UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-08576

American High-Income Municipal Bond Fund

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street

Los Angeles, California 90071

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (213) 486-9200

Date of fiscal year end: July 31

Date of reporting period: July 31, 2013

Courtney R. Taylor

American High-Income Municipal Bond Fund

333 South Hope Street

Los Angeles, California 90071

(Name and Address of Agent for Service)

Copies to:

Michael Glazer

Bingham McCutchen LLP

355 South Grand Avenue, Suite 4400

Los Angeles, California 90071

(Counsel for the Registrant)

ITEM 1 – Reports to Stockholders

Invest in municipal bonds

for tax-advantaged income.

| American Funds Short-Term Tax-Exempt Bond Fund® Limited Term Tax-Exempt Bond Fund of America® The Tax-Exempt Bond Fund of America® American High-Income Municipal Bond Fund® American Funds Tax-Exempt Fund of New York® The Tax-Exempt Fund of California® |

| Annual reports for the period ended July 31, 2013 |

American Funds Short-Term Tax-Exempt Bond Fund seeks to provide current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

Limited Term Tax-Exempt Bond Fund of America seeks to provide current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

The Tax-Exempt Bond Fund of America seeks to provide a high level of current income exempt from federal income tax, consistent with preservation of capital.

American High-Income Municipal Bond Fund seeks to provide a high level of current income exempt from regular federal income tax.

American Funds Tax-Exempt Fund of New York seeks to provide a high level of current income exempt from regular federal, New York state and New York City income taxes, with a secondary objective of preservation of capital.

The Tax-Exempt Fund of California seeks to provide a high level of current income exempt from regular federal and California state income taxes, with a secondary objective of preservation of capital.

Each fund is one of more than 40 offered by one of the nation’s largest mutual fund families, American Funds, from Capital Group. For more than 80 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge had been deducted (maximum 2.50% for American Funds Short-Term Tax-Exempt Bond Fund and Limited Term Tax-Exempt Bond Fund of America; 3.75% for The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, American Funds Tax-Exempt Fund of New York and The Tax-Exempt Fund of California), the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. For current information and month-end results, visit americanfunds.com.

Here are the total returns on a $1,000 investment with all distributions reinvested for periods ended June 30, 2013 (the most recent calendar quarter-end) and the total annual fund operating expense ratios as of the prospectus dated October 1, 2013 (unaudited):

| Cumulative total returns | Average annual total returns | Gross | ||||||||||||||

| Class A shares | 1 year | 5 years | 10 years/Lifetime* | expense ratios | ||||||||||||

| Reflecting 2.50% maximum sales charge | ||||||||||||||||

| American Funds Short-Term Tax-Exempt Bond Fund | –2.09 | % | 0.90 | % | 1.43 | % | 0.59 | % | ||||||||

| Limited Term Tax-Exempt Bond Fund of America | –1.85 | 3.78 | 3.12 | 0.60 | ||||||||||||

| Reflecting 3.75% maximum sales charge | ||||||||||||||||

| The Tax-Exempt Bond Fund of America | –2.76 | 4.23 | 3.69 | 0.55 | ||||||||||||

| American High-Income Municipal Bond Fund | –0.57 | 4.69 | 3.94 | 0.69 | ||||||||||||

| American Funds Tax-Exempt Fund of New York | –3.77 | — | 2.86 | 0.66 | ||||||||||||

| The Tax-Exempt Fund of California | –2.26 | 4.85 | 3.86 | 0.63 | ||||||||||||

| * | Applicable only to American Funds Tax-Exempt Fund of New York, which began operations on 11/1/10.All other funds reflect 10-year results. |

For other share class results, visit americanfunds.com and americanfundsretirement.com.

The five- and 10-year investment results for American Funds Short-Term Tax-Exempt Bond Fund include the fund’s results as a money market fund through the date of its conversion (August 7, 2009) to a short-term tax-exempt bond fund, and therefore are not representative of the fund’s results had it operated as a short-term tax-exempt bond fund for the full term of those periods. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers (and expense reimbursements for American Funds Short-Term Tax-Exempt Bond Fund and American Funds Tax-Exempt Fund of New York), without which results would have been lower. The adviser has committed to retain any reimbursements for American Funds Tax-Exempt Fund of New York only through September 30, 2013. Visit americanfunds.com for more information.

A summary of each fund’s 30-day yield can be found on page 3.

Individual funds are listed in this report according to their risk potential, with state-specific funds listed last.

Contents

Fellow investors:

We are pleased to present you with this annual report for six American Funds municipal bond funds. This report covers the period from August 1, 2012, through July 31, 2013, for American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund and American Funds Tax-Exempt Fund of New York. The report also covers the period from September 1, 2012, through July 31, 2013, for The Tax-Exempt Bond Fund of America and The Tax-Exempt Fund of California, whose fiscal years have changed.

The municipal bond market enjoyed relative strength during much of the fiscal year, but the period closed with a broad selloff that ensued in May, triggered by signs of a stronger economy, rising U.S. Treasury yields and indications from the Federal Reserve that it might begin to reduce its bond purchase program. For the 12 months ended July 31, 2013, the Barclays Municipal Bond Index, a broad measure of the investment-grade tax-exempt bond market, recorded a 2.19% loss. By way of comparison, the Barclays U.S. Aggregate Index, a broad measure of the investment-grade taxable fixed-income market, declined 1.91%. In general, shorter duration municipal bonds fared better than longer duration issues. Although below investment-grade securities (those rated Ba/BB and below) sustained some of the sharpest declines in the final two months of the period, overall returns for these higher yielding bonds were generally better. Barclays High Yield Municipal Bond Index gained 0.80% during the fiscal year. All market indexes referenced in this report are unmanaged and, therefore, have no expenses.

Against this backdrop, results for these six American Funds tax-exempt bond funds were generally negative. Total returns ranged from 0.16% for American Funds Short-Term Tax-Exempt Bond Fund to –3.16% for American Funds Tax-Exempt Fund of New York. While we are disappointed with the overall results, we are gratified that all six funds outpaced their respective peer groups, as measured by Lipper. (Turn to pages 4 through 16 for detailed results for each fund.)

Economic and market overview

Fixed-income markets experienced two distinct phases during the fiscal year. For much of the period, yields for U.S. Treasuries and many other categories of bonds remained near historic lows as investors focused on the slow pace of the economic recovery and the possible effects of automatic tax increases and across-the-board federal government budget cuts. As has been the case over the past few years, enthusiasm for municipal bonds was relatively high during these first months of the fiscal year. With the Fed holding short-term interest rates near zero, investors were drawn to the municipal market in part by the relatively attractive yields of some tax-exempt bonds compared with taxable securities.

However, many of these conditions reversed during the closing months of the year, creating a highly challenging and volatile climate for bond investors. Housing market data indicated that home prices increased in March and April at their fastest pace since 2006, triggering greater optimism about the healing economy. During May and June, rising interest rates and indications from the Fed that it might reduce its monthly asset purchases fueled a sharp selloff in Treasuries. The yield on the benchmark 10-year note rose 82 basis points to 2.52% in two months.

| American Funds Tax-Exempt Funds | 1 |

In a volatile three months for fixed-income securities broadly, municipal bonds suffered particularly acute declines from May through July, reflecting, in part, the relative illiquidity in the market. As investors became increasingly concerned about rising interest rates and possible Fed action, redemptions from municipal bond mutual funds spiked. Outflows exceeded $1 billion each week of June, including a record $4.5 billion the week of June 26, according to data from Lipper.

The municipal market came under further pressure in July, when Detroit filed for bankruptcy protection — the largest U.S. city ever to do so. It is important to point out that the circumstances leading to Detroit’s bankruptcy are particular to that city’s financial struggles and are in no way directly related to most of the thousands of issuers in the vast municipal bond market. However, given the size and scope of the city’s bankruptcy — its debt is estimated to be between $18 billion and $20 billion — the proceedings could contribute to heightened volatility in the short term. As such, we are paying close attention to developments. We also note that the funds had very limited exposure to Detroit’s debt during the period.

Looking ahead

As the economy strengthens, we remain alert to the potential impact of rising interest rates and possible Fed action, but we remind investors that these developments will likely take some time. With this in mind, we have worked hard to position the funds relatively conservatively, carefully seeking a balance between risk and potential reward.

We expect continued volatility in the coming months. The direction of U.S. fiscal policy is uncertain, and political gridlock could resurface as the debt ceiling deadline approaches. That said, there are reasons for optimism. The fiscal outlook for many state and local governments is improving. What’s more, the recent market selloff was indiscriminate, and we are finding a number of long-term investment opportunities at what we believe are attractive prices. We continue to focus on the long term and base each of our investment decisions on in-depth research of individual bond issuers as well as economic and market conditions.

We thank you for the confidence you have placed in us, and we look forward to reporting back to you in six months.

Sincerely,

Brenda S. Ellerin

President, American Funds Short-Term Tax-Exempt Bond Fund and Limited Term Tax-Exempt Bond Fund of America

Neil L. Langberg

President, The Tax-Exempt Bond Fund of America and The Tax-Exempt Fund of California

Karl J. Zeile

President, American High-Income Municipal Bond Fund and American Funds Tax-Exempt Fund of New York

September 9, 2013

For current information about the funds, visit americanfunds.com.

| 2 | American Funds Tax-Exempt Funds |

Funds’ 30-day yields

Below is a summary of each fund’s 30-day yield and 12-month distribution rate for Class A shares as of August 31, 2013. Both measures reflect the 2.50%/3.75% maximum sales charge. Each fund’s 30-day yield is calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula. The SEC yield reflects the rate at which each fund is earning income on its current portfolio of securities while the distribution rate reflects the funds’ past dividends paid to shareholders. Accordingly, the funds’ SEC yields and distribution rates may differ. The equivalent taxable yield assumes a 43.4% tax rate.1

| Class A shares | SEC 30-day yield | Equivalent taxable yield | 12-month distribution rate | |||||||||

| Reflecting 2.50% maximum sales charge | ||||||||||||

| American Funds Short-Term Tax-Exempt Bond Fund | 0.42 | % | 0.74 | % | 1.17 | % | ||||||

| Limited Term Tax-Exempt Bond Fund of America | 1.17 | 2.07 | 2.45 | |||||||||

| Reflecting 3.75% maximum sales charge | ||||||||||||

| The Tax-Exempt Bond Fund of America | 2.77 | 4.89 | 3.44 | |||||||||

| American High-Income Municipal Bond Fund | 4.15 | 7.33 | 4.35 | |||||||||

| American Funds Tax-Exempt Fund of New York | 2.80 | 5.67 | 2 | 2.98 | ||||||||

| The Tax-Exempt Fund of California | 3.24 | 6.60 | 3 | 3.75 | ||||||||

| 1 | Based on 2013 federal tax rates. For the year 2013, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly).Thus, taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 2 | For investors in the 50.59% federal, New York state and New York City tax bracket. |

| 3 | For investors in the 50.93% federal and California state tax bracket. |

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Bond ratings, which typically range from Aaa/AAA (highest) to D (lowest), are assigned by credit rating agencies such as Moody’s, Standard & Poor’s and/or Fitch as an indication of an issuer’s creditworthiness. Income may be subject to state or local income taxes and/or federal alternative minimum taxes. Also, certain other income (such as distributions from gains on the sale of certain bonds purchased at less than par value, for The Tax-Exempt Bond Fund of America), as well as capital gain distributions, may be taxable. High-yield/lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than investment-grade/higher rated bonds. American Funds Tax-Exempt Fund of New York and The Tax-Exempt Fund of California are more susceptible to factors adversely affecting issuers of each state’s tax-exempt securities than a more widely diversified municipal bond fund. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the funds.

| American Funds Tax-Exempt Funds | 3 |

American Funds Short-Term Tax-Exempt Bond Fund

The fund produced a positive total return of 0.16%, exceeding the 0.08% result of the Lipper Short Municipal Debt Funds Average, a peer group measure. The unmanaged Barclays Municipal Short 1–5 Years Index, which has no expenses, returned 0.50%. See page 16 for additional results.

For the fiscal year, the fund paid monthly dividends totaling 12.5 cents a share, amounting to a federally tax-exempt income return of 1.22% for investors who reinvested dividends. This is equivalent to a taxable income return of 2.16% for investors in the 43.4%1 maximum federal tax bracket. A portion of the fund’s return may also be exempt from some state and local taxes.

In a turbulent market environment, the fund’s focus on high-quality issues with shorter durations helped it generate a positive return. Many of the fund’s largest investments were among sectors where revenue bonds support critical local enterprises, including airports (9.9%), hospital facilities (9.0%) and electric utilities (5.1%).

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 1.20% tax-exempt distribution rate3 as of July 31, 2013.

| The fund’s tax-exempt | |||||||||||||||||

| If your taxable income is … | … then your federal | distribution rate of 1.20% is | |||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of … | ||||||||||||||

| $ | 0 – | 8,925 | $ | 0 – | 17,850 | 10.0 | % | 1.33 | % | ||||||||

| 8,926 – | 36,250 | 17,851 – | 72,500 | 15.0 | 1.41 | ||||||||||||

| 36,251 – | 87,850 | 72,501 – | 146,400 | 25.0 | 1.60 | ||||||||||||

| 87,851 – | 183,250 | 146,401 – | 223,050 | 28.0 | 1.67 | ||||||||||||

| 183,251 – | 398,350 | 223,051 – | 398,350 | 36.8 | 1 | 1.90 | |||||||||||

| 398,351 – | 400,000 | 398,351 – | 450,000 | 38.8 | 1 | 1.96 | |||||||||||

| Over 400,000 | Over 450,000 | 43.4 | 1 | 2.12 | |||||||||||||

| 1 | For the year 2013, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2013 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phase-out of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2013. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 2.50% on the $10,000 investment.1 Thus, the net amount invested was $9,750. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 4 | American Funds Tax-Exempt Funds |

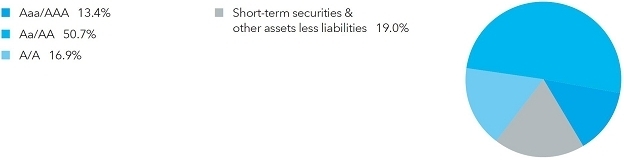

How a $10,000 investment has grown

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $500,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | Consists of the Lipper Tax-Exempt Money Market Funds Index through July 31, 2009 (the period ended prior to the fund’s conversion from a tax-exempt money market fund to a short-term tax-exempt bond fund), and the Barclays Municipal Short 1–5 Years Index thereafter. Results of the Lipper Tax-Exempt Money Market Funds Index do not reflect any sales charges. The Barclays index is unmanaged and, therefore, has no expenses. |

| 3 | Prior to August 7, 2009, the fund was operated as a money market fund and did not have an initial sales charge. |

| 4 | In 2009, the fund changed its fiscal year-end from September 30 to July 31. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

| For periods ended July 31, 2013* | |||

| 1 year | 5 years | 10 years | |

| Class A shares | –2.30% | 0.89% | 1.43% |

| * | Assumes reinvestment of all distributions and payment of the maximum 2.50% sales charge. |

The five-and 10-year investment results include the fund’s results as a money market fund through the date of its conversion (August 7, 2009) to a short-term tax-exempt bond fund, and therefore are not representative of the fund’s results had it operated as a short-term tax-exempt bond fund for the full term of those periods. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect expense reimbursements, without which results would have been lower. Visit americanfunds.com for more information.

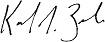

Quality ratings*

Percent of net assets

| * | Bond ratings, which typically range from Aaa/AAA (highest) to D (lowest), are assigned by credit rating agencies such as Moody’s, Standard & Poor’s and/or Fitch as an indication of an issuer’s creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 5 |

Limited Term Tax-Exempt Bond Fund of America

The fund’s total return was –0.13%. That result outpaced the –1.84% return of the fund’s peer group, as measured by the Lipper Intermediate Municipal Debt Funds Average. By way of comparison, the return for the unmanaged Barclays Municipal Short-Intermediate 1–10 Years Index, which has no expenses, was –0.18%. See page 16 for fund results over longer periods of time.

For the fiscal year, the fund paid monthly dividends totaling about 40 cents a share, amounting to a federally tax-exempt income return of 2.47% for investors who reinvested dividends. This is equivalent to a taxable income return of 4.36% for investors in the 43.4%1 maximum federal tax bracket.

The fund invests in investment-grade bonds (those rated Baa/BBB and above) with short- to medium-length maturities. This relatively conservative approach helped it provide a measure of relative stability during the year. At the end of the year, debt rated A and higher accounted for 82.7% of the portfolio’s holdings. The portfolio included significant holdings of revenue bonds in a variety of sectors, including hospital facilities (12.2%), airports (12.2%) and electric utilities (7.3%).

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 2.45% tax-exempt distribution rate3 as of July 31, 2013.

| The fund’s tax-exempt | |||||||||||||||||

| If your taxable income is … | … then your federal | distribution rate of 2.45% is | |||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of … | ||||||||||||||

| $ | 0 – | 8,925 | $ | 0 – | 17,850 | 10.0 | % | 2.72 | % | ||||||||

| 8,926 – | 36,250 | 17,851 – | 72,500 | 15.0 | 2.88 | ||||||||||||

| 36,251 – | 87,850 | 72,501 – | 146,400 | 25.0 | 3.27 | ||||||||||||

| 87,851 – | 183,250 | 146,401 – | 223,050 | 28.0 | 3.40 | ||||||||||||

| 183,251 – | 398,350 | 223,051 – | 398,350 | 36.8 | 1 | 3.88 | |||||||||||

| 398,351 – | 400,000 | 398,351 – | 450,000 | 38.8 | 1 | 4.00 | |||||||||||

| Over 400,000 | Over 450,000 | 43.4 | 1 | 4.33 | |||||||||||||

| 1 | For the year 2013, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly).Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2013 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phase-out of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2013. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 2.50% on the $10,000 investment.1 Thus, the net amount invested was $9,750. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 6 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $500,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The market index is unmanaged and, therefore, has no expenses. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

| For periods ended July 31, 2013* | |||

| 1 year | 5 years | 10 years | |

| Class A shares | –2.63% | 3.68% | 3.44% |

| * | Assumes reinvestment of all distributions and payment of the maximum 2.50% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Quality ratings*

Percent of net assets

| * | Bond ratings, which typically range from Aaa/AAA (highest) to D (lowest), are assigned by credit rating agencies such as Moody’s, Standard & Poor’s and/or Fitch as an indication of an issuer’s creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 7 |

The Tax-Exempt Bond Fund of America

For the 11 months ended July 31, 2013, the fund recorded a –1.93% decline. The result was better than both the –3.26% total return of the Lipper General & Insured Municipal Debt Funds Average, a peer group measure, and the –2.30% return of the Barclays Municipal Bond Index, which is unmanaged and has no expenses. Results for longer time periods can be found on page 16.

For the 11-month period, the fund paid monthly dividends totaling about 40.1 cents a share, amounting to a federally tax-exempt income return of 3.11% for investors who reinvested dividends. This is equivalent to a taxable income return of 5.49% for investors in the 43.4%1 maximum federal tax bracket. The fund does not invest in bonds subject to the Alternative Minimum Tax (AMT).

In advance of the turbulent period that closed out the fiscal year, the fund’s managers adopted a relatively conservative approach, focusing on shorter duration securities. At fiscal year-end the fund’s average duration was seven years. Although the fund’s overall return was negative, this approach helped results on a relative basis. The fund’s managers continued to concentrate on revenue bonds, an area of the market where they believe credit research is most useful. With investments in more than 2,000 individual securities representing 50 U.S. states and territories, the fund also maintained broad geographic diversification.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 3.40% tax-exempt distribution rate3 as of July 31, 2013.

| The fund’s tax-exempt | |||||||||||||||||

| If your taxable income is … | … then your federal | distribution rate of 3.40% is | |||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of … | ||||||||||||||

| $ | 0 – | 8,925 | $ | 0 – | 17,850 | 10.0 | % | 3.78 | % | ||||||||

| 8,926 – | 36,250 | 17,851 – | 72,500 | 15.0 | 4.00 | ||||||||||||

| 36,251 – | 87,850 | 72,501 – | 146,400 | 25.0 | 4.53 | ||||||||||||

| 87,851 – | 183,250 | 146,401 – | 223,050 | 28.0 | 4.72 | ||||||||||||

| 183,251 – | 398,350 | 223,051 – | 398,350 | 36.8 | 1 | 5.38 | |||||||||||

| 398,351 – | 400,000 | 398,351 – | 450,000 | 38.8 | 1 | 5.56 | |||||||||||

| Over 400,000 | Over 450,000 | 43.4 | 1 | 6.01 | |||||||||||||

| 1 | For the year 2013, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly).Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2013 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phase-out of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2013. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.1 Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 8 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The index is unmanaged and, therefore, has no expenses. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

| For periods ended July 31, 2013* | |||

| 1 year | 5 years | 10 years | |

| Class A shares | –5.34% | 4.01% | 3.93% |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Quality ratings*

Percent of net assets

| * | Bond ratings, which typically range from Aaa/AAA (highest) to D (lowest), are assigned by credit rating agencies such as Moody’s, Standard & Poor’s and/or Fitch as an indication of an issuer’s creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 9 |

American High-Income Municipal Bond Fund

The fund recorded a total return of –0.25%, outpacing the –2.62% return of the Lipper High-Yield Municipal Debt Funds Average, a measure of the fund’s peer group. The unmanaged Barclays High Yield Municipal Bond Index, which has no expenses, advanced 0.80%. For fund results over extended time frames, see page 16.

For the period, the fund paid monthly dividends totaling 63.4 cents a share, amounting to a federally tax-exempt income return of 4.27% for investors who reinvested dividends. This is equivalent to a taxable income return of 7.54% for investors in the 43.4%1 maximum federal tax bracket. A portion of the fund’s return may also be exempt from some state and local taxes.

Although higher yielding bonds sustained particularly steep declines in the final three months of the fiscal year, generally speaking lower rated bonds outpaced the broader market in part because of strong demand for yield in the earlier part of the period.

The fund’s managers rely on intensive credit research in their efforts to identify bonds that they believe offer the best potential return given their risk. This research-driven approach has resulted in a broadly diversified portfolio. We believe strong credit selection bolstered the fund’s result on a relative basis as it avoided some of the more troubled issuers in the market. While the fund’s overall total return was negative for the year, we believe the portfolio is well positioned for the long term.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 4.22% tax-exempt distribution rate3 as of July 31, 2013.

| The fund’s tax-exempt | ||||||||||||||||||||||

| If your taxable income is … | … then your federal | distribution rate of 4.22% is | ||||||||||||||||||||

| Single | Joint | tax rate is … | equivalent to a taxable rate of … | |||||||||||||||||||

| $ | 0 | – | 8,925 | $ | 0 | – | 17,850 | 10.0 | % | 4.69 | % | |||||||||||

| 8,926 | – | 36,250 | 17,851 | – | 72,500 | 15.0 | 4.96 | |||||||||||||||

| 36,251 | – | 87,850 | 72,501 | – | 146,400 | 25.0 | 5.63 | |||||||||||||||

| 87,851 | – | 183,250 | 146,401 | – | 223,050 | 28.0 | 5.86 | |||||||||||||||

| 183,251 | – | 398,350 | 223,051 | – | 398,350 | 36.8 | 1 | 6.68 | ||||||||||||||

| 398,351 | – | 400,000 | 398,351 | – | 450,000 | 38.8 | 1 | 6.90 | ||||||||||||||

| Over 400,000 | Over 450,000 | 43.4 | 1 | 7.46 | ||||||||||||||||||

| 1 | For the year 2013, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2013 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phase-out of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2013. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.1 Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 10 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The index is unmanaged and, therefore, has no expenses. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2013*

| 1 year | 5 years | 10 years | ||||

| Class A shares | –4.00% | 4.49% | 4.00% |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

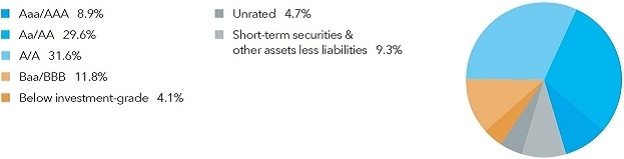

Quality ratings*

Percent of net assets

| * | Bond ratings, which typically range from Aaa/AAA (highest) to D (lowest), are assigned by credit rating agencies such as Moody’s, Standard & Poor’s and/or Fitch as an indication of an issuer’s creditworthiness. If agency ratings differ, securities are placed in the lowest-rated category. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. |

| The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 11 |

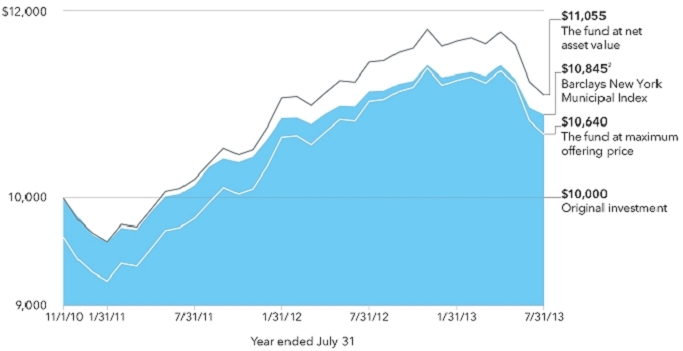

American Funds Tax-Exempt Fund of New York

The fund registered a decline of –3.16%. That result bested the –3.85% total return of the Lipper New York Municipal Debt Funds Average, a measure of its peer group. The unmanaged Barclays New York Municipal Index, which has no expenses, declined –2.25%. The fund’s lifetime (since 11/1/10) average annual total return can be found on page 16.

For the fiscal year, the fund paid monthly dividends totaling about 31 cents a share, representing an income return of 2.90% for those who reinvested dividends. For investors in the 50.59% combined effective federal, New York state and New York City tax bracket, this is equivalent to a taxable income return of 5.87%.

Generally speaking, New York municipal bonds lagged the broader market during the period, in part due to a healthy level of issuance within the state.

The fund’s managers sought to maintain a broadly diversified portfolio throughout the period, including holdings spanning the credit spectrum and representing a wide variety of sectors and issuers. A modest exposure to securities issued by Puerto Rico contributed to the fund’s negative return, as Puerto Rico’s credit rating was downgraded by Moody’s during the year.

Tax-exempt yields vs. taxable yields

Find your estimated 2013 taxable income below to determine your combined federal and New York state tax rate,1,2 then look in the right-hand column to see what you would have had to earn from a taxable investment to equal the fund’s 2.93% tax-exempt distribution rate3 at July 31, 2013.

| … then your combined | The fund’s tax-exempt | |||||||||||||||||||||

| If your taxable income is … | federal and New York | distribution rate of 2.93% is | ||||||||||||||||||||

| Single | Joint | state tax rate is … | equivalent to a taxable rate of … | |||||||||||||||||||

| $ | 0 | – | 8,200 | $ | 0 | – | 16,450 | 13.60 | % | 3.39 | % | |||||||||||

| 8,201 | – | 8,925 | 16,451 | – | 17,850 | 14.05 | 3.41 | |||||||||||||||

| 8,926 | – | 11,300 | 17,851 | – | 22,600 | 18.83 | 3.61 | |||||||||||||||

| 11,301 | – | 13,350 | 22,601 | – | 26,750 | 19.46 | 3.64 | |||||||||||||||

| 13,351 | – | 20,550 | 26,751 | – | 41,150 | 20.02 | 3.66 | |||||||||||||||

| 20,551 | – | 36,250 | 41,151 | – | 72,500 | 20.48 | 3.68 | |||||||||||||||

| 36,251 | – | 77,150 | 72,501 | – | 146,400 | 29.84 | 4.18 | |||||||||||||||

| 77,151 | – | 87,850 | – | 29.99 | 4.19 | |||||||||||||||||

| – | 146,401 | – | 154,350 | 32.64 | 4.35 | |||||||||||||||||

| 87,851 | – | 183,250 | 154,351 | – | 223,050 | 32.79 | 4.36 | |||||||||||||||

| 183,251 | – | 205,850 | 223,051 | – | 308,750 | 41.00 | 4.97 | |||||||||||||||

| 205,851 | – | 398,350 | 308,751 | – | 398,350 | 41.13 | 4.98 | |||||||||||||||

| 398,351 | – | 400,000 | 398,351 | – | 450,000 | 42.99 | 5.14 | |||||||||||||||

| 400,001 | – | 1,029,250 | 450,001 | – | 2,058,550 | 47.28 | 5.56 | |||||||||||||||

| Over 1,029,250 | Over 2,058,550 | 48.39 | 5.68 | |||||||||||||||||||

| 1 | Income generated by the fund’s investments is also generally exempt from New York City taxes, offering additional tax advantages to New York City residents. |

| 2 | Based on 2013 federal and New York state tax rates. (State rates from 4.00% to 8.82% are individually calculated for each bracket. The federal brackets are expanded to include additional state brackets.) The effective combined tax rates assume full deductibility of state taxes. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2013. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.1 Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 12 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

(for the period November 1, 2010, to July 31, 2013, with dividends reinvested)

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The index is unmanaged and, therefore, has no expenses. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2013*

| 1 year | Lifetime (since 11/1/10) | |||

| Class A shares | –6.77% | 2.29% |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect expense reimbursements, without which results would have been lower. These reimbursements may be adjusted or discontinued by the investment adviser at any time, subject to any restrictions in the fund’s prospectus. Visit americanfunds.com for more information.

Quality ratings*

Percent of net assets

| * | Bond ratings, which typically range from Aaa/AAA (highest) to D (lowest), are assigned by credit rating agencies such as Moody’s, Standard & Poor’s and/or Fitch as an indication of an issuer’s creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 13 |

The Tax-Exempt Fund of California

For the 11 months ended July 31, 2013, the fund declined –1.45%. That result was better than the –2.95% total return of the fund’s peer group, as measured by the Lipper California Municipal Debt Funds Average. By way of comparison, the unmanaged Barclays California Municipal Index, which has no expenses, registered a –1.79% return. See page 16 for fund results over extended time periods.

For the period, the fund paid monthly dividends totaling about 58.5 cents a share, amounting to an income return of 3.39% for investors who reinvested dividends. This is equivalent to a taxable income return of 6.91% for investors in the 50.93% effective combined federal and California tax bracket.

The health of the California economy improved markedly over the fiscal period, and the state reported that income and sales tax receipts had increased. With higher income and sales taxes in effect this year, this trend is likely to continue if the economy continues to gain strength.

During the period, the fund’s managers began to position the fund more defensively, opting for shorter duration bonds. The portfolio remains heavily invested in revenue bonds, such as those issued by airports, water and sewer facilities, and electric utilities.

Tax-exempt yields vs. taxable yields

Find your estimated 2013 taxable income below to determine your combined federal and California tax rate,* then look in the right-hand column to see what you would have had to earn from a taxable investment to equal the fund’s 3.68% tax-exempt distribution rate† at July 31, 2013.

| … then your combined | The fund’s tax-exempt | |||||||||||||||||||||

| If your taxable income is … | federal and California | distribution rate of 3.68% is | ||||||||||||||||||||

| Single | Joint | state tax rate is … | equivalent to a taxable rate of … | |||||||||||||||||||

| $ | 0 | – | 7,582 | $ | 0 | – | 15,164 | 10.90 | % | 4.13 | % | |||||||||||

| 7,583 | – | 8,925 | 15,165 | – | 17,850 | 11.80 | 4.17 | |||||||||||||||

| 8,926 | – | 17,976 | 17,851 | – | 35,952 | 16.70 | 4.42 | |||||||||||||||

| 17,977 | – | 28,371 | 35,953 | – | 56,742 | 18.40 | 4.51 | |||||||||||||||

| 28,372 | – | 36,250 | 56,743 | – | 72,500 | 20.10 | 4.61 | |||||||||||||||

| 36,251 | – | 39,384 | 72,501 | – | 78,768 | 29.50 | 5.22 | |||||||||||||||

| 39,385 | – | 49,774 | 78,769 | – | 99,548 | 31.00 | 5.33 | |||||||||||||||

| 49,775 | – | 87,850 | 99,549 | – | 146,400 | 31.98 | 5.41 | |||||||||||||||

| 87,851 | – | 183,250 | 146,401 | – | 223,050 | 34.70 | 5.64 | |||||||||||||||

| 183,251 | – | 254,250 | 223,051 | – | 398,350 | 42.68 | 6.42 | |||||||||||||||

| 254,251 | – | 305,100 | – | 43.31 | 6.49 | |||||||||||||||||

| 305,101 | – | 398,350 | – | 43.94 | 6.56 | |||||||||||||||||

| – | 398,351 | – | 450,000 | 44.49 | 6.63 | |||||||||||||||||

| 398,351 | – | 400,000 | – | 45.72 | 6.78 | |||||||||||||||||

| – | 450,001 | – | 508,500 | 48.66 | 7.17 | |||||||||||||||||

| – | 508,501 | – | 610,200 | 49.23 | 7.25 | |||||||||||||||||

| 400,001 | – | 508,500 | 610,201 | – | 1,000,000 | 49.80 | 7.33 | |||||||||||||||

| 508,501 | – | 1,000,000 | 1,000,001 | – | 1,017,000 | 50.36 | 7.41 | |||||||||||||||

| Over 1,000,000 | Over 1,017,000 | 50.93 | 7.50 | |||||||||||||||||||

| * | Based on 2013 federal and 2013 California tax rates. (State rates from 1.0% to 13.3% are individually calculated for each bracket. The federal brackets are expanded to include additional state brackets.) The effective combined tax rates paid by California residents may be lower than those shown due to the availability of income tax deductions. |

| † | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of July 31, 2013. Capital gains distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown on the following page are for Class A shares and, unless otherwise indicated, reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.1 Thus, the net amount invested was $9,625. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 14 | American Funds Tax-Exempt Funds |

How a $10,000 investment has grown

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The index is unmanaged and, therefore, has no expenses. |

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended July 31, 2013*

| 1 year | 5 years | 10 years | ||||

| Class A shares | –4.73% | 4.68% | 4.12% |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

Quality ratings*

Percent of net assets

| * | Bond ratings, which typically range from Aaa/AAA (highest) to D (lowest), are assigned by credit rating agencies such as Moody’s, Standard & Poor’s and/or Fitch as an indication of an issuer’s creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| American Funds Tax-Exempt Funds | 15 |

Results at a glance

For periods ended July 31, 2013, with distributions reinvested

| Cumulative total returns | Average annual total returns | |||||||||||||||

| 1 year | 5 years | 10 years | Lifetime1 | |||||||||||||

| American Funds Short-Term Tax-Exempt Bond Fund (Class A shares) | 0.16 | % | — | % | — | % | 1.73 | % | ||||||||

| Barclays Municipal Short 1-5 Years Index2,3 | 0.50 | — | — | 2.25 | ||||||||||||

| Lipper Short Municipal Debt Funds Average | 0.08 | — | — | 1.61 | ||||||||||||

| Limited Term Tax-Exempt Bond Fund of America (Class A shares) | –0.13 | 4.20 | 3.70 | 4.35 | ||||||||||||

| Barclays Municipal Short-Intermediate 1-10 Years Index2,4 | –0.18 | 4.15 | 3.93 | 4.56 | ||||||||||||

| Lipper Intermediate Municipal Debt Funds Average | –1.84 | 4.09 | 3.68 | 4.44 | ||||||||||||

| The Tax-Exempt Bond Fund of America (Class A shares) | –1.65 | 4.81 | 4.32 | 6.74 | ||||||||||||

| Barclays Municipal Bond Index2 | –2.19 | 5.07 | 4.71 | – | 5 | |||||||||||

| Lipper General & Insured Municipal Debt Funds Average | –3.04 | 4.48 | 3.94 | 6.49 | ||||||||||||

| American High-Income Municipal Bond Fund (Class A shares) | –0.25 | 5.29 | 4.40 | 5.43 | ||||||||||||

| Barclays Municipal Bond Index2 | –2.19 | 5.07 | 4.71 | 5.64 | ||||||||||||

| Barclays High Yield Municipal Bond Index2 | 0.80 | 6.08 | 6.10 | – | 5 | |||||||||||

| Lipper High-Yield Municipal Debt Funds Average | –2.62 | 4.37 | 4.11 | 4.89 | ||||||||||||

| American Funds Tax-Exempt Fund of New York (Class A shares) | –3.16 | — | — | 3.72 | ||||||||||||

| Barclays New York Municipal Index2 | –2.25 | — | — | 3.00 | ||||||||||||

| Lipper New York Municipal Debt Funds Average | –3.85 | — | — | 2.51 | ||||||||||||

| The Tax-Exempt Fund of California (Class A shares) | –1.03 | 5.48 | 4.52 | 5.69 | ||||||||||||

| Barclays California Municipal Index2 | –1.63 | 5.35 | 4.96 | — | 5 | |||||||||||

| Lipper California Municipal Debt Funds Average | –2.74 | 4.73 | 4.15 | 5.62 | ||||||||||||

| 1 | Since 8/7/09 (American Funds Short-Term Tax-Exempt Bond Fund), 10/6/93 (Limited Term Tax-Exempt Bond Fund of America), 10/3/79 (The Tax-Exempt Bond Fund of America), 9/26/94 (American High-Income Municipal Bond Fund), 11/1/10 (American Funds Tax-Exempt Fund of New York) and 10/28/86 (The Tax-Exempt Fund of California). |

| 2 | The index is unmanaged and, therefore, has no expenses. |

| 3 | Barclays Municipal Short 1–5 Years Index is a market value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to five years. |

| 4 | Barclays Municipal Short-Intermediate 1-10 Years Index is a market-value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to 10 years. |

| 5 | This index did not exist at the fund’s inception. |

| 16 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

Summary investment portfolio July 31, 2013

| Bonds, notes & other debt instruments 81.02% | Principal amount (000) | Value (000) | Percent of net assets | |||||||||

| California 8.27% | ||||||||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2007-E-3, 0.76% 2047 (put 2019)1 | $ | 3,000 | $ | 3,018 | .39 | % | ||||||

| Various Purpose G.O. Ref. Bonds, 5.00% 2018 | 3,000 | 3,500 | .46 | |||||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (St. Joseph Health System), Series 2009-B, 5.00% 2015 | 1,000 | 1,077 | ||||||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (St. Joseph Health System), Series 2009-C, 5.00% 2034 (put 2014) | 4,500 | 4,724 | ||||||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (St. Joseph Health System), Series 2013-B, 5.00% 2043 (put 2017) | 1,145 | 1,298 | 1.15 | |||||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (St. Joseph Health System), Series 2013-D, 5.00% 2043 (put 2020) | 1,500 | 1,705 | ||||||||||

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (J. Paul Getty Trust), Series 2011-A-1, 0.56% 2038 (put 2014)1 | 7,500 | 7,517 | ||||||||||

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (J. Paul Getty Trust), Series 2012-B-1, 0.36% 2047 (put 2015)1 | 530 | 530 | 1.31 | |||||||||

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (J. Paul Getty Trust), Series 2013-A-1, 0.34% 2047 (put 2016)1 | 2,000 | 1,994 | ||||||||||

| Los Angeles County Metropolitan Transportation Auth., Proposition A, Sales Tax Rev. Ref. Bonds, Series 2013-A, 5.00% 2018 | 3,000 | 3,532 | .46 | |||||||||

| Other securities | 34,602 | 4.50 | ||||||||||

| 63,497 | 8.27 | |||||||||||

| Colorado 1.06% | ||||||||||||

| Dept. of Transportation, Transportation Rev. Ref. Anticipation Notes, 5.00% 2016 | 5,000 | 5,690 | .74 | |||||||||

| Other securities | 2,413 | .32 | ||||||||||

| 8,103 | 1.06 | |||||||||||

| Florida 9.46% | ||||||||||||

| Citizens Property Insurance Corp., Coastal Account Secured Bonds, Series 2011-A-1, 5.00% 2015 | 1,500 | 1,611 | ||||||||||

| Citizens Property Insurance Corp., High-Risk Account Secured Bonds, Series 2009-A-1, 6.00% 2017 | 1,300 | 1,503 | ||||||||||

| Citizens Property Insurance Corp., High-Risk Account Secured Bonds, Series 2010-A-1, 5.00% 2015 | 1,000 | 1,074 | 1.33 | |||||||||

| Citizens Property Insurance Corp., High-Risk Account Secured Bonds, Series 2010-A-1, 5.00% 2016 | 4,905 | 5,416 | ||||||||||

| Citizens Property Insurance Corp., High-Risk Account Secured Rev. Ref. Bonds, Series 2007-A, National insured, 5.00% 2015 | 550 | 586 | ||||||||||

| Hurricane Catastrophe Fund Fin. Corp., Rev. Bonds, Series 2010-A, 5.00% 2015 | 4,000 | 4,320 | ||||||||||

| Hurricane Catastrophe Fund Fin. Corp., Rev. Bonds, Series 2010-A, 5.00% 2016 | 4,295 | 4,767 | 1.18 | |||||||||

| City of Lakeland, Energy System Rev. Ref. Bonds, Series 2012, 0.81% 20171 | 3,800 | 3,777 | .49 | |||||||||

| Miami-Dade County, Aviation Rev. Ref. Bonds, Series 2005-B, AMT, Assured Guaranty Municipal insured, 5.00% 2016 | 3,000 | 3,266 | .43 | |||||||||

| State Board of Education, Public Education Capital Outlay Ref. Bonds, Series 2009-B, 5.00% 2015 | 3,000 | 3,250 | .42 | |||||||||

| City of Tampa, Utility Tax Rev. Ref. Bonds, National insured, 5.00% 2015 | 3,615 | 3,954 | .51 | |||||||||

| Other securities | 39,140 | 5.10 | ||||||||||

| 72,664 | 9.46 | |||||||||||

| American Funds Tax-Exempt Funds | 17 |

American Funds Short-Term Tax-Exempt Bond Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | Percent of net assets | |||||||||

| Illinois 3.85% | ||||||||||||

| Unemployment Insurance Fund Building Receipts Rev. Bonds (Illinois Dept. of Employment Security), Series 2012-A, 5.00% 2016 | $ | 4,000 | $ | 4,538 | .59 | % | ||||||

| Other securities | 25,043 | 3.26 | ||||||||||

| 29,581 | 3.85 | |||||||||||

| Indiana 2.80% | ||||||||||||

| Health and Educational Fac. Fncg. Auth., Rev. Bonds (Ascension Health Credit Group), Series 2011-A-1, 1.50% 2036 (put 2014) | 2,000 | 2,025 | ||||||||||

| Health and Educational Fac. Fncg. Auth., Rev. Bonds (Ascension Health Credit Group), Series 2005-A-5, 2.00% 2027 (put 2017) | 2,000 | 2,002 | .93 | |||||||||

| Health Fac. Fin. Auth., Rev. Bonds (Ascension Health Credit Group), Series 2005-A-6, 5.00% 2027 (put 2014) | 3,000 | 3,118 | ||||||||||

| Other securities | 14,379 | 1.87 | ||||||||||

| 21,524 | 2.80 | |||||||||||

| Michigan 3.65% | ||||||||||||

| Kent Hospital Fin. Auth., Rev. Ref. Bonds (Spectrum Health System), Series 2008-A, 5.50% 2047 (put 2015) | 5,000 | 5,361 | .70 | |||||||||

| Regents of the University of Michigan, General Rev. Ref. Bonds, Series 2012-F, 0.46% 2043 (put 2016)1 | 3,000 | 3,000 | .39 | |||||||||

| Other securities | 19,645 | 2.56 | ||||||||||

| 28,006 | 3.65 | |||||||||||

| Minnesota 1.98% | ||||||||||||

| G.O. State Ref. Bonds, Series 2007, 5.00% 2013 | 4,000 | 4,000 | ||||||||||

| G.O. State Various Purpose Ref. Bonds, Series 2010-D, 4.00% 2013 | 4,650 | 4,650 | 1.13 | |||||||||

| Other securities | 6,541 | .85 | ||||||||||

| 15,191 | 1.98 | |||||||||||

| Missouri 1.11% | ||||||||||||

| City of St. Louis, Airport Rev. Ref. Bonds (Lambert-St. Louis International Airport), Series 2007-B, AMT, Assured Guaranty Municipal insured, 5.00% 2016 | 5,000 | 5,515 | .72 | |||||||||

| Other securities | 3,033 | .39 | ||||||||||

| 8,548 | 1.11 | |||||||||||

| Nevada 2.40% | ||||||||||||

| Clark County, Airport System Rev. Bonds, Series 2004-A-1, AMT, FGIC-National insured, 5.50% 2017 | 4,500 | 4,691 | .61 | |||||||||

| Other securities | 13,768 | 1.79 | ||||||||||

| 18,459 | 2.40 | |||||||||||

| 18 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

| Principal amount (000) | Value (000) | Percent of net assets | ||||||||||

| New Jersey 2.84% | ||||||||||||

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2010-2, 4.00% 2013 | $ | 2,000 | $ | 2,024 | ||||||||

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2010-2, 5.00% 2014 | 2,000 | 2,117 | ||||||||||

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2011-A-1, AMT, 0.575% 20201 | 460 | 457 | 1.38 | % | ||||||||

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2012-1A, AMT, 4.00% 2017 | 3,500 | 3,751 | ||||||||||

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2012-1A, AMT, 5.00% 2018 | 2,000 | 2,228 | ||||||||||

| Other securities | 11,256 | 1.46 | ||||||||||

| 21,833 | 2.84 | |||||||||||

| New Mexico 0.88% | ||||||||||||

| Educational Assistance Foundation, Education Loan Rev. Ref. Bonds, Series 2009-C, AMT, 3.90% 2014 | 3,000 | 3,093 | .40 | |||||||||

| Other securities | 3,650 | .48 | ||||||||||

| 6,743 | .88 | |||||||||||

| New York 8.61% | ||||||||||||

| City of New York, G.O. Bonds, Fiscal 2008 Series J-4, 0.61% 20251 | 5,000 | 5,066 | ||||||||||

| City of New York, G.O. Bonds, Fiscal 2010 Series C, 5.00% 2014 | 1,000 | 1,048 | ||||||||||

| City of New York, G.O. Bonds, Fiscal 2010 Series C, 5.00% 2015 | 1,000 | 1,090 | ||||||||||

| City of New York, G.O. Bonds, Fiscal 2011 Series B, 5.00% 2015 | 1,000 | 1,090 | 1.52 | |||||||||

| City of New York, G.O. Bonds, Fiscal 2011 Series I-1, 5.00% 2015 | 1,000 | 1,090 | ||||||||||

| City of New York, G.O. Bonds, Fiscal 2011 Series I-1, 5.00% 2017 | 1,000 | 1,145 | ||||||||||

| City of New York, G.O. Bonds, Fiscal 2012 Series I, 5.00% 2018 | 1,000 | 1,165 | ||||||||||

| New York City, Health and Hospitals Corp., Health System Rev. Ref. Bonds, Series 2010-A, 5.00% 2017 | 3,000 | 3,348 | .43 | |||||||||

| Triborough Bridge and Tunnel Auth., General Rev. Bonds, Series 2008-B, 5.00% 2025 (put 2013) | 4,000 | 4,053 | .53 | |||||||||

| Other securities | 47,063 | 6.13 | ||||||||||

| 66,158 | 8.61 | |||||||||||

| North Carolina 0.39% | ||||||||||||

| Medical Care Commission, Health Care Facs. Rev. Ref. Bonds (Wake Forest Baptist Obligated Group), Series 2012-C, 0.80% 2033 (put 2017)1 | 3,000 | 3,000 | .39 | |||||||||

| North Dakota 0.52% | ||||||||||||

| Housing Fin. Agcy., Housing Fin. Program Bonds (Home Mortgage Fin. Program), Series 2012-A, 3.75% 2042 | 3,785 | 3,960 | .52 | |||||||||

| Ohio 3.04% | ||||||||||||

| City of Cleveland, Airport System Rev. Bonds, Series 2000-C, Assured Guaranty Municipal insured, 5.00% 2017 | 2,500 | 2,779 | ||||||||||

| City of Cleveland, Airport System Rev. Ref. Bonds, Series 2011-A, Assured Guaranty Municipal insured, 5.00% 2016 | 4,500 | 4,915 | 1.00 | |||||||||

| Other securities | 15,655 | 2.04 | ||||||||||

| 23,349 | 3.04 | |||||||||||

| American Funds Tax-Exempt Funds | 19 |

American Funds Short-Term Tax-Exempt Bond Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | Percent of net assets | |||||||||

| Oregon 1.33% | ||||||||||||

| Dept. of Administrative Services, Ref. Certs. of Part., Series 2009-D, 5.00% 2013 | $ | 3,345 | $ | 3,386 | .44 | % | ||||||

| Other securities | 6,859 | .89 | ||||||||||

| 10,245 | 1.33 | |||||||||||

| Pennsylvania 2.15% | ||||||||||||

| Econ. Dev. Fncg. Auth., Unemployment Compensation Rev. Bonds, Series 2012-B, 5.00% 2021 | 4,000 | 4,572 | .59 | |||||||||

| Other securities | 11,962 | 1.56 | ||||||||||

| 16,534 | 2.15 | |||||||||||

| South Carolina 0.40% | ||||||||||||

| Public Service Auth., Rev. Ref. Obligations (Santee Cooper), Series 2012-C, 5.00% 2013 | 3,000 | 3,048 | .40 | |||||||||

| Tennessee 2.02% | ||||||||||||

| Housing Dev. Agcy., Homeownership Program Bonds, Issue 2012-1-C, 4.50% 2037 | 1,410 | 1,551 | ||||||||||

| Housing Dev. Agcy., Homeownership Program Bonds, Issue 2012-2-C, 4.00% 2038 | 980 | 1,058 | ||||||||||

| Housing Dev. Agcy., Homeownership Program Rev. Ref. Bonds, Issue 2011-1-A, AMT, 4.50% 2031 | 2,725 | 2,922 | 1.15 | |||||||||

| Housing Dev. Agcy., Homeownership Program Rev. Ref. Bonds, Issue 2012-1-A, AMT, 4.50% 2038 | 1,175 | 1,238 | ||||||||||

| Housing Dev. Agcy., Residential Fin. Program Bonds, Issue 2013-1-C, 3.00% 2038 | 2,000 | 2,074 | ||||||||||

| Memphis-Shelby County Airport Auth., Airport Rev. Ref. Bonds, Series 2011-A-1, AMT, 5.00% 2016 | 3,220 | 3,536 | .46 | |||||||||

| Other securities | 3,138 | .41 | ||||||||||

| 15,517 | 2.02 | |||||||||||

| Texas 5.75% | ||||||||||||

| Grand Parkway Transportation Corp., System Toll Rev. Bonds, Series 2013-C, 2.00% 2017 (put 2014) | 5,000 | 5,040 | .66 | |||||||||

| Houston Independent School Dist. (Harris County), Limited Tax Schoolhouse Bonds, Series 2013-B, 1.00% 2035 (put 2014) | 6,000 | 6,027 | ||||||||||

| Houston Independent School Dist. (Harris County), Limited Tax Schoolhouse Bonds, Series 2013-B, 2.00% 2037 (put 2016) | 3,400 | 3,489 | 1.24 | |||||||||

| Other securities | 29,611 | 3.85 | ||||||||||

| 44,167 | 5.75 | |||||||||||

| Vermont 0.53% | ||||||||||||

| Student Assistance Corp., Education Loan Rev. Notes, Series 2012-B, AMT, 1.773% 20221 | 4,054 | 4,066 | .53 | |||||||||

| Virginia 0.43% | ||||||||||||

| Tobacco Settlement Fncg. Corp., Tobacco Settlement Asset-backed Bonds, Series 2005, 5.50% 2026 (preref. 2014) | 3,080 | 3,285 | .43 | |||||||||

| Washington 2.65% | ||||||||||||

| Public Utility Dist. No. 2 of Grant County, Electric System Rev. Ref. Bonds, Series 2011-I, 5.00% 2017 | 3,750 | 4,227 | .55 | |||||||||

| Other securities | 16,092 | 2.10 | ||||||||||

| 20,319 | 2.65 | |||||||||||

| 20 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

| Principal amount (000) | Value (000) | Percent of net assets | ||||||||||

| Wisconsin 1.30% | ||||||||||||

| Health and Educational Facs. Auth., Rev. Bonds (Ascension Health Alliance Senior Credit Group), Series 2013-B-2, 4.00% 2043 (put 2019) | $ | 1,000 | $ | 1,087 | .14 | % | ||||||

| Other securities | 8,902 | 1.16 | ||||||||||

| 9,989 | 1.30 | |||||||||||

| Other states & U.S. territories 13.60% | ||||||||||||

| Other securities | 104,427 | 13.60 | ||||||||||

| Total bonds, notes & other debt instruments (cost: $614,838,000) | 622,213 | 81.02 | ||||||||||

| Short-term securities 19.86% | ||||||||||||

| State of Alaska, City of Valdez, Marine Terminal Rev. Ref. Bonds (ExxonMobil Project), Series 2001, 0.05% 20291 | 2,000 | 2,000 | ||||||||||

| State of Alaska, City of Valdez, Marine Terminal Rev. Ref. Bonds (Exxon Pipeline Co. Project), Series 1993-C, 0.05% 20331 | 3,500 | 3,500 | ||||||||||

| State of Texas, Lower Neches Valley Auth., Industrial Dev. Corp., Exempt Facs. Rev. Ref. Bonds (ExxonMobil Project), Series 2001-B, AMT, 0.05% 20291 | 16,200 | 16,200 | 4.38 | |||||||||

| Lincoln County, Wyoming, Pollution Control Rev. Bonds (Exxon Project), Series 1987-B, AMT, 0.04% 20171 | 5,900 | 5,900 | ||||||||||

| Lincoln County, Wyoming, Pollution Control Rev. Bonds (Exxon Project), Series 1987-C, AMT, 0.04% 20171 | 6,000 | 6,000 | ||||||||||

| Maricopa County, Arizona Pollution Control Corp., Pollution Control Rev. Ref. Bonds (Arizona Public Service Co. Palo Verde Project), Series 2009-B, JPMorgan Chase LOC, 0.05% 20291 | 5,000 | 5,000 | .65 | |||||||||

| California Infrastructure and Econ. Dev. Bank, Demand Rev. Bonds (Buck Institute for Age Research), Series 2001, U.S. Bank LOC, 0.04% 20371 | 12,000 | 12,000 | 1.56 | |||||||||

| California Health Facs. Fncg. Auth., Rev. Bonds (St. Joseph Health System), Series 2011-B, 0.05% 20411 | 1,000 | 1,000 | .13 | |||||||||

| California Pollution Control Fncg. Auth., Pollution Control Rev. Ref. Bonds (Pacific Gas and Electric Co.), Series 1996-C, JPMorgan Chase LOC, 0.06% 20261 | 4,100 | 4,100 | .53 | |||||||||

| State of Connecticut, Health and Educational Facs. Auth., Rev. Bonds (Yale University Issue), Series 2001-V-1, 0.03% 20361 | 550 | 550 | ||||||||||

| State of Connecticut, Health and Educational Facs. Auth., Rev. Bonds | .67 | |||||||||||

| (Yale University Issue), Series Y-3, 0.03% 20351 | 4,600 | 4,600 | ||||||||||

| Jackson County, Mississippi, Port Fac. Rev. Ref. Bonds (Chevron U.S.A. Inc. Project), Series 1993, 0.04% 20231 | 2,700 | 2,700 | ||||||||||

| Mississippi Business Fin. Corp., Gulf Opportunity Zone Industrial Dev. Rev. Bonds (Chevron U.S.A. Inc. Project), Series 2009-F, 0.05% 20301 | 1,200 | 1,200 | ||||||||||

| Mississippi Business Fin. Corp., Gulf Opportunity Zone Industrial Dev. Rev. Bonds (Chevron U.S.A. Inc. Project), Series 2007-A, 0.05% 20301 | 7,400 | 7,400 | ||||||||||

| Mississippi Business Fin. Corp., Gulf Opportunity Zone Industrial Dev. Rev. Bonds (Chevron U.S.A. Inc. Project), Series 2007-E, 0.05% 20301 | 3,700 | 3,700 | 3.69 | |||||||||

| Mississippi Business Fin. Corp., Gulf Opportunity Zone Industrial Dev. Rev. Bonds (Chevron U.S.A. Inc. Project), Series 2009-C, 0.04% 20301 | 5,250 | 5,250 | ||||||||||

| Mississippi Business Fin. Corp., Gulf Opportunity Zone Industrial Dev. Rev. Bonds (Chevron U.S.A. Inc. Project), Series 2010-B, 0.04% 20301 | 1,000 | 1,000 | ||||||||||

| Mississippi Business Fin. Corp., Gulf Opportunity Zone Industrial Dev. Rev. Bonds (Chevron U.S.A. Inc. Project), Series 2011-A, 0.04% 20351 | 7,095 | 7,095 | ||||||||||

| American Funds Tax-Exempt Funds | 21 |

American Funds Short-Term Tax-Exempt Bond Fund

| Short-term securities (continued) | Principal amount (000) | Value (000) | Percent of net assets | |||||||||

| Health and Educational Facs. Auth. of the State of Missouri, Demand Educational Facs. Rev. Bonds (Washington University), Series 2004-B, 0.05% 20341 | $ | 1,000 | $ | 1,000 | ||||||||

| Health and Educational Facs. Auth. of the State of Missouri, Demand Educational Facs. Rev. Bonds (Washington University), Series 1996-A, 0.05% 20301 | 2,800 | 2,800 | .79 | % | ||||||||

| Health and Educational Facs. Auth. of the State of Missouri, Demand Educational Facs. Rev. Bonds (Washington University), Series 1996-D, 0.04% 20301 | 2,300 | 2,300 | ||||||||||

| Health and Educational Facs. Auth. of the State of Missouri, Demand Educational Facs. Rev. Ref. Bonds (Saint Louis University), Series 2008-A-2, 0.04% 20351 | 8,050 | 8,050 | 1.05 | |||||||||

| New Hampshire Health and Education Facs. Auth., Rev. Ref. Bonds (Dartmouth College Issue), Series 2007-A, 0.05% 20311 | 9,500 | 9,500 | 1.24 | |||||||||

| City of New York, New York, G.O. Bonds, Fiscal 1993 Series A-7, JPMorgan Chase LOC, 0.05% 20201 | 6,300 | 6,300 | ||||||||||

| City of New York, New York, G.O. Bonds, Fiscal 2008 Series L, Subseries L-4, 0.04% 20381 | 800 | 800 | 1.59 | |||||||||

| City of New York, New York, G.O. Bonds, Fiscal 2012 Series G, Subseries G-5, 0.03% 20421 | 5,100 | 5,100 | ||||||||||

| Charlotte-Mecklenburg Hospital Auth., North Carolina, Carolinas HealthCare System, Health Care Rev. Ref. Bonds, Series 2007-B, Wells Fargo Bank LOC, 0.04% 20451 | 9,575 | 9,575 | 1.25 | |||||||||

| Other securities | 17,885 | 2.33 | ||||||||||

| Total short-term securities (cost: $152,505,000) | 152,505 | 19.86 | ||||||||||

| Total investment securities (cost: $767,343,000) | 774,718 | 100.88 | ||||||||||

| Other assets less liabilities | (6,709 | ) | (.88 | ) | ||||||||

| Net assets | $ | 768,009 | 100.00 | % | ||||||||

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

| 1 | Coupon rate may change periodically. For short-term securities, the date of the next scheduled coupon rate change is considered to be the maturity date. |

Key to abbreviations

Agcy. = Agency

AMT = Alternative Minimum Tax

Auth. = Authority

Certs. of Part. = Certificates of Participation

Dept. = Department

Dev. = Development

Dist. = District

Econ. = Economic

Fac. = Facility

Facs. = Facilities

Fin. = Finance

Fncg. = Financing

G.O. = General Obligation

LOC = Letter of Credit

Preref. = Prerefunded

Redev. = Redevelopment

Ref. = Refunding

Rev. = Revenue

TECP = Tax-Exempt Commercial Paper

See Notes to Financial Statements

| 22 | American Funds Tax-Exempt Funds |

Limited Term Tax-Exempt Bond Fund of America

Summary investment portfolio July 31, 2013

| Bonds, notes & other debt instruments 90.49% | Principal amount (000) | Value (000) | Percent of net assets | |||||||||

| Alabama 1.20% | ||||||||||||

| Federal Aid Highway Fin. Auth., Federal Highway Grant Anticipation Bonds, Series 2012, 5.00% 2022 | $ | 8,385 | $ | 9,583 | .31 | % | ||||||

| Other securities | 27,230 | .89 | ||||||||||

| 36,813 | 1.20 | |||||||||||

| Arizona 2.32% | ||||||||||||

| Industrial Dev. Auth. of the County of Maricopa, Health Fac. Rev. Ref. Bonds (Catholic Healthcare West), Series 2009-C, 5.00% 2038 (put 2014) | 8,500 | 8,803 | .28 | |||||||||

| Other securities | 62,725 | 2.04 | ||||||||||

| 71,528 | 2.32 | |||||||||||

| California 11.80% | ||||||||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2006-C-1, 0.96% 2045 (put 2023)1 | 10,000 | 9,917 | .32 | |||||||||

| Econ. Recovery Bonds, Ref. Series 2009-A, 5.00% 2020 | 9,000 | 10,557 | ||||||||||

| Econ. Recovery Bonds, Ref. Series 2009-B, 5.00% 2023 (put 2014) | 11,250 | 11,742 | .72 | |||||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (St. Joseph Health System), Series 2009-D, 5.00% 2034 (put 2016) | 7,500 | 8,312 | .27 | |||||||||

| City of Long Beach, Harbor Rev. Ref. Bonds, Series 1998-A, AMT, FGIC-National insured, 6.00% 2016 | 8,430 | 9,570 | .31 | |||||||||

| Los Angeles Unified School Dist. (County of Los Angeles), G.O. Ref. Bonds, Series 2011-A-1, 5.00% 2018 | 7,010 | 8,220 | .27 | |||||||||

| Port of Oakland, Rev. Ref. Bonds, Series 2012-P, AMT, 5.00% 2021 | 7,750 | 8,680 | .28 | |||||||||

| Pollution Control Fncg. Auth., Solid Waste Disposal Rev. Ref. Bonds (Republic Services, Inc. Project), Series 2002-C, AMT, 5.25% 2023 (put 2017)2 | 8,250 | 8,918 | .29 | |||||||||

| Public Facs. Fncg. Auth. of the City of San Diego, Sewer Rev. Bonds, Series 2009-A, 5.00% 2017 | 8,500 | 9,729 | .32 | |||||||||

| City of San Jose, Airport Rev. Bonds, Series 2007-A, AMT, AMBAC insured, 5.50% 2020 | 7,820 | 8,646 | .28 | |||||||||

| Other securities | 269,143 | 8.74 | ||||||||||

| 363,434 | 11.80 | |||||||||||

| Connecticut 0.47% | ||||||||||||

| Special Tax Obligation Ref. Bonds, Transportation Infrastructure Purposes, Series 2009-1, 5.00% 2019 | 8,550 | 10,066 | .33 | |||||||||

| Other securities | 4,522 | .14 | ||||||||||

| 14,588 | .47 | |||||||||||

| District of Columbia 1.44% | ||||||||||||

| University Rev. Bonds (Georgetown University Issue), Series 2001-B, 4.70% 2031 (put 2018) | 8,500 | 9,468 | .31 | |||||||||

| Other securities | 34,722 | 1.13 | ||||||||||

| 44,190 | 1.44 | |||||||||||

| American Funds Tax-Exempt Funds | 23 |

Limited Term Tax-Exempt Bond Fund of America

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | Percent of net assets | |||||||||

| Florida 9.77% | ||||||||||||

| Citizens Property Insurance Corp., Coastal Account Secured Bonds, Series 2011-A-1, 5.00% 2018 | $ | 2,000 | $ | 2,271 | ||||||||

| Citizens Property Insurance Corp., Coastal Account Secured Bonds, Series 2011-A-1, 5.00% 2019 | 5,000 | 5,678 | ||||||||||

| Citizens Property Insurance Corp., High-Risk Account Secured Bonds, Series 2009-A-1, 5.50% 2017 | 10,035 | 11,426 | 1.21 | % | ||||||||

| Citizens Property Insurance Corp., High-Risk Account Secured Bonds, Series 2010-A-1, 5.00% 2015 | 8,000 | 8,591 | ||||||||||

| Citizens Property Insurance Corp., High-Risk Account Secured Bonds, Series 2010-A-1, 5.25% 2017 | 8,350 | 9,430 | ||||||||||

| Hurricane Catastrophe Fund Fin. Corp., Rev. Bonds, Series 2008-A, 5.00% 2014 | 13,500 | 14,077 | .46 | |||||||||

| Jacksonville Aviation Auth., Rev. Bonds, Series 2006, AMT, AMBAC insured, 5.00% 2018 | 7,585 | 8,408 | .27 | |||||||||

| Miami-Dade County, Aviation Rev. Bonds, Series 2010-A, 5.00% 2021 | 2,250 | 2,558 | ||||||||||

| Miami-Dade County, Aviation Rev. Ref. Bonds, Series 2012-A, AMT, 5.00% 2020 | 5,750 | 6,481 | ||||||||||

| Miami-Dade County, Aviation Rev. Ref. Bonds, Series 2012-A, AMT, 5.00% 2021 | 11,600 | 12,874 | ||||||||||

| Miami-Dade County, Miami International Airport (Hub of the Americas), Aviation Rev. Ref. Bonds, Series 2003-E, AMT, National insured, 5.375% 2017 | 2,000 | 2,290 | ||||||||||

| Miami-Dade County, Miami International Airport (Hub of the Americas), Aviation Rev. Ref. Bonds, Series 2005-B, AMT, XLCA insured, 5.00% 2018 | 1,000 | 1,082 | 1.09 | |||||||||

| Miami-Dade County, Miami International Airport (Hub of the Americas), Aviation Rev. Ref. Bonds, Series 2009-A, 5.75% 2022 | 1,500 | 1,695 | ||||||||||