UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

Investment Managers Series Trust III

(Exact name of registrant as specified in charter)

235 West Galena Street

Milwaukee, Wisconsin 53212

(Address of Principal Executive Offices, including Zip Code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, California 91740

(Name and Address of Agent for Service)

COPIES TO:

Laurie Anne Dee

Morgan, Lewis & Bockius LLP

600 Anton Boulevard, Suite 1800

Costa Mesa, California 92626

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

FPA Crescent Fund

Institutional Class/FPACX

SEMI-ANNUAL SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the FPA Crescent Fund (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://fpa.com/funds/overview/crescent. You can also request this information by contacting us at (800) 638-3060.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

FPA Crescent Fund

(Institutional Class/FPACX) | $55 | 1.05% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The FPA Crescent Fund – Institutional Class (“Fund” or “Crescent”) gained 8.76% in the trailing six months 2024 and 16.37% in the trailing twelve months on a net basis, which includes reinvestment of all distributions. The MSCI ACWI Index and the S&P 500 Index returns for the six-month period were 11.30% and 15.29%; 19.38% and 24.56% for the trailing-twelve month period, respectively. The Fund is managed according to FPA’s Contrarian Value Strategy, which seeks to invest in companies that currently appear out of favor or undervalued but have a favorable outlook for growth, in the portfolio manager’s estimation, over 5-10 years. The portfolio managers conduct deep research into the underlying financial condition and prospects of individual companies, and only select those whose securities are offered at a “substantial discount” to the portfolio managers’ estimation of the company’s worth or intrinsic value.

TOP PERFORMANCE CONTRIBUTORS*

Holcim, a building material (largely concrete, cement, and aggregates) company has performed well over the past year. In addition to strong operating performance, management has taken several steps to return value to shareholders and improve awareness of the company's underlying business strength, including repurchasing shares, increasing the dividend, and announcing plans to separate the company's North American business.

Citigroup's shares have appreciated (along with other bank stocks) from a profoundly depressed level of less than 50% of tangible book value to a modestly depressed level of 70%. We expect the company to deliver significantly improved results and sizable capital returns over the next few years.

TOP PERFORMANCE DETRACTORS*

Charter has faced challenging operating conditions that have led to its share price weakness. Competitors have been overbuilding with fiber assets and fixed wireless has proven to be meaningful. There has been concern regarding the sustainability of business derived from subsidized customers. And, the company's near-term capital spending budget has exceeded expectations. Compounding matters, its relatively high leverage ratio adds volatility to its stock price. We look forward to the company demonstrating the competitive strength of its converged (fixed and wireless) connectivity offering, ramping down capital spending, and reaccelerating share repurchases.

CarMax is the largest independent used vehicle dealer in the US. With 245 locations and 30 years of operating experience, CarMax has built a strong brand focused on providing the best user experience for buying a used car. CarMax uses the data from its millions of vehicles purchased and sold to understand the right price to buy, recondition, and sell used vehicles, and as a result, has consistently generated an industry-leading gross profit per unit (GPU) for decades. We believe each part of CarMax’s sales proposition would be difficult for smaller independent peers to replicate, let alone the entire customer value proposition. Even Carvana, CarMax’s best-known peer, lacks:

1. The option to shop in-store or test-drive the vehicle for 24 hours before purchase.

2. CarMax’s range of finance providers.

3. CarMax’s 10-day money back guarantee (Carvana has a shorter 7-day money-back guarantee).

While a recent downturn in used vehicle sales due to the impact of higher inflation and interest rates on monthly vehicle payments has hurt CarMax’s recent volumes and market share, we believe it continues to improve the customer experience, which we think will result in increased vehicle sales volumes and market share gains within its existing store base that should drive higher profits per vehicle and improve the company’s returns on invested capital. As of year-end 2023, CarMax has ~4% of the fragmented used vehicle market, and while we don’t know exactly how big the company can ultimately grow, a good long-term yardstick is CarMax’s oldest stores, which have 10%+ market share (which is still growing).

*The information provided does not reflect all positions purchased, sold or recommended during the trailing twelve months (“TTM”). It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities or sectors listed. As of 6/30/2024, the positions sizes for the securities mentioned as a percentage of net assets was: Holcim (3.3%), Citigroup (2.7%), Charter (1.1%), and CarMax (1.1%). The company data and statistics referenced in the Contributors and Detractors sections, including competitor data, are sourced from company press releases, investor presentations, financial disclosures, SEC filings, or company websites, unless otherwise noted. Past performance is no guarantee, nor is it indicative, of future results.

Indices are unmanaged and do not reflect any commissions, transaction costs, or fees and expenses which would be incurred by an investor purchasing the underlying securities and which would reduce the performance in an actual account. You cannot invest directly in an index. The MSCI ACWI USD Index is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The S&P 500 Index includes a representative sample of 500 hundred companies in leading industries of the U.S. economy. The Index focuses on the large-cap segment of the market, with over 80% coverage of U.S. equities, but is also considered a proxy for the total market.

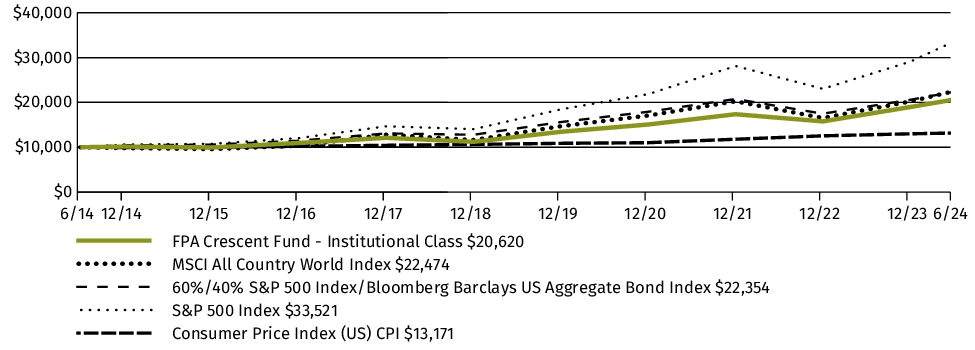

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 6 Months | 1 Year | 5 Years | 10 Years |

| FPA Crescent Fund (Institutional Class/FPACX) | 8.76% | 16.37% | 9.96% | 7.50% |

| MSCI All Country World Index | 11.30% | 19.38% | 10.76% | 8.43% |

| 60%/40% S&P 500 Index/Bloomberg Barclays US Aggregate Bond Index | 8.70% | 15.42% | 9.01% | 8.38% |

| S&P 500 Index | 15.29% | 24.56% | 15.05% | 12.86% |

| Consumer Price Index (US) CPI | 1.36% | 3.03% | 4.15% | 2.79% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://fpa.com/funds/overview/crescent for the most recent performance information.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $10,379,527,285% |

| Total number of portfolio holdings | $164% |

| Total advisory fee paid/(reimbursed) | $45,408,257% |

| Portfolio turnover rate as of the end of the reporting period | $4% |

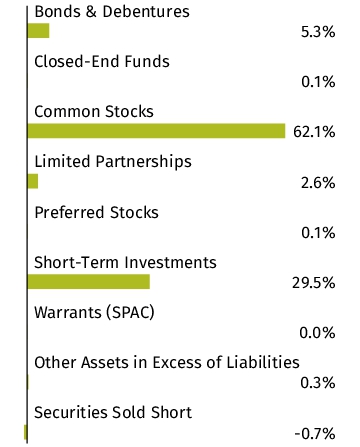

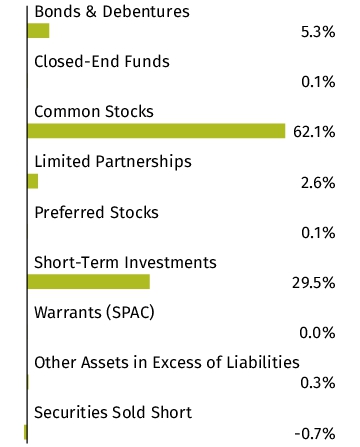

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Top Ten Holdings table may not reflect the total exposure to an issuer. The Sector Allocation chart represents Common Stocks of the Fund.

| Alphabet, Inc. - Class A | 3.6% |

| Holcim AG | 3.3% |

| Analog Devices, Inc. | 3.1% |

| Meta Platforms, Inc. - Class A | 3.0% |

| Citigroup, Inc. | 2.7% |

| Comcast Corp. - Class A | 2.7% |

| TE Connectivity Ltd. | 2.7% |

| International Flavors & Fragrances, Inc. | 2.4% |

| Alphabet, Inc. - Class C | 2.4% |

| Jefferies Financial Group, Inc. | 2.3% |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://fpa.com/funds/overview/crescent. You can also request this information by contacting us at (800) 638-3060.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communications to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (800) 638-3060 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

UMB Distribution Services, LLC serves as the Fund's distributor.

FPA Crescent Fund

Investor Class/FPFRX

SEMI-ANNUAL SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the FPA Crescent Fund (“Fund”) for the period of April 30, 2024 (commencement of operations) to June 30, 2024. You can find additional information about the Fund at https://fpa.com/funds/overview/crescent. You can also request this information by contacting us at (800) 638-3060.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

FPA Crescent Fund

(Investor Class/FPFRX)1 | $20 | 1.15% |

| 1 | The Investor Class commenced operations on April 30, 2024. If the Investor Class had been operational for the entire semi-annual period of January 1, 2024 to June 30, 2024, expenses would have been higher. |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The FPA Crescent Fund – Investor Class (“Fund” or “Crescent”) gained 8.71%1 in the trailing six months 2024 and 16.26%1 in the trailing twelve months on a net basis, which includes reinvestment of all distributions. The MSCI ACWI Index and the S&P 500 Index returns for the six-month period were 11.30% and 15.29%; 19.38% and 24.56% for the trailing-twelve month period, respectively. The Fund is managed according to FPA’s Contrarian Value Strategy, which seeks to invest in companies that currently appear out of favor or undervalued but have a favorable outlook for growth, in the portfolio manager’s estimation, over 5-10 years. The portfolio managers conduct deep research into the underlying financial condition and prospects of individual companies, and only select those whose securities are offered at a “substantial discount” to the portfolio managers’ estimation of the company’s worth or intrinsic value.

TOP PERFORMANCE CONTRIBUTORS*

Holcim, a building material (largely concrete, cement, and aggregates) company has performed well over the past year. In addition to strong operating performance, management has taken several steps to return value to shareholders and improve awareness of the company's underlying business strength, including repurchasing shares, increasing the dividend, and announcing plans to separate the company's North American business.

Citigroup's shares have appreciated (along with other bank stocks) from a profoundly depressed level of less than 50% of tangible book value to a modestly depressed level of 70%. We expect the company to deliver significantly improved results and sizable capital returns over the next few years.

TOP PERFORMANCE DETRACTORS*

Charter has faced challenging operating conditions that have led to its share price weakness. Competitors have been overbuilding with fiber assets and fixed wireless has proven to be meaningful. There has been concern regarding the sustainability of business derived from subsidized customers. And, the company's near-term capital spending budget has exceeded expectations. Compounding matters, its relatively high leverage ratio adds volatility to its stock price. We look forward to the company demonstrating the competitive strength of its converged (fixed and wireless) connectivity offering, ramping down capital spending, and reaccelerating share repurchases.

CarMax is the largest independent used vehicle dealer in the US. With 245 locations and 30 years of operating experience, CarMax has built a strong brand focused on providing the best user experience for buying a used car. CarMax uses the data from its millions of vehicles purchased and sold to understand the right price to buy, recondition, and sell used vehicles, and as a result, has consistently generated an industry-leading gross profit per unit (GPU) for decades. We believe each part of CarMax’s sales proposition would be difficult for smaller independent peers to replicate, let alone the entire customer value proposition. Even Carvana, CarMax’s best-known peer, lacks:

1. The option to shop in-store or test-drive the vehicle for 24 hours before purchase.

2. CarMax’s range of finance providers.

3. CarMax’s 10-day money back guarantee (Carvana has a shorter 7-day money-back guarantee).

While a recent downturn in used vehicle sales due to the impact of higher inflation and interest rates on monthly vehicle payments has hurt CarMax’s recent volumes and market share, we believe it continues to improve the customer experience, which we think will result in increased vehicle sales volumes and market share gains within its existing store base that should drive higher profits per vehicle and improve the company’s returns on invested capital. As of year-end 2023, CarMax has ~4% of the fragmented used vehicle market, and while we don’t know exactly how big the company can ultimately grow, a good long-term yardstick is CarMax’s oldest stores, which have 10%+ market share (which is still growing).

*The information provided does not reflect all positions purchased, sold or recommended during the trailing twelve months (“TTM”). It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities or sectors listed. As of 6/30/2024, the positions sizes for the securities mentioned as a percentage of net assets was: Holcim (3.3%), Citigroup (2.7%), Charter (1.1%), and CarMax (1.1%). The company data and statistics referenced in the Contributors and Detractors sections, including competitor data, are sourced from company press releases, investor presentations, financial disclosures, SEC filings, or company websites, unless otherwise noted. Past performance is no guarantee, nor is it indicative, of future results.

Indices are unmanaged and do not reflect any commissions, transaction costs, or fees and expenses which would be incurred by an investor purchasing the underlying securities and which would reduce the performance in an actual account. You cannot invest directly in an index. The MSCI ACWI USD Index is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The S&P 500 Index includes a representative sample of 500 hundred companies in leading industries of the U.S. economy. The Index focuses on the large-cap segment of the market, with over 80% coverage of U.S. equities, but is also considered a proxy for the total market.

1Investor Class shares commenced operations on April 30, 2024. The performance figures for Investor Class shares include the performance for the Institutional shares for the periods prior to the inception date of Investor Class shares, adjusted for the difference in Institutional Class shares and Investor Class shares expenses. Investor Class shares impose higher expenses than Institutional Class shares. Since Investor Class shares have higher expenses and are therefore more expensive than Institutional Class shares, the returns for Investor Class shares will be lower than the returns shown for Institutional Class shares.”

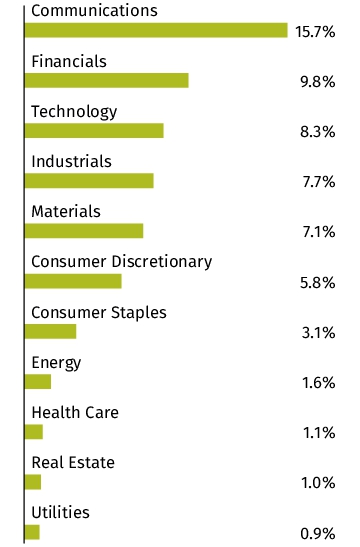

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 6 Months | 1 Year | 5 Years | 10 Years |

| FPA Crescent Fund (Investor Class/FPFRX)1 | 8.71% | 16.26% | 9.85% | 7.40% |

| MSCI All Country World Index | 11.30% | 19.38% | 10.76% | 8.43% |

| 60%/40% S&P 500 Index/Bloomberg Barclays US Aggregate Bond Index | 8.70% | 15.42% | 9.01% | 8.38% |

| S&P 500 Index | 15.29% | 24.56% | 15.05% | 12.86% |

| Consumer Price Index (US) CPI | 1.36% | 3.03% | 4.15% | 2.79% |

| 1 | Investor Class commenced operations on April 30, 2024. The performance figures for Investor Class shares include the performance for the Institutional Class shares for the periods prior to the inception date of Investor Class shares, adjusted for the difference in Institutional Class shares and Investor Class shares expenses. Investor Class shares impose higher expenses than Institutional Class shares. Since Investor Class shares have higher expenses and are therefore more expensive than Institutional Class shares, the returns for Investor Class shares will be lower than the returns shown for Institutional Class shares. |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://fpa.com/funds/overview/crescent for the most recent performance information.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $10,379,527,285% |

| Total number of portfolio holdings | $164% |

| Total advisory fee paid/(reimbursed) | $45,408,257% |

| Portfolio turnover rate as of the end of the reporting period | $4% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Top Ten Holdings table may not reflect the total exposure to an issuer. The Sector Allocation chart represents Common Stocks of the Fund.

| Alphabet, Inc. - Class A | 3.6% |

| Holcim AG | 3.3% |

| Analog Devices, Inc. | 3.1% |

| Meta Platforms, Inc. - Class A | 3.0% |

| Citigroup, Inc. | 2.7% |

| Comcast Corp. - Class A | 2.7% |

| TE Connectivity Ltd. | 2.7% |

| International Flavors & Fragrances, Inc. | 2.4% |

| Alphabet, Inc. - Class C | 2.4% |

| Jefferies Financial Group, Inc. | 2.3% |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://fpa.com/funds/overview/crescent. You can also request this information by contacting us at (800) 638-3060.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communications to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (800) 638-3060 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

UMB Distribution Services, LLC serves as the Fund's distributor.

FPA Crescent Fund

Supra Institutional Class/FPCSX

SEMI-ANNUAL SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the FPA Crescent Fund (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://fpa.com/funds/overview/crescent. You can also request this information by contacting us at (800) 638-3060.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

FPA Crescent Fund

(Supra Institutional Class/FPCSX) | $51 | 0.99% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The FPA Crescent Fund – Supra Institutional Class (“Fund” or “Crescent”) gained 8.81% in the trailing six months 2024 and 16.46% in the trailing twelve months on a net basis, which includes reinvestment of all distributions. The MSCI ACWI Index and the S&P 500 Index returns for the six-month period were 11.30% and 15.29%; 19.38% and 24.56% for the trailing-twelve month period, respectively. The Fund is managed according to FPA’s Contrarian Value Strategy, which seeks to invest in companies that currently appear out of favor or undervalued but have a favorable outlook for growth, in the portfolio manager’s estimation, over 5-10 years. The portfolio managers conduct deep research into the underlying financial condition and prospects of individual companies, and only select those whose securities are offered at a “substantial discount” to the portfolio managers’ estimation of the company’s worth or intrinsic value.

TOP PERFORMANCE CONTRIBUTORS*

Holcim, a building material (largely concrete, cement, and aggregates) company has performed well over the past year. In addition to strong operating performance, management has taken several steps to return value to shareholders and improve awareness of the company's underlying business strength, including repurchasing shares, increasing the dividend, and announcing plans to separate the company's North American business.

Citigroup's shares have appreciated (along with other bank stocks) from a profoundly depressed level of less than 50% of tangible book value to a modestly depressed level of 70%. We expect the company to deliver significantly improved results and sizable capital returns over the next few years.

TOP PERFORMANCE DETRACTORS*

Charter has faced challenging operating conditions that have led to its share price weakness. Competitors have been overbuilding with fiber assets and fixed wireless has proven to be meaningful. There has been concern regarding the sustainability of business derived from subsidized customers. And, the company's near-term capital spending budget has exceeded expectations. Compounding matters, its relatively high leverage ratio adds volatility to its stock price. We look forward to the company demonstrating the competitive strength of its converged (fixed and wireless) connectivity offering, ramping down capital spending, and reaccelerating share repurchases.

CarMax is the largest independent used vehicle dealer in the US. With 245 locations and 30 years of operating experience, CarMax has built a strong brand focused on providing the best user experience for buying a used car. CarMax uses the data from its millions of vehicles purchased and sold to understand the right price to buy, recondition, and sell used vehicles, and as a result, has consistently generated an industry-leading gross profit per unit (GPU) for decades. We believe each part of CarMax’s sales proposition would be difficult for smaller independent peers to replicate, let alone the entire customer value proposition. Even Carvana, CarMax’s best-known peer, lacks:

1. The option to shop in-store or test-drive the vehicle for 24 hours before purchase.

2. CarMax’s range of finance providers.

3. CarMax’s 10-day money back guarantee (Carvana has a shorter 7-day money-back guarantee).

While a recent downturn in used vehicle sales due to the impact of higher inflation and interest rates on monthly vehicle payments has hurt CarMax’s recent volumes and market share, we believe it continues to improve the customer experience, which we think will result in increased vehicle sales volumes and market share gains within its existing store base that should drive higher profits per vehicle and improve the company’s returns on invested capital. As of year-end 2023, CarMax has ~4% of the fragmented used vehicle market, and while we don’t know exactly how big the company can ultimately grow, a good long-term yardstick is CarMax’s oldest stores, which have 10%+ market share (which is still growing).

*The information provided does not reflect all positions purchased, sold or recommended during the trailing twelve months (“TTM”). It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities or sectors listed. As of 6/30/2024, the positions sizes for the securities mentioned as a percentage of net assets was: Holcim (3.3%), Citigroup (2.7%), Charter (1.1%), and CarMax (1.1%). The company data and statistics referenced in the Contributors and Detractors sections, including competitor data, are sourced from company press releases, investor presentations, financial disclosures, SEC filings, or company websites, unless otherwise noted. Past performance is no guarantee, nor is it indicative, of future results.

Indices are unmanaged and do not reflect any commissions, transaction costs, or fees and expenses which would be incurred by an investor purchasing the underlying securities and which would reduce the performance in an actual account. You cannot invest directly in an index. The MSCI ACWI USD Index is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The S&P 500 Index includes a representative sample of 500 hundred companies in leading industries of the U.S. economy. The Index focuses on the large-cap segment of the market, with over 80% coverage of U.S. equities, but is also considered a proxy for the total market.

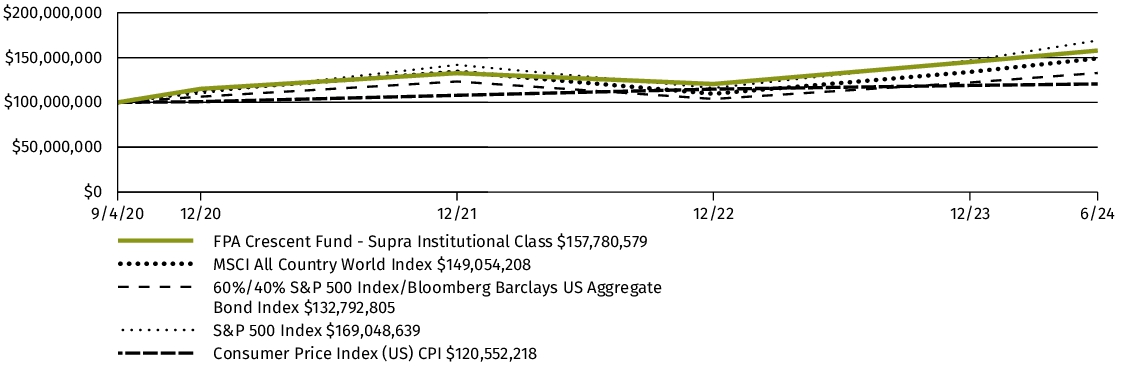

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $100,000,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $100,000,000

| AVERAGE ANNUAL TOTAL RETURN | 6 Months | 1 Year | Since

Inception1 |

| FPA Crescent Fund (Supra Institutional Class/FPCSX) | 8.81% | 16.46% | 12.68% |

| MSCI All Country World Index | 11.30% | 19.38% | 11.02% |

| 60%/40% S&P 500 Index/Bloomberg Barclays US Aggregate Bond Index | 8.70% | 15.42% | 7.71% |

| S&P 500 Index | 15.29% | 24.56% | 14.74% |

| Consumer Price Index (US) CPI | 1.36% | 3.03% | 5.00% |

| 1 | Supra Institutional Class commenced operations on September 4, 2020. |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://fpa.com/funds/overview/crescent for the most recent performance information.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $10,379,527,285% |

| Total number of portfolio holdings | $164% |

| Total advisory fee paid/(reimbursed) | $45,408,257% |

| Portfolio turnover rate as of the end of the reporting period | $4% |

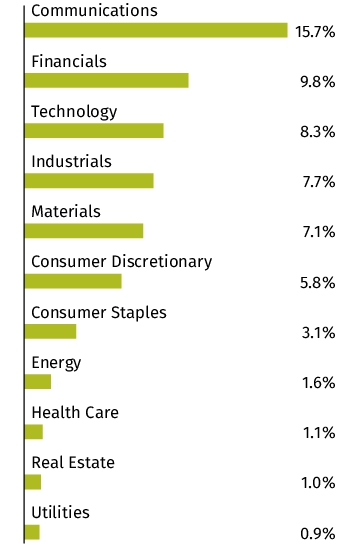

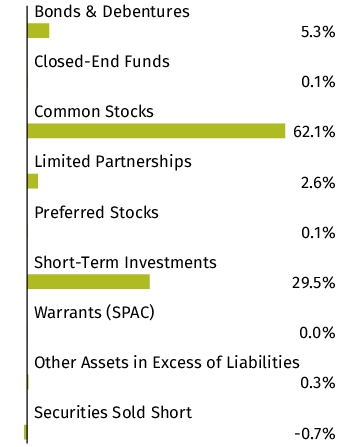

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Top Ten Holdings table may not reflect the total exposure to an issuer. The Sector Allocation chart represents Common Stocks of the Fund.

| Alphabet, Inc. - Class A | 3.6% |

| Holcim AG | 3.3% |

| Analog Devices, Inc. | 3.1% |

| Meta Platforms, Inc. - Class A | 3.0% |

| Citigroup, Inc. | 2.7% |

| Comcast Corp. - Class A | 2.7% |

| TE Connectivity Ltd. | 2.7% |

| International Flavors & Fragrances, Inc. | 2.4% |

| Alphabet, Inc. - Class C | 2.4% |

| Jefferies Financial Group, Inc. | 2.3% |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://fpa.com/funds/overview/crescent. You can also request this information by contacting us at (800) 638-3060.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communications to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (800) 638-3060 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

UMB Distribution Services, LLC serves as the Fund's distributor.

FPA Flexible Fixed Income Fund

Advisor Class/FFIAX

SEMI-ANNUAL SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the FPA Flexible Fixed Income Fund (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://fpa.com/funds/overview/flexible-fixed-income. You can also request this information by contacting us at (800) 638-3060.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

FPA Flexible Fixed Income Fund

(Advisor Class/FFIAX) | $30 | 0.60% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

For the twelve-month period ending June 30, 2024, the FPA Flexible Fixed Income Fund’s Advisor Class (“Fund”) net return was 7.84%, which includes reinvestment of all distributions and for the six-month period, net return was 2.37%.

What affected the Fund’s performance?

Most recently citing “modest further progress” toward its inflation objective, the Federal Reserve left the Fed Funds rate unchanged during the quarter.1 The Federal Reserve further explained that it is looking for “greater confidence that inflation is moving sustainably toward two percent” before reducing the Fed Funds rate.2 Treasury yields increased by 35-54 basis points across the yield curve during the first half of 2024 while, generally, debt market spreads did not change meaningfully, notwithstanding changes in spreads in certain segments of the market.3

We have been taking of advantage higher yields to buy longer-duration bonds, because we believe these bonds not only offer an attractive absolute long-term return but also improve the short-term return profile of the portfolio. During the second quarter, we bought fixed-rate, High Quality bonds including agency-guaranteed residential mortgage pools, non-agency residential mortgage-backed securities (RMBS), agency-guaranteed commercial mortgage-backed securities (CMBS), asset-backed securities (ABS) backed by equipment, ABS backed by prime quality auto loans, non-agency CMBS backed by single-family rental properties, and ABS backed by credit card receivables. These investments had a weighted average life of 6.4 years and a weighted average duration of 5.3 years. We also extended the duration of the Fund’s Treasury holdings.

We do not generally view Credit (investments rated BBB or lower) as attractively priced but we continue to search and will seek to opportunistically invest in Credit when we believe that the price adequately compensates for the risk of permanent impairment of capital and near-term mark-to-market risk.4 On an absolute basis, we still see an attractive opportunity to buy longer duration, High Quality bonds (rated single-A or higher) which we believe will enhance the Fund’s long-term returns and the Fund’s short-term upside versus downside return profile.

Fund performance can be attributed to the following:5

The largest contributors to performance during the first half of 2024 were collateralized loan obligations (CLO) backed by corporate loans which benefited from coupon payments and higher prices due to lower spreads. The second largest contributors to performance were the corporate bond and loan holdings with the return due to a combination of coupon payments and price appreciation caused by a decrease in spreads. The third largest contributors to performance were asset-backed securities (ABS) backed by equipment due to coupon payments, partially offset by lower prices caused by an increase in risk-free rates.

The only detractor from performance was the Fund’s Treasury holdings due to a decrease in price caused by an increase in risk-free rates. While there were other individual bonds that detracted from performance, there were no other detractors at the sector level.

1 Federal Reserve Open Market Committee statement on 6/12/2024.

2 Federal Reserve Chairman Jerome Powell’s press conference on 6/12/2024.

3 Source: Bloomberg. Debt market is represented by the Bloomberg U.S. Aggregate Bond index. Basis Point (bps) is equal to one hundredth of one percent, or 0.01%. Credit Spread or Spread is the difference in yield between a U.S. Treasury bond and another debt security of the same maturity but different credit quality.

4 The ratings agencies that provide ratings are the Nationally Recognized Statistical Ratings Organizations (NRSROs): DBRS, Inc., Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc., Moody’s Investors Service, Inc., and S&P Global Ratings. Credit ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings of BB and below are lower-rated securities (junk bonds). High-yielding, non-investment grade bonds (junk bonds) involve higher risks than investment grade bonds. Bonds with credit ratings of CCC or below have higher default risk.

5 This information is not a recommendation for a specific security or sector and these securities/sectors may not be in the Fund at the time you receive this report. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. The portfolio holdings as of the most recent quarter-end may be obtained at fpa.com.

Past performance is no guarantee, nor is it indicative, of future results.

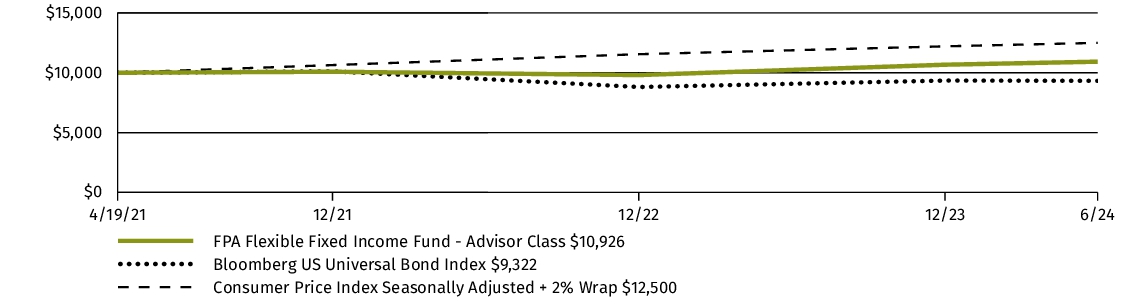

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 6 Months | 1 Year | Since

Inception1 |

| FPA Flexible Fixed Income Fund (Advisor Class/FFIAX) | 2.37% | 7.84% | 2.81% |

| Bloomberg US Universal Bond Index | -0.28% | 3.47% | -2.17% |

| Consumer Price Index Seasonally Adjusted + 2% Wrap | 2.41% | 5.05% | 7.51% |

| 1 | Advisor Class commenced operations on April 19, 2021. |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://fpa.com/funds/overview/flexible-fixed-income for the most recent performance information.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $1,149,171,922% |

| Total number of portfolio holdings | $361% |

| Total advisory fee paid/(reimbursed) | $2,356,759% |

| Portfolio turnover rate as of the end of the reporting period | $25% |

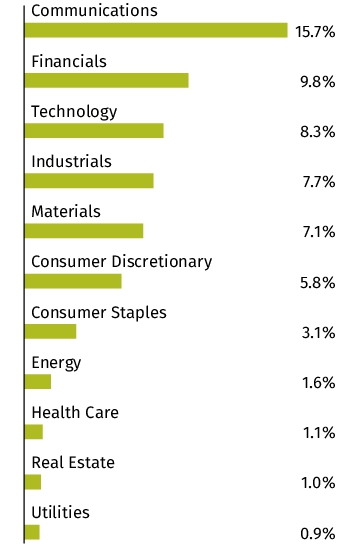

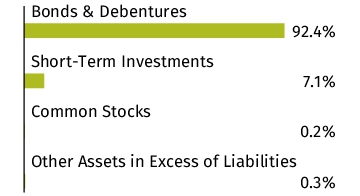

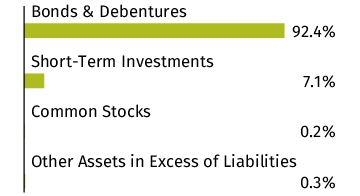

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Top Ten Holdings table may not reflect the total exposure to an issuer. Interest rate presented in the Top Ten Holdings are as of the reporting period end. The Sector Allocation chart represents Bonds & Debentures of the Fund.

| U.S. Treasury Note, 4.125%, 3/31/2029 | 4.6% |

| U.S. Treasury Note, 4.250%, 2/28/2029 | 3.7% |

| U.S. Treasury Note, 4.000%, 1/31/2029 | 2.2% |

| Fannie Mae Pool, 1.000%, 3/1/2037 | 1.4% |

| U.S. Treasury Note, 4.625%, 9/30/2030 | 1.0% |

| Fannie Mae Pool, 1.500%, 8/1/2036 | 0.9% |

| Ford Credit Floorplan Master Owner Trust A, Series 2018-4, Class A, 4.060%, 11/15/2030 | 0.9% |

| Verizon Master Trust, Series 2024-2, Class A, 4.830%, 12/22/2031 | 0.9% |

| Midcap Financial Issuer Trust, 6.500%, 5/1/2028 | 0.9% |

| Fannie Mae Pool, 1.000%, 12/1/2036 | 0.9% |

Material Fund Changes

Effective May 1, 2024, the Fund's Advisor Class the contractual expense limit was changed from 0.60% to 0.604%.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's prospectus, which is dated April 30, 2024 at https://fpa.com/funds/overview/flexible-fixed-income.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://fpa.com/funds/overview/flexible-fixed-income. You can also request this information by contacting us at (800) 638-3060.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communications to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (800) 638-3060 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

UMB Distribution Services, LLC serves as the Fund's distributor.

FPA Flexible Fixed Income Fund

Institutional Class/FPFIX

SEMI-ANNUAL SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the FPA Flexible Fixed Income Fund (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://fpa.com/funds/overview/flexible-fixed-income. You can also request this information by contacting us at (800) 638-3060.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

FPA Flexible Fixed Income Fund

(Institutional Class/FPFIX) | $28 | 0.55% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

For the twelve-month period ending June 30, 2024, the FPA Flexible Fixed Income Fund’s Institutional Class (“Fund”) net return was 7.87%, which includes reinvestment of all distributions and for the six-month period, net return was 2.39%.

What affected the Fund’s performance?

Most recently citing “modest further progress” toward its inflation objective, the Federal Reserve left the Fed Funds rate unchanged during the quarter.1 The Federal Reserve further explained that it is looking for “greater confidence that inflation is moving sustainably toward two percent” before reducing the Fed Funds rate.2 Treasury yields increased by 35-54 basis points across the yield curve during the first half of 2024 while, generally, debt market spreads did not change meaningfully, notwithstanding changes in spreads in certain segments of the market.3

We have been taking of advantage higher yields to buy longer-duration bonds, because we believe these bonds not only offer an attractive absolute long-term return but also improve the short-term return profile of the portfolio. During the second quarter, we bought fixed-rate, High Quality bonds including agency-guaranteed residential mortgage pools, non-agency residential mortgage-backed securities (RMBS), agency-guaranteed commercial mortgage-backed securities (CMBS), asset-backed securities (ABS) backed by equipment, ABS backed by prime quality auto loans, non-agency CMBS backed by single-family rental properties, and ABS backed by credit card receivables. These investments had a weighted average life of 6.4 years and a weighted average duration of 5.3 years. We also extended the duration of the Fund’s Treasury holdings.

We do not generally view Credit (investments rated BBB or lower) as attractively priced but we continue to search and will seek to opportunistically invest in Credit when we believe that the price adequately compensates for the risk of permanent impairment of capital and near-term mark-to-market risk.4 On an absolute basis, we still see an attractive opportunity to buy longer duration, High Quality bonds (rated single-A or higher) which we believe will enhance the Fund’s long-term returns and the Fund’s short-term upside versus downside return profile.

Fund performance can be attributed to the following:5

The largest contributors to performance during the first half of 2024 were collateralized loan obligations (CLO) backed by corporate loans which benefited from coupon payments and higher prices due to lower spreads. The second largest contributors to performance were the corporate bond and loan holdings with the return due to a combination of coupon payments and price appreciation caused by a decrease in spreads. The third largest contributors to performance were asset-backed securities (ABS) backed by equipment due to coupon payments, partially offset by lower prices caused by an increase in risk-free rates.

The only detractor from performance was the Fund’s Treasury holdings due to a decrease in price caused by an increase in risk-free rates. While there were other individual bonds that detracted from performance, there were no other detractors at the sector level.

1 Federal Reserve Open Market Committee statement on 6/12/2024.

2 Federal Reserve Chairman Jerome Powell’s press conference on 6/12/2024.

3 Source: Bloomberg. Debt market is represented by the Bloomberg U.S. Aggregate Bond index. Basis Point (bps) is equal to one hundredth of one percent, or 0.01%. Credit Spread or Spread is the difference in yield between a U.S. Treasury bond and another debt security of the same maturity but different credit quality.

4 The ratings agencies that provide ratings are the Nationally Recognized Statistical Ratings Organizations (NRSROs): DBRS, Inc., Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc., Moody’s Investors Service, Inc., and S&P Global Ratings. Credit ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings of BB and below are lower-rated securities (junk bonds). High-yielding, non-investment grade bonds (junk bonds) involve higher risks than investment grade bonds. Bonds with credit ratings of CCC or below have higher default risk.

5 This information is not a recommendation for a specific security or sector and these securities/sectors may not be in the Fund at the time you receive this report. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. The portfolio holdings as of the most recent quarter-end may be obtained at fpa.com.

Past performance is no guarantee, nor is it indicative, of future results.

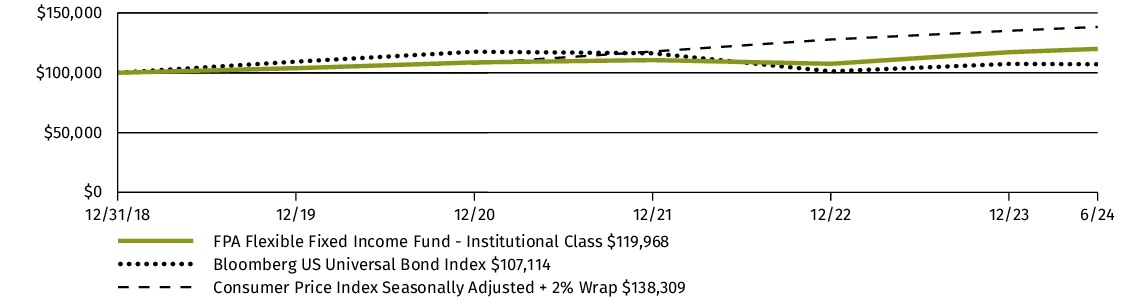

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $100,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $100,000

| AVERAGE ANNUAL TOTAL RETURN | 6 Months | 1 Year | 5 Years | Since

Inception1 |

| FPA Flexible Fixed Income Fund (Institutional Class/FPFIX) | 2.39% | 7.87% | 3.17% | 3.37% |

| Bloomberg US Universal Bond Index | -0.28% | 3.47% | 0.11% | 1.26% |

| Consumer Price Index Seasonally Adjusted + 2% Wrap | 2.41% | 5.05% | 6.25% | 6.04% |

| 1 | Institutional Class commenced operations on December 31, 2018. |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit https://fpa.com/funds/overview/flexible-fixed-income for the most recent performance information.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $1,149,171,922% |

| Total number of portfolio holdings | $361% |

| Total advisory fee paid/(reimbursed) | $2,356,759% |

| Portfolio turnover rate as of the end of the reporting period | $25% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Top Ten Holdings table may not reflect the total exposure to an issuer. Interest rate presented in the Top Ten Holdings are as of the reporting period end. The Sector Allocation chart represents Bonds & Debentures of the Fund.

| U.S. Treasury Note, 4.125%, 3/31/2029 | 4.6% |

| U.S. Treasury Note, 4.250%, 2/28/2029 | 3.7% |

| U.S. Treasury Note, 4.000%, 1/31/2029 | 2.2% |

| Fannie Mae Pool, 1.000%, 3/1/2037 | 1.4% |

| U.S. Treasury Note, 4.625%, 9/30/2030 | 1.0% |

| Fannie Mae Pool, 1.500%, 8/1/2036 | 0.9% |

| Ford Credit Floorplan Master Owner Trust A, Series 2018-4, Class A, 4.060%, 11/15/2030 | 0.9% |

| Verizon Master Trust, Series 2024-2, Class A, 4.830%, 12/22/2031 | 0.9% |

| Midcap Financial Issuer Trust, 6.500%, 5/1/2028 | 0.9% |

| Fannie Mae Pool, 1.000%, 12/1/2036 | 0.9% |

Material Fund Changes

Effective May 1, 2024, the Fund's Institutional Class the contractual expense limit was changed from 0.55% to 0.554%.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's prospectus, which is dated April 30, 2024 at https://fpa.com/funds/overview/flexible-fixed-income.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://fpa.com/funds/overview/flexible-fixed-income. You can also request this information by contacting us at (800) 638-3060.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communications to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (800) 638-3060 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

UMB Distribution Services, LLC serves as the Fund's distributor.

(b) Not applicable.

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

FPA Crescent Fund

(Institutional Class: FPACX)

(Investor Class: FPFRX)

(Supra Institutional Class: FPCSX)

SEMI-ANNUAL FINANCIALS AND OTHER INFORMATION

JUNE 30, 2024

FPA Crescent Fund

A series of Investment Managers Series Trust III

Table of Contents

| Item 7. Financial Statements and Financial Highlights | |

| Schedule of Investments | 1 |

| Statement of Assets and Liabilities | 10 |

| Statement of Operations | 11 |

| Statements of Changes in Net Assets | 12 |

| Financial Highlights | 13 |

| Notes to Financial Statements | 16 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the FPA Crescent Fund (the “Fund”). This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective shareholder report and prospectus.

www.fpa.com

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

FPA Crescent Fund

SCHEDULE OF INVESTMENTS

As of June 30, 2024 (Unaudited)

Principal

Amount | | | | | Value | |

| | | | BONDS & DEBENTURES — 5.3% | | | |

| | | | | COMMERCIAL MORTGAGE-BACKED SECURITIES — 0.1% | | | | |

| | | | | AGENCY — 0.1% | | | | |

| | | | | Eleven Madison Mortgage Trust | | | | |

| $ | 12,681,000 | | | Series 2015-11MD, Class A, 3.673%, 9/10/2035(a),(b) | | $ | 12,115,459 | |

| | | | | TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES | | | | |

| | | | | (Cost $11,328,615) | | | 12,115,459 | |

| | | | | CONVERTIBLE BONDS — 1.8% | | | | |

| | | | | Delivery Hero AG | | | | |

| | 2,600,000 | | | 1.000%, 4/30/2026 | | | 2,513,555 | |

| | 86,200,000 | | | 1.000%, 1/23/2027 | | | 76,357,064 | |

| | 1,600,000 | | | 1.500%, 1/15/2028 | | | 1,319,539 | |

| | 4,300,000 | | | 3.250%, 2/21/2030 | | | 4,006,342 | |

| | | | | Wayfair, Inc. | | | | |

| | 84,672,000 | | | 0.625%, 10/1/2025 | | | 78,746,061 | |

| | 4,278,000 | | | 1.000%, 8/15/2026 | | | 3,848,994 | |

| | | | | Zillow Group, Inc. | | | | |

| | 1,703,000 | | | 2.750%, 5/15/2025 | | | 1,716,440 | |

| | 12,336,000 | | | 1.375%, 9/1/2026 | | | 14,872,417 | |

| | | | | TOTAL CONVERTIBLE BONDS | | | | |

| | | | | (Cost $176,608,356) | | | 183,380,412 | |

| | | | | CORPORATE BANK DEBT — 0.9% | | | | |

| | | | | CB&I STS Delaware LLC | | | | |

| | | | | 13.096% (3-Month Term SOFR+776.2 basis points), | | | | |

| | 41,356,147 | | | 12/31/2026(b),(c),(d),(e),(f),(g) | | | 41,769,708 | |

| | | | | Cornerstone OnDemand, Inc. | | | | |

| | 2,525,781 | | | 9.343% (1-Month Term SOFR+375 basis points), 10/16/2028(b),(d),(g) | | | 2,374,234 | |

| | | | | Farfetch U.S. Holdings, Inc. | | | | |

| | 21,182,895 | | | 11.575% (3-Month Term SOFR+625 basis points), 10/20/2027(b),(d),(g) | | | 19,647,135 | |

| | | | | Lealand Finance Company B.V. Senior Exit LC | | | | |

| | (26,423,879 | ) | | 3.500%, 6/30/2027(b),(c),(d),(e),(g),(h),(i) | | | (14,112,245 | ) |

| | | | | Lealand Reficar LC Term Loan | | | | |

| | 2,484,394 | | | 12.798% (3-Month Term SOFR+750 basis points), 6/30/2027(b),(c),(d),(e),(g),(h),(i) | | | 2,065,454 | |

| | | | | McDermott LC | | | | |

| | 31,488,530 | | | 9.593%, 6/30/2027(b),(c),(d),(e),(g),(h) | | | 16,374,036 | |

| | | | | McDermott Tanks Escrow LC | | | | |

| | 7,265,394 | | | 6.346% (3-Month Term SOFR+101.2 basis points), 12/31/2026(b),(c),(d),(e),(g) | | | 3,778,005 | |

| | | | | McDermott Technology Americas, Inc. | | | | |

| | 1,074,221 | | | 8.458% (1-Month Term SOFR+300 basis points), 6/30/2027(b),(c),(d),(g) | | | 590,821 | |

| | 38,775,902 | | | 9.457% (1-Month Term SOFR+400 basis points), 12/31/2027(b),(c),(d),(f),(g) | | | 17,061,397 | |

| | | | | Vision Solutions, Inc. | | | | |

| | 2,525,553 | | | 11.750% (3-Month Term SOFR+400 basis points), 4/24/2028(b),(d),(g) | | | 2,484,513 | |

| | | | | TOTAL CORPORATE BANK DEBT | | | | |

| | | | | (Cost $144,966,055) | | | 92,033,058 | |

FPA Crescent Fund

SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2024 (Unaudited)

Principal

Amount | | | | | Value | |

| | | | CORPORATE BONDS — 0.3% | | | |

| | | | | ENERGY — 0.0% | | | | |

| | | | | Gulfport Energy Corp. | | | | |

| $ | 637,767 | | | 8.000%, 5/17/2026 | | $ | 641,976 | |

| | | | | FINANCIALS — 0.3% | | | | |

| | | | | Charles Schwab Corp. | | | | |

| | 18,976,000 | | | 4.000% (USD 5 Year Tsy+316.8 basis points)(b),(j) | | | 17,595,358 | |

| | 2,588,000 | | | 5.000% (3-Month USD Libor+257.5 basis points)(b),(j) | | | 2,351,845 | |

| | | | | Vornado Realty LP | | | | |

| | 8,815,000 | | | 3.500%, 1/15/2025 | | | 8,682,775 | |

| | 8,623,000 | | | 2.150%, 6/1/2026 | | | 7,914,448 | |

| | | | | | | | 36,544,426 | |

| | | | | TOTAL CORPORATE BONDS | | | | |

| | | | | (Cost $33,647,812) | | | 37,186,402 | |

| | | | | U.S. TREASURY NOTES & BONDS — 2.2% | | | | |

| | | | | U.S. Treasury Note | | | | |

| | 231,000,000 | | | 5.000%, 8/31/2025 | | | 230,783,784 | |

| | | | | TOTAL U.S. TREASURY NOTES & BONDS | | | | |

| | | | | (Cost $231,394,400) | | | 230,783,784 | |

| | | | | TOTAL BONDS & DEBENTURES | | | | |

| | | | | (Cost $597,945,238) | | | 555,499,115 | |

Number

of Shares | | | | | | |

| | | | | CLOSED-END FUNDS — 0.1% | | | | |

| | 4,756,180 | | | Altegrity, Inc.(e),(g) | | | 11,081,900 | |

| | | | | TOTAL CLOSED-END FUNDS | | | | |

| | | | | (Cost $0) | | | 11,081,900 | |

| | | | | COMMON STOCKS — 62.1% | | | | |

| | | | | AEROSPACE & DEFENSE — 2.1% | | | | |

| | 796,571 | | | Howmet Aerospace, Inc. | | | 61,837,807 | |

| | 724,451 | | | Safran S.A. | | | 153,144,814 | |

| | | | | | | | 214,982,621 | |

| | | | | APPAREL & TEXTILE PRODUCTS — 0.9% | | | | |

| | 606,475 | | | Cie Financiere Richemont S.A. - Class A | | | 94,666,799 | |

| | | | | ASSET MANAGEMENT — 1.3% | | | | |

| | 273,088 | | | Groupe Bruxelles Lambert N.V. | | | 19,491,663 | |

| | 408,466 | | | LPL Financial Holdings, Inc. | | | 114,084,554 | |

| | 457,176 | | | Pershing Square Tontine Holdings Ltd.(e),(g) | | | - | |

| | | | | | | | 133,576,217 | |

| | | | | BANKING — 4.7% | | | | |

| | 4,452,588 | | | Citigroup, Inc. | | | 282,561,234 | |

| | 3,496,861 | | | Wells Fargo & Co. | | | 207,678,575 | |

| | | | | | | | 490,239,809 | |

FPA Crescent Fund

SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2024 (Unaudited)

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | BEVERAGES — 2.7% | | | | |

| | 2,137,538 | | | Heineken Holding N.V. | | $ | 168,590,355 | |

| | 4,857,064 | | | JDE Peet’s N.V. | | | 96,745,974 | |

| | 2,186,351 | | | Swire Pacific Ltd. - Class A | | | 19,318,260 | |

| | | | | | | | 284,654,589 | |

| | | | | BIOTECH & PHARMA — 0.4% | | | | |

| | 152,000 | | | Bio-Rad Laboratories, Inc.* | | | 41,512,720 | |

| | | | | CABLE & SATELLITE — 3.8% | | | | |

| | 393,387 | | | Charter Communications, Inc. - Class A* | | | 117,606,978 | |

| | 7,087,694 | | | Comcast Corp. - Class A | | | 277,554,097 | |

| | | | | | | | 395,161,075 | |

| | | | | CHEMICALS — 2.4% | | | | |

| | 2,596,396 | | | International Flavors & Fragrances, Inc. | | | 247,202,863 | |

| | | | | COMMERCIAL SUPPORT SERVICES — 0.1% | | | | |

| | 228,457 | | | Eurofins Scientific S.E. | | | 11,388,599 | |

| | 2,654 | | | Rentokil Initial PLC | | | 15,472 | |

| | | | | | | | 11,404,071 | |

| | | | | CONSTRUCTION MATERIALS — 3.3% | | | | |

| | 3,902,547 | | | Holcim AG* | | | 345,821,694 | |

| | | | | E-COMMERCE DISCRETIONARY — 2.2% | | | | |

| | 1,810,103 | | | Alibaba Group Holding Ltd. | | | 16,341,481 | |

| | 1,075,603 | | | Amazon.com, Inc.* | | | 207,860,280 | |

| | | | | | | | 224,201,761 | |

| | | | | ELECTRIC UTILITIES — 0.9% | | | | |

| | 2,241,472 | | | FirstEnergy Corp. | | | 85,781,133 | |

| | 720,710 | | | PG&E Corp. | | | 12,583,597 | |

| | | | | | | | 98,364,730 | |

| | | | | ELECTRICAL EQUIPMENT — 2.7% | | | | |

| | 1,833,926 | | | TE Connectivity Ltd. | | | 275,877,488 | |

| | | | | ENGINEERING & CONSTRUCTION — 0.9% | | | | |

| | 56,585,375 | | | McDermott International, Ltd.*,(c),(e),(g) | | | 16,409,759 | |

| | 694,573 | | | Samsung C&T Corp. | | | 71,652,282 | |

| | | | | | | | 88,062,041 | |

| | | | | ENTERTAINMENT CONTENT — 0.6% | | | | |

| | 33,130 | | | Epic Games, Inc.(e),(g) | | | 8,812,580 | |

| | 2,861,357 | | | Nexon Co., Ltd. | | | 52,909,050 | |

| | | | | | | | 61,721,630 | |

| | | | | FOOD — 0.2% | | | | |

| | 1,628,225 | | | Herbalife Ltd.* | | | 16,917,258 | |

| | | | | HEALTH CARE FACILITIES & SVCS — 0.7% | | | | |

| | 233,915 | | | ICON PLC* | | | 73,325,334 | |

FPA Crescent Fund

SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2024 (Unaudited)

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | INDUSTRIAL SUPPORT SERVICES — 1.3% | | | | |

| | 699,096 | | | Ferguson PLC | | $ | 135,379,940 | |

| | | | | INSTITUTIONAL FINANCIAL SVCS — 2.3% | | | | |

| | 4,697,583 | | | Jefferies Financial Group, Inc. | | | 233,751,730 | |

| | | | | INSURANCE — 1.5% | | | | |

| | 540,107 | | | Aon PLC - Class A | | | 158,564,613 | |

| | | | | INTERNET MEDIA & SERVICES — 11.3% | | | | |

| | 2,056,031 | | | Alphabet, Inc. - Class A | | | 374,506,047 | |

| | 1,340,310 | | | Alphabet, Inc. - Class C | | | 245,839,660 | |

| | 551,839 | | | Delivery Hero S.E.* | | | 13,089,777 | |

| | 646,495 | | | Just Eat Takeaway.com N.V.* | | | 7,778,295 | |

| | 629,810 | | | Meta Platforms, Inc. - Class A | | | 317,562,798 | |

| | 58,893 | | | Netflix, Inc.* | | | 39,745,708 | |

| | 2,882,508 | | | Prosus N.V.* | | | 102,668,897 | |

| | 951,959 | | | Uber Technologies, Inc.* | | | 69,188,380 | |

| | | | | | | | 1,170,379,562 | |

| | | | | LEISURE FACILITIES & SERVICES — 1.6% | | | | |

| | 1,533,842 | | | Entain PLC | | | 12,214,896 | |

| | 402,415 | | | Marriott International, Inc. - Class A | | | 97,291,875 | |

| | 308,095 | | | Vail Resorts, Inc. | | | 55,497,152 | |

| | | | | | | | 165,003,923 | |

| | | | | METALS & MINING — 1.4% | | | | |

| | 25,011,010 | | | Glencore PLC* | | | 142,617,452 | |

| | 55,123 | | | Metals Acquisition Corp. - Class A* | | | 754,634 | |

| | | | | | | | 143,372,086 | |

| | | | | OIL & GAS PRODUCERS — 1.6% | | | | |

| | 420,528 | | | Gulfport Energy Corp.* | | | 63,499,728 | |

| | 5,262,897 | | | Kinder Morgan, Inc. | | | 104,573,763 | |

| | | | | | | | 168,073,491 | |

| | | | | OTHER COMMON STOCK — 0.2% | | | | |

| | — | | | Other Common Stock(k) | | | 25,028,700 | |

| | | | | REIT — 1.0% | | | | |

| | 4,120,722 | | | Douglas Emmett, Inc. | | | 54,846,810 | |

| | 1,668,698 | | | Vornado Realty Trust | | | 43,870,070 | |

| | | | | | | | 98,716,880 | |

| | | | | RETAIL - DISCRETIONARY — 1.1% | | | | |

| | 1,521,148 | | | CarMax, Inc.* | | | 111,560,994 | |

| | | | | SEMICONDUCTORS — 5.3% | | | | |

| | 1,420,350 | | | Analog Devices, Inc. | | | 324,209,091 | |

| | 56,193 | | | Broadcom, Inc. | | | 90,219,547 | |

FPA Crescent Fund

SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2024 (Unaudited)

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SEMICONDUCTORS (Continued) | | | | |

| | 512,600 | | | NXP Semiconductors N.V. | | $ | 137,935,534 | |

| | | | | | | | 552,364,172 | |

| | | | | TECHNOLOGY HARDWARE — 2.2% | | | | |

| | 418,505 | | | Dell Technologies, Inc. - Class C | | | 57,716,025 | |

| | 1,942,412 | | | NCR Atleos Corp.* | | | 52,483,972 | |

| | 2,751,836 | | | NCR Voyix Corp.* | | | 33,985,175 | |

| | 1,626,680 | | | Nintendo Co., Ltd. | | | 86,505,526 | |

| | | | | | | | 230,690,698 | |

| | | | | TECHNOLOGY SERVICES — 0.8% | | | | |

| | 1,430,916 | | | LG Corp. | | | 83,786,291 | |

| | | | | TRANSPORTATION EQUIPMENT — 0.6% | | | | |

| | 422,836 | | | Westinghouse Air Brake Technologies Corp. | | | 66,829,230 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $3,704,487,661) | | | 6,441,195,010 | |

| | | | | LIMITED PARTNERSHIPS — 2.6% | | | | |

| | 150,000 | | | Footpath Ventures SPV IV LP(g),(l) | | | 12,451,569 | |

| | 2,073,734 | | | FPS Group Ltd.(c),(e),(g) | | | 219,391,056 | |

| | 107,799 | | | FPS Shelby Holdco I LLC(c),(e),(g) | | | 8,876,467 | |

| | 958,312 | | | GACP II LP(g),(l) | | | 2,755,180 | |

| | 1,146,250 | | | Sound Holding FP(c),(e),(g) | | | 22,692,387 | |

| | 120,000 | | | U.S. Farming Realty Trust II LP(c),(e),(g) | | | 2,982,096 | |

| | | | | TOTAL LIMITED PARTNERSHIPS | | | | |

| | | | | (Cost $159,402,891) | | | 269,148,755 | |

| | | | | PREFERRED STOCKS — 0.1% | | | | |

| | | | | ENERGY — 0.0% | | | | |

| | 1,345 | | | Gulfport Energy Corp., 10.000%, (e) | | | 1,256,051 | |

| | | | | | | | | |

| | | | | INDUSTRIALS — 0.1% | | | | |

| | 26,288 | | | McDermott International, Ltd., 8.000%, (c),(e),(g) | | | 4,854,471 | |

| | | | | TOTAL PREFERRED STOCKS | | | | |

| | | | | (Cost $2,473,080) | | | 6,110,522 | |

| | | | | WARRANTS (SPAC) — 0.0% | | | | |

| | 18,063 | | | American Oncology Network, Inc., Expiration Date: March 31, 2028* | | | 542 | |

| | 160,436 | | | Atlantic Coastal Acquisition Corp. II, Expiration Date: June 2, 2028* | | | 9,626 | |

| | 266,952 | | | BigBear.ai Holdings, Inc., Expiration Date: December 31, 2028* | | | 42,045 | |

| | 173,528 | | | Brand Engagement Network, Inc., Expiration Date: December 31, 2027* | | | 5,588 | |

| | 1,007,550 | | | BurTech Acquisition Corp., Expiration Date: December 18, 2026* | | | 251,888 | |

| | 123,284 | | | Churchill Capital Corp. VII, Expiration Date: February 29, 2028* | | | 43,149 | |

| | 167,442 | | | ECARX Holdings, Inc., Expiration Date: December 21, 2027* | | | 5,760 | |

| | 414,327 | | | Electriq Power Holdings, Inc., Expiration Date: January 25, 2028* | | | 83 | |

| | 64,614 | | | Global Partner Acquisition Corp. II, Expiration Date: December 30, 2027*,(e) | | | - | |

FPA Crescent Fund

SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2024 (Unaudited)

Number

of Shares | | | | | Value | |

| | | | | WARRANTS (SPAC) (Continued) | | | | |

| | 344,044 | | | Golden Arrow Merger Corp., Expiration Date: July 31, 2027* | | $ | 51,951 | |

| | 98,835 | | | Heliogen, Inc., Expiration Date: March 31, 2028* | | | 692 | |

| | 316,054 | | | MariaDB PLC, Expiration Date: December 16, 2027* | | | 32,870 | |

| | 216,065 | | | NioCorp Developments Ltd., Expiration Date: March 17, 2028* | | | 50,127 | |

| | 91,791 | | | Northern Star Investment Corp. III, Expiration Date: February 24, 2028*,(e) | | | 9 | |

| | 70,911 | | | Northern Star Investment Corp. IV, Expiration Date: December 31, 2027*,(e) | | | 7 | |

| | 193,976 | | | Plum Acquisition Corp. I, Expiration Date: December 31, 2028* | | | 16,488 | |

| | 13,439 | | | Plum Acquisition Corp. III, Expiration Date: March 31, 2028* | | | 876 | |

| | 23,455 | | | PowerUp Acquisition Corp., Expiration Date: February 18, 2027* | | | 645 | |

| | 10,692 | | | Prenetics Global Ltd., Expiration Date: December 31, 2026* | | | 149 | |

| | 77,074 | | | Ross Acquisition Corp. II, Expiration Date: February 12, 2026*,(e) | | | 6,952 | |

| | 516,072 | | | Sable Offshore Corp., Expiration Date: December 31, 2028* | | | 2,203,627 | |

| | 178,581 | | | Slam Corp., Expiration Date: December 31, 2027* | | | 44,645 | |

| | 27,467 | | | Swvl Holdings Corp., Expiration Date: March 31, 2027* | | | 387 | |

| | | | | TOTAL WARRANTS (SPAC) | | | | |

| | | | | (Cost $1,423,348) | | | 2,768,106 | |

| | | | | SHORT-TERM INVESTMENTS — 29.5% | | | | |

| | | | | MONEY MARKET INVESTMENTS — 0.0% | | | | |

| | 2,585,003 | | | Morgan Stanley Institutional Liquidity Treasury Portfolio - Institutional Class,5.06%(m) | | | 2,585,003 | |

Principal

Amount | | | | | | |

| | | | COMMERCIAL PAPER — 9.7% | | | |

| $ | 10,000,000 | | | Cisco Systems, Inc., 5.32%, 7/29/2024 | | | 9,958,622 | |

| | 70,000,000 | | | Cisco Systems, Inc., 5.32%, 8/5/2024 | | | 69,637,944 | |

| | 67,873,000 | | | Johnson & Johnson Co., 5.23%, 7/1/2024 | | | 67,873,000 | |

| | 21,800,000 | | | Johnson & Johnson Co., 5.15%, 7/12/2024 | | | 21,765,695 | |

| | 57,000,000 | | | Johnson & Johnson Co., 5.30%, 8/1/2024 | | | 56,739,858 | |

| | 125,000,000 | | | Johnson & Johnson Co., 5.27%, 10/10/2024 | | | 123,151,840 | |

| | 40,000,000 | | | Kenvue, Inc., 5.33%, 7/23/2024 | | | 39,869,711 | |

| | 25,500,000 | | | Microsoft Corp., 5.28%, 7/8/2024 | | | 25,473,820 | |

| | 73,000,000 | | | Microsoft Corp., 5.28%, 7/9/2024 | | | 72,914,347 | |

| | 69,000,000 | | | Nestle Capital, 5.31%, 7/15/2024 | | | 68,857,515 | |

| | 60,000,000 | | | Nestle Capital, 5.33%, 7/22/2024 | | | 59,813,450 | |

| | 52,000,000 | | | PepsiCo., Inc., 5.30%, 10/3/2024 | | | 51,280,378 | |

| | 50,000,000 | | | Pfizer, Inc., 5.32%, 10/2/2024 | | | 49,312,834 | |

| | 17,000,000 | | | Roche Holdings, Inc., 5.30%, 7/19/2024 | | | 16,954,950 | |

| | 50,000,000 | | | Roche Holdings, Inc., 5.30%, 7/30/2024 | | | 49,786,528 | |

| | 125,000,000 | | | Walmart Stores, Inc., 5.29%, 7/5/2024 | | | 124,926,528 | |

| | 100,000,000 | | | Walmart Stores, Inc., 5.29%, 7/8/2024 | | | 99,897,139 | |

| | | | | | | | 1,008,214,159 | |

| | | | | TREASURY BILLS — 19.8% | | | | |

| | 40,000,000 | | | U.S. Treasury Bill, 1.75%, 7/2/2024(n) | | | 39,994,206 | |

FPA Crescent Fund

SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2024 (Unaudited)

Principal

Amount | | | | | Value | |

| | | | | TREASURY BILLS (Continued) | | | | |

| $ | 16,000,000 | | | U.S. Treasury Bill, 3.56%, 7/5/2024(n) | | $ | 15,990,650 | |

| | 80,000,000 | | | U.S. Treasury Bill, 4.26%, 7/9/2024(n) | | | 79,906,710 | |

| | 40,000,000 | | | U.S. Treasury Bill, 4.43%, 7/11/2024(n) | | | 39,941,839 | |

| | 67,000,000 | | | U.S. Treasury Bill, 4.70%, 7/16/2024(n) | | | 66,853,689 | |

| | 51,000,000 | | | U.S. Treasury Bill, 4.77%, 7/18/2024(n) | | | 50,873,587 | |

| | 51,000,000 | | | U.S. Treasury Bill, 4.88%, 7/23/2024(n) | | | 50,836,880 | |

| | 65,000,000 | | | U.S. Treasury Bill, 4.92%, 7/25/2024(n) | | | 64,773,094 | |

| | 85,000,000 | | | U.S. Treasury Bill, 5.05%, 8/6/2024(n) | | | 84,555,008 | |

| | 81,000,000 | | | U.S. Treasury Bill, 5.07%, 8/8/2024(n) | | | 80,552,194 | |

| | 81,000,000 | | | U.S. Treasury Bill, 5.10%, 8/13/2024(n) | | | 80,493,514 | |

| | 81,000,000 | | | U.S. Treasury Bill, 5.13%, 8/15/2024(n) | | | 80,468,842 | |

| | 50,000,000 | | | U.S. Treasury Bill, 5.14%, 8/20/2024(n) | | | 49,636,111 | |

| | 89,000,000 | | | U.S. Treasury Bill, 5.16%, 8/22/2024(n) | | | 88,326,060 | |

| | 51,000,000 | | | U.S. Treasury Bill, 5.17%, 8/27/2024(n) | | | 50,577,476 | |

| | 72,000,000 | | | U.S. Treasury Bill, 5.19%, 8/29/2024(n) | | | 71,378,669 | |

| | 90,000,000 | | | U.S. Treasury Bill, 5.19%, 9/3/2024(n) | | | 89,158,653 | |

| | 136,000,000 | | | U.S. Treasury Bill, 5.00%, 9/5/2024(n) | | | 134,698,466 | |

| | 69,000,000 | | | U.S. Treasury Bill, 5.20%, 9/10/2024(n) | | | 68,285,609 | |

| | 44,000,000 | | | U.S. Treasury Bill, 5.22%, 9/12/2024(n) | | | 43,532,980 | |

| | 63,000,000 | | | U.S. Treasury Bill, 5.22%, 9/17/2024(n) | | | 62,286,651 | |

| | 62,000,000 | | | U.S. Treasury Bill, 5.21%, 9/19/2024(n) | | | 61,280,905 | |

| | 70,000,000 | | | U.S. Treasury Bill, 5.22%, 9/24/2024(n) | | | 69,136,067 | |

| | 90,000,000 | | | U.S. Treasury Bill, 5.19%, 9/26/2024(n) | | | 88,864,353 | |

| | 83,000,000 | | | U.S. Treasury Bill, 5.21%, 10/1/2024(n) | | | 81,702,328 | |

| | 276,000,000 | | | U.S. Treasury Bill, 5.12%, 10/3/2024(n) | | | 272,256,364 | |

| | 83,000,000 | | | U.S. Treasury Bill, 5.25%, 10/17/2024(n) | | | 81,893,759 | |

| | | | | | | | 2,048,254,664 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $3,059,217,813) | | | 3,059,053,826 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 99.7% | | | | |

| | | | | (Cost $7,524,950,031) | | | 10,344,857,234 | |

| | | | | | | | | |

| | | | | Other Assets in Excess of Liabilities — 0.3% | | | 34,670,051 | |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 10,379,527,285 | |

Number

of Shares | | | | | | |

| | | | | SECURITIES SOLD SHORT — (0.7)% | | | | |

| | | | | COMMON STOCKS — (0.2)% | | | | |

| | (83,600 | ) | | Sartorius AG | | | (19,606,340 | ) |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Proceeds $30,372,551) | | | (19,606,340 | ) |

FPA Crescent Fund

SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2024 (Unaudited)

Number

of Shares | | | | | Value | |

| | | | | EXCHANGE-TRADED FUNDS — (0.5)% | | | | |

| | (98,879 | ) | | SPDR S&P 500 ETF Trust | | $ | (53,811,929 | ) |

| | | | | TOTAL EXCHANGE-TRADED FUNDS | | | | |

| | | | | (Proceeds $52,373,098) | | | (53,811,929 | ) |

| | | | | | | | | |

| | | | | TOTAL SECURITIES SOLD SHORT | | | | |

| | | | | (Proceeds $82,745,649) | | $ | (73,418,269 | ) |

ETF — Exchange-Traded Fund

LLC — Limited Liability Company

LP — Limited Partnership

PLC — Public Limited Company

REIT — Real Estate Investment Trust

| * | Non-income producing security. |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities are restricted and may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities is $12,115,459, which represents 0.12% of Net Assets. |

| (b) | Variable or floating rate security. |

| (d) | Bank loans generally pay interest at rates which are periodically determined by reference to a base lending rate plus a premium. All loans carry a variable rate of interest. These base lending rates are generally (i) the Prime Rate offered by one or more major United States banks, (ii) the lending rate offered by one or more European banks such as the London Interbank Offered Rate (“LIBOR”), (iii) the Certificate of Deposit rate, or (iv) Secured Overnight Financing Rate (“SOFR”). Bank Loans, while exempt from registration, under the Securities Act of 1933, contain certain restrictions on resale and cannot be sold publicly. Floating rate bank loans often require prepayments from excess cash flow or permit the borrower to repay at its election. The degree to which borrowers repay, whether as a contractual requirement or at their election, cannot be predicted with accuracy. |

| (e) | The value of these securities was determined using significant unobservable inputs. These are reported as Level 3 securities in the Fair Value Hierarchy. |

| (f) | Payment-in-kind interest is generally paid by issuing additional par/shares of the security rather than paying cash. |

| (g) | Restricted securities. These restricted securities constituted 3.88% of total net assets at June 30, 2024, most of which are considered liquid by the Adviser. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under policies adopted by authority of the Fund’s Board of Trustees. |

| (h) | As of June 30, 2024, the Fund had entered into commitments to fund various delayed draw debt-related investments. Such commitments are subject to the satisfaction of certain conditions set forth in the documents governing those investments and there can be no assurance that such conditions will be satisfied. See Note 10 of the Notes to Financial Statements for further information on these commitments and contingencies. |

| (i) | All or a portion of the loan is unfunded. |

| (j) | Perpetual security. Maturity date is not applicable. |

| (k) | As permitted by U.S. Securities and Exchange Commission regulations, “Other” Common Stocks include holdings in their first year of acquisition that have not previously been publicly disclosed. |

| (l) | Investment valued using net asset value per share (or its equivalent) as a practical expedient. |

| (m) | The rate is the annualized seven-day yield at period end. |

| (n) | Treasury bill discount rate. |

See accompanying Notes to Financial Statements.

FPA Crescent Fund

SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2024 (Unaudited)

Total Return Swaps – Short

| Receive | | Pay | | | Payment Frequency | | Counterparty | | Expiration Date | | Notional Amount | | | Value | | | Upfront Premiums Paid(Received) | | | Unrealized Appreciation (Depreciation) | |

| Cresco Labs, Inc. | | | CDOR01M + 1.500% | | | Annual | | Nomura Securities International, Inc. | | 7/31/2025 | | CAD | 1,600,522 | | | $ | (121,687 | ) | | | — | | | $ | (121,687 | ) |

| Green Thumb Industries, Inc. | | | OBFR + 1.500% | | | Annual | | Nomura Securities International, Inc. | | 7/31/2025 | | $ | 2,078,319 | | | | 347,128 | | | | — | | | | 347,128 | |

| Trulieve Cannabis Corp. | | | CDOR01M + 1.500% | | | Annual | | Nomura Securities International, Inc. | | 7/31/2025 | | CAD | 521,511 | | | | 246,606 | | | | — | | | | 246,606 | |