UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-08572

Bishop Street Funds

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip Code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-262-9565

Date of fiscal year end: December 31, 2023

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

BISHOP STREET FUNDS® ANNUAL REPORT DECEMBER 31, 2023 HAWAII MUNICIPAL BOND FUND INVESTMENT ADVISER BISHOP STREET CAPITAL MANAGEMENT

The Fund files its complete schedule of investments with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT is available on the SEC’s website at http://www.sec.gov, and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies (if any) relating to portfolio securities is available without charge, by calling 1-800-262-9565 or by visiting the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available without charge, by calling 1-800-262-9565 or by visiting the Fund’s website at http://www.bishopstreetfunds. com or the website of the Securities and Exchange Commission.

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 9 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 22 | ||||

| 24 | ||||

| Report of Independent Registered Public Accounting Firm | 36 | |||

| 38 | ||||

| 40 | ||||

| 42 | ||||

| 1 |

Dear Shareholder:

It hardly seems possible to write this annual letter without acknowledging the most momentous event of the past year for Hawaii residents, the Maui wildfires on August 8th. While there are ongoing economic impacts, including for issuers of Hawaii municipal bonds, the fires more importantly claimed about 100 lives and continue to disrupt life for thousands more. Fortunately, many in Maui, the State of Hawaii, and throughout the world are providing resources to those most impacted by the fires, and we trust that this support will continue through the long rebuilding process. | ||

We would also like to welcome former shareholders of the Hawaii Municipal Fund (SURFX), who are now part of the Bishop Street ohana. Please rest assured that your investments will continue to be carefully managed to provide sustainable and reliable tax-free income by investing in Hawaii.

Turning now to matters of markets and finance, Fed Chair Jerome Powell was unusually blunt in his news conference on January 31st, saying “Let’s be honest. This is a good economy”. For a Fed Chair, this about as strong an endorsement of the economic situation as you will ever hear, and understandably so. The annual inflation rate has fallen from 9.1% in mid-2022 to 3.4% at the end of 2023 and is poised to fall further. Core PCE, the Fed’s preferred measure of inflation, showed only a 1.9% annual rate over the past six months, back below the Fed’s 2% target. It’s too early to say the fight against inflation has been won, but it is increasingly looking that way. The Fed, who last year boosted interest rates at an unprecedented pace in an effort to throttle inflation, are now talking openly of rate cuts—the only question seems to be the timing. The talk of lowering the Fed Funds rate is all the more remarkable because economic growth is still surging, which would normally preclude any consideration of cutting interest rates. In the fourth quarter of last year GDP growth remained strong at 3.3%, and unemployment was only 3.7%, very low by historical standards.

Many readers of this letter may be surprised at the rosy picture painted by economists. Indeed, surveys show that consumers have a far more negative view of the economy than the data would suggest. Of the myriad factors behind this disconnect, the biggest is probably the cumulative effect of high inflation over the past three years. Even though prices are not growing as fast as before, that is little comfort at the

| Bishop Street Funds | 2 |

|

supermarket, where prices remain much higher than in 2021. Unfortunately, there is no quick fix. Bringing prices broadly down again, i.e., deflation, could really only happen in another Depression, which nobody wants. Instead, the “sticker shock” for consumers will gradually wear away over time, helped by rising incomes. The most recent consumer surveys show this is already happening.

Looking ahead, a strong economy does not always presage strong market performance (and visa versa), but the most likely path in 2024 appears to be an economic soft landing and continued positive equity market performance. With the recent fall in interest rates, the bond market appears to be close to fair value, and returns are likely to be close to current yields. For most investors an appropriate mix of stocks, bonds, and other investments continues to make sense. In our view, the safety and tax advantages of municipal bonds should make them a core part of that mix for many investors.

As always, thank you for your continued trust and confidence in Bishop Street Capital Management and First Hawaiian Bank.

Sincerely,

Ken Miller, CFA

Chairman, Chief Executive Officer and Chief Investment Officer

Bishop Street Capital Management

February 7, 2024

The performance data quoted represents past performance. Past performance does not guarantee future results. Index returns are for illustrative purposes only and do not represent actual Fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

Investing involves risk including possible loss of principal. Diversification does not protect against market loss.

| December 31, 2023 | 3 | www.bishopstreetfunds.com |

BISHOP STREET

DEFINITION OF COMPARATIVE INDEX

FUNDS

Definition of Comparative Index

The ICE BofAML 1-22 Year US Municipal Securities Index is a subset of the ICE BofAML US Municipal Securities Index including all securities with a remaining term to final maturity greater than or equal to 1 years and less than 22 years.

Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).

| Bishop Street Funds | 4 |

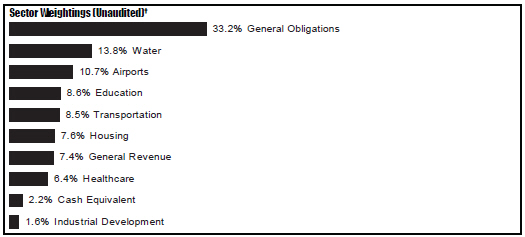

Hawaii Municipal Bond Fund (Unaudited)

2023 was a year marked by change. Over the first 10 months, yields surged as a hawkish Fed aimed to tame inflation. During this period, municipal market performance suffered, with the US 10-year Treasury yield crossing 5%—its highest level in 16 years. However, in the last two months of the year, we witnessed a policy pivot as the Fed removed the likelihood of further tightening and opened the door to rate cuts. This shift led to falling yields, driving historically strong returns in November and December.

Despite the volatility of 2023, municipal yields remain elevated at levels not seen since 2010, creating an opportunity for individual municipal investors seeking a higher level of tax-exempt income. Looking ahead, the US economy is expected to continue to grow at a moderate but slower pace.

Along with communities across the state, we mourned the losses from the devastating August wildfires on Maui. Our thoughts remain with everyone affected. Despite the challenges of the wildfires and their impact on the state, Hawai’i’s economy has shown resilience continuing to grow at a moderate pace in 2023. The strength in tourism and GET tax revenue helped to increase the state general fund revenue YOY in 2023 with state general excise and use tax revenue increasing by 4.9% YOY. However, visitor spending has been weak this year due to the weak yen and the Maui wildfires. Going forward, the state general fund is forecast to grow 4% in fiscal year 2024 and benefit in following years from the impacts of lower benchmark interest rates, a strong labor market, and a strong outlook for the construction sector. Overall, we believe the financial position of Hawai’i’s municipalities will continue to remain stable going forward.

The Bishop Street Hawaii Municipal Bond Fund, Class I returned 2.46% for the year, underperforming the ICE BofAML 1-22 Year US Municipal Securities Index which returned 5.65%. The Fund’s exposure to Hawaiian Electric bonds, which have potential liability related to the Maui wildfires, negatively impacted performance relative to other states. Since August, we have reduced our exposure to Hawaiian Electric. The fund has taken advantage of the rise in interest rates by purchasing higher yielding bonds. The fund also continues to provide a steady stream of tax-exempt income from Federal and State income tax for Hawai’i residents. One basis point is 1/100 of one percent.

| December 31, 2023 | 5 | www.bishopstreetfunds.com |

|

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be higher or lower than the performance quoted. For performance data current to the most recent month end, please visit www.bishopstreetfunds.com or call 1-800-262-9565.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

Investing involves risk including possible loss of principal. Diversification does not protect against market loss.

| Bishop Street Funds | 6 |

| Hawaii Municipal Bond Fund |

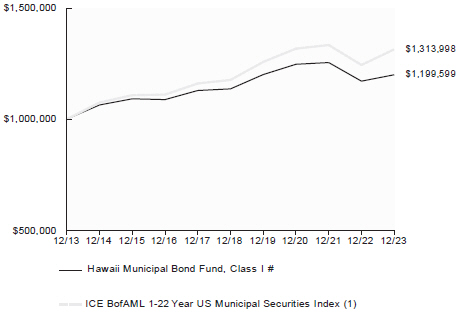

Performance Comparison

Comparison of Change in the Value of a $1,000,000 Investment in the Hawaii Municipal Bond

Fund, Class I*, versus the ICE BofAML 1-22 Year US Municipal Securities Index.

# Account value if you reinvested income and capital gains.

(1) See page 4 for definition of comparative index.

* The graph is based on only Class I Shares; performance for Class A would be different due to differences in fee structures.

Average Annual Total Returns†

One Year | Annualized Return | Annualized 5 Year Return | Annualized Return | |||||

| Hawaii Municipal Bond Fund, Class I | 2.46% | -1.28% | 1.09% | 1.84% | ||||

| Hawaii Municipal Bond Fund, Class A | 2.30% | -1.50% | 0.85% | 1.58% | ||||

| Hawaii Municipal Bond Fund, Class A, with load** | -0.80% | -2.50% | 0.24% | 1.27% | ||||

| ICE BofAML 1-22 Year US Municipal Securities Index | 5.65% | -0.09% | 2.24% | 2.77% |

** Reflects 3.00% sales charge.

† Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Fee waivers are in effect; if they had not been in effect, performance would have been lower.

| December 31, 2023 | 7 | www.bishopstreetfunds.com |

| Hawaii Municipal Bond Fund |

Top Ten Holdings (Unaudited)†

| Coupon Rate | Maturity Date | Percentage Investments | ||||||

1. | Hawaii State, Airports System Authority, Ser A, AMT | 5.000% | 07/01/45 | 3.3% | ||||

2. | Hawaii State, Department of Budget & Finance | 5.000% | 07/01/35 | 2.3% | ||||

3. | Hawaii State, Housing Finance & Development, Ser A | 4.000% | 09/01/33 | 2.0% | ||||

4. | Hawaii State, Housing Finance & Development, Ser A | 3.750% | 01/01/31 | 1.8% | ||||

5. | Hawaii State, Harbor System Revenue, Ser C | 4.000% | 07/01/40 | 1.5% | ||||

6. | Honolulu Hawaii City & County, HUD SECT 8 Insured | 5.000% | 06/01/27 | 1.4% | ||||

7. | Hawaii State, Ser EO | 5.000% | 08/01/30 | 1.4% | ||||

8. | Hawaii State, Department of Budget & Finance | 3.200% | 07/01/39 | 1.4% | ||||

9. | Hawaii State, Housing Finance & Development, Ser A | 4.950% | 04/01/29 | 1.4% | ||||

10. | Honolulu Hawaii City & County, Ser A | 5.000% | 10/01/37 | 1.4% |

† Percentages based on total investments. Top ten holdings do not include short-term investments.

| Bishop Street Funds | 8 |

Face | Value (000) | |||||

| MUNICIPAL BONDS —96.3% | ||||||

Arkansas – 0.3% |

| |||||

| Little Rock Arkansas, Ser A, GO | ||||||

| $ 750 | 4.000%, 02/01/37 | $ | 771 | |||

|

|

| ||||

Hawaii – 95.5% | ||||||

| Hawaii County, GO | ||||||

| 525 | 5.000%, 09/01/40 | 604 | ||||

| 1,060 | 4.000%, 09/01/42 | 1,081 | ||||

| Hawaii County, Ser A, GO | ||||||

| 1,160 | 5.000%, 09/01/27 | 1,217 | ||||

| 825 | 5.000%, 09/01/30 | 864 | ||||

| 675 | 5.000%, 09/01/32 | 707 | ||||

| 940 | 5.000%, 09/01/33 | 1,007 | ||||

| 35 | 5.000%, 09/01/35 | 37 | ||||

| 345 | 5.000%, 09/01/36 | 367 | ||||

| 1,500 | 4.000%, 09/01/35 | 1,530 | ||||

| 130 | 4.000%, 09/01/36 | 138 | ||||

| 1,500 | 4.000%, 09/01/40 | 1,533 | ||||

| Hawaii County, Ser B, GO | ||||||

| 125 | 4.000%, 09/01/26 | 129 | ||||

| Hawaii County, Ser C, GO | ||||||

| 125 | 5.000%, 09/01/27 | 131 | ||||

| Hawaii County, Ser D, GO | ||||||

| 800 | 4.000%, 09/01/31 | 830 | ||||

| Hawaii State, Airports System Authority, Ser A, RB, AMT | ||||||

| 385 | 5.000%, 07/01/31 | 413 | ||||

| 1,000 | 5.000%, 07/01/36 | 1,119 | ||||

| 2,040 | 5.000%, 07/01/41 | 2,061 | ||||

| 1,735 | 5.000%, 07/01/43 | 1,799 | ||||

| 7,335 | 5.000%, 07/01/45 | 7,396 | ||||

| 2,600 | 5.000%, 07/01/48 | 2,671 | ||||

| 1,500 | 5.000%, 07/01/51 | 1,570 | ||||

| 2,800 | 4.000%, 07/01/39 | 2,823 | ||||

| Hawaii State, Airports System Authority, Ser B, RB, AMT | ||||||

| 1,000 | 5.000%, 07/01/24 | 1,007 | ||||

| Hawaii State, Airports System Authority, Ser D, RB | ||||||

| 100 | 5.000%, 07/01/28 | 111 | ||||

| December 31, 2023 | 9 | www.bishopstreetfunds.com |

| Hawaii Municipal Bond Fund |

Schedule of Investments

Face | Value (000) | |||||

Hawaii – (continued) | ||||||

| $ 1,025 | 5.000%, 07/01/29 | $ | 1,159 | |||

| 450 | 5.000%, 07/01/33 | 517 | ||||

| 135 | 5.000%, 07/01/34 | 155 | ||||

| 1,000 | 4.000%, 07/01/37 | 1,039 | ||||

| 260 | 4.000%, 07/01/39 | 266 | ||||

| Hawaii State, Department of Budget & Finance, Pacific Health Project, Ser A, RB | ||||||

| 310 | 4.000%, 01/01/24 | 310 | ||||

| Hawaii State, Department of Budget & Finance, RB | ||||||

| 500 | 5.000%, 07/01/25 | 514 | ||||

| 1,000 | 5.000%, 07/01/26 | 1,049 | ||||

| 1,040 | 5.000%, 07/01/27 | 1,115 | ||||

| 1,200 | 5.000%, 07/01/28 | 1,314 | ||||

| 2,460 | 5.000%, 07/01/29 | 2,735 | ||||

| 5,000 | 5.000%, 07/01/35 | 5,128 | ||||

| 275 | 4.000%, 01/01/25 | 275 | ||||

| 140 | 4.000%, 01/01/26 | 140 | ||||

| 665 | 4.000%, 01/01/27 | 668 | ||||

| 350 | 4.000%, 01/01/28 | 353 | ||||

| 250 | 4.000%, 01/01/31 | 252 | ||||

| 270 | 4.000%, 01/01/32 | 272 | ||||

| 790 | 4.000%, 03/01/37 | 536 | ||||

| 4,670 | 3.200%, 07/01/39 | 3,124 | ||||

| 435 | 3.000%, 01/01/34 | 393 | ||||

| 600 | 3.000%, 01/01/35 | 539 | ||||

| 585 | 3.000%, 01/01/36 | 517 | ||||

| Hawaii State, Department of Budget & Finance, Ser A, RB | ||||||

| 75 | 5.000%, 07/01/29 | 77 | ||||

| 515 | 5.000%, 07/01/30 | 529 | ||||

| 185 | 5.000%, 07/01/35 | 190 | ||||

| 1,805 | 4.000%, 07/01/40 | 1,796 | ||||

| Hawaii State, Department of Hawaiian Home Lands, Kapolie Office Facilities, Ser A, COP | ||||||

| 150 | 5.000%, 11/01/24 | 152 | ||||

| 530 | 5.000%, 11/01/26 | 564 | ||||

| Hawaii State, Department of Hawaiian Home Lands, Kapolie Office Facilities, Ser A, RB | ||||||

| 15 | 5.000%, 11/01/25 | 16 | ||||

| 680 | 5.000%, 11/01/29 | 739 | ||||

| Bishop Street Funds | 10 |

Schedule of Investments

Face | Value (000) | |||||

Hawaii – (continued) | ||||||

| $ 500 | 5.000%, 11/01/30 | $ | 543 | |||

| 350 | 5.000%, 11/01/31 | 379 | ||||

| Hawaii State, Department of Hawaiian Home Lands, RB | ||||||

| 240 | 5.000%, 04/01/24 | 241 | ||||

| 810 | 5.000%, 04/01/25 | 831 | ||||

| 50 | 5.000%, 04/01/26 | 52 | ||||

| 600 | 5.000%, 04/01/27 | 645 | ||||

| 240 | 5.000%, 04/01/29 | 256 | ||||

| 715 | 5.000%, 04/01/30 | 760 | ||||

| 960 | 5.000%, 04/01/31 | 1,019 | ||||

| 550 | 5.000%, 04/01/32 | 583 | ||||

| 10 | 3.000%, 04/01/32 | 10 | ||||

| Hawaii State, Department of Transportation, Airports System, COP, AMT | ||||||

| 510 | 5.250%, 08/01/25 | 510 | ||||

| 1,055 | 5.000%, 08/01/27 | 1,055 | ||||

| 2,075 | 5.000%, 08/01/28 | 2,075 | ||||

| Hawaii State, Department of Transportation, RB, AMT | ||||||

| 1,420 | 5.250%, 08/01/24 | 1,421 | ||||

| 2,570 | 5.250%, 08/01/26 | 2,571 | ||||

| Hawaii State, Harbor System Revenue, Ser A, RB, AMT | ||||||

| 755 | 5.000%, 07/01/24 | 761 | ||||

| 750 | 5.000%, 07/01/26 | 785 | ||||

| 520 | 4.000%, 07/01/36 | 535 | ||||

| Hawaii State, Harbor System Revenue, Ser C, RB | ||||||

| 1,260 | 4.000%, 07/01/32 | 1,341 | ||||

| 1,000 | 4.000%, 07/01/37 | 1,039 | ||||

| 85 | 4.000%, 07/01/38 | 88 | ||||

| 2,160 | 4.000%, 07/01/39 | 2,213 | ||||

| 3,405 | 4.000%, 07/01/40 | 3,460 | ||||

| Hawaii State, Highway Revenue, RB | ||||||

| 1,110 | 5.000%, 01/01/37 | 1,275 | ||||

| 20 | 5.000%, 01/01/38 | 23 | ||||

| 380 | 5.000%, 01/01/40 | 428 | ||||

| 1,245 | 5.000%, 01/01/41 | 1,397 | ||||

| Hawaii State, Highway Revenue, Ser A, RB | ||||||

| 535 | 5.000%, 01/01/30 | 601 | ||||

| 1,045 | 5.000%, 01/01/33 | 1,055 | ||||

| December 31, 2023 | 11 | www.bishopstreetfunds.com |

| Hawaii Municipal Bond Fund |

Schedule of Investments

Face | Value (000) | |||||

Hawaii – (continued) | ||||||

| $ 385 | 5.000%, 01/01/36 | $ | 427 | |||

| 720 | 4.000%, 01/01/32 | 737 | ||||

| 1,250 | 4.000%, 01/01/34 | 1,278 | ||||

| 1,360 | 4.000%, 01/01/35 | 1,388 | ||||

| 330 | 4.000%, 01/01/36 | 336 | ||||

| Hawaii State, Housing Finance & Development, Ser A, RB, FHLMC Insured | ||||||

| 80 | 3.300%, 01/01/26 | 80 | ||||

| Hawaii State, Housing Finance & Development, Ser A, RB | ||||||

| 3,000 | 4.950%, 04/01/29 | 3,063 | ||||

| 2,005 | 4.750%, 10/01/27 | 2,030 | ||||

| 4,500 | 4.000%, 09/01/33 | 4,503 | ||||

| 4,035 | 3.750%, 01/01/31 | 4,037 | ||||

| Hawaii State, Ser EO, GO | ||||||

| 1,610 | 5.000%, 08/01/24, Pre-Refunded @ 100(A) | 1,629 | ||||

| 1,210 | 5.000%, 08/01/29 | 1,222 | ||||

| 3,105 | 5.000%, 08/01/30 | 3,134 | ||||

| Hawaii State, Ser EP, GO (A) | ||||||

| 880 | 5.000%, 08/01/24, Pre-Refunded @ 100 | 891 | ||||

| 65 | 5.000%, 08/01/26, Pre-Refunded @ 100 | 66 | ||||

| Hawaii State, Ser ET, GO | ||||||

| 685 | 5.000%, 10/01/25, Pre-Refunded @ 100(A) | 712 | ||||

| 1,000 | 4.000%, 10/01/26 | 1,020 | ||||

| Hawaii State, Ser FB, GO | ||||||

| 50 | 4.000%, 04/01/29 | 51 | ||||

| Hawaii State, Ser FG, GO | ||||||

| 150 | 5.000%, 10/01/27 | 159 | ||||

| 125 | 5.000%, 10/01/28 | 133 | ||||

| 660 | 5.000%, 10/01/30 | 698 | ||||

| 350 | 5.000%, 10/01/31 | 370 | ||||

| Hawaii State, Ser FH, GO | ||||||

| 120 | 5.000%, 10/01/27 | 127 | ||||

| 190 | 4.000%, 10/01/31 | 196 | ||||

| Hawaii State, Ser FK, GO | ||||||

| 2,025 | 5.000%, 05/01/29 | 2,172 | ||||

| 1,100 | 4.000%, 05/01/36 | 1,132 | ||||

| Hawaii State, Ser FN-REF, GO | ||||||

| 780 | 5.000%, 10/01/30 | 843 | ||||

| Bishop Street Funds | 12 |

Schedule of Investments

Face | Value (000) | |||||

Hawaii – (continued) | ||||||

| Hawaii State, Ser FT, GO | ||||||

| $ 210 | 5.000%, 01/01/30 | $ | 231 | |||

| 1,055 | 5.000%, 01/01/31 | 1,159 | ||||

| 250 | 5.000%, 01/01/36 | 272 | ||||

| Hawaii State, Ser FW, GO | ||||||

| 2,040 | 5.000%, 01/01/37 | 2,261 | ||||

| 2,045 | 5.000%, 01/01/39 | 2,233 | ||||

| 650 | 4.000%, 01/01/37 | 677 | ||||

| Honolulu Hawaii City & County, Board of Water Supply, RB | ||||||

| 215 | 5.000%, 07/01/34 | 261 | ||||

| 140 | 5.000%, 07/01/36 | 167 | ||||

| 400 | 5.000%, 07/01/42 | 455 | ||||

| Honolulu Hawaii City & County, Board of Water Supply, Ser A, RB | ||||||

| 100 | 5.000%, 07/01/24 | 101 | ||||

| 410 | 5.000%, 07/01/24, Pre-Refunded @ 100(A) | 413 | ||||

| 100 | 5.000%, 07/01/27 | 109 | ||||

| 1,900 | 5.000%, 07/01/28 | 2,111 | ||||

| 1,470 | 5.000%, 07/01/29 | 1,670 | ||||

| 100 | 5.000%, 07/01/30 | 116 | ||||

| 400 | 5.000%, 07/01/34 | 477 | ||||

| 400 | 4.000%, 07/01/36 | 422 | ||||

| 1,000 | 4.000%, 07/01/38 | 1,040 | ||||

| 1,000 | 4.000%, 07/01/40 | 1,027 | ||||

| 2,035 | 4.000%, 07/01/46 | 2,050 | ||||

| Honolulu Hawaii City & County, GO | ||||||

| 265 | 4.000%, 09/01/33 | 279 | ||||

| 200 | 4.000%, 09/01/43 | 203 | ||||

| 1,085 | 3.250%, 07/01/35 | 1,107 | ||||

| 785 | 3.000%, 07/01/33 | 783 | ||||

| 1,330 | 3.000%, 07/01/34 | 1,320 | ||||

| Honolulu Hawaii City & County, RB, HUD SECT 8 Insured | ||||||

| 3,050 | 5.000%, 06/01/27(B) | 3,172 | ||||

| Honolulu Hawaii City & County, Ser A, GO | ||||||

| 555 | 5.000%, 10/01/29 | 574 | ||||

| 800 | 5.000%, 10/01/31 | 828 | ||||

| 575 | 5.000%, 09/01/32 | 624 | ||||

| 1,440 | 5.000%, 10/01/32 | 1,490 | ||||

| December 31, 2023 | 13 | www.bishopstreetfunds.com |

| Hawaii Municipal Bond Fund |

Schedule of Investments

Face | Value (000) | |||||

Hawaii – (continued) | ||||||

| $ 1,275 | 5.000%, 09/01/33 | $ | 1,381 | |||

| 530 | 5.000%, 09/01/35 | 571 | ||||

| 275 | 5.000%, 10/01/36 | 283 | ||||

| 2,970 | 5.000%, 10/01/37 | 3,049 | ||||

| 1,185 | 5.000%, 09/01/38 | 1,286 | ||||

| 1,100 | 5.000%, 09/01/42 | 1,181 | ||||

| 1,000 | 4.000%, 07/01/33 | 1,084 | ||||

| 785 | 4.000%, 07/01/34 | 848 | ||||

| 1,200 | 4.000%, 09/01/37 | 1,231 | ||||

| 1,015 | 4.000%, 07/01/41 | 1,040 | ||||

| Honolulu Hawaii City & County, Ser B, GO | ||||||

| 85 | 5.250%, 07/01/45 | 97 | ||||

| 650 | 5.000%, 07/01/37 | 754 | ||||

| Honolulu Hawaii City & County, Ser C, GO | ||||||

| 835 | 5.000%, 08/01/34 | 942 | ||||

| 1,000 | 5.000%, 07/01/38 | 1,117 | ||||

| 2,400 | 5.000%, 08/01/44 | 2,595 | ||||

| 620 | 5.000%, 07/01/45 | 677 | ||||

| 1,000 | 4.000%, 10/01/32 | 1,030 | ||||

| 2,135 | 4.000%, 10/01/33 | 2,197 | ||||

| 1,355 | 4.000%, 08/01/39 | 1,391 | ||||

| 585 | 4.000%, 07/01/40 | 600 | ||||

| 170 | 3.000%, 10/01/28 | 171 | ||||

| Honolulu Hawaii City & County, Ser F, GO | ||||||

| 625 | 5.000%, 07/01/33 | 718 | ||||

| Honolulu Hawaii City & County, Wastewater System Revenue, RB | ||||||

| 1,000 | 5.000%, 07/01/25, Pre-Refunded @ 100(A) | 1,033 | ||||

| 610 | 5.000%, 07/01/34 | 731 | ||||

| 2,100 | 4.000%, 07/01/39 | 2,156 | ||||

| Honolulu Hawaii City & County, Wastewater System Revenue, Ser A, RB | ||||||

| 385 | 5.000%, 07/01/31 | 407 | ||||

| 500 | 5.000%, 07/01/34 | 592 | ||||

| 1,535 | 5.000%, 07/01/36 | 1,610 | ||||

| 90 | 5.000%, 07/01/47 | 100 | ||||

| 2,750 | 5.000%, 07/01/49 | 2,936 | ||||

| 1,960 | 4.000%, 07/01/37 | 2,033 | ||||

| Bishop Street Funds | 14 |

Schedule of Investments

Face | Value (000) | |||||

Hawaii – (continued) | ||||||

| $ 3,000 | 4.000%, 07/01/38 | $ | 3,081 | |||

| 920 | 4.000%, 07/01/39 | 942 | ||||

| 1,000 | 4.000%, 07/01/44 | 1,007 | ||||

| 2,990 | 4.000%, 07/01/49 | 2,956 | ||||

| Honolulu Hawaii City & County, Wastewater System Revenue, Ser B, RB | ||||||

| 240 | 4.000%, 07/01/29 | 247 | ||||

| 115 | 4.000%, 07/01/32 | 118 | ||||

| Honolulu Hawaii City & County, Wastewater System Revenue, Ser S, RB | ||||||

| 795 | 5.000%, 07/01/25, Pre-Refunded @ 100(A) | 822 | ||||

| Kauai County, Community Facilities District, RB | ||||||

| 1,300 | 5.000%, 05/15/49 | 1,302 | ||||

| 1,000 | 5.000%, 05/15/51 | 1,005 | ||||

| Kauai County, GO | ||||||

| 175 | 5.000%, 08/01/26 | 186 | ||||

| 100 | 5.000%, 08/01/27 | 109 | ||||

| 140 | 5.000%, 08/01/28 | 152 | ||||

| 25 | 5.000%, 08/01/30 | 27 | ||||

| 340 | 5.000%, 08/01/37 | 363 | ||||

| 150 | 4.000%, 08/01/32 | 157 | ||||

| 125 | 4.000%, 08/01/33 | 131 | ||||

| 10 | 3.000%, 08/01/38 | 9 | ||||

| Maui County, GO | ||||||

| 460 | 5.000%, 03/01/24 | 462 | ||||

| 500 | 5.000%, 03/01/29 | 564 | ||||

| 205 | 5.000%, 09/01/29 | 228 | ||||

| 1,550 | 5.000%, 03/01/34 | 1,804 | ||||

| 400 | 5.000%, 03/01/38 | 458 | ||||

| 1,000 | 4.000%, 09/01/28 | 1,021 | ||||

| 500 | 4.000%, 03/01/36 | 535 | ||||

| 675 | 4.000%, 03/01/37 | 713 | ||||

| 65 | 3.125%, 06/01/31 | 65 | ||||

| 500 | 3.000%, 06/01/27 | 500 | ||||

| 400 | 3.000%, 03/01/31 | 400 | ||||

| 3,000 | 2.125%, 06/01/24 | 2,982 | ||||

| Maui County, RB | ||||||

| 520 | 3.250%, 09/01/36 | 520 | ||||

| December 31, 2023 | 15 | www.bishopstreetfunds.com |

| Hawaii Municipal Bond Fund |

Schedule of Investments

Face | Value (000) | |||||

Hawaii – (continued) | ||||||

| University of Hawaii, RB | ||||||

| $ 2,000 | 5.000%, 10/01/29 | $ | 2,117 | |||

| 1,200 | 5.000%, 10/01/30 | 1,268 | ||||

| 1,600 | 5.000%, 10/01/31 | 1,687 | ||||

| University of Hawaii, Ser B, RB | ||||||

| 1,510 | 5.000%, 10/01/34 | 1,561 | ||||

| 1,030 | 3.000%, 10/01/28 | 1,029 | ||||

| University of Hawaii, Ser D, RB | ||||||

| 700 | 4.000%, 10/01/32 | 750 | ||||

| 325 | 4.000%, 10/01/33 | 348 | ||||

| 100 | 3.000%, 10/01/30 | 99 | ||||

| 750 | 3.000%, 10/01/36 | 711 | ||||

| University of Hawaii, Ser E, RB | ||||||

| 1,430 | 5.000%, 10/01/32 | 1,508 | ||||

| University of Hawaii, Ser F, RB | ||||||

| 100 | 5.000%, 10/01/27 | 109 | ||||

| 600 | 5.000%, 10/01/33 | 652 | ||||

| 2,425 | 5.000%, 10/01/35 | 2,629 | ||||

|

|

| ||||

| 218,771 | ||||||

|

|

| ||||

Oklahoma – 0.0% | ||||||

| Oklahoma State, Development Finance Authority, RB | ||||||

| 19 | 5.000%, 06/01/44 | 19 | ||||

|

|

| ||||

Texas – 0.4% | ||||||

| Tomball City, Independent School District, GO, PSF-GTD Insured | ||||||

| 1,000 | 5.000%, 02/15/28 | 1,022 | ||||

|

|

| ||||

Wisconsin – 0.1% | ||||||

| Public Finance Authority, Ser A, RB | ||||||

| 250 | 5.000%, 07/01/28(C) | 260 | ||||

|

|

| ||||

| TOTAL MUNICIPAL BONDS (Cost $227,886) | 220,843 | |||||

|

|

| ||||

| Bishop Street Funds | 16 |

Schedule of Investments

Shares | Value (000) | |||||

| CASH EQUIVALENT — 2.2% | ||||||

| 5,043,926 | First American Treasury Obligations Fund, Cl X, 5.280% (D) (Cost $ 5,044) | $ | 5,044 | |||

|

|

| ||||

| TOTAL INVESTMENTS (Cost $ 232,930)—98.5% | $ | 225,887 | ||||

|

|

| ||||

Percentages are based on Net Assets of $229,277 (000).

| (A) | Pre-Refunded Security — The maturity date shown is the pre-refunded date. |

| (B) | Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates on certain securities are not based on published reference rates and spreads and are either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

| (C) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutions. At December 31, 2023, these securities amounted to $260($ Thousands), representing 0.11% of net assets of the Fund. |

| (D) | The rate reported is the 7-day effective yield as of December 31, 2023. |

AMT—Alternative Minimum Tax

Cl— Class

COP—Certificate of Participation

FHLMC—Federal Home Loan Mortgage Corporation

GO—General Obligation

PSF-GTD — Guaranteed by Permanent School Fund

RB—Revenue Bond

Ser—Series

Cost figures are shown in thousands.

The following is a summary of the inputs used as of December 31, 2023, in valuing the Fund’s investments carried at value (000):

| Hawaii Municipal Bond Fund | ||||||||||||||||

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Municipal Bonds | $ | — | $ | 220,843 | $ | — | $ | 220,843 | ||||||||

Cash Equivalent | 5,044 | — | — | 5,044 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total Investments in Securities | $ | 5,044 | $ | 220,843 | $ | — | $ | 225,887 | ||||||||

Amounts designated as “-” are either $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2 in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| December 31, 2023 | 17 | www.bishopstreetfunds.com |

| Bishop Street Funds |

Statement of Assets and Liabilities (000)

December 31, 2023

Hawaii Municipal Bond Fund | ||||

Assets: | ||||

Investments, at Cost | $ | 232,930 | ||

Investments, at Value | $ | 225,887 | ||

Dividends and Interest Receivable | 3,895 | |||

Receivable for Investment Securities Sold | 20 | |||

Prepaid Expenses | 5 | |||

Total Assets | 229,807 | |||

Liabilities: | ||||

Income Distribution Payable | 201 | |||

Payable for Investment Securities Purchased | 151 | |||

Investment Advisory Fees Payable (Note 3) | 35 | |||

Distribution Fees Payable, Class A | 26 | |||

Payable for Fund Shares Redeemed | 14 | |||

Shareholder Servicing Fees Payable | 11 | |||

Administrative Fees Payable | 9 | |||

Chief Compliance Officer Fees Payable | 2 | |||

Audit Fees Payable | 28 | |||

Other Accrued Expenses Payable | 53 | |||

Total Liabilities | 530 | |||

Commitments and Contingencies † | ||||

Net Assets | $ | 229,277 | ||

Paid-in Capital | $ | 248,353 | ||

Total Accumulated Losses | (19,076 | ) | ||

Net Assets | $ | 229,277 | ||

Class I Shares: | ||||

Net Assets | $ | 95,422 | ||

Outstanding Shares of Beneficial Interest | 9,587 | |||

Net Asset Value, Offering and Redemption Price | $ | 9.95 | ||

Class A Shares: | ||||

Net Assets | $ | 133,855 | ||

Outstanding Shares of Beneficial Interest | 13,446 | |||

Net Asset Value, Offering and Redemption Price | $ | 9.96 | ||

Maximum Offering Price Per Shares — Class A | $ | 10.27 | ||

† See Note 3 in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| Bishop Street Funds | 18 |

| Bishop Street Funds |

For the year ended December 31, 2023

Hawaii Municipal Bond Fund | ||||

Investment Income: | ||||

Interest Income | $ | 3,059 | ||

Total Investment Income | 3,059 | |||

Expenses: | ||||

Investment Advisory Fees | 425 | |||

Shareholder Servicing Fees | 304 | |||

Administrative Fees | 239 | |||

Distribution Fees, Class A | 52 | |||

Chief Compliance Officer Fees | 7 | |||

Transfer Agent Fees | 119 | |||

Legal Fees | 51 | |||

Audit Fees | 36 | |||

Trustees’ Fees | 34 | |||

Printing Fees | 25 | |||

Pricing Fees | 23 | |||

Registration Fees | 13 | |||

Custody Fees | 8 | |||

Miscellaneous Expenses | 24 | |||

Total Expenses | 1,360 | |||

Less Waivers: | ||||

Investment Advisory Fees | (302 | ) | ||

Shareholder Servicing Fees | (182 | ) | ||

Administrative Fees | (158 | ) | ||

Total Waivers | (642 | ) | ||

Total Net Expenses | 718 | |||

Net Investment Income | 2,341 | |||

Net Realized Loss | (3,365 | ) | ||

Net Change in Unrealized | ||||

Appreciation | 5,196 | |||

Net Realized and Unrealized Gain | 1,831 | |||

Increase in Net Assets Resulting from Operations | $ | 4,172 | ||

The accompanying notes are an integral part of the financial statements.

| 19 | www.bishopstreetfunds.com |

| Bishop Street Funds |

Statements of Changes in Net Assets (000)

For the year ended December 31,

Hawaii Municipal Bond Fund | ||||||||

| 2023 | 2022 | |||||||

Investment Activities from Operations: | ||||||||

Net Investment Income | $ | 2,341 | $ | 1,929 | ||||

Net Realized Loss | (3,365 | ) | (584 | ) | ||||

Net Change in Unrealized Appreciation (Depreciation) | 5,196 | (10,330 | ) | |||||

Increase (Decrease) in Net Assets Resulting from Operations | 4,172 | (8,985 | ) | |||||

Distributions: | ||||||||

Class I Shares | (1,934 | ) | (1,743 | ) | ||||

Class A Shares | (376 | ) | (185 | ) | ||||

Total Distributions | (2,310 | ) | (1,928 | ) | ||||

Capital Share Transactions: | ||||||||

Class I Shares: | ||||||||

Proceeds from Shares Issued | 5,847 | 8,244 | ||||||

Reinvestments of Cash Distributions | 320 | 287 | ||||||

Cost of Shares Redeemed | (16,778 | ) | (11,624 | ) | ||||

Total Class I Capital Share Transactions | (10,611 | ) | (3,093 | ) | ||||

Class A Shares: | ||||||||

Proceeds from Shares Issued | 151 | 71 | ||||||

Reinvestments of Cash Distributions | 271 | 138 | ||||||

Cost of Shares Redeemed | (3,786 | ) | (3,336 | ) | ||||

Merger (Note 11) | 123,227 | — | ||||||

Total Class A Capital Share Transactions | 119,863 | (3,127 | ) | |||||

Net Increase (Decrease) in Net Assets from Capital Share Transactions | 109,252 | (6,220 | ) | |||||

Total Increase (Decrease) in Net Assets | 111,114 | (17,133 | ) | |||||

Net Assets: | ||||||||

Beginning of Year | 118,163 | 135,296 | ||||||

End of Year | $ | 229,277 | $ | 118,163 | ||||

Share Transactions: | ||||||||

Class I Shares: | ||||||||

Shares Issued | 591 | 812 | ||||||

Shares Issued in Lieu of Cash Distributions | 32 | 29 | ||||||

Shares Redeemed | (1,708 | ) | (1,152 | ) | ||||

Total Class I Transactions | (1,085 | ) | (311 | ) | ||||

Class A Shares: | ||||||||

Shares Issued | 15 | 7 | ||||||

Shares Issued in Lieu of Cash Distributions | 27 | 14 | ||||||

Shares Redeemed | (382 | ) | (333 | ) | ||||

Shares Contributed in Merger (Note 11) | 12,524 | — | ||||||

Total Class A Transactions | 12,184 | (312 | ) | |||||

Net Increase (Decrease) in Shares Outstanding from Share Transactions | 11,099 | (623 | ) | |||||

The accompanying notes are an integral part of the financial statements.

| Bishop Street Funds | 20 |

This page intentionally left blank.

| Bishop Street Funds |

For a share outstanding throughout the year ended December 31,

| Investment Activities |

Total | Dividends and Distributions | ||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Year | Net Investment Income (Loss)(1) |

Net Realized and | Net Investment Income | Capital Gains | ||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||

| HAWAII MUNICIPAL BOND FUND |

| |||||||||||||||||||||||||||||

Class I Shares: |

| |||||||||||||||||||||||||||||

2023 | $ | 9.90 | $ | 0.19 | $ | 0.05 | $ | 0.24 | $ | (0.19 | ) | $ | — | |||||||||||||||||

2022 | 10.78 | 0.16 | (0.88 | ) | (0.72 | ) | (0.16 | ) | — | |||||||||||||||||||||

2021 | 10.90 | 0.16 | (0.10 | ) | 0.06 | (0.16 | ) | (0.02 | ) | |||||||||||||||||||||

2020 | 10.73 | 0.20 | 0.21 | 0.41 | (0.20 | ) | (0.04 | ) | ||||||||||||||||||||||

2019 | 10.39 | 0.25 | 0.34 | 0.59 | (0.25 | ) | — | |||||||||||||||||||||||

Class A Shares: |

| |||||||||||||||||||||||||||||

2023 | $ | 9.90 | $ | 0.16 | $ | 0.06 | $ | 0.22 | $ | (0.16 | ) | $ | — | |||||||||||||||||

2022 | 10.77 | 0.13 | (0.87 | ) | (0.74 | ) | (0.13 | ) | — | |||||||||||||||||||||

2021 | 10.90 | 0.14 | (0.11 | ) | 0.03 | (0.14 | ) | (0.02 | ) | |||||||||||||||||||||

2020 | 10.74 | 0.17 | 0.20 | 0.37 | (0.17 | ) | (0.04 | ) | ||||||||||||||||||||||

2019 | 10.39 | 0.22 | 0.35 | 0.57 | (0.22 | ) | — | |||||||||||||||||||||||

| † | Total return is for the period indicated and has not been annualized. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Fee waivers are in effect; if they had not been in effect, performance would have been lower. |

| (1) | Per share net investment income calculated using average shares. |

| (2) | Portfolio turnover rate is for the period indicated and periods of less than one year have not been annualized. Excludes effect of in-kind transfers. |

Amounts designated as “-” are either $0 or have been rounded to $0.

| Bishop Street Funds | 22 |

| Total Dividends and Distributions | Net Asset Value, End of Year | Total Return† | Net Assets, End of Year (000) | Ratio of Expenses to Average Net Assets | Ratio of Expenses to Average Net Assets (Excluding Waivers) |

Ratio of Net | Portfolio Turnover Rate(2) | |||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

| $ | (0.19 | ) | $ | 9.95 | 2.46 | % | $ | 95,422 | 0.55 | % | 1.08 | % | 1.96 | % | 23 | % | ||||||||||||||||||||||

| (0.16 | ) | 9.90 | (6.68 | ) | 105,663 | 0.55 | 1.04 | 1.59 | 15 | |||||||||||||||||||||||||||||

| (0.18 | ) | 10.78 | 0.62 | 118,341 | 0.55 | 1.03 | 1.49 | 14 | ||||||||||||||||||||||||||||||

| (0.24 | ) | 10.90 | 3.85 | 108,718 | 0.55 | 1.04 | 1.85 | 31 | ||||||||||||||||||||||||||||||

| (0.25 | ) | 10.73 | 5.69 | 111,254 | 0.55 | 1.04 | 2.31 | 36 | ||||||||||||||||||||||||||||||

| $ | (0.16 | ) | $ | 9.96 | 2.30 | % | $ | 133,855 | 0.80 | % | 1.33 | % | 1.75 | % | 23 | % | ||||||||||||||||||||||

| (0.13 | ) | 9.90 | (6.83 | ) | 12,500 | 0.80 | 1.29 | 1.33 | 15 | |||||||||||||||||||||||||||||

| (0.16 | ) | 10.77 | 0.27 | 16,955 | 0.80 | 1.28 | 1.25 | 14 | ||||||||||||||||||||||||||||||

| (0.21 | ) | 10.90 | 3.50 | 16,726 | 0.80 | 1.29 | 1.60 | 31 | ||||||||||||||||||||||||||||||

| (0.22 | ) | 10.74 | 5.48 | 17,059 | 0.80 | 1.29 | 2.06 | 36 | ||||||||||||||||||||||||||||||

The accompanying notes are an integral part of the financial statements.

| 23 | www.bishopstreetfunds.com |

| Bishop Street Funds |

December 31, 2023

The amounts included in the Notes to Financial Statements are in thousands unless otherwise noted.

| 1. | ORGANIZATION |

The Bishop Street Funds (the “Trust”) is registered under the Investment Company Act of 1940, as amended, as an open-end, management investment company. The Bishop Street Funds consists of the Hawaii Municipal Bond Fund (the “Fund”). The Fund is non-diversified. Class A Shares of the Fund are subject to a sales load as disclosed in the prospectus. The assets of the Fund are segregated, and a shareholder’s interest is limited to the Fund in which shares are held. The Fund’s prospectus provides a description of the Fund’s investment objectives, policies and strategies.

The Bishop Street Hawaii Municipal Bond Fund (ticker: BHIAX), managed by Bishop Street Capital Management, has acquired the Hawaii Municipal Fund (ticker: SURFX) managed by the Lee Financial Group Hawaii, Inc. After approval from shareholders of SURFX, the funds were reorganized in a tax-free transaction, which closed on December 4, 2023. SURFX shares were converted to their equivalent value in BHIAX shares, which will continue to be managed by Bishop Street Capital Management to produce tax-free income by investing in Hawaii municipal bonds. See Note 11 for additional details on the merger plan.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following are significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund. The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board (“FASB”).

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the fair value of assets, the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and such differences could be material.

Security Valuation

The Fund’s investments in equity securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on the NASDAQ Stock Market (the “NASDAQ”)) including securities traded over the counter, are valued at the last quoted sale price on an exchange or market (foreign or domestic) on which they are traded on valuation date (or at approximately 4:00 pm ET if a security’s primary exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. Debt securities are priced based upon valuations provided by independent, third-party pricing agents, if available. Investment companies are valued at Net Asset Value.

| Bishop Street Funds | 24 |

Such values generally reflect the last reported sales price in the most advantageous market, if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the fair value for such securities. Such methodologies typically include matrix systems which reflect such factors as security prices, yields, maturities and ratings. Debt obligations with remaining maturities of sixty days or less may be valued at their amortized cost, which approximates market value provided that it is determined the amortized cost continues to approximate fair value. Should existing credit, liquidity or interest rate conditions in the relevant markets and issuer specific circumstances suggest that amortized cost does not approximate fair value, then the amortized cost method may not be used. Prices for most securities held in the Fund is provided daily by recognized independent pricing agents.

If a security price cannot be obtained from an independent, third-party pricing agent, the Fund seeks to obtain a bid price from at least one independent broker.

Securities for which market prices are not “readily available” are valued in accordance with fair value procedures (the “Fair Value Procedures”) established by Bishop Street Capital Management (the “Adviser”) and approved by the Trust’s Board of Trustees (the “Board”). Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Adviser as the “valuation designee” to determine the fair value of securities and other instruments for which no readily available market quotations are available. The Fair Value Procedures are implemented through a Fair Value Committee (the “Committee”) of the Adviser.

Some of the more common reasons that may necessitate that a security be valued using fair value procedures include: the security’s trading has been halted or suspended; the security has been de-listed from a national exchange; the security’s primary trading market is temporarily closed at a time when under normal conditions it would be open; the security has not been traded for an extended period of time; the security’s primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government imposed restrictions. When a security is valued in accordance with the fair value procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

In accordance with the authoritative guidance on fair value measurement under U.S. GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| • | Level 1 — Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| December 31, 2023 | 25 | www.bishopstreetfunds.com |

| Bishop Street Funds |

| • | Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, referenced indices, quoted prices in inactive markets, adjusted quoted prices in active markets, etc.); and |

| • | Level 3 — Prices, inputs or modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

Federal Income Taxes

It is the Fund’s intention to continue to qualify as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Sub-chapter M of the Internal Revenue Code of 1986, as amended, and to distribute substantially all of its income to shareholders. Accordingly, no provision for Federal income taxes has been made in the financial statements.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely-than-not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last 3 open tax year ends, as applicable), on-going analysis of and changes to tax laws, regulations and interpretations thereof.

Security Transactions and Investment Income

Security transactions are accounted for on trade date. Costs used in determining net realized capital gains and losses on the sale of securities are on the basis of specific identification. Interest income is recorded on the accrual basis from settlement date and dividend income is recorded on ex-dividend date.

Discounts and premiums are accreted or amortized using the effective interest method over the life of each security and are recorded as interest income. Realized gains (losses) on paydowns of mortgage-backed and asset-backed securities are recorded as an adjustment to interest income.

| Bishop Street Funds | 26 |

Classes

Class-specific expenses are borne by the applicable class of shares. Income, realized and unrealized gains/losses and non-class-specific expenses are allocated to the respective class on the basis of relative daily net assets. Distribution fees are the only class-specific expense.

Expenses

Expenses that are directly related to the Fund are charged directly to that Fund. Other operating expenses of the Trust are prorated to the Fund on the basis of relative net assets.

Dividends and Distributions to Shareholders

Dividends from net investment income are declared daily and paid on a monthly basis for the Fund. Any net realized capital gains will be distributed at least annually for the Fund. Distributions to shareholders are recorded on the ex-dividend date.

Front-End Sales Commission

Front-end sales commissions (the “sales charges”) are not recorded as expenses of the Fund. Sales charges are deducted from proceeds from the sales of Fund shares prior to investment in Class A Shares.

Cash Overdraft Charges

U.S. Bank, N.A. serves as custodian (the “Custodian”) for the Fund. The Custodian plays no role in determining the investment policies of the Fund or which securities are to be purchased or sold by the Fund. If the Fund has a cash overdraft on a given day, it will be assessed an overdraft charge of the Prime Rate plus 4.00%. Cash overdraft charges are included in miscellaneous expenses on the Statement of Operations. For the year ended December 31, 2023, there were no cash overdraft charges.

| 3. | INVESTMENT ADVISORY AGREEMENT |

Investment advisory services are provided to the Fund by the Adviser, a registered adviser and wholly owned subsidiary of First Hawaiian Bank. First Hawaiian Bank is a wholly owned subsidiary of First Hawaiian Inc. The Adviser is entitled to receive an annual fee of 0.35% of the average daily net assets of the Fund. The Adviser has contractually agreed, through April 30, 2024, to waive a portion of its advisory fee (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses (collectively, excluded expenses) to the extent necessary to keep operating expenses at or below certain percentages of the respective average daily net assets.

The contractual expense limitations are as follows:

Hawaii Municipal Bond Fund, Class I Shares | 0.55 | % | ||

Hawaii Municipal Bond Fund, Class A Shares | 0.80 | % |

| December 31, 2023 | 27 | www.bishopstreetfunds.com |

| Bishop Street Funds |

If at any point it becomes unnecessary for the Adviser to reduce fees and make expense reimbursements, the Board may permit the Adviser to retain the difference between the Total Annual Fund Operating Expenses and contractual expense limitations to recapture all or a portion of its prior expense reductions or reimbursements made during the preceding three year period during which this agreement was in place. During the year ended December 31, 2023, the Adviser did not recapture any previously waived fees.

As of December 31, 2023, fees which were previously waived by the Investment Manager which may be subject to possible future reimbursement to the Adviser were as follows:

Hawaii Municipal Bond Fund | Expires | |||

$275 | 12/31/2024 | |||

263 | 12/31/2025 | |||

302 | 12/31/2026 |

| 4. | ADMINISTRATIVE, CUSTODIAN, TRANSFER AGENT, DISTRIBUTION AND SHAREHOLDER SERVICES |

The Fund and the Administrator are parties to an Administration Agreement under which the Administrator provides administrative services to the Fund. For these services, the Administrator is paid an asset based fee which will vary depending on the number of share classes and the average daily net assets of the Fund. The Administrator has voluntarily agreed to waive a portion of its fee equal to 0.13% of the Fund’s average daily net assets. These fee waivers are voluntary and may be discontinued at any time. For the year ended December 31, 2023, the Fund was charged $239 for these services. For the year ended December 31, 2023, the Administrator waived $158 for these services to the Fund. These fees and waivers are labeled as “Administrative Fees/Waivers” on the Statement of Operations.

The Custodian plays no role in determining the investment policies of the Fund or which securities are to be purchased or sold by the Fund. These fees are labeled on the Statement of Operations as “Custody Fees.”

SS&C Global Investor Distribution Solutions, Inc. (“SS&C”) acts as the Transfer Agent of the Fund. As such, SS&C provides transfer agency, dividend disbursing and shareholder services to the Fund. These fees are disclosed on the Statement of Operations as “Transfer Agent Fees.”

SEI Investments Distribution Co. (“SIDCO”), the “Distributer” a wholly owned subsidiary of SEI Investments Company, acts as the Trust’s Distributor pursuant to the distribution agreement. The Fund has adopted a Distribution Plan (the “Plan”) on behalf of Class A Shares pursuant to Rule 12b-1 under the Investment Company Act of 1940. The Plan provides that Class A Shares will bear the cost of their distribution expenses. SIDCO, as compensation for its services under the Plan, receives a distribution fee, computed daily and payable monthly, of 0.25% of the average daily net assets attributable to the Fund’s Class A Shares. This fee is disclosed as “Distribution Fees, Class A” on the Statement of Operations.

| Bishop Street Funds | 28 |

The Trust has adopted and entered into a shareholder service plan and agreement with SIDCO. The Fund pays to SIDCO a shareholder servicing fee not to exceed an annual rate of 0.25% of the average daily net asset value of all shares of the fund, which is computed daily and paid monthly. Under the shareholder service plan, SIDCO may perform, or may compensate other service providers for performing various shareholder and administrative services. SIDCO may also retain as profit any difference between the fee it receives and amount it pays to third parties. For the year, SIDCO paid the entire amount of fees received under the shareholder service plan to First Hawaiian Bank, the Parent Company of Bishop Street Capital Management, for shareholder services performed by First Hawaiian Bank on behalf of SIDCO for the benefit of certain shareholders to the Fund. SIDCO has voluntarily agreed to waive a portion its fee equal 0.15% of average daily net asset value. These fees and waivers are represented as “Shareholder Servicing Fees/Waivers” on the Statement of Operations.

| 5. | TRANSACTIONS WITH AFFILIATES |

Certain officers of the Trust are also officers of SEI Investments Global Funds Services (the “Administrator”), a wholly owned subsidiary of SEI Investments Company, and/or SIDCO. Such officers are paid no fees by the Trust other than the Chief Compliance Officer (“CCO”) as described below, for serving as officers of the Trust.

A portion of the services provided by the CCO and his staff, who are employees of the Administrator, are paid for by the Trust as incurred. The services include regulatory oversight of the Trust’s Advisers and service providers as required by SEC regulations. The CCO’s services and expenses have been approved by and are reviewed by the Board. These fees are disclosed on the Statement of Operations as “Chief Compliance Officer Fees.”

| 6. | INVESTMENT TRANSACTIONS |

The cost of security purchases and the proceeds from the sale and maturities of securities, other than short-term investments, for the year ended December 31, 2023 are presented below for the Fund.

| Hawaii Municipal Bond Fund | ||||

Purchases | ||||

Other | $ | 27,324 | ||

Sales and Maturities | ||||

Other | $ | 34,669 | ||

For the year ended December 31, 2023, there were no purchases or sales of long-term U.S. Government securities.

For the year ended December 31, 2023, in-kind transactions associated with the merger were $122,738.

| December 31, 2023 | 29 | www.bishopstreetfunds.com |

| Bishop Street Funds |

| 7. | FEDERAL TAX INFORMATION |

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP.

As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent. To the extent these differences are permanent in nature, they are charged or credited to undistributed net investment income (loss), accumulated net realized gain (loss) or paid in capital, as appropriate, in the period that the differences arise. The permanent differences that are credited or charged to Paid-in Capital and Distributable Earnings (Accumulated Losses) as of December 31, 2023 is primarily related to merger adjustments with the Bishop Street Hawaii Municipal Bond Fund.

| Paid-in Capital | Accumulated Losses | |||||

Hawaii Municipal Bond Fund | $8,090 | $(8,090) | ||||

The tax character of dividends and distributions declared during the years ended December 31, 2023 and 2022 were as follows:

| Ordinary Income | Tax Exempt Income | Total | ||||||||||||

2023 | $ | 80 | $ | 2,230 | $ 2,310 | |||||||||

2022 | 20 | 1,908 | 1,928 | |||||||||||

As of December 31, 2023, the components of Accumulated Losses on a tax basis were as follows:

| Hawaii Municipal Bond Fund | ||||

Capital Loss Carryforwards | $ | (11,762 | ) | |

Unrealized Depreciation | (7,181 | ) | ||

Other Temporary Differences | (133 | ) | ||

|

|

| ||

Total Accumulated Losses | $ | (19,076 | ) | |

|

|

| ||

For Federal income tax purposes, capital loss carryforwards may be carried forward indefinitely and applied against all future gains. As of December 31, 2023, the Fund had $1,908 and $9,854 in short-term and long-term capital loss carryforwards, respectively. The utilization of capital losses to offset future realized gain will likely be subject to an annual limitation.

For Federal income tax purposes, the cost of securities owned at December 31, 2023 is different from amounts reported for financial reporting purposes. The Federal tax cost and aggregate gross unrealized appreciation and depreciation for the investments held by the Fund at December 31, 2023, were as follows:

| Bishop Street Funds | 30 |

| Hawaii Municipal Bond Fund | ||||

Federal Tax Cost | $ | 233,068 | ||

|

| |||

Gross Unrealized Appreciation | 880 | |||

Gross Unrealized Depreciation | (8,061) | |||

|

| |||

Net Unrealized Depreciation | $ | (7,181) | ||

|

| |||

| 8. | RISKS |

The Fund invests primarily in debt instruments in the state of Hawaii. The issuers’ ability to meet their obligations may be affected by economic developments in that state. In addition, the Fund’s investments in debt securities are subject to “credit risk,” which is the risk that an issuer will be unable, or will be perceived to be unable, to repay its obligations at maturity and “interest rate risk” which is the potential for fluctuations in bond prices due to changing interest rates. Funds that invest primarily in high quality debt securities generally are subject to less credit risk than funds that invest in lower quality debt securities.

Certain debt securities are backed by credit enhancements from various financial institutions and financial guarantee assurance agencies. These credit enhancements reinforce the credit quality of the individual securities; however, if any of the financial institutions or financial guarantee assurance agencies’ credit quality should deteriorate, it could cause the individual security’s credit quality to change. Additionally, if the Fund concentrates its credit enhancements in any one financial institution, the risk of credit quality deterioration increases. The following tables provide detail on the approximate percentage of the Fund’s investments in securities with these types of enhancements, as well as the name of the entity providing the largest proportion of enhancements in the Fund.

% or investments in securities with credit enhancements or liquidity enhancements | 1.40% | |

Largest % of investments in securities with credit enhancements or liquidity enhancements from a single institution | 1.40% | |

(Public School Fund Guarantee) |

The value of asset-backed securities may be affected by the credit risk of the servicing agent for the pool, the originator of the loans or receivables, or the financial institution(s) providing the credit support. In addition to credit risk, asset-backed securities and other securities with early redemption features are subject to pre-payment risk. During periods of declining interest rates, prepayment of loans underlying asset-backed securities can be expected to accelerate or an issuer may retire an outstanding bond early to reduce interest costs. The Fund’s ability to maintain positions in such securities will be affected by reductions in the principal amount of such securities resulting from prepayments, and its ability to reinvest the returns of principal at comparable yields is subject to the general prevailing interest rates at that time.

| December 31, 2023 | 31 | www.bishopstreetfunds.com |

| Bishop Street Funds |

The market value of the Fund’s investments in fixed income securities may change in response to interest rate changes and other factors. During periods of falling interest rates, the values of fixed income securities generally rise. Conversely, during periods of rising interest rates, the values of such securities generally decline. Changes by recognized rating agencies in the ratings of any fixed income security and in the ability of an issuer to make payments of interest and principal may also affect the value of these investments.

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be established; however, based on experience, the risk of loss from such claims is considered remote.

| 9. | LINE OF CREDIT |

Through December 31, 2023, the Fund, had entered into an agreement which enabled it to participate in a $5 million unsecured committed revolving line of credit on a first come, first served basis, with U.S. Bank, N.A. The proceeds from the borrowings are permitted to be used to finance the Fund’s short term general working capital requirements, including the funding of shareholder redemptions.

For the year ended December 31, 2023 the Fund did not have borrowings under the line of credit.

| 10. | OTHER |

At December 31, 2023, the percentage of total shares outstanding held by shareholders owning 10% or greater of total shares outstanding of the Fund, which comprised omnibus accounts that were held on behalf of several individual shareholders, was as follows:

| Number of Shareholders | % of Outstanding Shares | |||||

Hawaii Municipal Bond Fund, Class I Shares | 1 | 80% | ||||

Hawaii Municipal Bond Fund, Class A Shares | – | – |

| 11. | FUND MERGER |

At a meeting held on August 22, 2023, the Trust’s Board considered a proposal for the reorganization of the Hawaii Municipal Fund, a series of the Lee Financial Mutual Fund, Inc. series trust (the “Merged Fund”), into the Hawaii Municipal Bond Fund, a series of the Trust managed by Bishop Street Capital Management (the “Acquiring Fund”). Following review, the Board approved the reorganization of the Hawaii Municipal Fund managed by Lee Financial Group Hawaii, Inc. (“Lee Financial”) into the Hawaii Municipal Bond Fund managed by Bishop Street Capital Management (the “Reorganization”). The investment objectives of the Merged Fund and the Acquiring Fund were similar. The investment objective of the Merged Fund was to provide a high level of current income exempt from federal and Hawaii state income taxes, consistent with preservation of capital and prudent investment management, while the

| Bishop Street Funds | 32 |

Acquiring Fund’s investment objective is to provide high current income exempt from federal and Hawaii state income taxes. The principal investment strategies of the Merged Fund and Acquiring Fund shared a number of similarities.

The Board of Trustees of the Lee Financial Mutual Fund, Inc. series trust determined that the Reorganization was in the best interest of the Merged Fund’s shareholders and approved an Agreement and Plan of Reorganization (the “Plan of Reorganization”), which was subsequently approved by the Trust’s Board on August 22, 2023. The shareholders of the Merged Fund approved the Reorganization at a special shareholders meeting held on November 28, 2023. The transfer of shareholder assets under the Reorganization was tax-free, meaning that neither the shareholders of the Merged Fund nor the Acquiring Fund realized any gains or losses for federal income tax purposes as a result of the transaction. The Reorganization occurred following the close of business on December 1, 2023, whereby the assets and the stated liabilities of the Merged Fund were transferred to the corresponding Acquiring Fund.

Merged Fund | Shares Outstanding | Acquiring Fund | Shares Converted | Merged Fund Net Asset Value of Converted Shares | ||||||||||

| Hawaii Municipal Fund | 12,496 | | Bishop Street Hawaii Municipal Bond Fund |

| 12,524 | $ | 123,227 | |||||||

The net assets before acquisition were as follows: | ||||||||||||||

Merged Fund | Net Assets | Unrealized Appreciation (Depreciation) on Investments | Acquiring Fund | Net Assets | ||||||||||

| Hawaii Municipal Fund | $ | 123,227 | $ | (5,379 | ) | Bishop Street Hawaii Municipal Bond Fund | $ | 104,315 | ||||||

The net assets of the Acquiring Fund immediately following the acquisition were $227,542.

Assuming the acquisition had been completed on January 3, 2023, the Acquiring Fund’s pro-forma results of operations for the period ended December 31, 2023, would have been as follows:

| December 31, 2023 | 33 | www.bishopstreetfunds.com |

| Bishop Street Funds |

Net investment income (a) | $4,836 | |

Net realized and unrealized gain on investments (b) | (1,133) | |

Net increase in net assets resulting from operations | 3,703 |

(a) $2,340, as reported in the Statement of Operations, plus $2,496 Net investment income from the Merged Fund pre-merger.

(b) $1,832, as reported in the Statement of Operations, plus $(2,965) Net realized and unrealized gain (loss) on investments from the Merged Fund pre-merger.

Because the Merged Fund and Acquiring Fund have been managed as an integrated single Fund since the completion date it is not feasible to separate the income/(losses) and gains/ (losses) of the Merged Fund that have been included in the Acquiring Fund’s Statement of Operations since December 1, 2023.

| 12. | SUBSEQUENT EVENTS |

The Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no adjustments were required to the financial statements.

| Bishop Street Funds | 34 |

This page intentionally left blank.

| Bishop Street Funds |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Bishop Street Funds and Shareholders of Hawaii Municipal Bond Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Hawaii Municipal Bond Fund (constituting Bishop Street Funds, referred to hereafter as the “Fund”) as of December 31, 2023, the related statement of operations for the year ended December 31, 2023, the statements of changes in net assets for each of the two years in the period ended December 31, 2023, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2023 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2023 and the financial highlights for each of the five years in the period ended December 31, 2023 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2023 by correspondence with the custodian, transfer agent and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

February 29, 2024

We have served as the auditor of one or more investment companies in Bishop Street Capital Management since 1998.

| Bishop Street Funds | 36 |

This page intentionally left blank.

| Bishop Street Funds |

All mutual funds have operating expenses. As a shareholder of a mutual fund you incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, which include (among others) costs for portfolio management, administrative services, distribution and service (12b-1), shareholder service fees, and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns.

Operating expenses such as these are deducted from a mutual fund’s gross income and directly reduce its final investment return. These expenses are expressed as a percentage of the mutual fund’s average net assets; this percentage is known as the mutual fund’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The expenses shown in the table below do not include any transactional costs, such as sales charges (loads), redemption fees, or exchange fees, if applicable. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period from July 1, 2023 to December 31, 2023.

The table on the next page illustrates your Fund’s costs in two ways:

| • | Actual Fund Return. This section helps you to estimate the actual expenses after fee waivers that your Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return. |

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your actual account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period.” |

| • | Hypothetical 5% Return. This section helps you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to make this 5% calculation. You can assess your Fund’s comparative cost by comparing the hypothetical result |

| Bishop Street Funds | 38 |

| (Unaudited) |

for your Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other funds.

Note: Because the return is set at 5% for comparison purposes - NOT your Fund’s actual return - the account values shown may not apply to your specific investment.

Beginning 7/1/23 | Ending Account Value 12/31/23 | Annualized Expense Ratios | Expenses Paid During Period* | |||||||||||||||||||

Hawaii Municipal Bond Fund—Class I | ||||||||||||||||||||||

Actual Fund Return | $1,000.00 | $1,010.30 | 0.55 | % | $2.79 | |||||||||||||||||

Hypothetical 5% Return | 1,000.00 | 1,022.43 | 0.55 | 2.80 | ||||||||||||||||||

Hawaii Municipal Bond Fund—Class A | ||||||||||||||||||||||

Actual Fund Return | $1,000.00 | $1,010.00 | 0.80 | % | $4.05 | |||||||||||||||||

Hypothetical 5% Return | 1,000.00 | 1,021.17 | 0.80 | 4.08 | ||||||||||||||||||

* Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| December 31, 2023 | 39 | www.bishopstreetfunds.com |

| Bishop Street Funds |

Notice to Shareholders of Bishop Street Funds

For shareholders that do not have a December 31, 2023 taxable year end, this notice is for informational purposes only. For shareholders with a December 31, 2023 tax year end, please consult your tax adviser as to the pertinence of this notice.

(A)* Long Term Capital Gains Distributions (Tax Basis) | B* Ordinary Income Distributions (Tax Basis) | C* Tax Exempt | (A+B+C) (D) Total | |||||||||

0.00% | 3.68% | 96.32% | 100.00% |

| * | Items (A), (B) and (C) are based on the percentage of each fund’s total distribution. |

| (1) | Qualifying dividends represent dividends which qualify for the corporate dividends received deduction and is reflected as a percentage of ordinary income distributions (the total of short-term capital gain and net investment income distributions). |

| (2) | The percentage in this column represents the amount of “Qualifying Dividend Income” as created by the Jobs and Growth Tax Relief Reconciliation Act of 2003 and is reflected as a percentage of “Ordinary Income Distributions” (the total of short term capital gain and net investment income distributions). It is the intention of the Fund to designate the maximum amount permitted by the law. |

| (3) | “U.S. Government Interest” represents the amount of interest that was derived from direct U.S. Government Obligations and distributed during the fiscal year. This amount is reflected as a percentage of total ordinary income distributions (the total of short term capital gain and net investment income distributions). Generally, interest from direct U.S. Government Obligations is exempt from state income tax. However, for residents of California, Connecticut and New York, the statutory threshold requirements were not satisfied to permit exemption of these amounts from state income. |

| Bishop Street Funds | 40 |

| (Unaudited) |

For the fiscal year ended December 31, 2023, each fund has designated the following items with regard to distributions paid during the year.