UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-08572

Bishop Street Funds

(Exact name of registrant as specified in charter)

101 Federal Street

Boston, MA 02110

(Address of principal executive offices)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-262-9565

Date of fiscal year end: December 31, 2013

Date of reporting period: June 30, 2013

| Item 1. | Reports to Stockholders. |

The Funds file their complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies (if any) relating to portfolio securities is available without charge, by calling 1-800-262-9565 or by visiting the Commission’s website at http://www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available without charge, by calling 1-800-262-9565 or by visiting the Funds’ website at http://www.bishopstreetfunds.com or the website of the Securities and Exchange Commission.

BISHOP STREET

TABLE OF CONTENTS

FUNDS

1

BISHOP STREET

LETTER TO SHAREHOLDERS

FUNDS

Dear Shareholder:

As in years past, the first six months of 2013 proved to be full of surprises. The year began with the U.S. economy teetering on the edge of a fiscal cliff as lawmakers struggled to find a workable solution to our budget deficits. But with a fiscal policy resolution finally in hand and the Federal Reserve willing to provide much needed support, investor confidence returned and the search for growth opportunities continued. The big winner was U.S. stocks, with the S&P 500 Index gaining an impressive 14 percent – its best start in fifteen years! The U.S. economy was the “best of the worst” as the Eurozone continued to struggle and the emerging economies experienced a slowdown. The exception in Asia was the MSCI Japan Index which surged almost 15.4 percent in U.S. dollar terms on the heels of aggressive economic policy measures designed to resolve Japan’s macro-economic problems.

Perhaps the most significant event in the first half was the message from Fed Chairman Bernanke that the economy was finally beginning to show sustained life and the time had come to unwind its aggressive easy monetary programs. The change in policy stance sent shock waves around the globe leading to a sell-off in both stocks and bonds. Bonds in particular, took the news especially hard as investors abandoned fixed income strategies sending the ten-year Treasury yields soaring 100 basis points to 2.6 percent. As a result, the Barclay’s U.S. Aggregate Bond Index declined 2.4 percent – the worst first half showing for bonds in nearly 20 years. Further, with no inflation in sight, gold and commodities suffered as well declining 27 percent and 5.5 percent, respectively.

So what is in store for the balance of the year?

From a technical standpoint, the S&P 500 has generally responded well with a strong performance in the first half. This will depend on how the bond market responds to QE tapering, investor reaction and confidence in Japan’s new economic policies and the success of emerging economies in engineering their respective soft landings. If the U.S. economy continues to improve, the Eurozone rises from recession and emerging economies seize the opportunity to enact much needed reforms, we believe the longer-term uptrends in the equity markets are likely to continue.

2

Diversification remains the key

As we have discussed in previous messages to our shareholders, we believe in the benefits of a balanced, diversified portfolio in any successful investment program. Whether enjoying the benefits of growth and higher earnings found in our equity funds or stable income and cash flow found in our investment grade fixed income funds, we believe a balanced portfolio will likely result in long-term investment success. In this regard, we hope that the Bishop Street family of funds will continue to play an important role in your investment program.

Thank you for your continued trust and investment in the Bishop Street Funds.

Sincerely,

Michael K. Hirai, CFA, CPA

President and Chief Investment Officer

Bishop Street Capital Management

July 15, 2013

The performance data quoted represents past performance. Past performance does not guarantee future results. Index returns are for illustrative purposes only and do not represent actual Fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

Investing involves risk including possible loss of principal. Diversification does not protect against market loss.

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

3

BISHOP STREET

DEFINITIONS OF COMPARATIVE INDICES

FUNDS

Definitions of Comparative Indices

The S&P 500 Composite Index is a widely recognized index of 500 stocks designed to mimic the overall U.S. equity market’s industry weightings.

Barclay’s U.S. Aggregate Bond Index covers the USD-denominated, investment-grade fixed-rate, taxable bond market of SEC-registered securities. The index includes bonds from the Treasury, Goverment-Related, Corporate, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS sectors. The U.S. Aggregate Index is a component of the U.S. Universal Index in its entirety. The index was created in 1986, with index history backfilled to January 1, 1976.

The MSCI Japan Index is a free-float adjusted market capitalization weighted index that is designed to track the equity market performance of Japanese securities listed on Tokyo Stock Exchange, Osaka Stock Exchange, JASDAQ and Nagoya Stock Exchange. The MSCI Japan Total Return Index takes into account both price performance and income from dividend payments. The MSCI Japan Index is constructed based on the MSCI Global Investable Market Indices Methodology, targeting a free-float market capitalization coverage of 85%.

4

| | | | |

| Strategic Growth Fund | | | (unaudited) | |

Top Ten Equity Holdings†

| | | | | | | | |

| | | | | | Percentage of

Investments | |

| |

| | 1. | | | Honeywell International | | | 2.3% | |

| |

| | 2. | | | Hertz Global Holdings | | | 2.2% | |

| |

| | 3. | | | Michael Kors Holdings | | | 2.2% | |

| |

| | 4. | | | Macy’s | | | 2.2% | |

| |

| | 5. | | | Union Pacific | | | 2.2% | |

| |

| | 6. | | | Cigna | | | 2.2% | |

| |

| | 7. | | | AutoZone | | | 2.2% | |

| |

| | 8. | | | Herbalife | | | 2.1% | |

| |

| | 9. | | | Microsoft | | | 2.1% | |

| |

| | 10. | | | Alliance Data Systems | | | 2.1% | |

| † | | Percentages based on total investments. Top ten holdings do not include short-term investments. |

Schedule of Investments

| | | | | | | | |

Shares | | | | | Value

(000) | |

| | COMMON STOCK — 99.8% | |

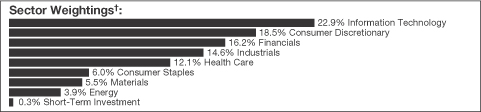

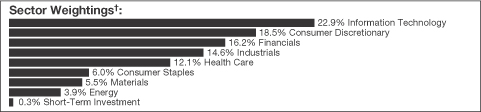

| Consumer Discretionary — 18.6% | | | | |

| | 2,600 | | | AutoZone* | | $ | 1,102 | |

| | 20,900 | | | CBS | | | 1,022 | |

| | 13,400 | | | Home Depot | | | 1,038 | |

| | 26,000 | | | Lowe’s | | | 1,063 | |

| | 23,200 | | | Macy’s | | | 1,114 | |

| | 18,000 | | | Michael Kors Holdings* | | | 1,116 | |

| | 13,300 | | | PetSmart | | | 891 | |

| | 14,700 | | | Scripps Networks Interactive | | | 981 | |

| | 19,300 | | | TJX | | | 966 | |

| | | | | | | | |

| | | | | | | 9,293 | |

| | | | | | | | |

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

5

| | | | |

| Strategic Growth Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| Consumer Staples — 6.0% | | | | |

| | 8,700 | | | Costco Wholesale | | $ | 962 | |

| | 16,800 | | | CVS | | | 961 | |

| | 23,800 | | | Herbalife | | | 1,074 | |

| | | | | | | | |

| | | | | | | 2,997 | |

| | | | | | | | |

| Energy — 3.9% | | | | |

| | 27,200 | | | Oasis Petroleum* | | | 1,057 | |

| | 12,400 | | | Schlumberger | | | 889 | |

| | | | | | | | |

| | | | | | | 1,946 | |

| | | | | | | | |

| Financials — 16.2% | | | | |

| | 11,700 | | | ACE | | | 1,047 | |

| | 20,600 | | | Allstate | | | 991 | |

| | 13,600 | | | American Express | | | 1,016 | |

| | 3,900 | | | BlackRock | | | 1,002 | |

| | 20,800 | | | Citigroup | | | 998 | |

| | 6,500 | | | Goldman Sachs Group | | | 983 | |

| | 1,850 | | | Mastercard | | | 1,063 | |

| | 13,800 | | | Prudential Financial | | | 1,008 | |

| | | | | | | | |

| | | | | | | 8,108 | |

| | | | | | | | |

| Health Care — 12.1% | | | | |

| | 18,700 | | | AmerisourceBergen | | | 1,044 | |

| | 10,300 | | | Amgen | | | 1,016 | |

| | 4,600 | | | Biogen Idec* | | | 990 | |

| | 7,600 | | | Celgene* | | | 889 | |

| | 15,200 | | | Cigna | | | 1,102 | |

| | 33,500 | | | Mylan* | | | 1,039 | |

| | | | | | | | |

| | | | | | | 6,080 | |

| | | | | | | | |

| Industrials — 14.6% | | | | |

| | 16,000 | | | BE Aerospace* | | | 1,009 | |

| | 8,500 | | | Cummins | | | 922 | |

| | 17,200 | | | Equifax | | | 1,013 | |

| | 45,400 | | | Hertz Global Holdings* | | | 1,126 | |

| | 14,600 | | | Honeywell International | | | 1,159 | |

| | 8,700 | | | Stericycle* | | | 961 | |

| | 7,200 | | | Union Pacific | | | 1,111 | |

| | | | | | | | |

| | | | | | | 7,301 | |

| | | | | | | | |

| Information Technology — 22.9% | | | | |

| | 5,900 | | | Alliance Data Systems* | | | 1,068 | |

| | 2,150 | | | Apple | | | 852 | |

6

| | | | |

| Strategic Growth Fund | | | (unaudited) | |

Schedule of Investments

(concluded)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| | | | | | | | |

| Information Technology — (continued) | | | | |

| | 28,200 | | | Broadcom | | $ | 952 | |

| | 40,700 | | | Cisco Systems | | | 989 | |

| | 16,800 | | | eBay* | | | 869 | |

| | 31,100 | | | Microsoft | | | 1,074 | |

| | 29,000 | | | Oracle | | | 891 | |

| | 14,800 | | | Qualcomm | | | 904 | |

| | 18,700 | | | Teradata* | | | 939 | |

| | 5,700 | | | Visa | | | 1,042 | |

| | 12,900 | | | VMware* | | | 864 | |

| | 25,500 | | | Xilinx | | | 1,010 | |

| | | | | | | | |

| | | | | | | 11,454 | |

| | | | | | | | |

| Materials — 5.5% | | | | |

| | 5,000 | | | CF Industries Holdings | | | 858 | |

| | 13,900 | | | Eastman Chemical | | | 973 | |

| | 9,600 | | | Monsanto | | | 948 | |

| | | | | | | | |

| | | | | | | 2,779 | |

| | | | | | | | |

| | TOTAL COMMON STOCK (Cost $40,169) | | | 49,958 | |

| | | | | | | | |

|

| | SHORT-TERM INVESTMENT (A) — 0.3% | |

| | 150,346 | | | Dreyfus Cash Management Fund, Institutional Shares, 0.050% (Cost $150) | | | 150 | |

| | | | | | | | |

| | TOTAL INVESTMENTS (Cost $40,319) — 100.1% | | $ | 50,108 | |

| | | | | | | | |

Percentages are based on Net Assets of $50,073 (000).

| * | Non-income producing security. |

| (A) | The rate shown is the 7-day effective yield as of June 30, 2013. |

Cost figures are shown in thousands.

The accompanying notes are an integral part of the financial statements.

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

7

| | | | |

| Dividend Value Fund | | | (unaudited) | |

Top Ten Equity Holdings†

| | | | | | | | |

| | | | | | Percentage of

Investments | |

| |

| | 1. | | | Verizon Communications | | | 3.0% | |

| |

| | 2. | | | Microsoft | | | 2.8% | |

| | |

| | 3. | | | Pfizer | | | 2.8% | |

| | |

| | 4. | | | Philip Morris International | | | 2.8% | |

| | |

| | 5. | | | International Business Machines | | | 2.7% | |

| | |

| | 6. | | | Exxon Mobil | | | 2.7% | |

| | |

| | 7. | | | Johnson & Johnson | | | 2.7% | |

| | |

| | 8. | | | Merck | | | 2.6% | |

| | |

| | 9. | | | Sherwin-Williams | | | 2.5% | |

| | |

| | 10. | | | AT&T | | | 2.5% | |

| † | | Percentages based on total investments. Top ten holdings do not include short-term investments. |

Schedule of Investments

| | | | | | | | |

Shares | | | | | Value

(000) | |

| | COMMON STOCK — 97.3% | |

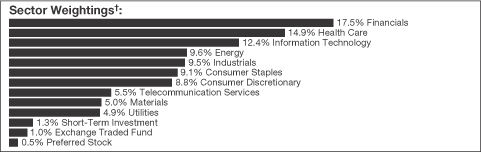

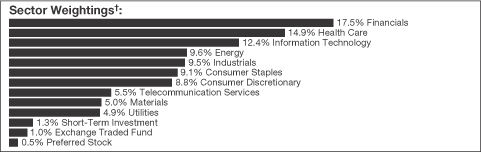

| Consumer Discretionary — 8.8% | | | | |

| | 17,760 | | | Home Depot | | $ | 1,376 | |

| | 6,055 | | | Macy’s | | | 291 | |

| | 8,535 | | | Mattel | | | 386 | |

| | 10,190 | | | McDonald’s | | | 1,009 | |

| | 5,510 | | | Nordstrom | | | 330 | |

| | 14,630 | | | Time Warner | | | 846 | |

| | 8,650 | | | TJX | | | 433 | |

| | 1,585 | | | VF | | | 306 | |

| | | | | | | | |

| | | | | | | 4,977 | |

| | | | | | | | |

8

| | | | |

| Dividend Value Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| Consumer Staples — 9.1% | | | | |

| | 19,550 | | | Altria Group | | $ | 684 | |

| | 13,040 | | | Coca-Cola Co. | | | 523 | |

| | 8,500 | | | General Mills | | | 413 | |

| | 6,725 | | | Kimberly-Clark | | | 653 | |

| | 18,000 | | | Philip Morris International | | | 1,559 | |

| | 9,890 | | | Procter & Gamble | | | 762 | |

| | 7,120 | | | Wal-Mart Stores | | | 530 | |

| | | | | | | | |

| | | | | | | 5,124 | |

| | | | | | | | |

| Energy — 9.6% | | | | |

| | 10,270 | | | Chevron | | | 1,215 | |

| | 5,870 | | | ConocoPhillips | | | 355 | |

| | 16,910 | | | Exxon Mobil | | | 1,528 | |

| | 15,690 | | | Kinder Morgan | | | 599 | |

| | 6,460 | | | Occidental Petroleum | | | 577 | |

| | 5,565 | | | Phillips 66 | | | 328 | |

| | 13,000 | | | Royal Dutch Shell PLC ADR | | | 829 | |

| | | | | | | | |

| | | | | | | 5,431 | |

| | | | | | | | |

| Financials — 17.5% | | | | |

| | 4,985 | | | ACE | | | 446 | |

| | 11,065 | | | American Express | | | 827 | |

| | 2,114 | | | AvalonBay Communities‡ | | | 285 | |

| | 2,555 | | | BlackRock | | | 656 | |

| | 4,885 | | | Chubb | | | 414 | |

| | 6,155 | | | CME Group | | | 467 | |

| | 6,300 | | | Fifth Third Bancorp | | | 114 | |

| | 23,675 | | | JPMorgan Chase | | | 1,250 | |

| | 15,510 | | | Marsh & McLennan | | | 619 | |

| | 6,365 | | | MetLife | | | 291 | |

| | 8,290 | | | Northern Trust | | | 480 | |

| | 19,100 | | | People’s United Financial | | | 285 | |

| | 6,960 | | | PNC Financial Services Group | | | 507 | |

| | 1,985 | | | Public Storage‡ | | | 304 | |

| | 1,625 | | | Simon Property Group‡ | | | 257 | |

| | 4,415 | | | T Rowe Price Group | | | 323 | |

| | 13,705 | | | Unum Group | | | 403 | |

| | 21,660 | | | US Bancorp | | | 783 | |

| | 27,935 | | | Wells Fargo | | | 1,153 | |

| | | | | | | | |

| | | | | | | 9,864 | |

| | | | | | | | |

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

9

| | | | |

| Dividend Value Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| Health Care — 14.9% | | | | |

| | 17,435 | | | Abbott Laboratories | | $ | 608 | |

| | 23,390 | | | AbbVie | | | 967 | |

| | 10,580 | | | Amgen | | | 1,044 | |

| | 26,900 | | | Bristol-Myers Squibb | | | 1,202 | |

| | 17,560 | | | Johnson & Johnson | | | 1,508 | |

| | 31,615 | | | Merck | | | 1,468 | |

| | 56,610 | | | Pfizer | | | 1,586 | |

| | | | | | | | |

| | | | | | | 8,383 | |

| | | | | | | | |

| Industrials — 9.5% | | | | |

| | 7,975 | | | Boeing | | | 817 | |

| | 3,100 | | | Deere | | | 252 | |

| | 6,725 | | | Dover | | | 522 | |

| | 6,315 | | | Emerson Electric | | | 344 | |

| | 10,760 | | | Honeywell International | | | 854 | |

| | 3,955 | | | Illinois Tool Works | | | 274 | |

| | 4,750 | | | Parker Hannifin | | | 453 | |

| | 8,835 | | | Raytheon | | | 584 | |

| | 6,400 | | | United Parcel Service | | | 553 | |

| | 3,150 | | | United Technologies | | | 293 | |

| | 10,190 | | | Waste Management | | | 411 | |

| | | | | | | | |

| | | | | | | 5,357 | |

| | | | | | | | |

| Information Technology — 12.4% | | | | |

| | 11,690 | | | Accenture PLC | | | 841 | |

| | 8,535 | | | Automatic Data Processing | | | 588 | |

| | 25,055 | | | Cisco Systems | | | 609 | |

| | 36,890 | | | Intel | | | 893 | |

| | 8,070 | | | International Business Machines | | | 1,542 | |

| | 8,930 | | | Kla-Tencor | | | 498 | |

| | 46,355 | | | Microsoft | | | 1,601 | |

| | 11,925 | | | Texas Instruments | | | 416 | |

| | | | | | | | |

| | | | | | | 6,988 | |

| | | | | | | | |

| Materials — 5.1% | | | | |

| | 11,325 | | | EI du Pont de Nemours | | | 595 | |

| | 4,700 | | | LyondellBasell Industries NV | | | 311 | |

| | 8,280 | | | RPM International | | | 265 | |

| | 7,900 | | | Sherwin-Williams | | | 1,395 | |

| | 8,070 | | | Sonoco Products | | | 279 | |

| | | | | | | | |

| | | | | | | 2,845 | |

| | | | | | | | |

10

| | | | |

| Dividend Value Fund | | | (unaudited) | |

Schedule of Investments

(concluded)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| | | | | | | | |

| Telecommunication Services — 5.5% | | | | |

| | 39,260 | | | AT&T | | $ | 1,390 | |

| | 33,815 | | | Verizon Communications | | | 1,702 | |

| | | | | | | | |

| | | | | | | 3,092 | |

| | | | | | | | |

| Utilities — 4.9% | | | | |

| | 7,900 | | | American Electric Power | | | 354 | |

| | 10,650 | | | CMS Energy | | | 289 | |

| | 4,725 | | | Dominion Resources | | | 269 | |

| | 4,065 | | | Duke Energy | | | 274 | |

| | 3,410 | | | NextEra Energy | | | 278 | |

| | 6,765 | | | Northeast Utilities | | | 284 | |

| | 5,930 | | | Sempra Energy | | | 485 | |

| | 8,390 | | | Westar Energy | | | 268 | |

| | 6,860 | | | Wisconsin Energy | | | 281 | |

| | | | | | | | |

| | | | | | | 2,782 | |

| | | | | | | | |

| | TOTAL COMMON STOCK (Cost $39,403) | | | 54,843 | |

| | | | | | | | |

|

| | EXCHANGE TRADED FUND — 1.0% | |

| | 3,590 | | | SPDR S&P 500 ETF Trust, Ser 1 (Cost $559) | | | 574 | |

| | | | | | | | |

|

| | PREFERRED STOCK — 0.4% | |

| | 1,575 | | | Fifth Third Bancorp, 8.50% (Cost $234) | | | 246 | |

| | | | | | | | |

|

| | SHORT-TERM INVESTMENT (A) — 1.3% | |

| | 744,394 | | | Dreyfus Cash Management Fund, Institutional Shares, 0.050% (Cost $744) | | | 744 | |

| | | | | | | | |

| | TOTAL INVESTMENTS (Cost $40,940) — 100.0% | | $ | 56,407 | |

| | | | | | | | |

Percentages are based on Net Assets of $56,391 (000).

| ‡ | Real Estate Investment Trust |

| (A) | The rate shown is the 7-day effective yield as of June 30, 2013. |

ADR — American Depositary Receipt

ETF — Exchange Traded Fund

PLC — Public Limited Company

Ser — Series

SPDR — S&P Depositary Receipt

Cost figures are shown in thousands.

The accompanying notes are an integral part of the financial statements.

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

11

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Top Ten Holdings†

| | | | | | | | | | | | | | | | |

| | | | | | Coupon

Rate | | | Maturity

Date | | | Percentage of

Investments | |

| |

| | 1. | | | U.S. Treasury Note | | | 0.125% | | | | 08/31/13 | | | | 2.7% | |

| |

| | 2. | | | U.S. Treasury Note | | | 0.250% | | | | 09/15/14 | | | | 2.1% | |

| |

| | 3. | | | California State, Build America Bonds | | | 7.550% | | | | 04/01/39 | | | | 1.9% | |

| |

| | 4. | | | International Business Machines | | | 8.375% | | | | 11/01/19 | | | | 1.7% | |

| |

| | 5. | | | Rio Tinto Finance USA | | | 9.000% | | | | 05/01/19 | | | | 1.6% | |

| |

| | 6. | | | Aflac | | | 8.500% | | | | 05/15/19 | | | | 1.6% | |

| |

| | 7. | | | St. Louis School District, Qualified School Construction Boards | | | 6.100% | | | | 04/01/25 | | | | 1.6% | |

| |

| | 8. | | | FHLB | | | 5.125% | | | | 03/10/17 | | | | 1.6% | |

| |

| | 9. | | | MetLife | | | 6.817% | | | | 08/15/18 | | | | 1.5% | |

| |

| | 10. | | | FHLB | | | 3.750% | | | | 12/14/18 | | | | 1.5% | |

| † | | Percentages based on total investments. Top ten holdings do not include short-term investments. |

Schedule of Investments

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

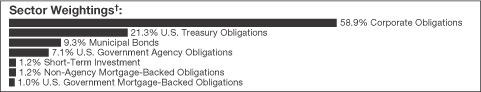

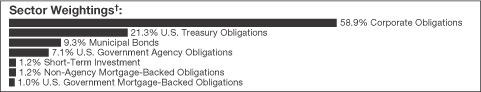

| | CORPORATE OBLIGATIONS — 58.3% | |

| Banks — 5.4% | | | | |

| | | | Bank of Oklahoma | | | | |

| $ | 500 | | | 0.226%, 05/15/17 (A) | | $ | 490 | |

| | | | Barclays Bank PLC | | | | |

| | 675 | | | 6.750%, 05/22/19 | | | 804 | |

| | | | Citigroup | | | | |

| | 383 | | | 6.500%, 08/19/13 | | | 386 | |

| | 520 | | | 6.000%, 08/15/17 | | | 586 | |

12

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Banks — (continued) | | | | |

| | | | Goldman Sachs Group MTN | | | | |

| $ | 500 | | | 7.500%, 02/15/19 | | $ | 594 | |

| | 550 | | | 0.676%, 07/22/15 (A) | | | 544 | |

| | | | JPMorgan Chase | | | | |

| | 450 | | | 3.150%, 07/05/16 | | | 467 | |

| | | | US Bancorp MTN | | | | |

| | 500 | | | 3.000%, 03/15/22 | | | 485 | |

| | | | | | | | |

| | | | | | | 4,356 | |

| | | | | | | | |

| Consumer Discretionary — 3.3% | | | | |

| | | | Anheuser-Busch InBev Finance | | | | |

| | 425 | | | 1.250%, 01/17/18 | | | 412 | |

| | | | AutoZone | | | | |

| | 250 | | | 4.000%, 11/15/20 | | | 255 | |

| | | | Home Depot | | | | |

| | 700 | | | 5.875%, 12/16/36 | | | 823 | |

| | | | Johnson Controls | | | | |

| | 500 | | | 4.250%, 03/01/21 | | | 523 | |

| | | | Macy’s Retail Holdings | | | | |

| | 300 | | | 2.875%, 02/15/23 | | | 277 | |

| | | | McDonald’s MTN | | | | |

| | 350 | | | 1.875%, 05/29/19 | | | 345 | |

| | | | | | | | |

| | | | | | | 2,635 | |

| | | | | | | | |

| Consumer Staples — 5.3% | | | | |

| | | | Bunge Finance | | | | |

| | 500 | | | 8.500%, 06/15/19 | | | 617 | |

| | | | Campbell Soup | | | | |

| | 500 | | | 4.250%, 04/15/21 | | | 523 | |

| | | | Colgate-Palmolive MTN | | | | |

| | 900 | | | 1.950%, 02/01/23 | | | 813 | |

| | | | ConAgra Foods | | | | |

| | 500 | | | 1.900%, 01/25/18 | | | 491 | |

| | | | Genentech | | | | |

| | 1,000 | | | 4.750%, 07/15/15 | | | 1,079 | |

| | | | Hershey | | | | |

| | 250 | | | 2.625%, 05/01/23 | | | 237 | |

| | | | Teva Pharmaceutical Finance BV | | | | |

| | 500 | | | 2.400%, 11/10/16 | | | 515 | |

| | | | | | | | |

| | | | | | | 4,275 | |

| | | | | | | | |

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

13

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Energy — 5.2% | | | | |

| | | | Cameron International | | | | |

| $ | 375 | | | 4.500%, 06/01/21 | | $ | 397 | |

| | | | Devon Energy | | | | |

| | 400 | | | 6.300%, 01/15/19 | | | 464 | |

| | | | Halliburton | | | | |

| | 1,000 | | | 6.150%, 09/15/19 | | | 1,205 | |

| | | | Kinder Morgan Energy Partners | | | | |

| | 500 | | | 9.000%, 02/01/19 | | | 639 | |

| | | | Murphy Oil | | | | |

| | 625 | | | 2.500%, 12/01/17 | | | 617 | |

| | | | Occidental Petroleum | | | | |

| | 375 | | | 2.700%, 02/15/23 | | | 346 | |

| | | | Valero Energy | | | | |

| | 425 | | | 6.625%, 06/15/37 | | | 488 | |

| | | | | | | | |

| | | | | | | 4,156 | |

| | | | | | | | |

| Financials — 16.0% | | | | |

| | | | Aflac | | | | |

| | 1,000 | | | 8.500%, 05/15/19 | | | 1,278 | |

| | | | American Express Credit MTN | | | | |

| | 545 | | | 2.375%, 03/24/17 | | | 557 | |

| | | | Aon | | | | |

| | 500 | | | 3.125%, 05/27/16 | | | 522 | |

| | | | Bank of America | | | | |

| | 1,050 | | | 3.700%, 09/01/15 | | | 1,095 | |

| | | | Bank of New York Mellon MTN | | | | |

| | 500 | | | 4.150%, 02/01/21 | | | 532 | |

| | | | Capital One Financial | | | | |

| | 500 | | | 7.375%, 05/23/14 | | | 529 | |

| | | | Daimler Finance North America LLC | | | | |

| | 600 | | | 6.500%, 11/15/13 | | | 613 | |

| | | | Ford Motor Credit LLC | | | | |

| | 500 | | | 2.500%, 01/15/16 | | | 504 | |

| | | | General Electric Capital MTN | | | | |

| | 625 | | | 6.150%, 08/07/37 | | | 707 | |

| | 600 | | | 1.273%, 03/15/23 (A) | | | 595 | |

| | | | Marsh & McLennan | | | | |

| | 465 | | | 9.250%, 04/15/19 | | | 608 | |

| | | | MetLife | | | | |

| | 1,000 | | | 6.817%, 08/15/18 | | | 1,211 | |

| | | | Morgan Stanley MTN | | | | |

| | 500 | | | 5.750%, 10/18/16 | | | 552 | |

14

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Financials — (continued) | | | | |

| | | | Prudential Financial MTN | | | | |

| $ | 320 | | | 7.375%, 06/15/19 | | $ | 391 | |

| | | | Royal Bank of Canada MTN | | | | |

| | 875 | | | 0.850%, 03/08/16 | | | 870 | |

| | | | Svensk Exportkredit AB | | | | |

| | 1,000 | | | 2.125%, 07/13/16 | | | 1,032 | |

| | | | Toyota Motor Credit MTN | | | | |

| | 400 | | | 2.800%, 01/11/16 | | | 417 | |

| | 500 | | | 1.375%, 01/10/18 | | | 487 | |

| | | | Ventas Realty | | | | |

| | 415 | | | 2.700%, 04/01/20‡ | | | 392 | |

| | | | | | | | |

| | | | | | | 12,892 | |

| | | | | | | | |

| Health Care — 6.6% | | | | |

| | | | Amgen | | | | |

| | 350 | | | 5.700%, 02/01/19 | | | 402 | |

| | | | AstraZeneca PLC | | | | |

| | 1,000 | | | 5.900%, 09/15/17 | | | 1,162 | |

| | | | Becton Dickinson and | | | | |

| | 500 | | | 3.125%, 11/08/21 | | | 493 | |

| | | | Celgene | | | | |

| | 500 | | | 3.250%, 08/15/22 | | | 474 | |

| | | | Gilead Sciences | | | | |

| | 875 | | | 3.050%, 12/01/16 | | | 925 | |

| | | | Merck Sharp & Dohme | | | | |

| | 1,000 | | | 5.000%, 06/30/19 | | | 1,142 | |

| | | | UnitedHealth Group | | | | |

| | 700 | | | 2.875%, 03/15/22 | | | 667 | |

| | | | | | | | |

| | | | | | | 5,265 | |

| | | | | | | | |

| Industrials — 3.0% | | | | |

| | | | Caterpillar | | | | |

| | 500 | | | 7.900%, 12/15/18 | | | 645 | |

| | | | Emerson Electric | | | | |

| | 500 | | | 2.625%, 02/15/23 | | | 473 | |

| | | | Precision Castparts | | | | |

| | 900 | | | 1.250%, 01/15/18 | | | 875 | |

| | | | Raytheon | | | | |

| | 475 | | | 2.500%, 12/15/22 | | | 437 | |

| | | | | | | | |

| | | | | | | 2,430 | |

| | | | | | | | |

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

15

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Information Technology — 6.3% | | | | |

| | | | Affiliated Computer Services | | | | |

| $ | 500 | | | 5.200%, 06/01/15 | | $ | 530 | |

| | | | DIRECTV Holdings LLC | | | | |

| | 1,000 | | | 3.500%, 03/01/16 | | | 1,051 | |

| | | | EMC | | | | |

| | 250 | | | 1.875%, 06/01/18 | | | 247 | |

| | | | Intel | | | | |

| | 425 | | | 1.350%, 12/15/17 | | | 416 | |

| | | | International Business Machines | | | | |

| | 1,000 | | | 8.375%, 11/01/19 | | | 1,340 | |

| | | | News America | | | | |

| �� | 410 | | | 6.650%, 11/15/37 | | | 472 | |

| | | | Symantec | | | | |

| | 500 | | | 2.750%, 09/15/15 | | | 515 | |

| | | | Texas Instruments | | | | |

| | 500 | | | 1.000%, 05/01/18 | | | 478 | |

| | | | | | | | |

| | | | | | | 5,049 | |

| | | | | | | | |

| Materials — 3.5% | | | | |

| | | | BHP Billiton Finance | | | | |

| | 950 | | | 5.250%, 12/15/15 | | | 1,046 | |

| | | | Praxair | | | | |

| | 500 | | | 2.200%, 08/15/22 | | | 458 | |

| | | | Rio Tinto Finance USA | | | | |

| | 1,000 | | | 9.000%, 05/01/19 | | | 1,299 | |

| | | | | | | | |

| | | | | | | 2,803 | |

| | | | | | | | |

| Telecommunication Services — 1.5% | |

| | | | Alltel | | | | |

| | 250 | | | 7.000%, 03/15/16 | | | 287 | |

| | | | AT&T | | | | |

| | 305 | | | 5.500%, 02/01/18 | | | 349 | |

| | | | Cellco Partnership | | | | |

| | 450 | | | 8.500%, 11/15/18 | | | 584 | |

| | | | | | | | |

| | | | | | | 1,220 | |

| | | | | | | | |

| Transportation — 1.4% | | | | |

| | | | Burlington Northern Santa Fe LLC | | | | |

| | 625 | | | 4.450%, 03/15/43 | | | 582 | |

| | | | Continental Airlines | | | | |

| | 498 | | | 9.000%, 07/08/16 | | | 572 | |

| | | | | | | | |

| | | | | | | 1,154 | |

| | | | | | | | |

16

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Utilities — 0.8% | | | | |

| | | | CenterPoint Energy | | | | |

| $ | 350 | | | 5.950%, 02/01/17 | | $ | 398 | |

| | | | Duke Energy | | | | |

| | 250 | | | 1.625%, 08/15/17 | | | 245 | |

| | | | | | | | |

| | | | | | | 643 | |

| | | | | | | | |

| | TOTAL CORPORATE OBLIGATIONS (Cost $45,578) | | | 46,878 | |

| | | | | | | | |

|

| | U.S. TREASURY OBLIGATIONS — 21.1% | |

| | | | U.S. Treasury Bond | | | | |

| | 700 | | | 7.250%, 05/15/16 | | | 832 | |

| | 800 | | | 6.000%, 02/15/26 | | | 1,074 | |

| | 500 | | | 5.375%, 02/15/31 | | | 651 | |

| | 500 | | | 4.750%, 02/15/37 | | | 617 | |

| | 1,000 | | | 4.500%, 08/15/39 | | | 1,196 | |

| | 335 | | | 3.750%, 08/15/41 | | | 354 | |

| | | | U.S. Treasury Note | | | | |

| | 275 | | | 3.750%, 11/15/18 | | | 307 | |

| | 350 | | | 3.625%, 02/15/21 | | | 389 | |

| | 625 | | | 3.125%, 10/31/16 | | | 672 | |

| | 500 | | | 3.125%, 01/31/17 | | | 539 | |

| | 600 | | | 2.875%, 03/31/18 | | | 643 | |

| | 405 | | | 2.625%, 04/30/16 | | | 428 | |

| | 650 | | | 2.375%, 10/31/14 | | | 669 | |

| | 1,000 | | | 2.375%, 02/28/15 | | | 1,035 | |

| | 500 | | | 2.375%, 07/31/17 | | | 526 | |

| | 1,000 | | | 2.125%, 05/31/15 | | | 1,034 | |

| | 500 | | | 2.125%, 08/15/21 | | | 498 | |

| | 500 | | | 2.000%, 11/15/21 | | | 491 | |

| | 325 | | | 1.375%, 02/28/19 | | | 321 | |

| | 800 | | | 1.000%, 01/15/14 | | | 804 | |

| | 1,700 | | | 0.250%, 09/15/14 | | | 1,701 | |

| | 2,145 | | | 0.125%, 08/31/13 | | | 2,145 | |

| | | | | | | | |

| | TOTAL U.S. TREASURY OBLIGATIONS (Cost $16,493) | | | 16,926 | |

| | | | | | | | |

|

| | MUNICIPAL BONDS — 9.2% | |

| | | | California State, Build America Bonds, GO | | | | |

| | 1,130 | | | 7.550%, 04/01/39 | | | 1,513 | |

| | | | City of Minneapolis Minnesota, GO | | | | |

| | 250 | | | 4.900%, 03/01/25 | | | 279 | |

| | 300 | | | 4.800%, 03/01/24 | | | 336 | |

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

17

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| | MUNICIPAL BONDS (continued) | |

| | | | City of New York New York, GO | | | | |

| $ | 300 | | | 5.817%, 10/01/31 | | $ | 335 | |

| | | | Connecticut State, GO | | | | |

| | 800 | | | 5.295%, 10/01/29 | | | 850 | |

| | | | County, of Kauai Hawaii, GO | | | | |

| | 500 | | | 5.663%, 08/01/29 | | | 559 | |

| | | | Hawaii State, GO | | | | |

| | 750 | | | 5.480%, 02/01/28 | | | 871 | |

| | 100 | | | 5.330%, 02/01/26 | | | 116 | |

| | | | Houston Independent School District, GO | | | | |

| | 250 | | | 6.125%, 02/15/28 | | | 286 | |

| | | | Michigan State, Ser A, GO | | | | |

| | 1,000 | | | 3.850%, 05/15/26 | | | 978 | |

| | | | St. Louis School District, Qualified School Construction Boards, GO | | | | |

| | 1,070 | | | 6.100%, 04/01/25 | | | 1,259 | |

| | | | | | | | |

| | TOTAL MUNICIPAL BONDS (Cost $6,960) | | | 7,382 | |

| | | | | | | | |

|

| | U.S. GOVERNMENT AGENCY OBLIGATIONS — 7.0% | |

| | | | FHLB | | | | |

| | 1,100 | | | 5.125%, 03/10/17 | | | 1,254 | |

| | 1,000 | | | 4.125%, 03/13/20 | | | 1,107 | |

| | 1,100 | | | 3.750%, 12/14/18 | | | 1,207 | |

| | | | FHLMC | | | | |

| | 875 | | | 8.250%, 06/01/16 | | | 1,053 | |

| | | | FNMA | | | | |

| | 1,000 | | | 2.000%, 02/07/14 | | | 1,002 | |

| | | | | | | | |

| | TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS (Cost $5,414) | | | 5,623 | |

| | | | | | | | |

|

| | NON-AGENCY MORTGAGE-BACKED OBLIGATION (A) — 1.2% | |

| | | | GSR Mortgage Loan Trust, Ser 2004-4, Cl 3A2 | | | | |

| | 968 | | | 2.050%, 04/25/32 | | | 939 | |

| | | | | | | | |

| | TOTAL NON-AGENCY MORTGAGE-BACKED OBLIGATION (Cost $867) | | | 939 | |

| | | | | | | | |

|

| | U.S. GOVERNMENT MORTGAGE-BACKED OBLIGATIONS — 1.0% | |

| | | | FNMA, Ser 2003-33, Cl AB | | | | |

| | 510 | | | 3.750%, 03/25/33 | | | 527 | |

| | | | FNMA, Ser 889958 | | | | |

| | 140 | | | 5.000%, 10/01/23 | | | 150 | |

18

| | | | |

| High Grade Income Fund | | | (unaudited) | |

Schedule of Investments

(concluded)

| | | | | | | | |

Face

Amount

(000)/Shares | | | | | Value

(000) | |

| | U.S. GOVERNMENT MORTGAGE-BACKED OBLIGATIONS (continued) | |

| | | | FNMA REMIC, Ser 2007-B1, Cl BE | | | | |

| $ | 56 | | | 5.450%, 12/25/20 | | $ | 56 | |

| | | | GNMA, Ser 2003-7, Cl PE | | | | |

| | 73 | | | 5.500%, 11/16/31 | | | 73 | |

| | | | | | | | |

| | TOTAL U.S. GOVERNMENT MORTGAGE-BACKED OBLIGATIONS (Cost $782) | | | 806 | |

| | | | | | | | |

|

| | SHORT-TERM INVESTMENT (B) — 1.2% | |

| | 997,978 | | | Dreyfus Cash Management Fund, Institutional Shares, 0.050% (Cost $998) | | | 998 | |

| | | | | | | | |

| | TOTAL INVESTMENTS (Cost $77,092) — 99.0% | | $ | 79,552 | |

| | | | | | | | |

Percentages are based on Net Assets of $80,338 (000).

| ‡ | Real Estate Investment Trust |

| (A) | Floating Rate Security — The rate reflected on the Schedule of Investments is the rate in effect on June 30, 2013. The maturity date shown is the final maturity date. |

| (B) | The rate shown is the 7-day effective yield as of June 30, 2013. |

Cl — Class

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Corporation

GNMA — Government National Mortgage Corporation

GO — General Obligation

LLC — Limited Liability Corporation

MTN — Medium Term Note

PLC — Public Limited Company

REMIC — Real Estate Mortgage Investment Conduit

Ser — Series

Cost figures are shown in thousands.

The accompanying notes are an integral part of the financial statements

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

19

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Top Ten Holdings†

| | | | | | | | | | | | | | | | |

| | | | | | Coupon

Rate | | | Maturity

Date | | | Percentage

of

Investments | |

| |

| | 1. | | | Hawaii State, RB | | | 5.250% | | | | 07/01/27 | | | | 1.8% | |

| |

| | 2. | | | Hawaii State, GO | | | 5.000% | | | | 12/01/31 | | | | 1.8% | |

| |

| | 3. | | | Hawaii State, RB | | | 5.000% | | | | 07/01/16 | | | | 1.6% | |

| |

| | 4. | | | Honolulu Hawaii City & County, GO | | | 4.000% | | | | 11/01/19 | | | | 1.5% | |

| |

| | 5. | | | Hawaii State, Housing Finance & Development, RB | | | 6.500% | | | | 07/01/33 | | | | 1.4% | |

| |

| | 6. | | | Hawaii State, Department of Budget & Finance, RB | | | 4.600% | | | | 05/01/26 | | | | 1.4% | |

| |

| | 7. | | | Honolulu Hawaii City & County, Board of Water Supply, RB | | | 5.000% | | | | 07/01/26 | | | | 1.4% | |

| |

| | 8. | | | University of Hawaii, RB | | | 4.500% | | | | 07/15/23 | | | | 1.4% | |

| |

| | 9. | | | Honolulu Hawaii City & County, GO | | | 5.000% | | | | 07/01/14 | | | | 1.4% | |

| |

| | 10. | | | Hawaii State, Department of Hawaiian Home Lands, COP | | | 5.000% | | | | 11/01/31 | | | | 1.4% | |

| † | | Percentages based on total investments. Top ten holdings do not include short-term investments. |

Schedule of Investments

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| | MUNICIPAL BONDS — 98.4% | |

| Alabama — 0.2% | | | | |

| | | | Huntsville, Electric System Revenue, RB | | | | |

| $ | 225 | | | 5.250%, 12/01/29 | | $ | 255 | |

| | | | | | | | |

20

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Alaska — 1.2% | | | | |

| | | | Alaska Municipal Bond Bank Authority, Ser 3, RB, Bond Bank Moral Obligation Insured | | | | |

| $ | 1,000 | | | 5.000%, 09/01/22 | | $ | 1,159 | |

| | | | Anchorage Alaska, Water Authority, RB, NPFGC Insured | | | | |

| | 200 | | | 5.000%, 05/01/37 | | | 206 | |

| | | | Little Rock, Sewer Revenue, RB | | | | |

| | 500 | | | 5.000%, 08/01/20 | | | 587 | |

| | | | | | | | |

| | | | | | | 1,952 | |

| | | | | | | | |

| Arizona — 0.7% | | | | |

| | | | Glendale Arizona, Water and Sewer Authority, RB | | | | |

| | 1,000 | | | 5.000%, 07/01/23 | | | 1,142 | |

| | | | | | | | |

| California — 3.1% | |

| | | | California State, GO | | | | |

| | 200 | | | 5.000%, 02/01/21 | | | 234 | |

| | 1,300 | | | 5.000%, 02/01/22 | | | 1,515 | |

| | 1,000 | | | 5.000%, 04/01/38 | | | 1,023 | |

| | | | California State, GO, AGM Insured | | | | |

| | 800 | | | 4.500%, 12/01/32 | | | 829 | |

| | | | California State, Health Facilities Financing Authority, Stanford Hospital, Ser B, RB | | | | |

| | 1,000 | | | 5.000%, 11/15/25 | | | 1,105 | |

| | | | | | | | |

| | | | | | | 4,706 | |

| | | | | | | | |

| Colorado — 0.4% | | | | |

| | | | Denver City & County, School District No. 1, GO | | | | |

| | 500 | | | 5.000%, 12/01/24 | | | 577 | |

| | | | | | | | |

| Georgia — 0.7% | |

| | | | Main Street, Natural Gas, Ser B, RB | | | | |

| | 1,000 | | | 5.000%, 03/15/18 | | | 1,081 | |

| | | | | | | | |

| Hawaii — 79.7% | | | | |

| | | | Hawaii Airports System Revenue State, Ser A, RB | | | | |

| | 300 | | | 5.250%, 07/01/21 | | | 349 | |

| | | | Hawaii County, Ser A, GO | | | | |

| | 500 | | | 5.000%, 09/01/20 | | | 590 | |

| | 1,000 | | | 5.000%, 07/15/22 | | | 1,120 | |

| | 250 | | | 5.000%, 09/01/22 | | | 296 | |

| | 500 | | | 4.000%, 03/01/22 | | | 537 | |

| | | | Hawaii County, Ser A, GO, AGM Insured | | | | |

| | 125 | | | 5.000%, 07/15/13, Pre-Refunded @ 100 (A) | | | 125 | |

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

21

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Hawaii County, Ser A, GO, AMBAC Insured | | | | |

| $ | 1,000 | | | 5.000%, 07/15/15 | | $ | 1,089 | |

| | | | Hawaii County, Ser A, GO, NPFGC Insured | | | | |

| | 1,055 | | | 5.250%, 07/15/14, Pre-Refunded @ 100 (A) | | | 1,110 | |

| | 1,000 | | | 5.000%, 07/15/14, Pre-Refunded @ 100 (A) | | | 1,049 | |

| | | | Hawaii County, Ser C, GO | | | | |

| | 1,275 | | | 4.000%, 09/01/24 | | | 1,370 | |

| | | | Hawaii Harbor System Revenue State, Ser A, RB | | | | |

| | 100 | | | 5.000%, 07/01/25 | | | 108 | |

| | | | Hawaii Housing Finance & Development, Ser A, RB | | | | |

| | 1,000 | | | 5.000%, 05/01/34 | | | 1,040 | |

| | 1,000 | | | 0.700%, 12/01/15 | | | 998 | |

| | | | Hawaii Pacific Health, Ser A, RB | | | | |

| | 1,000 | | | 4.625%, 07/01/21 | | | 1,061 | |

| | | | Hawaii State, Airport System Authority, RB, AGM Insured | | | | |

| | 1,000 | | | 5.250%, 07/01/27 | | | 1,116 | |

| | | | Hawaii State, Airport System Authority, Ser A, RB | | | | |

| | 2,500 | | | 5.250%, 07/01/27 | | | 2,774 | |

| | 900 | | | 5.250%, 07/01/30 | | | 982 | |

| | 1,250 | | | 5.000%, 07/01/22 | | | 1,426 | |

| | | | Hawaii State, Airport System Authority, RB, AMT | | | | |

| | 1,500 | | | 4.125%, 07/01/24 | | | 1,547 | |

| | 1,000 | | | 3.000%, 07/01/17 | | | 1,047 | |

| | | | Hawaii State, Department of Budget & Finance, Chaminade University, RB, Radian Insured | | | | |

| | 1,000 | | | 4.750%, 01/01/36 | | | 984 | |

| | | | Hawaii State, Department of Budget & Finance, Electric Company Project, Ser A, RB, AMT, FGIC Insured | | | | |

| | 750 | | | 4.800%, 01/01/25 | | | 757 | |

| | 1,160 | | | 4.650%, 03/01/37 | | | 1,152 | |

| | | | Hawaii State, Department of Budget & Finance, Electric Company Project, Ser A, RB, AMT, NPFGC Insured | | | | |

| | 1,250 | | | 5.650%, 10/01/27 | | | 1,254 | |

| | | | Hawaii State, Department of Budget & Finance, Mid Pacific Institute, RB, Radian Insured | | | | |

| | 1,000 | | | 5.000%, 01/01/26 | | | 1,003 | |

| | | | Hawaii State, Department of Budget & Finance, RB | | | | |

| | 300 | | | 3.600%, 11/15/20 | | | 295 | |

| | 300 | | | 3.350%, 11/15/19 | | | 296 | |

| | | | Hawaii State, Department of Budget & Finance, Ser B, RB, AMT, FGIC Insured | | | | |

| | 2,165 | | | 4.600%, 05/01/26 | | | 2,150 | |

22

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Hawaii State, Department of Hawaiian Home Lands, Kapolei Office Facilities, Ser A, COP, AGM Insured | | | | |

| $ | 2,000 | | | 5.000%, 11/01/31 | | $ | 2,071 | |

| | | | Hawaii State, Harbor System Authority, Ser A, RB | | | | |

| | 1,125 | | | 4.250%, 07/01/21 | | | 1,221 | |

| | | | Hawaii State, Harbor System Authority, Ser A, RB, AMT, AGM Insured | | | | |

| | 370 | | | 5.750%, 07/01/29 | | | 371 | |

| | | | Hawaii State, Harbor System Authority, Ser B, RB, AMT, AGM Insured | | | | |

| | 500 | | | 5.000%, 01/01/23 | | | 507 | |

| | | | Hawaii State, Harbor System Authority, Ser B, RB, AMT, AMBAC Insured | | | | |

| | 200 | | | 5.500%, 07/01/19 | | | 200 | |

| | | | Hawaii State, Highway Authority, RB | | | | |

| | 500 | | | 5.750%, 01/01/28 | | | 556 | |

| | 605 | | | 5.500%, 07/01/18 | | | 716 | |

| | 1,000 | | | 5.500%, 01/01/25 | | | 1,116 | |

| | | | Hawaii State, Highway Authority, RB, BHAC Insured | | | | |

| | 550 | | | 4.750%, 01/01/22 | | | 600 | |

| | | | Hawaii State, Highway Authority, Ser A, RB | | | | |

| | 700 | | | 5.000%, 01/01/31 | | | 761 | |

| | | | Hawaii State, Highway Authority, Ser A, RB, AGM Insured | | | | |

| | 500 | | | 5.000%, 07/01/19 | | | 535 | |

| | 1,000 | | | 5.000%, 07/01/21 | | | 1,064 | |

| | 1,565 | | | 5.000%, 07/01/22 | | | 1,662 | |

| | | | Hawaii State, Highway Authority, Ser B, RB, AGM Insured | | | | |

| | 1,250 | | | 5.250%, 07/01/18 | | | 1,464 | |

| | 1,600 | | | 5.250%, 07/01/19 | | | 1,902 | |

| | 2,300 | | | 5.000%, 07/01/16 | | | 2,480 | |

| | | | Hawaii State, Housing Finance & Development, Kuhio Park Terrace Multi-Family Housing, Ser A, RB, FHLMC Insured | | | | |

| | 200 | | | 3.900%, 04/01/22 | | | 208 | |

| | 115 | | | 3.750%, 04/01/21 | | | 120 | |

| | 180 | | | 3.500%, 04/01/20 | | | 186 | |

| | 115 | | | 3.000%, 04/01/18 | | | 118 | |

| | | | Hawaii State, Housing Finance & Development, Rental Housing System, Ser B, RB, AGM Insured | | | | |

| | 2,000 | | | 6.500%, 07/01/33 | | | 2,161 | |

| | | | Hawaii State, Housing Finance & Development, Single-Family Housing, Ser B, RB, GNMA/FNMA Insured | | | | |

| | 495 | | | 3.450%, 01/01/22 | | | 501 | |

| | | | Hawaii State, Ser CM, GO, AGM Insures FGIC Insured | | | | |

| | 1,000 | | | 6.500%, 12/01/14 | | | 1,088 | |

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

23

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Hawaii State, Ser DB, GO, NPFGC Insured | | | | |

| $ | 230 | | | 5.250%, 09/01/13 , Pre-Refunded @ 100 (A) | | $ | 232 | |

| | | | Hawaii State, Ser DD, GO, NPFGC Insured | | | | |

| | 1,000 | | | 5.000%, 05/01/16 | | | 1,035 | |

| | | | Hawaii State, Ser DF, GO, AMBAC Insured | | | | |

| | 90 | | | 5.000%, 07/01/15, Pre-Refunded @ 100 (A) | | | 98 | |

| | 470 | | | 5.000%, 07/01/21 | | | 502 | |

| | | | Hawaii State, Ser DG, GO, AMBAC Insured | | | | |

| | 1,000 | | | 5.000%, 07/01/16 | | | 1,083 | |

| | | | Hawaii State, Ser DI, GO, AGM Insured | | | | |

| | 1,935 | | | 5.000%, 03/01/16, Pre-Refunded @ 100 (A) | | | 2,148 | |

| | 375 | | | 5.000%, 03/01/25 | | | 405 | |

| | | | Hawaii State, Ser DK, GO | | | | |

| | 210 | | | 5.000%, 05/01/18 | | | 243 | |

| | 475 | | | 5.000%, 05/01/25 | | | 534 | |

| | | | Hawaii State, Ser DN, GO | | | | |

| | 200 | | | 5.250%, 08/01/25 | | | 229 | |

| | | | Hawaii State, Ser DO, GO | | | | |

| | 850 | | | 5.000%, 08/01/17 | | | 975 | |

| | | | Hawaii State, Ser DQ, GO | | | | |

| | 100 | | | 5.000%, 06/01/21 | | | 117 | |

| | | | Hawaii State, Ser DR, GO | | | | |

| | 1,095 | | | 5.000%, 06/01/17 | | | 1,250 | |

| | 490 | | | 4.250%, 06/01/19 | | | 555 | |

| | | | Hawaii State, Ser DT, GO | | | | |

| | 270 | | | 5.000%, 11/01/19 | | | 319 | |

| | 175 | | | 4.500%, 11/01/19 | | | 202 | |

| | | | Hawaii State, Ser DY, GO | | | | |

| | 800 | | | 5.000%, 02/01/19 | | | 935 | |

| | 1,000 | | | 5.000%, 02/01/20 | | | 1,181 | |

| | | | Hawaii State, Ser DZ, GO | | | | |

| | 1,015 | | | 5.000%, 12/01/17 | | | 1,174 | |

| | 390 | | | 5.000%, 12/01/22 | | | 455 | |

| | 960 | | | 5.000%, 12/01/23 | | | 1,110 | |

| | 190 | | | 5.000%, 12/01/24 | | | 218 | |

| | 120 | | | 5.000%, 12/01/26 | | | 136 | |

| | 250 | | | 5.000%, 12/01/28 | | | 279 | |

| | 1,300 | | | 5.000%, 12/01/29 | | | 1,442 | |

| | 2,500 | | | 5.000%, 12/01/31 | | | 2,744 | |

| | | | Hawaii State, Ser EA, GO | | | | |

| | 935 | | | 5.000%, 12/01/21 | | | 1,115 | |

| | 1,000 | | | 5.000%, 12/01/22 | | | 1,166 | |

24

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Hawaii State, Ser EE, GO | | | | |

| $ | 1,000 | | | 4.000%, 11/01/24 | | $ | 1,068 | |

| | | | Hawaii State, Ser EF, GO | | | | |

| | 300 | | | 5.000%, 11/01/23 | | | 350 | |

| | | | Honolulu Hawaii City & County, Ad Valorem Property Tax Project, Ser B, GO, NPFGC Insured | | | | |

| | 2,000 | | | 5.000%, 07/01/14, Pre-Refunded @ 100 (A) | | | 2,095 | |

| | | | Honolulu Hawaii City & County, Board of Water Supply, Ser A, RB | | | | |

| | 1,050 | | | 5.000%, 07/01/19 | | | 1,234 | |

| | 670 | | | 3.000%, 07/01/17 | | | 714 | |

| | | | Honolulu Hawaii City & County, Board of Water Supply, Ser A, RB, FGIC Insured | | | | |

| | 1,000 | | | 4.750%, 07/01/14, Pre-Refunded @ 100 (A) | | | 1,045 | |

| | | | Honolulu Hawaii City & County, Board of Water Supply, Ser A, RB, NPFGC Insured | | | | |

| | 2,000 | | | 5.000%, 07/01/26 | | | 2,148 | |

| | | | Honolulu Hawaii City & County, Board of Water Supply, Ser B, RB, AMT, NPFGC Insured | | | | |

| | 1,000 | | | 5.250%, 07/01/20 | | | 1,080 | |

| | 1,000 | | | 5.250%, 07/01/21 | | | 1,074 | |

| | 325 | | | 5.000%, 07/01/15 | | | 352 | |

| | | | Honolulu Hawaii City & County, Ser A, GO | | | | |

| | 100 | | | 5.250%, 08/01/31 | | | 112 | |

| | 1,100 | | | 5.250%, 04/01/32 | | | 1,214 | |

| | 600 | | | 5.000%, 11/01/22 | | | 713 | |

| | 1,000 | | | 5.000%, 04/01/33 | | | 1,075 | |

| | 1,000 | | | 4.250%, 08/01/32 | | | 1,023 | |

| | 2,000 | | | 4.000%, 11/01/19 | | | 2,243 | |

| | 500 | | | 4.000%, 11/01/37 | | | 490 | |

| | | | Honolulu Hawaii City & County, Ser A, GO, AGM Insured | | | | |

| | 1,000 | | | 5.000%, 07/01/22 | | | 1,110 | |

| | | | Honolulu Hawaii City & County, Ser B, GO | | | | |

| | 300 | | | 5.000%, 12/01/16 | | | 340 | |

| | 250 | | | 5.000%, 12/01/18 | | | 293 | |

| | 395 | | | 5.000%, 08/01/21 | | | 470 | |

| | 800 | | | 4.000%, 11/01/27 | | | 831 | |

| | | | Honolulu Hawaii City & County, Ser B, GO, AGM Insured | | | | |

| | 290 | | | 5.250%, 07/01/15 | | | 317 | |

| | 1,015 | | | 5.250%, 07/01/16 | | | 1,141 | |

| | 345 | | | 5.250%, 07/01/18 | | | 405 | |

| | | | Honolulu Hawaii City & County, Ser C, GO | | | | |

| | 200 | | | 4.750%, 09/01/18 | | | 230 | |

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

25

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Honolulu Hawaii City & County, Ser D, GO | | | | |

| $ | 1,000 | | | 5.250%, 09/01/22 | | $ | 1,149 | |

| | | | Honolulu Hawaii City & County, Ser D, GO, NPFGC Insured | | | | |

| | 2,000 | | | 5.000%, 07/01/15, Pre-Refunded @ 100 (A) | | | 2,176 | |

| | | | Honolulu Hawaii City & County, Ser F, GO, NPFGC Re-insures FGIC Insured | | | | |

| | 1,000 | | | 5.000%, 07/01/15, Pre-Refunded @ 100 (A) | | | 1,088 | |

| | | | Honolulu Hawaii City & County, Wastewater System Authority, | | | | |

| | | | Ser A, RB | | | | |

| | 500 | | | 5.000%, 07/01/20 | | | 577 | |

| | 1,000 | | | 5.000%, 07/01/25 | | | 1,131 | |

| | 100 | | | 5.000%, 07/01/31 | | | 109 | |

| | 1,000 | | | 5.000%, 07/01/38 | | | 1,064 | |

| | 1,000 | | | 4.000%, 07/01/31 | | | 1,003 | |

| | | | Honolulu Hawaii City & County, Wastewater System Authority, Ser B, RB | | | | |

| | 1,000 | | | 4.000%, 07/01/28 | | | 1,020 | |

| | | | Honolulu Hawaii City & County, Wastewater System Authority, Ser Junior A-1, RB, NPFGC Insured | | | | |

| | 815 | | | 5.000%, 07/01/22 | | | 881 | |

| | | | Honolulu Hawaii City & County, Wastewater System Authority, Ser Senior A, RB, NPFGC Insured | | | | |

| | 1,000 | | | 5.000%, 07/01/31 | | | 1,064 | |

| | | | Honolulu Hawaii City & County, Wastewater System Authority, Waipahu Towers Project, Ser A, RB, AMT, GNMA Collateral Insured | | | | |

| | 180 | | | 6.900%, 06/20/35 | | | 180 | |

| | | | Kauai County, Ser A, GO | | | | |

| | 250 | | | 5.000%, 08/01/21 | | | 296 | |

| | 250 | | | 4.000%, 08/01/24 | | | 269 | |

| | 250 | | | 3.250%, 08/01/23 | | | 254 | |

| | | | Kauai County, Ser A, GO, NPFGC Re-insures FGIC Insured | | | | |

| | 3,195 | | | 5.000%, 08/01/15, Pre-Refunded @ 100 (A) | | | 3,489 | |

| | 415 | | | 5.000%, 08/01/21 | | | 443 | |

| | 160 | | | 4.250%, 08/01/14 | | | 167 | |

| | | | Maui County, GO | | | | |

| | 225 | | | 5.000%, 06/01/20 | | | 266 | |

| | | | Maui County, GO, NPFGC Insured | | | | |

| | 910 | | | 5.000%, 03/01/15, Pre-Refunded @ 100 (A) | | | 978 | |

| | 85 | | | 5.000%, 03/01/17 | | | 90 | |

| | 205 | | | 5.000%, 03/01/24 | | | 216 | |

| | | | Maui County, Ser A, GO | | | | |

| | 1,000 | | | 5.000%, 07/01/19 | | | 1,125 | |

26

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Hawaii — (continued) | | | | |

| | | | Maui County, Ser A, GO, AGM Insured | | | | |

| $ | 1,000 | | | 3.500%, 07/01/16 | | $ | 1,071 | |

| | | | Maui County, Ser A, GO, NPFGC Insured | | | | |

| | 1,000 | | | 4.750%, 07/01/25 | | | 1,068 | |

| | | | Maui County, Ser B, GO | | | | |

| | 50 | | | 4.000%, 06/01/14 | | | 52 | |

| | 375 | | | 4.000%, 06/01/16 | | | 404 | |

| | 500 | | | 4.000%, 06/01/21 | | | 541 | |

| | | | Maui County, Ser B, GO, NPFGC Insured | | | | |

| | 500 | | | 5.000%, 07/01/16 | | | 554 | |

| | 500 | | | 5.000%, 09/01/17 | | | 522 | |

| | | | Maui County, Ser B, GO, NPFGC Re-insures FGIC Insured | | | | |

| | 100 | | | 5.250%, 03/01/14 | | | 103 | |

| | | | University of Hawaii, College Improvements Project, Ser A, RB, AGC Insured | | | | |

| | 1,400 | | | 5.000%, 10/01/23 | | | 1,530 | |

| | | | University of Hawaii, College Improvements Project, Ser A, RB, NPFGC Insured | | | | |

| | 200 | | | 5.000%, 07/15/19 | | | 220 | |

| | 150 | | | 5.000%, 07/15/22 | | | 163 | |

| | | | University of Hawaii, Ser A, RB | | | | |

| | 100 | | | 6.000%, 10/01/38 | | | 113 | |

| | | | University of Hawaii, Ser A, RB, NPFGC Insured | | | | |

| | 975 | | | 5.000%, 07/15/21 | | | 1,064 | |

| | 2,000 | | | 4.500%, 07/15/23 | | | 2,139 | |

| | | | University of Hawaii, Ser A-2, RB | | | | |

| | 1,000 | | | 4.000%, 10/01/18 | | | 1,104 | |

| | | | | | | | |

| | | | | | | 123,965 | |

| | | | | | | | |

| Kansas — 0.4% | | | | |

| | | | Sedgwick County, Unified School District No. 260 Derby, GO | | | | |

| | 500 | | | 5.000%, 10/01/29 | | | 549 | |

| | | | | | | | |

| Maine — 0.5% | | | | |

| | | | Maine Health & Higher Educational Facilities Authority, Ser A, RB | | | | |

| | 750 | | | 5.250%, 07/01/31 | | | 790 | |

| | | | | | | | |

| Massachusetts — 1.4% | | | | |

| | | | Commonwealth of Massachusetts, Ser B, GO, AGM Insured | | | | |

| | 1,300 | | | 5.250%, 08/01/28 | | | 1,515 | |

| | | | Massachusetts Bay Transportation Authority, Ser A, RB | | | | |

| | 600 | | | 5.250%, 07/01/29 | | | 693 | |

| | | | | | | | |

| | | | | | | 2,208 | |

| | | | | | | | |

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

27

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Minnesota — 0.3% | | | | |

| | | | Minnesota Housing Finance Agency, RB, GNMA/FNMA Insured | | | | |

| $ | 465 | | | 4.875%, 07/01/26 | | $ | 491 | |

| | | | | | | | |

| Nebraska — 0.1% | | | | |

| | | | Omaha Nebraska, GO | | | | |

| | 100 | | | 5.250%, 10/15/19 | | | 117 | |

| | | | | | | | |

| Nevada — 0.6% | | | | |

| | | | Nevada State, GO | | | | |

| | 500 | | | 5.000%, 03/01/21 | | | 585 | |

| | | | Nevada State, Municipal Bond Bank Projects, Ser F, GO, AGM Insured | | | | |

| | 250 | | | 5.000%, 12/01/24 | | | 266 | |

| | | | | | | | |

| | | | | | | 851 | |

| | | | | | | | |

| New Mexico — 0.1% | | | | |

| | | | New Mexico Finance Authority, Ser Senior Lien, RB | | | | |

| | 150 | | | 5.000%, 06/01/26 | | | 165 | |

| | | | | | | | |

| New York — 2.2% | | | | |

| | | | Metropolitan Transportation Authority, Ser A, RB | | | | |

| | 1,000 | | | 4.000%, 11/15/20 | | | 1,076 | |

| | | | New York, New York, Ser F, GO | | | | |

| | 500 | | | 3.000%, 08/01/16 | | | 529 | |

| | | | New York, New York, Ser H, GO | | | | |

| | 500 | | | 5.000%, 08/01/20 | | | 587 | |

| | 500 | | | 4.000%, 08/01/18 | | | 557 | |

| | | | New York, New York, Ser H-1, GO | | | | |

| | 600 | | | 5.000%, 03/01/18 | | | 693 | |

| | | | | | | | |

| | | | | | | 3,442 | |

| | | | | | | | |

| Ohio — 0.4% | | | | |

| | | | Akron Ohio, GO | | | | |

| | 500 | | | 5.000%, 12/01/21 | | | 555 | |

| | | | | | | | |

| Oklahoma — 1.1% | | | | |

| | | | Oklahoma City Water Utilities Trust, RB | | | | |

| | 125 | | | 5.000%, 07/01/40 | | | 135 | |

| | | | Oklahoma Water Resources Board, RB | | | | |

| | 500 | | | 4.000%, 10/01/40 | | | 482 | |

| | 1,000 | | | 3.000%, 10/01/18 | | | 1,055 | |

| | | | | | | | |

| | | | | | | 1,672 | |

| | | | | | | | |

28

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(continued)

| | | | | | | | |

Face

Amount

(000) | | | | | Value

(000) | |

| Oregon — 0.5% | | | | |

| | | | Oregon State, Facilities Authority, RB | | | | |

| $ | 225 | | | 5.000%, 10/01/19 | | $ | 262 | |

| | | | Oregon State, Ser E, GO | | | | |

| | 375 | | | 4.000%, 05/01/26 | | | 396 | |

| | | | | | | | |

| | | | | | | 658 | |

| | | | | | | | |

| Puerto Rico — 2.0% | | | | |

| | | | Commonwealth of Puerto Rico, GO, NPFGC Insured | | | | |

| | 1,500 | | | 6.000%, 07/01/15 | | | 1,567 | |

| | | | Puerto Rico Electric Power Authority, Ser ZZ, RB | | | | |

| | 500 | | | 5.000%, 07/01/24 | | | 474 | |

| | | | Puerto Rico Highway & Transportation Authority, Ser N, RB, AGM Insured | | | | |

| | 1,000 | | | 5.500%, 07/01/26 | | | 1,035 | |

| | | | | | | | |

| | | | | | | 3,076 | |

| | | | | | | | |

| South Carolina — 0.4% | | | | |

| | | | Sumter South Carolina, Waterworks & Sewer Improvement Systems, RB, XLCA Insured | | | | |

| | 500 | | | 5.000%, 12/01/21 | | | 557 | |

| | | | | | | | |

| Texas — 0.9% | | | | |

| | | | North East Independent School District, GO, | | | | |

| | 275 | | | 5.250%, 02/01/28 | | | 324 | |

| | | | Port of Houston Authority, Ser D-1, GO | | | | |

| | 1,000 | | | 5.000%, 10/01/35 | | | 1,095 | |

| | | | | | | | |

| | | | | | | 1,419 | |

| | | | | | | | |

| Utah — 1.0% | | | | |

| | | | Mountain Regional Water Special Service District, RB, AGM Insured | | | | |

| | 1,000 | | | 4.000%, 12/15/26 | | | 1,027 | |

| | 500 | | | 4.000%, 12/15/27 | | | 509 | |

| | | | | | | | |

| | | | | | | 1,536 | |

| | | | | | | | |

| Washington — 0.5% | | | | |

| | | | Port of Seattle Washington, Ser A, RB | | | | |

| | 750 | | | 5.000%, 08/01/26 | | | 832 | |

| | | | | | | | |

| | TOTAL MUNICIPAL BONDS (Cost $150,579) | | | 152,596 | |

| | | | | | | | |

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

29

| | | | |

| Hawaii Municipal Bond Fund | | | (unaudited) | |

Schedule of Investments

(concluded)

| | | | | | | | |

Shares | | | | | Value

(000) | |

| | SHORT-TERM INVESTMENT (B) — 0.3% | |

| | 529,268 | | | Dreyfus Tax-Exempt Cash Management Fund, Institutional Shares, 0.000% (Cost $529) | | $ | 529 | |

| | | | | | | | |

| | TOTAL INVESTMENTS (Cost $151,108) — 98.7% | | $ | 153,125 | |

| | | | | | | | |

Percentages are based on Net Assets of $155,131 (000).

(A) Pre-Refunded Security – The maturity date shown is the pre-refunded date.

(B) The rate reported is the 7-day effective yield as of June 30, 2013.

AGC — American Guarantee Corporation

AGM — Assured Guaranty Municipal Corp.

AMBAC — American Municipal Bond Assurance Company

AMT — Alternative Minimum Tax

BHAC — Berkshire Hathaway Assurance Corporation

COP — Certificate of Participation

FGIC — Financial Guarantee Insurance Corporation

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Corporation

GNMA — Government National Mortgage Corporation

GO — General Obligation

NPFGC — National Public Finance Guarantee Corporation

RB — Revenue Bond

Ser — Series

XLCA — XL Capital

Cost figures are shown in thousands.

The accompanying notes are an integral part of the financial statements.

30

| | | | |

| Bishop Street Funds | | | (unaudited) | |

Statements of Assets and Liabilities (000)

June 30, 2013

| | | | | | | | | | | | |

| | | Strategic

Growth

Fund | | | Dividend

Value

Fund | | | High

Grade

Income

Fund | |

Assets: | | | | | | | | | | | | |

Investments, at Cost | | $ | 40,319 | | | $ | 40,940 | | | $ | 77,092 | |

| |

Investments, at Value | | $ | 50,108 | | | $ | 56,407 | | | $ | 79,552 | |

Cash | | | — | | | | — | | | | 25 | |

Dividends and Interest Receivable | | | 26 | | | | 85 | | | | 748 | |

Receivable for Fund Shares Sold | | | 24 | | | | 2 | | | | 5 | |

Reclaim Receivable | | | 1 | | | | 5 | | | | — | |

Receivable for Investment Securities Sold | | | — | | | | — | | | | 721 | |

Prepaid Expenses | | | 3 | | | | 2 | | | | 5 | |

| |

Total Assets | | | 50,162 | | | | 56,501 | | | | 81,056 | |

| |

Liabilities: | | | | | | | | | | | | |

Advisory Fees Payable | | | 31 | | | | 31 | | | | 22 | |

Payable for Fund Shares Redeemed | | | 28 | | | | 39 | | | | 19 | |

Shareholder Servicing Fees Payable | | | 4 | | | | 5 | | | | 7 | |

Administrative Fees Payable | | | 4 | | | | 5 | | | | 8 | |

Payable for Investment Securities Purchased | | | — | | | | — | | | | 563 | |

Income Distribution Payable | | | — | | | | — | | | | 52 | |

Chief Compliance Officer Fees Payable | | | — | | | | — | | | | 1 | |

Other Accrued Expenses Payable | | | 22 | | | | 30 | | | | 46 | |

| |

Total Liabilities | | | 89 | | | | 110 | | | | 718 | |

| |

Net Assets | | $ | 50,073 | | | $ | 56,391 | | | $ | 80,338 | |

| |

Paid-in Capital | | $ | 41,387 | | | $ | 58,238 | | | $ | 76,574 | |

Accumulated Net Investment Loss, Undistributed (Distributions in Excess of) Net Investment Income | | | (18 | ) | | | (7 | ) | | | 1 | |

Accumulated Net Realized Gain (Loss) on Investments | | | (1,085 | ) | | | (17,307 | ) | �� | | 1,303 | |

Net Unrealized Appreciation on Investments | | | 9,789 | | | | 15,467 | | | | 2,460 | |

| |

Net Assets | | $ | 50,073 | | | $ | 56,391 | | | $ | 80,338 | |

| |

Class I Shares: | | | | | | | | | | | | |

Net Assets | | $ | 50,073 | | | $ | 56,391 | | | $ | 80,338 | |

Outstanding Shares of Beneficial Interest

(unlimited authorization — no par value) | | | 3,332 | | | | 5,027 | | | | 7,956 | |

Net Asset Value, Offering and Redemption Price Per Share — Class I (Net Assets / Shares Outstanding) | | $ | 15.03 | | | $ | 11.22 | | | $ | 10.10 | |

| |

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

31

| | | | |

| Bishop Street Funds | | | (unaudited) | |

Statement of Assets and Liabilities (000)

June 30, 2013

| | | | |

| | | Hawaii

Municipal

Bond

Fund | |

Assets: | | | | |

Investments, at Cost | | $ | 151,108 | |

| |

Investments, at Value | | $ | 153,125 | |

Dividends and Interest Receivable | | | 2,527 | |

Receivable for Fund Shares Sold | | | 12 | |

Prepaid Expenses | | | 8 | |

| |

Total Assets | | | 155,672 | |

| |

Liabilities: | | | | |

Income Distribution Payable | | | 260 | |

Payable for Fund Shares Redeemed | | | 135 | |

Advisory Fees Payable | | | 24 | |

Shareholder Servicing Fees Payable | | | 13 | |

Administrative Fees Payable | | | 9 | |

Chief Compliance Officer Fees Payable | | | 1 | |

Other Accrued Expenses Payable | | | 99 | |

| |

Total Liabilities | | | 541 | |

| |

Net Assets | | $ | 155,131 | |

| |

Paid-in Capital | | $ | 152,041 | |

Undistributed Net Investment Income | | | 4 | |

Accumulated Net Realized Gain on Investments | | | 1,069 | |

Net Unrealized Appreciation on Investments | | | 2,017 | |

| |

Net Assets | | $ | 155,131 | |

| |

Class I Shares: | | | | |

Net Assets | | $ | 129,942 | |

Outstanding Shares of Beneficial Interest

(unlimited authorization — no par value) | | | 12,166 | |

Net Asset Value, Offering and Redemption Price Per Share — Class I

(Net Assets / Shares Outstanding) | | $ | 10.68 | |

| |

Class A Shares: | | | | |

Net Assets | | $ | 25,189 | |

Outstanding Shares of Beneficial Interest

(unlimited authorization — no par value) | | | 2,359 | |

Net Asset Value and Redemption Price Per Share — Class A

(Net Assets / Shares Outstanding) | | $ | 10.68 | |

| |

Maximum Offering Price Per Shares — Class A ($10.68 / 97.00%) | | $ | 11.01 | |

| |

The accompanying notes are an integral part of the financial statements.

32

| | | | |

| Bishop Street Funds | | | (unaudited) | |

Statements of Operations (000)

For the six-month period ended June 30, 2013

| | | | | | | | | | | | |

| | | Strategic

Growth

Fund | | | Dividend

Value

Fund | | | High

Grade

Income

Fund | |

Investment Income: | | | | | | | | | | | | |

Dividend Income | | $ | 268 | | | $ | 854 | | | $ | — | |

Interest Income | | | — | | | | — | | | | 1,222 | |

Less: Foreign Taxes Withheld | | | — | | | | (3 | ) | | | — | |

| |

Total Investment Income | | | 268 | | | | 851 | | | | 1,222 | |

| |

Expenses: | | | | | | | | | | | | |

Investment Adviser Fees | | | 182 | | | | 213 | | | | 230 | |

Shareholder Servicing Fees | | | 62 | | | | 72 | | | | 104 | |

Administrative Fees | | | 49 | | | | 58 | | | | 84 | |

Chief Compliance Officer Fees | | | 2 | | | | 2 | | | | 3 | |

Transfer Agent Fees | | | 20 | | | | 21 | | | | 25 | |

Printing Fees | | | 8 | | | | 10 | | | | 14 | |

Audit Fees | | | 6 | | | | 7 | | | | 11 | |

Legal Fees | | | 4 | | | | 5 | | | | 7 | |

Trustees’ Fees | | | 3 | | | | 3 | | | | 5 | |

Registration Fees | | | 2 | | | | 1 | | | | 8 | |

Custody Fees | | | 2 | | | | 2 | | | | 3 | |

Pricing Fees | | | — | | | | 1 | | | | 9 | |

Miscellaneous Expenses | | | 3 | | | | 3 | | | | 4 | |

| |

Total Expenses | | | 343 | | | | 398 | | | | 507 | |

| |

Less Waivers: | | | | | | | | | | | | |

Shareholder Servicing Fees | | | (37 | ) | | | (43 | ) | | | (63 | ) |

Administrative Fees | | | (20 | ) | | | (23 | ) | | | (33 | ) |

Investment Adviser Fees | | | — | | | | (30 | ) | | | (93 | ) |

| |

Total Waivers | | | (57 | ) | | | (96 | ) | | | (189 | ) |

| |

Total Net Expenses | | | 286 | | | | 302 | | | | 318 | |

| |

Net Investment Income (Loss) | | | (18 | ) | | | 549 | | | | 904 | |

| |

Net Realized Gain on Investments | | | 1,266 | | | | 3,125 | | | | 908 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | 3,634 | | | | 4,642 | | | | (4,179 | ) |

| |

Net Realized and Unrealized Gain (Loss) on Investments | | | 4,900 | | | | 7,767 | | | | (3,271 | ) |

| |

Increase (Decrease) in Net Assets Resulting from Operations | | $ | 4,882 | | | $ | 8,316 | | | $ | (2,367 | ) |

| |

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

33

| | | | |

| Bishop Street Funds | | | (unaudited) | |

Statement of Operations (000)

For the six-month period ended June 30, 2013

| | | | |

| | | Hawaii

Municipal

Bond

Fund | |

Investment Income: | | | | |

Interest Income | | $ | 2,630 | |

| |

Total Investment Income | | | 2,630 | |

| |

Expenses: | | | | |

Investment Adviser Fees | | | 281 | |

Shareholder Servicing Fees | | | 201 | |

Administrative Fees | | | 161 | |

Distribution Fees, Class A | | | 32 | |

Chief Compliance Officer Fees | | | 6 | |

Transfer Agent Fees | | | 46 | |

Printing Fees | | | 27 | |

Audit Fees | | | 21 | |

Pricing Fees | | | 16 | |

Legal Fees | | | 13 | |

Trustees’ Fees | | | 10 | |

Registration Fees | | | 6 | |

Custody Fees | | | 4 | |

Miscellaneous Expenses | | | 8 | |

| |

Total Expenses | | | 832 | |

| |

Less Waivers: | | | | |

Investment Adviser Fees | | | (133 | ) |

Shareholder Servicing Fees | | | (120 | ) |

Administrative Fees | | | (104 | ) |

| |

Total Waivers | | | (357 | ) |

| |

Total Net Expenses | | | 475 | |

| |

Net Investment Income | | | 2,155 | |

| |

Net Realized Gain on Investments | | | 441 | |

Net Change in Unrealized Depreciation on Investments | | | (7,086 | ) |

| |

Net Realized and Unrealized Loss on Investments | | | (6,645 | ) |

| |

Decrease in Net Assets Resulting from Operations | | $ | (4,490 | ) |

| |

The accompanying notes are an integral part of the financial statements.

34

Statements of Changes in Net Assets (000)

For the six-month period ended June 30, 2013 (unaudited) and the year ended December 31, 2012

| | | | | | | | | | | | | | | | |

| | | Strategic

Growth Fund | | | Dividend

Value Fund | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

Investment Activities from Operations: | | | | | | | | | | | | | | | | |

Net Investment Income (Loss) | | $ | (18 | ) | | $ | 106 | | | $ | 549 | | | $ | 1,302 | |

Net Realized Gain on Investments | | | 1,266 | | | | 6,930 | | | | 3,125 | | | | 2,201 | |

Net Increase from Payments by Affiliate and Net Gains Realized on Capital Transactions (See note 5) | | | — | | | | 122 | | | | — | | | | — | |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | 3,634 | | | | (1,542 | ) | | | 4,642 | | | | 2,746 | |

| |

Increase in Net Assets Resulting from Operations | | | 4,882 | | | | 5,616 | | | | 8,316 | | | | 6,249 | |

| |

Dividends and Distributions to Shareholders: | | | | | | | | | | | | | | | | |

Net Investment Income: | | | | | | | | | | | | | | | | |

Class I Shares | | | — | | | | (107 | ) | | | (555 | ) | | | (1,309 | ) |

| |

Total Dividends and Distributions to Shareholders | | | — | | | | (107 | ) | | | (555 | ) | | | (1,309 | ) |

| |

Capital Share Transactions: | | | | | | | | | | | | | | | | |

Proceeds from Shares Issued | | | 1,498 | | | | 15,372 | | | | 363 | | | | 3,727 | |

Reinvestments of Cash Distributions | | | — | | | | 79 | | | | 396 | | | | 911 | |

Cost of Shares Redeemed | | | (2,951 | ) | | | (24,729 | ) | | | (9,266 | ) | | | (11,127 | ) |

| |

Net Decrease in Net Assets from Capital Share Transactions | | | (1,453 | ) | | | (9,278 | ) | | | (8,507 | ) | | | (6,489 | ) |

| |

Total Increase (Decrease) in Net Assets | | | 3,429 | | | | (3,769 | ) | | | (746 | ) | | | (1,549 | ) |

| |

Net Assets: | | | | | | | | | | | | | | | | |

Beginning of Period | | | 46,644 | | | | 50,413 | | | | 57,137 | | | | 58,686 | |

| |

End of Period | | $ | 50,073 | | | $ | 46,644 | | | $ | 56,391 | | | $ | 57,137 | |

| |

Accumulated Net Investment Loss/Undistributed (Distributions in Excess of) Net Investment Income | | $ | (18 | ) | | $ | — | | | $ | (7 | ) | | $ | (1 | ) |

| |

Share Transactions: | | | | | | | | | | | | | | | | |

Shares Issued | | | 91 | | | | 1,116 | | | | 34 | | | | 384 | |

Shares Issued in Lieu of Cash Distributions | | | — | | | | 6 | | | | 36 | | | | 94 | |

Shares Redeemed | | | (199 | ) | | | (1,802 | ) | | | (858 | ) | | | (1,150 | ) |

| |

Net Decrease in Shares Outstanding from

Share Transactions | | | (108 | ) | | | (680 | ) | | | (788 | ) | | | (672 | ) |

| |

Amounts designated as “—” are either $0 or zero shares, or have been rounded to $0 or zero shares.

The accompanying notes are an integral part of the financial statements.

| | | | |

| June 30, 2013 | | | | www.bishopstreetfunds.com |

35

Statements of Changes in Net Assets (000)

For the six-month period ended June 30, 2013 (unaudited) and the year ended December 31, 2012

| | | | | | | | | | | | | | | | |

| | | High Grade

Income Fund | | | Hawaii Municipal

Bond Fund | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

Investment Activities from Operations: | | | | | | | | | | | | | | | | |

Net Investment Income | | $ | 904 | | | $ | 2,246 | | | $ | 2,155 | | | $ | 4,498 | |

Net Realized Gain on Investments | | | 908 | | | | 1,681 | | | | 441 | | | | 1,747 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | (4,179 | ) | | | 592 | | | | (7,086 | ) | | | 1,618 | |

| |

Increase (Decrease) in Net Assets Resulting from Operations | | | (2,367 | ) | | | 4,519 | | | | (4,490 | ) | | | 7,863 | |

| |

Dividends and Distributions to Shareholders: | | | | | | | | | | | | | | | | |

Net Investment Income: | | | | | | | | | | | | | | | | |

Class I Shares | | | (904 | ) | | | (2,229 | ) | | | (1,839 | ) | | | (3,849 | ) |

Class A Shares | | | — | | | | — | | | | (319 | ) | | | (649 | ) |

Capital Gains: | | | | | | | | | | | | | | | | |

Class I Shares | | | — | | | | (1,585 | ) | | | — | | | | (493 | ) |

Class A Shares | | | — | | | | — | | | | — | | | | (92 | ) |

| |

Total Dividends and Distributions to Shareholders | | | (904 | ) | | | (3,814 | ) | | | (2,158 | ) | | | (5,083 | ) |

| |

Capital Share Transactions: | | | | | | | | | | | | | | | | |

Class I Shares: | | | | | | | | | | | | | | | | |

Proceeds from Shares Issued | | | 2,890 | | | | 10,770 | | | | 10,396 | | | | 18,071 | |

Reinvestments of Cash Distributions | | | 576 | | | | 2,396 | | | | 326 | | | | 702 | |