The Company is in the business of mining, development and exploration of precious and base metal properties. Interests in these properties are held directly and indirectly through exploitation and exploration concessions, leases, options and working interests. The Company’s properties are located in Mexico and the USA. The Company’s principal and only material mineral property interest is the Dolores property located in Chihuahua, Mexico on which a feasibility study has been concluded and construction of a mine is nearing completion. The Company also has property interests in Sonora, Mexico (the “Northern Sonora Properties”). The Northern Sonora Properties include the La Bolsa gold deposit, Real Viejo silver prospect and the Planchas de Plata silver prospect, each at various stages of exploration. The Company’s other mineral property interests are in the USA.

In June 2002, the Company initiated a drilling program designed to bring the Dolores property to final feasibility and lead to a production decision. This drilling program was expanded in 2003 through 2007 to include condemnation and geotechnical drilling. Other activities on the Dolores property included additional geological mapping and sampling, road construction, initiating the community relocation program and, since April 2006, construction of an 18,000 tonnes per day, heap-leach, gold and silver mine.

The initial economics for the Dolores Mine were established in an independent feasibility study prepared by Kappes, Cassiday & Associates of Reno, Nevada (the “KCA report”). The report is entitled “Technical Report For the Dolores Heap Leach Project In Mexico”, is dated April 11, 2006, and is available on SEDAR at www.sedar.com. Based on interim conclusions made available to the Company, on February 23, 2006 the Board of Directors of Minefinders Corporation Ltd. approved the construction, by its wholly-owned subsidiary Compañía Minera Dolores S.A. de C.V. (“CMD”), of a conventional open pit heap leach mine and processing plant, subject to obtaining all necessary permits and the required funding. During 2006, the Company completed two financings including issuing 11,000,000 common shares at CDN$8.50 per share for net proceeds of US$78.7 million and issuing $85,000,000 of 4.5% unsecured convertible senior notes for net proceeds of $81.55 million. The bank project financing that had been proposed in late 2005 was not required, and those arrangements were cancelled. In 2007, the Company signed an agreement for a $50 million revolving three year term credit facility with Scotia Capital and is fully funded to complete construction and commissioning of the Dolores Mine.

Development and construction at Dolores began in the second quarter of 2006 with first shipping of gold and silver doré expected in the second quarter of 2008.

In April 2006, the Company completed an internal update of the resource model (see news release dated April 25, 2006 and the SEDAR filing of the NI 43-101 technical report) that incorporated all drilling results completed through 2005. In July 2006, the Company updated its estimated reserve base (reported in a news release dated July 25, 2006). An internal technical report on the internal mineral reserve update was filed on September 7, 2006 and is available on SEDAR.

An updated resource model (“updated resource”), incorporating all drill results through December 2006, was reviewed and audited during the second quarter of 2007 by the independent engineering firm of Chlumsky, Armbrust and Meyer (“CAM”) of Denver, Colorado and was reported by news release on June 12, 2007. An NI 43-101-compliant technical report in support of this updated resource audit dated July 26, 2007 was filed and is available for viewing on SEDAR. At a 0.4 gpt cutoff grade, the updated resource model estimated 106.3 million tonnes grading 0.918 gpt gold and 43.5 gpt silver in the measured and indicated categories. The measured and indicated resource using a 0.4 gpt AuEq cutoff represents an increase of 23.1% in contained gold and 21.3% in contained silver when compared to the previously audited resources reported in December, 2004.

On February 14, 2008, the Company reported updated reserves and economics for the Dolores Mine taking into account the increase in operating and capital cost estimates, higher gold and silver prices and an increase in proven and probable reserves from those incorporated in the KCA report. A National Instrument 43-101 (“NI 43-101”) technical report dated March 25, 2008 (the “Gustavson report”) supporting the updated economics and reserves was prepared by Gustavson and Associates of Denver, Colorado (“Gustavson”) and filed on SEDAR.

The updated in-pit reserve estimation was prepared and audited by Gustavson and is based on the updated resource. It is the first independent estimation of reserves at Dolores since the KCA report. Assuming a base case gold price of US$600/oz and silver price of US$10/oz, when adjusted for stockpiled material, the open-pit reserve base at the Dolores Mine has increased to 2.44 million ounces of gold and 126.64 million ounces of silver (or 4.55 million gold equivalent ounces using a silver to gold ratio of 60:1). This is an increase of 24.8% in contained gold reserve and an increase of 22.1% in contained silver reserve from the KCA report. The new reserves are contained in 99.3 million tonnes of proven and probable ore having an average grade of 0.77 gpt gold and 39.67 gpt silver and using economic gold equivalent cut-off grades ranging from 0.26 gpt to 0.37 gpt for the various ore types.

Initial capital and pre-commercial production operating costs estimated in the updated economics total $192 million, of which $141 million has been spent to December 31, 2007. The remaining estimated capital expenditures of $51 million, which includes a $10 million dollar contingency, consist primarily of pre-commercial production mining and processing expenses, commissioning of the crushing and conveying circuit, construction activities related to site drainage and water management, and completion of certain mine facilities including the truck shop, offices and warehouse. These capital expenses are expected to be incurred through fiscal 2008 and are expected to be funded from existing working capital, the $50 million revolving credit facility and cash flow from operations.

Total average cash operating costs per ounce of gold and ounce of gold-equivalent silver, based on a ratio of silver to gold of 52:1, are estimated in the updated economics at $297 for the life of the mine. The updated economics indicate a pre-tax undiscounted net present value of $831 million and a pre-tax internal rate of return of 26% using $675 per ounce as the price of gold and $13.00 per ounce as the price of silver. Sustaining capital costs over the life of mine are estimated in the updated economics at $50 million.

Exploration and development drilling activities continued on the Dolores property throughout 2007. The property is open in all directions, and there is significant potential for underground resources to be identified. Additional funds have been allocated to allow further exploration drilling to take place in 2008.

Drilling and other exploration work has continued in 2007 on the Northern Sonora properties, Planchas de Plata and Real Viejo. Results have been encouraging and further drilling programs will be carried out in 2008. Within the United States, drilling at the Gutsy Project in Nevada did not indicate sufficient potential to warrant further work. The Company still maintains active claims at the Dottie Project in Nevada, the Wickes Project in Montana, and the Oro Blanco Project in Arizona.

Financing

In the last three years, the Corporation has completed two financings to fund the development and construction of the mine at Dolores.

On April 21, 2006, the Corporation completed an equity financing by issuing 11,000,000 common shares at CDN$8.50 per share for net proceeds of US$78.7 million. The shares issued under this financing were qualified by short form prospectus.

On October 24, 2006, the Corporation completed the issue of $85,000,000 of 4.5% unsecured convertible senior notes due December 15, 2011, which are convertible into common shares at 91.9118 common shares for each $1,000 principal amount of notes. A total of 7,812,500 common shares are issuable upon conversion, and additional shares may become issuable following the occurrence of certain corporate acts or events. The shares potentially issuable under this financing were qualified by short form prospectus in Canada and the filing of a registration statement in the USA. The net amount realized was $81.55 million.

In December 2007, the Company also signed an agreement for a $50 million revolving three year term credit facility with Scotia Capital, a subsidiary of the Bank of Nova Scotia. The facility is available for drawdown in US or Canadian dollars with repayment at any time at a bank base rate or a LIBOR-based rate (plus 25 to 200 basis points depending on type of loan and financial and operating measures), payable according to the quoted rate term. The facility is secured by a pledge of the Company’s shares in its US and Mexican subsidiaries and by physical assets at the Dolores Mine. Under the terms of the facility, $17.5 million was immediately available at closing with an increase to $35 million on registration of certain security documents in Mexico. The available credit further increases

from $35 million to $50 million subject to completion of an updated reserve statement, mine plan and environmental management plan for the Dolores Mine. Subsequent to December 31, 2007, the Company satisfied these conditions and the amount available under the facility was increased to the full $50 million as of March 5, 2008.

In addition to interest earned on bank deposits, the Corporation received net proceeds on exercise of stock options of $146,000 in 2005; $1,160,000 in 2006: and $6,782,000 in 2007.

DESCRIPTION OF THE BUSINESS

Overview

The information provided under this caption and under “Principal Property - The Dolores Property”; “Northern Sonora Properties”; and “Property Interests in the United States” has been prepared by Mark H. Bailey, M.Sc., P.Geo., President & CEO of the Corporation, who is a “qualified person” as defined in NI 43-101. The information under “Principal Property – The Dolores Property” has been derived from reports prepared by other “qualified persons” who are named in that section of this AIF.

The Company is a mining, development and exploration company. The Company’s principal and only material property is the Dolores property. The Dolores property contains an economically viable ore body on which construction of a gold and silver mine is nearing completion.

The Company also has property interests in Northern Sonora (which include the La Bolsa deposit, the Real Viejo silver prospect and the Planchas de Plata prospect). The Northern Sonora Properties are without a known body of commercial ore. There is no surface plant or equipment on any of these properties.

Since November 1995, the Company has been actively working on the Dolores property. Property work included use of aerial photographs and topography, satellite imagery, road construction and infrastructure development, surface mapping, surface sampling, underground sampling, geophysics, diamond core and reverse circulation drilling, metallurgical studies, environmental base line studies, initial resource modelling and mine engineering, an environmental impact study and feasibility studies. These efforts have led to the discovery of a major epithermal gold and silver deposit on which construction of an 18,000 tpd heap leach gold and silver mine is nearing completion. First production of gold and silver doré is expected in the second quarter of 2008.

Drilling is ongoing at Dolores to convert resources that are outside the current mine plan into additional surface and/or underground mineable reserves.

The Northern Sonora Properties continue to be of interest and further exploration programs are planned for 2008.

In the USA, the Company has maintained its interests in the Gutsy/Buckskin Mountain properties and the Dottie property, in Nevada; in the Oro Blanco property in Arizona; and has acquired the Wickes lode claims in Montana. Drilling at the Gutsy Project in Nevada during 2007 did not indicate sufficient potential to warrant further work going forward.

In the following discussions on the Company’s several properties and projects, the reader is cautioned that any statements pertaining to the results of an economic analysis of mineral resources that are not mineral reserves do not demonstrate their economic viability.

PRINCIPAL PROPERTY - THE DOLORES PROPERTY

In 2006, Minefinders Corporation Ltd. received a bankable-level feasibility study from KCA on its 100% owned Dolores gold and silver deposit in Chihuahua, Mexico. On the basis of that study, in February 2006, the Corporation’s Board of Directors directed management to proceed with the development and construction of an 18,000 tonnes per day open-pit, heap leach mine at Dolores, subject to permits and financing, both of which were obtained. On February 14, 2008, the Company reported updated reserves and economics for the Dolores Mine taking into account the increase in operating and capital cost estimates, higher gold and silver prices and an increase in proven and probable reserves from those incorporated in the KCA report. Details of the updated reserves and

economics for the Dolores Mine are detailed in the Gustavson report. Construction of the Dolores Mine is substantially complete. Remaining construction activities are focused on completion of the conveying system, truck shop, warehouse and offices. In addition, construction activities related to site drainage and water management will progress concurrent with operations through 2008.

The planned operations are entirely conventional. Ore mined in the open pit will be trucked to a three-stage crushing system, and then conveyed to and stacked on permanent pads where it will be leached using a sodium cyanide solution. The resulting solution containing gold and silver will be processed in a standard Merrill-Crowe recovery plant to recover the precious metals for smelting, and transportation to a refinery. The metals will be sold to a refinery or to other participants in the world-wide commodity markets that exist to trade in these metals. No refining or sale contracts have been entered into.

Production and economic forecasts, based on results expected after a normal start-up period, are discussed in detail in the Gustavson report and in summary later in this section of the AIF.

Environmental requirements and a summary of applicable Mexican taxes are also discussed in the Gustavson report.

Most of the information given in this section is derived from the Gustavson report dated March 25, 2008 entitled “Technical Report on the Mineable Reserve for the Dolores Gold-Silver Project, Chihuahua State, Mexico”, which has been filed on SEDAR, is available at www.sedar.com, and which is incorporated in this AIF by reference. The principal author of the Gustavson report was William Crowl, who is an independent “qualified person” as defined in NI 43-101. Information given in this section is also derived from the updated resource model reviewed and audited during the second quarter of 2007 by CAM for which an NI 43-101-compliant technical report dated July 26, 2007 was filed on SEDAR and is incorporated in this AIF by reference.

Gustavson Report

All the information under this caption “Gustavson Report”, unless otherwise identified, is drawn or summarized entirely from the NI 43-101 compliant technical report by Gustavson dated March 25, 2008 and available on SEDAR at www.sedar.com.

Summary of Project Economics

The estimated economics of the 18,000 tonnes per day mine plan are summarized as follows:

| o | | Initial capital costs, including a $10 million contingency and pre-commercial production operating costs, of $192 million, of which $141 million has been spent as at December 31, 2007; |

| o | | Sustaining capital costs over the life of mine of $50 million; |

| o | | Estimated life of mine average cash operating costs of $297 per ounce of gold and gold-equivalent silver (AuEq - based upon a 1:52, gold:silver ratio), or $32 per ounce gold, net of silver credits (using $13 per ounce silver), excluding royalties; |

| o | | pre-tax cash flow having an estimated undiscounted net present value of $831 million and an internal rate of return of 26%; and |

| o | | payback of capital costs in 2 years. |

The open-pit mine plan and updated Dolores Mine economics do not take into account significant high-grade gold and silver mineralization that lies below and up to one kilometer peripheral to the proposed pit or increased gold and silver production that would result from processing high grade open pit ore through a mill. The completion of the mill feasibility study and evaluation of underground development are examples of the optimization efforts that will continue beyond the start of production from the Dolores open pit mine.

Summary of Capital and Operating Costs

Capital and operating costs use pricing current at December 31, 2007 for all costs and components.

Table 1 - Direct and Indirect Capital Costs

Category | Spent at Dec 31, 2007 | Forecast to complete | Forecast at Complete |

Mining Equipment | $34,396,653 | $0 | $34,396,653 |

Processing, Plant and Facilities | $77,183,970 | $5,500,000 | $82,683,970 |

Water management installations | $30,496 | $11,000,000 | $11,030,496 |

Camp and townsite | $10,945,647 | $0 | $10,945,647 |

Spare parts and initial fills | $773,496 | $2,500,000 | $3,273,496 |

Indirect and pre-production owner's costs | $8,896,072 | $19,136,020 | $28,032,092 |

EPCM | $8,873,784 | $3,000,000 | $11,873,784 |

Contingencies | $0 | $10,000,000 | $10,000,000 |

| $141,100,118 | $51,136,020 | $192,236,138 |

The anticipated $50 million of sustaining capital is spread over the mine life.

Table 2 - Operating Cost Summary - Life of Mine

Area | Cost per Tonne |

Mining | $4.73 |

Processing | $3.40 |

Support services (including laboratory) | $0.11 |

General and Administrative | $0.79 |

Total | $9.03 |

Reclamation and closure costs are estimated to be $9.5 million, or about $0.10 per tonne of crushed ore. These costs are not included in the operating cost estimation, but are included in the life of mine cash flows.

Summary of Dolores Mine Production

The 18,000 tpd mine plan estimates production of 99.3 million tonnes of proven and probable ore reserves at an average grade of 0.77 gpt gold and 39.67 gpt silver, with a strip ratio of 3.7:1, and using economic gold-equivalent cut-off grades ranging from 0.26 gpt to 0.37 gpt for the various ore types. Weighted average recovery from the leach pad is estimated at 74% for gold and 51% for silver. The mine would place approximately 2.44 million ounces of gold and 126.6 million ounces of silver on the heap leach pad and recover 1.766 million ounces of gold and 64.4 million ounces of silver (3.0 million ounces of gold equivalent (“AuEq”)) over a 16 year mine life.

Table 3 - Proven and Probable Reserves

NI 43-101 technical report dated March 25, 2008 is available on SEDAR

Reserves(1)(2) | Tonnes | Gold (gpt) | Gold (Oz) | Silver (gpt) | Silver (Oz) | AuEq (gpt)(3) | AuEq (Oz)(3) |

Proven | 56,629,000 | 0.80 | 1,453,946 | 40.32 | 73,415,147 | 1.47 | 2,677,532 |

Probable | 42,675,000 | 0.72 | 989,713 | 38.80 | 53,229,746 | 1.37 | 1,876,875 |

Proven & Probable | 99,305,000 | 0.77 | 2,443,659 | 39.67 | 126,644,893 | 1.43 | 4,554,407 |

(1) | Proven and probable reserves have been estimated as of December 31, 2007 in accordance with definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum on November 14, 2004. Gustavson has prepared and audited these estimates. William J. Crowl of Gustavson is the “Qualified Person” as defined in NI 43-101 for this mineral reserve statement. Some numbers may not sum due to rounding. |

(2) | Using $600 per ounce gold; $10.00 per ounce silver. |

(3) | Gold equivalent ounces (“AuEq”) are based on a 60:1 silver to gold ratio, without regard to metallurgical recoveries. |

The total audited measured and indicated resources at Dolores (which include the mineral reserves), are 3.1 million ounces of gold and 148.7 million ounces of silver, contained in 106.3 million tonnes grading 0.918 gpt gold and 43.5 gpt silver, at a cutoff grade of 0.4 gpt AuEq (see Table 4, below). An additional 661,000 ounces of gold and 27.5 million ounces of silver, contained in 30.3 million tonnes, are classified as “inferred resources” (see news release dated June 12, 2007 and SEDAR filings, available at www.sedar.com, for NI 43-101 technical reports).

Table 4 Measured and Indicated Resources

NI 43-101 technical report dated July 26, 2007 is available on SEDAR

Resources (4)(5) | Tonnes | Gold (gpt) | Gold (Oz) | Silver (gpt) | Silver (Oz) | AuEq (gpt) (6) | AuEq (6) (Oz) |

Measured | 54,092,000 | 0.980 | 1,705,000 | 46.5 | 80,788,000 | 1.754 | 3,051,000 |

Indicated | 52,200,000 | 0.853 | 1,432,000 | 40.5 | 67,954,000 | 1.528 | 2,565,000 |

Measured + indicated | 106,292,000 | 0.918 | 3,137,000 | 43.5 | 148,743,000 | 1.643 | 5,616,000 |

Inferred | 30,350,000 | 0.677 | 661,000 | 28.2 | 27,517,000 | 1.147 | 1,120,000 |

(4) | Measured and indicated resources and inferred resources estimates were prepared by employees of the Company under the supervision of Mark H. Bailey, P. Geol., President and Chief Executive Officer, and audited by CAM. Some numbers may not sum due to rounding. |

(5) | 0.4 gpt AuEq cutoff; cutoff based on gpt AuEq at 75:1 silver to gold ratio, having regard to metallurgical recoveries. |

(6) | Based on updated 60:1 silver to gold ratio, without regard to metallurgical recoveries. |

Summary of Sensitivity Analysis

Total estimated revenues from the sale of gold and silver over the life of mine is $2,023,918,000 based on $675 per troy ounce for gold and $13 per troy ounce for silver. Metal prices were calculated based on a weighted average of 60% historical data and 40% future projections.

The financial analysis was prepared on a pre-tax basis with sensitivities evaluated for the metal prices, capital cost, operating cost and metal production. A detailed after-tax inclusive financial analysis was outside the scope of the Gustavson report.

On a pre-tax basis, the project has an NPV (at 3% percent discount rate) of $563 million with an internal rate of return of 26% and a payback of 2 years. The project is most sensitive to changes in metal prices followed by metal production, operating costs, and initial capital costs.

Gustavson ran cash flow sensitivities at plus and minus five and ten percent to changes in operating and capital costs, metal price, and recovered metal. The Dolores Mine is most sensitive to metal price changes, followed by variations in recovered metal, and then operating cost. A large percentage of the capital cost has already been spent, so there is much less uncertainty regarding capital. The following figures have been prepared by Gustavson. Figure 1 shows the project cash cost sensitivity, Figure 2 shows the total cost sensitivity, and Figure 3 shows the NPV sensitivity.

Figure 1 - Cash Cost Sensitivity

Figure 2 - Total Cost Sensitivity

Figure 3 - NPV Sensitivity

Description and Location

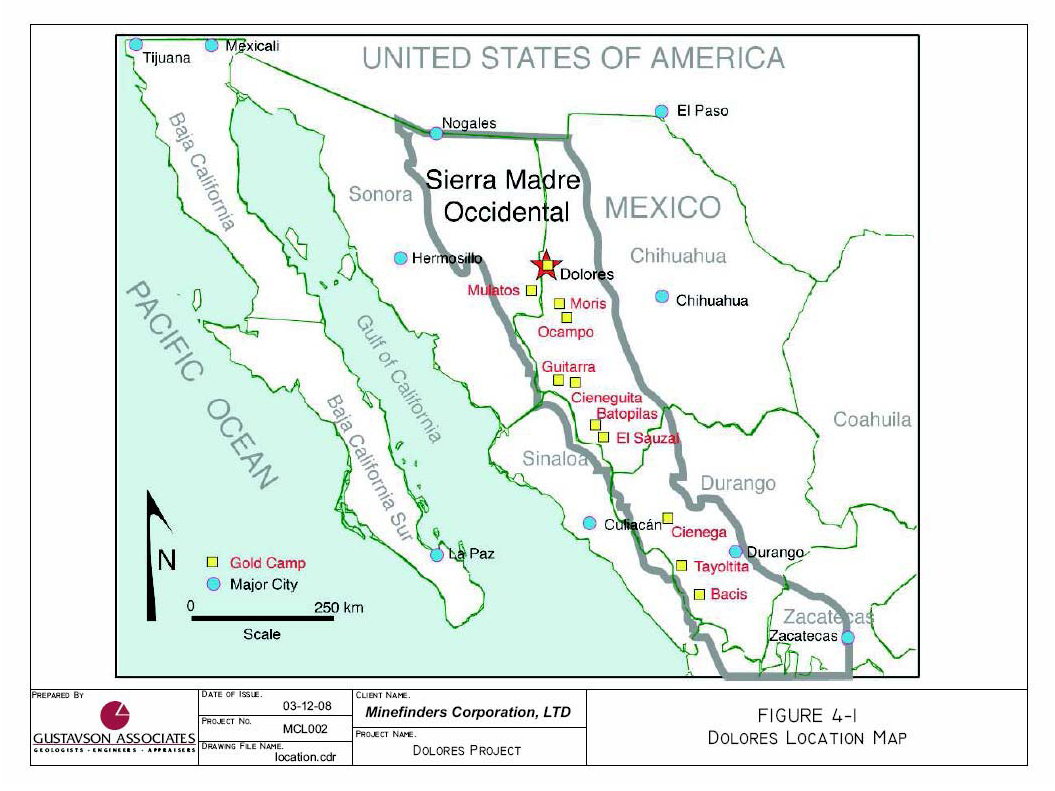

The Dolores project is located in the Sierra Madre Occidental Range in the State of Chihuahua, northern Mexico at Latitude 29° 00’ North, Longitude 108°32’ West. It is in the Municipality of Madera, about 94 km by road (45 km by air) southwest of the town of Madera, and 250 km west of the city of Chihuahua (Figure 4-1).

Mineral rights to the Dolores Project are controlled by three mining concessions shown in Table 5 and Figure 4-2, below. The Corporation, through its wholly owned Mexican subsidiary CMD, directly owns the Dolores, Silvia and Unificacion Real Cananea concessions. Total area of concessions under control of Minefinders remains 27,700 hectares.

As of September 2006, payment for the several smaller concessions was completed and full title transfers were duly registered and recorded by November of 2006, giving Minefinders 100 percent interest in all of the properties. A Net Smelter Return (NSR) royalty of 2 percent on silver and 3.25 percent on gold production is payable to Royal Gold, Inc. This royalty ownership only applies to the Dolores deposit contained within the confines of the Unificacion Real Cananea concession. There is no royalty on the other two concessions, which at this time do not contain reserves.

Table 5

Dolores Mineral Concessions | Title No. | Area (ha) | Expiry Date |

Silvia | 217587 | 2,866 | August 20, 2052 |

Unificacion Real Cananea | 227028 | 1,920 | December 12, 2039 |

Dolores | 221593 | 22,914 | March 3, 2054 |

Total | | 27,700 | |

The three concessions shown on Figure 4-2 and listed in Table 5 are contiguous and cover the Mineral Resource defined in this study. All claims, license fees and taxes for property owned or under the control of the Company, have been fully paid and are up to date. All concessions have been converted to exploitation status and the Company has the access and the right to carry out exploration activities up to and including all mining operations.

Access and Local Conditions

The property is accessed via a recently completed/upgraded 92-km access road suitable for truck traffic from Yepachi, Chihuahua. Alternative access is via dirt roads from Madera or light aircraft landing on a dirt landing strip located about 8 km from the mine site. Topography is rugged, with elevations ranging from 1,200 to 2,000 meters.

Vegetation is characteristic of the Sierra Madre, with thorny plants and cacti, replaced by oak and pine forests at higher elevations. The climate is typical of the Sierra Madre with an average temperature of 18° C, lows of -10° C and highs of 45° Celsius. Precipitation averages 250 mm, most of it occurring from July to September as brief heavy rainstorms. Snowfall is common in December and January but does not remain on the ground for long. Water is available from a small local reservoir, from underground workings, and from Rio Tutuaca.

Construction of the mine plant is presently nearing completion, including crushing facilities, leach pad, conveying and stacking, solution ponds, Merrill Crowe and refining facilities, shops, permanent campsite, and power generation and distribution. Pre-production mining (road pioneering) is taking place, with an effort to pre-strip waste and avoid ore which would require stockpiling.

The village of Dolores occupies an area directly over the southern extend of the mineral resource. The agreement between the Company and Ejido Huizopa allows for the relocation of the village. New homes for the villagers have been completed about three kilometres from the mine site. Residents of the village are in the process of moving.

History

Mining in the Dolores region started in the 1800's. Mechanized production occurred between 1915 and 1929, with no records of any production since that time. Incomplete mining records from 1922 to 1931 indicate that total production during this time was about 372,000 tonnes of ore containing over 116,000 ounces of gold and 6 million ounces of silver. Most of this production came from several underground stope mine operations within and beyond the Dolores resource study area.

The district then remained idle until 1993 when the Company began acquiring a land position. Drilling started in 1996, with a total of over 200,000 meters of combined core and reverse circulation drilling in 850 holes to June of 2007. Several independent mineral resource estimates of the Dolores property were prepared between 1997 and 2007, showing an increasing mineral inventory as drilling progressed. A complete bankable level feasibility study for the project was prepared by KCA in 2006, and project construction is taking place at the site now. Additional exploration drilling was completed in 2006 with the objective of obtaining data that would further enhance quality of the Mineral Resource estimate. CAM was engaged in May 2007 to prepare a new audit of the updated resource estimation that integrated the newly acquired data. Gustavson was retained in November of 2007 to prepare a reserve estimate and production schedule based on the audited Dolores April 2007 mineral resource. Pre-production stripping is proceeding concurrent with construction. The first gold and silver production is expected in the second quarter of 2008.

Geology and Mineralization

The Dolores gold-silver deposit in the Sierra Madre Occidental is a low- to medium-sulfidation epithermal deposit hosted in andesite volcanic rocks of the Lower Volcanic Series of Tertiary age. Mineralization is present in a NNW-striking, steeply-dipping structural zone, and is concentrated in fractures and stock works that lie within and adjacent to latite dikes. The deposit shows characteristics similar to economic deposits in volcanic rocks of Tertiary age in Mexico, South America, Indonesia and elsewhere. Gold and silver mineralization is present in veins, silica stockworks, breccias and replacements. Deeper mineralization tends to be preferentially concentrated in high-grade structurally controlled zones that evolve into wider stockworks, veinlets and disseminations at higher elevations. Mineralization is limited to the lowermost portion of the less competent, more permeable, latite flows and tuffs that overlie the andesitic host rocks. Minerals present include galena, sphalerite, stibnite, arsenopyrite pyrite, silver sulfides, native silver and visible gold. Clay-illite-hematite alteration with no significant gold or silver values (commonly referred to as “steam heated” alteration) also is present above and lateral to mineralized zones and is a characteristic feature of this type of epithermal mineralization.

Mineralization occurs in an area over 4,000 meters long and up to 1,000 meters wide, with over 700 meters of vertical extent. The extent of mineralization at depth has not been fully defined. The bulk of the deposit is high in the system where feeders widen into breccias and stockworks up to a few hundred meters wide that form halos around the main structures. Grades in the feeders are in the ranges of 10 to 30 g/t gold and 300 to more than 1,000 g/t silver. Disseminated mineralization that lies adjacent to high grade feeder structures at upper levels has lower grades in the range of 0.3 to 2 g/t gold and up to 150 g/t silver. The width of coherent mineralization commonly is about 200 up to 300 meters wide, and lies in zones that trend NNW and dip steeply to the west.

Some vein and disseminated gold-silver mineralization is known to extend in a NNW and SSE direction beyond the limits of the resource estimate area. This mineralization may be considered exploration potential and may eventually be classed as Resource.

Exploration

Exploration drilling now occurring at Dolores is intended to expand the resource below and peripheral to the open pit mine. No changes to the resource model have occurred since CAM’s audit of the resource in July 2007.

During 1994, Minefinders carried out limited initial mapping and sampling to evaluate the Dolores property. Since November 1995, the property has been subject to extensive geological, geochemical and geophysical surveys and exploratory drilling to identify drilling targets and define a mineralized gold and silver system. Additionally, surface and underground sampling has exceeded 10,000 rock chip samples.

Drilling

The mineral resource estimate has not changed since it was last audited by CAM in July 2007. Sixteen reverse circulation holes and thirteen diamond drill holes were not included in the CAM audit because the results were not available at that time. Gustavson has not modified the earlier resource estimate and has not included these drill holes in its analysis. Current drilling is designed to expand the known resource at Dolores and does not impact or otherwise influence the minable mineral reserves considered here.

Sampling and Assaying

CAM reported in its NI 43-101 compliant audit that logging and sampling procedures in 2006-7 followed industry-standard norms, as did earlier drilling campaigns. CAM concluded the quality assurance and quality control used by the analytical laboratories and by the Company’s protocols are appropriate and conform to common industry practice.

Mineral Resource Estimation

The Dolores mineral resource was audited in July 2007 by CAM. The Company provided Gustavson with the audited resource block model, from which Gustavson developed the minable reserves and production schedule. Gustavson was not charged with validating or verifying the previously audited resource estimate. Gustavson used a re-blocked resource model to more closely represent current mining practice and the equipment fleet now mining the deposit. Gustavson investigated the re-blocked model tonnage and grade to verify that the re-blocked model represents minable units.

Minefinders' Mineral Resource estimates, as audited and publicly released on June 12, 2007, are shown in Tables 6 and 7.

Table 6 - Dolores Measured and Indicated Mineral Resource Estimates

(Minefinders, 2007- Audited by CAM)

Cutoff | Tonnes | Gold | Gold | Silver | Silver | Aueq | Aueq |

g/t 1 | | g/t | ounces | g/t | Ounces | g/t 2 | ounces 2 |

3.0 | 10,571,000 | 3.844 | 1,306,000 | 155.3 | 52,769,000 | 6.432 | 2,186,000 |

2.0 | 20,225,000 | 2.721 | 1,769,000 | 114.6 | 74,539,000 | 4.632 | 3,012,000 |

1.0 | 45,077,000 | 1.680 | 2,435,000 | 76.1 | 110,305,000 | 2.949 | 4,273,000 |

0.8 | 55,032,000 | 1.470 | 2,602,000 | 67.4 | 119,201,000 | 2.593 | 4,588,000 |

0.6 | 73,436,000 | 1.202 | 2,838,000 | 56.0 | 132,095,000 | 2.135 | 5,039,000 |

0.5 | 88,295,000 | 1.052 | 2,987,000 | 49.5 | 140,531,000 | 1.877 | 5,329,000 |

0.4 | 106,292,000 | 0.918 | 3,137,000 | 43.5 | 148,743,000 | 1.643 | 5,616,000 |

0.3 | 123,382,000 | 0.819 | 3,249,000 | 39.0 | 154,826,000 | 1.470 | 5,829,000 |

1. Cutoff based on grams per tonne Aueq at a 75:1 silver to gold ratio having regard to metallurgical recoveries.

2. Grams per tonne Aueq resource based on updated 60:1 silver to gold ratio.

Table 7 - Dolores Inferred Mineral Resource Estimate (Minefinders, 2007) 0.4 g/t Cutoff

| Tonnes | Gold ounces | Silver (ounces) |

Inferred | 30,350,000 | 661,000 | 27,517,000 |

1. Cutoff based on grams per tonne Aueq at a 75:1 silver to gold ratio having regard to metallurgical recoveries.

Gustavson Associates Reserve Audit

Gustavson verified the reserve model by re-estimating the grade using longer composite intervals and alternative modeling techniques. Results indicate the mineral resource estimate is reasonable. Reblocking the resource model to 6x10x7.5 meter blocks appears to produce selective mining unit grades similar to other estimation methods. Gustavson recommends closely monitoring mine production and reconciling it to the block model. Modifying the model as needed, to match actual mining practice and production data will help create the best possible production planning tools.

The Dolores mineral reserve estimate was created and modeled using Datamine’s version 4.0 (release 1740.7) NPV scheduler. The re-blocked resource model was used for the optimization analysis using the Datamine economic pit limit optimizer. Gustavson ran the model utilizing incremental profit factors from 1% to 100% (full value) of the calculated block value to create shells of increasing total value and decreasing marginal value. Gustavson used pit 38 shell as a basis for final pit design with haul roads.

Overall, the incremental change going from pit shell 38 to the ultimate pit would require mining 45% more rock and processing 21% more rock to increase the life of mine profit by 7%. Selection of this shell gives a more economically robust pit design thus pit shell 38 was selected as the basis for final design. Given the physical topographic constraints on the project, and increased risk associated with mining more rock, Gustavson believes the design is prudent.

Final Pit Design with haul roads

The Dolores pit haul roads were designed with a 10% grade and 26 meter overall width. 6.4 meter wide catch benches were designed with every other bench (every 15m) having a 67 degree inter-bench face angle. Table 8 shows the Dolores Proven and Probable Mineral Reserves from the final pit design.

Table 8

Dolores Project Proven and Probable Mineral Reserves |

| | | | | |

ORE | | | MnOx | Sulfide | Mixed | Oxide | Total |

Proven | TONNES | | 2,368,000 | 17,440,000 | 18,755,000 | 18,066,000 | 56,629,000 |

| Au (g/t) | | 0.65 | 1.05 | 0.72 | 0.66 | 0.80 |

| Ag (g/t) | | 65.40 | 33.58 | 42.53 | 41.25 | 40.32 |

| Au cont oz | 49,398 | 588,768 | 431,615 | 384,166 | 1,453,946 |

| Ag cont oz | 4,978,629 | 18,829,966 | 25,648,377 | 23,958,175 | 73,415,147 |

| Au rec oz | | 39,024 | 369,876 | 340,976 | 303,491 | 1,053,367 |

| Ag rec oz | | 1,045,512 | 11,955,406 | 13,337,156 | 11,020,761 | 37,358,835 |

Probable | TONNES | | 1,466,000 | 12,623,000 | 15,678,000 | 12,908,000 | 42,675,000 |

| Au (g/t) | | 0.58 | 0.96 | 0.65 | 0.59 | 0.72 |

| Ag (g/t) | | 62.08 | 32.68 | 39.68 | 41.05 | 38.80 |

| Au cont oz | 27,298 | 390,369 | 326,616 | 245,429 | 989,713 |

| Ag cont oz | 2,926,560 | 13,263,477 | 20,002,619 | 17,037,092 | 53,229,746 |

| Au rec oz | | 21,565 | 244,071 | 258,027 | 193,889 | 717,552 |

| Ag rec oz | | 614,578 | 8,336,294 | 10,401,384 | 7,837,062 | 27,189,318 |

TOTAL | TONNES | | 3,834,000 | 30,063,000 | 34,433,000 | 30,974,000 | 99,305,000 |

| Au (g/t) | | 0.62 | 1.01 | 0.68 | 0.63 | 0.77 |

| Ag (g/t) | | 64.13 | 33.20 | 41.24 | 41.17 | 39.67 |

| Au cont oz | 76,696 | 979,137 | 758,231 | 629,595 | 2,443,659 |

| Ag cont oz | 7,905,189 | 32,093,443 | 45,650,995 | 40,995,267 | 126,644,893 |

| Au rec oz | | 60,590 | 613,947 | 599,002 | 497,380 | 1,770,919 |

| Ag rec oz | | 1,660,090 | 20,291,700 | 23,738,540 | 18,857,823 | 64,548,152 |

WASTE | TONNES | | | | | | 367,120,000 |

The production schedule for the life of the project was created using Datamine NPV Scheduler. Optimized extraction sequences were created and used as a basis for design of each mining phase.

Rather than balance stripping ratio over the project life, truck hours were balanced based on changing the productivity by phase and bench required to deliver rock to their respective dumps or primary crusher. The productivity was then used to determine truck fleet requirements and total equipment hours for each time period. Equipment hours then formed the basis of the equipment operating cost estimate.

Dolores Mine Upside Potential

The information and forward looking statements in the following paragraph provides information not specifically included in the Gustavson Report.

The Company is planning to undertake a feasibility study in 2008 to assess the economic viability of adding a flotation mill, which could enhance recoveries from high-grade ore in the open pit, process additional underground ore and increase annual production capacity. Previous flotation mill test work showed recoveries from sulphide ores of 90-92% for gold and 90% for silver.

Additional drilling reflected in the new resource model as audited by CAM has increased the Company’s understanding of the geometry, grade, and tenor of mineralization below the planned open pit mine. The drilling has confirmed sufficient underground high-grade resource to support a pre-feasibility study to develop the underground portion of the Dolores deposit. Based on a positive pre-feasibility study, an exploration/production decline will be constructed to provide access to further define and develop reserves in conjunction with initiating underground mining operations. With an aggressive budget, it is anticipated that these resources could be brought into production within a three to four year period.

By press release on February 27, 2008, the Company reported results from recent drilling of the Dolores East Dike satellite target, located approximately 200 meters from the eastern edge of the Dolores open pit mine. Drilling

results indicate a significant high-grade gold and silver deposit adjacent to the current reserve at the Dolores Mine with high-grade intercepts including 41.2 meters containing 4.07 gpt gold and 148.1 gpt silver and 83.8 meters containing 2.01 gpt gold with 76.4 gpt silver. Ten individual intervals exceeded the 10 gpt gold-equivalent threshold (at 60:1 silver to gold ratio) with assay values that ranged up to 73.64 gpt gold and 723.7 gpt silver over 1.52 meters.

Drilling in late 2007 was directed towards delineation of the Dolores East Dike satellite deposit with the addition of 20 infill holes along the 350 meter strike length of this northwest-trending mineralized zone. This drilling, in combination with the 11 previously drilled holes, provides the density of drill data necessary to model and estimate a new resource for potential inclusion in the Dolores Mine reserves and economics. The drilled Dolores East Dike deposit dips moderately westward sub parallel to, and along, the slope of the East Dike ridge. This geometry suggests that the resource could be readily mined by side-hill strip with a low strip ratio.

The Dolores East Dike deposit consists of near surface mineralization characterized by high-grade structures surrounded by lower-grade disseminated gold and silver mineralization extending outward over widths of 20 to 50 meters. Mineralization drilled to date extends from section 1850 N through 2200 N for more than 350 meters of strike-length. Additional extension of the Dolores East Dike zone to the north is indicated by core hole D-451 that was drilled in 2006, located more than 50 meters further to the north and somewhat offset to the east, that encountered mineralization including individual intercepts of up to 15.98 gpt gold and 26.0 gpt silver over two meters of width. Consequently, mineralization related to the Dolores East Dike remains open in several directions. Refer to press release dated February 27, 2008 for the summary of the material 2007 Dolores East Dike deposit drill intercepts in relation to their grades and widths.

The open-pit mine plan and updated Dolores Mine economics do not take into account the East Dike deposit or other significant high-grade gold and silver mineralization that lies below and up to one kilometre peripheral to the proposed pit or increased gold and silver production that would result from processing high grade open pit ore through a mill. The completion of the mill feasibility study and evaluation of underground development are examples of the optimization efforts that will continue beyond the start of production from the Dolores open pit mine.

NORTHERN SONORA PROPERTIES

Although these properties are not currently material to the Company, the Company considers the Northern Sonora Properties to be worthy of future exploration expenditures and has been conducting, and will continue to conduct, exploration work on each of the following properties.

The information given in this section was prepared by Mark H. Bailey, the Corporation’s President and CEO, and a “qualified person” as defined in NI 43-101.

Description and Location

The Northern Sonora Properties are located in the northern part of Sonora State, Mexico. The Northern Sonora Properties consist of the 14 exploration/exploitation concessions described below, comprising a total of approximately 28,300 hectares.

Northern Sonora Properties Concessions

Concession Name | Title No. | Area (hectares) | Expiry Date |

Abe | 216305 | 996 | April 29, 2052 |

Oro Fino | 215622 | 649 | March 4, 2052 |

La Pistola | 220056 | 1,698 | June 3, 2053 |

La Gloria | 221626 | 1,087 | March 3, 2054 |

Los Adobes | 218455 | 6,173 | November 4, 2052 |

El Ruido | 218448 | 3,788 | November 4, 2052 |

Anita (amplificacion)* | 228331 | 6,840 | November 7, 2056 |

El Manzanal ** | 213593 | 220 | May 18, 2051 |

Anita ** | 221743 | 500 | March 19, 2054 |

El Durazno 2* | 227956 | 2117 | September 14, 2056 |

Tio Flaco | 221168 | 708 | December 2, 2053 |

El Correo | 217446 | 2,718 | July 15, 2052 |

Cadena de Oro | 220974 | 366 | November 10,, 2053 |

El Durazno ** | 212967 | 440 | February 20, 2051 |

La Virginia | 230426 | 45,798 | August 23, 2057 |

La Virginia 2 | 230427 | 31,216 | August 23, 2057 |

Rusty | 231238 | 4,963 | January 25, 2058 |

Ryan Fracc. 1 | 231239 | 677 | January 25, 2058 |

Ryan Fracc. 2 | 231240 | 2 | January 25, 2058 |

Georgia Fracc. 1 | 231241 | 254 | January 25, 2058 |

Georgia Fracc. 2 | 231242 | 64 | January 25, 2058 |

| | | |

Total Area | | 111,274 | |

* Staked in 2008

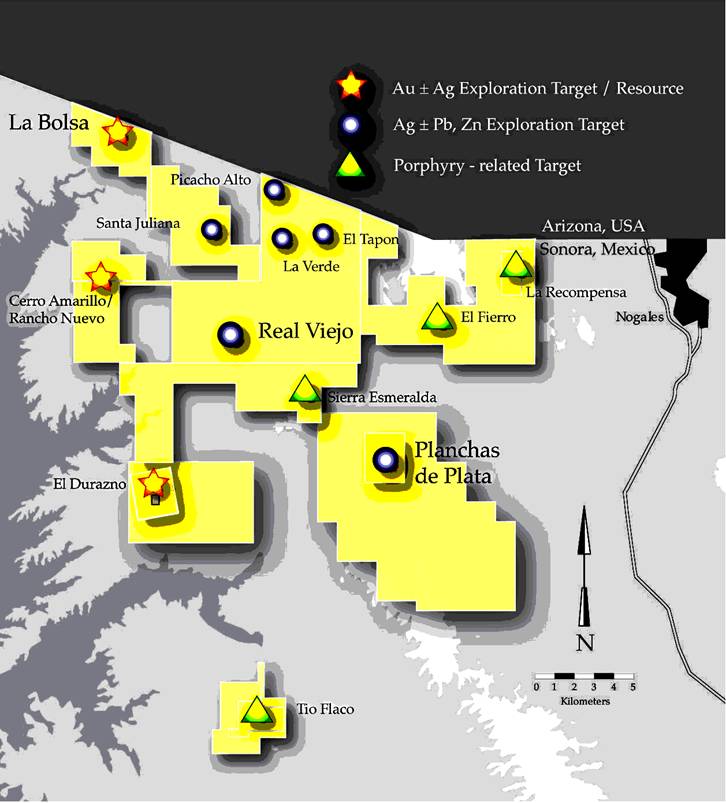

In 2007 the Company staked an additional 82,974 hectares of mineral concessions that were awarded by the Mexican government to the Company. This ground encompasses several different prospective precious metals mineralized trends within the state of Sonora, Mexico that were identified during regional reconnaissance programs completed by the Company during the year. Concessions staked previous to 2007 generally occur within the Company’s Northern Sonora Project area which includes the La Bolsa property in the northwest corner of the block, the Real Viejo silver prospect in the central portion of the concessions, the Planchas de Plata (Anita claim) silver prospect located to the southeast of the main concessions, and porphyry related base metal mineralization in the eastern portion of the concession block (the El Fierro and La Recompensa mineralized systems) as indicated in Figure 5. These project areas have been the site of substantial exploration drilling including that completed at the Planchas de Plata properties and the Real Viejo properties during the course of 2007. The Company has obtained all required permits to conduct exploration drilling on the projects through the next several exploration programs. The properties are not subject to any environmental liabilities.

Climate, Accessibility, Local Resource Infrastructure and Physiography

The climate in the area is high desert, semi–arid with average annual precipitation of approximately 20 cm. Most of the precipitation falls during the wet season lasting from July to mid September. Temperatures range from 5 degrees Celsius in winter to 48 degrees Celsius in summer. Exploration can be undertaken throughout the year.

The local economy is supported mainly by cattle ranching, with the nearby city of Nogales, Mexico (population exceeding 100,000), providing most of the economy for the region. Skilled and unskilled labour is abundantly available from nearby Nogales. Water for drilling is available from local sources including ponds and water wells. Surface rights to all known areas of mineralization and potential waste disposal, tailings, storage, heap leach pads and plant sites are held under agreements by the Company.

Site topography is characterized by low to moderately rugged terrain with elevations ranging from 1,000 to 1,800 meters above sea level.

Figure 5 - Northern Sonora Properties

Nature of Transport

The project area is serviced by narrow, winding, dirt and paved roads from Nogales. A network of roads to provide access for drilling has been established on several of the more advanced prospects located on the properties. Modern services are available at Nogales, within 30 kilometres of most of the prospects.

Sampling and Integrity of Samples

Since 1994 the Company has taken more than 9,000 surface samples over the project area, drilled 131 holes at La Bolsa, 44 holes on the Real Viejo prospect, 103 holes on the Planchas de Plata prospect, and completed extensive geological mapping and airborne geophysical surveys over the entire claim block. All assays were completed by Bondar Clegg, ALS Chemex or Inspectorate under the same quality assurance regime as for the Dolores property.

La Bolsa Property

The La Bolsa property is located on the Abe concession in the northern part of Sonora State, Mexico, approximately 30 kilometres west of the Mexican city of Nogales, and 97 kilometres SSW of Tucson, Arizona. The property is best accessed from Tucson, by taking Highway I–19 approximately 110 kilometres south to Nogales. Access to the property from Nogales is by four-wheel drive vehicle over a combination of paved and dirt roads.

History of Property

There is no known written information pertaining to the La Bolsa property although historic pits, shafts, adits and exploratory trenches occur within the property. The greatest concentration of these are found on top of, and on the east flank of the main mineralized hill where an access tunnel, several shafts, and over half a dozen surface pits were dug to exploit high grade (to 0.48 opt gold and 8.3 opt silver – verified by the Company) carbonate-rich breccias and veining.

Ownership

The La Bolsa property was staked by the Corporation’s wholly owned subsidiary Minera Minefinders, S.A. de CV. (“Minera Minefinders”) which is the registered owner of all the exploration concessions. The property is not subject to any underlying royalties or title encumbrances.

Although the Company owns the mineral rights, the surface rights to much of the Abe Concession are owned by Roberto Pierson Suarez (“Pierson”) who has executed a surface rights agreement that has a term of 20 years ending in 2017, and is renewable for an additional 20 years. The Company pays the annual rent and disturbance fees and the Company will continue to hold the property and advance it to a feasibility study as market conditions allow. In addition, the agreement provides that the Company is to pay Pierson a one-time fee of $500,000 for each mine that the Company puts into production on a Pierson–owned property.

Geology and Mineralization

The geological setting of the La Bolsa property consists of Tertiary volcanic and sedimentary units shown to overlie or intrude Cretaceous and Jurassic sedimentary and volcanic rocks consisting of interbedded siltstone, sandstone, conglomerate, limestone, and rhyolite flows and tuffs.

Several Tertiary volcanic and volcaniclastic rock types have been identified on the property. Volcaniclastic and tuff beds are correlated to the lowermost units of the Tertiary Montana Peak Formation in the Oro Blanco Mining District of Arizona, located to the immediate north.

The La Bolsa property contains an inferred resource of 8.3 million tons grading 0.025 opt gold and 0.254 opt silver. Mineralization and alteration is characterized by silicification, sericitization and quartz–calcite or quartz–adularia stockwork veining and brecciation hosted by volcaniclastic sediments and intermediate volcanic flows intruded by felsic dikes and plugs. Quartz–calcite veins up to 4.56 meters in width have been noted at the surface although most of the quartz–veining occurs as stockworks. Pink replacement textures have been described as potassic alteration or

adularization but no pattern has been defined. The presence of pyrite is suggested by iron–oxide pseudomorphs and hematite and limonite along fractures. Carbonate veins and breccia zones are found throughout the mineralized La Bolsa property.

Exploration Activity

The La Bolsa mineralized system was discovered and staked in 1994 by Company personnel while exploring the Hill of Gold prospect in the Oro Blanco Mining District (Arizona) adjacent to the international boundary. Further prospecting, mapping and rock geochemical sampling (1,200 samples) outlined a coincident gold–silver anomaly which extends for about 800 meters and averages about 120 meters in width. Approximately 994 meters of surface trench rock sampling by the Company produced significant values, including 125 meters averaging 1.10 gpt gold in Trench 95–1 and 152 meters averaging 1.10 gpt gold along sample line 1000S. During late 1995 and early 1996, 42 reverse circulation drill holes totalling 4,835 meters and 7 diamond drill holes totalling 614.5 meters were completed.

In mid–1996, a preliminary resource estimate concluded there was gold mineralized material of 122,600 equivalent ounces of gold (i.e., 4,087,000 tons at .030 opt using .01 cut-off), including modest silver credits. Bottle-roll cyanide leach metallurgical test work on eight samples of mineralized drill cuttings leached over a period of 72 hours had recoveries ranging from 57% to 95%, while four samples (including a split of the 57%/72 hr. sample) leached for 96 hours had extraction rates in the 80.6% to 86.0% range. Bottle roll tests suggested amenability of the samples to heap leach extraction techniques with low reagent consumption.

A second phase drilling program was completed in August 1998. Results from that drilling included 26 mineralized holes from the 28 holes drilled to extend the La Bolsa property. A revised resource estimate utilizing polygonal methods tabulated 8.3 million tons, grading .025 opt gold and .254 opt silver, containing 208,000 ounces of gold and 2.1 million ounces of silver, at a .01 opt cut-off grade.

Additional work on the resource area was carried out in 2003 to advance the property nearer to the pre-feasibility study stage. The drilling program completed in 2003 included drilling of 23 core holes for 2,085 meters, and 11 RC holes for 1,838 meters. In 2004, an additional 15 core holes totalling 1,418 meters were drilled.

Drilling by the Company in early 2008 was initiated primarily to obtain an additional 10 core holes to provide material for completion of additional metallurgical column testwork that will be used to confirm anticipated recoveries of gold and silver for the project. Several of these holes also were placed to outline additional resource potentials within the project area. Geochemical results from this program are pending.

To date a total of 144 drill holes totalling have been completed within the La Bolsa Project area.

Additional exploration is required at the La Bolsa property to bring the project to the pre–feasibility stage. This will entail limited infill drilling, systematic engineering study, bulk density testing, geostatistical analysis of the assay database, together with mining studies, ongoing metallurgical testwork, and economic evaluations.

Planchas de Plata and Real Viejo Property

Following the initial success on the La Bolsa discovery, the Company staked additional concessions expanding the Northern Sonora Properties to their present size. Work on these additional concessions during the period from 1996 through 2007 included regional and detailed geologic mapping, geochemical sampling programs, both reverse-circulation and core drill programs, and airborne and ground geophysical surveys. This comprehensive exploration effort resulted in the discovery of additional gold–silver mineralized systems and two porphyry copper related base metal systems.

Ownership

The concessions were staked and are 100% controlled by Minera Minefinders. Surface rights in the area belong to various ranchers. Agreements have been executed between the Company and several surface rights owners. The agreements provide for surface rights for exploration, development, and mining within the properties, in return for annual payments of $10,000 to $35,000, and lump-sum compensation of $350,000 to $550,000 for any mine to go into production on these properties.

Geology and Mineralization

The geologic setting of the Northern Sonora Properties consists of Tertiary intermediate to felsic flows and tuffs overlying a diverse package of conglomerate, sandstone, siltstone, and thinly layered limestones with interspersed intermediate volcanic flows and tuffs. The entire area is believed underlain by Mesozoic metavolcanic and metasedimentary units. The structural regime is dominated by an older series of northeast trending structures cut by a later series of northwest trending horsts and grabens. Gold mineralization is localized at the edges of several circular features, which are interpreted as related to Tertiary volcanism.

Mineralized systems identified to date are dominantly silver-lead-zinc gold systems. These are confined to ENE and NW trending structural zones occurring within Mesozoic to early Tertiary volcanic and volcaniclastic rocks. These systems vary in size from 500 to 2,000 meters strike length. The El Fiero and La Recompensa targets are large porphyry related base-metal (Cu-Mo-Zn-Pb) targets located within the eastern portion of the claim block. Alteration at each of these systems includes square kilometres composed of strong iron oxides, sericitic and argillic alteration, and scattered quartz tourmaline stockworks in Jurassic to Cretaceous felsic volcanics. Intruding the area of the projects is a series of rhyolite, granodiorite, and diorite dikes and plugs. Exploration mapping and sampling will continue on these targets as time allows in an effort to bring them to the drill stage.

Exploration Activity

From 1996 to early 2002 geological mapping and geochemical sampling utilizing the reconnaissance mapping and geophysical surveys was completed over an area exceeding 150 square kilometres to the south and east of the La Bolsa property. This work led to the discovery of at least fourteen major areas of anomalous gold and/or silver mineralization. Historic mining activity can be found at most of these targets with the most extensive workings developed on silver mineralization such as at the La Dura Mine, Real Viejo Mine, Santa Juliana Mine, and La Recompensa Mine. There are no historic records for these workings and only the La Recompensa Mine has been recorded on existing maps. Exploration work since 2002 has focused on the systematic drill testing of the more prospective zones.

During late 1996 through 1997 the Company contracted a helicopter–borne magnetic, radiometric and electromagnetic survey as well as colour aerial photography, covering more than 90,000 hectares of the combined La Reserva/El Correo, Northern Sonora and Oro Blanco properties. The purpose of this survey was to assist with mapping lithology, structure, alteration and potential mineralized zones.

Beginning in 2004, drill programs were initiated on both the Real Viejo and Planchas de Plata silver prospects. To the end of 2007 the Company has completed a total of 44 holes (28 RC and 16 core, totalling 5,503 meters) at Real Viejo, and a total of 126 holes (48 RC and 78 core, totalling 24751 meters) were completed at Planchas de Plata. In 2006, due to success at Planchas de Plata the Company staked an additional 6,840 hectares covering the south-eastern extension of the system and completed 17.4 kilometres of ground based geophysics. The Company has now identified mineralization along six kilometres of strike length within the Planchas de Plata district and continues to assess the project. Positive results at Real Viejo in late 2007 also have resulted in renewed drilling which is ongoing at the Real Viejo Project area. Additional drilling is anticipated for both projects during the course of 2008.

PROPERTY INTERESTS IN THE UNITED STATES

The Company has interests in four claim areas in the United States: the Gutsy/Buckskin Mountain property and Dottie property in the state of Nevada, the Oro Blanco property in the state of Arizona and the 30 unpatented lode mining claims known as the Wickes property in Montana, acquired in 2006. These properties are not sufficiently advanced to make them material to the Company’s asset base.

The Gutsy/Buckskin Mountain property is located in Elko County, Nevada along the Carlin Trend due north of Newmont’s Rain Mine. Drilling at the Gutsy/Buckskin Mountain property did not indicate sufficient potential to warrant further work going forward. The Dottie property is located in Elko County, Nevada, approximately eight miles west of Queenstake Resources’ Jerrit Canyon operations. The Company’s Oro Blanco property in Arizona adjoins the La Bolsa property in northern Sonora.

Exploration work on the Company’s Lodi Hills and Clear projects in Nevada did not show significant potential and these properties were dropped in 2006.

SPECIALIZED SKILL AND KNOWLEDGE

The Company has entered the commissioning phase at the Dolores Mine and is engaging many employees with special skills, including senior managers with project management skills, mining and processing engineers, mine geologists, assayers, fleet maintenance engineers, machine operators and mechanics. There is great competition for such personnel in the current buoyant state of the industry. The Company has an active recruitment program, already has several highly qualified project management engineers on staff, and anticipates that it will not have significant difficulty in recruiting other personnel as the Dolores Mine moves toward commercial production. Training programs are in place for workers who are recruited locally.

ENVIRONMENTAL PROTECTION

There was no significant financial and operational effect from environmental protection requirements in 2007. However, as the Dolores Mine moves toward commercial production the Company’s exposure to financial costs and operating requirements will escalate rapidly. The Gustavson report incorporates in its financial and operating analysis all of the costs and operational requirements necessary for the Company to comply with the highest international environmental protection standards. The Company intends to comply fully with those standards and any that may be imposed by regulation or otherwise. In its Financial Statements for 2007 the Company has accounted for future reclamation costs that will arise from its construction and operating activities to December 31, 2007.

NUMBER OF EMPLOYEES

As at December 31, 2007, the Company had a total of 231 employees. None of the Company's employees belongs to a union or is subject to a collective agreement. The Company considers its employee relations to be good. The Company expects to be in full operational mode by mid-2008, and will be increasing its on-site workforce at Dolores to approximately 310 employees plus 80 contract mine equipment maintenance personnel.

COMPETITION

The Company competes with other mining companies for the acquisition of mineral claims, permits, concessions and other mineral interests as well as for the recruitment and retention of qualified employees. There is significant competition for the limited number of gold acquisition opportunities and, as a result, the Company may be unable to acquire attractive gold mining properties on terms it considers acceptable.

RISK FACTORS

The Corporation’s securities should be considered a speculative investment due to the nature of its business. Investors should carefully consider all of the information disclosed in this AIF, including all documents incorporated by reference, before making an investment in the Corporation’s securities. The following risk factors could materially affect the Company’s business, financial condition or results of operations and could cause actual events to differ materially from those described in forward-looking statements. In such an event, the market prices of the Corporation’s securities could decline and investors could lose all or part of their investments. The risks include but are not limited to those risks set forth below.

No revenue from operations and no mining operations.

The Company is a mineral exploration company in the process of developing a mine and has no revenue from operations and no mining operations of any kind. Other than the Dolores project, its properties are in the exploration stage, and the Company has not defined or delineated any proven or probable reserves on any of its other properties. Mineral exploration involves significant risk because few properties that are explored contain bodies of ore that would be commercially economic to develop into producing mines. If its current exploration programs do not result in the discovery of commercial ore, the Company may need to write-off part or all of its investment in its existing properties and will seek to acquire additional properties. The determination of whether any mineral deposits on its properties are economic is affected by numerous factors beyond its control, including:

| • the metallurgy of the mineralization forming the mineral deposit; |

| • market fluctuations for metal prices; |

| • the proximity and capacity of natural resource markets and processing equipment; and |

| • government regulation of prices, taxes, royalties, land tenure, land use, importing

and exporting of minerals and environmental protection. |

No history of production and no assurance of successful operations or profitable production of precious metals.

The Company has no history of producing metals from its current portfolio of mineral exploration properties. Most of its properties are in the early development or exploration stage. Only the Dolores project is currently under development, and production there will be subject to completing construction of the mine, processing plants, roads, and other related works and infrastructure. As a result, the Company is subject to all of the risks associated with establishing new mining operations and business enterprises including:

• the timing and cost, which can be considerable, of the construction of mining and processing facilities;

• the availability and costs of skilled labour and mining equipment;

• the availability and cost of appropriate smelting and refining arrangements;

• compliance with environmental and other governmental approval and permit requirements;

• the availability of funds to finance construction and development activities;

• potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants which may delay or prevent development activities; and

• potential increases in construction and operating costs due to changes in the cost of fuel, power, materials and supplies.

The costs, timing and complexities of mine construction and development are increased by the remote location of mining properties such as the Dolores project. It is common in new mining operations to experience unexpected problems and delays during construction, development and mine start-up. In addition, delays in the commencement of mineral production often occur. Accordingly, the Company cannot assure investors that its activities will result in profitable mining operations or that the Company will successfully establish mining operations or profitably produce metals at any of its properties.

Arrangements with Ejido Huizopa and its members.

The members of the local commune, Ejido Huizopa, are local inhabitants who have rights to conduct agricultural activities on property which includes and surrounds the area where the Dolores project is located. To bring the Dolores project to production the Company needs to have satisfactory arrangements in place with the Ejido and its members for access and surface disturbances. The Company believes such arrangements are in place, and is implementing certain long-term solutions for the relocation of members of the Ejido. Any inability to successfully maintain those agreements with the Ejido and its members could impair or impede the Company’s ability to successfully mine the property.

Funding to develop mineral properties and to complete exploration programs.

The Company has limited financial resources. It had working capital of approximately $28.8 million at December 31, 2007 and had cash and cash equivalents of $20.9 million at that date. In addition, the Company has access to a $50 million revolving credit facility. The Company intends to fund its operations from working capital, the revolving credit facility and revenue from production at the Dolores project. Its ability to continue future exploration and development activities, if any, will depend in part on its ability to commence production and generate material revenues from production at the Dolores project or to obtain additional external financing. The sources of external financing that the Company could use for these purposes might include public or private offerings of equity and debt. In addition, the Company could enter into one or more strategic alliances or joint ventures, or could decide to sell certain property interests, and it might utilize a combination of these sources. The external financing chosen may not be available on acceptable terms, or at all.

If the Company is unable to generate sufficient funds from its operations and is also unable to secure external financing to continue exploration and development, it may have to postpone the development of, or sell, its properties.

There can be no assurance that the Company will commence production on any of its projects or generate sufficient revenues to meet its obligations as they become due or obtain necessary financing on acceptable terms, if at all. Failure to meet its obligations on a timely basis could result in the loss or substantial dilution of its property interests. In addition, should the Company incur significant losses in future periods, it may be unable to continue as a going concern, and realization of assets and settlement of liabilities in other than the normal course of business may be at amounts significantly different from those included in this AIF.

Differences in US and Canadian reporting of reserves and resources.

The Company’s reserve and resource estimates are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as the Company generally reports reserves and resources in accordance with Canadian practices. These practices are different from those used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated and inferred resources, which are not permitted in disclosure filed with the SEC by United States issuers. In the United States, mineralization may not be classified as a ‘‘reserve’’ unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, ‘‘inferred resources’’ have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of ‘‘contained ounces’’ is permitted disclosure under Canadian regulations; however, the SEC permits issuers to report ‘‘resources’’ only as in-place tonnage and grade without reference to unit measures.

Accordingly, information concerning descriptions of mineralization, reserves and resources contained in this AIF, or in the documents incorporated herein by reference, may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC.

Actual costs, production and economic returns may differ significantly from those anticipated, and no assurance that development will result in profitable mining operations.

The Company has estimated operating and capital costs for Dolores based on information available, and believes that these estimates are accurate. However, costs for labour, regulatory compliance, energy, mine and plant equipment and materials needed for mine development and construction have increased significantly industry-wide. In light of these factors, actual costs related to mine development and construction may exceed the Company’s estimates.

The Company does not have an operating history upon which it can base estimates of future operating costs for the Dolores project, and it intends to rely upon the economic feasibility study of the project and estimates contained therein. Such studies derive estimates of cash operating costs from, among other things:

• anticipated tonnage, grades and metallurgical characteristics of the ore to be mined and processed;

| • anticipated recovery rates of gold and other metals from the ore; |

| • cash operating costs of comparable facilities and equipment; and |

| • anticipated climatic conditions. |

Capital and operating costs, production and economic returns, and other estimates contained in feasibility studies may differ significantly from actual costs, and there can be no assurance that actual capital and operating costs will not be higher than currently anticipated or disclosed.

In addition, the Company’s calculations of cash costs and cash cost per ounce may differ from similarly titled measures of other companies and are not intended to be an indicator of projected operating profit.

Risks related to future drilling results.

The results of future drilling programs may not produce reserves and resources that can be mined or processed profitably. The results of drilling programs are, by their very nature, uncertain.

Reserves and resources are estimates and may yield less actual production.

Unless otherwise indicated, mineralization figures presented in this AIF and in the Company’s filings with securities regulatory authorities, press releases and other public statements that may be made from time to time are based upon estimates made by independent geologists and the Company’s geologists. When making determinations about whether to advance any of its projects to development, the Company must rely upon such estimates as to the mineral reserves and grades of mineralization on its properties. Until ore is actually mined and processed, mineral reserves and grades of mineralization must be considered as estimates only.

These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. The Company cannot assure investors that:

| • the estimates will be accurate; |

| • reserve, resource or other mineralization estimates will be accurate; or |

| • this mineralization can be mined or processed profitably. |

Any material changes in mineral reserve estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital.

Because the Company has not completed mine construction at the Dolores project and has not commenced actual production on any of its properties, mineralization estimates, including reserve and resource estimates, for its properties may require adjustments or downward revisions based upon actual production experience. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by its feasibility studies and drill results. There can be no assurance that minerals recovered in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale.

The resource estimates contained in this AIF have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for gold and silver may render portions of the mineralization, reserve and resource estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability of the Dolores and other projects. Any material reductions in estimates of mineralization, or of the Company’s ability to extract this mineralization, could have a material adverse effect on its results of operations or financial condition.

Some of the Company’s properties, including the Northern Sonora Properties, are in the exploration stage, which means that the Company has not established the presence of any proven and probable reserves. There can be no assurance that subsequent testing or future studies will establish proven and probable reserves on these properties. The Company cannot assure investors that mineral recovery rates achieved in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale.

Prices of gold and silver fluctuate widely, affecting profitability and financial condition.

The Company’s profitability and long-term viability depend, in large part, upon the market prices of gold, silver and other metals and minerals produced from its mineral properties. The market prices of gold, silver and other metals are volatile and are affected by numerous factors beyond its control, including:

| • expectations with respect to the rate of inflation; |

| • the relative strength of the US dollar and certain other currencies; |

| • global or regional political or economic conditions; |

| • supply and demand for jewellery and industrial products containing metals; and |

| • transactions by central banks and other holders, speculators

and producers of gold and other metals in response to any of the above factors. |