UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-8598

The Commerce Funds

(Exact name of registrant as specified in charter)

|

| 922 Walnut St., Fourth Floor, Mail Code = TB4-1, Kansas City, Missouri 64106 |

| (Address of principal executive offices) (Zip code) |

Diana E. McCarthy, Esq.,

Drinker Biddle & Reath LLP

One Logan Square, Suite 2000

Philadelphia, PA 19103

(Name and address of agent for service)

Registrant’s telephone number, including area code:1-800-995-6365

Date of fiscal year end 10/31

Date of reporting period: 4/30/11

| ITEM 1. | | REPORTS TO SHAREHOLDERS |

The Semi-Annual Report to Shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1) is filed herewith.

The Commerce Funds

The Commerce Funds

Semi-Annual Report

April 30, 2011

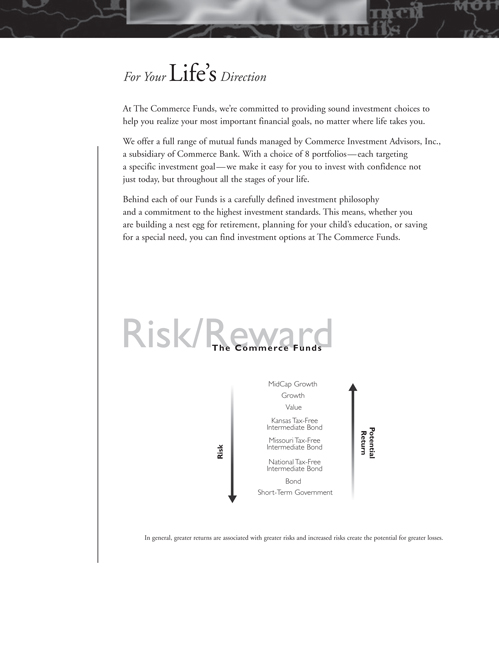

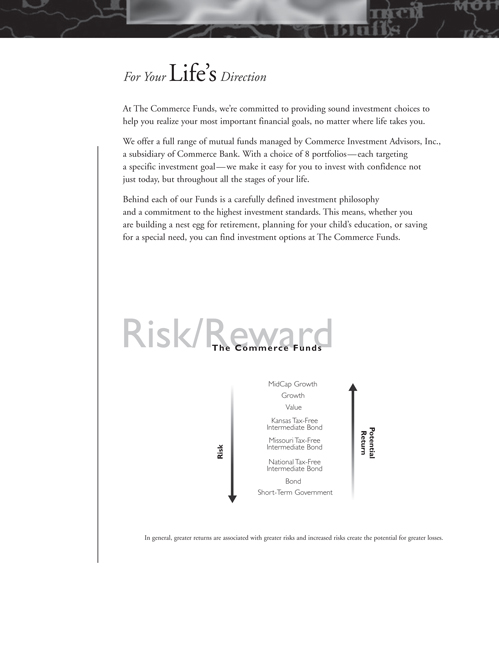

For Your Life’s Direction

At The Commerce Funds, we’re committed to providing sound investment choices to help you realize your most important financial goals, no matter where life takes you.

We offer a full range of mutual funds managed by Commerce Investment Advisors, Inc., a subsidiary of Commerce Bank. With a choice of 8 portfolios—each targeting a specific investment goal—we make it easy for you to invest with confidence not

just today, but throughout all the stages of your life.

Behind each of our Funds is a carefully defined investment philosophy and a commitment to the highest investment standards. This means, whether you are building a nest egg for retirement, planning for your child’s education, or saving for a special need, you can find investment options at The Commerce Funds.

Risk/Reward

The Commerce Funds

Risk

MidCap Growth

Growth

Value

Kansas Tax-Free

Intermediate Bond

Missouri Tax-Free

Intermediate Bond

National Tax-Free

Intermediate Bond

Bond

Short-Term Government

Potential

Return

In general, greater returns are associated with greater risks and increased risks create the potential for greater losses.

COMMERCE FUNDS

Table of Contents

Please note:

The information in this semi-annual report is as of April 30, 2011 and is unaudited. To view more recent information about each Commerce Fund’s performance and portfolio or to obtain a prospectus, please visit our website at www.commercefunds.com. This report is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus, which contains more complete information about the Commerce Funds’ investment policies, management and expenses. Investors should read the prospectus carefully before investing.

You may also receive Commerce Funds information by calling toll free 1-800-995-6365 or by writing to P.O. Box 219525, Kansas City, Missouri, 64121-9525, or you may contact your investment professional. The Commerce Funds publish performance and portfolio information for each Commerce Fund at the end of every calendar quarter. Investors should read the prospectus carefully before investing or sending money.

COMMERCE FUNDS

Performance and Expense Ratio Information

April 30, 2011 (Unaudited)

| | | | | | | | | | |

PERFORMANCE REVIEW | | | | | | | | | | |

| November 1, 2010 - April 30, 2011 | | Fund Total Return(a) | | | Index Total Return | | | Index |

Equity Funds: | | | | | | | | | | |

Growth | | | 13.68 | % | | | 16.96 | % | | Russell 1000® Growth(b) |

Value | | | 18.88 | | | | 17.29 | | | Russell 1000® Value(c) |

Mid Cap Growth | | | 19.33 | | | | 22.62 | | | Russell Midcap® Growth(d) |

Fixed Income Funds: | | | | | | | | | | |

Bond | | | 1.13 | | | | 0.02 | | | Barclays Capital U.S. Aggregate Bond(e) |

Short-Term Government | | | 0.10 | | | | -0.26 | | | Citigroup 1-5 Year Treasury/Government Sponsored(f) |

National Tax-Free Intermediate Bond | | | -1.03 | | | | -0.33 | | | Barclays Capital 3-15 Year Blend(g) |

Missouri Tax-Free Intermediate Bond | | | -0.51 | | | | -0.33 | | | Barclays Capital 3-15 Year Blend(g) |

Kansas Tax-Free Intermediate Bond | | | -0.49 | | | | -0.33 | | | Barclays Capital 3-15 Year Blend(g) |

| (a) | | Returns assume expense reimbursements and are not annualized. Returns do not reflect the deduction of taxes that a shareholder would pay on capital gains or other taxable distributions or the redemption of Fund shares. |

| (b) | | The Russell 1000® Growth Index, an unmanaged index, is a market capitalization weighted index of those 1,000 Russell companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect the deduction of any fees, expenses or taxes. |

| (c) | | The Russell 1000® Value Index is an unmanaged market capitalization weighted index of those 1,000 Russell companies with lower price-to-book ratios and lower forecasted growth values. The Index figures do not reflect the deduction of any fees, expenses or taxes. |

| (d) | | The Russell Midcap® Growth Index, an unmanaged index, measures the performance of those Russell midcap companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect the deduction of any fees, expenses or taxes. |

| (e) | | The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index comprised of the Barclays Capital Government Corporate Bond Index, Mortgage-Backed Securities Index and Asset-Backed Securities Index. The Index figures do not reflect the deduction of any fees, expenses or taxes. |

| (f) | | The Citigroup 1-5 Year Treasury/Government Sponsored Index is an unmanaged index comprised of Treasury securities with a minimum principal amount of $1 billion and U.S. Government securities with a minimum principal amount of $100 million. The securities range in maturity from one to five years. The Index figures do not reflect the deduction of any fees, expenses or taxes. |

| (g) | | The Barclays Capital 3-15 Year Blend Index is an unmanaged index composed of investment grade municipal securities ranging from 2 to 17 years in maturity. The Index figures do not reflect the deduction of any fees, expenses or taxes. |

| | | | | | | | | | | | | | | | | | | | |

STANDARDIZED AVERAGE ANNUAL TOTAL RETURNS(h) | | | | | | | | | | | | | | | | | | | | |

| For the period ended 03/31/2011 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date | |

Equity Funds: | | | | | | | | | | | | | | | | | | | | |

Growth | | | 13.64 | % | | | 2.73 | % | | | 2.32 | % | | | 7.15 | % | | | 12/12/94 | |

Value | | | 15.34 | | | | 0.75 | | | | 2.80 | | | | 4.32 | | | | 3/3/97 | |

Mid Cap Growth | | | 28.62 | | | | 4.42 | | | | 5.20 | | | | 7.95 | | | | 12/12/94 | |

Fixed Income Funds: | | | | | | | | | | | | | | | | | | | | |

Bond | | | 8.05 | | | | 7.37 | | | | 5.68 | | | | 6.54 | | | | 12/12/94 | |

Short-Term Government | | | 3.14 | | | | 4.82 | | | | 3.91 | | | | 5.08 | | | | 12/12/94 | |

National Tax-Free Intermediate Bond | | | 2.18 | | | | 3.93 | | | | 4.09 | | | | 4.62 | | | | 2/21/95 | |

Missouri Tax-Free Intermediate Bond | | | 1.99 | | | | 3.81 | | | | 3.93 | | | | 4.47 | | | | 2/21/95 | |

Kansas Tax-Free Intermediate Bond | | | 1.78 | | | | 3.84 | | | | 3.95 | | | | 4.16 | | | | 12/26/00 | |

| (h) | | The Standardized Average Annual Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. |

These returns represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the total return figures in the above charts.

Returns assume fee waivers and expense reductions. Absent these waivers and reductions, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on capital gains or other taxable distributions or the redemption of Fund shares.

| | | | | | | | |

EXPENSE RATIOS(i) | | | | | | | | |

| | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Reimbursement) | |

Equity Funds: | | | | | | | | |

Growth | | | 1.13 | % | | | 1.25 | % |

Value | | | 0.70 | | | | 0.95 | |

Mid Cap Growth | | | 1.34 | | | | 1.34 | |

Fixed Income Funds: | | | | | | | | |

Bond | | | 0.84 | | | | 0.84 | |

Short-Term Government | | | 0.68 | | | | 0.90 | |

National Tax-Free Intermediate Bond | | | 0.70 | | | | 0.87 | |

Missouri Tax-Free Intermediate Bond | | | 0.70 | | | | 0.86 | |

Kansas Tax-Free Intermediate Bond | | | 0.70 | | | | 0.96 | |

| (i) | | The expense ratios of the Funds, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations), are as set forth above according to the most recent publicly available Prospectus for the Funds and may differ from the expense ratios disclosed in the Financial Highlights in this report. Applicable waivers and expense limitations may be modified or terminated in the future, consistent with the terms of any arrangements in place. If this occurs, the expense ratios may change without shareholder approval. |

2

COMMERCE GROWTH FUND

Schedule of Investments

April 30, 2011 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| | Common Stocks – 94.7% | |

| Commercial Services – 1.0% | |

| | 33,200 | | | Thomson Reuters Corp. | | | $ 1,343,604 | |

| | | |

| Communications* – 1.0% | |

| | 34,000 | | | SBA Communications Corp. Class A | | | 1,313,420 | |

| | | |

| Consumer Durables – 2.4% | |

| | 142,100 | | | Ford Motor Co.* | | | 2,198,287 | |

| | 44,300 | | | Leggett & Platt, Inc. | | | 1,164,647 | |

| | | | | | | | |

| | | | | | | 3,362,934 | |

| | | |

| Consumer Non-Durables – 5.4% | |

| | 22,500 | | | Coach, Inc. | | | 1,345,725 | |

| | 8,600 | | | Colgate-Palmolive Co. | | | 725,410 | |

| | 29,400 | | | PepsiCo, Inc. | | | 2,025,366 | |

| | 22,400 | | | Philip Morris International, Inc. | | | 1,555,456 | |

| | 9,700 | | | Polo Ralph Lauren Corp. | | | 1,268,469 | |

| | 7,800 | | | The Coca-Cola Co. | | | 526,188 | |

| | | | | | | | |

| | | | | | | 7,446,614 | |

| | | |

| Consumer Services – 5.3% | |

| | 40,800 | | | DIRECTV Class A* | | | 1,982,472 | |

| | 20,700 | | | eBay, Inc.* | | | 712,080 | |

| | 28,900 | | | Expedia, Inc. | | | 723,367 | |

| | 41,400 | | | Las Vegas Sands Corp.* | | | 1,946,214 | |

| | 5,100 | | | McDonald’s Corp. | | | 399,381 | |

| | 42,800 | | | Starbucks Corp. | | | 1,548,932 | |

| | | | | | | | |

| | | | | | | 7,312,446 | |

| | | |

| Electronic Technology – 19.0% | |

| | 15,700 | | | Apple, Inc.* | | | 5,467,211 | |

| | 83,100 | | | Cadence Design Systems, Inc.* | | | 862,578 | |

| | 84,300 | | | Cisco Systems, Inc. | | | 1,480,308 | |

| | 95,200 | | | Dell, Inc.* | | | 1,476,552 | |

| | 7,900 | | | F5 Networks, Inc.* | | | 800,744 | |

| | 16,400 | | | Harris Corp. | | | 871,332 | |

| | 74,400 | | | Hewlett-Packard Co. | | | 3,003,528 | |

| | 119,000 | | | Intel Corp. | | | 2,759,610 | |

| | 50,600 | | | Linear Technology Corp. | | | 1,760,880 | |

| | 11,600 | | | Lockheed Martin Corp. | | | 919,300 | |

| | 33,600 | | | Novellus Systems, Inc.* | | | 1,078,560 | |

| | 81,300 | | | QLogic Corp.* | | | 1,461,774 | |

| | 23,300 | | | QUALCOMM, Inc. | | | 1,324,372 | |

| | 61,800 | | | Texas Instruments, Inc. | | | 2,195,754 | |

| | 16,400 | | | Zebra Technologies Corp. Class A* | | | 644,356 | |

| | | | | | | | |

| | | | | | | 26,106,859 | |

| | | |

| Energy Minerals – 10.8% | |

| | 44,300 | | | Arch Coal, Inc. | | | 1,519,490 | |

| | 18,700 | | | Chevron Corp. | | | 2,046,528 | |

| | 8,000 | | | Cimarex Energy Co. | | | 884,720 | |

| | 19,300 | | | ConocoPhillips | | | 1,523,349 | |

| | 72,500 | | | Exxon Mobil Corp. | | | 6,380,000 | |

| | 22,200 | | | Occidental Petroleum Corp. | | | 2,537,238 | |

| | | | | | | | |

| | | | | | | 14,891,325 | |

| | | |

| Finance – 2.3% | |

| | 46,400 | | | Morgan Stanley & Co. | | | 1,213,360 | |

| | | |

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| | Common Stocks – (continued) | |

| Finance – (continued) | |

| | 15,800 | | | Prudential Financial, Inc. | | | $ 1,002,036 | |

| | 51,400 | | | The Charles Schwab Corp. | | | 941,134 | |

| | | | | | | | |

| | | | | | | 3,156,530 | |

| | | |

| Health Services* – 1.5% | |

| | 35,000 | | | Medco Health Solutions, Inc. | | | 2,076,550 | |

| | | |

| Health Technology – 6.5% | |

| | 13,000 | | | Abbott Laboratories | | | 676,520 | |

| | 22,400 | | | Allergan, Inc. | | | 1,782,144 | |

| | 19,600 | | | C. R. Bard, Inc. | | | 2,092,300 | |

| | 48,700 | | | Gilead Sciences, Inc.* | | | 1,891,508 | |

| | 6,500 | | | Johnson & Johnson | | | 427,180 | |

| | 26,200 | | | Medtronic, Inc. | | | 1,093,850 | |

| | 15,500 | | | Stryker Corp. | | | 914,500 | |

| | | | | | | | |

| | | | | | | 8,878,002 | |

| | | |

| Industrial Services – 2.2% | |

| | 8,900 | | | Diamond Offshore Drilling, Inc. | | | 675,243 | |

| | 26,100 | | | Schlumberger Ltd. | | | 2,342,475 | |

| | | | | | | | |

| | | | | | | 3,017,718 | |

| | | |

| Non-Energy Minerals – 3.5% | |

| | 17,100 | | | Cliffs Natural Resources, Inc. | | | 1,602,612 | |

| | 26,000 | | | Freeport-McMoRan Copper & Gold, Inc. | | | 1,430,780 | |

| | 9,600 | | | Newmont Mining Corp. | | | 562,656 | |

| | 31,500 | | | Southern Copper Corp. | | | 1,179,990 | |

| | | | | | | | |

| | | | | | | 4,776,038 | |

| | | |

| Process Industries – 1.1% | |

| | 49,300 | | | International Paper Co. | | | 1,522,384 | |

| | | |

| Producer Manufacturing – 7.9% | |

| | 6,200 | | | Cummins, Inc. | | | 745,116 | |

| | 16,800 | | | Eaton Corp. | | | 899,304 | |

| | 64,100 | | | General Electric Co. | | | 1,310,845 | |

| | 22,300 | | | The Timken Co. | | | 1,257,497 | |

| | 23,900 | | | TRW Automotive Holdings Corp.* | | | 1,363,734 | |

| | 40,600 | | | United Technologies Corp. | | | 3,636,948 | |

| | 23,200 | | | WABCO Holdings, Inc.* | | | 1,713,320 | |

| | | | | | | | |

| | | | | | | 10,926,764 | |

| | | |

| Retail Trade – 5.7% | |

| | 6,400 | | | AutoZone, Inc.* | | | 1,807,232 | |

| | 12,900 | | | Dollar Tree, Inc.* | | | 741,750 | |

| | 81,700 | | | Lowe’s Cos., Inc. | | | 2,144,625 | |

| | 4,400 | | | Netflix, Inc.* | | | 1,023,748 | |

| | 14,900 | | | Target Corp. | | | 731,590 | |

| | 58,800 | | | The Gap, Inc. | | | 1,366,512 | |

| | | | | | | | |

| | | | | | | 7,815,457 | |

| | | |

| Technology Services – 15.6% | |

| | 26,700 | | | Adobe Systems, Inc.* | | | 895,785 | |

| | 33,800 | | | BMC Software, Inc.* | | | 1,697,774 | |

| | 7,400 | | | Google, Inc. Class A* | | | 4,026,340 | |

| | 39,100 | | | International Business Machines Corp. | | | 6,669,678 | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 3 |

COMMERCE GROWTH FUND

Schedule of Investments (continued)

April 30, 2011 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| | Common Stocks – (continued) | |

| Technology Services – (continued) | |

| | 120,800 | | | Microsoft Corp. | | | $ 3,143,216 | |

| | 86,700 | | | Oracle Corp. | | | 3,125,535 | |

| | 17,700 | | | Rovi Corp.* | | | 859,512 | |

| | 26,200 | | | VeriSign, Inc. | | | 968,352 | |

| | | | | | | | |

| | | | | | | 21,386,192 | |

| | | |

| Transportation – 3.5% | |

| | 52,000 | | | Frontline Ltd. | | | 1,149,720 | |

| | 15,500 | | | Union Pacific Corp. | | | 1,603,785 | |

| | 62,450 | | | United Continental Holdings, Inc.* | | | 1,425,109 | |

| | 8,800 | | | United Parcel Service, Inc. Class B | | | 659,736 | |

| | | | | | | | |

| | | | | | | 4,838,350 | |

| | | |

| | TOTAL COMMON STOCKS | |

| (Cost $109,224,033) | | | $130,171,187 | |

| | | |

| | | | | | | | |

| | Exchange Traded Fund – 3.6% | |

| | 78,400 | | | iShares Russell 1000 Growth Index Fund | |

| (Cost $4,679,877) | | | $ 4,896,080 | |

| | | |

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

| Short-term Investment(a) – 1.8% | |

Repurchase Agreement – 1.8% | |

| State Street Bank & Trust Co. | |

| $2,509,000 | | | 0.010 | % | | | 05/02/11 | | | $ | 2,509,000 | |

Maturity Value: $2,509,002 | |

(Cost $2,509,000) | | | | | | | | | |

| | |

| TOTAL INVESTMENTS – 100.1% | |

(Cost $116,412,910) | | | | | | | $ | 137,576,267 | |

| | |

LIABILITIES IN EXCESS OF

OTHER ASSETS – (0.1)% | | | | (69,890) | |

| | |

| NET ASSETS – 100.0% | | | $ | 137,506,377 | |

| | |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| * | | Non-income producing security. |

| (a) | | Repurchase agreement was entered into on April 29, 2011. This agreement was fully collateralized by $2,530,000 U.S. Treasury Note, 1.000%, due 04/30/12 with a market value of $2,561,160. |

| |

PORTFOLIO COMPOSITION

| | | | | | | | |

| | | AS OF

4/30/11 | | | AS OF

10/31/10 | |

| | |

Electronic Technology | | | 19.0 | % | | | 20.6 | % |

Technology Services | | | 15.6 | | | | 16.0 | |

Energy Minerals | | | 10.8 | | | | 7.8 | |

Producer Manufacturing | | | 7.9 | | | | 7.0 | |

Health Technology | | | 6.5 | | | | 10.6 | |

Retail Trade | | | 5.7 | | | | 4.9 | |

Consumer Non-Durables | | | 5.4 | | | | 8.3 | |

Consumer Services | | | 5.3 | | | | 5.0 | |

Exchange Traded Fund | | | 3.6 | | | | — | |

Transportation | | | 3.5 | | | | 2.9 | |

Non-Energy Minerals | | | 3.5 | | | | 1.5 | |

Consumer Durables | | | 2.4 | | | | 2.7 | |

Finance | | | 2.3 | | | | 3.0 | |

Industrial Services | | | 2.2 | | | | 2.0 | |

Health Services | | | 1.5 | | | | 2.5 | |

Process Industries | | | 1.1 | | | | 2.4 | |

Communications | | | 1.0 | | | | 1.1 | |

Commercial Services | | | 1.0 | | | | — | |

Distribution Services | | | — | | | | 1.2 | |

Short-term Investment | | | 1.8 | | | | 0.6 | |

| | |

| TOTAL INVESTMENTS | | | 100.1 | % | | | 100.1 | % |

| | |

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Underlying investment categories of exchange traded funds (“ETFs”) held by the Fund are not reflected in the table above. Consequently, the Fund’s overall investment category allocations may differ from the percentages contained in the table above.

The Fund is actively managed and, as such, its composition may differ over time.

| | |

| 4 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE VALUE FUND

Schedule of Investments

April 30, 2011 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| | Common Stocks – 94.9% | |

| Commercial Services – 0.4% | |

| | 11,000 | | | R.R. Donnelley & Sons Co. | | | $ 207,460 | |

| | | |

| Communications – 4.9% | |

| | 55,000 | | | AT&T, Inc. | | | 1,711,600 | |

| | 6,656 | | | CenturyLink, Inc. | | | 271,432 | |

| | 22,000 | | | Verizon Communications, Inc. | | | 831,160 | |

| | | | | | | | |

| | | | | | | 2,814,192 | |

| | | |

| Consumer Non-Durables – 18.6% | |

| | 41,500 | | | Altria Group, Inc. | | | 1,113,860 | |

| | 40,000 | | | Avon Products, Inc. | | | 1,175,200 | |

| | 23,000 | | | ConAgra Foods, Inc. | | | 562,350 | |

| | 12,000 | | | General Mills, Inc. | | | 462,960 | |

| | 17,000 | | | Kimberly-Clark Corp. | | | 1,123,020 | |

| | 17,000 | | | PepsiCo, Inc. | | | 1,171,130 | |

| | 17,500 | | | Procter & Gamble Co. | | | 1,135,750 | |

| | 31,000 | | | Reynolds American, Inc. | | | 1,150,410 | |

| | 16,000 | | | The Coca-Cola Co. | | | 1,079,360 | |

| | 10,000 | | | The Hershey Co. | | | 577,100 | |

| | 11,000 | | | V.F. Corp. | | | 1,106,160 | |

| | | | | | | | |

| | | | | | | 10,657,300 | |

| | | |

| Consumer Services – 0.9% | |

| | 11,000 | | | Darden Restaurants, Inc. | | | 516,670 | |

| | | |

| Distribution Services – 1.9% | |

| | 20,000 | | | Genuine Parts Co. | | | 1,074,000 | |

| | | |

| Electronic Technology – 8.2% | |

| | 3,000 | | | General Dynamics Corp. | | | 218,460 | |

| | 25,000 | | | Intel Corp. | | | 579,750 | |

| | 20,000 | | | Intersil Corp. Class A | | | 295,400 | |

| | 32,500 | | | Linear Technology Corp. | | | 1,131,000 | |

| | 14,000 | | | Lockheed Martin Corp. | | | 1,109,500 | |

| | 29,000 | | | Microchip Technology, Inc. | | | 1,190,160 | |

| | 4,000 | | | Raytheon Co. | | | 194,200 | |

| | | | | | | | |

| | | | | | | 4,718,470 | |

| | | |

| Energy Minerals – 8.6% | |

| | 25,500 | | | Chevron Corp. | | | 2,790,720 | |

| | 27,500 | | | ConocoPhillips | | | 2,170,575 | |

| | | | | | | | |

| | | | | | | 4,961,295 | |

| | | |

| Finance – 11.3% | |

| | 3,500 | | | Bank of Hawaii Corp. | | | 170,765 | |

| | 1,500 | | | BlackRock, Inc. | | | 293,910 | |

| | 21,000 | | | Federated Investors, Inc. Class B | | | 541,380 | |

| | 30,000 | | | GATX Corp. | | | 1,268,100 | |

| | 6,000 | | | HCP, Inc. | | | 237,720 | |

| | 58,500 | | | Kimco Realty Corp. | | | 1,143,090 | |

| | 16,000 | | | Liberty Property Trust | | | 562,720 | |

| | 3,000 | | | M&T Bank Corp. | | | 265,110 | |

| | 8,000 | | | Senior Housing Properties Trust | | | 189,760 | |

| | 2,000 | | | Simon Property Group, Inc. | | | 229,080 | |

| | 4,000 | | | Taubman Centers, Inc. | | | 232,600 | |

| | 6,000 | | | The Chubb Corp. | | | 391,140 | |

| | 8,500 | | | The Travelers Cos., Inc. | | | 537,880 | |

| | | |

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| | Common Stocks – (continued) | |

| Finance – (continued) | |

| | 2,000 | | | Vornado Realty Trust | | | $ 193,360 | |

| | 10,000 | | | Weyerhaeuser Co. | | | 230,100 | |

| | | | | | | | |

| | | | | | | 6,486,715 | |

| | | |

| Health Technology – 8.6% | |

| | 16,000 | | | Abbott Laboratories | | | 832,640 | |

| | 8,000 | | | Eli Lilly & Co. | | | 296,080 | |

| | 20,000 | | | Johnson & Johnson | | | 1,314,400 | |

| | 22,000 | | | Merck & Co., Inc. | | | 790,900 | |

| | 80,000 | | | Pfizer, Inc. | | | 1,676,800 | |

| | | | | | | | |

| | | | | | | 4,910,820 | |

| | | |

| Industrial Services – 0.9% | |

| | 13,000 | | | Waste Management, Inc. | | | 512,980 | |

| | | |

| Process Industries – 4.2% | |

| | 17,000 | | | Greif, Inc. Class A | | | 1,055,700 | |

| | 9,000 | | | MeadWestvaco Corp. | | | 303,210 | |

| | 30,000 | | | Sonoco Products Co. | | | 1,036,800 | |

| | | | | | | | |

| | | | | | | 2,395,710 | |

| | | |

| Producer Manufacturing – 6.5% | |

| | 5,000 | | | Eaton Corp. | | | 267,650 | |

| | 90,000 | | | General Electric Co. | | | 1,840,500 | |

| | 19,000 | | | Illinois Tool Works, Inc. | | | 1,109,790 | |

| | 22,000 | | | Pitney Bowes, Inc. | | | 540,320 | |

| | | | | | | | |

| | | | | | | 3,758,260 | |

| | | |

| Retail Trade – 3.0% | |

| | 60,000 | | | SUPERVALU, Inc. | | | 675,600 | |

| | 28,000 | | | The Home Depot, Inc. | | | 1,039,920 | |

| | | | | | | | |

| | | | | | | 1,715,520 | |

| | | |

| Technology Services – 5.6% | |

| | 21,000 | | | Automatic Data Processing, Inc. | | | 1,141,350 | |

| | 40,000 | | | Microsoft Corp. | | | 1,040,800 | |

| | 31,000 | | | Paychex, Inc. | | | 1,014,010 | |

| | | | | | | | |

| | | | | | | 3,196,160 | |

| | | |

| Utilities – 11.3% | |

| | 6,000 | | | Alliant Energy Corp. | | | 237,240 | |

| | 6,000 | | | DTE Energy Co. | | | 303,180 | |

| | 20,000 | | | Duke Energy Corp. | | | 373,000 | |

| | 8,000 | | | Edison International | | | 314,160 | |

| | 5,000 | | | Exelon Corp. | | | 210,750 | |

| | 47,500 | | | MDU Resources Group, Inc. | | | 1,134,775 | |

| | 21,000 | | | OGE Energy Corp. | | | 1,116,570 | |

| | 16,000 | | | ONEOK, Inc. | | | 1,119,040 | |

| | 5,000 | | | PG&E Corp. | | | 230,400 | |

| | 4,500 | | | Progress Energy, Inc. | | | 213,525 | |

| | 8,000 | | | Questar Corp. | | | 140,560 | |

| | 7,000 | | | The Southern Co. | | | 273,280 | |

| | 17,000 | | | UGI Corp. | | | 566,100 | |

| | 10,000 | | | Xcel Energy, Inc. | | | 243,300 | |

| | | | | | | | |

| | | | | | | 6,475,880 | |

| | | |

| | TOTAL COMMON STOCKS | |

| (Cost $49,708,979) | | | $54,401,432 | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 5 |

COMMERCE VALUE FUND

Schedule of Investments (continued)

April 30, 2011 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| | Exchange Traded Fund – 2.1% | |

| | 17,500 | | | iShares Russell 1000 Value Index Fund | | | | |

| (Cost $1,162,996) | | | $ 1,232,875 | |

| | | |

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

| Short-term Investment(a) – 2.9% | |

Repurchase Agreement – 2.9% | |

| State Street Bank & Trust Co. | |

| $1,657,000 | | | 0.010 | % | | | 05/02/11 | | | $ | 1,657,000 | |

Maturity Value: $1,657,001 | |

(Cost $1,657,000) | | | | | | | | | |

| | |

| TOTAL INVESTMENTS – 99.9% | |

(Cost $52,528,975) | | | | | | | $ | 57,291,307 | |

| | |

OTHER ASSETS IN EXCESS OF LIABILITIES – 0.1% | | | | 56,149 | |

| | |

| NET ASSETS – 100.0% | | | $ | 57,347,456 | |

| | |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| (a) | | Repurchase agreement was entered into on April 29, 2011. This agreement was fully collateralized by $1,670,000 U.S. Treasury Note, 1.000%, due 04/30/12 with a market value of $1,690,568. |

| |

PORTFOLIO COMPOSITION

| | | | | | | | |

| | | AS OF

4/30/11 | | | AS OF

10/31/10 | |

| | |

Consumer Non-Durables | | | 18.6 | % | | | 5.7 | % |

Finance | | | 11.3 | | | | 26.4 | |

Utilities | | | 11.3 | | | | 5.1 | |

Energy Minerals | | | 8.6 | | | | 9.8 | |

Health Technology | | | 8.6 | | | | 9.9 | |

Electronic Technology | | | 8.2 | | | | 3.9 | |

Producer Manufacturing | | | 6.5 | | | | 6.3 | |

Technology Services | | | 5.6 | | | | 4.2 | |

Communications | | | 4.9 | | | | 5.2 | |

Process Industries | | | 4.2 | | | | 3.0 | |

Retail Trade | | | 3.0 | | | | 1.6 | |

Exchange Traded Fund | | | 2.1 | | | | 3.0 | |

Distribution Services | | | 1.9 | | | | 0.8 | |

Consumer Services | | | 0.9 | | | | 7.5 | |

Industrial Services | | | 0.9 | | | | 3.4 | |

Commercial Services | | | 0.4 | | | | 0.9 | |

Transportation | | | — | | | | 0.9 | |

Consumer Durables | | | — | | | | 0.8 | |

Health Services | | | — | | | | 0.7 | |

Non-Energy Minerals | | | — | | | | 0.3 | |

Short-term Investment | | | 2.9 | | | | 0.7 | |

| | |

| TOTAL INVESTMENTS | | | 99.9 | % | | | 100.1 | % |

| | |

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Underlying investment categories of exchange traded funds (“ETFs”) held by the Fund are not reflected in the table above. Consequently, the Fund’s overall investment category allocations may differ from the percentages contained in the table above.

The Fund is actively managed and, as such, its composition may differ over time.

| | |

| 6 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE MIDCAP GROWTH FUND

Schedule of Investments

April 30, 2011 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| | Common Stocks – 94.9% | |

| Commercial Services – 3.7% | | | | |

| | 4,900 | | | FactSet Research Systems, Inc. | | | $ 536,109 | |

| | 16,700 | | | FTI Consulting, Inc.* | | | 666,330 | |

| | 13,400 | | | Lender Processing Services, Inc. | | | 394,362 | |

| | 8,800 | | | The Brink’s Co. | | | 290,488 | |

| | 18,100 | | | The McGraw-Hill Cos., Inc. | | | 732,507 | |

| | | | | | | | |

| | | | | | | 2,619,796 | |

| | | |

| Communications* – 1.7% | | | | |

| | 16,400 | | | SBA Communications Corp. Class A | | | 633,532 | |

| | 27,100 | | | TW Telecom, Inc. | | | 583,734 | |

| | | | | | | | |

| | | | | | | 1,217,266 | |

| | | |

| Consumer Durables* – 1.3% | | | | |

| | 14,100 | | | Tempur-Pedic International, Inc. | | | 885,198 | |

| | | |

| Consumer Non-Durables – 4.3% | | | | |

| | 11,200 | | | Brown-Forman Corp., Class B | | | 804,832 | |

| | 26,500 | | | Coach, Inc. | | | 1,584,965 | |

| | 9,100 | | | The Clorox Co. | | | 633,906 | |

| | | | | | | | |

| | | | | | | 3,023,703 | |

| | | |

| Consumer Services – 5.6% | | | | |

| | 1,900 | | | Chipotle Mexican Grill, Inc. Class A* | | | 506,901 | |

| | 31,800 | | | Expedia, Inc. | | | 795,954 | |

| | 28,900 | | | Marriott International, Inc. Class A | | | 1,020,170 | |

| | 1,700 | | | Priceline.com, Inc.* | | | 929,917 | |

| | 4,400 | | | Wynn Resorts Ltd. | | | 647,460 | |

| | | | | | | | |

| | | | | | | 3,900,402 | |

| | | |

| Electronic Technology – 16.9% | | | | |

| | 116,000 | | | Advanced Micro Devices, Inc.* | | | 1,055,600 | |

| | 16,700 | | | Altera Corp. | | | 813,290 | |

| | 65,400 | | | Cadence Design Systems, Inc.* | | | 678,852 | |

| | 6,800 | | | Dolby Laboratories, Inc. Class A* | | | 340,408 | |

| | 19,800 | | | Harris Corp. | | | 1,051,974 | |

| | 32,400 | | | JDS Uniphase Corp.* | | | 675,216 | |

| | 26,200 | | | Juniper Networks, Inc.* | | | 1,004,246 | |

| | 31,400 | | | Linear Technology Corp. | | | 1,092,720 | |

| | 24,700 | | | Marvell Technology Group Ltd.* | | | 381,121 | |

| | 19,700 | | | Novellus Systems, Inc.* | | | 632,370 | |

| | 37,000 | | | NVIDIA Corp.* | | | 740,000 | |

| | 32,400 | | | ON Semiconductor Corp.* | | | 340,524 | |

| | 19,400 | | | SanDisk Corp.* | | | 953,316 | |

| | 33,800 | | | Xilinx, Inc. | | | 1,178,268 | |

| | 23,300 | | | Zebra Technologies Corp. Class A* | | | 915,457 | |

| | | | | | | | |

| | | | | | | 11,853,362 | |

| | | |

| Energy Minerals – 6.0% | | | | |

| | 19,500 | | | Arch Coal, Inc. | | | 668,850 | |

| | 6,400 | | | Cimarex Energy Co. | | | 707,776 | |

| | 9,500 | | | CONSOL Energy, Inc. | | | 513,855 | |

| | 15,400 | | | SM Energy Co. | | | 1,168,244 | |

| | 10,100 | | | Ultra Petroleum Corp.* | | | 512,979 | |

| | 4,500 | | | Walter Energy, Inc. | | | 621,990 | |

| | | | | | | | |

| | | | | | | 4,193,694 | |

| | | |

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| | Common Stocks – (continued) | |

| Finance – 7.2% | | | | |

| | 7,995 | | | Eaton Vance Corp. | | | $ 269,991 | |

| | 8,800 | | | Endurance Specialty Holdings Ltd. | | | 390,192 | |

| | 7,800 | | | Federal Realty Investment Trust | | | 682,968 | |

| | 18,300 | | | Genworth Financial, Inc. Class A* | | | 223,077 | |

| | 4,200 | | | IntercontinentalExchange, Inc.* | | | 505,470 | |

| | 11,800 | | | Jefferies Group, Inc. | | | 285,206 | |

| | 10,600 | | | Principal Financial Group, Inc. | | | 357,750 | |

| | 7,600 | | | Rayonier, Inc. | | | 504,336 | |

| | 18,800 | | | T. Rowe Price Group, Inc. | | | 1,207,900 | |

| | 29,000 | | | TD Ameritrade Holding Corp. | | | 624,660 | |

| | | | | | | | |

| | | | | | | 5,051,550 | |

| | | |

| Health Services* – 2.7% | | | | |

| | 6,680 | | | Cerner Corp. | | | 802,802 | |

| | 11,000 | | | Laboratory Corporation of America Holdings | | | 1,061,170 | |

| | | | | | | | |

| | | | | | | 1,863,972 | |

| | | |

| Health Technology – 7.0% | | | | |

| | 6,540 | | | Allergan, Inc. | | | 520,323 | |

| | 11,080 | | | C. R. Bard, Inc. | | | 1,182,790 | |

| | 15,500 | | | DENTSPLY International, Inc. | | | 581,870 | |

| | 18,100 | | | Hill-Rom Holdings, Inc. | | | 814,681 | |

| | 11,500 | | | Illumina, Inc.* | | | 816,270 | |

| | 5,200 | | | Life Technologies Corp.* | | | 287,040 | |

| | 9,900 | | | Varian Medical Systems, Inc.* | | | 694,980 | |

| | | | | | | | |

| | | | | | | 4,897,954 | |

| | | |

| Industrial Services – 1.7% | | | | |

| | 7,800 | | | Core Laboratories NV | | | 748,644 | |

| | 10,000 | | | FMC Technologies, Inc.* | | | 464,800 | |

| | | | | | | | |

| | | | | | | 1,213,444 | |

| | | |

| Non-Energy Minerals – 1.7% | | | | |

| | 6,100 | | | Cliffs Natural Resources, Inc. | | | 571,692 | |

| | 29,400 | | | Titanium Metals Corp.* | | | 588,882 | |

| | | | | | | | |

| | | | | | | 1,160,574 | |

| | | |

| Process Industries – 7.0% | | | | |

| | 24,200 | | | Crown Holdings, Inc.* | | | 905,080 | |

| | 34,000 | | | International Paper Co. | | | 1,049,920 | |

| | 13,400 | | | Nalco Holding Co. | | | 391,414 | |

| | 10,400 | | | PPG Industries, Inc. | | | 984,568 | |

| | 15,336 | | | Sigma-Aldrich Corp. | | | 1,082,415 | |

| | 5,700 | | | The Sherwin-Williams Co. | | | 469,053 | |

| | | | | | | | |

| | | | | | | 4,882,450 | |

| | | |

| Producer Manufacturing – 9.0% | | | | |

| | 9,000 | | | Avery Dennison Corp. | | | 375,660 | |

| | 6,200 | | | Cummins, Inc. | | | 745,116 | |

| | 5,700 | | | Dover Corp. | | | 387,828 | |

| | 5,400 | | | Joy Global, Inc. | | | 545,130 | |

| | 5,800 | | | Lincoln Electric Holdings, Inc. | | | 455,764 | |

| | 25,900 | | | Masco Corp. | | | 347,578 | |

| | 10,550 | | | Parker Hannifin Corp. | | | 995,076 | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 7 |

COMMERCE MIDCAP GROWTH FUND

Schedule of Investments (continued)

April 30, 2011 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| | Common Stocks – (continued) | |

| Producer Manufacturing – (continued) | | | | |

| | 16,900 | | | The Timken Co. | | | $ 952,991 | |

| | 9,200 | | | The Toro Co. | | | 624,772 | |

| | 15,600 | | | TRW Automotive Holdings Corp.* | | | 890,136 | |

| | | | | | | | |

| | | | | | | 6,320,051 | |

| | | |

| Retail Trade – 5.1% | | | | |

| | 3,800 | | | AutoZone, Inc.* | | | 1,073,044 | |

| | 21,900 | | | Chico’s FAS, Inc. | | | 320,397 | |

| | 4,000 | | | Netflix, Inc.* | | | 930,680 | |

| | 6,260 | | | Nordstrom, Inc. | | | 297,663 | |

| | 12,000 | | | PetSmart, Inc. | | | 506,040 | |

| | 5,700 | | | Ross Stores, Inc. | | | 420,033 | |

| | | | | | | | |

| | | | | | | 3,547,857 | |

| | | |

| Technology Services – 10.6% | | | | |

| | 14,100 | | | Akamai Technologies, Inc.* | | | 485,604 | |

| | 6,200 | | | Alliance Data Systems Corp.* | | | 589,000 | |

| | 13,300 | | | Autodesk, Inc.* | | | 598,234 | |

| | 22,700 | | | BMC Software, Inc.* | | | 1,140,221 | |

| | 55,100 | | | Compuware Corp.* | | | 624,283 | |

| | 15,500 | | | MICROS Systems, Inc.* | | | 806,310 | |

| | 14,400 | | | Red Hat, Inc.* | | | 683,568 | |

| | 15,600 | | | Rovi Corp.* | | | 757,536 | |

| | 10,200 | | | Teradata Corp.* | | | 570,384 | |

| | 18,400 | | | VeriSign, Inc. | | | 680,064 | |

| | 24,400 | | | Western Union Co. | | | 518,500 | |

| | | | | | | | |

| | | | | | | 7,453,704 | |

| | | |

| Transportation – 2.5% | | | | |

| | 8,500 | | | Con-way, Inc. | | | 330,820 | |

| | 33,600 | | | Delta Air Lines, Inc.* | | | 348,768 | |

| | 22,100 | | | Frontline Ltd. | | | 488,631 | |

| | 24,990 | | | United Continental Holdings, Inc.* | | | 570,272 | |

| | | | | | | | |

| | | | | | | 1,738,491 | |

| | | |

| Utilities – 0.9% | | | | |

| | 35,300 | | | CenterPoint Energy, Inc. | | | 656,580 | |

| | | |

| | TOTAL COMMON STOCKS | | | | |

| (Cost $47,831,542) | | | $66,480,048 | |

| | | |

| | | | | | | | |

| | Exchange Traded Fund – 4.8% | | | | |

| | 53,400 | | | iShares Russell Midcap Growth Index Fund | |

| (Cost $3,025,509) | | | $ 3,368,472 | |

| | | |

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

| Short-term Investment(a) – 0.5% | | | | | |

Repurchase Agreement – 0.5% | | | | | |

| State Street Bank & Trust Co. | | | | | |

| $338,000 | | | 0.010 | % | | | 05/02/11 | | | $ | 338,000 | |

Maturity Value: $338,000 | |

(Cost $338,000) | | | | | | | | | |

| | |

| TOTAL INVESTMENTS – 100.2% | | | | | |

(Cost $51,195,051) | | | | | | | $ | 70,186,520 | |

| | |

LIABILITIES IN EXCESS OF OTHER ASSETS – (0.2)% | | | | (141,208) | |

| | |

| NET ASSETS – 100.0% | | | $ | 70,045,312 | |

| | |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| * | | Non-income producing security. |

| (a) | | Repurchase agreement was entered into on April 29, 2011. This agreement was fully collateralized by $345,000 U.S. Treasury Note, 1.000%, due 04/30/12 with a market value of $349,249. |

PORTFOLIO COMPOSITION

| | | | | | | | |

| | | AS OF

4/30/11 | | | AS OF

10/31/10 | |

| | |

Electronic Technology | | | 16.9 | % | | | 14.1 | % |

Technology Services | | | 10.6 | | | | 12.6 | |

Producer Manufacturing | | | 9.0 | | | | 9.3 | |

Finance | | | 7.2 | | | | 7.5 | |

Health Technology | | | 7.0 | | | | 8.9 | |

Process Industries | | | 7.0 | | | | 7.0 | |

Energy Minerals | | | 6.0 | | | | 2.5 | |

Consumer Services | | | 5.6 | | | | 6.6 | |

Retail Trade | | | 5.1 | | | | 8.0 | |

Exchange Traded Fund | | | 4.8 | | | | — | |

Consumer Non-Durables | | | 4.3 | | | | 5.1 | |

Commercial Services | | | 3.7 | | | | 2.5 | |

Health Services | | | 2.7 | | | | 4.6 | |

Transportation | | | 2.5 | | | | 4.1 | |

Communications | | | 1.7 | | | | 1.2 | |

Industrial Services | | | 1.7 | | | | 2.3 | |

Non-Energy Minerals | | | 1.7 | | | | 0.8 | |

Consumer Durables | | | 1.3 | | | | 1.5 | |

Utilities | | | 0.9 | | | | 1.1 | |

Short-term Investment | | | 0.5 | | | | 0.5 | |

| | |

| TOTAL INVESTMENTS | | | 100.2 | % | | | 100.2 | % |

| | |

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Underlying investment categories of exchange traded funds (“ETFs”) held by the Fund are not reflected in the table above. Consequently, the Fund’s overall investment category allocations may differ from the percentages contained in the table above.

The Fund is actively managed and, as such, its composition may differ over time.

| | |

| 8 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE BOND FUND

Schedule of Investments

April 30, 2011 (Unaudited)

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

| Asset-Backed Securities – 8.9% | |

Auto(a) – 0.3% | | | | | |

| Citifinancial Auto Issuance Trust Series 2009-1, Class A2 | |

| $ 1,696,419 | | | 1.830 | % | | | 11/15/12 | | | $ | 1,699,733 | |

| | |

Commercial – 1.4% | | | | | |

| LB-UBS Commercial Mortgage Trust Series 2002-C1, Class A4 | |

| 6,164,836 | | | 6.462 | | | | 03/15/31 | | | | 6,332,224 | |

| Small Business Administration Series 2006-P10B, Class 1 | |

| 2,377,915 | | | 5.681 | | | | 08/10/16 | | | | 2,574,075 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,906,299 | |

| | |

Credit Card – 0.6% | | | | | |

| Citibank Credit Card Issuance Trust Series 2004, Class A8 | |

| 3,600,000 | | | 4.900 | | | | 12/12/16 | | | | 3,979,782 | |

| | |

Equipment(a) – 0.1% | | | | | |

| CIT Equipment Collateral Series 2010-VT1A, Class A2 | |

| 728,909 | | | 1.510 | | | | 05/15/12 | | | | 730,024 | |

| | |

Home Equity – 3.5% | | | | | |

| Ameriquest Mortgage Securities, Inc. Series 2004-FR1W, Class A6(b) | |

| 2,000,000 | | | 5.440 | | | | 05/25/34 | | | | 1,860,000 | |

| Carrington Mortgage Loan Trust Series 2006-NC5, Class A1(b) | |

| 617,306 | | | 0.263 | | | | 01/25/37 | | | | 607,933 | |

| Chase Funding Mortgage Loan Asset-Backed Certificates Series 2002-3, Class 1A5 | |

| 3,185,995 | | | 5.407 | | | | 06/25/32 | | | | 3,151,395 | |

| Countrywide Asset-Backed Certificates Series 2007-QH1, Class A1(a)(b) | |

| 1,277,985 | | | 0.413 | | | | 02/25/37 | | | | 846,380 | |

| Equifirst Mortgage Loan Trust Series 2003-2, Class 2A2 | |

| 1,068,223 | | | 3.750 | | | | 09/25/33 | | | | 1,040,013 | |

| Equity One ABS, Inc. Series 2004-2, Class AF5 | |

| 450,000 | | | 5.199 | | | | 07/25/34 | | | | 432,726 | |

| Lehman XS Trust Series 2005-1, Class 1A4(b) | |

| 903,636 | | | 0.553 | | | | 07/25/35 | | | | 756,723 | |

| Renaissance Home Equity Loan Trust Series 2005-3, Class AF3 | |

| 682,586 | | | 4.814 | | | | 11/25/35 | | | | 657,795 | |

| Renaissance Home Equity Loan Trust Series 2005-3, Class AF4 | |

| 1,125,000 | | | 5.140 | | | | 11/25/35 | | | | 979,230 | |

| Residential Asset Mortgage Products, Inc. Series 2003-RZ3, Class A6 | |

| 2,176,540 | | | 3.400 | | | | 03/25/33 | | | | 2,168,626 | |

| Residential Asset Mortgage Products, Inc. Series 2003-RZ4, Class A6 | |

| 3,971,280 | | | 5.490 | | | | 10/25/33 | | | | 3,165,070 | |

| Residential Funding Mortgage Securities I, Inc. Series 2000-HI2, Class AI5 | |

| 804,558 | | | 8.850 | | | | 03/25/25 | | | | 791,716 | |

| Residential Funding Mortgage Securities I, Inc. Series 2000-HI4, Class AI7 | |

| 818,916 | | | 8.480 | | | | 09/25/30 | | | | 809,243 | |

| SACO I Trust Series 2005-7 Class A(b) | |

| 274,674 | | | 0.773 | | | | 09/25/35 | | | | 239,580 | |

| | |

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

| Asset-Backed Securities – (continued) | |

Home Equity – (continued) | | | | |

| Soundview Home Equity Loan Trust Series 2006-EQ1, Class A2(b) | |

| $ 280,331 | | | 0.323 | % | | 10/25/36 | | $ | 274,118 | |

| Southern Pacific Secured Asset Corp. Series 1998-2, Class A7 | |

| 4,049,538 | | | 6.740 | | | 07/25/29 | | | 1,895,054 | |

| Structured Asset Securities Corp. Series 2005-9XS, Class 1A3A | |

| 2,290,430 | | | 5.250 | | | 06/25/35 | | | 2,098,778 | |

| Terwin Mortgage Trust Series 2005-16HE, Class AF2 | |

| 426,357 | | | 4.429 | | | 09/25/36 | | | 422,436 | |

| Wells Fargo Home Equity Trust Series 2004-2, Class AI5(b) | |

| 554,054 | | | 4.890 | | | 05/25/34 | | | 558,931 | |

| | | | | | | | | | |

| | | | | | | | | 22,755,747 | |

| | |

Manufactured Housing – 2.2% | | | | |

| Green Tree Financial Corp. Series 1993-4, Class A5 | |

| 1,571,138 | | | 7.050 | | | 01/15/19 | | | 1,608,830 | |

| Green Tree Financial Corp. Series 1995-5, Class M1(b) | |

| 642,952 | | | 7.650 | | | 09/15/26 | | | 655,230 | |

| Green Tree Financial Corp. Series 1996-4, Class A7(b) | |

| 955,517 | | | 7.900 | | | 06/15/27 | | | 984,321 | |

| Green Tree Financial Corp. Series 1996-6, Class A6 | |

| 219,169 | | | 7.950 | | | 09/15/27 | | | 231,421 | |

| Green Tree Financial Corp. Series 1997-3, Class A6 | |

| 77,697 | | | 7.320 | | | 03/15/28 | | | 84,498 | |

| Green Tree Financial Corp. Series 1998-3, Class A5 | |

| 3,872,815 | | | 6.220 | | | 03/01/30 | | | 4,122,805 | |

| Green Tree Financial Corp. Series 1998-3, Class A6(b) | |

| 483,725 | | | 6.760 | | | 03/01/30 | | | 511,830 | |

| Lehman Manufactured Housing Contract Series 2001-B, Class A3 | |

| 416,822 | | | 4.350 | | | 05/15/14 | | | 418,267 | |

| Mid-State Trust Series 11, Class A1 | |

| 367,330 | | | 4.864 | | | 07/15/38 | | | 356,200 | |

| Newcastle Investment Trust Series 2011-MH1, Class A(a) | |

| 4,000,000 | | | 2.450 | | | 12/10/33 | | | 3,999,489 | |

| Oakwood Mortgage Investors, Inc. Series 1996-C, Class A6 | |

| 1,362,489 | | | 7.650 | | | 04/15/27 | | | 1,362,583 | |

| | | | | | | | | | |

| | | | | | | | | 14,335,474 | |

| | |

Student Loans – 0.8% | |

| Northstar Education Finance, Inc. Series 2005-1, Class A5(b) | |

| 2,019,600 | | | 1.023 | | | 10/30/45 | | | 1,940,553 | |

| SLM Student Loan Trust Series 2011-A, Class A2(a) | |

| 2,900,000 | | | 4.370 | | | 04/17/28 | | | 2,950,637 | |

| | | | | | | | | | |

| | | | | | | | | 4,891,190 | |

| | |

| TOTAL ASSET-BACKED SECURITIES | | | | |

(Cost $54,010,585) | | $ | 57,298,249 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

COMMERCE BOND FUND

Schedule of Investments (continued)

April 30, 2011 (Unaudited)

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

| Taxable Municipal Bond Obligations – 12.3% | |

Alabama – 0.2% | | | | | |

| Montgomery Alabama Taxable GO Warrants Series 2005 (AGM) | |

| $ 1,295,000 | | | 4.790 | % | | | 04/01/15 | | | $ | 1,402,226 | |

| | |

Alaska – 0.1% | | | | | | | | | | | | |

| Providence Alaska Health System Direct Obligation Series 2005 | |

| 500,000 | | | 4.790 | | | | 10/01/11 | | | | 508,840 | |

| | |

California – 3.0% | | | | | |

| Anaheim California Public Financing Authority Revenue Bonds Build America Bonds | |

| 4,000,000 | | | 5.685 | | | | 10/01/40 | | | | 3,826,680 | |

| Hillsborough School District GO Bonds Capital Appreciation Election 2002 C(c) | |

| 10,590,000 | | | 0.000 | | | | 09/01/42 | | | | 1,186,716 | |

| 11,420,000 | | | 0.000 | | | | 09/01/43 | | | | 1,180,371 | |

| Industry California Sales Tax Revenue Bonds Taxable Series 2005 (NATL-RE) | |

| 3,045,000 | | | 5.000 | | | | 01/01/13 | | | | 3,110,924 | |

| Napa Valley Unified School District GO Bonds (Build America Bonds-Taxable) Series B | |

| 3,000,000 | | | 6.507 | | | | 08/01/43 | | | | 3,054,120 | |

| San Francisco City & County Airports Commission Revenue Bonds Refunding Second Series C | |

| 3,000,000 | | | 5.000 | | | | 05/01/17 | | | | 3,312,960 | |

| Santa Clara County CA Fremont Union High School District GO Bonds Capital Appreciation Election 2008 B(c) | |

| 11,005,000 | | | 0.000 | | | | 08/01/37 | | | | 1,711,938 | |

| 12,290,000 | | | 0.000 | | | | 08/01/39 | | | | 1,624,615 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 19,008,324 | |

| | |

District of Columbia – 0.8% | | | | | |

| Metropolitan Washington D.C. Airport Authority System Revenue Bonds Series B | |

| 5,000,000 | | | 5.250 | | | | 10/01/25 | | | | 5,368,500 | |

| | |

Florida – 0.3% | |

| Inland Protection Financing Corp. Florida Revenue Bonds Build America Bonds Series 2010 | |

| 2,000,000 | | | 4.700 | | | | 07/01/19 | | | | 2,069,760 | |

| | |

Illinois – 0.3% | |

| Will County Community Consolidated School District No. 30-C Troy Township Taxable GO Series 2007 (AGM) | |

| 1,100,000 | | | 5.650 | | | | 10/01/18 | | | | 1,198,417 | |

| Will County Forest Preservation District GO Bonds Build America Bonds Direct Payment Series 2009 | |

| 1,000,000 | | | 5.700 | | | | 12/15/27 | | | | 1,039,260 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,237,677 | |

| | |

Indiana – 1.0% | |

| Indiana Bond Bank Revenue Bonds Taxable School Severance Funding Series 2006-11 (XLCA) | |

| 2,190,000 | | | 5.650 | | | | 07/15/13 | | | | 2,403,678 | |

| | |

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

| Taxable Municipal Bond Obligations – (continued) | |

Indiana – (continued) | |

| Indianapolis Multi-School Building Corp. Revenue Bonds (Refunding First Mortgage) | |

| $ 5,000,000 | | | 3.000 | % | | 01/15/26 | | $ | 4,040,150 | |

| | | | | | | | | | |

| | | | | | | | | 6,443,828 | |

| | |

Iowa – 0.6% | | | | |

| Iowa Higher Education Loan Authority Revenue Bonds Refunding Private College Facility (Grinnell College Project) | |

| 2,500,000 | | | 5.000 | | | 12/01/19 | | | 2,908,375 | |

| | |

Maryland – 0.2% | |

| Baltimore County Maryland GO Bonds Build America Bonds Consolidated Public Improvement Series 2009 B | |

| 1,000,000 | | | 5.000 | | | 11/01/23 | | | 1,044,290 | |

| | |

Massachusetts – 0.0% | |

| University of Massachusetts Building Authority Revenue Bonds Refunding Taxable Series 2006-2 (AMBAC) | |

| 255,000 | | | 5.360 | | | 05/01/11 | | | 255,000 | |

| | |

Michigan – 0.2% | |

| Utica Community Schools GO Bonds (Taxable-Qualified School Construction-Direct Payment) | |

| 1,500,000 | | | 5.875 | | | 05/01/22 | | | 1,544,505 | |

| | |

Missouri – 1.9% | |

| Curators University of Missouri System Facilities Revenue Bonds Build America Bonds | |

| 2,500,000 | | | 5.792 | | | 11/01/41 | | | 2,674,625 | |

| Missouri Joint Municipal Electric Utility Commission Power Project Revenue Bonds Build America Bonds Series 2009 | |

| 2,000,000 | | | 5.078 | | | 01/01/17 | | | 2,067,160 | |

| Missouri Joint Municipal Electric Utility Commission Power Project Revenue Bonds Taxable Series 2009 B | |

| 1,570,000 | | | 4.693 | | | 01/01/16 | | | 1,619,110 | |

| Missouri State Highways & Transit Commission State Road Revenue Bonds Build America Bonds Series 2010 | |

| 2,800,000 | | | 4.820 | | | 05/01/23 | | | 2,921,940 | |

| New Liberty Hospital District Revenue Bonds Build America Bonds Series 2010 B | |

| 1,345,000 | | | 5.704 | | | 12/01/19 | | | 1,407,448 | |

| St. Louis Package Revenue Bonds Series 2006 B (NATL-RE) | |

| 1,560,000 | | | 5.020 | | | 12/15/12 | | | 1,618,750 | |

| | | | | | | | | | |

| | | | | | | | | 12,309,033 | |

| | |

Nevada – 0.4% | |

| Clark County Nevada Sales & Excise Tax Revenue Bonds Build America Bonds Series 2010 C | |

| 2,525,000 | | | 5.100 | | | 07/01/21 | | | 2,533,989 | |

| | |

New Jersey – 0.2% | |

| New Jersey Economic Development Authority Revenue Bonds Taxable Designated Industry Series 2004-A | |

| 1,000,000 | | | 5.200 | | | 03/01/14 | | | 1,070,060 | |

| | |

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE BOND FUND

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

| Taxable Municipal Bond Obligations – (continued) | |

New York – 1.2% | |

| New York GO Build America Bonds Series 2010 | |

| $ 2,000,000 | | | 4.908 | % | | 06/01/21 | | $ | 2,068,720 | |

| 1,055,000 | | | 5.008 | | | 06/01/22 | | | 1,098,497 | |

| New York State Housing Finance Agency Personal Income Tax Revenue Bonds Taxable Economic Development & Housing Series 2006 B | |

| 3,925,000 | | | 5.220 | | | 09/15/15 | | | 4,287,160 | |

| | | | | | | | | | |

| | | | | | | | | 7,454,377 | |

| | |

Ohio – 0.7% | |

| Ohio State GO Build America Bonds Series 2010 | |

| 2,500,000 | | | 3.000 | | | 11/01/18 | | | 2,386,400 | |

| Ohio State GO Build America Bonds Taxable Conservation Project Direct Payment Series 2009 C | |

| 1,960,000 | | | 4.471 | | | 03/01/19 | | | 2,057,686 | |

| | | | | | | | | | |

| | | | | | | | | 4,444,086 | |

| | |

Oregon – 0.1% | |

| Multnomah County Oregon School District 1J Portland GO Bonds Refunding Taxable Series 2004 | |

| 785,000 | | | 5.165 | | | 06/15/11 | | | 788,729 | |

| | |

Pennsylvania – 0.5% | |

| State Public School Building Authority Revenue Bonds (Qualified School Construction Bonds) | |

| 3,000,000 | | | 6.495 | | | 09/15/28 | | | 3,185,310 | |

| | |

Rhode Island – 0.5% | |

| Providence Rhode Island GO Bonds Refunding Taxable Series 2004 B (AGM) | |

| 710,000 | | | 4.960 | | | 07/15/14 | | | 750,761 | |

| Rhode Island Convention Center Authority Revenue Bonds Taxable Civic Center Series 2006 A (AGM) | |

| 2,155,000 | | | 5.810 | | | 05/15/16 | | | 2,336,214 | |

| | | | | | | | | | |

| | | | | | | | | 3,086,975 | |

| | |

South Carolina – 0.2% | |

| South Carolina State Public Service Authority Revenue Bonds Santee Cooper Taxable Series 2008 B | |

| 1,150,000 | | | 7.308 | | | 01/01/14 | | | 1,307,861 | |

| | |

| TOTAL TAXABLE MUNICIPAL BOND OBLIGATIONS | |

(Cost $75,726,345) | | $ | 78,971,745 | |

| | |

| | | | | | | | | | |

| Mortgage-Backed Obligations – 31.3% | |

Collateralized Mortgage Obligations – 27.0% | |

| ABN Amro Mortgage Corp. Series 2003-13, Class A2 | |

| $ 20,964 | | | 5.500 | % | | 02/25/18 | | $ | 20,962 | |

| Banc of America Alternative Loan Trust Series 2004-1, Class 1A1 | |

| 4,294,761 | | | 6.000 | | | 02/25/34 | | | 4,513,871 | |

| Banc of America Alternative Loan Trust Series 2005-10, Class 6A1 | |

| 2,965,359 | | | 5.500 | | | 11/25/20 | | | 2,901,942 | |

| | |

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

| Mortgage-Backed Obligations – (continued) | |

Collateralized Mortgage Obligations – (continued) | |

| Banc of America Alternative Loan Trust Series 2006-3, Class 6A1 | |

| $ 634,503 | | | 6.000 | % | | 04/25/36 | | $ | 625,181 | |

| Bear Stearns Alt-A Trust Series 2005-9, Class 25A1(b) | |

| 3,436,065 | | | 5.518 | | | 11/25/35 | | | 2,580,412 | |

| Bear Stearns Asset Backed Securities Trust Series 2003-AC7, Class A2 | |

| 1,107,473 | | | 5.750 | | | 01/25/34 | | | 1,130,862 | |

| Chase Mortgage Finance Corp. Series 2003-S13, Class A1 | |

| 1,321,176 | | | 5.500 | | | 11/25/33 | | | 1,366,655 | |

| Citicorp Mortgage Securities, Inc. Series 2006-4, Class 3A1 | |

| 271,668 | | | 5.500 | | | 08/25/21 | | | 273,702 | |

| Citigroup Mortgage Loan Trust, Inc. Series 2004-NCM2, Class 1CB2 | |

| 2,164,369 | | | 6.750 | | | 08/25/34 | | | 2,186,214 | |

| Citigroup Mortgage Loan Trust, Inc. Series 2005-10, Class 1A5A(b) | |

| 1,800,191 | | | 5.593 | | | 12/25/35 | | | 1,372,286 | |

| Citigroup Mortgage Loan Trust, Inc. Series 2007-AR5, Class 1A3A(b) | |

| 902,531 | | | 5.567 | | | 04/25/37 | | | 614,490 | |

| Citigroup Mortgage Loan Trust, Inc. Series 2009-3, Class 2A1(a) | |

| 3,363,668 | | | 5.750 | | | 09/25/21 | | | 3,430,942 | |

| Citimortgage Alternative Loan Trust Series 2006-A3, Class 2A1 | |

| 575,579 | | | 5.500 | | | 07/25/36 | | | 533,124 | |

| Countrywide Alternative Loan Trust Series 2004-18CB, Class 3A1 | |

| 1,197,250 | | | 5.250 | | | 09/25/19 | | | 1,220,524 | |

| Countrywide Alternative Loan Trust Series 2005-5R, Class A2 | |

| 926,953 | | | 4.750 | | | 12/25/18 | | | 935,136 | |

| Countrywide Alternative Loan Trust Series 2005-J1, Class 3A1 | |

| 347,353 | | | 6.500 | | | 08/25/32 | | | 338,496 | |

| Countrywide Alternative Loan Trust Series 2007-J2, Class 2A1 | |

| 877,559 | | | 6.000 | | | 07/25/37 | | | 716,370 | |

| Countrywide Home Loans Trust Series 2003-J6, Class 1A1 | |

| 2,828,181 | | | 5.500 | | | 08/25/33 | | | 3,007,343 | |

| Countrywide Home Loans Trust Series 2004-J1, Class 2A4 | |

| 1,226,108 | | | 4.750 | | | 01/25/19 | | | 1,255,736 | |

| Countrywide Home Loans Trust Series 2005-27, Class 2A1 | |

| 3,449,884 | | | 5.500 | | | 12/25/35 | | | 3,133,236 | |

| Countrywide Home Loans Trust Series 2005-6, Class 2A1 | |

| 816,084 | | | 5.500 | | | 04/25/35 | | | 753,120 | |

| CS First Boston Mortgage Securities Corp. Series 2003-19, Class 1A4 | |

| 1,118,426 | | | 5.250 | | | 07/25/33 | | | 1,154,116 | |

| CS First Boston Mortgage Securities Corp. Series 2005-5, Class 2A9 | |

| 9,000,000 | | | 5.500 | | | 07/25/35 | | | 8,817,903 | |

| FHLMC REMIC PAC Series 1579, Class PM | |

| 425,076 | | | 6.700 | | | 09/15/23 | | | 476,398 | |

| FHLMC REMIC PAC Series 2103, Class TE | |

| 368,002 | | | 6.000 | | | 12/15/28 | | | 396,625 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

COMMERCE BOND FUND

Schedule of Investments (continued)

April 30, 2011 (Unaudited)

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

| Mortgage-Backed Obligations – (continued) | |

Collateralized Mortgage Obligations – (continued) | |

| FHLMC REMIC PAC Series 2110, Class PG | |

| $ 1,887,542 | | | 6.000 | % | | 01/15/29 | | $ | 2,077,004 | |

| FHLMC REMIC PAC Series 2640, Class DR | |

| 1,316,014 | | | 4.000 | | | 08/15/17 | | | 1,336,877 | |

| FHLMC REMIC PAC Series 2716, Class DT | |

| 495,192 | | | 5.000 | | | 02/15/30 | | | 509,054 | |

| FHLMC REMIC PAC Series 2760, Class EC | |

| 4,050,000 | | | 4.500 | | | 04/15/17 | | | 4,185,884 | |

| FHLMC REMIC PAC Series 2836, Class XQ | |

| 183,910 | | | 4.500 | | | 09/15/27 | | | 185,520 | |

| FHLMC REMIC PAC Series 2907, Class HC | |

| 951,340 | | | 5.000 | | | 06/15/27 | | | 960,254 | |

| FHLMC REMIC Series 2391, Class Z | |

| 4,633,210 | | | 6.000 | | | 12/15/31 | | | 5,129,289 | |

| FHLMC REMIC Series 2508, Class OY | |

| 1,183,040 | | | 4.500 | | | 10/15/17 | | | 1,254,852 | |

| FHLMC REMIC Series 2603, Class C | |

| 2,620,000 | | | 5.500 | | | 04/15/23 | | | 2,889,777 | |

| FHLMC REMIC Series 2677, Class BC | |

| 800,000 | | | 4.000 | | | 09/15/18 | | | 845,390 | |

| FHLMC REMIC Series 2840, Class JL | |

| 1,087,820 | | | 4.500 | | | 06/15/23 | | | 1,127,258 | |

| FHLMC REMIC Series 2866, Class DH | |

| 2,628,956 | | | 4.000 | | | 09/15/34 | | | 2,779,397 | |

| FHLMC REMIC Series 2890, Class KB | |

| 3,115,000 | | | 4.500 | | | 02/15/19 | | | 3,317,513 | |

| FHLMC REMIC TAC Series 2658, Class A | |

| 1,069,486 | | | 4.500 | | | 08/15/18 | | | 1,101,657 | |

| First Horizon Alternative Mortgage Securities Series 2004-FA2, Class 1A1 | |

| 1,451,950 | | | 6.000 | | | 01/25/35 | | | 1,445,196 | |

| First Horizon Alternative Mortgage Securities Series 2006-RE1, Class A1 | |

| 4,980,989 | | | 5.500 | | | 05/25/35 | | | 4,396,878 | |

| FNMA REMIC FNIC PAC Series 2001-45, Class WG | |

| 697,283 | | | 6.500 | | | 09/25/31 | | | 787,383 | |

| FNMA REMIC PAC Series 2003-1, Class PG | |

| 1,316,231 | | | 5.500 | | | 09/25/31 | | | 1,375,444 | |

| FNMA REMIC PAC Series 2003-117, Class KB | |

| 3,000,000 | | | 6.000 | | | 12/25/33 | | | 3,384,835 | |

| FNMA REMIC PAC Series 2003-14, Class AP | |

| 308,338 | | | 4.000 | | | 03/25/33 | | | 323,763 | |

| FNMA REMIC PAC Series 2004-53, Class NC | |

| 3,344,635 | | | 5.500 | | | 07/25/24 | | | 3,552,902 | |

| FNMA REMIC Series 2002-73, Class OE | |

| 3,775,405 | | | 5.000 | | | 11/25/17 | | | 4,068,589 | |

| FNMA REMIC Series 2002-82, Class XE | |

| 3,205,000 | | | 5.000 | | | 12/25/17 | | | 3,452,312 | |

| FNMA REMIC Series 2003-83, Class PG | |

| 700,000 | | | 5.000 | | | 06/25/23 | | | 756,432 | |

| | |

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

| Mortgage-Backed Obligations – (continued) | |

Collateralized Mortgage Obligations – (continued) | |

| FNMA REMIC Series 2003-84, Class PG | |

| $ 540,000 | | | 5.000 | % | | 03/25/32 | | $ | 580,047 | |

| FNMA Series 2003-W6, Class 2A32 | |

| 442,050 | | | 6.500 | | | 09/25/42 | | | 494,495 | |

| GNMA Series 1998-12, Class EB | |

| 675,491 | | | 6.500 | | | 05/20/28 | | | 705,479 | |

| Impac CMB Trust Series 2004-4, Class 1A1(b) | |

| 3,374,927 | | | 0.853 | | | 09/25/34 | | | 2,603,948 | |

| Impac CMB Trust Series 2004-4, Class 2A2 | |

| 5,316,246 | | | 4.857 | | | 09/25/34 | | | 5,213,674 | |

| Impac Secured Assets Corp. Series 2004-2, Class A6 | |

| 1,503,004 | | | 5.181 | | | 08/25/34 | | | 1,455,077 | |

| JPMorgan Alternative Loan Trust Series 2006-S1, Class 1A16 | |

| 3,350,245 | | | 6.000 | | | 03/25/36 | | | 2,862,298 | |

| JPMorgan Mortgage Trust Series 2005-S3, Class 1A20 | |

| 5,000,000 | | | 5.500 | | | 01/25/36 | | | 4,931,560 | |

| JPMorgan Mortgage Trust Series 2007-A2, Class 4A2(b) | |

| 1,000,000 | | | 5.900 | | | 04/25/37 | | | 894,068 | |

| Master Alternative Loans Trust Series 2004-4, Class 1A1 | |

| 657,802 | | | 5.500 | | | 05/25/34 | | | 674,016 | |

| Master Alternative Loans Trust Series 2004-4, Class 8A1 | |

| 2,341,150 | | | 6.500 | | | 05/25/34 | | | 2,429,350 | |

| Master Asset Securitization Trust Series 2003-10, Class 3A1 | |

| 590,940 | | | 5.500 | | | 11/25/33 | | | 621,910 | |

| Master Asset Securitization Trust Series 2003-7, Class 1A1 | |

| 1,076,921 | | | 5.500 | | | 09/25/33 | | | 1,122,529 | |

| Master Asset Securitization Trust Series 2004-3, Class 5A1 | |

| 113,567 | | | 6.250 | | | 01/25/32 | | | 114,716 | |

| Merrill Lynch Mortgage Investors Trust Series 2005-A8, Class A1C1(b) | |

| 488,251 | | | 5.250 | | | 08/25/36 | | | 495,263 | |

| Morgan Stanley Mortgage Loan Trust Series 2005-7, Class 2A1(b) | |

| 3,738,536 | | | 5.586 | | | 11/25/35 | | | 3,639,371 | |

| Morgan Stanley Mortgage Loan Trust Series 2007-12, Class 3A22 | |

| 3,731,795 | | | 6.000 | | | 08/25/37 | | | 3,296,279 | |

| RBSGC Mortgage Pass-Through Certificates Series 2007-B, Class 2A1(b) | |

| 4,728,774 | | | 5.997 | | | 11/25/21 | | | 4,020,886 | |

| RBSGC Mortgage Pass-Through Certificates Series 2007-B, Class 3A1(b) | |

| 340,471 | | | 5.332 | | | 07/25/35 | | | 335,238 | |

| Residential Accredit Loans, Inc. Series 2003-QS7, Class A2 | |

| 2,583,947 | | | 4.750 | | | 04/25/33 | | | 2,626,236 | |

| Residential Accredit Loans, Inc. Series 2004-QS2, Class CB | |

| 4,574,273 | | | 5.750 | | | 02/25/34 | | | 4,610,071 | |

| Residential Accredit Loans, Inc. Series 2005-QS11, Class A2(b) | |

| 741,111 | | | 0.713 | | | 07/25/35 | | | 609,012 | |

| | |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE BOND FUND

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

| Mortgage-Backed Obligations – (continued) | |

Collateralized Mortgage Obligations – (continued) | |

| Residential Asset Mortgage Products, Inc. Series 2004-SL4, Class A2 | |

| $ 1,525,670 | | | 6.000 | % | | 07/25/32 | | $ | 1,539,565 | |

| Residential Asset Securitization Trust Series 2004-A6, Class A1 | |

| 3,297,128 | | | 5.000 | | | 08/25/19 | | | 3,289,640 | |

| Residential Funding Mortgage Securities Corp. Series 2003-RM2, Class AIII | |

| 751,539 | | | 6.000 | | | 05/25/33 | | | 781,670 | |

| Residential Funding Mortgage Securities I, Inc. Series 2003-S8, Class A1 | |

| 499,982 | | | 5.000 | | | 05/25/18 | | | 514,277 | |

| Residential Funding Mortgage Securities I, Inc. Series 2005-S7, Class A5 | |

| 1,375,788 | | | 5.500 | | | 11/25/35 | | | 1,316,426 | |

| Residential Funding Mortgage Securities I, Inc. Series 2005-S9, Class A5 | |

| 2,983,695 | | | 5.750 | | | 12/25/35 | | | 2,815,534 | |

| Residential Funding Mortgage Securities I, Inc. Series 2006-S12, Class 1A1 | |

| 2,678,669 | | | 5.500 | | | 12/25/21 | | | 2,672,283 | |

| Sequoia Mortgage Trust Series 2004-10, Class A1A(b) | |

| 1,035,790 | | | 0.523 | | | 11/20/34 | | | 962,539 | |

| Structured Asset Securities Corp. Series 2003-20, Class 1A1 | |

| 3,107,103 | | | 5.500 | | | 07/25/33 | | | 3,220,696 | |

| Structured Asset Securities Corp. Series 2003-31A, Class 2A7(b) | |

| 1,262,717 | | | 2.561 | | | 10/25/33 | | | 1,201,335 | |

| Structured Asset Securities Corp. Series 2003-34A, Class 3A3(b) | |

| 1,843,596 | | | 2.574 | | | 11/25/33 | | | 1,763,803 | |

| Structured Asset Securities Corp. Series 2004-11XS, Class 1A4B | |

| 3,220,006 | | | 5.710 | | | 06/25/34 | | | 2,957,286 | |

| Structured Asset Securities Corp. Series 2005-6, Class 5A2 | |

| 610,043 | | | 5.000 | | | 05/25/35 | | | 612,498 | |

| Washington Mutual Alternative Mortgage Pass-Through Certificates Series 2005-4, Class 4A1 | |

| 2,328,903 | | | 5.500 | | | 06/25/20 | | | 2,325,398 | |

| Washington Mutual MSC Mortgage Pass-Through Series 2002-MS2, Class 3A1 | |

| 165,763 | | | 6.500 | | | 05/25/32 | | | 165,724 | |

| Wells Fargo Mortgage Backed Securities Trust Series 2003-6, Class 1A1 | |

| 696,847 | | | 5.000 | | | 06/25/18 | | | 722,148 | |

| Wells Fargo Mortgage Backed Securities Trust Series 2005-1, Class 3A1 | |

| 469,785 | | | 5.250 | | | 01/25/20 | | | 483,920 | |

| Wells Fargo Mortgage Backed Securities Trust Series 2005-AR15, Class 1A2(b) | |

| 1,300,171 | | | 5.048 | | | 09/25/35 | | | 1,252,738 | |

| Wells Fargo Mortgage Backed Securities Trust Series 2006-12, Class A5 | |

| 500,000 | | | 6.000 | | | 10/25/36 | | | 200,138 | |

| | |

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

| Mortgage-Backed Obligations – (continued) | |

Collateralized Mortgage Obligations – (continued) | |

| Wells Fargo Mortgage Backed Securities Trust Series 2007-2, Class 3A5 | |

| $ 1,000,000 | | | 5.250 | % | | | 03/25/37 | | | $ | 963,210 | |

| WF-RBS Commercial Mortgage Trust Series 2011-C2, Class A1(a) | |

| 3,943,631 | | | 2.501 | | | | 02/15/44 | | | | 4,003,921 | |

| | |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | |

(Cost $152,710,571) | | | | | | | $ | 173,099,378 | |

| | |

Commercial Mortgage Obligations – 1.4% | |

| GNMA Series 2003-16, Class B | |

| $3,580,000 | | | 4.490 | % | | | 08/16/25 | | | $ | 3,748,556 | |

| GNMA Series 2003-38, Class JC(b) | |

| 93,174 | | | 7.321 | | | | 08/16/42 | | | | 105,247 | |

| GNMA Series 2004-60, Class C(b) | |

| 5,000,000 | | | 5.240 | | | | 03/16/28 | | | | 5,259,779 | |

| | |

TOTAL COMMERCIAL MORTGAGE OBLIGATIONS | |

(Cost $8,711,766) | | | | | | | $ | 9,113,582 | |

| | |

Mortgage-Backed Pass-Through Obligations – 2.9% | |

| FHLMC | |

| $ 57,425 | | | 8.500 | % | | | 02/01/19 | | | $ | 63,042 | |

| 105,802 | | | 8.500 | | | | 03/01/21 | | | | 119,405 | |

| 616,249 | | | 7.000 | | | | 05/01/26 | | | | 708,143 | |

| 37,428 | | | 7.000 | | | | 10/01/30 | | | | 43,155 | |

| 91,047 | | | 7.500 | | | | 12/01/30 | | | | 105,869 | |

| 171,888 | | | 7.500 | | | | 01/01/31 | | | | 199,871 | |

| 324,994 | | | 7.000 | | | | 08/01/31 | | | | 374,967 | |

| 3,960,038 | | | 5.000 | | | | 05/01/33 | | | | 4,205,428 | |

| 697,863 | | | 2.604 | (b) | | | 05/01/34 | | | | 723,813 | |

| 1,377,689 | | | 5.269 | (b) | | | 01/01/36 | | | | 1,474,013 | |

| FNMA | |

| 55,226 | | | 6.000 | | | | 12/01/13 | | | | 57,870 | |

| 28,440 | | | 6.500 | | | | 07/01/14 | | | | 31,258 | |

| 51,752 | | | 9.000 | | | | 11/01/21 | | | | 58,374 | |

| 84,622 | | | 9.000 | | | | 02/01/25 | | | | 99,358 | |

| 17,040 | | | 6.500 | | | | 03/01/26 | | | | 19,277 | |

| 29,984 | | | 8.000 | | | | 07/01/28 | | | | 34,968 | |

| 134,151 | | | 6.500 | | | | 10/01/28 | | | | 151,760 | |

| 93,207 | | | 2.455 | (b) | | | 12/01/28 | | | | 94,251 | |

| 55,772 | | | 6.500 | | | | 01/01/29 | | | | 63,093 | |

| 79,110 | | | 6.000 | | | | 07/01/29 | | | | 87,466 | |

| 103,725 | | | 7.500 | | | | 09/01/29 | | | | 120,807 | |

| 76,371 | | | 7.000 | | | | 03/01/31 | | | | 87,990 | |

| 35,470 | | | 7.500 | | | | 03/01/31 | | | | 41,346 | |

| 195,707 | | | 7.000 | | | | 11/01/31 | | | | 225,473 | |

| 322,969 | | | 7.000 | | | | 01/01/32 | | | | 372,091 | |

| 1,163,331 | | | 6.000 | | | | 12/01/32 | | | | 1,286,221 | |

| 313,093 | | | 5.310 | (b) | | | 02/01/33 | | | | 334,278 | |

| 1,274,582 | | | 5.000 | | | | 07/01/33 | | | | 1,354,360 | |

| 662,951 | | | 5.219 | (b) | | | 10/01/34 | | | | 697,234 | |

| 1,492,601 | | | 5.078 | (b) | | | 02/01/35 | | | | 1,583,630 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

COMMERCE BOND FUND

Schedule of Investments (continued)

April 30, 2011 (Unaudited)

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

| Mortgage-Backed Obligations – (continued) | |

Mortgage-Backed Pass-Through Obligations – (continued) | |

| GNMA | |

| $ 210,279 | | | 8.000 | % | | | 02/15/22 | | | $ | 245,699 | |

| 83,728 | | | 7.500 | | | | 08/20/25 | | | | 97,067 | |

| 386,736 | | | 7.500 | | | | 07/20/26 | | | | 448,172 | |

| 460,817 | | | 6.500 | | | | 04/15/31 | | | | 522,312 | |

| 345,641 | | | 6.500 | | | | 05/15/31 | | | | 391,767 | |

| 1,819,472 | | | 5.500 | | | | 04/15/33 | | | | 1,993,378 | |

| | |

TOTAL MORTGAGE-BACKED PASS-THROUGH OBLIGATIONS | |

(Cost $17,114,791) | | | | | | | $ | 18,517,206 | |

| | |

| TOTAL MORTGAGE-BACKED OBLIGATIONS | |

(Cost $178,537,128) | | | $ | 200,730,166 | |

| | |

| | | | | | | | | | | | |

| Corporate Obligations – 27.4% | |

Aerospace/Defense – 0.8% | |

| Goodrich Corp. | |

| $ 1,000,000 | | | 4.875 | % | | | 03/01/20 | | | $ | 1,050,798 | |

| Lockheed Martin Corp. | |

| 1,972,000 | | | 6.150 | | | | 09/01/36 | | | | 2,163,085 | |

| United Technologies Corp. | |

| 2,000,000 | | | 5.700 | | | | 04/15/40 | | | | 2,158,174 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,372,057 | |

| | |

Beverages – 0.7% | |

| Anheuser-Busch Cos., Inc. | |

| 1,500,000 | | | 5.600 | | | | 03/01/17 | | | | 1,691,634 | |

| PepsiCo, Inc. | |

| 2,500,000 | | | 4.500 | | | | 01/15/20 | | | | 2,638,737 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,330,371 | |

| | |

Cable TV – 1.3% | |

| Comcast Corp. | |

| 1,500,000 | | | 5.700 | | | | 07/01/19 | | | | 1,648,860 | |

| 1,250,000 | | | 6.400 | | | | 05/15/38 | | | | 1,325,300 | |

| DIRECTV Holdings LLC/DIRECTV Financing Co, Inc. | |

| 3,000,000 | | | 3.500 | | | | 03/01/16 | | | | 3,045,894 | |

| Time Warner Cable, Inc. | |

| 2,000,000 | | | 6.200 | | | | 07/01/13 | | | | 2,202,318 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,222,372 | |

| | |

Chemicals – 0.5% | |

| E.I. du Pont de Nemours and Co. | |

| 1,000,000 | | | 3.250 | | | | 01/15/15 | | | | 1,045,408 | |

| Sigma-Aldrich Corp. | |

| 2,000,000 | | | 3.375 | | | | 11/01/20 | | | | 1,894,484 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,939,892 | |

| | |

Commercial Banks – 2.4% | |

| Barclays Bank PLC | |

| 2,000,000 | | | 5.125 | | | | 01/08/20 | | | | 2,057,744 | |

| | |

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

| Corporate Obligations – (continued) | |

Commercial Banks – (continued) | |

| Credit Suisse AG | |

| $3,000,000 | | | 5.400 | % | | 01/14/20 | | $ | 3,094,251 | |

| Credit Suisse New York | |

| 1,500,000 | | | 5.000 | | | 05/15/13 | | | 1,607,731 | |

| KeyBank NA | |

| 2,540,000 | | | 5.800 | | | 07/01/14 | | | 2,792,268 | |

| Wachovia Bank NA | |

| 2,000,000 | | | 5.000 | | | 08/15/15 | | | 2,158,994 | |

| Wells Fargo Bank NA | |

| 3,125,000 | | | 4.750 | | | 02/09/15 | | | 3,360,800 | |

| | | | | | | | | | |

| | | | | | | | | 15,071,788 | |

| | |

Communications Equipment – 0.4% | |

| Cisco Systems, Inc. | |

| 2,500,000 | | | 4.450 | | | 01/15/20 | | | 2,600,468 | |

| | |

Computers – 0.3% | |

| Hewlett-Packard Co. | |

| 2,000,000 | | | 2.125 | | | 09/13/15 | | | 1,986,362 | |

| | |

Consumer Services – 0.3% | |

| eBay, Inc. | |

| 2,000,000 | | | 1.625 | | | 10/15/15 | | | 1,933,334 | |

| | |

Diversified Manufacturing – 1.1% | |

| GE Capital Trust I(b) | |

| 3,525,000 | | | 6.375 | | | 11/15/67 | | | 3,657,187 | |

| Ingersoll-Rand Global Holding Co. Ltd. | |

| 1,000,000 | | | 9.500 | | | 04/15/14 | | | 1,204,123 | |

| Parker-Hannifin Corp. | |

| 2,000,000 | | | 3.500 | | | 09/15/22 | | | 1,883,504 | |

| | | | | | | | | | |

| | | | | | | | | 6,744,814 | |

| | |

Electric – 2.2% | |

| Columbus Southern Power Co. | |

| 2,870,000 | | | 5.850 | | | 10/01/35 | | | 2,976,750 | |

| Connecticut Light & Power Co. | |

| 415,000 | | | 5.650 | | | 05/01/18 | | | 465,892 | |

| Duke Energy Corp. | |

| 1,525,000 | | | 5.300 | | | 10/01/15 | | | 1,716,741 | |

| Exelon Generation Co. LLC | |

| 1,470,000 | | | 5.350 | | | 01/15/14 | | | 1,592,377 | |

| PacifiCorp | |

| 2,400,000 | | | 5.650 | | | 07/15/18 | | | 2,709,857 | |

| San Diego Gas & Electric Co. | |

| 1,585,000 | | | 5.300 | | | 11/15/15 | | | 1,780,836 | |

| Southern California Edison Co. | |

| 3,000,000 | | | 5.500 | | | 03/15/40 | | | 3,102,000 | |

| | | | | | | | | | |

| | | | | | | | | 14,344,453 | |

| | |

Financial – 6.3% | |

| Bank One Corp. | |

| 1,000,000 | | | 8.530 | | | 03/01/19 | | | 1,230,037 | |

| | |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE BOND FUND

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

| Corporate Obligations – (continued) | |

Financial – (continued) | |

| Bear Stearns Companies, Inc. | |

| $1,000,000 | | | 7.250 | % | | 02/01/18 | | $ | 1,174,944 | |

| Blackstone Holdings Finance Co. LLC(a) | |

| 3,000,000 | | | 5.875 | | | 03/15/21 | | | 2,972,127 | |

| Citigroup, Inc. | |

| 2,750,000 | | | 6.010 | | | 01/15/15 | | | 3,048,169 | |

| Equitable Life Assurance Society of the United States(a) | |

| 6,220,000 | | | 7.700 | | | 12/01/15 | | | 7,233,897 | |

| General Electric Capital Corp. | |