UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-08576

American High-Income Municipal Bond Fund

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street

Los Angeles, California 90071

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (213) 486-9200

Date of fiscal year end: July 31

Date of reporting period: July 31, 2016

Steven I. Koszalka

American High-Income Municipal Bond Fund

333 South Hope Street

Los Angeles, California 90071

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

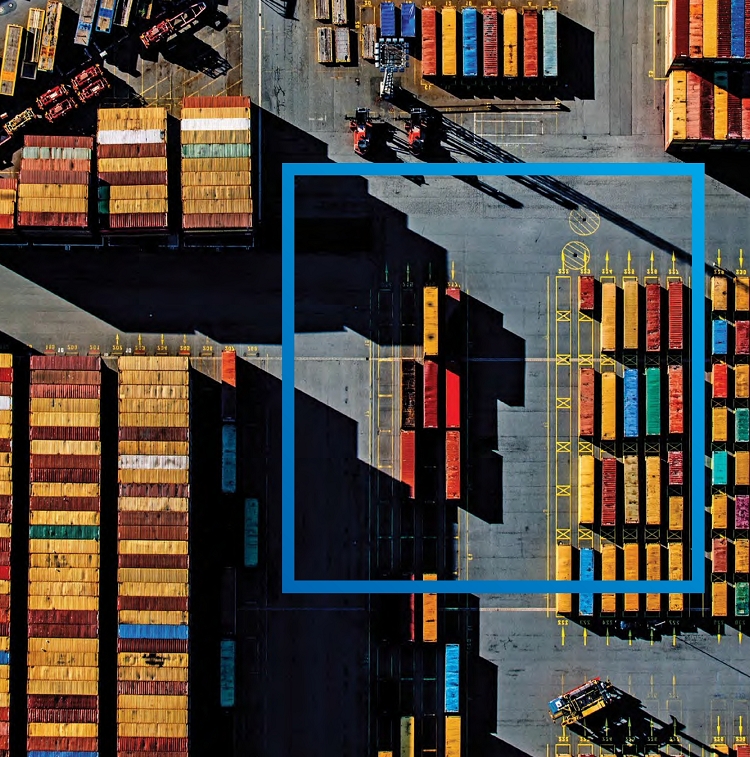

Invest in municipal bonds

for tax-advantaged income.

| American Funds Short-Term Tax-Exempt Bond Fund® Limited Term Tax-Exempt Bond Fund of America® The Tax-Exempt Bond Fund of America® American High-Income Municipal Bond Fund® The Tax-Exempt Fund of California® American Funds Tax-Exempt Fund of New York® Annual report for the year ended July 31, 2016 |

American Funds Short-Term Tax-Exempt Bond Fund seeks to provide you with current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

Limited Term Tax-Exempt Bond Fund of America seeks to provide you with current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

The Tax-Exempt Bond Fund of America seeks to provide you with a high level of current income exempt from federal income tax, consistent with the preservation of capital.

American High-Income Municipal Bond Fund seeks to provide you with a high level of current income exempt from regular federal income tax.

The Tax-Exempt Fund of California seeks to provide you with a high level of current income exempt from regular federal and California state income taxes. Its secondary objective is preservation of capital.

American Funds Tax-Exempt Fund of New York seeks to provide you with a high level of current income exempt from regular federal, New York state and New York City income taxes. Its secondary objective is preservation of capital.

Each fund is one of more than 40 offered by one of the nation’s largest mutual fund families, American Funds, from Capital Group. For 85 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge had been deducted (maximum 2.50% for American Funds Short-Term Tax-Exempt Bond Fund and Limited Term Tax-Exempt Bond Fund of America; 3.75% for The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York), the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. For current information and month-end results, visit americanfunds.com.

Here are the total returns on a $1,000 investment with all distributions reinvested for periods ended June 30, 2016 (the most recent calendar quarter-end), and the total annual fund operating expense ratios as of the prospectus dated October 1, 2016 (unaudited):

| Cumulative total returns | Average annual total returns | Gross | ||||||||||||||

| Class A shares | 1 year | 5 years | 10 years/Lifetime* | expense ratios | ||||||||||||

| Reflecting 2.50% maximum sales charge | ||||||||||||||||

| American Funds Short-Term Tax-Exempt Bond Fund | –1.02 | % | 0.64 | % | 1.32 | % | 0.59 | % | ||||||||

| Limited Term Tax-Exempt Bond Fund of America | 0.73 | 2.37 | 3.31 | 0.59 | ||||||||||||

| Reflecting 3.75% maximum sales charge | ||||||||||||||||

| The Tax-Exempt Bond Fund of America | 3.36 | 4.94 | 4.38 | 0.54 | ||||||||||||

| American High-Income Municipal Bond Fund | 5.84 | 7.21 | 4.76 | 0.67 | ||||||||||||

| The Tax-Exempt Fund of California | 3.51 | 5.66 | 4.66 | 0.60 | ||||||||||||

| American Funds Tax-Exempt Fund of New York | 3.75 | 4.56 | 4.20 | 0.72 | ||||||||||||

| * | Applicable only to American Funds Tax-Exempt Fund of New York, which began operations on 11/1/10. All other funds reflect 10-year results. |

For other share class results, visit americanfunds.com.

The 10-year investment result for American Funds Short-Term Tax-Exempt Bond Fund includes the fund’s results as a money market fund through the date of its conversion (August 7, 2009) to a short-term tax-exempt bond fund, and therefore is not representative of the fund’s results had it operated as a short-term tax-exempt bond fund for the full term of that period. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers and/or expense reimbursements, without which results would have been lower. The investment adviser is currently reimbursing a portion of other expenses for American Funds Tax-Exempt Fund of New York. Investment results reflect the reimbursement, without which the results would have been lower. This reimbursement will be in effect through at least September 30, 2017, unless modified or terminated by the fund’s board. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. Please see the fund’s most recent prospectus for details.

A summary of each fund’s 30-day yield can be found on page 3.

Individual funds are listed in this report according to their risk potential, with the lowest risk funds listed first.

We are pleased to present you with this annual report for our six municipal bond funds: American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York. This report covers the 12 months ended July 31, 2016, the conclusion of the funds’ fiscal year.

It was a strong period for the municipal market, as healthy demand, economic uncertainty and the accommodative monetary policy employed by a number of central banks contributed to a favorable environment for bond prices. Against this backdrop, all of the funds produced solid results. Total returns ranged from 1.51% for American Funds Short-Term Tax-Exempt Bond Fund to 9.45% for American High-Income Municipal Bond Fund. (See pages 4 through 16 for fund specific results and information.)

Economic and market overview

Municipal bond prices climbed steadily during the funds’ fiscal year. The Bloomberg Barclays Municipal Bond Index, a broad measure of the investment-grade market (bonds rated BBB/Baa and above), posted its 13th straight month of positive total returns in July. In general, bond price appreciation accounted for an unusually high proportion of these returns, as yields for many types of municipal securities remain near multiyear lows. We caution investors that such strong capital appreciation is unusual in the municipal market and unlikely to continue indefinitely.

A number of conditions helped support the rally. Equity markets were volatile at times as investors grappled with a slowing global economy and questioned the sustainability of the U.S. expansion. This spurred investors to seek the relative stability of bonds. For the period, the Bloomberg Barclays U.S. Treasury Index rose 5.77%. The implementation of negative interest rates in Europe and Japan further drove demand for U.S. fixed income securities. As of July 31, the yield on a 10-year U.S. Treasury bond was 1.46%. Tax-exempt bonds also benefited from these trends, generally outpacing Treasuries.

After increasing its target federal funds rate in December, a move that was widely anticipated, the Federal Reserve indicated it would take a cautious approach to further rate hikes in the face of mixed economic signals. However, after choosing to leave interest rates unchanged in its July meeting, the Federal Open Market Committee’s postmeeting statement noted that the near-term risks to the economic outlook had diminished.

In July, Puerto Rico failed to make some $1 billion in payments to bondholders, including $780 million of principal and interest on general obligation bonds. The default was the largest ever in the municipal market. We remind investors that Puerto Rico’s fiscal challenges are unique, and its issuers are not representative of the risk profile of the broader tax-exempt universe. What’s more, while prices for bonds linked to Puerto Rico have come under intense pressure in recent years, the bonds themselves held up comparatively well during the fiscal year.

Higher yielding municipal bonds outpaced investment-grade issues. The Bloomberg Barclays High-Yield Municipal Bond Index gained 13.44% for the year,

| American Funds Tax-Exempt Funds | 1 |

compared with a 6.94% increase for the Bloomberg Barclays Municipal Bond Index. The wide disparity in returns can be partially attributed to the high concentrations of tobacco-related bonds in the index — which generated some of the strongest returns for the period — and the presence of Puerto Rican bonds. In general, longer term bonds tended to outpace those of shorter duration. Revenue bonds, which support essential services such as water, sewer and electric utilities, generated higher returns on the whole than general obligation bonds.

Despite the low-rate environment, issuance was relatively modest for the 12 months. Investor demand for municipal bonds, however, was robust. These conditions further buoyed the year-long rally. As has been the case for some time, most of the funds covered in this report maintained relatively short duration positions throughout the fiscal year. In a strong bull market, this approach served as a drag on relative results. That said, we are pleased with the funds’ overall results and believe they are prudently positioned for the future.

Looking ahead

U.S. payroll employment registered a strong 292,000 gain in June, while wages continued to rise. Retail sales, housing starts and home sales increased. That said, while the U.S. does not appear to be entering a recession, growth remains modest. What’s more, many of the conditions that helped foster the recent bond market rally — weak growth abroad and unprecedented actions adopted by central banks around the world — remain in place. Currently we see no clear signal that these conditions are likely to end soon.

Therefore, we are seeking to maintain an evenhanded approach to the market going forward, mindful of the potential for rising rates and heightened volatility, but also aware that a lower for longer interest rate scenario could remain in place for some time. We are working hard to maintain an appropriate balance between risk and potential reward, relying on both macroeconomic and in-depth credit research to seek to identify bonds that can add value for investors.

Investment flows for each of the funds were solidly positive during the year. We take this opportunity to welcome our new investors.

We endeavor to be responsible stewards of your capital. As such, we thank you for the confidence you have placed in us.

Sincerely,

Brenda S. Ellerin

President, American Funds Short-Term Tax-Exempt Bond Fund and Limited Term Tax-Exempt Bond Fund of America

Neil L. Langberg

President, The Tax-Exempt Bond Fund of America and The Tax-Exempt Fund of California

Karl J. Zeile

President, American High-Income Municipal Bond Fund and American Funds Tax-Exempt Fund of New York

September 12, 2016

For current information about the funds, visit americanfunds.com.

| 2 | American Funds Tax-Exempt Funds |

Funds’ 30-day yields

Below is a summary of each fund’s 30-day yield and 12-month distribution rate for Class A shares as of August 31, 2016. Both measures reflect the 2.50%/3.75% maximum sales charge. Each fund’s 30-day yield is calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula. The SEC yield reflects the rate at which each fund is earning income on its current portfolio of securities while the distribution rate reflects the funds’ past dividends paid to shareholders. Accordingly, the funds’ SEC yields and distribution rates may differ. The equivalent taxable yield assumes a 43.4% tax rate.1

| SEC | Equivalent | 12-month | ||||||||||

| Class A shares | 30-day yield | taxable yield | distribution rate | |||||||||

| Reflecting 2.50% maximum sales charge | ||||||||||||

| American Funds Short-Term Tax-Exempt Bond Fund | 0.24 | % | 0.42 | % | 0.99 | % | ||||||

| Limited Term Tax-Exempt Bond Fund of America | 0.39 | 0.69 | 2.08 | |||||||||

| Reflecting 3.75% maximum sales charge | ||||||||||||

| The Tax-Exempt Bond Fund of America | 1.29 | 2.28 | 2.96 | |||||||||

| American High-Income Municipal Bond Fund | 2.13 | 3.76 | 3.61 | |||||||||

| The Tax-Exempt Fund of California | 0.81 | 1.65 | 2 | 2.95 | ||||||||

| American Funds Tax-Exempt Fund of New York | 1.25 | 3 | 2.42 | 4 | 2.33 | |||||||

| 1 | Based on 2016 federal tax rates. For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 2 | For investors in the 50.93% federal and California state tax bracket. |

| 3 | The SEC 30-day yield for American Funds Tax-Exempt Fund of New York is 1.25% with the fund’s reimbursement. |

| 4 | For investors in the 48.39% federal and New York state tax bracket. |

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Income may be subject to state or local income taxes and/or federal alternative minimum taxes. Also, certain other income (such as distributions from gains on the sale of certain bonds purchased at less than par value, for The Tax-Exempt Bond Fund of America), as well as capital gain distributions, may be taxable. High-yield/lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than investment-grade/higher rated bonds. The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York are more susceptible to factors adversely affecting issuers of each state’s tax-exempt securities than a more widely diversified municipal bond fund. Refer to the funds’ prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the funds.

| American Funds Tax-Exempt Funds | 3 |

American Funds Short-Term Tax-Exempt Bond Fund

The fund produced a total return of 1.51% for the fiscal year ended July 31, 2016, outpacing the 1.20% return of the Lipper Short Municipal Debt Funds Average, a peer group measure. By way of comparison, the unmanaged Bloomberg Barclays Municipal Short 1–5 Years Index, which has no expenses, recorded a 2.15% gain. Investors cannot invest directly in an index.

The fund paid monthly dividends totaling 10.3 cents a share for the year. This amounts to a federally tax-exempt income return of 1.02% for investors who reinvested dividends. That is equivalent to a taxable income return of 1.80% for investors in the 43.4%1 maximum federal tax bracket. A portion of the fund’s return also may be exempt from some state and local taxes.

Throughout the year, the fund’s managers took an evenhanded approach to the market, avoiding aggressive investments. Given the low-yield environment, fund expenses had a notable impact on returns relative to the unmanaged index. Issues from a broad array of sectors contributed to the fund’s overall positive return. Among the most additive were revenue bonds supporting housing and transportation projects.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 0.98% tax-exempt distribution rate3 as of July 31, 2016.

| The fund’s tax-exempt | ||||||||||||||||

| If your taxable income is … | ... then your federal | distribution rate of 0.98% is | ||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of ... | |||||||||||||

| $ | 0 – | 9,275 | $ | 0 – | 18,550 | 10.0 | % | 1.09 | % | |||||||

| 9,276 – | 37,650 | 18,551 – | 75,300 | 15.0 | 1.15 | |||||||||||

| 37,651 – | 91,150 | 75,301 – | 151,900 | 25.0 | 1.31 | |||||||||||

| 91,151 – | 190,150 | 151,901 – | 231,450 | 28.0 | 1.36 | |||||||||||

| 190,151 – | 413,350 | 231,451 – | 413,350 | 36.8 | 1 | 1.55 | ||||||||||

| 413,351 – | 415,050 | 413,351 – | 466,950 | 38.8 | 1 | 1.60 | ||||||||||

| Over 415,050 | Over 466,950 | 43.4 | 1 | 1.73 | ||||||||||||

| 1 | For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2016 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2016. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

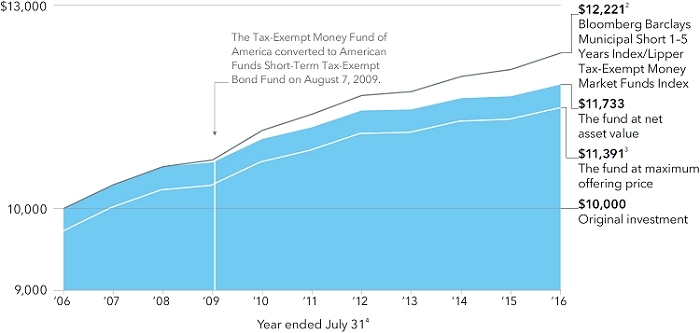

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 2.50% on the $10,000 investment.1 Thus, the net amount invested was $9,750. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 4 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $500,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | Consists of the Lipper Tax-Exempt Money Market Funds Index through July 31, 2009 (the period ended prior to the fund’s conversion from a tax-exempt money market fund to a short-term tax-exempt bond fund), and the Bloomberg Barclays Municipal Short 1–5 Years Index thereafter. Results of the Lipper Tax-Exempt Money Market Funds Index do not reflect any sales charges. The Bloomberg Barclays index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

| 3 | Prior to August 7, 2009, the fund was operated as a money market fund and did not have an initial sales charge. |

| 4 | In 2009, the fund changed its fiscal year-end from September 30 to July 31. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

| For periods ended July 31, 2016* | |||||

| 1 year | 5 years | 10 years | |||

| Class A shares | –1.02% | 0.60% | 1.31% |

| * | Assumes reinvestment of all distributions and payment of the maximum 2.50% sales charge. |

The 10-year investment result includes the fund’s results as a money market fund through the date of its conversion (August 7, 2009) to a short-term tax-exempt bond fund, and therefore is not representative of the fund’s results had it operated as a short-term tax-exempt bond fund for the full term of that period. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect expense reimbursements, without which results would have been lower. Visit americanfunds.com for more information.

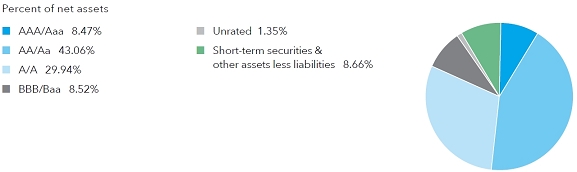

Portfolio quality summary*

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 5 |

Limited Term Tax-Exempt Bond Fund of America

The fund recorded a 2.97% total return for the 12 months ended July 31. That result lagged the 3.98% gain of the unmanaged Bloomberg Barclays Municipal Short-Intermediate 1–10 Years Index, which has no expenses. Investors cannot invest directly in an index. The fund’s result also trailed the 3.11% total return of the Lipper Short-Intermediate Municipal Debt Funds Average, a peer group measure.

For the fiscal year, the fund paid monthly dividends totaling about 34.7 cents a share. Those individuals who reinvested dividends received a federally tax-exempt income return of 2.20%. This is equivalent to a taxable income return of 3.89% for investors in the 43.4%1 maximum federal tax bracket.

For some time, the fund’s managers have maintained a short duration position. In what proved to be a strong bull market, this approach held back the fund’s returns on a relative basis. Given the low-rate environment, fund expenses also had a notable impact on relative results. Investments in transportation, government public service and health care bonds generated some of the strongest returns of the fiscal year.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 2.11% tax-exempt distribution rate3 as of July 31, 2016.

| The fund’s tax-exempt | ||||||||||||||||

| If your taxable income is … | … then your federal | distribution rate of 2.11% is | ||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of … | |||||||||||||

| $ | 0 – | 9,275 | $ | 0 – | 18,550 | 10.0 | % | 2.34 | % | |||||||

| 9,276 – | 37,650 | 18,551 – | 75,300 | 15.0 | 2.48 | |||||||||||

| 37,651 – | 91,150 | 75,301 – | 151,900 | 25.0 | 2.81 | |||||||||||

| 91,151 – | 190,150 | 151,901 – | 231,450 | 28.0 | 2.93 | |||||||||||

| 190,151 – | 413,350 | 231,451 – | 413,350 | 36.8 | 1 | 3.34 | ||||||||||

| 413,351 – | 415,050 | 413,351 – | 466,950 | 38.8 | 1 | 3.45 | ||||||||||

| Over 415,050 | Over 466,950 | 43.4 | 1 | 3.73 | ||||||||||||

| 1 | For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2016 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2016. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

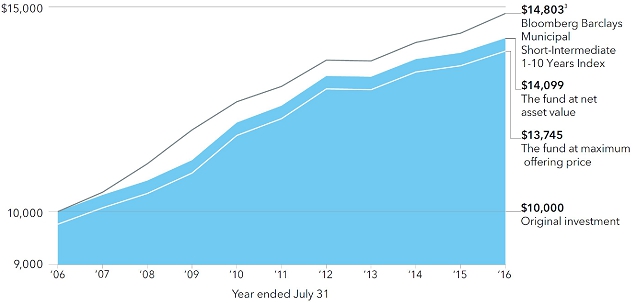

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 2.50% on the $10,000 investment.1 Thus, the net amount invested was $9,750.2 Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 6 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $500,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The maximum initial sales charge was 3.75% until October 31, 2006. |

| 3 | The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2016*

| 1 year | 5 years | 10 years | |||

| Class A shares | 0.38% | 2.19% | 3.23% |

*Assumes reinvestment of all distributions and payment of the maximum 2.50% sales charge.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Portfolio quality summary*

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 7 |

The Tax-Exempt Bond Fund of America

The fund produced a solid 6.69% total return for the fiscal year. This result trailed the 6.94% gain of the unmanaged Bloomberg Barclays Municipal Bond Index, which has no expenses. Investors cannot invest directly in an index. By way of comparison, the Lipper General & Insured Municipal Debt Funds Average, a peer group measure, recorded a 6.89% total return.

The fund paid monthly dividends totaling about 41.4 cents a share for the fiscal year, amounting to a federally tax-exempt income return of 3.24% for investors who reinvested dividends. This is equivalent to a taxable income return of 5.72% for investors in the 43.4%1 maximum federal tax bracket. The fund does not invest in bonds subject to the Alternative Minimum Tax (AMT).

The fund’s managers maintained the relatively conservative approach they had adopted in recent periods, focusing on shorter duration securities. This approach held the fund back slightly in relative terms. It is important to note, however, that fund managers are comfortable with portfolio positioning going forward and will continue to seek a sensible balance between identifying incremental yield opportunities and managing risk. Among the strongest contributors to the fund’s results were holdings of heath care and transportation issues.

We take this opportunity to welcome investors who formerly held shares in The Tax-Exempt Fund of Maryland and The Tax-Exempt Fund of Virginia, which merged with the fund effective June 17, 2016.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 2.97% tax-exempt distribution rate3 as of July 31, 2016.

| The fund’s tax-exempt | ||||||||||||||||

| If your taxable income is … | … then your federal | distribution rate of 2.97% is | ||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of … | |||||||||||||

| $ | 0 – | 9,275 | $ | 0 – | 18,550 | 10.0 | % | 3.30 | % | |||||||

| 9,276 – | 37,650 | 18,551 – | 75,300 | 15.0 | 3.49 | |||||||||||

| 37,651 – | 91,150 | 75,301 – | 151,900 | 25.0 | 3.96 | |||||||||||

| 91,151 – | 190,150 | 151,901 – | 231,450 | 28.0 | 4.13 | |||||||||||

| 190,151 – | 413,350 | 231,451 – | 413,350 | 36.8 | 1 | 4.70 | ||||||||||

| 413,351 – | 415,050 | 413,351 – | 466,950 | 38.8 | 1 | 4.85 | ||||||||||

| Over 415,050 | Over 466,950 | 43.4 | 1 | 5.25 | ||||||||||||

| 1 | For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2016 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2016. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

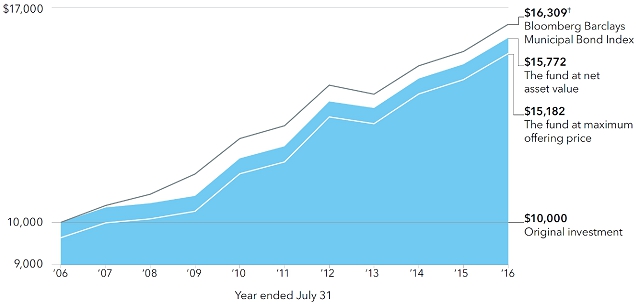

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.* Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 8 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| * | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| † | The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2016*

| 1 year | 5 years | 10 years | |||

| Class A shares | 2.73% | 4.71% | 4.26% |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Portfolio quality summary*

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 9 |

American High-Income Municipal Bond Fund

The fund generated a 9.45% total return for the fiscal year ended July 31, 2016, slightly trailing the 9.62% gain of the Lipper High Yield Municipal Debt Funds Average, a measure of the fund’s peer group. The fund also lagged the 13.44% total return of the unmanaged Bloomberg Barclays High Yield Municipal Bond Index, which has no expenses. The fund exceeded the 6.94% total return of the unmanaged Bloomberg Barclays Municipal Bond Index, which also has no expenses. Investors cannot invest directly in an index.

The fund paid monthly dividends totaling 61.4 cents a share, amounting to a federally tax-exempt income return of 4.07% for investors who reinvested dividends. This is equivalent to a taxable income return of 7.19% for investors in the 43.4%1 maximum federal tax bracket. A portion of the fund’s return also may be exempt from some state and local taxes.

The strong bull market has resulted in credit spread tightening across the municipal bond universe. Tighter spreads indicate that demand has driven prices for lower quality bonds closer to those for higher quality bonds. Given these conditions, the fund’s managers have adopted a relatively conservative stance, seeking to balance risk and potential reward and avoid paying too much for bonds of relatively lower quality. While this approach held back relative results in the recently concluded fiscal year, we believe the fund is well positioned going forward. We note that the Bloomberg Barclays High Yield Municipal Bond Index has substantial concentrations in tobacco and Puerto Rico-related bonds, areas of the market that were particularly strong during the fiscal year. The fund invests in a broad range of tax-exempt bonds, representing a diversity of sectors, industries and credit quality.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 3.65% tax-exempt distribution rate3 as of July 31, 2016.

| The fund’s tax-exempt | ||||||||||||||||

| If your taxable income is … | … then your federal | distribution rate of 3.65% is | ||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of … | |||||||||||||

| $ | 0 – | 9,275 | $ | 0 – | 18,550 | 10.0 | % | 4.06 | % | |||||||

| 9,276 – | 37,650 | 18,551 – | 75,300 | 15.0 | 4.29 | |||||||||||

| 37,651 – | 91,150 | 75,301 – | 151,900 | 25.0 | 4.87 | |||||||||||

| 91,151 – | 190,150 | 151,901 – | 231,450 | 28.0 | 5.07 | |||||||||||

| 190,151 – | 413,350 | 231,451 – | 413,350 | 36.8 | 1 | 5.78 | ||||||||||

| 413,351 – | 415,050 | 413,351 – | 466,950 | 38.8 | 1 | 5.96 | ||||||||||

| Over 415,050 | Over 466,950 | 43.4 | 1 | 6.45 | ||||||||||||

| 1 | For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2016 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2016. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.* Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 10 | American Funds Tax-Exempt Funds |

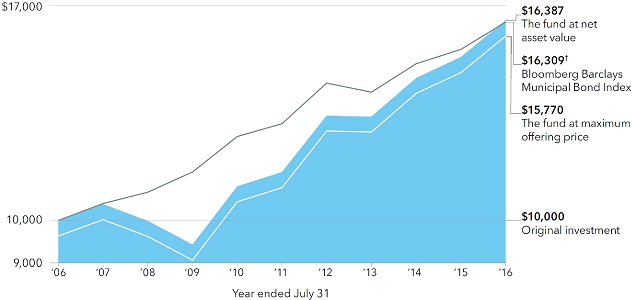

How a $10,000 investment has grown

| * | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| † | The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2016*

| 1 year | 5 years | 10 years | |||

| Class A shares | 5.34% | 6.95% | 4.66% |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

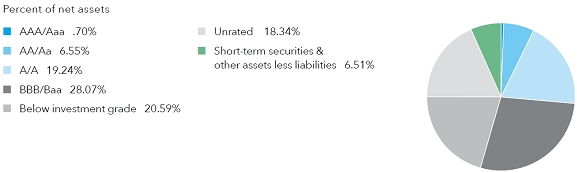

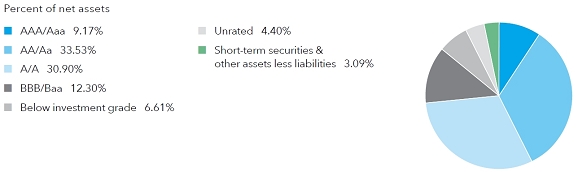

Portfolio quality summary*

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 11 |

The Tax-Exempt Fund of California

The fund produced a 6.65% total return for the fiscal year. That result lagged the 6.95% gain of the unmanaged Bloomberg Barclays California Municipal Index, which has no expenses. Investors cannot invest directly in an index. The fund’s result also trailed the 8.11% total return of the Lipper California Municipal Debt Funds Average, a peer group measure.

For the period, the fund paid monthly dividends totaling about 56.4 cents a share. Investors who chose to reinvest dividends received an income return of 3.24%. This is equivalent to a taxable income return of 5.72% for those in the 50.93% effective combined federal and California tax bracket.

California’s economy is strengthening. The unemployment rate was 5.5% in July, down from 6.1% a year earlier, providing a constructive backdrop for municipal bonds. Shortly after the close of the fiscal year, Fitch upgraded the state’s credit rating to AA, following similar increases by two other major rating agencies. The fund’s managers sought to maintain a relatively short duration position throughout the period, an approach that detracted from the fund’s returns in relative terms. Because the fund’s approach historically has been relatively conservative, it has lagged the broader market during periods of strength. However, the managers believe this approach provides the potential to outpace the market during challenging periods and over the long term. The fund’s return was supported by positive contributions from holdings across a spectrum of sectors, credit quality and duration.

Tax-exempt yields vs. taxable yields

Find your estimated 2016 taxable income below to determine your combined federal and California tax rate,* then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 2.98% tax-exempt distribution rate† at July 31, 2016.

| then your combined | The fund’s tax-exempt | |||||||||||||||||||||

| If your taxable income is … | federal and California | distribution rate of 2.98% is | ||||||||||||||||||||

| Single | Joint | state tax rate is … | equivalent to a taxable rate of… | |||||||||||||||||||

| $ | 0 – | 7,850 | $ | 0 – | 15,700 | 10.90 | % | 3.34 | % | |||||||||||||

| 7,851 – | 9,275 | 15,701 – | 18,550 | 11.80 | 3.38 | |||||||||||||||||

| 9,276 – | 18,610 | 18,551 – | 37,220 | 16.70 | 3.58 | |||||||||||||||||

| 18,611 – | 29,372 | 37,221 – | 58,744 | 18.40 | 3.65 | |||||||||||||||||

| 29,373 – | 37,650 | 58,745 – | 75,300 | 20.10 | 3.73 | |||||||||||||||||

| 37,651 – | 40,773 | 75,301 – | 81,546 | 29.50 | 4.23 | |||||||||||||||||

| 40,774 – | 51,530 | 81,547 – | 103,060 | 31.00 | 4.32 | |||||||||||||||||

| 51,531 – | 91,150 | 103,061 – | 151,900 | 31.98 | 4.38 | |||||||||||||||||

| 91,151 – | 190,150 | 151,901 – | 231,450 | 34.70 | 4.56 | |||||||||||||||||

| 190,151 – | 263,222 | 231,451 – | 413,350 | 42.68 | 5.20 | |||||||||||||||||

| 263,223 – | 315,866 | – | 43.31 | 5.26 | ||||||||||||||||||

| 315,867 – | 413,350 | – | 43.94 | 5.32 | ||||||||||||||||||

| – | 413,351 – | 466,950 | 44.49 | 5.37 | ||||||||||||||||||

| 413,351 – | 415,050 | – | 45.72 | 5.49 | ||||||||||||||||||

| – | 466,951 – | 526,444 | 48.66 | 5.80 | ||||||||||||||||||

| – | 526,445 – | 631,732 | 49.23 | 5.87 | ||||||||||||||||||

| 415,051 – | 526,443 | 631,733 – | 1,000,000 | 49.80 | 5.94 | |||||||||||||||||

| 526,444 – | 1,000,000 | 1,000,001 – | 1,052,886 | 50.36 | 6.00 | |||||||||||||||||

| Over 1,000,000 | Over 1,052,886 | 50.93 | 6.07 | |||||||||||||||||||

| * | Based on 2016 federal and 2015 California tax rates. (State rates from 1.0% to 13.3% are individually calculated for each bracket. The federal brackets are expanded to include additional state brackets.) The effective combined tax rates paid by California residents may be lower than those shown due to the availability of income tax deductions. |

| † | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2016. Capital gains distributions, if any, are added back at the maximum offering price to determine the rate. |

| Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.* Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com. | |

| 12 | American Funds Tax-Exempt Funds |

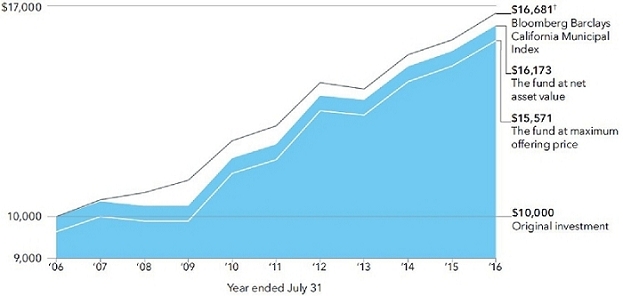

How a $10,000 investment has grown

| * | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| † | The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

| The results shown are before taxes on fund distributions and sale of fund shares. | |

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2016*

| 1 year | 5 years | 10 years | |||

| Class A shares | 2.63% | 5.36% | 4.53% |

* Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Portfolio quality summary*

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 13 |

American Funds Tax-Exempt Fund of New York

The fund recorded a total return of 6.95% for the fiscal year. That result slightly exceeded the 6.72% total return of the unmanaged Bloomberg Barclays New York Municipal Index, which has no expenses. Investors cannot invest directly in an index. However, the fund trailed the 7.35% gain of the Lipper New York Municipal Debt Funds Average, a peer group measure.

The fund paid monthly dividends totaling 27.1 cents a share for the fiscal year. This represents an income return of 2.57% for those who reinvested dividends. For investors in the 50.59% combined effective federal, New York state and New York City tax bracket, this is equivalent to a taxable income return of 4.55%.

Over the period, the fund received positive contributions from a variety of holdings. Investments in the government public service, education and health care sectors were among those with the strongest returns.

Tax-exempt yields vs. taxable yields

Find your estimated 2016 taxable income below to determine your combined federal and New York state tax rate,1,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 2.35% tax-exempt distribution rate3 at July 31, 2016.

| then your combined | The fund’s tax-exempt | |||||||||||||||||||||

| If your taxable income is … | federal and New York | distribution rate of 2.35% is | ||||||||||||||||||||

| Single | Joint | state tax rate is … | equivalent to a taxable rate of… | |||||||||||||||||||

| $ | 0 – | 8,400 | $ | 0 – | 16,950 | 13.60 | % | 2.72 | % | |||||||||||||

| 8,401 – | 9,275 | 16,951 – | 18,550 | 14.05 | 2.73 | |||||||||||||||||

| 9,276 – | 11,600 | 18,551 – | 23,300 | 18.83 | 2.90 | |||||||||||||||||

| 11,601 – | 13,750 | 23,301 – | 27,550 | 19.46 | 2.92 | |||||||||||||||||

| 13,751 – | 21,150 | 27,551 – | 42,450 | 20.02 | 2.94 | |||||||||||||||||

| 21,151 – | 37,650 | 42,451 – | 75,300 | 20.48 | 2.96 | |||||||||||||||||

| 37,651 – | 79,600 | 75,301 – | 151,900 | 29.84 | 3.35 | |||||||||||||||||

| 79,601 – | 91,150 | – | 29.99 | 3.36 | ||||||||||||||||||

| – | 151,901 – | 159,350 | 32.64 | 3.49 | ||||||||||||||||||

| 91,151 – | 190,150 | 159,351 – | 231,450 | 32.79 | 3.50 | |||||||||||||||||

| 190,151 – | 212,500 | 231,451 – | 318,750 | 41.00 | 3.98 | |||||||||||||||||

| 212,501 – | 413,350 | 318,751 – | 413,350 | 41.13 | 3.99 | |||||||||||||||||

| 413,351 – | 415,050 | 413,351 – | 466,950 | 42.99 | 4.12 | |||||||||||||||||

| 415,051 – | 1,062,650 | 466,951 – | 2,125,450 | 47.28 | 4.46 | |||||||||||||||||

| Over 1,062,650 | Over 2,125,450 | 48.39 | 4.55 | |||||||||||||||||||

| 1 | Income generated by the fund’s investments is also generally exempt from New York City taxes, offering additional tax advantages to New York City residents. |

| 2 | Based on 2016 federal and 2015 New York state tax rates. (State rates from 4.00% to 8.82% are individually calculated for each bracket. The federal brackets are expanded to include additional state brackets.) The effective combined tax rates assume full deductibility of state taxes. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2016. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

| Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.* Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com. | |

| 14 | American Funds Tax-Exempt Funds |

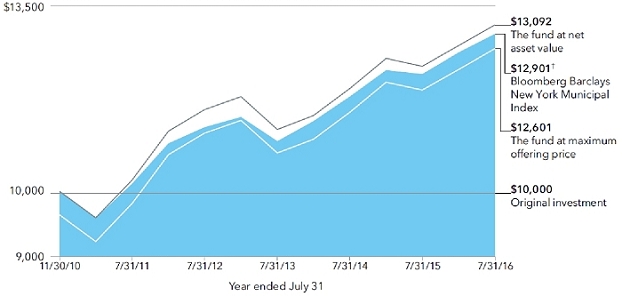

How a $10,000 investment has grown

(for the period November 1, 2010, to July 31, 2016, with dividends reinvested)

| * | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| † | The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

| The results shown are before taxes on fund distributions and sale of fund shares. | |

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2016*

| 1 year | 5 years | Lifetime | |||

| Class A shares | 2.89% | 4.35% | 4.11% |

*Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect expense reimbursements, without which results would have been lower. The investment adviser is currently reimbursing a portion of other expenses. This reimbursement will be in effect through at least September 30, 2017, unless modified or terminated by the fund’s board. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. Visit americanfunds.com for more information.

Portfolio quality summary*

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 15 |

Results at a glance

For periods ended July 31, 2016, with distributions reinvested

| Cumulative total returns | Average annual total returns | |||||||||||||||

| 1 year | 5 years | 10 years | Lifetime1 | |||||||||||||

| American Funds Short-Term Tax-Exempt Bond Fund (Class A shares) | 1.51 | % | 1.10 | % | — | 1.45 | % | |||||||||

| Bloomberg Barclays Municipal Short 1–5 Years Index2 | 2.15 | 1.59 | 3.00 | % | 1.99 | |||||||||||

| Lipper Short Municipal Debt Funds Average | 1.20 | 1.04 | 1.80 | 1.31 | ||||||||||||

| Limited Term Tax-Exempt Bond Fund of America (Class A shares) | 2.97 | 2.71 | 3.49 | 4.12 | ||||||||||||

| Bloomberg Barclays Municipal Short-Intermediate 1–10 Years Index3 | 3.98 | 2.92 | 4.00 | 4.38 | ||||||||||||

| Lipper Short-Intermediate Municipal Debt Funds Average | 3.11 | 2.17 | 2.97 | 3.61 | ||||||||||||

| The Tax-Exempt Bond Fund of America (Class A shares) | 6.69 | 5.51 | 4.66 | 6.68 | ||||||||||||

| Bloomberg Barclays Municipal Bond Index | 6.94 | 5.13 | 5.01 | — | 4 | |||||||||||

| Lipper General & Insured Municipal Debt Funds Average | 6.89 | 5.31 | 4.35 | 6.64 | ||||||||||||

| American High-Income Municipal Bond Fund (Class A shares) | 9.45 | 7.78 | 5.06 | 5.81 | ||||||||||||

| Bloomberg Barclays Municipal Bond Index | 6.94 | 5.13 | 5.01 | 5.68 | ||||||||||||

| Bloomberg Barclays High Yield Municipal Bond Index | 13.44 | 7.59 | 5.06 | — | 4 | |||||||||||

| Lipper High Yield Municipal Debt Funds Average | 9.62 | 7.15 | 4.31 | 5.30 | ||||||||||||

| The Tax-Exempt Fund of California (Class A shares) | 6.65 | 6.17 | 4.93 | 5.76 | ||||||||||||

| Bloomberg Barclays California Municipal Index | 6.95 | 5.84 | 5.25 | — | 4 | |||||||||||

| Lipper California Municipal Debt Funds Average | 8.11 | 6.40 | 4.72 | 5.77 | ||||||||||||

| American Funds Tax-Exempt Fund of New York (Class A shares) | 6.95 | 5.15 | — | 4.80 | ||||||||||||

| Bloomberg Barclays New York Municipal Index | 6.72 | 4.97 | 4.97 | 4.53 | ||||||||||||

| Lipper New York Municipal Debt Funds Average | 7.35 | 5.02 | 4.25 | 4.31 | ||||||||||||

| 1 | Since 8/7/09 (American Funds Short-Term Tax-Exempt Bond Fund), 10/6/93 (Limited Term Tax-Exempt Bond Fund of America), 10/3/79 (The Tax-Exempt Bond Fund of America), 9/26/94 (American High-Income Municipal Bond Fund), 10/28/86 (The Tax-Exempt Fund of California) and 11/1/10 (American Funds Tax-Exempt Fund of New York). |

| 2 | The Bloomberg Barclays Municipal Short 1–5 Years Index is a market value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to five years. |

| 3 | The Bloomberg Barclays Municipal Short-Intermediate 1–10 Years Index is a market value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to 10 years. |

| 4 | This index did not exist at the fund’s inception. |

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Bloomberg Barclays source: Bloomberg Index Services Ltd.

| 16 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

Summary investment portfolio July 31, 2016

| Bonds, notes & other debt instruments 93.07% | Principal amount (000) | Value (000) | ||||||

| Alabama 2.39% | ||||||||

| Black Belt Energy Gas Dist., Gas Supply Rev. Bonds, Series 2016-A, 4.00% 2046 (put 2021) | $ | 9,500 | $ | 10,647 | ||||

| Other securities | 7,996 | |||||||

| 18,643 | ||||||||

| California 9.29% | ||||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2006-C-1, 1.34% 2045 (put 2023)1 | 6,600 | 6,596 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2007-E-3, 1.14% 2047 (put 2019)1 | 3,000 | 3,000 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2014-G, 1.04% 2034 (put 2020)1 | 2,000 | 1,992 | ||||||

| G.O. Bonds, Series 2012-A, 0.89% 2033 (put 2018)1 | 1,500 | 1,495 | ||||||

| Various Purpose G.O. Bonds, 3.00% 2016 | 5,000 | 5,001 | ||||||

| Various Purpose G.O. Bonds, 4.00% 2030 (put 2021) | 500 | 570 | ||||||

| Various Purpose G.O. Ref. Bonds, 5.00% 2018 | 3,000 | 3,224 | ||||||

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (J. Paul Getty Trust), Series 2013-A-2, 0.846% 2047 (put 2019)1 | 3,500 | 3,502 | ||||||

| Other securities | 47,206 | |||||||

| 72,586 | ||||||||

| Connecticut 1.60% | ||||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2014-C-1, 4.00% 2044 | 895 | 979 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, 4.00% 2044 | 1,480 | 1,566 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, Series 2012-F-2, AMT, 2.75% 2035 | 670 | 677 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, Series 2015-A, 3.50% 2044 | 3,445 | 3,679 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, Series 2015-C-1, 3.50% 2045 | 1,985 | 2,132 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, Series 2016-A-1, 4.00% 2045 | 1,400 | 1,532 | ||||||

| Other securities | 1,898 | |||||||

| 12,463 | ||||||||

| Florida 4.39% | ||||||||

| Citizens Property Insurance Corp., Personal Lines Account/Commercial Lines Account Secured Bonds, Series 2012-A-1, 5.00% 2017 | 1,000 | 1,037 | ||||||

| Citizens Property Insurance Corp., Personal Lines Account/Commercial Lines Account Secured Bonds, Series 2012-A-1, 5.00% 2019 | 7,450 | 8,315 | ||||||

| City of Lakeland, Energy System Rev. Ref. Bonds, Series 2012, 1.19% 20171 | 3,800 | 3,802 | ||||||

| Other securities | 21,113 | |||||||

| 34,267 | ||||||||

| Georgia 3.16% | ||||||||

| Dev. Auth. Of Floyd County, Pollution Control Rev. Bonds (Georgia Power Company Plant Hammond Project), 2.35% 2022 (put 2020) | 4,000 | 4,177 | ||||||

| Metropolitan Atlanta Rapid Transit Auth., Sales Tax Rev. Ref. Bonds (Third Indenture Series), Series 2014-A, 0.74% 2025 (put 2017)1 | 5,250 | 5,250 | ||||||

| Metropolitan Atlanta Rapid Transit Auth., Sales Tax Rev. Ref. Bonds, Series 2014-B, 0.72% 2025 (put 2017)1 | 3,500 | 3,497 | ||||||

| Other securities | 11,760 | |||||||

| 24,684 | ||||||||

| Illinois 7.29% | ||||||||

| Build Bonds (Sales Tax Rev. Bonds), Series June 2013, 5.00% 2020 | 3,500 | 4,023 | ||||||

| City of Chicago, Water Rev. Bonds, Series 2004, 5.00% 2023 | 2,750 | 3,279 | ||||||

| Educational Facs. Auth., Rev. Bonds (University of Chicago), Series 1998-B, 1.65% 2025 (put 2019) | 10,390 | 10,563 | ||||||

| Educational Facs. Auth., Rev. Bonds (University of Chicago), Series 2001-B-1, 1.10% 2036 (put 2018) | 1,250 | 1,256 | ||||||

| American Funds Tax-Exempt Funds | 17 |

American Funds Short-Term Tax-Exempt Bond Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | ||||||

| Illinois (continued) | ||||||||

| Housing Dev. Auth., Multifamily Housing Rev. Notes (Marshall Field Garden Apartment Homes), 1.44% 2050 (put 2025)1 | $ | 3,400 | $ | 3,383 | ||||

| Unemployment Insurance Fund Building Receipts Rev. Bonds (Illinois Dept. of Employment Security), Series 2012-A, 5.00% 2016 | 4,000 | 4,070 | ||||||

| Other securities | 30,386 | |||||||

| 56,960 | ||||||||

| Indiana 1.71% | ||||||||

| Dev. Fin. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2001, AMT, 1.75% 2031 (put 2018) | 500 | 507 | ||||||

| Health and Educational Fac. Fncg. Auth., Rev. Bonds (Ascension Health Credit Group), Series 2005-A-5, 2.00% 2027 (put 2017) | 1,875 | 1,899 | ||||||

| Other securities | 10,953 | |||||||

| 13,359 | ||||||||

| Massachusetts 4.66% | ||||||||

| Dev. Fin. Agcy., Rev. Bonds (Partners HealthCare System), Series 2014-M-3, 0.99% 2038 (put 2018)1 | 8,315 | 8,314 | ||||||

| Educational Fncg. Auth., Education Loan Rev. Bonds, Series 2016-J, AMT, 5.00% 2024 | 3,000 | 3,582 | ||||||

| Educational Fncg. Auth., Education Loan Rev. Bonds, Issue J, Series 2012, AMT, 5.00% 2018 | 1,000 | 1,070 | ||||||

| Educational Fncg. Auth., Education Loan Rev. Bonds, Series 2014-I, AMT, 4.00% 2017 | 400 | 405 | ||||||

| Educational Fncg. Auth., Education Loan Rev. Bonds, Series 2014-I, AMT, 4.00% 2018 | 500 | 519 | ||||||

| Educational Fncg. Auth., Education Loan Rev. Bonds, Series 2014-I, AMT, 5.00% 2021 | 3,000 | 3,379 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 167, 4.00% 2043 | 845 | 894 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 169, 4.00% 2044 | 900 | 976 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 172, 4.00% 2045 | 1,480 | 1,595 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 181, 4.00% 2044 | 1,000 | 1,094 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 160, AMT, 3.75% 2034 | 460 | 476 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 162, 2.75% 2041 | 510 | 521 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 165, 2.65% 2041 | 1,640 | 1,679 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 171, 4.00% 2044 | 915 | 1,002 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 177, AMT, 4.00% 2039 | 3,415 | 3,706 | ||||||

| Other securities | 7,207 | |||||||

| 36,419 | ||||||||

| Michigan 3.17% | ||||||||

| State Hospital Fin. Auth., Project Rev. Ref. Bonds (Ascension Health Credit Group), Series 2010-F3, 1.40% 2047 (put 2018) | 1,500 | 1,514 | ||||||

| Other securities | 23,227 | |||||||

| 24,741 | ||||||||

| Minnesota 1.63% | ||||||||

| Housing Fin. Agcy., Homeownership Fin. Bonds (Mortgage-Backed Securities Program), Series 2011-G, 4.25% 2035 | 620 | 649 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2012-D, 4.00% 2040 | 855 | 893 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2013-A, AMT, 3.00% 2031 | 695 | 714 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2014-A, 4.00% 2038 | 1,225 | 1,339 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2014-C, AMT, 4.00% 2045 | 4,695 | 5,051 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2015-A, AMT, 4.00% 2041 | 930 | 1,010 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2015-E, AMT, 3.50% 2046 | 950 | 1,013 | ||||||

| Other securities | 2,054 | |||||||

| 12,723 | ||||||||

| Nebraska 1.65% | ||||||||

| Central Plains Energy Project, Gas Supply Rev. Ref. Bonds, Series 2014, 5.00% 2039 (put 2019) | 4,200 | 4,746 | ||||||

| Other securities | 8,158 | |||||||

| 12,904 | ||||||||

| 18 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

| Principal amount (000) | Value (000) | |||||||

| Nevada 1.88% | ||||||||

| Clark County, Pollution Control Rev. Ref. Bonds (Southern California Edison Company), Series 2010, 1.875% 2031 (put 2020) | $ | 5,500 | $ | 5,638 | ||||

| Other securities | 9,083 | |||||||

| 14,721 | ||||||||

| New Jersey 4.01% | ||||||||

| Econ. Dev. Auth., School Facs. Construction Rev. Ref. Bonds, Series 2014-PP, 5.00% 2019 | 4,000 | 4,347 | ||||||

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2012-1A, AMT, 4.00% 2017 | 3,500 | 3,631 | ||||||

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2012-1A, AMT, 5.00% 2018 | 2,000 | 2,167 | ||||||

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2016-1-A, AMT, 5.00% 2020 | 750 | 845 | ||||||

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2016-1-A, AMT, 5.00% 2021 | 2,000 | 2,290 | ||||||

| Higher Education Student Assistance Auth., Student Loan Rev. Ref. Bonds, Series 2014-1A1, AMT, 5.00% 2018 | 2,250 | 2,438 | ||||||

| Turnpike Auth., Turnpike Rev. Ref. Bonds, Series 2013-D, 1.06% 2023 (put 2017)1 | 4,000 | 4,000 | ||||||

| Other securities | 11,605 | |||||||

| 31,323 | ||||||||

| New Mexico 0.97% | ||||||||

| City of Farmington, Pollution Control Rev. Ref. Bonds (Southern California Edison Company Four Corners Project), 1.875% 2029 (put 2020) | 2,000 | 2,056 | ||||||

| City of Farmington, Pollution Control Rev. Ref. Bonds (Southern California Edison Company Four Corners Project), Series 2005-B, 1.875% 2029 (put 2020) | 2,250 | 2,313 | ||||||

| Other securities | 3,207 | |||||||

| 7,576 | ||||||||

| New York 9.82% | ||||||||

| Dormitory Auth., School Districts Rev. Bond Fncg. Program Rev. Bonds, Series 2016-A, 5.00% 2022 | 4,165 | 5,091 | ||||||

| Metropolitan Transportation Auth., Transportation Rev. Bonds, Series 2011-D, 5.00% 2016 | 1,000 | 1,014 | ||||||

| Metropolitan Transportation Auth., Transportation Rev. Bonds, Series 2014-A-1, 4.00% 2019 | 750 | 829 | ||||||

| Metropolitan Transportation Auth., Transportation Rev. Bonds, Series 2014-C, 5.00% 2020 | 2,000 | 2,342 | ||||||

| Metropolitan Transportation Auth., Transportation Rev. Bonds, Series 2015-A-2, 1.02% 2039 (put 2020)1 | 6,250 | 6,210 | ||||||

| Mortgage Agcy., Homeowner Mortgage Rev. Bonds, Series 178, 3.50% 2043 | 1,765 | 1,821 | ||||||

| Mortgage Agcy., Homeowner Mortgage Rev. Bonds, Series 191, 3.50% 2034 | 3,270 | 3,430 | ||||||

| Mortgage Agcy., Homeowner Mortgage Rev. Bonds, Series 195, 4.00% 2046 | 3,000 | 3,298 | ||||||

| Mortgage Agcy., Homeowner Mortgage Rev. Bonds, Series 197, 3.50% 2044 | 1,000 | 1,088 | ||||||

| Mortgage Agcy., Homeowner Mortgage Rev. Bonds, Series 52, AMT, 3.50% 2030 | 1,000 | 1,069 | ||||||

| City of New York, G.O. Bonds, Fiscal 2004, Series 2014-A-6, 0.94% 20311 | 2,500 | 2,496 | ||||||

| City of New York, G.O. Bonds, Series 2008-J-4, 0.99% 20251 | 6,000 | 6,000 | ||||||

| City of New York, G.O. Bonds, Series 2011-I-1, 5.00% 2017 | 1,000 | 1,045 | ||||||

| City of New York, G.O. Bonds, Series 2012-I, 5.00% 2018 | 1,000 | 1,088 | ||||||

| City of New York, G.O. Bonds, Series 2014-A, 5.00% 2020 | 1,500 | 1,745 | ||||||

| Thruway Auth., General Rev. Junior Indebtedness Obligations, Series 2013-A, 5.00% 2019 | 4,700 | 5,254 | ||||||

| Other securities | 32,919 | |||||||

| 76,739 | ||||||||

| Ohio 2.06% | ||||||||

| Solid Waste Disposal Rev. Bonds (Waste Management Inc. Project), Series 2002, AMT, 1.70% 2022 (put 2018) | 2,500 | 2,534 | ||||||

| Other securities | 13,543 | |||||||

| 16,077 | ||||||||

| American Funds Tax-Exempt Funds | 19 |

American Funds Short-Term Tax-Exempt Bond Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | ||||||

| Oregon 1.31% | ||||||||

| G.O. Bonds (Veterans’ Welfare Bonds Series 94), Series 2014-H, 4.00% 2044 | $ | 3,050 | $ | 3,350 | ||||

| Other securities | 6,898 | |||||||

| 10,248 | ||||||||

| Pennsylvania 2.82% | ||||||||

| Econ. Dev. Fncg. Auth., Unemployment Compensation Rev. Bonds, Series 2012-B, 5.00% 2021 | 4,000 | 4,248 | ||||||

| Turnpike Commission, Turnpike Rev. Bonds, Series 2016, 5.00% 2021 | 3,500 | 4,103 | ||||||

| Other securities | 13,715 | |||||||

| 22,066 | ||||||||

| Rhode Island 1.13% | ||||||||

| Housing and Mortgage Fin. Corp., Homeownership Opportunity Bonds, Series 66-A-1, 4.00% 2033 | 3,275 | 3,517 | ||||||

| Other securities | 5,305 | |||||||

| 8,822 | ||||||||

| South Carolina 0.66% | ||||||||

| Public Service Auth., Rev. Obligations (Santee Cooper), Series 2012-A, 4.00% 2020 | 2,945 | 3,325 | ||||||

| Other securities | 1,803 | |||||||

| 5,128 | ||||||||

| Tennessee 1.73% | ||||||||

| Housing Dev. Agcy., Homeownership Program Bonds, Issue 2012-1-C, 4.50% 2037 | 875 | 940 | ||||||

| Housing Dev. Agcy., Homeownership Program Bonds, Issue 2012-2-C, 4.00% 2038 | 635 | 678 | ||||||

| Housing Dev. Agcy., Homeownership Program Rev. Ref. Bonds, Issue 2011-1-A, AMT, 4.50% 2031 | 1,525 | 1,637 | ||||||

| Housing Dev. Agcy., Homeownership Program Rev. Ref. Bonds, Issue 2012-1-A, AMT, 4.50% 2038 | 740 | 789 | ||||||

| Housing Dev. Agcy., Residential Fin. Program Bonds, 4.00% 2046 | 480 | 526 | ||||||

| Housing Dev. Agcy., Residential Fin. Program Bonds, Issue 2013-1-C, 3.00% 2038 | 1,365 | 1,427 | ||||||

| Housing Dev. Agcy., Residential Fin. Program Bonds, Series 2013-2-A, AMT, 4.00% 2043 | 745 | 801 | ||||||

| Housing Dev. Agcy., Residential Fin. Program Bonds, Series 2014-1-A, AMT, 4.00% 2039 | 1,755 | 1,901 | ||||||

| Housing Dev. Agcy., Residential Fin. Program Bonds, Series 2014-2-A, AMT, 4.00% 2045 | 1,470 | 1,589 | ||||||

| Housing Dev. Agcy., Residential Fin. Program Bonds, Series 2014-2-C, 4.00% 2045 | 1,115 | 1,204 | ||||||

| Housing Dev. Agcy., Residential Fin. Program Bonds, Series 2016-1-B, 3.50% 2047 | 960 | 1,040 | ||||||

| Other securities | 999 | |||||||

| 13,531 | ||||||||

| Texas 7.37% | ||||||||

| Grand Parkway Transportation Corp., Grand Parkway System Toll Rev. Ref. Bond Anticipation Notes, Series 2014-A, 3.00% 2016 | 8,150 | 8,230 | ||||||

| Mission Econ. Dev. Corp., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2008, AMT, 2.50% 2020 (put 2013) | 2,000 | 2,073 | ||||||

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, 5.00% 2018 | 2,000 | 2,133 | ||||||

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, Series 2012-C, 2.00% 2027 (put 2016) | 1,160 | 1,165 | ||||||

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, Series 2015-B, 0.82% 2033 (put 2018)1 | 6,000 | 5,980 | ||||||

| Transportation Commission, G.O. Mobility Fund Bonds, Series 2014-B, 0.82% 2041 (put 2018) 1 | 6,500 | 6,460 | ||||||

| Other securities | 31,509 | |||||||

| 57,550 | ||||||||

| Virginia 0.87% | ||||||||

| Commonwealth Transportation Board, Federal Transportation Grant Anticipation Rev. Notes, Series 2013-A, 5.00% 2020 | 3,000 | 3,454 | ||||||

| Other securities | 3,354 | |||||||

| 6,808 | ||||||||

| 20 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

| Principal amount (000) | Value (000) | |||||||

| Washington 3.41% | ||||||||

| Econ. Dev. Fin. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2008, 2.125% 20202 | $ | 2,500 | $ | 2,571 | ||||

| Energy Northwest, Electric Rev. Ref. Bonds (Project No. 1), Series 2012-A, 5.00% 2017 | 5,000 | 5,209 | ||||||

| Other securities | 18,821 | |||||||

| 26,601 | ||||||||

| Wisconsin 2.67% | ||||||||

| Health and Educational Facs. Auth., Rev. Bonds (Ascension Health Alliance Senior Credit Group), Series 2013-B-2, 4.00% 2043 (put 2019) | 1,000 | 1,087 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Ascension Health Alliance Senior Credit Group), Series 2013-B-3, 5.00% 2043 (put 2020) | 4,500 | 5,178 | ||||||

| Housing and Econ. Dev. Auth., Home Ownership Rev. Bonds, Series 2016-A, AMT, 3.50% 2046 | 4,000 | 4,260 | ||||||

| Public Fin. Auth., Solid Waste Disposal Rev. Ref. Bonds (Waste Management, Inc. Project), Series 2016-A-4, AMT, 2.00% 2033 (put 2021) | 1,500 | 1,536 | ||||||

| Other securities | 8,778 | |||||||

| 20,839 | ||||||||

| Other states & U.S. territories 11.42% | ||||||||

| Other securities | 89,172 | |||||||

| Total bonds, notes & other debt instruments (cost: $717,940,000) | 726,950 | |||||||

| Short-term securities 6.39% | ||||||||

| State of California, Educational Facs. Auth., Higher Education Commercial Paper, Series 2016-S-4, 0.44% 10/5/2016 | 5,000 | 5,000 | ||||||

| State of Maryland, Montgomery County, Consolidated Public Improvement Bond Anticipation Notes, Series 2006-A, 0.39% 20261 | 3,500 | 3,500 | ||||||

| State of Maryland, Montgomery County, Consolidated Public Improvement Bond Anticipation Notes, Series 2009-B, 0.45% 8/9/2016 | 2,000 | 2,000 | ||||||

| State of Massachusetts, Health and Educational Facs. Auth., Higher Education Commercial Paper, Series 2016-EE, 0.43% 9/6/2016 | 4,811 | 4,811 | ||||||

| State of Massachusetts, School Building Auth., Dedicated Sales Tax Rev. Ref. Bonds, Series 2015-C, 5.00% 8/15/2016 | 4,000 | 4,008 | ||||||

| State of New York, Metropolitan Transportation Auth., Transportation Rev. Bond Anticipation Notes, Series 2015-B-1-G, 1.00% 8/1/2016 | 12,000 | 12,001 | ||||||

| State of New York, Metropolitan Transportation Auth., Transportation Rev. Bond Anticipation Notes, Series 2016-A-1-F 2.00% 10/1/2016 | 1,000 | 1,003 | ||||||

| State of New York, City of New York, G.O. Bonds, Series 1994-E-2, 0.39% 20201 | 3,000 | 3,000 | ||||||

| State of New York, New York City Transitional Fin. Auth., Future Tax Secured Rev. Ref. Bonds, Series 2016-E-4, 0.39% 20451 | 2,000 | 2,000 | ||||||

| State of New York, New York City, Transitional Fin. Auth., New York City Recovery Bonds, Fiscal Series 2003-1, Subseries 1-C, 0.39% 20221 | 3,585 | 3,585 | ||||||

| State of Virginia, Industrial Dev. Auth. of Loudoun County, Virginia, Multi-Modal Rev. Bonds (Howard Hughes Medical Institute Issue), Series 2003-E, 0.44% 20381 | 5,000 | 5,000 | ||||||

| Other securities | 4,006 | |||||||

| Total short-term securities (cost: $49,911,000) | 49,914 | |||||||

| Total investment securities 99.46% (cost: $767,851,000) | 776,864 | |||||||

| Other assets less liabilities 0.54% | 4,249 | |||||||

| Net assets 100.00% | $ | 781,113 | ||||||

| American Funds Tax-Exempt Funds | 21 |

American Funds Short-Term Tax-Exempt Bond Fund

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

| 1 | Coupon rate may change periodically. For short-term securities, the date of the next scheduled coupon rate change is considered to be the maturity date. |

| 2 | Acquired in a transaction exempt from registration under Rule 144A of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $2,571,000, which represented .33% of the net assets of the fund. |

Key to abbreviations

Agcy. = Agency

AMT = Alternative Minimum Tax

Auth. = Authority

Certs. of Part. = Certificates of Participation

Dept. = Department

Dev. = Development

Dist. = District

Econ. = Economic

Fac. = Facility

Facs. = Facilities

Fin. = Finance

Fncg. = Financing

G.O. = General Obligation

LOC = Letter of Credit

Preref. = Prerefunded

Redev. = Redevelopment

Ref. = Refunding

Rev. = Revenue

TECP = Tax-Exempt Commercial Paper

See Notes to Financial Statements

| 22 | American Funds Tax-Exempt Funds |

Limited Term Tax-Exempt Bond Fund of America

Summary investment portfolio July 31, 2016

| Bonds, notes & other debt instruments 91.34% | Principal amount (000) | Value (000) | ||||||

| Alabama 1.30% | ||||||||

| Black Belt Energy Gas Dist., Gas Supply Rev. Bonds, Series 2016-A, 4.00% 2046 (put 2021) | $ | 18,500 | $ | 20,732 | ||||

| Other securities | 28,178 | |||||||

| 48,910 | ||||||||

| California 11.53% | ||||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2006-C-1, 1.34% 2045 (put 2023)1 | 20,500 | 20,488 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2007-C-1, 1.34% 2047 (put 2023)1 | 3,500 | 3,498 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2007-E-3, 1.14% 2047 (put 2019)1 | 1,000 | 1,000 | ||||||