UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08544

fpa FUNDS TRUST

(Exact name of registrant as specified in charter)

11601 WILSHIRE BLVD., STE. 1200

LOS ANGELES, CALIFORNIA 90025

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

J. RICHARD ATWOOD, PRESIDENT FPA FUNDS TRUST 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 |

Registrant’s telephone number, including area code: (310) 473-0225

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Item 1: Report to Shareholders.

| (a) | The Reports to Shareholders are attached herewith. |

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Dear Shareholder:

Overview

The FPA Crescent Fund — Institutional Class ("Fund" or "Crescent") gained 1.87% in 2021's fourth quarter and increased 15.17% for the calendar year.1 The Fund generated 64.2% of the average of the S&P 500 and MSCI ACWI NR USD's ("MSCI ACWI") return in 2021, underperforming its own 75.8% average net risk exposure.2

Crescent's performance and that of its underlying equity exposure are captured in the following table:

Exhibit A: Performance versus Illustrative Indices3

| | Q4 2021 | | 2021 | |

Crescent | | | 1.87 | % | | | 15.17 | % | |

Crescent — Long Equity | | | 3.68 | % | | | 23.18 | % | |

MSCI ACWI NR USD | | | 6.68 | % | | | 18.54 | % | |

S&P 500 | | | 11.03 | % | | | 28.71 | % | |

60% MSCI ACWI NR USD/ 40% BBg US Agg | | | 4.02 | % | | | 10.20 | % | |

60% S&P 500 / 40% BBg US Agg | | | 6.57 | % | | | 15.86 | % | |

1 Effective September 4, 2020, the current single class of shares of the Fund was renamed the Institutional Class shares. Unless otherwise noted, all data herein is representative of the Institutional Share Class.

2 Risk assets are any assets that are not risk free and generally refers to any financial security or instrument, such as equities, commodities, high-yield bonds, and other financial products that are likely to fluctuate in price. Risk exposure refers to the Fund's exposure to risk assets as a percent of total assets. The Fund's net risk exposure as of December 31, 2021 was 74.8%.

3 Comparison to the indices is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. An investor cannot invest directly in an index. The long equity segment of the Fund is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Long equity holdings only includes equity securities excluding paired trades, short-sales, and preferred securities. The long equity performance information shown herein is for illustrative purposes only and may not reflect the impact of material economic or market factors. No representation is being made that any account, product or strategy will or is likely to achieve profits, losses, or results similar to those shown. Long equity performance does not represent the return an investor in the Fund can or should expect to receive. Fund shareholders may only invest or redeem their shares at net asset value.

Past performance is no guarantee, nor is it indicative, of future results.

1

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Portfolio discussion

The top contributors to and detractors from the Fund's trailing 12-month returns are listed below.

Exhibit B: Trailing Twelve-Month Contributors and Detractors as of December 31, 20214

| Contributors | | Perf.

Cont. | | Avg. %

of Port. | | Detractors | | Perf.

Cont. | | Avg. %

of Port. | |

Alphabet | | | 3.01 | % | | | 5.7 | % | | Alibaba | | | -0.69 | % | | | 1.2 | % | |

American International Group | | | 1.41 | % | | | 2.9 | % | | SPDR S&P 500 ETF (short) | | | -0.53 | % | | | -2.0 | % | |

Broadcom | | | 1.39 | % | | | 2.9 | % | | Softbank ADR/Softbank | | | -0.52 | % | | | 1.0 | % | |

Jefferies Financial Group | | | 1.22 | % | | | 2.0 | % | | Nexon | | | -0.41 | % | | | 0.9 | % | |

Glencore | | | 1.20 | % | | | 2.2 | % | | Naspers & Prosus | | | -0.39 | % | | | 2.8 | % | |

| | | 8.23 | % | | | 15.7 | % | | | | | -2.55 | % | | | 3.8 | % | |

Economic recovery and persistent easy money continued to underpin the financial markets, allowing 2020's global stock market rally to continue in 2021 and benefiting certain positions held in the Fund (as much as global stock volatility temporarily hurt their stock prices in Q1 2020). Crescent's top five contributors added 8.2% to the Fund's return in 2021, about 3.2x the sum of the top five detractors. Importantly, there was a lack of significant news that impacted the individual investments in the above table.

Exposure to each of the top five contributors was reduced in 2021, as their respective valuations reached levels high enough to warrant a reduction in holding size, but not their complete elimination from the portfolio. We did sell out of nine stocks completely in 2021, however. We similarly moved on from these positions largely as a result of valuation, which also drove other changes. Along with the reduction in position size of six financial service companies, we also eliminated positions in Bank of America and CIT Group. The Fund's exposure to travel-related companies was also reduced as a function of selling some of our Marriott International and all of Booking Holdings stakes.

We believe that the portfolio changes in the last year resulted in the exchange of less appealing risk-reward opportunities for more attractive ones. Ten new equities were added in 2021, including new positions in video game stocks Ubisoft Entertainment and Activision Blizzard, which joined Nexon and Epic Corp to comprise our current sector exposure of 3.1%.

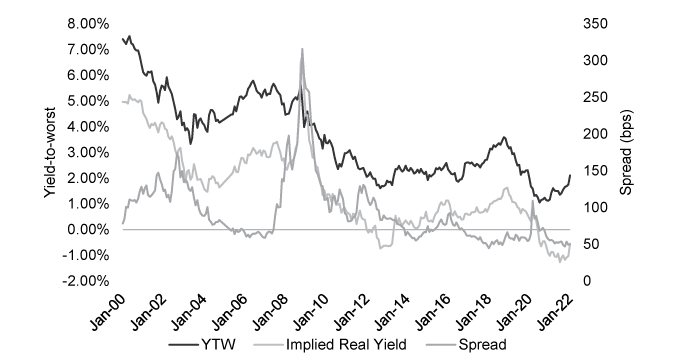

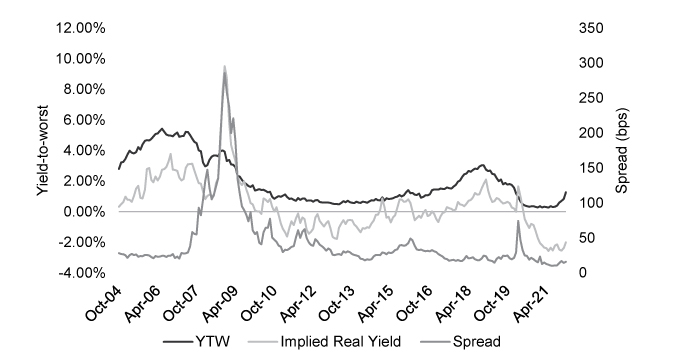

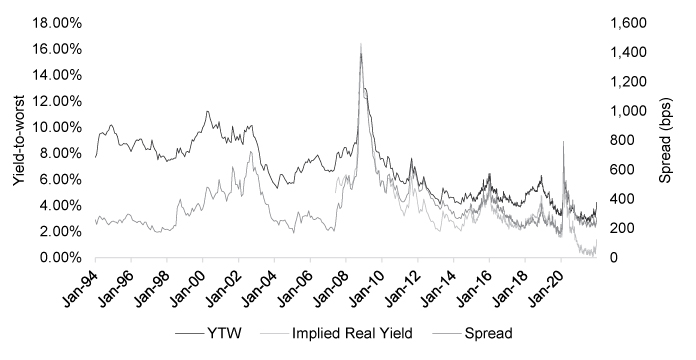

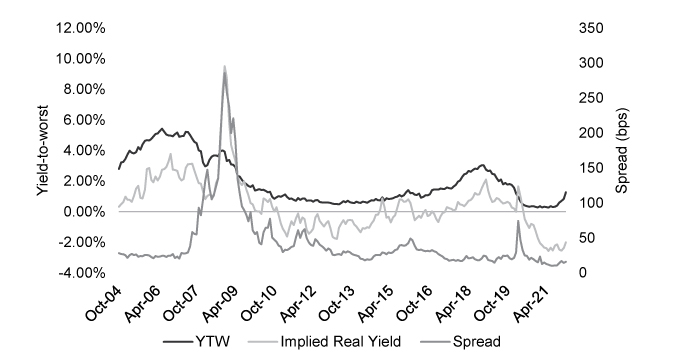

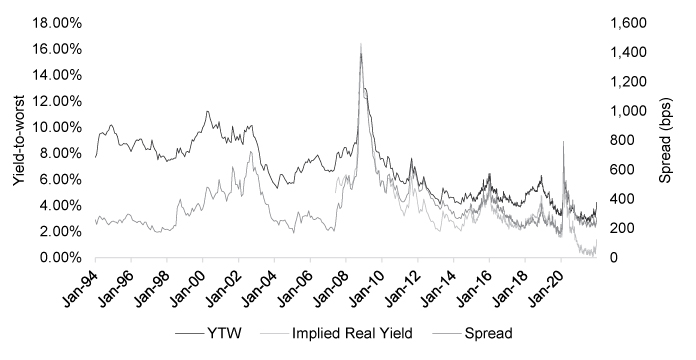

Unsurprisingly due to low yields, there were no new high yield positions and just one new private credit investment.

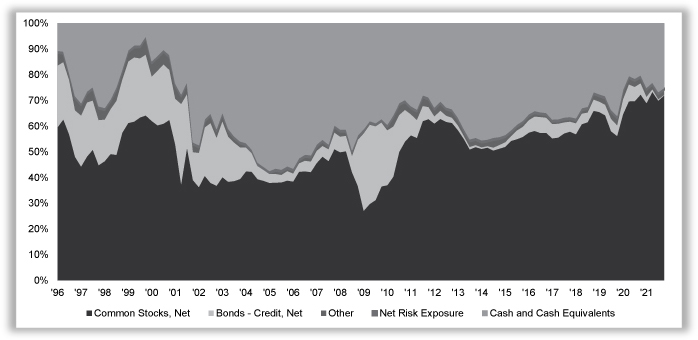

Crescent ended 2021 with net risk exposure of 74.8%, lower year over year by approximately five percentage points.

4 Reflects the top five contributors and detractors to the Fund's performance based on contribution to return for the trailing twelve months ("TTM"). Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. A copy of the methodology used and a list of every holding's contribution to the overall Fund's performance during the TTM is available by contacting FPA Client Service at crm@fpa.com. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed.

Past performance is no guarantee, nor is it indicative, of future results.

2

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

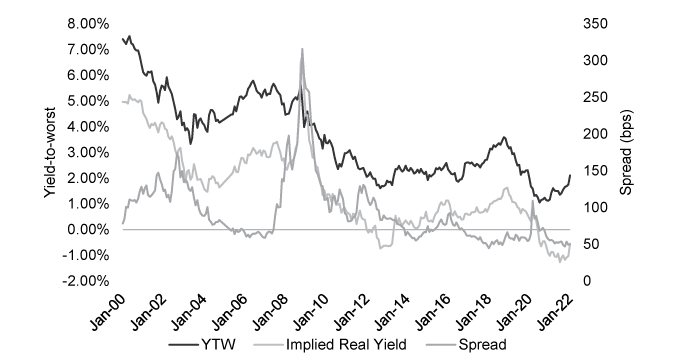

While the global stock markets remain at more elevated valuation levels, the potential for continued financial repression and its inflationary consequences is the reason why Crescent has a larger position in equities than has been typical (and less in corporate bonds). We believe that more "balanced" portfolios of stocks and bonds (e.g., the 60/40 equity/fixed income portfolios) are likely to generate weaker long-term returns, dragged down by the low yielding bonds — both investment grade and high yield, when compared to a more equity-centric portfolio. The poor performance of fixed income instruments last year, as shown in Exhibit C, and in stark contrast to the equity returns shown in Exhibit A, might just be a harbinger of things to come.

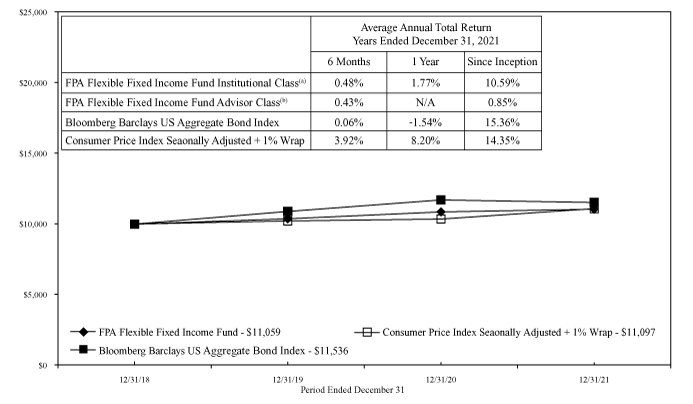

Exhibit C: Bond Returns5

| | 2021 | |

| 10-Year Government Bonds | |

United States | | | -5.7 | % | |

Germany | | | -10.2 | % | |

Japan | | | -10.5 | % | |

| US Corporate Bonds | |

Investment Grade | | | -1.0 | % | |

High Yield | | | 3.3 | % | |

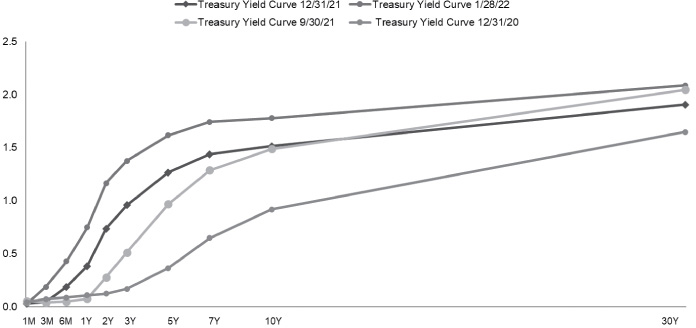

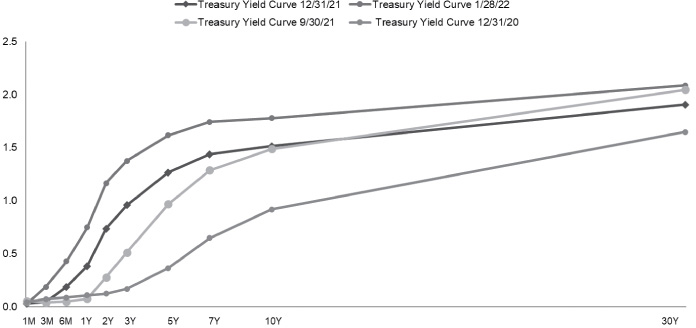

Wrestling with how much to own of stocks versus bonds doesn't seem like much of a contest. The low starting yields of bonds in general, and corporate bonds more specifically with their additional burden of potential default, offered a negative real yield at quarter end and into the beginning of 2022. With such an anemic starting point, it appears that the earnings growth potential of stocks affords the better opportunity for those with a longer-term view despite higher-than-average equity valuations (Exhibit D).

5 Source: Bloomberg. As of December 31, 2021.

Past performance is no guarantee, nor is it indicative, of future results.

3

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

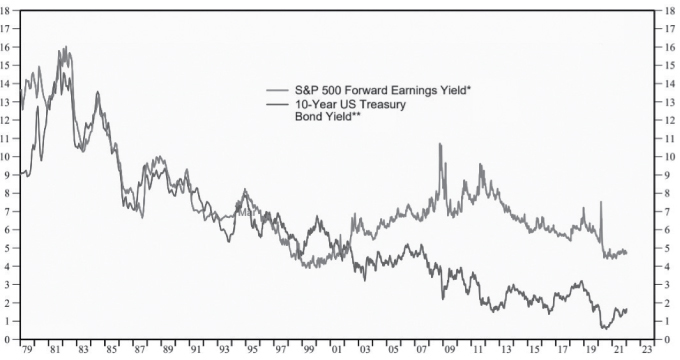

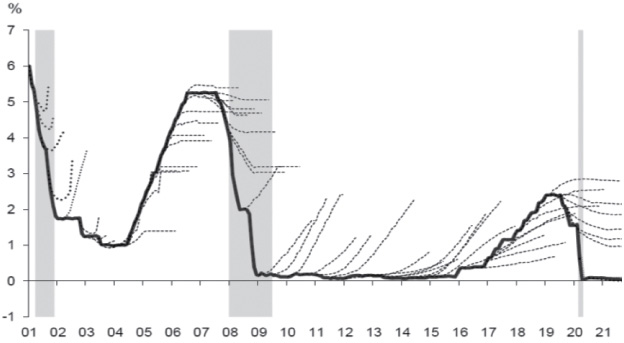

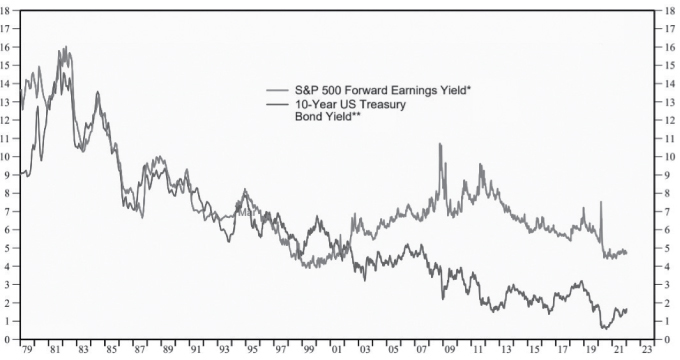

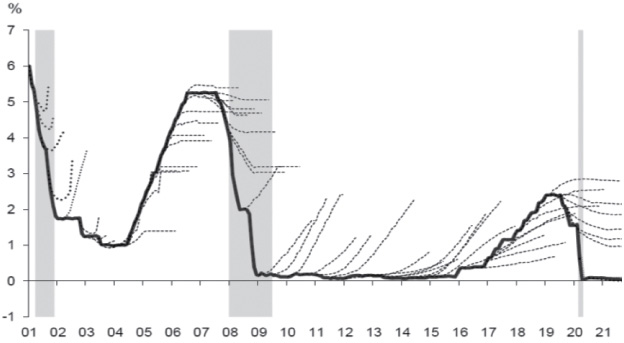

Exhibit D: S&P 500 Forward Earnings Yield & Nominal 10-Year Treasury Bond Yield6

The S&P 500's estimated 2022 P/E is 21.5x, which in its inverse translates to an estimated earnings yield of 4.7%. Given lower stock valuations outside the U.S., the estimated 2022 earnings yield for the global MSCI ACWI is a higher 5.6%. Contrast this with a 1.5% 10-year U.S. Treasury yield or worse, the 0.07% and -0.09% yields for Japanese and German government bonds.7

Assuming positive economic growth over the next decade, we believe the total return potential of stocks should exceed that of bonds, albeit with greater volatility. While volatility satisfies the institutional definition of equity risk, we have a different view. More precisely, risk is losing money, or a permanent impairment of capital, and should not factor in episodic, yet temporary price declines. Crescent's oft-stated goal is to deliver an equity-like rate of return while avoiding a permanent impairment of capital. The potential discomfort that comes with the ups and downs of the market must be borne if one is to achieve equity-like rates of return.

6 Source: Yardeni.com, I/B/E/S data by Refinitiv, FRED. Chart data covers the period December 31,1978 through January 7, 2022.

* Year-ahead forward consensus expected earnings divided by S&P 500 stock price index. Monthly through March 1994, then weekly.

** Monthly through March 1994, then weekly.

7 Source: Bloomberg, FRED. US, Japanese and German 10-year government bond yields as of December 31, 2021.

Past performance is no guarantee, nor is it indicative, of future results.

4

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

It is not a truism that more invested = more risk. There are different kinds of risk. We believe, for example, that being less invested in risk assets invites the greater risk of inflation eroding the value of your cash or "conservative" fixed income instruments.

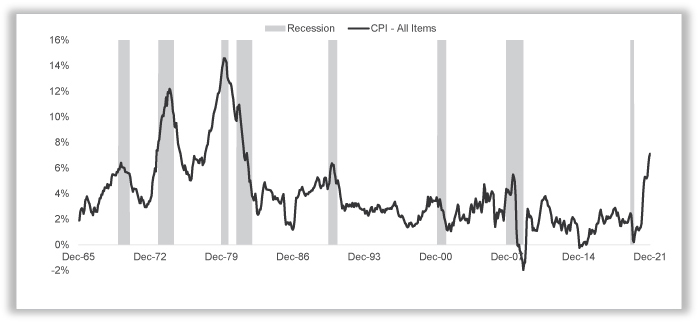

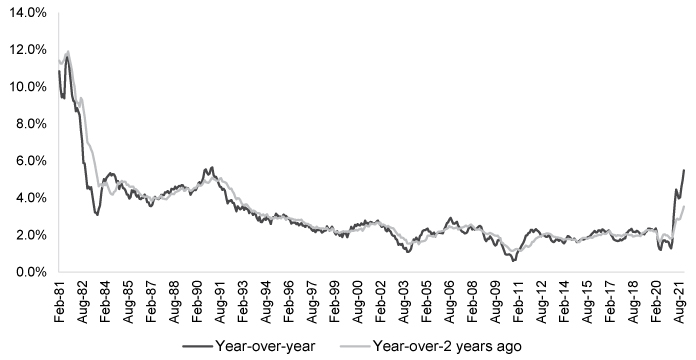

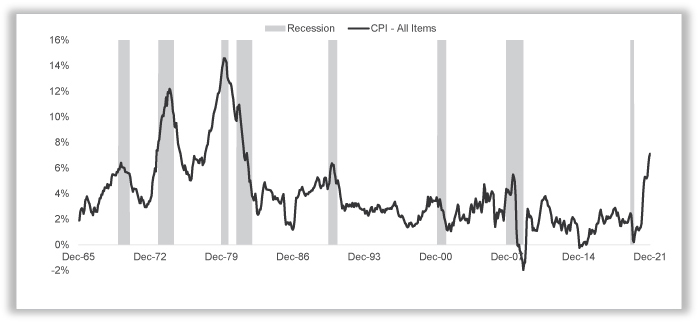

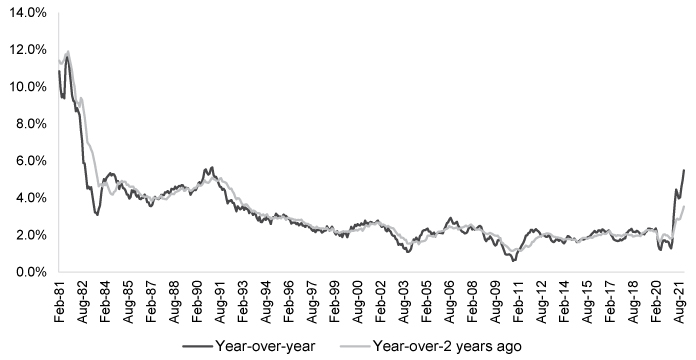

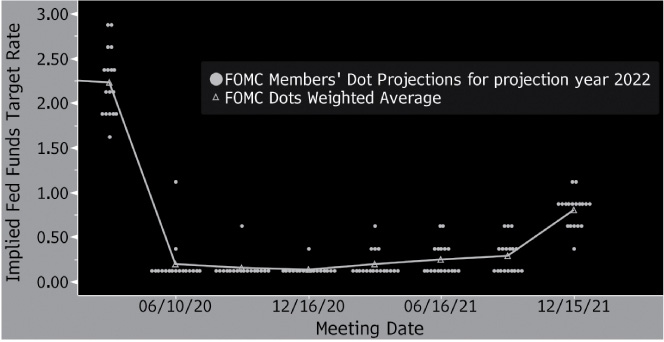

The easy money environment since the great financial crisis set the stage for higher inflation. The pandemic has made things worse, impacting both size and availability of the labor pool and causing supply chain disruptions. While one can reasonably argue that domestic inflation in the future will be lower than 2021's 7%, we believe that inflation will likely average higher in this next decade than the preceding one — something that is not currently expected just as last year's rise was not anticipated (Exhibits E and F).8

Exhibit E: CPI 1965 to 20219

8 Average inflation over the past 10 years (2011-2020) was approximately 1.9%.

9 Source: FRED. Chart data covers the period December 31, 1965 through December 31, 2021. CPI stands for Consumer Price Index.

Past performance is no guarantee, nor is it indicative, of future results.

5

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

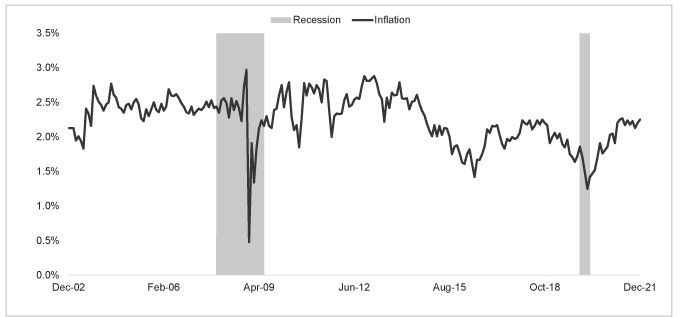

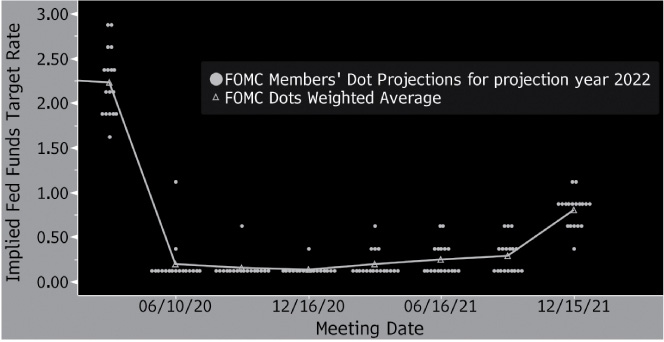

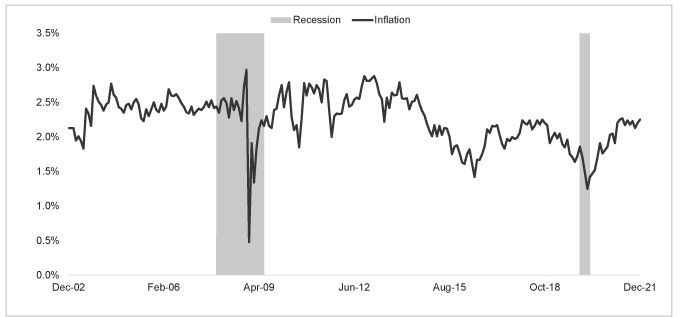

Exhibit F: 5-Year Forward US Inflation Expectation Rate10

We manage your capital to seek to provide an acceptable real rate of return over time — both in the absolute and factoring in the risk assumed to achieve it. This requires us to seek to protect our/your portfolio from the diminution of real return that inflation can cause. To accomplish this, we:

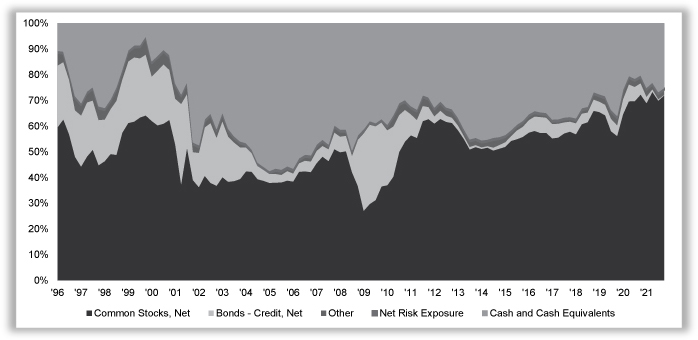

◼ Own more stocks than the historical average (Exhibit G), including the Fund's holdings of lower priced overseas-based businesses that we believe offer better potential for risk-adjusted returns than their US counterparts.

◼ Hold good to great quality businesses at good prices. Owning shares in businesses that are both less expensive and growing faster than the stock market should help to achieve our goal (Exhibit H).

◼ Have avoided low-yielding bonds, particularly those with unappreciated credit risk (Exhibit G).

10 Source: FRED. Chart data covers the period December 31, 2002 through December 31, 2021.

Past performance is no guarantee, nor is it indicative, of future results.

6

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit G: FPA Crescent Historic Asset Class Composition11

11 Source: FPA. Chart data covers the period March 31, 1996 through December 31, 2021.

Past performance is no guarantee, nor is it indicative, of future results.

7

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit H: FPA Crescent Long Equity Holding Valuation and Earnings Growth vs Stock Market12

| | Price/Earnings

1 Year Forward | | Price/Book | | 3-Year Trailing

EPS Growth | | 3-Year Forward

Estimated

EPS Growth | |

| | 12/31/2020 | | 12/31/2021 | | 12/31/2020 | | 12/31/2021 | | 12/31/2020 | | 12/31/2021 | | 12/31/2020 | | 12/31/2021 | |

FPA Crescent —

Long Equity

Portfolio | | | 18.9 | x | | | 15.6 | x | | | 1.6 | x | | | 1.8 | x | | | -30 | % | | | 22 | % | | | 40 | % | | | 21 | % | |

vs. MSCI

ACWI NR | | | -10 | % | | | -13 | % | | | -43 | % | | | -42 | % | | | | | | | | | | | 79 | % | | | 150 | % | |

vs. S&P 500 | | | -21 | % | | | -25 | % | | | -62 | % | | | -62 | % | | | | | | | | | | | 84 | % | | | 121 | % | |

MSCI ACWI NR | | | 21.1 | x | | | 18.0 | x | | | 2.8 | x | | | 3.1 | x | | | -4 | % | | | 5 | % | | | 22 | % | | | 9 | % | |

S&P 500 | | | 23.9 | x | | | 20.9 | x | | | 4.2 | x | | | 4.8 | x | | | 1 | % | | | 9 | % | | | 22 | % | | | 10 | % | |

Hopefully, the Fund's long equity exposure will continue to outperform global indices as it has done historically. Long equities held by Crescent outperformed the S&P 500 by 0.70% since 2007 and beaten the MSCI ACWI by 4.22% since 2011 when the Fund began to tilt more international (Exhibit I).

12 Source: CapIQ, Factset, Bloomberg, FPA calculations. 3-Year Forward Estimated EPS Growth is based on FPA calculations using consensus data from CapIQ, Factset and Bloomberg. Forward looking statistics are estimates and subject to change. Comparison to the S&P 500 and MSCI ACWI Indices is being used as a representation of the "market" and is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. Please refer to footnote 3 for the definition of the long equity holdings and other important information and refer to Page 1 for net returns of the Fund. The long equity holdings average weight in the Fund was 74.4% and 75.1% for Q4 2021 and TTM through 12/31/21, respectively. The long equity holdings average weight in the Fund was 75.2% and 71.6% for Q4 2020 and TTM through 12/31/20, respectively. The long equity statistics shown herein are for illustrative purposes only and may not reflect the impact of material economic or market factors. No representation is being made that any account, product or strategy will or is likely to achieve results similar to those shown. Long equity statistics noted herein do not represent the results that the Fund or an investor can or should expect to receive. Fund shareholders can only purchase and redeem shares at net asset value.

Past performance is no guarantee, nor is it indicative, of future results.

8

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit I: Long Equity Carve-Out Gross Performance vs. Indices13

| | CAGR

1/1/07 to

12/31/21 | | CAGR

1/1/11 to

12/31/21 | | 2021 | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

FPACX Long

Equity | | | 11.36 | % | | | 14.17 | % | | | 23.18 | % | | | 12.55 | % | | | 31.53 | % | | | -12.33 | % | | | 21.07 | % | | | 15.57 | % | | | -0.64 | % | | | 13.64 | % | | | 38.12 | % | | | 17.77 | % | | | 4.58 | % | | | 22.48 | % | | | 38.66 | % | | | -38.27 | % | | | 11.47 | % | |

MSCI

ACWI NR* | | | | | 9.95 | % | | | 18.54 | % | | | 16.25 | % | | | 26.60 | % | | | -9.42 | % | | | 23.97 | % | | | 7.86 | % | | | -2.36 | % | | | 4.16 | % | | | 22.80 | % | | | 16.13 | % | | | -7.35 | % | | | — | | | | — | | | | — | | | | — | | |

Excess Return

vs. MSCI

ACWI NR | | | | | 4.22 | % | | | 4.64 | % | | | -3.71 | % | | | 4.93 | % | | | -2.91 | % | | | -2.90 | % | | | 7.71 | % | | | 1.72 | % | | | 9.48 | % | | | 15.32 | % | | | 1.64 | % | | | 11.93 | % | | | — | | | | — | | | | — | | | | — | | |

S&P 500 | | | 10.66 | % | | | 15.16 | % | | | 28.71 | % | | | 18.40 | % | | | 31.49 | % | | | -4.38 | % | | | 21.83 | % | | | 11.96 | % | | | 1.38 | % | | | 13.69 | % | | | 32.39 | % | | | 16.00 | % | | | 2.11 | % | | | 15.06 | % | | | 26.46 | % | | | -37.00 | % | | | 5.49 | % | |

Excess Return

vs. S&P 500 | | | 0.70 | % | | | -0.99 | % | | | -5.53 | % | | | -5.85 | % | | | 0.04 | % | | | -7.95 | % | | | -0.76 | % | | | 3.61 | % | | | -2.02 | % | | | -0.05 | % | | | 5.73 | % | | | 1.77 | % | | | 2.47 | % | | | 7.42 | % | | | 12.20 | % | | | -1.27 | % | | | 5.98 | % | |

Closing

We wish we could tell you the Crescent portfolio is as cheap as it has ever been, but given the market and the Fund's strong performance since Q1 2020's market bottom, you know that cannot be true. We have repositioned the portfolio as a function of old opportunities that have come to fruition and new opportunities that we believe offer reasonable prospects for attractive risk-adjusted future returns. The portfolio is also built to withstand multiple potential outcomes: e.g., inflation, stagflation, and recession.14

We just watched Peter Jackson's The Beatles: Get Back. Although a music documentary, we couldn't help but appreciate how those four young men from Liverpool managed to focus on what they do best and what they wanted to accomplish, despite pressure from others to do some things differently. Your portfolio managers

13 As of December 31, 2021, which represents latest data available. Data shown from January 1, 2007 as that is when FPA began capturing this data. CAGR shown for period 1/1/2007 through 12/31/2021 for the S&P 500 and for the period 1/1/2011 through 12/31/2021 for the MSCI ACWI.

* The MSCI ACWI NR was not considered a relevant illustrative index prior to 2011 because the Fund was not classified as a global mandate until this point in time.

Source: FPA and Morningstar Direct. FPACX or Fund refers to FPA Crescent Fund — Institutional Class. The table shows the performance of the long equity segment of the Fund only and is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Please refer to page 1 for overall net performance of the Fund since inception. Long equity holdings only includes equity securities excluding paired trades, short-sales, and preferred securities. The long equity performance information shown herein is for illustrative purposes only and may not reflect the impact of material economic or market factors. No representation is being made that any account, product or strategy will or is likely to achieve profits, losses, or results similar to those shown. Long equity performance does not represent the return an investor in the Fund can or should expect to receive. Fund shareholders may only invest or redeem their shares at net asset value. Comparison to the S&P 500 and the MSCI ACWI NR indices is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. An investor cannot invest directly in an index. Active stock selection refers to the fact that the Fund can make investments outside of the index or in different weights than the index and thus Fund performance may differ, sometimes materially, for any given period as compared to a given index.

14 The performance of the Fund, the S&P 500 and the MSCI ACWI NR for the period since the Q1 2020 bottom, 03/24/2020, to 12/31/2021 was 77.77%, 119.03,% and 102.12%, respectively. Fund performance is net of fees and expenses and includes reinvestment of distributions.

Past performance is no guarantee, nor is it indicative, of future results.

9

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

similarly come together to concentrate on the long-term, which means shutting our ears to the many cacophonous voices that whisper to us in the short-term.

Best wishes in the New Year and may you and your families be in good health.

Respectfully submitted,

FPA Crescent Portfolio Managers

January 31, 2022

Important Disclosures

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale with respect to any securities, products or services discussed, and neither does it provide investment advice. Any such offer or solicitation shall only be made pursuant to the Fund's Prospectus, which supersedes the information contained herein in its entirety. This presentation does not constitute an investment management agreement or offering circular.

The views expressed herein and any forward-looking statements are as of the date of the publication and are those of the portfolio management team and are subject to change without notice. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data have been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities or sectors are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio managers, the Adviser, or the distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security or sector examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

Investments, including investments in mutual funds, carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund may purchase foreign securities, including American Depository Receipts (ADRs) and other depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks; these risks may be heightened when investing in emerging markets. Foreign investments, especially those of companies in emerging markets, can be riskier, less liquid, harder to value, and more volatile than investments in the United States. Adverse political and economic developments or changes in the value of foreign currency can make it more difficult for the Fund to value the securities. Differences in tax and accounting standards, difficulties in obtaining information about foreign companies, restrictions on receiving investment proceeds from a foreign country, confiscatory foreign tax laws, and potential difficulties in enforcing contractual obligations, can all add to the risk and volatility of foreign investments.

Small and mid-cap stocks involve greater risks and may fluctuate in price more than larger company stocks. Short-selling involves increased risks and transaction costs. You risk paying more for a security than you received from its sale.

The return of principal in a bond investment is not guaranteed. Bonds have issuer, interest rate, inflation and credit risks. Interest rate risk is the risk that when interest rates go up, the value of fixed income securities,

10

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

such as bonds, typically go down and investors may lose principal value. Credit risk is the risk of loss of principal due to the issuer's failure to repay a loan. Generally, the lower the quality rating of a security, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults the security may lose some or all of its value. Lower rated bonds, callable bonds and other types of debt obligations involve greater risks. Mortgage-backed securities and asset-backed securities are subject to prepayment risk and the risk of default on the underlying mortgages or other assets. High yield securities can be volatile and subject to much higher instances of default. Derivatives may increase volatility.

The ratings agencies that provide ratings are Standard and Poor's, Moody's, and Fitch. Credit ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings BB and below are lower-rated securities (junk bonds). High-yielding, non-investment grade bonds (junk bonds) involve higher risks than investment grade bonds. Bonds with credit ratings of CCC or below have high default risk.

Value securities, including those selected by the Fund's portfolio managers, are subject to the risk that their intrinsic value may never be realized by the market because the market fails to recognize what the portfolio managers consider to be their true business value or because the portfolio managers have misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

Investing in Special Purpose Acquisition Companies ("SPACS") involves risks. Because SPACs and similar entities have no operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the entity's management to identify and complete a profitable acquisition. SPACs are not required to provide the depth of disclosures or undergo the rigorous due diligence of a traditional initial public offering (IPO). Investors in SPACs may become exposed to speculative investments, foreign or domestic, in higher risk sectors/industries. SPAC investors generally pay certain fees and give the sponsor certain incentives (e.g., discounted ownership stakes) not found in traditional IPOs. Due to this, an investment in a SPAC may include potential conflicts and the potential for misalignment of incentives in the structure of the SPAC. For more information relating to the risks of investing in SPACs please refer to the Fund's Prospectus.

While transactions in derivatives may reduce certain risks, they entail certain other risks. Derivatives may magnify the Fund's gains or losses, causing it to make or lose substantially more than it invested. Derivatives have a risk of default by the counterparty to a contract. When used for hedging purposes, increases in the value of the securities the Fund holds or intends to acquire should offset any losses incurred with a derivative.

Investments in private securities and limited partnerships present risks. These investments are not registered under the federal securities laws, and are generally eligible for sale only to certain eligible investors. They may be illiquid, and thus more difficult to sell, because there may be relatively few potential purchasers for such investments, and the sale of such investments may also be restricted under securities laws.

Please refer to the Fund's Prospectus for a complete overview of the primary risks associated with the Fund.

In making any investment decision, you must rely on your own examination of the Fund, including the risks involved in an investment. Investments mentioned herein may not be suitable for all recipients and in each case, potential investors are advised not to make any investment decision unless they have taken independent advice from an appropriately authorized advisor. An investment in any security mentioned herein does not

11

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

guarantee a positive return as securities are subject to market risks, including the potential loss of principal. You should not construe the contents of this document as legal, tax, investment or other advice or recommendations.

Index Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund may be less diversified than the indices noted herein, and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund's investment strategy. Indices are unmanaged and do not reflect any commissions, transaction costs, or fees and expenses which would be incurred by an investor purchasing the underlying securities and which would reduce the performance in an actual account. You cannot invest directly in an index. The Fund does not include outperformance of any index in its investment objectives.

S&P 500 Index includes a representative sample of 500 hundred companies in leading industries of the U.S. economy. The Index focuses on the large-cap segment of the market, with over 80% coverage of U.S. equities, but is also considered a proxy for the total market.

MSCI ACWI NR USD Index is a free float-adjusted market capitalization weighted index that is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 26 emerging markets.

CAGR is the compound annual growth rate is the rate of return (RoR) that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each period of the investment's life span.

Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics. The CPI is presented to illustrate the Fund's purchasing power against changes in the prices of goods as opposed to a benchmark, which is used to compare the Fund's performance. There can be no guarantee that the CPI will reflect the exact level of inflation at any given time.

Bloomberg (BBg) US Aggregate Bond Index provides a measure of the performance of the US investment grade bonds market, which includes investment grade US Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have at least 1-year remaining in maturity. In addition, the securities must be denominated in US dollars and must be fixed rate, nonconvertible, and taxable.

60% S&P500/ 40% Bloomberg US Aggregate Bond Index is a hypothetical combination of unmanaged indices and comprises 60% S&P 500 Index and 40% Bloomberg US Aggregate Bond Index.

60% MSCI ACWI NR USD/ 40% Bloomberg US Aggregate Bond Index is a hypothetical combination of unmanaged indices and comprises 60% MSCI ACWI Index and 40% Bloomberg US Aggregate Bond Index.

Other Definitions

Corporate bond is a type of debt security that is issued by a firm and sold to investors. The company gets the capital it needs and in return the investor is paid a pre-established number of interest payments at either a fixed or variable interest rate.

Earnings Per Share (EPS) is calculated as a company's profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company's profitability.

12

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Earnings Per Share Growth is defined as the percentage change in normalized earnings per share over the previous 12-month period to the latest year end.

Earnings yield refers to the earnings per share for the most recent 12-month period divided by the current market price per share. The earnings yield (the inverse of the P/E ratio) shows the percentage of a company's earnings per share.

Government bond is a debt security issued by a government to support government spending and obligations. Government bonds can pay periodic interest payments called coupon payments.

High-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Inflation is the decline of purchasing power of a given currency over time. A quantitative estimate of the rate at which the decline in purchasing power occurs can be reflected in the increase of an average price level of a basket of selected goods and services in an economy over some period of time.

Investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Long Equity Performance represents the performance of stocks that the Fund owned over the given time periods and excludes the long equity portion of a pair trade, short-sales, limited partnerships, derivatives/futures, corporate bonds, mortgage backed securities, and cash and cash equivalents.

Market Capitalization refers to the total dollar market value of a company's outstanding shares of stock. Commonly referred to as "market cap," it is calculated by multiplying the total number of a company's outstanding shares by the current market price of one share.

Market Cycles, also known as stock market cycles, is a wide term referring to trends or patterns that emerge during different markets or business environments.

Net Equity Exposure includes long equity securities minus short-sales and preferred securities.

Net Risk Exposure is a measure of the extent to which a fund's trading book is exposed to market fluctuations. In regards to the Fund, it is the percent of the portfolio exposed to Risk Assets.

Price to Book is used to compare a firm's market capitalization to its book value. It's calculated by dividing the company's stock price per share by its book value per share (BVPS). An asset's book value is equal to its carrying value on the balance sheet, and companies calculate it netting the asset against its accumulated depreciation.

Price to Earnings is the ratio for valuing a company that measures its current share price relative to its EPS. The price-to-earnings ratio is also sometimes known as the price multiple or the earnings multiple.

Trailing Price to Earnings is a relative valuation multiple that is based on the last 12 months of actual earnings.

Forward Price to Earnings is a version of the ratio of price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation.

Risk Assets is any asset that carries a degree of risk. Risk asset generally refers to assets that have a significant degree of price volatility, such as equities, commodities, high-yield bonds, real estate and currencies, but does not include cash and cash equivalents.

Standard Deviation is a measure of the dispersion of a set of data from its mean.

13

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Treasury bonds (T-bonds) are government debt securities issued by the U.S. Federal government that have maturities greater than 20 years. T-bonds earn periodic interest until maturity, at which point the owner is also paid a par amount equal to the principal.

Volatility is a statistical measure of the dispersion of returns for a given security or market index. In most cases, the higher the volatility, the riskier the security. Volatility is often measured as either the standard deviation or variance between returns from that same security or market index.

Yield refers to the earnings generated and realized on an investment over a particular period of time. It's expressed as a percentage based on the invested amount, current market value, or face value of the security.

©2021 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted by Morningstar to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The FPA Funds are distributed by UMB Distribution Services, LLC, 235 W. Galena Street, Milwaukee, WI, 53212.

14

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. These views may not be relied upon as investment advice or as an indication of trading intent on behalf of any First Pacific Advisors portfolio. Security examples featured are samples for presentation purposes and are intended to illustrate our investment philosophy and its application. It should not be assumed that most recommendations made in the future will be profitable or will equal the performance of the securities. This information and data has been prepared from sources believed reliable. The accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

15

FPA CRESCENT FUND

HISTORICAL PERFORMANCE

(Unaudited)

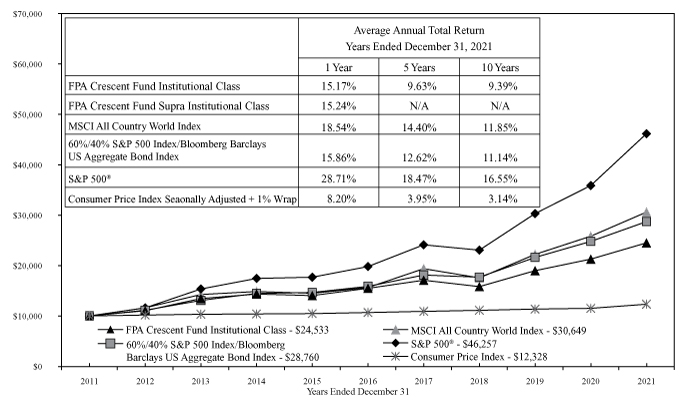

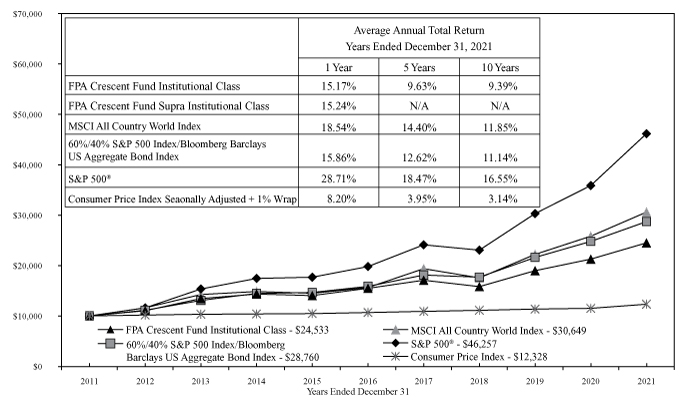

Change in Value of a $10,000 Investment in FPA Crescent Fund Institutional Class vs. S&P 500, MSCI All Country World Index, 60%/40% S&P 500 Index/Bloomberg Barclays US Aggregate Bond Index and Consumer Price Index for the Ten Years Ended December 31, 2021

The Standard & Poor's 500 Stock Index (S&P 500) is a capitalization-weighted index which covers industrial, utility, transportation and financial service companies, and represents approximately 75% of the New York Stock Exchange (NYSE) capitalization and 30% of NYSE issuers and is considered a measure of large capitalization stock performance. The MSCI All Country World Index is a float-adjusted market capitalization index that is designed to measure the combined equity market performance of developed and emerging market countries. The 60%/40% S&P 500 Index/Bloomberg Barclays U.S. Aggregate Bond Index is a composite blend of 60% of the S&P 500 Index and 40% of the Bloomberg Barclays U.S. Aggregate Bond Index. The Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of U.S. consumer prices as determined by the U.S. Bureau of Labor Statistics. The S&P 500, MSCI All Country World and 60%/40% S&P 500/Bloomberg Barclays U.S. Aggregate Bond indexes are included as broad-based comparisons to the capitalization characteristics of the Fund's portfolio. The CPI is included as comparison of the Fund's results to inflation.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpa.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio and redemption fees can be found on pages 36, 37, 42 and 43. The Prospectus details the Fund's objective and policies, sales charges, and other matters of interest to prospective investors. Please read the Prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpa.com, by email at crm@fpa.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

16

FPA CRESCENT FUND

PORTFOLIO SUMMARY

December 31, 2021

Common Stocks | | | | | 71.8 | % | |

Internet Media | | | 12.1 | % | | | | | |

Semiconductor Devices | | | 7.3 | % | | | | | |

Cable & Satellite | | | 5.9 | % | | | | | |

Application Software | | | 4.5 | % | | | | | |

Cement & Aggregates | | | 3.4 | % | | | | | |

Electrical Components | | | 3.1 | % | | | | | |

Diversified Banks | | | 3.0 | % | | | | | |

P&C Insurance | | | 2.9 | % | | | | | |

Banks | | | 2.5 | % | | | | | |

Industrial Distribution & Rental | | | 2.5 | % | | | | | |

Insurance Brokers | | | 2.3 | % | | | | | |

Base Metals | | | 2.3 | % | | | | | |

Investment Companies | | | 2.2 | % | | | | | |

Institutional Brokerage | | | 1.8 | % | | | | | |

Food Services | | | 1.7 | % | | | | | |

E-Commerce Discretionary | | | 1.3 | % | | | | | |

Chemicals | | | 1.3 | % | | | | | |

Infrastructure Software | | | 1.1 | % | | | | | |

Hotels, Restaurants & Leisure | | | 1.1 | % | | | | | |

Railroad Rolling Stock | | | 1.0 | % | | | | | |

Apparel, Footwear & Accessory Design | | | 1.0 | % | | | | | |

Specialty Chemicals | | | 1.0 | % | | | | | |

Wealth Management | | | 0.9 | % | | | | | |

Telecom Carriers | | | 0.9 | % | | | | | |

Midstream — Oil & Gas | | | 0.8 | % | | | | | |

Commercial & Residential Building

Equipment & Systems | | | 0.8 | % | | | | | |

Computer Hardware & Storage | | | 0.7 | % | | | | | |

Real Estate Owners & Developers | | | 0.6 | % | | | | | |

Marine Shipping | | | 0.5 | % | | | | | |

Industrials | | | 0.5 | % | | | | | |

Integrated Utilities | | | 0.4 | % | | | | | |

Entertainment Content | | | 0.2 | % | | | | | |

Oil & Gas Services & Equipment | | | 0.2 | % | | | | | |

Closed End Fund | | | | | 0.3 | % | |

Limited Partnerships | | | | | 1.5 | % | |

Preferred Stocks | | | | | 0.1 | % | |

Warrant | | | | | 0.0 | % | |

Special Purpose Acquisition Companies | | | | | 3.2 | % | |

Bonds & Debentures | | | | | 18.5 | % | |

U.S. Treasuries | | | 18.3 | % | | | | | |

Corporate Bank Debt | | | 0.2 | % | | | | | |

Corporate Bonds & Notes | | | 0.0 | % | | | | | |

Short-term Investments | | | | | 5.7 | % | |

Securities Sold Short | | | | | (2.5 | )% | |

Other Assets And Liabilities, Net | | | | | 1.4 | % | |

Net Assets | | | | | 100.0 | % | |

17

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS

December 31, 2021

COMMON STOCKS | | Shares | | Fair Value | |

INTERNET MEDIA — 12.1% | |

Alphabet, Inc. Class A(a) | | | 120,086 | | | $ | 347,893,946 | | |

Alphabet, Inc. Class C(a) | | | 92,424 | | | | 267,437,162 | | |

Baidu, Inc. ADR (China)(a) | | | 3,912,174 | | | | 72,548,475 | | |

Meta Platforms, Inc. Class A(a) | | | 895,761 | | | | 301,289,212 | | |

Naspers, Ltd. N Shares (South Africa) | | | 345,972 | | | | 53,670,711 | | |

Prosus NV (Netherlands) | | | 2,430,289 | | | | 203,448,914 | | |

| | | $ | 1,246,288,420 | | |

SEMICONDUCTOR DEVICES — 7.3% | |

Analog Devices, Inc. | | | 1,683,454 | | | $ | 295,900,710 | | |

Broadcom, Inc. | | | 536,804 | | | | 357,194,750 | | |

NXP Semiconductors NV (Netherlands) | | | 429,743 | | | | 97,886,860 | | |

| | | $ | 750,982,320 | | |

CABLE & SATELLITE — 5.9% | |

Charter Communications, Inc. Class A(a)(b) | | | 390,978 | | | $ | 254,905,927 | | |

Comcast Corp. Class A(b) | | | 6,979,258 | | | | 351,266,055 | | |

| | | $ | 606,171,982 | | |

APPLICATION SOFTWARE — 4.5% | |

Activision Blizzard, Inc. | | | 2,313,470 | | | $ | 153,915,159 | | |

Entain PLC (Isle of Man)(a) | | | 3,205,123 | | | | 73,013,490 | | |

Epic Games, Inc.(a)(c)(d)(e) | | | 33,130 | | | | 29,320,050 | | |

Nexon Co. Ltd. (Japan) | | | 4,096,691 | | | | 79,205,779 | | |

Open Text Corp. (Canada) | | | 1,515,451 | | | | 71,953,613 | | |

Ubisoft Entertainment SA (France)(a) | | | 1,111,750 | | | | 54,514,860 | | |

| | | $ | 461,922,951 | | |

CEMENT & AGGREGATES — 3.4% | |

HeidelbergCement AG (Germany) | | | 1,012,913 | | | $ | 68,638,527 | | |

LafargeHolcim Ltd. (Switzerland) | | | 5,535,770 | | | | 282,559,990 | | |

| | | $ | 351,198,517 | | |

ELECTRICAL COMPONENTS — 3.1% | |

TE Connectivity Ltd. (Switzerland) | | | 1,944,520 | | | $ | 313,728,857 | | |

DIVERSIFIED BANKS — 3.0% | |

Citigroup, Inc. | | | 3,571,897 | | | $ | 215,706,860 | | |

Flutter Entertainment PLC (Ireland)(a) | | | 369,704 | | | | 58,848,549 | | |

Gulfport Energy Corp.(a) | | | 503,402 | | | | 36,260,046 | | |

| | | $ | 310,815,455 | | |

18

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2021

COMMON STOCKS — Continued | | Shares | | Fair Value | |

P&C INSURANCE — 2.9% | |

American International Group, Inc.(b) | | | 5,195,127 | | | $ | 295,394,921 | | |

BANKS — 2.5% | |

Signature Bank | | | 86,091 | | | $ | 27,847,856 | | |

Wells Fargo & Co. | | | 4,809,287 | | | | 230,749,590 | | |

| | | $ | 258,597,446 | | |

INDUSTRIAL DISTRIBUTION & RENTAL — 2.5% | |

Howmet Aerospace, Inc. | | | 4,577,152 | | | $ | 145,690,748 | | |

LG Corp. (South Korea) | | | 1,610,540 | | | | 109,604,783 | | |

| | | $ | 255,295,531 | | |

INSURANCE BROKERS — 2.3% | |

Aon PLC Class A (Britain) | | | 790,294 | | | $ | 237,530,765 | | |

BASE METALS — 2.3% | |

Glencore PLC (Switzerland) | | | 46,063,352 | | | $ | 233,777,756 | | |

INVESTMENT COMPANIES — 2.2% | |

Groupe Bruxelles Lambert SA (Belgium) | | | 2,039,158 | | | $ | 227,886,352 | | |

INSTITUTIONAL BROKERAGE — 1.8% | |

Jefferies Financial Group, Inc.(b) | | | 4,697,583 | | | $ | 182,266,220 | | |

FOOD SERVICES — 1.7% | |

JDE Peet's NV (Netherlands) | | | 4,041,690 | | | $ | 124,699,634 | | |

Just Eat Takeaway.com NV (Netherlands)(a)(f) | | | 965,437 | | | | 53,275,784 | | |

| | | $ | 177,975,418 | | |

E-COMMERCE DISCRETIONARY — 1.3% | |

Alibaba Group Holding Ltd. ADR(China)(a) | | | 5,586,312 | | | $ | 85,182,204 | | |

Amazon.com, Inc.(a) | | | 15,136 | | | | 50,468,570 | | |

| | | $ | 135,650,774 | | |

CHEMICALS — 1.3% | |

International Flavors & Fragrances, Inc. | | | 867,290 | | | $ | 130,657,238 | | |

INFRASTRUCTURE SOFTWARE — 1.1% | |

FirstEnergy Corp. | | | 2,789,666 | | | $ | 116,022,209 | | |

HOTELS, RESTAURANTS & LEISURE — 1.1% | |

Marriott International, Inc. Class A(a) | | | 693,390 | | | $ | 114,575,764 | | |

19

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2021

COMMON STOCKS — Continued | | Shares | | Fair Value | |

RAILROAD ROLLING STOCK — 1.0% | |

Westinghouse Air Brake Technologies Corp. | | | 1,123,039 | | | $ | 103,443,122 | | |

APPAREL, FOOTWEAR & ACCESSORY DESIGN — 1.0% | |

Cie Financiere Richemont SA (Switzerland) | | | 676,970 | | | $ | 101,746,095 | | |

SPECIALTY CHEMICALS — 1.0% | |

Univar Solutions, Inc.(a) | | | 3,486,932 | | | $ | 98,854,522 | | |

WEALTH MANAGEMENT — 0.9% | |

LPL Financial Holdings, Inc. | | | 606,686 | | | $ | 97,124,362 | | |

TELECOM CARRIERS — 0.9% | |

SoftBank Group Corp. (Japan) | | | 1,963,022 | | | $ | 92,732,866 | | |

MIDSTREAM — OIL & GAS — 0.8% | |

Kinder Morgan, Inc.(b) | | | 5,262,897 | | | $ | 83,469,546 | | |

COMMERCIAL & RESIDENTIAL BUILDING EQUIPMENT &

SYSTEMS — 0.8% | |

Samsung C&T Corp. (South Korea) | | | 801,618 | | | $ | 80,246,092 | | |

COMPUTER HARDWARE & STORAGE — 0.7% | |

Dell Technologies, Inc. C Shares(a) | | | 1,192,689 | | | $ | 66,993,341 | | |

REAL ESTATE OWNERS & DEVELOPERS — 0.6% | |

Swire Pacific Ltd. Class A (Hong Kong) | | | 10,113,170 | | | $ | 57,520,515 | | |

MARINE SHIPPING — 0.5% | |

Sound Holding FP (Luxembourg)(c)(d)(e)(g)(h) | | | 1,146,250 | | | $ | 55,564,380 | | |

INDUSTRIALS — 0.5% | |

Uber Technologies, Inc.(a) | | | 1,183,677 | | | $ | 49,631,577 | | |

INTEGRATED UTILITIES — 0.4% | |

PG&E Corp.(a) | | | 3,597,611 | | | $ | 43,674,998 | | |

20

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2021

COMMON STOCKS — Continued | | Shares | | Fair Value | |

ENTERTAINMENT CONTENT — 0.2% | |

Netflix, Inc.(a) | | | 42,588 | | | $ | 25,656,715 | | |

OIL & GAS SERVICES & EQUIPMENT — 0.2% | |

McDermott International Ltd.(a)(g) | | | 46,782,420 | | | $ | 19,180,792 | | |

| TOTAL COMMON STOCKS — 71.8% (Cost $4,545,733,988) | | $ | 7,382,577,819 | | |

CLOSED END FUND — 0.3% | |

Altaba Escrow(c)(Cost $0) | | | 4,756,180 | | | $ | 28,204,147 | | |

LIMITED PARTNERSHIPS | |

FPS LLC (Marine Shipping)(c)(d)(e)(g)(h) | | | 1,185,446 | | | $ | 83,704,351 | | |

FPS Shelby Holding I LLC (Marine Shipping)(c)(d)(e)(g)(h) | | | 107,799 | | | | 8,876,468 | | |

Footpath Ventures SpV IV LP (Private Credit)(c)(d)(e) | | | 150,000 | | | | 15,108,448 | | |

GACP II LP (Private Credit)(c)(d)(e) | | | 958,312 | | | | 29,634,927 | | |

U.S. Farming Realty Trust LP (Real Estate)(c)(d)(e)(g) | | | 350,000 | | | | 5,966,001 | | |

U.S. Farming Realty Trust II LP (Real Estate)(c)(d)(e)(g) | | | 120,000 | | | | 8,343,236 | | |

| TOTAL LIMITED PARTNERSHIPS — 1.5% (Cost $152,581,792) | | $ | 151,633,431 | | |

PREFERRED STOCKS | |

ENGINEERING SERVICES — 0.1% | |

McDermott International, Inc.(c)(d)(e)(g) | | | 22,591 | | | $ | 13,554,380 | | |

ENERGY — 0.0% | |

Gulfport Energy Corp.(d)(e) | | | 1,345 | | | $ | 727,363 | | |

| TOTAL PREFERRED STOCKS — 0.1% (Cost $1,272,525) | | $ | 14,281,743 | | |

WARRANT — 0.0% | |

ENERGY — 0.0% | |

Cie Financiere Richemont SA 11/22/2023(a) (Cost $0) | | | 2,521,536 | | | $ | 2,767,270 | | |

21

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2021

SPECIAL PURPOSE ACQUISITION COMPANIES(a) — 3.2% | | Shares | | Fair Value | |

Accelerate Acquisition Corp. | | | 1,824 | | | $ | 18,185 | | |

African Gold Acquisition Corp. | | | 175,509 | | | | 1,769,131 | | |

Agile Growth Corp. | | | 972,411 | | | | 9,539,352 | | |

Alpha Partners Technology Merger Corp. | | | 40,319 | | | | 397,142 | | |

Angel Pond Holdings Corp. | | | 948,163 | | | | 9,367,850 | | |

Apollo Strategic Growth Capital II | | | 206,968 | | | | 2,061,401 | | |

Ares Acquisition Corp. | | | 494,451 | | | | 4,909,898 | | |

Artisan Acquisition Corp. Class A | | | 42,770 | | | | 325,484 | | |

Atlantic Coastal Acquisition Corp. | | | 1,651,462 | | | | 12,344,725 | | |

Babylon Holdings Ltd.(a) | | | 12,409 | | | | 8,438 | | |

BigBear.ai Holdings, Inc. | | | 266,952 | | | | 216,231 | | |

Broadscale Acquisition Corp. | | | 1,046,401 | | | | 8,517,706 | | |

BurTech Acquisition Corp. | | | 438,637 | | | | 4,390,756 | | |

Churchill Capital Corp. VII | | | 616,422 | | | | 6,177,165 | | |

Colonnade Acquisition Corp. II | | | 1,032,132 | | | | 10,197,464 | | |

COVA Acquisition Corp. | | | 334,885 | | | | 3,348,850 | | |

DHC Acquisition Corp. | | | 520,584 | | | | 5,091,312 | | |

Digital Transformation Opportunities Corp. | | | 72,255 | | | | 716,047 | | |

Disruptive Acquisition Corp. I | | | 1,032,135 | | | | 10,125,244 | | |

ESM Acquisition Corp. | | | 157 | | | | 1,559 | | |

Flame Acquisition Corp. | | | 1,032,145 | | | | 10,300,807 | | |

Forest Road Acquisition Corp. II | | | 1,242,983 | | | | 12,319,205 | | |

Fortress Value Acquisition Corp. IV | | | 493,906 | | | | 4,850,157 | | |

FTAC Hera Acquisition Corp. | | | 124,395 | | | | 1,238,974 | | |

Fusion Acquisition Corp. II | | | 173,927 | | | | 1,721,008 | | |

Glenfarne Merger Corp. | | | 1,033,214 | | | | 10,249,483 | | |

Global Partner Acquisition Corp. II | | | 387,688 | | | | 3,818,727 | | |

Golden Arrow Merger Corp. | | | 1,032,132 | | | | 10,114,894 | | |

Gores Holdings VII, Inc. | | | 4,846 | | | | 48,412 | | |

Gores Holdings VIII, Inc. | | | 264,895 | | | | 2,461,460 | | |

Gores Technology Partners II, Inc. | | | 6,490 | | | | 65,419 | | |

GX Acquisition Corp. II | | | 864,261 | | | | 6,402,015 | | |

Haymaker Acquisition Corp. III | | | 9,171 | | | | 73,443 | | |

Heliogen, Inc. | | | 98,835 | | | | 168,019 | | |

Hudson Executive Investment Corp. III | | | 1,243,215 | | | | 12,195,939 | | |

InterPrivate IV InfraTech Partners, Inc. | | | 866,479 | | | | 8,534,818 | | |

Kismet Acquisition Three Corp. | | | 1,032,132 | | | | 10,114,894 | | |

Landcadia Holdings IV, Inc. | | | 1,243,001 | | | | 12,430,010 | | |

Lazard Growth Acquisition Corp. I | | | 37,457 | | | | 370,450 | | |

Lead Edge Growth Opportunities Ltd. | | | 111,893 | | | | 1,121,168 | | |

22

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2021

SPECIAL PURPOSE ACQUISITION COMPANIES — Continued | | Shares or

Principal

Amount | | Fair Value | |

Macondray Capital Acquisition Corp. I | | | 1,030,833 | | | $ | 10,277,405 | | |

Mason Industrial Technology, Inc. | | | 760,239 | | | | 7,541,571 | | |

Metals Acquisition Corp. | | | 539,903 | | | | 5,318,045 | | |

Mission Advancement Corp. | | | 613,285 | | | | 6,071,521 | | |

Monument Circle Acquisition Corp. | | | 69,903 | | | | 692,739 | | |

Northern Star Investment Corp. III | | | 550,747 | | | | 5,466,164 | | |

Northern Star Investment Corp. IV | | | 425,470 | | | | 4,216,408 | | |

Orion Acquisition Corp. | | | 252,217 | | | | 2,484,337 | | |

Peridot Acquisition Corp. II | | | 582,407 | | | | 5,783,302 | | |

Pershing Square Tontine Holdings Ltd. Class A | | | 457,176 | | | | 9,015,511 | | |

Pine Technology Acquisition Corp. | | | 1,290,095 | | | | 9,704,737 | | |

Plum Acquisition Corp. I | | | 969,880 | | | | 9,436,932 | | |

Queen's Gambit Growth Capital | | | 109,868 | | | | 833,354 | | |

Ross Acquisition Corp. II | | | 231,224 | | | | 2,316,864 | | |

RXR Acquisition Corp. | | | 9,883 | | | | 97,842 | | |

Silver Spike Acquisition Corp. II | | | 130,768 | | | | 1,301,142 | | |

Slam Corp. | | | 714,327 | | | | 7,057,551 | | |

Stratim Cloud Acquisition Corp. | | | 671,649 | | | | 6,582,160 | | |

TCW Special Purpose Acquisition Corp. | | | 118,726 | | | | 1,175,387 | | |

Tio Tech A (Germany) | | | 297,050 | | | | 2,946,736 | | |

TLG Acquisition One Corp. | | | 1,242,983 | | | | 12,305,532 | | |

Twelve Seas Investment Co. II | | | 990,015 | | | | 9,830,849 | | |

Viking Acquisition (Norway)(c)(d)(e) | | | 9,562,500 | | | | 7,238,931 | | |

Virgin Orbit Holdings, Inc. | | | 94,559 | | | | 132,383 | | |

TOTAL SPECIAL PURPOSE ACQUISITION COMPANIES — 3.2%

(Cost $328,301,389) | | $ | 325,950,645 | | |

BONDS & DEBENTURES | |

CORPORATE BONDS & NOTES | |

ENERGY — 0.0% | |

Gulfport Energy Corp. — 6.000% 10/15/2024(d)(e) | | $ | 18,209,000 | | | $ | — | | |

Gulfport Energy Corp. — 6.375% 5/15/2025(d)(e) | | | 8,822,000 | | | | — | | |

Gulfport Energy Corp. — 6.375% 1/15/2026(d)(e) | | | 9,128,000 | | | | — | | |

Gulfport Energy Corp. — 6.625% 5/1/2023(d)(e) | | | 9,417,000 | | | | — | | |

| | | $ | — | | |

| TOTAL CORPORATE BONDS & NOTES — 0.0% (Cost $0) | | $ | — | | |

23

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2021

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

CORPORATE BANK DEBT | |

McDermott LC,

1M USD LIBOR + 4.000% — 4.131% 12/31/2025(c)(d)(e)(g)(i)(j) | | $ | 28,718,370 | | | $ | 17,142,040 | | |

McDermott Senior Exit LC — 3.000% 6/30/2024(e)(g)(i) | | | 19,843,000 | | | | (9,326,210 | ) | |

McDermott Technology Americas, Inc.,

1M USD LIBOR + 1.000% — 1.087% 6/30/2025(c)(g)(j) | | | 33,083,090 | | | | 14,225,729 | | |

McDermott Technology Americas, Inc.,

1M USD LIBOR + 3.000% — 3.090% 6/30/2024(c)(g)(j) | | | 1,074,102 | | | | 612,238 | | |

Steenbok LUX Financial 2 SARL, PIK — 10.750% 12/31/2022(c) | | | 741,988 | | | | 763,446 | | |

| TOTAL CORPORATE BANK DEBT — 0.2% (Cost $97,809,620) | | $ | 23,417,243 | | |

U.S. TREASURIES | |

U.S. Treasury Bills — 0.020% 2/24/2022(k) | | $ | 70,000,000 | | | $ | 69,994,911 | | |

U.S. Treasury Bills — 0.030% 1/13/2022(k) | | | 100,000,000 | | | | 99,999,440 | | |

U.S. Treasury Bills — 0.030% 1/18/2022(k) | | | 100,000,000 | | | | 99,998,360 | | |

U.S. Treasury Bills — 0.030% 1/27/2022(k) | | | 85,000,000 | | | | 84,997,458 | | |

U.S. Treasury Bills — 0.030% 3/1/2022(k) | | | 121,000,000 | | | | 120,989,134 | | |

U.S. Treasury Bills — 0.033% 2/22/2022(k) | | | 118,000,000 | | | | 117,994,348 | | |

U.S. Treasury Bills — 0.035% 3/31/2022(k) | | | 120,000,000 | | | | 119,986,644 | | |

U.S. Treasury Bills — 0.037% 3/3/2022(k) | | | 40,000,000 | | | | 39,996,684 | | |

U.S. Treasury Bills — 0.038% 1/25/2022(k) | | | 127,000,000 | | | | 126,999,047 | | |

U.S. Treasury Bills — 0.041% 1/4/2022(k) | | | 125,000,000 | | | | 124,999,912 | | |

U.S. Treasury Bills — 0.041% 1/11/2022(k) | | | 77,000,000 | | | | 76,999,361 | | |

U.S. Treasury Bills — 0.041% 2/1/2022(k) | | | 90,000,000 | | | | 89,994,492 | | |

U.S. Treasury Bills — 0.043% 2/8/2022(k) | | | 50,000,000 | | | | 49,998,890 | | |

U.S. Treasury Bills — 0.043% 2/17/2022(k) | | | 100,000,000 | | | | 99,995,980 | | |

U.S. Treasury Bills — 0.046% 1/6/2022(k) | | | 75,000,000 | | | | 74,999,813 | | |

U.S. Treasury Bills — 0.047% 3/10/2022(k) | | | 110,000,000 | | | | 109,985,810 | | |

U.S. Treasury Bills — 0.047% 5/5/2022(k) | | | 200,000,000 | | | | 199,937,900 | | |

U.S. Treasury Bills — 0.048% 1/20/2022(k) | | | 75,000,000 | | | | 74,999,423 | | |

U.S. Treasury Cash Management Bills — 0.025% 2/15/2022(k) | | | 100,000,000 | | | | 99,996,470 | | |

| TOTAL U.S. TREASURIES — 18.3% (Cost $1,882,908,376) | | $ | 1,882,864,077 | | |

| TOTAL BONDS & DEBENTURES — 18.5% (Cost $1,980,717,996) | | $ | 1,906,281,320 | | |

TOTAL INVESTMENT SECURITIES — 95.4%

(Cost $7,008,607,690) | | $ | 9,811,696,375 | | |

24

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2021

SHORT-TERM INVESTMENTS | | Shares or

Principal

Amount | | Fair Value | |

Amazon.com, Inc. | |

| — 0.061% 2/11/2022 | | $ | 17,000,000 | | | $ | 16,998,838 | | |

| — 0.061% 2/14/2022 | | | 43,000,000 | | | | 42,996,847 | | |

Apple, Inc. — 0.051% 1/11/2022 | | | 25,000,000 | | | | 24,999,653 | | |

Cisco Systems, Inc. | |

| — 0.081% 2/2/2022 | | | 60,000,000 | | | | 59,995,733 | | |

| — 0.081% 2/3/2022 | | | 20,000,000 | | | | 19,998,533 | | |

Johnson & Johnson — 0.061% 2/15/2022 | | | 40,000,000 | | | | 39,997,000 | | |

Nestle Capital Corp. — 0.071% 1/12/2022 | | | 125,000,000 | | | | 124,997,326 | | |

National Finance International Ltd. — 0.071% 1/11/2022 | | | 45,200,000 | | | | 45,199,121 | | |

Roche Holdings, Inc | |

| — 0.041% 1/19/2022 | | | 25,000,000 | | | | 24,999,500 | | |

| — 0.041% 1/21/2022 | | | 25,000,000 | | | | 24,999,445 | | |

Roche Holdings, Inc. — 0.051% 1/10/2022 | | | 60,000,000 | | | | 59,999,250 | | |

State Street Bank Repurchase Agreement — 0.00% 1/3/2022

(Dated 12/31/2021, repurchase price of $104,822,000, collateralized by

$105,499,400 principal amount U.S. Treasury Notes 0.625% —

1.75% 2027 — 2028, fair value $106,918,513)(l) | | | 104,822,000 | | | | 104,822,000 | | |

TOTAL SHORT-TERM INVESTMENTS — 5.7%

(Cost $590,003,246) | | $ | 590,003,246 | | |

| TOTAL INVESTMENTS — 101.1% (Cost $7,598,610,936) | | $ | 10,401,699,621 | | |

SECURITIES SOLD SHORT — (2.5)% | |

COMMON STOCKS SOLD SHORT — (2.5)% | |

SoftBank Corp. (Japan) | | | (1,426,732 | ) | | | (18,040,352 | ) | |

SPDR S&P 500 ETF Trust | | | (505,929 | ) | | | (240,296,038 | ) | |

TOTAL COMMON STOCKS SOLD SHORT

(Proceeds $188,622,673) | | $ | (258,336,390 | ) | |

| TOTAL SECURITIES SOLD SHORT(Proceeds $188,622,673) | | $ | (258,336,390 | ) | |

Other assets and liabilities, net — 1.4% | | | 141,592,762 | | |

NET ASSETS — 100.0% | | $ | 10,284,955,993 | | |

25

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2021

(a) Non-income producing security.

(b) As of December 31, 2021, investments with a value of $947,582,500 were fully or partially segregated with the broker(s)/custodian as collateral for short option contracts.

(c) Restricted securities. These restricted securities constituted 3.29% of total net assets at December 31, 2021, most of which are considered liquid by the Adviser. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under policies adopted by authority of the Fund's Board of Trustees.

(d) These securities have been valued in good faith under policies adopted by authority of the Board of Trustees in accordance with the Fund's fair value procedures. These securities constituted 2.68% of total net assets at December 31, 2021.

(e) Investments categorized as a significant unobservable input (Level 3) (See Note 8 of the Notes to Financial Statements).

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid.

(g) Affiliated Security.

(h) Controlled company.

(i) All or a portion of this holding is subject to unfunded loan commitments. The stated interest rate reflects the weighted average of the reference rate and spread for the funded portion, if any, and the commitment fees on the portion of the loan that is unfunded.

(j) Variable/Floating Rate Security — The rate shown is based on the latest available information as of December 31, 2021. For Corporate Bank Debt, the rate shown may represent a weighted average interest rate. Certain variable rate securities are not based on a published rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description.

(k) Zero coupon bond. Coupon amount represents effective yield to maturity.

(l) Security pledged as collateral (See Note 10 of the Notes to Financial Statements)

26

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2021

Purchased Options

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate

Index | | Exercise

Rate | | Expiration

Date | | Counter-

party | | Notional

Amount | | Premium | | Fair Value | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/15/2023 | | Barclays

Bank

PLC | | $ | 4,776,000,000 | | | $ | 1,265,640 | | | $ | 682,968 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/22/2023 | | Barclays

Bank

PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 702,072 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/01/2023 | | Barclays

Bank

PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 740,280 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/08/2023 | | Barclays

Bank

PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 764,160 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/15/2023 | | Goldman

Sachs

Inter-

national | | | 9,204,500,000 | | | | 2,531,237 | | | | 902,041 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/22/2023 | | Goldman

Sachs

Inter-

national | | | 9,204,500,000 | | | | 2,531,238 | | | | 920,450 | | |

27

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2021

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate

Index | | Exercise

Rate | | Expiration

Date | | Counter-

party | | Notional

Amount | | Premium | | Fair Value | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/01/2023 | | Goldman

Sachs

Inter-

national | | $ | 9,204,500,000 | | | $ | 2,531,237 | | | $ | 948,063 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/08/2023 | | Goldman

Sachs

Inter-

national | | | 9,204,500,000 | | | | 2,531,238 | | | | 975,677 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/15/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 374,625 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/22/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 394,875 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/01/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 415,125 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/08/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 440,438 | | |

Call —

OIS Cap

Swap(c)(e) | | Receive | | 3-Month

USD-LIBOR | | | 0.68 | % | | 1/11/2029 | | Morgan

Stanley | | | 260,061,813 | | | | 7,038,227 | | | | 14,960,836 | | |

| | | $ | 27,288,237 | | | $ | 23,221,610 | | |

28

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2021

Written Options

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate

Index | | Exercise

Rate | | Expiration

Date | | Counter-

party | | Notional

Amount | | Premium | | Fair Value | |

Put — OIS

Floor

Swap(c)(e) | | Pay | | 3-Month

USD-LIBOR | | | 0.35 | % | | 1/11/2029 | | Morgan

Stanley | | $ | (260,061,813 | ) | | $ | (7,038,227 | ) | | $ | (3,501,472 | ) | |

29

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES

December 31, 2021

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

Altaba Escrow | | 09/01/2021 | | | — | | | $ | 28,204,147 | | | | 0.27 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Barclays

Bank PLC 4.000% 02/15/2023 | | 02/26/2020 | | $ | 1,265,640 | | | | 682,968 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Barclays

Bank PLC

4.000% 02/22/2023 | | 02/26/2020 | | | 1,265,640 | | | | 702,072 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Barclays

Bank PLC 4.000% 03/01/2023 | | 02/26/2020 | | | 1,265,640 | | | | 740,280 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Barclays

Bank PLC 4.000% 03/08/2023 | | 02/26/2020 | | | 1,265,640 | | | | 764,160 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Goldman

Sachs International 4.000%

02/15/2023 | | 02/26/2020 | | | 2,531,237 | | | | 902,041 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Goldman

Sachs International 4.000%

02/22/2023 | | 02/26/2020 | | | 2,531,238 | | | | 920,450 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Goldman

Sachs International 4.000%

03/01/2023 | | 02/26/2020 | | | 2,531,237 | | | | 948,063 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Goldman

Sachs International 4.000%

03/08/2023 | | 02/26/2020 | | | 2,531,238 | | | | 975,677 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Morgan

Stanley 4.000% 02/15/2023 | | 02/26/2020 | | | 1,265,625 | | | | 374,625 | | | | 0.00 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Morgan

Stanley 4.000% 02/22/2023 | | 02/26/2020 | | | 1,265,625 | | | | 394,875 | | | | 0.00 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Morgan

Stanley 4.000% 03/01/2023 | | 02/26/2020 | | | 1,265,625 | | | | 415,125 | | | | 0.00 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Morgan

Stanley 4.000% 03/08/2023 | | 02/26/2020 | | | 1,265,625 | | | | 440,438 | | | | 0.00 | % | |

30

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

December 31, 2021

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

Epic Games, Inc. | | 06/25/2020 | | $ | 19,049,750 | | | $ | 29,320,050 | | | | 0.28 | % | |

FPS LLC (Marine Shipping)

| | 01/11/2021, 04/13/2021,

07/06/2021, 12/21/2021 | | | 100,019,744 | | | | 83,704,351 | | | | 0.81 | % | |

FPS Shelby Holding I LLC

(Marine Shipping) | | 02/04/2020, 03/26/2020,

04/29/2020, 07/24/2020 | | | 10,191,935 | | | | 8,876,468 | | | | 0.09 | % | |

Footpath Ventures SpV IV LP | | 09/24/2021 | | | 15,180,000 | | | | 15,108,448 | | | | 0.15 | % | |

GACP II L.P. (Credit) | | 01/17/2020 | | | 17,691,919 | | | | 29,634,927 | | | | 0.29 | % | |

McDermott International, Inc. | | 12/31/2020 | | | — | | | | 13,554,380 | | | | 0.13 | % | |

McDermott LC, 1M USD

LIBOR + 4.000% — 4.131%

12/31/2025 | | 03/04/2021, 03/05/2021 | | | 35,777,645 | | | | 17,142,040 | | | | 0.17 | % | |

McDermott Technology Americas,

Inc., 1M USD LIBOR +

1.000% — 1.087% 6/30/2025

| | 01/29/2021, 02/26/2021,

03/31/2021, 04/30/2021,

05/31/2021, 06/30/2021,

07/30/2021,08/31/2021,

09/30/2021, 10/29/2021,

11/30/2021 | | | 68,814,705 | | | | 14,225,729 | | | | 0.14 | % | |

McDermott Technology Americas,

Inc., 1M USD LIBOR +

3.000% — 3.090% 6/30/2024 | | 07/01/2020 | | | 1,074,102 | | | | 612,238 | | | | 0.01 | % | |

OIS CAP SWAPTION 0.680

JAN29 0.680 CALL Morgan

Stanley 0.680% 01/11/2029 | | 10/19/2020 | | | 7,038,227 | | | | 14,960,836 | | | | 0.14 | % | |

OIS FLOOR SWAPTION 0.350

JAN29 0.350 PUT Morgan

Stanley 0.350% 01/11/2029 | | 10/19/2020 | | | (7,038,227 | ) | | | (3,501,472 | ) | | | (0.03 | )% | |

Sound Holding FP | | 10/07/2013 | | | 68,546,025 | | | | 55,564,380 | | | | 0.54 | % | |

Steenbok LUX Financial 2

SARL, PIK — 10.750%

12/31/2022 | | 06/30/2021, 12/31/2021 | | | 774,873 | | | | 763,446 | | | | 0.01 | % | |

U.S. Farming Realty Trust II, L.P.

(Real Estate)

| | 12/24/2012, 04/29/2013,

06/17/2013, 10/28/2013,

01/14/2014, 04/22/2014,

06/25/2014, 09/09/2014,

10/08/2014, 12/18/2014,

06/18/2015, 07/29/2015 | | | 9,498,194 | | | | 8,343,236 | | | | 0.08 | % | |

31

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

December 31, 2021

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

U.S. Farming Realty Trust, L.P.

(Real Estate)

| | 11/26/2010, 01/31/2011,

03/09/2011, 04/15/2011,

05/10/2011, 06/27/2011,

08/15/2011, 10/17/2011,

10/28/2011, 11/28/2011,

01/03/2012, 01/26/2012,

04/05/2012, 07/13/2012,

12/07/2012, 08/01/2013 | | | — | | | $ | 5,966,001 | | | | 0.06 | % | |

Viking Acquisitions (Norway) | | 06/03/2021 | | $ | 7,607,534 | | | | 7,238,931 | | | | 0.07 | % | |

TOTAL RESTRICTED

SECURITIES | | | | $ | 374,476,436 | | | $ | 337,978,910 | | | | 3.29 | % | |

See accompanying Notes to Financial Statements.

32

FPA CRESCENT FUND

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2021

ASSETS | |

| Investment securities — at fair value (identified cost $6,630,082,694) | | $ | 9,593,852,970 | | |

| Investments in affiliates — at fair value (identified cost $378,524,996) | | | 217,843,405 | | |

Short-term investments — at amortized cost (maturities 60 days or less) | | | 590,003,246 | | |

Purchased options, at value (premiums paid $27,288,237) | | | 23,221,610 | | |

Deposits for securities sold short | | | 200,949,412 | | |

Cash | | | 2,603,729 | | |

Foreign currencies, at value (identified cost $431,563) | | | 433,749 | | |

Receivable for: | |

Investment securities sold | | | 54,929,510 | | |

Dividends and interest | | | 16,968,233 | | |

Capital Stock sold | | | 2,823,573 | | |

Prepaid expenses and other assets | | | 133,147 | | |

Total assets | | | 10,703,762,584 | | |

LIABILITIES | |

Securities sold short — at fair value (proceeds $188,622,673) | | | 258,336,390 | | |

Written options, at value (premiums received $7,038,227) | | | 3,501,472 | | |

Payable for: | |

Investment securities purchased | | | 123,999,928 | | |

Due to broker — OTC derivatives collateral | | | 16,844,124 | | |

Advisory fees | | | 7,956,957 | | |

Capital Stock repurchased | | | 5,452,107 | | |

Accrued expenses and other liabilities | | | 2,715,613 | | |

Total liabilities | | | 418,806,591 | | |

NET ASSETS | | $ | 10,284,955,993 | | |

SUMMARY OF SHAREHOLDERS' EQUITY | |

Capital Stock — no par value; unlimited authorized shares;

277,906,528 outstanding shares | | $ | 7,619,890,262 | | |

| Distributable earnings | | | 2,665,065,731 | | |

NET ASSETS | | $ | 10,284,955,993 | | |

Institutional Class: | |

Net Assets | | $ | 8,394,401,553 | | |

Shares outstanding, no par value; unlimited authorized shares | | | 226,818,699 | | |

Offering and redemption price per share | | $ | 37.01 | | |

Supra Institutional Class: | |

Net Assets | | $ | 1,890,554,440 | | |

Shares outstanding, no par value; unlimited authorized shares | | | 51,087,829 | | |

Offering and redemption price per share | | $ | 37.01 | | |

See accompanying Notes to Financial Statements.

33

FPA CRESCENT FUND

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2021

INVESTMENT INCOME | |

Dividends (net of foreign taxes withheld of $4,842,819) | | $ | 112,947,887 | | |

Interest | | | 8,841,456 | | |

Total investment income | | | 121,789,343 | | |

EXPENSES | |

Advisory fees | | | 98,798,209 | | |

Short sale dividend expense | | | 9,081,861 | | |

Transfer agent fees and expenses | | | 6,359,107 | | |

Custodian fees | | | 528,330 | | |

Other professional fees | | | 412,533 | | |

Administrative services fees — Institutional Class | | | 6,612,982 | | |