- ADTN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFM14A Filing

ADTRAN (ADTN) DEFM14AProxy related to merger

Filed: 2 Dec 21, 4:42pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

ADTRAN, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

PROXY STATEMENT OF ADTRAN, INC. | PROSPECTUS OF ACORN HOLDCO, INC. |

Dear ADTRAN stockholder:

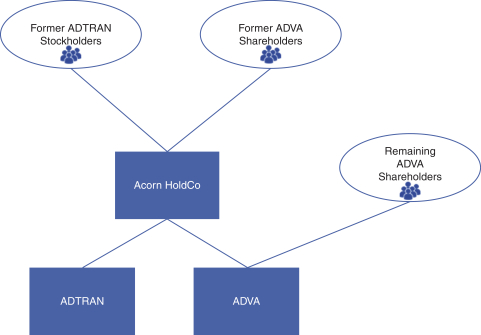

I am pleased to invite you to attend a special meeting of stockholders of ADTRAN, Inc., a Delaware corporation, or ADTRAN, to be held virtually by live webcast on January 6, 2022, at 10:30 a.m., Central time. As previously announced, ADTRAN and ADVA Optical Networking SE, a European stock corporation, or ADVA, have entered into a business combination agreement, or the business combination agreement, providing for a combination of their businesses under a new Delaware holding company, Acorn HoldCo, Inc., or Acorn HoldCo. Pursuant to this business combination agreement, ADTRAN’s business will be brought under Acorn HoldCo through a merger, or the merger, and ADVA’s business will be brought under Acorn HoldCo through an exchange offer, or the exchange offer, and together with the merger, the business combination.

The settlement of the exchange offer will be subject to and occur as soon as is practicable after the merger. In the merger, each share of common stock of ADTRAN, par value $0.01 per share, or the ADTRAN shares, will be converted into the right to receive one share of common stock, par value $0.01 per share of Acorn HoldCo, or the Acorn HoldCo shares. In the exchange offer, shareholders of ADVA, or the ADVA shareholders, will be offered to exchange each of their no-par bearer shares (auf den Inhaber lautende Stückaktien) of ADVA, or the ADVA shares, for 0.8244 Acorn HoldCo shares, or the offer exchange ratio. The closing of the merger and the settlement of the exchange offer is subject to the satisfaction or, if permissible, waiver of certain conditions, including the minimum acceptance condition, the ADTRAN stockholders’ approval condition, the regulatory condition, and the other conditions described in the section “The Exchange Offer—Conditions to the Exchange Offer.” Except for the regulatory condition, all conditions to the exchange offer must be satisfied on or prior to the expiration of the acceptance period on January 12, 2022, 24:00 hours, Central European Time, as extended, or the acceptance period. The regulatory condition must be satisfied within twelve months following the end of the acceptance period, i.e., by January 12, 2023, or, if permissible, waived. As a result, the conversion of ADTRAN shares pursuant to the merger and the exchange of ADVA shares pursuant to the exchange offer may take place on a date that is significantly later than the end of the acceptance period, or may not occur.

Based on the number of ADTRAN shares estimated to be outstanding, on a fully diluted basis, immediately prior to the merger, Acorn HoldCo anticipates issuing up to 51,232,929 Acorn HoldCo shares in connection with the merger. Based on the ADVA shares estimated to be outstanding, on a fully diluted basis, immediately prior to the settlement of the exchange offer, Acorn HoldCo anticipates issuing up to 43,596,720 Acorn HoldCo shares in connection with the exchange offer. Based on the closing price of ADTRAN shares as of November 4, 2021 of $20.64 per share, the market value of the Acorn Holdco shares issued in connection with the exchange offer would be approximately $899.8 million.

Upon completion of the business combination, and assuming that all of the outstanding ADVA shares are exchanged in the exchange offer, former ADTRAN stockholders will own approximately 54% of the outstanding Acorn HoldCo shares and former ADVA shareholders will own approximately 46% of the outstanding Acorn HoldCo shares. Acorn HoldCo will apply to list the Acorn HoldCo shares on the Nasdaq Global Select Stock Market, or Nasdaq, and on the Frankfurt Stock Exchange (trading in euros). ADTRAN shares, which are listed on Nasdaq under the symbol “ADTN” will be delisted from Nasdaq upon or as soon as practicable after the completion of the merger, as permitted by applicable law. Following the business combination, we expect that Acorn HoldCo, Inc. will change its name to “ADTRAN Holdings, Inc.” and its ticker symbol will be “ADTN.” We urge you to obtain current market quotations of each of the ADTRAN shares and the ADVA shares prior to casting your vote.

In order for the business combination to be completed, the business combination agreement must be adopted by the ADTRAN stockholders. Accordingly, ADTRAN will hold a special meeting of its stockholders on January 6, 2022, at which, among other business to be considered by ADTRAN stockholders, ADTRAN stockholders will be asked to adopt the business combination agreement. Information about the ADTRAN special meeting, the business combination and other business to be considered by ADTRAN stockholders is contained in this document, which we urge you to read. In particular, see the section of this proxy statement/prospectus entitled “Risk Factors” beginning on page 32 for a discussion of various factors that you should consider before making your investment decision.

Your vote is very important. Whether or not you plan to attend the ADTRAN special meeting virtually, please take appropriate action to make sure your ADTRAN shares are represented at the ADTRAN special meeting. Your failure to vote will have the same effect as voting against the adoption of the business combination agreement. The board of directors of ADTRAN, or the ADTRAN board of directors, unanimously recommends that you vote FOR the adoption of the business combination agreement and other related matters. We are not asking ADVA shareholders for a proxy and ADVA shareholders are requested not to send us a proxy.

On behalf of our board of directors, I thank you for your support and look forward to the successful completion of the business combination.

Sincerely, |

Thomas R. Stanton |

| Chief Executive Officer and Chairman of the Board of Directors |

| ADTRAN, Inc. |

Neither the U.S. Securities and Exchange Commission, or the SEC, nor any state securities commission has approved or disapproved of the securities to be issued in connection with the business combination or passed upon the adequacy or accuracy of this document. Any representation to the contrary is a criminal offense.

This document is dated December 2, 2021, and is first being mailed to ADTRAN stockholders on or about December 3, 2021.

ADDITIONAL INFORMATION

This document incorporates important business and financial information about ADTRAN filed with the SEC that is not included in or delivered with this document. You can obtain any of the documents filed with the SEC by ADTRAN at no cost from the SEC’s website at https://www.sec.gov/. You may also request copies of these documents, including documents incorporated by reference into this document, at no cost, by contacting ADTRAN. Please see “General Information—Where You Can Find More Information; Documents Available for Inspection” for more details. In order to receive timely delivery of the documents in advance of the special meeting of ADTRAN stockholders, you should make your request to ADTRAN at 901 Explorer Boulevard, Huntsville, Alabama 35806-2807, United States, +1 (256) 963-8000, no later than December 30, 2021, or five trading days prior to the special meeting of ADTRAN stockholders.

No person is authorized to provide any information with respect to the matters that this document describes other than the information contained in this document, and, if provided, the information must not be relied upon as having been authorized by Acorn HoldCo, ADTRAN, or ADVA. This document does not constitute an offer to sell or a solicitation of an offer to buy securities or a solicitation of a proxy in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer or a solicitation. Neither the delivery of this document nor any distribution of securities made under this document will, under any circumstances, create an implication that there has been no change in the affairs of Acorn HoldCo, ADTRAN, or ADVA since the date of this document or that any information contained herein is correct as of any time subsequent to the date of this document.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON JANUARY 6, 2022

Dear ADTRAN stockholder:

A special meeting of the stockholders of ADTRAN, Inc., or ADTRAN, will be held virtually by live webcast on January 6, 2022, at 10:30 a.m., Central time. You can participate in the meeting by visiting www.virtualshareholdermeeting.com/ADTN2022SM, where you will be able to listen to the meeting live and vote during the meeting. Please log into the website by 10:30 a.m., Central time, on the day of the meeting. There is no physical location for the special meeting.

The purpose of the ADTRAN special meeting is for ADTRAN stockholders:

| • | to consider and vote on a proposal to adopt the business combination agreement, dated as of August 30, 2021, by and among ADTRAN, Acorn HoldCo, Inc., or Acorn HoldCo, Acorn MergeCo, Inc., or Merger Sub, and ADVA Optical Networking SE, or ADVA, as the same may be amended from time to time, or the business combination proposal, pursuant to which, among other things, ADTRAN and ADVA agreed to combine their businesses through a merger and an exchange offer, respectively, and become subsidiaries of Acorn HoldCo; |

| • | to consider and vote on a non-binding advisory proposal to approve the compensation that may become payable to ADTRAN’s named executive officers in connection with the business combination, or the compensation proposal; and |

| • | to consider and vote on any proposal that may be made by the chairman of the ADTRAN board of directors to adjourn or postpone the special meeting in order to (1) solicit additional proxies with respect to the above-mentioned proposals and/or (2) hold the special meeting on a date that is no later than the day prior to the expiration of the acceptance period, in the event that such date of expiration is extended, or the stockholder adjournment proposal. |

The business combination proposal requires the affirmative vote of a majority of the outstanding ADTRAN shares entitled to vote at the ADTRAN special meeting or at a postponement thereof (meaning that, of the ADTRAN shares outstanding, a majority must be voted “FOR” such proposal), or the ADTRAN stockholders’ approval. The business combination cannot be completed without approval of the business combination proposal. A failure to vote, a broker non-vote, or an abstention will have the same effect as a vote “AGAINST” the business combination proposal. The compensation proposal and the stockholder adjournment proposal each requires the affirmative vote of a majority of the ADTRAN shares present at the special meeting or represented by proxy and entitled to vote at the ADTRAN special meeting (meaning that, of the ADTRAN shares represented at the ADTRAN special meeting and entitled to vote, a majority must be voted “FOR” such proposals). An abstention will have the same effect as a vote “AGAINST” such proposals. A failure to vote and broker non-votes will have no effect on the vote on either of the compensation proposal or the stockholder adjournment proposal. The ADTRAN board of directors unanimously recommends that you vote FOR each of these proposals.

Only holders of record of ADTRAN shares at the close of business on November 16, 2021, the record date for the ADTRAN special meeting, will be entitled to notice of, and to vote at, the ADTRAN special meeting or any adjournment or postponement thereof. A list of the ADTRAN stockholders of record as of November 16, 2021, will be available for inspection during ordinary business hours at ADTRAN’s offices located at 901 Explorer Boulevard, Huntsville, Alabama, 35806, from November 16, 2021, up to and including the date of the ADTRAN special meeting.

Please remember that your shares cannot be voted unless you cast your vote by one of the following methods: (1) sign and return a proxy card; (2) call the toll-free number listed on the proxy card; (3) vote through the internet as indicated on the proxy card; or (4) vote during the ADTRAN special meeting. You should NOT send documents representing ADTRAN shares with the proxy card. Following the consummation of the business combination, you will receive information on how you will receive Acorn HoldCo shares for your ADTRAN shares.

If you sign, date, and return your proxy card without indicating how you wish to vote, your proxy will be voted FOR each of the proposals presented at the special meeting. If you fail to return your proxy card or fail to instruct your bank, broker, or other nominee how to vote, and do not attend the special meeting virtually, the effect will be, among other things, that your shares will not be counted for purposes of determining whether a quorum is present at the special meeting and will not be voted, but will have the same effect as a vote AGAINST the approval of the business combination. An abstention will be counted towards the quorum requirement but will not count as a vote cast at the special meeting, but will have the same effect as a vote AGAINST the business combination proposal, the compensation proposal and the stockholder adjournment proposal. A broker non-vote will not be counted towards the quorum requirement and will have no effect on the vote on either of the compensation proposal or the stockholder adjournment proposal, although it will have the same effect as a vote AGAINST the business combination proposal. You can also attend the special meeting virtually and vote online even if you have previously voted by submitting a proxy pursuant to any of the methods noted above. If you are a stockholder of record and you attend the special general meeting virtually and wish to vote online, you may withdraw your proxy and vote online.

| BY ORDER OF THE BOARD OF DIRECTORS, |

Thomas R. Stanton Chief Executive Officer and Chairman of the Board of Directors |

| December 2, 2021 |

YOUR VOTE IS VERY IMPORTANT. PLEASE VOTE YOUR SHARES PROMPTLY, WHETHER OR NOT YOU EXPECT TO ATTEND THE ADTRAN SPECIAL MEETING VIRTUALLY. YOU CAN FIND INSTRUCTIONS FOR VOTING ON THE ENCLOSED PROXY CARD. IF YOU ARE UNCERTAIN OF HOW YOU HOLD YOUR SHARES OR NEED ASSISTANCE IN VOTING YOUR SHARES, PLEASE CONTACT MORROW SODALI, LLC, ADTRAN’S PROXY SOLICITOR, AT 470 WEST AVENUE STAMFORD CT 06902, EMAIL ADDRESS: ADTN.INFO@INVESTOR.MORROWSODALI.COM, (203) 658-9400 (BANKS AND BROKERAGE FIRMS) AND (800) 662-5200 (STOCKHOLDER TOLL-FREE).

i

| Page | ||||

| 80 | ||||

| 81 | ||||

| 82 | ||||

| 82 | ||||

| 82 | ||||

| 83 | ||||

| 83 | ||||

| 85 | ||||

| 87 | ||||

| 88 | ||||

| 88 | ||||

| 89 | ||||

| 90 | ||||

| 95 | ||||

| 100 | ||||

| 102 | ||||

| 107 | ||||

| 118 | ||||

Listing of Acorn HoldCo Shares; Delisting and Deregistration of ADTRAN Shares | 118 | |||

Effect of the Business Combination on the Market for ADVA Shares | 119 | |||

| 119 | ||||

| 120 | ||||

| 123 | ||||

| 124 | ||||

| 125 | ||||

| 130 | ||||

| 130 | ||||

| 131 | ||||

| 133 | ||||

| 135 | ||||

| 135 | ||||

| 135 | ||||

| 139 | ||||

| 140 | ||||

| 141 | ||||

| 143 | ||||

Conduct of the Business Pending the Consummation of the Business Combination | 144 | |||

| 145 | ||||

| 145 | ||||

| 147 | ||||

| 148 | ||||

| 148 | ||||

| 148 | ||||

| 148 | ||||

| 150 | ||||

| 150 | ||||

| 150 | ||||

| 150 | ||||

| 151 | ||||

ii

| Page | ||||

| 154 | ||||

| 156 | ||||

| 156 | ||||

| 156 | ||||

| 157 | ||||

| 157 | ||||

| 158 | ||||

| 158 | ||||

| 158 | ||||

| 158 | ||||

| 158 | ||||

| 159 | ||||

| 159 | ||||

| 159 | ||||

| 159 | ||||

| 160 | ||||

| 161 | ||||

General Provisions Relating to Profit Allocation and Dividend Payments | 161 | |||

| 161 | ||||

| 161 | ||||

| 163 | ||||

| 164 | ||||

| 165 | ||||

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 167 | |||

| 183 | ||||

| 183 | ||||

| 183 | ||||

Information About Acorn HoldCo Before the Business Combination | 183 | |||

| 183 | ||||

| 184 | ||||

| 192 | ||||

| 192 | ||||

| 192 | ||||

| 193 | ||||

Supervisory Board of ADVA Following the Proposed Business Combination | 193 | |||

| 193 | ||||

| 197 | ||||

| 198 | ||||

| 198 | ||||

| 200 | ||||

| 200 | ||||

| 200 | ||||

| 201 | ||||

| 201 | ||||

| 203 | ||||

| 203 | ||||

| 204 | ||||

| 204 | ||||

| 204 | ||||

| 205 | ||||

| 205 | ||||

iii

| Page | ||||

| 207 | ||||

| 207 | ||||

| 208 | ||||

| 209 | ||||

| 225 | ||||

| 230 | ||||

| 238 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF ADTRAN | 240 | |||

| 240 | ||||

| 243 | ||||

| 246 | ||||

| 246 | ||||

| 255 | ||||

| 258 | ||||

| 259 | ||||

| 261 | ||||

| 261 | ||||

| 261 | ||||

| 261 | ||||

| 264 | ||||

| 264 | ||||

| 266 | ||||

| 268 | ||||

| 268 | ||||

| 269 | ||||

| 269 | ||||

| 270 | ||||

| 270 | ||||

| 271 | ||||

| 272 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF ADVA | 273 | |||

| 273 | ||||

| 273 | ||||

| 276 | ||||

| 282 | ||||

| 284 | ||||

| 290 | ||||

| 290 | ||||

| 290 | ||||

General Provisions Governing a Change in Authorized Share Capital; Issuance of Common Stock | 291 | |||

General Provisions Governing a Liquidation of Acorn HoldCo; Liquidation Distributions | 292 | |||

Reporting Requirements for Stockholders, Directors and Officers | 292 | |||

Anti-Takeover Effects of Delaware Law, Acorn HoldCo’s Certificate of Incorporation and Bylaws | 293 | |||

COMPARISON OF EQUITYHOLDER RIGHTS BEFORE AND AFTER THE BUSINESS COMBINATION | 297 | |||

| 321 | ||||

| 323 | ||||

| 324 | ||||

| F-1 | ||||

iv

The following questions and answers are intended to briefly address some commonly asked questions regarding the business combination. These questions and answers may not address all questions that may be important to you. You should carefully read this entire document, including its annexes and documents referred to herein, for a more complete understanding of the business combination agreement, the transactions contemplated by the business combination agreement, Acorn HoldCo, ADTRAN and ADVA. You may obtain additional information without charge by following the instructions under “General Information—Where You Can Find More Information; Documents Available for Inspection.”

About the Business Combination

| Q: | What are ADTRAN and ADVA proposing? |

| A: | On August 30, 2021, ADTRAN, Acorn HoldCo, Merger Sub and ADVA entered into a business combination agreement, pursuant to which, among other things, ADTRAN and ADVA agreed to combine their businesses, through the merger and the exchange offer, respectively, and become subsidiaries of Acorn HoldCo. Following the consummation of the business combination, Acorn HoldCo, Inc. will change its name to “ADTRAN Holdings, Inc.” and its ticker symbol will be “ADTN.” |

ADTRAN and ADVA proposed the business combination because, among other reasons, the management and boards of both companies believe that the business combination:

| • | will enhance the market positioning and go-to-market capabilities of the combined group; |

| • | will combine the companies’ complementary portfolios. which is expected to enhance the offerings of both companies to customers and solidify the position of the combined group as a fully integrated, end-to-end fiber access and transport portfolio under a modern, SDN-controlled architecture and enable the acceleration of software-based recurring revenue streams; and |

| • | is expected to generate approximately $52 million in pre-tax annual cost synergies realized within two years post-closing, driven by identified supply chain efficiencies and operating model optimization, which are expected to enable ADTRAN to improve its cost structure and increase profitability. |

| Q: | What factors did the ADTRAN board of directors consider in reaching its decision to approve the business combination agreement and the transactions contemplated thereby? |

| A: | In reaching its decision to approve the business combination agreement and the transactions contemplated thereby, the ADTRAN board of directors considered a number of factors, including but not limited to the following (which are not necessarily presented in order of their relative importance to ADTRAN): |

| • | the business combination is expected to enhance the market positioning and go-to-market capabilities of the combined company, including by diversifying ADTRAN’s client base by providing greater access to an international client network; |

| • | the business combination will combine the companies’ complementary technology portfolios and better position the combined group to participate in an unprecedented investment cycle in fiber connectivity; |

| • | the business combination is expected to generate approximately $52 million in pre-tax annual cost synergies realized within two years post-closing; |

| • | the combined group will be well-capitalized and will have a larger equity market capitalization as compared to ADTRAN; |

1

| • | the combined group’s experience and knowledge, as well as the cultural alignment between ADTRAN and ADVA; |

| • | the combined group’s board of directors would be composed of six of the current directors of ADTRAN and three additional directors designated by ADVA, ADTRAN’s current CEO will be the chairman and CEO of the combined group and the senior management team of the combined group will consist of a combination of senior management talent from each of ADVA and ADTRAN; |

| • | ADVA’s largest shareholder, EGORA Holding GmbH, has signed an irrevocable undertaking to tender 7,000,000 ADVA shares held by it and its subsidiaries (representing approximately 13.7% of ADVA’s share capital) in the exchange offer; |

| • | the ability of ADTRAN stockholders to approve or reject the business combination by voting on the adoption of the business combination agreement; |

| • | the favorability and fairness of the offer exchange ratio and the fact that the exchange offer is fixed and will not fluctuate in the event that the market price of ADVA shares increases relative to the market price of ADTRAN common stock prior to completion of the business combination; |

| • | the current and prospective business environment in which ADTRAN and ADVA operate, historical information concerning ADTRAN’s and ADVA’s respective businesses and the results of the due diligence review of ADVA and its business conducted by ADTRAN and its advisors; |

| • | alternatives reasonably available to ADTRAN and the recommendation of ADTRAN senior management in favor of the business combination; |

| • | the impact of the business combination on the customers, suppliers and employees of ADTRAN; and |

| • | the terms of the business combination agreement, including that the headquarters of the combined group would be ADTRAN’s current headquarters in Huntsville, Alabama, and the fact that such terms were the result of arms-length negotiations between representatives of ADTRAN and ADVA. |

The ADTRAN board of directors weighed these advantages and opportunities against a number of potentially negative factors in its deliberations concerning the business combination agreement and the transactions contemplated thereby, including:

| • | the offer exchange ratio is fixed and will not fluctuate in the event that the market price of ADTRAN common stock increases relative to the market price of ADVA shares prior to completion of the business combination; |

| • | the dilution of the ownership interests of ADTRAN’s current stockholders in ADTRAN that would result from settlement of the exchange offer; |

| • | the risk that ADVA’s financial performance may not meet ADTRAN’s expectations; |

| • | the risk that the business combination may not be completed or may be delayed despite the parties’ efforts, including the possibility that conditions to the parties’ obligations to complete the business combination may not be satisfied or may be subject to certain terms, conditions or limitations imposed by governmental authorities; |

| • | the potential challenges and difficulties in integrating the operations of ADTRAN and ADVA, including potential difficulties in retaining key personnel; |

| • | the potential effects of the business combination on the overall business of ADTRAN, including potential litigation and its relationships with customers, suppliers and regulators; |

| • | the risk that ADVA shareholders may not tender their shares in the exchange offer or that ADTRAN stockholders may not approve the adoption of the business combination agreement at the ADTRAN special meeting; |

2

| • | the possibility of diversion of management attention during the pendency of the business combination and the substantial costs to be incurred in connection with the business combination; |

| • | the terms of the business combination agreement, including those that restrict ADTRAN’s business and provide ADVA the right to change its recommendation supporting the business combination or terminate the business combination agreement under certain circumstances; and |

| • | risks of the type and nature described under entitled “Risk Factors” beginning on page 32 and the matters described in the section entitled “Forward-Looking Statements” beginning on page 66. |

The above contains only summaries of certain factors considered by the ADTRAN board of directors in reaching its decision to approve the business combination agreement and the transactions contemplated thereby. See the section entitled “The Business Combination—ADTRAN’s Reasons for the Business Combination” for more information.

| Q: | What factors did the ADVA management board and supervisory board consider in reaching their decision to approve the business combination agreement and the transactions contemplated thereby? |

| A: | The ADVA management board and supervisory board considered a number of factors pertaining to the strategic rationale for the business combination as generally supporting their decision to enter into the business combination agreement, including but in no case limited to, the following material factors: |

| • | the proposed business combination brings together two leading companies with complementary strengths and expertise and offers a unique opportunity to create a leader in optical networking and carrier Ethernet; |

| • | the expectation that the combination of ADTRAN and ADVA will lead to a higher level of innovations in the market for optical networking in general with a greater scale of research and development activities; |

| • | the combined group will have an expanded customer base with a larger addressable market, a more diversified geographic footprint and increased opportunities to participate in near-term networking infrastructure investments and key industry trends momentum; |

| • | the potential of the business combination to create additional value for shareholders through synergies, including growth and innovation, and the fact that ADVA shareholders have the opportunity to participate in any future earnings and growth of the combined group; |

| • | its general understanding of ADTRAN’s business, operations, historical and current financial condition, projected financial performance, as well as current and projected earnings, taking into account the results of ADVA’s due diligence review of ADTRAN; |

| • | due to the minimum acceptance threshold of 70% of ADVA shares, Acorn HoldCo will have sufficient voting power to implement integration measures in the combined group; |

| • | the total offer consideration represents a premium of 33% to ADVA’s closing price as of August 27, 2021, the last trading day prior to the signing of the business combination agreement and a premium of 22% to ADVA’s three-months volume-weighted average share price as of August 27, 2021; |

| • | the terms of the business combination agreement that were the product of extensive arms-length negotiations between the parties; and |

| • | the leadership and governance of the combined group. |

3

In connection with its deliberations, the ADVA management board also comprehensively weighed the factors described above against certain potential risks and uncertainties as well as potentially negative factors associated with the proposed business combination, including:

| • | the possibility that the business combination might not be completed, or that completion might be unduly delayed, for reasons beyond the parties’ control; |

| • | the risk that governmental regulatory agencies may not approve the business combination or may impose terms and conditions on their approvals; |

| • | the risk that the operational integration of the businesses would be delayed and that anticipated synergies and other potential benefits from the business combination might not be fully achieved or not achieved in the expected time frames; |

| • | the potential for management and employee diversion in connection with the business combination and the substantial costs to be incurred in connection with the business combination; |

| • | the fact that the consideration is subject to a fixed exchange ratio which will not adjust upward to compensate for declines, or downward to compensate for increases, in ADTRAN’s common stock price prior to completion of the business combination; |

| • | the restrictions on the conduct of ADVA’s business during the period between the signing of the business combination agreement and completion of the business combination; |

| • | the potential negative impacts on ADVA, its business and the price of its shares if the business combination is not completed due to a termination of the business combination agreement; and |

| • | risks of the type and nature described under the section of this proxy statement/prospectus entitled “Risk Factors” beginning on page 32 and the matters described in the section entitled “Forward-Looking Statements” beginning on page 66. |

The above contains only summaries of certain factors considered by the management board and the supervisory board of ADVA in reaching their decision to enter into the business combination agreement. See the section entitled “The Business Combination—ADVA’s Reasons for the Business Combination” for more information.

| Q: | Do any of ADTRAN’S and ADVA’s current directors, board members and executive officers have interests in the business combination that may be different from or in addition to the interests of ADTRAN stockholders and ADVA shareholders? |

| A: | Yes, certain of the ADTRAN directors, executive officers and designees to the pre-closing Acorn HoldCo board of directors and certain of the ADVA management board members and supervisory board members may have interests in the business combination that may be different from, or in addition to, the interests of ADTRAN stockholders and ADVA shareholders, respectively. |

In the case of ADTRAN directors, executive officers and designees to the pre-closing Acorn HoldCo board of directors, these interests include the continued service of certain directors and executive officers following the closing of the business combination. Upon completion of the business combination, Thomas R. Stanton, current Chairman and Chief Executive Officer of ADTRAN, will become Chairman of the Acorn HoldCo board of directors and Chief Executive Officer of Acorn HoldCo and Michael K. Foliano, current Chief Financial Officer of ADTRAN, will become Chief Financial Officer of Acorn HoldCo. Other executive officers of ADTRAN may assume positions as executive officers of Acorn HoldCo or of the combined group and/or of direct or indirect subsidiaries of Acorn HoldCo upon or following completion of

4

the business combination. Subject to the terms of the business combination agreement, Thomas R. Stanton and some or all of ADTRAN’s other executive officers may, prior to the consummation of the business combination, enter into new employment agreements or arrangements or other retention arrangements with Acorn HoldCo and/or direct or indirect subsidiaries of Acorn HoldCo or ADTRAN, but the terms of such arrangements, if any, have not yet been determined.

Additionally, ADTRAN’s executive officers, directors and designees to the pre-closing Acorn HoldCo board of directors hold stock-based awards under the 2006 Employee Stock Incentive Plan, the 2015 Employee Stock Incentive Plan, the 2020 Employee Stock Incentive Plan and the 2020 Directors Stock Plan, or the ADTRAN equity plans. Under the business combination agreement, ADTRAN stock-based awards will generally be converted into corresponding stock-based awards of Acorn HoldCo, on substantially the same terms and conditions as were applicable to the corresponding ADTRAN stock-based award prior to the business combination. However, in the case of the performance share units measured in ADTRAN shares, or ADTRAN PSUs, each ADTRAN PSU outstanding immediately prior to the effective time of the merger, at the effective time of the merger, whether vested or unvested, will, without any required action on the part of the holder thereof, be converted into a restricted stock unit measured in Acorn HoldCo shares, or an Acorn HoldCo RSU, on substantially the same terms and conditions as were applicable to such ADTRAN PSU immediately prior to the effective time of the merger, except that the Acorn HoldCo RSUs will be subject to service-vesting conditions only, not performance-vesting conditions. The treatment of such equity awards is discussed in further detail under the section entitled “The Business Combination—Interests of Directors, Board Members and Executive Officers of ADTRAN, ADVA and Acorn HoldCo in the Business Combination—ADTRAN—Treatment of Outstanding Equity Awards.” For more information on the value of the ADTRAN PSUs held by the named executed officers of ADTRAN that will be converted into Acorn HoldCo RSUs, see the section entitled “The Business Combination—Interests of Directors, Board Members and Executive Officers of ADTRAN, ADVA and Acorn HoldCo in the Business Combination—ADTRAN—Quantification of Potential Payments to ADTRAN’s Named Executive Officers in Connection with the Business Combination.”

In the case of certain of ADVA supervisory board members and management board members, these interests include continued positions as directors and executive officers of Acorn HoldCo. Specifically, the parties agreed, subject to the organizational and governance rules under applicable stock corporation law and any applicable fiduciary duties, that they will use their reasonable best efforts to take all action necessary to have the boards of directors of Acorn HoldCo and ADVA staffed according to the provisions in the business combination agreement. Immediately following the closing of the offer, Acorn HoldCo’s board of directors shall consist of nine board members. Brian Protiva, chairman of the management board and Chief Executive Officer of ADVA, Nikos Theodosopoulos, chairman of the supervisory board of ADVA, and Johanna Hey, vice chairwoman of the supervisory board of ADVA, are designated to be appointed to Acorn HoldCo’s board of directors. Pursuant to the terms of the business combination agreement, Acorn HoldCo intends to transition the members of ADVA’s management board to executive officer positions at Acorn HoldCo. Acorn HoldCo has agreed to appoint Christoph Glingener, current Chief Technology Officer of ADVA, as Chief Technical Officer of Acorn HoldCo. Scott St. John, current Chief Marketing and Sales Officer of ADVA, shall be appointed as Chief Marketing and Sales Officer of Acorn HoldCo, unless Mr. St. John is offered a six-month transition and severance package. Acorn HoldCo has also agreed to transition Ulrich Dopfer, current Chief Financial Officer of ADVA, to Chief Financial Officer of Acorn HoldCo within five years of closing of the transaction contemplated by the business combination agreement, unless Mr. Dopfer is offered a severance package. Any contracts entered into by members of ADVA’s management board and Acorn HoldCo shall have terms (i) no less favorable in all material respects than the current terms with ADVA at the date of the business combination agreement, including term and remuneration elements, up to December 31, 2022, and (ii) no less favorable, with respect to such person’s

5

new role at Acorn HoldCo, than the terms of the service contracts in place between Acorn HoldCo (or its subsidiaries) and those individuals holding corresponding positions at the Bidder (or its subsidiaries) (adjusted for local market norms).

Additionally, members of the ADVA management board have agreed, pursuant to separate agreements with Acorn HoldCo, to convert their respective ADVA stock options into Acorn HoldCo stock options on the terms set forth in the business combination agreement, with the exception of vested ADVA stock options that are exercised prior to the consummation of the business combination in accordance with past practice. All members of ADVA’s management board participate in ADVA’s stock option program for the management board, which (with the exception of termination rights for vested options) does not provide for any termination, termination rights and/or accelerated vesting in case of a change of control in ADVA. Pursuant to the business combination agreement, all ADVA stock options that are outstanding and unexercised immediately prior to the closing of the business combination may, at the option of the holder thereof, be converted into an Acorn HoldCo stock option to purchase (i) Acorn HoldCo shares (rounded down to the nearest whole share) equal to the product of (A) the number of ADVA shares subject to such ADVA stock option immediately prior to the consummation of the business combination and (B) the offer exchange ratio, (ii) at an exercise price per ADVA share (rounded up to the nearest whole cent) equal to the quotient of (A) the exercise price per ADVA share of such ADVA stock option immediately prior to the consummation of the business combination and (B) the offer exchange ratio. Each such Acorn HoldCo stock option will be subject to (1) the same vesting and expiration terms as applied to such ADVA stock option immediately prior to the consummation of the business combination and (2) the same terms and conditions (other than vesting and expiration terms) as applied to ADTRAN stock options immediately prior to the effective time of the merger. Brian Protiva, Ulrich Dopfer, Christoph Glingener and Scott St. John have each agreed, pursuant to separate agreements with Acorn HoldCo, to convert their respective ADVA stock options into Acorn HoldCo stock options on the same terms as set forth above, with the exception of vested ADVA stock options that are exercised prior to the consummation of the business combination in accordance with past practice.

The ADTRAN board and the ADVA management board and supervisory boards were aware of and considered these interests (to the extent that they existed at the time), among other matters, in evaluating and negotiating the business combination, and, in the case of ADTRAN, in recommending to its stockholders that they approve the business combination. ADVA’s management and supervisory boards will further consider these interests in connection with issuing their reasoned opinion containing their recommendation to ADVA shareholders regarding acceptance of the exchange offer. You should take these interests into account in deciding whether to approve the business combination. For a detailed discussion of these interests, see the section entitled “The Business Combination—Interests of Directors, Board Members and Executive Officers of ADTRAN, ADVA and Acorn HoldCo in the Business Combination” for more information.

| Q: | What will be the beneficial ownership of Acorn HoldCo immediately following the business combination? |

| A: | We estimate that upon completion of the offer, and assuming that all of the outstanding ADVA shares are validly tendered in the offer and not properly withdrawn, former ADVA shareholders will own approximately 46% of the outstanding common stock of Acorn HoldCo, and former ADTRAN stockholders with own the remaining 54% of the outstanding stock of Acorn HoldCo. |

| Q: | When do you expect the business combination to be completed? |

| A: | The settlement of the exchange offer will be subject to and occur as soon as practicable after the merger. The closing of the merger and the settlement of the exchange offer are subject to certain conditions, |

6

| including the minimum acceptance condition, the ADTRAN stockholders’ approval condition, the regulatory condition, and the other conditions described under “The Exchange Offer—Conditions to the Exchange Offer.” The timing for settlement of the exchange offer will depend on the satisfaction of such conditions. Under the terms of the exchange offer, all conditions to the exchange offer must be satisfied by the end of the acceptance period on January 12, 2022, 24:00 hours, Central European Time, as extended, or the acceptance period, except for the regulatory condition. The regulatory condition must be satisfied within twelve months following the end of the acceptance period, i.e., by January 12, 2023. If the regulatory condition is not satisfied by that date or if any other condition is not satisfied at the end of the acceptance period (unless any such non-satisfied condition has been waived, if permissible), the exchange offer will terminate and settlement will not occur. The parties currently expect regulatory approval to be finalized and the business combination to be completed in the first half of 2022 but in no event later than the date that is twelve months after the expiration of the acceptance period, i.e., January 12, 2023. As a result, the conversion of ADTRAN shares pursuant to the merger and the exchange of ADVA shares pursuant to the exchange offer may be made on a date that is significantly later than the end of the acceptance period, or may not occur. See “The Exchange Offer” for a more detailed discussion. |

| Q: | If the business combination is completed, will the Acorn HoldCo shares issued pursuant to the business combination agreement be listed for trading? |

| A: | Prior to the time of delivery of the Acorn HoldCo shares pursuant to the merger and the exchange offer, Acorn HoldCo will apply to admit its shares to listing and trading on Nasdaq, subject to official notice of issuance, and will apply to admit its shares to listing and trading on the regulated market (Regulierter Markt) of the Frankfurt Stock Exchange and the sub-segment thereof with additional post-admission obligations (Prime Standard). The listings are intended to preserve current ADTRAN stockholders’ and ADVA shareholders’ access to their historic trading markets in the United States and in Germany and may further improve liquidity in Acorn HoldCo shares and Acorn HoldCo’s access to additional equity financing sources. Nevertheless, as with listings on more than one stock exchange of certain other issuers, the liquidity in the market for Acorn HoldCo shares may be adversely affected if trading is split between two markets at least in the short term and could result in price differentials of Acorn HoldCo shares between the two exchanges. |

| Q: | What happens if the business combination is not completed? |

| A: | If ADTRAN stockholders do not approve the business combination proposal or if the business combination is not completed because any other conditions to the exchange offer, including the minimum acceptance condition or the regulatory condition, are not satisfied or waived, or for any other reason, ADTRAN and ADVA will remain independent public companies. ADTRAN shares and ADVA shares will continue to be listed and traded on Nasdaq and the Frankfurt Stock Exchange, respectively. ADTRAN will continue to have securities registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and will continue to be required to file periodic reports with the SEC. |

ADTRAN and ADVA have certain rights to terminate the business combination agreement. For a summary of termination rights and the effects of a termination of the business combination agreement, see “The Business Combination Agreement—Termination—Termination Rights.”

| Q: | Who will lead the combined group? |

| A: | Pursuant to the business combination agreement, at the effective time of the merger, Thomas R. Stanton, current Chairman and CEO of ADTRAN, will serve as the CEO of Acorn HoldCo and the chairman of the Acorn HoldCo board of directors. Michael K. Foliano, ADTRAN’s current Chief Financial Officer, will |

7

| serve as the Chief Financial Officer of Acorn HoldCo. Christoph Glingener, ADVA’s current Chief Technology Officer, will serve as the Chief Technical Officer of Acorn HoldCo. |

| Q: | Who will comprise the board of directors of Acorn HoldCo? |

| A: | Upon completion of the business combination, the Acorn HoldCo board of directors will consist of nine members, including Mr. Stanton and eight other directors, consisting of five non-executive directors to be designated for appointment by ADTRAN, H. Fenwick Huss, Gregory J. McCray, Balan Nair, Jacqueline H. Rice and Kathryn A. Walker, and three directors to be designated for appointment by ADVA, Brian Protiva, as vice chairman, Nikos Theodosopoulos and Johanna Hey. Under the bylaws of Acorn HoldCo that will be in effect on completion of the business combination, directors of Acorn HoldCo will be elected each year at the annual meeting of stockholders. |

| Q: | How will my Acorn HoldCo shares acquired in the business combination differ from my ADTRAN shares or ADVA shares, as applicable? |

| A: | Until the completion of the business combination (and in the case of ADVA shareholders that do not tender their ADVA shares in the exchange offer, until such shareholders no longer hold ADVA shares), Delaware law and the ADTRAN certificate of incorporation and bylaws will continue to govern the rights of ADTRAN stockholders, and German law and the ADVA articles of incorporation will continue to govern the rights of ADVA shareholders. After completion of the business combination (or, as applicable, the post-completion reorganization), Delaware law and the Acorn HoldCo amended and restated certificate of incorporation and bylaws will govern the rights of Acorn HoldCo stockholders. |

The rights of Acorn HoldCo stockholders after the business combination will be substantially the same as the rights of ADTRAN stockholders prior to the business combination, except that, among others, Acorn HoldCo’s organizational documents will provide for:

| • | the ability of the Acorn HoldCo board of directors to issue classes of preferred stock; and |

| • | exclusive forum in certain courts in the State of Delaware or the federal district courts of the United States for certain types of lawsuits. |

Material differences in the rights of ADVA shareholders prior to the business combination, on the one hand, and the rights of Acorn HoldCo stockholders after the business combination, on the other hand, will include, among others, the following:

| • | ADVA shareholders will be represented by a single board of directors, not by a management board (Vorstand) and a supervisory board (Aufsichtsrat); |

| • | an Acorn HoldCo stockholder may propose and have business conducted at an annual meeting by providing the required notice, a proxy statement and form of proxy to stockholders holding the minimum percentage of shares required to approve the proposed business; |

| • | approval of extraordinary actions, including any merger, consolidation or sale of substantially all of the assets of Acorn HoldCo, will require a majority of the voting power of Acorn HoldCo in order to be effective; |

| • | Acorn HoldCo’s board of directors may authorize the issuance of preferred stock, whereas ADVA’s articles of association currently do not authorize the issuance of preferred stock; |

| • | Acorn HoldCo’s stockholders may amend Acorn HoldCo’s bylaws by the affirmative vote of a majority of the outstanding shares entitled to vote thereon; and |

8

| • | Acorn HoldCo stockholders have no preemptive rights to purchase or to be offered to purchase any shares or other securities of Acorn HoldCo. |

For a more complete discussion, see the section of this proxy statement/prospectus titled “Comparison of Equityholder Rights Before and After the Business Combination.”

| Q: | Will my Acorn HoldCo shares acquired in the business combination receive dividends? |

| A: | The dividend policy for the combined group will be determined following completion of the business combination. Although Acorn HoldCo currently expects to pay dividends, any dividend paid or changes to its dividend policy are within the discretion of its board of directors and will depend upon many factors, including distributions of earnings to Acorn HoldCo by its subsidiaries, the financial condition and results of operations of the combined group, legal requirements, including limitations imposed by Delaware law, restrictions in any debt agreements that limit its ability to pay dividends to stockholders and other factors Acorn HoldCo’s board of directors deems relevant. For a further discussion of the risks related to the payment of dividends after the business combination, see “Risk Factors—Risks Relating to Acorn HoldCo Shares.” |

| Q: | Until what time can tendered ADVA shares be withdrawn? |

| A: | ADVA shareholders who have accepted the offer may withdraw their ADVA shares at any time during the acceptance period, including any extension thereof. The additional acceptance period, if any, is not an extension of the acceptance period and will commence following the acceptance period, including any extension thereof, as required by the German Takeover Act. Following the expiration date, withdrawal rights will cease, and any ADVA shares tendered into the offer cannot be withdrawn. There will be no withdrawal rights during any additional acceptance period or, if applicable, a put right period (as described in “The Exchange Offer—Timetable—Put Right Period” and “The Exchange Offer—Withdrawal Rights”). |

| Q: | What is the procedure to withdraw previously tendered ADVA shares? |

| A: | To withdraw previously tendered ADVA shares (except in an additional acceptance period, during which there will be no withdrawal rights), (i) declaring their withdrawal in writing to their relevant custodian bank for a specified number of tendered ADVA shares, where in the event that no number is specified, the withdrawal shall be deemed to have been declared for all of the tendered ADVA shares of the ADVA shareholders concerned; and (ii) instructing their relevant custodian bank to cause such number of tendered ADVA shares held in their securities deposit accounts as is equivalent to the number of tendered ADVA shares in respect of which they have declared their withdrawal to be re-booked to ISIN DE0005103006 at Clearstream (as described in “The Exchange Offer—Withdrawal Rights”). |

About the ADTRAN Special Meeting

| Q: | What are the proposals on which ADTRAN stockholders are being asked to vote? |

| A: | ADTRAN stockholders are being asked to consider and vote on a proposal to adopt the business combination agreement. The business combination agreement provides for a combination of the businesses of ADTRAN and ADVA under Acorn HoldCo. ADVA’s business will be brought under Acorn HoldCo through the exchange offer and ADTRAN’s business will be brought under Acorn HoldCo through the merger. |

ADTRAN stockholders are also being asked to consider and vote on a non-binding advisory proposal to approve the compensation that may become payable to ADTRAN’s named executive officers in connection

9

with the business combination. This proposal is being made in accordance with Section 14A of the Exchange Act and the applicable rules thereunder.

Finally, ADTRAN stockholders are being asked to approve any proposal that may be made by the chairman of the ADTRAN board of directors to adjourn or postpone the special meeting in order to (1) solicit additional proxies with respect to the above-mentioned proposals and/or (2) hold the special meeting on a date that is no later than the day prior to the expiration of the acceptance period, in the event that such date of expiration is extended.

The ADTRAN board of directors unanimously recommends that the ADTRAN stockholders vote “FOR” each of these proposals. For a discussion of the reasons for this recommendation, see “The Business Combination—ADTRAN’s Reasons for the Business Combination.”

| Q: | What are the most significant conditions to the business combination? |

| A: | The exchange offer will be subject to a number of conditions, including the minimum acceptance condition, the registration statement condition, the ADTRAN stockholders’ approval condition, the regulatory condition, the no ADVA material adverse change condition and the other conditions set forth in the section of this proxy statement/prospectus titled “The Business Combination Agreement—Conditions to Completing the Business Combination.” The conditions to the exchange offer must be satisfied or, if permissible, waived prior to the expiration date, except for the regulatory condition, which may remain outstanding after the expiration date. The regulatory condition must be satisfied on or prior to January 12, 2023 or, if permissible, waived. If the regulatory condition is not satisfied on or prior to January 12, 2023 (or, if permissible, waived), the offer will terminate and will not be consummated. |

Following the satisfaction or valid waiver of each of the offer conditions, the certificate of merger shall be filed with the Secretary of State of the State of Delaware and become effective at that time (or at such later time as may be agreed by the parties in writing and specified in the certificate of merger).

The settlement of the exchange offer will be subject to and occur as soon as is practicable after the merger.

| Q: | What will I receive in the merger if I am an ADTRAN stockholder? |

| A: | In the merger, ADTRAN stockholders will be entitled to receive one Acorn HoldCo share for each of their ADTRAN shares. |

| Q: | As an ADTRAN stockholder, will I have appraisal rights in connection with the merger? |

| A: | Under the Delaware General Corporation Law, which governs the merger, as well as under the ADTRAN certificate of incorporation and bylaws, ADTRAN stockholders are not entitled to any appraisal rights in connection with the merger. See “The Business Combination —Appraisal Rights.” |

| Q: | Will ADTRAN stockholders be subject to taxation on the Acorn HoldCo shares received in the merger? |

| A: | The merger is intended to qualify as a “reorganization” under Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”), and the merger, taken together with the exchange offer, is intended to qualify as an “exchange” under Section 351(a) of the Code. If the merger and business combination so qualify, a U.S. holder (as defined herein) of ADTRAN shares generally will not recognize any gain or loss for U.S. federal income tax purposes on the exchange of ADTRAN shares for Acorn HoldCo shares in the merger. |

10

For a further discussion of certain U.S. federal income tax consequences of the merger to ADTRAN stockholders, see “Material U.S. Federal Income Tax Considerations — Tax Consequences to U.S. Holders.”

Tax matters are very complicated and the tax consequences of the merger to each ADTRAN stockholder may depend on such stockholder’s particular facts and circumstances. ADTRAN stockholders are urged to consult their own tax advisors to understand fully the tax consequences to them of the merger.

| Q: | What is the recommendation of the ADTRAN board of directors as to each proposal that may be voted on at the ADTRAN special meeting? |

| A: | The ADTRAN board of directors has unanimously approved and declared advisable the business combination agreement, the business combination and all of the other transactions contemplated by the business combination agreement, declared that the transactions contemplated by the business combination agreement are fair to and in the best interests of ADTRAN and its stockholders, directed that the adoption of the business combination agreement be submitted to a vote of ADTRAN stockholders at the ADTRAN special meeting and resolved to recommend that the ADTRAN stockholders vote to adopt the business combination agreement and approve the other matters submitted for approval in connection with the business combination agreement at the ADTRAN special meeting. |

Accordingly, the ADTRAN board of directors unanimously recommends that ADTRAN stockholders vote:

| 1. | “FOR” the business combination proposal; |

| 2. | “FOR” the compensation proposal; and |

| 3. | “FOR” the stockholder adjournment proposal. |

| Q: | When and where is the ADTRAN special meeting? |

| A: | The ADTRAN special meeting will be held virtually by live webcast on January 6, 2022, at 10:30 a.m., Central time. You can participate in the meeting by visiting www.virtualshareholdermeeting.com/ADTN2022SM, where you will be able to listen to the meeting live and vote during the meeting. Please log in to the website by 10:30 a.m., Central time, on the day of the meeting. There is no physical location for the special meeting. |

| Q: | Who is entitled to vote at the ADTRAN special meeting? |

| A: | Only holders of record of ADTRAN shares at the close of business on November 16, 2021, the record date for the ADTRAN special meeting, will be entitled to notice of, and to vote at, the ADTRAN special meeting or any adjournment or postponement thereof. |

| Q: | Who is soliciting my proxy? |

| A: | The ADTRAN management, at the direction of the ADTRAN board of directors, is soliciting your proxy for use at the ADTRAN special meeting. It is expected that the solicitation will be primarily by mail or the internet, but proxies may also be solicited personally, by advertisement or by telephone, by directors, officers or employees of ADTRAN without special compensation or by ADTRAN’s proxy solicitor, Morrow Sodali, LLC. This document describes the voting procedures and the proposals to be voted on at the ADTRAN special meeting. |

| Q: | Who will solicit and pay the cost of soliciting proxies? |

| A: | ADTRAN has engaged Morrow Sodali, LLC to assist in the solicitation of proxies from stockholders at a fee of $20,000 plus reimbursement of out-of-pocket expenses. ADTRAN also may reimburse banks, |

11

| brokerage firms, other nominees or their respective agents for their expenses in forwarding proxy materials to beneficial owners of ADTRAN shares. ADTRAN’s directors, officers and employees also may solicit proxies by telephone, by facsimile, by mail, on the internet or during the special meeting. They will not be paid any additional amounts for soliciting proxies. |

| Q: | What is “householding”? |

| A: | A single proxy statement will be delivered to multiple stockholders sharing an address, unless contrary instructions have been received from an affected stockholder. Once you have received notice from your broker that it will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and you prefer to receive a separate proxy statement, please notify your broker or contact ADTRAN’s proxy solicitor, Morrow Sodali, LLC at (203) 658-9400 (banks and brokerage firms) and (800) 662-5200 (stockholders toll-free), or via email at adtn.info@investor.morrowsodali.com. ADTRAN stockholders who currently receive multiple copies of this document at their address and would like to request “householding” of their communications should contact their broker or bank. |

| Q: | How do I vote if I am an ADTRAN stockholder? |

| A: | If you are an ADTRAN stockholder and you hold your ADTRAN shares in your own name, you may submit your vote for or against the proposals submitted at the ADTRAN special meeting or your abstention during the special meeting or by proxy. Your vote is important. Because many stockholders cannot attend the special meeting, it is necessary that a large number be represented by proxy. Most stockholders have a choice of voting over the internet, by using a toll-free telephone number, or by completing a proxy card or voting instruction card, as described below: |

| • | Vote on the Internet. If you have internet access, you may submit your proxy or voting instructions by following the instructions provided with your proxy materials and on your proxy card or voting instruction card; |

| • | Vote by Telephone. You can also vote by telephone by following the instructions provided with your proxy materials and on your proxy card or voting instruction card. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded; or |

| • | Vote by Mail. You may choose to vote by mail by marking your proxy card or voting instruction card, dating and signing it, and returning it in the postage-paid envelope provided. |

Information and applicable deadlines for using the proxy card, or voting by telephone or through the internet, are set forth in the enclosed proxy card instructions. Alternatively, you may vote at the ADTRAN special meeting virtually by ballot.

If your ADTRAN shares are registered in the name of a broker, bank or other nominee (which is also known as being held in “street name”), that broker, bank or other nominee has enclosed or will provide a voting instruction card for you to direct the broker, bank or other nominee how to vote your shares. ADTRAN stockholders who hold shares in “street name” must return their instructions to their broker, bank or other nominee on how to vote their shares. If your ADTRAN shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record, to be able to vote at the special meeting.

You should be aware that, as of September 30, 2021, ADTRAN’s directors and executive officers and their affiliates owned and were entitled to vote approximately 2.0% of the outstanding ADTRAN shares entitled to vote at the ADTRAN special meeting, compared to the more than 50% of ADTRAN shares outstanding and entitled to vote at the ADTRAN special meeting required to approve the business combination proposal.

12

| Q: | If I am an ADTRAN stockholder, what vote is required to approve each proposal, and what happens if I do not vote or if I abstain from voting? |

| A: | The business combination cannot be completed without approval of the business combination proposal. The business combination proposal requires the affirmative vote of a majority of the ADTRAN shares outstanding and entitled to vote at the ADTRAN special meeting. A failure to vote, a broker non-vote or an abstention will have the same effect as a vote “AGAINST” the business combination proposal. |

The compensation proposal and the stockholder adjournment proposal each requires the affirmative vote of a majority of the ADTRAN shares present at the special meeting or represented by proxy and entitled to vote at the ADTRAN special meeting. An abstention will have the same effect as a vote “AGAINST” such proposals. A failure to vote and broker non-votes will have no effect on the vote on either of the compensation proposal and the stockholder adjournment proposal.

The presence, at the special meeting or by proxy, of the holders of a majority of the shares entitled to vote shall constitute a quorum. ADTRAN shares represented at the ADTRAN special meeting and entitled to vote but not voted, including ADTRAN shares represented by abstentions, will be considered present for quorum purposes. Broker non-votes will not be counted for purposes of determining whether a quorum is present.

| Q: | If I am an ADTRAN stockholder and my ADTRAN shares are held in “street name” by a broker, bank or other nominee, will my broker or bank vote my shares for me? |

| A: | If you hold your ADTRAN shares in “street name” and do not provide voting instructions to your broker, your ADTRAN shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. Generally, your broker, bank or other nominee does not have discretionary authority to vote on the business combination proposal, the compensation proposal or the stockholder adjournment proposal. Accordingly, your broker, bank or other nominee will vote your shares held by it in “street name” only if you provide voting instructions. You should follow the procedures that your broker, bank or other nominee provides. Shares that are not voted because you do not properly instruct your broker, bank or other nominee will have the same effect as a vote “AGAINST” the business combination proposal. Broker non-votes are not considered shares entitled to vote on the compensation proposal and the stockholder adjournment proposal and, therefore, will have no effect on the vote on any of such proposals. |

Alternatively, you can attend the ADTRAN special meeting virtually and vote during the special meeting if your ADTRAN shares are held in the name of a bank, broker or other holder of record, by obtaining a proxy, executed in your favor, from the holder of record, to be able to vote at the special meeting.

| Q: | Can I change my vote after I have delivered my proxy? |

| A: | Yes. If you are an ADTRAN stockholder of record, there are three ways to change your vote after you have submitted a proxy: |

| • | you may send a later-dated, signed proxy card to the address indicated on the proxy card, which must be received prior to the ADTRAN special meeting; |

| • | you may subsequently vote by phone or Internet, or may attend virtually and vote during the ADTRAN special meeting; or |

| • | you may send a notice of revocation to the agent for ADTRAN, which notice must be received prior to the ADTRAN special meeting. |

13

Simply attending the ADTRAN special meeting without voting will not revoke your proxy. ADTRAN proxy cards can be sent by mail to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

If your ADTRAN shares are held in an account at a broker, bank or other nominee and you have instructed your broker, bank or other nominee on how to vote your shares, you should follow the instructions provided by your broker, bank or other nominee to change your vote.

| Q: | What will happen if the proposals to be considered at the ADTRAN special meeting are not approved? |

| A: | ADTRAN, ADVA, Merger Sub and Acorn HoldCo will not be able to complete the business combination if ADTRAN stockholders do not approve the business combination proposal. The approval of the compensation proposal or the stockholder adjournment proposal is not a condition to the completion of the business combination. |

| Q: | When should I submit my proxy? |

| A: | Whether or not you expect to attend the special meeting virtually, please promptly submit your proxy or voting instruction. Most stockholders have a choice of voting over the internet, by telephone or by using a traditional proxy card (including by mail). Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other nominee to see which voting methods are available to you. |

Please be aware that, if you own shares in a brokerage account, you must instruct your broker on how to vote your shares. Without your instructions, Nasdaq rules do not allow your broker to vote your shares on any of the proposals. Please exercise your right as a stockholder to vote on all proposals, including the business combination proposal, by instructing your broker by proxy.

| Q: | Who can help answer my questions? |

| A: | The information provided above in the question and answer format is for your convenience only and is merely a summary of some of the information contained in this document. You should read carefully the entire document, including the information in the Annexes. See the section entitled “General Information — Where You Can Find More Information; Documents Available for Inspection.” If you are an ADTRAN stockholder and have any questions about the business combination, or how to submit your proxy, or if you need additional copies of this document or the enclosed proxy card, you should contact: |

Morrow Sodali LLC

470 West Avenue

Stamford CT 06902

Individuals call toll-free (800) 662-5200

Banks and brokers call (203) 658-9400

Email: ADTN.info@investor.morrowsodali.com

14

This summary highlights selected information in this document and may not contain all of the information that is important to you. You should carefully read this entire document, including its annexes and documents referred to herein, for a more complete understanding of the business combination agreement, the transactions contemplated by the business combination agreement, ADTRAN, ADVA, and Acorn HoldCo. You may obtain additional information without charge by following the instructions under “General Information—Where You Can Find More Information; Documents Available for Inspection.”

Information About the Companies

Acorn HoldCo

Acorn HoldCo is a newly incorporated corporation formed under the laws of Delaware on August 10, 2021, that will become the parent company of ADTRAN and ADVA upon the completion of the business combination. To date, Acorn HoldCo has not conducted any material activities other than those incidental to its formation and the matters contemplated by the business combination agreement. Following the consummation of the business combination, Acorn HoldCo, Inc. will change its name to “ADTRAN Holdings, Inc.” and its ticker symbol will be “ADTN.”

Acorn HoldCo’s principal executive office is located at 901 Explorer Boulevard, Huntsville, Alabama 35806-2807, and its telephone number at that location is +1 (256) 963-8000. Acorn HoldCo’s registered office is located at Corporation Trust Center, 1209 N. Orange Street, Wilmington, New Castle County, Delaware 19801.

ADTRAN

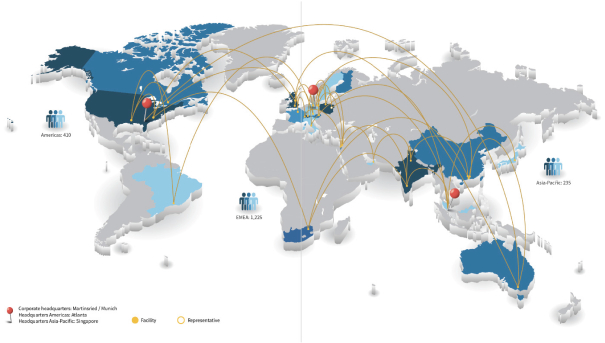

ADTRAN is a leading global provider of networking and communications platforms and services focused on the broadband access market. ADTRAN’s vision is to enable a fully connected world where the power to communicate is available to everyone, everywhere. ADTRAN’s unique approach, unmatched industry expertise and innovative solutions enable us to address almost any customer need. ADTRAN’s products and services are utilized by a diverse global customer base of network operators that range from those having regional or national reach and operating as telephone or cable television network operators to alternative network providers such as municipalities or utilities, as well as managed service providers who serve small- and medium-sized businesses and distributed enterprises. ADTRAN had approximately 1,450 employees as of August 20, 2021.

ADTRAN began operations in January 1986. Headquartered in Huntsville, Alabama, ADTRAN is located in Cummings Research Park. ADTRAN’s mailing address is 901 Explorer Boulevard, Huntsville, Alabama, 35806. ADTRAN’s telephone number at that location is (256) 963-8000. ADTRAN’s website is www.adtran.com. No information contained on ADTRAN’s website is intended to be included as part of, or incorporated by reference into, this registration statement.

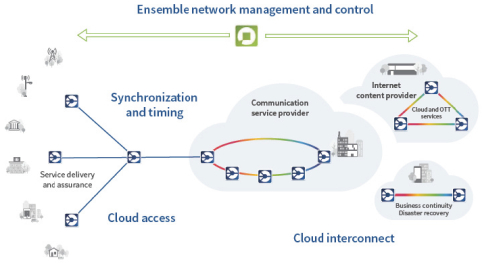

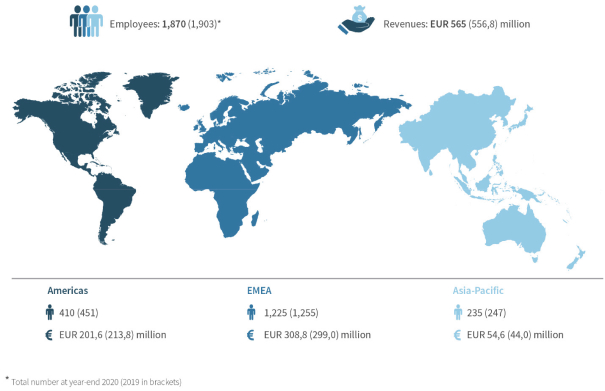

ADVA

ADVA, a societas europaea (SE), is incorporated under the laws of the European Union and of Germany. ADVA develops and provides innovative solutions to network operations (private enterprises, communication services providers and internet content provides), focusing on solutions for cloud access, cloud interconnect and network synchronization. ADVA employs approximately 1,900 professionals worldwide as of August 20, 2021.

ADVA’s registered offices are located at Märzenquelle 1–3, 98617 Meiningen/Dreißigacker, Germany, and its telephone number at that location is +49 (0) 36 93 450 0. The address of the head office is Fraunhoferstrasse 9a, 82159 Martinsried/Munich, Germany. ADVA’s shares are listed on the Frankfurt Stock Exchange, ISIN: DE0005103006.

15

Merger Sub

Acorn MergeCo, Inc., or Merger Sub, is a Delaware corporation and wholly-owned subsidiary of Acorn HoldCo that was formed on August 10, 2021, solely for the purpose of effecting the merger. To date, Merger Sub has not conducted any material activities other than those incidental to its formation and the matters contemplated by the business combination agreement. Upon effectiveness of the merger, Merger Sub will merge with and into ADTRAN, with ADTRAN surviving the merger as a direct wholly-owned subsidiary of Acorn HoldCo.

Merger Sub’s principal executive offices are located at 901 Explorer Boulevard, Huntsville, Alabama 35806-2807, and its telephone number at that location is +1 (256) 963-8000. Its registered office is located at Corporation Trust Center, 1209 N. Orange Street, Wilmington, New Castle County, Delaware 19801.

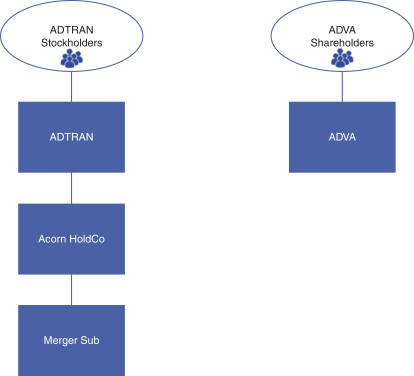

The Business Combination and the Business Combination Agreement

Pursuant to the business combination agreement, ADVA and ADTRAN have agreed to combine their businesses under Acorn HoldCo, a new holding company incorporated under the laws of the State of Delaware. The effect of the business combination will be that ADVA and ADTRAN will become subsidiaries of Acorn HoldCo. ADTRAN will become a wholly-owned direct subsidiary of Acorn HoldCo through a merger of Merger Sub, a wholly-owned direct subsidiary of Acorn HoldCo, with and into ADTRAN, with ADTRAN surviving the merger, and ADVA will become a direct subsidiary of Acorn HoldCo through an exchange offer of Acorn HoldCo shares for ADVA shares. The business combination agreement is more fully described in the section “The Business Combination Agreement” and a copy of the business combination agreement is attached as Annex A to this document. We encourage you to read the business combination agreement carefully and in its entirety, as it is the legal document that governs the relationship between ADTRAN and ADVA with respect to the business combination.

The Merger

The parties to the business combination agreement have agreed that, following the satisfaction or valid waiver of each of the offer conditions, the certificate of merger shall be filed with the Secretary of State of the State of Delaware and become effective at that time (or at such later time as may be agreed by the parties in writing and specified in the certificate of merger). At the effective time of the merger, Merger Sub, a wholly owned direct subsidiary of Acorn HoldCo, will merge with and into ADTRAN, with ADTRAN surviving the merger, as a result of which ADTRAN will become a wholly owned direct subsidiary of Acorn HoldCo. The settlement of the exchange offer will be subject to and occur as soon as is practicable after the merger. The merger is discussed in more detail in the section “The Business Combination Agreement — The Merger.”

Merger Consideration