| | OMB APPROVAL |

| | OMB Number: | 3235-0570 |

| | Expires: | August 31, 2010 |

| UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . . . .18.9 |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| | | | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08612 |

|

MARTIN CURRIE BUSINESS TRUST |

(Exact name of registrant as specified in charter) |

|

Saltire Court, 20 Castle Terrace, Edinburgh, Scotland | | EH1 2ES |

(Address of principal executive offices) | | (Zip code) |

|

Grant Spence c/o Martin Currie, Inc. Saltire Court 20 Castle Terrace Edinburgh Scotland EH1 2ES |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 011-44-131-229-5252 | |

|

Date of fiscal year end: | April 30 | |

|

Date of reporting period: | May 1, 2009 to October 31, 2009 | |

| | | | | | | | | |

Explanatory Note: The registrant, an open-end investment company registered pursuant to Section 8(b) of the Investment Company Act of 1940 (the “Act”), has not filed a registration statement that has gone effective under the Securities Act of 1933 (the “1933 Act”) because beneficial interests in the registrant are issued and sold solely in private transactions that do not involve any public offering within the meaning of Section 4(2) of the 1933 Act. Accordingly, this report is not filed under Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934.

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

MARTIN CURRIE BUSINESS TRUST

MCBT Opportunistic EAFE Fund

MCBT Global Emerging Markets Fund

MCBT Pan European Select Fund

SEMI-ANNUAL REPORT

OCTOBER 31, 2009

MARTIN CURRIE BUSINESS TRUST

TABLE OF CONTENTS

| | | Page | |

| Management Discussion and Analysis | | | 2 | | |

|

| Schedules of Investments | |

|

| MCBT Opportunistic EAFE Fund | | | 11 | | |

|

| MCBT Global Emerging Markets Fund | | | 15 | | |

|

| MCBT Pan European Select Fund | | | 18 | | |

|

| Statements of Assets & Liabilities | | | 21 | | |

|

| Statements of Operations | | | 22 | | |

|

| Statements of Changes in Net Assets | | | 23 | | |

|

| Financial Highlights | | | 25 | | |

|

| Notes to Financial Statements | | | 28 | | |

|

| Other Information | | | 35 | | |

|

| Trustees and Officers | | | 38 | | |

|

1

MCBT OPPORTUNISTIC EAFE FUND

PROFILE AT OCTOBER 31, 2009

OBJECTIVE Capital appreciation through investment in an international portfolio of primarily equity and equity-related securities traded in Europe, Australasia and the Far East.

LAUNCH DATE July 1, 1994

FUND SIZE $76.1m

PERFORMANCE Total return from May 1, 2009 through October 31, 2009

| •MCBT Opportunistic EAFE Fund | | | +26.5 | % | |

| •Morgan Stanley Capital International (MSCI) EAFE Index | | | +31.5 | % | |

Annualized total return from November 1, 2004 through October 31, 2009

| •MCBT Opportunistic EAFE Fund | | | +4.6 | % | |

| •Morgan Stanley Capital International (MSCI) EAFE Index | | | +5.6 | % | |

Annualized total return from November 1, 1999 through October 31, 2009

| •MCBT Opportunistic EAFE Fund (excluding all transaction fees) | | | +1.8 | % | |

| •MCBT Opportunistic EAFE Fund (including all transaction fees) | | | +1.1 | % | |

| •Morgan Stanley Capital International (MSCI) EAFE Index | | | +2.5 | % | |

Annualized total return from July 1, 1994 through October 31, 2009

| •MCBT Opportunistic EAFE Fund (excluding all transaction fees) | | | +5.2 | % | |

| •MCBT Opportunistic EAFE Fund (including all transaction fees) | | | +4.4 | % | |

| •Morgan Stanley Capital International (MSCI) EAFE Index (a) | | | +4.9 | % | |

(a) Performance for the benchmark is not available from July 1, 1994 (commencement of investment operations). For that reason, performance for the benchmark is shown from July 31, 1994.

PORTFOLIO COMMENTS Confounding many, the recovery that began in March not only continued through the second quarter but accelerated into the third. From the start of July until the end of September, a number of international markets enjoyed their best quarter for more than a decade, although most markets suffered a slight pullback in October. The rally was broadly based, with every market sector enjoying a positive return. The continuing contraction in credit spreads saw highly leveraged stocks leading the way, prompting some to describe the rally as a 'dash for trash'.

Hopes of a rebound in global economic activity caused recovery stocks, cyclical industries and small and mid-cap companies to perform well. The increased appetite for risk propelled emerging markets and some developed Asian markets back to pre-Lehman levels. In relative terms, the performance of the larger developed markets and stable growth sectors languished. Over the autumn, Japan underperformed despite a dramatic election victory for the opposition party. In the currency markets the dollar weakened against the euro and the yen and against commodity-based currencies such as the Australian dollar.

2

MCBT OPPORTUNISTIC EAFE FUND

PROFILE AT OCTOBER 31, 2009

Against this backdrop, the fund posted a return of 26.5% for the period under review, underperforming the benchmark index, which rose 31.5%. The main detractor over the period was Autonomy, the British-based maker of data-retrieval software. After a powerful run, the shares sold off in October on the announcement of disappointing third-quarter profit margins. Despite strong sales growth, increased research and development outlays, as well as an inflated marketing bill, ate into profits. Autonomy aside, the main negative has been our Japanese exposure. Japanese companies Sekisui House, Sumitomo Mitsui and Toyota Motor Corp accounted for our next three largest detractors. This suggests that the weakness in the Japanese markets has been the result of common factors, such as the concerns surrounding the recent general election, the impact of the yen's strength on Japan's exporters and the prospect for a significant round of re-capit alization. We continue to focus on stock-specific opportunities in which we see compelling valuations and positive change. Once these broader concerns subside, we believe that this strategy will gain traction.

Most of our key positive contributors were financials. The fund's top-performing stock was Banco Santander, driven by its exposure to both developed and emerging markets, as was our holding in HSBC, while Storebrand gained significantly from rising asset prices. Sun Hung Kai, a Hong Kong property development company, was also among the fund's best contributors. The company operates in a property market with US-style (low) interest rates but enjoys Chinese levels of demand. An increase in loans issuance in the region has further stimulated the Hong Kong property market and led to a succession of earnings upgrades.

OUTLOOK

So far, the third-quarter earnings season has generally been positive, with 84% of companies beating earnings expectations. And, in an important contrast to the second quarter, most companies are also beating expectations on sales. This trend will have to be sustained for positive momentum to continue in the markets.

Overall, the profile of the fund reflects our cautious optimism about the markets, with positive exposure to factors indicative of global growth. Our risk profile demonstrates that the fund remains focused on companies with financial flexibility and superior earnings-growth potential.

The main focus of our recent activity has been ensuring that the fund has an appropriate level of exposure to a recovery in global growth. Although economic data is still weak in absolute terms, we have seen increasing instances of data being better (less negative) than expectations. Improvement in global economies has been driven by the overwhelming fiscal and monetary support of national governments and central banks - and their rhetoric suggests that this will not be withdrawn before growth is independently sustainable.

INVESTMENT MANAGER PROFILE James Fairweather has primary responsibility for the day-to-day management of the Fund and spent three years with Montague Loebl Stanley & Co. as an institutional sales and economics assistant. He moved into Eurobond sales for 18 months with Kleinwort Benson before joining Martin Currie in 1984. He has worked in our Far East, North American and continental European investment teams. Appointed a director in 1987, James became head of our continental European team in 1992. He was appointed deputy chief investment officer in 1994 with overall responsibility for Martin Currie's investments in emerging markets. James was promoted to chief investment officer in 1997.

3

MCBT OPPORTUNISTIC EAFE FUND

PROFILE AT OCTOBER 31, 2009

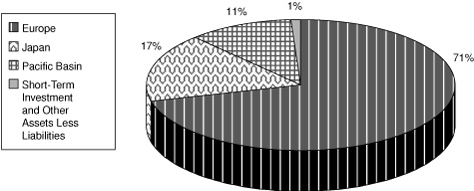

ASSET ALLOCATION

(% of net assets)

TOP TEN HOLDINGS

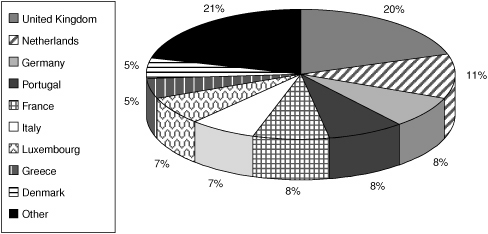

BY REGION/COUNTRY

| Europe | | | | % of net assets | |

| HSBC Holdings | | United Kingdom | | | 3.6 | | |

| BP | | United Kingdom | | | 3.5 | | |

| Banco Santander | | Spain | | | 3.1 | | |

| Roche Holding | | Switzerland | | | 2.9 | | |

| Toyota Motor Corp. | | Japan | | | 2.6 | | |

| Credit Suisse Group | | Switzerland | | | 2.6 | | |

| Siemens | | Germany | | | 2.5 | | |

| E. ON | | Germany | | | 2.5 | | |

| Unilever | | Netherlands | | | 2.4 | | |

| GlaxoSmithKline | | United Kingdom | | | 2.4 | | |

4

MCBT GLOBAL EMERGING MARKETS FUND

PROFILE AT OCTOBER 31, 2009

OBJECTIVE Capital appreciation through investment primarily in equity and equity-related securities of issuers located in a number of countries with emerging markets and developing economies.

LAUNCH DATE February 14, 1997

FUND SIZE $201.5m

PERFORMANCE Total return from May 1, 2009 through October 31, 2009

| •MCBT Global Emerging Markets Fund | | | +32.9 | % | |

| •Morgan Stanley Capital International (MSCI) Emerging Markets Free Index | | | +40.1 | % | |

Annualized total return from November 1, 2004 through October 31, 2009

| •MCBT Global Emerging Markets Fund | | | +14.8 | % | |

| •Morgan Stanley Capital International (MSCI) Emerging Markets Free Index | | | +17.2 | % | |

Annualized total return from November 1, 1999 through October 31, 2009

| •MCBT Global Emerging Markets Fund (excluding all transaction fees) | | | +10.5 | % | |

| •MCBT Global Emerging Markets Fund (including all transaction fees) | | | +9.6 | % | |

| •Morgan Stanley Capital International (MSCI) Emerging Markets Free Index | | | +11.5 | % | |

Annualized total return from February 14, 1997 through October 31, 2009

| •MCBT Global Emerging Markets Fund (excluding all transaction fees) | | | +7.2 | % | |

| •MCBT Global Emerging Markets Fund (including all transaction fees) | | | +6.3 | % | |

| •Morgan Stanley Capital International (MSCI) Emerging Markets Free Index (a) | | | +7.1 | % | |

(a) Performance for the benchmark is not available from February 14, 1997 (commencement of investment operations). For that reason, performance for the benchmark is shown from February 28, 1997.

PORTFOLIO COMMENTS By the start of the period under review, investors had already regained their appetite for risk. Emerging markets were more than a month into a strong rally which, apart from a slight reverse in June, was to continue until October. In the six months from the end of April, the MSCI Emerging Markets index rose 40.1%. The stocks that led the highly cyclical rally were typically smaller, lower-quality companies. After its pause in June, the rally continued apace, sustained by the impact of various government stimulus packages, by the weakening of the U.S. dollar and by a perception that the global economy was in recovery. On a micro level, meanwhile, analysts significantly upgraded their earnings expectations for a host of companies. While the fourth quarter of 2008 saw analysts slashing their earnings forecasts, this year has seen them applying the largest upgrades for 25 years. Smaller companies continued to outperform. The market latched on to the improvements in industrial production and leading indicators, resulting in much talk of the 'green shoots of recovery.'

Against this backdrop, the portfolio lagged its benchmark, rising 32.9% over the six months. The biggest negative contributor to relative returns was HTC Corp, the Taiwanese maker of handheld computers. Delays in the launch of new products and intensifying competition forced this

5

MCBT GLOBAL EMERGING MARKETS FUND

PROFILE AT OCTOBER 31, 2009

company to revise down its third-quarter guidance. The fund's position in Korean civil engineer Hyundai Development was another major drag on returns. Third-quarter earnings results came in far below the market's expectations as the company was hit with bad-debt expenses. In India, Bharti Airtel suffered both from deteriorating fundamentals and because its defensive characteristics proved unappealing to investors in the liquidity-driven rally. We have sold all three positions. Also in India, property firm Unitech was another of the fund's biggest detractors, thanks to two dilutive rights issues and, late in the period, the publication of poor results.

Latin America was the best-performing region in our portfolio, with Mexican housing developer Corporacion GEO delivering the fund's largest relative return. The valuation gap between Geo and its peers has begun to narrow and it continues to demonstrate operational excellence. Our stock selection in Brazil made a positive contribution. Here, homebuilder PDG Realty was one of our strongest performers, as it benefited from improved demand associated with the government's recently announced housing package. Another top performer was Hypermarcas. The Brazilian consumer-goods company was boosted by a re-rating and by earnings-accretive acquisitions.

OUTLOOK

We continue to see real improvements in both economic data and companies' operating performance. The key question, however, remains how sustainable these improvements will be once restocking is complete and as government stimulus packages come to an end. Despite the recent improvements there is still a real risk that consensus expectations of a 'v-shaped' economic recovery may prove overly optimistic. Our investment focus remains on high-quality franchises with a strong link to robust domestic consumption. Within this framework, however, we have bought selected stocks with a degree of cyclical sensitivity.

INVESTMENT MANAGER PROFILE Dariusz Sliwinski is a director of Martin Currie and speaks Polish, Russian, English and Italian. Dariusz initially received a master's degree in electronic engineering before working in a number of different industries in post-communist Poland. After gaining an MBA from SDA Bocconi in Milan, Dariusz became an investment manager in 1994. He initially worked with Powszechny Bank Gospodarczy Investment Fund, moving to Consortium Raiffeisen Atkins in 1995 to become a senior investment manager.

Dariusz joined Martin Currie's emerging markets team in 1997. He was initially responsible for managing emerging European mandates, and assumed responsibility for Martin Currie's Europe, Middle East and Africa ("EMEA") portfolios in 2001. In December 2002, he was appointed manager of two flagship funds - MCBT Global Emerging Markets and an emerging markets open-end fund offered to non-U.S. investors.

6

MCBT GLOBAL EMERGING MARKETS FUND

PROFILE AT OCTOBER 31, 2009

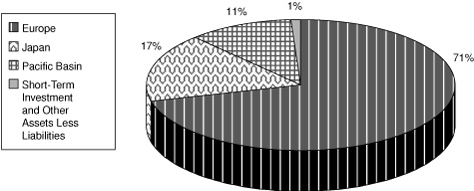

ASSET ALLOCATION

(% of net assets)

TOP TEN HOLDINGS

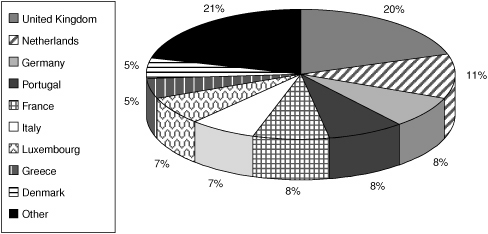

BY REGION/COUNTRY

| Latin America | | | | % of net assets | |

| Petroleo Brasileiro, ADR | | Brazil | | | 4.1 | | |

| Vale, Class A | | Brazil | | | 3.2 | | |

PDG Realty SA Empreendimentos e

Participacoes | | Brazil | | | 2.8 | | |

Compania de Minas

Buenaventura, ADR | | Peru | | | 2.3 | | |

| Pacific Basin | |

| Samsung Electronics Co., Ltd. | | South Korea | | | 3.9 | | |

| CNOOC Ltd. | | China | | | 3.5 | | |

China Construction Bank Corp.,

H Shares | | China | | | 3.5 | | |

| Bank of China Ltd., H Shares | | China | | | 3.3 | | |

Taiwan Semiconductor

Manufacturing Co., Ltd. | | Taiwan | | | 2.8 | | |

Hon Hai Precision Industry

Co., Ltd. | | Taiwan | | | 2.5 | | |

7

MCBT PAN EUROPEAN SELECT FUND

PROFILE AT OCTOBER 31, 2009

OBJECTIVE Capital appreciation through investment primarily in equity and equity-related securities of midsized companies located in developed European countries, including the United Kingdom.

LAUNCH DATE June 6, 2002

FUND SIZE $30.2m

PERFORMANCE Total return from May 1, 2009 through October 31, 2009

| •MCBT Pan European Select Fund | | | +34.5 | % | |

| •Morgan Stanley Capital International (MSCI) European Index | | | +34.0 | % | |

Annualized total return from November 1, 2004 through October 31, 2009

| •MCBT Pan European Select Fund | | | +6.1 | % | |

| •Morgan Stanley Capital International (MSCI) European Index | | | +5.9 | % | |

Annualized total return from June 6, 2002 through October 31, 2009

| •MCBT Pan European Select Fund | | | +10.7 | % | |

| •Morgan Stanley Capital International (MSCI) European Index | | | +7.7 | % | |

PORTFOLIO COMMENTS The six months to October 31, 2009 constituted a very strong period for European stock markets, which rose by 34.5%. The market was correct in anticipating a strong second-quarter earnings season. Industrial companies cut costs proactively in the downturn; they were rewarded when sales recovered from the unwinding of inventories that straddled the end of 2008 and the beginning of 2009 (albeit to lower levels than before the crisis). Similarly, retailers benefited from their aggressive and proactive reduction of working capital. Compared with past crises, pricing has been remarkably disciplined. Banks in particular have benefited from the leveraged effect of asset-price recovery. Companies across sectors successfully raised capital, with an almost universally positive share-price reaction. There was also a strong recovery in the prices of commodities, notably copper, while oil prices remained above $70 a barrel.

At the same time, interest rates and policy settings remain remarkably accommodative. The corporate moves outlined above have enabled companies to make money without raising prices in a way that would take inflation above the central banks' targets. Against this backdrop, there was a marked outperformance by risky assets, notably banks, emerging markets, mid-caps, and commodity currencies against the dollar. Later in the period, however, there were some tentative signs that sector breadth was increasing from its earlier extremely narrow setting.

This was a good period for the fund, which outperformed its benchmark by 49 basis points. For the six months to the end of October, our top contributor was the UK-listed copper miner Kazakhmys, which rallied strongly from a very low valuation due to positive change in the form of improving copper prices. We also benefited from the performance of satellite navigation company TomTom. Thanks to better pricing and greater cost-cutting, this company announced results above our expectations - and far above those of the market. Seismic company Petroleum Geo Services also performed well, on strong second-quarter results, as did HeidelbergCement (balance-sheet repair at corporate level and at the company's main owner), Cookson (strong steel

8

MCBT PAN EUROPEAN SELECT FUND

PROFILE AT OCTOBER 31, 2009

prices), and Infineon (improving prospects in the semiconductor industry and continued attractive business with the iPhone).

Among our financial holdings, IG Group outperformed on better-than-expected first-half numbers, while Denmark's Danske Bank and Norway's DNB Nor were also strong. Hedge-fund manager Man Group performed well due to its 12% dividend yield and the positive fund flows reported by its U.S. peers.

The main detractors from performance included defensive stocks such as Scor (reinsurance) and Terna (electricity grids). We believe that the outlook for these companies is robust and continue to hold the stocks. The fund also suffered from the poor performance of Punch Taverns, as investors grew more risk-averse towards the end of the period. Earlier, earnings from bunker-fuel distributor Aegean Maritime disappointed; faced with this negative change, we sold our holding. Other weak performers were French gaming software company Ubisoft, which revised its guidance negatively, and German pharmaceutical company Merck, which suffered a setback in the approval of a key drug. We sold both stocks.

OUTLOOK

The process of adjustment to the new environment seems to be over, but that new environment is a very uncomfortable one. Deleveraging will be painful, and will involve a substantial reduction in demand. Against this, the level of financial and fiscal stimulus is unprecedented. Having performed well so far this year, we remain confident that we will be able to find stocks which will benefit both from the current environment and the inefficiencies created by the market's reaction to that environment. Many of the stocks we find are defensive, with solid balance sheets and high dividend yields. But many are growth stocks with an attractive valuation and underappreciated resilience. Recently, we have also been able to find undervalued cyclical stocks. We aim as much as possible to keep a balance within the portfolio. We are confident our process will deliver positive relative and absolute performance for 2009 as a whole.

INVESTMENT MANAGER PROFILE Stewart Higgins joined Martin Currie in 1987. He was a UK portfolio manager for three years before moving to the European desk in 1990. He has been managing pan-European portfolios since 1997. In 2008, he was appointed head of Europe. Stewart also co-manages our European mid-cap funds with Dr. Eric Woehrling.

Dr. Eric Woehrling joined Martin Currie in 2000 to design the company's European mid-cap products, which he has managed with Stewart Higgins since their launch in June 2002. Eric is lead manager of the Martin Currie GF Pan-European Opportunities Fund, a winner of a Lipper Fund Award 2008 and an S&P award in 2007. Before his move to Martin Currie, Eric worked for Stewart Ivory from 1997. He worked on the UK and emerging markets desks, before moving to the European desk, where he specialized in European smaller companies.

9

MCBT PAN EUROPEAN SELECT FUND

PROFILE AT OCTOBER 31, 2009

ASSET ALLOCATION

(% of net assets)

TOP TEN HOLDINGS

BY REGION/COUNTRY

| Europe | | | | % of net assets | |

| Terna-Rete Electtrica Nazionale SpA | | Italy | | | 4.5 | | |

| Synthes, Inc. | | United States | | | 4.1 | | |

| Portugal Telecom SGPS | | Portugal | | | 4.0 | | |

| Koninklijke Boskalis Westminster | | Netherlands | | | 3.9 | | |

| Swisscom | | Switzerland | | | 3.7 | | |

| SES | | Luxembourg | | | 3.6 | | |

| Centrica | | United Kingdom | | | 3.4 | | |

| Continental | | Germany | | | 3.3 | | |

| Oriflame Cosmetics | | Luxembourg | | | 3.3 | | |

| SSL International | | United Kingdom | | | 3.3 | | |

10

MCBT OPPORTUNISTIC EAFE FUND

SCHEDULE OF INVESTMENTS

OCTOBER 31, 2009 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – 99.8% | |

| EUROPE – 71.2% | |

| AUSTRIA – 1.1% | |

| Wienerberger | | | 47,254 | | | $ | 851,519 | | |

| TOTAL AUSTRIA – (Cost $976,896) | | | 851,519 | | |

| DENMARK – 1.3% | |

| Carlsberg, B Shares | | | 13,924 | | | | 973,355 | | |

| TOTAL DENMARK – (Cost $948,469) | | | 973,355 | | |

| FRANCE – 9.5% | |

| Alstom | | | 14,394 | | | | 996,570 | | |

| Cie de Saint-Gobain | | | 22,831 | | | | 1,111,536 | | |

| France Telecom | | | 66,939 | | | | 1,655,126 | | |

| Sanofi-Aventis | | | 23,151 | | | | 1,692,172 | | |

| Societe Generale | | | 26,999 | | | | 1,793,285 | | |

| TOTAL FRANCE – (Cost $6,537,164) | | | 7,248,689 | | |

| GERMANY – 6.7% | |

| E.ON | | | 50,483 | | | | 1,929,647 | | |

| MAN | | | 14,946 | | | | 1,230,399 | | |

| Siemens | | | 21,491 | | | | 1,936,545 | | |

| TOTAL GERMANY – (Cost $5,863,401) | | | 5,096,591 | | |

| GREECE – 1.7% | |

| National Bank of Greece | | | 36,313 | | | | 1,318,683 | | |

| TOTAL GREECE – (Cost $1,017,448) | | | 1,318,683 | | |

| ITALY – 1.9% | |

| UniCredit S.p.A. | | | 430,422 | | | | 1,439,850 | | |

| TOTAL ITALY – (Cost $1,515,983) | | | 1,439,850 | | |

| LUXEMBOURG – 1.2% | |

| ArcelorMittal | | | 28,356 | | | | 949,402 | | |

| TOTAL LUXEMBOURG – (Cost $786,574) | | | 949,402 | | |

| NETHERLANDS – 7.0% | |

| ASML Holding | | | 51,421 | | | | 1,384,351 | | |

| Gemalto | | | 26,393 | | | | 1,108,593 | | |

| Heineken | | | 21,478 | | | | 951,001 | | |

| Unilever | | | 60,277 | | | | 1,856,405 | | |

| TOTAL NETHERLANDS – (Cost $4,632,821) | | | 5,300,350 | | |

See Notes to Financial Statements.

11

MCBT OPPORTUNISTIC EAFE FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2009 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – Continued | |

| EUROPE – Continued | |

| NORWAY – 1.7% | |

| Storebrand ASA | | | 193,907 | | | $ | 1,319,971 | | |

| TOTAL NORWAY – (Cost $742,463) | | | 1,319,971 | | |

| PORTUGAL – 1.7% | |

| Portugal Telecom SGPS | | | 114,650 | | | | 1,309,341 | | |

| TOTAL PORTUGAL – (Cost $1,190,418) | | | 1,309,341 | | |

| RUSSIA – 1.0% | |

| Rosneft Oil Co., GDR | | | 95,250 | | | | 728,663 | | |

| TOTAL RUSSIA – (Cost $714,275) | | | 728,663 | | |

| SPAIN – 4.4% | |

| Banco Santander | | | 1,939 | | | | 31,160 | | |

| Banco Santander | | | 144,785 | | | | 2,330,588 | | |

| Banco Santander | | | 33 | | | | 6 | | |

| Iberdrola Renovables | | | 214,988 | | | | 955,504 | | |

| TOTAL SPAIN – (Cost $2,138,356) | | | 3,317,258 | | |

| SWITZERLAND – 10.6% | |

| ABB Ltd. | | | 86,420 | | | | 1,609,926 | | |

| Credit Suisse Group | | | 36,712 | | | | 1,960,940 | | |

| Petroplus Holdings | | | 50,359 | | | | 1,101,373 | | |

| Roche Holding | | | 13,830 | | | | 2,215,868 | | |

| Zurich Financial Services | | | 5,165 | | | | 1,182,430 | | |

| TOTAL SWITZERLAND – (Cost $6,633,492) | | | 8,070,537 | | |

| UNITED KINGDOM – 21.4% | |

| Autonomy Corp.* | | | 61,744 | �� | | | 1,357,130 | | |

| Babcock International Group | | | 89,705 | | | | 889,993 | | |

| Barclays | | | 273,831 | | | | 1,432,695 | | |

| BP | | | 279,821 | | | | 2,635,282 | | |

| GlaxoSmithKline | | | 87,510 | | | | 1,797,151 | | |

| HSBC Holdings | | | 245,454 | | | | 2,716,247 | | |

| Pearson | | | 105,489 | | | | 1,435,754 | | |

| Persimmon | | | 130,797 | | | | 862,504 | | |

| Rio Tinto | | | 37,450 | | | | 1,652,886 | | |

| William Morrison Supermarkets | | | 321,874 | | | | 1,475,814 | | |

| TOTAL UNITED KINGDOM – (Cost $12,651,923) | | | 16,255,456 | | |

| TOTAL EUROPE – (Cost $46,349,683) | | | 54,179,665 | | |

See Notes to Financial Statements.

12

MCBT OPPORTUNISTIC EAFE FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2009 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – Continued | |

| JAPAN – 17.0% | |

| Aisin Seiki Co., Ltd. | | | 40,900 | | | $ | 1,029,858 | | |

| Bank of Yokohama, Ltd. | | | 202,000 | | | | 980,361 | | |

| INPEX Corp. | | | 132 | | | | 1,080,045 | | |

| Itochu Corp. | | | 151,000 | | | | 943,359 | | |

| JGC Corp. | | | 64,000 | | | | 1,229,126 | | |

| Mitsui Fudosan Co., Ltd. | | | 67,000 | | | | 1,075,687 | | |

| Nikon Corp. | | | 62,000 | | | | 1,157,299 | | |

| Nomura Holdings Inc. | | | 156,100 | | | | 1,092,339 | | |

| Panasonic Corp. | | | 70,600 | | | | 978,751 | | |

| Shin-Etsu Chemical Co., Ltd. | | | 27,100 | | | | 1,427,629 | | |

| Toyota Motor Corp. | | | 49,700 | | | | 1,966,637 | | |

| TOTAL JAPAN – (Cost $12,901,815) | | | 12,961,091 | | |

| PACIFIC BASIN – 11.6% | |

| AUSTRALIA – 1.2% | |

| Incitec Pivot Ltd. | | | 394,466 | | | | 916,482 | | |

| TOTAL AUSTRALIA – (Cost $1,100,374) | | | 916,482 | | |

| CHINA – 4.6% | |

| Bank of China Ltd., H Shares | | | 2,637,000 | | | | 1,506,804 | | |

| China Life Insurance Co., Ltd., H Shares | | | 190,000 | | | | 875,767 | | |

| Netease.com Inc., ADR | | | 29,200 | | | | 1,127,704 | | |

| TOTAL CHINA – (Cost $2,115,454) | | | 3,510,275 | | |

| HONG KONG – 1.8% | |

| Sun Hung Kai Properties Ltd. | | | 89,000 | | | | 1,345,272 | | |

| TOTAL HONG KONG – (Cost $1,131,158) | | | 1,345,272 | | |

| INDONESIA – 1.3% | |

| PT Telekomunikasi Indonesia, ADR | | | 29,600 | | | | 1,003,736 | | |

| TOTAL INDONESIA – (Cost $1,003,650) | | | 1,003,736 | | |

| SOUTH KOREA – 1.6% | |

| Samsung Electronics Co., Ltd., GDR, 144A | | | 4,030 | | | | 1,227,135 | | |

| TOTAL SOUTH KOREA – (Cost $928,058) | | | 1,227,135 | | |

| TAIWAN – 1.1% | |

| Taiwan Semiconductor Manufacturing Co., Ltd., ADR | | | 90,600 | | | | 864,324 | | |

| TOTAL TAIWAN – (Cost $976,079) | | | 864,324 | | |

| TOTAL PACIFIC BASIN – (Cost $7,254,773) | | | 8,867,224 | | |

| TOTAL COMMON STOCKS – (Cost $66,506,271) | | | 76,007,980 | | |

See Notes to Financial Statements.

13

MCBT OPPORTUNISTIC EAFE FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2009 (Unaudited)

| | | Principal

Amount | | US$

Value | |

| SHORT-TERM INVESTMENTS – 1.1% | |

Repurchase Agreement with State Street Bank and Trust,

0.01%, 11/02/2009 (a) | | $ | 811,000 | | | $ | 811,000 | | |

| TOTAL SHORT-TERM INVESTMENTS – (Cost $811,000) | | | 811,000 | | |

| TOTAL INVESTMENTS (b) – (Cost $67,317,271) – 100.9% | | | 76,818,980 | | |

| OTHER ASSETS LESS LIABILITIES – (0.9)% | | | (697,282 | ) | |

| NET ASSETS – 100.0% | | $ | 76,121,698 | | |

Notes to Schedule of Investments:

† Percentages of long-term investments are presented in the portfolio by country. Percentages of long-term investments by industry are as follows: Auto Parts 1.4%, Automobiles 2.6%, Bank Investment Contracts 1.4%, Banks 17.8%, Brewery 1.3%, Building Maintenance & Services 1.2%, Chemicals 1.9%, Computer Services 1.5%, Construction and Building Materials 1.5%, Construction Materials 1.1%, Diversified 2.6%, Drugs & Health Care 2.3%, Electrical Equipment 2.1%, Electronics 2.9%, Engineering 1.6%, Fertilizers 1.2%, Financial Services 1.4%, Food & Beverages 3.7%,Homebuilders 1.1%, Import/Export 1.2%, Industrials 1.3%, Insurance 4.4%, Manufacturing 4.2%, Medical Products 5.1%, Metals 1.2%, Mining 2.2%, Oil & Gas 4.5%, Oil Refining and Marketing 1.4%, Photography 1.5%, Publishing 1.9%, Real Estate 3.2%, Retail Grocery 1.9%, Semiconductor manufacturing Equipment 2.9%, Software 3.3%, Telecommunications Servi ces 5.2% and Utilities 3.8%.

* Non-income producing security.

(a) Repurchase agreement, dated 10/30/2009, due 11/02/2009 with repurchase proceeds of $811,001 is collateralized by Federal Home Loan Bank, 4.375% due 9/17/2010 with a market value of $831,680.

(b) The values of the Portfolio are determined based on Level 1 inputs established by FAS 157.

ADR American Depositary Receipts

GDR Global Depositary Receipts

144A Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

See Notes to Financial Statements.

14

MCBT GLOBAL EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS

OCTOBER 31, 2009 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – 90.8% | |

| AFRICA – 7.3% | |

| SOUTH AFRICA – 7.3% | |

| ArcelorMittal South Africa Ltd. | | | 131,296 | | | $ | 1,765,762 | | |

| Aspen Pharmacare Holdings Ltd.* | | | 404,737 | | | | 3,397,317 | | |

| MTN Group Ltd. | | | 249,532 | | | | 3,745,607 | | |

| Murray & Roberts Holdings Ltd. | | | 450,184 | | | | 3,200,634 | | |

| Standard Bank Group Ltd. | | | 201,219 | | | | 2,517,220 | | |

| TOTAL SOUTH AFRICA – (Cost $11,986,422) | | | 14,626,540 | | |

| TOTAL AFRICA – (Cost $11,986,422) | | | 14,626,540 | | |

| EUROPE – 10.4% | |

| RUSSIA – 8.9% | |

| Gazprom OAO, ADR | | | 166,833 | | | | 3,990,484 | | |

| LUKOIL, ADR | | | 77,466 | | | | 4,524,014 | | |

| Novolipetsk Steel (NLMK), GDR, 144A,* | | | 76,800 | | | | 1,990,559 | | |

| Rosneft Oil Co., GDR* | | | 527,950 | | | | 4,038,818 | | |

| Vimpel-Communications, ADR* | | | 184,300 | | | | 3,304,499 | | |

| TOTAL RUSSIA – (Cost $15,010,962) | | | 17,848,374 | | |

| TURKEY – 1.5% | |

| Turkiye Is Bankasi | | | 810,894 | | | | 3,045,609 | | |

| TOTAL TURKEY – (Cost $1,923,677) | | | 3,045,609 | | |

| TOTAL EUROPE – (Cost $16,934,639) | | | 20,893,983 | | |

| LATIN AMERICA – 17.8% | |

| BRAZIL – 9.9% | |

| Cia Brasileira de Meios de Pagamento | | | 263,075 | | | | 2,411,820 | | |

| Hypermarcas* | | | 186,000 | | | | 3,808,481 | | |

| PDG Realty SA Empreendimentos e Participacoes | | | 669,200 | | | | 5,660,241 | | |

| Petroleo Brasileiro, ADR | | | 203,736 | | | | 8,173,888 | | |

| TOTAL BRAZIL – (Cost $12,888,080) | | | 20,054,430 | | |

| MEXICO – 4.1% | |

| America Movil SAB de C.V. | | | 1,788,200 | | | | 3,926,151 | | |

| Corporacion GEO SAB de CV, Series B* | | | 1,612,100 | | | | 4,272,073 | | |

| TOTAL MEXICO – (Cost $5,267,084) | | | 8,198,224 | | |

| PERU – 3.8% | |

| Compania de Minas Buenaventura, ADR | | | 137,300 | | | | 4,609,161 | | |

| Credicorp Ltd. | | | 45,144 | | | | 3,116,290 | | |

| TOTAL PERU – (Cost $7,253,018) | | | 7,725,451 | | |

| TOTAL LATIN AMERICA – (Cost $25,408,182) | | | 35,978,105 | | |

See Notes to Financial Statements.

15

MCBT GLOBAL EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2009 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – Continued | |

| OTHER AREAS – 7.9% | |

| INDIA – 7.9% | |

| Axis Bank Ltd. | | | 154,294 | | | $ | 2,902,103 | | |

| Hero Honda Motors Ltd. | | | 95,232 | | | | 3,124,637 | | |

| Infrastructure Development Finance Co., Ltd. | | | 1,049,431 | | | | 3,249,370 | | |

| Reliance Industries Ltd. | | | 77,986 | | | | 3,155,731 | | |

| Unitech Ltd. | | | 2,064,519 | | | | 3,479,319 | | |

| TOTAL INDIA – (Cost $15,066,649) | | | 15,911,160 | | |

| TOTAL OTHER AREAS – (Cost $15,066,649) | | | 15,911,160 | | |

| PACIFIC BASIN – 47.4% | |

| CHINA – 15.7% | |

| Bank of China Ltd., H Shares | | | 11,658,000 | | | | 6,661,478 | | |

| China Construction Bank Corp., H Shares | | | 8,126,000 | | | | 6,980,833 | | |

| China Life Insurance Co., Ltd., H Shares | | | 524,000 | | | | 2,415,275 | | |

| CNOOC Ltd. | | | 4,791,000 | | | | 7,111,194 | | |

| Industrial and Commercial Bank of China Ltd., H Shares | | | 4,941,000 | | | | 3,930,006 | | |

| Netease.com Inc., ADR* | | | 117,000 | | | | 4,518,540 | | |

| TOTAL CHINA – (Cost $21,310,632) | | | 31,617,326 | | |

| HONG KONG – 4.5% | |

| China Resources Land Ltd. | | | 1,450,007 | | | | 3,498,180 | | |

| GOME Electrical Appliances Holdings Ltd.* | | | 12,124,000 | | | | 3,563,818 | | |

| Pacific Basin Shipping Ltd. | | | 2,678,000 | | | | 1,962,773 | | |

| TOTAL HONG KONG – (Cost $7,951,568) | | | 9,024,771 | | |

| INDONESIA – 2.4% | |

| Bank Rakyat Indonesia | | | 3,846,737 | | | | 2,808,040 | | |

| PT Telekomunikasi Indonesia, Series B | | | 2,269,500 | | | | 1,965,607 | | |

| TOTAL INDONESIA – (Cost $4,827,189) | | | 4,773,647 | | |

| MALAYSIA – 2.2% | |

| Axiata Group Berhad* | | | 2,070,122 | | | | 1,757,939 | | |

| CIMB Group Holdings Berhad | | | 770,143 | | | | 2,799,872 | | |

| TOTAL MALAYSIA – (Cost $3,286,062) | | | 4,557,811 | | |

| SOUTH KOREA – 13.0% | |

| GS Engineering & Construction Corp. | | | 26,414 | | | | 2,335,781 | | |

| Hyundai Mobis | | | 19,164 | | | | 2,501,850 | | |

| Industrial Bank Of Korea* | | | 271,740 | | | | 3,301,236 | | |

| KT&G Corp. | | | 33,894 | | | | 1,979,469 | | |

| LG Innotek Co., Ltd. | | | 20,439 | | | | 1,808,488 | | |

| NHN Corp.* | | | 12,494 | | | | 1,856,221 | | |

| POSCO | | | 4,587 | | | | 1,904,890 | | |

| Samsung Electronics Co., Ltd. | | | 13,167 | | | | 7,926,158 | | |

See Notes to Financial Statements.

16

MCBT GLOBAL EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2009 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – Continued | |

| PACIFIC BASIN – Continued | |

| SOUTH KOREA – Continued | |

| Samsung Fire & Marine Insurance Co., Ltd. | | | 14,581 | | | $ | 2,673,045 | | |

| TOTAL SOUTH KOREA – (Cost $22,194,337) | | | 26,287,138 | | |

| TAIWAN – 9.6% | |

| Fubon Financial Holding Co., Ltd.* | | | 3,096,000 | | | | 3,453,926 | | |

| Hon Hai Precision Industry Co., Ltd. | | | 1,263,279 | | | | 4,973,612 | | |

| MediaTek, Inc. | | | 137,374 | | | | 1,944,808 | | |

| Taiwan Fertilizer Co., Ltd. | | | 1,027,000 | | | | 3,205,243 | | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | | 3,135,822 | | | | 5,703,534 | | |

| TOTAL TAIWAN – (Cost $14,413,143) | | | 19,281,123 | | |

| TOTAL PACIFIC BASIN – (Cost $73,982,931) | | | 95,541,816 | | |

| TOTAL COMMON STOCKS – (Cost $143,378,823) | | | 182,951,604 | | |

| PREFERRED STOCKS – 6.5% | |

| LATIN AMERICA – 6.5% | |

| BRAZIL – 6.5% | |

| AES Tiete SA (shown in units of 1,000) | | | 221,112 | | | | 2,491,527 | | |

| Itau Unibanco Holding | | | 212,493 | | | | 4,040,937 | | |

| Vale, Class A | | | 291,977 | | | | 6,538,654 | | |

| TOTAL BRAZIL – (Cost $8,335,454) | | | 13,071,118 | | |

| TOTAL LATIN AMERICA – (Cost $8,335,454) | | | 13,071,118 | | |

| TOTAL PREFERRED STOCKS – (Cost $8,335,454) | | | 13,071,118 | | |

| TOTAL INVESTMENTS (a) – (Cost $151,714,277) – 97.3% | | | 196,022,722 | | |

| OTHER ASSETS LESS LIABILITIES – 2.7% | | | 5,491,784 | | |

| NET ASSETS – 100.0% | | $ | 201,514,506 | | |

Notes to Schedule of Investments:

† Percentages of long-term investments are presented in the portfolio by country. Percentages of long-term investments by industry are as follows: Auto Parts 1.2%, Automobiles 1.6%, Bank & Insurance Services 1.2%, Banks 20.8%, Building and Construction 2.8%, Chemicals 1.6%, Computers 2.5%, Drugs & Health Care 1.7%, Electric Utilities 1.2%, Electronics 4.8%, Finance & Banking 3.3%, Gas & Pipeline Utilities 2.0%, Homebuilders 2.1%, Household Products 1.9%, Insurance 2.5%, Internet Services 0.9%, Metals 3.3%, Mining 2.3%, Oil & Gas 5.5%, Oil – Refining & Marketing 1.6%, Oil Integrated 6.3%, Real Estate 6.2%, Retail 1.8%, Semi-conductor Manufacturing Equipment 3.8%, Software 2.2%, Steel 2.9%, Telecommunications 1.0%, Telecommunications Equipment 0.8%, Telecommunications Services 5.5%, Tobacco 1.0% and Transportation 1.0%.

* Non-income producing security.

(a) The values of the Portfolio are determined based on Level 1 inputs established by FAS 157.

ADR American Depositary Receipts

GDR Global Depositary Receipts

144A Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

See Notes to Financial Statements.

17

MCBT PAN EUROPEAN SELECT FUND

SCHEDULE OF INVESTMENTS

OCTOBER 31, 2009 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – 96.4% | |

| BELGIUM – 2.1% | |

| Mobistar | | | 9,373 | | | $ | 643,831 | | |

| TOTAL BELGIUM – (Cost $642,924) | | | 643,831 | | |

| DENMARK – 4.6% | |

| DSV A/S* | | | 44,821 | | | | 694,146 | | |

| FLSmidth & Co. A/S | | | 13,489 | | | | 710,064 | | |

| TOTAL DENMARK – (Cost $1,342,673) | | | 1,404,210 | | |

| FRANCE – 8.2% | |

| Atos Origin* | | | 19,664 | | | | 920,453 | | |

| Iliad | | | 8,374 | | | | 906,571 | | |

| Rhodia* | | | 44,832 | | | | 658,083 | | |

| TOTAL FRANCE – (Cost $2,479,932) | | | 2,485,107 | | |

| GERMANY – 8.4% | |

| Continental * | | | 18,724 | | | | 1,006,130 | | |

| Fresenius | | | 8,392 | | | | 417,473 | | |

| Kloeckner & Co.* | | | 24,361 | | | | 535,112 | | |

| SGL Carbon* | | | 15,402 | | | | 592,281 | | |

| TOTAL GERMANY – (Cost $2,871,901) | | | 2,550,996 | | |

| GREECE – 5.3% | |

| National Bank of Greece* | | | 19,073 | | | | 692,624 | | |

| OPAP | | | 35,913 | | | | 917,592 | | |

| TOTAL GREECE – (Cost $1,456,132) | | | 1,610,216 | | |

| ITALY – 7.0% | |

| Saras SpA | | | 238,297 | | | | 772,220 | | |

| Terna - Rete Elettrica Nazionale SpA | | | 340,768 | | | | 1,350,663 | | |

| TOTAL ITALY – (Cost $2,182,455) | | | 2,122,883 | | |

| LUXEMBOURG – 6.9% | |

| Oriflame Cosmetics | | | 17,800 | | | | 1,000,796 | | |

| SES | | | 49,541 | | | | 1,073,765 | | |

| TOTAL LUXEMBOURG – (Cost $1,803,533) | | | 2,074,561 | | |

| NETHERLANDS – 10.8% | |

| Gemalto* | | | 13,519 | | | | 567,843 | | |

| Heineken | | | 21,343 | | | | 945,023 | | |

| Koninklijke Boskalis Westminster | | | 33,993 | | | | 1,191,408 | | |

| TomTom* | | | 58,442 | | | | 555,656 | | |

| TOTAL NETHERLANDS – (Cost $3,309,163) | | | 3,259,930 | | |

See Notes to Financial Statements.

18

MCBT PAN EUROPEAN SELECT FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2009 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – Continued | |

| NORWAY – 4.2% | |

| DnB NOR ASA* | | | 63,200 | | | $ | 725,072 | | |

| Petroleum Geo-Services ASA* | | | 57,400 | | | | 539,161 | | |

| TOTAL NORWAY – (Cost $751,070) | | | 1,264,233 | | |

| PORTUGAL – 8.4% | |

| Banco Espirito Santo | | | 87,317 | | | | 643,753 | | |

| Brisa Auto-Estradas de Portugal | | | 68,409 | | | | 673,577 | | |

| Portugal Telecom SGPS | | | 106,181 | | | | 1,212,623 | | |

| TOTAL PORTUGAL – (Cost $1,922,301) | | | 2,529,953 | | |

| SWEDEN – 2.4% | |

| Swedish Match | | | 34,600 | | | | 717,643 | | |

| TOTAL SWEDEN – (Cost $731,876) | | | 717,643 | | |

| SWITZERLAND – 3.7% | |

| Swisscom | | | 3,092 | | | | 1,117,439 | | |

| TOTAL SWITZERLAND – (Cost $921,546) | | | 1,117,439 | | |

| UNITED KINGDOM – 20.3% | |

| Centrica | | | 255,867 | | | | 1,039,308 | | |

| Intertek Group | | | 43,382 | | | | 893,111 | | |

| Man Group | | | 158,235 | | | | 800,394 | | |

| Pearson | | | 45,712 | | | | 622,162 | | |

| Punch Taverns* | | | 722,394 | | | | 983,034 | | |

| QinetiQ | | | 297,611 | | | | 797,684 | | |

| SSL International | | | 95,461 | | | | 992,151 | | |

| TOTAL UNITED KINGDOM – (Cost $5,920,513) | | | 6,127,844 | | |

| UNITED STATES – 4.1% | |

| Synthes, Inc. | | | 10,414 | | | | 1,235,834 | | |

| TOTAL UNITED STATES – (Cost $1,242,849) | | | 1,235,834 | | |

| TOTAL COMMON STOCKS – (Cost $27,578,868) | | | 29,144,680 | | |

| | | Principal

Amount | | | |

| SHORT-TERM INVESTMENTS – 2.8% | |

Repurchase Agreement with State Street Bank and Trust,

0.01%, 11/02/2009 (a) | | $ | 839,000 | | | | 839,000 | | |

| TOTAL SHORT-TERM INVESTMENTS – (Cost $839,000) | | | 839,000 | | |

| TOTAL INVESTMENTS (b) – (Cost $28,417,868) – 99.2% | | | 29,983,680 | | |

| OTHER ASSETS LESS LIABILITIES – 0.8% | | | 230,616 | | |

| NET ASSETS – 100.0% | | $ | 30,214,296 | | |

See Notes to Financial Statements.

19

MCBT PAN EUROPEAN SELECT FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2009 (Unaudited)

Notes to Schedule of Investments:

† Percentages of long-term investments are presented in the portfolio by country. Percentages of long-term investments by industry are as follows: Aerospace & Defense 2.6%, Banks 8.8%, Business Services 2.3%, Chemicals 2.2%, Commercial Services 3.0%, Computer Services 4.9%, Construction 2.3%, Cosmetics & Toiletries 3.3%, Electric Utilities 4.5%, Engineering 4.0%, Financial Services 2.6%, Food & Beverages 3.1%, Hotels & Restaurants 6.3%, Medical Products 4.7%, Medical Services 4.1%, Multimedia 3.6%, Oil-Refining and Marketing 2.5%, Oil-field Services 1.8%, Publishing 2.1%, Software 1.8%, Steel 1.8%, Telecommunications Services 12.8%, Tires & Rubber 3.3%, Tobacco 2.4%, Transportation 2.2% and Utilities 3.4%.

* Non-income producing security.

(a) Repurchase agreement, dated 10/30/2009, due 11/02/2009 with repurchase proceeds of $839,001 is collateralized by Federal Home Loan Mortgage Company, 4.375% due 9/17/2010 with a market value of $857,670.

(b) The values of the Portfolio are determined based on Level 1 inputs established by FAS157.

See Notes to Financial Statements.

20

MARTIN CURRIE BUSINESS TRUST

STATEMENTS OF ASSETS AND LIABILITIES

OCTOBER 31, 2009 (Unaudited)

| | | MCBT

Opportunistic EAFE

Fund | | MCBT

Global Emerging

Markets Fund | | MCBT

Pan European

Select Fund | |

| ASSETS | |

| Investments in securities, at value | | $ | 76,007,980 | | | $ | 196,022,722 | | | $ | 29,144,680 | | |

| Repurchase agreement | | | 811,000 | | | | – | | | | 839,000 | | |

| Cash | | | 950 | | | | – | | | | 370 | | |

| Foreign currency, at value | | | 17 | | | | 1,935,023 | | | | – | | |

| Receivable for investments sold | | | 2,579,560 | | | | 6,224,953 | | | | 4,820,676 | | |

| Dividends and interest receivable | | | 93,097 | | | | 94,405 | | | | – | | |

| Foreign tax reclaims receivable | | | 166,554 | | | | 26,615 | | | | 78,033 | | |

| TOTAL ASSETS | | | 79,659,158 | | | | 204,303,718 | | | | 34,882,759 | | |

| LIABILITIES | |

| Unrealized depreciation on spot contracts | | | 29,697 | | | | – | | | | 5,741 | | |

| Payable to Custodian Bank | | | – | | | | 869,345 | | | | – | | |

| Payable for investments purchased | | | 3,299,483 | | | | 1,182,374 | | | | 4,545,611 | | |

| Management fee payable | | | 140,002 | | | | 412,328 | | | | 58,864 | | |

| Administration fee payable | | | 4,266 | | | | 24,993 | | | | 8,570 | | |

| Capital gains taxes accrued | | | – | | | | 107,639 | | | | – | | |

| Accrued expenses and other liabilities | | | 64,012 | | | | 192,533 | | | | 49,677 | | |

| TOTAL LIABILITIES | | | 3,537,460 | | | | 2,789,212 | | | | 4,668,463 | | |

| TOTAL NET ASSETS | | $ | 76,121,698 | | | $ | 201,514,506 | | | $ | 30,214,296 | | |

| COMPOSITION OF NET ASSETS | |

| Paid-in capital | | $ | 116,718,588 | | | $ | 254,753,078 | | | $ | 75,397,652 | | |

| Undistributed net investment income | | | 1,343,237 | | | | 3,833,068 | | | | 112,698 | | |

Accumulated net realized loss on investments

and foreign currency transactions | | | (51,467,730 | ) | | | (101,282,222 | ) | | | (46,864,470 | ) | |

| Net unrealized appreciation on investments and foreign currency | | | 9,527,603 | | | | 44,210,582 | | | | 1,568,416 | | |

| TOTAL NET ASSETS | | $ | 76,121,698 | | | $ | 201,514,506 | | | $ | 30,214,296 | | |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING* | | | 8,055,819 | | | | 46,259,666 | | | | 5,278,332 | | |

| NET ASSET VALUE PER SHARE | | $ | 9.45 | | | $ | 4.36 | | | $ | 5.72 | | |

| Identified cost of investments: | |

| Unaffiliated issuers | | $ | 67,317,271 | | | $ | 151,714,277 | | | $ | 28,417,868 | | |

| Cost of foreign currency | | $ | 18 | | | $ | 1,942,512 | | | $ | – | | |

* Unlimited number of shares authorized

See Notes to Financial Statements.

21

MARTIN CURRIE BUSINESS TRUST

STATEMENTS OF OPERATIONS

SIX MONTHS ENDED OCTOBER 31, 2009 (Unaudited)

| | | MCBT

Opportunistic EAFE

Fund | | MCBT

Global Emerging

Markets Fund | | MCBT

Pan European

Select Fund | |

| INVESTMENT INCOME | |

| Interest income | | $ | 76 | | | $ | 99 | | | $ | 76 | | |

| Dividend income | | | 1,486,665 | | | | 3,690,467 | | | | 412,660 | | |

| Foreign taxes withheld | | | (152,267 | ) | | | (367,730 | ) | | | (35,696 | ) | |

| TOTAL INVESTMENT INCOME | | | 1,334,474 | | | | 3,322,836 | | | | 377,040 | | |

| EXPENSES | |

| Management fees | | | 262,531 | | | | 836,464 | | | | 113,901 | | |

| Custodian fees | | | 69,759 | | | | 263,243 | | | | 63,059 | | |

| Administration fees | | | 20,952 | | | | 75,307 | | | | 13,375 | | |

| Audit fees | | | 19,317 | | | | 19,308 | | | | 19,308 | | |

| Legal fees | | | 10,857 | | | | 42,202 | | | | 9,456 | | |

| Transfer agent fees | | | 3,118 | | | | 3,469 | | | | 3,261 | | |

| Trustees fees | | | 4,482 | | | | 18,607 | | | | 4,140 | | |

| Stock dividend tax | | | – | | | | 11,049 | | | | – | | |

| Miscellaneous expenses | | | 20,447 | | | | 71,433 | | | | 20,425 | | |

| TOTAL EXPENSES | | | 411,463 | | | | 1,341,082 | | | | 246,925 | | |

| NET EXPENSES | | | 411,463 | | | | 1,341,082 | | | | 246,925 | | |

| NET INVESTMENT INCOME | | | 923,011 | | | | 1,981,754 | | | | 130,115 | | |

REALIZED AND UNREALIZED GAIN (LOSS)

ON INVESTMENTS AND FOREIGN

CURRENCY TRANSACTIONS | |

| Net realized gain (loss) on investments | | | (4,533,304 | ) | | | (863,646 | ) | | | 7,684,473 | | |

| Net realized gain (loss) on foreign currency transactions | | | (2,299 | ) | | | (146,867 | ) | | | 15,957 | | |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments | | | 20,268,511 | | | | 57,647,678 | | | | 959,546 | | |

| Foreign currency | | | 11,832 | | | | (10,396 | ) | | | 5,792 | | |

| Deferred foreign capital gains taxes | | | – | | | | (107,639 | ) | | | – | | |

NET GAIN ON INVESTMENTS AND FOREIGN

CURRENCY TRANSACTIONS | | | 15,744,740 | | | | 56,626,769 | | | | 8,665,768 | | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 16,667,751 | | | $ | 58,608,523 | | | $ | 8,795,883 | | |

See Notes to Financial Statements.

22

MARTIN CURRIE BUSINESS TRUST

STATEMENTS OF CHANGES IN NET ASSETS

| | | MCBT Opportunistic

EAFE Fund | | MCBT Global Emerging

Markets Fund | |

| | | Six Months

Ended

October 31, 2009

(Unaudited) | | Year

Ended

April 30, 2009 | | Six Months

Ended

October 31, 2009

(Unaudited) | | Year

Ended

April 30, 2009 | |

| NET ASSETS, beginning of period | | $ | 63,179,789 | | | $ | 101,516,485 | | | $ | 214,781,838 | | | $ | 470,285,917 | | |

| INCREASE IN NET ASSETS FROM OPERATIONS: | |

| Net investment income | | | 923,011 | | | | 1,671,263 | | | | 1,981,754 | | | | 8,012,049 | | |

| Net realized loss | | | (4,535,603 | ) | | | (33,532,403 | ) | | | (1,010,513 | ) | | | (100,805,315 | ) | |

Net change in net unrealized appreciation on

investments and foreign currency transactions | | | 20,280,343 | | | | (16,546,086 | ) | | | 57,637,282 | | | | (122,124,253 | ) | |

| Net increase (decrease) in net assets from operations | | | 16,667,751 | | | | (48,407,226 | ) | | | 58,608,523 | | | | (214,917,519 | ) | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | |

| Net investment income | | | – | | | | (1,768,278 | ) | | | – | | | | (5,973,131 | ) | |

| Net realized gains | | | – | | | | – | | | | – | | | | (74,548,822 | ) | |

| Total distributions | | | – | | | | (1,768,278 | ) | | | – | | | | (80,521,953 | ) | |

| CAPITAL SHARE TRANSACTIONS: | |

| Net proceeds from sale of shares | | | 53,133 | | | | 19,020,498 | | | | 10,245,742 | | | | 25,381,193 | | |

| Reinvestment of distributions to shareholders | | | – | | | | 1,768,278 | | | | – | | | | 79,636,872 | | |

| Cost of shares repurchased | | | (3,778,975 | ) | | | (8,949,968 | ) | | | (82,121,597 | ) | | | (65,082,672 | ) | |

| Total increase (decrease) in net assets from capital share transactions | | | (3,725,842 | ) | | | 11,838,808 | | | | (71,875,855 | ) | | | 39,935,393 | | |

| NET INCREASE (DECREASE) IN NET ASSETS | | | 12,941,909 | | | | (38,336,696 | ) | | | (13,267,332 | ) | | | (255,504,079 | ) | |

| NET ASSETS, end of period | | $ | 76,121,698 | | | $ | 63,179,789 | | | $ | 201,514,506 | | | $ | 214,781,838 | | |

| Undistributed net investment income | | $ | 1,343,237 | | | $ | 420,226 | | | $ | 3,833,068 | | | $ | 1,851,314 | | |

| OTHER INFORMATION: | |

| Capital share transactions: | |

| Shares sold | | | 5,937 | | | | 1,704,676 | | | | 2,536,051 | | | | 5,533,771 | | |

| Shares issued in reinvestment of distributions to shareholders | | | – | | | | 230,846 | | | | – | | | | 27,651,692 | | |

| Shares repurchased | | | (410,858 | ) | | | (836,287 | ) | | | (21,724,486 | ) | | | (17,868,287 | ) | |

| Net share transactions | | | (404,921 | ) | | | 1,099,235 | | | | (19,188,435 | ) | | | 15,317,176 | | |

See Notes to Financial Statements.

23

MARTIN CURRIE BUSINESS TRUST

STATEMENTS OF CHANGES IN NET ASSETS

| | | MCBT Pan European

Select Fund | |

| | | Six Months

Ended

October 31, 2009

(Unaudited) | | Year

Ended

April 30, 2009 | |

| NET ASSETS, beginning of period | | $ | 29,038,283 | | | $ | 98,784,943 | | |

| INCREASE IN NET ASSETS FROM OPERATIONS: | |

| Net investment income | | | 130,115 | | | | 2,610,648 | | |

| Net realized gain (loss) | | | 7,700,430 | | | | (53,796,517 | ) | |

Net change in net unrealized appreciation (depreciation) on

investments and foreign currency transactions | | | 965,338 | | | | (12,749,414 | ) | |

| Net increase (decrease) in net assets from operations | | | 8,795,883 | | | | (63,935,283 | ) | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | |

| Net investment income | | | – | | | | (2,759,091 | ) | |

| Net realized gains | | | – | | | | (2,446,515 | ) | |

| Total distributions | | | – | | | | (5,205,606 | ) | |

| CAPITAL SHARE TRANSACTIONS: | |

| Net proceeds from sale of shares | | | 352,158 | | | | 24,197,910 | | |

| Reinvestment of distributions to shareholders | | | – | | | | 5,104,404 | | |

| Cost of shares repurchased | | | (7,972,028 | ) | | | (29,908,085 | ) | |

| Total decrease in net assets from capital share transactions | | | (7,619,870 | ) | | | (605,771 | ) | |

| NET INCREASE (DECREASE) IN NET ASSETS | | | 1,176,013 | | | | (69,746,660 | ) | |

| NET ASSETS, end of period | | $ | 30,214,296 | | | $ | 29,038,283 | | |

| Undistributed net investment income (loss) | | $ | 112,698 | | | $ | (17,417 | ) | |

| OTHER INFORMATION: | |

| Capital share transactions: | |

| Shares sold | | | 81,518 | | | | 2,489,931 | | |

| Shares issued in reinvestment of distributions to shareholders | | | – | | | | 1,195,411 | | |

| Shares repurchased | | | (1,623,013 | ) | | | (5,791,157 | ) | |

| Net share transactions | | | (1,541,495 | ) | | | (2,105,815 | ) | |

See Notes to Financial Statements.

24

MCBT OPPORTUNISTIC EAFE FUND

FINANCIAL HIGHLIGHTS

FOR A SHARE OUTSTANDING FOR THE PERIOD

| | | Six Months Ended

October 31, 2009

(Unaudited) (2) | | Year

Ended

April 30, 2009 (2) | | Year

Ended

April 30, 2008 (2) | | Year

Ended

April 30, 2007 (2) | | Year

Ended

April 30, 2006 (2) | | Year

Ended

April 30, 2005 (2) | |

PER SHARE OPERATING

PERFORMANCE | |

Net asset value,

beginning of period | | $ | 7.470 | | | $ | 13.790 | | | $ | 14.260 | | | $ | 12.310 | | | $ | 11.020 | | | $ | 10.450 | | |

| Net investment income | | | 0.111 | | | | 0.208 | | | | 0.166 | | | | 0.088 | | | | 0.071 | | | | 0.119 | | |

Net realized and unrealized gain

(loss) on investments and

foreign currency transactions | | | 1.869 | | | | (6.315 | ) | | | (0.242 | ) | | | 1.905 | | | | 4.600 | | | | 0.779 | | |

| Total from investment operations | | | 1.980 | | | | (6.107 | ) | | | (0.076 | ) | | | 1.993 | | | | 4.671 | | | | 0.898 | | |

| Less distributions: | |

| Net investment income | | | – | | | | (0.213 | ) | | | (0.010 | ) | | | (0.043 | ) | | | (1.991 | ) | | | (0.184 | ) | |

| Net realized gains | | | – | | | | – | | | | (0.384 | ) | | | – | | | | (1.390 | ) | | | (0.144 | ) | |

| Total distributions | | | – | | | | (0.213 | ) | | | (0.394 | ) | | | (0.043 | ) | | | (3.381 | ) | | | (0.328 | ) | |

| Net asset value, end of period | | $ | 9.450 | | | $ | 7.470 | | | $ | 13.790 | | | $ | 14.260 | | | $ | 12.310 | | | $ | 11.020 | | |

TOTAL INVESTMENT

RETURN (1) | | | 26.51 | %(3) | | | (44.33 | )% | | | (0.72 | )% | | | 16.22 | % | | | 48.23 | % | | | 8.41 | % | |

RATIOS AND

SUPPLEMENTAL DATA | |

| Net assets, end of period | | $ | 76,121,698 | | | $ | 63,179,789 | | | $ | 101,516,485 | | | $ | 29,118,526 | | | $ | 25,347,676 | | | $ | 29,858,561 | | |

Operating gross expenses to

average net assets | | | 1.10 | %(4) | | | 1.14 | % | | | 1.13 | % | | | 1.70 | % | | | 1.79 | % | | | 1.38 | % | |

Operating net expenses to average

net assets | | | 1.10 | %(4) | | | 1.14 | % | | | 1.17 | % | | | 1.61 | % | | | 1.79 | % | | | 1.38 | % | |

Net investment income to average

net assets | | | 2.46 | %(4) | | | 2.24 | % | | | 1.16 | % | | | 0.70 | % | | | 0.61 | % | | | 1.09 | % | |

| Portfolio turnover rate | | | 52 | % | | | 97 | % | | | 77 | % | | | 106 | % | | | 81 | % | | | 103 | % | |

(1) Total return at net asset value assuming all distributions reinvested.

(2) The per share amounts were computed using an average number of shares outstanding during the year.

(3) Periods less than one year are not annualized.

(4) Annualized.

See Notes to Financial Statements.

25

MCBT GLOBAL EMERGING MARKETS FUND

FINANCIAL HIGHLIGHTS

FOR A SHARE OUTSTANDING FOR THE PERIOD

| | | Six Months Ended

October 31, 2009

(Unaudited) (2) | | Year

Ended

April 30, 2009 (2) | | Year

Ended

April 30, 2008 (2) | | Year

Ended

April 30, 2007 (2) | | Year

Ended

April 30, 2006 (2) | | Year

Ended

April 30, 2005 (2) | |

PER SHARE OPERATING

PERFORMANCE | |

Net asset value,

beginning of period | | $ | 3.280 | | | $ | 9.380 | | | $ | 10.950 | | | $ | 11.050 | | | $ | 7.830 | | | $ | 8.240 | | |

| Net investment income | | | 0.038 | | | | 0.139 | | | | 0.079 | (4) | | | 0.090 | | | | 0.149 | | | | 0.104 | | |

Net realized and unrealized gain

(loss) on investments and

foreign currency transactions | | | 1.042 | | | | (4.625 | ) | | | 2.322 | | | | 1.771 | (3) | | | 5.347 | | | | 1.487 | | |

| Total from investment operations | | | 1.080 | | | | (4.486 | ) | | | 2.401 | | | | 1.861 | | | | 5.496 | | | | 1.591 | | |

| Less distributions: | |

| Net investment income | | | – | | | | (0.120 | ) | | | (0.061 | ) | | | (0.087 | ) | | | (0.167 | ) | | | (0.118 | ) | |

| Net realized gains | | | – | | | | (1.494 | ) | | | (3.910 | ) | | | (1.874 | ) | | | (2.109 | ) | | | (1.883 | ) | |

| Total distributions | | | – | | | | (1.614 | ) | | | (3.971 | ) | | | (1.961 | ) | | | (2.276 | ) | | | (2.001 | ) | |

| Net asset value, end of period | | $ | 4.360 | | | $ | 3.280 | | | $ | 9.380 | | | $ | 10.950 | | | $ | 11.050 | | | $ | 7.830 | | |

TOTAL INVESTMENT

RETURN (1) | | | 32.93 | %(5) | | | (45.43 | )% | | | 18.69 | %(4) | | | 18.30 | % | | | 77.13 | % | | | 18.41 | % | |

RATIOS AND

SUPPLEMENTAL DATA | |

| Net assets, end of period | | $ | 201,514,506 | | | $ | 214,781,838 | | | $ | 470,285,917 | | | $ | 522,330,052 | | | $ | 491,169,979 | | | $ | 312,918,246 | | |

Operating gross expenses to

average net assets | | | 1.28 | %(6) | | | 1.16 | % | | | 1.10 | % | | | 1.11 | % | | | 1.13 | % | | | 1.16 | % | |

Operating net expenses to average

net assets | | | 1.28 | %(6) | | | 1.16 | % | | | 1.10 | % | | | 1.11 | % | | | 1.13 | % | | | 1.16 | % | |

Net investment income to average

net assets | | | 1.90 | %(6) | | | 2.70 | % | | | 0.69 | % | | | 0.85 | % | | | 1.56 | % | | | 1.25 | % | |

| Portfolio turnover rate | | | 58 | % | | | 103 | % | | | 63 | % | | | 67 | % | | | 102 | % | | | 93 | % | |

(1) Total return at net asset value assuming all distributions reinvested.

(2) The per share amounts were computed using an average number of shares outstanding during the year.

(3) Includes a non-recurring gain from Martin Currie recorded as a result of an incorrectly executed trade. The non-recurring gain resulted in an increase in net realized and unrealized gain (loss) on investments and foreign currency transactions of $0.013 per share. Excluding this non-recurring gain, total investment return would have been 0.12% lower.

(4) Includes investment income from Martin Currie as a result of a reimbursement of overdraft fees. Excluding this investment income would have no effect on net investment income or total investment return.

(5) Periods less than one year are not annualized.

(6) Annualized.

See Notes to Financial Statements.

26

MCBT PAN EUROPEAN SELECT FUND

FINANCIAL HIGHLIGHTS

FOR A SHARE OUTSTANDING FOR THE PERIOD

| | | Six Months Ended

October 31, 2009

(Unaudited) (2) | | Year

Ended

April 30, 2009 (2) | | Year

Ended

April 30, 2008 (2) | | Year

Ended

April 30, 2007 (2) | | Year

Ended

April 30, 2006 (2) | | Year

Ended

April 30, 2005 (2) | |

PER SHARE OPERATING

PERFORMANCE | |

Net asset value,

beginning of period | | $ | 4.260 | | | $ | 11.070 | | | $ | 20.830 | | | $ | 19.570 | | | $ | 15.060 | | | $ | 15.060 | | |

| Net investment income | | | 0.023 | | | | 0.284 | | | | 0.239 | (5) | | | 0.384 | | | | 0.191 | (6) | | | 0.072 | | |

Net realized and unrealized gain

(loss) on investments and

foreign currency transactions | | | 1.437 | | | | (6.464 | ) | | | (1.532 | ) | | | 6.018 | | | | 8.222 | | | | 2.400 | | |

| Total from investment operations | | | 1.460 | | | | (6.180 | ) | | | (1.293 | ) | | | 6.402 | | | | 8.413 | | | | 2.472 | | |

| Less distributions: | |

| Net investment income | | | – | | | | (0.334 | ) | | | (0.315 | ) | | | (0.351 | ) | | | (0.262 | ) | | | (0.049 | ) | |

| Net realized gains | | | – | | | | (0.296 | ) | | | (8.152 | ) | | | (4.791 | ) | | | (3.641 | ) | | | (2.423 | ) | |

| Total distributions | | | – | | | | (0.630 | ) | | | (8.467 | ) | | | (5.142 | ) | | | (3.903 | ) | | | (2.472 | ) | |

| Net asset value, end of period | | $ | 5.720 | | | $ | 4.260 | | | $ | 11.070 | | | $ | 20.830 | | | $ | 19.570 | | | $ | 15.060 | | |

TOTAL INVESTMENT

RETURN (1) | | | 34.51 | %(3) | | | (55.84 | )% | | | (9.54 | )%(5) | | | 36.46 | % | | | 64.64 | % | | | 16.07 | % | |

RATIOS AND

SUPPLEMENTAL DATA | |

| Net assets, end of period | | $ | 30,214,296 | | | $ | 29,038,283 | | | $ | 98,784,943 | | | $ | 167,992,389 | | | $ | 114,826,430 | | | $ | 93,954,059 | | |

Operating gross expenses to

average net assets | | | 1.62 | %(4) | | | 1.37 | % | | | 1.29 | % | | | 1.32 | % | | | 1.30 | % | | | 1.37 | % | |

Operating net expenses to average

net assets | | | 1.62 | %(4) | | | 1.23 | % | | | 1.29 | % | | | 1.32 | % | | | 1.30 | % | | | 1.37 | % | |

Net investment income to average

net assets | | | 0.86 | %(4) | | | 4.25 | % | | | 1.47 | % | | | 1.94 | % | | | 1.12 | %(6) | | | 0.47 | % | |

| Portfolio turnover rate | | | 170 | % | | | 218 | % | | | 91 | % | | | 55 | % | | | 104 | % | | | 119 | % | |

(1) Total return at net asset value assuming all distributions reinvested.

(2) The per share amounts were computed using an average number of shares outstanding during the year.

(3) Periods less than one year are not annualized.

(4) Annualized.

(5) Includes investment income from Martin Currie as a result of a reimbursement of overdraft fees. Excluding this investment income would have no effect on net investment income or total investment return.

(6) Net investment income per share and the net investment income to average net assets ratio includes non-recurring dividend income amounting to $0.108 and 0.63%, respectively.

See Notes to Financial Statements.

27

MARTIN CURRIE BUSINESS TRUST

NOTES TO FINANCIAL STATEMENTS

NOTE A - ORGANIZATION

Martin Currie Business Trust ("MCBT") (the "Trust") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company organized as a Massachusetts business trust on May 20, 1994. The Trust currently offers three funds which have differing investment objectives and policies: MCBT Opportunistic EAFE Fund (the "Opportunistic EAFE Fund"), MCBT Global Emerging Markets Fund (the "Global Emerging Markets Fund"), and MCBT Pan European Select Fund (the "Pan European Select Fund") (each a "Fund" and collectively, the "Funds"). The Opportunistic EAFE Fund, the Global Emerging Markets Fund, and the Pan European Select Fund commenced investment operations on July 1, 1994, February 14, 1997, and June 6, 2002, respectively. The Trust's Declaration of Trust permits the Board of Trustees to issue an unlimited number of full and fractional shares of beneficial interest of each Fund, without par v alue.

NOTE B - SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements:

Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and income and expenses at the date of the financial statements. Actual results could differ from these estimates.

Valuation of Investments - The Funds' portfolio securities traded on a securities exchange are valued at the last quoted sale price, or, if no sale occurs, at the mean of the most recent quoted bid and asked prices. Unlisted securities for which market quotations are readily available are valued at the mean of the most recent quoted bid and asked prices. Equity securities listed on the NASDAQ National Market System are valued at the NASDAQ Official Closing Price. Prices for securities which are primarily traded in foreign markets are furnished by quotation services expressed in the local currency's value and are translated into U.S. dollars at the current rate of exchange. Short-term securities and debt securities with a remaining maturity of 60 days or less are valued at their amortized cost. Securities for which current market quotations are unavailable, or for which available quotations are not deemed by the investment manager to be representative of market value, and securities affected by significant events that occurred after the close of the relevant market but prior to the close of the New York Stock Exchange (as of which time each Fund's net asset value is determined) are valued at fair value as determined in good faith by the Trustees of the Trust ("Trustees"), or by persons acting pursuant to procedures approved by the Trustees. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer's financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances. By its nature, a fair value price is an estimate of the value of a security at a given point in time and does not reflect an actual market price, whic h may be different by a material amount. For purposes of determining whether fair valuation is appropriate, "significant events" may include events relating to a single issuer (e.g., corporate actions or announcements) or events relating to multiple issuers (e.g., governmental actions or natural disasters). At October 31, 2009, there were no fair valued securities held by the Funds.

Fair Value Measurement - In accordance with FASB ASC 820-10, Fair Value Measurements and Disclosures, (formerly Statement of Financial Accounting Standards ("SFAS") No. 157), the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurement) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (level 3 measurements). FASB ASC 820-10-35-39 to 55 provides three levels of the fair value hierarchy as follows:

The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

• Level 1 - Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date;

28

MARTIN CURRIE BUSINESS TRUST

NOTES TO FINANCIAL STATEMENTS

• Level 2 - Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active;

• Level 3 - Inputs that are unobservable.

The following is a summary of the inputs used as of October 31, 2009 in valuing the Fund's investments carried at value:

| Fund | | Level 1 | | Level 2 | | Level 3 | | Total | |

| Opportunistic EAFE Fund | |

| Common Stocks | | $ | 76,007,980 | | | $ | – | | | $ | – | | | $ | 76,007,980 | | |

| Short Terms | | | 811,000 | | | | – | | | | – | | | | 811,000 | | |

| Global Emerging Markets Fund | |

| Common Stocks | | | 182,951,604 | | | | – | | | | – | | | | 182,951,604 | | |

| Preferred Stocks | | | 13,071,118 | | | | – | | | | – | | | | 13,071,118 | | |

| Pan European Select Fund | |

| Common Stocks | | | 29,144,680 | | | | – | | | | – | | | | 29,144,680 | | |

| Short Terms | | | 839,000 | | | | – | | | | – | | | | 839,000 | | |

Repurchase Agreements - In connection with transactions in repurchase agreements, the Funds' custodian takes possession of the underlying collateral securities, the value or market price of which is at least equal to the principal amount, including interest, of the repurchase transaction. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market on a daily basis to ensure the adequacy of the collateral. In the event of default of the obligation to repurchase, each Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings that could delay or increase the c ost of such realization or retention.

Securities Lending - The Funds may lend any of their securities held by State Street Bank and Trust Company ("State Street") as custodian to certain qualified brokers, except those securities which the Funds or the Investment Manager specifically identify as not being available. By lending their investment securities, the Funds attempt to increase their net investment income through the receipt of interest on the loan. Any gain or loss in the market price of the securities loaned that might occur and any interest or dividends declared during the term of the loan would accrue to the accounts of the Funds. Risks of delay in recovery of the securities or even loss of rights in non-cash collateral may occur should the borrower of the securities fail financially, as well as risks of loss from the investment of cash collateral (which may be increased at time of h igh market volatility). Risks may also arise to the extent that the value of non-cash collateral decreases below the value of the securities loaned.

Upon entering into a securities lending transaction, a Fund receives cash or other securities as collateral in an amount equal to or exceeding 100% of the current market value of the loaned securities. At the time of lending, collateral received must generally equal or exceed 102% of the current market value of the loaned securities with respect to fixed income and US dollar denominated equity securities and 105% of the current market value of the loaned securities with respect to other securities. Any cash received as collateral is generally invested by State Street, acting in its capacity as securities lending agent (the "Agent"), in the State Street Navigator Securities Lending Prime Portfolio. A portion of the dividends received on the collateral is rebated to the borrower of the securities, and the remainder is split between the Agent and the Fund.

The Funds have not engaged in any securities lending activities during the period ended October 31, 2009.

Investment Transactions - Investment security transactions are recorded on the date of purchase or sale. Realized gains and losses from security transactions are determined on the basis of identified cost.

29

MARTIN CURRIE BUSINESS TRUST

NOTES TO FINANCIAL STATEMENTS

Investment Income - Dividend income is recorded on the ex-dividend date (net of foreign withholding taxes). Certain dividends from foreign securities may be recorded subsequent to the ex-dividend date and as soon as the Fund is informed of such dividends. Interest income is recorded daily on the accrual basis and includes accretion of discount and amortization of premium on investments. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Foreign Currency Translations - The records of the Funds are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at a current rate of exchange of such currency to determine the value of investments, other assets and liabilities on a daily basis when a Fund's net asset value is determined. Purchases and sales of securities and income and expenses are converted at the prevailing rate of exchange on the respective dates of such transactions.

Each Fund may realize currency gains or losses between the trade and settlement dates on security transactions. To minimize such currency gains or losses, the Fund may enter into forward foreign currency contracts ("Forwards").

The net U.S. dollar value of foreign currency underlying all contractual commitments held by each Fund on each day and the resulting net unrealized appreciation, depreciation and related net receivable or payable amounts are determined by using forward currency exchange rates supplied by a quotation service. Reported net realized gains and losses on foreign currency transactions represent net gains and losses from sales and maturities of Forwards, disposition of foreign currencies, currency gains and losses realized between the trade and settlement dates on security transactions, and the difference between the amount of net investment income accrued and the US dollar amount actually received. The effects of changes in foreign currency exchange rates on investments in securities are not segregated in the Statements of Operations from the effects of changes in market prices of those securities, and are included with the net realized and unreal ized gain or loss on investment securities.

Forward Foreign Currency Contracts - A Forward is an agreement between two parties to buy and sell a currency at a set price on a future date. The market value of the Forward fluctuates with changes in currency exchange rates. The Forward is marked-to-market daily at the prevailing forward exchange rate of the underlying currencies and the change in the market value is recorded by the Fund as an unrealized gain or loss. When the Forward is closed, the Fund records a realized gain or loss equal to the difference between the value at the time it was opened and the value at the time it was closed. The Funds may enter into Forwards in connection with planned purchases and sales of securities, to hedge specific receivables or payables against changes in future exchange rates or to hedge the US dollar value of portfolio securities denominated in a foreign currenc y. At October 31, 2009, none of the Funds had open Forwards.

Although Forwards limit the risk of loss due to a decline in the value of hedged currency, they also limit any potential gain that might result should the value of the currency increase. In addition, the Funds could be exposed to additional risks if the counterparties to the contracts are unable to meet the terms of their contracts.