | |

CORPORATE BANK DEBT | |

Dell International LLC Term Loan B, 1M USD LIBOR + 2.000% — 2.750%

9/19/2025(d)(h) | | $ | 16,351,119 | | | $ | 16,361,420 | | |

Gray Television, Inc. Term Loan, 1M USD LIBOR + 2.250% — 2.394%

2/7/2024(d)(h) | | | 21,837,000 | | | | 21,659,684 | | |

| McDermott Intl Senior Exit LC — 0.000% 6/30/2024(d)(e)(l) | | | 12,520,193 | | | | (1,252,019 | ) | |

| McDermott LC — 1.000% 12/31/2021(d)(e)(l) | | | 22,648,178 | | | | 28,053,885 | | |

McDermott Super Senior Exit LC, 1M USD LIBOR + 0.500%

6/30/2024(d)(e)(l) | | | 49,113,301 | | | | (4,665,764 | ) | |

McDermott Technology Americas, Inc., 6/30/2024(d) | | | 1,074,102 | | | | 859,281 | | |

McDermott Technology Americas, Inc., 1M USD LIBOR + 1.000% —

1.146% 6/30/2025(d)(h) | | | 32,176,109 | | | | 20,270,949 | | |

Steenbok LUX Financial 2 SARL, PIK — 10.750% 12/31/2021(d) | | | 1,112,278 | | | | 903,611 | | |

Western Digital Corp. Term Loan B 4, 1M USD LIBOR + 1.750% — 1.896%

4/29/2023(d)(h) | | | 27,421,120 | | | | 27,369,842 | | |

| TOTAL CORPORATE BANK DEBT — 1.1% (Cost $179,360,394) | | $ | 109,560,889 | | |

MUNICIPALS | |

Commonwealth of Puerto Rico GO,

Series 2014 A, (SER A), — 8.000% 7/1/2035 | | $ | 111,230,000 | | | $ | 76,192,550 | | |

Puerto Rico Public Buildings Authority Rev., Series 2012 U,

(REF-GOVT FACS-SER U), — 5.250% 7/1/2042 | | | 54,920,000 | | | | 42,837,600 | | |

| TOTAL MUNICIPALS — 1.2% (Cost $47,159,988) | | $ | 119,030,150 | | |

24

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2020

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

U.S. TREASURIES | |

U.S. Treasury Bills — 0.028% 1/12/2021(i) | | $ | 36,800,000 | | | $ | 36,799,293 | | |

U.S. Treasury Bills — 0.044% 1/14/2021(i) | | | 60,000,000 | | | | 59,999,034 | | |

U.S. Treasury Bills — 0.045% 1/26/2021(i) | | | 55,000,000 | | | | 54,998,070 | | |

U.S. Treasury Bills — 0.056% 1/28/2021(i) | | | 35,000,000 | | | | 34,998,023 | | |

U.S. Treasury Bills — 0.062% 2/18/2021(i) | | | 30,000,000 | | | | 29,996,895 | | |

U.S. Treasury Bills — 0.067% 2/4/2021(i) | | | 65,000,000 | | | | 64,995,365 | | |

U.S. Treasury Bills — 0.068% 2/2/2021(i) | | | 65,000,000 | | | | 64,995,294 | | |

U.S. Treasury Bills — 0.069% 2/25/2021(i) | | | 35,000,000 | | | | 34,995,205 | | |

U.S. Treasury Bills — 0.071% 1/21/2021(i) | | | 40,000,000 | | | | 39,998,680 | | |

U.S. Treasury Bills — 0.071% 2/11/2021(i) | | | 40,000,000 | | | | 39,996,056 | | |

U.S. Treasury Bills — 0.072% 2/23/2021(i) | | | 48,000,000 | | | | 47,995,594 | | |

U.S. Treasury Bills — 0.073% 2/9/2021(i) | | | 70,000,000 | | | | 69,995,618 | | |

U.S. Treasury Bills — 0.086% 3/2/2021(i) | | | 27,000,000 | | | | 26,996,679 | | |

| TOTAL U.S. TREASURIES — 6.0% (Cost $606,762,499) | | $ | 606,759,806 | | |

| TOTAL BONDS & DEBENTURES — 10.4% (Cost $1,006,415,614) | | $ | 1,051,641,729 | | |

| TOTAL INVESTMENT SECURITIES — 88.2% (Cost $6,226,228,327) | | $ | 8,897,073,633 | | |

SHORT-TERM INVESTMENTS | |

Apple, Inc. | |

| — 0.091% 1/7/2021 | | $ | 115,000,000 | | | $ | 114,998,275 | | |

| — 0.101% 2/1/2021 | | | 40,000,000 | | | | 39,996,556 | | |

| — 0.101% 2/2/2021 | | | 25,000,000 | | | | 24,997,778 | | |

| — 0.101% 2/3/2021 | | | 25,000,000 | | | | 24,997,708 | | |

| — 0.101% 2/5/2021 | | | 50,000,000 | | | | 49,995,139 | | |

| — 0.101% 2/8/2021 | | | 20,000,000 | | | | 19,997,889 | | |

| — 0.101% 2/12/2021 | | | 35,000,000 | | | | 34,995,917 | | |

Chevron Corp. | |

| — 0.091% 2/3/2021 | | | 89,400,000 | | | | 89,392,624 | | |

| — 0.091% 2/5/2021 | | | 50,000,000 | | | | 49,995,625 | | |

| — 0.101% 1/5/2021 | | | 15,000,000 | | | | 14,999,833 | | |

| — 0.101% 1/28/2021 | | | 15,000,000 | | | | 14,998,875 | | |

| — 0.101% 2/12/2021 | | | 18,000,000 | | | | 17,997,900 | | |

| — 0.112% 1/6/2021 | | | 57,000,000 | | | | 56,999,129 | | |

| — 0.112% 1/8/2021 | | | 45,000,000 | | | | 44,999,038 | | |

| — 0.112% 2/10/2021 | | | 28,000,000 | | | | 27,996,578 | | |

25

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2020

SHORT-TERM INVESTMENTS — Continued | | Shares or

Principal

Amount | | Fair Value | |

Exxon Mobil Corp. | |

| — 0.091% 1/29/2021 | | $ | 70,000,000 | | | $ | 69,995,100 | | |

| — 0.101% 1/22/2021 | | | 20,000,000 | | | | 19,998,833 | | |

| — 0.101% 2/22/2021 | | | 48,000,000 | | | | 47,993,067 | | |

| — 0.101% 2/23/2021 | | | 75,000,000 | | | | 74,988,958 | | |

| — 0.101% 2/24/2021 | | | 80,000,000 | | | | 79,988,000 | | |

Nestle Cap Corp. | |

| — 0.091% 2/4/2021 | | | 43,000,000 | | | | 42,996,345 | | |

| — 0.091% 2/5/2021 | | | 75,000,000 | | | | 74,993,438 | | |

Nestle Finance International Ltd. — 0.112% 1/5/2021 | | | 19,600,000 | | | | 19,599,760 | | |

Roche Holding, Inc. | |

| — 0.071% 1/15/2021 | | | 30,000,000 | | | | 29,999,183 | | |

| — 0.081% 1/20/2021 | | | 34,000,000 | | | | 33,998,564 | | |

| — 0.091% 1/11/2021 | | | 44,000,000 | | | | 43,998,900 | | |

| — 0.091% 1/13/2021 | | | 40,000,000 | | | | 39,998,800 | | |

State Street Bank Repurchase Agreement — 0.00% 1/4/2021

(Dated 12/31/2020, repurchase price of $796,000, collateralized by

$684,500 principal amount U.S. Treasury Notes — 0.375% 2023,

fair value $811,940)(j) | | | 796,000 | | | | 796,000 | | |

TOTAL SHORT-TERM INVESTMENTS — 12.0%

(Cost $1,206,703,812) | | $ | 1,206,703,812 | | |

| TOTAL INVESTMENTS — 100.2% (Cost $7,432,932,139) | | $ | 10,103,777,445 | | |

SECURITIES SOLD SHORT — (3.8)% | |

COMMON STOCKS SOLD SHORT — (3.3)% | |

Softbank Corp. (Japan) | | | (1,005,890 | ) | | $ | (12,625,918 | ) | |

Volkswagen AG (Preference Shares) (Germany) | | | (408,519 | ) | | | (76,345,557 | ) | |

| | | $ | (88,971,475 | ) | |

| OTHER COMMON STOCKS SOLD SHORT(k) | | $ | (245,584,519 | ) | |

| TOTAL COMMON STOCKS SOLD SHORT (Proceeds $304,928,608) | | $ | (334,555,994 | ) | |

CORPORATE BONDS & NOTES SOLD SHORT — (0.5)% | |

Dell International LLC / EMC Corp. — 7.125% 6/15/2024(g) | | $ | (16,693,000 | ) | | $ | (17,312,727 | ) | |

Western Digital Corp. — 4.750% 2/15/2026 | | | (27,578,000 | ) | | | (30,600,847 | ) | |

TOTAL CORPORATE BONDS & NOTES SOLD SHORT

(Proceeds $44,594,096) | | $ | (47,913,574 | ) | |

26

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2020

SECURITIES SOLD SHORT — Continued | | Shares | | Fair Value | |

| TOTAL SECURITIES SOLD SHORT (Proceeds $349,522,704) | | $ | (382,469,568 | ) | |

| Other assets and liabilities, net — 3.6% | | | 361,327,679 | | |

NET ASSETS — 100.0% | | $ | 10,082,635,556 | | |

(a) Non-income producing security.

(b) As of December 31, 2020, investments with a value of $1,114,987,500 were fully or partially segregated with the broker(s)/custodian as collateral for open short contracts.

(c) Affiliated Security.

(d) Restricted securities. These restricted securities constituted 3.90% of total net assets at December 31, 2020, most of which are considered liquid by the Adviser. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under policies adopted by authority of the Fund's Board of Trustees.

(e) Investments categorized as a significant unobservable input (Level 3) (See Note 8 of the Notes to Financial Statements).

(f) Controlled company.

(g) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid.

(h) Variable/Floating Rate Security — The rate shown is based on the latest available information as of December 31, 2020. For Corporate Bank Debt, the rate shown may represent a weighted average interest rate. Certain variable rate securities are not based on a published rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description.

(i) Zero coupon bond. Coupon amount represents effective yield to maturity.

(j) Security pledged as collateral (See Note 10 of the Notes to Financial Statements).

(k) As permitted by U.S. Securities and Exchange Commission regulations, "Other" Common Stocks include holdings in their first year of acquisition that have not previously been publicly disclosed.

(l) All or a portion of this holding is subject to unfunded loan commitments. The stated interest rate reflects the weighted average of the reference rate and spread for the funded portion, if any, and the commitment fees on the portion of the loan that is unfunded. See Note 11.

27

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2020

Purchased Options

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate

Index | | Exercise

Rate | | Expiration

Date | | Counter-

party | | Notional

Amount | | Premium | | Fair Value | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/15/2023 | | Barclays

Bank

PLC | | $ | 4,776,000,000 | | | $ | 1,265,640 | | | $ | 955,200 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/22/2023 | | Barclays

Bank

PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 1,002,960 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/01/2023 | | Barclays

Bank

PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 1,002,960 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/08/2023 | | Barclays

Bank

PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 1,002,960 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/15/2023 | | Goldman

Sachs

Inter-

national | | | 9,204,500,000 | | | | 2,531,237 | | | | 2,393,170 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/22/2023 | | Goldman

Sachs

Inter-

national | | | 9,204,500,000 | | | | 2,531,238 | | | | 2,393,170 | | |

28

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2020

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate

Index | | Exercise

Rate | | Expiration

Date | | Counter-

party | | Notional

Amount | | Premium | | Fair Value | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/01/2023 | | Goldman

Sachs

Inter-

national | | $ | 9,204,500,000 | | | $ | 2,531,237 | | | $ | 2,485,215 | | |

Call —

CMS Cap

Swap(d)(e) | |

Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/08/2023 | | Goldman

Sachs

Inter-

national | | | 9,204,500,000 | | | | 2,531,238 | | | | 2,485,215 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/15/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 405,000 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/22/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 405,000 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/01/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 405,000 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/08/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 455,625 | | |

Call —

OIS Cap

Swap(d)(e) | | Receive | | 3-Month

USD-LIBOR | | | 0.68 | % | | 1/11/2029 | | Morgan

Stanley | | | 260,061,813 | | | | 7,038,227 | | | | 8,454,610 | | |

| | | $ | 27,288,237 | | | $ | 23,846,085 | | |

29

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2020

Written Options

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate

Index | | Exercise

Rate | | Expiration

Date | | Counter-

party | | Notional

Amount | | Premium | | Fair Value | |

Put — OIS

Floor

Swap(d)(e) | |

Pay | |

3-Month

USD-LIBOR | |

0.35% | |

1/11/2029 | |

Morgan

Stanley | | $ | (260,061,813 | ) | | $ | (7,038,227 | ) | | $ | (6,353,310 | ) | |

Swap Agreements outstanding as of December 31, 2020 were as follows:

Credit Default Swaps on Asset-Backed Securities — Buy Protection (1)

Description | |

Payment

Frequency | |

Fixed Deal

Pay Rate | |

Expiration

Date | |

Counterparty | |

Notional

Amount (2) | |

Value (3) | | Upfront

Payments

Paid

(Received) | |

Unrealized

Appreciation

(Depreciation) | |

Dell Inc. 7.1% Bonds

due 4/15/2028(d)(e) | | | Q | | | | 1.00 | % | | 6/20/2024 | | Barclays

Bank PLC | | $ | 7,682,605 | | | $ | 1,898 | | | $ | 202,178 | | | $ | (200,280 | ) | |

Dell Inc. 7.1% Bonds

due 4/15/2028(d)(e) | | | Q | | | | 1.00 | % | | 6/20/2024 | | Goldman Sachs

International | | | 29,846,904 | | | | (76,085 | ) | | | 784,532 | | | | (860,617 | ) | |

Dell Inc. 7.1% Bonds

due 4/15/2028(d)(e) | | | Q | | | | 1.00 | % | | 12/20/2024 | | Goldman Sachs

International | | | 4,801,628 | | | | 7,845 | | | | 121,216 | | | | (113,371 | ) | |

Dell Inc. 7.1% Bonds

due 4/15/2028(d)(e) | | | Q | | | | 1.00 | % | | 6/20/2024 | | Morgan

Stanley | | | 17,362,671 | | | | 6,954 | | | | 424,310 | | | | (417,356 | ) | |

| | | | | | | | | | | | | $ | (59,388 | ) | | $ | 1,532,236 | | | $ | (1,591,624 | ) | |

(1) If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying investments comprising the referenced index or (ii) receive a net settlement amount in the form of cash or investments equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying investments comprising the referenced index.

(2) The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement.

(3) The quoted market prices and resulting values for credit default swap agreements on Asset-Backed Securities serve as an indicator of the current status of the payment/performance risk and represent the expected amount paid or received for the credit derivative had the notional amount of the swap agreement been closed/sold as of year-end. Increasing values (buy protection) or decreasing values (sell protection), when compared to the notional amount of the swap, represent a deterioration of the referenced entity's credit soundness and a greater likelihood of risk of default or other credit event occurring as defined under the terms of the agreement.

30

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES

December 31, 2020

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

Altaba Escrow

| | 09/26/2014, 09/29/2014,

09/30/2014, 10/03/2014,

10/06/2014, 10/07/2014,

08/28/2015, 11/01/2016,

11/02/2016, 11/03/2016 | | $ | — | | | $ | 67,513,975 | | | | 0.67 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Barclays

Bank PLC 4.000% 02/15/2023 | | 02/26/2020 | | | 1,265,640 | | | | 955,200 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Barclays

Bank PLC 4.000% 02/22/2023 | | 02/26/2020 | | | 1,265,640 | | | | 1,002,960 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Barclays

Bank PLC 4.000% 03/01/2023 | | 02/26/2020 | | | 1,265,640 | | | | 1,002,960 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Barclays

Bank PLC 4.000% 03/08/2023 | | 02/26/2020 | | | 1,265,640 | | | | 1,002,960 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Goldman

Sachs International 4.000%

02/15/2023 | | 02/26/2020 | | | 2,531,237 | | | | 2,393,170 | | | | 0.02 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Goldman

Sachs International 4.000%

02/22/2023 | | 02/26/2020 | | | 2,531,238 | | | | 2,393,170 | | | | 0.02 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Goldman

Sachs International 4.000%

03/01/2023 | | 02/26/2020 | | | 2,531,237 | | | | 2,485,215 | | | | 0.02 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Goldman

Sachs International 4.000%

03/08/2023 | | 02/26/2020 | | | 2,531,238 | | | | 2,485,215 | | | | 0.02 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Morgan

Stanley 4.000% 02/15/2023 | | 02/26/2020 | | | 1,265,625 | | | | 405,000 | | | | 0.00 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Morgan

Stanley 4.000% 02/22/2023 | | 02/26/2020 | | | 1,265,625 | | | | 405,000 | | | | 0.00 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Morgan

Stanley 4.000% 3/01/2023 | | 02/26/2020 | | | 1,265,625 | | | | 405,000 | | | | 0.00 | % | |

31

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

December 31, 2020

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Morgan

Stanley 4.000% 03/08/2023 | | 02/26/2020 | | $ | 1,265,625 | | | $ | 455,625 | | | | 0.00 | % | |

Dell, Inc. 7.1% Bonds due

4/15/2028 | | 09/12/2019, 10/10/2019 | | | 202,178 | | �� | | 1,898 | | | | 0.00 | % | |

Dell, Inc. 7.1% Bonds due

4/15/2028 | | 11/10/2020 | | | 784,532 | | | | (76,085 | ) | | | 0.00 | % | |

Dell, Inc. 7.1% Bonds due

4/15/2028 | | 11/01/2019 | | | 121,216 | | | | 7,845 | | | | 0.00 | % | |

Dell, Inc. 7.1% Bonds due

4/15/2028

| | 09/05/2019, 10/15/2019,

10/17/2019 | | |

424,310 | | | |

6,954 | | | |

0.00% | | |

Dell International LLC Term

Loan B — 2.750% 09/19/2025

| | 01/31/2020, 04/30/2020,

06/09/2020, 11/10/2020,

12/15/2020 | | |

16,419,408 | | | |

16,361,420 | | | |

0.16% | | |

Epic Games, Inc. | | 06/25/2020 | | | 19,049,750 | | | | 19,049,750 | | | | 0.19 | % | |

FPS LLC (Marine Shipping)

| | 02/03/2020, 03/02/2020,

03/09/2020, 04/09/2020,

05/29/2020, 07/20/2020 | | | 97,594,052 | | | | 65,661,790 | | | | 0.65% | | |

FPS Shelby Holding I LLC

| | 02/04/2020, 03/26/2020,

04/29/2020, 07/24/2020 | | | 10,779,935 | | | | 9,464,470 | | | | 0.09 | % | |

GACP II LP (Credit) | | 01/17/2020 | | | 31,187,670 | | | | 37,883,328 | | | | 0.38 | % | |

Gray Television, Inc. Term

Loan — 2.394% 02/07/2024

| | 06/13/2019, 06/14/2019,

06/18/2019, 06/21/2019,

07/19/2019 | | |

21,837,691 | | | |

21,659,684 | | | |

0.21% | | |

Kamsarmax Shipping — 7.000%

11/4/2021 | | 11/04/2020, 11/06/2020 | | | 6,064,516 | | | | 4,410,116 | | | | 0.04 | % | |

McDermott International, Inc. | | 12/31/2020 | | | — | | | | 7,906,722 | | | | 0.08 | % | |

McDermott LC — 1.000%

12/31/2021 | | 12/31/2020 | | | 36,413,228 | | | | 28,053,885 | | | | 0.28 | % | |

McDermott Intl Senior Exit LC

06/30/2024 | | 07/01/2020 | | | 2,343,241 | | | | (1,252,019 | ) | | | (0.01 | )% | |

McDermott Super Senior

Exit LC. — 0.500% 06/30/2024 | | 02/28/2020, 12/14/2020 | | | (372,878 | ) | | | (4,665,764 | ) | | | (0.05 | )% | |

McDermott Technology Americas,

Inc. — 1.146% 06/30/2025

| | 07/20/2020, 07/29/2020,

08/03/2020, 09/01/2020,

11/02/2020, 11/30/2020,

12/31/2020, 01/05/2021 | | |

78,128,758 | | | |

20,270,949 | | | |

0.20% | | |

32

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

December 31, 2020

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

McDermott Technology Americas,

Inc. 06/30/2024 | | 07/01/2020 | | $ | 1,074,102 | | | $ | 859,281 | | | | 0.01 | % | |

OIS CAP SWAPTION 0.680

JAN29 0.680 CALL Morgan

Stanley 0.680% 01/11/2029 | | 10/19/2020 | | | 7,038,227 | | | | 8,454,610 | | | | 0.08 | % | |

OIS FLOOR SWAPTION 0.350

JAN29 0.350 PUT Morgan

Stanley 0.350% 01/11/2029 | | 10/19/2020 | | | (7,038,227 | ) | | | (6,353,310 | ) | | | (0.06 | )% | |

Sound Holding FP | | 10/07/2013 | | | 68,546,025 | | | | 31,923,993 | | | | 0.32 | % | |

Steenbok LUX Financial 2

SARL — 10.750% 12/31/2021 | | 03/04/2020, 06/30/2020

12/31/2020 | | | 1,026,823 | | | | 903,611 | | | | 0.01 | % | |

U.S. Farming Realty Trust II, L.P.

(Real Estate)

| | 12/24/2012, 04/29/2013,

06/17/2013, 10/28/2013,

01/14/2014, 04/22/2014,

06/25/2014, 09/09/2014,

10/08/2014, 12/18/2014,

06/18/2015, 07/29/2015 | | | 9,498,194 | | | | 8,544,132 | | | | 0.08 | % | |

U.S. Farming Realty Trust, L.P.

(Real Estate)

| | 11/26/2010, 01/31/2011,

03/09/2011, 04/15/2011,

05/10/2011, 06/27/2011,

08/15/2011, 10/17/2011,

10/28/2011, 11/28/2011,

01/03/2012, 01/26/2012,

04/05/2012, 07/13/2012,

12/07/2012, 08/01/2013 | | | 14,150,049 | | | | 17,906,498 | | | | 0.18 | % | |

Western Digital Corp. Term

Loan B 4 — 1.896% 04/29/2023 | | 01/27/2020, 02/27/2020 | | | 27,176,503 | | | | 27,369,842 | | | | 0.27 | % | |

TOTAL RESTRICTED

SECURITIES | | | | $ | 462,699,313 | | | $ | 397,259,050 | | | | 3.90 | % | |

See accompanying Notes to Financial Statements.

33

FPA CRESCENT FUND

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2020

ASSETS | |

Investment securities — at fair value (identified cost $5,976,186,496) | | $ | 8,731,469,850 | | |

| Investments in affiliates — at fair value (identified cost $250,041,831) | | | 165,603,783 | | |

Short-term investments — at amortized cost (maturities 60 days or less) | | | 1,206,703,812 | | |

Purchased options, at value (premiums paid $27,288,237) | | | 23,846,085 | | |

Deposits for securities sold short | | | 365,645,523 | | |

Cash | | | 3,091,981 | | |

Receivable for: | |

Investment securities sold | | | 46,129,459 | | |

Dividends and interest | | | 15,313,927 | | |

Capital Stock sold | | | 2,574,134 | | |

| Total assets | | | 10,560,378,554 | | |

LIABILITIES | |

| Securities sold short, at fair value (proceeds $349,522,704) | | | 382,469,568 | | |

Swaps, at fair value (net upfront payments paid $1,532,236) | | | 59,388 | | |

Written options, at value (premiums received $7,038,227) | | | 6,353,310 | | |

Payable for: | |

| Investment securities purchased | | | 10,340,478 | | |

Due to broker — OTC derivatives collateral | | | 13,324,124 | | |

Capital Stock repurchased | | | 10,430,976 | | |

Advisory fees | | | 8,354,572 | | |

Due to custodian | | | 2,332 | | |

Accrued expenses and other liabilities | | | 46,408,250 | | |

| Total liabilities | | | 477,742,998 | | |

NET ASSETS | | $ | 10,082,635,556 | | |

SUMMARY OF SHAREHOLDERS' EQUITY | |

Capital Stock — no par value; unlimited authorized shares;

280,272,255 outstanding shares | | $ | 7,330,812,709 | | |

| Distributable earnings | | | 2,751,822,847 | | |

NET ASSETS | | $ | 10,082,635,556 | | |

Institutional Class | |

Net Assets | | $ | 8,903,455,242 | | |

Shares outstanding, no par value; unlimited authorized shares | | | 247,499,188 | | |

Offering and redemption price per share | | $ | 35.97 | | |

Supra Institutional Class: | |

Net Assets | | $ | 1,179,180,314 | | |

Shares outstanding, no par value; unlimited authorized shares | | | 32,773,067 | | |

Offering and redemption price per share | | $ | 35.98 | | |

See accompanying Notes to Financial Statements.

34

FPA CRESCENT FUND

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2020

INVESTMENT INCOME | |

Dividends (net of foreign taxes withheld of $2,989,879) | | $ | 133,372,135 | | |

Interest | | | 47,073,560 | | |

| Income from affiliates | | | 450,388 | | |

| Total investment income | | | 180,896,083 | | |

EXPENSES | |

Advisory fees | | | 105,040,186 | | |

Short sale dividend expense | | | 7,956,438 | | |

Transfer agent fees and expenses | | | 4,014,642 | | |

Administrative services fees — Institutional Class | | | 2,587,719 | | |

Legal fees | | | 1,154,895 | | |

Reports to shareholders | | | 655,682 | | |

Custodian fees | | | 586,535 | | |

Other professional fees | | | 523,820 | | |

Trustee fees and expenses | | | 361,488 | | |

Audit and tax services fees | | | 87,956 | | |

Filing fees | | | 78,474 | | |

Administrative services fees — Supra Institutional Class(a) | | | 12,155 | | |

Other | | | 168,914 | | |

Total expenses | | | 123,228,904 | | |

Reimbursement from Adviser | | | (2,325,297 | ) | |

Net expenses | | | 120,903,607 | | |

Net investment income | | | 59,992,476 | | |

NET REALIZED AND UNREALIZED APPRECIATION (DEPRECIATION) | |

Net realized gain (loss) on: | |

| Investments | | | 783,158,012 | | |

| Investments in affiliates | | | (148,782,471 | ) | |

In-kind redemptions | | | 176,855,075 | | |

Written options | | | 7,420,352 | | |

Purchased options | | | 678,439 | | |

Swap contracts | | | (1,937,868 | ) | |

Investments in foreign currency transactions | | | (739,922 | ) | |

Net change in unrealized appreciation (depreciation) of: | |

| Investments | | | (204,482,377 | ) | |

| Investments in affiliates | | | (132,349,306 | ) | |

| Investment securities sold short | | | 35,981,560 | | |

Written options | | | 1,629,507 | | |

Purchased options | | | 2,430,365 | | |

Swap contracts | | | (312,900 | ) | |

Translation of foreign currency denominated amounts | | | 731,149 | | |

Net realized and unrealized gain | | | 520,279,615 | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 580,272,091 | | |

(a) Period from September 4, 2020, date operations commenced, through December 31, 2020.

See accompanying Notes to Financial Statements.

35

FPA CRESCENT FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended

December 31, 2020 | | Year Ended

December 31, 2019 | |

INCREASE (DECREASE) IN NET ASSETS | |

Operations: | |

Net investment income | | $ | 59,992,476 | | | $ | 271,832,039 | | |

| Net realized gain | | | 816,651,617 | | | | 413,989,963 | | |

| Net change in unrealized appreciation (depreciation) | | | (296,372,002 | ) | | | 1,912,005,408 | | |

Net increase in net assets resulting from operations | | | 580,272,091 | | | | 2,597,827,410 | | |

Distributions to shareholders — Institutional Class | | | (510,592,905 | ) | | | (654,441,642 | ) | |

Distributions to shareholders — Supra Institutional Class(a) | | | (12,461,447 | ) | | | N/A | | |

Total Distributions to shareholders | | | (523,054,352 | ) | | | (654,441,642 | ) | |

Capital Stock transactions:(b) | |

Proceeds from Capital Stock sold | | | 2,408,393,979 | | | | 1,538,225,165 | | |

Proceeds from shares issued to shareholders upon reinvestment of

dividends and distributions | | | 458,862,950 | | | | 565,800,499 | | |

Cost of Capital Stock repurchased(c) | | | (6,850,927,376 | ) | | | (3,745,562,801 | ) | |

Net decrease from Capital Stock transactions | | | (3,983,670,447 | ) | | | (1,641,537,137 | ) | |

Total change in net assets | | | (3,926,452,708 | ) | | | 301,848,631 | | |

NET ASSETS | |

Beginning of Year | | | 14,009,088,264 | | | | 13,707,239,633 | | |

End of Year | | $ | 10,082,635,556 | | | $ | 14,009,088,264 | | |

(a) Period from September 4, 2020, date operations commenced, through December 31, 2020.

(b) See Note 9, Capital Stock, in the Notes to Financial Statements.

(c) Net of redemption fees of $444,210 and $481,210 for the year ended December 31, 2020 and year ended December 31, 2019, respectively, see Note 7.

See accompanying Notes to Financial Statements.

36

FPA CRESCENT FUND

FINANCIAL HIGHLIGHTS

| | | Year Ended December 31, | |

Institutional Class | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 | |

Per share operating performance: | |

Net asset value at beginning of year | | $ | 33.83 | | | $ | 29.53 | | | $ | 34.69 | | | $ | 32.61 | | | $ | 31.06 | | |

Income from investment operations: | |

Net investment income* | | | 0.18 | | | | 0.62 | | | | 0.24 | | | | 0.23 | | | | 0.24 | | |

Net realized and unrealized gain (loss)

on investment securities | | | 3.69 | | | | 5.25 | | | | (2.78 | ) | | | 3.14 | | | | 2.93 | | |

Total from investment operations | | | 3.87 | | | | 5.87 | | | | (2.54 | ) | | | 3.37 | | | | 3.17 | | |

Less distributions: | |

Dividends from net investment income | | | (0.11 | ) | | | (0.80 | ) | | | (0.21 | ) | | | (0.34 | ) | | | (0.29 | ) | |

Distributions from net realized

capital gains | | | (1.62 | ) | | | (0.77 | ) | | | (2.41 | ) | | | (0.95 | ) | | | (1.34 | ) | |

Total distributions | | | (1.73 | ) | | | (1.57 | ) | | | (2.62 | ) | | | (1.29 | ) | | | (1.63 | ) | |

Redemption fees | | | — | ** | | | — | ** | | | — | ** | | | — | ** | | | 0.01 | | |

Net asset value at end of year | | $ | 35.97 | | | $ | 33.83 | | | $ | 29.53 | | | $ | 34.69 | | | $ | 32.61 | | |

Total investment return | | | 12.11 | % | | | 20.02 | % | | | (7.43 | )% | | | 10.39 | % | | | 10.25 | % | |

Ratios/supplemental data: | |

Net assets, end of year (in $000's) | | $ | 8,903,455 | | | $ | 14,009,883 | | | $ | 13,707,240 | | | $ | 17,484,747 | | | $ | 16,555,035 | | |

Ratio of expenses to average net assets: | |

Before reimbursement from Adviser | | | 1.15 | %‡ | | | 1.23 | %‡ | | | 1.18 | %‡ | | | 1.10 | %‡ | | | 1.09 | %‡ | |

After reimbursement from Adviser | | | 1.13 | %‡ | | | 1.23 | %‡ | | | 1.18 | %‡ | | | 1.10 | %‡ | | | 1.09 | %‡ | |

Net investment income: | |

Before reimbursement from Adviser | | | 0.54 | % | | | 1.90 | % | | | 0.70 | % | | | 0.66 | % | | | 0.77 | % | |

After reimbursement from Adviser | | | 0.56 | % | | | 1.90 | % | | | 0.70 | % | | | 0.66 | % | | | 0.77 | % | |

Portfolio turnover rate | | | 29 | % | | | 23 | % | | | 64 | % | | | 18 | % | | | 35 | % | |

* Per share amount is based on average shares outstanding.

** Rounds to less than $0.01 per share.

‡ For the periods ended December 31, 2020, December 31, 2019, December 31, 2018, December 31, 2017 and December 31, 2016, the expense ratio includes short sale dividend expense equal to 0.07%, 0.16%, 0.11%, 0.03% and 0.02% of average net assets, respectively.

See accompanying Notes to Financial Statements.

37

FPA CRESCENT FUND

FINANCIAL HIGHLIGHTS

Supra Institutional Class | | Period from

September 4,

through

December 31,

2020 | |

Per share operating performance: | |

Net asset value at beginning of period | | $ | 31.96 | | |

Income from investment operations: | |

Net investment income* | | | 0.01 | | |

Net realized and unrealized gain on investment securities | | | 4.81 | | |