- ADTN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ADTRAN (ADTN) DEF 14ADefinitive proxy

Filed: 28 Mar 23, 10:04am

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. | |||

NOTICE OF 2023 ANNUAL MEETING

AND

PROXY STATEMENT

| Corporate Office | U.S. Mail | Toll-Free: 1 800 9Adtran | |||

| 901 Explorer Blvd. | P.O. Box 140000 | Telephone: 256 963 8000 | ||||

| Huntsville, AL 35806 | Huntsville, AL 35814-4000 | http:/www.adtran.com |

March 28, 2023

Dear Stockholder:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders of ADTRAN Holdings, Inc. to be held on Wednesday, May 10, 2023, at 10:30 a.m., Central Time. We are pleased to announce that this year’s Annual Meeting will be a virtual meeting conducted by live webcast on the Internet. You will be able to attend and participate in the meeting by visiting www.virtualshareholdermeeting.com/ADTN2023 and entering the 16-digit control number included on your Notice of Internet Availability of Proxy Materials (the “Notice”) or on your proxy card if you receive the proxy materials by mail. You will not be able to attend the Annual Meeting in person.

The attached Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the meeting. During the meeting, we also will report on Adtran’s operations during the past year and our plans for the future.

We have elected to take advantage of Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders on the Internet. We believe that the rules will allow us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the annual meeting.

Your vote, whether during the virtual meeting on May 10, 2023 or by proxy, is important. Please review the instructions on each of your voting options described in the accompanying proxy materials and the Notice you received in the mail. If you are unable to participate in the virtual meeting, I urge you to vote as soon as possible.

| Sincerely, |

|

| THOMAS R. STANTON |

| Chairman of the Board |

ADTRAN HOLDINGS, INC.

901 EXPLORER BOULEVARD

HUNTSVILLE, ALABAMA 35806

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD WEDNESDAY, MAY 10, 2023

NOTICE HEREBY IS GIVEN that the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of ADTRAN Holdings, Inc. (the “Company”) will be held on Wednesday, May 10, 2023, at 10:30 a.m., Central Time, via live webcast. You can participate in the meeting by visiting www.virtualshareholdermeeting.com/ADTN2023 and entering the 16-digit control number included on your Notice or proxy card. If you hold your shares through an intermediary, such as a bank or broker, and do not have a control number, please contact the bank or broker. Please log in to the website by 10:15 a.m., Central Time, on the day of the meeting. There is no physical location for the Annual Meeting.

The Annual Meeting is being held for the purposes of considering and voting upon:

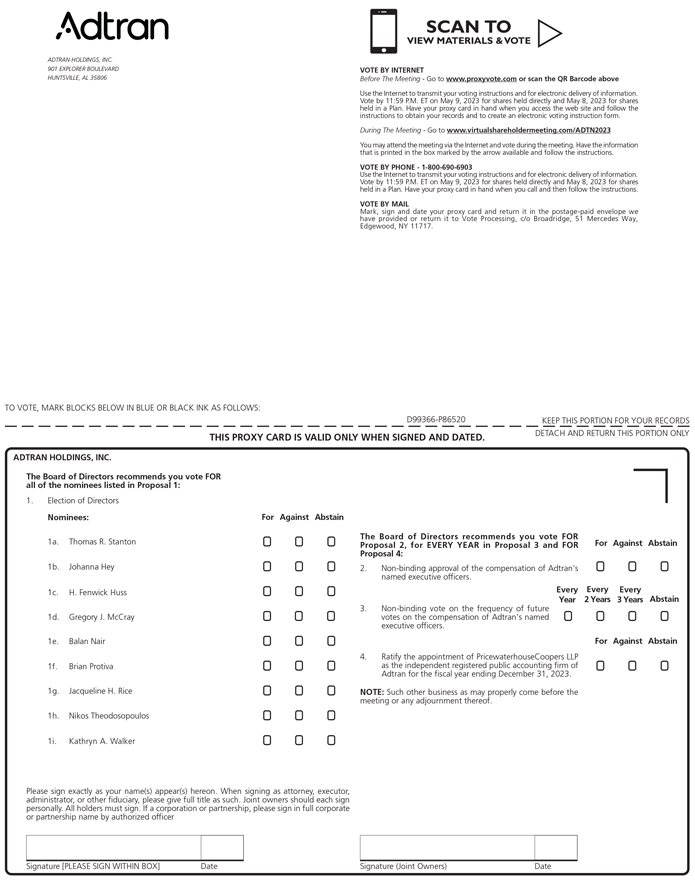

| 1. | A proposal to elect nine directors to serve until the 2024 Annual Meeting of Stockholders; |

| 2. | An advisory proposal with respect to the compensation of the Company’s named executive officers (“NEOs”), as described in the Compensation Discussion and Analysis, executive compensation tables and accompanying narrative in the attached Proxy Statement; |

| 3. | An advisory proposal with respect to the frequency of future votes on the compensation of the Company’s NEOs; |

| 4. | A proposal to ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2023; and |

| 5. | Such other business as properly may come before the Annual Meeting or any adjournments thereof. The Board of Directors is not aware of any other business to be presented for a vote of the stockholders at the Annual Meeting. |

The Board of Directors recommends that you vote FOR each of the nine director nominees; FOR the approval on an advisory basis of the compensation of the Company’s NEOs; FOR the option of “EVERY YEAR” as the preferred frequency for future advisory votes on the compensation of the Company’s NEOs; and FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. The Annual Meeting may be adjourned from time to time without notice other than announcement at the meeting or at adjournments thereof, and any business for which notice is hereby given may be transacted at any such adjournment.

Information relating to the above matters is set forth in the attached Proxy Statement. Stockholders of record at the close of business on March 13, 2023, are entitled to receive notice of and to vote during the Annual Meeting and any adjournments thereof.

Whether or not you plan to participate in the Annual Meeting, we urge you to review these materials carefully, which are available at https://materials.proxyvote.com/00738A. We also encourage you to vote by (i) following the instructions on the notice that you received from your broker, bank or other nominee if your shares are held beneficially in “street name” or (ii) one of the following means if your shares are registered directly in your name with the Company’s transfer agent:

| • | By Internet: Go to the website www.proxyvote.com and follow the instructions. You will need the control number included on your Notice to obtain your records and vote by Internet. |

| • | By Telephone: From a touch-tone telephone, dial toll-free 1-800-690-6903 and follow the recorded instructions. You will need the control number included on your Notice in order to vote by telephone. |

| • | By Mail: You may request a hard copy of the proxy materials, including a proxy card, by following the instructions on your Notice. If you request and receive a proxy card, please mark your selections on the proxy card, date and sign your name exactly as it appears on the proxy card and mail the proxy card in the pre-paid envelope that will be provided to you. Mailed proxy cards must be received no later than May 9, 2023 in order to be counted for the Annual Meeting. |

You can submit questions in advance of the Annual Meeting by visiting www.proxyvote.com, entering your 16-digit control number, and using the “Questions for Management” feature. You can submit questions during the Annual Meeting by following the instructions on the meeting website. Management will answer pertinent questions in the “Investor Resources” section of our website at https://investors.adtran.com. The questions and answers will be available as soon as practicable after the Annual Meeting and will remain available for thirty (30) days after posting.

| By order of the Board of Directors, |

|

| MICHAEL K. FOLIANO |

| Senior Vice President of Finance, Chief Financial Officer and Corporate Secretary |

Huntsville, Alabama

March 28, 2023

TABLE OF CONTENTS

| Page | ||||

| 3 | ||||

Security Ownership of Certain Beneficial Owners and Management | 8 | |||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 22 | ||||

| 24 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 47 | ||||

| 48 | ||||

| 51 | ||||

| 53 | ||||

| 55 | ||||

| 55 | ||||

| 60 | ||||

| 62 | ||||

| 69 | ||||

| 74 | ||||

| 75 | ||||

| 77 | ||||

Policies and Procedures for Review and Approval of Related Person Transactions | 77 | |||

| 77 | ||||

| 78 | ||||

| 79 | ||||

Proposal 2: Advisory Vote Regarding Compensation of Our Named Executive Officers | 80 | |||

Proposal 3: Advisory Vote Regarding Frequency of Future Say-On-Pay Votes | 81 | |||

Proposal 4: Ratification of Appointment of Independent Registered Public Accounting Firm | 82 | |||

i

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD WEDNESDAY, MAY 10, 2023

This Proxy Statement, along with the accompanying Notice of Annual Meeting of Stockholders, contains information about the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of ADTRAN Holdings, Inc. (the “Company”), including any adjournments or postponements of the Annual Meeting. The Annual Meeting will be held on Wednesday, May 10, 2023 at 10:30 a.m., Central Time. We are pleased to announce that this year’s Annual Meeting will be a virtual meeting conducted by live webcast on the Internet. You will be able to attend and participate in the meeting by visiting www.virtualshareholdermeeting.com/ADTN2023 and entering the 16-digit control number included on your Notice of Internet Availability of Proxy Materials (the “Notice”) or on your proxy card if you receive the proxy materials by mail. If you hold your shares through an intermediary, such as a bank or broker, and do not have a control number, please contact the bank or broker. Please log in to the website by 10:15 a.m., Central Time, on the day of the meeting. You may vote during the Annual Meeting by following the instructions available on the meeting website. There is no physical location for the Annual Meeting.

You can submit questions in advance of the Annual Meeting by visiting www.proxyvote.com, entering your 16-digit control number, and using the “Questions for Management” feature. You can submit questions during the Annual Meeting by following the instructions on the meeting website. Management will answer pertinent questions in the “Investor Resources” section of our website at https://investors.adtran.com. The questions and answers will be available as soon as practicable after the Annual Meeting and will remain available for thirty (30) days after posting.

We are providing this Proxy Statement to the stockholders of the Company in connection with the solicitation of proxies by our Board of Directors to be voted during the Annual Meeting and at any adjournments of that meeting.

On or about March 28, 2023, we began sending the Notice to all stockholders entitled to vote in advance of or during the virtual Annual Meeting. We encourage all of our stockholders to vote on the proposals presented, and we hope the information contained in this document will help you decide how you wish to vote.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on May 10, 2023:

This Notice, the Proxy Statement and the 2022 Annual Report to Stockholders of ADTRAN Holdings, Inc. are available free of charge to view, print and download at https://materials.proxyvote.com/00738A.

Additionally, you can find a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, including financial statements and schedules thereto, on the website of the Securities and Exchange Commission (the “SEC”) at www.sec.gov, or in the “SEC Filings” section of our website at

1

https://investors.adtran.com. You may also obtain a printed copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, including financial statements and schedules thereto, free of charge, from us by sending a written request to: ADTRAN Holdings, Inc., Attn: Corporate Secretary, 901 Explorer Boulevard, Huntsville, Alabama 35806. Exhibits will be provided upon written request.

2

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

Why is the Company soliciting my proxy?

The Board of Directors of the Company (the “Board”) is soliciting your proxy to vote at the 2023 Annual Meeting of Stockholders to be held on Wednesday, May 10, 2023 at 10:30 a.m., Central Time, via live webcast and any adjournments of the meeting, which we refer to as the “virtual Annual Meeting” or the “Annual Meeting.” This Proxy Statement along with the accompanying Notice of Annual Meeting of Stockholders summarizes the purposes of the meeting and the information you need to know to vote during the Annual Meeting.

How can I participate in the virtual Annual Meeting?

You will be able to attend and participate in the Annual Meeting by visiting www.virtualshareholdermeeting.com/ADTN2023 and entering the 16-digit control number included on your Notice or proxy card. If you hold your shares through an intermediary, such as a bank or broker, and do not have a control number, please contact the bank or broker. Please log in to the website by 10:15 a.m., Central Time, on the day of the meeting. You may vote during the Annual Meeting by following the instructions available on the meeting website.

You can submit questions in advance of the Annual Meeting by visiting www.proxyvote.com, entering your 16-digit control number, and using the “Questions for Management” feature. You can submit questions during the Annual Meeting by following the instructions on the meeting website. Management will answer pertinent questions in the “Investor Resources” section of our website at https://investors.adtran.com. The questions and answers will be available as soon as practicable after the Annual Meeting and will remain available for thirty (30) days after posting.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules and regulations adopted by the SEC, instead of mailing a printed copy of our proxy materials to each stockholder of record, we are furnishing proxy materials, including this Proxy Statement and our 2022 Annual Report to Stockholders, by providing access to such documents on the Internet. Stockholders will not receive printed copies of the proxy materials unless they request them. Instead, commencing on or about March 28, 2023, a Notice was sent to our stockholders which instructs you on how to access and review the proxy materials on the Internet. The Notice also instructs you on how to submit your proxy via the Internet or by telephone. If you would like to receive a paper or email copy of our proxy materials, please follow the instructions for requesting such materials in the Notice.

Why am I receiving these materials?

Our Board is providing these proxy materials to you on the Internet or, upon your request, will deliver printed versions of these materials to you by mail, in connection with the Annual Meeting, which will take place on May 10, 2023. Stockholders are invited to participate in the virtual Annual Meeting and are requested to vote on the proposals described in this Proxy Statement.

What is included in these materials?

These proxy materials include:

| • | our Proxy Statement for the Annual Meeting; and |

| • | our 2022 Annual Report to Stockholders. |

3

If you request printed versions of these materials by mail, these materials will also include the proxy card for the Annual Meeting.

What proposals will be voted on during the Annual Meeting?

You will be voting on the matters listed below (with the Board’s recommendation on each matter):

| Items of Business | Board Recommendation | Page Reference | ||||

| 1. | Elect nine directors to serve until the 2024 Annual Meeting of Stockholders | FOR | 11 | |||

| 2. | Approve on an advisory basis the compensation of our NEOs | FOR | 80 | |||

| 3. | Approve on an advisory basis the frequency of future advisory votes on the compensation of our NEOs | EVERY YEAR | 81 | |||

| 4. | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 | FOR | 82 | |||

What shares owned by me can be voted?

All shares owned by you as of the close of business on March 13, 2023 (the “Record Date”) may be voted. You may cast one vote per share of common stock that you held on the Record Date. These include shares that are: (1) held directly in your name as the stockholder of record, and (2) held for you as the beneficial owner through a stock broker, bank or other nominee. At the close of business on the Record Date, there were 78,634,186 shares of our common stock outstanding. Each stockholder is entitled to one vote in person or by proxy for each share of common stock held on all matters properly to come before the Annual Meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most of the Company’s stockholders hold their shares through a stock broker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially through a nominee.

Stockholder of Record

If your shares are registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the stockholder of record with respect to those shares, and the Notice is being sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to the persons named as proxy holders, Thomas R. Stanton, the Company’s Chief Executive Officer and Chairman of the Board, and Michael K. Foliano, the Company’s Senior Vice President of Finance, Chief Financial Officer and Corporate Secretary, or to vote prior to or during the virtual Annual Meeting. If you request printed copies of the proxy materials, the Company will provide a proxy card for you to use. You may also vote by Internet or by telephone, as described below under the heading “How can I vote my shares without participating in the Annual Meeting in real time?”

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and a notice is being sent to you by your broker or nominee who is considered the stockholder of record with respect to those shares. As the beneficial owner, you are invited to participate in the virtual Annual Meeting. You also have the right to direct your broker on how to vote these shares. The notice that you receive from your broker or nominee should include instructions for you to direct your broker or nominee how to vote your shares. You may also vote prior to the Annual Meeting by Internet or by telephone, as described below under “How can I vote my shares without participating in the Annual Meeting in real time?” However, shares held in “street name” may be voted during the Annual Meeting by you only if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

4

How can I vote my shares during the virtual Annual Meeting?

Shares held directly in your name as the stockholder of record or shares held beneficially in “street name” may be voted during the virtual Annual Meeting. If you choose to vote your shares during the virtual Annual Meeting and you are the stockholder of record, you will need the control number included on your Notice or proxy card. If you hold your shares in “street name” and do not have a control number, please contact the bank or broker.

How can I vote my shares without participating in the Annual Meeting in real time?

Whether you hold your shares directly as the stockholder of record or beneficially in “street name,” you may direct your vote by proxy without participating in the virtual Annual Meeting in real time. If you are the stockholder of record, you can vote by proxy by one of the following means:

| • | By Internet: Go to the website www.proxyvote.com and follow the instructions. You will need the control number included on your Notice to obtain your records and vote by Internet. |

| • | By Telephone: From a touch-tone telephone, dial toll-free 1-800-690-6903 and follow the recorded instructions. You will need the control number included on your Notice in order to vote by telephone. |

| • | By Mail: You may request a hard copy of the proxy materials, including a proxy card, by following the instructions on your Notice. If you request and receive a proxy card, please mark your selections on the proxy card, date and sign your name exactly as it appears on the proxy card and mail the proxy card in the pre-paid envelope that will be provided to you. Mailed proxy cards must be received no later than May 9, 2023 in order to be counted for the Annual Meeting. |

If you hold your shares beneficially in “street name,” please follow the instructions provided in the notice from your broker, or, if you request printed copies of proxy materials, on the proxy card or voting instruction form. We urge you to review the proxy materials carefully before you vote. These materials are available at https://materials.proxyvote.com/00738A.

Can I revoke my proxy or change my vote?

You may revoke your proxy or change your voting instructions prior to the vote during the virtual Annual Meeting. You may enter a new vote by using the Internet or the telephone or by mailing a new proxy card or new voting instruction form bearing a later date (which will automatically revoke your earlier voting instructions), which new vote must be received by 11:59 p.m., Central Time, on May 9, 2023. You may also enter a new vote by participating in and voting during the virtual Annual Meeting. Your participation in the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

5

What is the voting requirement to approve each of the proposals?

| Proposal | Vote Required for Approval | Effect of Abstentions | Broker Discretionary Voting | Unmarked Signed Proxy Cards | ||||

1. Election of directors | The number of votes exceeds the number | No effect | No | Voted “For” All Director Nominees | ||||

2. Non-binding advisory vote to approve the compensation of our NEOs | Majority of shares represented and entitled to vote | Counted as “Against” | No | Voted “For” | ||||

3. Non-binding advisory vote on the frequency of future “Say-On-Pay” votes | Majority of shares represented and entitled to vote | Counted as “Against” | No | Voted for “EVERY YEAR” | ||||

4. Ratification of appointment of independent registered public accounting firm | Majority of shares represented and entitled to vote | Counted as “Against” | Yes | Voted “For” | ||||

| (1) | If you are a beneficial owner whose shares are held of record by a broker, you must instruct the broker how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal on which the broker does not have discretionary authority to vote. This is called a “broker non-vote.” Because broker non-votes are not voted affirmatively or negatively, they will not be considered in determining the number of votes necessary for approval and, therefore, will have no effect on the outcome of Proposal 1. Because brokers are not entitled to vote on Proposal 2 or 3 in the absence of instructions, broker non-votes will have no effect on the outcome of these proposals. |

| (2) | Pursuant to the Company’s Director Resignation Policy, an uncontested director is required to promptly tender to the Chairman of the Board of Directors an irrevocable contingent resignation in the event that such director fails to receive a sufficient number of votes for election or re-election. The Nominating and Corporate Governance Committee of the Board is required to consider on an expedited basis such director’s tendered resignation and make a recommendation to the Board concerning the acceptance or rejection of the tendered resignation. The Board is required to take formal action on the Nominating and Corporate Governance Committee’s recommendation expeditiously following receipt, and the Company will publicly disclose the Board’s decision and, if applicable, its reasoning for rejecting the tendered resignation. |

What does it mean if I receive more than one Notice, proxy card or voting instruction form?

It means your shares are registered differently or are held in more than one account. For each Notice you receive, please submit your vote for each control number you have been assigned. If you request and receive paper copies of proxy materials, please provide voting instructions for all proxy cards and voting instruction forms you receive.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results during the Annual Meeting and publish preliminary results, or final results if available, in a Current Report on Form 8-K within four business days of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

6

What happens if additional proposals are presented during the Annual Meeting?

Other than the four proposals described in this Proxy Statement, we do not expect any matters to be presented for a vote during the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Thomas R. Stanton, the Company’s Chief Executive Officer and Chairman of the Board, and Michael K. Foliano, the Company’s Senior Vice President of Finance, Chief Financial Officer and Corporate Secretary, will have the discretion to vote your shares on any additional matters properly presented for a vote during the Annual Meeting. If for any unforeseen reason, any one or more of the Company’s nominees for director is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

What is the quorum requirement for the Annual Meeting?

The quorum requirement for holding the Annual Meeting and transacting business is a majority of the outstanding shares entitled to vote or act at the meeting. The shares may be present by participating in the Annual Meeting or represented by proxy at the Annual Meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. If a quorum is not present or if we decide that more time is necessary for the solicitation of proxies, we may adjourn the Annual Meeting. We may do this with or without a stockholder vote. Alternatively, if the stockholders vote to adjourn the Annual Meeting in accordance with the Company’s Bylaws, the named proxies will vote all shares of common stock for which they have voting authority in favor of adjournment.

Who will bear the cost of soliciting proxies for the Annual Meeting?

The Company will pay the entire cost of soliciting proxies for the Annual Meeting, including the distribution of proxy materials. We have hired Georgeson Inc. to assist in the solicitation of proxies from stockholders at a fee of approximately $8,000 plus reasonable out-of-pocket expenses. We will request brokers or nominees to forward this Proxy Statement to their customers and principals and will reimburse them for expenses so incurred. If deemed necessary, we may also use our officers and regular employees, without additional compensation, to solicit proxies personally or by telephone.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of March 13, 2023, by (1) each of our directors, (2) each of our executive officers named in the Summary Compensation Table in this Proxy Statement and (3) all of our directors and executive officers as a group, based in each case on information furnished to us by these persons. We believe that each of the named individuals and each director and executive officer included in the group has sole voting and investment power with regard to the shares shown except as otherwise noted.

Name and Relationship to Company | Number of Shares of Common Stock (1) | Percent of Class (2) | ||

Thomas R. Stanton | 603,450 | * | ||

Chairman of the Board, Chief Executive Officer and Director | ||||

Michael K. Foliano | 122,587 | * | ||

Senior Vice President of Finance, Chief Financial Officer and Corporate Secretary | ||||

Ronald D. Centis | 44,892 | * | ||

Senior Vice President of Operations | ||||

Raymond Harris | 42,060 | * | ||

Chief Information Officer | ||||

James D. Wilson, Jr. | 89,588 | * | ||

Chief Revenue Officer | ||||

Christoph Glingener | 0 | * | ||

Chief Technology Officer Chief Executive Officer – ADVA Optical Networking SE | ||||

Johanna Hey | 0 | * | ||

Director | ||||

H. Fenwick Huss | 56,449 | * | ||

Lead Director | ||||

Gregory J. McCray | 21,742 | * | ||

Director | ||||

Balan Nair | 74,222 | * | ||

Director | ||||

Brian Protiva | 402,967 | * | ||

Director | ||||

Jacqueline H. Rice | 39,345 | * | ||

Director | ||||

Nikos Theodosopoulos | 0 | * | ||

Director | ||||

Kathryn A. Walker | 47,512 | * | ||

Director | ||||

All directors and executive officers as a group (14 persons) | 1,544,814 | 1.95% |

| * | Represents beneficial ownership of less than 1% of the shares of common stock. |

| (1) | Beneficial ownership as reported in the table has been determined in accordance with applicable Securities and Exchange Commission (“SEC”) regulations and includes shares of our common stock that may be issued upon the exercise of stock options that are exercisable within 60 days of March 13, 2023 as follows: Mr. Stanton – 263,780 shares; Mr. Foliano – 52,303 shares; Mr. Wilson – 20,034 shares; Mr. Protiva – 52,997 shares; and all directors and executive officers as a group – 389,114 shares. The shares included in the table above do not include shares of our common stock that may be issued upon distribution of stock |

8

| awards that were deferred pursuant to the Company’s nonqualified deferred compensation plans (collectively, the “Deferred Compensation Plan”), which the individual becomes entitled to upon separation of service from the Company, but which shares are actually payable, at the earliest, on the first day of the month following the six month anniversary of the participant’s separation from service, as follows: Mr. Stanton – 219,931 shares; Mr. Foliano – 41,458 shares; Mr. Wilson – 17,339 shares; and all directors and executive officers as a group – 278,728 shares. |

Additionally, pursuant to the terms of the ADTRAN Holdings, Inc. 2020 Directors Stock Plan, the unvested shares of restricted stock awarded to our directors do not entitle the holder to exercise any voting or other stockholder rights with respect to such shares. Accordingly, the shares included in the table above do not include (i) 4,790 shares of unvested time-based restricted stock awarded to each of Dr. Huss, Messrs. McCray, Nair and Protiva, and Mses. Rice and Walker and (ii) 6,698 shares of unvested time-based restricted stock awarded to each of Ms. Hey and Mr. Theodosopoulos, which do not vest within 60 days of March 13, 2023. Pursuant to SEC regulations, all shares not currently outstanding that are subject to options exercisable within 60 days or to which an officer or director may become entitled upon vesting of RSUs within 60 days are deemed to be outstanding for the purpose of computing “Percent of Class” held by the holder thereof but are not deemed to be outstanding for the purpose of computing the “Percent of Class” held by any other stockholder.

The shares shown include: as to Mr. Foliano, 250 shares held by the Company’s 401(k) plan; as to Mr. Wilson, 4,151 shares held by the Company’s 401(k) plan; as to Ms. Rice, 39,345 shares held in a trust; and as to all directors and executive officers as a group, 4,401 shares held in Company 401(k) plan accounts and 39,345 shares held by trusts for which an executive officer or director is a beneficiary or trustee.

| (2) | Percentage of ownership is based on 78,634,186 shares of Company common stock outstanding as of March 13, 2023. |

9

The following table sets forth information regarding the beneficial ownership of our common stock as of the date indicated for each person, other than the officers or directors of Adtran, known to us to be the beneficial owner of more than 5% of our outstanding common stock.

Name and Address of Beneficial Owner | Number of Shares of Common Stock | Percent of Class | ||||||

BlackRock, Inc. (1) | 13,723,837 | 17.45 | % | |||||

55 East 52nd Street | ||||||||

The Vanguard Group (2) | 8,099,787 | 10.30 | % | |||||

100 Vanguard Blvd | ||||||||

EGORA Ventures AG (f/k/a EGORA Holding | 4,889,435 | 6.22 | % | |||||

GmbH) (3) Fraunhoferstr. 22 82152 Planegg-Martinsried/Munich, Germany | ||||||||

| (1) | The amount shown and the following information are derived from an amended Schedule 13G filed by BlackRock, Inc. on January 26, 2023, reporting beneficial ownership as of December 31, 2022. According to the Schedule 13G, BlackRock, Inc. has sole voting power over 13,632,800 shares and sole dispositive power as to all of the shares. The Schedule 13G indicates various persons have the right to receive or the power to direct the receipt of dividends from or the proceeds from the sale of the shares; however, no one person’s beneficial interest in the shares is more than 5% of the total shares, except BlackRock Fund Advisors. |

| (2) | The amount shown and the following information are derived from an amended Schedule 13G filed by The Vanguard Group on February 9, 2023, reporting beneficial ownership as of December 30, 2022. According to the Schedule 13G, the Vanguard Group, a registered investment adviser, has shared voting power over 122,711 shares, sole dispositive power over 7,917,241 shares, and shared dispositive power over 182,546 shares. |

| (3) | The amount shown and the following information are derived from a Schedule 13D filed jointly by EGORA Ventures AG (f/k/a EGORA Holding GmbH) (“EGORA”), EGORA Investments GmbH (“EGORA GmbH”) and Brian Protiva on July 20, 2022, which reflects that EGORA beneficially owned 4,889,435 shares as of July 15, 2022. According to the Schedule 13D, EGORA has sole voting and dispositive power with respect to all of the shares. EGORA owns 100% of the capital stock of EGORA GmbH and Mr. Protiva is the record and beneficial owner of approximately 42.61% of the capital stock of EGORA. Mr. Protiva disclaims beneficial ownership of the shares held by EGORA. |

10

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors

Our Board of Directors currently consists of nine members. The Board has nominated Thomas R. Stanton, Johanna Hey, H. Fenwick Huss, Gregory J. McCray, Balan Nair, Brian Protiva, Jacqueline H. Rice, Nikos Theodosopoulos and Kathryn A. Walker for election as directors at the 2023 Annual Meeting. Each of these individuals currently serves as a director.

In July 2022, the Company completed a business combination pursuant to which ADTRAN, Inc., through a merger that closed on July 8, 2022 (the “Merger”), became a wholly-owned subsidiary of the Company, and through an exchange offer that settled on July 15, 2022 (the “Exchange Offer”), the Company acquired approximately 65% of the outstanding shares of ADVA Optical Networking SE, a company organized and existing under the laws of Germany (“ADVA”). Each of Messrs. Stanton, Huss, McCray and Nair and Mses. Rice and Walker, the directors of ADTRAN, Inc., was elected to the Board of the Company, as the successor issuer to ADTRAN, Inc., upon the closing of the Merger. Upon consummation of the Exchange Offer, each of Johanna Hey, Brian Protiva and Nikos Theodosopoulos was elected to the Company’s Board, and Mr. Protiva was named Vice Chairman of the Board. The skills that these new directors bring to the Board are instrumental to our achievement of synergies and global strategy going forward. The term “Business Combination” refers to both ADTRAN, Inc. and ADVA becoming subsidiaries of the Company through the Merger and the Exchange Offer, respectively, and the “closing of the Business Combination” refers to July 15, 2022. References in this Proxy Statement to “Adtran,” the “Company,” “we,” “our” and “us” refer to ADTRAN, Inc. prior to the Merger and to ADTRAN Holdings, Inc. following the Merger.

If elected as a director at the Annual Meeting, each of the nominees would serve a one-year term expiring at the 2024 Annual Meeting of Stockholders and until his or her successor has been duly elected and qualified. There are no family relationships among the directors, director nominees or the executive officers. Pursuant to the Company’s Director Resignation Policy, each of the director nominees is deemed to have agreed to promptly tender to the Chairman of the Board of Directors an irrevocable contingent resignation in the event that such director fails to receive a sufficient number of votes for re-election (a “majority against vote”). If any director nominee receives a majority against vote at the Annual Meeting, the Nominating and Corporate Governance Committee of the Board of Directors will recommend to the Board, and the Board will determine, whether to accept or reject the resignation tendered by such individual. Following the Board’s decision, the Company will file a Current Report on Form 8-K with the SEC in order to disclose the decision and, if applicable, the Board’s reasoning for rejecting the tendered resignation.

Our Bylaws provide that our Board consists of a single class of directors and that the terms of office of the directors is one year from the time of their election until the next annual meeting of stockholders and until their successors are duly elected and qualified. In addition, our Bylaws provide that, in general, vacancies on our Board may be filled by a majority of directors in office, even if less than a quorum, or by a sole remaining director (and not by the stockholders). Our Bylaws provide that the exact number of directors will be fixed from time to time by our Board pursuant to a resolution adopted by a majority of the whole Board.

Our Board of Directors seeks to ensure that the Board is composed of members whose experience, qualifications, attributes and skills, when taken together, will allow the Board to satisfy its oversight responsibilities effectively in light of the Company’s business and the laws and stock exchange rules that govern its affairs. We have no minimum qualifications for director candidates. In general, however, our Board will review and evaluate both incumbent and potential new directors in an effort to achieve diversity of skills and experience among our directors so that our Board has an effective mix of technical, financial, operating and management experience. Our Board has adopted corporate governance principles to guide the Company and the Board on various governance matters, and these principles task the Nominating and Corporate Governance

11

Committee of the Board with establishing criteria for the selection of potential directors, taking into account the following desired attributes:

• | Leadership | • | Business experiences | |||

• | Independence | • | Industry knowledge | |||

• | Interpersonal skills | • | Diversity of viewpoints | |||

• Financial acumen | ||||||

We believe that our Board should be comprised predominantly of independent directors from diverse backgrounds external to the Company, but should nevertheless include the insight and judgment of our senior management. Our Board has no specific requirements regarding diversity but believes that its membership should reflect a diversity of experience, gender, race, ethnicity and age. Our Board is currently 33% female, 33% ethnically diverse, and 66% female or ethnically diverse. The following diversity statistics are reported in the standardized disclosure matrix that is required by the listing rules of the Nasdaq Stock Market (“Nasdaq”):

| Board Diversity Matrix (as of March 28, 2023) | ||||||||||||

Board Size: | ||||||||||||

Total Number of Directors: 9 | ||||||||||||

Gender: | Female | Male | Non-Binary | Gender Undisclosed | ||||||||

Number of Directors Based on Gender Identity | 3 | 6 | — | — | ||||||||

Number of Directors Who Identify in Any of the Categories Below: | ||||||||||||

African American or Black | — | 1 | — | — | ||||||||

Alaskan Native or American Indian | — | — | — | — | ||||||||

Asian | — | 2 | — | — | ||||||||

Hispanic or Latinx | — | — | — | — | ||||||||

Native Hawaiian or Pacific Islander | — | — | — | — | ||||||||

White | 3 | 3 | — | — | ||||||||

Two or More Races or Ethnicities | — | — | — | — | ||||||||

LGBTQ+ | — | |||||||||||

Demographic Background Undisclosed | — | |||||||||||

In assessing the experience, qualifications, attributes and skills that led our Nominating and Corporate Governance Committee and Board to conclude that each director has the appropriate qualifications to serve as a director of the Company, the Board focused on the information discussed in each of the director nominees’ individual biographies set forth on pages 12 to 16 of this Proxy Statement. In evaluating the suitability of the director nominees for re-election, our Nominating and Corporate Governance Committee also considered the director’s past performance, including attendance at meetings and participation in and contributions to the activities of the Board and its committees, as applicable.

Information Regarding the Nominees for Director

Set forth below is certain information regarding the nine nominees for director, including their ages, principal occupations or employment for at least the past five years, the length of their tenure as directors, and the names of other public companies in which such persons hold or have held directorships during the past five years. Additionally, information about the specific experience, qualifications, attributes or skills that led to our Board’s conclusion at the time of filing of this Proxy Statement that each person listed below should serve as a director is set forth below. The stock ownership with respect to each director nominee is set forth in the Security Ownership of Certain Beneficial Owners and Management table on page 8.

12

THOMAS R. STANTON, age 58, was named our Chief Executive Officer in September 2005 and named Chairman of the Board in 2007. Mr. Stanton joined Adtran in 1995 as Vice President of Marketing for the Carrier Networks (“CN”) Division. Since that time, he has held a number of senior management positions within the Company, including Senior Vice President and General Manager of the CN Division. Prior to joining Adtran, he served as Vice President of Marketing and Engineering at Transcrypt International and held several senior management positions with E. F. Johnson Company. Mr. Stanton has served on the board of directors of a number of technology companies and is a past chairman of the board for both the Federal Reserve Bank of Atlanta’s Birmingham Branch and the Telecommunications Industry Association. He currently serves on the board of the Economic Development Partnership of Alabama and the Huntsville Chamber of Commerce and has served on the board of BancorpSouth Bank (NYSE: BXS) since October 2015. Mr. Stanton holds a Bachelor of Science degree in Computer Engineering from Auburn University.

Mr. Stanton has been a member of our Board since September 2005. Mr. Stanton has been selected as a nominee for director because he is our Chief Executive Officer and has extensive knowledge of all facets of our Company and extensive experience in all aspects of our industry.

JOHANNA HEY, age 52, has served on the supervisory board of ADVA since June 2013 and became its chair in August 2022. She also currently serves on the supervisory board of the Gothaer Versicherungsbank VVaG and the Gothaer Finanzholding AG, as well as the supervisory boards of the University of Cologne Executive School GmbH and Flossbach von Storch AG.

Ms. Hey is a professor on tax law in Germany. Since 2006, she has been the director of the Institute for Tax Law at the University of Cologne and has served on the Scientific Advisory Board of the Federal Ministry of Finance of Germany. Since the winter term of 2002/2003, Ms. Hey has been the chair of corporate law at the Heinrich Heine University in Düsseldorf, Germany. From 2004 to 2012, Ms. Hey was a member of the committee and first Vice President of the German Association of University Professors. In 2010, she was announced as the head of science of the Berlin Finance and Taxation Institute and, in the same year, was elected to the Permanent Deputation of the Association of German Jurists. From 2011 to 2016, she was head of the Scientific Advisory Board of German Tax Lawyers. Since 2011, Ms. Hey has been a member of the Scientific Advisory Board of the Centre for European Economic Research.

Ms. Hey has been a member of our Board since the closing of the Business Combination in July 2022. Ms. Hey has been selected as a nominee for director because of her long-time service on the supervisory board of ADVA and her expertise in accounting and European and international tax law. She also has experience as a board member for various companies and organizations.

H. FENWICK HUSS, age 72, served as the Willem Kooyker Dean of the Zicklin School of Business at Baruch College, a senior college of The City University of New York, from July 2014 to December 2022. He also served as a tenured Professor in Baruch’s Stan Ross Department of Accountancy. He previously served as Dean of the J. Mack Robinson College of Business at Georgia State University from 2004 to 2014. Prior to his appointment as Dean, Dr. Huss was Associate Dean from 1998 to 2004 and Director of the School of Accountancy at Georgia State from 1996 to 1998, and on the faculty since 1989. He also served on the faculty of the University of Maryland as an assistant professor from 1983 to 1989 and is a visiting professor at the Université Paris 1 Pantheon-Sorbonne.

Dr. Huss has been a member of our Board since October 2002 and has served as our Lead Director since May 2015. Dr. Huss has been selected as a nominee for director because he brings the point of view of academia and, in particular, the information and new concepts that develop in the business school environment. Dr. Huss also has extensive experience and knowledge of financial accounting and corporate finance and management experience in the academic environment.

GREGORY MCCRAY, age 59, is an experienced executive with more than 30 years of business, marketing, sales, engineering, operations, mergers and acquisitions, management and international experience in

13

the communications technology industry. Since June 2018, Mr. McCray has served as the Chief Executive Officer of FDH Infrastructure Services (“FDH”), an engineering and science company that monitors, inspects, designs and performs structural analysis for infrastructure assets utilizing wireless monitoring devices and patented non-destructive testing techniques. During his career, Mr. McCray has served in a number of management and executive roles, including CEO of Access/Google Fiber in 2017; CEO of Aero Communications Inc., which provides installation, services and support to the communications industry, from 2013 to 2016; CEO of Antenova, a developer of antennas and radio frequency modules for mobile devices, from 2003 to 2012; Chairman and CEO of Piping Hot Networks, which brought broadband fixed wireless access equipment to market, from 2001 to 2002; and Senior Vice President of customer operations at Lucent Technologies from 1996 to 2000, where he managed the Customer Technical Operations Group for Europe, the Middle East and Africa. Mr. McCray currently serves on the board of directors of FDH, FreeWave Technologies and DigitalBridge Group, Inc. (NYSE: DBRG), where he also serves as a member of the Compensation and Nominating & Corporate Governance Committees. Mr. McCray served as a director of CenturyLink, Inc. (NYSE: CTL), the third largest network operator in America, from January 2005 to February 2017, where he served as chairman of the Cyber Security & Risk Committee from 2015 to 2017. Mr. McCray holds a Bachelor of Science degree in Computer Engineering from Iowa State University and a Master of Science degree in Industrial & Systems Engineering from Purdue University. He has also completed executive business programs at the University of Illinois, Harvard, and INSEAD.

Mr. McCray has been a member of our Board since May 2017. Mr. McCray has been selected as a nominee for director because of his extensive experience as an executive and senior manager in the telecommunications and technology industries during the course of his career, as well as his experience as a director of publicly-held companies.

BALAN NAIR, age 56, has served as President and Chief Executive Officer of Liberty Latin America Ltd. (NASDAQ: LILA) since 2018. Liberty Latin America is an integrated telecommunications company, focused on the Caribbean Islands and Latin America. Mr. Nair is an experienced and proven business executive with more than 20 years in the telecommunications industry. He has been a part of the Liberty family of companies since 2007, when he joined Liberty Global plc (NASDAQ: LBTYA) as its Senior Vice President and Chief Technology Officer. He most recently served as Executive Vice President and Chief Technology and Innovation Officer from 2007 to 2017. In this role, he was responsible for overseeing Liberty Global’s worldwide network, as well as Technology and Innovation operations, including Product Development, IT, Network Operations, Mobile Operations and Global Supply Chain functions. He was also responsible for Corporate Strategy and Venture Investments. Mr. Nair was an executive officer of Liberty Global and sat on Liberty Global’s Executive Leadership Team and the Investment Committee. Before joining Liberty Global, Mr. Nair served as Chief Technology Officer and Executive Vice President of AOL LLC, a global web services company. Prior to his role at AOL LLC, he spent more than 12 years at Qwest Communications International Inc., most recently as Chief Information Officer and Chief Technology Officer. Mr. Nair has a long history of working in the telephone, web world, and cable and media industries. He has served on the board of directors of Charter Communications, Inc. (NASDAQ: CHTR), a leading cable operator in the United States, since 2013, and on the board of Liberty Latin America since December 2017. He graduated from Iowa State University with a Bachelor of Science degree in Electrical Engineering and a Master of Business Administration degree. Mr. Nair holds a patent in systems development and is a Licensed Professional Engineer in Colorado.

Mr. Nair has been a member of our Board since February 2007. Mr. Nair has been selected as a nominee for director because he has extensive experience with the technologies that influence our industry and our markets and because he has management experience, particularly managing technical personnel, as well as his experience as a director of a publicly-held company.

BRIAN PROTIVA, age 58, led ADVA Optical Networking SE as Chief Executive Officer since co-founding the company in 1994 through August 31, 2022. As the CEO, he was responsible for ADVA’s overall strategy, M&A and human resources and he led every department at some point during his tenure. He fully

14

retired as an employee of ADVA on December 31, 2022. Prior to co-founding and leading ADVA, Mr. Protiva served as the managing director of a holding company, AMS Electronics GmbH which he converted into Egora Holding GmbH, where he also co-managed a number of its subsidiaries. In addition, Mr. Protiva has served as a member of the board of directors of AMS Technologies AG since 2013.

Mr. Protiva has served as Vice Chairman of our Board since the closing of the Business Combination in July 2022. Mr. Protiva has been selected as a nominee for director because of his 30 years of experience in the networking industry combined with his leadership skills in building ADVA into a market leading optical networking company.

JACQUELINE H. (JACKIE) RICE, age 50, has served as General Counsel and Corporate Secretary of MillerKnoll, Inc. (NASDAQ: MLKN), a design and manufacturing company that researches, designs and manufactures interior furnishings for use in various environments, including residential, office, healthcare and educational settings, since February 2019. Previously, she served as Principal of RH Associates, a global consulting firm providing legal, risk and compliance advisory services for clients across all industries and geographies, from January 2018 to January 2019. From 2014 to 2017, Ms. Rice served as Target Corporation’s (NYSE: TGT) Executive Vice President and Chief Risk and Compliance Officer with responsibility for enterprise and vendor risk, corporate security and corporate compliance and ethics. Prior to joining Target, she served as Chief Compliance Officer and legal counsel of General Motors (NYSE: GM) from 2013 to 2014 and Executive Director, Global Ethics and Compliance of General Motors from 2010 to 2013. Ms. Rice has served on the board of directors for the Michigan West Coast Chamber of Commerce since October 2021. Ms. Rice graduated from the University of Detroit Mercy School of Law, where she was editor-in-chief of the Law Review, and she obtained her undergraduate degree from James Madison College at Michigan State University.

Ms. Rice has been a member of our Board since August 2016. Ms. Rice has been selected as a nominee for director because of her legal background and her experience with governance, compliance, ethics and risk management for large, publicly-held corporations.

NIKOS THEODOSOPOULOS, age 60, served as chairman of the supervisory board of ADVA from January 2015 until August 2022. He also currently serves on the board of directors of Arista Networks Inc.

In September 2012, he founded and currently serves as the managing member of NT Advisors, LLC, a technology consulting firm. Prior to founding NT Advisors, LLC, he was an equity research analyst for 18 years primarily at UBS Group AG, covering the technology sector, where he eventually served as the Global Technology Strategist and Technology Sector Head of U.S. Equity Research. Prior to his career in investment banking, he spent 10 years at AT&T Network Systems and Bell Laboratories. He holds a Master in Business Administration from New York University, a Master of Science from Stanford University, and a Bachelor of Science from Columbia University.

Mr. Theodosopoulos has been a member of our Board since the closing of the Business Combination in July 2022. Mr. Theodosopoulos has been selected as a nominee for director because of his experience in the technology industry and his vast public board experience in the technology industry including Chairman, Audit Committee Chair, and Compensation Committee Chair roles.

KATHRYN A. WALKER, age 63, has more than 30 years of experience in the communications industry. Since 2009, she has served as a managing director for OpenAir Equity Partners, a venture capital firm focusing on the wireless, communications and mobile Internet sectors. In addition, Ms. Walker is serving concurrently as Chief Technology Officer at Main Street Data, an agriculture data science company founded by OpenAir Equity Partners. Prior to joining OpenAir Equity Partners, Ms. Walker worked in a variety of roles at various subsidiaries of Sprint Corporation from 1985 to 2009, culminating in the position of Chief Information and Chief Network Officer at Sprint Nextel Corporation. She currently serves on the board of directors for SmartHome Ventures, on the Council of Trustees at South Dakota State University, and as the President of the

15

Board of Trustees at Missouri University of Science and Technology. Ms. Walker is a National Association of Corporate Directors (“NACD”) Board Leadership Fellow. The NACD Fellowship is a comprehensive and continuous program of study that empowers directors with the latest insights, intelligence and leading boardroom practices, and Ms. Walker demonstrates a commitment to the highest standards of exemplary board leadership by earning NACD Fellowship – The Gold Standard Director Credential – year after year. Ms. Walker also was elected to the NACD Directorship 100 in 2021 in recognition of her corporate governance expertise.

Ms. Walker has been a member of our Board since May 2014. Ms. Walker has been selected as a nominee for director because she has extensive experience with the technologies that influence our industry and our markets. She also possesses governance expertise and management experience, particularly managing technical personnel.

Voting of Proxies

Unless otherwise instructed, the proxy holders will vote proxies held by them “For” the election of Thomas R. Stanton, Johanna Hey, H. Fenwick Huss, Gregory J. McCray, Balan Nair, Brian Protiva, Jacqueline H. Rice, Nikos Theodosopoulos and Kathryn A. Walker as directors for a one-year term expiring at the 2024 Annual Meeting of Stockholders and until their successors have been duly elected and qualified. Each of the nominees has consented to serve his or her term as a director if elected. If any of the nominees should be unavailable to serve for any reason (which is not anticipated), the Board may designate a substitute nominee or nominees (in which event the persons named on the enclosed proxy card will vote the shares represented by all valid proxies for the election of the substitute nominee or nominees), allow the vacancies to remain open until a suitable candidate or candidates are located, or by resolution provide for a lesser number of directors.

The Board of Directors unanimously recommends that the stockholders vote “For”

the election of the nine nominees named above.

16

CORPORATE GOVERNANCE

Governance Highlights

Our Board of Directors is committed to having sound corporate governance principles. Such principles are essential to running our business efficiently and to maintaining our integrity in the marketplace. The “Corporate Governance” section of this Proxy Statement describes our governance framework, which includes the following features:

• Majority voting in uncontested director elections • No classified Board • 8 of 9 independent directors • Diverse Board that is 33% female, 33% ethnically diverse, and 66% female or ethnically diverse • Independent Lead Director of the Board • Directors required to submit resignations if they do not receive sufficient votes for re-election • Separate Board committee dedicated to ESG oversight • Annual Board and committee evaluations, as well as director self-evaluations, with focus on tangible improvements • No poison pill • Limitation on directorships of other publicly-traded companies | • Mature environmental management system that is ISO 14001 certified, as part of comprehensive sustainability program • Stock ownership guidelines and equity retention requirements for non-employee directors • Regular executive sessions of independent directors • All directors attended 75% or more of Board and applicable committee meetings in 2022 • No supermajority standards — stockholders may amend our bylaws and charter and approve mergers and business combinations by simple majority vote • Risk oversight by full Board and designated committees |

Composition of the Board

Our Board seeks to ensure that the Board, as a whole, is strong in its collective knowledge of, and has a diversity of skills and experience with respect to, accounting and finance, management and leadership, vision and strategy, business operations, business judgment, crisis management, risk assessment, industry knowledge, corporate governance and global markets. As part of our annual Board self-evaluation process, the Board evaluates whether or not the Board as a whole has the appropriate mix of skills, experience, backgrounds and diversity in relation to the needs of the Company for the current issues facing the Company.

Directors to be nominated by the Company for election at the annual stockholders’ meeting are approved by the Board upon recommendation by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee considers candidates for Board membership from recommendations by third-party executive search firms and candidates recommended by stockholders and by management, as well as recommendations from its committee members and other members of the Board. When the Nominating and Corporate Governance Committee reviews a potential new candidate, the Committee looks specifically at the candidate’s qualifications in light of the needs of the Board and the Company at that time given the then current mix of director attributes.

Process for Stockholders to Recommend Director Nominees

As provided in its charter, the Nominating and Corporate Governance Committee will consider potential director candidates submitted by stockholders. To recommend a nominee, a stockholder should write to the Nominating and Corporate Governance Committee at ADTRAN Holdings, Inc., Attn: Corporate Secretary,

17

901 Explorer Boulevard, Huntsville, Alabama 35806 (for overnight delivery) or at P.O. Box 140000, Huntsville, Alabama 35814-4000 (for mail delivery). Any recommendation must include:

| • | the name and address of the nominee; |

| • | all information relating to the nominee that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); |

| • | a brief biographical description, including his or her occupation for at least the last ten years, and a statement of the qualifications of the nominee, taking into account the criteria set forth above; and |

| • | the nominee’s signed consent to be named in the proxy statement if nominated and to serve as a director if elected. |

The Corporate Secretary will promptly forward these materials to the Chair of the Nominating and Corporate Governance Committee and the Chairman of the Board. The Nominating and Corporate Governance Committee may contact a recommended candidate to request additional information about the candidate’s independence, qualifications and other information that would assist the Committee in evaluating the candidate. The Charter of the Nominating and Corporate Governance Committee and the Company’s Corporate Governance Principles set forth factors that the Board and the Nominating and Corporate Governance Committee may consider in evaluating a director nominee, regardless of the recommending party.

In addition to submitting nominations in advance to the Nominating and Corporate Governance Committee for consideration, a stockholder also may nominate persons for election to the Board of Directors in person at a stockholders meeting. Section 3.4 of the Company’s Bylaws provides for procedures pursuant to which stockholders may nominate a candidate for election as a director of the Company. Furthermore, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice to the Company that complies with the informational and timing requirements of Rule 14a-19 under the Exchange Act to comply with the SEC’s universal proxy rules, in addition to satisfying the requirements under our Bylaws. The chairperson of the meeting shall have the power to determine and declare to the meeting whether or not a nomination was made in accordance with the procedures set forth in our Bylaws and, if the chairperson determines that a nomination is not in accordance with the procedures set forth in the Bylaws, to declare that the defective nomination will be disregarded. A copy of our Bylaws is available in the “Corporate Governance” section of our website at https://investors.adtran.com. Printed copies of the Bylaws may also be obtained at no charge by writing to the Corporate Secretary at ADTRAN Holdings, Inc., Attn: Corporate Secretary, 901 Explorer Boulevard, Huntsville, Alabama 35806.

Board, Committee and Individual Director Evaluation Program

Pursuant to the Corporate Governance Principles, the Board and each of its committees conduct an annual evaluation of its performance, led by the Nominating and Corporate Governance Committee. The evaluation is intended to determine whether the Board and its committees are functioning effectively and fulfilling the requirements set forth in the Corporate Governance Principles or the committee’s charter, as applicable. Beginning in 2018, the evaluations also included self-evaluations pursuant to which the directors were asked to examine their own contributions to the Board or committee, as appropriate, and potential areas of improvement. The Nominating and Corporate Governance Committee formalized the following self-evaluation program, with the goal of placing additional emphasis on improvements to processes and effectiveness:

| Board and Committee members complete self-evaluations: These questionnaires are completed individually in order to encourage honest feedback from the directors. |

18

| Group discussions: The Board or committee, as applicable, engages in a discussion of the completed questionnaires in order to assess performance in areas such as meeting efficiency, membership and structure, culture and operational effectiveness, and execution of roles and responsibilities. | |

| Focus on outcomes: The Nominating and Corporate Governance Committee discusses the outcomes of the Board and committee evaluations, determines appropriate follow-up action items and assigns responsibility for such actions. | |

The Company used an independent third party to provide an annual evaluation designed to assure feedback and continuous improvement.

Corporate Governance Principles

The Board of Directors has adopted Corporate Governance Principles that set forth the Company’s fundamental corporate governance principles and provide a flexible framework for the governance of the Company. The Corporate Governance Principles address, among other things, Board duties and responsibilities, management development and succession planning, Board membership and independence, Board meetings and Board committees, access to senior management and experts, director orientation and continuing education, and annual performance evaluations. The Nominating and Corporate Governance Committee regularly reviews and reassesses the adequacy of the Corporate Governance Principles and recommends any proposed changes to the Board, and the full Board approves such changes as it deems appropriate. A copy of our Corporate Governance Principles is available in the “Corporate Governance” section of our website at https://investors.adtran.com.

Director Independence

Nasdaq listing standards require that the Company have a majority of independent directors. Accordingly, because our Board currently has nine members, Nasdaq requires that five or more of the directors be independent. Nasdaq’s listing standards provide that no director will qualify as “independent” for these purposes unless the Board affirmatively determines that the director has no relationship with the Company that would interfere with the exercise of the director’s independent judgment in carrying out the responsibilities of a director. Additionally, the listing standards set forth a list of relationships that would preclude a finding of independence.

The Board affirmatively determines the independence of each director and nominee for election as a director. The Board makes this determination annually. In accordance with Nasdaq’s listing standards, we do not consider a director to be independent unless the Board determines that (i) no relationship exists that would preclude a finding of independence under Nasdaq’s listing standards and (ii) the director has no relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company) that would interfere with the exercise of the director’s independent judgment in carrying out his or her responsibilities as a director. Members of the Audit, Compensation and Nominating and Corporate Governance Committees must also meet applicable independence tests of Nasdaq and the SEC. Additionally, the charter of the Environmental, Social and Governance (“ESG”) Committee requires that its members also be independent under Nasdaq’s listing standards.

The Board has reviewed a summary of directors’ responses to a questionnaire asking about their relationships with the Company, as well as material provided by management related to transactions, relationships or arrangements between the Company and the directors and parties related to the directors. Following this review, the Board determined that seven of the nine directors (Ms. Hey, Dr. Huss, Mr. McCray, Mr. Nair, Ms. Rice, Mr. Theodosopoulos and Ms. Walker) are independent. Additionally, the Board determined that each current member of the Audit, Compensation, Nominating and Corporate Governance, and ESG Committees, as well as each director who served on any of the committees during 2022, also satisfies the independence tests referenced above.

19

Company Leadership Structure

The Board of Directors oversees the business and affairs of the Company and monitors the performance of its management. The basic responsibility of the Board is to lead the Company by exercising its business judgment to act in what each director reasonably believes to be the best interests of the Company and its stockholders. Although the Board is not involved in the Company’s day-to-day operations, the directors keep themselves informed about the Company through meetings of the Board, reports from management and discussions with the Company’s NEOs. Directors also communicate with the Company’s outside advisors, as necessary.

The Board does not have a policy as to whether the role of Chair of the Board and Chief Executive Officer should be separate or whether the Chair should be a management or a non-management director. The Corporate Governance Principles provide that whether to have the same person occupy the offices of Chair and Chief Executive Officer should be decided by the Board, from time to time, in its business judgment after considering relevant circumstances. If the Chair is also the Chief Executive Officer, or if the Board otherwise determines that it is appropriate, the Board will also elect an independent lead director (as described below). Thomas R. Stanton has held the roles of Chairman and the Company’s Chief Executive Officer since 2007 and Brian Protiva has served as Vice Chairman of the Board since the closing of the Business Combination on July 15, 2022. The Board believes that this leadership structure promotes strategy development and execution, and facilitates information flow between management and the Board.

The Board has determined that it is in the best interests of the Company and its stockholders to elect an independent director to serve in a lead capacity (the “Lead Director”) to perform the duties and responsibilities set forth in the Corporate Governance Principles and as determined by the Board. The Board elected H. Fenwick Huss as the Lead Director in May 2015. Dr. Huss presides over the regular executive sessions of the independent directors, serves as a liaison between the independent directors and the Chairman and Vice Chairman, and presides over the Board’s annual evaluation of the Chief Executive Officer, among other duties. We believe this structure facilitates the development of a productive relationship between the independent directors and the Chairman and Vice Chairman and ensures effective communication between the Board and management.

Board Structure and Committees

The Board of Directors conducts its business through meetings of the full Board and through committees of the Board, consisting of an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and an ESG Committee. The Board may from time to time form other committees as circumstances warrant. Such committees will have the authority and responsibility as delegated by the Board. Only members of the Board can be members of a committee, and each committee is required to report its actions to the full Board.

Each committee operates under a written charter adopted by the Board, which are available in the “Corporate Governance” section of our website at https://investors.adtran.com. The Nominating and Corporate Governance Committee is responsible for evaluating the membership of the committees and making recommendations to the Board regarding the same, which it does annually following a review of the Board’s current competencies. This periodic review of each director’s specific skills and experience allows the Nominating and Corporate Governance Committee to ensure that the committees are organized for optimal effectiveness.

The Board met six times in 2022. None of the incumbent directors attended less than 75% of the aggregate of (a) the total number of meetings held in 2022 of the Board while he or she was a director and (b) the total number of meetings held in 2022 of all committees of the Board on which he or she served. Absent extenuating circumstances, directors are expected to participate in annual meetings of the Company’s stockholders, and all of our directors serving at that time attended the 2022 Annual Meeting of Stockholders, except Mr. Nair.

20

The following table sets forth the current membership and the roles and responsibilities of each committee of the Board, as well as the number of meetings that each committee held during 2022:

| Audit Committee | Current Members | |

ROLES AND RESPONSIBILITIES: | H. Fenwick Huss (Chair) Johanna Hey Gregory J. McCray Jacqueline H. Rice Nikos Theodosopoulos

Number of Meetings in 2022: 11 | |

• Review financial reports and other financial information provided by us to the public or any governmental body • Review the qualifications, performance and independence of our independent registered public accounting firm • Discuss the financial statements and other financial information with management and the independent auditors and review the integrity of the Company’s internal and external financial reporting process • Review with management various reports regarding the Company’s system of internal controls and consult with the independent auditors regarding internal controls and the accuracy of the Company’s financial statements • Assist the Board in fulfilling its oversight responsibilities with respect to the Company’s compliance with legal and regulatory requirements and review the Company’s risk assessment and risk management policies • Annually review and monitor compliance with the Company’s Code of Conduct and review and approve all requests for waivers of the Code of Conduct • Establish and maintain procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters • Review the activities, organizational structure and qualifications of the internal audit department • Review, oversee and approve all related party transactions (as required to be disclosed pursuant to Item 404 of SEC Regulation S-K) in accordance with the Company’s Code of Conduct and its other policies and procedures | ||

| INDEPENDENCE: | ||

All members of the Audit Committee qualify as independent under applicable Nasdaq listing standards and satisfy the heightened independence standards under SEC rules. Furthermore, in accordance with SEC rules, the Board has determined that Dr. Huss qualifies as an “audit committee financial expert” as defined by the applicable SEC rules.

| Compensation Committee | Current Members | |

ROLES AND RESPONSIBILITIES: | Nikos Theodosopoulos (Chair) Gregory J. McCray Balan Nair

Number of Meetings in 2022: 6 | |

• Administer, review and make recommendations to the Board regarding the Company’s incentive compensation, equity-based and deferred compensation plans • Review the Company’s incentive compensation arrangements to consider whether they encourage excessive risk-taking and evaluate compensation policies and practices that could mitigate any such risk • Review and approve the compensation of the Chief Executive Officer and all executive officers, including the annual performance goals and objectives relevant to their compensation, and oversee succession planning for executive positions • Review and make recommendations to the Board regarding any employment agreements and any severance arrangements or plans, including any benefits to be provided in connection with a change in control, for the Chief Executive Officer and other executive officers • Review and approve all director compensation and benefits for service on the Board and Board committees and recommend any changes to the Board as necessary • Exercise general oversight of the Company’s benefit plans

| ||

21

| INDEPENDENCE: | ||

| All members of the Compensation Committee qualify as independent under applicable Nasdaq listing standards and satisfy the heightened independence standards under SEC rules. | ||

| Nominating and Corporate Governance Committee | Current Members | |

ROLES AND RESPONSIBILITIES: | Jacqueline H. Rice (Chair) H. Fenwick Huss Gregory J. McCray Kathryn A. Walker

Number of Meetings in 2022: 3 | |