UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-08572

Bishop Street Funds

(Exact name of registrant as specified in charter)

101 Federal Street

Boston, MA 02110

(Address of principal executive offices)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-262-9565

Date of fiscal year end: December 31, 2012

Date of reporting period: June 30, 2012

| Item 1. | Reports to Stockholders. |

The Funds file their complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies (if any) relating to portfolio securities is available without charge, by calling 1-800-262-9565 or by visiting the Commission’s website at http://www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available without charge, by calling 1-800-262-9565 or by visiting the Funds’ website at http://www.bishopstreetfunds.com or the website of the Securities and Exchange Commission.

BISHOP STREET

TABLE OF CONTENTS

FUNDS

1

BISHOP STREET

LETTER TO SHAREHOLDERS

FUNDS

Dear Shareholder:

Optimism for a strong U.S. economic recovery and renewed hope for a resolution in Europe helped fuel yet another impressive stock market rally during the first half of 2012; however, renewed crisis in the Euro Zone, a China slowdown, and political uncertainty both here and abroad served to keep optimism muted for the time being. Despite the many challenges facing investors, the S&P 500 produced an impressive 9.5 percent gain during the first six months of the year, proving its resilience once again. Against this back drop, interest rates fell sharply in the second quarter in response to a slowdown in global economic growth, lower oil, lower inflation, and a Fed on hold. Looking ahead, these factors will continue to weigh heavily on the markets. That said, we remain constructive on the U.S. stock market given the strength of corporate balance sheets, financial support pledged by the Central Banks, and steady investor confidence.

Déjà vu all over again

The first quarter of the year was marked by better than expected earnings and economic news. As a result, the S&P 500 Index advanced a surprising 12.6 percent – one of the strongest quarterly returns on record. Meanwhile, U.S. Treasury prices weakened considerably with yields on the 30-year bond rising nearly 45 basis points to 3.34 percent by quarter’s end. Bad news out of the Euro Zone continued to arrive in waves, further fueling fears of a Euro breakup. Banks took center stage once again as fears of another financial system collapse helped reverse the first quarter rally. U.S. economic data remained mixed with most indicating that a slow down was at hand. As a result, the S&P 500 lost 2.8 percent in the second quarter but this was not enough to dampen investor optimism and hope.

Politics and the Unknown

The U.S. now stands at a critical crossroad with the presidential election and leadership issues muddying an already cloudy picture. A sagging economy, growing fiscal deficits, ballooning debt, expiring tax cuts, and key regional political battles all will weigh in to shape our future. Across the Atlantic and Pacific, viable solutions available to the vast array of economic and geopolitical issues are few and far between, and while

2

discussions have been primarily focused on economics, the likely solutions will be politically driven with or without the consent of Germany and France.

A Look Ahead

The Federal Reserve has remained committed to holding interest rates near zero well into 2014, but given the problems in Europe, weakness in China, and a mixed economic picture in the U.S., it is likely that the Fed will be forced to keep interest rates low for even longer and will remain committed to kick-starting housing and reducing unemployment. We believe that this accommodative stance along with greater clarity in the political arena will ultimately provide a platform for holding risky assets during the second half of the year. While economic growth might slow further and unemployment remain high, support from the Fed and the ECB should be enough to avoid a catastrophic end. Accordingly, we continue to favor the U.S. equity market and spread sectors in the fixed income markets.

Benefits of a Balanced Portfolio

While the first six months did produce strong stock market gains, experience continues to support the diversification of your portfolio. Whether enjoying the benefits of growth and higher earnings, or collecting the stable cash flows found in the fixed income markets, a balanced portfolio helps cushion declines while allowing for growth of principal. Therefore, we believe the key to long-term investment success is to hold a well-diversified portfolio tailored to your risk appetite and long-term goals. In this regard we hope that the Bishop Street family of funds will continue to play an important role in your investment program.

Thank you for your continued trust and investment in the Bishop Street Funds.

Sincerely,

Michael K. Hirai, CFA, CPA

President and Chief Investment Officer

Bishop Street Capital Management

July 24, 2012

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

3

| | | | |

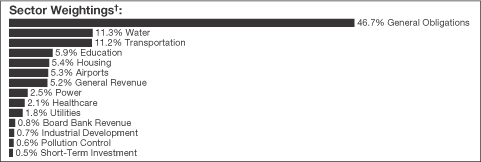

| Strategic Growth Fund | | | (unaudited) | |

Top Ten Equity Holdings†

| | | | | | |

| | | | | Percentage of

Investments | |

| |

| | | Express Scripts Holding | | | 2.3% | |

| |

| | | Alliance Data Systems | | | 2.2% | |

| |

| | | Herbalife | | | 2.2% | |

| |

| | | TIBCO Software | | | 2.2% | |

| |

| | | Intuit | | | 2.2% | |

| |

| | | Deere | | | 2.2% | |

| |

| | | PetSmart | | | 2.2% | |

| |

| | | Exxon Mobil | | | 2.2% | |

| |

| | | Oracle | | | 2.2% | |

| |

| | | EI du Pont de Nemours | | | 2.2% | |

| |

|

|

† Percentages are based on total investments. Top ten holdings do not include short-term investments. |

Schedule of Investments

| | | | | | | | |

Shares | | | | | Value

(000) | |

| | | | | | | | |

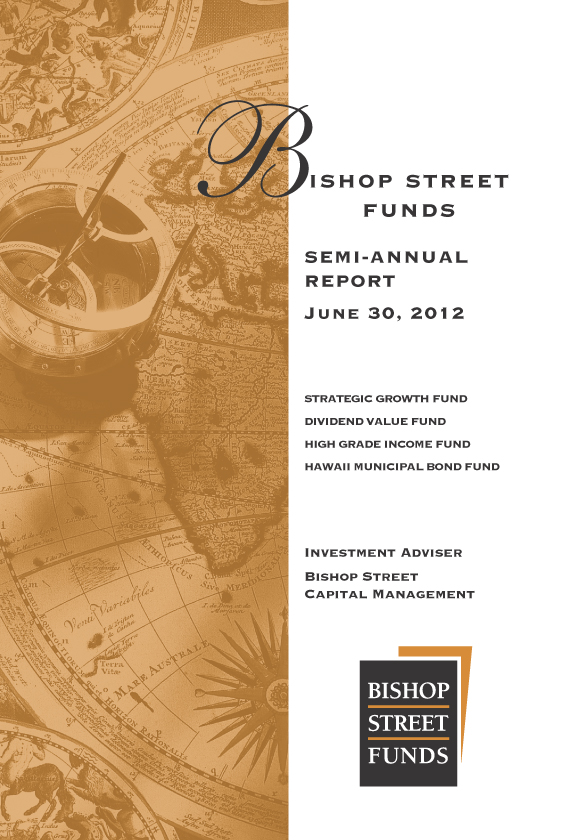

| | COMMON STOCK‡ — 100.1% | |

| Consumer Discretionary — 19.5% | | | | |

| | 2,600 | | | AutoZone* | | $ | 955 | |

| | 14,200 | | | Bed Bath & Beyond* | | | 878 | |

| | 29,900 | | | CBS | | | 980 | |

| | 13,800 | | | Coach | | | 807 | |

| | 16,900 | | | Dollar General* | | | 919 | |

| | 54,400 | | | GameStop | | | 999 | |

| | 15,300 | | | PetSmart | | | 1,043 | |

| | 1,400 | | | priceline.com* | | | 930 | |

| | 22,600 | | | TJX | | | 970 | |

| | 13,300 | | | Yum! Brands | | | 857 | |

| | | | | | | | |

| | | | | | | 9,338 | |

| | | | | | | | |

4

| | | | |

| Strategic Growth Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| | | | | | | | |

| Consumer Staples — 6.1% | | | | |

| | 10,000 | | | Costco Wholesale | | $ | 950 | |

| | 19,800 | | | CVS | | | 925 | |

| | 21,700 | | | Herbalife | | | 1,049 | |

| | | | | | | | |

| | | | | | | 2,924 | |

| | | | | | | | |

| Energy — 5.8% | | | | |

| | 12,100 | | | Exxon Mobil | | | 1,035 | |

| | 13,000 | | | National Oilwell Varco | | | 838 | |

| | 14,100 | | | Schlumberger | | | 915 | |

| | | | | | | | |

| | | | | | | 2,788 | |

| | | | | | | | |

| Financials — 6.1% | | | | |

| | 13,800 | | | ACE | | | 1,023 | |

| | 27,600 | | | Allstate | | | 968 | |

| | 15,800 | | | American Express | | | 920 | |

| | | | | | | | |

| | | | | | | 2,911 | |

| | | | | | | | |

| Health Care — 12.0% | | | | |

| | 23,700 | | | Agilent Technologies | | | 930 | |

| | 23,800 | | | AmerisourceBergen | | | 937 | |

| | 13,700 | | | Celgene* | | | 879 | |

| | 20,500 | | | Cigna | | | 902 | |

| | 19,300 | | | Express Scripts Holding* | | | 1,077 | |

| | 16,800 | | | UnitedHealth Group | | | 983 | |

| | | | | | | | |

| | | | | | | 5,708 | |

| | | | | | | | |

| Industrials — 20.1% | | | | |

| | 9,900 | | | Cummins | | | 960 | |

| | 12,900 | | | Deere | | | 1,043 | |

| | 16,400 | | | Dover | | | 879 | |

| | 20,000 | | | Equifax | | | 932 | |

| | 17,300 | | | Honeywell International | | | 966 | |

| | 17,400 | | | Joy Global | | | 987 | |

| | 13,400 | | | Norfolk Southern | | | 962 | |

| | 10,100 | | | Stericycle* | | | 926 | |

| | 8,300 | | | Union Pacific | | | 990 | |

| | 4,900 | | | W.W. Grainger | | | 937 | |

| | | | | | | | |

| | | | | | | 9,582 | |

| | | | | | | | |

| Information Technology — 26.4% | | | | |

| | 7,800 | | | Alliance Data Systems* | | | 1,053 | |

| | 1,750 | | | Apple* | | | 1,022 | |

| | 23,600 | | | eBay* | | | 991 | |

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

5

| | | | |

| Strategic Growth Fund | | | (unaudited) | |

Schedule of Investments

(concluded)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| | | | | | | | |

| Information Technology — (continued) | | | | |

| | 9,700 | | | F5 Networks* | | $ | 966 | |

| | 4,800 | | | International Business Machines | | | 939 | |

| | 17,600 | | | Intuit | | | 1,045 | |

| | 2,150 | | | Mastercard | | | 925 | |

| | 31,100 | | | Microsoft | | | 951 | |

| | 34,800 | | | Oracle | | | 1,034 | |

| | 14,700 | | | Qualcomm | | | 818 | |

| | 35,000 | | | TIBCO Software* | | | 1,047 | |

| | 26,400 | | | VeriFone Systems* | | | 874 | |

| | 28,400 | | | Xilinx | | | 953 | |

| | | | | | | | |

| | | | | | | 12,618 | |

| | | | | | | | |

| Materials — 4.1% | | | | |

| | 4,700 | | | CF Industries Holdings | | | 910 | |

| | 20,400 | | | EI du Pont de Nemours | | | 1,032 | |

| | | | | | | | |

| | | | | | | 1,942 | |

| | | | | | | | |

| | TOTAL COMMON STOCK (Cost $40,606) | | | 47,811 | |

| | | | | | | | |

|

| | SHORT-TERM INVESTMENT (A) — 0% | |

| | 4,747 | | | Dreyfus Cash Management Fund, Institutional Shares, 0.083% | | | 5 | |

| | | | | | | | |

| | TOTAL SHORT-TERM INVESTMENT (Cost $5) | | | 5 | |

| | | | | | | | |

| | TOTAL INVESTMENTS (Cost $40,611) — 100.1% | | $ | 47,816 | |

| | | | | | | | |

Percentages are based on Net Assets of $47,784 ($ Thousands).

| ‡ | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting. |

| * | Non-income producing security. |

| (A) | The rate shown is the 7-day effective yield as of June 30, 2012. |

Cost figures are shown in thousands.

The accompanying notes are an integral part of the financial statements.

6

| | | | |

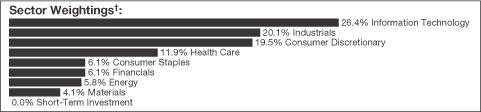

| Dividend Value Fund | | | (unaudited) | |

Top Ten Equity Holdings†

| | | | | | |

| | | | | Percentage of

Investments | |

| |

| | | Philip Morris International | | | 3.4% | |

| |

| | | Verizon Communications | | | 3.3% | |

| |

| | | International Business Machines | | | 3.2% | |

| |

| | | Exxon Mobil | | | 3.0% | |

| |

| | | Microsoft | | | 2.9% | |

| |

| | | AT&T | | | 2.9% | |

| |

| | | Intel | | | 2.8% | |

| |

| | | Merck | | | 2.7% | |

| |

| | | Pfizer | | | 2.7% | |

| |

| | | Bristol-Myers Squibb | | | 2.3% | |

| |

|

|

† Percentages are based on total investments. Top ten holdings do not include short-term investments. |

Schedule of Investments

| | | | | | | | |

Shares | | | | | Value

(000) | |

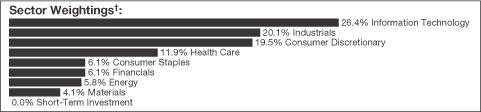

| | COMMON STOCK — 98.3% | |

| Consumer Discretionary — 9.0% | |

| | 21,070 | | | Home Depot | | $ | 1,116 | |

| | 7,495 | | | Limited Brands | | | 319 | |

| | 7,185 | | | Macy’s | | | 247 | |

| | 10,125 | | | Mattel | | | 329 | |

| | 12,090 | | | McDonald’s | | | 1,070 | |

| | 7,970 | | | McGraw-Hill | | | 359 | |

| | 10,320 | | | Meredith | | | 330 | |

| | 6,530 | | | Nordstrom | | | 324 | |

| | 17,360 | | | Time Warner | | | 668 | |

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

7

| | | | |

| Dividend Value Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| Consumer Discretionary — (continued) | |

| | 10,265 | | | TJX | | $ | 441 | |

| | | | | | | | |

| | | | | | | 5,203 | |

| | | | | | | | |

| Consumer Staples — 12.3% | |

| | 23,200 | | | Altria Group | | | 802 | |

| | 7,735 | | | Coca-Cola Co. | | | 605 | |

| | 6,995 | | | Diageo PLC | | | 721 | |

| | 9,650 | | | General Mills | | | 372 | |

| | 13,125 | | | HJ Heinz | | | 714 | |

| | 7,970 | | | Kimberly-Clark | | | 668 | |

| | 22,395 | | | Philip Morris International | | | 1,954 | |

| | 11,735 | | | Procter & Gamble | | | 719 | |

| | 8,450 | | | Wal-Mart Stores | | | 589 | |

| | | | | | | | |

| | | | | | | 7,144 | |

| | | | | | | | |

| Energy — 11.0% | |

| | 12,185 | | | Chevron | | | 1,286 | |

| | 6,975 | | | ConocoPhillips | | | 390 | |

| | 20,060 | | | Exxon Mobil | | | 1,717 | |

| | 18,615 | | | Kinder Morgan | | | 600 | |

| | 7,660 | | | Occidental Petroleum | | | 657 | |

| | 10,320 | | | Penn West Petroleum | | | 138 | |

| | 3,485 | | | Phillips 66* | | | 116 | |

| | 15,420 | | | Royal Dutch Shell PLC | | | 1,040 | |

| | 6,730 | | | Schlumberger | | | 437 | |

| | | | | | | | |

| | | | | | | 6,381 | |

| | | | | | | | |

| Financials — 14.0% | |

| | 13,125 | | | American Express | | | 764 | |

| | 13,125 | | | Arthur J Gallagher | | | 460 | |

| | 3,040 | | | BlackRock | | | 516 | |

| | 5,785 | | | Chubb | | | 421 | |

| | 1,460 | | | CME Group | | | 391 | |

| | 5,080 | | | Digital Realty Trust ‡ | | | 381 | |

| | 28,085 | | | JPMorgan Chase | | | 1,003 | |

| | 7,545 | | | MetLife | | | 233 | |

| | 9,840 | | | Northern Trust | | | 453 | |

| | 22,662 | | | People’s United Financial | | | 263 | |

| | 8,260 | | | PNC Financial Services Group | | | 505 | |

| | 5,785 | | | Progressive | | | 121 | |

| | 2,350 | | | Public Storage ‡ | | | 339 | |

| | 2,110 | | | RenaissanceRe Holdings | | | 160 | |

| | 5,245 | | | T Rowe Price Group | | | 330 | |

| | 16,250 | | | Unum Group | | | 311 | |

| | 19,370 | | | US Bancorp | | | 623 | |

8

| | | | |

| Dividend Value Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| Financials — (continued) | |

| | 25,575 | | | Wells Fargo | | $ | 855 | |

| | | | | | | | |

| | | | | | | 8,129 | |

| | | | | | | | |

| Health Care — 14.3% | | | | |

| | 15,755 | | | Abbott Laboratories | | | 1,016 | |

| | 8,225 | | | Amgen | | | 600 | |

| | 37,425 | | | Bristol-Myers Squibb | | | 1,345 | |

| | 25,555 | | | GlaxoSmithKline PLC | | | 1,165 | |

| | 15,005 | | | Johnson & Johnson | | | 1,014 | |

| | 37,515 | | | Merck | | | 1,566 | |

| | 67,160 | | | Pfizer | | | 1,545 | |

| | | | | | | | |

| | | | | | | 8,251 | |

| | | | | | | | |

| Industrials — 8.6% | | | | |

| | 3,880 | | | Boeing | | | 288 | |

| | 3,685 | | | Deere | | | 298 | |

| | 7,970 | | | Dover | | | 427 | |

| | 7,495 | | | Emerson Electric | | | 349 | |

| | 12,770 | | | Honeywell International | | | 713 | |

| | 4,695 | | | Illinois Tool Works | | | 248 | |

| | 5,820 | | | Norfolk Southern | | | 418 | |

| | 5,630 | | | Parker Hannifin | | | 433 | |

| | 10,125 | | | Raytheon | | | 573 | |

| | 10,645 | | | United Technologies | | | 804 | |

| | 12,090 | | | Waste Management | | | 404 | |

| | | | | | | | |

| | | | | | | 4,955 | |

| | | | | | | | |

| Information Technology — 12.4% | | | | |

| | 13,865 | | | Accenture PLC | | | 833 | |

| | 10,125 | | | Automatic Data Processing | | | 564 | |

| | 5,785 | | | Canon | | | 231 | |

| | 60,605 | | | Intel | | | 1,615 | |

| | 9,575 | | | International Business Machines | | | 1,873 | |

| | 55,000 | | | Microsoft | | | 1,682 | |

| | 14,080 | | | Texas Instruments | | | 404 | |

| | | | | | | | |

| | | | | | | 7,202 | |

| | | | | | | | |

| Materials — 5.3% | | | | |

| | 3,755 | | | BHP Billiton | | | 245 | |

| | 13,440 | | | EI du Pont de Nemours | | | 680 | |

| | 9,220 | | | Nucor | | | 349 | |

| | 9,815 | | | RPM International | | | 267 | |

| | 9,400 | | | Sherwin-Williams | | | 1,244 | |

| | 9,575 | | | Sonoco Products | | | 289 | |

| | | | | | | | |

| | | | | | | 3,074 | |

| | | | | | | | |

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

9

| | | | |

| Dividend Value Fund | | | (unaudited) | |

Schedule of Investments

(concluded)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| Telecommunication Services — 6.3% | | | | |

| | 46,580 | | | AT&T | | $ | 1,661 | |

| | 42,615 | | | Verizon Communications | | | 1,894 | |

| | 10,805 | | | Windstream | | | 104 | |

| | | | | | | | |

| | | | | | | 3,659 | |

| | | | | | | | |

| Utilities — 5.1% | | | | |

| | 9,385 | | | American Electric Power | | | 375 | |

| | 12,640 | | | CMS Energy | | | 297 | |

| | 5,605 | | | Dominion Resources | | | 303 | |

| | 6,370 | | | National Fuel Gas | | | 299 | |

| | 4,045 | | | NextEra Energy | | | 278 | |

| | 8,028 | | | Northeast Utilities | | | 312 | |

| | 7,040 | | | Sempra Energy | | | 485 | |

| | 9,955 | | | Westar Energy | | | 298 | |

| | 8,145 | | | Wisconsin Energy | | | 322 | |

| | | | | | | | |

| | | | | | | 2,969 | |

| | | | | | | | |

| | TOTAL COMMON STOCK (Cost $46,340) | | | 56,967 | |

| | | | | | | | |

|

| | PREFERRED STOCK — 0.4% | |

| Financials — 0.4% | | | | |

| | 1,865 | | | Fifth Third Bancorp, 8.50% | | | 255 | |

| | | | | | | | |

| | TOTAL PREFERRED STOCK (Cost $276) | | | 255 | |

| | | | | | | | |

|

| | SHORT-TERM INVESTMENT (A) — 1.2% | |

| | 692,390 | | | Dreyfus Cash Management Fund, Institutional Shares, 0.083% | | | 692 | |

| | | | | | | | |

| | TOTAL SHORT-TERM INVESTMENT (Cost $692) | | | 692 | |

| | | | | | | | |

| | TOTAL INVESTMENTS (Cost $47,308) — 99.9% | | $ | 57,914 | |

| | | | | | | | |

Percentages are based on Net Assets of $57,979 ($ Thousands).

| ‡ | Real Estate Investment Trust |

| * | Non-income producing security. |

| (A) | The rate shown is the 7-day effective yield as of June 30, 2012. |

PLC — Public Limited Company

Cost figures are shown in thousands.

The accompanying notes are an integral part of the financial statements.

10

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Top Ten Holdings†

| | | | | | | | | | | | | | |

| | | | | Coupon

Rate | | | Maturity

Date | | | Percentage

of

Investments | |

| |

| | | U.S. Treasury Note | | | 0.125% | | | | 08/31/13 | | | | 2.4% | |

| |

| | | U.S. Treasury Bond | | | 4.500% | | | | 08/15/39 | | | | 2.3% | |

| |

| | | U.S. Treasury Bond | | | 4.750% | | | | 02/15/37 | | | | 2.0% | |

| |

| | | U.S. Treasury Note | | | 0.250% | | | | 09/15/14 | | | | 1.9% | |

| |

| | | IBM | | | 8.375% | | | | 11/01/19 | | | | 1.6% | |

| |

| | | California State, Build America Bonds | | | 7.550% | | | | 04/01/39 | | | | 1.6% | |

| |

| | | Boston Properties | | | 5.625% | | | | 11/15/20 | | | | 1.6% | |

| |

| | | U.S. Treasury Bond | | | 4.375% | | | | 05/15/41 | | | | 1.5% | |

| |

| | | Rio Tinto Finance USA | | | 9.000% | | | | 05/01/19 | | | | 1.5% | |

| |

| | | Caterpillar | | | 7.900% | | | | 12/15/18 | | | | 1.5% | |

|

|

† Percentages are based on total investments. Top ten holdings do not include short-term investments. |

Schedule of Investments

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

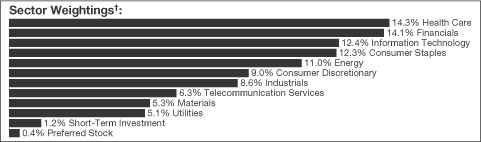

| | | | CORPORATE OBLIGATIONS — 49.5% | | | | |

| Consumer Discretionary — 2.6% | | | | |

| | | | AutoZone | | | | |

| $ | 525 | | | 4.000%, 11/15/20 | | $ | 561 | |

| | | | Home Depot | | | | |

| | 700 | | | 5.875%, 12/16/36 | | | 897 | |

| | | | Johnson Controls | | | | |

| | 500 | | | 4.250%, 03/01/21 | | | 537 | |

| | | | McDonald’s MTN | | | | |

| | 350 | | | 1.875%, 05/29/19 | | | 349 | |

| | | | | | | | |

| | | | | | | 2,344 | |

| | | | | | | | |

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

11

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Consumer Staples — 5.3% | | | | |

| | | | Bunge Finance | | | | |

| $ | 500 | | | 8.500%, 06/15/19 | | $ | 624 | |

| | | | Campbell Soup | | | | |

| | 500 | | | 4.250%, 04/15/21 | | | 566 | |

| | | | Genentech | | | | |

| | 1,000 | | | 4.750%, 07/15/15 | | | 1,105 | |

| | | | PepsiAmericas | | | | |

| | 650 | | | 4.875%, 01/15/15 | | | 714 | |

| | | | Teva Pharmaceutical Finance BV | | | | |

| | 500 | | | 2.400%, 11/10/16 | | | 517 | |

| | | | Wal-Mart Stores | | | | |

| | 1,000 | | | 5.375%, 04/05/17 | | | 1,188 | |

| | | | | | | | |

| | | | | | | 4,714 | |

| | | | | | | | |

| Energy — 5.2% | | | | |

| | | | Cameron International | | | | |

| | 375 | | | 4.500%, 06/01/21 | | | 401 | |

| | | | Devon Energy | | | | |

| | 1,000 | | | 6.300%, 01/15/19 | | | 1,229 | |

| | | | Halliburton | | | | |

| | 1,000 | | | 6.150%, 09/15/19 | | | 1,236 | |

| | | | Hess | | | | |

| | 400 | | | 8.125%, 02/15/19 | | | 515 | |

| | | | Kinder Morgan Energy Partners | | | | |

| | 710 | | | 9.000%, 02/01/19 | | | 917 | |

| | | | Occidental Petroleum | | | | |

| | 375 | | | 2.700%, 02/15/23 | | | 377 | |

| | | | | | | | |

| | | | | | | 4,675 | |

| | | | | | | | |

| Financials — 16.0% | | | | |

| | | | Aflac | | | | |

| | 1,000 | | | 8.500%, 05/15/19 | | | 1,305 | |

| | | | American Express Credit MTN | | | | |

| | 500 | | | 5.875%, 05/02/13 | | | 521 | |

| | 545 | | | 2.375%, 03/24/17 | | | 559 | |

| | | | Aon | | | | |

| | 500 | | | 3.125%, 05/27/16 | | | 521 | |

| | | | Bank of America MTN | | | | |

| | 1,050 | | | 4.900%, 05/01/13 | | | 1,074 | |

| | | | Bank of New York Mellon MTN | | | | |

| | 500 | | | 4.150%, 02/01/21 | | | 552 | |

| | | | Boston Properties | | | | |

| | 1,200 | | | 5.625%, 11/15/20 ‡ | | | 1,380 | |

12

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Financials — (continued) | | | | |

| | | | Capital One Financial | | | | |

| $ | 1,000 | | | 7.375%, 05/23/14 | | $ | 1,098 | |

| | | | Citigroup | | | | |

| | 1,100 | | | 6.500%, 08/19/13 | | | 1,153 | |

| | | | Daimler Finance North America LLC | | | | |

| | 840 | | | 6.500%, 11/15/13 | | | 900 | |

| | | | Eksportfinans ASA MTN | | | | |

| | 600 | | | 1.875%, 04/02/13 | | | 588 | |

| | | | General Electric Capital MTN | | | | |

| | 625 | | | 6.150%, 08/07/37 | | | 738 | |

| | | | Goldman Sachs Group MTN | | | | |

| | 500 | | | 7.500%, 02/15/19 | | | 570 | |

| | 550 | | | 0.866%, 07/22/15 (A) | | | 508 | |

| | | | JPMorgan Chase | | | | |

| | 450 | | | 3.150%, 07/05/16 | | | 463 | |

| | | | JPMorgan Chase Capital XXVII, Ser AA | | | | |

| | 1,000 | | | 7.000%, 11/01/39 | | | 1,000 | |

| | | | Svensk Exportkredit AB | | | | |

| | 1,000 | | | 2.125%, 07/13/16 | | | 1,029 | |

| | | | Toyota Motor Credit MTN | | | | |

| | 400 | | | 2.800%, 01/11/16 | | | 420 | |

| | | | | | | | |

| | | | | | | 14,379 | |

| | | | | | | | |

| Health Care — 4.3% | | | | |

| | | | Aristotle Holding | | | | |

| | 500 | | | 2.650%, 02/15/17 (B) | | | 509 | |

| | | | AstraZeneca PLC | | | | |

| | 1,000 | | | 5.900%, 09/15/17 | | | 1,201 | |

| | | | Gilead Sciences | | | | |

| | 875 | | | 3.050%, 12/01/16 | | | 924 | |

| | | | Merck | | | | |

| | 1,000 | | | 5.000%, 06/30/19 | | | 1,199 | |

| | | | | | | | |

| | | | | | | 3,833 | |

| | | | | | | | |

| Industrials — 1.5% | | | | |

| | | | Caterpillar | | | | |

| | 1,000 | | | 7.900%, 12/15/18 | | | 1,348 | |

| | | | | | | | |

| Information Technology — 6.8% | | | | |

| | | | BMC Software | | | | |

| | 760 | | | 7.250%, 06/01/18 | | | 915 | |

| | | | Dell | | | | |

| | 400 | | | 5.625%, 04/15/14 | | | 433 | |

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

13

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Information Technology — (continued) | | | | |

| | | | Hewlett-Packard | | | | |

| $ | 1,000 | | | 2.125%, 09/13/15 | | $ | 1,008 | |

| | | | IBM | | | | |

| | 1,000 | | | 8.375%, 11/01/19 | | | 1,425 | |

| | | | News America | | | | |

| | 500 | | | 6.650%, 11/15/37 | | | 584 | |

| | | | Symantec | | | | |

| | 1,100 | | | 2.750%, 09/15/15 | | | 1,130 | |

| | | | Xerox | | | | |

| | 500 | | | 8.250%, 05/15/14 | | | 558 | |

| | | | | | | | |

| | | | | | | 6,053 | |

| | | | | | | | |

| Materials — 4.7% | | | | |

| | | | BHP Billiton Finance | | | | |

| | 950 | | | 5.250%, 12/15/15 | | | 1,084 | |

| | | | Monsanto | | | | |

| | 700 | | | 7.375%, 08/15/12 | | | 705 | |

| | | | Nucor | | | | |

| | 1,000 | | | 4.875%, 10/01/12 | | | 1,009 | |

| | | | Rio Tinto Finance USA | | | | |

| | 1,000 | | | 9.000%, 05/01/19 | | | 1,367 | |

| | | | | | | | |

| | | | | | | 4,165 | |

| | | | | | | | |

| Telecommunication Services — 1.4% | | | | |

| | | | Alltel | | | | |

| | 250 | | | 7.000%, 03/15/16 | | | 299 | |

| | | | AT&T | | | | |

| | 305 | | | 5.500%, 02/01/18 | | | 362 | |

| | | | Cellco Partnership | | | | |

| | 450 | | | 8.500%, 11/15/18 | | | 616 | |

| | | | | | | | |

| | | | | | | 1,277 | |

| | | | | | | | |

| Transportation Services — 1.0% | | | | |

| | | | Continental Airlines | | | | |

| | 796 | | | 9.000%, 07/08/16 | | | 912 | |

| | | | | | | | |

| Utilities — 0.7% | | | | |

| | | | Potomac Edison | | | | |

| | 600 | | | 5.350%, 11/15/14 | | | 653 | |

| | | | | | | | |

| | TOTAL CORPORATE OBLIGATIONS (Cost $41,028) | | | 44,353 | |

| | | | | | | | |

14

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| | U.S. TREASURY OBLIGATIONS — 26.6% | |

| | | | U.S. Treasury Bond | | | | |

| $ | 700 | | | 7.250%, 05/15/16 | | $ | 878 | |

| | 800 | | | 6.000%, 02/15/26 | | | 1,173 | |

| | 500 | | | 5.375%, 02/15/31 | | | 729 | |

| | 1,250 | | | 4.750%, 02/15/37 | | | 1,743 | |

| | 1,500 | | | 4.500%, 08/15/39 | | | 2,035 | |

| | 1,025 | | | 4.375%, 05/15/41 | | | 1,369 | |

| | 850 | | | 3.125%, 11/15/41 | | | 914 | |

| | | | U.S. Treasury Note | | | | |

| | 1,000 | | | 4.250%, 08/15/13 | | | 1,044 | |

| | 575 | | | 3.750%, 11/15/18 | | | 674 | |

| | 350 | | | 3.625%, 02/15/21 | | | 413 | |

| | 625 | | | 3.125%, 10/31/16 | | | 691 | |

| | 500 | | | 3.125%, 01/31/17 | | | 555 | |

| | 600 | | | 2.875%, 03/31/18 | | | 667 | |

| | 405 | | | 2.625%, 04/30/16 | | | 437 | |

| | 650 | | | 2.375%, 10/31/14 | | | 680 | |

| | 1,000 | | | 2.375%, 02/28/15 | | | 1,052 | |

| | 500 | | | 2.375%, 07/31/17 | | | 540 | |

| | 1,000 | | | 2.125%, 05/31/15 | | | 1,049 | |

| | 500 | | | 2.125%, 08/15/21 | | | 525 | |

| | 1,000 | | | 2.000%, 11/15/21 | | | 1,037 | |

| | 1,000 | | | 1.375%, 02/28/19 | | | 1,021 | |

| | 800 | | | 1.000%, 01/15/14 | | | 808 | |

| | 1,700 | | | 0.250%, 09/15/14 | | | 1,696 | |

| | 2,145 | | | 0.125%, 08/31/13 | | | 2,141 | |

| | | | | | | | |

| | TOTAL U.S. TREASURY OBLIGATIONS (Cost $22,059) | | | 23,871 | |

| | | | | | | | |

| | |

| | | | MUNICIPAL BONDS — 9.0% | | | | |

| | | | Arizona Public Service | | | | |

| | 500 | | | 6.250%, 08/01/16 | | | 586 | |

| | | | California State, Build America Bonds, GO | | | | |

| | 1,100 | | | 7.550%, 04/01/39 | | | 1,415 | |

| | | | City of Minneapolis Minnesota, GO | | | | |

| | 250 | | | 4.900%, 03/01/25 | | | 280 | |

| | 300 | | | 4.800%, 03/01/24 | | | 336 | |

| | | | City of New York New York, GO | | | | |

| | 300 | | | 5.817%, 10/01/31 | | | 337 | |

| | | | Connecticut State, GO | | | | |

| | 800 | | | 5.295%, 10/01/29 | | | 933 | |

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

15

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| | | | MUNICIPAL BONDS (continued) | | | | |

| | | | Hawaii State, GO | | | | |

| $ | 700 | | | 5.480%, 02/01/28 | | $ | 846 | |

| | | | Honolulu Hawaii City & County, Build America Bonds, GO | | | | |

| | 435 | | | 6.300%, 09/01/34 | | | 492 | |

| | | | Houston Independent School District, GO | | | | |

| | 250 | | | 6.125%, 02/15/28 | | | 295 | |

| | | | St. Louis School District, Qualified School Construction Boards, GO | | | | |

| | 1,070 | | | 6.100%, 04/01/25 | | | 1,333 | |

| | | | Tennessee State, School Bond Authority, GO | | | | |

| | 500 | | | 4.848%, 09/15/27 | | | 565 | |

| | | | Utah State, Ser B, GO | | | | |

| | 575 | | | 3.369%, 07/01/21 | | | 623 | |

| | | | | | | | |

| | TOTAL MUNICIPAL BONDS (Cost $7,384) | | | 8,041 | |

| | | | | | | | |

|

| | U.S. GOVERNMENT AGENCY OBLIGATIONS — 7.7% | |

| | | | FHLB | | | | |

| | 1,100 | | | 5.125%, 03/10/17 | | | 1,307 | |

| | 1,000 | | | 4.125%, 03/13/20 | | | 1,181 | |

| | 1,100 | | | 3.750%, 12/14/18 | | | 1,262 | |

| | | | FHLMC | | | | |

| | 875 | | | 8.250%, 06/01/16 | | | 1,078 | |

| | | | FHLMC MTN | | | | |

| | 1,000 | | | 4.250%, 05/22/13 | | | 1,035 | |

| | | | FNMA | | | | |

| | 1,000 | | | 0.750%, 02/07/14 | | | 1,005 | |

| | | | | | | | |

| | TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS (Cost $6,481) | | | 6,868 | |

| | | | | | | | |

|

| | U.S. GOVERNMENT MORTGAGE-BACKED OBLIGATIONS — 2.0% | |

| | | | FNMA, Ser 2003-33, Cl AB | | | | |

| | 845 | | | 3.750%, 03/25/33 | | | 882 | |

| | | | FNMA, Ser 889958 | | | | |

| | 236 | | | 5.000%, 10/01/23 | | | 255 | |

| | | | FNMA REMIC, Ser 2007-B1, Cl BE | | | | |

| | 269 | | | 5.450%, 12/25/20 | | | 277 | |

| | | | GNMA, Ser 2003-7, Cl PE | | | | |

| | 340 | | | 5.500%, 11/16/31 | | | 351 | |

| | | | | | | | |

| | TOTAL U.S. GOVERNMENT MORTGAGE-BACKED OBLIGATIONS (Cost $1,694) | | | 1,765 | |

| | | | | | | | |

16

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(concluded)

| | | | | | | | |

Face

Amount

(000)/Shares | | | | | Value

(000) | |

| | ASSET-BACKED SECURITY — 1.3% | |

| | | | GSR Mortgage Loan Trust, Ser 2004-4, Cl 3A2 | | | | |

| $ | 1,209 | | | 2.050%, 04/25/32 (A) | | $ | 1,204 | |

| | | | | | | | |

| | TOTAL ASSET-BACKED SECURITY (Cost $1,077) | | | 1,204 | |

| | | | | | | | |

|

| | SHORT-TERM INVESTMENT (C) — 3.1% | |

| | 2,828,515 | | | Dreyfus Cash Management Fund, Institutional Shares, 0.083% | | | 2,829 | |

| | | | | | | | |

| | TOTAL SHORT-TERM INVESTMENT (Cost $2,829) | | | 2,829 | |

| | | | | | | | |

| | TOTAL INVESTMENTS (Cost $82,552) — 99.2% | | $ | 88,931 | |

| | | | | | | | |

Percentages are based on Net Assets of $89,616 ($ Thousands).

| ‡ | Real Estate Investment Trust |

| (A) | Floating Rate Security — The rate reflected on the Schedule of Investments is the rate in effect on June 30, 2012. The maturity date shown is the final maturity date. |

| (B) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutions. At June 30, 2012, these securities amounted to $509 ($ Thousands), representing 0.57% of net assets of the Fund. |

| (C) | The rate shown is the 7-day effective yield as of June 30, 2012. |

Cl — Class

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Corporation

GNMA — Government National Mortgage Corporation

GO — General Obligation

LLC — Limited Liability Corporation

MTN — Medium Term Note

PLC — Public Limited Company

REMIC — Real Estate Mortgage Investment Conduit

Ser — Series

Cost figures are shown in thousands.

The accompanying notes are an integral part of the financial statements.

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

17

| | | | |

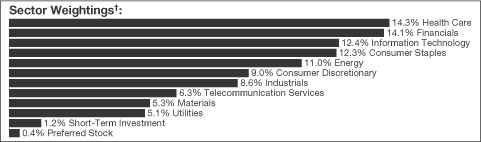

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Top Ten Holdings†

| | | | | | | | | | | | | | |

| | | | | Coupon

Rate | | | Maturity

Date | | | Percentage

of

Investments | |

| |

| | | Hawaii State, Housing Finance & Development, RB | | | 5.350% | | | | 07/01/18 | | | | 2.2% | |

| |

| | | Hawaii State, RB | | | 5.250% | | | | 07/01/27 | | | | 1.9% | |

| |

| | | Hawaii State, RB | | | 5.000% | | | | 07/01/16 | | | | 1.7% | |

| |

| | | Hawaii State, RB | | | 5.000% | | | | 01/01/25 | | | | 1.5% | |

| |

| | | Honolulu Hawaii City & County, Board of Water Supply, RB | | | 5.000% | | | | 07/01/26 | | | | 1.4% | |

| |

| | | Hawaii State, Housing Finance & Development, RB | | | 6.500% | | | | 07/01/33 | | | | 1.4% | |

| |

| | | Honolulu Hawaii City & County, GO | | | 5.000% | | | | 07/01/21 | | | | 1.4% | |

| |

| | | Honolulu Hawaii City & County, Board of Water Supply, RB | | | 5.000% | | | | 07/01/14 | | | | 1.4% | |

| |

| | | University of Hawaii, RB | | | 4.500% | | | | 07/15/23 | | | | 1.4% | |

| |

| | | Honolulu Hawaii City & County, GO | | | 5.000% | | | | 07/01/17 | | | | 1.4% | |

| |

|

|

† Percentages are based on total investments. Top ten holdings do not include short-term investments. |

Schedule of Investments

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| | MUNICIPAL BONDS — 98.5% | |

| Alaska — 0.9% | | | | |

| | | | Alaska Municipal Bond Bank Authority, Ser 3, RB, Bond Bank Moral Obligation Insured | | | | |

| $ | 1,000 | | | 5.000%, 09/01/22 | | $ | 1,225 | |

18

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Alaska (continued) | |

| | | | City of Anchorage Alaska, Water Department, RB, NPFGC Insured | | | | |

| $ | 200 | | | 5.000%, 05/01/37 | | $ | 213 | |

| | | | | | | | |

| | | | | | | 1,438 | |

| | | | | | | | |

| Arizona — 1.5% | | | | |

| | | | City of Glendale Arizona, Water and Sewer, RB | | | | |

| | 1,000 | | | 5.000%, 07/01/23 | | | 1,202 | |

| | | | City of Mesa Arizona, GO | | | | |

| | 1,000 | | | 4.250%, 07/01/31 | | | 1,068 | |

| | | | | | | | |

| | | | | | | 2,270 | |

| | | | | | | | |

| California — 1.9% | | | | |

| | | | California Health Facilities Financing Authority, Stanford Hospital,

Ser B, RB | | | | |

| | 1,000 | | | 5.000%, 11/15/25 | | | 1,148 | |

| | | | California State, GO | | | | |

| | 1,000 | | | 5.000%, 04/01/38 | | | 1,049 | |

| | | | California State, GO, AGM Insured | | | | |

| | 800 | | | 4.500%, 12/01/32 | | | 810 | |

| | | | | | | | |

| | | | | | | 3,007 | |

| | | | | | | | |

| Colorado — 0.4% | | | | |

| | | | Denver City & County, School District No. 1, GO | | | | |

| | 500 | | | 5.000%, 12/01/24 | | | 605 | |

| | | | | | | | |

| Georgia — 0.7% | | | | |

| | | | Main Street, Natural Gas, Ser B, RB | | | | |

| | 1,000 | | | 5.000%, 03/15/18 | | | 1,084 | |

| | | | | | | | |

| Hawaii — 80.7% | | | | |

| | | | Hawaii County, Ser A, GO | | | | |

| | 500 | | | 4.000%, 03/01/22 | | | 560 | |

| | | | Hawaii County, Ser A, GO, AGM Insured | | | | |

| | 125 | | | 5.000%, 07/15/21 | | | 131 | |

| | 1,500 | | | 5.000%, 07/15/23 | | | 1,565 | |

| | | | Hawaii County, Ser A, GO, NPFGC Insured | | | | |

| | 1,055 | | | 5.250%, 07/15/18 | | | 1,150 | |

| | 1,000 | | | 5.000%, 07/15/24 | | | 1,074 | |

| | | | Hawaii County, Unlimited Public Improvements, Ser A, GO | | | | |

| | 1,000 | | | 5.000%, 07/15/22 | | | 1,162 | |

| | | | Hawaii County, Unlimited Public Improvements, Ser A, GO,

AMBAC Insured | | | | |

| | 1,000 | | | 5.000%, 07/15/15 | | | 1,126 | |

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

19

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Hawaii Pacific Health, Ser A, RB | | | | |

| $ | 1,000 | | | 4.625%, 07/01/21 | | $ | 1,106 | |

| | | | Hawaii State, Airport System, RB, AGM Insured | | | | |

| | 1,000 | | | 5.250%, 07/01/27 | | | 1,149 | |

| | | | Hawaii State, Airport System, Ser A, RB | | | | |

| | 2,500 | | | 5.250%, 07/01/27 | | | 2,901 | |

| | 200 | | | 5.250%, 07/01/30 | | | 229 | |

| | 1,250 | | | 5.000%, 07/01/22 | | | 1,474 | |

| | | | Hawaii State, Airport System, RB, AMT | | | | |

| | 15 | | | 6.900%, 07/01/12 | | | 15 | |

| | 1,500 | | | 4.125%, 07/01/24 | | | 1,578 | |

| | 1,000 | | | 3.000%, 07/01/17 | | | 1,049 | |

| | | | Hawaii State, Department of Budget & Finance, Chaminade University, RB, Radian Insured | | | | |

| | 1,000 | | | 4.750%, 01/01/36 | | | 1,020 | |

| | | | Hawaii State, Department of Budget & Finance, Electric Company Project, Ser A, RB, AMT, AMBAC Insured | | | | |

| | 445 | | | 5.100%, 09/01/32 | | | 445 | |

| | | | Hawaii State, Department of Budget & Finance, Electric Company Project, Ser A, RB, AMT, FGIC Insured | | | | |

| | 750 | | | 4.800%, 01/01/25 | | | 765 | |

| | 1,000 | | | 4.650%, 03/01/37 | | | 1,013 | |

| | | | Hawaii State, Department of Budget & Finance, Electric Company Project, Ser A, RB, AMT, NPFGC Insured | | | | |

| | 1,250 | | | 5.650%, 10/01/27 | | | 1,267 | |

| | | | Hawaii State, Department of Budget & Finance, Mid Pacific Institute, RB, Radian Insured | | | | |

| | 1,000 | | | 5.000%, 01/01/26 | | | 1,027 | |

| | | | Hawaii State, Department of Budget & Finance, RB | | | | |

| | 300 | | | 3.600%, 11/15/20 | | | 300 | |

| | 300 | | | 3.350%, 11/15/19 | | | 300 | |

| | | | Hawaii State, Department of Hawaiian Home Lands, Kapolei Office Facilities, Ser A, COP, AGM Insured | | | | |

| | 2,000 | | | 5.000%, 11/01/31 | | | 2,159 | |

| | | | Hawaii State, Harbor System, Ser A, RB | | | | |

| | 1,125 | | | 4.250%, 07/01/21 | | | 1,248 | |

| | | | Hawaii State, Harbor System, Ser A, RB, AMT, AGM Insured | | | | |

| | 370 | | | 5.750%, 07/01/29 | | | 371 | |

| | | | Hawaii State, Harbor System, Ser B, RB, AMT, AGM Insured | | | | |

| | 1,000 | | | 5.000%, 01/01/13 | | | 1,021 | |

| | 500 | | | 5.000%, 01/01/23 | | | 517 | |

| | | | Hawaii State, Harbor System, Ser B, RB, AMT, AMBAC Insured | | | | |

| | 200 | | | 5.500%, 07/01/19 | | | 200 | |

20

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Hawaii State, Highway, RB | | | | |

| $ | 500 | | | 5.750%, 01/01/28 | | $ | 587 | |

| | 605 | | | 5.500%, 07/01/18 | | | 749 | |

| | 1,000 | | | 5.500%, 01/01/25 | | | 1,171 | |

| | | | Hawaii State, Highway, RB, BHAC Insured | | | | |

| | 550 | | | 4.750%, 01/01/22 | | | 634 | |

| | | | Hawaii State, Highway, Ser A, RB | | | | |

| | 2,000 | | | 5.000%, 01/01/25 | | | 2,399 | |

| | 1,300 | | | 5.000%, 01/01/31 | | | 1,505 | |

| | | | Hawaii State, Highway, Ser A, RB, AGM Insured | | | | |

| | 500 | | | 5.000%, 07/01/19 | | | 555 | |

| | 1,000 | | | 5.000%, 07/01/21 | | | 1,103 | |

| | 1,565 | | | 5.000%, 07/01/22 | | | 1,721 | |

| | | | Hawaii State, Highway, Ser B, RB, AGM Insured | | | | |

| | 1,250 | | | 5.250%, 07/01/18 | | | 1,529 | |

| | 1,600 | | | 5.250%, 07/01/19 | | | 1,980 | |

| | 2,300 | | | 5.000%, 07/01/16 | | | 2,583 | |

| | | | Hawaii State, Housing Finance & Development, Kuhio Park Terrace Multi-Family Housing, Ser A, RB, FHLMC Insured | | | | |

| | 200 | | | 3.900%, 04/01/22 | | | 213 | |

| | 115 | | | 3.750%, 04/01/21 | | | 123 | |

| | 180 | | | 3.500%, 04/01/20 | | | 190 | |

| | 115 | | | 3.000%, 04/01/18 | | | 120 | |

| | | | Hawaii State, Housing Finance & Development, Rental Housing System, Ser B, RB, AGM Insured | | | | |

| | 2,000 | | | 6.500%, 07/01/33 | | | 2,219 | |

| | | | Hawaii State, Housing Finance & Development, Single-Family Housing, Ser A, RB, AMT, FNMA Collateral Insured | | | | |

| | 475 | | | 5.400%, 07/01/30 | | | 475 | |

| | 3,355 | | | 5.350%, 07/01/18 | | | 3,357 | |

| | | | Hawaii State, Housing Finance & Development, Single-Family Housing, Ser B, RB, GNMA/FNMA Insured | | | | |

| | 500 | | | 3.450%, 01/01/22 | | | 516 | |

| | | | Hawaii State, Improvements Authority, Ser DF, GO, AMBAC Insured | | | | |

| | 1,250 | | | 5.000%, 07/01/18 | | | 1,401 | |

| | 1,250 | | | 5.000%, 07/01/21 | | | 1,391 | |

| | | | Hawaii State, Ser CM, GO, AGM Insures FGIC Insured | | | | |

| | 1,000 | | | 6.500%, 12/01/14 | | | 1,143 | |

| | | | Hawaii State, Ser DA, GO, NPFGC Insured | | | | |

| | 425 | | | 5.250%, 09/01/13 , Pre-Refunded @ 100 (A) | | | 449 | |

| | 425 | | | 5.250%, 09/01/23 | | | 447 | |

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

21

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Hawaii State, Ser DB, GO, NPFGC Insured | | | | |

| $ | 230 | | | 5.250%, 09/01/13 , Pre-Refunded @ 100 (A) | | $ | 243 | |

| | 770 | | | 5.250%, 09/01/16 | | | 815 | |

| | | | Hawaii State, Ser DD, GO, NPFGC Insured | | | | |

| | 260 | | | 5.250%, 05/01/14 , Pre-Refunded @ 100 (A) | | | 283 | |

| | | | Hawaii State, Ser DF, GO, AMBAC Insured | | | | |

| | 30 | | | 5.000%, 07/01/15 , Pre-Refunded @ 100 (A) | | | 34 | |

| | 60 | | | 5.000%, 07/01/22 | | | 67 | |

| | | | Hawaii State, Ser DG, GO, AMBAC Insured | | | | |

| | 1,000 | | | 5.000%, 07/01/16 | | | 1,131 | |

| | | | Hawaii State, Ser DI, GO, AGM Insured | | | | |

| | 500 | | | 5.000%, 03/01/24 | | | 565 | |

| | 1,500 | | | 5.000%, 03/01/25 | | | 1,689 | |

| | | | Hawaii State, Ser DK, GO | | | | |

| | 475 | | | 5.000%, 05/01/25 | | | 546 | |

| | | | Hawaii State, Ser DN, GO | | | | |

| | 200 | | | 5.250%, 08/01/25 | | | 236 | |

| | | | Hawaii State, Ser DO, GO | | | | |

| | 850 | | | 5.000%, 08/01/17 | | | 1,016 | |

| | | | Hawaii State, Ser DR, GO | | | | |

| | 1,000 | | | 5.000%, 06/01/17 | | | 1,191 | |

| | | | Hawaii State, Ser DT, GO | | | | |

| | 250 | | | 5.000%, 11/01/19 | | | 309 | |

| | 175 | | | 4.500%, 11/01/19 | | | 210 | |

| | | | Hawaii State, Ser DY, GO | | | | |

| | 750 | | | 5.000%, 02/01/19 | | | 915 | |

| | 710 | | | 5.000%, 02/01/20 | | | 875 | |

| | | | Hawaii State, Ser DZ, GO | | | | |

| | 1,000 | | | 5.000%, 12/01/17 | | | 1,205 | |

| | 190 | | | 5.000%, 12/01/24 | | | 231 | |

| | 250 | | | 5.000%, 12/01/28 | | | 294 | |

| | 1,000 | | | 5.000%, 12/01/29 | | | 1,171 | |

| | 1,100 | | | 4.000%, 12/01/30 | | | 1,176 | |

| | | | Hawaii State, Ser EA, GO | | | | |

| | 1,000 | | | 5.000%, 12/01/22 | | | 1,238 | |

| | 500 | | | 3.000%, 12/01/20 | | | 545 | |

| | | | Hawaii State, Unlimited Public Improvements, Ser DD, GO, NPFGC Insured | | | | |

| | 1,000 | | | 5.000%, 05/01/16 | | | 1,085 | |

| | | | Honolulu Hawaii City & County, Ad Valorem Property Tax Project, Ser B, GO, NPFGC Insured | | | | |

| | 2,000 | | | 5.000%, 07/01/17 | | | 2,165 | |

22

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Honolulu Hawaii City & County, Board of Water Supply, Ser A, RB | | | | |

| $ | 1,050 | | | 5.000%, 07/01/19 | | $ | 1,290 | |

| | 670 | | | 3.000%, 07/01/17 | | | 733 | |

| | | | Honolulu Hawaii City & County, Board of Water Supply, Ser A, RB, FGIC Insured | | | | |

| | 1,000 | | | 4.750%, 07/01/14 , Pre-Refunded @ 100 (A) | | | 1,087 | |

| | | | Honolulu Hawaii City & County, Board of Water Supply, Ser A, RB, NPFGC Insured | | | | |

| | 2,000 | | | 5.000%, 07/01/26 | | | 2,237 | |

| | | | Honolulu Hawaii City & County, Board of Water Supply, Ser A, RB, NPFGC Re-insures FGIC Insured | | | | |

| | 2,000 | | | 5.000%, 07/01/14 , Pre-Refunded @ 100 (A) | | | 2,183 | |

| | | | Honolulu Hawaii City & County, Board of Water Supply, Ser B, RB, AMT, NPFGC Insured | | | | |

| | 1,000 | | | 5.250%, 07/01/20 | | | 1,117 | |

| | 1,000 | | | 5.250%, 07/01/21 | | | 1,111 | |

| | 325 | | | 5.000%, 07/01/15 | | | 361 | |

| | | | Honolulu Hawaii City & County, Ser A, GO | | | | |

| | 1,100 | | | 5.250%, 04/01/32 | | | 1,265 | |

| | 1,000 | | | 5.000%, 04/01/33 | | | 1,114 | |

| | 1,000 | | | 4.250%, 08/01/32 | | | 1,071 | |

| | | | Honolulu Hawaii City & County, Ser A, GO, AGM Insured | | | | |

| | 1,000 | | | 5.000%, 07/01/22 | | | 1,146 | |

| | | | Honolulu Hawaii City & County, Ser A, GO, NPFGC Insured | | | | |

| | 70 | | | 5.250%, 03/01/28 | | | 72 | |

| | 1,950 | | | 5.000%, 07/01/21 | | | 2,183 | |

| | 500 | | | 5.000%, 07/01/23 | | | 557 | |

| | | | Honolulu Hawaii City & County, Ser B, GO | | | | |

| | 250 | | | 5.000%, 12/01/18 | | | 305 | |

| | 395 | | | 5.000%, 08/01/21 | | | 492 | |

| | | | Honolulu Hawaii City & County, Ser B, GO, AGM Insured | | | | |

| | 290 | | | 5.250%, 07/01/15 | | | 330 | |

| | 1,000 | | | 5.250%, 07/01/16 | | | 1,175 | |

| | 345 | | | 5.250%, 07/01/18 | | | 423 | |

| | | | Honolulu Hawaii City & County, Ser B, GO, NPFGC Insured | | | | |

| | 1,000 | | | 5.000%, 07/01/15 | | | 1,086 | |

| | | | Honolulu Hawaii City & County, Ser C, GO | | | | |

| | 200 | | | 4.750%, 09/01/18 | | | 237 | |

| | | | Honolulu Hawaii City & County, Ser D, GO | | | | |

| | 1,000 | | | 5.250%, 09/01/22 | | | 1,225 | |

| | | | Honolulu Hawaii City & County, Ser D, GO, AGM Insures NPFGC Insured | | | | |

| | 1,000 | | | 5.000%, 07/01/22 | | | 1,118 | |

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

23

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Honolulu Hawaii City & County, Ser D, GO, NPFGC Insured | | | | |

| $ | 1,000 | | | 5.000%, 07/01/20 | | $ | 1,120 | |

| | 1,000 | | | 5.000%, 07/01/23 | | | 1,115 | |

| | | | Honolulu Hawaii City & County, Ser F, GO, NPFGC Re-insures FGIC Insured | | | | |

| | 1,000 | | | 5.000%, 07/01/29 | | | 1,095 | |

| | | | Honolulu Hawaii City & County, Sewer Improvements, 1st Board Resolution, Ser Senior A, RB, NPFGC Insured | | | | |

| | 1,000 | | | 5.000%, 07/01/31 | | | 1,080 | |

| | | | Honolulu Hawaii City & County, Sewer Improvements, 2nd Board Resolution, Ser A, RB | | | | |

| | 500 | | | 5.000%, 07/01/20 | | | 602 | |

| | | | Honolulu Hawaii City & County, Sewer Improvements, Ser A, RB | | | | |

| | 1,000 | | | 5.000%, 07/01/25 | | | 1,190 | |

| | 1,000 | | | 5.000%, 07/01/38 | | | 1,121 | |

| | 1,000 | | | 4.000%, 07/01/31 | | | 1,056 | |

| | | | Honolulu Hawaii City & County, Sewer Improvements, Ser Junior A-1, RB, NPFGC Insured | | | | |

| | 815 | | | 5.000%, 07/01/22 | | | 909 | |

| | | | Honolulu Hawaii City & County, Waipahu Towers Project, Ser A, RB, AMT, GNMA Collateral Insured | | | | |

| | 190 | | | 6.900%, 06/20/35 | | | 190 | |

| | | | Kauai County, Ser A, GO | | | | |

| | 250 | | | 4.000%, 08/01/24 | | | 281 | |

| | 250 | | | 3.250%, 08/01/23 | | | 267 | |

| | | | Kauai County, Ser A, GO, NPFGC Re-insures FGIC Insured | | | | |

| | 2,440 | | | 5.000%, 08/01/15, Pre-Refunded @ 100 (A) | | | 2,772 | |

| | 1,610 | | | 5.000%, 08/01/21 | | | 1,785 | |

| | | | Maui County, GO, NPFGC Insured | | | | |

| | 100 | | | 5.000%, 03/01/17 | | | 110 | |

| | 1,100 | | | 5.000%, 03/01/24 | | | 1,187 | |

| | | | Maui County, Ser A, GO | | | | |

| | 1,000 | | | 5.000%, 07/01/19 | | | 1,166 | |

| | | | Maui County, Ser A, GO, AGM Insured | | | | |

| | 1,000 | | | 3.500%, 07/01/16 | | | 1,100 | |

| | | | Maui County, Ser A, GO, NPFGC Insured | | | | |

| | 1,000 | | | 4.750%, 07/01/25 | | | 1,096 | |

| | | | Maui County, Ser B and C, GO, NPFGC Insured | | | | |

| | 500 | | | 5.000%, 07/01/16 | | | 580 | |

| | | | Maui County, Ser B, GO | | | | |

| | 500 | | | 4.000%, 06/01/21 | | | 564 | |

24

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Maui County, Ser B, GO, NPFGC Insured | | | | |

| $ | 500 | | | 5.000%, 09/01/17 | | $ | 543 | |

| | | | University of Hawaii, College Improvements Project, Ser A, RB, AGC Insured | | | | |

| | 1,400 | | | 5.000%, 10/01/23 | | | 1,565 | |

| | | | University of Hawaii, College Improvements Project, Ser A, RB, NPFGC Insured | | | | |

| | 200 | | | 5.000%, 07/15/19 | | | 227 | |

| | 150 | | | 5.000%, 07/15/22 | | | 168 | |

| | | | University of Hawaii, Ser A, RB | | | | |

| | 100 | | | 6.000%, 10/01/38 | | | 118 | |

| | | | University of Hawaii, Ser A, RB, NPFGC Insured | | | | |

| | 975 | | | 5.000%, 07/15/21 | | | 1,096 | |

| | 2,000 | | | 4.500%, 07/15/23 | | | 2,170 | |

| | | | University of Hawaii, Ser A-2, RB | | | | |

| | 1,000 | | | 4.000%, 10/01/18 | | | 1,138 | |

| | | | | | | | |

| | | | 127,046 | |

| | | | | | | | |

| Maine — 0.5% | | | | |

| | | | Maine Health & Higher Educational Facilities Authority, Ser A, RB | | | | |

| | 750 | | | 5.250%, 07/01/31 | | | 830 | |

| | | | | | | | |

| Massachusetts — 1.6% | | | | |

| | | | Commonwealth of Massachusetts, Ser B, GO, AGM Insured | | | | |

| | 1,300 | | | 5.250%, 08/01/28 | | | 1,688 | |

| | | | Massachusetts Bay Transportation Authority, Ser A, RB | | | | |

| | 600 | | | 5.250%, 07/01/29 | | | 771 | |

| | | | | | | | |

| | | | 2,459 | |

| | | | | | | | |

| Minnesota — 0.3% | | | | |

| | | | Minnesota Housing Finance Agency, RB, GNMA/FNMA Insured | | | | |

| | 500 | | | 4.875%, 07/01/26 | | | 540 | |

| | | | | | | | |

| Nevada — 0.2% | | | | |

| | | | Nevada State, Municipal Bond Bank Projects, Ser F, GO, AGM Insured | | | | |

| | 250 | | | 5.000%, 12/01/24 | | | 273 | |

| | | | | | | | |

| New York — 1.5% | | | | |

| | | | City of New York New York, Ser F, GO | | | | |

| | 500 | | | 3.000%, 08/01/16 | | | 541 | |

| | | | City of New York New York, Ser H-1, GO | | | | |

| | 600 | | | 5.000%, 03/01/18 | | | 716 | |

| | | | New York State, Dormitory Authority, New York University, Ser A, RB | | | | |

| | 1,000 | | | 3.100%, 07/01/17 | | | 1,084 | |

| | | | | | | | |

| | | | 2,341 | |

| | | | | | | | |

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

25

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Ohio — 0.4% | | | | |

| | | | City of Akron Ohio, GO | | | | |

| $ | 500 | | | 5.000%, 12/01/21 | | $ | 566 | |

| | | | | | | | |

| Oklahoma — 1.7% | | | | |

| | | | Oklahoma Water Resources Board, RB | | | | |

| | 500 | | | 4.000%, 10/01/40 | | | 518 | |

| | 1,000 | | | 3.000%, 10/01/18 | | | 1,088 | |

| | | | Tulsa Industrial Authority, University of Tulsa, RB | | | | |

| | 1,000 | | | 5.000%, 10/01/22 | | | 1,153 | |

| | | | | | | | |

| | | | 2,759 | |

| | | | | | | | |

| Puerto Rico — 2.2% | | | | |

| | | | Commonwealth of Puerto Rico, GO, NPFGC Insured | | | | |

| | 1,500 | | | 6.000%, 07/01/15 | | | 1,670 | |

| | | | Puerto Rico Electric Power Authority, Ser ZZ, RB | | | | |

| | 500 | | | 5.000%, 07/01/24 | | | 533 | |

| | | | Puerto Rico Highway & Transportation Authority, Ser N, RB, AGM Insured | | | | |

| | 1,000 | | | 5.500%, 07/01/26 | | | 1,177 | |

| | | | | | | | |

| | | | 3,380 | |

| | | | | | | | |

| South Carolina — 0.4% | | | | |

| | | | Sumter South Carolina, Waterworks & Sewer Improvement Systems, RB, XLCA Insured | | | | |

| | 500 | | | 5.000%, 12/01/21 | | | 555 | |

| | | | | | | | |

| Texas — 0.7% | | | | |

| | | | Port of Houston Authority, Ser D-1, GO | | | | |

| | 1,000 | | | 5.000%, 10/01/35 | | | 1,160 | |

| | | | | | | | |

| Washington — 2.2% | | | | |

| | | | King County Washington, GO | | | | |

| | 1,000 | | | 4.750%, 01/01/34 | | | 1,069 | |

| | | | Washington Economic Development Finance Authority, RB | | | | |

| | 1,000 | | | 4.125%, 06/01/30 | | | 1,047 | |

| | | | Washington State, Motor Vehicle Tax, Ser C, GO | | | | |

| | 1,000 | | | 5.000%, 06/01/22 | | | 1,228 | |

| | | | | | | | |

| | | | | | | 3,344 | |

| | | | | | | | |

| Wisconsin — 0.7% | | | | |

| | | | Wisconsin State, Ser D, GO, AGM Insured | | | | |

| | 1,000 | | | 5.000%, 05/01/21 | | | 1,143 | |

| | | | | | | | |

| | TOTAL MUNICIPAL BONDS (Cost $146,231) | | | 154,800 | |

| | | | | | | | |

26

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(concluded)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| | SHORT-TERM INVESTMENT (B) — 0.5% | |

| | 780,841 | | | Dreyfus Tax-Exempt Cash Management Fund, Institutional Shares, 0.000% | | $ | 781 | |

| | | | | | | | |

| | TOTAL SHORT-TERM INVESTMENT (Cost $781) | | | 781 | |

| | | | | | | | |

| | TOTAL INVESTMENTS (Cost $147,012) — 99.0% | | $ | 155,581 | |

| | | | | | | | |

Percentages are based on Net Assets of $157,092 ($ Thousands).

| (A) | Pre-Refunded Security — The maturity date shown is the pre-refunded date. |

| (B) | The rate shown is the 7-day effective yield as of June 30, 2012. |

AGC — American Guarantee Corporation

AGM — Assured Guaranty Municipal Corp.

AMBAC — American Municipal Bond Assurance Company

AMT — Alternative Minimum Tax

BHAC — Berkshire Hathaway Assurance Corporation

COP — Certificate of Participation

FGIC — Financial Guarantee Insurance Corporation

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Corporation

GNMA — Government National Mortgage Corporation

GO — General Obligation

NPFGC — National Public Finance Guarantee Corporation

RB — Revenue Bond

Ser — Series

XLCA — XL Capital

Cost figures are shown in thousands.

The accompanying notes are an integral part of the financial statements.

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

27

| | | | |

| Bishop Street Funds | | | (unaudited) | |

Statements of Assets and Liabilities (000)

June 30, 2012

| | | | | | | | | | | | |

| | | Strategic

Growth

Fund | | | Dividend

Value

Fund | | | High

Grade

Income

Fund | |

Assets: | | | | | | | | | | | | |

Investments, at Cost | | $ | 40,611 | | | $ | 47,308 | | | $ | 82,552 | |

| |

Investments, at Value | | $ | 47,816 | | | $ | 57,914 | | | $ | 88,931 | |

Cash | | | — | | | | — | | | | 25 | |

Receivable for Investment Securities Sold | | | 127 | | | | — | | | | — | |

Dividends and Interest Receivable | | | 26 | | | | 124 | | | | 832 | |

Due from Shareholder Servicing Agent | | | 6 | | | | 7 | | | | 11 | |

Prepaid Expenses | | | 5 | | | | 1 | | | | 7 | |

Due from Administrator | | | 3 | | | | 3 | | | | 6 | |

Reclaim Receivable | | | 1 | | | | 4 | | | | — | |

Receivable for Fund Shares Sold | | | — | | | | — | | | | 1 | |

Due from Adviser | | | — | | | | 5 | | | | 16 | |

| |

Total Assets | | | 47,984 | | | | 58,058 | | | | 89,829 | |

| |

Liabilities: | | | | | | | | | | | | |

Payable for Investment Securities Purchased | | | 119 | | | | — | | | | — | |

Payable for Fund Shares Redeemed | | | 12 | | | | 4 | | | | 35 | |

Line of Credit Payable | | | 5 | | | | — | | | | — | |

Income Distribution Payable | | | — | | | | — | | | | 66 | |

Investment Adviser Fees Payable | | | 28 | | | | 34 | | | | 41 | |

Shareholder Servicing Fees Payable | | | 10 | | | | 12 | | | | 18 | |

Administrative Fees Payable | | | 8 | | | | 9 | | | | 15 | |

Chief Compliance Officer Fees Payable | | | 1 | | | | 1 | | | | 1 | |

Other Accrued Expenses Payable | | | 17 | | | | 19 | | | | 37 | |

| |

Total Liabilities | | | 200 | | | | 79 | | | | 213 | |

| |

Net Assets | | $ | 47,784 | | | $ | 57,979 | | | $ | 89,616 | |

| |

Paid-in Capital | | $ | 45,474 | | | $ | 68,793 | | | $ | 81,804 | |

Undistributed Net Investment Income

(Distributions in Excess of Net Investment Income) | | | 13 | | | | (4 | ) | | | 2 | |

Accumulated Net Realized Gain (Loss) on Investments | | | (4,908 | ) | | | (21,416 | ) | | | 1,431 | |

Net Unrealized Appreciation on Investments | | | 7,205 | | | | 10,606 | | | | 6,379 | |

| |

Net Assets | | $ | 47,784 | | | $ | 57,979 | | | $ | 89,616 | |

| |

Class I Shares: | | | | | | | | | | | | |

Net Assets | | $ | 47,784 | | | $ | 57,979 | | | $ | 89,616 | |

Outstanding Shares of Beneficial Interest

(unlimited authorization — no par value) | | | 3,633 | | | | 6,023 | | | | 8,452 | |

Net Asset Value, Offering and Redemption Price Per Share — Class I (Net Assets / Shares Outstanding) | | $ | 13.15 | | | $ | 9.63 | | | $ | 10.60 | |

| |

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

28

| | | | |

| Bishop Street Funds | | | (unaudited) | |

Statements of Assets and Liabilities (000)

June 30, 2012

| | | | |

| | | Hawaii

Municipal

Bond

Fund | |

Assets: | | | | |

Investments, at Cost | | $ | 147,012 | |

| |

Investments, at Value | | $ | 155,581 | |

Dividends and Interest Receivable | | | 2,771 | |

Due from Adviser | | | 20 | |

Due from Shareholder Servicing Agent | | | 20 | |

Due from Administrator | | | 17 | |

Receivable for Fund Shares Sold | | | 15 | |

Prepaid Expenses | | | 7 | |

Reclaim Receivable | | | — | |

| |

Total Assets | | | 158,431 | |

| |

Liabilities: | | | | |

Payable for Investment Securities Purchased | | | 881 | |

Income Distribution Payable | | | 272 | |

Payable for Fund Shares Redeemed | | | 8 | |

Investment Adviser Fees Payable | | | 45 | |

Shareholder Servicing Fees Payable | | | 33 | |

Administrative Fees Payable | | | 26 | |

Distribution Fees Payable | | | 5 | |

Chief Compliance Officer Fees Payable | | | 2 | |

Other Accrued Expenses Payable | | | 67 | |

| |

Total Liabilities | | | 1,339 | |

| |

Net Assets | | $ | 157,092 | |

| |

Paid-in Capital | | $ | 148,124 | |

Undistributed Net Investment Income | | | 54 | |

Accumulated Net Realized Gain on Investments | | | 345 | |

Net Unrealized Appreciation on Investments | | | 8,569 | |

| |

Net Assets | | $ | 157,092 | |

| |

Class I Shares: | | | | |

Net Assets | | $ | 133,244 | |

Outstanding Shares of Beneficial Interest

(unlimited authorization — no par value) | | | 12,025 | |

Net Asset Value, Offering and Redemption Price Per Share — Class I

(Net Assets / Shares Outstanding) | | $ | 11.08 | |

| |

Class A Shares: | | | | |

Net Assets | | $ | 23,848 | |

Outstanding Shares of Beneficial Interest

(unlimited authorization — no par value) | | | 2,152 | |

Net Asset Value and Redemption Price Per Share — Class A

(Net Assets / Shares Outstanding) | | $ | 11.08 | |

| |

Maximum Offering Price Per Shares — Class A ($11.08 ÷ 97.00%) | | $ | 11.42 | |

| |

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

29

| | | | |

| Bishop Street Funds | | | (unaudited) | |

Statements of Operations (000)

For the six-month period ended June 30, 2012

| | | | | | | | | | | | |

| | | Strategic

Growth

Fund | | | Dividend

Value

Fund | | | High

Grade

Income

Fund | |

Investment Income: | | | | | | | | | | | | |

Dividend Income | | $ | 306 | | | $ | 945 | | | $ | 3 | |

Interest Income | | | — | | | | — | | | | 1,536 | |

Less: Foreign Taxes Withheld | | | (1 | ) | | | (6 | ) | | | — | |

| |

Total Investment Income | | | 305 | | | | 939 | | | | 1,539 | |

| |

Expenses: | | | | | | | | | | | | |

Investment Adviser Fees | | | 188 | | | | 215 | | | | 253 | |

Shareholder Servicing Fees | | | 64 | | | | 73 | | | | 115 | |

Administrative Fees | | | 51 | | | | 58 | | | | 92 | |

Chief Compliance Officer Fees | | | 1 | | | | 1 | | | | 2 | |

Transfer Agent Fees | | | 19 | | | | 19 | | | | 24 | |

Audit Fees | | | 7 | | | | 8 | | | | 11 | |

Printing Fees | | | 6 | | | | 7 | | | | 12 | |

Legal Fees | | | 4 | | | | 5 | | | | 8 | |

Trustees’ Fees | | | 3 | | | | 4 | | | | 6 | |

Custody Fees | | | 2 | | | | 2 | | | | 2 | |

Registration Fees | | | 1 | | | | 1 | | | | 8 | |

Line of Credit | | | 1 | | | | — | | | | — | |

Miscellaneous Expenses | | | 3 | | | | 4 | | | | 14 | |

| |

Total Expenses | | | 350 | | | | 397 | | | | 547 | |

| |

Less Waivers: | | | | | | | | | | | | |

Shareholder Servicing Fees | | | (38 | ) | | | (44 | ) | | | (69 | ) |

Administrative Fees | | | (20 | ) | | | (23 | ) | | | (37 | ) |

Investment Adviser Fees | | | — | | | | (25 | ) | | | (91 | ) |

| |

Total Waivers | | | (58 | ) | | | (92 | ) | | | (197 | ) |

| |

Total Net Expenses | | | 292 | | | | 305 | | | | 350 | |

| |

Net Investment Income | | | 13 | | | | 634 | | | | 1,189 | |

| |

Net Realized Gain on Investments | | | 4,380 | | | | 1,213 | | | | 1,150 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | (492 | ) | | | 2,527 | | | | 332 | |

| |

Net Realized and Unrealized Gain on Investments | | | 3,888 | | | | 3,740 | | | | 1,482 | |

| |

Increase in Net Assets Resulting from Operations | | $ | 3,901 | | | $ | 4,374 | | | $ | 2,671 | |

| |

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

30

| | | | |

| Bishop Street Funds | | | (unaudited) | |

Statements of Operations (000)

For the six-month period ended June 30, 2012

| | | | |

| | | Hawaii

Municipal

Bond

Fund | |

Investment Income: | | | | |

Interest Income | | $ | 2,785 | |

| |

Total Investment Income | | | 2,785 | |

| |

Expenses: | | | | |

Investment Adviser Fees | | | 276 | |

Shareholder Servicing Fees | | | 197 | |

Administrative Fees | | | 157 | |

Distribution Fees, Class A | | | 31 | |

Chief Compliance Officer Fees | | | 3 | |

Transfer Agent Fees | | | 42 | |

Printing Fees | | | 20 | |

Audit Fees | | | 16 | |

Legal Fees | | | 14 | |

Trustees’ Fees | | | 10 | |

Custody Fees | | | 4 | |

Registration Fees | | | 4 | |

Miscellaneous Expenses | | | 23 | |

| |

Total Expenses | | | 797 | |

| |

Less Waivers: | | | | |

Shareholder Servicing Fees | | | (118 | ) |

Investment Adviser Fees | | | (113 | ) |

Administrative Fees | | | (102 | ) |

| |

Total Waivers | | | (333 | ) |

| |

Total Net Expenses | | | 464 | |

| |

Net Investment Income | | | 2,321 | |

| |

Net Realized Gain on Investments | | | 879 | |

Net Change in Unrealized Appreciation on Investments | | | 1,084 | |

| |

Net Realized and Unrealized Gain on Investments | | | 1,963 | |

| |

Increase in Net Assets Resulting from Operations | | $ | 4,284 | |

| |

The accompanying notes are an integral part of the financial statements.

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

31

Statements of Changes in Net Assets (000)

For the six-month period ended June 30, 2012 (unaudited) and the year ended December 31, 2011

| | | | | | | | | | | | | | | | |

| | | Strategic

Growth Fund | | | Dividend

Value Fund | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

Investment Activities from Operations: | | | | | | | | | | | | | | | | |

Net Investment Income (Loss) | | $ | 13 | | | $ | (61 | ) | | $ | 634 | | | $ | 1,198 | |

Net Realized Gain on Investments | | | 4,380 | | | | 1,795 | | | | 1,213 | | | | 38 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | (492 | ) | | | (3,372 | ) | | | 2,527 | | | | 2,219 | |

| |

Increase (Decrease) in Net Assets Resulting from Operations | | | 3,901 | | | | (1,638 | ) | | | 4,374 | | | | 3,455 | |

| |

Dividends and Distributions to Shareholders: | | | | | | | | | | | | | | | | |

Net Investment Income: | | | | | | | | | | | | | | | | |

Class I Shares | | | — | | | | — | | | | (640 | ) | | | (1,202 | ) |

Return of Capital: | | | | | | | | | | | | | | | | |

Class I Shares | | | — | | | | — | | | | — | | | | (2 | ) |

| |

Total Dividends and Distributions to Shareholders | | | — | | | | — | | | | (640 | ) | | | (1,204 | ) |

| |

Capital Share Transactions: | | | | | | | | | | | | | | | | |

Proceeds from Shares Issued | | | 13,621 | | | | 9,273 | | | | 1,525 | | | | 6,943 | |

Reinvestments of Cash Distributions | | | — | | | | — | | | | 433 | | | | 820 | |

Cost of Shares Redeemed | | | (20,151 | ) | | | (7,276 | ) | | | (6,399 | ) | | | (5,192 | ) |

| |

Net Increase (Decrease) in Net Assets from Capital Share Transactions | | | (6,530 | ) | | | 1,997 | | | | (4,441 | ) | | | 2,571 | |

| |

Total Increase (Decrease) in Net Assets | | | (2,629 | ) | | | 359 | | | | (707 | ) | | | 4,822 | |

| |

Net Assets: | | | | | | | | | | | | | | | | |

Beginning of Period | | | 50,413 | | | | 50,054 | | | | 58,686 | | | | 53,864 | |

| |

End of Period | | $ | 47,784 | | | $ | 50,413 | | | $ | 57,979 | | | $ | 58,686 | |

| |

Undistributed Net Investment Income (Distributions in Excess of Net Investment Income) | | $ | 13 | | | $ | — | | | $ | (4 | ) | | $ | 2 | |

| |

Share Transactions: | | | | | | | | | | | | | | | | |

Shares Issued | | | 976 | | | | 737 | | | | 162 | | | | 782 | |

Shares Issued in Lieu of Cash Distributions | | | — | | | | — | | | | 45 | | | | 93 | |

Shares Redeemed | | | (1,463 | ) | | | (573 | ) | | | (671 | ) | | | (594 | ) |

| |

Net Increase (Decrease) in Shares Outstanding from Share Transactions | | | (487 | ) | | | 164 | | | | (464 | ) | | | 281 | |

| |

Amounts designated as “—” are either $0 or zero shares, or have been rounded to $0 or zero shares.

The accompanying notes are an integral part of the financial statements.

32

Statements of Changes in Net Assets (000)

For the six-month period ended June 30, 2012 (unaudited) and the year ended December 31, 2011

| | | | | | | | | | | | | | | | |

| | | High Grade

Income Fund | | | Hawaii Municipal

Bond Fund | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

Investment Activities from Operations: | | | | | | | | | | | | | | | | |

Net Investment Income | | $ | 1,189 | | | $ | 3,291 | | | $ | 2,321 | | | $ | 5,178 | |

Net Realized Gain (Loss) on Investments | | | 1,150 | | | | 3,085 | | | | 879 | | | | (489 | ) |

Net Change in Unrealized Appreciation on Investments | | | 332 | | | | 272 | | | | 1,084 | | | | 8,018 | |

| |

Increase in Net Assets Resulting from Operations | | | 2,671 | | | | 6,648 | | | | 4,284 | | | | 12,707 | |

| |

Dividends and Distributions to Shareholders: | | | | | | | | | | | | | | | | |

Net Investment Income: | | | | | | | | | | | | | | | | |

Class I Shares | | | (1,189 | ) | | | (3,214 | ) | | | (1,946 | ) | | | (4,439 | ) |

Class A Shares | | | — | | | | — | | | | (328 | ) | | | (738 | ) |

Capital Gains: | | | | | | | | | | | | | | | | |

Class I Shares | | | — | | | | (3,062 | ) | | | — | | | | — | |

| |

Total Dividends and Distributions to Shareholders | | | (1,189 | ) | | | (6,276 | ) | | | (2,274 | ) | | | (5,177 | ) |

| |

Capital Share Transactions: | | | | | | | | | | | | | | | | |

Class I Shares: | | | | | | | | | | | | | | | | |

Proceeds from Shares Issued | | | 5,974 | | | | 11,128 | | | | 7,615 | | | | 14,976 | |

Reinvestments of Cash Distributions | | | 751 | | | | 3,912 | | | | 245 | | | | 476 | |

Cost of Shares Redeemed | | | (11,697 | ) | | | (26,191 | ) | | | (6,659 | ) | | | (23,943 | ) |

| |

Total Class I Capital Share Transactions | | | (4,972 | ) | | | (11,151 | ) | | | 1,201 | | | | (8,491 | ) |

| |

Class A Shares: | | | | | | | | | | | | | | | | |

Proceeds from Shares Issued | | | — | | | | — | | | | 2,522 | | | | 2,303 | |

Reinvestments of Cash Distributions | | | — | | | | — | | | | 234 | | | | 487 | |

Cost of Shares Redeemed | | | — | | | | — | | | | (2,601 | ) | | | (8,655 | ) |

| |

Total Class A Capital Share Transactions | | | — | | | | — | | | | 155 | | | | (5,865 | ) |

| |

Net Increase (Decrease) in Net Assets from Capital Share Transactions | | | (4,972 | ) | | | (11,151 | ) | | | 1,356 | | | | (14,356 | ) |

| |

Total Increase (Decrease) in Net Assets | | | (3,490 | ) | | | (10,779 | ) | | | 3,366 | | | | (6,826 | ) |

| |

Net Assets: | | | | | | | | | | | | | | | | |

Beginning of Period | | | 93,106 | | | | 103,885 | | | | 153,726 | | | | 160,552 | |

| |

End of Period | | $ | 89,616 | | | $ | 93,106 | | | $ | 157,092 | | | $ | 153,726 | |

| |

Undistributed Net Investment Income | | $ | 2 | | | $ | 2 | | | $ | 54 | | | $ | 7 | |

| |

Share Transactions: | | | | | | | | | | | | | | | | |

Class I Shares: | | | | | | | | | | | | | | | | |

Shares Issued | | | 570 | | | | 1,055 | | | | 689 | | | | 1,422 | |

Shares Issued in Lieu of Cash Distributions | | | 71 | | | | 373 | | | | 22 | | | | 45 | |

Shares Redeemed | | | (1,110 | ) | | | (2,473 | ) | | | (603 | ) | | | (2,270 | ) |

| |

Total Class I Transactions | | | (469 | ) | | | (1,045 | ) | | | 108 | | | | (803 | ) |

| |

Class A Shares: | | | | | | | | | | | | | | | | |

Shares Issued | | | — | | | | — | | | | 228 | | | | 218 | |

Shares Issued in Lieu of Cash Distributions | | | — | | | | — | | | | 21 | | | | 46 | |

Shares Redeemed | | | — | | | | — | | | | (235 | ) | | | (832 | ) |

| |

Total Class A Transactions | | | — | | | | — | | | | 14 | | | | (568 | ) |

| |

Net Increase (Decrease) in Shares Outstanding from Share Transactions | | | (469 | ) | | | (1,045 | ) | | | 122 | | | | (1,371 | ) |

| |

Amounts designated as “—” are either $0 or zero shares, or have been rounded to $0 or zero shares.

The accompanying notes are an integral part of the financial statements.

| | | | |

| June 30, 2012 | | | | www.bishopstreetfunds.com |

33

Financial Highlights

For a share outstanding throughout the six-month period ended June 30, 2012 (unaudited) and the years ended

December 31,

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Investment Activities | | Total

Investment

Activities

from

Operations | | Dividends and

Distributions from | | |

| | | Net Asset

Value,

Beginning

of Period | | Net

Investment

Income

(Loss)(1) | | Net Realized

and Unrealized

Gain (Loss) on

Investments | | | Net

Investment

Income | | Capital

Gains | | Total

Dividends

and

Distributions |

STRATEGIC GROWTH FUND |

Class I Shares: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2012 | | | $ | 12.24 | | | | $ | — | ** | | | $ | 0.91 | | | | $ | 0.91 | | | | $ | — | | | | $ | — | | | | $ | — | |