UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08544

FPA FUNDS TRUST

(Exact Name of Registrant as Specified in Charter)

235 West Galena Street

Milwaukee, Wisconsin 53212

(Address of Principal Executive Offices, including Zip Code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, California 91740

(Name and Address of Agent for Service)

COPIES TO:

Laurie Anne Dee

Morgan, Lewis & Bockius LLP

600 Anton Boulevard, Suite 1800

Costa Mesa, California 92626

Registrant’s telephone number, including area code: (626) 385-5777

Date of fiscal year end: September 30

Date of reporting period: September 30, 2023

Item 1: Report to Shareholders.

| (a) | The Reports to Shareholders are attached herewith. |

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

Annual Report

September 30, 2023

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders,

FPA New Income Fund (the "Fund") returned 1.32% in the third quarter of 2023 and 3.60% year-to-date through September 30, 2023.

Sector | | As of 9/30/2023 | |

Yield-to-worst1 | | | 6.61 | % | |

Effective Duration | | | 2.22 years | | |

Spread Duration | | | 2.52 years | | |

High Quality Exposure2 | | | 90 | % | |

Credit Exposure3 | | | 10 | % | |

During the quarter, the Federal Reserve continued its efforts to lower inflation, raising the Fed Funds rate by 25 basis points in July before leaving the Fed Funds rate unchanged in September.4 Tighter monetary policy and Fed commentary, along with macroeconomic data that does not consistently point to weaker inflation, drove risk-free rates higher during the quarter. In general, investment-grade and high-yield debt spreads were essentially unchanged during the quarter, while higher risk-free rates led to higher overall yields.5 On an absolute basis, we continue to see attractive opportunities to buy longer-duration, High Quality bonds (rated single-A or higher) that we believe will enhance the Fund's long-term returns and the Fund's short-term upside versus downside return profile. We do not generally view Credit (investments rated BBB or lower) as attractively priced, but we continue to search for, and will seek to opportunistically invest in, Credit when we believe the price adequately compensates for the risk of permanent impairment of capital and near-term mark-to-market risk. The Fund's Credit exposure was essentially unchanged at 10% as of September 30, 2023 versus 10.2% as of June 30, 2023. Cash and equivalents represented 3.5% of the portfolio on September 30, 2023 versus 4.0% on June 30, 2023.

Portfolio Attribution6

The largest contributors to performance during the quarter were the corporate holdings — including bonds, loans, and common stock. The common stock of PHI Group, Inc. (PHI) contributed a significant portion

1 Yield-to-worst ("YTW") is presented gross of fees and reflects the lowest potential yield that can be received on a debt investment without the issuer defaulting. YTW considers the impact of expected prepayments, calls and/or sinking funds, among other things. Average YTW is based on the weighted average YTW of the investments held in the Fund's portfolio. YTW may not represent the yield an investor should expect to receive. As of September 30, 2023, the Fund's subsidized/unsubsidized 30-day SEC standardized yield ("SEC Yield") was 4.91%/4.77% respectively. The SEC Yield calculation is an annualized measure of the Fund's dividend and interest payments for the last 30 days, less the Fund expenses. Subsidized yield reflects fee waivers and/or expense reimbursements during the period. Without waivers and/or reimbursements, yields would be reduced. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect. The SEC Yield calculation shows investors what they would earn in yield over the course of a 12-month period if the fund continued earning the same rate for the rest of the year.

2 High Quality is defined as investments rated A or higher, Treasuries, and cash and equivalents.

3 Credit is defined as investments rated BBB or lower, including non-rated investments.

4 Source: Bloomberg. Federal Reserve; https://www.federalreserve.gov/newsevents/pressreleases/monetary20230816a.htm; https://www.federalreserve.gov/newsevents/pressreleases/monetary20231011a.htm

5 Source: Bloomberg.

6 This information is not a recommendation for a specific security or sector and these securities/sectors may not be in the Fund at the time you receive this report. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

1

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

of the corporate holdings' return due to price appreciation and dividends. PHI represented approximately 0.6% of the portfolio, on average, during the quarter, and common stock holdings in total represented approximately 1.2% of the portfolio, on average, during the quarter. The common stock holdings in the portfolio represent value received for past investments in either corporate bonds or loans that have been restructured. We generally intend to hold these common stock investments until their market price better reflects our estimate of their intrinsic value. Corporate bonds and loans also contributed to performance during the quarter.

The second- and third-largest contributors to performance were collateralized loan obligations (CLOs) backed by corporate loans and CLOs backed by commercial real estate loans, respectively, due mostly to income from coupon payments with some additional benefit from higher prices due to lower spreads. These CLOs are highly-rated, and most are floating rate bonds that have benefited from increases in their coupons as interest rates have risen.

Agency-guaranteed commercial mortgage backed securities (CMBS) and Treasury bonds were the largest and second-largest detractors from performance during the quarter, respectively, due to lower prices caused by higher risk-free rates. There were no other meaningful detractors from performance during the quarter.

Portfolio Activity7

The table below shows the portfolio's sector-level exposures at September 30, 2023 compared to June 30, 2023:

| Sector | | % Portfolio

9/30/2023 | | % Portfolio

6/30/2023 | |

ABS | | | 47.3 | | | | 47.0 | | |

CLO | | | 12.2 | | | | 13.4 | | |

Corporate | | | 6.9 | | | | 6.7 | | |

Agency CMBS | | | 11.0 | | | | 6.5 | | |

Non-Agency CMBS | | | 8.5 | | | | 8.9 | | |

Agency RMBS | | | 1.9 | | | | 2.0 | | |

Non-Agency RMBS | | | 4.9 | | | | 5.3 | | |

Stripped Mortgage-backed | | | 0.4 | | | | 0.4 | | |

U.S. Treasury | | | 3.4 | | | | 5.8 | | |

Cash and equivalents | | | 3.5 | | | | 4.0 | | |

Total | | | 100.0 | % | | | 100.0 | % | |

Yield-to-worst1 | | | 6.61 | % | | | 6.64 | % | |

Effective Duration (years) | | | 2.22 | | | | 1.99 | | |

Spread Duration (years) | | | 2.52 | | | | 2.35 | | |

Average Life (years) | | | 2.89 | | | | 2.67 | | |

We continue to take advantage of higher yields by actively buying longer-duration, High Quality bonds. The duration of these investments is guided by our duration test, which seeks to identify the longest-duration bonds that we expect will produce at least a breakeven return over a 12-month period, assuming a bond's yield will increase by 100 bps during that period. Consistent with this test, during the third quarter, we bought: agency-guaranteed CMBS; Treasury bonds; AAA-rated asset-backed securities (ABS) backed by equipment; AAA-rated ABS backed by prime quality credit card receivables; AAA-rated ABS backed by prime quality auto loans;

7 Portfolio composition will change due to ongoing management of the Fund.

2

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

AAA-rated non-agency CMBS secured by single family homes; and AAA-rated ABS backed by cell towers. On average, these investments had a duration of 4.3 years.

Within Credit, we bought a BBB-rated corporate bond. We also added to an existing high-yield bond investment that was largely paid for by selling a pari passu loan, because we believe the bond has a more attractive return profile than the loan.

In addition to the loan sale referenced above, to fund this quarter's investments we sold existing short-duration holdings, including High Quality ABS, CLOs, and CMBS with an average duration of less than one year. We also sold Treasuries to buy other similar- or longer-duration bonds. Lastly, we sold another corporate loan where the price was high enough that the prospective returns no longer made the investment attractive to own.

Market Commentary

We believe we are in the midst of one of the most attractive bond markets we have seen in over a decade and have been taking advantage of the attractive investment opportunities we see to seek to improve the short- and long-term return profile of the Fund. In contrast, we have encountered fixed income investors who are caught up in the game of trying to time the market and call a bottom, or — in bond terms — call the peak in rates. We do not believe that trying to bet on rates or time the market is a good way to make money in either the short or long term. We believe betting on interest rates is speculative and, thus, fraught with risk. Moreover, we believe trying to forecast the direction of interest rates and time the market has an unimpressive track record.

To support our contention that trying to predict the direction of interest rates is a difficult way to make money, research shows that "forecasters were often only slightly more accurate than chance, and usually lost to simple extrapolation algorithms. Also, forecasters with the biggest news media profiles tended to lose to their lower profile colleagues, suggesting a rather perverse inverse relationship between fame and accuracy."8 Forecasting is hard and we would be in awe of anyone who had a consistent track record of forecasting success. Given the difficulties of forecasting, we are puzzled why people even attempt to forecast, let alone bet capital on those forecasts.

We believe our approach to bond investing is different from other bonds managers in two respects. First, we don't try to time the market or speculate on the market because we believe that approach is too risky and is a low-conviction way to make money in the short and long term. Instead, we focus on whether the price of an investment compensates us for that investment's risks. Second, we invest with a flexible mandate. Whereas many other bond funds track an index, we believe index-based investing is fundamentally flawed because index-tracking funds, generally speaking, are required to own a certain part of the market all of the time, regardless of price. It's obvious to us that one should pay attention to price and valuation to help avoid bubbles or expensive markets and, in the process, maximize long-term returns.

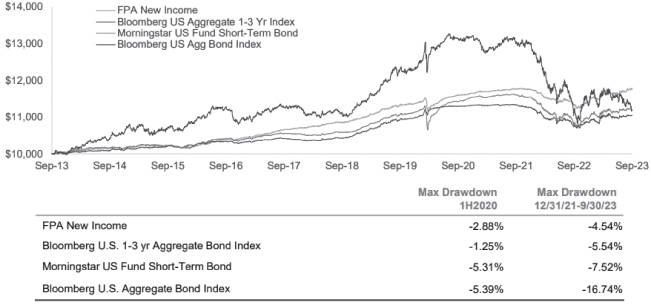

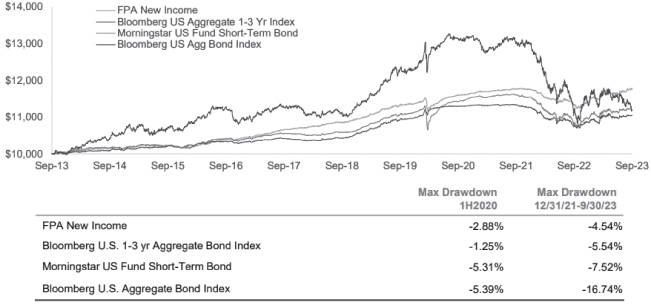

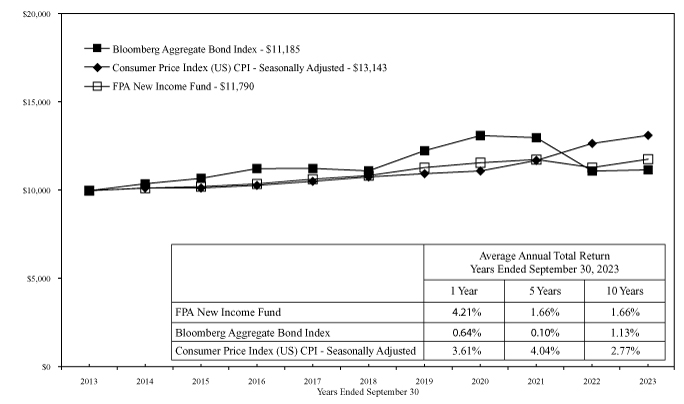

For decades, we have been investing using price as our guide. The chart below shows the value of a $10,000 investment in New Income over the last ten years compared to the Aggregate Bond Index, the 1-3- year Index, and short-term bond funds. It is clear that the Fund has enjoyed not only a higher return than the overall bond market and other comparable funds but also a much smoother ride along the way, with the smoother ride evidenced by New Income's generally smaller drawdowns during periods of market turbulence.

8 Philip E. Tetlock, Professor, Univ. of Pennsylvania, co-author of "Superforecasting: The Art and Science of Prediction", https://www.sas.upenn.edu/tetlock/publications

3

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Growth of $10,000 over ten years

Source: Morningstar Direct; As of 9/30/2023. FPNIX Inception is July 11, 1984. The following 10-year performance is as of September 30, 2023: FPA New Income, 1.66%; Bloomberg U.S. 1-3 yr Aggregate Bond Index, 1.01%; Morningstar U.S. Fund Short-Term Bond, 1.28%; Bloomberg U.S. Aggregate Bond Index, 1.13%. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data, which may be higher or lower than the performance data quoted, may be obtained at www.fpa.com or by calling toll-free, 1-800-982-4372. As of its most recent prospectus, the Fund's total expense ratio is 0.58% and net expense ratio is 0.45%.

It is nice to have an investment whose price does not move much in the short-term but the smoother ride (lower volatility) is also an important contributor to long-term returns, because it creates the opportunity to redeploy capital at close to 100 cents on the dollar into cheaper, more attractive investments if and when those opportunities arise — precisely the situation that we find ourselves in today.

4

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

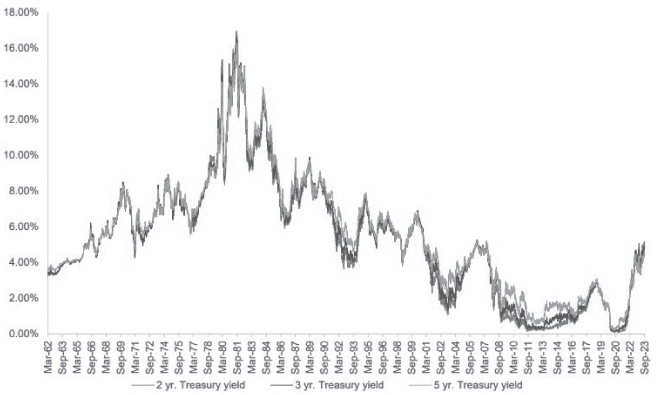

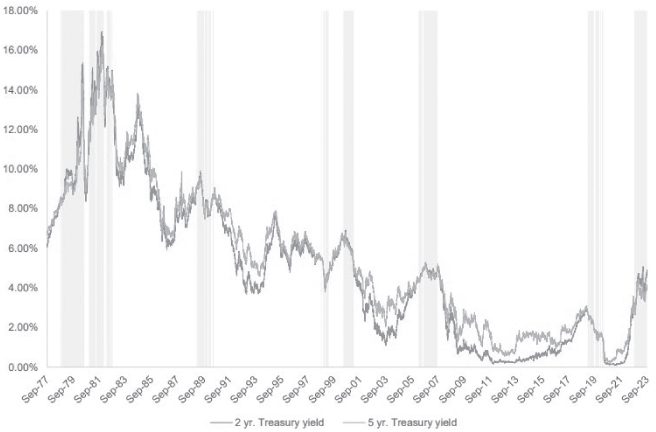

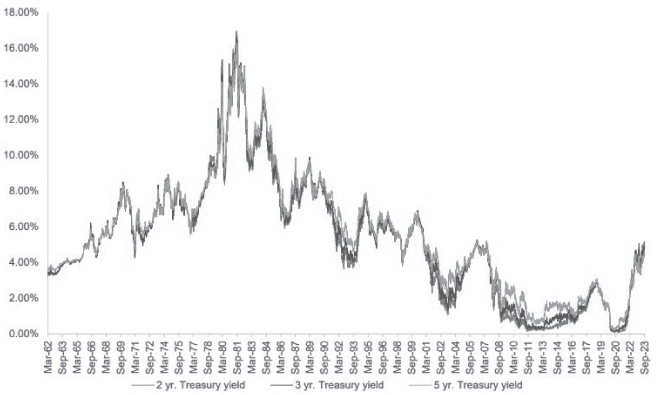

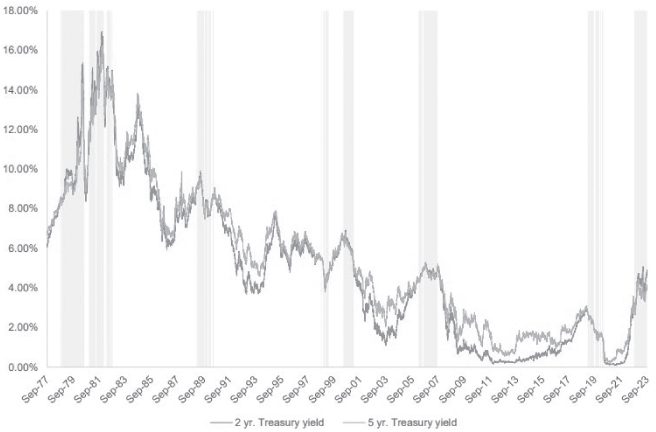

As shown in the following chart, Treasury yields are at 10-15- year highs:

Treasury Yield

Source: Bloomberg; As of 9/30/2023

5

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

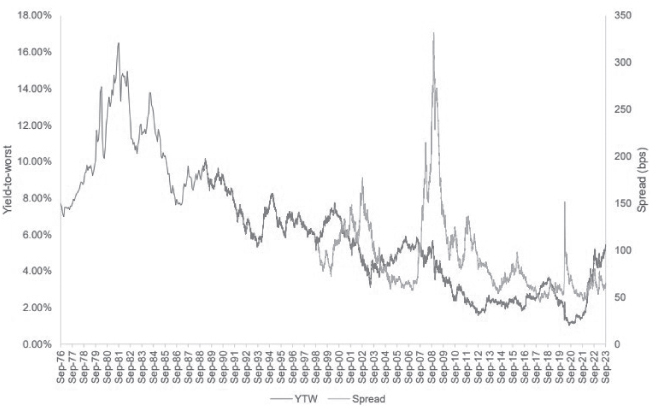

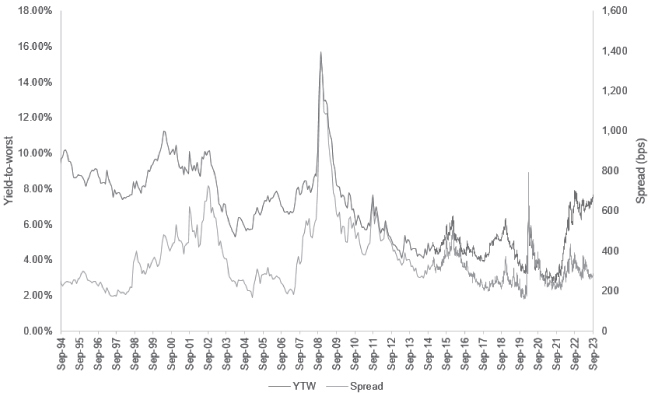

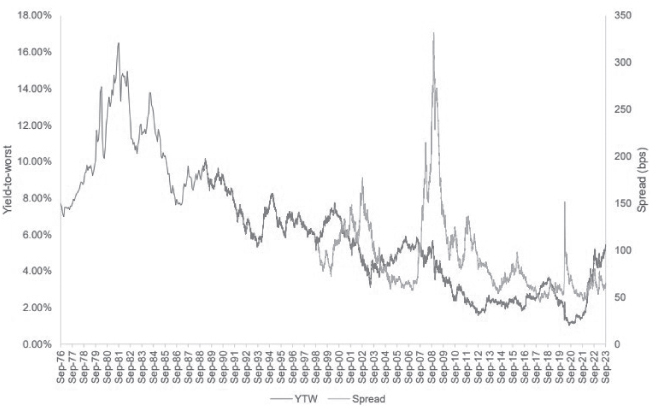

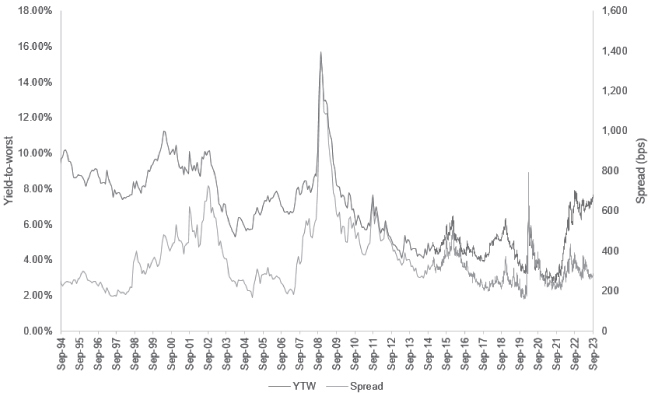

Similarly, the yield on investment grade bonds in general is at 10-15- year highs, as shown by the yield of the Aggregate Bond index in the following chart:

Bloomberg U.S. Aggregate Bond Index

Source: Bloomberg. As of 9/30/2023. YTW is yield-to-worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the-run treasury. Past performance is no guarantee, nor is it indicative, of future results. Please refer to the end of the presentation for Important Disclosures and Index definitions.

We do not know how long rates will stay at these levels. We hope that yields remain this high or higher indefinitely because that is a path to making more money for our investors but, to quote Master Shifu in Kung Fu Panda: "Yesterday is history, tomorrow is a mystery, but today is a gift. That is why it is called the present." We don't take investing advice from cartoons, but we can't argue with Master Shifu's sentiment. We want to take advantage of the yields available today by locking them in for as long as possible, because we believe that over the long term our investors will be better off earning these yields for multiple years. That said, circling back to the value of limiting short-term volatility, we want to be vigilant and thoughtful about limiting the short-term price risk or duration risk related to increases in interest rates.

6

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

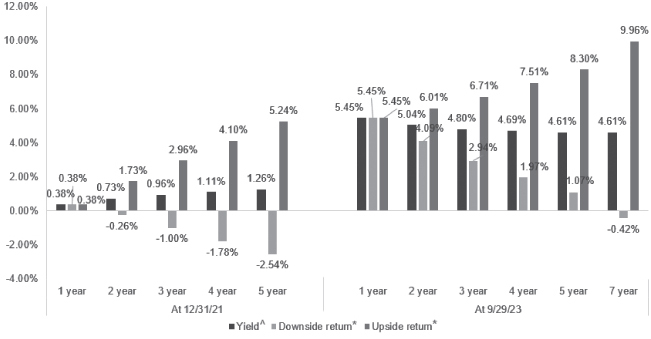

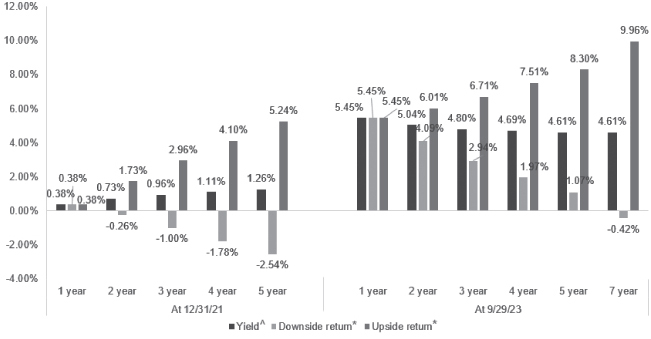

Rather than using duration to bet on interest rates or, alternatively, instead of being stuck with the duration of an index, we choose the duration of our investments by investing in bonds that have enough yield to compensate for their duration. We compare yield to duration, specifically by employing our 100 bps duration test described earlier. The following chart applies this test to the Treasury yield curve:

Hypothetical 12-month U.S. Treasury Returns

Source: Bloomberg, FPA; As of the dates noted.^ Yield to Maturity is the annualized total return anticipated on a bond if the bond is held until it matures and assumes all payments are made as scheduled and are reinvested at the same rate. The expected return assumes no change in interest rates over the next 12 months. * Upside return estimates the 12-month total return assuming yields decline by 100 bps over 12 months. Downside return estimates the 12-month total return assuming yields increase by 100 bps over 12 months. Return estimates assume gradual change in yield over 12 months. The hypothetical stress test data provided herein is for illustrative and informational purposes only and is intended to demonstrate the mathematical impact of a change in Treasury yields on hypothetical Treasury returns. No representation is being made that any account, product or strategy will or is likely to achieve profits, losses, or results similar to those shown. Hypothetical results do not reflect trading in actual accounts, and does not reflect the impact that all economic, market or other factors may have on the management of the account. Hypothetical results have certain inherent limitations. There are frequently sharp differences between simulated results and the actual results subsequently achieved by any particular account, product or strategy. Past performance is no guarantee, nor is it indicative, of future results. Please refer to the back of this commentary for important disclosures.

7

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

The first bar shown for each period represents Treasury yields of various maturities. The second bar shown for each period represents the results of our 100 bps duration test, which assumes yields increase by 100 bps over twelve months and which we view as a short-term downside scenario with respect to interest rate changes. For example, if one bought the 5-year Treasury at a 4.61% yield on September 29, 2023 and yields subsequently increased by 100 bps, the 5-year Treasury would produce a total return of 1.07% over twelve months. The same analysis applied to a 7-year Treasury would result in a total return loss of -0.42%. Consequently, the 5-year Treasury would be a candidate for the Fund's portfolio but the 7-year Treasury would not.

Conversely, the third bar for each period represents above show the total return on Treasuries over twelve months if yields decreased by 100 bps. We view that scenario as a short-term upside scenario with respect to interest rate changes. The 5-year Treasury offered a potential upside return of 8.30%. Although the 7-year Treasury offered a higher potential upside return, that result has to be balanced with the prospect of losing money in the short-term. The 5-year Treasury captures over 80% of the upside return of the 7-year Treasury and offers a positive downside return versus the 7-year Treasury's negative downside return. We've learned after many years of patient investing that reaching for every last basis point often doesn't turn out well; it is better in the long term to balance the potential reward with the risk of realizing that reward. Of course, our investment universe is not limited to 5- and 7-year maturities. We can therefore avail ourselves of opportunities in bonds maturing between five and seven years as well as other investment grade bonds besides Treasuries that still have breakeven or positive expected downside returns while approaching the upside of 7-year bonds.

By way of comparison, the market was very different in 2021, as shown on the left side of the chart above. Yields were incredibly low at that time, which meant compensation for taking on risk was much lower. During that time, other bond managers may have maintained a longer duration portfolio in line with their respective benchmarks, regardless of price or yield. In our eyes, the potential reward of those longer duration investments wasn't worth the risk. To explain: note that the upside return assumes that yields decline by 100 bps which, given the starting yields in 2021, meant that yields would have to get very close to zero or negative to realize the upside. Zero or negative yields were possible, but again, we emphasize that one of the keys to attractive long-term returns is balancing potential reward with the risk of realizing that reward.

We believe that always owning any part of the market, regardless of price, is not a good strategy for achieving attractive short- and long-term returns. We believe that an important part of our value-add is actively managing duration based on the price of duration so, consequently, we do not track an index. In 2021, our investment approach, which emphasizes price and flexibility, proved its power when we used its flexibility to steer toward shorter-duration bonds because the low yield on bonds led us to that conclusion. Today, yields are higher, and the duration test described above leads us to own longer duration bonds. As noted earlier, this past quarter, the average duration of our new investments was 4.3 years. Compared to a bond manager that may bet on the direction of interest rates, we believe our price-driven approach is more transparent, less subject to a manager's changing opinions, and less risky than trying to invest based on forecasts of the future.

Since the end of 2021, we have increased the Fund's duration by 0.8 years — from 1.4 years to 2.2 years at the end of September. The Fund's duration is now in line with the Morningstar short-term bond category, which was 2.2 years at the end of September.9 We will continue to add longer duration bonds to the portfolio and increase the Fund's duration as long as yields are high enough. Our active duration management makes the Fund one of the most actively managed bond funds in its category with respect to duration.

9 Source: Morningstar Direct.

8

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Looking ahead, we believe the Fund's active management offers a compelling way to invest in the bond market. We also believe our disciplined, absolute value-driven rotation into longer duration bonds is making the portfolio more attractive in both the short and long term. Nevertheless, investors often ask why they should invest in an actively-managed portfolio of bonds like ours versus owning cash or core duration bonds10. Answering those questions assumes that we can time the market. We will be the first to admit that we can neither predict the future nor time the market. No one can know what the future holds. If bond investors were good at forecasting rates, then most bond investors would not have had such poor returns in 2022.11 The Fund, however, had a return of -3.10% in 2022 as compared to the Bloomberg Aggregate Bond Index return of -13.01% and the -5.22% return of the Morningstar Short Term Bond category, because our focus is on valuation at the security level rather than trying to predict the future.

It is important to focus on what is knowable in advance and consider upside versus downside. We know there is an opportunity cost to holding cash: foregoing returns available on other investments. We also know we can capture more yield and much of the short-term upside of core duration but with better downside protection via our investments in 4-6 year maturity bonds. We will be thrilled to buy core duration if and when yields are high enough to compensate for that longer duration. Presently, yields are not there. Until yields are high enough to buy core duration, we believe it makes more sense to have multiple ways to win rather than to bet the ranch on a singular outcome (i.e., lower yields).

From a duration perspective, we believe the Fund is positioned to benefit in the following ways: First, we believe we are buying attractive long-term yields via highly-rated, longer-maturity bonds that we believe will yield more than core bonds (using the Aggregate Bond Index as a proxy for core bonds). Second, as described above, we believe we are buying bonds with short-term downside protection against rates rising 100 bps over the next twelve months. And third, we are introducing upside optionality into the portfolio that captures much of the short-term upside of core bonds in the event that rates decline for any reason.

10 "Core duration bonds" or "core bonds" refer to bonds similar in duration to Bloomberg U.S. Aggregate Bond Index. As of 9/30/2023, the duration of the Bloomberg U.S. Aggregate Bond Index is 6.1 years.

11 Source: CNBC, January 7, 2023; https://www.cnbc.com/2023/01/07/2022-was-the-worst-ever-year-for-us-bonds-how-to-position-for-2023.html

Past performance is no guarantee, nor is it indicative, of future results.

9

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Regarding that last possibility, we note that the yield curve is presently inverted and that history indicates Treasury yields tend to decline after yield curve inversions, as shown in the following chart:

2 yr. and 5 yr. Treasury Yield

Source: Bloomberg; As of 9/30/2023

We're not betting on this outcome; it's just one of multiple ways we could win (i.e., achieve positive outcomes for our investors).

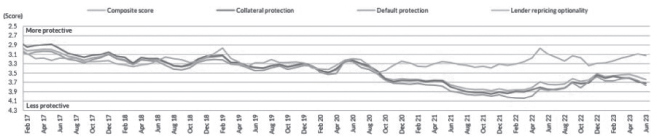

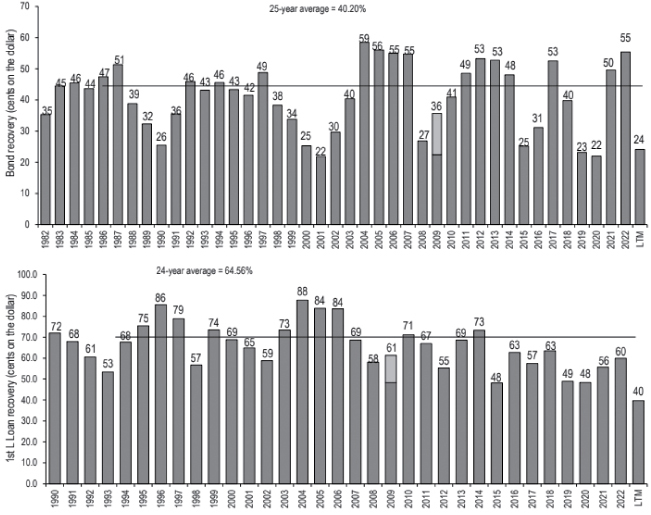

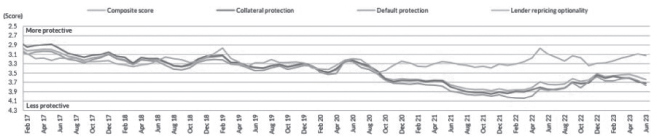

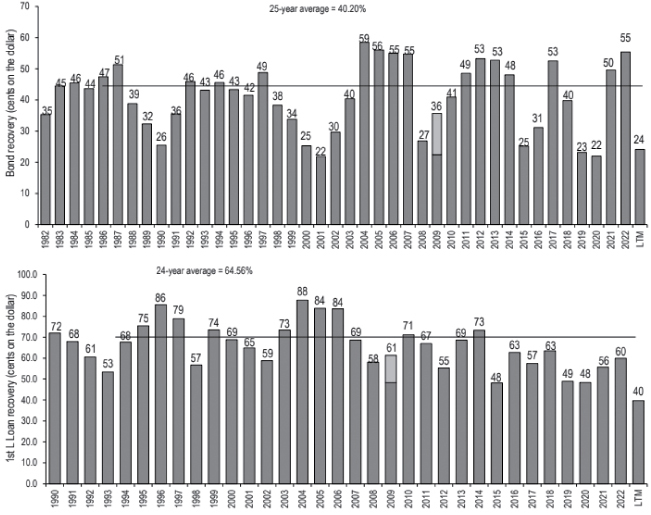

Although we see compelling opportunity in longer-maturity, investment-grade bonds, we see little opportunity in lower- or high-yield rated debt. To understand whether the return on lower-rated debt is worth the risk, we must understand the risk. Rising interest rates have called into question companies' ability to sustain their capital structures due to decreasing debt service coverage ratios. Even if one believed that debt were well covered by enterprise or asset value, whether that debt will be paid depends on whether the owners of the equity want to pay it. Leveraged loans and high-yield bonds are supposed to have protections against companies impairing lenders by changing lenders' claim on assets or taking asset value away from lenders. The expensive debt market prior to 2022 was characterized by low yields and weak protections for lenders (i.e., debt investors),

10

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

as shown in the charts below. In combination with defaults, these weak protections have led to lower recoveries on high-yield bonds and loans.

Covenant Review's Documentation Score

Three-Month Rolling Average

Chart covers the period February 2017 through June 2023. Source: Fitch Ratings; North American and EMEA Leveraged Finance Chart Book: 1H23 — Limited Activity Amid Rates, Default Concerns; August 3, 2023. Chart Source: Covenant Review. Note: Covenant Review's Documentation Scoring Overview. The score, sub scores and qualitative scores will be expressed as follows: 1, Most Protective; 2, Fairly Protective; 3, Flexible; 4, Deficient; 5, Seriously Deficient. Analysis includes the U.S. 1st Lien institutional loan universe.

11

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

High yield: focus should be on risk vs. reward

Source: J.P. Morgan; Moody's Investors Service; S&P/HIS Markit; Pitchbook Data, Inc.; US High Yield and Leveraged Loan Strategy (JPM); October 9, 2023.

12

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Bloomberg U.S. Corporate High Yield BB excl. Energy

Source: Bloomberg. As of September 30, 2023. YTW is Yield-to-Worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the-run Treasury. Past performance is no guarantee, nor is it indicative, of future results.

While yields on high yield rated debt are at 10-15 year highs, we believe the extra compensation to own high-yield rated debt instead of investment grade rated debt is generally not attractive compared to the significant incremental credit risk associated with high-yield rated debt. As always, we are bottom-up investors, so we continue to hunt for attractively priced investment opportunities in lower rated debt, but we generally end up concluding that the price isn't right yet.

In summary, successfully timing the market is hard. No one can credibly ring a bell and say now is the time to buy. We believe that focusing on valuation avoids the need to time the market. Using that approach, we believe buying longer-duration, but not quite core-duration bonds, at least not yet, is one of the best investment opportunities we currently see. This is why most of our investment activity during the quarter was directed toward highly-rated, longer-maturity, fixed-rate bonds. We hope that through the Fund — managed with our time-tested and disciplined approach — investors can avoid the anxiety of trying get the timing right.

13

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Investment Team Update

The success of our investment process depends on having a team of philosophically-aligned investors, all rowing in the same direction. Speaking personally, I couldn't be more proud of our team: Joe Choi, Nazanin Pajoom, Prakash Gopinath, Ryan Taylor, and Felix Moy. It is through their hard work and discipline that we have been able to achieve what I consider to be best-in-class returns.

We are delighted to announce a recent addition to the team: Felix Partow will initially focus on residential mortgage-related investments and will take the seat of our former longtime mortgage analyst, Julian Mann, who recently retired. We're very excited to have Felix Partow as part of our team.

We're also excited to announce that Prakash has been appointed as Co-Director of Research. Prakash has been part of our team since 2015, working on a variety of investments and providing sound counsel along the way. Prakash is a thoughtful, measured, and long-term-oriented value investor — very consistent with the multi-decade philosophy with which we have managed the Fund. Prakash and I will work together to guide our investment process.

Thomas (Tom) Atteberry previously co-managed the Fund, retired as an FPA partner in July 2022 and transitioned to a senior advisory role to the investment team and to FPA. He would have stepped in as Portfolio Manager of the Fund if I were incapacitated. Going forward, Prakash will assume my responsibilities if I am unavailable. Tom will no longer be a Senior Advisor to our investment team but will remain a Senior Advisor to FPA.

Thank you for your confidence and continued support.

Abhijeet Patwardhan

Portfolio Manager

November 2023

14

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Appendix: Attribution and portfolio activity for the fiscal year ending September 30, 2023

Portfolio Attribution12

Largest contributors to performance:

• Collateralized loan obligations (CLOs) backed by corporate loans

• Corporate holdings, including loans, bonds and common stock

• Non-agency commercial mortgage-backed securities (CMBS), particularly CLOs backed by commercial real estate loans

Largest detractors from performance:

• Agency-guaranteed CMBS

While there were individual investments that detracted from performance during the fiscal year, there were no other meaningful detractors from performance at the sector level.

Portfolio Activity13

| Sector | | % Portfolio

9/30/2023 | | % Portfolio

9/30/2022 | |

ABS | | | 47.3 | | | | 66.3 | | |

CLO | | | 12.2 | | | | 19.5 | | |

Corporate | | | 6.9 | | | | 5.8 | | |

Agency CMBS | | | 11.0 | | | | 3.5 | | |

Non-Agency CMBS | | | 8.5 | | | | 7.6 | | |

Agency RMBS | | | 1.9 | | | | 2.1 | | |

Non-Agency RMBS | | | 4.9 | | | | 5.1 | | |

Stripped Mortgage-backed | | | 0.4 | | | | 0.4 | | |

U.S. Treasury | | | 3.4 | | | | 9.0 | | |

Cash and equivalents | | | 3.5 | | | | 0.6 | | |

Total | | | 100.0 | % | | | 100.0 | % | |

Yield-to-worst | | | 6.61 | % | | | 5.70 | % | |

Effective Duration (years) | | | 2.22 | | | | 1.71 | | |

Spread Duration (years) | | | 2.52 | | | | 2.21 | | |

Average Life (years) | | | 2.89 | | | | 2.44 | | |

12 This information is not a recommendation for a specific security or sector and these securities/sectors may not be in the Fund at the time you receive this report. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

13 Portfolio composition will change due to ongoing management of the Fund.

Past performance is no guarantee, nor is it indicative, of future results.

15

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Important Disclosures

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale of any securities, products or services discussed, and neither does it provide investment advice. Any such offer or solicitation shall only be made pursuant to the Fund's Prospectus, which supersedes the information contained herein in its entirety.

The views expressed herein and any forward-looking statements are as of the date of the publication and are those of the portfolio management team. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data. You should not construe the contents of this document as legal, tax, accounting, investment or other advice or recommendations.

Abhijeet Patwardhan has been portfolio manager for the Fund since November 2015. Thomas Atteberry managed/co-managed the Fund from November 2004 through June 2022. Effective July 1, 2022, Mr. Atteberry transitioned to a Senior Advisory role. There were no material changes to the investment process due to this transition. Effective September 30, 2023, Mr. Atteberry no longer acts as a Senior Advisor to the investment team, but he remains as Senior Advisor to FPA.

Effective July 28, 2023, FPA New Income, Inc. (the "Predecessor Fund") was reorganized into the FPA Funds Trust and its new name is FPA New Income Fund. There was no change in its investment objective, investment strategy or fundamental investment policies. FPA continues to be the adviser to the Fund. For more information, please refer to the announcement on FPA's website at: https://fpa.com/news-special-commentaries/fund-announcements/2023/06/26/fpa-announces-fund-reorganizations.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities or sectors are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio manager, the Adviser, or the distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security or sector examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

The statements made herein may be forward-looking and/or based on current expectations, projections, and/or information currently available. Actual results may differ from those anticipated. The portfolio manager and/or FPA cannot assure future results and disclaims any obligation to update or alter any statistical data and/or references thereto, as well as any forward-looking statements, whether as a result of new information, future events, or otherwise. Such statements may or may not be accurate over the long-term.

Investments, including investments in mutual funds, carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund may purchase foreign securities, including depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks; these risks may be elevated when investing in emerging markets. Foreign investments, especially those of companies in emerging markets, can be riskier, less liquid, harder to value, and more volatile than investments in the United States. The securities of smaller, less well-known companies can be more volatile than those of larger companies.

16

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

The return of principal in a bond fund is not guaranteed. Bond funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the Fund. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds.

Interest rate risk is the risk that when interest rates go up, the value of fixed income instruments, such as bonds, typically go down and investors may lose principal value. Credit risk is the risk of loss of principal due to the issuer's failure to repay a loan. Generally, the lower the quality rating of a fixed income instrument, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults the fixed income instrument may lose some or all of its value.

Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; such derivatives may increase volatility. Convertible securities are generally not investment grade and are subject to greater credit risk than higher-rated investments. High yield securities can be volatile and subject to much higher instances of default.

Collateralized debt obligations ("CDOs"), which include collateralized loan obligations ("CLOs"), collateralized bond obligations ("CBOs"), and other similarly structured securities, carry additional risks in addition to interest rate risk and default risk. This includes, but is not limited to: (i) distributions from the underlying collateral may not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; and (iii) the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results. Investments in CDOs are also more difficult to value than other investments.

Value style investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize what the portfolio management team considers the true business value or because the portfolio management team has misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

The ratings agencies that provide ratings are the Nationally Recognized Statistical Ratings Organizations (NRSROs) DBRS, Inc., Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc., Moody's Investors Service, Inc., and S&P Global Ratings. Credit ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings of BB and below are lower-rated securities (junk bonds). High-yielding, non-investment grade bonds (junk bonds) involve higher risks than investment grade bonds. Bonds with credit ratings of CCC or below have higher default risk.

Please refer to the Fund's Prospectus for a complete overview of the primary risks associated with the Fund.

The Fund is not authorized for distribution unless preceded or accompanied by a current prospectus. The prospectus can be accessed at: https://fpa.com/request-funds-literature.

Important Disclosures for Hypothetical Stress-Tested Results

The hypothetical and estimated data provided herein is for illustrative and informational purposes only. No representation is being made that FPNIX will or is likely to achieve profits, losses, or results similar to those shown. Hypothetical and estimated results do not reflect trading in actual accounts, and do not reflect the impact that economic, market or other factors may have on the management of the account.

The hypothetical and estimated results as set forth in this commentary do not represent actual results; actual results may significantly differ from the theoretical data being presented. Hypothetical/estimated results

17

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

have certain inherent limitations. Hypothetical models theoretically may be changed from time to time to obtain more favorable results. There may be sharp differences between simulated or estimated results and the actual results subsequently achieved by any particular account, product or strategy. In addition, simulated/estimated results cannot account for the impact of certain market risks such as a lack of liquidity or default risk. There are numerous other factors related to the markets in general or the implementation of any specific strategy which cannot be fully accounted for in the preparation of simulated or estimated results, all of which can adversely affect actual results.

A client's individual portfolio results may vary from any hypothetical or estimated results because of the timing of trades, deposits and withdrawals, the impact of management fees and taxes, market fluctuations, trading costs, cash flows, custodian fees, among other factors. Hypothetical results are not meant to be construed as a prediction of the future return of the Fund. Past performance is no guarantee, nor is it indicative, of future results.

Index / Category Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund will be less diversified than the indices noted herein and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund's investment strategy. Indices are unmanaged, do not reflect any commissions, fees or expenses which would be incurred by an investor purchasing the underlying securities. The Fund does not include outperformance of any index or benchmark in its investment objectives. Investors cannot invest directly in an index.

Bloomberg U.S. Aggregate Bond Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have at least 1 year remaining in maturity. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

Bloomberg U.S. Aggregate 1-3 Year Bond Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have a remaining maturity of 1 to 3 years. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

Bloomberg U.S. High Yield Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds. Bloomberg U.S. High Yield BB ex Energy Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable BB-rated corporate bonds excluding energy sector. Bloomberg U.S. High Yield B ex Energy Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable B-rated corporate bonds excluding energy sector.

The Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics. There can be no guarantee that the CPI will reflect the exact level of inflation at any given time. This index reflects non-seasonally adjusted returns.

CPI + 100 bps is the measure of the CPI plus an additional 100 basis points.

Morningstar Short-term Bond Category portfolios invest primarily in corporate and other investment-grade U.S. fixed-income issues and typically have durations of 1.0 to 3.5 years. These portfolios are attractive to

18

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

fairly conservative investors, because they are less sensitive to interest rates than portfolios with longer durations. Morningstar calculates monthly breakpoints using the effective duration of the Morningstar Core Bond Index in determining duration assignment. Short-term is defined as 25% to 75% of the three-year average effective duration of the Morningstar Core Bond Index. As of March 31, 2023, there were 597 funds in this category.

Other Definitions

ABS (Asset Backed Securities): financial securities backed by a loan, lease or receivables against assets other than real estate and mortgage-backed securities.

Basis Point (bps) is equal to one hundredth of one percent, or 0.01%. 100 basis points = 1%.

CLO (Collateralized Loan Obligation): is a single security backed by a pool of debt.

CMBS (Commercial Mortgage Backed Security): a mortgage-backed security backed by commercial mortgages rather than residential mortgages.

Core duration bonds (also known as core bonds) refer to bonds similar in duration to Bloomberg U.S. Aggregate Bond Index.

Coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

Corporate Holdings include bank debt, corporate bonds and common stock.

Effective Duration (years) is the duration calculation for bonds with embedded options. Effective duration takes into account that expected cash flows will fluctuate as interest rates change.

Mark-to-market is a method of recording the price or value of a security, portfolio, or account to reflect the current market value rather than book value.

A bond premium occurs when the price of the bond has increased in the secondary market. A bond might trade at a premium because its interest rate is higher than current rates in the market.

RMBS (Residential Mortgage Backed Securities): mortgage-backed securities backed by residential mortgages.

Stripped Mortgage-Backed Securities: a trust comprised of mortgage-backed securities which are split into principal-only strips and interest-only strips.

Weighted Average Life (years) is the average length of time that each dollar of unpaid principal on a loan, a mortgage or an amortizing bond remains outstanding.

Yield-to-Maturity (YTM) is the expected rate of return anticipated on a bond if held until it matures. YTM is considered a long-term bond yield expressed as an annual rate. The YTM calculation takes into account the bond's current market price, par value, coupon interest rate and time to maturity. It is also assumed that all coupon payments are reinvested at the same rate as the bond's current yield.

©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted by Morningstar to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The FPA Funds are distributed by UMB Distribution Services, LLC, (the "Distributor"), 235 W. Galena Street, Milwaukee, WI, 53212. The Distributor is not affiliated with FPA.

19

FPA NEW INCOME FUND

HISTORICAL PERFORMANCE

(Unaudited)

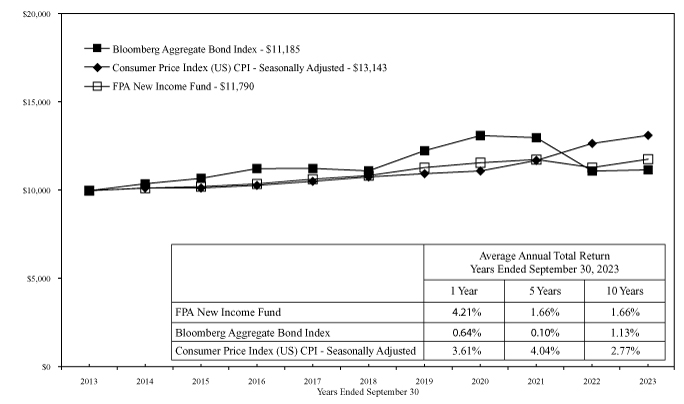

Change in Value of a $10,000 Investment in FPA New Income Fund vs. Barclays U.S. Aggregate Index and Consumer Price Index + 100 Basis Points from October 1, 2013 to September 30, 2023. The Average Annual Total Return table and Growth of Assumed $10,000 Investment graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is not indicative of future performance. The Bloomberg Barclays U.S. Aggregate Bond Index a broad-based unmanaged composite of four major subindexes: U.S. Government Index; U.S. Credit Index; U.S. Mortgage-Backed Securities Index; and U.S. Asset-Backed Securities Index. The index holds investment quality bonds. The Consumer Price Index is an unmanaged index representing the rate of inflation of U.S. consumer prices as determined by the US Department of Labor Statistics. The performance of the Fund and of the Averages is computed on a total return basis which includes reinvestment of all distributions.

Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. This data represents past performance, and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Current month-end performance data can be obtained by visiting the website at www.fpa.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio can be found in the Financial Highlights section of this report.

The Prospectus details the Fund's objective and policies, charges, and other matters of interest to prospective investors. Please read the prospectus carefully before investing. The Prospectus may be obtained by visiting the website at https://fpa.com/request-funds-literature.

20

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS

As of September 30, 2023

| BONDS & DEBENTURES — 94.8% | | Principal

Amount | | Value | |

ASSET-BACKED SECURITIES — 56.4% | |

AUTO — 12.5% | |

Ally Auto Receivables Trust

Series 2023-1, Class A4, 5.270%, 11/15/2028 | | $ | 8,996,000 | | | $ | 8,965,538 | | |

BMW Vehicle Owner Trust

Series 2022-A, Class A4, 3.440%, 12/26/2028 | | | 25,298,000 | | | | 24,123,629 | | |

Series 2023-A, Class A4, 5.250%, 11/26/2029 | | | 6,776,000 | | | | 6,744,948 | | |

Capital One Prime Auto Receivables Trust

Series 2022-2, Class A4, 3.690%, 12/15/2027 | | | 15,513,000 | | | | 14,773,612 | | |

CarMax Auto Owner Trust

Series 2020-3, Class C, 1.690%, 4/15/2026 | | | 1,064,000 | | | | 1,027,550 | | |

Series 2022-3, Class A4, 4.060%, 2/15/2028 | | | 63,819,000 | | | | 61,390,534 | | |

Series 2022-3, Class B, 4.690%, 2/15/2028 | | | 19,152,000 | | | | 18,497,019 | | |

Series 2023-2, Class A4, 5.010%, 11/15/2028 | | | 21,176,000 | | | | 20,849,290 | | |

Series 2023-1, Class A4, 4.650%, 1/16/2029 | | | 10,892,000 | | | | 10,641,745 | | |

Series 2023-3, Class A4, 5.260%, 2/15/2029 | | | 20,637,000 | | | | 20,473,470 | | |

Drive Auto Receivables Trust

Series 2021-3, Class C, 1.470%, 1/15/2027 | | | 36,980,000 | | | | 35,920,974 | | |

DT Auto Owner Trust

Series 2021-3A, Class C, 0.870%, 5/17/2027(a) | | | 18,106,000 | | | | 17,462,596 | | |

Series 2021-4A, Class C, 1.500%, 9/15/2027(a) | | | 13,540,000 | | | | 12,842,063 | | |

Series 2022-1A, Class C, 2.960%, 11/15/2027(a) | | | 18,926,000 | | | | 18,437,934 | | |

Exeter Automobile Receivables Trust

Series 2022-1A, Class C, 2.560%, 6/15/2028 | | | 49,707,000 | | | | 48,132,521 | | |

Flagship Credit Auto Trust

Series 2021-2, Class C, 1.270%, 6/15/2027(a) | | | 17,609,000 | | | | 16,529,854 | | |

Ford Credit Auto Owner Trust

Series 2020-B, Class B, 1.190%, 1/15/2026 | | | 400,000 | | | | 391,035 | | |

Series 2023-A, Class A4, 4.560%, 12/15/2028 | | | 14,487,000 | | | | 14,128,858 | | |

Series 2023-B, Class A4, 5.060%, 2/15/2029 | | | 7,137,000 | | | | 7,056,046 | | |

GM Financial Consumer Automobile Receivables Trust

Series 2022-3, Class A4, 3.710%, 12/16/2027 | | | 25,555,000 | | | | 24,497,087 | | |

Series 2023-1, Class A4, 4.590%, 7/17/2028 | | | 15,767,000 | | | | 15,327,965 | | |

Series 2023-3, Class A4, 5.340%, 12/18/2028 | | | 13,758,000 | | | | 13,761,364 | | |

GM Financial Revolving Receivables Trust

Series 2021-1, Class A, 1.170%, 6/12/2034(a) | | | 38,305,000 | | | | 33,690,676 | | |

Series 2023-1, Class A, 5.120%, 4/11/2035(a) | | | 49,942,000 | | | | 48,909,849 | | |

Honda Auto Receivables Owner Trust

Series 2022-2, Class A4, 3.760%, 12/18/2028 | | | 6,350,000 | | | | 6,110,103 | | |

Hyundai Auto Receivables Trust

Series 2022-B, Class A4, 3.800%, 8/15/2028 | | | 14,340,000 | | | | 13,749,155 | | |

Series 2023-B, Class A4, 5.310%, 8/15/2029 | | | 10,743,000 | | | | 10,703,286 | | |

21

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2023

| BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

Mercedes-Benz Auto Receivables Trust

Series 2023-1, Class A4, 4.310%, 4/16/2029 | | $ | 10,006,000 | | | $ | 9,704,336 | | |

Nissan Auto Receivables Owner Trust

Series 2022-B, Class A4, 4.450%, 11/15/2029 | | | 13,366,000 | | | | 12,989,473 | | |

Series 2023-A, Class A4, 4.850%, 6/17/2030 | | | 15,538,000 | | | | 15,256,330 | | |

Porsche Financial Auto Securitization Trust

Series 2023-1A, Class A4, 4.720%, 6/23/2031(a) | | | 17,279,000 | | | | 17,001,755 | | |

Prestige Auto Receivables Trust

Series 2021-1A, Class C, 1.530%, 2/15/2028(a) | | | 13,545,000 | | | | 12,711,853 | | |

Santander Drive Auto Receivables Trust

Series 2022-1, Class C, 2.560%, 4/17/2028 | | | 33,202,000 | | | | 32,060,615 | | |

SFS Auto Receivables Securitization Trust

Series 2023-1A, Class A4, 5.470%, 12/20/2029(a) | | | 8,951,000 | | | | 8,805,043 | | |

Toyota Auto Loan Extended Note Trust

Series 2022-1A, Class A, 3.820%, 4/25/2035(a) | | | 54,519,000 | | | | 51,255,509 | | |

Series 2023-1A, Class A, 4.930%, 6/25/2036(a) | | | 43,813,000 | | | | 42,857,255 | | |

Toyota Auto Receivables Owner Trust

Series 2022-C, Class A4, 3.770%, 2/15/2028 | | | 10,600,000 | | | | 10,112,966 | | |

Series 2023-A, Class A4, 4.420%, 8/15/2028 | | | 16,189,000 | | | | 15,729,848 | | |

Series 2023-B, Class A4, 4.660%, 9/15/2028 | | | 19,879,000 | | | | 19,366,106 | | |

Series 2023-C, Class A4, 5.010%, 2/15/2029 | | | 25,523,000 | | | | 25,193,684 | | |

Volkswagen Auto Loan Enhanced Trust

Series 2023-1, Class A4, 5.010%, 1/22/2030 | | | 11,637,000 | | | | 11,491,739 | | |

Westlake Automobile Receivables Trust

Series 2021-3A, Class C, 1.580%, 1/15/2027(a) | | | 69,605,000 | | | | 66,621,869 | | |

Series 2022-1A, Class C, 3.110%, 3/15/2027(a) | | | 52,910,000 | | | | 51,120,790 | | |

World Omni Auto Receivables Trust

Series 2020-C, Class C, 1.390%, 5/17/2027 | | | 3,415,000 | | | | 3,224,191 | | |

Series 2023-A, Class A4, 4.660%, 5/15/2029 | | | 14,612,000 | | | | 14,247,200 | | |

Series 2023-B, Class A4, 4.680%, 5/15/2029 | | | 21,627,000 | | | | 21,127,375 | | |

Series 2023-C, Class A4, 5.030%, 11/15/2029 | | | 10,417,000 | | | | 10,303,661 | | |

| | $ | 976,320,299 | | |

COLLATERALIZED LOAN OBLIGATION — 12.2% | |

ABPCI Direct Lending Fund CLO X LP

Series 2020-10A, Class A1A, 7.538% (3-Month Term SOFR+221.161

basis points), 1/20/2032(a),(b) | | | $19,397,000 | | | | $19,177,892 | | |

ABPCI Direct Lending Fund IX LLC

Series 2020-9A, Class A1R, 7.019% (3-Month Term SOFR+166.161

basis points), 11/18/2031(a),(b) | | | 43,972,000 | | | | 43,357,140 | | |

Blackrock Mount Adams CLO IX LP

Series 2021-9A, Class A1, 7.028% (3-Month Term SOFR+163.161

basis points), 9/22/2031(a),(b) | | | 22,452,459 | | | | 22,329,060 | | |

22

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2023

| BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

Brightwood Capital MM CLO Ltd.

Series 2021-2A, Class A, 7.219% (3-Month Term SOFR+191.161

basis points), 11/15/2030(a),(b) | | | $73,757,094 | | | | $72,927,916 | | |

BTC Holdings Fund I LLC

8.362%, 1/28/2027(c),(d) | | | 957,183 | | | | 957,183 | | |

BTC Offshore Holdings Fund

8.245%, 10/20/2029(c),(d) | | | 18,000,000 | | | | 18,000,000 | | |

Cerberus Loan Funding XL LLC

Series 2023-1A, Class A, 7.708% (3-Month Term SOFR+240

basis points), 3/22/2035(a),(b) | | | 10,299,000 | | | | 10,274,818 | | |

Cerberus Loan Funding XLI LLC

Series 2023-2A, Class A1, 7.801% (3-Month Term SOFR+255

basis points), 7/15/2035(a),(b) | | | 51,840,000 | | | | 51,832,950 | | |

Cerberus Loan Funding XXIX LP

Series 2020-2A, Class A, 7.469% (3-Month Term SOFR+216.161

basis points), 10/15/2032(a),(b) | | | 79,469,000 | | | | 79,267,069 | | |

Fortress Credit Opportunities IX CLO Ltd.

Series 2017-9A, Class A1TR, 7.119% (3-Month Term SOFR+181.161

basis points), 10/15/2033(a),(b) | | | 118,776,000 | | | | 115,619,172 | | |

Golub Capital Partners CLO 36M Ltd.

Series 2018-36A, Class A, 6.931% (3-Month Term SOFR+156.161

basis points), 2/5/2031(a),(b) | | | 61,004,870 | | | | 60,636,644 | | |

Golub Capital Partners CLO 42M Ltd.

Series 2019-42A, Class A2, 7.588% (3-Month Term SOFR+226.161

basis points), 4/20/2031(a),(b) | | | 13,772,000 | | | | 13,638,453 | | |

Golub Capital Partners CLO 45M Ltd.

Series 2019-45A, Class B1, 8.138% (3-Month Term SOFR+281.161

basis points), 10/20/2031(a),(b) | | | 17,314,000 | | | | 16,875,921 | | |

Golub Capital Partners CLO 67M Ltd.

Series 2023-67A, Class A1, 7.631% (3-Month Term SOFR+250

basis points), 5/9/2036(a),(b) | | | 43,478,000 | | | | 43,473,348 | | |

Lake Shore MM CLO III LLC

Series 2019-2A, Class A2R, 2.525%, 10/17/2031(a) | | | 11,083,000 | | | | 10,113,504 | | |

Series 2019-2A, Class A1R, 7.050% (3-Month Term SOFR+174.161

basis points), 10/17/2031(a),(b) | | | 23,662,000 | | | | 23,240,438 | | |

Lake Shore MM CLO IV Ltd.

Series 2021-1A, Class X, 6.750% (3-Month Term SOFR+144.161

basis points), 10/15/2033(a),(b) | | | 10,375,799 | | | | 10,343,322 | | |

LCM XX LP

Series 20A, Class AR, 6.628% (3-Month Term SOFR+130.161

basis points), 10/20/2027(a),(b) | | | 52,852 | | | | 52,841 | | |

23

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2023

| BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

Owl Rock CLO VI Ltd.

Series 2021-6A, Class A, 7.109% (3-Month Term SOFR+171.161

basis points), 6/21/2032(a),(b) | | | $66,692,000 | | | | $65,323,213 | | |

Parliament CLO II Ltd.

Series 2021-2A, Class A, 6.991% (3-Month Term SOFR+161.161

basis points), 8/20/2032(a),(b) | | | 40,086,125 | | | | 39,251,772 | | |

Parliament Funding II Ltd.

Series 2020-1A, Class AR, 6.838% (3-Month Term SOFR+151.161

basis points), 10/20/2031(a),(b) | | | 39,877,451 | | | | 39,390,428 | | |

Saranac CLO III Ltd.

Series 2014-3A, Class ALR, 7.258% (3-Month USD Libor+160

basis points), 6/22/2030(a),(b) | | | 15,749,533 | | | | 15,728,272 | | |

VCP CLO II Ltd.

Series 2021-2A, Class A1, 7.239% (3-Month Term SOFR+193.161

basis points), 4/15/2031(a),(b) | | | 101,155,000 | | | | 100,327,249 | | |

Woodmont Trust

Series 2019-6A, Class A1R, 7.050% (3-Month Term SOFR+174.161

basis points), 7/15/2031(a),(b) | | | 62,588,000 | | | | 61,934,456 | | |

Series 2019-6A, Class A1R2, 7.050% (3-Month Term SOFR+174.161

basis points), 7/15/2031(a),(b) | | | 16,952,000 | | | | 16,774,987 | | |

| | $ | 950,848,048 | | |

CREDIT CARD — 3.5% | |

American Express Credit Account Master Trust

Series 2022-2, Class A, 3.390%, 5/15/2027 | | $ | 53,566,000 | | | $ | 51,778,079 | | |

Series 2023-2, Class A, 4.800%, 5/15/2030 | | | 66,293,000 | | | | 65,084,810 | | |

Series 2023-4, Class A, 5.150%, 9/16/2030 | | | 62,969,000 | | | | 62,708,352 | | |

Chase Issuance Trust

Series 2023-A2, Class A, 5.080%, 9/16/2030 | | | 45,545,000 | | | | 44,913,578 | | |

Discover Card Execution Note Trust

Series 2022-A2, Class A, 3.320%, 5/15/2027 | | | 50,645,000 | | | | 48,858,027 | | |

| | $ | 273,342,846 | | |

EQUIPMENT — 16.7% | |

ARI Fleet Lease Trust

Series 2022-A, Class A3, 3.430%, 1/15/2031(a) | | $ | 10,094,000 | | | $ | 9,742,934 | | |

Avis Budget Rental Car Funding AESOP LLC

Series 2019-3A, Class A, 2.360%, 3/20/2026(a) | | | 8,591,000 | | | | 8,194,481 | | |

Series 2021-2A, Class A, 1.660%, 2/20/2028(a) | | | 4,211,000 | | | | 3,679,291 | | |

Series 2023-1A, Class A, 5.250%, 4/20/2029(a) | | | 13,136,000 | | | | 12,688,178 | | |

Series 2023-4A, Class A, 5.490%, 6/20/2029(a) | | | 38,251,000 | | | | 37,223,639 | | |

Series 2023-6A, Class A, 5.810%, 12/20/2029(a) | | | 48,017,000 | | | | 47,341,607 | | |

Series 2023-8A, Class A, 6.020%, 2/20/2030(a) | | | 34,038,000 | | | | 33,758,197 | | |

24

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2023

| BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

CNH Equipment Trust

Series 2021-B, Class A3, 0.440%, 8/17/2026 | | $ | 1,389,305 | | | $ | 1,333,366 | | |

Series 2022-A, Class A3, 2.940%, 7/15/2027 | | | 19,831,000 | | | | 18,998,066 | | |

Series 2022-B, Class A4, 3.910%, 3/15/2028 | | | 7,414,000 | | | | 7,058,113 | | |

Series 2023-A, Class A4, 4.770%, 10/15/2030 | | | 6,738,000 | | | | 6,569,347 | | |

Series 2023-B, Class A4, 5.460%, 3/17/2031 | | | 17,009,000 | | | | 16,957,575 | | |

Coinstar Funding LLC

Series 2017-1A, Class A2, 5.216%, 4/25/2047(a) | | | 12,024,375 | | | | 10,072,126 | | |

Dell Equipment Finance Trust

Series 2022-2, Class B, 4.400%, 7/22/2027(a) | | | 5,100,000 | | | | 4,958,885 | | |

Series 2022-2, Class C, 4.740%, 7/22/2027(a) | | | 4,700,000 | | | | 4,523,036 | | |

Series 2022-1, Class C, 2.940%, 8/23/2027(a) | | | 17,567,000 | | | | 17,000,552 | | |

Enterprise Fleet Financing LLC

Series 2022-2, Class A3, 4.790%, 5/21/2029(a) | | | 32,246,000 | | | | 31,348,581 | | |

Series 2022-3, Class A3, 4.290%, 7/20/2029(a) | | | 9,703,000 | | | | 9,285,914 | | |

Series 2023-1, Class A3, 5.420%, 10/22/2029(a) | | | 28,811,000 | | | | 28,274,891 | | |

Series 2022-4, Class A3, 5.650%, 10/22/2029(a) | | | 18,980,000 | | | | 18,849,235 | | |

Series 2023-2, Class A3, 5.500%, 4/22/2030(a) | | | 37,963,000 | | | | 37,234,904 | | |

Enterprise Fleet Funding LLC

Series 2021-1, Class A3, 0.700%, 12/21/2026(a) | | | 2,050,000 | | | | 1,964,693 | | |

Ford Credit Floorplan Master Owner Trust A

Series 2020-2, Class A, 1.060%, 9/15/2027 | | | 5,070,000 | | | | 4,620,664 | | |

Series 2018-4, Class A, 4.060%, 11/15/2030 | | | 78,467,000 | | | | 72,948,196 | | |

GMF Floorplan Owner Revolving Trust

Series 2023-2, Class A, 5.340%, 6/15/2030(a) | | | 18,848,000 | | | | 18,579,041 | | |

GreatAmerica Leasing Receivables

Series 2023-1, Class A4, 5.060%, 3/15/2030(a) | | | 16,501,000 | | | | 16,024,727 | | |

GreatAmerica Leasing Receivables Funding LLC

Series 2022-1, Class A4, 5.350%, 7/16/2029(a) | | | 17,738,000 | | | | 17,569,296 | | |

Hertz Vehicle Financing III LLC

Series 2023-4A, Class A, 6.150%, 3/25/2030(a) | | | 31,918,000 | | | | 31,752,799 | | |

Hertz Vehicle Financing III LP

Series 2021-2A, Class A, 1.680%, 12/27/2027(a) | | | 44,631,000 | | | | 39,180,885 | | |

Hertz Vehicle Financing LLC

Series 2022-4A, Class A, 3.730%, 9/25/2026(a) | | | 11,875,000 | | | | 11,393,107 | | |

Series 2022-2A, Class A, 2.330%, 6/26/2028(a) | | | 38,642,000 | | | | 34,160,475 | | |

Series 2022-5A, Class A, 3.890%, 9/25/2028(a) | | | 72,333,000 | | | | 66,738,816 | | |

HPEFS Equipment Trust

Series 2022-2A, Class B, 4.200%, 9/20/2029(a) | | | 9,732,000 | | | | 9,340,713 | | |

Series 2022-2A, Class C, 4.430%, 9/20/2029(a) | | | 5,634,000 | | | | 5,383,899 | | |

25

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2023

| BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

John Deere Owner Trust

Series 2022-B, Class A4, 3.800%, 5/15/2029 | | $ | 17,226,000 | | | $ | 16,496,970 | | |

Series 2023-A, Class A4, 5.010%, 12/17/2029 | | | 15,675,000 | | | | 15,514,986 | | |

Series 2023-B, Class A4, 5.110%, 5/15/2030 | | | 11,706,000 | | | | 11,498,229 | | |

Series 2023-C, Class A4, 5.390%, 8/15/2030 | | | 15,742,000 | | | | 15,681,414 | | |

Kubota Credit Owner Trust

Series 2022-1A, Class A3, 2.670%, 10/15/2026(a) | | | 88,222,000 | | | | 84,360,991 | | |

Series 2022-2A, Class A4, 4.170%, 6/15/2028(a) | | | 34,050,000 | | | | 32,463,726 | | |

Series 2023-2A, Class A4, 5.230%, 6/15/2028(a) | | | 12,897,000 | | | | 12,712,030 | | |

Series 2023-1A, Class A4, 5.070%, 2/15/2029(a) | | | 9,456,000 | | | | 9,313,971 | | |

M&T Equipment Notes

Series 2023-1A, Class A4, 5.750%, 7/15/2030(a) | | | 9,785,000 | | | | 9,656,219 | | |

MMAF Equipment Finance LLC

Series 2023-A, Class A4, 5.500%, 12/13/2038(a) | | | 24,563,000 | | | | 24,254,614 | | |

Series 2020-A, Class A5, 1.560%, 10/9/2042(a) | | | 7,081,000 | | | | 6,163,709 | | |

NextGear Floorplan Master Owner Trust

Series 2022-1A, Class A2, 2.800%, 3/15/2027(a) | | | 72,271,000 | | | | 69,092,218 | | |

Prosper Marketplace Issuance Trust

Series 2017-1A, 5.300%, 3/15/2042(c) | | | 16,279,678 | | | | 13,878,426 | | |

Verizon Master Trust

Series 2022-4, Class A, 3.400%, 11/20/2028 | | | 77,914,000 | | | | 75,040,158 | | |

Series 2022-4, Class B, 3.640%, 11/20/2028 | | | 34,616,000 | | | | 32,757,328 | | |

Series 2022-4, Class C, 3.890%, 11/20/2028 | | | 8,987,000 | | | | 8,497,777 | | |

Series 2022-6, Class A, 3.670%, 1/22/2029 | | | 37,943,000 | | | | 36,605,115 | | |

Series 2023-3, Class A, 4.730%, 4/21/2031(a) | | | 59,567,000 | | | | 58,640,048 | | |

Series 2023-6, Class A, 5.350%, 9/22/2031(a) | | | 76,585,000 | | | | 76,151,690 | | |

| | $ | 1,303,529,848 | | |

NON-AGENCY — 0.3% | |

Progress Residential Trust

Series 2023-SFR2, Class A, 4.500%, 10/17/2028(a) | | $ | 27,217,000 | | | $ | 25,541,984 | | |

OTHER — 11.2% | |

ABPCI Direct Lending Fund ABS I Ltd.

Series 2020-1A, Class A, 3.199%, 12/20/2030(a) | | $ | 37,013,521 | | | $ | 34,843,788 | | |

ABPCI Direct Lending Fund ABS II LLC

Series 2022-2A, Class A1, 7.457% (3-Month Term SOFR+210

basis points), 3/1/2032(a),(b) | | | 26,204,000 | | | | 25,968,164 | | |

Cologix Data Centers US Issuer LLC

Series 2021-1A, Class A2, 3.300%, 12/26/2051(a) | | | 58,068,000 | | | | 51,166,183 | | |

26

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2023

| BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

DataBank Issuer

Series 2021-1A, Class A2, 2.060%, 2/27/2051(a) | | $ | 14,750,000 | | | $ | 12,947,431 | | |

Elm Trust

Series 2020-3A, Class A2, 2.954%, 8/20/2029(a) | | | 8,016,482 | | | | 7,529,144 | | |

Series 2020-4A, Class A2, 2.286%, 10/20/2029(a) | | | 7,970,271 | | | | 7,375,306 | | |

FCI Funding LLC

Series 2021-1A, Class A, 1.130%, 4/15/2033(a) | | | 2,803,401 | | | | 2,720,533 | | |

Golub Capital Partners ABS Funding Ltd.

Series 2020-1A, Class A2, 3.208%, 1/22/2029(a) | | | 31,156,087 | | | | 29,498,583 | | |

Series 2021-1A, Class A2, 2.773%, 4/20/2029(a) | | | 56,366,000 | | | | 52,517,104 | | |

Series 2021-2A, Class A, 2.944%, 10/19/2029(a) | | | 95,445,000 | | | | 84,033,978 | | |

Louisiana Local Government Environmental Facilities & Community

Development Auth Rev. 3.615%, 2/1/2029 | | | 38,683,391 | | | | 37,202,328 | | |

Monroe Capital ABS Funding Ltd.

Series 2021-1A, Class A2, 2.815%, 4/22/2031(a) | | | 45,379,000 | | | | 43,333,542 | | |

Oklahoma Development Finance Authority

4.135%, 12/1/2033 | | | 29,797,806 | | | | 28,032,776 | | |

4.285%, 2/1/2034 | | | 10,600,097 | | | | 10,184,763 | | |

3.877%, 5/1/2037 | | | 24,775,835 | | | | 22,813,273 | | |

Oportun Funding XIV LLC

Series 2021-A, Class A, 1.210%, 3/8/2028(a) | | | 6,565,494 | | | | 6,333,373 | | |

Oportun Issuance Trust

Series 2021-C, Class A, 2.180%, 10/8/2031(a) | | | 64,181,000 | | | | 58,339,348 | | |

PFS Financing Corp.

Series 2022-A, Class A, 2.470%, 2/15/2027(a) | | | 105,379,000 | | | | 100,559,386 | | |

Series 2022-A, Class B, 2.770%, 2/15/2027(a) | | | 21,651,000 | | | | 20,517,282 | | |

Series 2022-C, Class A, 3.890%, 5/15/2027(a) | | | 77,233,000 | | | | 74,739,911 | | |

Series 2022-C, Class B, 4.390%, 5/15/2027(a) | | | 11,913,000 | | | | 11,541,391 | | |

Series 2022-D, Class A, 4.270%, 8/15/2027(a) | | | 71,781,000 | | | | 69,909,870 | | |

SpringCastle America Funding LLC

Series 2020-AA, Class A, 1.970%, 9/25/2037(a) | | | 14,347,392 | | | | 12,981,491 | | |

Texas Natural Gas Securitization Finance Corp.

5.102%, 4/1/2035 | | | 8,561,000 | | | | 8,373,805 | | |

TVEST LLC

Series 2020-A, Class A, 4.500%, 7/15/2032(a) | | | 1,696,361 | | | | 1,681,677 | | |

Vantage Data Centers Issuer LLC

Series 2020-1A, Class A2, 1.645%, 9/15/2045(a) | | | 19,214,000 | | | | 17,301,928 | | |

VCP RRL ABS I Ltd.

Series 2021-1A, Class A, 2.152%, 10/20/2031(a) | | | 39,655,209 | | | | 36,055,745 | | |

27

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2023

| BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

WEPCo Environmental Trust Finance LLC

Series 2021-1, Class A, 1.578%, 12/15/2035 | | $ | 10,109,233 | | | $ | 8,340,411 | | |

| | $ | 876,842,514 | | |

| TOTAL ASSET-BACKED SECURITIES (Cost $4,548,099,157) | | $ | 4,406,425,539 | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES — 19.7% | |

AGENCY — 11.1% | |

Federal Home Loan Mortgage Corp.

Series K051, Class A2, 3.308%, 9/25/2025 | | $ | 38,614,000 | | | $ | 37,091,485 | | |

Series K054, Class A2, 2.745%, 1/25/2026 | | | 3,600,000 | | | | 3,397,592 | | |

Series K057, Class A2, 2.570%, 7/25/2026 | | | 87,324,000 | | | | 81,399,626 | | |

Series K058, Class A2, 2.653%, 8/25/2026 | | | 13,173,000 | | | | 12,253,479 | | |

Series K061, Class A2, 3.347%, 11/25/2026(b) | | | 78,855,000 | | | | 74,638,521 | | |

Series K062, Class A2, 3.413%, 12/25/2026 | | | 41,061,276 | | | | 38,831,788 | | |

Series K063, Class A2, 3.430%, 1/25/2027(b) | | | 16,539,000 | | | | 15,644,806 | | |

Series K065, Class A2, 3.243%, 4/25/2027 | | | 9,702,802 | | | | 9,106,518 | | |

Series K066, Class A2, 3.117%, 6/25/2027 | | | 7,223,000 | | | | 6,724,660 | | |

Series K068, Class A2, 3.244%, 8/25/2027 | | | 8,509,735 | | | | 7,929,427 | | |

Series K072, Class A2, 3.444%, 12/25/2027 | | | 12,338,034 | | | | 11,529,101 | | |

Series K073, Class A2, 3.350%, 1/25/2028 | | | 29,086,020 | | | | 27,056,691 | | |

Series K076, Class A2, 3.900%, 4/25/2028 | | | 16,051,256 | | | | 15,226,701 | | |

Series K077, Class A2, 3.850%, 5/25/2028(b) | | | 4,086,000 | | | | 3,864,737 | | |

Series K079, Class A2, 3.926%, 6/25/2028 | | | 30,559,000 | | | | 28,946,172 | | |

Series K080, Class A2, 3.926%, 7/25/2028(b) | | | 23,177,000 | | | | 21,937,941 | | |

Series K081, Class A2, 3.900%, 8/25/2028(b) | | | 62,589,000 | | | | 59,110,666 | | |

Series K082, Class A2, 3.920%, 9/25/2028(b) | | | 45,702,000 | | | | 43,164,657 | | |

Series K083, Class A2, 4.050%, 9/25/2028(b) | | | 23,453,000 | | | | 22,269,543 | | |

Series K084, Class A2, 3.780%, 10/25/2028(b) | | | 55,047,723 | | | | 51,494,739 | | |

Series K085, Class A2, 4.060%, 10/25/2028(b) | | | 27,924,000 | | | | 26,525,566 | | |

Series K089, Class A2, 3.563%, 1/25/2029 | | | 24,117,714 | | | | 22,309,148 | | |

Series K091, Class A2, 3.505%, 3/25/2029 | | | 16,203,000 | | | | 14,927,382 | | |

Series K093, Class A2, 2.982%, 5/25/2029 | | | 3,986,000 | | | | 3,568,365 | | |

Series K095, Class A2, 2.785%, 6/25/2029 | | | 77,253,000 | | | | 68,237,328 | | |

Series K094, Class A2, 2.903%, 6/25/2029 | | | 60,450,000 | | | | 53,711,300 | | |

Series K097, Class A2, 2.508%, 7/25/2029 | | | 40,814,000 | | | | 35,366,086 | | |

Series K096, Class A2, 2.519%, 7/25/2029 | | | 77,308,000 | | | | 67,116,169 | | |

| | $ | 863,380,194 | | |

28

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2023

| BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

AGENCY STRIPPED — 0.4% | |

Government National Mortgage Association

Series 2014-77, Class IO, 0.580%, 12/16/2047(b) | | $ | 11,168,121 | | | $ | 106,048 | | |

Series 2012-25, Class IO, 0.398%, 8/16/2052(b) | | | 495,939 | | | | 193 | | |

Series 2012-150, Class IO, 0.437%, 11/16/2052(b) | | | 16,844,778 | | | | 267,470 | | |

Series 2012-114, Class IO, 0.621%, 1/16/2053(b) | | | 14,977,448 | | | | 296,663 | | |

Series 2012-125, Class IO, 0.176%, 2/16/2053(b) | | | 36,655,160 | | | | 229,564 | | |

Series 2012-79, Class IO, 0.353%, 3/16/2053(b) | | | 37,038,850 | | | | 473,812 | | |

Series 2012-45, Class IO, 0.000%, 4/16/2053(b),(e) | | | 973,999 | | | | 1 | | |

Series 2013-45, Class IO, 0.085%, 12/16/2053(b) | | | 21,363,524 | | | | 20,966 | | |

Series 2013-125, Class IO, 0.229%, 10/16/2054(b) | | | 7,037,361 | | | | 101,464 | | |

Series 2014-157, Class IO, 0.190%, 5/16/2055(b) | | | 24,687,616 | | | | 175,670 | | |

Series 2014-153, Class IO, 0.341%, 4/16/2056(b) | | | 29,169,639 | | | | 384,120 | | |

Series 2014-175, Class IO, 0.536%, 4/16/2056(b) | | | 66,809,696 | | | | 1,129,284 | | |

Series 2014-138, Class IO, 0.539%, 4/16/2056(b) | | | 5,280,691 | | | | 102,171 | | |

Series 2014-187, Class IO, 0.617%, 5/16/2056(b) | | | 67,177,905 | | | | 1,506,706 | | |

Series 2015-41, Class IO, 0.277%, 9/16/2056(b) | | | 7,274,069 | | | | 88,797 | | |

Series 2015-108, Class IO, 0.337%, 10/16/2056(b) | | | 1,489,912 | | | | 19,632 | | |

Series 2014-110, Class IO, 0.181%, 1/16/2057(b) | | | 12,474,861 | | | | 75,240 | | |

Series 2015-19, Class IO, 0.295%, 1/16/2057(b) | | | 27,941,729 | | | | 417,458 | | |

Series 2015-7, Class IO, 0.454%, 1/16/2057(b) | | | 16,901,265 | | | | 336,847 | | |

Series 2015-169, Class IO, 0.258%, 7/16/2057(b) | | | 45,063,455 | | | | 584,009 | | |

Series 2015-150, Class IO, 0.364%, 9/16/2057(b) | | | 7,641,003 | | | | 147,639 | | |

Series 2016-125, Class IO, 0.829%, 12/16/2057(b) | | | 53,439,174 | | | | 2,046,373 | | |

Series 2016-65, Class IO, 0.494%, 1/16/2058(b) | | | 29,348,653 | | | | 710,182 | | |

Series 2016-106, Class IO, 0.969%, 9/16/2058(b) | | | 84,781,601 | | | | 3,818,563 | | |

Series 2020-43, Class IO, 1.260%, 11/16/2061(b) | | | 42,256,542 | | | | 3,127,677 | | |

Series 2020-71, Class IO, 1.086%, 1/16/2062(b) | | | 55,397,356 | | | | 3,739,698 | | |

Series 2020-75, Class IO, 0.869%, 2/16/2062(b) | | | 100,289,504 | | | | 5,965,551 | | |

Series 2020-42, Class IO, 0.937%, 3/16/2062(b) | | | 126,353,057 | | | | 7,756,839 | | |

| | $ | 33,628,637 | | |

NON-AGENCY — 8.2% | |

A10 Bridge Asset Financing LLC

Series 2021-D, Class A1FX, 2.589%, 10/1/2038(a) | | $ | 6,174,991 | | | $ | 5,824,494 | | |

ACRE Commercial Mortgage Ltd.

Series 2021-FL4, Class A, 6.275% (1-Month Term SOFR+94.448

basis points), 12/18/2037(a),(b) | | | 6,551,002 | | | | 6,507,052 | | |

ACRES Commercial Realty Ltd.

Series 2021-FL1, Class A, 6.647% (1-Month Term SOFR+131.448

basis points), 6/15/2036(a),(b) | | | 55,344,441 | | | | 54,412,059 | | |

Series 2021-FL2, Class A, 6.847% (1-Month Term SOFR+151.448

basis points), 1/15/2037(a),(b) | | | 13,444,000 | | | | 13,310,478 | | |

29

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2023

| BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

Arbor Realty Commercial Real Estate Notes Ltd.

Series 2021-FL1, Class A, 6.417% (1-Month Term SOFR+108.448

basis points), 12/15/2035(a),(b) | | | $14,920,000 | | | | $14,778,966 | | |

Series 2021-FL2, Class A, 6.547% (1-Month Term SOFR+121.448

basis points), 5/15/2036(a),(b) | | | 45,859,000 | | | | 45,442,279 | | |

Series 2021-FL4, Class A, 6.797% (1-Month Term SOFR+146.448

basis points), 11/15/2036(a),(b) | | | 59,062,000 | | | | 58,491,113 | | |

Series 2022-FL1, Class A, 6.763% (30-Day SOFR Average+145

basis points), 1/15/2037(a),(b) | | | 57,822,000 | | | | 57,171,474 | | |

Series 2022-FL2, Class A, 7.182% (1-Month Term SOFR+185

basis points), 5/15/2037(a),(b) | | | 35,540,000 | | | | 35,401,799 | | |

BBCMS Trust

Series 2015-SRCH, Class A1, 3.312%, 8/10/2035(a) | | | 10,440,595 | | | | 9,603,930 | | |

BDS Ltd. | |

Series 2021-FL8, Class A, 6.365% (1-Month Term SOFR+103.448

basis points), 1/18/2036(a),(b) | | | 11,823,494 | | | | 11,718,792 | | |

BX Commercial Mortgage Trust | |

Series 2021-VOLT, Class E, 7.446% (1-Month Term SOFR+211.448

basis points), 9/15/2036(a),(b) | | | 28,900,000 | | | | 27,563,225 | | |

HERA Commercial Mortgage Ltd. | |

Series 2021-FL1, Class A, 6.495% (1-Month Term SOFR+116.448

basis points), 2/18/2038(a),(b) | | | 47,157,048 | | | | 45,780,849 | | |

Independence Plaza Trust

Series 2018-INDP, Class A, 3.763%, 7/10/2035(a) | | | 11,081,000 | | | | 10,412,921 | | |

JPMBB Commercial Mortgage Securities Trust