UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2003

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 0-24796

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

(Exact name of registrant as specified in its charter)

| BERMUDA | | N/A |

| (State or other jurisdiction of incorporation and organization) | | (IRS Employer Identification No.) |

| Clarendon House, Church Street, Hamilton | | HM CX Bermuda |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: 441-296-1431

Indicate by check mark whether registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for each shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YesxNoo

Indicate by check mark whether the registrant is an accelerated filer (as defined by Rule 12b-2 of the Exchange Act)

YesxNoo

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| Class | | Outstanding as of November 5, 2003 |

| |

|

| Class A Common Stock, par value $0.08 | | 18,577,100 |

| Class B Common Stock, par value $0.08 | | 7,934,736 |

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

FORM 10-Q

For the quarterly period ended September 30, 2003

INDEX

| | | | Page |

| |

| | | |

| | | |

| | | | |

| | | | 3 |

| | | | |

| | | | 5 |

| | | | |

| | | | 7 |

| | | | |

| | | | 8 |

| | | | |

| | | | 9 |

| | | |

| | | 25 |

| | | |

| | | 35 |

| | | |

| | | 36 |

| | |

| |

| | | |

| | | 37 |

| | | |

| | | 38 |

| | | |

| | | 38 |

| | |

| 39 |

| | |

| 39 |

| | | | |

Item 1. Financial Statements

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

CONSOLIDATED BALANCE SHEETS

(US$000s, except share and per share data)

| | | September 30, 2003 (Unaudited) | December 31, 2002 |

ASSETS | | | | | | | |

| CURRENT ASSETS: | | | | | | | |

| Cash and cash equivalents | | $ | 91,271 | | $ | 49,644 | |

| Restricted cash | | | 85,235 | | | 6,168 | |

| Accounts receivable (net of allowances for bad debts of $6,021 and $7,481, respectively) | | | 15,220 | | | 21,357 | |

| Program rights costs | | | 10,900 | | | 10,997 | |

| Advances to affiliates | | | 5,861 | | | 3,842 | |

| Asset held for sale (Note 12) | | | 5,672 | | | 5,473 | |

| Other short-term assets | | | 3,884 | | | 4,141 | |

| | |

| |

| |

| Total current assets | | | 218,043 | | | 101,622 | |

| Loans to related parties | | | 4,952 | | | 7,742 | |

| Investments in/advances to unconsolidated affiliates | | | 20,341 | | | 21,637 | |

| Property, plant and equipment (net of depreciation of $51,865 and $47,244, respectively) | | | 15,665 | | | 14,078 | |

| Program rights costs | | | 9,322 | | | 6,982 | |

| License costs and other intangibles (net of amortization of $10,067 and $10,762 respectively) (Note 9. | | | 2,433 | | | 2,144 | |

| Goodwill, net (Note 9) | | | 23,431 | | | 18,201 | |

| Other assets | | | 2,224 | | | 4,286 | |

| | |

| |

| |

| Total assets | | $ | 296,411 | | $ | 176,692 | |

| | |

| |

| |

CONSOLIDATED BALANCE SHEETS (continued)

(US$000s, except share and per share data)

| | | September 30, 2003 (Unaudited) | December 31, 2002 |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | |

| CURRENT LIABILITIES: | | | | | | | |

Accounts payable and accrued liabilities | | $ | 30,758 | | $ | 36,856 | |

Duties and other taxes payable | | | 15,402 | | | 18,088 | |

Income taxes payable | | | 4,432 | | | 5,181 | |

Current portion of credit facilities | | | - | | | 8,303 | |

Current portion of obligations under capital leases | | | 84 | | | 137 | |

Investments payable | | | 1,256 | | | 1,256 | |

Advances from related parties | | | 4,348 | | | 1,361 | |

| | |

| |

| |

| Total current liabilities | | | 56,280 | | | 71,182 | |

| NON-CURRENT LIABILITIES: | | | | | | | |

Long-term portion of credit facilities | | | 9,133 | | | 19,836 | |

Long-term portion of obligations under capital leases | | | 703 | | | 682 | |

$100,000,000 9 3/8% Senior Notes due 2004 (Note 13) | | | - | | | 99,964 | |

Euro 71,581,961 8 1/8% Senior Notes due 2004 (Note 13) | | | - | | | 75,036 | |

Other liabilities | | | 2,836 | | | 3,849 | |

| | |

| |

| |

| Total non-current liabilities | | | 12,672 | | | 199,367 | |

Minority interests in consolidated subsidiaries | | | 462 | | | 2,019 | |

| SHAREHOLDERS' EQUITY: | | | | | | | |

| Class A Common Stock, $0.08 par value: authorized: | | | | | | | |

| 100,000,000 shares at September 30, 2003 and December 31, 2002; issued and outstanding : 18,577,100 at September 30, 2003 and 18,523,768 at December 31, 2002 | | | 1,486 | | | 1,482 | |

| Class B Common Stock, $0.08 par value: authorized: | | | | | | | |

| 15,000,000 shares at September 30, 2003 and December 31, 2002; issued and outstanding : 7,934,736 at September 30, 2003 and December 31, 2002 | | | 635 | | | 635 | |

Additional paid-in capital | | | 367,691 | | | 359,342 | |

Retained earnings/(accumulated deficit) | | | (139,058 | ) | | (452,011 | ) |

Accumulated other comprehensive income/(loss) | | | (3,757 | ) | | (5,324 | ) |

| | |

| |

| |

| Total shareholders' equity/(deficit) | | | 226,997 | | | (95,876 | ) |

| | |

| |

| |

| Total liabilities and shareholders' equity | | $ | 296,411 | | $ | 176,692 | |

| | |

| |

| |

CONSOLIDATED STATEMENTS OF OPERATIONS

(US$000s, except share and per share data)

(Unaudited)

| | | For the three months ended September 30, | For the nine months ended September 30, |

| | 2003 | 2002 Restated (1) | 2003 | 2002 Restated (1) |

| | | | | | | | | | | | | | |

| Net revenues | | $ | 21,886 | | $ | 17,139 | | $ | 77,334 | | $ | 61,281 | |

| STATION EXPENSES: | | | | | | | | | | | | | |

Operating costs and expenses | | | 10,851 | | | 6,391 | | | 32,480 | | | 25,491 | |

Amortization of program rights | | | 5,822 | | | 5,281 | | | 19,984 | | | 13,800 | |

Depreciation of station fixed assets and other intangibles | | | 1,258 | | | 1,418 | | | 3,818 | | | 4,339 | |

| | |

| |

| |

| |

| |

Total station operating costs and expenses | | | 17,931 | | | 13,090 | | | 56,282 | | | 43,630 | |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSES | | | 1,935 | | | 3,505 | | | 8,115 | | | 8,588 | |

| CORPORATE EXPENSES: | | | | | | | | | | | | | |

| Corporate operating costs (excluding stock based employee compensation) | | | 4,970 | | | 2,619 | | | 11,220 | | | 8,722 | |

| Stock based employee compensation (Note 10) | | | 1,719 | | | 1,467 | | | 8,343 | | | 1,884 | |

| | |

| |

| |

| |

| |

| Operating income/(loss) | | | (4,669 | ) | | (3,542 | ) | | (6,626 | ) | | (1,543 | ) |

| Loss on write down of investment | | | - | | | - | | | - | | | (2,685 | ) |

| Equity in income/(loss) of unconsolidated affiliates | | | (1,374 | ) | | (2,539 | ) | | 232 | | | (1,193 | ) |

| Net interest and other expense | | | (365 | ) | | 2,643 | | | (12,391 | ) | | (9,451 | ) |

| Change in fair value of derivative | | | - | | | - | | | - | | | 1,108 | |

| Foreign currency exchange (loss)/gain, net | | | (221 | ) | | 55 | | | (10,537 | ) | | (5,459 | ) |

| | |

| |

| |

| |

| |

| Income/(loss) before provision for income taxes, minority interest and discontinued operations | | | (6,629 | ) | | (3,383 | ) | | (29,322 | ) | | (19,223 | ) |

| Provision for income taxes | | | (212 | ) | | (938 | ) | | (3,177 | ) | | (4,807 | ) |

| Minority interest in (income)/loss of consolidated subsidiaries | | | (9 | ) | | (1,445 | ) | | (93 | ) | | (115 | ) |

| | |

| |

| |

| |

| |

| Net income/(loss) from continuing operations | | | (6,850 | ) | | (5,766 | ) | | (32,592 | ) | | (24,145 | ) |

| Discontinued operations - Czech Republic (Note 12): | | | | | | | | | | | | | |

Gain/(loss) from discontinued operations (Czech Republic)... | | | 264 | | | 20,608 | | | 345,545 | | | 14,768 | |

Income tax benefit/(charge) | | | - | | | - | | | - | | | - | |

| | |

| |

| |

| |

| |

| Net income/(loss) | | $ | (6,586 | ) | $ | 14,842 | | $ | 312,953 | | $ | (9,377 | ) |

| | |

| |

| |

| |

| |

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

CONSOLIDATED STATEMENTS OF OPERATIONS (continued)

(US$000s, except share and per share data)

(Unaudited)

| | | For the three months ended September 30, | For the nine months ended September 30, |

| | 2003 | 2002 Restated (1) | 2003 | 2002 Restated (1) |

| PER SHARE DATA: | | | | | |

| Net income/(loss) per share (Note 7) | | | | | |

| Continuing operations - Basic and Diluted | | $ | (0.26 | ) | $ | (0.22 | ) | $ | (1.23 | ) | $ | (0.91 | ) |

| Discontinued operations – Basic | | | 0.01 | | | 0.78 | | | 13.03 | | | 0.56 | |

| Discontinued operations – Diluted | | | 0.01 | | | 0.70 | | | 11.58 | | | 0.56 | |

| Total Net income/(loss) – Basic | | | (0.25 | ) | | 0.56 | | | 11.80 | | | (0.35 | ) |

| Total Net income/(loss) – Diluted | | $ | (0.25 | ) | $ | 0.50 | | $ | 10.49 | | $ | (0.35 | ) |

| | | | | | | | | | | | | | |

| Weighted average common shares used in computing per share amounts (2): | | | | | | | | | | | | | |

| Basic (‘000s) | | | 26,512 | | | 26,458 | | | 26,512 | | | 26,458 | |

| Diluted (‘000s) (3) - continuing | | | 26,512 | | | 29,448 | | | 26,512 | | | 26,458 | |

| Diluted (‘000s) (3) - discontinued | | | 29,835 | | | 29,448 | | | 29,835 | | | 26,458 | |

| (1) Restated to reflect discontinued Czech Republic operations. |

| (2) All per share data has been adjusted for the two-for-one stock split which occurred on November 4, 2003 (for further information see Note 8, "Two-For–One Stock Split"). |

| (3) Diluted EPS for the three months ended September 30, 2003 does not include the impact of 2,627,383 stock options and 696,000 warrants then outstanding, as their inclusion would reduce the net loss per share and would be anti-dilutive. Diluted EPS for the nine months ended September 30, 2002 does not include the impact of 2,294,168 stock options and 696,000 warrants then outstanding, as their inclusion would reduce the net loss per share and would be anti-dilutive. |

CONSOLIDATED STATEMENT OF SHAREHOLDERS' EQUITY

(US$000s)

(Unaudited)

| | | | Comprehensive Income/ (Loss) | | | Class A Common Stock | | | Class B Common Stock | | | Additional Paid-In Capital | | | Retained Earnings/ (Accumulated Deficit) | | | Accumulated Other Comprehensive Income/(Loss) | | | Total Shareholders' Equity/ (Deficit) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, December 31, 2002 | | | | | | 1,482 | | | 635 | | | 359,342 | | | (452,011 | ) | | (5,324 | ) | | (95,876 | ) |

| Stock based employee compensation | | | | | | | | | | | | 8,343 | | | | | | | | | 8,343 | |

| Stock options exercised | | | | | | 4 | | | | | | 6 | | | | | | | | | 10 | |

| Net income | | | 312,953 | | | | | | | | | | | | 312,953 | | | | | | 312,953 | |

| Other comprehensive income: | | | | | | | | | | | | | | | | | | | | | | |

| Unrealized translation adjustments | | | 1,567 | | | | | | | | | | | | | | | 1,567 | | | 1,567 | |

| | |

| |

| Total comprehensive income | | | 314,520 | | | | | | | | | | | | | | | | | | | |

| | |

| | | | | | | | | | | | | | | | | | | |

| BALANCE, September 30, 2003 | | | | | $ | 1,486 | | $ | 635 | | $ | 367,691 | | $ | (139,058 | ) | $ | (3,757 | ) | $ | 226,997 | |

| | | | | |

| |

| |

| |

| |

| |

| |

CONSOLIDATED STATEMENTS OF CASH FLOWS

(US$000s) - (Unaudited)

| | | For the nine months ended September 30, |

| | | 2003 | 2002 Restated (1) |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income/(loss) | | $ | 312,953 | | $ | (9,377 | ) |

| Adjustments to reconcile net income/(loss) to net cash used in operating activities: | | | | | | | |

Loss/(income) from discontinued operations | | | (345,545 | ) | | (14,768 | ) |

Equity in income/(loss) of unconsolidated affiliates | | | (232 | ) | | 1,193 | |

Depreciation and amortization | | | 25,886 | | | 19,652 | |

Loss on write down of investment. | | | - | | | 2,685 | |

Stock based compensation | | | 8,343 | | | 1,884 | |

Minority interest in loss of consolidated subsidiaries | | | 93 | | | 1,453 | |

Foreign currency exchange loss/(gain), net | | | 10,537 | | | 5,459 | |

Net change in: | | | | | | | |

Restricted cash | | | (78,592 | ) | | 1,889 | |

Accounts receivable | | | 6,751 | | | 4,021 | |

Program rights costs | | | (24,363 | ) | | (16,260 | ) |

Advances from affiliates | | | 2,920 | | | 3,710 | |

Other short-term assets | | | 1,271 | | | 2,282 | |

Accounts payable and accrued liabilities | | | (9,716 | ) | | (11,636 | ) |

Short term payables to bank | | | - | | | (1,576 | ) |

Income and other taxes payable | | | (4,421 | ) | | 8,087 | |

| | |

| |

| |

| Net cash provided by/(used in) operating activities | | | (94,115 | ) | | (1,302 | ) |

| | |

| |

| |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | |

Acquisition of fixed assets | | | (4,906 | ) | | (1,993 | ) |

Investments in subsidiaries and affiliates | | | (5,891 | ) | | - | |

Loans and advances to affiliates | | | 1,999 | | | - | |

License costs, other assets and intangibles | | | 910 | | | 157 | |

| | |

| |

| |

| Net cash provided by/(used in) investing activities | | | (7,888 | ) | | (1,836 | ) |

| | |

| |

| |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | |

Cash facilities and payments under capital leases | | | (19,757 | ) | | 15,303 | |

Repurchase/redemption of Senior Notes | | | (182,608 | ) | | - | |

Issuance of stock | | | 8 | | | - | |

Other long-term liabilities | | | (831 | ) | | 20 | |

| | |

| |

| |

| Net cash received from/(used in) financing activities | | | (203,188 | ) | | 15,323 | |

| | |

| |

| |

| NET CASH RECEIVED FROM/(USED IN) DISCONTINUED OPERATIONS | | | 346,254 | | | 16,805 | |

| | |

| |

| |

| IMPACT OF EXCHANGE RATE FLUCTUATIONS ON CASH | | | 564 | | | 581 | |

| | |

| |

| |

| Net increase/(decrease) in cash and cash equivalents | | | 41,627 | | | 29,571 | |

| CASH EQUIVALENTS, beginning of period | | | 49,644 | | | 22,053 | |

| CASH EQUIVALENTS, end of period | | $ | 91,271 | | $ | 51,624 | |

| | |

| |

| |

| SUPPLEMENTAL INFORMATION OF CASH FLOW INFORMATION: | | | | | | | |

| Cash paid for interest | | $ | 15,040 | | $ | 16,304 | |

| Cash paid for income taxes (net of refunds) | | $ | 4,010 | | $ | 63 | |

| SUPPLEMENTAL INFORMATION OF NON-CASH FINANCING TRANSACTIONS: | | | | | | | |

| Acquisition of property, plant and equipment under capital lease | | $ | - | | $ | - | |

Notes to Consolidated Financial Statements

September 30, 2003

1. Basis of Presentation

Central European Media Enterprises Ltd. is a Bermuda company that, together with its subsidiaries and affiliates, invests in, develops and operates national and regional commercial television stations and networks in Central and Eastern Europe. At present, we have operations in Romania, the Slovak Republic, Slovenia and Ukraine.

The interim statements for the nine months ended September 30, 2003 should be read in conjunction with the Notes to the Consolidated Financial Statements contained in our December 31, 2002 Form 10-K filed with the SEC on March 10, 2003 as amended by our Form 10-K/A filed with the SEC on April 25, 2003 and our amendment No.2 to our Form 10-K/A filed with the SEC on August 21, 2003. In the opinion of management, the interim unaudited financial statements included herein reflect all adjustments necessary, consisting of normal recurring adjustments, for a presentation in conformity with United States Generally Accepted Accounting Principles (US GAAP). The consolidated results of operations for interim periods are not necessarily indicative of the results to be expected for a full year.

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting year. Actual results could differ from those estimates.

The consolidated financial statements include the accounts of Central European Media Enterprises Ltd and investments in entities over which we have control. The financial statements of entities in which we hold more than a majority voting interest are consolidated. Entities in which we hold less than a majority voting interest but over which we have the ability to exercise significant influence are accounted for using the equity method. Other investments are accounted for using the cost method. For further information, see Note 2, "Group Operations".

On June 19, 2003, the Board of Central European Media Enterprises Ltd decided to withdraw from Czech operations. The revenues and expenses of the Czech operations and the award income and related legal expenses have therefore all been treated as discontinued operations for the year 2003 and the prior year comparatives have been restated. For additional information, see Note 12, "Discontinued Operations".

2. Group Operations

In each market, we have interests both in license companies and in operating companies. License companies have been authorized by the relevant local regulatory authority to engage in television broadcasting in accordance with the terms of a particular license. Revenues are generated primarily through operating companies, which acquire programming for provision to the corresponding license companies and which sell advertising time that is acquired from or made available by the license companies. In Ukraine, the license company also engages directly in the acquisition of programming and the sale of some advertising time. Our economic interest in the operating companies corresponds with our voting interest other than in the Slovak Republic, where we are entitled by contract to a share of

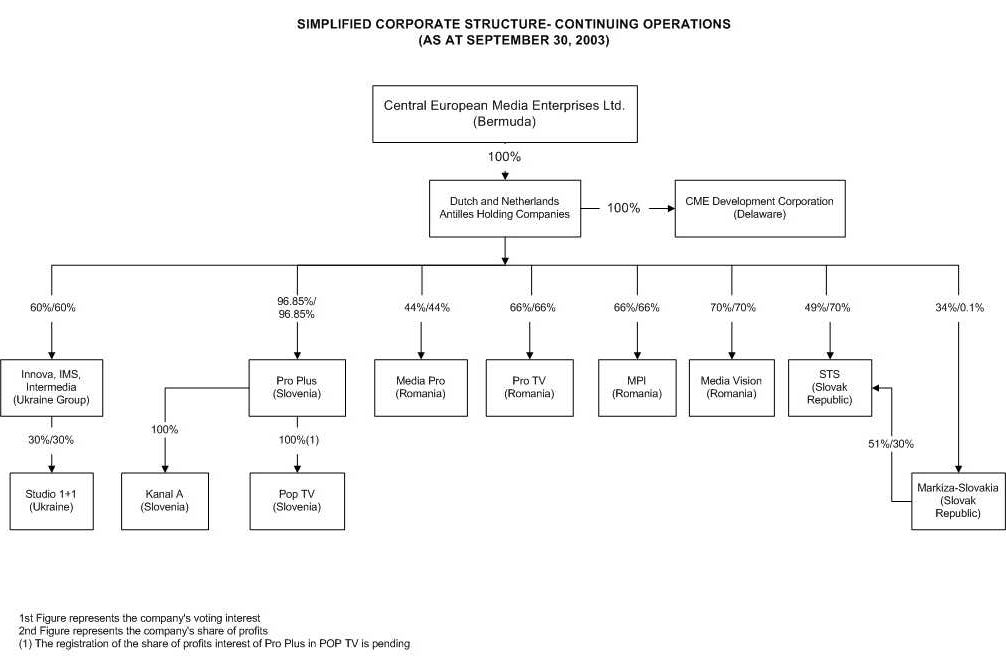

profits that is in excess of our voting interest. Below is an overview of our operating structure, the accounting treatment for each entity and a chart entitled "Simplified Corporate Structure - Continuing Operations".

| Key Subsidiaries and Affiliates as at 30 September, 2003 | | | Share of Profits | | | Voting Interest | | | Accounting Treatment | | | TV Network | |

| |

| |

| |

| |

| |

Continuing Operations | | | | | | | | | | | | | |

| Romania | | | | | | | | | | | | | |

Operating Companies: | | | | | | | | | | | | | |

| Media Pro International S.A. (MPI) | | | 66 | % | | 66 | % | | Subsidiary | | | | |

| Media Vision S.R.L. (Media Vision) | | | 70 | % | | 70 | % | | Subsidiary | | | | |

License Companies: | | | | | | | | | | | | | |

| Pro TV S.A. - formerly Pro TV S.R.L. (Pro TV) | | | 66 | % | | 66 | % | | Subsidiary | | | PRO TV and PRO TV INTERNATIONAL | |

| Media Pro S.R.L. (Media Pro) | | | 44 | % | | 44 | % | | Equity Accounted Affiliate | | | PRO TV and ACASA | |

| | | | | | | | | | | | | | |

| Slovenia | | | | | | | | | | | | | |

Operating Company: | | | | | | | | | | | | | |

| Produkcija Plus, d.o.o. (Pro Plus) | | | 96.85 | % | | 96.85 | % | | Subsidiary | | | | |

License Companies: | | | | | | | | | | | | | |

| Pop TV d.o.o. (Pop TV) | | | 96.85 | % | | 96.85 | % | | Subsidiary | | | POP TV | |

| Kanal A d.o.o. (Kanal A) | | | 96.85 | % | | 96.85 | % | | Subsidiary | | | KANAL A | |

| | | | | | | | | | | | | | |

| Slovak Republic | | | | | | | | | | | | | |

Operating Company: | | | | | | | | | | | | | |

| Slovenska Televizna Spolocnost, spol. s r.o. (STS) | | | 70 | % | | 49 | % | | Equity Accounted Affiliate | | | | |

License Company: | | | | | | | | | | | | | |

| Markiza-Slovakia s r.o. (Markiza) | | | 0.1 | % | | 34 | % | | Equity Accounted Affiliate | | | MARKIZA TV | |

| | | | | | | | | | | | | | |

| Ukraine | | | | | | | | | | | | | |

Operating Companies: | | | | | | | | | | | | | |

| Innova Film GmbH (Innova) | | | 60 | % | | 60 | % | | Subsidiary | | | | |

| International Media Services Ltd. (IMS) | | | 60 | % | | 60 | % | | Subsidiary | | | | |

| Enterprise "Inter-Media" (Inter-Media) | | | 60 | % | | 60 | % | | Subsidiary | | | | |

License Company: | | | | | | | | | | | | | |

| Broadcasting Company "Studio 1+1" (Studio 1+1) | | | 18 | % | | 18 | % | | Equity Accounted Affiliate | | | STUDIO 1+1 | |

| | | | | | | | | | | | | | |

Discontinued Operations | | | | | | | | | | | | | |

| Czech Republic | | | | | | | | | | | | | |

Operating Company: | | | | | | | | | | | | | |

| Ceska Nezavisla Televizni Spolecnost, spol. s r.o. (CNTS) | | | 93.2 | % | | 93.2 | % | | Subsidiary | | | | |

License Company: | | | | | | | | | | | | | |

| CET 21 spol. s r.o. (CET) | | | 3.125 | % | | 3.125 | % | | Cost Method | | | | |

Romania

We have a 66% voting interest in the Romanian company MPI and are entitled to a 66% share of profits. Although we have majority voting power in MPI, certain financial and corporate matters require the affirmative vote of either Mr. Sarbu or Mr. Tiriac, the co-shareholders in MPI.

Until the completion of the restructuring of our Romanian operations (see Note 4, "Acquisitions"), MPI and Pro TV are responsible for the provision of programming and the sale of advertising for the license-holders of two networks broadcasting under the brand names: PRO TV and PRO TV INTERNATIONAL. Pro TV holds 19 of the 22 licenses used by the PRO TV and PRO TV INTERNATIONAL networks. We hold a 66% voting and share of profits interest in Pro TV. The remaining three licenses for the PRO TV network together with the licenses for ACASA, the PRO FM and PRO AM radio networks are held and operated by MPI and by Media Pro, in which we hold a 44% voting interest and are entitled to a 44% share of profits. MPI is assisting in the operation of the business along with the license holding companies Pro TV and Medi a Pro during the transition period until the restructuring has completed.

We have a 70% voting interest in Media Vision, a Romanian production and subtitling company, and are entitled to a 70% share of its profits.

Slovenia

We have a 96.85% voting interest in Pro Plus, the operating company for our Slovenian operations, and are entitled to a 96.85% share of its profits. Pro Plus has a 100% voting interest and share of profits in Pop TV and Kanal A, giving us a 96.85% voting interest and share of profits in these companies. Pop TV holds all of the licenses for the operation of the POP TV network and Kanal A holds all licenses for the KANAL A network. Pro Plus has entered into an agreement with each of Pop TV and Kanal A under which Pro Plus provides all programming to the POP TV network and the KANAL A network and sells advertising on behalf of each network.

Slovak Republic

We have a 49% voting interest and are entitled to a 70% share of profits inSTS, the operating company for the MARKIZA TV network. We havea 34% voting interest in Markiza, the license holding company for theMARKIZATV network, and are entitled to a 0.1% share of its profits.

Ukraine

Innova, IMS, Inter-Media and Studio 1+1 comprise "The Studio 1+1 Group". Through our 60% voting interest in Innova which in turn holds 100% of Inter-Media we control Inter-Media's 30% voting interest in Studio 1+1, the license holding company for the STUDIO 1+1 network and have an 18% economic interest in Studio 1+1. We are entitled to a 60% share of the profits in the operating companies servicing Studio 1+1 (Innova, IMS and Inter-Media).

3. New Accounting Standards

Variable Interest Entities

In January 2003, the FASB issued Interpretation No. 46, "Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51," ("FIN 46") which requires all variable interest entities ("VIE"s) to be consolidated by the primary beneficiary. The primary beneficiary is the entity that holds the majority of the beneficial interests in the VIE. In addition, the interpretation expands disclosure requirements both for VIEs that are consolidated and for VIEs in which the entity holds a significant but not a majority beneficial interest. On October 9, 2003 FASB Staff Position FIN46-6 was issued, allowing deferral under certain conditions, of the effective date for application of the provisions of Interpretation No. 46. We meet these conditions.

We are continuing to review whether any of our interests in companies that are not at present consolidated may require consolidation under FIN 46 and have accordingly deferred implementation. The review includes our interests in STS (the operating company in the Slovak Republic) and Studio 1+1 (the license company in Ukraine), consolidation of which would have a material effect on our financial statements. Summary financial information for these entities is included in Note 6, "Summary Financial Information for Unconsolidated Affiliates".

Amendment of SFAS No. 133 on Derivative Instruments and Hedging Activities

In April 2003 the FASB issued Statement No. 149, "Amendment of SFAS No. 133 on Derivative Instruments and Hedging Activities" ("SFAS No. 149").The Statement amends and clarifies accounting for derivative instruments, including certain derivative instruments embedded in other contracts, and for hedging activities under SFAS No. 133. In particular, this Statement clarifies under what circumstances a contract with an initial net investment meets the characteristic of a derivative as discussed in SFAS No. 133. In addition, it clarifies when a derivative contains a financing com ponent that warrants special reporting in the statement of cash flows. SFAS No. 149 amends certain other existing pronouncements.

This Statement is effective for contracts entered into or modified after June 30, 2003, except as stated below and for hedging relationships designated after June 30, 2003.

The provisions of this Statement that relate to SFAS No. 133 Implementation Issues that have been effective for fiscal quarters that began prior to June 15, 2003, should continue to be applied in accordance with their respective effective dates. In addition, certain provisions relating to forward purchases or sales of when-issued securities or other securities that do not yet exist, should be applied to existing contracts as well as new contracts entered into after June 30, 2003. SFAS No. 149 should be applied prospectively.

Adoption of the provisions of SFAS No. 149 did not have a material effect on our results of operations and financial position.

Certain Financial Instruments with Characteristics of both Liabilities and Equity

In May 2003, the FASB issued SFAS No. 150, Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity ("SFAS No. 150"). This statement establishes standards for how an issuer classifies and measures in its statement of financial position certain financial instruments with characteristics of both liabilities and equity. In accordance with the standard, financial instruments that embody obligations for the issuer are required to be classified as liabilities. This statement shall be effective for financial instruments entered into or modified after May 31, 2003 and otherwise shall be effective at the beginning of the first interim period beginning after June 15, 2003. Adop tion of the provisions of SFAS No. 150 did not have a material effect on our results of operations and financial position.

4. Acquisitions

Slovenia

On January 30, 2003, we consolidated our interests in two license companies, Pop TV and Kanal A, into Pro Plus. We paid Euro 5 million (approximately US$ 5.4 million) to purchase the interests held by certain Slovenian individuals and thereby acquire an additional 11.35% of Pro Plus, bringing our total voting interest and share of profits in Pro Plus to 96.85%. In connection with that consolidation Pro Plus became the direct owner of 100% of the equity of Pop TV and 10% of the equity of Kanal A. On April 1, 2003 Pro Plus acquired the remaining 90% of Kanal A from Superplus Holding d.d. ("Superplus") in exchange for extinguishing a liability owed to Pro Plus by Superplus. Superplus is owned by individuals who are holding the shares in trust for us.

This transaction provides us with direct control of all our license companies in Slovenia. This has been reflected in the consolidated financial statements. As a result we have recognized an additional US$ 4.3 million of goodwill.

The goodwill and other amounts arising on acquisition may be subject to adjustment as the fair value assessment for the assets acquired and the liabilities assumed at the date of acquisition is determined. We are in the process of making this assessment.

Romania

On March 21, 2003, we and Messrs Sarbu and Tiriac, executed documentation (i) for us to assume majority control in Pro TV; and (ii) to convert Pro TV from a limited liability company to a joint stock company. The increase in our voting interest and share of profits in Pro TV was at no material cost. Following a change in Romanian legislation permitting the transfer of broadcasting licenses from their initial owners to third parties, MPI is now transferring the provision of programming and the sale of advertising for the stations which comprise the PRO TV, ACASA and PRO TV INTERNATIONAL networks to Pro TV. Pro TV, formerly solely a license holding company, is being transformed into the exclusive operator for the licenses for our Romanian operations. As part of this transformation, Pro TV's governance str ucture has been modified to replicate the voting interest, share of profits, composition of the Council of Administration and voting rules of MPI, thereby enhancing our corporate control.

On the same date, we reached an agreement with Messrs Sarbu and Tiriac to consolidate broadcasting operations in Romania. We and Messrs Sarbu and Tiriac have agreed that, subject to the prior approval of the Romanian Media Council, Media Pro will sell three licenses for the PRO TV network and the licenses for the PRO FM and PRO AM radio networks to Pro TV, making Pro TV the sole owner and operator of all the Romanian broadcasting licenses. We have obtained an independent valuation of the licenses and are in the process of seeking approval from the Romanian Media Council for the transfer of the licenses at the independently assessed price from Media Pro to Pro TV.

On completion, we expect to have secured direct control over our television broadcasting license holders in Romania, reduced the cost and number of our operating companies, and simplified operations. Under an agreement between Mr. Tiriac and Mr. Sarbu, Mr. Tiriac has agreed to transfer his shareholding in MPI, Pro TV and Media Pro to Mr. Sarbu following completion of a multi-year series of payments by Mr. Sarbu. Upon completion of these payments, Mr. Sarbu would control the remainder of the shares in MPI, Pro TV and Media Pro not owned by us.

The goodwill and other amounts arising on acquisition may be subject to adjustment as the fair value assessment for the assets acquired and the liabilities assumed at the date of acquisition is determined. We are in the process of making this assessment.

5. Segment Data

We evaluate the performance of our operations on a geographic basis. Our reportable segments are comprised of Romania, Slovak Republic, Slovenia and Ukraine.

We evaluate the performance of our segments based on Segment EBITDA and Segment Broadcast Cash Flow. Segment EBITDA and Segment Broadcast Cash Flow include STS and Markiza (our operating and license companies in the Slovak Republic) and Studio 1+1 (our license company in Ukraine), neither of which are consolidated under US GAAP.

Our assets and liabilities are managed centrally and are reported internally in the same manner as the consolidated financial statements, thus no additional information is provided.

Segment EBITDA is determined as segment net income/loss, which includes costs for program rights amortization, before interest, taxes, depreciation and amortization of intangible assets. Items that are not allocated to our segments for purposes of evaluating their performance, and therefore are not included in Segment EBITDA, include:

| · | expenses presented as corporate expenses in our consolidated statements of operations (i.e., corporate operating costs and development expenses, net arbitration related costs/proceeds, stock based compensation and amortization of goodwill); |

| | |

| · | changes in the fair value of derivatives; |

| | |

| · | foreign currency exchange gains and losses; |

| | |

| · | Certain unusual or infrequent items (e.g., gains and losses/impairments on assets or investments). |

Segment EBITDA is also used as a target for management bonuses.

Acquired program costs are a significant proportion of our TV stations' cost structure. We use Segment Broadcast Cash Flow to help us control these costs. Segment Broadcast Cash Flow is determined as Segment EBITDA excluding charges for program rights amortization but reduced by cash paid for program rights. When compared with Segment EBITDA, this indicates to management whether the cash investment in program rights in the period was greater or less than the accounting charge for program rights amortization. If the cash investment is greater (i.e. if Segment Broadcast Cash Flow is lower than Segment EBITDA), this provides warning to management and investors that future program rights amortization costs are likely to increase.

Below are tables showing our Segment EBITDA and Segment Broadcast Cash Flow by operation and reconciling these figures to our consolidated US GAAP results for the three and nine months ended September 30, 2003 and 2002:

| | | SEGMENT FINANCIAL INFORMATION |

| | | For the three months ended September 30, |

| | | (US $000's) |

| | | Net Revenues (1) | Segment EBITDA | Segment Broadcast Cash Flow |

| | | 2003 | 2002 | 2003 | 2002 | 2003 | 2002 |

| Country | | | | | | | |

| Romania (2) | | $ | 10,536 | | $ | 7,422 | | $ | 2,312 | | $ | 965 | | $ | 1,880 | | $ | 1,089 | |

| Slovak Republic (MARKIZA TV) | | | 9,272 | | | 6,846 | | | 387 | | | (353 | ) | | 581 | | | (530 | ) |

| Slovenia (POP TV and KANAL A) | | | 5,639 | | | 5,060 | | | 461 | | | 223 | | | 71 | | | 547 | |

| Ukraine (STUDIO 1+1) | | | 6,097 | | | 5,791 | | | (210 | ) | | 220 | | | 45 | | | 18 | |

| | |

| |

| |

| |

| |

| |

| |

| Total Segment Data | | $ | 31,544 | | $ | 25,119 | | $ | 2,950 | | $ | 1,055 | | $ | 2,577 | | $ | 1,124 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation to Consolidated Statement of Operations: | | | | | | | | | | | | | | | | | | | |

| Consolidated Net Revenues / Income/(loss)before provision for income taxes, minority interest and discontinued operations | | $ | 21,886 | | $ | 17,139 | | $ | (6,629 | ) | $ | (3,383 | ) | $ | (6,629 | ) | $ | (3,383 | ) |

| Corporate Expenses | | | - | | | - | | | 6,689 | | | 4,086 | | | 6,689 | | | 4,086 | |

| Unconsolidated Affiliates: | | | | | | | | | | | | | | | | | | | |

| Ukraine (Studio 1+1) | | | 386 | | | 1,134 | | | (715 | ) | | (554 | ) | | (715 | ) | | (554 | ) |

| Slovak Republic (MARKIZA TV) | | | 9,272 | | | 6,846 | | | 387 | | | (353 | ) | | 387 | | | (353 | ) |

| Station Depreciation | | | - | | | - | | | 1,258 | | | 1,418 | | | 1,258 | | | 1,418 | |

| Equity in income/(loss) of unconsolidated affiliates | | | - | | | - | | | 1,374 | | | 2,539 | | | 1,374 | | | 2,539 | |

| Net interest and other expense | | | - | | | - | | | 365 | | | (2,643 | ) | | 365 | | | (2,643 | ) |

| Foreign currency exchange (loss)/gain, net | | | - | | | - | | | 221 | | | (55 | ) | | 221 | | | (55 | ) |

| Cash paid for programming | | | - | | | - | | | - | | | - | | | (8,930 | ) | | (7,326 | ) |

| Program amortization | | | - | | | - | | | - | | | - | | | 8,557 | | | 7,395 | |

| | |

| |

| |

| |

| |

| |

| |

| Total Segment Data | | $ | 31,544 | | $ | 25,119 | | $ | 2,950 | | $ | 1,055 | | $ | 2,577 | | $ | 1,124 | |

| | |

| |

| |

| |

| |

| |

| |

| | | SEGMENT FINANCIAL INFORMATION |

| | | For the nine months ended September 30, |

| | | (US $000's) |

| | | Net Revenues (1) | Segment EBITDA | Segment Broadcast Cash Flow |

| | | 2003 | 2002 | 2003 | 2002 | 2003 | 2002 |

Country | | | | | | | |

| Romania (2) | | $ | 33,544 | | $ | 22,711 | | $ | 7,373 | | $ | 2,550 | | $ | 4,911 | | $ | 1,979 | |

| Slovak Republic (MARKIZA TV) | | | 33,458 | | | 25,330 | | | 6,824 | | | 3,129 | | | 6,919 | | | 3,464 | |

| Slovenia (POP TV and KANAL A) | | | 24,548 | | | 22,742 | | | 6,810 | | | 6,236 | | | 6,381 | | | 6,859 | |

| Ukraine (STUDIO 1+1) | | | 22,085 | | | 20,145 | | | 2,161 | | | 4,150 | | | 2,037 | | | 2,676 | |

| | |

| |

| |

| |

| |

| |

| |

| Total Segment Data | | $ | 113,635 | | $ | 90,928 | | $ | 23,168 | | $ | 16,065 | | $ | 20,248 | | $ | 14,978 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation to Consolidated Statement of Operations: | | | | | | | | | | | | | | | | | | | |

| Consolidated Net Revenues / Income/(loss) before provision for income taxes, minority interest and discontinued operations | | $ | 77,334 | | $ | 61,281 | | $ | (29,322 | ) | $ | (19,223 | ) | $ | (29,322 | ) | $ | (19,223 | ) |

| Corporate Expenses | | | - | | | - | | | 19,563 | | | 10,606 | | | 19,563 | | | 10,606 | |

| Unconsolidated Affiliates: | | | | | | | | | | | | | | | | | | | |

| Ukraine (Studio 1+1) | | | 2,843 | | | 4,317 | | | (411 | ) | | (466 | ) | | (411 | ) | | (466 | ) |

| Slovak Republic (MARKIZA TV) | | | 33,458 | | | 25,330 | | | 6,824 | | | 3,129 | | | 6,824 | | | 3,129 | |

| Station Depreciation | | | - | | | - | | | 3,818 | | | 4,339 | | | 3,818 | | | 4,339 | |

| Loss on write down of investment | | | - | | | - | | | - | | | 2,685 | | | - | | | 2,685 | |

| Equity in income/(loss) of unconsolidated affiliates | | | - | | | - | | | (232 | ) | | 1,193 | | | (232 | ) | | 1,193 | |

| Net interest and other expense | | | - | | | - | | | 12,391 | | | 9,451 | | | 12,391 | | | 9,451 | |

| Change in fair value of derivative | | | - | | | - | | | - | | | (1,108 | ) | | - | | | (1,108 | ) |

| Foreign currency exchange (loss)/gain, net | | | - | | | - | | | 10,537 | | | 5,459 | | | 10,537 | | | 5,459 | |

| Cash paid for programming | | | - | | | - | | | - | | | - | | | (30,002 | ) | | (21,207 | ) |

| Program amortization | | | - | | | - | | | - | | | - | | | 27,082 | | | 20,120 | |

| | |

| |

| |

| |

| |

| |

| |

| Total Segment Data | | $ | 113,635 | | $ | 90,928 | | $ | 23,168 | | $ | 16,065 | | $ | 20,248 | | $ | 14,978 | |

| | |

| |

| |

| |

| |

| |

| |

6. Summary Financial Information for Unconsolidated Affiliates

| | | STS | | Studio 1+1 | |

| | |

| |

| |

| | | At September 30, 2003 | | At December 31, 2002 | | At September 30, 2003 | | At December 31, 2002 | |

| | |

| |

| |

| |

| |

| | | (US$ 000's) | | | (US$ 000's) | | | (US$ 000's) | | | (US$ 000's) | |

| | |

| |

| |

| |

| |

| Current assets | | $ | 21,734 | | $ | 15,596 | | $ | 6,616 | | $ | 5,935 | |

| Non-current assets | | | 13,789 | | | 13,254 | | | 852 | | | 1,033 | |

| Current liabilities | | | (15,433 | ) | | (10,734 | ) | | (10,116 | ) | | (8,218 | ) |

| Non-current liabilities | | | (2,386 | ) | | (2,629 | ) | | - | | | - | |

| | |

| |

| |

| |

| |

| Net assets/(liabilities) | | $ | 17,704 | | $ | 15,487 | | $ | (2,648 | ) | $ | (1,250 | ) |

| | |

| |

| |

| |

| |

| | | STS | | Studio 1+1 | |

| | |

| |

| |

| | | For the three months ended September 30, | | For the three months ended September 30, | |

| | |

| |

| |

| | | | 2003 | | | 2002 | | | 2003 | | | 2002 | |

| | |

| |

| |

| |

| |

| | | | (US$ 000's) | | | (US$ 000's) | | | (US$ 000's) | | | (US$ 000's) | |

| | |

| |

| |

| |

| |

| Net revenues | | $ | 9,272 | | $ | 6,846 | | $ | 5,043 | | $ | 4,263 | |

| Operating (loss)/profit | | | (559 | ) | | (1,887 | ) | | (785 | ) | | (629 | ) |

| Net (loss)/profit | | | (653 | ) | | (697 | ) | | (945 | ) | | (1,131 | ) |

| Movement in Accumulated other comprehensive income/(loss) | | | (289 | ) | | 560 | | | - | | | - | |

| | | STS | | Studio 1+1 | |

| | |

| |

| |

| | | For the nine months ended September 30, | | For the nine months ended September 30, | |

| | |

| |

| |

| | | | 2003 | | | 2002 | | | 2003 | | | 2002 | |

|

| | |

| |

| |

| |

| |

| | | | (US$ 000's) | | | (US$ 000's) | | | (US$ 000's) | | | (US$ 000's) | |

| | |

| |

| |

| |

| |

| Net revenues | | $ | 33,458 | | $ | 25,330 | | $ | 18,243 | | $ | 15,465 | |

| Operating (loss)/profit | | | 3,803 | | | 769 | | | (635 | ) | | (727 | ) |

| Net (loss)/profit | | | 3,222 | | | 917 | | | (1,398 | ) | | (1,702 | ) |

| Movement in Accumulated other comprehensive income/(loss) | | | (2,358 | ) | | 1,528 | | | - | | | - | |

Our share of income/(loss) in Unconsolidated Affiliates for the nine months ended September 30, 2003 was a loss of US$ 1,398,000 for the unconsolidated entities of the Studio 1+1 Group and a profit of US$ 2,255,000 for STS. Our share of income/(loss) in Unconsolidated Affiliates for the nine months ended September 30, 2002 was a loss of US$ 1,702,000 for unconsolidated entities of the Studio 1+1 Group and a profit of US$ 1,763,000 for STS.

7. Earnings Per Share

Basic net income/(loss) per common share is computed by dividing net income by the weighted average number of common shares outstanding. Diluted net income per common share is computed by dividing net income by the weighted average number of common shares and dilutive common share equivalents then outstanding.

| | | For the three months ended September 30, |

| | |

| |

| | | Net Income/(Loss) | | Common Shares | | Net Income/(Loss) per Common Share | |

| | |

| |

| |

| |

| | | 2003 | | | 2002 | | | 2003 | | | 2002 | | | 2003 | | | 2002 | |

| | |

| |

| |

| |

| |

| |

| |

Basic EPS | | | | | | | | | | | | | | | | | | | |

| Net income/(loss) attributable to common stock | | $ | (6,586 | ) | $ | 14,842 | | | 26,512 | | | 26,458 | | $ | (0.25 | ) | $ | 0.56 | |

| Effect of dilutive securities : stock options | | | - | | | - | | | - | | | 2,294 | | | - | | | (0.05 | ) |

| Effect of dilutive securities : stock warrants | | | - | | | - | | | - | | | 696 | | | - | | | (0.01 | ) |

Diluted EPS | | | | | | | | | | | | | | | | | | | |

| Net income/(loss) attributable to common stock | | $ | (6,586 | ) | $ | 14,842 | | | 26,512 | | | 29,448 | | $ | (0.25 | ) | $ | 0.50 | |

| | |

| |

| |

| |

| |

| |

| |

| | | For the nine months ended September 30, |

| | |

| |

| | | Net Income/(Loss) | | Common Shares | | Net Income/(Loss) per Common Share | |

| | |

| |

| |

| |

| | | 2003 | | | 2002 | | | 2003 | | | 2002 | | | 2003 | | | 2002 | |

| | |

| |

| |

| |

| |

| |

| |

Basic EPS | | | | | | | | | | | | | | | | | | | |

| Net income/(loss) attributable to common stock | | $ | 312,953 | | $ | (9,377 | ) | | 26,512 | | | 26,458 | | $ | 11.80 | | $ | (0.35 | ) |

| Effect of dilutive securities : stock options | | | - | | | - | | | 2,627 | | | - | | | (1.04 | ) | | - | |

| Effect of dilutive securities : stock warrants | | | - | | | - | | | 696 | | | - | | | (0.27 | ) | | - | |

Diluted EPS | | | | | | | | | | | | | | | | | | | |

| Net income/(loss) attributable to common stock | | $ | 312,953 | | $ | (9,377 | ) | | 29,835 | | | 26,458 | | $ | 10.49 | | $ | (0.35 | ) |

| | |

| |

| |

| |

| |

| |

| |

Diluted EPS for the three months ended September 30, 2003 does not include the impact of 2,627,383 stock options and 696,000 warrants then outstanding, as their inclusion would reduce the net loss per share and would be anti-dilutive. Diluted EPS for the nine months ended September 30, 2003 includes the impact of 2,627,383 stock options and 696,000 warrants then outstanding.

Diluted EPS for the three months ended September 30, 2002 includes the impact of 2,294,168 stock options and 696,000 warrants then outstanding. Diluted EPS for the nine months ended September 30, 2002 does not include the impact of 2,294,168 stock options and 696,000 warrants then outstanding, as their inclusion would reduce the net loss per share and would be anti-dilutive.

Except as otherwise noted, all share and per share information in these financial statements have been retroactively adjusted to reflect the two-for-one stock split which occurred on January 10, 2003 and also the two-for-one stock split which occurred on November 4, 2003. See Note 8, "Two-For-One Stock Split". On a fully diluted basis, we would have 21,758,483 shares of Class A Common Stock and 8,076,736 shares of Class B Common Stock as at September 30, 2003, and 21,387,936 shares of Class A Common Stock and 8,060,736 shares of Class B Common Stock as at September 30, 2002.

8. Two-For–One Stock Split

On October 14, 2003 a duly authorized committee of the Board of Central European Media Enterprises Ltd. approved a two-for-one stock split by way of the issue of one pari-passu bonus share in respect of each share of Class A or Class B Common Stock. This applied to stockholders as at the record date of October 27, 2003. Payment has been made in full by way of a transfer from the additional paid-in capital

account on November 4, 2003.Our stock traded on Nasdaq at the new split price on the ex-dividend date of November 5, 2003.

The two-for-one stock split: (i) had no effect on the par value of our Class A and Class B Common Stock; (ii) increased the value of the authorized share capital of our Class A Common Stock from US$ 743,084 to US$ 1,486,168; and (iii) increased the value of the authorized share capital of our Class B Common Stock from US$ 317,389 to US$ 634,779.

9. Goodwill and Other Intangibles

The carrying amount of goodwill and other intangibles at September 30, 2003 and December 31, 2002 are as follows:

| | | As at December 31, 2002 (US$ 000s) |

| | |

| |

| | | Gross Amount | | Accumulated Amortization | | Net Amount | |

| | |

| |

| |

| |

| License costs and other intangibles: | | | | | | | | | | |

| License acquisition cost | | $ | 6,592 | | $ | (5,086 | ) | $ | 1,506 | |

| Broadcast license cost | | | 2,205 | | | (2,035 | ) | | 170 | |

| Software license cost | | | 4,109 | | | (3,641 | ) | | 468 | |

| | |

| |

| |

| |

| Total | | $ | 12,906 | | $ | (10,762 | ) | $ | 2,144 | |

| | |

| |

| |

| |

| Goodwill | | | | | | | | | | |

| Slovenian operations | | $ | 20,146 | | $ | (6,041 | ) | $ | 14,105 | |

| Ukrainian operations | | | 22,096 | | | (18,000 | ) | | 4,096 | |

| | |

| |

| |

| |

| Total | | $ | 42,242 | | $ | (24,041 | ) | $ | 18,201 | |

| | |

| |

| |

| |

| | | As at September 30, 2003 (US$ 000s) |

| | |

|

| | | Gross Amount | | Accumulated Amortization | | Net Amount | |

| | |

| |

| |

| |

| License costs and other intangibles: | | | | | | | | | | |

| License acquisition cost | | $ | 6,592 | | $ | (5,086 | ) | $ | 1,506 | |

| Broadcast license cost | | | 2,385 | | | (2,197 | ) | | 188 | |

| Software license cost | | | 3,523 | | | (2,784 | ) | | 739 | |

| | |

| |

| |

| |

| Total | | $ | 12,500 | | $ | (10,067 | ) | $ | 2,433 | |

| | |

| |

| |

| |

| | | | | | | | | | | |

| Goodwill | | | | | | | | | | |

| Slovenian operations | | $ | 25,416 | | $ | (6,081 | ) | $ | 19,335 | |

| Ukrainian operations | | | 22,096 | | | (18,000 | ) | | 4,096 | |

| | |

| |

| |

| |

| Total | | $ | 47,512 | | $ | (24,081 | ) | $ | 23,431 | |

| | |

| |

| |

| |

The anticipated amortization on our license costs and other intangibles for the next five years is as follows:

| | | US$ 000s |

| | |

|

| | | 2003 | 2004 | 2005 | 2006 | 2007 |

| License costs and other intangibles: | | | | | | |

| License acquisition cost (1) | | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | |

| Broadcast license cost (1) | | | - | | | - | | | - | | | - | | | - | |

| Software license cost | | | 62 | | | 246 | | | 246 | | | 185 | | | - | |

| | |

| |

| |

| |

| |

| |

| Total | | $ | 62 | | $ | 246 | | $ | 246 | | $ | 185 | | $ | - | |

| | |

| |

| |

| |

| |

| |

| |

(1) Indefinite useful life assets |

The aggregate amortization expense for the three and nine months ended September 30, 2003 was US$ 224,000 and US$ 412,000, respectively.

10. Stock Based Compensation

We account for employee stock option awards granted, modified or settled since January 1, 2003 according to SFAS 148, "Accounting for Stock-Based Compensation – Transition & Disclosure", whereby compensation costs are determined consistent with the fair value approach required by SFAS 123, "Accounting for Stock-Based Compensation".

In the three months to September 30, 2003 no options were awarded. In the nine months to September 30, 2003, 252,000 incentive and non-incentive stock options were awarded.

In accordance with SFAS 123 the total fair value for these awards of US$ 1,440,615, is recognized in the Statement of Operations using straight line amortization over the vesting period of the awards. In the three months to September 30, 2003 a total charge of US$ 97,910 was recognized, and in the nine months to September 30, 2003 a total charge of US$ 163,184 was recognized.

In relation to APB 25 "Accounting for Stock Issued to Employees", our stock based employee compensation charge, is calculated according to FASB Interpretation 44, "Accounting for Certain Transactions involving Stock Compensation" ("FIN 44"). This requires that compensation cost for modified awards are adjusted for increases and decreases in the intrinsic value in subsequent periods until that award is exercised, forfeited or expires unexercised; subject to a minimum of the original intrinsic value at the original measurement date. As a result of increases in our stock price growth, for the first nine months of 2003 and 2002 there was a charge of US$ 8,180,000 and US$ 1,884,000, respectively and for the third quarter of 2003 and 2002 there was a charge of US$ 1,621,000 and US$ 1,467,000, respectively, in respect of variable plan accounting. Prior to the adoption of SFAS 123 we followed APB25, "Accounting for Stock Issued to Employee", for all employee stock option awards granted, modified or settled before January 1, 2003.

The charge for stock based employee compensation in our consolidated income statement can be summarized as follows:

| | | For the three months ended September 30, | | For the nine months ended September 30, | |

| | |

| |

| |

| | | | 2003 | | | 2002 | | | 2003 | | | 2002 | |

| | |

| |

| |

| |

| |

| | | (US$ 000’s) | | (US$ 000’s) | |

| | |

| |

| |

| Stock based employee compensation charged under FIN 44 | | $ | 1,621 | | $ | 1,467 | | $ | 8,180 | | $ | 1,884 | |

| Stock based employee compensation charged under SFAS 148 | | | 98 | | | - | | | 163 | | | - | |

| | |

| |

| |

| |

| |

| Total stock based employee compensation | | $ | 1,719 | | $ | 1,467 | | $ | 8,343 | | $ | 1,884 | |

| | |

| |

| |

| |

| |

Proforma Disclosures

Had we determined costs for employee stock option awards granted, modified or settled prior to January 1, 2003 consistent with the fair value approach required by SFAS 123 for all periods presented, using the Black-Scholes option pricing model with the assumptions as estimated on the date of each grant, our net income/(loss) and net income/(loss) per common share would decrease/(increase) to the following pro forma amounts:

| | | | | | For the three months ended September 30, (US$ 000’s, except per share data) | | For the nine months ended September 30, (US$ 000’s, except per share data) | |

| | | | | |

| |

| |

| | | | | | | 2003 | | | 2002 | | | 2003 | | | 2002 | |

| | | | |

| |

| |

| |

| |

| Net Income/(Loss) | | | As Reported | | $ | (6,586 | ) | $ | 14,842 | | $ | 312,953 | | $ | (9,377 | ) |

| Add back: Variable Plan stock based compensation expense | | | As Reported | | | 1,621 | | | 1,467 | | | 8,180 | | | 1,884 | |

| Add back: Fixed Plan stock based compensation expense | | | As Reported | | | 98 | | | - | | | 163 | | | - | |

| | | | | |

| |

| |

| |

| |

| Net Income/(Loss) prior to any Stock Based Compensation expense | | | Pro Forma | | | (4,867 | ) | | 16,309 | | | 321,296 | | | (7,493 | ) |

| Deduct: Stock based compensation expensed in the current period | | | As Reported | | | (1,719 | ) | | (1,467 | ) | | (8,343 | ) | | (1,884 | ) |

| Deduct: Stock based compensation expense determined under fair value based method for all awards made prior January 1, 2003, net of related tax effects | | | Pro Forma Expense | | | (142 | ) | | (129 | ) | | (426 | ) | | (408 | ) |

| | | | | |

| |

| |

| |

| |

| Net Income/(Loss) | | | Pro Forma | | $ | (6,728 | ) | $ | 14,713 | | $ | 312,527 | | $ | (9,785 | ) |

| | | | | |

| |

| |

| |

| |

| Net Income/(Loss) Per Common Share – Basic: | | | As Reported | | $ | (0.25 | ) | $ | 0.56 | | $ | 11.80 | | $ | (0.35 | ) |

| | | | Pro Forma | | $ | (0.25 | ) | $ | 0.56 | | $ | 11.79 | | $ | (0.37 | ) |

| Net Income/(Loss) Per Common Share –Diluted: | | | As Reported | | $ | (0.25 | ) | $ | 0.50 | | $ | 10.49 | | $ | (0.35 | ) |

| | | | Pro Forma | | $ | (0.25 | ) | $ | 0.50 | | $ | 10.48 | | $ | (0.37 | ) |

11. Commitments and Contingencies

Litigation

Ukraine

In relation to our litigation with AITI, a television station in Ukraine, on April 9, 2003 the Economic Court of Kiev dismissed the claim brought by AITI, ruling that the licenses operated by Studio 1+1 were correctly granted and remain valid. AITI appealed this judgment to the Court of Appeal, which upheld the findings of the Economic Court of Kiev on June 19, 2003. AITI has further appealed to the Court of Cassation, although a date for the appeal hearing is yet to be confirmed.

We believe that the claim brought by AITI is groundless and will assist in the pursuit of the defense of this matter vigorously. If the decision in the Ukraine court system is ultimately unfavorable, it could result in the loss of the broadcast license of Studio 1+1.

General Litigation

We are, from time to time, a party to litigation that arises in the normal course of our business operations. Other than those claims discussed above, we are not presently a party to any suchlitigation which could reasonably be expected to have a material adverse effect on its business or operations.

Foreign Exchange Contracts

In limited instances, we enter into forward foreign exchange contracts to hedge foreign currency transactions for periods consistent with our identified exposures. At September 30, 2003, there were no foreign exchange contracts outstanding.

Station Program Rights Agreements

We had program rights commitments of US$ 3,557,000 and US$ 4,734,000 in respect of future programming which includes contracts signed with license periods starting after September 30, 2003 and 2002, respectively.

Operating Lease Commitments

For the periods ended September 30, 2003 and 2002 we paid aggregate rent on all facilities of US$ 1,553,000 and US$ 1,857,000, respectively. Future minimum operating lease payments at September 30, 2003 for non-cancellable operating leases with remaining terms in excess of one year (net of amounts to be recharged to third parties) are payable as follows:

| | | At September 30, 2003 (US$ 000’s) | |

| | |

| |

| 2003 | | $ | 322 | |

| 2004 | | | 567 | |

| 2005 | | | 567 | |

| 2006 | | | 567 | |

| 2007 | | | 567 | |

| 2008 and thereafter | | | 3,120 | |

| | |

| |

| Total | | $ | 5,710 | |

| | |

| |

12. Discontinued Operations

Czech Republic

On April 4, 2003 the Czech Republic deposited US$ 354,943,542.54 following the findings of the Tribunal in our Uncitral Arbitration into an escrow account. On May 19, 2003, the escrowed amount was released as a result of the favorable ruling of the Svea Court of Sweden.

On June 19, 2003, our Board of Directors decided to withdraw from Czech operations. The revenues and expenses of the Czech operations and the award income and related legal expenses have therefore all been accounted for as discontinued operations for the year 2003 and the prior year comparatives have been restated.

For the first nine months of 2003, we incurred US$ 11,791,000 of legal costs relating to the arbitration proceedings against the Czech Republic and to the ICC Arbitration Tribunal against Dr Zelezny compared to US$ 9,587,000 for the first nine months of 2002. Arbitration Related (Proceeds)/Costs for the first nine months of 2002 were previously classified in corporate operating costs and development expenses.

| | | For the nine monthsended September 30, (US$ 000's) |

| | | 2003 | 2002 |

| Arbitration Related Proceeds | | $ | 359,884 | | $ | 28,953 | |

| Arbitration Related Costs | | | (14,339 | ) | | (14,185 | ) |

| | |

| |

| |

| Net Arbitration Related Proceeds/(Costs) | | $ | 345,545 | | $ | 14,768 | |

| | |

| |

| |

On October 23, 2003 we sold our 93.2% participation interest in CNTS, our Czech operating company, for US$ 53.2 million. See Note14, "Subsequent Event".

13. US$100 million 93/8% and Euro 71.6 million 81/8% (approximately US$75 million) Senior Notes

Between May 15, 2003 and June 30, 2003, we purchased US$ 16,449,000 of our US$ Senior Notes and Euro 18,793,000 (approximately US$ 21.5 million) of our Euro Senior Notes at various prices all generating a net cash saving. The premium paid above the face value of the Senior Notes on repurchase and cancellation is recognized in our Consolidated Income Statement as a loss of US$ 308,000 and led to an interest saving of approximately US$ 726,000.

On August 15, 2003 we redeemed all the remaining Senior Notes at face value.

14. Subsequent Event

On October 23, 2003 we sold our 93.2% participation interest in CNTS, our Czech operating company, for US$ 53.2 million.

The first instalment of US$ 7.5 million was received on October 8, 2003 and the second US$ 7.5 million instalment was received on October 23, 2003. The remainder of the purchase price will be settled by payments of US$ 20 million plus all accrued interest on or before July 15, 2004 and US$ 18.2 million plus all accrued interest on or before July 15, 2005. The sale agreement provides for a discount of US$2.0 million if payment of the full amount is received prior to December 31, 2003, or a discount of US$1.0 million if payment of the full amount is received prior to July 15, 2004.

The outstanding payment is secured by 250,000 shares of Ceska pojistovna, a.s., a leading insurance company in the Czech Republic.

We have been advised that this transaction is not subject to tax in the Czech Republic or the Netherlands because it is the sale of our ownership or participation interest.

As a result of this sale and the related assignment we ceased to be a party to any litigation in the Czech Republic.

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Our consolidated net revenues for the first nine months of 2003 increased by US$ 16,053,000 or 26% compared with the first nine months of 2002. Following the receipt of US$ 358.6 million from the Czech Republic government, our net income for the first nine months of 2003 was US$ 312,953,000 compared to a net loss of US$ 9,377,000 for the first nine months of 2002.

Corporate

On May 19, 2003, we received US$ 358,635,000 from the Czech Republic government in final settlement following our Uncitral Arbitration.

Between May 15, 2003 and June 30, 2003 we purchased US$ 16,449,000 of our US$ Senior Notes and Euro 18,793,000 (approximately US$ 21.5 million) of our Euro Senior Notes at various prices all generating a net cash saving. On August 15, 2003, we redeemed all of the remaining Senior Notes at 100% of face value.

On May 29, 2003, we settled our outstanding debt and accrued interest with GoldenTree Asset Management in the sum of US$ 15,300,000. No additional warrants were issued.

On May 27, 2003, we repaid our outstanding debt and accrued interest to Czech Sporitelna Bank for a sum of Kc 253,262,000 (approximately US$ 9.2 million).

We disagree with the Dutch tax authorities on the taxability of the award received from the Czech Republic. We have now received advice from our tax counsel and two additional Dutch legal opinions that the main part of the Czech award (US$ 270 million) should not be taxable under Dutch law and that the interest element of the award (US$ 86 million) also should not be taxable.

The advice received by us expressed the view that there is a high probability that the Supreme Court of the Netherlands would affirm the non-taxability of at least the main part of the award in the event we elect to litigate any final decision of the Dutch tax authorities. We have received a provisional tax assessment from the Dutch Tax Authorities. The taxable amount according to this assessment is US$ 227 million with tax payable of US$ 78.5 million. Until a decision of the Dutch Tax Court or an earlier ruling by the Dutch Tax Authorities, we have deposited US$ 78.5 million in an interest bearing Dutch bank account, reflecting our expected maximum tax liability at 34.5%, reduced by carried forward losses. We are treating this deposit as restricted cash. We are making strong representations to the Dutc h tax authorities and to the Ministry of Finance in the Netherlands to highlight the disparity between the positive framework of the Bilateral Investment Treaty and the current position of its Tax Inspectors. We believe that our tax liability is zero, since the potential tax liability on the interest from the award would be fully offset by our carried forward losses. Consequently, no provision has been made for any Dutch tax on the Czech award in these statements.

On May 19, 2003 we paid Euro 3.4 million (approximately US$ 3.8 million) to the Dutch tax authorities to settle outstanding corporate tax liabilities up to and including 2000.

Czech Republic

On October 23, 2003 we sold our 93.2% participation interest in CNTS, our Czech operating company, for US$ 53.2 million.

The first instalment of US$ 7.5 million was received on October 8, 2003 and the second US$ 7.5 million instalment was received on October 23, 2003. The remainder of the purchase price will be settled by payments of US$ 20 million plus all accrued interest on or before July 15, 2004 and US$ 18.2 million plus all accrued interest on or before July 15, 2005. The sale agreement provides for a discount of US$2.0 million if payment of the full amount is received prior to December 31,2003,or a discount of US$1.0 million if payment of the full amount is received prior to July 15, 2004.

The outstanding payment is secured by 250,000 shares of Ceska pojistovna, a.s., a leading insurance company in the Czech Republic.

We have been advised that this transaction is not subject to tax in the Czech Republic or the Netherlands because it is the sale of our ownership or participation interest.

Results of Operations - Discontinued Operations

Czech Republic

On June 19, 2003, our Board of Directors decided to withdraw from Czech operations. On October 23, 2003 we sold our 93.2% participation interest in CNTS, our Czech operating company, for US$ 53.2 million.

The revenues and expenses of the Czech operations and the award income and related legal expenses have therefore all been treated as discontinued operations for the year 2003 and the prior year comparatives have been restated.

For additional information, see Note 12 to the accompanying unaudited consolidated financial statements "Discontinued Operations".

Results of Operations - Continuing Operations

Three months ended September 30, 2003 compared to three months ended September 30, 2002

Net Revenues

| | | | 2003 | | | 2002 | | | US$ increase/ (decrease) | | | % change | |

Country | | US$ 000's | | | | |

| Romania | | $ | 10,536 | | $ | 7,422 | | $ | 3,114 | | | 42 | % |

| Slovenia | | | 5,639 | | | 5,060 | | | 579 | | | 11 | % |

| Ukraine | | | 5,711 | | | 4,657 | | | 1,054 | | | 23 | % |

| | |

| |

| |

| |

| |

| Total Consolidated Net Revenues | | $ | 21,886 | | $ | 17,139 | | $ | 4,747 | | | 28 | % |

| | |

| |

| |

| |

| |

Our consolidated net revenues increased by US$ 4,747,000, or 28%, to US$ 21,886,000 for the third quarter of 2003 from US$ 17,139,000 for the third quarter of 2002 primarily due to a:

| · | 42% increase in the revenues of our Romanian operations. This increase is as a result of a higher advertising ratecard and general growth in the Romanian TV advertising market, together with the reorganization of Romanian sales arrangements to sell directly advertising previously bartered to related parties; |

| | |

| · | 11% increase in the revenues of our Slovenian operations. The increase in net revenue was affected by the US dollar depreciating by 9% against the Slovenian tolar in the third quarter of 2003. In local currency terms, net revenues decreased by 15% due to weaker market conditions; and |

| | |

| · | 23% increase in the revenues of our Ukrainian operations (which includes IMS and Innova but excludes Studio 1+1) as a result of significantly increased sales of programming from a subsidiary to an associate within the Studio 1+1 Group. Increased programme sales revenues reflect the increased cost of acquired programming. |

Station Expenses

| | | | 2003 | | | 2002 | | | US$ (increase)/ decrease | | | % change | |

| | | US$ 000's | | | | |

Country | | | | | | | | | | | | | |

| Romania | | $ | 8,436 | | $ | 5,316 | | $ | (3,120 | ) | | (59) | % |

| Slovenia | | | 4,747 | | | 4,449 | | | (298 | ) | | (7) | % |

| Ukraine | | | 4,748 | | | 3,325 | | | (1,423 | ) | | (43) | % |

| | |

| |

| |

| |

| |

| Total Consolidated Station Expenses | | $ | 17,931 | | $ | 13,090 | | $ | (4,841 | ) | | (37) | % |

| | |

| |

| |

| |

| |

Total station operating costs and expenses (including amortization of program rights and depreciation of fixed assets and other intangibles) increased by US$ 4,841,000, or 37%, to US$ 17,931,000 for the third quarter of 2003 from US$ 13,090,000 for the third quarter of 2002 primarily due to a:

| · | 59% increase in station operating costs and expenses of our Romanian operations. This increase is as a result of an increase in program amortization charges including the direct purchases of programming to replace a previous related party barter agreement. Additionally, salary costs have increased significantly due to a change in the domestic legislation, effective from January 2003, which increased employers' liability for social security charges; |

| | |

| · | 7% increase in station operating costs and expenses of our Slovenian operations. This increase is due to appreciation of the Slovenian tolar, thereby increasing the expenses of our Slovenian operations in US dollar terms. In local currency terms, station operating costs and expenses of our Slovenian operations decreased by 18% as a result of acquired programming cost savings; and |

| | |

| · | 43% increase in station operating costs and expenses of our Ukrainian operations. This increase is as a result of an increase in both acquired programming and self-production costs. We have significantly increased our investment in programming for 2003 as a response to the competitive environment and on the basis of expected revenue growth. |

Station selling, general and administrative expenses decreased by US$ 1,570,000, or 45%, to US$ 1,935,000 for the third quarter of 2003 from US$ 3,505,000 for the third quarter of 2002. The reduction is primarily attributable to our Romanian operations, where costs decreased due to the recovery of receivables against which provisions had been raised in prior periods. US$ 0.7m of this relates to a reduction in the provision for receivables from parties related or connected to our minority shareholder, Mr. Sarbu. In our Slovenian operations cost increases of 16% were entirely attributable to the weaker US dollar.

Corporate Expenses

Corporate operating costs and development expenses for the third quarter of 2003 and 2002 were US$ 4,970,000 and US$ 2,619,000 respectively, an increase of US$ 2,351,000. This increase is primarily attributable to higher compliance costs in 2003 in relation to Sarbanes-Oxley and accounting technical advice, and to increased directors' and officers' insurance costs.

Stock based employee compensation for the third quarter of 2003 and 2002 was a charge of US$ 1,719,000 and US$ 1,467,000, respectively. The increase of US$ 252,000 is primarily as a result of the increase in our stock price growth in the third quarter of 2003 compared to the growth in the third quarter of 2002. (For further discussion, see Note 10 to the Consolidated Financial Statements, "Stock Based Compensation").

As a result of the above factors, we generated an operating loss of US$ 4,669,000 for the third quarter of 2003 compared to US$ 3,542,000 for the third quarter of 2002.

Results Below Operating Income/(Loss)

Equity in income/(loss) of unconsolidated affiliates was a loss of US$ 1,374,000 for the third quarter of 2003 compared to a loss of US$ 2,539,000 for the third quarter of 2002. This change of US$ 1,165,000 is detailed below:

| | | Three months to September 30, (US$ 000's) | |

| | |

| |

| | | | 2003 | | | 2002 | | | US$ increase/ (decrease) | |

| Slovak Republic operations | | $ | (457 | ) | $ | (154 | ) | $ | (303 | ) |

| Ukrainian operations | | | (945 | ) | | (1,131 | ) | | 186 | |

| Romanian operations | | | 28 | | | (1,254 | ) | | 1,282 | |

| | |

| |

| |

| |

| Equity in income/(loss) of unconsolidated affiliates | | $ | (1,374 | ) | $ | (2,539 | ) | $ | 1,165 | |

| | |

| |

| |

| |

The net revenues and operating expenses of our Slovak Republic operations increased by 35% and 21%, respectively. Net revenues increased by 8% in local currency terms as our Slovak operation kept its market share in a growing market. Additionally, the increase in revenues was as a result of the Slovak koruna appreciating by over 20% against the US dollar year-on-year. In local currency terms, operating expenses decreased by 4% for the third quarter of 2003 compared to 2002. This decrease was more than offset by the strength of the Slovak koruna and resulted in an increase of 21% in US$ dollar terms. The net revenues of our equity accounted affiliate in Ukraine increased by 18% as a result of a growth in the Ukrainian television advertising market. Included in the equity accounting for Romania in 2002 wa s Pro TV. Following the restructuring of our Romanian operations, Pro TV has been fully consolidated as a subsidiary from April 1, 2003.

Net interest and other expense was an expense of US$ 365,000 for the third quarter of 2003 compared to an income of US$ 2,643,000 for the third quarter of 2002. The 2002 income was primarily a result of a re-scheduling agreement in the third quarter of 2002 relating to our Romanian tax liabilities which enabled us to reverse a provision for possible penalties and interest.

A net foreign currency exchange loss of US$ 221,000 for the third quarter of 2003 compares to a net currency exchange gain of US$ 55,000 for the third quarter of 2002. This foreign currency exchange loss is a result of a significant weakening of the US dollar against the Euro which affected our Euro denominated balances.

Provision for income taxes decreased by US$ 726,000 to US$ 212,000 for the third quarter of 2003 from a provision of US$ 938,000 for the third quarter of 2002.

Minority interest in income of consolidated subsidiaries was US$ 9,000 for the third quarter of 2003 compared to US$ 1,445,000 for the third quarter of 2002.

As a result of these factors, our net loss from continuing operations was US$ 6,850,000 for the third quarter of 2003 compared to a net loss of US$ 5,766,000 for the third quarter of 2002.

Nine months ended September 30, 2003 compared to nine months ended September 30, 2002

Net Revenues

| | | | 2003 | | | 2002 | | | US$ increase/ (decrease) | | | % change | |

| | | US$ 000's | | | | |

Country | | | | | | | | | | | | | |

| Romania | | $ | 33,544 | | $ | 22,711 | | $ | 10,833 | | | 48 | % |

| Slovenia | | | 24,548 | | | 22,742 | | | 1,806 | | | 8 | % |

| Ukraine | | | 19,242 | | | 15,828 | | | 3,414 | | | 22 | % |

| | |

| |

| |

| |

| |

| Total Consolidated Net Revenues | | $ | 77,334 | | $ | 61,281 | | $ | 16,053 | | | 26 | % |

| | |

| |

| |

| |

| |

Our consolidated net revenues increased by US$ 16,053,000, or 26%, to US$ 77,334,000 for the nine months ended September 30, 2003 from US$ 61,281,000 for the nine months ended September 30, 2002 primarily due to a:

| · | 48% increase in the revenues of our Romanian operations. This increase is as a result of a higher advertising ratecard and general growth in the Romanian TV advertising market together with the reorganization of Romanian sales arrangements to sell directly advertising previously bartered to related parties; |

| | |

| · | 8% increase in the revenues of our Slovenian operations. Our Slovenian revenues are denominated in Euros. The increase in net revenue was affected by the US dollar depreciating by 14% against the Slovenian tolar (SIT) and the Euro appreciating against the Slovenian tolar by 4% compared to the first nine months of 2002. In local currency terms, net revenues decreased by 13% due to incremental revenue derived from the FIFA World Cup in June 2002 which did not re-occur in June 2003; and |

| | |

| · | 22% increase in the revenues of our Ukrainian operations (which includes IMS and Innova but excludes Studio 1+1) as a result of significantly increased sales from a subsidiary to an associate within the Studio 1+1 Group. |

Station Expenses

| | | | 2003 | | | 2002 | | | US$ (increase)/ decrease | | | % change | |

| | | US$ 000's | | | |

Country | | | | | | | | | | | | | |

| Romania | | $ | 24,756 | | $ | 18,731 | | $ | (6,025 | ) | | (32) | % |

| Slovenia | | | 16,271 | | | 15,243 | | | (1,028 | ) | | (7) | % |

| Ukraine | | | 15,255 | | | 9,656 | | | (5,599 | ) | | (58) | % |

| | |

| |

| |

| |

| |

| Total Consolidated Station Expenses | | $ | 56,282 | | $ | 43,630 | | $ | (12,652 | ) | | (29) | % |

| | |

| |

| |

| |

| |