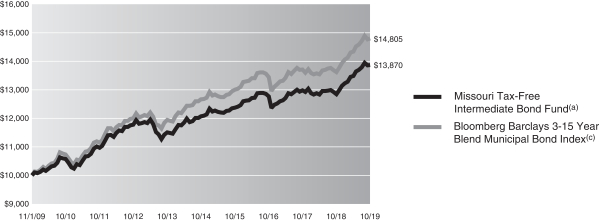

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-8598

The Commerce Funds

(Exact name of Registrant as specified in charter)

|

| 922 Walnut St., Fourth Floor, Mail Code = TB4-1, Kansas City, Missouri 64106 |

| (Address of principal executive offices) (Zip code) |

Diana E. McCarthy

Drinker Biddle & Reath LLP

One Logan Square

Suite 2000

Philadelphia, PA 19103-6996

(Name and address of agent for service)

Registrant’s telephone number, including area code:1-800-995-6365

Date of fiscal year end: 10/31

Date of reporting period: 10/31/19

| ITEM 1. | | REPORTS TO SHAREHOLDERS. |

The Annual Report to Shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1) is filed herewith.

THE COMMERCE FUNDS Annual Report | October 31, 2019 Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission (“SEC”), paper copies of the The Commerce Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from The Commerce Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the The Commerce Funds’ website (www.commercefunds.com) and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you have already elected to receive your shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from The Commerce Funds electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or by calling1-800-995-6365. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, please contact your financial intermediary to continue receiving paper copies of your shareholder reports. You may also inform the The Commerce Funds that you wish to continue receiving paper copies of your shareholder reports by calling1-800-995-6365. Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary. You must provide separate instructions to each of your financial intermediaries.

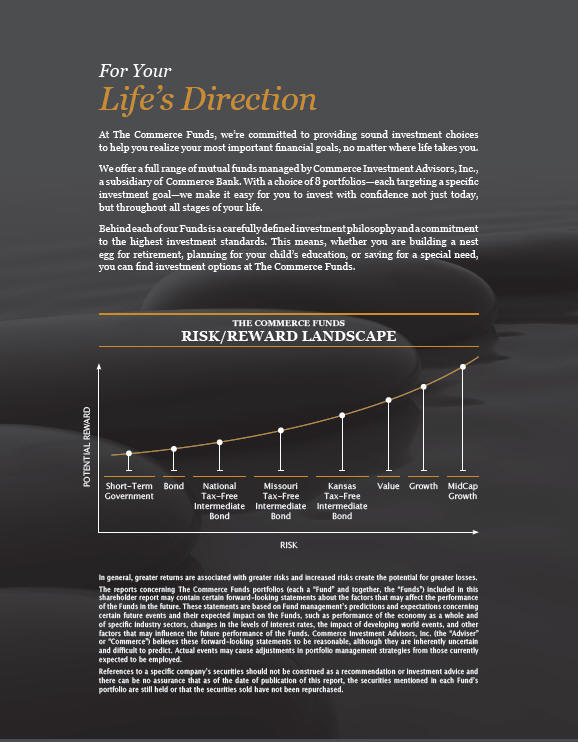

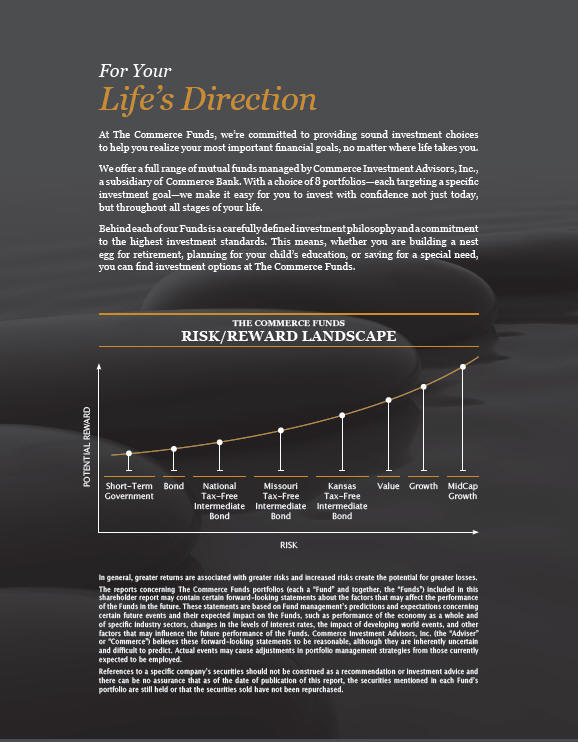

For Your Life’s Direction At The Commerce Funds, we’re committed to providing sound investment choices to help you realize your most important financial goals, no matter where life takes you. We offer a full range of mutual funds managed by Commerce Investment Advisors, Inc., a subsidiary of Commerce Bank. With a choice of 8 portfolios—each targeting a specific investment goal—we make it easy for you to invest with confidence not just today, but throughout all stages of your life. Behind each of our Funds is a carefully defined investment philosophy and a commitment to the highest investment standards. This means, whether you are building a nest egg for retirement, planning for your child’s education, or saving for a special need, you can find investment options at The Commerce Funds. THE COMMERCE FUNDS RISK/REWARD LANDSCAPE POTENTIAL REWARD RISK Short-Term Government Bond National Tax-Free Intermediate Bond Missouri Tax-Free Intermediate Bond Kansas Tax-Free Intermediate Bond Value Growth MidCap Growth In general, greater returns are associated with greater risks and increased risks create the potential for greater losses. The reports concerning The Commerce Funds portfolios (each a “Fund” and together, the “Funds”) included in this shareholder report may contain certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Commerce Investment Advisors, Inc. (the “Adviser” or “Commerce”) believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed. References to a specific company’s securities should not be construed as a recommendation or investment advice and there can be no assurance that as of the date of publication of this report, the securities mentioned in each Fund’s portfolio are still held or that the securities sold have not been repurchased.

COMMERCE FUNDS

Table of Contents

Please note:

The information in this annual report is as of October 31, 2019 and is audited, except where noted. The securities mentioned in this report may no longer be held by the Funds. To view more recent information about each Commerce Fund’s performance and portfolio or to obtain a prospectus, please visit our website atwww.commercefunds.com. This report is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus, which contains more complete information about the Commerce Funds’ investment policies, management and expenses. Investors should read the prospectus carefully before investing.

You may also receive Commerce Funds information by calling toll free 1-800-995-6365 or by writing to P.O. Box 219525, Kansas City, Missouri, 64121-9525, or you may contact your investment professional. The Commerce Funds publish performance and portfolio information for each Commerce Fund at the end of every calendar quarter. Investors should read the prospectus carefully before investing or sending money.

COMMERCE GROWTH FUND

Growth Fund Overview

We present you with the annual report for theCommerce Growth Fund for the one-year period ended October 31, 2019. Using a predominantly quantitative analysis, with some additional fundamental analysis depending on market conditions, the Fund invests principally in stocks of companies that have had below average price volatility in the past.

A conversation with Joe Williams, Portfolio Manager of the Growth Fund.

Q: How did the Fund perform over the review period?

A: The Fund had an annual return of 19.10% for the12-month period ended October 31, 2019, outperforming the Russell 1000 Growth Index (the “Index”), which returned 17.10% for the same period. Technology stocks were once again the drivers of the Index’s performance, as the sector, which makes up 37.60% of the Index, was up 22.3% for the period.

Q: Were there any significant adjustments made to the Fund’s portfolio during the period?

A: The Fund increased its portfolio holdings in the information technology sector to 36.0% from 32.5% during the period, thus reducing the Fund’s underweight to the sector relative to the Index. The information technology sector was the third best-performing sector for the period (up 22.3%) and the Fund saw attractive opportunities to increase its exposure to the sector. The Fund also decreased its portfolio holdings in the consumer staples sector to 3.4% from 7.2%, establishing an underweight position to the sector through the sale of Constellation Brands, Colgate-Palmolive, and Kimberly-Clark.

Q: Could you describe some specific strategies and holdings that enhanced the Fund’s returns during the period?

A: Stock selection in the industrials sector, which constitutes 11% of the Index, was the largest contributor to the Fund’s relative performance for the period. The Fund’s

industrials sector holdings returned 22.3% versus the 14.2% return of the industrials sector component of the Index. The Fund’s top performers in the industrials sector were Northrop Grumman Corporation and Armstrong World Industries, up 48% and 44%, respectively.

Q: What were some examples of strategies and holdings that didn’t work well for the Fund during the period?

A: The Fund’s underweight position in the information technology sector, specifically its underweight in semi-conductor stocks, caused some of the Fund’s underperformance for the period. The Fund didn’t own some of the information technology sector’s best performing semi-conductor stocks, such as Lam Research Corporation (up 96%), KLA Corporation (up 90%), and Advanced Micro Devices (up 86%), which hurt relative performance.

References to specific securities should not be construed as a recommendation or investment advice and securities referenced may no longer be held in a Fund’s portfolio.

2

COMMERCE GROWTH FUND

Performance Summary

October 31, 2019 (Unaudited)

The following is performance information for the Commerce Growth Fund (“Growth Fund”) for various time periods. The returns represent past performance. Past performance is no guarantee of future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund is not subject to a sales charge, so a sales charge is not applied to its total returns. In addition to the Adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting the Fund. Please visit our website at www.commercefunds.com to obtain the most recent month-end returns.

| | | | | | | | |

| | Performance Review | | | | | | |

| | | | |

| | | November 1, 2018 - October 31, 2019 | | Fund Total Return(a) | | Index Total Return(c) | | Index |

| | | | |

| | | Growth Fund | | 19.10% | | 17.10% | | Russell 1000® Growth(c) |

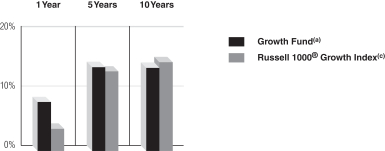

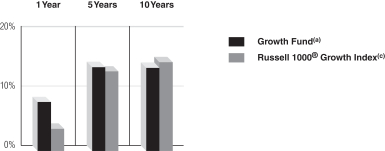

Standardized Average Annual Total Return through September 30, 2019(b)

| | | | | | | | |

| | Standardized Average Annual Total Return through September 30, 2019(b) | | One Year | | Five Years | | Ten Years |

| | | | |

| | | Growth Fund(a) | | 8.19% | | 14.14% | | 14.03% |

| | | | |

| | | Russell 1000® Growth Index(c) | | 3.71% | | 13.39% | | 14.94% |

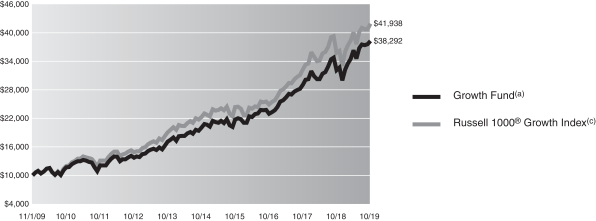

Growth Fund Shares 10 Year Performance

Performance of a $10,000 Investment, with distributions reinvested, from November 1, 2009 through October 31, 2019.

| | | | | | | | |

| | Average Annual Total Return through October 31, 2019 | | One Year | | Five Years | | Ten Years |

| | | | |

| | | Growth Fund(a) | | 19.10% | | 13.77% | | 14.37% |

| | | | | | |

| | Expense Ratios(d) | | | | |

| | | |

| | | | | Net Expense Ratio (Current) | | Gross Expense Ratio (Before Reimbursements) |

| | | |

| | | Growth Fund | | 0.77% | | 0.77% |

| (a) | | Returns reflect any applicable fee waivers or expense reductions. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | | The Standardized Average Annual Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value (“NAV”). Current performance may be lower or higher than the total return figures in the above charts. Returns reflect any fee waivers and expense reductions. Absent these waivers and reductions, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on capital gains or other taxable distributions or the redemption of Fund shares. |

| (c) | | The Russell 1000® Growth Index, an unmanaged index, measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect any deduction for fees, taxes or expenses. |

| (d) | | The Fund’s expense ratios, both net (net of applicable fee waivers and/or expense reimbursements) and gross (before applicable fee waivers and/or expense reimbursements), set forth above are as of the most recent publicly available prospectus for the Fund (March 1, 2019) and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Adviser has contractually agreed to reduce or limit the Total Annual Fund Operating Expenses, excluding interest, taxes, acquired fund fees and expenses and extraordinary expenses. This agreement will remain in place through March 1, 2020. After this date, the Adviser or the Fund may terminate the contractual arrangement. If this occurs, the expense ratios may change without shareholder approval. |

3

COMMERCE GROWTH FUND

Schedule of Investments

October 31, 2019

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

|

| | Common Stocks – 96.6% | |

| | Aerospace & Defense – 1.1% | |

| | 4,945 | | | Lockheed Martin Corp. | | | $ 1,862,683 | |

| | |

| | Beverages – 2.3% | |

| | 14,295 | | | PepsiCo, Inc. | | | 1,960,845 | |

| | 35,625 | | | The Coca-Cola Co. | | | 1,939,069 | |

| | | | | | | | |

| | | | | | | 3,899,914 | |

| | |

| | Biotechnology – 1.2% | |

| | 9,920 | | | Amgen, Inc. | | | 2,115,440 | |

| | |

| | Building Products – 1.9% | |

| | 16,525 | | | Armstrong World Industries, Inc. | | | 1,545,583 | |

| | 6,680 | | | Lennox International, Inc. | | | 1,652,365 | |

| | | | | | | | |

| | | | | | | 3,197,948 | |

| | |

| | Capital Markets – 4.4% | |

| | 13,600 | | | Cboe Global Markets, Inc. | | | 1,566,040 | |

| | 20,665 | | | Intercontinental Exchange, Inc. | | | 1,949,123 | |

| | 16,885 | | | T. Rowe Price Group, Inc. | | | 1,955,283 | |

| | 46,170 | | | The Charles Schwab Corp. | | | 1,879,581 | |

| | | | | | | | |

| | | | | | | 7,350,027 | |

| | |

| | Chemicals – 3.3% | |

| | 9,785 | | | Ecolab, Inc. | | | 1,879,405 | |

| | 23,530 | | | RPM International, Inc. | | | 1,704,278 | |

| | 3,555 | | | The Sherwin-Williams Co. | | | 2,034,597 | |

| | | | | | | | |

| | | | | | | 5,618,280 | |

| | |

| | Commercial Services & Supplies – 2.2% | |

| | 47,162 | | | Rollins, Inc. | | | 1,797,344 | |

| | 16,945 | | | Waste Management, Inc. | | | 1,901,398 | |

| | | | | | | | |

| | | | | | | 3,698,742 | |

| | |

| | Communications Equipment – 1.1% | |

| | 40,535 | | | Cisco Systems, Inc. | | | 1,925,818 | |

| | |

| | Diversified Consumer Services – 0.9% | |

| | 33,680 | | | Service Corp. International | | | 1,531,766 | |

| | |

| | Electrical Equipment – 2.0% | |

| | 17,535 | | | AMETEK, Inc. | | | 1,607,083 | |

| | 9,895 | | | Rockwell Automation, Inc. | | | 1,701,841 | |

| | | | | | | | |

| | | | | | | 3,308,924 | |

| | |

| | Electronic Equipment, Instruments & Components – 2.1% | |

| | 20,255 | | | Amphenol Corp. Class A | | | 2,032,184 | |

| | 29,390 | | | FLIR Systems, Inc. | | | 1,515,349 | |

| | | | | | | | |

| | | | | | | 3,547,533 | |

| | |

| | Entertainment* – 2.0% | |

| | 23,795 | | | Live Nation Entertainment, Inc. | | | 1,677,547 | |

| | 267,045 | | | Zynga, Inc. Class A | | | 1,647,668 | |

| | | | | | | | |

| | | | | | | 3,325,215 | |

| | |

| | Equity Real Estate Investment Trusts (REITs) – 2.2% | |

| | 13,785 | | | Crown Castle International Corp. | | | 1,913,220 | |

| | 7,860 | | | Public Storage | | | 1,751,680 | |

| | | | | | | | |

| | | | | | | 3,664,900 | |

| | |

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

|

| | Common Stocks – (continued) | |

| | Health Care Equipment & Supplies – 3.5% | |

| | 23,295 | | | Abbott Laboratories | | | $ 1,947,695 | |

| | 7,670 | | | Becton Dickinson & Co. | | | 1,963,520 | |

| | 8,855 | | | Stryker Corp. | | | 1,915,071 | |

| | | | | | | | |

| | | | | | | 5,826,286 | |

| | |

| | Health Care Providers & Services – 2.3% | |

| | 9,555 | | | Laboratory Corp. of America Holdings* | | | 1,574,377 | |

| | 9,270 | | | UnitedHealth Group, Inc. | | | 2,342,529 | |

| | | | | | | | |

| | | | | | | 3,916,906 | |

| | |

| | Hotels, Restaurants & Leisure – 4.4% | |

| | 15,760 | | | Marriott International, Inc. Class A | | | 1,994,428 | |

| | 9,070 | | | McDonald’s Corp. | | | 1,784,069 | |

| | 21,515 | | | Starbucks Corp. | | | 1,819,308 | |

| | 17,315 | | | Yum! Brands, Inc. | | | 1,761,109 | |

| | | | | | | | |

| | | | | | | 7,358,914 | |

| | |

| | Industrial Conglomerates – 2.3% | |

| | 11,575 | | | Honeywell International, Inc. | | | 1,999,350 | |

| | 5,425 | | | Roper Technologies, Inc. | | | 1,828,008 | |

| | | | | | | | |

| | | | | | | 3,827,358 | |

| | |

| | Interactive Media & Services* – 6.9% | |

| | 5,620 | | | Alphabet, Inc. Class A | | | 7,074,456 | |

| | 23,570 | | | Facebook, Inc. Class A | | | 4,517,190 | |

| | | | | | | | |

| | | | | | | 11,591,646 | |

| | |

| | Internet & Direct Marketing Retail* – 4.3% | |

| | 4,065 | | | Amazon.com, Inc. | | | 7,222,123 | |

| | |

| | IT Services – 13.1% | |

| | 11,945 | | | Automatic Data Processing, Inc. | | | 1,937,837 | |

| | 12,670 | | | Broadridge Financial Solutions, Inc. | | | 1,586,537 | |

| | 14,575 | | | Fidelity National Information Services, Inc. | | | 1,920,402 | |

| | 18,570 | | | Fiserv, Inc.* | | | 1,971,020 | |

| | 6,680 | | | FleetCor Technologies, Inc.* | | | 1,965,390 | |

| | 10,925 | | | Jack Henry & Associates, Inc. | | | 1,546,543 | |

| | 9,095 | | | Mastercard, Inc. Class A | | | 2,517,587 | |

| | 23,465 | | | Paychex, Inc. | | | 1,962,613 | |

| | 18,540 | | | PayPal Holdings, Inc.* | | | 1,930,014 | |

| | 8,460 | | | VeriSign, Inc.* | | | 1,607,569 | |

| | 17,470 | | | Visa, Inc. Class A | | | 3,124,684 | |

| | | | | | | | |

| | | | | | | 22,070,196 | |

| | |

| | Life Sciences Tools & Services – 3.1% | |

| | 20,820 | | | Agilent Technologies, Inc. | | | 1,577,115 | |

| | 2,320 | | | Mettler-Toledo International, Inc.* | | | 1,635,461 | |

| | 6,850 | | | Thermo Fisher Scientific, Inc. | | | 2,068,563 | |

| | | | | | | | |

| | | | | | | 5,281,139 | |

| | |

| | Machinery – 2.2% | |

| | 12,485 | | | Illinois Tool Works, Inc. | | | 2,104,721 | |

| | 13,720 | | | The Middleby Corp.* | | | 1,659,434 | |

| | | | | | | | |

| | | | | | | 3,764,155 | |

| | |

| | |

| 4 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE GROWTH FUND

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

|

| | Common Stocks – (continued) | |

| | Media – 1.1% | |

| | 42,105 | | | Comcast Corp. Class A | | | $ 1,887,146 | |

| | |

| | Multiline Retail – 1.2% | |

| | 12,230 | | | Dollar General Corp. | | | 1,960,958 | |

| | |

| | Personal Products – 1.1% | |

| | 9,980 | | | The Estee Lauder Cos., Inc. Class A | | | 1,858,975 | |

| | |

| | Pharmaceuticals – 1.2% | |

| | 14,865 | | | Johnson & Johnson | | | 1,962,775 | |

| | |

| | Road & Rail – 1.2% | |

| | 11,855 | | | Union Pacific Corp. | | | 1,961,528 | |

| | |

| | Semiconductors & Semiconductor Equipment – 1.1% | |

| | 15,110 | | | Texas Instruments, Inc. | | | 1,782,829 | |

| | |

| | Software – 12.3% | |

| | 6,965 | | | Adobe, Inc.* | | | 1,935,782 | |

| | 7,360 | | | ANSYS, Inc.* | | | 1,620,304 | |

| | 33,025 | | | CDK Global, Inc. | | | 1,669,083 | |

| | 16,710 | | | Citrix Systems, Inc. | | | 1,819,051 | |

| | 19,755 | | | Manhattan Associates, Inc.* | | | 1,480,637 | |

| | 73,200 | | | Microsoft Corp. | | | 10,494,684 | |

| | 7,635 | | | Palo Alto Networks, Inc.* | | | 1,736,123 | |

| | | | | | | | |

| | | | | | | 20,755,664 | |

| | |

| | Specialty Retail – 1.2% | |

| | 8,465 | | | The Home Depot, Inc. | | | 1,985,720 | |

| | |

| | Technology Hardware, Storage & Peripherals – 6.3% | |

| | 42,495 | | | Apple, Inc. | | | 10,571,056 | |

| | |

| | Textiles, Apparel & Luxury Goods – 1.1% | |

| | 21,255 | | | Nike, Inc. Class B | | | 1,903,385 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $113,596,477) | | | $162,535,949 | |

| | |

| | | | | | | | |

|

| | Exchange Traded Fund – 2.1% | |

| | 21,025 | | | iShares Russell 1000 Growth ETF | | | | |

| | (Cost $3,376,992) | | | $ 3,451,044 | |

| | |

| | | | | | | | | | | | |

| Shares | | Dividend

Rate | | | | | | Value | |

|

| Investment Company – 1.3% | |

State Street Institutional US Government Money Market

Fund — Premier Class | |

| 2,136,113 | | | 1.741 | % | | | | | | $ | 2,136,113 | |

(Cost $2,136,113) | | | | | | | | | |

| |

| TOTAL INVESTMENTS – 100.0% | |

(Cost $119,109,582) | | | | | | | $ | 168,123,106 | |

| |

OTHER ASSETS IN EXCESS OF

LIABILITIES – 0.0% | | | | 55,955 | |

| |

| NET ASSETS – 100.0% | | | | | | | $ | 168,179,061 | |

| |

| | |

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

| * | | Non-income producing security. |

PORTFOLIO COMPOSITION

| | | | | | | | |

| | | AS OF

10/31/19 | | | AS OF

10/31/18 | |

| |

Information Technology | | | 36.0 | % | | | 32.5 | % |

Consumer Discretionary | | | 13.0 | | | | 13.6 | |

Industrials | | | 12.9 | | | | 14.0 | |

Health Care | | | 11.4 | | | | 12.6 | |

Communication Services | | | 10.0 | | | | 7.7 | |

Financials | | | 4.4 | | | | 4.8 | |

Consumer Staples | | | 3.4 | | | | 7.2 | |

Materials | | | 3.3 | | | | 5.4 | |

Real Estate | | | 2.2 | | | | — | |

Exchange-Traded Funds | | | 2.1 | | | | 1.3 | |

Investment Company | | | 1.3 | | | | — | |

Repurchase Agreement | | | — | | | | 0.9 | |

| |

| TOTAL INVESTMENTS | | | 100.0 | % | | | 100.0 | % |

| |

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Underlying investment categories of investment companies, held by the Fund are not reflected in the table above. Consequently, the Fund’s overall investment category allocations may differ from the percentages contained in the table above.

The Fund is actively managed and, as such, its composition may differ over time.

| | |

| The accompanying notes are an integral part of these financial statements. | | 5 |

COMMERCE VALUE FUND

Value Fund Overview

We present you with the annual report for theCommerce Value Fund for the one-year period ended October 31, 2019. Using a predominately quantitative analysis, with some additional fundamental analysis depending on market conditions, the Fund invests principally in stocks within the Russell 1000® Value Index (“Index”) universe that have an above average dividend yield, as determined by the Adviser.

A conversation with Matt Schmitt, Portfolio Manager of the Value Fund.

Q: How did the Fund perform over the review period?

A: The Fund returned 14.65% over the 12-month period ended October 31, 2019, outperforming the Index, which returned 11.21% for the same period. Stock selection had the greatest positive effect on the Fund outperformance over the year, while sector allocation was the primary detractor from the Fund’s performance.

Q: Were there any significant adjustments made to the Fund’s portfolio during the period?

A: There were a few adjustments made to the Fund’s sector allocations during the 12-month period. The information technology sector moved from 5.6% to 7.5% of the Fund’s portfolio with the purchase of Intel Corporation. In addition, the real estate sector went from 0.0% to 3.9% of the Fund’s portfolio with the purchase of Highwoods Properties, Inc. These increases helped the Fund to outperform the Index, as both the technology and real estate sectors were among the top performing sectors for the year. The largest sector reduction in the Fund’s portfolio during the period was made in the financials sector, which moved from 26.6% to 20.4% of the Fund’s portfolio with the sale of Aflac Incorporated, Arthur J. Gallagher & Co., BB&T Corporation, and Ameriprise Financial, Inc. In addition, the Fund’s allocation to the energy sector was reduced from 11.4% to 8.8% during the period, with the sale of Occidental Petroleum Corp. The financials and energy sectors returned 10.54% and -12.53%, respectively, over the 12-month period.

Q: Could you describe some specific strategies and holdings that enhanced the Fund’s returns during the period?

A: The Fund benefited from security selection within the consumer staples sector, with overweight positions to Procter & Gamble, PepsiCo, Inc., and Kimberly-Clark Corporation returning 44.35%, 25.79%, and 31.64%, respectively, during the period. Additionally, security selection within the energy sector helped the Fund to outperform the Index, with overweight positions to Chevron Corporation and ONEOK, Inc. returning 8.22% and 12.22%, respectively, while the energy sector returned -12.53% for the period. Further positive performance was captured by the Fund’s allocation to Target Corporation in the consumer discretionary sector, which returned 58.20% for the period. The Fund had a 1.9% allocation to Target Corporation while the Index had only a 0.4% weight of the stock during the period.

Q: What were some examples of strategies and holdings that didn’t work well for the Fund during the period?

A: The Fund’s sector allocation was the primary detractor of performance. The real estate sector, which was 5.5% of the Index, was the top performing sector during the period, returning 25.09% for the 12 months ended October 31, 2019. However, the Fund’s underweight position in the real estate sector, at 3.9%, detracted from performance. In addition, the utilities sector, which was 6.8% of the Index, was the second best performing sector during the period, returning 23.02%. The Fund’s underweight position of 3.9% in the utilities sector also detracted from performance for the year.

References to specific securities should not be construed as a recommendation or investment advice and securities referenced may no longer be held in a Fund’s portfolio.

6

COMMERCE VALUE FUND

Performance Summary

October 31, 2019 (Unaudited)

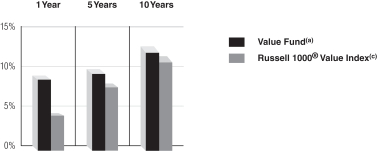

The following is performance information for the Commerce Value Fund (“Value Fund”) for various time periods. The returns represent past performance. Past performance is no guarantee of future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund is not subject to a sales charge, so a sales charge is not applied to its total returns. In addition to the Adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting the Fund. Please visit our website at www.commercefunds.com to obtain the most recent month-end returns.

| | | | | | | | |

| | Performance Review | | | | | | |

| | | | |

| | | November 1, 2018 - October 31, 2019 | | Fund Total Return(a) | | Index Total Return(c) | | Index |

| | | | |

| | | Value Fund | | 14.65% | | 11.21% | | Russell 1000® Value(c) |

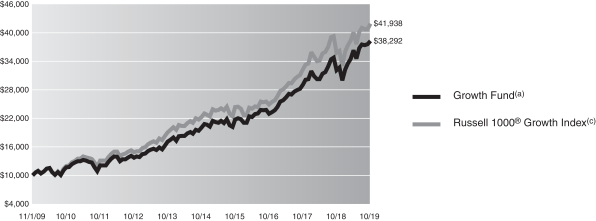

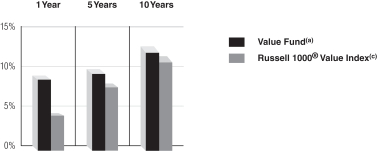

Standardized Average Annual Total Return through September 30, 2019(b)

| | | | | | | | |

| | Standardized Average Annual Total Return throughSeptember 30, 2019(b) | | One Year | | Five Years | | Ten Years |

| | | | |

| | | Value Fund(a) | | 8.72% | | 9.63% | | 12.68% |

| | | | |

| | | Russell 1000® Value Index(c) | | 4.00% | | 7.79% | | 11.46% |

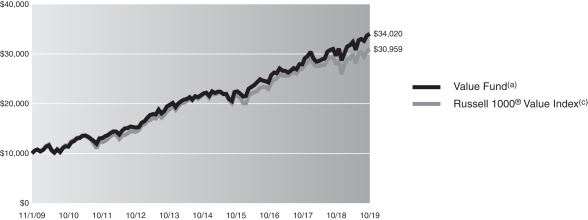

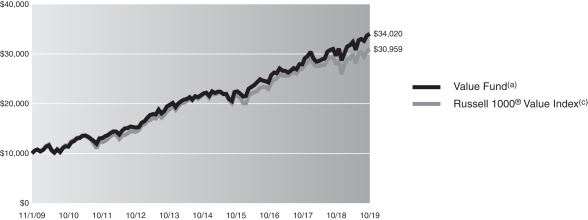

Value Fund Shares 10 Year Performance

Performance of a $10,000 Investment, with distributions reinvested, from November 1, 2009 through October 31, 2019.

| | | | | | | | |

| | Average Annual Total Return through October 31, 2019 | | One Year | | Five Years | | Ten Years |

| | | | |

| | | Value Fund(a) | | 14.65% | | 9.40% | | 13.02% |

| | | | | | |

| | Expense Ratios(d) | | | | |

| | | |

| | | | | Net Expense Ratio (Current) | | Gross Expense Ratio (Before Reimbursements) |

| | | |

| | | Value Fund | | 0.71% | | 0.80% |

| (a) | | Returns reflect any applicable fee waivers or expense reductions. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | | The Standardized Average Annual Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Current performance may be lower or higher than the total return figures in the above charts. |

Returns reflect any fee waivers and expense reductions. Absent these waivers and reductions, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on capital gains or other taxable distributions or the redemption of Fund shares.

| (c) | | The Russell 1000® Value Index, an unmanaged index, measures the performance of the large-cap value segment of the U.S. equity universe. It includes Russell 1000 companies with lower price-to-book ratios and lower expected growth values. The Index figures do not reflect any deduction for fees, taxes or expenses. |

| (d) | | The Fund’s expense ratios, both net (net of applicable fee waivers and/or expense reimbursements) and gross (before applicable fee waivers and/or expense reimbursements), set forth above are as of the most recent publicly available prospectus for the Fund (March 1, 2019) and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Adviser has contractually agreed to reduce or limit the Total Annual Fund Operating Expenses, excluding interest, taxes, acquired fund fees and expenses and extraordinary expenses. This agreement will remain in place through March 1, 2020. After this date, the Adviser or the Fund may terminate the contractual arrangement. If this occurs, the expense ratios may change without shareholder approval. |

7

COMMERCE VALUE FUND

Schedule of Investments

October 31, 2019

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

|

| | Common Stocks – 94.7% | |

| | Aerospace & Defense – 1.8% | |

| | 13,750 | | | Lockheed Martin Corp. | | | $ 5,179,350 | |

| | |

| | Air Freight & Logistics – 1.8% | |

| | 45,000 | | | United Parcel Service, Inc. Class B | | | 5,182,650 | |

| | |

| | Banks – 10.3% | |

| | 68,000 | | | JPMorgan Chase & Co. | | | 8,494,560 | |

| | 338,000 | | | People’s United Financial, Inc. | | | 5,465,460 | |

| | 96,500 | | | U.S. Bancorp. | | | 5,502,430 | |

| | 193,000 | | | Wells Fargo & Co. | | | 9,964,590 | |

| | | | | | | | |

| | | | | | | 29,427,040 | |

| | |

| | Beverages – 3.7% | |

| | 98,000 | | | Molson Coors Brewing Co. Class B | | | 5,166,560 | |

| | 39,500 | | | PepsiCo, Inc. | | | 5,418,215 | |

| | | | | | | | |

| | | | | | | 10,584,775 | |

| | |

| | Biotechnology – 4.9% | |

| | 41,500 | | | Amgen, Inc. | | | 8,849,875 | |

| | 81,500 | | | Gilead Sciences, Inc. | | | 5,192,365 | |

| | | | | | | | |

| | | | | | | 14,042,240 | |

| | |

| | Capital Markets – 6.5% | |

| | 12,000 | | | BlackRock, Inc. | | | 5,540,400 | |

| | 38,000 | | | CME Group, Inc. | | | 7,818,500 | |

| | 46,500 | | | T. Rowe Price Group, Inc. | | | 5,384,700 | |

| | | | | | | | |

| | | | | | | 18,743,600 | |

| | |

| | Communications Equipment – 1.8% | |

| | 109,500 | | | Cisco Systems, Inc. | | | 5,202,345 | |

| | |

| | Containers & Packaging – 3.9% | |

| | 132,000 | | | International Paper Co. | | | 5,765,760 | |

| | 93,000 | | | Sonoco Products Co. | | | 5,366,100 | |

| | | | | | | | |

| | | | | | | 11,131,860 | |

| | |

| | Distributors – 2.0% | |

| | 55,500 | | | Genuine Parts Co. | | | 5,693,190 | |

| | |

| | Diversified Telecommunication Services – 4.8% | |

| | 218,000 | | | AT&T, Inc. | | | 8,390,820 | |

| | 90,000 | | | Verizon Communications, Inc. | | | 5,442,300 | |

| | | | | | | | |

| | | | | | | 13,833,120 | |

| | |

| | Electric Utilities – 2.0% | |

| | 24,000 | | | NextEra Energy, Inc. | | | 5,720,160 | |

| | |

| | Electrical Equipment – 2.0% | |

| | 83,000 | | | Emerson Electric Co. | | | 5,822,450 | |

| | |

| | Equity Real Estate Investment Trusts (REITs) – 3.9% | |

| | 119,500 | | | Highwoods Properties, Inc. | | | 5,592,600 | |

| | 60,500 | | | WP Carey, Inc. | | | 5,569,630 | |

| | | | | | | | |

| | | | | | | 11,162,230 | |

| | |

| | Health Care Providers & Services – 2.0% | |

| | 84,500 | | | CVS Health Corp. | | | 5,609,955 | |

| | |

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

|

| | Common Stocks – (continued) | |

| | Hotels, Restaurants & Leisure – 1.7% | |

| | 25,500 | | | McDonald’s Corp. | | | $ 5,015,850 | |

| | |

| | Household Products – 3.8% | |

| | 40,000 | | | Kimberly-Clark Corp. | | | 5,315,200 | |

| | 44,000 | | | The Procter & Gamble Co. | | | 5,478,440 | |

| | | | | | | | |

| | | | | | | 10,793,640 | |

| | |

| | Industrial Conglomerates – 1.9% | |

| | 32,500 | | | 3M Co. | | | 5,362,175 | |

| | |

| | Insurance – 3.6% | |

| | 112,500 | | | MetLife, Inc. | | | 5,263,875 | |

| | 95,000 | | | Principal Financial Group, Inc. | | | 5,071,100 | |

| | | | | | | | |

| | | | | | | 10,334,975 | |

| | |

| | IT Services – 1.9% | |

| | 65,000 | | | Paychex, Inc. | | | 5,436,600 | |

| | |

| | Machinery – 2.0% | |

| | 41,500 | | | Caterpillar, Inc. | | | 5,718,700 | |

| | |

| | Multi-Utilities – 1.9% | |

| | 66,500 | | | Dominion Energy, Inc. | | | 5,489,575 | |

| | |

| | Multiline Retail – 3.8% | |

| | 110,500 | | | Kohl’s Corp. | | | 5,664,230 | |

| | 50,000 | | | Target Corp. | | | 5,345,500 | |

| | | | | | | | |

| | | | | | | 11,009,730 | |

| | |

| | Oil, Gas & Consumable Fuels – 8.8% | |

| | 87,000 | | | Chevron Corp. | | | 10,104,180 | |

| | 149,000 | | | Exxon Mobil Corp. | | | 10,067,930 | |

| | 72,000 | | | ONEOK, Inc. | | | 5,027,760 | |

| | | | | | | | |

| | | | | | | 25,199,870 | |

| | |

| | Pharmaceuticals – 8.2% | |

| | 62,000 | | | Johnson & Johnson | | | 8,186,480 | |

| | 64,000 | | | Merck & Co., Inc. | | | 5,546,240 | |

| | 258,000 | | | Pfizer, Inc. | | | 9,899,460 | |

| | | | | | | | |

| | | | | | | 23,632,180 | |

| | |

| | Semiconductors & Semiconductor Equipment – 3.8% | |

| | 104,500 | | | Intel Corp. | | | 5,907,385 | |

| | 41,500 | | | Texas Instruments, Inc. | | | 4,896,585 | |

| | | | | | | | |

| | | | | | | 10,803,970 | |

| | |

| | Specialty Retail – 1.9% | |

| | 23,500 | | | The Home Depot, Inc. | | | 5,512,630 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $237,132,277) | | | $271,644,860 | |

| | |

| | | | | | | | |

|

| | Exchange Traded Fund – 3.4% | |

| | 75,000 | | | iShares Russell 1000 Value Index Fund | | | | |

| | (Cost $9,517,142) | | | $ 9,755,250 | |

| | |

| | |

| 8 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE VALUE FUND

| | | | | | | | | | |

| Shares | | | Dividend

Rate | | | | Value | |

|

| | Investment Company – 1.5% | |

| State Street Institutional US Government Money

Market Fund — Premier Class |

|

| | 4,396,208 | | | 1.741% | | | | | $ 4,396,208 | |

| | (Cost $4,396,208) | | | | | | |

| | |

| | TOTAL INVESTMENTS – 99.6% | |

| | (Cost $251,045,627) | | | | | $285,796,318 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 0.4% | | | 1,185,492 | |

| | |

| | NET ASSETS – 100.0% | | | | | $286,981,810 | |

| | |

| | |

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

PORTFOLIO COMPOSITION

| | | | | | | | |

| | | AS OF

10/31/19 | | | AS OF

10/31/18 | |

| |

Financials | | | 20.4 | % | | | 26.6 | % |

Health Care | | | 15.1 | | | | 15.6 | |

Industrials | | | 9.5 | | | | 8.7 | |

Consumer Discretionary | | | 9.5 | | | | 8.3 | |

Energy | | | 8.8 | | | | 11.4 | |

Information Technology | | | 7.5 | | | | 5.6 | |

Consumer Staples | | | 7.4 | | | | 8.1 | |

Communication Services | | | 4.8 | | | | 4.9 | |

Utilities | | | 3.9 | | | | 4.0 | |

Real Estate | | | 3.9 | | | | — | |

Materials | | | 3.9 | | | | 3.8 | |

Exchange Traded Fund | | | 3.4 | | | | 2.7 | |

Investment Company | | | 1.5 | | | | — | |

Repurchase Agreement | | | — | | | | 0.3 | |

| |

| TOTAL INVESTMENTS | | | 99.6 | % | | | 100.0 | % |

| |

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Underlying investment categories of investment companies, held by the Fund are not reflected in the table above. Consequently, the Fund’s overall investment category allocations may differ from the percentages contained in the table above.

The Fund is actively managed and, as such, its composition may differ over time.

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

COMMERCE MIDCAP GROWTH FUND

MidCap Growth Fund Overview

We present you with the annual report for theCommerce MidCap Growth Fund for the one-year period ended October 31, 2019. Using a predominately quantitative analysis, with some additional fundamental analysis depending on market conditions, the Fund invests principally in stock of companies that have had below-average price volatility in the past.

A conversation with Joe Williams, Portfolio Manager of the MidCap Growth Fund.

Q: How did the Fund perform over the review period?

A: The Fund had an annual return of 19.76% for the12-month period ended October 31, 2019, outperforming the Russell MidCap Growth Index (the “Index”), which returned 18.93% for the same period. Technology and industrial sector stocks, which account for 50% of the securities included in the Index (of the Index’s market cap), were up 27% and 22%, respectively, pushing the Index to all-time-highs during the period.

Q: Were there any significant adjustments made to the Fund’s portfolio during the period?

A: The Fund increased its portfolio holdings in the information technology sector to 31.5% from 26.8% during the period, thus reducing the Fund’s underweight to the sector relative to the Index. The Fund also decreased its holdings in the consumer discretionary sector to 14.2% from 18.8%, establishing an underweight position to the sector primarily through selling retail stocks such as Ross Stores, Carter’s, Tiffany & Co, and Best Buy.

Q: Could you describe some specific strategies and holdings that enhanced the Fund’s returns during the period?

A: The Fund’s stock selection and overweight position in the industrials sector were the largest contributors to relative Fund performance for the year. The Fund’s industrials sector holdings were up 24.2%, outperforming the 21.6% return of the industrials sector component of the Index. The

Fund’s approximately 3% overweight to the industrials sector also helped its performance relative to the Index.

Q: What were some examples of strategies and holdings that didn’t work well for the Fund during the period?

A: Stock selection in the financials sector hurt the Fund’s relative performance. The Fund’s financials sector stocks were up 13.2%, underperforming the 19.8% return of the industrials sector component of the Index. Fund holdings of Comerica Incorporated (down 16.8%), Eaton Vance Corp (down 7.1%) and Northern Trust Corp (down 5.2%) were the primary detractors from the Fund’s relative performance in the financials sector.

References to specific securities should not be construed as a recommendation or investment advice and securities referenced may no longer be held in a Fund’s portfolio.

10

COMMERCE MIDCAP GROWTH FUND

Performance Summary

October 31, 2019 (Unaudited)

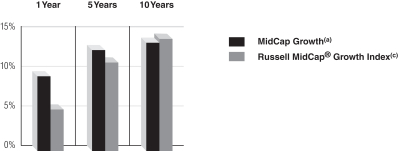

The following is performance information for the Commerce MidCap Growth Fund (“MidCap Growth”) for various time periods. The returns represent past performance. Past performance is no guarantee of future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund is not subject to a sales charge, so a sales charge is not applied to its total returns. In addition to the Adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting the Fund. Please visit our website at www.commercefunds.com to obtain the most recent month-end returns.

| | | | | | | | |

| | Performance Review | | | | | | |

| | | | |

| | | November 1, 2018 - October 31, 2019 | | Fund Total Return(a) | | Index Total Return(c) | | Index |

| | | | |

| | | MidCap Growth | | 19.76% | | 18.93% | | Russell Midcap® Growth(c) |

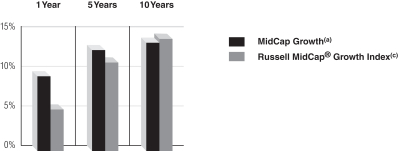

Standardized Average Annual Total Return through September 30, 2019(b)

| | | | | | | | |

| | Standardized Average Annual Total Return through September 30, 2019(b) | | One Year | | Five Years | | Ten Years |

| | | | |

| | | MidCap Growth(a) | | 9.37% | | 12.65% | | 13.57% |

| | | | |

| | | Russell MidCap® Growth Index(c) | | 5.20% | | 11.12% | | 14.08% |

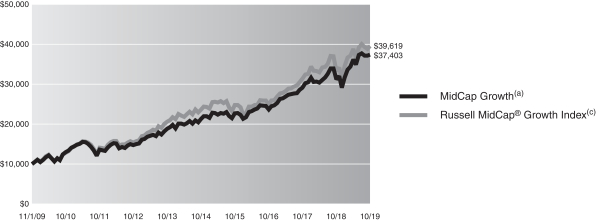

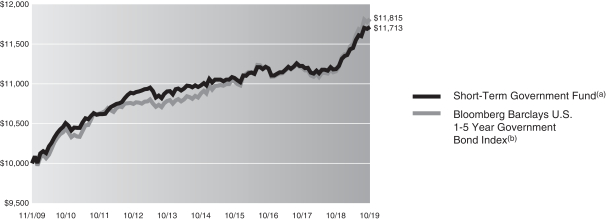

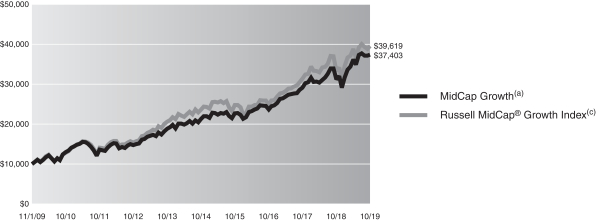

MidCap Growth Fund Shares 10 Year Performance

Performance of a $10,000 Investment, with distributions reinvested, from November 1, 2009 through October 31, 2019.

| | | | | | | | |

| | Average Annual Total Return through October 31, 2019 | | One Year | | Five Years | | Ten Years |

| | | | |

| | | MidCap Growth(a) | | 19.76% | | 11.96% | | 14.10% |

| | | | | | |

| | Expense Ratios(d) | | | | |

| | | |

| | | | | Net Expense Ratio (Current) | | Gross Expense Ratio (Before Reimbursements) |

| | | |

| | | MidCap Growth | | 0.84% | | 0.84% |

| (a) | | Returns reflect any applicable fee waivers or expense reductions. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | | The Standardized Average Annual Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Current performance may be lower or higher than the total return figures in the above charts. |

Returns reflect any fee waivers and expense reductions. Absent these waivers and reductions, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on capital gains or other taxable distributions or the redemption of Fund shares.

| (c) | | The Russell Midcap® Growth Index, an unmanaged index, measures the performance of the mid-cap growth segment at the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect any deduction for fees, taxes, or expenses. |

| (d) | | The Fund’s expense ratios, both net (net of applicable fee waivers and/or expense limitations) and gross (before applicable fee waivers and/or expense limitations), set forth above are as of the most recent publicly available prospectus for the Fund (March 1, 2019) and may differ from the expense ratios disclosed in the Financial Highlights in this report. Applicable waivers and expense limitations are voluntary and may be modified or terminated at any time by the Adviser. If this occurs, the expense ratios may change without shareholder approval. |

11

COMMERCE MIDCAP GROWTH FUND

Schedule of Investments

October 31, 2019

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

|

| | Common Stocks – 95.4% | |

| | Aerospace & Defense – 2.4% | |

| | 21,110 | | | HEICO Corp. | | | $ 2,603,707 | |

| | 5,160 | | | TransDigm Group, Inc. | | | 2,715,605 | |

| | | | | | | | |

| | | | | | | 5,319,312 | |

| | |

| | Air Freight & Logistics – 1.0% | |

| | 30,695 | | | CH Robinson Worldwide, Inc. | | | 2,321,770 | |

| | |

| | Airlines* – 1.2% | |

| | 29,680 | | | United Airlines Holdings, Inc. | | | 2,696,131 | |

| | |

| | Banks – 1.2% | |

| | 41,245 | | | Comerica, Inc. | | | 2,698,248 | |

| | |

| | Biotechnology* – 1.2% | |

| | 36,650 | | | BioMarin Pharmaceutical, Inc. | | | 2,683,147 | |

| | |

| | Building Products – 1.2% | |

| | 28,130 | | | Armstrong World Industries, Inc. | | | 2,630,999 | |

| | |

| | Capital Markets – 4.7% | |

| | 9,695 | | | FactSet Research Systems, Inc. | | | 2,457,876 | |

| | 16,820 | | | Morningstar, Inc. | | | 2,722,149 | |

| | 11,430 | | | MSCI, Inc. | | | 2,681,021 | |

| | 22,460 | | | T. Rowe Price Group, Inc. | | | 2,600,868 | |

| | | | | | | | |

| | | | | | | 10,461,914 | |

| | |

| | Chemicals – 1.3% | |

| | 38,540 | | | RPM International, Inc. | | | 2,791,452 | |

| | |

| | Commercial Services & Supplies – 1.3% | |

| | 77,722 | | | Rollins, Inc. | | | 2,961,985 | |

| | |

| | Communications Equipment – 1.2% | |

| | 15,975 | | | Motorola Solutions, Inc. | | | 2,656,962 | |

| | |

| | Containers & Packaging – 1.2% | |

| | 64,225 | | | Sealed Air Corp. | | | 2,682,678 | |

| | |

| | Distributors – 1.3% | |

| | 13,885 | | | Pool Corp. | | | 2,879,749 | |

| | |

| | Diversified Consumer Services – 2.3% | |

| | 17,225 | | | Bright Horizons Family Solutions, Inc.* | | | 2,558,257 | |

| | 55,710 | | | Service Corp. International | | | 2,533,691 | |

| | | | | | | | |

| | | | | | | 5,091,948 | |

| | |

| | Diversified Financial Services – 1.2% | |

| | 49,570 | | | Voya Financial, Inc. | | | 2,674,797 | |

| | |

| | Electrical Equipment – 2.5% | |

| | 29,665 | | | AMETEK, Inc. | | | 2,718,797 | |

| | 15,975 | | | Rockwell Automation, Inc. | | | 2,747,540 | |

| | | | | | | | |

| | | | | | | 5,466,337 | |

| | |

| | Electronic Equipment, Instruments & Components – 3.8% | |

| | 28,250 | | | Amphenol Corp. Class A | | | 2,834,323 | |

| | 23,185 | | | CDW Corp. | | | 2,965,593 | |

| | 50,945 | | | FLIR Systems, Inc. | | | 2,626,724 | |

| | | | | | | | |

| | | | | | | 8,426,640 | |

| | |

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

|

| | Common Stocks – (continued) | |

| | Entertainment* – 2.4% | |

| | 37,565 | | | Live Nation Entertainment, Inc. | | | $ 2,648,333 | |

| | 454,985 | | | Zynga, Inc. Class A | | | 2,807,257 | |

| | | | | | | | |

| | | | | | | 5,455,590 | |

| | |

| | Equity Real Estate Investment Trusts (REITs) – 3.5% | |

| | 22,835 | | | Extra Space Storage, Inc. | | | 2,563,685 | |

| | 33,535 | | | Lamar Advertising Co. Class A | | | 2,683,135 | |

| | 10,790 | | | SBA Communications Corp. | | | 2,596,614 | |

| | | | | | | | |

| | | | | | | 7,843,434 | |

| | |

| | Food Products – 1.2% | |

| | 16,740 | | | McCormick & Co., Inc. | | | 2,689,951 | |

| | |

| | Health Care Equipment & Supplies – 3.5% | |

| | 8,705 | | | The Cooper Cos., Inc. | | | 2,533,155 | |

| | 22,565 | | | Varian Medical Systems, Inc.* | | | 2,726,078 | |

| | 18,075 | | | West Pharmaceutical Services, Inc. | | | 2,599,908 | |

| | | | | | | | |

| | | | | | | 7,859,141 | |

| | |

| | Health Care Providers & Services – 2.2% | |

| | 6,270 | | | Chemed Corp. | | | 2,469,816 | |

| | 15,360 | | | Laboratory Corp. of America Holdings* | | | 2,530,867 | |

| | | | | | | | |

| | | | | | | 5,000,683 | |

| | |

| | Health Care Technology – 1.2% | |

| | 39,270 | | | Cerner Corp. | | | 2,635,802 | |

| | |

| | Hotels, Restaurants & Leisure – 5.0% | |

| | 10,920 | | | Domino’s Pizza, Inc. | | | 2,966,090 | |

| | 33,015 | | | Dunkin’ Brands Group, Inc. | | | 2,595,639 | |

| | 27,960 | | | Hilton Worldwide Holdings, Inc. | | | 2,711,002 | |

| | 136,525 | | | The Wendy’s Co. | | | 2,891,600 | |

| | | | | | | | |

| | | | | | | 11,164,331 | |

| | |

| | Household Products – 1.2% | |

| | 36,840 | | | Church & Dwight Co., Inc. | | | 2,576,590 | |

| | |

| | IT Services – 15.5% | |

| | 29,170 | | | Akamai Technologies, Inc.* | | | 2,523,205 | |

| | 42,985 | | | Black Knight, Inc.* | | | 2,759,637 | |

| | 37,610 | | | Booz Allen Hamilton Holding Corp. | | | 2,646,616 | |

| | 21,480 | | | Broadridge Financial Solutions, Inc. | | | 2,689,725 | |

| | 18,570 | | | Euronet Worldwide, Inc.* | | | 2,601,100 | |

| | 25,530 | | | Fiserv, Inc.* | | | 2,709,754 | |

| | 9,190 | | | FleetCor Technologies, Inc.* | | | 2,703,882 | |

| | 19,335 | | | Gartner, Inc.* | | | 2,979,137 | |

| | 40,600 | | | GoDaddy, Inc. Class A* | | | 2,640,218 | |

| | 18,125 | | | Jack Henry & Associates, Inc. | | | 2,565,775 | |

| | 32,475 | | | Paychex, Inc. | | | 2,716,209 | |

| | 13,850 | | | VeriSign, Inc.* | | | 2,631,777 | |

| | 13,040 | | | WEX, Inc.* | | | 2,466,907 | |

| | | | | | | | |

| | | | | | | 34,633,942 | |

| | |

| | Leisure Equipment & Products – 1.0% | |

| | 22,130 | | | Hasbro, Inc. | | | 2,153,470 | |

| | |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE MIDCAP GROWTH FUND

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

|

| | Common Stocks – (continued) | |

| | Life Sciences Tools & Services – 3.6% | |

| | 34,475 | | | Agilent Technologies, Inc. | | | $ 2,611,481 | |

| | 13,380 | | | Bio-Techne Corp. | | | 2,785,315 | |

| | 3,720 | | | Mettler-Toledo International, Inc.* | | | 2,622,377 | |

| | | | | | | | |

| | | | | | | 8,019,173 | |

| | |

| | Machinery – 7.1% | |

| | 37,910 | | | Fortive Corp. | | | 2,615,790 | |

| | 56,565 | | | Graco, Inc. | | | 2,556,738 | |

| | 15,635 | | | IDEX Corp. | | | 2,431,711 | |

| | 18,080 | | | Nordson Corp. | | | 2,835,125 | |

| | 22,155 | | | The Middleby Corp.* | | | 2,679,647 | |

| | 36,045 | | | The Toro Co. | | | 2,780,151 | |

| | | | | | | | |

| | | | | | | 15,899,162 | |

| | |

| | Media – 1.0% | |

| | 60,545 | | | CBS Corp. Class B | | | 2,182,042 | |

| | |

| | Multiline Retail – 1.2% | |

| | 16,890 | | | Dollar General Corp. | | | 2,708,143 | |

| | |

| | Professional Services* – 1.1% | |

| | 4,525 | | | CoStar Group, Inc. | | | 2,486,578 | |

| | |

| | Road & Rail – 1.2% | |

| | 23,435 | | | Landstar System, Inc. | | | 2,651,670 | |

| | |

| | Semiconductors & Semiconductor Equipment – 2.4% | |

| | 57,350 | | | Entegris, Inc. | | | 2,752,800 | |

| | 44,380 | | | Maxim Integrated Products, Inc. | | | 2,603,331 | |

| | | | | | | | |

| | | | | | | 5,356,131 | |

| | |

| | Software – 8.6% | |

| | 12,570 | | | ANSYS, Inc.* | | | 2,767,285 | |

| | 40,060 | | | Cadence Design Systems, Inc.* | | | 2,617,921 | |

| | 27,495 | | | Citrix Systems, Inc. | | | 2,993,106 | |

| | 12,685 | | | Palo Alto Networks, Inc.* | | | 2,884,442 | |

| | 19,310 | | | Synopsys, Inc.* | | | 2,621,333 | |

| | 80,660 | | | Teradata Corp.* | | | 2,414,154 | |

| | 10,275 | | | Tyler Technologies, Inc.* | | | 2,759,043 | |

| | | | | | | | |

| | | | | | | 19,057,284 | |

| | |

| | Specialty Retail – 2.4% | |

| | 17,100 | | | Advance Auto Parts, Inc. | | | 2,778,408 | |

| | 26,850 | | | Tractor Supply Co. | | | 2,551,287 | |

| | | | | | | | |

| | | | | | | 5,329,695 | |

| | |

| | Textiles, Apparel & Luxury Goods – 1.1% | |

| | 26,380 | | | Columbia Sportswear Co. | | | 2,386,071 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $172,643,756) | | | $212,532,952 | |

| | |

| | | | | | | | |

|

| | Exchange Traded Fund – 3.3% | |

| | 51,270 | | | iShares Russell Midcap Growth Index Fund | | | | |

| | (Cost $7,120,072) | | | $ 7,381,854 | |

| | |

| | | | | | | | | | | | |

| Shares | | Dividend

Rate | | | | | | Value | |

|

| Investment Company – 1.2% | |

State Street Institutional US Government Money

Market Fund — Premier Class | |

| 2,621,081 | | | 1.741 | % | | | | | | $ | 2,621,081 | |

(Cost $2,621,081) | | | | | | | | | |

| |

| TOTAL INVESTMENTS – 99.9% | |

(Cost $182,384,909) | | | | | | | $ | 222,535,887 | |

| |

OTHER ASSETS IN EXCESS OF LIABILITIES – 0.1% | | | | 160,641 | |

| |

| NET ASSETS – 100.0% | | | | | | | $ | 222,696,528 | |

| |

| | |

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

| * | | Non-income producing security. |

PORTFOLIO COMPOSITION

| | | | | | | | |

| | | AS OF

10/31/19 | | | AS OF

10/31/18 | |

| |

Information Technology | | | 31.5 | % | | | 26.8 | % |

Industrials | | | 19.1 | | | | 18.9 | |

Consumer Discretionary | | | 14.2 | | | | 18.8 | |

Health Care | | | 11.8 | | | | 13.8 | |

Financials | | | 7.1 | | | | 11.0 | |

Real Estate | | | 3.5 | | | | — | |

Communication Services | | | 3.4 | | | | 1.4 | |

Materials | | | 2.4 | | | | 4.8 | |

Consumer Staples | | | 2.4 | | | | 2.8 | |

Exchange Traded Fund | | | 3.3 | | | | 0.5 | |

Investment Company | | | 1.2 | | | | — | |

Repurchase Agreement | | | — | | | | 1.3 | |

| |

| TOTAL INVESTMENTS | | | 99.9 | % | | | 100.1 | % |

| |

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Underlying investment categories of investment companies, held by the Fund are not reflected in the table above. Consequently, the Fund’s overall investment category allocations may differ from the percentages contained in the table above.

The Fund is actively managed and, as such, its composition may differ over time.

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

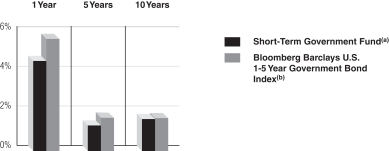

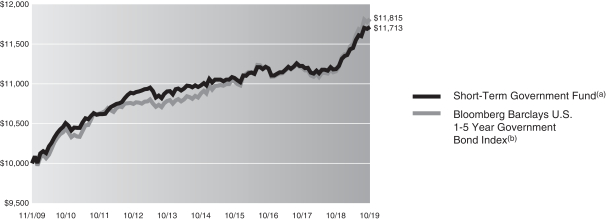

COMMERCE BOND FUND

Bond Fund Overview

We present you with the annual report for theCommerce Bond Fund for the one-year period ended October 31, 2019.

A conversation with Scott Colbert and Brent Schowe, Portfolio Managers of the Bond Fund.

Q: How did the Fund perform over the review period?

A: Over the one-year period ended October 31, 2019, the Fund generated a cumulative total return of 10.90%. This return compares to the 11.51% cumulative total return of the Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index (the “Index”).

Q: What were the material factors that affected the Fund’s performance relative to its benchmark during the reporting period?

A: A key detractor from the Fund’s performance during the period was the level of the Fund’s duration. Treasury yields across the yield curve declined over 100 basis points during the period and the Fund lagged in performance, in part, because it had a shorter duration than the Index. The Fund’s overweight positions in lower-rated, investment grade securities and corporate bonds contributed to its performance relative to the Index during the period.

Q: Were there any significant adjustments made to the Fund’s portfolio during the period?

A: The Fund’s corporate bond exposure was increased and Treasury exposure was lowered during the 12 months ended October 31, 2019. In the second half of the period, the duration of the Fund’s portfolio was gradually increased so that it was closer to the Index’s duration. After the Federal Reserve indicated that it was planning to stop raising interest rates and the inflation outlook looked subdued, the potential for additional increases in Treasury yields seemed diminished. When the probability for higher rates is lessened, it helps to maintain the Fund’s duration closer to neutral relative to the Index.

Q: Could you describe some specific strategies and holdings that enhanced the Fund’s returns during the period?

A: Maintaining an overweight position in corporate bonds and an overweight in BBB rated holdings relative to the Index helped to enhance Fund performance during the period. Give the stable nature of the economy over the period, the risk premium associated with corporate bonds declined, which helped corporate bond prices to rise. As the year progressed, the Fund’s duration was moved closer to neutral relative to the Index. This increase in the Fund’s average duration relative to the Index, on average, contributed to the Fund’s performance.

Q: What were some examples of strategies and holdings that didn’t work well for the Fund during the period?

A: Starting the period with the Fund’s duration shorter than the Index did not help the Fund’s performance. The Federal Reserve ceased raising interest rates in 2019 and instead reversed course by lowering them three times. The Fund did not fully benefit from the resulting lower interest rates because its average duration was shorter than the Index’s duration.

14

COMMERCE BOND FUND

Performance Summary

October 31, 2019 (Unaudited)

The following is performance information for the Commerce Bond Fund (“Bond Fund”) for various time periods. The returns represent past performance. Past performance is no guarantee of future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund is not subject to a sales charge, so a sales charge is not applied to its total returns. In addition to the Adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting the Fund. Please visit our website at www.commercefunds.com to obtain the most recent month-end returns.

| | | | | | | | |

| | Performance Review | | | | | | |

| | | | |

| | | November 1, 2018 - October 31, 2019 | | Fund Total Return(a) | | Index Total Return(c) | | Index |

| | | | |

| | | Bond Fund | | 10.90% | | 11.51% | | Bloomberg Barclays U.S. Aggregate Bond(c) |

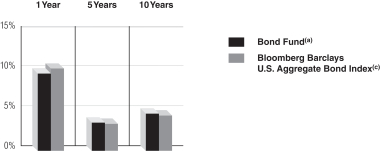

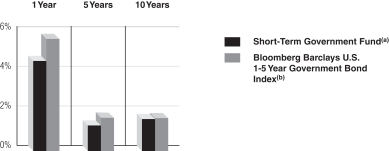

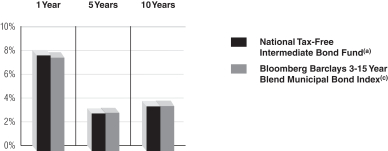

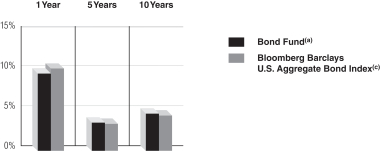

Standardized Average Annual Total Return through September 30, 2019(b)

| | | | | | | | |

| | Standardized Average Annual Total Return through September 30, 2019(b) | | One Year | | Five Years | | Ten Years |

| | | | |

| | | Bond Fund(a) | | 9.65% | | 3.55% | | 4.64% |

| | | | |

| | | Bloomberg Barclays U.S. Aggregate Bond Index(c) | | 10.30% | | 3.38% | | 3.75% |

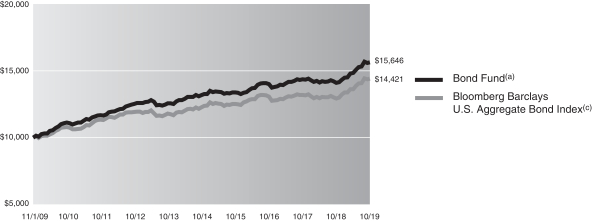

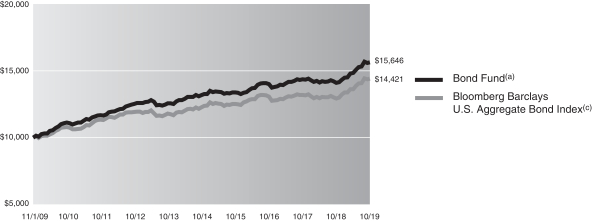

Bond Fund 10 Year Performance

Performance of a $10,000 Investment, with distributions reinvested, from November 1, 2009 through October 31, 2019.

| | | | | | | | |

| | Average Annual Total Return through October 31, 2019 | | One Year | | Five Years | | Ten Years |

| | | | |

| | | Bond Fund(a) | | 10.90% | | 3.48% | | 4.58% |

| | | | | | |

| | Expense Ratios(d) | | | | |

| | | |

| | | | | Net Expense Ratio (Current) | | Gross Expense Ratio (Before Reimbursements) |

| | | |

| | | Bond Fund | | 0.66% | | 0.66% |

| (a) | | Returns reflect any applicable fee waivers or expense reductions. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | | The Standardized Average Annual Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Current performance may be lower or higher than the total return figures in the above charts. |

Returns reflect any fee waivers and expense reductions. Absent these waivers and reductions, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on capital gains or other taxable distributions or the redemption of Fund shares.

| (c) | | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and commercial mortgage-backed securities. The Index figures do not reflect any deduction for fees, taxes or expenses. |

| (d) | | The Fund’s expense ratios, both net (net of applicable fee waivers and/or expense reimbursements) and gross (before applicable fee waivers and/or expense reimbursements), set forth above are as of the most recent publicly available prospectus for the Fund (March 1, 2019) and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Adviser has contractually agreed to reduce or limit the Total Annual Fund Operating Expenses, excluding interest, taxes, acquired fund fees and expenses and extraordinary expenses. This agreement will remain in place through March 1, 2020. After this date, the Adviser or the Fund may terminate the contractual arrangement. If this occurs, the expense ratios may change without shareholder approval. |

15

COMMERCE BOND FUND

Schedule of Investments

October 31, 2019

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – 41.8% | |

Aerospace/Defense – 0.2% | |

| United Technologies Corp. | |

| $ 2,000,000 | | | 5.700 | % | | | 04/15/40 | | | $ | 2,670,387 | |

| |

Auto Manufacturers – 2.0% | |

| BMW Finance NV(a)(b) | |

| 4,000,000 | | | 2.400 | | | | 08/14/24 | | | | 4,018,917 | |

|

| Ford Motor Co.(a) | |

| 2,000,000 | | | 4.346 | | | | 12/08/26 | | | | 2,010,880 | |

|

| Ford Motor Credit Co. LLC | |

| 2,500,000 | | | 4.134 | | | | 08/04/25 | | | | 2,491,576 | |

|

| General Motors Co.(a) | |

| 3,450,000 | | | 6.600 | | | | 04/01/36 | | | | 4,005,219 | |

|

| General Motors Financial Co., Inc.(a) | |

| 2,000,000 | | | 3.950 | | | | 04/13/24 | | | | 2,070,108 | |

|

| PACCAR Financial Corp. | |

| 5,000,000 | | | 2.150 | | | | 08/15/24 | | | | 5,022,712 | |

|

| Volkswagen Group of America Finance LLC(b) | |

| 4,000,000 | | | 4.750 | | | | 11/13/28 | | | | 4,536,427 | |

| | | | | | | | | | | | |

| | | | 24,155,839 | |

| |

Banks – 6.8% | |

| Bank of America Corp. | |

| 3,000,000 | | | 4.000 | | | | 01/22/25 | | | | 3,199,857 | |

|

| (3M USD LIBOR + 1.040%) | |

| 3,749,000 | | | 3.419(a)(c) | | | | 12/20/28 | | | | 3,924,129 | |

|

| BB&T Corp.(a) | |

| 5,455,000 | | | 2.500 | | | | 08/01/24 | | | | 5,526,804 | |

|

| Citigroup, Inc. | |

| 3,000,000 | | | 5.500 | | | | 09/13/25 | | | | 3,431,819 | |

| 3,500,000 | | | 4.450 | | | | 09/29/27 | | | | 3,850,637 | |

|

| Cooperatieve Rabobank UA | |

| 3,100,000 | | | 2.750 | | | | 01/10/23 | | | | 3,162,217 | |

|

| Credit Suisse AG | |

| 3,000,000 | | | 3.000 | | | | 10/29/21 | | | | 3,057,009 | |

|

| Deutsche Bank AG | |

| 2,000,000 | | | 3.125 | | | | 01/13/21 | | | | 2,009,198 | |

|

| HSBC Holdings PLC | |

| 3,130,000 | | | 6.100 | | | | 01/14/42 | | | | 4,461,733 | |

|

| HSBC USA, Inc. | |

| 1,052,000 | | | 9.300 | | | | 06/01/21 | | | | 1,160,596 | |

|

| JPMorgan Chase & Co.(c) | |

| (3M USD LIBOR + 0.610%) | |

| 1,500,000 | | | 3.514(a) | | | | 06/18/22 | | | | 1,533,732 | |

|

| (3M USD LIBOR + 1.000%) | |

| 150,000 | | | 2.936 | | | | 04/26/23 | | | | 149,805 | |

|

| (3M USD LIBOR + 1.160%) | |

| 1,650,000 | | | 3.702(a) | | | | 05/06/30 | | | | 1,774,951 | |

|

| (3M USD LIBOR + 1.330%) | |

| 2,000,000 | | | 4.452(a) | | | | 12/05/29 | | | | 2,266,389 | |

|

| (3M USD LIBOR + 3.470%) | |

| 1,222,000 | | | 5.406(a) | | | | 12/29/49 | | | | 1,229,332 | |

| |

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – (continued) | |

Banks – (continued) | |

|

| KeyBank NA | |

| $ 4,000,000 | | | 3.400% | | | | 05/20/26 | | | $ | 4,197,576 | |

| Lloyds Bank PLC | |

| 1,640,000 | | | 6.375 | | | | 01/21/21 | | | | 1,726,081 | |

|

| Mitsubishi UFJ Financial Group, Inc. | |

| 3,000,000 | | | 3.777 | | | | 03/02/25 | | | | 3,201,847 | |

|

| Morgan Stanley | |

| 4,375,000 | | | 4.100 | | | | 05/22/23 | | | | 4,632,717 | |

|

| PNC Bank NA(a) | |

| 2,500,000 | | | 2.950 | | | | 01/30/23 | | | | 2,562,825 | |

|

| The PNC Financial Services Group, Inc.(a) | |

| 3,750,000 | | | 3.150 | | | | 05/19/27 | | | | 3,959,018 | |

|

| (3M USD LIBOR + 3.678%) | |

| 2,500,000 | | | 6.750 | (c) | | | 07/29/49 | | | | 2,665,250 | |

|

| U.S. Bancorp(a) | |

| 2,050,000 | | | 3.600 | | | | 09/11/24 | | | | 2,180,092 | |

|

| UBS Group Funding Switzerland AG(a)(b)(c) | |

| (3M USD LIBOR + 0.954%) | |

| 2,750,000 | | | 2.859 | | | | 08/15/23 | | | | 2,789,518 | |

|

| Wells Fargo & Co. | |

| 2,500,000 | | | 4.100 | | | | 06/03/26 | | | | 2,689,979 | |

| 1,500,000 | | | 4.650 | | | | 11/04/44 | | | | 1,766,961 | |

| 5,000,000 | | | 4.750 | | | | 12/07/46 | | | | 5,972,161 | |

|

| Wells Fargo Bank NA(d) | |

| 2,000,000 | | | 6.180 | | | | 02/15/36 | | | | 2,540,000 | |

| | | | | | | | | | | | |

| | | | 81,622,233 | |

| |

Beverages(a) – 0.8% | |

| Anheuser-Busch InBev Worldwide, Inc. | |

| 6,000,000 | | | 4.439 | | | | 10/06/48 | | | | 6,734,744 | |

|

| PepsiCo, Inc. | |

| 2,190,000 | | | 4.450 | | | | 04/14/46 | | | | 2,763,829 | |

| | | | | | | | | | | | |

| | | | 9,498,573 | |

| |

Biotechnology – 0.4% | |

| Amgen, Inc. | |

| 1,295,000 | | | 6.400 | | | | 02/01/39 | | | | 1,756,064 | |

|

| Celgene Corp.(a) | |

| 3,250,000 | | | 3.900 | | | | 02/20/28 | | | | 3,570,695 | |

| | | | | | | | | | | | |

| | | | 5,326,759 | |

| |

Chemicals(a) – 0.4% | |

| PPG Industries, Inc. | |

| 2,355,000 | | | 2.400 | | | | 08/15/24 | | | | 2,377,954 | |

|

| Praxair, Inc. | |

| 2,740,000 | | | 3.200 | | | | 01/30/26 | | | | 2,902,676 | |

| | | | | | | | | | | | |

| | | | 5,280,630 | |

| |

Commercial Services – 1.0% | |

| Henry J. Kaiser Family Foundation | |

| 6,250,000 | | | 3.356 | | | | 12/01/25 | | | | 6,593,657 | |

|

| Northwestern University | |

| 1,000,000 | | | 4.643 | | | | 12/01/44 | | | | 1,277,487 | |

| |

| | |

| 16 | | The accompanying notes are an integral part of these financial statements. |

COMMERCE BOND FUND

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

|

| Corporate Obligations – (continued) | |

Commercial Services – (continued) | |

|

| The Corp. of Gonzaga University | |

| $ 3,500,000 | | | 4.158% | | | | 04/01/46 | | | $ | 3,987,410 | |

| | | | | | | | | | | | |

| | | | 11,858,554 | |

| |

Distribution/Wholesale(a) – 0.2% | |

|

| WW Grainger, Inc. | |

| 2,260,000 | | | 4.600 | | | | 06/15/45 | | | | 2,697,169 | |

| |

Diversified Financial Services – 3.1% | |

|

| Air Lease Corp.(a) | |

| 2,500,000 | | | 3.000 | | | | 09/15/23 | | | | 2,543,187 | |

|

| Aircastle Ltd.(a) | |

| 1,000,000 | | | 4.250 | | | | 06/15/26 | | | | 1,040,233 | |

|

| American Express Co.(a) | |

| 3,115,000 | | | 3.125 | | | | 05/20/26 | | | | 3,274,882 | |

|

| Brookfield Asset Management, Inc.(a) | |

| 2,000,000 | | | 4.000 | | | | 01/15/25 | | | | 2,138,794 | |

|

| CDP Financial, Inc.(b) | |

| 1,000,000 | | | 3.150 | | | | 07/24/24 | | | | 1,061,609 | |

|

| Citicorp Lease Pass-Through Trust1999-1(b) | |

| 1,859,423 | | | 8.040 | | | | 12/15/19 | | | | 1,871,879 | |

|

| CME Group, Inc. | |

| 1,685,000 | | | 3.000 | | | | 09/15/22 | | | | 1,744,024 | |

|

| Franklin Resources, Inc. | |

| 5,000,000 | | | 2.850 | | | | 03/30/25 | | | | 5,166,793 | |

|

| Invesco Finance PLC | |

| 6,509,000 | | | 3.125 | | | | 11/30/22 | | | | 6,683,436 | |

|

| Janus Capital Group, Inc.(a) | |

| 3,000,000 | | | 4.875 | | | | 08/01/25 | | | | 3,271,410 | |

|

| Legg Mason, Inc. | |

| 3,895,000 | | | 5.625 | | | | 01/15/44 | | | | 4,393,362 | |

|

| TD Ameritrade Holding Corp.(a) | |

| 1,225,000 | | | 2.750 | | | | 10/01/29 | | | | 1,230,207 | |

|

| The Charles Schwab Corp. | |

| 2,500,000 | | | 3.225 | | | | 09/01/22 | | | | 2,581,897 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 37,001,713 | |

| |

Electric – 3.6% | |

| Arizona Public Service Co. | |

| 2,150,000 | | | 6.875 | | | | 08/01/36 | | | | 3,015,932 | |

|

| Consumers Energy Co.(a) | |

| 3,290,000 | | | 3.950 | | | | 07/15/47 | | | | 3,813,114 | |

|

| Duke Energy Progress LLC(a) | |

| 2,000,000 | | | 2.800 | | | | 05/15/22 | | | | 2,045,545 | |

|

| Emerson Electric Co. | |

| 1,000,000 | | | 6.125 | | | | 04/15/39 | | | | 1,385,678 | |

|

| Entergy Louisiana LLC(a) | |

| 3,000,000 | | | 3.780 | | | | 04/01/25 | | | | 3,181,306 | |

|

| Gulf Power Co.(a) | |

| 1,250,000 | | | 4.550 | | | | 10/01/44 | | | | 1,413,396 | |

| Louisville Gas & Electric Co.(a) | |

| 1,850,000 | | | 4.650 | | | | 11/15/43 | | | | 2,217,863 | |

| |

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

|

| Corporate Obligations – (continued) | |

Electric – (continued) | |

|

| National Grid USA | |

| $ 3,375,000 | | | 8.000 | % | | 11/15/30 | | $ | 4,694,610 | |

|

| Ohio Power Co. | |

| 2,870,000 | | | 5.850 | | | 10/01/35 | | | 3,768,163 | |

|

| Pacific Gas & Electric Co.(e) | |

| 2,000,000 | | | 6.350 | | | 02/15/38 | | | 2,030,000 | |

|

| PacifiCorp | |

| 1,900,000 | | | 6.100 | | | 08/01/36 | | | 2,595,756 | |

|

| PPL Electric Utilities Corp.(a) | |

| 1,025,000 | | | 4.750 | | | 07/15/43 | | | 1,272,563 | |

|

| PSEG Power LLC | |

| 5,500,000 | | | 8.625 | | | 04/15/31 | | | 7,742,193 | |

|

| Southern California Edison Co. | |

| 1,000,000 | | | 5.550 | | | 01/15/37 | | | 1,201,661 | |

|

| Wisconsin Public Service Corp.(a) | |

| 3,000,000 | | | 3.300 | | | 09/01/49 | | | 3,101,681 | |

| | | | | | | | | | |

| | | | | | | | | 43,479,461 | |

| |

Electronics(a) – 0.2% | |

| PerkinElmer, Inc. | |

| 2,410,000 | | | 3.300 | | | 09/15/29 | | | 2,429,749 | |

| |

Gas(a) – 0.6% | |

| Atmos Energy Corp. | |

| 1,400,000 | | | 4.125 | | | 03/15/49 | | | 1,648,467 | |

|

| Boston Gas Co.(b) | |

| 1,000,000 | | | 3.001 | | | 08/01/29 | | | 1,038,313 | |

|

| Northwest Natural Gas Co. | |

| 4,650,000 | | | 3.869 | | | 06/15/49 | | | 4,993,143 | |

| | | | | | | | | | |

| | | | | | | | | 7,679,923 | |

| |

Healthcare-Services – 2.5% | |

| Adventist Health System(a) | |

| 7,000,000 | | | 2.952 | | | 03/01/29 | | | 7,029,413 | |

|

| Ascension Health | |

| 3,000,000 | | | 2.532 | (a) | | 11/15/29 | | | 3,014,045 | |

| 1,500,000 | | | 3.945 | | | 11/15/46 | | | 1,728,865 | |

|

| Baptist Health South Florida, Inc. | |

| 3,695,000 | | | 4.342 | | | 11/15/41 | | | 4,279,398 | |

|

| Community Health Network, Inc. | |

| 2,225,000 | | | 4.237 | | | 05/01/25 | | | 2,409,454 | |

|

| Mayo Clinic | |

| 2,600,000 | | | 3.774 | | | 11/15/43 | | | 2,887,473 | |

|

| SSM Health Care Corp.(a) | |

| 3,000,000 | | | 3.688 | | | 06/01/23 | | | 3,144,679 | |

| 4,990,000 | | | 3.823 | | | 06/01/27 | | | 5,371,921 | |

| | | | | | | | | | |

| | | | | | | | | 29,865,248 | |

| |

Insurance – 4.0% | |

| American International Group, Inc.(a) | |

| 2,000,000 | | | 3.750 | | | 07/10/25 | | | 2,139,595 | |

|

| Arch Capital Group Ltd. | |

| 2,149,000 | | | 7.350 | | | 05/01/34 | | | 3,106,091 | |

| |

| | |

| The accompanying notes are an integral part of these financial statements. | | 17 |

COMMERCE BOND FUND

Schedule of Investments(continued)

October 31, 2019

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

|

| Corporate Obligations – (continued) | |

Insurance – (continued) | |

|

| Berkshire Hathaway Finance Corp.(a) | |

| $ 4,220,000 | | | 4.200 | % | | 08/15/48 | | $ | 4,965,598 | |

|

| Guardian Life Global Funding(b) | |

| 2,000,000 | | | 2.000 | | | 04/26/21 | | | 2,002,955 | |

|

| Loews Corp.(a) | |

| 3,900,000 | | | 3.750 | | | 04/01/26 | | | 4,206,207 | |

|

| MassMutual Global Funding II(b) | |

| 6,150,000 | | | 2.950 | | | 01/11/25 | | | 6,351,811 | |

|

| MetLife, Inc.(a) | |

| 2,055,000 | | | 10.750 | | | 08/01/39 | | | 3,379,530 | |

|

| Metropolitan Life Global Funding I(b) | |

| 1,360,000 | | | 2.400 | | | 06/17/22 | | | 1,372,600 | |

|

| New York Life Global Funding(b) | |

| 2,000,000 | | | 2.000 | | | 04/13/21 | | | 2,003,972 | |

|

| Principal Life Global Funding II(b) | |

| 2,000,000 | | | 2.200 | | | 04/08/20 | | | 2,002,075 | |

|

| Prudential Financial, Inc.(a)(c) | |

| (3M USD LIBOR + 4.175%) | |

| 2,000,000 | | | 5.875 | | | 09/15/42 | | | 2,167,740 | |

|

| Reinsurance Group of America, Inc. | |

| 2,100,000 | | | 5.000 | | | 06/01/21 | | | 2,192,255 | |

| 2,000,000 | | | 3.950 | (a) | | 09/15/26 | | | 2,114,275 | |

|

| The Prudential Insurance Co. of America(b) | |

| 2,775,000 | | | 8.300 | | | 07/01/25 | | | 3,578,487 | |

|

| The Travelers Cos., Inc.(a) | |

| 2,000,000 | | | 4.100 | | | 03/04/49 | | | 2,359,131 | |

|

| Travelers Property Casualty Corp. | |

| 1,493,000 | | | 7.750 | | | 04/15/26 | | | 1,974,824 | |

|

| Voya Financial, Inc. | |

| 1,800,000 | | | 3.650 | | | 06/15/26 | | | 1,898,275 | |

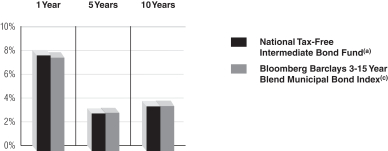

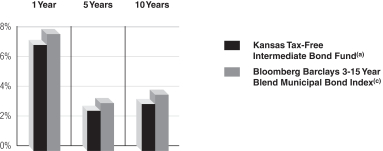

| | | | | | | | | | |