UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | | | |

| | | For the quarterly period ended June 30, 2005 | |

| | | | |

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission File Number 0-24796

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

(Exact name of registrant as specified in its charter)

BERMUDA | 98-0438382 |

| (State or other jurisdiction of incorporation and organization) | (IRS Employer Identification No.) |

Clarendon House, Church Street, Hamilton | HM CX Bermuda |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (441)-296-1431

Indicate by check mark whether registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for each shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant is an accelerated filer (as defined by Rule 12b-2 of the Exchange Act)

Yes x No ¨

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| | Class | | Outstanding as of August 1, 2005 | |

| | Class A Common Stock, par value $0.08 | | 30,516,734 | |

| | Class B Common Stock, par value $0.08 | | 7,334,768 | |

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

FORM 10-Q

For the quarterly period ended June 30, 2005

INDEX

| | | | Page |

Part I. Financial information | |

| | Item 1. Financial Statements | |

| | | | 3 |

| | | | 5 |

| | | | 7 |

| | | | 8 |

| | | | 9 |

| | | 36 |

| | | 62 |

| | | 63 |

Part II. Other Information | |

| | | 64 |

| | | 67 |

| | Item 5. Other Information | 68 |

| | | 68 |

| 68 |

| 69 |

Part I. Financial Information

Item 1. Financial Statements

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

CONSOLIDATED BALANCE SHEETS

(US$000s, except share and per share data)

(Unaudited)

| | | June 30, 2005 | | December 31, 2004 | |

ASSETS | | | | | |

| | | | | | |

Current Assets | | | | | |

| | | | | | |

| Cash and cash equivalents | | $ | 113,797 | | $ | 152,568 | |

| | | | | | | | |

| Restricted cash (Note 4) | | | 33,177 | | | 15,574 | |

| | | | | | | | |

| Accounts receivable (net of allowances of $8,426, $6,140, respectively) | | | 104,073 | | | 45,170 | |

| | | | | | | | |

| Other receivable (Note 5) | | | - | | | 18,368 | |

| | | | | | | | |

| Program rights | | | 34,713 | | | 22,055 | |

| | | | | | | | |

| Loans to related parties | | | 300 | | | 300 | |

| | | | | | | | |

| Other short-term assets (Note 8) | | | 38,972 | | | 11,014 | |

| | | | | | | | |

Total Current Assets | | | 325,032 | | | 265,049 | |

| | | | | | | | |

Non-Current Assets | | | | | | | |

| | | | | | | | |

| Loans to related parties | | | 2,795 | | | 2,525 | |

| | | | | | | | |

| Investments in associated companies | | | 29,304 | | | 28,558 | |

| | | | | | | | |

| Acquisition costs (Note 18) | | | - | | | 10,770 | |

| | | | | | | | |

| Property, plant and equipment (net of depreciation of $104,494, $63,882, respectively) | | | 47,684 | | | 31,548 | |

| | | | | | | | |

| Program rights | | | 31,115 | | | 18,299 | |

| | | | | | | | |

| Goodwill (Note 7) | | | 774,504 | | | 59,092 | |

| | | | | | | | |

| Other intangibles (Note 7) | | | 162,838 | | | 27,331 | |

| | | | | | | | |

| Other assets (Note 8) | | | 16,417 | | | 1,467 | |

| | | | | | | | |

Total Non-Current Assets | | | 1,064,657 | | | 179,590 | |

| | | | | | | | |

Total Assets | | $ | 1,389,689 | | $ | 444,639 | |

The accompanying notes are an integral part of these consolidated financial statements.

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

CONSOLIDATED BALANCE SHEETS (continued)

(US$000s, except share and per share data)

(Unaudited)

| | | June 30, 2005 | | December 31, 2004 | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | |

| | | | | | | | |

Current Liabilities: | | | | | | | |

| | | | | | | | |

| Accounts payable and accrued liabilities (Note 9) | | $ | 107,171 | | $ | 67,042 | |

| | | | | | | | |

| Duties and other taxes payable | | | 26,267 | | | 20,243 | |

| | | | | | | | |

| Income taxes payable | | | 9,144 | | | 4,658 | |

| | | | | | | | |

| Credit facilities and obligations under capital leases | | | 24,880 | | | 10,472 | |

| | | | | | | | |

| Settlement liability (Note 10) | | | 1,047 | | | - | |

| | | | | | | | |

| Deferred consideration - Croatia (Note 5) | | | 3,686 | | | 6,384 | |

| | | | | | | | |

| Deferred consideration - Czech Republic (Note 5) | | | 24,159 | | | - | |

| | | | | | | | |

| Deferred tax | | | 1,346 | | | 946 | |

| | | | | | | | |

Total Current Liabilities | | | 197,700 | | | 109,745 | |

| | | | | | | | |

Non-Current Liabilities | | | | | | | |

| | | | | | | | |

| Accounts payable and accrued liabilities | | | 520 | | | 734 | |

| | | | | | | | |

| Credit facilities and obligations under capital leases | | | 5,049 | | | 8,898 | |

| | | | | | | | |

| Settlement liability (Note 10) | | | 48,971 | | | - | |

| | | | | | | | |

| Euro 245.0 million 8.25% Senior Notes due 2012 (Note 11) | | | 296,596 | | | - | |

| | | | | | | | |

| Euro 125.0 million floating rate Senior Notes due 2012 (Note 11) | | | 151,324 | | | - | |

| | | | | | | | |

| Income taxes payable | | | 3,251 | | | 3,120 | |

| | | | | | | | |

| Provision for losses in investments in associated companies | | | 26 | | | - | |

| | | | | | | | |

| Deferred tax | | | 36,670 | | | 6,213 | |

| | | | | | | | |

Total Non-Current Liabilities | | | 542,407 | | | 18,965 | |

| | | | | | | | |

| Minority interests in consolidated subsidiaries | | | 9,902 | | | 4,861 | |

| | | | | | | | |

SHAREHOLDERS' EQUITY: | | | | | | | |

| | | | | | | | |

| Class A Common Stock, $0.08 par value: | | | | | | | |

| | | | | | | | |

| Authorized: 100,000,000 shares at June 30, 2005 and December 31, 2004; issued and outstanding: 30,506,734 at June 30, 2005 and 21,049,400 at December 31, 2004 | | | 2,441 | | | 1,684 | |

| | | | | | | | |

| Class B Common Stock, $0.08 par value: | | | | | | | |

| | | | | | | | |

| Authorized: 15,000,000 shares at June 30, 2005 and December 31, 2004; issued and outstanding: 7,334,768 at June 30, 2005 and December 31, 2004 | | | 587 | | | 587 | |

| | | | | | | | |

| Preferred Stock, $0.08 par value: | | | | | | | |

| | | | | | | | |

| Authorized 5,000,000 shares at June 30, 2005 and December 31, 2004; issued and outstanding: none at June 30, 2005 and December 31, 2004 | | | | | | | |

| | | | | | | | |

| Additional paid-in capital | | | 742,668 | | | 387,305 | |

| | | | | | | | |

| Retained earnings/(accumulated deficit) | | | (69,958 | ) | | (87,468 | ) |

| | | | | | | | |

| Accumulated other comprehensive (loss)/income | | | (36,058 | ) | | 8,960 | |

| | | | | | | | |

Total shareholders' equity | | | 639,680 | | | 311,068 | |

| | | | | | | | |

Total liabilities and shareholders' equity | | $ | 1,389,689 | | $ | 444,639 | |

The accompanying notes are an integral part of these consolidated financial statements.

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD. CONSOLIDATED STATEMENTS OF OPERATIONS

(US$000s, except share and per share data)

(Unaudited)

| | | For the Three Months Ended June 30, | | For the Six Months Ended June 30, | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

| | | | | | | | | | |

Net revenues | | $ | 113,109 | | $ | 44,886 | | $ | 161,413 | | $ | 80,734 | |

| | | | | | | | | | | | | | |

| Operating costs | | | 18,117 | | | 7,338 | | | 29,402 | | | 13,409 | |

| | | | | | | | | | | | | | |

| Cost of programming | | | 32,081 | | | 15,950 | | | 54,403 | | | 29,563 | |

| | | | | | | | | | | | | | |

| Depreciation of station fixed assets and other intangibles | | | 4,623 | | | 1,336 | | | 6,836 | | | 2,798 | |

| | | | | | | | | | | | | | |

Total station operating costs and expenses | | | 54,821 | | | 24,624 | | | 90,641 | | | 45,770 | |

| | | | | | | | | | | | | | |

| Station selling, general and administrative expenses | | | 12,562 | | | 4,322 | | | 19,490 | | | 7,884 | |

| | | | | | | | | | | | | | |

| Corporate operating costs (including non-cash stock based compensation (see Note 15) of $ (1.4) million and $ 2.4 million for the three months ended June 30, 2005 and 2004, respectively and $ 1.7 million and $ 4.3 million for the six months ended June 30, 2005 and 2004, respectively) | | | 3,451 | | | 7,107 | | | 11,182 | | | 12,225 | |

| | | | | | | | | | | | | | |

| Amortization of intangibles | | | 82 | | | 62 | | | 159 | | | 62 | |

| | | | | | | | | | | | | | |

| Impairment charge (Note 6) | | | 35,331 | | | - | | | 35,331 | | | - | |

| | | | | | | | | | | | | | |

Operating income | | | 6,862 | | | 8,771 | | | 4,610 | | | 14,793 | |

| | | | | | | | | | | | | | |

| Interest income | | | 559 | | | 786 | | | 1,638 | | | 2,240 | |

| | | | | | | | | | | | | | |

| Interest expense | | | (6,424 | ) | | (667 | ) | | (6,731 | ) | | (885 | ) |

| | | | | | | | | | | | | | |

| Foreign currency exchange gain/(loss), net | | | 30,159 | | | (1,289 | ) | | 29,430 | | | (1,922 | ) |

| | | | | | | | | | | | | | |

| Other income/(expense) | | | 312 | | | (10 | ) | | (3,689 | ) | | (781 | ) |

| | | | | | | | | | | | | | |

Income before provision for income taxes, minority interest, equity in income of unconsolidated affiliates and discontinued operations | | | 31,468 | | | 7,591 | | | 25,258 | | | 13,445 | |

| | | | | | | | | | | | | | |

| Provision for income taxes | | | (3,565 | ) | | (5,769 | ) | | (5,906 | ) | | (6,939 | ) |

| | | | | | | | | | | | | | |

Income before minority interest, equity in income of unconsolidated affiliates and discontinued operations | | | 27,903 | | | 1,822 | | | 19,352 | | | 6,506 | |

| | | | | | | | | | | | | | |

| Minority interest in income of consolidated subsidiaries | | | (4,104 | ) | | (379 | ) | | (4,681 | ) | | (457 | ) |

| | | | | | | | | | | | | | |

| Equity in income of unconsolidated affiliates | | | 4,049 | | | 4,304 | | | 4,883 | | | 5,199 | |

| | | | | | | | | | | | | | |

Net income from continuing operations | | | 27,848 | | | 5,747 | | | 19,554 | | | 11,248 | |

| | | | | | | | | | | | | | |

| Discontinued operations - Czech Republic: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Pre-tax income from discontinued operations | | | 46 | | | 285 | | | 164 | | | - | |

| | | | | | | | | | | | | | |

| Tax on disposal of discontinued operations | | | (2,435 | ) | | - | | | (2,208 | ) | | (45 | ) |

| | | | | | | | | | | | | | |

Net income/(loss) from discontinued operations | | | (2,389 | ) | | 285 | | | (2,044 | ) | | (45 | ) |

| | | | | | | | | | | | | | |

Net income | | $ | 25,459 | | $ | 6,032 | | $ | 17,510 | | $ | 11,203 | |

The accompanying notes are an integral part of these consolidated financial statements.

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

CONSOLIDATED STATEMENTS OF OPERATIONS (continued)

(US$ 000's, except share and per share data)

(Unaudited)

| | | For the Three Months Ended June 30, | | For the Six Months Ended June 30, | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

| | | | | | | | | | |

| PER SHARE DATA: | | | | | | | | | |

| | | | | | | | | | |

| Net income per share (Note 14) | | | | | | | | | |

| | | | | | | | | | |

| Continuing operations - Basic (1) | | $ | 0.81 | | $ | 0.21 | | $ | 0.62 | | $ | 0.41 | |

| | | | | | | | | | | | | | |

| Continuing operations - Diluted (1) | | $ | 0.79 | | $ | 0.20 | | $ | 0.61 | | $ | 0.39 | |

| | | | | | | | | | | | | | |

| Discontinued operations - Basic | | $ | (0.07 | ) | $ | 0.01 | | $ | (0.06 | ) | $ | - | |

| | | | | | | | | | | | | | |

| Discontinued operations - Diluted | | $ | (0.07 | ) | $ | 0.01 | | $ | (0.07 | ) | $ | - | |

| | | | | | | | | | | | | | |

| Net income - Basic (1) | | $ | 0.74 | | $ | 0.22 | | $ | 0.56 | | $ | 0.41 | |

| | | | | | | | | | | | | | |

| Net income - Diluted (1) | | $ | 0.72 | | $ | 0.21 | | $ | 0.54 | | $ | 0.39 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Weighted average common shares used in computing per share amounts (000s): | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Continuing operations - Basic (as restated) (1) | | | 34,274 | | | 27,854 | | | 31,345 | | | 27,471 | |

| | | | | | | | | | | | | | |

| Continuing operations - Diluted (as restated) (1) | | | 35,145 | | | 29,033 | | | 32,288 | | | 28,956 | |

| | | | | | | | | | | | | | |

| Discontinued operations - Basic (as restated) (1) | | | 34,274 | | | 27,854 | | | 31,345 | | | 27,471 | |

| | | | | | | | | | | | | | |

| Discontinued operations - Diluted (as restated) (1) | | | 35,145 | | | 29,033 | | | 32,288 | | | 28,956 | |

| | | | | | | | | | | | | | |

| Net income - Basic (as restated) (1) | | | 34,274 | | | 27,854 | | | 31,345 | | | 27,471 | |

| | | | | | | | | | | | | | |

| Net income - Diluted (as restated) (1) | | | 35,145 | | | 29,033 | | | 32,288 | | | 28,956 | |

| | | | | | | | | | | | | | |

| (1) See Note 14, “Earnings Per Share”. | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

CONSOLIDATED STATEMENT OF SHAREHOLDERS' EQUITY

(US$ 000’s)

(Unaudited)

| | | Comprehensive Income/(loss) | | Class A Common Stock | | Class B Common Stock | | Additional Paid-In Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Income/(Loss) | | Total Shareholders' Equity | |

BALANCE, December 31, 2004 | | | | | $ | 1,684 | | $ | 587 | | $ | 387,305 | | $ | (87,468 | ) | $ | 8,960 | | $ | 311,068 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | | | | | | | | 1,682 | | | | | | | | | 1,682 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| New stock issued | | | | | | 713 | | | | | | 351,334 | | | | | | | | | 352,047 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Stock options exercised | | | | | | 44 | | | | | | 2,347 | | | | | | | | | 2,391 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Comprehensive income/(loss): | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 17,510 | | | | | | | | | | | | 17,510 | | | | | | 17,510 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income/(loss): | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative translation adjustments | | | (45,018 | ) | | | | | | | | | | | | | | (45,018 | ) | | (45,018 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Comprehensive loss | | $ | (27,508 | ) | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

BALANCE, June 30, 2005 | | | | | $ | 2,441 | | $ | 587 | | $ | 742,668 | | $ | (69,958 | ) | $ | (36,058 | ) | $ | 639,680 | |

The accompanying notes are an integral part of these consolidated financial statements.

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD. CONSOLIDATED STATEMENTS OF CASH FLOWS

(US$ 000’s) - (Unaudited)

| | | For the Six Months Ended June 30, | |

| | | 2005 | | 2004 | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | |

Net income | | $ | 17,510 | | $ | 11,203 | |

| Adjustments to reconcile net income/(loss) to net cash used in operating activities: | | | | | | | |

| (Income)/loss from discontinued operations | | | 2,044 | | | 45 | |

| Equity in income, net of dividends received | | | (720 | ) | | (5,199 | ) |

| Depreciation and amortization | | | 38,363 | | | 20,431 | |

| Impairment charge | | | 35,331 | | | - | |

| Interest accrued on loans | | | (84 | ) | | (828 | ) |

| Loss on disposal of fixed assets | | | 389 | | | | |

| Stock based compensation | | | 1,682 | | | 4,254 | |

| Minority interest in income of consolidated subsidiaries | | | 4,681 | | | 457 | |

| Foreign currency exchange (gain)/loss, net | | | (29,430 | ) | | 1,922 | |

| Net change in (net of effects of acquisitions and disposals of businesses): | | | | | | | |

| Accounts receivable | | | (6,424 | ) | | (2,744 | ) |

| Program rights costs | | | (37,056 | ) | | (21,009 | ) |

| Other assets | | | (4,082 | ) | | (3,256 | ) |

| Accounts payable and accrued liabilities | | | (2,679 | ) | | (5,633 | ) |

| Change in fair value of derivatives | | | (643 | ) | | - | |

| Short term payables to bank | | | - | | | 1,016 | |

| Income and other taxes payable | | | 4,521 | | | - | |

Net cash generated from continuing operating activities | | | 23,403 | | | 659 | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | |

| Restricted cash | | | (18,677 | ) | | (24 | ) |

| Acquisition of fixed assets | | | (8,539 | ) | | (3,438 | ) |

| Proceeds from disposal of fixed assets | | | 124 | | | - | |

| Investments in subsidiaries and affiliates (1) | | | (12,884 | ) | | (17,084 | ) |

| Acquisition of TV Nova (Czech Republic) Group | | | (218,381 | ) | | - | |

| Loans and advances to related parties | | | - | | | 400 | |

| License costs, other assets and intangibles | | | - | | | 904 | |

Net cash used in investing activities | | | (258,357 | ) | | (19,242 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | |

| Cash facilities and payments under capital leases | | | (9,942 | ) | | (622 | ) |

| Net proceeds from issuance of Senior Notes | | | 476,188 | | | - | |

Repayment of notes for acquisition of TV Nova (Czech Republic) Group | | | (491,703 | ) | | - | |

| Issuance of stock | | | 233,547 | | | 3,583 | |

| Dividends paid to minority shareholders | | | (77 | ) | | - | |

Net cash received from/(used in) financing activities | | | 208,013 | | | 2,961 | |

NET CASH USED IN DISCONTINUED OPERATIONS (OPERATING) | | | (2,000 | ) | | (9,274 | ) |

IMPACT OF EXCHANGE RATE FLUCTUATIONS ON CASH | | | (9,830 | ) | | (2,043 | ) |

| Net decrease in cash and cash equivalents | | | (38,771 | ) | | (26,939 | ) |

CASH AND CASH EQUIVALENTS, beginning of period | | | 152,568 | | | 192,246 | |

CASH AND CASH EQUIVALENTS, end of period | | $ | 113,797 | | $ | 165,307 | |

| SUPPLEMENTAL CASH FLOW INFORMATION: | | | | | | | |

| Cash paid for interest | | $ | 278 | | $ | 144 | |

| Cash paid for income taxes (net of refunds) | | $ | 11,965 | | $ | 14,089 | |

| Exchange of 3.5 million Class A Common Stock (Note 5) | | $ | 120,883 | | $ | - | |

| Notes taken out for acquisition of TV Nova (Czech Republic) Group (Note 5) | | $ | 491,703 | | $ | - | |

| Exchange of Other Receivable (Note 5) | | $ | 18,541 | | $ | - | |

| Purchase of Krsak interest financed with payable | | $ | 24,683 | | $ | - | |

(1) For the six months ended June 30, 2004, Investments in subsidiaries and affiliates excluded non-cash investing activities of US$ 3.4 million relating to our increased investment in our Romanian operations. For further information, see Note 5, "Acquisitions and Disposals".

The accompanying notes are an integral part of these consolidated financial statements.

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

Notes to the Consolidated Financial Statements

June 30, 2005

Central European Media Enterprises Ltd. is a Bermuda company that, together with its subsidiaries and affiliates, invests in, develops and operates national commercial television channels and stations in Central and Eastern Europe. As at June 30, 2005, we have operations in Croatia, the Czech Republic, Romania, the Slovak Republic, Slovenia and Ukraine.

The interim statements for the six months ended June 30, 2005 should be read in conjunction with the Notes to the Consolidated Financial Statements contained in our December 31, 2004 Form 10-K filed with the Securities and Exchange Commission ("SEC") on March 15, 2005 as amended by our Form 10-K/A filed with the SEC on April 1, 2005. In the opinion of management, the interim unaudited financial statements included herein reflect all adjustments necessary, consisting of normal recurring adjustments, for a presentation in conformity with United States Generally Accepted Accounting Principles ("US GAAP"). The consolidated results of operations for interim periods are not necessarily indicative of the results to be expected for a full year.

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting year. Actual results could differ from those estimates. There have been no significant changes in our critical accounting policies since our disclosure in Part II, Item 8, “Financial Statements and Supplementary Data” of our December 31, 2004 Form 10-K filed with the SEC on March 15, 2005, as amended by our Form 10-K/A filed on April 1, 2005, other than the addition of a new critical accounting policy on reporting exchange differences on inter-company foreign currency transactions that have characteristics of a loan with a long term nature (for further information, see Part I, Item 16, VI. “Critical Accounting Policies and Estimates”).

The consolidated financial statements include the accounts of Central European Media Enterprises Ltd. and investments in entities over which we have control. We consolidate the financial statements of entities in which we hold more than a majority voting interest and also those entities which are deemed to be a Variable Interest Entity of which we are the primary beneficiary as defined by FASB Interpretation No. 46 (revised December 2003), “Consolidation of Variable Interest Entities” ("FIN 46 (R)"). Entities in which we hold less than a majority voting interest but over which we have the ability to exercise significant influence are accounted for using the equity method. Other investments are accounted for using the cost method.

We, like other television operators, experience seasonality, with advertising sales tending to be lower during the first and third quarters of each calendar year, particularly during the summer holiday period (typically July and August), and higher during the second and fourth quarters of each calendar year, particularly toward the end of the year.

Stock-based Compensation

Stock-based compensation costs are determined when options are issued and are measured under the fair value method as defined in SFAS 123, "Accounting for Stock-based Compensation" ("SFAS 123"). We adopted SFAS 123 prospectively for employee stock option awards granted, modified, or settled beginning January 1, 2003, as contemplated by SFAS 148, "Accounting for Stock-based Compensation - Transition & Disclosure" ("SFAS 148"). In prior periods, we used the intrinsic method of accounting as defined in APB 25, "Accounting for Stock Issued to Employees" ("APB 25").

Pro Forma Disclosures

Had compensation costs for employee stock option awards granted, modified or settled prior to January 1, 2003 been determined consistent with the fair value approach required by SFAS 123 for all periods presented, using the Black-Scholes option pricing model with the assumptions as estimated on the date of each grant, our net income and net income per common share would decrease to the following pro forma amounts:

| | | | | For the Three Months Ended June 30, | | For the Six Months Ended June 30, | |

| | | | | (US$ 000’s, except per share data) | |

| | | | | 2005 | | 2004 | | 2005 | | 2004 | |

| | | | | | | | | | | | |

| Net Income | | | As Reported | | $ | 25,459 | | $ | 6,032 | | $ | 17,510 | | $ | 11,203 | |

| Add/(deduct): Stock-based compensation expense/(income) included in reported net income, net of related tax effects | | | As Reported | | | (1,419 | ) | | 2,369 | | | 1,682 | | | 4,254 | |

| Add/(deduct): Total stock-based compensation expense determined under fair value based method for all awards, net of related tax effects | | | Pro Forma Expense | | | 1,384 | | | (2,422 | ) | | (1,727 | ) | | (4,361 | ) |

| Net Income | | | Pro Forma | | $ | 25,424 | | $ | 5,979 | | $ | 17,465 | | $ | 11,096 | |

| | | | | | | | | | | | | | | | | |

| Net Income Per Common Share - Basic: | | | As Reported | | $ | 0.74 | | $ | 0.22 | | $ | 0.56 | | $ | 0.41 (1 | ) |

| | | | Pro Forma | | $ | 0.74 | | $ | 0.21 | | $ | 0.56 | | $ | 0.40 | |

| | | | | | | | | | | | | | | | | |

| Net Income Per Common Share -Diluted: | | | As Reported | | $ | 0.72 | | $ | 0.21 (1 | ) | $ | 0.54 | | $ | 0.39 (1 | ) |

| | | | Pro Forma | | $ | 0.72 | | $ | 0.21 (1 | ) | $ | 0.54 | | $ | 0.38 (1 | ) |

(1) As restated, for further information, see Note 14, “Earnings Per Share”.

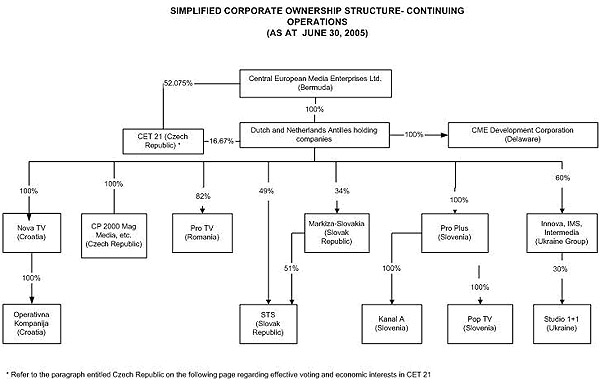

Central European Media Enterprises Ltd. was incorporated on June 15, 1994 under the laws of Bermuda. Our assets are held through a series of Dutch and Netherlands Antilles holding companies. In each market in which we operate, we have ownership interests both in license companies and in operating companies. License companies have been authorized by the relevant local regulatory authority to engage in television broadcasting in accordance with the terms of a particular license. We generate revenues primarily through our operating companies which acquire programming for broadcast by the corresponding license holding company and enter into agreements with advertisers and advertising agencies on behalf of the respective license company. In the Czech Republic, Romania and Ukraine, the license company also acts as an operating company. Our share of profits in the operating companies corresponds with our voting interest other than in the Slovak Republic and Ukraine, where we are entitled by contract to a share of profits that is in excess of our voting interest. Below is an overview of our operating structure, the accounting treatment for each entity and a chart entitled “Simplified Corporate Ownership Structure - Continuing Operations”.

Key Subsidiaries and Affiliates as at June 30, 2005 | | Voting Interest | | Share of Profits | | Accounting Treatment | | TV Channels | |

Continuing Operations | | | | | | | | | |

| | | | | | | | | | |

Croatia | | | | | | | | | |

Operating Company: | | | | | | | | | |

| Operativna Kompanija d.o.o. (OK) | | | 100 | % | | 100 | % | | Consolidated | | | | |

| | | | | | | | | | Subsidiary | | | | |

License Company: | | | | | | | | | | | | | |

| Nova TV d.d. (Nova TV Croatia) | | | 100 | % | | 100 | % | | Consolidated | | | NOVA TV (Croatia) | |

| | | | | | | | | | Subsidiary | | | | |

| | | | | | | | | | | | | | |

Czech Republic | | | | | | | | | | | | | |

Operating Companies: | | | | | | | | | | | | | |

| Ceska Produkcni 2000 a.s. (CP 2000) | | | 100 | % | | 100 | % | | Consolidated | | | | |

| | | | | | | | | | Subsidiary | | | | |

| MAG MEDIA 99 a.s. (Mag Media) | | | 100 | % | | 100 | % | | Consolidated | | | | |

| | | | | | | | | | Subsidiary | | | | |

License Company: | | | | | | | | | | | | | |

| CET 21 s.r.o. (CET 21) | | | 96.5 | % | | 96.5 | % | | Consolidated | | | TV NOVA | |

| | | | | | | | | | Subsidiary | | | (Czech Republic) | |

| | | | | | | | | | | | | | |

Romania | | | | | | | | | | | | | |

Operating Companies: | | | | | | | | | | | | | |

| Media Pro International | | | 82 | % | | 82 | % | | Consolidated | | | | |

| S.A. (MPI) | | | | | | | | | Subsidiary | | | | |

| | | | | | | | | | | | | | |

| Media Vision S.R.L. (Media Vision) | | | 70 | % | | 70 | % | | Consolidated | | | | |

| | | | | | | | | | Subsidiary | | | | |

License Companies: | | | | | | | | | | | | | |

| Pro TV S.A. - formerly Pro TV S.R.L. (Pro TV) | | | 82 | % | | 82 | % | | Consolidated | | | PRO TV, ACASA, | |

| | | | | | | | | | Subsidiary | | | PRO CINEMA and | |

| | | | | | | | | | | | | PRO TV | |

| | | | | | | | | | | | | INTERNATIONAL | |

| | | | | | | | | | | | | | |

| Radio Pro S.R.L. - Formerly Media Pro S.R.L | | | 20 | % | | 20 | % | | Equity Accounted | | | PRO FM (radio), | |

| (Radio Pro) | | | | | | | | | Affiliate | | | INFOPRO | |

| | | | | | | | | | | | | | |

Slovenia | | | | | | | | | | | | | |

Operating Company: | | | | | | | | | | | | | |

| Produkcija Plus d.o.o. (Pro Plus) | | | 100 | % | | 100 | % | | Consolidated | | | | |

| | | | | | | | | | Subsidiary | | | | |

License Companies: | | | | | | | | | | | | | |

| Pop TV d.o.o. (Pop TV) | | | 100 | % | | 100 | % | | Consolidated | | | POP TV | |

| | | | | | | | | | Subsidiary | | | | |

| | | | | | | | | | | | | | |

| Kanal A d.o.o. (Kanal A) | | | 100 | % | | 100 | % | | Consolidated | | | KANAL A | |

| | | | | | | | | | Subsidiary | | | | |

Key Subsidiaries and Affiliates as at June 30, 2005 | | Voting Interest | | Share of Profits | | Accounting Treatment | | TV Channels | |

Continuing Operations | | | | | | | | | |

| | | | | | | | | | |

Slovak Republic | | | | | | | | | |

Operating Company: | | | | | | | | | |

| Slovenska Televizna Spolocnost s.r.o. (STS) | | | 49 | % | | 70 | % | | Equity Accounted | | | | |

| | | | | | | | | | Affiliate | | | | |

License Company: | | | | | | | | | | | | | |

| Markiza-Slovakia s.r.o. (Markiza) | | | 34 | % | | 0.1 | % | | Equity Accounted | | | MARKIZA TV | |

| | | | | | | | | | Affiliate | | | | |

| | | | | | | | | | | | | | |

Ukraine | | | | | | | | | | | | | |

Operating Companies: | | | | | | | | | | | | | |

| Innova Film GmbH (Innova) | | | 60 | % | | 60 | % | | Consolidated | | | | |

| | | | | | | | | | Subsidiary | | | | |

| International Media Services Ltd. (IMS) | | | 60 | % | | 60 | % | | Consolidated | | | | |

| | | | | | | | | | Subsidiary | | | | |

| Enterprise "Inter-Media" (Inter-Media) | | | 60 | % | | 60 | % | | Consolidated | | | | |

| | | | | | | | | | Subsidiary | | | | |

License Company: | | | | | | | | | | | | | |

| Broadcasting Company "Studio 1+1" (Studio 1+1) | | | 18 | % | | 60 | % | | Consolidated | | | STUDIO 1+1 | |

| | | | | | | | | | Variable Interest | | | | |

| | | | | | | | | | Entity | | | | |

Croatia

We own 100% of Nova TV (Croatia), which holds a national terrestrial broadcast license for Croatia. Nova TV (Croatia) owns 100% of OK, which provides programming and advertising services for the NOVA TV (Croatia) channel.

Czech Republic

We own 68.745% of CET 21, which holds the national terrestrial broadcast license for TV NOVA (Czech Republic). Our voting and economic interest in CET 21 is effectively 96.50% because CET 21 itself holds an undistributed 28.755% interest that is not entitled to voting rights or dividends. We own 100% of CP 2000 and CP 2000 owns 100% of Mag Media. CP 2000 and its subsidiaries provide services related to programming, production and advertising to CET 21.

Romania

We have a voting and economic interest of 82% in Pro TV and MPI. Our voting and economic interest in both companies increased from 66% to 80% on March 29, 2004 when we acquired an additional 14% of MPI and Pro TV from our partner and General Director Adrian Sarbu. We acquired an additional 2% of MPI and Pro TV from Mr. Sarbu on February 28, 2005. Pro TV holds all 27 PRO TV licenses, including a recently awarded license for Constanta, Romania’s third biggest population center and main port. In addition, Pro TV holds the licenses for ACASA, PRO TV INTERNATIONAL and PRO CINEMA.

We have a 70% voting and economic interest in Media Vision, a production and subtitling company.

We have a 20% voting and economic interest in Radio Pro, which holds the licenses for the PRO FM and INFOPRO radio networks.

On July 29, 2005, we acquired from Mr. Sarbu an additional 3% voting and economic interest in MPI and Pro TV (for further information, see Note 19, “Subsequent Events”).

Slovenia

Following the exercise by Marijan Jurenec of his put option and sale of his 3.15% interest in Pro Plus to us on June 24, 2005, we own 100% of Pro Plus, the operating company for our Slovenian operations. Pro Plus has a 100% voting and economic interest in Pop TV , which holds the licenses for the POP TV network, and Kanal A, which holds the licenses for the KANAL A network.

Slovak Republic

We have a 49% voting interest and are entitled to a 70% share of profits in STS, the operating company for the MARKIZA TV network. We have a 34% voting interest in Markiza, the license holding company for the MARKIZA TV network, and are entitled to a 0.1% share of its profits.

Ukraine

The Studio 1+1 Group consists of several entities in which we hold direct or indirect interests. We hold a 60% ownership and economic interest in each of Innova and IMS. Innova owns 100% of Inter-Media, a Ukrainian company, which in turn holds a 30% voting and economic interest in Studio 1+1, which holds the license for the STUDIO 1+1 network.

Because of regulatory restrictions on direct foreign ownership of broadcasters, our indirect ownership interest in Studio 1+1 is 18%. We entered into an additional agreement on December 30, 2004 with Boris Fuchsmann, Alexander Rodnyansky and Studio 1+1 which re-affirms our entitlement to 60% of any distribution from Studio 1+1 to its shareholders until such time as Ukrainian legislation allows us to increase our direct interest in Studio 1+1 to 60%.

3. | Recent Accounting Pronouncements |

Stock Based Compensation

On December 16, 2004, the FASB issued SFAS 123 (revised 2004), "Share-Based Payment", which is a revision of SFAS 123, "Accounting for Stock-Based Compensation". SFAS 123(R) supersedes APB Opinion No. 25, "Accounting for Stock Issued to Employees", and amends SFAS 95, "Statement of Cash Flows". Generally, the approach in SFAS 123(R) is similar to the approach described in Statement 123. However, SFAS 123(R) requires all share-based payments to employees, including grants of employee stock options, to be recognized in the income statement based on their fair values. Pro forma disclosure is no longer an alternative. We will adopt SFAS 123(R) on January 1, 2006. We do not expect the adoption of SFAS 123(R) to have a material impact on our financial statements.

In connection with the acquisition of TV Nova (Czech Republic), we held CZK 600 million (approximately US$ 24.2 million) as at June 30, 2005 (December 31, 2004: nil) as restricted cash (for further information see Note 5, “Acquisitions and Disposals”).

In connection with the acquisition of Nova TV (Croatia), we held Euro 3.0 million (approximately US$ 3.7 million) as at June 30, 2005 (December 31, 2004: Euro 7.6 million, approximately US$ 10.3 million) as restricted cash (for further information see Note 5, “Acquisitions and Disposals”).

Additionally, we had US$ 5.2 million (December 31, 2004: US$ 5.1 million) classified as restricted cash in relation to our self insurance program for directors' and officers' liability insurance at both June 30, 2005 and December 31, 2004.

5. | Acquisitions and Disposals |

Czech Republic

Acquisition - TV Nova

On May 2, 2005, we acquired an 85% interest in the TV Nova (Czech Republic) Group from PPF (Cyprus) Ltd. The TV Nova (Czech Republic) Group is a group of companies that own and operate the TV NOVA channel in the Czech Republic, including Ceska Produkcni 2000 (''CP 2000''), Mag Media and CET 21. Consideration for this acquisition was approximately US$ 631 million, including the incurrence of $ 492 million of indebtedness to PPF (which was repaid in cash on May 5, 2005), 3,500,000 unregistered shares of our Class A common stock and forgiveness of a US$ 18.4 million receivable categorized as “Other Receivable” in our consolidated balance sheet as at December 31, 2004. The final purchase price is subject to adjustment based on a post-completion audit for changes in the level of working capital and indebtedness from the time we entered into a framework agreement with PPF on December 13, 2004 to the completion date.

On May 27, 2005, we acquired from Peter Krsak his 16.67% interest in CET 21, which holds the national terrestrial broadcast license for TV NOVA in the Czech Republic. Consideration for this transaction is CZK 1.2 billion (approximately US$ 49 million). The purchase price is payable in two installments; one half of the consideration was paid on May 27, 2005. The second installment of CZK 600 million (approximately US$ 24.2 million) will be paid on the earlier of July 15, 2006 or the date on which we are registered with the Czech commercial register as the owner of 52.075% of CET 21 and this installment is classified in our consolidated balance sheet as deferred consideration as at June 30, 2005.

Following the exercise of our call option, we acquired from PPF its remaining 15% interest in the TV Nova (Czech Republic) Group for consideration of approximately US$ 216.4 million on May 31, 2005.

As a result of these transactions, we have acquired a 100% interest in CP 2000, which provides services related to programming, production and advertising for TV NOVA (Czech Republic) and a 100% interest in Vilja a.s., which owns a 52.075% interest in CET 21. When aggregated with the purchase of the Krsak interest, we own 68.745% of CET 21. Our voting and economic interest in CET 21 is 96.50% because CET 21 itself holds an undistributed 28.755% interest that is not entitled to voting rights or dividends.

The remaining minority interests in CET 21 are currently held by Ceska Sporitelna a.s. (1.25%) and CEDC GmbH (1.25%). Subject to the consent of the Czech Media Council, the interests of Ceska Sporitelna and CEDC will also be transferred to the TV Nova (Czech Republic) Group for nominal consideration.

The following table summarizes the estimated fair values of the assets acquired and liabilities assumed at the date of acquisition. We are in the process of obtaining full third-party valuations of the fair values of the net assets acquired; thus, the allocation of the purchase price is subject to change.

| | | US$ 000’s | |

| | | | |

| Cash | | $ | 35,592 | |

| | | | | |

| Receivables | | | 56,832 | |

| | | | | |

| Property, plant and equipment | | | 12,977 | |

| | | | | |

| Program library | | | 23,141 | |

| | | | | |

| Intangible assets subject to amortization | | | 120,604 | |

| | | | | |

| Intangible assets not subject to amortization | | | 17,701 | |

| | | | | |

| Goodwill | | | 771,815 | |

| | | | | |

| Other assets | | | 25,933 | |

| | | | | |

| Liabilities | | | (120,817 | ) |

| | | | | |

| Deferred tax liability | | | (31,795 | ) |

| | | | | |

| Minority interest | | | (2,200 | ) |

| | | | | |

Total purchase price | | $ | 909,783 | |

Total purchase price includes US$ 12.9 million of capitalized acquisition costs.

The intangible assets subject to amortization are comprised of approximately US$ 5 million in customer relationships, which are being amortized over nine years, and approximately US$ 116 million relating to the acquired television broadcast license, which is being amortized over twelve years.

Intangible assets not subject to amortization relate to the ‘TV NOVA’ trade name.

Our consolidated statement of operations reflects the increased interest expense and amortization charges resulting from the acquisition of 85% of the TV Nova (Czech Republic) Group on May 2, 2005, the Krsak interest on May 27, 2005 and 15% of the TV Nova (Czech Republic) Group on May 31, 2005. On an unaudited pro-forma basis, assuming that these acquisitions had occurred at the beginning of each period presented, our consolidated statement of operations would have been as follows:

| | | For the Three Months Ended June 30, | | For the Six Months Ended June 30, | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

| | | | | | | | | | |

| Pro-forma | | (US$ 000's, except per share data) | |

| | | | |

| Net revenues | | $ | 139,552 | | $ | 103,582 | | $ | 243,537 | | $ | 184,971 | |

| | | | | | | | | | | | | | |

| Net income from continuing operations | | $ | 35,238 | | $ | 22,635 | | $ | 38,118 | | $ | 35,557 | |

| | | | | | | | | | | | | | |

| Net income | | $ | 32,849 | | $ | 22,920 | | $ | 36,074 | | $ | 35,512 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net income - Basic | | $ | 0.88 | | $ | 0.62 | | $ | 0.96 | | $ | 0.97 | |

| | | | | | | | | | | | | | |

| Net income - Diluted | | $ | 0.86 | | $ | 0.60 | | $ | 0.94 | | $ | 0.94 | |

The pro-forma net income for each period presented reflects all costs relating to the Senior Notes issued to finance the acquisition of the TV Nova (Czech Republic) Group and the Krsak interest and increased amortization charges relating to the intangibles acquired at their preliminary fair value. The earnings per share calculation reflects the increase in the number of shares issued relating to these acquisitions.

The primary reason for the purchase of the TV Nova (Czech Republic) Group and the main factor that contributed to a purchase price that results in a recognition of goodwill is the opportunity for us to secure a significant broadcasting asset at a favorable valuation. Adding the leading broadcaster of one of the larger Central and East European markets to our portfolio of stations and channels has doubled our size and substantially enhanced our cash-flows, confirming our position as the dominant broadcaster in the region. Ownership of a significant asset such as the TV Nova (Czech Republic) Group creates a solid base for further expansion when opportunities arise.

Romania

Acquisition - MPI and Pro TV

On March 29, 2004, we acquired a 14% voting and economic interest in each of our consolidated subsidiaries MPI and Pro TV from Rootland Trading Limited for purchase consideration of US$ 20.3 million. Rootland Trading Limited is controlled by Mr. Adrian Sarbu. This acquisition brought our total voting and economic interest in both companies to 80%.

The consideration for the acquisition consisted of US$ 16.9 million cash and the settlement of loans receivable due from companies controlled by Mr. Sarbu that he had personally guaranteed (Inter-Media srl: US$ 1.8 million and Media Pro Pictures: US$ 1.6 million).

The purchase price was agreed by reference to an independent valuation report and was based on a multiple of MPI and Pro TV's future earnings. In accordance with the SFAS No. 141, "Business Combinations" ("FAS 141"), we have allocated US$ 3.7 million to broadcast licenses, US$ 5.5 million to trademarks and US$ 2.0 million to customer relationships, all of which were preliminarily allocated to goodwill. We have recognized a corresponding deferred tax liability on the tax basis difference arising from these assets. Both trademarks and broadcast licenses have been assigned an indefinite life, while customer relationships are deemed to have an economic useful life of, and are amortized on a straight-line basis over, eight years. An amount of US$ 8.8 million was recognized as goodwill.

On February 28, 2005, we acquired from Mr. Sarbu an additional 2% voting and economic interest in MPI and Pro TV for aggregate consideration of US$ 5 million. Following this transaction we own a voting and economic interest in MPI and Pro TV of 82%. The purchase price was agreed by reference to the valuation methodology in a 2003 independent valuation report and was based on a multiple of MPI and Pro TV’s earnings. In accordance with the FAS No. 141, we have allocated US$ 1.2 million to broadcast licenses, US$ 0.9 million to trademarks and US$ 0.2 million to customer relationships. We have recognized a corresponding deferred tax liability on the tax basis difference arising from these assets. Both trademarks and broadcast licenses have been assigned an indefinite life, while customer relationships are deemed to have a remaining economic useful life of, and are amortized on a straight-line basis over, seven years. An amount of US$ 2.9 million was recognized as goodwill.

On July 29, 2005, we acquired from Mr. Sarbu an additional 3% voting and economic interest in MPI and Pro TV for aggregate consideration of US$ 15 million. Following this transaction we own a voting and economic interest in MPI and Pro TV of 85%. The purchase price was determined by reference to an independent valuation report prepared in July 2005 and was based on a multiple of MPI and Pro TV's future earnings. We are initiating a fair value exercise to allocate the purchase price to the acquired assets and liabilities. Upon completion of the fair value exercise, the purchase price allocation will include the broadcast license intangible asset and other intangible assets to be identified (for further information see Part I, Note 19, “Subsequent Events”).

Croatia

Acquisition - Nova TV

We acquired 100% of Nova TV (Croatia) and OK in Croatia for Euro 20.3 million (approximately US$ 24.7 million at the time of acquisition) on July 16, 2004. The purchase price is payable in three installments. Euro 15.6 million (approximately US$ 19.0 million at the time of payment) was paid at closing on the basis of an estimated purchase price. Euro 1.7 million (approximately US$ 2.1 million at the time of payment) was paid on February 9, 2005 following the determination of the final purchase price. Approximately Euro 3.0 million (approximately US$ 3.7 million) of the total purchase price will be held in escrow and is classified at June 30, 2005 in our consolidated balance sheet as restricted cash until the date on which any claims by us in excess of such amount relating to breaches of representation and warranty or covenants provisions contained in the acquisition agreement are resolved or settled. As at August 1, 2005, the final Euro 3.0 million (approximately US$ 3.7 million) had not been paid.

In May 2005, we completed a fair value exercise and allocated the purchase price to the acquired assets and liabilities. This fair value exercise included identifying separately identifiable intangible assets. In accordance with FAS 141, we allocated US$ 18.7 million to broadcast licenses and US$ 7.4 million to trademarks, both of which were preliminarily allocated to goodwill net of taxes. We recognized a deferred tax liability arising from these assets. Both trademarks and broadcast licenses were assigned an indefinite life. After allocating the purchase price to all acquired assets, liabilities and intangible assets, US$ 10.4 million of goodwill remained.

Slovenia

Acquisition - Pro Plus

On June 24, 2005, we acquired from Marijan Jurenec an additional 3.15% interest in Pro Plus for Euro 4.7 million (approximately US$ 5.7 million). The purchase price was determined with reference to the put option agreement between Mr. Jurenec and us entered into in January 2003. Following this transaction we own a voting and economic interest in Pro Plus of 100%. In accordance with the FAS No. 141, we have allocated US$ 2.5 million to broadcast licenses and US$ 0.5 million to trademarks. We have recognized a corresponding deferred tax liability on the tax basis difference arising from these assets of US$ 0.7 million. Both trademarks and broadcast licenses have been assigned an indefinite life. An amount of US$ 2.3 million was recognized as goodwill.

In connection with our on-going review of our Croatian operations and following a strategic assessment of the performance of Nova TV (Croatia) undertaken during the quarter, we modified our strategy for Croatia in late June 2005. This new strategy requires higher current expenditures than had been planned prior to the strategic assessment in order to secure our audience and market share targets. As part of our second quarter close process we performed an analysis of our Croatian business to determine if it was impaired, given that the new strategy results in cash flows that differ significantly from those previously forecast. SFAS 142 “Goodwill and Other Intangible Assets” (“FAS 142”) requires that when such circumstances exist, the carrying value of the intangible assets with indefinite lives are compared to their fair value to determine whether an impairment exists. If an asset is determined to be impaired, the loss is measured as the excess of the carrying value over the fair value. As a result of our analysis, we have recognized an impairment charge of US$ 18.6 million relating to the broadcast license, US$ 7.0 million relating to trademarks and US$ 9.7 million relating to goodwill. Included in provision for income taxes is a US$ 5.1 million credit representing a release of deferred tax relating to the impairment charge on the license and trademark. A further impairment charge relating to other Long-Lived assets was not deemed necessary under the requirements of SFAS 144 “Accounting for the Impairment or Disposal of Long-Lived Assets” (“FAS 144”). For purposes of the impairment assessment, the fair value of the trademark was determined using the royalty relief method and the fair value of the broadcast license was determined using the build-out method. The royalty relief method measures the after-tax royalties saved by owning the intangible assets; the build-out method assumes that the business begins holding only the license and a plan must build up the assets and workforce needed to run the business.

7. | Goodwill and Intangible Assets |

The carrying amount of goodwill and other intangibles as at June 30, 2005 and December 31, 2004 is as follows:

Goodwill:

| | | Carrying | | Additions in | | Allocation | | Impairment | | Foreign | | Carrying | |

| | | amount as at | | the period | | | | | | Exchange | | amount as at | |

| | | December 31, | | | | | | | | movements | | June 30, 2005 | |

| | | 2004 | | | | | | | | | | | |

| | | (US$ 000’s) | |

| Slovenian operations | | $ | 14,724 | | | 2,300 | | | - | | | - | | | (1,626 | ) | $ | 15,398 | |

| | | | | | | | | | | | | | | | | | | | |

| Ukrainian operations | | $ | 4,096 | | | - | | | - | | | - | | | - | | $ | 4,096 | |

| | | | | | | | | | | | | | | | | | | | |

| Romanian operations | | $ | 8,826 | | | 2,919 | | | - | | | - | | | - | | $ | 11,745 | |

| | | | | | | | | | | | | | | | | | | | |

| Croatian operations | | $ | 31,446 | | | - | | | (18,817 | ) | | (9,706 | ) | | (2,193 | ) | $ | 730 | |

| | | | | | | | | | | | | | | | | | | | |

| Czech Republic operations | | $ | - | | | 771,815 | | | - | | | - | | | (29,280 | ) | $ | 742,535 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 59,092 | | $ | 777,034 | | | (18,817 | ) | | (9,706 | ) | | (33,099 | ) | $ | 774,504 | |

Other intangibles:

| | | Carrying | | Additions / | | Impairment | | Amortization in | | Foreign | | Carrying | |

| | | amount as at | | Allocations in | | | | the period | | exchange | | amount as at | |

| | | December 31, | | the period | | | | | | movements | | June 30, 2005 | |

| | | 2004 | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | (US$ 000’s) | |

| License acquisition cost | | $ | 1,506 | | | - | | | - | | | - | | | - | | $ | 1,506 | |

| | | | | | | | | | | | | | | | | | | | |

| Broadcast license | | $ | 13,069 | | | 137,853 | | | (18,604 | ) | | (1,492 | ) | | (5,508 | ) | $ | 125,318 | |

| | | | | | | | | | | | | | | | | | | | |

| Trademarks | | $ | 10,519 | | | 26,545 | | | (7,021 | ) | | - | | | (1,029 | ) | $ | 29,014 | |

| | | | | | | | | | | | | | | | | | | | |

| Customer relationships | | $ | 2,237 | | | 5,232 | | | - | | | (256 | ) | | (213 | ) | $ | 7,000 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 27,331 | | $ | 169,630 | | $ | (25,625 | ) | $ | (1,748 | ) | $ | (6,750 | ) | $ | 162,838 | |

All license acquisition costs and trademarks are assets with indefinite useful lives and are subject to annual impairment reviews. Our broadcast licenses primarily have indefinite lives and are subject to annual impairment reviews, except for our broadcast licenses in the Czech Republic and Ukraine. The licenses in Ukraine have economic useful lives of, and are amortized on a straight-line basis over, seven and ten years. The license in the Czech Republic has an economic useful life of, and is amortized on a straight-line basis over, twelve years. Customer relationships are deemed to have an economic useful life of, and are amortized on a straight-line basis over, between seven and nine years. The estimated amortization expense is US$ 7.9 million for 2005 and US$ 12.3 million for each of the years 2006-2010.

Other assets consist of the following:

| | | As at June 30, 2005 | | December 31, 2004 | |

| | | US$ 000’s | | US$ 000’s | |

Current: | | | | | |

| | | | | | |

Prepaid expenses | | $ | 16,637 | | $ | 9,026 | |

| | | | | | | | |

| VAT recoverable | | | 2,210 | | | 664 | |

| | | | | | | | |

| Income taxes receivable | | | 12,326 | | | - | |

| | | | | | | | |

| Capitalized debt costs | | | 1,906 | | | - | |

| | | | | | | | |

| Other | | | 5,893 | | | 1,324 | |

| | | $ | 38,972 | | $ | 11,014 | |

| | | | | | | | |

Long term: | | | | | | | |

| | | | | | | | |

Capitalized debt costs | | $ | 11,166 | | $ | - | |

| | | | | | | | |

| Other | | | 5,251 | | | 1,467 | |

| | | $ | 16,417 | | $ | 1,467 | |

Income taxes receivable represent a receivable for income taxes due to TV Nova (Czech Republic) Group. Capitalized debt costs represent the costs incurred in connection with the issuance of our Senior Notes in May 2005 (for further information see Note 11, “Senior Notes”).

9. | Accounts Payable and Accrued Liabilities |

Accounts payable and accrued liabilities consist of the following:

| | | As at June 30, 2005 | | As at December 31, 2004 | |

| | | US$ 000’s | | US$ 000’s | |

| Accounts payable | | $ | 18,985 | | $ | 16,642 | |

| | | | | | | | |

| Programming liabilities | | | 44,024 | | | 22,156 | |

| | | | | | | | |

| Other accrued liabilities | | | 44,162 | | | 28,244 | |

| | | $ | 107,171 | | $ | 67,042 | |

The increase in the above accounts relate primarily to our acquisition of the TV Nova (Czech Republic) Group in May 2005.

The settlement liability consists of the following:

| | | As at June 30, 2005 | | December 31, 2004 | |

| | | US$ 000’s | | US$ 000’s | |

Current: | | | | | |

| Mediation liability | | $ | 1,047 | | $ | - | |

| | | | | | | | |

Long term: | | | | | | | |

Mediation liability | | $ | 48,971 | | $ | - | |

The settlement liability represents a settlement amount owed by CET 21 under a settlement agreement among CET 21, Ceska nezavisla televizni spolecnost, spol. s.r.o. ("CNTS") and the PPF Group dated December 19, 2003 following a mediation. This liability was assumed as part of the TV Nova (Czech Republic) Group acquisition (for further information, see Note 5, “Acquisitions and Disposals”).

In 1999, CET 21, then unrelated to PPF Group, withdrew from a cooperation agreement with CNTS, our former operating company in the Czech Republic, and began broadcasting a substitute signal for TV NOVA in direct competition with CNTS. As a result, we together with CNTS filed a claim for breach of the contract and in 2003, initiated arbitration proceedings against CET 21 for the loss in value of our investment in CNTS. In October 2003, PPF Media B.V. purchased our interest in CNTS and all claims relating thereto and continued the legal proceedings against CET 21. Any and all disputes between CNTS and CET 21 were finally settled pursuant to the settlement agreement of December 19, 2003.

Under the terms of the settlement agreement, CET 21 is obliged to pay US$ 101.3 million to PPF Media B.V. and US$ 3.1 million to CNTS in full and final settlement of all claims. The payment schedule provides for payments through 2007 and unpaid amounts bear interest at a rate of 8.5% per annum on the unpaid balance. As at June 30, 2005, the unpaid amount of this liability was US$ 50.0 million (US$ 1.0 million of which is classified in our consolidated balance sheet as current settlement liability).

On May 5, 2005, we issued Senior Notes in the aggregate principal amount of Euro 370 million (approximately US$ 447.9 million), consisting of Euro 245 million (approximately US$ 296.6 million) 8.25% Senior Notes due May 2012 and Euro 125 million (approximately US$ 151.3 million) floating rate Senior Notes due May 2012, which bear interest at six-month Euro Inter-Bank Offered Rate (“EURIBOR”) plus 5.5% (EURIBOR - 6 month as at June 30, 2005 was 2.1%). Interest is payable semi-annually in arrears on each May 15 and November 15, commencing November 15, 2005. The Senior Notes are secured senior obligations and rank pari passu with all existing and future senior indebtedness and are effectively subordinated to all existing and future indebtedness of our subsidiaries. The terms of our indebtedness restrict the manner in which our business is conducted, including the incurrence of additional indebtedness, the making of investments, the payment of dividends or the making of other distributions, entering into certain affiliate transactions and the sale of assets.

The Senior Notes are redeemable at our option, in whole or in part, at the redemption prices set forth below:

| | Euro 245 million 8.25% Senior Notes | | Euro 125 million floating rate Senior Notes |

| | | | |

| | Redemption Price | | Redemption Price |

| | | | |

| May 15, 2009 | 104.125% | May 15, 2007 | 102.000% |

| | | | |

| May 15, 2010 | 102.063% | May 15, 2008 | 101.000% |

| | | | |

| May 15, 2011 and thereafter | 100.00% | May 15, 2009 and thereafter | 100.000% |

The fair value of the Senior Notes as at June 30, 2005 was approximately Euro 265.8 million (approximately US$ 321.8 million) for the Euro 245 million 8.25% Senior Notes and approximately Euro 130.0 million (approximately US$ 157.4 million) for the Euro 125 million floating rate Senior Notes. These are approximate values as the market for these bonds is illiquid.

We manage our business on a country-by-country basis and review the performance of each business segment using data that reflects 100% of operating and license company results. Our business segments are comprised of Croatia, the Czech Republic, Romania, the Slovak Republic, Slovenia and Ukraine.

We evaluate the performance of our business segments based on Segment Net Revenues and Segment EBITDA. Segment Net Revenues and Segment EBITDA include STS and Markiza (our operating and license companies in the Slovak Republic) for the six and three months ended June 30, 2005 and STS, Markiza and Radio Pro in Romania for the six and three months ended June 30, 2004. These entities are not consolidated under US GAAP.

Our key performance measure of the efficiency of our business segments is EBITDA margin. We define Segment EBITDA margin as the ratio of Segment EBITDA to Segment Net Revenue.

Our assets and liabilities are managed centrally and are reported internally in the same manner as the consolidated financial statements, consequently no additional segment information is provided in respect of assets and liabilities.

Segment EBITDA is determined as segment net income/loss, which includes costs for program rights amortization, before interest, taxes, depreciation and amortization of intangible assets. Items that are not allocated to our business segments for purposes of evaluating their performance and therefore are not included in Segment EBITDA, include:

| · | expenses presented as corporate expenses in our consolidated statements of operations (i.e., corporate operating costs, stock-based compensation and amortization of intangibles); |

| · | changes in the fair value of derivatives; |

| · | foreign currency exchange gains and losses; |

| · | certain unusual or infrequent items (e.g., extraordinary gains and losses, impairments on assets or investments). |

Segment EBITDA is also used as a component in determining management bonuses.

Below is a table showing our Segment EBITDA by operation and reconciling these figures to our consolidated US GAAP results for the three and six months ended June 30, 2005 and 2004:

| | | SEGMENT FINANCIAL INFORMATION | |

| | | For the Three Months Ended June 30, | |

| | | (US $000's) | |

| | | Segment Net Revenues (1) | | Segment EBITDA | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

Country | | | | | | | | | |

| | | | | | | | | | |

| Croatia (NOVA TV) | | $ | 7,652 | | $ | - | | $ | (1,337 | ) | $ | - | |

| | | | | | | | | | | | | | |

| Czech Republic (TV NOVA) | | | 47,767 | | | - | | | 28,287 | | | - | |

| | | | | | | | | | | | | | |

| Romania (2) | | | 26,592 | | | 18,702 | | | 11,974 | | | 5,920 | |

| | | | | | | | | | | | | | |

| Slovak Republic (MARKIZA TV) | | | 19,627 | | | 17,448 | | | 7,956 | | | 8,393 | |

| | | | | | | | | | | | | | |

| Slovenia (POP TV and KANAL A) | | | 13,920 | | | 13,751 | | | 6,490 | | | 6,860 | |

| | | | | | | | | | | | | | |

| Ukraine (STUDIO 1+1) | | | 17,178 | | | 13,248 | | | 4,935 | | | 4,895 | |

| | | | | | | | | | | | | | |

Total Segment Data | | $ | 132,736 | | $ | 63,149 | | $ | 58,305 | | $ | 26,068 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Reconciliation to Consolidated Statement of Operations: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Consolidated Net Revenues / Income before provision for income taxes, minority interest, equity in income of unconsolidated affiliates and discontinued operations | | $ | 113,109 | | $ | 44,886 | | $ | 31,468 | | $ | 7,591 | |

| | | | | | | | | | | | | | |

| Corporate operating costs (including non-cash stock based compensation (see Note 15) of $ (1.9) million and $ 2.4 million for the three months ended June 30, 2005 and 2004, respectively)) | | | - | | | - | | | 3,451 | | | 7,107 | |

| | | | | | | | | | | | | | |

| Amortization of intangibles | | | - | | | - | | | 82 | | | 62 | |

| | | | | | | | | | | | | | |

| Impairment charge | | | - | | | - | | | 35,331 | | | - | |

| | | | | | | | | | | | | | |

| Unconsolidated equity affiliates (3) | | | 19,627 | | | 18,263 | | | 7,956 | | | 8,792 | |

| | | | | | | | | | | | | | |

| Station depreciation | | | - | | | - | | | 4,623 | | | 1,336 | |

| | | | | | | | | | | | | | |

| Interest income | | | - | | | - | | | (559 | ) | | (786 | ) |

| | | | | | | | | | | | | | |

| Interest expense | | | - | | | - | | | 6,424 | | | 667 | |

| | | | | | | | | | | | | | |

| Foreign currency exchange (gain)/loss, net | | | - | | | - | | | (30,159 | ) | | 1,289 | |

| | | | | | | | | | | | | | |

| Other (income)/expense | | | - | | | - | | | (312 | ) | | 10 | |

| | | | | | | | | | | | | | |

Total Segment Data | | $ | 132,736 | | $ | 63,149 | | $ | 58,305 | | $ | 26,068 | |

(1) All net revenues are derived from external customers. There are no inter-segmental revenues.

(2) Romanian networks are PRO TV, PRO CINEMA, ACASA and PRO TV INTERNATIONAL for the three months ended June 30, 2005 and PRO TV, PRO CINEMA, ACASA, PRO TV INTERNATIONAL, PRO FM and INFOPRO for the three months ended June 30, 2004.

(3) Unconsolidated equity affiliates are STS and Markiza in the Slovak Republic for the three months ended June 30, 2005 and STS, Markiza and Radio Pro in Romania for the three months ended June 30, 2004.

| | | SEGMENT FINANCIAL INFORMATION | |

| | | For the Six Months Ended June 30, | |

| | | (US $000's) | |

| | | Segment Net Revenues (1) | | Segment EBITDA | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

Country | | | | | | | | | |

| Croatia (NOVA TV) | | $ | 12,607 | | $ | - | | $ | (4,759 | ) | $ | - | |

| Czech Republic (TV NOVA) | | | 47,767 | | | - | | | 28,287 | | | - | |

| Romania (2) | | | 45,648 | | | 32,787 | | | 18,136 | | | 10,238 | |

| Slovak Republic (MARKIZA TV) | | | 32,270 | | | 29,343 | | | 10,126 | | | 9,724 | |

| Slovenia (POP TV and KANAL A) | | | 23,853 | | | 23,408 | | | 9,170 | | | 10,787 | |

| Ukraine (STUDIO 1+1) | | | 31,538 | | | 25,354 | | | 7,284 | | | 9,252 | |

Total Segment Data | | $ | 193,683 | | $ | 110,892 | | $ | 68,244 | | $ | 40,001 | |

| | | | | | | | | | | | | | |

Reconciliation to Consolidated Statement of Operations: | | | | | | | | | | | | | |

Consolidated Net Revenues / Income before provision for income taxes, minority interest, equity in income of unconsolidated affiliates and discontinued operations | | $ | 161,413 | | $ | 80,734 | | $ | 25,258 | | $ | 13,445 | |

| Corporate operating costs (including non-cash stock based compensation (see Note 15) of $ 1.7 million and $ 4.3 million for the six months ended June 30, 2005 and 2004, respectively)) | | | - | | | - | | | 11,182 | | | 12,225 | |

| Amortization of intangibles | | | - | | | - | | | 159 | | | 62 | |

| Impairment charge | | | - | | | - | | | 35,331 | | | - | |

| Unconsolidated equity affiliates (3) | | | 32,270 | | | 30,158 | | | 10,126 | | | 10,123 | |

| Station depreciation | | | - | | | - | | | 6,836 | | | 2,798 | |

| Interest income | | | - | | | - | | | (1,638 | ) | | (2,240 | ) |

| Interest expense | | | - | | | - | | | 6,731 | | | 885 | |

| Foreign currency exchange (gain)/loss, net | | | - | | | - | | | (29,430 | ) | | 1,922 | |

| Other expense | | | - | | | - | | | 3,689 | | | 781 | |

Total Segment Data | | $ | 193,683 | | $ | 110,892 | | $ | 68,244 | | $ | 40,001 | |

(1) All net revenues are derived from external customers. There are no inter-segmental revenues.

(2) Romanian networks are PRO TV, PRO CINEMA, ACASA and PRO TV INTERNATIONAL for the six months ended June 30, 2005 and PRO TV, PRO CINEMA, ACASA, PRO TV INTERNATIONAL, PRO FM and INFOPRO for the six months ended June 30, 2004.

(3) Unconsolidated equity affiliates are STS and Markiza in the Slovak Republic for the six months ended June 30, 2005 and STS, Markiza and Radio Pro in Romania for the six months ended June 30, 2004.

13. | Summary Financial Information for Significant Unconsolidated Affiliates |

| | | STS (MARKIZA TV) | |

| | | As at June 30, 2005 | | As at December 31, 2004 | |

| | | (US$ 000's) | | (US$ 000's) | |

| Current assets | | $ | 24,795 | | $ | 25,548 | |

| | | | | | | | |

| Non-current assets | | | 18,008 | | | 16,919 | |

| | | | | | | | |

| Current liabilities | | | (25,557 | ) | | (15,445 | ) |

| | | | | | | | |

| Non-current liabilities | | | (131 | ) | | (149 | ) |

| | | | | | | | |

| Net Assets | | $ | 17,115 | | $ | 26,873 | |

| | | STS (MARKIZA TV) | |

| | | For the Three Months Ended June 30, | | For the Six Months Ended June 30, | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

| | | (US$ 000's) | |

| Net revenues | | $ | 19,627 | | $ | 17,448 | | $ | 32,270 | | $ | 29,343 | |

| | | | | | | | | | | | | | |

| Operating costs | | | (12,213 | ) | | (9,551 | ) | | (23,253 | ) | | (20,736 | ) |

| | | | | | | | | | | | | | |

| Operating income | | | 7,414 | | | 7,897 | | | 9,017 | | | 8,607 | |

| | | | | | | | | | | | | | |

| Net income | | | 5,787 | | | 6,691 | | | 7,084 | | | 7,494 | |

| | | | | | | | | | | | | | |

| Movement in accumulated other comprehensive income/(loss) | | | (467 | ) | | (230 | ) | | 1,381 | | | (169 | ) |

Our share of income in Unconsolidated Affiliates for STS was US$ 5.0 million and US$ 4.8 million for the first six months of 2005 and 2004, respectively.

We account for earnings per share pursuant to FAS No. 128, “Earnings Per Share”. Basic net income per common share (“Basic EPS”) is computed by dividing net income by the weighted average number of common shares outstanding. Diluted net income per common share (“Diluted EPS”) is computed by dividing net income by the weighted average number of common shares and dilutive common share equivalents then outstanding. FAS No. 128 requires the presentation of both Basic EPS and Diluted EPS on the face of the consolidated statement of operations. A reconciliation between the numerator and denominator of Basic EPS and Diluted EPS is as follows:

| | | For the Three Months Ended June 30, | |

| | | Net Income/(Loss) (US$ 000's) | | Common Shares (000's) | | Net Income/(Loss) per Common Share | |

| | | 2005 | | 2004 | | 2005 | | 2004 (as restated) | | 2005 | | 2004 (as restated) | |

Basic EPS | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Net income attributable to common stock | | $ | 25,459 | | $ | 6,032 | | | 34,274 | | | 27,854 | | $ | 0.74 | | $ | 0.22 | |

| | | | | | | | | | | | | | | | | | | | |

| Effect of dilutive securities : stock options | | | - | | | - | | | 871 | | | 1,179 | | | (0.02 | ) | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | |

Diluted EPS | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Net income attributable to common stock | | $ | 25,459 | | $ | 6,032 | | | 35,145 | | | 29,033 | | $ | 0.72 | | $ | 0.21 | |

| | | For the Six Months Ended June 30, | |

| | | Net Income/(Loss) (US$ 000's) | | Common Shares (000's) | | Net Income/(Loss) per Common Share | |

| | | 2005 | | 2004 | | 2005 | | 2004 (as restated) | | 2005 | | 2004 (as restated) | |

Basic EPS | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net income attributable to common stock | | $ | 17,510 | | $ | 11,203 | | | 31,345 | | | 27,471 | | $ | 0.56 | | $ | 0.41 | |

| | | | | | | | | | | | | | | | | | | | |

| Effect of dilutive securities : stock options | | | - | | | - | | | 943 | | | 1,485 | | | (0.02 | ) | | (0.02 | ) |

| | | | | | | | | | | | | | | | | | | | |

Diluted EPS | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Net income attributable to common stock | | $ | 17,510 | | $ | 11,203 | | | 32,288 | | | 28,956 | | $ | 0.54 | | $ | 0.39 | |

Restatement of 2004 Earnings Per Share

FAS 128 requires the same number of potential common shares used in computing the diluted per share amount for income from continuing operations be used in computing the diluted per share amounts for discontinued operations and net income where there is a loss from continuing operations. Also, in determining the weighted average number of common shares used in the earnings per share computations, it is required to calculate a weighted average number of shares issued and outstanding during the period. In the three months ended June 30, 2004, we incorrectly computed the fully diluted earnings per share for continuing operations and the fully diluted earnings per share. In the six months ended June 30, 2004 we incorrectly computed the basic earnings per share for continuing operations, the fully diluted earnings per share for continuing operations, the basic earnings per share and the fully diluted earnings per share. We also incorrectly calculated basic and diluted weighted average number of shares outstanding in the three and six months ended June 30, 2004. The following table summarizes the restated weighted average common shares and earnings per share for the three and six months ended June 30, 2004.

| | | For the three months ended June 30, 2004 | | For the six months ended June 30, 2004 | |

| | | As previously reported | | As restated | | As previously reported | | As restated | |

| Continuing operations - Basic | | | | | | | | | |

| | | | | | | | | | |

| Income from continuing operations per share | | | - | | | - | | $ | 0.40 | | $ | 0.41 | |

| | | | | | | | | | | | | | |

| Weighted average common shares used in computing per share amounts (000s) | | | 28,034 | | | 27,854 | | | 28,034 | | | 27,471 | |

| | | | | | | | | | | | | | |

| Continuing operations - Diluted | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Income from continuing operations per share | | $ | 0.19 | | $ | 0.20 | | $ | 0.38 | | $ | 0.39 | |

| | | | | | | | | | | | | | |

| Weighted average common shares used in computing per share amounts (000s) | | | 29,977 | | | 29,033 | | | 29,977 | | | 28,956 | |

| | | | | | | | | | | | | | |

| Discontinued operations - Basic | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Weighted average common shares used in computing per share amounts (000s) | | | 28,034 | | | 27,854 | | | 28,034 | | | 27,471 | |

| | | | | | | | | | | | | | |

| Discontinued operations - Diluted | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Weighted average common shares used in computing per share amounts (000s) | | | 29,977 | | | 29,033 | | | 29,977 | | | 28,956 | |

| | | | | | | | | | | | | | |

| Net Income -Basic | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net Income per share | | | - | | | - | | $ | 0.40 | | $ | 0.41 | |

| | | | | | | | | | | | | | |

| Weighted average common shares used in computing per share amounts (000s) | | | 28,034 | | | 27,854 | | | 28,034 | | | 27,471 | |

| | | | | | | | | | | | | | |

| Net Income - Diluted | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net Income per share | | $ | 0.20 | | $ | 0.21 | | $ | 0.37 | | $ | 0.39 | |

| | | | | | | | | | | | | | |

| Weighted average common shares used in computing per share amounts (000s) | | | 29,977 | | | 29,033 | | | 29,977 | | | 28,956 | |

15. | Stock-based Compensation |

Stock-based compensation costs are determined when options are issued and are measured under the fair value method as defined in SFAS 123. We adopted SFAS 123 prospectively for employee stock option awards granted, modified, or settled beginning January 1, 2003, as contemplated by SFAS 148. In prior periods, we used the intrinsic method of accounting as defined in APB 25.

2005 Option Grants

Pursuant to the Amended and Restated 1995 Stock Incentive Plan, the Compensation Committee of our Board of Directors awarded a grant of options to non-executive directors and employees to purchase 122,000 shares of our common stock on June 2, 2005. These options vest in equal installments over 4 years. The exercise price of the granted options ranges from US$ 44.50 to US$ 46.73, with a weighted average exercise price of US$ 44.61. The fair value of the option grants was estimated on the date of the grant using the Black-Scholes option-pricing model, with the following assumptions used:

Date of Option Grant | Options granted | Risk Free Interest Rate | Expected life | Expected volatility |

| | | | | |

| June 2, 2005 | 122,000 | 3.74% | 6.25 years | 53.24% |

The expected stock price volatility was calculated as 53.24% based on an analysis of the historical stock price volatility of the Company and its peers for the preceding 6.25-year period. We consider this basis to represent the best indicator of expected volatility over the life of the option. The expected dividend yield for the above grant was assumed to be 0%.

The weighted average fair value of the above grant made in the six months ended June 30, 2005 is US$ 24.56 per option. In accordance with SFAS 123, the total fair value of these options of US$ 3.0 million will be recognized as expense in the Statement of Operations over the vesting period of the award.

2004 Option Grants

Pursuant to the 1995 Stock Option Plan, the Compensation Committee of our Board of Directors awarded employees options to purchase 160,000 shares of our Class A Common Stock, with a vesting period of 4 years, on February 2, 2004, 10,000 such options, with vesting periods of 3 years, on May 3, 2004 and 20,000 such options, with vesting periods of 3 years, on May 5, 2004. On June 2, 2004, an automatic grant of non-incentive options to purchase 112,000 shares of our common stock was made to non-executive directors, with a vesting period of 4 years pursuant to the 1995 Stock Option Plan. The fair value of the option grants was estimated on the date of the grant using the Black-Scholes option pricing model, with the following assumptions used:

Date of Option Grant | Options granted | Risk Free Interest Rate | Expected life | Expected volatility |

| | | | | |

| February 2, 2004 | 160,000 | 3.18% | 6 years | 51.5% |

| | | | | |