UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08544

Investment Managers Series TRUST III

(Exact Name of Registrant as Specified in Charter)

235 West Galena Street

Milwaukee, Wisconsin 53212

(Address of Principal Executive Offices, including Zip Code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, California 91740

(Name and Address of Agent for Service)

COPIES TO:

Laurie Anne Dee

Morgan, Lewis & Bockius LLP

600 Anton Boulevard, Suite 1800

Costa Mesa, California 92626

Registrant’s telephone number, including area code: (626) 385-5777

Date of fiscal year end: September 30

Date of reporting period: March 31, 2024

EXPLANATORY NOTE: “The Registrant is filing this amendment to its Form N-CSRS/A for the period ended March 31, 2024 , originally filed with the Securities and Exchange Commission on June 25, 2024, (Accession Number 0001104659-24-074789), to update the signature page and two certifications to reflect the date of filing. The effect of these amendments had no impact to the net assets of the Fund. Other than the aforementioned revision, this Form N-CSRS/A does not reflect events occurring after the filing of the original Form N-CSRS/A, or modify or update the disclosures therein in any way.”

Item 1: Report to Shareholders.

| (a) | The Reports to Shareholders are attached herewith. |

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street Milwaukee, Wisconsin 53212

Semi-Annual Report

March 31, 2024

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

Dear Shareholder:

FPA New Income Fund (the "Fund") returned 0.86% in the first quarter of 2024.

Sector | | As of 3/31/2024 | |

Yield-to-worst1 | | | 5.53 | % | |

Effective Duration | | | 3.04 years | | |

Spread Duration | | | 2.95 years | | |

High Quality Exposure2 | | | 90 | % | |

Credit Exposure3 | | | 10 | % | |

Uncertainty about the pace of disinflation led to an increase in risk-free rates during the quarter as Treasury yields increased by 25-40 bps across the yield curve and spreads narrowed across the bond market. On an absolute basis, we continue to see an attractive opportunity to buy longer duration "High Quality" bonds (rated single-A or higher) that we believe will enhance the Fund's long-term returns and short-term upside-versus-downside return profile. We do not generally view "Credit" (investments rated BBB or lower, including non-rated investments) as attractively priced, but we continue to search and will opportunistically invest in Credit when we believe prices adequately compensate for the risk of permanent impairment of capital and near-term mark-to-market risk. The Fund's Credit exposure was essentially unchanged at 10.0% on March 31, 2024 versus 9.9% on December 31, 2023. Cash and equivalents represented 4.6% of the portfolio on March 31, 2024 versus 3.9% on December 31, 2023.

Portfolio Attribution4

First Quarter 2024

The largest contributor to performance were asset-backed securities (ABS) backed by equipment due to coupon payments, which were partially offset by lower prices as a result of an increase in risk-free rates. The second- and third-largest contributors to performance were collateralized loan obligations (CLOs) backed by corporate loans and CLOs backed by commercial real estate loans, respectively, which benefited from coupon payments and higher prices due to narrower spreads. These high-quality CLOs are predominantly floating rate.

1 Yield-to-worst ("YTW") is presented gross of fees and reflects the lowest potential yield that can be received on a debt investment without the issuer defaulting. YTW considers the impact of expected prepayments, calls and/or sinking funds, among other things. Average YTW is based on the weighted average YTW of the investments held in the Fund's portfolio. YTW may not represent the yield an investor should expect to receive. As of March 31, 2024, the Fund's subsidized/unsubsidized 30-day SEC standardized yield ("SEC Yield") was 4.72%/4.58% respectively. The SEC Yield calculation is an annualized measure of the Fund's dividend and interest payments for the last 30 days, less the Fund expenses. Subsidized yield reflects fee waivers and/or expense reimbursements during the period. Without waivers and/or reimbursements, yields would be reduced. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect. The SEC Yield calculation shows investors what they would earn in yield over the course of a 12-month period if the fund continued earning the same rate for the rest of the year.

2 High Quality is defined as investments rated A or higher, Treasuries, and cash and equivalents.

3 Credit is defined as investments rated BBB or lower, including non-rated investments.

4 This information is not a recommendation for a specific security or sector and these securities/sectors may not be in the Fund at the time you receive this report. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. The portfolio holdings as of the most recent quarter-end may be obtained at fpa.com.

Past results are no guarantee, nor are they indicative, of future results.

1

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

The only detractor from performance during the quarter were U.S. Treasury bonds, which decreased in price as a result of an increase in risk-free rates. Although there were other individual bonds that detracted from performance during the quarter, there were no other meaningful detractors at the sector level.

Portfolio Activity5

The table below shows the portfolio's sector-level exposures at March 31, 2024 compared to December 31, 2023:

Sector | | % Portfolio

3/31/2024 | | % Portfolio

12/31/2023 | |

ABS | | | 38.2 | % | | | 41.9 | % | |

CLO | | | 4.5 | % | | | 5.4 | % | |

Corporate | | | 6.8 | % | | | 7.0 | % | |

Agency CMBS | | | 13.6 | % | | | 12.3 | % | |

Non-Agency CMBS | | | 6.3 | % | | | 7.7 | % | |

Agency RMBS | | | 13.9 | % | | | 12.2 | % | |

Non-Agency RMBS | | | 4.7 | % | | | 4.3 | % | |

Stripped Mortgage-backed | | | 0.4 | % | | | 0.4 | % | |

U.S. Treasury | | | 7.1 | % | | | 4.9 | % | |

Cash and equivalents | | | 4.6 | % | | | 3.9 | % | |

Total | | | 100.0 | % | | | 100.0 | % | |

Yield-to-worst1 | | | 5.53 | % | | | 5.57 | % | |

Effective Duration (years) | | | 3.04 | % | | | 2.75 | % | |

Spread Duration (years) | | | 2.95 | % | | | 2.77 | % | |

Average Life (years) | | | 3.70 | % | | | 3.40 | % | |

As yields have increased over the past 27 months, we have taken advantage of this opportunity to buy longer-duration bonds. We believe these bonds not only offer an attractive absolute long-term return but also improve the short-term return profile of the portfolio. The duration of these investments is guided by our duration test, which seeks to identify the longest-duration bonds that we expect will produce at least a breakeven return over a 12-month period, assuming a bond's yield will increase by 100 bps during that period. Consistent with this test, during the first quarter, we bought fixed-rate, High Quality bonds including agency mortgage pools, ABS backed by equipment, agency-guaranteed commercial mortgage-backed securities (CMBS), non-agency residential mortgage-backed securities (RMBS), ABS backed by credit card receivables, ABS backed by prime quality auto loans, and utility cost-recovery bonds. On average, these investments had a weighted average life of 5.5 years. We also extended the duration of and added to our Treasury holdings. Finally, we bought a AAA-rated floating-rate CLO. Within Credit, we bought a BBB-rated corporate bond.

5 Portfolio composition will change due to ongoing management of the Fund. Please see the 'Important Disclosures' for important information and definitions of key terms.

2

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

To fund these investments, we used a combination of proceeds from maturing investments and sales of existing short-maturity holdings including, but not limited to, High Quality ABS, CLOs (both corporate loan-backed CLOs and commercial real estate-backed CLOs) and agency-guaranteed CMBS. The High Quality investments that we sold had a weighted average life of 1.2 years. Lastly, we sold a short-maturity BBB-rated corporate bond to take advantage of other, more attractive opportunities.

Market Commentary

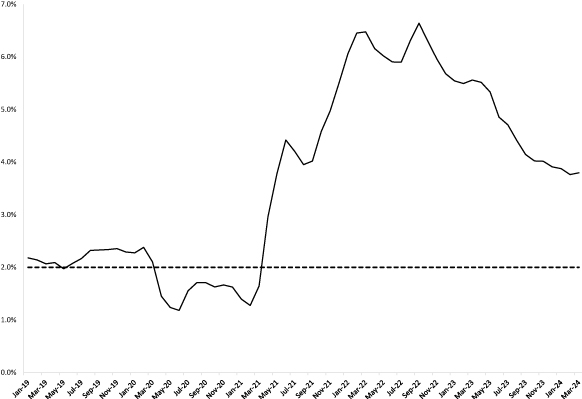

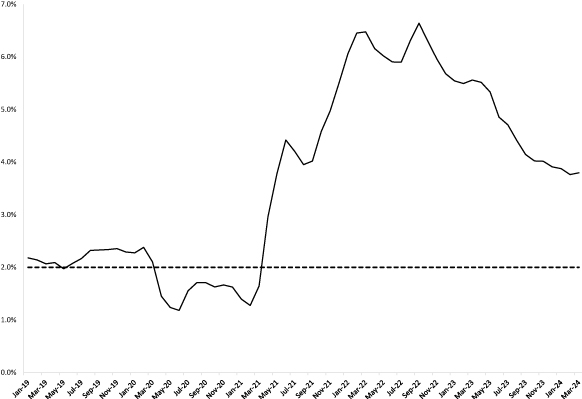

As shown in the following chart, progress on reducing inflation appears to have stalled, casting doubt on the timeline of reaching the Federal Reserve's 2% target.

CPI Urban Consumers less Food and Energy year/year Change

Source: US Department of Labor. As of March 31, 2024. The Consumer Price Index, or CPI, reflects the average change over time in prices paid by urban consumers for a market basket of consumer goods and services. The Federal Reserve seeks to achieve an average of 2% inflation rate (https://www.federalreserve.gov/newsevents/pressreleases/monetary20221102a.htm). Dotted line represents the Federal Reserve target.

3

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

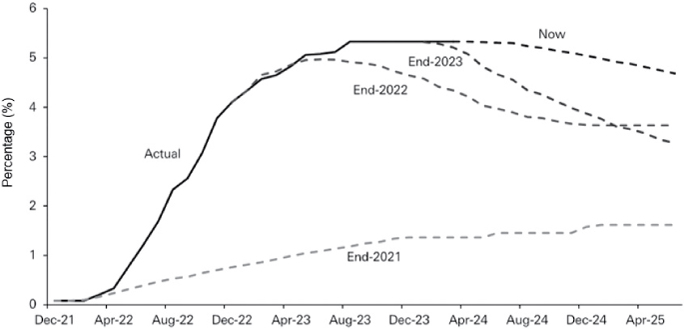

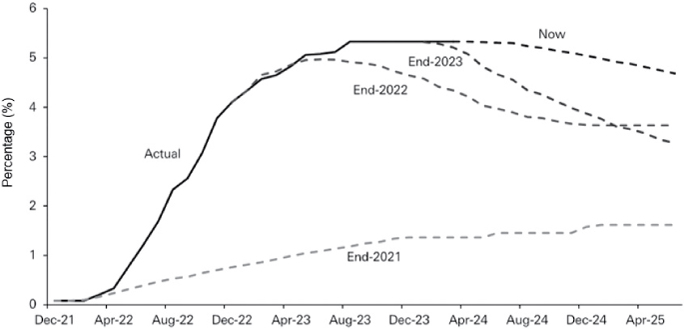

By other measures, inflation may have accelerated. Consequently, whereas at the end of 2023 the market was expecting the Federal Reserve to institute more than six cuts to the Fed Funds rate in 2024, at the end of March 2024 the market expected only around three cuts. As of April 2024, those expectations had further decreased to perhaps one rate cut in 2024. There has even been chatter among some commentators that the Fed may need to raise rates at some point. The uncertainty about the macroeconomic environment has led to volatility in expectations for the Fed Funds rate with the market consistently too optimistic about the Fed lowering rates:

Fed Funds Rate and Futures Pricing

Source: Deutsche Bank, Bloomberg Finance LP; "What keeps us awake at night?'; April 29,2024. Dotted lines represent futures pricing as of dates noted.

4

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

In response, risk-free rates increased during the first quarter, as shown below.

U.S. Treasury Yield Curve

Source: Bloomberg; As of 3/29/2024

The market vacillates about what the Fed will or will not do, and for good reason. It's difficult to forecast the future using data that is both stale (inflation data is published with a lag) and imprecise (inflation statistics don't accurately capture pricing in the economy because of imputed prices or sticky prices like rent, for example). For this reason, we have avoided trying to forecast what the Fed will do because we find that trying to invest by betting on the Fed and the macroeconomy is short-term oriented and speculative and creates a less certain path to attractive long-term returns. Instead, we focus on long-term returns using price as our guide. We define "price" as the combination of factors that could affect the return of and return on our capital including, among other things, dollar price, coupon, spread, maturity, call protection, loan-to-value, and structure.

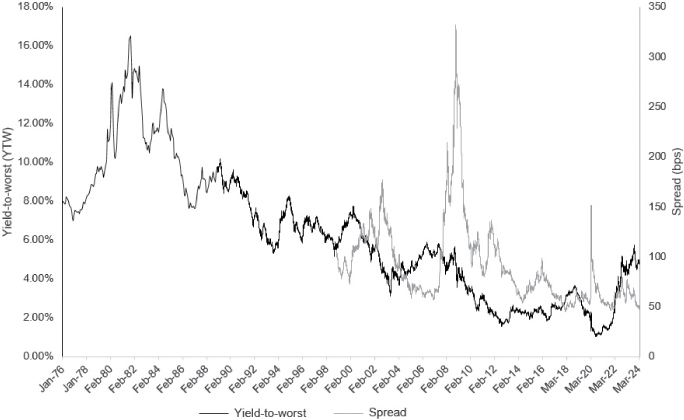

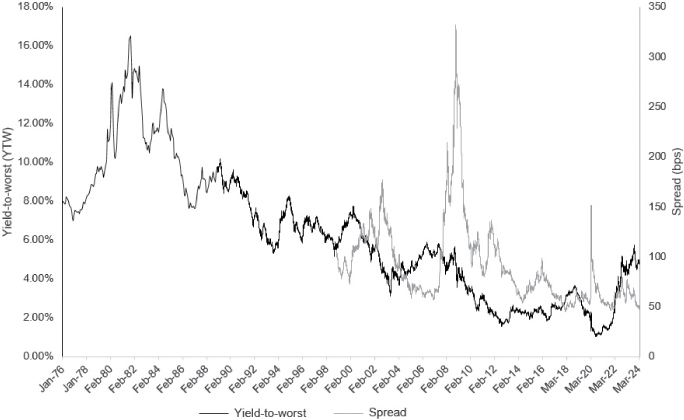

The following two charts show that Treasury yields and yields on High Quality bonds are currently among the highest in over 15 years.

5

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Treasury Yield

Source: Bloomberg. Data from 1/5/1962-3/29/2024. Past performance is no guarantee, nor is it indicative, of future results. Please refer to the end of the commentary for Important Disclosures and definitions of key terms.

6

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Bloomberg U.S. Aggregate Bond Index

Source: Bloomberg. As of March 31, 2024. YTW is Yield-to-Worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the-run treasury. Past results are no guarantee, nor is it indicative, of future results. Please refer to the end of the commentary for Important Disclosures and Index definitions.

As we have described in past commentaries, higher yields over the past couple of years have created what we believe is an attractive opportunity to buy longer-duration, High Quality bonds. We believe our investors will be better off in the long-term earning today's yields for multiple years. Therefore, we want to lock in today's yields for as long as possible. However, because the future is uncertain, we also want to be thoughtful about limiting the short-term mark-to-market risk associated with increases in interest rates.

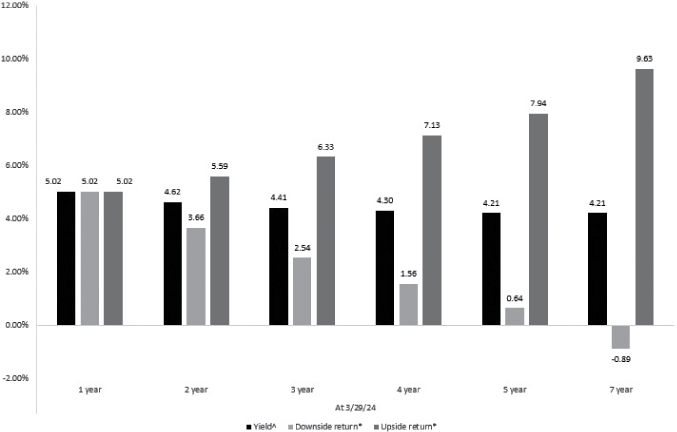

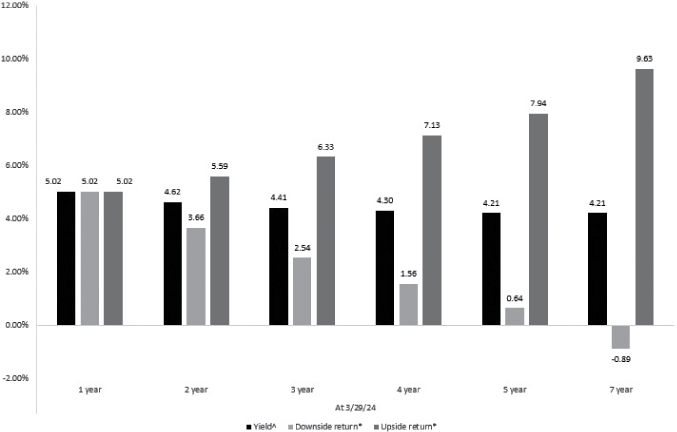

To help strike the balance between locking in yields for as long as possible and providing some short-term price-related downside protection, we select the duration of our investments using the duration test described above. The chart below illustrates our 100 bps duration test.

7

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Hypothetical 12-month U.S. Treasury Returns

Source: Bloomberg. ^ Yield-to-maturity is the annualized total return anticipated on a bond if the bond is held until it matures and assumes all payments are made as scheduled and are reinvested at the same rate. The expected return assumes no change in interest rates over the next 12 months. * Upside return estimates the 12-month total return assuming yields decline by 100 bps over 12 months. Downside return estimates the 12-month total return assuming yields increase by 100 bps over 12 months. Return estimates assume gradual change in yield over 12 months. The hypothetical stress test data provided herein is for illustrative and informational purposes only and is intended to demonstrate the mathematical impact of a change in Treasury yields on hypothetical Treasury returns. No representation is being made that any account, product or strategy will or is likely to achieve profits, losses, or results similar to those shown. Hypothetical results do not reflect trading in actual accounts, and does not reflect the impact that all economic, market or other factors may have on the management of the account. Hypothetical results have certain inherent limitations. There are frequently sharp differences between simulated results and the actual results subsequently achieved by any particular account, product or strategy. Past performance is no guarantee, nor is it indicative, of future results. Please refer to the back of the commentary for important disclosures.

8

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

The first bar shown for each period represents Treasury yields of various maturities at March 29, 2024. The second bar shown for each period represents the results of our 100 bps duration test and represent the short-term downside return potential for these bonds. For example, the 5-year Treasury purchased at a 4.21% yield would be expected to return 0.64% over twelve months if its yield increased by 100 bps from 4.21% to 5.21% during that time. A similar analysis applied to the 7-year Treasury would result in a total return loss of -0.89%. With a better-than-breakeven return, the 5-year Treasury would be a candidate for the portfolio but the 7-year Treasury would not because it produces an expected loss over twelve months.

Shorter-maturity bonds would also pass our duration test in today's market and would be expected to produce positive short-term returns if yields increase, but longer-maturity bonds add more short-term upside potential to the portfolio. The third bar shown for each period represents the short-term upside return potential, namely the potential total return over twelve months if rates decrease by 100 bps. The 5-year Treasury offers a potential upside return of 7.9%. Although the 7-year Treasury offers a higher potential total return in the upside scenario, that upside should be balanced with the prospect of losing money in the short-term. The 5-year Treasury captures over 80% of the short-term upside return of the 7-year Treasury but with less short-term downside risk. Likewise, our investments in longer-duration bonds create the potential for the portfolio to capture a meaningful portion of the upside offered by longer-duration bonds like those represented in the Bloomberg Aggregate Bond Index. At the same time, our focus on downside protection means using our 100 bps duration test to identify longer duration bonds that we believe will preserve capital in the short-term if rates rise (within reason), thereby enabling opportunistic redeployment into more attractive investment opportunities if and when they appear.

To that end, we have spent the past 27 months increasing the Fund's duration. Whereas the average fund in the Morningstar U.S. Short Term bond category had a 2.75-year duration at the end of 2021 — before rates began to increase — and maintained a similar duration of 2.79 years through March 2024, the Fund's duration increased from 1.39 years at December 31, 2021 to 3.04 years at March 31, 2024, a 1.65 year increase.6 When rates were very low in 2021, the Fund had a far-below-average duration because we believed investors should take less risk when the market is expensive (i.e., when rates are low). Now that the market is cheaper (i.e., rates are higher), we believe investors should be willing to take on more duration risk because they are now being compensated for that risk through higher yields.

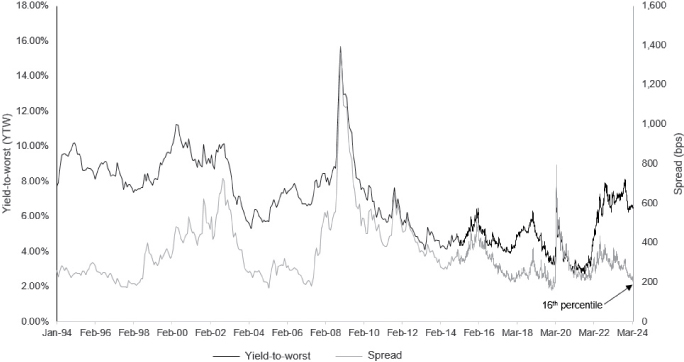

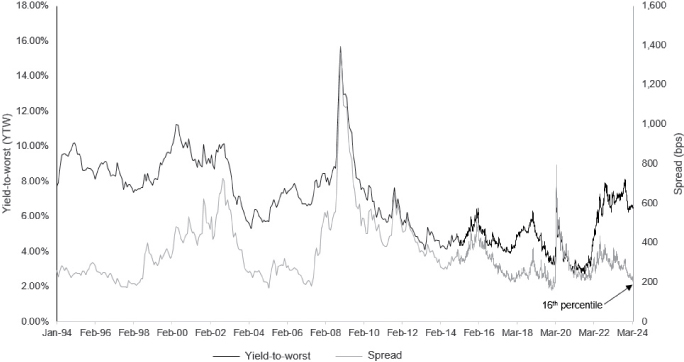

Although we see an attractive opportunity to buy longer-duration High Quality bonds, we do not generally see attractive investment opportunities in lower-rated debt. In the high yield market, yields also remain near 15-year highs, but spreads have retreated to the 16th percentile, as measured by the BB component of the Bloomberg U.S. Corporate High Yield index excluding Energy, an index we believe provides the most consistent view of high yield market prices over time with fewer distortions caused by changes in the composition of the overall high yield index.

6 Source: Morningstar Direct, FactSet.

9

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Bloomberg U.S. Corporate High Yield BB excl. Energy

Source: Bloomberg. As of March 29, 2024. YTW is Yield-to-Worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the-run Treasury. Past results are no guarantee, nor is it indicative, of future results. Please refer to the end of the commentary for Important Disclosures and Index definitions.

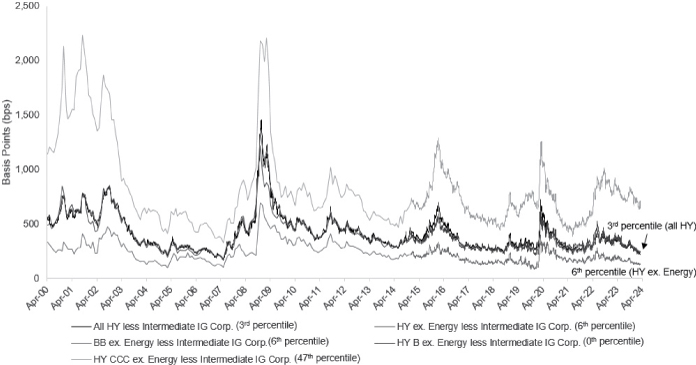

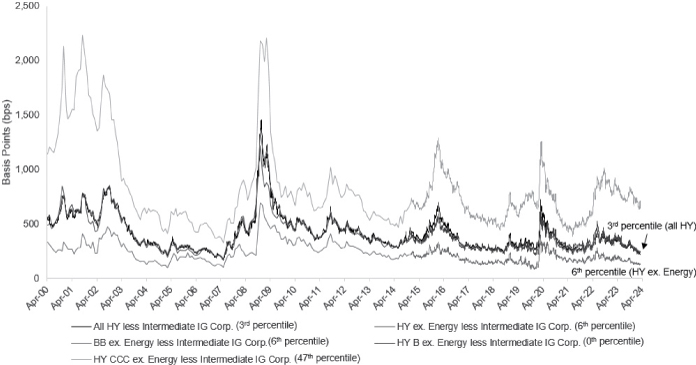

Further, the extra spread offered by high yield bonds in comparison to investment grade bonds has also compressed. For example, the spread on the aforementioned BB-rated high yield index, excluding energy, less the spread on investment grade corporate bonds has decreased to the sixth percentile.

10

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Bloomberg U.S. Corporate High Yield Spread less

Bloomberg U.S. Investment Grade Corporate Spread

Source: Bloomberg. As of March 29, 2024. Past results are no guarantee, nor is it indicative, of future results. Please refer to the end of the commentary for Important Disclosures and Index definitions.

Importantly, measures of the high yield market such as yield and spread do not account for changes in the underlying quality of bonds in the market at any given point in time. Suffice it to say, it is our opinion that there has been a degradation in the quality of high yield bonds over the past few years (most notably via weaker structural protections for bondholders) which, all things being equal, makes high yield debt more expensive than the charts above would suggest. Given current prices in the yield market, we generally find that, compared to investment grade bonds, the low spreads in the high yield market do not offer enough incremental compensation for the extra credit risk involved in high yield debt. We continue to research the high yield market for investment opportunities, but these days we typically find High Quality bonds more appealing.

11

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

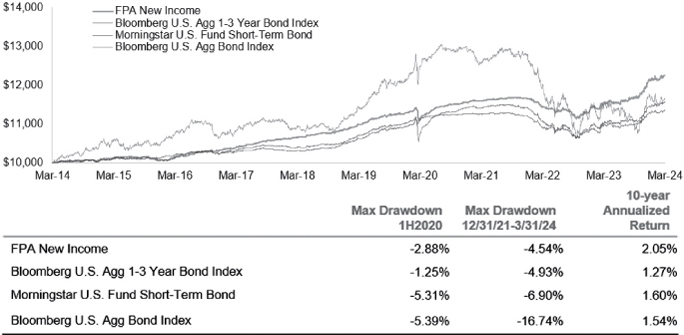

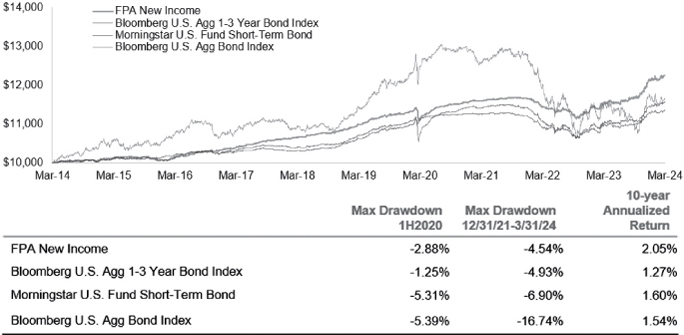

As always, we invest with a flexible, opportunistic, patient, and long-term -oriented investment approach that seeks attractive short- and long-term risk-adjusted returns. Inherent in that approach is a willingness to choose a different tack than other bond investors, whether buying longer-duration bonds or leaning toward higher quality bonds. The chart below shows that our willingness to deviate from the crowd has been beneficial to our investors over the long-term as evidenced by the Fund having compounded capital at a greater rate of return over the past 10 years with less volatility and generally smaller drawdowns compared to other comparable funds, indices or even the broader bond market:

Growth of $10,000 over Ten Years

Source: Morningstar Direct. As of 3/31/2024. Maximum Drawdown is the maximum loss from a peak to a trough of a portfolio, before a new peak is attained. FPA New Income Fund — Institutional Class ("Fund") inception is July 11, 1984. Fund performance is net of all fees and expenses and includes the reinvestment of distributions. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that if you redeem your investment in the Fund it may be worth more or less than its original cost. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Current month-end performance data for the Fund, which may be higher or lower than the performance data quoted, may be obtained at fpa.com or by calling toll-free, 1-800-982-4372. The Funds net expense ratio as indicated in its most recent prospectus is 0.45%. Please refer to page 1 for net performance of the Fund and the end of this commentary for Important Disclosures and definitions of key terms.

12

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

With our personal capital invested in the Fund, we are pleased with the returns on our investment and we hope our fellow investors feel the same. Our focus though remains on the present and we are excited about the investment opportunities created by higher yields.

Thank you for your confidence and continued support.

Abhijeet Patwardhan

Portfolio Manager

April 2024

13

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Important Disclosures

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale of any securities, products or services discussed, and neither does it provide investment advice. Any such offer or solicitation shall only be made pursuant to the Fund's Prospectus, which supersedes the information contained herein in its entirety.

The views expressed herein and any forward-looking statements are as of the date of the publication and are those of the portfolio management team. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data. You should not construe the contents of this document as legal, tax, accounting, investment or other advice or recommendations.

Abhijeet Patwardhan has been portfolio manager for the Fund since November 2015. Thomas Atteberry managed/co-managed the Fund from November 2004 through June 2022. Effective July 1, 2022, Mr. Atteberry transitioned to a Senior Advisory role. There were no material changes to the investment process due to this transition. Effective September 30, 2023, Mr. Atteberry no longer acts as a Senior Advisor to the investment team, but he remains as Senior Advisor to FPA.

Effective July 28, 2023, FPA New Income, Inc. was reorganized into the FPA Funds Trust and its new name is FPA New Income Fund. There was no change in its investment objective, investment strategy or fundamental investment policies. FPA continues to be the adviser to the Fund. For more information, please refer to the announcement on FPA's website at: https://fpa.com/news-special-commentaries/fund-announcements/2023/06/26/fpa-announces-fund-reorganizations. Effective January 10, 2024, the FPA Funds Trust was renamed to the Investment Managers Series Trust III.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities or sectors are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio manager, the Adviser, or the distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security or sector examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at fpa.com.

The statements made herein may be forward-looking and/or based on current expectations, projections, and/or information currently available. Actual results may differ from those anticipated. The portfolio manager and/or FPA cannot assure future results and disclaims any obligation to update or alter any statistical data and/or references thereto, as well as any forward-looking statements, whether as a result of new information, future events, or otherwise. Such statements may or may not be accurate over the long-term.

Investments, including investments in mutual funds, carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund may purchase foreign securities, including depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks; these risks may be elevated when investing in emerging markets. Foreign investments, especially those of companies in emerging markets, can be riskier, less liquid, harder to value, and more volatile than investments in the United States. The securities of smaller, less well-known companies can be more volatile than those of larger companies.

The return of principal in a bond fund is not guaranteed. Bond funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the Fund. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds.

14

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

Interest rate risk is the risk that when interest rates go up, the value of fixed income instruments, such as bonds, typically go down and investors may lose principal value. Credit risk is the risk of loss of principal due to the issuer's failure to repay a loan. Generally, the lower the quality rating of a fixed income instrument, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults, the fixed income instrument may lose some or all of its value.

Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; such derivatives may increase volatility. Convertible securities are generally not investment grade and are subject to greater credit risk than higher-rated investments. High yield securities can be volatile and subject to much higher instances of default.

Collateralized debt obligations ("CDOs"), which include collateralized loan obligations ("CLOs"), collateralized bond obligations ("CBOs"), and other similarly structured securities, carry additional risks in addition to interest rate risk and default risk. This includes, but is not limited to: (i) distributions from the underlying collateral may not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; and (iii) the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results. Investments in CDOs are also more difficult to value than other investments.

Value style investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize what the portfolio management team considers the true business value or because the portfolio management team has misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

The ratings agencies that provide ratings are the Nationally Recognized Statistical Ratings Organizations (NRSROs) DBRS, Inc., Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc., Moody's Investors Service, Inc., and S&P Global Ratings. Credit ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings of BB and below are lower-rated securities (junk bonds). High-yielding, non-investment grade bonds (junk bonds) involve higher risks than investment grade bonds. Bonds with credit ratings of CCC or below have higher default risk.

Please refer to the Fund's Prospectus for a complete overview of the primary risks associated with the Fund.

The Fund is not authorized for distribution unless preceded or accompanied by a current prospectus. The prospectus can be accessed at: https://fpa.com/request-funds-literature.

Important Disclosures for Hypothetical Stress-Tested Results

The hypothetical and estimated data provided herein is for illustrative and informational purposes only. No representation is being made that Fund or the securities used for the simulation will or is likely to achieve profits, losses, or results similar to those shown. Hypothetical and estimated results do not reflect trading in actual accounts, and do not reflect the impact that economic, market or other factors may have on the management of the account.

The hypothetical and estimated results as set forth in this commentary do not represent actual results; actual results may significantly differ from the theoretical data being presented. Hypothetical/estimated results have certain inherent limitations. Hypothetical models theoretically may be changed from time to time to obtain more favorable results. There may be sharp differences between simulated or estimated results and the actual results subsequently achieved by any particular security, account, product or strategy. In addition, simulated/estimated results cannot account for the impact of certain market risks such as a lack of liquidity or

15

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

default risk. There are numerous other factors related to the markets in general or the implementation of any specific strategy which cannot be fully accounted for in the preparation of simulated or estimated results, all of which can adversely affect actual results.

A client's individual portfolio results may vary from any hypothetical or estimated results because of the timing of trades, deposits and withdrawals, the impact of management fees and taxes, market fluctuations, trading costs, cash flows, custodian fees, among other factors. Hypothetical results are not meant to be construed as a prediction of the future return of the Fund. Past performance is no guarantee, nor is it indicative, of future results.

Index / Category Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund will be less diversified than the indices noted herein and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund's investment strategy. Indices are unmanaged, do not reflect any commissions, fees or expenses which would be incurred by an investor purchasing the underlying securities. The Fund does not include outperformance of any index or benchmark in its investment objectives. Investors cannot invest directly in an index.

Bloomberg U.S. Aggregate Bond Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have at least 1 year remaining in maturity. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

Bloomberg U.S. Aggregate 1-3 Year Bond Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have a remaining maturity of 1 to 3 years. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

Bloomberg U.S. Corporate High Yield Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds. Bloomberg U.S. Corporate High Yield BB ex Energy Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable BB-rated corporate bonds excluding energy sector. Bloomberg U.S. Corporate High Yield B ex Energy Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable B-rated corporate bonds excluding energy sector.

Bloomberg U.S. Investment Grade Corporate Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility, and financial issuers.

The Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics. There can be no guarantee that the CPI will reflect the exact level of inflation at any given time. This index reflects non-seasonally adjusted returns.

CPI + 100 bps is the measure of the CPI plus an additional 100 basis points.

Morningstar Short-term Bond Category portfolios invest primarily in corporate and other investment-grade U.S. fixed-income issues and typically have durations of 1.0 to 3.5 years. These portfolios are attractive to fairly conservative investors, because they are less sensitive to interest rates than portfolios with longer durations. Morningstar calculates monthly breakpoints using the effective duration of the Morningstar Core Bond Index in

16

FPA NEW INCOME FUND

LETTER TO SHAREHOLDERS

(Continued)

determining duration assignment. Short-term is defined as 25% to 75% of the three-year average effective duration of the Morningstar Core Bond Index. As of March 31, 2024, there were 581 funds in this category.

Other Definitions

ABS (Asset Backed Securities): financial securities backed by a loan, lease or receivables against assets other than real estate and mortgage-backed securities.

Basis Point (bps) is equal to one hundredth of one percent, or 0.01%. 100 basis points = 1%.

CLO (Collateralized Loan Obligation): is a single security backed by a pool of debt.

CMBS (Commercial Mortgage Backed Security): a mortgage-backed security backed by commercial mortgages rather than residential mortgages.

Convexity is the curvature in the relationship between bond prices and interest rates. It reflects the rate at which the duration of a bond changes as interest rates change.

Core duration bonds (also known as core bonds) refer to bonds similar in duration to Bloomberg U.S. Aggregate Bond Index.

Coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

Corporate Holdings include bank debt, corporate bonds and common stock.

Effective Duration (years) is the duration calculation for bonds with embedded options. Effective duration takes into account that expected cash flows will fluctuate as interest rates change.

Mark-to-market is a method of recording the price or value of a security, portfolio, or account to reflect the current market value rather than book value.

A bond premium occurs when the price of the bond has increased in the secondary market. A bond might trade at a premium because its interest rate is higher than current rates in the market.

RMBS (Residential Mortgage Backed Securities): mortgage-backed securities backed by residential mortgages.

Stripped Mortgage-Backed Securities: a trust comprised of mortgage-backed securities which are split into principal-only strips and interest-only strips.

Weighted Average Life (years) is the average length of time that each dollar of unpaid principal on a loan, a mortgage or an amortizing bond remains outstanding. It is also referred to as "Average Life" or "Weighted Average Maturity."

Yield-to-Maturity (YTM) is the expected rate of return anticipated on a bond if held until it matures. YTM is considered a long-term bond yield expressed as an annual rate. The YTM calculation takes into account the bond's current market price, par value, coupon interest rate and time to maturity. It is also assumed that all coupon payments are reinvested at the same rate as the bond's current yield.

©2024 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted by Morningstar to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The FPA Funds are distributed by UMB Distribution Services, LLC, ("UMBDS"), 235 W. Galena Street, Milwaukee, WI, 53212. UMB is not affiliated with FPA.

17

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — 93.5% | | Principal

Amount | | Value | |

ASSET-BACKED SECURITIES — 42.6% | |

AUTO — 8.7% | |

Ally Auto Receivables Trust

Series 2023-1, Class A4, 5.270%, 11/15/2028 | | $ | 8,996,000 | | | $ | 9,014,660 | | |

BMW Vehicle Owner Trust

Series 2022-A, Class A4, 3.440%, 12/26/2028 | | | 25,298,000 | | | | 24,412,057 | | |

Series 2023-A, Class A4, 5.250%, 11/26/2029 | | | 6,776,000 | | | | 6,810,323 | | |

Capital One Prime Auto Receivables Trust

Series 2022-2, Class A4, 3.690%, 12/15/2027 | | | 15,513,000 | | | | 14,937,597 | | |

CarMax Auto Owner Trust

Series 2022-3, Class A4, 4.060%, 2/15/2028 | | | 63,819,000 | | | | 62,364,201 | | |

Series 2022-3, Class B, 4.690%, 2/15/2028 | | | 19,152,000 | | | | 18,761,184 | | |

Series 2023-2, Class A4, 5.010%, 11/15/2028 | | | 21,176,000 | | | | 21,136,316 | | |

Series 2023-1, Class A4, 4.650%, 1/16/2029 | | | 10,892,000 | | | | 10,766,971 | | |

Series 2023-3, Class A4, 5.260%, 2/15/2029 | | | 20,637,000 | | | | 20,725,520 | | |

Ford Credit Auto Owner Trust

Series 2023-A, Class A4, 4.560%, 12/15/2028 | | | 14,487,000 | | | | 14,335,310 | | |

Series 2023-B, Class A4, 5.060%, 2/15/2029 | | | 7,137,000 | | | | 7,102,640 | | |

GM Financial Consumer Automobile Receivables Trust

Series 2022-3, Class A4, 3.710%, 12/16/2027 | | | 25,555,000 | | | | 24,811,917 | | |

Series 2023-1, Class A4, 4.590%, 7/17/2028 | | | 15,767,000 | | | | 15,571,691 | | |

Series 2023-3, Class A4, 5.340%, 12/18/2028 | | | 13,758,000 | | | | 13,821,733 | | |

GM Financial Revolving Receivables Trust

Series 2021-1, Class A, 1.170%, 6/12/2034(a) | | | 38,305,000 | | | | 34,922,550 | | |

Series 2023-1, Class A, 5.120%, 4/11/2035(a) | | | 49,942,000 | | | | 50,339,384 | | |

Series 2023-2, Class A, 5.770%, 8/11/2036(a) | | | 12,704,000 | | | | 13,139,099 | | |

Series 2024-1, Class A, 4.980%, 12/11/2036 | | | 49,685,000 | | | | 49,993,544 | | |

Honda Auto Receivables Owner Trust

Series 2022-2, Class A4, 3.760%, 12/18/2028 | | | 6,350,000 | | | | 6,183,401 | | |

Hyundai Auto Receivables Trust

Series 2022-B, Class A4, 3.800%, 8/15/2028 | | | 14,340,000 | | | | 13,994,048 | | |

Series 2023-B, Class A4, 5.310%, 8/15/2029 | | | 10,743,000 | | | | 10,834,739 | | |

Mercedes-Benz Auto Receivables Trust

Series 2023-1, Class A4, 4.310%, 4/16/2029 | | | 10,006,000 | | | | 9,851,439 | | |

Mercedes-Benz Auto Receivables Trust

Series 2024-1, Class A4, 4.790%, 7/15/2031 | | | 8,831,000 | | | | 8,815,392 | | |

Nissan Auto Receivables Owner Trust

Series 2022-B, Class A4, 4.450%, 11/15/2029 | | | 13,366,000 | | | | 13,126,374 | | |

Series 2023-A, Class A4, 4.850%, 6/17/2030 | | | 15,538,000 | | | | 15,386,658 | | |

Porsche Financial Auto Securitization Trust

Series 2023-1A, Class A4, 4.720%, 6/23/2031(a) | | | 17,279,000 | | | | 17,135,147 | | |

18

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

SFS Auto Receivables Securitization Trust

Series 2023-1A, Class A4, 5.470%, 12/20/2029(a) | | $ | 8,951,000 | | | $ | 9,043,256 | | |

Toyota Auto Loan Extended Note Trust

Series 2022-1A, Class A, 3.820%, 4/25/2035(a) | | | 54,519,000 | | | | 52,782,226 | | |

Series 2023-1A, Class A, 4.930%, 6/25/2036(a) | | | 43,813,000 | | | | 43,959,721 | | |

Toyota Auto Receivables Owner Trust

Series 2022-C, Class A4, 3.770%, 2/15/2028 | | | 10,600,000 | | | | 10,253,015 | | |

Series 2023-A, Class A4, 4.420%, 8/15/2028 | | | 16,189,000 | | | | 15,924,383 | | |

Series 2023-B, Class A4, 4.660%, 9/15/2028 | | | 19,879,000 | | | | 19,573,561 | | |

Series 2023-C, Class A4, 5.010%, 2/15/2029 | | | 25,523,000 | | | | 25,533,942 | | |

Volkswagen Auto Loan Enhanced Trust

Series 2023-1, Class A4, 5.010%, 1/22/2030 | | | 11,637,000 | | | | 11,473,636 | | |

World Omni Auto Receivables Trust

Series 2023-A, Class A4, 4.660%, 5/15/2029 | | | 14,612,000 | | | | 14,396,770 | | |

Series 2023-B, Class A4, 4.680%, 5/15/2029 | | | 21,627,000 | | | | 21,322,544 | | |

Series 2023-C, Class A4, 5.030%, 11/15/2029 | | | 10,417,000 | | | | 10,419,304 | | |

| | | $ | 742,976,253 | | |

COLLATERALIZED LOAN OBLIGATION — 4.4% | |

ABPCI Direct Lending Fund CLO X LP

Series 2020-10A, Class A1A, 7.529% (3-Month Term SOFR+221.161

basis points), 1/20/2032(a),(b) | | | $19,397,000 | | | | $19,397,795 | | |

BTC Offshore Holdings Fund

8.230%, 10/20/2029(c),(d) | | | 11,518,874 | | | | 11,518,874 | | |

Cerberus Loan Funding XL LLC

Series 2023-1A, Class A, 7.714% (3-Month Term SOFR+240

basis points), 3/22/2035(a),(b) | | | 10,299,000 | | | | 10,386,655 | | |

Cerberus Loan Funding XLI LLC

Series 2023-2A, Class A1, 7.864% (3-Month Term SOFR+255

basis points), 7/15/2035(a),(b) | | | 51,840,000 | | | | 52,938,179 | | |

Cerberus Loan Funding XLIII LLC

Series 2023-4A, Class A, 7.822% (3-Month Term SOFR+242.5

basis points), 10/15/2035(a),(b) | | | 52,569,000 | | | | 53,483,543 | | |

Fortress Credit Opportunities IX CLO Ltd.

Series 2017-9A, Class A1TR, 7.126% (3-Month Term SOFR+181.161

basis points), 10/15/2033(a),(b) | | | 118,776,000 | | | | 118,452,573 | | |

Golub Capital Partners CLO 45M Ltd.

Series 2019-45A, Class B1, 8.129% (3-Month Term SOFR+281.161

basis points), 10/20/2031(a),(b) | | | 17,314,000 | | | | 17,314,519 | | |

Golub Capital Partners CLO 46M Ltd.

Series 2019-46A, Class A1R, 0.000% (30-Day SOFR Average+0.000

basis points), 4/20/2037(a) | | | 41,996,000 | | | | 41,996,000 | | |

19

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

Golub Capital Partners CLO 67M Ltd.

Series 2023-67A, Class A1, 7.814% (3-Month Term SOFR+250

basis points), 5/9/2036(a),(b) | | | $43,478,000 | | | | $43,731,564 | | |

Lake Shore MM CLO III LLC

Series 2019-2A, Class A2R, 2.525%, 10/17/2031(a) | | | 10,104,518 | | | | 9,673,166 | | |

| | | $ | 378,892,868 | | |

CREDIT CARD — 3.1% | |

American Express Credit Account Master Trust

Series 2023-2, Class A, 4.800%, 5/15/2030 | | $ | 66,293,000 | | | $ | 66,408,515 | | |

Series 2023-4, Class A, 5.150%, 9/15/2030 | | | 77,963,000 | | | | 79,272,412 | | |

Chase Issuance Trust

Series 2023-A2, Class A, 5.080%, 9/15/2030 | | | 45,545,000 | | | | 46,031,020 | | |

Series 2024-A2, Class A, 4.630%, 1/15/2031 | | | 68,829,000 | | | | 68,575,207 | | |

| | | $ | 260,287,154 | | |

EQUIPMENT — 14.4% | |

Avis Budget Rental Car Funding AESOP LLC

Series 2021-2A, Class A, 1.660%, 2/20/2028(a) | | $ | 4,211,000 | | | $ | 3,837,620 | | |

Series 2023-1A, Class A, 5.250%, 4/20/2029(a) | | | 13,136,000 | | | | 13,150,796 | | |

Series 2023-4A, Class A, 5.490%, 6/20/2029(a) | | | 38,251,000 | | | | 38,491,503 | | |

Series 2023-6A, Class A, 5.810%, 12/20/2029(a) | | | 48,017,000 | | | | 49,014,548 | | |

Series 2023-8A, Class A, 6.020%, 2/20/2030(a) | | | 34,038,000 | | | | 35,122,519 | | |

Series 2024-1A, Class A, 5.360%, 6/20/2030(a) | | | 14,768,000 | | | | 14,842,234 | | |

Series 2024-3A, Class A, 5.230%, 12/20/2030 | | | 57,519,000 | | | | 57,390,393 | | |

CNH Equipment Trust

Series 2022-B, Class A4, 3.910%, 3/15/2028 | | | 7,414,000 | | | | 7,204,139 | | |

Series 2023-A, Class A4, 4.770%, 10/15/2030 | | | 6,738,000 | | | | 6,673,317 | | |

Series 2023-B, Class A4, 5.460%, 3/17/2031 | | | 17,009,000 | | | | 17,292,195 | | |

Coinstar Funding LLC

Series 2017-1A, Class A2, 5.216%, 4/25/2047(a) | | | 11,960,245 | | | | 10,601,220 | | |

Enterprise Fleet Financing LLC

Series 2022-2, Class A3, 4.790%, 5/21/2029(a) | | | 32,246,000 | | | | 31,978,342 | | |

Series 2022-3, Class A3, 4.290%, 7/20/2029(a) | | | 9,703,000 | | | | 9,441,015 | | |

Series 2023-1, Class A3, 5.420%, 10/22/2029(a) | | | 28,811,000 | | | | 28,951,730 | | |

Series 2022-4, Class A3, 5.650%, 10/22/2029(a) | | | 18,980,000 | | | | 19,116,330 | | |

Series 2023-2, Class A3, 5.500%, 4/22/2030(a) | | | 37,963,000 | | | | 38,371,471 | | |

Series 2023-3, Class A3, 6.410%, 6/20/2030(a) | | | 34,823,000 | | | | 35,670,226 | | |

Ford Credit Floorplan Master Owner Trust A

Series 2020-2, Class A, 1.060%, 9/15/2027 | | | 5,070,000 | | | | 4,762,335 | | |

Series 2018-4, Class A, 4.060%, 11/15/2030 | | | 83,027,000 | | | | 79,867,333 | | |

20

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

GMF Floorplan Owner Revolving Trust

Series 2023-2, Class A, 5.340%, 6/15/2030(a) | | $ | 18,848,000 | | | $ | 19,078,911 | | |

Series 2024-2A, Class A, 5.060%, 3/17/2031(a) | | | 29,442,000 | | | | 29,596,756 | | |

GreatAmerica Leasing Receivables

Series 2023-1, Class A4, 5.060%, 3/15/2030(a) | | | 16,501,000 | | | | 16,173,166 | | |

GreatAmerica Leasing Receivables Funding LLC

Series 2022-1, Class A4, 5.350%, 7/16/2029(a) | | | 17,738,000 | | | | 17,705,383 | | |

Helios Issuer LLC

Series 2023-GRID1, Class 1A, 5.750%, 12/20/2050(a) | | | 7,205,232 | | | | 7,322,201 | | |

Hertz Vehicle Financing III LLC

Series 2023-4A, Class A, 6.150%, 3/25/2030(a) | | | 31,918,000 | | | | 33,010,288 | | |

Hertz Vehicle Financing III LP

Series 2021-2A, Class A, 1.680%, 12/27/2027(a) | | | 44,631,000 | | | | 40,592,519 | | |

Hertz Vehicle Financing LLC

Series 2022-4A, Class A, 3.730%, 9/25/2026(a) | | | 11,875,000 | | | | 11,599,761 | | |

Series 2022-2A, Class A, 2.330%, 6/26/2028(a) | | | 38,642,000 | | | | 35,396,714 | | |

Series 2022-5A, Class A, 3.890%, 9/25/2028(a) | | | 72,333,000 | | | | 69,038,362 | | |

John Deere Owner Trust

Series 2022-B, Class A4, 3.800%, 5/15/2029 | | | 17,226,000 | | | | 16,713,601 | | |

Series 2023-A, Class A4, 5.010%, 12/17/2029 | | | 15,675,000 | | | | 15,536,729 | | |

Series 2023-B, Class A4, 5.110%, 5/15/2030 | | | 11,706,000 | | | | 11,607,398 | | |

Series 2023-C, Class A4, 5.390%, 8/15/2030 | | | 15,742,000 | | | | 15,882,883 | | |

Kubota Credit Owner Trust

Series 2022-2A, Class A4, 4.170%, 6/15/2028(a) | | | 34,050,000 | | | | 32,958,926 | | |

Series 2023-2A, Class A4, 5.230%, 6/15/2028(a) | | | 12,897,000 | | | | 12,798,626 | | |

Series 2023-1A, Class A4, 5.070%, 2/15/2029(a) | | | 9,456,000 | | | | 9,383,250 | | |

M&T Equipment Notes

Series 2023-1A, Class A4, 5.750%, 7/15/2030(a) | | | 9,785,000 | | | | 9,716,895 | | |

MMAF Equipment Finance LLC

Series 2023-A, Class A4, 5.500%, 12/13/2038(a) | | | 24,567,000 | | | | 24,431,206 | | |

Series 2020-A, Class A5, 1.560%, 10/9/2042(a) | | | 7,081,000 | | | | 6,290,127 | | |

Series 2024-A, Class A4, 5.100%, 7/13/2049(a) | | | 15,739,000 | | | | 15,733,625 | | |

Prop 2017-1A

5.300%, 3/15/2042(c),(d) | | | 13,090,009 | | | | 11,290,133 | | |

Verizon Master Trust

Series 2022-6, Class A, 3.670%, 1/22/2029 | | | 37,943,000 | | | | 37,165,100 | | |

Series 2023-3, Class A, 4.730%, 4/21/2031(a) | | | 59,567,000 | | | | 59,324,646 | | |

Series 2023-6, Class A, 5.350%, 9/22/2031(a) | | | 76,585,000 | | | | 78,155,184 | | |

Series 2024-2, Class A, 4.830%, 12/22/2031(a) | | | 85,708,000 | | | | 85,669,037 | | |

| | | $ | 1,223,950,693 | | |

21

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

OTHER — 12.0% | |

ABPCI Direct Lending Fund ABS I Ltd.

Series 2020-1A, Class A, 3.199%, 12/20/2030(a) | | $ | 32,871,932 | | | $ | 31,387,633 | | |

ABPCI Direct Lending Fund ABS II LLC

Series 2022-2A, Class A1, 7.419% (3-Month Term SOFR+210

basis points), 3/1/2032(a),(b) | | | 26,204,000 | | | | 25,660,372 | | |

American Tower Trust 1

5.490%, 3/15/2028(a) | | | 77,012,000 | | | | 77,434,488 | | |

Brazos Securitization LLC

5.014%, 9/1/2031(a) | | | 9,051,037 | | | | 9,006,676 | | |

Cleco Securitization I LLC

4.016%, 3/1/2031 | | | 20,106,742 | | | | 19,252,206 | | |

Cologix Data Centers US Issuer LLC

Series 2021-1A, Class A2, 3.300%, 12/26/2051(a) | | | 58,068,000 | | | | 52,064,384 | | |

Consumers 2023 Securitization Funding LLC

5.210%, 9/1/2031 | | | 22,847,000 | | | | 22,961,235 | | |

DataBank Issuer

Series 2021-1A, Class A2, 2.060%, 2/27/2051(a) | | | 14,750,000 | | | | 13,384,514 | | |

DTE Electric Securitization Funding II LLC

5.970%, 3/1/2033 | | | 29,726,000 | | | | 30,654,937 | | |

Elm Trust

Series 2020-3A, Class A2, 2.954%, 8/20/2029(a) | | | 4,650,698 | | | | 4,447,733 | | |

Series 2020-4A, Class A2, 2.286%, 10/20/2029(a) | | | 4,951,669 | | | | 4,711,805 | | |

FCI Funding LLC

Series 2021-1A, Class A, 1.130%, 4/15/2033(a) | | | 1,369,549 | | | | 1,356,367 | | |

Golub Capital Partners ABS Funding Ltd.

Series 2020-1A, Class A2, 3.208%, 1/22/2029(a) | | | 25,046,792 | | | | 23,852,861 | | |

Series 2021-1A, Class A2, 2.773%, 4/20/2029(a) | | | 48,770,678 | | | | 46,187,392 | | |

Series 2021-2A, Class A, 2.944%, 10/19/2029(a) | | | 95,445,000 | | | | 88,047,726 | | |

Kansas Gas Service Securitization I LLC

5.486%, 8/1/2032 | | | 47,781,986 | | | | 48,740,527 | | |

Louisiana Local Government Environmental Facilities & Community

Development Auth Rev. 3.615%, 2/1/2029 | | | 33,161,936 | | | | 32,073,658 | | |

Monroe Capital ABS Funding Ltd.

Series 2021-1A, Class A2, 2.815%, 4/22/2031(a) | | | 40,218,436 | | | | 39,046,832 | | |

Oklahoma Development Finance Authority

4.135%, 12/1/2033 | | | 28,308,459 | | | | 27,237,602 | | |

4.285%, 2/1/2034 | | | 10,073,973 | | | | 9,808,071 | | |

3.877%, 5/1/2037 | | | 23,605,124 | | | | 22,691,842 | | |

Oportun Issuance Trust

Series 2021-C, Class A, 2.180%, 10/8/2031(a) | | | 64,181,000 | | | | 60,568,303 | | |

22

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

PFS Financing Corp.

Series 2022-C, Class B, 4.390%, 5/15/2027(a) | | $ | 11,913,000 | | | $ | 11,683,132 | | |

Series 2022-D, Class A, 4.270%, 8/15/2027(a) | | | 71,781,000 | | | | 70,691,228 | | |

PG&E Recovery Funding LLC

5.045%, 7/15/2032 | | | 36,831,297 | | | | 36,576,432 | | |

PG&E Wildfire Recovery Funding LLC

4.022%, 6/1/2031 | | | 47,672,956 | | | | 46,698,344 | | |

SBA Tower Trust

1.631%, 11/15/2026(a) | | | 14,427,000 | | | | 12,954,169 | | |

2.328%, 1/15/2028(a) | | | 17,196,000 | | | | 15,334,230 | | |

6.599%, 1/15/2028(a) | | | 12,423,000 | | | | 12,690,903 | | |

SpringCastle America Funding LLC

Series 2020-AA, Class A, 1.970%, 9/25/2037(a) | | | 12,448,782 | | | | 11,390,875 | | |

Texas Natural Gas Securitization Finance Corp.

5.102%, 4/1/2035 | | | 8,561,000 | | | | 8,625,307 | | |

TVEST LLC

Series 2020-A, Class A, 4.500%, 7/15/2032(a) | | | 901,318 | | | | 898,035 | | |

Vantage Data Centers Issuer LLC

Series 2020-1A, Class A2, 1.645%, 9/15/2045(a) | | | 19,214,000 | | | | 17,988,815 | | |

VCP RRL ABS I Ltd.

Series 2021-1A, Class A, 2.152%, 10/20/2031(a) | | | 34,907,184 | | | | 32,860,995 | | |

Virginia Power Fuel Securitization LLC

4.877%, 5/1/2031 | | | 46,386,000 | | | | 46,202,358 | | |

WEPCo Environmental Trust Finance LLC

Series 2021-1, Class A, 1.578%, 12/15/2035 | | | 9,664,729 | | | | 8,274,661 | | |

| | | $ | 1,023,446,648 | | |

| TOTAL ASSET-BACKED SECURITIES (Cost $3,660,866,997) | | $ | 3,629,553,616 | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES — 20.3% | |

AGENCY — 13.6% | |

Federal Home Loan Mortgage Corp.

Series K054, Class A2, 2.745%, 1/25/2026 | | $ | 3,600,000 | | | $ | 3,464,608 | | |

Series K057, Class A2, 2.570%, 7/25/2026 | | | 87,324,000 | | | | 83,252,187 | | |

Series K058, Class A2, 2.653%, 8/25/2026 | | | 13,173,000 | | | | 12,525,258 | | |

Series K061, Class A2, 3.347%, 11/25/2026(b) | | | 78,273,705 | | | | 75,525,531 | | |

Series K062, Class A2, 3.413%, 12/25/2026 | | | 41,061,276 | | | | 39,620,374 | | |

Series K063, Class A2, 3.430%, 1/25/2027(b) | | | 16,539,000 | | | | 15,958,550 | | |

Series K065, Class A2, 3.243%, 4/25/2027 | | | 9,702,802 | | | | 9,266,598 | | |

Series K066, Class A2, 3.117%, 6/25/2027 | | | 7,223,000 | | | | 6,898,659 | | |

23

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

Series K068, Class A2, 3.244%, 8/25/2027 | | $ | 8,509,735 | | | $ | 8,128,685 | | |

Series K072, Class A2, 3.444%, 12/25/2027 | | | 12,338,034 | | | | 11,788,207 | | |

Series K073, Class A2, 3.350%, 1/25/2028 | | | 29,086,020 | | | | 27,791,128 | | |

Series K076, Class A2, 3.900%, 4/25/2028 | | | 16,051,256 | | | | 15,659,885 | | |

Series K077, Class A2, 3.850%, 5/25/2028(b) | | | 4,086,000 | | | | 3,945,761 | | |

Series K079, Class A2, 3.926%, 6/25/2028 | | | 30,559,000 | | | | 29,818,595 | | |

Series K080, Class A2, 3.926%, 7/25/2028(b) | | | 25,020,308 | | | | 24,415,444 | | |

Series K081, Class A2, 3.900%, 8/25/2028(b) | | | 62,664,000 | | | | 60,525,177 | | |

Series K082, Class A2, 3.920%, 9/25/2028(b) | | | 46,777,000 | | | | 45,181,717 | | |

Series K083, Class A2, 4.050%, 9/25/2028(b) | | | 24,028,000 | | | | 23,449,571 | | |

Series K084, Class A2, 3.780%, 10/25/2028(b) | | | 68,841,723 | | | | 66,498,413 | | |

Series K085, Class A2, 4.060%, 10/25/2028(b) | | | 27,924,000 | | | | 27,252,794 | | |

Series K089, Class A2, 3.563%, 1/25/2029 | | | 27,195,714 | | | | 25,902,161 | | |

Series K091, Class A2, 3.505%, 3/25/2029 | | | 25,293,822 | | | | 24,185,452 | | |

Series K093, Class A2, 2.982%, 5/25/2029 | | | 4,340,000 | | | | 4,019,902 | | |

Series K095, Class A2, 2.785%, 6/25/2029 | | | 84,442,000 | | | | 77,376,949 | | |

Series K094, Class A2, 2.903%, 6/25/2029 | | | 62,185,000 | | | | 57,604,882 | | |

Series K097, Class A2, 2.508%, 7/25/2029 | | | 40,814,000 | | | | 36,994,732 | | |

Series K096, Class A2, 2.519%, 7/25/2029 | | | 90,012,000 | | | | 81,214,281 | | |

| 2.537%, 10/25/2029 | | | 33,400,000 | | | | 30,110,558 | | |

| 1.639%, 1/25/2030 | | | 4,756,000 | | | | 4,074,227 | | |

Freddie Mac Multifamily Structured Pass-Through Certificates

Series K088, Class A2, 3.690%, 1/25/2029 | | | 4,691,000 | | | | 4,485,065 | | |

Series K090, Class A2, 3.422%, 2/25/2029 | | | 43,626,000 | | | | 41,277,512 | | |

Series K092, Class A2, 3.298%, 4/25/2029 | | | 2,376,000 | | | | 2,232,144 | | |

Series K103, Class A2, 2.651%, 11/25/2029 | | | 47,045,000 | | | | 42,649,134 | | |

Series K105, Class A2, 1.872%, 1/25/2030 | | | 1,370,000 | | | | 1,187,348 | | |

Series K104, Class A2, 2.253%, 1/25/2030 | | | 1,355,000 | | | | 1,201,380 | | |

Series K751, Class A2, 4.412%, 3/25/2030 | | | 61,806,000 | | | | 61,173,490 | | |

Series K109, Class A2, 1.558%, 4/25/2030 | | | 17,591,000 | | | | 14,807,905 | | |

Series K114, Class A2, 1.366%, 6/25/2030 | | | 7,589,000 | | | | 6,275,459 | | |

Series K754, Class A2, 4.940%, 11/25/2030(b) | | | 49,832,183 | | | | 50,739,677 | | |

| | | $ | 1,158,479,400 | | |

AGENCY STRIPPED — 0.4% | |

Government National Mortgage Association

Series 2014-77, Class IO, 0.570%, 12/16/2047(b) | | $ | 10,743,812 | | | $ | 95,036 | | |

Series 2012-25, Class IO, 0.398%, 8/16/2052(b) | | | 105,027 | | | | 3 | | |

Series 2012-150, Class IO, 0.437%, 11/16/2052(b) | | | 16,305,409 | | | | 257,901 | | |

Series 2012-114, Class IO, 0.623%, 1/16/2053(b) | | | 14,623,703 | | | | 214,166 | | |

Series 2012-125, Class IO, 0.172%, 2/16/2053(b) | | | 34,848,677 | | | | 212,162 | | |

Series 2012-79, Class IO, 0.352%, 3/16/2053(b) | | | 36,096,554 | | | | 457,740 | | |

24

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

Series 2012-45, Class IO, 0.000%, 4/16/2053(b),(e) | | $ | 589,171 | | | $ | 1 | | |

Series 2013-45, Class IO, 0.073%, 12/16/2053(b) | | | 19,689,740 | | | | 12,735 | | |

Series 2013-125, Class IO, 0.232%, 10/16/2054(b) | | | 6,771,653 | | | | 95,617 | | |

Series 2014-157, Class IO, 0.189%, 5/16/2055(b) | | | 24,399,270 | | | | 158,949 | | |

Series 2014-153, Class IO, 0.341%, 4/16/2056(b) | | | 28,725,572 | | | | 358,699 | | |

Series 2014-138, Class IO, 0.527%, 4/16/2056(b) | | | 4,950,725 | | | | 90,458 | | |

Series 2014-175, Class IO, 0.534%, 4/16/2056(b) | | | 65,947,231 | | | | 1,077,644 | | |

Series 2014-187, Class IO, 0.615%, 5/16/2056(b) | | | 66,208,645 | | | | 1,439,045 | | |

Series 2015-41, Class IO, 0.168%, 9/16/2056(b) | | | 5,538,955 | | | | 39,479 | | |

Series 2015-108, Class IO, 0.338%, 10/16/2056(b) | | | 1,455,065 | | | | 15,535 | | |

Series 2014-110, Class IO, 0.106%, 1/16/2057(b) | | | 11,804,873 | | | | 64,246 | | |

Series 2015-19, Class IO, 0.294%, 1/16/2057(b) | | | 27,578,231 | | | | 390,853 | | |

Series 2015-7, Class IO, 0.454%, 1/16/2057(b) | | | 16,727,356 | | | | 322,575 | | |

Series 2015-169, Class IO, 0.256%, 7/16/2057(b) | | | 44,523,187 | | | | 539,305 | | |

Series 2015-150, Class IO, 0.365%, 9/16/2057(b) | | | 7,578,744 | | | | 139,699 | | |

Series 2016-125, Class IO, 0.870%, 12/16/2057(b) | | | 38,504,592 | | | | 1,472,489 | | |

Series 2016-65, Class IO, 0.491%, 1/16/2058(b) | | | 29,043,686 | | | | 681,228 | | |

Series 2016-106, Class IO, 0.969%, 9/16/2058(b) | | | 83,720,192 | | | | 3,727,650 | | |

Series 2020-43, Class IO, 1.261%, 11/16/2061(b) | | | 41,769,063 | | | | 3,083,292 | | |

Series 2020-71, Class IO, 1.102%, 1/16/2062(b) | | | 53,559,429 | | | | 3,631,115 | | |

Series 2020-75, Class IO, 0.870%, 2/16/2062(b) | | | 99,355,681 | | | | 5,877,862 | | |

Series 2020-42, Class IO, 0.937%, 3/16/2062(b) | | | 125,143,995 | | | | 7,618,341 | | |

| | | $ | 32,073,825 | | |

NON-AGENCY — 6.3% | |

A10 Bridge Asset Financing LLC

Series 2021-D, Class A1FX, 2.589%, 10/1/2038(a) | | $ | 5,468,841 | | | $ | 5,229,831 | | |

ACRES Commercial Realty Ltd.

Series 2021-FL1, Class A, 6.640% (1-Month Term SOFR+131.448

basis points), 6/15/2036(a),(b) | | | 50,204,790 | | | | 49,850,861 | | |

Series 2021-FL2, Class A, 6.840% (1-Month Term SOFR+151.448

basis points), 1/15/2037(a),(b) | | | 12,690,979 | | | | 12,625,603 | | |

Arbor Realty Commercial Real Estate Notes Ltd.

Series 2021-FL2, Class A, 6.540% (1-Month Term SOFR+121.448

basis points), 5/15/2036(a),(b) | | | 11,932,803 | | | | 11,892,089 | | |

Series 2021-FL4, Class A, 6.790% (1-Month Term SOFR+146.448

basis points), 11/15/2036(a),(b) | | | 59,062,000 | | | | 58,619,573 | | |

Series 2022-FL1, Class A, 6.769% (30-Day SOFR Average+145

basis points), 1/15/2037(a),(b) | | | 57,822,000 | | | | 57,370,312 | | |

Series 2022-FL2, Class A, 7.175% (1-Month Term SOFR+185

basis points), 5/15/2037(a),(b) | | | 35,540,000 | | | | 35,462,271 | | |

BBCMS Trust

Series 2015-SRCH, Class A1, 3.312%, 8/10/2035(a) | | | 9,211,793 | | | | 8,642,365 | | |

25

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

BX Commercial Mortgage Trust

Series 2021-VOLT, Class E, 7.440% (1-Month Term SOFR+211.448

basis points), 9/15/2036(a),(b) | | | $28,900,000 | | | | $28,484,620 | | |

HERA Commercial Mortgage Ltd. | |

Series 2021-FL1, Class A, 6.491% (1-Month Term SOFR+116.448

basis points), 2/18/2038(a),(b) | | | 40,568,451 | | | | 39,900,350 | | |

Independence Plaza Trust

Series 2018-INDP, Class A, 3.763%, 7/10/2035(a) | | | 11,081,000 | | | | 10,606,446 | | |

JPMBB Commercial Mortgage Securities Trust

Series 2015-C31, Class A3, 3.801%, 8/15/2048 | | | 7,303,193 | | | | 7,058,802 | | |

KREF Ltd.

Series 2021-FL2, Class A, 6.510% (1-Month Term SOFR+118.448

basis points), 2/15/2039(a),(b) | | | 19,179,000 | | | | 18,723,742 | | |

MF1 Ltd.

Series 2020-FL4, Class A, 7.140% (1-Month Term SOFR+181.448

basis points), 11/15/2035(a),(b) | | | 7,752,285 | | | | 7,757,130 | | |

Progress Residential Trust

Series 2023-SFR2, Class A, 4.500%, 10/17/2028(a) | | | 27,217,000 | | | | 26,517,499 | | |

Series 2021-SFR11, Class A, 2.283%, 1/17/2039(a) | | | 13,809,396 | | | | 12,190,638 | | |

Series 2021-SFR7, Class A, 1.692%, 8/17/2040(a) | | | 14,323,782 | | | | 12,386,422 | | |

Series 2021-SFR9, Class A, 2.013%, 11/17/2040(a) | | | 8,797,640 | | | | 7,666,029 | | |

Series 2021-SFR10, Class A, 2.393%, 12/17/2040(a) | | | 56,266,438 | | | | 50,022,197 | | |

STWD Ltd.

Series 2021-FL2, Class A, 6.641% (1-Month Term SOFR+131.448

basis points), 4/18/2038(a),(b) | | | 29,989,730 | | | | 29,509,774 | | |

TRTX Issuer Ltd.

Series 2022-FL5, Class A, 6.968% (30-Day SOFR Average+165

basis points), 2/15/2039(a),(b) | | | 37,857,000 | | | | 37,589,983 | | |

VMC Finance LLC

Series 2021-HT1, Class A, 7.091% (1-Month Term SOFR+176.448

basis points), 1/18/2037(a),(b) | | | 12,103,632 | | | | 11,953,593 | | |

| | | $ | 540,060,130 | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(Cost $1,760,847,995) | | $ | 1,730,613,355 | | |

CORPORATE BANK DEBT — 0.8% | |

Axiom Global, Inc.

10.179% (1-Month Term SOFR+485 basis points), 10/1/2026(b),(d),(f) | | $ | 22,601,282 | | | $ | 21,866,741 | | |

26

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

Capstone Acquisition Holdings, Inc. 2020 Delayed Draw Term Loan

10.180% (1-Month Term SOFR+485 basis points),

11/12/2027(b),(c),(d),(f) | | $ | 1,067,255 | | | $ | 1,021,681 | | |

Capstone Acquisition Holdings, Inc. 2020 Term Loan

10.180% (1-Month Term SOFR+485 basis points), 11/12/2027(b),(c),(d),(f) | | | 18,345,463 | | | | 17,562,075 | | |

Frontier Communications Holdings LLC

9.195% (1-Month Term SOFR+386.4 basis points), 10/8/2027(b),(d),(f) | | | 23,085,030 | | | | 22,931,053 | | |

JC Penney Corp., Inc.

9.500% (3-Month USD Libor+425 basis points), 6/23/2025*,(b),(d),(f),(h) | | | 26,698,432 | | | | 2,670 | | |

Lealand Finance Company B.V. Senior Exit LC

5.250%, 6/30/2027(b),(c),(d),(f),(g),(i) | | | 10,625,126 | | | | (3,825,045 | ) | |

McDermott Tanks Secured LC

10.250%, 12/31/2026(b),(c),(d),(f),(g),(i) | | | 5,724,134 | | | | (915,862 | ) | |

McDermott Technology Americas, Inc.

6.443% (1-Month Term SOFR+111.4 basis points), 12/31/2027(b),(d),(e),(f),(j) | | | 338,566 | | | | 134,580 | | |

Windstream Services LLC

11.676% (1-Month Term SOFR+635 basis points),

9/21/2027(b),(d),(f) | | | 12,962,268 | | | | 12,616,564 | | |

| TOTAL CORPORATE BANK DEBT (Cost $76,490,809) | | $ | 71,394,457 | | |

CORPORATE BONDS — 4.1% | |

COMMUNICATIONS — 0.1% | |

Frontier Communications Holdings LLC

5.875%, 10/15/2027(a) | | $ | 5,925,000 | | | $ | 5,719,477 | | |

CONSUMER DISCRETIONARY — 0.2% | |

Amazon.com, Inc.

1.650%, 5/12/2028 | | $ | 22,427,000 | | | $ | 19,994,258 | | |

FINANCIALS — 2.8% | |

Apollo Debt Solutions BDC Senior Notes

8.620%, 9/28/2028(c),(d),(f),(g) | | $ | 26,023,000 | | | $ | 26,023,000 | | |

Ares Capital Corp.

2.875%, 6/15/2028 | | | 41,510,000 | | | | 36,970,010 | | |

Blackstone Private Credit Fund

3.250%, 3/15/2027 | | | 33,271,000 | | | | 30,682,902 | | |

Blue Owl Credit Income Corp.

4.700%, 2/8/2027 | | | 6,893,000 | | | | 6,531,432 | | |

7.750%, 9/16/2027 | | | 49,529,000 | | | | 50,675,884 | | |

7.950%, 6/13/2028(a) | | | 22,579,000 | | | | 23,347,363 | | |

27

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

HPS Corporate Lending Fund

6.750%, 1/30/2029(a) | | $ | 24,864,000 | | | $ | 24,791,322 | | |

Oaktree Strategic Credit Fund

8.400%, 11/14/2028(a) | | | 27,351,000 | | | | 28,982,624 | | |

OCREDIT BDC Senior Notes

7.770%, 3/7/2029(c),(d) | | | 12,891,000 | | | | 12,891,000 | | |

| | | $ | 240,895,537 | | |

HEALTH CARE — 0.5% | |

Heartland Dental LLC/Heartland Dental Finance Corp.

10.500% (1-Month Term SOFR+0.000 basis points), 4/30/2028(a),(d),(f) | | $ | 40,809,000 | | | $ | 43,257,540 | | |

TECHNOLOGY — 0.5% | |

Hlend Senior Notes

8.170%, 3/15/2028(c),(d) | | $ | 42,500,000 | | | $ | 42,500,000 | | |

| TOTAL CORPORATE BONDS (Cost $343,724,659) | | $ | 352,366,812 | | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES — 18.6% | |

AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 0.0% | |

Federal National Mortgage Association

Series 2010-43, Class MK, 5.500%, 5/25/2040 | | $ | 310,429 | | | $ | 309,848 | | |

Series 2012-144, Class PD, 3.500%, 4/25/2042 | | | 1,187,210 | | | | 1,139,413 | | |

Series 2013-93, Class PJ, 3.000%, 7/25/2042 | | | 587,446 | | | | 552,366 | | |

| | | $ | 2,001,627 | | |

AGENCY POOL ADJUSTABLE RATE — 2.0% | |

Fannie Mae Pool

1.726% (30-Day SOFR Average+211 basis points), 7/1/2051(b) | | $ | 2,875,821 | | | $ | 2,497,193 | | |

1.970% (30-Day SOFR Average+207.5 basis points), 8/1/2051(b) | | | 26,718,316 | | | | 23,597,833 | | |

1.609% (30-Day SOFR Average+209.5 basis points), 9/1/2051(b) | | | 2,072,356 | | | | 1,788,377 | | |

1.892% (30-Day SOFR Average+233 basis points), 4/1/2052(b) | | | 23,654,388 | | | | 20,558,904 | | |

Freddie Mac Non Gold Pool

1.687% (30-Day SOFR Average+213 basis points), 9/1/2051(b) | | | 9,873,316 | | | | 8,510,564 | | |

2.568% (30-Day SOFR Average+213 basis points), 3/1/2052(b) | | | 13,252,476 | | | | 11,825,191 | | |

2.546% (30-Day SOFR Average+214 basis points), 5/1/2052(b) | | | 8,356,773 | | | | 7,487,814 | | |

2.154% (30-Day SOFR Average+217.6 basis points), 7/1/2052(b) | | | 83,673,824 | | | | 73,149,941 | | |

3.404% (30-Day SOFR Average+221.8 basis points), 11/1/2052(b) | | | 11,295,623 | | | | 10,432,838 | | |

2.160% (30-Day SOFR Average+217.7 basis points), 5/1/2053(b) | | | 12,335,269 | | | | 10,884,517 | | |

| | | $ | 170,733,172 | | |

28

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

AGENCY POOL FIXED RATE — 11.9% | |

Fannie Mae Pool

1.500%, 12/1/2035 | | $ | 80,440,147 | | | $ | 70,139,320 | | |

1.000%, 4/1/2036 | | | 17,931,887 | | | | 15,004,820 | | |

1.500%, 4/1/2036 | | | 5,976,753 | | | | 5,196,453 | | |

1.500%, 4/1/2036 | | | 9,623,974 | | | | 8,367,509 | | |

1.500%, 8/1/2036 | | | 108,057,213 | | | | 93,949,717 | | |

1.500%, 8/1/2036 | | | 7,730,715 | | | | 6,709,346 | | |

1.500%, 9/1/2036 | | | 13,285,821 | | | | 11,530,521 | | |

1.500%, 10/1/2036 | | | 32,665,047 | | | | 28,277,942 | | |

1.000%, 12/1/2036 | | | 104,353,275 | | | | 86,687,183 | | |

1.000%, 3/1/2037 | | | 155,415,596 | | | | 129,105,103 | | |

2.000%, 11/1/2040 | | | 7,160,160 | | | | 6,032,857 | | |

2.500%, 5/1/2041 | | | 16,723,659 | | | | 14,564,016 | | |

2.000%, 7/1/2041 | | | 10,001,257 | | | | 8,389,144 | | |

1.500%, 10/1/2041 | | | 65,673,520 | | | | 53,195,242 | | |

1.500%, 11/1/2041 | | | 97,165,312 | | | | 78,703,446 | | |

2.000%, 8/1/2042 | | | 23,732,649 | | | | 19,907,158 | | |

3.500%, 4/1/2044 | | | 34,538,655 | | | | 31,668,368 | | |

Federal Home Loan Mortgage Corp.

2.500%, 11/1/2027 | | | 1,364,252 | | | | 1,309,381 | | |

2.500%, 2/1/2028 | | | 974,416 | | | | 935,765 | | |

2.500%, 8/1/2028 | | | 503,293 | | | | 480,750 | | |

2.500%, 11/1/2028 | | | 56,025,571 | | | | 53,609,732 | | |

Federal National Mortgage Association

2.500%, 1/1/2028 | | | 532,792 | | | | 511,035 | | |

2.500%, 11/1/2030 | | | 27,235,534 | | | | 25,871,088 | | |

2.500%, 10/1/2031 | | | 3,343,307 | | | | 3,204,732 | | |

2.500%, 2/1/2035 | | | 33,359,208 | | | | 31,937,629 | | |

Freddie Mac Pool

1.500%, 11/1/2035 | | | 107,603,817 | | | | 93,824,524 | | |

1.500%, 6/1/2036 | | | 17,342,229 | | | | 15,002,228 | | |

1.000%, 7/1/2036 | | | 6,316,342 | | | | 5,268,658 | | |

1.500%, 8/1/2036 | | | 31,995,639 | | | | 27,768,430 | | |

1.500%, 10/1/2036 | | | 23,971,194 | | | | 20,751,724 | | |

1.500%, 11/1/2036 | | | 7,048,956 | | | | 6,128,674 | | |

2.000%, 5/1/2042 | | | 42,411,302 | | | | 35,574,977 | | |

2.000%, 8/1/2042 | | | 28,648,768 | | | | 23,968,172 | | |

| | | $ | 1,013,575,644 | | |

29

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 4.7% | |

Citigroup Mortgage Loan Trust

Series 2014-A, Class A, 4.000%, 1/25/2035(a),(b) | | $ | 2,152,671 | | | $ | 2,039,054 | | |

GS Mortgage-Backed Securities Trust

Series 2021-PJ6, Class A8, 2.500%, 11/25/2051 | | | 13,230,900 | | | | 11,491,141 | | |

Series 2021-PJ7, Class A8, 2.500%, 1/25/2052(a),(b) | | | 18,531,460 | | | | 16,075,995 | | |

Series 2022-PJ2, Class A24, 3.000%, 6/25/2052 | | | 16,044,566 | | | | 14,227,078 | | |

J.P. Morgan Mortgage Trust

Series 2021-13, Class A4, 2.500%, 4/25/2052 | | | 15,189,717 | | | | 13,220,218 | | |

Series 2022-3, Class A4A, 2.500%, 8/25/2052 | | | 3,508,817 | | | | 3,030,336 | | |

Series 2024-3, Class A4, 3.000%, 5/25/2054 | | | 33,629,000 | | | | 29,687,570 | | |

PRET LLC

Series 2021-NPL6, Class A1, 2.487%, 7/25/2051(a),(k) | | | 9,590,317 | | | | 9,267,853 | | |

Series 2021-NPL5, Class A1, 2.487%, 10/25/2051(a),(k) | | | 51,565,972 | | | | 49,754,310 | | |

Pretium Mortgage Credit Partners I LLC

Series 2021-NPL2, Class A1, 1.992%, 6/27/2060(a),(k) | | | 21,953,817 | | | | 21,306,200 | | |

Series 2021-NPL4, Class A1, 2.363%, 10/27/2060(a),(k) | | | 33,956,415 | | | | 32,699,847 | | |

Pretium Mortgage Credit Partners LLC

Series 2024-RPL1, Class A1, 3.900%, 10/25/2063 | | | 9,194,500 | | | | 8,656,714 | | |

PRPM LLC

Series 2021-2, Class A1, 5.115%, 3/25/2026(a),(b) | | | 13,504,418 | | | | 13,266,727 | | |

Series 2021-9, Class A1, 2.363%, 10/25/2026(a) | | | 17,207,636 | | | | 16,575,835 | | |

Series 2021-10, Class A1, 2.487%, 10/25/2026(a),(k) | | | 22,652,109 | | | | 21,852,909 | | |

Series 2021-11, Class A1, 2.487%, 11/25/2026(a),(k) | | | 25,244,717 | | | | 24,407,204 | | |

Towd Point Mortgage Trust

Series 2018-2, Class A1, 3.250%, 3/25/2058(a),(b) | | | 16,309,040 | | | | 15,733,588 | | |

Series 2018-5, Class A1A, 3.250%, 7/25/2058(a),(b) | | | 10,125,003 | | | | 9,797,115 | | |

Series 2020-4, Class A1, 1.750%, 10/25/2060(a) | | | 8,104,278 | | | | 7,129,910 | | |

Series 2023-1, Class A1, 3.750%, 1/25/2063(a) | | | 22,617,626 | | | | 21,203,552 | | |

VCAT LLC

Series 2021-NPL1, Class A1, 5.289%, 12/26/2050(a),(k) | | | 1,824,697 | | | | 1,809,421 | | |

Series 2021-NPL2, Class A1, 5.115%, 3/27/2051(a) | | | 12,144,534 | | | | 11,968,020 | | |

VOLT C LLC

Series 2021-NPL9, Class A1, 1.992%, 5/25/2051(a) | | | 12,532,670 | | | | 12,218,583 | | |

VOLT XCIV LLC

Series 2021-NPL3, Class A1, 5.239%, 2/27/2051(a),(k) | | | 15,143,829 | | | | 14,876,715 | | |

VOLT XCV LLC

Series 2021-NPL4, Class A1, 5.240%, 3/27/2051(a) | | | 15,314,953 | | | | 14,994,931 | | |

| | | $ | 397,290,826 | | |

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES

(Cost $1,585,992,770) | | $ | 1,583,601,269 | | |

30

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Value | |

U.S. TREASURY NOTES & BONDS — 7.1% | |

U.S. Treasury Note

4.000%, 1/31/2029 | | $ | 400,728,000 | | | $ | 396,700,443 | | |

4.250%, 2/28/2029 | | | 95,241,000 | | | | 95,393,081 | | |

4.625%, 9/30/2030 | | | 106,471,000 | | | | 108,837,690 | | |

| TOTAL U.S. TREASURY NOTES & BONDS (Cost $600,322,323) | | $ | 600,931,214 | | |

| TOTAL BONDS & DEBENTURES (Cost $8,028,245,553) | | $ | 7,968,460,723 | | |

COMMON STOCKS — 1.6% | | Number

of Shares | | | |

METALS & MINING — 0.6% | |

Boart Longyear Group Ltd.*,(c) | | | 43,018,605 | | | $ | 55,114,609 | | |

REAL ESTATE SERVICES — 0.1% | |

Copper Property CTL Pass Through Trust(d) | | | 520,208 | | | $ | 5,124,049 | | |

TRANSPORTATION & LOGISTICS — 0.9% | |

PHI Group, Inc.(c),(d),(l) | | | 3,806,420 | | | $ | 76,128,400 | | |

| TOTAL COMMON STOCKS (Cost $139,264,410) | | $ | 136,367,058 | | |

SHORT-TERM INVESTMENTS — 5.5% | |

MONEY MARKET INVESTMENTS — 1.2% | |

Morgan Stanley Institutional Liquidity Treasury Portfolio — Institutional

Class, 5.08%(m) | | | 102,316,425 | | | $ | 102,316,425 | | |

TREASURY BILLS — 4.3% | | Principal

Amount | | | |

U.S. Treasury Bill, 2.64%, 4/4/2024(n) | | $ | 362,923,000 | | | $ | 362,765,128 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $465,081,554) | | $ | 465,081,553 | | |

| TOTAL INVESTMENTS — 100.6% (Cost $8,632,591,517) | | $ | 8,569,909,334 | | |

Liabilities in Excess of Other Assets — (0.6)% | | | (47,456,002 | ) | |

TOTAL NET ASSETS — 100.0% | | $ | 8,522,453,332 | | |

31

FPA NEW INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

As of March 31, 2024

(Unaudited)

BDC — Business Development Company

IO — Interest Only

LLC — Limited Liability Company

LP — Limited Partnership

US — United States

* Non-income producing security.

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities are restricted and may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities is $3,170,987,405, which represents 37.21% of Net Assets.

(b) Variable or floating rate security.