UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-8598

The Commerce Funds

(Exact name of registrant as specified in charter)

|

| 922 Walnut Fourth Floor Kansas City, Missouri 64106 |

| (Address of principal executive offices) (Zip code) |

Diana E. McCarthy, Esq.,

Drinker Biddle & Reath LLP

One Logan Square

18th & Cherry Streets

Philadelphia, PA 19103

(Name and address of agent for service)

Registrant’s telephone number, including area code:1-800-995-6365

Date of fiscal year end 10/31/04

Date of reporting period: 4/30/04

| ITEM 1. | | REPORTS TO SHAREHOLDERS |

The following is a copy of the Semi-Annual Report to Shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

The Commerce Funds

Semi-Annual Report

April 30, 2004

commerce funds

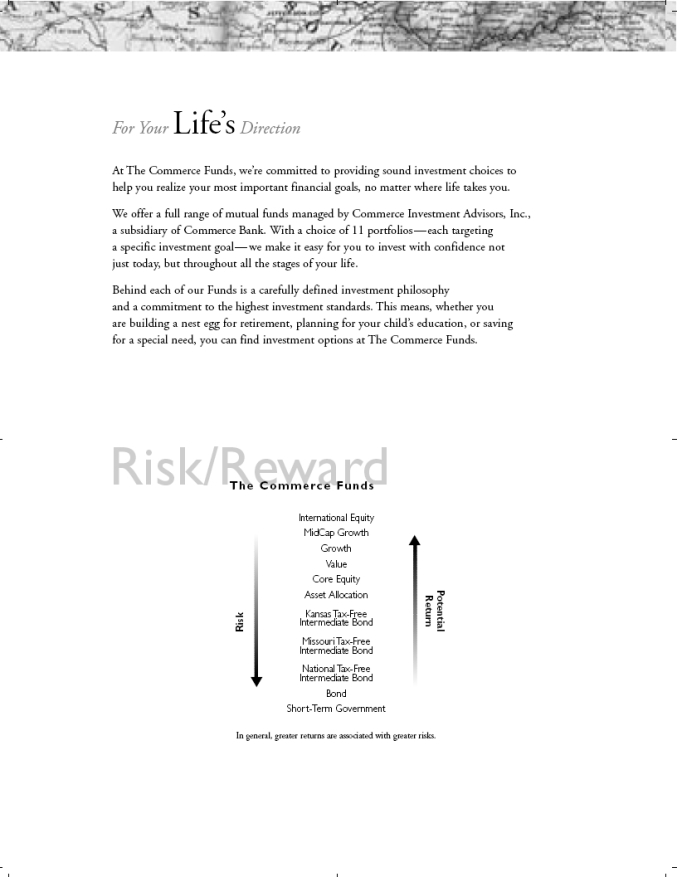

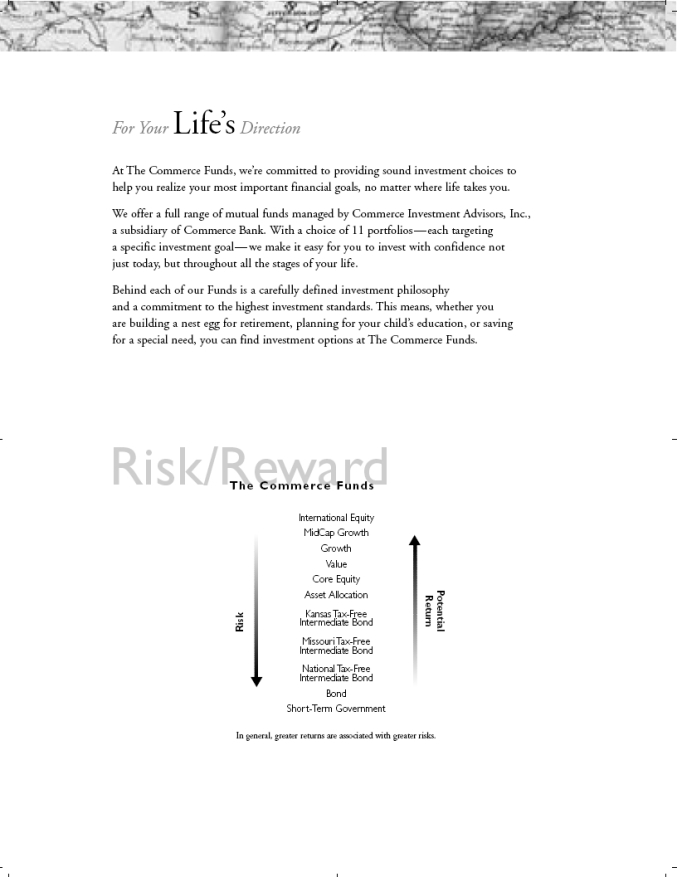

For Your Life’s Direction

At The Commerce Funds, we’re committed to providing sound investment choices to help you realize your most important financial goals, no matter where life takes you.

We offer a full range of mutual funds managed by Commerce Investment Advisors, Inc., a subsidiary of Commerce Bank. With a choice of 11 portfolios—each targeting a specific investment goal—we make it easy for you to invest with confidence not just today, but throughout all the stages of your life.

Behind each of our Funds is a carefully defined investment philosophy and a commitment to the highest investment standards. This means, whether you are building a nest egg for retirement, planning for your child’s education, or saving for a special need, you can find investment options at The Commerce Funds.

Risk/Reward

The Commerce Funds

International Equity

MidCap Growth

Growth

Value

Core Equity

Asset Allocation

Kansas Tax-Free

Intermediate Bond

Missouri Tax-Free

Intermediate Bond

National Tax-Free

Intermediate Bond

Bond

Short-Term Government

Risk Potential Return

In general, greater returns are associated with greater risks.

COMMERCE FUNDS

Table of Contents

| | |

Performance Reviews and Statements of Investments | | |

| |

Core Equity | | 2 |

| |

Growth | | 4 |

| |

Value | | 6 |

| |

MidCap Growth | | 8 |

| |

International Equity | | 10 |

| |

Asset Allocation | | 14 |

| |

Bond | | 15 |

| |

Short-Term Government | | 20 |

| |

National Tax-Free Intermediate Bond | | 23 |

| |

Missouri Tax-Free Intermediate Bond | | 30 |

| |

Kansas Tax-Free Intermediate Bond | | 36 |

| |

Statements of Assets and Liabilities | | 40 |

| |

Statements of Operations | | 42 |

| |

Statements of Changes in Net Assets | | 44 |

| |

Notes to Financial Statements | | 48 |

| |

Financial Highlights | | 60 |

Please note:

The information in this semi-annual report is as of April 30, 2004 and is unaudited. To view more recent information about each Commerce Fund’s performance and portfolio or to get a prospectus, please visit our website at www.commercefunds.com.

You may also receive Commerce Funds information by calling toll free 1-800-995-6365 or by writing to P.O. Box 219525, Kansas City, Missouri, 64121-9525, or you may contact your investment professional. The Commerce Funds publish performance and portfolio information for each Commerce Fund at the end of every calendar quarter. Investors should read the prospectus carefully before investing or sending money.

COMMERCE CORE EQUITY FUND

Core Equity Fund

Performance Review(a) (Unaudited)

For the six months ended April 30, 2004, the Institutional Shares of the Fund had a total return of 6.65%, based on Net Asset Value (NAV). The Service Shares had a total return, without sales charge, of 6.55% for the same period based on NAV. This compares to the Lipper Large Cap Core Funds Index(b) six-month return of 5.09% and the S&P 500 Index(c) six-month return of 6.27%. Past performance is no guarantee of future results.

Statement of Investments

April 30, 2004 (Unaudited)

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – 97.8% |

| Commercial Services – 1.0% |

| 32,525 | | Omnicom Group, Inc. | | $ 2,586,063 |

|

| Communications – 1.6% |

| 108,935 | | Verizon Communications, Inc. | | 4,111,207 |

|

| Consumer Durables – 5.1% |

| 66,960 | | Fortune Brands, Inc. | | 5,105,700 |

| 83,395 | | Harley-Davidson, Inc. | | 4,696,806 |

| 135,940 | | Leggett & Platt, Inc. | | 3,072,244 |

| | | | |

|

| | | | | 12,874,750 |

|

| Consumer Non-Durables – 4.2% |

| 38,090 | | Anheuser-Busch Companies, Inc. | | 1,951,732 |

| 70,275 | | Jones Apparel Group, Inc. | | 2,572,065 |

| 57,335 | | The Procter & Gamble Co. | | 6,063,176 |

| | | | |

|

| | | | | 10,586,973 |

|

| Consumer Services – 6.7% |

| 65,385 | | eBay, Inc.* | | 5,219,031 |

| 112,095 | | Fox Entertainment Group, Inc.* | | 3,121,846 |

| 82,465 | | International Game Technology | | 3,112,229 |

| 163,875 | | McDonald’s Corp. | | 4,462,316 |

| 31,710 | | Viacom, Inc. Class B* | | 1,225,591 |

| | | | |

|

| | | | | 17,141,013 |

|

| Distribution Services – 3.0% |

| 26,435 | | Cardinal Health, Inc. | | 1,936,364 |

| 150,215 | | SYSCO Corp. | | 5,745,723 |

| | | | |

|

| | | | | 7,682,087 |

|

| Electronic Technology – 9.9% |

| 240,590 | | Cisco Systems, Inc.* | | 5,021,113 |

| 123,120 | | Dell, Inc.* | | 4,273,495 |

| 153,105 | | Intel Corp. | | 3,939,392 |

| 83,660 | | National Semiconductor Corp.* | | 3,412,491 |

| 41,580 | | QUALCOMM, Inc. | | 2,597,087 |

| 76,910 | | Tektronix, Inc. | | 2,276,536 |

|

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| Electronic Technology – (continued) |

| 94,350 | | Texas Instruments, Inc. | | $ 2,368,185 |

| 52,300 | | UTStarcom, Inc.* | | 1,378,105 |

| | | | |

|

| | | | | 25,266,404 |

|

| Energy Minerals – 5.7% |

| 58,680 | | ConocoPhillips | | 4,183,884 |

| 44,355 | | EOG Resources, Inc. | | 2,184,484 |

| 190,960 | | Exxon Mobil Corp. | | 8,125,348 |

| | | | |

|

| | | | | 14,493,716 |

|

| Finance – 20.7% |

| 86,180 | | AFLAC, Inc. | | 3,639,381 |

| 42,000 | | Bank of America Corp. | | 3,380,580 |

| 67,325 | | Charter One Financial, Inc. | | 2,246,635 |

| 169,295 | | Citigroup, Inc. | | 8,141,397 |

| 67,880 | | Freddie Mac | | 3,964,192 |

| 68,685 | | J. P. Morgan Chase & Co. | | 2,582,556 |

| 33,610 | | Legg Mason, Inc. | | 3,094,137 |

| 49,995 | | Lehman Brothers Holdings, Inc. | | 3,669,633 |

| 53,510 | | Lincoln National Corp. | | 2,401,529 |

| 67,330 | | Merrill Lynch & Co., Inc. | | 3,651,306 |

| 199,180 | | Principal Financial Group, Inc. | | 7,031,054 |

| 81,620 | | Wachovia Corp. | | 3,734,115 |

| 61,455 | | Washington Mutual, Inc. | | 2,420,712 |

| 51,640 | | Wells Fargo & Co. | | 2,915,594 |

| | | | |

|

| | | | | 52,872,821 |

|

| Health Services – 2.5% |

| 58,940 | | Aetna, Inc. | | 4,877,285 |

| 40,920 | | Lincare Holdings, Inc.* | | 1,421,152 |

| | | | |

|

| | | | | 6,298,437 |

|

| Health Technology – 9.8% |

| 66,755 | | Amgen, Inc.* | | 3,756,304 |

| 86,150 | | Boston Scientific Corp.* | | 3,548,519 |

|

| (a) | | Fund returns assume fee waivers and expense reductions and are not annualized. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (b) | | The Lipper Large Cap Core Funds Index is an unmanaged index consisting of funds that, by portfolio practice, invest at least 75% of their equity assets in companies that have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index. The Index figures do not reflect any fees, expenses or taxes. |

| (c) | | The S&P 500 Index is an unmanaged index that emphasizes large capitalization companies. The Index figures do not reflect any fees, expenses or taxes. |

| | |

| 2 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE CORE EQUITY FUND

| | | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

Health Technology – (continued) |

| 16,715 | | Genentech, Inc.* | | $ | 2,052,602 |

| 66,605 | | Johnson & Johnson | | | 3,598,668 |

| 55,780 | | Medtronic, Inc. | | | 2,814,659 |

| 133,240 | | Pfizer, Inc. | | | 4,764,662 |

| 18,165 | | Stryker Corp. | | | 1,797,063 |

| 34,460 | | Zimmer Holdings, Inc.* | | | 2,751,631 |

| | | | |

|

|

| | | | | | 25,084,108 |

|

Producer Manufacturing – 9.8% |

| 65,640 | | 3M Co. | | | 5,676,547 |

| 43,390 | | Caterpillar, Inc. | | | 3,372,705 |

| 67,600 | | Danaher Corp. | | | 6,254,352 |

| 193,435 | | General Electric Co. | | | 5,793,378 |

| 59,300 | | Ingersoll-Rand Co. | | | 3,827,815 |

| | | | |

|

|

| | | | | | 24,924,797 |

|

Retail Trade – 6.1% |

| 28,000 | | AutoZone, Inc.* | | | 2,451,960 |

| 68,825 | | Best Buy Co., Inc. | | | 3,733,756 |

| 161,715 | | Office Depot, Inc.* | | | 2,831,630 |

| 38,685 | | The Gap, Inc. | | | 851,457 |

| 64,825 | | Wal-Mart Stores, Inc. | | | 3,695,025 |

| 61,550 | | Williams-Sonoma, Inc.* | | | 1,999,144 |

| | | | |

|

|

| | | | | | 15,562,972 |

|

Technology Services – 8.1% |

| 50,215 | | International Business

Machines Corp. | | | 4,427,456 |

| 346,835 | | Microsoft Corp. | | | 9,007,305 |

| 186,515 | | Oracle Corp.* | | | 2,092,698 |

| 81,755 | | Symantec Corp.* | | | 3,683,063 |

| 28,230 | | Yahoo!, Inc.* | | | 1,424,486 |

| | | | |

|

|

| | | | | | 20,635,008 |

|

Transportation – 1.1% |

| 39,015 | | FedEx Corp. | | | 2,805,569 |

|

Utilities – 2.5% |

| 37,430 | | Entergy Corp. | | | 2,043,678 |

| 65,440 | | Exelon Corp. | | | 4,380,554 |

| | | | |

|

|

| | | | | | 6,424,232 |

|

| TOTAL COMMON STOCKS | | | |

(Cost $217,128,846) | | $ | 249,350,157 |

|

| | | | | | | |

Principal Amount | | Interest

Rate | | Maturity

Date | | Value |

| Repurchase Agreement – 1.2% |

| State Street Bank & Trust Co.^ | | | |

| $2,962,000 | | 0.75% | | 05/03/2004 | | $ | 2,962,000 |

| Maturity Value: $2,962,185 | | | | | |

|

| TOTAL REPURCHASE AGREEMENT | | | |

(Cost $2,962,000) | | | | $ | 2,962,000 |

|

| TOTAL INVESTMENTS – 99.0% | | | |

(Cost $220,090,846) | | | | | 252,312,157 |

| Other assets in excess of liabilities – 1.0% | | | 2,490,785 |

|

| Net Assets – 100.0% | | $ | 254,802,942 |

|

| | |

| * | | Non-income producing security. |

| ^ | | Repurchase agreement was entered into on April 30, 2004. At April 30, 2004, this agreement was fully collateralized by U.S. Treasury Notes. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 3 |

COMMERCE GROWTH FUND

Growth Fund

Performance Review(a) (Unaudited)

For the six months ended April 30, 2004, the Institutional Shares of the Fund had a total return of 2.59%, based on Net Asset Value (NAV). The Service Shares had a total return, without sales charge, of 2.48% for the same period based on NAV. This compares to the Lipper Large-Cap Growth Funds Index(b) six-month return of 2.70% and the Russell 1000 Growth Index(c) six-month return of 4.14%. Past performance is no guarantee of future results.

Statement of Investments

April 30, 2004 (Unaudited)

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – 99.8% |

| Communications – 1.3% | | |

| 105,600 | | Nextel Communications, Inc.* | | $ 2,519,616 |

|

| Consumer Durables – 1.0% | | |

| 39,000 | | Electronic Arts, Inc.* | | 1,974,180 |

|

| Consumer Non-Durables – 6.8% | | |

| 40,400 | | Anheuser-Busch Companies, Inc. | | 2,070,096 |

| 29,000 | | Colgate-Palmolive Co. | | 1,678,520 |

| 63,100 | | PepsiCo, Inc. | | 3,438,319 |

| 58,900 | | The Procter & Gamble Co. | | 6,228,675 |

| | | | |

|

| | | | | 13,415,610 |

|

| Consumer Services – 3.9% | | |

| 32,600 | | eBay, Inc.* | | 2,602,132 |

| 51,100 | | Harrah’s Entertainment, Inc. | | 2,717,498 |

| 60,900 | | International Game Technology | | 2,298,366 |

| | | | |

|

| | | | | 7,617,996 |

|

| Distribution Services – 1.6% | | |

| 26,700 | | CDW Corp. | | 1,668,483 |

| 39,500 | | SYSCO Corp. | | 1,510,875 |

| | | | |

|

| | | | | 3,179,358 |

|

| Electronic Technology – 20.2% | | |

| 86,600 | | Advanced Fibre Communications, Inc.* | | 1,446,220 |

| 406,700 | | Cisco Systems, Inc.* | | 8,487,829 |

| 153,700 | | Dell, Inc.* | | 5,334,927 |

| 76,500 | | Fairchild Semiconductor International, Inc.* | | 1,489,455 |

| 262,300 | | Intel Corp. | | 6,748,979 |

| 74,600 | | Jabil Circuit, Inc.* | | 1,968,694 |

| 60,200 | | L-3 Communications Holdings, Inc. | | 3,716,748 |

| 75,500 | | Lam Research Corp.* | | 1,671,570 |

| 26,700 | | Lexmark International, Inc.* | | 2,415,282 |

| 74,300 | | Microchip Technology, Inc. | | 2,081,886 |

| 143,900 | | Texas Instruments, Inc. | | 3,611,890 |

|

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| Electronic Technology – (continued) | | |

| 35,000 | | UTStarcom, Inc.* | | $ 922,250 |

| | | | |

|

| | | | | 39,895,730 |

|

| Energy Minerals – 1.7% | | |

| 69,300 | | EOG Resources, Inc. | | 3,413,025 |

|

| Finance – 10.6% | | |

| 77,500 | | American Express Co. | | 3,793,625 |

| 43,200 | | American International Group, Inc. | | 3,095,280 |

| 43,600 | | Citigroup, Inc. | | 2,096,724 |

| 66,800 | | Morgan Stanley & Co., Inc. | | 3,432,852 |

| 36,200 | | The Progressive Corp. | | 3,168,224 |

| 95,100 | | Wells Fargo & Co. | | 5,369,346 |

| | | | |

|

| | | | | 20,956,051 |

|

| Health Services – 4.6% | | |

| 20,800 | | Quest Diagnostics, Inc. | | 1,754,480 |

| 80,300 | | UnitedHealth Group, Inc. | | 4,936,844 |

| 22,100 | | WellPoint Health Networks, Inc.* | | 2,468,349 |

| | | | |

|

| | | | | 9,159,673 |

|

| Health Technology – 12.6% | | |

| 24,300 | | Allergan, Inc. | | 2,139,615 |

| 49,400 | | Becton, Dickinson & Co. | | 2,497,170 |

| 46,700 | | Forest Laboratories, Inc.* | | 3,011,216 |

| 41,500 | | Medtronic, Inc. | | 2,094,090 |

| 309,300 | | Pfizer, Inc. | | 11,060,568 |

| 41,900 | | Stryker Corp. | | 4,145,167 |

| | | | |

|

| | | | | 24,947,826 |

|

| Industrial Services – 1.0% | | |

| 46,000 | | BJ Services Co.* | | 2,047,000 |

|

| Miscellaneous – 4.5% | | |

| 59,500 | | Biotech HOLDRs Trust* | | 8,920,835 |

|

| (a) | | Fund returns assume fee waivers and expense reductions and are not annualized. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (b) | | The Lipper Large-Cap Growth Funds Index is an unmanaged index consisting of funds that, by portfolio practice, invest at least 75% of their equity assets in companies that have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index. The Index figures do not reflect any fees, expenses or taxes. |

| (c) | | The Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect any fees, expenses or taxes. |

| | |

| 4 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE GROWTH FUND

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| Non-Energy Minerals – 2.6% | | |

| 69,700 | | Freeport-McMoRan Copper & Gold, Inc. Class B | | $ 2,125,850 |

| 79,000 | | Newmont Mining Corp. | | 2,954,600 |

| | | | |

|

| | | | | 5,080,450 |

|

| Producer Manufacturing – 8.9% | | |

| 66,800 | | 3M Co. | | 5,776,864 |

| 33,200 | | Danaher Corp. | | 3,071,664 |

| 294,400 | | General Electric Co. | | 8,817,280 |

| | | | |

|

| | | | | 17,665,808 |

|

| Retail Trade – 9.4% | | |

| 73,900 | | Bed Bath & Beyond, Inc.* | | 2,743,168 |

| 38,600 | | Lowe’s Companies, Inc. | | 2,009,516 |

| 147,800 | | The Gap, Inc. | | 3,253,078 |

| 87,800 | | The Home Depot, Inc. | | 3,089,682 |

| 100,900 | | The TJX Cos., Inc. | | 2,479,113 |

| 89,500 | | Wal-Mart Stores, Inc. | | 5,101,500 |

| | | | |

|

| | | | | 18,676,057 |

|

| Technology Services – 9.1% | | |

| 43,000 | | Affiliated Computer Services, Inc.* | | 2,085,500 |

| 44,600 | | International Business Machines Corp. | | 3,932,382 |

| 21,700 | | Mercury Interactive Corp.* | | 923,335 |

| 347,800 | | Microsoft Corp. | | 9,032,366 |

| 42,800 | | Symantec Corp.* | | 1,928,140 |

| | | | |

|

| | | | | 17,901,723 |

|

| TOTAL COMMON STOCKS | | |

| (Cost $169,727,712) | | $197,370,938 |

|

| | | | | | | | |

Principal Amount | | Interest Rate | | | Maturity Date | | Value | |

| Repurchase Agreement – 0.7% | |

| State Street Bank & Trust Co.^ | | | |

| $1,483,000 | | 0.75 | % | | 05/03/2004 | | $ 1,483,000 | |

| Maturity Value: $1,483,093 | | | |

|

|

| TOTAL REPURCHASE AGREEMENT | | | |

(Cost $1,483,000) | | $ 1,483,000 | |

|

|

| TOTAL INVESTMENTS – 100.5% | | | |

(Cost $171,210,712) | | 198,853,938 | |

| Liabilities in excess of other assets – (0.5)% | | (1,074,491 | ) |

|

|

| Net Assets – 100.0% | | $197,779,447 | |

|

|

| | |

| * | | Non-income producing security. |

| ^ | | Repurchase agreement was entered into on April 30, 2004. At April 30, 2004, this agreement was fully collateralized by U.S. Treasury Notes. |

| | |

|

|

| Investment Abbreviations: |

| HOLDRs | | —Holding Company Depositary Receipts. |

|

| | |

| The accompanying notes are an integral part of these financial statements. | | 5 |

COMMERCE VALUE FUND

Value Fund

Performance Review(a) (Unaudited)

For the six months ended April 30, 2004, the Institutional Shares of the Fund had a total return of 4.10%, based on Net Asset Value (NAV). The Service Shares had a total return, without sales charge, of 3.97% for the same period based on NAV. This compares to the Lipper Large Cap Value Funds Index(b) six-month return of 8.00% and the Russell 1000 Value Index(c) six-month return of 8.15%. Past performance is no guarantee of future results.

Statement of Investments

April 30, 2004 (Unaudited)

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – 97.8% |

| Commercial Services – 0.2% | | |

| 18,600 | | The Interpublic Group of Cos., Inc.* | | $ 291,834 |

|

| Communications – 1.7% | | |

| 52,800 | | Verizon Communications, Inc. | | 1,992,672 |

|

| Consumer Durables – 2.5% | | |

| 47,600 | | Ethan Allen Interiors, Inc. | | 1,978,732 |

| 38,800 | | Furniture Brands International, Inc. | | 1,091,832 |

| | | | |

|

| | | | | 3,070,564 |

|

| Consumer Non-Durables – 4.5% | | |

| 17,400 | | Anheuser-Busch Companies, Inc. | | 891,576 |

| 15,500 | | Colgate-Palmolive Co. | | 897,140 |

| 11,100 | | Kellogg Co. | | 476,190 |

| 14,900 | | Kimberly-Clark Corp. | | 975,205 |

| 18,000 | | Reebok International Ltd. | | 654,840 |

| 14,500 | | The Procter & Gamble Co. | | 1,533,375 |

| | | | |

|

| | | | | 5,428,326 |

|

| Consumer Services – 13.8% | | |

| 134,100 | | Cendant Corp. | | 3,175,488 |

| 6,400 | | Clear Channel Communications, Inc. | | 265,536 |

| 18,700 | | Cox Communications, Inc.* | | 611,303 |

| 36,700 | | Fox Entertainment Group, Inc.* | | 1,022,095 |

| 17,100 | | Gannett Co., Inc. | | 1,482,228 |

| 26,700 | | Mandalay Resort Group | | 1,533,915 |

| 47,700 | | Marriott International, Inc. | | 2,249,532 |

| 11,300 | | Starwood Hotels & Resorts Worldwide, Inc. | | 449,627 |

| 30,306 | | The DIRECTV Group, Inc.* | | 542,478 |

| 31,800 | | The Walt Disney Co. | | 732,354 |

| 96,300 | | Time Warner, Inc.* | | 1,619,766 |

| 24,200 | | Tribune Co. | | 1,158,696 |

| 46,100 | | Viacom, Inc. Class B | | 1,781,765 |

| | | | |

|

| | | | | 16,624,783 |

|

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| Electronic Technology – 5.5% | | |

| 41,300 | | Avaya, Inc.* | | $ 564,984 |

| 3,300 | | General Dynamics Corp. | | 308,946 |

| 15,500 | | Harris Corp. | | 698,275 |

| 81,500 | | Hewlett-Packard Co. | | 1,605,550 |

| 15,500 | | National Semiconductor Corp.* | | 632,245 |

| 46,100 | | Polycom, Inc.* | | 879,588 |

| 20,800 | | Rockwell Automation, Inc. | | 679,952 |

| 90,700 | | Xerox Corp.* | | 1,218,101 |

| | | | |

|

| | | | | 6,587,641 |

|

| Energy Minerals – 9.4% | | |

| 28,700 | | ChevronTexaco Corp. | | 2,626,050 |

| 13,200 | | ConocoPhillips | | 941,160 |

| 21,400 | | Devon Energy Corp. | | 1,309,680 |

| 144,300 | | Exxon Mobil Corp. | | 6,139,965 |

| 9,000 | | Marathon Oil Corp. | | 302,040 |

| | | | |

|

| | | | | 11,318,895 |

|

| Finance – 31.1% | | |

| 32,900 | | American International Group, Inc. | | 2,357,285 |

| 48,487 | | Bank of America Corp. | | 3,902,718 |

| 12,100 | | Charter One Financial, Inc. | | 403,777 |

| 120,966 | | Citigroup, Inc. | | 5,817,255 |

| 12,900 | | First Horizon National Corp. | | 567,084 |

| 32,800 | | Franklin Resources, Inc. | | 1,798,424 |

| 69,300 | | J. P. Morgan Chase & Co. | | 2,605,680 |

| 5,700 | | Jefferson-Pilot Corp. | | 282,663 |

| 7,700 | | Lehman Brothers Holdings, Inc. | | 565,180 |

| 52,300 | | Lincoln National Corp. | | 2,347,224 |

| 33,500 | | MBNA Corp. | | 816,730 |

| 46,400 | | Merrill Lynch & Co., Inc. | | 2,516,272 |

| 49,000 | | MetLife, Inc. | | 1,690,500 |

| 60,100 | | Morgan Stanley & Co., Inc. | | 3,088,539 |

| 36,700 | | Principal Financial Group, Inc. | | 1,295,510 |

| 16,800 | | The Allstate Corp. | | 771,120 |

|

| (a) | | Fund returns assume fee waivers and expense reductions and are not annualized. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (b) | | The Lipper Large Cap Value Funds Index is an unmanaged index consisting of funds that, by portfolio practice, invest at least 75% of their equity assets in companies that have a below-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index. The Index figures do not reflect any fees, expenses or taxes. |

| (c) | | The Russell 1000 Value Index measures the performance of those 1,000 Russell companies with lower price-to-book ratios and lower forecasted growth values. The Index figures do not reflect any fees, expenses or taxes. |

| | |

| 6 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE VALUE FUND

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| Finance – (continued) | | |

| 20,700 | | The Bank of New York Co., Inc. | | $ 603,198 |

| 9,200 | | The Progressive Corp. | | 805,184 |

| 16,500 | | Trustmark Corp. | | 439,230 |

| 63,045 | | U.S. Bancorp | | 1,616,474 |

| 19,200 | | Wachovia Corp. | | 878,400 |

| 40,700 | | Wells Fargo & Co. | | 2,297,922 |

| | | | |

|

| | | | | 37,466,369 |

|

| Health Services – 2.3% | | |

| 13,100 | | Aetna, Inc. | | 1,084,025 |

| 6,800 | | Anthem, Inc.* | | 602,344 |

| 15,000 | | Pediatrix Medical Group, Inc.* | | 1,072,500 |

| | | | |

|

| | | | | 2,758,869 |

|

| Health Technology – 1.5% | | |

| 24,800 | | Becton, Dickinson & Co. | | 1,253,640 |

| 20,600 | | Bristol-Myers Squibb Co. | | 517,060 |

| | | | |

|

| | | | | 1,770,700 |

|

| Industrial Services – 0.2% | | |

| 10,100 | | Waste Management, Inc. | | 286,840 |

|

| Process Industries – 3.8% | | |

| 12,000 | | Air Products & Chemicals, Inc. | | 597,720 |

| 26,900 | | Donaldson Co., Inc. | | 737,867 |

| 14,600 | | International Paper Co. | | 588,672 |

| 24,300 | | Rohm and Haas Co. | | 942,354 |

| 33,400 | | Smurfit-Stone Container Corp.* | | 574,146 |

| 30,000 | | The Dow Chemical Co. | | 1,190,700 |

| | | | |

|

| | | | | 4,631,459 |

|

| Producer Manufacturing – 8.1% | | |

| 38,800 | | 3M Co. | | 3,355,424 |

| 15,500 | | Caterpillar, Inc. | | 1,204,815 |

| 26,600 | | Deere & Co. | | 1,809,864 |

| 26,600 | | Dover Corp. | | 1,064,798 |

| 12,600 | | Energizer Holdings, Inc.* | | 545,580 |

| 17,400 | | Masco Corp. | | 487,374 |

| 22,950 | | PACCAR, Inc. | | 1,295,757 |

| | | | |

|

| | | | | 9,763,612 |

|

| Retail Trade – 3.6% | | |

| 32,000 | | CVS Corp. | | 1,236,160 |

| 12,600 | | InterActiveCorp* | | 401,562 |

| 32,100 | | Limited Brands | | 662,544 |

| 11,200 | | The Neiman Marcus Group, Inc. | | 544,768 |

| 19,900 | | The Talbots, Inc. | | 695,505 |

| 15,100 | | Zale Corp.* | | 844,392 |

| | | | |

|

| | | | | 4,384,931 |

|

| Technology Services – 3.8% | | |

| 14,700 | | Automatic Data Processing, Inc. | | 644,007 |

| 20,100 | | Computer Sciences Corp.* | | 822,291 |

| 19,200 | | International Business Machines Corp. | | 1,692,864 |

| 40,700 | | Network Associates, Inc.* | | 638,176 |

| 55,800 | | Unisys Corp.* | | 727,074 |

| | | | |

|

| | | | | 4,524,412 |

|

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| Transportation – 0.5% | | |

| 42,700 | | Southwest Airlines Co. | | $ 609,756 |

|

| Utilities – 5.3% | | |

| 24,800 | | Dominion Resources, Inc. | | 1,582,488 |

| 32,000 | | Entergy Corp. | | 1,747,200 |

| 4,700 | | Exelon Corp. | | 314,618 |

| 4,900 | | Kinder Morgan, Inc. | | 295,029 |

| 21,800 | | Progress Energy, Inc. | | 932,386 |

| 24,300 | | Public Service Enterprise Group, Inc. | | 1,042,470 |

| 18,400 | | The Southern Co. | | 529,184 |

| | | | |

|

| | | | | 6,443,375 |

|

| TOTAL COMMON STOCKS | | |

| (Cost $106,658,411) | | $117,955,038 |

|

| | | | | | |

| | | |

Principal Amount | | Interest Rate | | Maturity Date | | Value |

| Repurchase Agreement – 0.1% |

| State Street Bank & Trust Co.^ | | |

| $143,000 | | 0.75% | | 05/03/2004 | | $ 143,000 |

| Maturity Value: $143,009 | | |

|

| TOTAL REPURCHASE AGREEMENT | | |

| (Cost $143,000) | | $ 143,000 |

|

| TOTAL INVESTMENTS – 97.9% | | |

| (Cost $106,801,411) | | 118,098,038 |

| Other assets in excess of liabilities – 2.1% | | 2,508,274 |

|

| Net Assets – 100.0% | | $120,606,312 |

|

| | |

| * | | Non-income producing security. |

| ^ | | Repurchase agreement was entered into on April 30, 2004. At April 30, 2004, this agreement was fully collateralized by U.S. Treasury Notes. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 7 |

COMMERCE MIDCAP GROWTH FUND

MidCap Growth Fund

Performance Review(a) (Unaudited)

For the six months ended April 30, 2004, the Institutional Shares of the Fund had a total return of 6.31%, based on Net Asset Value (NAV). The Service Shares had a total return, without sales charge, of 6.19% for the same period based on NAV. This compares to the Lipper MidCap Growth Funds Index(b) six-month return of 3.55% and the Russell Midcap Growth Index(c) six-month return of 5.74%. Past performance is no guarantee of future results.

Statement of Investments

April 30, 2004 (Unaudited)

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – 99.7% |

| Commercial Services – 4.2% | | |

| 40,820 | | Equifax, Inc. | | $ 1,000,498 |

| 38,155 | | Harte-Hanks, Inc. | | 914,194 |

| 12,234 | | Moody’s Corp. | | 789,215 |

| 50,822 | | The Interpublic Group of Cos., Inc.* | | 797,397 |

| | | | |

|

| | | | | 3,501,304 |

|

| Communications – 2.1% | | |

| 30,594 | | Nextel Communications, Inc.* | | 729,973 |

| 15,375 | | Telephone & Data Systems, Inc. | | 1,014,135 |

| | | | |

|

| | | | | 1,744,108 |

|

| Consumer Durables – 2.0% | | |

| 31,726 | | Electronic Arts, Inc.* | | 1,605,970 |

|

| Consumer Non-Durables – 2.5% | | |

| 78,565 | | Del Monte Foods Co.* | | 868,929 |

| 5,705 | | Hershey Foods Corp. | | 507,117 |

| 11,358 | | The Timberland Co.* | | 712,374 |

| | | | |

|

| | | | | 2,088,420 |

|

| Consumer Services – 7.9% | | |

| 24,434 | | Brinker International, Inc.* | | 939,732 |

| 21,463 | | Dow Jones & Co., Inc. | | 989,230 |

| 29,671 | | Harrah’s Entertainment, Inc. | | 1,577,904 |

| 29,170 | | International Game Technology | | 1,100,876 |

| 9,933 | | International Speedway Corp. | | 418,477 |

| 8,488 | | The E.W. Scripps Co. | | 895,908 |

| 14,005 | | The New York Times Co. | | 641,569 |

| | | | |

|

| | | | | 6,563,696 |

|

| Distribution Services – 2.3% | | |

| 16,740 | | CDW Corp. | | 1,046,083 |

| 25,279 | | Performance Food Group Co.* | | 888,051 |

| | | | |

|

| | | | | 1,934,134 |

|

| Electronic Technology – 17.0% | | |

| 38,784 | | Advanced Fibre Communications, Inc.* | | 647,693 |

|

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| Electronic Technology – (continued) | | |

| 14,050 | | Alliant Techsystems, Inc.* | | $ 833,025 |

| 40,405 | | Cadence Design Systems, Inc.* | | 517,992 |

| 12,940 | | Harris Corp. | | 582,947 |

| 17,432 | | KLA-Tencor Corp.* | | 726,392 |

| 17,791 | | L-3 Communications Holdings, Inc. | | 1,098,416 |

| 16,618 | | Lexmark International, Inc.* | | 1,503,264 |

| 23,100 | | Microchip Technology, Inc. | | 647,262 |

| 30,842 | | National Semiconductor Corp.* | | 1,258,045 |

| 41,830 | | Polycom, Inc.* | | 798,116 |

| 33,040 | | Rockwell Collins, Inc. | | 1,065,540 |

| 33,010 | | Synopsys, Inc.* | | 882,357 |

| 52,542 | | Teradyne, Inc.* | | 1,070,806 |

| 22,877 | | Thermo Electron Corp.* | | 668,008 |

| 22,658 | | Waters Corp.* | | 977,693 |

| 96,225 | | Western Digital Corp.* | | 777,498 |

| | | | |

|

| | | | | 14,055,054 |

|

| Energy Minerals – 4.4% | | |

| 33,550 | | CONSOL Energy, Inc. | | 960,537 |

| 23,210 | | EOG Resources, Inc. | | 1,143,092 |

| 17,472 | | Newfield Exploration Co.* | | 920,425 |

| 19,118 | | Pioneer Natural Resources Co. | | 625,350 |

| | | | |

|

| | | | | 3,649,404 |

|

| Finance – 6.5% | | |

| 33,378 | | Federated Investors, Inc., Class B | | 981,313 |

| 17,355 | | Fidelity National Financial, Inc. | | 635,193 |

| 18,890 | | First Horizon National Corp. | | 830,404 |

| 13,778 | | IndyMac Bancorp, Inc. | | 443,101 |

| 11,033 | | Legg Mason, Inc. | | 1,015,698 |

| 17,685 | | SouthTrust Corp. | | 549,650 |

| 42,465 | | Waddell & Reed Financial, Inc. | | 943,997 |

| | | | |

|

| | | | | 5,399,356 |

|

| Health Services – 7.2% | | |

| 12,752 | | Anthem, Inc.* | | 1,129,572 |

| 35,192 | | Caremark Rx, Inc.* | | 1,191,249 |

|

| (a) | | Fund returns assume fee waivers and expense reductions and are not annualized. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (b) | | The Lipper MidCap Growth Funds Index is an unmanaged index consisting of funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalization (on a three-year weighted basis) of less than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. The Index figures do not reflect any fees, expenses or taxes. |

| (c) | | The Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect any fees, expenses or taxes. |

| | |

| 8 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE MIDCAP GROWTH FUND

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| Health Services – (continued) | | |

| 12,524 | | Express Scripts, Inc.* | | $ 968,606 |

| 25,445 | | IMS Health, Inc. | | 642,486 |

| 14,281 | | Quest Diagnostics, Inc. | | 1,204,603 |

| 17,886 | | Stericycle, Inc.* | | 855,309 |

| | | | |

|

| | | | | 5,991,825 |

|

| Health Technology – 8.9% | | |

| 26,635 | | Biomet, Inc. | | 1,052,083 |

| 17,158 | | Hillenbrand Industries, Inc. | | 1,158,165 |

| 6,658 | | Invitrogen Corp.* | | 480,907 |

| 40,737 | | King Pharmaceuticals, Inc.* | | 702,713 |

| 13,972 | | Pharmaceutical Resources, Inc.* | | 563,072 |

| 7,336 | | St. Jude Medical, Inc.* | | 559,443 |

| 10,062 | | Varian Medical Systems, Inc.* | | 863,722 |

| 25,080 | | Zimmer Holdings, Inc.* | | 2,002,638 |

| | | | |

|

| | | | | 7,382,743 |

|

| Industrial Services – 2.9% | | |

| 14,635 | | BJ Services Co.* | | 651,258 |

| 18,173 | | Jacobs Engineering Group, Inc.* | | 757,996 |

| 17,694 | | Smith International, Inc.* | | 968,746 |

| | | | |

|

| | | | | 2,378,000 |

|

| Process Industries – 3.8% | | |

| 29,952 | | Ecolab, Inc. | | 892,570 |

| 16,940 | | Praxair, Inc. | | 619,157 |

| 18,738 | | Sigma-Aldrich Corp. | | 1,061,320 |

| 12,145 | | The Valspar Corp. | | 602,999 |

| | | | |

|

| | | | | 3,176,046 |

|

| Producer Manufacturing – 7.0% | | |

| 17,898 | | Avery Dennison Corp. | | 1,149,588 |

| 14,462 | | Dover Corp. | | 578,914 |

| 23,270 | | Energizer Holdings, Inc.* | | 1,007,591 |

| 15,544 | | ITT Industries, Inc. | | 1,232,484 |

| 11,735 | | Molex, Inc. | | 349,468 |

| 32,949 | | Pitney Bowes, Inc. | | 1,441,519 |

| | | | |

|

| | | | | 5,759,564 |

|

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| Retail Trade – 7.7% | | |

| 16,840 | | Chico’s FAS, Inc.* | | $ 685,893 |

| 55,708 | | Dollar General Corp. | | 1,045,082 |

| 40,864 | | Ross Stores, Inc. | | 1,246,352 |

| 48,428 | | Staples, Inc. | | 1,247,505 |

| 71,687 | | The TJX Cos., Inc. | | 1,761,350 |

| 12,695 | | Williams-Sonoma, Inc.* | | 413,716 |

| | | | |

|

| | | | | 6,399,898 |

|

| Technology Services – 11.8% | | |

| 31,775 | | Adobe Systems, Inc. | | 1,313,578 |

| 16,975 | | Affiliated Computer Services, Inc.* | | 823,288 |

| 35,240 | | BEA Systems, Inc.* | | 402,088 |

| 37,230 | | Ceridian Corp.* | | 795,977 |

| 41,539 | | Citrix Systems, Inc.* | | 791,318 |

| 39,005 | | Fiserv, Inc.* | | 1,426,023 |

| 32,960 | | Intuit, Inc.* | | 1,399,811 |

| 57,567 | | SunGard Data Systems, Inc.* | | 1,500,772 |

| 29,097 | | Symantec Corp.* | | 1,310,820 |

| | | | |

|

| | | | | 9,763,675 |

|

| Utilities – 1.5% | | |

| 19,946 | | Kinder Morgan, Inc. | | 1,200,949 |

|

| TOTAL COMMON STOCKS | | |

| (Cost $74,177,712) | | $82,594,146 |

|

| | | | | | | | |

| | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

| Repurchase Agreement – 0.3% | |

| State Street Bank & Trust Co.^ | | | |

| $243,000 | | 0.75 | % | | 05/03/2004 | | $ 243,000 | |

Maturity Value: $243,015 | | | |

|

|

| TOTAL REPURCHASE AGREEMENT | | | |

(Cost $243,000) | | | | | $ 243,000 | |

|

|

| TOTAL INVESTMENTS – 100.0% | | | |

(Cost $74,420,712) | | 82,837,146 | |

| Liabilities in excess of other assets – 0.0% | | (5,005 | ) |

|

|

| Net Assets – 100.0% | | $82,832,141 | |

|

|

| | |

| * | | Non-income producing security. |

| ^ | | Repurchase agreement was entered into on April 30, 2004. At April 30, 2004, this agreement was fully collateralized by U.S. Treasury Notes. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

COMMERCE INTERNATIONAL EQUITY FUND

International Equity Fund

Performance Review(a) (Unaudited)

For the six months ended April 30, 2004, the Institutional Shares of the Fund had a total return of 11.86%, based on Net Asset Value (NAV). The Service Shares had a total return, without sales charge, of 11.71% for the same period based on NAV. This compares to the Lipper International Equity Funds Index(b) six-month return of 11.00% and the Morgan Stanley Capital International Europe, Australasia and Far East Index(c) (“MSCI EAFE”) six-month return of 12.58%. Past performance is no guarantee of future results.

Statement of Investments

April 30, 2004 (Unaudited)

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – 98.8% |

| Australian Dollar – 2.4% |

| 42,577 | | National Australia Bank Ltd. (Commercial Banks) | | $ 905,109 |

| 111,216 | | The News Corp. Ltd. (Media) | | 1,024,481 |

| 77,917 | | Westpac Banking Corp. (Commercial Banks) | | 981,909 |

| 69,720 | | James Hardie Industries NV (Construction Materials) | | 336,960 |

| | | | |

|

| | | | | 3,248,459 |

|

| British Pound Sterling – 23.3% |

| 309,080 | | Barclays PLC (Commercial Banks) | | 2,788,462 |

| 82,701 | | British American Tobacco PLC (Tobacco) | | 1,254,526 |

| 183,143 | | BT Group PLC (Diversified Telecommunication Services) | | 580,004 |

| 142,415 | | Cadbury Schweppes PLC (Food Products) | | 1,133,238 |

| 215,586 | | Centrica PLC (Gas Utilities) | | 835,747 |

| 181,586 | | Compass Group PLC (Hotels Restaurant & Leisure) | | 1,143,704 |

| 121,897 | | Diageo PLC (Beverages) | | 1,636,081 |

| 26,953 | | Enterprise Inns PLC (Hotels Restaurant & Leisure) | | 291,702 |

| 95,638 | | GlaxoSmithKline PLC (Pharmaceuticals) | | 1,980,178 |

| 20,155 | | GUS PLC (Internet & Catalog Retail) | | 279,278 |

| 207,697 | | HSBC Holdings PLC (Commercial Banks) | | 2,977,449 |

| 179,993 | | Kingfisher PLC (Specialty Retail) | | 904,541 |

| 74,021 | | Lloyds TSB Group PLC (Commercial Banks) | | 553,548 |

| 69,423 | | Marks & Spencer Group PLC (Multiline Retail) | | 340,258 |

| 121,686 | | Prudential PLC (Insurance) | | 956,417 |

| 64,259 | | Reed Elsevier PLC (Media) | | 598,544 |

|

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| British Pound Sterling – (continued) |

| 21,714 | | Royal Bank of Scotland Group PLC (Commercial Banks) | | $ 652,228 |

| 127,853 | | Smith & Nephew PLC (HealthCare Equipment & Supplies) | | 1,298,641 |

| 37,579 | | Smiths Group PLC (Industrial Conglomerates) | | 465,709 |

| 476,852 | | Tesco PLC (Food & Staples Retailing) | | 2,104,503 |

| 44,531 | | Tomkins PLC (Industrial Conglomerates) | | 213,714 |

| 13,827 | | Travis Perkins PLC (Specialty Retail) | | 352,032 |

| 214,655 | | Unilever PLC (Food Products) | | 2,026,075 |

| 1,286,901 | | Vodafone Group PLC (Wireless Telecommunication Services) | | 3,128,013 |

| 18,409 | | Whitbread PLC (Hotels Restaurant & Leisure) | | 243,326 |

| 101,248 | | Wolseley PLC (Trading Company & Distribution) | | 1,484,678 |

| 78,518 | | WPP Group PLC (Media) | | 774,545 |

| | | | |

|

| | | | | 30,997,141 |

|

| Canadian Dollar – 0.4% |

| 12,946 | | Royal Bank of Canada (Commercial Banks) | | 575,535 |

|

| Euro – 33.2% |

| Finland – 1.0% |

| 97,336 | | Nokia Oyj (Communications Equipment) | | 1,368,585 |

|

| France – 9.8% |

| 39,173 | | Aventis SA (Pharmaceuticals) | | 2,981,485 |

| 67,833 | | AXA (Insurance) | | 1,427,391 |

| 27,865 | | BNP Paribas SA (Commercial Banks) | | 1,671,964 |

| 45,933 | | France Telecom SA* (Diversified Telecommunication Services) | | 1,107,385 |

|

| (a) | | Fund returns assume fee waivers and expense reductions and are not annualized. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (b) | | The Lipper International Equity Funds Index is an unmanaged index consisting of funds that invest their assets in securities with primary trading markets outside of the United States. The Index figures do not reflect any fees, expenses or taxes. |

| (c) | | The Morgan Stanley Capital International Europe, Australasia and Far East (“MSCI EAFE”) Index is an unmanaged index of securities in 21 developed markets outside of North America, in Europe, Australia and the Far East. The Index figures do not reflect any fees, expenses or taxes. |

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE INTERNATIONAL EQUITY FUND

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| France – (continued) |

| 15,409 | | Lafarge SA (Construction Materials) | | $ 1,282,595 |

| 24,661 | | Total SA (Oil & Gas) | | 4,557,291 |

| | | | |

|

| | | | | 13,028,111 |

|

| Germany – 6.0% |

| 38,155 | | Bayer AG (Chemicals) | | 1,038,678 |

| 52,446 | | Bayerische Motoren Werke (BMW) AG (Automobiles) | | 2,259,347 |

| 18,204 | | Deutsche Bank AG (Capital Markets) | | 1,498,890 |

| 48,327 | | E.ON AG (Electric Utilities) | | 3,200,701 |

| | | | |

|

| | | | | 7,997,616 |

|

| Ireland – 1.0% |

| 58,307 | | CRH PLC (Construction Materials) | | 1,237,413 |

|

| Italy – 3.8% |

| 145,281 | | ENI SPA (Oil & Gas) | | 2,950,970 |

| 660,172 | | Telecom Italia SPA* (Diversified Telecommunication Services) | | 2,115,004 |

| | | | |

|

| | | | | 5,065,974 |

|

| Netherlands – 8.4% |

| 123,090 | | ABN AMRO Holding NV (Commercial Banks) | | 2,674,177 |

| 12,028 | | Heineken NV (Beverages) | | 507,068 |

| 144,071 | | ING Groep NV (Diversified Financial Services) | | 3,085,136 |

| 26,270 | | Koninklijke Ahold NV* (Food & Staples Retailing) | | 203,247 |

| 80,391 | | Koninklijke (Royal) Philips Electronics NV (Household Durables) | | 2,187,489 |

| 91,842 | | Reed Elsevier NV (Media) | | 1,289,137 |

| 33,257 | | TPG NV (Air Freight & Logistics) | | 716,547 |

| 18,955 | | VNU NV (Media) | | 529,852 |

| | | | |

|

| | | | | 11,192,653 |

|

| Spain – 3.2% |

| 208,927 | | Banco Santander Central Hispano SA (Commercial Banks) | | 2,241,985 |

| 132,828 | | Telefonica SA* (Diversified Telecommunication Services) | | 1,974,202 |

| | | | |

|

| | | | | 4,216,187 |

|

| Total Euro | | 44,106,539 |

|

| Hong Kong Dollar – 3.9% |

| 115,000 | | Esprit Holdings Ltd. (Specialty Retail) | | 474,762 |

| 363,500 | | Johnson Electric Holdings Ltd. (Electrical Equipment) | | 321,570 |

| 143,000 | | Cheung Kong Holdings Ltd. (Real Estate) | | 1,100,042 |

| 72,523 | | Hang Seng Bank Ltd. (Commercial Banks) | | 920,520 |

| 328,000 | | Li & Fung Ltd. (Distributors) | | 510,943 |

|

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| Hong Kong Dollar – (continued) |

| 124,000 | | Sun Hung Kai Properties Ltd. (Real Estate) | | $ 1,065,169 |

| 117,500 | | Swire Pacific Ltd. Series ‘A’ (Real Estate) | | 768,299 |

| | | | |

|

| | | | | 5,161,305 |

|

| Japanese Yen – 17.6% |

| 10,510 | | Acom Co. Ltd. (Consumer Finance) | | 748,504 |

| 94,000 | | Canon, Inc. (Office Electronics) | | 4,931,455 |

| 16,100 | | Fanuc Ltd. (Machinery) | | 986,146 |

| 54,700 | | Honda Motor Co. Ltd. (Automobiles) | | 2,195,633 |

| 18,500 | | Hoya Corp. (Electronic Equipment & Instruments) | | 2,001,450 |

| 52 | | Millea Holdings, Inc. (Insurance) | | 739,727 |

| 132 | | Mitsubishi Tokyo Financial Group, Inc. (Commercial Banks) | | 1,174,503 |

| 68,000 | | Mitsui Sumitomo Insurance Co. Ltd. (Insurance) | | 640,167 |

| 575 | | Nippon Telegraph & Telephone Corp. (Diversified Telecommunication Services) | | 3,021,791 |

| 490 | | NTT DoCoMo, Inc. (Wireless Telecommunication Services) | | 972,319 |

| 38,000 | | Ricoh Co. Ltd. (Office Electronics) | | 757,486 |

| 7,900 | | Rohm Co. Ltd. (Semiconductor & Semiconductor Equipment) | | 985,666 |

| 34,900 | | Shin-Etsu Chemical Co. Ltd. (Chemicals) | | 1,410,356 |

| 31,000 | | Shionogi & Co. Ltd. (Pharmaceuticals) | | 487,899 |

| 174 | | Sumitomo Mitsui Financial Group (Commercial Banks) | | 1,314,873 |

| 23,900 | | Takeda Chemical Industries Ltd. (Pharmaceuticals) | | 963,666 |

| | | | |

|

| | | | | 23,331,641 |

|

| Korean Won – 4.8% |

| 14,010 | | Hyundai Motor Co. (Automobiles) | | 534,323 |

| 42,420 | | Korea Electric Power Corp. (Electric Utilities) | | 694,135 |

| 20,330 | | KT Corp. (Diversified Telecommunication Services) | | 708,652 |

| 8,089 | | POSCO (Metals & Mining) | | 989,280 |

| 7,265 | | Samsung Electronics Co. Ltd. (Semiconductor & Semiconductor Equipment) | | 3,448,762 |

| | | | |

|

| | | | | 6,375,152 |

|

| Singapore Dollar – 0.6% |

| 106,000 | | United Overseas Bank Ltd. (Commercial Banks) | | 853,507 |

|

| Swiss Franc – 12.4% |

| 18,805 | | Nestle AG (Food Products) | | 4,751,408 |

| 64,543 | | Novartis AG (Pharmaceuticals) | | 2,873,771 |

| 26,126 | | Roche Holding AG (Pharmaceuticals) | | 2,737,076 |

|

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

COMMERCE INTERNATIONAL EQUITY FUND

Statement of Investments (continued)

April 30, 2004 (Unaudited)

| | | | |

| | |

| Shares | | Description | | Value |

| Common Stocks – (continued) |

| Swiss Franc – (continued) |

| 33,133 | | Swiss Re (Insurance) | | $ 2,177,133 |

| 56,591 | | UBS AG (Capital Markets) | | 4,017,148 |

| | | | |

|

| | | | | 16,556,536 |

|

| United States Dollar – 0.2% |

| 27,969 | | Taiwan Semiconductor Manufacturing Co. Ltd. ADR* (Semiconductor & Semiconductor Equipment) | | 266,545 |

|

| TOTAL COMMON STOCKS | | |

| (Cost $110,895,890) | | $131,472,360 |

|

| | | | | |

| | | | | | | |

| | | |

Principal Amount | | Interest Rate | | | Maturity Date | | Value |

| Convertible Bonds – 0.1% |

Euro | | | | | |

France | | | | | |

| AXA SA (Insurance) @ | | |

| $5,490 | | 0.00 | % | | 12/21/2004 | | $ 109,935 |

|

| TOTAL CONVERTIBLE BONDS |

(Cost $81,183) | | | | | $ 109,935 |

|

| TOTAL INVESTMENTS – 98.9% | | |

(Cost $110,977,073) | | | | | 131,582,295 |

| Other assets in excess of liabilities – 1.1% | | 1,467,475 |

|

| Net Assets – 100.0% | | | | | $133,049,770 |

|

| | |

| * | | Non-income producing security. |

| @ | | Security issued with a zero coupon. |

| | |

|

|

| Investment Abbreviations: |

| ADR | | —AmericanDepositary Receipt |

|

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE INTERNATIONAL EQUITY FUND

| | | |

| | | As a % of

Net Assets | |

| Common Stock Industry Classifications† | |

Air Freight & Logistics | | 0.5 | % |

Automobiles | | 3.8 | |

Beverages | | 1.6 | |

Capital Markets | | 4.2 | |

Chemicals | | 1.8 | |

Commercial Banks | | 15.3 | |

Communications Equipment | | 1.0 | |

Constructions Materials | | 2.2 | |

Consumer Finance | | 0.6 | |

Distributors | | 0.4 | |

Diversified Financial Services | | 2.3 | |

Diversified Telecommunication Services | | 7.2 | |

Electric Utilities | | 2.9 | |

Electrical Equipment | | 0.2 | |

Electrical Equipment & Instruments | | 1.5 | |

Food & Staples Retailing | | 1.7 | |

Food Products | | 6.0 | |

Gas Utilities | | 0.6 | |

HealthCare Equipment & Supplies | | 1.0 | |

Hotels Restaurant & Leisure | | 1.3 | |

Household Durables | | 1.6 | |

Industrial Conglomerates | | 0.5 | |

Insurance | | 4.5 | |

Internet & Catalog Retail | | 0.2 | |

Machinery | | 0.7 | |

Media | | 3.2 | |

Metals & Mining | | 0.7 | |

Multiline Retail | | 0.3 | |

Office Electronics | | 4.3 | |

Oil & Gas | | 5.7 | |

Pharmaceuticals | | 8.9 | |

Real Estate | | 2.2 | |

Semiconductor & Semiconductor Equipment | | 3.5 | |

Specialty Retail | | 1.3 | |

Tobacco | | 0.9 | |

Trading Company & Distribution | | 1.1 | |

Wireless Telecommunication Services | | 3.1 | |

|

|

| TOTAL COMMON STOCK | | 98.8 | % |

|

|

| | |

| † | | Industry concentrations greater than one-tenth of one percent are disclosed. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

COMMERCE ASSET ALLOCATION FUND

Asset Allocation Fund

Performance Review(a) (Unaudited)

For the six months ended April 30, 2004, the Institutional Shares of the Fund had a total return of 3.93%, based on Net Asset Value (NAV). The Service Shares had a total return, without sales charge, of 3.81% for the same period based on NAV. This compares to the Russell 1000 Index(b) six-month return of 6.11% and the Asset Allocation Composite Index(c) six-month return of 4.92%. Past performance is no guarantee of future results.

Statement of Investments

April 30, 2004 (Unaudited)

| | | | | |

| | |

| Shares | | Description | | Value | |

| Mutual Funds (Institutional Shares) – 101.3% | |

| Equity – 60.5% | | | |

| 183,740 | | Commerce Value Fund – 19.3% | | $ 3,981,645 | |

| 186,298 | | Commerce Growth Fund – 18.9% | | 3,917,851 | |

| 134,935 | | Commerce International Equity

Fund – 12.1% | | 2,509,787 | |

| 53,055 | | PIMCO PEA Renaissance Fund – 6.1% | | 1,256,340 | |

| 34,093 | | Commerce MidCap Growth

Fund – 4.1% | | 855,746 | |

| | | | |

|

|

| | | | | 12,521,369 | |

|

|

| Fixed Income – 40.8% | | | |

| 456,726 | | Commerce Bond Fund – 40.8% | | 8,449,438 | |

|

|

TOTAL MUTUAL FUNDS (INSTITUTIONAL

SHARES) – 101.3% |

|

| (Cost $19,107,318) | | 20,970,807 | |

| Liabilities in excess of other assets – (1.3)% | | (277,208 | ) |

|

|

| Net Assets – 100.0% | | $20,693,599 | |

|

|

| | |

|

For information on the underlying Commerce mutual funds, please call our toll free Shareholder Services Line at

1-800-995-6365 or visit us on the web at www.commercefunds.com. |

| (a) | | Fund returns assume fee waivers and expense reductions and are not annualized. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (b) | | The Russell 1000 Index is an unmanaged market-weighted index comprised of the 1000 largest U.S. companies. The Index figures do not reflect any fees, expenses or taxes. |

| (c) | | The Asset Allocation Composite Index (“Composite Index”) is a hypothetical representation prepared by Commerce Investment Advisors, Inc. of the performance of the Fund’s asset classes weighted according to their respective weightings in the Fund’s target range. The Composite Index is comprised of the Russell 1000 Index (48%), the Lehman Brothers Aggregate Bond Index (40%) and Morgan Stanley Capital International Europe Australasia and Far East Index (“MSCI EAFE”) (12%). The Composite Index figures do not reflect any deduction for fees, taxes or expenses. |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE BOND FUND

Bond Fund

Performance Review(a) (Unaudited)

For the six months ended April 30, 2004, the Institutional Shares of the Fund had a total return of 1.13%, based on Net Asset Value (NAV). The Service Shares had a total return, without sales charge, of 1.06% for the same period based on NAV. This compares to the Lipper Intermediate Investment Grade Funds Index(b) six-month return of 1.33% and the Lehman Brothers Aggregate Bond Index(c) six-month return of 1.25%. Past performance is no guarantee of future results.

Statement of Investments

April 30, 2004 (Unaudited)

| | | | | | | |

Principal Amount | | Interest

Rate | | | Maturity Date | | Value |

| Asset-Backed Securities – 17.9% |

Auto – 0.8% | | | | | |

| Distribution Financial Services Trust Series 1999-3, Class A6 |

| $ 5,000,000 | | 6.88 | % | | 11/15/2016 | | $ 5,279,807 |

|

Commercial – 3.2% | | | | | |

| Asset Securitization Corp. Series 1995-MD4, Class A1 |

| 2,573,335 | | 7.10 | | | 08/13/2029 | | 2,724,841 |

| Asset Securitization Corp. Series 1997-D4, Class 4IE |

| 4,100,000 | | 7.53 | | | 04/14/2029 | | 4,587,039 |

LB Commercial Conduit Mortgage Trust Series 1998-C4,

Class A1B |

| 6,600,000 | | 6.21 | | | 10/15/2035 | | 7,149,684 |

| LB-UBS Commercial Mortgage Trust Series 2002-C1, Class A4 |

| 5,500,000 | | 6.46 | | | 03/15/2031 | | 6,023,398 |

| | | | | | | |

|

| | | | | | | | 20,484,962 |

|

Credit Card – 3.4% | | | | | |

| Citibank Credit Card Master Trust I Series 1997-6, Class B@ |

| 5,000,000 | | 0.00 | | | 08/15/2006 | | 4,980,469 |

| Citibank Credit Card Master Trust I Series 1999-2, Class B |

| 3,570,000 | | 6.15 | | | 03/10/2011 | | 3,875,448 |

| MBNA Master Credit Card Trust Series 1999-B, Class B |

| 5,000,000 | | 6.20 | | | 08/15/2011 | | 5,436,810 |

| Standard Credit Card Master Trust Series 1995-1, Class B |

| 7,000,000 | | 8.45 | | | 01/07/2007 | | 7,322,910 |

| | | | | | | |

|

| | | | | | | | 21,615,637 |

|

Home Equity – 5.3% | | | | | |

American Business Financial Services, Inc. Series 1996-1,

Class A † |

| 151,854 | | 7.95 | | | 09/15/2026 | | 151,854 |

| Cityscape Home Loan Trust Series 1997-4, Class A5 |

| 2,521,957 | | 7.01 | | | 10/25/2018 | | 2,520,199 |

Contimortgage Home Equity Loan Trust Series 1999-3,

Class A6 |

| 2,293,735 | | 7.68 | | | 12/25/2029 | | 2,409,855 |

|

| | | | | | | |

Principal Amount | | Interest

Rate | | | Maturity Date | | Value |

| Asset-Backed Securities – (continued) |

Home Equity – (continued) | | |

| Green Tree Home Improvement Loan Trust Series 1997-E, Class HEM1 |

| $ 4,023,726 | | 7.28 | % | | 01/15/2029 | | $ 4,066,894 |

Merrill Lynch Mortgage Investors, Inc. Series 1991-H1,

Class M1 |

| 874,918 | | 7.36 | | | 07/15/2011 | | 874,463 |

| Residential Asset Securities Corp. Series 1999-KS1, Class AI8 |

| 2,414,809 | | 6.32 | | | 04/25/2030 | | 2,505,181 |

Residential Funding Mortgage Securities I, Inc. Series 2000-HI2,

Class AI5 |

| 11,029,000 | | 8.35 | | | 03/25/2025 | | 11,597,762 |

Residential Funding Mortgage Securities I, Inc. Series 2000-HI4,

Class AI7 |

| 8,849,000 | | 7.98 | | | 09/25/2030 | | 9,391,474 |

| | | | | | | |

|

| | | | | | | | 33,517,682 |

|

Manufactured Housing – 5.2% | | |

| Associates Manufactured Housing Pass-Through Series 1996-1, Class A5 |

| 4,266,161 | | 7.60 | | | 03/15/2027 | | 4,477,635 |

| Green Tree Financial Corp. Series 1993-4, Class A5 |

| 10,744,414 | | 7.05 | | | 01/15/2019 | | 11,196,733 |

| Green Tree Financial Corp. Series 1995-5, Class M1 |

| 2,000,000 | | 7.65 | | | 09/15/2026 | | 2,096,502 |

| Green Tree Financial Corp. Series 1996-4, Class A7 |

| 4,714,211 | | 7.90 | | | 06/15/2027 | | 5,108,277 |

| Green Tree Financial Corp. Series 1998-3, Class A5 |

| 896,389 | | 6.22 | | | 03/01/2030 | | 886,468 |

| Green Tree Financial Corp. Series 1998-3, Class A6 |

| 1,060,823 | | 6.76 | | | 03/01/2030 | | 1,073,022 |

| Green Tree Financial Corp. Series 1999-1, Class M1 |

| 3,750,000 | | 6.56 | | | 03/01/2020 | | 1,321,875 |

| Green Tree Financial Corp. Series 1999-1, Class M2 |

| 1,500,000 | | 7.34 | | | 11/01/2028 | | 322,500 |

|

| (a) | | Fund returns assume fee waivers and expense reductions and are not annualized. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of funds shares. |

| (b) | | The Lipper Intermediate Investment Grade Funds Index is an unmanaged index consisting of funds that invest at least 65% of their assets in investment grade debt issues with dollar-weighted average maturities of five to ten years. The Index figures do not reflect any fees, expenses or taxes. |

| (c) | | The Lehman Brothers Aggregate Bond Index is an unmanaged index comprised of the Lehman Brothers Government Corporate Bond Index, Mortgage-Backed Securities Index and Asset-Backed Securities Index. The Index figures do not reflect any fees, expenses or taxes. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 15 |

COMMERCE BOND FUND

Statement of Investments (continued)

April 30, 2004 (Unaudited)

| | | | | | | |

Principal Amount | | Interest

Rate | | | Maturity Date | | Value |

| Asset-Backed Securities – (continued) |

Manufactured Housing – (continued) | | |

Indymac Manufactured Housing Contract Series 1997-1,

Class A3 |

| $ 1,524,751 | | 6.61 | % | | 02/25/2028 | | $ 1,442,032 |

Indymac Manufactured Housing Contract Series 1997-1,

Class A4 |

| 1,089,108 | | 6.75 | | | 02/25/2028 | | 1,036,608 |

Indymac Manufactured Housing Contract Series 1998-1,

Class A5 |

| 1,921,907 | | 6.96 | | | 09/25/2028 | | 1,755,031 |

| Oakwood Mortgage Investors, Inc. Series 1997-A, Class A5 |

| 2,158,588 | | 7.13 | | | 05/15/2027 | | 2,227,951 |

| | | | | | | |

|

| | | | | | | | 32,944,634 |

|

| TOTAL ASSET-BACKED SECURITIES |

(Cost $113,038,165) | | $113,842,722 |

|

| |

| Municipal – 0.2% |

| New Jersey Economic Development Authority Revenue Bonds Taxable Designated Industry Series A |

| $ 1,000,000 | | 5.20 | % | | 03/01/2014 | | $ 1,003,740 |

|

| TOTAL MUNICIPAL |

(Cost $1,000,000) | | $ 1,003,740 |

|

| |

| Collateralized Mortgage Obligations – 12.9% |

| Federal Home Loan Mortgage Corp. FGIC PAC Series 2430, Class UD |

| $10,579,800 | | 6.00 | % | | 03/15/2017 | | $ 11,119,714 |

Federal Home Loan Mortgage Corp. PAC Series 2110,

Class PG |

| 4,500,000 | | 6.00 | | | 01/15/2029 | | 4,689,623 |

Federal Home Loan Mortgage Corp. PAC Series 2633,

Class PC |

| 6,000,000 | | 4.50 | | | 07/15/2015 | | 5,982,828 |

| Federal Home Loan Mortgage Corp. REMIC PAC Series 1579, Class PM |

| 2,824,706 | | 6.70 | | | 09/15/2023 | | 2,987,521 |

| Federal Home Loan Mortgage Corp. Series 2524, Class WC |

| 1,950,000 | | 6.00 | | | 11/15/2028 | | 1,974,967 |

| Federal Home Loan Mortgage Corp. Series 2677, Class BC |

| 800,000 | | 4.00 | | | 09/15/2018 | | 694,906 |

Federal National Mortgage Association FNIC PAC Series

2001-45, Class WG |

| 3,600,000 | | 6.50 | | | 09/25/2031 | | 3,741,722 |

Federal National Mortgage Association FNIC PAC Series

2001-76, Class UC |

| 10,000,000 | | 5.50 | | | 11/25/2015 | | 10,420,315 |

| Federal National Mortgage Association PAC Series 2003-14, Class AP |

| 2,545,064 | | 4.00 | | | 03/25/2033 | | 2,541,630 |

|

| | | | | | | |

Principal Amount | | Interest

Rate | | | Maturity Date | | Value |

| Collateralized Mortgage Obligations – (continued) |

| Federal National Mortgage Association REMIC Series 1992-1, Class E |

| $ 274,164 | | 7.50 | % | | 01/25/2007 | | $ 286,531 |

Federal National Mortgage Association Series 2000-M2,

Class C |

| 4,600,000 | | 7.02 | # | | 07/17/2022 | | 5,140,289 |

Federal National Mortgage Association Series 2003-86,

Class OC |

| 5,270,000 | | 5.00 | | | 09/25/2026 | | 5,343,532 |

| Government National Mortgage Association REMIC Series 1998-12, Class EB |

| 4,053,033 | | 6.50 | | | 05/20/2028 | | 4,188,313 |

| Government National Mortgage Association Series 2004-9, Class A |

| 4,221,458 | | 3.36 | | | 08/16/2022 | | 4,159,518 |

Residential Funding Mortgage Securities Corp. Series

1999-S14, Class IIA1 |

| 1,603,112 | | 6.50 | | | 06/25/2029 | | 1,599,766 |

Residential Funding Mortgage Securities Corp. Series

2003-RM2, Class AIII |

| 8,097,985 | | 6.00 | | | 05/25/2033 | | 8,359,298 |

Residential Funding Mortgage Securities I, Inc. Series

1999-S20, Class A1 |

| 290,748 | | 6.50 | | | 09/25/2014 | | 290,297 |

| Residential Funding Mortgage Securities I, Inc. Series 2003-S8, Class A1 |

| 3,128,870 | | 5.00 | | | 05/25/2018 | | 3,193,507 |

| Wells Fargo Mortgage Backed Securities Trust Series 2003-6, Class 1A1 |

| 4,465,229 | | 5.00 | | | 06/25/2018 | | 4,496,147 |

|

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS |

(Cost $79,333,131) | | $81,210,424 |

|

| |

| Corporate Obligations – 27.9% |

Agency – 0.1% | | | | | |

| Farmer Mac MTN |

| $ 542,000 | | 6.68 | % | | 06/10/2014 | | $ 611,155 |

|

Cable TV – 0.3% | | |

| Comcast Corp. |

| 1,600,000 | | 6.50 | | | 01/15/2015 | | 1,686,720 |

|

Financial – 15.5% | | |

| Allstate Financial Global Funding † |

| 2,400,000 | | 6.15 | | | 02/01/2006 | | 2,560,171 |

| American General Finance Corp. MTN Series H |

| 3,000,000 | | 4.50 | | | 11/15/2007 | | 3,089,937 |

| Apache Finance Property Ltd. |

| 4,500,000 | | 7.00 | | | 03/15/2009 | | 5,123,853 |

| Bear Stearns Companies, Inc. |

| 4,500,000 | | 4.00 | | | 01/31/2008 | | 4,537,589 |

| BHP Billiton Finance USA Ltd. |

| 2,044,000 | | 4.80 | | | 04/15/2013 | | 2,016,559 |

|

| | |

| 16 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE BOND FUND

| | | | | | | |

Principal Amount | | Interest

Rate | | | Maturity Date | | Value |

| Corporate Obligations – (continued) |

Financial – (continued) | | |

| Caterpillar Financial Services Corp. MTN Series F |

| $ 1,500,000 | | 2.65 | % | | 01/30/2006 | | $ 1,505,246 |

| Deluxe Corp. |

| 1,300,000 | | 5.00 | | | 12/15/2012 | | 1,302,636 |

| Equitable Life Assurance Society of the United States † |

| 11,775,000 | | 7.70 | | | 12/01/2015 | | 13,694,219 |

| Ford Motor Credit Co. |

| 3,250,000 | | 5.80 | | | 01/12/2009 | | 3,310,174 |

| General Electric Capital Corp. MTN Series A |

| 3,000,000 | | 5.00 | | | 06/15/2007 | | 3,145,734 |

| 4,325,000 | | 5.88 | | | 02/15/2012 | | 4,590,373 |

| General Motors Acceptance Corp. |

| 1,750,000 | | 6.63 | | | 10/15/2005 | | 1,839,691 |

| 1,900,000 | | 6.15 | | | 04/05/2007 | | 2,010,375 |

| 1,900,000 | | 8.00 | | | 11/01/2031 | | 2,005,306 |

| Metropolitan Life Insurance Co. † |

| 8,000,000 | | 7.70 | | | 11/01/2015 | | 9,334,496 |

| Morgan Stanley |

| 900,000 | | 6.75 | | | 04/15/2011 | | 994,231 |

| 1,720,000 | | 5.30 | | | 03/01/2013 | | 1,719,047 |

| Morgan Stanley Traded Custody Receipts † |

| 16,380,000 | | 7.68 | # | | 03/01/2032 | | 18,798,343 |

| PNC Bank, N.A. |

| 8,250,000 | | 7.88 | | | 04/15/2005 | | 8,705,491 |

| Reed Elsevier Capital, Inc. |

| 1,800,000 | | 6.75 | | | 08/01/2011 | | 2,041,578 |

| SLM Corp. MTN |

| 2,443,000 | | 4.00 | | | 01/15/2009 | | 2,427,277 |

| Wells Fargo & Co. |

| 3,480,000 | | 3.13 | | | 04/01/2009 | | 3,324,635 |

| | | | | | | |

|

| | | | | | | | 98,076,961 |

|

Forestry – 0.1% | | |

| Weyerhaeuser Co. |

| 457,000 | | 6.75 | | | 03/15/2012 | | 500,989 |

|

Industrial – 3.2% | | |

| Campbell Soup Co. |

| 2,600,000 | | 8.88 | | | 05/01/2021 | | 3,416,085 |

| Receipts on Corporate Securities Trust CHR-1998-1 |

| 5,874,734 | | 6.50 | | | 08/01/2018 | | 5,803,591 |

| Receipts on Corporate Securities Trust NSC-1998-1 |

| 3,440,281 | | 6.38 | | | 05/15/2017 | | 3,594,887 |

| Ryder System, Inc. |

| 4,000,000 | | 6.60 | | | 11/15/2005 | | 4,217,056 |

| Service Master Co. |

| 2,661,000 | | 7.10 | | | 03/01/2018 | | 2,865,950 |

| Waste Managemet, Inc. |

| 560,000 | | 7.65 | | | 03/15/2011 | | 644,878 |

| | | | | | | |

|

| | | | | | | | 20,542,447 |

|

| | | | | | | |

Principal Amount | | Interest

Rate | | | Maturity Date | | Value |

| Corporate Obligations – (continued) |

Multimedia – 0.4% | | |

| AOL Time Warner |

| $ 495,000 | | 6.13 | % | | 04/15/2006 | | $ 524,960 |

| 1,600,000 | | 6.75 | | | 04/15/2011 | | 1,740,911 |

| | | | | | | |

|

| | | | | | | | 2,265,871 |

|

Oil & Gas – 0.7% | | |

| Occidental Petroleum Corp. |

| 2,925,000 | | 7.38 | | | 11/15/2008 | | 3,308,353 |

| Tosco Corp. |

| 1,258,000 | | 7.25 | | | 01/01/2007 | | 1,385,324 |

| | | | | | | |

|

| | | | | | | | 4,693,677 |

|

Oil-Field Services – 0.1% | | |

| Halliburton Co. |

| 620,000 | | 5.50 | | | 10/15/2010 | | 633,610 |

|

Real Estate – 2.4% | | |

| Archstone Communities Trust |

| 3,000,000 | | 8.20 | | | 07/03/2005 | | 3,186,000 |

| EOP Operating LP |

| 3,300,000 | | 7.75 | | | 11/15/2007 | | 3,735,471 |

| Merry Land & Investment, Inc. |

| 1,000,000 | | 6.88 | | | 11/01/2004 | | 1,024,748 |

| Simon Debartolo Group LP |

| 5,000,000 | | 6.75 | | | 06/15/2005 | | 5,225,350 |

| Speiker Properties LP |

| 1,600,000 | | 7.35 | | | 12/01/2017 | | 1,789,754 |

| | | | | | | |

|

| | | | | | | | 14,961,323 |

|

Sovereign Agency – 0.3% | | |

| Resolution Funding Corp. |

| 1,500,000 | | 8.13 | | | 10/15/2019 | | 1,911,574 |

|

Utilities – 2.0% | | |

| GTE Corp. |

| 12,000,000 | | 6.84 | | | 04/15/2018 | | 12,824,184 |

|

Yankee – 2.8% | | | | | |

| Deutsche Telekom International Finance BV |

| 1,335,000 | | 8.00 | # | | 06/15/2010 | | 1,577,404 |

| France Telecom SA |

| 1,286,000 | | 8.75 | # | | 03/01/2011 | | 1,520,307 |

| Hanson Overseas BV |

| 5,000,000 | | 6.75 | | | 09/15/2005 | | 5,285,610 |

| Swiss Bank Corp. |

| 8,000,000 | | 7.38 | | | 06/15/2017 | | 9,407,112 |

| | | | | | | |

|

| | | | | | | | 17,790,433 |

|

| TOTAL CORPORATE OBLIGATIONS |

(Cost $169,155,765) | | $176,498,944 |

|

| | |

| The accompanying notes are an integral part of these financial statements. | | 17 |

COMMERCE BOND FUND

Statement of Investments (continued)

April 30, 2004 (Unaudited)

| | | | | | | |

Principal Amount | | Interest

Rate | | | Maturity Date | | Value |

| Foreign Debt Obligations – 0.1% |

Sovereign – 0.1% | | | | | |

| Republic of Poland |

| $ 592,000 | | 5.25 | % | | 01/15/2014 | | $ 587,560 |

|

| TOTAL FOREIGN DEBT OBLIGATIONS |

(Cost $584,222) | | | | | $ 587,560 |

|

| |

| Mortgage-Backed Pass-Through Obligations – 16.0% |

| Federal Home Loan Mortgage Corp. |

| $ 375,364 | | 6.00 | % | | 12/01/2013 | | $ 388,662 |

| 588,871 | | 8.50 | | | 02/01/2019 | | 647,963 |

| 753,461 | | 8.50 | | | 03/01/2021 | | 829,576 |

| 3,731,310 | | 7.00 | | | 05/01/2026 | | 3,950,871 |

| 552,766 | | 7.00 | | | 10/01/2030 | | 583,752 |

| 593,995 | | 7.50 | | | 12/01/2030 | | 638,063 |

| 1,176,805 | | 7.50 | | | 01/01/2031 | | 1,264,112 |

| 2,473,361 | | 7.00 | | | 08/01/2031 | | 2,611,897 |

| 9,878,210 | | 5.00 | | | 05/01/2033 | | 9,584,508 |

| 8,832,612 | | 5.50 | | | 06/01/2033 | | 8,826,839 |

| Federal National Mortgage Association |

| 1,334,606 | | 5.50 | | | 01/01/2009 | | 1,382,305 |

| 1,013,450 | | 7.00 | | | 07/01/2009 | | 1,083,285 |

| 198,089 | | 6.50 | | | 02/01/2012 | | 211,637 |

| 446,397 | | 6.00 | | | 12/01/2013 | | 457,124 |

| 306,674 | | 6.50 | | | 07/01/2014 | | 321,867 |

| 635,548 | | 9.00 | | | 11/01/2021 | | 708,357 |

| 3,173 | | 6.50 | | | 05/01/2024 | | 3,316 |

| 93,856 | | 6.50 | | | 08/01/2024 | | 98,085 |

| 224,335 | | 6.50 | | | 09/01/2024 | | 234,443 |

| 53,104 | | 6.50 | | | 09/01/2024 | | 55,497 |

| 161,673 | | 9.00 | | | 02/01/2025 | | 181,030 |

| 159,274 | | 6.50 | | | 03/01/2026 | | 166,207 |

| 521,191 | | 8.00 | | | 07/01/2028 | | 569,336 |

| 860,918 | | 6.50 | | | 10/01/2028 | | 897,211 |

| 194,180 | | 7.00 | | | 10/01/2028 | | 205,496 |

| 742,335 | | 5.76 | # | | 12/01/2028 | | 763,748 |

| 348,251 | | 6.50 | | | 01/01/2029 | | 362,932 |

| 356,049 | | 6.00 | | | 07/01/2029 | | 364,540 |

| 834,644 | | 7.50 | | | 09/01/2029 | | 893,554 |

| 657,078 | | 7.00 | | | 03/01/2031 | | 694,604 |

| 408,844 | | 7.50 | | | 03/01/2031 | | 437,332 |

| 1,282,477 | | 7.00 | | | 11/01/2031 | | 1,355,725 |

| 3,133,357 | | 7.00 | | | 01/01/2032 | | 3,312,317 |

| 6,994,495 | | 5.00 | | | 02/01/2033 | | 6,781,727 |

| 6,538,364 | | 5.50 | | | 03/01/2033 | | 6,528,213 |

| 6,765,586 | | 5.50 | | | 03/01/2033 | | 6,755,082 |

| 4,464,424 | | 5.00 | | | 07/01/2033 | | 4,328,619 |

| 14,345,311 | | 4.50 | | | 08/01/2033 | | 13,478,908 |

| 4,945,946 | | 5.00 | | | 02/01/2034 | | 4,795,635 |

| Government National Mortgage Association |

| 1,190,726 | | 8.00 | | | 02/15/2022 | | 1,310,029 |

| 499,249 | | 7.50 | | | 08/20/2025 | | 537,399 |

| 1,773,223 | | 7.50 | | | 07/20/2026 | | 1,904,975 |

| 3,320,001 | | 6.50 | | | 04/15/2031 | | 3,468,741 |

|

| | | | | | | |

Principal Amount | | Interest

Rate | | | Maturity Date | | Value |

| Mortgage-Backed Pass-Through Obligations – (continued) |

| Government National Mortgage Association – (continued) |

| $3,897,617 | | 6.50 | % | | 05/15/2031 | | $ 4,072,235 |

| 2,806,783 | | 5.50 | | | 10/15/2033 | | 2,810,409 |

|

| TOTAL MORTGAGE-BACKED PASS-THROUGH OBLIGATIONS |

(Cost $100,169,232) | | $100,858,163 |

|

| |

| U.S. Government Agency Obligations – 22.4% |

| Federal Home Loan Bank |

| $10,000,000 | | 5.13 | % | | 03/06/2006 | | $ 10,492,280 |

| 23,755,000 | | 2.75 | | | 11/15/2006 | | 23,696,420 |

| 8,210,000 | | 4.88 | | | 11/15/2006 | | 8,613,210 |

| 7,000,000 | | 5.59 | | | 02/03/2009 | | 7,519,512 |

| 2,270,000 | | 5.58 | | | 02/17/2009 | | 2,437,058 |

| 3,025,000 | | 7.13 | | | 02/15/2030 | | 3,536,582 |

| Federal Home Loan Mortgage Corp. |

| 15,000,000 | | 2.75 | | | 08/15/2006 | | 15,027,750 |

| 12,000,000 | | 4.50 | | | 07/15/2013 | | 11,613,444 |

| Federal National Mortgage Association |

| 22,000,000 | | 3.38 | | | 12/15/2008 | | 21,520,796 |

| 6,150,000 | | 6.00 | | | 05/15/2011 | | 6,678,494 |

| 1,300,000 | | 5.08 | | | 06/24/2018 | | 1,245,594 |

| 8,900,000 | | 7.13 | | | 01/15/2030 | | 10,477,694 |

| 10,000,000 | | 6.63 | | | 11/15/2030 | | 11,110,100 |

| Tennessee Valley Authority |

| 5,765,000 | | 6.00 | | | 03/15/2013 | | 6,254,397 |

| 1,000,000 | | 7.13 | | | 05/01/2030 | | 1,176,439 |

|

| TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS |

(Cost $143,384,713) | | $141,399,770 |

|

| |

| U.S. Treasury Obligations – 0.5% |

| United States Treasury Bonds |

| $ 400,000 | | 8.00 | % | | 11/15/2021 | | $ 526,937 |

| United States Treasury Notes |

| 1,750,000 | | 3.63 | | | 05/15/2013 | | 1,651,290 |

| 1,200,000 | | 4.25 | | | 11/15/2013 | | 1,177,219 |

|

| TOTAL U.S. TREASURY OBLIGATIONS |

(Cost $3,498,857) | | $ 3,355,446 |

|

| |

| Repurchase Agreement – 1.3% |

| State Street Bank & Trust Co.^ |

| $8,155,000 | | 0.75 | % | | 05/03/2004 | | $ 8,155,000 |

Maturity Value: $8,155,510 | | |

|

| TOTAL REPURCHASE AGREEMENT |

(Cost $8,155,000) | | $ 8,155,000 |

|

| TOTAL INVESTMENTS – 99.2% |

(Cost $618,319,085) | | 626,911,769 |

| Other assets in excess of liabilities – 0.8% | | 5,018,276 |

|

| Net Assets – 100.0% | | $631,930,045 |

|

| | |

| 18 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE BOND FUND

| | |

| † | | Securities are exempt from registration under Rule 144A of the Securities Act of 1933. Under procedures approved by the Board of Trustees, such securities have been determined to be liquid by the Investment Adviser and may be resold, normally to qualified institutional buyers in transactions exempt from registration. Total market value of Rule 144A securities amounted to $44,539,083 which represents 7.0% of net assets as of April 30, 2004. |

| # | | Variable rate security. Coupon rate disclosed is that which is in effect at April 30, 2004. |

| ^ | | Repurchase agreement was entered into on April 30, 2004. At April 30, 2004, this agreement was fully collateralized by U.S. Treasury Notes. |

| @ | | Security issued with a zero coupon. The actual effective yield of this security is different than the stated coupon due to the accretion of discount. |

| | |

|

|

| Investment Abbreviations: |

| FGIC | | —Insured by Financial Guaranty Insurance Co. |

| FNIC | | —Financial Network Investment Corporation |

| MTN | | —Medium-Term Note |

| PAC | | —Planned Amortization Class |

| REMIC | | —Real Estate Mortgage Investment Conduit |

|

| | |

| The accompanying notes are an integral part of these financial statements. | | 19 |

COMMERCE SHORT-TERM GOVERNMENT FUND

Short-Term Government Fund

Performance Review(a) (Unaudited)