| | OMB APPROVAL |

| | OMB Number: | 3235-0570 |

| | Expires: | August 31, 2011 |

| UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . . .18.9 |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| | | | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08612 |

|

MARTIN CURRIE BUSINESS TRUST |

(Exact name of registrant as specified in charter) |

|

Saltire Court, 20 Castle Terrace, Edinburgh, Scotland | | EH1 2ES |

(Address of principal executive offices) | | (Zip code) |

|

Grant Spence

c/o Martin Currie, Inc.

Saltire Court

20 Castle Terrace

Edinburgh

Scotland EH1 2ES |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 011-44-131-229-5252 | |

|

Date of fiscal year end: | April 30 | |

|

Date of reporting period: | May 1, 2010 to October 31, 2010 | |

| | | | | | | | | |

Explanatory Note: The registrant, an open-end investment company registered pursuant to Section 8(b) of the Investment Company Act of 1940 (the “Act”), has not filed a registration statement that has gone effective under the Securities Act of 1933 (the “1933 Act”) because beneficial interests in the registrant are issued and sold solely in private transactions that do not involve any public offering within the meaning of Section 4(2) of the 1933 Act. Accordingly, this report is not filed under Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934.

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

MARTIN CURRIE BUSINESS TRUST

MCBT Opportunistic EAFE Fund

MCBT Global Emerging Markets Fund

MCBT European Select Fund

SEMI-ANNUAL REPORT

OCTOBER 31, 2010

MARTIN CURRIE BUSINESS TRUST

TABLE OF CONTENTS

| | | Page | |

| Management Discussion and Analysis | | | 2 | | |

|

| Schedules of Investments | |

|

| MCBT Opportunistic EAFE Fund | | | 13 | | |

|

| MCBT Global Emerging Markets Fund | | | 17 | | |

|

| MCBT European Select Fund | | | 21 | | |

|

| Statements of Assets & Liabilities | | | 24 | | |

|

| Statements of Operations | | | 25 | | |

|

| Statements of Changes in Net Assets | | | 26 | | |

|

| Financial Highlights | | | 28 | | |

|

| Notes to Financial Statements | | | 31 | | |

|

| Other Information | | | 39 | | |

|

| Trustees and Officers | | | 42 | | |

|

1

MCBT OPPORTUNISTIC EAFE FUND

PROFILE AT OCTOBER 31, 2010

OBJECTIVE Capital appreciation through investment in an international portfolio of primarily equity and equity-related securities traded in Europe, Australasia and the Far East.

LAUNCH DATE July 1, 1994

FUND SIZE $59.0m

PERFORMANCE Total return from May 1, 2010 through October 31, 2010

| •MCBT Opportunistic EAFE Fund | | | +3.5 | % | |

| •Morgan Stanley Capital International (MSCI) EAFE Index* | | | +6.0 | % | |

Annualized total return from November 1, 2005 through October 31, 2010

| •MCBT Opportunistic EAFE Fund | | | +2.4 | % | |

| •Morgan Stanley Capital International (MSCI) EAFE Index* | | | +3.8 | % | |

Annualized total return from November 1, 2000 through October 31, 2010

| •MCBT Opportunistic EAFE Fund (excluding all transaction fees) | | | +2.3 | % | |

| •MCBT Opportunistic EAFE Fund (including all transaction fees) | | | +1.5 | % | |

| •Morgan Stanley Capital International (MSCI) EAFE Index* | | | +3.6 | % | |

Annualized total return from July 1, 1994 through October 31, 2010

| •MCBT Opportunistic EAFE Fund (excluding all transaction fees) | | | +5.1 | % | |

| •MCBT Opportunistic EAFE Fund (including all transaction fees) | | | +4.3 | % | |

| •Morgan Stanley Capital International (MSCI) EAFE Index (a)* | | | +5.1 | % | |

(a) Performance for the benchmark is not available from July 1, 1994 (commencement of investment operations). For that reason, performance for the benchmark is shown from July 31, 1994.

* Gross of Dividends

Performance shown is net of all fees after reimbursement from Martin Currie Inc. (the "Investment Manager" or "Martin Currie"). Returns and net asset values of Fund investments will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Each performance figure, including all transaction fees, assumes purchase at the beginning and redemption at the end of the stated period and is calculated using an offering and redemption price which prior to June 28, 2000, reflects a transaction fee of 75 basis points on purchase and 75 basis points on redemption. Transaction fees were paid to the Fund to cover trading costs. Transaction fees were eliminated effective June 28, 2000. Past performance is not indicative of future performance. Performance shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

2

MCBT OPPORTUNISTIC EAFE FUND

PROFILE AT OCTOBER 31, 2010

PORTFOLIO COMMENTS Global markets continued to rise in the six months under review, albeit at a much slower rate than their astonishing growth in the 12 months covered by our last report. The MSCI EAFE index finished the period 6% higher in US dollar terms. Getting there was a tortuous journey, however. On the one hand, investors fretted about sovereign-default risk, global growth and the extent to which growth depends on China; these concerns weighed heavily on the market in May and June. On the other hand, there was a recognition that valuations remain out of line with their historic levels, thereby creating an impulse towards a 'normalization' trade. For much of this year, the market's response to these conflicting forces has been binary, with each day's market movements being characterised as either a 'risk on' or a 'risk off' trade. A strong July (+9.5%), thanks to anticipation of a decent results season, was followed by a poor August (-3.1%) as economic data disappointed (notably in the US) and worries arose that China might be heavy-handed in restraining investment. Global markets bounced back in September (+9.8%) as better - or less bad - economic data, especially in the US, sharpened appetite for risk. The rally continued through October (+3.6) as investors (correctly) anticipated further quantitative easing from the Federal Reserve.

Regionally, Europe, Asia and global emerging markets outperformed. Meanwhile, Japan had a very poor six months, as the consequences of a rising yen and the perpetual political wrangling that has plagued the country for much of the last decade left its market friendless.

In this environment the fund underperformed its benchmark, rising 3.5%. On the sector level, stock selection in healthcare made the biggest negative contribution. Our positions here suffered from concern in July that biologic compounds, previously seen as being protected from generic competition given the complexity of the structure, were now vulnerable after the FDA approved a competitor to a Sanofi-Aventis drug. Stock selection in telecoms (which led the index overall) and financials was also detrimental. Conversely, there was good stock selection in energy and (especially) materials, but the marked overweight to consumer discretionary made the biggest positive contribution.

Four of the five worst-performing holdings were Japanese. Dai-ichi Mutual Life Insurance, the biggest detractor, was a victim of the flattening yield curve in the Japanese government bond market. Broker Nomura Holdings fell on fears of further capital-raising. Ricoh, which makes printers, suffered along with the tech sector from fears over a build-up in inventories in the summer. Kirin, the beer and soft drinks company, was hurt by the strength of the yen and weak domestic demand. The other main detractor was Persimmon, the UK homebuilder, which plummeted early in the review period as holdings perceived to be particularly exposed to the faltering UK economy were punished severely.

On the positive side, there were stellar performances from two emerging-market stocks in the consumer discretionary sector: SJM Holdings, the Macao casino operator, and PDG Realty, the Brazilian homebuilder. SJM is profiting from greater numbers of Chinese visitors with more disposable income, while PDG is benefiting from both positive operational momentum and general strength in the Brazilian consumer. Other key contributors included UK oil-services company Petrofac, on strong results, Australia's Newcrest Mining, after the ongoing economic uncertainty and, later, QE anticipation pushed up the gold price, and British American Tobacco, whose defensive characteristics were especially appealing to investors during the falling markets at the beginning of the period.

3

MCBT OPPORTUNISTIC EAFE FUND

PROFILE AT OCTOBER 31, 2010

OUTLOOK

Our market expectations have changed little from early this year. The economic environment will likely remain constrained by fiscal deficits in the US and much of Europe, while we expect global growth will be driven by expansion in emerging markets - mainly China, India and Brazil. As a result, we expect markets will struggle to make much overall headway, and a volatile trading environment is likely for a protracted period. Monetary policy, especially that conducted by the United States, is likely to continue to affect currency and asset prices around the world. As the US prints more money, we are seeing sharp increases in the dollar price of hard assets like gold, oil and agricultural commodities. Capital is flowing into developing regions, pushing up prices and strengthening currencies. The portfolio is exposed to these dynamics through stocks like Henderson Land Development (Hong Kong real estate), Gold Fields, Newcrest Minin g (both gold miners) and Incitec Pivot (fertilizer). Elsewhere, the focus remains on finding those franchises that operate in structural growth markets and those that can help themselves through internal improvement or corporate restructuring.

INVESTMENT MANAGER PROFILE James Fairweather, Christine Montgomery and David Sheasby are primarily responsible for the day-to-day management of the Fund.

James Fairweather spent three years with Montague Loebl Stanley & Co. as an institutional sales and economics assistant. He moved into Eurobond sales for 18 months with Kleinwort Benson before joining Martin Currie in 1984. He has worked in Martin Currie's Far East, North American and continental European investment teams. Appointed a director in 1987, James became head of the continental European team in 1992. He was appointed deputy chief investment officer in 1994 with overall responsibility for Martin Currie's investments in emerging markets. James was promoted to chief investment officer in 1997.

Christine Montgomery joined Martin Currie in 2009 as a director in Martin Currie's global team with responsibility for EAFE and ACWI ex US mandates. She joined from Edinburgh Partners, where she was an investment partner, managing global and international portfolios for institutional clients, mostly in North America. Before that, she was a global-equities fund manager at Franklin Templeton Investments. Christine began her investment career at Aegon Asset Management (formerly Scottish Equitable). During her 12 years with the company, her roles included head of equities, head of fixed-income and deputy CIO. Before joining Aegon, she had worked in the Department of Accounting at the University of Edinburgh.

David Sheasby joined Martin Currie in 2004 as a director in our global team. He is lead portfolio manager for the EAFE ADR strategy and supports the managers of the global ex-US portfolios. Before coming to Martin Currie, David worked for Aegon Asset Management (formerly Scottish Equitable) for 18 years. From 2002 he was a senior portfolio manager for global equities, developing and directing Aegon's global strategy. During his time with Aegon, David headed its global equity, emerging markets and European teams, and prior to that, served as a European portfolio manager at Aegon from 1987 to 1994.

4

MCBT OPPORTUNISTIC EAFE FUND

PROFILE AT OCTOBER 31, 2010

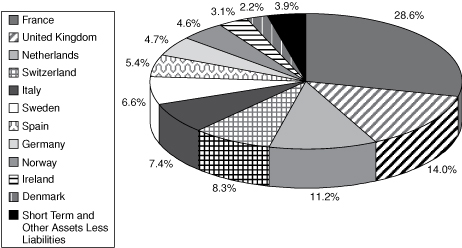

ASSET ALLOCATION

(% of net assets)

TOP TEN HOLDINGS

BY REGION/COUNTRY*

| | | | | % of net assets | |

| Europe | |

| Siemens AG | | (Germany) | | | 2.9 | | |

| British American Tobacco PLC | | (United Kingdom) | | | 2.8 | | |

| Roche Holding AG | | (Switzerland) | | | 2.8 | | |

| Royal Dutch Shell | | (United Kingdom) | | | 2.7 | | |

| Telefonica SA | | (Spain) | | | 2.5 | | |

| Sanofi-Aventis | | (France) | | | 2.4 | | |

| Xstrata PLC | | (United Kingdom) | | | 2.4 | | |

| ABB Ltd. | | (Switzerland) | | | 2.4 | | |

| SJM Holdings Ltd. | | (Hong Kong) | | | 2.3 | | |

| DnB NOR ASA | | (Norway) | | | 2.3 | | |

* Excludes short-term investments

The Fund is actively managed and therefore portfolio holdings and characteristics will change over time.

5

MCBT GLOBAL EMERGING MARKETS FUND

PROFILE AT OCTOBER 31, 2010

OBJECTIVE Capital appreciation through investment primarily in equity and equity-related securities of issuers located in a number of countries with emerging markets and developing economies.

LAUNCH DATE February 14, 1997

FUND SIZE $138.2m

PERFORMANCE Total return from May 1, 2010 through October 31, 2010

| •MCBT Global Emerging Markets Fund | | | +14.3 | % | |

| •Morgan Stanley Capital International (MSCI) Emerging Markets Index* | | | +10.2 | % | |

Annualized total return from November 1, 2005 through October 31, 2010

| •MCBT Global Emerging Markets Fund | | | +13.5 | % | |

| •Morgan Stanley Capital International (MSCI) Emerging Markets Index* | | | +15.3 | % | |

Annualized total return from November 1, 2000 through October 31, 2010

| •MCBT Global Emerging Markets Fund (excluding all transaction fees) | | | +13.6 | % | |

| •MCBT Global Emerging Markets Fund (including all transaction fees) | | | +12.7 | % | |

| •Morgan Stanley Capital International (MSCI) Emerging Markets Index* | | | +15.0 | % | |

Annualized total return from February 14, 1997 through October 31, 2010

| •MCBT Global Emerging Markets Fund (excluding all transaction fees) | | | +8.5 | % | |

| •MCBT Global Emerging Markets Fund (including all transaction fees) | | | +7.6 | % | |

| •Morgan Stanley Capital International (MSCI) Emerging Markets Index (a)* | | | +8.2 | % | |

(a) Performance for the benchmark is not available from February 14, 1997 (commencement of investment operations). For that reason, performance for the benchmark is shown from February 28, 1997.

* Gross of Dividends

Performance shown is net of all fees. Returns and net asset values of Fund investments will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Each performance figure, including all transaction fees, assumes purchase at the beginning and redemption at the end of the stated period and is calculated using an offering and redemption price which prior to October 1, 1998, reflects a transaction fee of 100 basis points on purchase and 100 basis points on redemption. Transaction fees were paid to the Fund to cover trading costs. Transaction fees were eliminated effective October 1, 1998. Past performance is not indicative of future performance. Performance shown does not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares.

6

MCBT GLOBAL EMERGING MARKETS FUND

PROFILE AT OCTOBER 31, 2010

PORTFOLIO COMMENTS Emerging markets continued to rise in the six months under review, albeit at a slower pace than the extraordinary rally that took place in the previous 12 months. The MSCI Emerging Markets index strongly outperformed the global index, gaining 10.2% in US dollar terms against a 3.3% rise in the MSCI World Index. Asian and Latin American stocks came in just above the emerging-markets index, while the Europe, Middle East and Africa (EMEA) region lagged.

Global events played an important role in sentiment towards emerging markets. Early in the period, the sovereign-debt crisis in Greece threatened to spread to other southern European economies, notably Spain and Portugal. In addition, tightening measures by the Chinese authorities in the real estate sector, banking industry and, latterly, in materials heightened investors' sensitivity to any weakening economic figures (of which there were a few).

Later in the period, sentiment improved dramatically so that many emerging markets were demonstrably less skittish than the S&P500, for example. This reflected the somewhat schizophrenic combination of weak US economic data and increasing optimism about a second wave of quantitative easing (QE). In contrast to this and to the lingering sovereign-credit concerns in Europe, emerging markets have continued to deliver both solid growth momentum and an absence of 'shocks' (either political or economic).

Having underperformed in previous reporting period, the fund fared much better in the six months under review, rising 14.3% against a 10.2% gain in the benchmark. Three of the fund's six best-performing stocks came from Brazil. Good stock picking was key here, as that country was of the weaker markets in the period. Two of them came from Brazil's consumer-discretionary sector: top performer Cia Hering, a manufacturer and retailer of branded clothing, and PDG, a house builder. Both benefited from positive operational momentum and general strength in the Brazilian consumer. (The fund's other Brazilian outperformer was oil giant Petrobras). The second most successful holding was also in the consumer-discretionary sector - Macau casino operator SJM, which is profiting from greater numbers of Chinese consumers with significant disposable income. SJM's strong third-quarter results reflected the health of the mass gaming market in Maca u, which is fed directly by southern China. The upcoming introduction of a direct rail link to the mainland should unlock further interest in the resort. Korea's Samsung Engineering was another significant contributor after delivering impressive new orders from the Middle East and Asia. Peruvian gold miner Buenaventura also did well, as the continuing economic uncertainty and QE anticipation drove up the price of gold.

On the negative side, many of the fund's largest detractors came from Russia. Gas champion Gazprom suffered from ongoing weakness in natural-gas prices. Vimpelcom underperformed on rumours (subsequently confirmed) of the acquisition of Naguib Sawiri's telecom assets. Meanwhile, Petropavlovsk, a Russian gold miner, suffered as its expected ramp-up of operations continued to fall behind schedule. There was poor performance, too, from Korean tech stocks Samsung Electronics and LG Display, as investors worried about a build-up in inventories over the summer.

7

MCBT GLOBAL EMERGING MARKETS FUND

PROFILE AT OCTOBER 31, 2010

OUTLOOK

We consider emerging-market economies to be in a very healthy state. They are generally well managed; given their increasing stability, investors' perceptions have improved significantly. The contrast to developed economies is marked and should result in superior growth rates. After many years of sound policy implementation, inflation is well controlled in most emerging regions. In those countries that are experiencing a pick-up in inflation, the central banks remain vigilant against the risk that inflation poses to the structural growth of their economies.

As global investors seek growth, emerging economies are seeing record inflows. This trend looks set to continue and has many significant benefits for emerging markets: increased investment, lower funding costs, greater availability of funding and equity-market support. But it also creates one difficulty: appreciation pressure on emerging-market currencies. Intervention in the currency markets is already active and growing but is likely to become an increasingly 'hot' topic. Therefore, our focus remains on investing in companies with high-quality franchises and strong links to robust domestic consumption. We believe that the primary driver of growth for many emerging economies will shift from exports towards domestic demand. The medium- and long-term growth opportunities in developing markets remain vast.

INVESTMENT MANAGER PROFILE Kim Catechis joined Martin Currie in October 2010 as head of global emerging markets, a role he held at Scottish Widows Investment Partnership (SWIP) since 1998, when he established and recruited its global emerging markets team. At SWIP, Kim was responsible for £2.2 billion in funds under management and was lead portfolio manager on the firm's Global Emerging Markets equity fund. He also specialized in energy-sector research. Before joining SWIP, Kim established and managed two asset-management ventures in Spain: Eagle Star Inversions and, earlier, FG Gestión. He began his investment career as a portfolio manager for Edinburgh Fund Managers in 1987. Kim is fluent in French, German, Spanish, Portuguese and Greek, has intermediate Russian skills and is studying Mandarin.

8

MCBT GLOBAL EMERGING MARKETS FUND

PROFILE AT OCTOBER 31, 2010

ASSET ALLOCATION

(% of net assets)

TOP TEN HOLDINGS

BY REGION/COUNTRY*

| | | | | % of net assets | |

| Pacific Basin | |

| Samsung Electronics Co., Ltd. | | (South Korea) | | | 3.4 | | |

| SJM Holdings Ltd. | | (Hong Kong) | | | 3.2 | | |

| CNOOC Ltd. | | (China) | | | 3.2 | | |

| Industrial Bank of Korea | | (South Korea) | | | 2.9 | | |

| Latin America | |

| Petroleo Brasileiro SA | | (Brazil) | | | 3.1 | | |

PDG Realty SA Empreendimentos e

Participacoes | | (Brazil) | | | 3.0 | | |

| Vale SA, Class A | | (Brazil) | | | 2.9 | | |

| Cia Hering | | (Brazil) | | | 2.7 | | |

Compania de Minas

Buenaventura SA | | (Peru) | | | 2.7 | | |

| Europe | |

| Turkiye Garanti Bankasi AS | | (Turkey) | | | 2.7 | | |

* Excluding short-term investments.

The Fund is actively managed and therefore portfolio holdings and characteristics will change over time.

9

MCBT EUROPEAN SELECT FUND

PROFILE AT OCTOBER 31, 2010

OBJECTIVE Capital appreciation through investment primarily in equity and equity-related securities of midsized companies located in developed European countries, including the United Kingdom.

LAUNCH DATE June 6, 2002

FUND SIZE $14.7m

PERFORMANCE Total return from May 1, 2010 through October 31, 2010

| •MCBT European Select Fund | | | +8.5 | % | |

| •Morgan Stanley Capital International (MSCI) European Index* | | | +8.9 | % | |

Annualized total return from November 1, 2005 through October 31, 2010

| •MCBT European Select Fund | | | +3.1 | % | |

| •Morgan Stanley Capital International (MSCI) European Index* | | | +4.5 | % | |

Annualized total return from June 6, 2002 through October 31, 2010

| •MCBT European Select Fund | | | +10.5 | % | |

| •Morgan Stanley Capital International (MSCI) European Index* | | | +7.7 | % | |

* Gross of dividends

Performance shown is net of all fees. Returns and net asset values of Fund investments will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is not indicative of future performance. Performance shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

PORTFOLIO COMMENTS After outperforming in the preceding twelve months, the fund marginally underperformed its benchmark in the six months to 31 October. The fund gained 8.5% in US dollar terms against an 8.9% rise in the MSCI European Index.

It was far from a smooth upward trajectory. European markets were weak early in the period. Greece's deficit had triggered a loss of confidence in European sovereign debt and, by extension, in the banking system that held this debt. Our risk models suggested that investors were more risk-averse in the sell-off that took hold in May and June than during any other decline in recent times. The realized correlation among the Stoxx 50 constituents reached an all-time high, exceeding the levels seen in the immediate aftermath of the Lehman Brothers collapse.

Later in the period, however, things improved considerably. The results season was supportive to equity prices, with a high percentage of companies beating estimates and raising their guidance. And while sovereign spreads of certain countries, notably Portugal and Ireland, remained elevated, the Greek government's willingness to reduce spending and increase tax collection, as well as the support given by the European Central Bank (ECB), IMF, and fiscally strong European countries, reduced the risk of sovereign default - not just for Greece but for peripheral Europe as a whole. The ECB stress test, while overly lenient, forces banks to give a country breakdown of their

10

MCBT EUROPEAN SELECT FUND

PROFILE AT OCTOBER 31, 2010

sovereign exposure. This allows banks to discriminate between peers in choosing whom to lend to in the wholesale market, so that strong banks will no longer be penalised by association. Finally, the Basel III requirements were longer dated and less onerous than feared. All these factors, combined with the ultra-low valuations on offer, allowed European equity markets to recover strongly. Currency movements provided a further boost to returns in US dollars.

The main contributors to the fund's modest underperformance were German healthcare company Celesio, Norwegian oil-services company Petroleum Geo-Services (PGS), and Cookson, the UK-listed supplier to the steel industry. Celesio, the biggest detractor by some distance, was hurt in May by worries that fiscal austerity might have an impact on sales. PGS was weak after missing forecasts on operating profits in its quarter-two results and announcing that a dividend payment was unlikely in the next four quarters. And Cookson suffered as steel production outside China dropped off. We sold all three stocks.

On the positive side, the fund's top performer during the period was French auto-parts manufacturer Valeo, which reported excellent results and raised guidance again. The company delivered strong organic growth in its top line as well as impressive cost control, leading to free cash flow and operating profits that were better than expected. Another key contributor was Dialog Semiconductor, the German power-management-chip company, which rallied hard on the back of a number of design wins. French testing and inspection group Bureau Veritas also helped returns after releasing a strong set of first-half results and a positive outlook statement on sales. Given the oil spill in the Gulf of Mexico, avoiding BP made a major positive contribution to relative performance.

OUTLOOK

Since the end of October, developments have been mixed. The US Federal Reserve's second round of quantitative easing has contributed to increased confidence in a global recovery, but heightened concerns about sovereign debt in peripheral European states, as well as tightening measures in China, have offset that somewhat. Corporate profitability continues to be strong in general; European companies are reporting profit growth - and delivering earnings surprises - in line with their global peers. Yet their PE multiples fell to historical discounts to these same global peers in June and July. On balance, we expect a favourable environment for stocks in general and for evidence-based stock picking in particular over the coming quarters.

INVESTMENT MANAGER PROFILE Dr. Eric Woehrling joined Martin Currie in 2000 to design the European mid-cap products, which he has managed or co-managed since their launch in June 2002. Eric is lead manager of the Martin Currie GF Pan-European Opportunities Fund, a winner of the Lipper Fund Award 2008 and an S&P award in 2007. Before his move to Martin Currie, Eric worked for Stewart Ivory from 1997. He worked on the UK and emerging markets desks, before moving to the European desk, where he specialized in European smaller companies.

Palaniappan Chidambaram joined Martin Currie as an investment analyst in 2007, after managing his personal venture-capital investment. He became a portfolio manager in 2008, since when he has managed Martin Currie's European portfolios alongside

11

MCBT EUROPEAN SELECT FUND

PROFILE AT OCTOBER 31, 2010

Dr Eric Woehrling. He was previously a senior analyst with Rabobank International's financial-markets research team in London, and before that led the South Asian telecommunications banking practice at ANZ Bank, based in Mumbai. Palaniappan started his career as a telecommunications analyst with Peregrine Capital in Mumbai. He holds a degree in aerospace engineering from the Indian Institute of Technology and an MBA from the Indian Institute of Management. He is a chartered financial analyst and also a chartered market technician.

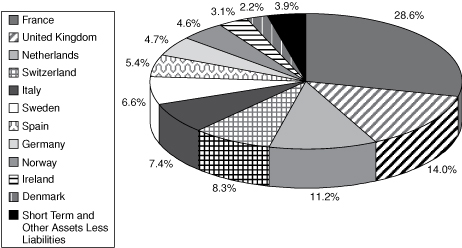

ASSET ALLOCATION

(% of net assets)

TOP TEN HOLDINGS

BY REGION/COUNTRY*

| | | | | % of net assets | |

| Europe | |

| Technip SA | | (France) | | | 4.0 | | |

| ING Groep NV | | (Netherlands) | | | 4.0 | | |

| Valeo SA | | (France) | | | 3.9 | | |

| Groupe Eurotunnel SA | | (France) | | | 3.6 | | |

| Terna-Rete Elettrica Nazionale SpA | | (Italy) | | | 3.6 | | |

| Abengoa SA | | (Spain) | | | 3.4 | | |

| Scania AB | | (Sweden) | | | 3.3 | | |

| Swedish Match AB | | (Sweden) | | | 3.3 | | |

| Bureau Veritas SA | | (France) | | | 3.3 | | |

| United Business Media Ltd. | | (Ireland) | | | 3.1 | | |

* Excluding short-term investments.

The Fund is actively managed and therefore portfolio holdings and characteristics will change over time.

12

MCBT OPPORTUNISTIC EAFE FUND

SCHEDULE OF INVESTMENTS

OCTOBER 31, 2010 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – 96.8% | |

| AFRICA – 2.1% | |

| SOUTH AFRICA – 2.1% | |

| Gold Fields Ltd., ADR | | | 76,800 | | | $ | 1,211,136 | | |

| TOTAL SOUTH AFRICA – (Cost $1,007,753) | | | 1,211,136 | | |

| TOTAL AFRICA – (Cost $1,007,753) | | | 1,211,136 | | |

| EUROPE – 54.6% | |

| FRANCE – 6.4% | |

| BNP Paribas | | | 14,899 | | | | 1,089,700 | | |

| Sanofi-Aventis SA | | | 20,503 | | | | 1,431,940 | | |

| Technip SA | | | 14,945 | | | | 1,256,139 | | |

| TOTAL FRANCE – (Cost $3,438,867) | | | 3,777,779 | | |

| GERMANY – 6.5% | |

| Adidas AG | | | 19,893 | | | | 1,297,694 | | |

| Aixtron A (a) | | | 24,339 | | | | 794,369 | | |

| Siemens AG | | | 15,208 | | | | 1,737,346 | | |

| TOTAL GERMANY – (Cost $3,032,444) | | | 3,829,409 | | |

| LUXEMBOURG – 2.1% | |

| SES SA | | | 48,458 | | | | 1,241,978 | | |

| TOTAL LUXEMBOURG – (Cost $1,064,617) | | | 1,241,978 | | |

| NETHERLANDS – 9.2% | |

| Gemalto NV | | | 19,073 | | | | 868,579 | | |

| Heineken NV | | | 19,666 | | | | 996,857 | | |

| ING Groep NV* | | | 116,890 | | | | 1,247,813 | | |

| Philips Electronics | | | 42,307 | | | | 1,279,525 | | |

| Unilever NV | | | 34,835 | | | | 1,032,938 | | |

| TOTAL NETHERLANDS – (Cost $4,534,397) | | | 5,425,712 | | |

| NORWAY – 2.3% | |

| DnB NOR ASA | | | 100,400 | | | | 1,378,301 | | |

| TOTAL NORWAY – (Cost $1,153,476) | | | 1,378,301 | | |

| SPAIN – 2.6% | |

| Telefonica SA | | | 55,416 | | | | 1,496,283 | | |

| TOTAL SPAIN – (Cost $1,419,745) | | | 1,496,283 | | |

| SWITZERLAND – 6.8% | |

| ABB, Ltd.* | | | 67,306 | | | | 1,393,930 | | |

| Credit Suisse Group AG | | | 23,579 | | | | 974,022 | | |

| Roche Holding AG | | | 11,298 | | | | 1,659,022 | | |

| TOTAL SWITZERLAND – (Cost $3,608,695) | | | 4,026,974 | | |

See Notes to Financial Statements.

13

MCBT OPPORTUNISTIC EAFE FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2010 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – Continued | |

| EUROPE – Continued | |

| UNITED KINGDOM – 18.7% | |

| Amlin PLC | | | 98,036 | | | $ | 638,720 | | |

| Barclays PLC | | | 246,836 | | | | 1,086,092 | | |

| British American Tobacco PLC | | | 43,584 | | | | 1,662,117 | | |

| Compass Group PLC | | | 127,992 | | | | 1,049,026 | | |

| Inchcape PLC* | | | 144,757 | | | | 808,815 | | |

| Pearson PLC | | | 76,230 | | | | 1,165,895 | | |

| Persimmon PLC* | | | 98,599 | | | | 538,747 | | |

| Petrofac, Ltd. | | | 46,845 | | | | 1,098,159 | | |

| Royal Dutch Shell, B Shares | | | 49,795 | | | | 1,594,585 | | |

| Xstrata PLC | | | 71,952 | | | | 1,394,461 | | |

| TOTAL UNITED KINGDOM – (Cost $10,185,630) | | | 11,036,617 | | |

| TOTAL EUROPE – (Cost $28,437,871) | | | 32,213,053 | | |

| JAPAN – 17.2% | |

| Bank of Yokohama, Ltd. | | | 146,000 | | | | 718,479 | | |

| Bridgestone Corp. | | | 57,400 | | | | 1,029,305 | | |

| Dai-ichi Mutual Life Insurance Co. (a) | | | 463 | | | | 561,561 | | |

| INPEX Corp. | | | 167 | | | | 868,516 | | |

| Kirin Holdings Co., Ltd. | | | 77,000 | | | | 1,056,394 | | |

| Mitsui Fudosan Co., Ltd. | | | 44,000 | | | | 831,664 | | |

| Nippon Yusen Kabushiki Kaisha | | | 253,000 | | | | 1,065,826 | | |

| NTT DoCoMo, Inc. | | | 608 | | | | 1,023,785 | | |

| Panasonic Corp. | | | 71,000 | | | | 1,043,780 | | |

| Ricoh Co. Ltd. (a) | | | 62,000 | | | | 867,553 | | |

| Sekisui House Ltd. | | | 81,000 | | | | 761,986 | | |

| Suzuki Motor Corp. | | | 12,400 | | | | 304,100 | | |

| TOTAL JAPAN – (Cost $10,074,806) | | | 10,132,949 | | |

| LATIN AMERICA – 3.3% | |

| BRAZIL – 3.3% | |

| Banco do Brasil SA | | | 38,500 | | | | 749,486 | | |

| PDG Realty SA Empreendimentos e Participacoes | | | 96,300 | | | | 1,204,670 | | |

| TOTAL BRAZIL – (Cost $1,539,744) | | | 1,954,156 | | |

| TOTAL LATIN AMERICA – (Cost $1,539,744) | | | 1,954,156 | | |

| MIDDLE EAST – 1.7% | |

| ISRAEL – 1.7% | |

| Teva Pharmaceutical Industries Ltd., ADR | | | 19,700 | | | | 1,022,430 | | |

| TOTAL ISRAEL – (Cost $1,085,173) | | | 1,022,430 | | |

| TOTAL MIDDLE EAST – (Cost $1,085,173) | | | 1,022,430 | | |

See Notes to Financial Statements.

14

MCBT OPPORTUNISTIC EAFE FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2010 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – Continued | |

| PACIFIC BASIN – 17.9% | |

| AUSTRALIA – 5.9% | |

| Incitec Pivot Ltd. | | | 304,781 | | | $ | 1,110,599 | | |

| Leighton Holdings Ltd. (a) | | | 29,624 | | | | 1,064,968 | | |

| Newcrest Mining Ltd. | | | 33,430 | | | | 1,308,544 | | |

| TOTAL AUSTRALIA – (Cost $2,876,553) | | | 3,484,111 | | |

| CHINA – 4.2% | |

| Bank of China Ltd., H Shares | | | 1,213,000 | | | | 727,683 | | |

| Ctrip.com International Ltd., ADR* | | | 21,700 | | | | 1,129,919 | | |

| Mindray Medical International Ltd., ADR (a) | | | 20,500 | | | | 594,090 | | |

| TOTAL CHINA – (Cost $1,958,410) | | | 2,451,692 | | |

| HONG KONG – 3.5% | |

| Henderson Land Development Co., Ltd. | | | 99,000 | | | | 703,106 | | |

| SJM Holdings Ltd. | | | 929,000 | | | | 1,380,691 | | |

| TOTAL HONG KONG – (Cost $1,443,842) | | | 2,083,797 | | |

| SINGAPORE – 1.6% | |

| DBS Group Holdings Ltd. | | | 89,000 | | | | 955,806 | | |

| TOTAL SINGAPORE – (Cost $942,599) | | | 955,806 | | |

| SOUTH KOREA – 1.4% | |

| KT Corp., ADR (a) | | | 38,600 | | | | 798,634 | | |

| TOTAL SOUTH KOREA – (Cost $779,415) | | | 798,634 | | |

| THAILAND – 1.3% | |

| Bangkok Bank Public Co., Ltd. | | | 153,500 | | | | 791,052 | | |

| TOTAL THAILAND – (Cost $659,102) | | | 791,052 | | |

| TOTAL PACIFIC BASIN – (Cost $8,659,921) | | | 10,565,092 | | |

| TOTAL COMMON STOCKS – (Cost $50,805,268) | | | 57,098,816 | | |

| RIGHTS AND WARRANTS – 1.2% | |

| TAIWAN – 1.2% | |

| Hon Hai Precision Industry Co., Ltd., 144A | | | 187,899 | | | | 711,797 | | |

| TOTAL TAIWAN – (Cost $620,668) | | | 711,797 | | |

| TOTAL RIGHTS AND WARRANTS – (Cost $620,668) | | | 711,797 | | |

| COLLATERAL FOR SECURITIES ON LOAN – 5.5% | |

| State Street Navigator Prime Portfolio | | | 3,241,662 | | | | 3,241,662 | | |

| TOTAL COLLATERAL FOR SECURITIES ON LOAN – (Cost $3,241,662) | | | 3,241,662 | | |

See Notes to Financial Statements.

15

MCBT OPPORTUNISTIC EAFE FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2010 (Unaudited)

| | | Principal

Amount | | US$

Value | |

| SHORT-TERM INVESTMENTS – 2.4% | |

Repurchase Agreement with State Street Bank and Trust,

0.01%, 11/01/2010 (b) | | $ | 1,403,000 | | | $ | 1,403,000 | | |

| TOTAL SHORT-TERM INVESTMENTS – (Cost $1,403,000) | | | 1,403,000 | | |

| TOTAL INVESTMENTS – (Cost $56,070,598) – 105.9% | | | 62,455,275 | | |

| OTHER ASSETS LESS LIABILITIES – (5.9)% | | | (3,475,851 | ) | |

| NET ASSETS – 100.0% | | $ | 58,979,424 | | |

Notes to Schedule of Investments:

† Percentages of long-term investments are presented in the portfolio by country. Percentages of long-term investments by industry are as follows: Apparel & Textiles 2.2%, Auto Parts 1.8%, Automobiles 0.5%, Banks 13.0%, Building Construction 1.3%, Computer Services 1.5%, Computers 1.2%, Construction 1.8%, Diversified 3.8%, Drugs & Health Care 1.8%, Electrical Equipment 3.9%, Electronics 4.0%, Fertilizers 1.9%, Food & Beverages 7.2%, Homebuilders 0.9%, Hotels & Restaurants 4.3%, Insurance 2.1%, Manufacturing 3.0%, Medical Products 6.4%, Mining 6.8%, Multimedia 2.2%, Oil & Gas 5.7%, Oil Integrated 2.8%, Publishing 2.0%, Real Estate 4.7%, Retail 1.4%, Semi-conductor Manufacturing Equipment 1.4%, Telecommunications Services 5.7%, Tobacco 2.9%, and Transportation 1.8%.

* Non-income producing security.

(a) A portion of this security was held on loan. As of October 31, 2010, the market value of the securities loaned was $3,704,133.

(b) Repurchase agreement, dated 10/29/2010, due 11/01/2010 with repurchase proceeds of $1,403,001 is collateralized by United States Treasury Note, 1.00% due 4/30/2012 with a market value of $1,436,084.

ADR American Depositary Receipts

144A Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

See Notes to Financial Statements.

16

MCBT GLOBAL EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS

OCTOBER 31, 2010 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – 88.8% | |

| AFRICA – 5.1% | |

| SOUTH AFRICA – 5.1% | |

| Aspen Pharmacare Holdings Ltd.* | | | 248,661 | | | $ | 3,319,030 | | |

| Impala Platinum Holdings Ltd. | | | 49,028 | | | | 1,385,802 | | |

| MTN Group Ltd. (a) | | | 127,203 | | | | 2,288,020 | | |

| TOTAL SOUTH AFRICA – (Cost $4,456,831) | | | 6,992,852 | | |

| TOTAL AFRICA – (Cost $4,456,831) | | | 6,992,852 | | |

| EUROPE – 12.8% | |

| RUSSIA – 7.7% | |

| Gazprom OAO, ADR (a) | | | 150,505 | | | | 3,294,162 | | |

| JSC MMC Norilsk Nickel, ADR* | | | 72,788 | | | | 1,357,496 | | |

| LUKOIL, ADR | | | 32,705 | | | | 1,826,574 | | |

| Pharmstandard OJSC-S, GDR, 144A* | | | 80,700 | | | | 2,098,200 | | |

| VimpelCom Ltd., ADR* | | | 136,700 | | | | 2,095,611 | | |

| TOTAL RUSSIA – (Cost $10,826,877) | | | 10,672,043 | | |

| TURKEY – 5.1% | |

| Turkiye Garanti Bankasi AS | | | 619,137 | | | | 3,798,519 | | |

| Turkiye Is Bankasi | | | 727,900 | | | | 3,273,228 | | |

| TOTAL TURKEY – (Cost $3,497,515) | | | 7,071,747 | | |

| TOTAL EUROPE – (Cost $14,324,392) | | | 17,743,790 | | |

| LATIN AMERICA – 18.4% | |

| BRAZIL – 10.7% | |

| Banco do Brasil SA | | | 150,900 | | | | 2,937,593 | | |

| Cia Hering | | | 76,900 | | | | 3,787,787 | | |

| Hypermarcas SA* | | | 158,700 | | | | 2,613,421 | | |

| Light SA | | | 101,700 | | | | 1,281,194 | | |

| PDG Realty SA Empreendimentos e Participacoes | | | 334,900 | | | | 4,189,451 | | |

| TOTAL BRAZIL – (Cost $8,746,234) | | | 14,809,446 | | |

| MEXICO – 5.0% | |

| America Movil SAB de CV | | | 771,600 | | | | 2,211,445 | | |

| Corporacion GEO SAB de CV, Series B* | | | 715,900 | | | | 2,272,699 | | |

| Fomento Economico Mexicano SAB de CV, Series B | | | 424,900 | | | | 2,336,468 | | |

| TOTAL MEXICO – (Cost $3,706,173) | | | 6,820,612 | | |

| PERU – 2.7% | |

| Compania de Minas Buenaventura SA, ADR | | | 71,000 | | | | 3,765,840 | | |

| TOTAL PERU – (Cost $2,382,491) | | | 3,765,840 | | |

| TOTAL LATIN AMERICA – (Cost $14,834,898) | | | 25,395,898 | | |

See Notes to Financial Statements.

17

MCBT GLOBAL EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2010 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – Continued | |

| OTHER AREAS – 6.2% | |

| INDIA – 6.2% | |

| Axis Bank Ltd. | | | 85,164 | | | $ | 2,818,032 | | |

| Infrastructure Development Finance Co., Ltd. | | | 786,808 | | | | 3,542,186 | | |

| Maruti Suzuki India Ltd. | | | 62,723 | | | | 2,181,645 | | |

| TOTAL INDIA – (Cost $5,978,743) | | | 8,541,863 | | |

| TOTAL OTHER AREAS – (Cost $5,978,743) | | | 8,541,863 | | |

| PACIFIC BASIN – 46.3% | |

| CHINA – 12.3% | |

| Bank of China Ltd., H Shares | | | 4,859,000 | | | | 2,914,930 | | |

| China Mobile Ltd. | | | 233,500 | | | | 2,378,303 | | |

| China Railway Construction Corp., Ltd. (a) | | | 1,752,000 | | | | 2,190,212 | | |

| CNOOC Ltd. | | | 2,111,000 | | | | 4,362,938 | | |

| Industrial and Commercial Bank of China Ltd., H Shares | | | 3,036,000 | | | | 2,444,075 | | |

| Netease.com Inc., ADR (a)* | | | 66,200 | | | | 2,767,160 | | |

| TOTAL CHINA – (Cost $11,371,386) | | | 17,057,618 | | |

| HONG KONG – 5.0% | |

| China Taiping Insurance Holdings Co., Ltd.* | | | 695,600 | | | | 2,548,626 | | |

| SJM Holdings Ltd. | | | 2,956,000 | | | | 4,393,243 | | |

| TOTAL HONG KONG – (Cost $4,377,301) | | | 6,941,869 | | |

| INDONESIA – 1.8% | |

| Bank Mandiri Tbk PT | | | 3,169,500 | | | | 2,482,406 | | |

| TOTAL INDONESIA – (Cost $2,066,780) | | | 2,482,406 | | |

| MALAYSIA – 4.0% | |

| Axiata Group Berhad* | | | 2,109,522 | | | | 3,044,112 | | |

| CIMB Group Holdings Berhad | | | 946,186 | | | | 2,520,933 | | |

| TOTAL MALAYSIA – (Cost $3,052,116) | | | 5,565,045 | | |

| SOUTH KOREA – 13.6% | |

| Hyundai Mobis | | | 10,670 | | | | 2,655,054 | | |

| Industrial Bank Of Korea | | | 282,610 | | | | 4,056,122 | | |

| KT Corp. | | | 30,950 | | | | 1,221,222 | | |

| LG Display Co., Ltd. | | | 33,860 | | | | 1,158,507 | | |

| POSCO | | | 2,914 | | | | 1,196,417 | | |

| Samsung Electronics Co., Ltd. | | | 7,174 | | | | 4,749,727 | | |

| Samsung Engineering Co., Ltd. | | | 23,438 | | | | 3,738,832 | | |

| TOTAL SOUTH KOREA – (Cost $14,556,029) | | | 18,775,881 | | |

See Notes to Financial Statements.

18

MCBT GLOBAL EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2010 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – Continued | |

| PACIFIC BASIN – Continued | |

| TAIWAN – 7.7% | |

| Chinatrust Financial Holding Co., Ltd. | | | 3,038,696 | | | $ | 1,895,371 | | |

| Formosa Plastics Corp. | | | 838,000 | | | | 2,402,769 | | |

| Hon Hai Precision Industry Co., Ltd. | | | 356,552 | | | | 1,350,686 | | |

| Taiwan Fertilizer Co., Ltd. | | | 631,000 | | | | 2,153,372 | | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | | 1,363,822 | | | | 2,796,990 | | |

| TOTAL TAIWAN – (Cost $7,182,901) | | | 10,599,188 | | |

| THAILAND – 1.9% | |

| Kasikornbank PCL | | | 358,500 | | | | 1,399,083 | | |

| Thai Oil PCL | | | 694,600 | | | | 1,227,945 | | |

| TOTAL THAILAND – (Cost $2,082,578) | | | 2,627,028 | | |

| TOTAL PACIFIC BASIN – (Cost $44,689,091) | | | 64,049,035 | | |

| TOTAL COMMON STOCKS – (Cost $84,283,955) | | | 122,723,438 | | |

| PREFERRED STOCKS – 9.6% | |

| LATIN AMERICA – 9.6% | |

| BRAZIL – 9.6% | |

| AES Tiete SA (shown in units of 1,000) | | | 135,912 | | | | 1,874,455 | | |

| Itau Unibanco Holding SA | | | 130,693 | | | | 3,189,884 | | |

| Petroleo Brasileiro SA | | | 278,100 | | | | 4,228,010 | | |

| Vale SA, Class A | | | 142,477 | | | | 4,001,221 | | |

| TOTAL BRAZIL – (Cost $8,730,917) | | | 13,293,570 | | |

| TOTAL LATIN AMERICA – (Cost $8,730,917) | | | 13,293,570 | | |

| TOTAL PREFERRED STOCKS – (Cost $8,730,917) | | | 13,293,570 | | |

| COLLATERAL FOR SECURITIES ON LOAN – 1.3% | |

| State Street Navigator Prime Portfolio | | | 1,768,809 | | | | 1,768,809 | | |

| TOTAL COLLATERAL FOR SECURITIES ON LOAN – (Cost $1,768,809) | | | 1,768,809 | | |

| | | Principal

Amount | | | |

| SHORT-TERM INVESTMENTS – 3.6% | |

Repurchase Agreement with State Street Bank and Trust,

0.01%, 11/01/2010 (b) | | $ | 4,942,000 | | | | 4,942,000 | | |

| TOTAL SHORT-TERM INVESTMENTS – (Cost $4,942,000) | | | 4,942,000 | | |

| TOTAL INVESTMENTS – (Cost $99,725,681) – 103.3% | | | 142,727,817 | | |

| OTHER ASSETS LESS LIABILITIES – (3.3)% | | | (4,504,830 | ) | |

| NET ASSETS – 100.0% | | $ | 138,222,987 | | |

See Notes to Financial Statements.

19

MCBT GLOBAL EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2010 (Unaudited)

Notes to Schedule of Investments:

† Percentages of long-term investments are presented in the portfolio by country. Percentages of long-term investments by industry are as follows: Apparel & Textiles 2.8%, Auto Parts 2.0%, Automobiles 1.6%, Banks 24.8%, Brewery 1.7%, Chemicals 1.6%, Computers 0.9%, Construction 4.4%, Drugs & Health Care 4.0%, Electric Utilities 2.3%, Electronics 4.3%, Finance & Banking 2.6%, Gas & Pipeline Utilities 2.4%, Homebuilders 1.7%, Hotels & Restaurants 3.2%, Household Products 1.9%, Insurance 1.9%, Metals 4.0%, Mining 3.8%, Oil & Gas 6.3%, Oil – Refining And Marketing 0.9%, Oil Integrated 1.3%, Plastics 1.8%, Real Estate 3.1%, Semi-conductor Manufacturing Equipment 2.1%, Software 2.0%, Steel 0.9%, Telecommunications 3.3%, Telecommunications Equipment 2.2%, and Telecommunications Services 4.2%.

* Non-income producing security.

(a) A portion of this security was held on loan. As of October 31, 2010, the market value of the securities loaned was 5,093,034.

(b) Repurchase agreement, dated 10/29/2010, due 11/01/2010 with repurchase proceeds of $4,942,004 is collateralized by United States Treasury Note, 1.00% due 04/30/2012 with a market value of $5,044,053.

ADR American Depositary Receipts

GDR Global Depositary Receipts

144A Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

See Notes to Financial Statements.

20

MCBT EUROPEAN SELECT FUND

SCHEDULE OF INVESTMENTS

OCTOBER 31, 2010 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – 96.1% | |

| DENMARK – 2.2% | |

| AP Moller - Maersk A/S | | | 37 | | | $ | 321,103 | | |

| TOTAL DENMARK – (Cost $304,842) | | | 321,103 | | |

| FRANCE – 28.6% | |

| Bureau Veritas SA | | | 6,491 | | | | 479,715 | | |

| Carrefour SA | | | 5,110 | | | | 275,807 | | |

| Cie Generale de Geophysique-Veritas (a)* | | | 18,624 | | | | 434,175 | | |

| Groupe Eurotunnel SA | | | 52,969 | | | | 526,451 | | |

| Natixis* | | | 53,434 | | | | 327,746 | | |

| Rhodia SA | | | 12,383 | | | | 344,176 | | |

| Societe Generale | | | 4,626 | | | | 277,015 | | |

| Technip SA | | | 7,027 | | | | 590,625 | | |

| Valeo SA* | | | 10,550 | | | | 567,076 | | |

| Vivendi Universal | | | 13,255 | | | | 378,098 | | |

| TOTAL FRANCE – (Cost $3,334,372) | | | 4,200,884 | | |

| GERMANY – 4.7% | |

| Aixtron AG (a) | | | 10,077 | | | | 328,890 | | |

| Fresenius Medical Care AG & Co. | | | 2,290 | | | | 145,879 | | |

| GEA Group AG | | | 8,395 | | | | 219,546 | | |

| TOTAL GERMANY – (Cost $619,115) | | | 694,315 | | |

| IRELAND – 3.1% | |

| United Business Media Ltd. | | | 43,075 | | | | 454,160 | | |

| TOTAL IRELAND – (Cost $424,366) | | | 454,160 | | |

| ITALY – 7.4% | |

| Azimut Holding SpA | | | 34,783 | | | | 354,852 | | |

| Terna - Rete Elettrica Nazionale SpA | | | 113,250 | | | | 522,515 | | |

| UniCredit SpA | | | 82,583 | | | | 215,281 | | |

| TOTAL ITALY – (Cost $1,005,149) | | | 1,092,648 | | |

| NETHERLANDS – 11.2% | |

| ASM International (a)* | | | 13,471 | | | | 343,856 | | |

| CSM | | | 12,051 | | | | 381,576 | | |

| Gemalto NV | | | 7,306 | | | | 332,713 | | |

| ING Groep NV* | | | 54,596 | | | | 582,818 | | |

| TOTAL NETHERLANDS – (Cost $1,487,864) | | | 1,640,963 | | |

| NORWAY – 4.6% | |

| DnB NOR ASA | | | 26,056 | | | | 357,699 | | |

| Statoil Fuel & Retail ASA* | | | 45,349 | | | | 321,344 | | |

| TOTAL NORWAY – (Cost $591,964) | | | 679,043 | | |

See Notes to Financial Statements.

21

MCBT EUROPEAN SELECT FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2010 (Unaudited)

| | | Shares | | US$

Value | |

| COMMON STOCKS† – Continued | |

| SPAIN – 5.4% | |

| Abengoa SA (a) | | | 17,844 | | | $ | 494,222 | | |

| Grifols SA (a) | | | 17,923 | | | | 290,238 | | |

| TOTAL SPAIN – (Cost $660,158) | | | 784,460 | | |

| SWEDEN – 6.6% | |

| Scania AB | | | 22,944 | | | | 487,757 | | |

| Swedish Match AB | | | 17,317 | | | | 484,020 | | |

| TOTAL SWEDEN – (Cost $747,975) | | | 971,777 | | |

| SWITZERLAND – 8.3% | |

| Julius Baer Group Ltd. | | | 10,608 | | | | 447,799 | | |

| Syngenta AG | | | 1,586 | | | | 438,707 | | |

| Temenos Group AG* | | | 9,975 | | | | 334,510 | | |

| TOTAL SWITZERLAND – (Cost $1,002,827) | | | 1,221,016 | | |

| UNITED KINGDOM – 14.0% | |

| Centrica PLC | | | 42,014 | | | | 223,641 | | |

| Dialog Semiconductor PLC* | | | 15,736 | | | | 287,127 | | |

| Mondi PLC | | | 51,525 | | | | 429,318 | | |

| National Grid PLC | | | 38,430 | | | | 363,312 | | |

| Tullett Prebon PLC | | | 55,930 | | | | 354,893 | | |

| Xstrata PLC | | | 20,328 | | | | 393,966 | | |

| TOTAL UNITED KINGDOM – (Cost $1,573,473) | | | 2,052,257 | | |

| TOTAL COMMON STOCKS – (Cost $11,752,105) | | | 14,112,626 | | |

| COLLATERAL FOR SECURITIES ON LOAN – 7.4% | |

| State Street Navigator Prime Portfolio | | | 1,089,690 | | | | 1,089,690 | | |

| TOTAL COLLATERAL FOR SECURITIES ON LOAN – (Cost $1,089,690) | | | 1,089,690 | | |

| | | Principal

Amount | | | |

| SHORT-TERM INVESTMENTS – 5.4% | |

Repurchase Agreement with State Street Bank and Trust,

0.01%, 11/01/2010 (b) | | $ | 799,000 | | | | 799,000 | | |

| TOTAL SHORT-TERM INVESTMENTS – (Cost $799,000) | | | 799,000 | | |

| TOTAL INVESTMENTS – (Cost $13,640,795) – 108.9% | | | 16,001,316 | | |

| OTHER ASSETS LESS LIABILITIES – (8.9)% | | | (1,306,762 | ) | |

| NET ASSETS – 100.0% | | $ | 14,694,554 | | |

See Notes to Financial Statements.

22

MCBT EUROPEAN SELECT FUND

SCHEDULE OF INVESTMENTS (Continued)

OCTOBER 31, 2010 (Unaudited)

Notes to Schedule of Investments:

† Percentages of long-term investments are presented in the portfolio by country. Percentages of long-term investments by industry are as follows: Auto Parts 4.0%, Banks 11.5%, Brewery 3.0%, Broadcasting 2.3%, Building Construction 4.7%, Chemicals 2.4%, Commercial Services 3.4%, Computer Services 2.4%, Construction 3.5%, Diversified 6.6%, Electric Utilities 3.7%, Finance 2.5%, Food & Beverages 2.7%, Industrial Machinery 3.5%, Medical Products 1.0%, Medical Services 2.1%, Mining 2.8%, Multimedia 2.7%, Oil & Gas 7.3%, Publishing 3.2%, Retail Grocery 1.9%, Semi-conductor Manufacturing Equipment 6.8%, Software 2.4%, Specialty Retail 2.3%, Tobacco 3.4%, Transportation 3.7%, and Utilities 4.2%.

* Non-income producing security.

(a) A portion of this security was held on loan. As of October 31, 2010, the market value of the securities loaned was $1,387,589.

(b) Repurchase agreement, dated 10/29/2010, due 11/01/2010 with repurchase proceeds of $799,001 is collateralized by United States Treasury Note, 1.00% due 4/30/2012 with a market value of $816,995.

See Notes to Financial Statements.

23

MARTIN CURRIE BUSINESS TRUST

STATEMENTS OF ASSETS AND LIABILITIES

OCTOBER 31, 2010 (Unaudited)

| | | MCBT

Opportunistic EAFE

Fund | | MCBT

Global Emerging

Markets Fund | | MCBT

European

Select Fund | |

| ASSETS | |

| Investments in securities, at value | | $ | 61,052,275 | | | $ | 137,785,817 | | | $ | 15,202,316 | | |

| Repurchase agreement | | | 1,403,000 | | | | 4,942,000 | | | | 799,000 | | |

| Cash | | | 426 | | | | 64 | | | | 477 | | |

| Unrealized appreciation on spot contracts | | | 181 | | | | – | | | | 554 | | |

| Foreign currency, at value | | | 5,214 | | | | 61,977 | | | | – | | |

| Receivable for investments sold | | | – | | | | 34,945,832 | | | | 4,790,871 | | |

| Dividends and interest receivable | | | 76,984 | | | | 75,371 | | | | 11,188 | | |

| Foreign tax reclaims receivable | | | 167,873 | | | | 9,226 | | | | 87,473 | | |

| TOTAL ASSETS | | | 62,705,953 | | | | 177,820,287 | | | | 20,891,879 | | |

| LIABILITIES | |

| Unrealized depreciation on spot contracts | | | – | | | | 85,188 | | | | 34,721 | | |

| Payable for investments purchased | | | 304,100 | | | | – | | | | 369,895 | | |

| Payable for Fund shares repurchased | | | – | | | | 37,078,741 | | | | 4,606,127 | | |

| Collateral for securities on loan (Note B) | | | 3,241,662 | | | | 1,768,809 | | | | 1,089,690 | | |

| Management fee payable | | | 98,572 | | | | 333,027 | | | | 39,738 | | |

| Administration fee payable | | | 5,264 | | | | 6,843 | | | | 1,268 | | |

| Capital gains taxes accrued | | | 12,009 | | | | 192,703 | | | | – | | |

| Accrued expenses and other liabilities | | | 68,432 | | | | 131,989 | | | | 55,886 | | |

| TOTAL LIABILITIES | | | 3,730,039 | | | | 39,597,300 | | | | 6,197,325 | | |

| TOTAL NET ASSETS | | $ | 58,975,914 | | | $ | 138,222,987 | | | $ | 14,694,554 | | |

| COMPOSITION OF NET ASSETS | |

| Paid-in capital | | $ | 70,286,349 | | | $ | 158,860,933 | | | $ | 58,940,372 | | |

| Undistributed net investment income | | | 301,163 | | | | 627,160 | | | | 127,873 | | |

Accumulated net realized loss on investments

and foreign currency transactions | | | (18,014,339 | ) | | | (64,126,102 | ) | | | (46,749,180 | ) | |

| Net unrealized appreciation on investments and foreign currency | | | 6,402,741 | | | | 42,860,996 | | | | 2,375,489 | | |

| TOTAL NET ASSETS | | $ | 58,975,914 | | | $ | 138,222,987 | | | $ | 14,694,554 | | |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING* | | | 6,096,359 | | | | 25,752,587 | | | | 2,357,704 | | |

| NET ASSET VALUE PER SHARE | | $ | 9.67 | | | $ | 5.37 | | | $ | 6.23 | | |

| Identified cost of investments: | |

| Unaffiliated issuers | | $ | 56,070,598 | | | $ | 99,725,681 | | | $ | 13,640,795 | | |

| Cost of foreign currency | | $ | 5,130 | | | $ | 61,792 | | | $ | – | | |

* Unlimited number of shares authorized

See Notes to Financial Statements.

24

MARTIN CURRIE BUSINESS TRUST

STATEMENTS OF OPERATIONS

SIX MONTHS ENDED OCTOBER 31, 2010 (Unaudited)

| | | MCBT

Opportunistic EAFE

Fund | | MCBT

Global Emerging

Markets Fund | | MCBT

European

Select Fund | |

| INVESTMENT INCOME | |

| Interest income (1) | | $ | 14,269 | | | $ | 6,100 | | | $ | 13,182 | | |

| Dividend income | | | 566,883 | | | | 1,940,183 | | | | 250,566 | | |

| Foreign taxes withheld | | | (46,737 | ) | | | (205,677 | ) | | | (35,762 | ) | |

| TOTAL INVESTMENT INCOME | | | 534,415 | | | | 1,740,606 | | | | 227,986 | | |

| EXPENSES | |

| Management fees | | | 176,419 | | | | 664,787 | | | | 85,000 | | |

| Custodian fees | | | 74,872 | | | | 209,876 | | | | 71,941 | | |

| Administration fees | | | 17,161 | | | | 61,010 | | | | 9,194 | | |

| Audit fees | | | 26,569 | | | | 26,567 | | | | 25,409 | | |

| Legal fees | | | 18,316 | | | | 55,779 | | | | 8,990 | | |

| Transfer agent fees | | | 3,108 | | | | 3,130 | | | | 2,895 | | |

| Trustees fees | | | 6,261 | | | | 19,394 | | | | 2,849 | | |

| Stock dividend tax | | | – | | | | 3,204 | | | | – | | |

| Miscellaneous expenses | | | 11,152 | | | | 46,803 | | | | 5,952 | | |

| TOTAL EXPENSES | | | 333,858 | | | | 1,090,550 | | | | 212,230 | | |

| Management fee reimbursement | | | (18,857 | ) | | | – | | | | – | | |

| NET EXPENSES | | | 315,001 | | | | 1,090,550 | | | | 212,230 | | |

| NET INVESTMENT INCOME | | | 219,414 | | | | 650,056 | | | | 15,756 | | |

REALIZED AND UNREALIZED GAIN (LOSS)

ON INVESTMENTS AND FOREIGN

CURRENCY TRANSACTIONS | |

| Net realized gain on investments | | | 1,938,140 | | | | 19,639,088 | | | | 599,478 | | |

| Net realized loss on foreign currency transactions | | | (26,819 | ) | | | (209,694 | ) | | | (23,133 | ) | |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments | | | 252,849 | | | | (1,964,337 | ) | | | 233,708 | | |

| Foreign currency | | | 15,190 | | | | 42,837 | | | | 14,241 | | |

| Deferred foreign capital gains tax | | | (12,009 | ) | | | 79,398 | | | | – | | |

NET GAIN ON INVESTMENTS AND FOREIGN

CURRENCY TRANSACTIONS | | | 2,167,351 | | | | 17,587,292 | | | | 824,294 | | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 2,386,765 | | | $ | 18,237,348 | | | $ | 840,050 | | |

| (1) Interest income includes security lending income of: | | $ | 14,223 | | | $ | 5,825 | | | $ | 13,134 | | |

See Notes to Financial Statements.

25

MARTIN CURRIE BUSINESS TRUST

STATEMENTS OF CHANGES IN NET ASSETS

| | | MCBT Opportunistic

EAFE Fund | | MCBT Global Emerging

Markets Fund | |

| | | Six Months

Ended

October 31, 2010

(Unaudited) | | Year

Ended

April 30, 2010 | | Six Months

Ended

October 31, 2010

(Unaudited) | | Year

Ended

April 30, 2010 | |

| NET ASSETS, beginning of period | | $ | 49,376,649 | | | $ | 63,179,789 | | | $ | 198,603,173 | | | $ | 214,781,838 | | |

| INCREASE IN NET ASSETS FROM OPERATIONS: | |

| Net investment income | | | 219,414 | | | | 1,120,019 | | | | 650,056 | | | | 2,252,855 | | |

| Net realized gain (loss) | | | 1,911,321 | | | | (1,664,859 | ) | | | 19,429,394 | | | | 16,243,248 | | |

Net change in net unrealized appreciation (depreciation) on

investments and foreign currency transactions | | | 256,030 | | | | 16,899,451 | | | | (1,842,102 | ) | | | 58,129,798 | | |

| Net increase in net assets from operations | | | 2,386,765 | | | | 16,354,611 | | | | 18,237,348 | | | | 76,625,901 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | |

| Net investment income | | | – | | | | (1,324,320 | ) | | | – | | | | (3,654,100 | ) | |

| Total distributions | | | – | | | | (1,324,320 | ) | | | – | | | | (3,654,100 | ) | |

| CAPITAL SHARE TRANSACTIONS: | |

| Net proceeds from sale of shares | | | 7,600,000 | | | | 153,133 | | | | – | | | | 18,719,500 | | |

| Reinvestment of distributions to shareholders | | | – | | | | 1,324,320 | | | | – | | | | 3,399,745 | | |

| Cost of shares repurchased | | | (387,500 | ) | | | (30,310,884 | ) | | | (78,617,534 | ) | | | (111,269,711 | ) | |

| Total increase (decrease) in net assets from capital share transactions | | | 7,212,500 | | | | (28,833,431 | ) | | | (78,617,534 | ) | | | (89,150,466 | ) | |

| NET INCREASE (DECREASE) IN NET ASSETS | | | 9,599,265 | | | | (13,803,140 | ) | | | (60,380,186 | ) | | | (16,178,665 | ) | |

| NET ASSETS, end of period | | $ | 58,975,914 | | | $ | 49,376,649 | | | $ | 138,222,987 | | | $ | 198,603,173 | | |

| Undistributed net investment income (loss) | | $ | 301,163 | | | $ | 81,749 | | | $ | 627,160 | | | $ | (22,896 | ) | |

| OTHER INFORMATION: | |

| Capital share transactions: | |

| Shares sold | | | 851,660 | | | | 16,938 | | | | – | | | | 4,429,410 | | |

| Shares issued in reinvestment of distributions to shareholders | | | – | | | | 137,663 | | | | – | | | | 748,842 | | |

| Shares repurchased | | | (43,116 | ) | | | (3,327,526 | ) | | | (16,464,469 | ) | | | (28,409,297 | ) | |

| Net share transactions | | | 808,544 | | | | (3,172,925 | ) | | | (16,464,469 | ) | | | (23,231,045 | ) | |

See Notes to Financial Statements.

26

MARTIN CURRIE BUSINESS TRUST

STATEMENTS OF CHANGES IN NET ASSETS

| | | MCBT European

Select Fund | |

| | | Six Months

Ended

October 31, 2010

(Unaudited) | | Year

Ended

April 30, 2010 | |

| NET ASSETS, beginning of period | | $ | 28,895,232 | | | $ | 29,038,283 | | |

| INCREASE IN NET ASSETS FROM OPERATIONS: | |

| Net investment income | | | 15,756 | | | | 216,858 | | |

| Net realized gain | | | 576,345 | | | | 7,278,952 | | |

| Net change in net unrealized appreciation on investments and foreign currency transactions | | | 247,949 | | | | 1,524,462 | | |

| Net increase in net assets from operations | | | 840,050 | | | | 9,020,272 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | |

| Net investment income | | | – | | | | (126,901 | ) | |

| Total distributions | | | – | | | | (126,901 | ) | |

| CAPITAL SHARE TRANSACTIONS: | |

| Net proceeds from sale of shares | | | – | | | | 352,158 | | |

| Reinvestment of distributions to shareholders | | | – | | | | 126,901 | | |

| Cost of shares repurchased | | | (15,040,728 | ) | | | (9,515,481 | ) | |

| Total decrease in net assets from capital share transactions | | | (15,040,728 | ) | | | (9,036,422 | ) | |

| NET DECREASE IN NET ASSETS | | | (14,200,678 | ) | | | (143,051 | ) | |

| NET ASSETS, end of period | | $ | 14,694,554 | | | $ | 28,895,232 | | |

| Undistributed net investment income | | $ | 127,873 | | | $ | 112,117 | | |

| OTHER INFORMATION: | |

| Capital share transactions: | |

| Shares sold | | | – | | | | 81,518 | | |

| Shares issued in reinvestment of distributions to shareholders | | | – | | | | 21,692 | | |

| Shares repurchased | | | (2,665,220 | ) | | | (1,900,114 | ) | |

| Net share transactions | | | (2,665,220 | ) | | | (1,796,904 | ) | |

See Notes to Financial Statements.

27

MCBT OPPORTUNISTIC EAFE FUND

FINANCIAL HIGHLIGHTS

FOR A SHARE OUTSTANDING FOR THE PERIOD

| | | Six Months Ended

October 31, 2010

(Unaudited) (2) | | Year

Ended

April 30, 2010 (2) | | Year

Ended

April 30, 2009 (2) | | Year

Ended

April 30, 2008 (2) | | Year

Ended

April 30, 2007 (2) | | Year

Ended

April 30, 2006 (2) | |

PER SHARE OPERATING

PERFORMANCE | |

| Net asset value, beginning of period | | $ | 9.340 | | | $ | 7.470 | | | $ | 13.790 | | | $ | 14.260 | | | $ | 12.310 | | | $ | 11.020 | | |

| Net investment income | | | 0.039 | | | | 0.144 | | | | 0.208 | | | | 0.166 | | | | 0.088 | | | | 0.071 | | |

Net realized and unrealized gain

(loss) on investments and

foreign currency transactions | | | 0.291 | | | | 1.890 | | | | (6.315 | ) | | | (0.242 | ) | | | 1.905 | | | | 4.600 | | |

| Total from investment operations | | | 0.330 | | | | 2.034 | | | | (6.107 | ) | | | (0.076 | ) | | | 1.993 | | | | 4.671 | | |

| Less distributions: | |

| Net investment income | | | – | | | | (0.164 | ) | | | (0.213 | ) | | | (0.010 | ) | | | (0.043 | ) | | | (1.991 | ) | |

| Net realized gains | | | – | | | | – | | | | – | | | | (0.384 | ) | | | – | | | | (1.390 | ) | |

| Total distributions | | | – | | | | (0.164 | ) | | | (0.213 | ) | | | (0.394 | ) | | | (0.043 | ) | | | (3.381 | ) | |

| Net asset value, end of period | | $ | 9.670 | | | $ | 9.340 | | | $ | 7.470 | | | $ | 13.790 | | | $ | 14.260 | | | $ | 12.310 | | |

TOTAL INVESTMENT

RETURN (1) | | | 3.53 | %(3) | | | 27.17 | % | | | (44.33 | )% | | | (0.72 | )% | | | 16.22 | % | | | 48.23 | % | |

RATIOS AND

SUPPLEMENTAL DATA | |

| Net assets, end of period | | $ | 58,975,914 | | | $ | 49,376,649 | | | $ | 63,179,789 | | | $ | 101,516,485 | | | $ | 29,118,526 | | | $ | 25,347,676 | | |

Operating gross expenses to

average net assets | | | 1.33 | %(4) | | | 1.17 | % | | | 1.14 | % | | | 1.13 | % | | | 1.70 | % | | | 1.79 | % | |

Operating net expenses to average

net assets | | | 1.25 | %(4) | | | 1.17 | % | | | 1.14 | % | | | 1.17 | % | | | 1.61 | % | | | 1.79 | % | |

Net investment income to average

net assets | | | 0.87 | %(4) | | | 1.56 | % | | | 2.24 | % | | | 1.16 | % | | | 0.70 | % | | | 0.61 | % | |

| Portfolio turnover rate | | | 35 | % | | | 103 | % | | | 97 | % | | | 77 | % | | | 106 | % | | | 81 | % | |

(1) Total return at net asset value assuming all distributions reinvested.

(2) The per share amounts were computed using an average number of shares outstanding during the year.

(3) Periods less than one year are not annualized.

(4) Annualized.

See Notes to Financial Statements.

28

MCBT GLOBAL EMERGING MARKETS FUND

FINANCIAL HIGHLIGHTS

FOR A SHARE OUTSTANDING FOR THE PERIOD

| | | Six Months Ended

October 31, 2010

(Unaudited) (2) | | Year

Ended

April 30, 2010 (2) | | Year

Ended

April 30, 2009 (2) | | Year

Ended

April 30, 2008 (2) | | Year

Ended

April 30, 2007 (2) | | Year

Ended

April 30, 2006 (2) | |

PER SHARE OPERATING

PERFORMANCE | |

| Net asset value, beginning of period | | $ | 4.700 | | | $ | 3.280 | | | $ | 9.380 | | | $ | 10.950 | | | $ | 11.050 | | | $ | 7.830 | | |

| Net investment income | | | 0.018 | | | | 0.047 | | | | 0.139 | | | | 0.079 | (5) | | | 0.090 | | | | 0.149 | | |

Net realized and unrealized gain

(loss) on investments and

foreign currency transactions | | | 0.652 | | | | 1.452 | | | | (4.625 | ) | | | 2.322 | | | | 1.771 | (6) | | | 5.347 | | |

| Total from investment operations | | | 0.670 | | | | 1.499 | | | | (4.486 | ) | | | 2.401 | | | | 1.861 | | | | 5.496 | | |

| Less distributions: | |

| Net investment income | | | – | | | | (0.079 | ) | | | (0.120 | ) | | | (0.061 | ) | | | (0.087 | ) | | | (0.167 | ) | |

| Net realized gains | | | – | | | | – | | | | (1.494 | ) | | | (3.910 | ) | | | (1.874 | ) | | | (2.109 | ) | |

| Total distributions | | | – | | | | (0.079 | ) | | | (1.614 | ) | | | (3.971 | ) | | | (1.961 | ) | | | (2.276 | ) | |

| Net asset value, end of period | | $ | 5.370 | | | $ | 4.700 | | | $ | 3.280 | | | $ | 9.380 | | | $ | 10.950 | | | $ | 11.050 | | |

TOTAL INVESTMENT

RETURN (1) | | | 14.26 | %(3) | | | 45.79 | % | | | (45.43 | )% | | | 18.69 | %(5) | | | 18.30 | % | | | 77.13 | % | |

RATIOS AND

SUPPLEMENTAL DATA | |

| Net assets, end of period | | $ | 138,222,987 | | | $ | 198,603,173 | | | $ | 214,781,838 | | | $ | 470,285,917 | | | $ | 522,330,052 | | | $ | 491,169,979 | | |

Operating gross expenses to

average net assets | | | 1.31 | %(4) | | | 1.23 | % | | | 1.16 | % | | | 1.10 | % | | | 1.11 | % | | | 1.13 | % | |

Operating net expenses to average

net assets | | | 1.31 | %(4) | | | 1.23 | % | | | 1.16 | % | | | 1.10 | % | | | 1.11 | % | | | 1.13 | % | |

Net investment income to average

net assets | | | 0.78 | %(4) | | | 1.10 | % | | | 2.70 | % | | | 0.69 | % | | | 0.85 | % | | | 1.56 | % | |

| Portfolio turnover rate | | | 19 | % | | | 112 | % | | | 103 | % | | | 63 | % | | | 67 | % | | | 102 | % | |

(1) Total return at net asset value assuming all distributions reinvested.

(2) The per share amounts were computed using an average number of shares outstanding during the year.

(3) Periods less than one year are not annualized.

(4) Annualized.

(5) Includes investment income from Martin Currie as a result of a reimbursement of overdraft fees. Excluding this investment income would have no effect on net investment income or total investment return.

(6) Includes a non-recurring gain from Martin Currie recorded as a result of an incorrectly executed trade. The non-recurring gain resulted in an increase in net realized and unrealized gain (loss) on investments and foreign currency transactions of $0.013 per share. Excluding this non-recurring gain, total investment return would have been 0.12% lower.

See Notes to Financial Statements.

29

MCBT EUROPEAN SELECT FUND

FINANCIAL HIGHLIGHTS

FOR A SHARE OUTSTANDING FOR THE PERIOD

| | | Six Months Ended

October 31, 2010

(Unaudited) (2) | | Year

Ended

April 30, 2010 (2) | | Year

Ended

April 30, 2009 (2) | | Year

Ended

April 30, 2008 (2) | | Year

Ended

April 30, 2007 (2) | | Year

Ended

April 30, 2006 (2) | |

PER SHARE OPERATING

PERFORMANCE | |

| Net asset value, beginning of period | | $ | 5.750 | | | $ | 4.260 | | | $ | 11.070 | | | $ | 20.830 | | | $ | 19.570 | | | $ | 15.060 | | |

| Net investment income | | | 0.004 | | | | 0.040 | | | | 0.284 | | | | 0.239 | (5) | | | 0.384 | | | | 0.191 | (6) | |

Net realized and unrealized gain

(loss) on investments and

foreign currency transactions | | | 0.476 | | | | 1.474 | | | | (6.464 | ) | | | (1.532 | ) | | | 6.018 | | | | 8.222 | | |

| Total from investment operations | | | 0.480 | | | | 1.514 | | | | (6.180 | ) | | | (1.293 | ) | | | 6.402 | | | | 8.413 | | |

| Less distributions: | |

| Net investment income | | | – | | | | (0.024 | ) | | | (0.334 | ) | | | (0.315 | ) | | | (0.351 | ) | | | (0.262 | ) | |

| Net realized gains | | | – | | | | – | | | | (0.296 | ) | | | (8.152 | ) | | | (4.791 | ) | | | (3.641 | ) | |

| Total distributions | | | – | | | | (0.024 | ) | | | (0.630 | ) | | | (8.467 | ) | | | (5.142 | ) | | | (3.903 | ) | |

| Net asset value, end of period | | $ | 6.230 | | | $ | 5.750 | | | $ | 4.260 | | | $ | 11.070 | | | $ | 20.830 | | | $ | 19.570 | | |

TOTAL INVESTMENT

RETURN (1) | | | 8.52 | %(3) | | | 35.53 | % | | | (55.84 | )% | | | (9.54 | )%(5) | | | 36.46 | % | | | 64.64 | % | |

RATIOS AND

SUPPLEMENTAL DATA | |

| Net assets, end of period | | $ | 14,694,554 | | | $ | 28,895,232 | | | $ | 29,038,283 | | | $ | 98,784,943 | | | $ | 167,992,389 | | | $ | 114,826,430 | | |

Operating gross expenses to

average net assets | | | 1.87 | %(4) | | | 1.61 | % | | | 1.37 | % | | | 1.29 | % | | | 1.32 | % | | | 1.30 | % | |

Operating net expenses to average

net assets | | | 1.87 | %(4) | | | 1.61 | % | | | 1.23 | % | | | 1.29 | % | | | 1.32 | % | | | 1.30 | % | |

Net investment income to average

net assets | | | 0.14 | %(4) | | | 0.72 | % | | | 4.25 | % | | | 1.47 | % | | | 1.94 | % | | | 1.12 | %(6) | |

| Portfolio turnover rate | | | 144 | % | | | 307 | % | | | 218 | % | | | 91 | % | | | 55 | % | | | 104 | % | |

(1) Total return at net asset value assuming all distributions reinvested.

(2) The per share amounts were computed using an average number of shares outstanding during the year.

(3) Periods less than one year are not annualized.

(4) Annualized.

(5) Includes investment income from Martin Currie as a result of a reimbursement of overdraft fees. Excluding this investment income would have no effect on net investment income or total investment return.

(6) Net investment income per share and the net investment income to average net assets ratio includes non-recurring dividend income amounting to $0.108 and 0.63%, respectively.

See Notes to Financial Statements.

30

MARTIN CURRIE BUSINESS TRUST

NOTES TO FINANCIAL STATEMENTS

NOTE A - ORGANIZATION

Martin Currie Business Trust ("MCBT") (the "Trust") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company organized as a Massachusetts business trust on May 20, 1994. The Trust currently offers three funds which have differing investment objectives and policies: MCBT Opportunistic EAFE Fund (the "Opportunistic EAFE Fund"), MCBT Global Emerging Markets Fund (the "Global Emerging Markets Fund"), and MCBT European Select Fund (the "European Select Fund") (each a "Fund" and collectively, the "Funds"). The Opportunistic EAFE Fund, the Global Emerging Markets Fund, and the European Select Fund commenced investment operations on July 1, 1994, February 14, 1997, and June 6, 2002, respectively. The Trust's Declaration of Trust permits the Board of Trustees to issue an unlimited number of full and fractional shares of beneficial interest of each Fund, without par value.

NOTE B - SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements:

Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and income and expenses at the date of the financial statements. Actual results could differ from these estimates.

Foreign Investments - The Funds will invest extensively in foreign securities (i.e., those which are not listed on a United States securities exchange). Investing in foreign securities involves risks not typically found in investing in U.S. markets. These include risks of adverse changes in foreign economic, political, regulatory and other conditions, and changes in currency exchange rates, exchange control regulations (including currency blockage), expropriation of assets or nationalization, imposition of withholding taxes on dividend or interest payments and capital gains, and possible difficulty in obtaining and enforcing judgments against foreign entities. The securities of some foreign companies and foreign securities markets are less liquid and at times more volatile than securities of comparable U.S. companies and U.S. securities markets.

Valuation of Investments - Equity securities listed on an established securities exchange normally are valued at their last sale price on the exchange where primarily traded. Equity securities listed on the NASDAQ National Market System are valued at the NASDAQ Official Closing Price. Equity securities listed on an established securities exchange or on the NASDAQ National Market System for which there is no reported sale during the day, and in the case of over the counter securities not so listed, are valued at the mean between the last bid and asked price, except that short-term securities and debt obligations with sixty (60) days or less remaining until maturity may be valued at their amortized cost. Other securities for which current market quotations are not readily available (including certain restricted securities, if any) and all other assets are tak en at fair value as determined in good faith by or in accordance with valuation procedures approved by the Trustees of the Trust (the "Trustees"), although the actual calculations may be made by persons acting pursuant to the direction of the Trustees or by pricing services.

Generally, trading in foreign securities markets is substantially completed each day at various times prior to the close of regular trading on the New York Stock Exchange. Occasionally, events affecting the value of foreign fixed income securities and of equity securities of non-U.S. issuers not traded on a U.S. exchange may occur between the completion of substantial trading of such securities for the day and the close of regular trading on the New York Stock Exchange, which events will not be reflected in the computation of a Fund's net asset value. If events materially affecting the value of any Fund's portfolio securities occur during such period, then these securities will be valued at their fair value as determined in good faith by or in accordance with valuation procedures approved by the Trustees, which may include the use of a third party valuation service. During the period covered by this report, certain foreign securities held by the Funds were subject to Fair value pricing adjustments made at the direction of third-party pricing vendors approved by the Board. Fair value pricing involves subjective judgments, and the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security. As of October 31, 2010, the Fund held no

31